UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Tara Tilbury

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612)376-7132

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Semi-Annual Report For the six months ended March 31, 2020 Access Capital Community Investment Fund RBC Impact Bond Fund Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling800-422-2766. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call800-422-2766 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | RBC Funds | | |

| | | | | | | | |

About your Semi Annual Report | | | | | | | | This semi-annual report (Unaudited) includes detailed information about your Fund including financial statements, performance, and a complete list of its holdings. |

| | | | | | | | The RBC Funds compare their performance against various indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly. |

| | | | | | | | We hope the financial information presented will help you evaluate your investment in the RBC Funds. We also encourage you to read your Fund’s prospectus for further detail as to your Fund’s investment policies and risk profile. RBC Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.rbcgam.us. |

| | | | | | | | A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.us; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. |

| | | | | | | | Information regarding how your Fund voted proxies relating to portfolio securities during the most recent12-month period ended June 30 is available (i) on the Fund’s website at www.rbcgam.us; and (ii) on the Commission’s website at http://www.sec.gov. |

| | | | | | | | A schedule of each Fund’s portfolio holdings is filed with the Commission for the first and third quarters of each fiscal year on FormN-PORT. This information is available on the Commission’s website at http://www.sec.gov. |

| Table of | | | | | | | | Portfolio Managers | | 1 |

| Contents | | | | | | | | Performance Summary | | 2 |

| | | | | | | | Fund Statistics | | |

| | | | | | | | - Access Capital Community Investment Fund | | 4 |

| | | | | | | | - RBC Impact Bond Fund | | 5 |

| | | | | | | | Schedule of Portfolio Investments | | 6 |

| | | | | | | | Financial Statements | | |

| | | | | | | | - Statements of Assets and Liabilities | | 36 |

| | | | | | | | - Statements of Operations | | 38 |

| | | | | | | | - Statements of Changes in Net Assets | | 39 |

| | | | | | | | Financial Highlights | | 41 |

| | | | | | | | Notes to Financial Statements | | 46 |

| | | | | | | | Share Class Information | | 61 |

| | | | | | | | Supplemental Information | | 62 |

| | | | | | | | Liquidity Risk Disclosure (Unaudited) | | 64 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

| | | |

RBC Global Asset Management (U.S.) Inc.(“RBCGAM-US”) serves as the investment advisor to the Funds. RBCGAM-US employs a team approach to the management of the Funds, with no individual team member being solely responsible for the investment decisions. The Funds’ management team has access to RBCGAM-US’s investment research and other money management resources. | | | | | |

Brian Svendahl, CFA |

Brian Svendahl, CFA Managing Director, Co-Head, U.S. Fixed Income Brian Svendahl oversees the fixed income research, portfolio management and trading at RBCGAM-US. In addition to shaping the firm’s overall fixed income philosophy and process, he is a portfolio manager for the Funds and many of RBCGAM-US’s government mandates. Brian joined RBCGAM-US in 2005 and most recently led the mortgage and government team before being promoted toCo-Head in 2012. Prior to joining RBCGAM-US, he held several risk management, research and trading positions at Wells Fargo. Brian’s experience also includes liability management and implementing balance sheet hedging strategies. He earned a BS in economics from the University of Minnesota and a BBA in finance and an MBA from the University of Minnesota Carlson School of Management. Brian is a CFA charterholder. | | | | |

Scott Kirby Vice President, Senior Portfolio Manager Scott Kirby is a member of the government and mortgage research team in RBCGAM-US’s fixed income group and serves asco-portfolio manager for the firm’s community investment strategy, including the Access Capital Community Investment Fund. Scott joined RBCGAM-US in 2012 and most recently served as manager of investments of a broad-based asset portfolio for a large foundation, supporting its mission to reduce poverty. Previously he led the structured assets investment team of Ameriprise Financial/Riversource Investments, where he served as senior portfolio manager for more than $20 billion in agency andnon-agency mortgage-backed, commercial mortgage-backed and asset-backed securities. He earned a BS in finance and an MBA in finance from the University of Minnesota Carlson School of Management. | | | | | |

Scott Kirby |

| | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

1

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Since

Inception | | | Net

Expense

Ratio(a)(b) | | | Gross

Expense

Ratio(a)(b) | |

| Average Annual Total Returns as of March 31, 2020 (Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | |

Access Capital Community Investment Fund | | | | | | | | | | | | | | | | | | | | | |

Class A(c) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 3.75% | | | 2.09% | | | | 1.55% | | | | 1.18% | | | | 2.10% | | | | 3.68% | | | | | | | | | |

- At Net Asset Value | | | 6.03% | | | | 2.85% | | | | 1.96% | | | | 2.49% | | | | 3.86% | | | | 0.95% | | | | 1.11% | |

Class I(e) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 6.28% | | | | 3.16% | | | | 2.32% | | | | 2.81% | | | | 4.17% | | | | 0.60% | | | | 0.66% | |

Class IS(f) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 6.23% | | | | 3.29% | | | | 2.47% | | | | 3.02% | | | | 4.43% | | | | 0.40% | | | | 0.73% | |

| | | | | | | |

Bloomberg Barclays U.S. Securitized Index(g) | | | 6.89% | | | | 4.02% | | | | 2.93% | | | | 3.37% | | | | 4.78% | | | | | | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index(g) | | | 8.93% | | | | 4.82% | | | | 3.36% | | | | 3.88% | | | | 4.94% | | | | | | | | | |

RBC Impact Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A(d) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 3.75% | | | 4.53% | | | | N/A | | | | N/A | | | | N/A | | | | 2.58% | | | | | | | | | |

- At Net Asset Value | | | 8.56% | | | | N/A | | | | N/A | | | | N/A | | | | 4.13% | | | | 0.70% | | | | 1.07% | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.83% | | | | N/A | | | | N/A | | | | N/A | | | | 4.57% | | | | 0.45% | | | | 1.62% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.87% | | | | N/A | | | | N/A | | | | N/A | | | | 4.67% | | | | 0.40% | | | | 1.52% | |

| | | | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index(g) | | | 8.93% | | | | N/A | | | | N/A | | | | N/A | | | | 5.10% | | | | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. For performance data current to the most recentmonth-end go to www.rbcgam.us. Please see footnotes below.

| (a) | The Fund’s expenses reflect the most recent year end (September 30, 2019). For Class A of Impact Bond Fund, the expenses reflect the period from January 28, 2020 (commencement of operations) to March 31, 2020. |

| (b) | The advisor has contractually agreed to waive fees and/or pay operating expenses to keep total operating expenses (excluding certain fees such as brokerage costs, interest, taxes and acquired fund fees and expenses) at 0.80% for Class A shares, 0.45% for Class I shares and 0.40% for Class IS shares of the Access Capital Community Investment Fund and at 0.70% for Class A shares, 0.45% for Class I shares and 0.40% for Class R6 shares of the Impact Bond Fund until January 31, 2020 (January 31, 2021 for Class IS Shares). Prior to March 11, 2019, the rates were 0.95% for Class A Shares and 0.70% for Class I Shares of the Access Capital Community Investment Fund. |

| (c) | The inception date for Class A shares of the Fund is January 29, 2009. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class A shares, as applicable. |

2

|

PERFORMANCE SUMMARY (UNAUDITED) |

| (d) | The inception date for Class A shares of the Fund is January 28,2020. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class A shares, as applicable. |

| (e) | Class I commenced operations on July 28, 2008. The performance in the table reflects the performance of Access Capital Strategies Community Investment Fund, Inc., the predecessor to the Fund. From its inception, June 23, 1998, until May 30, 2006, the predecessor fund elected status as a business development company. From May 31, 2006 until July 27, 2008, the predecessor fund operated as a continuously offeredclosed-end interval management company. If the predecessor fund had operated as anopen-end management company, performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements which, if excluded, would cause performance to be lower. |

| (f) | The inception date for Class IS shares of the Fund is March 11, 2019. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class IS shares, as applicable. |

| (g) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. |

The Bloomberg Barclays US Aggregate Bond Index measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. It includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities (agency andnon-agency).

The Bloomberg Barclays US Securitized Index represents the securitized portion (mortgage-backed, asset-backed and commercial mortgage-backed securities) of the Bloomberg Barclays US Aggregate Bond Index. You cannot invest directly in an index.

3

| | | | | | | | | | | | | | |

| | | | | | FUND STATISTICS (UNAUDITED) | | | | |

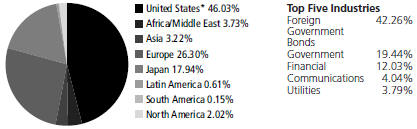

| | | | | | Access Capital Community Investment Fund | |

Investment Objective | | | | | | Seeks to invest in geographically specific debt securities located in portions of the United States designated by Fund shareholders. | |

Benchmark | | | | | | Bloomberg Barclays U.S. Securitized Index Bloomberg Barclays U.S. Aggregate Bond Index | |

| | | |

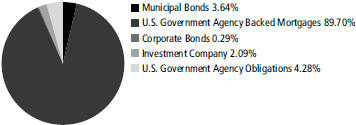

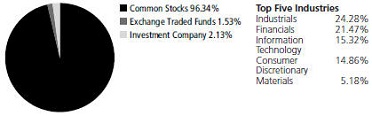

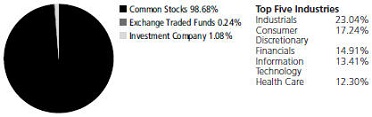

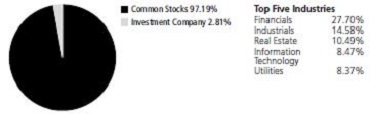

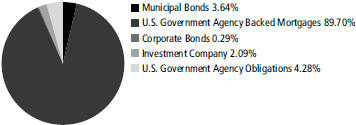

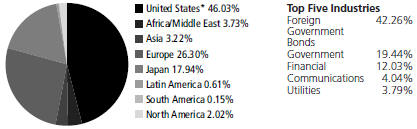

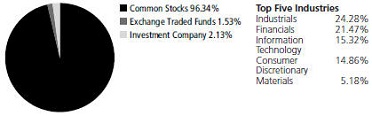

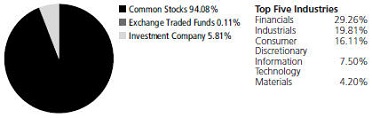

Asset Allocation as of 3/31/20 (% of Fund’s investments) | | | | | |

| |

Top Ten Holdings (excluding investment companies) (as of 3/31/20) (% of Fund’s net assets) | | | | | | Fannie Mae, Pool #BL4650, 2.30%, 10/1/31 Ginnie Mae, Series 2012-58, Class B, 2.20%, 3/16/44 Ginnie Mae, Series 2012-33, Class B, 2.89%, 3/16/46 Freddie Mac, Pool #ZA5238, 3.50%, 2/1/48 Fannie Mae, Pool #CA1507, 4.00%, 4/1/48 Ginnie Mae, Series 2017-94, Class AH, 2.60%, 2/16/59 | | 1.64% 1.46% 1.10% 0.79% 0.71% 0.68% | | Missouri Housing Development Commission, Revenue, Series 1, 3.75%, 3/1/42 Fannie Mae, Pool #AM4392, 3.79%, 10/1/23 Freddie Mac, Pool #RA1988, 3.00%, 1/1/50 Fannie Mae, Pool #CA0534, 3.50%, 10/1/47 | | | 0.64% 0.54% 0.53% 0.51% | |

| | | | | | *A listing of all portfolio holdings can be found beginning on page 6 | |

| | | |

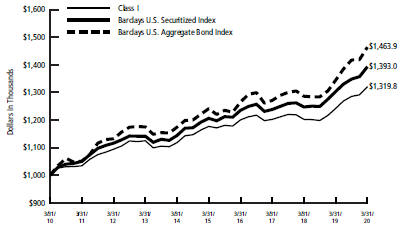

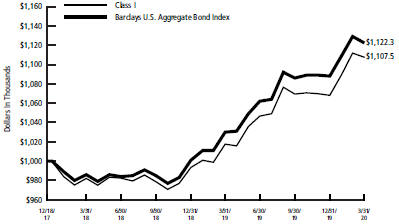

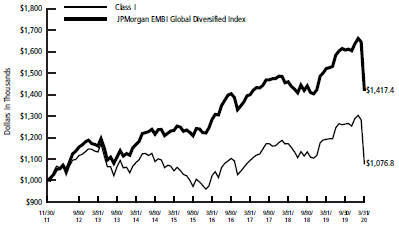

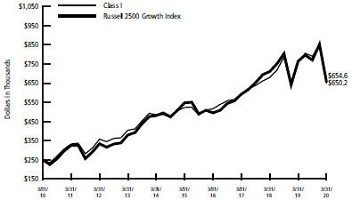

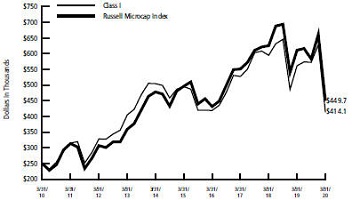

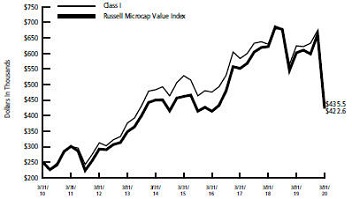

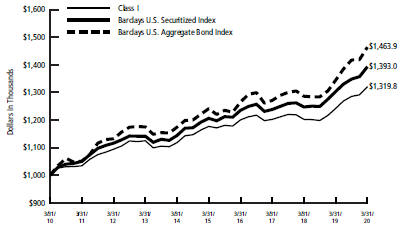

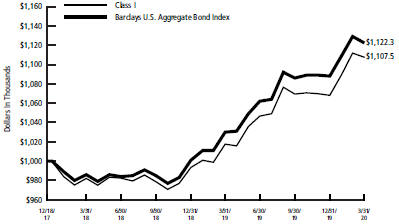

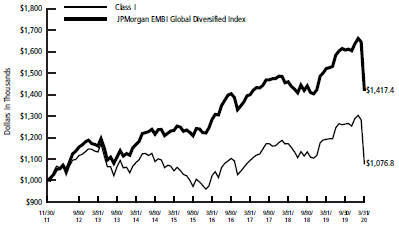

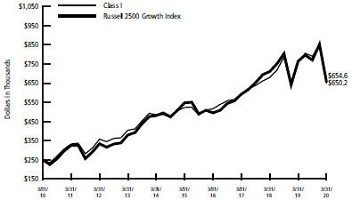

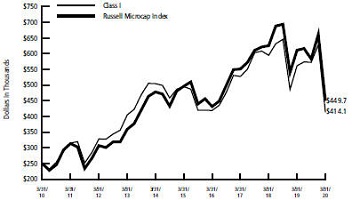

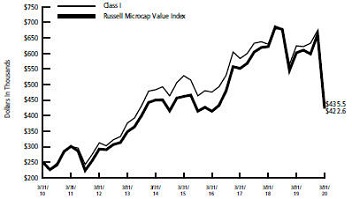

Growth of $1,000,000 Initial Investment Over 10 Years | | | | | |

| |

| | | |

| | | | | | The graph reflects an initial investment of $1,000,000 over a 10 year period and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

4

| | | | | | | | | | | | | | | | |

FUND STATISTICS (UNAUDITED) | | | | | | | | | | | | | | | | |

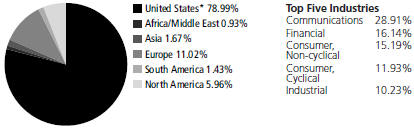

RBC Impact Bond Fund | | | | | | | | |

Seeks to achieve a high level of current income consistent with preservation of capital. | | | | | | | | Investment Objective |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | | Benchmark |

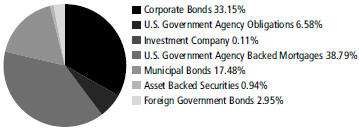

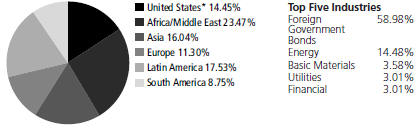

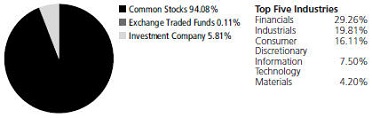

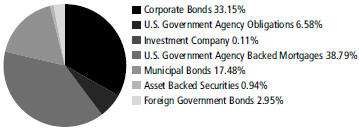

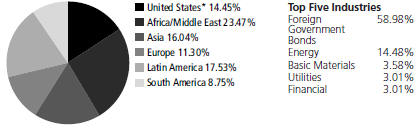

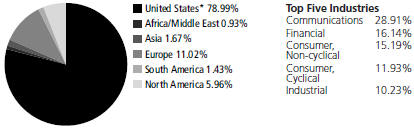

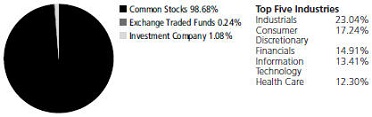

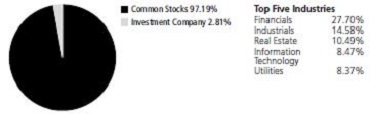

| | | | | | | | Asset Allocation

as of 3/31/20 (% of Fund’s investments) |

Fannie Mae, Pool #CA3451, 3.50%, 5/1/49 Fannie Mae, Pool #CA3405, 3.50%, 4/1/49 Freddie Mac, Pool #V85365, 3.50%, 4/1/49 NextEra Energy Capital Holdings, Inc., 3.55%, 5/1/27 Xcel Energy, Inc., 3.30%, 6/1/25 Providence Health & Services Obligated Group, 4.16%, 10/1/42 | | | 1.87% 1.50% 1.45% 1.42% 1.42% 1.36% | | | Freddie Mac, Pool #V85445, 3.50%, 4/1/49 Shire Acquisitions Investments Ireland DAC, 3.20%, 9/23/26 Fannie Mae, Pool #CA3456, 3.50%, 5/1/49 Fannie Mae, Pool #BO1263, 3.50%, 6/1/49 | | 1.29% 1.26% 1.24% 1.17% | | | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/20) (% of Fund’s net

assets) |

*A listing of all portfolio holdings can be found beginning on page 27 | | | | | | | | | | |

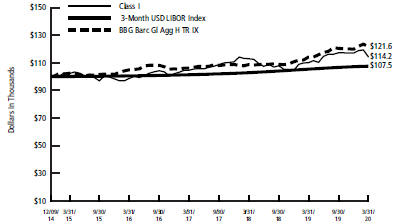

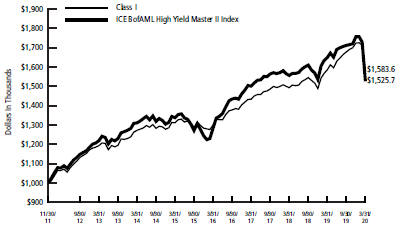

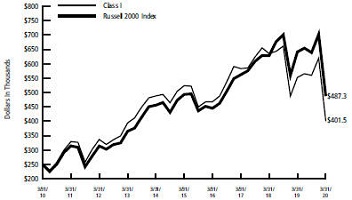

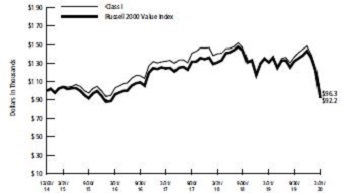

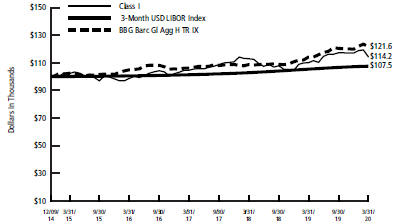

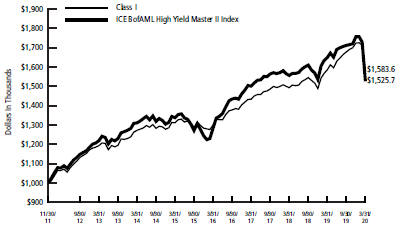

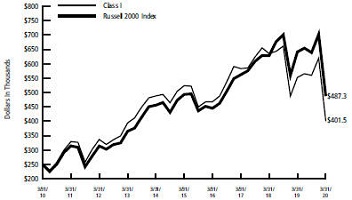

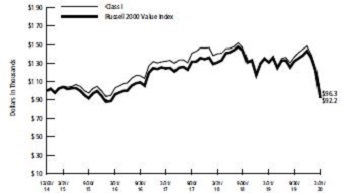

| | | | | | | | Growth of $1,000,000 Initial Investment Since Inception (12/18/17) |

| The graph reflects an initial investment of $1,000,000 over the period from December 18, 2017 (commencement of operations) to March 31, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

5

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

U.S. Government Agency Backed Mortgages — 89.35% | | | | |

Fannie Mae — 49.81% | | | | |

$125,000 | | (TBA), 0.00%, 4/15/20(a),(b) | | $ | 140,801 | |

58,632 | | Pool #257656, 6.00%, 8/1/38 | | | 62,958 | |

116,193 | | Pool #257663, 5.50%, 8/1/38 | | | 130,121 | |

109,017 | | Pool #257892, 5.50%, 2/1/38 | | | 122,063 | |

72,376 | | Pool #257913, 5.50%, 1/1/38 | | | 81,037 | |

55,439 | | Pool #258022, 5.50%, 5/1/34 | | | 62,410 | |

118,588 | | Pool #258070, 5.00%, 6/1/34 | | | 131,718 | |

36,205 | | Pool #258121, 5.50%, 6/1/34 | | | 40,758 | |

46,936 | | Pool #258152, 5.50%, 8/1/34 | | | 52,837 | |

62,415 | | Pool #258157, 5.00%, 8/1/34 | | | 69,326 | |

59,100 | | Pool #258163, 5.50%, 8/1/34 | | | 66,531 | |

103,755 | | Pool #258166, 5.50%, 9/1/34 | | | 116,801 | |

70,481 | | Pool #258224, 5.50%, 12/1/34 | | | 79,344 | |

55,338 | | Pool #258238, 5.00%, 1/1/35 | | | 61,464 | |

84,087 | | Pool #258251, 5.50%, 1/1/35 | | | 94,660 | |

100,746 | | Pool #258305, 5.00%, 3/1/35 | | | 111,828 | |

50,917 | | Pool #258336, 5.00%, 4/1/35 | | | 56,518 | |

55,256 | | Pool #258340, 5.00%, 3/1/35 | | | 61,334 | |

59,015 | | Pool #258394, 5.00%, 5/1/35 | | | 65,507 | |

56,160 | | Pool #258403, 5.00%, 6/1/35 | | | 62,338 | |

75,317 | | Pool #258404, 5.00%, 6/1/35 | | | 83,602 | |

44,119 | | Pool #258410, 5.00%, 4/1/35 | | | 48,973 | |

87,246 | | Pool #258448, 5.00%, 8/1/35 | | | 96,843 | |

164,557 | | Pool #258450, 5.50%, 8/1/35 | | | 185,147 | |

68,662 | | Pool #258571, 5.50%, 11/1/35 | | | 77,253 | |

196,404 | | Pool #258627, 5.50%, 2/1/36 | | | 220,979 | |

51,448 | | Pool #258658, 5.50%, 3/1/36 | | | 57,634 | |

45,547 | | Pool #258737, 5.50%, 12/1/35 | | | 51,024 | |

39,161 | | Pool #259181, 6.50%, 3/1/31 | | | 41,931 | |

7,304 | | Pool #259187, 6.50%, 4/1/31 | | | 7,348 | |

63,552 | | Pool #259190, 6.50%, 4/1/31 | | | 69,397 | |

72,772 | | Pool #259316, 6.50%, 11/1/31 | | | 79,662 | |

26,952 | | Pool #259378, 6.00%, 12/1/31 | | | 28,327 | |

30,751 | | Pool #259393, 6.00%, 1/1/32 | | | 32,498 | |

38,995 | | Pool #259590, 5.50%, 11/1/32 | | | 43,949 | |

154,115 | | Pool #259611, 5.50%, 11/1/32 | | | 173,694 | |

33,167 | | Pool #259634, 5.50%, 12/1/32 | | | 37,380 | |

126,356 | | Pool #259659, 5.50%, 2/1/33 | | | 142,408 | |

30,182 | | Pool #259671, 5.50%, 2/1/33 | | | 34,016 | |

73,178 | | Pool #259686, 5.50%, 3/1/33 | | | 82,615 | |

32,912 | | Pool #259722, 5.00%, 5/1/33 | | | 36,780 | |

99,301 | | Pool #259725, 5.00%, 5/1/33 | | | 110,973 | |

92,789 | | Pool #259729, 5.00%, 6/1/33 | | | 103,695 | |

56,390 | | Pool #259761, 5.00%, 6/1/33 | | | 63,018 | |

99,004 | | Pool #259777, 5.00%, 7/1/33 | | | 110,641 | |

75,546 | | Pool #259781, 5.00%, 7/1/33 | | | 84,426 | |

6

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 45,788 | | Pool #259789, 5.00%, 7/1/33 | | $ | 51,170 | |

110,178 | | Pool #259816, 5.00%, 8/1/33 | | | 123,128 | |

25,351 | | Pool #259819, 5.00%, 8/1/33 | | | 28,331 | |

46,904 | | Pool #259830, 5.00%, 8/1/33 | | | 52,416 | |

31,031 | | Pool #259848, 5.00%, 9/1/33 | | | 34,678 | |

66,170 | | Pool #259867, 5.50%, 10/1/33 | | | 74,703 | |

51,137 | | Pool #259869, 5.50%, 10/1/33 | | | 57,731 | |

51,780 | | Pool #259875, 5.50%, 10/1/33 | | | 58,458 | |

84,515 | | Pool #259930, 5.00%, 11/1/33 | | | 94,449 | |

34,876 | | Pool #259998, 5.00%, 3/1/34 | | | 38,737 | |

637,109 | | Pool #465946, 3.61%, 9/1/20 | | | 637,109 | |

1,707,883 | | Pool #468226, 3.86%, 6/1/21 | | | 1,727,176 | |

261,018 | | Pool #469101, 3.75%, 2/1/27 | | | 291,674 | |

280,138 | | Pool #470828, 3.53%, 3/1/32 | | | 318,995 | |

76,828 | | Pool #557295, 7.00%, 12/1/29 | | | 84,180 | |

23,393 | | Pool #576445, 6.00%, 1/1/31 | | | 24,039 | |

64,886 | | Pool #579402, 6.50%, 4/1/31 | | | 71,878 | |

74,822 | | Pool #583728, 6.50%, 6/1/31 | | | 82,481 | |

30,325 | | Pool #590931, 6.50%, 7/1/31 | | | 33,880 | |

41,514 | | Pool #590932, 6.50%, 7/1/31 | | | 43,907 | |

27,103 | | Pool #601865, 6.50%, 4/1/31 | | | 27,816 | |

30,667 | | Pool #601868, 6.00%, 7/1/29 | | | 32,256 | |

45,501 | | Pool #607611, 6.50%, 11/1/31 | | | 49,227 | |

89,390 | | Pool #634271, 6.50%, 5/1/32 | | | 99,751 | |

38,680 | | Pool #644232, 6.50%, 6/1/32 | | | 41,811 | |

22,626 | | Pool #644432, 6.50%, 7/1/32 | | | 23,796 | |

37,891 | | Pool #644437, 6.50%, 6/1/32 | | | 40,789 | |

1,483,441 | | Pool #663159, 5.00%, 7/1/32 | | | 1,658,935 | |

68,076 | | Pool #670278, 5.50%, 11/1/32 | | | 76,725 | |

29,284 | | Pool #676702, 5.50%, 11/1/32 | | | 33,005 | |

47,276 | | Pool #677591, 5.50%, 12/1/32 | | | 53,282 | |

62,957 | | Pool #681883, 6.00%, 3/1/33 | | | 67,862 | |

99,512 | | Pool #686542, 5.50%, 3/1/33 | | | 112,345 | |

204,419 | | Pool #695961, 5.50%, 1/1/33 | | | 230,389 | |

175,017 | | Pool #696407, 5.50%, 4/1/33 | | | 197,587 | |

372,288 | | Pool #702478, 5.50%, 6/1/33 | | | 420,297 | |

110,513 | | Pool #702479, 5.00%, 6/1/33 | | | 123,503 | |

134,537 | | Pool #720025, 5.00%, 8/1/33 | | | 150,351 | |

140,295 | | Pool #723066, 5.00%, 4/1/33 | | | 156,785 | |

186,928 | | Pool #723067, 5.50%, 5/1/33 | | | 211,033 | |

199,063 | | Pool #723070, 4.50%, 5/1/33 | | | 220,402 | |

255,103 | | Pool #727311, 4.50%, 9/1/33 | | | 282,448 | |

122,611 | | Pool #727312, 5.00%, 9/1/33 | | | 137,022 | |

141,004 | | Pool #727315, 6.00%, 10/1/33 | | | 158,069 | |

35,984 | | Pool #738589, 5.00%, 9/1/33 | | | 40,214 | |

45,389 | | Pool #739269, 5.00%, 9/1/33 | | | 50,724 | |

47,558 | | Pool #743595, 5.50%, 10/1/33 | | | 53,691 | |

7

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$136,571 | | Pool #748041, 4.50%, 10/1/33 | | $ | 151,211 | |

82,433 | | Pool #749891, 5.00%, 9/1/33 | | | 92,122 | |

98,852 | | Pool #749897, 4.50%, 9/1/33 | | | 109,449 | |

191,526 | | Pool #753533, 5.00%, 11/1/33 | | | 214,037 | |

40,376 | | Pool #755679, 6.00%, 1/1/34 | | | 43,641 | |

37,234 | | Pool #763551, 5.50%, 3/1/34 | | | 41,916 | |

85,905 | | Pool #763820, 5.50%, 1/1/34 | | | 96,983 | |

42,427 | | Pool #776851, 6.00%, 10/1/34 | | | 45,894 | |

654,673 | | Pool #777621, 5.00%, 2/1/34 | | | 731,622 | |

76,907 | | Pool #781741, 6.00%, 9/1/34 | | | 84,336 | |

3,777 | | Pool #781907, 5.00%, 2/1/21 | | | 3,778 | |

128,234 | | Pool #781954, 5.00%, 6/1/34 | | | 142,431 | |

133,190 | | Pool #781959, 5.50%, 6/1/34 | | | 149,937 | |

239,453 | | Pool #783893, 5.50%, 12/1/34 | | | 269,562 | |

68,793 | | Pool #783929, 5.50%, 10/1/34 | | | 77,443 | |

11,347 | | Pool #788329, 6.50%, 8/1/34 | | | 11,483 | |

108,563 | | Pool #797627, 5.00%, 7/1/35 | | | 120,505 | |

102,242 | | Pool #798725, 5.50%, 11/1/34 | | | 115,098 | |

73,560 | | Pool #799548, 6.00%, 9/1/34 | | | 80,839 | |

701,025 | | Pool #806754, 4.50%, 9/1/34 | | | 776,754 | |

302,252 | | Pool #806757, 6.00%, 9/1/34 | | | 339,004 | |

486,864 | | Pool #806761, 5.50%, 9/1/34 | | | 548,082 | |

106,935 | | Pool #808205, 5.00%, 1/1/35 | | | 118,774 | |

183,565 | | Pool #815009, 5.00%, 4/1/35 | | | 203,757 | |

83,614 | | Pool #817641, 5.00%, 11/1/35 | | | 92,811 | |

112,880 | | Pool #820334, 5.00%, 9/1/35 | | | 125,297 | |

259,787 | | Pool #820335, 5.00%, 9/1/35 | | | 288,364 | |

167,903 | | Pool #820336, 5.00%, 9/1/35 | | | 186,372 | |

97,560 | | Pool #822008, 5.00%, 5/1/35 | | | 108,292 | |

162,018 | | Pool #829005, 5.00%, 8/1/35 | | | 179,840 | |

34,151 | | Pool #829006, 5.50%, 9/1/35 | | | 38,424 | |

154,333 | | Pool #829275, 5.00%, 8/1/35 | | | 171,310 | |

146,787 | | Pool #829276, 5.00%, 8/1/35 | | | 162,934 | |

326,278 | | Pool #829649, 5.50%, 3/1/35 | | | 367,305 | |

277,920 | | Pool #844361, 5.50%, 11/1/35 | | | 312,695 | |

104,575 | | Pool #845245, 5.50%, 11/1/35 | | | 117,660 | |

34,582 | | Pool #866969, 6.00%, 2/1/36 | | | 36,137 | |

176,879 | | Pool #871072, 5.50%, 2/1/37 | | | 198,047 | |

164,694 | | Pool #884693, 5.50%, 4/1/36 | | | 184,498 | |

417,804 | | Pool #885724, 5.50%, 6/1/36 | | | 468,043 | |

53,333 | | Pool #911730, 5.50%, 12/1/21 | | | 54,034 | |

70,185 | | Pool #919368, 5.50%, 4/1/37 | | | 78,584 | |

270,482 | | Pool #922582, 6.00%, 12/1/36 | | | 300,393 | |

209,454 | | Pool #934941, 5.00%, 8/1/39 | | | 230,566 | |

286,168 | | Pool #934942, 5.00%, 9/1/39 | | | 315,013 | |

150,976 | | Pool #941204, 5.50%, 6/1/37 | | | 169,043 | |

58,000 | | Pool #943394, 5.50%, 6/1/37 | | | 64,941 | |

325,732 | | Pool #948600, 6.00%, 8/1/37 | | | 365,339 | |

8

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 74,176 | | Pool #952678, 6.50%, 8/1/37 | | $ | 81,193 | |

86,214 | | Pool #952693, 6.50%, 8/1/37 | | | 94,626 | |

98,382 | | Pool #975769, 5.50%, 3/1/38 | | | 110,175 | |

71,935 | | Pool #982898, 5.00%, 5/1/38 | | | 79,191 | |

135,135 | | Pool #984842, 5.50%, 6/1/38 | | | 151,333 | |

107,871 | | Pool #986239, 6.00%, 7/1/38 | | | 118,074 | |

120,631 | | Pool #986957, 5.50%, 7/1/38 | | | 135,091 | |

67,131 | | Pool #990510, 5.50%, 8/1/38 | | | 75,178 | |

161,113 | | Pool #990511, 6.00%, 8/1/38 | | | 178,392 | |

160,094 | | Pool #990617, 5.50%, 9/1/38 | | | 179,284 | |

198,222 | | Pool #AA0645, 4.50%, 3/1/39 | | | 218,395 | |

134,852 | | Pool #AA2243, 4.50%, 5/1/39 | | | 148,576 | |

126,255 | | Pool #AA3142, 4.50%, 3/1/39 | | | 139,104 | |

251,825 | | Pool #AA3206, 4.00%, 4/1/39 | | | 273,398 | |

413,776 | | Pool #AA3207, 4.50%, 3/1/39 | | | 455,887 | |

114,052 | | Pool #AA4468, 4.00%, 4/1/39 | | | 123,822 | |

226,810 | | Pool #AA7042, 4.50%, 6/1/39 | | | 249,893 | |

362,683 | | Pool #AA7658, 4.00%, 6/1/39 | | | 393,752 | |

102,290 | | Pool #AA7659, 4.50%, 6/1/39 | | | 112,700 | |

95,728 | | Pool #AA7741, 4.50%, 6/1/24 | | | 99,058 | |

2,506,711 | | Pool #AB7798, 3.00%, 1/1/43 | | | 2,657,372 | |

1,246,489 | | Pool #AB9204, 3.00%, 4/1/43 | | | 1,319,649 | |

192,468 | | Pool #AC1463, 5.00%, 8/1/39 | | | 211,868 | |

102,608 | | Pool #AC1464, 5.00%, 8/1/39 | | | 112,950 | |

351,214 | | Pool #AC2109, 4.50%, 7/1/39 | | | 386,958 | |

35,634 | | Pool #AC4394, 5.00%, 9/1/39 | | | 39,226 | |

259,878 | | Pool #AC4395, 5.00%, 9/1/39 | | | 286,073 | |

116,806 | | Pool #AC5328, 5.00%, 10/1/39 | | | 128,580 | |

230,722 | | Pool #AC5329, 5.00%, 10/1/39 | | | 253,979 | |

195,128 | | Pool #AC6304, 5.00%, 11/1/39 | | | 214,796 | |

207,600 | | Pool #AC6305, 5.00%, 11/1/39 | | | 228,525 | |

138,902 | | Pool #AC6307, 5.00%, 12/1/39 | | | 152,903 | |

302,443 | | Pool #AC6790, 5.00%, 12/1/39 | | | 332,928 | |

939,095 | | Pool #AC7199, 5.00%, 12/1/39 | | | 1,033,753 | |

507,637 | | Pool #AD1470, 5.00%, 2/1/40 | | | 558,806 | |

1,077,668 | | Pool #AD1471, 4.50%, 2/1/40 | | | 1,187,342 | |

133,668 | | Pool #AD1560, 5.00%, 3/1/40 | | | 147,072 | |

767,706 | | Pool #AD1585, 4.50%, 2/1/40 | | | 845,836 | |

349,574 | | Pool #AD1586, 5.00%, 1/1/40 | | | 384,811 | |

450,674 | | Pool #AD1638, 4.50%, 2/1/40 | | | 496,262 | |

145,599 | | Pool #AD1640, 4.50%, 3/1/40 | | | 160,327 | |

1,440,407 | | Pool #AD1942, 4.50%, 1/1/40 | | | 1,586,998 | |

222,632 | | Pool #AD1943, 5.00%, 1/1/40 | | | 245,073 | |

758,671 | | Pool #AD1988, 4.50%, 2/1/40 | | | 835,413 | |

369,841 | | Pool #AD2896, 5.00%, 3/1/40 | | | 406,928 | |

216,857 | | Pool #AD4456, 4.50%, 4/1/40 | | | 238,793 | |

667,940 | | Pool #AD4458, 4.50%, 4/1/40 | | | 735,505 | |

9

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 368,377 | | Pool #AD4940, 4.50%, 6/1/40 | | $ | 405,640 | |

94,855 | | Pool #AD4946, 4.50%, 6/1/40 | | | 104,450 | |

288,405 | | Pool #AD5728, 5.00%, 4/1/40 | | | 317,326 | |

219,538 | | Pool #AD7239, 4.50%, 7/1/40 | | | 241,745 | |

117,774 | | Pool #AD7242, 4.50%, 7/1/40 | | | 129,687 | |

175,162 | | Pool #AD7256, 4.50%, 7/1/40 | | | 192,880 | |

387,578 | | Pool #AD7271, 4.50%, 7/1/40 | | | 426,783 | |

265,712 | | Pool #AD7272, 4.50%, 7/1/40 | | | 292,590 | |

272,438 | | Pool #AD8960, 5.00%, 6/1/40 | | | 299,758 | |

130,629 | | Pool #AD9613, 4.50%, 8/1/40 | | | 143,843 | |

887,773 | | Pool #AD9614, 4.50%, 8/1/40 | | | 977,575 | |

83,270 | | Pool #AE2011, 4.00%, 9/1/40 | | | 90,432 | |

1,309,590 | | Pool #AE2012, 4.00%, 9/1/40 | | | 1,422,231 | |

118,055 | | Pool #AE2023, 4.00%, 9/1/40 | | | 128,209 | |

648,700 | | Pool #AE5432, 4.00%, 10/1/40 | | | 704,496 | |

333,936 | | Pool #AE5435, 4.50%, 9/1/40 | | | 367,715 | |

334,783 | | Pool #AE5806, 4.50%, 9/1/40 | | | 368,647 | |

532,508 | | Pool #AE5861, 4.00%, 10/1/40 | | | 578,310 | |

509,225 | | Pool #AE5862, 4.00%, 10/1/40 | | | 553,024 | |

351,220 | | Pool #AE5863, 4.00%, 10/1/40 | | | 381,429 | |

284,214 | | Pool #AE6850, 4.00%, 10/1/40 | | | 308,660 | |

28,209 | | Pool #AE6851, 4.00%, 10/1/40 | | | 30,635 | |

155,321 | | Pool #AE7699, 4.00%, 11/1/40 | | | 168,680 | |

416,181 | | Pool #AE7703, 4.00%, 10/1/40 | | �� | 451,978 | |

667,358 | | Pool #AE7707, 4.00%, 11/1/40 | | | 724,759 | |

242,469 | | Pool #AH0300, 4.00%, 11/1/40 | | | 263,324 | |

410,397 | | Pool #AH0301, 3.50%, 11/1/40 | | | 440,091 | |

40,285 | | Pool #AH0302, 4.00%, 11/1/40 | | | 43,750 | |

426,095 | | Pool #AH0306, 4.00%, 12/1/40 | | | 462,744 | |

459,670 | | Pool #AH0508, 4.00%, 11/1/40 | | | 499,207 | |

876,792 | | Pool #AH0537, 4.00%, 12/1/40 | | | 952,206 | |

560,086 | | Pool #AH0914, 4.50%, 11/1/40 | | | 616,741 | |

444,580 | | Pool #AH0917, 4.00%, 12/1/40 | | | 482,819 | |

639,301 | | Pool #AH1077, 4.00%, 1/1/41 | | | 694,289 | |

723,066 | | Pool #AH2973, 4.00%, 12/1/40 | | | 785,259 | |

425,958 | | Pool #AH2980, 4.00%, 1/1/41 | | | 462,595 | |

954,283 | | Pool #AH5656, 4.00%, 1/1/41 | | | 1,036,363 | |

235,109 | | Pool #AH5657, 4.00%, 2/1/41 | | | 255,332 | |

484,816 | | Pool #AH5658, 4.00%, 2/1/41 | | | 526,517 | |

326,388 | | Pool #AH5662, 4.00%, 2/1/41 | | | 354,462 | |

446,990 | | Pool #AH5882, 4.00%, 2/1/26 | | | 471,775 | |

587,923 | | Pool #AH6764, 4.00%, 3/1/41 | | | 638,921 | |

1,108,993 | | Pool #AH6768, 4.00%, 3/1/41 | | | 1,205,189 | |

218,714 | | Pool #AH7277, 4.00%, 3/1/41 | | | 237,686 | |

814,171 | | Pool #AH7281, 4.00%, 3/1/41 | | | 884,794 | |

363,589 | | Pool #AH7526, 4.50%, 3/1/41 | | | 400,827 | |

583,665 | | Pool #AH7537, 4.00%, 3/1/41 | | | 634,294 | |

389,030 | | Pool #AH8878, 4.50%, 4/1/41 | | | 428,874 | |

10

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 288,398 | | Pool #AH8885, 4.50%, 4/1/41 | | $ | 317,935 | |

252,772 | | Pool #AH9050, 3.50%, 2/1/26 | | | 265,961 | |

526,380 | | Pool #AI0114, 4.00%, 3/1/41 | | | 572,040 | |

503,778 | | Pool #AI1846, 4.50%, 5/1/41 | | | 555,374 | |

416,951 | | Pool #AI1847, 4.50%, 5/1/41 | | | 459,655 | |

1,029,624 | | Pool #AI1848, 4.50%, 5/1/41 | | | 1,135,076 | |

655,887 | | Pool #AI1849, 4.50%, 5/1/41 | | | 723,062 | |

356,211 | | Pool #AJ0651, 4.00%, 8/1/41 | | | 387,109 | |

301,713 | | Pool #AJ7668, 4.00%, 11/1/41 | | | 327,884 | |

632,325 | | Pool #AJ9133, 4.00%, 1/1/42 | | | 687,174 | |

565,904 | | Pool #AK6715, 3.50%, 3/1/42 | | | 605,606 | |

725,962 | | Pool #AK6716, 3.50%, 3/1/42 | | | 776,892 | |

495,431 | | Pool #AK6718, 3.50%, 2/1/42 | | | 530,188 | |

430,009 | | Pool #AM0635, 2.55%, 10/1/22 | | | 430,009 | |

863,208 | | Pool #AM1750, 3.04%, 12/1/30 | | | 935,082 | |

2,837,534 | | Pool #AM4392, 3.79%, 10/1/23 | | | 3,036,901 | |

229,523 | | Pool #AM6907, 3.68%, 10/1/32 | | | 258,457 | |

1,442,512 | | Pool #AM7764, 3.05%, 1/1/27 | | | 1,571,373 | |

473,829 | | Pool #AM9780, 3.31%, 3/1/31 | | | 531,551 | |

350,000 | | Pool #AN0360, 3.95%, 12/1/45 | | | 397,863 | |

1,056,397 | | Pool #AN0915, 3.01%, 2/1/26 | | | 1,141,810 | |

309,867 | | Pool #AN1381, 2.56%, 8/1/26 | | | 328,748 | |

935,651 | | Pool #AN2066, 2.75%, 7/1/26 | | | 988,310 | |

953,085 | | Pool #AN2746, 2.30%, 9/1/26 | | | 997,458 | |

974,718 | | Pool #AN3157, 2.25%, 10/1/26 | | | 1,017,445 | |

472,229 | | Pool #AN3919, 2.82%, 12/1/26 | | | 508,537 | |

1,145,000 | | Pool #AN4045, 3.15%, 1/1/29 | | | 1,243,668 | |

855,140 | | Pool #AN5053, 3.34%, 4/1/27 | | | 945,096 | |

208,521 | | Pool #AN6580, 3.36%, 9/1/29 | | | 234,530 | |

959,426 | | Pool #AN7154, 3.21%, 10/1/32 | | | 1,070,619 | |

967,003 | | Pool #AN7904, 3.44%, 12/1/27 | | | 1,076,528 | |

483,582 | | Pool #AN7982, 2.80%, 1/1/26 | | | 513,736 | |

2,000,000 | | Pool #AN8055, 3.05%, 1/1/30 | | | 2,208,765 | |

1,500,000 | | Pool #AN8121, 3.16%, 1/1/35 | | | 1,653,969 | |

978,049 | | Pool #AN9057, 3.47%, 4/1/28 | | | 1,096,128 | |

976,476 | | Pool #AN9844, 3.80%, 7/1/30 | | | 1,128,379 | |

458,129 | | Pool #AO2923, 3.50%, 5/1/42 | | | 490,269 | |

1,560,849 | | Pool #AO8029, 3.50%, 7/1/42 | | | 1,670,352 | |

494,860 | | Pool #AP7483, 3.50%, 9/1/42 | | | 529,578 | |

415,613 | | Pool #AQ6710, 2.50%, 10/1/27 | | | 431,378 | |

1,566,538 | | Pool #AQ7193, 3.50%, 7/1/43 | | | 1,671,982 | |

388,518 | | Pool #AR6928, 3.00%, 3/1/43 | | | 411,321 | |

870,272 | | Pool #AS1916, 4.00%, 3/1/44 | | | 936,009 | |

469,814 | | Pool #AS1917, 4.00%, 3/1/44 | | | 507,163 | |

193,161 | | Pool #AS2129, 4.00%, 3/1/44 | | | 207,752 | |

880,017 | | Pool #AS2439, 4.00%, 5/1/44 | | | 949,975 | |

470,903 | | Pool #AS2784, 4.00%, 7/1/44 | | | 506,473 | |

11

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$1,416,382 | | Pool #AS3244, 4.00%, 9/1/44 | | $ | 1,523,370 | |

1,658,856 | | Pool #AS3494, 4.00%, 10/1/44 | | | 1,784,160 | |

1,351,655 | | Pool #AS3726, 4.00%, 11/1/44 | | | 1,453,754 | |

848,227 | | Pool #AS3728, 4.00%, 11/1/44 | | | 912,298 | |

639,585 | | Pool #AS3929, 4.00%, 12/1/44 | | | 687,896 | |

701,733 | | Pool #AS3930, 4.00%, 11/1/44 | | | 754,739 | |

1,000,194 | | Pool #AS4070, 4.00%, 12/1/44 | | | 1,076,329 | |

308,561 | | Pool #AS4390, 3.50%, 2/1/45 | | | 328,867 | |

975,732 | | Pool #AS4732, 3.50%, 4/1/45 | | | 1,038,785 | |

1,099,968 | | Pool #AS4905, 3.50%, 4/1/45 | | | 1,171,050 | |

1,032,804 | | Pool #AS5341, 3.50%, 7/1/45 | | | 1,099,545 | |

926,968 | | Pool #AS5576, 4.00%, 8/1/45 | | | 995,709 | |

700,366 | | Pool #AS5919, 3.50%, 9/1/45 | | | 745,625 | |

404,686 | | Pool #AS5922, 3.50%, 9/1/45 | | | 430,837 | |

989,321 | | Pool #AS6303, 4.00%, 11/1/45 | | | 1,062,686 | |

664,091 | | Pool #AS6469, 4.00%, 12/1/45 | | | 713,338 | |

247,715 | | Pool #AS6607, 4.00%, 1/1/46 | | | 266,085 | |

1,463,643 | | Pool #AS6778, 3.50%, 3/1/46 | | | 1,556,330 | |

632,178 | | Pool #AS6958, 3.50%, 4/1/46 | | | 672,540 | |

1,046,489 | | Pool #AS7138, 3.50%, 5/1/46 | | | 1,112,759 | |

762,907 | | Pool #AS7139, 3.50%, 5/1/46 | | | 811,219 | |

1,440,820 | | Pool #AS7334, 3.00%, 6/1/46 | | | 1,515,760 | |

1,332,747 | | Pool #AS7335, 3.00%, 5/1/46 | | | 1,402,067 | |

944,432 | | Pool #AS7336, 3.00%, 6/1/46 | | | 996,302 | |

2,474,194 | | Pool #AS7504, 3.00%, 7/1/46 | | | 2,602,883 | |

477,557 | | Pool #AS7516, 3.00%, 7/1/46 | | | 502,396 | |

1,583,544 | | Pool #AS7517, 3.00%, 6/1/46 | | | 1,665,908 | |

683,653 | | Pool #AS7518, 3.00%, 7/1/46 | | | 720,044 | |

382,749 | | Pool #AS7674, 3.00%, 8/1/46 | | | 402,657 | |

1,481,097 | | Pool #AS7676, 3.00%, 8/1/46 | | | 1,558,133 | |

690,728 | | Pool #AS8077, 3.00%, 10/1/46 | | | 727,039 | |

1,449,587 | | Pool #AS8289, 3.00%, 10/1/46 | | | 1,524,983 | |

1,812,051 | | Pool #AS8441, 3.00%, 11/1/46 | | | 1,906,300 | |

1,532,814 | | Pool #AS8633, 3.50%, 1/1/47 | | | 1,629,882 | |

993,071 | | Pool #AS8776, 3.50%, 2/1/47 | | | 1,055,959 | |

218,465 | | Pool #AS9308, 4.00%, 2/1/47 | | | 234,951 | |

1,262,125 | | Pool #AS9381, 4.00%, 4/1/47 | | | 1,349,655 | |

1,399,030 | | Pool #AS9549, 4.00%, 5/1/47 | | | 1,496,054 | |

2,132,305 | | Pool #AS9550, 4.00%, 5/1/47 | | | 2,280,183 | |

932,575 | | Pool #AS9727, 3.50%, 6/1/47 | | | 988,461 | |

764,432 | | Pool #AS9729, 4.00%, 6/1/47 | | | 817,446 | |

776,767 | | Pool #AS9825, 4.00%, 6/1/47 | | | 833,091 | |

718,916 | | Pool #AT2688, 3.00%, 5/1/43 | | | 761,111 | |

211,736 | | Pool #AT2691, 3.00%, 5/1/43 | | | 224,163 | |

627,789 | | Pool #AT3963, 2.50%, 3/1/28 | | | 652,200 | |

294,483 | | Pool #AT7873, 2.50%, 6/1/28 | | | 306,079 | |

439,617 | | Pool #AU0971, 3.50%, 8/1/43 | | | 469,207 | |

582,332 | | Pool #AU2165, 3.50%, 7/1/43 | | | 621,529 | |

12

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 814,830 | | Pool #AU2188, 3.50%, 8/1/43 | | $ | 869,677 | |

372,367 | | Pool #AU6054, 4.00%, 9/1/43 | | | 401,641 | |

316,370 | | Pool #AU6718, 4.00%, 10/1/43 | | | 341,550 | |

642,794 | | Pool #AU7003, 4.00%, 11/1/43 | | | 697,268 | |

487,538 | | Pool #AU7005, 4.00%, 11/1/43 | | | 526,343 | |

792,169 | | Pool #AV0679, 4.00%, 12/1/43 | | | 858,352 | |

449,327 | | Pool #AV9282, 4.00%, 2/1/44 | | | 480,468 | |

677,937 | | Pool #AW0993, 4.00%, 5/1/44 | | | 735,319 | |

242,581 | | Pool #AW1565, 4.00%, 4/1/44 | | | 261,583 | |

70,869 | | Pool #AW3671, 4.00%, 4/1/44 | | | 76,123 | |

819,555 | | Pool #AW5046, 4.00%, 7/1/44 | | | 881,520 | |

590,300 | | Pool #AW5047, 4.00%, 7/1/44 | | | 634,888 | |

315,731 | | Pool #AW7040, 4.00%, 6/1/44 | | | 338,353 | |

692,946 | | Pool #AW8629, 3.50%, 5/1/44 | | | 738,518 | |

805,675 | | Pool #AX2884, 3.50%, 11/1/44 | | | 858,661 | |

1,347,408 | | Pool #AX4860, 3.50%, 12/1/44 | | | 1,436,020 | |

631,406 | | Pool #AY0075, 3.50%, 11/1/44 | | | 672,930 | |

758,004 | | Pool #AY1389, 3.50%, 4/1/45 | | | 806,987 | |

740,378 | | Pool #AY3435, 3.50%, 5/1/45 | | | 788,222 | |

640,043 | | Pool #AY5571, 3.50%, 6/1/45 | | | 681,403 | |

1,172,310 | | Pool #BC0802, 3.50%, 4/1/46 | | | 1,246,548 | |

1,154,231 | | Pool #BC0804, 3.50%, 4/1/46 | | | 1,227,325 | |

693,855 | | Pool #BC1135, 3.00%, 6/1/46 | | | 730,789 | |

1,365,844 | | Pool #BD5021, 3.50%, 2/1/47 | | | 1,452,338 | |

2,054,226 | | Pool #BD7140, 4.00%, 4/1/47 | | | 2,196,689 | |

2,037,898 | | Pool #BE4232, 3.00%, 12/1/46 | | | 2,145,029 | |

942,112 | | Pool #BE9743, 3.50%, 4/1/47 | | | 1,000,149 | |

2,107,026 | | Pool #BH2665, 3.50%, 9/1/47 | | | 2,233,293 | |

951,067 | | Pool #BH4659, 4.00%, 6/1/47 | | | 1,019,952 | |

1,929,560 | | Pool #BJ0657, 4.00%, 2/1/48 | | | 2,057,039 | |

1,019,220 | | Pool #BJ2670, 4.00%, 4/1/48 | | | 1,086,556 | |

1,633,503 | | Pool #BJ5158, 4.00%, 4/1/48 | | | 1,741,422 | |

782,356 | | Pool #BK7685, 4.00%, 10/1/48 | | | 835,967 | |

1,296,468 | | Pool #BK7924, 4.00%, 11/1/48 | | | 1,382,120 | |

8,920,000 | | Pool #BL4650, 2.30%, 10/1/31 | | | 9,181,769 | |

2,400,000 | | Pool #BL4970, 2.80%, 11/1/36 | | | 2,519,948 | |

1,671,170 | | Pool #BO1263, 3.50%, 6/1/49 | | | 1,772,050 | |

1,486,188 | | Pool #BO3599, 3.00%, 9/1/49 | | | 1,558,598 | |

1,197,103 | | Pool #BO5263, 3.00%, 9/1/49 | | | 1,255,429 | |

2,108,072 | | Pool #CA0114, 3.50%, 8/1/47 | | | 2,234,402 | |

460,861 | | Pool #CA0268, 3.50%, 8/1/47 | | | 490,963 | |

2,279,220 | | Pool #CA0334, 3.50%, 9/1/47 | | | 2,415,805 | |

2,690,910 | | Pool #CA0534, 3.50%, 10/1/47 | | | 2,854,794 | |

1,157,539 | | Pool #CA0536, 3.50%, 10/1/47 | | | 1,226,906 | |

860,026 | | Pool #CA0551, 4.00%, 10/1/47 | | | 919,670 | |

915,981 | | Pool #CA0565, 3.50%, 10/1/47 | | | 971,820 | |

1,527,266 | | Pool #CA0742, 3.50%, 11/1/47 | | | 1,618,790 | |

13

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$1,015,478 | | Pool #CA0743, 3.50%, 11/1/47 | | $ | 1,079,506 | |

1,164,660 | | Pool #CA0825, 3.50%, 12/1/47 | | | 1,235,591 | |

1,024,100 | | Pool #CA0981, 3.50%, 12/1/47 | | | 1,085,470 | |

1,739,864 | | Pool #CA1070, 3.50%, 1/1/48 | | | 1,844,128 | |

700,635 | | Pool #CA1115, 3.50%, 1/1/48 | | | 742,622 | |

1,275,761 | | Pool #CA1130, 3.50%, 1/1/48 | | | 1,353,459 | |

1,509,733 | | Pool #CA1131, 3.50%, 2/1/48 | | | 1,600,206 | |

1,807,235 | | Pool #CA1132, 3.50%, 1/1/48 | | | 1,915,537 | |

1,454,601 | | Pool #CA1140, 3.50%, 1/1/48 | | | 1,541,770 | |

1,372,980 | | Pool #CA1144, 3.50%, 2/1/48 | | | 1,455,258 | |

496,793 | | Pool #CA1152, 3.50%, 2/1/48 | | | 526,564 | |

1,023,024 | | Pool #CA1160, 3.50%, 2/1/48 | | | 1,087,504 | |

1,096,748 | | Pool #CA1161, 3.50%, 2/1/48 | | | 1,163,015 | |

808,888 | | Pool #CA1162, 3.50%, 2/1/48 | | | 858,151 | |

851,551 | | Pool #CA1338, 4.00%, 3/1/48 | | | 910,744 | |

1,798,982 | | Pool #CA1339, 3.50%, 3/1/48 | | | 1,907,678 | |

1,151,406 | | Pool #CA1418, 4.00%, 3/1/48 | | | 1,230,200 | |

588,515 | | Pool #CA1420, 4.00%, 3/1/48 | | | 628,789 | |

1,081,702 | | Pool #CA1468, 4.00%, 3/1/48 | | | 1,153,166 | |

1,848,152 | | Pool #CA1469, 4.00%, 3/1/48 | | | 1,970,252 | |

869,132 | | Pool #CA1471, 4.00%, 3/1/48 | | | 928,690 | |

3,701,196 | | Pool #CA1507, 4.00%, 4/1/48 | | | 3,945,719 | |

1,058,452 | | Pool #CA1610, 3.50%, 3/1/48 | | | 1,122,404 | |

1,241,551 | | Pool #CA1611, 4.00%, 4/1/48 | | | 1,326,628 | |

1,054,039 | | Pool #CA1612, 3.50%, 4/1/48 | | | 1,116,956 | |

1,166,637 | | Pool #CA1613, 4.00%, 4/1/48 | | | 1,243,712 | |

474,793 | | Pool #CA2381, 4.00%, 9/1/48 | | | 507,328 | |

985,449 | | Pool #CA2440, 4.00%, 9/1/48 | | | 1,050,554 | |

796,517 | | Pool #CA2441, 4.00%, 10/1/48 | | | 851,099 | |

450,105 | | Pool #CA2442, 4.00%, 10/1/48 | | | 483,377 | |

1,058,084 | | Pool #CA2443, 4.00%, 10/1/48 | | | 1,130,589 | |

1,095,833 | | Pool #CA2468, 4.00%, 10/1/48 | | | 1,170,925 | |

765,525 | | Pool #CA2594, 4.00%, 11/1/48 | | | 824,901 | |

738,203 | | Pool #CA2913, 4.00%, 1/1/49 | | | 786,973 | |

1,252,941 | | Pool #CA2914, 4.00%, 1/1/49 | | | 1,335,718 | |

1,705,671 | | Pool #CA3042, 4.00%, 1/1/49 | | | 1,822,552 | |

1,138,087 | | Pool #CA3043, 4.00%, 2/1/49 | | | 1,213,275 | |

1,675,863 | | Pool #CA3044, 4.50%, 2/1/49 | | | 1,809,571 | |

1,149,240 | | Pool #CA3045, 4.50%, 1/1/49 | | | 1,242,629 | |

97,962 | | Pool #CA3132, 4.00%, 2/1/49 | | | 104,980 | |

703,082 | | Pool #CA3557, 3.50%, 5/1/49 | | | 743,231 | |

2,179,312 | | Pool #CA3628, 3.50%, 6/1/49 | | | 2,303,760 | |

1,160,692 | | Pool #CA3793, 3.50%, 6/1/49 | | | 1,228,448 | |

272,199 | | Pool #CA3936, 3.50%, 7/1/49 | | | 288,089 | |

540,645 | | Pool #CA4043, 3.00%, 8/1/49 | | | 566,987 | |

1,247,268 | | Pool #CA4320, 3.00%, 9/1/49 | | | 1,308,038 | |

1,789,690 | | Pool #CA5106, 3.00%, 1/1/50 | | | 1,876,887 | |

452,222 | | Pool #CA5132, 3.00%, 2/1/50 | | | 474,255 | |

14

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$2,226,718 | | Pool #CA5309, 3.00%, 3/1/50 | | $ | 2,337,464 | |

1,160,215 | | Pool #CA5312, 3.00%, 3/1/50 | | | 1,221,797 | |

52,119 | | Pool #MC0013, 5.50%, 12/1/38 | | | 58,366 | |

85,015 | | Pool #MC0014, 5.50%, 12/1/38 | | | 95,205 | |

69,763 | | Pool #MC0016, 5.50%, 11/1/38 | | | 78,125 | |

67,159 | | Pool #MC0038, 4.50%, 3/1/39 | | | 73,994 | |

46,544 | | Pool #MC0059, 4.00%, 4/1/39 | | | 50,531 | |

82,388 | | Pool #MC0081, 4.00%, 5/1/39 | | | 89,446 | |

43,724 | | Pool #MC0112, 4.50%, 6/1/39 | | | 48,174 | |

87,700 | | Pool #MC0127, 4.50%, 7/1/39 | | | 96,626 | |

487,766 | | Pool #MC0154, 4.50%, 8/1/39 | | | 537,406 | |

87,823 | | Pool #MC0160, 4.50%, 8/1/39 | | | 96,761 | |

205,453 | | Pool #MC0171, 4.50%, 9/1/39 | | | 226,362 | |

298,295 | | Pool #MC0177, 4.50%, 9/1/39 | | | 328,653 | |

119,504 | | Pool #MC0270, 4.50%, 3/1/40 | | | 131,592 | |

349,197 | | Pool #MC0325, 4.50%, 7/1/40 | | | 384,520 | |

326,151 | | Pool #MC0584, 4.00%, 1/1/42 | | | 354,442 | |

156,482 | | Pool #MC0585, 4.00%, 1/1/42 | | | 170,055 | |

61,622 | | Pool #MC3344, 5.00%, 12/1/38 | | | 67,838 | |

| | | | | | |

| | | | | 278,254,553 | |

| | | | | | |

Freddie Mac — 18.79% | | | | |

1,414,763 | | Pool #Q63813, 3.50%, 4/1/49 | | | 1,501,854 | |

2,102,985 | | Pool #RA1234, 3.50%, 8/1/49 | | | 2,225,748 | |

1,714,939 | | Pool #RA1382, 3.00%, 9/1/49 | | | 1,798,495 | |

1,983,886 | | Pool #RA1383, 3.00%, 9/1/49 | | | 2,080,546 | |

2,147,630 | | Pool #RA1470, 3.00%, 10/1/49 | | | 2,252,267 | |

1,566,075 | | Pool #RA1713, 3.00%, 11/1/49 | | | 1,642,378 | |

1,746,213 | | Pool #RA1714, 3.00%, 11/1/49 | | | 1,831,292 | |

1,605,344 | | Pool #RA1715, 3.00%, 10/1/49 | | | 1,683,560 | |

1,568,998 | | Pool #RA1716, 3.00%, 11/1/49 | | | 1,645,443 | |

627,113 | | Pool #RA1724, 2.50%, 10/1/49 | | | 650,059 | |

629,048 | | Pool #RA1979, 3.00%, 12/1/49 | | | 660,692 | |

1,189,895 | | Pool #RA1987, 3.00%, 12/1/49 | | | 1,252,558 | |

2,840,655 | | Pool #RA1988, 3.00%, 1/1/50 | | | 2,979,058 | |

1,883,444 | | Pool #RA2158, 3.00%, 2/1/50 | | | 1,976,064 | |

1,030,726 | | Pool #RA2162, 3.00%, 2/1/50 | | | 1,081,989 | |

2,136,478 | | Pool #RA2255, 3.00%, 3/1/50 | | | 2,242,736 | |

2,362,729 | | Pool #RA2256, 3.00%, 3/1/50 | | | 2,480,240 | |

1,220,209 | | Pool #RA2340, 3.00%, 3/1/50 | | | 1,280,897 | |

521,651 | | Pool #RA2395, 2.50%, 4/1/50 | | | 540,819 | |

1,568,609 | | Pool #WA3103, 3.30%, 2/1/27 | | | 1,729,368 | |

996,988 | | Pool #WA5002, 2.62%, 11/1/31 | | | 1,062,507 | |

1,957,264 | | Pool #WN3000, 3.14%, 1/1/28 | | | 2,151,836 | |

1,000,000 | | Pool #WN3049, 2.39%, 9/1/31 | | | 1,037,998 | |

984,359 | | Pool #ZA4828, 4.00%, 3/1/47 | | | 1,051,388 | |

762,319 | | Pool #ZA4891, 3.50%, 3/1/47 | | | 807,984 | |

1,763,442 | | Pool #ZA4892, 4.00%, 5/1/47 | | | 1,885,610 | |

15

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 888,588 | | Pool #ZA4893, 3.50%, 4/1/47 | | $ | 943,306 | |

1,445,646 | | Pool #ZA4912, 3.50%, 5/1/47 | | | 1,532,243 | |

1,810,200 | | Pool #ZA4913, 4.00%, 5/1/47 | | | 1,935,607 | |

1,300,824 | | Pool #ZA5036, 3.50%, 9/1/47 | | | 1,378,747 | |

2,048,843 | | Pool #ZA5070, 3.50%, 11/1/47 | | | 2,171,573 | |

853,314 | | Pool #ZA5090, 3.50%, 11/1/47 | | | 904,430 | |

1,602,954 | | Pool #ZA5174, 3.50%, 12/1/47 | | | 1,698,975 | |

4,143,542 | | Pool #ZA5238, 3.50%, 2/1/48 | | | 4,391,750 | |

1,119,605 | | Pool #ZA5245, 3.50%, 1/1/48 | | | 1,186,672 | |

2,475,372 | | Pool #ZA5253, 3.50%, 1/1/48 | | | 2,623,652 | |

2,294,386 | | Pool #ZA5254, 4.00%, 1/1/48 | | | 2,450,620 | |

993,466 | | Pool #ZA5308, 4.00%, 1/1/48 | | | 1,062,292 | |

900,240 | | Pool #ZA5575, 4.00%, 7/1/48 | | | 961,810 | |

1,053,454 | | Pool #ZA5637, 4.50%, 8/1/48 | | | 1,137,361 | |

944,608 | | Pool #ZA5645, 4.00%, 8/1/48 | | | 1,012,170 | |

425,276 | | Pool #ZA6576, 3.50%, 4/1/49 | | | 449,898 | |

115,374 | | Pool #ZI0238, 5.00%, 6/1/33 | | | 128,947 | |

200,754 | | Pool #ZI0412, 5.00%, 8/1/33 | | | 224,372 | |

75,766 | | Pool #ZI0543, 4.50%, 8/1/33 | | | 83,900 | |

31,613 | | Pool #ZI0548, 5.00%, 8/1/33 | | | 35,332 | |

53,255 | | Pool #ZI0549, 5.00%, 8/1/33 | | | 59,520 | |

36,080 | | Pool #ZI0743, 4.50%, 9/1/33 | | | 39,954 | |

121,015 | | Pool #ZI0807, 5.00%, 9/1/33 | | | 135,251 | |

74,872 | | Pool #ZI0959, 6.00%, 10/1/33 | | | 82,027 | |

245,634 | | Pool #ZI1023, 5.50%, 11/1/33 | | | 277,287 | |

40,134 | | Pool #ZI1352, 5.50%, 12/1/33 | | | 45,306 | |

100,633 | | Pool #ZI1353, 5.50%, 1/1/34 | | | 113,601 | |

219,052 | | Pool #ZI1493, 5.50%, 1/1/34 | | | 247,279 | |

160,786 | | Pool #ZI1524, 5.50%, 2/1/34 | | | 181,506 | |

76,558 | | Pool #ZI1630, 5.50%, 3/1/34 | | | 86,179 | |

171,972 | | Pool #ZI1689, 5.50%, 4/1/34 | | | 193,583 | |

90,476 | | Pool #ZI1802, 5.50%, 4/1/34 | | | 101,845 | |

152,108 | | Pool #ZI1991, 5.00%, 5/1/34 | | | 168,953 | |

274,308 | | Pool #ZI2332, 5.00%, 6/1/34 | | | 304,686 | |

160,428 | | Pool #ZI2333, 5.00%, 6/1/34 | | | 178,195 | |

168,712 | | Pool #ZI2888, 6.00%, 12/1/34 | | | 189,705 | |

223,558 | | Pool #ZI2939, 5.50%, 12/1/34 | | | 251,651 | |

161,999 | | Pool #ZI3102, 5.00%, 1/1/35 | | | 179,939 | |

90,786 | | Pool #ZI3254, 5.50%, 4/1/35 | | | 102,154 | |

192,645 | | Pool #ZI3507, 5.00%, 9/1/35 | | | 213,827 | |

170,253 | | Pool #ZI3713, 5.00%, 5/1/35 | | | 188,973 | |

87,498 | | Pool #ZI4118, 5.50%, 1/1/36 | | | 98,454 | |

103,001 | | Pool #ZI4119, 5.00%, 1/1/36 | | | 114,326 | |

155,735 | | Pool #ZI4120, 5.50%, 1/1/36 | | | 175,236 | |

223,465 | | Pool #ZI4200, 5.50%, 2/1/36 | | | 251,447 | |

93,781 | | Pool #ZI4201, 6.00%, 2/1/36 | | | 102,665 | |

250,911 | | Pool #ZI4429, 5.00%, 6/1/35 | | | 278,499 | |

135,600 | | Pool #ZI4521, 5.50%, 7/1/35 | | | 152,580 | |

16

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 188,164 | | Pool #ZI4572, 5.50%, 8/1/35 | | $ | 211,726 | |

83,348 | | Pool #ZI4605, 5.50%, 9/1/35 | | | 93,784 | |

134,922 | | Pool #ZI4606, 5.50%, 9/1/35 | | | 151,817 | |

123,223 | | Pool #ZI4704, 5.00%, 11/1/35 | | | 136,772 | |

130,946 | | Pool #ZI4705, 5.00%, 11/1/35 | | | 145,344 | |

78,579 | | Pool #ZI4706, 5.50%, 11/1/35 | | | 88,419 | |

138,894 | | Pool #ZI4855, 6.00%, 5/1/36 | | | 151,464 | |

76,963 | | Pool #ZI4882, 6.00%, 5/1/36 | | | 85,391 | |

247,414 | | Pool #ZI4979, 6.00%, 6/1/36 | | | 275,477 | |

6,746 | | Pool #ZI4980, 6.50%, 6/1/36 | | | 6,763 | |

66,965 | | Pool #ZI5006, 6.00%, 6/1/36 | | | 70,484 | |

177,498 | | Pool #ZI5896, 5.50%, 4/1/37 | | | 198,742 | |

185,769 | | Pool #ZI5912, 5.50%, 4/1/37 | | | 208,003 | |

77,260 | | Pool #ZI6164, 5.50%, 5/1/37 | | | 86,507 | |

134,999 | | Pool #ZI6186, 6.00%, 6/1/37 | | | 148,728 | |

96,312 | | Pool #ZI6311, 5.50%, 6/1/37 | | | 107,840 | |

142,255 | | Pool #ZI6352, 5.50%, 7/1/37 | | | 159,281 | |

203,592 | | Pool #ZI6583, 5.50%, 8/1/37 | | | 227,959 | |

124,460 | | Pool #ZI6598, 6.00%, 8/1/37 | | | 136,571 | |

64,544 | | Pool #ZI6814, 6.00%, 10/1/37 | | | 71,762 | |

58,465 | | Pool #ZI6976, 5.50%, 7/1/37 | | | 65,463 | |

84,763 | | Pool #ZI7383, 5.00%, 4/1/38 | | | 93,325 | |

360,012 | | Pool #ZI9925, 5.00%, 4/1/40 | | | 396,024 | |

149,782 | | Pool #ZJ0038, 4.50%, 5/1/40 | | | 164,922 | |

410,432 | | Pool #ZJ0482, 4.50%, 9/1/40 | | | 451,922 | |

389,221 | | Pool #ZJ0844, 4.00%, 12/1/40 | | | 422,691 | |

255,070 | | Pool #ZJ1058, 4.00%, 12/1/40 | | | 277,005 | |

197,095 | | Pool #ZJ1264, 4.00%, 1/1/41 | | | 214,044 | |

424,877 | | Pool #ZJ1444, 4.00%, 3/1/41 | | | 461,688 | |

359,325 | | Pool #ZJ1445, 4.50%, 3/1/41 | | | 396,100 | |

27,504 | | Pool #ZJ4162, 7.50%, 2/1/30 | | | 28,774 | |

92,382 | | Pool #ZJ5032, 6.50%, 5/1/31 | | | 102,290 | |

45,162 | | Pool #ZJ5104, 6.50%, 6/1/31 | | | 48,723 | |

38,141 | | Pool #ZJ5458, 6.50%, 11/1/31 | | | 40,904 | |

39,744 | | Pool #ZJ5928, 6.50%, 3/1/32 | | | 42,383 | |

145,187 | | Pool #ZJ6638, 6.00%, 11/1/32 | | | 163,159 | |

72,667 | | Pool #ZJ6955, 5.50%, 3/1/33 | | | 82,031 | |

52,163 | | Pool #ZJ6956, 5.50%, 3/1/33 | | | 58,885 | |

2,994 | | Pool #ZJ9911, 5.00%, 1/1/21 | | | 2,995 | |

279,375 | | Pool #ZK4661, 2.50%, 11/1/27 | | | 289,977 | |

141,781 | | Pool #ZL1284, 4.50%, 4/1/41 | | | 156,292 | |

475,942 | | Pool #ZL2630, 3.50%, 12/1/41 | | | 510,379 | |

355,867 | | Pool #ZL2708, 3.50%, 1/1/42 | | | 381,616 | |

297,431 | | Pool #ZL2750, 4.00%, 2/1/42 | | | 323,201 | |

1,153,051 | | Pool #ZL5676, 3.00%, 4/1/43 | | | 1,220,751 | |

803,813 | | Pool #ZL6090, 3.00%, 6/1/43 | | | 851,008 | |

658,184 | | Pool #ZL6097, 3.00%, 6/1/43 | | | 696,828 | |

17

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 899,428 | | Pool #ZL9372, 3.00%, 4/1/45 | | $ | 947,952 | |

555,903 | | Pool #ZL9669, 3.50%, 6/1/45 | | | 591,826 | |

396,390 | | Pool #ZM1422, 3.50%, 7/1/46 | | | 421,468 | |

999,307 | | Pool #ZM1423, 3.50%, 7/1/46 | | | 1,062,526 | |

1,234,180 | | Pool #ZM1736, 3.00%, 9/1/46 | | | 1,298,324 | |

1,358,823 | | Pool #ZM1738, 3.00%, 9/1/46 | | | 1,429,445 | |

887,122 | | Pool #ZM8750, 4.00%, 9/1/48 | | | 945,696 | |

1,070,743 | | Pool #ZN1022, 4.00%, 11/1/48 | | | 1,141,433 | |

24,494 | | Pool #ZN5269, 6.50%, 10/1/31 | | | 25,339 | |

49,797 | | Pool #ZN5316, 5.00%, 5/1/34 | | | 55,312 | |

76,004 | | Pool #ZN5321, 5.50%, 5/1/34 | | | 85,555 | |

46,290 | | Pool #ZN5322, 5.50%, 5/1/34 | | | 52,107 | |

76,470 | | Pool #ZN5323, 5.50%, 6/1/34 | | | 86,079 | |

54,394 | | Pool #ZN5332, 5.00%, 11/1/34 | | | 60,417 | |

49,018 | | Pool #ZN5333, 5.50%, 11/1/34 | | | 55,177 | |

911,635 | | Series 2017-SB42, Class A10F, 2.96%, 10/25/27(c) | | | 964,887 | |

2,556,891 | | Series 2018-SB47, Class A10F, 3.35%, 1/25/28(c) | | | 2,735,336 | |

470,136 | | Series 2018-SB52, Class A10F, 3.48%, 6/25/28(c) | | | 501,896 | |

1,036,043 | | Series 2018-SB53, Class A10F, 3.66%, 6/25/28(c) | | | 1,124,294 | |

482,457 | | Series 2018-SB56, Class A10F, 3.70%, 10/25/28(c) | | | 525,559 | |

1,993,271 | | Series 2019-SB63, Class A10F, 2.78%, 3/25/29(c) | | | 2,093,033 | |

786,839 | | Series 2019-SB64, Class A10F, 2.71%, 5/25/29(c) | | | 812,816 | |

2,593,304 | | Series 2019-SB65, Class A5F, 1.99%, 5/25/24(c) | | | 2,647,026 | |

996,516 | | Series 2019-SB66, Class A5H, 2.32%, 6/25/39(c) | | | 1,024,871 | |

1,000,000 | | Series-K158, Class A2, 3.90%, 12/25/30(c) | | | 1,159,137 | |

| | | | | | |

| | | | | 104,915,396 | |

| | | | | | |

Ginnie Mae — 20.75% | | | | |

80,946 | | Pool #409117, 5.50%, 6/20/38 | | | 87,201 | |

644,928 | | Pool #442423, 4.00%, 9/20/41 | | | 706,892 | |

91,379 | | Pool #487643, 5.00%, 2/15/39 | | | 98,374 | |

205,900 | | Pool #616936, 5.50%, 1/15/36 | | | 246,155 | |

211,657 | | Pool #617904, 5.75%, 9/15/23 | | | 211,921 | |

1,196,706 | | Pool #618363, 4.00%, 9/20/41 | | | 1,311,683 | |

425,702 | | Pool #624106, 5.13%, 3/15/34 | | | 426,136 | |

302,886 | | Pool #654705, 4.00%, 9/20/41 | | | 331,987 | |

384,760 | | Pool #664269, 5.85%, 6/15/38 | | | 384,239 | |

23,621 | | Pool #675509, 5.50%, 6/15/38 | | | 24,902 | |

155,375 | | Pool #697672, 5.50%, 12/15/38 | | | 174,449 | |

261,033 | | Pool #697814, 5.00%, 2/15/39 | | | 284,048 | |

344,624 | | Pool #697885, 4.50%, 3/15/39 | | | 380,360 | |

105,790 | | Pool #698112, 4.50%, 5/15/39 | | | 116,759 | |

493,832 | | Pool #698113, 4.50%, 5/15/39 | | | 545,040 | |

50,455 | | Pool #699294, 5.63%, 9/20/38 | | | 54,830 | |

1,225,909 | | Pool #713519, 6.00%, 7/15/39 | | | 1,459,920 | |

110,195 | | Pool #714561, 4.50%, 6/15/39 | | | 121,621 | |

263,155 | | Pool #716822, 4.50%, 4/15/39 | | | 291,820 | |

224,850 | | Pool #716823, 4.50%, 4/15/39 | | | 249,343 | |

18

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 113,510 | | Pool #717132, 4.50%, 5/15/39 | | $ | 125,281 | |

434,634 | | Pool #720080, 4.50%, 6/15/39 | | | 481,978 | |

273,506 | | Pool #724629, 5.00%, 7/20/40 | | | 304,895 | |

587,601 | | Pool #726550, 5.00%, 9/15/39 | | | 667,436 | |

263,559 | | Pool #729018, 4.50%, 2/15/40 | | | 290,888 | |

356,868 | | Pool #729346, 4.50%, 7/15/41 | | | 397,780 | |

396,480 | | Pool #738844, 3.50%, 10/15/41 | | | 431,056 | |

157,237 | | Pool #738845, 3.50%, 10/15/41 | | | 170,949 | |

998,471 | | Pool #738862, 4.00%, 10/15/41 | | | 1,092,543 | |

305,145 | | Pool #747241, 5.00%, 9/20/40 | | | 340,166 | |

732,036 | | Pool #748654, 3.50%, 9/15/40 | | | 785,396 | |

145,924 | | Pool #748846, 4.50%, 9/20/40 | | | 160,476 | |

389,132 | | Pool #757016, 3.50%, 11/15/40 | | | 417,497 | |

191,730 | | Pool #757017, 4.00%, 12/15/40 | | | 209,374 | |

524,803 | | Pool #759297, 4.00%, 1/20/41 | | | 575,880 | |

232,803 | | Pool #759298, 4.00%, 2/20/41 | | | 255,460 | |

157,274 | | Pool #762877, 4.00%, 4/15/41 | | | 172,092 | |

174,295 | | Pool #763564, 4.50%, 5/15/41 | | | 196,160 | |

373,189 | | Pool #770481, 4.00%, 8/15/41 | | | 409,137 | |

43,540 | | Pool #770482, 4.50%, 8/15/41 | | | 49,013 | |

445,191 | | Pool #770517, 4.00%, 8/15/41 | | | 487,135 | |

355,834 | | Pool #770529, 4.00%, 8/15/41 | | | 389,359 | |

181,517 | | Pool #770537, 4.00%, 8/15/41 | | | 198,619 | |

354,761 | | Pool #770738, 4.50%, 6/20/41 | | | 390,408 | |

497,451 | | Pool #779592, 4.00%, 11/20/41 | | | 545,245 | |

119,768 | | Pool #779593, 4.00%, 11/20/41 | | | 131,276 | |

448,472 | | Pool #AA6312, 3.00%, 4/15/43 | | | 482,227 | |

483,907 | | Pool #AA6424, 3.00%, 5/15/43 | | | 520,329 | |

1,023,458 | | Pool #AB2733, 3.50%, 8/15/42 | | | 1,111,525 | |

1,753,058 | | Pool #AB2745, 3.00%, 8/15/42 | | | 1,894,001 | |

1,302,019 | | Pool #AB2841, 3.00%, 9/15/42 | | | 1,406,699 | |

494,816 | | Pool #AB2843, 3.00%, 9/15/42 | | | 534,598 | |

118,001 | | Pool #AB2852, 3.50%, 9/15/42 | | | 128,887 | |

482,441 | | Pool #AE6946, 3.00%, 6/15/43 | | | 518,753 | |

176,376 | | Pool #AE8253, 4.00%, 2/20/44 | | | 192,375 | |

493,144 | | Pool #AG8915, 4.00%, 2/20/44 | | | 538,333 | |

926,547 | | Pool #AK6446, 3.00%, 1/15/45 | | | 996,515 | |

658,433 | | Pool #AK7036, 3.00%, 4/15/45 | | | 705,454 | |

440,473 | | Pool #AO3594, 3.50%, 8/20/45 | | | 468,773 | |

525,616 | | Pool #AP3887, 3.50%, 9/20/45 | | | 567,250 | |

612,657 | | Pool #AR4919, 3.50%, 3/20/46 | | | 650,452 | |

888,335 | | Pool #AR4970, 3.50%, 4/20/46 | | | 943,135 | |

1,076,939 | | Pool #AR9008, 3.00%, 5/20/46 | | | 1,151,818 | |

729,211 | | Pool #AS2921, 3.50%, 4/20/46 | | | 774,196 | |

386,339 | | Pool #AS4332, 3.00%, 6/20/46 | | | 413,201 | |

811,094 | | Pool #AS5511, 3.50%, 3/20/46 | | | 861,130 | |

1,153,546 | | Pool #AX7237, 3.50%, 11/20/46 | | | 1,224,707 | |

19

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 700,741 | | Pool #BO2104, 3.00%, 8/20/49 | | $ | 741,921 | |

1,586,172 | | Pool #BR3787, 3.00%, 12/20/49 | | | 1,679,384 | |

700,000 | | Series2012-100, Class B, 2.31%, 11/16/51(c) | | | 718,950 | |

1,574,861 | | Series2012-107, Class A, 1.15%, 1/16/45 | | | 1,550,401 | |

1,600,000 | | Series2012-112, Class B, 2.56%, 1/16/53(c) | | | 1,663,807 | |

1,879,412 | | Series2012-115, Class A, 2.13%, 4/16/45 | | | 1,909,611 | |

2,043,936 | | Series2012-120, Class A, 1.90%, 2/16/53 | | | 2,059,014 | |

1,032,968 | | Series2012-131, Class A, 1.90%, 2/16/53 | | | 1,040,790 | |

456,572 | | Series2012-144, Class AD, 1.77%, 1/16/53 | | | 457,492 | |

6,000,000 | | Series2012-33, Class B, 2.89%, 3/16/46 | | | 6,122,265 | |

107,937 | | Series2012-35, Class C, 3.25%, 11/16/52(c) | | | 113,388 | |

8,000,000 | | Series2012-58, Class B, 2.20%, 3/16/44 | | | 8,145,825 | |

218,195 | | Series2012-70, Class A, 1.73%, 5/16/42 | | | 217,907 | |

154,262 | | Series2012-72, Class A, 1.72%, 5/16/42 | | | 153,966 | |

1,025,213 | | Series2012-78, Class A, 1.68%, 3/16/44 | | | 1,023,444 | |

581,238 | | Series2013-101, Class AG, 1.76%, 4/16/38 | | | 580,634 | |

585,464 | | Series2013-105, Class A, 1.71%, 2/16/37 | | | 584,728 | |

631,972 | | Series2013-107, Class A, 2.00%, 5/16/40 | | | 635,731 | |

365,015 | | Series2013-126, Class BK, 2.45%, 10/16/47(c) | | | 376,864 | |

11,813 | | Series2013-127, Class A, 2.00%, 3/16/52 | | | 11,799 | |

476,961 | | Series2013-17, Class A, 1.13%, 1/16/49 | | | 474,743 | |

574,028 | | Series2013-29, Class AB, 1.77%, 10/16/45 | | | 574,439 | |

578,274 | | Series2013-33, Class A, 1.06%, 7/16/38 | | | 575,925 | |

1,772,853 | | Series2013-63, Class AB, 1.38%, 3/16/45 | | | 1,755,371 | |

825,966 | | Series2013-97, Class AC, 2.00%, 6/16/45 | | | 833,277 | |

519,349 | | Series2014-148, Class A, 2.65%, 11/16/43 | | | 524,408 | |

1,726,160 | | Series2014-172, Class AF, 2.50%, 9/16/41 | | | 1,742,821 | |

60,854 | | Series2014-54, Class AB, 2.62%, 10/16/43 | | | 60,869 | |

212,066 | | Series2014-77, Class AC, 2.35%, 10/16/40 | | | 212,888 | |

479,753 | | Series2014-82, Class AB, 2.40%, 5/16/45 | | | 487,040 | |

88,969 | | Series2015-107, Class AB, 2.50%, 11/16/49 | | | 91,870 | |

2,038,343 | | Series2015-114, Class AD, 2.50%, 11/15/51 | | | 2,099,351 | |

871,316 | | Series2015-128, Class AD, 2.50%, 12/16/50 | | | 898,512 | |

582,162 | | Series2015-130, Class AH, 2.90%, 8/16/47(c) | | | 596,683 | |

2,102,027 | | Series2015-135, Class AC, 2.35%, 4/16/49 | | | 2,157,077 | |

923,546 | | Series2015-136, Class AC, 2.50%, 3/16/47 | | | 952,035 | |

533,589 | | Series2015-15, Class A, 2.00%, 11/16/48 | | | 538,762 | |

1,262,894 | | Series2015-154, Class AD, 2.50%, 5/16/54 | | | 1,306,475 | |

664,295 | | Series2015-171, Class DA, 2.37%, 3/16/46 | | | 681,872 | |

560,810 | | Series2015-2, Class A, 2.50%, 12/16/44 | | | 565,440 | |

967,857 | | Series2015-22, Class A, 2.40%, 8/16/47 | | | 991,650 | |

1,620,432 | | Series2015-70, Class AB, 2.30%, 11/16/48 | | | 1,659,584 | |

299,239 | | Series2015-75, Class A, 3.00%, 2/16/44 | | | 304,979 | |

277,680 | | Series2015-98, Class AB, 2.20%, 11/16/43 | | | 282,106 | |

493,850 | | Series2016-11, Class AD, 2.25%, 11/16/43 | | | 501,921 | |

693,420 | | Series2016-14, Class AB, 2.15%, 8/16/42 | | | 703,336 | |

1,633,922 | | Series2016-152, Class EA, 2.20%, 8/15/58 | | | 1,672,295 | |

2,283,745 | | Series2016-157, Class AC, 2.00%, 11/16/50 | | | 2,308,109 | |

20

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 807,674 | | Series2016-26, Class A, 2.25%, 12/16/55 | | $ | 822,209 | |

656,529 | | Series2016-28, Class AB, 2.40%, 11/16/55 | | | 670,668 | |

597,006 | | Series2016-36, Class AB, 2.30%, 6/16/56 | | | 610,177 | |

768,078 | | Series2016-39, Class AH, 2.50%, 9/16/44 | | | 789,570 | |

846,384 | | Series2016-50, Class A, 2.30%, 7/16/52 | | | 864,317 | |

2,124,023 | | Series2016-64, Class CA, 2.30%, 3/16/45 | | | 2,169,661 | |

1,313,937 | | Series2016-67, Class A, 2.30%, 7/16/56 | | | 1,340,767 | |

748,450 | | Series2016-94, Class AC, 2.20%, 8/16/57 | | | 765,800 | |

759,833 | | Series2016-96, Class BA, 1.95%, 3/16/43 | | | 765,643 | |

1,307,496 | | Series2017-127, Class AB, 2.50%, 2/16/59 | | | 1,354,989 | |

1,425,223 | | Series2017-135, Class AE, 2.60%, 10/16/58 | | | 1,483,320 | |

930,959 | | Series2017-140, Class A, 2.50%, 2/16/59 | | | 965,003 | |

459,010 | | Series2017-157, Class AH, 2.55%, 2/16/53 | | | 474,735 | |

1,734,723 | | Series2017-41, Class AC, 2.25%, 3/16/57 | | | 1,769,350 | |

1,117,179 | | Series2017-46, Class A, 2.50%, 11/16/57 | | | 1,158,076 | |

2,030,487 | | Series2017-71, Class AS, 2.70%, 4/16/57 | | | 2,110,966 | |

809,904 | | Series2017-9, Class AE, 2.40%, 9/16/50 | | | 833,008 | |

3,673,201 | | Series2017-94, Class AH, 2.60%, 2/16/59 | | | 3,820,113 | |

1,067,414 | | Series2018-2, Class AD, 2.40%, 3/16/59 | | | 1,097,560 | |

890,162 | | Series2018-26, Class AD, 2.50%, 3/16/52 | | | 917,120 | |

2,315,668 | | Series2018-3, Class AG, 2.50%, 10/16/58 | | | 2,396,034 | |

| | | | | | |

| | | | | 115,788,382 | |

| | | | | | |

| |

Total U.S. Government Agency Backed Mortgages | | | 498,958,331 | |

| | | | | | |

(Cost $477,767,240) | | | | |

| |

U.S. Government Agency Obligations — 4.26% | | | | |

Small Business Administration — 4.26% | | | | |

217,764 | | 0.88%, 1/1/32(a) | | | 227,120 | |

3,640,806 | | 1.26%, 7/18/30(a),(d),(e) | | | 52,409 | |

218,922 | | (Prime Index - 2.600%), 2.15%, 7/25/41(f) | | | 215,547 | |

583,943 | | (Prime Index - 2.600%), 2.15%, 9/25/41(f) | | | 574,928 | |

312,196 | | (Prime Index - 2.600%), 2.15%, 9/25/41(f) | | | 307,331 | |

537,294 | | (Prime Index - 2.600%), 2.15%, 7/25/42(f) | | | 528,759 | |

1,476,537 | | (Prime Index - 2.550%), 2.20%, 7/25/42(f) | | | 1,453,868 | |

361,251 | | (Prime Index - 2.525%), 2.23%, 11/25/41(f) | | | 356,407 | |

725,913 | | (Prime Index - 2.500%), 2.25%, 2/25/28(f) | | | 718,348 | |

906,366 | | (Prime Index - 1.400%), 3.35%, 7/25/41(f) | | | 921,687 | |

19,076 | | 3.36%, 7/1/21(a) | | | 19,386 | |

778,319 | | 3.36%, 7/8/24(a),(g) | | | 813,687 | |

329,371 | | 3.85%, 9/16/34(a) | | | 349,367 | |

2,235,701 | | (Prime Index - 0.675%), 4.08%, 9/25/43(f) | | | 2,325,581 | |

398,924 | | (Prime Index - 0.421%), 4.33%, 11/25/27(f) | | | 408,443 | |

286,007 | | (Prime Index - 0.207%), 4.54%, 2/25/40(f) | | | 297,378 | |

605,692 | | (Prime Index - 0.059%), 4.69%, 7/25/29(f) | | | 630,108 | |

114,653 | | (Prime Index + 0.050%), 4.80%, 12/25/40(f) | | | 120,566 | |

868,932 | | (Prime Index + 0.107%), 4.86%, 8/25/29(f) | | | 904,698 | |

21

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

$ 669,769 | | (Prime Index + 0.168%), 4.92%, 6/25/29(f) | | $ | 698,192 | |

680,133 | | (Prime Index + 0.190%), 4.94%, 11/25/28(f) | | | 705,998 | |

771,193 | | (Prime Index + 0.325%), 5.08%, 2/25/45(f) | | | 829,101 | |

158,152 | | (Prime Index + 0.355%), 5.11%, 2/25/26(f) | | | 163,353 | |

34,561 | | 5.13%, 2/28/24(a) | | | 36,049 | |

76,654 | | (Prime Index + 0.667%), 5.42%, 8/25/27(f) | | | 79,447 | |

109,649 | | (Prime Index + 0.700%), 5.45%, 2/25/28(f) | | | 114,502 | |

719,978 | | (Prime Index + 0.712%), 5.46%, 3/25/30(f) | | | 769,143 | |

468,975 | | (Prime Index + 0.785%), 5.54%, 9/25/28(f) | | | 495,687 | |

635,591 | | (Prime Index + 0.799%), 5.55%, 2/25/28(f) | | | 664,488 | |

1,041,096 | | (Prime Index + 0.801%), 5.55%, 6/25/29(f) | | | 1,105,530 | |

172,987 | | (Prime Index + 0.814%), 5.56%, 6/25/28(f) | | | 180,475 | |

850,751 | | (Prime Index + 0.820%), 5.57%, 5/25/29(f) | | | 896,114 | |

417,042 | | (Prime Index + 0.836%), 5.59%, 3/25/29(f) | | | 438,986 | |

249,240 | | (Prime Index + 0.846%), 5.60%, 2/25/30(f) | | | 266,467 | |

626,946 | | (Prime Index + 0.859%), 5.61%, 2/25/29(f) | | | 662,640 | |

214,885 | | (Prime Index + 0.905%), 5.66%, 1/25/29(f) | | | 225,772 | |

582,332 | | (Prime Index + 0.908%), 5.66%, 7/25/30(f) | | | 626,281 | |

336,598 | | (Prime Index + 0.925%), 5.68%, 5/25/29(f) | | | 359,241 | |

435,493 | | (Prime Index + 0.940%), 5.69%, 7/25/29(f) | | | 460,885 | |

113,760 | | (Prime Index + 0.936%), 5.69%, 7/25/29(f) | | | 122,124 | |

117,531 | | (Prime Index + 0.973%), 5.72%, 11/25/28(f) | | | 124,844 | |

240,815 | | (Prime Index + 1.054%), 5.80%, 9/25/29(f) | | | 260,058 | |

350,734 | | (Prime Index + 1.060%), 5.81%, 12/25/29(f) | | | 382,146 | |

871,726 | | (Prime Index + 1.144%), 5.89%, 9/25/28(f) | | | 917,442 | |

90,537 | | (Prime Index + 1.191%), 5.94%, 11/25/26(f) | | | 95,160 | |

475,527 | | (Prime Index + 1.202%), 5.95%, 5/25/29(f) | | | 505,810 | |

191,564 | | (Prime Index + 1.226%), 5.98%, 6/25/29(f) | | | 206,285 | |

53,955 | | (Prime Index + 1.602%), 6.35%, 7/25/28(f) | | | 57,363 | |

97,321 | | 9.08%, 9/25/29(a) | | | 118,195 | |

| | | | | | |

| | | | | 23,793,396 | |

| | | | | | |

| |

Total U.S. Government Agency Obligations | | | 23,793,396 | |

| | | | | | |

(Cost $24,731,845) | | | | |

22

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

Municipal Bonds — 3.63% | | | | |

California — 1.14% | | | | |

$ 500,000 | | California Health Facilities Financing Authority Revenue, 1.90%, 6/1/21 | | $ | 499,335 | |

2,000,000 | | California Health Facilities Financing Authority Revenue, 2.93%, 6/1/32, Callable 6/1/29 @ 100 | | | 1,969,260 | |

890,000 | | California Statewide Communities Development Authority Revenue, Series B, 5.25%, 10/20/42, (Credit Support: Ginnie Mae), Callable 5/1/20 @ 100 | | | 891,549 | |

1,000,000 | | City & County of San Francisco Affordable Housing GO, Series F, 2.39%, 6/15/26 | | | 1,031,430 | |

200,000 | | City & County of San Francisco Housing GO, Series H, 1.95%, 6/15/27 | | | 199,930 | |

1,675,000 | | City of Los Angeles Housing GO, Series A, 2.95%, 9/1/28, Callable 9/1/27 @ 100 | | | 1,755,433 | |

| | | | | | |

| | | | | 6,346,937 | |

| | | | | | |

Colorado — 0.08% | |

402,661 | | Colorado Housing & Finance Authority Revenue, Series V, 3.40%, 11/1/45, (Credit Support: FHA) | | | 454,673 | |

| | | | | | |

|

District of Columbia — 0.14% | |

734,492 | | District of Columbia Housing Finance Agency Refunding Revenue, 3.24%, 3/1/49, (Credit Support: FHA) | | | 799,369 | |

| | | | | | |

|

Georgia — 0.19% | |

1,000,000 | | Atlanta Development Authority Revenue, 2.87%, 12/1/26 | | | 1,060,110 | |

| | | | | | |

|

Illinois — 0.17% | |

260,000 | | City of Chicago Multi Family Revenue, Mercy Preservation Project, 4.55%, 8/1/26, (Credit Support: Freddie Mac), Callable 8/1/20 @ 100 | | | 262,434 | |

685,400 | | Illinois State Housing Development Authority Revenue, Series A, 2.63%, 3/1/48, (Credit Support: FHA) | | | 709,320 | |

| | | | | | |

| | | | | 971,754 | |

| | | | | | |

Massachusetts — 0.04% | |

205,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 3.09%, 6/1/20 | | | 205,795 | |

| | | | | | |

|

Minnesota — 0.09% | |

485,267 | | City of Minnetonka Housing Revenue, Series A, 3.00%, 11/1/34, (Credit Support: Fannie Mae) | | | 521,546 | |

| | | | | | |

23

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Access Capital Community Investment Fund (cont.)

March 31, 2020 (Unaudited)

| | | | | | |

Principal Amount | | | | Value | |

Missouri — 0.64% | |

$3,009,628 | | Missouri Housing Development Commission Revenue, Series 1, 3.75%, 3/1/42, (Credit Support: FHA), Callable 3/1/25 @ 100 | | $ | 3,569,359 | |

| | | | | | |

|

New York — 0.96% | |

400,000 | | New York City Housing Development Corp. Revenue, Series G, 1.93%, 11/1/21 | | | 396,664 | |

170,000 | | New York City Housing Development Corp. Revenue, Series G, 2.04%, 5/1/22 | | | 168,482 | |

100,000 | | New York City Housing Development Corp. Revenue, Series G, 2.14%, 11/1/22 | | | 98,993 | |

200,000 | | New York City Housing Development Corp. Revenue, Series G, 2.37%, 5/1/24 | | | 197,320 | |

40,000 | | New York City Housing Development Corp. Revenue, Series G, 2.47%, 11/1/24 | | | 39,521 | |

300,000 | | New York City Housing Development Corp. Revenue, Series G, 2.62%, 5/1/26, Callable 11/1/25 @ 100 | | | 296,112 | |

500,000 | | New York City Housing Development Corp. Revenue, Series B, 3.56%, 11/1/26, Callable 2/1/26 @ 100 | | | 518,180 | |

1,000,000 | | New York City Housing Development Corp. Revenue, Series B, 3.61%, 11/1/27, Callable 2/1/26 @ 100 | | | 1,036,040 | |

500,000 | | New York City Housing Development Corp. Revenue, State of New York Mortgage Agency, 3.33%, 2/1/28, (Credit Support: SONYMA), Callable 8/1/25 @ 100 | | | 545,560 | |

500,000 | | New York City Housing Development Corp. Revenue, Series B, 3.81%, 11/1/29, Callable 2/1/26 @ 100 | | | 520,435 | |

540,000 | | New York State Housing Finance Agency Revenue, Series A, 4.50%, 11/15/27, Callable 5/1/20 @ 100 | | | 541,118 | |

1,000,000 | | New York State Housing Finance Agency Revenue, Series A, 4.65%, 11/15/38, Callable 5/1/20 @ 100 | | | 1,006,210 | |

| | | | | | |

| | | | | 5,364,635 | |

| | | | | | |

Vermont — 0.02% | |