UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Tara Tilbury

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 376-7132

Date of fiscal year end: March 31

Date of reporting period: September 30, 2020

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | |

PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

RBC Global Asset Management (U.S.) Inc. (“RBC GAM-US”) serves as the investment advisor and RBC Global Asset Management (UK) Limited (“RBC GAM-UK”) serves as the investment sub-advisor to the Funds and is responsible for the overall management of the Funds’ portfolios. The individual primarily responsible for the day-to-day management of each Fund’s portfolio is set forth below. | | | | | | |

Philippe Langham Senior Portfolio Manager and Head of Emerging Market Equities Philippe Langham is Head of Emerging Market Equities at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Equity Fund and RBC Emerging Markets Small Cap Equity Fund. Philippe joined RBC GAM-UK in November 2009 from Societe Generale Asset Management, where he was Head of Global Emerging Markets. He was previously Director and Head of Emerging Markets and Asia at Credit Suisse in Zurich. Prior to that, he managed Global Emerging Markets, Asian, Latin American and U.S. portfolios for nine years at the Kuwait Investment Office. Philippe holds a BSc in economics from the University of Manchester in England and is a Chartered Accountant. | | | | | | |

Laurence Bensafi Senior Portfolio Manager and Deputy Head of Emerging Markets Equity Laurence Bensafi is Deputy Head of Emerging Markets Equity at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Value Equity Fund. Prior to joining RBC GAM-UK in 2013, Laurence was the Head of Aviva Investors’ Emerging Markets team, where she was responsible for managing Global Emerging Markets income funds and for developing quantitative stock selection and analysis models. Laurence began her investment career as a Quantitative Analyst at Societe Generale Asset Management, supporting European and Global Equity portfolio management by developing quantitative models to assist in the portfolio construction and security selection process. In 1997, Laurence obtained a Magistere d’Economiste Statisticien & D.E.S.S. Statistique et Econometrie from Toulouse University in France. Laurence is a CFA charterholder. | | | | | | |

Habib Subjally Senior Portfolio Manager and Head of Global Equities Habib Subjally is Head of Global Equities at RBC GAM-UK and is responsible for portfolio management of RBC Global Opportunities Fund and RBC International Opportunities Fund. Prior to joining RBC GAM-UK in 2014 Habib and his team spent eight years together at First State managing global equities. Previously he was Head of Small & Mid Cap Research at Credit Suisse and Head of the Global equities team at Invesco. Habib began his fund management career at Merrill Lynch Investment Managers, where he was Head of North American and Global equities research. He holds a BSc (Hons) from the London School of Economics and holds Chartered Accountant and ASIP designations. | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

1

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

Average Annual Total Returns as of September 30, 2020 (Unaudited) | |

|

RBC Emerging Markets Equity Fund | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 2.41% | | | | 1.27% | | | | 6.70% | | | | 4.70% | | | | | | | | | |

- At Net Asset Value | | | 8.62% | | | | 3.30% | | | | 7.96% | | | | 5.62% | | | | 1.13% | | | | 1.36% | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.92% | | | | 3.57% | | | | 8.18% | | | | 5.86% | | | | 0.88% | | | | 1.02% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.87% | | | | 3.56% | | | | 8.18% | | | | 5.98% | | | | 0.88% | | | | 0.91% | |

| | | | | | |

MSCI Emerging Markets

Net Total Return USD Index(d) | | | 10.54% | | | | 2.42% | | | | 8.97% | | | | 3.78% | | | | | | | | | |

RBC Emerging Markets Small Cap Equity Fund | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (11.74)% | | | | (6.33)% | | | | 0.88% | | | | (0.53)% | | | | | | | | | |

- At Net Asset Value | | | (6.35)% | | | | (4.45)% | | | | 2.07% | | | | 0.34% | | | | 1.70% | | | | 4.32% | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | (6.06)% | | | | (4.22)% | | | | 2.33% | | | | 0.59% | | | | 1.45% | | | | 4.06% | |

| | | | | | |

MSCI Emerging Markets

Small Cap Net Total Return USD Index(d) | | | 6.89% | | | | (1.09)% | | | | 4.60% | | | | 2.29% | | | | | | | | | |

RBC Emerging Markets Value Equity Fund | | | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 3.48% | | | | N/A | | | | N/A | | | | (4.65)% | | | | 0.95% | | | | 6.68% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 3.54% | | | | N/A | | | | N/A | | | | (4.57)% | | | | 0.88% | | | | 6.67% | |

| | | | | | |

MSCI Emerging Markets

Net Total Return USD Index(d) | | | 10.54% | | | | N/A | | | | N/A | | | | (0.47)% | | | | | | | | | |

RBC Global Opportunities Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 11.45% | | | | 9.58% | | | | 12.53% | | | | 10.11% | | | | | | | | | |

- At Net Asset Value | | | 18.26% | | | | 11.77% | | | | 13.86% | | | | 11.24% | | | | 1.11% | | | | 1.64% | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 18.57% | | | | 12.05% | | | | 14.06% | | | | 11.42% | | | | 0.86% | | | | 1.25% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 18.65% | | | | 12.09% | | | | 14.11% | | | | 11.46% | | | | 0.81% | | | | 5.44% | |

| | | | | | |

MSCI ACWI Net

Total Return USD Index(d) | | | 10.44% | | | | 7.12% | | | | 10.30% | | | | 7.13% | | | | | | | | | |

2

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

Average Annual Total Returns as of September 30, 2020 (Unaudited) | |

|

RBC International Opportunities Fund | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (0.15)% | | | | 1.90% | | | | 5.31% | | | | 3.21% | | | | | | | | | |

- At Net Asset Value | | | 5.93% | | | | 3.93% | | | | 6.57% | | | | 4.27% | | | | 1.14% | | | | 1.38% | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 7.19% | | | | 4.51% | | | | 6.99% | | | | 4.64% | | | | 0.89% | | | | 1.21% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 7.41% | | | | 4.58% | | | | 7.05% | | | | 4.71% | | | | 0.84% | | | | 28.05% | |

| | | | | | |

MSCI ACWI ex US Index(d) | | | 3.00% | | | | 1.16% | | | | 6.23% | | | | 3.17% | | | | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes below.

| (a) | The since inception date (commencement of operations) is December 20, 2013 for RBC Emerging Markets Equity Fund and RBC Emerging Markets Small Cap Equity Fund for Class A and Class I shares and November 22, 2016 for Class R6 shares, February 9, 2018 for RBC Emerging Markets Value Equity Fund for Class I and Class R6 shares and December 3, 2014 for RBC Global Opportunities Fund and RBC International Opportunities Fund for Class I shares, November 22,2016 for Class R6 shares and January 28, 2020 for Class A Shares. The performance in the table for Class R6 shares prior to November 22,2016 reflects the performance of the Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class R6 shares. The performance in the table for Class A shares of Global Opportunities Fund and International Opportunities Fund prior to January 28, 2020, reflects the performance of Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class A shares. |

| (b) | The Funds’ expenses reflect actual expenses for the most recent fiscal year ended March 31, 2020. |

| (c) | The Advisor has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels listed under net expense ratio until July 31, 2022 (September 30, 2022 for RBC Emerging Markets Equity Fund). |

| (d) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. |

3

|

PERFORMANCE SUMMARY (UNAUDITED) |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large and mid capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index.

The MSCI Emerging Markets Small Cap Index includes small capitalization representation across emerging markets countries. It covers approximately 14% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index.

The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large and mid capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity performance of developed and emerging markets. It captures large and mid capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index.

4

| | | | | | | | | | | | | | | | | | |

FUND STATISTICS (UNAUDITED) | | | | | | | | | | | |

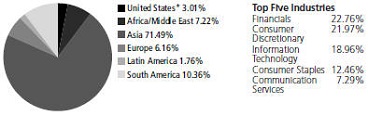

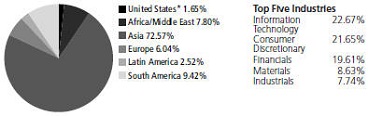

RBC Emerging Markets Equity Fund | | | | | | | | | | | |

Long-term growth of capital. | | | | | | | | | | | Investment Objective |

MSCI Emerging Markets Net Total Return USD Index | | | | | | | | | | | Benchmark |

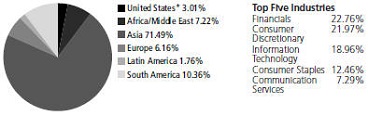

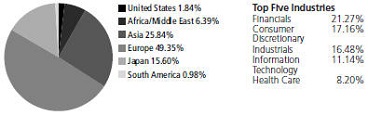

| | | | | | | | | Asset Allocation as of 9/30/20 (% of Fund’s investments) & Top Five Industries (as of 9/30/20) (% of

Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 3.01% of investments. | | | | | | | | | | | |

Taiwan Semiconductor | | 6.62% | | Unilever Plc | | | 3.72 | % | | | | | | | | | | Top Ten Holdings (excluding investment companies) (as of 9/30/20) (% of Fund’s net assets) |

Manufacturing Co. Ltd. | | | | Ping An Insurance Group Co. of | | | 3.55 | % | | | | | | | | |

Alibaba Group Holding Ltd. | | 6.42% | | China Ltd. | | | | | | | | | | | | |

Tencent Holdings Ltd. | | 5.01% | | Antofagasta Plc | | | 3.31 | % | | | | | | | | |

Naspers Ltd. | | 4.50% | | Dr Reddy’s Laboratories Ltd. | | | 3.13 | % | | | | | | | | |

Tata Consultancy Services Ltd. | | 4.27% | | AIA Group Ltd. | | | 2.96 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 10 | | | | | | | | | | | | |

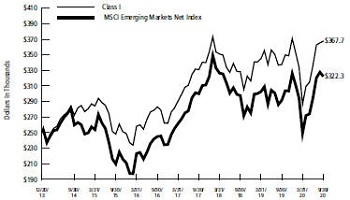

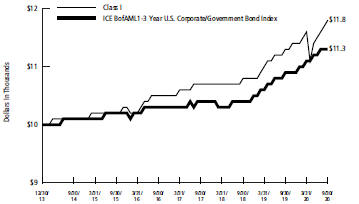

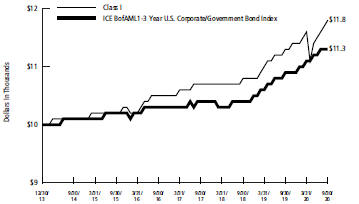

The graph reflects an initial investment of $250,000 over the period from December 20, 2013 (commencement of operations) to September 30, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | | | | | | | | | Growth of $250,000 Initial Investment Since Inception (12/20/13) |

5

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | FUND STATISTICS (UNAUDITED) | |

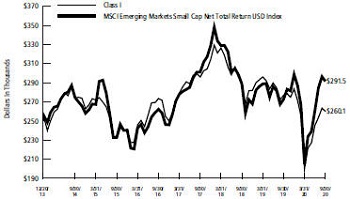

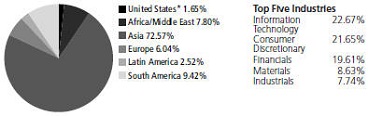

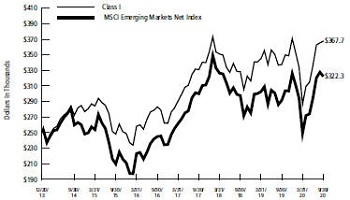

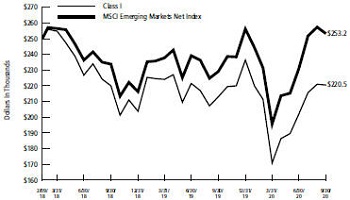

| | | | | | | | | | RBC Emerging Markets Small Cap Equity Fund | |

| Investment Objective | | | | | | | | | | Long-term growth of capital. | |

| Benchmark | | | | | | | | | | MSCI Emerging Markets Small Cap Net Total Return USD Index | |

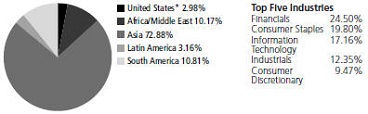

Asset Allocation as of 9/30/20 (% of Fund’s investments) & Top Five Industries (as of 9/30/20) (% of

Fund’s net assets) | | | | | | | |

| |

| | | |

| | | | | | | | | | *Includes U.S. dollar denominated cash equivalent investments representing 2.98% of investments. | |

Top Ten Holdings (excluding investment companies) (as of 9/30/20) (% of Fund’s net assets) | | | | | | | | | | Voltronic Power Technology Corp. | | 4.85% | | AVI Ltd. | | | 3.29 | % |

| | Century Pacific Food, Inc. | | 4.53% | | Leeno Industrial, Inc. | | | 3.25 | % |

| | Chroma ATE, Inc. | | 4.47% | | JSE Ltd. | | | 3.09 | % |

| | Fleury SA | | 3.57% | | Giant Manufacturing Co. Ltd. | | | 3.05 | % |

| | Marico Ltd. | | 3.55% | | Bajaj Holdings & Investment Ltd. | | | 3.03 | % |

| | | | | | | | | | |

| | *A listing of all portfolio holdings can be found beginning on page 13 | |

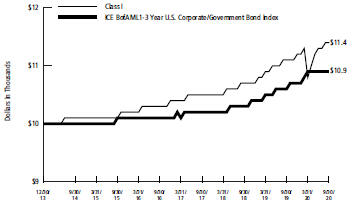

| Growth of $250,000 Initial Investment Since Inception (12/20/13) | | | | | | | | | |

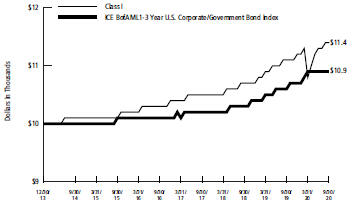

The graph reflects an initial investment of $250,000 over the period from December 20, 2013 (commencement of operations) to September 30, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

6

| | | | | | | | | | | | | | | | | | |

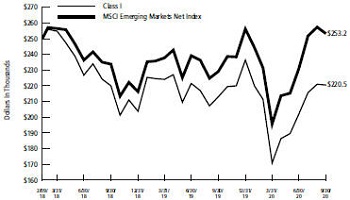

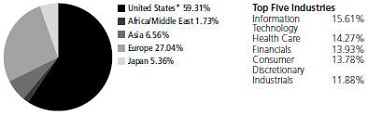

FUND STATISTICS (UNAUDITED) | | | | | | | | | | | |

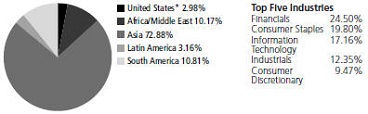

RBC Emerging Markets Value Equity Fund | | | | | | | | | | | |

Long-term growth of capital. | | | | | | | | | | | Investment Objective |

MSCI Emerging Markets Net Total Return USD Index | | | | | | | | | | | Benchmark |

| | | | | | | | | Asset Allocation as of 9/30/20 (% of Fund’s investments) & Top Five Industries (as of 9/30/20) (% of

Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 0.82% of investments. | | | | | | | | | | | |

Alibaba Group Holding Ltd. | | 6.84% | | Ping An Bank Co. Ltd. | | | 2.23 | % | | | | | | | | | | Top Ten Holdings (excluding investment companies) (as of 9/30/20) (% of Fund’s net assets) |

Taiwan Semiconductor

Manufacturing Co. Ltd. | | 5.44% | | Ping An Insurance Group Co. of

China Ltd. | | | 2.15 | % | | | | | | | | |

Samsung Electronics Co. Ltd. | | 5.34% | | Hyundai Motor Co. | | | 2.04 | % | | | | | | | | |

Naspers Ltd. | | 2.44% | | Flat Glass Group Co. Ltd. | | | 1.71 | % | | | | | | | | |

Antofagasta Plc | | 2.38% | | E-MART, Inc. | | | 1.69 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 17 | | | | | | | | | | | | |

The graph reflects an initial investment of $250,000 over the period from February 9, 2018 (commencement of operations) to September 30, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | | | | | | | | | Growth of $250,000 Initial Investment Since Inception (2/9/18) |

7

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | FUND STATISTICS (UNAUDITED) | |

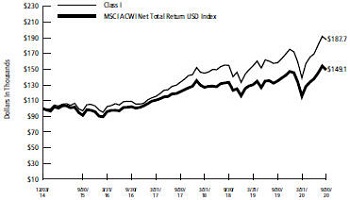

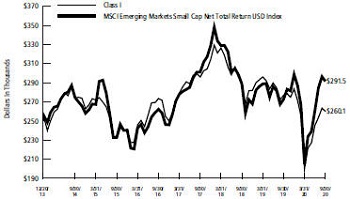

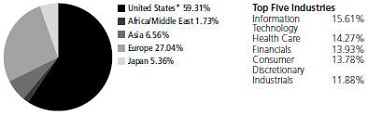

| | | | | | | | | | RBC Global Opportunities Fund | |

| Investment Objective | | | | | | | | | | Long-term growth of capital. | |

| Benchmark | | | | | | | | | | MSCI ACWI Net Total Return USD Index | |

Asset Allocation as of 9/30/20 (% of Fund’s investments) & Top Five Industries (as of 9/30/20) (% of

Fund’s net assets) | | | | | | | |

| |

| | | |

| | | | | | | | | | *Includes U.S. dollar denominated cash equivalent investments representing 0.86% of investments. | |

Top Ten Holdings (excluding investment companies) (as of 9/30/20) (% of Fund’s net assets) | | | | | | | | | | Microsoft Corp. | | 5.11% | | Alphabet, Inc. | | | 3.78 | % |

| | Amazon.com, Inc. | | 4.32% | | Nidec Corp. | | | 3.68 | % |

| | Roche Holding AG | | 4.26% | | American Water Works Co., Inc. | | | 3.64 | % |

| | Danaher Corp. | | 4.25% | | UnitedHealth Group, Inc. | | | 3.64 | % |

| | Deutsche Post AG | | 3.85% | | Orsted A/S | | | 3.53 | % |

| | *A listing of all portfolio holdings can be found beginning on page 22 | |

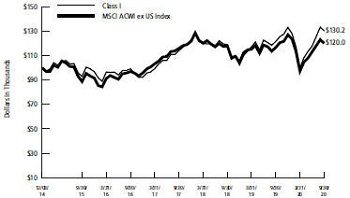

Growth of $100,000 Initial Investment Since Inception (12/3/14) | | | | | | | | | |

The graph reflects an initial investment of $100,000 over the period from December 3, 2014 (commencement of operations) to September 30, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

8

| | | | | | | | | | | | | | | | | | |

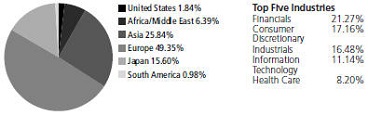

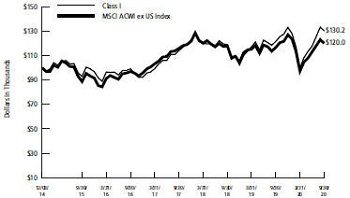

FUND STATISTICS (UNAUDITED) | | | | | | | | | | | |

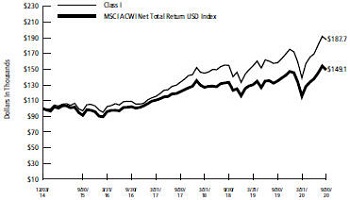

RBC International Opportunities Fund | | | | | | | | | | | |

Long-term growth of capital. | | | | | | | | | | | Investment Objective |

MSCI ACWI ex USA Net Total Return USD Index | | | | | | | | | | | Benchmark |

| | | | | | | | | Asset Allocation as of 9/30/20 (% of Fund’s investments) & Top Five Industries (as of 9/30/20) (% of

Fund’s net assets) |

| | | |

| | | | | | | | | | | |

Taiwan Semiconductor | | 7.27% | | Deutsche Post AG

| | | 4.81 | % | | | | | | | | | | Top Ten Holdings (excluding investment companies) (as of 9/30/20) (% of Fund’s net assets) |

Manufacturing Co. Ltd. | | | | Orsted A/S | | | 4.43 | % | | | | | | | | |

Nidec Corp. | | 5.43% | | Neste Oyj | | | 3.97 | % | | | | | | | | |

Naspers Ltd. | | 5.39% | | Partners Group Holding AG | | | 3.57 | % | | | | | | | | |

Roche Holding AG | | 5.16% | | Croda International Plc | | | 3.54 | % | | | | | | | | |

AIA Group Ltd. | | 4.88% | | | | | | | | | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 25 | | | | | | | | | | | | | | |

The graph reflects an initial investment of $100,000 over the period from December 3, 2014 (commencement of operations) to September 30, 2020 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | | | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/3/14) |

9

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 98.61% | | | | |

Argentina — 0.62% | | | | |

9,900 | | MercadoLibre, Inc.* | | $ | 10,716,552 | |

| | | | | | |

| |

Bangladesh — 0.04% | | | | |

1,343,153 | | BRAC Bank Ltd. | | | 642,527 | |

| | | | | | |

| | |

Brazil — 4.26% | | | | | | |

2,342,000 | | B3 SA - Brasil Bolsa Balcao | | | 22,986,705 | |

6,945,960 | | Banco Bradesco SA | | | 22,362,036 | |

6,804,930 | | Raia Drogasil SA | | | 28,548,256 | |

| | | | | | |

| | | | | 73,896,997 | |

| | | | | | |

Chile — 4.14% | | | | | | |

4,353,644 | | Antofagasta Plc | | | 57,456,326 | |

4,926,036 | | SACI Falabella | | | 14,431,777 | |

| | | | | | |

| | | | | 71,888,103 | |

| | | | | | |

China — 23.85% | | | | | | |

378,700 | | Alibaba Group Holding Ltd., ADR* | | | 111,330,226 | |

7,251,354 | | China Resources Land Ltd. | | | 33,072,154 | |

6,434,400 | | Fuyao Glass Industry Group Co. Ltd., Series H(a) | | | 23,715,405 | |

2,191,022 | | Midea Group Co. Ltd., Class A | | | 23,483,000 | |

5,927,912 | | Ping An Insurance Group Co. of China Ltd., Series H | | | 61,536,754 | |

1,639,077 | | Sunny Optical Technology Group Co. Ltd. | | | 25,458,677 | |

1,287,985 | | Tencent Holdings Ltd. | | | 86,994,873 | |

907,600 | | Yum China Holdings, Inc. | | | 48,057,420 | |

| | | | | | |

| | | | | 413,648,509 | |

| | | | | | |

Hong Kong — 4.08% | | | | |

5,158,190 | | AIA Group Ltd. | | | 51,272,912 | |

413,142 | | Hong Kong Exchanges & Clearing Ltd. | | | 19,448,036 | |

| | | | | | |

| | | | | 70,720,948 | |

| | | | | | |

India — 15.60% | | | | | | |

775,340 | | Dr Reddy’s Laboratories Ltd. | | | 54,299,169 | |

91,380 | | Dr. Reddy’s Laboratories Ltd., ADR | | | 6,356,393 | |

2,011,671 | | HDFC Bank Ltd.* | | | 29,530,954 | |

483,688 | | Hero MotoCorp Ltd. | | | 20,645,466 | |

2,109,950 | | Housing Development Finance Corp. Ltd. | | | 50,011,507 | |

4,321,176 | | Mahindra & Mahindra Ltd. | | | 35,726,210 | |

2,190,879 | | Tata Consultancy Services Ltd. | | | 74,122,765 | |

| | | | | | |

| | | | | 270,692,464 | |

| | | | | | |

Indonesia — 2.59% | | | | |

10,109,868 | | Bank Central Asia Tbk PT | | | 18,454,609 | |

253,938,200 | | Kalbe Farma Tbk PT | | | 26,532,685 | |

| | | | | | |

| | | | | 44,987,294 | |

| | | | | | |

10

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Korea — 9.16% | | | | | | |

90,183 | | Amorepacific Corp. | | $ | 12,572,466 | |

1,416,367 | | Hanon Systems | | | 14,956,346 | |

57,365 | | NCSoft Corp. | | | 39,532,140 | |

137,552 | | Samsung Fire & Marine Insurance Co. Ltd. | | | 21,428,440 | |

1,138,897 | | Shinhan Financial Group Co. Ltd. | | | 26,719,182 | |

609,898 | | SK Hynix, Inc. | | | 43,719,169 | |

| | | | | | |

| | | | | 158,927,743 | |

| | | | | | |

Mexico — 1.78% | | | | | | |

550,900 | | Fomento Economico Mexicano SAB de CV, ADR | | | 30,955,071 | |

| | | | | | |

| | |

Peru — 1.51% | | | | | | |

211,260 | | Credicorp Ltd. | | | 26,194,127 | |

| | | | | | |

| |

Philippines — 2.37% | | | | |

2,251,975 | | SM Investments Corp. | | | 41,069,852 | |

| | | | | | |

| |

South Africa — 7.34% | | | | |

2,181,676 | | Clicks Group Ltd. | | | 28,882,300 | |

2,690,955 | | Discovery Ltd. | | | 20,431,712 | |

442,185 | | Naspers Ltd., N Shares | | | 78,100,442 | |

| | | | | | |

| | | | | 127,414,454 | |

| | | | | | |

Taiwan — 14.49% | | | | |

16,742,644 | | E.Sun Financial Holding Co. Ltd. | | | 14,910,775 | |

197,000 | | Largan Precision Co. Ltd. | | | 23,070,579 | |

2,257,028 | | MediaTek, Inc. | | | 47,824,102 | |

6,811,530 | | Standard Foods Corp. | | | 14,369,289 | |

7,635,854 | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 114,874,386 | |

16,803,468 | | Uni-President Enterprises Corp. | | | 36,392,288 | |

| | | | | | |

| | | | | 251,441,419 | |

| | | | | | |

Thailand — 0.51% | | | | |

3,607,400 | | Kasikornbank Public Co. Ltd., NVDR | | | 8,806,239 | |

| | | | | | |

| | |

Turkey — 1.26% | | | | | | |

23,862,592 | | Enka Insaat ve Sanayi AS | | | 21,779,586 | |

| | | | | | |

| |

United Kingdom — 5.01% | | | | |

1,054,118 | | Mondi Plc | | | 22,343,954 | |

1,047,058 | | Unilever Plc | | | 64,554,812 | |

| | | | | | |

| | | | | 86,898,766 | |

| | | | | | |

Total Common Stocks | | | 1,710,680,651 | |

| | | | | | |

(Cost $1,601,117,544) | | | | |

11

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Investment Company — 3.06% | | | | |

53,107,826 | | U.S. Government Money Market Fund, RBC Institutional Class 1 (b) | | $ | 53,107,826 | |

| | | | | | |

Total Investment Company | | | 53,107,826 | |

| | | | | | |

(Cost $53,107,826) | | | | |

| |

Total Investments | | $ | 1,763,788,477 | |

(Cost $1,654,225,370)(c) — 101.67% | | | | |

| |

Liabilities in excess of other assets — (1.67)% | | | (29,050,478) | |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 1,734,737,999 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (b) | Affiliated investment. |

| (c) | See Notes to Schedules of Portfolio Investments for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

NVDR - Non-Voting Depository Receipt

Portfolio Diversification (Unaudited)

| | |

| Industries | | Percentage

of Net Assets |

| | | | |

Financials | | | 22.75 | % |

Consumer Discretionary | | | 21.97 | % |

Information Technology | | | 18.97 | % |

Consumer Staples | | | 12.47 | % |

Communication Services | | | 7.29 | % |

Health Care | | | 5.03 | % |

Materials | | | 4.60 | % |

Industrials | | | 3.62 | % |

Real Estate | | | 1.91 | % |

Other | | | 1.39 | % |

| | | | |

| | | 100.00 | % |

| | | | |

See Notes to the Financial Statements.

12

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 96.07% | | | | |

Bangladesh — 3.58% | | | | |

269,098 | | BRAC Bank Ltd. | | $ | 128,729 | |

156,130 | | Delta Brac Housing Finance Corp Ltd. | | | 169,655 | |

| | | | | | |

| | | | | 298,384 | |

| | | | | | |

Brazil — 4.25% | | | | | | |

1,397 | | Arco Platform Ltd., Class A* | | | 57,054 | |

62,700 | | Fleury SA | | | 297,763 | |

| | | | | | |

| | | | | 354,817 | |

| | | | | | |

Chile — 5.23% | | | | | | |

170,111 | | Inversiones Aguas Metropolitanas SA | | | 123,293 | |

34,231 | | Inversiones La Construccion SA | | | 203,612 | |

78,118 | | Parque Arauco SA | | | 109,356 | |

| | | | | | |

| | | | | 436,261 | |

| | | | | | |

China — 8.30% | | | | | | |

264,000 | | Greatview Aseptic Packaging Co. Ltd. | | | 101,544 | |

20,899 | | Hongfa Technology Co. Ltd., Class A | | | 141,041 | |

94,972 | | InnoCare Pharma Ltd.*,(a) | | | 124,405 | |

124,743 | | Precision Tsugami China Corp. Ltd. | | | 105,877 | |

1,252 | | Silergy Corp. | | | 74,227 | |

105,000 | | SITC International Holdings Co. Ltd. | | | 145,474 | |

| | | | | | |

| | | | | 692,568 | |

| | | | | | |

Egypt — 0.98% | | | | | | |

22,721 | | Integrated Diagnostics Holdings Plc(a) | | | 81,732 | |

| | | | | | |

| |

Hong Kong — 2.80% | | | | |

60,000 | | Vitasoy International Holdings Ltd. | | | 233,969 | |

| | | | | | |

| | |

India — 16.91% | | | | | | |

7,660 | | Bajaj Holdings & Investment Ltd. | | | 252,685 | |

22,918 | | Cholamandalam Financial Holdings Ltd. | | | 122,967 | |

47,041 | | Cyient Ltd. | | | 245,523 | |

60,111 | | Marico Ltd. | | | 296,087 | |

9,679 | | Sundaram Finance Ltd. | | | 170,882 | |

24,524 | | Tata Consumer Products Ltd. | | | 166,382 | |

19,027 | | Tube Investments of India Ltd. | | | 156,029 | |

| | | | | | |

| | | | | 1,410,555 | |

| | | | | | |

Indonesia — 2.11% | | | | |

2,000,979 | | Sarimelati Kencana PT | | | 77,316 | |

1,227,100 | | Selamat Sempurna Tbk PT | | | 98,641 | |

| | | | | | |

| | | | | 175,957 | |

| | | | | | |

Korea — 8.56% | | | | | | |

17,709 | | DGB Financial Group, Inc. | | | 82,972 | |

13

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

2,759 | | Koh Young Technology, Inc. | | $ | 211,108 | |

2,573 | | Leeno Industrial, Inc. | | | 270,987 | |

15,805 | | Macquarie Korea Infrastructure Fund | | | 148,538 | |

| | | | | | |

| | | | | 713,605 | |

| | | | | | |

Malaysia — 1.48% | | | | |

136,600 | | Bermaz Auto Berhad | | | 45,548 | |

25,160 | | LPI Capital Berhad | | | 78,261 | |

| | | | | | |

| | | | | 123,809 | |

| | | | | | |

Mexico — 3.16% | | | | |

56,200 | | Bolsa Mexicana de Valores SAB de CV | | | 126,778 | |

90,800 | | Corp. Inmobiliaria Vesta SAB de CV | | | 136,417 | |

| | | | | | |

| | | | | 263,195 | |

| | | | | | |

Pakistan — 1.13% | | | | |

31,000 | | Packages Ltd. | | | 94,160 | |

| | | | | | |

| |

Peru — 1.32% | | | | |

3,231 | | InRetail Peru Corp.(a) | | | 109,822 | |

| | | | | | |

| |

Philippines — 6.74% | | | | |

1,066,850 | | Century Pacific Food, Inc. | | | 378,133 | |

558,794 | | Integrated Micro-Electronics, Inc.* | | | 65,731 | |

61,820 | | Security Bank Corp. | | | 118,252 | |

| | | | | | |

| | | | | 562,116 | |

| | | | | | |

South Africa — 6.38% | | | | |

62,034 | | AVI Ltd. | | | 274,694 | |

36,846 | | JSE Ltd. | | | 257,625 | |

| | | | | | |

| | | | | 532,319 | |

| | | | | | |

Sri Lanka — 1.28% | | | | |

155,189 | | Hatton National Bank Plc | | | 106,670 | |

| | | | | | |

Taiwan — 18.16% | | | | |

70,000 | | Chroma ATE, Inc. | | | 373,129 | |

26,835 | | Giant Manufacturing Co. Ltd. | | | 254,271 | |

16,274 | | Innodisk Corp. | | | 89,765 | |

28,373 | | Pacific Hospital Supply Co. Ltd. | | | 69,056 | |

5,337 | | Poya International Co. Ltd. | | | 102,080 | |

57,247 | | Standard Foods Corp. | | | 120,766 | |

11,916 | | Voltronic Power Technology Corp. | | | 404,771 | |

38,027 | | Wistron NeWeb Corp. | | | 101,022 | |

| | | | | | |

| | | | | 1,514,860 | |

| | | | | | |

Thailand — 0.90% | | | | |

21,100 | | Aeon Thana Sinsap Thailand Public Co. Ltd., NVDR | | | 74,662 | |

| | | | | | |

14

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

| |

United Arab Emirates — 2.80% | | | | |

200,246 | | Aramex PJSC | | $ | 233,182 | |

| | | | | | |

| |

Total Common Stocks | | | 8,012,643 | |

| | | | | | |

(Cost $8,565,172) | | | | |

| |

Preferred Stocks — 0.86% | | | | |

Korea — 0.86% | | | | |

1,451 | | Amorepacific Corp. | | | 71,441 | |

| | | | | | |

| |

Philippines — 0.00% | | | | |

58,000 | | Security Bank Corp.*,(b),(c) | | | 120 | |

| | | | | | |

| |

Total Preferred Stocks | | | 71,561 | |

| | | | | | |

(Cost $124,030) | | | | |

| |

Investment Company — 2.97% | | | | |

247,923 | | U.S. Government Money Market Fund, RBC Institutional Class 1 (d) | | | 247,923 | |

| | | | | | |

| |

Total Investment Company | | | 247,923 | |

| | | | | | |

(Cost $247,923) | | | | |

| |

Total Investments | | $ | 8,332,127 | |

(Cost $8,937,125)(e) — 99.90% | | | | |

| |

Other assets in excess of liabilities — 0.10% | | | 8,582 | |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 8,340,709 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (b) | The Pricing Committee has fair valued this security under procedures established by the Fund’s Board of Trustees. |

| (c) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (d) | Affiliated investment. |

| (e) | See Notes to Schedules of Portfolio Investments for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

NVDR - Non-Voting Depository Receipt

15

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | |

| Portfolio Diversification (Unaudited) | |

Industries | | Percentage

of Net Assets | |

Financials | | | 24.49% | |

Consumer Staples | | | 19.80% | |

Information Technology | | | 17.16% | |

Industrials | | | 12.35% | |

Consumer Discretionary | | | 9.48% | |

Health Care | | | 6.87% | |

Real Estate | | | 2.95% | |

Materials | | | 2.35% | |

Utilities | | | 1.48% | |

Other | | | 3.07% | |

| | | 100.00% | |

See Notes to the Financial Statements.

16

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Value Equity Fund |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 97.03% | | | | |

Brazil — 2.44% | | | | | | |

61,600 | | Banco do Brasil SA | | $ | 325,775 | |

87,000 | | CCR SA | | | 197,364 | |

44,000 | | Hypera SA | | | 232,775 | |

| | | | | | |

| | | | | 755,914 | |

| | | | | | |

Chile — 3.72% | | | | | | |

55,928 | | Antofagasta Plc | | | 738,099 | |

25,173 | | Inversiones La Construccion SA | | | 149,733 | |

89,608 | | SACI Falabella | | | 262,524 | |

| | | | | | |

| | | | | 1,150,356 | |

| | | | | | |

China — 29.97% | | | | | | |

7,200 | | Alibaba Group Holding Ltd., ADR* | | | 2,116,656 | |

3,800 | | Baidu, Inc., ADR* | | | 481,042 | |

142,000 | | China Resources Cement Holdings Ltd. | | | 195,215 | |

458,000 | | China Unicom Hong Kong Ltd. | | | 300,628 | |

412,000 | | Chinasoft International Ltd. | | | 300,822 | |

200,000 | | CSPC Pharmaceutical Group Ltd. | | | 390,409 | |

197,583 | | Flat Glass Group Co. Ltd., Class H | | | 529,932 | |

49,800 | | Gree Electric Appliances, Inc. of Zhuhai, Class A | | | 392,106 | |

642,000 | | Industrial & Commercial Bank of China Ltd., Class H | | | 334,415 | |

193,500 | | KWG Group Holdings Ltd. | | | 333,256 | |

701,000 | | Lee & Man Paper Manufacturing Ltd. | | | 510,060 | |

900 | | NetEase, Inc., ADR | | | 409,203 | |

534,000 | | Nexteer Automotive Group Ltd. | | | 374,111 | |

321,399 | | Ping An Bank Co. Ltd., Class A | | | 719,122 | |

64,000 | | Ping An Insurance Group Co. of China Ltd., Series H | | | 664,374 | |

82,970 | | Sany Heavy Industry Co. Ltd., Class A | | | 304,789 | |

68,000 | | Shimao Property Holdings Ltd. | | | 283,692 | |

289,000 | | SITC International Holdings Co. Ltd. | | | 400,399 | |

246,400 | | Zoomlion Heavy Industry Science and Technology Co. Ltd., Class H | | | 238,067 | |

| | | | | | |

| | | | | 9,278,298 | |

| | | | | | |

Egypt — 0.94% | | | | | | |

68,280 | | Commercial International Bank Egypt SAE, GDR | | | 292,673 | |

| | | | | | |

| | |

Greece — 0.64% | | | | | | |

327,783 | | Alpha Bank AE* | | | 198,198 | |

| | | | | | |

| |

Hong Kong — 2.25% | | | | |

1,665,000 | | Pacific Basin Shipping Ltd. | | | 256,495 | |

218,000 | | Xinyi Glass Holdings Ltd. | | | 440,889 | |

| | | | | | |

| | | | | 697,384 | |

| | | | | | |

17

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Value Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Hungary — 1.40% | | | | |

29,786 | | MOL Hungarian Oil & Gas Plc* | | $ | 162,129 | |

8,975 | | OTP Bank Plc* | | | 270,136 | |

| | | | | | |

| | | | | 432,265 | |

| | | | | | |

India — 8.01% | | | | | | |

189,977 | | Apollo Tyres Ltd. | | | 337,481 | |

72,346 | | Axis Bank Ltd.* | | | 418,693 | |

83,739 | | Indiabulls Housing Finance Ltd. | | | 180,097 | |

27,464 | | Infosys Ltd. | | | 377,634 | |

49,463 | | Mahindra & Mahindra Ltd. | | | 408,945 | |

126,927 | | Redington India Ltd. | | | 203,947 | |

10,091 | | Reliance Industries Ltd. | | | 306,039 | |

29,193 | | Shriram Transport Finance Co. Ltd. | | | 246,410 | |

| | | | | | |

| | | | | 2,479,246 | |

| | | | | | |

Indonesia — 0.64% | | | | |

656,700 | | Bank Negara Indonesia Persero Tbk PT | | | 196,992 | |

| | | | | | |

| | |

Korea — 16.90% | | | | | | |

1,711 | | Com2uSCorp | | | 167,493 | |

7,885 | | DB Insurance Co. Ltd. | | | 304,729 | |

4,340 | | E-MART, Inc. | | | 524,364 | |

9,341 | | Fila Holdings Corp. | | | 291,907 | |

17,440 | | Hana Financial Group, Inc. | | | 418,962 | |

4,139 | | Hyundai Motor Co. | | | 630,453 | |

6,334 | | LG Corp. | | | 402,170 | |

33,266 | | Samsung Electronics Co. Ltd. | | | 1,651,463 | |

7,103 | | SK Hynix, Inc. | | | 509,163 | |

4,692 | | SKC Co. Ltd. | | | 331,796 | |

| | | | | | |

| | | | | 5,232,500 | |

| | | | | | |

Mexico — 2.53% | | | | | | |

91,500 | | Cemex SAB de CV, ADR | | | 347,700 | |

560,050 | | Gentera SAB de CV* | | | 158,049 | |

199,700 | | PLA Administradora Industrial S de RL de CV, REIT | | | 277,538 | |

| | | | | | |

| | | | | 783,287 | |

| | | | | | |

Pakistan — 0.97% | | | | |

381,821 | | Habib Bank Ltd. | | | 300,957 | |

| | | | | | |

| | |

Peru — 0.66% | | | | | | |

96,093 | | Alicorp SAA | | | 204,527 | |

| | | | | | |

| |

Philippines — 1.40% | | | | |

340,300 | | Ayala Land, Inc. | | | 209,439 | |

116,800 | | Security Bank Corp. | | | 223,420 | |

| | | | | | |

| | | | | 432,859 | |

| | | | | | |

18

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Value Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Russia — 3.44% | | | | |

3,540 | | LUKOIL PJSC, ADR | | $ | 204,545 | |

11,812 | | MMC Norilsk Nickel PJSC, ADR | | | 284,943 | |

1,006,500 | | Sistema PJSFC | | | 272,865 | |

83,800 | | VEON Ltd., ADR | | | 105,588 | |

5,349 | | X5 Retail Group NV, GDR | | | 197,677 | |

| | | | | | |

| | | | | 1,065,618 | |

| | | | | | |

South Africa — 5.91% | | | | |

339,451 | | Growthpoint Properties Ltd. | | | 248,127 | |

123,513 | | Imperial Logistics Ltd. | | | 278,790 | |

939,937 | | KAP Industrial Holdings Ltd.* | | | 136,535 | |

22,565 | | Mr Price Group Ltd. | | | 176,942 | |

69,221 | | MTN Group Ltd. | | | 232,246 | |

4,283 | | Naspers Ltd., N Shares | | | 756,480 | |

| | | | | | |

| | | | | 1,829,120 | |

| | | | | | |

Taiwan — 11.52% | | | | |

61,498 | | Chailease Holding Co. Ltd. | | | 281,708 | |

38,000 | | FLEXium Interconnect, Inc. | | | 160,710 | |

50,979 | | Innodisk Corp. | | | 281,194 | |

13,000 | | Lotes Co. Ltd. | | | 208,503 | |

11,000 | | MediaTek, Inc. | | | 233,079 | |

31,000 | | Merida Industry Co. Ltd. | | | 251,251 | |

121,000 | | Primax Electronics Ltd. | | | 180,104 | |

55,000 | | Sercomm Corp. | | | 138,169 | |

112,000 | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 1,684,937 | |

38,000 | | Tripod Technology Corp. | | | 145,654 | |

| | | | | | |

| | | | | 3,565,309 | |

| | | | | | |

Thailand — 0.42% | | | | |

463,000 | | Krung Thai Bank Public Co. Ltd., FOR | | | 129,625 | |

| | | | | | |

| |

Turkey — 0.59% | | | | |

50,115 | | KOC Holding AS | | | 94,881 | |

44,243 | | TAV Havalimanlari Holding AS | | | 87,740 | |

| | | | | | |

| | | | | 182,621 | |

| | | | | | |

United Arab Emirates — 0.99% | | | | |

554,418 | | Aldar Properties PJSC | | | 305,984 | |

| | | | | | |

| |

United States — 0.84% | | | | |

255,900 | | Samsonite International SA*,(a) | | | 259,844 | |

| | | | | | |

19

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Value Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Vietnam — 0.85% | | | | |

229,205 | | Hoa Phat Group JSC | | $ | 262,939 | |

| | | | | | |

| |

Total Common Stocks | | | 30,036,516 | |

| | | | | | |

(Cost $29,908,250) | | | | |

| |

Preferred Stocks — 2.65% | | | | |

Brazil — 1.80% | | | | | | |

38,300 | | Centrais Eletricas Brasileiras SA, Class B | | | 213,532 | |

97,900 | | Petroleo Brasileiro SA | | | 343,423 | |

| | | | | | |

| | | | | 556,955 | |

| | | | | | |

Colombia — 0.85% | | | | |

36,637 | | Banco Davivienda SA | | | 262,308 | |

| | | | | | |

| |

Total Preferred Stocks | | | 819,263 | |

| | | | | | |

(Cost $1,020,749) | | | | | | |

| |

Rights/Warrants — 0.00% | | | | |

Taiwan — 0.00% | | | | | | |

651 | | Chailease Holding Co. Ltd., Rights* | | | 697 | |

| | | | | | |

| |

Total Rights/Warrants | | | 697 | |

| | | | | | |

(Cost $0) | | | | | | |

Investment Company — 0.83% | | | | |

254,941 | | U.S. Government Money Market Fund, RBC Institutional Class 1 (b) | | | 254,941 | |

| | | | | | |

Total Investment Company | | | 254,941 | |

| | | | | | |

(Cost $254,941) | | | | | | |

| |

Total Investments | | $ | 31,111,417 | |

(Cost $31,183,940)(c) — 100.51% | | | | |

| |

Liabilities in excess of other assets — (0.51)% | | | (156,609) | |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 30,954,808 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (b) | Affiliated investment. |

| (c) | See Notes to Schedules of Portfolio Investments for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

20

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Value Equity Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

Abbreviations used are defined below:

ADR - American Depositary Receipt

FOR - Foreign Ownership Receipt

GDR - Global Depositary Receipt

REIT - Real Estate Investment Trust

Portfolio Diversification (Unaudited)

| | |

Industries | | Percentage

of Net Assets |

| | | | |

Information Technology | | | 22.66 | % |

Consumer Discretionary | | | 21.64 | % |

Financials | | | 19.63 | % |

Materials | | | 8.63 | % |

Industrials | | | 7.75 | % |

Real Estate | | | 5.36 | % |

Communication Services | | | 5.04 | % |

Energy | | | 3.28 | % |

Consumer Staples | | | 2.99 | % |

Health Care | | | 2.01 | % |

Utilities | | | 0.69 | % |

Other | | | 0.32 | % |

| | | | |

| | | 100.00 | % |

| | | | |

See Notes to the Financial Statements.

21

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 98.63% | | | | |

Belgium — 2.72% | | | | |

56,267 | | Anheuser-Busch InBev NV | | $ | 3,029,458 | |

| | | | | | |

| |

Denmark — 3.53% | | | | |

28,594 | | Orsted A/S(a) | | | 3,939,681 | |

| | | | | | |

| | |

Finland — 2.74% | | | | | | |

57,955 | | Neste Oyj | | | 3,051,912 | |

| | | | | | |

| |

Germany — 3.85% | | | | |

94,694 | | Deutsche Post AG | | | 4,296,819 | |

| | | | | | |

| |

Hong Kong — 3.17% | | | | |

355,694 | | AIA Group Ltd. | | | 3,535,633 | |

| | | | | | |

| | |

Japan — 5.33% | | | | | | |

65,398 | | MISUMI Group, Inc. | | | 1,833,559 | |

43,794 | | Nidec Corp. | | | 4,106,911 | |

| | | | | | |

| | | | | 5,940,470 | |

| | | | | | |

Netherlands — 1.69% | | | | |

1,024 | | Adyen NV*,(a) | | | 1,888,763 | |

| | | | | | |

| |

South Africa — 1.73% | | | | |

10,888 | | Naspers Ltd., N Shares | | | 1,923,081 | |

| | | | | | |

| | |

Spain — 2.27% | | | | | | |

91,528 | | Industria de Diseno Textil SA | | | 2,532,081 | |

| | | | | | |

| |

Switzerland — 4.26% | | | | |

13,869 | | Roche Holding AG | | | 4,750,695 | |

| | | | | | |

| | |

Taiwan — 3.36% | | | | | | |

46,200 | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 3,745,434 | |

| | | | | | |

| |

United Kingdom — 5.83% | | | | |

34,352 | | Croda International Plc | | | 2,771,043 | |

49,207 | | InterContinental Hotels Group Plc* | | | 2,582,910 | |

94,852 | | St. James’s Place Plc | | | 1,141,112 | |

| | | | | | |

| | | | | 6,495,065 | |

| | | | | | |

United States — 58.15% | | | | |

2,878 | | Alphabet, Inc., Class A* | | | 4,217,997 | |

1,530 | | Amazon.com, Inc.* | | | 4,817,557 | |

22

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | | | |

| Shares | | | | | Value | |

| | 28,000 | | | American Water Works Co., Inc. | | $ | 4,056,640 | |

| | 44,400 | | | Blackstone Group, Inc. (The), Class A | | | 2,317,680 | |

| | 20,400 | | | Bluebird Bio, Inc.* | | | 1,100,580 | |

| | 18,600 | | | CyberArk Software Ltd.* | | | 1,923,612 | |

| | 22,000 | | | Danaher Corp. | | | 4,737,260 | |

| | 16,700 | | | Ecolab, Inc. | | | 3,337,328 | |

| | 45,900 | | | EOG Resources, Inc. | | | 1,649,646 | |

| | 14,612 | | | Estee Lauder Cos, Inc. (The), Class A | | | 3,189,069 | |

| | 29,900 | | | First Republic Bank | | | 3,260,894 | |

| | 39,450 | | | Fortive Corp. | | | 3,006,484 | |

| | 14,100 | | | Incyte Corp.* | | | 1,265,334 | |

| | 5,500 | | | MarketAxess Holdings, Inc. | | | 2,648,745 | |

| | 27,100 | | | Microsoft Corp. | | | 5,699,943 | |

| | 4,800 | | | NVIDIA Corp. | | | 2,597,856 | |

| | 10,900 | | | SVB Financial Group* | | | 2,622,758 | |

| | 62,900 | | | TJX Cos, Inc. (The) | | | 3,500,385 | |

| | 28,600 | | | T-Mobile US, Inc.* | | | 3,270,696 | |

| | 13,000 | | | UnitedHealth Group, Inc. | | | 4,053,010 | |

| | 7,200 | | | Workday, Inc., Class A* | | | 1,548,936 | |

| | | | | | | | |

| | | | | | | 64,822,410 | |

| | | | | | | | |

| | Total Common Stocks | | | 109,951,502 | |

| | | | | | | | |

| | (Cost $94,809,909) | | | | |

| |

| | Investment Company — 0.85% | | | | |

| | 950,503 | | | U.S. Government Money Market Fund, RBC Institutional Class 1 (b) | | | 950,503 | |

| | | | | | | | |

| | Total Investment Company | | | 950,503 | |

| | | | | | | | |

| | (Cost $950,503) | | | | |

| |

| | Total Investments | | $ | 110,902,005 | |

| | (Cost $95,760,412)(c) — 99.48% | | | | |

| |

| | Other assets in excess of liabilities — 0.52% | | | 574,901 | |

| | | | | | | | |

| |

| | NET ASSETS — 100.00% | | $ | 111,476,906 | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (b) | Affiliated investment. |

| (c) | See Notes to Schedules of Portfolio Investments for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

23

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

Portfolio Diversification (Unaudited)

| | |

Industries | | Percentage

of Net Assets |

| | | | |

Information Technology | | | 15.61 | % |

Health Care | | | 14.27 | % |

Financials | | | 13.93 | % |

Consumer Discretionary | | | 13.77 | % |

Industrials | | | 11.88 | % |

Utilities | | | 7.17 | % |

Communication Services | | | 6.72 | % |

Consumer Staples | | | 5.58 | % |

Materials | | | 5.48 | % |

Energy | | | 4.22 | % |

Other | | | 1.37 | % |

| | | | |

| | | 100.00 | % |

| | | | |

See Notes to the Financial Statements.

24

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 98.71% | | | | |

Argentina — 0.97% | | | | |

1,200 | | MercadoLibre, Inc.* | | $ | 1,298,976 | |

| | | | | | |

| |

Australia — 3.81% | | | | |

985,699 | | Oil Search Ltd. | | | 1,885,380 | |

27,284 | | Rio Tinto Plc | | | 1,641,754 | |

247,165 | | Treasury Wine Estates Ltd. | | | 1,588,100 | |

| | | | | | |

| | | | | 5,115,234 | |

| | | | | | |

Austria — 1.16% | | | | | | |

74,061 | | Erste Group Bank AG* | | | 1,550,876 | |

| | | | | | |

| |

Belgium — 2.45% | | | | |

61,139 | | Anheuser-Busch InBev NV | | | 3,291,770 | |

| | | | | | |

| |

Denmark — 4.43% | | | | |

43,098 | | Orsted A/S(a) | | | 5,938,042 | |

| | | | | | |

| | |

Finland — 3.97% | | | | | | |

101,043 | | Neste Oyj | | | 5,320,928 | |

| | | | | | |

| |

Germany — 4.81% | | | | |

142,381 | | Deutsche Post AG | | | 6,460,656 | |

| | | | | | |

| |

Hong Kong — 4.88% | | | | |

659,000 | | AIA Group Ltd. | | | 6,550,524 | |

| | | | | | |

| | |

India — 3.44% | | | | | | |

92,266 | | HDFC Bank Ltd., ADR* | | | 4,609,609 | |

| | | | | | |

| | |

Ireland — 1.57% | | | | | | |

16,500 | | Kerry Group Plc | | | 2,113,425 | |

| | | | | | |

| | |

Japan — 15.40% | | | | | | |

273,800 | | Astellas Pharma, Inc. | | | 4,081,426 | |

124,700 | | MISUMI Group, Inc. | | | 3,496,205 | |

77,702 | | Nidec Corp. | | | 7,286,734 | |

23,500 | | Oriental Land Co. Ltd | | | 3,295,763 | |

63,200 | | Recruit Holdings Co. Ltd. | | | 2,510,011 | |

| | | | | | |

| | | | | 20,670,139 | |

| | | | | | |

25

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Netherlands — 3.83% | | | | |

1,499 | | Adyen NV*,(a) | | $ | 2,764,898 | |

27,814 | | Wolters Kluwer NV | | | 2,372,616 | |

| | | | | | |

| | | | | 5,137,514 | |

| | | | | | |

Singapore — 1.79% | | | | |

163,300 | | DBS Group Holdings Ltd. | | | 2,400,731 | |

| | | | | | |

| |

South Africa — 5.39% | | | | |

40,959 | | Naspers Ltd., N Shares | | | 7,234,339 | |

| | | | | | |

| | |

Spain — 3.49% | | | | | | |

169,505 | | Industria de Diseno Textil SA | | | 4,689,279 | |

| | | | | | |

| |

Switzerland — 10.31% | | | | |

954 | | Barry Callebaut AG | | | 2,124,905 | |

5,215 | | Partners Group Holding AG | | | 4,796,778 | |

20,200 | | Roche Holding AG | | | 6,919,319 | |

| | | | | | |

| | | | | 13,841,002 | |

| | | | | | |

Taiwan — 9.32% | | | | | | |

3,084,208 | | E.Sun Financial Holding Co. Ltd. | | | 2,746,755 | |

120,318 | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 9,754,180 | |

| | | | | | |

| | | | | 12,500,935 | |

| | | | | | |

Thailand — 2.26% | | | | |

515,900 | | Kasikornbank Pcl, NVDR | | | 1,260,049 | |

2,792,900 | | Minor International PCL* | | | 1,766,259 | |

| | | | | | |

| | | | | 3,026,308 | |

| | | | | | |

United Kingdom — 12.70% | | | | |

58,910 | | Croda International Plc | | | 4,752,042 | |

90,300 | | InterContinental Hotels Group Plc* | | | 4,739,910 | |

379,111 | | Legal & General Group Plc | | | 924,832 | |

12,423 | | Linde Plc | | | 2,937,197 | |

307,066 | | St. James’s Place Plc | | | 3,694,143 | |

| | | | | | |

| | | | | 17,048,124 | |

| | | | | | |

United States — 1.81% | | | | |

23,500 | | CyberArk Software Ltd.* | | | 2,430,370 | |

| | | | | | |

| | |

Zambia — 0.92% | | | | | | |

137,771 | | First Quantum Minerals Ltd. | | | 1,228,149 | |

| | | | | | |

| |

Total Common Stocks | | | 132,456,930 | |

| | | | | | |

(Cost $117,720,421) | | | | |

26

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | |

| Shares | | | | Value | |

Rights/Warrants — 0.03% | | | | |

Thailand — 0.03% | | | | | | |

160,923 | | Minor International Public Co. Ltd., Warrants, Expire 7/31/23* | | $ | 37,834 | |

| | | | | | |

| |

Total Rights/Warrants | | | 37,834 | |

| | | | | | |

(Cost $0) | | | | | | |

| | |

Total Investments | | | | $ | 132,494,764 | |

(Cost $117,720,421)(b) — 98.74% | | | | |

| |

Other assets in excess of liabilities — 1.26% | | | 1,694,814 | |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 134,189,578 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| (b) | See Notes to Schedules of Portfolio Investments for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

NVDR - Non-Voting Depository Receipt

Portfolio Diversification (Unaudited)

| | |

Industries | | Percentage

of Net Assets |

| | | | |

Financials | | | 21.26 | % |

Consumer Discretionary | | | 17.16 | % |

Industrials | | | 16.49 | % |

Information Technology | | | 11.14 | % |

Health Care | | | 8.20 | % |

Materials | | | 7.87 | % |

Consumer Staples | | | 6.79 | % |

Energy | | | 5.37 | % |

Utilities | | | 4.43 | % |

Other* | | | 1.29 | % |

| | | | |

| | | 100.00 | % |

| | | | |

| * | Includes cash, interest and dividend receivable, pending trades and Fund share transactions, warrants, and accrued expenses payable. | |

See Notes to the Financial Statements.

27

|

FINANCIAL STATEMENTS |

Statements of Assets and Liabilities |

|

| September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | | RBC Emerging Markets

Equity Fund | | | RBC Emerging

Markets Small Cap

Equity Fund | | | RBC Emerging

Markets Value

Equity Fund | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Investments in securities, at value: | | | | | | | | | | | | | | | | | | | | |

Unaffiliated investments (cost $1,601,117,544, $8,689,202 and $30,928,999, respectively) | | | | | | $ | 1,710,680,651 | | | | | | | $ | 8,084,204 | | | $ | 30,856,476 | |

Affiliated investments (cost $53,107,826, $247,923 and $254,941, respectively) | | | | | | | 53,107,826 | | | | | | | | 247,923 | | | | 254,941 | |

Foreign currency, at value (cost $9,497,715, $225 and $8,840, respectively) | | | | | | | 9,501,866 | | | | | | | | 205 | | | | 8,840 | |

Interest and dividend receivable | | | | | | | 2,071,599 | | | | | | | | 22,513 | | | | 49,925 | |

Receivable from advisor | | | | | | | — | | | | | | | | 13,372 | | | | — | |

Receivable for capital shares issued | | | | | | | 2,758,842 | | | | | | | | — | | | | — | |

Receivable for investments sold | | | | | | | 203,064 | | | | | | | | 84,739 | | | | — | |

Prepaid expenses and other assets | | | | | | | 55,489 | | | | | | | | 21,766 | | | | 26,325 | |

| | | | | | | | | | | | | | | | | | | | |

Total Assets | | | | | | | 1,778,379,337 | | | | | | | | 8,474,722 | | | | 31,196,507 | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Foreign withholding tax payable | | | | | | | 31,793 | | | | | | | | 25,512 | | | | 7,824 | |

Payable for capital shares redeemed | | | | | | | 703,257 | | | | | | | | — | | | | — | |

Payable for investments purchased | | | | | | | 41,503,865 | | | | | | | | 53,193 | | | | 195,545 | |

Accrued expenses and other payables: | | | | | | | | | | | | | | | | | | | | |

Investment advisory fees | | | | | | | 979,839 | | | | | | | | — | | | | 824 | |

Accounting fees | | | | | | | 20,140 | | | | | | | | 7,019 | | | | 7,082 | |

Audit fees | | | | | | | 11,909 | | | | | | | | 11,908 | | | | 11,909 | |

Trustees’ fees | | | | | | | 20,186 | | | | | | | | 141 | | | | 95 | |

Distribution fees | | | | | | | 6,497 | | | | | | | | 8,114 | | | | — | |

Custodian fees | | | | | | | 81,233 | | | | | | | | 13,087 | | | | 1,860 | |

Shareholder reports | | | | | | | 15,217 | | | | | | | | 3,837 | | | | 5,188 | |

Transfer agent fees | | | | | | | 226,342 | | | | | | | | 3,747 | | | | 1,434 | |

Other | | | | | | | 41,060 | | | | | | | | 7,455 | | | | 9,938 | |

| | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | | | | | | 43,641,338 | | | | | | | | 134,013 | | | | 241,699 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets | | | | | | $ | 1,734,737,999 | | | | | | | $ | 8,340,709 | | | $ | 30,954,808 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets Consists of: | | | | | | | | | | | | | | | | | | | | |

Capital | | | | | | $ | 1,642,445,324 | | | | | | | $ | 9,708,758 | | | $ | 31,876,615 | |

Accumulated earnings | | | | | | | 92,292,675 | | | | | | | | (1,368,049 | ) | | | (921,807 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Assets | | | | | | $ | 1,734,737,999 | | | | | | | $ | 8,340,709 | | | $ | 30,954,808 | |

| | | | | | | | | | | | | | | | | | | | |

28

|

FINANCIAL STATEMENTS |

Statements of Assets and Liabilities (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | RBC Emerging Markets

Equity Fund | | | RBC Emerging

Markets Small Cap

Equity Fund | | | RBC Emerging

Markets Value

Equity Fund | |

Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 18,835,013 | | | | | | | $ | 2,428,221 | | | | | | | $ | N/A | |

Class I | | | | | | | 1,504,590,472 | | | | | | | | 5,912,488 | | | | | | | | 28,745,820 | |

Class R6 | | | | | | | 211,312,514 | | | | | | | | N/A | | | | | | | | 2,208,988 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 1,734,737,999 | | | | | | | $ | 8,340,709 | | | | | | | $ | 30,954,808 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding (Unlimited number of shares authorized, no par value): | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | 1,546,757 | | | | | | | | 282,875 | | | | | | | | N/A | |

Class I | | | | | | | 121,245,746 | | | | | | | | 682,996 | | | | | | | | 3,470,087 | |

Class R6 | | | | | | | 16,947,859 | | | | | | | | N/A | | | | | | | | 266,905 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 139,740,362 | | | | | | | | 965,871 | | | | | | | | 3,736,992 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Values and Redemption Prices Per Share: | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 12.18 | | | | | | | $ | 8.58 | | | | | | | $ | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | | $ | 12.41 | | | | | | | $ | 8.66 | | | | | | | $ | 8.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class R6 | | | | | | $ | 12.47 | | | | | | | $ | N/A | | | | | | | $ | 8.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Maximum Offering Price Per Share: | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 12.92 | | | | | | | $ | 9.10 | | | | | | | $ | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Maximum Sales Charge - Class A | | | | | | | 5.75 | % | | | | | | | 5.75 | % | | | | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

29

|

FINANCIAL STATEMENTS |

Statements of Assets and Liabilities (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | RBC Global

Opportunities Fund | | | RBC International

Opportunities Fund | |

Assets: | | | | | | | | | | | | | | | | |

Investments in securities, at value: | | | | | | | | | | | | | | | | |

Unaffiliated investments (cost $94,809,909 and $117,720,421, respectively) | | | | | | $ | 109,951,502 | | | | | | | $ | 132,494,764 | |

Affiliated investments (cost $950,503 and $0, respectively) | | | | | | | 950,503 | | | | | | | | — | |

Interest and dividend receivable | | | | | | | 105,561 | | | | | | | | 376,661 | |

Receivable for capital shares issued | | | | | | | 486,235 | | | | | | | | 4,075 | |

Receivable for investments sold | | | | | | | — | | | | | | | | 3,385,035 | |

Prepaid expenses and other assets | | | | | | | 50,542 | | | | | | | | 45,784 | |

| | | | | | | | | | | | | | | | |

Total Assets | | | | | | | 111,544,343 | | | | | | | | 136,306,319 | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign currency overdraft, at value (cost $51 and $174) | | | | | | | 62 | | | | | | | | 176 | |

Cash overdraft | | | | | | | — | | | | | | | | 1,978,255 | |

Foreign withholding tax payable | | | | | | | 720 | | | | | | | | 1,131 | |

Payable for capital shares redeemed | | | | | | | — | | | | | | | | 25,297 | |

Payable for investments purchased | | | | | | | — | | | | | | | | 13,722 | |

Accrued expenses and other payables: | | | | | | | | | | | | | | | | |

Investment advisory fees | | | | | | | 39,579 | | | | | | | | 58,754 | |

Accounting fees | | | | | | | 7,842 | | | | | | | | 7,988 | |

Audit fees | | | | | | | 7,920 | | | | | | | | 7,920 | |

Trustees’ fees | | | | | | | 730 | | | | | | | | 1,210 | |

Distribution fees | | | | | | | 16 | | | | | | | | 19 | |

Custodian fees | | | | | | | 981 | | | | | | | | 1,471 | |

Shareholder reports | | | | | | | 5,493 | | | | | | | | 4,202 | |

Transfer agent fees | | | | | | | 1,070 | | | | | | | | 10,984 | |

Other | | | | | | | 3,024 | | | | | | | | 5,612 | |

| | | | | | | | | | | | | | | | |

Total Liabilities | | | | | | | 67,437 | | | | | | | | 2,116,741 | |

| | | | | | | | | | | | | | | | |

Net Assets | | | | | | $ | 111,476,906 | | | | | | | $ | 134,189,578 | |

| | | | | | | | | | | | | | | | |

Net Assets Consists of: | | | | | | | | | | | | | | | | |

Capital | | | | | | $ | 93,185,263 | | | | | | | $ | 117,243,845 | |

Accumulated earnings | | | | | | | 18,291,643 | | | | | | | | 16,945,733 | |

| | | | | | | | | | | | | | | | |

Net Assets | | | | | | $ | 111,476,906 | | | | | | | $ | 134,189,578 | |

| | | | | | | | | | | | | | | | |

30

|

FINANCIAL STATEMENTS |

Statements of Assets and Liabilities (cont.) |

|

| September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | RBC Global

Opportunities Fund | | | RBC International

Opportunities Fund | |

Net Assets | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 14,479 | | | | | | | $ | 9,952 | |

Class I | | | | | | | 79,474,862 | | | | | | | | 134,165,563 | |

Class R6 | | | | | | | 31,987,565 | | | | | | | | 14,063 | |

| | | | | | | | | | | | | | | | |

Total | | | | | | $ | 111,476,906 | | | | | | | $ | 134,189,578 | |

| | | | | | | | | | | | | | | | |

Shares Outstanding (Unlimited number of shares authorized, no par value): | | | | | | | | | | | | | | | | |

Class A | | | | | | | 874 | | | | | | | | 916 | |

Class I | | | | | | | 4,788,269 | | | | | | | | 12,203,389 | |

Class R6 | | | | | | | 1,924,126 | | | | | | | | 1,272 | |

| | | | | | | | | | | | | | | | |

Total | | | | | | | 6,713,269 | | | | | | | | 12,205,577 | |

| | | | | | | | | | | | | | | | |

Net Asset Values and Redemption Prices Per Share: | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 16.57 | | | | | | | $ | 10.87 | |

| | | | | | | | | | | | | | | | |

Class I | | | | | | $ | 16.60 | | | | | | | $ | 10.99 | |

| | | | | | | | | | | | | | | | |

Class R6 | | | | | | $ | 16.62 | | | | | | | $ | 11.06 | |

| | | | | | | | | | | | | | | | |

Maximum Offering Price Per Share: | | | | | | | | | | | | | | | | |

Class A | | | | | | $ | 17.58 | | | | | | | $ | 11.53 | |

| | | | | | | | | | | | | | | | |

Maximum Sales Charge - Class A | | | | | | | 5.75 | % | | | | | | | 5.75 | % |

| | | | | | | | | | | | | | | | |

| | | | |

See Notes to the Financial Statements. | | | | | | | | | | | | | | | | |

31

|

FINANCIAL STATEMENTS |

Statements of Operations |

|

For the Six Months Ended September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | RBC Emerging Markets

Equity Fund | | | RBC Emerging

Markets Small Cap

Equity Fund | | | RBC Emerging

Markets Value

Equity Fund | |

Investment Income: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | | | | | $ | 5,973 | | | | | | | $ | 9 | | | | | | | $ | (1,314 | ) |

Dividend income - unaffiliated | | | | | | | 18,076,654 | | | | | | | | 130,298 | | | | | | | | 133,227 | |

Dividend income - affiliated | | | | | | | 5,474 | | | | | | | | 133 | | | | | | | | 3 | |

Foreign tax withholding | | | | | | | (1,979,774 | ) | | | | | | | (19,220 | ) | | | | | | | (12,669 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investment Income | | | | | | | 16,108,327 | | | | | | | | 111,220 | | | | | | | | 119,247 | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment advisory fees | | | | | | | 5,897,064 | | | | | | | | 44,109 | | | | | | | | 31,998 | |

Distribution fees–Class A | | | | | | | 23,960 | | | | | | | | 2,825 | | | | | | | | — | |

Accounting fees | | | | | | | 74,095 | | | | | | | | 31,631 | | | | | | | | 36,085 | |

Audit fees | | | | | | | 18,903 | | | | | | | | 18,903 | | | | | | | | 18,903 | |

Custodian fees | | | | | | | 288,038 | | | | | | | | 24,235 | | | | | | | | 20,960 | |

Insurance fees | | | | | | | 9,984 | | | | | | | | 2,156 | | | | | | | | 840 | |

Legal fees | | | | | | | 48,837 | | | | | | | | 313 | | | | | | | | 121 | |

Registrations and filing fees | | | | | | | 43,864 | | | | | | | | 18,474 | | | | | | | | 19,946 | |

Shareholder reports | | | | | | | 48,960 | | | | | | | | 9,946 | | | | | | | | 9,695 | |

Transfer agent fees–Class A | | | | | | | 22,868 | | | | | | | | 2,104 | | | | | | | | — | |

Transfer agent fees–Class I | | | | | | | 651,031 | | | | | | | | 3,121 | | | | | | | | 1,845 | |

Transfer agent fees–Class R6 | | | | | | | 2,441 | | | | | | | | — | | | | | | | | 1,785 | |

Trustees’ fees and expenses | | | | | | | 42,973 | | | | | | | | 261 | | | | | | | | 141 | |

Tax expense | | | | | | | 21,088 | | | | | | | | 17,221 | | | | | | | | 6,520 | |

Other fees | | | | | | | 22,904 | | | | | | | | 2,233 | | | | | | | | 2,296 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses before fee waiver/reimbursement | | | | | | | 7,217,010 | | | | | | | | 177,532 | | | | | | | | 151,135 | |

Expenses waived/reimbursed by: | | | | | | | | | | | | | | | | | | | | | | | | |

Advisor | | | | | | | (706,279 | ) | | | | | | | (122,741 | ) | | | | | | | (113,852 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net expenses | | | | | | | 6,510,731 | | | | | | | | 54,791 | | | | | | | | 37,283 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | | | | | 9,597,596 | | | | | | | | 56,429 | | | | | | | | 81,964 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Realized/Unrealized Gains/(Losses): | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains/(losses) on: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment transactions | | | | | | | (10,465,038 | ) | | | | | | | (228,382 | ) | | | | | | | (126,647 | ) |

Foreign currency transactions | | | | | | | (744,214 | ) | | | | | | | (6,634 | ) | | | | | | | (56,179 | ) |

Foreign tax | | | | | | | (22,560 | ) | | | | | | | (1,024 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net realized losses | | | | | | | (11,231,812 | ) | | | | | | | (236,040 | ) | | | | | | | (182,826 | ) |

Net change in unrealized appreciation/(depreciation) on: | | | | | | | | | | | | | | | | | | | | | | | | |

Investments | | | | | | | 352,119,505 | | | | | | | | 2,144,711 | | | | | | | | 1,044,958 | |

Foreign currency | | | | | | | 53,622 | | | | | | | | 385 | | | | | | | | 208 | |

Foreign tax | | | | | | | 186,815 | | | | | | | | 1,826 | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net unrealized gains | | | | | | | 352,359,942 | | | | | | | | 2,146,922 | | | | | | | | 1,045,166 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net assets resulting from operations | | | | | | $ | 350,725,726 | | | | | | | $ | 1,967,311 | | | | | | | $ | 944,304 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

32

|

FINANCIAL STATEMENTS |

Statements of Operations (cont.) |

|

| For the Six Months Ended September 30, 2020 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | RBC Global

Opportunities Fund | | | RBC International

Opportunities Fund | |

Investment Income: | | | | | | | | | | | | | | | | |

Interest income | | | | | | $ | 761 | | | | | | | $ | — | |

Dividend income - unaffiliated | | | | | | | 549,768 | | | | | | | | 1,147,425 | |

Dividend income - affiliated | | | | | | | 239 | | | | | | | | 492 | |

Foreign tax withholding | | | | | | | (36,844 | ) | | | | | | | (123,990 | ) |

| | | | | | | | | | | | | | | | |

Total Investment Income | | | | | | | 513,924 | | | | | | | | 1,023,927 | |

Expenses: | | | | | | | | | | | | | | | | |

Investment advisory fees | | | | | | | 337,803 | | | | | | | | 422,444 | |

Distribution fees–Class A | | | | | | | 13 | | | | | | | | 415 | |

Accounting fees | | | | | | | 27,211 | | | | | | | | 30,336 | |

Audit fees | | | | | | | 22,914 | | | | | | | | 22,914 | |

Custodian fees | | | | | | | 17,181 | | | | | | | | 19,480 | |

Insurance fees | | | | | | | 2,158 | | | | | | | | 2,156 | |

Legal fees | | | | | | | 7,094 | | | | | | | | 10,259 | |

Registrations and filing fees | | | | | | | 36,806 | | | | | | | | 33,665 | |

Shareholder reports | | | | | | | 12,859 | | | | | | | | 11,515 | |

Transfer agent fees–Class A | | | | | | | 1,663 | | | | | | | | 1,663 | |

Transfer agent fees–Class I | | | | | | | 20,203 | | | | | | | | 46,659 | |

Transfer agent fees–Class R6 | | | | | | | 1,859 | | | | | | | | 1,785 | |

Trustees’ fees and expenses | | | | | | | 2,196 | | | | | | | | 2,929 | |

Tax expense | | | | | | | 2,340 | | | | | | | | 2,489 | |

Other fees | | | | | | | 2,798 | | | | | | | | 3,867 | |

| | | | | | | | | | | | | | | | |

Total expenses before fee waiver/reimbursement | | | | | | | 495,098 | | | | | | | | 612,576 | |

Expenses waived/reimbursed by: | | | | | | | | | | | | | | | | |

Advisor | | | | | | | (114,669 | ) | | | | | | | (134,090 | ) |

| | | | | | | | | | | | | | | | |

Net expenses | | | | | | | 380,429 | | | | | | | | 478,486 | |

| | | | | | | | | | | | | | | | |