UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Tara Tilbury

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 376-7132

Date of fiscal year end: September 30

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

Semi-Annual Report For the six months ended March 31, 2024 RBC BlueBay Access Capital Community Investment Fund RBC BlueBay Impact Bond Fund RBC ®

| | | | | | | | | | |

| | | | | | | |

| | | |

| | | | | | RBC Funds | |

| | | |

| | | |

About your Semi Annual Report | | | | | | This semi-annual report (Unaudited) includes detailed information about your Fund including financial statements, performance, and a complete list of its holdings. The RBC Funds compare their performance against various indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly. We hope the financial information presented will help you evaluate your investment in the RBC Funds. We also encourage you to read your Fund’s prospectus for further detail as to your Fund’s investment policies and risk profile. RBC Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.rbcgam.com. | |

| | | |

| | | | | | A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.com; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. | |

| | | | |

| | | | | | Each year the Trust files its proxy voting record for the twelve-month period ended June 30 with the SEC on Form N-PX no later than August 31. The records can be obtained on the SEC’s website at www.sec.gov and without charge by calling the Funds at 1-800-422-2766. | | | | |

| | | | |

| | | | | | A schedule of each Fund’s portfolio holdings is filed with the Commission for the first and third quarters of each fiscal year on Form N-PORT. This information is available on the Commission’s website at http://www.sec.gov and on the Funds’ website at www.dfinview.com/usrbcgam. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. | | | | |

| | | |

| | | | |

Table of | | | | | | Portfolio Managers | | | 1 | |

Contents | | | | | | Performance Summary | | | 2 | |

| | | | | | Fund Statistics (Unaudited) | | | | |

| | | | | | - RBC BlueBay Access Capital Community Investment Fund | | | 4 | |

| | | | | | - RBC BlueBay Impact Bond Fund | | | 5 | |

| | | | | | Schedules of Portfolio Investments | | | 6 | |

| | | | | | Financial Statements | | | | |

| | | | | | - Statements of Assets and Liabilities | | | 43 | |

| | | | | | - Statements of Operations | | | 45 | |

| | | | | | - Statements of Changes in Net Assets | | | 46 | |

| | | | | | Financial Highlights | | | 48 | |

| | | | | | Notes to Financial Statements | | | 54 | |

| | | | | | Share Class Information | | | 68 | |

| | | | | | Supplemental Information | | | 69 | |

| | | | | | Statement Regarding Liquidity Risk Management Program (Unaudited) | | | 71 | |

| | | | | | | | | | |

| | | | | | |

| | | |

| PORTFOLIO MANAGERS | | | | | | |

| | | |

RBC Global Asset Management (U.S.) Inc.(“RBC GAM-US”) serves as the investment advisor to the Funds. RBC GAM-US employs a team approach to the management of the Funds, with no individual team member being solely responsible for the investment decisions. The Funds’ management team has access to RBC GAM-US’s investment research and other money management resources. | | | | | | |

| | | |

Brian Svendahl, CFA BlueBay Senior Portfolio Manager | | | | | | |

| Brian is a BlueBay senior portfolio manager on the BlueBay Fixed Income team at RBC Global Asset Management (U.S.) Inc. He has had a leadership role within the Minneapolis-based fixed income group since 2012 and has been the lead portfolio manager for the firm’s impact investing strategies since 2006. He also managed many government and mortgage strategies. Brian joined the organization in 2005, having held risk management, research, and trading positions with a large American multinational financial services company since 1992. Brian holds an MBA, a BBA in Finance and a Bachelor of Science in Economics from the University of Minnesota. He is also a CFA® charterholder and a Financial Risk Manager (FRM®). | | | | | | |

| | | |

| | | | | | |

1

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | 5

Year | | 10

Year | | Since

Inception | | Net

Expense

Ratio(a)(b) | | Gross

Expense

Ratio(a)(b) |

Average Annual Total Returns as of March 31, 2024 (Unaudited) | | | | | | | | | | | | | | | | | |

| | | | | |

RBC BlueBay Access Capital Community Investment Fund | | | | | | | | | | | | | | | | | | | | | |

Class A(c) | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 3.75% | | | (2.89 | )% | | | (1.54 | )% | | | 0.08 | % | | | 2.71 | % | | | | | | | | |

- At Net Asset Value | | | 0.88 | % | | | (0.79 | )% | | | 0.47 | % | | | 2.86 | % | | | 0.80 | % | | | 1.05 | % |

Class I(e) | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 1.23 | % | | | (0.44 | )% | | | 0.83 | % | | | 3.18 | % | | | 0.45 | % | | | 0.53 | % |

Class IS(f) | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 1.14 | % | | | (0.42 | )% | | | 0.94 | % | | | 3.40 | % | | | 0.40 | % | | | 0.53 | % |

| | | | | | |

Bloomberg US Securitized Index(h) | | | 1.61 | % | | | (0.25 | )% | | | 1.18 | % | | | 3.70 | % | | | | | | | | |

RBC BlueBay Impact Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class A(d) | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 3.75% | | | (1.29 | )% | | | (0.79 | )% | | | N/A | | | | (0.41 | )% | | | | | | | | |

- At Net Asset Value | | | 2.59 | % | | | (0.04 | )% | | | N/A | | | | 0.20 | % | | | 0.71 | % | | | 1.10 | % |

Class I | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 2.85 | % | | | 0.26 | % | | | N/A | | | | 0.49 | % | | | 0.46 | % | | | 0.63 | % |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 2.90 | % | | | 0.29 | % | | | N/A | | | | 0.54 | % | | | 0.41 | % | | | 0.49 | % |

Class Y(g) | | | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 2.90 | % | | | N/A | | | | N/A | | | | (2.85 | )% | | | 0.41 | % | | | 0.50 | % |

| | | | | | |

Bloomberg U.S. Aggregate Bond Index(h) | | | 1.70 | % | | | 0.36 | % | | | N/A | | | | 0.76 | % | | | | | | | | |

Parentheses indicate negative performance returns.

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. For performance data current to the most recent month-end go to www.rbcgam.com. Please see footnotes below.

The names of the funds were changed from Access Capital Community Investment Fund and RBC Impact Bond Fund to RBC BlueBay Access Capital Community Investment Fund and RBC BlueBay Impact Bond Fund, respectively, on July 26, 2023.

| (a) | The Funds’ expenses are from the Funds’ most recent prospectus dated January 29, 2024. For current expense ratio information, please see the Financial Highlights starting on page 48. |

| (b) | The advisor has contractually agreed to waive fees and/or pay operating expenses to keep total operating expenses at 0.80% for Class A shares, 0.45% for Class I shares and 0.40% for Class IS shares of the RBC BlueBay Access Capital Community Investment Fund and at 0.70% for Class A shares, 0.45% for Class I shares, 0.40% for Class R6 shares and 0.40% for Class Y shares of the RBC BlueBay Impact Bond Fund until January 31, 2025. |

2

|

PERFORMANCE SUMMARY (UNAUDITED) |

| (c) | The inception date for Class A shares of the Fund is January 29, 2009. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class A shares, as applicable. |

| (d) | The inception date for Class A shares of the Fund is January 28, 2020. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, which has an inception date of December 18, 2017, adjusted to reflect the fees and expenses of Class A shares, as applicable. |

| (e) | Class I shares commenced operations on July 28, 2008. The performance in the table prior to that date reflects the performance of Access Capital Strategies Community Investment Fund, Inc., the predecessor to the Fund. From its inception, June 23, 1998, until May 30, 2006, the predecessor fund elected status as a business development company. From May 31, 2006 until July 27, 2008, the predecessor fund operated as a continuously offered closed-end interval management company. If the predecessor fund had operated as an open-end management company, performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements which, if excluded, would cause performance to be lower. |

| (f) | The inception date for Class IS shares of the Fund is March 11, 2019. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class IS shares, as applicable. |

| (g) | The inception date for Class Y shares of the Fund is April 12, 2021. |

| (h) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. |

The Bloomberg U.S. Securitized Index represents the securitized portion (mortgage-backed, asset-backed and commercial mortgage-backed securities) of the Bloomberg U.S. Aggregate Bond Index.

The Bloomberg U.S. Aggregate Bond Index measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. It includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities (agency and non-agency).

Mutual fund investing involves risk. Principal loss is possible.

3

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | FUND STATISTICS (UNAUDITED) |

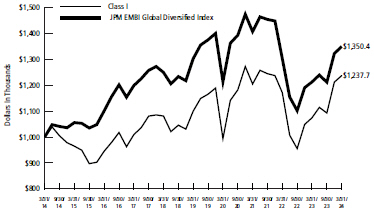

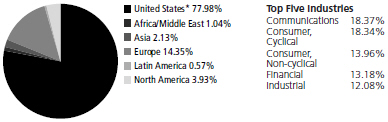

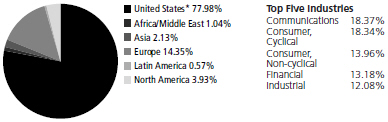

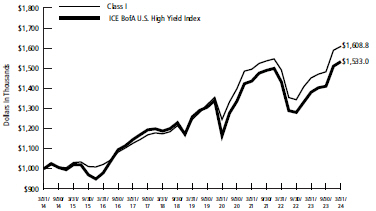

| | | | | | | | RBC BlueBay Access Capital Community Investment Fund |

Investment Objective | | | | | | | | The Fund’s investment objective is to provide current income consistent with the preservation of capital by investing primarily in high quality debt securities and other debt instruments supporting community development, including investments deemed to be qualified under the Community Reinvestment Act of 1977, as amended (the “CRA”). |

Benchmark | | | | | | | | Bloomberg U.S. Securitized Index |

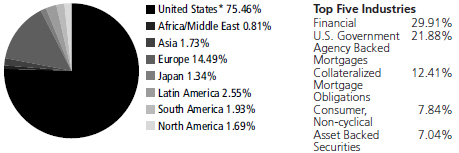

Asset Allocation as of 3/31/24 (% of Fund’s investments) | | | | | | | |

|

Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) | | | | | | | | Fannie Mae, 2.00%, 4/1/54 Fannie Mae, 2.50%, 4/1/54 Fannie Mae, Pool #CB4463,

4.50%, 8/1/52 Fannie Mae, Pool #CB5037,

5.50%, 11/1/52 Fannie Mae, Pool #CB4314,

4.50%, 8/1/52 Freddie Mac, Pool #RA7503,

4.50%, 7/1/52 | | | 5.44 2.61 1.75 1.47 1.35 1.27 | % % % % % % | | Fannie Mae, Pool #BL4650,

2.30%, 10/1/31 Fannie Mae, Pool #CB3797,

4.00%, 6/1/52 Freddie Mac, Pool #RA5427,

2.50%, 6/1/51 Freddie Mac, Pool #RA5020,

2.00%, 4/1/51 | | | 1.15 1.04 0.92 0.91 | % % % % | | |

| | | | | | *A listing of all portfolio holdings can be found beginning on page 6 |

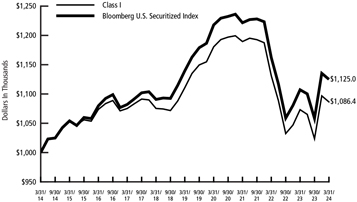

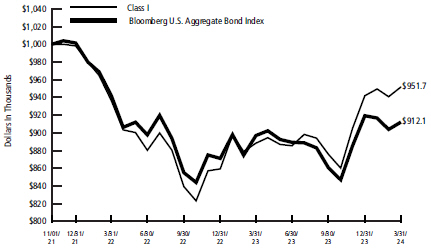

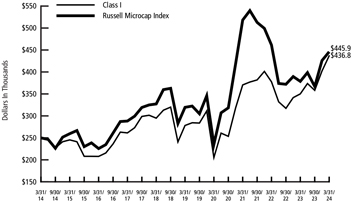

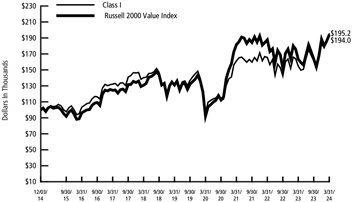

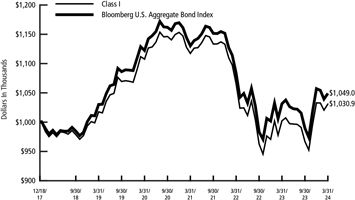

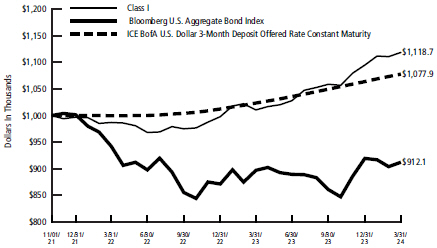

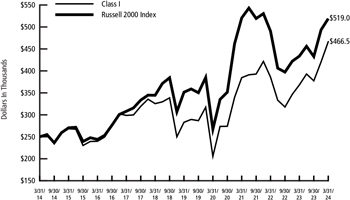

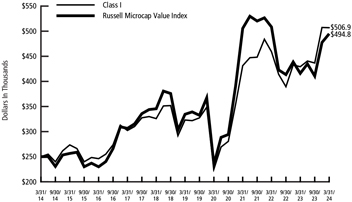

Growth of $1,000,000 Initial Investment Over 10 Years | | | | | | | |

| | | |

| | | | | | | | The graph reflects an initial hypothetical investment of $ 1,000,000 over the 10 year period ended March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. |

4

| | | | | | | | | | | | | | | | | | |

| | | | |

| | FUND STATISTICS (UNAUDITED) | | | | | | | |

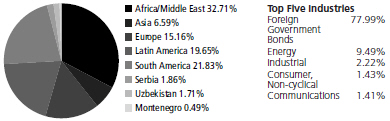

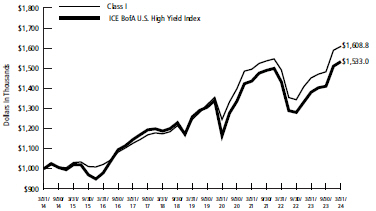

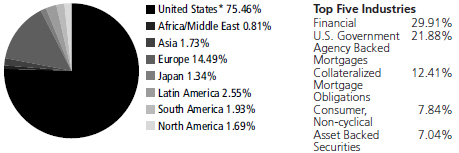

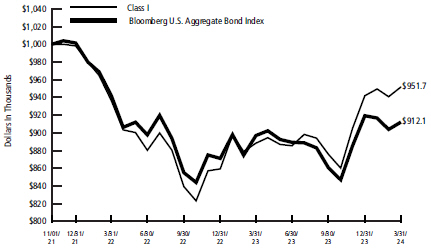

| | RBC BlueBay Impact Bond Fund | | | | | | | |

| | The Fund seeks to achieve a high level of current income consistent with preservation of capital. | | | | | | | Investment Objective |

| | Bloomberg U.S. Aggregate Bond Index | | | | | | | Benchmark |

| | | | |

| |

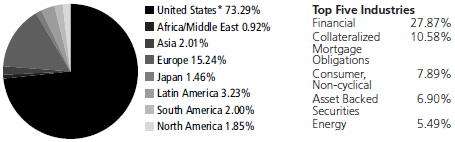

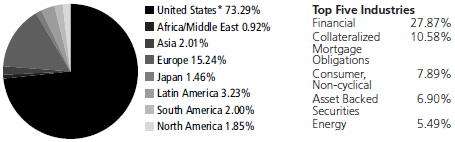

| | | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) |

| | | | | | | |

| | Becton Dickinson & Co., 4.69%, 2/13/28 Hertz Vehicle Financing III LLC, 5.49%, 6/25/27 Lendbuzz Securitization Trust, Series 2023-3A, Class A2, 7.50%, 12/15/28 Amgen, Inc., 5.25%, 3/2/33 Fannie Mae, Pool #BZ0523, 4.50%, 2/1/29 Sunnova Sol IV Issuer LLC, Series 2022-A, Class C, 3.53%, 2/22/49 | |

| 1.57%

1.51% 1.45% 1.33% 1.31% 1.22% |

| | Tesla Auto Lease Trust, Series 2021-B, Class C, 1.12%, Fannie Mae, Pool #BS1730, 1.53%, 4/1/28 Luminace Issuer LLC, Series 2022-1, Class B, 5.91%, 7/31/62 American Water Capital Corp.,

4.45%, 6/1/32 | | | 1.19% 1.17% 1.15% 1.15% | | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | |

| | | | |

| | *A listing of all portfolio holdings can be found beginning on page 29 | | | | | | | |

| |

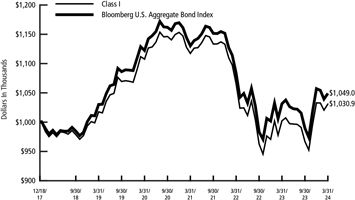

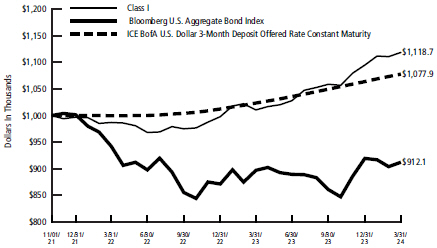

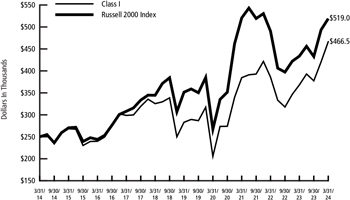

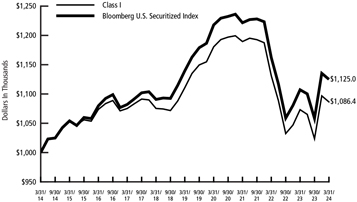

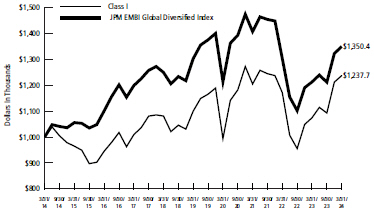

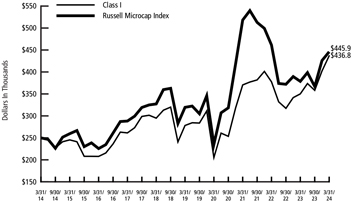

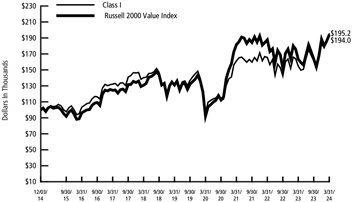

| | | | | | | Growth of $1,000,000 Initial Investment Since Inception (12/18/17) |

| | The graph reflects an initial hypothetical investment of $1,000,000 over the period from December 18, 2017 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | |

5

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| |

| | U.S. Government Agency Backed Mortgages — 99.17% | | | | |

| | Fannie Mae — 62.96% | | | | |

| | $20,900,000 | | | 2.50%, 4/1/54 | | $ | 17,286,139 | |

| | 45,500,000 | | | 2.00%, 4/1/54 | | | 36,026,399 | |

| | 640,331 | | | 6.00%, 10/1/53 | | | 647,029 | |

| | 43,878 | | | Pool #258022, 5.50%, 5/1/34 | | | 44,710 | |

| | 39,758 | | | Pool #258070, 5.00%, 6/1/34 | | | 39,789 | |

| | 45,664 | | | Pool #258157, 5.00%, 8/1/34 | | | 45,700 | |

| | 46,461 | | | Pool #258163, 5.50%, 8/1/34 | | | 47,344 | |

| | 68,030 | | | Pool #258251, 5.50%, 1/1/35 | | | 69,320 | |

| | 80,555 | | | Pool #258305, 5.00%, 3/1/35 | | | 80,634 | |

| | 48,171 | | | Pool #258394, 5.00%, 5/1/35 | | | 48,218 | |

| | 35,914 | | | Pool #258410, 5.00%, 4/1/35 | | | 35,949 | |

| | 50,257 | | | Pool #258448, 5.00%, 8/1/35 | | | 50,306 | |

| | 76,164 | | | Pool #258450, 5.50%, 8/1/35 | | | 77,888 | |

| | 137,945 | | | Pool #258627, 5.50%, 2/1/36 | | | 141,071 | |

| | 20,986 | | | Pool #258737, 5.50%, 12/1/35 | | | 21,458 | |

| | 18,977 | | | Pool #259378, 6.00%, 12/1/31 | | | 19,476 | |

| | 15,506 | | | Pool #259393, 6.00%, 1/1/32 | | | 15,913 | |

| | 29,577 | | | Pool #259590, 5.50%, 11/1/32 | | | 30,051 | |

| | 71,240 | | | Pool #259611, 5.50%, 11/1/32 | | | 72,386 | |

| | 5,540 | | | Pool #259634, 5.50%, 12/1/32 | | | 5,629 | |

| | 23,061 | | | Pool #259671, 5.50%, 2/1/33 | | | 23,430 | |

| | 55,614 | | | Pool #259686, 5.50%, 3/1/33 | | | 56,525 | |

| | 52,602 | | | Pool #259725, 5.00%, 5/1/33 | | | 52,643 | |

| | 42,992 | | | Pool #259761, 5.00%, 6/1/33 | | | 43,026 | |

| | 65,276 | | | Pool #259777, 5.00%, 7/1/33 | | | 65,328 | |

| | 35,309 | | | Pool #259789, 5.00%, 7/1/33 | | | 35,337 | |

| | 36,154 | | | Pool #259830, 5.00%, 8/1/33 | | | 36,183 | |

| | 23,900 | | | Pool #259848, 5.00%, 9/1/33 | | | 23,919 | |

| | 51,603 | | | Pool #259867, 5.50%, 10/1/33 | | | 52,445 | |

| | 32,000 | | | Pool #259869, 5.50%, 10/1/33 | | | 32,522 | |

| | 26,077 | | | Pool #259998, 5.00%, 3/1/34 | | | 26,098 | |

| | 234,527 | | | Pool #469101, 3.75%, 2/1/27 | | | 228,173 | |

| | 250,004 | | | Pool #470828, 3.53%, 3/1/32 | | | 233,095 | |

| | 4,008 | | | Pool #576445, 6.00%, 1/1/31 | | | 4,078 | |

| | 21,983 | | | Pool #579402, 6.50%, 4/1/31 | | | 22,753 | |

| | 21,277 | | | Pool #583728, 6.50%, 6/1/31 | | | 22,022 | |

| | 9,076 | | | Pool #590931, 6.50%, 7/1/31 | | | 9,395 | |

| | 30,976 | | | Pool #607611, 6.50%, 11/1/31 | | | 32,061 | |

| | 27,395 | | | Pool #644437, 6.50%, 6/1/32 | | | 28,499 | |

| | 629,059 | | | Pool #663159, 5.00%, 7/1/32 | | | 629,635 | |

| | 25,930 | | | Pool #670278, 5.50%, 11/1/32 | | | 26,345 | |

| | 9,383 | | | Pool #676702, 5.50%, 11/1/32 | | | 9,533 | |

| | 36,152 | | | Pool #677591, 5.50%, 12/1/32 | | | 36,733 | |

| | 14,382 | | | Pool #681883, 6.00%, 3/1/33 | | | 14,888 | |

| | 17,535 | | | Pool #686542, 5.50%, 3/1/33 | | | 17,823 | |

| | 150,203 | | | Pool #695961, 5.50%, 1/1/33 | | | 152,612 | |

6

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

| | |

Principal

Amount | | | | | Value | |

| | |

| | $ 92,787 | | | Pool #696407, 5.50%, 4/1/33 | | $ | 94,301 | |

| | 249,444 | | | Pool #702478, 5.50%, 6/1/33 | | | 253,530 | |

| | 81,019 | | | Pool #702479, 5.00%, 6/1/33 | | | 81,084 | |

| | 30,170 | | | Pool #723066, 5.00%, 4/1/33 | | | 30,194 | |

| | 124,836 | | | Pool #723067, 5.50%, 5/1/33 | | | 126,881 | |

| | 107,702 | | | Pool #723070, 4.50%, 5/1/33 | | | 106,054 | |

| | 174,382 | | | Pool #727311, 4.50%, 9/1/33 | | | 171,708 | |

| | 94,837 | | | Pool #727312, 5.00%, 9/1/33 | | | 94,913 | |

| | 111,310 | | | Pool #727315, 6.00%, 10/1/33 | | | 115,190 | |

| | 27,867 | | | Pool #738589, 5.00%, 9/1/33 | | | 27,889 | |

| | 34,664 | | | Pool #739269, 5.00%, 9/1/33 | | | 34,691 | |

| | 66,399 | | | Pool #748041, 4.50%, 10/1/33 | | | 65,381 | |

| | 63,850 | | | Pool #749891, 5.00%, 9/1/33 | | | 63,900 | |

| | 83,059 | | | Pool #753533, 5.00%, 11/1/33 | | | 83,125 | |

| | 30,644 | | | Pool #755679, 6.00%, 1/1/34 | | | 31,721 | |

| | 280,657 | | | Pool #777621, 5.00%, 2/1/34 | | | 280,882 | |

| | 61,430 | | | Pool #781741, 6.00%, 9/1/34 | | | 63,607 | |

| | 45,461 | | | Pool #781959, 5.50%, 6/1/34 | | | 46,327 | |

| | 23,630 | | | Pool #783893, 5.50%, 12/1/34 | | | 24,079 | |

| | 55,047 | | | Pool #783929, 5.50%, 10/1/34 | | | 56,094 | |

| | 602 | | | Pool #788329, 6.50%, 8/1/34 | | | 634 | |

| | 46,528 | | | Pool #799548, 6.00%, 9/1/34 | | | 48,167 | |

| | 518,913 | | | Pool #806754, 4.50%, 9/1/34 | | | 511,375 | |

| | 222,627 | | | Pool #806757, 6.00%, 9/1/34 | | | 230,514 | |

| | 266,016 | | | Pool #806761, 5.50%, 9/1/34 | | | 271,083 | |

| | 86,052 | | | Pool #808205, 5.00%, 1/1/35 | | | 86,121 | |

| | 147,855 | | | Pool #815009, 5.00%, 4/1/35 | | | 148,001 | |

| | 38,821 | | | Pool #820336, 5.00%, 9/1/35 | | | 38,860 | |

| | 78,646 | | | Pool #822008, 5.00%, 5/1/35 | | | 78,724 | |

| | 118,852 | | | Pool #829276, 5.00%, 8/1/35 | | | 118,970 | |

| | 102,304 | | | Pool #829649, 5.50%, 3/1/35 | | | 104,250 | |

| | 126,864 | | | Pool #844361, 5.50%, 11/1/35 | | | 129,739 | |

| | 23,464 | | | Pool #845245, 5.50%, 11/1/35 | | | 23,994 | |

| | 19,252 | | | Pool #866969, 6.00%, 2/1/36 | | | 20,017 | |

| | 63,791 | | | Pool #884693, 5.50%, 4/1/36 | | | 65,233 | |

| | 184,122 | | | Pool #885724, 5.50%, 6/1/36 | | | 188,281 | |

| | 57,852 | | | Pool #919368, 5.50%, 4/1/37 | | | 59,128 | |

| | 228,640 | | | Pool #922582, 6.00%, 12/1/36 | | | 238,818 | |

| | 82,523 | | | Pool #934941, 5.00%, 8/1/39 | | | 82,683 | |

| | 249,623 | | | Pool #934942, 5.00%, 9/1/39 | | | 250,107 | |

| | 167,019 | | | Pool #948600, 6.00%, 8/1/37 | | | 174,474 | |

| | 61,071 | | | Pool #952678, 6.50%, 8/1/37 | | | 64,720 | |

| | 84,174 | | | Pool #986239, 6.00%, 7/1/38 | | | 87,921 | |

| | 103,982 | | | Pool #986957, 5.50%, 7/1/38 | | | 106,436 | |

| | 138,557 | | | Pool #990617, 5.50%, 9/1/38 | | | 141,843 | |

| | 135,212 | | | Pool #AA0645, 4.50%, 3/1/39 | | | 132,672 | |

| | 233,572 | | | Pool #AA3207, 4.50%, 3/1/39 | | | 229,176 | |

7

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 192,165 | | | Pool #AA7042, 4.50%, 6/1/39 | | $ | 188,547 | |

| | 225,220 | | | Pool #AA7658, 4.00%, 6/1/39 | | | 215,113 | |

| | 2,844 | | | Pool #AA7741, 4.50%, 6/1/24 | | | 2,829 | |

| | 597,927 | | | Pool #AB7798, 3.00%, 1/1/43 | | | 535,626 | |

| | 797,282 | | | Pool #AB9204, 3.00%, 4/1/43 | | | 713,713 | |

| | 66,055 | | | Pool #AC1463, 5.00%, 8/1/39 | | | 66,184 | |

| | 228,397 | | | Pool #AC2109, 4.50%, 7/1/39 | | | 224,106 | |

| | 225,150 | | | Pool #AC4395, 5.00%, 9/1/39 | | | 225,588 | |

| | 84,386 | | | Pool #AC5329, 5.00%, 10/1/39 | | | 84,550 | |

| | 173,465 | | | Pool #AC6305, 5.00%, 11/1/39 | | | 173,801 | |

| | 121,028 | | | Pool #AC6307, 5.00%, 12/1/39 | | | 121,260 | |

| | 257,632 | | | Pool #AC6790, 5.00%, 12/1/39 | | | 258,132 | |

| | 268,875 | | | Pool #AC7199, 5.00%, 12/1/39 | | | 269,405 | |

| | 253,111 | | | Pool #AD1470, 5.00%, 2/1/40 | | | 253,718 | |

| | 519,820 | | | Pool #AD1471, 4.50%, 2/1/40 | | | 510,030 | |

| | 477,896 | | | Pool #AD1585, 4.50%, 2/1/40 | | | 468,895 | |

| | 302,854 | | | Pool #AD1586, 5.00%, 1/1/40 | | | 303,443 | |

| | 194,789 | | | Pool #AD1638, 4.50%, 2/1/40 | | | 190,964 | |

| | 123,632 | | | Pool #AD1640, 4.50%, 3/1/40 | | | 121,204 | |

| | 513,381 | | | Pool #AD1942, 4.50%, 1/1/40 | | | 503,711 | |

| | 141,434 | | | Pool #AD1988, 4.50%, 2/1/40 | | | 138,770 | |

| | 159,297 | | | Pool #AD2896, 5.00%, 3/1/40 | | | 159,679 | |

| | 13,682 | | | Pool #AD4456, 4.50%, 4/1/40 | | | 13,414 | |

| | 374,556 | | | Pool #AD4458, 4.50%, 4/1/40 | | | 367,209 | |

| | 165,360 | | | Pool #AD4940, 4.50%, 6/1/40 | | | 162,116 | |

| | 64,990 | | | Pool #AD4946, 4.50%, 6/1/40 | | | 63,715 | |

| | 104,084 | | | Pool #AD5728, 5.00%, 4/1/40 | | | 104,334 | |

| | 46,206 | | | Pool #AD7242, 4.50%, 7/1/40 | | | 45,300 | |

| | 79,628 | | | Pool #AD7256, 4.50%, 7/1/40 | | | 78,066 | |

| | 211,809 | | | Pool #AD7271, 4.50%, 7/1/40 | | | 207,654 | |

| | 230,386 | | | Pool #AD7272, 4.50%, 7/1/40 | | | 225,867 | |

| | 77,113 | | | Pool #AD8960, 5.00%, 6/1/40 | | | 77,298 | |

| | 290,002 | | | Pool #AD9614, 4.50%, 8/1/40 | | | 284,308 | |

| | 6,565 | | | Pool #AE2011, 4.00%, 9/1/40 | | | 6,268 | |

| | 632,196 | | | Pool #AE2012, 4.00%, 9/1/40 | | | 603,612 | |

| | 102,770 | | | Pool #AE2023, 4.00%, 9/1/40 | | | 98,131 | |

| | 207,389 | | | Pool #AE5432, 4.00%, 10/1/40 | | | 198,026 | |

| | 289,417 | | | Pool #AE5435, 4.50%, 9/1/40 | | | 283,737 | |

| | 111,458 | | | Pool #AE5806, 4.50%, 9/1/40 | | | 109,271 | |

| | 259,232 | | | Pool #AE5861, 4.00%, 10/1/40 | | | 247,511 | |

| | 114,190 | | | Pool #AE5862, 4.00%, 10/1/40 | | | 109,030 | |

| | 240,776 | | | Pool #AE6850, 4.00%, 10/1/40 | | | 229,889 | |

| | 134,723 | | | Pool #AE7699, 4.00%, 11/1/40 | | | 128,621 | |

| | 361,656 | | | Pool #AE7703, 4.00%, 10/1/40 | | | 345,276 | |

| | 137,667 | | | Pool #AE7707, 4.00%, 11/1/40 | | | 131,443 | |

| | 110,545 | | | Pool #AH0300, 4.00%, 11/1/40 | | | 105,549 | |

| | 153,255 | | | Pool #AH0301, 3.50%, 11/1/40 | | | 141,587 | |

| | 5,992 | | | Pool #AH0302, 4.00%, 11/1/40 | | | 5,721 | |

8

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 208,643 | | | Pool #AH0306, 4.00%, 12/1/40 | | $ | 199,224 | |

| | 322,419 | | | Pool #AH0508, 4.00%, 11/1/40 | | | 307,841 | |

| | 505,876 | | | Pool #AH0537, 4.00%, 12/1/40 | | | 483,013 | |

| | 483,075 | | | Pool #AH0914, 4.50%, 11/1/40 | | | 473,589 | |

| | 235,191 | | | Pool #AH0917, 4.00%, 12/1/40 | | | 224,557 | |

| | 193,532 | | | Pool #AH1077, 4.00%, 1/1/41 | | | 184,798 | |

| | 172,711 | | | Pool #AH2973, 4.00%, 12/1/40 | | | 164,913 | |

| | 202,750 | | | Pool #AH2980, 4.00%, 1/1/41 | | | 193,587 | |

| | 530,670 | | | Pool #AH5656, 4.00%, 1/1/41 | | | 506,686 | |

| | 301,073 | | | Pool #AH5658, 4.00%, 2/1/41 | | | 287,460 | |

| | 215,962 | | | Pool #AH5662, 4.00%, 2/1/41 | | | 206,212 | |

| | 98,969 | | | Pool #AH5882, 4.00%, 2/1/26 | | | 97,150 | |

| | 142,354 | | | Pool #AH6764, 4.00%, 3/1/41 | | | 135,917 | |

| | 572,011 | | | Pool #AH6768, 4.00%, 3/1/41 | | | 545,476 | |

| | 279,489 | | | Pool #AH7281, 4.00%, 3/1/41 | | | 266,524 | |

| | 99,674 | | | Pool #AH7526, 4.50%, 3/1/41 | | | 97,608 | |

| | 373,883 | | | Pool #AH7537, 4.00%, 3/1/41 | | | 356,538 | |

| | 127,608 | | | Pool #AH8878, 4.50%, 4/1/41 | | | 124,965 | |

| | 131,657 | | | Pool #AH8885, 4.50%, 4/1/41 | | | 128,926 | |

| | 37,213 | | | Pool #AH9050, 3.50%, 2/1/26 | | | 36,355 | |

| | 322,379 | | | Pool #AI0114, 4.00%, 3/1/41 | | | 307,424 | |

| | 226,040 | | | Pool #AI1846, 4.50%, 5/1/41 | | | 221,350 | |

| | 253,761 | | | Pool #AI1847, 4.50%, 5/1/41 | | | 248,501 | |

| | 473,113 | | | Pool #AI1848, 4.50%, 5/1/41 | | | 463,295 | |

| | 299,799 | | | Pool #AI1849, 4.50%, 5/1/41 | | | 293,577 | |

| | 157,779 | | | Pool #AJ0651, 4.00%, 8/1/41 | | | 150,450 | |

| | 522,910 | | | Pool #AJ9133, 4.00%, 1/1/42 | | | 498,652 | |

| | 194,237 | | | Pool #AK6715, 3.50%, 3/1/42 | | | 179,557 | |

| | 316,873 | | | Pool #AK6716, 3.50%, 3/1/42 | | | 292,923 | |

| | 153,628 | | | Pool #AK6718, 3.50%, 2/1/42 | | | 142,013 | |

| | 210,176 | | | Pool #AM6907, 3.68%, 10/1/32 | | | 193,420 | |

| | 350,000 | | | Pool #AN0360, 3.95%, 12/1/45 | | | 286,634 | |

| | 853,233 | | | Pool #AN2066, 2.75%, 7/1/26 | | | 811,409 | |

| | 868,625 | | | Pool #AN2746, 2.30%, 9/1/26 | | | 819,121 | |

| | 783,883 | | | Pool #AN5053, 3.34%, 4/1/27 | | | 753,922 | |

| | 192,757 | | | Pool #AN6580, 3.36%, 9/1/29 | | | 181,090 | |

| | 882,433 | | | Pool #AN7154, 3.21%, 10/1/32 | | | 798,375 | |

| | 1,994,166 | | | Pool #AN8055, 3.05%, 1/1/30 | | | 1,838,082 | |

| | 1,496,754 | | | Pool #AN8121, 3.16%, 1/1/35 | | | 1,284,038 | |

| | 488,790 | | | Pool #AN8915, 3.48%, 4/1/30 | | | 458,788 | |

| | 178,380 | | | Pool #AO2923, 3.50%, 5/1/42 | | | 165,001 | |

| | 534,880 | | | Pool #AO8029, 3.50%, 7/1/42 | | | 494,454 | |

| | 123,091 | | | Pool #AP7483, 3.50%, 9/1/42 | | | 113,788 | |

| | 109,310 | | | Pool #AQ6710, 2.50%, 10/1/27 | | | 105,387 | |

| | 561,141 | | | Pool #AQ7193, 3.50%, 7/1/43 | | | 517,983 | |

| | 135,685 | | | Pool #AR6928, 3.00%, 3/1/43 | | | 121,476 | |

| | 740,190 | | | Pool #AS3494, 4.00%, 10/1/44 | | | 700,688 | |

9

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 176,067 | | | Pool #AS3726, 4.00%, 11/1/44 | | $ | 166,671 | |

| | 177,406 | | | Pool #AS3929, 4.00%, 12/1/44 | | | 167,938 | |

| | 214,165 | | | Pool #AS4070, 4.00%, 12/1/44 | | | 201,707 | |

| | 140,211 | | | Pool #AS4390, 3.50%, 2/1/45 | | | 129,064 | |

| | 161,655 | | | Pool #AS4732, 3.50%, 4/1/45 | | | 148,396 | |

| | 630,126 | | | Pool #AS4905, 3.50%, 4/1/45 | | | 577,570 | |

| | 895,721 | | | Pool #AS5341, 3.50%, 7/1/45 | | | 819,723 | |

| | 238,537 | | | Pool #AS5576, 4.00%, 8/1/45 | | | 225,596 | |

| | 394,741 | | | Pool #AS5919, 3.50%, 9/1/45 | | | 363,358 | |

| | 205,429 | | | Pool #AS6303, 4.00%, 11/1/45 | | | 194,275 | |

| | 225,574 | | | Pool #AS6607, 4.00%, 1/1/46 | | | 213,328 | |

| | 566,884 | | | Pool #AS6778, 3.50%, 3/1/46 | | | 519,066 | |

| | 254,796 | | | Pool #AS6958, 3.50%, 4/1/46 | | | 233,666 | |

| | 704,177 | | | Pool #AS7138, 3.50%, 5/1/46 | | | 642,783 | |

| | 365,768 | | | Pool #AS7139, 3.50%, 5/1/46 | | | 333,878 | |

| | 665,295 | | | Pool #AS7334, 3.00%, 6/1/46 | | | 587,053 | |

| | 718,663 | | | Pool #AS7335, 3.00%, 5/1/46 | | | 634,145 | |

| | 315,930 | | | Pool #AS7336, 3.00%, 6/1/46 | | | 275,142 | |

| | 1,188,792 | | | Pool #AS7504, 3.00%, 7/1/46 | | | 1,048,985 | |

| | 431,005 | | | Pool #AS7516, 3.00%, 7/1/46 | | | 380,317 | |

| | 283,240 | | | Pool #AS7517, 3.00%, 6/1/46 | | | 249,942 | |

| | 116,559 | | | Pool #AS7518, 3.00%, 7/1/46 | | | 102,858 | |

| | 145,162 | | | Pool #AS7674, 3.00%, 8/1/46 | | | 128,090 | |

| | 961,655 | | | Pool #AS7676, 3.00%, 8/1/46 | | | 848,560 | |

| | 605,984 | | | Pool #AS8077, 3.00%, 10/1/46 | | | 534,717 | |

| | 226,941 | | | Pool #AS8289, 3.00%, 10/1/46 | | | 200,252 | |

| | 462,805 | | | Pool #AS8441, 3.00%, 11/1/46 | | | 408,377 | |

| | 718,712 | | | Pool #AS8633, 3.50%, 1/1/47 | | | 656,051 | |

| | 294,623 | | | Pool #AS8776, 3.50%, 2/1/47 | | | 268,936 | |

| | 326,683 | | | Pool #AS9381, 4.00%, 4/1/47 | | | 307,623 | |

| | 154,480 | | | Pool #AS9549, 4.00%, 5/1/47 | | | 145,493 | |

| | 571,898 | | | Pool #AS9550, 4.00%, 5/1/47 | | | 538,583 | |

| | 184,004 | | | Pool #AS9825, 4.00%, 6/1/47 | | | 173,268 | |

| | 409,973 | | | Pool #AT2688, 3.00%, 5/1/43 | | | 367,128 | |

| | 189,721 | | | Pool #AT3963, 2.50%, 3/1/28 | | | 181,432 | |

| | 72,401 | | | Pool #AT7873, 2.50%, 6/1/28 | | | 69,395 | |

| | 255,045 | | | Pool #AU0971, 3.50%, 8/1/43 | | | 235,429 | |

| | 347,210 | | | Pool #AU2165, 3.50%, 7/1/43 | | | 320,506 | |

| | 314,872 | | | Pool #AU2188, 3.50%, 8/1/43 | | | 290,655 | |

| | 9,004 | | | Pool #AU6054, 4.00%, 9/1/43 | | | 8,544 | |

| | 250,694 | | | Pool #AU7003, 4.00%, 11/1/43 | | | 237,906 | |

| | 174,931 | | | Pool #AU7005, 4.00%, 11/1/43 | | | 165,998 | |

| | 181,735 | | | Pool #AV0679, 4.00%, 12/1/43 | | | 172,575 | |

| | 249,705 | | | Pool #AV9282, 4.00%, 2/1/44 | | | 236,425 | |

| | 125,954 | | | Pool #AW1565, 4.00%, 4/1/44 | | | 119,232 | |

| | 528,250 | | | Pool #AW5046, 4.00%, 7/1/44 | | | 500,156 | |

| | 76,638 | | | Pool #AW5047, 4.00%, 7/1/44 | | | 72,664 | |

| | 100,258 | | | Pool #AW7040, 4.00%, 6/1/44 | | | 94,942 | |

10

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 53,468 | | | Pool #AW8629, 3.50%, 5/1/44 | | $ | 49,086 | |

| | 637,169 | | | Pool #AX2884, 3.50%, 11/1/44 | | | 578,919 | |

| | 439,122 | | | Pool #AX4860, 3.50%, 12/1/44 | | | 403,644 | |

| | 535,008 | | | Pool #AY1389, 3.50%, 4/1/45 | | | 489,615 | |

| | 162,644 | | | Pool #AY3435, 3.50%, 5/1/45 | | | 149,714 | |

| | 492,540 | | | Pool #AY5571, 3.50%, 6/1/45 | | | 450,750 | |

| | 258,306 | | | Pool #BC0802, 3.50%, 4/1/46 | | | 236,518 | |

| | 230,456 | | | Pool #BC0804, 3.50%, 4/1/46 | | | 210,681 | |

| | 349,361 | | | Pool #BC1135, 3.00%, 6/1/46 | | | 308,287 | |

| | 675,255 | | | Pool #BD5021, 3.50%, 2/1/47 | | | 617,097 | |

| | 895,059 | | | Pool #BD7140, 4.00%, 4/1/47 | | | 842,919 | |

| | 1,000,976 | | | Pool #BE4232, 3.00%, 12/1/46 | | | 883,256 | |

| | 171,806 | | | Pool #BE9743, 3.50%, 4/1/47 | | | 157,039 | |

| | 465,215 | | | Pool #BH2665, 3.50%, 9/1/47 | | | 423,653 | |

| | 101,687 | | | Pool #BH4659, 4.00%, 6/1/47 | | | 96,038 | |

| | 253,037 | | | Pool #BJ0657, 4.00%, 2/1/48 | | | 237,840 | |

| | 300,757 | | | Pool #BJ2670, 4.00%, 4/1/48 | | | 282,730 | |

| | 724,773 | | | Pool #BJ5158, 4.00%, 4/1/48 | | | 681,332 | |

| | 292,251 | | | Pool #BK7685, 4.00%, 10/1/48 | | | 274,734 | |

| | 412,418 | | | Pool #BK7924, 4.00%, 11/1/48 | | | 388,079 | |

| | 8,920,000 | | | Pool #BL4650, 2.30%, 10/1/31 | | | 7,614,029 | |

| | 434,190 | | | Pool #BL5454, 2.77%, 1/1/35 | | | 366,335 | |

| | 98,829 | | | Pool #BO1263, 3.50%, 6/1/49 | | | 90,325 | |

| | 428,260 | | | Pool #BO3599, 3.00%, 9/1/49 | | | 373,499 | |

| | 552,004 | | | Pool #BO5263, 3.00%, 9/1/49 | | | 481,420 | |

| | 2,182,115 | | | Pool #BO6771, 2.50%, 5/1/51 | | | 1,813,588 | |

| | 635,243 | | | Pool #BP3417, 2.50%, 5/1/51 | | | 527,960 | |

| | 543,577 | | | Pool #BP8731, 2.50%, 6/1/50 | | | 456,374 | |

| | 866,266 | | | Pool #BP8741, 2.50%, 6/1/50 | | | 722,794 | |

| | 1,573,220 | | | Pool #BQ4469, 2.00%, 2/1/51 | | | 1,253,297 | |

| | 475,626 | | | Pool #BQ4493, 1.50%, 2/1/51 | | | 359,470 | |

| | 362,071 | | | Pool #BQ5723, 2.00%, 10/1/50 | | | 288,797 | |

| | 1,125,911 | | | Pool #BQ7523, 2.00%, 11/1/50 | | | 897,999 | |

| | 776,375 | | | Pool #BQ7524, 2.50%, 10/1/50 | | | 650,861 | |

| | 4,274,595 | | | Pool #BR0940, 2.00%, 4/1/51 | | | 3,399,964 | |

| | 798,743 | | | Pool #BR1037, 2.50%, 5/1/51 | | | 663,847 | |

| | 1,982,815 | | | Pool #BR1113, 2.00%, 11/1/50 | | | 1,580,829 | |

| | 803,599 | | | Pool #BR1114, 1.50%, 11/1/50 | | | 607,656 | |

| | 316,317 | | | Pool #BR1115, 2.50%, 12/1/50 | | | 263,438 | |

| | 1,128,556 | | | Pool #BR2051, 2.50%, 6/1/51 | | | 937,609 | |

| | 2,592,512 | | | Pool #BR2234, 2.50%, 8/1/51 | | | 2,152,262 | |

| | 893,568 | | | Pool #BR3565, 2.00%, 1/1/51 | | | 712,133 | |

| | 764,504 | | | Pool #BR3566, 2.50%, 12/1/50 | | | 640,435 | |

| | 214,721 | | | Pool #BR7088, 2.00%, 3/1/51 | | | 170,853 | |

| | 3,000,000 | | | Pool #BS0046, 1.23%, 12/1/27 | | | 2,622,288 | |

| | 1,023,651 | | | Pool #BS0345, 1.61%, 1/1/36 | | | 775,911 | |

| | 2,545,000 | | | Pool #BS0391, 1.63%, 1/1/33 | | | 2,018,792 | |

11

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 500,000 | | | Pool #BS0915, 1.62%, 3/1/31 | | $ | 398,907 | |

| | 1,000,000 | | | Pool #BS1281, 1.59%, 3/1/31 | | | 815,200 | |

| | 186,453 | | | Pool #BS1326, 1.19%, 3/1/26 | | | 173,682 | |

| | 1,873,390 | | | Pool #BS1482, 1.61%, 3/1/31 | | | 1,558,303 | |

| | 700,000 | | | Pool #BS1524, 2.01%, 3/1/33 | | | 570,283 | |

| | 1,500,000 | | | Pool #BS1560, 2.03%, 4/1/31 | | | 1,247,834 | |

| | 965,255 | | | Pool #BS4422, 2.59%, 3/1/32 | | | 833,399 | |

| | 1,000,000 | | | Pool #BS5203, 2.41%, 4/1/32 | | | 853,985 | |

| | 241,027 | | | Pool #BS5840, 3.78%, 7/1/32 | | | 220,622 | |

| | 669,000 | | | Pool #BS6083, 4.38%, 7/1/32 | | | 653,350 | |

| | 400,000 | | | Pool #BS6178, 3.41%, 7/1/29 | | | 371,752 | |

| | 884,000 | | | Pool #BS8032, 5.00%, 3/1/28 | | | 882,320 | |

| | 1,000,000 | | | Pool #BS8302, 4.61%, 4/1/28 | | | 995,309 | |

| | 1,000,000 | | | Pool #BS8303, 4.61%, 4/1/28 | | | 995,313 | |

| | 2,735,000 | | | Pool #BS8483, 4.81%, 5/1/28 | | | 2,714,175 | |

| | 534,483 | | | Pool #BS8518, 4.30%, 5/1/28 | | | 525,977 | |

| | 2,800,000 | | | Pool #BS8572, 4.23%, 5/1/28 | | | 2,751,269 | |

| | 3,400,000 | | | Pool #BS9849, 4.97%, 11/1/28 | | | 3,432,211 | |

| | 600,000 | | | Pool #BS9972, 5.76%, 11/1/28 | | | 623,975 | |

| | 1,754,190 | | | Pool #BT6821, 2.50%, 10/1/51 | | | 1,455,212 | |

| | 1,220,596 | | | Pool #BT8237, 4.00%, 6/1/52 | | | 1,130,125 | |

| | 239,668 | | | Pool #BT8243, 4.00%, 6/1/52 | | | 221,917 | |

| | 1,680,443 | | | Pool #BT9419, 2.50%, 11/1/51 | | | 1,393,513 | |

| | 1,384,613 | | | Pool #BU1334, 2.50%, 2/1/52 | | | 1,146,906 | |

| | 1,776,284 | | | Pool #BU1337, 3.00%, 2/1/52 | | | 1,531,831 | |

| | 213,696 | | | Pool #BV4205, 3.00%, 2/1/52 | | | 184,335 | |

| | 2,695,487 | | | Pool #BV8876, 3.50%, 4/1/52 | | | 2,415,234 | |

| | 1,400,000 | | | Pool #BZ0540, 5.04%, 2/1/34 | | | 1,430,758 | |

| | 553,337 | | | Pool #CA0114, 3.50%, 8/1/47 | | | 503,902 | |

| | 556,354 | | | Pool #CA0334, 3.50%, 9/1/47 | | | 507,766 | |

| | 164,917 | | | Pool #CA0536, 3.50%, 10/1/47 | | | 150,515 | |

| | 580,174 | | | Pool #CA0551, 4.00%, 10/1/47 | | | 546,376 | |

| | 467,500 | | | Pool #CA0565, 3.50%, 10/1/47 | | | 425,587 | |

| | 237,840 | | | Pool #CA0743, 3.50%, 11/1/47 | | | 217,397 | |

| | 634,647 | | | Pool #CA0825, 3.50%, 12/1/47 | | | 577,948 | |

| | 629,520 | | | Pool #CA0981, 3.50%, 12/1/47 | | | 573,279 | |

| | 183,097 | | | Pool #CA1070, 3.50%, 1/1/48 | | | 167,107 | |

| | 467,339 | | | Pool #CA1115, 3.50%, 1/1/48 | | | 425,587 | |

| | 957,857 | | | Pool #CA1130, 3.50%, 1/1/48 | | | 872,282 | |

| | 180,213 | | | Pool #CA1131, 3.50%, 2/1/48 | | | 164,475 | |

| | 283,402 | | | Pool #CA1132, 3.50%, 1/1/48 | | | 258,083 | |

| | 420,232 | | | Pool #CA1144, 3.50%, 2/1/48 | | | 382,689 | |

| | 103,439 | | | Pool #CA1152, 3.50%, 2/1/48 | | | 94,198 | |

| | 387,288 | | | Pool #CA1160, 3.50%, 2/1/48 | | | 354,000 | |

| | 465,614 | | | Pool #CA1161, 3.50%, 2/1/48 | | | 423,686 | |

| | 269,463 | | | Pool #CA1338, 4.00%, 3/1/48 | | | 253,279 | |

| | 541,792 | | | Pool #CA1339, 3.50%, 3/1/48 | | | 493,004 | |

| | 178,204 | | | Pool #CA1418, 4.00%, 3/1/48 | | | 167,501 | |

12

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 181,524 | | | Pool #CA1468, 4.00%, 3/1/48 | | $ | 170,645 | |

| | 463,259 | | | Pool #CA1469, 4.00%, 3/1/48 | | | 435,436 | |

| | 173,613 | | | Pool #CA1471, 4.00%, 3/1/48 | | | 163,368 | |

| | 1,055,578 | | | Pool #CA1507, 4.00%, 4/1/48 | | | 992,308 | |

| | 392,475 | | | Pool #CA1610, 3.50%, 3/1/48 | | | 357,134 | |

| | 409,376 | | | Pool #CA1611, 4.00%, 4/1/48 | | | 384,839 | |

| | 403,908 | | | Pool #CA1612, 3.50%, 4/1/48 | | | 368,155 | |

| | 488,284 | | | Pool #CA1613, 4.00%, 4/1/48 | | | 459,017 | |

| | 188,297 | | | Pool #CA2381, 4.00%, 9/1/48 | | | 177,013 | |

| | 208,273 | | | Pool #CA2440, 4.00%, 9/1/48 | | | 195,764 | |

| | 166,460 | | | Pool #CA2441, 4.00%, 10/1/48 | | | 156,637 | |

| | 160,429 | | | Pool #CA2442, 4.00%, 10/1/48 | | | 150,961 | |

| | 353,604 | | | Pool #CA2443, 4.00%, 10/1/48 | | | 332,413 | |

| | 188,434 | | | Pool #CA2468, 4.00%, 10/1/48 | | | 177,141 | |

| | 453,824 | | | Pool #CA2594, 4.00%, 11/1/48 | | | 427,417 | |

| | 241,594 | | | Pool #CA2913, 4.00%, 1/1/49 | | | 227,113 | |

| | 302,462 | | | Pool #CA3042, 4.00%, 1/1/49 | | | 284,325 | |

| | 345,445 | | | Pool #CA3043, 4.00%, 2/1/49 | | | 324,744 | |

| | 167,293 | | | Pool #CA3045, 4.50%, 1/1/49 | | | 162,143 | |

| | 27,056 | | | Pool #CA3132, 4.00%, 2/1/49 | | | 25,444 | |

| | 155,421 | | | Pool #CA3557, 3.50%, 5/1/49 | | | 141,560 | |

| | 349,013 | | | Pool #CA3628, 3.50%, 6/1/49 | | | 316,058 | |

| | 191,874 | | | Pool #CA3793, 3.50%, 6/1/49 | | | 174,450 | |

| | 134,144 | | | Pool #CA3936, 3.50%, 7/1/49 | | | 121,963 | |

| | 411,472 | | | Pool #CA4043, 3.00%, 8/1/49 | | | 358,858 | |

| | 483,620 | | | Pool #CA4320, 3.00%, 9/1/49 | | | 421,780 | |

| | 313,667 | | | Pool #CA5106, 3.00%, 1/1/50 | | | 273,559 | |

| | 413,277 | | | Pool #CA5132, 3.00%, 2/1/50 | | | 360,432 | |

| | 944,930 | | | Pool #CA5309, 3.00%, 3/1/50 | | | 823,187 | |

| | 528,071 | | | Pool #CA5312, 3.00%, 3/1/50 | | | 460,036 | |

| | 1,126,952 | | | Pool #CA6151, 2.50%, 6/1/50 | | | 940,655 | |

| | 279,623 | | | Pool #CA6251, 3.00%, 6/1/50 | | | 243,354 | |

| | 1,256,369 | | | Pool #CA6263, 2.50%, 7/1/50 | | | 1,048,288 | |

| | 1,245,611 | | | Pool #CA6966, 2.00%, 9/1/50 | | | 993,917 | |

| | 2,232,652 | | | Pool #CA6967, 2.00%, 9/1/50 | | | 1,782,095 | |

| | 1,341,101 | | | Pool #CA6968, 2.00%, 9/1/50 | | | 1,070,111 | |

| | 1,045,959 | | | Pool #CA6969, 2.00%, 9/1/50 | | | 834,881 | |

| | 1,258,617 | | | Pool #CA6971, 2.50%, 9/1/50 | | | 1,048,992 | |

| | 1,364,467 | | | Pool #CA6972, 2.50%, 8/1/50 | | | 1,137,636 | |

| | 976,406 | | | Pool #CA6973, 2.50%, 9/1/50 | | | 814,087 | |

| | 896,054 | | | Pool #CA7258, 2.50%, 9/1/50 | | | 746,815 | |

| | 1,150,737 | | | Pool #CA7259, 2.50%, 9/1/50 | | | 959,080 | |

| | 1,406,532 | | | Pool #CA7317, 2.00%, 10/1/50 | | | 1,121,884 | |

| | 1,761,432 | | | Pool #CA7549, 2.00%, 10/1/50 | | | 1,404,961 | |

| | 1,660,128 | | | Pool #CA7917, 2.00%, 11/1/50 | | | 1,336,083 | |

| | 865,968 | | | Pool #CA8069, 1.50%, 12/1/50 | | | 654,651 | |

| | 1,055,318 | | | Pool #CA8070, 2.00%, 12/1/50 | | | 841,369 | |

13

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $3,636,969 | | | Pool #CA8077, 2.00%, 12/1/50 | | $ | 2,899,629 | |

| | 628,032 | | | Pool #CA8425, 1.50%, 12/1/50 | | | 478,685 | |

| | 1,021,618 | | | Pool #CA8432, 2.00%, 12/1/50 | | | 814,184 | |

| | 1,328,532 | | | Pool #CA8685, 1.50%, 1/1/51 | | | 1,004,338 | |

| | 3,867,916 | | | Pool #CA8811, 2.00%, 1/1/51 | | | 3,081,353 | |

| | 4,388,201 | | | Pool #CA9048, 2.00%, 2/1/51 | | | 3,495,835 | |

| | 279,452 | | | Pool #CB0245, 2.50%, 4/1/51 | | | 232,257 | |

| | 761,939 | | | Pool #CB0437, 2.50%, 5/1/51 | | | 633,260 | |

| | 613,325 | | | Pool #CB0480, 2.50%, 5/1/51 | | | 509,554 | |

| | 142,545 | | | Pool #CB0576, 2.50%, 5/1/51 | | | 118,427 | |

| | 259,537 | | | Pool #CB0582, 2.50%, 5/1/51 | | | 215,625 | |

| | 1,912,393 | | | Pool #CB0688, 2.50%, 6/1/51 | | | 1,588,825 | |

| | 420,954 | | | Pool #CB0689, 2.50%, 6/1/51 | | | 349,731 | |

| | 945,105 | | | Pool #CB0972, 2.50%, 6/1/51 | | | 784,905 | |

| | 473,765 | | | Pool #CB1003, 2.50%, 7/1/51 | | | 393,459 | |

| | 300,430 | | | Pool #CB1010, 2.50%, 7/1/51 | | | 249,506 | |

| | 1,350,067 | | | Pool #CB1060, 2.00%, 7/1/51 | | | 1,072,151 | |

| | 1,895,504 | | | Pool #CB1311, 2.50%, 8/1/51 | | | 1,573,619 | |

| | 1,696,341 | | | Pool #CB1444, 2.50%, 8/1/51 | | | 1,407,749 | |

| | 969,542 | | | Pool #CB1515, 2.50%, 8/1/51 | | | 804,597 | |

| | 1,702,818 | | | Pool #CB1532, 2.50%, 9/1/51 | | | 1,413,126 | |

| | 1,588,258 | | | Pool #CB1809, 2.50%, 10/1/51 | | | 1,317,561 | |

| | 1,033,050 | | | Pool #CB1956, 2.50%, 10/1/51 | | | 856,660 | |

| | 789,696 | | | Pool #CB2029, 2.50%, 11/1/51 | | | 654,859 | |

| | 1,734,281 | | | Pool #CB2205, 2.50%, 11/1/51 | | | 1,437,620 | |

| | 704,119 | | | Pool #CB2268, 2.50%, 12/1/51 | | | 583,675 | |

| | 491,358 | | | Pool #CB2467, 2.50%, 12/1/51 | | | 407,156 | |

| | 1,783,416 | | | Pool #CB2515, 2.50%, 12/1/51 | | | 1,477,797 | |

| | 2,730,755 | | | Pool #CB2761, 3.00%, 2/1/52 | | | 2,354,949 | |

| | 5,825,086 | | | Pool #CB2797, 3.00%, 2/1/52 | | | 5,023,437 | |

| | 5,560,988 | | | Pool #CB2938, 3.00%, 2/1/52 | | | 4,789,518 | |

| | 1,159,385 | | | Pool #CB3052, 3.00%, 2/1/52 | | | 998,544 | |

| | 995,393 | | | Pool #CB3249, 3.00%, 4/1/52 | | | 857,200 | |

| | 1,953,657 | | | Pool #CB3281, 3.50%, 4/1/52 | | | 1,750,533 | |

| | 423,739 | | | Pool #CB3413, 3.50%, 4/1/52 | | | 381,326 | |

| | 808,075 | | | Pool #CB3489, 2.50%, 4/1/52 | | | 668,811 | |

| | 640,186 | | | Pool #CB3490, 3.00%, 4/1/52 | | | 551,275 | |

| | 7,408,910 | | | Pool #CB3797, 4.00%, 6/1/52 | | | 6,859,761 | |

| | 5,432,646 | | | Pool #CB4056, 4.50%, 7/1/52 | | | 5,181,280 | |

| | 2,893,405 | | | Pool #CB4208, 4.50%, 7/1/52 | | | 2,759,529 | |

| | 2,362,705 | | | Pool #CB4272, 4.50%, 7/1/52 | | | 2,252,735 | |

| | 9,379,959 | | | Pool #CB4314, 4.50%, 8/1/52 | | | 8,943,376 | |

| | 12,150,030 | | | Pool #CB4463, 4.50%, 8/1/52 | | | 11,581,066 | |

| | 358,437 | | | Pool #CB4473, 4.50%, 8/1/52 | | | 342,758 | |

| | 4,768,557 | | | Pool #CB4539, 4.50%, 9/1/52 | | | 4,545,276 | |

| | 4,328,808 | | | Pool #CB4595, 4.00%, 9/1/52 | | | 4,007,957 | |

| | 6,035,380 | | | Pool #CB4767, 5.00%, 9/1/52 | | | 5,895,616 | |

| | 2,880,231 | | | Pool #CB4966, 5.50%, 10/1/52 | | | 2,869,635 | |

14

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | | | | | |

Principal Amount | | | | | Value | |

| | | |

| | $ 1,612,762 | | | Pool #CB4967, 5.50%, 10/1/52 | | | | | | $ | 1,608,553 | |

| | 9,765,005 | | | Pool #CB5037, 5.50%, 11/1/52 | | | | | | | 9,728,604 | |

| | 4,023,482 | | | Pool #CB5048, 6.00%, 11/1/52 | | | | | | | 4,059,191 | |

| | 5,602,686 | | | Pool #CB5166, 6.00%, 11/1/52 | | | | | | | 5,652,410 | |

| | 2,781,593 | | | Pool #CB5199, 6.00%, 11/1/52 | | | | | | | 2,806,279 | |

| | 2,617,756 | | | Pool #CB5202, 6.50%, 11/1/52 | | | | | | | 2,671,911 | |

| | 391,037 | | | Pool #CB5220, 6.50%, 12/1/52 | | | | | | | 399,281 | |

| | 3,175,845 | | | Pool #CB5343, 6.00%, 12/1/52 | | | | | | | 3,204,031 | |

| | 330,046 | | | Pool #CB5344, 6.50%, 12/1/52 | | | | | | | 341,291 | |

| | 1,707,931 | | | Pool #CB5385, 6.00%, 12/1/52 | | | | | | | 1,723,583 | |

| | 2,632,626 | | | Pool #CB5549, 6.00%, 1/1/53 | | | | | | | 2,655,508 | |

| | 898,193 | | | Pool #CB5586, 6.00%, 1/1/53 | | | | | | | 905,999 | |

| | 4,498,693 | | | Pool #CB5728, 5.50%, 2/1/53 | | | | | | | 4,478,345 | |

| | 1,433,495 | | | Pool #CB5732, 5.50%, 2/1/53 | | | | | | | 1,427,022 | |

| | 4,545,191 | | | Pool #CB5797, 5.50%, 3/1/53 | | | | | | | 4,519,367 | |

| | 1,905,429 | | | Pool #CB5804, 6.00%, 2/1/53 | | | | | | | 1,922,355 | |

| | 2,846,619 | | | Pool #CB5946, 5.50%, 3/1/53 | | | | | | | 2,830,445 | |

| | 2,158,685 | | | Pool #CB5980, 5.50%, 3/1/53 | | | | | | | 2,146,526 | |

| | 182,295 | | | Pool #CB6005, 5.50%, 4/1/53 | | | | | | | 181,268 | |

| | 1,906,227 | | | Pool #CB6126, 5.00%, 4/1/53 | | | | | | | 1,859,051 | |

| | 507,259 | | | Pool #CB6138, 5.00%, 4/1/53 | | | | | | | 494,715 | |

| | 613,826 | | | Pool #CB6208, 5.50%, 5/1/53 | | | | | | | 610,369 | |

| | 399,093 | | | Pool #CB6368, 5.00%, 5/1/53 | | | | | | | 389,216 | |

| | 1,342,567 | | | Pool #CB6400, 5.00%, 5/1/53 | | | | | | | 1,309,341 | |

| | 1,432,480 | | | Pool #CB6564, 5.50%, 6/1/53 | | | | | | | 1,424,412 | |

| | 333,720 | | | Pool #CB6607, 5.50%, 7/1/53 | | | | | | | 331,838 | |

| | 338,138 | | | Pool #CB6783, 5.00%, 7/1/53 | | | | | | | 329,991 | |

| | 247,840 | | | Pool #CB6826, 5.50%, 7/1/53 | | | | | | | 246,794 | |

| | 1,840,152 | | | Pool #CB6953, 5.50%, 8/1/53 | | | | | | | 1,829,697 | |

| | 2,377,408 | | | Pool #CB6955, 6.00%, 8/1/53 | | | | | | | 2,398,526 | |

| | 2,657,243 | | | Pool #CB7160, 6.50%, 9/1/53 | | | | | | | 2,712,169 | |

| | 340,804 | | | Pool #CB7202, 6.50%, 10/1/53 | | | | | | | 347,848 | |

| | 3,357,907 | | | Pool #CB7222, 5.50%, 10/1/53 | | | | | | | 3,338,829 | |

| | 1,467,134 | | | Pool #CB7223, 6.00%, 10/1/53 | | | | | | | 1,479,883 | |

| | 2,794,876 | | | Pool #CB7376, 6.00%, 10/1/53 | | | | | | | 2,819,164 | |

| | 2,195,254 | | | Pool #CB7454, 6.00%, 11/1/53 | | | | | | | 2,214,330 | |

| | 607,966 | | | Pool #CB7455, 6.50%, 11/1/53 | | | | | | | 625,281 | |

| | 215,131 | | | Pool #CB7467, 6.50%, 11/1/53 | | | | | | | 221,258 | |

| | 544,419 | | | Pool #CB7548, 6.50%, 11/1/53 | | | | | | | 555,672 | |

| | 2,287,425 | | | Pool #CB7585, 6.50%, 11/1/53 | | | | | | | 2,334,707 | |

| | 1,188,712 | | | Pool #CB7586, 7.00%, 12/1/53 | | | | | | | 1,225,016 | |

| | 1,110,602 | | | Pool #CB7625, 6.50%, 12/1/53 | | | | | | | 1,142,234 | |

| | 1,963,430 | | | Pool #CB7683, 6.00%, 12/1/53 | | | | | | | 1,980,492 | |

| | 2,088,833 | | | Pool #CB7704, 6.50%, 12/1/53 | | | | | | | 2,132,010 | |

| | 1,724,340 | | | Pool #CB7728, 7.00%, 12/1/53 | | | | | | | 1,800,333 | |

| | 351,596 | | | Pool #CB7733, 6.50%, 12/1/53 | | | | | | | 362,343 | |

| | 1,309,697 | | | Pool #CB7918, 6.00%, 1/1/54 | | | | | | | 1,338,451 | |

15

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 913,556 | | | Pool #CB7919, 6.50%, 1/1/54 | | $ | 947,101 | |

| | 1,927,131 | | | Pool #CB8093, 5.50%, 3/1/54 | | | 1,933,547 | |

| | 2,061,175 | | | Pool #CB8094, 6.00%, 2/1/54 | | | 2,098,976 | |

| | 1,993,020 | | | Pool #CB8108, 5.50%, 3/1/54 | | | 2,002,333 | |

| | 2,332,751 | | | Pool #CB8261, 5.50%, 3/1/54 | | | 2,319,603 | |

| | 1,072,168 | | | Pool #CB8284, 5.50%, 4/1/54 | | | 1,066,125 | |

| | 1,266,782 | | | Pool #CB8285, 6.00%, 4/1/54 | | | 1,291,584 | |

| | 44,649 | | | Pool #MC0013, 5.50%, 12/1/38 | | | 45,696 | |

| | 72,857 | | | Pool #MC0014, 5.50%, 12/1/38 | | | 74,574 | |

| | 60,564 | | | Pool #MC0016, 5.50%, 11/1/38 | | | 61,991 | |

| | 75,767 | | | Pool #MC0127, 4.50%, 7/1/39 | | | 74,342 | |

| | 233,652 | | | Pool #MC0154, 4.50%, 8/1/39 | | | 229,254 | |

| | 76,225 | | | Pool #MC0160, 4.50%, 8/1/39 | | | 74,792 | |

| | 158,958 | | | Pool #MC0177, 4.50%, 9/1/39 | | | 155,972 | |

| | 104,634 | | | Pool #MC0270, 4.50%, 3/1/40 | | | 102,581 | |

| | 132,778 | | | Pool #MC0584, 4.00%, 1/1/42 | | | 126,618 | |

| | | | | | | | |

| | | | | | | 417,152,924 | |

| | | | | | | | |

| | Freddie Mac — 31.99% | | | | |

| | 411,776 | | | Pool #Q63813, 3.50%, 4/1/49 | | | 373,321 | |

| | 724,241 | | | Pool #QB5148, 2.00%, 11/1/50 | | | 577,447 | |

| | 1,189,109 | | | Pool #QB5731, 2.00%, 11/1/50 | | | 948,404 | |

| | 1,825,913 | | | Pool #QB5732, 2.50%, 11/1/50 | | | 1,521,237 | |

| | 1,508,442 | | | Pool #QB6982, 2.00%, 11/1/50 | | | 1,202,628 | |

| | 364,448 | | | Pool #QB6992, 1.50%, 12/1/50 | | | 275,584 | |

| | 1,127,530 | | | Pool #QC4676, 2.50%, 7/1/51 | | | 936,408 | |

| | 760,560 | | | Pool #QC6090, 2.50%, 8/1/51 | | | 631,405 | |

| | 1,667,629 | | | Pool #QC6108, 2.50%, 8/1/51 | | | 1,383,923 | |

| | 1,010,724 | | | Pool #QC6643, 2.50%, 8/1/51 | | | 838,774 | |

| | 1,063,047 | | | Pool #QC9175, 2.50%, 10/1/51 | | | 881,866 | |

| | 1,704,921 | | | Pool #QD0152, 2.50%, 10/1/51 | | | 1,413,811 | |

| | 263,253 | | | Pool #QD1762, 2.00%, 11/1/51 | | | 208,817 | |

| | 2,546,494 | | | Pool #QD4183, 2.50%, 12/1/51 | | | 2,110,899 | |

| | 818,265 | | | Pool #QD7419, 3.00%, 2/1/52 | | | 705,841 | |

| | 380,469 | | | Pool #QE0994, 3.50%, 4/1/52 | | | 340,970 | |

| | 3,175,960 | | | Pool #QE2342, 4.00%, 5/1/52 | | | 2,940,557 | |

| | 4,769,858 | | | Pool #QE7866, 4.00%, 8/1/52 | | | 4,416,316 | |

| | 1,166,242 | | | Pool #QE9025, 4.00%, 8/1/52 | | | 1,079,800 | |

| | 591,546 | | | Pool #QE9026, 5.00%, 8/1/52 | | | 578,306 | |

| | 1,036,000 | | | Pool #QE9027, 4.50%, 8/1/52 | | | 987,775 | |

| | 1,390,209 | | | Pool #QF0539, 4.00%, 9/1/52 | | | 1,287,166 | |

| | 243,921 | | | Pool #QG5944, 5.00%, 6/1/53 | | | 238,169 | |

| | 239,200 | | | Pool #RA1234, 3.50%, 8/1/49 | | | 216,626 | |

| | 252,697 | | | Pool #RA1382, 3.00%, 9/1/49 | | | 220,385 | |

| | 1,316,633 | | | Pool #RA1383, 3.00%, 9/1/49 | | | 1,148,277 | |

| | 249,705 | | | Pool #RA1470, 3.00%, 10/1/49 | | | 217,776 | |

| | 266,374 | | | Pool #RA1713, 3.00%, 11/1/49 | | | 232,313 | |

| | 463,141 | | | Pool #RA1714, 3.00%, 11/1/49 | | | 403,920 | |

16

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 618,120 | | | Pool #RA1716, 3.00%, 11/1/49 | | $ | 539,082 | |

| | 461,406 | | | Pool #RA1724, 2.50%, 10/1/49 | | | 386,595 | |

| | 368,705 | | | Pool #RA1979, 3.00%, 12/1/49 | | | 321,528 | |

| | 650,281 | | | Pool #RA1987, 3.00%, 12/1/49 | | | 567,130 | |

| | 1,357,982 | | | Pool #RA1988, 3.00%, 1/1/50 | | | 1,184,339 | |

| | 737,688 | | | Pool #RA2158, 3.00%, 2/1/50 | | | 642,875 | |

| | 724,778 | | | Pool #RA2162, 3.00%, 2/1/50 | | | 631,624 | |

| | 720,235 | | | Pool #RA2255, 3.00%, 3/1/50 | | | 627,665 | |

| | 1,050,414 | | | Pool #RA2256, 3.00%, 3/1/50 | | | 915,407 | |

| | 713,898 | | | Pool #RA2340, 3.00%, 3/1/50 | | | 621,921 | |

| | 287,240 | | | Pool #RA2395, 2.50%, 4/1/50 | | | 239,935 | |

| | 1,344,308 | | | Pool #RA3207, 2.50%, 7/1/50 | | | 1,121,245 | |

| | 2,774,785 | | | Pool #RA3208, 2.50%, 7/1/50 | | | 2,314,362 | |

| | 806,823 | | | Pool #RA3339, 2.00%, 8/1/50 | | | 644,004 | |

| | 1,228,594 | | | Pool #RA3552, 2.00%, 9/1/50 | | | 980,660 | |

| | 1,126,684 | | | Pool #RA3553, 2.50%, 8/1/50 | | | 939,382 | |

| | 3,159,849 | | | Pool #RA3679, 2.00%, 9/1/50 | | | 2,521,199 | |

| | 1,623,768 | | | Pool #RA3680, 2.50%, 9/1/50 | | | 1,353,831 | |

| | 477,332 | | | Pool #RA3733, 2.00%, 10/1/50 | | | 380,857 | |

| | 524,617 | | | Pool #RA3734, 2.50%, 10/1/50 | | | 437,241 | |

| | 788,495 | | | Pool #RA3747, 2.00%, 9/1/50 | | | 629,374 | |

| | 1,611,929 | | | Pool #RA3751, 2.00%, 10/1/50 | | | 1,294,196 | |

| | 2,460,240 | | | Pool #RA3803, 1.50%, 12/1/50 | | | 1,859,882 | |

| | 384,380 | | | Pool #RA3861, 1.50%, 10/1/50 | | | 290,730 | |

| | 1,543,110 | | | Pool #RA3862, 2.00%, 10/1/50 | | | 1,231,226 | |

| | 1,566,051 | | | Pool #RA3917, 1.50%, 10/1/50 | | | 1,184,500 | |

| | 3,408,196 | | | Pool #RA3918, 2.00%, 10/1/50 | | | 2,718,294 | |

| | 780,704 | | | Pool #RA3928, 1.50%, 11/1/50 | | | 590,344 | |

| | 195,119 | | | Pool #RA3929, 2.00%, 10/1/50 | | | 156,770 | |

| | 543,005 | | | Pool #RA4018, 2.00%, 1/1/51 | | | 432,582 | |

| | 500,907 | | | Pool #RA4055, 2.00%, 11/1/50 | | | 399,511 | |

| | 688,394 | | | Pool #RA4056, 1.50%, 11/1/50 | | | 520,542 | |

| | 6,857,731 | | | Pool #RA4195, 2.00%, 12/1/50 | | | 5,467,430 | |

| | 4,577,206 | | | Pool #RA4254, 2.00%, 12/1/50 | | | 3,647,826 | |

| | 770,096 | | | Pool #RA4274, 1.50%, 12/1/50 | | | 582,323 | |

| | 840,996 | | | Pool #RA4357, 2.00%, 1/1/51 | | | 670,235 | |

| | 1,374,784 | | | Pool #RA4377, 2.00%, 2/1/51 | | | 1,102,090 | |

| | 2,146,527 | | | Pool #RA4420, 2.00%, 1/1/51 | | | 1,710,018 | |

| | 3,060,747 | | | Pool #RA4503, 2.00%, 2/1/51 | | | 2,438,327 | |

| | 757,787 | | | Pool #RA4548, 2.00%, 2/1/51 | | | 603,687 | |

| | 1,827,551 | | | Pool #RA4578, 2.00%, 2/1/51 | | | 1,454,181 | |

| | 292,372 | | | Pool #RA4590, 2.00%, 2/1/51 | | | 232,640 | |

| | 256,350 | | | Pool #RA4597, 2.00%, 2/1/51 | | | 204,220 | |

| | 240,465 | | | Pool #RA4618, 2.00%, 2/1/51 | | | 191,565 | |

| | 793,853 | | | Pool #RA4621, 2.00%, 2/1/51 | | | 631,668 | |

| | 1,336,041 | | | Pool #RA4738, 2.00%, 3/1/51 | | | 1,063,087 | |

| | 3,598,762 | | | Pool #RA4745, 2.00%, 3/1/51 | | | 2,863,531 | |

17

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $1,367,915 | | | Pool #RA4775, 2.00%, 3/1/51 | | $ | 1,088,449 | |

| | 1,091,743 | | | Pool #RA4835, 2.50%, 3/1/51 | | | 907,703 | |

| | 2,058,955 | | | Pool #RA4872, 2.50%, 4/1/51 | | | 1,711,867 | |

| | 7,607,293 | | | Pool #RA5020, 2.00%, 4/1/51 | | | 6,050,753 | |

| | 3,156,845 | | | Pool #RA5021, 1.50%, 4/1/51 | | | 2,383,620 | |

| | 396,870 | | | Pool #RA5043, 2.50%, 4/1/51 | | | 329,845 | |

| | 632,789 | | | Pool #RA5045, 2.50%, 5/1/51 | | | 525,920 | |

| | 2,909,165 | | | Pool #RA5068, 2.00%, 4/1/51 | | | 2,313,014 | |

| | 1,627,419 | | | Pool #RA5173, 2.50%, 4/1/51 | | | 1,352,572 | |

| | 923,164 | | | Pool #RA5195, 2.50%, 5/1/51 | | | 763,213 | |

| | 751,144 | | | Pool #RA5197, 2.50%, 5/1/51 | | | 624,287 | |

| | 1,289,689 | | | Pool #RA5217, 2.50%, 5/1/51 | | | 1,083,294 | |

| | 1,090,564 | | | Pool #RA5237, 2.50%, 5/1/51 | | | 906,385 | |

| | 1,946,971 | | | Pool #RA5350, 2.50%, 6/1/51 | | | 1,617,552 | |

| | 1,449,700 | | | Pool #RA5387, 2.50%, 6/1/51 | | | 1,213,807 | |

| | 222,991 | | | Pool #RA5404, 2.50%, 6/1/51 | | | 185,193 | |

| | 7,357,132 | | | Pool #RA5427, 2.50%, 6/1/51 | | | 6,110,056 | |

| | 1,100,988 | | | Pool #RA5509, 2.50%, 7/1/51 | | | 914,365 | |

| | 460,748 | | | Pool #RA5525, 2.50%, 7/1/51 | | | 382,649 | |

| | 698,697 | | | Pool #RA5541, 2.50%, 7/1/51 | | | 580,264 | |

| | 1,912,579 | | | Pool #RA5621, 2.50%, 8/1/51 | | | 1,587,793 | |

| | 235,307 | | | Pool #RA5686, 2.50%, 7/1/51 | | | 195,349 | |

| | 1,671,047 | | | Pool #RA5701, 2.00%, 8/1/51 | | | 1,326,537 | |

| | 1,534,474 | | | Pool #RA5719, 2.50%, 10/1/51 | | | 1,272,469 | |

| | 3,149,389 | | | Pool #RA5726, 2.50%, 8/1/51 | | | 2,613,598 | |

| | 1,737,340 | | | Pool #RA5796, 2.50%, 8/1/51 | | | 1,441,773 | |

| | 1,850,341 | | | Pool #RA5873, 2.50%, 9/1/51 | | | 1,535,550 | |

| | 695,321 | | | Pool #RA5874, 2.50%, 9/1/51 | | | 576,813 | |

| | 2,559,170 | | | Pool #RA5948, 2.50%, 12/1/51 | | | 2,120,612 | |

| | 140,460 | | | Pool #RA5951, 2.50%, 9/1/51 | | | 116,520 | |

| | 3,308,107 | | | Pool #RA6030, 2.50%, 10/1/51 | | | 2,744,285 | |

| | 64,450 | | | Pool #RA6108, 3.50%, 3/1/52 | | | 57,769 | |

| | 1,267,396 | | | Pool #RA6117, 2.50%, 10/1/51 | | | 1,050,992 | |

| | 1,290,899 | | | Pool #RA6276, 2.50%, 11/1/51 | | | 1,070,482 | |

| | 381,161 | | | Pool #RA6305, 2.50%, 11/1/51 | | | 316,079 | |

| | 1,224,423 | | | Pool #RA6317, 2.50%, 11/1/51 | | | 1,015,357 | |

| | 85,408 | | | Pool #RA6389, 2.50%, 11/1/51 | | | 71,451 | |

| | 1,728,271 | | | Pool #RA6516, 2.50%, 12/1/51 | | | 1,432,102 | |

| | 1,383,266 | | | Pool #RA6687, 3.00%, 1/1/52 | | | 1,192,901 | |

| | 2,854,003 | | | Pool #RA6743, 2.50%, 1/1/52 | | | 2,364,921 | |

| | 1,921,233 | | | Pool #RA6760, 3.00%, 2/1/52 | | | 1,656,833 | |

| | 927,671 | | | Pool #RA6782, 3.00%, 2/1/52 | | | 804,802 | |

| | 2,251,775 | | | Pool #RA6801, 3.00%, 2/1/52 | | | 1,949,172 | |

| | 3,768,179 | | | Pool #RA6858, 3.00%, 3/1/52 | | | 3,245,424 | |

| | 1,455,047 | | | Pool #RA6930, 3.50%, 3/1/52 | | | 1,304,216 | |

| | 1,057,150 | | | Pool #RA6978, 3.50%, 3/1/52 | | | 955,097 | |

| | 1,431,101 | | | Pool #RA6983, 2.50%, 3/1/52 | | | 1,184,744 | |

| | 473,398 | | | Pool #RA7098, 3.50%, 3/1/52 | | | 424,251 | |

18

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 168,880 | | | Pool #RA7146, 3.50%, 4/1/52 | | $ | 151,321 | |

| | 2,065,543 | | | Pool #RA7162, 3.50%, 4/1/52 | | | 1,850,786 | |

| | 187,237 | | | Pool #RA7284, 3.50%, 4/1/52 | | | 168,496 | |

| | 108,919 | | | Pool #RA7344, 4.00%, 4/1/52 | | | 101,319 | |

| | 5,922,520 | | | Pool #RA7454, 4.00%, 6/1/52 | | | 5,483,543 | |

| | 4,202,082 | | | Pool #RA7469, 4.00%, 5/1/52 | | | 3,890,624 | |

| | 8,843,233 | | | Pool #RA7503, 4.50%, 7/1/52 | | | 8,434,061 | |

| | 2,754,354 | | | Pool #RA7714, 4.50%, 7/1/52 | | | 2,626,141 | |

| | 2,619,108 | | | Pool #RA7872, 4.50%, 9/1/52 | | | 2,496,460 | |

| | 4,867,562 | | | Pool #RA7897, 4.50%, 9/1/52 | | | 4,639,623 | |

| | 3,260,850 | | | Pool #RA8627, 5.50%, 3/1/53 | | | 3,242,458 | |

| | 1,896,700 | | | Pool #RA8684, 5.00%, 3/1/53 | | | 1,849,973 | |

| | 329,993 | | | Pool #RA9790, 6.00%, 9/1/53 | | | 333,607 | |

| | 1,010,995 | | | Pool #RA9975, 6.00%, 10/1/53 | | | 1,019,976 | |

| | 965,071 | | | Pool #WA3211, 1.91%, 9/1/35 | | | 736,279 | |

| | 1,058,228 | | | Pool #WA3305, 1.75%, 6/1/37 | | | 765,647 | |

| | 920,976 | | | Pool #WA5002, 2.62%, 11/1/31 | | | 807,045 | |

| | 250,000 | | | Pool #WN2304, 4.45%, 12/1/32 | | | 240,694 | |

| | 1,000,000 | | | Pool #WN3049, 2.39%, 9/1/31 | | | 856,231 | |

| | 418,947 | | | Pool #ZA4828, 4.00%, 3/1/47 | | | 394,542 | |

| | 52,705 | | | Pool #ZA4891, 3.50%, 3/1/47 | | | 48,476 | |

| | 422,644 | | | Pool #ZA4892, 4.00%, 5/1/47 | | | 398,034 | |

| | 309,681 | | | Pool #ZA4893, 3.50%, 4/1/47 | | | 283,515 | |

| | 608,407 | | | Pool #ZA4912, 3.50%, 5/1/47 | | | 554,052 | |

| | 603,157 | | | Pool #ZA4913, 4.00%, 5/1/47 | | | 568,021 | |

| | 896,977 | | | Pool #ZA5070, 3.50%, 11/1/47 | | | 818,642 | |

| | 153,157 | | | Pool #ZA5090, 3.50%, 11/1/47 | | | 139,993 | |

| | 380,084 | | | Pool #ZA5174, 3.50%, 12/1/47 | | | 347,415 | |

| | 1,262,038 | | | Pool #ZA5238, 3.50%, 2/1/48 | | | 1,149,288 | |

| | 403,654 | | | Pool #ZA5245, 3.50%, 1/1/48 | | | 367,591 | |

| | 942,221 | | | Pool #ZA5253, 3.50%, 1/1/48 | | | 859,934 | |

| | 363,656 | | | Pool #ZA5254, 4.00%, 1/1/48 | | | 342,501 | |

| | 575,566 | | | Pool #ZA5308, 4.00%, 1/1/48 | | | 542,037 | |

| | 748,851 | | | Pool #ZA5575, 4.00%, 7/1/48 | | | 703,966 | |

| | 610,020 | | | Pool #ZA5637, 4.50%, 8/1/48 | | | 589,465 | |

| | 509,519 | | | Pool #ZA5645, 4.00%, 8/1/48 | | | 478,984 | |

| | 57,932 | | | Pool #ZA6576, 3.50%, 4/1/49 | | | 52,947 | |

| | 75,632 | | | Pool #ZI0238, 5.00%, 6/1/33 | | | 75,691 | |

| | 135,764 | | | Pool #ZI0412, 5.00%, 8/1/33 | | | 135,873 | |

| | 58,047 | | | Pool #ZI0543, 4.50%, 8/1/33 | | | 57,160 | |

| | 55,260 | | | Pool #ZI1023, 5.50%, 11/1/33 | | | 56,162 | |

| | 77,925 | | | Pool #ZI1353, 5.50%, 1/1/34 | | | 79,200 | |

| | 117,742 | | | Pool #ZI1493, 5.50%, 1/1/34 | | | 119,670 | |

| | 93,711 | | | Pool #ZI1524, 5.50%, 2/1/34 | | | 95,240 | |

| | 59,254 | | | Pool #ZI1689, 5.50%, 4/1/34 | | | 60,382 | |

| | 50,989 | | | Pool #ZI1802, 5.50%, 4/1/34 | | | 51,960 | |

| | 120,003 | | | Pool #ZI1991, 5.00%, 5/1/34 | | | 120,099 | |

19

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 84,409 | | | Pool #ZI2332, 5.00%, 6/1/34 | | $ | 84,477 | |

| | 128,520 | | | Pool #ZI2939, 5.50%, 12/1/34 | | | 130,964 | |

| | 74,706 | | | Pool #ZI3102, 5.00%, 1/1/35 | | | 74,766 | |

| | 73,875 | | | Pool #ZI3254, 5.50%, 4/1/35 | | | 75,546 | |

| | 157,063 | | | Pool #ZI3507, 5.00%, 9/1/35 | | | 157,218 | |

| | 84,430 | | | Pool #ZI3713, 5.00%, 5/1/35 | | | 84,514 | |

| | 72,145 | | | Pool #ZI4118, 5.50%, 1/1/36 | | | 73,780 | |

| | 129,156 | | | Pool #ZI4120, 5.50%, 1/1/36 | | | 132,057 | |

| | 175,454 | | | Pool #ZI4200, 5.50%, 2/1/36 | | | 179,425 | |

| | 74,882 | | | Pool #ZI4201, 6.00%, 2/1/36 | | | 77,855 | |

| | 58,285 | | | Pool #ZI4429, 5.00%, 6/1/35 | | | 58,342 | |

| | 52,210 | | | Pool #ZI4521, 5.50%, 7/1/35 | | | 53,391 | |

| | 145,474 | | | Pool #ZI4572, 5.50%, 8/1/35 | | | 148,766 | |

| | 56,736 | | | Pool #ZI4605, 5.50%, 9/1/35 | | | 58,022 | |

| | 4,767 | | | Pool #ZI4606, 5.50%, 9/1/35 | | | 4,875 | |

| | 36,566 | | | Pool #ZI4704, 5.00%, 11/1/35 | | | 36,602 | |

| | 107,637 | | | Pool #ZI4705, 5.00%, 11/1/35 | | | 107,744 | |

| | 45,507 | | | Pool #ZI4706, 5.50%, 11/1/35 | | | 46,537 | |

| | 185,633 | | | Pool #ZI4979, 6.00%, 6/1/36 | | | 193,888 | |

| | 25,592 | | | Pool #ZI5006, 6.00%, 6/1/36 | | | 26,722 | |

| | 158,431 | | | Pool #ZI5912, 5.50%, 4/1/37 | | | 161,929 | |

| | 81,993 | | | Pool #ZI6311, 5.50%, 6/1/37 | | | 83,803 | |

| | 55,370 | | | Pool #ZI6814, 6.00%, 10/1/37 | | | 57,826 | |

| | 49,511 | | | Pool #ZI6976, 5.50%, 7/1/37 | | | 50,606 | |

| | 193,591 | | | Pool #ZI9925, 5.00%, 4/1/40 | | | 194,055 | |

| | 64,546 | | | Pool #ZJ0038, 4.50%, 5/1/40 | | | 63,279 | |

| | 196,506 | | | Pool #ZJ0482, 4.50%, 9/1/40 | | | 192,649 | |

| | 209,764 | | | Pool #ZJ0844, 4.00%, 12/1/40 | | | 200,284 | |

| | 115,137 | | | Pool #ZJ1058, 4.00%, 12/1/40 | | | 109,933 | |

| | 84,914 | | | Pool #ZJ1264, 4.00%, 1/1/41 | | | 81,082 | |

| | 223,126 | | | Pool #ZJ1444, 4.00%, 3/1/41 | | | 212,786 | |

| | 94,493 | | | Pool #ZJ1445, 4.50%, 3/1/41 | | | 92,534 | |

| | 43,336 | | | Pool #ZJ5032, 6.50%, 5/1/31 | | | 44,860 | |

| | 26,279 | | | Pool #ZJ5458, 6.50%, 11/1/31 | | | 27,199 | |

| | 21,018 | | | Pool #ZJ5928, 6.50%, 3/1/32 | | | 21,865 | |

| | 67,876 | | | Pool #ZJ6638, 6.00%, 11/1/32 | | | 70,253 | |

| | 55,751 | | | Pool #ZJ6955, 5.50%, 3/1/33 | | | 56,661 | |

| | 40,267 | | | Pool #ZJ6956, 5.50%, 3/1/33 | | | 40,925 | |

| | 35,228 | | | Pool #ZK4661, 2.50%, 11/1/27 | | | 33,949 | |

| | 275,799 | | | Pool #ZL2630, 3.50%, 12/1/41 | | | 255,431 | |

| | 311,991 | | | Pool #ZL2708, 3.50%, 1/1/42 | | | 288,340 | |

| | 823,854 | | | Pool #ZL5676, 3.00%, 4/1/43 | | | 737,500 | |

| | 378,326 | | | Pool #ZL6090, 3.00%, 6/1/43 | | | 338,671 | |

| | 178,517 | | | Pool #ZL6097, 3.00%, 6/1/43 | | | 159,789 | |

| | 519,285 | | | Pool #ZL9372, 3.00%, 4/1/45 | | | 458,589 | |

| | 336,414 | | | Pool #ZL9669, 3.50%, 6/1/45 | | | 307,871 | |

| | 192,640 | | | Pool #ZM1422, 3.50%, 7/1/46 | | | 175,844 | |

| | 211,024 | | | Pool #ZM1423, 3.50%, 7/1/46 | | | 192,626 | |

20

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 153,871 | | | Pool #ZM1736, 3.00%, 9/1/46 | | $ | 135,781 | |

| | 853,709 | | | Pool #ZM1738, 3.00%, 9/1/46 | | | 753,309 | |

| | 516,378 | | | Pool #ZM8750, 4.00%, 9/1/48 | | | 485,428 | |

| | 280,132 | | | Pool #ZN1022, 4.00%, 11/1/48 | | | 263,341 | |

| | 7,781 | | | Pool #ZN5269, 6.50%, 10/1/31 | | | 8,054 | |

| | 60,097 | | | Pool #ZN5321, 5.50%, 5/1/34 | | | 61,236 | |

| | 36,802 | | | Pool #ZN5322, 5.50%, 5/1/34 | | | 37,500 | |

| | 43,670 | | | Pool #ZN5332, 5.00%, 11/1/34 | | | 43,705 | |

| | 581,781 | | | Series 2017-SB42, Class A10F, 2.96%, 10/25/27(a) | | | 542,921 | |

| | 317,964 | | | Series 2018-SB52, Class A10F, 3.46%, 6/25/28(a) | | | 300,298 | |

| | 687,386 | | | Series 2018-SB53, Class A10F, 3.63%, 6/25/28(a) | | | 648,746 | |

| | 250,595 | | | Series 2018-SB56, Class A10F, 3.69%, 10/25/28(a) | | | 237,178 | |

| | 438,088 | | | Series 2019-SB64, Class A10F, 2.71%, 5/25/29(a) | | | 399,215 | |

| | 591,932 | | | Series 2019-SB66, Class A5H, 2.32%, 6/25/39(a) | | | 581,169 | |

| | 1,343,049 | | | Series 2020-SB81, Class A10H, 1.26%, 10/25/40(a) | | | 1,093,185 | |

| | 980,141 | | | Series 2022-SB100, Class A10F, 2.01%, 5/25/32(a) | | | 807,833 | |

| | 754,198 | | | Series 2022-SB96, Class A7F, 1.88%, 1/25/29(a) | | | 660,943 | |

| | 2,827,723 | | | Series Q014, Class A1, 1.56%, 1/25/36 | | | 2,281,819 | |

| | | | | | | | |

| | | | | | | 211,576,497 | |

| | | | | | | | |

| | Ginnie Mae — 3.90% | | | | |

| | 180,455 | | | Pool #442423, 4.00%, 9/20/41 | | | 173,187 | |

| | 81,482 | | | Pool #616936, 5.50%, 1/15/36 | | | 83,466 | |

| | 675,985 | | | Pool #618363, 4.00%, 9/20/41 | | | 648,736 | |

| | 336,626 | | | Pool #664269, 5.85%, 6/15/38 | | | 336,626 | |

| | 20,291 | | | Pool #675509, 5.50%, 6/15/38 | | | 20,478 | |

| | 134,051 | | | Pool #697672, 5.50%, 12/15/38 | | | 137,445 | |

| | 58,907 | | | Pool #697814, 5.00%, 2/15/39 | | | 59,219 | |

| | 295,989 | | | Pool #697885, 4.50%, 3/15/39 | | | 292,219 | |

| | 91,102 | | | Pool #698112, 4.50%, 5/15/39 | | | 89,941 | |

| | 424,025 | | | Pool #698113, 4.50%, 5/15/39 | | | 418,623 | |

| | 612,390 | | | Pool #713519, 6.00%, 7/15/39 | | | 640,916 | |

| | 155,503 | | | Pool #716822, 4.50%, 4/15/39 | | | 153,522 | |

| | 55,697 | | | Pool #716823, 4.50%, 4/15/39 | | | 54,987 | |

| | 208,317 | | | Pool #720080, 4.50%, 6/15/39 | | | 205,663 | |

| | 236,077 | | | Pool #724629, 5.00%, 7/20/40 | | | 237,670 | |

| | 300,854 | | | Pool #726550, 5.00%, 9/15/39 | | | 302,609 | |

| | 139,521 | | | Pool #729346, 4.50%, 7/15/41 | | | 137,711 | |

| | 206,260 | | | Pool #738844, 3.50%, 10/15/41 | | | 191,950 | |

| | 137,324 | | | Pool #738845, 3.50%, 10/15/41 | | | 127,794 | |

| | 196,344 | | | Pool #738862, 4.00%, 10/15/41 | | | 188,473 | |

| | 168,118 | | | Pool #747241, 5.00%, 9/20/40 | | | 169,253 | |

| | 516,253 | | | Pool #748654, 3.50%, 9/15/40 | | | 480,436 | |

| | 92,901 | | | Pool #748846, 4.50%, 9/20/40 | | | 91,739 | |

| | 247,710 | | | Pool #757016, 3.50%, 11/15/40 | | | 230,539 | |

| | 154,562 | | | Pool #757017, 4.00%, 12/15/40 | | | 148,365 | |

| | 191,681 | | | Pool #759297, 4.00%, 1/20/41 | | | 183,942 | |

| | 138,394 | | | Pool #759298, 4.00%, 2/20/41 | | | 132,802 | |

21

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 137,333 | | | Pool #762877, 4.00%, 4/15/41 | | $ | 131,824 | |

| | 76,917 | | | Pool #763564, 4.50%, 5/15/41 | | | 75,919 | |

| | 167,353 | | | Pool #770481, 4.00%, 8/15/41 | | | 160,644 | |

| | 38,457 | | | Pool #770482, 4.50%, 8/15/41 | | | 37,958 | |

| | 118,699 | | | Pool #770517, 4.00%, 8/15/41 | | | 113,941 | |

| | 111,716 | | | Pool #770529, 4.00%, 8/15/41 | | | 107,233 | |

| | 43,191 | | | Pool #770537, 4.00%, 8/15/41 | | | 41,460 | |

| | 130,386 | | | Pool #770738, 4.50%, 6/20/41 | | | 128,843 | |

| | 150,017 | | | Pool #779592, 4.00%, 11/20/41 | | | 143,975 | |

| | 98,237 | | | Pool #779593, 4.00%, 11/20/41 | | | 94,276 | |

| | 236,301 | | | Pool #AA6312, 3.00%, 4/15/43 | | | 210,655 | |

| | 318,053 | | | Pool #AA6424, 3.00%, 5/15/43 | | | 285,677 | |

| | 384,054 | | | Pool #AB2733, 3.50%, 8/15/42 | | | 356,857 | |

| | 281,218 | | | Pool #AB2745, 3.00%, 8/15/42 | | | 252,761 | |

| | 631,172 | | | Pool #AB2841, 3.00%, 9/15/42 | | | 567,302 | |

| | 42,026 | | | Pool #AB2843, 3.00%, 9/15/42 | | | 37,776 | |

| | 375,965 | | | Pool #AE6946, 3.00%, 6/15/43 | | | 337,715 | |

| | 68,445 | | | Pool #AG8915, 4.00%, 2/20/44 | | | 65,372 | |

| | 305,149 | | | Pool #AK6446, 3.00%, 1/15/45 | | | 271,157 | |

| | 375,103 | | | Pool #AK7036, 3.00%, 4/15/45 | | | 335,668 | |

| | 280,834 | | | Pool #AO3594, 3.50%, 8/20/45 | | | 260,277 | |

| | 145,726 | | | Pool #AP3887, 3.50%, 9/20/45 | | | 135,055 | |

| | 312,667 | | | Pool #AR4919, 3.50%, 3/20/46 | | | 288,623 | |

| | 457,739 | | | Pool #AR4970, 3.50%, 4/20/46 | | | 422,513 | |

| | 416,785 | | | Pool #AS2921, 3.50%, 4/20/46 | | | 384,722 | |

| | 345,700 | | | Pool #AS4332, 3.00%, 6/20/46 | | | 309,336 | |

| | 400,267 | | | Pool #AS5511, 3.50%, 3/20/46 | | | 369,465 | |

| | 686,847 | | | Pool #AX7237, 3.50%, 11/20/46 | | | 633,992 | |

| | 544,154 | | | Pool #BO2104, 3.00%, 8/20/49 | | | 477,607 | |

| | 1,453,897 | | | Pool #BR3787, 3.00%, 12/20/49 | | | 1,289,410 | |

| | 700,000 | | | Series 2012-100, Class B, 2.31%, 11/16/51(a) | | | 620,820 | |

| | 289,792 | | | Series 2012-107, Class A, 1.15%, 1/16/45 | | | 264,678 | |

| | 852,113 | | | Series 2012-115, Class A, 2.13%, 4/16/45 | | | 728,355 | |

| | 862,367 | | | Series 2012-120, Class A, 1.90%, 2/16/53 | | | 727,164 | |

| | 370,799 | | | Series 2012-131, Class A, 1.90%, 2/16/53 | | | 313,587 | |

| | 135,334 | | | Series 2012-144, Class AD, 1.77%, 1/16/53 | | | 117,476 | |

| | 74,568 | | | Series 2013-105, Class A, 1.71%, 2/16/37 | | | 73,148 | |

| | 81,065 | | | Series 2013-126, Class BK, 2.45%, 10/16/47(a) | | | 70,662 | |

| | 172,132 | | | Series 2013-29, Class AB, 1.77%, 10/16/45 | | | 157,462 | |

| | 93,142 | | | Series 2013-63, Class AB, 1.38%, 3/16/45 | | | 90,485 | |

| | 279,961 | | | Series 2013-97, Class AC, 2.00%, 6/16/45 | | | 250,001 | |

| | 32,300 | | | Series 2015-107, Class AB, 2.50%, 11/16/49 | | | 28,685 | |

| | 335,158 | | | Series 2015-114, Class AD, 2.50%, 11/15/51 | | | 315,729 | |

| | 166,148 | | | Series 2015-128, Class AD, 2.50%, 12/16/50 | | | 154,376 | |

| | 139,274 | | | Series 2015-130, Class AH, 2.90%, 8/16/47(a) | | | 133,776 | |

| | 859,209 | | | Series 2015-135, Class AC, 2.35%, 4/16/49 | | | 744,931 | |

| | 314,591 | | | Series 2015-136, Class AC, 2.50%, 3/16/47 | | | 286,546 | |

| | 121,151 | | | Series 2015-15, Class A, 2.00%, 11/16/48 | | | 107,759 | |

22

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC BlueBay Access Capital Community Investment Fund (cont.)

March 31, 2024 (Unaudited)

| | | | | | | | |

Principal Amount | | | | | Value | |

| | |

| | $ 378,554 | | | Series 2015-154, Class AD, 2.50%, 5/16/54 | | $ | 327,519 | |

| | 308,071 | | | Series 2015-171, Class DA, 2.37%, 3/16/46 | | | 270,389 | |

| | 278,973 | | | Series 2015-22, Class A, 2.40%, 8/16/47 | | | 258,701 | |

| | 415,772 | | | Series 2015-70, Class AB, 2.30%, 11/16/48 | | | 366,008 | |

| | 63,025 | | | Series 2016-11, Class AD, 2.25%, 11/16/43 | | | 60,856 | |

| | 142,275 | | | Series 2016-14, Class AB, 2.15%, 8/16/42 | | | 134,323 | |

| | 770,959 | | | Series 2016-152, Class EA, 2.20%, 8/15/58 | | | 623,266 | |

| | 893,998 | | | Series 2016-157, Class AC, 2.00%, 11/16/50 | | | 745,412 | |

| | 262,009 | | | Series 2016-39, Class AH, 2.50%, 9/16/44 | | | 242,657 | |

| | 82,868 | | | Series 2016-50, Class A, 2.30%, 7/16/52 | | | 79,170 | |

| | 372,988 | | | Series 2016-64, Class CA, 2.30%, 3/16/45 | | | 348,391 | |

| | 7,668 | | | Series 2016-67, Class A, 2.30%, 7/16/56 | | | 7,668 | |

| | 165,809 | | | Series 2016-94, Class AC, 2.20%, 8/16/57 | | | 137,228 | |

| | 111,135 | | | Series 2016-96, Class BA, 1.95%, 3/16/43 | | | 105,288 | |