QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

HOSPIRA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

April 1, 2005

Dear Hospira Shareholder:

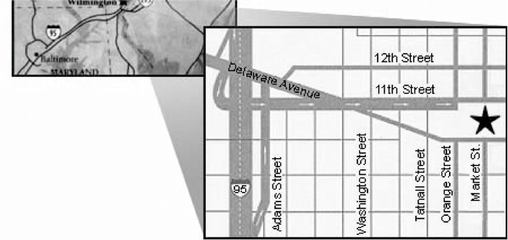

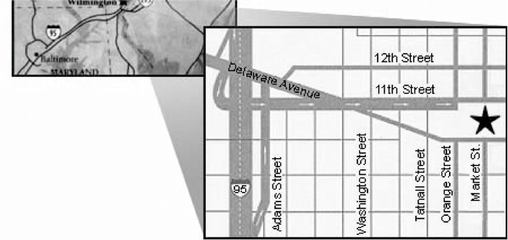

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of Hospira, Inc. at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware on Monday, May 9, 2005 at 10:00 a.m. Eastern Time.

This booklet includes the notice of annual meeting and the proxy statement. The proxy statement describes the business to be transacted at the meeting and provides other information about the company that you should know when you vote your shares.

The principal business to be conducted at the meeting will be the election of three Class I directors, approval of the Hospira 2004 Long-Term Stock Incentive Plan, approval of the Hospira, Inc. 2004 Performance Incentive Plan, and ratification of the appointment of Deloitte & Touche LLP as Hospira's auditors.

It is important that your shares be represented, whether or not you attend the meeting. Shareholders of record can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services appear on the proxy card. You can also vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it promptly using the envelope provided. If you hold your shares through your broker or other intermediary, that person or institution will provide you with instructions on how to vote your shares.

We look forward to your participation in our first annual meeting as a publicly held company.

| Sincerely, |

|

|

|

|

|

David A. Jones

Chairman of the Board | | | | Christopher B. Begley

Chief Executive Officer |

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 9, 2005

The 2005 Annual Meeting of Shareholders of Hospira, Inc. will be held at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware, on Monday, May 9, 2005, at 10:00 a.m., Eastern Time. The purposes of the meeting are:

- 1.

- To elect three persons to serve as Class I directors on our board of directors until the annual meeting in 2008 (Item 1 on the proxy card);

- 2.

- To approve the Hospira 2004 Long-Term Stock Incentive Plan (Item 2 on the proxy card);

- 3.

- To approve the Hospira, Inc. 2004 Performance Incentive Plan (Item 3 on the proxy card);

- 4.

- To ratify the appointment of Deloitte & Touche LLP as auditors of Hospira for 2005 (Item 4 on the proxy card); and

- 5.

- To transact such other business as may properly come before the meeting or any adjournment of the meeting.

The board of directors recommends that you vote FOR the matters described in Items 1 through 4 above.

This proxy statement and the accompanying proxy card are first being mailed to shareholders on or about April 1, 2005.

The board of directors has set the close of business on March 11, 2005 as the record date for the meeting. This means that owners of common stock as of that day are entitled to receive this notice of the meeting, and vote at the meeting and any adjournments or postponements of the meeting.

A proxy statement with respect to the annual meeting accompanies and forms a part of this notice. A list of shareholders as of the record date will be available for inspection by any shareholder for any purpose relevant to the annual meeting during regular business hours at our principal business address for ten days prior to the meeting.

Your vote is important. We encourage you to read the enclosed proxy statement and to submit a proxy so that your shares will be represented and voted even if you do not attend. You may submit your proxy over the Internet or by telephone or mail. If you do attend the meeting, you may revoke your proxy and vote in person.

By order of the board of directors

Brian J. Smith

Secretary

April 1, 2005

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

HOSPIRA, INC.

PROXY STATEMENT

FOR

2005 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 9, 2005

GENERAL INFORMATION

Why did I receive this proxy statement?

Our board of directors is soliciting proxies for use at our annual meeting of shareholders to be held on May 9, 2005, beginning at 10:00 a.m., Eastern Time, at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware, and any adjournments or postponements of the meeting. In order to solicit your proxy, we must furnish you with this proxy statement, which contains information that we are required to provide you by law. This proxy statement was first sent to shareholders on approximately April 1, 2005.

What will be covered at the annual meeting?

Shareholders will vote on the following matters:

- •

- election of three Class I directors;

- •

- approval of our long-term stock incentive plan;

- •

- approval of our performance incentive plan; and

- •

- ratification of the appointment of Deloitte & Touche LLP as our 2005 auditors.

Who may vote at the meeting?

We have set a record date of March 11, 2005, meaning that shareholders of record at the close of business that date may vote at the meeting or at adjournments or postponements of the meeting.

How many votes do I have?

You have one vote for each share of common stock you hold on all matters that may properly come before the meeting.

What constitutes a quorum?

The presence in person or by proxy of the holders of shares of common stock representing a majority of all issued and outstanding shares of common stock entitled to vote will constitute a quorum. On March 11, 2005, the record date, there were 157,452,475 shares of common stock issued and outstanding.

Votes cast in person or by proxy will be tabulated by an inspector of election, appointed for the meeting, who will determine whether a quorum is present. Shares of common stock represented by a properly completed proxy will be counted as present at the meeting for purposes of determining a quorum, without regard to whether the proxy indicates that the shareholder is casting a vote or abstaining.

What vote is required to approve each matter?

If there is a quorum at the meeting, the following vote requirements apply.

Election of Directors. Directors are elected by a plurality of the votes present at the meeting. As a result, at the 2005 annual meeting, the three Class I directors who receive the most votes will be elected to the board. Abstentions and instructions to withhold votes with respect to any nominee will

result in those nominees receiving fewer votes but will not count as votes against that nominee. You are not allowed to cumulate votes in the election of directors.

Other Matters. The other matters covered at the meeting require that more votes be cast for the matter than against the matter. Abstentions and broker non-votes (discussed below) will not be counted as a vote for or against those matters.

If there are not sufficient votes for approval of any of the matters to be voted upon at the meeting, the meeting may be adjourned by the chairman of the meeting or a majority of the votes present at the meeting in order to permit further solicitation of proxies.

How do I vote by proxy?

If you are a shareholder of record, you have a choice of voting over the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. The Internet and telephone voting facilities for shareholders of record will close at 11:59 p.m. Eastern Time on May 8, 2005. Other deadlines may apply to you if your stock is held of record by a bank, a broker or other holder of record.

If you are a shareholder of record and submit to us a proxy that does not indicate how your shares are to be voted on a matter, properly completed proxies will be voted FOR the election of all Class I director nominees, FOR the approval of the Hospira 2004 Long-Term Stock Incentive Plan, FOR the approval of the Hospira, Inc. 2004 Performance Incentive Plan, and FOR the ratification of Deloitte & Touche LLP as our auditors for 2005. Other matters that properly come before the meeting will be voted upon by the persons named on the proxy card in accordance with their best judgment.

What is a broker non-vote and how does it affect the voting requirements?

If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen. On matters on which the broker is prohibited from exercising voting authority, which is called a "broker non-vote," your shares will not be voted. Broker non-votes will have no effect on the number of votes required to approve any of the matters covered at the meeting. On matters on which the broker is permitted to exercise voting authority, the broker will vote your shares in its discretion. Brokers may not exercise voting authority on the proposal in this proxy statement relating to the approval of our long-term stock incentive plan.

How do I vote if I hold my shares through a broker or other nominee?

If you hold your shares through a broker or other nominee, you may instruct your broker or other nominee to vote your shares by following instructions that the broker or other nominee provides for you. Most brokers offer voting by mail, by telephone and on the Internet.

How do I vote if I hold shares through the Hospira 401(k) Retirement Savings Plan?

If you hold shares through the Hospira 401(k) Retirement Savings Plan, you will receive a proxy card that will serve as an instruction to the co-trustees of the plan as to how to vote your shares. You may vote your shares by completing the proxy card and mailing it in the postage-paid envelope provided. You may also vote by telephone or Internet by following the instructions provided with the proxy card. If you do not vote shares you hold in the Hospira 401(k) Retirement Savings Plan, the co-trustees of the plan will vote your shares in their discretion.

2

The trustee of the plan is Putnam Fiduciary Trust Company and the co-trustees are Terrence Kearney, Lori Carlson, and Henry Weishaar. Each of the co-trustees is an officer of Hospira. Plan benefits are provided through the Hospira 401(k) Retirement Savings Trust. The voting power with respect to the Hospira shares held under the plan is held by and shared between the co-trustees and the participants. The co-trustees may use their own discretion with respect to those shares for which voting instructions are not received on a timely basis.

How do I vote in person?

If you are a shareholder of record, you may vote your shares in person at the meeting. However, we encourage you to vote by proxy in advance, even if you plan to attend the meeting.

Can I revoke a proxy?

Yes. You can revoke your proxy by:

- •

- giving written notice to our corporate secretary;

- •

- delivering a later-dated proxy; or

- •

- voting in person at the meeting.

If I submit a proxy, will my vote be kept confidential?

Our policy is that all proxies, ballots, and voting tabulations that reveal how a particular shareholder has voted be kept confidential and not be disclosed, except:

- •

- where disclosure may be required by law or regulation;

- •

- where disclosure may be necessary in order for us to assert or defend claims;

- •

- where a shareholder provides comments with a proxy;

- •

- where a shareholder expressly requests disclosure;

- •

- to allow the inspectors of election to certify the results of a vote; or

- •

- in other limited circumstances, such as a contested election or proxy solicitation not approved and recommended by the board of directors.

Who will be tabulating and certifying votes at the meeting?

We have engaged EquiServe Trust Company, N.A., our transfer agent, to serve as the tabulator of votes and a representative of EquiServe to serve as inspector of election and certify the votes.

Who will pay the costs and expenses for this proxy solicitation?

We will pay all costs of soliciting proxies, including charges made by brokers and other persons holding common stock in their names or in the names of nominees, for reasonable expenses incurred in sending proxy materials to beneficial owners and obtaining their proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally and by telephone, Internet and facsimile, all without extra compensation. We also have retained the services of Georgeson Shareholder Communications, Inc. to aid in the solicitation of proxies at an estimated cost of $15,000, plus reimbursement for reasonable out-of-pocket expenses.

3

Can I elect to receive future proxy statements and annual reports electronically instead of by mail?

Yes. If you are a shareholder of record or participant in the Hospira 401(k) Retirement Savings Plan, you can choose this option by taking one of the following actions:

- •

- following the instructions provided if you vote over the Internet or by telephone; or

- •

- following the procedures contained in the "Investor Relations" section of our Web site at www.hospira.com.

If you choose to view future proxy statements and annual reports over the Internet, you will receive a proxy card in the mail next year with instructions containing the Internet address of those materials. Your choice will remain in effect until you notify Hospira Investor Relations in writing, by mail or through the Investor Relations section of our Web site, and tell us otherwise. You do not have to elect Internet access each year. If you hold your shares through a broker or other nominee, you may follow the procedures contained in the "Investor Relations" section of our Web site at www.hospira.com. If it is feasible for you to do so, we encourage you to elect to receive future proxy statements and annual reports electronically to assist us in reducing our printing and mailing expenses.

This proxy statement and the 2004 Annual Report to Shareholders are available on our Web site at www.hospira.com.

How can I attend the meeting?

You will need an admission ticket to enter the meeting. Shareholders of record will find an admission ticket attached to their proxy cards. If you plan to attend the meeting in person, please retain the admission ticket. A map and directions to the meeting are included on the inside back cover of this proxy statement and with your proxy card. If you arrive at the meeting without an admission ticket or you hold your stock through a broker, bank or other nominee, we will only admit you if we are able to verify that you are a Hospira shareholder. You may prove that you are a Hospira shareholder by, among other ways, providing us with a copy of a recent bank or brokerage account statement showing that you own Hospira common stock. Shareholders will be admitted to the meeting location beginning at 9:30 a.m. Eastern Time.

4

PROPOSALS TO BE VOTED UPON

Proposal 1

Election of Directors

Our board of directors consists of eight persons. The board of directors is divided into three classes, with one class of directors elected at each annual meeting. Currently, Class I and Class III each consists of three directors and Class II consists of two directors. Each director holds office for a term of three years and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. On February 23, 2005, our Class I director, Joel T. Allison, notified us that he would not be running for re-election to our board of directors at the 2005 annual meeting. On that date, our board of directors, upon the recommendation of the nominations and compensation committee, nominated Judith C. Pelham for election to the board of directors at the 2005 annual meeting.

Irving W. Bailey, II, Judith C. Pelham and Jacque J. Sokolov each have been nominated by the board of directors to serve as a Class I director, to hold office until the annual meeting in 2008. A properly submitted proxy will be voted by the persons named on the proxy card for the election of Mr. Bailey, Ms. Pelham and Dr. Sokolov, unless you indicate that your vote should be withheld. If elected, Mr. Bailey, Ms. Pelham and Dr. Sokolov will each serve until the 2008 annual meeting and his or her successor is elected and qualified or until his or her earlier death, resignation or removal. Each of the nominees has indicated his or her willingness to serve if elected, and the board of directors has no reason to believe that any of the nominees will be unavailable for election, but if such a situation should arise, the proxy will be voted in accordance with the best judgment of the proxyholder for such person or persons as may be designated by the board of directors, unless the shareholder has directed otherwise.

You can find the principal occupation and other information about Mr. Bailey, Ms. Pelham and Dr. Sokolov, along with information regarding our other directors, later in this proxy statement under "Our Board of Directors."

The board of directors recommends that the shareholders vote FOR the election of Irving W. Bailey, II, Judith C. Pelham and Jacque J. Sokolov as Class I directors.

Proposal 2

Approval of Hospira 2004 Long-Term Stock Incentive Plan

The Hospira 2004 Long-Term Stock Incentive Plan, which we refer to as the "2004 Stock Plan," provides for the grant of stock option awards, stock appreciation rights, restricted stock awards and other cash- and stock-based awards to our employees and directors, including our executive officers. The purpose of the 2004 Stock Plan is to enable us to:

- •

- attract and retain qualified employees and directors;

- •

- motivate participants, by means of appropriate incentives, to achieve long-range goals;

- •

- provide incentive compensation opportunities that are competitive with those of other similar companies; and

- •

- further align participants' interests with those of our other shareholders through compensation that is based on our common stock;

thereby promoting our long-term financial interest, including the growth in value of our equity and enhancement of long-term shareholder return.

You are being asked to approve the 2004 Stock Plan so that awards under the plan will continue to be tax deductible as performance-based compensation under U.S. federal income tax law. Under U.S.

5

federal income tax law, certain remuneration in excess of $1 million to the five executive officers named later in this proxy statement under "Summary Compensation Table" (sometimes referred to as the "named executive officers") may not be deductible. However, performance-based compensation is fully deductible if the plan under which such compensation is awarded is approved by the shareholders and certain other requirements are met.

The federal income tax regulations provide a transitional rule for a new public company like Hospira that was created in a spin-off from another public company. The 2004 Stock Plan was approved by Abbott, in its capacity as our sole shareholder, before the spin-off. In these circumstances, the transitional rule provides that performance-based compensation is exempt from the $1 million limitation if such compensation was awarded or granted prior to the first regularly scheduled meeting of shareholders that occurs more than 12 months after the date the company becomes a separate publicly traded company.

Accordingly, you are being asked to approve the 2004 Stock Plan so that future awards under the plan will be tax deductible. If our shareholders do not approve this plan, the nominations and compensation committee of our board will consider whether to continue to make awards to named executive officers under the 2004 Stock Plan in the future, even if tax deductibility is not assured.

The board of directors recommends that the shareholders vote FOR the approval of the Hospira 2004 Long-Term Stock Incentive Plan.

Description of 2004 Stock Plan

Prior to our spin-off from Abbott Laboratories, we adopted, and Abbott approved in its capacity as sole shareholder, the 2004 Stock Plan. This description is qualified by reference to the full text of the plan, which is attached as Exhibit A to this proxy statement.

Administration

The 2004 Stock Plan is administered by the nominations and compensation committee of our board of directors, which is composed entirely of non-employee directors who meet the criteria of "outside director" under Section 162(m) of the Internal Revenue Code and "non-employee director" in the rules adopted under Section 16 of the Securities Exchange Act of 1934. This committee selects the individuals who will receive options or other awards from among the eligible participants, and determines the form of those awards, the number of shares or dollar targets of the options or awards, and all terms and conditions of the options or awards. This committee is empowered to approve and certify the level of attainment of any performance targets established in connection with awards under the plan as may be required under Section 162(m) of the Internal Revenue Code. Our chief executive officer has the authority to make certain awards to employees who are not executive officers.

Award Forms

Under the 2004 Stock Plan, the committee may grant incentive stock options, which meet the criteria of Section 422 of the Internal Revenue Code, and non-qualified stock options, which are not intended to qualify as incentive stock options. Both types of stock option awards will be settled in common stock. The committee may also grant stock appreciation rights, either in tandem with stock options or on a stand-alone basis. The committee may also grant restricted stock, performance units, and performance shares, and other cash- and stock-based awards under the 2004 Stock Plan.

Maximum Stock Award Levels

The maximum number of shares available for awards under the 2004 Stock Plan is 31,000,000 shares of our common stock. As of February 28, 2005, there were outstanding awards covering

6

14,887,911 shares and there were 15,006,741 shares available to be issued as awards under the 2004 Stock Plan. To the extent any shares of stock covered by an award are not delivered to a participant or beneficiary because the award is forfeited or canceled, or the shares of stock are not delivered because the award is settled in cash or used to satisfy the applicable tax-withholding obligation, such shares shall not be deemed to have been delivered for purposes of determining the maximum number of shares of stock available for delivery under the plans. If the exercise price of any award is satisfied by tendering shares of our common stock to us, only the number issued net of the shares tendered will be deemed to have been delivered for purposes of the maximum. For purposes of the foregoing, shares of restricted stock shall not be deemed to be delivered until such shares have their restrictions removed.

The following additional limits apply to the 2004 Stock Plan. The maximum number of shares that may be covered by awards granted to any one individual as an option or a stock appreciation right is 1,000,000 shares during any one calendar-year period (excluding any awards intended to constitute conversion awards). The maximum number of shares of stock that may be issued in conjunction with awards granted as bonus shares, stock units, performance shares, performance units, restricted stock and restricted stock units, shall be 25 percent of the maximum number of shares reserved for delivery under the 2004 Stock Plan. For stock awards that are intended to be "performance-based compensation" (as that term is used for purposes of Internal Revenue Code Section 162(m)), no more than 500,000 shares of stock may be subject to such awards granted to any one individual during any one calendar-year period. The maximum dollar amount of cash incentive awards that are intended to be "performance-based compensation" granted to any one individual during any one calendar-year period shall be no more than $5,000,000. Shares issued as conversion awards in connection with the spin-off did not count against these limits.

Other than with respect to initial grants to new directors or one-time grants under our non-employee director fee plan due to extraordinary circumstances, the maximum number of shares that may be covered by awards granted to any one non-employee director in any one calendar year relating to options and stock appreciation rights will be 100,000 shares and relating to other stock awards will be 50,000 shares. The foregoing limitations will not apply to cash-based director fees that the non-employee director elects to receive in the form of stock or stock units.

Stock Option Awards

Stock options awarded may be either incentive stock options or non-qualified stock options. Options will expire no later than the tenth anniversary of the date of grant. The exercise price of stock options may not be less than the fair market value on the date of grant, except for options and awards converted to Hospira awards in connection with the spin-off or an acquisition. The committee may establish vesting or performance requirements which must be met prior to the exercise of the stock options. Stock options under the 2004 Stock Plan may be granted in tandem with stock appreciation rights.

At the time of the spin-off, conversion options were issued to certain Hospira employees to replace options to purchase Abbott stock. The conversion options were intended to have the same intrinsic value and ratio of the exercise price per share to the market value per share as the related cancelled Abbott option. As a result, some of the conversion options had exercise prices less than the Hospira stock value on the date of grant. All other terms and conditions of a conversion option, including the vesting schedule, remained substantially the same as those of the related cancelled option. In connection with the spin-off, an aggregate of 7,454,240 conversion options were awarded with a weighted average exercise price of $28.36.

Some conversion options, like the original Abbott options, provide for the grant of an additional option—a replacement option—if the exercise price is paid using Hospira shares rather than cash and the fair market value of a Hospira share is at least 125% of the exercise price of the option at the time

7

of exercise. The replacement option covers the same number of shares as those surrendered to exercise the original option (plus the number of shares surrendered or withheld to satisfy tax withholding), and has an exercise price based on the then fair market value of the shares. The replacement option is first exercisable six months following the date of grant and will have an expiration date equal to the original option.

Restricted Stock and Restricted Stock Unit Awards

Under the 2004 Stock Plan, the committee may also grant shares of restricted stock. These grants will generally be subject to the continued employment of the participant and may also be subject to performance criteria at the discretion of the committee. If the participant's employment terminates prior to the completion of the specified employment or the attainment of the specified performance goals, the awards will lapse and the shares will be returned to us as determined by the committee. During the restriction period, the participant would generally be entitled to vote the shares and receive any dividends on these shares. Restricted stock certificates, to the extent issued, would bear a legend giving notice of the restrictions relating to the grant.

Under the 2004 Stock Plan, the committee may grant restricted stock units, which is the grant of a right to receive shares of stock in the future, with such right to future delivery of such shares subject to a risk of forfeiture or other restrictions that will lapse upon the achievement of one or more goals relating to the completion of service or the achievement of performance objectives, as may be determined by the committee.

Performance-Based Awards

The committee may also grant performance units and performance shares under the 2004 Stock Plan. A performance share award is a grant of a right to receive shares of stock or stock units, which grant is contingent on the achievement of performance or other objectives during a specified period. A performance unit award is a grant of a right to receive a designated dollar value amount of stock, cash or combination thereof, which is contingent on the achievement of performance or other objectives during a specified period.

Section 162(m) of the Internal Revenue Code requires that performance awards be based upon objective performance measures in order to be deductible if they and other remuneration paid to an executive officer in any year are in excess of $1 million. The committee may designate whether any such award being granted to any participant is intended to be "performance-based compensation" as that term is used in Section 162(m) of the Code. Any such awards designated as intended to be "performance-based compensation" shall be conditioned on the achievement of one or more performance measures, to the extent required by Section 162(m) of the Code. The performance measures that may be used by the committee for such awards shall be based on any one or more of the following, as selected by the committee:

- •

- earnings, including operating income or net income, earnings before interest and taxes, earnings before interest, taxes, depreciation and amortization, or earnings per share;

- •

- financial return ratios, including return on investment, invested capital, equity or assets;

- •

- increases in revenue, operating or net cash flows, cash flow return on investment or net operating income;

- •

- market share, debt load reduction, expense management or economic value added;

- •

- total shareholder return or stock price; and

- •

- strategic business objectives, consisting of one or more objectives based on meeting specific cost targets, business expansion goals and goals relating to acquisitions or divestitures.

8

Performance measures may be based on the performance of Hospira as a whole or any defined performance groups within Hospira, and may be expressed as relative to the comparable measures at comparison companies or a defined index. Partial achievement of the performance targets may result in a payment or vesting based upon the degree of achievement. In establishing any performance measures under the 2004 Stock Plan, the committee may provide for the exclusion of the effects of the following items, to the extent identified in the audited financial statements of Hospira, including footnotes, or in the Management's Discussion and Analysis section of Hospira's annual report: (i) extraordinary, unusual, and/or non-recurring items of gain or loss; (ii) gains or losses on the disposition of a business; (iii) changes in tax or accounting principles, regulations or laws; or (iv) mergers or acquisitions. To the extent not specifically excluded, such effects shall be included in any applicable performance measure.

Bonus Shares and Stock Units

Under the 2004 Stock Plan, the committee may grant bonus share and stock unit awards which are grants of shares of stock or units in return for previously performed services, or in return for the participant surrendering other compensation that may be due. Stock units are the right to receive shares of stock or their cash equivalent, or a combination of both, in the future.

Adjustments

In the event of a corporate transaction involving Hospira (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination or exchange of shares), the committee may adjust outstanding awards to preserve the benefits or potential benefits of the awards. The adjustments, in the discretion of the committee, may include (i) adjustment of the number and kind of shares which may be delivered under the plans; (ii) adjustment of the number and kind of shares subject to outstanding awards; (iii) adjustment of the exercise price of outstanding options and stock appreciation rights; and (iv) any other adjustments that the committee determines to be equitable.

Change in Control

Generally, upon a change in control of Hospira (as defined in the plans), all outstanding options and stock appreciation rights will become fully exercisable and all stock units, restricted stock, restricted stock units, performance shares and performance units will become fully vested, provided, however, that if the vesting was based upon the level of performance achieved, such awards shall be fully earned and vested (and all performance measures deemed to be achieved).

Amendment and Termination

With certain exceptions, our board of directors may, at any time, amend or terminate the 2004 Stock Plan and may amend any award agreement provided that no amendment or termination may, in the absence of written consent to the change by the affected participant (or, if the participant is not then living, the affected beneficiary), adversely affect the rights of any participant or beneficiary under any award granted under the plan prior to the date such amendment is adopted by the board.

Tax Consequences

The following is a brief summary of the principal federal income tax consequences of stock option awards under the 2004 Stock Plan. The summary is based on current federal income tax laws and interpretations thereof, all of which are subject to change at any time, possibly with retroactive effect. The summary is not intended to be exhaustive.

Non-Qualified Stock Options. A participant who receives a non-qualified option does not recognize taxable income upon the grant of the option, and the company is not entitled to a tax deduction. The

9

participant will recognize ordinary income upon the exercise of the option in an amount equal to the excess of the fair market value of the option shares on the exercise date over the option price. Such income will be treated as compensation to the participant subject to applicable withholding requirements. The company is generally entitled to a tax deduction in an amount equal to the amount taxable to the participant as ordinary income in the year the income is taxable to the participant. Any appreciation in value after the time of exercise will be taxable to the participant as capital gain and will not result in a deduction by the company.

Incentive Stock Options. A participant who receives an incentive stock option does not recognize taxable income upon the grant or exercise of the option, and the company is not entitled to a tax deduction. The difference between the option price and the fair market value of the option shares on the date of exercise, however, will be treated as a tax preference item for purposes of determining the alternative minimum tax liability, if any, of the participant in the year of exercise. The company will not be entitled to a deduction with respect to any item of tax preference.

A participant will recognize gain or loss upon the disposition of shares acquired from the exercise of incentive stock options. The nature of the gain or loss depends on how long the option shares were held. If the option shares are not disposed of pursuant to a "disqualifying disposition" (i.e., no disposition occurs within two years from the date the option was granted nor one year from the date of exercise), the participant will recognize long-term capital gain or capital loss depending on the selling price of the shares. If option shares are sold or disposed of as part of a disqualifying disposition, the participant must recognize ordinary income in an amount equal to the lesser of the amount of gain recognized on the sale, or the difference between the fair market value of the option shares on the date of exercise and the option price. Any additional gain will be taxable to the participant as a long-term or short-term capital gain, depending on how long the option shares were held. The company is generally entitled to a deduction in computing its federal income taxes for the year of disposition in an amount equal to any amount taxable to the participant as ordinary income.

Plan Benefit Information

The following table sets forth the number of stock option awards under the 2004 Stock Plan awarded to the persons and groups listed below during the life of the plan through December 31, 2004. As future awards are within the discretion of our nominations and compensation committee and depend on various factors, we cannot determine the awards that will be made in the future under this plan.

Name and Position

| | Number of

Securities

Underlying

Stock

Options

| |

|---|

| Christopher B. Begley, Chief Executive Officer and Director | | 500,000 | |

| John Arnott, Senior Vice President, Global Commercial Operations | | 230,276 | (1) |

| Terrence C. Kearney, Senior Vice President, Finance, and Chief Financial Officer | | 444,905 | (2) |

| Edward A. Ogunro, Senior Vice President, Research and Development, Medical and Regulatory Affairs, and Chief Scientific Officer | | 80,000 | |

| Brian J. Smith, Senior Vice President, General Counsel and Secretary | | 80,000 | |

| All current executive officers as a group | | 1,370,181 | (3) |

| All current directors who are not executive officers as a group | | 200,000 | |

| All employees, including all current officers who are not executive officers, as a group | | 14,719,329 | (4) |

- (1)

- Includes 150,276 conversion options.

10

- (2)

- Includes 349,376 conversion options.

- (3)

- Includes 499,652 conversion options.

- (4)

- Includes 6,954,588 conversion options.

Equity Compensation Plan Information

The following table gives information, as of December 31, 2004, about our common stock that may be issued upon the exercise of options and other equity awards under all compensation plans under which equity securities are reserved for issuance; the 2004 Stock Plan is our only equity compensation plan pursuant to which our equity securities are authorized for issuance.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options,

warrants and rights

(#)

| | Weighted-average exercise

price of outstanding options,

warrants and rights

($)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities reflected

in the first column)(#)

|

|---|

| Equity compensation plans approved by security holders(1)(2) | | 15,053,202 | | $ | 27.55 | | 15,006,741 |

| Equity compensation plans not approved by security holders | | — | | | — | | — |

| Total | | 15,053,202 | | $ | 27.55 | | 15,006,741 |

- (1)

- The 2004 Stock Plan was approved by Abbott Laboratories, in its capacity as our sole shareholder, prior to our spin-off from Abbott.

- (2)

- Includes 7,454,240 conversion options awarded at the time of the spin-off with a weighted average exercise price of $28.36. Conversion options are more fully described above under "—Description of 2004 Stock Plan—Stock Option Awards."

Proposal 3

Approval of Amended Hospira, Inc. 2004 Performance Incentive Plan

The amended Hospira, Inc. 2004 Performance Incentive Plan (the "Performance Incentive Plan") provides for awards to officers of Hospira, which are based on the attainment of specified performance goals or objectives. The purposes of the Performance Incentive Plan are to:

- •

- provide flexibility to us in our ability to attract, motivate and retain the services of participants who make significant contributions to our success and to allow participants to share in our success;

- •

- optimize our profitability and growth through incentives which are consistent with our goals and which link the performance objectives of participants to those of our shareholders; and

- •

- provide participants with an incentive for excellence in individual performance.

Officers of Hospira are eligible to participate in the plan. The nominations and compensation committee of our board of directors is empowered to determine the specific participants in the plan. The committee has designated the named executive officers as participants in this plan for our 2005 fiscal year.

At the annual meeting, you are being asked to approve the Performance Incentive Plan so that awards will continue to be tax deductible as performance-based compensation under U.S. federal

11

income tax law as described above under Proposal 2. Should the shareholders not approve the Performance Incentive Plan, no awards will be made under the Performance Incentive Plan for the 2005 fiscal year. In such case, however, the nominations and compensation committee will consider other alternatives for the overall compensation package being provided to our executive officers.

The board of directors recommends that the shareholders vote FOR the approval of the amended Hospira, Inc. 2004 Performance Incentive Plan.

Description of the Performance Incentive Plan

Following is a summary of the material features of the Performance Incentive Plan. It is qualified by reference to the full text of the plan, which is attached as Exhibit B to this proxy statement.

Administration

The Performance Incentive Plan is administered by the nominations and compensation committee of the board of directors. The committee has sole responsibility for determining the participants, establishing performance objectives, setting award targets and determining award amounts.

Performance Objectives

The Performance Incentive Plan's performance objectives are determined with reference to our Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA").

Awards

The maximum amount payable for any fiscal year is:

- •

- 2.0% of our EBITDA for our chief executive officer;

- •

- 1.5% of our EBITDA for our chief operating officer; and

- •

- 1.0% of our EBITDA for any other participant.

We do not currently have a chief operating officer. When making awards to participants under the plan, the nominations and compensation committee has the discretion to reduce, but not increase, such percentages. The committee has determined that it will take into account our net income, cash flows, net sales and corporate well-being when exercising such discretion.

Amendment or Modification

Our board of directors may modify, amend, suspend or terminate the Performance Incentive Plan. However, no modification may, without the consent of the participant, reduce the right of a participant to a payment or distribution to which the participant is entitled by reason of an outstanding award allocation.

Plan Benefit Information

Mr. Begley was the only participant under the Performance Incentive Plan for 2004. On February 23, 2005, the committee awarded Mr. Begley $1.12 million under the plan as his 2004 bonus. Such amount is included in the "Bonus" column in the "Summary Compensation Table" later in this proxy statement. The committee has designated the named executive officers as participants under the plan for 2005. As future awards will be based on our future financial performance and are within the discretion of the nominations and compensation committee, we cannot determine the awards that will be made in the future under this plan.

12

Proposal 4

Ratification of Independent Registered Public Accountants

The audit and public policy committee of our board of directors is empowered to annually appoint a firm of independent registered public accountants to serve as auditors. The audit and public policy committee appointed Deloitte & Touche LLP to act as auditors for 2005. Deloitte & Touche LLP has served as our auditors since 2004.

Although the audit and public policy committee has sole authority to appoint auditors, it is seeking the opinion of the shareholders regarding its appointment of Deloitte & Touche LLP as auditors for 2005. For this reason, shareholders are being asked to ratify this appointment. If the shareholders do not ratify the appointment of Deloitte & Touche LLP as auditors for 2005, the audit and public policy committee will take that fact into consideration, but may, nevertheless, continue to retain Deloitte & Touche LLP.

Representatives of Deloitte & Touche LLP are expected to be present at the annual meeting and will be given the opportunity to make a statement if they desire to do so. They also will be available to respond to appropriate questions.

The board of directors recommends a vote FOR ratification of the appointment of Deloitte & Touche LLP as independent registered public accountants for 2005.

13

OWNERSHIP OF OUR STOCK

The following table sets forth information regarding beneficial ownership of our common stock as of March 22, 2005:

- •

- by our continuing directors, our nominee for director, our chief executive officer and the other named executive officers; and

- •

- by all continuing directors and executive officers as a group.

We are not aware of any person or group that beneficially owns 5% or more of our outstanding common stock.

Each person named below, and our current directors and executive officers as a group, collectively beneficially own less than 1% of our outstanding common stock. Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. A person is deemed to be the beneficial owner of any shares of common stock if such person has or shares the right to vote or dispose of such common stock, or has the right to acquire beneficial ownership at any time within 60 days of the date of the table.

Name

| | Number of Shares

Beneficially Owned

|

|---|

| David A. Jones, Chairman of the Board of Directors(1) | | 284,943 |

| Irving W. Bailey, II, Director(2) | | 15,000 |

| Connie R. Curran, RN, Ed.D, Director(3) | | — |

| Jacque J. Sokolov, M.D., Director(4) | | 1,754 |

| John C. Staley, Director(5) | | — |

| William L. Weiss, Director(6) | | 265 |

| Judith C. Pelham, Nominee | | — |

| Christopher B. Begley, Chief Executive Officer and Director(7) | | 219,169 |

| John Arnott, Senior Vice President, Global Commercial Operations(8) | | 120,268 |

| Terrence C. Kearney, Senior Vice President, Finance, and Chief Financial Officer(9) | | 327,719 |

| Edward A. Ogunro, Senior Vice President, Research and Development, Medical and Regulatory Affairs and Chief Scientific Officer(10) | | 32,173 |

| Brian J. Smith, Senior Vice President, General Counsel and Secretary(11) | | 34,595 |

| All directors and executive officers as a group (12 persons)(12) | | 1,052,616 |

- (1)

- Includes 1,600 shares held by Mr. Jones' spouse for which Mr. Jones disclaims beneficial ownership and 133,334 shares issuable upon the exercise of options exercisable within 60 days. Also includes 1,754 restricted shares that are subject to forfeiture under certain conditions.

- (2)

- Does not include 1,754 restricted share units held in a deferred share account that are subject to forfeiture under certain conditions.

- (3)

- Does not include 3,185.0083 stock units and restricted share units held in a deferred share account, of which 1,754 are subject to forfeiture under certain conditions.

- (4)

- Consists of 1,754 restricted shares that are subject to forfeiture under certain conditions.

- (5)

- Does not include 1,754 restricted share units held in a deferred share account that are subject to forfeiture under certain conditions.

- (6)

- Includes 190 shares held in a family limited partnership for which Mr. Weiss disclaims beneficial ownership, except to the extent of his pecuniary interest therein. Does not include 1,745.4159 stock

14

units and restricted share units held in a deferred share account, of which 1,086 are subject to forfeiture under certain conditions.

- (7)

- Includes 25,990 shares held in Mr. Begley's 401(k) account and 166,667 shares issuable upon the exercise of options exercisable within 60 days.

- (8)

- Includes 269 shares held in Mr. Arnott's 401(k) account and 117,152 shares issuable upon the exercise of options exercisable within 60 days. Also includes 2,847 shares held by Mr. Arnott's spouse, for which Mr. Arnott disclaims beneficial interest.

- (9)

- Includes 2,082 shares held in Mr. Kearney's 401(k) account and 306,977 shares issuable upon the exercise of options exercisable within 60 days.

- (10)

- Includes 959 shares held in Dr. Ogunro's 401(k) account and 26,667 shares issuable upon the exercise of options exercisable within 60 days.

- (11)

- Includes 2,518 shares held in Mr. Smith's 401(k) account and 26,667 shares issuable upon the exercise of options exercisable within 60 days.

- (12)

- Includes 33,721 shares held in 401(k) accounts of executive officers, 3,508 shares that are subject to forfeiture under certain conditions and 789,731 shares issuable upon the exercise of options exercisable within 60 days. Also includes 6,311 shares and shares issuable upon the exercise of options within 60 days held by spouses of directors and executive officers for which the beneficial ownership is disclaimed. Also includes 190 shares held in family limited partnerships for which the beneficial ownership is disclaimed, except to the extent of the pecuniary interest therein.

15

OUR BOARD OF DIRECTORS

Class I—Nominees For Term Expiring in 2008

Irving W. Bailey, II, age 63, has served as our director since our spin-off from Abbott Laboratories on April 30, 2004. Mr. Bailey has served as a Managing Director of Chrysalis Ventures, a private equity management firm, from June 2001 to January 2005 and a Senior Advisor to Chrysalis Ventures since January 2005. Mr. Bailey served as President of Bailey Capital Corporation, also a private equity management firm, from January 1998 to June 2001, and as Chief Executive Officer of Providian Corporation, an insurance and diversified financial services company, from 1988 to 1997. Mr. Bailey also serves as a director of AEGON, N.V. and Computer Sciences Corporation.

Judith C. Pelham, age 59, is a nominee to be elected to our board at the 2005 annual meeting. From May 2000 until her retirement in December 2004, Ms. Pelham was President and CEO of Trinity Health, a national system of healthcare facilities, including hospitals, long-term care, home care, psychiatric care, residences for the elderly, and ambulatory care, and the third largest Catholic healthcare system in the United States. From January 1993 to April 2000, Ms. Pelham was the President and Chief Executive Officer of Mercy Health Services, a system of hospitals, home care, long-term care, ambulatory services and managed care. From 1982 to 1992, Ms. Pelham was President and Chief Executive Officer of Daughters of Charity Health Services, Austin, Texas, a network of hospitals, home care and ambulatory services serving central Texas. Ms. Pelham is a director of Amgen, Inc.

Jacque J. Sokolov, M.D., age 50, has served as our director since our spin-off from Abbott Laboratories on April 30, 2004. Dr. Sokolov has served since 1999 as the Chairman and a Senior Partner of Sokolov, Sokolov, Burgess, a national healthcare management consulting, project development and investment firm. Dr. Sokolov previously served as Chairman of Coastal Physician Group, Inc., which later became PhyAmerica Physician Group, Inc., from 1994 until 1997 and as Vice President and Chief Medical Officer for Southern California Edison from 1989 until 1992. Dr. Sokolov also serves as a director of MedCath Corporation, a national provider of cardiovascular services.

Class II Directors Whose Terms Expire in 2006

Christopher B. Begley, age 52, has served as our Chief Executive Officer and director since our spin-off from Abbott Laboratories on April 30, 2004. Prior to his becoming our Chief Executive Officer, Mr. Begley provided 18 years of service to Abbott, and was Abbott's Senior Vice President, Hospital Products, between 2000 and 2004. Prior to his appointment as Senior Vice President, Hospital Products, Mr. Begley served as Abbott's Senior Vice President, Chemical and Agricultural Products from 1999 to 2000, Vice President, Abbott Health Systems, from 1998 to 1999, and Vice President, MediSense Operations, in 1998. Mr. Begley also serves as a director of Children's Memorial Hospital, the Healthcare Leadership Council, The Executive Club of Chicago and AdvaMed.

John C. Staley, age 63, has served as our director since our spin-off from Abbott Laboratories on April 30, 2004. Mr. Staley served as the Managing Partner of the Lake Michigan Area of Ernst & Young LLP, a position that he held from 1985 to his retirement in June 2001. Mr. Staley also serves as a trustee of CenterPoint Properties Trust, a real estate investment trust, and as a director of eLoyalty Corporation, a management consulting firm focused on customer relationship management. Mr. Staley is also a member of, and the former Chairman of, the Board of Trustees of DePaul University.

Class III Directors Whose Terms Expire in 2007

Connie R. Curran, RN, Ed.D., age 57, has served as our director since our spin-off from Abbott Laboratories on April 30, 2004. Dr. Curran has served as the Executive Director of C-Change, formerly the National Dialogue on Cancer, a health advocacy organization, since 2003. From 1995 to 2000, Dr. Curran served as President and Chief Executive Officer of CurranCare, LLC, a healthcare consulting company. Upon the acquisition of CurranCare by Cardinal Health Consulting Services in

16

November 2000, Dr. Curran served as President of Cardinal Health Consulting Services, a consulting company with expertise in surgical services, hospital operations, case management and home care, until February 2002. Dr. Curran has served as Vice President of the American Hospital Association and Dean at the Medical College of Wisconsin. Dr. Curran also serves as a director of CardioDynamics International Corp., DeVry, Inc. and IDX Systems Corporation.

David A. Jones, age 73, has served as the Chairman of our board of directors since our spin-off from Abbott Laboratories on April 30, 2004. Mr. Jones was a director of Abbott for over 20 years, from 1982 until his retirement from the Abbott board in 2003. He is a co-founder of Humana Inc. and served as Chairman and Chief Executive Officer since its organization in 1961 until he retired as Chief Executive Officer in 1997. In 1999, Mr. Jones resumed his responsibilities as Chief Executive Officer and held that position until 2000, when he resumed the position of Chairman.

William L. Weiss, age 75, was elected to our board of directors on August 25, 2004. Mr. Weiss is Chairman Emeritus of Ameritech Corporation, serving as Chairman and Chief Executive Officer of Ameritech from the company's formation in 1984 until his retirement from the company in 1994. He previously has served on the board of directors of The Quaker Oats Company, Merrill Lynch & Co., Abbott Laboratories and Tenneco Corporation. Mr. Weiss also has acted as a trustee of Pennsylvania State University and as director of the Milton S. Hershey Medical Center.

Our board of directors held six meetings during 2004, of which five were regularly scheduled meetings and one was a special meeting. No director attended fewer than 75% of the meetings of the board of directors and of the committees of the board of directors on which such director served. We anticipate that our directors will attend the 2005 annual meeting. The 2005 annual meeting will be our first annual meeting of shareholders as an independent public company.

Independence

The board annually determines the independence of directors based on a review by the directors and the nominations and compensation committee. No director may qualify as independent unless the board of directors affirms that the director has no material relationship with us. As required by our corporate governance guidelines, the board will consider all relevant facts and circumstances in connection with that determination, including the following standards:

- •

- a director who is, or has been within the last three years, our employee, or whose immediate family member is, or has been within the last three years, our executive officer is not independent;

- •

- a director who receives, or whose immediate family member receives, more than $100,000 from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), and other than amounts received by an immediate family member for service as a non-executive employee, during any 12-month period in the last three years is not independent;

- •

- a director who, or whose immediate family member, is a current partner of a firm that is our internal or external auditor is not independent;

- •

- a director who is a current employee of a firm that is our internal or external auditor is not independent;

- •

- a director who has an immediate family member who is a current employee of a firm that is our internal or external auditor and who participates in such firm's audit, assurance or tax compliance (but not tax planning) practice is not independent;

- •

- a director who, or whose immediate family member, was within the last three years a partner or employee of a firm that is our internal or external auditor and personally worked on our audit during that time is not independent;

17

- •

- a director who is employed, or whose immediate family member is employed, or has been employed in the last three years, as an executive officer of another company where any of our present executive officers at the same time serves or served on that company's compensation committee is not independent;

- •

- a director who is a current employee, or whose immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues, is not independent; and

- •

- a director who is an executive officer of a charitable organization that receives charitable contributions (other than matching contributions) from us that are in excess of the greater of $1 million or 2% of such charitable organization's consolidated gross revenues is not independent.

In applying the above criteria, at its February 23, 2005 meeting, our board determined that each of Mr. Bailey, Dr. Curran, Mr. Jones, Ms. Pelham, Dr. Sokolov, Mr. Staley and Mr. Weiss is independent within the meaning of our director independence standards and Section 303A.02 of the listing standards of the New York Stock Exchange and was not aware of any other relationship between a director and Hospira that would affect his or her independence. Each member of our audit and public policy committee and our nominations and compensation committee meet such independence standards.

In making its determination with respect to Mr. Jones, our board of directors considered the consulting agreement that Mr. Jones entered into with Abbott during August 2003. Under the agreement, Mr. Jones was paid approximately $172,000 from our former parent company between August 2003 and the agreement's termination on April 30, 2004 (the date of the spin-off).

The agreement provided that Mr. Jones would provide services relating to the spin-off. Around the time of the consulting agreement, Abbott announced in a press release its intention to effect the spin-off, and that Mr. Jones would serve as our chairman and Mr. Begley would serve as our chief executive officer. Mr. Jones is a former independent director of Abbott and was selected as chairman of Hospira because he had substantial experience in the healthcare industry and would bring credibility to Hospira. The services actually provided by Mr. Jones primarily included identifying qualified persons to serve as our independent directors after the spin-off and periodically advising Mr. Begley on matters relating to the spin-off and our business.

Our board determined that the services provided by Mr. Jones under the consulting agreement were similar to services that would be provided by an independent director. Therefore, the board of directors determined that the consulting agreement with Abbott was not a material relationship with Hospira, and determined Mr. Jones to be independent. To assist the board in making this determination, we received guidance from the New York Stock Exchange.

Our independent directors must meet at least twice a year in regularly scheduled executive sessions, and, in practice, meets in an executive session at every regularly scheduled board meeting. The chairman of the board normally presides at these meetings.

Committees of the Board of Directors

Our board of directors has the following committees:

Executive Committee

Mr. Jones (chairman), Mr. Begley, Mr. Bailey and Mr. Staley serve on our executive committee. During 2004, our executive committee did not meet. The executive committee is required to consist of a majority of independent directors. The executive committee exercises the powers and authority of the board of directors in the management of our everyday business and affairs with respect to issues which the chairman of the committee or our chief executive officer determines should not be postponed until

18

the next regular meeting of our board of directors or do not require a meeting of the board of directors. The executive committee may not approve or adopt, or recommend to shareholders, any action or matter which must be submitted to our shareholders for approval pursuant to Delaware law. The executive committee also may not adopt, amend or repeal our bylaws.

Audit and Public Policy Committee

Mr. Staley (chairman), Dr. Curran, and Mr. Allison currently serve on our audit and public policy committee. Mr. Allison will not be running for re-election to the board at the 2005 annual meeting. Upon her election to the board, Ms. Pelham will replace Mr. Allison on the committee. During 2004, our audit and public policy committee met nine times. All members of the audit and public policy committee must satisfy the independence requirements of the New York Stock Exchange. Our board has determined that each of Mr. Staley, Dr. Curran and Ms. Pelham is independent and financially literate, as required by the New York Stock Exchange. In 2004, our board made such determination with respect to Mr. Allison. The board has designated Mr. Staley as the "audit committee financial expert," within the meaning of the rules under the Securities Exchange Act of 1934 and the New York Stock Exchange.

The functions of the audit and public policy committee include:

- •

- meeting periodically with our management, internal auditors and independent auditors regarding our internal controls, accounting and financial reporting;

- •

- appointing and evaluating the independent auditors;

- •

- reviewing and discussing our financial statements and financial press releases with our management and independent auditors;

- •

- establishing procedures for the receipt, retention and treatment of complaints received by our company regarding accounting matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting matters;

- •

- developing and recommending to the board of directors ethics and compliance programs, policies and procedures;

- •

- reviewing our quality control and regulatory compliance programs and the sufficiency of and compliance with our code of business conduct; and

- •

- reviewing current and emerging social, political, economic and environmental trends or issues that could affect our business.

Both the independent auditors and the internal auditors regularly meet privately with the audit and public policy committee and have unrestricted access to the audit and public policy committee.

The audit and public policy committee is governed by a written charter, which is attached as Exhibit C to this proxy statement and is available on our Web site at www.hospira.com.

Nominations and Compensation Committee

Mr. Bailey (chairman), Dr. Sokolov and Mr. Weiss serve on our nominations and compensation committee. During 2004, the nominations and compensation committee met two times. All members of the nominations and compensation committee must satisfy the independence requirements of the New York Stock Exchange, be "non-employee directors" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and be "outside directors" for purposes of Section 162(m) of the Internal Revenue Code. Our board has determined that each of Mr. Bailey, Dr. Sokolov and Mr. Weiss is independent and eligible to serve on the committee.

19

The functions of the nominations and compensation committee include:

- •

- developing the general criteria for selecting members of the board of directors and assisting the board in identifying and attracting qualified candidates;

- •

- recommending to the board of directors the nominees for election as directors, considering the criteria described above and any potential nominees recommended by our shareholders;

- •

- recommending to the board of directors persons to be elected as executive officers;

- •

- reviewing and assessing the adequacy of our corporate governance guidelines;

- •

- reviewing the performance of our executive officers;

- •

- reviewing and determining the executive officers' compensation;

- •

- reviewing and, as it deems appropriate, recommending to the board of directors, policies, practices and procedures relating to the compensation of our officers, other managerial employees and non-employee directors and the establishment and administration of our employee benefit plans; and

- •

- exercising authority under our employee equity incentive plan.

The nominations and compensation committee is governed by a written charter, which is attached as Exhibit D to this proxy statement and is available on our Web site at www.hospira.com.

The process used by the nominations and compensation committee to identify a nominee to our board of directors depends on the qualities being sought. Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve our governance and strategic needs. Candidates will be considered on the basis of a range of criteria, including broad-based business knowledge and relationships, and prominence and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the board of director's oversight role with respect to our business and affairs. Shareholders may recommend persons as potential nominees for director by complying with the procedures set forth later in this proxy statement under "Other Shareholder Information—Procedure for Recommendation and Nominations of Directors and Transaction of Business at Annual Meeting." The nominations and compensation committee will consider potential nominees recommended by shareholders, but has no obligation to recommend such candidates. The evaluation criteria are the same for each person considered for nomination to the board.

The directors who have served on our board since our spin-off from Abbott were referred to us before the spin-off through the efforts of David A. Jones, our chairman; Christopher B. Begley, our chief executive officer and director; and Abbott, our former parent company, and were determined to have satisfied our director qualification standards. Mr. Weiss joined our board in August 2004. He was referred to us by Mr. Jones and Mr. Begley and was determined to be a superior candidate and to have satisfied our director qualification standards.

Ms. Pelham, nominee for Class I director, was referred to the nominations and compensation committee by Mr. Jones and Mr. Begley. The committee considered Ms. Pelham's qualifications, notably her experience and professional accomplishments in an industry relevant to our business and affairs, and determined that she would be a superior candidate to serve on our board. In light of Mr. Allison's decision not to run for re-election to our board, the committee recommended, and the board determined, that Ms. Pelham be nominated for election to the board at the 2005 annual meeting.

Furthermore, the nominations and compensation committee determined that all nominees for Class I director standing for election at the 2005 annual meeting satisfied our director qualification standards.

20

Communicating with the Board of Directors

You may communicate with our board of directors or our independent directors as a group by writing a letter to the chairman of our audit and public policy committee (for accounting or disclosure matters) or the chairman of our board (for all other matters) addressed to:

Director Communications

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

Our general counsel and secretary will review the communication and forward the communication to the addressee or to the director or directors he believes to be most appropriate.

In addition, you may contact the chairman of our audit and public policy committee through the Helpline of our Office of Ethics and Compliance by calling 1-866-311-4632. You will have the option to directly refer matters to the audit and public policy committee. Our Vice President—Ethics and Compliance will be notified in such cases.

Corporate Governance Materials

Our corporate governance guidelines, our code of business conduct and ethics, and the charters of our audit and public policy committee and our nominations and compensation committee are available on our Web site atwww.hospira.com. We will provide a copy of any of these materials to any shareholder free of charge upon written request to:

Corporate Governance Material Request

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

21

DIRECTOR COMPENSATION

Our non-employee directors receive an annual cash retainer in the amount of $50,000 per year, and meeting fees of $1,000 for attending each board meeting and board committee meeting in person ($500 for each meeting other than in person). Each director who serves in the role of chairman of any committee receives a committee chairman fee of $5,000. Pursuant to our non-employee director fee plan, in consideration of the additional duties and responsibilities required for serving as chairman of the board, on May 3, 2004, Mr. Jones received a one-time initial grant of an option having a 10-year term to purchase 200,000 shares of our common stock at a price equal to $28.50 per share, the fair market value at the time of the grant.

Additionally, each non-employee director receives an annual grant of restricted stock, which will generally vest as of the first regularly scheduled annual meeting of shareholders following the date of grant. For each such grant, the number of shares of restricted stock granted to each director equals that number of shares equal in value to $50,000 as of the date of grant. The first grant of restricted stock (1,754 shares, which had a fair market value of $28.50 per share at the time of the grant) occurred as of May 3, 2004, and in the future will occur on the last business day of the calendar year quarter in which the annual meeting of shareholders occurs. These shares of restricted stock are issued under the 2004 Stock Plan. Non-employee directors may elect to defer all or a portion of their annual retainer fees, committee chairman fees, meeting fees and restricted stock awards. The cash-based fees will be deferred into a stock unit account. Restricted stock may, based on an election by the director, be deferred and granted as restricted stock units and recorded in the director's stock unit account. The stock unit account will be paid out, at the directors election, on the first business day after the calendar quarter in which the director's service terminates or in up to 10 annual installments from and after that date. Any shares of stock distributed to non-employee directors at the end of the applicable deferral periods shall be issued under the terms of the 2004 Stock Plan.

The following table shows the amount and form of compensation paid to each of our continuing non-employee directors during 2004. Compensation includes annual retainer fees, committee chairman fees, meeting fees and restricted stock grants.

Director

| | Cash

| | Number of Shares of

Restricted Stock

| | Number of Deferred

Stock Units

| | Number of Securities

Underlying Stock

Option Awards

|

|---|

| Irving W. Bailey II | | $ | 43,868 | | — | | 1,754 | | — |

| Connie R. Curran | | | — | | — | | 3,185.0083 | | — |

| David A. Jones(1) | | | 42,868 | | 1,754 | | — | | 200,000 |

| Jacque J. Sokolov | | | 45,516 | | 1,754 | | — | | — |

| John C. Staley | | | 47,868 | | — | | 1,754 | | — |

| William L. Weiss(2) | | | — | | — | | 1,745.4159 | | — |

- (1)

- On August 13, 2003, Abbott Laboratories, our former parent, entered into a consulting agreement with our chairman, David A. Jones. Pursuant to the terms of the agreement, Mr. Jones provided advisory consulting services relating to our spin-off from Abbott prior to the spin-off. The consulting agreement terminated on April 30, 2004, the date of the spin-off. Mr. Jones received approximately $92,000 in 2003 and $80,000 in 2004 pursuant to the terms of the consulting agreement. These payments are not included in the table above.

- (2)

- Mr. Weiss joined the board of directors in August 2004.

22

PERFORMANCE GRAPH

The following graph compares the performance of our common stock for the periods indicated with the performance of the S&P 500 Stock Index and the S&P Health Care Index.

Comparison of Cumulative Total Return

| | May 3, 2004

| | December 31, 2004

|

|---|

| Hospira, Inc. | | $ | 100 | | $ | 123.89 |

| S&P 500 Stock Index | | | 100 | | | 108.45 |

| S&P Health Care Index | | | 100 | | | 96.75 |