QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

HOSPIRA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

March 31, 2006

Dear Hospira Shareholder:

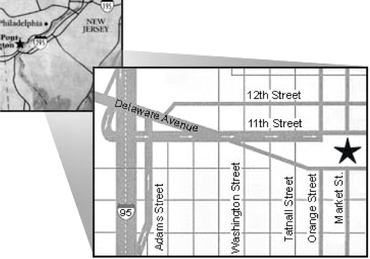

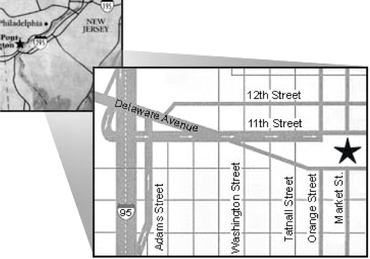

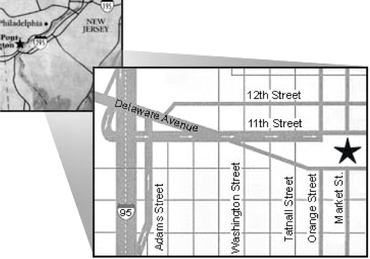

You are cordially invited to attend the 2006 Annual Meeting of Shareholders of Hospira, Inc. at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware, on Wednesday, May 17, 2006 at 10:00 a.m., Eastern Time.

This booklet includes the notice of annual meeting and the proxy statement. The proxy statement describes the business to be transacted at the meeting and provides other information about the company that you should know when you vote your shares.

The principal business to be conducted at the meeting will be the election of directors and ratification of the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors.

It is important that your shares be represented, whether or not you attend the meeting. Shareholders of record can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services appear on the proxy card. You can also vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it promptly using the envelope provided. If you hold shares through your broker or other intermediary, that person or institution will provide you with instructions on how to vote your shares.

We look forward to your participation in the 2006 annual meeting.

|

|

Sincerely, |

|

|

|

|

|

David A. Jones

Chairman of the Board | | | Christopher B. Begley

Chief Executive Officer |

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 17, 2006

The 2006 Annual Meeting of Shareholders of Hospira, Inc. will be held at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware, on Wednesday, May 17, 2006, at 10:00 a.m., Eastern Time. The purposes of the meeting are to:

- 1.

- elect four directors, including one Class I director for a two-year term until the annual meeting in 2008, two Class II directors for a three-year term until the annual meeting in 2009, and one Class III director for a one-year term until the annual meeting in 2007 (Item 1 on the proxy card);

- 2.

- ratify the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors for 2006 (Item 2 on the proxy card); and

- 3.

- transact such other business as may properly come before the meeting or any adjournment of the meeting.

The board of directors recommends that you vote FOR the matters described in Items 1 and 2 above.

This notice and proxy statement and the accompanying proxy card are first being mailed to shareholders on or about March 31, 2006.

The board of directors has set the close of business on March 20, 2006 as the record date for the meeting. This means that owners of common stock as of that date are entitled to receive this notice of the meeting, and vote at the meeting and any adjournments or postponements of the meeting.

A proxy statement with respect to the annual meeting accompanies and forms a part of this notice. A list of shareholders as of the record date will be available for inspection by any shareholder for any purpose relevant to the annual meeting during regular business hours at our principal business address and at the place of the meeting for ten days prior to the meeting.

Your vote is important. We encourage you to read the enclosed proxy statement and to submit a proxy so that your shares will be represented and voted even if you do not attend. You may submit your proxy over the Internet or by telephone or mail. If you do attend the meeting, you may revoke your proxy and vote in person.

By order of the board of directors

Brian J. Smith

Secretary

March 31, 2006

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

HOSPIRA, INC.

PROXY STATEMENT

FOR

2006 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 17, 2006

GENERAL INFORMATION

Why did I receive this proxy statement?

Our board of directors is soliciting proxies for use at our annual meeting of shareholders to be held on May 17, 2006 beginning at 10:00 a.m., Eastern Time, at the Hotel du Pont, Eleventh and Market Streets, Wilmington, Delaware, and any adjournments or postponements of the meeting. In order to solicit your proxy, we must furnish you with this proxy statement, which contains information that we are required to provide you by law. This proxy statement and the accompanying proxy card were first sent to shareholders on about March 31, 2006.

What will be covered at the annual meeting?

Shareholders will vote on the following matters:

- •

- election of directors; and

- •

- ratification of the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors.

Who may vote at the meeting?

The board of directors has set a record date of March 20, 2006, meaning that shareholders of record at the close of business on that date may vote at the meeting, or at adjournments or postponements of the meeting.

How many votes do I have?

You have one vote for each share of common stock you hold on all matters that may properly come before the meeting.

What constitutes a quorum?

The presence in person or by proxy of the holders of shares of common stock representing a majority of all issued and outstanding shares of common stock entitled to vote will constitute a quorum. On February 28, 2006, there were 162,267,637 shares of common stock issued and outstanding.

Votes cast in person or by proxy will be tabulated by an inspector of election, appointed for the meeting, who will determine whether a quorum is present. Shares of common stock represented by a properly completed proxy will be counted as present at the meeting for purposes of determining a quorum, without regard to whether the proxy indicates that the shareholder is casting a vote or abstaining.

What vote is required to approve each matter?

If there is a quorum at the meeting, the following vote requirements apply.

Election of directors. Directors are elected by a plurality of the votes present at the meeting. As a result, at the 2006 annual meeting, the four directors who receive the most votes will be elected to the board. Instructions to withhold votes with respect to any nominee will result in that nominee receiving fewer votes but will not count as votes against that nominee.

Ratification of independent registered public accountants. To ratify the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors,

more votes must be cast for the proposal than against the proposal. Abstentions and broker non-votes (discussed below) will not be counted as a vote for or against those matters.

How do I vote by proxy?

If you are a shareholder of record, you have a choice of voting over the Internet, by using a toll-free telephone number or by completing your proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card to see the options available to you. Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. The Internet and telephone voting facilities for shareholders of record will close at 11:59 p.m., Eastern Time, on May 16, 2006. Other deadlines may apply to you if your stock is held of record by a bank, a broker or other holder of record.

The proxies will vote your shares on each matter as you direct. If you do not indicate how your shares are to be voted on a matter, properly completed proxies will be voted FOR the election of all director nominees and FOR the ratification of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as our auditors. Other matters that properly come before the meeting will be voted upon by the persons named on the proxy card in accordance with their best judgment.

What is a broker non-vote and how does it affect the voting requirements?

If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen. On matters on which the broker is prohibited from exercising voting authority, which is called a "broker non-vote," your shares will not be voted. Broker non-votes will have no effect on the number of votes required to approve any of the matters covered at the meeting. On matters on which the broker is permitted to exercise voting authority, the broker will vote your shares in its discretion. We expect that brokers can exercise voting authority on all proposals in this proxy statement.

How do I vote if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, you may instruct your broker, bank or other nominee to vote your shares by following instructions that the broker, bank or other nominee provides for you. Most brokers offer voting by mail, by telephone and on the Internet.

How do I vote if I hold shares through the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan?

If you hold shares through the Hospira 401(k) Retirement Savings Plan, you will receive a proxy card that will serve as an instruction to the co-trustees of the plan's trust as to how to vote your shares. If you hold your shares through the Hospira Puerto Rico Retirement Savings Plan, you will receive a proxy card that will serve as an instruction to the trustees of that plan's trust as to how to vote your shares. You may vote your shares by completing the proxy card and mailing it in the postage-paid envelope provided. You may also vote by telephone or Internet by following the instructions provided with the proxy card. If you do not vote shares you hold in the Hospira 401(k) Retirement Savings Plan, the co-trustees of the plan's trust will vote your shares in their discretion. If you do not vote shares you hold in the Hospira Puerto Rico Retirement Savings Plan, the trustees of that plan's trust, Banco Popular de Puerto Rico, will vote your shares in the same matter as shares voted by the participants.

The co-trustees of the plans are Terrence Kearney, Lori Carlson, and Henry Weishaar. Each of the co-trustees is an officer of Hospira. The voting power with respect to the Hospira shares held under the Hospira 401(k) Retirement Savings Plan is held by and shared between the co-trustees and the

2

participants. The co-trustees may use their own discretion with respect to those shares for which voting instructions are not received on a timely basis. Fiduciary Counselors Inc. is the independent fiduciary of the plans for purposes of monitoring the suitability of acquiring and holding Hospira's shares, and does not vote the Hospira shares held under the plans.

How do I vote in person?

If you are a shareholder of record, you may vote your shares in person at the meeting. However, we encourage you to vote by proxy in advance, even if you plan to attend the meeting.

Can I revoke a proxy?

Yes. You can revoke your proxy by:

- •

- giving written notice to our corporate secretary;

- •

- delivering a later-dated proxy; or

- •

- voting in person at the meeting.

If I submit a proxy, will my vote be kept confidential?

Our policy is that all proxies, ballots, and voting tabulations that reveal how a particular shareholder has voted be kept confidential and not be disclosed, except:

- •

- where disclosure may be required by law or regulation;

- •

- where disclosure may be necessary in order for us to assert or defend claims;

- •

- where a shareholder provides comments with a proxy;

- •

- where a shareholder expressly requests disclosure;

- •

- to allow the inspectors of election to certify the results of a vote; or

- •

- in other limited circumstances, such as a contested election or a proxy solicitation not approved and recommended by the board of directors.

Who will be tabulating and certifying votes at the meeting?

We have engaged Computershare Trust Company, our transfer agent, to serve as the tabulator of votes and a representative of Computershare to serve as inspector of election and certify the votes.

Who will pay the costs and expenses for this proxy solicitation?

We will pay all costs of soliciting proxies, including charges made by brokers and other persons holding common stock in their names or in the names of nominees, for reasonable expenses incurred in sending proxy materials to beneficial owners and obtaining their proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally and by telephone, Internet and facsimile, all without extra compensation. We also have retained the services of Georgeson Shareholder Communications, Inc. to aid in the solicitation of proxies at a cost of $15,000, plus reimbursement for reasonable out-of-pocket expenses.

3

Can I elect to receive future proxy statements and annual reports electronically instead of by mail?

Yes. If you are a shareholder of record or participant in the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan, you can choose this option by taking one of the following actions:

- •

- follow the instructions provided if you vote over the Internet or by telephone; or

- •

- follow the procedures contained in the "Investor Relations" section of our Web site at www.hospira.com.

If you choose to view future proxy statements and annual reports over the Internet, you will receive a proxy card in the mail next year with instructions containing the Internet address of those materials. Your choice will remain in effect until you notify Hospira Investor Relations in writing, by mail or through the Investor Relations section of our Web site, and tell us otherwise. You do not have to elect Internet access each year.

If you hold your shares through a broker, bank or other nominee, you may follow the procedures contained in the "Investor Relations" section of our Web site at www.hospira.com. If it is feasible for you to do so, we encourage you to elect to receive future proxy statements and annual reports electronically to assist us in reducing our printing and mailing expenses.

This proxy statement and the 2005 Annual Report to Shareholders are available in the "Investor Relations" section of our Web site at www.hospira.com.

How can I attend the meeting?

You will need an admission ticket to enter the meeting. Shareholders of record will find an admission ticket attached to their proxy cards. If you plan to attend the meeting in person, please retain the admission ticket. A map and directions to the meeting are included on the outside back cover of this proxy statement and with your proxy card. If you arrive at the meeting without an admission ticket or you hold your stock through a broker, bank or other nominee, we will only admit you if we are able to verify that you are a Hospira shareholder. You may prove that you are a Hospira shareholder by, among other ways, providing us with a copy of a recent bank or brokerage account statement showing that you own Hospira common stock. Shareholders will be admitted to the meeting location beginning at 9:30 a.m., Eastern Time.

4

OWNERSHIP OF OUR STOCK

Ownership by Certain Beneficial Owners

The only shareholder known to us to be the beneficial owner of more than 5% of Hospira's outstanding common stock is FMR Corp., which reported ownership as of February 14, 2006 of 9,760,495 shares, representing approximately 6.1% of our common stock. FMR Corp. had shared investment power over those shares and the sole power to vote 726,901 shares. This information is as reported in filings with the Securities and Exchange Commission. No changes in this holding have come to our attention since February 14, 2006. We are not aware of any other beneficial owner of more than 5% of Hospira common stock.

Ownership by Directors and Management

The following table sets forth information regarding ownership of our common stock as of February 28, 2006:

- •

- by our current directors, our chief executive officer and the other named executive officers; and

- •

- by all directors and executive officers as a group.

Each person named below, and our current directors and executive officers as a group, collectively beneficially own less than 1% of our outstanding common stock. Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. A person is deemed to be the beneficial owner of any shares of common stock if such person has or shares the right to vote or dispose of such common stock, or has the right to acquire beneficial ownership at any time within 60 days of the date of the table. Deferred share units held by directors may not be voted or disposed of by the director until the shares are distributed to the director upon or after the director's service on the board terminates and therefore are not considered to be beneficially owned. The number of options exercisable within 60 days and the number of deferred share units are stated separately and not included in the "Number of Shares" column.

5

Ronald A. Matricaria and Mark F. Wheeler have been nominated for election to the board of directors at the 2006 annual meeting. Neither of them hold any shares of Hospira stock, Hospira stock options or deferred share units.

Name

| | Number of

Shares

| | Options

Exercisable

within

60 Days

| | Deferred

Share Units

|

|---|

| David A. Jones, Chairman of the Board of Directors(1) | | 205,889 | | 200,000 | | — |

| Irving W. Bailey, II, Director(2) | | 15,000 | | — | | 4,289 |

| Connie R. Curran, RN, Ed.D, Director | | — | | — | | 7,374 |

| Jacque J. Sokolov, M.D., Director | | 4,289 | | — | | — |

| John C. Staley, Director | | — | | — | | 4,289 |

| William L. Weiss, Director(3) | | 265 | | — | | 5,790 |

| Judith C. Pelham, Director | | 2,535 | | — | | — |

| Christopher B. Begley, Chief Executive Officer and Director(4) | | 52,508 | | 166,667 | | — |

| John Arnott, Senior Vice President, Global Commercial Operations(5) | | 16,041 | | 141,793 | | — |

| Terrence C. Kearney, Senior Vice President, Finance, and Chief Financial Officer(6) | | 41,158 | | 276,573 | | — |

| Edward A. Ogunro, Senior Vice President, Research and Development, Medical and Regulatory Affairs and Chief Scientific Officer(7) | | 5,506 | | 26,667 | | — |

| Brian J. Smith, Senior Vice President, General Counsel and Secretary(8) | | 7,928 | | 26,667 | | — |

| All directors and executive officers as a group (13 persons)(9) | | 355,317 | | 850,634 | | 21,742 |

For each non-employee director, the number of shares or deferred share units, as the case may be, includes 2,535 shares of restricted stock or restricted share units that are subject to forfeiture under certain conditions.

- (1)

- The number of shares held by Mr. Jones Includes 1,600 shares held by his spouse for which he disclaims beneficial ownership.

- (2)

- The shares held by Mr. Bailey are held indirectly through IWB Investments, L.P.

- (3)

- The number of shares held by Mr. Weiss include 75 shares held indirectly through a SEP-IRA.

- (4)

- The number of shares held by Mr. Begley includes 25,996 shares held in his 401(k) account.

- (5)

- The number of shares held by Mr. Arnott includes 269 shares held in his 401(k) account and 15,772 shares held by his spouse of which he disclaims beneficial ownership.

- (6)

- The number of shares held by Mr. Kearney includes 2,678 shares held in his 401(k) account. Mr. Kearney serves as a co-trustee of, and has shared voting power over the Hospira shares held under, the Hospira 401(k) Retirement Savings Plan, the Hospira Ashland Union 401(k) Plan and Trust and the Hospira Puerto Rico Retirement Savings Plan. The number of shares provided in the table does not include the 4,049,060 Hospira shares held under those plans by all participants.

- (7)

- The number of shares held by Dr. Ogunro includes 959 shares held in his 401(k) account.

- (8)

- The number of shares held by Mr. Smith includes 2,518 shares held in his 401(k) account.

- (9)

- Includes 35,447 shares held in 401(k) accounts of executive officers, and 7,605 shares and 10,140 deferred share units that are unvested restricted shares and subject to forfeiture under certain conditions. Also includes 18,636 shares and 600 options exercisable within 60 days held by spouses of directors and executive officers for which the beneficial ownership is disclaimed.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class of directors elected for a three-year term at each annual meeting. Class I and Class III each consist of three directors and Class II consists of two directors. Each director holds office until the third annual meeting after the meeting at which such director is elected and until his or her successor is duly elected and qualified or until his or her earlier resignation, removal or death. The terms of the Class II directors expire at the 2006 annual meeting.

On March 14, 2006, Judith C. Pelham, a Class I director whose term expires in 2008, and William L. Weiss, a Class III director whose term expires in 2007, resigned from the board effective upon the 2006 annual meeting. As permitted under our by-laws, the board of directors has determined that it will nominate successors to their board seats for election by the shareholders at the 2006 annual meeting for the remainder of their terms. Therefore, one Class I director, two Class II directors and one Class III director will be elected at the 2006 annual meeting.

Upon the recommendation of the nominations and compensation committee, the board of directors has nominated:

- •

- Ronald A. Matricaria for election as a Class I director to hold office until the annual meeting in 2008;

- •

- Christopher B. Begley and John C. Staley for election as Class II directors to hold office until the annual meeting in 2009; and

- •

- Mark F. Wheeler for election as a Class III director to hold office until the annual meeting in 2007.

A properly submitted proxy will be voted by the persons named on the proxy card for the election of each nominee, unless you indicate that your vote should be withheld. If elected, each nominee will serve until the expiration of his term and his successor is elected and qualified or until his earlier resignation, removal or death. Each of the nominees has indicated his willingness to serve if elected, and the board of directors has no reason to believe that any of the nominees will be unavailable for election, but if such a situation should arise, the proxy will be voted in accordance with the best judgment of the proxyholder for such person or persons as may be designated by the board of directors, unless the shareholder has directed otherwise.

The board of directors recommends that the shareholders vote FOR the election of each nominee listed above.

7

OUR BOARD OF DIRECTORS

Nominees

Christopher B. Begley, age 53, is nominated to be elected as a Class II director for a term expiring at the 2009 annual meeting. He has served as our Chief Executive Officer and director since our spin-off from Abbott Laboratories, a global broad-based healthcare company, on April 30, 2004. Prior to his becoming our Chief Executive Officer, Mr. Begley provided 18 years of service to Abbott, and was Abbott's Senior Vice President, Hospital Products, between 2000 and 2004. Prior to his appointment as Senior Vice President, Hospital Products, Mr. Begley served as Abbott's Senior Vice President, Chemical and Agricultural Products from 1999 to 2000, Vice President, Abbott Health Systems, from 1998 to 1999, and Vice President, MediSense Operations, in 1998. Mr. Begley also serves as a director of Children's Memorial Hospital (Chicago), The Executive Club of Chicago and AdvaMed.

John C. Staley, age 64, is nominated to be elected as a Class II director for a term expiring at the 2009 annual meeting. He has served as our director since our spin-off from Abbott on April 30, 2004. Mr. Staley served as the Managing Partner of the Lake Michigan Area of Ernst & Young LLP, a public accounting firm, a position that he held from 1985 to his retirement in June 2001. Mr. Staley also serves as a director of eLoyalty Corporation. Mr. Staley is also a member of, and the former Chairman of, the Board of Trustees of DePaul University.

Ronald A. Matricaria, age 63, is nominated to be elected as a Class I director for a term expiring at the 2008 annual meeting. From April 1993 to December 2002, he served, at various times, as the Chairman, Chief Executive Officer and President of St. Jude Medical, Inc., a developer, manufacturer and distributor of cardiovascular medical devices. He retired from the St. Jude board in December 2002. Mr. Matricaria currently serves as the non-executive Chairman of the Board of directors of Haemonetics Corporation and is a director of Invitrogen Corp. and VistaCare, Inc.

Mark F. Wheeler, M.D., M.P.H., age 56, is nominated to be elected as a Class III director for a term expiring at the 2007 annual meeting. He has been employed by General Electric Company, a diversified technology, media and financial services company, as Acting Vice President Engineering, Centricity Enterprise Business Unit, since February 2006. He served as chief technical architect of IDX Systems Corporation, a healthcare information technology services provider, from 1997 until December 2005, when IDX was acquired by General Electric, and served on IDX's board of directors from 1999 through the acquisition. Dr. Wheeler co-founded PHAMIS, Inc. in 1981 and served as its Director of Research and Development from its founding until its acquisition by IDX in 1997.

Continuing Directors

Class III Directors Whose Terms Expire in 2007

Connie R. Curran, RN, Ed.D., age 58, has served as our director since our spin-off from Abbott on April 30, 2004. Dr. Curran has served as the Executive Director of C-Change, formerly the National Dialogue on Cancer, a health advocacy organization, since 2003. From 1995 to 2000, Dr. Curran served as President and Chief Executive Officer of CurranCare, LLC, a healthcare consulting company. Upon the acquisition of CurranCare by Cardinal Health Consulting Services in November 2000, Dr. Curran served as President of Cardinal Health Consulting Services, a consulting company with expertise in surgical services, hospital operations, case management and home care, until February 2002. Dr. Curran has served as Vice President of the American Hospital Association and Dean at the Medical College of Wisconsin. Dr. Curran also serves as a director of CardioDynamics International Corp. and DeVry, Inc.

David A. Jones, age 74, has served as the Chairman of our board of directors since our spin-off from Abbott on April 30, 2004. He is a co-founder of Humana Inc., a provider of health insurance products and related services, and served as its Chairman and Chief Executive Officer since its

8

organization in 1961 until he retired as Chief Executive Officer in 1997. In 1999, Mr. Jones resumed his responsibilities as Chief Executive Officer and held that position until 2000, when he resumed the position of Chairman. Mr. Jones retired as Chairman of Humana in 2005. Mr. Jones was a director of Abbott for over 20 years, from 1982 until his retirement from the Abbott board in 2003.

Class I Directors Whose Terms Expire in 2008

Irving W. Bailey, II, age 64, has served as our director since our spin-off from Abbott on April 30, 2004. Mr. Bailey has served as a Managing Director of Chrysalis Ventures, a private equity management firm, from June 2001 to January 2005 and a Senior Advisor to Chrysalis Ventures since January 2005. Mr. Bailey served as President of Bailey Capital Corporation, also a private equity management firm, from January 1998 to June 2001, and as Chief Executive Officer of Providian Corporation, an insurance and diversified financial services company, from 1988 to 1997. Mr. Bailey also serves as a director of AEGON, N.V. and Computer Sciences Corporation.

Jacque J. Sokolov, M.D., age 51, has served as our director since our spin-off from Abbott on April 30, 2004. Dr. Sokolov has served since 1999 as the Chairman and a Senior Partner of Sokolov, Sokolov, Burgess, a national healthcare management consulting, project development and investment firm. Dr. Sokolov previously served as Chairman of Coastal Physician Group, Inc., which later became PhyAmerica Physician Group, Inc., from 1994 until 1997 and as Vice President and Chief Medical Officer for Southern California Edison from 1989 until 1992. Dr. Sokolov also serves as a director of MedCath Corporation.

9

CORPORATE GOVERNANCE

Our board of directors held six meetings during 2005, all of which were regularly scheduled meetings. No director attended fewer than 75% of the meetings of the board of directors and of the committees of the board of directors on which such director served. We anticipate that our directors will attend the 2006 annual meeting. All of our continuing directors attended the 2005 annual meeting.

Our independent directors must meet at least twice a year in regularly scheduled executive sessions, and, in practice, meet in an executive session without management present at every regularly scheduled board meeting. The chairman of the board normally presides at these meetings.

Independence

The board annually determines the independence of directors based on a review by the directors and the nominations and compensation committee. No director may qualify as independent unless the board of directors affirms that the director has no material relationship with us. As required by our corporate governance guidelines, the board will consider all relevant facts and circumstances in connection with that determination, including the following:

- •

- a director who is, or has been within the last three years, our employee, or whose immediate family member is, or has been within the last three years, our executive officer is not independent;

- •

- a director who receives, or whose immediate family member receives, more than $100,000 from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), and other than amounts received by an immediate family member for service as a non-executive employee, during any 12-month period in the last three years is not independent;

- •

- a director who, or whose immediate family member, is a current partner of a firm that is our internal or external auditor is not independent;

- •

- a director who is a current employee of a firm that is our internal or external auditor is not independent;

- •

- a director who has an immediate family member who is a current employee of a firm that is our internal or external auditor and who participates in such firm's audit, assurance or tax compliance (but not tax planning) practice is not independent;

- •

- a director who, or whose immediate family member, was within the last three years a partner or employee of a firm that is our internal or external auditor and personally worked on our audit during that time is not independent;

- •

- a director who is employed, or whose immediate family member is employed, or has been employed in the last three years, as an executive officer of another company where any of our present executive officers at the same time serves or served on that company's compensation committee is not independent;

- •

- a director who is a current employee, or whose immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues, is not independent; and

- •

- a director who is an executive officer of a charitable organization that receives charitable contributions (other than matching contributions) from us that are in excess of the greater of $1 million, or 2% of such charitable organization's consolidated gross revenues is not independent.

10

On March 14, 2006, our board determined that each of Mr. Bailey, Dr. Curran, Mr. Jones, Mr. Matricaria, Dr. Sokolov, Mr. Staley and Dr. Wheeler is independent within the meaning of our director independence standards and Section 303A.02 of the listing standards of the New York Stock Exchange. In doing so, the board was not aware of any disqualifying relationship under the above criteria and, additionally, was not aware of any other relationship between such director and Hospira that would affect his or her independence.

The board considered relationships that would not require disclosure in this proxy statement as a related party transaction, and would not impair independence under the standards described above, to be categorically immaterial relationships for purposes of such independence determinations. We are required to disclose in this proxy statement, among other things, transactions involving over $60,000 in which a director, nominee or immediate family member thereof has a material direct or indirect interest, and certain business relationships between us and an entity of which a director is an executive officer or significant shareholder. Any relationships, other than categorically immaterial relationships, that the board considered in connection with the independence determination are described below.

In making its determination with respect to Mr. Jones, our board of directors considered the consulting agreement that Mr. Jones entered into with Abbott, our former parent company, during August 2003. Under the agreement, Mr. Jones was paid approximately $172,000 from Abbott between August 2003 and the agreement's termination on April 30, 2004 (the date of the spin-off).

The agreement provided that Mr. Jones would provide services relating to the spin-off. Around the time of the consulting agreement, Abbott announced in a press release its intention to effect the spin-off, and that Mr. Jones would serve as our chairman and Mr. Begley would serve as our chief executive officer. Mr. Jones is a former independent director of Abbott and was selected as chairman of Hospira because he had substantial experience in the healthcare industry and would bring credibility to Hospira. The services actually provided by Mr. Jones primarily included identifying qualified persons to serve as our independent directors after the spin-off and periodically advising Mr. Begley on matters relating to the spin-off and our business.

Our board determined that the services provided by Mr. Jones under the consulting agreement were similar to services that would be provided by an independent director. Therefore, the board of directors determined that the consulting agreement with Abbott was not a material relationship with Hospira, and determined Mr. Jones to be independent. To assist the board in making its determination of Mr. Jones' independence in 2005, we received guidance from the New York Stock Exchange.

Committees of the Board of Directors

Our board of directors has the following committees:

Executive Committee

Mr. Jones (chairman), Mr. Begley, Mr. Bailey and Mr. Staley serve on our executive committee. During 2005, our executive committee did not meet. The executive committee is required to consist of a majority of independent directors. The executive committee exercises the powers and authority of the board of directors in the management of our everyday business and affairs with respect to issues which the chairman of the committee or our chief executive officer determines should not be postponed until the next regular meeting of our board of directors or do not require a meeting of the board of directors. The executive committee may not approve or adopt, or recommend to shareholders, any action or matter which must be submitted to our shareholders for approval pursuant to Delaware law. The executive committee also may not adopt, amend or repeal our by-laws.

11

Audit and Public Policy Committee

Mr. Staley (chairman), Dr. Curran, and Ms. Pelham currently serve on our audit and public policy committee. Upon his election to the board at the 2006 annual meeting, Dr. Wheeler will join the committee. During 2005, our audit and public policy committee met 11 times. All members of the audit and public policy committee must satisfy the independence requirements of the New York Stock Exchange. Our board has determined that each of Mr. Staley, Dr. Curran and Dr. Wheeler is independent and financially literate, as required by the New York Stock Exchange, and made such determination with respect to Ms. Pelham in 2005. The board has designated Mr. Staley as the "audit committee financial expert," within the meaning of the rules under the Securities Exchange Act of 1934 and the New York Stock Exchange and our corporate governance guidelines.

The functions of the committee include:

- •

- meeting periodically with our management, internal auditors and independent auditors regarding our internal controls, accounting and financial reporting;

- •

- appointing and evaluating the independent auditors;

- •

- reviewing and discussing our financial statements and financial press releases with our management and independent auditors;

- •

- establishing procedures for the receipt, retention and treatment of complaints received by our company regarding accounting matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting matters;

- •

- providing oversight over certain compliance programs, policies and procedures; and

- •

- providing oversight over certain company political and charitable activities.

Both the independent auditors and the internal auditors regularly meet privately with the audit and public policy committee and have unrestricted access to the audit and public policy committee.

The audit and public policy committee is governed by a written charter, which is attached as Exhibit A to this proxy statement and is available on our Web site at www.hospira.com.

Nominations and Compensation Committee

Mr. Bailey (chairman), Dr. Sokolov and Mr. Weiss currently serve on our nominations and compensation committee. Upon his election to the board at the 2006 annual meeting, Mr. Matricaria will join the committee. During 2005, the nominations and compensation committee met six times. All members of the nominations and compensation committee must satisfy the independence requirements of the New York Stock Exchange, be "non-employee directors" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and be "outside directors" for purposes of Section 162(m) of the Internal Revenue Code. Our board has determined that each of Mr. Bailey, Mr. Matricaria and Dr. Sokolov is independent and eligible to serve on the committee, and made such determination with respect to Mr. Weiss in 2005.

The functions of the committee, as to nominations and corporate governance, include:

- •

- developing the general criteria for selecting members of the board of directors and assisting the board in identifying and attracting qualified candidates;

- •

- recommending to the board of directors the nominees for election as directors, considering the criteria described above and any potential nominees recommended by our shareholders;

- •

- recommending to the board of directors persons to be elected as executive officers; and

- •

- reviewing and assessing the adequacy of our corporate governance guidelines.

12

The functions of the committee, as to compensation, include:

- •

- reviewing the performance of our executive officers;

- •

- reviewing and determining the executive officers' compensation;

- •

- reviewing and, as it deems appropriate, recommending to the board of directors, policies, practices and procedures relating to the compensation of our officers, other managerial employees and non-employee directors and the establishment and administration of our employee benefit plans; and

- •

- exercising authority under our employee equity incentive plan and management incentive plans.

The nominations and compensation committee is governed by a written charter, which is attached as Exhibit B to this proxy statement and is available on our Web site at www.hospira.com.

The process used by the nominations and compensation committee to identify a nominee to our board of directors depends on the qualities being sought. Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve our governance and strategic needs. Candidates will be considered on the basis of a range of criteria, including broad-based business knowledge and relationships, and prominence and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the board of directors' oversight role with respect to our business and affairs.

Director candidates can be referred to the committee from a variety of sources, including by our officers, directors and shareholders. The committee enlisted a third-party search firm to assist it in identifying and evaluating qualified candidates.

If the board determines to seek a new member and a candidate is referred to the committee, the committee will review the candidate's qualifications in light of the attributes being sought by the board. If the committee determines that a candidate's qualifications are potentially suitable for service on the board, the committee will conduct an investigation of the candidate's background. Typically, candidates are interviewed by one or more members of the committee and our chairman before being nominated for the election to the board.

Mr. Matricaria and Dr. Wheeler have been nominated for election to our board. The committee believes that each nominee, through his experience, accomplishments in industries and fields important to our business, and areas of expertise, is highly qualified to serve on our board and determined that each satisfied our director qualification standards. Dr. Wheeler was referred to the committee by an independent member of our board, and Mr. Matricaria was referred to the committee by a third-party search firm and an independent member of our board.

Mr. Begley and Mr. Staley have served on the board since the spin-off. The committee determined that each of them satisfied our continuing director qualification standards.

Shareholders may recommend persons as potential nominees for director by complying with the procedures set forth later in this proxy statement under "Other Shareholder Information—Procedure for Recommendation and Nominations of Directors and Transaction of Business at Annual Meeting." The nominations and compensation committee will consider potential nominees recommended by shareholders, but has no obligation to recommend such candidates. The evaluation criteria are the same for each person considered for nomination to the board.

Science and Technology Committee

Dr. Sokolov (chairman), Dr. Curran and Mr. Begley serve on the science and technology committee. Upon his election to the board at the 2006 annual meeting, Dr. Wheeler will join the

13

committee. The committee provides general oversight, and advises our board, as to certain matters relating to our product pipeline and other matters as delegated to it by the board. The committee was established in, and met one time during, 2005.

Director Share Ownership Guidelines

Within three years after joining the board, each non-employee director is required to own and retain a minimum number of shares of Hospira common stock whose aggregate value is equal to three times such director's annual retainer fees, and maintain that minimum throughout his or her service on the board. "Annual retainer fees" are currently $50,000. For purposes of the ownership guidelines, common stock includes restricted stock, restricted stock units and deferred stock units awarded to non-employee directors.

Communicating with the Board of Directors

You may communicate with our board of directors or our independent directors as a group by writing a letter to the chairman of our audit and public policy committee (for accounting or disclosure matters), the chairman of our board (for any other matter) or any of our other independent directors, addressed to:

Director Communications

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

Our general counsel and secretary will review the communication and forward the communication to the addressee or to the director or directors he believes to be most appropriate.

In addition, you may contact the chairman of our audit and public policy committee through the Helpline of our Office of Ethics and Compliance by calling 1-866-311-4632. You will have the option to directly refer matters to the audit and public policy committee. Our Vice President, Ethics and Compliance will be notified in such cases.

Corporate Governance Materials

Our corporate governance guidelines, our code of business conduct and ethics, and the charters of our audit and public policy committee and our nominations and compensation committee are available in the "Investor Relations" section of our Web site at www.hospira.com. We will provide a copy of any of these materials to any shareholder free of charge upon written request to:

Corporate Governance Material Request

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

14

DIRECTOR COMPENSATION

Our non-employee directors receive an annual cash retainer in the amount of $50,000 per year, and meeting fees of $1,000 for attending each board meeting and board committee meeting in person ($500 for each meeting other than in person). Each director who serves in the role of chairman of any committee receives a chairman fee of (1) $10,000 for the chairman of the audit and public policy committee; and (2) $7,500 for each other board committee.

Additionally, on the last day of the calendar quarter in which our annual meeting is held, each non-employee director receives an annual grant of restricted stock, which will generally vest as of the first regularly scheduled annual meeting of shareholders following the date of grant. For each such grant, the number of shares of restricted stock granted to each director equals that number of shares equal in value to $100,000 as of the date of grant. These shares of restricted stock are issued under the Hospira 2004 Long-Term Stock Incentive Plan (the "2004 Stock Plan"). In 2005, the non-employee directors' fee plan was amended to increase the value of the restricted stock award to $100,000 from $50,000. For each director, the 2005 award was 2,535 shares of restricted stock, consisting of 1,276 shares awarded as of June 30, 2005 and 1,259 shares awarded as of October 26, 2005, the date of the amendment.

Non-employee directors may elect to defer all or a portion of their annual retainer fees, committee chairman fees, meeting fees and restricted stock awards. The cash-based fees will be deferred into a stock unit account. Restricted stock may, based on an election by the director, be deferred and granted as restricted stock units and recorded in the director's stock unit account. The stock unit account will be paid out, at the director's prior election, on the first business day after the calendar quarter in which the director's service terminates or in up to 10 annual installments from and after that date. Any shares of stock distributed to non-employee directors at the end of the applicable deferral periods shall be issued under the terms of the 2004 Stock Plan.

The following table shows the amount and form of compensation paid to each of our non-employee directors during 2005. Compensation includes annual retainer fees, committee chairman fees, meeting fees and restricted stock grants.

Director

| | Cash

| | Number of Shares of

Restricted Stock

| | Number of Deferred

Share Units(1)

|

|---|

| Irving W. Bailey II | | $ | 67,625 | | — | | 2,535 |

| Connie R. Curran | | | — | | — | | 4,189 |

| David A. Jones | | | 61,625 | | 2,535 | | — |

| Judith C. Pelham(2) | | | 41,780 | | 2,535 | | — |

| Jacque J. Sokolov | | | 65,391 | | 2,535 | | — |

| John C. Staley | | | 70,250 | | — | | 2,535 |

| William L. Weiss | | | — | | — | | 4,045 |

- (1)

- Includes annual restricted stock awards and cash-based fees that the director has elected to defer in accordance with the non-employee directors' fee plan. Dr. Curran and Mr. Weiss elected to defer all cash-based fees into a stock unit account.

- (2)

- Ms. Pelham was elected to the board of directors on May 9, 2005.

15

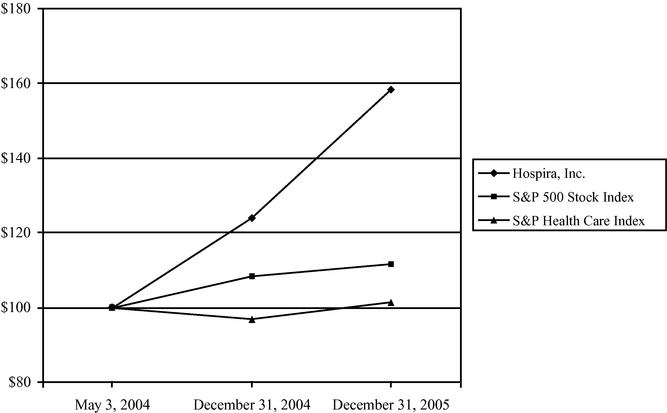

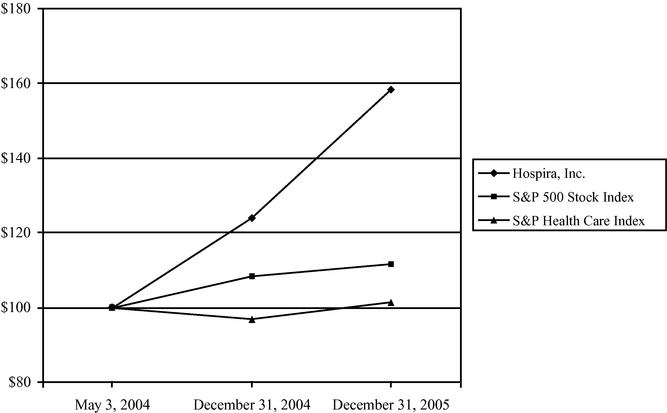

PERFORMANCE GRAPH

The following graph compares the performance of our common stock for the periods indicated with the performance of the S&P 500 Stock Index and the S&P Health Care Index.

Comparison of Cumulative Total Return

Assumes $100 was invested on May 3, 2004 (the first date our common stock was traded on the New York Stock Exchange) in our common stock and each index. Values are as of the close of the U.S. stock markets on December 31, 2004 and 2005, and assumes dividends are reinvested. No cash dividends have been declared or paid on our common stock. Returns over the indicated period may not be indicative of future returns.

16

EXECUTIVE COMPENSATION

Report of Nominations and Compensation Committee on Executive Compensation

The nominations and compensation committee is responsible for approving the compensation program for Hospira's executives. The committee has engaged an independent consultant to assist it in the performance of its duties. The consultant regularly provides the committee with analyses of competitive practice and compensation relevant to the company's executive jobs and industry. In addition, the committee routinely requests and receives recommendations from the consultant with regard to CEO pay, other key executive pay, long-term incentive award levels and other executive compensation matters of concern to the committee.

Hospira's Pay-for-Performance Philosophy

At Hospira, we recognize that all employees have an impact on the performance of our business. Accordingly, we have designed our pay programs to help communicate our key strategies and reward the successful execution of those strategies through results. Our total rewards programs (including compensation, benefit, and work environment dimensions) will help us attract, retain and motivate the best people in the industries where we compete for talent.

We offer a competitive total rewards package to our employees around the world. The basis for any compensation and/or benefits comparison is formed by benchmarking against market rates based on industry and geography. We compare our total rewards with annual compensation and benefits peer groups that focus on appropriately sized industries where we compete for talent.

Base salaries are determined based on a review of a position's level of responsibility, experience and expertise relative to the external marketplace and peers within the organization, and will be strongly tied to individual job performance. Incentive programs may be based on a combination of corporate, business unit and/or individual performance and are designed to pay below-average rewards for below- average performance and above-average rewards for above-average performance. Long-term incentives are provided to certain individuals based on their impact on overall results and prevailing market practices.

Our goal is to design and administer an executive compensation program in a manner that aligns the interests of our shareholders with the ability to attract, retain and motivate outstanding leadership. Therefore, total compensation is determined by the success of our company. We provide total compensation opportunities that are competitive in the marketplace and include the opportunity for our executives to earn above-average rewards when merited by corporate and individual performance.

On an annual basis the committee receives a competitive analysis from its executive compensation consultant. This analysis includes a review of Hospira officers' total compensation and benefits in comparison to a peer group of companies selected from the medical device, generic pharmaceutical and hospital supply industries. Companies have been selected to reflect Hospira's size, technologies and product markets. In addition, the consultant provides comparisons to similarly sized companies from published survey data for the healthcare and general industries.

Hospira's executive compensation program is based upon our Pay-for-Performance Philosophy. Under our program, an executive's direct compensation is based on the following components:

- •

- base salary;

- •

- an annual incentive or bonus payment; and

- •

- long-term incentives, which have consisted of stock options but may include cash-based awards, stock-based awards and/or stock appreciation rights.

17

As of the end of 2004, benefits under Hospira's defined benefit pension plan and supplemental pension plan in which our executives participated were frozen, and the named executive officers no longer accrue additional years of service under those plans. Hospira does not currently provide perquisites to the named executive officers and, instead, pays cash to each named executive officer in lieu of perquisites. Hospira does not currently offer a deferred compensation plan, other than the Hospira 401(k) Retirement Savings Plan, which allows Hospira executives to participate up to the annual IRS limits on the same terms as all other employees.

Summary of 2005 Compensation

| | Salary

| | Incentive Plan Award(1)

| | Other Hospira Compensation(2)

| | Value of Stock Options Awarded(3)

| | Other(4)(5)

| | Total

|

|---|

Christopher B. Begley

Chief Executive Officer and Director | | $ | 766,154 | | $ | 1,038,423 | | $ | 18,900 | | $ | 2,567,250 | | $ | 736,471 | | $ | 5,127,198 |

John Arnott

Senior Vice President, Global Commercial Operations |

|

|

362,615 |

|

|

391,633 |

|

|

18,900 |

|

|

798,700 |

|

|

191,086 |

|

|

1,762,934 |

Terrence C. Kearney

Senior Vice President, Finance and Chief Financial Officer |

|

|

362,615 |

|

|

391,633 |

|

|

18,900 |

|

|

798,700 |

|

|

1,611,144 |

|

|

3,182,992 |

Edward A. Ogunro

Senior Vice President, Research and Development, Medical and Regulatory Affairs and Chief Scientific Officer |

|

|

362,615 |

|

|

391,633 |

|

|

18,900 |

|

|

798,700 |

|

|

455,612 |

|

|

2,027,460 |

Brian J. Smith

Senior Vice President, General Counsel and Secretary |

|

|

362,615 |

|

|

342,679 |

|

|

18,900 |

|

|

570,500 |

|

|

— |

|

|

1,294,694 |

- (1)

- Awarded in February 2006 based upon 2005 performance.

- (2)

- Consists only of the company contribution to the officer's 401(k) account.

- (3)

- Determined using a Black-Scholes stock option valuation model as of the date of the grant. For further details regarding the assumptions used in such determination, please see Note 1 to the "Option/SAR Grants in Last Fiscal Year" table in this proxy statement. For Mr. Arnott and Mr. Kearney, this column does not include the value of replacement stock options awarded in connection with the exercise of options converted from Abbott stock options held by the officer at the time of the spin-off. The value of those options are included in the "Other" column following.

- (4)

- For Mr. Arnott and Mr. Kearney, includes $191,086 and $462,194, respectively, representing the value of replacement stock options awarded during the year, calculated using a Black-Scholes stock option valuation model using the assumptions described in Note 1 to the "Option/SAR Grants in Last Fiscal Year" table in this proxy statement.

- (5)

- For Mr. Begley, Mr. Kearney and Dr. Ogunro, includes a one-time contribution made by Hospira during 2005 to a grantor trust under such officer's supplemental pension plan and related taxes paid on behalf of such officer in the following amounts:

Officer

| | Amount Contributed to Grantor Trust

| | Tax Withholding

| | Total

|

|---|

| Mr. Begley | | $ | 445,933 | | $ | 290,538 | | $ | 736,471 |

| Mr. Kearney | | | 695,689 | | | 453,261 | | | 1,148,950 |

| Dr. Ogunro | | | 275,873 | | | 179,739 | | | 455,612 |

18

The Hospira pension plan and supplemental pension plan were established at the spin-off and replicated, in all material respects, the benefit formulas of the Abbott pension plan and supplemental pension plan. Each of Hospira's executive officers were beneficiaries of the Abbott pension plan before the spin-off and are entitled to benefits under the Hospira pension plan and supplemental pension plan based upon prior service with Abbott. The officers named above were entitled to receive contributions into their grantor trusts based upon benefits earned under the supplemental pension plan. The amount contributed by Hospira represents the amount for which it was responsible to fund for the period between May 1, 2004 and December 31, 2004 pursuant to its agreement with Abbott in connection with the spin-off. As benefits under the pension plan and supplemental pension plan were frozen as of December 31, 2004, there will be no further contributions by Hospira to the grantor trusts. Abbott retained the obligation to maintain the trusts and will retain all ongoing trust related expenses.

In the "Summary Compensation Table" following this report, the amount contributed to such officer's grantor trust is reported in the "All Other Compensation" column and the amount of taxes withheld on behalf of such officer is reported in the "Other Annual Compensation" column.

Base Salary

In addition to the factors outlined in our Pay-for-Performance Philosophy, an executive's base salary is determined by an assessment of sustained performance against individual job responsibilities including, where appropriate, the impact of such performance on our business results, current salary in relation to the competitive market for the job, experience and potential for advancement.

For 2005, each named executive officer received an approximately 3% increase to his base salary, which was consistent with increases given to all Hospira employees.

In addition to the base salary, each named executive officer receives cash in lieu of perquisites. Mr. Begley received $50,000 and each other named executive officer received $25,000. These amounts are reported as salary in this proxy statement.

Annual Incentives

Hospira's annual incentive program is designed to establish a link between annual incentives and our financial success by rewarding participants when our company achieves or exceeds established financial and business objectives. Bonuses payable to the named executive officers are subject to a maximum determined for each officer, as a percentage of Hospira's EBITDA. The committee establishes performance goals for purposes of determining the actual award for each individual officer. These goals may include financial measures approved by our board of directors such as consolidated net earnings, EBITDA (earnings before interest, taxes, depreciation and amortization), profitability, cash flow, total or net sales, and earnings per share, and non-financial measures such as the attainment of selected strategic goals. An individual executive's annual incentive award is based on a percentage of salary determined by the executive's job level and competitive survey data, subject to the maximum described above. It is our intent that our annual incentive program for key executives meet the requirements of the Omnibus Budget Reconciliation Act of 1993 and that appropriate levels of deductibility be maintained.

The committee established a target incentive award for Mr. Begley of 100% and 70% to 80% for the other named executive officers. These targets reflect competitive market practice and are consistent with the committee's intent to provide greater emphasis on variable performance-based compensation than on base-salary compensation. Awards can range from zero to 200% of target depending on performance against the goals set by the committee. During 2005, the goals included Hospira's sales, earnings and cash flows and a measure of corporate well-being. In 2005 the company exceeded the approved target financial goals for sales, income and cash flows incorporated into the company's business plan and met the well-being goal. Based on this performance, the committee determined that

19

it would approve awards equal to 145% of target for named executive officers, which was consistent with the performance multiplier earned for corporate results by all other management and employee plan participants.

Long-Term Incentives

Long-term incentive awards made during 2005 consisted of non-qualified stock option awards having a ten-year term, with vesting over a three-year period; one-third vests on each anniversary of the grant date. The awards were based on competitive practice and recommendations from the executive compensation consultant to the committee. In particular, the committee determined that it would award Mr. Begley a grant of 225,000 option shares, which falls slightly below the median of the competitive market data.

Other

Certain officers receive compensation pursuant to arrangements that were in place prior to the spin-off from Abbott. Abbott stock options held by Mr. Kearney and Mr. Arnott at the time of the spin-off were converted to an equivalent value of Hospira stock options and retained their terms. Pursuant to the terms of the spin-off, each of Mr. Begley, Dr. Ogunro and Mr. Smith was required to retain his Abbott options rather than receiving conversion options because each was eligible to retire from Abbott at the time of the spin-off.

The terms of the converted options held by Mr. Kearney and Mr. Arnott include a replacement feature pursuant to which the holder receives a replacement stock option in connection with a qualifying exercise. The replacement feature is described in more detail in Note 3 to the "Option/SAR Grant in Last Fiscal Year" table in this proxy statement. As long as Mr. Arnott and Mr. Kearney hold, and make qualifying exercises of, stock options converted from Abbott stock options having this feature, they will continue to receive replacement stock option awards.

During 2005, Hospira made a one-time contribution to the grantor trusts of Mr. Begley, Mr. Kearney and Dr. Ogunro established in connection with the supplemental pension plan carried over from the spin-off, as more fully described in Note 5 to the table under "Summary of 2005 Compensation" above.

Change of Control Agreements

Hospira has in place change of control agreements with the named executive officers, which are described under "Change of Control Agreements" in this proxy statement. The agreements are designed to retain the named executive officers and provide continuity of management in the event of an actual or threatened change of control and ensure that their compensation and benefits expectations would be satisfied in such event. Upon consultation with its executive compensation consultant, the committee believes that the agreements are consistent with competitive market practice in both form and value.

Internal Revenue Code Section 162(m)

Under Section 162(m) of the Internal Revenue Code, Hospira may not take a federal income tax deduction for compensation paid in excess of $1 million to its chief executive officer or any of its four other highest paid executive officers. This limitation does not apply, however, to "performance-based" compensation, as defined under the Federal tax laws, under a plan approved by shareholders. Stock options and Hospira's annual incentive awards generally qualify as "performance-based" compensation, are awarded under plans approved by shareholders and are, therefore, fully deductible.

20

The committee considers the anticipated tax treatment to Hospira and its executive officers when reviewing executive compensation. The deductibility of some types of compensation payments can depend upon the timing of an executive's vesting or exercise of previously granted rights. Interpretations of and changes in applicable tax laws and regulations, as well as other factors beyond the committee's control, also can affect deductibility of compensation.

The committee will continue to assess alternatives for preserving the deductibility of compensation payments and benefits. However, the committee will not necessarily seek to limit executive compensation to amounts deductible under Section 162(m), since the committee wishes to maintain the flexibility to structure compensation programs in ways that best promote the interests of Hospira and its shareholders.

Executive Share Retention and Ownership Guidelines

In order to promote equity ownership and further align the interests of management with Hospira's shareholders, the committee has adopted share retention and ownership guidelines for senior management. Under these guidelines, the chief executive officer must hold at least 50,000 shares and other corporate officers must hold at least 25,000 shares. These minimum holdings must be attained within five years after becoming a corporate officer.

NOMINATIONS AND COMPENSATION COMMITTEE

Irving W. Bailey, II, Chairman

Jacque J. Sokolov

William L. Weiss

21

SUMMARY COMPENSATION TABLE

The following table shows compensation paid to our chief executive officer and our four highest paid executive officers for the period as indicated. The 2004 period represents the partial year from April 30, 2004 (the date of our spin-off from Abbott Laboratories) through December 31, 2004. The 2005 period represents the full year.

| |

| | Annual Compensation

| |

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

($)(1)

| | Bonus

($)

| | Other Annual Compensation

($)(2)

| | Common Stock Underlying Options/SARs

(#)(3)

| | All Other Compensation

($)(4)

|

|---|

Christopher B. Begley

Chief Executive Officer and Director | | 2005

2004 | | $

| 766,154

509,033 | | $

| 1,038,423

1,122,622 | | $

$ | 290,538

8,133 | | 225,000

500,000 | | $

| 464,833

15,652 |

John Arnott

Senior Vice President, Global Commercial Operations |

|

2005

2004 |

|

|

362,615

254,157 |

|

|

391,633

402,235 |

|

|

—

1,953 |

|

70,000

20,447

80,000 |

(5)

|

|

18,900

9,333 |

Terrence C. Kearney

Senior Vice President, Finance and Chief Financial Officer |

|

2005

2004 |

|

|

362,615

251,515 |

|

|

391,633

452,623 |

|

|

453,261

2,092 |

|

70,000

47,382

90,000

5,529 |

(5)

(5) |

|

714,589

9,234 |

Edward A. Ogunro

Senior Vice President, Research and Development, Medical and Regulatory Affairs and Chief Scientific Officer |

|

2005

2004 |

|

|

362,615

256,172 |

|

|

391,633

433,530 |

|

|

179,739

2,312 |

|

70,000

80,000 |

|

|

294,773

9,885 |

Brian J. Smith

Senior Vice President, General Counsel and Secretary |

|

2005

2004 |

|

|

362,615

239,019 |

|

|

342,679

310,477 |

|

|

—

— |

|

50,000

80,000 |

|

|

18,900

6,059 |

- (1)

- The 2004 period represents salary paid from the spin-off to December 31, 2004. During 2004, the annualized base salary, excluding the cash payment in lieu of perquisities, was $700,000 for Mr. Begley and $330,000 for each other named executive officer. In all periods, salary includes a cash payment to each officer in lieu of perquisites. During 2005, such payment was $50,000 to Mr. Begley and $25,000 to each other named executive officer.

- (2)

- For each period, represents amounts reimbursed for the payment of taxes. For 2004, such taxes were paid in connection with the employer contribution to such officer's supplemental 401(k) plan. For 2005, such taxes were paid in connection with a one-time contribution by Hospira to such officer's grantor trust under the supplemental pension plan, as described more fully in Note 5 to the "Summary of 2005 Compensation" table included in the Report of the Nominations and Compensation Committee on Executive Compensation above.

- During 2004, no officer received perquisites that exceeded $50,000. During 2005, no officer received perquisites.

- (3)

- The 2004 period excludes Hospira stock options awarded that were converted from Abbott stock options held by Mr. Arnott and Mr. Kearney at the time of the spin-off. These options are referred to as "conversion options." In 2004, at the time of the spin-off, Mr. Arnott received 150,276 conversion options and Mr. Kearney received 349,376 conversion options with varying exercise prices, vesting schedules and expiration dates to replace Abbott Laboratories options formerly held by each of them. Pursuant to the terms of our spin-off, each of Mr. Begley, Dr. Ogunro and Mr. Smith was required to

22

retain his Abbott options rather than receiving conversion options because each was eligible to retire from Abbott at the time of the spin-off.

- (4)

- For 2005, includes for each named executive officer $18,900 of employer contributions made to the Hospira 401(k) Retirement Savings Plan. In addition, for Mr. Begley, Mr. Kearney and Dr. Ognuro, the amounts include a one-time contribution by Hospira to such officer's grantor trust under the supplemental pension plan of $445,933, $695,689 and $275,873, respectively. The contribution to the grantor trust is described more fully in Note 5 to the "Summary of 2005 Compensation" table included in the Report of the Nominations and Compensation Committee on Executive Compensation above.

- For the 2004 period the entire amounts represent employer contributions to the Hospira 401(k) Retirement Savings Plan and such officer's Hospira 401(k) supplemental plan. For periods after 2004, no contributions were made to any supplemental plan.

- (5)

- These are replacement stock options awarded in connection with the exercise of conversion options. They are described in the table under "Option/SAR Grants in Last Fiscal Year" immediately following.

23

OPTION/SAR GRANTS IN LAST FISCAL YEAR

The following table provides information regarding the Hospira stock options received by our named executive officers during 2005.

Name

| | Number of Securities Underlying Options/SARs Granted(#)

| | Percent of Total Options/SARs Granted to Employees in Fiscal Year (%)

| | Exercise or Base Price ($/Sh.)

| | Expiration Date

| | Grant Date Present Value(1)

|

|---|

| Christopher B. Begley | | 225,000 | (2) | 6.52 | | 32.47 | | May 9, 2015 | | $ | 2,567,250 |

John Arnott

Replacement Options(3): |

|

70,000

2,681

6,542

2,909

2,739

5,576 |

(2)

|

2.03

0.08

0.19

0.08

0.08

0.16 |

|

32.47

31.73

35.80

44.47

44.47

44.47 |

|

May 9, 2015

February 14, 2013

February 14, 2013

February 9, 2011

February 9, 2012

February 14, 2013 |

|

|

798,700

19,920

54,102

30,254

28,486

58,325 |

Terrence C. Kearney

Replacement Options(3): |

|

70,000

10,689

298

10,033

1,497

4,741

17,843

2,281 |

(2)

|

2.03

0.31

0.01

0.29

0.04

0.14

0.52

0.07 |

|

32.47

39.36

39.36

39.36

43.80

43.80

43.80

43.80 |

|

May 9, 2015

February 20, 2014

February 9, 2006

February 13, 2008

February 14, 2007

February 13, 2008

February 12, 2009

February 11, 2010 |

|

|

798,700

97,591

2,599

92,203

15,254

48,500

182,712

23,335 |

Edward A. Ogunro |

|

70,000 |

(2) |

2.03 |

|

32.47 |

|

May 9, 2015 |

|

|

798,700 |

Brian J. Smith |

|

50,000 |

(2) |

1.45 |

|

32.47 |

|

May 9, 2015 |

|

|

570,500 |

- (1)

- These values were determined using a Black-Scholes stock option valuation model. For options, other than replacement options, the model uses the following assumptions: expected volatility of 30%, dividend yield of 0.0%, risk-free interest of 3.9%, and option life of 5.4 years. For replacement options, the model uses the following assumptions: expected volatility of 30%, dividend yield of 0.0%, risk-free interest of 4.3%, and an option life equal to 2.5 years. Expected volatility is based on the historic volatility of companies in the same industry as Hospira and with similar market capitalization. Risk-free interest is based on the rates available at the time of the grant for zero-coupon U.S. government issues with a remaining term equal to the option's expected life.

- (2)

- One-third of the shares covered by these options are exercisable after one year; two-thirds after two years; and all after three years.

- (3)