QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | |

| | Filed by the Registrantý |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

|

o |

|

Preliminary Proxy Statement |

|

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

|

Definitive Proxy Statement |

|

o |

|

Definitive Additional Materials |

|

o |

|

Soliciting Material Pursuant to §240.14a-12

|

| | | | |

HOSPIRA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

March 30, 2009

Dear Hospira Shareholder:

You are cordially invited to attend the 2009 Annual Meeting of Shareholders of Hospira, Inc. at the Ritz-Carlton, 1881 Curtis Street, Denver, Colorado, on Thursday, May 14, 2009 at 10:00 a.m., Mountain Time.

This booklet includes the notice of annual meeting and the proxy statement. The proxy statement describes the business to be transacted at the meeting and provides other information about the company that you should know when you vote your shares.

The principal business to be conducted at the meeting will be the election of directors, ratification of the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors, and approval of the amendments to Hospira's 2004 Long-Term Stock Incentive Plan.

It is important that your shares be represented, whether or not you attend the meeting. Shareholders of record can vote their shares via the Internet or by using a toll-free telephone number. Instructions for accessing the proxy materials appear on the Notice of Internet Availability of Proxy Materials mailed to you on or around March 30, 2009. If you hold shares through your broker or other intermediary, that person or institution will provide you with instructions on how to vote your shares.

We look forward to your participation in the 2009 annual meeting.

Sincerely,

Christopher B. Begley

Chairman and Chief Executive Officer

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 14, 2009

The 2009 Annual Meeting of Shareholders of Hospira, Inc. will be held at the Ritz-Carlton, 1881 Curtis Street, Denver, Colorado, on Thursday, May 14, 2009, at 10:00 a.m., Mountain Time. The purposes of the meeting are to:

- •

- elect four directors for three-year terms until the annual meeting in 2012 and one director for a one-year term until the annual meeting in 2010 (Item 1 on the proxy card);

- •

- ratify the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors for 2009 (Item 2 on the proxy card);

- •

- approve amendments to the Hospira 2004 Long-Term Stock Incentive Plan (Item 3 on the proxy card); and

- •

- transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

The board of directors recommends that you vote FOR the matters described above.

A proxy statement with respect to the annual meeting accompanies and forms a part of this notice. We are pleased to take advantage of the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders on the Internet. We believe these rules will allow us to provide our shareholders with the required information more quickly and efficiently, lowering our printing and mailing costs and reducing the environmental impact of our Annual Meeting.

Shareholders of record have been mailed a Notice of Internet Availability of Proxy Materials on or around March 30, 2009, which provides shareholders with instructions on how to access the proxy materials and our Annual Report on the Internet, and if they prefer, how to request paper copies of these materials. Hospira employees who hold Hospira shares in the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan and other shareholders who have previously requested paper copies of these materials may receive these materials by e-mail or in paper form.

The board of directors has set the close of business on March 18, 2009 as the record date for the meeting. This means that owners of common stock as of that date are entitled to vote at the meeting and any adjournments or postponements of the meeting.

Your vote is important. We encourage you to read the proxy statement and to submit a proxy so that your shares will be represented and voted even if you do not attend. You may submit your proxy over the Internet or by telephone or mail. If you do attend the meeting, you may revoke your proxy and vote in person.

By order of the board of directors.

Brian J. Smith

Secretary

March 30, 2009

Hospira, Inc.

275 North Field Drive

Lake Forest, IL 60045

www.hospira.com

HOSPIRA, INC.

PROXY STATEMENT

FOR

2009 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 14, 2009

GENERAL INFORMATION

Why am I receiving these materials?

Our board of directors is soliciting proxies for use at our annual meeting of shareholders to be held on May 14, 2009, and any adjournments or postponements of the meeting. The meeting will be held at the Ritz-Carlton, 1881 Curtis Street, Denver, Colorado and will begin at 10:00 a.m., Mountain Time. In order to solicit your proxy, we have made these materials available to you on the Internet, by e-mail, or by mail. We made these materials available to shareholders on or around March 30, 2009.

What will be voted on at the annual meeting?

Shareholders will vote on the following matters:

- •

- election of five directors;

- •

- ratification of the appointment of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as Hospira's auditors; and

- •

- approval of amendments to the Hospira 2004 Long-Term Stock Incentive Plan.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis. Your election to receive proxy materials by e-mail will remain in effect until you terminate it. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Hospira employees who hold Hospira shares in the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan and other shareholders who have previously requested paper copies of these materials may receive these materials by e-mail or in paper form.

We elected to use electronic notice and access for our proxy materials because we believe it will reduce our printing and mailing costs, and thereby, reduce the environmental impact of our annual shareholders' meeting.

Who may vote at the meeting?

The board of directors has set a record date of March 18, 2009 (the "record date"), meaning that shareholders of record at the close of business on that date may vote at the meeting, or at adjournments or postponements of the meeting.

How many votes do I have?

You have one vote for each share of common stock you hold.

1

What constitutes a quorum?

The presence in person or by proxy of the holders of shares of common stock representing a majority of all issued and outstanding shares of common stock entitled to vote will constitute a quorum. On January 31, 2009, there were 159,627,866 shares of common stock issued and outstanding.

Shares of common stock represented by a properly completed proxy will be counted as present at the meeting for purposes of determining a quorum, even if the proxy indicates that the shareholder is abstaining from voting. Your shares will be counted for purposes of determining a quorum if you are present and vote in person at the meeting, or if you vote on the Internet, by telephone, or by properly submitting a proxy card or voting instruction form by mail.

What vote is required to approve each matter?

If there is a quorum at the meeting, the following vote requirements apply.

Election of Directors. Directors are elected by a plurality of the votes present at the meeting. As a result, at the 2009 annual meeting, the five directors who receive the most votes will be elected to the board. Abstentions and instructions to withhold votes with respect to any nominee will result in those nominees receiving fewer votes but will not count as votes against that nominee.

Other Matters. The other matters covered at the meeting require that more votes be cast for the matter than against the matter. Abstentions and broker non-votes (discussed below) will not be counted as a vote for or against those matters.

What happens if a director nominee does not receive more votes for election than "withhold" votes in an uncontested election?

Under our policy, which is included in our corporate governance guidelines, that nominee would be elected to the board but would be required to tender his or her resignation following certification of the shareholder vote. Our independent directors would be required to take action with respect to the resignation within 90 days after the shareholder vote is certified and publicize its decision.

How do I vote by proxy?

If you are a shareholder of record, you have a choice of voting over the Internet, voting by telephone using a toll-free telephone number or voting by requesting and completing a proxy card and mailing it in a postage-paid envelope. Please refer to your Notice to see the options available to you. The Internet and telephone voting facilities for shareholders of record will close at 11:59 p.m., Eastern Time, on May 13, 2009. Other deadlines may apply to you if your stock is held of record by a bank, a broker or other nominee.

The proxies will vote your shares on each matter as you direct. If you do not indicate how your shares are to be voted on a matter, properly completed proxies will be voted FOR the election of all director nominees, FOR the ratification of Deloitte & Touche LLP as the firm of independent registered public accountants to serve as our auditors, and FOR the approval of the amendments to Hospira's 2004 Long-Term Stock Incentive Plan. Other matters that properly come before the meeting will be voted upon by the proxies in accordance with their best judgment.

What is a broker non-vote and how does it affect the voting requirements?

If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, the broker will vote your shares as you direct. If you do not give instructions, one of two things can happen. On matters on which the broker is prohibited from exercising voting authority ("non-routine" matters), which is called a "broker non-vote," your shares

2

will not be voted. Broker non-votes will have no effect on the number of votes required to approve any of the matters being voted on at the meeting. On matters on which the broker is permitted to exercise voting authority ("routine" matters), the broker will vote your shares in its discretion. We believe the brokers may exercise voting authority on proposals 1 and 2 related to the election of directors and ratification of the independent public accountants, but may not exercise voting authority on the third proposal in this proxy statement related to the approval of amendments to our long-term stock incentive plan.

How do I vote if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, you may instruct that person to vote your shares by following instructions that such person gives you. Most brokers offer voting by mail, by telephone and on the Internet.

How do I vote if I hold shares through the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan?

If you hold shares through the Hospira 401(k) Retirement Savings Plan or the Hospira Puerto Rico Retirement Savings Plan, you will receive materials that will contain instructions to the respective trustee of each plan's trust as to how to vote your shares. You may vote your shares by completing a proxy card, or you may vote by telephone or internet by following the instructions provided with the materials. If you do not vote shares you hold in the Hospira 401(k) Retirement Savings Plan, Fiduciary Counselors Inc. will vote your shares in its discretion. Fiduciary Counselors may use its own discretion with respect to those shares under the Hospira 401(k) Retirement Savings Plan for which voting instructions are not received on a timely basis. Fiduciary Counselors is the independent fiduciary of the plan for purposes of monitoring the suitability of acquiring and holding Hospira's shares. If you do not vote shares you hold in the Hospira Puerto Rico Retirement Savings Plan, the trustee of that plan's trust, Banco Popular de Puerto Rico, will vote your shares in the same proportion as shares voted by the other participants.

How do I vote in person?

If you are a shareholder of record, you may vote your shares in person at the meeting. However, we encourage you to vote by proxy in advance, even if you plan to attend the meeting.

Can I revoke a proxy?

Yes. You can revoke your proxy by:

- •

- giving written notice to our corporate secretary;

- •

- delivering a later-dated proxy; or

- •

- voting in person at the meeting.

If I submit a proxy, will my vote be kept confidential?

Our policy is that all proxies, ballots, and voting tabulations that can reveal how a particular shareholder has voted be kept confidential and not be disclosed, except:

- •

- where disclosure may be required by law or regulation;

- •

- where disclosure may be necessary in order for us to assert or defend claims;

- •

- where a shareholder expressly requests disclosure;

- •

- to allow the inspectors of election to certify the results of a vote; or

3

- •

- in other limited circumstances, such as a contested election or a proxy solicitation not approved and recommended by the board of directors.

Who will be tabulating and certifying votes at the meeting?

We have engaged Broadridge Investor Communication Solutions ("Broadridge") to serve as the tabulator of votes and a representative of Broadridge to serve as inspector of election and to certify the votes.

Who will pay the costs and expenses for this proxy solicitation?

We will pay all costs of soliciting proxies, including charges made by brokers and other persons holding common stock in their names or in the names of nominees, for reasonable expenses incurred in sending proxy materials to beneficial owners and obtaining their proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally and by telephone, Internet and facsimile, all without extra compensation. We also have retained the services of Georgeson Inc. to aid in the solicitation of proxies at a cost of $12,500, plus reimbursement for reasonable out-of-pocket expenses.

How can I attend the meeting?

Attendance at the annual meeting is limited to shareholders as of the record date or their proxies. If your shares are registered in your name, the Notice serves as your admission ticket and you must present the Notice at the meeting. If your shares are held by a broker, bank or nominee, you must bring to the meeting a brokerage statement showing ownership as of the record date. Directions to the meeting are included on the Notice and proxy card. Shareholders will be admitted to the meeting location beginning at 9:30 a.m., Mountain Time.

What is "householding" and how does it work?

We have adopted "householding," a procedure approved by the SEC under which multiple shareholders of Hospira stock who reside at the same address will receive a single copy of the Notice, or a single set of annual report and other proxy materials, unless the affected shareholder has provided contrary instructions. This procedure reduces printing costs and postage fees. If you reside at the same address as another shareholder of Hospira stock and wish to receive a separate copy of the applicable materials, you may do so by making a written or oral request to: Hospira Investor Relations, 275 North Field Drive, Department 051M, Building H1, Lake Forest, Illinois 60045, 224-212-2711. Upon your request, we will promptly deliver a separate copy to you. The proxy statement and our 2008 Annual Report on Form 10-K are also available at: http://www.hospira.com/2009Report.

If you participate in householding and you wish instead to receive a separate Notice or annual report and other proxy materials, you may contact Broadridge at any time, either by calling toll free 1-800-542-1061, or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York, 11717. Any shareholders who share the same address and currently receive multiple copies of the Notice, or the annual report and other proxy materials, who wish to receive only one copy in the future may contact their bank, broker, or other holder of record, or Hospira's Investor Relations at the contact information listed above, to request information about householding.

4

OWNERSHIP OF OUR STOCK

Based on information contained in a Schedule 13G filed by Capital World Investors, a division of Capital Research & Management Company, and a Schedule 13G filed by Harris Associates L.P. with the Securities and Exchange Commission on February 13, 2009, as of December 31, 2008, they owned the following Hospira shares:

| | | | | | | | | |

Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | Percent

of Class | |

|---|

| Common Stock | | Capital World Investors, a division of Capital

Research and Management Company, 333 South

Hope Street, Los Angeles, California, 90071 | | | 18,207,000 | | | 11.4 | % |

Common Stock |

|

Harris Associates L.P. and Harris Associates Inc.,

Two North LaSalle Street, Suite 500, Chicago,

Illinois, 60602-3790 |

|

|

9,487,210 |

|

|

5.94 |

% |

The following additional table sets forth information regarding ownership of our common stock as of January 31, 2009 by our directors, our chief executive officer and the other named executive officers employed by us as of the date of the table; and by all directors and executive officers as a group. Each person named below owns, and our current directors and executive officers as a group, collectively, own, less than 1% of our outstanding common stock.

Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. A person is deemed to be the beneficial owner of any share of common stock if such person has or shares the right to vote or dispose of such common stock, or has the right to acquire beneficial ownership at any time within 60 days of the date of the table. Deferred share units held by directors may not be voted or disposed of by the director until the shares are distributed to the director upon or after termination of the director's service on the board. Therefore, deferred share units are not considered to be beneficially owned and are not considered for purposes of determining the percentage of common stock owned by any person. The number of stock options exercisable within 60 days of the date of the table and the number of deferred share units owned by each person are stated separately and not included in the "Number of Shares" column.

| | | | | | | | | | |

Name | | Number of

Shares | | Stock Options

Exercisable

within

60 Days | | Deferred

Share Units | |

|---|

Irving W. Bailey, II, Lead Director | | | 15,000 | (1) | | — | | | 14,169 | (2) |

Barbara L. Bowles, Director | | | — | | | — | | | 3,775 | (2) |

Connie R. Curran, Director | | | — | | | — | | | 23,947 | (2) |

Roger W. Hale, Director | | | 9,033 | (2) | | — | | | 1,220 | |

Ronald A. Matricaria, Director | | | 9,881 | (2) | | — | | | — | |

Heino von Prondzynski, Director | | | — | | | — | | | — | |

Jacque J. Sokolov, Director | | | 19,169 | (2)(3) | | — | | | — | |

John C. Staley, Director | | | — | | | — | | | 14,169 | (2) |

Mark F. Wheeler, Director | | | — | | | — | | | 9,880 | (2) |

Christopher B. Begley, Chairman of the Board of Directors and Chief Executive Officer | | | 54,216 | (4) | | 997,500 | | | — | |

Terrence C. Kearney, Chief Operating Officer | | | 79,235 | (5) | | 495,908 | | | — | |

Sumant Ramachandra, Chief Scientific Officer | | | 15,000 | (6) | | — | | | — | |

Brian J. Smith, Senior Vice President, General Counsel and Secretary | | | 24,999 | (7) | | 179,334 | | | — | |

5

| | | | | | | | | | |

Name | | Number of

Shares | | Stock Options

Exercisable

within

60 Days | | Deferred

Share Units | |

|---|

Thomas E. Werner, Senior Vice President, Finance, and Chief Financial Officer | | | 2,100 | (8) | | 57,334 | | | — | |

All directors and executive officers as a group (17 persons) | | | 250,512 | (9) | | 1,774,076 | | | 67,160 | (10) |

- (1)

- The shares held by Mr. Bailey are held indirectly through IWB Investments, L.P.

- (2)

- The number of shares or deferred share units, as the case may be, includes 3,775 shares or units that are subject to forfeiture under certain conditions.

- (3)

- The shares held by Mr. Sokolov include the following shares held indirectly: 3,000 shares held indirectly through a profit sharing plan and 2,000 shares held indirectly through his daughters' trusts.

- (4)

- The number of shares held by Mr. Begley includes 27,704 shares held in his 401(k) account.

- (5)

- The number of shares held by Mr. Kearney includes 3,554 shares held in his 401(k) account.

- (6)

- The shares held by Dr. Ramachandra are restricted shares awarded to him in connection with his appointment as Senior Vice President and Chief Scientific Officer on July 7, 2008. They vest on the earlier of September 11, 2011, a change in control of Hospira, death, or disability. The number of shares held by Dr. Ramachandra does not include 324 Hospira phantom shares held in Hospira's Non-Qualified Savings and Investment Plan.

- (7)

- The number of shares held by Mr. Smith includes 9,714 shares held in his 401(k) account.

- (8)

- The number of shares held by Mr. Werner does not include 381 Hospira phantom shares held in Hospira's Non-Qualified Savings and Investment Plan.

- (9)

- Includes 40,974 shares held in 401(k) accounts of executive officers and 11,325 shares subject to forfeiture under certain conditions. This number does not include 324 and 381 Hospira phantom shares held by Dr. Ramachandra and Mr. Werner, respectively, in Hospira's Non-Qualified Savings and Investment Plan. In addition, this number does not include performance share units earned in 2008.

- (10)

- Includes 18,875 deferred share units that are subject to forfeiture under certain conditions.

6

PROPOSAL 1

ELECTION OF DIRECTORS

The board is divided into three classes, with one class of directors being elected for a three-year term at each annual meeting. There are three Class I seats, four Class II seats and three Class III seats. Each director generally holds office until the third annual meeting after the meeting at which such director is elected and until his or her successor is duly elected and qualified, or until his or her earlier resignation, removal or death. The Class II directors are being elected at the 2009 annual meeting.

On March 3, 2009, as permitted under our bylaws, the board decided to appoint Heino von Prondzynski to Hospira's board as a Class III director. Although Mr. v. Prondzynski's term expires at the 2010 annual meeting, the board determined to include him as a director nominee at the 2009 annual meeting.

Upon the recommendation of its governance and public policy committee, the board of directors has nominated Christopher B. Begley, Barbara L. Bowles, Roger W. Hale and John C. Staley, to be elected as Class II directors to hold office until the 2012 annual meeting, and Heino von Prondzynski to be elected as a Class III director to hold office until the 2010 annual meeting.

A properly submitted proxy will be voted by the persons named on the proxy card for the election of each nominee, unless you indicate that your vote should be withheld. If elected, each nominee will serve until the expiration of his term and his successor is elected and qualified or until his earlier resignation, removal or death. Each of the nominees is willing to serve if elected, and the board of directors has no reason to believe that any of the nominees will be unavailable for election, but if such a situation should arise, the proxy will be voted in accordance with the best judgment of the proxy holder for such person or persons as may be designated by the board of directors, unless the shareholder has directed otherwise.

The board of directors recommends that the shareholders vote FOR the election of Christopher B. Begley, Barbara L. Bowles, Roger W. Hale and John C. Staley to the board of directors as Class II directors, and Heino von Prondzynski to the board of directors as a Class III director.

OUR BOARD OF DIRECTORS

Nominees for Election as Class II Directors at the 2009 Annual Meeting

Christopher B. Begley, age 56, has served as our Chief Executive Officer and director since our spin-off from Abbott Laboratories, a global broad-based healthcare company, in 2004. He became the chairman of the board effective at the 2007 annual meeting. Prior to his becoming our Chief Executive Officer, Mr. Begley provided 18 years of service to Abbott, and was Abbott's Senior Vice President, Hospital Products, between 2000 and 2004. Prior to his appointment as Senior Vice President, Hospital Products, Mr. Begley served as Abbott's Senior Vice President, Chemical and Agricultural Products, from 1999 to 2000, Vice President, Abbott Health Systems, from 1998 to 1999, and Vice President, MediSense Operations, in 1998. Mr. Begley also serves as a director of Sara Lee Corporation and AdvaMed.

Barbara L. Bowles, age 61, has served as our director since her election to our board in May 2008. She recently founded and serves as president of the Landers Bowles Family Foundation, which is dedicated to providing charitable gifts primarily to educational entities in order to support disadvantaged high school and college students. She served as the Vice Chair of Profit Investment Management, an equity investment advisory firm, from January 2006 until retiring on December 31, 2007. She was the founder and served as Chairman of the Kenwood Group, Inc., an equity investment firm, from 1989 until January 2006 when The Kenwood Group was acquired by Profit Investment Management. From 1984 to 1989, Ms. Bowles was Corporate Vice President and Director, Investor

7

Relations for Kraft, Inc., a diversified packaged food and beverage company. Ms. Bowles also serves as a director of Black & Decker Corporation, Wisconsin Energy Corporation, Children's Memorial Hospital, the Chicago Urban League, and Hyde Park Bank. She is a trustee of Fisk University and also serves on the University of Chicago Graduate School of Business Advisory Council.

Roger W. Hale, age 65, has served as our director since his election to our board in October 2006. He has served as Chairman of the Board and Chief Executive Officer of LG&E Energy Corporation, a diversified energy services company, from August 1990 until retiring in April 2001. Prior to joining LG&E Energy Corporation, he was Executive Vice President of BellSouth Corporation, a communications services company. From 1966 to 1986, Mr. Hale held several executive positions with AT&T Co., a communications services company, including Vice President, Southern Region from 1983 to 1986. Mr. Hale is also a director of Ashland, Inc.

John C. Staley, age 67, has served as our director since our spin-off from Abbott in 2004. Mr. Staley served as the Managing Partner of the Lake Michigan Area of Ernst & Young LLP, a public accounting firm, a position that he held from 1985 to his retirement in June 2001. Mr. Staley also serves as a director of eLoyalty Corporation and Nicor Inc. Mr. Staley is also a member of, and the former Chairman of, the Board of Trustees of DePaul University.

Nominee for Election as a Class III director with a Term Expiring in 2010

Heino von Prondzynski, age 59, has served as our director since March 2009 and is nominated to be elected as a Class III director for a term expiring at the 2010 annual meeting. Mr. v. Prondzynski served as chief executive officer of Roche Diagnostics and as a member of the executive committee of F. Hoffman-La Roche Ltd. (a Swiss-based healthcare company that develops diagnostic and therapeutic products) from early 2000 to 2005, retiring from Roche at the end of 2006. From 1996 to 2000, Mr. v. Prondzynski held several executive positions at Chiron Corporation (a multinational biotechnology firm that develops biopharmaceuticals, vaccines, and blood testing products), and from 1976 to 1996 at Bayer AG (a German-based maker of healthcare products, specialty materials, and agricultural products). Mr. v. Prondzynski serves on the board of BB Medtech, Qiagen NV, Epigenomics AG and Koninklijke Philips Electronics NV.

Continuing Directors

Class III Directors Whose Terms Expire in 2010

Connie R. Curran, RN, Ed.D., age 61, has served as our director since our spin-off from Abbott in 2004. Dr. Curran has served as the president of Curran Associates, a healthcare consulting firm, since July 2006. She previously served as the Executive Director of C-Change, formerly the National Dialogue on Cancer, a health advocacy organization, from 2003 to July 2006. From 1995 to 2000, Dr. Curran served as President and Chief Executive Officer of CurranCare, LLC, a healthcare consulting company. Upon the acquisition of CurranCare by Cardinal Health Consulting Services in November 2000, Dr. Curran served as President of Cardinal Health Consulting Services, a consulting company with expertise in surgical services, hospital operations and case management and home care, until February 2002. Dr. Curran has previously served as Vice President of the American Hospital Association and Dean at the Medical College of Wisconsin. Dr. Curran also serves as a director of DeVry, Inc. and Volcano Corporation.

Mark F. Wheeler, M.D., M.P.H., age 59, has served as our director since his election to our board at the 2006 annual meeting. Dr. Wheeler has served as Director of Clinical Informatics for PeaceHealth, an integrated delivery network of hospitals in the Pacific Northwest, since January 2007. He previously served as Acting Vice President Engineering, Centricity Enterprise Business Unit of General Electric Company, a diversified technology, media and financial services company, from February 2006 to January 2007. He served as chief technical architect of IDX Systems Corporation, a healthcare

8

information technology services provider, from 1997 until December 2005, when IDX was acquired by General Electric, and served on IDX's board of directors from 1999 through 2005.

Class I Directors Whose Terms Expire in 2011

Irving W. Bailey, II, age 67, has served as our director since our spin-off from Abbott in 2004 and has served as the lead director since the 2007 annual meeting. Mr. Bailey has served as a Managing Director of Chrysalis Ventures, a private equity management firm, from June 2001 to January 2005, and a Senior Advisor to Chrysalis Ventures since January 2005. Mr. Bailey served as President of Bailey Capital Corporation, also a private equity management firm, from January 1998 to June 2001, and as Chief Executive Officer of Providian Corporation, an insurance and diversified financial services company, from 1988 to 1997. Mr. Bailey also serves as Vice Chairman of Aegon, N.V. and as a director of Computer Sciences Corporation.

Ronald A. Matricaria, age 66, has served as our director since his election to our board at the 2006 annual meeting. From April 1993 to December 2002, he served, at various times, as the Chairman, Chief Executive Officer and President of St. Jude Medical, Inc., a developer, manufacturer and distributor of cardiovascular medical devices. He retired from the St. Jude board in December 2002. Mr. Matricaria currently serves as a director of Life Technologies and Volcano Corporation.

Jacque J. Sokolov, M.D., age 54, has served as our director since our spin-off from Abbott in 2004. Dr. Sokolov has served since 1999 as the Chairman and a Senior Partner of SSB Solutions, Inc., a national healthcare management consulting, project development and investment firm. Dr. Sokolov previously served as Chairman of Coastal Physician Group, Inc., which later became PhyAmerica Physician Group, Inc., from 1994 until 1997, and as Vice President and Chief Medical Officer for Southern California Edison from 1989 until 1992. Dr. Sokolov also serves as a director of MedCath Corporation.

9

CORPORATE GOVERNANCE

Lead Director

Our corporate governance guidelines provide that if the duties of the chairman and chief executive officer are combined, the independent directors will elect a lead director. Mr. Begley is our chairman and chief executive officer and Mr. Bailey is our lead director. The lead director is an independent director and is responsible for the following:

- •

- coordinating the activities of the independent directors;

- •

- presiding over the executive sessions of the independent directors;

- •

- collaborating with the chairman and chief executive officer on setting board meeting schedules and agendas; and

- •

- assisting with the oversight of the annual performance evaluation of the board and the chief executive officer.

Meetings

Our board of directors held seven meetings during 2008. No director attended fewer than 75% of the total number of meetings of the board of directors and the committees of the board of directors on which such director served. We have no formal policy on director attendance at our annual meetings but we encourage all of our directors to attend annual meetings. All of our directors serving at the time attended the 2008 annual meeting, except for Mr. Bailey, Dr. Curran, and Mr. Hale due to flight cancellations caused by bad weather.

Our independent directors meet in an executive session without management present at every regularly scheduled board meeting. As lead director, Mr. Bailey presides at these executive sessions.

Independence

The board annually determines the independence of directors. No director may qualify as independent unless the board of directors affirms that the director has no material relationship with us. As required by our corporate governance guidelines, the board will consider all relevant facts and circumstances in connection with that determination, including the following:

- •

- a director who is, or has been within the last three years, our employee, or whose immediate family member is, or has been within the last three years, our executive officer is not independent;

- •

- a director who receives, or whose immediate family member receives, more than $120,000 from us in direct compensation, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), and other than amounts received by an immediate family member for service as a non-executive employee, during any 12-month period in the last three years is not independent;

- •

- a director who, or whose immediate family member, is a current partner of a firm that is our internal or external auditor is not independent;

- •

- a director who is a current employee of a firm that is our internal or external auditor is not independent;

- •

- a director with an immediate family member who is a current employee of a firm that is our internal or external auditor and who personally worked on our (or a subsidiary's) audit is not independent;

10

- •

- a director who, or whose immediate family member, was within the last three years a partner or employee of a firm that is our internal or external auditor and personally worked on our audit during that time is not independent;

- •

- a director who is employed, or whose immediate family member is employed, or has been employed in the last three years, as an executive officer of another company where any of our present executive officers at the same time serves or served on that company's compensation committee is not independent;

- •

- a director who is a current employee, or whose immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues, is not independent; and

- •

- a director who is an executive officer of a charitable organization that receives charitable contributions (other than matching contributions) from us that are in excess of the greater of $1 million or 2% of such charitable organization's consolidated gross revenues is not independent.

On March 3, 2009, our board determined that each of Mr. Bailey, Ms. Bowles, Dr. Curran, Mr. Hale, Mr. Matricaria, Mr. v. Prondzynski, Dr. Sokolov, Mr. Staley and Dr. Wheeler is independent within the meaning of our director independence standards and the listing standards of the New York Stock Exchange. In making these independence determinations, the board was not aware of any disqualifying relationship under the above criteria and, additionally, was not aware of any other relationship between such director and Hospira that would affect his or her independence. Relationships considered by the board not to impair independence are described below.

We sell products in the ordinary course of business to hospitals affiliated with PeaceHealth, Dr. Wheeler's current employer. We do not believe that the business relationship is material to either party in amount or significance. Sales to PeaceHealth-affiliated hospitals represented less than 1% of Hospira and PeaceHealth's net revenues. Dr. Wheeler is not an executive officer of PeaceHealth or the affiliated hospitals, is not involved in the business relationship, and is not compensated by us or PeaceHealth directly or indirectly as a result of such business. Accordingly, the board determined that he did not have a material interest in such business relationship and that such business relationship is not a material relationship with Dr. Wheeler.

Our director independence standards are included in our corporate governance guidelines, which are available in the investor relations section of our Web site atwww.hospira.com.

Committees of the Board of Directors

Our board of directors has the following committees:

Audit Committee

Mr. Staley (chair), Ms. Bowles, Dr. Curran and Dr. Wheeler serve on the audit committee. During 2008, the audit committee met eleven times. All members of the committee must be independent and must satisfy the audit committee member eligibility requirements of the New York Stock Exchange and the SEC. Our board determined that Mr. Staley, Ms. Bowles, Dr. Curran and Dr. Wheeler are financially literate and eligible to serve on the committee. The board has designated Mr. Staley and Ms. Bowles as "audit committee financial experts," within the meaning of the rules of the New York Stock Exchange and the SEC.

The primary functions of the committee include:

- •

- meeting periodically with our management, internal auditors and independent registered public accounting firm regarding our internal controls, accounting and financial reporting;

11

- •

- appointing and evaluating the independent registered public accounting firm;

- •

- reviewing and discussing our financial statements and financial press releases with our management and independent registered public accounting firm; and

- •

- establishing procedures for the receipt, retention and treatment of complaints received by our company regarding accounting matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting matters.

Both the independent registered public accounting firm and the internal auditors regularly meet privately with the audit committee and have unrestricted access to the audit committee.

The audit committee is governed by a written charter, which is available on our Web site atwww.hospira.com. The eligibility criteria for committee members are included in the charter.

Compensation Committee

Mr. Matricaria (chair), Mr. Hale and Dr. Sokolov serve on the compensation committee. On March 3, 2009, Mr. v. Prondzynski was added to the committee. During 2008, the compensation committee met six times. All members of the compensation committee must be independent and must be "non-employee directors" for purposes of Rule 16b-3 under the Securities Exchange Act of 1934 and "outside directors" for purposes of Section 162(m) of the Internal Revenue Code. Our board determined that Mr. Matricaria, Mr. Hale, Dr. Sokolov, and Mr. v. Prondzynski are eligible to serve on the committee.

The primary functions of the committee include:

- •

- reviewing and determining the executive officers' compensation;

- •

- reviewing and, as it deems appropriate, recommending to the board of directors, policies, practices and procedures relating to the compensation of our officers, other managerial employees and non-employee directors and the establishment and administration of our employee benefit plans; and

- •

- exercising authority under our employee equity incentive plan and management incentive plans. (The committee may delegate the responsibility to administer and make grants under these plans to management except to the extent such delegation would be inconsistent with applicable laws or regulations.)

For a description of how the compensation committee administers our executive compensation program, please see "2008 Compensation Discussion and Analysis—General Administration" later in this proxy statement. The compensation committee has engaged Watson Wyatt as its independent compensation consultant. Watson Wyatt provides counsel and advice on executive and non-employee director compensation matters, including providing information regarding the peer groups against which performance and pay should be examined. In addition, Watson Wyatt makes recommendations related to executive officer pay, long-term incentive award levels and other executive compensation matters of concern to the committee.

The compensation committee is governed by a written charter, which is available on our Web site atwww.hospira.com. The eligibility standards for committee members are included in the charter.

Governance and Public Policy Committee

Dr. Curran (chair), Mr. Bailey and Mr. Hale serve on the governance and public policy committee. During 2008, the governance and public policy committee met five times. All members of the governance and public policy committee must be independent. Our board determined that Dr. Curran, Mr. Bailey and Mr. Hale are eligible to serve on the committee.

12

The functions of the committee include:

- •

- developing the general criteria for selecting members of the board of directors and assisting the board in identifying and attracting qualified candidates;

- •

- recommending to the board of directors the nominees for election as directors, considering the criteria described herein and any potential nominees recommended by our shareholders;

- •

- recommending to the board of directors persons to be elected as executive officers;

- •

- reviewing and assessing the adequacy of our corporate governance guidelines;

- •

- providing general oversight over certain compliance programs, policies and procedures; and

- •

- providing general oversight over certain company political and charitable activities.

The process used by the committee to identify a nominee to our board of directors depends on the qualities being sought. Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve our governance and strategic needs. Candidates will be considered on the basis of a range of criteria, including broad-based business knowledge and relationships, and prominence and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the board of directors' oversight role with respect to our business and affairs.

Director candidates can be referred to the committee from a variety of sources, including by our officers, directors and shareholders. The committee has from time to time enlisted a third-party search firm to assist it in identifying and evaluating qualified candidates. The committee has the sole authority to engage director candidate search firms. In 2008, our chief executive officer referred Ms. Bowles to the committee for consideration as a director candidate. In May 2008, Ms. Bowles was appointed to Hospira's Board. In March 2009, Mr. v. Prondzynski was added to Hospira's board. He was recommended by a third-party search firm hired by the committee to assist it in identifying qualified candidates with international business experience.

If the board determines to seek a new member and a candidate is referred to the committee, the committee will review the candidate's qualifications in light of the attributes being sought by the board. If the committee determines that a candidate's qualifications are potentially suitable for service on the board, the committee will conduct an investigation of the candidate's background. Typically, candidates are interviewed by one or more members of the committee, the lead director and our chairman before being nominated for election to the board.

A shareholder may recommend persons as potential nominees for director by submitting the names of such persons in writing to the chairman of the governance and public policy committee or our secretary. Recommendations should be accompanied by a statement of qualifications and confirmation of the person's willingness to serve. A nominee who is recommended by a shareholder following these procedures will receive the same consideration as other comparably qualified nominees. The committee will consider potential nominees recommended by shareholders, but has no obligation to recommend such candidates. The evaluation criteria are the same for each person considered for nomination to the board.

The governance and public policy committee is governed by a written charter, which is available on our Web site atwww.hospira.com. The eligibility standards for committee members are included in the charter.

Science and Technology Committee

Dr. Sokolov (chair), Dr. Curran, Mr. Matricaria, Dr. Wheeler and Mr. Begley serve on the science and technology committee. On March 3, 2009, Mr. v. Prondzynski was added to the committee. The

13

committee provides general oversight, and advises our board, as to certain matters relating to our product pipeline and other matters as delegated to it by the board. The committee met five times during 2008.

The science and technology committee is governed by a written charter, which is available on our Web site atwww.hospira.com.

Director Share Ownership Guidelines

Within five years after joining the board, each non-employee director is required to own and retain a minimum number of shares of Hospira common stock whose aggregate value is equal to five times such director's annual retainer fees, and maintain that minimum throughout his or her service on the board. "Annual retainer fees" are currently $50,000. For purposes of the ownership guidelines, common stock includes restricted stock, restricted stock units and deferred stock units awarded to non-employee directors. All directors have attained such minimum, except Ms. Bowles and Mr. v. Prondzynski who were added to the Board in May 2008 and March 2009, respectively. We believe that they are making adequate progress toward achieving this minimum requirement on time.

Communicating with the Board of Directors

You may communicate with our board of directors by writing a letter to our chairman. You may contact our independent directors by writing a letter to the chairman of our audit committee (for accounting or disclosure matters), our lead director or any of our other independent directors. The letter should be addressed to:

Director Communications

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

Our general counsel and secretary will review the communication and forward the communication to the addressee or, in the absence of an addressee, to the director or directors he believes to be most appropriate.

In addition, you may contact the chairman of our audit committee through the Helpline of our Office of Ethics and Compliance by calling 1-866-311-4632. You will have the option to directly refer matters to the audit committee. Our Vice President, Ethics and Compliance will be notified in such cases.

Corporate Governance Materials

Our corporate governance guidelines, our code of business conduct and ethics, and the charters of our audit committee, compensation committee, governance and public policy committee, and science and technology committee are available in the investor relations section of our Web site atwww.hospira.com. We will provide a copy of any of these materials to any shareholder free of charge upon written request to:

Corporate Governance Material Request

Hospira General Counsel and Secretary

Hospira, Inc.

275 North Field Drive

Department NLEG, Building H1

Lake Forest, Illinois 60045

14

DIRECTOR COMPENSATION

Our non-employee directors receive an annual cash retainer in the amount of $50,000 per year, and meeting fees of $1,500 for attending each board meeting and board committee meeting in person ($1,000 for each meeting other than in person). The lead director receives additional cash fees of $25,000 per year. Each director who serves in the role of chairman of any committee receives a chairman fee of: (1) $10,000 for the chairman of the audit committee; and (2) $7,500 for each other board committee.

Additionally, on the last day of the calendar quarter in which our annual meeting is held, each non-employee director receives an annual grant of restricted stock, which will generally vest as of the first regularly scheduled annual meeting of shareholders following the date of grant. For each such grant, the number of shares of restricted stock granted to each director equals that number of shares equal in value to $150,000 as of the date of grant. Directors may dispose of this stock while serving on the board if they have met the minimum holding requirements under the company's share ownership guidelines for directors.

Non-employee directors may elect to defer all or a portion of their fees and restricted stock awards. The cash-based fees will be deferred into a stock unit account. Restricted stock may, based on an election by the director, be deferred and granted as restricted stock units and recorded in the director's stock unit account. The stock unit account will be paid out, at the director's prior election, in a lump sum on the first business day after the calendar quarter in which the director's service terminates or in up to 10 annual installments from and after that date.

The following table shows the amount and form of compensation paid to each of our non-employee directors during 2008. Compensation includes annual retainer fees, committee chairman fees, meeting fees and restricted stock awards.

| | | | | | | | | | |

Director | | Fees Earned

or Paid

in Cash | | Stock

Awards(1) | | Total | |

|---|

Irving W. Bailey II | | $ | 92,000 | | $ | 150,000 | | $ | 242,000 | |

Barbara L. Bowles | | | 48,231 | | | 150,000 | | | 198,231 | |

Connie R. Curran(2) | | | 93,000 | | | 150,000 | | | 243,000 | |

Roger W. Hale | | | 74,500 | | | 150,000 | | | 224,500 | |

Ronald A. Matricaria | | | 85,500 | | | 150,000 | | | 235,500 | |

Jacque J. Sokolov | | | 85,500 | | | 150,000 | | | 235,500 | |

John C. Staley | | | 82,500 | | | 150,000 | | | 232,500 | |

Mark F. Wheeler | | | 82,000 | | | 150,000 | | | 232,000 | |

- (1)

- The value of Hospira stock awards is determined on a basis consistent with the calculation of the related expense in Hospira's income statement for the year ended December 31, 2008 included in its consolidated audited financial statements contained in Hospira's 2008 Annual Report to Shareholders. The cost resulting from the restricted stock award is recognized over the one-year vesting period based on the fair value of the stock on the date of grant. Mr. Bailey, Ms. Bowles, Dr. Curran, Mr. Staley and Mr. Wheeler elected to defer their restricted stock awards into a stock unit account.

- (2)

- Dr. Curran elected to defer all of her cash-based fees into a stock unit account.

15

2008 COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis explains how our executive compensation program is administered and provides a general discussion of:

- •

- the philosophy underlying our compensation program;

- •

- the elements of our compensation program;

- •

- the compensation paid to the named executive officers during 2008; and

- •

- other relevant matters involving our compensation program.

Please read this compensation discussion and analysis in conjunction with the information contained in the executive compensation tables immediately following this section.

Executive Summary

Hospira's direct executive compensation program has three elements, each of which is targeted at market median of our peer group and published surveys. Our executive compensation philosophy is to favor variable pay opportunities based on performance versus fixed pay. In 2008, the compensation committee requested the independent compensation consultant to examine our executive pay-for-performance alignment. The consultant provided the committee with a three-year (2005-2007) historical pay analysis for the named executive officers against the company's financial performance for the same period. In addition, the report compared Hospira's performance and pay versus its peer group. The conclusion from this study reinforced the compensation actions the committee directionally is taking on executive pay. The three elements of Hospira's direct program are:

- •

- Base Salary. As the actual base salaries of our executives were below market median, the compensation committee embarked on a multi-year program in 2007 to increase base salaries to the market median. Consistent with this program, base salaries were 5 to 10% below the market median in 2008. In response to the economic conditions in the global economy, no merit salary increases were given in 2009 for our named executive officers.

- •

- Annual Cash Incentive Award. Annual cash incentive awards or bonuses are determined against the company's performance targets that are derived from the annual operating plan and the committee's desire to incent executives to act in a lawful, compliant and ethical manner. For 2008, performance against these targets led to a pay out for the executives of 94.9% of the target level for each executive.

- •

- Long-Term Incentive Award. Our long-term incentive program changed in 2008 from strictly an options program to one that consists of two components: a stock option award and the award of performance share units tied to total shareholder return, both of which we believe represents "pay for performance" as the performance of the executive drives the value of Hospira's stock. For our chief executive officer, the stock options constitute 60% of the total long-term incentive award and performance share units constitute 40% of the award. For our other executive officers, the mix of stock options and performance share units was generally 50/50. In 2009, the long-term incentive award mix for our chief executive officer will be 60% of the annual grant value awarded in performance share units and 40% awarded in stock options. The options, awarded on March 6, 2008 with an exercise price of $43.18, vest over three years and have a term of seven years. The performance share units were also awarded on March 6, 2008 and are earned based on the achievement of total shareholder return over the three year period 2008 through 2010 relative to the performance of a pre-established peer group, described under "Discussion of Compensation Program—Long-Term Equity Compensation."

16

General Administration

The compensation committee of our board of directors oversees our executive compensation program. The committee consists entirely of independent directors and makes compensation decisions involving our named executive officers. The independent members of our board of directors further review and approve all components of compensation decisions involving our chief executive officer, including base salary, annual incentive and long-term incentives.

The committee has engaged an independent consultant, Watson Wyatt, to assist it in the performance of its duties. The consultant regularly provides the committee with analyses of competitive practice and compensation relevant to the company's executive jobs and industry. In addition, the committee routinely requests and receives recommendations from the consultant with regard to executive officer pay, long-term incentive award levels and other executive compensation matters of concern to the committee. On matters relating to executive compensation, the consultant reports directly to the committee. The committee has the sole authority to hire and fire the consultant.

In 2007, the committee adopted a policy that prohibits Watson Wyatt from performing any other services to the company other than the duties Watson Wyatt performs as the committee's independent consultant. This is intended to strengthen the independence of Watson Wyatt and avoid any future conflicts of interest. However, as certain activities were underway already and the committee felt that terminating such activities mid-term would be detrimental to the company, Watson Wyatt was permitted to perform the following grandfathered services in 2008: serving as consultants for the investments of assets held by our defined benefit and defined contribution plans. During 2008, Watson Wyatt received compensation for these grandfathered activities in the amount of $210,830. In 2009, Watson Wyatt will continue to serve as consultants for the investments of assets held by our defined contribution plans and, for a few months at the beginning of 2009, our defined benefit plans.

Role of Executive Officers and Management in Compensation Decisions

Our chief human resources officer works with our chairman and chief executive officer to develop recommendations on matters of compensation philosophy, plan design and specific awards for executive officers. In conjunction with our chief human resources officer, our chairman and chief executive officer assesses performance and makes pay recommendations to the committee for each executive officer other than himself. Watson Wyatt provides competitive data and makes independent recommendations on competitive pay for our chairman and chief executive officer to the committee. The committee considers all of these recommendations and makes decisions as it deems appropriate. In making these decisions, the committee considers multiple factors, including individual performance, achievement of goals, desired versus actual competitive compensation position and retention importance. Compensation recommendations for our chairman and chief executive officer are reviewed by the chair of our compensation committee in executive session with the independent members of our board of directors prior to final approval. Our chief human resources officer generally attends, and our chairman and chief executive officer and senior vice president, general counsel and secretary occasionally attend committee meetings but are not present for any discussion of their own compensation.

Market Data Used to Benchmark Pay

With the assistance of our compensation consultant, the committee benchmarks elements of our executive compensation against a peer group of companies selected from the medical device, generic pharmaceutical and hospital supply industries. Watson Wyatt conducted the initial and independent review of the public company peer group and, based on its knowledge of our industry and the committee's preferences, recommends companies for possible inclusion in the comparator group. The committee then selects which peer group companies to ultimately include, which reflect Hospira's size,

17

technologies, product markets and the talent pool from which we recruit. Before 2007, the group consisted evenly of medical device, generic pharmaceutical and hospital supply companies. In 2007, the committee reviewed the sources of external data in relation to the competitive market to help ensure that we attract, reward and retain executive talent from the appropriate market. Based on that review, the committee determined that our benchmark data should reflect a heavier mix of medical device and generic pharmaceutical companies.

Based on such criteria, the committee included the following companies in the peer group for the competitive analyses for 2008 compensation:

| | | | | | | |

| | 12/31/2007(1)

($000) | |

|---|

| | Market

Capitalization | | Revenue | |

|---|

Bard CR Inc. | | $ | 9,511 | | $ | 2,202 | |

Barr Pharmaceuticals Inc. | | | 5,729 | | | 2,500 | |

Baxter International Inc. | | | 36,828 | | | 11,263 | |

Becton Dickinson & Company | | | 19,512 | | | 7,155 | |

Biogen Idec Inc. | | | 16,948 | | | 3,171 | |

Boston Scientific Corp. | | | 17,355 | | | 8,357 | |

DENTSPLY International Inc. | | | 6,795 | | | 2,009 | |

Forest Laboratories Inc. | | | 12,193 | | | 3,836 | |

Genzyme Corp. | | | 19,922 | | | 3,813 | |

Gilead Sciences Inc. | | | 42,737 | | | 4,230 | |

Hospira, Inc.(2) | | | 6,766 | | | 3,436 | |

King Pharmaceuticals Inc. | | | 2,519 | | | 2,136 | |

Mylan Inc. | | | 5,256 | | | 2,179 | |

St. Jude Medical, Inc. | | | 13,980 | | | 3,779 | |

Stryker Corp. | | | 30,723 | | | 6,000 | |

Thermo Fisher Scientific Inc. | | | 24,144 | | | 9,746 | |

Watson Pharmaceuticals Inc. | | | 2,813 | | | 2,496 | |

- (1)

- All numbers are as of December 31, 2007, except for Becton Dickinson (September 30, 2008) and Forest Laboratories (March 31, 2008). Because Mylan recently changed its fiscal year-end to December 31, the revenue information listed for Mylan reflects only 9 months of revenue.

- (2)

- Hospira is included in the list solely for ease of comparison. Among the peer group, Hospira revenue ranks at the 44th percentile versus the median of the group at $3,779 billion.

Watson Wyatt's competitive analyses also contained relevant published survey benchmark data from the healthcare and general industries which the committee uses as secondary sources of information to support the peer group analysis. The sources used included general industry and pharma/biotech information from Towers Perrin. The peer group and published surveys together were used to determine market median pay opportunities for salary, annual and long-term incentives, and total direct compensation (sum of salary, annual incentives and long-term incentives).

When making executive compensation decisions, the committee also reviews executive tally sheets that reflect the total compensation opportunity, realizable compensation, aggregate value of all

18

long-term incentive grants, the value of other benefits, and pay related to various termination scenarios as an additional data point to the market data.

Discussion of Compensation Program

Principles

At Hospira, we recognize that all employees affect the performance of our business. Accordingly, we have designed our pay programs to help reinforce our key strategies and reward the successful execution of those strategies. We intend for our compensation program to allow us to attract, retain and motivate the best people from the industries where we compete for talent.

The goal of our program is to align the interests of our shareholders for successful business results and long-term growth with our ability to attract, retain and motivate outstanding leadership. Therefore, total compensation is determined by the success of our company. We provide total compensation opportunities that are competitive in the marketplace and include the opportunity for our executives to earn above-average rewards when merited by corporate and individual performance.

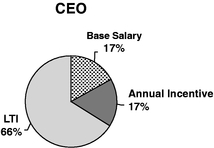

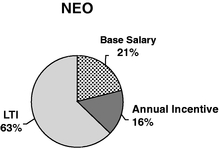

In establishing our program, we favor variable pay opportunities based on performance over fixed pay. Total direct compensation is comprised of three elements: base salary, an annual cash incentive award and a long-term equity incentive award. We intend for our program to reflect competitive market practice and to provide an appropriate mix of short and long-term rewards to incent the achievement of both short-term goals and our long-term strategies. We target total direct compensation at the market median, based on an analysis of the compensation practices of the competitive peer group. Based on our peer group data, the committee believes that our total direct compensation mix, as explained below, is competitive with the peer group. Long-term incentive provides the highest percentage of total direct compensation, with over 50% of the total mix. This is to ensure executives are closely aligned with our shareholders and create long-term value. Base salary provides the lowest percentage, with a range of between 15% to 25% of the mix. We adjust the various elements of compensation to provide each executive the opportunity to earn market median total direct compensation when targeted performance is achieved. For 2008, the mix for our CEO and our other named executive officers (NEO) was as follows:

Hospira Compensation Elements

Hospira targets its base salaries at the market median, based on an analysis of the competitive peer group. The salaries for the named executive officers are approved by the committee based on the CEO's recommendation and review of each officer's performance during the previous year. The CEO's base salary is approved by the independent members of the Board based on his performance during the previous year.

We determine and adjust an executive's base salary by assessing sustained performance against individual job responsibilities including, where appropriate, the impact of performance on our business

19

results, current salary in relation to the competitive market for the job, experience and potential for advancement. We administer the same standards for base salary increases for Hospira's executives as for other salaried employees. In addition, we do not provide our named executives with any competitive perquisites such as cars or car allowances, club memberships, financial planning, tax preparation assistance or supplemental insurance benefits.

Annual base salary rates for our named executive officers in 2007 and 2008 were as follows:

| | | | | | | | | | |

Executive Officer | | Year | | Salary | | % of Target

TDC(2) | |

|---|

Christopher B. Begley, Chairman and Chief Executive Officer | | | 2008 | | $ | 1,050,000 | | | 17 | % |

| | | 2007 | | | 960,000 | | | 19 | % |

Terrence C. Kearney, Chief Operating Officer | | |

2008 | | |

625,000 | | |

21 |

% |

| | | 2007 | | | 575,000 | | | 22 | % |

Sumant Ramachandra, Senior Vice President and Chief Scientific Officer(1) | | |

2008 | | |

475,000 | | |

19 |

% |

Thomas E. Werner, Senior Vice President, Finance and Chief Financial Officer | | |

2008 | | |

445,000 | | |

21 |

% |

| | | 2007 | | | 405,000 | | | 25 | % |

Brian J. Smith, Senior Vice President, General Counsel and Secretary | | |

2008 | | |

425,000 | | |

25 |

% |

| | | 2007 | | | 390,000 | | | 32 | % |

- (1)

- Dr. Ramachandra joined Hospira on July 7, 2008.

- (2)

- Total direct compensation is comprised of salary plus annual incentive target plus long-term incentive opportunity.

Based on data provided by the consultant, base salaries for our named executive officers are 5-10% below the competitive market median. As stated under "Executive Summary" above, this reflects the adjustments in 2007 and 2008 designed to increase base salaries towards the market median. In response to the worsening global economic conditions, it was decided that no merit increases would be given in 2009 for any named executive officers.

Annual Cash Incentive Award

Executives have an opportunity to earn an annual cash incentive award. When added to the executive base salary (total cash compensation), the committee targets the market median of the peer group. The goal of our annual incentive plan for the named executive officers is to establish a significant link between the award and our success by rewarding participants when we achieve or exceed established financial goals and business objectives. Target opportunities are set at the market median with an opportunity to achieve at or above 75th percentile annual incentive for excellent performance.

Our named executive officers generally participate in the 2004 Hospira, Inc. Performance Incentive Plan. In December of each year, the committee determines the participants in the Performance Incentive Plan for the following year. In December 2007, the committee named Mr. Begley, Mr. Kearney, Mr. Werner and Mr. Smith as participants in the plan for 2008.

The plan was approved by our shareholders in 2005, and allows for awards to be tax deductible under the requirements of Section 162(m) of the Internal Revenue Code. The plan provides for a base

20

award equal to 2.0% of our earnings before interest, taxes, depreciation and amortization for our chief executive officer, 1.5% for our chief operating officer and 1.0% for each other named executive officer. In determining actual awards under the Performance Incentive Plan, the committee has the discretion to reduce, but not increase, actual awards from the base awards.

In practice, taking into account that a target opportunity award could be higher than intended, the committee uses its discretion to substantially reduce the actual awards from the base awards each year, and did so during 2008. In exercising this discretion and determining actual awards, at the first meeting during the performance period, the committee establishes goals for that performance period and, at the first meeting after completion of the performance period, measures performance against those goals. The committee has generally established the same corporate goals and goal weightings as those used for determining awards payable to Hospira's non-executive managers under Hospira's management incentive plan. As a result, Hospira's entire management team has the same opportunity to earn above and below target awards. While the committee consults with management in connection with the establishment of these goals, the committee has the sole discretion to set, and measure performance against, these goals.

As Dr. Ramachandra joined Hospira during 2008, he was not named a participant in the Performance Incentive Plan. The terms of his hire included a contractual minimum bonus of $200,000. Dr. Ramachandra was also given an opportunity to earn more than the contractual minimum bonus if warranted based upon performance against the same goals that the committee considered in using its discretion to determine actual amounts to the participants in the Performance Incentive Plan, prorated for the portion of the year that Dr. Ramachandra was employed.

Using the structure of our cash incentive program, the committee establishes a target award for each officer determined as a percentage of the officer's base salary, which is earned based on performance against the goals set by the committee. Officers earn more than the target award (up to a maximum set by the committee of two times the target award) if goals are exceeded, less than the target award if goals are not achieved at the target level but achieved above a threshold level set by the committee (one-half of the target award is the threshold payout), and no award if goals fail to meet the threshold level of performance.

The target incentive award percentages for each named officer position did not change from 2007 to 2008 since award opportunities were consistent with the market median. For purposes of the 2008 annual incentive award, the base salary was the actual cash flow base salary received.

The 2008 financial goals were established to focus executive attention and action on financial and business performance that the committee believed would deliver shareholder return and long-term growth. In establishing these goals, the committee consulted with management, reviewed its 2008 business plan and set goals that were attainable based upon the execution of the plan. In placing the greatest weights on earnings and sales performance, the committee intended to emphasize annual growth of our base business at a level that the committee believed would establish positive shareholder return, balanced with emphasizing our strategy to invest for long-term growth of our business. The committee also placed emphasis on generation of cash as a key measure for our ability to invest for growth. The committee believed that components of the corporate well-being goal motivated performance within critical areas for Hospira's long-term success.

21

For purposes of determining the 2008 cash incentive award paid to each named executive officer, the committee set the following goals and weights at its February 2008 meeting:

| | | | | | | | |

Goal to Achieve Target Payout | | Weight | | Description |

|---|

Adjusted net income of $414 million | | 40% | | Our adjusted net income means our net income determined in accordance with generally accepted accounting principles, excluding restructuring charges and other expenses relating to the closing or exiting of some of our manufacturing plants, purchase accounting charges and acquisition and integration-related expenses and other expenses and gains that we believe are not indicative of our ongoing operating performance. We believe the adjusted measure provides a more meaningful indicator of our management's performance in managing our base business. These adjustments are described in our earnings press releases. |