UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

x | Soliciting Material under §240.14a-12 |

|

HOSPIRA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

On February 26, 2015, Hospira, Inc. made available via links on its internal intranet site the transcript and accompanying presentation materials set forth below.

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us 2015 Thomson Reuters. All rights reserved. Republication or redistribution of c Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) CORPORATE PARTICIPANTS Chuck Triano Pfizer Inc. -SVP, IR Ian Read Pfizer Inc. - Chairman & CEO Frank D’Amelio Pfizer Inc. - EVP, Business Operations & CFO John Young Pfizer Inc. - Group President, Global Established Pharma Business Tony Maddaluna Pfizer Inc. - EVP & President, Pfizer Global Supply CONFERENCE CALL PARTICIPANTS Jami Rubin Goldman Sachs - Analyst Gregg Gilbert Deutsche Bank-Analyst Marc Goodman UBS-Analyst Ari Jahja Credit Suisse - Analyst Mark Schoenebaum Evercore ISI - Analyst John Boris SunTrust Robinson Humphrey - Analyst Andrew Baum Citigroup - Analyst Tim Anderson Sanford C. Bernstein & Company - Analyst Manoj Garg Healthco - Analyst David Risinger Morgan Stanley - Analyst Chris Schott JPMorgan - Analyst Alex Arfaei BMO Capital Markets - Analyst Jeff Holford Jefferies & Company - Analyst Colin Bristow BofA Merrill Lynch - Analyst Seamus Fernandez Leerink Partners -Analyst PRESENTATION Operator Good day, everyone, and welcome to Pfizer’s analyst and investor call. Today’s call is being recorded. At this time I would like to turn the call over to Mr. Chuck Triano, Senior Vice President of Investor Relations. Please go ahead, sir. Chuck Triano - Pfizer Inc. - SVP, IR Thank you, operator. Good morning and thanks for joining us today on short notice to review our proposed acquisition of Hospira, which we announced this morning. I am joined today by our Chairman and CEO, Ian Read; Frank D’Amelio, ourCFO; John Young, President of Global Established Pharma; Doug Lankier, General Counsel; as well as other members of management. 2 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, isprohibitec without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

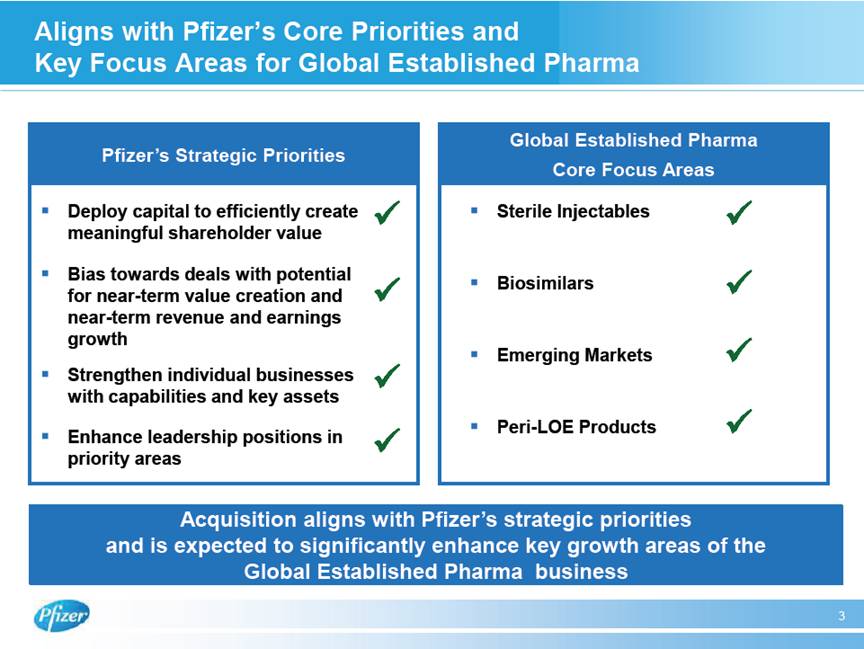

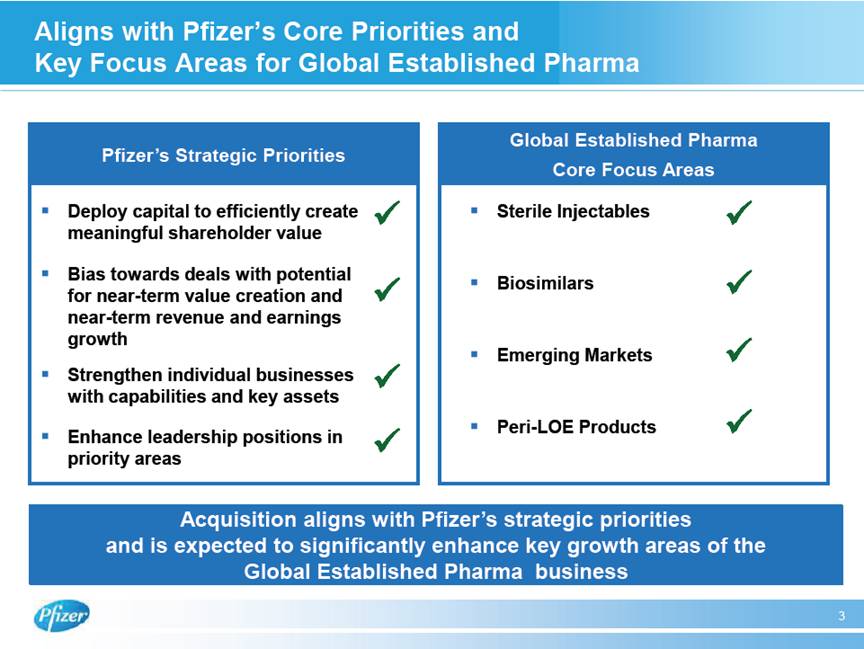

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) The slides that will be presented on the call can be viewed on our home page, Pfizer.com, by clicking on the link for Pfizer Analyst and Investor Call to Discuss Proposed Hospira Acquisition located in the Investor Presentations section in the lower right-hand corner of this page. Before we start, I would like to remind that our discussion during this conference call will include forward-looking statements and that actual results could differ materially from those projected in the forward-looking statements. Factors that could cause actual results to differ are discussed in the press release today announcing the planned acquisition, Pfizer’s 2013 annual report on Form 10-K, and in our reports on Forms 10-Q and 8-K. We will now have prepared remarks from Ian, Frank, and John, and then we will move to a question-and-answer session. With that I will now turn the call over to Ian Read. Ian? Ian Read - Pfizer Inc. - Chairman & CEO Thank you, Chuck. Good morning and thank you for joining us on short notice. We felt it was important to have this call to talk about the announcement we issued this morning. During my remarks I will talk about why acquiring Hospira is a good strategic fit and aligns with our core priorities. Frank D’Amelio will discuss the financial terms of the transaction and John Young will provide some detail on how Hospira aligns with and strengthens our Global Established Pharma business. I will add some concluding remarks and then we will open the call up to your questions. We have consistently said that we look at business development as an enabler of our strategy. We will evaluate all potential deals against a set of strategic priorities. These priorities include doing deals that use our capital efficiently in ways that create meaningful shareholder value, that have the potential for near-term solid value creation, that strengthen our individual businesses or capabilities in key assets that enhance our leadership positions in the most attractive core areas. The acquisition of Hospira meets all these objectives. I will touch briefly on the main ways it does. We expect the transaction will deliver immediate accretion and improve Pfizer’s near-term revenue and earnings growth opportunities. Hospira aligns with our commercial structure and is an excellent strategic fit with our Global Established Pharma business. A few words about how this acquisition aligns with the core focus areas within this business. In Sterile Injectables we currently have a branded portfolio of 73 products across multiple therapeutic areas, primarily resulting from historic acquisitions. The portfolio includes anesthetics, anti-infectives, and oncology. The addition of Hospira will greatly expand ourcapabilities through the addition of their top-tier and broad portfolio of organically-grown generic sterile injectables, including acute care and oncology injectables. In Biosimilars, our strategy is to build a broad portfolio. With the addition of Hospira we obtain a Biosimilar portfolio of both marketed and pipeline assets, including Epogen, GCSF, and Peg-GCSF. In Emerging Markets, we have strong brand equity across these geographies due to the recognized quality and value of our portfolio of products. The reach of Hospira’s broad portfolios with sterile injectables can be extended geographically to Emerging Markets, where Pfizer has an extensive footprint and strong capabilities. We see the addition of Hospira as providing us with a durable growth opportunity over the long-term, driven by their broad portfolios of sterile injectables and biosimilars, technical manufacturing capabilities, and our ability to grow the portfolio with our commercial capabilities, global scale, scientific expertise, and world-class development skills. As well as an untapped demand for generic sterile injectables in the projected medium-term in a number of markets. And the overall rate of growth forecsted in both the generic sterile injectables and biosimilars space. In a moment, Frank and John will go into greater depth on how this proposed acquisition will make us a market leader in a key focus area for the Global Established Pharmaceutical business and how it will help to drive greater sustainability over the long-term. Before they do, I want to share with you a brief overview of Hospira’s business. 3 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, isprohibitec without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

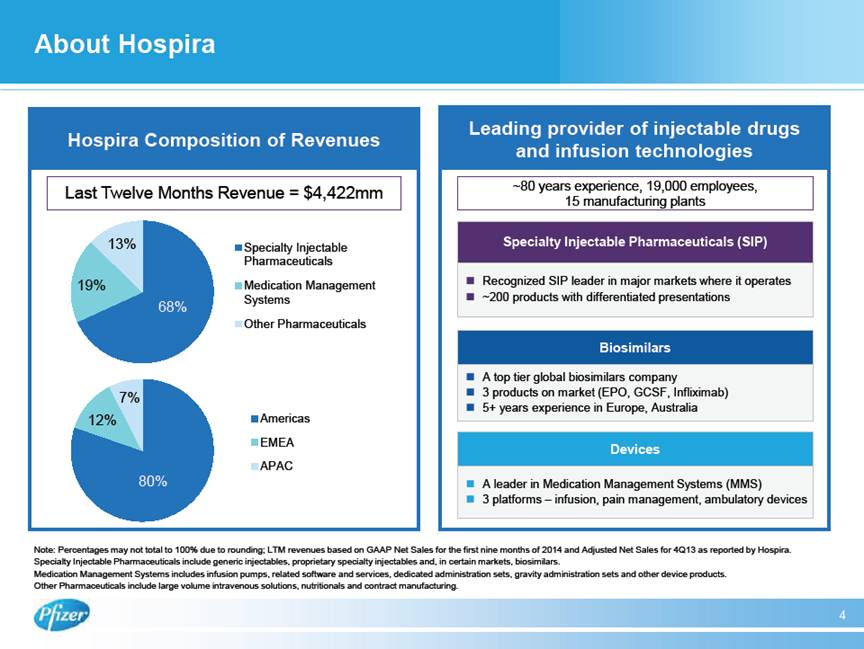

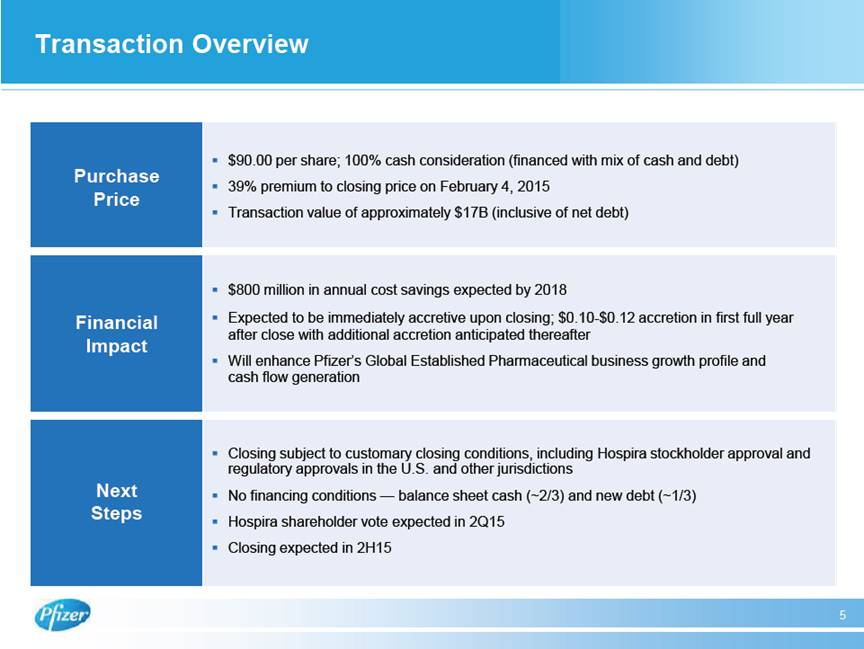

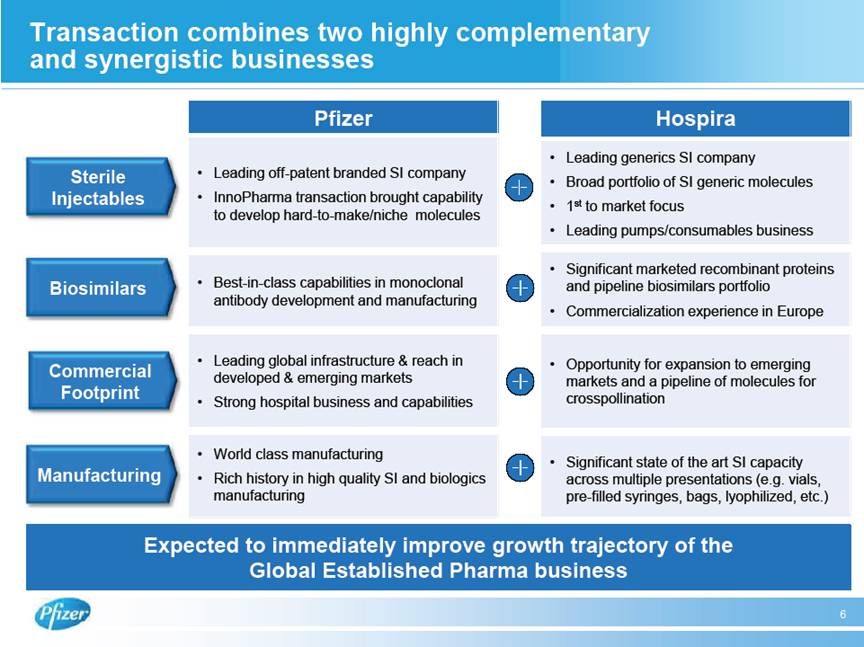

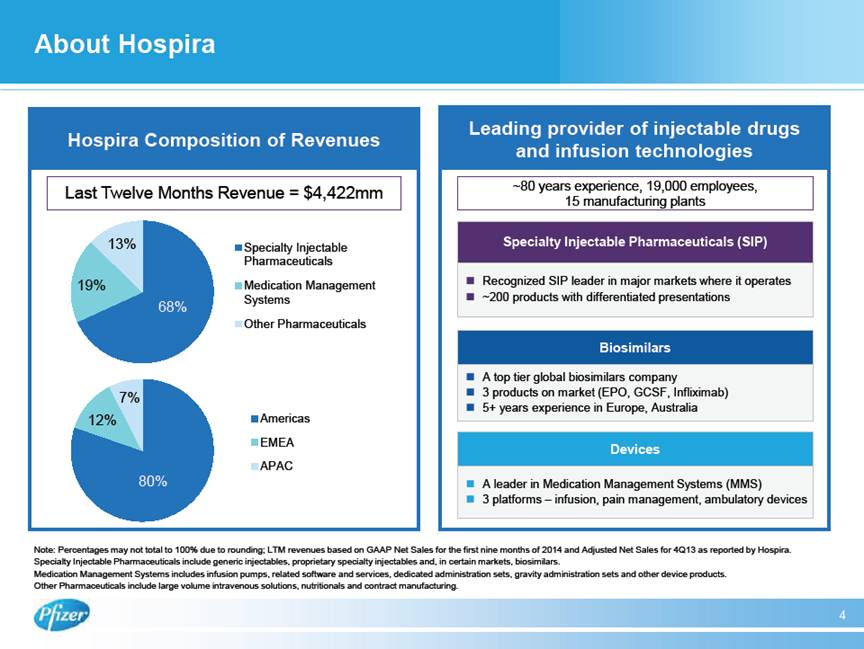

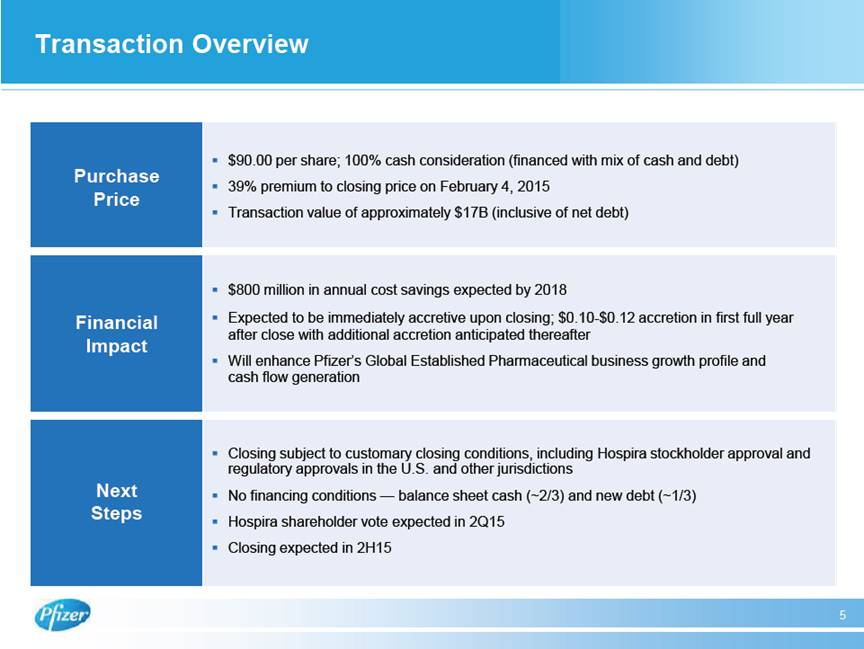

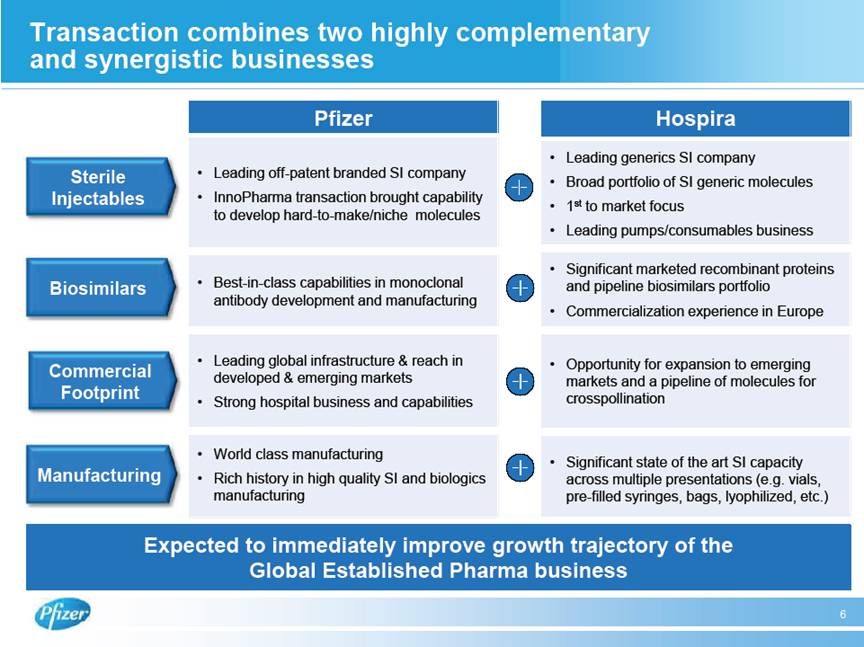

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Hospira is a leading provider of injectable drugs and infusion technologies and a global leader in biosimilars. They have approximately 80 years of experience and are a leader across areas of their portfolio. They are a leading generic injectable pharmaceuticals provider globally. They are a top-tier biosimilars company with more than five years experience in Europe and Australia with three products already on the market. And they are a leader in medication management global systems. This transaction combines two strong and very well-matched businesses that will be poised to take advantage of opportunities in highly attractive markets that are large and growing. Now I’m going to turn it over to Frank, who will take you through the financial details of the transaction. Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Thanks, Ian. Good day, everyone. I’m going to quickly provide an overview of the transaction. Under the terms of the agreement, Pfizer will acquire all of Hospira’s outstanding common shares for $90 per share, which we will fund through a combination of cash and new debt with approximately two-thirds being financed through existing cash and one-third through debt. The purchase price represents a premium of 39% to Hospira’s closing price on February 4, 2015, and a total enterprise value of approximately $17 billion, which includes net debt. It is important to note that this transaction does not impact our previous guidance for our tax rate or expected share repurchases and dividend payments in 2015. As part of this transaction, we expect to realize $800 million in annual cost savings by 2018. Slightly more than half of the savings are expected to come from SI&A expenses with the remainder coming from - primarily from COGS and to a much lesser extent R&D. We expect to achieve 50% of the total savings by the first full year after the close, 75% in second year, and 100% by the third year. We anticipate that the transaction will be immediately accretive to EPS upon closing and expect $0.10 to $0.12 of EPS accretion in the first full year after close with additional accretion anticipated after that. The addition of Hospira will enhance Pfizer’s GEP business growth profile and cash flow generation with an immediate incremental revenue source and products that can be expanded into additional markets given Pfizer’s global reach. The transaction is subject to the customary closing conditions, including Hospira’s shareholder approval, which we expect in the second quarter of this year, and regulatory approval in several jurisdictions, including the US and the EU. It is important to note that there is no financing condition to close. We have sufficient cash and the ability to issue new debt; consequently we expect the closing to occur in the second half of 2015. Before I hand it over to John Young, I want to point out that although we have not made any decision regarding any potential future actions that could involve an external separation of any of our businesses, we do not believe that this transaction will have an impact on the timing of a potential split should we decide to do so. John? John Young - Pfizer Inc. - Group President, Global Established Pharma Business Okay. Thankyou, Frank, and good morning, everyone. Hospira and the Global Established Pharma business arehighly complementary and synergistic in four key areas and the addition of Hospira is expected to immediately improve the growth trajectory of the Global Established Pharma business, while adding an important component of sustainability and durability to our portfolio. I will begin with Sterile Injectables. We are bringing together GEP’s portfolio of leading branded off-patent Sterile Injectables with Hospira’s leading generic sterile injectables business to create a leader in the attractive and growing off-patent sterile injectables segment. If you recall, last year’s InnoPharma transaction brought us the capability to develop hard-to-make and niche molecules with a portfolio of molecules currently in development and Hospira will add the broadest portfolio of generic sterile injectables molecules in the industry to our business with a focus on first-to-market, along with a world-class pump and medications delivery systems business. Moving on to Biosimilars. Pfizer has best-in-class capabilities in monoclonal antibody development and Hospira adds significant marketed recombinant proteins, an attractive biosimilars pipeline, and broad commercialization experience in Europe. 4 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

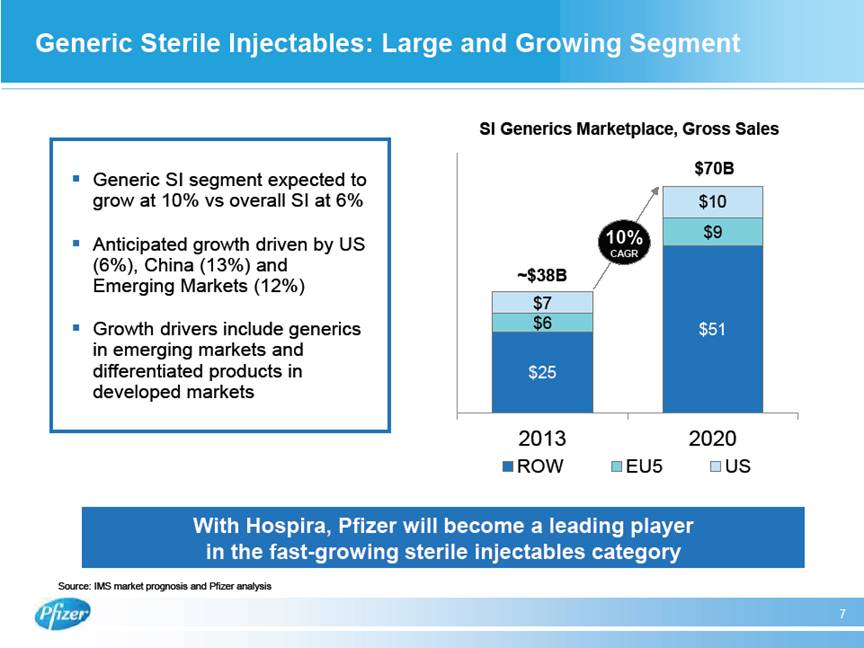

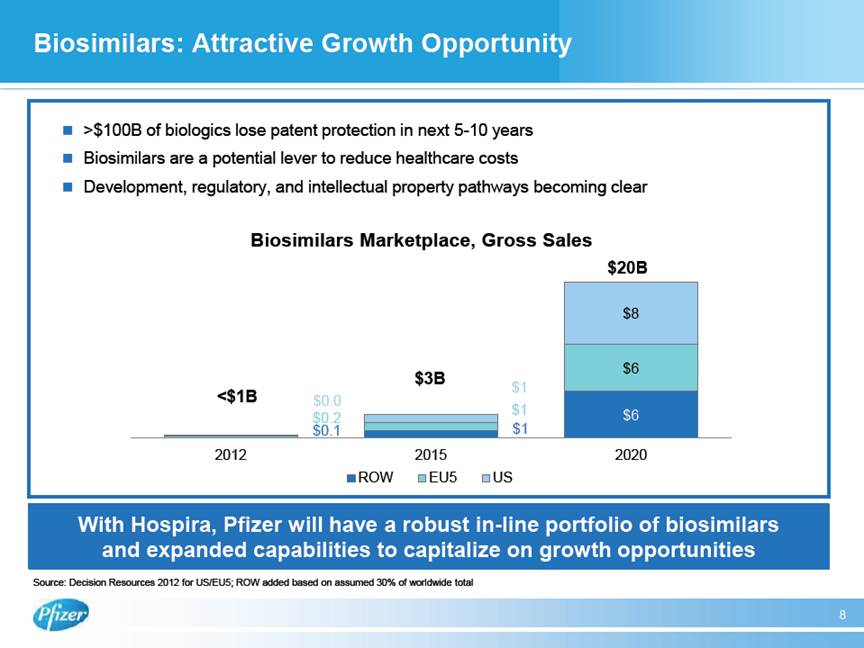

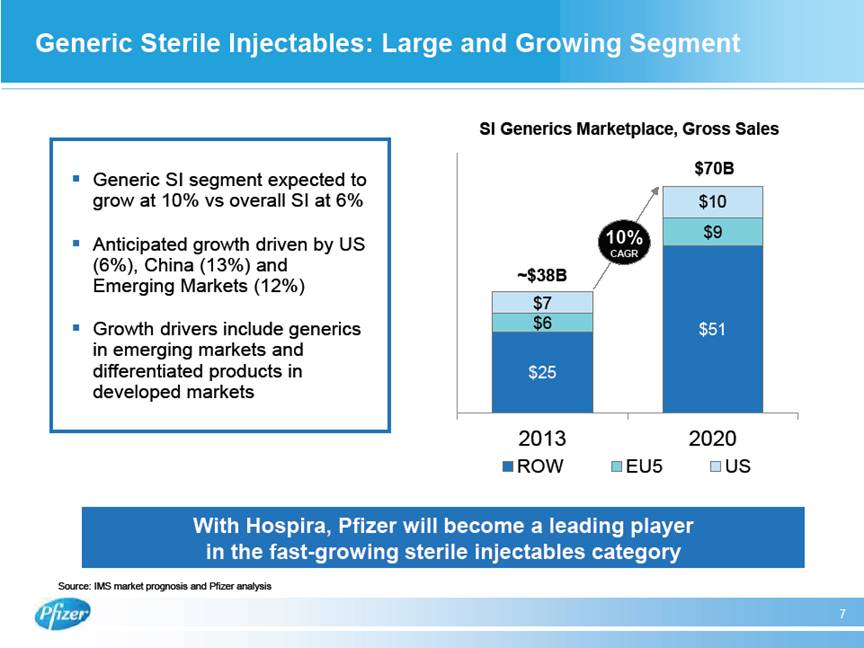

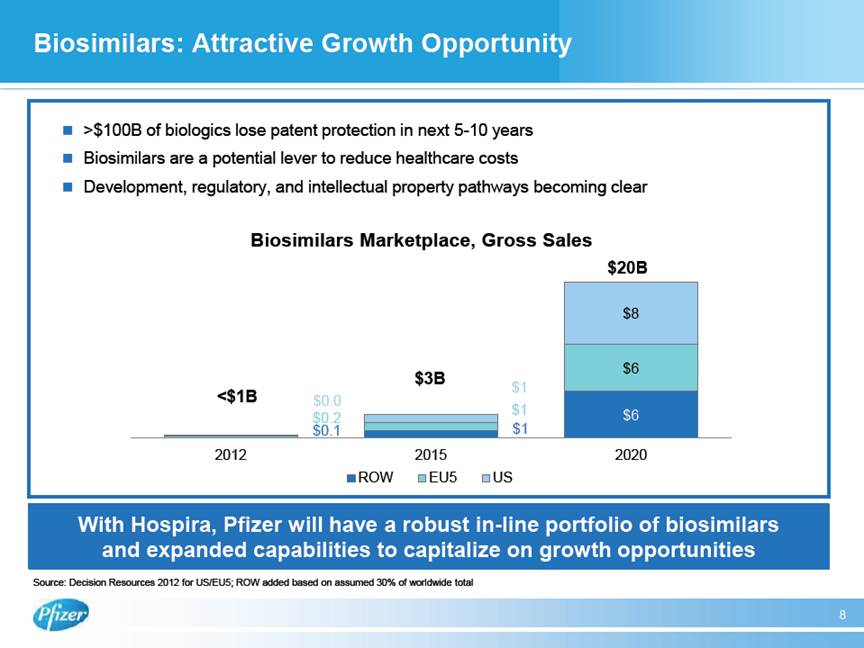

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Regarding our commercial footprints, GEP’s broad global infrastructure and reach in developed and emerging markets, our strong hospital business, and medical and commercial capabilities will help accelerate Hospira’s global expansion program for its pipeline of existing and new molecules. GEP will leverage its strong existing commercial footprint, global scale, and expertise in science and world-class development capabilities to expand the reach for Hospira’s products, which are now distributed primarily in the United States and Europe, to Latin America, AfME, China, and Asia, where GEP has a significant presence. In manufacturing we’ll join Pfizer’s world-class manufacturing capabilities, including our rich history in high-quality sterile injectables and Biologics manufacturing, with Hospira’s significant additional state-of-the-art sterile injectables capacity across multiple areas including vials, pre-filled syringes, and lyophilized products. Hospira’s new Vizag facility will bring significant additional sterile injectables manufacturing capacity and will be an important component for future growth and cost reduction when it comes online. FDA approval is pending for Vizag, and while in progress, immediate approval was not an essential component of value creation in this transaction. I would like to note that the retention of key talent from both companies is very important and our teams will work closely together to help ensure that we move forward with the best talent from across both organizations while achieving a competitive cost structure. Together GEP and Hospira will be a leading player in the large and fast-growing global generic sterile injectables segment, which is projected to grow from $37 billion in 2013 to $70 billion in 2020, a growth rate of 10% versus 6% projected growth for the combined branded and sterile injectables segment marketplaces. Future market growth is anticipated to be largely driven by China with 13%, the US with 6%, and other emerging markets with 12% with growth driven by both generic sterile injectables volume and Emerging Markets, as well as differentiated presentations in hard-to-make products in Developed Markets. Moving on to Biosimilars, the addition of Hospira comes at a key point in the growth and development of the biosimilars segment. Biosimilars are a potential lever to reduce healthcare costs, and development, regulatory, and intellectual-property pathways are becoming clear. GEP will have a robust portfolio of both marketed biosimilars and development and manufacturing capabilities to capitalize on key growth opportunities as around $100 billion of patented biologic molecules lose patent protection in the next 5 to 10 years. With Hospira, both our pipeline and commercialized portfolio will be further enhanced and now diversified to include recombinants as well. So I will now turn it back to Ian to summarize the presentation. Ian Read - Pfizer Inc. - Chairman & CEO Thank you, John. In closing, this deal is well aligned with our strategy. It meets all the priorities for business development I cited earlier. It will make us a top-tier player with leading positions in highly attractive and growing market segments. It will add durable growth opportunities to our business over the long term. It will accelerate the growth trajectory of the Global Established Pharma business and will provide a strong element of robustness to its portfolio. It brings to us additional expertise and talent in key areas and it has compelling financial impact which we believe will result in shareholder value creation. Now I will open up to your questions. Thankyou. Chuck Triano - Pfizer Inc. - SVP, IR Thanks, Ian. Operator, if we could please poll for questions, thanks. 5 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us 82015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) QUESTIONS AND ANSWERS Operator (Operator Instructions) Jami Rubin, Goldman Sachs. Jami Rubin - Goldman Sachs - Analyst Thank you very much and congratulations on what really looks like a great deal. Ian, do you view the Hospira deal as sufficient enough to allow the GEP business to now stand on its own to eventually spin out? I appreciate Frank’s comments on this deal not interrupting your timeline, but when you think about the businesses that you need and can this company be an independent company, do you now have all the pieces in place to make that decision? Or, if not, are there other business lines that you are still looking for, as well as a tax strategy? Because, clearly, if that business were to stand on its own it would be competing with other companies that have much lower tax rates. My second question, to John, is on biosimilars. Do you have a differentiated view on the development into the biosimilars space? Thanks very much. Ian Read - Pfizer Inc. - Chairman & CEO Jami, thank you for the question. We like the business. We are always looking for ways of strengthening our businesses; we will continue to look for ways of strengthening our businesses. But as we have previously stated, at this time we have not made and, frankly, are not in a position to make any decision regarding potential future action that could involve an external split of any of our businesses. We believe it will take the next few years to fully realize the potential of these businesses, which is predicated upon the success of our product launches, these brands in our Innovative pipeline; strengthening our capabilities to grow all our patent profile, which this deal certainly has done; continuing effective cost management and capital allocation. So, frankly, this deal — we are doing it becuse it fits strategically, fits with the GEP business, and the transaction is expected to maximize the growth opportunities and drive greater sustainability in the GEP business. Thank you for your question. John Young - Pfizer Inc. - Group President, Global Established Pharma Business So in regard to your question on biosimilars, I think first of all, as I mentioned in my comments, we see the emerging biosimilars marketplace as being an extremely attractive market in terms of size and potential. As I mentioned again in my comments, Jami, we are seeing certainly regulators becoming clearer on the regulatory pathway and also IP considerations also becoming clearer. We are excited by Hospira’s significant marketed and pipeline biosimilars portfolio, because it will complement Pfizer’s evolving biosimilars portfolio and our world-class development capabilities. Obviously we will work closely with regulators in their review in order to obtain the necessary approvals going forward. Operator Gregg Gilbert, Deutsche Bank. 7 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Gregg Gilbert - Deutsche Bank - Analyst Thanks, I have a few; I will ask them up front. First, can you quantify the overlap between your on-market injectable products as well as the products in development between yourselves and Hospira? Secondly, Ian and John, do you have thoughts on the pump and device business? Is that likely to remain part of the portfolio, or will you consider options for that? And, thirdly, do you expect to hold on to all of the biosimilars that Hospira had partnered with Celltrion and perhaps their financial partners that are involved in some as well? So can you just let us know that everything we know Hospira has in biosimilars is likely to stay? Thanks. Ian Read - Pfizer Inc. - Chairman & CEO Thank you, Gregg. I think I will ask John to answer these questions. He has been very involved in the due diligence, and as a leader in this business, I would like him to address these issues. John Young - Pfizer Inc. - Group President, Global Established Pharma Business Thank you, Gregg. First of all, in relation to the MMS, the pump business, I think we believe that Hospira has a leading pumps and consumables business, which differentiates them from the competition, which will provide Pfizer with novel capabilities in an adjacent area and a new source of revenue growth. And Pfizer will continue to operate the MMS pump business as a part of the overall GEP organization. In relation to antitrust issues, maybe I can just cover that overall and just say that our analysis suggests that our businesses are actually highly complementary. Obviously, we would work with regulators very closely to obtain the necessary approvals. Ian Read - Pfizer Inc. - Chairman & CEO Thank you. I would like to emphasize that we like the pump and device business and we continue - we intend to continue managing it and look forward to being involved in that business. Operator Marc Goodman, UBS. Marc Goodman - UBS - Analyst Just a continuation on the biosimilars. So is there overlap in the biosimilar product pipeline here? And, second of all, are there any timelines that Hospira has provided for launches that you would like us to change and think about differently? Ian Read - Pfizer Inc. - Chairman & CEO At this stage, Marc, we have done some due diligence. We need to get in and sit down and look at the overall plans. We are satisfied at this stage that the complementary nature of the biosimilars business is a good fit and we expect it to drive value for Pfizer’s shareholders. Operator Vamil Divan, Credit Suisse. 8 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Ari Jahja - Credit Suisse - Analyst Good morning. This is Ari Jahja in for Vamil Divan. Thanks for taking my questions; I have a couple here. First, would there be any assets that Pfizer might need to divest in order to secure timely regulatory approvals? Then second, can we get a sense of how much revenue at Hospira is driven from China, given Pfizer’s number one position there? Thank you. Ian Read - Pfizer Inc. - Chairman & CEO It’s too early to talk about divesting of assets. We need to talk to the regulators. We believe that the businesses are highly complementary and look forward to our conversations with the regulators. John Young - Pfizer Inc. - Group President, Global Established Pharma Business And in regard to China, our understanding at this early stage is that Hospira has a relatively small part of its business in China. Clearly, for GEP, we have a much larger and growing business in China with a very large commercial footprint. So as we understand the synergy of the two businesses in greater detail over the coming months, certainly we would look to explore opportunities for future growth in what is obviously a very attractive market in this segment. Operator Mark Schoenebaum, Evercore ISI. Mark Schoenebaum - Evercore ISI - Analyst Thanks a lot. Thank you very much for taking my question. I was wondering, since this deal is far smaller than obviously the AstraZeneca deal would have been, should investors have an expectation that you are still on the prowl for larger deals or there will be a pause so that the organization can absorb Hospira? And then the second is related to Jami’s question. We understand you have made no decisions, of course, around splitting the Company up, but you had said many times in the past that you would need three years of audited financials before such a split was likely to occur. I would just like to confirm that the end of that three-year period would still occur in 2017 and that the acquisition of Hospira would not somehow reset year one, so to speak. Thanks very much. Ian Read - Pfizer Inc. - Chairman & CEO So, Mark, on the latter part of your question, we confirm end of 2017. We confirm it does not reset. On — I wouldn’t quite use your word, the word prowl. I think we continue to look at opportunities. Frank has talked about our capacity where we continue to look at opportunities. We have opportunities of all size from bolt-ons to niche opportunities to major acquisitions and the criteria has to be of course, as we always said, that they create shareholder value. And the other criteria I illustrated. Frank, do you want to talk a little bit about our capacity to continue to do deals? 8 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Sure. We continue to have a very strong balance sheet. We continue to have a very strong capital structure. We continue to have a significant amount of cash. Our credit ratings are very high within the investment grade area: A, A+, AA. If you look at our debt to EBITDA it’s roughly 2. So we continue to have the capacity to do deals and, as always, our compass will be transactions that create shareholder value. We are agnostic to size and what we are all about is creating shareholder value. Chuck Triano - Pfizer Inc. - SVP, IR And regarding the three years of financials for -? Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Ian talked on that. We said no change to our ability to 2017. Operator John Boris, SunTrust. John Boris - SunTrust Robinson Humphrey-Analyst Great. Thanks for taking the questions and Congrats on the deal. So, Ian, I think in the fourth-quarter conference call, you indicated that there was a near-term deal. If you can just clarify, is this the near-term deal that you referred to? Then secondly, if you had a scale weighing branded pipeline opportunity versus generic opportunity, you obviously have a lot of powder still dry to be able to make additional acquisitions and put that to work. Which way are you leaning? Is it more branded from up the innovation core, or is it leaning more towards the generic side? On biosimilars, when I look at the portfolio of the assets that Hospira is working on, you currently have in Phase 3 Herceptin, Rituxan, Remicade. You also have Avastin and Humira that are in Phase 1. That is a mirror image of what Hospira has partnered with Celltrion, so wouldn’t it be logical to part way with the Celltrion assets, especially since internally developed ones would be better to maintain or keep? Last question just has to do with the breakup fee. Can you maybe just discuss is there any breakup fee involved here, and then are you going to seek regulatory approval in China also, in addition to the US and EU? Thanks. Ian Read - Pfizer Inc. - Chairman & CEO Thanks, John. A lot of very good questions as usual. You know, on the biosimilars overlap that you indicate, we will take new decisions that are best focused on patient needs and value, and have a lot of conversations with the regulators on that issue. So rest assured that we have looked at this and we believe it will take the appropriate decisions to conserve value in the deal. I didn’t actually say —I would like to make a slight correction; I didn’t say we were looking for a short-term deal on the fourth quarter. I said we were more looking for deals that produce short-term revenue and earnings. So this is not an indication of the deal has been made. This is an indication of a deal that we have done that meets that criteria. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) As to whether I think we now - whether our focus moves from one business to the other, our focus has always been on value and not particularly which business. It’s always been, for me, it’s $1 from — $1 of profit or $1 of value from any business is worth the same; it’s $1. So we tend to focus on where are the best deals and how we can achieve them. And I thinkthere was one last question. Chuck Triano - Pfizer Inc. - SVP, IR Breakup fee. Ian Read - Pfizer Inc. - Chairman & CEO Breakup fee. Chuck Triano - Pfizer Inc. - SVP, IR Then he asked about regulatory approval in China. So on the breakup fee, John, there is a breakup fee in the deal. It’s a $500 million breakup fee. Regarding details on the breakup fee will be — the merger agreement will be publicly filed in the next few days and, therefore, the specifics around the breakup fee will be available in the filing. (multiple speakers) On the regulatory for China? Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Yes, so we are currently analyzing the business in China, but we currently do not anticipate a filing being required there. Operator Andrew Baum,Citi. Andrew Baum - Citigroup - Analyst Good morning, a couple of questions. Firstly, looking into the future, assuming biosimilars pans out, there are plenty of opportunities that you can leverage your existing group structure through both market access bundling and the like, as well as through co-promotion. Neither would seem that straightforward to do. How are you thinking about beginning to develop those competencies to leverage the whole organization? And then second, perhaps you could talk through the magnitude of the cost reductions that would be achieved through the integration of Hospira, particularly the timing? Should we assume initial cost savings for SG&A and then the manufacturing COGS reductions fairly - somewhere in the future? Ian Read - Pfizer Inc. - Chairman & CEO Andrew, you raise a good question about the complementary nature of our broad portfolio and different contact levels with our customers. We do tend to have a one face to the customer. While we have different divisions, certainly in the US, we have one face to our customer, which pulls 21 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) together all our disparate interests with that customer. And we will continue to do that both in the US and elsewhere and look to benefit both patients and Pfizer from the multiple contact points we have with our customers. On the second question of the magnitude, Frank, would you like to answer that please? Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Sure. In terms of magnitude of the cost savings, $800 million. Essentially over three years: 50% by year one, 75% by year two, 100% by year three. More than half of those cost synergies are in SI&A, while of the remainder — the remainder is primarily COGS with, to a much lesser extent, R&D. And then in terms of the cadence, obviously we will get as much as we can from all of them as quickly as we can, but understand your comment obviously around the COGS piece and what we will need to do in the manufacturing area. Ian Read - Pfizer Inc. - Chairman & CEO I would like to emphasize that we look at, as we always have done in all acquisitions, as we take - as we look at cost savings, we look at both our organizations; we look at the talent in both. We are very well aware that Hospira has a lot of talented individuals and have been very successful, as our organization has been successful, so we look to create a combined organization that has the best talent from both organizations. And that is a very important principle for us. Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO As we have done in prior transactions, we typically take synergies from both companies. Operator Tim Anderson, Sanford Bernstein. Tim Anderson - Sanford C. Bernstein & Company-Analyst Thank you. It’s a little bit of a broader question on biosimilars, but wondering if you can talk about the economic case for biosimilars given a very recent development, which is that in Norway just a few days ago a Remicade biosimilar went out at a tender price of 70% discount to the brand, which is remarkably different than I think the 30% and 40% discounts that people think about. And I am wondering your thoughts on if that’s potentially a seismic shift on the pricing of other biosimilars seeing as that is on a monoclonal antibody, and whether that at all calls into question the economic case for biosimilars in Europe. Ian Read - Pfizer Inc. - Chairman & CEO Thank you, Tim. I will let John start to answer that and then may add just comments on the end of it. John Young - Pfizer Inc. - Croup President, Global Established Pharma Business Yes, I think overall we believe that the market opportunity and the economic case for biosimilars remains strong. And I think in regard to the specifics of that case, I think we would simply say we don’t expect that level of pricing across most European markets in the US market. 22 THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Ian Read - Pfizer Inc. - Chairman & CEO Tim, it’s a matter of quality. It’s a matter of the patience; demand for quality. Different markets patients have different says, have a different voice in the quality of the product they expect to receive. Norway has traditionally been a very difficult market on that type of area. And it’s also a question of capacity inside the whole supply chain to meet the volumes. So I think that while we acknowledge that there will be obviously a discount from the originator, we don’t as yet see that that discount will destroy the business case for biosimilars. Operator Manoj Garg, Healthco. Manoj Garg - Healthco -Analyst Thanks for taking the question. I have a couple of facilities-related questions. One, you highlighted Vizag in your prepared remarks, but what is your confidence on Rocky Mount and past its regulatory issues and the significant investments there? Ian Read - Pfizer Inc. - Chairman & CEO We have on the line our head of manufacturing, global head, Tony Maddaluna, who has done the due diligence. So perhaps I will ask Tony to address that. Tony Maddaluna - Pfizer Inc. - EVP & President, Pfizer Global Supply Thanks, Ian. So we performed a review of Hospira’s manufacturing network and had several discussions with their operations folks and their quality leadership, and we visited three key sites. We visited Rocky Mount, we visited Costa Rica, and we visited Vizag. As a result of this review, we feel very comfortable that the issues raised by the regulators have been addressed or are being properly addressed. Consequently, we are comfortable with the transaction based on this review. Operator David Risinger, Morgan Stanley. David Risinger -Morgan Stanley - Analyst Thanks, very much. I have one question on Celltrion and then a simple question. With respect to Hospira’s dependence on Celltrion for its currently-marketed biosimilars and its biosimilar pipeline, could you just discuss the scope of that dependence, the partnership, and the economics between the companies? And then separately, with respect to a question earlier on the three years of audited financials, I believe that you had said end of 2017, Ian, but my understanding was that the three years of audited financials would be done at the end of 2016. So if you could just circle back to that, that would be great. Ian Read - Pfizer Inc. - Chairman & CEO I will have Frank talk about the three years and then we will answer your question on Celltrion to the extent that we can. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO So on the audited financial, Dave is right. What we talked about was prospectively three years of audited financials beginning in 2014, which would’ve meant 2014, 2015, and 2016. Then obviously being in a position to exercise the option if we chose to do so in 2017. So that was the 2017 that Ian was referring to, but, Dave, you’re right; 2014, 2015, 2016. Ian Read - Pfizer Inc. - Chairman & CEO And so we don’t see any change in that, Dave, but we don’t see us completing the third year and immediately being in a position to trigger a transaction should we so wish to trigger one. And I do think it is important for Pfizer’s shareholders that we have time to understand the full value of the assets that we are putting together and the strength of the businesses we are putting together. So I think I see us taking steps towards an optionality as we have discussed. Would you like to mention — discuss the Celltrion situation? John Young - Pfizer Inc. - Group President, Global Established Pharma Business Yes, I think just generally we are very excited by both their market and their pipeline in the biosimilars portfolio. We do think it is complementary. I think just to highlight, their marketed recombinant products are not dependent on Celltrion. They were developed, as we understand, by Hospira alone. And obviously for any other products in both companies’ portfolios, we will work closely with regulators and their view in order to obtain the approvals as we have already mentioned. Operator Chris SchottJPMorgan. Chris Schott -JPMorgan -Analyst Great. Thanks very much for the questions. Just the first question here: can you just talk about the growth profile for GEP post the Hospira acquisition? I know the business is still working through some LOEs right now, but when we thinkabout the pro forma business, is this something we now think about as a growing business in 2016 and beyond? I’m just trying to get a sense of— to just shift us fully into the position where this is actually a growing business for you. Then my second question, I know it’s been asked a couple of different ways here, but just overall I’m just trying to get a sense of what is your sense of urgency to pursue further transactions post the Hospira deal when we factor in —? Obviously there’s a lot going on in the space. There’s a lot of M&A activity across the board - where valuations are, where your debt capacity is. I know you’re very focused on value to shareholders, but I’m just trying to get a sense of the sense of urgency for further M&A at this point going forward. Thanks very much. Ian Read - Pfizer Inc. - Chairman & CEO Thank you. John, would you like to comment on the growth profile? THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us 82015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) John Young - Pfizer Inc. - Group President, Global Established Pharma Business Thanks for the question, Chris. As you know, we obviously don’t provide guidance by individual business, but what I can tell you is that Hospira represents an immediate incremental revenue source with products that can be expanded into additional markets given Pfizer’s global reach. So we think it’s a very complementary fit to our existing GEP business and will enhance our growth profile. Ian Read - Pfizer Inc. - Chairman & CEO Chris, we always have a sense of urgency on creating shareholder value and we will continue to look at opportunities where BD can strengthen our businesses. And I don’t —I believe that the Hospira process — acquisition is a nice contained, bolt-on in a business that we have established and I don’t think it will distract us from our ability to continue to look at appropriate deals that can add value. Operator Alex Arfaei, BMO Capital Markets. Alex Arfaei - BMO Capital Markets - Analyst Good morning and congratulations on the deal. It looks like a good one. Frank, I just wanted to follow up on your earlier comments on synergies. I appreciate that SI&A synergies can happen fairly quickly, but Hospira has a low gross margin compared to your established products business. It looks like 40% versus 82%. How quickly can you improve that with your manufacturing skill? As a follow-up, could you provide little bit more color on the potential magnitude of the revenue synergies you are expecting by launching these products in new markets? Hospira says their SIP products in particular are number one where they are sold, so I would imagine these are commonly-used products. And depending on the number of markets that you are planning to introduce them, they will be significant revenue synergies. So any comments on that will be great. Thank you. Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO So the lower margins, the way I would answer the question is by saying you are absolutely right; their margins are lower than our margins. However, when you incorporate it into Pfizer on an overall basis, the impact on Pfizer’s overall margins will be material. And separately, I would handle the margin question. On revenue synergies we clearly incorporated revenue synergies into our overall valuation for the deal. That’s obviously part of our diligence, part of the analytics that we work through. Based on all that we believe we are buying Hospira at a fair price. Operator JeffHolford, Jefferies. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Jeff Holford - Jefferies & Company - Analyst Thanks very much for taking my question. Can you just tell us, given the cash component of this deal, are you repatriating money from overseas to finance this transaction? Will it impact any of the underlying assumptions you made regarding the 2015 tax rate or your ability to pursue share repurchase or the deployments of cash within the US yet in the beginning of the year? Thank you. Ian Read - Pfizer Inc. - Chairman & CEO I will ask Frank to answer that, but I would just like to strengthen or comment further on Frank’s reply on margin improvement. It is not as if we are beginning from a standing start of these cost savings. Hospira management has been focused on this and has plans, and we send them into due diligence to progressively improve their margins. So while this transaction will help accelerate that, that is a component of our ability to make these cost savings. Frank, if you want to go through —? Frank D’Amelio - Pfizer Inc. - EVP, Business Operations & CFO Jeff, in terms of how we are paying for the transaction, two-thirds cash, one-third debt. Of the cash, some of the cash is in it from the US and some of the cash is coming from overseas. And to your point about the tax rate, it does not impact the guidance we gave on last week’s earnings call regarding our 2015 tax rate, which we said was approximately 25%. It also does not impact what we said regarding dividends and buybacks, which was we would be returning approximately $13 billion to our shareholders this year through a combination of dividends and buybacks. Operator Colin Bristow, Bank of America. Colin Bristow - BofA Merrill Lynch -Analyst Thanks for taking the questions and Congrats on the deal. Just one quick one. How is the potential for the split of Pfizer into an innovative and generics business impacting how you are thinking about synergy realization in this acquisition? I ask because it feels like one of the questions around the potential split is any synergies created through the separation. And so I’m curious are you leaving any additional infrastructure in place versus if a split were not being considered? Thanks. Ian Read - Pfizer Inc. - Chairman & CEO No, we are not, Colin, because we had separated our Established Products business from our Innovative business and we are taking steps to make sure those businesses run efficiently. And so we will ensure that the Sterile Injectables of the Hospira business, which is part of Established Products, is efficiently integrated into our business. And so I don’t think we are leaving any money on the table, so to speak, if that was the point of your question. Chuck Triano - Pfizer Inc. - SVP, IR Operator, can we take our last question please? THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| FEBRUARY 05, 2015 / 2:00PM, PFE - Pfizer Inc Discussing Proposed Acquisition of Hospira Call (Analyst and Investor) Operator Seamus Fernandez, Leerink. Seamus Fernandez - Leerink Partners - Analyst Thanks very much and congratulations on getting my name exactly pronounced right. In terms of the Celltrion portion of the Hospira relationship, can you just help us better understand if there are any considerations in the context of the contract with Celltrion and Hospira that would require any movement? I know you said that you are not going to — you don’t believe that there is any overlap that requires offloading certain products, but are there any features of that transaction that we need to better understand, whether it be regional overlaps that Pfizer doesn’t believe is an issue or just any incremental clarity? Ian Read - Pfizer Inc. - Chairman & CEO Seamus, I would say that clearly we are at the early stages. We haven’t sat down with Celltrion yet. We have looked at the contractual relationship between Hospira and Celltrion. We are satisfied that that will allow us to continue to maximize value and continue to have a good relationship with Celltrion and will enable us to have the appropriate discussions with regulators and those discussions and the expectations of those discussions are factored into the value of the deal. So we — and we look forward to a discussion with Celltrion on these issues. So I think you can feel satisfied that we don’t think this is a major issue for the transaction, but at this stage we really can’t say anymore on this. Thank you. Chuck Triano - Pfizer Inc. - SVP, IR Thanks, Ian, and thanks, everybody, for your attention this morning. Operator Ladies and gentlemen, thank you for participating in the analyst call. This concludes the conference. You may now disconnect. DISCLAIMER Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes. In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized. THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY’S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDE DON THIS WEBSITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY’S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS. ©2015, Thomson Reuters. All Rights Reserved. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us c2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

| Acquisition of Hospira February 5, 2015 |

| Forward-Looking Statements and Non-GAAP Financial Information Our discussions during this conference call will include forward-looking statements about, among other things, Pfizer’s planned acquisition of Hospira, including its potential benefits, anticipated synergies, accretion, and growth, the combined company’s plans and prospects, the financial condition, results of operations and business of Pfizer and the combined company, anticipated industry growth rates and the anticipated timing of closing of the transaction, that are subject to substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information regarding these factors can be found in the press release dated February 5, 2015 announcing the planned acquisition, Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and in our subsequent reports on Form 10-Q, including in the sections thereof captioned “Risk Factors” and “Forward-Looking Information That May Affect Future Results”, as well as in our subsequent reports on Form 8-K, all of which are filed with the SEC and available at www.sec.gov and www.pfizer.com. The forward-looking statements in this presentation speak only as of the original date of this presentation and we undertake no obligation to update or revise any of these statements. Also, the discussions during this conference call may include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP). Any non-U.S. GAAP financial measures presented should not be viewed as substitutes for financial measures required by U.S. GAAP, have no standardized meaning prescribed by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies. 2 |

| Aligns with Pfizer’s Core Priorities and Key Focus Areas for Global Established Pharma 3 Global Established Pharma Core Focus Areas Pfizer’s Strategic Priorities # Deploy capital to efficiently create meaningful shareholder value # Bias towards deals with potential for near-term value creation and near-term revenue and earnings growth # Strengthen individual businesses with capabilities and key assets # Enhance leadership positions in priority areas # Sterile Injectables # Biosimilars # Emerging Markets # Peri-LOE Products Acquisition aligns with Pfizer’s strategic priorities and is expected to significantly enhance key growth areas of the Global Established Pharma business |

| About Hospira 4 Hospira Composition of Revenues Leading provider of injectable drugs and infusion technologies $ Recognized SIP leader in major markets where it operates $ ~200 products with differentiated presentations Specialty Injectable Pharmaceuticals (SIP) $ A top tier global biosimilars company $ 3 products on market (EPO, GCSF, Infliximab) $ 5+ years experience in Europe, Australia Biosimilars $ A leader in Medication Management Systems (MMS) $ 3 platforms – infusion, pain management, ambulatory devices Devices ~80 years experience, 19,000 employees, 15 manufacturing plants Last Twelve Months Revenue = $4,422mm 80% 12% 7% Americas EMEA APAC 68% 19% 13% Specialty Injectable Pharmaceuticals Medication Management Systems Other Pharmaceuticals Note: Percentages may not total to 100% due to rounding; LTM revenues based on GAAP Net Sales for the first nine months of 2014 and Adjusted Net Sales for 4Q13 as reported by Hospira. Specialty Injectable Pharmaceuticals include generic injectables, proprietary specialty injectables and, in certain markets, biosimilars. Medication Management Systems includes infusion pumps, related software and services, dedicated administration sets, gravity administration sets and other device products. Other Pharmaceuticals include large volume intravenous solutions, nutritionals and contract manufacturing. |

| Transaction Overview 5 Purchase Price # $90.00 per share; 100% cash consideration (financed with mix of cash and debt) # 39% premium to closing price on February 4, 2015 # Transaction value of approximately $17B (inclusive of net debt) Financial Impact # $800 million in annual cost savings expected by 2018 # Expected to be immediately accretive upon closing; $0.10-$0.12 accretion in first full year after close with additional accretion anticipated thereafter # Will enhance Pfizer’s Global Established Pharmaceutical business growth profile and cash flow generation Next Steps # Closing subject to customary closing conditions, including Hospira stockholder approval and regulatory approvals in the U.S. and other jurisdictions # No financing conditions — balance sheet cash (~2/3) and new debt (~1/3) # Hospira shareholder vote expected in 2Q15 # Closing expected in 2H15 |

| Transaction combines two highly complementary and synergistic businesses Sterile Injectables Expected to immediately improve growth trajectory of the Global Established Pharma business 6 Biosimilars Commercial Footprint Manufacturing Pfizer • Leading off-patent branded SI company • InnoPharma transaction brought capability to develop hard-to-make/niche molecules • Best-in-class capabilities in monoclonal antibody development and manufacturing • Leading global infrastructure & reach in developed & emerging markets • Strong hospital business and capabilities • World class manufacturing • Rich history in high quality SI and biologics manufacturing Hospira • Leading generics SI company • Broad portfolio of SI generic molecules • 1st to market focus • Leading pumps/consumables business • Significant marketed recombinant proteins and pipeline biosimilars portfolio • Commercialization experience in Europe • Opportunity for expansion to emerging markets and a pipeline of molecules for crosspollination • Significant state of the art SI capacity across multiple presentations (e.g. vials, pre-filled syringes, bags, lyophilized, etc.) |

| Generic Sterile Injectables: Large and Growing Segment 7 With Hospira, Pfizer will become a leading player in the fast-growing sterile injectables category $25 $51 $6 $9 $7 $10 2013 2020 ROW EU5 US ~$38B $70B # Generic SI segment expected to grow at 10% vs overall SI at 6% # Anticipated growth driven by US (6%), China (13%) and Emerging Markets (12%) # Growth drivers include generics in emerging markets and differentiated products in developed markets Source: IMS market prognosis and Pfizer analysis 10% CAGR SI Generics Marketplace, Gross Sales |

| Biosimilars: Attractive Growth Opportunity 8 With Hospira, Pfizer will have a robust in-line portfolio of biosimilars and expanded capabilities to capitalize on growth opportunities Source: Decision Resources 2012 for US/EU5; ROW added based on assumed 30% of worldwide total $ >$100B of biologics lose patent protection in next 5-10 years $ Biosimilars are a potential lever to reduce healthcare costs $ Development, regulatory, and intellectual property pathways becoming clear $0.1 $1 $6 $0.2 $1 $6 $0.0 $1 $8 2012 2015 2020 ROW EU5 US <$1B $3B Biosimilars Marketplace, Gross Sales $20B |

| Key Takeaways # Acquisition of Hospira will be immediately accretive on closing and will deliver improvement in the growth trajectory of the Global Established Pharma Business and Pfizer overall # The transaction aligns with our new commercial structure and is an excellent strategic fit within our Global Established Pharma business # The transaction will enable Pfizer to capitalize on important growth opportunities and leverage Pfizer’s strengths, including its global reach, to drive greater sustainability of the Global Established Pharma business over the long-term # Provides Pfizer additional expertise and key talent # The transaction is expected to have a compelling financial impact and create shareholder value Creating shareholder value through disciplined capital deployment |

This communication may be deemed to be solicitation material in respect of the proposed acquisition of Hospira. In connection with the proposed merger, Hospira intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Following the filing of the definitive proxy statement with the SEC, Hospira will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed merger. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE MERGER THAT HOSPIRA WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HOSPIRA AND THE PROPOSED MERGER. The preliminary proxy statement, the definitive proxy statement and other relevant materials in connection with the proposed merger (when they become available), and any other documents filed by Hospira with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC through the Investor Relations section of Hospira’s website, www.hospira.com, or by sending a request to: Investor Relations, Hospira, Inc., 275 North Field Drive, Dept. NLEG, Bldg. H1, Lake Forest, Illinois 60045.

Hospira and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Hospira’s stockholders with respect to the proposed merger. Information about Hospira’s directors and executive officers and their ownership of Hospira’s common stock is set forth in Hospira’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the SEC on February 12, 2015, and Hospira’s proxy statement for its 2014 Annual Meeting of Shareholders, which was filed with the SEC on March 21, 2014. Information regarding the identity of the potential participants, and their direct or indirect interests in the merger, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the proposed merger.

About Hospira

Hospira, Inc. is the world’s leading provider of injectable drugs and infusion technologies, and a global leader in biosimilars. Through its broad, integrated portfolio, Hospira is uniquely positioned to Advance Wellness™ by improving patient and caregiver safety while reducing healthcare costs. The company is headquartered in Lake Forest, Ill. Learn more at www.hospira.com.

Private Securities Litigation Reform Act of 1995 —

A Caution Concerning Forward-Looking Statements

Information provided and statements contained in this report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this report and the company assumes no obligation to update the information included in this report. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy and statements regarding the contemplated merger with Pfizer Inc. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these

factors, see the risk factors set forth in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the fiscal year ended December 31, 2014. Additional factors may include the effect of the announcement of the merger and related transactions on Hospira’s business relationships, operating results and business generally; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with Pfizer Inc., and the risk that the merger agreement with Pfizer Inc. may be terminated in circumstances that require Hospira to pay a termination fee to Pfizer Inc.; the outcome of any legal proceedings that may be instituted against Hospira related to the merger agreement with Pfizer Inc.; and the failure to satisfy conditions to completion of the merger with Pfizer Inc., including the receipt of all required regulatory approvals related to the merger with Pfizer Inc. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.