UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

| (Mark One) | | |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011 |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

COMMISSION FILE NUMBER 001-33484

|

HELICOS BIOSCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 05-0587367 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

One Kendall Square

Building 200

Cambridge, Massachusetts

(Address of principal executive offices) |

|

02139

(Zip Code) |

Registrant's telephone number, including area code:(617) 264-1800 |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value | | OTC Bulletin Board |

Securities registered pursuant to Section 12(g) of the Act:None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's Common Stock held beneficially or of record by stockholders who are not affiliates of the registrant, based upon the closing price of the Common Stock on June 30, 2011, as reported by the OTCQB Global Market, was approximately $6,119,963. For the purposes hereof, "affiliates" include all executive officers and directors of the registrant.

As of March 19, 2012, the Company had 87,196,489 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

HELICOS BIOSCIENCES CORPORATION (a development stage company)

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

2

Table of Contents

PART I

ITEM 1. BUSINESS OVERVIEW

Helicos BioSciences Corporation ("Helicos" or the "Company") is a life sciences company focused on innovative genetic analysis technologies and the monetization of that technology and related intellectual property. Helicos has developed a proprietary technology to enable the rapid analysis of large volumes of genetic material by directly sequencing single molecules of DNA or RNA. Our True Single Molecule Sequencing (tSMS)TM approach differs from current methods of sequencing DNA or RNA because it analyzes individual molecules of DNA directly instead of analyzing a large number of copies of the molecule which must be produced through complex sample preparation techniques. Our tSMS technology eliminates the need for costly, labor-intensive and time-consuming sample preparation techniques, such as amplification or cloning, which are required by other methods to produce a sufficient quantity of genetic material for analysis.

Our Helicos® Genetic Analysis Platform is designed to obtain sequencing information by repetitively performing a cycle of biochemical reactions on individual DNA or RNA molecules and imaging the results after each cycle. The platform consists of an instrument called the HeliScope™ Single Molecule Sequencer, an image analysis computer tower called the HeliScope™ Analysis Engine, associated reagents, which are chemicals used in the sequencing process, and disposable supplies. The information generated from using our tSMS products may lead to improved drug therapies, personalized medical treatments and more accurate diagnostics for cancer and other diseases.

As previously disclosed in our quarterly and periodic reports with the Securities and Exchange Commission, we have had limited operations to date and our activities have consisted primarily of raising capital, conducting research and development and recruiting personnel. Accordingly, we are considered to be in the development stage at December 31, 2011, as defined by the Financial Accounting Standards Board ("FASB"). We operate as one reportable segment. Helicos is a Delaware corporation and was incorporated on May 9, 2003. Furthermore, as of December 31, 2011 and March 23, 2012, we had $1.0 million and $34,000, respectively, in cash and cash equivalents.

As a result of several headcount reductions and restructurings during 2010, which eliminated approximately 60 positions, we entered the first quarter of 2011 with only 22 employees. In order to further conserve our limited resources, during the second quarter of 2011, we further reduced our workforce by phasing out six business and research positions. These six positions were phased out during the third quarter of 2011 and we ultimately reduced our total headcount to ten positions. In addition, during the third quarter of 2011, we entered into a new lease reducing the size and associated expense of our leased facility in Cambridge, Massachusetts which houses our headquarters and scientific laboratory.

Notwithstanding these most recent workforce reductions and despite our previous reductions, restructurings, expense saving measures, and the bridge loan facility (the "Bridge Debt Financing") contemplated by the Subordinated Secured Note Purchase Agreement (the "Note Purchase Agreement") we entered into in 2010 with investment funds affiliated with Atlas Venture and Flagship Ventures (the "Purchasers"), pursuant to which we agreed to sell to the Purchasers, and the Purchasers agreed to purchase, up to an aggregate of $4,000,000 of convertible promissory notes (the "Notes"), we do not have sufficient funds to operate our business. We continue to require significant additional capital on a month-to-month basis in order to continue our operations beyond the existing $2,000,000 committed portion of the Bridge Debt Financing. As of the date of this filing, all $2,000,000 has been drawn against this committed facility. Potential sources of additional funding may include funding from the $2,000,000 uncommitted portion of the Bridge Debt Financing facility and/or from other sources that have not yet been identified, but there can be no assurance that any such funding will be available on reasonable terms, if at all. The remaining uncommitted portion of funding under the Bridge Debt Financing facility of $1,625,000, if made available by the Purchasers in their sole discretion, is not

3

Table of Contents

sufficient to fund operations and related litigation expenses through the current planned September 2012 trial date and the ultimate resolution of the pending Patent Litigation. As of the date of this filing, $375,000 has been advanced under the uncommitted portion of the Bridge Debt Financing facility on a short term basis. The maturity date of the notes issued under the uncommitted portion of the Bridge Debt Financing facility is May 15, 2012. No further commitments beyond the current outstanding notes with a maturity date of May 15, 2012 have been made under the uncommitted portion of the Bridge Debt Financing facility. We are currently in active discussions with the Purchasers regarding the possibility of additional short-term financing to support Helicos' continued operations. The Company and Purchasers have not yet agreed on such financing and there can be no guarantee that we will obtain such financing or any other sources of funding or that Helicos can obtain any additional financing on terms favorable to Helicos or in amounts sufficient to meet Helicos' needs. As a result, we are no longer able to remain current in making payments to trade vendors and other unsecured creditors when such payments are due. Workforce reductions, as well as curtailed financial resources, will further impact our ability to operate our business. In addition, these constraints have caused us to significantly scale back service support and reagent supply to our current installed base. We have also significantly curtailed collaborative activities with other parties. Despite these measures, there cannot be any assurance that we will have sufficient resources to operate our business.

In January 2012, we made a final $1,070,000 payment on the senior debt facility pursuant to the Loan and Security Agreement among us, certain lenders and General Electric Capital Corporation, as agent, dated as of December 31, 2007, as amended (the "Loan Agreement"). As a result, our obligations under the Loan Agreement have been satisfied and the senior debt lenders no longer have a security interest in our assets, including our intellectual property assets.

We require substantial additional funding in order to continue our operations. If we are unable to successfully raise additional capital, we may have to cease operations and/or seek bankruptcy protection. If we are required to seek protection from our creditors through a bankruptcy filing, it is likely that there would be little or no assets available for payment or distribution to our stockholders, and that our stockholders will lose their entire investment in us. In addition, to seeking additional funding we are actively exploring a variety of strategic transactions, including the sale, license or other disposition of a portion of our assets in order to raise funding, or the potential sale of all or substantially all our assets or a sale of the Company. We believe it is very unlikely that stockholders would receive any significant value from any such transaction.

During 2011, we deployed our limited resources by focusing on intellectual property monetization and concentrating our research and development efforts in targeted areas designed to achieve tangible proof-of-concept goals, which were designed to enable us to seek partnership opportunities with companies interested in next-generation sequencing, or to pursue other funding and strategic alternatives. With a limited number of employees and resources, however, our ability to pursue research and development efforts in targeted areas proved unsuccessful and are unlikely to resume. Going forward, we are only able to focus our limited resources on intellectual property monetization and selected research and development activities that are primarily related to grant-funded initiatives and that support our limited sequencing services. In order to defend our intellectual property rights through licensing and enforcement strategies, we have taken several actions. First, on August 27, 2010, we filed a lawsuit against Pacific Biosciences of California, Inc. ("Pacific Biosciences") for patent infringement. The lawsuit, filed in the United States District Court for the District of Delaware (the "Court"), accuses Pacific Biosciences of infringing four patents and seeks injunctive relief and monetary damages. Second, on October 14, 2010, we announced the launch of a technology licensing program for our Single Molecule Sequencing and Sequencing-by-Synthesis intellectual property. Third, on October 22, 2010, we filed an amended complaint against Pacific Biosciences by naming Illumina, Inc. and Life Technologies Corporation as additional defendants. The amended lawsuit alleges that the defendants willfully infringe our patents in suit by using their respective technologies, sequencing systems and

4

Table of Contents

products which we allege are within the scope of one or more claims of our patents in suit. We are seeking a permanent injunction enjoining the defendants from further infringement as well as monetary and punitive damages, costs and attorneys' fees, interests and other relief as determined by the Court. See Part I, Item 3, Legal Proceedings, for more information regarding the litigation. We believe that the proceeds generated by these litigations (the "Patent Litigation"), if we are successful, could be substantial. There is no assurance that we will be successful in the Patent Litigation, and even in the event of a favorable outcome in this litigation there can be no assurance that there will be any proceeds remaining for common stockholders, as a result of various arrangements in place with professional service providers, bridge lenders, licensors and others. As of the date of this filing, we do not have adequate financial resources and will continue to need to generate additional funding from various sources including contract sequencing service projects, government grants and yet to be identified third party financing arrangements in order to continue our intellectual property monetization strategy. There can be no assurance that we will be able to generate the funding necessary to continue our intellectual property monetization strategy. If we are unable to execute our operations according to our plans and obtain additional financing, we will be forced to cease operations and/or seek bankrupty protection.

In connection with the Bridge Debt Financing and as security for our obligations under our contingency fee arrangement with outside intellectual property litigation counsel relating to the patent infringement lawsuit we filed against Pacific Biosciences of California, Inc., Illumina, Inc. and Life Technologies Corporation, we entered into a subordinated security agreement with outside intellectual property litigation counsel. Pursuant to this agreement, we agreed to grant outside intellectual property litigation counsel a priority security interest in the patent infringement lawsuit. Under the terms of the contingency fee arrangement, we are obligated to pay outside intellectual property litigation counsel up to 40% of the proceeds paid to us in connection with the settlement, judgment or other resolution of the cause of action that is the subject of the intellectual property litigation against Pacific Biosciences, Illumina and Life Technologies (an any recovery therefrom) (the "Cause of Action") or certain business transactions resulting from or relating to the patent infringement lawsuit. To date, we, and those providing professional services in connection with this patent litigation on a contingent basis have expended significant resources in pursuit of this intellectual property monetization effort and are expected to continue to do so going forward. There is no assurance that we will be successful in this litigation, and even in the event of a favorable outcome in this litigation there can be no assurance that there will be any proceeds remaining for common stockholders, as a result of various arrangements in place with professional service providers, bridge lenders, licensors and others.

As an inducement for the Purchasers to enter into the Bridge Debt Financing, we entered into a Risk Premium Payment Agreement, dated as of November 16, 2010, with the Purchasers (the "Risk Premium Agreement") Under the terms of the Risk Premium Agreement, we have agreed to pay the Purchasers the following portions of the consideration we receive (the "Payment Consideration") in Liquidity Transactions, as defined below: (i) until the aggregate Payment Consideration equals $10 million, 60% of the Payment Consideration; (ii) for aggregate Payment Consideration from $10 million to $20 million, 50% of the Payment Consideration; (iii) for aggregate Payment Consideration from $20 million to $30 million, 40% of the Payment Consideration; (iv) for aggregate Payment Consideration from $30 million to $40 million, 30% of the Payment Consideration; and (v) for aggregate Payment Consideration in excess of $40 million, 10% of the Payment Consideration (any such payments, "Risk Premium Payments"). For purposes of determining amounts payable under the Risk Premium Agreement, the Payment Consideration will not include amounts we use to first satisfy specified existing obligations, including obligations under the Loan Agreement, under professional contingency arrangements (including the contingency fee arrangement between us and Outside IP Litigation Counsel relating to the Cause of Action) and obligations that may arise under existing technology license agreements (the "Existing IP Licensing Agreements") between us and each of Arizona Technology Enterprises, Roche Diagnostics GMBH and Roche Diagnostics Corporation, and

5

Table of Contents

California Institute of Technology (as previously disclosed by us, under the Existing IP Licensing Agreements, we are obligated to pay license fees in connection with the licensing, sublicensing, legal settlements or sales of specified intellectual property or services provided to third parties ranging from a single digit percentage up to one-half of the income from those activities).

For purposes of the Risk Premium Agreement and subject to various provisions therein, the following shall constitute Liquidity Transactions: (A) the receipt by us of any payments from third parties relating to the intellectual property portfolio of the Company, including payments received as a license or other settlement in patent infringement litigation brought by us ("IP Licensing Events"); (B) a merger of the Company in which there is a change of control; and (C) the sale or exclusive license by us of all or substantially all of our assets or intellectual property

In approving the transactions relating to the Bridge Debt Financing, the Board approved a management incentive plan (the "Management Incentive Plan") pursuant to which participants in the Management Incentive Plan, including Dr. Ivan Trifunovich and Mr. Jeffrey Moore, will be entitled to receive, in the aggregate, an amount equal to 7.5% of certain payment consideration resulting from intellectual property licensing events. The specific terms of the Management Incentive Plan, administration and all payments to be made to management thereunder will be under the control and direction of the Board. The Bridge Debt Financing and Risk Premium Agreement and all of the transactions contemplated by those agreements were approved by an independent committee of the Board. In addition, Noubar B. Afeyan, PhD, who is the founder, a Managing Partner and the Chief Executive Officer of Flagship Ventures, and Peter Barrett, Ph.D., who is a Partner of Atlas Venture, abstained from the vote of the Board approving the transactions.

Please see Part I, Item 1A, in this Form 10-K, for a discussion of the risks related to ownership of our common stock.

Our future capital requirements will depend on many factors and we may require additional capital beyond our currently anticipated amounts. Any such required additional capital may not be available on reasonable terms, if at all, given our prospects, the current economic environment and restricted access to capital markets. The continued depletion of our resources may make future funding more difficult or expensive to attain. Additional equity financing may be dilutive to our stockholders; debt financing, if available, may involve significant cash payment obligations and covenants that restrict our ability to operate as a business; and strategic partnerships may result in royalties or other terms which reduce our economic potential from any adjustments to our existing long-term strategy. If we are unable to execute our operations according to our plans or to obtain additional financing, we may be forced to cease operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amount of reclassification of liabilities, or any adjustment that might be necessary should we be unable to continue as a going concern.

Since our inception, we have incurred losses and have not generated positive cash flows from operations. We expect our losses to continue for a considerable period of time. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and equity/(deficit). As of December 31, 2011 and March 23, 2012, we had $1.0 million and $34,000, respectively, in cash and cash equivalents. We will, on a month-to-month basis during 2012, require significant additional capital to continue our operations, As of the date of this filing, all amounts available under the $2,000,000 committed facility have been drawn and no additional funding under the committed facility is available to support ongoing operations. Potential sources of additional funding may include funding from the $2,000,000 uncommitted portion of the Bridge Debt Financing facility and/or from other sources that have not yet been identified. Although we are engaged in active discussions with the Bridge Debt lenders with regard to securing funding from the $2,000,000 uncommitted portion of the Bridge Debt facility and are also exploring other funding options with the Bridge Debt lenders, there can be no assurance that any such funding or other sources of funding will

6

Table of Contents

be available to us on reasonable terms, if at all. As of the date of this filing, $375,000 has been advanced under the uncommitted portion of the Bridge Debt Financing facility on a short term basis. The maturity date of the notes issued under the uncommitted portion of the Bridge Debt Financing facility is May 15, 2012. We are currently in active discussions with the Purchasers regarding the possibility of additional short-term financing to support Helicos' continued operations. The Company and Purchasers have not yet agreed on such financing and there can be no guarantee that we will obtain such financing or any other sources of funding or that Helicos can obtain any additional financing on terms favorable to Helicos or in amounts sufficient to meet Helicos' needs. If the Company is unable to execute its operations according to its plans and obtain additional financing, the Company will be forced to cease operations and/or seek bankruptcy protection. Because our present capital resources are not sufficient to fund our planned operations for a twelve month period as of the date of this Annual Report on Form 10-K for the year ended December 31, 2011, our current financial resources raise substantial doubt about our ability to continue as a going concern.

BACKGROUND ON DNA STRUCTURE AND FUNCTION

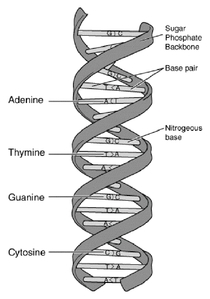

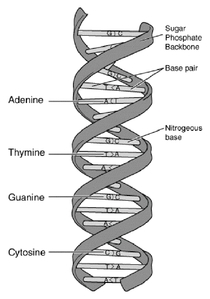

The genetic program that controls a living cell is encoded in its DNA. The diagram below shows the typical double-helix structure of DNA. The two strands are made of subunits called nucleotides, each of which contains a phosphate, a sugar and a side-chain called a base. The phosphates and sugars form the backbone of the polymer, and the bases face each other. The letters A, G, T and C represent the four types of nucleotide bases: adenine, guanine, thymine and cytosine.

| | |

The bases align with each other in a complementary structure held together by hydrogen bonds. A "T" on one strand always bonds with an "A" on the other strand, and a "G" on one strand always bonds with a "C" on the other strand. This bonding between DNA strands is called hybridization, and the resulting structure is called a base pair.

The genome of an organism is a complete DNA sequence of that organism. The human genome contains about three billion base pairs of DNA, which is represented twice in each cell. In a human, the individual acquires one version of the genome from the mother and one version from the father. |

|

|

The human genome includes approximately 30,000 genes. Genes are segments of DNA that contain the information needed for a cell to make proteins. Each gene has one or more parts called exons including coding regions that specify the sequence of amino acids for that protein. Genes also contain regulatory elements that determine when, where and how much protein is made. While it is currently understood that approximately 97% of the human genome does not code for proteins, recent research suggests that this non-coding DNA also contains important regulatory elements which play important roles in controlling when and how much genes are expressed. In addition, new knowledge reveals a wealth of information contained within the transcribed regions of the genome that do not make up protein coding genes but yet these non-coding RNAs are becoming increasingly important in the study of biology.

The process of making proteins using the information contained within DNA involves a process called gene expression. To express a gene, enzymes called RNA polymerases transcribe the coding region into molecules of messenger RNA, or mRNA. The mRNA moves from the nucleus into the cytoplasm, where the cell's protein synthesis machinery translates the genetic sequence information and assembles a chain of amino acids into a protein.

7

Table of Contents

GENETIC ANALYSIS INDUSTRY OVERVIEW

Genomic information has become a critical tool to understand the mechanics of life, the environmental effect on biological systems, as well as diagnosis and treatment of disease. Life science tools that analyze genomic material have provided tremendous insights into the complexity and variability of the genome and have changed the methods and strategies by which scientists conduct their research. Genomic information enables the possibility and promise of personalized medicine and should bring forth a new era in patient knowledge whereby individuals now can have access to their own genetic information to make informed decisions concerning the prevention and treatment of disease in partnership with their physician.

Since the development of genetic engineering techniques in the 1970s, the analysis of genetic material has become a mainstay of biological research. The first automated DNA sequencer was invented in 1986, based on technology developed by Frederick Sanger and his colleagues in 1975, which is commonly referred to as Sanger sequencing. Subsequent versions of commercial DNA sequencers have increased the speed of DNA sequencing by 3,000 fold, making possible the Human Genome Project. In 1996 the first commercial microarray was introduced and enabled a new era of RNA analysis by measuring gene expression across many genes in a single experiment. Subsequent versions of the commercial microarrays including DNA and RNA have significantly increased the amount of information per experiment and provided selected single nucleotide polymorphisms, or SNPs of the whole human genome on a single chip, enabled large scale genome-wide SNP association studies and have been commercialized for several diagnostic applications.

Since 2007, there has been significant replacement of both of these existing genetic analysis technologies with Next Generation Sequencers (NGS) and Single-Molecule Sequencing technologies, because the limitations of Sanger sequencing technologies, such as low throughput, high cost and complexity of use restricted their use in large-scale studies. Next generation DNA and cDNA sequencing have emerged to provide the most comprehensive genome-wide information without any prior knowledge of the sequence or sequence variation contained within experimental samples.

Nevertheless, as next generation sequencing technologies continue to improve the speed and reduce the per base cost of DNA sequencing, these instruments continue to be limited by their detection sensitivity, thereby requiring DNA amplification to obtain sufficient material to adequately read the sequence. As with Sanger-based sequencing technologies, this requirement for amplification adds to the cost and complexity of these sequencing methods, and presents limits on the scalability of sample preparation and may limit the accuracy of the data produced. Moreover, many NGS technologies appear to possess biases and are hampered by their lack of absolute quantitative accuracy which may limit their applicability to the broader genetic analysis space. Additionally, the practical application of sequence data for molecular diagnostics is still heavily burdened by the costs associated with NGS sample preparation workflows.

In the past, the prohibitive cost of high-volume sequencing at the genome scale has caused scientists to use other genetic analysis technologies to examine discrete aspects of gene structure or function. For example, researchers use gene expression analysis to compare amounts of mRNA made from different genes, and genotyping to examine specific gene segments known to contain sequence variations, called single nucleotide polymorphisms, or SNPs. Technologies available for gene expression analysis and genotyping include:

- •

- chip- or bead-based microarrays, in which collections of short DNA molecules are attached to the surface of a glass chip or to beads and used to determine the identity and abundance of particular DNA or RNA molecules in a sample; and

8

Table of Contents

- •

- real-time PCR, also called RT-PCR, which is the method of biochemically copying or amplifying the DNA in a sample through a process called PCR in which the identity and quantity of amplified DNA from the sample is measured as the analysis is performed.

While these other genetic analysis technologies address the cost limitations of DNA and RNA sequencing, they generally provide only limited information and suffer from a range of technical limitations, the most important of which is the high cost of replacement as new sequence information is added and products are updated. NGS technologies that enable a broad range of applications with a relatively similar sample preparation methodology and data analysis format would greatly enable the ability to perform both broad and deep studies of important biological samples. NGS technologies that do not require significant investments in up front automation and infrastructure would also allow large scale studies to be performed in mid to small sized laboratories as well as translational and diagnostic laboratories by allowing continuous use of the same capital equipment for each of the different genetic analysis applications.

The scope and pace of much important research, and the routine application of genomic information in clinical medicine, had been limited by the shear cost of data acquisition however today we have begun to see hope for patients. Dramatic NGS sequencing performance improvements have resulted in the declining cost of whole genome sequencing and now enable large scale experimentation not previously possible. Efforts to overcome this barrier have been supported by the National Institutes of Health, whose National Human Genome Research Institute established the "Revolutionary Genome Sequencing Technologies—The $1,000 Genome," grant program to fund researchers' efforts to develop technology to enable the complete sequencing of an individual human genome at a cost of approximately $1,000 along with the more recent Sequencing Technology Development Program representing NHGRI's Signature Project for the American Recovery and Reinvestment Act. This project was specifically designed to support large-scale, high impact research projects that are expected to accelerate critical scientific breakthroughs and enable growth and investment in biomedical research. We have been supported by grants, from both of these funding initiatives, which have been applied directly to the development of our single molecule sequencing technology. In April 2010, we were awarded an R01 Research Project Grant from the NHGRI for Direct RNA Sequencing and are eligible to receive reimbursement for our research expenses of up to $1.6 million through February 2013. In June 2010, we were awarded a Fast Track Phase 1 Small Business Innovation Research grant to pursue research related to the development of methods to sequence patient DNA and RNA samples at an attomole level. The phase 1 portion of the grant provides funding for eligible research expenses of up to $146,000 through November 2010. Subsequent to December 31, 2010 we received approval for Phase II Fast Track funding for an additional two years totaling approximately $1.5 million. Additionally, we received a $150,000 subcontract award for a Department of Homeland Security grant funded to the Midwest Research Institute to interrogate rare variant detection in bacterial samples using our single molecule sequencing technology. In October 2010, we were awarded three federal grants totaling approximately $722,000 under the Patient Protection and Affordable Care Act of 2010, of which $472,000 was received during the fourth quarter of 2010 and the balance was received during the first quarter of 2011. The costs associated with these grants were incurred in prior 2009 and 2010 fiscal periods. The grants were awarded under the Qualified Therapeutic Discovery Project (QTDP) aimed towards producing products that diagnose diseases or determine molecular factors related to diseases by developing molecular diagnostics to guide therapeutic decisions.

Scientists have long realized that many of the disadvantages of ensemble based sequencing could be addressed through the direct sequencing of single molecules. The ability to directly measure individual sequences has the potential to reduce the cost and complexity of large scale experiments while increasing sensitivity. The simplicity of the sample preparation and detection would also provide the capability to combine multiple application techniques in order to get the most comprehensive view of each sample. For nearly 20 years, researchers have attempted without success to develop such a

9

Table of Contents

single molecule sequencing technology. Past efforts fell short largely due to complexity or technological hurdles in signal detection, surface materials, biochemistry, enzymology, bioinformatics, automation or engineering. In 2003, one of our co-founders, Stephen R. Quake, DPhil, demonstrated, we believe for the first time, that sequence information could be obtained from single molecules of DNA. We have replicated and improved upon Professor Quake's approach to develop our True Single Molecule Sequencing (tSMS)™ technology. (Harris, T., et al., Single molecule DNA sequencing of a viral genome.Science 2008, 320:106-109; Bowers, J., et al. Virtual terminator nucleotides for next-generation DNA sequencing.Nat Methods 2009, 6:593-595.) However, while other parties continue to innovate new sequencing and related technologies, we are no longer able to keep pace due to our lack of sufficient financial and other resources. As a result, while competing technologies emerge and gain market acceptance through rapid development and consumer adoption, we have been unable to make meaningful technological advances.

HELICOS TECHNOLOGY

Our True Single Molecule Sequencing (tSMS)™ technology is a powerful approach that directly measures single molecules. This novel approach allows our system to directly analyze billions of individual sequences in parallel and avoids the need for complex sample preparation techniques, amplification or cloning required by other methods. Our products utilizing our tSMS technology benefit from simple, scalable sample preparation techniques and automated high-throughput sequencing processes that enable sequencing with speed and provide unprecedented quantitative accuracy. This technology was designed to provide scientists and clinicians with extensive capabilities for basic and translational research, for pharmaceutical research and development, and for the development and clinical application of genomic diagnostics.

Our Helicos® Genetic Analysis System (the "Helios System") was designed to provide the following benefits:

- •

- Enhanced single-molecule throughput. Scientists measure the throughput of a DNA sequencing technology based on the number of bases analyzed per unit of time. The HeliScope™ Single Molecule Sequencer has achieved throughput rates of approximately 180 million analyzable bases per hour, depending on the application. The HeliScope Sequencer remains the highest throughput single molecule platform providing sequence information on upwards of a billion nucleic acid molecules per run. In addition, we have designed the imaging capability of the HeliScope Sequencer to accommodate a maximum throughput approaching one billion bases per hour. To achieve this additional increase in throughput, we would need to improve the efficiency and accuracy of the system's sequencing chemistry, increase the density of strands of DNA that bind to the surface of the flow cell in which the sequencing reactions take place and make corresponding enhancements to the image processing software.

- •

- Simplicity of sampling preparation. Because the sample preparation process for genome sequencing using our HeliScope Sequencer involves only small quantities of reagents and a few simple steps, we believe that it will be less costly, less time-consuming, less error prone, and require lower amounts of starting material (without amplification) than the sample preparation processes used in current NGS technologies.

- •

- Scalability. The sample preparation process is highly scalable because it does not require the need for the costly automation of complex sample preparation techniques, amplification or cloning required by existing NGS methods and thus makes genomic scale studies possible in small to mid-sized research organizations.

During the initial research market commercialization phase of our business, our business plan, which we can no longer pursue due to our lack of adequate financial resources, was based on our belief that our Helicos System could be used as a universal method of genetic analysis potentially replacing

10

Table of Contents

existing methods of gene expression analysis and genotyping. Based on the quantitative performance exhibited by the HeliScope Sequencer, our business plan was based on the belief that the Helicos System was capable of performing applications of gene expression analysis at a comparable cost per sample, and in the case of high volume analyses, at lower cost, in comparison with then-current technologies. We believe, however, that performing expression analysis using the tSMS approach provides a more unbiased and accurate measurement of expression and reveals new insight into the complexity of the transcriptome (Kapranov et al 2010. New class of gene-termini-associated human RNAs suggests a novel RNA copying mechanism.Nature. 2010, 29: 642-6). In addition, although we do not have the financial resources to explore the application of Helicos' technology in the field of molecular diagnostics, we believe that Helicos' technology is uniquely suited for applications in molecular diagnostics. In particular, we believe that our platform's quantitative accuracy, the use of small sample quantities in simple preparation methods, and high throughput, as well as lack of biases typically seen with sample amplification, can be especially useful in the field of molecular diagnostics.

Our True Single Molecule Sequencing (tSMS)™ Technology

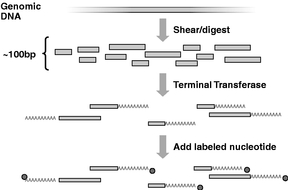

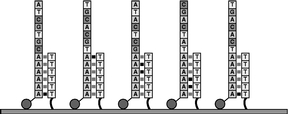

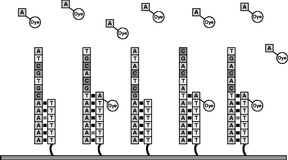

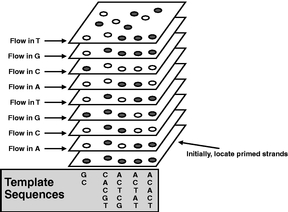

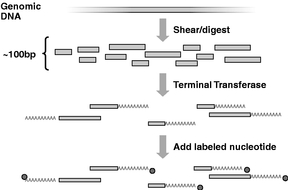

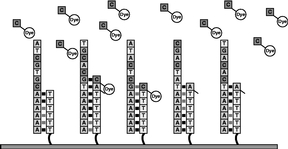

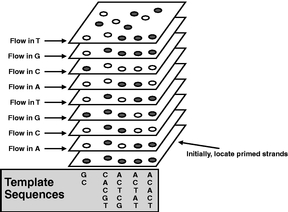

Our True Single Molecule Sequencing (tSMS)™ technology enables the simultaneous sequencing of large numbers of strands of single DNA or RNA molecules. The first step of our single molecule sequencing approach is to cut, or shear, a sample of DNA or RNA into relatively small fragments. The double helix of each fragment is then separated into its two complementary strands. Each strand is used as a template for synthesis of a new complementary strand. This is accomplished through a series of biochemical reactions in which each of the four bases are successively introduced. If the introduced base is complementary to the next base in the template, it will be added to the new strand. Each of the added bases is tagged with a fluorescent dye, which is illuminated, imaged and then removed. The sequence of each new DNA or RNA strand is determined by collating the images of the illuminated bases from each cycle of highly specific incorporation and imaging. The raw sequencing data is then analyzed by computer algorithms.

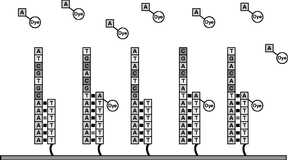

The series of figures below outlines an example of how our tSMS technology operates to sequence single molecules from genomic DNA. The actual process our HeliScope™ Single Molecule Sequencer will utilize to sequence DNA molecules will depend on the application. In September 2009 we published the first demonstration of the direct sequencing of RNA molecules which enables additional potentially significant areas of research and in 2010 published an extension of our work on direct RNA sequencing demonstrating genome surveys of polyadenylation maps in yeast and human RNAs.

| | |

Figure 1

To prepare the sample for sequencing, the genomic DNA is first cut into small pieces of about 100 bases. The enzyme called terminal transferase is then used to add a string of "A" nucleotides to one end of each strand. Then, a nucleotide labeled with a single fluorescent dye molecule is added to the end of the strand. |

|

|

11

Table of Contents

12

Table of Contents

| | |

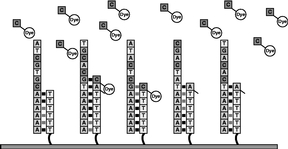

Figure 6

The process outlined in Figures 4 and 5 is repeated with each of the four types of labeled nucleotides. Repeating this cycle for a total of 120 times adds an average of more than 33-35 nucleotides to the primer strand. The number of bases added to a primer is the "read length." |

|

|

Figure 7

The system's computer analyzes the series of images from each cycle and determines the sequence of bases in the template strand. The sequence is "read" by correlating the position of a fluorescent molecule in its vertical track with the knowledge of which base was added at that cycle. Finally, the sequence data is exported to another computer system for further analysis depending on the application. |

|

|

The Helicos® Genetic Analysis Platform

The Helicos® Genetic Analysis Platform consists of the following components:

- •

- Helicos® Genetic Analysis System—The instrument component of the Helicos Genetic Analysis Platform consists of three major components:

- •

- The HeliScope™ Single Molecule Sequencer which performs the True Single Molecule Sequencing (tSMS)™ chemistry and directly analyzes images of single molecules, producing accurate sequences of billions of templates at a time. The HeliScope Sequencer consists of a high-speed mechanical stage and a laser illumination subsystem, an image acquisition subsystem, a fluid handling subsystem and computer subsystems that control and analyze the sequencing reactions. To operate the instrument, a user loads a prepared sample of DNA, complementary DNA (cDNA) or RNA onto our flow cell using the HeliScope™ Sample Loader, places the flow cell on the mechanical stage and inserts our consumable reagent pack into the fluid handling system. From that point onward, all sequencing reactions are conducted automatically by the instrument. After each base is added, the mechanical stage moves the flow cells under a microscope lens. Four lasers illuminate the fluorescent tags of the bases, and a camera images the flow cells through the microscope lens.

- •

- HeliScope™ Analysis Engine provides computing power for near real-time image analysis and on-board data storage. The on-board data storage is appropriately sized to support two complete runs, enabling flexibility of operation and maximizing uptime. The Analysis Engine operates downstream from the HeliScope™ Sequencer in the data pipeline. It consists of the System Server, Object Finders, and an uninterruptible power supply (UPS). Components are mounted in a single enclosure for locating convenience and installation ease. Data communication between the HeliScope Sequencer and Analysis Engine is accomplished across Gigabit Ethernet (GigE) lines, providing high reliability and allowing for considerable physical distance between components.

13

Table of Contents

- •

- HeliScope™ Sample Loader facilitates and speeds the loading of samples into the Helicos® flow cells. It provides 25 discreet loading ports to ensure proper separation of samples and ease of loading.

- •

- Helicos® True Single Molecule Sequencing (tSMS)™ Reagent Kits. Reagent kits for sequencing which consist of proprietary formulations of a DNA polymerase enzyme, our proprietary fluorescently tagged bases, our proprietary imaging reagent, a proprietary formulation of a cleavage reagent and our proprietary application specific flow cells that have a proprietary surface coating with the chemical and optical properties needed for single molecule sequencing.

Consumable reagents. The biochemical sequencing reactions that occur in the HeliScope Sequencer involve the use of a proprietary formulation of a DNA polymerase enzyme, proprietary fluorescently tagged bases and proprietary imaging reagents. We have developed proprietary nucleotide triphosphates, called Virtual Terminator™ Nucleotides that allow us to add only one base at a time to each DNA strand. Our proprietary imaging reagents improve the stability of our fluorescent tags and increase their brightness. Our cleavage reagents are used to remove the fluorescent tags from the Virtual Terminators nucleotides.

Disposable supplies. The HeliScope™ Single Molecule Sequencer is designed to perform sequencing reactions inside one or two glass flow cells. When two flow cells are used, the system alternates between the flow cells, performing sequencing reactions in one flow cell while recording images from the other. Each flow cell has an active area of about 16 square centimeters and contains 25 separate channels. Our flow cells are designed to allow researchers to sequence separate samples in each channel, which will enable the simultaneous sequencing of at least 50 different DNA, cDNA or RNA samples. Our flow cell is designed to permit binding of DNA strands at an average density of approximately 100 million strands of DNA per square centimeter, equaling an average of approximately 2.8 billion strands of DNA for both flow cells. In addition, we have other reagent kit and run configurations that allow customers to choose the use of 1 or 2 flow cells and between 1 and 50 channels, adjust the number of strands of DNA imaged, and select run times between 2.5 and 8 days.

SCIENTIFIC APPLICATIONS

Our ability to build genomic knowledge from patient samples to discover and inform healthcare options will require novel, simplified methods for gene sequencing derived from patient natural DNA as well as methods for the analysis of limiting quantities of nucleic acids derived from clinical samples, including, but not limited to, fine needle aspirates, circulating tumor cells and body fluids. Further, many patient specimens with linked clinical information have been collected and stored as formalin-fixed paraffin embedded tissues. The Helicos® Genetic Analysis System provides new opportunities for genomic studies which utilize limiting nucleic acid quantities and encompass many areas of research, development and diagnostic use. Our current limited commercialization and research and development efforts are focused on research efforts that are supported by existing grant funding and that support our limited sequencing services. These include:

- •

- Analysis of Small Sample Quantities: With funding from a Phase I SBIR Grant, Helicos has demonstrated the ability to perform experimentation not possible with other commercially available NGS platforms—maintaining the basic principles of simple sample preparation involving no amplification and minimal sample manipulation enabling experiments never before possible. The ability to work with attomole level nucleic acid as well as new technologies emerging from this work remain core to our business and allow competitive distinction for Helicos at this time. By enabling the analysis of small amounts of nucleic acid material, without the requirement for amplification, a number of commercial and scientific applications can be realized including: 1) the detection and analysis of small amounts of circulating tumor cells from bodily fluids will enable diagnostics for the early detection of cancer onset, 2) the ability to perform molecular analyses on rare and precious biomedical samples without consuming large

14

Table of Contents

amounts of the sample and without skewing the results by amplification will enable heretofore impossible retrospective clinical research, 3) the ability to manipulate and analyze degraded and damaged nucleic acid material will facilitate forensic studies, and 4) the potential for direct analysis of unculturable microorganisms, which represent over 80% of the earth's microbiome and are available in limited quantities, can be analyzed for the discovery and scientific insight into novel biological functions and the elucidation of pathogenic molecular pathways.

- •

- Direct RNA Sequencing: The traditional approaches to transcriptome analyses have been typically dependent on the creation of a cDNA intermediate, an indirect measurement of the RNA in the cell. A unique feature of the Helicos System is our ability to sequence RNA directly without amplification or cDNA conversion. This method can also be adapted for experiments where sample material is limiting. We currently focus on demonstrating the unique attributes of the data derived from this technology with collaborators across the globe.

- •

- Accurate Quantitation for RNA and DNA: Digital gene expression and RNA Sequencing provides a hypothesis free, global, and quantitative analysis of the transcriptome. Helicos single molecule sequencing method allows for the quantitative measurement of virtually all genes in a sample by counting the number of individual mRNA molecules produced from each gene. This allows one to examine all the genes present in a cell or tissue in a hypothesis independent manner with no bias toward the genes believed to be expressed. We believe the end result is a highly sensitive and quantitative measurement which will allow not only for the detection of highly expressed transcripts but also for the detection of very rare transcripts represented by only a few molecules of RNA per cell. Our DNA quantitation has focused on the application of quantitative analysis of the human genome for detection of copy number differences across the genome.

- •

- Ancient DNA Sequencing: Ancient DNA sequencing benefits from the unique attributes of the Helicos single molecule direct sequencing methods. DNA derived from tissue abstracts obtained from ancient remains may be degraded, heavily modified and contaminated with larger fragments of modern DNA. Traditional sequencing methods depend on ligation and amplification steps and typically enrich for the larger, modern DNA leading to low sequence yields of the ancient DNA of interest. With SMS methods, degraded ancient DNA is simply tailed and sequenced in the presence of the modern DNA and provides significant benefit in yield and sequence output for researchers.

RESEARCH AND DEVELOPMENT

We advanced the development of our True Single Molecule Sequencing (tSMS)™ technology since we began operations in 2003. In 2004, we began to produce sequence data from single molecules of DNA and in 2005, we sequenced genomic DNA from a small virus called M13 using our tSMS technology. Also in 2005, we began to design the Helicos® Genetic Analysis System. In 2006, we received a $2 million grant from the National Human Genome Research Institute and completed the design of the critical components of the Helicos System. In 2007, we substantially finished the assembly of five commercial grade Helicos Systems and began shipping our Helicos Systems to initial customers in 2008. Our initial shipment to our first customer, Expression Analysis, Inc. ("EA"), was made on March 5, 2008. This system was an early version and did not consistently achieve our commercial specification levels at EA and, as a result, on January 27, 2009, we agreed to have EA return the Helicos System that was installed at EA. Following EA's return of this system, our commercial relationship with EA was suspended. EA did not make any payments for this Helicos System that was ultimately returned.

In 2008, we introduced a second generation Virtual Terminator™ Nucleotides with improved performance and shelf-life and second generation image analysis software with improved performance. During 2010, we invested in limited research and development activities to maintain the performance of our Helicos System and develop new applications with the existing system. We do not plan to allocate a

15

Table of Contents

significant amount of resources to research and development activities beyond selected activities that are primarily related to grant-funded initiatives and to support our limited sequencing services.

In the years ended December 31, 2009, 2010, and 2011 we incurred $18.3 million, $14.0 million and $4.9 million respectively, of research and development expenses. Research and Development expense for fiscal years 2009, 2010 and 2011, included charges of $3.1 million, $2.6 million and $2.0 million, respectively, in connection with write-offs of certain inventory or accrual of non-cancellable purchase commitments for inventory items that are no longer used in the business and we included this charge in research and development expense.

MANUFACTURING AND RAW MATERIALS

As a result of our limited resources, we only manufacture a limited supply of consumables for our installed base of customers and internal usage requirements and no longer manufacture instruments.

MARKETING, SALES, SERVICE AND SUPPORT

As a result of our limited resources, we have significantly curtailed or eliminated our sales, marketing and service efforts. We expect that any revenues in the foreseeable future will be derived primarily from conducting research under grants that have been awarded to us, the sale of sequencing services to research institutions in the academic, clinical, governmental, pharmaceutical, biotechnology and agriculture biology segments, and from the sale of consumables to our installed base of customers. To date, we have instruments in operation at several research institutions including two academic centers, a genome center, a cancer center and two commercial locations. As of the date of this filing, we do not foresee commencing any efforts to sell new instruments.

COMPETITION IN THE GENETIC ANALYSIS MARKET

Competition among entities developing or commercializing instruments, research tools or services for genetic analysis is intense. A number of companies offer DNA sequencing equipment or consumables, including Life Technologies, Inc., Beckman Coulter, Inc., the Life Sciences Division of GE Healthcare, Illumina, Inc., Complete Genomics, Inc. and Roche Applied Science. Furthermore, a number of other companies and academic groups are in the process of developing novel techniques for DNA sequencing. These companies include, among others, Ion Torrent (recently acquired by Life Technologies Corporation), Genizon BioSciences, Intelligent Bio-Systems, Lucigen, Microchip Biotechnologies, Pacific Biosciences, Shimadzu Biotech, ZS Genetics, Oxford Nanopore, NabSys and IBM. For RNA analysis and/or genotyping there are a number of companies that offer equipment and supplies including Affymetrix, Inc., Agilent Technologies, Life Technologies Corporation (formerly Applera Corporation), Bio-Rad Laboratories, Luminex and Nanostring. Three companies provide a wide range of products that span both DNA and RNA analysis—Life Technologies, Corporation, Affymetrix, Inc. and Illumina, Inc. However, the solutions that are provided by these competitors are separate applications that require different sample preparation techniques, consumables, analysis software and instrumentation with limited correlation between platforms.

Many of these companies have substantially greater capital resources, research and product development capabilities and greater financial, scientific, manufacturing, marketing, and distribution experience and resources, including human resources, than we do. These companies may develop or commercialize genetic analysis technologies before us or that are more effective than those we are developing, and may obtain patent protection or other intellectual property rights that could limit our rights to offer genetic analysis products or services.

INTELLECTUAL PROPERTY

Developing and maintaining a strong intellectual property position is an important element of our business strategy. In light of our intensified focus on intellectual property monetization through

16

Table of Contents

licensing and enforcement strategies, this aspect of our business has become even more central to our strategy and operations. See Part I, Item 3, Legal Proceedings for further discussion relating to our patent infringement enforcement actions. To that end, we have increased the resources of outside legal counsel, and established a disciplined process of growing and broadening our intellectual property assets, which involves substantial management attention. Our patent portfolio relating to our proprietary technology is comprised, on a worldwide basis, of various patents and pending patent applications, which, in either case, we own directly or for which we are the exclusive or semi-exclusive licensee. A number of these patents and patent applications are foreign counterparts of U.S. patents or patent applications. Among other things, our patent estate includes patents and/or patent applications having claims directed to:

- •

- a broad array of next generation sequencing technologies based on sequencing-by-synthesis methods;

- •

- the overall True Single Molecule Sequencing (tSMS)™ method;

- •

- certain components of the Helicos® Genetic Analysis Platform, including our laser illumination subassembly, our flow cells and various methods for using our HeliScope Sequencer;

- •

- methods for focusing our lasers and imaging our flow cell surfaces, and our use of combinations of laser optical paths;

- •

- our Virtual Terminator™ Nucleotides and other nucleotides;

- •

- various aspects of our sample preparation processes;

- •

- algorithms for analysis of our data;

- •

- reagent formulations for imaging and for sequencing; and

- •

- methods that can be used in molecular diagnostic testing for making inferences about disease state and for improving accuracy.

Within broad technological categories, our patent portfolio can be broken down as follows: most of our issued (81%) and pending (60%) patents are directed to sequencing by synthesis, primarily at the single molecule level; the smallest portion of the patent portfolio (3% of issued patents and 3% of pending applications) involves bioinformatics and data processing; the remainder of the portfolio is roughly evenly split among sample preparation (6% of issued patents and 12% of pending applications), instrumentation (10% of issued patents and 11% of pending applications), and commercial applications (14% of pending patent applications). The last-mentioned of these groups—commercial applications—encompasses wide areas of scientific and commercial interest including direct RNA sequencing, single-cell analysis, high-throughput screening, digital gene expression, and candidate region re-sequencing.

Our patents generally have terms of 20 years from their respective non-provisional priority filing dates. The first non-provisional patent applications prosecuted by Helicos were filed in 2004 and thus our issued patents are not scheduled to expire until 2024 or later. We have filed terminal disclaimers in certain later-filed patents, which means that such later-filed patents are scheduled to expire earlier than the twentieth anniversary of their respective non-provisional priority filing dates, although not earlier than 2024 with respect to patent applications prosecuted by Helicos. We have also in-licensed patents and patent applications. All of the material patents and patent applications to which we have licensed rights are scheduled to expire in 2017 or later.

Patent law relating to the scope of claims in the technology field in which we operate is still evolving. The degree to which we will be able to protect our technology with patents, therefore, is uncertain. Others may independently develop similar or alternative technologies, duplicate any of our technologies and, if patents are licensed or issued to us, design around the patented technologies

17

Table of Contents

licensed to or developed by us. In addition, we could incur substantial costs in litigation if we are required to defend ourselves in patent suits brought by third parties or if we initiate such suits.

We regard as proprietary any technology that we or our exclusive licensors have developed or discovered, including technologies disclosed in our patent estate, and that was not previously in the public domain. Aspects of our technology that we consider proprietary may be placed into the public domain by us or by our licensors, either through publication or as a result of the patent process. We may choose for strategic business reasons to make some of our proprietary technology publicly available whether or not it is protected by any patent or patent application.

With respect to proprietary know-how that is not patentable and for processes for which patents are difficult to obtain or enforce, we may rely on trade secret protection and/or confidentiality agreements to protect our interests. While we require all employees, consultants, collaborators, customers and licensees to enter into confidentiality agreements, we cannot be certain that proprietary information will not be disclosed or that others will not independently develop substantially equivalent proprietary information.

In addition to our patents, patent applications, confidential know-how, and potential trade secrets, we license technology that we consider to be material to our business.

Roche License Agreement. In June 2004, we entered into a license agreement with Roche Diagnostics (the "Roche License Agreement") which granted us a worldwide, semi-exclusive royalty-bearing license, with the right to grant sublicenses under a patent relating to sequencing methods. In connection with the Roche License Agreement, we paid an upfront fee of 175,000 Euros and committed to pay an annual license fee ranging from 10,000 to 40,000 Euros. There are no milestone payments potentially payable by us under the Roche License Agreement in addition to those described above. We have an option to convert the license to non-exclusive beginning in 2008, in which case the annual license fees would be reduced to 10,000 Euros beginning in 2008. We have the right to terminate the Roche License Agreement at any time for convenience upon 90 days prior written notice to Roche Diagnostics. We both have the right to terminate the Roche License Agreement upon breach by the other party, subject to notice and an opportunity to cure. The Roche License Agreement also terminates upon the occurrence of specified bankruptcy events. As part of the Roche License Agreement, we agreed to pay single digit royalties based on a percentage of defined net sales. We also agreed to pay half of our income amounts that we receive based on sublicenses that we grant to third parties. Our royalty obligation, if any, extends until the expiration of the last-to-expire of the licensed patents. Through December 31, 2011, no royalty payments have been made. All license fee amounts paid to date have been expensed to research and development expense as technological feasibility had not been established and the technology had no alternative future use. The total expense recognized under the Roche License Agreement for the years ended December 31, 2009, 2010 and 2011, and the period from May 9, 2003 (date of inception) through December 31, 2011 was $54,000, $59,000, $58,000 and $538,000, respectively.

AZTE License Agreement. In March 2005, we entered into a license agreement with Arizona Technology Enterprises (the "AZTE License Agreement") that granted us a worldwide, exclusive, irrevocable, royalty-bearing license, with the right to grant sublicenses, under specified patents and patent applications exclusively licensed by AZTE from Arizona State University and the University of Alberta (the "Licensed Patents"). In connection with the AZTE License Agreement, we paid an upfront fee of $350,000, committed to an annual license fee of $50,000, which has increased to $100,000 upon the successful issuance of a U.S. patent, committed to pay a three-year maintenance fee of $50,000, payable in equal annual installments beginning in March 2006, and issued 88,888 shares of restricted common stock, which vest in two equal installments upon the achievement of separate milestones. There are no milestone payments potentially payable by us under the AZTE License Agreement in addition to those described above. We are obligated to use reasonable commercial efforts to develop, manufacture and commercialize licensed products. In addition, if we fail to use

18

Table of Contents

commercially-reasonable efforts to develop, manufacture and sell licensed products, the AZTE License Agreement converts from exclusive to non-exclusive. The AZTE License Agreement will remain in force until terminated. We have the right to terminate the AZTE License agreement at any time for convenience upon 60 days prior written notice to Arizona Technology Enterprises. We both have the right to terminate the agreement upon breach by the other party, subject to notice and an opportunity to cure. The AZTE License Agreement also terminates upon the occurrence of specified bankruptcy events.

As part of the AZTE License Agreement, we agreed to pay a single digit percentage royalty based on defined net sales. We also agreed to pay a mid-teens percentage of specified sublicense income amounts that are received based on sublicenses granted to third parties which increases to 30 percent after we receive an aggregate of $50,000 of such amounts. Our royalty obligation, if any, extends until the expiration of the last-to-expire of the Licensed Patents. Through December 31, 2011, no royalty payments have been made. All license fee amounts paid to date have been expensed to research and development expense as technological feasibility had not been established and the technology had no alternative future use. In May 2006, in accordance with the license agreement, due to the successful issuance of a U.S. patent, the committed annual license fee increased from $50,000 to $100,000 and 44,444 shares of the restricted common stock vested. The vesting of 44,444 shares of restricted common stock resulted in a charge to research and development expense of $127,000 based on the fair value of our common stock at the time the milestone was achieved. The remaining 44,444 shares of restricted common stock vested immediately upon the successful issuance of a second U.S. patent on January 12, 2010 and we recorded an expense of $54,000 associated with the vesting of these shares. The total expense recognized under the AZTE License Agreement for the years ended December 31, 2009, 2010 and 2011, and the period from May 9, 2003 (date of inception) through December 31, 2011 was $141,000, $154,000, $100,000 and $1,244,000, respectively.

On August 26, 2011, we entered into a First Amendment to the License Agreement (the "Amendment") with AZTE. The Amendment expanded the field under the AZTE License Agreement so that AZTE has now granted us the exclusive right and license under the Licensed Patents to the full extent of the entire scope of all claims within the Licensed Patents, in all fields of use. AZTE's license to us under the AZTE License Agreement (the "AZTE Licensed Rights"), gives us the rights to several issued patents covering sequencing-by-synthesis methods and a number of pending patent applications, now expressly includes detection methods that do not rely on the detection of optically-labeled nucleotides (the "Expanded Field"). Under the terms of the Amendment, we will remain obligated to pay AZTE a specified percentage of income from our-granted sublicenses or other transfers of the AZTE Licensed Rights, including as part of any sale of the Company or litigation settlement. Amounts we owe to AZTE will be a percentage of the proportionate value of the AZTE Licensed Rights in any such transaction. We also agreed to make additional payments to AZTE for Company-granted sublicenses or other such transfers of the AZTE Licensed Rights within the Expanded Field. We retain our existing first right to initiate and pursue patent infringement suits involving the AZTE Licensed Rights. There has been no expense recorded for this amendment for the period ending December 31, 2011.

Caltech License Agreement. In November 2003, we entered into a license agreement with California Institute of Technology (the "Caltech License Agreement") that granted us a worldwide, exclusive, royalty-bearing license, with the right to grant sublicenses, under specified patents and patent applications, and a worldwide, non-exclusive royalty bearing license, with the right to grant sublicenses, under specified technology outside the scope of the licensed patents. In connection with the Caltech License Agreement, we issued 46,514 shares of common stock, and recorded a charge of $20,000. In addition, we pay an annual license fee of $10,000 per year. The license fee payments are creditable against single digit royalties calculated upon sales of products covered by patents licensed under the agreement. We are also obligated to pay California Institute of Technology a single digit percentage of specified license and sublicense income, a single digit percentage of proceeds from sales of specified

19

Table of Contents

intellectual property and a single digit percentage of service revenue amounts that we receive based on licenses and sublicenses that we grant, sales of intellectual property and services that we provide to third parties. The royalty obligation with respect to any licensed product extends until the later of the expiration of the last-to-expire of the licensed patents covering the licensed product and three years after the first commercial sale of the licensed product in any country for non-patented technology covered under the agreement. Through December 31, 2011, no royalty payments have been made. In March 2007, we amended the Caltech License Agreement to provide rights under an additional patent application under the terms of the existing license in exchange for a one-time payment of $50,000 to the California Institute of Technology. There are no milestone payments potentially payable by us under the Caltech License Agreement in addition to those described above. All license fee amounts paid to date and the value of the common stock issued have been expensed to research and development expense as technological feasibility had not been established and the technology had no alternative future use. The total expense recognized under the Caltech License Agreement for the years ended December 31, 2009, 2010 and 2011, and the period from May 9, 2003 (date of inception) through December 31, 2011 was $10,000, $10,000, $10,000 and $143,000, respectively.

PerkinElmer License Agreement. In April 2007, we entered into an agreement with PerkinElmer LAS, Inc. ("PerkinElmer"), in which PerkinElmer granted us a worldwide, non-exclusive, non-transferable, non-sublicensable, royalty bearing license under specified patents. Our license from PerkinElmer grants us rights under certain patents to produce and commercialize certain of the reagents used in some applications on the Helicos System, which contain chemicals purchased from PerkinElmer. In exchange for rights licensed from PerkinElmer, we are obligated to pay PerkinElmer a single digit percentage of our net revenue from the sale of reagents that contain chemicals covered by the patents licensed under the PerkinElmer agreement. There are no milestone payments potentially payable by us under this agreement with PerkinElmer. We have the right to terminate the agreement at any time upon 90 days written notice to PerkinElmer. Each party has the right to terminate the agreement upon breach by the other party subject to notice and an opportunity to cure. The agreement also terminates upon the occurrence of specified bankruptcy events. PerkinElmer has the sole right under the agreement to enforce the licensed patents. There has been no expense recorded for this agreement for any period from May 9, 2003 (inception) through December 31, 2011.

See Note 7 to the Consolidated Financial Statements contained in this Form 10-K for additional information on license agreements.

GOVERNMENTAL REGULATION

We are subject, both directly and indirectly, to existing and potential future government regulation of our operations and markets. The life sciences industry, which is the market for our technology, has historically been heavily regulated. Our business is also directly affected by a wide variety of government regulations applicable to business enterprises generally and to companies operating in the life science industry in particular. Given the evolving nature of this industry, legislative bodies or regulatory authorities may adopt additional regulations that adversely affect our market opportunities. In particular, if we decide to market our diagnostic assays as laboratory developed tests ("LDTs") under Clinical Laboratory Improvement Amendments ("CLIA"), we will need to seek CLIA certification, and be subject to the requirements and oversight of the Centers for Medicare and Medicaid Services. We may not receive such certification in a timely fashion or at all. Furthermore, CLIA regulations may change over time and the U.S. Food and Drug Administration ("FDA") may ultimately decide to regulate the devices and methods we will use in the delivery of our LDTs.

20

Table of Contents

COMPLIANCE WITH ENVIRONMENTAL PROVISIONS

We are not materially affected by compliance with federal, state, and local environmental provisions which have been enacted or adopted to regulate the distribution of materials into the environment.

CORPORATE INFORMATION

We were incorporated in Delaware in May 2003. In 2003, one of our co-founders, Professor Stephen R. Quake, who was then at the California Institute of Technology, demonstrated, we believe for the first time, that sequence information could be obtained from a single strand of DNA. Shortly thereafter, Noubar Afeyan, Chief Executive Officer of Flagship Ventures, and Stanley Lapidus, then a Venture Partner at Flagship Ventures, met with Professor Quake and agreed to found a company to develop and commercialize technology based on Professor Quake's single molecule approach. Combining the experience of Professor Quake in single molecule methods, Dr. Afeyan in the sequencing technology and life sciences businesses, and Mr. Lapidus in diagnostics and entrepreneurship, we focused exclusively on the technical and commercial development of technology based on Professor Quake's approach. Professor Eric Lander, Director of the Broad Institute of MIT and Harvard, and a leader in the DNA sequencing field, provided helpful guidance and advice during our founding stages.

EMPLOYEES

We had 10 full-time employees at December 31, 2011. We have never had a work stoppage and none of our employees are covered by collective bargaining agreements. We believe our employee relations are good. Our continuing operations depends in large part on our ability to retain our existing employees.

AVAILABLE INFORMATION

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, definitive proxy statements on Form 14A, current reports on Form 8-K, and any amendments to those reports are made available free of charge on our website, www.helicosbio.com, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission (the "SEC"). Statements of changes in beneficial ownership of our securities on Form 4 by our executive officers and directors are made available on our website by the end of the business day following the submission to the SEC of such filings. In addition, the SEC's website, www.sec.gov, contains reports, proxy statements, and other information regarding reports that we file electronically with the SEC. During 2010, our securities were delisted from the NASDAQ Global Market and the trading of our common stock was suspended before the opening of business on November 16, 2010. A Form 25-NSE was subsequently filed with the SEC on January 21, 2011 which removed our securities from listing and registration on The NASDAQ Stock Market. The Company's securities are currently traded under the symbol "HLCS" on the OTCQB which is a market tier for OTC-traded companies that are registered and reporting with the SEC. Investors can now view real time stock quotes for HLCS at http://www.otcmarkets.com.

Item 1A. RISK FACTORS