UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21497

ALLIANCEBERNSTEIN CORPORATE SHARES

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: April 30, 2011

Date of reporting period: October 31, 2010

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMI-ANNUAL REPORT

AllianceBernstein

Corporate Income Shares

Semi-Annual Report

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

The investment return and principal value of an investment in the Fund will fluctuate as the prices of the individual securities in which it invests fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For a free copy of the Fund’s prospectus, which contains this and other information, visit our web site at www.alliancebernstein.com or call your financial advisor or AllianceBernstein® at (800) 227-4618. Please read the prospectus carefully before you invest.

You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s web site at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) web site at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s web site at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

December 14, 2010

Semi-Annual Report

This report provides management’s discussion of fund performance for AllianceBernstein Corporate Income Shares (the “Fund”) for the semi-annual reporting period ended October 31, 2010. Please note, shares of this Fund are offered exclusively through registered investment advisers approved by AllianceBernstein L.P. (the “Adviser”).

Investment Objective and Policies

The Fund’s investment objective is high current income.

The Fund invests, under normal circumstances, at least 80% of its net assets in US corporate bonds. The Fund may also invest in US Government securities (other than US Government securities that are mortgage-backed or asset-backed securities), repurchase agreements, forward contracts relating to US Government securities and US dollar-denominated fixed-income securities issued by non-US companies. The Fund normally invests all of its assets in securities that are rated, at the time of purchase, at least BBB- or the equivalent. The Fund will not invest in unrated corporate debt securities. The Fund has the flexibility to invest in long- and short-term fixed-income securities. In making decisions about whether to buy or sell securities, the Fund will consider, among other things, the strength of certain sectors of the fixed-income market relative to others, interest rates and other general market conditions and the credit quality of individual issuers. The Fund also may invest in convertible debt securities; invest up

to 10% of its assets in inflation-protected securities; invest up to 5% of its net assets in preferred stock; purchase and sell interest rate futures contracts and options; enter into swap transactions; invest in zero coupon securities and payment-in-kind debentures; and make secured loans of portfolio securities.

Investment Results

The table on page 5 shows the Fund’s performance compared to its benchmark, the Barclays Capital US Credit Bond Index, for the six- and 12-month periods ended October 31, 2010.

The Fund underperformed its benchmark for the six-month period ended October 31, 2010, before sales charges. The Fund’s overweight to higher beta securities—issues whose spreads tend to narrow or widen by more than the index average when the market moves—and overweight to the financial industry detracted from relative performance as risk aversion spiked in the second quarter. The Fund’s underweight to non-corporate sectors also detracted for the six-month period.

The Fund outperformed its benchmark for the 12-month period ended October 31, 2010, before sales charges. The Fund’s overweight to higher beta securities and overweight to financial sector contributed to positive relative returns for the 12-month period as credit markets recovered throughout most of 2010. Overall yield curve positioning and exposure to high yield were positive contributors for both periods. The Fund held no derivative positions during the reporting periods.

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 1 | |

Market Review and Investment Strategy

The global economic recovery continued in 2010 driven by strong gains in emerging-market economies. Import growth in emerging-market economies boomed, acting as an important catalyst in the recovery of industrialized economies. Concerns over sovereign debt in peripheral Europe and the potential for a double-dip in the US economy however rose in the second quarter dampening market sentiment. Worries about the fiscal position of Greece intensified, causing Greek sovereign bond spreads to sharply widen. These worries spread to other peripheral countries such as Spain and Portugal, while shares of French, German and Spanish banks came under pressure as concerns grew about their exposure to troubled government debt. Downgrades of Greece, Portugal and Spain by the rating agencies added to the anxiety along with renewed concern about Ireland.

Most fixed income sectors posted solid positive returns for the six month period with US investment grade credit returning 6.43%. Corporates at 6.48% modestly outperformed non-corporate holdings at 6.26% for the six-month period ended October 31, 2010. By credit quality, lower rated credit outperformed the higher quality tiers and longer maturity credit outperformed shorter maturities. By industry, REITs returned 7.97%, transportation rose 7.82% and communications increased 7.25%. Underperforming industries for the six-month period included

energy, returning 5.97%, banking increasing 6.11% and capital goods rising 6.15%. Return dispersion among industries markedly decreased as credit markets continued to recover. All returns are according to the Barclays Capital Indices.

The Fund’s Corporate Income Shares Investment Team (the “Team”) believes that investment-grade corporate debt today offers attractive risk-adjusted return potential. Yield spreads remain above long-term averages, and US investment-grade corporates have strong fundamentals, with ample cash on their balance sheets and declining leverage. Earnings growth for the third quarter was strong with approximately 72% of companies beating earnings expectations (compared with a long term average of 57%). Earnings in the S&P 500 were up an impressive 34% year over year, and 26% excluding financials.

The Team also believes that overall supply is supportive for corporate issues. Net investment-grade issuance is expected to fall well below that of recent years, and money continues to flow into bond funds as investors seek higher yields. In contrast to the favorable supply picture for corporate debt, net issuance of government debt has dramatically increased. As a result, corporate debt is making up an increasingly smaller share of total bond-market issuance. The corporate component’s share of the Barclays Capital US Aggregate Index has dropped close to its lowest level in a decade.

| | |

| 2 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

The Fund’s investment-grade corporate holdings are concentrated in higher-beta issues. In recent quarters, the Team has tempered some of the Fund’s most aggressive overweights in higher-beta issues, which include cyclical subsectors such as financials, consumer cyclicals and basic industry, further diversifying the Fund’s

corporate holdings. The Fund also remains overweight in BBB-rated corporates and retains modest positions in junior subordinated capital securities. Furthermore, the Team continues to focus the Fund’s corporate holdings on five- to 10-year maturities.

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 3 | |

HISTORICAL PERFORMANCE

An Important Note About the Value of Historical Performance

The performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by calling (800) 227-4618.

The investment return and principal value of an investment in the Fund will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

Benchmark Disclosure

The unmanaged Barclays Capital US Credit Bond Index does not reflect fees and expenses associated with the active management of a fund portfolio. The Barclays Capital US Credit Index represents the performance of the US credit securities within the US fixed income market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Price fluctuation in the Fund’s securities may be caused by changes in the general level of interest rates or changes in bond credit quality ratings. Please note, as interest rates rise, existing bond prices fall and can cause the value of an investment in the Fund to decline. Changes in interest rates have a greater effect on bonds with longer maturities than those with shorter maturities. Similar to direct bond ownership, bond funds have the same interest rate, inflation and credit risks that are associated with the underlying bonds owned by the Fund. This Fund can utilize leverage as an investment strategy. When a fund borrows money or otherwise leverages its portfolio, it may be volatile because leverage tends to exaggerate the effect of any increase or decrease in the value of a Fund’s investments. The Fund may create leverage through the use of derivatives. High yield bonds, otherwise known as “junk bonds,” involve a greater risk of default and price volatility than other bonds. Investing in below-investment grade securities presents special risks, including credit risk. Investments in the Fund are not guaranteed because of fluctuation in the net asset value of the underlying fixed-income related investments. The Fund is subject to liquidity risk because derivatives and securities involving substantial interest rate and credit risk tend to involve greater liquidity risk. While the Fund invests principally in bonds and other fixed-income securities, in order to achieve its investment objective, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. These risks are fully discussed in the Fund’s prospectus.

(Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

THE FUND VS. ITS BENCHMARK PERIODS ENDED OCTOBER 31, 2010 | | NAV Returns | | | | |

| | 6 Months | | | 12 Months | | | | |

AllianceBernstein Corporate Income Shares | | | 6.09% | | | | 13.88% | | | | | |

| | |

Barclays Capital US Credit Bond Index | | | 6.43% | | | | 11.17% | | | | | |

| | |

| Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions. | |

| | | | | | | | | | | | |

See Historical Performance and Benchmark disclosures on previous page.

(Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 5 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | |

AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (OCTOBER 31, 2010) | |

| | | Returns | |

1 Year | | | 13.88 | % |

3 Year | | | 9.45 | % |

Since Inception* | | | 7.88 | % |

| | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2010) | |

| | | Returns | |

1 Year | | | 15.10 | % |

3 Year | | | 9.69 | % |

Since Inception* | | | 8.02 | % |

The prospectus fee table shows the fees and the Total Fund Operating Expenses of the Fund as 0.00% because the Adviser does not charge any fees or expenses and reimburses Fund operating expenses. Participants in a wrap fee program eligible to invest in the Fund pay fees to the program sponsor and should review the wrap program brochure provided by the sponsor for a discussion of fees and expenses charged.

| * | | Inception Date: 12/11/06. |

See Historical Performance disclosures on page 4.

| | |

| 6 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Historical Performance

FUND EXPENSES

(unaudited)

As a shareholder of the Fund, you incur various ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2010 | | | Ending

Account Value

October 31, 2010 | | | Expenses Paid

During Period* | |

| | | Actual | | | Hypothetical | | | Actual | | | Hypothetical** | | | Actual | | | Hypothetical | |

| Class A | | $ | 1,000 | | | $ | 1,000 | | | $ | 1,060.87 | | | $ | 1,025.21 | | | $ | 0.00 | | | $ | 0.00 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.00%. The Fund’s expenses are borne by the Adviser or it affiliates. |

| ** | | Assumes 5% return before expenses. |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 7 | |

Fund Expenses

PORTFOLIO SUMMARY

October 31, 2010 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $31.3

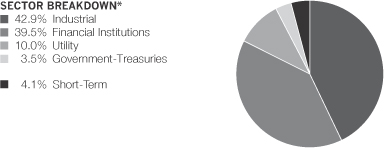

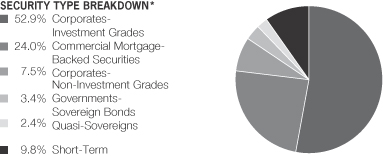

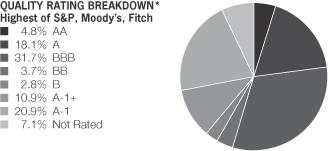

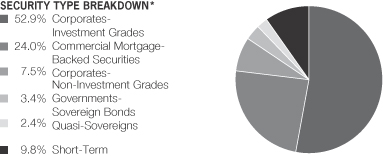

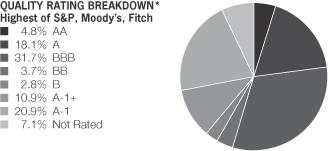

| * | | All data are as of October 31, 2010. The Fund’s sector breakdown is expressed as a percentage of total investments and may vary over time. |

Please note: The issuer classifications presented herein are based on the Barclays Capital Fixed Income Indices developed by Barclays Capital. The fund components are divided either into duration, country, bond ratings or corporate sectors as classified by Barclays Capital. These sector classifications are broadly defined. The “Portfolio of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Fund’s prospectus.

| | |

| 8 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

October 31, 2010 (unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

CORPORATES - INVESTMENT

GRADES – 87.2% | | | | | | | | |

Industrial – 40.4% | | | | | | | | |

Basic – 5.4% | | | | | | | | |

Alcoa, Inc.

5.72%, 2/23/19 | | $ | 130 | | | $ | 133,180 | |

AngloGold Ashanti Holdings PLC

5.375%, 4/15/20 | | | 90 | | | | 96,120 | |

ArcelorMittal

6.125%, 6/01/18 | | | 145 | | | | 158,580 | |

Commercial Metals Co.

7.35%, 8/15/18 | | | 80 | | | | 85,093 | |

Dow Chemical Co. (The)

7.375%, 11/01/29 | | | 195 | | | | 227,594 | |

Eastman Chemical Co.

7.25%, 1/15/24 | | | 135 | | | | 163,349 | |

Freeport-McMoRan Copper & Gold, Inc.

8.25%, 4/01/15 | | | 110 | | | | 117,838 | |

International Paper Co.

7.95%, 6/15/18 | | | 150 | | | | 183,408 | |

Lubrizol Corp.

8.875%, 2/01/19 | | | 95 | | | | 122,821 | |

Mosaic Co. (The)

7.625%, 12/01/16(a) | | | 80 | | | | 86,857 | |

Packaging Corp. of America

5.75%, 8/01/13 | | | 95 | | | | 102,922 | |

PPG Industries, Inc.

6.65%, 3/15/18 | | | 45 | | | | 54,309 | |

Teck Resources Ltd.

5.375%, 10/01/15 | | | 130 | | | | 144,613 | |

| | | | | | | | |

| | | | | | | 1,676,684 | |

| | | | | | | | |

Capital Goods – 3.9% | | | | | | | | |

Caterpillar, Inc.

7.375%, 3/01/97 | | | 280 | | | | 349,504 | |

CRH America, Inc.

5.30%, 10/15/13 | | | 170 | | | | 182,989 | |

General Electric Co.

5.25%, 12/06/17 | | | 230 | | | | 258,949 | |

Owens Corning

9.00%, 6/15/19 | | | 100 | | | | 121,223 | |

Republic Services, Inc.

5.50%, 9/15/19 | | | 145 | | | | 164,171 | |

Vulcan Materials Co.

7.00%, 6/15/18 | | | 140 | | | | 155,954 | |

| | | | | | | | |

| | | | | | | 1,232,790 | |

| | | | | | | | |

Communications - Media – 5.9% | | | | | | | | |

CBS Corp.

5.625%, 8/15/12 | | | 73 | | | | 77,848 | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 9 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

7.875%, 7/30/30 | | $ | 85 | | | $ | 100,314 | |

Comcast Cable Communications Holdings, Inc.

9.455%, 11/15/22 | | | 110 | | | | 156,216 | |

COX Communications, Inc.

5.875%, 12/01/16(a) | | | 135 | | | | 156,641 | |

DirecTV Holdings LLC/DirecTV Financing Co., Inc.

4.75%, 10/01/14 | | | 155 | | | | 170,147 | |

News America Holdings, Inc.

8.875%, 4/26/23 | | | 165 | | | | 226,927 | |

Omnicom Group, Inc.

6.25%, 7/15/19 | | | 115 | | | | 133,296 | |

RR Donnelley & Sons Co.

4.95%, 4/01/14 | | | 160 | | | | 167,250 | |

TCI Communications, Inc.

7.875%, 2/15/26 | | | 150 | | | | 186,315 | |

Time Warner Entertainment Co. LP

8.875%, 10/01/12 | | | 50 | | | | 56,780 | |

10.15%, 5/01/12 | | | 270 | | | | 304,654 | |

WPP Finance UK

8.00%, 9/15/14 | | | 100 | | | | 119,120 | |

| | | | | | | | |

| | | | | | | 1,855,508 | |

| | | | | | | | |

Communications - Telecommunications – 6.8% | | | | | |

American Tower Corp.

7.25%, 5/15/19 | | | 100 | | | | 119,750 | |

Ameritech Capital Funding Corp.

6.55%, 1/15/28 | | | 280 | | | | 291,366 | |

Bellsouth Capital Funding Corp.

7.12%, 7/15/97 | | | 395 | | | | 434,671 | |

Deutsche Telekom International Finance BV

5.875%, 8/20/13 | | | 190 | | | | 213,223 | |

Embarq Corp.

7.082%, 6/01/16 | | | 75 | | | | 85,638 | |

7.995%, 6/01/36 | | | 65 | | | | 71,020 | |

Qwest Corp.

7.625%, 6/15/15 | | | 55 | | | | 63,387 | |

8.875%, 3/15/12 | | | 110 | | | | 120,725 | |

Telecom Italia Capital SA

6.175%, 6/18/14 | | | 170 | | | | 189,939 | |

United States Cellular Corp.

6.70%, 12/15/33 | | | 135 | | | | 136,624 | |

Valor Telecommunications Enterprises

7.75%, 2/15/15 | | | 55 | | | | 57,063 | |

Verizon New York, Inc.

Series B

7.375%, 4/01/32 | | | 290 | | | | 332,063 | |

| | | | | | | | |

| | | | | | | 2,115,469 | |

| | | | | | | | |

Consumer Cyclical - Automotive – 1.2% | | | | | | | | |

Daimler Finance North America LLC

7.30%, 1/15/12 | | | 185 | | | | 198,050 | |

| | |

| 10 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

Harley-Davidson Funding Corp.

5.75%, 12/15/14(a) | | $ | 60 | | | $ | 64,649 | |

Johnson Controls, Inc.

5.50%, 1/15/16 | | | 105 | | | | 119,220 | |

| | | | | | | | |

| | | | | | | 381,919 | |

| | | | | | | | |

Consumer Cyclical - Entertainment – 1.3% | | | | | | | | |

Time Warner, Inc.

4.70%, 1/15/21 | | | 60 | | | | 64,559 | |

Turner Broadcasting System, Inc.

8.375%, 7/01/13 | | | 165 | | | | 192,575 | |

Viacom, Inc.

6.25%, 4/30/16 | | | 125 | | | | 147,984 | |

| | | | | | | | |

| | | | | | | 405,118 | |

| | | | | | | | |

Consumer Cyclical - Other – 1.2% | | | | | | | | |

Marriott International, Inc.

Series J

5.625%, 2/15/13 | | | 160 | | | | 173,348 | |

MDC Holdings, Inc.

5.50%, 5/15/13 | | | 43 | | | | 44,593 | |

Toll Brothers Finance Corp.

5.15%, 5/15/15 | | | 155 | | | | 158,641 | |

| | | | | | | | |

| | | | | | | 376,582 | |

| | | | | | | | |

Consumer Cyclical - Retailers – 1.8% | | | | | | | | |

AutoZone, Inc.

5.50%, 11/15/15 | | | 110 | | | | 123,701 | |

CVS Caremark Corp.

6.60%, 3/15/19 | | | 160 | | | | 194,531 | |

Kohl’s Corp.

6.25%, 12/15/17 | | | 85 | | | | 101,273 | |

Nordstrom, Inc.

7.00%, 1/15/38 | | | 120 | | | | 138,660 | |

| | | | | | | | |

| | | | | | | 558,165 | |

| | | | | | | | |

Consumer Non-Cyclical – 4.9% | | | | | | | | |

Altria Group, Inc.

9.25%, 8/06/19 | | | 85 | | | | 116,703 | |

9.70%, 11/10/18 | | | 75 | | | | 103,458 | |

Avon Products, Inc.

6.50%, 3/01/19 | | | 90 | | | | 110,155 | |

Bristol-Myers Squibb Co.

6.875%, 8/01/97 | | | 170 | | | | 198,892 | |

Bunge Ltd. Finance Corp.

5.35%, 4/15/14 | | | 90 | | | | 96,603 | |

ConAgra Foods, Inc.

9.75%, 3/01/21 | | | 100 | | | | 139,827 | |

Fortune Brands, Inc.

5.375%, 1/15/16 | | | 100 | | | | 106,969 | |

Kraft Foods, Inc.

6.50%, 11/01/31 | | | 140 | | | | 157,494 | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 11 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

McKesson Corp.

7.50%, 2/15/19 | | $ | 105 | | | $ | 131,444 | |

Newell Rubbermaid, Inc.

5.50%, 4/15/13 | | | 80 | | | | 87,064 | |

Reynolds American, Inc.

7.30%, 7/15/15 | | | 100 | | | | 117,038 | |

Whirlpool Corp.

8.60%, 5/01/14 | | | 130 | | | | 154,781 | |

| | | | | | | | |

| | | | | | | 1,520,428 | |

| | | | | | | | |

Energy – 4.8% | | | | | | | | |

Anadarko Petroleum Corp.

5.95%, 9/15/16 | | | 165 | | | | 180,452 | |

Hess Corp.

7.875%, 10/01/29 | | | 154 | | | | 195,591 | |

Marathon Oil Corp.

7.50%, 2/15/19 | | | 150 | | | | 193,174 | |

Nabors Industries, Inc.

9.25%, 1/15/19 | | | 85 | | | | 109,313 | |

Noble Energy, Inc.

8.25%, 3/01/19 | | | 98 | | | | 127,407 | |

Petro-Canada

6.05%, 5/15/18 | | | 135 | | | | 159,148 | |

Sunoco, Inc.

5.75%, 1/15/17 | | | 110 | | | | 116,777 | |

Valero Energy Corp.

9.375%, 3/15/19 | | | 115 | | | | 147,384 | |

Weatherford International Ltd.

9.625%, 3/01/19 | | | 110 | | | | 145,267 | |

Williams Cos., Inc. (The)

7.875%, 9/01/21 | | | 120 | | | | 143,398 | |

| | | | | | | | |

| | | | | | | 1,517,911 | |

| | | | | | | | |

Services – 0.4% | | | | | | | | |

Western Union Co. (The)

5.93%, 10/01/16 | | | 100 | | | | 117,051 | |

| | | | | | | | |

| | |

Technology – 2.1% | | | | | | | | |

Agilent Technologies, Inc.

5.00%, 7/15/20 | | | 13 | | | | 13,939 | |

Computer Sciences Corp.

5.00%, 2/15/13 | | | 125 | | | | 133,917 | |

Harris Corp.

5.00%, 10/01/15 | | | 90 | | | | 99,024 | |

Motorola, Inc.

6.50%, 11/15/28 | | | 125 | | | | 128,389 | |

Science Applications International Corp.

6.25%, 7/01/12 | | | 50 | | | | 54,196 | |

| | |

| 12 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

Xerox Corp.

6.40%, 3/15/16 | | $ | 185 | | | $ | 218,248 | |

| | | | | | | | |

| | | | | | | 647,713 | |

| | | | | | | | |

Transportation - Airlines – 0.2% | | | | | | | | |

Southwest Airlines Co.

5.25%, 10/01/14 | | | 65 | | | | 70,127 | |

| | | | | | | | |

| | |

Transportation - Services – 0.5% | | | | | | | | |

FedEx Corp.

8.00%, 1/15/19 | | | 100 | | | | 128,855 | |

Ryder System, Inc.

5.85%, 11/01/16 | | | 28 | | | | 31,588 | |

| | | | | | | | |

| | | | | | | 160,443 | |

| | | | | | | | |

| | | | | | | 12,635,908 | |

| | | | | | | | |

Financial Institutions – 37.3% | | | | | | | | |

Banking – 19.5% | | | | | | | | |

American Express Bank FSB

5.50%, 4/16/13 | | | 135 | | | | 147,228 | |

American Express Co.

7.00%, 3/19/18 | | | 45 | | | | 54,052 | |

Bank of America Corp.

5.42%, 3/15/17 | | | 400 | | | | 406,250 | |

BankAmerica Capital II

Series 2

8.00%, 12/15/26 | | | 137 | | | | 138,028 | |

BB&T Corp.

6.85%, 4/30/19 | | | 120 | | | | 145,962 | |

Bear Stearns Cos. LLC (The)

5.55%, 1/22/17 | | | 260 | | | | 284,294 | |

Capital One Financial Corp.

6.15%, 9/01/16 | | | 168 | | | | 186,385 | |

Citigroup, Inc.

4.875%, 5/07/15 | | | 320 | | | | 334,947 | |

5.00%, 9/15/14 | | | 305 | | | | 319,662 | |

6.125%, 8/25/36 | | | 115 | | | | 111,158 | |

Countrywide Financial Corp.

6.25%, 5/15/16 | | | 253 | | | | 269,852 | |

First Union Institutional Capital I

8.04%, 12/01/26 | | | 360 | | | | 370,404 | |

Goldman Sachs Group, Inc. (The)

6.00%, 6/15/20 | | | 345 | | | | 383,402 | |

6.125%, 2/15/33 | | | 275 | | | | 298,381 | |

HSBC Bank USA NA

4.625%, 4/01/14 | | | 145 | | | | 155,469 | |

JPMorgan Chase & Co.

3.40%, 6/24/15 | | | 175 | | | | 182,981 | |

4.95%, 3/25/20 | | | 235 | | | | 249,229 | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 13 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

KeyCorp

6.50%, 5/14/13 | | $ | 110 | | | $ | 121,042 | |

Manufacturers & Traders Trust Co.

5.629%, 12/01/21 | | | 270 | | | | 260,241 | |

Merrill Lynch & Co., Inc.

6.11%, 1/29/37 | | | 100 | | | | 95,198 | |

Morgan Stanley

5.50%, 7/24/20 | | | 475 | | | | 494,332 | |

7.25%, 4/01/32 | | | 130 | | | | 146,049 | |

SouthTrust Corp.

5.80%, 6/15/14 | | | 145 | | | | 160,056 | |

State Street Corp.

5.375%, 4/30/17 | | | 95 | | | | 109,089 | |

UBS AG/Stamford CT

5.875%, 12/20/17 | | | 170 | | | | 194,861 | |

Union Bank NA

5.95%, 5/11/16 | | | 290 | | | | 327,142 | |

Wells Fargo & Co.

4.375%, 1/31/13 | | | 45 | | | | 48,086 | |

4.625%, 4/15/14 | | | 100 | | | | 107,103 | |

| | | | | | | | |

| | | | | | | 6,100,883 | |

| | | | | | | | |

Brokerage – 0.7% | | | | | | | | |

Jefferies Group, Inc.

8.50%, 7/15/19 | | | 95 | | | | 112,175 | |

Schwab Capital Trust I

7.50%, 11/15/37 | | | 95 | | | | 100,402 | |

| | | | | | | | |

| | | | | | | 212,577 | |

| | | | | | | | |

Finance – 3.5% | | | | | | | | |

GE Capital Trust I

6.375%, 11/15/67 | | | 345 | | | | 341,119 | |

General Electric Capital Corp.

5.40%, 2/15/17 | | | 235 | | | | 259,642 | |

HSBC Finance Capital Trust IX

5.911%, 11/30/35 | | | 270 | | | | 257,850 | |

SLM Corp.

5.05%, 11/14/14 | | | 230 | | | | 227,125 | |

| | | | | | | | |

| | | | | | | 1,085,736 | |

| | | | | | | | |

Insurance – 10.8% | | | | | | | | |

Aetna, Inc.

6.00%, 6/15/16 | | | 100 | | | | 118,056 | |

Aflac, Inc.

3.45%, 8/15/15 | | | 15 | | | | 15,679 | |

Allstate Corp. (The)

6.125%, 5/15/37 | | | 35 | | | | 34,650 | |

Allstate Life Global Funding Trusts

5.375%, 4/30/13 | | | 140 | | | | 154,923 | |

Assurant, Inc.

5.625%, 2/15/14 | | | 110 | | | | 117,799 | |

| | |

| 14 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

Chubb Corp.

5.75%, 5/15/18 | | $ | 130 | | | $ | 150,205 | |

CIGNA Corp.

7.875%, 5/15/27 | | | 115 | | | | 135,995 | |

Coventry Health Care, Inc.

5.95%, 3/15/17 | | | 35 | | | | 35,717 | |

6.125%, 1/15/15 | | | 20 | | | | 21,027 | |

6.30%, 8/15/14 | | | 95 | | | | 101,054 | |

Genworth Financial, Inc.

6.515%, 5/22/18 | | | 115 | | | | 119,351 | |

Guardian Life Insurance Co. of America

7.375%, 9/30/39(a) | | | 75 | | | | 87,376 | |

Hartford Financial Services Group, Inc.

6.10%, 10/01/41 | | | 175 | | | | 157,599 | |

Humana, Inc.

6.45%, 6/01/16 | | | 90 | | | | 100,330 | |

Lincoln National Corp.

8.75%, 7/01/19 | | | 82 | | | | 105,736 | |

Markel Corp.

7.125%, 9/30/19 | | | 90 | | | | 102,954 | |

Marsh & McLennan Cos., Inc.

5.375%, 7/15/14 | | | 100 | | | | 109,076 | |

Metlife Capital Trust IV

7.875%, 12/15/37(a) | | | 250 | | | | 270,000 | |

Nationwide Mutual Insurance Co.

9.375%, 8/15/39(a) | | | 120 | | | | 140,744 | |

OneBeacon US Holdings, Inc.

5.875%, 5/15/13 | | | 105 | | | | 110,335 | |

Principal Financial Group, Inc.

7.875%, 5/15/14 | | | 135 | | | | 159,570 | |

Progressive Corp. (The)

6.375%, 1/15/12 | | | 110 | | | | 116,005 | |

Prudential Financial, Inc.

Series B

4.50%, 7/15/13 | | | 195 | | | | 208,236 | |

Swiss Re Solutions Holding Corp.

7.00%, 2/15/26 | | | 150 | | | | 162,655 | |

Travelers Cos., Inc. (The)

6.25%, 6/20/16 | | | 120 | | | | 142,899 | |

UnitedHealth Group, Inc.

4.875%, 3/15/15 | | | 140 | | | | 154,892 | |

WellPoint, Inc.

5.875%, 6/15/17 | | | 20 | | | | 23,090 | |

7.00%, 2/15/19 | | | 110 | | | | 133,845 | |

XL Capital Ltd.

6.25%, 5/15/27 | | | 105 | | | | 103,194 | |

| | | | | | | | |

| | | | | | | 3,392,992 | |

| | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 15 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

REITS – 2.8% | | | | | | | | |

Duke Realty LP

6.75%, 3/15/20 | | $ | 55 | | | $ | 62,041 | |

ERP Operating LP

5.25%, 9/15/14 | | | 165 | | | | 184,155 | |

HCP, Inc.

5.65%, 12/15/13 | | | 105 | | | | 114,833 | |

Health Care REIT, Inc.

6.20%, 6/01/16 | | | 145 | | | | 165,783 | |

Regency Centers LP

5.875%, 6/15/17 | | | 165 | | | | 181,160 | |

Simon Property Group LP

4.375%, 3/01/21 | | | 160 | | | | 163,934 | |

| | | | | | | | |

| | | | | | | 871,906 | |

| | | | | | | | |

| | | | | | | 11,664,094 | |

| | | | | | | | |

Utility – 9.5% | | | | | | | | |

Electric – 6.0% | | | | | | | | |

Allegheny Energy Supply Co. LLC

8.25%, 4/15/12(a) | | | 95 | | | | 102,647 | |

Ameren Corp.

8.875%, 5/15/14 | | | 105 | | | | 121,888 | |

Constellation Energy Group, Inc.

4.55%, 6/15/15 | | | 140 | | | | 151,471 | |

Consumers Energy Co.

Series D

5.375%, 4/15/13 | | | 105 | | | | 115,276 | |

Dominion Resources, Inc.

Series 06-B

6.30%, 9/30/66 | | | 235 | | | | 224,425 | |

DTE Energy Co.

6.35%, 6/01/16 | | | 130 | | | | 152,561 | |

FirstEnergy Corp.

Series C

7.375%, 11/15/31 | | | 157 | | | | 168,912 | |

Integrys Energy Group, Inc.

6.11%, 12/01/66 | | | 120 | | | | 112,350 | |

Nevada Power Co.

7.125%, 3/15/19 | | | 125 | | | | 154,401 | |

Nisource Finance Corp.

5.40%, 7/15/14 | | | 145 | | | | 162,334 | |

Oncor Electric Delivery Co. LLC

6.80%, 9/01/18 | | | 115 | | | | 140,306 | |

Potomac Electric Power Co.

6.50%, 11/15/37 | | | 115 | | | | 137,575 | |

Teco Finance, Inc.

6.572%, 11/01/17 | | | 110 | | | | 127,739 | |

| | | | | | | | |

| | | | | | | 1,871,885 | |

| | | | | | | | |

| | |

| 16 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

Natural Gas – 3.5% | | | | | | | | |

AGL Capital Corp.

5.25%, 8/15/19 | | $ | 105 | | | $ | 115,830 | |

CenterPoint Energy Resources Corp.

Series B

7.875%, 4/01/13 | | | 115 | | | | 132,434 | |

Colorado Interstate Gas Co.

6.80%, 11/15/15 | | | 115 | | | | 136,740 | |

Energy Transfer Partners LP

6.125%, 2/15/17 | | | 120 | | | | 133,508 | |

EQT Corp.

8.125%, 6/01/19 | | | 80 | | | | 98,430 | |

Kinder Morgan Energy Partners LP

7.40%, 3/15/31 | | | 95 | | | | 108,675 | |

Plains All American Pipeline LP

8.75%, 5/01/19 | | | 125 | | | | 159,616 | |

Southern Union Co.

7.60%, 2/01/24 | | | 60 | | | | 68,006 | |

Spectra Energy Capital LLC

8.00%, 10/01/19 | | | 120 | | | | 151,696 | |

| | | | | | | | |

| | | | | | | 1,104,935 | |

| | | | | | | | |

| | | | | | | 2,976,820 | |

| | | | | | | | |

Total Corporates - Investment Grades

(cost $25,409,508) | | | | | | | 27,276,822 | |

| | | | | | | | |

| | | | | | | | |

CORPORATES - NON-INVESTMENT

GRADES – 3.9% | | | | | | | | |

Industrial – 1.9% | | | | | | | | |

Basic – 0.6% | | | | | | | | |

United States Steel Corp.

6.05%, 6/01/17 | | | 105 | | | | 103,688 | |

Weyerhaeuser Co.

8.50%, 1/15/25 | | | 90 | | | | 99,108 | |

| | | | | | | | |

| | | | | | | 202,796 | |

| | | | | | | | |

Capital Goods – 0.7% | | | | | | | | |

Mohawk Industries, Inc.

6.875%, 1/15/16 | | | 100 | | | | 106,875 | |

Textron Financial Corp.

5.40%, 4/28/13 | | | 95 | | | | 99,833 | |

| | | | | | | | |

| | | | | | | 206,708 | |

| | | | | | | | |

Consumer Cyclical - Other – 0.4% | | | | | | | | |

Sheraton Holding Corp.

7.375%, 11/15/15 | | | 100 | | | | 112,375 | |

| | | | | | | | |

| | |

Consumer Non-Cyclical – 0.2% | | | | | | | | |

Universal Health Services, Inc.

7.125%, 6/30/16 | | | 65 | | | | 71,578 | |

| | | | | | | | |

| | | | | | | 593,457 | |

| | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 17 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| | |

| | | | | | | | |

Financial Institutions – 1.7% | | | | | | | | |

Banking – 0.8% | | | | | | | | |

Union Planters Corp.

7.75%, 3/01/11 | | $ | 176 | | | $ | 178,337 | |

Zions Bancorporation

5.65%, 5/15/14 | | | 75 | | | | 74,970 | |

| | | | | | | | |

| | | | | | | 253,307 | |

| | | | | | | | |

Finance – 0.2% | | | | | | | | |

International Lease Finance Corp.

5.625%, 9/20/13 | | | 65 | | | | 65,406 | |

| | | | | | | | |

| | |

Insurance – 0.7% | | | | | | | | |

American International Group, Inc.

6.25%, 3/15/37 | | | 220 | | | | 198,550 | |

| | | | | | | | |

| | | | | | | 517,263 | |

| | | | | | | | |

Utility – 0.3% | | | | | | | | |

Electric – 0.3% | | | | | | | | |

PPL Capital Funding, Inc.

Series A

6.70%, 3/30/67 | | | 105 | | | | 100,800 | |

| | | | | | | | |

| | |

Total Corporates - Non-Investment Grades

(cost $1,196,251) | | | | | | | 1,211,520 | |

| | | | | | | | |

| | | | | | | | |

GOVERNMENTS - TREASURIES – 3.5% | | | | | | | | |

United States – 3.5% | | | | | | | | |

U.S. Treasury Bonds

4.625%, 2/15/40

(cost $1,079,094) | | | 985 | | | | 1,093,043 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS – 4.1% | | | | | | | | |

Time Deposit – 4.1% | | | | | | | | |

State Street Time Deposit

0.01%, 11/01/10

(cost $1,274,000) | | | 1,274 | | | | 1,274,000 | |

| | | | | | | | |

| | |

Total Investments – 98.7%

(cost $28,958,853) | | | | | | | 30,855,385 | |

Other assets less liabilities – 1.3% | | | | | | | 404,701 | |

| | | | | | | | |

| | |

Net Assets – 100.0% | | | | | | $ | 31,260,086 | |

| | | | | | | | |

| (a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2010, the aggregate market value of these securities amounted to $908,914 or 2.9% of net assets. |

Glossary:

REIT – Real Estate Investment Trust

See notes to financial statements.

| | |

| 18 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Portfolio of Investments

STATEMENT OF ASSETS & LIABILITIES

October 31, 2010 (unaudited)

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $28,958,853) | | $ | 30,855,385 | |

Cash | | | 63 | |

Interest receivable | | | 497,900 | |

Receivable for shares of beneficial interest sold | | | 4,933 | |

| | | | |

Total assets | | | 31,358,281 | |

| | | | |

| Liabilities | | | | |

Payable for shares of beneficial interest redeemed | | | 49,857 | |

Dividends payable | | | 48,338 | |

| | | | |

Total liabilities | | | 98,195 | |

| | | | |

Net Assets | | $ | 31,260,086 | |

| | | | |

| Composition of Net Assets | | | | |

Shares of beneficial interest, at par | | $ | 29 | |

Additional paid-in capital | | | 33,043,170 | |

Undistributed net investment income | | | 74,130 | |

Accumulated net realized loss on investment transactions | | | (3,753,775 | ) |

Net unrealized appreciation on investments | | | 1,896,532 | |

| | | | |

| | $ | 31,260,086 | |

| | | | |

Net Asset Value Per Share—unlimited shares of beneficial interest authorized, $.00001 par value (based on 2,936,938 common shares outstanding) | | $ | 10.64 | |

| | | | |

See notes to financial statements.

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 19 | |

Statement of Assets & Liabilities

STATEMENT OF OPERATIONS

Six Months Ended October 31, 2010 (unaudited)

| | | | |

| Investment Income | | | | |

Interest | | $ | 874,087 | |

| | | | |

| Realized and Unrealized Gain on Investment Transactions | | | | |

Net realized gain on investment transactions | | | 441,383 | |

Net change in unrealized appreciation/depreciation of investments | | | 619,144 | |

| | | | |

Net gain on investment transactions | | | 1,060,527 | |

| | | | |

Net Increase in Net Assets from Operations | | $ | 1,934,614 | |

| | | | |

See notes to financial statements.

| | |

| 20 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Statement of Operations

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

October 31, 2010

(unaudited) | | | Year Ended

April 30,

2010 | |

| Increase in Net Assets from Operations | | | | | | | | |

Net investment income | | $ | 874,087 | | | $ | 3,087,579 | |

Net realized gain on investment transactions | | | 441,383 | | | | 148,192 | |

Net change in unrealized appreciation/depreciation of investments | | | 619,144 | | | | 11,746,902 | |

| | | | | | | | |

Net increase in net assets from operations | | | 1,934,614 | | | | 14,982,673 | |

| Dividends to Shareholders from | | | | | | | | |

Net investment income | | | (874,087 | ) | | | (3,087,579 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net decrease | | | (3,841,380 | ) | | | (34,848,331 | ) |

| | | | | | | | |

Total decrease | | | (2,780,853 | ) | | | (22,953,237 | ) |

| Net Assets | | | | | | | | |

Beginning of period | | | 34,040,939 | | | | 56,994,176 | |

| | | | | | | | |

End of period (including undistributed net investment income of $74,130 and $74,130, respectively) | | $ | 31,260,086 | | | $ | 34,040,939 | |

| | | | | | | | |

See notes to financial statements.

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 21 | |

Statement of Changes In Net Assets

NOTES TO FINANCIAL STATEMENTS

October 31, 2010 (unaudited)

NOTE A

Significant Accounting Policies

AllianceBernstein Corporate Shares (the “Trust”) was organized as a Massachusetts business trust under the laws of The Commonwealth of Massachusetts by an Agreement and Declaration of Trust (“Declaration of Trust”) dated January 26, 2004. The Trust is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company. The Trust operates as a “series” company currently having three separate portfolios: AllianceBernstein Corporate Income Shares (the “Portfolio”), AllianceBernstein Municipal Income Shares and AllianceBernstein Taxable Multi-Sector Income Shares. Each Portfolio is considered to be a separate entity for financial reporting and tax purposes. AllianceBernstein Corporate Income Shares commenced operations on December 11, 2006. AllianceBernstein Municipal Income Shares commenced operations on August 31, 2010. AllianceBernstein Taxable Multi-Sector Income Shares commenced operations on September 14, 2010. This report relates only to AllianceBernstein Corporate Income Shares. Prior to the commencement of investment operations on December 11, 2006, the Portfolio had no operations other than the sale to the Adviser of 10,000 Portfolio shares for $10 each for the aggregate amount of $100,000 on May 17, 2006.

Shares of the Portfolio are offered exclusively to holders of accounts established under wrap-fee programs sponsored and maintained by certain registered investment advisers approved by the Adviser. The Portfolio’s shares may be purchased at the relevant net asset value without a sales charge or other fee. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Portfolio.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Portfolio’s Board of Trustees.

In general, the market value of securities which are readily available and deemed reliable are determined as follows. Securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. Securities listed on more than one exchange are

| | |

| 22 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Notes to Financial Statements

valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed put or call options are valued at the last sale price. If there has been no sale on that day, such securities will be valued at the closing bid prices on that day; open futures contracts and options thereon are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; securities traded in the over-the-counter market (“OTC”) are valued at the mean of the current bid and asked prices as reported by the National Quotation Bureau or other comparable sources; U.S. government securities and other debt instruments having 60 days or less remaining until maturity are valued at amortized cost if their original maturity was 60 days or less; or by amortizing their fair value as of the 61st day prior to maturity if their original term to maturity exceeded 60 days; fixed-income securities, including mortgage backed and asset backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker/dealers. In cases where broker/dealer quotes are obtained, AllianceBernstein L.P. (the “Adviser”) may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security; and OTC and other derivatives are valued on the basis of a quoted bid price or spread from a major broker/dealer in such security. Investments in money market funds are valued at their net asset value each day.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Portfolio may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Portfolio values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Portfolio would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The U.S. GAAP disclosure requirements establish a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 23 | |

Notes to Financial Statements

independent of the Portfolio. Unobservable inputs reflect the Portfolio’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The following table summarizes the valuation of the Portfolio’s investments by the above fair value hierarchy levels as of October 31, 2010:

| | | | | | | | | | | | | | | | |

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Corporates—Investment Grades | | $ | – 0 | – | | $ | 27,276,822 | | | $ | – 0 | – | | $ | 27,276,822 | |

Corporates—Non-Investment Grades | | | – 0 | – | | | 1,211,520 | | | | – 0 | – | | | 1,211,520 | |

Governments—Treasuries | | | – 0 | – | | | 1,093,043 | | | | – 0 | – | | | 1,093,043 | |

Short-Term Investments | | | – 0 | – | | | 1,274,000 | | | | – 0 | – | | | 1,274,000 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | – 0 | – | | | 30,855,385 | | | | – 0 | – | | | 30,855,385 | |

Other Financial Instruments* | | | – 0 | – | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | | | | | |

Total | | $ | – 0 | – | | $ | 30,855,385 | | | $ | – 0 | – | | $ | 30,855,385 | |

| | | | | | | | | | | | | | | | |

| * | | Other financial instruments are derivative instruments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

3. Taxes

It is the Portfolio’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Portfolio’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Portfolio’s financial statements.

4. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Portfolio is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. The Portfolio amortizes premiums and accretes discounts as adjustments to interest income.

| | |

| 24 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Notes to Financial Statements

5. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Advisory Fee and Other Transactions with Affiliates

Under the terms of the Advisory Agreement, the Portfolio pays no advisory fee to the Adviser. The Adviser serves as investment manager and adviser of the Portfolio and continuously furnishes an investment program for the Portfolio and manages, supervises and conducts the affairs of the Portfolio, subject to the supervisions of the Portfolio’s Board of Trustees. The Advisory Agreement provides that the Adviser or an affiliate will furnish, or pay the expenses of the Portfolio for, office space, facilities and equipment, services of executive and other personnel of the Portfolio and certain administrative services.

The Portfolio has entered into a Distribution Agreement (the “Agreement”) with AllianceBernstein Investments, Inc., the Portfolio’s principal underwriter (the “Underwriter”), to permit the Underwriter to distribute the Portfolio’s shares, which are sold at their net asset value without any sales charge. The Underwriter receives no fee for this service. The Underwriter is a wholly owned subsidiary of the Adviser.

AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, acts as the Portfolios’ registrar, transfer agent and dividend-disbursing agent. ABIS registers the transfer, issuance and redemption of Portfolio shares and disburses dividends and other distributions to Portfolio shareholders. ABIS receives no fee for this service.

NOTE C

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the six months ended October 31, 2010 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding

U.S. government securities) | | $ | 4,558,238 | | | $ | 9,730,193 | |

U.S. government securities | | | 2,580,720 | | | | 1,831,120 | |

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Gross unrealized appreciation | | $ | 1,958,382 | |

Gross unrealized depreciation | | | (61,850 | ) |

| | | | |

Net unrealized appreciation | | $ | 1,896,532 | |

| | | | |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 25 | |

Notes to Financial Statements

NOTE D

Capital Stock

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares | | | | | | Amount | | | | |

| | | Six Months Ended

October 31, 2010

(unaudited) | | | Year Ended April 30, 2010 | | | | | | Six Months Ended

October 31, 2010

(unaudited) | | | Year Ended April 30, 2010 | | | | |

| | | | | | | | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 78,693 | | | | 498,687 | | | | | | | $ | 821,120 | | | $ | 4,670,365 | | | | | |

| | | | | | |

Shares redeemed | | | (446,458 | ) | | | (4,101,040 | ) | | | | | | | (4,662,500 | ) | | | (39,518,696 | ) | | | | |

| | | | | | |

Net decrease | | | (367,765 | ) | | | (3,602,353 | ) | | | | | | $ | (3,841,380 | ) | | $ | (34,848,331 | ) | | | | |

| | | | | | |

NOTE E

Risks Involved in Investing in the Portfolio

Interest Rate Risk and Credit Risk—Interest rate risk is the risk that changes in interest rates will affect the value of an Underlying Portfolio’s investments in fixed-income debt securities such as bonds or notes. Increases in interest rates may cause the value of the Portfolio’s investments to decline. Credit risk is the risk that the issuer or guarantor of a debt security, or the counterparty to a derivative contract, will be unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations. The degree of risk for a particular security may be reflected in its credit risk rating. Credit risk is greater for medium quality and lower-rated securities. Lower-rated debt securities and similar unrated securities (commonly known as “junk bonds”) have speculative elements or are predominantly speculative risks.

Indemnification Risk—In the ordinary course of business, the Portfolio enters into contracts that contain a variety of indemnifications. The Portfolio’s maximum exposure under these arrangements is unknown. However, the Portfolio has not had prior claims or losses pursuant to these indemnification provisions and expects the risk of loss thereunder to be remote. Therefore, the Portfolio has not accrued any liability in connection with these indemnification provisions.

NOTE F

Distributions to Shareholders

The tax character of distributions to be paid for the year ending April 30, 2011 will be determined at the end of the current fiscal year. The tax character of distributions paid during the fiscal years ended April 30, 2010 and April 30, 2009 were as follows:

| | | | | | | | |

| | | 2010 | | | 2009 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 3,087,579 | | | $ | 4,656,797 | |

Total taxable distributions | | | 3,087,579 | | | | 4,656,797 | |

| | | | | | | | |

Total distributions paid | | $ | 3,087,579 | | | $ | 4,656,797 | |

| | | | | | | | |

| | |

| 26 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Notes to Financial Statements

As of April 30, 2010, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 127,624 | |

Accumulated capital and other losses | | | (4,185,079 | )(a) |

Unrealized appreciation/(depreciation) | | | 1,267,309 | (b) |

| | | | |

Total accumulated earnings/(deficit) | | $ | (2,790,146 | )(c) |

| | | | |

| (a) | | On April 30, 2010, the Fund had capital loss carryforward of $4,185,079 of which $591,158 expires in 2016, $2,193,148 expires in 2017 and $1,400,773 expires in 2018. |

| (b) | | The difference between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales. |

| (c) | | The difference between book-basis and tax-basis components of accumulated earnings/(deficit) is attributable primarily to dividends payable. |

NOTE G

Change of Independent Registered Public Accounting Firm

On May 5, 2010, Ernst & Young LLP (“E&Y”) was selected as the Fund’s independent registered public accounting firm for the 2011 fiscal year. A majority of the Fund’s Board of Directors, including a majority of the Independent Directors, approved the appointment of E&Y. The predecessor independent registered public accounting firm’s reports on the Fund’s financial statements for each of the years ended April 30, 2009 and 2008 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During such fiscal periods and through May 5, 2010 there were no disagreements between the Fund and the predecessor independent registered public accounting firm on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which such disagreements, if not resolved to the satisfaction of the predecessor independent registered public accounting firm, would have caused them to make reference to the subject matter of the disagreement in connection with their reports on the financial statements for such periods.

NOTE H

Subsequent Events

Management has evaluated subsequent events for possible recognition or disclosure in the financial statements through the date the financial statements are issued. Management has determined that there are no material events that would require disclosure in the Portfolio’s financial statements through this date.

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 27 | |

Notes to Financial Statements

FINANCIAL HIGHLIGHTS

Selected Data For A Share Of Beneficial Interest Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

October 31,

2010 | | | Year Ended April 30, | | | December 11, 2006(a) to April 30, 2007 | |

| | | | 2010 | | | 2009 | | | 2008 | | |

| | | | |

Net asset value, beginning of period | | | $10.30 | | | | $8.25 | | | | $9.56 | | | | $9.89 | | | | $10.00 | |

| | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(b) | | | .28 | | | | .59 | | | | .57 | | | | .56 | | | | .21 | |

Net realized and unrealized gain (loss) on investment transactions | | | .34 | | | | 2.05 | | | | (1.31 | ) | | | (.33 | ) | | | (.11 | ) |

| | | | |

Net increase (decrease) in net asset value from operations | | | .62 | | | | 2.64 | | | | (.74 | ) | | | .23 | | | | .10 | |

| | | | |

Less: Dividends | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (.28 | ) | | | (.59 | ) | | | (.57 | ) | | | (.56 | ) | | | (.21 | ) |

| | | | |

Net asset value, end of period | | | $ 10.64 | | | | $ 10.30 | | | | $ 8.25 | | | | $ 9.56 | | | | $ 9.89 | |

| | | | |

Total Return | | | | | | | | | | | | | | | | | | | | |

Total investment return based on net asset value(c) | | | 6.09 | % | | | 32.72 | % | | | (7.76 | )% | | | 2.38 | % | | | 1.02 | % |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000’s omitted) | | | $ 31,260 | | | | $ 34,041 | | | | $ 56,994 | | | | $ 86,830 | | | | $ 89,127 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 3.94 | %(d) | | | 6.22 | % | | | 6.56 | % | | | 5.73 | % | | | 5.58 | %(d) |

Portfolio turnover rate. | | | 23 | % | | | 21 | % | | | 26 | % | | | 58 | % | | | 33 | % |

| (a) | | Commencement of operations. |

| (b) | | Based on average shares outstanding. |

| (c) | | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption on the last day of the period. Initial sales charges or contingent deferred sales charges are not reflected in the calculation of total investment return. Total return does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total investment return calculated for a period of less than one year is not annualized. |

See notes to financial statements.

| | |

| 28 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

Financial Highlights

BOARD OF TRUSTEES

| | |

| William H. Foulk, Jr.(1), Chairman | | Robert M. Keith, President and Chief Executive Officer Garry L. Moody(1) Marshall C. Turner, Jr.(1) Earl D. Weiner(1) |

| John H. Dobkin(1) | |

| Michael J. Downey(1) | |

D. James Guzy(1) Nancy P. Jacklin(1) | |

OFFICERS

| | |

Philip L. Kirstein, Senior Vice President and Independent Compliance Officer Douglas J. Peebles, Senior Vice President Lawrence J. Shaw(2), Senior Vice President Shawn E. Keegan(2) , Vice President | | Joel J. McKoan(2), Vice President Ashish C. Shah(2), Vice President Emilie D. Wrapp, Secretary Joseph J. Mantineo, Treasurer and Chief Financial Officer Phyllis J. Clarke, Controller |

| | |

Custodian and Accounting Agent State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111 Principal Underwriter AllianceBernstein Investments, Inc.

1345 Avenue of the Americas

New York, NY 10105 Transfer Agent AllianceBernstein Investor Services, Inc.

P.O. Box 786003

San Antonio, TX 78278-6003

Toll-Free (800) 221-5672 | | Legal Counsel Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004 Independent Registered Public Accounting Firm Ernst & Young LLP 5 Times Square New York, NY 10036 |

| (1) | | Member of the Audit Committee, the Governance and Nominating Committee and the Independent Directors Committee. Mr. Foulk is the sole member of the Fair Value Pricing Committee. |

| (2) | | The day-to-day management of, and investment decisions for, the Fund’s portfolio are made by the Corporate Income Shares Investment Team. Messrs. Shawn E. Keegan, Joel J. McKoan, Ashish C. Shah and Lawrence J. Shaw are the investment professionals primarily responsible for the day-to-day management of the Fund’s portfolio. |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 29 | |

Board of Trustees

THE FOLLOWING IS NOT PART OF THE SHAREHOLDER REPORT OR THE FINANCIAL STATEMENTS.

SUMMARY OF SENIOR OFFICER’S EVALUATION OF INVESTMENT ADVISORY AGREEMENT1

The following is a summary of the evaluation of the Investment Advisory Agreement between AllianceBernstein L.P. (the “Adviser”) and The AllianceBernstein Corporate Shares (the “Trust”) with respect to AllianceBernstein Corporate Income Shares (the “Portfolio”).2 The evaluation of the Investment Advisory Agreement was prepared by Philip L. Kirstein, the Senior Officer of the Trust, for the Trustees of the Trust, as required by the September 1, 2004 Assurance of Discontinuance (“AoD”) between the Adviser and the New York State Attorney General (the “NYAG”). The Senior Officer’s evaluation of the Investment Advisory Agreement is not meant to diminish the responsibility or authority of the Board of Trustees to perform its duties pursuant to Section 15 of the Investment Company Act of 1940 Act (the “40 Act”) and applicable state law. The purpose of the summary is to provide shareholders with a synopsis of the independent evaluation of the reasonableness of the advisory fees proposed to be paid by the Portfolio which was provided to the Trustees in connection with their review of the proposed approval of the continuance of the Investment Advisory Agreement.

The Senior Officer’s evaluation considered the following factors:

| | 1. | Advisory fees charged to institutional and other clients of the Adviser for like services; |

| | 2. | Advisory fees charged by other mutual fund companies for like services; |

| | 3. | Costs to the Adviser and its affiliates of supplying services pursuant to the advisory agreement, excluding any intra-corporate profit; |

| | 4. | Profit margins of the Adviser and its affiliates from supplying such services; |

| | 5. | Possible economies of scale as the Portfolio grows larger; and |

| | 6. | Nature and quality of the Adviser’s services including the performance of the Portfolio. |

These factors, with the exception of the first factor, are generally referred to as the “Gartenberg factors,” which were articulated by the United States Court of Appeals for the Second Circuit in 1982. The first factor is an additional factor required to be considered by the AoD. The Supreme Court recently held the Gartenberg decision was correct in its basic formulation of what Section 36(b) of

| 1 | | It should be noted that the Senior Officer’s fee evaluation was completed on October 21, 2010 and discussed with the Board of Trustees on November 2-4, 2010. |

| 2 | | Future references to the Portfolio do not include “AllianceBernstein.” |

| | |

| 30 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

the 40 Act requires: to face liability under Section 36(b), “an investment adviser must charge a fee that is so disproportionately large that it bears no reasonable relationship to the services rendered and could not have been the product of arms length bargaining.” Jones v. Harris Associates L.P., (No. 08-586), slip op. at 9, 559 U.S. 2010. In the Jones decision, the Court stated the Gartenberg approach fully incorporates the correct understanding of fiduciary duty within the context of Section 36(b) and noted with approval that “Gartenberg insists that all relevant circumstances be taken into account” and “uses the range of fees that might result from arms-length bargaining as the benchmark for reviewing challenged fees.”3

PORTFOLIO’S EXEMPTION FROM ADVISORY FEES OR EXPENSES

The Adviser proposed that the Portfolio pays no advisory fee to the Adviser for receiving the services to be provided pursuant to the Investment Advisory Agreement. The Portfolio is designed to serve the needs of the Adviser’s separately managed account (“SMA”) clients.4 Since SMA clients pay their wrap program provider a unitary fee for managing all investments of their portfolio, the Portfolio will not pay an advisory fee. The Adviser will also reimburse the Portfolio for all of its other operating expenses, except certain extraordinary expenses, taxes, brokerage costs and the interest on borrowed money.

The Portfolio’s net assets on September 30, 2010 are set forth below:

| | | | |

| Portfolio | | 09/30/10 Net Assets ($MM) | |

| Corporate Income Shares | | $ | 32.2 | |

The Portfolio, which offers only one no-load class of shares, is distributed through its principal underwriter, AllianceBernstein Investments, Inc. (“ABI”). Since the Portfolio is reimbursed by the Adviser for its operating expenses, the Portfolio does not have a distribution plan pursuant to Rule 12b-1 under the 40 Act. Set forth below are the Portfolio’s annual operating expenses in percentages:

| | | | |

| Annual Operating Expenses | | % | |

| Advisory Fees5 | | | 0.35 | % |

| Distribution Fees & Other Exp. | | | 0.00 | % |

| Fee Waiver / Reimbursements | | | -0.35 | % |

| | | | |

| Net Expenses | | | 0.00 | % |

| 4 | | The SMA clients currently employ the Adviser as one of several investment managers, and compensate the Adviser on the basis of all SMA assets managed, which would include assets of Corporate Income Shares. The Adviser’s current agreements with the SMA clients provide for payments to the Adviser. |

| 5 | | This amount reflects the portion of the wrap fee the expected initial client is expected to pay to the Adviser for managing and bearing all expenses of the Portfolio. |

| | | | |

| ALLIANCEBERNSTEIN CORPORATE INCOME SHARES • | | | 31 | |

| I. | ADVISORY FEES CHARGED TO INSTITUTIONAL AND OTHER CLIENTS. |

The advisory fees charged to investment companies which the Adviser manages and sponsors are normally higher than those charged to similar sized institutional accounts, including pension plans and sub-advised investment companies. The fee differential reflects, among other things, different services provided to such clients, and different liabilities assumed. Services provided by the Adviser to the Portfolio that are not provided to non-investment company clients include providing office space and personnel to serve as Fund Officers, who among other responsibilities make the certifications required under the Sarbanes-Oxley Act of 2002, and coordinating with and monitoring the Portfolio’s third party service providers such as Fund counsel, auditors, custodians, transfer agents and pricing services. The accounting, administrative, legal and compliance requirements for investment companies are more costly than those for institutional client assets due to the greater complexities and time required for investment companies. The Adviser also believes that it incurs substantial entrepreneurial risk when offering a new mutual fund since establishing a new mutual fund requires a large upfront investment and it may take a long time for the fund to achieve profitability since the fund must be priced to scale from inception in order to be competitive and assets are acquired one account at a time. In addition, managing the cash flow of an investment company may be more difficult than that of a stable pool of assets, such as an institutional account with little cash movement in either direction, particularly, if the fund is in net redemption and the Adviser is frequently forced to sell securities to raise cash for redemptions. However, managing a fund with positive cash flow may be easier at times than managing a stable pool of assets. Finally, in recent years, investment advisers have been sued by institutional clients and have suffered reputational damage both by the attendant publicity and outcomes other than complete victories. Accordingly, the legal and reputational risks associated with institutional accounts are greater than previously thought, although arguably still not equal to those related to the mutual fund industry.

Notwithstanding the Adviser’s view that managing an investment company is not comparable to managing other institutional accounts because the services provided are different, the Supreme Court has indicated consideration should be given to the advisory fees charged to institutional accounts with a similar investment style as the Portfolio.6 However, with respect to the Portfolio, the Adviser represented that there is no institutional product in the Adviser’s Form ADV that has a similar investment style as the Portfolio.

| 6 | | It should be noted that the Supreme Court stated that “courts may give such comparisons the weight that they merit in light of the similarities and differences between the services that the clients in question require, but the courts must be wary of inapt comparisons.” Among the significant differences the Supreme Court noted that may exist between services provided to mutual funds and institutional accounts are “higher marketing costs.” Jones v. Harris at 13. |

| | |

| 32 | | • ALLIANCEBERNSTEIN CORPORATE INCOME SHARES |

The Adviser represented that it does not sub-advise any registered investment company with a substantially similar investment style as the Portfolio.

| II. | MANAGEMENT FEES CHARGED BY OTHER MUTUAL FUND COMPANIES FOR LIKE SERVICES. |

Lipper, Inc., an analytical service that is not affiliated with the Adviser, compared the fees charged to the Funds with fees charged to other investment companies for similar services by other investment advisers.7,8 Each peer selected by Lipper had a similar fee arrangement as the Portfolio, which is to say that with respect to the Portfolio’s peers, all fund expenses, including management fees,9 were reimbursed by the investment adviser.