- UCTT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ultra Clean (UCTT) DEF 14ADefinitive proxy

Filed: 26 Apr 24, 5:22pm

| Filed by the Registrant ☒ | | | |

Filed by a Party other than the Registrant ☐ | | |

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials. | |||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Purposes: |

| • Elect our directors |

| • Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal 2024 |

| • Hold an advisory vote on executive compensation |

| • Conduct other business that may properly come before the annual meeting or any adjournment or postponement thereof |

Adjournments or Postponements |

| In the event of an adjournment, postponement or emergency that may change the annual meeting’s time, date or location, we will make an announcement, issue a press release or post information at www.uct.com/investors to notify stockholders, as appropriate. Information on or accessible through our website is not incorporated by reference in this Proxy Statement. |

| Important Notice Regarding The Availability Of Proxy Materials For The Stockholder Meeting To Be Held On May 22, 2024: This Proxy Statement, along with our 2023 Annual Report to Stockholders, is available on the following website: http://materials.proxyvote.com. |

| Sincerely, |

/s/ James P. Scholhamer James P. Scholhamer Chief Executive Officer April 25, 2024 |

| | | Date: May 22, 2024 Time: 12:30 p.m. Pacific Time |

| Virtual Meeting: | |||

| www.virtualshareholdermeeting.com/UCTT2024 | |||

| The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/UCTT2024, you must enter the control number found on your proxy card, voting instruction form or notice. | |||

| Who Can Vote: | |||

| March 28, 2024 is the record date for voting. Only stockholders of record at the close of business on that date may vote at the annual meeting or any adjournment thereof. | |||

| All stockholders are cordially invited to attend the meeting. At the meeting, you will hear a report on our business and have a chance to meet some of our directors and executive officers. | |||

| | | VOTE ONLINE |

| | | VOTE BY PHONE |

| | | VOTE BY MAIL Sign, date and return your proxy card in the postage-paid envelope. |

| | | VOTE DURING THE MEETING Whether you expect to attend the meeting or not, please vote electronically via the Internet or by telephone or by completing, signing and promptly returning the enclosed proxy card in the enclosed postage-prepaid envelope. You may change your vote and revoke your proxy at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement. |

| 1 |

| • | FOR the election of each of the named nominees for director; |

| • | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm; |

| • | FOR the approval of the compensation of our named executive officers; and |

| • | with respect to any other matter that may come before the annual meeting, as recommended by our Board of Directors or otherwise in the proxies’ discretion. |

| 2 |

| 3 |

| • | each person or group known by us to own beneficially more than five percent of our common stock; |

| • | each of our directors, director nominees and named executive officers individually; and |

| • | all directors and executive officers as a group. |

| | | SHARES OF COMMON STOCK BENEFICIALLY OWNED | ||||

| NAME AND ADDRESS OF BENEFICIAL OWNER | | | NUMBER | | | PERCENT |

| Greater than 5% Stockholders | | | | | ||

BlackRock, Inc.(1) | | | 7,201,258 | | | 16.1% |

55 East 52nd Street | | | | | ||

| New York, NY 10055 | | | | | ||

The Vanguard Group(2) | | | 4,360,555 | | | 9.8% |

| 100 Vanguard Boulevard | | | | | ||

| Malvern, PA 19355 | | | | | ||

Dimensional Fund Advisors L.P.(3) | | | 2,750,042 | | | 6.2% |

| 6300 Bee Cave Road | | | | | ||

| Austin, TX 78746 | | | | | ||

Frontier Capital Management(4) | | | 2,559,943 | | | 5.7% |

| 99 Summer Street | | | | | ||

| Boston, MA 02110 | | | | | ||

Swedbank Robur Fonder AB(5) | | | 2,434,224 | | | 5.5% |

| SE 105 34 | | | | | ||

| Stockholm, Sweden | | | | | ||

| Named Executive Officers, Directors and Director Nominees | | | | | ||

James P. Scholhamer(6) | | | 359,192 | | | * |

Sheri L. Savage(7) | | | 61,506 | | | * |

Vijayan S. Chinnasami(8) | | | 140,000 | | | * |

Christopher S. Cook(9) | | | 13,347 | | | * |

Jeffrey L. McKibben(10) | | | 8,228 | | | * |

Clarence L. Granger(11) | | | 97,134 | | | * |

Thomas T. Edman(11) | | | 34,196 | | | * |

David T. ibnAle(11) | | | 56,896 | | | * |

Emily M. Liggett(11) | | | 37,226 | | | * |

Ernest E. Maddock(11) | | | 34,396 | | | * |

Barbara V. Scherer(11) | | | 49,896 | | | * |

Jacqueline A. Seto(11) | | | 17,105 | | | * |

All Executive Officers and Directors as a Group (16 persons)(12) | | | 976,972 | | | 2.2% |

| * | Less than 1%. |

| (1) | Based on a Schedule 13G filed on January 22, 2024 with the SEC for the period ended December 29, 2023. |

| (2) | Based on a Schedule 13G filed with the SEC on February 13, 2024 for the period ended December 29, 2023. |

| (3) | Based on a Schedule 13G filed with the SEC on February 9, 2024 for the period ended December 29, 2023. |

| 4 |

| (4) | Based on a Schedule 13G filed with the SEC on February 14, 2024 for the period ended December 29, 2023. |

| (5) | Based on a Schedule 13G filed with the SEC on January 25, 2024 for the period ended December 29, 2023. |

| (6) | Includes (i) 8,001 performance restricted stock units that were scheduled to vest on March 15, 2024; (ii) 12,115 restricted stock units that were scheduled to vest on April 29, 2024; and (iii) 25,936 restricted stock units that were scheduled to vest on April 30, 2024. |

| (7) | Includes (i) 2,618 performance restricted stock units that were scheduled to vest on March 15, 2024; (ii) 2,053 restricted stock units that were scheduled to vest on March 25, 2024; (iii) 5,543 restricted stock units that were scheduled to vest on April 29, 2024; and (iv) 10,167 restricted stock units that were scheduled to vest on April 30, 2024. |

| (8) | No restricted stock units are scheduled to vest. |

| (9) | Includes (i) 7,127 restricted stock units that were scheduled to vest on April 29, 2024; and (ii) 6,220 restricted stock units that were scheduled to vest on April 30, 2024. |

| (10) | Includes (i) 2,771 restricted stock units that were scheduled to vest on April 29, 2024; and (ii) 3,628 restricted stock units that were scheduled to vest on April 30, 2024. |

| (11) | Includes 5,296 restricted stock awards that vest on May 17, 2024. |

| (12) | Consists of shares beneficially owned by our current executive officers and directors as of March 1, 2024, which include (i) 11,534 performance restricted stock units that were scheduled to vest on March 15, 2024; (ii) 2,908 restricted stock units that were scheduled to vest on March 25, 2024; (iii) 34,860 restricted stock units that were scheduled to vest on April 29, 2024; (iv) 64,945 restricted stock units that were scheduled to vest on April 30, 2024; and (v) 37,072 restricted stock awards that were scheduled to vest on May 17, 2024. |

| 5 |

•By telephone: | | | 510-576-4400 |

•By fax: | | | 510-576-4401 |

•In writing at our principal executive offices: | | | Ultra Clean Holdings, Inc. Attn: Secretary 26462 Corporate Avenue Hayward, CA 94545 |

| 6 |

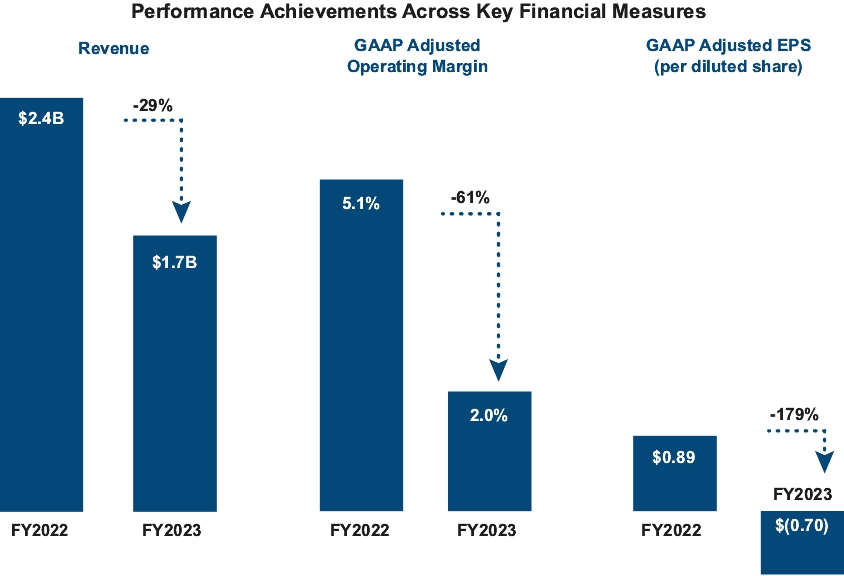

| • | Achieved revenue of $1.7 billion in 2023, compared to $2.4 billion in 2022. |

| • | GAAP operating margin was 2.0% in 2023, compared to 5.1% in prior year. Non-GAAP* operating margin was 4.9% in 2023, compared to 11.0% in 2022. Differences in annual results were mainly due to decreased efficiencies in lower volume of sales in 2023 compared to 2022. |

| • | GAAP earnings (loss) per share (“EPS”) was $(0.70) in 2023 and $0.89 in 2022. Non-GAAP EPS was $0.56 in 2023, compared to $3.98 in 2022. |

| 7 |

| • | Paid down $39 million in debt and repurchased $29 million of shares outstanding. During 2022 and 2023, UCT has paid down a total of $79 million in debt and repurchased $41 million of shares outstanding. |

| • | Completed the acquisition of HIS Innovations Group (“HIS”), a privately held company based in Hillsboro, Oregon. HIS is a leading supplier to the semiconductor sub-fab segment including the design, manufacturing, and integration of components, process solutions, and fully integrated sub-systems. The acquisition strengthens our leadership in developing and supplying critical products to the semiconductor industry and extends our reach into the sub-fab area. |

| • | Advanced global capacity while consolidating and modernizing operations into state-of-the-art, scalable facilities in strategic locations around the world. |

| 8 |

| | | YEARS ENDED | | | | | ||||||

| | | 12/29/2023 | | | 12/31/2022 | | | INCREASE (DECREASE) | | | % INCREASE (DECREASE) | |

| | | (DOLLARS ARE IN MILLIONS) | ||||||||||

| Revenues | | | $1,734.5 | | | $2,374.3 | | | $(639.8) | | | (26.9)% |

| Gross margin | | | 16.0% | | | 19.6% | | | (3.6)% | | | (18.4)% |

| Non-GAAP gross margin* | | | 16.6% | | | 20.2% | | | (3.6)% | | | (17.8)% |

| Income from operations | | | $35.2 | | | $120.4 | | | $(85.2) | | | (70.8)% |

| Non-GAAP income from operations* | | | $85.3 | | | $260.2 | | | $(174.9) | | | (67.2)% |

| Operating cash flow | | | $135.9 | | | $47.2 | | | $88.7 | | | 187.9% |

| Market capitalization at fiscal year end | | | $1,524.2 | | | $1,497.1 | | | $27.1 | | | 1.8% |

| * | Non-GAAP is adjusted for amortization of intangible assets, stock-based compensation, restructuring charges, acquisition activity costs, fair value adjustments, legal-related costs, VAT settlement, net loss on divestitures, Covid-19 related costs and the tax effects of the foregoing adjustments. See Appendix A for a reconciliation of income from operations to non-GAAP income from operations and gross margin to non- GAAP gross margin and for additional information about the non-GAAP measures we use in this proxy statement. |

| 9 |

| NAME | | | POSITION/OFFICE HELD WITH THE COMPANY | | | AGE | | | DIRECTOR SINCE |

| Clarence L. Granger | | | Chairman of the Board and Nominee for Director | | | 75 | | | 2002 |

| James P. Scholhamer | | | Chief Executive Officer, Director and Nominee for Director | | | 57 | | | 2015 |

| David T. ibnAle | | | Director and Nominee for Director | | | 52 | | | 2002 |

| Emily M. Liggett | | | Director and Nominee for Director | | | 68 | | | 2014 |

| Thomas T. Edman | | | Director and Nominee for Director | | | 61 | | | 2015 |

| Barbara V. Scherer | | | Director and Nominee for Director | | | 68 | | | 2015 |

| Ernest E. Maddock | | | Director and Nominee for Director | | | 66 | | | 2018 |

| Jacqueline A. Seto | | | Director and Nominee for Director | | | 58 | | | 2020 |

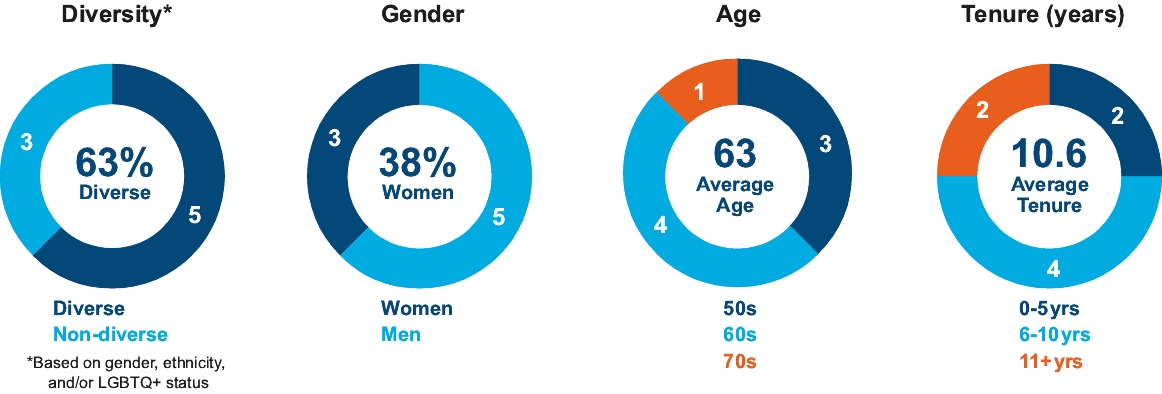

| Total Number of Directors | | | 8 |

| | | FEMALE | | | MALE | | | NON-BINARY | | | DID NOT DISCLOSE GENDER | |

| Part I: Gender Identity | | | | | | | | | ||||

| Directors | | | 3 | | | 5 | | | | | ||

| Part II: Demographic Background* | | | | | | | | | ||||

| African American or Black | | | | | 1 | | | | | |||

| Alaskan Native or Native American | | | | | | | | | ||||

| Asian | | | 1 | | | | | | | |||

| Hispanic or Latinx | | | | | | | | | ||||

| Native Hawaiian or Pacific Islander | | | | | | | | | ||||

| White | | | 1 | | | 3 | | | | | ||

| Two or More Races or Ethnicities | | | 1 | | | | | | | |||

| LGBTQ+ | | | | | 1 | | | | | |||

| Did Not Disclose Demographic Background | | | | | | | | |

| 10 |

| | | Clarence L. Granger — Chairman and Independent Director Director since 2002 Age: 75 Key qualifications and expertise considered by the Board in nominating this director: • Extensive knowledge of UCT’s business, strategy, people, operations, finances and competitive position in the semiconductor capital equipment industry as our former CEO • Executive leadership and vision • Global network of customer, industry and government relationships |

| Clarence L. Granger has served as our Chairman since October 2006. From 1996 to 2015, Mr. Granger served in multiple roles with UCT including Chief Operating Officer and Executive Vice President of Operations, culminating with 12 years as our Chief Executive Officer. Before joining UCT, Mr. Granger held executive management roles at Seagate Technology, HMT Technology and Xidex, including the position of Chief Executive Officer for HMT Technology. Mr. Granger has a B.S. in Industrial Engineering from the University of California at Berkeley and an M.S. in Industrial Engineering from Stanford University. | |||

| | | James P. Scholhamer — Chief Executive Officer and Director Director since 2015 Age: 57 Key qualifications and expertise considered by the Board in nominating this director: • Strong engineering and operations experience • Provides the Board of Directors with a unique perspective as Chief Executive Officer and leader of our strategic planning process |

| Before joining UCT as Chief Executive Officer in 2015, James P. Scholhamer served as Corporate Vice President and General Manager of Applied Materials, Inc., leading the Equipment Products Group and Display Services Group of its Global Service Division. Earlier at Applied Materials, Mr. Scholhamer served as Vice President of Operations-Energy for the Environmental and Display Products Division and Corporate Vice President and General Manager of the Display Business Group. Prior to joining Applied Materials, Mr. Scholhamer worked for Applied Films Corporation as Vice President of Operations, Engineering and Research Development and as Vice President of Thin Film Coating Division and Thin Film Equipment Division. Mr. Scholhamer holds a B.S. in Materials and Metallurgical Engineering from the University of Michigan. | |||

| 11 |

| | | David T. ibnAle — Independent Director Director since 2002 Age: 52 Key qualifications and expertise considered by the Board in nominating this director: • Expertise in corporate finance, accounting and strategy • Brings a thorough understanding of business management, including investment, corporate strategy and mergers and acquisitions to UCT’s growth initiatives • Qualifies as a financial expert and provides important support as a member of our Audit Committee |

| David T. ibnAle is a Founding and Managing Partner of Advance Venture Partners LLC. He has 26 years of experience as an investor in high-growth technology companies. Before co-founding AVP, Mr. ibnAle was a Managing Director of TPG Growth, the growth equity and middle-market investment platform of TPG. Prior to joining TPG Growth, he was an investment professional and Partner at Francisco Partners and an investment professional at Summit Partners. Mr. ibnAle has served on the Boards of Directors of several public and private technology companies, and currently serves on the Boards of Affinity, Alto Solutions, AutoLeap, Morning Consult, Nativo and UrbanSitter. Mr. ibnAle also serves as Vice Chair of the Board of Trustees and as Chair of the Investment Committee of the San Francisco Foundation and on the Board of Directors and Investment Committee of the Black Economic Alliance Venture Fund. Mr. ibnAle holds a B.A. in Public Policy and an M.A. in International Development Policy from Stanford University, and an M.B.A. from the Stanford University Graduate School of Business. | |||

| | | Emily Liggett — Independent Director Director since 2014 Age: 68 Key qualifications and expertise considered by the Board in nominating this director: • CEO and management experience in a variety of technical industrial companies • International perspective; has managed worldwide businesses, partnerships, and international joint ventures • Expertise in strategy, operations, new product development, sales, marketing, and business development for highly technical businesses |

| Emily Liggett is the Founder and Chief Executive Officer of Liggett Advisors, a strategy/implementation consulting business, since 2017. Previously, Ms. Liggett was CEO of NovaTorque, Inc., CEO of Apexon, CEO of Capstone Turbine and CEO of Elo TouchSystems. Before these roles, she held assignments in sales, marketing, operations and general management at Raychem Corporation, including GM of the Raychem Telecommunications Division. Ms. Liggett is presently a director of Materion Corporation. She was previously a director of Kaiser Aluminum, MTS Systems Corporation and of Immersion Corporation, and serves on the Purdue Research Foundation Board of Directors. As a board member, Ms. Liggett has developed expertise in oversight of corporate sustainability matters including environmental, social and governance best practices and implementation. Ms. Liggett has a B.S. in Chemical Engineering from Purdue University, an M.S. degree in Manufacturing Systems and an M.B.A. from Stanford University. | |||

| | | Thomas T. Edman — Independent Director Director since 2015 Age: 61 Key qualifications and expertise considered by the Board in nominating this director: • Business acumen and experience in the technology industry with sizeable companies, including as CEO of a public company • Extensive experience in Asia and with compensation matters |

| Thomas T. Edman is currently Chief Executive Officer of TTM Technologies Inc. since 2014 and has been a member of its Board of Directors since 2004. Mr. Edman held multiple management roles at Applied Materials Inc., including Group Vice President and General Manager of the AKT Display Business Group and Corporate Vice President of Corporate Business Development. Before that he served as President and CEO of Applied Films Corporation and also as General Manager of the High Performance Materials Division of Marubeni Specialty Chemicals Inc. Mr. Edman is currently the Chairman of the IPC, a trade association for the electronics manufacturing industry. Mr. Edman holds a B.A. in East Asian Studies (Japan) from Yale University and an M.B.A. from The Wharton School at the University of Pennsylvania. | |||

| 12 |

| | | Barbara V. Scherer — Independent Director Director since 2015 Age: 68 Key qualifications and expertise considered by the Board in nominating this director: • Extensive experience in the technology industry, including significant operational expertise • Practical and strategic insight into complex financial reporting and management issues |

| Barbara V. Scherer’s career spans more than 30 years, including 25 years in senior financial leadership roles in the technology industry. Previously, she was Senior Vice President, Finance and Administration and Chief Financial Officer of Plantronics Inc. from 1998 to 2012. Before Plantronics, she held executive management positions spanning 11 years in the disk drive industry, was an associate with The Boston Consulting Group and was a member of the corporate finance team at ARCO. Ms. Scherer is a member of the Board of Directors of NETGEAR Inc. a former chair of the audit committee and current chair of the compensation committee. She previously served as a director of Ansys Inc., chairing the audit committee from 2018-2022. She also served as a director of Keithley Instruments Inc., chaired audit committee from 2008-2010, and has experience serving on the boards of nonprofit organizations. Ms. Scherer received a B.A. from the University of California at Santa Barbara and an M.B.A. from the School of Management at Yale University. | |||

| | | Ernest E. Maddock — Independent Director Director since 2018 Age: 66 Key qualifications and expertise considered by the Board in nominating this director: • Practical and strategic insight into complex financial reporting and management issues • Significant operational expertise • Knowledge of critical drivers across the semiconductor ecosystem |

| Ernest E. Maddock has held leadership positions at multiple global companies during his career. Mr. Maddock served as Senior Vice President and Chief Financial Officer at Micron Technology from 2015 until his retirement in 2018. Prior to joining Micron, Mr. Maddock served as Executive Vice President and Chief Financial Officer of Riverbed Technology. Before joining Riverbed, he spent 15 years at Lam Research Corporation (“Lam”), rising to Executive Vice President and Chief Financial Officer. His previous roles at Lam included Vice President, Customer Support Business Group; and Group Vice President and Senior Vice President of Global Operations. Currently, Mr. Maddock serves on the Board of Directors of Avnet, Inc., Ouster Inc., Teradyne, Inc., and previously served as a member of the Board of Directors for Intersil Corporation. Mr. Maddock holds a B.S. in Industrial Management from the Georgia Institute of Technology and an M.B.A. from Georgia State University. | |||

| | | Jacqueline A. Seto — Independent Director Director since 2020 Age: 58 Key qualifications and expertise considered by the Board in nominating this director: • Deep understanding of the semiconductor industry • Proven strategic insight • Extensive experience in product strategy and marketing |

| Jacqueline A. Seto is currently Principal of Side People Consulting, partnering with emerging companies and with non-profit organizations advising on strategic and business planning, change management and other executive service consulting. Previously, Ms. Seto spent 22 years at Lam Research, where she advanced to the position of Group Vice President and General Manager of the Clean Business Unit. Her previous roles at Lam included Corporate Vice President and General Manager in the Reliant Business Unit, Vice President of Product and Strategic Marketing and Managing Director of Emerging Businesses. Ms. Seto currently serves as a member of the Board of Trustees for The Oregon Museum of Science and Industry, and as a member of the Board of Directors for the International Women’s Forum Oregon. She previously served as a member of the Board of Directors for TriAegis Residential Services, for Mastersranking.com and as the Board Secretary of Prevent Child Abuse Oregon. As a board member, Ms. Seto has developed expertise in oversight of corporate sustainability matters including environmental, social and governance best practices and implementation. Ms. Seto holds a Bachelor of Engineering in Chemical Engineering from McGill University. | |||

| 13 |

| | | Our Board of Directors recommends that you vote “FOR” each of the nominees to the Board of Directors set forth in this Proposal 1. |

| 14 |

| | | UCT is committed to sustainable solutions that minimize our environmental impact and support our long-term success. As a growing, global company, UCT is continuously improving and expanding the scope of our environmental efforts. Our policy sets environmental protection as a priority and is approved and supported by the executive leadership team. The foundation of the policy is the concept of reducing, reusing and recycling to minimize our environmental footprint. We focus on continuous improvement by regularly assessing new requirements and stakeholder input. In addition, we have established an Environmental Management System that includes procedures to maintain compliance with regulatory requirements and industry best practices. We have a goal of zero environmental impact incidents. Our performance against this policy is monitored via reviews and audits. |

| | | OUR EFFORTS TO ADVANCE INDUSTRY-WIDE SOLUTIONS UCT is committed to “SuCCESS2030” (Supply Chain Certification for Environmental and Social Sustainability) spearheaded by Applied Materials. This initiative supports sustainability efforts throughout the semiconductor equipment supply chain. The goal is to build a responsible and sustainable end-to-end supply chain for the future of semiconductors. Consistent with SuCCESS2030 goals, we are an active member of the Responsible Business Alliance (“RBA”) and adhere to the RBA Code of Conduct, which is a set of social, environmental and ethical industry standards. As a participant in SuCCESS2030, we engage with Applied Materials’ external auditors and analyze operational enhancements, including auditing our suppliers to ensure adherence to RBA guidelines. We also subscribe to the RBA’s Responsible Mineral Initiative, which establishes standards for environmentally responsible and ethical business practices in the electronics industry and its supply chain. In 2022, we successfully submitted the Conflict Minerals Reporting Template and Extended Minerals Reporting Template as part of our commitment to SuCCESS2030. In 2022, UCT became a Founding Member of the Semiconductor Climate Consortium (“SCC”), the first global alliance of semiconductor ecosystem companies focused on reducing greenhouse gas emissions across the value chain. The SCC’s members are committed to the following objectives: • Collaboration – Align on common approaches, technology innovations and communications channels to continuously reduce greenhouse gas emissions. |

| 15 |

| | | • Transparency – Publicly report progress and Scope 1, 2 and 3 emissions annually. • Ambition – Set near- and long-term decarbonization targets with the aim of reaching net zero emissions by 2050. | |

| | | SCC founding members are committed to driving climate progress within the semiconductor industry and support the Paris Agreement and related accords aimed at accelerating and intensifying the actions and investments required for a sustainable low-carbon future. | |

| | | Additionally, we are actively engaged with various industry efforts offered by our key customers, such as the Catalyze program that aims at furthering the adoption of renewable electricity throughout the global semiconductor value chain. | |

| | | To support our ambition, UCT is committed to lowering our greenhouse gas (“GHG”) emissions and sharing our progress on a timeline as required by various regulatory authorities. To achieve our objectives, since 2022 and continuing through 2023, we have been working with outside experts to develop internal processes and automated systems that will enable us to collect, analyze and report our GHG footprint across global operational sites. Our reporting will be aligned with the framework developed by the Task Force on Climate-related Financial Disclosures (“TCFD”), which has emerged as the most prominent global standard for reporting in accordance with the regulatory requirements. Once we have baseline data this year, our next step will be to develop an initiatives roadmap aligned with our business and operations strategy, for long term emissions reduction consistent with SCC and Science Based Target Initiative. Our key customers are supportive of our plan and required data sharing roadmap with them, some of which is expected to start later this year. Other highlights: | |

| | | ENERGY EFFICIENT OPERATIONS Increased efficiency can lower GHG emissions and other pollutants to help protect the environment. • UCT incorporates energy efficiency considerations into our capacity expansions. For example, our newest facilities in Ireland and Malaysia include infrastructure to support planned solar installations that will reduce our energy consumption over time. In addition, the site design of our recently opened state-of-the-art facility in Chandler, Arizona follows Leadership in Energy and Environmental Design (“LEED”) certification guidelines. We incorporate LED lighting and motion sensors in new facilities to reduce energy consumption. • Our global sites incorporate lean manufacturing methods where possible to increase energy efficiency and reduce waste. | |

| | | RESPONSIBLE USE OF RESOURCES UCT recognizes that the responsible use of natural resources is essential to sustainably growing our business and protecting the environment. • UCT follows RBA’s Responsible Minerals Assurance Process for tantalum. Tantalum is a rare metal commonly used in the electronics industry where high reliability in extreme environments is required. Tantalum is covered by regulations related to “conflict minerals” in the United States and the European Union. • Our Environmentally Clean Process (“ECP”) for tantalum-deposited parts recover up to 95% of the metal, enabling it to re-enter the commodity market and reduce the demand for mined material. • ECP also increases part lifetime and reduces wastewater generation while eliminating the use of chemicals at some of our high-volume cleaning facilities. • UCT acknowledges our duty to protect water sources in the communities in which we operate and strives to conserve water use across our global operations by sharing best practices among sites. • In 2023, we launched a survey with our suppliers on their awareness and level of adoption of ESG principles. Additionally, we are working with our suppliers on perfluoroalkyl and polyfluoroalkyl substances (“PFAS”) risk and possible alternate solutions. |

| 16 |

| | | REDUCING CHEMICAL USE UCT’s parts cleaning business uses chemical-free processes where possible. This lowers our environmental impact by reducing the amount of waste requiring treatment and enabling the safe return of water to the environment. | |

| | | MINIMIZING WASTE UCT is committed to reducing waste across our locations to limit our environmental footprint. We have implemented reuse programs for packaging materials with our customers and suppliers, adhering to the semiconductor industry’s stringent protective packaging requirements. | |

| | | REDUCING TRANSPORTATION To reduce our overall emissions, UCT seeks to minimize transportation emissions wherever possible among our operations, and with our suppliers and employees. Many of UCT’s sites are strategically positioned close to our customers, which reduces the distance products must travel. Where possible, we develop regional supply chains that reduce overall shipping requirements. |

| | | We aim to build a responsible and sustainable end-to-end supply chain, ensure employee health and safety in the workplace, foster an atmosphere of acceptance, inclusion, belonging, trust and mutual respect in the workplace, promote employee engagement inside and outside the company and give back to communities. UCT strives to positively impact society by ensuring the people we work with are safe and treated with dignity and respect. We strive to be a good neighbor in the communities in which we operate. |

| | | HEALTH, WELLNESS AND SAFETY • The safety of our personnel is our top priority. We have an established Safety policy to outline expectations, including our goal of zero accidents and injuries. Safety incident levels across our Products and Services Divisions are consistently below industry benchmarks. • We consistently train, educate and qualify personnel to enable a safety-focused work environment. | |

| | | • We subscribe to the Responsible Business Alliance (“RBA”) Responsible Labor Initiative, which establishes standards to ensure that working conditions in the electronics industry and its supply chains are safe and that workers are treated with respect and dignity. | |

| | | • We require written certification from strategic direct product suppliers that the materials incorporated into their products comply with applicable laws and regulations, including laws regarding slavery and human trafficking of the country or countries in which they are doing business. | |

| | | DIVERSITY, INCLUSION AND ENGAGEMENT Central to UCT’s values is the belief that employees are our most important assets. Our goal is to foster an atmosphere of acceptance, inclusion, belonging, trust and respect for all. We embrace diversity and multiculturalism. We respect regional differences while fostering a culture that maximizes both organizational and individual potential. Our culture emphasizes leadership, open and honest communication, training and mentoring, and a positive reward system. • Diversity initiatives are overseen by our executive management team, including efforts to recruit from a broad talent base and initiatives to support a more inclusive workforce. • UCT recently established an Employee Experience and Well-being committee focused on cultivating an environment that prioritizes respect, mental well-being and active engagement. In 2023, this committee introduced programs for our global employees to engage in new ways with leadership as well as improve their physical and mental health. • Our employees take mandatory training to establish behavioral expectations, improve |

| 17 |

| | | diversity and inclusion sentiment, and ensure that every employee is treated with dignity and respect. • In 2022, UCT completed a diversity survey of our employees holding the title vice president or higher; with 100% participation, 61% of these senior leaders self-identified as female and/or minorities. We are currently developing a framework to broaden our efforts to monitor diversity across all levels of the company. • UCT launched a company-wide learning management system (LMS) in 2022 that provides all employees with opportunities to advance their skills, knowledge and careers. Course offerings include leadership and professional skills, diversity and inclusion training, project management certification, environmental, health and safety courses and more. In 2023, more than 5,200 UCT employees engaged in LMS training for a total of more than 19,800 training hours. • We are committed to the success of our employees. In 2023, 99% of our global workforce participated in performance reviews to measure achievements and opportunities against personal and corporate goals. All of our full-time, permanent employees participate financially in the success of the company via formal profit sharing or performance bonus plans. • In 2023, UCT introduced specialized training for high-potential employees to enhance individual leadership capabilities and foster a culture of continuous improvement and innovation. • We actively solicit the input of our employees as part of our efforts to make UCT an attractive place to work and to enhance recruiting and retention. In 2022, the results of a company-wide survey revealed that 76% of our employees would recommend UCT as a good place to work. | |

| | | We are committed to contributing to the communities in which we operate and support our employees who participate in local events through the investment of time and resources. In 2023, UCT organized and conducted 31 events designed to give back and support local organizations and individuals. |

| | | Sound governance and strong leadership are key to delivering sustained value to our stakeholders. To succeed, we must safeguard and retain the trust of employees, partners, customers, investors and the communities in which we work and live. As stewards of the company, our Board of Directors provides guidance and oversight and ensures that we maintain our high ethical standards. Effective corporate governance requires achieving the right mix of experience, background and diversity in perspectives; this is particularly important in a complex and highly technical business like ours. For more information on board diversity, please see page 10. We benefit from a highly engaged and informed Board of Directors. Our board composition complies with Nasdaq and Securities and Exchange Commission rules regarding director independence and includes women and those from under-represented groups. Given the importance of ESG considerations, two of UCT’s three board committees share oversight responsibility for ESG: • The Nominating, Environmental, Social and Corporate Governance Committee (formerly the Nominating and Corporate Governance Committee) provides oversight and guidance for ESG matters focusing on environmental and governance areas. • The Compensation and People Committee (formerly the Compensation Committee) provides oversight and guidance for the social component of ESG, including talent and career development, employee retention, promotion of diversity, equity and inclusion and other people-related matters. |

| 18 |

| | | These committees meet regularly and provide input and guidance for consideration of environmental, social and governance matters to the broader board on a regular basis | |

| | | CYBERSECURITY Managing cyber-risk is increasingly critical to governance in today’s interconnected world. Our Board of Directors has the overall oversight responsibility for our risk management, and delegates the cybersecurity and other risks relating to our information controls and security to our Audit Committee. Both the Audit Committee and the full Board regularly receive updates from our management on cybersecurity matters and our ongoing risk management efforts, and actively participate in ongoing discussions. In addition, the Board and the Compensation and People Committee review and approve the key performance indicators applicable to all management personnel responsible for effectively managing cybersecurity risk management programs at UCT and engage in regular review of the Company’s performance against those indicators. UCT has a Chief Information Officer and a Chief Information Security Officer (“CISO”), who report to the Board formally once per year, and, in the interim, on specific issues as appropriate. UCT’s cybersecurity management program ensures that technology, data management and privacy risks are identified, analyzed and managed and, together with our broader business continuity plans, aim to not only address immediate response to cybersecurity incidents but also ensure swift restoration of critical systems and the maintenance of core business functions in the face of digital threats. Our senior management and information technology security teams devote considerable time and resources to conducting regular evaluations of our systems and implementing necessary enhancements to our security infrastructure to better guard against evolving cybersecurity threats. Our employees, contractors and directors receive regular information security training and participate in ongoing, mandatory cybersecurity awareness programs. UCT has a security risk insurance policy, and we continue to enhance our security posture consistent with the risk program established by our CISO. This includes expanding our global information security program, adding broad technical expertise, and advancing our enterprise security capabilities portfolio. We have adopted measures to combat potential cyberattacks and information espionage, including implementation of certain security tools to detect nefarious activities within our system. UCT’s information security is externally audited using the National Institute of Standards and Technology (“NIST”) Cybersecurity Framework, and our information security is also tested as part of the annual financial audit. UCT also participates in a number of customer cybersecurity audits each year, and our externally visible cybersecurity health is monitored by third-party service providers. |

| 19 |

| AUDIT COMMITTEE |

| Among other matters, the Audit Committee is responsible for: |

| • providing oversight of our accounting and financial reporting processes and audits of our financial statements; |

| • assisting the Board in its oversight of the integrity of our financial statements and the adequacy and effectiveness of our internal controls over financial reporting; |

| • periodically reviews risks related to data protection and cybersecurity; |

| • the qualifications, independence and performance of our independent auditors (including hiring and replacing our independent auditors as appropriate, reviewing and pre-approving any audit and non-audit services provided by our independent auditors and approving fees related to such services); |

| • the performance of our internal audit function; |

| • the review, approval and oversight of our Cash and Investment Policy and Financial Risk Management Policy, including oversight over our hedging strategy and the use of swaps and other derivative instruments for hedging risks; |

| • compliance with legal and regulatory requirements; |

| • compliance with our code of business conduct and ethics (and requests for waivers therefrom); and |

| • preparing the Audit Committee report that SEC rules require to be included in our proxy statement. |

| COMPENSATION AND PEOPLE COMMITTEE |

| Among other matters, our Compensation and People Committee: |

| • oversees our compensation and benefits programs and policies generally, including the issuance of equity-based compensation; |

| • evaluates the performance of our executive officers and other senior executives; |

| • reviews our management succession plan; |

| • oversees and sets compensation for our executive officers, Board members and other senior executives; |

| • reviews and recommends inclusion of the Compensation Discussion and Analysis required to be included in our proxy statement by SEC rules; |

| • oversees the social component of ESG matters; and |

| • oversees the administration of, and, as appropriate, the enforcement of the Company’s Compensation Recoupment Policy and any recoupment-related activity. |

| 20 |

| NOMINATING, ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE COMMITTEE |

| Among other matters, our Nominating, Environmental, Social and Corporate Governance Committee: |

| • reviews and evaluates the size, composition, function and duties of the Board consistent with its needs; |

| • establishes criteria for the selection of candidates to the Board and its committees, and identifies individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by shareholders; |

| • recommends to the Board director nominees for election at our annual or special meetings of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; |

| • recommends directors for appointment to committees of the Board; |

| • makes recommendations to the Board as to determinations of director independence; |

| • leads the process and assists the Board in evaluating its performance and the performance of its committees; |

| • periodically reviews our corporate governance guidelines and code of business conduct and ethics, and oversees compliance with our corporate governance guidelines; and |

| • oversees ESG matters focused on the environmental and governance components. |

| 21 |

| • | a $60,000 twelve-months cash retainer for service as a member of our Board of Directors |

| • | an additional $70,000 twelve-months cash fee for serving as independent chair of our Board of Directors |

| • | the following additional twelve-months cash retainers for service on the standing committees of our Board of Directors: |

| • | Audit Committee – $12,500 (or $25,000 for the chair) |

| • | Compensation and People Committee – $10,000 (or $20,000 for the chair) |

| • | Nominating, Environmental, Social and Corporate Governance Committee – 10,000 (or $20,000 for the chair). |

| 22 |

| NAME | | | FEES EARNED OR PAID IN CASH(3) ($) | | | STOCK AWARDS(1)(2) ($) | | | TOTAL ($) |

| Thomas T. Edman | | | 91,993 | | | 150,195 | | | 242,188 |

| Clarence L. Granger | | | 118,955 | | | 150,195 | | | 269,150 |

| David T. ibnAle | | | 82,048 | | | 150,195 | | | 232,243 |

| Emily M. Liggett | | | 83,699 | | | 150,195 | | | 233,894 |

| Ernest E. Maddock | | | 94,479 | | | 150,195 | | | 244,674 |

| Jacqueline A. Seto | | | 85,370 | | | 150,195 | | | 235,565 |

| Barbara V. Scherer | | | 82,048 | | | 150,195 | | | 232,243 |

| (1) | The amounts shown are the grant date fair values for restricted stock awards granted in fiscal year 2023 computed in accordance with FASB ASC Topic 718 based on the closing price of our common stock on the day preceding the grant date. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

| (2) | Messrs. Edman, Granger, ibnAle and Maddock and Mses. Liggett, Scherer and Seto each held an outstanding restricted stock award with respect to 5,296 shares of our common stock as of December 29, 2023. |

| 23 |

| 24 |

| 25 |

| | | FISCAL YEAR ENDED | ||||

| | | DECEMBER 29, 2023 | | | DECEMBER 30, 2022 | |

| Audit fees | | | $4,375,950 | | | $4,885,008 |

| Audit related fees | | | $188,000 | | | $96,500 |

| Total | | | $4,563,950 | | | $4,981,508 |

| | | Our Board of Directors recommends that you vote “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal 2024. |

| 26 |

| 27 |

| 28 |

| | | Our Board of Directors recommends that you vote “FOR” the approval of the non-binding advisory vote on compensation of our named executive officers for fiscal 2023 as disclosed pursuant to the compensation disclosure rules of the SEC, which disclosure includes the “Compensation Discussion and Analysis,” the compensation tables and other narrative executive compensation disclosures in this proxy statement. |

| 29 |

| NAME | | | AGE | | | POSITION |

| James P. Scholhamer | | | 57 | | | Chief Executive Officer & Director |

| Sheri L. Savage | | | 53 | | | Chief Financial Officer and Senior Vice President of Finance |

Vijayan S. Chinnasami(1) | | | 58 | | | Chief Operating Officer |

| Christopher S. Cook | | | 55 | | | President, Products Division |

| Jeffrey L. McKibben | | | 61 | | | Chief Information Officer |

| (1) | The Board approved termination of Mr. Chinnasami’s employment without cause, effective as of December 31, 2023. |

| • | Achieved revenue of $1.7 billion in 2023, a decrease of 26.9% year-over-year. |

| • | Non-GAAP operating margin was 4.9% in 2023, compared to 11% in 2022. |

| • | Non-GAAP EPS was $0.56 in 2023, compared to $3.98 in 2022. As of December 29, 2023, UCT had $307 million in cash and cash equivalents. |

| • | Our annual cash incentive outcomes for FY2023 were paid based on revenue, operating results and execution against strategic objectives. On average, the NEOs received annual cash incentive outcomes of 99% of target. |

| • | We made increases to target cash compensation, primarily through base salary increases, for our non-CEO NEOs ranging from 2.2% to 10% to more closely align their incentive with market levels. To bring him closer to competitive market levels, we increased target cash compensation to 6.9% for our CEO through a base salary increase, while his target incentive remained flat at 110% of base salary. |

| • | Target total pay opportunities (defined as base salary plus target annual incentive plus target equity grant) for all non-CEO NEOs increased by a range of 1% to 4%(1), and increased for our CEO by 14.3%, to similarly account for being below the market midrange and seeking to achieve parity with internal and external peers. |

| • | We continued to rely on performance-based equity as part of our long-term incentive program with a 55% mix for our CEO, 50% mix for Chief Financial Officer, Chief Operating Officer and Chief Information Officer and 25% for other NEOs. Based on the pre-determined calculation criteria set forth in our long-term incentive program, our performance-based equity payout for the equity granted in 2021 vested at 30%. |

| (1) | Pay opportunities for Christopher S. Cook is not included here as fiscal 2023 was his first annual equity grant cycle. |

| 30 |

| WHAT WE DO | | | WHAT WE DO NOT DO |

✔ Conduct an annual compensation review | | | ✗ No excessive perquisites or benefits |

✔ Conduct an annual Say-on-Pay advisory vote | | | ✗ No excise tax gross-ups |

✔ Conduct an annual compensation risk assessment | | | ✗ No hedging or pledging of equity holdings |

✔ Utilize an independent compensation consultant | | | ✗ No stock option repricing |

✔ Balance performance metrics in incentive plans | | | ✗ No single-trigger change in control benefits |

✔ Deliver more than 50% of CEO equity in PSUs | | | |

✔ Utilize relative performance in PSUs | | | |

✔ Provide market competitive severance benefits | | | |

✔ Maintain stock ownership guidelines | | | |

✔ Ability to clawback incentive payments | | | |

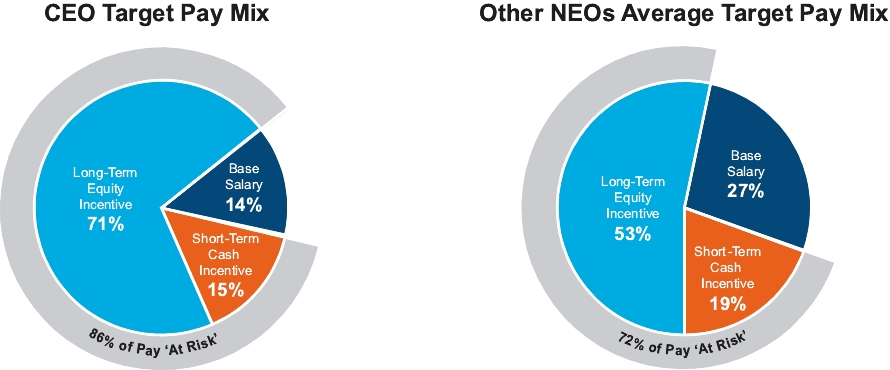

✔ Incorporate an average of 75% of “at risk” compensation for executive officers | | |

| 1. | Attract, reward, and retain executive officers and other key employees to help drive our business forward. More specifically, we compete for key talent with other companies in the semiconductor sector, and the competition is high. Further, we are in regular talent competition with other technology companies outside of the semiconductor sector, which puts upward pressure on pay opportunities – particularly long-term, equity incentive values. |

| 2. | Motivate key employees to achieve goals using individual performance goals combined with a balanced scorecard approach at the corporate, business unit and operational levels that enhance stockholder value. These corporate goals track with our longer-term objective of profitable growth and market share gains. Our corporate goals also addressed the integration of newly acquired businesses, including the integration of key talent. |

| 3. | Promote pay for performance, internal compensation equity and external competitiveness. |

| • | Pay compensation that is competitive with the practices of similarly situated electronics manufacturing services (EMS) companies and the practices of similar companies noted in industry surveys; and |

| • | Pay for performance by: |

| • | offering short-term cash incentive opportunities upon achievement of performance goals we consider challenging but achievable; and |

| • | providing significant, long-term equity incentive opportunities in order to retain those individuals with the leadership abilities necessary for increasing long-term stockholder value while aligning the interests of our executive officers with those of our stockholders. |

| 31 |

| 32 |

| (i) | base salary; |

| (ii) | cash incentive opportunities; |

| (iii) | annual long-term equity incentive awards (both time-based and performance-based); and |

| (iv) | retirement and welfare benefit plans, including a deferred compensation plan, a 401(k) plan, limited executive perquisites and other benefit programs generally available to all employees. |

| 33 |

• Advanced Energy Industries (AEIS) • Alpha & Omega Semiconductor (AOSL) • Benchmark Electronics (BHE) • Cohu (COHU) • Diodes (DIOD) • Fabrinet (FN) • FormFactor (FORM) • Ichor (ICHR) • Kimball Electronics (KE) • Kulicke and Soffa Industries (KLIC) | | | • Methode Electronics (MEI) • MKS Instruments (MKSI) • Onto Innovation (ONTO) • OSI Systems (OSIS) • Photronics (PLAB) • Plexus (PLXS) • Semtech (SMTC) • SMART Global Holdings (SGH) • Synaptics (SYNA) • TTM Technologies (TTMI) |

| - | Three companies were removed because they were acquired, downsized or outsized (CMC Materials, Azenta, Entegris) |

| 34 |

| | | BASE SALARY | |||||||

| NAME | | | 2023 | | | 2022 | | | Y/Y CHANGE |

| James P. Scholhamer | | | $775,000 | | | $725,000 | | | 6.9% |

| Sheri L. Savage | | | 550,000 | | | 500,000 | | | 10% |

Vijayan S. Chinnasami(1) | | | 600,000 | | | 580,000 | | | 3.4% |

| Christopher S. Cook | | | 500,000 | | | 480,000 | | | 4.2% |

| Jeffrey L. McKibben | | | 440,000 | | | 420,000 | | | 4.8% |

| (1) | The Board approved termination of Mr. Chinnasami’s employment without cause, effective 12/31/2023. |

| 35 |

| | | TARGET BONUS AS A PERCENTAGE OF BASE SALARY | ||||

| Named Executive Officer | | | 2023 | | | 2022 |

| James P. Scholhamer | | | 110% | | | 110% |

| Sheri L. Savage | | | 85% | | | 85% |

Vijayan S. Chinnasami(1) | | | 85% | | | 85% |

Christopher S. Cook(1) | | | 60% | | | 60% |

| Jeffrey L. McKibben | | | 60% | | | 60% |

| (1) | The Board approved termination of Mr. Chinnasami’s employment without cause, effective December 31, 2023. |

| 36 |

NAMED EXECUTIVE OFFICER(1) | | | 2023 CASH INCENTIVE BONUS | | | 2023 | | | 2023 | | | 2022 | |||||||||||||||

| | Q1 | | | Q2 | | | Q3 | | | Q4 | | | ANNUAL | | | TOTAL | | | TARGET(2) | | | ACHIEVEMENT | | | TOTAL | ||

| James P. Scholhamer | | | $70,538 | | | $50,841 | | | $99,478 | | | $110,508 | | | $456,720 | | | $788,084 | | | $825,000 | | | 96% | | | $925,479 |

| Sheri L. Savage | | | 37,591 | | | 27,094 | | | 53,139 | | | 60,601 | | | 245,390 | | | 423,814 | | | 446,250 | | | 95% | | | 485,484 |

Vijayan S Chinnasami(3) | | | 44,042 | | | 31,929 | | | 60,288 | | | 60,794 | | | 363,477 | | | 560,530 | | | 507,652 | | | 110% | | | 562,707 |

| Christopher S. Cook | | | 25,473 | | | 18,360 | | | 35,849 | | | 38,888 | | | 163,055 | | | 281,626 | | | 294,000 | | | 96% | | | 275,742 |

| Jeffrey L. McKibben | | | 22,289 | | | 16,065 | | | 31,382 | | | 34,222 | | | 139,675 | | | 243,633 | | | 258,000 | | | 94% | | | 288,893 |

| (1) | The Management Bonus Plan for 2023 included quarterly bonus opportunities based on Company financial and operational metrics, and a separate annual bonus opportunity based on additional annual Company financial and operational metrics and individual goals. |

| (2) | Target incentive cash compensation was calculated based on the Target Bonus as a Percentage of Base Salary table above and the executive officer’s base salary for 2023 as set forth in the Base Salary table above. |

| (3) | Vijayan S. Chinnasami’s termination was effective December 31, 2023. |

| 37 |

| 38 |

• Advanced Energy Industries (*) (AEIS) • Amkor (AMKR) • Applied Materials (AMAT) • ASM International (ASM) • ASML Holdings (ASML) • Axcelis Technologies (ACLS) • Azenta (AZTA) • Entegris (ENTG) • FormFactor (*) (FORM) • Ichor (*) (ICHR) | | | • KLA (KLAC) • Kulicke and Soffa Industries (*) (KLIC) • Lam Research (LRCX) • MKS Instruments (*) ((MKSI) • Nova Measuring Instruments (NVMI) • Onto Innovation (*) (ONTO) • PDF Solutions (PDFS) • Photronics (*) (PLAB) • Teradyne (TER) • Veeco Instruments (VECO) |

| 39 |

| FY2023-FY2025 RELATIVE REVENUE POSITIONING | | | PAYOUT |

Below 30th %ile | | | 0% |

30th %ile | | | 50% |

50th %ile | | | 100% |

80th %ile or above | | | 200% |

FY2023-FY2025 AVERAGE OPERATING EBITDA MARGIN(1) | | | PAYOUT |

| More than +200 basis points improvement | | | +25% |

| Within -200 and 200 basis points improvement | | | 0% |

| More than -200 basis point improvement | | | -25% |

| (1) | See Appendix A for a reconciliation of GAAP to non-GAAP measures and for additional information about the non-GAAP measures we use in this proxy statement. |

FY2023-FY2025 RELATIVE TSR(1) RANK (INCLUDING ULTRA CLEAN) | | | PAYOUT |

| Top Third (e.g., Rank 1 through 7) | | | +25% |

| Middle Third (e.g., Rank 8 through 15) | | | 0% |

| Bottom Third (e.g., Rank 16 through 22) | | | -25% |

| NAME | | | TIME- BASED (# SHARES) | | | PERFORMANCE- BASED (# SHARES) | | | TOTAL (# SHARES) | | | VALUE OF TARGET ANNUAL EQUITY GRANT ($)(1) |

| James P. Scholhamer | | | 55,985 | | | 68,426 | | | 124,411 | | | $4,000,000 |

| Sheri L. Savage | | | 21,772 | | | 21,772 | | | 43,544 | | | 1,400,000 |

Vijayan S. Chinnasami(2) | | | 21,772 | | | 21,772 | | | 43,544 | | | 1,400,000 |

| Christopher S. Cook | | | 18,661 | | | 6,220 | | | 24,881 | | | 800,000 |

| Jeffrey L. McKibben | | | 10,886 | | | 10,886 | | | 21,772 | | | 700,000 |

| (1) | The number of RSUs awarded to each of our executive officers was determined using a target dollar value, with the number of RSUs and PSUs granted to achieve such target dollar value based on the average closing price of the Company’s common stock during the 60 business days prior to the grant date. The grant date for these awards was April 28, 2023, and the average closing price was $32.15. |

| (2) | Vijayan S. Chinnasami termination effective December 31, 2023. His performance-based equity granted in 2023 was cancelled. |

| 40 |

| 41 |

| 42 |

| 43 |

| NAME AND POSITION | | | YEAR | | | SALARY ($) | | | BONUS ($) | | | STOCK AWARDS ($)(1) | | | NON-EQUITY INCENTIVE PLAN COMPENSATION ($)(2) | | | ALL OTHER COMPENSATION ($) | | | TOTAL ($) |

James P. Scholhamer Chief Executive Officer | | | 2023 | | | 736,538 | | | | | 3,507,146 | | | 788,084 | | | 11,996(3) | | | 5,043,765 | |

| | 2022 | | | 704,808 | | | | | 2,598,339 | | | 925,479 | | | 11,598 | | | 4,240,224 | |||

| | 2021 | | | 636,538 | | | | | 3,682,347 | | | 871,530 | | | 11,351 | | | 5,201,766 | |||

Sheri L. Savage Chief Financial Officer and Senior Vice President of Finance | | | 2023 | | | 511,539 | | | | | 1,227,505 | | | 423,814 | | | 10,366(4) | | | 2,173,224 | |

| | 2022 | | | 489,231 | | | | | 1,342,217 | | | 485,484 | | | 8,967 | | | 2,325,899 | |||

| | 2021 | | | 451,923 | | | | | 1,288,774 | | | 459,045 | | | 8,072 | | | 2,207,814 | |||

Vijayan S. Chinnasami(8) Chief Operating Officer | | | 2023 | | | 593,173 | | | | | 1,227,505(9) | | | 560,530 | | | 45,877(5) | | | 2,427,085 | |

| | 2022 | | | 573,511 | | | | | 1,342,217 | | | 562,707 | | | 44,563 | | | 2,522,998 | |||

| | 2021 | | | 532,404 | | | | | 1,288,774 | | | 549,333 | | | 44,444 | | | 2,414,955 | |||

Christopher S. Cook President, Products Division | | | 2023 | | | 484,615 | | | | | 701,395 | | | 281,626 | | | 2,075(6) | | | 1,469,712 | |

| | 2022 | | | 343,385 | | | 100,000 | | | 687,795 | | | 275,742 | | | 1,058 | | | 1,407,980 | ||

Jeffrey L. McKibben Chief Information Officer | | | 2023 | | | 424,615 | | | | | 613,753 | | | 243,633 | | | 8,363(7) | | | 1,290,364 | |

| | 2022 | | | 414,615 | | | | | 534,923 | | | 288,893 | | | 6,744 | | | 1,245,175 | |||

| | 2021 | | | 138,462 | | | | | 803,736 | | | 90,099 | | | 572 | | | 1,032,869 |

| (1) | Amounts shown do not reflect compensation received by the named executive officers. The amounts shown are the grant date fair value for stock awards granted in the applicable fiscal year, based on the 60 trading days average price of our common stock preceding the grant date. The other valuation assumptions and the methodology used to determine such amounts are set forth in Note 1 of the Notes to our Consolidated Financial Statements included in our Form 10-K for the year ended December 29, 2023. |

| (2) | Amounts consist of incentive bonuses earned in 2023. |

| (3) | This amount consists of (a) matching contribution of $9,900 under the 401(k) Plan and (b) $2,096 in disability, accident, and life insurance premiums. |

| (4) | This amount consists of (a) matching contribution of $8,269 under the 401(k) Plan and (b) $2,096 in disability, accident, and life insurance premiums. |

| (5) | This amount consists of auto allowance. |

| (6) | This amount consists of $2,075 in disability, accident, and life insurance premiums. |

| (7) | This amount consists of (a) matching contribution of $6,369 under the 401(k) Plan and (b) $1,993 in disability, accident, and life insurance premiums. |

| (8) | Vijayan S. Chinnasami was terminated without cause effective December 31, 2023; consistent with our severance policy, the performance-based equity granted in 2022 will vest at the end of its applicable performance period in accordance with our long-term incentive plan. |

| 44 |

| NAME | | | GRANT DATE | | | COMPENSATION COMMITTEE COMPENSATION ACTION DATE | | | ESTIMATED FUTURE PAYOUTS UNDER NON-EQUITY INCENTIVE PLAN AWARDS(1) | | | ESTIMATED FUTURE PAYOUTS UNDER EQUITY INCENTIVE PLANS(2) | | | ALL OTHER STOCK AWARDS NUMBER OF STOCK OR UNITS (#)(3) | | | GRANT DATE FAIR VALUE OF STOCK AWARDS ($)(4) | |||||||||

| | TARGET ($) | | | MAXIMUM ($) | | | THRESHOLD (#) | | | TARGET (#) | | | MAXIMUM (#) | | |||||||||||||

James P. Scholhamer | | | | | | | 852,500 | | | 1,705,000 | | | — | | | — | | | — | | | — | | | — | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | 17,107 | | | 68,426 | | | 136,852 | | | — | | | 1,928,929 | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | — | | | — | | | — | | | 55,985 | | | 1,578,217 | ||

Sheri L Savage | | | | | | | 467,500 | | | 935,000 | | | — | | | — | | | — | | | — | | | — | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | 5,443 | | | 21,772 | | | 43,544 | | | — | | | 613,753 | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | — | | | — | | | — | | | 21,772 | | | 613,753 | ||

Vijayan S. Chinnasami(5) | | | | | | | 510,000 | | | 1,020,000 | | | — | | | — | | | — | | | — | | | — | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | 5,443 | | | 21,772 | | | 43,544 | | | — | | | 613,753 | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | — | | | — | | | — | | | 21,772 | | | 613,753 | ||

| Christopher S. Cook | | | | | | | 300,000 | | | 600,000 | | | — | | | — | | | — | | | — | | | — | ||

| | | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | 1,555 | | | 6,220 | | | 12,440 | | | — | | | 175,342 | |

| | | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | — | | | — | | | — | | | 18,661 | | | 526,054 | |

Jeffrey L. McKibben | | | | | | | 264,000 | | | 528,000 | | | — | | | — | | | — | | | — | | | — | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | 2,722 | | | 10,886 | | | 21,772 | | | — | | | 306,876 | ||

| | 4/28/2023 | | | 3/22/2023 | | | — | | | — | | | — | | | — | | | — | | | 10,886 | | | 306,876 | ||

| (1) | Reflects target at 100% and maximum cash award amounts pursuant to the Management Bonus Plan for fiscal 2023. |

| (2) | Reflects performance-based restricted stock units. The amounts shown in the “Threshold”, “Target”, and “Maximum” columns reflect the payout opportunity associated with established levels of performance or achievement. |

| (3) | Represents time-based stock units issued under our stock incentive plan. |

| (4) | Under the terms of our stock incentive plan, fair market value is defined as the closing price on the day preceding the grant date. Our practice is for grants to be effective on the last Friday of the month in which the grant is approved. |

| (5) | Vijayan S. Chinnasami’s termination was effective December 31, 2023. |

| 45 |

| | | STOCK AWARDS | | | EQUITY INCENTIVE PLAN AWARDS | |||||||

| NAME | | | RSU SHARES OR UNITS THAT HAVE NOT VESTED (#) | | | MARKET VALUE OF SHARES OR UNITS THAT HAVE NOT VESTED ($)(1) | | | NUMBER OF UNEARNED SHARES, UNITS OR OTHER RIGHTS THAT HAVE NOT VESTED (#) | | | MARKET VALUE OF UNEARNED SHARES, UNITS OR OTHER RIGHTS THAT HAVE NOT VESTED ($)(1) |

| James P. Scholhamer | | | 7,275(2) | | | 248,369 | | | 8,001(3) | | | 273,154 |

| | 24,231(4) | | | 827,246 | | | 22,212(5) | | | 758,301 | ||

| | 55,985(8) | | | 1,911,328 | | | 34,213(9) | | | 1,168,032 | ||

| Sheri L. Savage | | | 2,910(2) | | | 99,347 | | | 2,618(3) | | | 89,379 |

| | 4,106(6) | | | 140,179 | | | 8,315(5) | | | 283,857 | ||

| | 11,086(4) | | | 378,476 | | | 10,886(9) | | | 371,648 | ||

| | 21,772(8) | | | 743,296 | | | — | | | — | ||

Vijayan S. Chinnasami(10) | | | — | | | — | | | 2,618(3) | | | 89,379 |

| | — | | | — | | | 8,315(5) | | | 283,857 | ||

| Christopher S. Cook | | | 14,254(7) | | | 486,632 | | | 3,110(9) | | | 106,175 |

| | 18,661(8) | | | 637,087 | | | — | | | — | ||

| Jeffrey L. McKibben | | | 5,320(7) | | | 181,625 | | | 4,157(5) | | | 141,920 |

| | 707(7) | | | 24,137 | | | 5,443(9) | | | 185,824 | ||

| | 5,543(4) | | | 189,238 | | | — | | | — | ||

| | 10,886(8) | | | 371,648 | | | — | | | — | ||

| (1) | Based on the closing price of our common stock as of December 29, 2023 (our fiscal 2023 year-end), which was $34.14. |

| (2) | Remaining units vest on April 30, 2024. |

| (3) | Represents performance-based awards granted in fiscal 2021, vested at the end of the 3-year performance cycle at 30% on 3/29/2024. |

| (4) | 1/2 vest on April 29, 2024, and April 29, 2025, respectively. |

| (5) | Represents performance-based awards granted in fiscal 2022, assuming achievement of the threshold target performance criteria at the end of the 3-year performance cycle. |

| (6) | Represents one-time transitional RSU. 1/2 vest on April 29, 2024, and April 29, 2025, respectively. |

| (7) | New hire grants, 1/3 vest on vesting anniversary date. |

| (8) | 1/3 vest on April 30, 2024, April 30, 2025, and April 30, 2026, respectively. |

| (9) | Represents performance-based awards granted in fiscal 2023, assuming achievement of the threshold target performance criteria at the end of the 3-year performance cycle. |

| (10) | Vijayan S. Chinnasami’s termination was effective December 31, 2023. Consistent with our severance policy, the performance-based equity granted in 2022 will vest at the end of its applicable performance period in accordance with our long-term incentive plan. |

| 46 |

| | | STOCK AWARDS | ||||

| NAME | | | NUMBER OF SHARES ACQUIRED ON VESTING (#) | | | VALUE REALIZED ON VESTING ($)(1) |

| James P. Scholhamer | | | 73,717 | | | 2,103,883 |

| Sheri L. Savage | | | 35,827 | | | 1,031,983 |

Vijayan S. Chinnasami(2) | | | 35,826 | | | 1,031,954 |

| Christopher S. Cook | | | 7,126 | | | 203,376 |

| Jeffrey L. McKibben | | | 8,797 | | | 290,237 |

| (1) | The value realized equals the fair market value of the Company’s common stock on the date of vesting multiplied by the number of stock awards vesting. |

| (2) | Vijayan S. Chinnasami termination was effective December 31, 2023. |

| 47 |

| NAME | | | SALARY ($) | | | CASH INCENTIVE ($) | | | HEALTH BENEFITS ($)(1) | | | VALUE OF ACCELERATED VESTING ($)(2) |

| James P. Scholhamer | | | $1,550,000 | | | $1,723,396 | | | $40,006 | | | $7,750,224 |

| Sheri L. Savage | | | 825,000 | | | 684,172 | | | 4,684 | | | 2,970,317 |

Vijayan S. Chinnasami(3) | | | — | | | — | | | — | | | — |

| Christopher S. Cook | | | 375,000 | | | 209,013 | | | 23,645 | | | 1,336,069 |

| Jeffrey L. McKibben | | | 330,000 | | | 199,697 | | | 35,005 | | | 1,422,136 |

| (1) | Estimated assuming that each executive enrolls in continued group health benefits. |

| (2) | Amounts based on our stock price as of December 29, 2023, less the option exercise price, in the case of options. |

| (3) | Vijayan S. Chinnasami termination effective December 31, 2023. Mr. Chinnasami was paid a severance amount consistent with our severance policy. |

| 48 |

| NAME | | | SALARY ($) | | | CASH INCENTIVE ($) | | | HEALTH BENEFITS ($)(1) | | | VALUE OF ACCELERATED VESTING ($)(2) |

| James P. Scholhamer | | | $1,162,500 | | | $1,292,547 | | | $30,004 | | | $4,777,040 |

| Sheri L. Savage | | | 550,000 | | | 456,114 | | | 2,342 | | | 904,437 |

Vijayan S. Chinnasami(3) | | | — | | | — | | | — | | | — |

| Christopher S. Cook | | | 375,000 | | | 139,342 | | | 23,645 | | | 455,667 |

| Jeffrey L. McKibben | | | 330,000 | | | 133,132 | | | 35,005 | | | 424,224 |

| (1) | Estimated assuming that each executive enrolls in continued group health benefits. |

| (2) | Amounts based on our stock price as of December 29, 2023, less the option exercise price, in the case of options. |

| (3) | Vijayan S. Chinnasami termination effective December 31, 2023. Mr. Chinnasami was paid a severance amount consistent with our severance policy. |

| 49 |

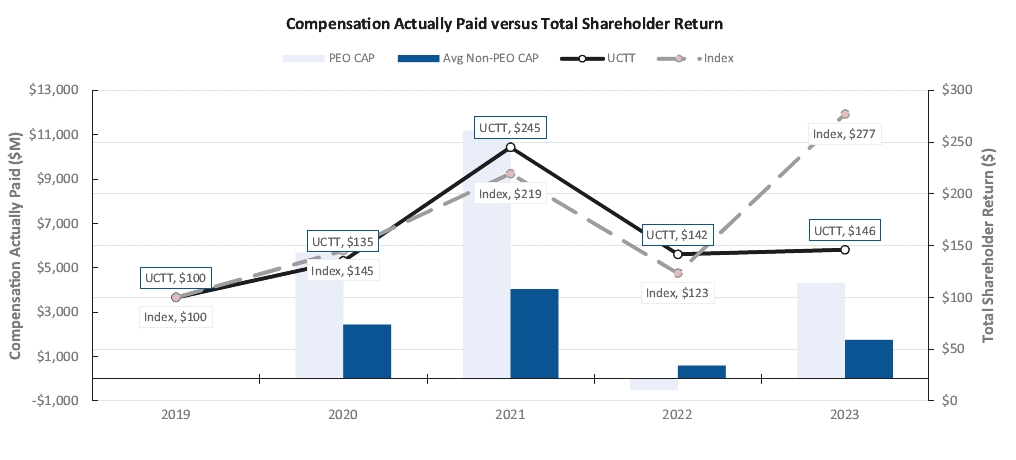

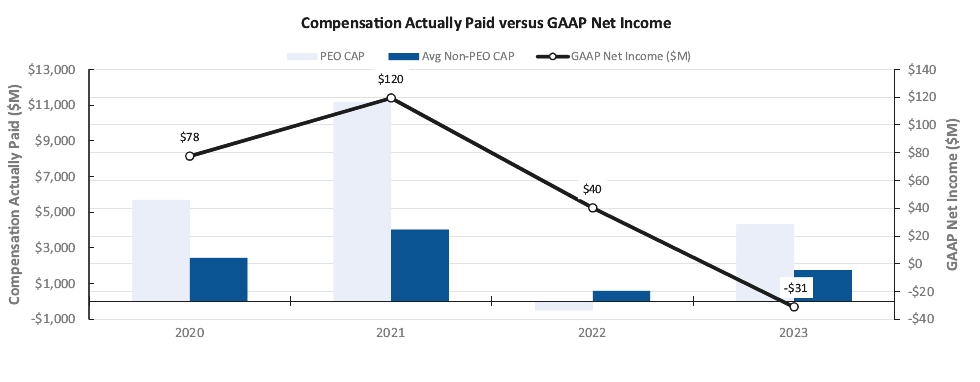

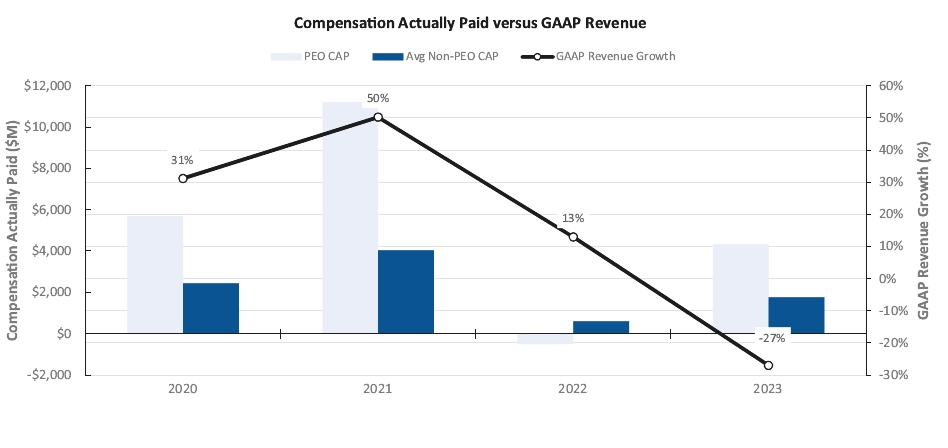

Year(1) | | | Summary Comp Table Total for PEO(2) | | | Compensation Actually Paid to PEO(3)(4) | | | Average Summary Comp Table Total for non-PEO NEOs(2) | | | Average Compensation Actually Paid to non-PEO NEOs(3)(5) | | | Company’s Total Shareholder Return(6) | | | Peer Group Total Shareholder Return(6) | | | GAAP Net Income | | | GAAP Revenue Growth(7) |

| (a) | | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) |

| 2023 | | | $5,043,765 | | | $4,314,644 | | | $1,840,096 | | | $1,751,380 | | | $146 | | | $277 | | | ($31,300,000) | | | -27% |

| 2022 | | | $4,240,224 | | | ($505,754) | | | $1,875,513 | | | $597,671 | | | $142 | | | $123 | | | $40,400,000 | | | 13% |

| 2021 | | | $5,201,766 | | | $11,184,818 | | | $1,754,208 | | | $4,029,427 | | | $245 | | | $219 | | | $119,500,000 | | | 50% |

| 2020 | | | $3,417,579 | | | $5,684,347 | | | $1,571,782 | | | $2,441,747 | | | $135 | | | $145 | | | $77,600,000 | | | 31% |

| (1) | NEOs included in the above compensation columns reflect the following: |

| Year | | | PEO #1 | | | NON-PEO NEOs |

| 2023 | | | Mr. Scholhamer | | | Messrs. Chinnasami, Cook, and McKibben and Ms. Savage |

| 2022 | | | Mr. Scholhamer | | | Messrs. Chinnasami, Cook, and McKibben and Ms. Savage |

| 2021 | | | Mr. Scholhamer | | | Messrs. Chinnasami, Williams, and Bentick and Ms. Savage |

| 2020 | | | Mr. Scholhamer | | | Messrs. Chinnasami, Williams, and Bentick and Ms. Savage |

| (2) | Amounts reported in this column represent (i) the total compensation as reported in the Summary Compensation Table for the applicable year in the case of our PEO and (ii) the average of the total compensation as reported in the Summary Compensation Table for the Company’s other NEOs for the applicable year. |

| (3) | SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine “compensation actually paid” as reported in the Pay versus Performance Table. “Compensation actually paid” does not necessarily represent cash and/or equity value transferred to the applicable NEO without restriction, but rather is a value calculated under applicable SEC rules. In general, “compensation actually paid” is calculated as Summary Compensation Table total compensation adjusted to include the fair market value of equity awards as of last day of the applicable fiscal year or, if earlier, the vesting date (rather than the grant date). |

| (4) | Compensation Actually Paid to our PEO reflects the following adjustments from total compensation reported in the Summary Compensation Table: |

| | | 2023 | |

| Total Reported in Summary Compensation Table (SCT) | | | $5,043,765 |

| Less, value of Stock Awards reported in SCT | | | ($3,507,146) |

| Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding | | | $3,959,355 |

| Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested | | | ($3,327,125) |

| Plus, FMV of Awards Granted this Year and that Vested this Year | | | $0 |

| Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year | | | $2,145,795 |

| Less Prior Year Fair Value of Prior Year awards that Failed to vest this Year | | | $0 |

| Total Adjustments | | | ($729,121) |

| Actual Compensation Paid | | | $4,314,644 |

| 50 |

| (5) | The average Compensation Actually Paid to the non-PEO NEOs reflects the following adjustments from Total compensation reported in the Summary Compensation Table: |

| | | 2023 | |

| Total Reported in Summary Compensation Table (SCT) | | | $1,840,096 |

| Less, value of Stock Awards reported in SCT | | | ($942,540) |

| Plus, Year-End value of Awards Granted in Fiscal Year that are Unvested and Outstanding | | | $1,077,483 |

| Plus, Change in Fair Value of Prior Year awards that are Outstanding and Unvested | | | ($861,772) |

| Plus, FMV of Awards Granted this Year and that Vested this Year | | | $0 |

| Plus, Change in Fair Value (from prior year-end) of Prior Year awards that Vested this year | | | $638,113 |

| Less Prior Year Fair Value of Prior Year awards that Failed to vest this Year | | | $0 |

| Total Adjustments | | | ($88,716) |

| Actual Compensation Paid | | | $1,751,380 |

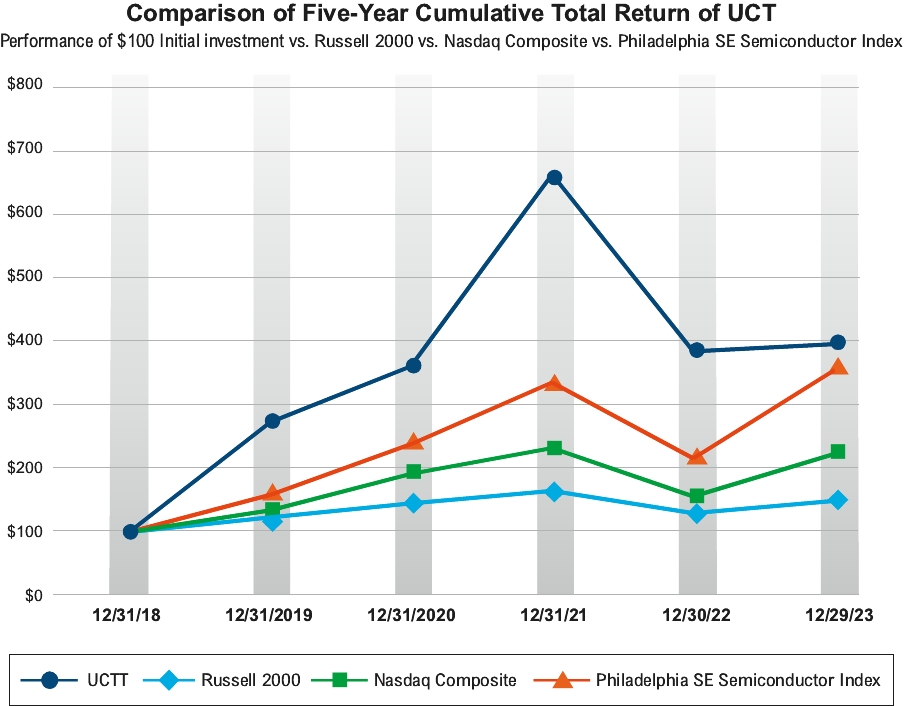

| (6) | Peer group TSR reflects the RDG Semiconductor Composite Index performance as reflected in our Annual Report on Form 10-K for the fiscal year ended December 29, 2023 pursuant to Item 201(e) of Regulation S-K. For the Company and peer group TSR, each year reflects what the cumulative value of $100 would be, including reinvestment of dividends, if such amount were invested on December 28, 2019. |

| (7) | GAAP Revenue Growth is used as the Company selected metric and it is part of our annual incentive program and the primary component of our PSUs which measures relative revenue growth against a select group of performance peers. |

| 51 |

| (i) | GAAP Revenue Growth |

| (ii) | Non-GAAP Adjusted Operating Margin |

| (iii) | Relative Total Shareholder Return |

| (iv) | Free Cash Flow |

| (v) | Strategic Programs (ERP implementation, expense reduction, site optimization and product transition goals) |

| (vi) | Human Capital Goals |

| 52 |

| | | BY ORDER OF THE BOARD OF DIRECTORS | ||||

| | | | | |||

| | | By: | | | /s/ James P. Scholhamer | |

| | | | | Name: James P. Scholhamer | ||

| | | | | Title: Chief Executive Officer | ||

| 53 |

| | | TWELVE MONTHS ENDED | ||||

| | | DECEMBER 29, 2023 | | | DECEMBER 30, 2022 | |

| Reconciliation of GAAP Net Income to Non-GAAP Net Income (in millions) | | | | | ||

| Reported net income attributable to UCT on a GAAP basis | | | $(31.1) | | | $40.4 |

Amortization of intangible assets(1) | | | 24.1 | | | 30.1 |

Stock-based compensation expense(2) | | | 12.5 | | | 19.3 |

Restructuring charges(3) | | | 9.2 | | | 3.3 |

Acquisition related costs(4) | | | 4.3 | | | 0.6 |

Fair value related adjustments(5) | | | 4.0 | | | — |

Legal-related costs(6) | | | (0.4) | | | 2.2 |

VAT settlement(7) | | | — | | | 2.9 |

Net loss on divestitures(8) | | | — | | | 77.4 |

Covid-19 related costs(9) | | | — | | | 2.9 |

Income tax effect of non-GAAP adjustments(11) | | | (10.2) | | | (22.2) |

Income tax effect of valuation allowance(12) | | | 12.8 | | | 23.9 |

| Non-GAAP net income attributable to UCT | | | $25.2 | | | $181.9 |

| | | | | |||

| Reconciliation of GAAP Income from operations to Non-GAAP Income from operations (in millions) | | | | | ||

| Reported income from operations on a GAAP basis | | | $35.2 | | | $120.4 |

Amortization of intangible assets(1) | | | 24.1 | | | 30.1 |

Stock-based compensation expense(2) | | | 12.5 | | | 19.3 |

Restructuring charges(3) | | | 9.2 | | | 3.3 |

Acquisition related costs(4) | | | 4.3 | | | 0.6 |

Fair value related adjustments(5) | | | 0.4 | | | — |

Legal-related costs(6) | | | (0.4) | | | 2.2 |

VAT settlement(7) | | | — | | | 4.0 |

Net loss on divestitures(8) | | | — | | | 77.4 |

Covid-19 related costs(9) | | | — | | | 2.2 |

| Non-GAAP income from operations | | | $85.3 | | | $260.2 |

| | | | | |||

| Reconciliation of GAAP Operating margin to Non-GAAP Operating margin | | | | | ||

| Reported operating margin on a GAAP basis | | | 2.0% | | | 5.1% |

Amortization of intangible assets(1) | | | 1.4% | | | 1.3% |

Stock-based compensation expense(2) | | | 0.7% | | | 0.8% |

Restructuring charges(3) | | | 0.5% | | | 0.1% |

Acquisition related costs(4) | | | 0.3% | | | 0.0% |

Fair value related adjustments(5) | | | 0.0% | | | — |

Legal-related costs(6) | | | 0.0% | | | 0.1% |

VAT settlement(7) | | | — | | | 0.2% |

Net loss on divestitures(8) | | | — | | | 3.3% |

Covid-19 related costs(9) | | | — | | | 0.1% |

| Non-GAAP operating margin | | | 4.9% | | | 11.0% |

| | | | | |||

| Reconciliation of GAAP Gross profit to Non-GAAP Gross profit (in millions) | | | | | ||

| Reported gross profit on a GAAP basis | | | $277.3 | | | $465.0 |

Amortization of intangible assets(1) | | | 6.5 | | | 6.3 |

Stock-based compensation expense(2) | | | 1.5 | | | 1.5 |

Restructuring charges(3) | | | 1.6 | | | 1.0 |

Fair value related adjustments(5) | | | 0.4 | | | — |

VAT settlement(7) | | | — | | | 4.0 |

Covid-19 related costs(9) | | | — | | | 2.9 |

| Non-GAAP gross profit | | | $287.3 | | | $480.7 |

| | | | | |||

| Reconciliation of GAAP Gross margin to Non-GAAP Gross margin | | | | | ||

| Reported gross margin on a GAAP basis | | | 16.0% | | | 19.6% |

Amortization of intangible assets(1) | | | 0.4% | | | 0.3% |

Stock-based compensation expense(2) | | | 0.1% | | | 0.1% |

Restructuring charges(3) | | | 0.1% | | | 0.0% |

Fair value related adjustments(5) | | | 0.0% | | | — |

VAT settlement(7) | | | —% | | | 0.2% |

Covid-19 related costs(9) | | | — | | | 0.1% |

| Non-GAAP gross margin | | | 16.6% | | | 20.2% |

| A-1 |

| | | TWELVE MONTHS ENDED | ||||

| | | DECEMBER 29, 2023 | | | DECEMBER 30, 2022 | |

| Reconciliation of GAAP Interest and other income (expense) to Non-GAAP Interest and other income (expense) (in millions) | | | | | ||

| Reported interest and other income (expense) on a GAAP basis | | | $(46.5) | | | $(32.1) |

Fair value related adjustments(8) | | | 4.9 | | | — |

| Non-GAAP interest and other income (expense) | | | $(41.6) | | | $(32.1) |

| | | | | |||