- UCTT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ultra Clean (UCTT) DEF 14ADefinitive proxy

Filed: 26 Apr 21, 12:35pm

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

ULTRA CLEAN HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

ULTRA CLEAN HOLDINGS, INC.

26462 Corporate Avenue

Hayward, CA 94545

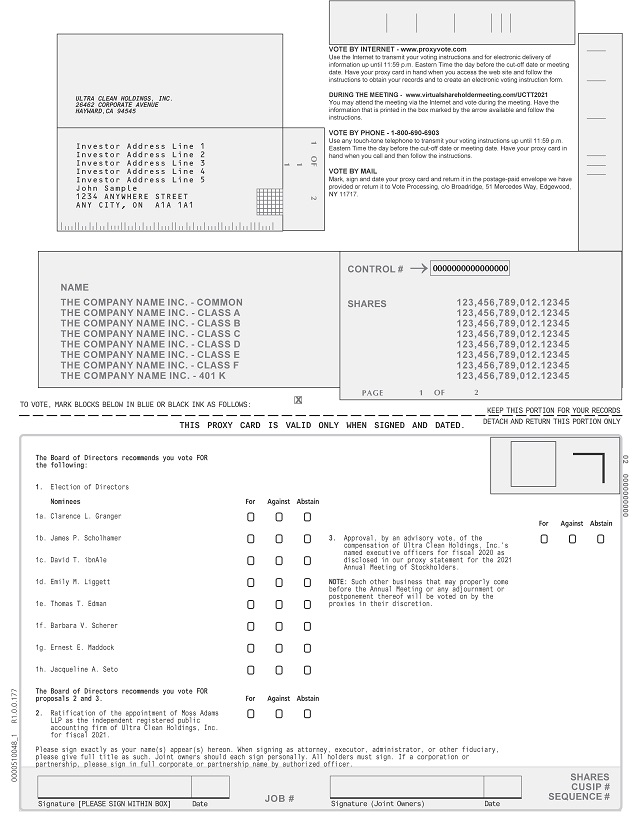

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS OF

ULTRA CLEAN HOLDINGS, INC.

Date: | May 20, 2021 |

Time: | 12:30 p.m. Pacific time |

Virtual Meeting: | www.virtualshareholdermeeting.com/UCTT2021 |

| The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/UCTT2021, you must enter the control number found on your proxy card, voting instruction form or notice. |

Purposes: | • | Elect our directors |

| • | Ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for fiscal 2021 |

| • | Hold an advisory vote on executive compensation |

| • | Conduct other business that may properly come before the annual meeting or any adjournment or postponement thereof |

Who Can Vote: | March 31, 2021 is the record date for voting. Only stockholders of record at the close of business on that date may vote at the annual meeting or any adjournment thereof. |

| All stockholders are cordially invited to attend the meeting. At the meeting, you will hear a report on our business and have a chance to meet some of our directors and executive officers. |

Adjournments or Postponements | In the event of an adjournment, postponement or emergency that may change the annual meeting’s time, date or location, we will make an announcement, issue a press release or post information at www.uct.com/investors to notify stockholders, as appropriate. Information on or accessible through our website is not incorporated by reference in this Proxy Statement. |

| Important Notice Regarding The Availability Of Proxy Materials For The Stockholder Meeting To Be Held On May 20, 2021: This Proxy Statement, along with our 2020 Annual Report to Stockholders, is available on the following website: http://materials.proxyvote.com/90385V. Whether you expect to attend the meeting or not, please vote electronically via the Internet or by telephone or by completing, signing and promptly returning the enclosed proxy card in the enclosed postage-prepaid envelope. You may change your vote and revoke your proxy at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement. |

Sincerely,

/s/ James P. Scholhamer

James P. Scholhamer

Chief Executive Officer

April 26, 2021

ULTRA CLEAN HOLDINGS, INC.

2021 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

ULTRA CLEAN HOLDINGS, INC.

26462 Corporate Avenue

Hayward, CA 94545

PROXY STATEMENT FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

May 20, 2021

INFORMATION CONCERNING SOLICITATION AND VOTING

Your vote is very important. For this reason, our Board of Directors is requesting that you permit your shares of common stock to be represented at our 2021 Annual Meeting of Stockholders by the proxies named on the enclosed proxy card. This proxy statement contains important information for you to consider in deciding how to vote on the matters brought before the meeting. The date of this proxy statement is April 26, 2021. The proxy statement and form of proxy are first being mailed to our stockholders on or about April 27, 2021.

Important Notice Regarding The Availability Of Proxy Materials For The Stockholder Meeting To Be Held On May 20, 2021: This Proxy Statement, along with our 2020 Annual Report to Stockholders, is available on the following website: http://materials.proxyvote.com/90385V.

General Information

Ultra Clean Holdings, Inc., referred to in this proxy statement as “Ultra Clean,” the “Company” or “we,” is soliciting the enclosed proxy for use at our Annual Meeting of Stockholders to be held on May 20, 2021 at 12:30 p.m., Pacific time or at any adjournment thereof for the purposes set forth in this proxy statement. Due to the continued public health impact of the coronavirus outbreak (COVID-19), our annual meeting will be a virtual meeting of stockholders, which will be conducted via a live audio webcast. You will be able to attend the Annual Meeting, submit your questions and vote online during the meeting by visiting www.virtualshareholdermeeting.com/UCTT2021.

In the event of an adjournment, postponement or emergency that may change the Annual Meeting’s time, date or location, we will make an announcement, issue a press release or post information at www.uct.com/investors to notify stockholders, as appropriate. Information on or accessible through our website is not incorporated by reference in this Proxy Statement.

Who May Attend and Vote at Our Annual Meeting

All holders of our common stock, as reflected in our records at the close of business on March 31, 2021, the record date for voting, may attend and vote at the meeting. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/UCTT2021, you must enter the control number found on your proxy card, voting instruction form or notice you previously received.

Each share of common stock that you owned on the record date entitles you to one vote on each matter properly brought before the meeting. As of the record date, there were issued and outstanding 40,659,905 shares of our common stock, $0.001 par value.

Holding Shares as a “Beneficial Owner” (or in “Street Name”)

Most stockholders are considered the “beneficial owners” of their shares, that is, they hold their shares through a broker, bank or nominee rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name.”

1

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. If you are a stockholder of record, we are sending paper copies of the proxy materials directly to you. As our stockholder of record, you have the right to grant your voting proxy directly to us by signing and mailing the enclosed proxy card or by voting on the Internet or telephone or at the annual meeting.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or nominee, you are considered the beneficial owner of shares held in street name, and the proxy statement is being forwarded to you by or on behalf of your broker, bank or nominee (who is considered the stockholder of record with respect to those shares). As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote by following the instructions you receive from your broker, bank or nominee. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares at the annual meeting unless you request, complete and deliver a proxy from your broker, bank or nominee.

How to Vote

You may vote in person at the virtual meeting or by proxy.

Voting by Proxy. If you are a stockholder of record, you may vote by proxy over the Internet, by telephone or by mail if you complete and return the enclosed proxy card by following the instructions on the proxy card. If your shares are held in street name, you have the right to direct your broker, bank or nominee how to vote by following the instructions you receive from your broker, bank or nominee. The shares voted electronically, telephonically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the annual meeting. We recommend that you vote by proxy even if you plan to attend the meeting. You may change your vote at the meeting even if you have previously submitted a proxy.

Voting at the Annual Meeting. The method or timing of your vote will not limit your right to vote at the annual meeting. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the annual meeting. You should allow yourself enough time prior to the annual meeting to obtain this proxy from the holder of record.

How Proxies Work

This proxy statement is furnished in connection with the solicitation of proxies by us for use at the annual meeting and at any adjournment of that meeting. If you give us your proxy, you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some or none of our director candidates. You may also vote for or against the other proposals, or you may abstain from voting.

If you give us your proxy but do not specify how your shares shall be voted on a particular matter, your shares will be voted:

| • | FOR the election of each of the named nominees for director; |

| • | FOR the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm; |

| • | FOR the approval of the compensation of our named executive officers; and |

| • | with respect to any other matter that may come before the annual meeting, as recommended by our Board of Directors or otherwise in the proxies’ discretion. |

Changing or Revoking Your Vote

You have the right to revoke your previously submitted proxy at any time before your proxy is exercised at the annual meeting.

2

If you are the stockholder of record, you may revoke your proxy by resubmitting your vote on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted), by signing and returning a new proxy card with a later date, by attending and voting at the annual meeting or by giving written notice to our Secretary that you wish to revoke your previously submitted proxy.

If you hold shares beneficially in street name, you may revoke your proxy by submitting new voting instructions to your broker, bank or nominee by following the instructions they provide you or, if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares, by attending and voting at the annual meeting.

Note that for both stockholders of record and beneficial owners, attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the annual meeting.

Important Notice Regarding Delivery of Stockholder Documents

Only one proxy statement, annual report and set of accompanying materials, if applicable, are being delivered by us to multiple stockholders sharing an address, who have consented to receiving one set of such materials, until we receive contrary instructions from any such stockholders. We will deliver, promptly upon written or oral request, a separate copy of such materials to a stockholder at a shared address to which a single copy of such materials was delivered. A stockholder who wishes to receive a separate copy of the proxy statement and accompanying materials now or in the future, or stockholders sharing an address who are receiving multiple copies of the proxy statement and accompanying materials and wish to receive a single copy of such materials, should submit a request to Broadridge, c/o Householding Department, 51 Mercedes Way, Edgewood, NY 11717 or call 800-542-1061.

Votes Needed to Hold the Meeting and Approve Proposals

In order to carry on the business of the annual meeting, stockholders entitled to cast a majority of the votes at a meeting of stockholders must be represented at the meeting, either in person or by proxy. In accordance with Delaware law, only votes cast “for” a matter constitute affirmative votes. A properly executed proxy marked “abstain” with respect to any matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Since abstentions will not be votes cast for a particular proposal, they will have the same effect as negative votes or votes against that proposal. Broker non-votes are also counted for the purpose of determining the presence of a quorum. Broker non-votes occur when shares held by a broker on behalf of a beneficial owner are not voted with respect to a particular proposal, which generally occurs when the broker has not received voting instructions from the beneficial owner and lacks the discretionary authority to vote the shares itself.

Election of Directors. Our Amended and Restated Bylaws provides that a director nominee must receive a majority of the votes cast with respect to such nominee in uncontested director elections (i.e., the number of shares voted “for” a director nominee must exceed the number of shares voted “against” such nominee). If an incumbent director nominee fails to receive a majority of the votes cast in an uncontested election, the director shall immediately tender his or her resignation to the Board. The Nominating and Corporate Governance Committee of the Board, or such other committee designated by the Board, shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board shall act on the resignation, taking into account the committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results. If the Board accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, the remaining members of the Board may fill the resulting vacancy or may decrease the size of the Board.

3

Brokers do not have discretionary authority to vote shares without instructions from beneficial owners in the election of directors. Therefore, beneficial owners who are not stockholders of record and who want their votes to be counted in the election of directors must give voting instructions to their bank, broker or nominee before the date of the annual meeting.

Ratification of the appointment of our independent registered public accounting firm. The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the proposal will be required to ratify the appointment of our independent registered public accounting firm for the current fiscal year. We believe that the ratification of our independent registered public accounting firm is a routine proposal for which brokers may vote shares held on behalf of beneficial owners who have not given voting instructions with respect to that proposal.

Advisory vote on the compensation of our named executive officers. The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the proposal will be sufficient to approve, by an advisory, non-binding vote, the compensation of our named executive officers for fiscal 2020. The advisory vote on the compensation of our named executive officers, while held annually, is not considered a routine proposal; therefore, brokers lack the discretionary authority to vote shares without instructions from beneficial owners for this proposal.

Approval of any other matter properly submitted to the stockholders at the annual meeting generally will require the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on that matter.

Security Ownership of Certain Beneficial Owners and Management

The table below sets forth information as of March 1, 2021 regarding the beneficial ownership (as defined by Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of our common stock by:

| • | each person or group known by us to own beneficially more than five percent of our common stock; |

| • | each of our directors, director nominees and named executive officers individually; and |

| • | all directors and executive officers as a group. |

In accordance with applicable rules of the Securities and Exchange Commission (the “SEC”), beneficial ownership includes voting or investment power with respect to securities and includes the shares issuable pursuant to stock options that are exercisable, and shares subject to restricted stock units that vest and are delivered, within 60 days of March 1, 2021. Shares issuable pursuant to the exercise of stock options, and restricted stock units that vest, in the 60 days following March 1, 2021, are deemed outstanding for the purpose of computing the ownership percentage of the person holding such options, or shares subject to restricted stock units, but are not deemed outstanding for computing the ownership percentage of any other person. The percentage of beneficial ownership for the following table is based on 40,618,631 shares of common stock outstanding as of March 1, 2021.

4

The address of each of the named individuals in the table below is c/o Ultra Clean Holdings, Inc., 26462 Corporate Avenue, Hayward, CA 94545 unless otherwise indicated below. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock.

| Shares of Common Stock Beneficially Owned | ||||||||

Name and Address of Beneficial Owner | Number | Percent | ||||||

Greater than 5% Stockholders | ||||||||

BlackRock, Inc.(1) | 6,917,582 | 17.0 | % | |||||

55 East 52nd Street New York, NY 10055 | ||||||||

The Vanguard Group(2) | 2,988,372 | 7.4 | % | |||||

100 Vanguard Boulevard Malvern, PA 19355 | ||||||||

Swedbank Robur Fonder AB(3) | 2,300,000 | 5.7 | % | |||||

SE-105 34 Stockholm, Sweden | ||||||||

Dimensional Fund Advisors LP(4) | 2,157,392 | 5.3 | % | |||||

6300 Bee Cave Road Building One Austin, TX 78746 | ||||||||

Named Executive Officers, Directors and Director Nominees | ||||||||

James P. Scholhamer(5) | 378,299 | * | ||||||

Sheri L. Savage(6) | 85,557 | * | ||||||

Vijayan S. Chinnasami(7) | 62,418 | * | ||||||

W. Joseph Williams(8) | 26,691 | * | ||||||

William C. Bentinck(9) | 39,388 | * | ||||||

Clarence L. Granger(10) | 88,438 | * | ||||||

Thomas T. Edman(10) | 26,200 | * | ||||||

David T. ibnAle(10) | 85,200 | * | ||||||

Emily M. Liggett(10) | 39,200 | * | ||||||

Ernest E. Maddock(10) | 22,700 | * | ||||||

Barbara V. Scherer(10) | 41,200 | * | ||||||

Jacqueline A. Seto(10) | 8,557 | * | ||||||

All Executive Officers and Directors as a Group (15 persons)(11) | 939,982 | 2.3 | % | |||||

| * | Less than 1%. |

| (1) | Based on a Schedule 13G filed with the SEC on January 25, 2021. |

| (2) | Based on a Schedule 13G/A filed with the SEC on February 10, 2021. |

| (3) | Based on a Schedule 13G filed with the SEC on February 13, 2020. |

| (4) | Based on a Schedule 13G/A filed with the SEC on February 12, 2021. |

| (5) | Includes (i) 8,838 performance restricted stock units and 12,277 restricted stock units that were scheduled to vest on March 30, 2021, (ii) 24,012 performance restricted stock units and 19,646 restricted stock units that were scheduled to vest on April 24, 2021 and (iii) 20,886 performance restricted stock units and 20,886 restricted stock units that were scheduled to vest on April 30, 2021. |

| (6) | Includes (i) 4,764 performance restricted stock units and 6,617 restricted stock units that were scheduled to vest on March 30, 2021, (ii) 10,914 performance restricted stock units and 10,914 restricted stock units that were scheduled to vest on April 24, 2021 and (iii) 10,443 performance restricted stock units and 10,443 restricted stock units that were scheduled to vest on April 30, 2021. |

5

| (7) | Includes (i) 5,457 performance restricted stock units and 16,371 restricted stock units that were scheduled to vest on April 24, 2021 and (ii) 25,295 restricted stock units that were scheduled to vest on April 26, 2021. |

| (8) | Consists of (i) 1,020 performance restricted stock units and 4,250 restricted stock units that were scheduled to vest on March 30, 2021, (ii) 2,292 performance restricted stock units and 6,876 restricted stock units that were scheduled to vest on April 24, 2021 and (iii) 3,063 performance restricted stock units and 9,190 restricted stock units that were scheduled to vest on April 30, 2021. |

| (9) | Includes (i) 2,292 performance restricted stock units and 6,876 restricted stock units that were scheduled to vest on April 24, 2021 and (ii) 18,269 restricted stock units that were scheduled to vest on April 26, 2021. |

| (10) | Includes 6,301 restricted stock awards that vest on May 19, 2021. |

| (11) | Consists of shares beneficially owned by our current executive officers and directors as of March 1, 2021, which include (i) 15,510 performance restricted stock units and 26,844 restricted stock units that were scheduled to vest on March 30, 2021, (ii) 49,605 performance restricted stock units and 74,597 restricted stock units that were scheduled to vest on April 24, 2021 (iii) 43,564 restricted stock units that were scheduled to vest on April 26, 2021, and (iv) 36,690 performance restricted stock units and 47,411 restricted stock units that were scheduled to vest on April 30, 2021. |

At the close of business on March 31, 2021, the record date, we had 40,659,905 shares of common stock outstanding. Each share of our common stock is entitled to one vote on all matters properly submitted for a stockholder vote.

Delinquent Section 16(a) Reports

Section 16(a) requires our directors, executive officers and beneficial holders of 10% or more of a registered class of our equity securities to file certain reports with the SEC regarding ownership of, and transactions in, our equity securities. Based solely on a review of Forms 3, 4 and 5 and amendments thereto furnished to us and written representations we received from our directors and officers required to file the reports, we believe that all of our directors, executive officers and beneficial holders of 10% or more of a registered class of our equity securities, filed, on a timely basis, all reports required by Section 16(a) of the Exchange Act for the year ended December 25, 2020.

Cost of Proxy Solicitation

We will pay the cost of this proxy solicitation. Some of our employees may also solicit proxies, without any additional compensation. We may also reimburse banks, brokerage firms and nominees for their expenses in forwarding proxy materials to their customers who are beneficial owners of our common stock and obtaining their voting instructions.

Deadline for Receipt of Stockholder Proposals

If you wish to submit a proposal for inclusion in the proxy statement for our 2022 Annual Meeting of Stockholders, you must follow the procedures outlined in Rule 14a-8 of the Exchange Act, and we must receive your proposal at the address below no later than January 20, 2022. Stockholders intending to present a proposal at the next annual meeting without the inclusion of such proposal in the Company’s proxy materials, including for the election of director nominees, must comply with the requirements set forth in our Amended and Restated Bylaws. The Amended and Restated Bylaws require, among other things, that a stockholder must submit a written notice of intent to present such a proposal at the address below not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders (as long as the date of the annual meeting is not advanced more than 30 days prior to such anniversary date or delayed more than 70 days after such anniversary date, in which case notice must be received no earlier than 120 days prior to such meeting and no later than the later of 70 days prior to such meeting or the 10th day following the public

6

announcement of the date of such meeting). Therefore, we must receive notice of such proposal for the 2022 Annual Meeting of Stockholders no earlier than January 20, 2022, and no later than February 19, 2022, otherwise such notice will be considered untimely and we will not be required to present it at the 2022 Annual Meeting of Stockholders. The Company reserves the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

Contacting Ultra Clean

If you have questions or would like more information about the annual meeting, you can contact us in either of the following ways:

• By telephone: | 510-576-4400 | |

• By fax: | 510-576-4401 | |

• In writing at our principal executive offices: | Ultra Clean Holdings, Inc. Attn: Secretary 26462 Corporate Avenue Hayward, CA 94545 | |

7

PROPOSAL 1: ELECTION OF DIRECTORS

Our Amended and Restated Bylaws provide that our Board of Directors shall be elected at the annual meeting of our stockholders, and each director so elected shall hold office until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. Our Board of Directors, at the recommendation of the Nominating and Corporate Governance Committee, has recommended for nomination the nominees for director named below. All of these nominees currently serve as our directors. Each nominee has consented to serve as a nominee, to serve as a director if elected, and to being named a nominee in this Proxy Statement. If a director nominee becomes unavailable before the election, your proxy authorizes the people named as proxies to vote for a replacement nominee if our Board of Directors names one.

Our Amended and Restated Bylaws provide that a director nominee must receive a majority of the votes cast with respect to such nominee in uncontested director elections (i.e., the number of shares voted “for” a director nominee must exceed the number of shares voted “against” such nominee). If an incumbent director nominee fails to receive a majority of the votes cast in an uncontested election, the director shall immediately tender his or her resignation to the Board. The Nominating and Corporate Governance Committee of the Board, or such other committee designated by the Board, shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board shall act on the resignation, taking into account the committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results. If the Board accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, the remaining members of the Board may fill the resulting vacancy or may decrease the size of the Board.

Name | Position/Office Held With the Company | Age | Director Since | |||||||

Clarence L. Granger | Chairman of the Board and Nominee for Director | 72 | 2002 | |||||||

James P. Scholhamer | Chief Executive Officer, Director and Nominee for Director | 54 | 2015 | |||||||

David T. ibnAle | Director and Nominee for Director | 49 | 2002 | |||||||

Emily M. Liggett | Director and Nominee for Director | 65 | 2014 | |||||||

Thomas T. Edman | Director and Nominee for Director | 58 | 2015 | |||||||

Barbara V. Scherer | Director and Nominee for Director | 65 | 2015 | |||||||

Ernest E. Maddock | Director and Nominee for Director | 63 | 2018 | |||||||

Jacqueline A. Seto | Director and Nominee for Director | 55 | 2020 | |||||||

8

Members of our Board self-identify as set forth in the table below:

| Board Diversity Matrix (As of March 24, 2021) | ||||||||

Total Number of Directors | 8 | |||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

Part I: Gender Identity | ||||||||

Directors | 3 | 4 | 1 | |||||

Part II: Demographic Background | ||||||||

African American or Black | 1 | |||||||

Alaskan Native or Native American | ||||||||

Asian | 1 | |||||||

Hispanic or Latinx | ||||||||

Native Hawaiian or Pacific Islander | ||||||||

White | 3 | 3 | ||||||

Two or More Races or Ethnicities | 1 | |||||||

|

|

|

| |||||

LGBTQ+ | 1 | |||||||

Did Not Disclose Demographic Background | 1 | |||||||

Set forth below is information about each of our nominees for director:

Clarence L. Granger has served as our Chairman since October 2006 and has been a member of our Board of Directors since May 2002. Mr. Granger formerly served as our Chief Executive Officer from November 2002 to January 2015. Mr. Granger served as our Executive Vice President and Chief Operating Officer from January 1998 to March 1999 and as our Executive Vice President of Operations from April 1996 to January 1998. Prior to joining Ultra Clean in April 1996, Mr. Granger served as Vice President of Media Operations for Seagate Technology, which designs, manufactures, markets and sells hard disk drives, from 1994 to 1996. Prior to that, Mr. Granger worked for HMT Technology, a supplier of high-performance thin-film disks, as Chief Executive Officer from 1993 to 1994, as Chief Operating Officer from 1991 to 1993 and as President from 1989 to 1994. Prior to that, Mr. Granger worked for Xidex as Vice President and General Manager, Thin Film Disk Division, from 1988 to 1989, as Vice President, Santa Clara Oxide Disk Operations, from 1987 to 1988, as Vice President, U.S. Tape Operations, from 1986 to 1987 and as Director of Engineering from 1983 to 1986. Mr. Granger holds a Master of Science degree in Industrial Engineering from Stanford University and a Bachelor of Science degree in Industrial Engineering from the University of California at Berkeley. Our Board of Directors values Mr. Granger’s perspective as our former Chief Executive Officer and his intimate knowledge of our employee base, operations, customers, suppliers and competitive position in the semiconductor capital equipment industry.

James P. Scholhamer joined the Company as Chief Executive Officer and a member of our Board of Directors in January 2015. Prior to joining Ultra Clean, Mr. Scholhamer served as Corporate Vice President and General Manager of Applied Materials, Inc., leading the Equipment Products Group and Display Services Group of its Global Service Division from February 2011 to January 2015. Mr. Scholhamer joined Applied Materials, Inc. in 2006, where, prior to his most recent position, he served as Vice President of Operations-Energy, for the Environmental and Display Products Division from July 2006 to December 2008 and Corporate Vice President and General Manager of the Display Business Group from December 2008 to February 2011. Prior to that, Mr. Scholhamer worked for Applied Films Corporation as Vice President of Operations, Engineering and Research Development in the company’s German office from September 2002 to July 2006 and as Vice President of Thin Film Coating Division and Thin Film Equipment Division in the company’s Colorado office from July 2000 to September 2002. Mr. Scholhamer holds a Bachelor of Science degree in Materials and Metallurgical Engineering from the University of Michigan. Our Board of Directors believes that Mr. Scholhamer brings strong engineering and operations experience to our Board of Directors and provides the Board of Directors with a unique perspective as our Chief Executive Officer and leader of our strategic planning process.

9

David T. ibnAle has served as a director of Ultra Clean since November 2002 and served as our Lead Director from February 2005 to February 2007. Mr. ibnAle is a Founding and Managing Partner of Advance Venture Partners, LLC. He has over 20 years of experience as an investor in small and mid-sized growth companies in the technology, media and communications sectors. Prior to co-founding Advance Venture Partners in 2014, Mr. ibnAle was a Managing Partner of Augusta Columbia Capital Group from 2011 to 2013, and a Managing Director of TPG Growth, the growth equity and middle market investment platform of TPG, from 2008 to 2011. Prior to joining TPG Growth, he was an investment professional and a Partner at Francisco Partners from 1999 to 2008, and he began his investing career at Summit Partners. Mr. ibnAle has served on the boards of directors of a number of public and private technology companies, and he currently serves on the Boards of Directors of Affinity, E.Merge Technology Acquisition Corp., Ginger, Morning Consult, Nativo, PebblePost and UrbanSitter. Mr. ibnAle holds a Bachelor of Arts degree in Public Policy and a Master’s degree in International Development Policy from Stanford University, and a Master’s degree in Business Administration from the Stanford University Graduate School of Business. Our Board of Directors values Mr. ibnAle’s experience as an investment professional, as well his experience in strategic planning and mergers and acquisitions, as he brings significant quantitative and qualitative financial experience to our Board of Directors. Mr. ibnAle qualifies as a financial expert and provides important support as a member of our Audit Committee.

Emily M. Liggett has served as a director of Ultra Clean since May 2014. Ms. Liggett is the Founder and Chief Executive Officer of Liggett Advisors, a strategy/implementation consulting business. She served as a business coach and consultant for Stanford Seed from 2017 to 2018. She was President and Chief Executive Officer of NovaTorque, Inc., a manufacturer of high-efficiency electric motor systems, from 2009 until late 2016, when it was acquired by Regal Beloit. She previously served as President and Chief Executive Officer of Apexon, Inc., a provider of supply chain optimization software solutions for global manufacturers, from 2004 to 2007. Ms. Liggett served as President and Chief Executive Officer of Capstone Turbine Corporation (provider of microturbine systems for clean, continuous distributed energy generation) from 2002 to 2003 and, prior to that, held various management and executive roles at Raychem Corporation (acquired by Tyco International in 1999) from 1984 to 2001, including Corporate Vice President of Raychem and Managing Director of Tyco Ventures. Ms. Liggett is presently a director of Materion Corporation since 2020, and of Kaiser Aluminum since 2018. She was a director of MTS Systems Corporation from 2010 to 2016 and was a director of Immersion Corporation from 2005 to 2011. She also served on the Purdue University School of Engineering Advisory Board from 2000 until 2018. Ms. Liggett holds a Bachelor of Science degree in Chemical Engineering from Purdue University, a Master of Science degree in Engineering and Manufacturing Systems from Stanford University and a Master’s degree in Business Administration from the Stanford University Graduate School of Business. Ms. Liggett’s qualifications to serve on our Board of Directors include her Chief Executive Officer and management experience in a variety of technical industrial companies. She has managed worldwide businesses, partnerships, and international joint ventures. She also has public company and private company operating and board experience, and expertise in strategy, operations, new product development, sales, marketing, and business development for highly technical businesses.

Thomas T. Edman has served as a director of Ultra Clean since June 2015. Mr. Edman has served as the Chief Executive Officer of TTM Technologies, Inc. since January 2014, as its President since January 2013 and as a member of its Board of Directors since September 2004. From early 2011 to December 2012, Mr. Edman served as Group Vice President and General Manager of the AKT Display Business Group, which is a division of Applied Materials Inc., a publicly held provider of nanomanufacturing technology solutions. From 2006 to 2011, Mr. Edman served as Corporate Vice President of Corporate Business Development of Applied Materials, Inc. Prior to that, Mr. Edman served as President and Chief Executive Officer of Applied Films Corporation from May 1998 until Applied Materials, Inc. acquired Applied Films Corporation in July 2006. From June 1996 until May 1998, Mr. Edman served as Chief Operating Officer and Executive Vice President of Applied Films Corporation. From 1993 until joining Applied Films, Mr. Edman served as General Manager of the High Performance Materials Division of Marubeni Specialty Chemicals, Inc., a subsidiary of a major Japanese trading corporation. Mr. Edman presently serves on the Board of Directors of the IPC, an electronic industry association and serves on the Executive Committee as Secretary and Treasurer. Mr. Edman previously served as Chairman

10

and as a member of the Board of Directors of FlexTech, formerly the United States Display Consortium and the AeA (American Electronics Association). Mr. Edman holds a Bachelor of Arts degree in East Asian Studies (Japan) from Yale University and a Master’s degree in Business Administration from The Wharton School at the University of Pennsylvania. Mr. Edman was nominated to the Board of Directors because of his business acumen and experience in the technology industry, having served in numerous senior executive roles with sizeable technology companies, including as the Chief Executive Officer of a public company. Mr. Edman also has extensive experience in Asia and with compensation-related matters.

Barbara V. Scherer has served as a director of Ultra Clean since June 2015. Ms. Scherer has served as a member of the Board of Directors of NETGEAR, Inc., a global networking company that delivers innovative products to consumers, businesses and service providers, since August 2011 and as a member of the Board of Directors of ANSYS, Inc., a publicly traded engineering simulation software and services company, since April 2013. Ms. Scherer was Senior Vice President, Finance and Administration and Chief Financial Officer of Plantronics, Inc., a global leader in audio communication devices for businesses and consumers, from 1998 to 2012. In this position, she was responsible for all aspects of the company’s financial management, as well as information technology, legal and investor relations. She was Vice President, Finance and Administration and Chief Financial Officer of Plantronics from 1997 to 1998. Prior to Plantronics, Ms. Scherer held various executive management positions spanning 11 years in the disk drive industry, was an associate with The Boston Consulting Group, and was a member of the corporate finance team at ARCO in Los Angeles. From 2004 through 2010, she served as a director of Keithley Instruments, Inc., a publicly traded test and measurement company, until its acquisition by Danaher Corporation. Ms. Scherer received a Bachelor of Arts degree from the University of California at Santa Barbara and her Master’s degree in Business Administration from the School of Management at Yale University. With a career spanning more than 30 years including 25 years in senior financial leadership roles in the technology industry, Ms. Scherer provides the Company with practical and strategic insight into complex financial reporting and management issues as well as significant operational expertise.

Ernest E. Maddock has served as a director of Ultra Clean since June 2018. Mr. Maddock has held leadership positions at multiple global companies during his career. From 2015 through his recent retirement, he served as Senior Vice President and Chief Financial Officer of Micron Technology. Prior to joining Micron, Mr. Maddock served as Executive Vice President and Chief Financial Officer of Riverbed Technology. Prior to Riverbed, he spent 15 years at Lam Research Corporation (“Lam”), rising to Executive Vice President and Chief Financial Officer in 2008 and serving in that role until April 2013. His previous roles at Lam included Vice President, Customer Support Business Group; and Group Vice President and Senior Vice President of Global Operations. Mr. Maddock also served as a member of the Board of Directors for Intersil Corporation from July 2015 to February 2017. Mr. Maddock holds a Bachelor of Science degree in Industrial Management from the Georgia Institute of Technology and a Master’s degree in Business Administration from Georgia State University. Mr. Maddock was nominated to the Board of Directors because he provides the Company with practical and strategic insight into complex financial reporting and management issues as well as significant operational expertise.

Jacqueline A. Seto has served as a director of Ultra Clean since January 2020. Ms. Seto spent 22 years at Lam Research Corporation (“Lam”) from 1994 until 2016. During that time, she served as Group Vice President and General Manager of the Cleans Product Group at Lam from August 2011 until November 2015. Prior to this position, her previous roles at Lam included Corporate Vice President and General Manager in the Reliant Business Unit from April 2009 to August 2011, Vice President of Product and Strategic Marketing from November 2007 to March 2009, and Managing Director of Emerging Businesses from August 2003 until November 2007. Since 2016, Ms. Seto has served as Principal at Side People Consulting, partnering with well-established corporate and emerging companies and with non-profit organizations advising on strategic and business planning, change management and other executive service consulting. Ms. Seto holds a Bachelor of Engineering in Chemical Engineering from McGill University in Quebec. Ms. Seto currently serves as a member of the Board of Trustees for The Oregon Museum of Science and Industry (OMSI) since January 2018, as a

11

member of the Board of Directors for Masterranking.com since April 2015, and as a member of the Board of Directors for International Women’s Forum Oregon since August 2020. She previously served as a member of the Board of Directors for TriAegis Residential Services from June 2001 until April 2007 and as the Board Secretary for Prevent Child Abuse Oregon (PCAO) from October 2017 until February 2021. Ms. Seto was nominated to the Board of Directors because her deep understanding of the semiconductor industry and her proven experience in strategic thinking adds a valuable voice to the Company’s long and short term business planning.

There are no family relationships among any of our directors and executive officers. There are no arrangements or understandings between any of our directors and us pursuant to which such director was or is to be selected as a director or nominee. Information related to the compensation of our Board of Directors can be found under “—Director Compensation” below.

Our Board of Directors recommends that you vote “FOR” each of the nominees to the Board of Directors set forth in this Proposal 1.

Structure of Board of Directors and Corporate Governance Information

Director Independence. We are required to comply with the director independence rules of the Nasdaq Stock Market (“Nasdaq”) and the SEC. These rules require that the board of directors of a listed company be composed of a majority of independent directors and that the audit committee, compensation committee and nominating and corporate governance committee be composed solely of independent directors.

Our Board of Directors has determined that each of our directors and director nominees is independent in accordance with applicable Nasdaq and SEC rules other than Mr. Scholhamer. Accordingly, a majority of our current Board of Directors is independent as required by Nasdaq rules and, upon election of each of our director nominees at the 2021 Annual Meeting of Stockholders, a majority of our Board of Directors will be independent as required by Nasdaq rules.

Director Responsibilities. We are governed by our Board of Directors and its various committees that meet throughout the year. Our Board of Directors currently consists of eight directors after Ms. Seto was elected to serve as a director effective January 1, 2020. During 2020, there were seven meetings of our Board of Directors. We expect directors to attend and prepare for all meetings of the Board of Directors and the meetings of the committees on which they serve. Each of our directors attended more than 75% of the aggregate number of meetings of the Board of Directors and the committees on which he or she served during 2020.

Board Leadership Structure. Our corporate governance guidelines allow for the flexibility to combine or separate the offices of Chairman and the Chief Executive Officer to best serve the interests of the Company and its stockholders. Mr. Scholhamer serves as the Chief Executive Officer of the Company and Mr. Granger serves as the Chairman of our Board of Directors. Our Board of Directors believes our current board leadership structure to be an efficient and successful leadership model for the Company, promoting clear accountability and effective decision-making. The roles of our Chairman and Chief Executive Officer are separated to allow Mr. Scholhamer to develop and execute on our corporate strategy and focus on day-to-day operations and company performance. Our Board of Directors believes that our stockholders benefit from Mr. Granger’s service as Chairman due to his deep background and experience in our industry and his knowledge of our operations as our former Chief Executive Officer. Our Board of Directors recognizes that a different leadership model may be warranted under different circumstances. Accordingly, our Board of Directors periodically reviews its leadership structure.

The Board also continually reviews the need for effective independent oversight. Each member of each of our Board of Director’s standing committees is an independent director, and each independent director is actively

12

involved in independent oversight. Our independent directors meet in executive session during each regularly scheduled quarterly meeting of our Board of Directors and periodically evaluate both our Chairman and our Chief Executive Officer as well as Board and committee performance. All directors have unrestricted access to management at all times and frequently communicate with the Chairman, the Chief Executive Officer and other members of management on a variety of topics. Given the above factors, our Board of Directors has determined that our leadership structure is appropriate.

Corporate Governance. Our Board of Directors has adopted corporate governance guidelines. These guidelines address items such as the qualifications and responsibilities of our directors and director candidates and the corporate governance policies and standards applicable to us in general. In addition, we have adopted a code of business conduct and ethics that applies to all officers, directors and employees. Our corporate governance guidelines and our code of business conduct and ethics as well as the charters of the Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee are available on our website at http://uct.com/investors/corporate-governance/.

Communicating with our Board of Directors. Any stockholder wishing to communicate with our Board of Directors may send a letter to our Secretary at 26462 Corporate Avenue, Hayward, CA 94545. Communications intended specifically for non-employee directors should be sent to the attention of the chair of the Nominating and Corporate Governance Committee.

Annual Meeting Attendance. Our Board of Directors has adopted a policy that all members should attend each annual meeting of stockholders when practical. Eight of our then nine incumbent directors attended the 2020 Annual Meeting of Stockholders.

Our Board of Directors plays an active role, as a whole and also at the committee level, in overseeing the management of our risks. Our Board of Directors regularly reviews reports from the management team on areas of material risk to the Company, including operational, financial, legal and strategic risks. Each of the committees of our Board of Directors also oversees the management of company risks that fall within the committee’s areas of responsibility. The Audit Committee periodically reviews risks associated with financial reporting and internal controls, as well as risks associated with liquidity, customer credit and inventory reserves. The Nominating and Corporate Governance Committee assists the Board in overseeing risks associated with board organization, membership, structure and corporate governance. The Compensation Committee assists the Board in reviewing whether any material risks arise from our compensation programs and in overseeing risks associated with succession planning for our executives. The Board also reviews our director and officer insurance annually.

Environmental, Human Capital, Social and Governance Considerations

The Company is committed to building customer trust on a foundation of competent personnel and suppliers, discipline to address customer requirements, robust business processes, governance and accountability and rapid and thorough problem solving, supported by a culture that emphasizes leadership, open and honest communication, prevention over reaction, training and mentoring, a strong governance system and a positive reward system. We apply our core values to work to build a responsible and sustainable end-to-end supply chain, ensure employee health and safety in the workplace, foster an atmosphere of acceptance, inclusion, trust and mutual respect in the workplace, promote employee engagement inside and outside the company and give back to communities. We are committed to efficient company management, protection of stockholders’ interests and transparency of corporate communications.

It is our policy to pursue our worldwide operations in a safe, socially and environmentally responsible manner that protects the health and wellbeing of our employees, our customers and the communities where we

13

operate while respecting the environment. Our operations are subject to federal, state and local regulatory requirements and foreign laws relating to environmental, waste management and health and safety matters, including measures relating to the release, use, storage, treatment, transportation, discharge, disposal and remediation of contaminants, hazardous substances and waste, as well as practices and procedures applicable to the construction and operation of our facilities.

Environmental:

| • | UCT participates in the Responsible Business Alliance’s Responsible Minerals Assurance Process for Tantalum. Our cleaning processes for tantalum-deposited parts recovers the tantalum, enabling it to re-enter the commodity market and reduce the demand for mined material, the majority of which originates from the Conflict Region in Africa. We adhere to the principles of the Responsible Business Alliance Code of Conduct. |

| • | Although cleaning is a chemical-intensive business, we, where possible, utilize chemical-free processing to remove significant volumes of deposited material. Reduction in the volume of film being chemically removed reduces the amount of chemicals used to meet the target cleanliness specifications. |

| • | The semiconductor industry has stringent packaging requirements which include the need to maintain the cleanliness of a part or system while providing structural support of heavy modules. These requirements may necessitate that product-specific crates be designed and fabricated or plastic cleanroom boxes be used. To minimize packaging waste we have implemented re-use programs for these type of materials with our customers and suppliers. |

| • | In 2020, UCT committed to a program titled “SuCCESS2030” designed to enhance the Company’s sustainability vision through its supply chain. UCT will endeavor to identify and coordinate efforts and develop capabilities to ensure its suppliers operate in an ethical, responsible, and sustainable manner. The goal is to build a responsible and sustainable end-to-end supply chain for the future of semiconductors. |

| • | We have adopted Environmental, Safety and Quality Policies that have been reviewed, endorsed and signed by management. Our safety incident levels for both the Products and Services Divisions are consistently below applicable industry benchmarks. |

Human Capital:

| • | We believe that our employees are our most important assets. The Company embraces diversity and multiculturalism and is reinforcing a culture of inclusion by committing to even greater transparency, clearer targets and comprehensive training to improve diversity and inclusion within the Company to ensure every employee is treated with dignity and respect. Our ultimate goal is to foster an atmosphere of acceptance, inclusion, trust and of mutual respect for all. To reach that goal, we provide mandatory practical and continuous education to all employees on behavioral expectations. Out of our fifteen executive officers and directors, five are women and six are non-white minorities. Out of our twenty-nine employees who are at the vice president level and above, seven are women and seven are non-white minorities. |

Social Responsibility:

| • | We believe that social responsibility is defined as sustaining the equilibrium between the business of the Company and the communities where we work and live. We apply this core value to employee engagement inside and outside the Company. Positively involving employees and giving back to communities is central to our culture. Supported by the Company, our employees contribute directly to the community with their time and resources. |

14

Governance:

| • | Our Board of Directors meets the two new California board diversity requirements regarding women and under-represented groups. |

| • | In addition, the Nominating and Corporate Governance Committee oversees environmental, social and governance (“ESG”) matters. |

Committees of Our Board of Directors

Our Board of Directors has three principal committees. The following describes each committee’s current membership, the number of meetings held during 2020 and its mission:

Audit Committee. Among other matters, the Audit Committee is responsible for:

| • | providing oversight of our accounting and financial reporting processes and audits of our financial statements; |

| • | assisting the Board in its oversight of the integrity of our financial statements and the adequacy and effectiveness of our internal controls over financial reporting; |

| • | the qualifications, independence and performance of our independent auditors (including hiring and replacing our independent auditors as appropriate, reviewing and pre-approving any audit and non-audit services provided by our independent auditors and approving fees related to such services); |

| • | the performance of our internal audit function; |

| • | the review, approval and oversight of our Cash and Investment Policy and Financial Risk Management Policy, including oversight over our hedging strategy and the use of swaps and other derivative instruments for hedging risks; |

| • | compliance with legal and regulatory requirements; |

| • | compliance with our code of business conduct and ethics (and requests for waivers therefrom); and |

| • | preparing the Audit Committee report that SEC rules require to be included in our proxy statement. |

A copy of the Audit Committee’s charter is available on our website at http://uct.com/investors/corporate-governance/.

The current members of the Audit Committee are Ernest E. Maddock (chair), Barbara V. Scherer, Thomas T. Edman and David T. ibnAle. Our Board of Directors has determined that each member of the committee satisfies both the SEC’s additional independence requirement for members of audit committees and the other requirements of Nasdaq for members of audit committees. The Board of Directors has also concluded that each member of the Audit Committee qualifies as an audit committee financial expert as defined by SEC rules and has the financial sophistication required by Nasdaq. The Audit Committee met four times in 2020.

Compensation Committee. Among other matters, our Compensation Committee:

| • | oversees our compensation and benefits programs and policies generally, including the issuance of equity-based compensation; |

| • | evaluates the performance of our executive officers and other senior executives; |

| • | reviews our management succession plan; |

| • | oversees and sets compensation for our executive officers, Board members and other senior executives; and |

| • | reviews and recommends inclusion of the Compensation Discussion and Analysis required to be included in our proxy statement by SEC rules. |

15

A copy of the Compensation Committee’s charter is available on our website at http://uct.com/investors/corporate-governance/. The Compensation Committee’s process for deliberations on executive compensation is described below under “Compensation Discussion and Analysis.”

As part of our oversight of our executive compensation program and in conjunction with the Compensation Committee, we consider the impact of our executive compensation program and the incentives created by different elements of the executive compensation program on our risk profile. In addition, we review all of our compensation policies and procedures, including the incentives that they create and factors that affect the likelihood of excessive risk-taking, to determine whether they present a significant risk to the Company. Based on this review, we have concluded that our compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

The current members of the Compensation Committee are Thomas T. Edman (chair), David T. ibnAle, Emily M. Liggett and Jacqueline A. Seto. Our Board of Directors has determined each member of the committee is independent as defined under Nasdaq and SEC rules. The Compensation Committee met seven times in 2020.

Nominating and Corporate Governance Committee. Among other matters, our Nominating and Corporate Governance Committee:

| • | reviews and evaluates the size, composition, function and duties of the Board consistent with its needs; |

| • | establishes criteria for the selection of candidates to the Board and its committees, and identifies individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by shareholders; |

| • | recommends to the Board director nominees for election at our annual or special meetings of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; |

| • | recommends directors for appointment to committees of the Board; |

| • | makes recommendations to the Board as to determinations of director independence; |

| • | leads the process and assists the Board in evaluating its performance and the performance of its committees; |

| • | periodically reviews our corporate governance guidelines and code of business conduct and ethics, and oversees compliance with our corporate governance guidelines; and |

| • | oversees ESG matters. |

A copy of the Nominating and Corporate Governance Committee’s charter is available on our website at http://uct.com/investors/corporate-governance/.

The current members of the Nominating and Corporate Governance Committee are Emily M. Liggett (chair), Barbara V. Scherer and Ernest E. Maddock. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent as defined under Nasdaq. The Nominating and Corporate Governance Committee met four times in 2020.

Consideration of Director Nominees

Director Qualifications. The Nominating and Corporate Governance Committee of the Board operates pursuant to a written charter and establishes membership criteria for the Board and each committee of the Board and recommends to the Board individuals for membership on the Board and its committees. There is no fixed set of qualifications that must be satisfied before a candidate will be considered. Rather, candidates for director

16

nominees are reviewed in the context of the current composition of our Board of Directors, our operating requirements and the interests of our stockholders. In conducting its assessment, the committee considers issues of judgment, diversity, age, skills, background, experience and such other factors as it deems appropriate given the needs of the Company and our Board of Directors. Although we do not have a formal policy with regard to the consideration of diversity, when identifying and selecting director nominees, the Nominating and Corporate Governance Committee also considers the impact a nominee would have in terms of increasing the diversity of our Board of Directors with respect to professional experience, skills, backgrounds, viewpoints and areas of expertise. The Nominating and Corporate Governance Committee also considers the independence, financial literacy and financial expertise standards required by our committee charters and applicable laws, rules and regulations, and the ability of the candidate to devote the time and attention necessary to serve as a director and a committee member.

Identifying and Evaluating Nominees for Director. In the event that vacancies are anticipated or otherwise arise, the Nominating and Corporate Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current directors, professional search firms engaged by us, stockholders or other persons. Candidates are evaluated at regular or special meetings of the Nominating and Corporate Governance Committee (or our independent directors) and may be considered at any point during the year.

Stockholder Nominees. Candidates for director recommended by stockholders will be considered by the Nominating and Corporate Governance Committee. Such recommendations should include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications for membership on our Board of Directors, information regarding any relationships between the candidate and our Company within the last three years and a written indication by the recommended candidate of the candidate’s willingness to serve on our Board of Directors. Stockholder recommendations, with such accompanying information, should be sent to the attention of the Chair of the Nominating and Corporate Governance Committee at the address listed under “Information Concerning Solicitation and Voting—Contacting Ultra Clean.”

Stockholders also may nominate directors for election at our annual meeting of stockholders by following the provisions set forth in our Amended and Restated Bylaws. The deadline and procedures for stockholder nominations are disclosed elsewhere in this proxy statement under the caption “Information Concerning Solicitation and Voting—Deadline for Receipt of Stockholder Proposals.”

Our non-employee directors earn the following annual retainers for service on our Board of Directors and its standing committees:

| • | a $60,000 annual cash retainer for service as a member of our Board of Directors; |

| • | an additional $40,000 annual cash fee for serving as independent chair of our Board of Directors; |

| • | the following additional annual cash retainers for service on the standing committees of our Board of Directors: |

| • | Audit Committee – $10,000 (or $20,000 for the chair); |

| • | Compensation Committee – $7,500 (or $15,000 for the chair); |

| • | Nominating and Corporate Governance Committee – $5,000 (or $10,000 for the chair). |

No fee is paid for attendance at any Board of Directors or committee meeting. Cash retainers for Board and committee service are paid quarterly.

17

Annual Stock Awards

On an annual basis, each non-employee director is eligible to receive an annual award of restricted stock. On the date of our 2020 annual meeting of stockholders, each of our non-employee directors at such time was granted a restricted stock award with a value of approximately $130,000 (equating to 6,301 shares of our common stock based on the closing price of our common stock on the business day immediately prior to the grant date) that fully vests on the earlier of (i) the day before the 2021 Annual Meeting of Stockholders and (ii) June 2, 2021. Ms. Seto, who was appointed to the Board effective January 1, 2020, was granted a restricted stock award for 2,256 shares of our common stock that fully vested on May 23, 2020.

Initial Stock Awards

Upon joining the Board (other than at an annual meeting), each non-employee director is eligible to receive an initial award of restricted stock, in an amount equal to the value of the annual non-employee director award for such year, pro-rated based on the length of services provided from appointment to the Board until the following annual stockholder meeting. The restricted stock will become fully vested on the date of the annual stockholder meeting following such award.

The following table sets forth compensation for our non-employee directors for fiscal 2020. Our only employee director during fiscal 2020, Mr. Scholhamer, does not receive separate compensation for service as a director. Information on Mr. Scholhamer’s compensation for fiscal 2020 is disclosed in the Summary Compensation Table below.

Name | Fees Earned or Paid In Cash ($) | Stock Awards(1)(2) ($) | Total ($) | |||||||||

Thomas T. Edman | $ | 82,671 | $ | 129,990 | $ | 212,661 | ||||||

Clarence L. Granger | 97,260 | 129,990 | 227,250 | |||||||||

David T. ibnAle | 75,377 | 129,990 | 205,366 | |||||||||

Emily M. Liggett | 75,377 | 129,990 | 205,366 | |||||||||

Ernest E. Maddock | 82,671 | 129,990 | 212,661 | |||||||||

Leonid Mezhvinsky(3) | 24,329 | — | 24,329 | |||||||||

Jacqueline A. Seto(4) | 64,375 | 184,134 | 222,414 | |||||||||

Barbara V. Scherer | 72,945 | 129,990 | 202,935 | |||||||||

| (1) | The amounts shown are the grant date fair values for restricted stock awards granted in fiscal year 2020 computed in accordance with FASB ASC Topic 718 based on the closing price of our common stock on the day preceding the grant date. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

| (2) | Messrs. Edman, Granger, ibnAle and Maddock and Mses. Liggett, Scherer and Seto each held a restricted stock award with respect to 6,301 shares of our common stock as of December 25, 2020. |

| (3) | Mr. Mezhvinsky did not stand for re-election to our Board of Directors in June 2020. |

| (4) | Ms. Seto became a member of our Board of Directors in January 2020. |

Stock Ownership Guidelines; Policy Against Hedging Transactions and Pledges

The Board of Directors has adopted stock ownership guidelines for our directors to more closely align the interests of our directors with those of our stockholders. The guidelines provide that each director should hold at least 3X annual cash compensation shares of our common stock, and that each director be allowed three years from the date such director joined our Board of Directors to accumulate such number of shares of our common stock. All of our directors are currently in compliance with our stock ownership guidelines.

18

The Board of Directors has also adopted stock ownership guidelines for our Chief Executive Officer. The policy was amended in February 2020 to provide that our Chief Executive Officer should hold common stock with a value at least 3X his or her base salary, and that he or she be allowed three years from the date such person becomes our Chief Executive Officer to accumulate such number of shares of our common stock. The amendment to the policy was intended to bring it in line with more contemporary governance and peer practices. Our current Chief Executive Officer is currently in compliance with our stock ownership guidelines.

The Company’s Insider Trading Policy, which can be found on our website, provides that our securities shall not be made subject to hedge transactions or puts and calls. The Insider Trading Policy further prohibits any pledges of our securities by our directors and executive officers.

The Compensation Committee determined to engage Semler Brossy, with respect to fiscal 2020 executive officer and non-employee director compensation matters. Semler Brossy was retained by our Compensation Committee to provide an independent review of the Company’s executive compensation programs, including an analysis of both the competitive market and the design of the programs for 2020. In addition, during 2020, Semler Brossy assisted the Compensation Committee with its CEO pay ratio analysis and its evaluation of its executive severance and change in control policies and provided our Compensation Committee assistance in developing our Compensation Discussion and Analysis in this proxy statement. Semler Brossy also furnished the Compensation Committee with reports on peer company practices relating to the following matters: short-term and long-term compensation program design; equity compensation; retention value of current equity holdings; target incentive opportunities; and compensation trends. For further discussion of the work conducted by Semler Brossy as our compensation consultant, see “Compensation Discussion and Analysis—Process for Determining Executive Compensation.”

Certain Relationships and Related Party Transactions

Transactions with Directors. The Company leases a facility from an entity controlled by Leonid Mezhvinsky, one of our former directors. In the year ended December 25, 2020, we incurred rent and other expenses resulting from the lease of this facility of approximately $438,000.

Related Person Transaction Policy. Our written Related Person Transaction Policy requires our Board of Directors or the Nominating and Corporate Governance Committee to review and approve all related person transactions. Our directors and officers are required to promptly notify our Chief Compliance Officer (which is currently our General Counsel) of any transaction which potentially involves a related person. Our Board of Directors or the Nominating and Corporate Governance Committee then considers all relevant facts and circumstances, including without limitation the commercial reasonableness of the terms of the transaction, the benefit and perceived benefit, or lack thereof, to the Company, opportunity costs of alternate transactions, the materiality and character of the related person’s direct or indirect interest, and the actual or apparent conflict of interest of the related person. Our Board of Directors or the Nominating and Corporate Governance Committee will not approve or ratify a related person transaction unless it has determined that, upon consideration of all relevant information, the transaction is in, or not inconsistent with, the best interests of the Company and its stockholders.

Other than as disclosed above, since December 27, 2019, we have not entered into any transactions, nor are there any currently proposed transactions, between us and a related party where the amount involved exceeds, or would exceed, $120,000, and in which any related person had or will have a direct or indirect material interest.

19

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Moss Adams LLP (“Moss Adams”) to serve as our independent registered public accounting firm for fiscal 2021. We are asking you to ratify this appointment. Ratification of the appointment of Moss Adams as our independent registered public accounting firm for fiscal 2021 requires the affirmative vote of the holders of a majority of our common stock present in person or represented by proxy at the annual meeting and entitled to vote thereon. Abstentions will have the same effect as negative votes for this proposal. Although ratification is not required for us to retain Moss Adams, in the event of a majority vote against ratification, the Audit Committee may reconsider its selection. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’ best interests. A representative of Moss Adams is expected to be present at the annual meeting of stockholders, will have the opportunity to make a statement if he/she desires to do so and is expected to be available to respond to appropriate questions.

Set forth below are the aggregate audit fees incurred for the professional services provided by Moss Adams and its affiliates in fiscal 2020 and fiscal 2019.

| Fiscal Year Ended | ||||||||

| December 25, 2020 | December 27, 2019 | |||||||

Audit fees | $ | 3,329,079 | $ | 3,842,569 | ||||

Audit related fees | $ | 21,000 | $ | 88,222 | ||||

Total | $ | 3,350,079 | $ | 3,930,791 | ||||

Audit fees consist of fees billed, or to be billed, for services rendered to us and our subsidiaries for the audit of our annual financial statements and internal control over financial reporting, reviews of our quarterly financial statements included in our quarterly reports on Form 10-Q and audit services provided in connection with other statutory and regulatory filings. Audit fees decreased in 2020 primarily as a result of decreased hours associated with our Services division. Audit related fees for 2020 consisted of fees billed for services rendered to us for employee benefit plans. Audit related fees for 2019 consisted of fees billed for services rendered to us for employee benefit plans and acquisition-related due diligence activity.

Preapproval Policy of Audit Committee of Services Performed by Independent Auditors

The Audit Committee’s policy requires that the committee preapprove audit and non-audit services to be provided by our independent auditors before the auditors are engaged to render services. The Audit Committee may delegate its authority to pre-approve services to one or more Audit Committee members; provided that such designees present any such approvals to the full Audit Committee at the next Audit Committee meeting.

All services described above were pre-approved in accordance with the Audit Committee’s pre-approval policies.

Our Board of Directors recommends that you vote “FOR” ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for fiscal 2021.

20

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Notwithstanding any statement to the contrary in any of our previous or future filings with the Securities and Exchange Commission, this report of the Audit Committee of our Board of Directors shall not be deemed “filed” with the Securities and Exchange Commission or “soliciting material” under the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any such filings.

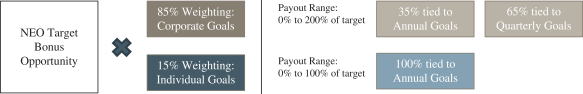

The Audit Committee, which currently consists of Ernest E. Maddock, Barbara V. Scherer, Thomas T. Edman and David T. ibnAle, evaluates audit performance, manages relations with our independent registered public accounting firm and evaluates policies and procedures relating to internal accounting functions and controls. The key responsibilities of our Audit Committee are set forth in our Audit Committee’s charter, which is available on our website at http://uct.com/investors/corporate-governance/. This report relates to the activities undertaken by the Audit Committee in fulfilling such responsibilities.