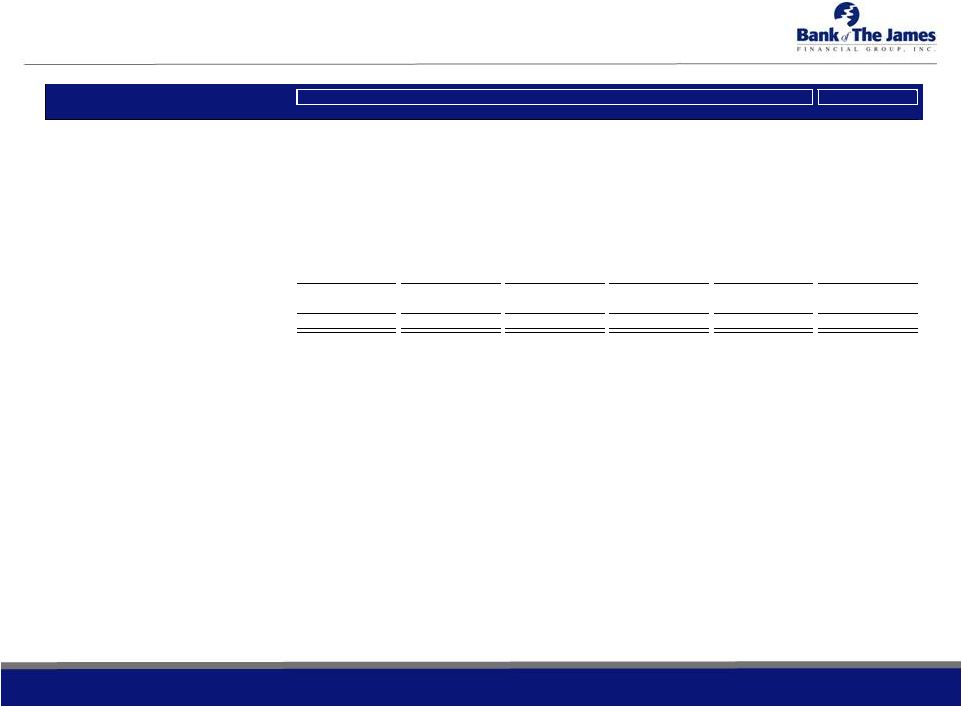

9 OPPORTUNITY FOR CONTINUED STRONG ORGANIC GROWTH Highlights • As the impact of the financial crisis waned in late 2011, the Company began to refocus on growth – Hired Mike Syrek as CLO – Developed expertise and platform to bank more sophisticated C&I relationships – Hired additional talented bankers in Lynchburg – Made key hires to expand into Charlottesville and Harrisonburg • The Company has positioned itself as the bank of choice – Opportunity to hire the best banking talent in the region – Customer service and reputation accelerate business development • Recent market disruption from recent mergers and branch sales further increases the ability to capitalize on talent and clients dislocated by this process • The Company’s market area provides an opportunity for significant continued organic growth • While bigger banks have historically dominated these markets, they are focused elsewhere • Significant opportunity to grow deposit market share – meaningful opportunity remains in Lynchburg Source: SNL Financial LC Note: Includes banks operating in Lynchburg, Charlottesville, Roanoke, and Harrisonburg Metropolitan Statistical Areas (MSAs); deposit market share data as of June 30, 2014 Current Market Area Rank Company Branches Deposits ($000s) Market Share (%) 1 Wells Fargo & Co. 41 4,057,881 22.84 2 BB&T Corp. 58 2,824,362 15.90 3 SunTrust Banks Inc. 38 2,554,070 14.38 4 Carter Bank & Trust 30 1,137,837 6.41 5 Union Bankshares Corp. 30 1,102,669 6.21 6 Bank of America Corp. 15 1,055,585 5.94 7 BNC Bancorp 8 708,282 3.99 8 First Citizens BancShares Inc. 17 450,961 2.54 9 Bank of the James Financial Group Inc. 10 402,765 2.27 10 Virginia National Bankshares Corp. 4 392,071 2.21 11 F & M Bank Corp. 6 378,121 2.13 12 Pinnacle Bankshares Corp. 9 320,444 1.80 13 United Bankshares Inc. 10 300,012 1.69 14 HomeTrust Bancshares Inc. 5 282,977 1.59 15 HomeTown Bankshares Corp. 4 280,863 1.58 16 American National Bankshares Inc. 8 215,216 1.21 17 Bank of Botetourt 7 211,288 1.19 18 Bank of Fincastle 8 183,937 1.04 19 Farmers Bank of Appomattox 4 161,708 0.91 20 Select Bank Financial Corp. 2 112,395 0.63 21 Southern National Bancorp of Virginia Inc. 1 92,496 0.52 22 First National Corp. 2 75,272 0.42 23 First Bancorp Inc. 3 67,454 0.38 24 Cardinal Bankshares Corp. 2 65,542 0.37 25 Summit Financial Group Inc. 2 52,628 0.30 26 Farmers & Merchants Bank of Craig County 1 45,621 0.26 27 Old Dominion National Bank 2 45,379 0.26 28 Blue Ridge Bankshares Inc. 2 44,378 0.25 29 Capital One Financial Corp. 1 35,799 0.20 30 BCC Bankshares Inc. 1 28,772 0.16 31 Allegheny Bancshares Inc. 1 28,631 0.16 32 Pioneer Bankshares Inc. 4 20,498 0.12 33 Fidelity BancShares (N.C.) Inc. 1 10,323 0.06 34 Woodforest Financial Group Inc. 9 9,110 0.05 35 First Bancorp 1 6,029 0.03 36 Virginia Bank Bankshares Inc. 1 3,256 0.02 Total 348 17,764,632 100 |