BANK OF THE JAMES FINANCIAL GROUP, INC.

828 Main Street

Lynchburg, VA 24504

Proxy Statement

2022 Annual Meeting of Shareholders

May 17, 2022 at 4:00 p.m.

GENERAL INFORMATION

Introduction

The board of directors (the “board of directors” or the “board”) of Bank of the James Financial Group, Inc. (the “Company”) is furnishing you with this proxy statement to solicit proxies on behalf of the Company to be voted at the 2022 Annual Meeting of Shareholders of the Company (the “Annual Meeting”). The Annual Meeting will be held virtually, online through the internet, on Tuesday, May 17, 2022 at 4:00 p.m., Eastern Time via live webcast. The proxies also may be voted at any adjournments or postponements of such meeting.

The Company is the holding company for Bank of the James (the “Bank”).

This proxy statement is being furnished to shareholders beginning on April 7, 2022. In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, the Company is furnishing this proxy statement over the internet to its shareholders. Most of the Company’s shareholders will not receive printed copies of this proxy statement; instead, most shareholders will receive the notice regarding the availability of proxy materials for the Annual Meeting of shareholders to be held on May 17, 2022 (the “Notice of Internet Availability”), which contains instructions on how to access the proxy materials over the internet and vote. The Notice of Internet Availability was first mailed to shareholders on April 7, 2022. By furnishing proxy materials over the internet, the Company is able to reduce the printing and mailing costs of this solicitation and help conserve natural resources. If you receive the Notice of Internet Availability but would still like to receive paper copies of the proxy materials, please follow the instructions on the Notice of Internet Availability. Shareholders may vote over the internet, by telephone, or by mail.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 17, 2022 A complete set of proxy materials relating to the Annual Meeting is available on the internet. These materials, including this Notice of 2022 Annual Meeting of Shareholders and Proxy Statement and Annual Report on Form 10-K Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the year ended December 31, 2021 (the “2021 Annual Report to Shareholders”) are available on the internet at the following website: http://www.proxyvote.com. |

Date, Time and Place of the Meeting

The solicitation of proxies is made by and on behalf of the board of directors of Financial to be used at the Annual Meeting of Shareholders to be held on May 17, 2022 at 4:00 p.m. local time. As a precautionary measure related to COVID-19 and to support the health and well-being of our shareholders, employees, and associates the Annual Meeting will be held in a virtual meeting format only, online through the internet. You will not be able to attend the Annual Meeting physically. You may attend the virtual meeting online at www.virtualshareholdermeeting.com/BOTJ2022. To attend the virtual

meeting, you must enter the control number found on your proxy card, the Notice of Internet Availability, or elsewhere within in these proxy materials.

Record Date

The close of business on March 22, 2022 (the “Record Date”) was the record date for the determination of shareholders entitled to notice of, and to vote, at the Annual Meeting.

Voting Rights of Shareholders

On the Record Date, there were 4,740,657 shares of common stock of Financial (the “Common Stock”) issued and outstanding. Financial has no other class of stock outstanding. Each outstanding share of Common Stock is entitled to one vote on all matters to be acted upon at the Annual Meeting. Only shareholders of record at the close of business on March 22, 2022 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

To the knowledge of Financial’s management, entities affiliated with Basswood Capital Management, LLC and Eidelman Virant Capital, Inc. beneficially owned approximately 6.37% and 5.21%, respectively, of Financial’s outstanding Common Stock as of the Record Date, as set forth in more detail under “Certain Beneficial Owners” below. Except for those entities, to the knowledge of Financial’s management, no other person owned beneficially more than 5% of Financial’s outstanding Common Stock. As of the Record Date, directors and executive officers of Financial and their affiliates, as a group, owned of record and beneficially, inclusive of options that have vested or will vest within 60 days thereof, a total of 629,950 shares of Common Stock, or approximately 13.22% of the shares of Common Stock deemed outstanding on such date.

Directors and executive officers of Financial have indicated an intention to vote their shares of Common Stock “FOR” the director nominees set forth herein, “FOR” the ratification of the appointment of Yount, Hyde & Barbour, P.C., “FOR” the approval of the non-binding resolution on executive compensation, and to have the shareholders vote on the non-binding resolution on executive compensation every “ONE YEAR.”

If you hold your shares in a bank or brokerage account, you will receive instructions from your bank or broker that you must follow for your shares to be voted. Please follow those instructions carefully to assure that your shares are voted in accordance with your wishes on the matters presented in this Proxy Statement.

Quorum

A quorum of shareholders is necessary to hold a valid meeting. If the holders of at least a majority of the total number of outstanding shares of Common Stock entitled to vote are represented in person at the virtual meeting or by proxy at the Annual Meeting, a quorum will exist. We will include broker non-votes, as defined below, and proxies marked as abstentions to determine the number of shares present at the Annual Meeting. In the event that there are not sufficient voting shares represented for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

VOTING AT THE MEETING

Proposals to be Considered

At the Annual Meeting, the shareholders will be asked to:

| · elect five (5) persons to serve as Group One directors for a term of three years; |

| · ratify the appointment of Yount, Hyde & Barbour, P.C. as the independent auditors of Financial for fiscal year 2022; |

| · vote to approve an advisory, non-binding resolution with respect to the executive compensation described in this Proxy Statement; and |

| · vote on an advisory, non-binding vote, on the frequency of future advisory votes on executive compensation. |

The board of directors is not aware of any other matters that are to come before the Annual Meeting except for incidental, procedural matters. If any other matters are properly brought before the Annual Meeting (as determined by a majority of the board of directors), the persons named in the accompanying proxy card will vote the shares represented by each proxy on such matters.

Procedures for Voting By Proxy; Revocation of Proxies

If you properly execute, deliver and do not revoke your proxy, the persons appointed as proxies will vote your shares according to the instructions you have specified on the proxy card. If you sign and return your proxy card but do not specify how the persons appointed as proxies are to vote your shares, your proxy will be voted “FOR” the election of the director nominees, “FOR” the ratification of the appointment of Yount, Hyde & Barbour, P.C., “FOR” the approval of the non-binding resolution on executive compensation, to have the shareholders vote on the non-binding vote on executive compensation occur every “ONE YEAR”, and in the best judgment of the persons appointed as proxies as to all other matters properly brought before the Annual Meeting. If any nominee for the election to the board of directors named in this Proxy Statement becomes unavailable for election for any reason, the proxy will be voted for a substitute nominee selected by the board of directors.

Any shareholder who executes a proxy has the power to revoke it at any time before it is voted by giving written notice of revocation to Financial, by executing and delivering a substitute proxy to Financial, or by attending the virtual Annual Meeting and voting online. If a shareholder desires to revoke a proxy by written notice, such notice should be mailed or delivered, so that it is received on or prior to the Annual Meeting date, to J. Todd Scruggs, Secretary, Bank of the James Financial Group, Inc., 828 Main Street, Lynchburg, Virginia 24504.

Effect of Broker Non-Votes and Abstentions

Brokers who hold shares of Common Stock for the accounts of their clients may vote these shares either as directed by their clients or in their own discretion if permitted by the exchange or other organizations of which they are members. A broker non-vote occurs when a broker, bank, or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. A broker non-vote is not considered a vote cast and does not count as a vote in favor of or against a particular proposal for which the broker has no discretionary

voting authority. In addition, if a shareholder abstains from voting on a particular proposal, the abstention is not considered a vote cast and does not count in favor of or against the proposal.

If your broker holds shares of Common Stock that you own in “street name,” then, under applicable rules, brokers may exercise discretionary voting power only on “routine” matters. Consequently, the broker may not vote your shares on Proposals One, Three and Four, none of which is considered routine, without receiving instructions from you. The broker may vote your shares on Proposal Two even if the broker does not receive instructions from you (ratification of the appointment of our independent auditor is considered a “routine” matter for which the broker may exercise discretionary voting power).

Vote Required

Each share of Financial’s Common Stock entitles the record holder thereof to one vote for each matter to be voted upon at the Annual Meeting. Shares for which the holder has elected to abstain or to withhold the proxies’ authority to vote and broker non-votes on a matter will count toward a quorum for the Annual Meeting, but will not be included in determining the number of votes cast with respect to a matter.

Proposal One: Directors are elected by a plurality of the votes cast. Thus, as to Proposal One concerning the the election of directors, those nominees receiving the greatest number of votes for election will be elected even if they do not receive a majority of votes cast. With regard to the election of directors, the proxy being provided by the board enables a shareholder to vote for the election of the nominees proposed by the board, to withhold authority to vote for the nominees being proposed, or to vote for the election of only certain nominees. Only shares that are voted in favor of a nominee will be counted toward that nominee’s achievement of a plurality. Accordingly, “withhold” votes and broker non-votes will have no effect on the outcome of this proposal.

Proposals Two and Three: As to i) the proposal set forth in Proposal Two to ratify the appointment of the independent registered accounting firm and ii) the proposal set forth in Proposal Three to approve the non-binding resolution regarding executive compensation, votes may be cast in favor or against, or shareholders may abstain from voting. Approval of each of these proposals requires an affirmative vote of a majority of the votes cast on the matter. Thus, although abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum, they are not counted for purposes of determining whether such a matter has been approved, and will have no effect.

Proposal Four: As to the advisory, non-binding proposal set forth in Proposal Four with respect to the frequency which shareholders will vote on our executive compensation, a shareholder may select that shareholders: (i) consider the proposal every “ONE YEAR”; (ii) consider the proposal every “TWO YEARS”; (iii) consider the proposal every THREE YEARS”; or (iv) “ABSTAIN” from voting on the proposal. The frequency of the advisory vote on the non-binding resolution approving the compensation of our named executive officers receiving the greatest number of votes (either every three years, every two years or every year) will be the frequency that shareholders approve. Thus, although abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum, they will have no effect on the outcome of this proposal. Even though this vote will neither be binding on the Company or the board of directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company, or the board of directors, the board of directors will take into account the outcome of this vote in making a determination on the frequency that advisory votes on executive compensation will be included in our proxy statements.

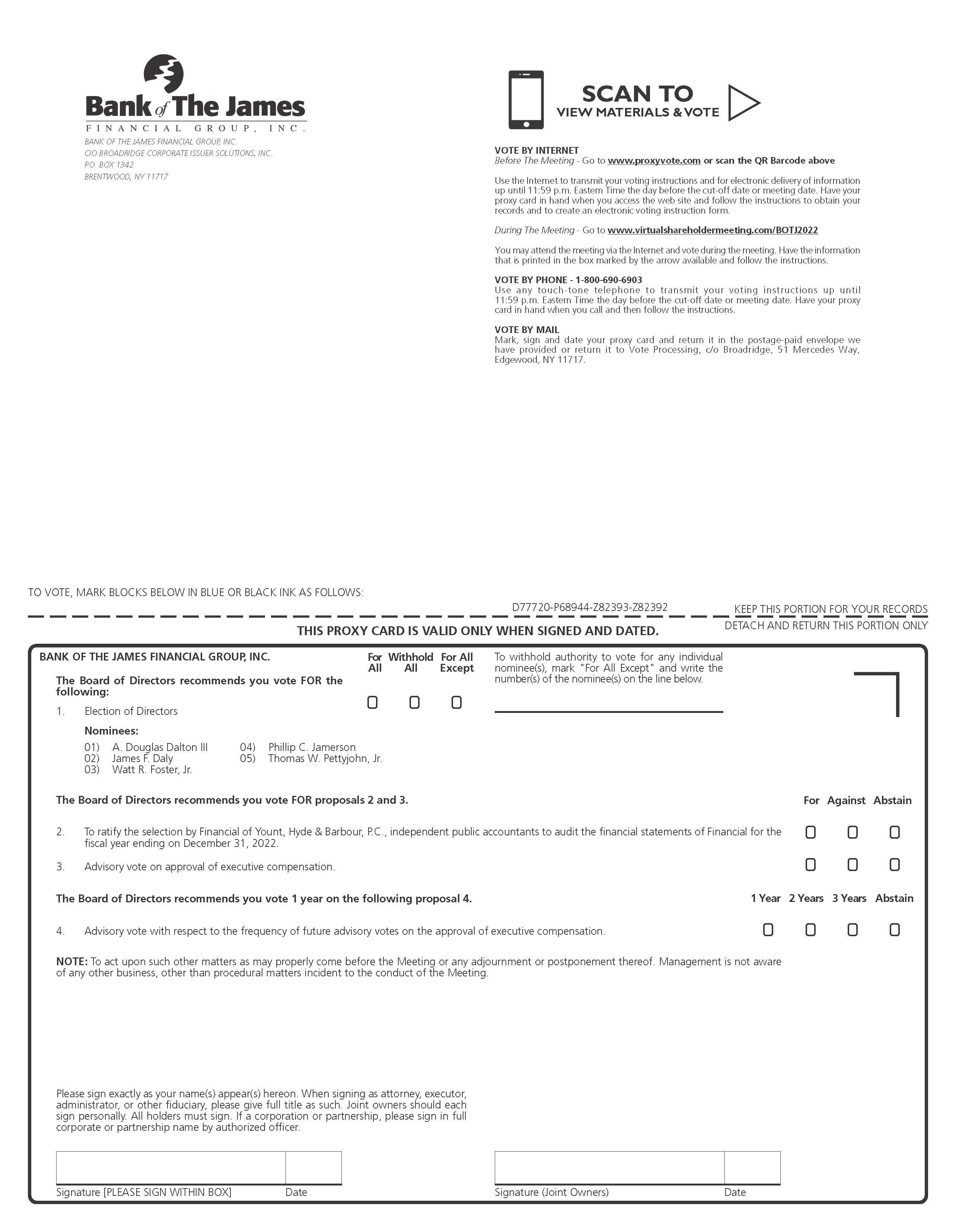

How to Vote Your Shares

Shareholders of Financial are requested to vote their shares by dialing 1-800-690-6903 and following the instructions, via the internet at the following address: http://www.proxyvote.com, or by completing, dating, and signing the form of proxy and returning by mail it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If a proxy is properly executed and returned in time for voting, it will be voted as indicated thereon. Shareholders attending the virtual Annual Meeting may vote online during the meeting.

Principal Executive Office

The principal executive offices of Financial are located at 828 Main Street, Lynchburg, Virginia 24504.

SOLICITATION OF PROXIES

Solicitation is being made on behalf of Financial by the board of directors by mail and electronic notice and access to the internet. If sufficient proxies are not returned in response to this solicitation, supplementary solicitations may also be made by mail, telephone, electronic communication or in person by directors, officers and employees of the Company, its subsidiaries or affiliates, none of whom will receive additional compensation for these services. Financial may retain an outside proxy solicitation firm to assist in the solicitation of proxies, but at this time does not have plans to do so. Costs of solicitation of proxies will be borne by Financial.

| | |

PROPOSAL ONE - ELECTION OF DIRECTORS |

| | |

Financial’s bylaws provide that the board of directors is to be composed of no less than five and no more than twenty-five directors. Our articles of incorporation further provide that the board of directors shall be divided into three groups (Groups One, Two, and Three), as nearly equal in number as possible, with staggered terms. Financial’s board of directors currently consists of 13 persons.

Under Virginia law, the terms of the incumbent Group One directors expire at the Annual Meeting, provided, however, that all directors continue to serve until their successors have been duly elected and qualified.

The following persons have been nominated for election to the board of directors of Financial: A. Douglas Dalton III, James F. Daly, Watt R. Foster, Jr., Phillip C. Jamerson, and Thomas W. Pettyjohn, Jr. If elected, the nominees will serve a three-year term to expire at the Annual Meeting of shareholders in 2025.

NOMINEES AND CONTINUING DIRECTORS

Nominees

Set forth below is certain information concerning the nominees.

Nominees |

Name | Age (1) | Position with Bank of the James Financial Group, Inc. | Director Since (2) | Group | Term to Expire |

A. Douglas Dalton III | 41 | Director | 2016 | One | 2025 |

James F. Daly | 64 | Director | 2007 | One | 2025 |

Watt R. Foster, Jr. | 62 | Director | 2005 | One | 2025 |

Phillip C. Jamerson | 63 | Director | 2016 | One | 2025 |

Thomas W. Pettyjohn, Jr. | 75 | Chairman | 1998 | One | 2025 |

(1)As of March 22, 2022.

(2)All of the directors of Financial also serve as members of the board of directors of the Bank.

Each of the nominees is currently a director of Financial whose current term expires at the Annual Meeting. Each nominee has agreed to serve if elected.

Continuing Directors

Set forth below is certain information concerning the continuing directors.

Continuing Directors |

Name | Age (1) | Position with Bank of the James Financial Group, Inc. | Director Since (2) | Group | Current Term Expires |

Robert R. Chapman III | 59 | Director; President of Financial, Chief Executive Officer of the Bank | 1998 | Two | 2023 |

Julie P. Doyle | 58 | Director | 2011 | Two | 2023 |

Lydia K. Langley | 57 | Director | 2015 | Two | 2023 |

Augustus A. Petticolas, Jr. | 73 | Director | 2005 | Two | 2023 |

Lewis C. Addison | 70 | Director | 2006 | Three | 2024 |

John R. Alford, Jr. | 61 | Director | 2009 | Three | 2024 |

William C. Bryant III | 57 | Director | 2005 | Three | 2024 |

J. Todd Scruggs | 54 | Director; Secretary-Treasurer of Financial, Executive Vice President and Chief Financial Officer of the Bank | 2007 | Three | 2024 |

(1)As of March 22, 2022.

(2)All of the directors of Financial also serve as members of the board of directors of the Bank. For all years prior to 2004, all directorships were with the Bank only.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS MATTERS

General

The business and affairs of Financial are managed under the direction of its board of directors in accordance with the Virginia Stock Corporation Act, Financial’s articles of incorporation, and Financial’s bylaws. Members of the board of directors are kept informed of Financial’s business through discussions with management, by reviewing materials provided to them, and by participating in meetings of the board of directors and its committees.

Independence of Directors

The board of directors is comprised of a majority of directors who qualify as independent based on the definition of “independent director” as defined by Rule 5605(a)(2) of the Listing Rules of the

NASDAQ Stock Market (“NASDAQ”). The board has determined that the following current directors and nominees of Financial are “independent” under the foregoing criteria:

Lewis C. Addison | A. Douglas Dalton III | James F. Daly |

Julie P. Doyle | Watt R. Foster, Jr. | Phillip C. Jamerson |

Lydia K. Langley | Augustus A. Petticolas, Jr. | Thomas W. Pettyjohn, Jr. |

The board of directors has determined that Messrs. Chapman and Scruggs do not qualify as independent directors because they currently serve as executive officers of Financial and the Bank. Mr. Bryant does not qualify as an independent director because in 2021 the Bank paid rent in excess of $200,000 to Jamesview Investments, LLC, an entity which Mr. Bryant owns. Mr. Alford does not qualify as an independent director because his law firm from time to time represents the Company in legal matters and has accepted compensation for such service. No other persons other than those set forth above served as a director of Financial in 2021.

Director Qualifications

The board of directors believes that it is necessary for each of the Company’s directors to possess many qualities and skills. The Nominating Committee seeks candidates who possess the background, skills and expertise to make a significant contribution to the board and to the Company and its shareholders. When searching for new candidates, the Nominating Committee considers the evolving needs of the board of directors and searches for candidates that fill any current or anticipated future gaps. Among other things, the Nominating Committee specifically considers the following:

| · | | Business experience and expertise; |

| · | | Particular goals and needs of Financial for additional competencies or characteristics; |

| · | | Educational background; and |

The Nominating Committee also considers such other criteria as may be relevant at the time and looks for candidates that will complement the existing board composition. The Nominating Committee does not have a formal policy with respect to diversity; however, the board of directors and the Nominating Committee believe that it is essential that the board members represent diverse viewpoints. In considering candidates for the board of directors, the Nominating Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the board of directors are also considered. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective directors.

Our board members bring a wealth of leadership experience, community ties, and knowledge of Region 2000 to the board of directors. In considering the directors’ and director nominees’ individual experience, qualifications, attributes and skills, the board has concluded that the appropriate experience, qualifications, attributes and skills are represented on the board as a whole and on each of the board’s committees.

The board has concluded that each director and nominee possesses the personal traits and characteristics described above. Each director has demonstrated business and financial acumen, an ability to exercise sound judgment, compatibility with other directors, as well as a commitment to service to the Company and our board. In addition to the information below regarding each director’s and nominee’s specific experience, qualifications, attributes and skills that led our board to the conclusion that

he/she should serve as a director, we also believe that all of our directors and director nominees have a reputation for integrity, honesty, and adherence to high ethical standards.

There are no family relationships among any directors, director nominees and executive officers.

DIRECTOR AND OFFICER BIOGRAPHICAL INFORMATION

The following discusses the backgrounds and qualifications of our director nominees and the directors continuing in office. Unless otherwise indicated, each of the following persons has held his or her present position for the last five years.

Nominees to the Board

A. Douglas Dalton III, 41, is Operations Manager for English Construction Company, Inc. He is a 2003 graduate of Virginia Tech and holds a bachelor’s degree in Business Management. He currently serves on the Board of Directors for Boys and Girls Club of Greater Lynchburg. Mr. Dalton served on the Altavista Advisory Board for Bank of the James for several years before being appointed to Financial’s board of directors. Mr. Dalton brings business skills such as project management, knowledge of the construction industry, and local economy knowledge to the board.

James F. Daly, 64, is the President of Daly Seven, Inc., a company engaged primarily in hotel development and management. Mr. Daly has served in this capacity since 1980. He is a graduate of Virginia Tech where he received a bachelor’s degree in Business Management. He formerly served on the advisory board for the Boys and Girls Club of Greater Lynchburg. Mr. Daly provides experience in commercial real estate management, commercial real estate financing, construction project management, and business operations.

Watt R. Foster, Jr., 62, is a native of Brookneal, Virginia. Mr. Foster is the President and Chief Executive Officer of Foster Fuels, Inc., a company engaged primarily in the sale and distribution of petroleum and propane products, and related products as well as the provision of emergency fuel delivery throughout the United States. He is also owner of Phelps Creek Angus Farm, a 500 head cow-calf operation located in Campbell County. Mr. Foster received a bachelor’s degree in Business Management from James Madison University. Mr. Foster is a member of the Staunton River Chapter of the Masonic Lodge. Mr. Foster provides the board with a strong knowledge of business, including the operation of wide ranging, complex operations, and real estate purchase and development.

Phillip C. Jamerson, 63 is Vice President and Owner of Jamerson Building Supply and Jamerson Real Estate and is the past Co-Owner and CEO of Jamerson-Lewis Construction. Mr. Jamerson is a 1981 graduate of Virginia Tech and has a B.S. degree in Building Construction. He is currently serving on the Board of Directors and Executive Committee of the Lynchburg Humane Society, the Board of the Courtland Park Foundation and the Board of Wolfbane Theater. He was previously a member of the Appomattox Economic Development Agency, the Region 2000 Workforce Development Board and Patrick Henry Family Services. Mr. Jamerson provides the board with a strong knowledge of business, including real estate purchase and development as well as construction and project management.

Thomas W. Pettyjohn, Jr., 75, is the chairman of the board of Financial. Mr. Pettyjohn grew up in Amherst County and has been a resident of Lynchburg since 1972. Mr. Pettyjohn received a bachelor’s degree in History and a J.D. from Washington & Lee University. Mr. Pettyjohn retired from Davidson & Garrard, Inc., an investment advisory firm in Lynchburg, on December 31, 2015. Mr.

Pettyjohn has an extensive banking background, having worked at Central Fidelity National Bank for many years. While at Central Fidelity, Mr. Pettyjohn held the titles of Executive Vice President and Division Manager of Residential Real Estate, Executive Vice President and Division Manager of Commercial Banking/Western Division, Vice President and In-House Counsel of Central Fidelity Bank’s predecessor, Fidelity American Bankshares, Inc., and statewide Manager for Indirect Lending. At the time of his retirement from Central Fidelity, Mr. Pettyjohn was Executive Vice President of Real Estate Administration for the Mortgage Division. Mr. Pettyjohn is currently on the board of directors and chairman of the finance committee of Amazement Square Children’s Museum. He has served as the President of the board of directors of Boonsboro Country Club, an elder and deacon of First Presbyterian Church and as chairman of the board of the First Presbyterian Weekday School. Mr. Pettyjohn has extensive experience in and knowledge of banking and law, including real estate, lending, commercial banking and financial matters and brings this valuable experience to the board.

Directors Continuing in Office

Robert R. Chapman III, 59, serves as the President of Financial and the Chief Executive Officer of the Bank. He has been a resident of Lynchburg for 25 years and has been the President of Financial since January 2004, CEO of the Bank since January 2003, and served as President of the Bank from January 2003 through October 2021. Mr. Chapman was a co-organizer of Bank of the James in 1999.�� Previously, Mr. Chapman was Vice President and Branch Manager and a Commercial Account Manager at Crestar Bank for 15 years. Mr. Chapman is a graduate of Virginia Military Institute where he received a bachelor’s degree in Economics. Following graduation, Mr. Chapman served as First Lieutenant in the United States Army. Mr. Chapman graduated from the Stonier Graduate School of Banking. Mr. Chapman is a past President of the Lynchburg City Schools Education Foundation. He also serves on the boards of the Centra Foundation, the VMI Keydet Club and is a member of First Presbyterian Church. In addition to his extensive experience in bank administration, asset/liability management, residential and commercial real estate lending, and business and industry lending, Mr. Chapman has experience in the day-to-day management of the Bank and knowledge of its business and operations.

Julie P. Doyle, 58, has lived in Lynchburg since 1993. Ms. Doyle is the President and Executive Director of The Education & Research Foundation, Inc. located in Lynchburg, a position she has held since 2005. Ms. Doyle directs the business operations of a clinical research site whose primary market focus is dermatological medications and products. Ms. Doyle holds a Bachelor of Science degree in Mechanical Engineering from the University of Notre Dame and a Master of Business Administration degree from George Washington University. Active in the community, Ms. Doyle currently holds board positions with Centra Health, Inc., University of Lynchburg, and the Lynchburg City Schools Education Foundation. She formerly served as the chair of the Lynchburg City School Board. Ms. Doyle provides the board with executive experience, a strong financial background, and good relationships within the community.

Lydia K. Langley, 59, is a Lynchburg native and recently retired owner of Langley Rentals for 28 years. Langley Rentals owned and managed residential rental properties, including apartments, duplexes, and single family homes in the Lynchburg area. Ms. Langley has a B.A. from the University of Virginia and a Masters of Administration from Lynchburg College. She served 9 years on the Planning Commission for the City of Lynchburg and was an original member of the Lynchburg Police Foundation. Ms. Langley previously served on the board of The Ellington as well as the Lynchburg Advisory Board of Bank of the James for five years before being appointed to the board of Financial. Ms. Langley provides the board with strong business knowledge, particularly related to the operation of a rental real estate business and local real estate values.

Dr. Augustus A. Petticolas, Jr., 73, has practiced dentistry in Lynchburg since 1976. He is a graduate of Livingstone College in Salisbury, North Carolina and holds a bachelor’s degree in English with a minor in Biological Sciences and French. He earned his Doctor of Dental Surgery degree at the University of Maryland. Dr. Petticolas is involved in numerous community endeavors and is a founding board member of the Free Clinic of Central Virginia, Inc. In addition, he currently serves on the boards of the Greater Lynchburg Community Trust and the Centra Health Foundation. He previously has served on the board of Centra Health, Inc. He joined the board of directors of Bank of the James in 2005. In July, 2008, Governor Tim Kaine appointed Dr. Petticolas to serve a four-year term on the Virginia Board of Dentistry. Dr. Petticolas brings business experience, knowledge of project management, and leadership skills to the board.

Lewis C. Addison, 70, is retired from his position as Senior Vice-President/Chief Financial Officer and Treasurer for Centra Health, Inc., where he had worked in various capacities since 1979. He holds a bachelor’s degree in Business with a major in Accounting from Virginia Tech. Mr. Addison was a Certified Public Accountant and is a Past President of the Virginia Chapter of the Healthcare Financial Management Association. He is currently Chairman of the Board of Piedmont Community Health Plan, Inc. and former Chairman of the Industrial Development Authority of the Town of Amherst. Mr. Addison has extensive experience in complex financial matters and serves as Financial’s audit committee financial expert under SEC guidelines.

John R. Alford, Jr., 61, is a shareholder with Caskie & Frost, P.C., a law firm based in Lynchburg. In his practice, Mr. Alford provides advice to corporations and other business entities in matters of corporate law, commercial transactions, and real estate and to individual clients in matters including estate planning, estate administration, and real estate matters. He received a bachelor’s degree in Economics from the University of Virginia and a J.D. from Washington & Lee University School of Law. Prior to joining the board of directors of Financial, Mr. Alford was a member of the Bank’s Lynchburg Advisory Board. Mr. Alford is a former board member of the Greater Lynchburg Community Foundation, a former board member of Sweet Briar College, a former president and former board member of Boonsboro Country Club, a former Trustee for James River Day School and a former chairman and board member for the Alliance for Families & Children. Mr. Alford provides the board with valuable experience and perspective gained in the legal profession as well as strong business contacts.

William C. Bryant III, 57, is the President of and Auctioneer for Ted Counts Realty and Auction Company. He holds a B.S. in Business Management from LaSalle University. Mr. Bryant received a certificate in Real Estate Appraisal from the International College of Real Estate Appraisal in Columbia, Tennessee and is a graduate of the Mosley Flint School of Real Estate in Roanoke, Virginia. In addition, he is a graduate of the Mendenhall School of Auctioneering in High Point, North Carolina, and obtained CAI designation through Indiana University, the Certified Auctioneers Institute in Bloomington, Indiana. Mr. Bryant is a member of the National Association of Realtors, the Virginia Association of Realtors, the National Association of Auctioneers, and the Virginia Association of Auctioneers. He previously served on the board of the Lynchburg Regional Chamber of Commerce and serves on the Commonwealth of Virginia Auctioneers Regulator Board and is a member of the Lynchburg Board of Realtors. Mr. Bryant provides executive experience, broad ties to the business community and significant experience in valuing assets in a broad range of categories, including real estate, heavy equipment, and livestock.

J. Todd Scruggs, 54, is the Secretary-Treasurer of Financial and Executive Vice President and Chief Financial Officer of the Bank. Mr. Scruggs was a co-organizer of the Bank and has served as its Chief Financial Officer since its formation in 1999. Prior to serving as an organizer for the Bank, Mr. Scruggs worked at Crestar Investment Group, where he was a Financial Consultant and an Investment Representative. Mr. Scruggs has a Bachelor of Science in Commerce from the University of Virginia

McIntire School of Commerce. Mr. Scruggs also graduated from the University of South Carolina School of Graduate Bank Investment Management. Mr. Scruggs is Secretary of both Financial and the Bank. He currently serves on the finance committee of Interfaith Outreach Association, the board of Boonsboro Country Club, the board of the E.C. Glass Foundation, and is involved with the Ways to Work Program at HumanKind. He has served on the board of the Central Virginia Community College Education Foundation and previously served on the board finance committee of Centra Health, Inc. Mr. Scruggs has experience in preparing and reviewing complex financial information, investment, asset/liability management, interacting with institutional investors, and regulatory matters.

Executive Officers Who Are Not Directors

The following sets forth biographical information and the business experience of each non-director executive officer of the Bank.

Michael A. Syrek, 50, was appointed President of Bank of the James in October 2021. Prior to assuming this position, Mr. Syrek served as the Executive Vice President and Chief Lending Officer since 2012. Prior to joining the Bank, Mr. Syrek served as President of SunTrust Bank for the Lynchburg, Virginia region and was also a commercial team leader where he supervised commercial relationship managers throughout central and western Virginia and West Virginia. Mr. Syrek graduated from James Madison University a Bachelor of Science in Accounting.

Harry P. Umberger, 56, has served as Executive Vice President and Senior Credit Officer of the Bank since December 2007. Mr. Umberger started his banking career in 1990 with Sovran Bank. He joined the Bank in 2001 as a Vice President and Commercial Lender. From 2003 to 2007, Mr. Umberger served as Senior Vice President and Senior Credit Officer of the Bank. He had also worked with two other Region 2000 community banks prior to joining the Bank. Mr. Umberger has a Bachelor of Arts degree from Hampden-Sydney College with majors in both Economics and Spanish. He is also a graduate of the Virginia Banker’s School of Bank Management.

Board Leadership and Risk Oversight

Robert R. Chapman III serves as Financial’s Chief Executive Officer and Thomas W. Pettyjohn, Jr., an independent director, serves as the Chairman of the Board. The Company has determined that splitting the role of Chairman of the Board and Chief Executive Officer is appropriate for the Company, because the board believes it is prudent to have an independent director set the agenda for board meetings instead of an inside director. The board feels this arrangement allows the directors to appropriately exercise their oversight role.

The board of directors is responsible for and actively involved in the oversight of risks that could affect Financial. The risks that are an inherent part of Financial’s business and operations include, but are not limited to, credit risk, market risk, operational risk, liquidity risk, interest rate risk, fiduciary risk, regulatory risk, information security risk (including cyber risk), legal risk and reputational risk. The board must have an appropriate understanding of the types of risks to which the organization is exposed, and the board must ensure that the organization’s management is fully capable, qualified and properly motivated to manage the risks arising from the organization’s business activities in a manner that is consistent with the board’s expectations. The board’s oversight is conducted primarily through committees of the board, as disclosed in the descriptions of each of the committees below, but the full board has retained responsibility for general oversight of risks. The board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within Financial and the Bank. Likewise, management is responsible for communicating and reinforcing the

compliance culture that the board has established and for implementing measures to promote the culture throughout the organization.

The Audit Committee of the board of directors is responsible for overseeing Financial’s risk management function on behalf of the board. In carrying out this responsibility, the Audit Committee works closely with the Company’s management and internal audit teams. The Audit Committee meets regularly with these individuals and receives an overview of findings from various risk management initiatives, including the Company’s enterprise risk management program, internal audits, Sarbanes-Oxley reports regarding internal controls over financial reporting and other regulatory compliance reports. The Bank’s Vice President & Audit Manager, in particular, provides a comprehensive report to the Audit Committee regarding Financial’s key risks. While the Audit Committee has primary responsibility for overseeing risk management, the entire Board of Directors is actively involved in overseeing this function for Financial through the enterprise risk management function.

Code of Ethics

Financial has adopted a code of ethics that applies to Financial’s directors, executive officers (including the principal financial officer, principal accounting officer or controller, or persons performing similar functions), and senior officers. The code of ethics has been posted under the “Investor Relations” section on Financial’s website: www.bankofthejames.bank. Any waiver or substantial amendments of the code of ethics applicable to our directors and executive officers also will be disclosed on our website.

Meeting Attendance

Board and Committee Meeting Attendance

The board of directors of Financial held fourteen (14) meetings during 2021. During 2021, except for Mr. Foster, who attended 73% of the meetings, each of the directors attended at least 75% of the meetings of the board of Financial and the committees of Financial on which they serve. In calculating attendance, the Company did not include meetings of the board of directors of the Bank or its committees.

Director Fees

Our outside directors serve and are compensated as both directors of Financial and the Bank. In the year ended December 31, 2021, Financial or the Bank, as applicable, paid the outside directors the following standard fees:

Description | Amount (1) |

Attendance at meeting of the board of directors of Financial or the Bank, Chairman of the Board | $2,100 |

Attendance at meeting of the board of directors of Financial or the Bank, Vice Chairman of the Board | $1,050 |

Attendance at meeting of the board of directors of Financial or the Bank | $700 |

Attendance at committee meeting of Financial or the Bank | $400 |

Board Annual Retainer | $3,000 |

Loan Committee Annual Retainer | $1,000 |

(1)Although directors serve and are compensated as directors of both Financial and the Bank, the directors do not receive additional compensation when a) the boards of Financial and the Bank meet on the same day; and b) when a committee of Financial and its corresponding committee of the Bank meet on the same day.

Members of the board of directors do not receive any compensation except as set forth herein. Non-employee board members are not eligible to receive awards under the 2018 Bank of the James Financial Group, Inc. Equity Incentive Plan. In 2021, total fees paid to non-employee directors were approximately $250,400.

The following table contains information regarding the compensation awarded or paid to, or earned by, Financial’s directors during the 2021 fiscal year.

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) |

Lewis C. Addison | $15,800 | - | - | - | $15,800 |

John R. Alford, Jr. | 25,800 | - | - | - | 25,800 |

William C. Bryant III | 17,000 | - | - | - | 17,000 |

Robert R. Chapman III (1) | - | - | - | - | - |

A. Douglas Dalton III | 13,300 | - | - | - | 13,300 |

James F. Daly | 26,600 | - | - | - | 26,600 |

Julie P. Doyle | 16,500 | - | - | - | 16,500 |

Watt R. Foster, Jr. | 17,400 | - | - | - | 17,400 |

Phillip C. Jamerson | 14,900 | - | - | - | 14,900 |

Lydia K. Langley | 27,700 | | | | 27,700 |

Augustus A. Petticolas, Jr. | 29,000 | - | - | - | 29,000 |

Thomas W. Pettyjohn, Jr. | 46,400 | - | - | - | 46,400 |

J. Todd Scruggs (1) | - | - | - | - | - |

Total | $250,400 | | | | $250,400 |

| (1) Messrs. Chapman and Scruggs are employee-directors and do not receive additional compensation for service on the boards of Financial or the Bank or committees thereof. |

Attendance at Meetings of Shareholders

Financial encourages each member of the board of directors to attend the upcoming Annual Meeting of Shareholders. Except for Mr. Addison, all of Financial’s directors attended the 2021 Annual Meeting of Shareholders of Financial.

COMMITTEES OF THE BOARD OF DIRECTORS OF FINANCIAL

The board of directors of Financial has the following four standing committees to assist the board in the discharge of its duties: Executive Committee, Audit Committee, Nominating Committee, and Compensation Committee. The board of directors of the Bank has corresponding committees and, in addition, has standing Loan, Investment, Enterprise Risk Management, and Compliance Committees to assist it in the discharge of its duties.

The board of directors of Financial has adopted charters for its Audit Committee, Nominating Committee, and Compensation Committee to define the duties and responsibilities of those committees. These charters are available on the “Investor Relations” page of our website (www.bankofthejames.bank)

under “Governance Documents.” If you would prefer to receive a copy via mail at no cost to you, please contact J. Todd Scruggs, Secretary of Financial.

Members of Board Committees

The following table sets forth the membership during the year ended December 31, 2021 of each of Financial’s standing committees:

Committee | Members |

Audit Committee | Augustus A. Petticolas Jr. - Chair Lewis C. Addison (1) James F. Daly Julie P. Doyle Phillip C. Jamerson Lydia K. Langley |

Executive Committee | Thomas W. Pettyjohn Jr. - Chair John R. Alford, Jr. Robert R. Chapman III James F. Daly Watt R. Foster, Jr. Lydia K. Langley Augustus A. Petticolas Jr. |

Nominating Committee | Watt R. Foster, Jr. - Chair Lewis C. Addison Augustus A. Petticolas Jr. |

Compensation Committee | Thomas W. Pettyjohn Jr. - Chair Lewis C. Addison James F. Daly Lydia K. Langley |

| (1) | | Audit Committee Financial Expert |

Executive Committee

The Executive Committee reviews extraordinary confidential issues and serves as a forum for discussing executive decisions. The Executive Committee has all the powers of the board in the management and the conduct of the business and affairs of Financial in the intervals between meetings of the full board, except that the Executive Committee may not increase the number of directors, fill vacancies on the board, remove directors, approve an amendment to the articles of incorporation or bylaws, approve a plan of merger or consolidation, or take other actions that cannot by law be delegated by the board. For the year ended December 31, 2021, the Executive Committee of Financial had twelve (12) meetings.

Audit Committee

Financial’s Audit Committee has been established in accordance with § 3(a)(58)(A) of the Securities Exchange Act. The Audit Committee reviews and approves compliance policies and

procedures and assists and monitors general audits performed by federal and state agencies. The Audit Committee is responsible for the selection and recommendation of the independent accounting firm for the annual audit. The Audit Committee of Financial reviews and accepts the reports of Financial’s independent auditors, internal auditor, and federal and state examiners. As part of its oversight of Financial’s financial statements, the Audit Committee reviews and discusses with management and Financial’s independent registered public accountants, all annual and quarterly financial statements and disclosures prior to their issuance. As discussed in “Board Leadership and Risk Oversight” above, the Audit Committee is also responsible for overseeing Financial’s risk management function on behalf of the board.

In addition, the Audit Committee reviews key initiatives and programs aimed at maintaining the effectiveness of Financial’s internal and disclosure control structure. As part of this process, the Audit Committee continues to monitor the scope and adequacy of Financial’s internal auditing program. In addition, the Audit Committee is the appropriate body to receive, review, and investigate, as appropriate, certain complaints, including those from whistleblowers. For the year ended December 31, 2021, the Audit Committee of Financial had four (4) meetings.

Financial’s board has determined that Lewis C. Addison is an “Audit Committee Financial Expert” as that term is defined by the Securities and Exchange Commission rules adopted pursuant to the Sarbanes-Oxley Act of 2002.

The board has determined that Mr. Addison and each other member of the Audit Committee qualify as independent based on the definition of “independent director” under the applicable NASDAQ rules and applicable Securities and Exchange Commission regulations. Each member of the Audit Committee is able to read and understand financial statements, including Financial’s balance sheet, income statement, and cash flow statement.

Nominating Committee

The Nominating Committee reviews and recommends candidates for nomination to the board for expiring/expired or otherwise vacant seats. For the year ended December 31, 2021 the Nominating Committee had one (1) meeting.

All members of the Nominating Committee are independent based on the definition of “independent director” under the applicable NASDAQ rules and applicable Securities and Exchange Commission regulations. Currently, Financial does not have a formal process by which to consider candidates recommended by shareholders. Financial believes that because of the current operating environment, it is critical for the board of directors to be comprised of individuals with the types of expertise and scope currently represented on the board and that the Nominating Committee is best positioned to identify such individuals. As discussed above, the Nominating Committee considers all candidates based on the criteria set forth under “Director Qualifications,” including share ownership, business experience and expertise, character, particular goals and needs of Financial for additional competencies or characteristics, educational background, and board experience in evaluating potential nominees.

Compensation Committee

The Compensation Committees of Financial and the Bank, as applicable, review, recommend, and approve compensation for its employees. Each member of the Compensation Committee is an “independent director” under the applicable NASDAQ rules and applicable Securities and Exchange Commission regulations. For the year ended December 31, 2021, the Compensation Committee of the Bank had one (1) meeting, but because Financial does not have any employees and does not compensate its officers directly, the Compensation Committee of Financial did not meet.

CERTAIN BENEFICIAL OWNERS

As of the Record Date, the following persons were the only shareholders known to the Company to beneficially own more than 5% of Financial’s outstanding Common Stock:

Name and Address of Individual or Identity of Group | Amount and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding |

Basswood Capital Management 645 Madison Ave, 10th Floor New York, NY 10022 | 302,080 (1) | 6.37 |

Eidelman Virant Capital, Inc. 8000 Maryland Ave St. Louis, MO 63105 | 246,828 (2) | 5.21 |

| (1) This information is based solely on a Schedule 13G filed with the SEC for the calendar year ending December 31, 2021, on behalf of Basswood Capital Management. |

| (2) This information is based solely on a Schedule 13G filed with the SEC for the calendar year ending December 31, 2021, on behalf of Eidelman Virant Capital, Inc. |

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information as of March 22, 2022 regarding the number of shares of Common Stock of Financial beneficially owned by (1) each director, (2) each executive officer, and (3) directors and executive officers as a group. The address of each director and executive officer is c/o Bank of the James Financial Group, Inc., 828 Main Street, Lynchburg, VA 24504.

Name | Common Stock Owned Beneficially (#) (1) | Percentage of Class (%) (2) |

Lewis C. Addison, Director | 17,708 | * |

John R. Alford, Jr. (3), Director | 19,374 | * |

William C. Bryant III (4), Director | 42,810 | * |

Robert R. Chapman III, Director, CEO | 110,164 | 2.32 |

A. Douglas Dalton III, Director | 10,953 | * |

James F. Daly (5), Director | 128,234 | 2.70 |

Julie P. Doyle (6), Director | 13,253 | * |

Watt R. Foster, Jr., Director | 115,150 | 2.43 |

Phillip C. Jamerson, Director | 2,178 | * |

Lydia K. Langley, Director | 100,077 | 2.11 |

Augustus A. Petticolas, Jr., Director | 2,354 | * |

Thomas W. Pettyjohn, Jr. (7), Director | 17,495 | * |

J. Todd Scruggs (8), Director, Secretary, EVP and CFO of the Bank | 32,770 | * |

Harry P. Umberger, EVP and Senior Credit Officer of the Bank | 1,780 | * |

Michael A. Syrek, EVP and President of the Bank | 12,650 | * |

Officers and Directors as a group (9) | 626,950 | 13.22 |

*Less than 1%

(1)For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he or she has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or she has the right to acquire beneficial ownership of the security within sixty days (“presently exercisable”). Beneficial ownership also includes any shares held in the name of an individual’s spouse, minor children or other relatives living in the individual’s home.

(2)The ownership percentage of each individual is calculated based on the total of 4,740,657 shares, which is comprised of shares of common stock that were outstanding as of March 22, 2022, plus the number of shares that are presently exercisable. Shares of common stock that are presently exercisable are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by any person or group, but are not deemed outstanding for the purpose of computing the percentage of common stock owned by any other person or group.

(3)Includes beneficial ownership of 2,310 shares held by Mr. Alford’s wife.

(4)Includes beneficial ownership of 42,810 shares held by Mr. Bryant as a joint tenant with his wife.

(5)Includes beneficial ownership of 42,467 shares held in a revocable trust of which Mr. Daly and his wife are co-trustees and 82,500 shares owned by Daly Group, LLC of which Mr. Daly is a member.

(6)Includes beneficial ownership of 2,050 shares owned by an entity owned by Ms. Doyle’s husband and 4,300 shares owned by Ms. Doyle’s husband.

(7)Includes 770 shares owned by Mr. Pettyjohn’s wife.

(8)Includes 158 shares owned by Mr. Scruggs’ wife.

(9)See notes 1 through 8.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Executive Officer Compensation

The Compensation Committees of Financial and the Bank are tasked with reviewing officer and employee compensation and employee benefit plans and making recommendations to the respective boards concerning such matters. The Compensation Committee also approves awards under the 2018 Bank of the James Financial Group, Inc. Equity Incentive Plan. Each Compensation Committee’s membership is determined by the board of the respective company that such Compensation Committee serves.

The Compensation Committees review and approve the goals of Financial and the Bank, as applicable, relevant to compensation, evaluate the performance of the President and Chief Executive Officer in light of these goals, and make a recommendation on the President and Chief Executive Officer’s compensation, including equity or other compensation, to the respective full board of directors which determines the appropriate compensation for the following year.

Compensation of senior management is determined by the Chief Executive Officer with direction from the Compensation Committee, while staying within the targeted overall compensation budgeted by the Bank.

The compensation of senior management is a mix of i) base salary; ii) retirement, insurance, and health benefits; iii) perquisites and other benefits; iv) for certain members of senior management, commissions on loan and investment sales; v) awards under the 2018 Bank of the James Financial Group, Inc. Equity Incentive Plan, and vi) for certain members of senior management, participation in a Salary Continuation Agreement. Formerly, members of senior management along with other employees participated in Financial’s 1999 stock option plan, which expired in 2009.

The primary objective of our compensation programs is to provide competitive compensation to attract, retain, and motivate qualified employees who will contribute to the long-term success of Financial and its subsidiaries. Compensation is designed to be competitive with the Bank’s peers and to enhance long-term value to the Company’s shareholders. In furtherance of this objective, the Compensation Committees regularly evaluate the compensation provided to the Bank’s executive officers to ensure that it remains competitive in relation to the compensation paid to similarly situated executive officers at other financial institutions of comparable size and performance. In addition, Financial endeavors to ensure that the compensation provided to Financial’s and its subsidiaries’ executive officers is internally

equitable based upon the skill requirements and responsibilities associated with each executive position. Financial does not believe that the current compensation structure incentivizes any employee to take undue risk.

Although neither Financial nor the Bank has adopted a bonus plan, the board of directors has the discretion to award bonuses to employees based on individual and company performance.

The officers of Financial presently are serving without compensation from Financial. They are, however, compensated by the Bank for services rendered as officers of the Bank. The table below summarizes certain information with respect to compensation paid by the Bank to certain employees of the Bank who performed policy-making duties for Financial for services rendered in all respects for the fiscal year ended December 31, 2021.

Summary Compensation Table—2021

| Annual Compensation | | Long Term Compensation | Total ($) |

Name and Principal Position | Year | Salary ($) | Bonus ($) | | Awards Options/ SARS (#)() | All Other Compens-ation ($) | |

|

Robert R. Chapman III (1) President of Financial and CEO of the Bank* | 2021 | 325,027 | 125,000 | | - | 123,261 | 573,288 |

| 2020 | 325,027 | 75,000 | | - | 117,753 | 517,780 |

| | | | | | | |

J. Todd Scruggs (2) Secretary-Treasurer of Financial and EVP and CFO of the Bank | 2021 | 285,000 | 100,000 | | | 78,895 | 463,895 |

| 2020 | 265,252 | 75,000 | | - | 71,555 | 411,807 |

| | | | | | | |

Michael A. Syrek (3), President of the Bank* | 2021 | 285,000 | 60,000 | | | 77,573 | 422,573 |

| | | | | | |

| | | | | | | |

Harry P. Umberger (4) EVP - SCO of the Bank | 2021 | 255,016 | 60,000 | | | | |

| 2020 | 237,816 | 45,000 | | - | 60,079 | 342,895 |

*On October 13, 2021, Mr. Syrek assumed the role of President of the Bank. Prior to that date, Mr. Chapman served as President of the Bank. Mr. Chapman remained the Bank’s Chief Executive Officer.

(1)“All Other Compensation” consists entirely of matching contributions made under the Bank’s 401(k) plan, life insurance premiums, and club dues, and $96,612 and $96,612 expensed by the Bank under Mr. Chapman’s Salary Continuation Agreement in 2021 and 2020, respectively.

(2)“All Other Compensation” consists entirely of matching contributions made under the Bank’s 401(k) plan, life insurance premiums, and club dues, and $42,694 and $42,694 expensed by the Bank under Mr. Scruggs’ Salary Continuation Agreement in 2021 and 2020, respectively.

(3)“All Other Compensation” consists entirely of matching contributions made under the Bank’s 401(k) plan, life insurance premiums, and club dues, and $52,913 expensed by the Bank under Mr. Syrek’s Salary Continuation Agreement in 2021, respectively.

(4)“All Other Compensation” consists entirely of matching contributions made under the Bank’s 401(k) plan, life insurance premiums, and $41,333 and $41,333 expensed by the Bank under Mr. Umberger’s Salary Continuation Agreement in 2021 and 2020, respectively.

Stock Option Plan

The 1999 Stock Option Plan, as amended, expired in 2009.

Outstanding Equity Awards at Fiscal Year End

In 2018, the Company adopted the 2018 Bank of the James Financial Group, Inc. Equity Incentive Plan (the “Incentive Plan”).

The following table provides information as of December 31, 2021 regarding Financial’s stock based awards under the Incentive Plan. The named executive officers have no other outstanding equity awards.

| Stock Awards |

Name | Number of Shares or Units of Stock That Have Not Vested (#) (1) | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) |

Robert R. Chapman III | 1,000 | 15,460 |

J. Todd Scruggs | 1,000 | 15,460 |

Harry P. Umberger | 833 | 12,878 |

Michael A. Syrek | 833 | 12,878 |

(1)These restricted stock units were awarded on January 2, 2019 under the Incentive Plan and vest in equal one-third amounts annually. The restricted stock units vested in three equal amounts on each of January 1, 2020, 2021, and 2022. Each restricted stock unit is equivalent to one share of Company common stock.

(2)The amounts in this column represent the number of restricted stock units held multiplied by the closing price of the Company’s common stock of $15.46 per share on December 31, 2021.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information concerning Financial’s equity compensation plans at December 31, 2021. All figures have been adjusted to reflect all stock dividends declared by Financial.

Plan Category | Number of Shares to be Issued Upon Exercise of Outstanding Option, Warrants, and Rights | Weighted Average Exercise Price of Outstanding Options. Warrants, and Rights | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Shares Reflected in First Column) |

Equity compensation plans approved by shareholders - | | | |

2018 Bank of the James Financial Group, Inc. Equity Incentive Plan (1) | 8,167 | $ 13.00 (2) | 225,500 |

2018 Bank of the James Financial Group, Inc. Employee Stock Purchase Plan (3) | - | - | 233,190 |

Equity compensation plans not approved by shareholders | N/A | N/A | N/A |

| | | |

Total | 8,167 | $ - | 458,690 |

(1)Shares available to be granted under the Equity Incentive Plan as of December 31, 2021, in the form of stock options, restricted stock, restricted stock units and performance units.

(2)Closing price of common stock on the date of grant.

(3)Shares reserved for issuance under the Employee Stock Purchase Plan (“ESPP”) as of December 31, 2021. Shares under the ESPP have no exercise price. To date, a total of 16,810 shares have been purchased under the ESPP.

Executive Compensation Arrangements

Employment Agreements

None of our employees have employment agreements. Information with respect to the payment upon change of control is set forth under “Salary Continuation Agreements” below.

Salary Continuation Agreements

The Bank entered into Salary Continuation Agreements on August 6, 2009 with each of Robert R. Chapman III, CEO of the Bank; J. Todd Scruggs, Executive Vice President and Chief Financial Officer;; and Harry P. Umberger, Executive Vice President and Senior Credit Officer and entered into a Salary Continuation Agreement with Michael A Syrek, President of the Bank on January 27, 2013 (collectively, the “Named Executive Officers”).

On October 18, 2016, the Bank entered into First Amendments to each of the Salary Continuation Agreements (each as amended, a “First Amended Salary Continuation Agreement”) with each of the Named Executive Officers, to be effective as of October 1, 2016. In connection with Mr. Umberger’s First Amended Salary Continuation Agreement, the Bank and Mr. Umberger also entered into that certain 2016 Salary Continuation Agreement (the “2016 Salary Continuation Agreement”), to be effective as of October 1, 2016. The First Amended Salary Continuation Agreements, and in the case of Mr. Umberger, the 2016 Salary Continuation Agreement, provide each of the Named Executive Officers with increased Supplemental Benefits, as summarized below.

Robert R. Chapman III. Mr. Chapman’s First Amended Salary Continuation Agreement provides for a lump sum payment of $2,315,177 payable within 90 days following Mr. Chapman’s normal retirement date at age 65 or the date of his death if he is employed by the Bank at the time of his death.

If Mr. Chapman’s employment terminates prior to his reaching age 65 other than for cause, death, disability, or change in control, Mr. Chapman shall be paid a lump sum equal to the Early Termination benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This amount is payable within 90 days following the date on which his employment terminates.

If Mr. Chapman becomes disabled prior to his reaching age 65, he shall receive a lump sum payment equal to the Disability benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding his disability. This amount shall be paid within 90 days following the date on which Mr. Chapman reaches age 65.

If Mr. Chapman’s employment with the Bank terminates within 24 months following a Change in Control (as defined in the initial Salary Continuation Agreement), Mr. Chapman shall be paid a lump sum equal to the Change in Control benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This payment shall be made within 90 days of the date on which Mr. Chapman’s employment terminates.

J. Todd Scruggs. Mr. Scruggs’ First Amended Salary Continuation Agreement provides for annual payments of $170,484 payable in equal monthly installments for 15 years beginning within 90 days following Mr. Scruggs’ normal retirement date at age 65 or the date of his death if he is employed by the Bank at the time of his death.

If Mr. Scruggs’ employment terminates prior to his reaching age 65 other than for cause, death, disability, or change in control, Mr. Scruggs shall be paid a lump sum equal to the Early Termination benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This amount is payable within 90 days following the date on which his employment terminates.

If Mr. Scruggs becomes disabled prior to his reaching age 65, he shall receive a lump sum payment equal to the Disability benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding his disability. This amount shall be paid within 90 days following the date on which Mr. Scruggs reaches age 65.

If Mr. Scruggs’ employment with the Bank terminates within 24 months following a Change in Control (as defined in the initial Salary Continuation Agreement), Mr. Scruggs shall be paid a lump sum equal to the Change in Control benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This payment shall be made within 90 days of the date on which Mr. Scruggs’ employment terminates.

Michael A. Syrek. Mr. Syrek’s Salary Continuation Agreement provides for a lump sum payment of $1,488,393 payable within 90 days following Mr. Syrek’s normal retirement date at age 65 or the date of his death if he is employed by the Bank at the time of his death

If Mr. Syrek’s employment terminates prior to his reaching age 65 other than for cause, death, disability, or change in control, Mr. Scruggs shall be paid a lump sum equal to the Early Termination benefit set forth on Schedule A of the First Amended Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This amount is payable within 90 days following the date on which his employment terminates.

If Mr. Syrek becomes disabled prior to his reaching age 65, he shall receive a lump sum payment equal to the Disability benefit set forth on Schedule A of the Continuation Agreement for the applicable plan year immediately preceding his disability. This amount shall be paid within 90 days following the date on which Mr. Syrek reaches age 65.

If Mr. Syrek’s employment with the Bank terminates within 24 months following a Change in Control (as defined in the initial Salary Continuation Agreement), Mr. Syrek shall be paid a lump sum equal to the Change in Control benefit set forth on Schedule A of the Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This payment shall be made within 90 days of the date on which Mr. Syrek’s employment terminates.

Harry P. Umberger. Mr. Umberger’s First Amended Salary Continuation Agreement freezes the amount of the Supplemental Benefits provided under Mr. Umberger’s initial Salary Continuation Agreement. Supplement Benefits are also provided under Mr. Umberger’s 2016 Salary Continuation Agreement.

Mr. Umberger’s 2016 Salary Continuation Agreement provides for a lump sum payment of $886,660 payable within the month following the date of Mr. Umberger’s separation from service after age 65 or the date of his death if he is employed by the Bank at the time of his death. In addition to this payment, Mr. Umberger’s First Amended Salary Continuation Agreement provides for annual payments of $44,085 payable in equal monthly installments for 15 years beginning within 90 days following Mr. Umberger’s normal retirement date at age 65 or the date of his death prior to attaining the age of 65 if he is employed by the Bank at the time of his death.

If Mr. Umberger’s employment terminates prior to his reaching age 65 other than for cause, death, disability, or change in control, Mr. Umberger shall be paid, pursuant to the 2016 Salary Continuation Agreement, a lump sum equal to the Early Termination benefit set forth on Schedule A of the 2016 Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This amount is payable within the month following the date on which his employment terminates. In addition to this payment, Mr. Umberger’s First Amended Salary Continuation Agreement

provides for an annual benefit, payable in equal monthly installments for 15 years, in the amount necessary to fully amortize the accrued benefit amount of $188,340.22 over the 15-year period, crediting interest monthly on the unpaid portion of such accrued benefit amount at an annual rate of 6% (the “Accrued Annual Benefit”). Payments on this Accrued Annual Benefit shall begin within 90 days following the date of Mr. Umberger’s early termination.

If Mr. Umberger becomes disabled prior to his reaching age 65, he shall receive, pursuant to the 2016 Salary Continuation Agreement, a lump sum payment equal to the Disability benefit set forth on Schedule A of the 2016 Salary Continuation Agreement for the applicable plan year immediately preceding his disability. This amount shall be paid within the month following the date of Mr. Umberger’s disability. In addition to this payment, Mr. Umberger’s First Amended Salary Continuation Agreement provides for the Accrued Annual Benefit in the event of Mr. Umberger’s disability. Payments on this Accrued Annual Benefit shall begin within 90 days following the date on which Mr. Umberger reaches age 65.

If Mr. Umberger’s employment with the Bank terminates within 24 months following a Change in Control (as defined in the 2016 Salary Continuation Agreement), Mr. Umberger shall be paid, pursuant to the 2016 Salary Continuation Agreement, a lump sum equal to the Change in Control benefit set forth on Schedule A of the 2016 Salary Continuation Agreement for the applicable plan year immediately preceding such termination date. This payment shall be made within the month following the date on which Mr. Umberger’s employment terminates. In addition to this payment, Mr. Umberger’s First Amended Salary Continuation Agreement provides for the Accrued Annual Benefit. Payments on this Accrued Annual Benefit shall begin within 90 days of the date on which Mr. Umberger’s employment terminates following a Change in Control.

TRANSACTIONS WITH RELATED PARTIES

Loans and Extensions of Credit. Financial maintains written policies and procedures to strictly control all loans to insiders in accordance with Federal law (Regulation O). Insiders include any executive officer, director, or principal shareholder and entities which such persons control. Some of the directors and officers of Financial and the Bank are at present, as in the past, customers of the Bank, and the Bank has had, and expects to have in the future, banking transactions in the ordinary course of its business with directors, officers, principal shareholders, and their associates, on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the same time for comparable transactions with others. These transactions do not involve more than the normal risk of collectability or present other unfavorable features. At December 31, 2021 and 2020 the total outstanding loans to directors and officers and their related parties, including loans guaranteed by such persons, aggregated $12,075,000 and $12,682,000, respectively. None of these loans or other extensions of credit are disclosed as nonaccrual, past due, restructured, or potential problem loans.

Other Transactions. The Bank entered into a lease agreement (the “Original Lease”) in October 2003 pursuant to which it currently leased approximately 29,623 square feet of office space at 828 Main Street, Lynchburg, Virginia. The property is owned by Jamesview Investments, LLC, a Virginia limited liability company (“Jamesview”), which is owned by our director, William C. Bryant III. On March 5, 2021, Bank received from Jamesview a fully-executed copy of an Amended and Restated Deed of Lease by and between the Bank and the Landlord for the Bank’s 828 Main Street, Lynchburg, Virginia location (the “Amended and Restated Lease”). Notwithstanding the March 5, 2021 date of execution by the Landlord, the parties have made the Amended and Restated Lease effective as of June 1, 2019, the parties having operated and performed in accordance with the terms of the Amended and Restated Lease since

that time. The amendment was approved in compliance with approval process for related party transactions discussed below.

The Amended and Restated Lease amends and restates in its entirety the Original Lease. The initial term of the Amended and Restated Lease commenced, accordingly, on June 1, 2019 and will run through July 31, 2024, following which time the Bank has three (3) 5-year renewal options available for its election.

The Bank is leasing approximately 32,400 square feet of office space under the Amended and Restated Lease. During the initial term of the Amended and Restated Lease, the Bank is obligated to pay monthly installments of rent in the amount of approximately $33,471 (the exact amount varies by the number of parking spots occupied by the Bank) for the leased premises. During 2021, the Bank made payments to Jamesview of approximately $400,000.

In 2020, Financial issued $10,050,000 in unregistered debt securities (the “2020 Notes”) to accredited investors in a private placement. The 2020 Notes bear interest at the rate of 3.25% per year with interest payable quarterly in arrears. One member of the board purchased $100,000 of the 2020 Notes and received approximately $3,250 in interest payments during 2021. One board member’s immediate family members purchased an aggregate of $400,000 of 2020 Notes and during 2021 received approximately $13,000 in interest payments from the 2020 Notes. The related parties above purchased the 2021 Notes on the same terms as all other purchasers of the 2020 Notes.

Approval Process for Related Party Transactions. The disinterested members of the board of directors review all related party transactions for potential conflicts of interest. The board of directors must approve all related party transactions and such transactions must be on terms not less favorable to Financial or the Bank than those that prevail in arms-length transactions with third parties. Related party transactions are those involving Financial and the Bank which are required to be disclosed pursuant to SEC Regulation S-K, Item 404.

There are no legal proceedings to which any director, officer, principal shareholder, or associate is a party that would be material and adverse to the Bank.

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed the audited consolidated financial statements of Financial with management and with Yount, Hyde & Barbour, P.C. (“YHB”), the independent auditors for the year ended December 31, 2021. Management represented to the Audit Committee that Financial’s financial statements were prepared in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), and the Audit Committee has reviewed and discussed the financial statements with management and the independent auditors. The discussions with YHB also included the matters required to be discussed by PCAOB and the SEC.

YHB provided to the Audit Committee the written disclosures and letter required by applicable requirements of the PCAOB regarding the firm’s communications with the Audit Committee concerning independence. YHB also discussed with the Audit Committee the firm’s independence from Financial, the Bank, and their management.

Based on the discussions with management and YHB, the Audit Committee’s review of the representations of management, and the report of YHB, the Audit Committee unanimously recommended

to the board of directors that the audited financial statements be included in Financial’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for the year ended December 31, 2021.

Submitted by the Audit Committee of Financial’s board of directors.

Augustus A. Petticolas, Jr. - Chair

Lewis C. Addison

James F. Daly

Julie P. Doyle

Lydia K. Langley

Phillip C. Jamerson

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

YHB served as independent auditors for Financial for 2021 and 2020. Representatives from YHB are expected to be present (virtually) at the Annual Meeting with the opportunity to make a statement and to answer any questions you may have.