UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material Pursuant to§240.14a-12 |

REYNOLDS AMERICAN INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange ActRules 14a-6(i)(1) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Disclaimer Important ACCESS TO THIS WEBSITE MAY BE RESTRICTED UNDER SECURITIES LAWS OR REGULATIONS IN CERTAIN JURISDICTIONS OUTSIDE OF THE UNITED STATES AND THE UNITED KINGDOM. THIS NOTICE REQUIRES YOU TO CONFIRM CERTAIN MATTERS (INCLUDING THAT YOU ARE NOT A RESIDENT OF SUCH A JURISDICTION), BEFORE YOU MAY OBTAIN ACCESS TO THE INFORMATION ON THIS WEBSITE. THESE MATERIALS ARE NOT DIRECTED AT OR TO BE ACCESSED BY PERSONS WHO ARE RESIDENTS OF ANY JURISDICTION OUTSIDE OF THE UNITED STATES OR THE UNITED KINGDOM WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION. In connection with the proposed merger of British American Tobacco p.l.c. (“BAT”) and Reynolds American Inc. (“Reynolds”) (the “Proposed Transaction”), you acknowledge the following: Access to this website Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Disclaimer Important ACCESS TO THIS WEBSITE MAY BE RESTRICTED UNDER SECURITIES LAWS OR REGULATIONS IN CERTAIN JURISDICTIONS OUTSIDE OF THE UNITED STATES AND THE UNITED KINGDOM. THIS NOTICE REQUIRES YOU TO CONFIRM CERTAIN MATTERS (INCLUDING THAT YOU ARE NOT A RESIDENT OF SUCH A JURISDICTION), BEFORE YOU MAY OBTAIN ACCESS TO THE INFORMATION ON THIS WEBSITE. THESE MATERIALS ARE NOT DIRECTED AT OR TO BE ACCESSED BY PERSONS WHO ARE RESIDENTS OF ANY JURISDICTION OUTSIDE OF THE UNITED STATES OR THE UNITED KINGDOM WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION. In connection with the proposed merger of British American Tobacco p.l.c. (“BAT”) and Reynolds American Inc. (“Reynolds”) (the “Proposed Transaction”), you acknowledge the following: Access to this website You are attempting to enter a website that is designated for the publication of documents and information in connection with the Proposed Transaction. If you would like to access this website, please read this notice carefully. This notice applies to all persons who view this website and, depending on where you are located, may affect your rights or responsibilities. BAT and Reynolds reserve the right to amend or update this notice at any time and you should, therefore, read it in full each time you visit the site. In addition, the contents of this website may be amended at any time, in whole or in part, at the sole discretion of BAT or Reynolds. This website contains electronic versions of materials relating to the Proposed Transaction. The materials you are seeking to access are made available for information purposes only and are subject to the terms and conditions set out below. Any person seeking to access this website represents and warrants to BAT and Reynolds that they are doing so for information purposes only. To allow you to view information about the Proposed Transaction, you must read this notice and then click “AGREE”. If you are unable to agree, you should not click “AGREE” and you will not be able to view information about the Proposed Transaction. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

If you are in any doubt about the contents of this website or the action you should take, you are recommended to seek your own personal financial, legal or tax advice from your stockbroker, bank manager, solicitor, accountant or other financial adviser authorised under the Financial Services and Markets Act 2000 (as amended) or, if you are located outside the United Kingdom, from an appropriately authorized independent financial adviser. Jurisdictions Outside of the United States and the United Kingdom Viewing the materials you are seeking to access may be restricted under securities laws in certain jurisdictions outside of the United States and the United Kingdom. These materials are not directed at or accessible by persons resident in any jurisdiction outside of the United States or the United Kingdom if to do so would constitute a violation of the relevant laws or regulations of that jurisdiction. Residents of the United States and the United Kingdom are not restricted from accessing this website, subject to the review and agreement with this notice. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

YOU SHOULD NOT DOWNLOAD, MAIL, FORWARD, DISTRIBUTE, SEND OR SHARE THE INFORMATION OR DOCUMENTS CONTAINED ON THIS WEBSITE TO OR WITH ANY PERSON. IN PARTICULAR, YOU SHOULD NOT MAIL, FORWARD, DISTRIBUTE OR SEND THE INFORMATION OR DOCUMENTS CONTAINED THEREIN TO ANY JURISDICTION WHERE IT WOULD BE UNLAWFUL TO DO SO. It is your responsibility to satisfy yourself as to the full observance of any relevant laws and regulatory requirements outside the United States and the United Kingdom. Any failure to do so may constitute a violation of the applicable laws and regulations. If you are in any doubt, you should not continue to seek to access this website. To the fullest extent permitted by applicable law, BAT and Reynolds disclaim any responsibility or liability for any such violations. Forward looking statements Certain statements in this website and the materials posted on this website, including any statements regarding the Proposed Transaction, the expected timetable for completing the Proposed Transaction, the benefits and synergies of the Proposed Transaction, future opportunities for the combined company and any other statements regarding BAT’s, Reynolds’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

facts are “forward-looking” statements made within the meaning of Section 21E of the United States Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Transaction will be satisfied and the Proposed Transaction will be completed on the anticipated timeframe, or at all; the failure to realize contemplated synergies and other benefits from the Proposed Transaction; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Transaction; the effect of the announcement of the Proposed Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Transaction, and related uncertainties as to whether the Proposed Transaction will be completed, on BAT’s, Reynolds’s or the combined company’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of BAT, Reynolds or the combined company. Additional information concerning these and other factors can be found in Reynolds’s filings with the U.S. Securities and Exchange Commission (“SEC”), including Reynolds’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and BAT’s Annual Reports, which may be obtained free of charge from BAT’s website www.bat.com. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and Reynolds and BAT undertake no obligation to update or revise publicly any forward-looking statements or other data or statements contained within this website, whether as a result of new information, future events or otherwise. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Additional information and where to find it This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this website or the materials posted on this website may be deemed to be solicitation material in respect of the Proposed Transaction by BAT or Reynolds. BAT and Reynolds have filed relevant materials with the SEC, including a registration statement on Form F-4 that includes a proxy statement of Reynolds that also constitutes a prospectus of BAT. The registration statement has not yet become effective and the proxy statement included therein is in preliminary form. Investors and security holders are urged to read all relevant documents filed with the SEC, including the proxy statement/prospectus, because they contain important information about the Proposed Transaction. Investors and security holders may obtain the documents free of charge at the SEC’s website, http://www.sec.gov or for free from BAT upon request to BAT at batir@bat.com / +44 (0) 20 7845 1000 (for documents filed with the SEC by BAT) or from Reynolds at raiinvestorrelations@reynoldsamerican.com / +1 (336) 741-5165 (for documents filed with the SEC by Reynolds). Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Participants in solicitation This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Nonetheless, BAT, Reynolds and their affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds common stock with respect to the Proposed Transaction. Information about such parties and a description of their interests are set forth in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.bat.com and Reynolds’s annual report for the year ended December 31, 2016, which was filed on Form 10-K with the SEC on February 9, 2017 and Reynolds’s Form 10-K/A, which was filed with the SEC on March 20, 2017 (such filings by Reynolds, collectively, “Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC Filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT and Reynolds have filed with the SEC in connection with the Proposed Transaction. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov or from BAT and Reynolds using the contact information above. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Non-solicitation This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group. Non-GAAP financial measures This website and the materials posted on this website contain non-GAAP financial measures. Non-GAAP financial measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with GAAP. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Non-solicitation This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group. Non-GAAP financial measures This website and the materials posted on this website contain non-GAAP financial measures. Non-GAAP financial measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with GAAP. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

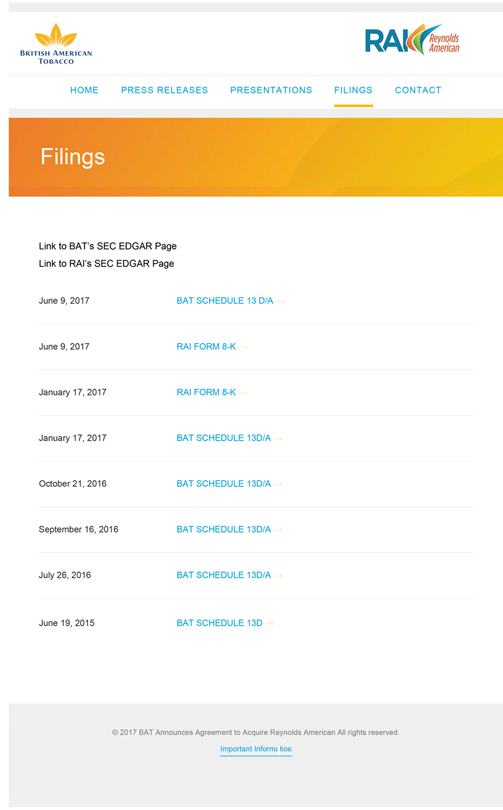

BRITISH AMERICAN TOBACCO Reynolds American

HOME PRESS RELEASES PRESENTATIONS FILINGS CONTACT

Filings

Link to BAT’s SEC EDGAR Page

Link to RAI’s SEC EDGAR Page

June 9, 2017 BAT SCHEDULE 13 D/A

June 9, 2017 RAI FORM8-K

January 17, 2017 RAI FORM8-K

January 17, 2017 BAT SCHEDULE 13D/A

October 21, 2016 BAT SCHEDULE 13D/A

September 16, 2016 BAT SCHEDULE 13D/A

July 26, 2016 BAT SCHEDULE 13D/A

June 19, 2015 BAT SCHEDULE 13D

2017 BAT Announces Agreement to Acquire Reynolds American All rights reserved.

Important Information

Important

ACCESS TO THIS WEBSITE MAY BE RESTRICTED UNDER SECURITIES LAWS OR REGULATIONS IN CERTAIN JURISDICTIONS OUTSIDE OF THE UNITED STATES AND THE UNITED KINGDOM. THIS NOTICE REQUIRES YOU TO CONFIRM CERTAIN MATTERS (INCLUDING THAT YOU ARE NOT A RESIDENT OF SUCH A JURISDICTION), BEFORE YOU MAY OBTAIN ACCESS TO THE INFORMATION ON THIS WEBSITE. THESE MATERIALS ARE NOT DIRECTED AT OR TO BE ACCESSED BY PERSONS WHO ARE RESIDENTS OF ANY JURISDICTION OUTSIDE OF THE UNITED STATES OR THE UNITED KINGDOM WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

In connection with the proposed merger of British American Tobacco p.l.c. (“BAT”) and Reynolds American Inc. (“Reynolds”) (the “Proposed Transaction”), you acknowledge the following:

Access to this website

You are attempting to enter a website that is designated for the publication of documents and information in connection with the Proposed Transaction.

If you would like to access this website, please read this notice carefully. This notice applies to all persons who view this website and, depending on where you are located, may affect your rights or responsibilities. BAT and Reynolds reserve the right to amend or update this notice at any time and you should, therefore, read it in full each time you visit the site. In addition, the contents of this website may be amended at any time, in whole or in part, at the sole discretion of BAT or Reynolds.

This website contains electronic versions of materials relating to the Proposed Transaction. The materials you are seeking to access are made available for information purposes only and are subject to the terms and conditions set out below. Any person seeking to access this website represents and warrants to BAT and Reynolds that they are doing so for information purposes only.

To allow you to view information about the Proposed Transaction, you must read this notice and then click “AGREE”. If you are unable to agree, you should not click “AGREE” and you will not be able to view information about the Proposed Transaction.

If you are in any doubt about the contents of this website or the action you should take, you are recommended to seek your own personal financial, legal or tax advice from your stockbroker, bank manager, solicitor, accountant or other financial adviser authorised under the Financial Services and Markets Act 2000 (as amended) or, if you are located outside the United Kingdom, from an appropriately authorized independent financial adviser.

Jurisdictions Outside of the United States and the United Kingdom

Viewing the materials you are seeking to access may be restricted under securities laws in certain jurisdictions outside of the United States and the United Kingdom. These materials are not directed at or accessible by persons resident in any jurisdiction outside of the United States or the United Kingdom if to do so would constitute a violation of the relevant laws or regulations of that jurisdiction.Residents of the United States and the United Kingdom are not restricted from accessing this website, subject to the review and agreement with this notice.

YOU SHOULD NOT DOWNLOAD, MAIL, FORWARD, DISTRIBUTE, SEND OR SHARE THE INFORMATION OR DOCUMENTS CONTAINED ON THIS WEBSITE TO OR WITH ANY PERSON. IN PARTICULAR, YOU SHOULD NOT MAIL, FORWARD, DISTRIBUTE OR SEND THE INFORMATION OR DOCUMENTS CONTAINED THEREIN TO ANY JURISDICTION WHERE IT WOULD BE UNLAWFUL TO DO SO.

It is your responsibility to satisfy yourself as to the full observance of any relevant laws and regulatory requirements outside the United States and the United Kingdom. Any failure to do so may constitute a violation of the applicable laws and regulations. If you are in any doubt, you should not continue to seek to access this website. To the fullest extent permitted by applicable law, BAT and Reynolds disclaim any responsibility or liability for any such violations.

Forward looking statements

Certain statements in this website and the materials posted on this website, including any statements regarding the Proposed Transaction, the expected timetable for completing the Proposed Transaction, the benefits and synergies of the Proposed Transaction, future opportunities for the combined company and any other statements regarding BAT’s, Reynolds’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 21E of the United States Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Transaction will be satisfied and the Proposed Transaction will be completed on the

anticipated timeframe, or at all; the failure to realize contemplated synergies and other benefits from the Proposed Transaction; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Transaction; the effect of the announcement of the Proposed Transaction, and related uncertainties as to whether the Proposed Transaction will be completed, on BAT’s, Reynolds’s or the combined company’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of BAT, Reynolds or the combined company.

Additional information concerning these and other factors can be found in Reynolds’s filings with the U.S. Securities and Exchange Commission (“SEC”), including Reynolds’s most recent Annual Reports on Form10-K, Quarterly Reports on Form10-Q and Current Reports on Form8-K and BAT’s Annual Reports, which may be obtained free of charge from BAT’s website www.bat.com. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and Reynolds and BAT undertake no obligation to update or revise publicly any forward-looking statements or other data or statements contained within this website, whether as a result of new information, future events or otherwise.

Additional information and where to find it

This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this website or the materials posted on this website may be deemed to be solicitation material in respect of the Proposed Transaction by BAT or Reynolds.

BAT and Reynolds have filed relevant materials with the SEC, including a registration statement on FormF-4 that includes a proxy statement of Reynolds that also constitutes a prospectus of BAT. The registration statement has not yet become effective and the proxy statement included therein is in preliminary form. Investors and security holders are urged to read all relevant documents filed with the SEC, including the proxy statement/prospectus, because they contain important information about the Proposed Transaction. Investors and security holders may obtain the documents free of charge at the SEC’s website, http://www.sec.gov or for free from BAT upon request to BAT at batir@bat.com / +44 (0) 20 7845 1000 (for documents filed with the SEC by BAT) or from Reynolds at raiinvestorrelations@reynoldsamerican.com / +1 (336)741-5165 (for documents filed with the SEC by Reynolds).

Participants in solicitation

This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Nonetheless, BAT, Reynolds and their affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds common stock with respect to the Proposed Transaction. Information about such parties and a description of their interests are set forth in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.bat.com and Reynolds’s annual report for the year ended December 31, 2016, which was filed on Form10-K with the SEC on February 9, 2017 and Reynolds’s Form10-K/A, which was filed with the SEC on March 20, 2017 (such filings by Reynolds, collectively, “Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC Filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT and Reynolds have filed with the SEC in connection with the Proposed Transaction. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov or from BAT and Reynolds using the contact information above.

Non-solicitation

This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group.

Non-GAAP financial measures

This website and the materials posted on this website containnon-GAAP financial measures.Non-GAAP financial measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with GAAP.