UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material Pursuant to §240.14a-12 |

REYNOLDS AMERICAN INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Disclaimer Important ACCESS TO THIS WEBSITE MAY BE RESTRICTED UNDER SECURITIES LAWS OR REGULATIONS IN CERTAIN JURISDICTIONS OUTSIDE OF THE UNITED STATES AND THE UNITED KINGDOM. THIS NOTICE REQUIRES YOU TO CONFIRM CERTAIN MATTERS (INCLUDING THAT YOU ARE NOT A RESIDENT OF SUCH A JURISDICTION), BEFORE YOU MAY OBTAIN ACCESS TO THE INFORMATION ON THIS WEBSITE. THESE MATERIALS ARE NOT DIRECTED AT OR TO BE ACCESSED BY PERSONS WHO ARE RESIDENTS OF ANY JURISDICTION OUTSIDE OF THE UNITED STATES OR THE UNITED KINGDOM WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION. In connection with the proposed merger of British American Tobacco p.I.c. (UBAT’:) and Reynolds American Inc. (‘Reynolds’) (the “Proposed Transaction”), you acknowledge the following: Access to this website You are attempting to enter a website that is designated for the publication of documents and information in connection with the Proposed Transaction. If you would like to access this website, please read this notice carefully. This notice applies to all persons who view this website and, depending on where you are located, may affect your rights or responsibilities. BAT and Reynolds reserve the right to amend or update this notice at any time and you should, therefore, read it in full each time you visit the site. In addition, the contents of this website may be amended at any time, in whole or in part, at the sole discretion of BAT or Reynolds. By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above. Agree

Disclaimer time and you should, therefore, read it in full each time you visit the site. In addition, the contents of this website may be amended at any time, in A whole or in part, at the sole discretion of BAT or Reynolds. This website contains electronic versions of materials relating to the Proposed Transaction. The materials you are seeking to access are made available for information purposes only and are subject to the terms and conditions set out below. Any person seeking to access this website represents and warrants to BAT and Reynolds that they are doing so for information purposes only. To allow you to view information about the Proposed Transaction, you must read this notice and then click “AGREE”. If you are unable to agree, you should not click “AGREE” and you will not be able to view information about the Proposed Transaction. If you are in any doubt about the contents of this website or the action you should take, you are recommended to seek your own personal financial, legal or tax advice from your stockbroker, bank manager, solicitor, accountant or other financial adviser authorised under the Financial Services and Markets Act 2000 (as amended) or, if you are located outside the United Kingdom, from an appropriately authorized independent financial adviser. Jurisdictions Outside of the United States and the United Kingdom Viewing the materials you are seeking to access may be restricted under securities laws in certain jurisdictions outside of the United States and the United Kingdom. These materials are not directed at or accessible by persons resident in any jurisdiction outside of the United States or the United Kingdom if to do so would constitute a violation of the relevant laws or regulations of that jurisdiction. Residents of the United States and the United Kingdom are not restricted from accessing this website, subject to the review and agreement with this notice. YOU SHOULD NOT DOWNLOAD, MAIL, FORWARD, DISTRIBUTE, SEND OR SHARE THE INFORMATION OR DOCUMENTS CONTAINED ON THIS WEBSITE TO OR WITH ANY PERSON. IN PARTICULAR, YOU SHOULD NOT MAIL, FORWARD, DISTRIBUTE OR SEND THE INFORMATION OR DOCUMENTS CONTAINED THEREIN TO ANY JURISDICTION WHERE IT WOULD BE UNLAWFUL TO DO SO. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Disclaimer It is your responsibility to satisfy’ yourself as to the full observance of any relevant laws and regulatory requirements outside the United States and the United Kingdom. Any failure to do so may constitute a violation of the applicable laws and regulations. If you are in any doubt, you should not continue to seek to access this website. To the fullest extent permitted by applicable law, BAT and Reynolds disclaim any responsibility or liability for any such violations. Forward looking statements Certain statements in this website and the materials posted on this website, including any statements regarding the Proposed Transaction, the expected timetable for completing the Proposed Transaction, the benefits and synergies of the Proposed Transaction, future opportunities for the combined company and any other statements regarding BAT’s, Reynolds’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 21E of the United States Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Transaction will be satisfied and the Proposed Transaction will be completed on the anticipated timeframe, or at all; the failure to realize contemplated synergies and other benefits from the Proposed Transaction; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Transaction; the effect of the announcement of the Proposed Transaction, and related uncertainties as to whether the Proposed Transaction will be completed, on BAT’s, Reynolds’s or the combined company’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement v strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and Agree By clicking ‘Agree1,1 acknowledge and agree to the terms and/or the other statements set forth above.

Disclaimer dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of BAT, Reynolds or the combined company. Additional information concerning these and other factors can be found in Reynolds’s filings with the U.S. Securities and Exchange Commission (“SEC”), including Reynolds’s most recent Annual Reports on Form10-K, Quarterly Reports on Form10-Q and Current Reports on Form8-K, which may be obtained free of charge at the SEC’s website, http://www.sec.gov, and BAT’s Annual Reports, which may be obtained free of charge from BAT’s website www.bat.com. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and Reynolds and BAT undertake no obligation to update or revise publicly any forward-looking statements or other data or statements contained within this website, whether as a result of new information, future events or otherwise. Additional information and where to find it This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this website or the materials posted on this website may be deemed to be solicitation material in respect of the Proposed Transaction by BAT or Reynolds. BAT and Reynolds have filed relevant materials with the SEC, including a registration statement on FormF-4 that includes a proxy statement of Reynolds that also constitutes a prospectus of BAT. On June 14, 2017, the SEC declared the registration statement effective. Reynolds commenced mailing the definitive proxy statement/prospectus to holders of Reynolds common stock on or about June 14, 2017. Investors and security holders are urged to read the definitive proxy statement/prospectus, which was also filed with the SEC on June 14, 2017, together with all other relevant documents filed with the SEC, because they contain important information about the Proposed Transaction. Investors and security holders may obtain the documents free of charge at the SEC’s website, http://www.sec.gov or for free from BAT upon request to BAT at batir@bat.com / +44 (0) 20 7845 1000 (for documents filed with the SEC by BAT) or from Reynolds at raiinvestorrelations@reynoldsamerican.com / +1 (336)741-5165 (for documents filed with the SEC by Reynolds). Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Disclaimer Participants in solicitation This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Nonetheless, BAT, Reynolds and their affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds common stock with respect to the Proposed Transaction. Information about such parties and a description of their interests are set forth in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.bat.com and Reynolds’s annual report for the year ended December 31, 2016, which was filed on Form10-K with the SEC on February 9, 2017, Reynolds’s Form10-K/A, which was filed with the SEC on March 20, 2017 and Reynolds’s definitive proxy statement/prospectus, which was filed with the SEC on June 14, 2017 (such filings by Reynolds, collectively, “Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC Filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT and Reynolds have filed with the SEC in connection with the Proposed Transaction. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov or from BAT and Reynolds using the contact information above.Non-solicitation This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

Disclaimer in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.bat.com and Reynolds’s annual report for the year A ended December 31, 2016, which was filed on Form10-K with the SEC on February 9: 2017, Reynolds’s Form10-K/A, which was filed with the SEC on March 20, 2017 and Reynolds’s definitive proxy statement/prospectus, wfiich was filed with the SEC on June 14, 2017 (such filings by Reynolds, collectively, ‘Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC Filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT and Reynolds have filed with the SEC in connection with the Proposed Transaction. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov or from BAT and Reynolds using the contact information above.Non-solicitation This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group.Non-GAAP financial measures This website and the materials posted on this website containnon-GAAP financial measures.Non-GAAP financial measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with GAAP. Agree By clicking “Agree”, I acknowledge and agree to the terms and/or the other statements set forth above.

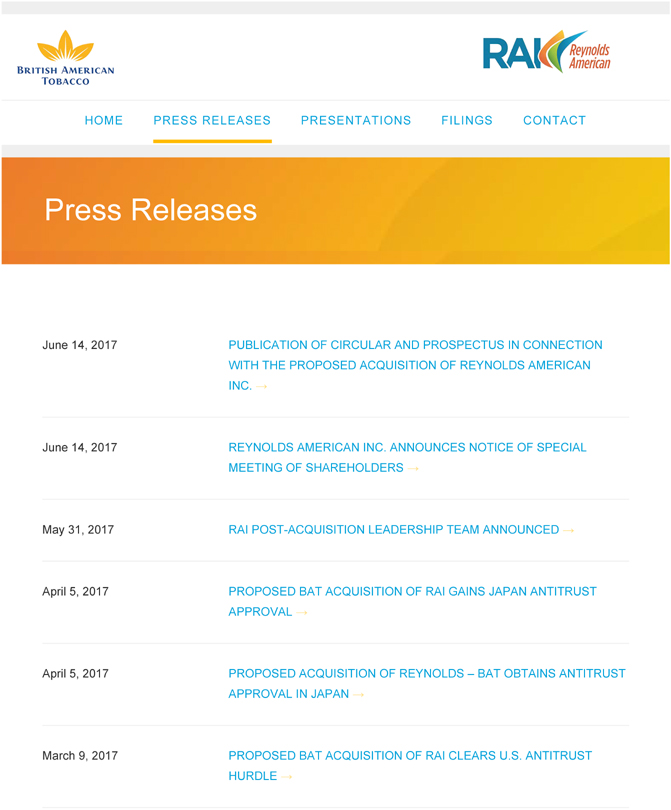

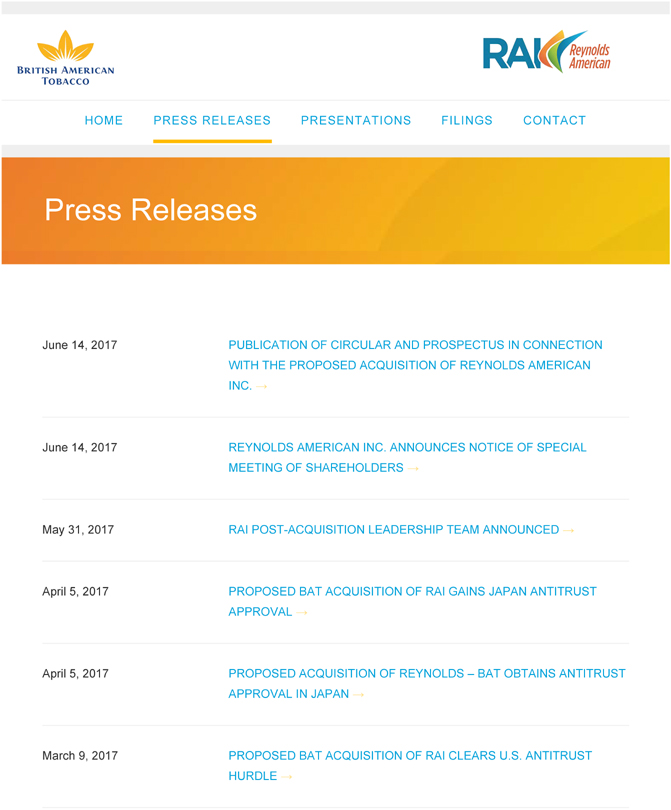

Press Releases June 14, 2017 PUBLICATION OF CIRCULAR AND PROSPECTUS IN CONNECTION WITH THE PROPOSED ACQUISITION OF REYNOLDS AMERICAN INC. June 14, 2017 REYNOLDS AMERICAN INC. ANNOUNCES NOTICE OF SPECIAL MEETING OF SHAREHOLDERS May 31, 2017 RAI POST-ACQUISITION LEADERSHIP TEAM ANNOUNCED April 5, 2017 PROPOSED BAT ACQUISITION OF RAI GAINS JAPAN ANTITRUST APPROVAL April 5, 2017 PROPOSED ACQUISITION OF REYNOLDS - BAT OBTAINS ANTITRUST APPROVAL IN JAPAN March 9, 2017 PROPOSED BAT ACQUISITION OF RAI CLEARS U.S. ANTITRUST HURDLE

March 9, 2017 PROPOSED ACQUISITION OF REYNOLDS - U.S. ANTITRUST CONDITION SATISFIED January 17, 2017 BAT ANNOUNCES AGREEMENT TO ACQUIRE REYNOLDS January 17, 2017 REYNOLDS AMERICAN ANNOUNCES ENTRY INTO MERGER AGREEMENT WITH BRITISH AMERICAN TOBACCO © 2017 BAT Announces Agreement to Acquire Reynolds American All rights reserved. Important Information

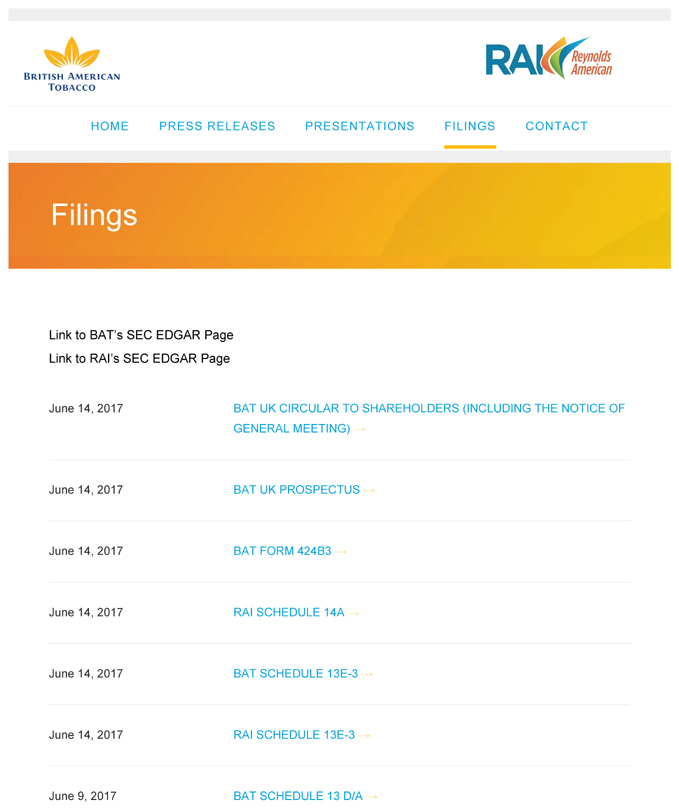

Link to BAT’s SEC EDGAR Page Link to RAI’s SEC EDGAR Page June 14, 2017 BAT UK CIRCULAR TO SHAREHOLDERS (INCLUDING THE NOTICE OF GENERAL MEETING) ^ June 14, 2017 BAT UK PROSPECTUS June 14, 2017 BAT FORM 424B3 June 14, 2017 RAI SCHEDULE 14A June 14, 2017 BAT SCHEDULE 13E-3 June 14, 2017 RAI SCHEDULE 13E-3 June 9, 2017 BAT SCHEDULE 13 D/A

June 9, 2017 RAI FORM 8-K January 17, 2017 RAI FORM 8-K January 17, 2017 BAT SCHEDULE 13D/A October 21, 2016 BAT SCHEDULE 13D/A September 16, 2016 BAT SCHEDULE 13D/A July 26, 2016 BAT SCHEDULE 13D/A June 19, 2015 BAT SCHEDULE 13D © 2017 BAT Announces Agreement to Acquire Reynolds American All rights reserved. Important Information

Important

ACCESS TO THIS WEBSITE MAY BE RESTRICTED UNDER SECURITIES LAWS OR REGULATIONS IN CERTAIN JURISDICTIONS OUTSIDE OF THE UNITED STATES AND THE UNITED KINGDOM. THIS NOTICE REQUIRES YOU TO CONFIRM CERTAIN MATTERS (INCLUDING THAT YOU ARE NOT A RESIDENT OF SUCH A JURISDICTION), BEFORE YOU MAY OBTAIN ACCESS TO THE INFORMATION ON THIS WEBSITE. THESE MATERIALS ARE NOT DIRECTED AT OR TO BE ACCESSED BY PERSONS WHO ARE RESIDENTS OF ANY JURISDICTION OUTSIDE OF THE UNITED STATES OR THE UNITED KINGDOM WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

In connection with the proposed merger of British American Tobacco p.l.c. (“BAT”) and Reynolds American Inc. (“Reynolds”) (the “Proposed Transaction”), you acknowledge the following:

Access to this website

You are attempting to enter a website that is designated for the publication of documents and information in connection with the Proposed Transaction.

If you would like to access this website, please read this notice carefully. This notice applies to all persons who view this website and, depending on where you are located, may affect your rights or responsibilities. BAT and Reynolds reserve the right to amend or update this notice at any time and you should, therefore, read it in full each time you visit the site. In addition, the contents of this website may be amended at any time, in whole or in part, at the sole discretion of BAT or Reynolds.

This website contains electronic versions of materials relating to the Proposed Transaction. The materials you are seeking to access are made available for information purposes only and are subject to the terms and conditions set out below. Any person seeking to access this website represents and warrants to BAT and Reynolds that they are doing so for information purposes only.

To allow you to view information about the Proposed Transaction, you must read this notice and then click “AGREE”. If you are unable to agree, you should not click “AGREE” and you will not be able to view information about the Proposed Transaction.

If you are in any doubt about the contents of this website or the action you should take, you are recommended to seek your own personal financial, legal or tax advice from your stockbroker, bank manager, solicitor, accountant or other financial adviser authorised under the Financial Services and Markets Act 2000 (as amended) or, if you are located outside the United Kingdom, from an appropriately authorized independent financial adviser.

Jurisdictions Outside of the United States and the United Kingdom

Viewing the materials you are seeking to access may be restricted under securities laws in certain jurisdictions outside of the United States and the United Kingdom. These materials are not directed at or accessible by persons resident in any jurisdiction outside of the United States or the United Kingdom if to do so would constitute a violation of the relevant laws or regulations of that jurisdiction.Residents of the United States and the United Kingdom are not restricted from accessing this website, subject to the review and agreement with this notice.

YOU SHOULD NOT DOWNLOAD, MAIL, FORWARD, DISTRIBUTE, SEND OR SHARE THE INFORMATION OR DOCUMENTS CONTAINED ON THIS WEBSITE TO OR WITH ANY PERSON. IN PARTICULAR, YOU SHOULD NOT MAIL, FORWARD, DISTRIBUTE OR SEND THE INFORMATION OR DOCUMENTS CONTAINED THEREIN TO ANY JURISDICTION WHERE IT WOULD BE UNLAWFUL TO DO SO.

It is your responsibility to satisfy yourself as to the full observance of any relevant laws and regulatory requirements outside the United States and the United Kingdom. Any failure to do so may constitute a violation of the applicable laws and regulations. If you are in any doubt, you should not continue to seek to access this website. To the fullest extent permitted by applicable law, BAT and Reynolds disclaim any responsibility or liability for any such violations.

Forward looking statements

Certain statements in this website and the materials posted on this website, including any statements regarding the Proposed Transaction, the expected timetable for completing the Proposed Transaction, the benefits and synergies of the Proposed Transaction, future opportunities for the combined company and any other statements regarding BAT’s, Reynolds’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 21E of the United States Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Transaction will be satisfied and the Proposed Transaction will be completed on the

anticipated timeframe, or at all; the failure to realize contemplated synergies and other benefits from the Proposed Transaction; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Transaction; the effect of the announcement of the Proposed Transaction, and related uncertainties as to whether the Proposed Transaction will be completed, on BAT’s, Reynolds’s or the combined company’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of BAT, Reynolds or the combined company.

Additional information concerning these and other factors can be found in Reynolds’s filings with the U.S. Securities and Exchange Commission (“SEC”), including Reynolds’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which may be obtained free of charge at the SEC’s website, http://www.sec.gov, and BAT’s Annual Reports, which may be obtained free of charge from BAT’s website www.bat.com. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and Reynolds and BAT undertake no obligation to update or revise publicly any forward-looking statements or other data or statements contained within this website, whether as a result of new information, future events or otherwise.

Additional information and where to find it

This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this website or the materials posted on this website may be deemed to be solicitation material in respect of the Proposed Transaction by BAT or Reynolds.

BAT and Reynolds have filed relevant materials with the SEC, including a registration statement on Form F-4 that includes a proxy statement of Reynolds that also constitutes a prospectus of BAT. On June 14, 2017, the SEC declared the registration statement effective. Reynolds commenced mailing the definitive proxy statement/prospectus to holders of Reynolds common stock on or about June 14, 2017. Investors and security holders are urged to read the definitive proxy statement/prospectus, which was also filed with the SEC on June 14, 2017, together with all other relevant documents filed with the SEC, because they contain important information about the Proposed Transaction. Investors and security holders may obtain the documents free of charge at the SEC’s website, http://www.sec.gov or for free from BAT upon request to BAT at batir@bat.com / +44 (0) 20 7845 1000 (for documents filed with the SEC by BAT) or from Reynolds at raiinvestorrelations@reynoldsamerican.com / +1 (336) 741-5165 (for documents filed with the SEC by Reynolds).

Participants in solicitation

This website and the materials posted on this website are neither solicitations of a proxy nor substitutes for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Transaction. Nonetheless, BAT, Reynolds and their affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds common stock with respect to the Proposed Transaction. Information about such parties and a description of their interests are set forth in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.bat.com and Reynolds’s annual report for the year ended December 31, 2016, which was filed on Form 10-K with the SEC on February 9, 2017, Reynolds’s Form 10-K/A, which was filed with the SEC on March 20, 2017 and Reynolds’s definitive proxy statement/prospectus, which was filed with the SEC on June 14, 2017 (such filings by Reynolds, collectively, “Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC Filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT and Reynolds have filed with the SEC in connection with the Proposed Transaction. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov or from BAT and Reynolds using the contact information above.

Non-solicitation

This website and the materials posted on this website shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This website and the materials posted on this website should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the Group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the Group.

Non-GAAP financial measures

This website and the materials posted on this website contain non-GAAP financial measures. Non-GAAP financial measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with GAAP.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN RELATION TO THE NEW BAT SHARES BASED ON THIS ANNOUNCEMENT.

BRITISH AMERICAN TOBACCO P.L.C.

Publication of Circular and Prospectus in connection with the Proposed Acquisition of Reynolds American Inc.

British American Tobacco p.l.c. (“BAT”) is pleased to announce that the UK Listing Authority has approved a Class 1 circular (the“Circular”) and a prospectus (the“Prospectus”) (dated 14 June 2017) in relation to its recommended offer to acquire the remaining 57.8% of Reynolds American Inc. (“Reynolds”) that it does not already own (the“Proposed Acquisition”).

The Circular contains a notice convening a general meeting of BAT, which is to be held at 2.00pm on 19 July 2017 at Hilton London Bankside,2-8 Great Suffolk Street, London SE1 0UG, United Kingdom, at which the resolution to approve the Proposed Acquisition and the authority for the Directors of BAT to allot and issue new BAT shares in connection with the Proposed Acquisition will be proposed.

The Prospectus relates to the proposed issue of new ordinary shares in connection with the Proposed Acquisition and the application for admission of new ordinary shares to the premium listing segment of the Official List and to trading on the main market for listed securities of the London Stock Exchange.

Subject to the satisfaction or waiver of the conditions as set out in the merger agreement, including approval of shareholders of both BAT and Reynolds, the expected effective date of the completion of the Proposed Acquisition is on or around 25 July 2017.

Availability of the Circular and Prospectus

Copies of the Circular will be circulated in hard copy to those BAT shareholders who have elected to receive it in that form. Other BAT shareholders will be sent notification that the Circular is available online. The Circular and the Prospectus will be made available in electronic form on BAT’s website athttp://www.bat.com/reynolds and will be available for inspection at the Company’s registered office at Globe House, 4 Temple Place, London WC2R 2PG, between the hours of 9.30am and 5.30pm on any Business Day from today’s date up to and including the conclusion of the Proposed Acquisition.

The Circular, together with related forms of proxy, and the Prospectus have also been submitted to the National Storage Mechanism, where they will shortly be available for inspection atwww.morningstar.co.uk/uk/NSM.

14 June 2017

ENQUIRIES

British American Tobacco Press Office

+44 (0) 20 7845 2888 (24 hours) | @BATPress

British American Tobacco Investor Relations

Mike Nightingale / Rachael Brierley / Sabina Marshman

+44 (0) 20 7845 1180 / 1519/ 1781

FTI Consulting (UK PR agency)

John Waples: +44 (0)20 3727 1515

Edward Bridges: +44 (0)20 3727 1067

David Waller: +44 (0)20 3727 1651

Sard Verbinnen & Co. (US PR agency)

US: George Sard / Jim Barron: +1 212 687 8080

UK: Michael Henson: +44 (0)20 3178 8914

Centerview Partners

UK: Nick Reid / Hadleigh Beals: +44 (0)207 409 9700

US: Blair Effron: +1 212 380 2650

Deutsche Bank

UK: Nigel Meek / James Ibbotson

Matt Hall / Jimmy Bastock (Corporate Broking)

+44 (0)207 545 8000

US: James Stynes: +1 212 250 2500

UBS

John Woolland / James Robertson

David Roberts / Alia Malik (Corporate Broking)

+44 (0)207 568 1000

NOTES TO EDITORS

About BAT

BAT is a global tobacco group with brands sold in more than 200 markets. It employs more than 50,000 people worldwide and has over 200 brands in its portfolio, with its cigarettes chosen by around one in eight of the world’s one billion smokers. BAT has market leading positions in at least 55 markets around the world. The Group generated £5 billion adjusted profit from operations in 2016.

Centerview Partners, Deutsche Bank and UBS are acting as financial advisers to BAT. Deutsche Bank and UBS are joint corporate brokers to BAT and acting as joint sponsors to BAT in relation to the transaction described in this announcement. Cravath, Swaine & Moore LLP and Herbert Smith Freehills LLP are acting for BAT as US and UK legal counsel respectively. PwC are acting as accountants and advisors to BAT on the transaction described in this announcement.

Centerview Partners UK LLP (“Centerview Partners”) is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Centerview Partners is acting exclusively for BAT and no one else in connection with the transaction described in this announcement. Centerview Partners will not regard any other person as its client in relation to the transaction described in this announcement and will not be responsible to any person other than BAT for providing the protections afforded to clients of Centerview Partners or for providing advice in relation to the transaction described in this announcement or any other matter referred to herein.

Deutsche Bank AG is authorised under German Banking Law (competent authority: European Central Bank) and, in the United Kingdom, by the Prudential Regulation Authority. It is subject to supervision by the European Central Bank and by BaFin, Germany’s Federal Financial Supervisory Authority, and is subject to limited regulation in the United Kingdom by the Prudential Regulation Authority and Financial Conduct Authority. Details about the extent of its authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority, are available on request or from www.db.com/en/content/eu_disclosures.htm.

Deutsche Bank AG, acting through its London branch (“DB London”), and Deutsche Bank Securities Inc. (“DBSI” and with DB London, “DB”) are acting as joint financial adviser and DB London is acting as joint corporate broker and joint sponsor to BAT. DB are acting exclusively for BAT and no one else in connection with the transaction described in this announcement. DB will not regard any other person as their client in relation to the transaction described in this

announcement and will not be responsible to any person other than BAT for providing the protections afforded to clients of DB or for providing advice in relation to the transaction described in this announcement or any other matter referred to herein.

UBS Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom. UBS Limited is acting exclusively for BAT and no one else in connection with the transaction described in this announcement. UBS Limited will not regard any other person as its client in relation to the transaction described in this announcement and will not be responsible to any person other than BAT for providing the protections afforded to clients of UBS Limited or for providing advice in relation to the transaction described in this announcement or any other matter referred to herein.

Apart from the responsibilities and liabilities, if any, which may be imposed on it by the Financial Services and Markets Act 2000, none of Centerview Partners, DB or UBS Limited accepts any responsibility whatsoever and makes no representation or warranty, express or implied, as to the contents of this announcement, including its accuracy, fairness, sufficiency, completeness or verification or for any other statement made or purported to be made by it, or on its behalf, in connection with BAT or the transaction described in this announcement, and nothing in this announcement is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or the future. Each of Centerview Partners, DB and UBS Limited accordingly disclaims to the fullest extent permitted by law all and any responsibility and liability whether arising in tort, contract or otherwise (save as referred to above) which it might otherwise have in respect of this announcement.

For further information

A copy of this announcement will be made available, subject to certain jurisdiction restrictions, on BAT’s website at BATReynolds.transactionannouncement.com. For the avoidance of doubt, the contents of this website is not incorporated into and does not form part of this announcement.

Overseas jurisdictions

The release, publication or distribution of this announcement in or into jurisdictions other than the United States or the United Kingdom may be restricted by law and therefore any persons who are subject to the law of any jurisdiction other than the United States or the United Kingdom should inform themselves about, and observe, any applicable legal or regulatory requirements. Any failure to comply with the applicable restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law, the companies and persons involved in the transaction disclaim any responsibility or liability for the violation of such restrictions by any person.

Copies of this announcement and formal documentation relating to the transaction will not be and must not be, mailed or otherwise forwarded, distributed or sent in, into or from any jurisdiction outside of the United States and the United Kingdom where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. Doing so may render invalid any related purported vote in respect of the transaction.

Forward looking statements

Certain statements in this communication regarding the Proposed Acquisition, the expected timetable for completing the Proposed Acquisition, the benefits and synergies of the Proposed Acquisition, future opportunities for the combined company and any other statements regarding BAT’s, Reynolds’s or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 21E of the United States Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data within

this communication. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Acquisition will be satisfied and the Proposed Acquisition will be completed on the anticipated timeframe, or at all; the failure to realize contemplated synergies and other benefits from the Proposed Acquisition; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Acquisition; the effect of the announcement of the Proposed Acquisition, and related uncertainties as to whether the Proposed Acquisition will be completed, on BAT’s, Reynolds’s or the combined company’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of BAT, Reynolds or the combined company.

Additional information concerning these and other factors can be found in Reynolds’s filings with the U.S. Securities and Exchange Commission (“SEC”), including Reynolds’s most recent Annual Reports on Form10-K, Quarterly Reports on Form10-Q and Current Reports on Form8-K, which may be obtained free of charge at the SEC’s website, http://www.sec.gov, and BAT’s Annual Reports, which may be obtained free of charge from BAT’s website www.BAT.com. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and BAT undertakes no obligation to update or revise publicly any forward-looking statements or other data or statements contained within this communication, whether as a result of new information, future events or otherwise.

No statement in this communication is intended to be a profit forecast and no statement in this communication should be interpreted to mean that earnings per share of BAT or Reynolds for the current or future financial years would necessarily match or exceed the historical published earnings per share of BAT or Reynolds, respectively.

Additional information and where to find it

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Acquisition. Any solicitation will only be made through materials filed with the SEC. Nonetheless, this communication may be deemed to be solicitation material in respect of the Proposed Acquisition by BAT.

BAT has filed relevant materials with the SEC, including a registration statement on FormF-4 that includes a proxy statement of Reynolds that also constitutes a prospectus of BAT. On 14 June 2017, the SEC declared the registration statement effective. Reynolds commenced mailing the definitive proxy statement/prospectus to holders of Reynolds common stock on or about 14 June 2017. Investors and security holders are urged to read the definitive proxy statement/prospectus, which was also filed with the SEC on 14 June 2017, together with all other relevant documents filed with the SEC, because they contain important information about the Proposed Acquisition. Investors and security holders may obtain the documents free of charge at the SEC’s website, http://www.sec.gov, or for free from BAT using the contact information above.

Participants in solicitation

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC in connection with the Proposed Acquisition. Nonetheless, BAT and its affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds common stock with respect to the Proposed Acquisition. Information about such parties and a description of their interests are set forth in BAT’s 2016 Annual Report, which may be obtained free of charge from BAT’s website www.BAT.com and Reynolds’s annual report for the year ended 31 December 2016, which was filed on Form10-K with the SEC on 9 February 2017, Reynolds’s Form10-K/A, which was filed with the SEC on 20 March 2017 and Reynolds’s definitive

proxy statement/prospectus, which was filed with the SEC on 14 June 2017 (such filings by Reynolds, collectively, “Reynolds SEC filings”). To the extent holdings of Reynolds securities by such parties have changed since the amounts contained in the Reynolds SEC filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties is also included in the materials that BAT has filed with the SEC in connection with the Proposed Acquisition. These documents may be obtained free of charge from the SEC’s website http://www.sec.gov, or from BAT using the contact information above.

Non-solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This communication should not be construed as, investment advice and is not intended to form the basis of any investment decision, nor does it form the basis of any contract for acquisition or investment in any member of the BAT group, financial promotion or any offer, invitation or recommendation in relation to any acquisition of, or investment in, any member of the BAT group.

If you are in any doubt about the contents of this announcement or the action you should take, you are recommended to seek your own independent personal financial advice immediately from your stockbroker, bank manager, solicitor, accountant, fund manager or other appropriate independent financial adviser duly authorised under the UK Financial Services and Market Act 2000 (as amended) if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser.

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek your own personal financial advice from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000, as amended (the “FSMA”) if you are resident in the United Kingdom, or, if not, from another appropriately authorised independent financial adviser.

If you have sold or otherwise transferred all of your existing ordinary shares in British American Tobacco p.l.c. (“BAT” or the “Company” and together with its subsidiary undertakings, the “BAT Group”), please send this document, together with the accompanying form of proxy (the “Proxy Form”), Proxy Form – South Africa (“PFSA”) or Voting Instruction Form, as appropriate, (other than documents or forms personalised to you) as soon as possible to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for delivery to the purchaser or transferee. However, these documents should not be forwarded, distributed or transmitted in, into or from any jurisdiction where to do so would violate the laws of that jurisdiction. If you have sold or otherwise transferred only part of your holdings of ordinary shares in BAT (the “BAT Shares”) you should retain these documents and contact the bank, stockbroker or other agent through whom the sale or transfer was effected.

This document should be read in conjunction with the prospectus published by BAT in relation to the Proposed Acquisition (as defined below) on or around the date of this document (the “Prospectus”) relating to the new ordinary shares (the “New BAT Shares”) to be issued pursuant to the Proposed Acquisition.

This document is not a prospectus and it does not constitute or form part of any offer or invitation to purchase, acquire, subscribe for, sell, dispose of or issue, or any solicitation of any offer to sell, dispose of, purchase or subscribe for, any securities.

BRITISH AMERICAN TOBACCO P.L.C.

(Incorporated and registered in England and Wales under the Companies Act 1985

with registered number 03407696)

Proposed Acquisition of Reynolds American Inc.

and

Notice of General Meeting

This document should be read as a whole. Your attention is drawn to therisk factors set out on pages 22 to 34 of Part II (Risk Factors) and to the letter from your Chairman which is set out on pages 8 to 21 of Part I (Letter from the Chairman) of this document and which recommends you vote in favour of the resolution to be proposed at the General Meeting referred to below.

Notice of the general meeting of BAT to be held at 2pm on 19 July 2017 at Hilton London Bankside,2-8 Great Suffolk Street, London SE1 0UG, United Kingdom (the “General Meeting”) is set out at the end of this document (the “Notice of General Meeting”). A Proxy Form, PFSA or Voting Instruction Form, as appropriate, for use at this General Meeting is enclosed. To be valid, the Proxy Form, PFSA or Voting Instruction Form, as appropriate, should be completed, signed and returned in accordance with the instructions printed thereon and Appendix 1 of the Notice of General Meeting. Proxy Forms and PFSAs must be received (1) in the case of a BAT Shareholder on the UK Register by Computershare Investor Services PLC (the “UK Registrar”), at The Pavilions, Bridgwater Road, Bristol BS99 6ZZ, United Kingdom; or (2) in the case of a BAT Shareholder holding certificated BAT Shares on the SA Register by Computershare Investor Services Proprietary Limited (the “SA Registrar”), at Rosebank Towers, 15 Biermann Avenue, Rosebank 2196, (PO Box 61051, Marshalltown 2107), South Africa, as soon as possible but in any event must arrive not later than 48 hours before the time fixed for the start of the meeting.

This document is a circular relating to the Proposed Acquisition which has been prepared in accordance with the Listing Rules.

Holders of BAT Shares (the “BAT Shareholders”) are advised to read the Prospectus which contains information relating to the BAT Shares. The Prospectus will be available on BAT’s website.

If you have any questions about this document, the General Meeting or the completion and return of the Proxy Form or PFSA, as appropriate, please contact the UK Registrar between 8.30am and 5.30pm (UK Time) Monday to Friday (excluding public holidays) on 0800 408 0094 (from the United Kingdom), or +44 370 889 3159 (from outside the United Kingdom, international rates apply) or the SA Registrar in relation to certificated BAT Shares on the SA Register between 8am and 5pm (South Africa time) Monday to Friday (excluding public holidays) on +27 11 370 5000. Please note that calls may be monitored or recorded and the Registrars cannot provide financial, legal or tax advice on the merits of the Proposed Acquisition.

Centerview Partners UK LLP (“Centerview Partners”) is authorised and regulated by the Financial Conduct Authority (the “FCA”) in the United Kingdom. Centerview Partners is acting as joint financial adviser to the Company and no one else in connection with the Proposed Acquisition and will not be responsible to any person other than the Company for providing the protections afforded to clients of Centerview Partners or for providing advice in relation to the Proposed Acquisition or any other matter referred to in this document.

Deutsche Bank AG is authorised under German Banking Law (competent authority: European Central Bank (the “ECB”)) and in the United Kingdom, by the Prudential Regulatory Authority (the “PRA”). Deutsche Bank AG is subject to the supervision by the ECB and by BaFin, Germany’s Federal Financial Supervisory Authority, and is subject to limited regulation in the United Kingdom by the PRA and the FCA. Deutsche Bank AG, acting through its London Branch (“Deutsche Bank”) is acting as joint financial adviser and joint sponsor to the Company and no one else in connection with the Proposed Acquisition and will not be responsible to any person other than the Company for providing the protections afforded to clients of Deutsche Bank or for providing advice in relation to the Proposed Acquisition or any other matter referred to in this document.

UBS Limited (“UBS”) is authorised by the PRA and regulated by the FCA and the PRA in the United Kingdom. UBS is acting as joint financial adviser and joint sponsor to the Company and no one else in connection with the Proposed Acquisition and will not be responsible to any person other than the Company for providing the protections afforded to clients of UBS or for providing advice in relation to the Proposed Acquisition or any other matter referred to in this document.

Apart from the responsibilities and liabilities, if any, which may be imposed on Centerview Partners, Deutsche Bank or UBS by the FSMA or the regulatory regime established thereunder, or under the regulatory regime of any jurisdiction where the exclusion of liability under the relevant regulatory regime would be illegal, void or unenforceable, Centerview Partners, Deutsche Bank and UBS accept no responsibility whatsoever for, or make any representation or warranty, express or implied, as to the contents of this document, including its accuracy, completeness or for any other statement made or purported to be made by either of them, or on their behalf, in connection with BAT, the BAT Group, the New BAT Shares or the Proposed Acquisition. Centerview Partners, Deutsche Bank and UBS and their subsidiaries, branches and affiliates accordingly disclaim all and any duty, liability and responsibility whether arising in tort, contract or otherwise (save as referred to above) in respect of this document or any such statement or otherwise.

Persons into whose possession this document comes should inform themselves about, and observe, any applicable restrictions and legal, exchange control or regulatory requirements in relation to the distribution of this document and the Proposed Acquisition. Any failure to comply with such restrictions or requirements may constitute a violation of the securities laws of any such jurisdiction. The contents of this document should not be construed as legal, business or tax advice.

Notice to overseas shareholders

The release, publication or distribution of this document in certain jurisdictions may be restricted by law. Persons who are not resident in the United Kingdom or who are subject to other jurisdictions should inform themselves of, and should observe, any applicable requirements. Any failure to comply with these requirements may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law, the companies and persons involved in the Proposed Acquisition disclaim any responsibility or liability for the violation of such requirements by any person.

i

NOTICE TO US SHAREHOLDERS

Additional information and where to find it

This document is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that have been and may be made with the United States Securities and Exchange Commission (the “SEC”) in connection with the Proposed Acquisition. Nonetheless, BAT, and its affiliates and each of their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Reynolds American Inc. (“RAI”) common stock with respect to the Proposed Acquisition.

Information about certain of such parties and a description of their interests are set forth in BAT’s annual report for the year ended 31 December 2016, which may be obtained free of charge from BAT’s websitewww.bat.com and RAI’s annual report for the year ended 31 December 2016, which was filed on Form10-K with the SEC on 9 February 2017, RAI’s Form 10-K/A, which was filed with the SEC on 20 March 2017 and RAI’s definitive proxy statement/prospectus, which was filed with the SEC on 14 June 2017 (such filings by RAI, collectively, “RAI SEC filings”). To the extent holdings of RAI securities by certain of such parties have changed since the amounts contained in the RAI SEC filings, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interest of such parties will also be included in the materials that BAT intends to file with the SEC in connection with the Proposed Acquisition. These documents (if and when available) may be obtained free of charge from the SEC’s websitehttp://www.sec.gov, or from BAT using the contact information above.

In connection with the Proposed Acquisition, BAT has filed relevant materials with the SEC, including a Registration Statement on FormF-4 (the“Registration Statement”) with the SEC that includes a proxy statement of RAI that also constitutes a prospectus of BAT. On 14 June 2017, the SEC declared the Registration Statement effective. RAI commenced mailing the definitive proxy statement/prospectus to holders of RAI common stock on or about 14 June 2017. Investors and security holders are urged to read the definitive proxy statement/prospectus, which was also filed with the SEC on 14 June 2017, together with all other relevant documents filed with the SEC, because they contain important information about the Proposed Acquisition. Investors and security holders may obtain the documents free of charge at the SEC’s website,http://www.sec.gov, or for free from BAT atbatir@bat.com or +44 (0) 20 7845 1000.

This document is not a substitute for the Registration Statement or other documents that BAT may file with the SEC in connection with the Proposed Acquisition. INVESTORS AND SECURITY HOLDERS OF RAI ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT AND ANY OTHER DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT BAT, RAI AND THE PROPOSED ACQUISITION.

Non-solicitation

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities under the United States federal securities laws, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended.

This document is dated 14 June 2017.

ii

CONTENTS

iii

EXPECTED TIMETABLE OF EVENTS AND INDICATIVE MERGER STATISTICS

Timetable

All references to time in this document and in the expected timetable are to the time in London, United Kingdom, unless otherwise stated. Each of the times and dates in the table below are indicative only and may be subject to change.

| | |

Event | | Time and Date |

| |

Announcement of the Proposed Acquisition | | 17 January 2017 |

| |

Publication of the Prospectus | | 14 June 2017 |

| |

Publication of the Circular | | 14 June 2017 |

| |

| Latest time and date for receipt of Proxy Forms and PFSAs | | 2pm (UK time) / 3pm (South Africa time) on 17 July 2017 |

| |

Voting record date (UK and South Africa) | | 6pm (UK time) / 7pm (South Africa time) on 17 July 2017 |

| |

General Meeting to approve the Proposed Acquisition | | 2pm (UK time) 19 July 2017 |

| |

RAI Special Meeting to approve the Proposed Acquisition | | 9am (New York time) on 19 July 2017 |

| |

Expected date of Completion | | 25 July 2017 |

| |

Expected date New BAT Shares issued and credited to CREST | | 25 July 2017 |

| |

| Expected date of admission and commencement of dealings in New BAT ADSs on the NYSE and conversion of Existing BAT ADSs | | 25 July 2017 |

| |

| Expected date of Admission and commencement of dealings in New BAT Shares on the LSE and the JSE | | 26 July 2017 |

Merger Statistics

| | |

Number of Existing BAT Shares1 | | 2,027,103,642 |

| |

| Number of New BAT Shares to be issued pursuant to the Proposed Acquisition | | up to 435,556,670 |

| |

| Number of BAT Shares in issue immediately following Admission1,2,3 | | up to 2,462,660,312 |

| |

| New BAT Shares as a percentage of the total BAT Shares immediately following Admission1,2,3 | | 17.69% |

| |

ISIN | | B0002875804 |

| |

SEDOL | | 0287580 |

| 1 | Number of BAT Shares as at the Latest Practicable Date (including treasury shares in BAT (“BAT Treasury Shares”) and shares owned by employee share trusts). There are 162,645,590 BAT Treasury Shares, representing 8.72% of BAT’s share capital excluding BAT Treasury Shares, as at the Latest Practicable Date. |

| 2 | Assumes that no new BAT Shares are issued as a result of (1) the exercise of any options or (2) awards vesting under the BAT Employee Share Schemes between the Latest Practicable Date and Admission. |

| 3 | Based on the number of BAT Shares in issue as at the Latest Practicable Date and that 435,556,670 New BAT Shares are issued in connection with the Proposed Acquisition. |

1

PRESENTATION OF INFORMATION

| 1. | Forward-looking statements |

Certain statements in this document regarding the Proposed Acquisition, the expected timetable for completing the Proposed Acquisition, the benefits and synergies of the Proposed Acquisition, future opportunities for the BAT Group and the RAI Group after the Proposed Acquisition has taken effect (the “Combined Group”) and any other statements regarding the BAT Group’s, the RAI Group’s or the Combined Group’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of section 21E of the Exchange Act. These statements are often, but not always, made through the use of words or phrases such as “believe”, “anticipate”, “could”, “may”, “would”, “should”, “intend”, “plan”, “potential”, “predict”, “will”, “expect”, “estimate”, “project”, “positioned”, “strategy”, “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual future financial condition, performance and results to differ materially from the plans, goals, expectations and results expressed in the forward-looking statements and other financial and/or statistical data within this document. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are uncertainties related to the following: whether the conditions to the Proposed Acquisition will be satisfied and the Proposed Acquisition will be completed on the anticipated timeframe, or at all; the failure to realise contemplated synergies and other benefits from the Proposed Acquisition; the incurrence of significant costs and the availability and cost of financing in connection with the Proposed Acquisition; the effect of the announcement of the Proposed Acquisition, and related uncertainties as to whether the Proposed Acquisition will be completed, on the BAT Group’s, the RAI Group’s or the Combined Group’s ability to retain customers, retain and hire key personnel and maintain relationships with suppliers and on their operating results and businesses generally; the ability to maintain credit ratings; changes in the tobacco industry and stock market trading conditions; changes or differences in domestic or international economic or political conditions; changes in tax laws and rates; the impact of adverse legislation and regulation; the ability to develop, produce or market new alternative products profitably; the ability to effectively implement strategic initiatives and actions taken to increase sales growth; the ability to enhance cash generation and pay dividends; adverse litigation and dispute outcomes; and changes in the market position, businesses, financial condition, results of operations or prospects of the BAT Group, the RAI Group or the Combined Group.

Important factors which may cause actual results to differ include, but are not limited to, those described in Part II (Risk Factors) of this Circular.

Forward-looking statements contained in this document speak only as at the date of this document. Each of the Company, the Directors, Centerview Partners, Deutsche Bank and UBS expressly disclaims any obligation or undertaking to publicly update any forward-looking statements or other data or statements contained in this document, whether as a result of new information, future or changes in events or otherwise, other than as required by law, regulation, the Prospectus Rules, the Listing Rules or the Disclosure Guidance and Transparency Rules of the FCA. Accordingly, prospective investors are cautioned not to place undue reliance on any of the forward-looking statements herein.

| 2. | Market and industry data |

Certain information in this document has been sourced from third parties. Save as set out below, where information in this document has been sourced from third parties, the source of such information has been clearly stated adjacent to the reproduced information.

All information contained in this document which has been sourced from third parties has been accurately reproduced and, as far as the Company is aware and is able to ascertain from information published by the relevant third party, no facts have been omitted which would render the reproduced information inaccurate or misleading.

All references to market data, industry statistics and forecasts and other information in this document consist of estimates based on data and reports compiled by industry professionals, organisations, analysts, publicly available information or the Company’s own knowledge of its sales and markets.

References to market share are the BAT Group’s estimates based on the latest available data from a number of internal and external sources.

2

US industry shipment volume and retail share of market data that appear in this Circular have been obtained from MSAi. This information is included in this Circular because it is used primarily as an indicator of the relative performance of industry participants, brands and market trends. All US market share results that appear, except as noted otherwise, in this document are based on US cigarette (or smokeless tobacco products, as applicable) shipments to retail outlets (“STR Data”), based on information submitted by wholesale locations and processed and managed by MSAi. However, investors should not rely on the STR Data reported by MSAi as being a precise measurement of actual market share as the shipments to retail outlets do not reflect actual consumer sales and do not track all volume and trade channels. Accordingly, the STR Data of the US tobacco industry as reported by MSAi may overstate or understate actual market share. Moreover, investors should be aware that in a product market experiencing overall declining consumption, a particular product can experience increasing market share relative to competing products, yet still be subject to declining consumption volumes.

Market data and statistics are inherently speculative and are not necessarily reflective of actual market conditions. Such statistics are based on market research, which itself is based on sampling and subjective judgments by both the researchers and the respondents, including judgments about what types of products and transactions should be included in the relevant market. In addition, the value of comparisons of statistics for different markets is limited by many factors, including that (i) the markets may be defined differently, (ii) the underlying information may be gathered by different methods and (iii) different assumptions may be applied in compiling the data. Accordingly, the market statistics included in this document should be viewed with caution and no representation or warranty is given by any person as to their accuracy.

When used in describing aspects of the BAT Group’s business, reference to volume is an unaudited operating measure and is calculated as the total global cigarette volume of the BAT Group’s brands sold by its subsidiaries.

References to the price of the BAT ADSs prior to 14 February 2017 are adjusted to give effect to the BAT ADS ratio change unless otherwise indicated.

| 3. | Sources and presentation of financial information |

| 3.1 | Presentation of RAI financial information |

The historical financial information relating to the RAI Group, including that which is incorporated by reference into Section A of Part III (Historical Financial Information of the RAI Group) of this document, has been prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”).

Section B of Part III of this document includes unaudited reconciliations of the RAI Group’s historical financial information from US GAAP to International Financial Reporting Standards as adopted by the European Union (“IFRS (EU)”).

The RAI Group completed the Lorillard Merger (as described in paragraph 2.1 of Part VIII (Information on the RAI Group) of the Prospectus) in June 2015. Section C of Part III of this document incorporates by reference historical financial information of the Lorillard Group for the year ended 31 December 2014 and includes historical financial information of the Lorillard Group for the period from 1 January 2015 to 11 June 2015, presented in accordance with US GAAP. Section D of Part III of this document includes unaudited reconciliations of the Lorillard Group’s historical financial information for the year ended 31 December 2014 and for the period from 1 January 2015 to 11 June 2015 from US GAAP to IFRS (EU).

| 3.2 | Combined Group Financial Information |

Following Completion, RAI will be a subsidiary within the BAT Group, and the accounting policies applied to the RAI Group will be the same as those applied to the BAT Group.

| 4. | Unaudited supplementarynon-IFRS (EU) measures of the BAT Group’s performance |

This document contains certain unaudited supplementary measures that are not required by, or presented in accordance with, IFRS (EU) or other generally accepted accounting principles. These measures are used by the BAT Group to assess the financial performance of its businesses. These measures include, among others, adjusted profit from operations, adjusted diluted earnings per share, constant exchange rate analysis, free cash flow, net debt and an underlying tax rate and are included because the Directors believe that they are important supplemental measures of operating

3

performance. The Directors believe that thenon-IFRS (EU) measures used provide investors with a means of evaluating, and an understanding of how the BAT Group evaluates its performance and results on a comparable basis that is not otherwise apparent on an IFRS (EU) basis, since manynon-recurring, infrequent ornon-cash items that the Directors believe not to be indicative of the core performance of the business may not be excluded when preparing financial measures under IFRS (EU).

The unaudited supplementarynon-IFRS (EU) measures contained in this document should not be considered in isolation from, or as a substitute for, measures presented in accordance with IFRS (EU). In addition, the unaudited supplementarynon-IFRS (EU) measures presented by the BAT Group may not be comparable to similarly titled measures presented by other businesses, as such businesses may define and calculate such measures differently than the BAT Group. Accordingly, undue reliance should not be placed on the unaudited supplementarynon-IFRS (EU) measures contained in this document.

| 4.1 | Non-IFRS (EU) financial measures used by the BAT Group |

| 4.1.1 | Adjusted profit from operations |

To supplement the BAT Group’s results from operations presented in accordance with IFRS (EU), the Directors review current and prior year adjusted profit from operations to evaluate the performance of the BAT Group and its geographic segments and to allocate resources to the overall business. Adjusted profit from operations is not a measure defined by IFRS (EU). The BAT Group’s most directly comparable IFRS (EU) measure to adjusted profit from operations is profit from operations. Adjusted profit from operations is defined as profit from operations before adjusting items in profit from operations. Adjusting items, as identified in accordance with the BAT Group’s accounting policies, represent certain items of income and expense which the BAT Group considers distinctive based on their size, nature or incidence. In identifying and quantifying adjusting items, the BAT Group consistently applies a policy that defines criteria that are required to be met for an item to be classified as adjusting and provides details of items that are specifically excluded from being classified as adjusting items. Adjusting items in profit from operations include restructuring and integration costs, amortisation of trademarks and similar intangibles, a gain on deemed partial disposal of a trademark, and a payment and release of a provision relating tonon-tobacco litigation.

| 4.1.2 | Constant exchange rate analysis |

Movements in foreign exchange rates have impacted the BAT Group’s profit from operations. The Directors review certain of its results, including revenue and adjusted profit from operations, at constant rates of exchange. The BAT Group calculates these financial measures at constant rates of exchange based on a retranslation, at prior year exchange rates, of the current year results of the BAT Group and its segments. The BAT Group does not adjust for the normal transactional gains and losses in operations that are generated by exchange movements. Although the Directors do not believe that these measures are a substitute for IFRS (EU) measures, the Directors believe that such results excluding the impact of currency fluctuationsyear-on-year provide additional useful information to investors regarding the operating performance on a local currency basis.

The BAT Group uses free cash flow to illustrate the cash flows before transactions relating to borrowings. Free cash flow is not a measure defined by IFRS (EU). The BAT Group defines free cash flow as net cash generated from operating activities adjusted for dividends paid tonon-controlling interests, net interest paid, net capital expenditure (offset by sales of assets in the period) and proceeds from associates’ sharebuy-backs. The most directly comparable IFRS (EU) measure to free cash flow is net cash generated from operating activities. The Directors believe that this additional measure, which is used internally, is useful to the users of the financial statements in helping them understand the underlying business performance and can provide insight into the cash flow available to, among other things, reduce debt and pay dividends. Free cash flow has limitations as an analytical tool. It is not a presentation made in accordance with IFRS (EU) and should not be considered as an alternative to net cash generated from operating activities determined in accordance with IFRS (EU). Free cash flow is not necessarily comparable to similarly titled measures used by other companies. As a result, investors should not consider this measure in isolation from, or as a substitute analysis for, the BAT Group’s results of operations or cash flows as determined in accordance with IFRS (EU).

4