| | |

| | Stradley Ronon Stevens & Young, LLP |

| | Suite 1601 |

| | 191 North Wacker Drive |

| | Chicago, IL 60606 |

| | Telephone 312.964.3500 |

| | Fax 312.964.3501 www.stradley.com |

VIA EDGAR

November 10, 2016

Kimberly A. Browning

Senior Counsel

Disclosure Review and Accounting Office

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Nuveen Floating Rate Income Fund |

| | File Numbers: 333-212355; 811-21494 |

Dear Ms. Browning:

This letter responds to the comments provided verbally on November 4, 2016 and November 9, 2016 by the staff of the Securities and Exchange Commission (the “SEC”) regarding the registration statement on Form N-2 (the “Registration Statement”), filed with respect to Term Preferred Shares of the Nuveen Floating Rate Income Fund (the “Registrant” or the “Fund”). For convenience, each of the comments applicable to the Fund are repeated below, with the response immediately following.

Enclosed for your convenience is a copy of pre-effective amendment no. 4 to the Registration Statement, which was filed with the SEC on the date of this letter and is marked to show changes from pre-effective amendment no. 3 to the Registration Statement as filed on November 2, 2016.

Prospectus

The Fund’s Investments – Investment Objective and Policies

| 1. | Comment: We note the new disclosure in the twelfth paragraph under this heading, that the Fund may invest in iBoxx Loan Total Return Swaps. The disclosure indicates that “[t]he |

| | iBoxx Loan Total Return Swap’s underlying index is theMarkit iBoxx USD Liquid Loan Total Return Index, which is a subset of the benchmarkMarkit iBoxx USD Leveraged Loan Index (emphasis added). |

a. Please confirm that each index related to the iBoxx Loan Total Return Swaps is properly identified.

b. Please specify whether these indices are rules-based indices and, if not, please describe how each index is constructed.

c. Please disclose whether Markit, the sponsor of the various iBoxx indices, is affiliated with the Fund or with Nuveen.

d. Please clarify the disclosure concerning “more liquid index constituents” (emphasis added) to specify what this means.

e. Please identify the source of the claim that the total return swaps written on the Markit iBoxx USD Liquid Leveraged Loans Total Return Index provide “an efficient and cost-effective basis” for obtaining exposure to the senior loan market.

f. Please further explain the meaning of the term “standardized” as described in the sixth sentence of this paragraph.

Response:

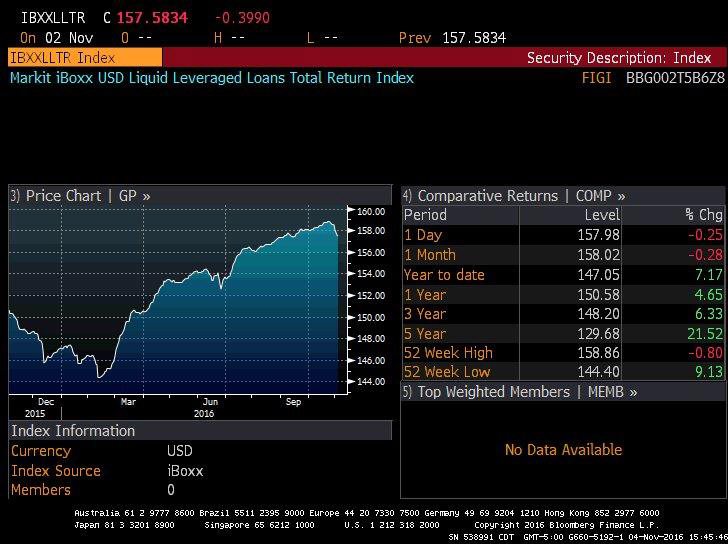

a. The Registrant has revised the description of each index in the twelfth paragraph under the heading, “The Fund’s Investments – Investment Objective and Policies” as indicated below. The Markit iBoxx USD Liquid Leveraged Loans Total Return Index (the “Total Return Index”) is a subset of the Markit iBoxx USD Liquid Leveraged Loan Index (the “Leveraged Loan Index”), and is designed to track the total return, as opposed to, for example, price-only movements, of certain index constituents comprising the Leveraged Loan Index. The Registrant supplementally submits the attached “screen shot” of a Bloomberg trading screen displaying the Total Return Index, which shows the unique trading identifier “IBXXLLTR” of the Total Return Index.

b. Both the Total Return Index and the Leveraged Loan Index are rules-based indices. The Registrant has updated the disclosure in this paragraph accordingly as indicated below.

c. Markit is not affiliated with Nuveen or the Fund. The Registrant has updated the disclosure in this paragraph accordingly as indicated below.

d. “More liquid” in this context refers to index constituents that feature greater transparent price discovery, smaller bid-offer spreads, and larger tradeable sizes at particular price quotes. The Registrant has updated the disclosure in this paragraph accordingly as indicated below.

e. The Registrant has revised the disclosure in this paragraph to clarify that the iBoxx Loan Total Return Swaps provide, in the Fund’s view, “an efficient and cost-effective basis” for obtaining exposure to the senior loan market.

f. The Registrant has revised the disclosure in this paragraph to delete references to “standardized” trading documentation, in order to eliminate confusion over the meaning of this term.

“The Fund may invest up to 5% of its Managed Assets in iBoxx Loan Total Return Swaps (as defined below).An iBoxx Loan Total Return Swapsareis a specific type of total return swaps onone or more indicesan indexthatareis designed to provide exposure to the Senior Loan market. The iBoxx Loan Total Return Swap’s underlying index is the Markit iBoxx USD LiquidLeveraged Loans Total Return Index, which isone of a subset ofindices designed to track thebenchmarkbroader, rules-based Markit iBoxx USDLiquid Leveraged Loan Index. “iBoxx Loan Total Return Swaps” means total return swaps written on the Markit iBoxx USD LiquidLeveraged Loans Total Return Index. Markit, which is not affiliated with Nuveen Investments or the Fund, created thisrules-based index to seek to track the broader senior loan market with a smaller subset of the more liquid index constituents,. The Fund believes that iBoxx Loan Total Return Swaps providingevia the index’s associated total return swap an efficient and cost-effective basis for obtaining exposure to the senior loan market.These total return swaps use standardized trading documentation and short form, electronic confirmations, which offer increased efficiency and lower costs than traditional total return swaps, which use variable or customized trading documentation and paper confirmations. The Fund anticipates using iBoxx Loan Total Return Swaps as a component of “synthetic investments” that, when combined with cash equivalents, replicate or emulate exposure to Senior Loans, as described above. iBoxx `Loan Total Return Swaps share risks that are similar to other derivative instruments in which the Fund may invest. See “Risk Factors—Security Level Risks—Derivatives Risk, Including the Risk of Swaps.”

General

| 2. | Comment: We remind you that the Registrant and its management are responsible for the accuracy and adequacy of their disclosures, notwithstanding any review, comments, action or absence of action by the staff of the SEC. |

Response: Acknowledged.

We believe that this information responds to all of your comments. If you should require additional information, please call me at 312.964.3502.

|

Sincerely yours, |

/s/ David P. Glatz |

David P. Glatz |

Enclosures

Copies (w/encl.) to

G. Zimmerman

E. Fess