UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-21527

The Endowment Master Fund, L.P.

(Exact name of registrant as specified in charter)

4265 SAN FELIPE, SUITE 800, HOUSTON, TX 77027

(Address of principal executive offices) (Zip code)

| | |

| | With a copy to: |

| A. Haag Sherman | | George J. Zornada |

| The Endowment Master Fund, L.P. | | K & L Gates LLP |

| 4265 San Felipe, Suite 800 | | State Street Financial Center |

| Houston, TX 77027 | | One Lincoln St. |

| (Name and address of agent for service) | | Boston, MA 02111-2950 |

| | | (617) 261-3231 |

Registrant’s telephone number, including area code: 800-725-9456

Date of fiscal year end: 12/31/09

Date of reporting period: 12/31/09

Item 1. Reports to Stockholders.

the

ENDOWMENT FUND

The Endowment Master Fund, L.P.

Shareholders’ Report

December 31, 2009

TABLE OF CONTENTS

Dear TEF Partners:

As we enter a new decade and near our 7th anniversary, we thought this would be an opportune time to (a) review the goals and objectives of The Endowment Fund (the “Fund” or “TEF”) and (b) discuss the Fund’s performance in 2009.

The Goals of The Endowment Fund

Since inception of the Fund in 20031, our long-term goals have been to preserve the purchasing power of invested capital to support the future spending needs of our clients and to generate consistent, long-term, returns across market cycles. We endeavor to deliver real returns (returns above inflation) of 7%2, similar to the long-term return on equities, but to produce those returns with approximately half of the annualized volatility of equities, as measured by standard deviation of returns.

By lowering the standard deviation of returns through a diversified portfolio management approach, similar to the model employed by the most successful Endowment management programs, cumulative wealth is increased through more consistent compounding. The mathematics of loss are very debilitating to long-term investment returns, and the ability to “lose less” in down markets allows for greater wealth accumulation, even if the returns in good markets modestly lag traditional indices. Harry Markowitz won his Nobel Prize for demonstrating the power of diversification and the impact on long-term investment returns and some of the most successful investment programs have embraced this model effectively over the past few decades. The Fund is managed in accordance with these principles and we have constructed a highly diversified portfolio that we believe is designed to capitalize on the benefits of the Markowitz approach.

The Endowment Model is focused on long-term wealth preservation and growth, as opposed to seeking to maximize returns in any one particular short-term period. By reducing the volatility of returns over time, the portfolio should achieve higher long-term returns. However, there will be periods of time where the portfolio trails more concentrated investment strategies that exhibit much higher volatility. Those strategies will typically have “higher highs” and “lower lows” and when that is true they are more likely to ultimately generate inferior returns to the Endowment Model portfolio approach in the long term.

The Diversified Portfolio in 2009

By definition, a diversified portfolio will almost always lag a concentrated portfolio in an “up market” (conversely it will almost always lead in a “down market”). As we entered 2009, we believed that a high level of diversification and “hedging” in the portfolio was the prudent portfolio posture given the high level of uncertainty in the markets in the wake of the financial crisis. Our conservative posture was very successful in reducing volatility, and preserving capital, during a very tumultuous first quarter. However, that posture also limited upside participation during the subsequent market rally over the final two-thirds of the year.

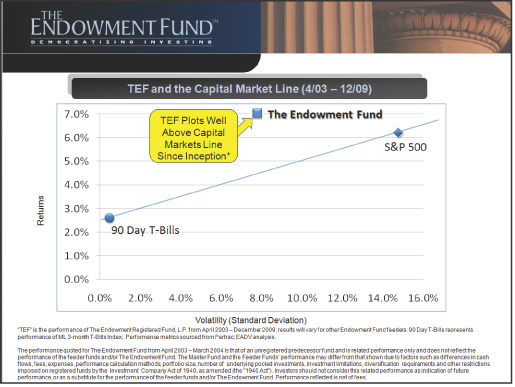

1 The performance quoted for The Endowment Fund from April 2003 – March 2004 is that of an unregistered predecessor fund and is related performance only and does not reflect the performance of the feeder funds and/or The Endowment Fund. The Master Fund and the Feeder Funds’ performance may differ from that shown due to factors such as differences in cash flows, fees, expenses, performance calculation methods, portfolio size, number of underlying pooled investments, investment limitations, diversification requirements and other restrictions imposed on registered funds by the Investment Company Act of 1940, as amended (the “1940 Act”). Investors should not consider this related performance as indication of future performance, or as a substitute for the performance of the feeder funds and/or The Endowment Fund. Performance reflected is net of fees.

2 However, we cannot guarantee we will achieve this objective and past performance is no guarantee of future results.

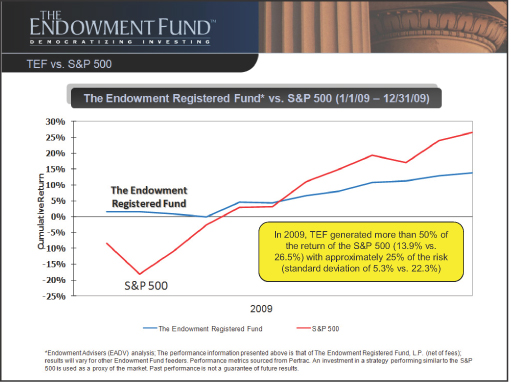

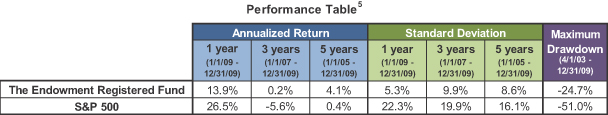

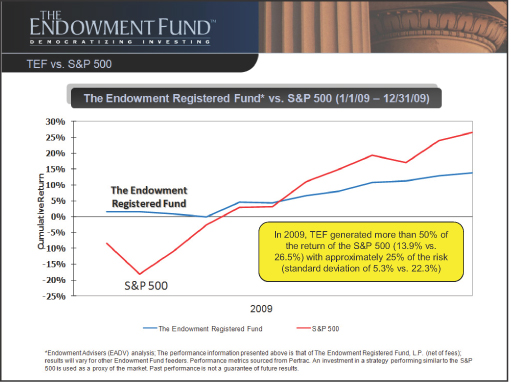

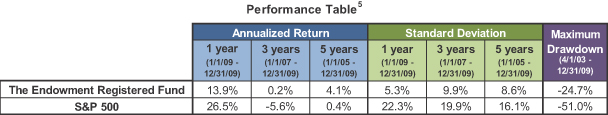

As shown in the graph above, the Fund3 produced a relatively stable stream of returns in 2009 and our high allocation to low volatility strategies and portfolio hedges generated a return profile with approximately 25% of the volatility4 of the S&P 500 Index. The “cost” of that reduced volatility was that the portfolio lagged the equity market over the entire year, capturing just over half of the index return. Given our goal is to generate consistent, long-term, returns we have never focused on single year returns and have not constructed the portfolio to be compared to the equity indices over short-term periods like quarters, or years. We are much more concerned with outperforming over longer periods of time by lowering the volatility of returns in the Fund. We achieved that goal very effectively as the Fund had less than 25% of the volatility of the S&P 500 during the year5. Lower volatility has been consistent since inception and the impact of the reduced volatility is shown in the table below. The Fund has significantly outperformed the equity market over rolling three and five year periods and has achieved those superior returns with dramatically less risk, as measured by the standard deviation of its returns.

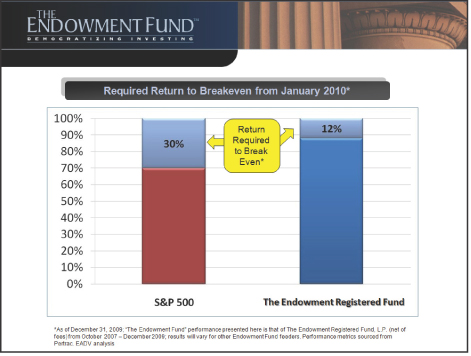

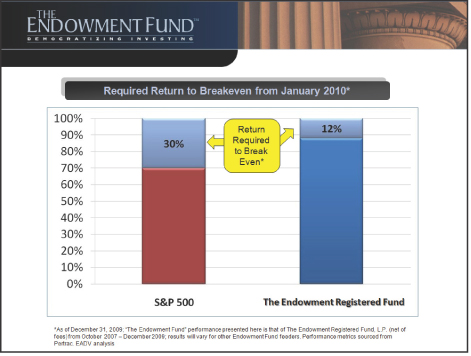

Another measure of superior risk adjusted returns is the ability of the Fund to limit the maximum drawdown of the portfolio to less than half of the drawdown of the S&P 500. From the maximum drawdown, the Fund needs to

3 The Endowment Fund has a variety of feeders, which all feed into a single “master” fund called The Endowment Master Fund, L.P. Each “feeder” fund has different expense ratios, which provide for slightly different returns from one “feeder” fund to the next. Accordingly, unless otherwise specified, the performance and standard volatility outlined herein are those of The Endowment Registered Fund, L.P., which is the largest “feeder” fund in The Endowment Fund complex. Your returns may vary, based on the feeder in which you invest and the timing of your investment. Please consult your capital account statement for the exact returns of your investment.

4 Please refer to the 1, 3 and 5 year TEF vs. S&P 500 performance comparisons in the Performance Table for more complete performance information.

5 Past performance is not a guarantee of future results.

recover approximately 33% to break even, while the equity index would have to rise just over 100% to recover the losses. We believe this is a critical distinction, one that means that the recovery rate for the Fund does not have to be as rapid or dramatic as the equity market to get an investor back to “even.”

Performance During the Financial Crisis and Market Rebound (October 2007 – December 2009)

Despite this fact, some investors have expressed concern that the Fund only captured 52% of the equity recovery in 2009 (TEF: 13.9% vs. the S&P 500: 26.5%). Lower volatility of returns means less downside in the bad periods (TEF lost significantly less than the S&P 500 in 2008, -24% vs. -37%) and less upside in the good periods, like the last half of 2009. However, the mathematics of loss is incontrovertible, as shown below.

As of January 1, 2010, the S&P 500 still must generate a 30% return to recover the level it reached at the October 2007 peak. In contrast, The Endowment Fund needs to generate a 12% return in order to recover the losses it sustained during the financial crisis. Our diversified approach limited losses during the worst of the crisis in September and October of 2008, and again in January and February of 2009, and while our hedged posture also limited upside participation during the recent rally, we finished the two year period well ahead of the equity markets. A dollar invested in a strategy which performed similarly to the S&P 500 on January 1, 2008 is now only worth 80 cents, while that same dollar invested in the Fund is worth 87 cents.6 Diversification is a proven way to limit losses in a portfolio and the Fund embraces the elegantly simple math of long-term wealth generation, which focuses on producing a lower volatility stream of returns.

2009 in Review

2009 proved a year of two distinct investing climates. The first ten weeks of 2009 saw a continuation of the dramatic drawdown of the fourth quarter of 2008. The remainder of 2009 saw a dramatic rebound in the US and global equity markets. We wanted to provide a recap of 2009 and how our Fund performed in the first ten weeks, and then thereafter.

January – February 2009 in Review

The last few months of 2008 were very challenging for all investors and we learned many valuable lessons about the limits of hedging and the risks of the “unknown unknowns” like government intervention and accounting rule

6 The S&P 500 return from January 2008 – December 2009 was -20.32%, while the return for The Endowment Registered Fund was -13.5%.

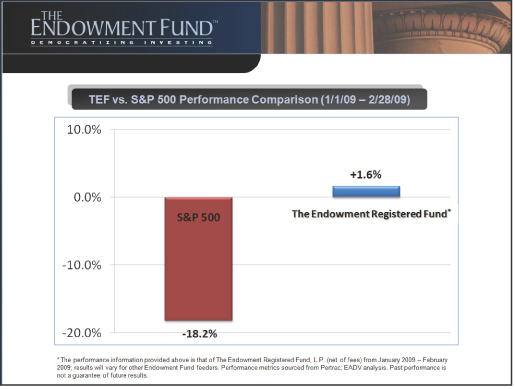

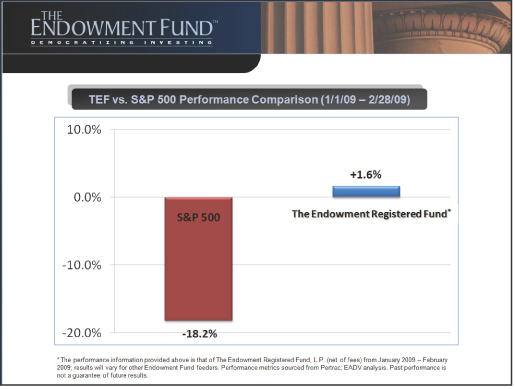

changes. We entered 2009 with large positions in credit (rather than equity) and significant hedges in the portfolio as we were concerned about continued fallout from the financial crisis. We believed that we could generate consistent returns in most market conditions by owning assets senior in the capital structure and wanted to limit equity exposure given the high degree of uncertainty in the market. Since TEF suffered a significant drawdown along with the rest of the industry in 2008, we are often asked the question “How will TEF perform if the market drops 20% again?” While past performance is no guarantee of future results, the chart below illustrates how The Endowment Fund performed during the 18% drawdown from January to February of 2009. Our hedged profile paid handsomely as we avoided most of the losses and dramatically reduced volatility in the portfolio.

The Great Equity Rally of 2009 – March to December

After the release of the Bank Stress Test Results in March, investors “got their nerve back”, animal spirits returned and equity markets surged in the following months. Our portfolio was positioned defensively and did not participate fully in the rally. While the Fund posted more consistent, linear returns of 12% over the balance of the year, stocks surged 55% from the nadir to finish 2009 up 26.5%.5

Our portfolio performance can be separated into three distinct blocks, Credit, Equity and Hedges. Our Credit portfolio (Enhanced Fixed Income (15%) and Arbitrage (18%)) performed quite well during the rally, rising nearly 24% and finished the year in line with equities, but with significantly lower volatility and risk. Our Equity portfolio (Domestic Equity (10%), International Equity (10%), Private Equity (12%), Energy (10%)) had mixed results with Domestic Equity and Private Equity rising around 10%, International Equity rising 22% and Energy surging 36%. The most challenging part of the portfolio were the hedges (which performed the best during the first part of the year) as Opportunistic Equity (13%), hedged Real Estate (5%) and Fixed Income (7%) struggled during the “melt-up.” Opportunistic Equity was flat, Real Estate was up modestly and Fixed Income (deflation hedge) lost 4%.5

Conclusion

The Fund (again, as evidenced by the performance of The Endowment Registered Fund, L.P.) has shown the ability to preserve capital during turbulent markets (yes, we learned a great deal during 2008) and also capture significant upside in bull markets. We believe TEF is an attractive solution for investors looking to

diversify a portion of their traditional equity exposure without giving up the potential ability to generate consistent real returns similar to long-term equity returns. On the heels of last year’s historic rally in the equity markets, valuations today are quite high by historic standards and expected returns over the next decade are low relative to history (GMO LLC now projects U.S. Equities to generate only 1.3% real returns over the next 7 years7). We believe there is a tremendous opportunity to “sell into strength” and reduce long equity exposure in client portfolios and replace that exposure with a portfolio that can generate similar returns with much lower volatility and more consistency.

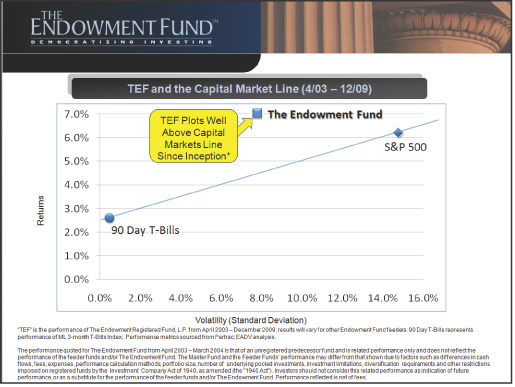

As the chart above illustrates quite nicely, since the Fund’s inception in 2003, the Fund has outperformed the S&P 500 by almost 1% per year on an annualized basis (7.1% net of fees vs. 6.2%) with approximately half the risk (8.0% vs. 14.8%) as measured by standard deviation. While no one can accurately predict the future, we are confident that the process inherent in the Endowment Model of investing is likely to generate consistent, long-term returns with low volatility for many decades to come. Past performance is no guarantee of future results.

The Endowment Fund Fees and Expenses

The Endowment Fund performance information presented in this document is net of fees and expenses. TEF fees are as follows: Management Fee: 1%, Servicing Fee: 1%. Fund Expenses vary by feeder and are listed below:

| | • | | Domestic Fund & Domestic QP Fund: 0.18% |

| | • | | Exempt Fund II8 : 1.43% |

| | • | | Exempt QP Fund II8: 1.22% |

7 GMO LLC. 7-Year Asset Class Return Forecast. As of 12/31/09. GMO is a privately held global investment management firm.

8 The Fund expenses shown are the expenses contained in the Private Placement Memorandum for the Fund. The actual expenses for the TEI Fund, Exempt Fund II and Exempt QP Fund II were lower than stated above (0.53%, 0.52% and 0.49%) after accounting for offshore withholding tax credit subsequently received.

We are grateful for your continued support and partnership. If you have any questions, please do not hesitate to call our Sales Desk at 1-800-725-9456.

Best regards,

| | |

| |

|

Mark W. Yusko | | John A. Blaisdell |

Chief Investment Officer Endowment Advisers, L.P. | | Co-Chief Executive Officer |

| |

| |

|

| Andrew B. Linbeck | | A. Haag Sherman |

Co-Chief Executive Officer | | Co-Chief Executive Officer |

The views expressed throughout this report are those of the Adviser and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of the Fund. Portfolio information provided in the report may not be representative of the Fund’s current or future investments and may change due to active management.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Partners

The Endowment Master Fund, L.P.:

We have audited the accompanying statement of assets, liabilities, and partners’ capital of The Endowment Master Fund, L.P. (the “Master Fund”), including the schedule of investments, as of December 31, 2009, and the related statement of operations for the year then ended, the statement of changes in partners’ capital for each of the years in the two-year period then ended, the statement of cash flows for the year then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Master Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009, by correspondence with custodians and investees; or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Endowment Master Fund, L.P. as of December 31, 2009, the results of its operations and its cash flows for the year then ended, the changes in its partners’ capital for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended in conformity with U.S. generally accepted accounting principles.

KPMG LLP

Columbus, Ohio

February 26, 2010

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Statement of Assets, Liabilities and Partners’ Capital

December 31, 2009

| | | |

| Assets | | | |

Investments in Investment Funds, at estimated fair value (cost $1,140,528,748) | | $ | 1,148,503,109 |

Investments in affiliated Investment Funds, at estimated fair value (cost $3,100,169,081) | | | 3,393,328,112 |

Investments in securities, at fair value (cost $475,178,323) | | | 470,477,680 |

| | | |

Total investments | | | 5,012,308,901 |

Cash and cash equivalents | | | 186,148,307 |

Prepaid contributions to Investment Funds | | | 102,391,759 |

Interest and dividends receivable | | | 629,640 |

Interest and dividends receivable from affiliated investments | | | 277,260 |

Receivable from investments sold | | | 252,007,689 |

Prepaids and other assets | | | 179,895 |

| | | |

Total assets | | | 5,553,943,451 |

| | | |

| Liabilities and Partners’ Capital | | | |

Contributions received in advance | | | 58,488,319 |

Withdrawals payable | | | 257,471,914 |

Investment Management Fees payable | | | 13,338,483 |

Offshore withholding tax payable | | | 9,986,850 |

Administration fees payable | | | 195,322 |

Payables to related parties | | | 103,285 |

Accounts payable and accrued expenses | | | 1,748,344 |

| | | |

Total liabilities | | | 341,332,516 |

| | | |

Partners’ capital | | | 5,212,610,935 |

| | | |

Total liabilities and partners’ capital | | $ | 5,553,943,451 |

| | | |

See accompanying notes to financial statements.

2

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Investments in Investment Funds | | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies | | | | | | | |

Cayman Islands | | | | | | | |

Arbitrage Strategies (0.67% of Partners’ Capital) | | | | | | | |

Montrica Global Opportunities Fund, L.P.(1)(2) | | 412,880 | | $ | 34,747,006 | | |

Domestic Equity (0.88% of Partners’ Capital) | | | | | | | |

Tiedemann/Falconer Partners, L.P.(3) | | | | | 45,831,080 | | |

Energy (0.78% of Partners’ Capital) | | | | | | | |

BlueGold Global Fund, L.P.(2) | | | | | 40,398,940 | | |

International Equity (4.04% of Partners’ Capital) | | | | | | | |

Algebris Global Finacials Fund, L.P.(2) | | | | | 65,902,226 | | |

Boyer Allan Greater China Fund, L.P.(3) | | | | | 33,145,460 | | |

S.R. Global Fund—Emerging Markets Portfolio (Class G, L.P.) | | | | | 37,758,192 | | |

S.R. Global Fund—International Portfolio (Class C, L.P.) | | | | | 73,800,951 | | |

Natural Resources (0.27% of Partners’ Capital) | | | | | | | |

Sentient Global Resources Fund III, L.P. | | | | | 14,000,000 | | |

Private Equity (2.29% of Partners’ Capital) | | | | | | | |

Carlyle Japan International Partners II, L.P. | | | | | 518,728 | | |

CJIP II Co-Invest, L.P. | | | | | 63,440 | | |

CX Partners Fund, Ltd.(2) | | | | | 3,526,463 | | |

Gavea Investment Fund II A, L.P. | | | | | 11,106,227 | | |

Gavea Investment Fund III, L.P. | | | | | 41,275,914 | | |

Hillcrest Fund, L.P.(3) | | | | | 1,128,542 | | |

Hony Capital Fund 2008, L.P. | | | | | 1,848,410 | | |

India Asset Recovery Fund, L.P.(1) | | | | | 1,230,253 | | |

J.C. Flowers III, L.P.(1) | | | | | 1,290,790 | | |

LC Fund IV, L.P.(2) | | | | | 3,538,836 | | |

New Horizon Capital III, L.P.(2) | | | | | 4,100,286 | | |

Orchid Asia IV, L.P.(1) | | | | | 7,716,545 | | |

Reservoir Capital Partners, L.P. | | | | | 3,157,838 | | |

Tiger Global Private Investment Partners IV, L.P.(1) | | | | | 7,371,726 | | |

Tiger Global Private Investment Partners V, L.P. | | | | | 7,627,216 | | |

Trustbridge Partners II, L.P.(2) | | | | | 17,645,511 | | |

Trustbridge Partners III, L.P.(2) | | | | | 6,418,556 | | |

Real Estate (0.65% of Partners’ Capital) | | | | | | | |

Forum European Realty Income III, L.P.(2) | | | | | 3,389,181 | | |

Phoenix Asia Real Estate Investments II, L.P.(1)(2) | | | | | 12,134,290 | | |

See accompanying notes to financial statements.

3

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

Cayman Islands (continued) | | | | | | | |

Real Estate (0.65% of Partners’ Capital) (continued) | | | | | | | |

Pheonix Real Estate Fund (T) L.P. | | | | $ | 18,552,438 | | |

| | | | | | | |

Total Cayman Islands | | | | | 499,225,045 | | |

| | | | | | | |

Guernsey | | | | | | | |

Private Equity (0.10% of Partners’ Capital) | | | | | | | |

Mid Europa Fund III LP | | | | | 5,460,688 | | |

| | | | | | | |

Total Guernsey | | | | | 5,460,688 | | |

| | | | | | | |

Republic of Mauritius | | | | | | | |

Real Estate (0.06% of Partners’ Capital) | | | | | | | |

Orbis Real Estate Fund I(1)(2) | | | | | 3,193,918 | | |

| | | | | | | |

Total Republic of Mauritius | | | | | 3,193,918 | | |

| | | | | | | |

Scotland | | | | | | | |

Private Equity (0.03% of Partners’ Capital) | | | | | | | |

Actis Umbrella Fund, L.P.(1) | | | | | 1,614,000 | | |

| | | | | | | |

Total Scotland | | | | | 1,614,000 | | |

| | | | | | | |

United Kingdom | | | | | | | |

Private Equity (0.13% of Partners’ Capital) | | | | | | | |

Darwin Private Equity I, L.P. | | | | | 2,626,172 | | |

Exponent Private Equity Partners II, L.P. | | | | | 3,935,062 | | |

Real Estate (0.10% of Partners’ Capital) | | | | | | | |

Benson Elliott Real Estate Partners II, L.P. | | | | | 1,702,943 | | |

Patron Capital L.P. II | | | | | 929,902 | | |

Patron Capital L.P. III | | | | | 2,364,465 | | |

| | | | | | | |

Total United Kingdom | | | | | 11,558,544 | | |

| | | | | | | |

United States | | | | | | | |

Arbitrage Strategies (14.31% of Partners’ Capital) | | | | | | | |

Black River Commodity Multi-Strategy Fund, LLC | | | | | 1,647,200 | | |

Eton Park Fund, L.P. | | | | | 69,105,373 | | |

Investcorp Silverback Arbitrage Fund, LLC(3) | | | | | 14,633,092 | | |

Kenmont Onshore Fund, L.P.(2) | | | | | 6,838,268 | | |

King Street Capital, L.P. | | | | | 25,772,946 | | |

Magnetar Capital Fund, L.P.(2) | | | | | 52,835,341 | | |

OZ Asia Domestic Partners, L.P.(2) | | | | | 21,215,327 | | |

Paulson Advantage Plus, L.P. | | | | | 125,991,843 | | |

Paulson Partners Enhanced, L.P.(2) | | | | | 62,076,060 | | |

See accompanying notes to financial statements.

4

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

United States (continued) | | | | | | | |

Arbitrage Strategies (14.31% of Partners’ Capital) (continued) | | | | | | | |

PIPE Equity Partners, L.L.C.(3) | | | | $ | 49,160,976 | | |

PIPE Select Fund, L.L.C.(3) | | | | | 54,096,983 | | |

PSAM WorldArb Partners, L.P.(2) | | | | | 40,726,688 | | |

Redbrick Capital, L.P.(2) | | | | | 44,433 | | |

Stark Investments Limited Partnership | | | | | 16,000,193 | | |

Stark Select Asset Fund, LLC | | | | | 5,452,027 | | |

Waterstone Market Neutral Fund, L.P.(3) | | | | | 99,885,299 | | |

Whitebox Multi-Strategy Fund, L.P.(2) | | 82,008 | | | 100,198,491 | | |

Domestic Equity (6.66% of Partners’ Capital) | | | | | | | |

Bonanza Partners, L.P.(2) | | | | | 1,041,811 | | |

Contrarian Equity Fund, L.P.(2) | | | | | 1,165,073 | | |

Empire Capital Partners Enchanced, L.P.(3) | | | | | 26,607,742 | | |

HealthCor, L.P.(2) | | | | | 78,511,767 | | |

Ithan Creek Partners, L.P.(2) | | | | | 62,308,137 | | |

Longhorn Onshore Investors, L.P.(2) | | | | | 40,537,561 | | |

Samlyn Onshore Fund, L.P.(2) | | | | | 94,955,663 | | |

Tiger Consumer Partners, L.P.(2) | | | | | 42,044,130 | | |

Energy (6.88% of Partners’ Capital) | | | | | | | |

ArcLight Energy Partners Fund IV, L.P.(1) | | | | | 9,500,000 | | |

CamCap Resources, L.P. | | | | | 235,784 | | |

Chilton Global Natural Resources Partners, L.P.(2) | �� | | | | 65,699,032 | | |

EnCap Energy Capital Fund VII-B, L.P. | | | | | 4,353,593 | | |

Encap Energy Infrastructure Fund | | | | | 945,000 | | |

Intervale Capital Fund, L.P.(2) | | | | | 11,200,495 | | |

Merit Energy Partners G, L.P. | | | | | 4,957,738 | | |

NGP Energy Technology Partners II, L.P. | | | | | 1,025,000 | | |

NGP IX Offshore Fund, L.P. | | | | | 7,973,575 | | |

NGP Midstream & Resources, L.P.(1) | | | | | 9,894,372 | | |

Quantum Parallel Partners V, L.P.(1) | | | | | 1,934,417 | | |

Southport Energy Plus Partners, L.P.(2) | | | | | 108,765,888 | | |

TPF II-A, L.P.(1) | | | | | 13,281,584 | | |

The Ospraie Fund, L.P. | | 31,614 | | | 3,775,055 | | |

Velite Energy, L.P.(2) | | | | | 115,196,350 | | |

Enhanced Fixed Income (12.04% of Partners’ Capital) | | | | | | | |

Anchorage Crossover Credit Fund II, L.P.(2) | | | | | 47,334,946 | | |

Ares Enhanced Credit Opportunities Fund, L.P. | | | | | 13,826,405 | | |

See accompanying notes to financial statements.

5

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

United States (continued) | | | | | | | |

Enhanced Fixed Income (12.04% of Partners’ Capital) (continued) | | | | | | | |

BDCM Partners I, L.P.(3) | | | | $ | 56,104,546 | | |

Contrarian Capital Fund I, L.P.(2) | | | | | 114,556,167 | | |

Halcyon European Structured Opportunities Fund, L.P.(3) | | | | | 2,122,848 | | |

Harbinger Capital Partners Fund I, L.P.(2) | | | | | 113,202,487 | | |

Investcorp Silverback Opportunistic Convertible Fund, LLC(3) | | | | | 28,645,035 | | |

Morgan Rio Capital Fund, L.P.(3) | | | | | 10,805,037 | | |

Ore Hill Fund II, L.P.(3) | | | | | 4,631,988 | | |

Prospect Harbor Credit Partners, L.P. | | | | | 43,122,235 | | |

Sorin Fund, L.P.(2) | | | | | 17,775,364 | | |

Standard Pacific Credit Opportunities Fund, L.P.(2) | | | | | 102,139,757 | | |

The Rohatyn Group Local Currency Opportunity Partners, L.P.(3) | | | | | 73,227,160 | | |

International Equity (5.43% of Partners’ Capital) | | | | | | | |

Dabroes Investment Fund L.P.(3) | | | | | 33,175,396 | | |

L-R Global Partners, L.P. | | | | | 428,445 | | |

Middle East North Africa Opportunities Fund, L.P.(3) | | 5,089 | | | 3,679,629 | | |

Monsoon India Inflection Fund, L.P. | | | | | 735,667 | | |

Monsoon India Inflection Fund 2, L.P. | | | | | 1,358,542 | | |

Penta Asia Domestic Partners, L.P. | | | | | 30,095,063 | | |

Skopos HG Fund, LLC(2) | | 262,504 | | | 37,290,645 | | |

Steel Partners Japan Strategic Fund, L.P.(2) | | | | | 27,426,237 | | |

Taiyo Fund, L.P. | | | | | 16,559,654 | | |

Tarpon All Equities Fund, LLC | | | | | 36,803,232 | | |

Tiger Asia Fund, L.P. | | | | | 46,053,832 | | |

Torrey Pines Fund, LLC(3) | | | | | 49,520,330 | | |

Natural Resources (0.01% of Partners’ Capital) | | | | | | | |

Tocqueville Gold Partners, L.P. | | | | | 526,615 | | |

Opportunistic Equity (13.37% of Partners’ Capital) | | | | | | | |

Atlas Institutional Fund, LLC(3) | | | | | 21,244,645 | | |

Corriente Partners, L.P.(2) | | | | | 42,867,486 | | |

Covepoint Emerging Markets Macro Fund, L.P.(2) | | | | | 63,761,021 | | |

Global GT, L.P. | | | | | 500,010 | | |

Global Undervalued Securities Fund (QP), L.P.(2) | | | | | 38,900,205 | | |

GMO Mean Reversion Fund (Onshore), L.P. | | | | | 35,541,851 | | |

Hayman Capital Partners, L.P.(2) | | | | | 35,978,288 | | |

See accompanying notes to financial statements.

6

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

United States (continued) | | | | | | | |

Opportunistic Equity (13.37% of Partners’ Capital) (continued) | | | | | | | |

Horseman Global Fund 2 L.P.(2) | | | | $ | 22,969,662 | | |

Miura Global Partners II, L.P.(2) | | | | | 58,773,242 | | |

NWI Explorer Global Macro Fund, L.P.(2) | | | | | 4,310,311 | | |

Pardus European Special Opportunities Fund, L.P.(2) | | | | | 9,952,831 | | |

Passport II, L.P.(2) | | | | | 58,662,250 | | |

R.G. Niederhoffer Global Fund, L.P.(3) | | | | | 26,594,262 | | |

Salem Global Opportunity Fund, L.P.(2) | | | | | 24,879,678 | | |

SCP Sakonnet Fund, L.P.(2) | | | | | 58,705,338 | | |

Tiger Global, L.P. | | | | | 44,513,459 | | |

Valiant Capital Partners, L.P.(2) | | | | | 94,003,401 | | |

Viking Global Equities, L.P. | | | | | 54,806,681 | | |

Private Equity (9.93% of Partners’ Capital) | | | | | | | |

ABRY Advanced Securities Fund, L.P. | | | | | 14,989,680 | | |

Accel-KKR Capital Partners III, L.P.(2) | | | | | 6,778,000 | | |

Advent Latin American Private Equity Fund IV-F, L.P. | | | | | 5,441,204 | | |

Audax Mezzanine Fund II, L.P.(1) | | | | | 4,759,407 | | |

BDCM Opportunity Fund II, L.P. | | | | | 4,834,445 | | |

Brazos Equity Fund II, L.P.(1) | | | | | 1,916,885 | | |

Brazos Equity Fund III, L.P. | | | | | 20,476 | | |

Capital Royalty Partners, L.P.(1) | | | | | 1,437,127 | | |

Carlyle Partners V, L.P.(1) | | | | | 3,806,876 | | |

Catterton Growth Partners, L.P.(2) | | | | | 6,442,971 | | |

CCM Small Cap Value Qualified Fund, L.P.(3) | | | | | 26,157,599 | | |

Chrysalis Ventures III, L.P. | | | | | 1,158,746 | | |

Crosslink Crossover Fund IV, L.P. | | | | | 1,793,711 | | |

Crosslink Crossover Fund V, L.P. | | | | | 23,022,260 | | |

Dace Ventures I, L.P.(2) | | | | | 1,016,195 | | |

Encore Consumer Capital Fund, L.P. | | | | | 2,217,381 | | |

European Divergence Fund, L.P.(3) | | | | | 89,262,288 | | |

Fairhaven Capital Partners, L.P. | | | | | 2,744,958 | | |

GMO Emerging Illiquid Fund, L.P.(1) | | | | | 8,271,849 | | |

Harbinger Capital Partners Special Situations Fund, L.P. | | | | | 19,291,789 | | |

HealthCor Partners Fund, L.P.(2) | | | | | 3,280,240 | | |

Integral Capital Partners VIII, L.P.(2) | | | | | 16,152,023 | | |

See accompanying notes to financial statements.

7

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

United States (continued) | | | | | | | |

Private Equity (9.93% of Partners’ Capital) (continued) | | | | | | | |

MatlinPatterson Global Opportunities Partners III, L.P. | | | | $ | 8,668,782 | | |

Monomoy Capital Partners, L.P.(1) | | | | | 2,841,107 | | |

Paulson Credit Opportunities, L.P.(2) | | | | | 129,216,188 | | |

Pine Brook Capital Partners, LP(1) | | | | | 7,124,710 | | |

Pinto America Growth Fund, L.P.(1) | | | | | 868,916 | | |

Private Equity Investment Fund IV, L.P.(1)(2) | | | | | 6,971,683 | | |

Private Equity Investors Fund V, L.P.(2) | | | | | 5,980,053 | | |

Q Funding III, L.P.(2) | | | | | 12,921,502 | | |

Q4 Funding, L.P.(2) | | | | | 36,403,334 | | |

Saints Capital VI, L.P.(2) | | | | | 8,114,436 | | |

Sanderling Venture Partners VI Co-Investment Fund, L.P. | | | | | 1,393,121 | | |

Sanderling Venture Partners VI, L.P. | | | | | 1,123,635 | | |

Silver Lake Partners III, L.P. | | | | | 3,038,484 | | |

Sterling Capital Partners II, L.P. | | | | | 1,694,002 | | |

Sterling Capital Partners III, L.P. | | | | | 3,224,594 | | |

Sterling Group Partners II, L.P.(1) | | | | | 1,421,986 | | |

Strategic Value Global Opportunities Fund I-A, L.P | | | | | 6,940,279 | | |

Tenaya Capital V, L.P. | | | | | 2,474,633 | | |

The Column Group, L.P. | | | | | 2,789,605 | | |

The Raptor Private Holdings, L.P. | | 12,072 | | | 5,937,266 | | |

The Resolute Fund II, L.P.(1) | | | | | 2,015,801 | | |

Trivest Fund IV, L.P.(2) | | | | | 5,773,050 | | |

Tuckerbrook SB Global Distressed Fund I, L.P.(2) | | | | | 6,667,136 | | |

VCFA Private Equity Partners IV, L.P.(1) | | | | | 2,363,539 | | |

VCFA Venture Partners V, L.P.(1) | | | | | 4,622,350 | | |

Voyager Capital Fund III, L.P. | | | | | 1,119,778 | | |

WestView Capital Partners II, L.P.(2) | | | | | 1,272,200 | | |

Real Estate (3.37% of Partners’ Capital) | | | | | | | |

Aslan Realty Partners III, L.L.C. | | | | | 518,930 | | |

CRM Windridge Partners, L.P.(2) | | | | | 15,288,746 | | |

Cypress Realty VI, L.P. | | | | | 5,110,848 | | |

DaVinci Corporate Opportunity Partners, L.P.(1) | | | | | 373,432 | | |

GTIS Brazil Real Estate Fund (Brazilian Real), LP(2) | | | | | 6,902,006 | | |

ING Clarion Global, L.P.(2) | | | | | 36,189,695 | | |

See accompanying notes to financial statements.

8

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Limited Partnerships, Exempted Limited Partnerships and Limited Liability Companies (continued) | | | | | | | |

United States (continued) | | | | | | | |

Real Estate (3.37% of Partners’ Capital) (continued) | | | | | | | |

Monsoon Infrastructure & Realty Co-Invest, L.P.(2) | | | | $ | 10,601,602 | | |

MONY/Transwestern Mezzanine Realty Partners II, L.L.C. | | | | | 521,600 | | |

Northwood Real Estate Co-Investors L.P. | | | | | 268,844 | | |

Northwood Real Estate Partners L.P. | | | | | 765,049 | | |

Oak Hill REIT Plus Fund, L.P.(2) | | | | | 12,704,167 | | |

Parmenter Realty Fund III, L.P.(1) | | | | | 6,589,553 | | |

Square Mile Partners III L.P. | | | | | 5,059,497 | | |

TCW Special Mortgage Credits Fund II, L.P.(1) | | | | | 71,457,318 | | |

Transwestern Mezzanine Realty Partners III, L.L.C.(2) | | | | | 739,500 | | |

Woodbourne Daybreak Global Fund L.P.(2) | | | | | 2,499,513 | | |

| | | | | | | |

Total United States | | | | | 3,753,070,770 | | |

| | | | | | | |

Total Limited Partnerships, Exempted Limited

Partnerships and Limited Liability Companies | | | | | 4,274,122,965 | | 82.00% |

| | | | | | | |

Passive Foreign Investment Companies | | | | | | | |

Bermuda Limited Liability Company | | | | | | | |

Private Equity (0.25% of Partners’ Capital) | | | | | | | |

El Tejar Limited | | | | | 12,860,000 | | |

| | | | | | | |

Total Bermuda Limited Liability Company | | | | | 12,860,000 | | |

| | | | | | | |

Cayman Companies Limited by Shares | | | | | | | |

Arbitrage Strategies (2.81% of Partners’ Capital) | | | | | | | |

CRC Global Structured Credit Fund Ltd.(2) | | 41,819 | | | 56,051,925 | | |

Overseas CAP Partners, Inc.(3) | | 60,228 | | | 90,211,691 | | |

International Equity (0.99% of Partners’ Capital) | | | | | | | |

Quorum Fund Limited(2) | | 349,876 | | | 17,140,272 | | |

The Russian Prosperity Fund(2) | | 1,056,068 | | | 34,681,260 | | |

Natural Resources (0.18% of Partners’ Capital) | | | | | | | |

Ospraie Special Opportunities (Offshore) Ltd. | | | | | 9,579,616 | | |

| | | | | | | |

Total Cayman Companies Limited by Shares | | | | | 207,664,764 | | |

| | | | | | | |

Republic of Mauritius | | | | | | | |

International Equity (0.57% of Partners’ Capital) | | | | | | | |

India Capital Fund Ltd.(2) | | 597,747 | | | 29,823,743 | | |

| | | | | | | |

Total Republic of Mauritius | | | | | 29,823,743 | | |

| | | | | | | |

Total Passive Foreign Investment Companies | | | | | 250,348,507 | | 4.80% |

| | | | | | | |

See accompanying notes to financial statements.

9

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Private Corporations | | | | | | | |

United States | | | | | | | |

Real Estate (0.33% of Partners’ Capital) | | | | | | | |

Legacy Partners Realty Fund II, Inc | | | | $ | 1,518,885 | | |

Legacy Partners Realty Fund III, Inc | | | | | 312,086 | | |

Net Lease Private REIT V, Inc(1) | | | | | 1,543,669 | | |

Net Lease Private REIT VI, Inc(1) | | | | | 3,985,109 | | |

Net Lease Private REIT VII, Inc(1)(2) | | | | | 5,000,000 | | |

Net Lease Private REIT VII-A, Inc(1)(2) | | | | | 5,000,000 | | |

| | | | | | | |

Total United States | | | | | 17,359,749 | | |

| | | | | | | |

Total Private Corporations | | | | | 17,359,749 | | 0.33% |

| | | | | | | |

Total Investments in Investment Funds

(Cost $4,240,697,829) | | | | | 4,541,831,221 | | 87.13% |

| | | | | | | |

Investments in Securities | | | | | | | |

Investments in Registered Investment Companies | | | | | | | |

Exchange Traded Funds | | | | | | | |

United States | | | | | | | |

Agencies (2.39% of Partners’ Capital) | | | | | | | |

iShares Barclays 20+ Year Treasury Bond Fund(1) | | 1,338,996 | | | 124,829,071 | | |

Domestic Equity (1.32% of Partners’ Capital) | | | | | | | |

iShares Russell 1000 Growth Index Fund(1) | | 931,290 | | | 46,424,806 | | |

Ultrashort Russell 2000 ProShares(1) | | 878,650 | | | 22,133,194 | | |

Natural Resources (2.07% of Partners’ Capital) | | | | | | | |

Market Vectors Gold Miners ETF(1) | | 797,662 | | | 36,859,961 | | |

SPDR Gold Trust | | 663,956 | | | 71,249,118 | | |

| | | | | | | |

Total United States | | | | | 301,496,150 | | |

| | | | | | | |

Total Exchange Traded Funds | | | | | 301,496,150 | | 5.78% |

| | | | | | | |

Open End Funds | | | | | | | |

United States | | | | | | | |

Arbitrage Strategies (0.21% of Partners’ Capital) | | | | | | | |

Fidelity Convertible Securities Fund(1) | | 488,710 | | | 10,653,868 | | |

Domestic Equity (1.22% of Partners’ Capital) | | | | | | | |

Hussman Strategic Growth Fund(1) | | 4,972,365 | | | 63,546,819 | | |

Enhanced Fixed Income (0.20% of Partners’ Capital) | | | | | | | |

Fidelity Floating Rate High Income Fund(1) | | 1,099,296 | | | 10,344,380 | | |

Fixed Income (0.09% of Partners’ Capital) | | | | | | | |

Wasatch Hoisington US Treasury Fund(1) | | 337,603 | | | 4,790,592 | | |

Natural Resources (0.75% of Partners’ Capital) | | | | | | | |

The Tocqueville Gold Fund | | 678,623 | | | 39,000,468 | | |

See accompanying notes to financial statements.

10

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | | |

Investments in Registered Investment Companies (continued) | | | | | | | | |

Open End Funds (continued) | | | | | | | | |

United States (continued) | | | | | | | | |

Real Estate (0.03% of Partners’ Capital) | | | | | | | | |

Ultrashort Real Estate ProShares | | | 224,100 | | $ | 1,678,509 | | |

| | | | | | | | |

Total United States | | | | | | 130,014,636 | | |

| | | | | | | | |

Total Open End Funds | | | | | | 130,014,636 | | 2.50% |

| | | | | | | | |

Total Investments in Registered Investment Companies | | | | | | 431,510,786 | | 8.28% |

| | | | | | | | |

Call Options Purchased | | | | | | | | |

United States (0.74% of Partners’ Capital) | | | | | | | | |

CMS Capital- 10 Year One Look Cap (OTC) | | | | | | | | |

10 Year USD Swap Rate | | | | | | | | |

(Strike Rate 5.50%, Expiration 05/01/19) | | $ | 1,079,000,000 | | | 11,145,086 | | |

CMS Capital- 10 Year One Look Cap (OTC) | | | | | | | | |

10 Year USD Swap Rate | | | | | | | | |

(Strike Rate 5.62%, Expiration 05/02/19) | | $ | 714,285,714 | | | 7,074,512 | | |

CMS Capital- 10 Year One Look Cap (OTC) | | | | | | | | |

10 Year USD Swap Rate | | | | | | | | |

(Strike Rate 6.50%, Expiration 05/01/19) | | $ | 1,350,000,000 | | | 10,284,130 | | |

CMS Capital- 10 Year One Look Cap (OTC) | | | | | | | | |

10 Year USD Swap Rate | | | | | | | | |

(Strike Rate 6.62%, Expiration 05/02/19) | | $ | 877,192,983 | | | 6,438,166 | | |

PowerShares DB US Dollar Index Bullish Fund | | | | | | | | |

(Strike Price $24.00, Expiration 03/20/10) | | | 135,000 | | | 3,375,000 | | |

| | | | | | | | |

Total United States | | | | | | 38,316,894 | | |

| | | | | | | | |

Total Call Options Purchased | | | | | | 38,316,894 | | 0.74% |

| | | | | | | | |

Put Options Purchased | | | | | | | | |

United States (0.01% of Partners’ Capital) | | | | | | | | |

Domestic Equity | | | | | | | | |

iShares Russell 2000 Index Fund | | | | | | | | |

(Strike Price $54.00, Expiration 01/16/10) | | | 27,000 | | | 270,000 | | |

International Equity | | | | | | | | |

iShares MSCI Emerging Markets Index Fund | | | | | | | | |

(Strike Price $35.00, Expiration 01/16/10) | | | 38,000 | | | 190,000 | | |

Natural Resources | | | | | | | | |

Market Vectors Gold Miners ETF | | | | | | | | |

(Strike Price $38.00, Expiration 01/16/10) | | | 15,000 | | | 90,000 | | |

See accompanying notes to financial statements.

11

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

December 31, 2009

| | | | | | | |

| | | Shares/

Par Value* | | Fair

Value | | % of

Partners’

Capital |

| | | | | | | |

Put Options Purchased (continued) | | | | | | | |

United States (0.01% of Partners’ Capital) (continued) | | | | | | | |

Natural Resources (continued) | | | | | | | |

SPDR Gold Trust | | | | | | | |

(Strike Price $95.00, Expiration 01/16/10) | | 20,000 | | $ | 100,000 | | |

| | | | | | | |

Total United States | | | | | 650,000 | | |

| | | | | | | |

Total Put Options Purchased | | | | | 650,000 | | 0.01% |

| | | | | | | |

Total Investments in Securities (Cost $475,178,323) | | | | | 470,477,680 | | 9.03% |

| | | | | | | |

Total Investments (Cost $4,715,876,152) | | | | $ | 5,012,308,901 | | 96.16% |

| | | | | | | |

The Master Fund’s total outstanding capital commitments to Investment Funds as of December 31, 2009 were $951,813,066. For certain Investment Funds for which the Master Fund has a capital commitment, the Master Fund may be allocated its pro-rata share of expenses prior to having to fund a capital call for such expenses.

All securities are non-income producing unless noted with a (1).

Refer to Note 4, Investments in Portfolio Securities, for information regarding the liquidity of the Master Fund’s investments.

| * | Shares, par value, notional amounts or contracts is listed for each investment if it is applicable for that investment type. |

| (1) | Income producing security. |

| (2) | Affiliated investments. |

| (3) | Affiliated investments for which ownership exceeds 25%. |

See accompanying notes to financial statements.

12

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Statement of Operations

Year Ended December 31, 2009

| | | | |

Investment income: | | | | |

Dividend income (net of foreign withholding tax of $80,196) | | $ | 10,486,042 | |

Interest income | | | 848,756 | |

Dividend income from affiliated investments | | | 904,260 | |

Interest income from affiliated investments | | | 245,291 | |

| | | | |

Total investment income | | | 12,484,349 | |

| | | | |

Expenses: | | | | |

Investment Management Fees | | | 50,501,255 | |

Administration fees | | | 2,329,428 | |

Legal fees | | | 740,497 | |

Professional fees | | | 1,083,443 | |

Custodian fees | | | 534,398 | |

Directors fees | | | 345,500 | |

Offshore withholding tax expense | | | 2,430,958 | |

Other expenses | | | 1,932,236 | |

| | | | |

Total expenses | | | 59,897,715 | |

| | | | |

Net investment loss | | | (47,413,366 | ) |

| | | | |

Net realized and unrealized gain (loss) from investments, affiliated investments, foreign currency transactions, options and redemptions in-kind: | | | | |

Net realized loss from investments, foreign currency transactions and options | | | (15,724,902 | ) |

Net realized loss from redemptions in-kind | | | (2,297,799 | ) |

Net realized loss from affiliated investments and foreign currency transactions | | | (28,864,561 | ) |

Change in unrealized appreciation/depreciation from investments | | | 799,921,746 | |

| | | | |

Net realized and unrealized gain from investments, affiliated investments, foreign currency transactions, options and redemptions in-kind | | | 753,034,484 | |

| | | | |

Net increase in partners’ capital resulting from operations | | $ | 705,621,118 | |

| | | | |

See accompanying notes to financial statements.

13

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Statement of Changes in Partners’ Capital

Years Ended December 31, 2008 and December 31, 2009

| | | | |

Partners’ capital at December 31, 2007 | | $ | 3,269,968,680 | |

Contributions | | | 3,111,597,819 | |

Withdrawals | | | (366,685,155 | ) |

Net decrease in partners’ capital resulting from operations: | | | | |

Net investment loss | | | (55,604,043 | ) |

Net realized loss from investments, options sold, not yet purchased and foreign currency transactions | | | (331,392,248 | ) |

Net realized loss from affiliated investments | | | (19,691,837 | ) |

Change in unrealized appreciation/depreciation from investments | | | (945,007,976 | ) |

| | | | |

Net decrease in partners’ capital resulting from operations | | | (1,351,696,104 | ) |

| | | | |

Partners’ capital at December 31, 2008 | | | 4,663,185,240 | |

| | | | |

Contributions | | | 714,436,768 | |

Withdrawals | | | (870,632,191 | ) |

Net increase in partners’ capital resulting from operations: | | | | |

Net investment loss | | | (47,413,366 | ) |

Net realized loss from investments, foreign currency transactions and options | | | (15,724,902 | ) |

Net realized loss from redemptions in-kind | | | (2,297,799 | ) |

Net realized loss from affiliated investments and foreign currency transactions | | | (28,864,561 | ) |

Change in unrealized appreciation/depreciation from investments | | | 799,921,746 | |

| | | | |

Net increase in partners’ capital resulting from operations | | | 705,621,118 | |

| | | | |

Partners’ capital at December 31, 2009 | | $ | 5,212,610,935 | |

| | | | |

See accompanying notes to financial statements.

14

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Statement of Cash Flows

Year Ended December 31, 2009

| | | | |

Cash flows from operating activities: | | | | |

Net increase in partners’ capital resulting from operations | | $ | 705,621,118 | |

Adjustments to reconcile net increase in partners’ capital resulting from operations to net cash provided by operating activities: | | | | |

Purchases of investments | | | (1,375,338,564 | ) |

Proceeds from disposition of investments | | | 1,493,223,429 | |

Net realized loss from investments, foreign currency transactions and options | | | 15,724,902 | |

Net realized loss from redemptions in-kind | | | 2,297,799 | |

Net realized loss from affiliated investments and foreign currency transactions | | | 28,864,561 | |

Change in unrealized appreciation/depreciation from investments | | | (799,921,746 | ) |

Decrease in prepaid contributions to Investment Funds | | | 62,608,241 | |

Increase in interest and dividends receivable | | | (108,673 | ) |

Decrease in interest and dividends receivable from affiliated investments | | | 139,604 | |

Decrease in receivable from investments sold | | | 93,111,921 | |

Increase in prepaids and other assets | | | (45,394 | ) |

Increase in Investment Management Fees payable | | | 1,210,436 | |

Decrease in offshore withholding tax payable | | | (3,216,474 | ) |

Decrease in administration fees payable | | | (293,623 | ) |

Increase in payable to related parties | | | 61,309 | |

Increase in accounts payable and accrued expenses | | | 572,803 | |

| | | | |

Net cash provided by operating activities | | | 224,511,649 | |

| | | | |

Cash flows from financing activities: | | | | |

Contributions | | | 712,740,444 | |

Withdrawals | | | (832,977,951 | ) |

| | | | |

Net cash used in financing activities | | | (120,237,507 | ) |

| | | | |

Net increase in cash and cash equivalents | | | 104,274,142 | |

Cash and cash equivalents at beginning of year | | | 81,874,165 | |

| | | | |

Cash and cash equivalents at end of year | | $ | 186,148,307 | |

| | | | |

Supplemental schedule of cash activity: | | | | |

Cash paid for interest | | $ | 12,479 | |

Cash paid for offshore withholding taxes | | | 16,221,914 | |

Supplemental schedule of noncash activity: | | | | |

Redemptions in-kind (Cost $16,601,081) | | $ | 14,303,282 | |

See accompanying notes to financial statements.

15

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements

December 31, 2009

(1) ORGANIZATION

The Endowment Master Fund, L.P. (the “Master Fund”) is a limited partnership organized under the laws of the state of Delaware. The Master Fund began operations in April 2003 (“Inception”). The Master Fund operated as an unregistered investment vehicle until March 10, 2004, at which time it registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Master Fund is the master fund in a master-feeder structure in which there are currently seven feeder funds.

The Master Fund’s investment objective is to preserve capital and to generate consistent long-term appreciation and returns across a market cycle (which is estimated to be five to seven years). The Master Fund pursues its investment objective by investing its assets in a variety of investment vehicles including but not limited to limited partnerships, limited liability companies, offshore corporations and other foreign investment vehicles (collectively, the “Investment Funds”), registered investment companies (including exchange traded funds) and direct investments in marketable securities and derivative instruments. The Master Fund is primarily a “fund of funds” and is intended to afford investors the ability to invest in a multi-manager portfolio, exhibiting a variety of investment styles and philosophies, in an attempt to achieve positive risk-adjusted returns over an extended period of time. The Master Fund’s investments are managed by a select group of investment managers identified by the Adviser, as hereinafter defined, to have investments that when grouped with other investments of the Master Fund result in a portfolio that is allocated more broadly across markets, asset classes, and risk profiles.

The Endowment Fund GP, L.P., a Delaware limited partnership, serves as the general partner of the Master Fund (the “General Partner”). To the fullest extent permitted by applicable law, the General Partner has irrevocably delegated to a board of directors (the “Board” and each member a “Director”) its rights and powers to monitor and oversee the business affairs of the Master Fund, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct, and operation of the Master Fund’s business. A majority of the members of the Board are independent of the General Partner and its management. To the extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Master Fund, the Adviser, or any committee of the Board.

The Board is authorized to engage an investment adviser and it has selected Endowment Advisers, L.P. (the “Adviser”), to manage the Master Fund’s portfolio and operations, pursuant to an investment management agreement (the “Investment Management Agreement”). The Adviser is a Delaware limited partnership that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Under the Investment Management Agreement, the Adviser is responsible for the establishment of an investment committee (the “Investment Committee”), which is responsible for developing, implementing, and supervising the Master Fund’s investment program subject to the ultimate supervision of the Board.

Under the Master Fund’s organizational documents, the Master Fund’s officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Master Fund. In the normal course of business, the Master Fund enters into contracts with service providers, which also provide for indemnifications by the Master Fund. The Master Fund’s maximum exposure under these arrangements is unknown, as this would involve any future potential claims that may be made against the Master Fund. However, based on experience, the General Partner expects that risk of loss to be remote.

16

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES

(a) BASIS OF ACCOUNTING

The accounting and reporting policies of the Master Fund conform with U.S. generally accepted accounting principles (“GAAP”).

(b) CASH EQUIVALENTS

The Master Fund considers all unpledged temporary cash investments with a maturity date at the time of purchase of three months or less to be cash equivalents.

(c) INVESTMENT SECURITIES TRANSACTIONS

The Master Fund records security transactions on a trade-date basis.

Investments that are held by the Master Fund, including those that have been sold but not yet purchased, are marked to estimated fair value at the date of the financial statements, and the corresponding change in unrealized appreciation/depreciation is included in the Statement of Operations.

In general, distributions received from Investment Funds are accounted for as a reduction to cost and any proceeds received above the allocated cost basis results in a realized gain. Realized gains or losses on the disposition of investments are accounted for based on the first in first out (“FIFO”) method.

(d) VALUATION OF INVESTMENTS

The valuation of the Master Fund’s investments will be determined as of the close of business at the end of any fiscal period, generally monthly. The valuation of the Master Fund’s investments is calculated by Citi Fund Services Ohio, Inc., the Master Fund’s independent administrator (the “Independent Administrator”).

The Board has formed a valuation committee (the “Board Valuation Committee”) that is responsible for overseeing the Master Fund’s valuation policies, making recommendations to the Board on valuation-related matters, and overseeing implementation by the Adviser’s Valuation Committee (as defined below) of the Master Fund’s valuation policies that the Board of the Master Fund has approved for purposes of determining the value of securities held by the Master Fund, including the fair value of the Master Fund’s investments in Investment Funds.

The Board has also authorized the establishment of a valuation committee of the Adviser (the “Adviser Valuation Committee”). The Adviser’s Valuation Committee’s function, subject to the oversight of the Board Valuation Committee and the Board, is generally to review the Investment Funds’ valuation methodologies, valuation determinations, and any information provided to the Adviser’s Valuation Committee by the Adviser or the Independent Administrator.

Investments held by the Master Fund are valued as follows:

| | • | | INVESTMENT FUNDS—Investments in Investment Funds are ordinarily carried at estimated fair value based on the valuations provided to the Independent Administrator by the investment managers of such Investment Funds or the administrators of such Investment Funds. These Investment Funds |

17

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

| | value their underlying investments in accordance with policies established by such Investment Funds. Prior to investing in any Investment Fund, the Adviser’s Valuation Committee, as part of the due diligence process, conducts a review of the valuation methodologies employed by the Investment Fund to determine whether such methods are appropriate for the asset types. The Master Fund’s valuations utilize the available financial information supplied by each Investment Fund and are net of management and estimated performance incentive fees or allocations payable to the Investment Funds’ managers pursuant to the Investment Funds’ agreements. Generally, Investment Funds in which the Master Fund invests will use market value when available, and otherwise will use principles of fair value applied in good faith. The Adviser’s Valuation Committee will consider whether it is appropriate, in light of the relevant circumstances, to value interests at net asset value as reported by an Investment Fund for valuation purposes, or whether to adjust such reported value to reflect estimated fair value. Because of the inherent uncertainty of valuation, this estimated fair value may significantly differ from the value that would have been used had a ready market for the investments in Investment Funds existed and such differences may be significant. The Master Fund’s investments in Investment Funds are subject to the terms and conditions of the respective operating agreements and offering memoranda of such Investment Funds. |

| | • | | SECURITIES LISTED ON A SECURITIES EXCHANGE—Securities listed 1) on one or more of the national securities exchanges or the OTC Bulletin Board are valued at the last reported sales price on the date of determination; and 2) on the Nasdaq Stock Market are valued at the Nasdaq Official Closing Price (“NOCP”), at the close of trading on the primary exchanges or markets where such securities are traded for the business day as of which such value is being determined. If the last reported sales price or the NOCP is not available, the securities are valued at the mean between the “bid” and “ask” prices at the close of trading on that date. Securities traded on a foreign securities exchange will generally be valued at their closing prices on the exchange where such securities are primarily traded and translated into U.S. dollars at the current exchange rate. If an event occurs between the close of the foreign exchange and the valuation date of the Master Fund’s net asset value that would materially affect the value of the security and the net asset value of the Master Fund, the value of such security and the net asset value of the Master Fund will be adjusted to reflect the change in the estimated value of the security. |

| | • | | OPTIONS—Options that are listed on a securities exchange or traded over-the-counter are valued at the mean between the closing “bid” and “ask” prices for such options on the date of determination. |

| | • | | SECURITIES NOT ACTIVELY TRADED—The value of securities, derivatives or synthetic securities that are not actively traded on an exchange shall be determined by obtaining quotes from brokers that normally deal in such securities or by an unaffiliated pricing service that may use actual trade data or procedures using market indices, matrices, yield curves, specific trading characteristics of certain groups of securities, pricing models or a combination of these procedures. |

| | • | | OTHER—Where no value is readily available from an Investment Fund or other security or where a value supplied by an Investment Fund is deemed not to be indicative of the Investment Fund’s value, the Adviser’s Valuation Committee and/or the Board Valuation Committee, in consultation with the Independent Administrator or the Adviser will determine, in good faith, the estimated fair value of the Investment Fund or security. |

| | • | | FOREIGN CURRENCY TRANSACTIONS—The accounting records of the Master Fund are maintained in U.S. dollars. Investments of the Master Fund denominated in a foreign currency, if any, are translated into U.S. dollar amounts at current exchange rates on the date of valuation. Purchases and |

18

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

| | sales of investments and income and expense items denominated in foreign securities are translated into U.S. dollar amounts at the exchange rate on the respective dates of such transactions. The Master Fund does not isolate the realized or unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the value of investments. |

(e) FAIR VALUE MEASUREMENTS

The Master Fund defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The inputs used to determine the fair value of the Master Fund’s investments are summarized in the three broad levels listed below:

| | • | | Level 1—quoted prices in active markets for identical assets. |

| | • | | Level 2—other significant inputs (including quoted prices of similar securities, interest |

rates, prepayment speeds, credit risk, etc.).

| | • | | Level 3—significant unobservable inputs (which may include the Master Fund’s own |

assumptions in determining the fair value of investments).

The inputs or methodology used to value investments are not necessarily an indication of the risk associated with investing in those securities.

When determining the fair value of the Master Fund’s investments, additional consideration is given to those assets or liabilities that have experienced a decrease in volume or level of activity in the primary market in which such investments normally trade (if any) for which circumstances have been identified that indicate that transactions in such markets may not be orderly.

19

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

The following is a summary categorization, as of December 31, 2009, of the Master Fund’s investments based on the level of inputs utilized in determining the value of such investments:

| | | | | | | | | | | |

| | | LEVEL 1

Quoted Prices | | LEVEL 2

Other Significant

Observable Inputs | | LEVEL 3

Significant

Unobservable Inputs | | Total |

| | | Investment

Securities | | Investment

Securities | | Investment

Funds | | Investments |

Assets | | | | | | | | | | | |

Limited Partnerships, Exempted Limited | | | | | | | | | | | |

Partnerships and Limited Liability Companies | | | | | | | | | | | |

Arbitrage Strategies | | | — | | — | | $ | 780,427,546 | | $ | 780,427,546 |

Domestic Equity | | | — | | — | | | 393,002,964 | | | 393,002,964 |

Energy | | | — | | — | | | 399,136,823 | | | 399,136,823 |

Enhanced Fixed Income | | | — | | — | | | 627,493,975 | | | 627,493,975 |

International Equity | | | — | | — | | | 493,733,501 | | | 493,733,501 |

Natural Resources | | | — | | — | | | 14,526,615 | | | 14,526,615 |

Opportunistic Equity | | | — | | — | | | 696,964,621 | | | 696,964,621 |

Private Equity | | | — | | — | | | 650,979,483 | | | 650,979,483 |

Real Estate | | | — | | — | | | 217,857,437 | | | 217,857,437 |

Passive Foreign Investment Companies | | | | | | | | | | | |

Arbitrage Strategies | | | — | | — | | | 146,263,616 | | | 146,263,616 |

International Equity | | | — | | — | | | 81,645,275 | | | 81,645,275 |

Natural Resources | | | — | | — | | | 9,579,616 | | | 9,579,616 |

Private Equity | | | — | | — | | | 12,860,000 | | | 12,860,000 |

Private Corporations | | | | | | | | | | | |

Real Estate | | | — | | — | | | 17,359,749 | | | 17,359,749 |

Investments in Registered Investment Companies | | | | | | | | | | | |

Arbitrage Strategies | | $ | 10,653,868 | | — | | | — | | | 10,653,868 |

Agencies | | | 124,829,071 | | — | | | — | | | 124,829,071 |

Domestic Equity | | | 132,104,819 | | — | | | — | | | 132,104,819 |

Enhanced Fixed Income | | | 10,344,380 | | — | | | — | | | 10,344,380 |

Fixed Income | | | 4,790,592 | | — | | | — | | | 4,790,592 |

Natural Resources | | | 147,109,547 | | — | | | — | | | 147,109,547 |

Real Estate | | | 1,678,509 | | — | | | — | | | 1,678,509 |

Call Options Purchased | | | — | | 38,316,894 | | | — | | | 38,316,894 |

Put Options Purchased | | | 650,000 | | — | | | — | | | 650,000 |

| | | | | | | | | | | |

Total Assets | | $ | 432,160,786 | | 38,316,894 | | $ | 4,541,831,221 | | $ | 5,012,308,901 |

| | | | | | | | | | | |

The categorization of investments amongst Levels 1 through 3 does not reflect the fact that many of the underlying investments held by the Investment Funds included in Level 3, if owned directly by the Master Fund, would be classified as Level 1 investments.

20

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | | | | | | | | | | | | | | |

| | | Investments |

| | | Balance as of

December 31,

2008 | | Net Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation/

Depreciation | | | Gross

Purchases | | Gross

(Sales) | | | Balance as of

December 31,

2009 |

Investments | | | | | | | | | | | | | | | | | | | | | |

Limited Partnerships, Exempted Limited | | | | | | | | | | | | | | | | | | | | | |

Partnerships and Limited Liability Companies | | | | | | | | | | | | | | | | | | | | | |

Arbitrage Strategies | | $ | 778,186,928 | | $ | 34,843,147 | | | $ | 140,322,997 | | | $ | 133,723,463 | | $ | (306,648,989 | ) | | $ | 780,427,546 |

Domestic Equity | | | 366,450,287 | | | (16,511,223 | ) | | | 59,124,888 | | | | 78,774,765 | | | (94,835,753 | ) | | | 393,002,964 |

Energy | | | 297,835,081 | | | 4,846,248 | | | | 95,338,869 | | | | 67,864,194 | | | (66,747,569 | ) | | | 399,136,823 |

Enhanced Fixed Income | | | 712,823,535 | | | 28,542,419 | | | | 146,565,079 | | | | 130,238,588 | | | (390,675,646 | ) | | | 627,493,975 |

International Equity | | | 417,914,507 | | | (50,487,834 | ) | | | 122,625,461 | | | | 80,000,000 | | | (76,318,633 | ) | | | 493,733,501 |

Natural Resources | | | 6,900,383 | | | — | | | | 2,775,326 | | | | 4,850,906 | | | — | | | | 14,526,615 |

Opportunistic Equity | | | 450,958,373 | | | 313,173 | | | | 22,032,573 | | | | 273,546,549 | | | (49,886,047 | ) | | | 696,964,621 |

Private Equity | | | 494,486,978 | | | 2,854,020 | | | | 69,551,886 | | | | 157,384,895 | | | (73,298,296 | ) | | | 650,979,483 |

Real Estate | | | 236,660,636 | | | (12,372,752 | ) | | | 22,663,618 | | | | 48,375,666 | | | (77,469,731 | ) | | | 217,857,437 |

Passive Foreign Investment Companies | | | | | | | | | | | | | | | | | | | | | |

Arbitrage Strategies | | | 114,277,935 | | | — | | | | 16,985,681 | | | | 15,000,000 | | | — | | | | 146,263,616 |

International Equity | | | 40,163,837 | | | (13,111,120 | ) | | | 61,481,438 | | | | 10,000,000 | | | (16,888,880 | ) | | | 81,645,275 |

Natural Resources | | | 9,438,103 | | | — | | | | 141,513 | | | | — | | | — | | | | 9,579,616 |

Private Equity | | | 9,700,000 | | | — | | | | 3,160,000 | | | | — | | | — | | | | 12,860,000 |

Real Estate | | | 7,019,400 | | | (3,710,112 | ) | | | 2,980,600 | | | | — | | | (6,289,888 | ) | | | — |

Private Corporations | | | | | | | | | | | | | | | | | | | | | |

Real Estate | | | 22,091,745 | | | — | | | | (8,768,056 | ) | | | 4,036,060 | | | — | | | | 17,359,749 |

| | | | | | | | | | | | | | | | | | | | | |

Total Investments | | $ | 3,964,907,728 | | $ | (24,794,034 | ) | | $ | 756,981,873 | | | $ | 1,003,795,086 | | $ | (1,159,059,432 | ) | | $ | 4,541,831,221 |

| | | | | | | | | | | | | | | | | | | | | |

The net realized gain (loss) and change in unrealized appreciation/depreciation in the table above are reflected in the accompanying Statement of Operations. The change in unrealized appreciation/ depreciation from Level 3 investments held at December 31, 2009 is $723,282,372.

(f) INVESTMENT INCOME

For investments in securities, dividend income is recorded on the ex-dividend date, net of withholding taxes. Interest income is recorded as earned on the accrual basis and includes amortization of premiums or accretion of discounts.

21

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

(g) FUND EXPENSES

Unless otherwise voluntarily or contractually assumed by the Adviser or another party, the Master Fund bears all expenses incurred in its business, including, but not limited to, the following: all costs and expenses related to investment transactions and positions for the Master Fund’s account; legal fees; accounting, auditing and tax preparation fees; recordkeeping and custodial fees; costs of computing the Master Fund’s net asset value; fees for data and software providers; research expenses; costs of insurance; registration expenses; offering costs; expenses of meetings of the partners; directors fees; all costs with respect to communications to partners; transfer taxes, offshore withholding taxes and taxes withheld on non-U.S. dividends; interest and commitment fees on loans and debit balances; and other types of expenses as may be approved from time to time by the Board. Offering costs are amortized over a twelve-month period or less from the date they are incurred.

(h) INCOME TAXES

The Master Fund is organized and operated as a limited partnership and is not subject to income taxes as a separate entity. Such taxes are the responsibility of the individual partners. Accordingly, no provision for income taxes has been made in the Master Fund’s financial statements. Investments in foreign securities may result in foreign taxes being withheld by the issuer of such securities. For U.S. offshore withholding tax, the Master Fund may serve as withholding agent for its offshore feeder funds.

The Master Fund has evaluated the tax positions taken or expected to be taken in the course of preparing the Master Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the Master Fund upon challenge by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold and that would result in a tax benefit or expense to the Master Fund would be recorded as a tax benefit or expense in the current period. For the year ended December 31, 2009, the Master Fund did not recognize any amounts for unrecognized tax benefit/expense. A reconciliation of unrecognized tax benefit/expense is not provided herein, as the beginning and ending amounts of unrecognized tax benefit/expense are zero, with no interim additions, reductions or settlements. Tax positions taken in tax years which remain open under the statute of limitations (generally three years for federal income tax purposes) are subject to examination by tax authorities.

(i) USE OF ESTIMATES

The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences may be significant.

(j) DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Master Fund may purchase or sell options as part of an asset overlay strategy to create investment exposure consistent with the Master Fund’s investment objectives. The Master Fund has invested in call and put option contracts during the year to adjust its exposure to potential changes in interest rates and to better manage risk related to certain strategies in the Master Fund’s Portfolio. The Master Fund’s direct investments in derivatives during the year ended December 31, 2009, consisted of the purchase, sale, execution and expiration of call and put options.

22

THE ENDOWMENT MASTER FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

December 31, 2009

Investment Funds in which the Master Fund invests will purchase and sell derivative securities and other financial instruments. The following is a summary of the fair value of derivative instruments held directly by the Master Fund as of December 31, 2009 and where such derivatives are recorded:

| | | | | |

| | | Asset Derivatives |

Primary Risk Exposure | | Statements of Assets and Liabilities | | Total Fair Value |

Options Contracts | | | | | |

Equity and Commodity Exposure: | | Investments in Securities, at fair value | | $ | 650,000 |

Interest Rate Exposure: | | Investments in Securities, at fair value | | | 38,316,894 |

The following is a summary of the effect of the Master Fund’s direct investments in derivative instruments on the Statement of Operations for the year ended December 31, 2009:

| | | | | | | | | |

Primary Risk Exposure | | Location of Gain (Loss)

from Derivatives

Recognized in Income | | Realized Gain

from Derivatives