UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a – 101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrant ☒

Filed by party other than Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Universal Biosensors, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| | (1) | Title of each class of securities to which transaction applies |

| | | |

| | (2) | Aggregate number of securities to which transaction applies |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set for the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

☐ Fee paid previously with preliminary materials

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

Universal Biosensors, Inc. ABN 67 950 836 446 1 Corporate Avenue Rowville Victoria 3178 Australia | |

Telephone: | +61 3 9213 9000 |

Facsimile: | +61 3 9213 9099 |

Email: | info@universalbiosensors.com |

www.universalbiosensors.com

May 3, 2021

Dear Stockholder:

You are cordially invited to the Annual Meeting (the “Meeting”) of stockholders of Universal Biosensors, Inc. (the “Company”, “we”, “our” or “UBI”), to be held on June 30, 2021 at 10:00 a.m. Australian Eastern Standard Time.

We discuss the matters to be acted upon at the Meeting in more detail in the attached Notice of Meeting and Proxy Statement. A copy of our annual report on Form 10-K for the fiscal year ended December 31, 2020 is available at our website at www.universalbiosensors.com and has been previously distributed to you or is accompanying this Proxy Statement. We encourage you to read the annual report. It includes our audited financial statements and other important information about us.

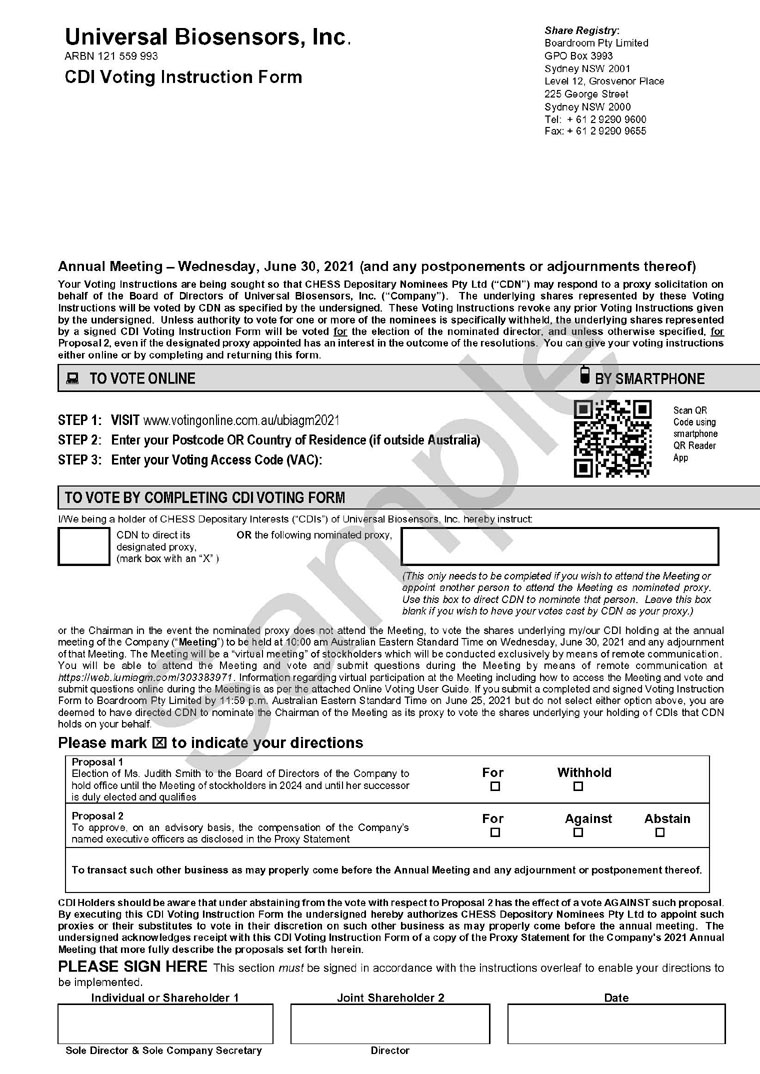

If you are a CDI Holder, to ensure your representation, please sign, date and return the enclosed CDI Voting Instruction Form or give your instructions online using the instructions on your CDI Voting Instruction Form. If you are a stockholder, please sign, date and return the enclosed Proxy Card. We hope that you can attend the Meeting.

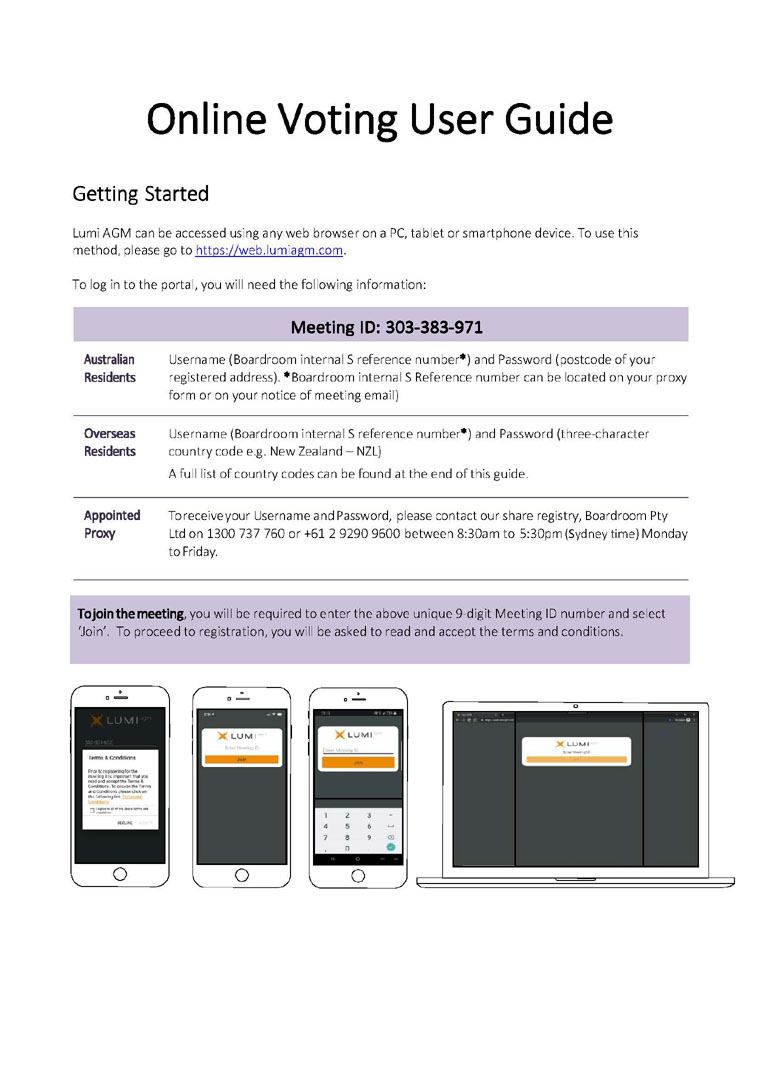

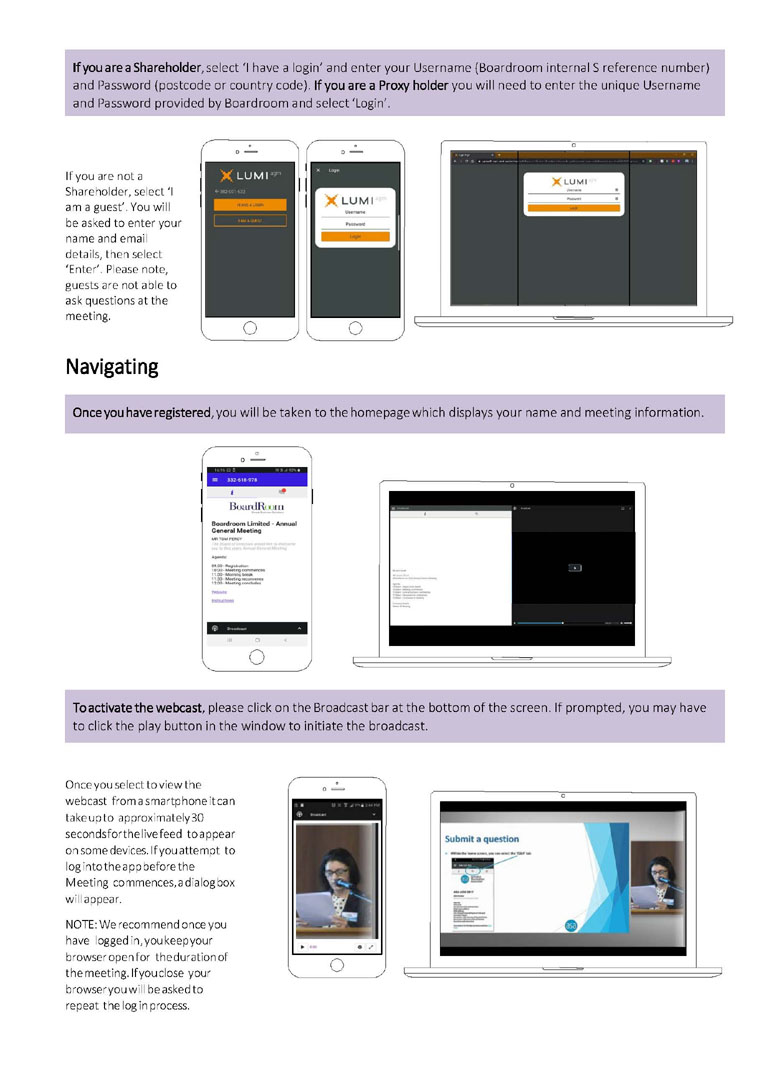

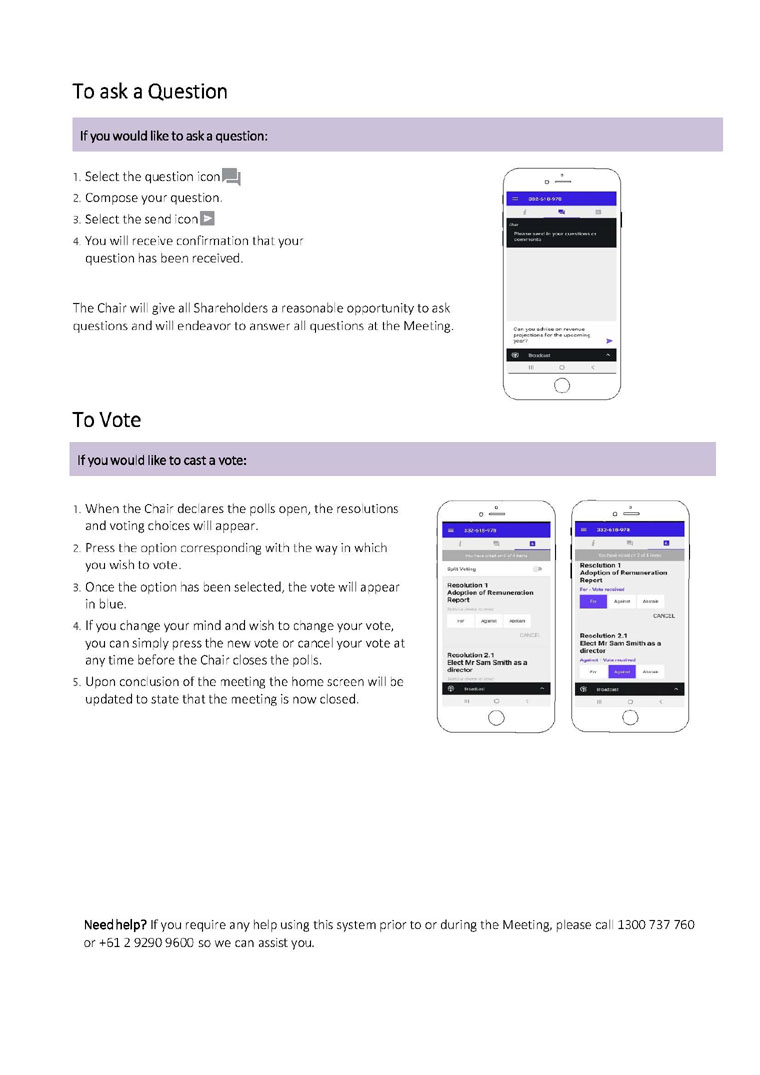

The Meeting will be a “virtual meeting” of stockholders which will be conducted exclusively by means of remote communication. You will be able to attend the Meeting and vote and submit questions during the Meeting by means of remote communication at https://web.lumiagm.com/303383971. Information regarding virtual participation at the Meeting including how to access the Meeting and vote and submit questions online during the Meeting is as per the attached Online Vote User Guide.

Thank you for your continued support of UBI.

Yours sincerely,

/s/ Craig Coleman

Mr. Craig Coleman

Non-executive Chairman

UNIVERSAL BIOSENSORS, INC.

NOTICE OF MEETING OF STOCKHOLDERS

TO BE HELD JUNE 30, 2021

May 3, 2021

NOTICE IS HEREBY GIVEN that the 2021 Annual General Meeting of stockholders (the “Meeting”) of Universal Biosensors, Inc. (ARBN 121 559 993) (the “Company”) will be held on June 30, 2021 at 10:00 a.m. Australian Eastern Standard Time. The Meeting will be a “virtual meeting” of stockholders for the purposes described below.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON JUNE 30, 2021

Date and Time: | | Wednesday, June 30, 2021 at 10:00 a.m. Australian Eastern Standard Time |

Items of Business: | | 1) | To consider and vote on the election of one member of the Board of Directors to hold office until the Meeting of stockholders in 2024 and until her successor is duly elected and qualifies; |

| | | | |

| | | 2) | To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement; and |

| | | | |

| | | 3) | To transact such other business as may properly come before the Meeting and any adjournment or postponement thereof. |

| | | |

| | | The Board of Directors recommends that you vote “For” the nominee for director named in the accompanying proxy statement and “For” Proposal 2. |

| | | |

Record Date: | | The record date for the determination of (i) stockholders of record entitled to receive notice of and to vote at the Meeting and (ii) holders of CDIs of record entitled to receive notice of and to direct CHESS Depositary Nominees Pty Ltd ACN 071 346 506 (“CDN”) how to vote at the Meeting, or any adjournments or postponements thereof, is the close of business on May 3, 2021. A complete list of stockholders and CDI holders of record on the record date will be available at the Company’s principal executive offices located at 1 Corporate Avenue, Rowville VIC 3178 Australia, for ten days before the Meeting and will be accessible during the virtual Meeting. |

| | | |

Internet Availability of Documents: | | You may access a copy of the proxy statement and the Company’s annual report on Form 10-K for the year ended December 31, 2020 at http://www.universalbiosensors.com/ under the Investor Centre tab. |

These items are fully discussed in the following pages, which are made part of this notice.

If you are a stockholder, you are encouraged to vote your shares by signing, dating and mailing your Proxy Card in the enclosed envelope or by attending the Meeting or. If you are a CDI Holder, you are encouraged to vote your CDIs by signing, dating and mailing your CDI Voting Instruction Form to the Company’s registrar in the enclosed envelope. Instructions for voting are set forth on the CDI Voting Instruction Form. Alternatively, holders of CDIs can direct CDN how to vote online by following the instructions at www.votingonline.com.au/ubiagm2021.

The Meeting will be a “virtual meeting” of stockholders which will be conducted exclusively by means of remote communication. You will be able to attend the Meeting by means of remote communication at https://web.lumiagm.com/303383971.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Craig Coleman

Craig Coleman

Non-executive Chairman

YOUR VOTE IS IMPORTANT, WHETHER YOU OWN A FEW SHARES/CDIs OR MANY.

This Notice and Proxy Statement is being first mailed to stockholders and CDI Holders of UBI on or after May 3, 2021.

UNIVERSAL BIOSENSORS, INC.

PROXY STATEMENT FOR MEETING OF STOCKHOLDERS

To be held June 30, 2021

TABLE OF CONTENTS

| | Page |

Information About Solicitation and Voting | 1 |

Proposal One – Election of Director | 3 |

Proposal Two – Advisory Vote on the Compensation of Senior Executives | 4 |

Management of the Company | 5 |

Executive Compensation | 11 |

Independent Public Accountants | 15 |

Security Ownership of Certain Beneficial Owners and Management | 16 |

Certain Relationships and Related Transactions | 18 |

Stockholder Communications with Board of Directors | 19 |

Availability of Form 10-K | 19 |

Where You Can Find More Information | 19 |

Householding | 20 |

UNIVERSAL BIOSENSORS, INC.

PROXY STATEMENT FOR MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 30, 2021

INFORMATION ABOUT SOLICITATION AND VOTING

General

The enclosed proxy and CDI Voting Instruction Form is solicited by the Board of Directors of Universal Biosensors, Inc. (the “Company” or “UBI”) for use in voting at the 2021 Annual General Meeting of stockholders (the “Meeting”) to be held on June 30, 2021 at 10:00 a.m. Australian Eastern Standard Time, and any postponement or adjournment of that Meeting. The Meeting will be a “virtual meeting” of stockholders which will be conducted by means of remote communication. The purpose of the Meeting is to consider and vote upon the proposals outlined in this Proxy Statement and the attached notice.

Record Date and Voting Securities

As of the close of business on May 3, 2021, the record date, there are in total 177,621,854 shares of the Company’s common stock, par value US$0.0001 per share, outstanding and entitled to vote at the Meeting. 177,542,700 of our outstanding shares are held by CHESS Depositary Nominees Pty Ltd ACN 071 346 506 (“CDN”), a wholly-owned subsidiary of ASX Limited ACN 008 624 691, which operates the Australian Securities Exchange (“ASX”) and the balance is held by 19 of our employees. Securities of companies incorporated outside of Australia, such as UBI, are traded as CHESS Depositary Interests (“CDIs”) on the ASX. CDIs represent beneficial interests in the common stock held by CDN. CDIs are traded on the ASX. As of May 3, 2021, there are 177,542,700 CDIs on issue and available to be traded on ASX. As of May 3, 2021, there are 20 holders of shares of our common stock (including CDN) and 1,930 holders of CDIs ("CDI Holders" or "Holders of CDIs").

CDIs are exchangeable, at the option of the holder, into shares of our common stock at a ratio of 1:1. Holders of CDIs have the right to direct CDN, as the holder of record of the underlying shares of common stock represented by their CDIs, how it should vote the underlying shares. If CDN does not receive a duly executed CDI Voting Instruction Form from a CDI Holder as to how to vote the underlying shares represented by those CDIs, those shares will not be voted and will not be considered present at the Meeting for quorum purposes. A holder of CDIs has the right to attend the Meeting but will be entitled to vote at the Meeting only if such holder directs CDN to designate such holder as proxy to vote the underlying shares of common stock represented by CDIs held by such holder. CDI Holders who wish to direct CDN how to vote the underlying shares should complete and return the enclosed CDI Voting Instruction Form or submit their instructions online by following the instructions on the CDI Voting Instruction Form, which is being delivered with this Proxy Statement to each CDI Holder by no later than 11:59 p.m. Australian Eastern Standard Time on June 25, 2021. CDI Holders may not revoke their proxies and change their votes after such time.

The record date is the close of business on May 3, 2021 (the “Record Date”). Only stockholders and CDI Holders of record on the books of the Company at the close of business on the Record Date are (1) with respect to stockholders, entitled to receive notice of and to vote at, and (2) with respect to CDI Holders, entitled to receive notice of and to direct CDN how to vote at, the Meeting and any adjournments thereof. Under arrangements established between the Company and CDN in connection with the issuance of CDIs, the holders of CDIs at the close of business on the Record Date are entitled to notice of and to attend the Meeting and to direct CDN how to vote by completing a CDI Voting Instruction Form or by submitting their voting instructions online.

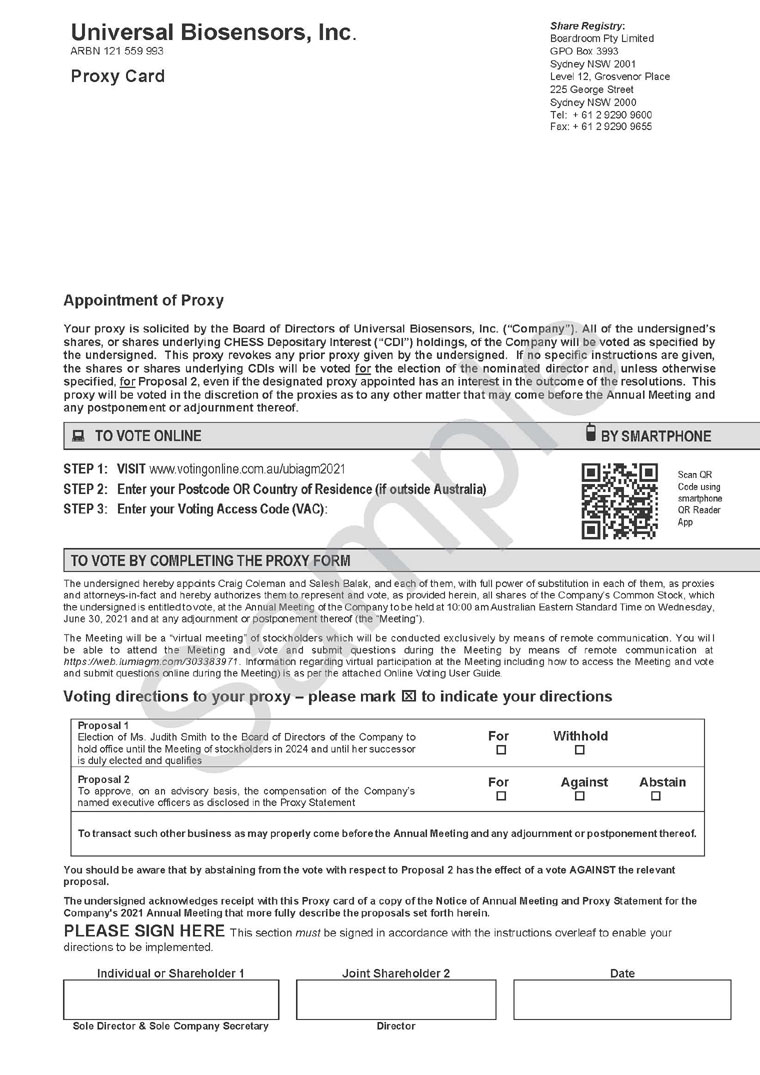

Voting and Solicitation

Each stockholder of record can vote at the Meeting by attending the Meeting in person and voting at the Meeting, or by completing and returning their properly dated and duly executed Proxy Card to Boardroom Pty Limited or the Company no later than 11:59 p.m. Australian Eastern Standard Time on June 29, 2021 in the manner set out below, but may alternatively deliver a completed Proxy Card to us at the Meeting. Alternatively, record holders may submit their instructions online by visiting www.votingonline.com.au/ubiagm2021 by no later than 11:59 p.m. Australian Eastern Standard Time on June 29, 2021. To use the online facility you will need the secure access information set out on your Proxy Card.

CDI Holders who wish to direct CDN how to vote but who are not attending the Meeting must return their duly executed voting instructions, via the enclosed CDI Voting Instruction Form, to Boardroom Pty Limited or the Company no later than 11:59 p.m. Australian Eastern Standard Time on June 25, 2021 in the manner set out below. If you are a CDI Holder and you wish to direct CDN to designate you or another person as proxy to vote the underlying shares of common stock represented by CDIs held by you and attend the Meeting in person, you are encouraged to return your properly dated and duly executed CDI Voting Instruction Form to Boardroom Pty Limited or the Company in the manner set out below but may also deliver the completed CDI Voting Instruction Form to us at the Meeting. Alternatively, CDI Holders may submit their instructions online by visiting www.votingonline.com.au/ubiagm2021 by no later than 11:59 p.m. Australian Eastern Standard Time on June 25, 2021. To use the online facility you will need the secure access information set out on your CDI Voting Instruction Form.

Proxy Cards and CDI Voting Instruction Forms may be submitted in the following manners:

By hand | Boardroom Pty Limited, Level 12, Grosvenor Place, 255 George Street, Sydney NSW 2000, Australia; or |

| | Universal Biosensors, Inc., 1 Corporate Avenue, Rowville VIC 3178, Australia. |

By post | Boardroom Pty Limited, GPO Box 3993, Sydney NSW 2001, Australia; or |

| | Universal Biosensors, Inc., 1 Corporate Avenue, Rowville VIC 3178, Australia. |

By facsimile | Boardroom Pty Limited on +61 2 9290 9655; or |

| | Universal Biosensors, Inc. on +61 3 9213 9099. |

Online | www.votingonline.com.au/ubiagm2021 |

At the Meeting, Proxy Holders and CDN may only vote the shares represented by all properly dated, executed and returned Proxy Cards (in the case of stockholders) and properly dated, executed and returned CDI Voting Instruction Forms or instructions properly delivered online (in the case of CDI Holders) in accordance with the instructions of the respective stockholders and CDI Holders. Proxies cannot be voted for a greater number of persons than the number of nominees named. If no specific instructions are given on a properly dated, executed and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or instructions properly delivered online (in the case of CDI Holders), the shares will be voted “FOR” the nominee for the Board identified herein or otherwise designated by the Board of Directors and “FOR” the approval, and on an advisory basis, of the compensation for named executive officers of the Company, as described in this proxy statement. In addition, if other matters come before the Meeting, the Proxy Holders and CDN will vote in their discretion with respect to such matters. On all matters to be voted on, each share of our common stock, and accordingly, each CDI, has one vote.

We are making this proxy solicitation by and on behalf of the Board of Directors. The cost of preparing, assembling, printing and mailing this Proxy Statement and the proxies solicited hereby will be borne by the Company. Proxies may be solicited personally or by telephone, electronic mail or facsimile by the Company’s officers, directors and regular employees, none of whom will receive additional compensation for assisting with solicitation.

Quorum; Required Vote; Voting Choices

A quorum is required for the transaction of business during the Meeting. A quorum is present when the holders of one-third of the common stock issued and outstanding and entitled to vote at a Meeting, are present in person or represented by proxy. Shares that are voted “FOR”, “AGAINST”, “ABSTAIN” or “WITHHOLD” on a matter are treated as being present at the Meeting for purposes of establishing a quorum and are also treated as votes cast by the common stock present in person or represented by proxy at the Meeting and entitled to vote on the subject matter. If no specific instructions are given on a properly dated, executed and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or instructions properly delivered online (in the case of CDI Holders), the shares will be treated as being present at the Meeting for purposes of establishing a quorum and will be voted for the director nominee and for the approval of compensation of the named executive officers of the Company.

In the director election, stockholders may vote “FOR” the nominee or “WITHHOLD” authority to vote for the nominee. The candidate for election as a director at the Meeting who receives the highest number of affirmative votes present or represented by proxy and entitled to vote on the election of the director at the Meeting will be elected. “Withheld” votes will not have any effect on the director election.

In the advisory vote on the compensation of the Company’s named executive officers, stockholders may vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal. The affirmative vote of a majority of shares of the Company’s common stock present or represented by proxy and entitled to vote at the Meeting will constitute approval of the compensation for named senior executives of the Company. This vote is advisory only and is therefore not binding on the Company. Abstentions will have the effect of negative votes with respect to the advisory vote on the compensation for named executive officers.

A broker “non-vote” occurs when your broker (if applicable) submits a proxy for your shares but does not indicate a vote for a particular proposal because the broker does not have authority to vote on that proposal and has not received specific voting instructions from you. If your shares are held by a broker, the broker may require your instructions in order to vote your shares. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen depending on the type of proposal. If the proposal is considered “routine,” the broker may vote your shares in its discretion. For other proposals, including the proposals in relation to the election of directors and the compensation of named executive officers, brokers that are members of an exchange registered as a national exchange under the U.S. Securities Exchange Act of 1934, as amended (“Exchange Act”), may not vote your shares without your instructions. All of the proposals to be considered at the Meeting are not routine, and therefore we do not expect any broker non votes at the Meeting.

Revocability of Proxies

If you are a stockholder entitled to vote and you have submitted a Proxy Card or instructions online, you may revoke your Proxy Card or online instructions at any time before the Meeting by delivering a written revocation to the Company Secretary of the Company, by delivering a duly executed Proxy Card or submitting instructions online, in each case bearing a later date or by attending and voting at the Meeting.

If you are a CDI Holder and you have submitted a CDI Voting Instruction Form or instructions online, you may revoke your CDI Voting Instruction Form or online instructions by no later than 11:59 p.m. Australian Eastern Standard Time on June 25, 2021 by delivering a written revocation to the Company Secretary of the Company, by delivering a duly executed CDI Voting Instruction Form or submitting instructions online, in each case bearing a later date.

PROPOSAL ONE – ELECTION OF A DIRECTOR

Our Board of Directors has been structured as a “staggered Board” comprising three classes of directors with members in each class of directors serving for staggered terms and until his or her successor is duly elected and qualifies or until his or her earlier death, resignation or removal. The Board of Directors currently consists of one Class I director (currently Ms. Judith Smith), whose term will expire at this year’s Meeting of stockholders, one Class II director (currently Mr. Craig Coleman), whose term will expire at the meeting of stockholders in 2023 and one Class III director (currently Mr. David Hoey), whose term will expire at the meeting of stockholders in 2022, in each case such director will hold office until the expiration of their term and until his or her successor is duly elected and qualifies, unless the director resigns, dies or is removed earlier.

Our Board of directors has nominated Ms. Judith Smith for election at the Meeting. If elected, unless she resigns, dies or is removed earlier, Ms. Judith Smith will hold office until the Meeting of stockholders in 2024 and until her successor is duly elected and qualifies.

For details of the qualifications, skills and experience of Ms. Judith Smith, refer to the section below titled “Management of the Company - Board of Directors”. The nominee is willing to be elected and to serve for their applicable term. Management expects that the nominee will be available for election, but if the nominee is unable to serve or for good cause will not serve, it is intended that such proxy will be voted in the proxy holder’s discretion for the election of another nominee or nominees to be designated by the Board of Directors to fill any such vacancy.

The Board of Directors unanimously recommends that you vote FOR the election of the nominated director as described herein. Proxy holders and CDN will vote as directed on the Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders) or, if no direction is made in a duly dated, executed and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders), “FOR” the nominated director. However, brokers who are members of a U.S. national securities exchange may not vote or submit instructions to the proxy holders or CDN if the beneficial owner of the shares has not given instructions. The election of the director requires the affirmative vote of a plurality of the shares of common stock present, in person or by proxy, and entitled to vote on the election of director.

PROPOSAL TWO – ADVISORY VOTE ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Company is providing stockholders with the opportunity to cast an advisory vote on the executive compensation programs and policies and the compensation paid to the executive officers named in this Proxy Statement. This proposal is known as a “say-on-pay vote”. Details of our compensation for our senior executives is set out under the headings “Executive Compensation Framework”, “Summary Compensation Table”, and “Narrative disclosure to summary compensation table and grants” of this Proxy Statement. These disclosures are made pursuant to Item 402 of United States Regulation S-K. As discussed in the Executive Compensation Framework section of this Proxy Statement, our compensation principles and underlying programs are designed to attract, motivate and retain key executives who are crucial to our long-term success. The vote is advisory and is not binding on the Company. However, the Board of Directors will take into account the outcome of the vote when considering future executive compensation arrangements. Details of how the Board of Directors has considered the results of the advisory vote will be included in future proxy statements.

We will seek an advisory vote in relation to compensation every year, which we believe will be the most effective means for conducting and responding to such an advisory vote.

The Board of Directors unanimously recommends that you vote FOR this proposal to approve, on an advisory basis, the compensation for the Company's named executives officers as disclosed in the Executive Compensation Framework, the compensation tables, and the related disclosure required pursuant to Item 402 of Regulation S-K contained in this Proxy Statement. The proxy holders and CDN will vote as directed on the Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders) or, if no direction is made in a duly dated, executed and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders), "FOR" this proposal. However, brokers who are members of a U.S. national securities exchange may not vote or submit instructions to the proxy holders or CDN if the beneficial owner of the shares has not given instructions. In order to be adopted as an advisory vote, this proposal must be approved by the affirmative vote of the holders of a majority of the shares of our common stock present, in person or by proxy, and entitled to vote at the Meeting.

MANAGEMENT OF THE COMPANY

The following table sets out the name, age and position of our directors, executive officers and certain significant employees at May 3, 2021:

Name | Age | Position | Served Since |

Craig Coleman | 55 | Non-executive Director | 2016 |

| | | Chairman of the Board of Directors | 2017 |

John Sharman | 54 | Chief Executive Officer | 2020 |

Salesh Balak | 52 | Chief Financial Officer | 2006 |

Judith Smith | 65 | Non-executive Director | 2015 |

David Hoey | 61 | Non-executive Director | 2016 |

Mr. John Sharman was appointed as the Chief Executive officer on March 6, 2020 with a commencement date of June 8, 2020. Mr. Sharman and Mr. Balak are not directors of the Company. Mr. Marshall Heinberg retired as a member of the Board of Directors on March 17, 2021. Our Certificate of Incorporation provides our Board of Directors shall consist of not less than three or more than nine members, the exact number of which shall be fixed from time to time by resolution adopted by the affirmative vote of a majority of the entire Board of Directors. |

Board of Directors

Mr. Craig Coleman BComm

Mr. Coleman is an experienced senior executive and director, with a 30-year career spanning banking and finance, corporate advisory, investment and funds management. During his executive career, Mr. Coleman was Managing Director of the ASX listed Home Building Society Ltd. Prior to this, Mr. Coleman held several senior executive positions with ANZ Banking Group Ltd, including Managing Director Banking Products, Managing Director Wealth Management, non-executive Director E*TRADE Australia Ltd and Head of Retail Banking New Zealand. Mr. Coleman’s experience in Australian public securities has included many public company directorships, including non-executive director of Pulse Health Limited (previous), Rubik Financial Ltd (previous) and Bell Financial Group (current), and Chairman of Pacific Star Network Limited (current). Mr. Coleman is also currently the Managing Partner Public Equity of Viburnum Funds, an Australian-based high conviction active ownership investment manager of public and private equities targeting multi-year compounding returns, founded in 2007. Viburnum Funds, as an investment manager for its associated funds, holds a beneficial interest and voting power of approximately 15% of the Company’s shares. Mr. Coleman was appointed as non-executive director in June 2016 and non-executive Chairman in August 2017. Mr. Coleman has served as Chairman of the Remuneration & Nomination Committee of the Board of Directors since June 2016. Mr. Coleman was appointed as a member of the Audit and Compliance Committee on January 1, 2019. Mr. Coleman’s term as a Class II director of the Company ends on the date of our 2023 annual meeting of stockholders. Mr. Coleman holds a Bachelor of Commerce from the University of Western Australia.

Ms. Judith Smith BEc (Hons), MAppFin, F Fin, GAICD

Ms. Smith is a highly experienced executive and director. During her career, Ms. Smith has worked in a number of investment management roles in the funds management industry, where she has been responsible for evaluating and investing in listed and unlisted companies. For the last five years, Ms. Smith has held non-executive positions in various companies described as follows. Ms. Smith was appointed a non-executive director of the Company on March 12, 2015 and her term as a Class I director of the Company ends on the date of the Meeting, and she has been nominated for election at the Meeting as a Class I director for a term of three years. Ms. Smith has served as a member of the Audit and Compliance Committee since March 12, 2015 and was appointed the Chairperson of the Audit and Compliance Committee on August 7, 2017. Ms. Smith was appointed as a member of the Remuneration and Nomination Committee on September 21, 2017. Ms. Smith was formerly the Head of Private Equity at IFM Investors, a global fund manager, and Chairperson of the IFM Risk Committee. Ms. Smith was also a member of the IFM Investments Committee, a role she has retained following her retirement from the firm in 2013. Prior to her role at IFM, Ms. Smith held various investment management roles including more than a decade at National Mutual Funds Management Ltd (NMFM). At NMFM, she managed Australian equity research and strategy, as well as Australian equity portfolios. Ms. Smith holds a Master of Applied Finance from the University of Melbourne and a Bachelor of Economics (Honours) from Monash University. She is a Fellow of the Financial Services Institute of Australasia and Graduate member of the Australian Institute of Company Directors. Ms. Smith was a member of the Audit Committee of the Australian Renewable Energy Agency (ARENA) from November 2016 to November 2018. She has been a director of ARENA from July 2012 to January 2016. Since March 2014, she has also served as a director and Chairperson of the Audit Committee of Acorn Capital Investment Fund Ltd (ASX:ACQ). Since January 2015, she has been a trustee director of industry superannuation fund, LUCRF and the Chairperson of the LUCRF Investment Committee. Ms. Smith is also on the advisory committee for the SA Venture Capital Fund. Ms. Smith is also a board member of Scale Investors Ltd., a not-for-profit organization promoting women entrepreneurs and women angel investors in early stage companies. In July 2018, Ms. Smith was appointed to the board of Funds SA and is also a member of its Audit Committee.

Mr. David Hoey

Mr. Hoey has extensive experience relevant to our Company, with more than 25 years’ experience in technology financing and commercialization. Mr. Hoey is a US-based director and his primary expertise is in business development, strategic planning, market development, corporate partnering and financings for medical technologies, diagnostics and drug development. Mr. Hoey was appointed a non-executive director of the Company on March 2, 2016 and his term as a Class III director of the Company ends on the date of our 2022 annual meeting of stockholders. Mr. Hoey has served as a member of the Audit and Compliance Committee since March 15, 2016 and as a member of the Remuneration & Nomination Committee between June 21, 2016 and September 21, 2017. Mr. Hoey was reappointed as a member of the Remuneration & Nomination Committee on January 1, 2019. Mr. Hoey is currently the Chief Executive Officer and a director of Vaxxas Pty Ltd, a company which has developed and is commercializing a novel vaccine delivery technology - the Nanopatch™. He was appointed to this position in October 2012. He also serves as an advisor to Healthcare Ventures LLC. During his career, Mr. Hoey has worked in management and leadership roles in the preclinical development of small molecule and biologic therapeutics, molecular diagnostic assays and platforms, and analytical instrumentation. Mr. Hoey served as vice president of business development at PathoGenetix, Inc., a company pioneering single molecule detection technologies for biodefense, clinical, and industrial applications from 2009 to 2012.

Executive Officers

Mr. John Sharman BEcon, CA, MAppFin

Mr. Sharman has served as our Chief Executive Officer since June 8, 2020. Mr. Sharman has extensive international business experience as Managing Director and Chief Executive Officer of ASX-listed companies and private equity businesses operating in Australia, the United Kingdom, Europe, Asia and the United States. His experience covers the pharmaceutical, medical equipment manufacturing and distribution, finance and fast-moving consumer goods businesses. Before joining Universal Biosensors, Inc., Mr. Sharman was the Chief Executive Officer of Medical Developments International (“MVP”) for over 10 years. Prior to joining MVP, Mr. Sharman was responsible for all facets of the investment cycle during his 10-year service as Managing Director of a private equity firm, CVC Venture Managers. Earlier years in his career were spent in the finance industry with National Australia Bank, PricewaterhouseCoopers as Director of Finance and KPMG where he was responsible for multiple capital raising transactions. He holds a Bachelor of Economics from Monash University and Master of Applied Finance from Macquarie University.

Mr. Salesh Balak BA, CA

Mr. Balak has served as our Chief Financial Officer since November 2006 and as a director of Universal Biosensors Pty Ltd since September 2010. Mr. Balak served as our Interim Chief Executive Officer from July 15, 2019 to June 7, 2020. He has served as a director of Hemostasis Reference Laboratory Inc. since November 30, 2016. Mr. Balak was appointed as our Company Secretary on December 20, 2018. Prior to joining Universal Biosensors, he was chief financial officer and company secretary of Pearl Healthcare Limited, an ASX-listed entity engaged in the manufacturing and healthcare sector. Mr. Balak joined Pearl Healthcare Limited in April 2003 initially as its Group Accounting Manager and was promoted to Chief Financial Officer in June 2004. While at Pearl Healthcare Limited, Mr. Balak was instrumental in the successful acquisition of four businesses and integration of its existing businesses. Prior to joining Pearl Healthcare Limited, Mr. Balak spent 13 years in the Business Services, Audit and Financial Advisory Services divisions of KPMG in both the Melbourne and Fiji offices. He holds a Bachelor of Arts in accounting and economics and is a member of the Institute of Chartered Accountants and Certified Practicing Accountants.

Corporate Governance

Director Independence

We are not listed on a U.S. securities exchange and, therefore, not subject to the corporate governance requirements of any such U.S. exchange, including those relating to independence of directors. For purposes of determining whether our directors are independent under applicable rules and regulations promulgated by the Securities and Exchange Commission, we have chosen to use the definition of “independence” established by the Nasdaq Stock Market under its Marketplace Rules, as permitted by such rules and regulations.

The Board undertakes a review of director independence on an annual basis and as events arise which may affect director independence.

We have determined that with the exception of Mr. Coleman, all the current directors and the director nominee are independent as defined under the ASX Listing Rules. We have determined that Mr. Coleman is not independent as defined pursuant to the ASX principles and recommendations because he is an executive officer of Viburnum Funds Pty Ltd, which together with its associated funds and entities holds in excess of 10% of our shares.

A copy of our corporate governance statement is available on our website at www.universalbiosensors.com.

Board Leadership Structure

The Company does not have a lead independent director. Our Board of Directors prefers the Company’s leadership structure to have the position of Chairman, and Chief Executive Officer held by two separate individuals. The Board believes that separating the two positions provides stronger governance and reinforces the Company’s sound framework of internal control. The Board regularly deliberates and discusses its appropriate leadership structure and the role and responsibilities of the Chairman of the Board and the Chief Executive Officer, based upon the needs of the Company from time to time to provide effective oversight of management.

Chief Executive Officer and Chief Financial Officer

The Board decided it was in the best interest of the Company to temporarily combine the roles of Chief Executive Officer and Chief Financial Officer following the resignation of Mr. Rick Legleiter on July 15, 2019. Mr. Salesh Balak continues to serve as the Chief Financial Officer of the Company and served as Acting Chief Executive Officer from July 15, 2019 to June 7, 2020. On June 8, 2020, Mr. John Sharman commenced his role as Chief Executive Officer.

Board Meetings and Board Committees

Our Board of Directors met on nine occasions during the year ended December 31, 2020. Each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board; and (ii) the total number of meetings held by all committees of the Board on which he or she served.

Members of our Board of Directors are encouraged to attend the Meeting of stockholders. All the current members of our Board of Directors attended the virtual meeting of stockholders held in 2020.

There are two committees of the Board: the Audit and Compliance Committee and the Remuneration and Nomination Committee.

Audit and Compliance Committee

The Company has a separately designated standing Audit and Compliance Committee. The current members of the Audit and Compliance Committee are Ms. Judith Smith (Chairperson), Mr. Craig Coleman and Mr. David Hoey. The Audit and Compliance Committee is governed by a formal charter, a copy of which is available on our website at www.universalbiosensors.com. The Board has determined that with the exception of Mr. Craig Coleman all members of the Audit and Compliance Committee meet the criteria for being independent directors pursuant to the ASX principles and recommendations. We have determined that Mr. Coleman is not independent as defined pursuant to the ASX principles and recommendations because he is an executive officer of Viburnum Funds Pty Ltd, which together with its associated funds and entities holds in excess of 10% of our shares.

The Audit and Compliance Committee also satisfies the ASX principles and recommendations that the Chairperson be an independent director. During the year ended December 31, 2020, the Audit and Committee met on five occasions. For more information in relation to the determination of which of our directors are considered independent under the Marketplace Rules of the Nasdaq Stock Market, refer to the section above titled “Corporate Governance”.

The Board has determined that Ms. Smith qualifies as an “audit committee financial expert”, as defined under the rules and regulations of the Securities and Exchange Commission.

Report of the Audit and Compliance Committee

The Audit and Compliance Committee’s primary role is to assist the Board of Directors in fulfilling its responsibility for oversight of the Company’s financial and accounting operations.

In discharging its responsibility for oversight of the audit process, the Committee obtained from the independent auditor, PricewaterhouseCoopers, the written disclosure and the letter required by applicable requirements of the Public Company Accounting Oversight Board. Such disclosure describes any relationships between the auditor and the Company that might bear on the auditor’s independence consistent with the Independent Standards Board Rule 3526, “Communication with Audit Committees Concerning Independence, of the Public Company Accounting Oversight Board” ("PCAOB"). The Company has discussed with the auditor any relationships that might impact the auditor’s objectivity and independence and satisfied itself as to the auditor’s independence.

The Committee discussed the matters required to be discussed by the applicable requirements of the PCAOB, and reviewed with the independent auditor the communications required by generally accepted auditing standards.

The Committee reviewed and discussed the audited financial statements of the Company as of and for the fiscal year ended December 31, 2020, with management and the independent auditor. Management has the responsibility for preparation of the Company's financial statements and the independent auditor has the responsibility for examination of those statements. Based upon the above-mentioned review and discussions with management and the independent auditor, the Committee recommended to the Board that the Company's audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for filing with the SEC.

By the Audit and Compliance Committee:

Judith Smith (Chairperson)

Craig Coleman

David Hoey

Remuneration and Nomination Committee

The Remuneration and Nomination Committee is governed by a formal charter, a copy of which is available on our website at www.universalbiosensors.com. The primary functions of the Remuneration and Nomination Committee are to develop and facilitate a process for Board and Director evaluation, assess the availability of Board candidates, make specific recommendations to the Board on remuneration and incentive plans for Directors and senior management, advise the Board on the recruitment, retention and termination policies for senior management and undertake a review of the Chief Executive Officer’s performance, at least annually, including recommending to the Board the Chief Executive Officer’s goals for the coming year and reviewing progress in achieving those goals. The Committee does not have any express right to delegate its authority but may do so on special authority from the Board.

The current members of the Remuneration and Nomination Committee are Mr. Craig Coleman (Chairman), Ms. Judith Smith and Mr. David Hoey. The Board has determined that with the exception of Mr. Craig Coleman, all members of the Remuneration and Nomination Committee meet the criteria for being independent under the ASX principles and guidance. We have determined that Mr. Coleman is not independent as defined under the ASX principles and guidance because he is an executive officer of Viburnum Funds Pty Ltd, which together with its associated funds and entities holds in excess of 10% of our shares. Accordingly, we do not satisfy the ASX principles and guidance that the Chairperson be an independent director. The Remuneration and Nomination Committee met on four occasions during the year ended December 31, 2020.

If necessary, the Remuneration and Nomination Committee (or the Board acting in its place) may use a variety of methods for identifying and evaluating potential nominees to the Board of Directors. Consideration is given to professional and technical experience of potential nominees including industry and market knowledge, education and skills. Recommendations may come from current Board members, professional search firms, members of management, stockholders or other persons. The Remuneration and Nomination Committee (or the Board acting in its place) will consider recommendations from any reasonable source, including director nominees recommended by stockholders. Stockholders wishing to suggest potential nominees can do so by contacting the Company Secretary. In assessing the qualifications of potential nominees, the Remuneration and Nomination Committee (or the Board acting in its place) may rely on personal interviews or discussions with the candidate and others familiar with the candidate’s professional background, on third party reference checks and on such other diligence information as is reasonably available.

Nominations of persons for election to our Board of Directors may be made for any annual meeting of stockholders, or at any special meeting of stockholders called for the purpose of electing directors in accordance with the requirements of our amended and restated certificate of incorporation and amended and restated bylaws. Stockholders wishing to nominate a director must give timely notice thereof in proper written form. To be timely, a stockholder’s notice in the form required by our amended and restated bylaws must be delivered to or mailed and received at our principal executive offices: (a) in the case of an annual meeting, not less than 90 days and not more than 120 days prior to the anniversary date of the immediately preceding annual meeting, provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which notice or public disclosure of the date of the annual meeting is given; and (b) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice or public disclosure of the date of the special meeting is given.

The Remuneration and Nomination Committee has processes in place to review the performance of our senior executives. Our Remuneration and Nomination Committee takes into consideration elements such as the following in setting compensation policies:

| | ● | comparison against publically available information; |

| | ● | regulatory requirements; |

| | ● | rate of employee turnover; |

| | ● | performance reviews and ratings; |

| | ● | salary adjustments and promotions; |

| | ● | content and effectiveness of our employee training; and |

| | ● | ability to retain and attract new employees. |

Corporate performance is also taken into account in setting compensation policies and making compensation decisions.

“See also “Other Matters - 2022 Stockholder Proposals”

Director Selection Process

As discussed above, it is the intention of our Board of Directors that we have a standing Remuneration and Nomination Committee that is responsible for assembling a group of nominees that, taken together, have the background, experience, qualifications, attributes and skills appropriate for functioning as a board. The Remuneration and Nomination Committee (or the Board, as applicable) periodically reviews the size and composition of the Board and determines whether to add or replace directors. We look for certain characteristics common to all Board members, including strong professional reputation, integrity, record of achievement and the ability and commitment to devote sufficient time and energy to the Board. We seek to nominate candidates who bring diverse backgrounds, skills, experience and perspectives to the Board. Diversity relating to background, skill, experience and perspective is one factor considered in the nomination process, and the Company has adopted a formal policy relating to diversity. Additionally, we seek to include at least one member of the Audit and Compliance Committee who qualifies as an “audit committee financial expert”.

Compensation Committee Interlocks and Insider Participation

During 2020, our Remuneration and Nomination Committee consisted of Mr. Craig Coleman (Chairman), Mr. Marshall Heinberg, Ms. Judith Smith and Mr. David Hoey. For more information on the Remuneration and Nomination Committee's (or, as applicable, the Board acting in its place) processes and procedures for the consideration and determination of executive and director compensation, see "Executive Compensation—Executive Compensation Framework" and "Compensation of Directors."

None of our executive officers other than Mr. Sharman and Mr. Balak participated in deliberations with respect to executive officer compensation. Mr. Sharman and Mr. Balak were absent from all discussions and votes in relation to their compensation as Chief Executive Officer and Chief Financial Officer, respectively.

None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers who serve on our board of directors or compensation committee. None of the members of our Remuneration and Nomination Committee or our Board currently are or have been an officer or employee of us or one of our subsidiaries. In addition, none of our directors has interlocking or other relationships with other boards, compensation committees or our executive officers that would require disclosure under Item 407(e)(4) of Regulation S-K.

Compensation of Directors

The following table provides information about the compensation of our directors for the year ended December 31, 2020.

| | Fees Earned or Paid in Cash (1) | | | All Other Compensation (2) | | | Total | |

| Name | | A$ | | | A$ | | | A$ | |

| | | | | | | | | | | | | |

Craig Coleman | | | 82,600 | | | | 7,847 | | | | 90,447 | |

Marshall Heinberg (3) | | | 77,600 | | | | - | | | | 77,600 | |

Judith Smith | | | 77,600 | | | | 7,372 | | | | 84,972 | |

David Hoey | | | 77,600 | | | | - | | | | 77,600 | |

(1) | Includes base pay and an annual allowance of A$2,600 paid to each board member. |

(2) | Represents superannuation payment of 9.50%. Marshall Heinberg and David Hoey are not residents for Australian tax purposes and therefore only receive superannuation when they attend meetings held in Australia. |

(3) | Mr. Marshall Heinberg ceased to be a board member, a member of the Audit and Compliance Committee and a member of the Remuneration and Nomination Committee on March 17, 2021. |

Our Remuneration and Nomination Committee makes recommendations to the Board of Directors with respect to the remuneration and benefits provided to directors and executive officers. The Remuneration and Nomination Committee met on four occasions during the year ended December 31, 2020. The Board of Directors determines what levels of director remuneration and benefits are appropriate. Pursuant to the ASX Listing Rules, our stockholders have approved an aggregate remuneration pool available to non-executive directors of A$700,000 per annum. The annual remuneration payable to our non-executive directors for the 2020 financial year comprised of:

| | ● | a base fee of A$80,000 per annum for the Chairperson; |

| | ● | a base fee of A$75,000 per annum for all other directors; and |

| | ● | statutory superannuation for the directors, which is 9.50% of the base fee (other than Messrs. Heinberg and Hoey, who being non-resident for Australian tax purposes, only receive superannuation when they attend meetings held in Australia). |

In addition, a director may be paid all traveling and other expenses properly incurred in attending meetings of directors or committees or stockholder meetings or otherwise in connection with the execution of his or her duties.

Code of Ethics

We have adopted a Code of Ethics for our Chief Executive Officer and Chief Financial Officer. The Code of Ethics is available on our website at www.universalbiosensors.com. We intend to satisfy any disclosure requirement under item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of the Code of Ethics for our Chief Executive Officer and Chief Financial Officer, by posting such information on our website at www.universalbiosensors.com.

EXECUTIVE COMPENSATION

Executive Compensation Framework

The objective of our executive compensation framework is to ensure the reward for performance is competitive and appropriate for the results delivered. The framework aligns executive reward with achievement of strategic objectives and the creation of value for stockholders and conforms to market best practice for delivery of reward. Our performance depends upon the quality of our directors and executives. In order to attract, motivate and retain highly skilled directors and executives, we use a combination of the following principles in our remuneration framework:

● | provide competitive remuneration to attract, motivate and retain high caliber directors and executives with appropriate skills and experience; |

● | remunerate with a mix of short and long term components; |

● | remunerate executives according to individual performance and pre-determined benchmarks through cash bonuses; and |

● | link executive remuneration to stockholder value through the issuance of securities. |

The executive remuneration framework for the year ended December 31, 2020 had the following components:

Our named executives are all employed by our wholly owned subsidiary, Universal Biosensors Pty Ltd. (“UBS”). Our named executive officers do not receive separate compensation in connection with their employment at UBS.

Base pay

Executives are offered a base pay that comprises the fixed component of their remuneration. Base pay is structured as a total employment cost package, which may be delivered as a combination of cash and prescribed non‑financial benefits at the executive’s discretion.

Cash bonuses

Cash bonuses are payable to employees upon the achievement of specific company-wide pre-determined milestones.

Superannuation

As required by Australian law, we contribute to standard defined contribution superannuation funds on behalf of all employees at an amount required by law, currently 9.50% of each such employee’s salary. Superannuation is a compulsory savings program whereby employers are required to pay a portion of an employee’s remuneration to an approved superannuation fund that the employee is typically not able to access until they are retired. We permit employees to choose an approved and registered superannuation fund into which the contributions are paid.

Consideration of Results of Prior Year Stockholder “Say-on-Pay” Vote

We will seek an advisory vote in relation to compensation from stockholders every year, which we believe will be the most effective means for conducting and responding to such an advisory vote. The Board will consider the outcome of each such stockholders advisory vote. Stockholders approved the resolution relating to the compensation at our general meeting of stockholders in 2020. At the 2020 general meeting, stockholders representing approximately 98.48% of our stock who cast votes, voted in favor of the compensation paid to our named executive officers for 2019. Accordingly, when developing our executive compensation program for 2020 and 2021, we considered the overall level of support as a key factor in our review of the program.

Summary Compensation Table

| | | | Salary | | | Bonus (1) | | | Aggregate Grant Date Fair Value of Option Awards (3) | | | All Other Compensation (4) | | | Total | |

| Name and Principal Position | | Year | | A$ | | | A$ | | | A$ | | | A$ | | | A$ | |

| | | | | | | | | | | | | | | | | | | | | | | |

John Sharman | | 2020 | | | 271,385 | | | | - | | | | 189,173 | | | | 25,782 | | | | 486,340 | |

Chief Executive Officer (5) | | 2019 | | | - | | | | - | | | | - | | | | - | | | | 0 | |

Salesh Balak | | 2020 | | | 327,696 | | | | 36,906 | | | | 55,000 | | | | 206,589 | | | | 626,191 | |

Chief Financial Officer & Company Secretary (6) | | 2019 | | | 354,557 | | | | 95,455 | | | | - | | | | 42,751 | | | | 492,763 | |

(1) | Amounts reported in this column represent the cash bonuses payable which amounts have been approved by our Board of Directors. |

(2) | In accordance with ASC 718, the fair value of the stock awards has been calculated as the closing price of the Company’s common stock on ASX on the day on which the employee stock awards were granted. |

(3) | In accordance with ASC 718, the fair value of the option grants was estimated on the date of each grant using the Trinomial Lattice model. |

(4) | Represents superannuation payment calculated as 9.50% of base pay. Included in the 2020 fiscal year is an amount of A$157,033 payable to Mr. Balak for his leave entitlements. |

(5) | Mr. Sharman commenced as the Chief Executive Officer on June 8, 2020. |

(6) | Mr. Balak served as our Interim Chief Executive Officer from July 15, 2019 to June 7, 2020. |

Grants of Plan-Based Awards During 2020

The following table provides information regarding the plan-based awards that we made to the named executive officers during the year ended December 31, 2020.

| | | | | Estimated Future Payouts Under Equity Incentive Plan Awards | | | Exercise or Base | | | Grant Date Fair Value of Stock and | |

| | | | | | | | | Price of Option | | | Option/ SAR | |

| | | | | Target (1) | | | Awards | | | Awards (2) | |

| Name | | Grant Date | | # | | | (A$/Sh) | | | A$ | |

John Sharman | (3) | Mar 25, 2020 | | | 2,364,666 | | | | 0.20 | | | | 0.03 | |

| | | Mar 25, 2020 | | | 2,364,667 | | | | 0.25 | | | | 0.03 | |

| | (4) | Mar 25, 2020 | | | 2,364,667 | | | | 0.30 | | | | 0.02 | |

Salesh Balak | | Sept 1, 2020 | | | 500,000 | | | | 0.30 | | | | 0.11 | |

(1) | The equity incentive plan awards consists of options awarded to named executives that have a time based vesting and exercise period. |

(2) | The fair value of the option grants were estimated on the date of each grant using the Trinomial Lattice model. |

(3) | Mr. John Sharman commenced as the Chief Executive Officer on June 8, 2020. All the options granted on March 25, 2020 vested on the same day. |

(4) | The options vested on September 1, 2020. |

Narrative disclosure to summary compensation table and grants

Employee Option Plan

The Employee Option Plan was adopted by the Board of Directors in 2004 and approved by our stockholders in October 2006. The Employee Option Plan permits our Board to grant stock options to our employees. The number of employee options able to be granted is limited to the amount permitted to be granted at law, the ASX Listing Rules and by the limits on our authorized share capital in our amended and restated certificate of incorporation. The ASX Listing Rules generally prohibit companies whose securities are quoted on the ASX from issuing securities exceeding 15% of issued share capital in any 12 month period, without stockholder approval.

Options may be granted to employees, which may be market priced or have an exercise price which exceeds the market price at the time of grant, which are subject to time based vesting and exercise period or based on achievement of predetermined key performance indicators. These key performance indicators are generally expected to be achieved after twelve months of grant date.

When exercisable, each option is convertible into one share of common stock at an exercise price determined on the date of grant. The exercise price is determined by the Board at the time of approval of grant. The exercise price may be in excess of the closing price of the Company’s common stock on ASX at the grant date or they may be calculated as the closing price of the Company’s common stock on ASX on the day on which the employee options were granted. If the latter, generally the exercise price of the market price options are calculated as the average closing price of the Company’s common stock on the ASX on the five days on which the Company’s common stock traded prior to the approval of grant. The Company has also previously granted certain options with a zero exercise price. The contractual life of each option granted is generally between five and ten years. No option holder has any right under the option to participate in any other issues of shares of our common stock or any other entity without first having exercised the options. Any exercise conditions must be satisfied before the options vest and become capable of exercise. All our options have been subject to time based vesting generally over either three or four years (depending on the year in which they were granted). The options issued to senior management in 2020 vested at the date of the grant of the options. In addition, the options granted to senior executives may also be subject to the achievement of specified predetermined key performance indicators. Exercise conditions are determined by the Board at the time of grant of the options. This determination would typically follow a recommendation from the Remuneration and Nomination Committee. To date, we have not extended or undertaken any other modifications to outstanding options. In 2007, the exercise price of all employee options on issue at that time were adjusted in accordance with a formula set out in the ASX Listing Rules as a result of a renounceable rights issue capital raising undertaken by the Company. The Company has not otherwise repriced any of its options. The options lapse on such date determined by the Board at the time of grant or earlier in accordance with the Employee Option Plan. Options may be subject to adjustment in the event of a stock split, stock dividend, consolidation or other change in the structure of our capitalization. Options carry no dividend or voting rights. With respect to options granted to named executives after 2009, the shares issued to those executives on exercise of their employee options are generally not able to be traded for a period up to four years from the grant date following which time the Board of Directors (or its delegate) must grant approval to trade, which may be granted or withheld at its sole discretion, for the shares to be traded. The shares generally become immediately tradable if the named executive ceases to be an employee of the Company and its associated group of companies.

Employee Share Plan

Our Employee Share Plan was adopted by the Board of Directors in 2009. The Employee Share Plan permits our Board to grant shares of our common stock to our employees. The number of shares able to be granted is limited to the amount permitted to be granted at law, the ASX Listing Rules and by the limits on our authorized share capital in our amended and restated certificate of incorporation. All our employees are eligible for shares under the Employee Share Plan. The Restricted Shares have the same terms of issue as our existing shares of common stock but are not able to be traded until the earlier of three years from the date on which the Restricted Shares are issued (or such other time period determined by Remuneration and Nomination Committee in accordance with the Employee Share Plan) or the date the relevant employee ceases to be an employee of the Company or any of its associated group of companies. There were no shares granted during 2020.

Executive Service Agreements

Remuneration and other terms of employment for the executive officers are formalized in executive service agreements between each executive officer and UBS. The material terms and conditions of each of the employment agreements with our executive officers who continued to serve at December 31, 2020 are substantially similar, a summary of which material terms and conditions is set out below:

● | the executive must devote his time and attention exclusively to our business and affairs, unless otherwise approved by us; |

● | the executive is bound by customary confidentiality, intellectual property assignment and non-competition clauses; |

● | the executive’s salary is to be reviewed on an annual basis; |

● | the executive may be entitled to a discretionary cash bonus or be granted stock options under the Employee Option Plan or ordinary shares under the Employee Share Plan as recommended by the Remuneration and Nomination Committee (or in its absence, the Board of Directors) and determined by our Board of Directors from time to time. |

● | each party has the right to terminate the agreement by giving three months’ notice to the other party or, in the case of Mr. Sharman’s agreement, with six months’ notice; |

● | we may also summarily terminate the agreement, at any time with notice, for certain specified forms of misconduct; and |

● | each agreement will terminate automatically on a date specified in the executive employment agreement unless extended by us from time to time. If the parties whose contracts have fixed end dates do not expressly extend the agreement, the executive’s employment will automatically extend for a further 12 months on the same terms. Mr. Sharman’s agreement does not have a specific end date and terminates with notice in accordance with its terms. |

Subject to applicable law, other than ongoing salary payments during the notice period and any outstanding annual leave and long service leave entitlements, no additional payments are payable on termination or change of control.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information as of December 31, 2020 regarding equity awards, including unexercised stock options that had not vested, for each of the named executive officers.

| | | Option Awards |

Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Option Exercise Price (A$) | | Option Expiration Date |

| | | | | | | | | | |

John Sharman (1) | | | 2,364,666 | | | | 0.20 | | March 24, 2024 |

| | | | 2,364,667 | | | | 0.25 | | March 24, 2025 |

| | | | 2,364,667 | | | | 0.30 | | March 24, 2025 |

Salesh Balak (2) | | | 40,000 | | | | - | | January 29, 2022 |

| | | | 721,000 | | | | 0.50 | | April 20, 2023 |

| | | | 216,300 | | | | 0.50 | | February 27, 2024 |

| | | | 500,000 | | | | 0.30 | | March 24, 2025 |

1. | The options vested on March 25, 2020 and became exercisable on September 24, 2020. |

| 2. | a. | The options expiring on January 29, 2022 vested and became exercisable in May 2017. |

| | b. | The options expiring on April 20, 2023 vested and became exercisable as at December 31, 2017. |

| | c. | The options expiring on February 27, 2024 vested and became exercisable on December 31, 2017. |

| | d. | The options expiring on March 24, 2025 vested on September 1, 2020 and became exercisable on March 1, 2021. |

Potential payments upon Termination or Change-in-control

See “Executive Compensation – Narrative disclosure to summary compensation table and grants – Executive Service Agreements.”

Equity Compensation Plan Information

Set out below are details of the Employee Option Plan as at December 31, 2020.

| | | Equity Compensation Plan Information | |

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted average exercise price of outstanding options, warrants and rights (A$) | | | Number of Securities remaining for future issuance | |

| | | | | | | | | | | | | |

Equity compensation plans approved by security holders | | | | | | | | | | | | |

- Employee options (2) | | | 9,398,450 | | | | 0.33 | | | | (1 | ) |

Equity compensation plans not approved by security holders | | | 0 | | | | 0.00 | | | | (1 | ) |

| | | | | | | | | | | | | |

Total | | | 9,398,450 | | | | 0.33 | | | | | |

| | (1) | The number of securities able to be granted is limited to the amount permitted to be granted at law, the ASX Listing Rules and by the limits on our authorized share capital in our amended and restated certificate of incorporation. The Listing Rules of ASX generally prohibits companies whose securities are quoted on ASX from issuing securities exceeding 15% of issued share capital in any 12 month period, without stockholder approval. |

| | (2) | The grant of options and shares to any of our directors require stockholder approval. |

INDEPENDENT PUBLIC ACCOUNTANTS

Appointment of Independent Registered Public Accounting Firm

Our Audit and Compliance Committee has appointed PricewaterhouseCoopers, Australia as our independent public accountants for the year ended December 31, 2020. Representatives of PricewaterhouseCoopers, Australia will participate in the Meeting, will have the opportunity to make a statement if such representative desires to do so, and will be available to respond to appropriate questions.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Audit Fees

PricewaterhouseCoopers, Australia audited our financial statements for the years ended December 31, 2020 and 2019.

| | | Year Ended December 31 | |

| | | 2020 | | | 2019 | |

| | | A$ | | | A$ | |

| | | | | | | | | |

(a) Audit Fees | | | | | | | | |

Financial Statements including Form 10-K and Form 10-Q | | | 255,000 | | | | 372,977 | |

| | | | | | | | | |

(b) Tax Fees | | | | | | | | |

Tax Returns | | | 66,863 | | | | 101,835 | |

Other tax Compliance and Advisory Services | | | 4,750 | | | | 56,660 | |

| | | | 71,613 | | | | 158,495 | |

Total | | | 326,613 | | | | 531,472 | |

Tax fees payable to PricewaterhouseCoopers, Australia and United States are in relation to the review and filing of our tax returns. They also include fees for tax advice we may have sought from time to time.

All audit and non-audit services to be performed by the Company's independent accountant must be approved in advance by the Audit and Compliance Committee and/or the Board. For audit services, each year the independent accountant provides the Audit and Compliance Committee with an engagement letter outlining the scope of proposed audit services to be performed during the year and the proposed fees, which must be formally accepted by the Committee before the audit commences. Any additional service proposed to be provided after the annual pre-approval process of audit services requires specific pre-approval by Audit and Compliance Committee. The Committee may delegate either general or specific pre-approval authority to any one of the Committee members or the Chief Financial Officer. The member or Chief Financial Officer to whom such authority is delegated must report any pre-approval decisions to the Committee at its next meeting. Accordingly, the Committee pre-approved all of the fees last year.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information known to us regarding beneficial ownership of our shares of common stock as of April 19, 2021 by the following persons:

• | each person known by us to be the beneficial owner of more than 5% of our common stock; |

• | our named executive officers listed in the “Summary Compensation Table”; |

• | our executive officers and directors as a group. |

Beneficial ownership is determined according to the rules of the Securities and Exchange Commission and generally means that a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security, and includes options and warrants that are exercisable within 60 days. Information with respect to beneficial ownership has been furnished to us by each director and executive officer. Holders of our CDIs have beneficial ownership of an equivalent number of our shares. Unless otherwise indicated, to our knowledge, each holder of our CDIs possesses sole power to direct CDN how to vote and has investment power over the shares listed, except for shares owned jointly with that person’s spouse.

The table below lists applicable percentage ownership based on 177,621,854 shares of common stock outstanding as of April 19, 2021 and 9,042,450 options to purchase our shares that are exercisable as of April 19, 2021 and within 60 days of this date. Options to purchase our shares that are exercisable within 60 days of April 19, 2021 are deemed to be beneficially owned by the person holding these options for the purpose of computing percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other holder.

For each of the persons listed in the table below, unless otherwise indicated:

| | ● | the shareholding information has been derived from our share register; and |

| | ● | their address is c/o Universal Biosensors, Inc., 1 Corporate Avenue, Rowville, Victoria 3178. |

Name and Address of Beneficial Owner | | Number of Shares (1) | | | Percentage of Class | |

| | | | | | | | | |

John Sharman | | | 7,094,000 | | (2) | | 3.84 | % |

Salesh Balak | | | 1,743,858 | | (3) | | * | |

Craig Coleman | | | 27,466,227 | | (4) | | 15.46 | % |

David Hoey | | | 566,414 | | (5) | | * | |

Judith Smith | | | 300,000 | | (6) | | * | |

Total Directors and Executives as a group (5 persons) | | | 37,170,499 | | | | 19.96 | % |

JP Morgan Nominees Australia Ltd | | | 45,410,636 | | (7) | | 25.57 | % |

Viburnum Funds Pty Ltd | | | 27,246,227 | | (8) | | 15.34 | % |

HSBC Custody Nominees (Australia) Ltd | | | 24,397,330 | | (9) | | 13.74 | % |

Sandhurst Trustees Ltd | | | 23,347,325 | | (10) | | 13.14 | % |

Jencay Australia Investment Fund | | | 20,792,320 | | (11) | | 11.71 | % |

* Represents beneficial ownership of less than one percent of our outstanding ordinary shares.

(1) | Includes shares issuable pursuant to options exercisable as of April 19, 2021 and within 60 days of this date. The figures represent the amounts last notified to us unless otherwise stated. The relevant stockholders may have acquired or disposed of shares since the last notification that are not reflected. |

(2) | Represents options exercisable as of April 19, 2021 and within 60 days of this date. |

(3) | Includes: (i) 262,392 shares in the form of CDIs Mr. Balak holds directly; (ii) 1,477,300 options exercisable as of April 19, 2021 and within 60 days of this date; and (iii) 4,166 restricted fully paid shares. |

(4) | Includes: (i) 220,000 shares in the form of CDIs held by a superannuation fund of which Mr. Coleman is a potential beneficiary; and (ii) 27,246,227 shares held by Viburnum Funds Pty Ltd (“Viburnum”) of which Mr. Coleman is a director. Mr. Coleman may be deemed to beneficially own, the common stock held by Viburnum due to Mr. Coleman serving as a director of Viburnum and may be deemed to share voting and dispositive power over such shares. Mr. Coleman disclaims beneficial ownership of the shares beneficially owned by Viburnum. |

(5) | Shares in the form of CDIs Mr. Hoey holds directly. |

(6) | Shares in the form of CDIs held by a superannuation fund of which Ms. Smith is a member. |

(7) | The address of J. P. Morgan Nominees Australia Ltd is GPO Box 3289, Sydney NSW 2001, Australia. |

(8) | The address of Viburnum Funds Pty Ltd (“Viburnum”) is 31 Carrington Street, Nedlands WA 6009. The ownership information is based in its entirety on material contained in Schedule 13D filed with the SEC on January 11, 2021. The shares beneficially owned by Viburnum are held by VF Strategic Equities Fund and separately managed accounts on behalf of Viburnum clients. Each of Mr. Craig Coleman, Mr. Marshall Allen and Mr. Anthony Howarth share voting and dispositive power over, and may be deemed to beneficially own all of the shares, beneficially owned by Viburnum, due to each of the foregoing individuals serving as a director of Viburnum. Each of Messrs. Coleman, Allen and Howarth disclaims beneficial ownership over these shares. |

(9) | The address of HSBC Custody Nominees (Australia) Ltd is GPO Box 5302, Sydney NSW 2001, Australia. |

(10) | The address of Sandhurst Trustees Ltd is Level 5, 120 Harbour Esplanade, Docklands VIC 3008, Australia. |

(11) | The address of Jencay Australia Investment Fund is Level 1, 488 Botany Rd, Alexandria, NSW 2015, Australia. The ownership information is based on its entirety on material contained in Form 604 filed with the ASX on June 26, 2019. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There were no related person transactions that would require disclosure under Item 404 of Regulation S-K.

OTHER MATTERS

2022 Stockholder Proposals

Under Rule 14a-8 under the Exchange Act, some stockholder proposals may be eligible for inclusion in our 2022 proxy statement. These stockholder proposals must be submitted, along with proof of ownership of our stock in accordance with Rule 14a-8(b)(2), to our corporate headquarters, care of our Company Secretary. We must receive all submissions no later than January 3, 2022. If your proposal is not received by the deadline or you do not otherwise comply with Rule 14a-8, we will not consider your proposal for inclusion in next year’s proxy materials. The Board reviews all stockholder proposals.

Alternatively, under our Bylaws, if a stockholder does not want to submit a proposal for the 2022 Meeting for inclusion in our proxy statement under Rule 14a-8 but wants to bring any other business before a Meeting of stockholders, or intends to nominate a person as a candidate for election to the Board directly (rather than making recommendations to our Remuneration and Nomination Committee or the Board when acting in its place), the stockholder must submit the proposal or nomination to our Company Secretary no earlier than March 2, 2022 and no later than April 1, 2022. However, if the date of the 2022 Meeting is changed by more than 30 days from the first anniversary of the 2021 Meeting, our Company Secretary must receive the notice no later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs.

Stockholders who intend to nominate an individual for election to the Board or to bring any other business before a Meeting of stockholders pursuant to our Bylaws must follow the procedures outlined in Sections 4.10 and/or 4.11 of Article IV of our Bylaws. We will not entertain any proposals or nominations at the annual meeting that do not comply with these requirements. Our Bylaws are posted on our website at www.universalbiosensors.com in the “Corporate Governance” section under “Investor information.” To make a submission or to request a copy of our Bylaws, stockholders should contact our Company Secretary.

Other Business