UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a – 101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Universal Biosensors, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

DEFINITIVE PROXY STATEMENT

Universal Biosensors, Inc. ABN 67 950 836 446 1 Corporate Avenue Rowville Victoria 3178 Australia Telephone: +61 3 9213 9000 Facsimile: +61 3 9213 9099 Email: info@universalbiosensors.com www.universalbiosensors.com |

|

UNIVERSAL BIOSENSORS, INC.

NOTICE OF MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2022

May 4, 2022

NOTICE IS HEREBY GIVEN that the special meeting of stockholders (the “Meeting”) of Universal Biosensors, Inc., a Delaware corporation (ARBN 121 559 993) (the “Company”), will be held on May 23, 2022 at 10:00 a.m. Australian Eastern Standard Time. The Meeting will be a “virtual meeting” of stockholders for the purposes described below.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON MAY 23, 2022

Date and Time: | | Monday, May 23, 2022 at 10:00 a.m. Australian Eastern Standard Time |

| | | |

Items of Business: | | To consider and vote on: 1) A proposal to approve the following resolution: THAT pursuant to and in accordance with Listing Rule 10.11 of the Australian Securities Exchange Ltd and for all other purposes, approval is given for the Company to issue 3,840,000 unquoted options over fully paid ordinary shares in the Company (Underwriter Options) to Viburnum Funds Pty Ltd, or its nominee, on the terms and conditions set out in the proxy statement accompanying this Notice. 2) One or more adjournments of the Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1. The Board of Directors (other than Mr. Craig Coleman, who abstained from voting on the matter being an interested director) recommends that you vote “FOR” both Proposals Nos. 1 and 2. |

| | | |

Voting Exclusion | | “Excluded Holders,” as defined in the accompanying proxy statement, will not be entitled to vote with respect to, and the Company will disregard any votes cast by Excepted Holders in favour of, Proposal 1, and the Company will disregard any votes cast by Excluded Holders with respect to Proposal 2. Refer to the "Voting Exclusion" statement on page 4 of the proxy statement accompanying this Notice. |

Record Date: | | The record date for the determination of (i) stockholders of record entitled to receive notice of and to vote at the Meeting and (ii) holders of CHESS Depositary Interests (“CDIs”) of record entitled to receive notice of and to direct CHESS Depositary Nominees Pty Ltd ACN 071 346 506 (“CDN”) how to vote at the Meeting, or any adjournments or postponements thereof, is the close of business on May 2, 2022. A complete list of stockholders and CDI holders of record on the record date will be available at the Company’s principal executive offices located at 1 Corporate Avenue, Rowville VIC 3178 Australia, for ten days before the Meeting and will be accessible during the Meeting. |

| | | |

Internet Availability of Documents: | | You may access a copy of the proxy statement and the documents incorporated by reference therein at http://www.universalbiosensors.com/ under the Investor Centre tab. |

These items are fully discussed in the following pages, which are made part of this notice.

If you are a stockholder, you are encouraged to vote your shares by signing, dating, and mailing your Proxy Card in the enclosed envelope or by virtually attending the Meeting. If you are a CDI Holder, you are encouraged to vote your CDIs by signing, dating, and mailing your CDI Voting Instruction Form to the Company’s registrar in the enclosed envelope. Instructions for voting are set forth on the CDI Voting Instruction Form. Alternatively, holders of CDIs can direct CDN on how to vote online by following the instructions at https://www.votingonline.com.au/ubispecialmeeting2022.

The Meeting will be a “virtual meeting” of stockholders that will be conducted exclusively by means of remote communication. You will be able to attend the Meeting by means of remote communication at https://web.lumiagm.com/343806865.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Salesh Balak | |

Name: | Salesh Balak | |

Title: | Company Secretary | |

YOUR VOTE IS IMPORTANT, WHETHER YOU OWN A FEW SHARES/CDIs OR MANY.

This Notice and Proxy Statement is being first mailed to stockholders and CDI Holders of UBI on or after May 4, 2022.

INFORMATION REGARDING UBINA CHESS DEPOSITARY INTERESTS

The Company’s CDIs to be issued in the Entitlement Offer and Placement, as described in the accompanying proxy statement, are traded on The Australian Securities Exchange under the symbol UBINA. Neither such CDIs nor the shares evidenced thereby have been or will be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States or to, or for the account of, a U.S. Person (within the meaning of Regulation S under the Securities Act), absent registration or an applicable exemption from the registration requirements. Hedging transactions involving these securities may not be conducted unless in compliance with the Securities Act.

UNIVERSAL BIOSENSORS, INC.

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

To be held on May 23, 2022

TABLE OF CONTENTS

| | Page | |

Information about Solicitation and Voting | 1 | |

Proposal One – Issuance of Underwriter Options | 5 | |

Proposal Two – Adjournment Proposal | 14 | |

Interest of Certain Persons in the Issuance of Underwriter Options | 14 | |

Security Ownership of Certain Beneficial Owners and Management | 15 | |

Householding | 17 | |

Where You Can Find More Information | 17 | |

Stockholder Communications with Board of Directors | 18 | |

Stockholder Proposals and Nominations | 18 | |

Annex A: UBI Annual Report on Form 10-K for the year ended December 31, 2021

Annex B: UBI 2021 Annual Report

Annex C: UBI Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022

UNIVERSAL BIOSENSORS, INC.

PROXY STATEMENT FOR MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2022

INFORMATION ABOUT SOLICITATION AND VOTING

General

The enclosed proxy and CDI Voting Instruction Form is solicited by the board of directors (the “Board of Directors”) of Universal Biosensors, Inc. (the “Company,” “we,” “our,” or “UBI”) for use in voting at the special meeting of stockholders (the “Meeting”) to be held on May 23, 2022, at 10:00 a.m., Australian Eastern Standard Time, and any postponement or adjournment of that Meeting. The Meeting will be a “virtual meeting” of stockholders that will be conducted by means of remote communication. The purpose of the Meeting is to consider and vote upon the proposals outlined in this Proxy Statement and the attached notice.

Record Date and Voting Securities

As of the close of business on May 2, 2022, the record date, there are in total 185,780,712 shares of the Company’s common stock, par value US $0.0001 per share, outstanding and entitled to vote at the Meeting, subject to the voting restrictions described below. All of our outstanding shares are held by CHESS Depositary Nominees Pty Ltd ACN 071 346 506 (“CDN”), a wholly-owned subsidiary of ASX Limited ACN 008 624 691, which operates the Australian Securities Exchange Ltd (“ASX”). Securities of companies incorporated outside of Australia, such as UBI, are traded as CHESS Depositary Interests (“CDIs”) on the ASX. CDIs represent beneficial interests in the common stock held by CDN. CDIs are traded on the ASX. As of the record date for the Meeting, there were 185,780,712 CDIs on issue and available to be traded on ASX. As of the record date for the Meeting, there was one holder of shares of our common stock (including CDN) and 2,555 holders of CDIs (“CDI Holders” or “Holders of CDIs”).

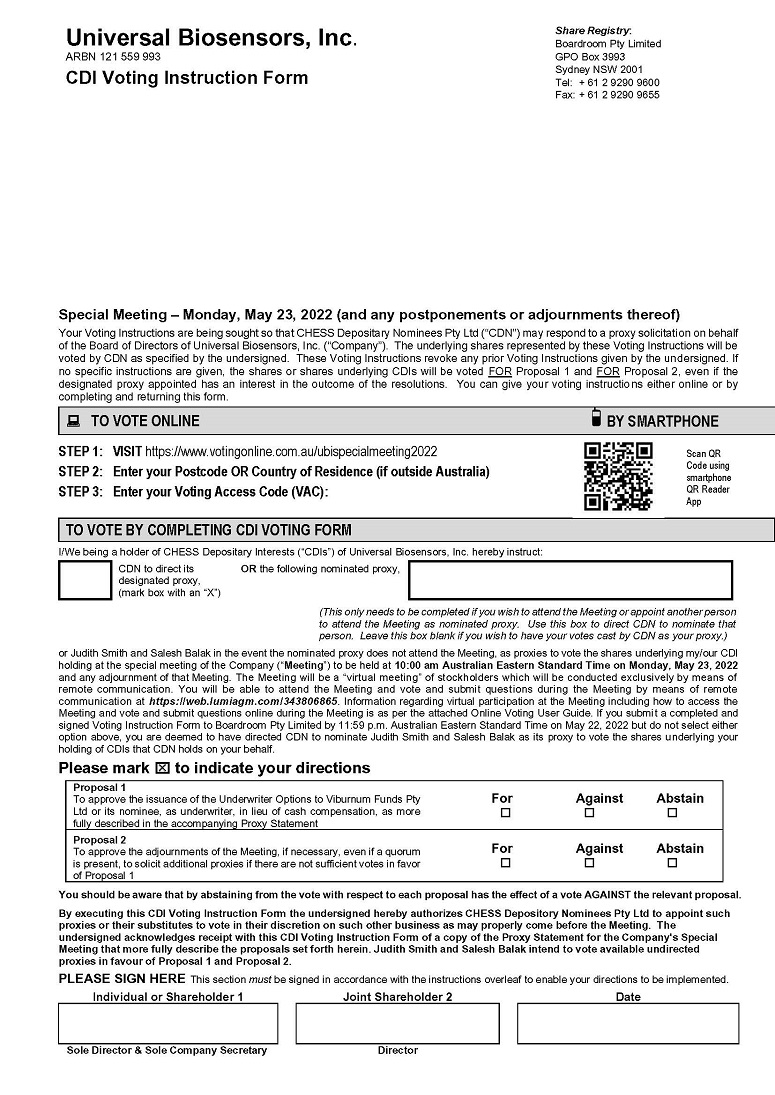

CDIs are exchangeable, at the option of the holder, into shares of our common stock at a ratio of 1:1. Holders of CDIs have the right to direct CDN, as the holder of record of the underlying shares of common stock represented by their CDIs, how it should vote the underlying shares. If CDN does not receive a duly executed CDI Voting Instruction Form from a CDI Holder as to how to vote the underlying shares represented by those CDIs, those shares will not be voted and will not be considered present at the Meeting for quorum purposes. A holder of CDIs has the right to attend the Meeting but will be entitled to vote at the Meeting only if such holder directs CDN to designate such holder as proxy to vote the underlying shares of common stock represented by CDIs held by such holder. CDI Holders who wish to direct CDN on how to vote the underlying shares should complete and return the enclosed CDI Voting Instruction Form or submit their instructions online by following the instructions on the CDI Voting Instruction Form, which is being delivered with this Proxy Statement to each CDI Holder by no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022. CDI Holders may not revoke their proxies and change their votes after such time.

The record date is the close of business on May 2, 2022 (the “Record Date”). Only stockholders and CDI Holders of record on the books of the Company at the close of business on the Record Date are (1) with respect to stockholders, entitled to receive notice of and to vote at, and (2) with respect to CDI Holders, entitled to receive notice of and to direct CDN how to vote at, the Meeting and any adjournments thereof. Under arrangements established between the Company and CDN in connection with the issuance of CDIs, the holders of CDIs at the close of business on the Record Date are entitled to notice of and to attend the Meeting and to direct CDN how to vote by completing a CDI Voting Instruction Form or by submitting their voting instructions online.

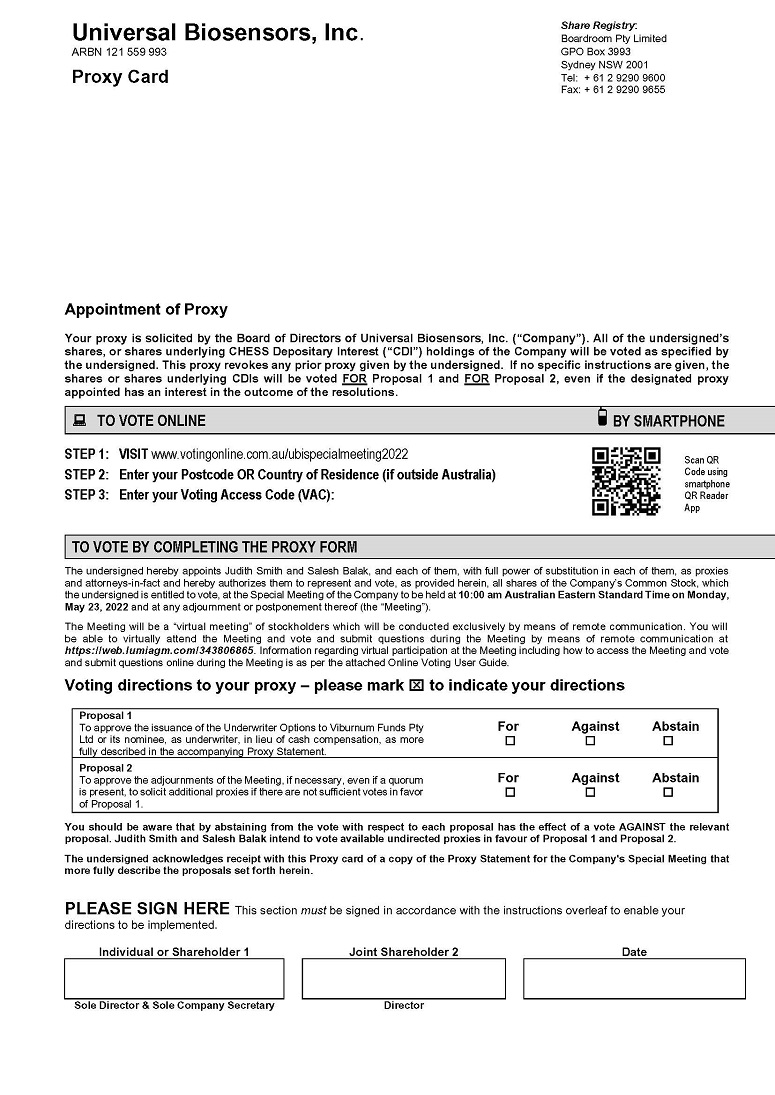

Voting and Solicitation

Subject to the voting restrictions described below, each stockholder of record can vote at the Meeting by virtually attending the Meeting and voting at the Meeting, or by completing and returning their properly dated and duly executed Proxy Card to Boardroom Pty Limited or the Company no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022, in the manner set out below, but may alternatively deliver a completed Proxy Card to us at the Meeting. Alternatively, record holders may submit their instructions online by visiting https://www.votingonline.com.au/ubispecialmeeting2022 by no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022. To use the online facility you will need the secure access information set out on your Proxy Card.

CDI Holders who wish to direct CDN how to vote but who are not attending the Meeting must return their duly executed voting instructions, via the enclosed CDI Voting Instruction Form, to Boardroom Pty Limited or the Company no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022, in the manner set out below. If you are a CDI Holder and you wish to direct CDN to designate you or another person as proxy to vote the underlying shares of common stock represented by CDIs held by you and virtually attend the Meeting, you are encouraged to return your properly dated and duly executed CDI Voting Instruction Form to Boardroom Pty Limited or the Company in the manner set out below. Alternatively, CDI Holders may submit their instructions online by visiting https://www.votingonline.com.au/ubispecialmeeting2022 by no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022. To use the online facility, you will need the secure access information set out on your CDI Voting Instruction Form.

Proxy Cards and CDI Voting Instruction Forms may be submitted in the following manners:

| | By hand | Boardroom Pty Limited, Level 12, Grosvenor Place, 255 George Street, Sydney NSW 2000, Australia; or Universal Biosensors, Inc., 1 Corporate Avenue, Rowville VIC 3178, Australia. |

| | By post | Boardroom Pty Limited, GPO Box 3993, Sydney NSW 2001, Australia; or Universal Biosensors, Inc., 1 Corporate Avenue, Rowville VIC 3178, Australia. |

| | By facsimile | Boardroom Pty Limited on +61 2 9290 9655; or Universal Biosensors, Inc. on +61 3 9213 9099. |

| | Online | https://www.votingonline.com.au/ubispecialmeeting2022 |

At the Meeting, proxy holders and CDN may only vote the shares represented by all properly dated, executed, and returned Proxy Cards (in the case of stockholders) and properly dated, executed, and returned CDI Voting Instruction Forms or instructions properly delivered online (in the case of CDI Holders) in accordance with the instructions of the respective stockholders and CDI Holders.

If no specific instructions are given on a properly dated, executed, and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or instructions properly delivered online (in the case of CDI Holders), the shares will be voted “FOR” the approval of each Proposal described in this proxy statement.

On all matters to be voted on, each share of our common stock, and accordingly, each CDI, has one vote, except that, as required by the ASX Listing Rules, pursuant to our certificate of incorporation and Bylaws, Excluded Holders (as defined below) will not be entitled to vote on Proposal 1. Although under Delaware law and our certificate of incorporation and bylaws, Excluded Holders are permitted to vote on Proposal 2, votes cast in favor of Proposal 2 by or on behalf of Excluded Holders will have no effect on the Company’s action with respect to Proposal 2.

We are making this proxy solicitation by and on behalf of the Board of Directors. The cost of preparing, assembling, printing, and mailing this Proxy Statement and the proxies solicited hereby will be borne by the Company. Proxies may be solicited personally or by telephone, electronic mail, or facsimile by the Company’s officers, directors, and regular employees, none of whom will receive additional compensation for assisting with solicitation.

Quorum; Required Vote; Voting Choices

A quorum is required for the transaction of business during the Meeting. A quorum is present when the holders of one-third of the shares of common stock issued and outstanding and entitled to vote at the Meeting are present in person or represented by proxy. Shares represented by properly-authorized proxies that are instructed to vote “FOR” or “AGAINST,” or instructed to “ABSTAIN,” with respect to any Proposal to be considered at the Meeting are treated as being present at the Meeting for purposes of establishing a quorum. Because the Excluded Holders are permitted, under Delaware law and our certificate of incorporation and bylaws, to vote with respect to Proposal 2, any shares held by Excluded Holders and represented by properly-authorized proxies will be treated as being present at the Meeting for purposes of establishing a quorum. If no specific instructions are given on a properly dated, executed, and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or instructions properly delivered online (in the case of CDI Holders), the shares will be treated as being present at the Meeting for purposes of establishing a quorum.

For each Proposal, subject to the exclusion of Excluded Holders described below under the caption “—Voting Exclusion,” stockholders may vote “FOR,” “AGAINST,” or “ABSTAIN.” The affirmative vote of the holders (other than Excluded Holders) of a majority of shares of the Company’s common stock present or represented by proxy and entitled to vote at the Meeting, other than Excluded Holders, subject to the quorum being present, will constitute approval of Proposal 1. The affirmative vote of holders of a a majority of the shares of our common stock present, in person or by proxy, and entitled to vote at the Meeting without regard to a quorum requirement will constitute approval of Proposal 2. Although Excluded Holders are, pursuant to our certificate of incorporation and bylaws, permitted to vote with respect to Proposal 2, the Company will disregard any votes cast by the Excluded Holders with respect to Proposal 2 and we will not adjourn the Meeting as contemplated by Proposal 2 unless Proposal 2 is also approved by the affirmative vote of a majority of the shares of our common stock present at the meeting, in person or by proxy, other than shares held by Excluded Holders, without regard to a quorum requirement. Abstentions will have the effect of negative votes with respect to each Proposal.

A broker “non-vote” occurs when your broker (if applicable) submits a proxy for your shares but does not indicate a vote for a particular proposal because the broker does not have authority to vote on that proposal and has not received specific voting instructions from you. If your shares are held by a broker, the broker may require your instructions in order to vote your shares. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, one of two things can happen depending on the type of proposal. If the proposal is considered “routine,” the broker may vote your shares in its discretion. For other proposals, brokers that are members of an exchange registered as a national exchange under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), may not vote your shares without your instructions. All of the proposals to be considered at the Meeting are not routine, and broker non-votes will not be counted as shares present and entitled to vote in connection with both proposals. Broker non-votes have no effect with respect to each Proposal.

Revocability of Proxies

If you are a stockholder entitled to vote and you have submitted a Proxy Card or instructions online, you may revoke your Proxy Card or online instructions at any time before the Meeting by delivering a written revocation to the Corporate Secretary of the Company, at 1 Corporate Avenue, Rowville VIC 3178 or at companysecretary@universalbiosensors.com, by delivering a duly executed Proxy Card or submitting instructions online, in each case bearing a later date or by attending and voting at the Meeting.

If you are a CDI Holder and you have submitted a CDI Voting Instruction Form or instructions online, you may revoke your CDI Voting Instruction Form or online instructions by no later than 11:59 p.m. Australian Eastern Standard Time on May 22, 2022, by delivering a written revocation to the Corporate Secretary of the Company, at 1 Corporate Avenue, Rowville VIC 3178 or at companysecretary@universalbiosensors.com, by delivering a duly executed CDI Voting Instruction Form or submitting instructions online, in each case bearing a later date.

Voting Exclusion

Excluded Holders are not, pursuant to the ASX Listing Rules, permitted to vote with in favour of Proposal 1. “Excluded Holders” are Viburnum Funds Pty Ltd (or its nominee) and any other person who will obtain a material benefit as a result of the issue of the Underwriter Options, as defined herein, (except a benefit solely by reason of being a holder of securities in the Company) and any of their Associates (as such term is defined in the ASX Listing Rules). The Company will disregard any votes cast in favour of Proposal 1 by or on behalf of an Excluded Holder. However, this does not apply to a vote cast in favour of Proposal 1 by:

| | (a) | a person as proxy or attorney for a person who is entitled to vote on the Proposals, in accordance with the directions given to the proxy or attorney to vote on the Proposals in that way; or |

| | (b) | the person chairing the Meeting as proxy or attorney for a person who is entitled to vote on the Proposals, in accordance with a direction given to the person chairing the Meeting to vote as the chair decides; or |

| | (c) | a holder acting solely in a nominee, trustee, custodial, or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| | i. | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting and is not an Associate of a person excluded from voting on the Proposals; and |

| | ii. | the holder votes on the Proposals in accordance with directions given by the beneficiary to the holder to vote in that way. |

Accordingly, under our certificate of incorporation and bylaws, because Excluded Holders are not, pursuant to the ASX listing rules, permitted to vote in favor of Proposal 1, Excluded Holders will not be entitled to vote with respect to Proposal 1.

PROPOSAL ONE – ISSUANCE OF UNDERWRITER OPTIONS

Background

The Company has undertaken an entitlement offer (“Entitlement Offer”) of A$20 million of CDIs to existing securityholders of the Company who are not, and who are not acting for the account of any, “U.S. Persons” within the meaning of Regulation S under the Securities Act of 1933, as amended, at a price per CDI of A$0.77.

On April 19, 2022, the Board of Directors of the Company approved the terms of the Entitlement Offer and recommended to submit the following proposal to the Company’s stockholders for approval:

THAT pursuant to and in accordance with Listing Rule 10.11 of the Australian Securities Exchange Ltd and for all other purposes, approval is given for the Company to issue 3,840,000 unquoted options over fully paid ordinary shares in the Company (Underwriter Options) to Viburnum Funds Pty Ltd, or its nominee, on the terms and conditions set out in this proxy statement.

No securityholders of the Company who with a registered address outside of Australia or New Zealand, or who are, or who are acting for the benefit of, U.S. Persons are invited, or will be permitted, to participate in the Entitlement Offer or purchase securities sold in the Entitlement Offer. The Company has instituted procedures to prevent any person who is not a resident of Australia or New Zealand, or any person who is, or who is acting for the benefit of, a U.S. Person, from purchasing securities offered or sold in the Entitlement Offer.

An existing securityholder of the Company, Viburnum Funds Pty Ltd (the “Underwriter”), has agreed to take up its full entitlement under the Entitlement Offer and fully underwrite the Entitlement Offer, which means that the Underwriter has agreed to subscribe for or procure others to subscribe for all securities (if any) not subscribed for by the Company’s eligible securityholders under the Entitlement Offer. In addition, pursuant to the terms of the underwriting agreement entered into between the Company and the Underwriter (the “Underwriting Agreement”), the Company will issue to the Underwriter, or its nominee, up to 3,840,000 unlisted options, in two tranches, as its underwriting fee (the “Underwriter Options”) in lieu of cash compensation. The Underwriter has advised the Company that it intends to hold the securities it acquires in the Entitlement Offer (including the Underwriter Options and any shares of UBI common stock or CDIs that it may acquire upon exercise of the Underwriter Options) in its own name or to allocate those securities to accounts for which it acts as discretionary investment manager, and that it currently has no plans to resell the securities acquired in the Entitlement Offer. The Underwriter has agreed that it will not resell any shares or CDIs it acquires in connection with the Entitlement Offer, including any shares or CDIs received upon exercise of the Underwriter Options, directly or indirectly, in or into the United States, or to a U.S. Person or resident of the United States, except in compliance with the registration requirements of the Securities Act and any other applicable securities laws of any state or other jurisdiction of the United States or pursuant to an exemption from, or in a transaction exempt from or not subject to, such registration requirements and any other applicable securities laws.

The Non-Executive Chairman of the Company, Mr. Craig Coleman, holds 33% of the issued shares in the Underwriter and is also an Executive Chairman and associate of the Underwriter. Consequently, the transaction between the Company and the Underwriter is governed, inter alia, by ASX Listing Rule 10.11 which requires the approval of the Company’s stockholders for issuance of the Underwriter Options in lieu of the payment of cash compensation to the Underwriter. As a result, the Company seeks stockholder approval to issue the Underwriter Options to the Underwriter or its nominee pursuant to the terms of the Underwriting Agreement.

Underwriter Compensation

In accordance with the terms of the Underwriting Agreement, the value of the Underwriter Options (calculated based on the Black-Scholes model) is 3.4% of the underwritten amount of the Entitlement Offer of A$20 million, or A$680,000. The Underwriter Options will vest upon issue, and have an expiry date of 3 years from their date of issue. The exercise price in respect of half of the Underwriter Options will be an amount equal to 120% of the price of CDIs issued in the Entitlement Offer (the “Offer Price”), or A$0.92. The second half of the Underwriter Options will have an exercise price equal to 130% of the Offer Price, or A$1.00.

If the stockholders of the Company do not approve Proposal 1 by June 30, 2022, or the Company fails to issue the Underwriter Options within one month after the date on which the Company’s stockholders approve the Proposal 1, the Company will be obligated to pay the Underwriter a cash underwriting fee of 4.5% of the underwritten amount of A$20 million, or A$900,000.

Applicable ASX Listing Rules

Approval of the Underwriter Options

ASX Listing Rule 10.11 requires stockholders’ approval to be obtained where an entity issues, or agrees to issue securities to a related party, or a person whose relationship with the entity or a related party is, in ASX’s opinion, such that approval should be obtained unless an exception in ASX Listing Rule 10.12 applies.

The terms of the Underwriting Agreement involve the issue of the Underwriter Options to the Underwriter, an “associate” (as defined in the ASX Listing Rules) of Mr Craig Coleman, who is a related party of the Company for the purpose of ASX Listing Rule 10.11. Therefore, the stockholders’ approval is required for such issuance unless an exception applies. It is the view of the Independent Directors that the exceptions set out in ASX Listing Rule 10.12 do not apply in the current circumstances.

Information required by ASX Listing Rule 10.13

Pursuant to and in accordance with ASX Listing Rule 10.13, the following information is provided to the Company’s stockholders in relation to the Underwriter Options to be issued to the Underwriter:

| | (a) | the Underwriter Options will be issued under ASX Listing Rule 10.11.3 to the Underwriter, which is an “associate” (as defined in the ASX Listing Rules) of Mr Craig Coleman, being a related party of the Company for the purposes of ASX Listing Rule 10.11.1, or its nominee; |

| | (b) | 3,840,000 Underwriter Options, being unquoted options over fully paid shares of common stock of the Company, will be issued to the Underwriter (or its nominee); |

| | (c) | a summary of the material terms of the Underwriter Options is included in the Section titled “Material Terms of the Underwriter Options“ below; |

| | (d) | the Underwriter Options are intended to be issued on or around May 23, 2022, but will be issued no later than 1 month after the date of the Meeting (or such later date to the extent permitted by any ASX waiver or modification of the ASX Listing Rules); |

| | (e) | the Underwriter Options will be issued at a nil issue price as consideration for the Underwriter underwriting the Entitlement Offer. However, the Underwriter Options, will be exercisable at an exercise price noted in the summary of the key terms of the Underwriter Options in the Section titled “Material Terms of the Underwriter Options“ below. Therefore, the Company anticipates to raise funds from any exercise of the Underwriter Options. The Company expects that such funds, if raised, will be applied towards its working capital requirements; |

| | (f) | the purpose of the issue of the Underwriter Options is to satisfy the Company’s obligations under the Underwriting Agreement, a summary of which is included in in the Section titled ”Material terms of the Underwriting Agreement“ below; |

| | (g) | a voting exclusion statement is included with the notice of Meeting. |

Material terms of the Underwriting Agreement

The Company and the Underwriter have entered into the Underwriting Agreement. Pursuant to its terms, the Underwriter will subscribe for (or procure subscribers for) CDIs offered under the Entitlement Offer that are not acquired by eligible securityholders.

Fees

Under the terms of the Underwriting Agreement, the Company will issue to the Underwriter or its nominee (subject the stockholders’ approval of Proposal 1) the Underwriter Options, on the terms described in section “Material Terms of the Underwriter Options“ below. The value of the Underwriter Options (calculated based on the Black-Scholes model) is 3.4% of the underwritten amount of the Entitlement Offer of A$20 million, or A$680,000.

If the stockholders of the Company do not approve Proposal 1 by June 30, 2022, or the Company fails to issue the Underwriter Options within one month after the date on which the Company’s stockholders approve the Proposal 1, the Company will be obligated to pay the Underwriter a cash underwriting fee of 4.5% of the underwritten amount of A$20 million, or A$900,000.

The Company is also obligated to pay any reasonable disbursements and out of pocket expenses of the Underwriter incurred and associated with the Entitlement Offer.

Termination Events

The Underwriting Agreement may be terminated by mutual consent of the parties or by either the Company or the Underwriter in the manner permitted by the Underwriting Agreement.

Pursuant to the Underwriting Agreement, the Underwriter may, in certain circumstances, terminate its obligations under the Underwriting Agreement on the occurrence of the following events at any time before the issue of CDIs under the Entitlement Offer:

| | ● | the S&P ASX 200 Index is 10% or more below its level as at the close of business on the business day prior to the date of the Underwriting Agreement, at close of trading for more than 3 consecutive business day; |

| | ● | the Company does not lodge the offer documents in accordance with the timetable (other than with the prior consent of the Underwriter) or the Entitlement Offer is withdrawn by the Company; |

| | ● | ASX has advised the Company that it will not or may not grant official quotation to the CDIs issued under the Entitlement Offer or admit the Company to trading on the ASX following completion of the Entitlement Offer on or prior to the shortfall notification deadline; |

| | ● | the Underwriter forms the view on reasonable grounds that a supplementary cleansing notice should be lodged with ASX and the Company fails to lodge a supplementary cleansing notice in such form and content and within such time as the Underwriter may reasonably require; |

| | ● | the Company lodges a supplementary cleansing notice without the prior written agreement of the Underwriter; |

| | ● | there is a statement in the offer documents that is misleading or deceptive or likely to mislead or deceive, or that there is an omission from the offer documents or if any statement in the offer documents becomes misleading or deceptive or likely to mislead or deceive or if the issue of the offer documents is or becomes misleading or deceptive or likely to mislead or deceive; |

| | ● | the Company is prevented from issuing the CDIs under the Entitlement Offer within the time required by the Underwriting Agreement, the Corporations Act, the ASX Listing Rules, any statute, regulation or order of a court of competent jurisdiction by ASIC, ASX or any court of competent jurisdiction or any governmental or semi-governmental agency or authority; |

| | ● | an application is made by ASIC for an order under any provision of the Corporations Act in relation to the offer documents, the time for notification by the Company to the Underwriter of any shortfall CDIs to be subscribed by the Underwriter has arrived, and that application has not been dismissed or withdrawn; |

| | ● | any authorisation which is material to anything referred to in the offer documents is repealed, revoked or terminated or expires, or is modified or amended in a manner unacceptable to the Underwriter acting reasonably; |

| | ● | an event of insolvency occurs in respect of the Company or one of its subsidiaries; |

| | ● | the Company or one of its subsidiaries makes, or agrees to make a major acquisition or enters into any major expenditure other than in accordance with any disclosure in the offer documents or any announcement released to the ASX prior to the date of the Underwriting Agreement; and |

| | ● | a director or senior manager of the Company or one of its subsidiaries is charged with an indictable offence or is disqualified from managing a corporation under the Corporations Act 2001 (Cth) (the “Corporations Act”). |

In addition, the Underwriter may terminate its obligations under the Underwriting Agreement if any of the following termination events occurs and, in the opinion of the Underwriter, has or is likely to have a material adverse effect on the outcome of the Entitlement Offer or on the likely trading price for the CDIs to be issued under the Entitlement Offer (including, without limitation, matters likely to have a material adverse effect on a decision of an investor to invest in the CDIs to be issued under the Entitlement Offer), a material adverse effect on the assets, liabilities, condition, trading or financial position and performance, profits and losses, results, prospects, business or operations of the Company and its subsidiaries either individually or taken as a whole (“Material Adverse Effect”), or where they may give rise to liability for the Underwriter under the Corporations Act:

| | ● | default or breach by the Company under the Underwriting Agreement of any terms, condition, covenant or undertaking; |

| | ● | any representation, warranty or undertaking given by the Company in the Underwriting Agreement is or becomes untrue or incorrect; |

| | ● | a contravention by the Company or any of its subsidiaries of any provision of its constituent documents, the Corporations Act, the Listing Rules or any other applicable legislation or any policy or requirement of ASIC or ASX; |

| | ● | an event occurs which gives rise to a Material Adverse Effect or any adverse change or any development including a likely Material Adverse Effect after the date of the Underwriting Agreement in the assets, liabilities, financial position, trading results, profits, forecasts, losses, prospects, business or operations of any of the Company or its subsidiaries including, without limitation, if any forecast in the offer documents becomes incapable of being met or in the Underwriter’s reasonable opinion, unlikely to be met in the projected time; |

| | ● | any of the due diligence results, or any part of the verification materials, provided to the Underwriter was false, misleading or deceptive or that there was an omission from them, in each case, at the time they were given; |

| | ● | without the prior approval of the Underwriter a public statement is made by the Company in relation to the Entitlement Offer or the offer documents other than a statement the Company is required to make in order to comply with its disclosure obligations under the Listing Rules and/or the Corporations Act; |

| | ● | any information supplied at any time by the Company or any person on its behalf to the Underwriter in respect of any aspect of the Entitlement Offer or the affairs of the Company or any of its subsidiaries is or becomes misleading or deceptive or likely to mislead or deceive; |

| | ● | there is introduced, or there is a public announcement of a proposal to introduce, into the Parliament of Australia or any of its States or Territories any Act or prospective Act or budget or the Reserve Bank of Australia or any Commonwealth or State authority adopts or announces a proposal to adopt any new, or any major change in, existing, monetary, taxation, exchange or fiscal policy that has not been publicly disclosed or proposed as at the date of the Underwriting Agreement; |

| | ● | certain capital events, including share consolidations or splits, share reductions, share buy-backs, granting options other than the Underwriter Options or as otherwise notified to the Underwriter prior to the date of the Underwriting Agreement, issuing convertible notes or the disposal or charge of the whole or a substantial part of the business or property of the Company or a subsidiary, or other insolvency events, occurs, other than as disclosed in the offer documents; |

| | ● | a judgment in an amount exceeding A$1,500,000 is obtained against the Company or a subsidiary and is not set aside or satisfied within 7 days; |

| | ● | after the date of the Underwriting Agreement, litigation, arbitration, administrative, or industrial proceedings are commenced against the Company or any subsidiary, other than any claims foreshadowed in the offer documents; |

| | ● | there is a change in the composition of the Board or a change in the senior management of the Company before the date of issue of the CDIs under the Entitlement Offer without the prior written consent of the Underwriter, such consent not to be unreasonably withheld; |

| | ● | a force majeure event occurs affecting the Company’s business or any obligation under the Underwriting Agreement lasting in excess of 7 days occurs; |

| | ● | the Company or a subsidiary passes or takes any steps to pass a resolution under section 254N, section 257A or section 260B of the Corporations Act or a resolution to amend its constituent documents without the prior written consent of the Underwriter; |

| | ● | the Company or a subsidiary alters its capital structure in any manner not contemplated by the offer documents, other than in certain circumstances, including the issue of CDIs which may be issued on conversion of any options on issue, any securities under an employee or executive incentive plan currently in place, CDIs under the Entitlement Offer and any institutional placement conducted in connection with the Entitlement Offer in accordance with the offer documents, or the Underwriting Agreement, or the Underwriter Options; |

| | ● | any agreement of the Company or its subsidiaries disclosed to ASX where the consideration or amount paid or payable by or to the Company or a subsidiary thereunder is at least A$1 million is terminated or substantially modified; |

| | ● | the Company becomes aware that any person is appointed under any legislation in respect of companies to investigate the affairs of the Company or a subsidiary; |

| | ● | there is an outbreak of hostilities not presently existing or a material escalation of hostilities (whether or not war has been declared) after the date of this agreement involving one or more of Australia, New Zealand, Japan, the United Kingdom, the United States of America, Hong Kong or the Peoples Republic of China, or any member of the European Union, or a terrorist act is perpetrated on any of the mentioned countries or any diplomatic, military, commercial or political establishment of any of those countries anywhere in the world; or |

| | ● | a suspension or material limitation in trading generally on ASX occurs or any material adverse change or disruption occurs in the existing financial markets, political or economic conditions of Australia, Japan, the United Kingdom, the United States of America, Hong Kong, the People’s Republic of China or the international financial markets, other than Russia and Ukraine. |

Conditions precedent, representations, warranties & undertakings, and indemnities

The Underwriting Agreement contains customary representations, warranties, and undertakings of the parties including, inter alia, the conduct of the parties in connection with the Entitlement Offer. Additionally, the Underwriting Agreement Contains:

| | ● | the obligation to underwrite is subject to the satisfaction of certain conditions precedent, including the delivery of certain due diligence materials and sign-offs, lodgement of documents associated with the Entitlement Offer with ASX in accordance with an agreed timetable, and receipt by the Company of all consents and waivers (in a form and substance reasonably acceptable to the Underwriter) required to enable the Entitlement Offer to proceed in accordance with the agreed timetable and the offer documents; and |

| | ● | the Company has agreed, subject to certain carve-outs, to indemnify and hold harmless the Underwriter and its directors, officers, employees, and agents against all claims, losses, damages, proceedings, liabilities, costs, or expenses, including penalties, fines, and interest that those parties may sustain or incur in connection with the Entitlement Offer. |

Material Terms of the Underwriter Options

Set out below is a summary of the key terms of the Underwriter Options:

| | (a) | 50% of the Underwriter Options (being 1,920,000 Underwriter Options) will be exercisable at an exercise price of A$0.92, representing 120% of the Offer Price; |

| | (b) | 50% of the Underwriter Options (being 1,920,000 Underwriter Options) will be exercisable at an exercise price of A$1.00, representing 130% of the Offer Price; |

| | (c) | the Underwriter Options will vest immediately on the issue and will expire 3 years after the date of issue; |

| | (d) | each Underwriter Option entitles the holder to subscribe for one fully paid share of common stock of the Company upon exercise of that Underwriter Option; |

| | (e) | the Underwriter Options may be exercised by written notice by the holder to the Company and payment of the exercise price for each Underwriter Option; |

| | (f) | within 3 business days after the date on which the exercise notice took effect, the Company must issue to the holder the shares of common stock issuable upon exercise of the Underwriter Options; |

| | (g) | the shares issuable upon exercise of the Underwriter Options rank equally with the then issued shares of common stock of the Company; |

| | (h) | the Company will make an application to ASX for quotation of the shares of common stock issuable upon exercise of the Underwriter Options through the ASX “FOR” facility within 3 business days of the issue of such shares; |

| | (i) | the Underwriter Options may be transferred at any time by the holder on prior written notice to the Company, but only: |

| | i. | pursuant to a registration statement that has been declared effective under the Securities Act; |

| | ii. | to a person that the holder, and any person acting on the holder’s behalf, reasonably believes to be a QIB purchasing for its own account or the account of a QIB to whom notice is given that the offer, sale or transfer is being made in reliance on Rule 144A under the Securities Act; or |

| | iii. | in another transaction exempt from, or not subject to, the registration requirements of the U.S. Securities Act (including an “offshore transaction” in accordance with Rule 903 or 904 of Regulation S under the Securities Act); |

and, in each case, in accordance with all applicable securities laws of any state or other jurisdiction of the United States, including any restrictions applicable to the holder resulting from the holder’s status as an “affiliate” of the Company within the meaning of Rule 405 under the Securities Act. The holder of Underwriter Options must notify subsequent transferees of the transfer restrictions set forth herein;

| | (j) | the number of shares to be delivered in respect of each Underwriter Option or the amount payable, if any, by the holder in respect of shares of the Company’s common stock to be delivered to the holder will be reorganized in accordance with the ASX Listing Rules as applicable to Underwriter Options at the time of any such reorganization (if the Company is then listed on the ASX), or otherwise as determined by the Board of Directors; |

| | (k) | if the Company consummates a pro rata issue of securities, bonus issue of securities, or other new issue of securities, the Company must notify the holder of the Underwriter Options in writing on the earlier of 20 business days prior to the closing date, and 5 business days prior to the record date, of any such issue to enable the holder to exercise the Underwriter Options prior to that date, and participate in the issue if the holder elects to do so; |

| | (l) | the holder of the Underwriter Option may only participate in new issues of shares of common stock of the Company made to holders of the Company’s outstanding common stock if the holder exercises that Underwriter Option and becomes the holder of the underlying shares of common stock of the Company on or prior to the record date for the new issue of shares of common stock of the Company. |

Ownership of UBI Securities by the Underwriter

The following table illustrates the approximate beneficial ownership by the Underwriter of the Company’s outstanding common shares and CDIs after completion of the Entitlement Offer, assuming (i) that 4,178,830 CDIs will be issued to the Underwriter upon the exercise in full of its entitlement, (ii) different levels of acceptances in the Entitlement Offer by eligible securityholders as shown in the table below and (iii) for each level of acceptance in the Entitlement Offer shown below, that the Underwriter Options are not exercised (either because they are not issued or because they expire without being exercised), and the Underwriter Options are exercised in full. Percentage ownership shown below is based on 185,780,712 shares of common stock outstanding and 28,624,984 outstanding shares or CDIs beneficially owned by the Underwriter (including all shares or CDIs that the Underwriter has the right or option to acquire upon exercise of outstanding options) as of May 2, 2022, and assuming the issuance of a total of 25,983,723 CDIs in the Entitlement Offer.

| | | Number of Shares/CDIs | | | Percentage of Class | |

Event | | No exercise of Underwriter Options | | | Full exercise of Underwriter Options | | | No exercise of Underwriter Options | | | Full exercise of Underwriter Options | |

Entitlement Offer is fully subscribed (no shortfall) | | | 32,803,814 | | | | 36,643,814 | | | | 15.49 | % | | | 17.00 | % |

75% acceptance by eligible securityholders (excluding the Underwriter) | | | 38,255,037 | | | | 42,095,037 | | | | 18.06 | % | | | 19.52 | % |

50% acceptance by eligible securityholders (excluding the Underwriter) | | | 43,706,260 | | | | 47,546,260 | | | | 20.64 | % | | | 22.05 | % |

25% acceptance by eligible securityholders (excluding the Underwriter) | | | 49,157,484 | | | | 52,997,484 | | | | 23.21 | % | | | 24.58 | % |

0% acceptance by eligible securityholders (excluding the Underwriter) | | | 54,608,707 | | | | 58,448,707 | | | | 25.79 | % | | | 27.11 | % |

Vote Required

In order to be adopted, Proposal 1 must be approved by the affirmative vote of holders of a majority of the shares of our common stock present, in person or by proxy, and entitled to vote at the Meeting (subject to the voting exclusion described above under the caption “Information about Solicitation and Voting—Voting Exclusion”), subject to the quorum being present.

Board Recommendation

The Board of Directors (other than Mr. Craig Coleman, who abstained from voting on the matter being an interested director) recommends that you vote “FOR” this Proposal 1. The Board of Directors (other than Mr. Craig Coleman, who abstained from voting on the matter being an interested director), considered that the terms of the underwriting arrangements are consistent with usual Australian market practice or, in certain instances, more favourable to the Company in the circumstances of the Entitlement Offer. In particular, the following matters were considered by the non-interested Directors to be favourable to the Company

| | ● | the value of the Underwriter Options is 3.4% of the underwritten amount of A$20 million (representing A$680,000), which it considered to be comparable to or lower than market practice for underwriting fees payable to underwriters in similar transactions; |

| | ● | the Underwriter Options have exercise prices at a material premium to the offer price to be paid by investors under the Entitlement Offer and will, if exercised, deliver additional funding to the Company at the time of exercise of such options; and |

| | ● | the payment of the underwriting fee by way of the issue of the Underwriter Options instead of a cash fee will allow the Company to preserve cash. |

It is noted that in the event that stockholders do not approve the issue of, or the Company fails to issue, the Underwriter Options, the Company is required to make a cash payment of 4.5% of the amount raised under the Entitlement Offer (representing a fee of approximately A$900,000). While the value of this fee as a proportion of the amount raised under the Entitlement Offer is not inconsistent with market practice for fees payable to underwriters in similar transactions, the non-interested Directors consider payment of the cash fee to be less favourable than payment of the underwriting fee by way of issue of the Underwriter Options, noting that the cash fee is a higher amount than the value of the Underwriter Options and would reduce the Company’s available cash.

The proxy holders and CDN will vote as directed on the Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders) or, if no direction is made in a duly dated, executed, and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders), “FOR” this proposal.

However, brokers who are members of a U.S. national securities exchange may not vote or submit instructions to the proxy holders or CDN if the beneficial owner of the shares has not given instructions.

Directors’ voting intentions

Each Director (other than Mr. Craig Coleman who intends to abstain from voting on the matter being an interested director) intends to vote the securities they control in favor of Proposal 1.

Voting intention

The Chairman of the Meeting intends to vote all available undirected proxies in favor of Proposal 1.

PROPOSAL TWO – ADJOURNMENT PROPOSAL

General

We are asking you to approve a proposal to approve one or more adjournments of the Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1.

If our stockholders approve this Proposal 2 (the “Adjournment Proposal”), we could adjourn the Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders that have previously returned properly executed proxies voting against the approval of Proposal 1. Among other things, approval of the Adjournment Proposal could mean that, even if we had received proxies representing a sufficient number of votes against approval of Proposal 1 such that Proposal 1 would be defeated, we could adjourn the Meeting without a vote and seek to convince the holders of those shares to change their votes to votes in favor of Proposal 1.

We do not intend to call a vote on this proposal if Proposal 1 is approved by our stockholders at the Meeting.

Vote Required

In order to be adopted, this Proposal 2 must be approved by the affirmative vote of the holders of a majority of the shares of our common stock present, in person or by proxy, and entitled to vote at the Meeting without regard to a quorum requirement. Although Excluded Holders are, pursuant to our certificate of incorporation and bylaws, permitted to vote with respect to Proposal 2, the Company will disregard any votes cast by the Excluded Holders with respect to Proposal 2 and we will not adjourn the Meeting as contemplated by Proposal 2 unless Proposal 2 is also approved by the affirmative vote of a majority of the shares of our common stock present at the meeting, in person or by proxy, other than shares held by Excluded Holders, without regard to a quorum requirement.

Board Recommendation

The Board of Directors (other than Mr. Craig Coleman, who abstained from voting on the matter being an interested director) recommends that you vote “FOR” this Proposal 2.

The proxy holders and CDN will vote as directed on the Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders) or, if no direction is made in a duly dated, executed, and returned Proxy Card (in the case of stockholders) or CDI Voting Instruction Form or online (in the case of CDI Holders), “FOR” this proposal.

However, brokers who are members of a U.S. national securities exchange may not vote or submit instructions to the proxy holders or CDN if the beneficial owner of the shares has not given instructions.

INTEREST OF CERTAIN PERSONS

IN THE ISSUANCE OF UNDERWRITER OPTIONS

In considering the recommendation of the Board of Directors to vote “FOR” the proposals presented at the Meeting, you should be aware that a director and the Non-Executive Chairman of the Company, Mr. Craig Coleman, is also an Executive Chairman and an associate of the Underwriter, the underwriter pursuant to the Underwriting Agreement and the recipient of the Underwriter Options. The Board of Directors was aware of and considered these interests, among other matters, in evaluating the terms of the Underwriting Agreement and the other transaction documents and in recommending to our stockholders that they vote in favor of the proposals presented at the Meeting. Additionally, Mr. Craig Coleman abstained from voting on the matter in his capacity as a member of the Board of Directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information known to us regarding beneficial ownership of our shares of common stock as of May 2, 2022, by the following persons:

| | • | each person known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | our named executive officers listed in the “Summary Compensation Table;” |

| | • | our executive officers and directors as a group. |

Beneficial ownership is determined according to the rules of the Securities and Exchange Commission and generally means that a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security, and includes options and warrants that are exercisable within 60 days. Information with respect to beneficial ownership has been furnished to us by each director and executive officer. Holders of our CDIs have beneficial ownership of an equivalent number of our shares. Unless otherwise indicated, to our knowledge, each holder of our CDIs possesses sole power to direct CDN on how to vote and has investment power over the shares listed, except for shares owned jointly with that person’s spouse.

The table below lists applicable percentage ownership based on 185,780,712 shares of common stock outstanding as of May 2, 2022, and 8,848,800 options to purchase our shares that are exercisable as of May 2, 2022, and within 60 days of this date. Options to purchase our shares that are exercisable within 60 days of May 2, 2022, are deemed to be beneficially owned by the person holding these options for the purpose of the computing percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other holder.

For each of the persons listed in the table below, unless otherwise indicated:

| | ● | the shareholding information has been derived from our share register; and |

| | ● | their address is c/o Universal Biosensors, Inc., 1 Corporate Avenue, Rowville, Victoria 3178. |

Name and Address of Beneficial Owner | | Number of Shares (1) | | | Percentage of Class | |

| | | | | | | | | |

John Sharman | | | 7,400,217 | (2) | | | 3.84 | % |

Salesh Balak | | | 1,773,858 | (3) | | | * | |

Craig Coleman | | | 28,844,984 | (4) | | | 15.53 | % |

David Hoey | | | 566,414 | (5) | | | * | |

Judith Smith | | | 300,000 | (6) | | | * | |

Graham McLean | | | - | | | | * | |

Total Directors and Executives as a group (6 persons) | | | 38,885,473 | | | | 20.01 | % |

Viburnum Funds Pty Ltd | | | 28,624,984 | (7) | | | 15.41 | % |

Sandhurst Trustees Ltd | | | 16,260,387 | (8) | | | 8.75 | % |

Jencay Australia Investment Fund | | | 17,024,745 | (9) | | | 9.16 | % |

* | Represents beneficial ownership of less than one percent of our outstanding ordinary shares. |

(1) | Includes shares issuable pursuant to options exercisable as of May 2, 2022, and within 60 days of this date. The figures represent the amounts last notified to us unless otherwise stated. The relevant stockholders may have acquired or disposed of shares since the last notification that are not reflected. Unless otherwise noted, the named beneficial owners have sole voting and investment power with respect to their beneficially owned shares. |

(2) | Includes (i) 30,000 shares in the form of CDIs Mr. Sharman holds directly; (ii) 276,217 shares in the form of CDIs held by Mr. Sharman’s wife (iii) 5,094,000 options held by Mr. Sharman, (iv) 1,000,000 options held by Mr. Sharman’s wife and (v) 1,000,000 options held by Mr. Sharman’s superannuation fund which are all exercisable as of May 2, 2022, and within 60 days of this date. The inclusion of the shares in clauses (ii), (iv), and (v) is not an admission of beneficial ownership of those shares by Mr. Sharman. |

(3) | Includes (i) 336,558 shares in the form of CDIs Mr. Balak holds directly; and (ii) 1,437,300 options exercisable as of May 2, 2022 and within 60 days of this date. |

(4) | Includes (i) 220,000 shares in the form of CDIs held by a superannuation fund of which Mr. Coleman is a potential beneficiary; and (ii) 28,624,984 shares held by Viburnum Funds Pty Ltd (“Viburnum”) of which Mr. Coleman is a director. Mr. Coleman may be deemed to beneficially own, the common stock held by Viburnum due to Mr. Coleman serving as a director of Viburnum and may be deemed to share voting and dispositive power over such shares. Mr. Coleman disclaims beneficial ownership of the shares beneficially owned by Viburnum. |

(5) | Shares in the form of CDIs Mr. Hoey holds directly. |

(6) | Shares in the form of CDIs held by a superannuation fund of which Ms. Smith is a member. |

(7) | The address of Viburnum Funds Pty Ltd (“Viburnum”) is 31 Carrington Street, Nedlands WA 6009. The ownership information is based in its entirety on material contained in Form 4 filed with the SEC on November 5, 2021. The shares beneficially owned by Viburnum are held by VF Strategic Equities Fund and separately managed accounts on behalf of Viburnum clients. Each of Mr. Craig Coleman, Mr. Marshall Allen, and Mr. Anthony Howarth share voting and dispositive power over, and may be deemed to beneficially own all of the shares, beneficially owned by Viburnum, due to each of the foregoing individuals serving as a director of Viburnum. Each of Messrs. Coleman, Allen, and Howarth disclaim beneficial ownership over these shares. |

(8) | The address of Sandhurst Trustees Ltd is Level 5, 120 Harbour Esplanade, Docklands VIC 3008, Australia. |

(9) | The address of Jencay Australia Investment Fund is Level 1, 488 Botany Rd, Alexandria, NSW 2015, Australia. The ownership information is based in its entirety on material contained in Form 604 filed with the ASX on September 14, 2021. |

HOUSEHOLDING

We have adopted a procedure approved by the SEC called “householding.” For purposes of householding, “Proxy Materials” refer to the Company’s proxy statement and the documents incorporated by reference therein. Under this procedure, a householding notice will be sent to stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials, and they will receive only one set of Proxy Materials unless we receive contrary instructions from one or more of these stockholders. This procedure reduces our printing costs and postage fees. Each stockholder who participates in householding will continue to receive a separate proxy card. If you participate in householding and wish to receive a separate copy of the Proxy Materials, please make a written request to our Company Secretary at 1 Corporate Avenue, Rowville VIC 3178 or at companysecretary@universalbiosensors.com. A separate copy of the Proxy Materials will be delivered promptly upon request.

If any stockholders in your household wish to begin receiving separate Proxy Materials, they may contact our Company Secretary at +613 9213 9000, 1 Corporate Avenue, Rowville VIC 3178 or at companysecretary@universalbiosensors.com. Other stockholders who have multiple accounts in their names or who share an address with other stockholders can request that only a single copy be sent to the household by calling at +613 9213 9000 or writing to the Company Secretary at 1 Corporate Avenue, Rowville VIC 3178 or by email at companysecretary@universalbiosensors.com.

WHERE YOU CAN FIND MORE INFORMATION

We file annual and quarterly reports, proxy statements, and other information with the SEC. Our public filings are available at the Internet website maintained by the SEC at http://www.sec.gov.

We will provide you without charge, upon your oral or written request, with a copy of any or all reports, proxy statements, and other documents we file with the SEC, as well as any or all of the documents incorporated by reference in this proxy statement (other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests for such copies should be directed to:

Company Secretary at +613 9213 9000, 1 Corporate Avenue, Rowville VIC 3178 or

at companysecretary@universalbiosensors.com

If you would like to request documents from the Company, please do so at least 10 business days before the date of the Meeting in order to receive the timely delivery of those documents prior to the Meeting.

Representatives of PricewaterhouseCoopers, our independent registered public accounting firm for our year ended December 31, 2021, are not expected to be present at the special meeting.

The Meeting will be a “virtual meeting” of stockholders that will be conducted exclusively by means of remote communication. You will be able to attend the Meeting and vote and submit questions during the Meeting by means of remote communication at https://web.lumiagm.com/343806865. Information regarding virtual participation at the Meeting including how to access the Meeting and vote and submit questions online during the Meeting is as per the attached Online Vote User Guide.

STOCKHOLDERS SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROXY STATEMENT TO VOTE THEIR SHARES AT THE MEETING. NO ONE HAS BEEN AUTHORIZED TO PROVIDE ANY INFORMATION THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS PROXY STATEMENT. THIS PROXY STATEMENT IS DATED MAY 4, 2022. STOCKHOLDERS SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROXY STATEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THAT DATE.

STOCKHOLDER COMMUNICATIONS WITH BOARD OF DIRECTORS

Any stockholder who wishes to send any communications to the Board or to individual directors should deliver such communications to the Company’s principal executive offices, 1 Corporate Avenue, Rowville VIC 3178, Attention: Company Secretary (companysecretary@universalbiosensors.com). Any such communication should indicate whether the communication is intended to be directed to the entire Board of Directors or to a particular director(s), and must indicate the number of shares of common stock beneficially owned by the stockholder. The Company Secretary will forward appropriate communications to the Board of Directors and/or the appropriate director(s). Inappropriate communications include correspondence that does not relate to the business or affairs of the Company or the functioning of the Board of Directors or its committees, advertisements or other commercial solicitations or communications, and communications that are frivolous, threatening, illegal, or otherwise not appropriate for delivery to directors.

STOCKHOLDER PROPOSALS AND NOMINATIONS

Requirements for Stockholder Proposals to be Considered for Inclusion in our Proxy Materials

Under Rule 14a-8(e) of the Exchange Act, to submit a proposal for inclusion in our Proxy Statement for the 2022 annual meeting of stockholders, currently scheduled to be held on June 21, 2022, stockholder proposals were required to be received by January 3, 2022, by Company Secretary 1 Corporate Avenue, Rowville VIC 3178.

In the event that we hold our 2022 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary date of the 2021 annual meeting, then notice of a stockholder proposal should be sent in a reasonable time before the Company begins to print and send its proxy materials.

Nominations

Nominations of persons for election to the Board of Directors may be made at any Annual Meeting of Stockholders by any stockholder of the Company, provided that such nomination is made pursuant to the requirements of our bylaws and is timely. To be timely, a stockholder’s notice to the Company Secretary must be delivered to or mailed and received at the principal executive offices of the Company (a) in the case of an annual meeting, not less than ninety (90) days nor more than one hundred twenty (120) days prior to the anniversary date of the immediately preceding annual meeting of stockholders; provided, however, that in the event that the annual meeting is called for a date that is not within thirty (30) days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs; and (b) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the tenth (10th) day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs.

The nomination notices for our 2022 annual meeting of stockholders were required to be received by April 1, 2022.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Salesh Balak | |

Name: | Salesh Balak | |

Title: | Company Secretary | |

Universal Biosensors, Inc. | |

Annex A

UNITED STATE

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2021

or

☐ Transition Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to ________

Commission file number: 000-52607

Universal Biosensors, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | 98-0424072 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Universal Biosensors, Inc. 1 Corporate Avenue, Rowville, 3178, Victoria Australia | | Not Applicable |

(Address of principal executive offices) | | (Zip Code) |

| | Telephone: +613 9213 9000 | |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Shares of Common Stock, par value US$0.0001 per share

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| Non-accelerated filer ☒ | | Smaller reporting company ☒ |

| | | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was A$91,148,185 (equivalent to US$68,525,205) as of June 30, 2021.

There were 177,838,504 shares of the registrant’s common stock, par value US$0.0001 per share, outstanding as of February 18, 2022.

Documents incorporated by reference:

Certain information contained in the registrant’s definitive Proxy Statement for the 2022 annual meeting of stockholders, to be filed not later than 120 days after the end of the fiscal year covered by this report, is incorporated by reference into Part III hereof.

Information contained on pages F-2 through F-35 of our Annual Report to Stockholders for the fiscal year ended December 31, 2021 (our “2021 Annual Report”) is incorporated by reference in our response to Items 7, 7A, 8 and 9A of Part II.

UNIVERSAL BIOSENSORS, INC.

TABLE OF CONTENTS

| | Page |

Part I | | |

| | | |

Item 1. | Business | 5 |

| | | |

Item 1A. | Risk Factors | 11 |

| | | |

Item 1B. | Unresolved Staff Comments | 22 |

| | | |

Item 2. | Properties | 23 |

| | | |

Item 3. | Legal Proceedings | 24 |

| | | |

Item 4. | Mine Safety Disclosures | 25 |

| | | |

Part II | | |

| | | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 26 |

| | | |

Item 6. | [Reserved] | 28 |

| | | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 29 |

| | | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 30 |

| | | |

Item 8. | Financial Statements and Supplementary Data | 31 |

| | | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 32 |

| | | |

Item 9A. | Controls and Procedures | 33 |

| | | |

Item 9B. | Other Information | 36 |

| | | |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 37 |

| | | |

Part III | | |

| | | |

Item 10. | Directors, Executive Officers and Corporate Governance | 38 |

| | | |

Item 11. | Executive Compensation | 39 |

| | | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 40 |

| | | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

| | | |

Item 14. | Principal Accountant Fees and Services | 42 |

| | | |

Part IV | | |

| | | |

Item 15. | Exhibits and Financial Statement Schedules | 43 |

| | | |

Item 16. | Form 10-K Summary | 46 |

| | | |

Signatures | 47 |

Unless otherwise noted, references in this Annual Report on Form 10-K (this “Form 10-K”) to “Universal Biosensors”, the “Company,” “Group,” “we,” “our” or “us” means Universal Biosensors, Inc. (“UBI”) a Delaware corporation and, when applicable, its wholly owned Australian operating subsidiary, Universal Biosensors Pty Ltd (“UBS”), its wholly owned US operating subsidiary, Universal Biosensors LLC (“UBS LLC”) and UBS’ wholly owned Canadian operating subsidiary, Hemostasis Reference Laboratory Inc. (“HRL”) and wholly owned Dutch operating subsidiary, Universal Biosensors B.V. (“UBS BV”). Unless otherwise noted, all references in this Form 10-K to “$”, “A$” or “dollars” and dollar amounts are references to Australian dollars. References to “US$”, “CAD$” and “€” are references to United States dollars, Canadian dollars and Euros, respectively.

Cautionary Note Regarding Forward-Looking Statements

This Form 10-K, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our, our customers and partners’ or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| | ● | the impact of global economic and political developments on our business, including economic slowdowns or recessions that may result from the outbreak of COVID-19, which could harm our commercialization efforts for our products as well as the value of our common stock and our ability to access capital markets, if required; |

| | ● | natural and manmade disasters, including pandemics such as COVID-19, and other force majeures, which could impact our operations, and those of our partners and other participants which operates within our industry; |

| | ● | our business and product development strategies; |

| | ● | our expectations with respect to collaborative, strategic or distribution arrangements; |

| | ● | our expectations with respect to the timing and amounts of revenues from our customers and partners; |

| | ● | our expectations with respect to the services we provide to, and the development projects we undertake for, our customers and partners; |

| | ● | our expectations with respect to regulatory submissions, clearances, market launches of products we develop or are involved in developing; |

| | ● | our expectations with respect to sales of products we develop or are involved in developing and the quantities of such products to be manufactured by us; |

| | ● | our expectations with respect to our research and development programs, the timing of product development and our associated research and development expenses; |

| | ● | the ability to protect our owned or licensed intellectual property; and |

| | ● | our estimates regarding our capital requirements, the sufficiency of our cash resources, our debt repayment obligations and our need for additional financing. |