- CLRB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Cellectar Biosciences (CLRB) FWPFree writing prospectus

Filed: 14 Nov 16, 12:00am

1 NASDAQ: CLRB Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333 - 214310 November 14, 2016

2 Safe Harbor Statement This slide presentation contains forward - looking statements . Such statements are valid only as of today, and we disclaim any obligation to update this information . These statements are only estimates and predictions and are subject to known and unknown risks and uncertainties that may cause actual future experience and results to differ materially from the statements made . These statements are based on our current beliefs and expectations as to such future outcomes . Drug discovery and development involve a high degree of risk . Factors that might cause such a material difference include, among others, uncertainties related to the ability to raise additional capital required to complete the development programs described herein, the ability to attract and retain partners for our technologies, the identification of lead compounds, the successful preclinical development thereof, the completion of clinical trials, the FDA review process and other government regulation, our pharmaceutical collaborators’ ability to successfully develop and commercialize drug candidates, competition from other pharmaceutical companies, product pricing and third - party reimbursement . A complete description of risks and uncertainties related to our business is contained in our periodic reports filed with the Securities and Exchange Commission including our Form 10 - K for the year ended December 31 , 2015 , filed on March 11 , 2016 , as amended on July 18 , 2016 and October 20 , 2016 . These forward looking statements are made only as of the date hereof, and we disclaim any obligation to update any such forward looking statements .

3 • This presentation highlights basic information about us and the offering. Because it is a summary that has been prepared sole ly for informational purposes, it does not contain all of the information that you should consider before investing in our company. Exc ept as otherwise indicated, this presentation speaks only as of the date hereof. • This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities by any person i n a ny jurisdiction in which it is unlawful for such person to make such an offering or solicitation. • Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of our securities or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal off ens e. • This presentation includes industry and market data that we obtained from industry publications and journals, third - party studie s and surveys, internal company studies and surveys, and other publicly available information. Industry publications and survey s generally state that the information contained therein has been obtained from sources believed to be reliable. Although we be lie ve the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurat e. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the volu nta ry nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumpti ons that were used in preparing the forecasts from the sources relied upon or cited herein. • We have filed a Registration Statement on Form S - 1 with the SEC, including a preliminary prospectus dated October 28, 2016 (the “Prospectus”), with respect to the offering of our securities to which this communication relates. Before you invest, yo u s hould read the Prospectus (including the risk factors described therein) and, when available, the final prospectus relating to the off ering, and the other documents filed with the SEC and incorporated by reference into the Prospectus, for more complete information about us and the offering. You may obtain these documents, including the Prospectus, for free by visiting EDGAR on the SEC website at http://www.sec.gov. • Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you request it by contacting Ladenburg Thalmann & Co. Inc., 570 Lexington Ave, 11th Floor, New York, NY 10022 or by email at prospectus@ladenburg.com. Statement about Free Writing Prospectus

4 Company Overview • Oncology - focused Biopharmaceutical Company in Madison, WI • Rapid Company Transformation Effected in 2015 – Strategy and therapeutic product focus – Financial Efficiency - Improved R&D and SG&A expenses • Phospholipid Drug Conjugate (PDC) Delivery Platform – Phospholipid Ether cancer - targeting vehicle – Enables delivery of diverse oncologic payloads – Increases payload therapeutic window • Strategy to Unlock PDC Delivery Platform Value – Advance CLR 131 therapeutic franchise – Develop early - stage chemotherapeutic conjugates – Expand PDC pipeline through collaborations • Extensive Intellectual Property Portfolio

5 • Proprietary Small - molecule • Highly Selective Cancer and Cancer Stem Cell (CSC) Targeting • Uptake and Prolonged Retention in Malignant Cells – Proof of concept (POC) in broad range of cancers • Ability to Attach Diverse Oncologic Payloads • Extensive Research and Peer Reviewed Scientific Validation Basis for PDC Delivery Platform Phospholipid Ether Cancer - Targeting Vehicle Phospholipid Ether (PLE) Image source: Generated in house, data on file.

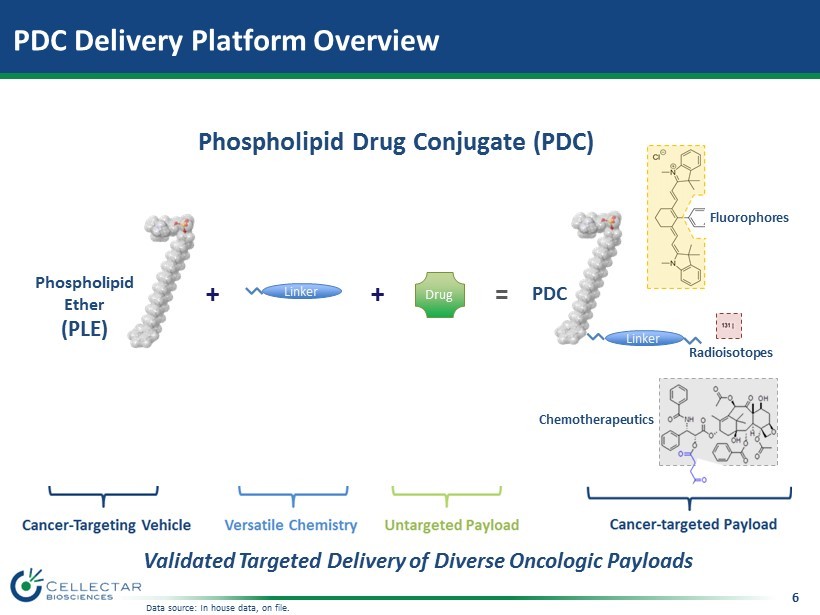

6 PDC Delivery Platform Overview Validated Targeted Delivery of Diverse Oncologic Payloads Phospholipid Drug Conjugate (PDC) + + Linker = Linker Drug Phospholipid Ether (PLE) PDC Fluorophores Chemotherapeutics Radioisotopes Data source: In house data, on file.

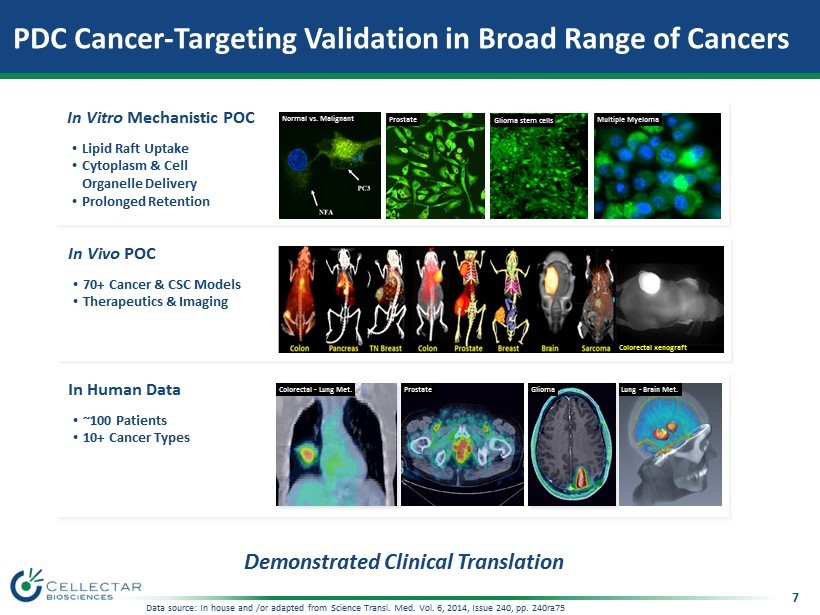

7 PDC Cancer - Targeting Validation in Broad Range of Cancers Demonstrated Clinical Translation In Vitro Mechanistic POC • Lipid Raft Uptake • Cytoplasm & Cell Organelle Delivery • Prolonged Retention In Vivo POC • 70+ Cancer & CSC Models • Therapeutics & Imaging In Human Data • ~100 Patients • 10+ Cancer Types Colorectal - Lung Met. Prostate Glioma Lung - Brain Met. Multiple Myeloma Normal vs. Malignant Glioma stem cells Colorectal xenograft Prostate Data source: In house and /or adapted from Science Transl. Med. Vol. 6, 2014, Issue 240, pp. 240ra75

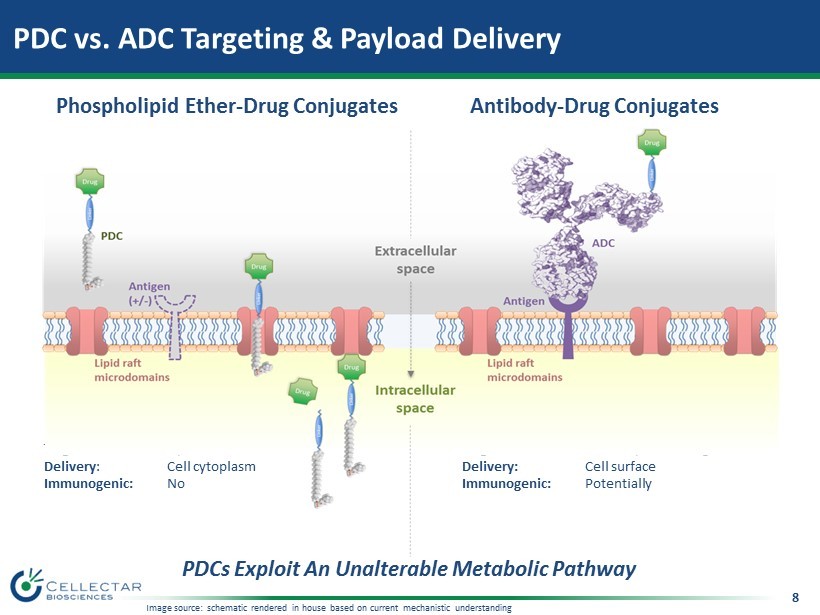

8 PDC vs. ADC Targeting & Payload Delivery Antibody - Drug Conjugates Phospholipid Ether - Drug Conjugates Target : Lipid rafts/ Caveolae Delivery : Cell cytoplasm Immunogenic: No Target: Tumor - specific antigens Delivery: Cell surface Immunogenic: Potentially PDCs Exploit An Unalterable Metabolic Pathway Image source: schematic rendered in house based on current mechanistic understanding

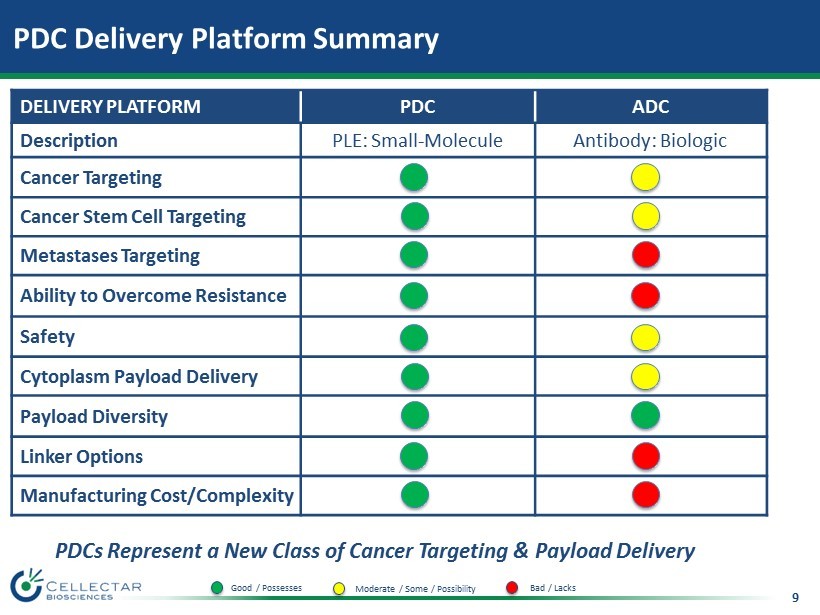

9 PDCs Represent a New Class of Cancer Targeting & Payload Delivery PDC Delivery Platform Summary DELIVERY PLATFORM PDC ADC Description PLE: Small - Molecule Antibody: Biologic Cancer Targeting Cancer Stem Cell Targeting Metastases Targeting Ability to Overcome Resistance Safety Cytoplasm Payload Delivery Payload Diversity Linker Options Manufacturing Cost/Complexity Good / Possesses Moderate / Some / Possibility Bad / Lacks

10 PDC Product Development Pipeline PDC Program Payload Indication Discovery Phase I Phase II CLR 131 1 Iodine - 131 Multiple Myeloma Pre - IND Hematologic Malignancies CLR 1800 - P Proprietary TBD 2 CLR 1602 - PTX 3 Paclitaxel CLR 1700 TBD Performance - based Performance - based CLR 124 Iodine - 124 CLR 1502 IR - 775 Glioma Breast Cancer Lumpectomy 1. Funded by $2M NCI Fast Track Grant 2. To Be Determined 3. PTX = Paclitaxel Phase II Expected Q1 2017 Phase I Phase II Phase I Ready Discovery Pre - IND Pre - IND Collaboration CLR 125 Iodine - 125 Micrometast. Disease Phase I Ready CTX CTX CTX Resources Focused On CLR 131 & CLR CTX Therapeutic Programs

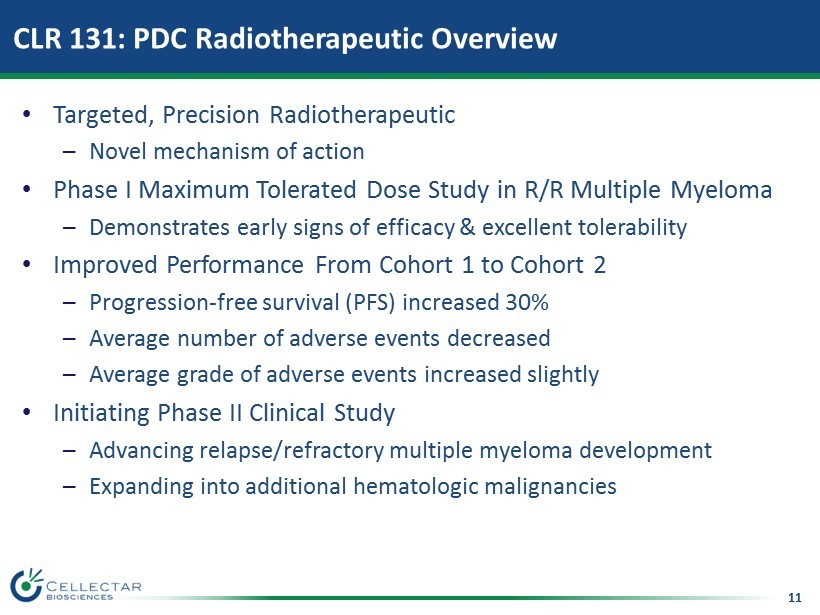

11 CLR 131: PDC Radiotherapeutic Overview • Targeted, Precision Radiotherapeutic – Novel mechanism of action • Phase I Maximum Tolerated Dose Study in R/R Multiple Myeloma – Demonstrates early signs of efficacy & excellent tolerability • Improved Performance From Cohort 1 to Cohort 2 – Progression - free survival (PFS) increased 30% – Average number of adverse events decreased – Average grade of adverse events increased slightly • Initiating Phase II Clinical Study – Advancing relapse/refractory multiple myeloma development – Expanding into additional hematologic malignancies

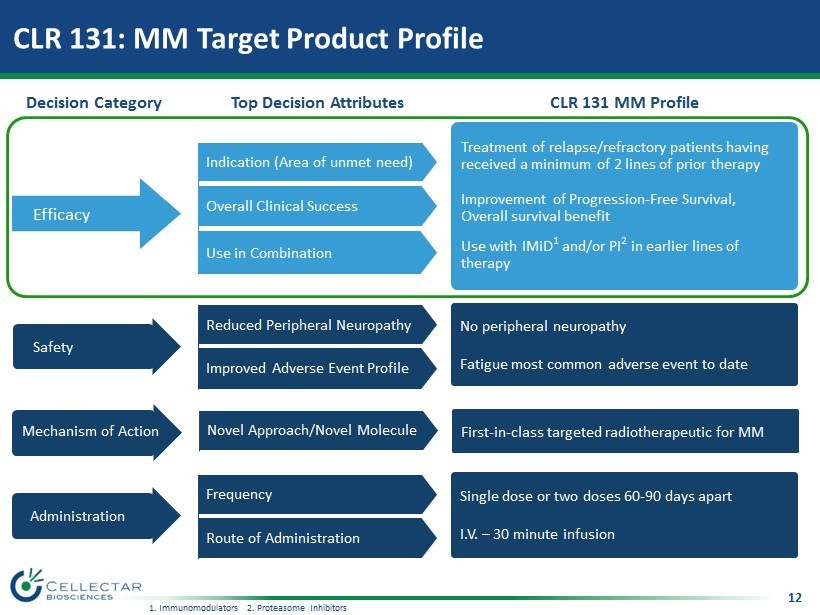

12 CLR 131: MM Target Product Profile Treatment of relapse/refractory patients having received a minimum of 2 lines of prior therapy Improvement of Progression - Free Survival, Overall survival benefit Use with IMiD 1 and/or PI 2 in earlier lines of therapy Use in Combination Overall Clinical Success Indication (Area of unmet need) Decision Category No peripheral neuropathy Fatigue most common adverse event to date Improved Adverse Event Profile Reduced Peripheral Neuropathy Single dose or two doses 60 - 90 days apart I.V. – 30 minute infusion Route of Administration Frequency First - in - class targeted radiotherapeutic for MM Novel Approach/Novel Molecule Top Decision Attributes CLR 131 MM Profile Safety Administration Mechanism of Action Efficacy 1. Immunomodulators 2. Proteasome Inhibitors

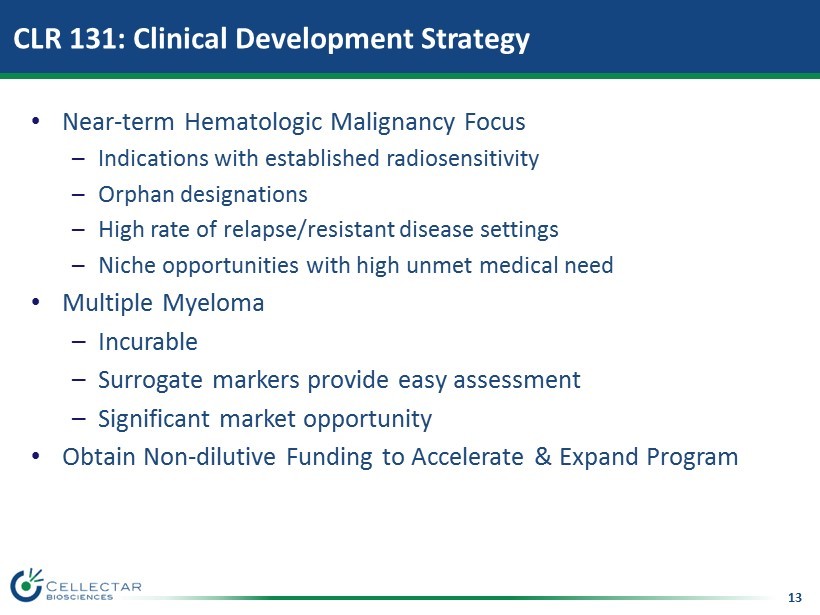

13 CLR 131: Clinical Development Strategy • Near - term Hematologic Malignancy Focus – Indications with established radiosensitivity – Orphan designations – High rate of relapse/resistant disease settings – Niche opportunities with high unmet medical need • Multiple Myeloma – Incurable – Surrogate markers provide easy assessment – Significant market opportunity • Obtain Non - dilutive Funding to Accelerate & Expand Program

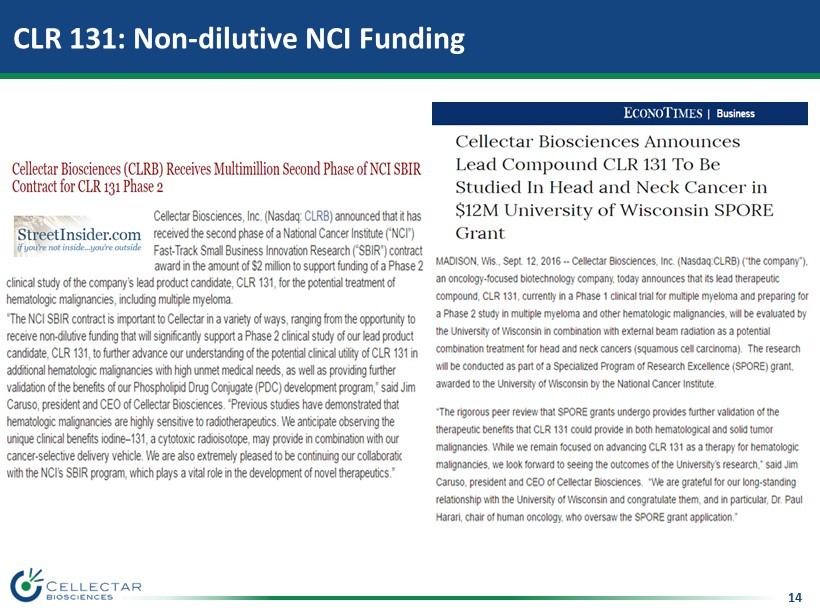

14 CLR 131: Non - dilutive NCI Funding

15 CLR 131: Phase I R/R Multiple Myeloma Study Overview • Multi - center, Open Label, Dose Escalation Trial Initiated Q2 2015 • Primary Objective: – Characterize safety & tolerability • Secondary Objectives: – Establish Phase II dose – Assess therapeutic activity • Dose Escalation < 2 of 6 DLT’s • 85 Day Post - dose Study Follow - up Cohort 1 12.5mCi/m 2 Cohort 2 18.75mCi/m 2 Cohort 3 25.0mCi/m 2 Cohort 4 31.25mCi/m 2 Currently In Cohort #3 at 25 mCi/m 2 Single Dose

16 CLR 131: Cohort 1 & Cohort 2 Patient Demographics 1.Excludes patient with 12 prior lines 2. Includes patient 108 2 Grade 4s (disease progression) Demographic Metric Cohort #1 (12.5 mCi/m 2 ) Cohort #2 (18.75 mCi/m 2 ) Evaluable Patients 4 4 Average Age 68 69 Gender (Female:Male ) 1:3 2:2 Prior Treatment Lines 4 1 /6.5 2 4 Prior Proteasome Inhibitor and IMiD Trx 4/4 4/4 Prior Rev, Velcade, Dex Trx, Including Triple Combinations 4/4 4/4 Prior Pomalyst & Kyprolis Trx, Including Triple Combinations 3/4 1/4 Stem Cell Transplant 1/4 3/4 Patient Demographics Essentially the Same Between Cohorts

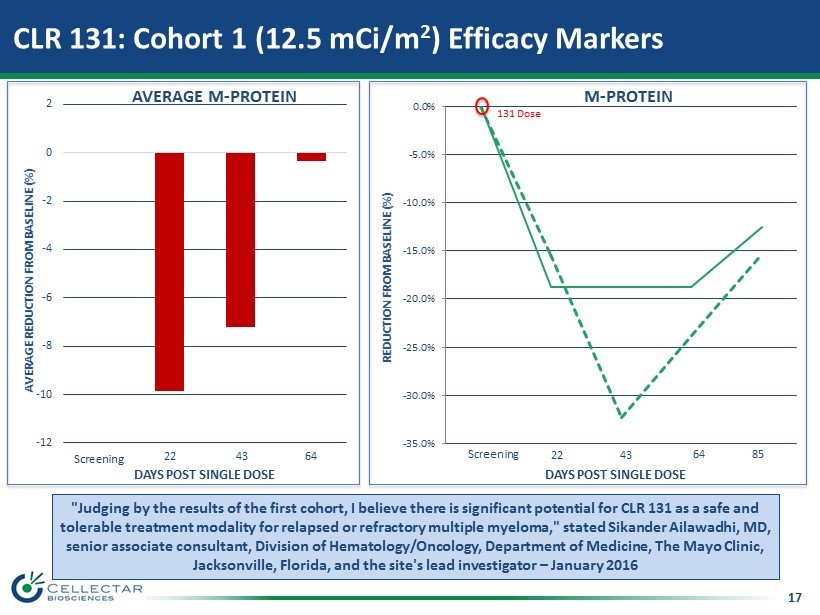

17 CLR 131: Cohort 1 (12.5 mCi/m 2 ) Efficacy Markers -12 -10 -8 -6 -4 -2 0 2 Screening D22 D43 D64 64 DAYS POST SINGLE DOSE AVERAGE REDUCTION FROM BASELINE (%) "Judging by the results of the first cohort, I believe there is significant potential for CLR 131 as a safe and tolerable treatment modality for relapsed or refractory multiple myeloma," stated Sikander Ailawadhi, MD, senior associate consultant, Division of Hematology/Oncology, Department of Medicine, The Mayo Clinic, Jacksonville, Florida, and the site's lead investigator – January 2016 AVERAGE M - PROTEIN 22 43 -35.0% -30.0% -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 131 Dose 22 43 64 DAYS POST SINGLE DOSE Screening 85 REDUCTION FROM BASELINE (%) M - PROTEIN

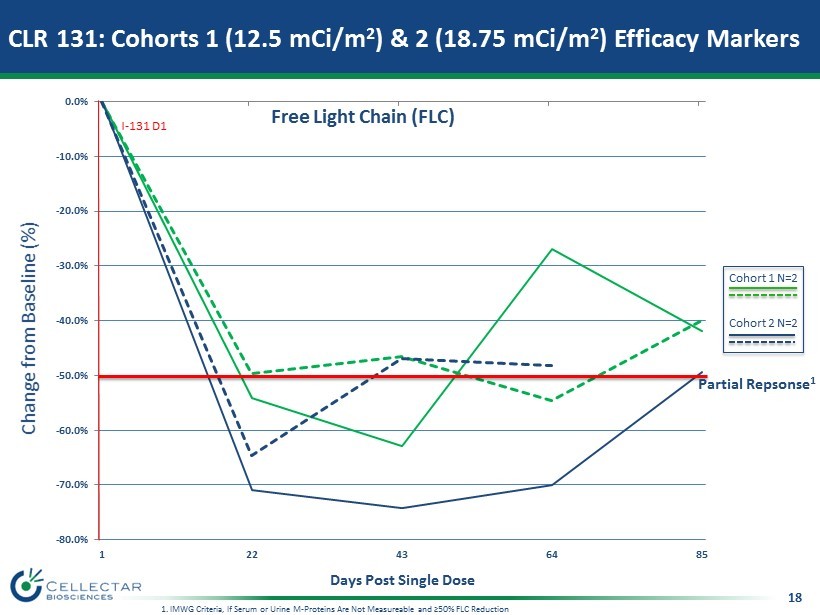

18 CLR 131: Cohorts 1 (12.5 mCi/m 2 ) & 2 (18.75 mCi/m 2 ) Efficacy Markers Change from Baseline (%) Days Post Single Dose -80.0% -70.0% -60.0% -50.0% -40.0% -30.0% -20.0% -10.0% 0.0% 1 22 43 64 85 Free Light Chain (FLC) I - 131 D1 Partial Repsonse 1 1. IMWG Criteria, If Serum or Urine M - Proteins Are Not Measureable and ≥50% FLC Reduction Cohort 1 N=2 Cohort 2 N=2

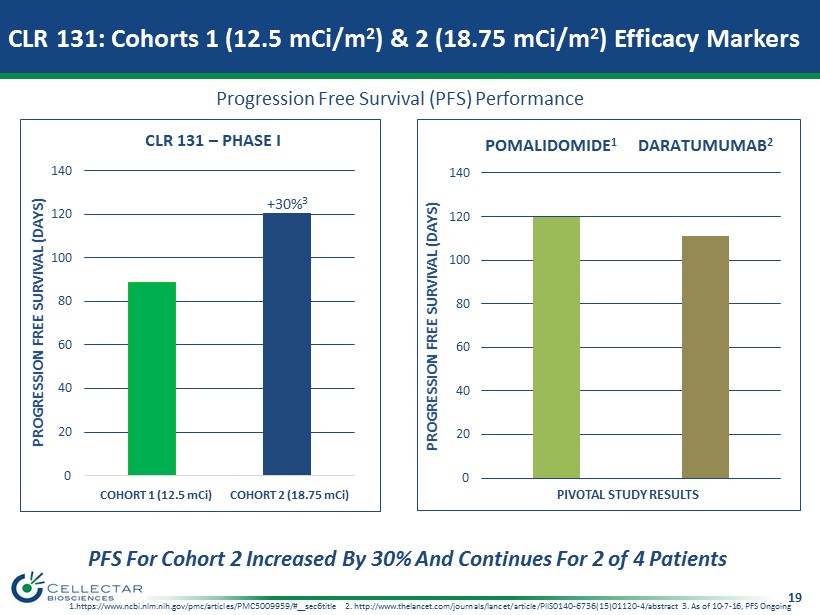

19 0 20 40 60 80 100 120 140 Cohort 1 Cohort 2 PROGRESSION FREE SURVIVAL (DAYS) CLR 131 – PHASE I 0 20 40 60 80 100 120 140 POMALYST 1 DARATUMUMAB 2 PIVOTAL STUDY RESULTS PROGRESSION FREE SURVIVAL (DAYS) +30% 3 PFS For Cohort 2 Increased By 30% And Continues For 2 of 4 Patients COHORT 1 (12.5 mCi) COHORT 2 (18.75 mCi) 1.https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5009959/#__sec6title 2. http://www.thelancet.com/journals/lancet/article/PII S01 40 - 6736(15)01120 - 4/abstract 3. As of 10 - 7 - 16, PFS Ongoing CLR 131: Cohorts 1 (12.5 mCi/m 2 ) & 2 (18.75 mCi/m 2 ) Efficacy Markers Progression Free Survival (PFS) Performance

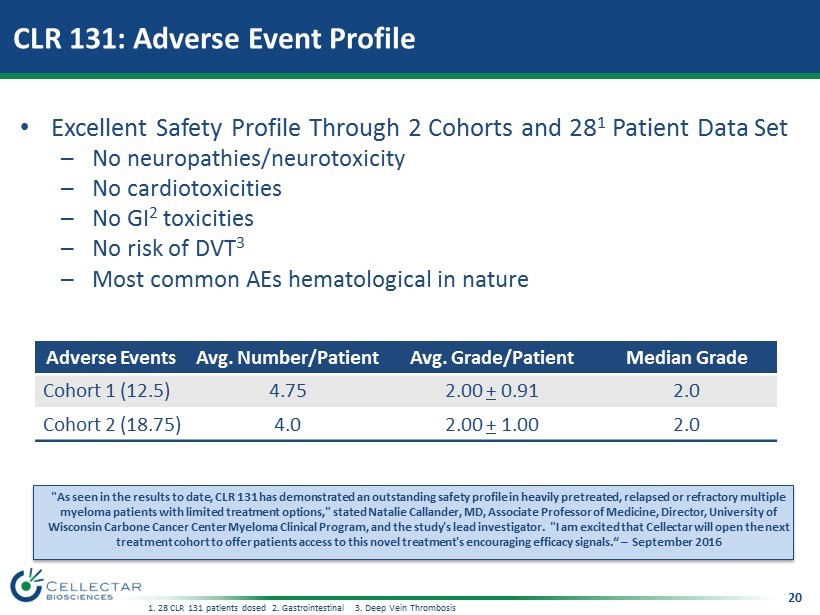

20 CLR 131: Adverse Event Profile Adverse Events Avg. Number/Patient Avg. Grade/Patient Median Grade Cohort 1 (12.5) 4.75 2.00 + 0.91 2.0 Cohort 2 (18.75) 4.0 2.00 + 1.00 2.0 "As seen in the results to date, CLR 131 has demonstrated an outstanding safety profile in heavily pretreated, relapsed or re fra ctory multiple myeloma patients with limited treatment options," stated Natalie Callander, MD, Associate Professor of Medicine, Director, Un ive rsity of Wisconsin Carbone Cancer Center Myeloma Clinical Program, and the study's lead investigator. "I am excited that Cellectar will open the next treatment cohort to offer patients access to this novel treatment's encouraging efficacy signals.“ – September 2016 1. 28 CLR 131 patients dosed 2. Gastrointestinal 3 . Deep Vein Thrombosis • Excellent Safety Profile Through 2 Cohorts and 28 1 Patient Data Set – No neuropathies/neurotoxicity – No cardiotoxicities – No GI 2 toxicities – No risk of DVT 3 – Most common AEs hematological in nature

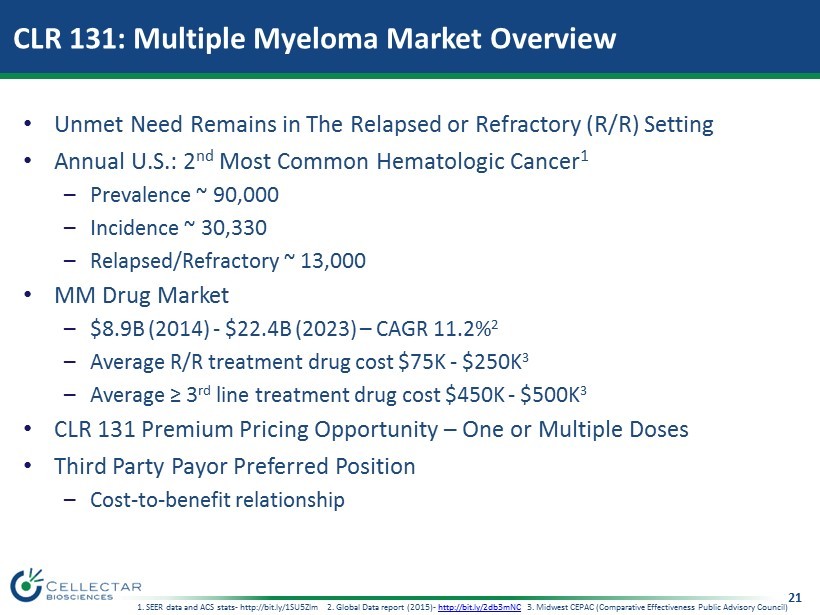

21 CLR 131: Multiple Myeloma Market Overview • Unmet Need Remains in The Relapsed or Refractory (R/R) Setting • Annual U.S.: 2 nd Most Common Hematologic Cancer 1 – Prevalence ~ 90,000 – Incidence ~ 30,330 – Relapsed/Refractory ~ 13,000 • MM Drug Market – $8.9B (2014) - $22.4B (2023) – CAGR 11.2% 2 – Average R/R treatment drug cost $75K - $250K 3 – Average ≥ 3 rd line treatment drug cost $450K - $500K 3 • CLR 131 Premium Pricing Opportunity – One or Multiple Doses • Third Party Payor Preferred Position – Cost - to - benefit relationship 1. SEER data and ACS stats - http://bit.ly/1SU5Zlm 2. Global Data report (2015) - http://bit.ly/2db3mNC 3. Midwest CEPAC (Comparative Effectiveness Public Advisory Council)

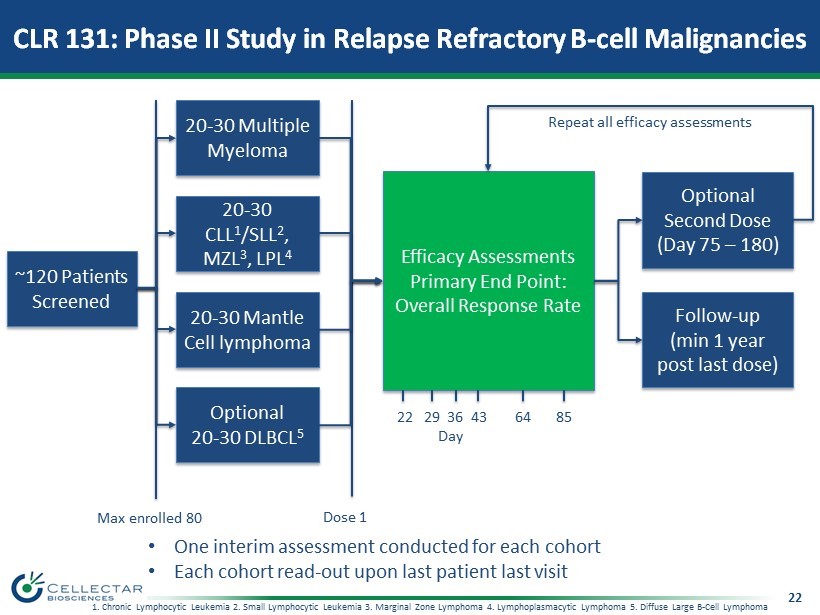

22 CLR 131: Phase II Study in Relapse Refractory B - cell Malignancies ~120 Patients Screened Optional 20 - 30 DLBCL 5 20 - 30 Mantle Cell lymphoma 20 - 30 CLL 1 /SLL 2 , MZL 3 , LPL 4 20 - 30 Multiple Myeloma Efficacy Assessments Primary End Point: Overall Response Rate Follow - up (min 1 year post last dose) Optional Second Dose (Day 75 – 180) 22 29 36 43 64 85 Day Dose 1 Repeat all efficacy assessments Max enrolled 80 • One interim assessment conducted for each cohort • Each cohort read - out upon last patient last visit 1. Chronic Lymphocytic Leukemia 2. Small Lymphocytic Leukemia 3. Marginal Zone Lymphoma 4. Lymphoplasmacytic Lymphoma 5. Diffuse Large B - Cell Lymphoma

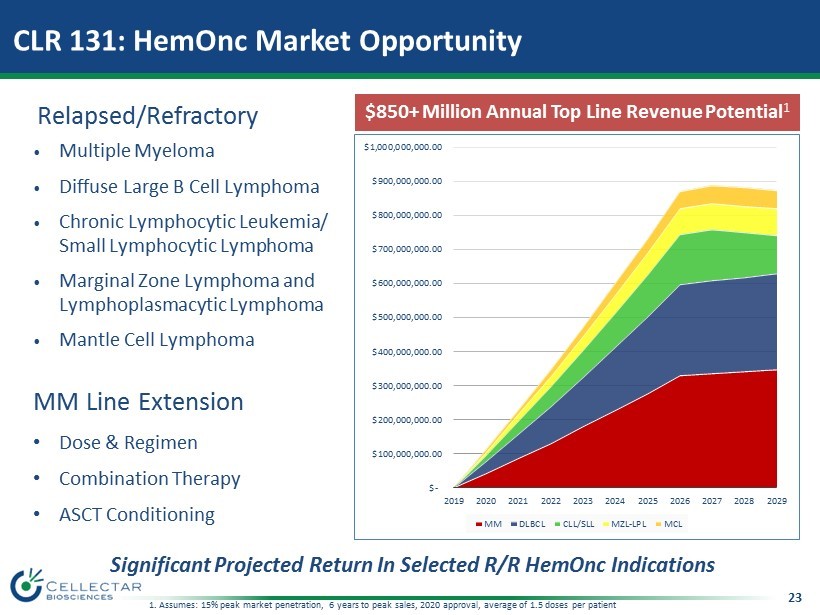

23 • Multiple Myeloma • Diffuse Large B Cell Lymphoma • Chronic Lymphocytic Leukemia/ Small Lymphocytic Lymphoma • Marginal Zone Lymphoma and Lymphoplasmacytic Lymphoma • Mantle Cell Lymphoma MM Line Extension • Dose & Regimen • Combination Therapy • ASCT Conditioning Relapsed/Refractory $850+ Million Annual Top Line Revenue Potential 1 Significant Projected Return In Selected R/R HemOnc Indications 1. Assumes: 15% peak market penetration, 6 years to peak sales, 2020 approval, average of 1.5 doses per patient CLR 131: HemOnc Market Opportunity $- $100,000,000.00 $200,000,000.00 $300,000,000.00 $400,000,000.00 $500,000,000.00 $600,000,000.00 $700,000,000.00 $800,000,000.00 $900,000,000.00 $1,000,000,000.00 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 MM DLBCL CLL/SLL MZL-LPL MCL

24 PDC Chemotherapeutic Program Overview • Objective – Develop chemotherapeutic PDCs with improved efficacy & tolerability • Clinical Rationale – Chemotherapeutics highly effective, yet highly toxic drugs – Combining the unique targeting capabilities of PDCs with cytotoxic drugs improves therapeutic index through targeted drug delivery – Cancer stem cell delivery – increased durability • Business Rationale – Reinvigorate failed, pre - clinical, and clinical chemotherapeutics – Reduced regulatory hurdles – New products, new patent life & life cycle management • Expansion of Intellectual Property Portfolio – Patent published May 2016 - “Existing or future cytotoxic agents” – Issued patent protecting series of paclitaxel PDCs

25 Pierre Fabre PDC Collaboration • Announced December 2015 – Launched Q1 2016 • Pierre Fabre Provides Selection of Proprietary Cytotoxins • Objectives – Co - design library of PDCs • Lead product conjugation completed – Conduct in vitro assessments – Conduct in vivo POC studies • Targeting/biodistribution data – Evaluate therapeutic index vs. untargeted payloads • Cellectar to lead conjugation and POC studies • Cellectar retains rights to all new intellectual property “We are convinced that Cellectar’s proprietary technology will provide our cytotoxic molecules with tissue specificity and enhanced safety which are typically lacking with untargeted agents.” - Laurent Audoly, Pierre Fabre - Head of R&D - December 2015

26 Financial Summary Capitalization as of September 30, 2016 Common Stock Outstanding 5,368,235 Warrants (Exercise prices ranging from $2.13 to $250.00) Stock Options 4,629,842 488,142 Fully Diluted Securities Outstanding 10,486,219 Cash Position $5,645,968 Cost Efficient, Targeted Investment Extends Runway

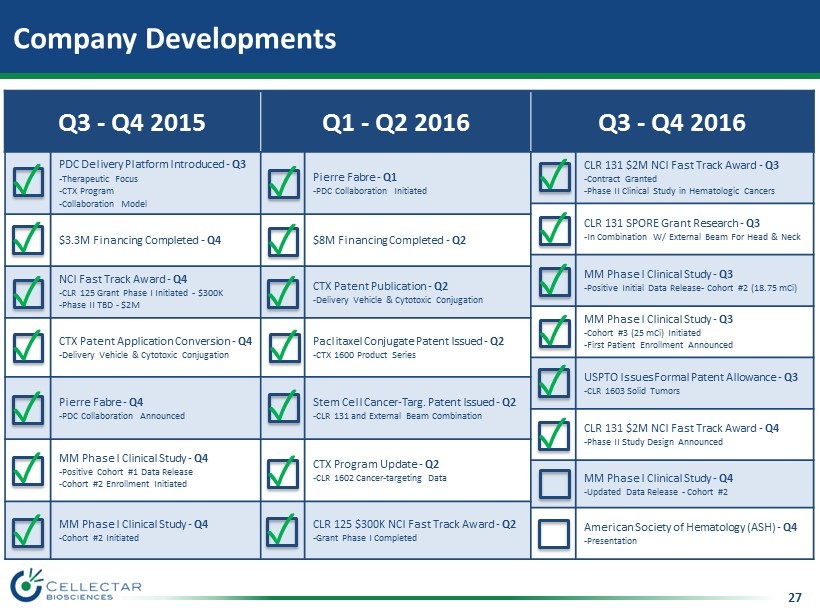

27 Company Developments Q3 - Q4 2015 Q1 - Q2 2016 Q3 - Q4 2016 PDC Delivery Platform Introduced - Q3 - Therapeutic Focus - CTX Program - Collaboration Model Pierre Fabre - Q1 - PDC Collaboration Initiated CLR 131 $2M NCI Fast Track Award - Q3 - Contract Granted - Phase II Clinical Study in Hematologic Cancers CLR 131 SPORE Grant Research - Q3 - In Combination W/ External Beam For Head & Neck $3.3M Financing Completed - Q4 $8M Financing Completed - Q2 MM Phase I Clinical Study - Q3 - Positive Initial Data Release - Cohort #2 (18.75 mCi) NCI Fast Track Award - Q4 - CLR 125 Grant Phase I Initiated - $300K - Phase II TBD - $2M CTX Patent Publication - Q2 - Delivery Vehicle & Cytotoxic Conjugation MM Phase I Clinical Study - Q3 - Cohort #3 (25 mCi) Initiated - First Patient Enrollment Announced CTX Patent Application Conversion - Q4 - Delivery Vehicle & Cytotoxic Conjugation Paclitaxel Conjugate Patent Issued - Q2 - CTX 1600 Product Series USPTO Issues Formal Patent Allowance - Q3 - CLR 1603 Solid Tumors Pierre Fabre - Q4 - PDC Collaboration Announced Stem Cell Cancer - Targ . Patent Issued - Q2 - CLR 131 and External Beam Combination CLR 131 $2M NCI Fast Track Award - Q4 - Phase II Study Design Announced MM Phase I Clinical Study - Q4 - Positive Cohort #1 Data Release - Cohort #2 Enrollment Initiated CTX Program Update - Q2 - CLR 1602 Cancer - targeting Data MM Phase I Clinical Study - Q4 - Updated Data Release - Cohort #2 MM Phase I Clinical Study - Q4 - Cohort #2 Initiated CLR 125 $300K NCI Fast Track Award - Q2 - Grant Phase I Completed American Society of Hematology (ASH) - Q4 - Presentation ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓

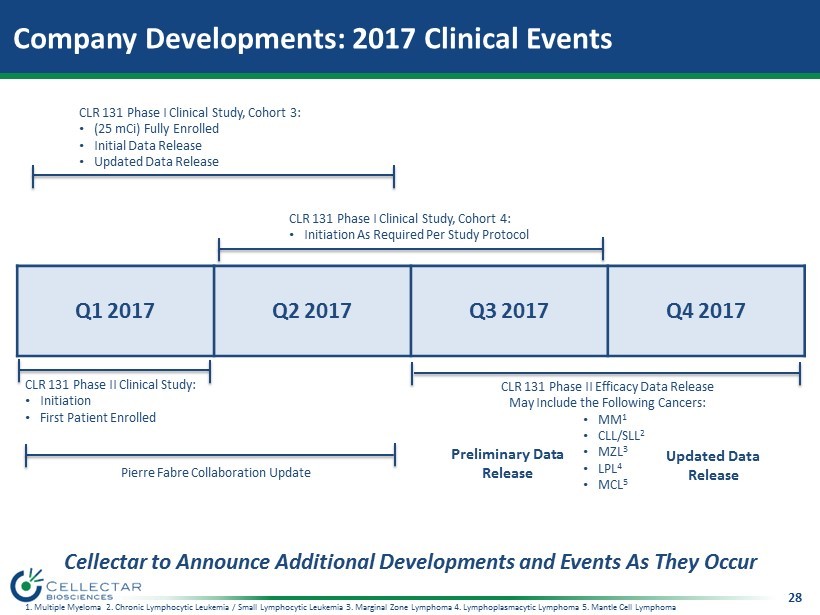

28 Company Developments: 2017 Clinical Events Q1 2017 Q2 2017 Q3 2017 Q4 2017 CLR 131 Phase I Clinical Study, Cohort 3: • (25 mCi) Fully Enrolled • Initial Data Release • Updated Data Release CLR 131 Phase II Clinical Study: • Initiation • First Patient Enrolled Pierre Fabre Collaboration Update CLR 131 Phase I Clinical Study, Cohort 4: • Initiation As Required Per Study Protocol 1. Multiple Myeloma 2. Chronic Lymphocytic Leukemia / Small Lymphocytic Leukemia 3. Marginal Zone Lymphoma 4. Lymphoplasmacytic Lymphoma 5. Mantle Cell Lymphoma Cellectar to Announce Additional Developments and Events As They Occur CLR 131 Phase II Efficacy Data Release May Include the Following Cancers: • MM 1 • CLL/SLL 2 • MZL 3 • LPL 4 • MCL 5 Preliminary Data Release Updated Data Release

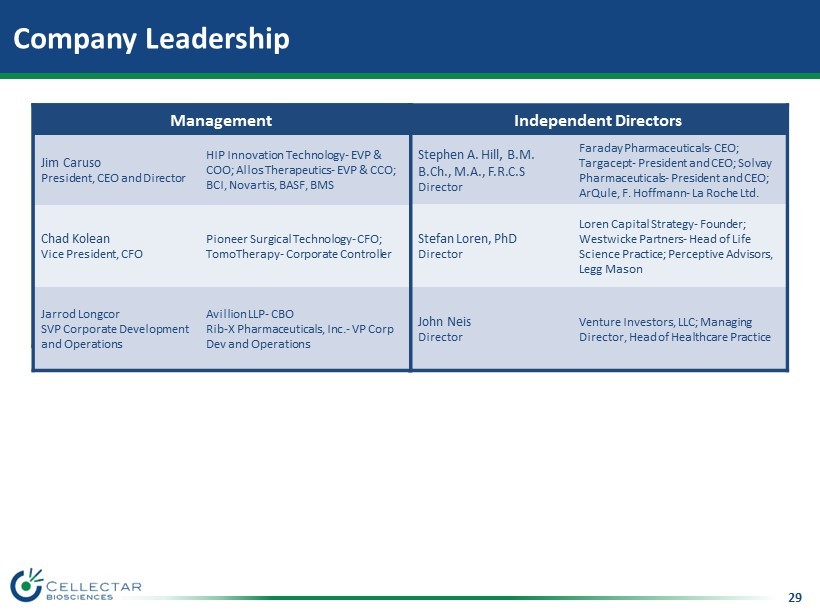

29 Company Leadership Management Jim Caruso President, CEO and Director HIP Innovation Technology - EVP & COO; Allos Therapeutics - EVP & CCO; BCI, Novartis, BASF, BMS Chad Kolean CFO Pioneer Surgical Technology - CFO; TomoTherapy - Corporate Controller Jarrod Longcor SVP Corporate Development and Operations Avillion LLP - CBO Rib - X Pharmaceuticals, Inc. - VP Corp Dev and Operations Independent Directors Stephen A. Hill , B.M. B.Ch., M.A., F.R.C.S Director Faraday Pharmaceuticals - CEO; Targacept - President and CEO; Solvay Pharmaceuticals - President and CEO; ArQule, F. Hoffmann - La Roche Ltd. Stefan Loren, PhD Director Loren Capital Strategy - Founder; Westwicke Partners - Head of Life Science Practice; Perceptive Advisors, Legg Mason John Neis Director Venture Investors, LLC; Managing Director, Head of Healthcare Practice Management Jim Caruso President, CEO and Director HIP Innovation Technology - EVP & COO; Allos Therapeutics - EVP & CCO; BCI, Novartis, BASF, BMS Chad Kolean Vice President, CFO Pioneer Surgical Technology - CFO; TomoTherapy - Corporate Controller Jarrod Longcor SVP Corporate Development and Operations Avillion LLP - CBO Rib - X Pharmaceuticals, Inc. - VP Corp Dev and Operations