1st Quarter Earnings Conference Call April 20, 2018 Exhibit 99.3

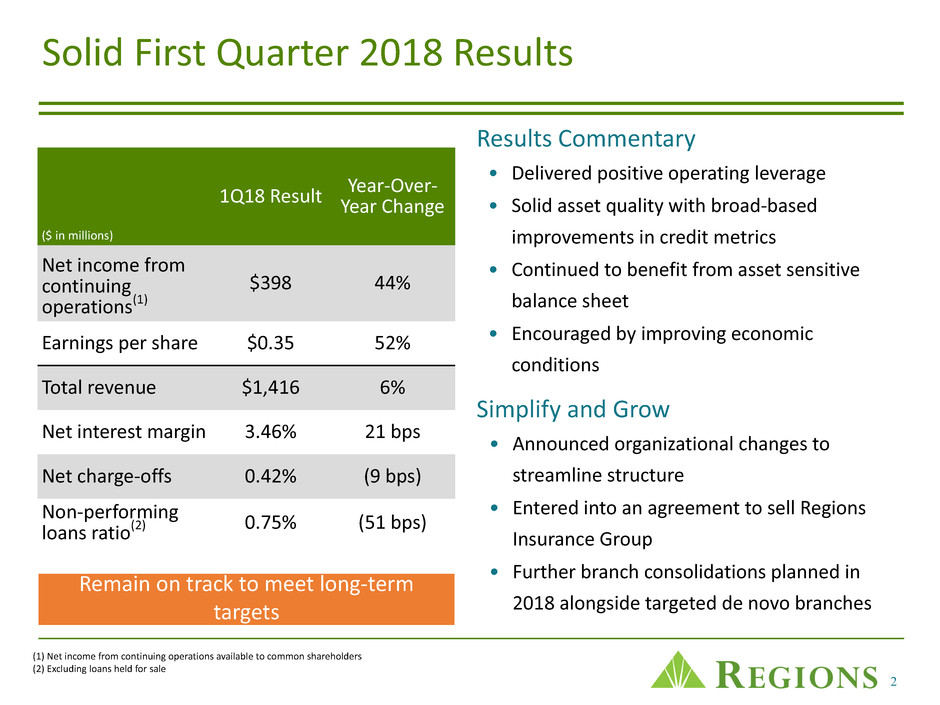

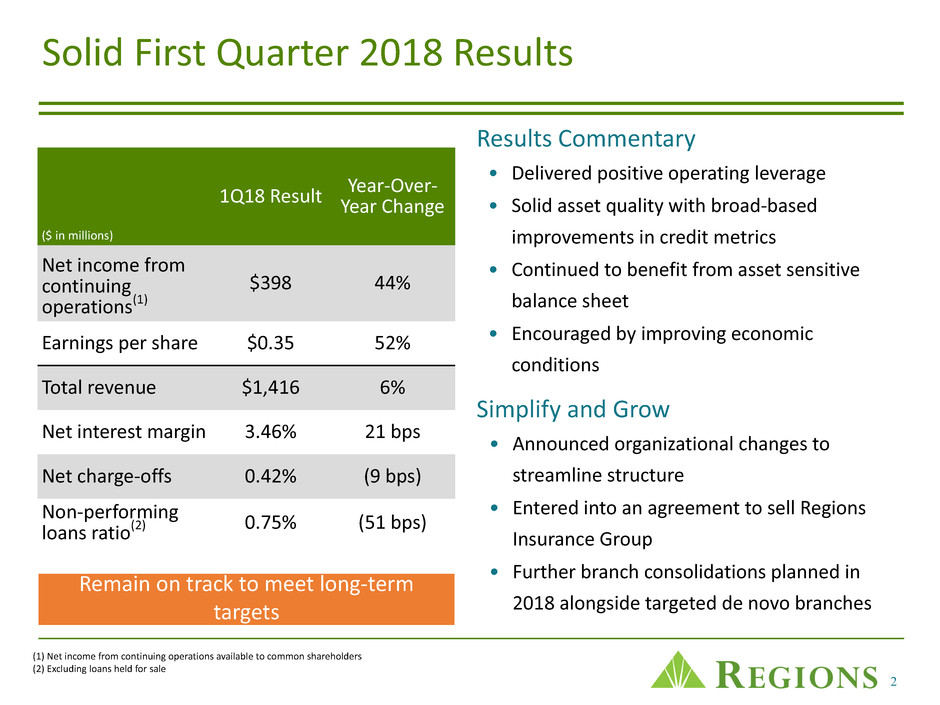

2 Solid First Quarter 2018 Results Results Commentary (1) Net income from continuing operations available to common shareholders (2) Excluding loans held for sale ($ in millions) 1Q18 Result Year-Over-Year Change Net income from continuing operations(1) $398 44% Earnings per share $0.35 52% Total revenue $1,416 6% Net interest margin 3.46% 21 bps Net charge-offs 0.42% (9 bps) Non-performing loans ratio(2) 0.75% (51 bps) • Delivered positive operating leverage • Solid asset quality with broad-based improvements in credit metrics • Continued to benefit from asset sensitive balance sheet • Encouraged by improving economic conditions Simplify and Grow • Announced organizational changes to streamline structure • Entered into an agreement to sell Regions Insurance Group • Further branch consolidations planned in 2018 alongside targeted de novo branches Remain on track to meet long-term targets

3 Asset Sensitivity Significant funding advantage driven by low-cost deposit base, accretive fixed-rate reinvestments Stable Asset Quality Broad-based credit metric improvements Capital Return Capital sufficient for organic growth, strategic opportunities, robust shareholder returns Revenue Growth & Efficiency Opportunities Identify and execute additional opportunities to increase revenues and reduce expenses through Managing for long-term performance Opportunities to drive growth and efficiencies

4 Average loans and leases Business Lending Adjusted Consumer Lending(1) 1Q17 2Q17 3Q17 4Q17 1Q18 48.9 49.0 48.3 48.2 48.6 29.2 $78.1 29.2 $78.2 29.6 $77.9 29.8 $78.0 30.1 $78.7 Prudently managing loans Transitioning to growth Quarter-over-Quarter • Reported average loans increased modestly; adjusted average loans(1) increased $620 million ◦ Adjusted average consumer loans(1) increased $157 million; growth in residential mortgage, indirect- vehicles, indirect-other consumer, and credit card ◦ Average business loans increased $463 million; solid C&I growth partially offset by declines in owner- occupied commercial real estate and investor real estate Year-over-Year (1Q18 vs 1Q17) • Reported average loans relatively unchanged; adjusted average loans(1) increased $577 million ◦ Growth in adjusted average consumer loans(1) offset by elevated payoffs, pay downs and de-risking efforts in average business loans ($ in billions) Adjusted total loans(1) Adjustments 1Q17 2Q17 3Q17 4Q17 1Q18 78.1 78.2 77.9 78.0 78.7 2.1 $80.2 1.9 $80.1 1.7 $79.6 1.5 $79.5 1.2 $79.9 Adjusted average loans and leases(1) ($ in billions) 2018 Expectations: Full-year adjusted average loans expected to grow low single digits (1) Non-GAAP; see appendix for reconciliation

5 Consumer Bank Corporate Bank Wealth Management Other 1Q17 2Q17 3Q17 4Q17 1Q18 56.2 57.1 57.0 56.9 57.1 28.2 27.6 27.6 28.4 27.7 10.0 9.5 9.3 9.2 8.9 3.6 $98.0 3.3 $97.5 3.0 $96.9 2.6 $97.1 1.7 $95.4 Low-cost deposits Time deposits + Other 1Q17 2Q17 3Q17 4Q17 1Q18 90.8 90.5 89.9 90.1 88.6 7.2 $98.0 7.0 $97.5 7.0 $96.9 7.0 $97.1 6.8 $95.4 Average deposits by type Quarter-over-Quarter • Average deposits decreased $1.6 billion ◦ Consumer deposits increased $225 million ◦ Seasonal decline in corporate deposits of $690 million ◦ Wealth Management deposits decreased $221 million; modest decline in interest-free and strategic reduction of certain collateralized deposits ◦ Other deposits declined $946 million; strategic reduction of retail brokered sweep deposits ◦ Deposit costs at 21 bps Year-over-Year (1Q18 vs 1Q17) • Average deposits decreased $2.5 billion ◦ Consumer growth offset by strategic reductions in corporate, wealth management, and other segments Optimizing deposit mix ($ in billions) ($ in billions) Average deposits by segment (1) Wealth Management segment deposits include Private Wealth Management and Institutional Services deposits. A break-out of these components is provided in the Company's quarterly Earnings Supplement. (2) Other deposits consist primarily of brokered deposits. (1) (2) 2018 Expectations: Full-year average deposits expected to grow low single digits, excluding brokered & Wealth Institutional Services deposits

6 1Q17 2Q17 3Q17 4Q17 1Q18 46 45 45 46 46 16 $62 16 $61 15 $60 14 $60 14 $60 1Q17 2Q17 3Q17 4Q17 1Q18 19 19 19 19 19 17 $36 17 $36 18 $37 18 $37 16 $35 $57 $8 $28 Deposits by Customer Type(1) (Retail vs. Business) Other Segment $1 Non-Interest Bearing Deposits by Customer Type(1) Deposit advantage • Retail deposits consist of consumer and private wealth accounts and represent 68% of total deposits • Business deposits consist of corporate, institutional services and other accounts - represent 32% of total deposits • 37% of total average 1Q18 deposits are non-interest bearing deposits Interest Bearing Deposits by Customer Type(1) • Over 45% of consumer low-cost deposit dollars have been customers for over 10 years • Through the current rising interest rate cycle, total cumulative deposit betas of only 13% ◦ Cumulative consumer retail deposit betas near zero ◦ Cumulative commercial deposit betas ~39% Consumer Segment Institutional Services* $1 Private Wealth* Corporate Segment * Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. (1) Average balances ($ in billions)($ in billions) ($ in billions)

7 2018 Expectations: Adjusted net interest income and other financing income growth of 4%-6% Quarter-over-Quarter • Net interest income (NII)(1) increased $8 million; net interest margin (NIM) +9 bps to 3.46%; adjusted NII (1)(2) increased $2 million; adjusted NIM(2) +7 bps ◦ Adjusted NII and NIM benefited from higher interest rates marginally offset by increased funding costs associated with 1Q18 opportunistic debt issuance ◦ Two fewer days in quarter; reduced NII ~$10 million but benefited NIM ~4 bps; offsetting NIM benefit is ~4 bps FTE adjustment related to tax reform Year-over-Year (1Q18 vs 1Q17) • NII increased $50 million or 6%; NIM +21 bps ◦ NII and NIM benefited from higher interest rates & prudent deposit management, partially offset by higher funding costs & lower average loan balances Net interest income(1) and net interest margin Net interest margin Adjusted NIM Net interest income Net interest income adjustment Taxable equivalent (FTE) adjustment 1Q17 2Q17 3Q17 4Q17 1Q18 3.25% 3.32% 3.36% 3.37% 3.46% 3.39% 859 882 897 901 9096 22 $881 22 $904 23 $920 23 $930 13 $922 Increasing net interest income(1) and net interest margin ($ in millions) (1) Net interest income and other financing income (2) Non-GAAP; see appendix for reconciliation (1) (2) (2) (1)(2)

8 Non-interest income Wealth - invest services Mortgage Capital markets Other Wealth - IM&T Card and ATM Service charges Selected items 1Q17 2Q17 3Q17 4Q17 1Q18 16 15 15 14 17 41 40 32 36 38 32 38 35 56 50 57 61 55 64 65 56 57 58 59 58 104 104 103 106 104 168 $474 169 175 171 171 6 $490 9 $482 10 $516 4 $507 Well-positioned for non-interest income growth (1) Non-GAAP; see appendix for reconciliation Quarter-over-Quarter • Non-interest income decreased $9 million; adjusted non-interest income(1) decreased $3 million ◦ Decline in capital markets and card & ATM fees partially offset by increase in mortgage income ◦ 1Q18 includes a $6 million increase to the value of an equity investment and a $7 million net gain on the sale of LIHTC investments offset by $4 million net impairment charges related to the value of operating lease assets Year-over-Year (1Q18 vs 1Q17) • Non-interest income increased $33 million; adjusted non-interest income(1) increased $29 million ◦ Growth in capital markets and service charges, partially offset by lower mortgage income ($ in millions) (1) 2018 Expectations: Adjusted non-interest income growth of 3-6%

9 Non-interest expense 1Q17 2Q17 3Q17 4Q17 1Q18 61.9% 62.3% 60.8% 60.5% 60.5% 838 865 847 869 862 5 $843 10 $875 6 $853 51 $920 22 $884 Disciplined expense management Quarter-over-Quarter • Non-interest expense decreased $36 million; adjusted non- interest expense(1) decreased $7 million ◦ Decrease in Visa class B shares expense and FDIC assessments, partially offset modest increases in salaries and benefits and professional fees • 1Q18 efficiency ratio 61.9%; adjusted efficiency ratio(1) unchanged at 60.5% • 1Q18 effective tax rate 23.6% Year-over-Year (1Q18 vs 1Q17) • Non-interest expense increased $41 million; adjusted non- interest expense(1) increased $24 million ◦ Increased salaries and benefits and professional fees • 2.3% adjusted positive operating leverage(1) (1) Non-GAAP; see appendix for reconciliation ($ in millions) Selected Items(1)Adjusted Non-Interest Expense(1) Adjusted efficiency ratio(1) 2018 Expectations: Adjusted non-interest expenses relatively stable; adjusted efficiency ratio <60%, adjusted operating leverage of 3%-5%, and effective tax rate of 20-22%

10 Non-performing loans Coverage ratio 1Q17 2Q17 3Q17 4Q17 1Q18 $1,004 $823 $760 $650 $601 106% 127% 137% 144% 140% • Broad-based asset quality improvement; non-performing loans, criticized, and troubled debt restructured loans all declined • NPLs(1) decreased 8% and represent 0.75% of loans outstanding, marking lowest level in over a decade • Criticized business loans decreased 9% and troubled debt restructured loans decreased 13% • Increase in adjusted net charge-offs(2) primarily due to elevated 4Q17 recoveries • Net charge-offs adjusted(2) for the residential mortgage loan sale (primarily TDRs) represent 40 bps of average loans NPLs and coverage ratio(1) Improving asset quality Classified Special mention 1Q17 2Q17 3Q17 4Q17 1Q18 2,395 2,118 2,021 1,449 1,298 1,143 $3,538 1,162 $3,280 941 $2,962 1,007 $2,456 925 $2,223 ($ in millions) ($ in millions) ($ in millions) Criticized Business Loans (1) Excludes loans held for sale (2) Non-GAAP; see appendix for reconciliation Net charge-offs and ratio 2018 Expectations: Net charge-offs of 35-50 bps; based on recent performance and market conditions, expect to be at low end of range Net charge-offs Net charge-offs ratio Adjusted net charge-offs ratio Net charge-offs related to loan sale(TDR) 1Q17 2Q17 3Q17 4Q17 1Q18 $100 $68 $76 $630.51% 0.34% 0.38% 0.31% 0.42% 0.40% $5 $84 (2)

11 1Q17 2Q17 3Q17 4Q17 1Q18 11.2% 11.4% 11.2% 11.0% 11.0% 1Q17 2Q17 3Q17 4Q17 1Q18 12.1% 12.3% 12.1% 11.9% 11.9% Tier 1 capital ratio(1) Industry leading capital and liquidity ratios • Repurchased $235 million or 12.5 million shares of common stock in 1Q18, and declared $101 million in dividends to common shareholders • Basel III common equity tier 1 ratio estimated at 11.1%(1); Fully phased-in Basel III common equity tier 1 ratio estimated at 11.0%(1)(2), well above regulatory minimums • At period-end, Regions was fully compliant with the Liquidity Coverage Ratio rule • Subject to approval, sale of insurance subsidiary expected to close in 3Q18 and generate ~$300 million of additional capital; expected to be used to repurchase shares (1) Current quarter ratios are estimated (2) Non-GAAP; see appendix for reconciliation (3) Based on ending balances Common equity Tier 1 ratio – Fully phased-in pro-forma(1)(2) Loan-to-deposit ratio(3) 1Q17 2Q17 3Q17 4Q17 1Q18 80% 82% 81% 83% 82%

12 2018 expectations • Adjusted ROATCE of 14 to 16%(1)(2) • Full-year adjusted average loans are expected to grow in the low single digits(1) • Full-year average deposits are expected to grow in the low single digits, excluding brokered and Wealth Institutional Services deposits(3) • Adjusted operating leverage of approximately 3% - 5%(1) – Adjusted net interest income and other financing income growth of 4% - 6%(1) – Adjusted non-interest income growth of 3% - 6%(1) – Adjusted non-interest expenses relatively stable(1) – Adjusted efficiency ratio < 60%(1) • Effective income tax rate of 20-22% • Net charge-offs of 35-50 bps(4) (1) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in attached appendix or previous filings with the SEC. (2) This long-term target has been updated to reflect the impact of corporate income tax reform. (3) Private Wealth Management and Institutional Services deposits are combined into the Wealth Management Segment. Total Other segment deposits consist primarily of brokered deposits. A break-out of these components is provided in the Company's quarterly Earnings Supplement. (4) Based on recent performance and current market conditions, we expect to be at the lower end of the range.

13 Appendix

14 Selected items impacting earnings • Incurred $15 million in severance and $3 million in branch consolidation expenses related to Simplify and Grow initiative • Sold $254 million of residential first mortgage loans (primarily TDRs) ◦ Incurred $4 million in transaction related costs ◦ Recognized $5 million in net charge- offs associated with the sale ◦ Released ~$21 million of loan loss allowance resulting in a net $16 million benefit to provision for loan losses • Incurred $4 million of net impairment charges reducing the value of certain operating lease assets and recognized $4 million of leveraged lease termination gains • Lower than anticipated losses associated with certain hurricanes resulted in a reduction to the company's hurricane-specific allowance for loan losses of ~ $30 million • Incurred $2 million of expense associated with Visa class B shares sold in a prior year * Based on income taxes at a 25% incremental rate beginning in 2018, and 38.5% for all prior periods. ** Items represent an outsized or unusual impact to the quarter or quarterly trends, but are not considered non-GAAP adjustments. Quarter Ended ($ amounts in millions, except per share data) 3/31/2018 12/31/2017 3/31/2017 Pre-tax adjusted items: Branch consolidation, property and equipment charges $ (3) $ (9) $ (1) Salaries and benefits related to severance charges (15) (2) (4) Expenses associated with residential mortgage loan sale (4) — — Securities gains (losses), net — 10 — Reduction in leveraged lease interest income resulting from tax reform — (6) — Contribution to Regions' charitable foundation associated with tax reform — (40) — Leveraged lease termination gains 4 — — Net provision benefit from residential mortgage loan sale 16 — — Tax reform adjustments through income tax expense — (61) — Diluted EPS impact* $ — $ (0.08) $ — Pre-tax additional selected items**: Operating lease impairment charges $ (4) $ — $ (5) Reduction of hurricane-related allowance for loan losses 30 — — Visa Class B shares expense (2) (11) (3)

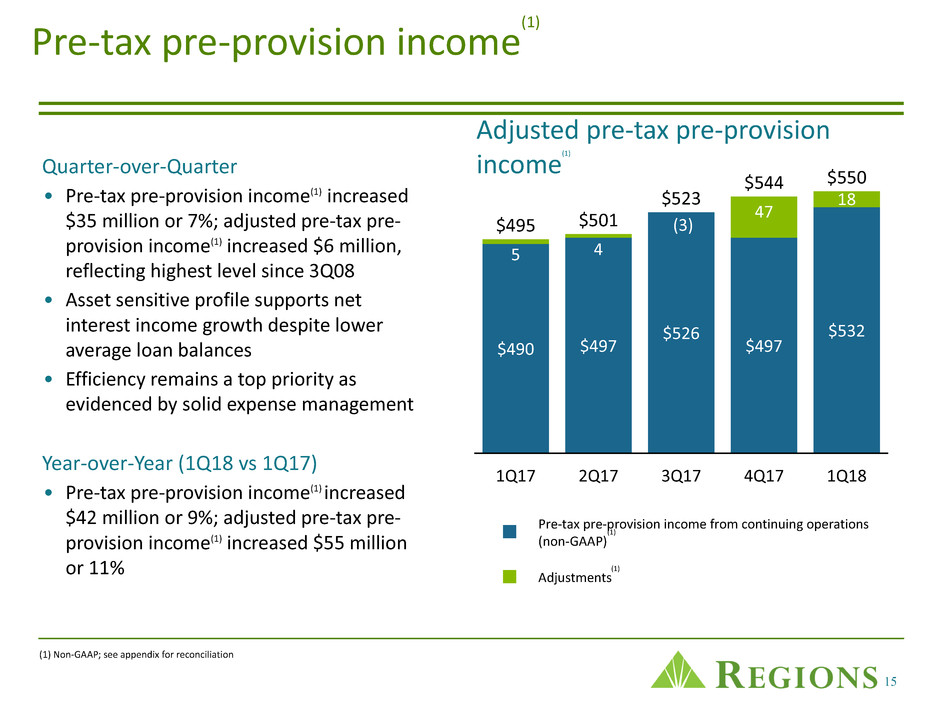

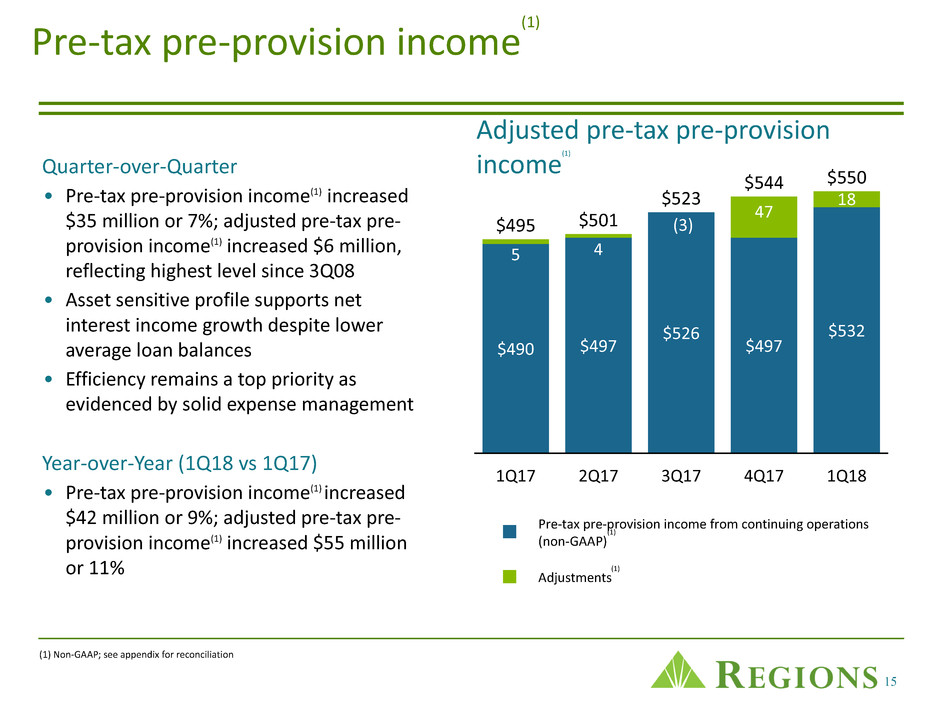

15 Pre-tax pre-provision income from continuing operations (non-GAAP) Adjustments 1Q17 2Q17 3Q17 4Q17 1Q18 $490 $497 $526 $523 $497 $532 5 $495 4 $501 47 $544 18 $550Quarter-over-Quarter • Pre-tax pre-provision income(1) increased $35 million or 7%; adjusted pre-tax pre- provision income(1) increased $6 million, reflecting highest level since 3Q08 • Asset sensitive profile supports net interest income growth despite lower average loan balances • Efficiency remains a top priority as evidenced by solid expense management Year-over-Year (1Q18 vs 1Q17) • Pre-tax pre-provision income(1) increased $42 million or 9%; adjusted pre-tax pre- provision income(1) increased $55 million or 11% Pre-tax pre-provision income (1) (1) (1) Non-GAAP; see appendix for reconciliation (1) Adjusted pre-tax pre-provision income(1) (3)

16 Adjusted Average Balances of Loans (non-GAAP) Non-GAAP reconciliation: adjusted average loans Regions believes adjusting total average loans for the impact of the first quarter 2018 residential first mortgage loan sale and the indirect vehicles third-party exit portfolio, provides a meaningful calculation of loan growth rates and presents them on the same basis as that applied by management. NM - Not Meaningful. (1) Adjustments to average loan balances assume a simple day-weighted average impact for the first quarter of 2018, and are equal to the ending balance of the residential first mortgage loans sold for the prior periods. Average Balances ($ amounts in millions) 1Q18 4Q17 3Q17 2Q17 1Q17 1Q18 vs. 4Q17 1Q18 vs. 1Q17 Total consumer loans $ 31,272 $ 31,367 $ 31,327 $ 31,147 $ 31,234 $ (95) (0.3)% $ 38 0.1 % Less: Balances of residential first mortgage loans sold(1) 164 254 254 254 254 (90) (35.4)% (90) (35.4)% Less: Indirect—vehicles third-party 1,061 1,223 1,406 1,611 1,835 (162) (13.2)% (774) (42.2)% Adjusted total consumer loans (non-GAAP) $ 30,047 $ 29,890 $ 29,667 $ 29,282 $ 29,145 $ 157 0.5 % $ 902 3.1 % Total Loans $ 79,891 $ 79,523 $ 79,585 $ 80,110 $ 80,178 368 0.5 % (287) (0.4)% Less: Balances of residential first mortgage loans sold(1) 164 254 254 254 254 (90) (35.4)% (90) (35.4)% Less: Indirect—vehicles third-party 1,061 1,223 1,406 1,611 1,835 (162) (13.2)% (774) (42.2)% Adjusted total loans (non-GAAP) $ 78,666 $ 78,046 $ 77,925 $ 78,245 $ 78,089 $ 620 0.8 % $ 577 0.7 %

17 Non-GAAP reconciliation: NII/NIM, non-interest income/expense, operating leverage and efficiency ratio NM - Not Meaningful The table below and on the following page present computations of the net interest margin; efficiency ratio, which is a measure of productivity, generally calculated as non-interest expense divided by total revenue; and the fee income ratio, generally calculated as non-interest income divided by total revenue. Management uses these ratios to monitor performance and believes these measures provide meaningful information to investors. Non- interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Net interest income and other financing income (GAAP) on a taxable-equivalent basis is presented excluding certain adjustments related to tax reform to arrive at adjusted net interest income and other financing income on a taxable-equivalent basis (non-GAAP). Non- interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Net interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non- GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. The table on the following page presents a computation of the operating leverage ratio (non-GAAP) which is the period to period percentage change in adjusted total revenue on a taxable-equivalent basis (non-GAAP) less the percentage change in adjusted non-interest expense (non-GAAP). Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Quarter Ended ($ amounts in millions) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 1Q18 vs. 4Q17 1Q18 vs. 1Q17 Non-interest expense (GAAP) A $ 884 $ 920 $ 853 $ 875 $ 843 $ (36) (3.9)% $ 41 4.9 % Adjustments: Contribution to Regions' charitable foundation associated with tax reform — (40) — — — 40 (100.0)% — NM Branch consolidation, property and equipment charges (3) (9) (5) (7) (1) 6 (66.7)% (2) 200.0 % Expenses associated with residential mortgage loan sale (4) — — — — (4) NM (4) NM Salary and employee benefits—severance charges (15) (2) (1) (3) (4) (13) NM (11) 275.0 % Adjusted non-interest expense (non-GAAP) B $ 862 $ 869 $ 847 $ 865 $ 838 $ (7) (0.8)% $ 24 2.9 % Net interest income and other financing income (GAAP) C $ 909 $ 901 $ 897 $ 882 $ 859 8 0.9 % 50 5.8 % Reduction in leveraged lease interest income resulting from tax reform — 6 — — — (6) (100.0)% — NM Adjusted net interest income and other financing income (non-GAAP) D $ 909 $ 907 $ 897 $ 882 $ 859 2 0.2 % 50 5.8 % Net interest income and other financing income (GAAP) $ 909 $ 901 $ 897 $ 882 $ 859 $ 8 0.9 % $ 50 5.8 % Taxable-equivalent adjustment 13 23 23 22 22 (10) (43.5)% (9) (40.9)% Net interest income and other financing income, taxable-equivalent basis E $ 922 $ 924 $ 920 $ 904 $ 881 $ (2) (0.2)% $ 41 4.7 % Reduction in leveraged lease interest income resulting from tax reform — 6 — — — (6) (100.0)% — NM Adjusted net interest income and other financing income, taxable equivalent basis (non-GAAP) F $ 922 $ 930 $ 920 $ 904 $ 881 $ (8) (0.9)% $ 41 4.7 % Net interest margin (GAAP) 3.46% 3.37% 3.36% 3.32% 3.25% Reduction in leveraged lease interest income resulting from tax reform — 0.02 — — — Adjusted net interest margin (non-GAAP) 3.46% 3.39% 3.36% 3.32% 3.25% Non-interest income (GAAP) G $ 507 $ 516 $ 482 $ 490 $ 474 $ (9) (1.7)% $ 33 7.0 % Adjustments: Securities (gains) losses, net — (10) (8) (1) — 10 (100.0)% — NM Leveraged lease termination gains (4) — (1) — — (4) NM (4) NM Gain on sale of affordable housing residential mortgage loans — — — (5) — — NM — NM Adjusted non-interest income (non-GAAP) H $ 503 $ 506 $ 473 $ 484 $ 474 $ (3) (0.6)% $ 29 6.1 % Total revenue C+G=I $ 1,416 $ 1,417 $ 1,379 $ 1,372 $ 1,333 $ (1) (0.1)% $ 83 6.2 % Adjusted total revenue (non-GAAP) D+H=J $ 1,412 $ 1,413 $ 1,370 $ 1,366 $ 1,333 $ (1) (0.1)% $ 79 5.9 % Total revenue, taxable-equivalent basis E $ 1,429 $ 1,440 $ 1,402 $ 1,394 $ 1,355 $ (11) (0.8)% $ 74 5.5 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) F+H=L $ 1,425 $ 1,436 $ 1,393 $ 1,388 $ 1,355 $ (11) (0.8)% $ 70 5.2 % Operating leverage ratio (GAAP) K-A 0.6 % Adjusted operating leverage ratio (non-GAAP) L-B 2.3 % Efficiency ratio (GAAP) A/K 61.9% 63.9% 60.9% 62.8% 62.2% Adjusted efficiency ratio (non-GAAP) B/L 60.5% 60.5% 60.8% 62.3% 61.9% Fee income ratio (GAAP) G/K 35.5% 35.9% 34.3% 35.2% 35.0% Adjusted fee income ratio (non-GAAP) H/L 35.3% 35.3% 33.9% 34.9% 35.0%

18 Select calculations for annualized net charge-offs as a percentage of average loans (GAAP) are presented in the table below. During the first quarter of 2018, Regions made the strategic decision to sell certain primarily performing troubled debt restructured, as well as, certain non-restructured interest-only residential first mortgage loans. These loans were marked down to fair value through net charge-offs. Management believes that excluding the incremental increase to net charge-offs from the affected net charge-off ratios to arrive at an adjusted net charge-off ratio (non-GAAP) will assist investors in analyzing the Company's credit quality performance as well as provide a better basis from which to predict future performance. Non- GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. As of and for Quarter Ended ($ amounts in millions) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Residential first mortgage net charge-offs (GAAP) A $ 7 $ 1 $ 2 $ 2 $ 2 Less: Net charge-offs associated with TDR sale 5 — — — — Adjusted residential first mortgage net charge-offs (non-GAAP) B $ 2 $ 1 $ 2 $ 2 $ 2 Total consumer net charge-offs (GAAP) C $ 58 $ 53 $ 47 $ 45 $ 49 Less: Net charge-offs associated with TDR sale 5 — — — — Adjusted total consumer net charge-offs (non-GAAP) D $ 53 $ 53 $ 47 $ 45 $ 49 Total net charge-offs (GAAP) E $ 84 $ 63 $ 76 $ 68 $ 100 Less: Net charge-offs associated with TDR sale 5 — — — — Adjusted total net charge-offs (non-GAAP) F $ 79 $ 63 $ 76 $ 68 $ 100 Average residential first mortgage loans (GAAP) G $ 13,977 $ 13,954 $ 13,808 $ 13,637 $ 13,469 Add: Average balances of residential first mortgage loans sold 90 — — — — Average residential first mortgage loans adjusted for residential first mortgage loans sold (non-GAAP) H $ 14,067 $ 13,954 $ 13,808 $ 13,637 $ 13,469 Average total consumer loans (GAAP) I $ 31,272 $ 31,367 $ 31,327 $ 31,147 $ 31,234 Add: Average balances of residential first mortgage loans sold 90 — — — — Average total consumer loans adjusted for residential first mortgage loans sold (non-GAAP) J $ 31,362 $ 31,367 $ 31,327 $ 31,147 $ 31,234 Average total loans (GAAP) K $ 79,891 $ 79,523 $ 79,585 $ 80,110 $ 80,178 Add: Average balances of residential first mortgage loans sold 90 — — — — Average total loans adjusted for residential first mortgage loans sold (non-GAAP) L $ 79,981 $ 79,523 $ 79,585 $ 80,110 $ 80,178 Residential first mortgage net charge-off percentage (GAAP)* A/G 0.21% 0.04% 0.05% 0.06% 0.08% Adjusted residential first mortgage net charge-off percentage (non-GAAP)* B/H 0.06% 0.04% 0.05% 0.06% 0.08% Total consumer net charge-off percentage (GAAP)* C/I 0.75% 0.66% 0.60% 0.58% 0.64% Adjusted total consumer net charge-off percentage (non-GAAP)* D/J 0.69% 0.66% 0.60% 0.58% 0.64% Total net charge-off percentage (GAAP)* E/K 0.42% 0.31% 0.38% 0.34% 0.51% Adjusted total net charge-off percentage (non-GAAP)* F/L 0.40% 0.31% 0.38% 0.34% 0.51% Non-GAAP reconciliation: Adjusted net charge-off ratio * Annualized

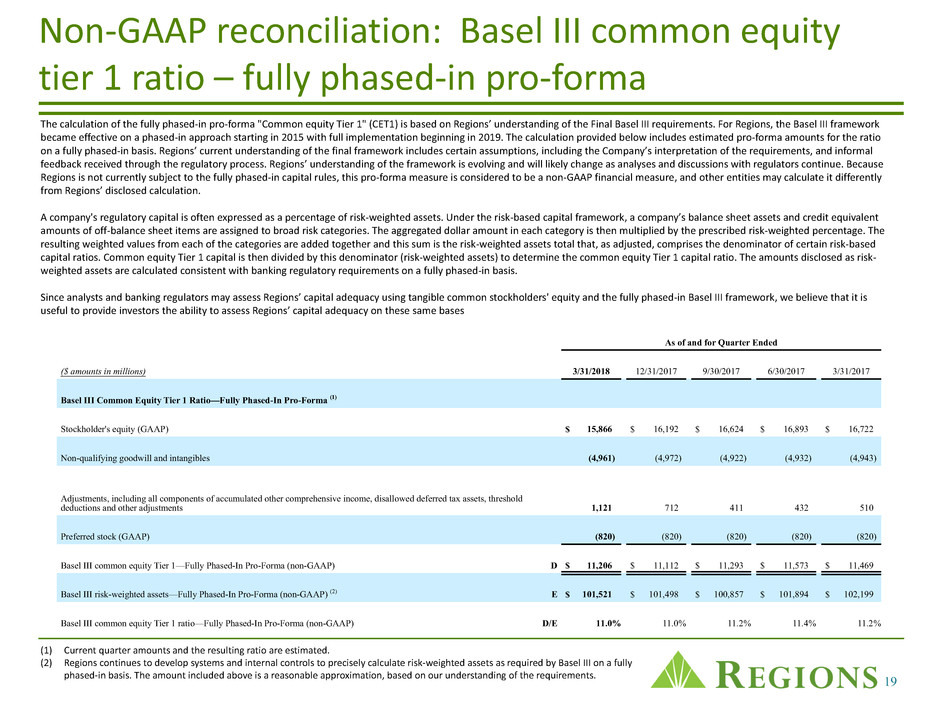

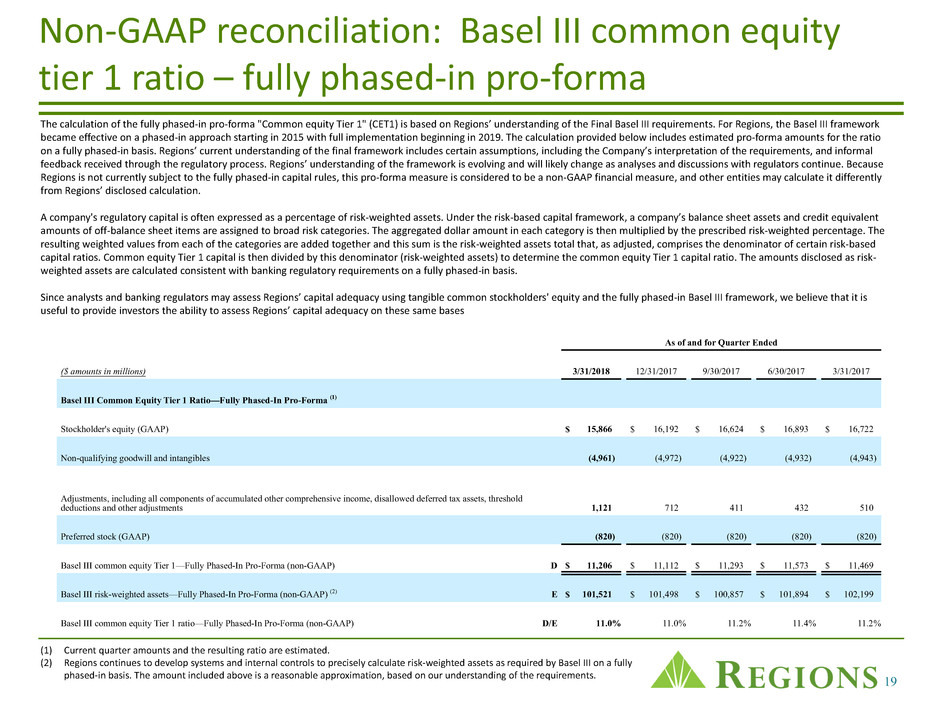

19 Non-GAAP reconciliation: Basel III common equity tier 1 ratio – fully phased-in pro-forma (1) Current quarter amounts and the resulting ratio are estimated. (2) Regions continues to develop systems and internal controls to precisely calculate risk-weighted assets as required by Basel III on a fully phased-in basis. The amount included above is a reasonable approximation, based on our understanding of the requirements. The calculation of the fully phased-in pro-forma "Common equity Tier 1" (CET1) is based on Regions’ understanding of the Final Basel III requirements. For Regions, the Basel III framework became effective on a phased-in approach starting in 2015 with full implementation beginning in 2019. The calculation provided below includes estimated pro-forma amounts for the ratio on a fully phased-in basis. Regions’ current understanding of the final framework includes certain assumptions, including the Company’s interpretation of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving and will likely change as analyses and discussions with regulators continue. Because Regions is not currently subject to the fully phased-in capital rules, this pro-forma measure is considered to be a non-GAAP financial measure, and other entities may calculate it differently from Regions’ disclosed calculation. A company's regulatory capital is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company’s balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to broad risk categories. The aggregated dollar amount in each category is then multiplied by the prescribed risk-weighted percentage. The resulting weighted values from each of the categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator of certain risk-based capital ratios. Common equity Tier 1 capital is then divided by this denominator (risk-weighted assets) to determine the common equity Tier 1 capital ratio. The amounts disclosed as risk- weighted assets are calculated consistent with banking regulatory requirements on a fully phased-in basis. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders' equity and the fully phased-in Basel III framework, we believe that it is useful to provide investors the ability to assess Regions’ capital adequacy on these same bases As of and for Quarter Ended ($ amounts in millions) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 Basel III Common Equity Tier 1 Ratio—Fully Phased-In Pro-Forma (1) Stockholder's equity (GAAP) $ 15,866 $ 16,192 $ 16,624 $ 16,893 $ 16,722 Non-qualifying goodwill and intangibles (4,961) (4,972) (4,922) (4,932) (4,943) Adjustments, including all components of accumulated other comprehensive income, disallowed deferred tax assets, threshold deductions and other adjustments 1,121 712 411 432 510 Preferred stock (GAAP) (820) (820) (820) (820) (820) Basel III common equity Tier 1—Fully Phased-In Pro-Forma (non-GAAP) D $ 11,206 $ 11,112 $ 11,293 $ 11,573 $ 11,469 Basel III risk-weighted assets—Fully Phased-In Pro-Forma (non-GAAP) (2) E $ 101,521 $ 101,498 $ 100,857 $ 101,894 $ 102,199 Basel III common equity Tier 1 ratio—Fully Phased-In Pro-Forma (non-GAAP) D/E 11.0% 11.0% 11.2% 11.4% 11.2%

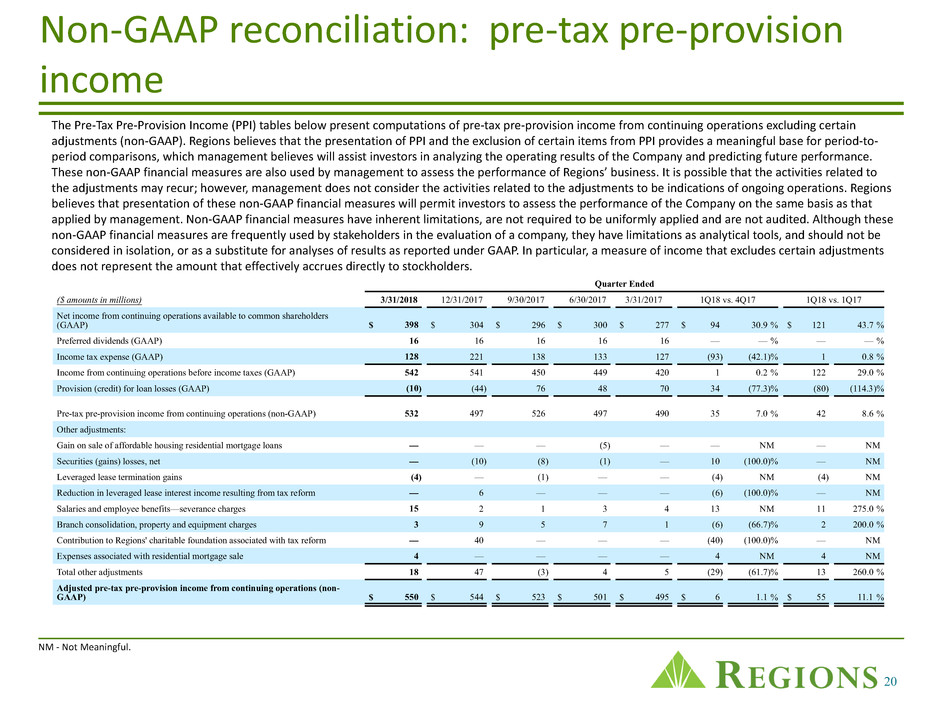

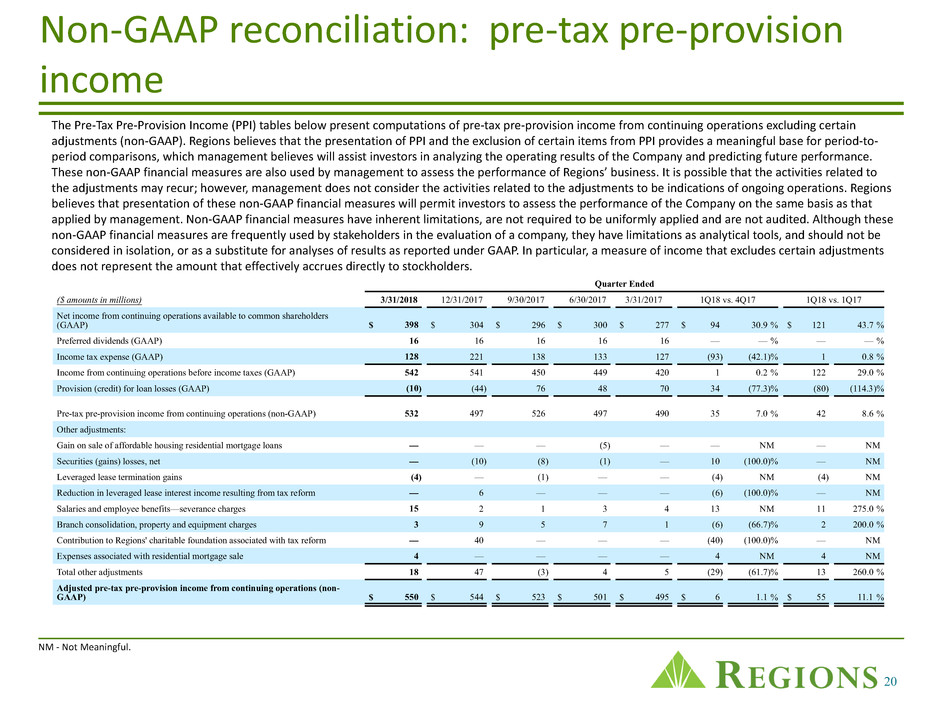

20 Non-GAAP reconciliation: pre-tax pre-provision income The Pre-Tax Pre-Provision Income (PPI) tables below present computations of pre-tax pre-provision income from continuing operations excluding certain adjustments (non-GAAP). Regions believes that the presentation of PPI and the exclusion of certain items from PPI provides a meaningful base for period-to- period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of income that excludes certain adjustments does not represent the amount that effectively accrues directly to stockholders. NM - Not Meaningful. Quarter Ended ($ amounts in millions) 3/31/2018 12/31/2017 9/30/2017 6/30/2017 3/31/2017 1Q18 vs. 4Q17 1Q18 vs. 1Q17 Net income from continuing operations available to common shareholders (GAAP) $ 398 $ 304 $ 296 $ 300 $ 277 $ 94 30.9 % $ 121 43.7 % Preferred dividends (GAAP) 16 16 16 16 16 — — % — — % Income tax expense (GAAP) 128 221 138 133 127 (93) (42.1)% 1 0.8 % Income from continuing operations before income taxes (GAAP) 542 541 450 449 420 1 0.2 % 122 29.0 % Provision (credit) for loan losses (GAAP) (10) (44) 76 48 70 34 (77.3)% (80) (114.3)% Pre-tax pre-provision income from continuing operations (non-GAAP) 532 497 526 497 490 35 7.0 % 42 8.6 % Other adjustments: Gain on sale of affordable housing residential mortgage loans — — — (5) — — NM — NM Securities (gains) losses, net — (10) (8) (1) — 10 (100.0)% — NM Leveraged lease termination gains (4) — (1) — — (4) NM (4) NM Reduction in leveraged lease interest income resulting from tax reform — 6 — — — (6) (100.0)% — NM Salaries and employee benefits—severance charges 15 2 1 3 4 13 NM 11 275.0 % Branch consolidation, property and equipment charges 3 9 5 7 1 (6) (66.7)% 2 200.0 % Contribution to Regions' charitable foundation associated with tax reform — 40 — — — (40) (100.0)% — NM Expenses associated with residential mortgage sale 4 — — — — 4 NM 4 NM Total other adjustments 18 47 (3) 4 5 (29) (61.7)% 13 260.0 % Adjusted pre-tax pre-provision income from continuing operations (non- GAAP) $ 550 $ 544 $ 523 $ 501 $ 495 $ 6 1.1 % $ 55 11.1 %

21 Forward-looking statements Forward-Looking Statements This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, adverse consequences related to tax reform, or other factors. • The effect of changes in tax laws, including the effect of Tax Reform and any future interpretations of or amendments to Tax Reform, which may impact our earnings, capital ratios and our ability to return capital to shareholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and savings habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business.

22 • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our business on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information; disruption or damage to our systems; increased costs; losses; or adverse effects to our reputation. • Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our costs; negatively affect our reputation; and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results. • Other risks identified from time to time in reports that we file with the SEC. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10- K for the year ended December 31, 2017, as filed with the SEC. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Evelyn Mitchell at (205) 264-4551. Forward-looking statements (continued)

23 ®