Exhibit 99.3 1st Quarter Earnings Conference Call April 17, 2020

Providing solutions to our customers, communities and associates Customers • Special financial assistance for customers experiencing pandemic related hardships • Helping business customers access the Small Business Administration's Paycheck Protection Program • Temporarily halted new foreclosures and repossessions, while also waiving certain fees Communities • Donating $5M toward consumer and small-business recovery efforts • Donating previously purchased advertising time to food banks across our footprint Associates • Branch activities limited to drive through services or in-office appointments; 97% remain open • Premium compensation for certain branch and operationally essential associates • Almost 50% of associates working remotely 2

Supporting our customers Customer SBA -Paycheck Additional Customer Protection Program Loan Assistance (1) Modifications (PPP) • Granting extension, • Began receiving PPP • Penalty-free CD deferrals, and forbearance applications April 3rd withdrawal • Loan payment deferral ◦ Through April 16th, • Waived fees for excessive requests through April facilitated assistance withdrawals on savings and 14th: to our business MMDA customers totaling ◦ ~17,000 consumer • Loan, credit card and loans; including ~$2.8 billion consumer mortgage ~4,000 mortgage ◦ Ramped up dedicated payment relief; including loans staff 20x normal no late fees levels ◦ ~12,000 for mortgage • No new efforts to loans serviced for ◦ Automated much of repossess vehicles or start others the application property foreclosures on process including use consumer real estate for 30 ◦ ~4,000 business loans of a client portal days (1) Go to Regions.com for specific terms and eligibility requirements. 3

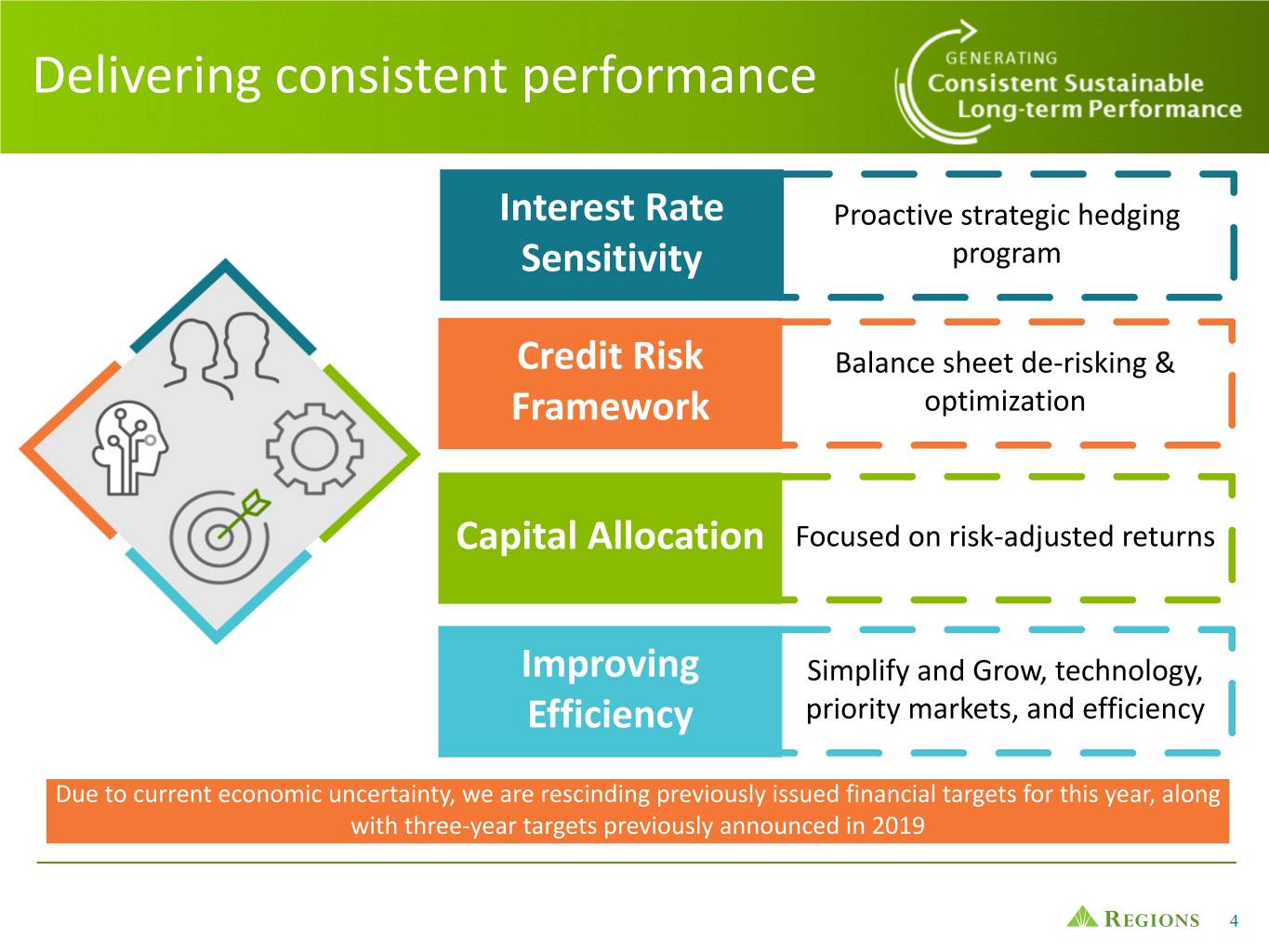

Delivering consistent performance Interest Rate Proactive strategic hedging Sensitivity program Credit Risk Balance sheet de-risking & Framework optimization Capital Allocation Focused on risk-adjusted returns Improving Simplify and Grow, technology, Efficiency priority markets, and efficiency Due to current economic uncertainty, we are rescinding previously issued financial targets for this year, along with three-year targets previously announced in 2019 4

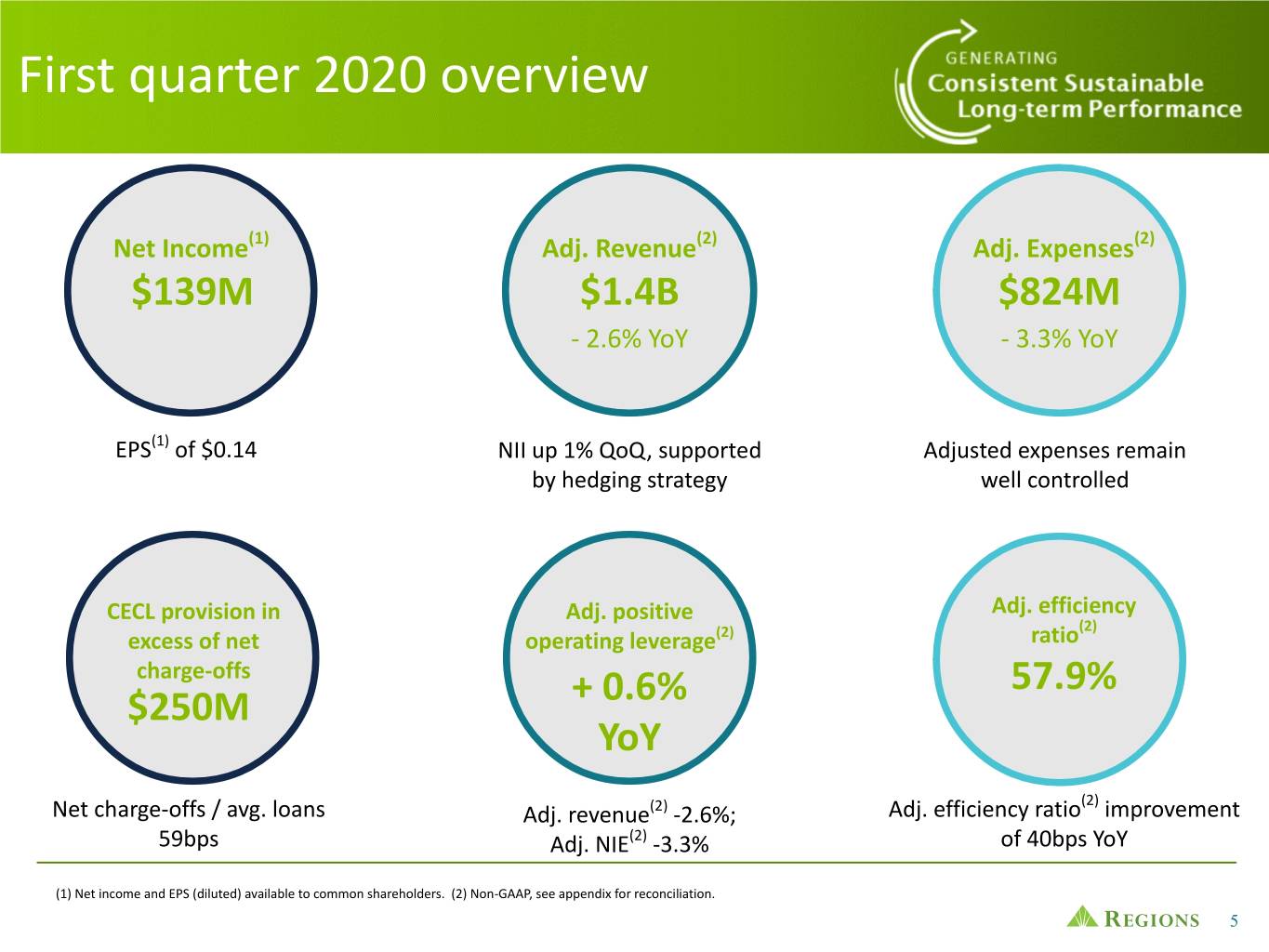

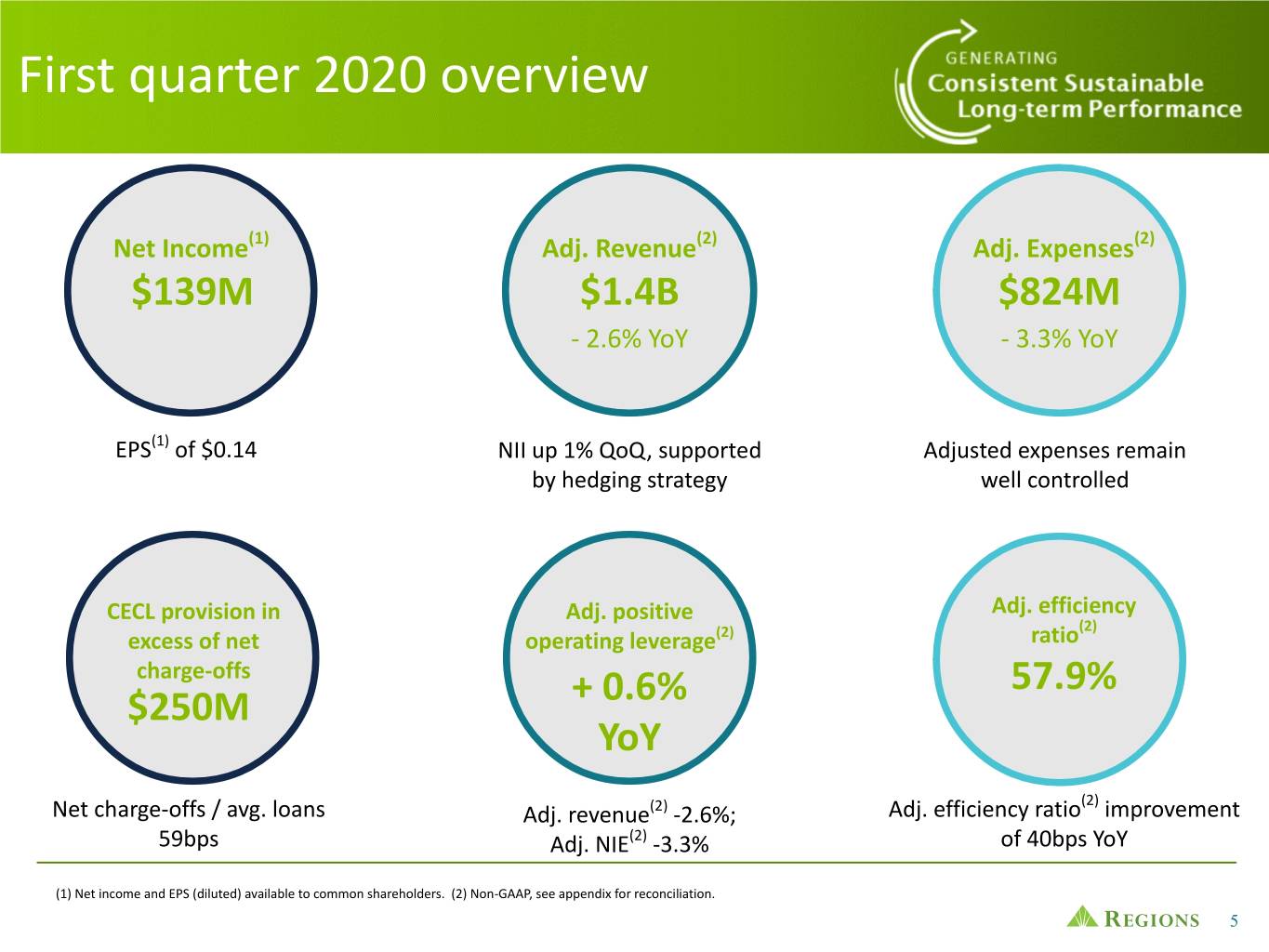

First quarter 2020 overview Net Income(1) Adj. Revenue(2) Adj. Expenses(2) $139M $1.4B $824M - 2.6% YoY - 3.3% YoY EPS(1) of $0.14 NII up 1% QoQ, supported Adjusted expenses remain by hedging strategy well controlled CECL provision in Adj. positive Adj. efficiency (2) excess of net operating leverage(2) ratio charge-offs 57.9% $250M + 0.6% YoY (2) Net charge-offs / avg. loans Adj. revenue(2) -2.6%; Adj. efficiency ratio improvement 59bps Adj. NIE(2) -3.3% of 40bps YoY (1) Net income and EPS (diluted) available to common shareholders. (2) Non-GAAP, see appendix for reconciliation. 5

First quarter 2020 highlights Summary of first quarter results Selected items impacting the quarter QoQ YoY ($ amounts in millions, except per share data) 1Q20 Change Change (amounts in millions, except per share data) 1Q20 Net interest income $ 928 1.1% (2.1)% Pre-tax adjusted items(1): Provision for credit losses 373 288.5% 309.9% Branch consolidation, property and equipment charges $ (11) Non-interest income 485 (13.7)% (3.4)% Salaries and benefits related to severance charges (1) Non-interest expense 836 (6.8)% (2.8)% Leveraged lease termination gains 2 Income before income taxes 204 (58.1)% (59.1)% Total pre-tax adjusted items(1) $ (10) Income tax expense 42 (57.1)% (60.0)% Diluted EPS impact(2) $ (0.01) Net income 162 (58.4)% (58.9)% Preferred dividends 23 —% 43.8% Pre-tax additional selected items(3): Net Income available to common CECL provision in excess of net charge-offs $ (250) shareholders $ 139 (62.0)% (63.2)% Capital markets income - CVA/DVA (34) Diluted EPS $ 0.14 (63.2)% (62.2)% MSR net hedge performance 14 (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. Tax rates associated with leveraged lease terminations are incrementally higher based on their structure. (3) Items represent an outsized or unusual impact to the quarter or quarterly trends, but are not considered non-GAAP adjustments. 6

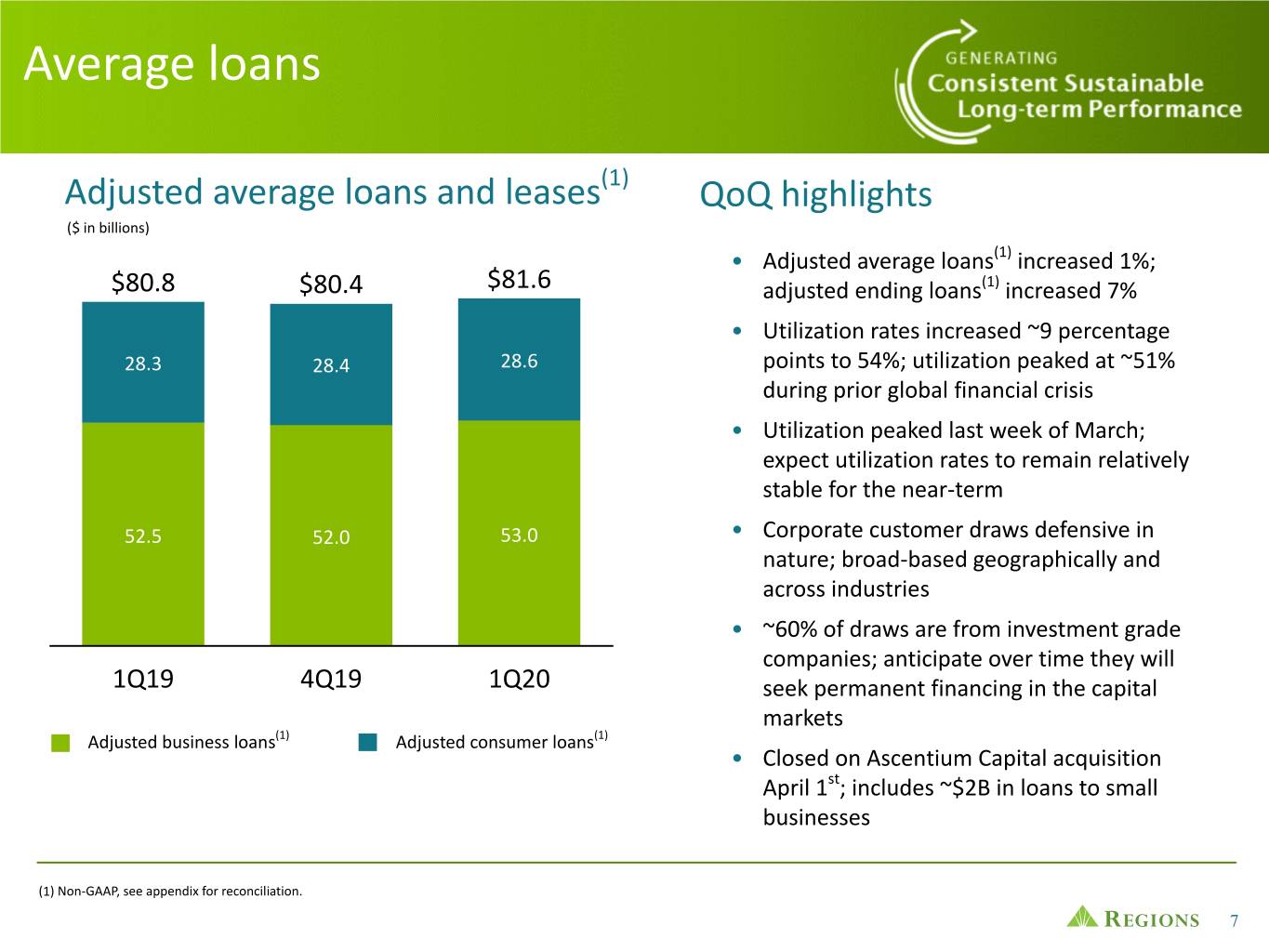

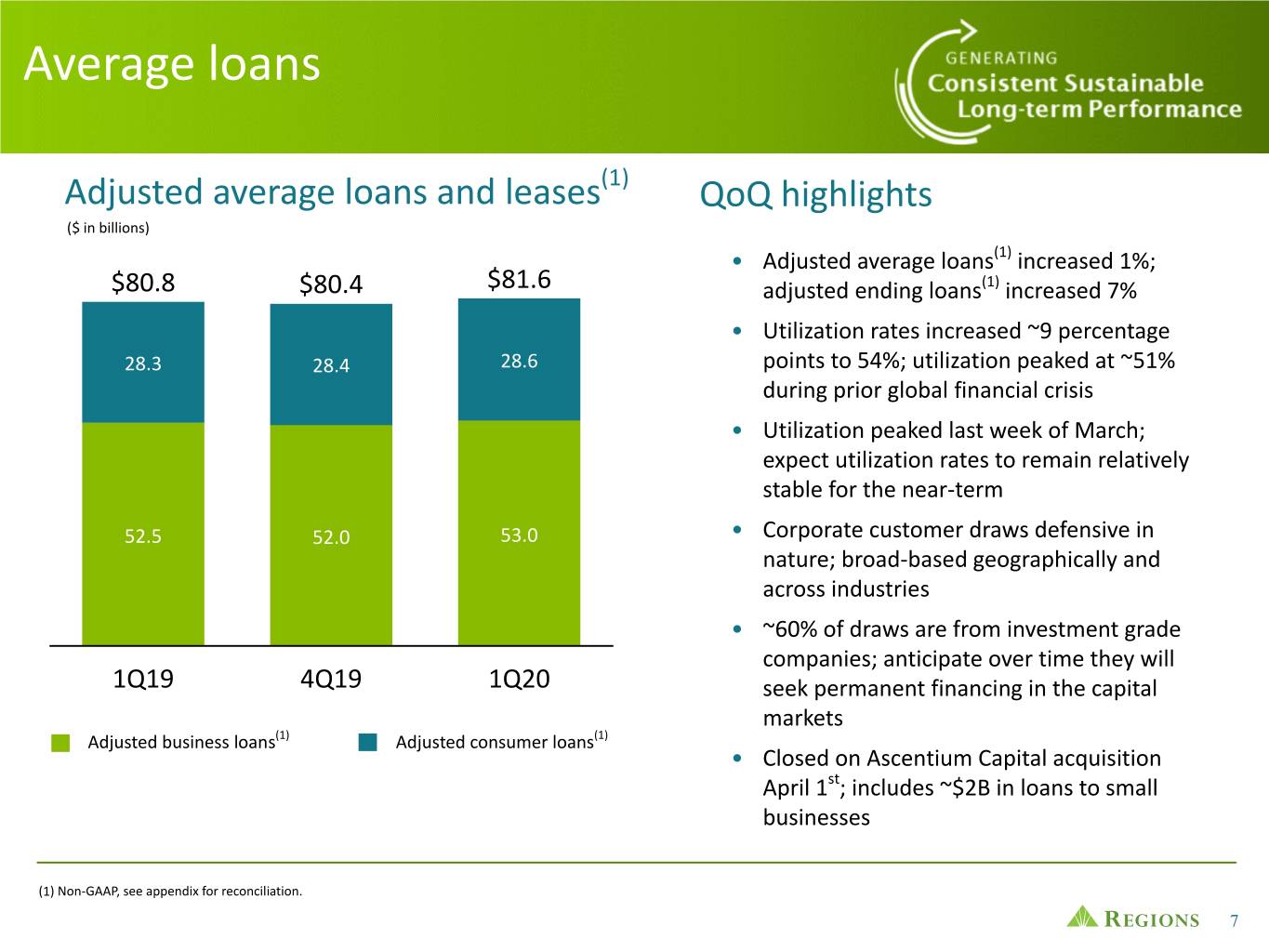

Average loans Adjusted average loans and leases(1) QoQ highlights ($ in billions) • Adjusted average loans(1) increased 1%; $80.8 $80.4 $81.6 adjusted ending loans(1) increased 7% • Utilization rates increased ~9 percentage 28.3 28.4 28.6 points to 54%; utilization peaked at ~51% during prior global financial crisis • Utilization peaked last week of March; expect utilization rates to remain relatively stable for the near-term 52.5 52.0 53.0 • Corporate customer draws defensive in nature; broad-based geographically and across industries • ~60% of draws are from investment grade companies; anticipate over time they will 1Q19 4Q19 1Q20 seek permanent financing in the capital markets Adjusted business loans(1) Adjusted consumer loans(1) • Closed on Ascentium Capital acquisition April 1st; includes ~$2B in loans to small businesses (1) Non-GAAP, see appendix for reconciliation. 7

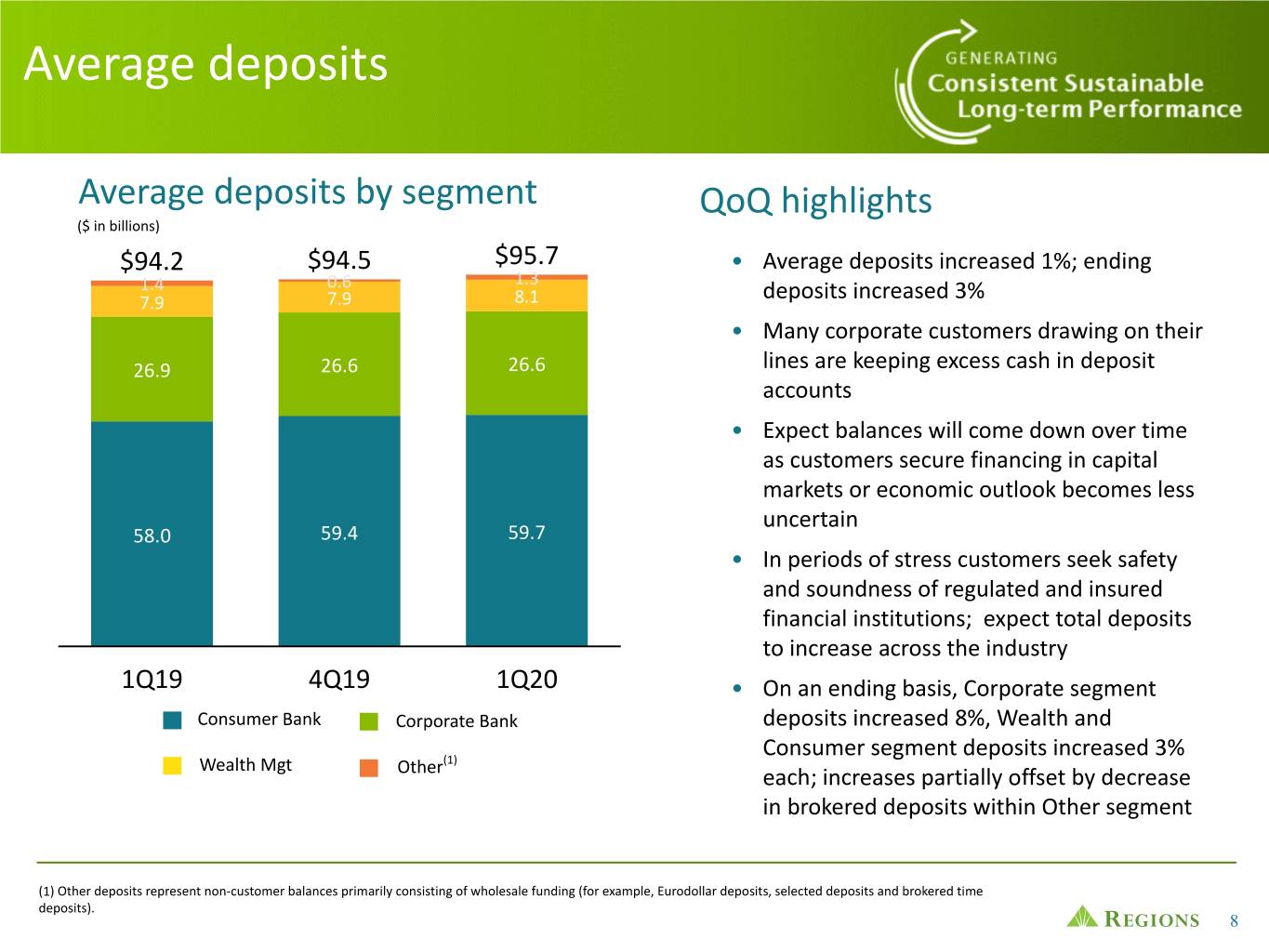

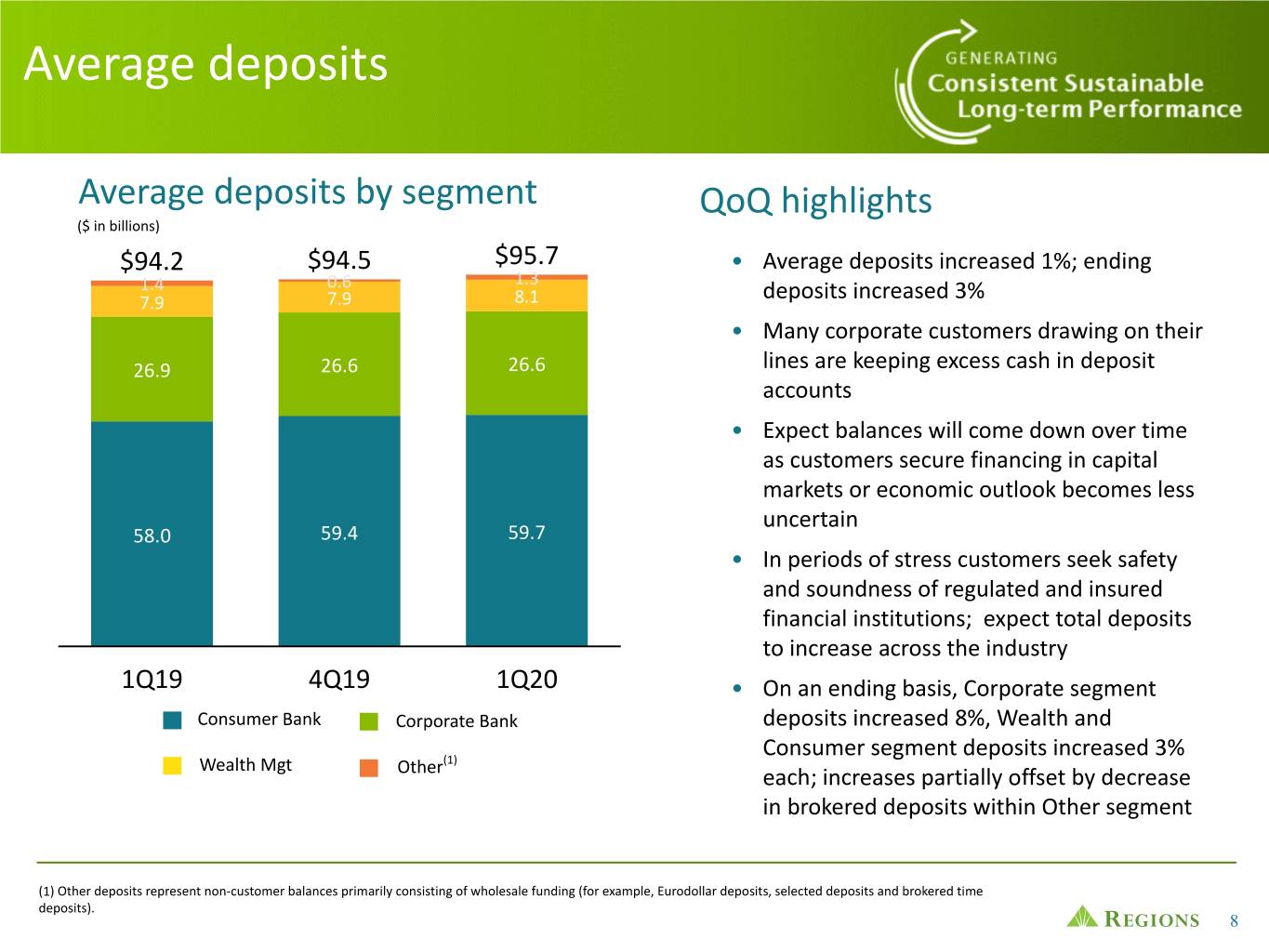

Average deposits Average deposits by segment QoQ highlights ($ in billions) $94.2 $94.5 $95.7 • Average deposits increased 1%; ending 1.4 0.6 1.3 7.9 7.9 8.1 deposits increased 3% • Many corporate customers drawing on their 26.9 26.6 26.6 lines are keeping excess cash in deposit accounts • Expect balances will come down over time as customers secure financing in capital markets or economic outlook becomes less uncertain 58.0 59.4 59.7 • In periods of stress customers seek safety and soundness of regulated and insured financial institutions; expect total deposits to increase across the industry 1Q19 4Q19 1Q20 • On an ending basis, Corporate segment Consumer Bank Corporate Bank deposits increased 8%, Wealth and Consumer segment deposits increased 3% Wealth Mgt (1) Other each; increases partially offset by decrease in brokered deposits within Other segment (1) Other deposits represent non-customer balances primarily consisting of wholesale funding (for example, Eurodollar deposits, selected deposits and brokered time deposits). 8

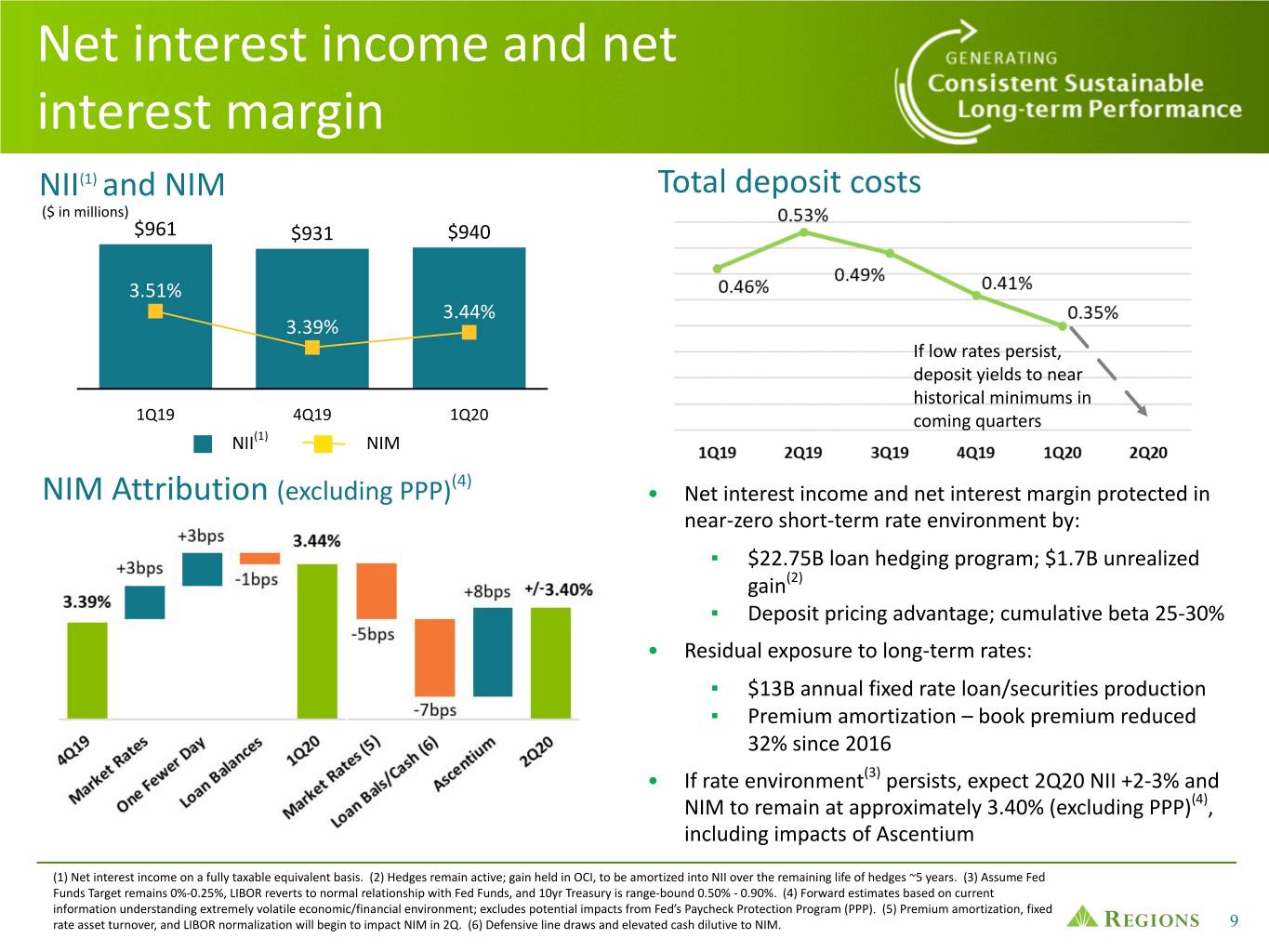

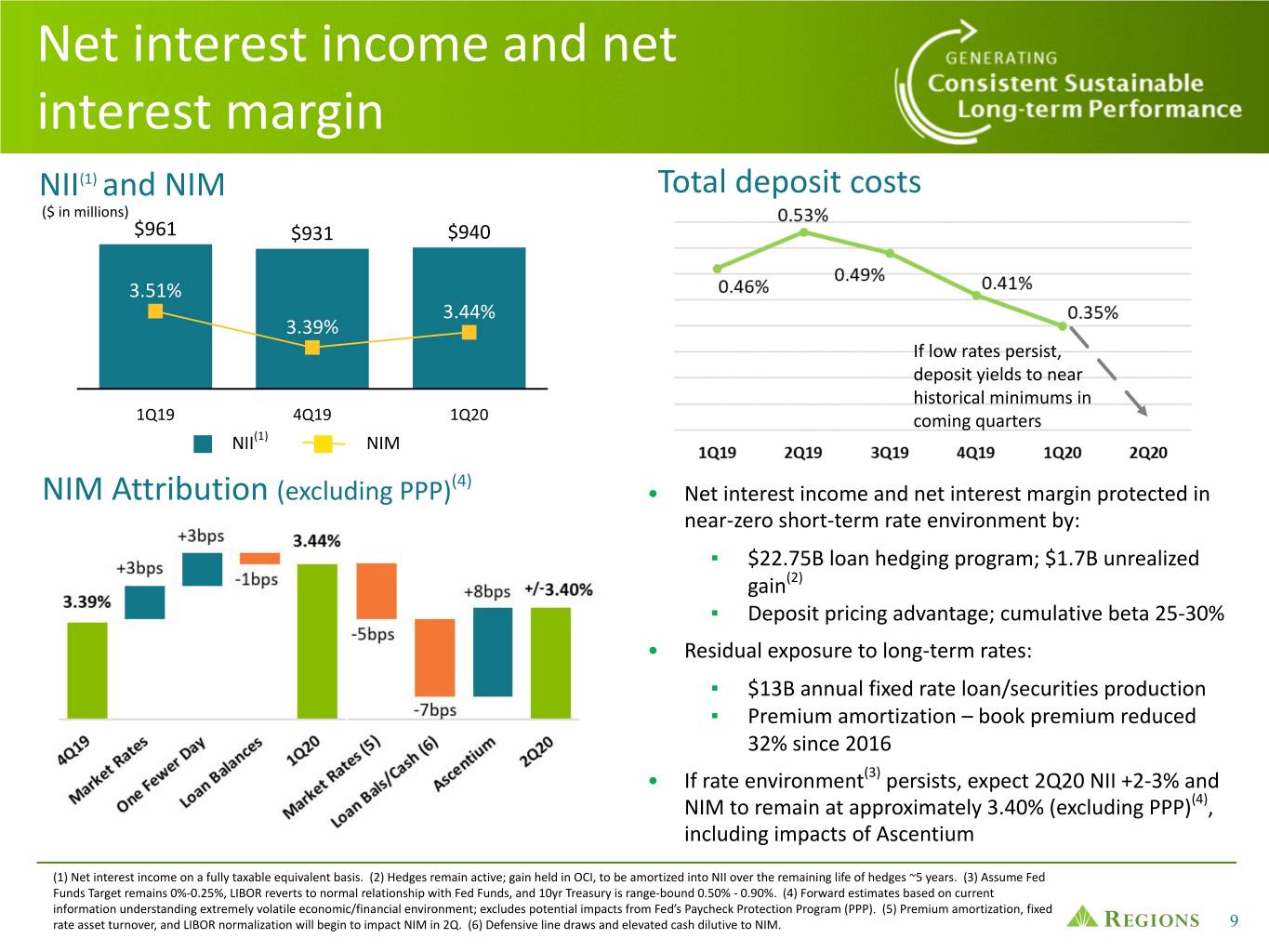

Net interest income and net interest margin NII(1) and NIM Total deposit costs ($ in millions) $961 $931 $940 3.51% 3.44% 3.39% If low rates persist, deposit yields to near historical minimums in 1Q19 4Q19 1Q20 coming quarters NII(1) NIM (4) NIM Attribution (excluding PPP) • Net interest income and net interest margin protected in near-zero short-term rate environment by: ▪ $22.75B loan hedging program; $1.7B unrealized gain(2) ▪ Deposit pricing advantage; cumulative beta 25-30% • Residual exposure to long-term rates: ▪ $13B annual fixed rate loan/securities production ▪ Premium amortization – book premium reduced 32% since 2016 • If rate environment(3) persists, expect 2Q20 NII +2-3% and NIM to remain at approximately 3.40% (excluding PPP)(4), including impacts of Ascentium (1) Net interest income on a fully taxable equivalent basis. (2) Hedges remain active; gain held in OCI, to be amortized into NII over the remaining life of hedges ~5 years. (3) Assume Fed Funds Target remains 0%-0.25%, LIBOR reverts to normal relationship with Fed Funds, and 10yr Treasury is range-bound 0.50% - 0.90%. (4) Forward estimates based on current information understanding extremely volatile economic/financial environment; excludes potential impacts from Fed’s Paycheck Protection Program (PPP). (5) Premium amortization, fixed rate asset turnover, and LIBOR normalization will begin to impact NIM in 2Q. (6) Defensive line draws and elevated cash dilutive to NIM. 9

Non-interest income Adjusted non-interest income(1) ($ in millions) $564 Change vs $501 $483 ($ in millions) 1Q20 4Q19 1Q19 Service charges $178 (4.8)% 1.7% Card and ATM fees 105 (6.3)% (3.7)% Wealth management income 84 —% 10.5% Capital markets income 1Q19 4Q19 1Q20 (excluding CVA/DVA) 43 (23.2)% (2.3)% • Non-interest income impacted by market volatility and Capital markets - CVA/DVA (34) NM NM economic uncertainty Mortgage income 68 38.8% 151.9% • Capital markets down due to CVA/DVA; M&A likely to remain on hold in near-term Market Value adjustments (on employee benefit assets - other) (25) NM NM • Mortgage up significantly - elevated sales and record Other 66 6.5% (10.8)% application volume, as well as positive net hedge performance Total non-interest income $485 (13.7)% (3.4)% • 30% reduction in consumer spending activity in late March; Adjusted non-interest income(1) $483 (14.4)% (3.6)% if levels persist, consumer non-interest income negatively impacted $20-25M/month from pre-March levels; declines expected to be partially offset by better than expected mortgage production resulting from lower rates (1) Non-GAAP; see appendix for reconciliation. NM - Not Meaningful 10

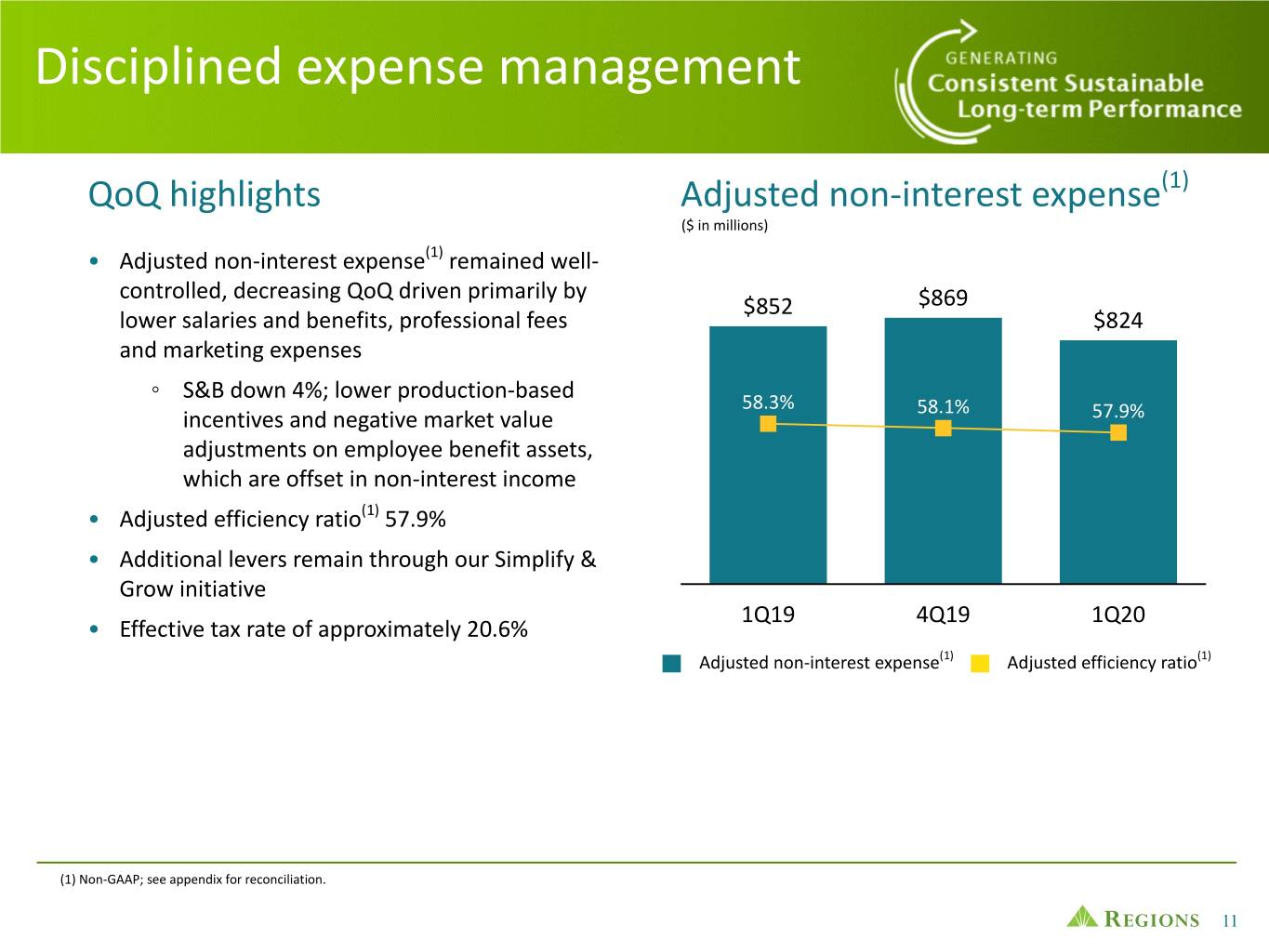

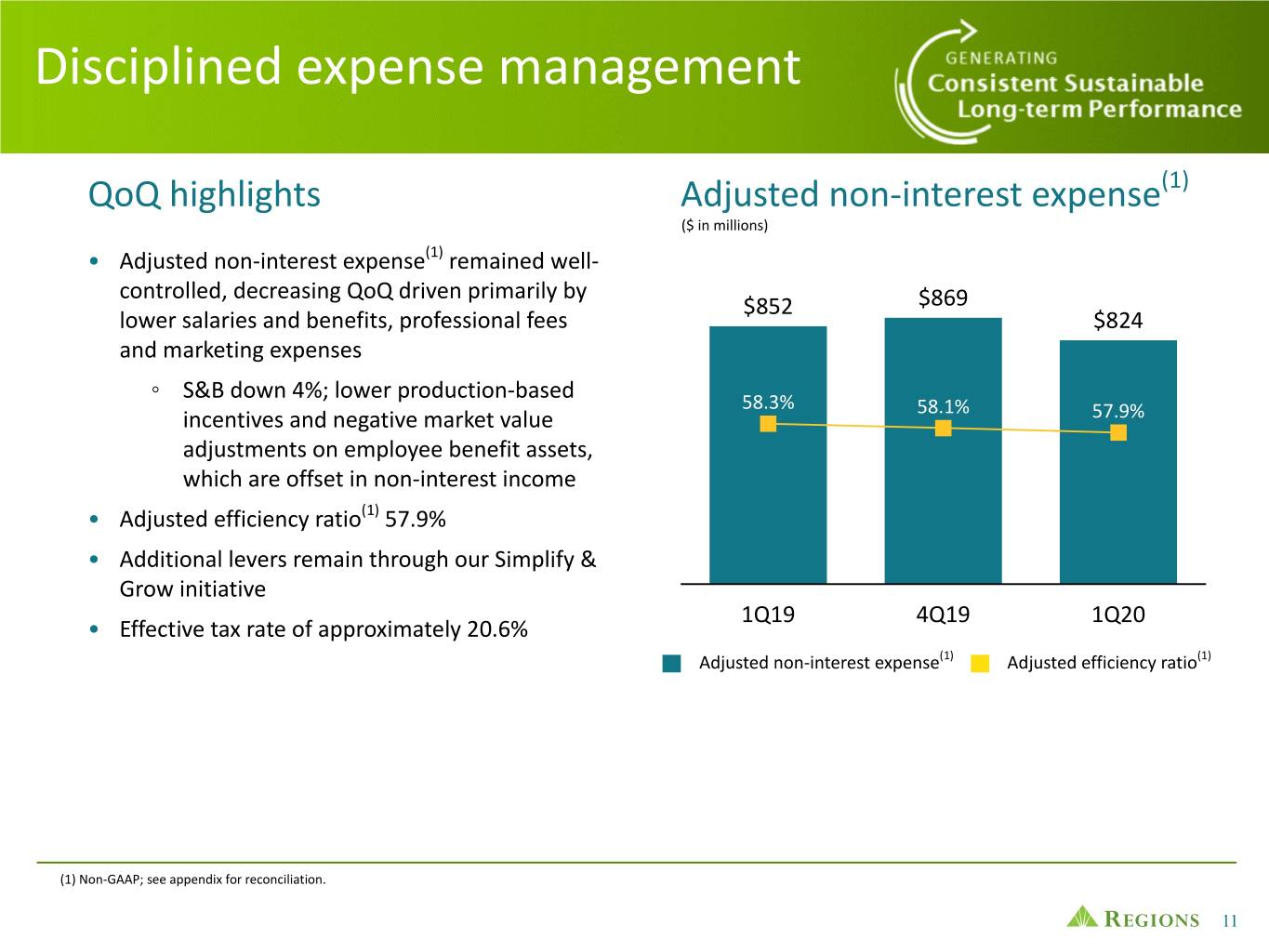

Disciplined expense management QoQ highlights Adjusted non-interest expense(1) ($ in millions) • Adjusted non-interest expense(1) remained well- controlled, decreasing QoQ driven primarily by $852 $869 lower salaries and benefits, professional fees $824 and marketing expenses ◦ S&B down 4%; lower production-based 58.3% 58.1% incentives and negative market value 57.9% adjustments on employee benefit assets, which are offset in non-interest income • Adjusted efficiency ratio(1) 57.9% • Additional levers remain through our Simplify & Grow initiative 1Q19 4Q19 1Q20 • Effective tax rate of approximately 20.6% Adjusted non-interest expense(1) Adjusted efficiency ratio(1) (1) Non-GAAP; see appendix for reconciliation. 11

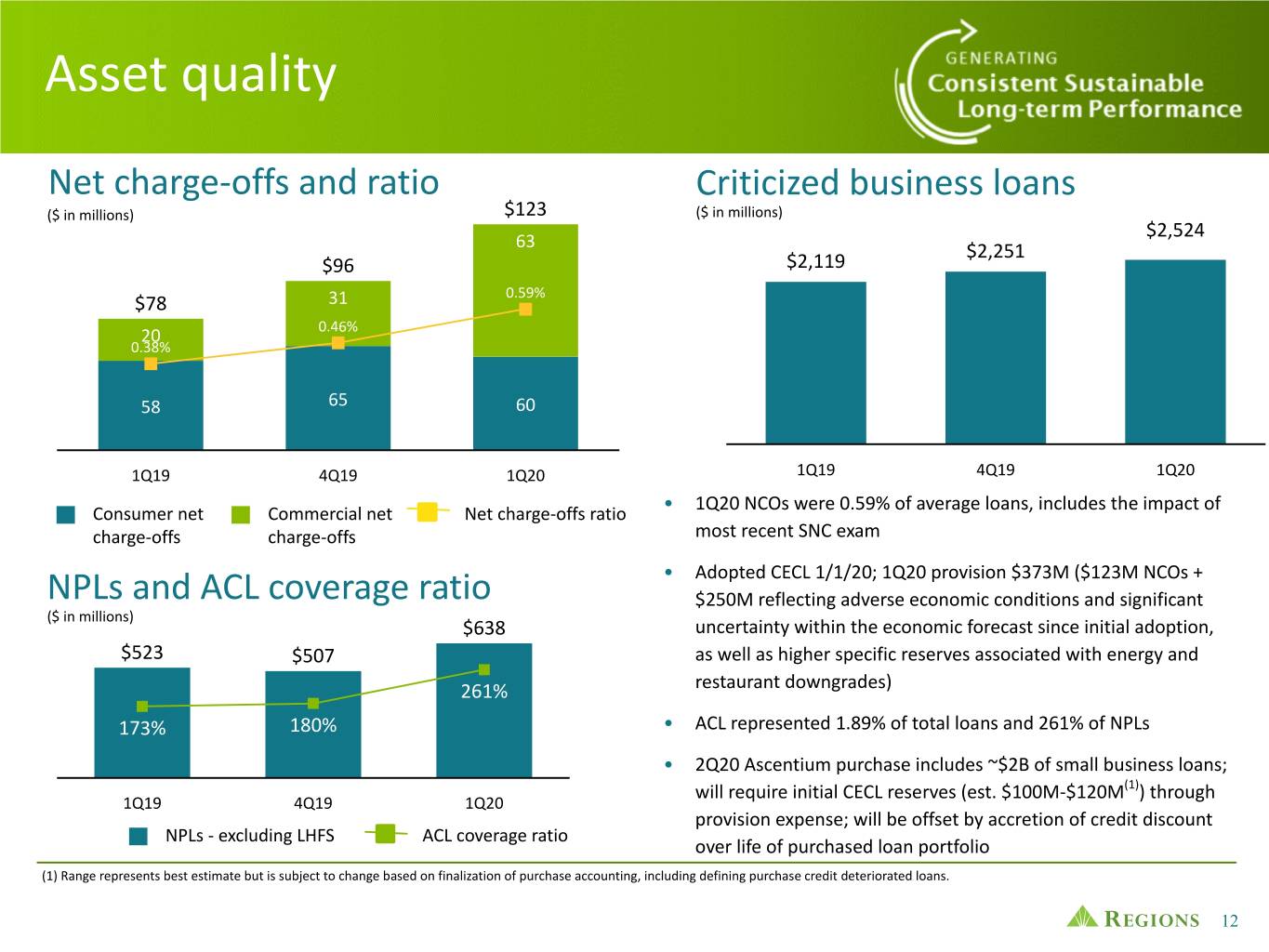

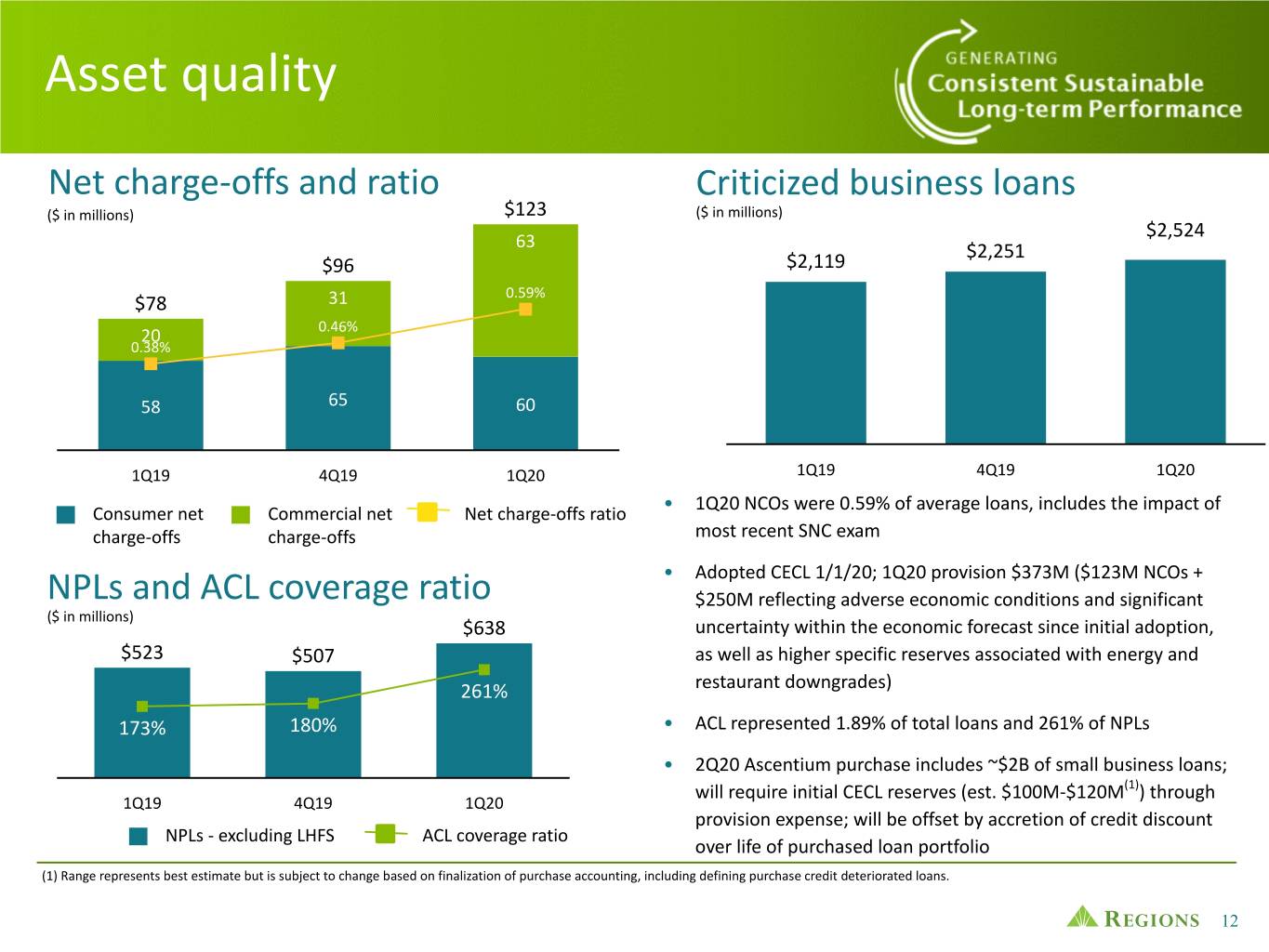

Asset quality Net charge-offs and ratio Criticized business loans ($ in millions) $123 ($ in millions) $2,524 63 $2,251 $96 $2,119 0.59% $78 31 20 0.46% 0.38% 58 65 60 1Q19 4Q19 1Q20 1Q19 4Q19 1Q20 • 1Q20 NCOs were 0.59% of average loans, includes the impact of Consumer net Commercial net Net charge-offs ratio charge-offs charge-offs most recent SNC exam • Adopted CECL 1/1/20; 1Q20 provision $373M ($123M NCOs + NPLs and ACL coverage ratio $250M reflecting adverse economic conditions and significant ($ in millions) $638 uncertainty within the economic forecast since initial adoption, $523 $507 as well as higher specific reserves associated with energy and 261% restaurant downgrades) 173% 180% • ACL represented 1.89% of total loans and 261% of NPLs • 2Q20 Ascentium purchase includes ~$2B of small business loans; will require initial CECL reserves (est. $100M-$120M(1)) through 1Q19 4Q19 1Q20 provision expense; will be offset by accretion of credit discount NPLs - excluding LHFS ACL coverage ratio over life of purchased loan portfolio (1) Range represents best estimate but is subject to change based on finalization of purchase accounting, including defining purchase credit deteriorated loans. 12

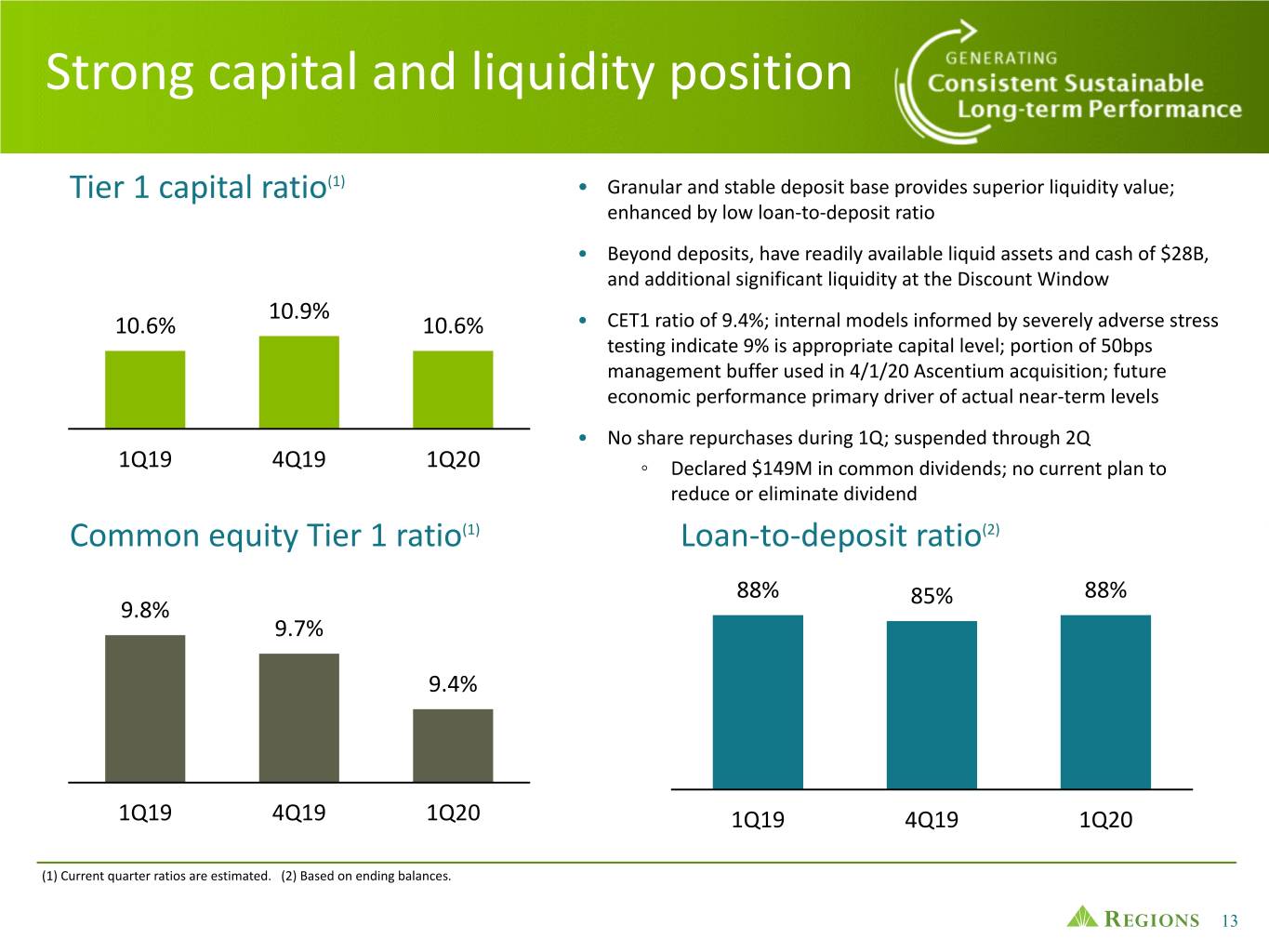

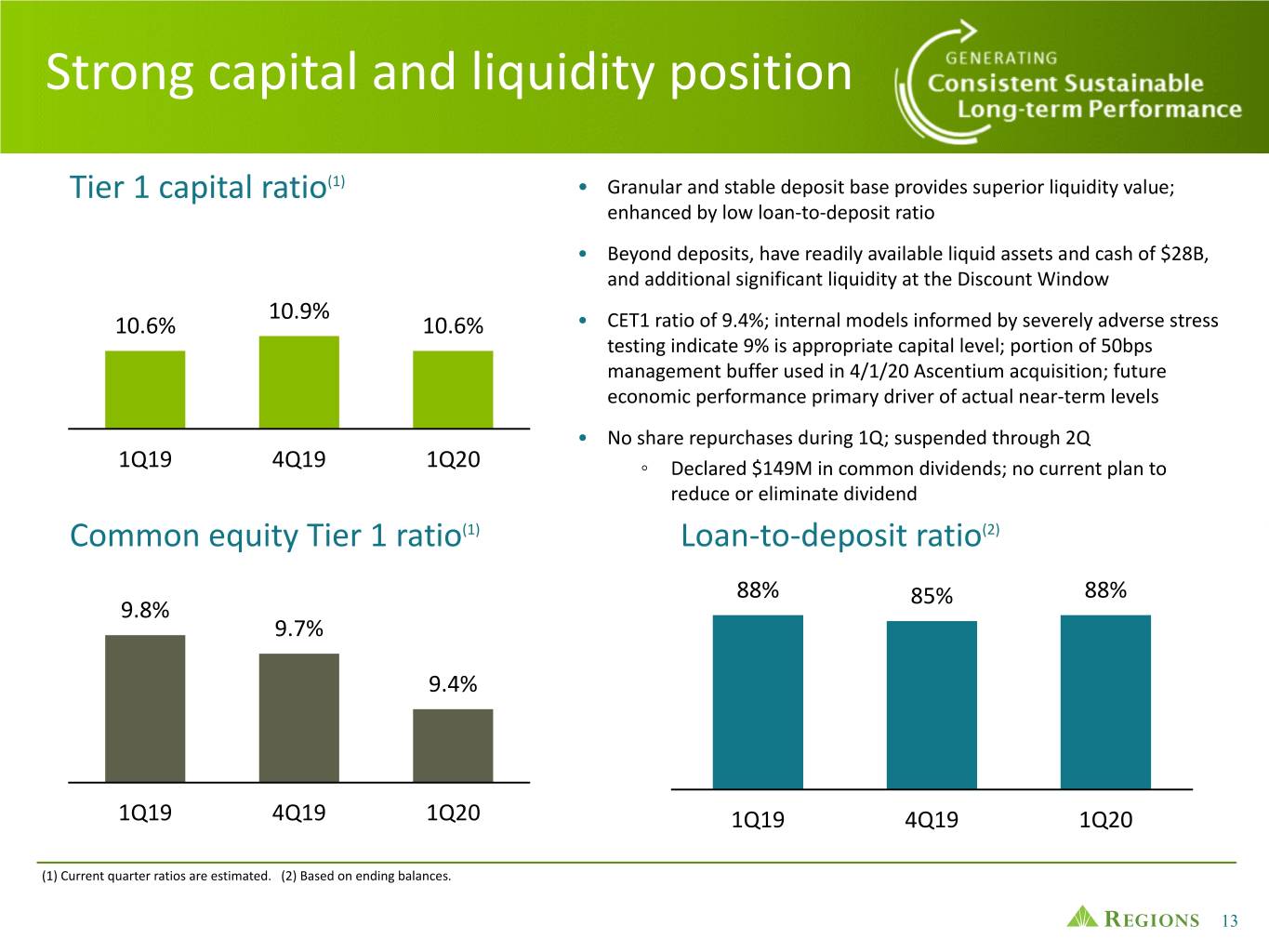

Strong capital and liquidity position Tier 1 capital ratio(1) • Granular and stable deposit base provides superior liquidity value; enhanced by low loan-to-deposit ratio • Beyond deposits, have readily available liquid assets and cash of $28B, and additional significant liquidity at the Discount Window 10.9% 10.6% 10.6% • CET1 ratio of 9.4%; internal models informed by severely adverse stress testing indicate 9% is appropriate capital level; portion of 50bps management buffer used in 4/1/20 Ascentium acquisition; future economic performance primary driver of actual near-term levels • No share repurchases during 1Q; suspended through 2Q 1Q19 4Q19 1Q20 ◦ Declared $149M in common dividends; no current plan to reduce or eliminate dividend Common equity Tier 1 ratio(1) Loan-to-deposit ratio(2) 88% 85% 88% 9.8% 9.7% 9.4% 1Q19 4Q19 1Q20 1Q19 4Q19 1Q20 (1) Current quarter ratios are estimated. (2) Based on ending balances. 13

Appendix 14

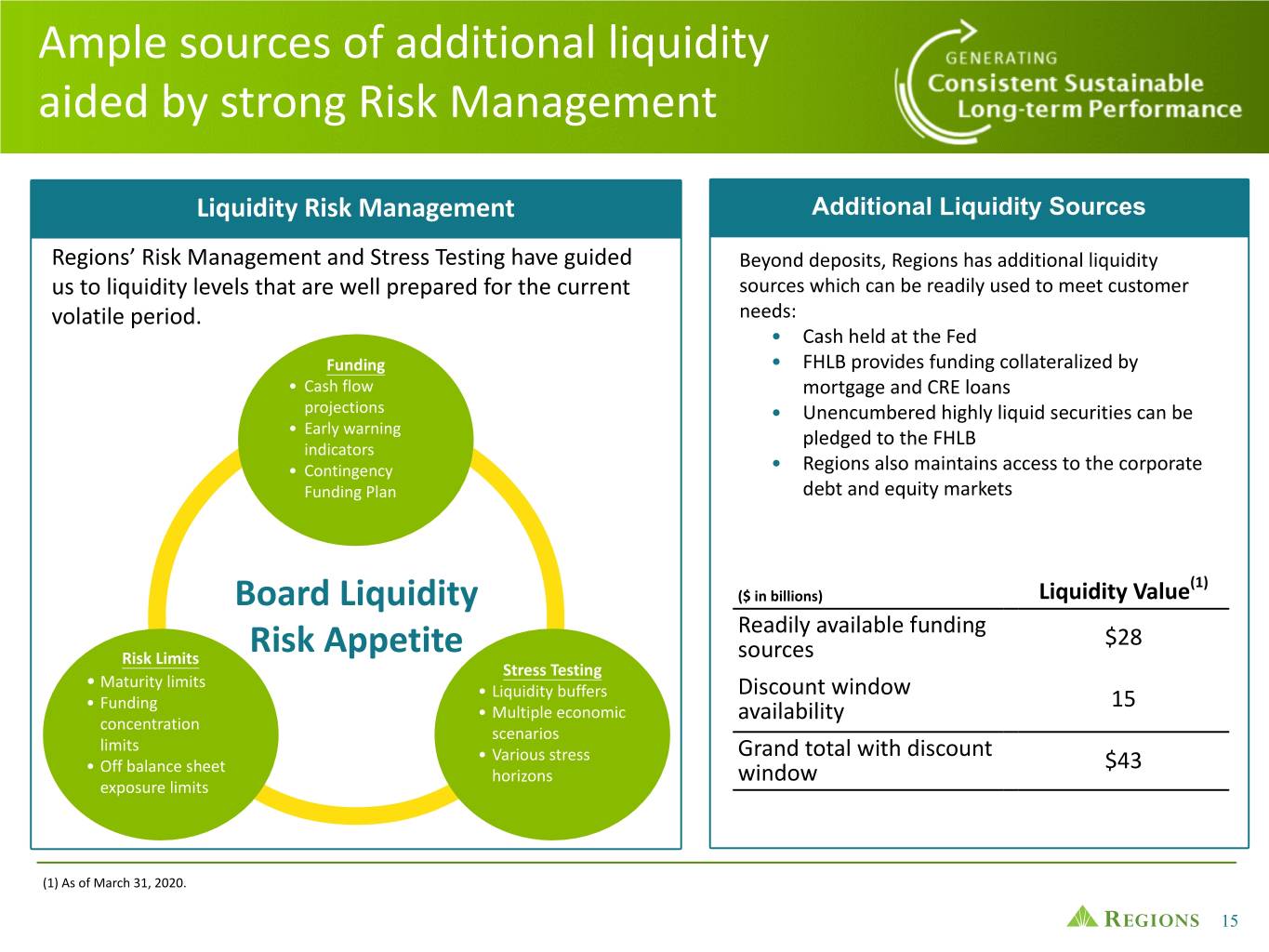

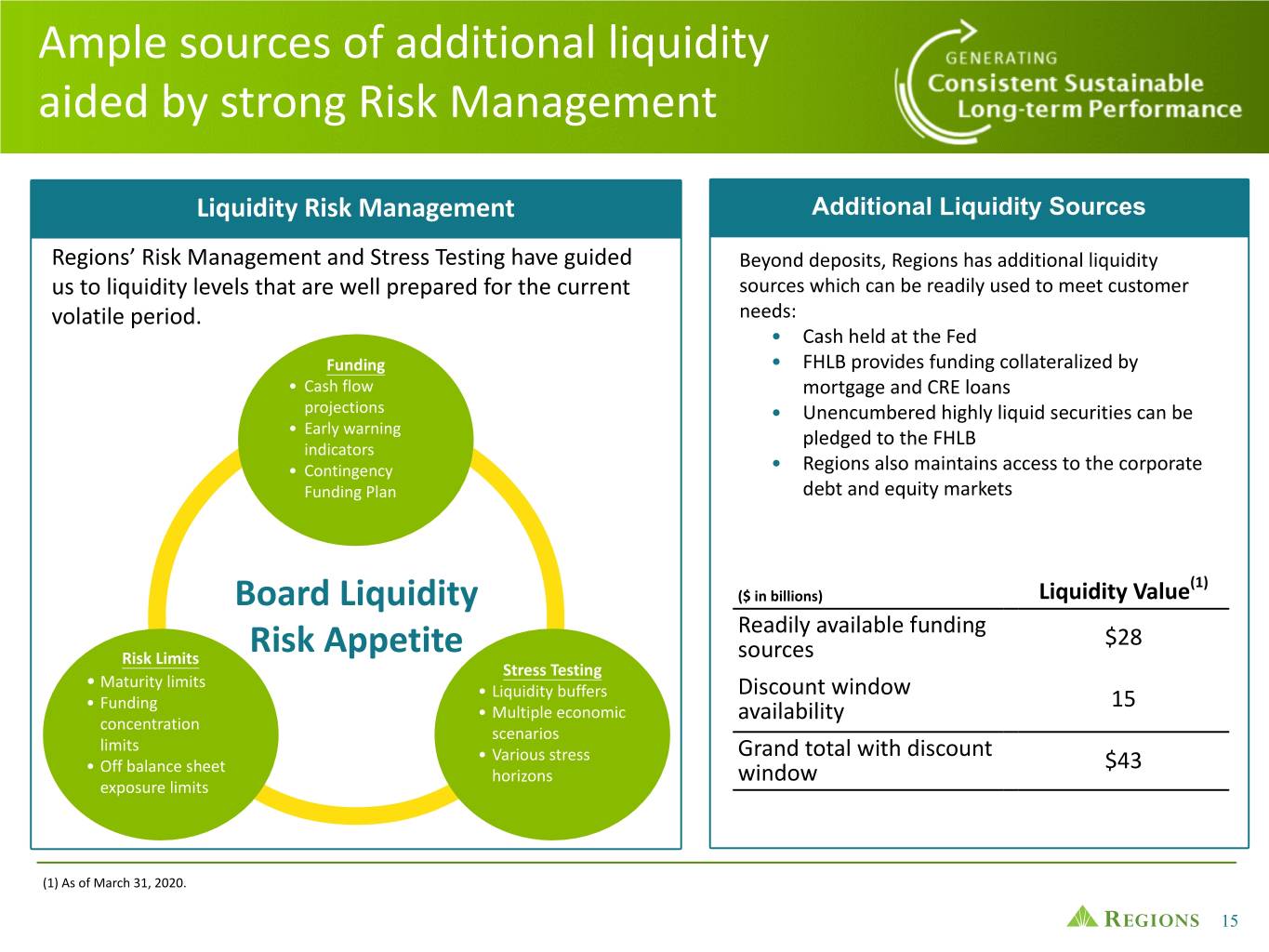

Ample sources of additional liquidity aided by strong Risk Management Liquidity Risk Management Additional Liquidity Sources Regions’ Risk Management and Stress Testing have guided Beyond deposits, Regions has additional liquidity us to liquidity levels that are well prepared for the current sources which can be readily used to meet customer volatile period. needs: • Cash held at the Fed Funding • FHLB provides funding collateralized by • Cash flow mortgage and CRE loans projections • Unencumbered highly liquid securities can be • Early warning pledged to the FHLB indicators • Contingency • Regions also maintains access to the corporate Funding Plan debt and equity markets (1) Board Liquidity ($ in billions) Liquidity Value Readily available funding $28 Risk Limits Risk Appetite sources Stress Testing • Maturity limits • Liquidity buffers Discount window • Funding 15 • Multiple economic availability concentration scenarios limits • Various stress Grand total with discount • Off balance sheet $43 horizons window exposure limits (1) As of March 31, 2020. 15

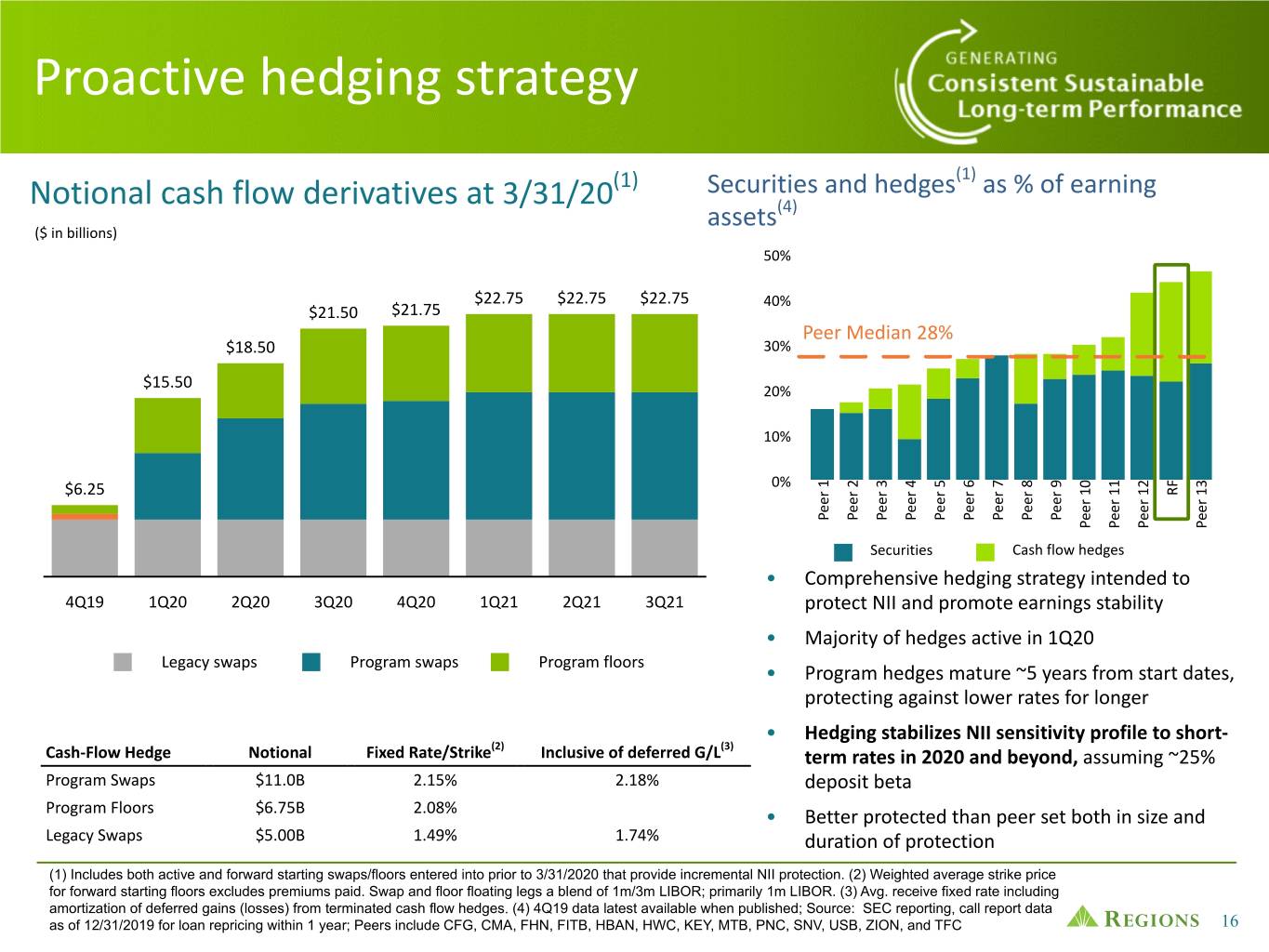

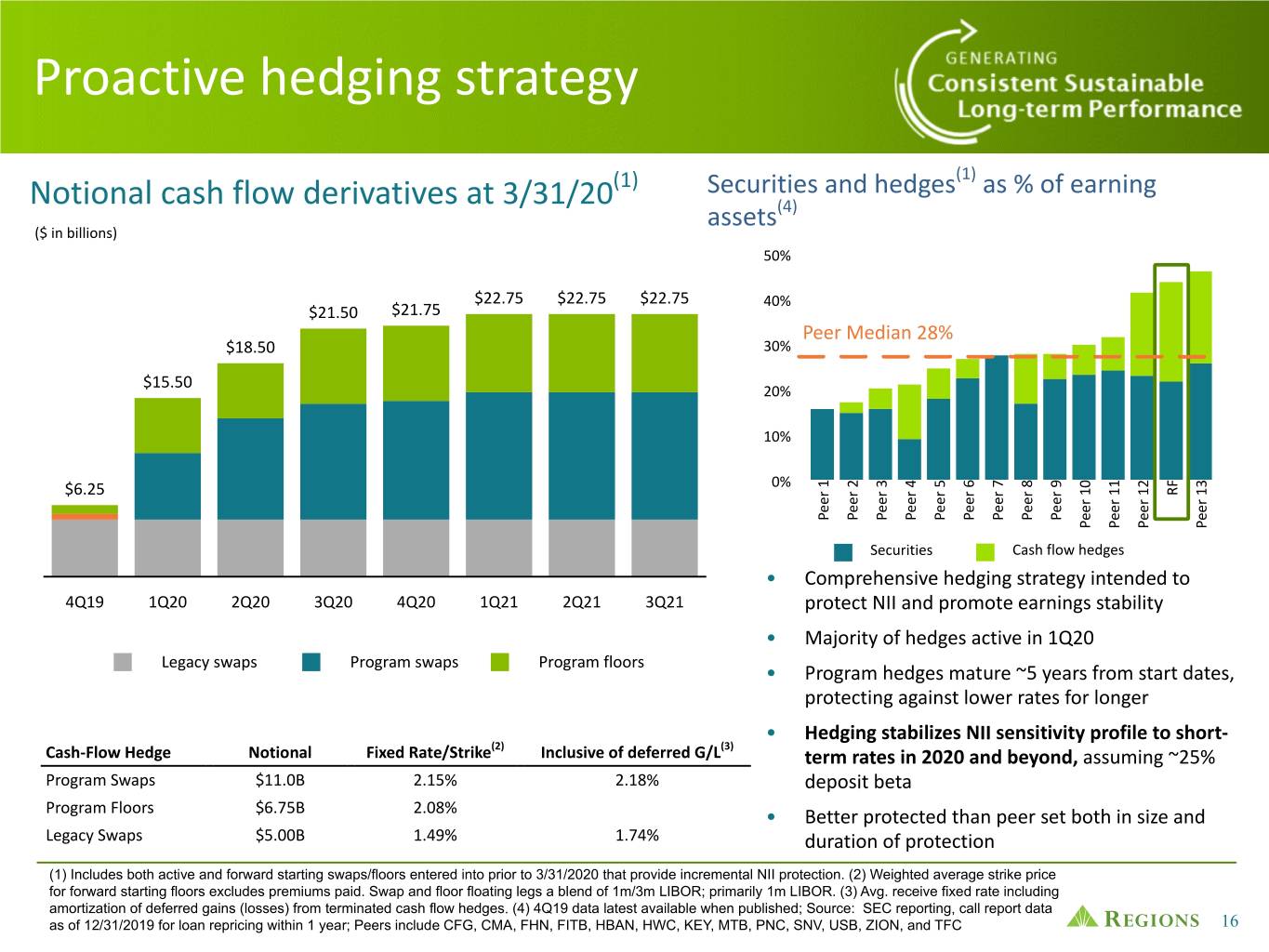

Proactive hedging strategy (1) Notional cash flow derivatives at 3/31/20(1) Securities and hedges as % of earning assets(4) ($ in billions) 50% $22.75 $22.75 $22.75 40% $21.50 $21.75 Peer Median 28% $18.50 30% $15.50 20% 10% F 0 1 2 3 0% 1 2 3 4 5 6 7 8 9 R 1 1 1 1 $6.25 r r r r r r r r r e e e e e e e e e r r r r e e e e e e e e e e e e e P P P P P P P P P e e e e P P P P Securities Cash flow hedges • Comprehensive hedging strategy intended to 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 protect NII and promote earnings stability • Majority of hedges active in 1Q20 Legacy swaps Program swaps Program floors • Program hedges mature ~5 years from start dates, protecting against lower rates for longer • Hedging stabilizes NII sensitivity profile to short- (2) (3) Cash-Flow Hedge Notional Fixed Rate/Strike Inclusive of deferred G/L term rates in 2020 and beyond, assuming ~25% Program Swaps $11.0B 2.15% 2.18% deposit beta Program Floors $6.75B 2.08% • Better protected than peer set both in size and Legacy Swaps $5.00B 1.49% 1.74% duration of protection (1) Includes both active and forward starting swaps/floors entered into prior to 3/31/2020 that provide incremental NII protection. (2) Weighted average strike price for forward starting floors excludes premiums paid. Swap and floor floating legs a blend of 1m/3m LIBOR; primarily 1m LIBOR. (3) Avg. receive fixed rate including amortization of deferred gains (losses) from terminated cash flow hedges. (4) 4Q19 data latest available when published; Source: SEC reporting, call report data as of 12/31/2019 for loan repricing within 1 year; Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, USB, ZION, and TFC 16

Interest rate exposure of future business and long-term rates Fixed / float loan mix(1) • The majority of Regions’ residual NII exposure to interest rates comes 100% from future business activities and cash-flow reinvestment; 2020 90% expectation: 80% 70% * ~$9.5B fixed rate loan production; $7.5B over remainder of year 60% 50% Peer median = 45% * ~$3.5B fixed rate securities reinvestment; $2.6B remainder of year 40% 30% • Balance sheet mix is a reasonable proxy for long-end rate sensitivity 20% * Exposure to fixed rate assets in-line with peers (~43% fixed 10% F 0 1 2 3 0% 1 2 3 4 5 6 7 8 9 R 1 1 1 1 r r r r r r r r r e e e e e e e e e excluding hedges) r r r r e e e e e e e e e e e e e P P P P P P P P P e e e e P P P P % Fixed % Variable • Within the securities portfolio, reinvestment and premium amortization Securities portfolio composition(2) contribute to a portion of Regions’ NII exposure to interest rates • Portfolio constructed to protect against lower market rates Corporate Bonds: 5.5% Agency/UST: 0.9% * 31% of securities portfolio in bullet-like collateral (CMBS, corporate Non-Agency CMBS: 2.5% bonds, and USTs), up from 27% at year-end 2018 * Purchase MBS with loan characteristics that offer prepayment Agency CMBS: protection: lower loan balances, seasoning, and state-specific 22.8% geographic concentrations $25.1B * Premium amortization expected to be in mid-to-upper $30M quarterly range with a 30 year primary mortgage rate ~3.25% Agency MBS: • Reduced ~$2B MBS and 10% of related book premium in 2019: book 68.3% premium lower by 32% since last time long-term rates hit lows in 2016 (1) 12/31/2019 data latest available; Source: SEC reporting, call report data for loan repricing within 1 year; Peers include CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, USB, ZION, and TFC. (2) Includes both AFS and HTM securities as of 3/31/2020. 17

CECL allowance for credit losses waterfall ($ in millions) Highlights • Day 1 adjustment due to 1/1/20 CECL adoption resulted in an allowance for credit losses (ACL) $207 $1,665 of $1.415B $36 • Q1 allowance increased $250M due primarily $501 $16 to the uncertainty associated with COVID–19, $(9) and higher specific reserves due to downgrades primarily in the Energy and Restaurant portfolios $914 • Several analyses were developed to inform our estimate including: ◦ Stressed analyses of all inputs 12/31/2019 Day 1 Lower Model Specific Economic 3/31/2020 ◦ Internal and external forecasts and Adjust- Consumer Enhance- Reserves Uncertainty specific industry shocks ment Balances ments & & Other Higher ◦ Specifically stressed GDP and Business unemployment rates Balances ◦ Potential benefits of stimulus packages • CECL process is embedded in how we manage capital 18

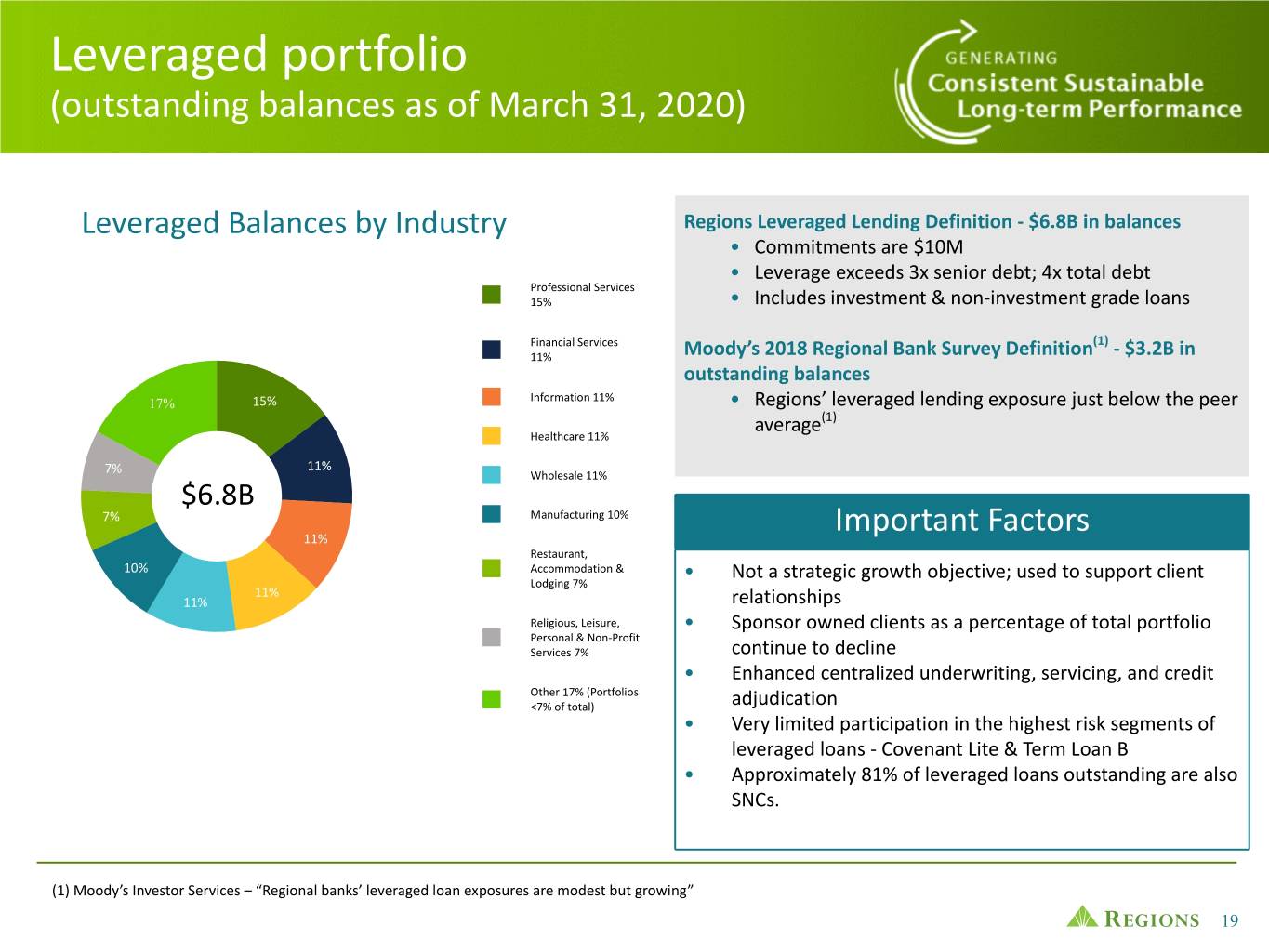

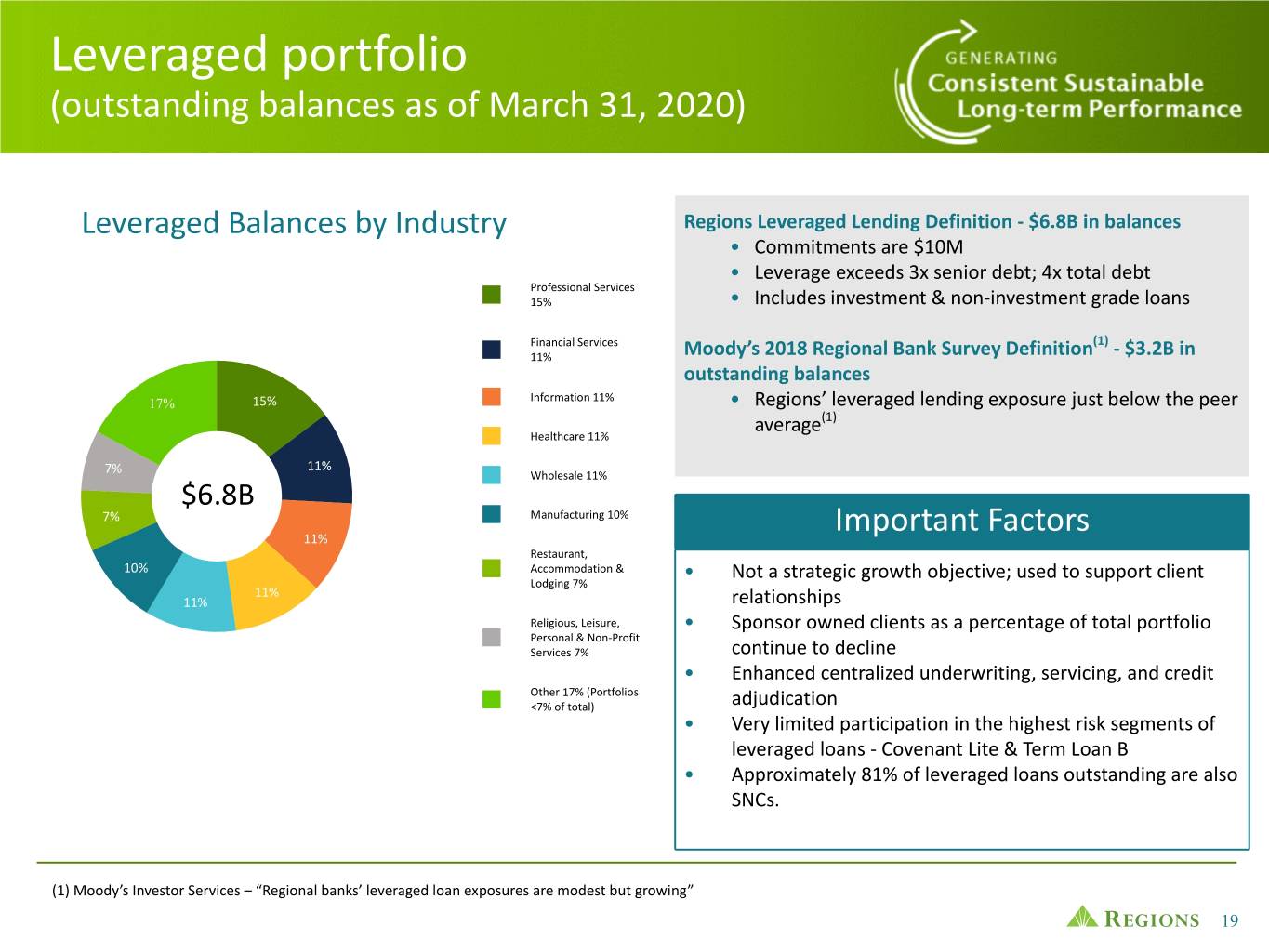

Leveraged portfolio (outstanding balances as of March 31, 2020) Leveraged Balances by Industry Regions Leveraged Lending Definition - $6.8B in balances • Commitments are $10M • Leverage exceeds 3x senior debt; 4x total debt Professional Services 15% • Includes investment & non-investment grade loans Financial Services (1) 11% Moody’s 2018 Regional Bank Survey Definition - $3.2B in outstanding balances 17% 15% Information 11% • Regions’ leveraged lending exposure just below the peer average(1) Healthcare 11% 11% 7% Wholesale 11% $6.8B 7% Manufacturing 10% Important Factors 11% Restaurant, 10% Accommodation & • Not a strategic growth objective; used to support client Lodging 7% 11% 11% relationships Religious, Leisure, • Sponsor owned clients as a percentage of total portfolio Personal & Non-Profit Services 7% continue to decline • Enhanced centralized underwriting, servicing, and credit Other 17% (Portfolios <7% of total) adjudication • Very limited participation in the highest risk segments of leveraged loans - Covenant Lite & Term Loan B • Approximately 81% of leveraged loans outstanding are also SNCs. (1) Moody’s Investor Services – “Regional banks’ leveraged loan exposures are modest but growing” 19

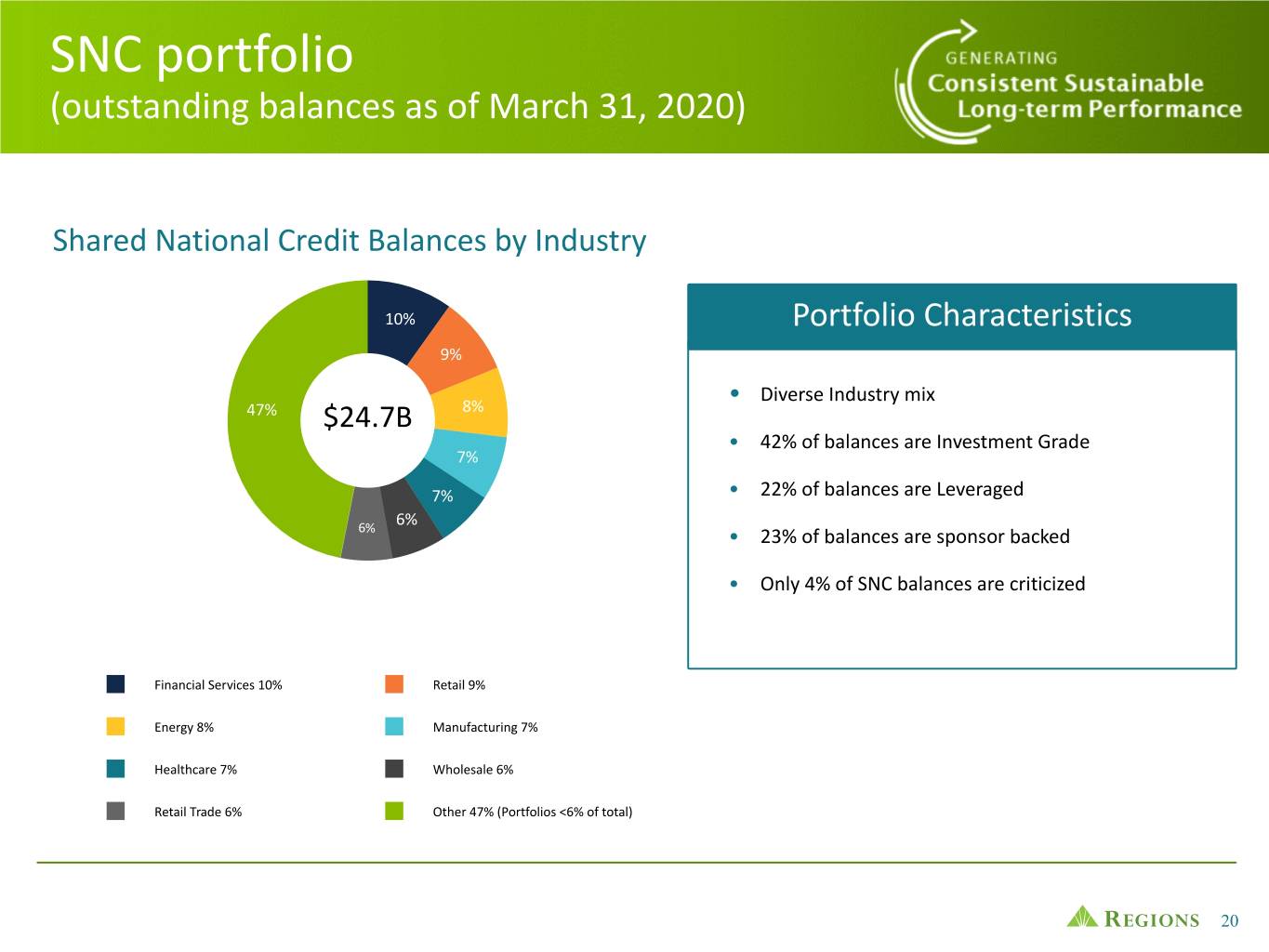

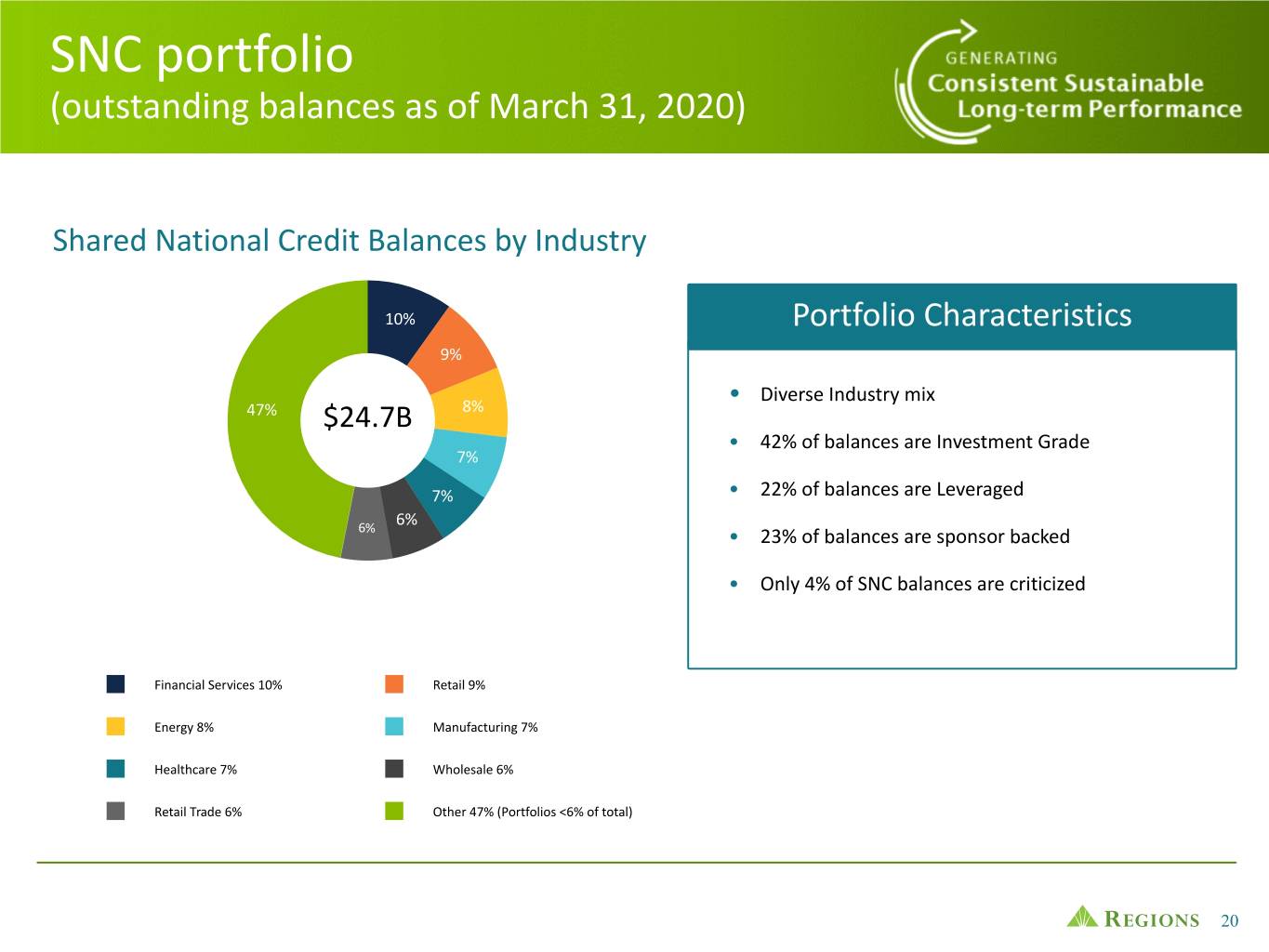

SNC portfolio (outstanding balances as of March 31, 2020) Shared National Credit Balances by Industry 10% Portfolio Characteristics 9% • Diverse Industry mix 47% $24.7B 8% • 42% of balances are Investment Grade 7% 7% • 22% of balances are Leveraged 6% 6% • 23% of balances are sponsor backed • Only 4% of SNC balances are criticized Financial Services 10% Retail 9% Energy 8% Manufacturing 7% Healthcare 7% Wholesale 6% Retail Trade 6% Other 47% (Portfolios <6% of total) 20

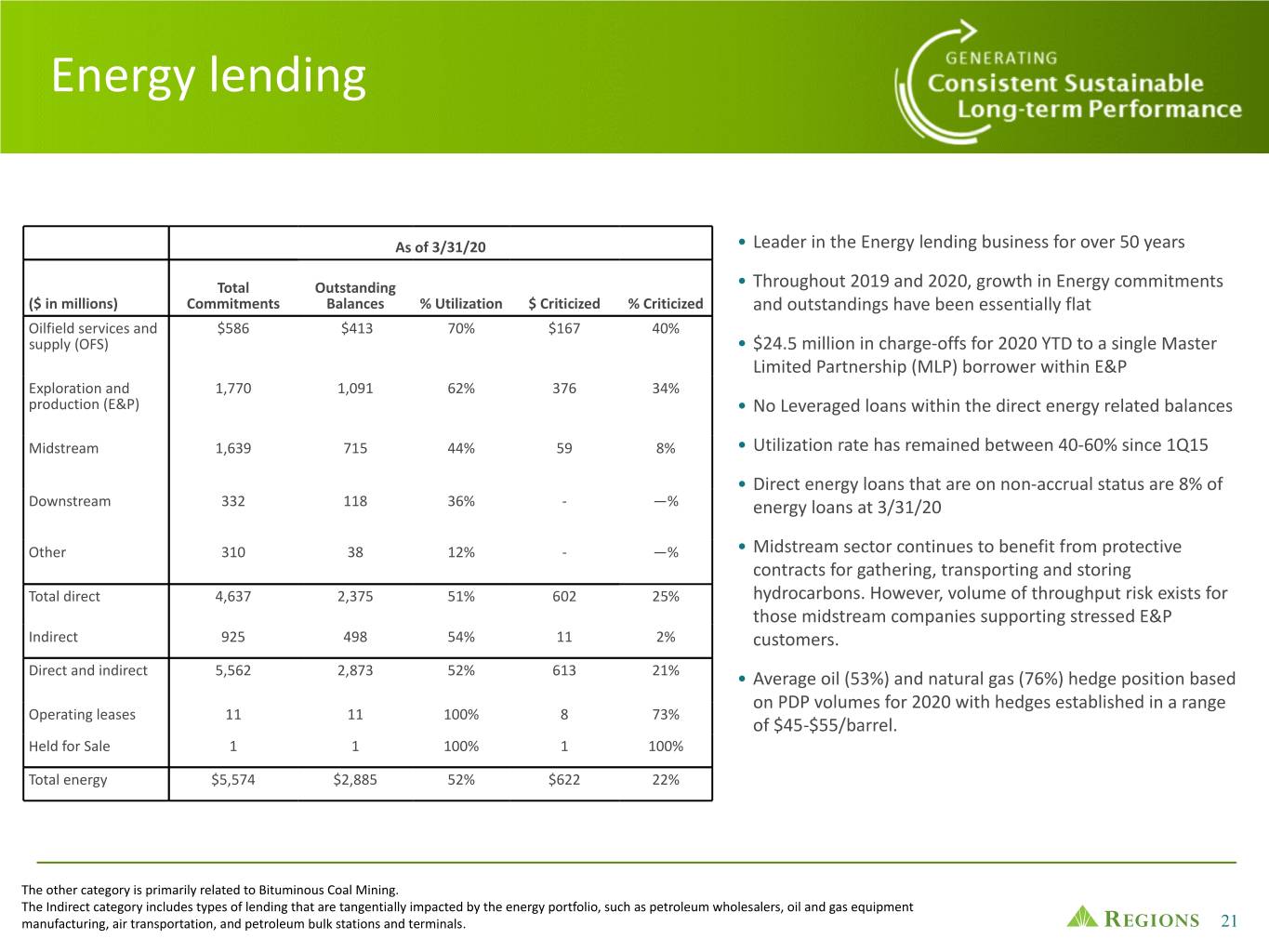

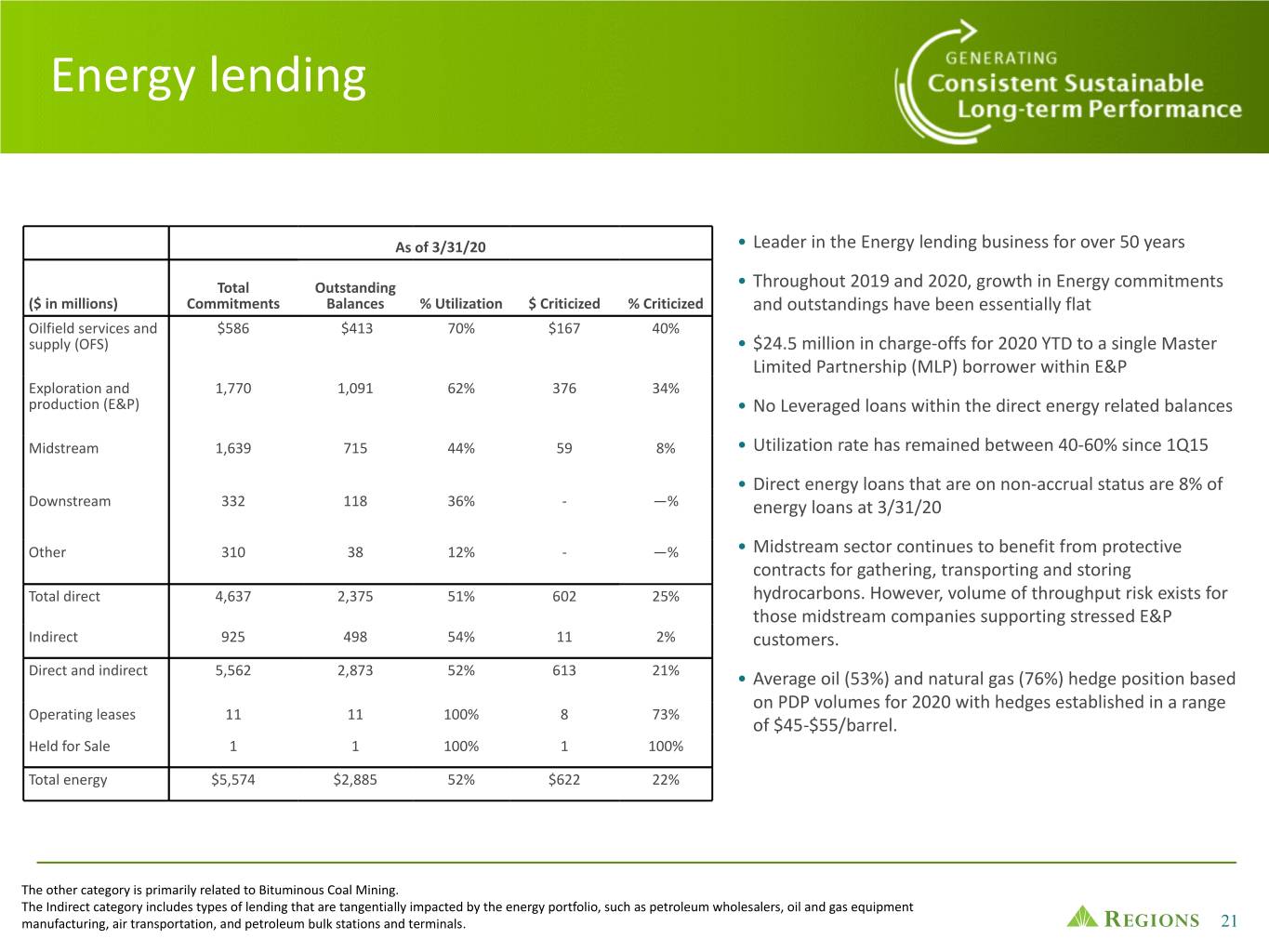

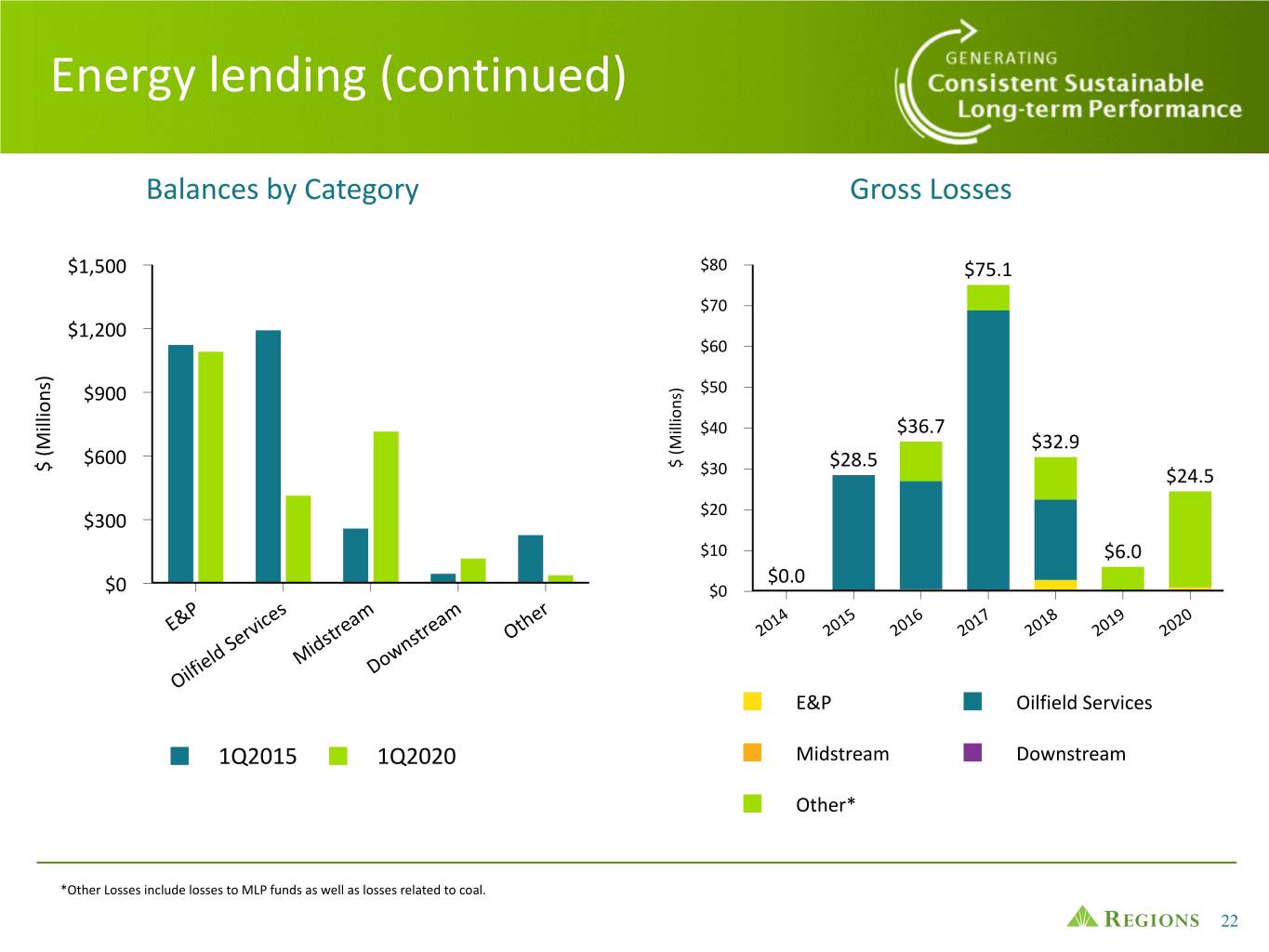

Energy lending As of 3/31/20 • Leader in the Energy lending business for over 50 years Total Outstanding • Throughout 2019 and 2020, growth in Energy commitments ($ in millions) Commitments Balances % Utilization $ Criticized % Criticized and outstandings have been essentially flat Oilfield services and $586 $413 70% $167 40% supply (OFS) • $24.5 million in charge-offs for 2020 YTD to a single Master 53 Limited Partnership (MLP) borrower within E&P Exploration and 1,770 1,091 62% 376 34% production (E&P) • No Leveraged loans within the direct energy related balances Midstream 1,639 715 44% 59 8% • Utilization rate has remained between 40-60% since 1Q15 • Direct energy loans that are on non-accrual status are 8% of Downstream 332 118 36% - —% energy loans at 3/31/20 Other 310 38 12% - —% • Midstream sector continues to benefit from protective contracts for gathering, transporting and storing Total direct 4,637 2,375 51% 602 25% hydrocarbons. However, volume of throughput risk exists for those midstream companies supporting stressed E&P Indirect 925 498 54% 11 2% customers. Direct and indirect 5,562 2,873 52% 613 21% • Average oil (53%) and natural gas (76%) hedge position based on PDP volumes for 2020 with hedges established in a range Operating leases 11 11 100% 8 73% of $45-$55/barrel. Held for Sale 1 1 100% 1 100% Total energy $5,574 $2,885 52% $622 22% The other category is primarily related to Bituminous Coal Mining. The Indirect category includes types of lending that are tangentially impacted by the energy portfolio, such as petroleum wholesalers, oil and gas equipment manufacturing, air transportation, and petroleum bulk stations and terminals. 21

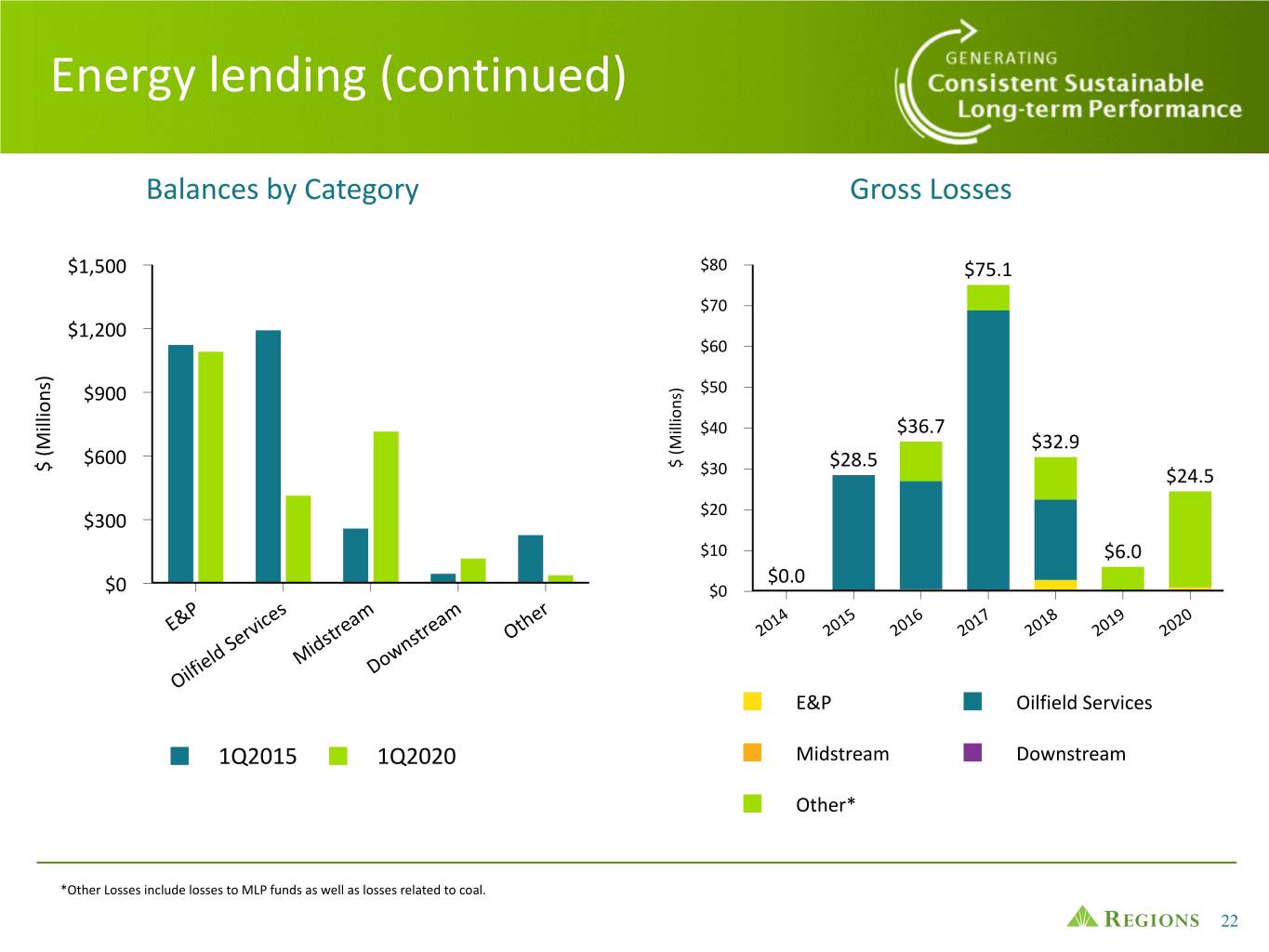

Energy lending (continued) Balances by Category Gross Losses $1,500 $80 $75.1 $70 $1,200 $60 53 ) s ) $50 s n $900 n o i o l i l l l i i $40 $36.7 M M $32.9 ( ( $600 $ $28.5 $ $30 $24.5 $20 $300 $10 $6.0 $0.0 $0 $0 P es m m er 4 5 6 7 8 9 0 E& ic a a th 01 01 01 01 01 01 02 rv tre tre O 2 2 2 2 2 2 2 Se s s d id wn el M o lfi D Oi E&P Oilfield Services 1Q2015 1Q2020 Midstream Downstream Other* *Other Losses include losses to MLP funds as well as losses related to coal. 22

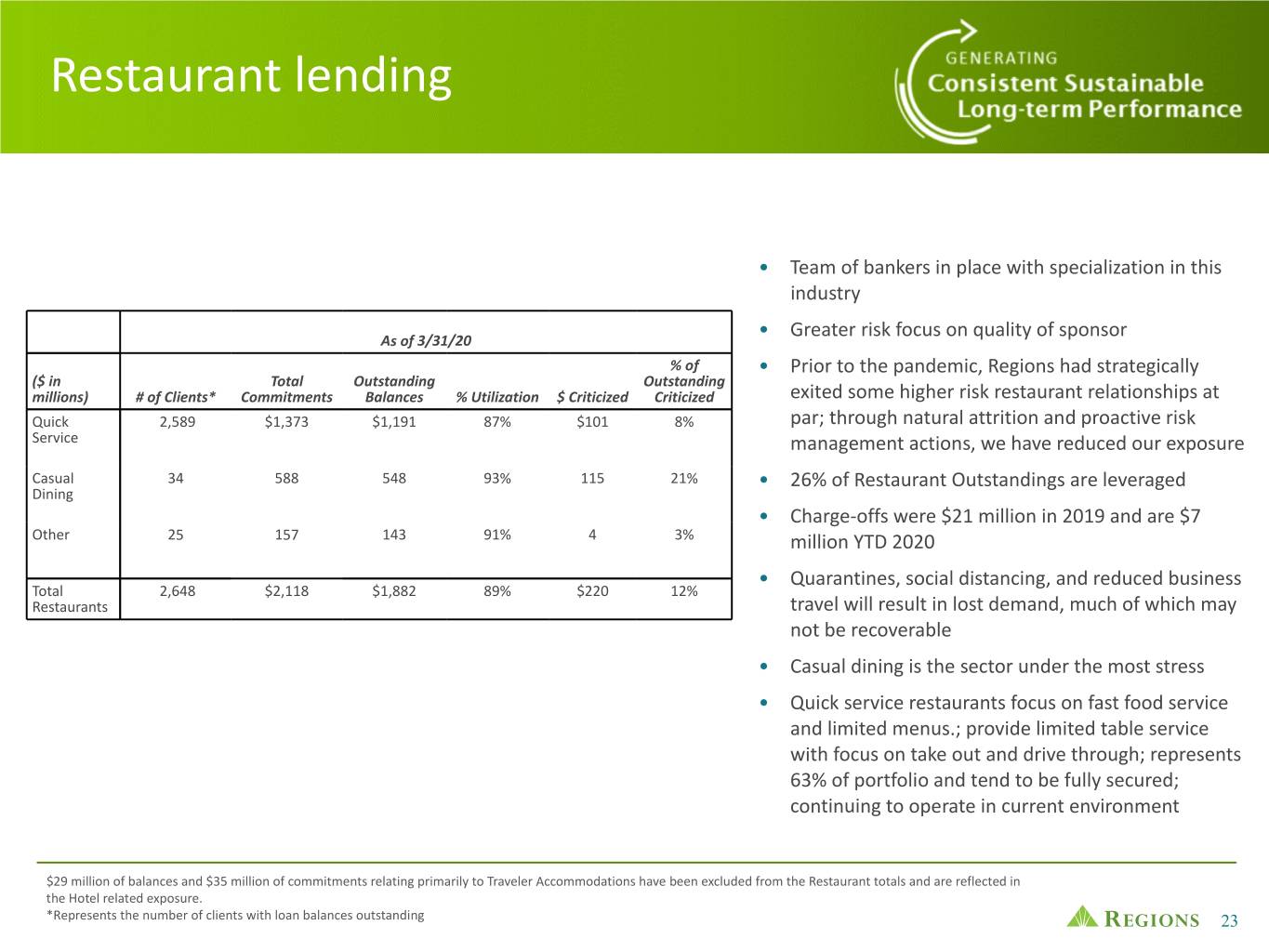

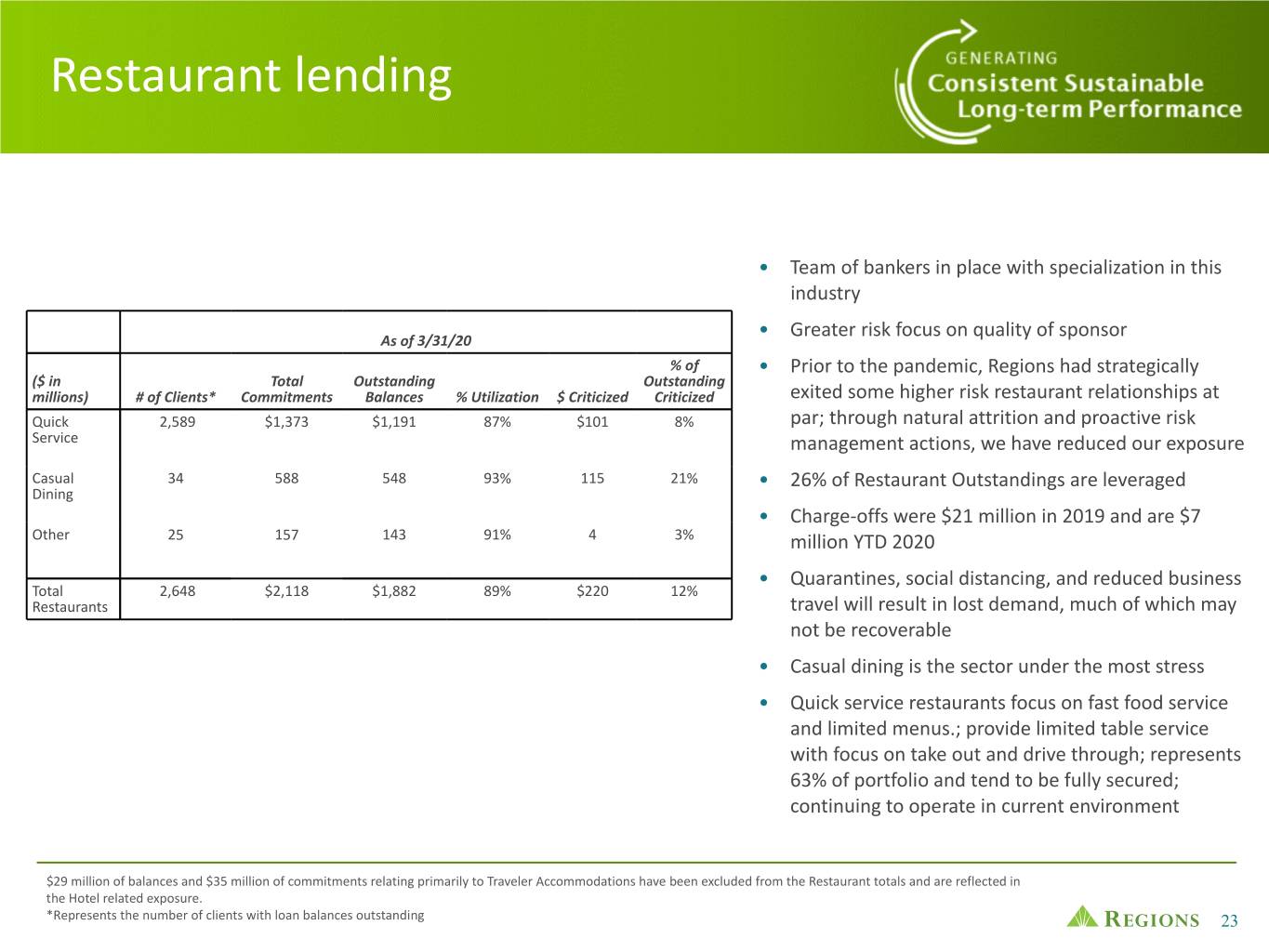

Restaurant lending • Team of bankers in place with specialization in this industry • Greater risk focus on quality of sponsor As of 3/31/20 53 % of • Prior to the pandemic, Regions had strategically ($ in Total Outstanding Outstanding millions) # of Clients* Commitments Balances % Utilization $ Criticized Criticized exited some higher risk restaurant relationships at Quick 2,589 $1,373 $1,191 87% $101 8% par; through natural attrition and proactive risk Service management actions, we have reduced our exposure Casual 34 588 548 93% 115 21% • 26% of Restaurant Outstandings are leveraged Dining • Charge-offs were $21 million in 2019 and are $7 Other 25 157 143 91% 4 3% million YTD 2020 • Quarantines, social distancing, and reduced business Total 2,648 $2,118 $1,882 89% $220 12% Restaurants travel will result in lost demand, much of which may not be recoverable • Casual dining is the sector under the most stress • Quick service restaurants focus on fast food service and limited menus.; provide limited table service with focus on take out and drive through; represents 63% of portfolio and tend to be fully secured; continuing to operate in current environment $29 million of balances and $35 million of commitments relating primarily to Traveler Accommodations have been excluded from the Restaurant totals and are reflected in the Hotel related exposure. *Represents the number of clients with loan balances outstanding 23

Hotel lending As of 3/31/20 • CRE – Unsecured outstanding balance is comprised of 12 REIT customers ($ in millions) Total Outstanding % Utilization $ Criticized % of Commitments Balances Outstanding 53 Criticized • 75% of balances are investment grade CRE-Unsecured $871 $795 91% $0 0% • 73% are SNCs • The REIT portfolio benefits from low leverage and IRE – Mortgage 218 212 97% — 0% diversity of property holdings. Companies have also taken proactive steps to reduced CAPEX to preserve IRE – 80 16 20% — 0% Construction cash. Consumer 35 29 83% — 0% Services Total Hotel $1,204 $1,052 87% $0 0% related Consumer services represents amounts relating primarily to Traveler Accommodations that have been excluded from the Restaurant totals and are reflected in the Hotel related exposure 24

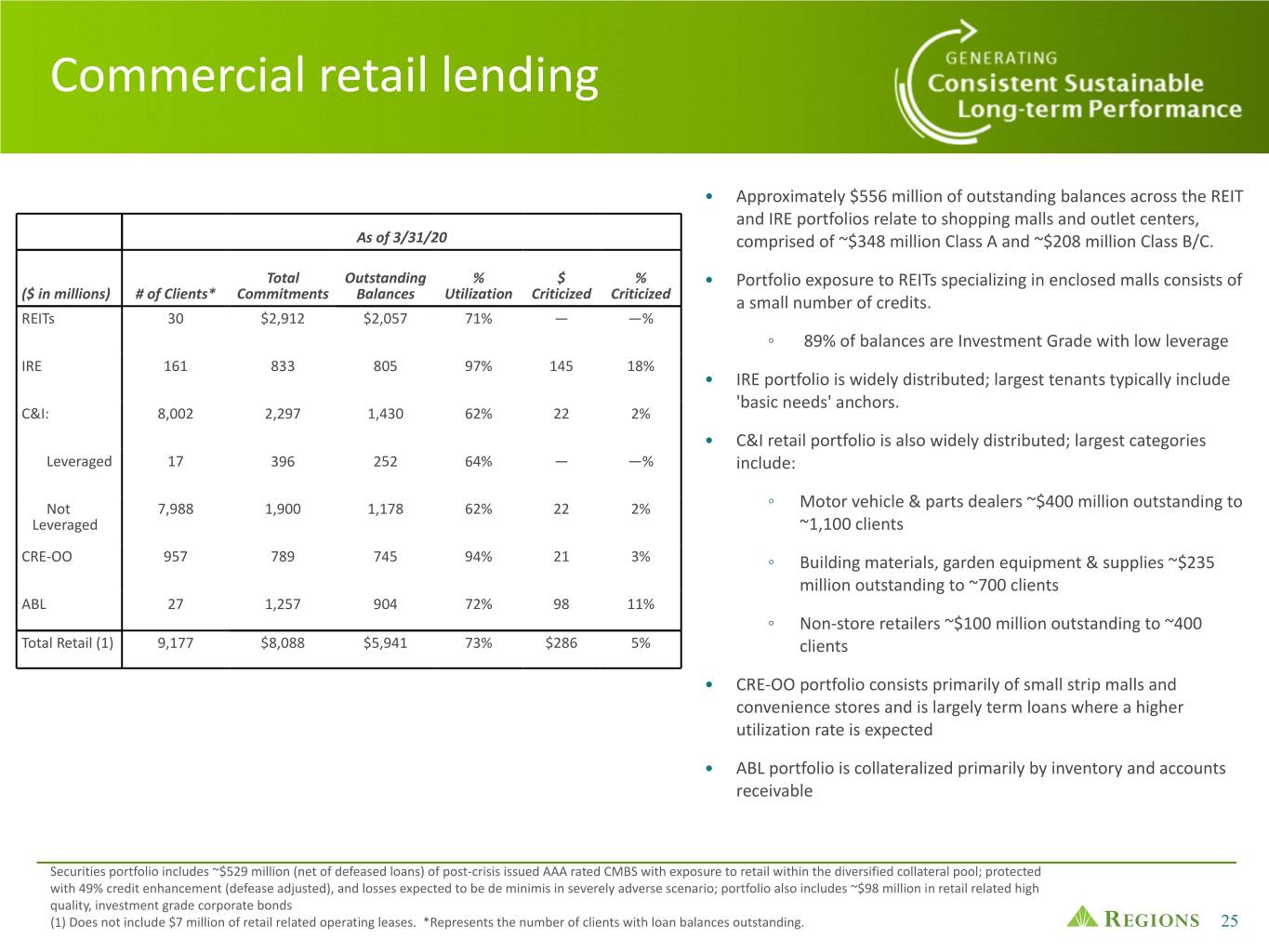

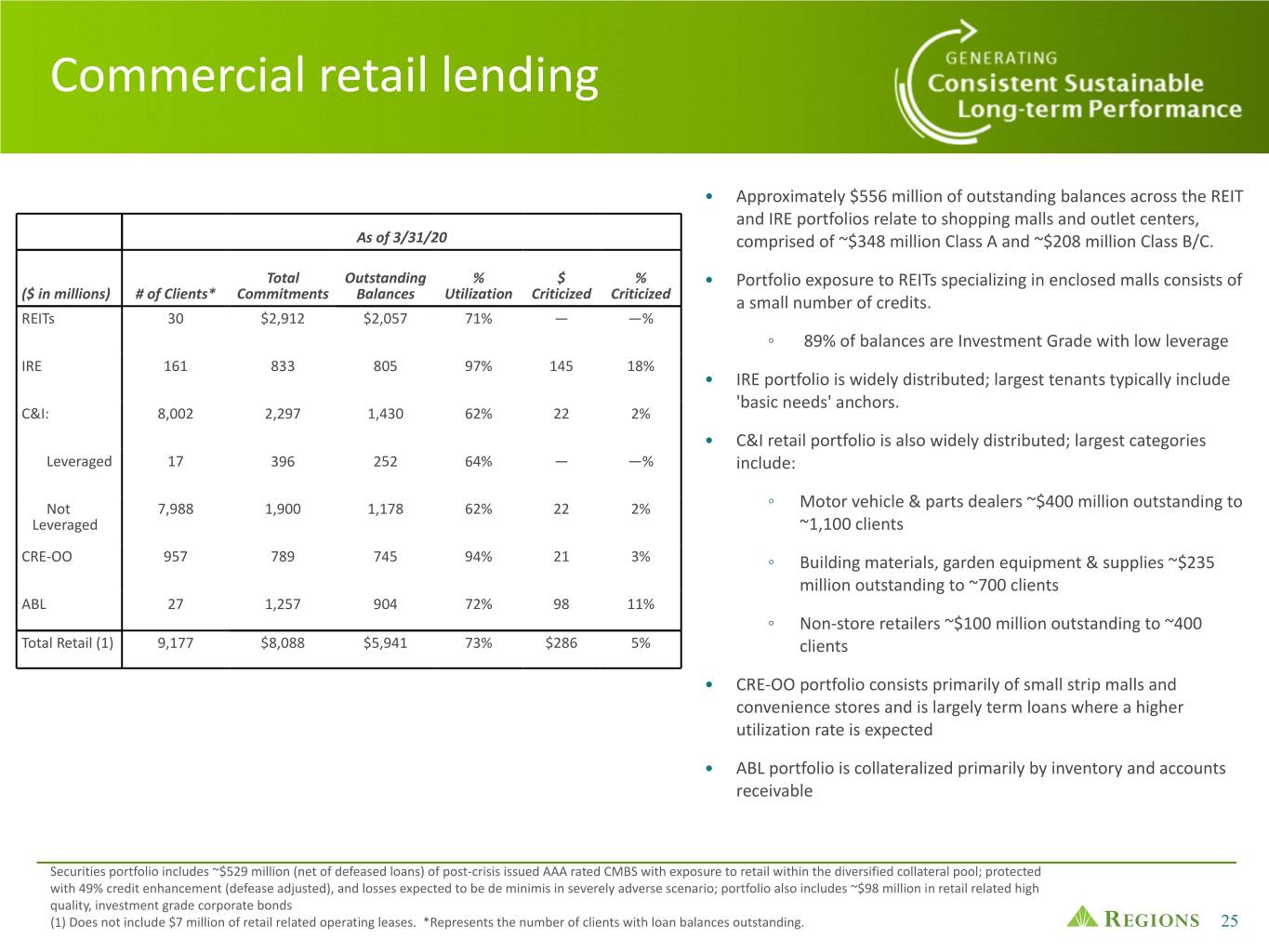

Commercial retail lending • Approximately $556 million of outstanding balances across the REIT and IRE portfolios relate to shopping malls and outlet centers, As of 3/31/20 comprised of ~$348 million Class A and ~$208 million Class B/C. Total Outstanding % $ % • Portfolio exposure to REITs specializing in enclosed malls consists of ($ in millions) # of Clients* Commitments Balances Utilization Criticized Criticized a small number of credits. REITs 30 $2,912 $2,057 71% — —% ◦ 89% of balances are Investment Grade with low leverage IRE 161 833 805 53 97% 145 18% • IRE portfolio is widely distributed; largest tenants typically include 'basic needs' anchors. C&I: 8,002 2,297 1,430 62% 22 2% • C&I retail portfolio is also widely distributed; largest categories Leveraged 17 396 252 64% — —% include: Not 7,988 1,900 1,178 62% 22 2% ◦ Motor vehicle & parts dealers ~$400 million outstanding to Leveraged ~1,100 clients CRE-OO 957 789 745 94% 21 3% ◦ Building materials, garden equipment & supplies ~$235 million outstanding to ~700 clients ABL 27 1,257 904 72% 98 11% ◦ Non-store retailers ~$100 million outstanding to ~400 Total Retail (1) 9,177 $8,088 $5,941 73% $286 5% clients • CRE-OO portfolio consists primarily of small strip malls and convenience stores and is largely term loans where a higher utilization rate is expected • ABL portfolio is collateralized primarily by inventory and accounts receivable Securities portfolio includes ~$529 million (net of defeased loans) of post-crisis issued AAA rated CMBS with exposure to retail within the diversified collateral pool; protected with 49% credit enhancement (defease adjusted), and losses expected to be de minimis in severely adverse scenario; portfolio also includes ~$98 million in retail related high quality, investment grade corporate bonds (1) Does not include $7 million of retail related operating leases. *Represents the number of clients with loan balances outstanding. 25

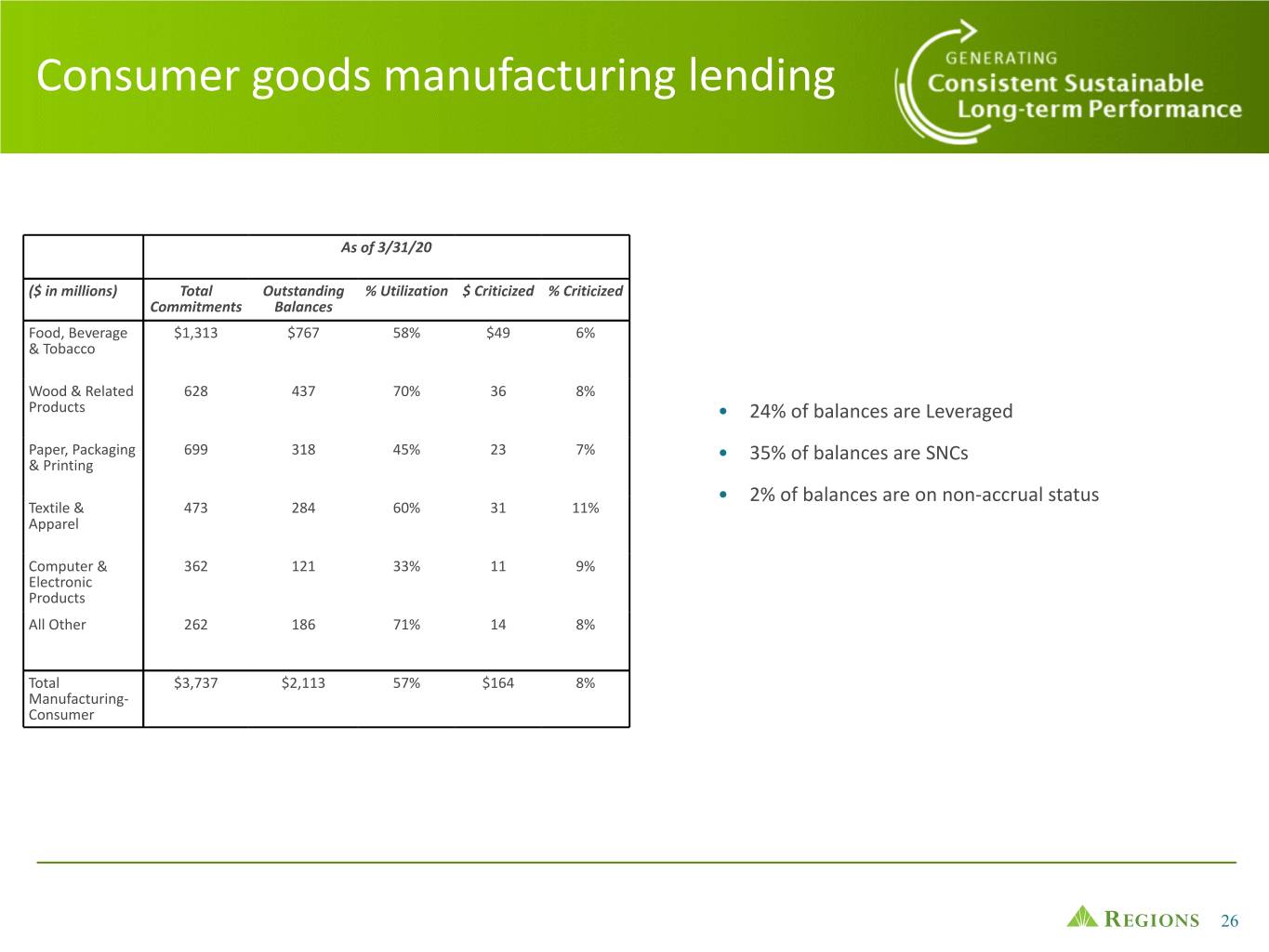

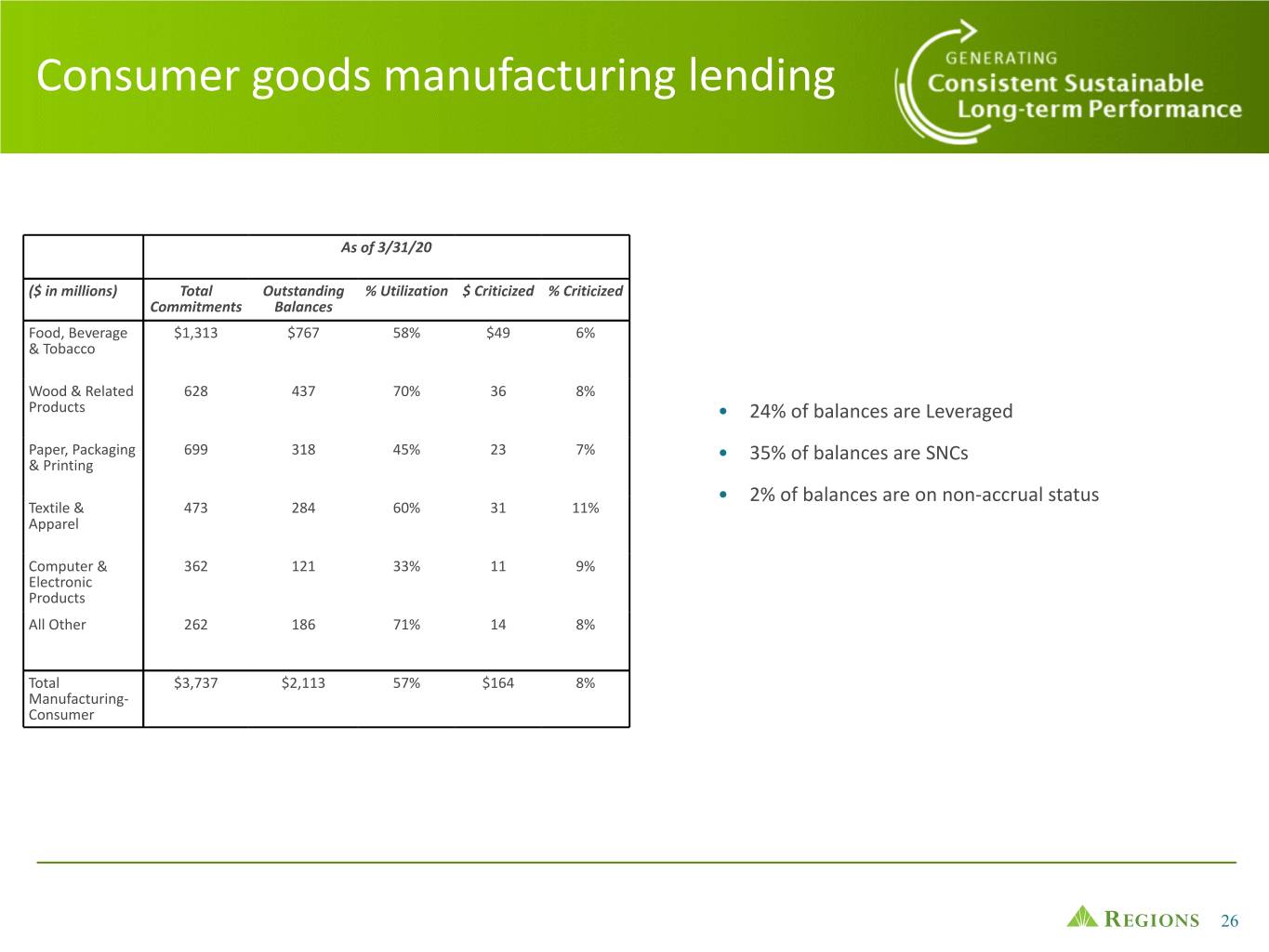

Consumer goods manufacturing lending As of 3/31/20 ($ in millions) Total Outstanding % Utilization $ Criticized % Criticized Commitments Balances Food, Beverage $1,313 $767 58% $49 6% & Tobacco 53 Wood & Related 628 437 70% 36 8% Products • 24% of balances are Leveraged Paper, Packaging 699 318 45% 23 7% • 35% of balances are SNCs & Printing • 2% of balances are on non-accrual status Textile & 473 284 60% 31 11% Apparel Computer & 362 121 33% 11 9% Electronic Products All Other 262 186 71% 14 8% Total $3,737 $2,113 57% $164 8% Manufacturing- Consumer 26

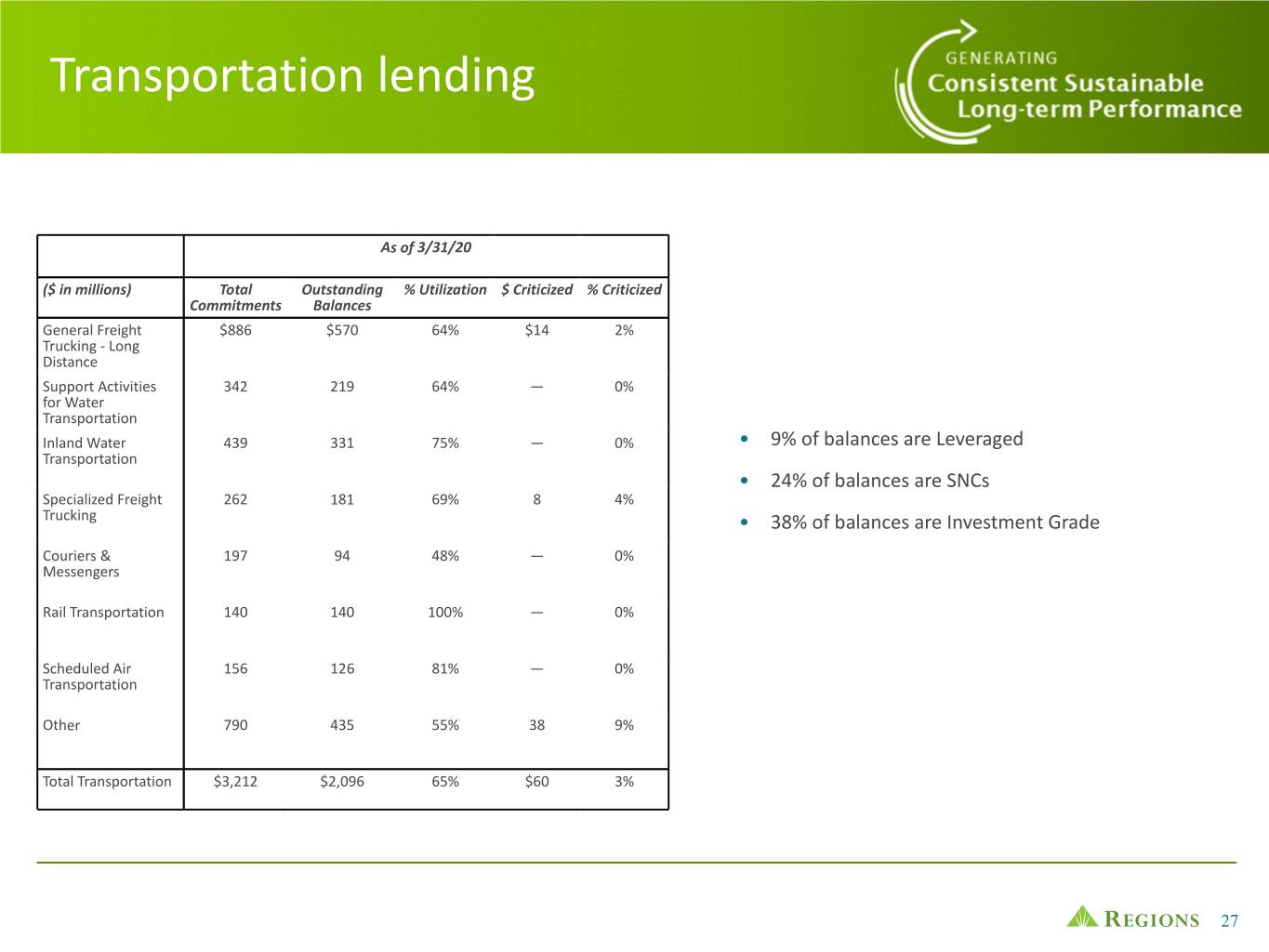

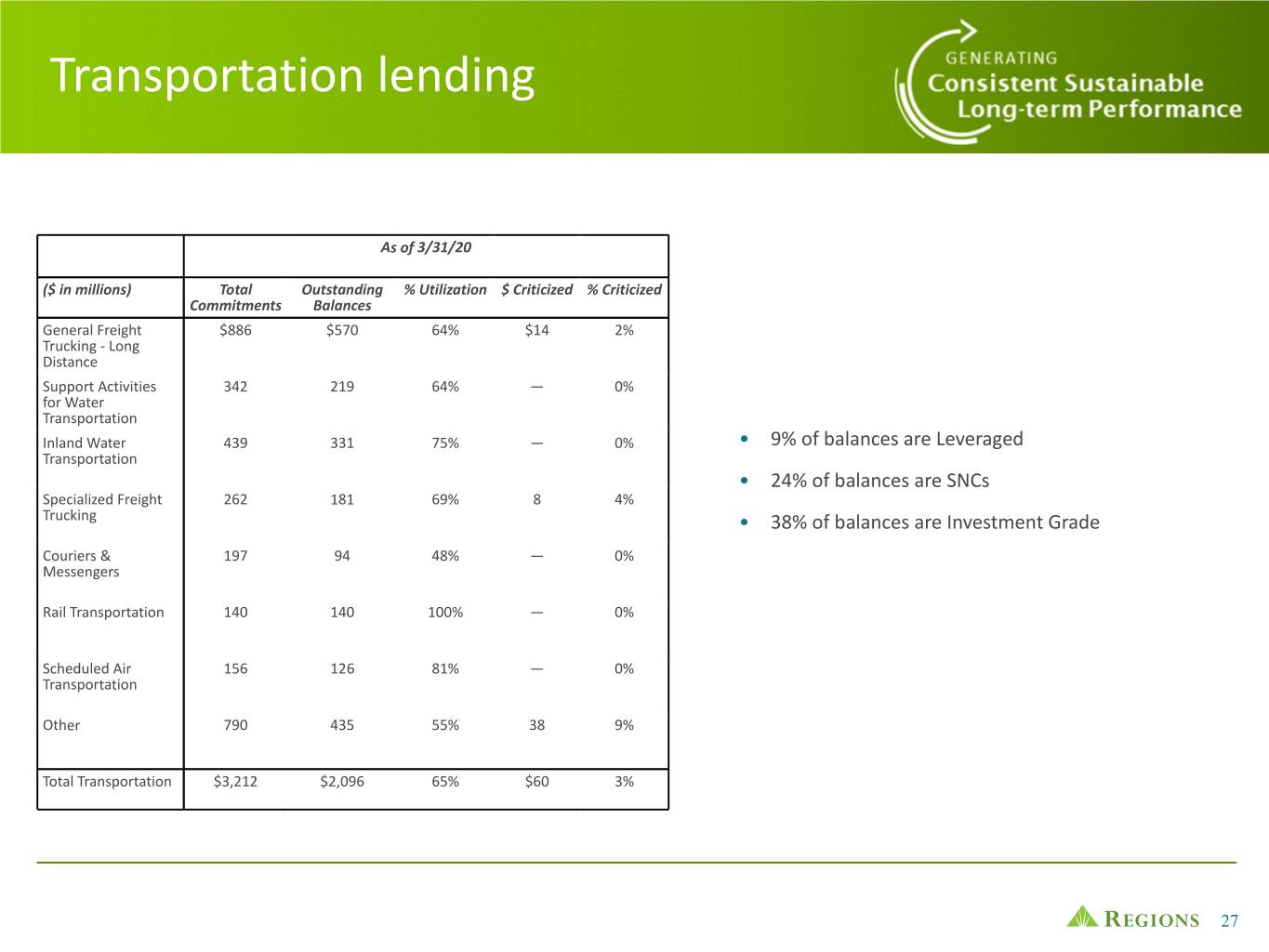

Transportation lending As of 3/31/20 ($ in millions) Total Outstanding % Utilization $ Criticized % Criticized Commitments Balances General Freight $886 $570 64% $14 2% Trucking - Long Distance 53 Support Activities 342 219 64% — 0% for Water Transportation Inland Water 439 331 75% — 0% • 9% of balances are Leveraged Transportation • 24% of balances are SNCs Specialized Freight 262 181 69% 8 4% Trucking • 38% of balances are Investment Grade Couriers & 197 94 48% — 0% Messengers Rail Transportation 140 140 100% — 0% Scheduled Air 156 126 81% — 0% Transportation Other 790 435 55% 38 9% Total Transportation $3,212 $2,096 65% $60 3% 27

Commercial loans As of 3/31/20 ($ in millions) Total Outstanding % Utilization Commitments Balances Administrative, Support, Waste & Repair $2,368 $1,558 66% Agriculture 672 422 63% • Includes Commercial and Commercial Real Educational Services 533,579 2,801 78% Estate-Owner Occupied Loans Energy - Oil, Gas & Coal 4,637 2,375 51% Financial Services 8,970 5,000 56% • Commitments to make commitments are Government & Public Sector 3,520 2,975 85% not included Healthcare 5,602 4,015 72% • The Real Estate section includes REITs Information 2,254 1,586 70% Professional, Scientific & Technical Services 3,331 2,098 63% • Utilization % presented incorporates all Real Estate 14,330 8,805 61% loan structures in the portfolio; utilization Religious, Leisure, Personal & Non-Profit Services 2,554 1,842 72% on revolving line structures only was ~54% Restaurant, Accommodation & Lodging 2,154 1,911 89% at 3/31/20 Retail Trade 4,343 3,080 71% Transportation & Warehousing 3,212 2,096 65% Utilities 4,561 2,255 49% Wholesale 6,062 3,667 60% Manufacturing 8,440 4,750 56% Other (1) 342 11 3% Total Commercial $80,931 $51,247 63% (1) Excludes commitments to make commitments 28

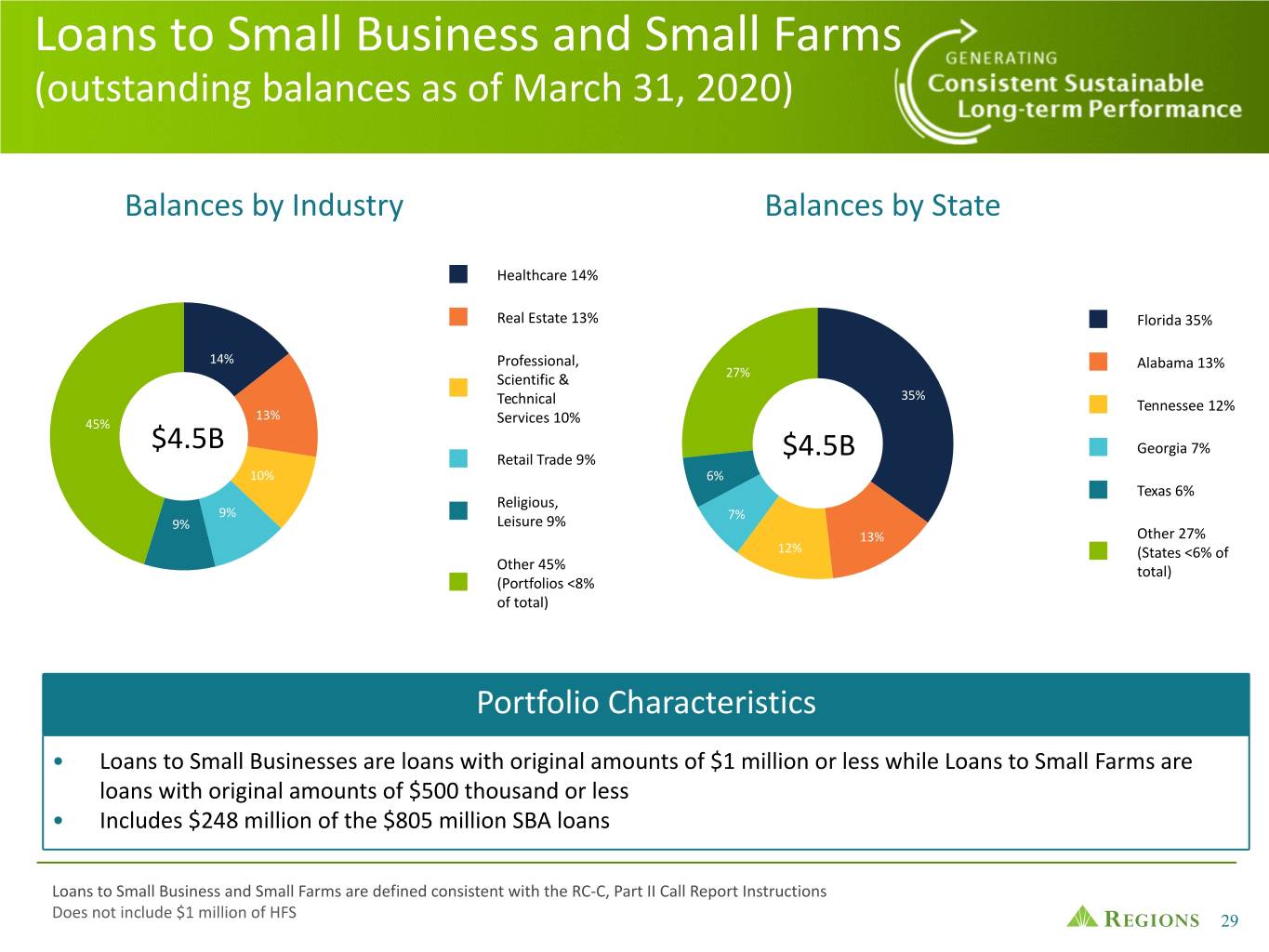

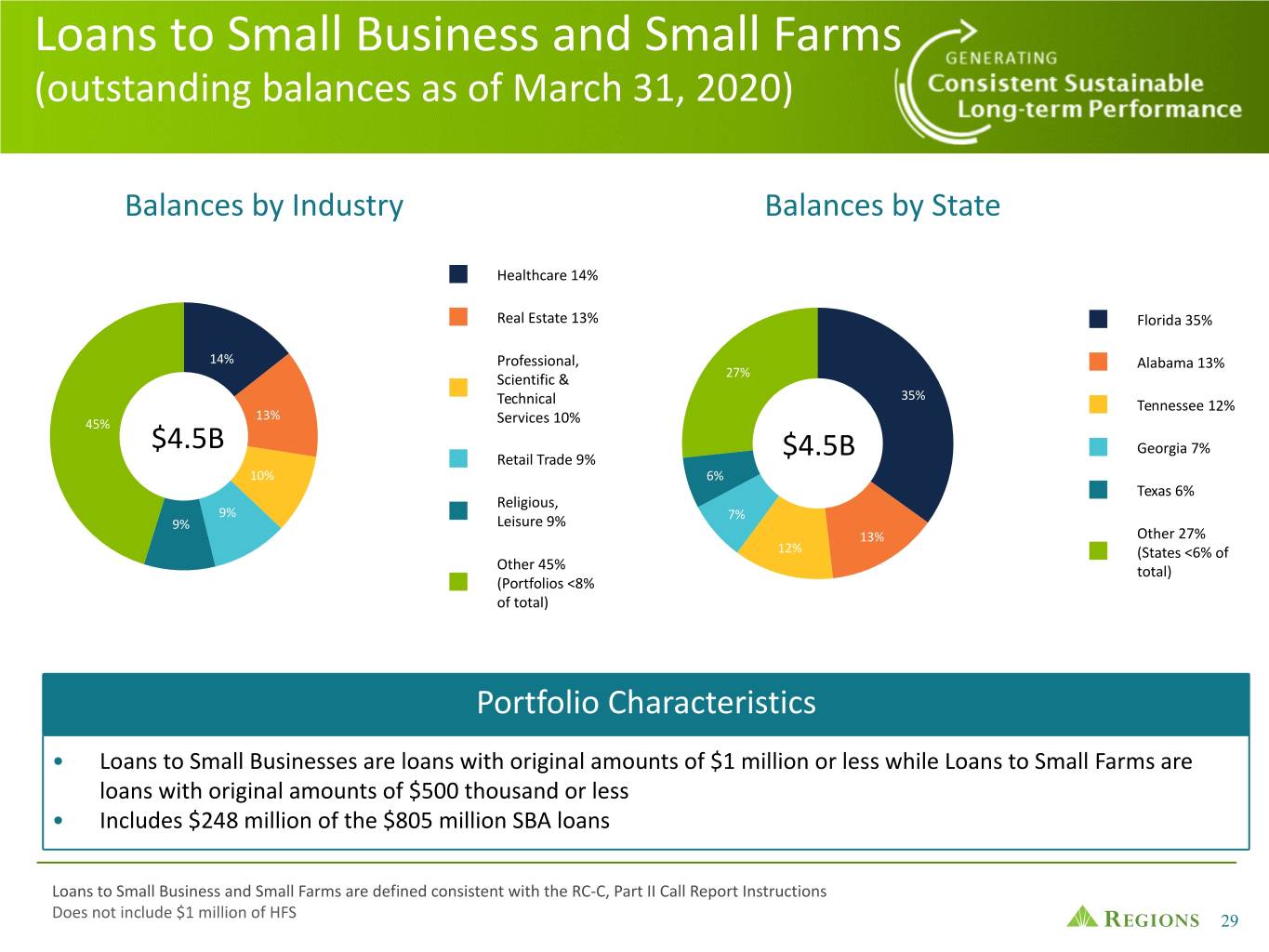

Loans to Small Business and Small Farms (outstanding balances as of March 31, 2020) Balances by Industry Balances by State Healthcare 14% Real Estate 13% Florida 35% 14% Professional, Alabama 13% Scientific & 27% 35% Technical Tennessee 12% 13% 45% Services 10% $4.5B Georgia 7% Retail Trade 9% $4.5B 10% 6% Texas 6% Religious, 9% 7% 9% Leisure 9% 13% Other 27% 12% (States <6% of Other 45% total) (Portfolios <8% of total) Portfolio Characteristics • Loans to Small Businesses are loans with original amounts of $1 million or less while Loans to Small Farms are loans with original amounts of $500 thousand or less • Includes $248 million of the $805 million SBA loans Loans to Small Business and Small Farms are defined consistent with the RC-C, Part II Call Report Instructions Does not include $1 million of HFS 29

SBA loans (outstanding balances as of March 31, 2020) Balances by Industry Balances by State Manufacturing 15% Retail Trade 13% Florida 32% 15% Restaurant, 25% Texas 17% Accommodation 31% 32% & Lodging 12% Georgia 11% 13% Religious, $805M Alabama 8% Leisure 11% $805M 7% 12% 9% Arkansas 7% Real Estate 9% 8% 9% 11% 17% Other 25% Healthcare 9% 11% (States <6% of total) Other 31% (Portfolios <9% of total) Portfolio Characteristics • 68% are 7(a) Program Loans; 30% are 504 Program Loans • $248 million fall into the Loans to Small Business and Small Farms definition • 70% are wholly or partially guaranteed by the US Government The 7(a) Program loans can be used to buy a business or obtain working capital. The 504 Program loans provide commercial real estate financing for owner-occupied properties. Loans to Small Business and Small Farms are defined consistent with the RC-C, Part II Call Report Instructions 30 Does not include $2 million of HFS

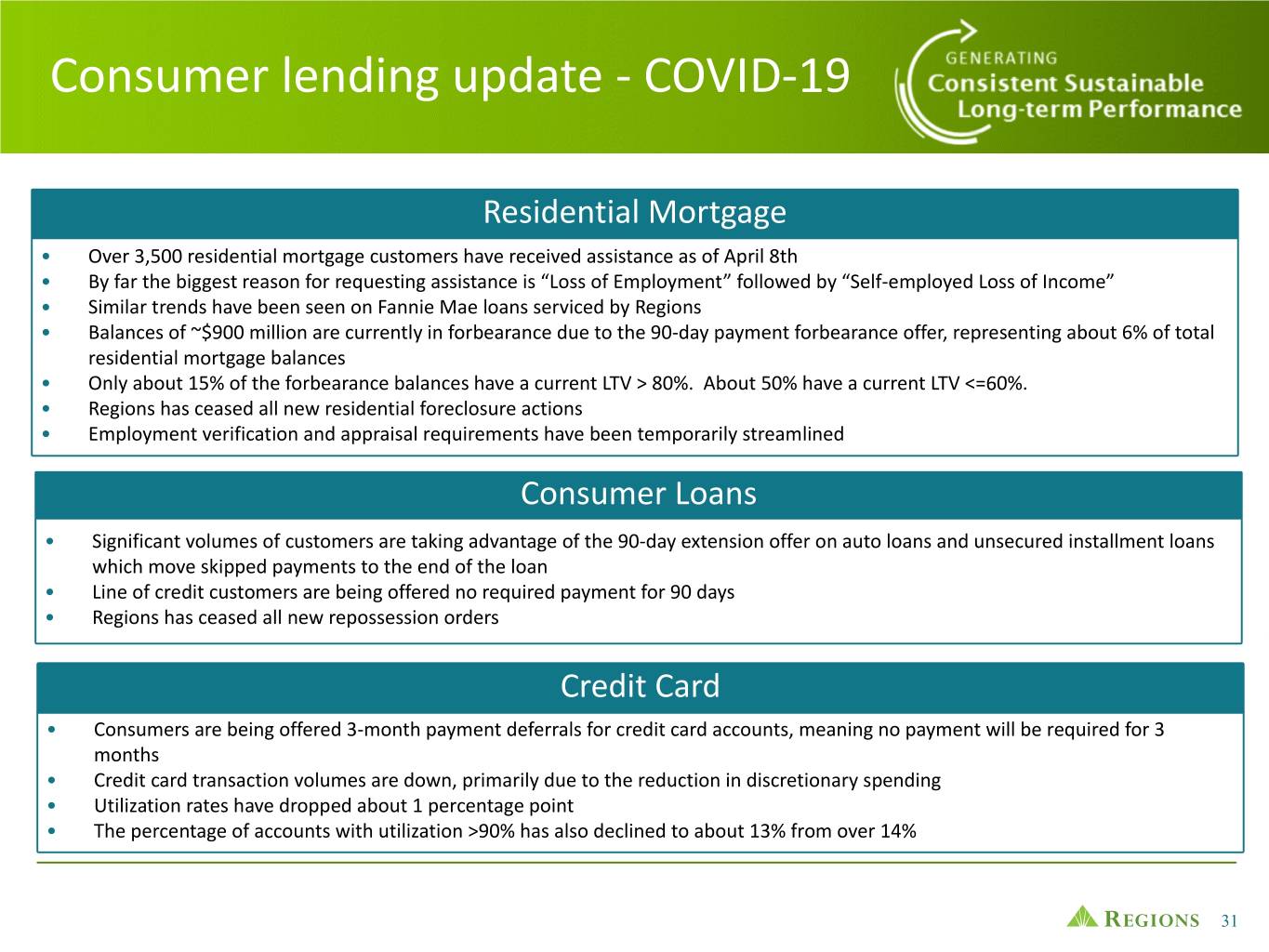

Consumer lending update - COVID-19 Residential Mortgage • Over 3,500 residential mortgage customers have received assistance as of April 8th • By far the biggest reason for requesting assistance is “Loss of Employment” followed by “Self-employed Loss of Income” • Similar trends have been seen on Fannie Mae loans serviced by Regions • Balances of ~$900 million are currently in forbearance due to the 90-day payment forbearance offer, representing about 6% of total residential mortgage balances • Only about 15% of the forbearance balances have a current LTV > 80%. About 50% have a current LTV <=60%. • Regions has ceased all new residential foreclosure actions • Employment verification and appraisal requirements have been temporarily streamlined Consumer Loans • Significant volumes of customers are taking advantage of the 90-day extension offer on auto loans and unsecured installment loans which move skipped payments to the end of the loan • Line of credit customers are being offered no required payment for 90 days • Regions has ceased all new repossession orders Credit Card • Consumers are being offered 3-month payment deferrals for credit card accounts, meaning no payment will be required for 3 months • Credit card transaction volumes are down, primarily due to the reduction in discretionary spending • Utilization rates have dropped about 1 percentage point • The percentage of accounts with utilization >90% has also declined to about 13% from over 14% 31

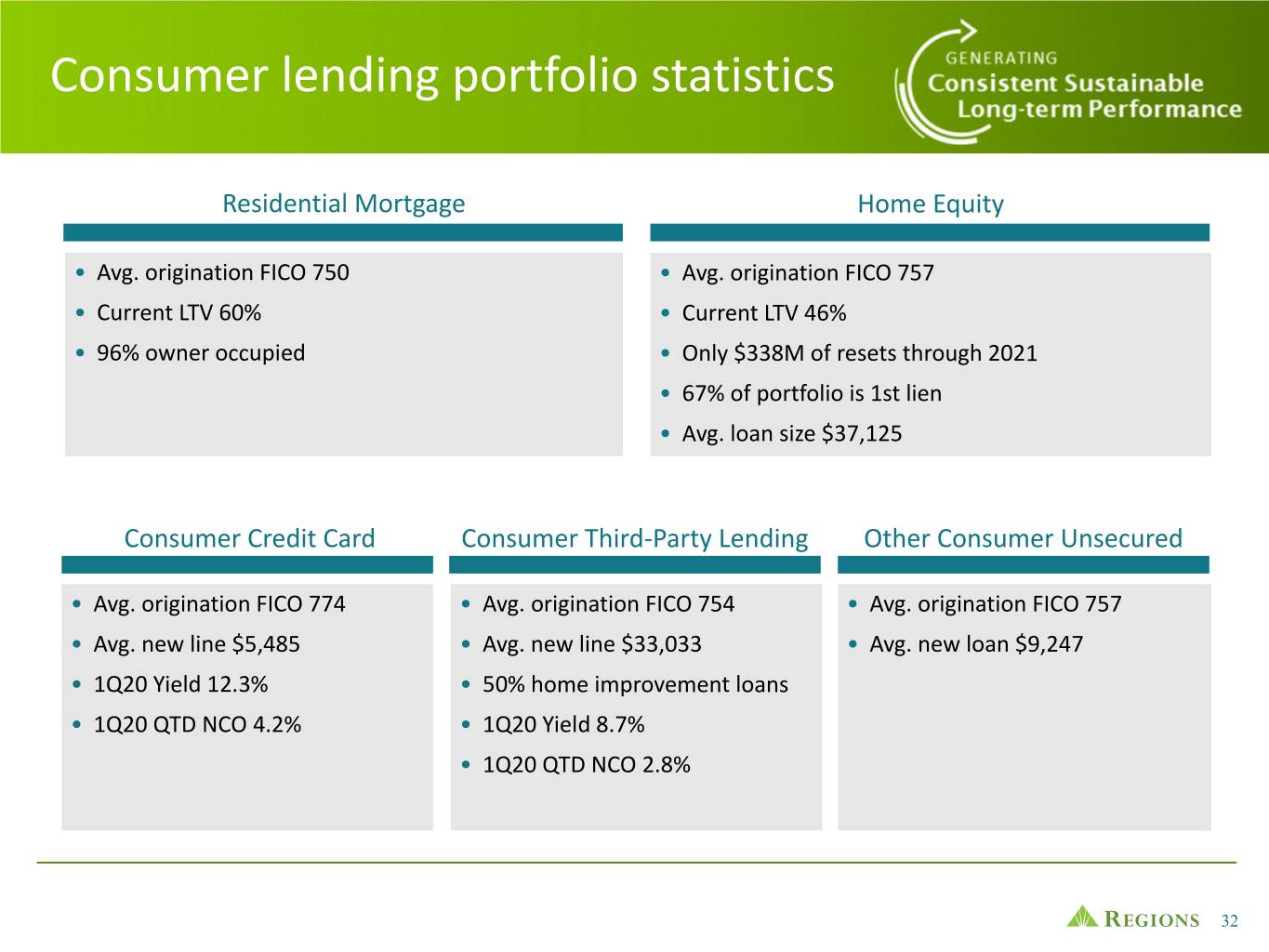

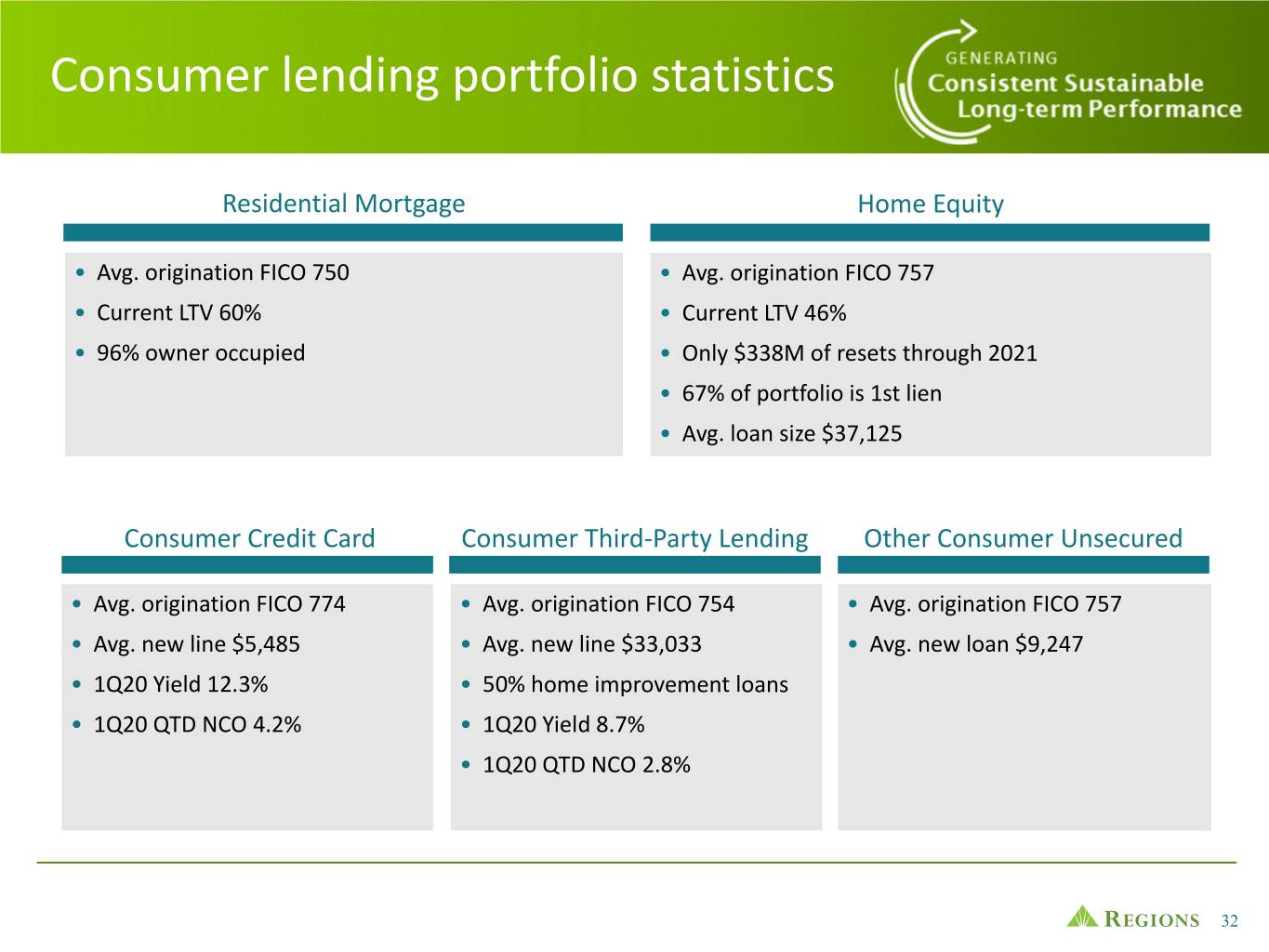

Consumer lending portfolio statistics Residential Mortgage Home Equity • Avg. origination FICO 750 • Avg. origination FICO 757 • Current LTV 60% • Current LTV 46% • 96% owner occupied • Only $338M of resets through 2021 • 67% of portfolio is 1st lien • Avg. loan size $37,125 Consumer Credit Card Consumer Third-Party Lending Other Consumer Unsecured • Avg. origination FICO 774 • Avg. origination FICO 754 • Avg. origination FICO 757 • Avg. new line $5,485 • Avg. new line $33,033 • Avg. new loan $9,247 • 1Q20 Yield 12.3% • 50% home improvement loans • 1Q20 QTD NCO 4.2% • 1Q20 Yield 8.7% • 1Q20 QTD NCO 2.8% 32

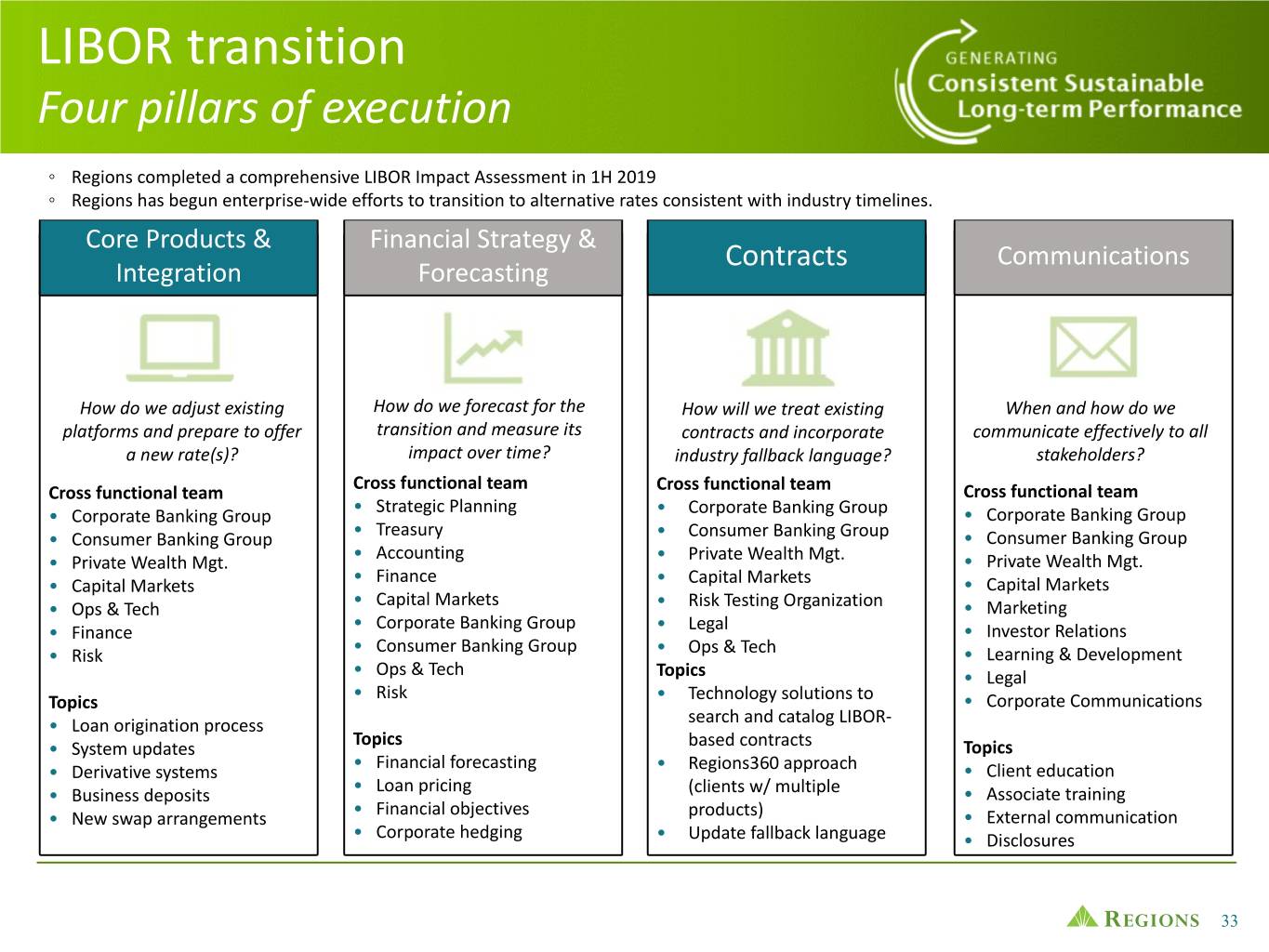

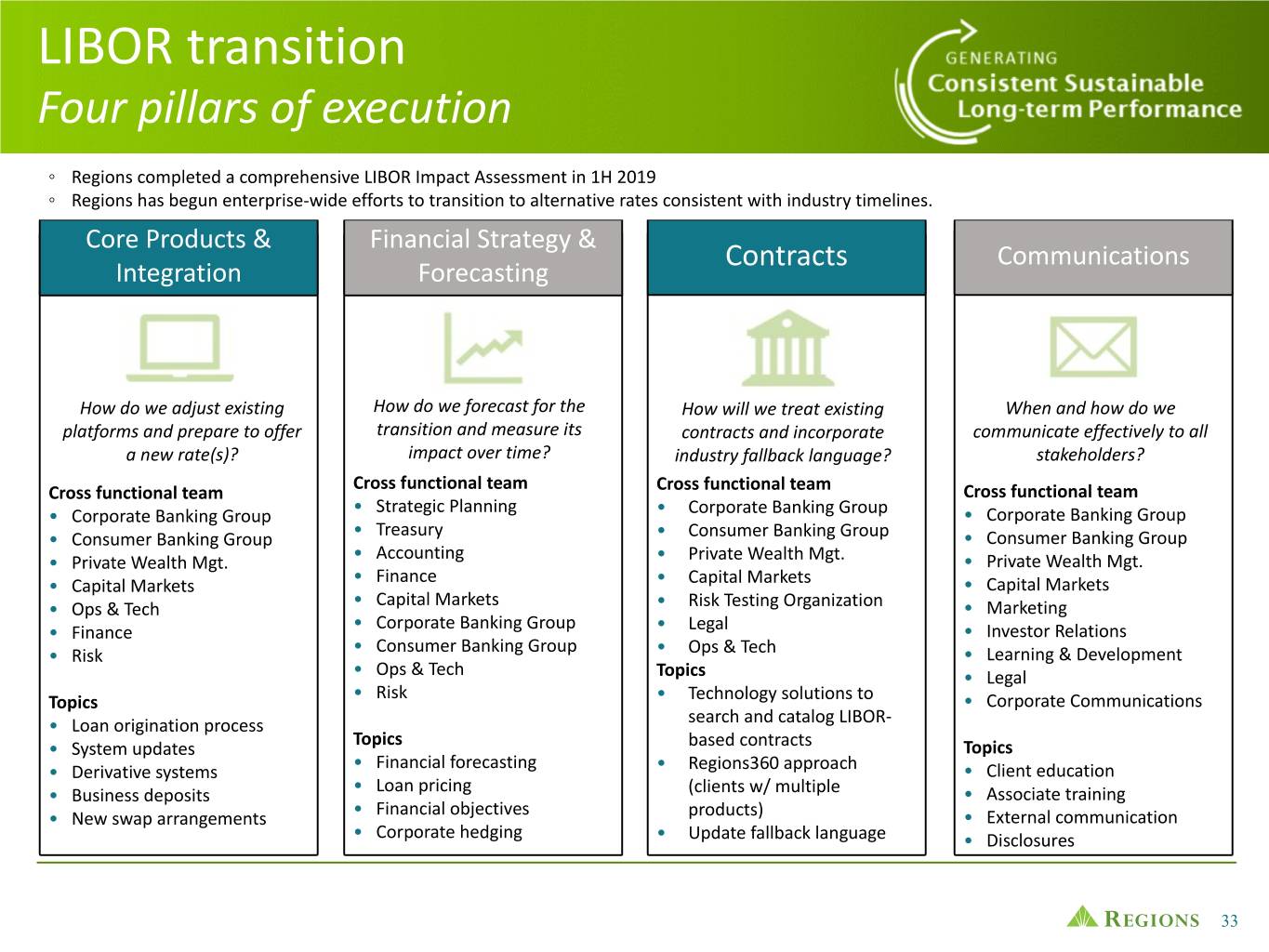

LIBOR transition Four pillars of execution ◦ Regions completed a comprehensive LIBOR Impact Assessment in 1H 2019 ◦ Regions has begun enterprise-wide efforts to transition to alternative rates consistent with industry timelines. Core Products & Financial Strategy & Contracts Communications Integration Forecasting How do we adjust existing How do we forecast for the How will we treat existing When and how do we platforms and prepare to offer transition and measure its contracts and incorporate communicate effectively to all a new rate(s)? impact over time? industry fallback language? stakeholders? Cross functional team Cross functional team Cross functional team Cross functional team • Strategic Planning • Corporate Banking Group • Corporate Banking Group • Corporate Banking Group • Treasury • Consumer Banking Group • Consumer Banking Group • Consumer Banking Group • Accounting • Private Wealth Mgt. • Private Wealth Mgt. • Private Wealth Mgt. • Finance • Capital Markets • Capital Markets • Capital Markets • Capital Markets • Ops & Tech • Risk Testing Organization • Marketing • Corporate Banking Group • Finance • Legal • Investor Relations • Consumer Banking Group • Risk • Ops & Tech • Learning & Development • Ops & Tech Topics • Legal • Risk Topics • Technology solutions to • Corporate Communications • Loan origination process search and catalog LIBOR- Topics • System updates based contracts Topics • Financial forecasting • Derivative systems • Regions360 approach • Client education • Loan pricing • Business deposits (clients w/ multiple • Associate training • Financial objectives • New swap arrangements products) • External communication • Corporate hedging • Update fallback language • Disclosures 33

Non-GAAP information Management uses pre-tax pre-provision income (non-GAAP) and adjusted pre-tax pre-provision income (non-GAAP), as well as the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non- GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non- interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non-GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to- period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations it is currently considered to be a non-GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculations. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance 34

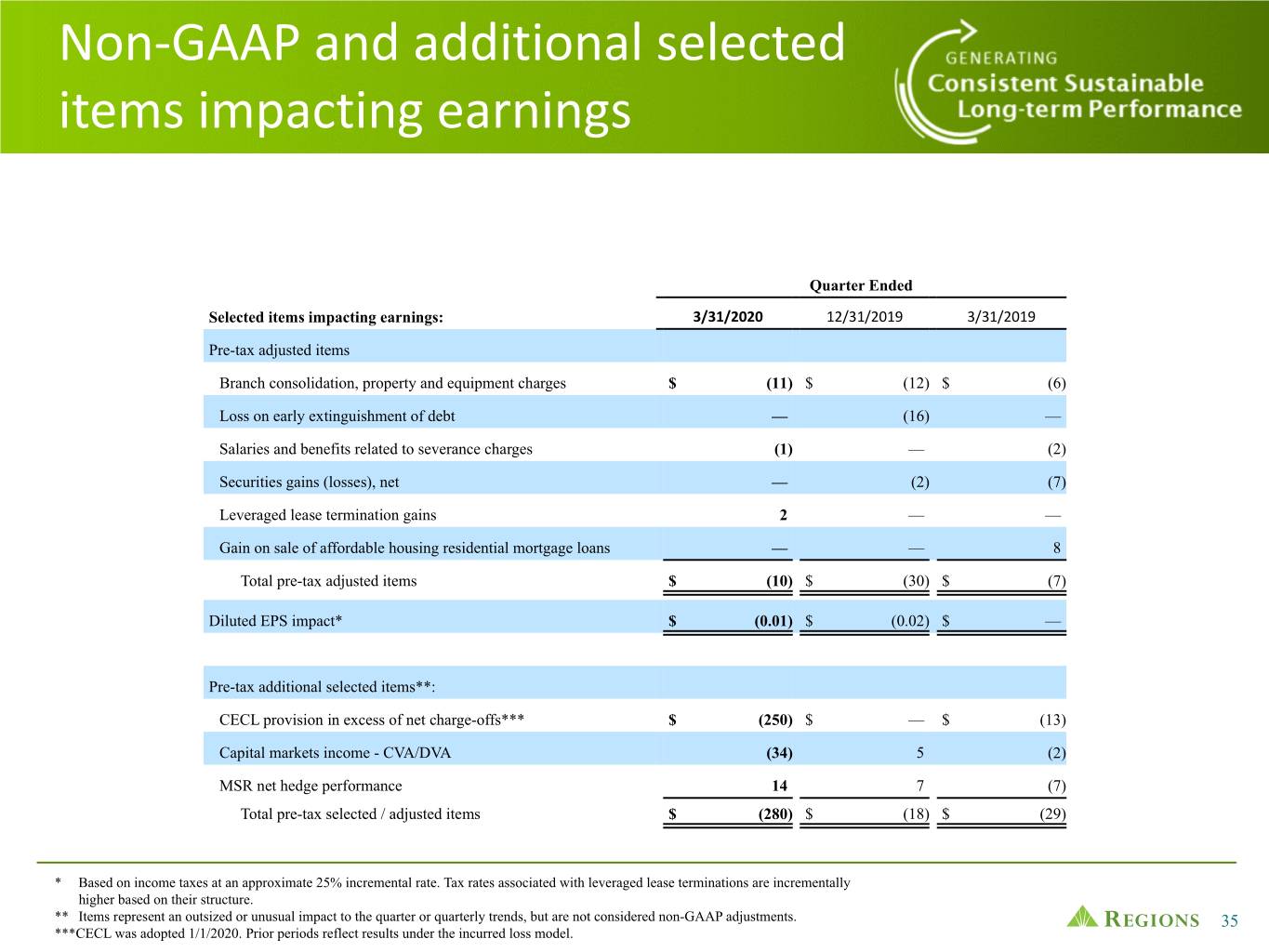

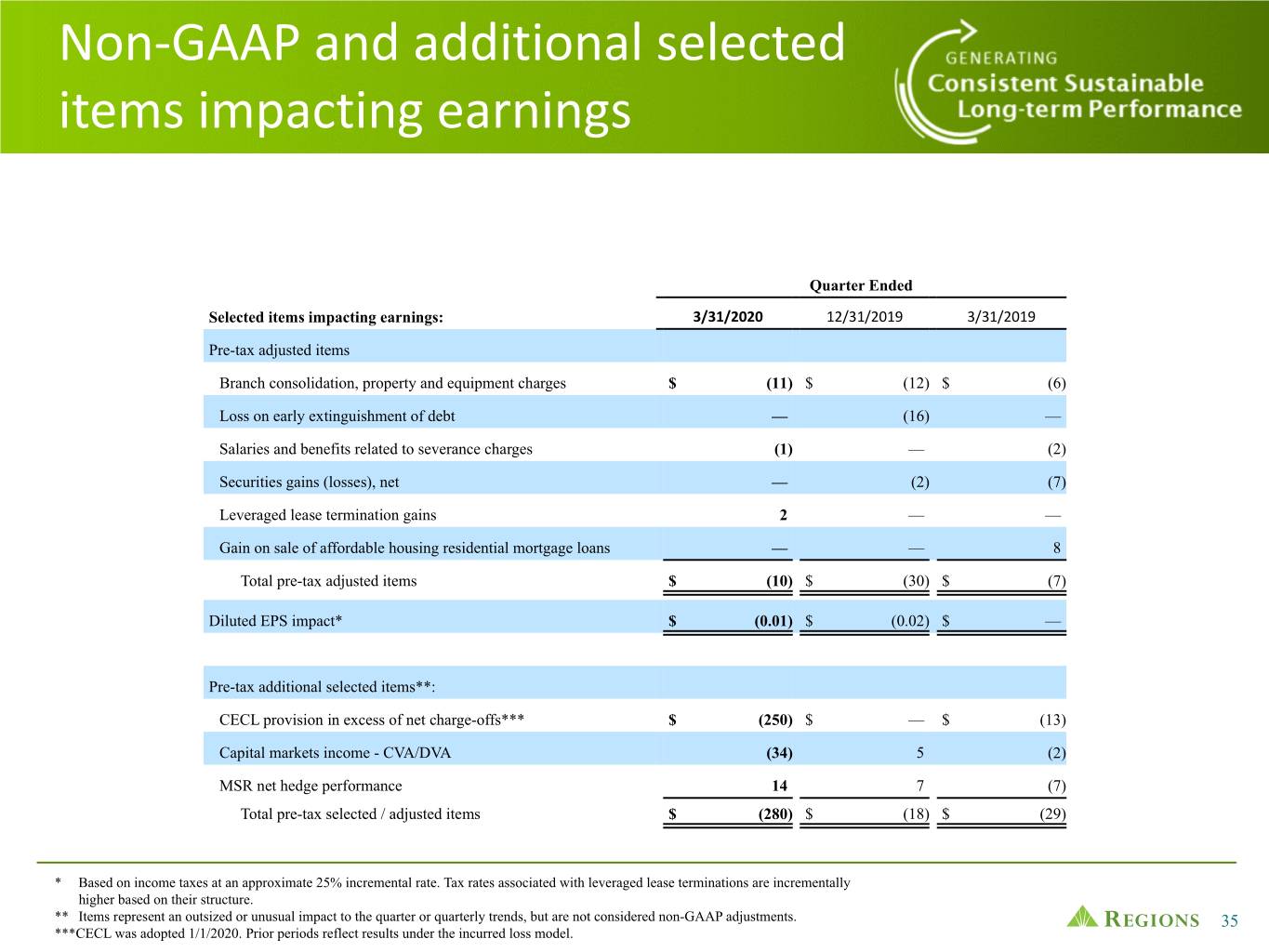

Non-GAAP and additional selected items impacting earnings Quarter Ended Selected items impacting earnings: 3/31/2020 12/31/2019 3/31/2019 Pre-tax adjusted items Branch consolidation, property and equipment charges $ (11) $ (12) $ (6) Loss on early extinguishment of debt — (16) — Salaries and benefits related to severance charges (1) — (2) Securities gains (losses), net — (2) (7) Leveraged lease termination gains 2 — — Gain on sale of affordable housing residential mortgage loans — — 8 Total pre-tax adjusted items $ (10) $ (30) $ (7) Diluted EPS impact* $ (0.01) $ (0.02) $ — Pre-tax additional selected items**: CECL provision in excess of net charge-offs*** $ (250) $ — $ (13) Capital markets income - CVA/DVA (34) 5 (2) MSR net hedge performance 14 7 (7) Total pre-tax selected / adjusted items $ (280) $ (18) $ (29) * Based on income taxes at an approximate 25% incremental rate. Tax rates associated with leveraged lease terminations are incrementally higher based on their structure. ** Items represent an outsized or unusual impact to the quarter or quarterly trends, but are not considered non-GAAP adjustments. 35 ***CECL was adopted 1/1/2020. Prior periods reflect results under the incurred loss model.

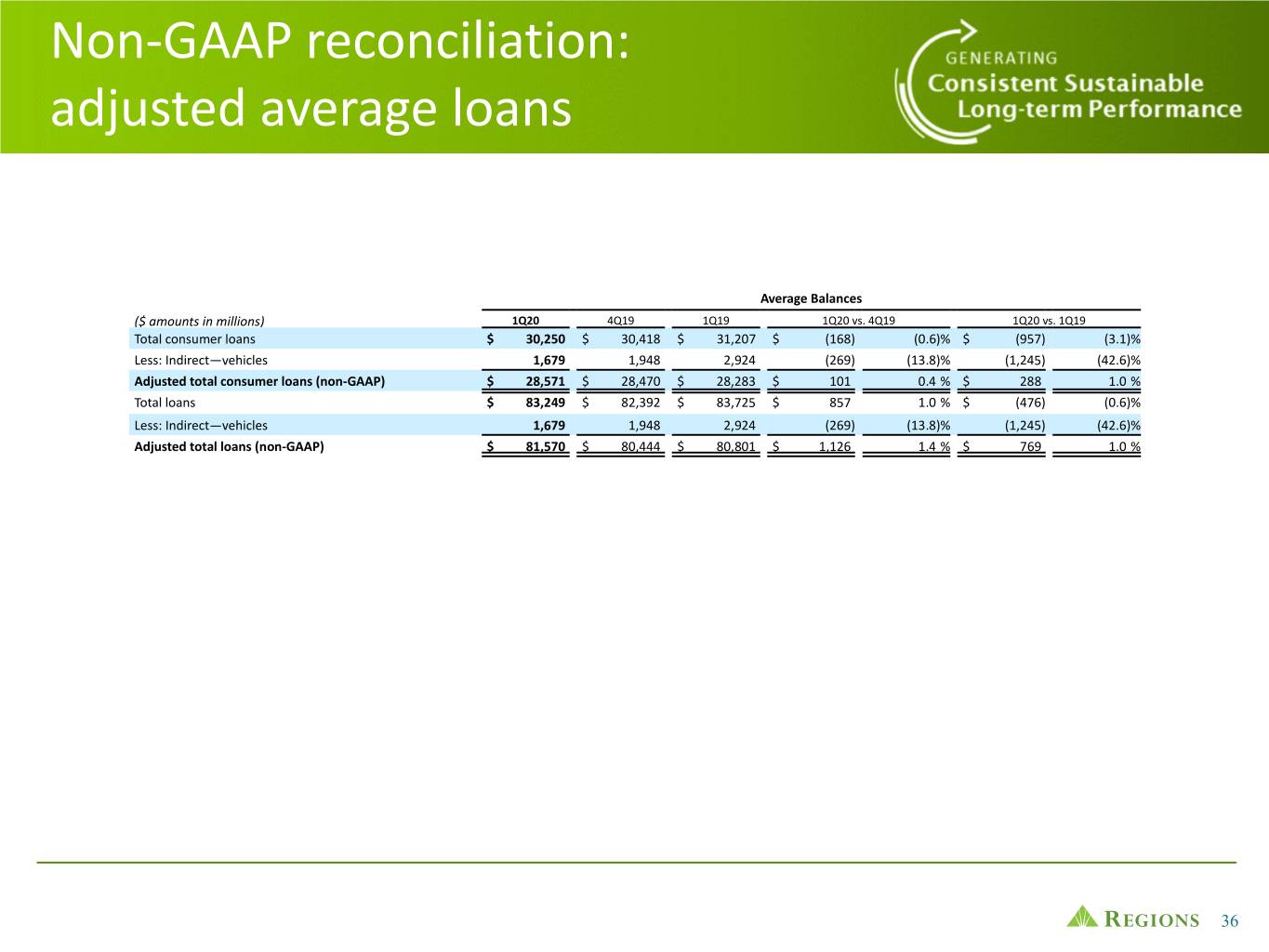

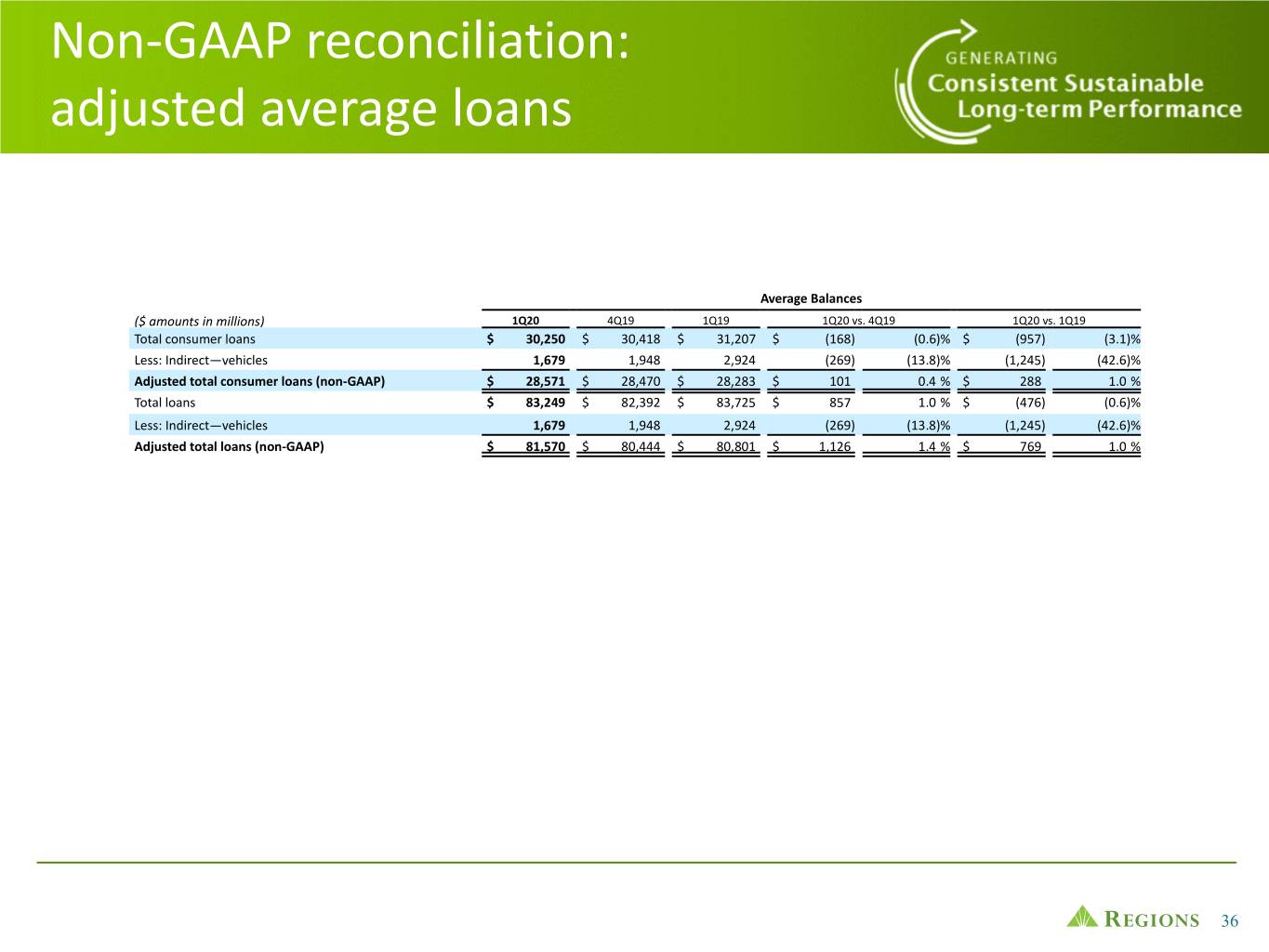

Non-GAAP reconciliation: adjusted average loans Average Balances ($ amounts in millions) 1Q20 4Q19 1Q19 1Q20 vs. 4Q19 1Q20 vs. 1Q19 Total consumer loans $ 30,250 $ 30,418 $ 31,207 $ (168) (0.6)% $ (957) (3.1)% Less: Indirect—vehicles 1,679 1,948 2,924 (269) (13.8)% (1,245) (42.6)% Adjusted total consumer loans (non-GAAP) $ 28,571 $ 28,470 $ 28,283 $ 101 0.4 % $ 288 1.0 % Total loans $ 83,249 $ 82,392 $ 83,725 $ 857 1.0 % $ (476) (0.6)% Less: Indirect—vehicles 1,679 1,948 2,924 (269) (13.8)% (1,245) (42.6)% Adjusted total loans (non-GAAP) $ 81,570 $ 80,444 $ 80,801 $ 1,126 1.4 % $ 769 1.0 % 36

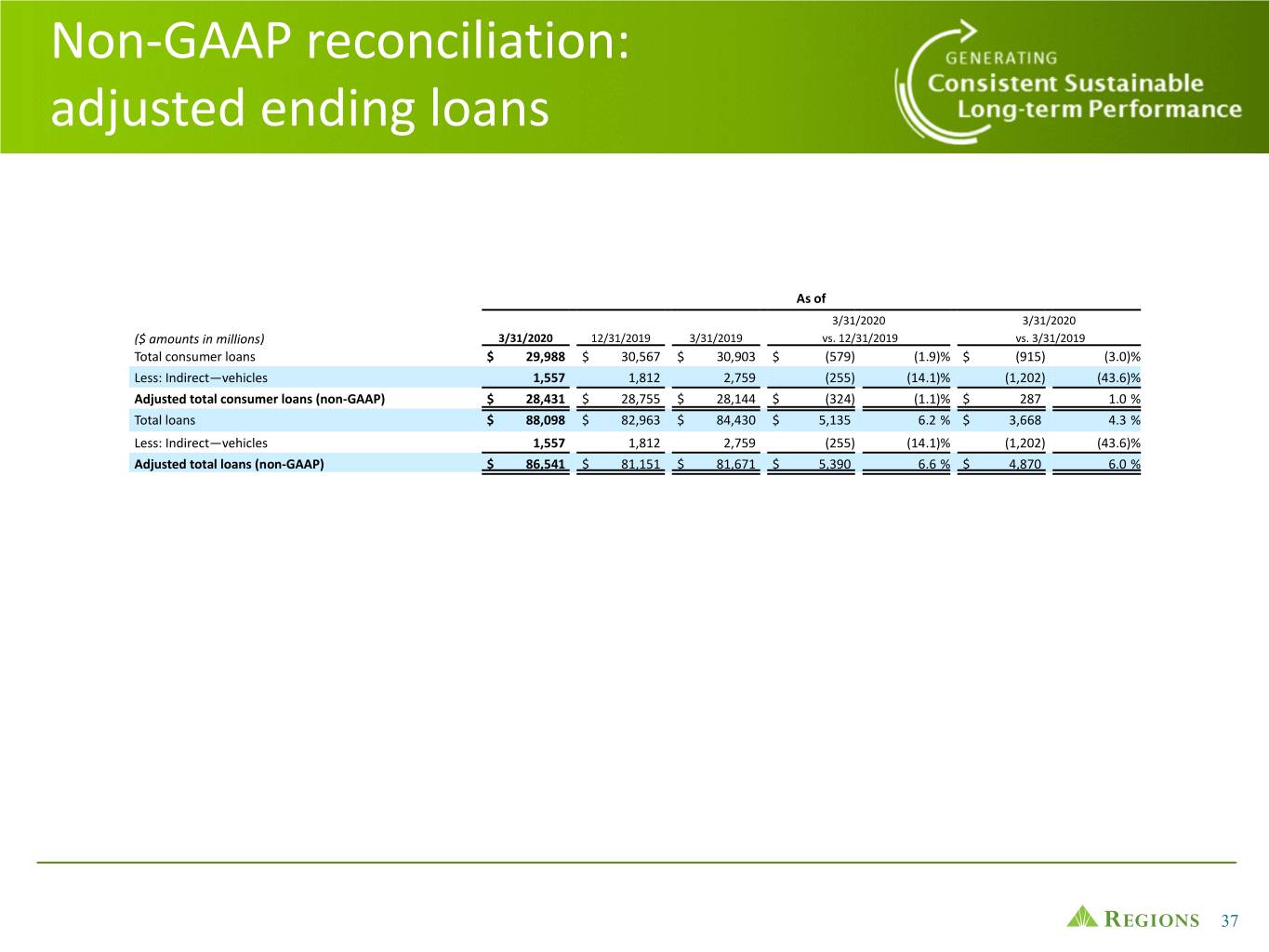

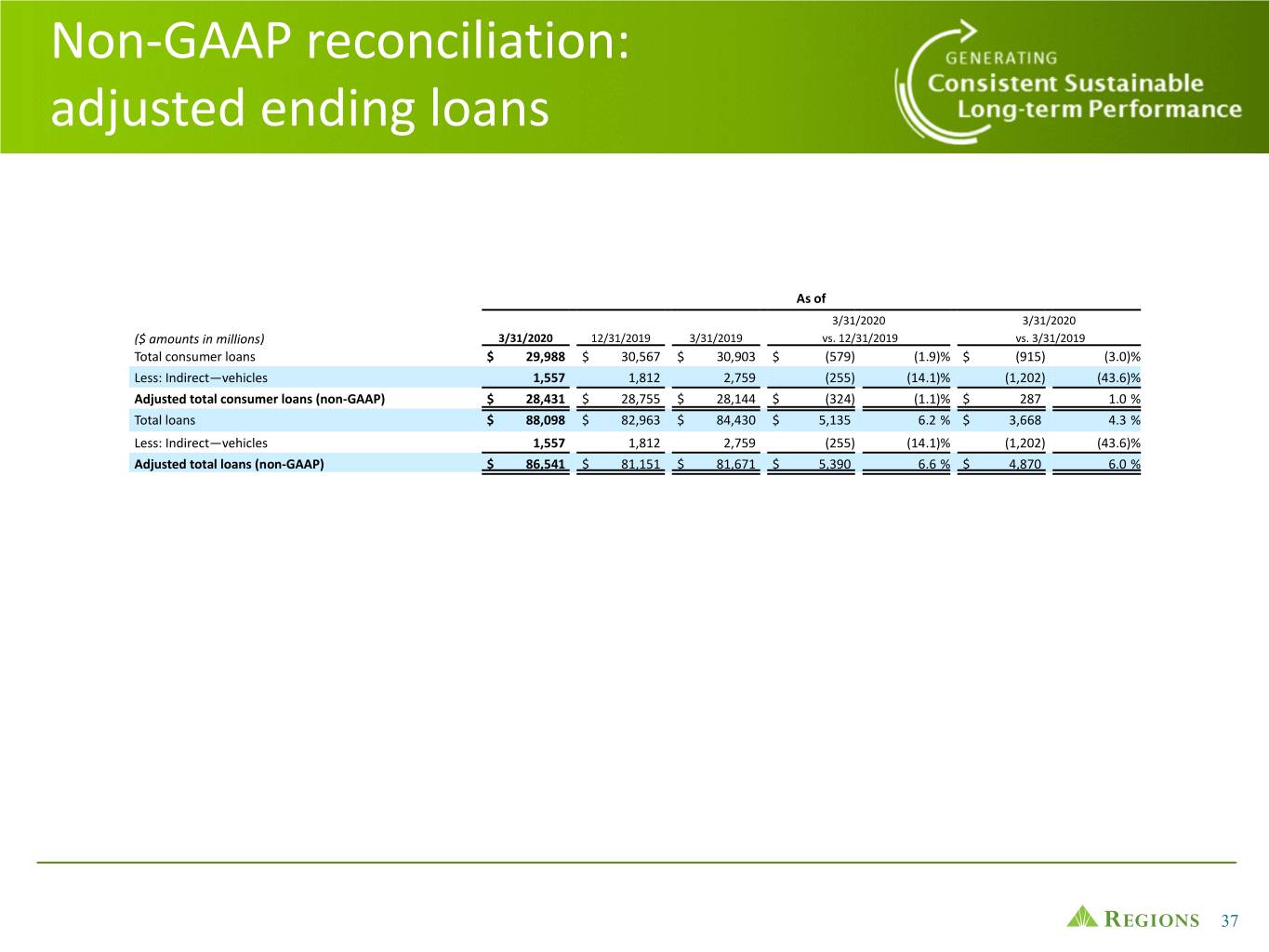

Non-GAAP reconciliation: adjusted ending loans As of 3/31/2020 3/31/2020 ($ amounts in millions) 3/31/2020 12/31/2019 3/31/2019 vs. 12/31/2019 vs. 3/31/2019 Total consumer loans $ 29,988 $ 30,567 $ 30,903 $ (579) (1.9)% $ (915) (3.0)% Less: Indirect—vehicles 1,557 1,812 2,759 (255) (14.1)% (1,202) (43.6)% Adjusted total consumer loans (non-GAAP) $ 28,431 $ 28,755 $ 28,144 $ (324) (1.1)% $ 287 1.0 % Total loans $ 88,098 $ 82,963 $ 84,430 $ 5,135 6.2 % $ 3,668 4.3 % Less: Indirect—vehicles 1,557 1,812 2,759 (255) (14.1)% (1,202) (43.6)% Adjusted total loans (non-GAAP) $ 86,541 $ 81,151 $ 81,671 $ 5,390 6.6 % $ 4,870 6.0 % 37

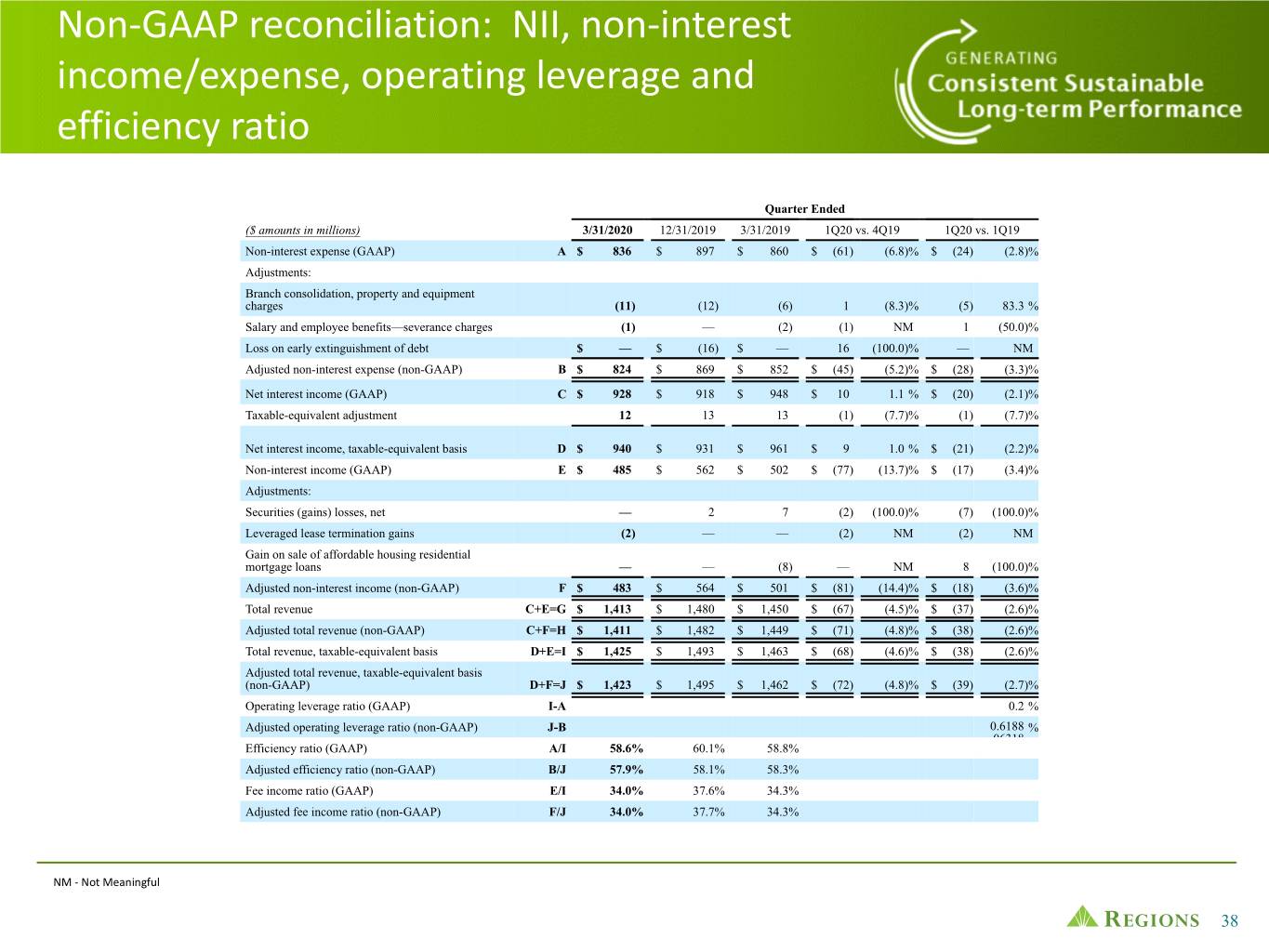

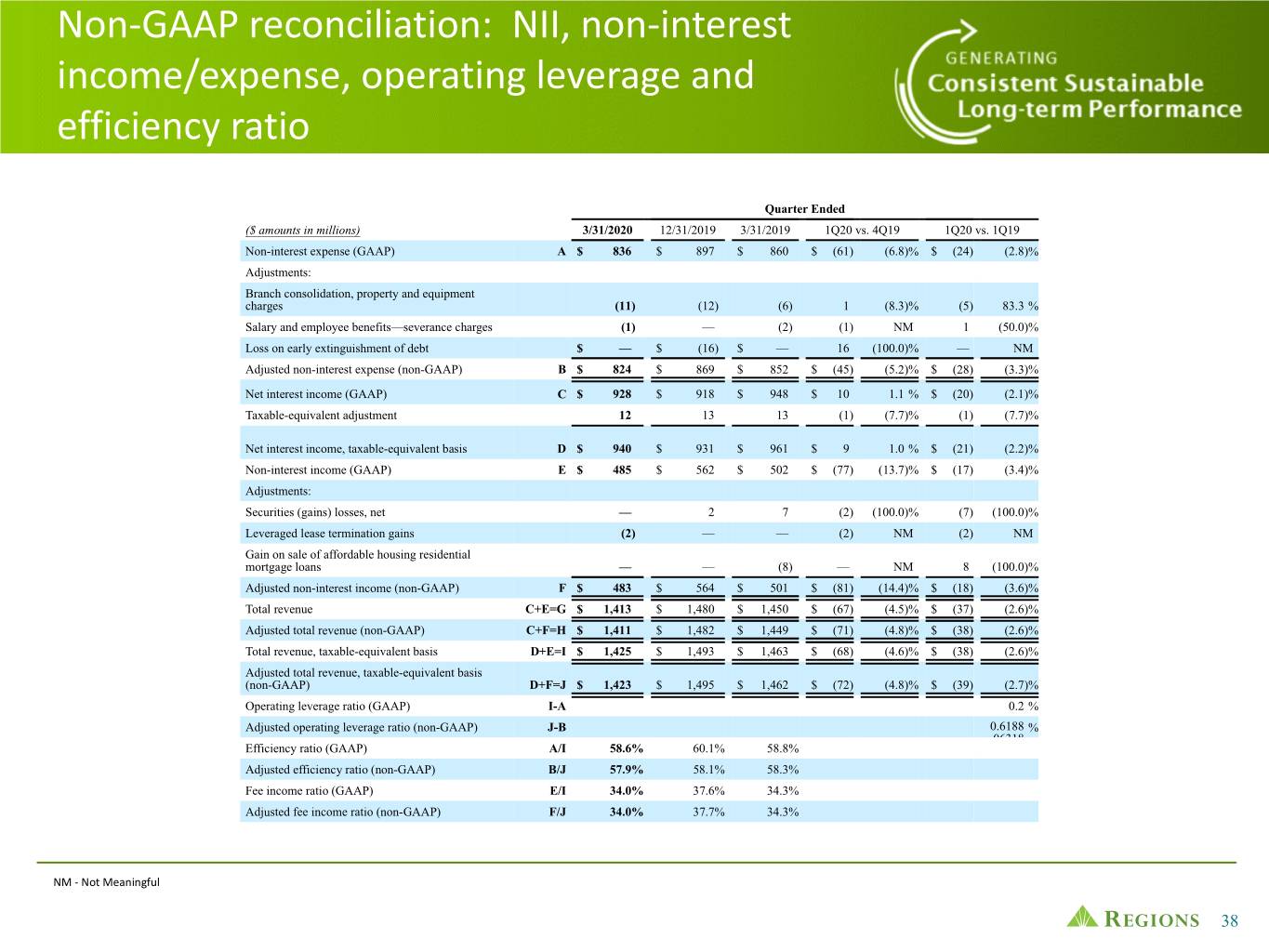

Non-GAAP reconciliation: NII, non-interest income/expense, operating leverage and efficiency ratio Quarter Ended ($ amounts in millions) 3/31/2020 12/31/2019 3/31/2019 1Q20 vs. 4Q19 1Q20 vs. 1Q19 Non-interest expense (GAAP) A $ 836 $ 897 $ 860 $ (61) (6.8)% $ (24) (2.8)% Adjustments: Branch consolidation, property and equipment charges (11) (12) (6) 1 (8.3)% (5) 83.3 % Salary and employee benefits—severance charges (1) — (2) (1) NM 1 (50.0)% Loss on early extinguishment of debt $ — $ (16) $ — 16 (100.0)% — NM Adjusted non-interest expense (non-GAAP) B $ 824 $ 869 $ 852 $ (45) (5.2)% $ (28) (3.3)% Net interest income (GAAP) C $ 928 $ 918 $ 948 $ 10 1.1 % $ (20) (2.1)% Taxable-equivalent adjustment 12 13 13 (1) (7.7)% (1) (7.7)% Net interest income, taxable-equivalent basis D $ 940 $ 931 $ 961 $ 9 1.0 % $ (21) (2.2)% Non-interest income (GAAP) E $ 485 $ 562 $ 502 $ (77) (13.7)% $ (17) (3.4)% Adjustments: Securities (gains) losses, net — 2 7 (2) (100.0)% (7) (100.0)% Leveraged lease termination gains (2) — — (2) NM (2) NM Gain on sale of affordable housing residential mortgage loans — — (8) — NM 8 (100.0)% Adjusted non-interest income (non-GAAP) F $ 483 $ 564 $ 501 $ (81) (14.4)% $ (18) (3.6)% Total revenue C+E=G $ 1,413 $ 1,480 $ 1,450 $ (67) (4.5)% $ (37) (2.6)% Adjusted total revenue (non-GAAP) C+F=H $ 1,411 $ 1,482 $ 1,449 $ (71) (4.8)% $ (38) (2.6)% Total revenue, taxable-equivalent basis D+E=I $ 1,425 $ 1,493 $ 1,463 $ (68) (4.6)% $ (38) (2.6)% Adjusted total revenue, taxable-equivalent basis (non-GAAP) D+F=J $ 1,423 $ 1,495 $ 1,462 $ (72) (4.8)% $ (39) (2.7)% Operating leverage ratio (GAAP) I-A 0.2 % Adjusted operating leverage ratio (non-GAAP) J-B 0.6188 % 06318 Efficiency ratio (GAAP) A/I 58.6% 60.1% 58.8% Adjusted efficiency ratio (non-GAAP) B/J 57.9% 58.1% 58.3% Fee income ratio (GAAP) E/I 34.0% 37.6% 34.3% Adjusted fee income ratio (non-GAAP) F/J 34.0% 37.7% 34.3% NM - Not Meaningful 38

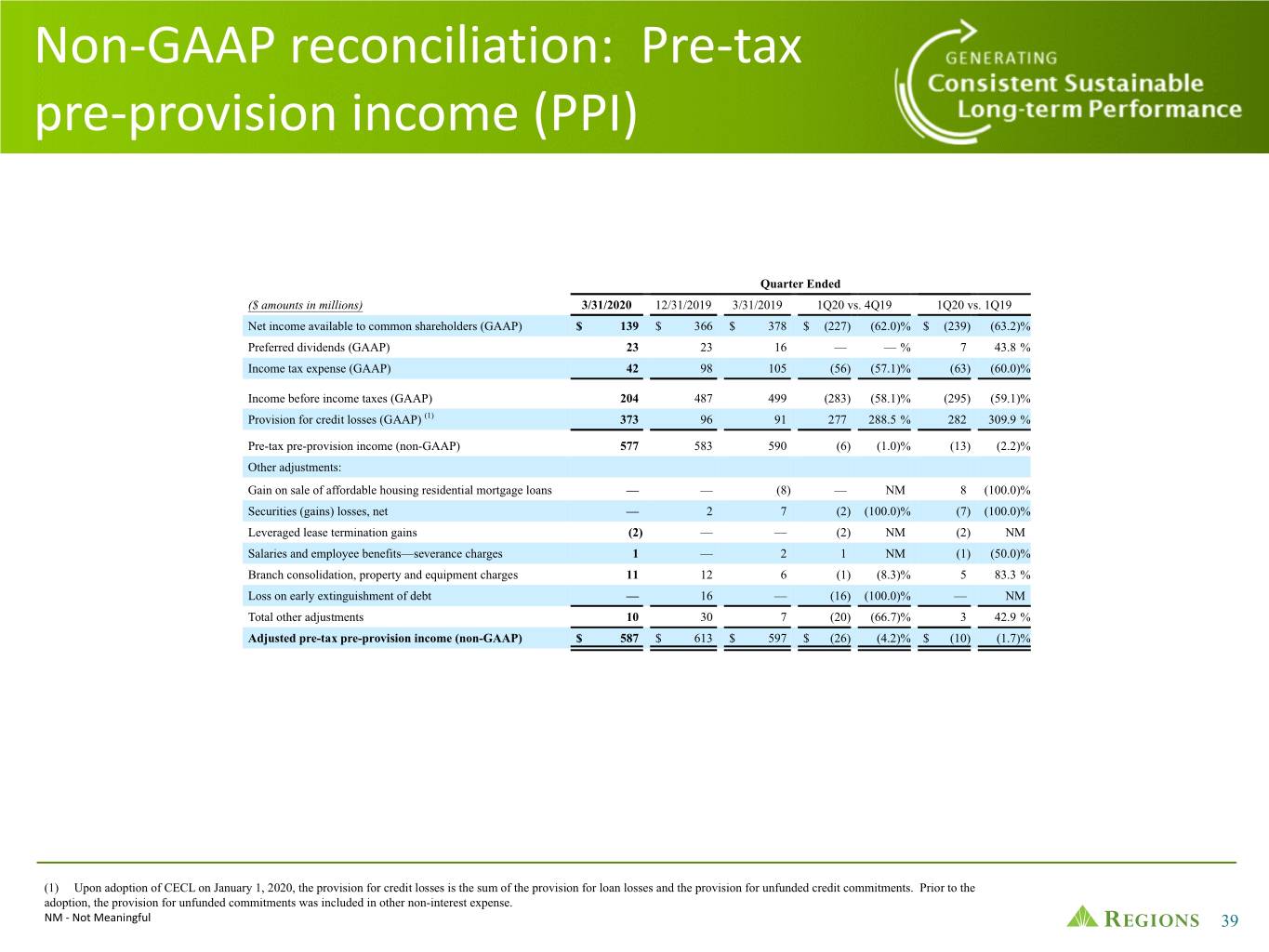

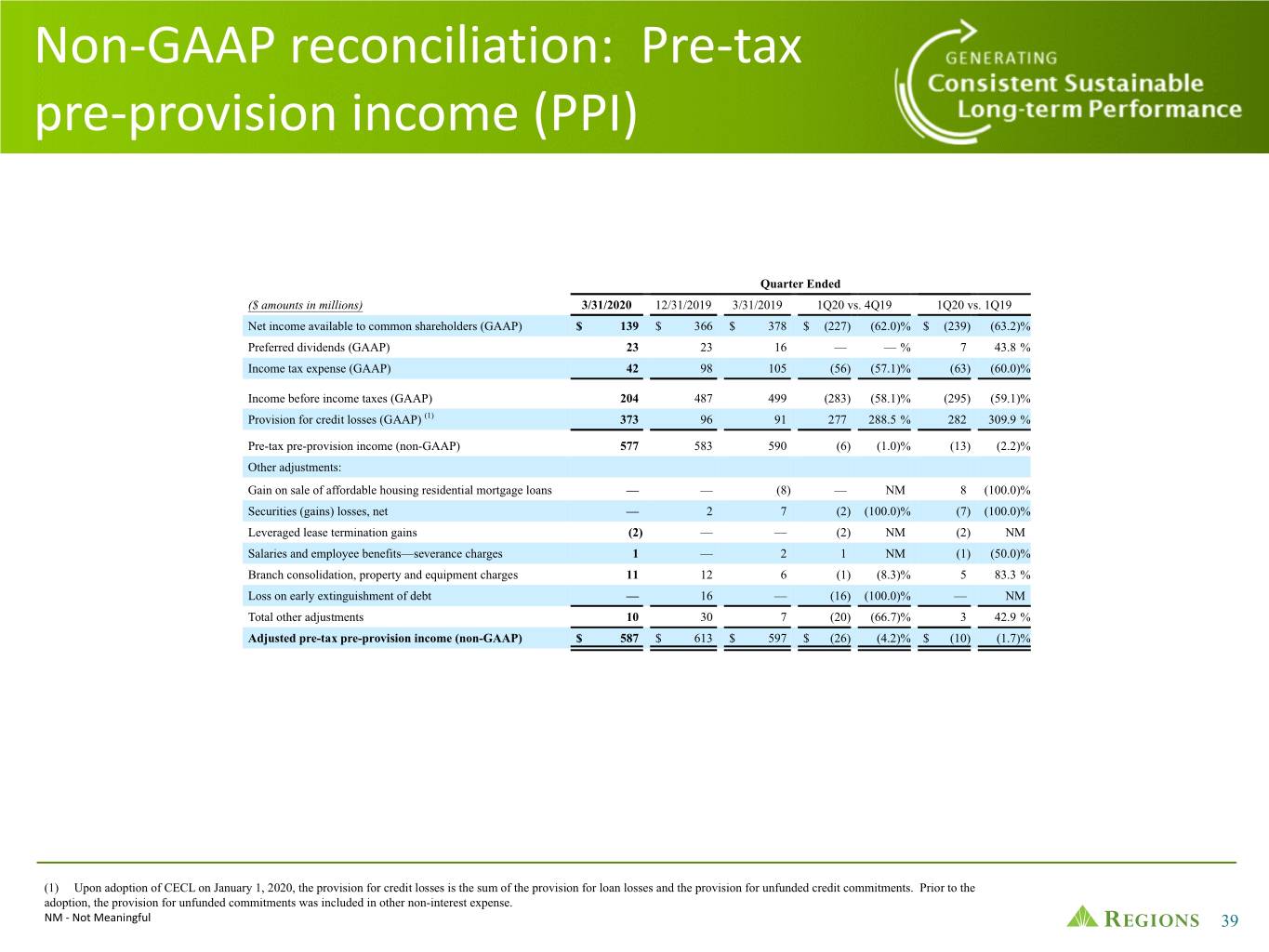

Non-GAAP reconciliation: Pre-tax pre-provision income (PPI) Quarter Ended ($ amounts in millions) 3/31/2020 12/31/2019 3/31/2019 1Q20 vs. 4Q19 1Q20 vs. 1Q19 Net income available to common shareholders (GAAP) $ 139 $ 366 $ 378 $ (227) (62.0)% $ (239) (63.2)% Preferred dividends (GAAP) 23 23 16 — — % 7 43.8 % Income tax expense (GAAP) 42 98 105 (56) (57.1)% (63) (60.0)% Income before income taxes (GAAP) 204 487 499 (283) (58.1)% (295) (59.1)% Provision for credit losses (GAAP) (1) 373 96 91 277 288.5 % 282 309.9 % Pre-tax pre-provision income (non-GAAP) 577 583 590 (6) (1.0)% (13) (2.2)% Other adjustments: Gain on sale of affordable housing residential mortgage loans — — (8) — NM 8 (100.0)% Securities (gains) losses, net — 2 7 (2) (100.0)% (7) (100.0)% Leveraged lease termination gains (2) — — (2) NM (2) NM Salaries and employee benefits—severance charges 1 — 2 1 NM (1) (50.0)% Branch consolidation, property and equipment charges 11 12 6 (1) (8.3)% 5 83.3 % Loss on early extinguishment of debt — 16 — (16) (100.0)% — NM Total other adjustments 10 30 7 (20) (66.7)% 3 42.9 % Adjusted pre-tax pre-provision income (non-GAAP) $ 587 $ 613 $ 597 $ (26) (4.2)% $ (10) (1.7)% (1) Upon adoption of CECL on January 1, 2020, the provision for credit losses is the sum of the provision for loan losses and the provision for unfunded credit commitments. Prior to the adoption, the provision for unfunded commitments was included in other non-interest expense. NM - Not Meaningful 39

Forward-looking statements Forward-Looking Statements This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement, including statements regarding the potential effects of the COVID-19 pandemic on our businesses and financial results and conditions. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in unemployment rates, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • The impact of pandemics, including the COVID-19 pandemic, on our businesses and financial results and conditions. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of changes in tax laws, including the effect of any future interpretations of or amendments to Tax Reform, which may impact our earnings, capital ratios and our ability to return capital to stockholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non-traditional financial services companies, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. 40

Forward-looking statements (continued) • Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our business on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage (specifically in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and impact of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather- related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. 41

Forward-looking statements (continued) • Our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to achieve our expense management initiatives. • Possible cessation or market replacement of LIBOR and the related effect on our LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Other risks identified from time to time in reports that we file with the SEC. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2019 as filed with the SEC. Further, statements about the potential effects of the COVID-19 pandemic on our businesses and financial results and conditions may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and us. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Evelyn Mitchell at (205) 264-4551. 42

® 43