- BATL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

Battalion Oil (BATL) SC 13E3Going private transaction

Filed: 12 Jan 24, 4:23pm

Exhibit 99.(b)(i)

Execution Version

| Fortress Credit Corp. |

CONFIDENTIAL

October 27, 2023

Ruckus Energy Holdings, LLC

17503 La Cantera Parkway, Suite 104-603

San Antonio, Texas 78257

Attn: Avi Mirman

Commitment Letter

Ladies and Gentlemen:

Reference is made to that certain Exclusivity and Expense Reimbursement Letter, dated September 22, 2023 (a copy of which is attached hereto as Exhibit B, the “Exclusivity and Reimbursement Letter”), to Ruckus Energy Holdings, LLC, a Delaware limited liability company (“Ruckus” or “you”), from the Investors (as defined therein).

You have advised Fortress Credit Corp. (“Fortress” and together with its affiliates, managed funds and accounts, collectively, the “Commitment Parties”, “we” or “us”) that Ruckus, which directly or indirectly controls San Jacinto Acquisition Corp., a Delaware corporation (“Merger Sub”), intends to acquire by merger Battalion Oil Corporation, a Delaware corporation (the “Company”), and its subsidiaries, including, without limitation, Halcón Holdings, LLC, a Delaware limited liability company (the “Borrower”). You have further advised us that, in connection with the foregoing, you intend to consummate the other Transactions described in the Transaction Description attached hereto as Exhibit A (the “Transaction Description”). Capitalized terms used but not defined herein shall have the meanings assigned to them in the Transaction Description or the Exclusivity and Reimbursement Letter or the Summary of Indicative Terms attached as Annex A to the Exclusivity and Reimbursement Letter (as amended hereinbelow, the “Term Sheet”; this commitment letter, the Transaction Description, the Term Sheet and the Conditions Precedent to Initial Borrowing attached hereto as Exhibit C, collectively, the “Commitment Letter”), as applicable. In the case of any such capitalized term that is subject to multiple and differing definitions, the appropriate meaning thereof in this letter agreement shall be determined by reference to the context in which it is used.

1. Commitment.

In connection with the Transactions, Fortress is pleased to advise you of its commitment to provide fifty percent (50%) (i.e., $100 million) of a senior secured first lien term loan facility in the aggregate principal amount of $200 million (the “Credit Facility”), upon the terms and conditions set forth in this Commitment Letter (including, without limitation, the last sentence of this paragraph) and subject only to the satisfaction (or written waiver by the Commitment Parties) of the conditions set forth or referenced in the section entitled “Conditions Precedent to Initial Borrowing” in Exhibit C hereto. The commitment of the Commitment Parties are several and not joint with any other Investor or any other Lender (as defined in the Term Sheet). You agree that no advisors, co-advisors, other agents, co-agents, arrangers, co-arrangers, bookrunners, co-bookrunners, managers or co-managers will be appointed, no other titles will be awarded and no compensation (other than compensation expressly contemplated by this Commitment Letter) will be paid in connection with the Credit Facility unless you and we shall so agree. Notwithstanding the foregoing, in the event the current 5-year simple average of the NYMEX WTI strip is less than $51.62/bbl as of the date that is 20 days prior to the scheduled Closing Date (the “WTI Strip Determination Date”), which scheduled Closing Date shall be set by written notice by Ruckus to Fortress on such WTI Strip Determination Date, then Fortress shall have the right (but not the obligation) to within five (5) days after the WTI Strip Determination Date, reduce the sizing of the Credit Facility under this Commitment Letter by delivering written notice to you of such reduction, (a) if the current 5-year simple average of the NYMEX WTI strip on the WTI Strip Determination Date is less than $51.62/bbl but greater than or equal to $45.00/bbl, to a Credit Facility amount no less than $185 million, (b) if the current 5-year simple average of the NYMEX WTI strip on the WTI Strip Determination Date is less than $45.00/bbl but greater than or equal to $40.00/bbl, to a Credit Facility amount no less than $180 million, (c) if the current 5-year simple average of the NYMEX WTI strip on the WTI Strip Determination Date is less than $40.00/bbl but greater than or equal to $35.00/bbl, to a Credit Facility amount no less than $175 million, or (d) if the current 5-year simple average of the NYMEX WTI strip on the WTI Strip Determination Date is less than $35.00/bbl to a Credit Facility amount determined by Fortress in its sole and absolute discretion; provided, that, for the avoidance of doubt, any right of Fortress to reduce its commitment pursuant hereto shall expire 5 days after the WTI Strip Determination Date.

2. Term Sheet Amendments.

The parties hereby acknowledge and agree that the Term Sheet is hereby amended as follows:

| (a) | Clause (iv) of the “Financial Covenants” section is hereby deleted in its entirety and replaced with the following new Clause (iv): |

“(iv) Minimum Liquidity shall be in an amount equal to the greater of: (a) $10 million and (b) an amount equal to three (3) months of (i) scheduled amortization under the “Minimum Mandatory Amortization” section plus (ii) accrued interest as specified under the “Interest Rate” section.”

| (b) | The last sentence in Clause (vi) of the “Financial Covenants” section is hereby deleted in its entirety and replaced with the following new sentence: |

“Borrower shall not approve any future drilling wells that have a planned IRR below 30% (such calculation subject to Administrative Agent’s and the Lenders’ review and approval) based on the current strip at the time of approving the project.”

All references to the “Term Sheet” in this Commitment Letter shall be deemed to refer to the Term Sheet as amended by this Section 2 for all purposes.

2

3. Information.

You hereby represent and warrant (prior to the date of the consummation of the Acquisition and the funding of the initial borrowing under the Credit Facility (the date of such borrowing, the “Closing Date”), to your knowledge with respect to the Company and its subsidiaries, including the Borrower) that (a) all written information and written data (other than (i) financial estimates, forecasts, projections and other forward-looking information (the “Projections”) and (ii) information of a general economic or industry specific nature) (the “Information”), that has been or will be made available to any Commitment Party, directly or indirectly, by you, the Company, the Borrower, or by any of your or its respective representatives on your behalf in connection with the transactions contemplated hereby, when taken as a whole, is or will be, when furnished, complete and correct in all material respects and does not or will not, when furnished, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein not materially misleading in light of the circumstances under which such statements are made (after giving effect to all supplements and updates thereto from time to time) and (b) the Projections that have been, or will be, made available to any Commitment Party, directly or indirectly, by you, the Company, the Borrower, or by any of your or its respective representatives on your behalf in connection with the transactions contemplated hereby have been, or will be, prepared in good faith based upon assumptions that are believed by you to be reasonable at the time such Projections are so furnished to the Commitment Parties; it being understood that the Projections are as to future events and are not to be viewed as facts, that the Projections are subject to significant uncertainties and contingencies, many of which are beyond your control, and that no assurance can be given that any particular Projections will be realized and that actual results during the period or periods covered by any such Projections may differ significantly from the projected results and such differences may be material. You agree that, if at any time prior to the Closing Date, you become aware that any of the representations and warranties in the preceding sentence would be incomplete or incorrect in any material respect if the Information and the Projections were being furnished, or such representations were being made, at such time, then you will promptly inform us thereof and will (or, with respect to the Information and Projections relating to the Company and its subsidiaries, including the Borrower, prior to the Closing Date, will use commercially reasonable efforts to) promptly supplement the Information and such Projections such that such representations and warranties are so complete and correct in all material respects. In arranging the Credit Facility, each of the Commitment Parties (x) will be entitled to use and rely on the Information and the Projections without responsibility for independent verification thereof and (y) assume no responsibility for the accuracy or completeness of the Information or the Projections.

4. Fees.

As consideration for the commitments of the Commitment Parties hereunder and for the agreement of Fortress to act in the capacity as administrative agent and collateral agent (Fortress in such capacity, together with its successors and assigns in such capacity, the “Administrative Agent”) for the Credit Facility and to perform the services described herein, you agree to pay (or cause to be paid) the fees set forth in the Term Sheet and any of the Facility Documentation (as defined below), if and to the extent payable in accordance with the terms thereof. Once paid, such fees shall not be refundable except as otherwise agreed in writing.

5. Conditions.

The commitment of the Commitment Parties hereunder to fund the Credit Facility on the Closing Date are subject solely to the conditions set forth herein and in Exhibit C hereto, and upon satisfaction (or written waiver by the Commitment Parties) of such conditions, the initial funding of the Credit Facility on the Closing Date shall occur.

Notwithstanding anything to the contrary in this Commitment Letter (including each of the exhibits attached hereto), the Facility Documentation or any other letter agreement or other undertaking concerning the financing of the Transactions to the contrary, the terms of the Facility Documentation shall be in a form such that they do not impair the availability of the Credit Facility on the Closing Date if the conditions set forth in Exhibit C hereto are satisfied (or are waived by the Commitment Parties). For the avoidance of doubt, in no event shall the Company or any of its subsidiaries be required to execute any Facility Documentation, or any other document or instruments (other than customary authorization letters), prior to, or that become effective prior to the consummation of the Acquisition and the funding of the Credit Facility and it being understood that, to the extent any collateral is not provided on the Closing Date (as defined in the Acquisition Agreement) after your use of commercially reasonable efforts to do so (other than (x) the filing of Uniform Commercial Code financing statements, and (y) the filing of intellectual property security agreements for intellectual property that is registered as of the Closing Date, the providing of such collateral shall not constitute a condition precedent to the availability of the Credit Facility on the Closing Date but shall be required to be provided after the Closing Date pursuant to arrangements to be mutually agreed upon. This paragraph, and the provisions herein, shall be referred to as the “Certain Funds Provisions”.

3

6. Exclusivity, Expense Reimbursement and Indemnity.

To induce the Commitment Parties to enter into this Commitment Letter and to proceed with the documentation of the Credit Facility, you agree that Section 2 (Exclusivity), Section 3 (Expense Reimbursement) and Section 5 (Indemnification) of the Exclusivity and Reimbursement Letter are incorporated herein mutatis mutandis.

7. Sharing of Information, Absence of Fiduciary Relationships, Affiliate Activities.

You acknowledge that the Commitment Parties and their respective affiliates may be providing debt financing, equity capital or other services (including, without limitation, financial advisory services) to other persons in respect of which you, the Company, and your and their respective affiliates, may have conflicting interests regarding the transactions described herein and otherwise. None of the Commitment Parties or their respective affiliates will use confidential information obtained from you, the Company, or your or their respective affiliates by virtue of the transactions contemplated by this Commitment Letter or their other relationships with you, the Company, or your or their respective affiliates in connection with the performance by them of services for other persons, and none of the Commitment Parties nor their respective affiliates will furnish any such information to other persons, except to the extent permitted below. You also acknowledge that none of the Commitment Parties or their respective affiliates has any obligation to use in connection with the transactions contemplated by this Commitment Letter, or to furnish to you, confidential information obtained by them from other persons.

As you know, certain of the Commitment Parties may be full service securities firms engaged, either directly or through their affiliates, in various activities, including securities trading, commodities trading, investment management, financing and brokerage activities and financial planning and benefits counseling for both companies and individuals. In the ordinary course of these activities, such Commitment Parties and certain of their respective affiliates may actively engage in commodities trading or trade the debt and equity securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of you, the Company and other companies which may be the subject of the arrangements contemplated by this Commitment Letter for their own account or for the accounts of their customers and may at any time hold long and short positions in such securities. Certain of the Commitment Parties or their respective affiliates may also co-invest with, make direct investments in, and invest or co-invest monies in or with funds or other investment vehicles managed by other parties, and such funds or other investment vehicles may trade or make investments in securities of you, the Company or other companies which may be the subject of the arrangements contemplated by this Commitment Letter or engage in commodities trading with any thereof. With respect to any securities and/or financial instruments so held by the Commitment Parties, their respective affiliates or any of their respective customers, all rights in respect of such securities and financial instruments, including any voting rights, will be exercised by the holder of the rights in its sole discretion.

4

The Commitment Parties and their respective affiliates may have economic interests that conflict with those of you and may be engaged in a broad range of transactions that involve interests that differ from yours and those of your affiliates, and the Commitment Parties have no obligation to disclose any of such interests to you or your affiliates. You agree that the Commitment Parties will act under this Commitment Letter as independent contractors, and that nothing in this Commitment Letter will be deemed to create an advisory, fiduciary or agency relationship or fiduciary or other implied duty between the Commitment Parties and you, the Company, or your respective equity holders or affiliates. You acknowledge and agree that (i) the transactions contemplated by this Commitment Letter are arm’s-length commercial transactions between the Commitment Parties and, if applicable, their affiliates, on the one hand, and you, on the other, (ii) in connection therewith and with the process leading to such transaction each Commitment Party and its applicable affiliates (as the case may be) is acting solely as a principal and has not been, is not and will not be acting as an advisor, agent or fiduciary of you, the Company, or your or their management, equity holders, creditors, affiliates, or any other person, (iii) the Commitment Parties and their applicable affiliates (as the case may be) have not assumed an advisory or fiduciary responsibility or any other obligation in favor of you or your affiliates with respect to the transactions contemplated hereby or the process leading thereto (irrespective of whether the Commitment Parties or any of their respective affiliates have advised or are currently advising you on other matters) except the obligations expressly set forth in this Commitment Letter and (iv) you have consulted your own legal and financial advisors to the extent you deemed appropriate. You further acknowledge and agree that (a) you are responsible for making your own independent judgment with respect to such transactions and the process leading thereto, (b) you are capable of evaluating and understand and accept the terms, risks and conditions of the transactions contemplated hereby, and (c) we have provided no legal, accounting, regulatory or tax advice, and you contacted your own legal, accounting, regulatory and tax advisors to the extent you have deemed appropriate. You agree that you will not claim that the Commitment Parties or their applicable affiliates, as the case may be, have rendered advisory services of any nature or respect, or owe a fiduciary or similar duty to you or your affiliates, in connection with such transaction or the process leading thereto and no Commitment Party, nor any of their respective affiliates, shall have any responsibility or liability to you with respect thereto. You hereby waive any claims that you or any of your affiliates may have against each of the Commitment Parties and their respective affiliates for breach of fiduciary duty or alleged breach of fiduciary duty in connection with the Transactions and agree that no Commitment Party, nor any of their respective affiliates, shall have any liability (whether direct or indirect) to you in respect of such a fiduciary claim or to any person asserting a fiduciary duty claim on behalf of or in right of you, including your equity holders, employees or creditors, in connection with the Transactions.

Without limiting the generality of this section, you hereby acknowledge that the Indemnified Persons may be engaged in such roles and that such roles may involve interests that differ from your interests and those of the Company and you, and you hereby waive any claims that you or your affiliates may have against the Commitment Parties’ Indemnified Persons (as defined in the Exclusivity and Reimbursement Letter) relating to this Commitment Letter or the Transaction as a result of any such conflict of interest and agree that such Indemnified Persons shall not have any liability (whether direct or indirect) to your or your affiliates in respect of any such claim or to any person asserting any such claim on behalf of you or your affiliates, including your equity owners.

5

8. Confidentiality.

You agree that you will not disclose, directly or indirectly, this Commitment Letter, including the Term Sheet and the other exhibits and attachments hereto or the contents of any of the foregoing, or the activities of any Commitment Party pursuant hereto or thereto, to any person or entity without prior written approval of Fortress, except (a) to the Equity Investors and your and their respective officers, directors, agents, employees, attorneys, accountants, advisors, controlling persons or equity holders, in each case, who are informed of the confidential nature thereof, on a confidential and need-to-know basis, (b) if the Commitment Parties consent in writing to such proposed disclosure (such consent not to be unreasonably withheld, delayed or conditioned), (c) pursuant to the order of any court or administrative agency in any pending legal, judicial, regulatory, or administrative proceeding, or otherwise as required by applicable law, rule or regulation or compulsory legal process or to the extent requested or required by governmental and/or regulatory authorities, in each case based on the reasonable advice of your legal counsel (and in each such case you agree (i) to the extent practicable and not prohibited by applicable law, rule or regulation to inform us promptly thereof and, to the extent practicable, prior to such disclosure and (ii) to use commercially reasonable efforts to ensure that any such information so disclosed is accorded confidential treatment), (d) to the extent reasonably necessary or advisable in connection with the exercise of any remedy or enforcement of any right under this Commitment Letter, (e) to the Company, the subsidiaries of the Company, including the Borrower, and the respective officers, directors, employees, agents, attorneys, accountants, advisors, controlling persons and equity holders of each of the foregoing, on a confidential and need-to-know basis (provided that, until after the Closing Date any disclosure of the Term Sheet or its contents to the Company, the subsidiaries of the Company, including the Borrower, or their respective officers, directors, employees, agents, attorneys, accountants, advisors, controlling persons and equity holders shall be redacted in a customary manner (as reasonably agreed by the Commitment Parties), including in respect of the amounts, percentages and basis points of compensation set forth therein, unless the Commitment Parties otherwise consent); provided that (i) you may disclose the Commitment Letter and its contents (but not the Term Sheet or the contents thereof (other than its existence)) in connection with any public or regulatory filing relating to the Transactions and (ii) you may disclose the aggregate fee amount contained in the Term Sheet (but not the Term Sheet) as part of Projections, pro forma information or a generic disclosure of aggregate sources and uses related to fee amounts related to the Transactions to the extent required in any regulatory filing relating to the Transactions. You agree to inform all such persons who receive information concerning this Commitment Letter that such information is confidential on the terms set forth herein. The restrictions on disclosure set forth in this paragraph (other than with respect to the Term Sheet and the contents thereof) shall expire and shall be of no further effect after the first anniversary of the date hereof.

The Commitment Parties reserve the right to review and approve, in advance, all materials, press releases, advertisements and disclosures by the Borrower or its affiliates that contain the name of the Commitment Parties or any of their affiliates or describe the Commitment Parties’ financing commitment, role or activities with respect to the Credit Facility.

6

The Commitment Parties and their affiliates will use all information provided to them or such affiliates by or on behalf of you hereunder or in connection with the Credit Facility and the related Transactions solely for the purpose of providing the services which are the subject of this Commitment Letter and negotiating, evaluating and consummating the transactions contemplated hereby and shall treat confidentially all such information and shall not publish, disclose or otherwise divulge, such information; provided that nothing herein shall prevent any Commitment Party and their affiliates from disclosing any such information (a) pursuant to the order of any court or administrative agency or in any pending legal, judicial, regulatory or administrative proceeding, or otherwise as required by applicable law, rule or regulation or compulsory legal process (in which case the Commitment Parties agree (except with respect to any routine audit or examination conducted by auditing accountants or any regulatory authority exercising examination or regulatory authority), (i) to the extent practicable and not prohibited by applicable law, rule or regulation, to inform you promptly thereof prior to disclosure and (ii) to use commercially reasonable efforts to ensure that any such information so disclosed is accorded confidential treatment), (b) upon the request or demand of any regulatory authority having or asserting jurisdiction over the Commitment Parties or any of their respective affiliates (in which case the Commitment Parties agree (except with respect to any routine audit or examination conducted by auditing accountants or any regulatory authority exercising examination or regulatory authority), (i) to the extent practicable and not prohibited by applicable law, rule or regulation, to inform you promptly thereof prior to disclosure and (ii) to use commercially reasonable efforts to ensure that any such information so disclosed is accorded confidential treatment), (c) to the extent that such information becomes publicly available other than by reason of improper disclosure by such Commitment Party or any of its affiliates or any related parties thereto in violation of any confidentiality obligations owing to you, the Equity Investors, the Company or any of your or their respective subsidiaries or affiliates or related parties (including those set forth in this paragraph), as determined by a court of competent jurisdiction in a final and non-appealable decision, (d) to the extent that such information is received by such Commitment Party or any of its affiliates from a third party that is not, to such Commitment Party’s knowledge, subject to any contractual or fiduciary confidentiality obligations owing to you, the Equity Investors, the Company or any of your or their respective subsidiaries or affiliates or related parties, (e) to the extent that such information is independently developed by the Commitment Parties or any of their affiliates, (f) to such Commitment Party’s affiliates and to its and their respective directors, officers, employees, legal counsel, independent auditors, rating agencies, professionals and other experts or agents who need to know such information in connection with the Transactions and who are informed of the confidential nature of such information and are or have been advised of their obligation to keep information of this type confidential, (g) to its and its affiliates potential or prospective partners and lenders, other Investors, Lenders, participants or assignees and to any direct or indirect contractual counterparty to any loan, swap or derivative transaction relating to you or any of your subsidiaries, in each case who agree to be bound by the terms of this paragraph (or language substantially similar to this paragraph); provided that the disclosure of any such information to any partners, lender, Investors, Lenders or prospective Lenders or participants or prospective participants referred to above shall be made subject to the acknowledgment and acceptance by such person that such information is being disseminated on a confidential basis (on substantially the terms set forth in this paragraph or as is otherwise reasonably acceptable to you and each Commitment Party, including, without limitation, as agreed in any information materials or other marketing materials) in accordance with the standard processes of such Commitment Party or customary market standards for dissemination of such type of information, (h) to the extent you shall have consented to such disclosure in writing (such consent not to be unreasonably withheld, conditioned or delayed) or (i) for purposes of enforcing its rights hereunder in any legal proceedings and for purposes of establishing a defense in any legal proceedings. The Commitment Parties’ and their affiliates’, if any, obligations under this paragraph shall terminate automatically and be superseded by the confidentiality provisions in the Facility Documentation upon the initial funding thereunder. Otherwise, the confidentiality provisions set forth in this paragraph shall survive the termination of this Commitment Letter and expire and shall be of no further effect after the first anniversary of the date hereof.

7

9. Miscellaneous.

This Commitment Letter and the commitments hereunder shall not be assignable by any party hereto without the prior written consent of each other party hereto (and any attempted assignment without such consent shall be null and void). This Commitment Letter and the commitments hereunder are intended to be solely for the benefit of the parties hereto (and Commitment Parties’ Indemnified Persons) and are not intended to confer any benefits upon, or create any rights in favor of, any person other than the parties hereto (and such Indemnified Persons to the extent expressly set forth herein). The Commitment Parties reserve the right to employ the services of their affiliates or branches in providing services contemplated hereby, and to allocate, in whole or in part, to their affiliates or branches certain fees payable to the Commitment Parties in such manner as the Commitment Parties and their affiliates or branches may agree in their sole discretion and, to the extent so employed, such affiliates and branches shall be entitled to the benefits and protections afforded to, and subject to the provisions governing the conduct of, the Commitment Parties hereunder. This Commitment Letter may not be amended or any provision hereof waived or modified except by an instrument in writing signed by each of the Commitment Parties and you. This Commitment Letter may be executed in any number of counterparts, each of which shall be deemed an original and all of which, when taken together, shall constitute one agreement. Delivery of an executed counterpart of a signature page of this Commitment Letter by facsimile transmission or other electronic transmission (including a “pdf” or “tif”) or any electronic signature complying with the U.S. federal ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law. This Commitment Letter (including the exhibits hereto), (i) are the only agreements that have been entered into among the parties hereto with respect to the Credit Facility and (ii) supersede all prior and/or contemporaneous understandings, whether written or oral, among us with respect to the Credit Facility and sets forth the entire understanding of the parties hereto with respect thereto, including any prior commitment letter(s) with respect to the Credit Facility by, between or among the parties hereto. THIS COMMITMENT LETTER, AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER, OR RELATED TO, THIS COMMITMENT LETTER SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT REFERENCE TO CHOICE OF LAW PRINCIPLES THEREOF OTHER THAN SECTION 5-1401 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK; provided, that, the interpretation of the definition of Company Material Adverse Effect and Parent Material Adverse Effect (as such terms are defined in Exhibit C hereto) and whether or not a Company Material Adverse Effect or a Parent Material Adverse Effect has occurred), shall, in each case, be governed by, and construed and interpreted in accordance with, the laws of the State of Delaware, without giving effect to the principles of conflicts of law thereof.

Any Commitment Party or any of their respective affiliates, may, in consultation with you, place customary advertisements, or provide customary notifications, in financial and other newspapers and periodicals (including league tables) or on a home page or similar place for dissemination of customary information on the Internet or worldwide web as it may choose, and circulate similar promotional materials, in each case, after the Closing Date, in the form of “tombstone” or otherwise describing the name of the Borrower, the Company or other obligor under the Credit Facility, and the amount, type and closing date of the Transactions, all at the expense of the applicable Commitment Party.

Each of the parties hereto agrees that this Commitment Letter is a binding and enforceable agreement (subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization and other similar laws relating to or affecting creditors' rights generally and general principles of equity (whether considered in a proceeding in equity or law)) with respect to the subject matter contained herein (it being acknowledged and agreed that the commitments provided hereunder (and which are to be available and/or funded on the Closing Date) are subject to the satisfaction (or written waiver by the Commitment Parties) of the conditions set forth or referenced in the section entitled “Conditions Precedent to Initial Borrowing” in Exhibit C hereto). Promptly following the execution of this Commitment Letter, the parties hereto shall proceed with the negotiation in good faith of the Facility Documentation for purposes of executing and delivering the Facility Documentation substantially simultaneously with the consummation of the transactions described in the Transaction Description.

EACH OF THE PARTIES HERETO IRREVOCABLY WAIVES THE RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM BROUGHT BY OR ON BEHALF OF ANY PARTY RELATED TO OR ARISING OUT OF THE ACQUISITION, THE TRANSACTIONS, THIS COMMITMENT LETTER OR THE PERFORMANCE OF SERVICES HEREUNDER OR THEREUNDER.

8

Each of the parties hereto hereby irrevocably and unconditionally (a) submits, for itself and its property, to the exclusive jurisdiction of any New York State court or Federal court of the United States of America, in each case, sitting in New York County in the State of New York, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Commitment Letter or the transactions contemplated hereby or thereby, or for recognition or enforcement of any judgment, and agrees that all claims in respect of any such action or proceeding shall only be heard and determined in such New York State court or, to the extent permitted by law, in such Federal court; provided that suit for the recognition or enforcement of any judgment obtained in any such New York State or federal court may be brought in any other court of competent jurisdiction, (b) waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Commitment Letter or the transactions contemplated hereby or thereby in any such New York State court or in any such Federal court, (c) waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court and (d) agrees that a final judgment in any such suit, action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Each of the parties hereto agrees that service of process, summons, notice or document by registered mail addressed to you or us at the addresses set forth above shall be effective service of process for any suit, action or proceeding brought in any such court.

We hereby notify you that pursuant to the requirements of the USA PATRIOT Act (Title III of Pub. L. 107-56 (signed into law October 26, 2001) (the “PATRIOT Act”) and 31 C.F.R. § 1010.230 (as amended, the “Beneficial Ownership Regulation”), each of us and each of the Lenders (as defined in the Term Sheet) may be required to obtain, verify and record information that identifies the Borrower, the Company and their respective subsidiaries, which information may include their names, addresses, tax identification numbers and other information that will allow each of us and the Lenders to identify the Borrower, the Company and their respective subsidiaries in accordance with the PATRIOT Act and the Beneficial Ownership Regulation. This notice is given in accordance with the requirements of the PATRIOT Act and the Beneficial Ownership Regulation and is effective for each of us and the Lenders. You hereby agree that the Commitment Parties shall be permitted to share any and all such information with the Lenders.

The indemnification, compensation (if applicable), reimbursement (if applicable), jurisdiction, information, governing law, sharing of information, absence of fiduciary relationships, affiliate activities, service of process, venue, waiver of jury trial and confidentiality provisions contained herein shall remain in full force and effect regardless of whether the Facility Documentation shall be executed and delivered and notwithstanding the termination or expiration of this Commitment Letter or the Commitment Parties’ commitments hereunder; provided that your obligations under this Commitment Letter (other than your obligations with respect to (a) compensation (if applicable) and (b) confidentiality of the Term Sheet and the contents thereof) shall automatically terminate and be superseded by the provisions of the Facility Documentation upon the initial funding thereunder, and you shall automatically be released from obligations in connection therewith at such time (provided that nothing in this sentence shall operate to release you from liabilities in connection with a breach of the terms of the Commitment Letter or the Exclusivity and Reimbursement Letter prior to the Closing Date). You may terminate this Commitment Letter at any time subject to the provisions of the preceding sentence.

Section headings used herein are for convenience of reference only and are not to affect the construction of, or to be taken into consideration in interpreting, this Commitment Letter.

9

If the foregoing correctly sets forth our agreement, please indicate your acceptance of the terms of this Commitment Letter by returning to us, executed counterparts hereof not later than 11:59 p.m., New York City time, on October 31, 2023. The Commitment Parties’ commitments and the obligations of Fortress in its capacity as an Administrative Agent hereunder will expire automatically and without further action or notice and without further obligation to you at such time in the event that the Commitment Parties have not received such executed counterparts in accordance with the immediately preceding sentence. If you do so execute and deliver to us this Commitment Letter, we agree, subject to the terms of the Exclusivity and Reimbursement Letter, to hold our commitment available for you until the earliest of (i) after execution of this Commitment Letter and prior to the consummation of the Transactions, the date on which an irrevocable written notice from you to the Commitment Parties is received by the Commitment Parties notifying the Commitment Parties that you desire to terminate the commitments hereunder, (ii) after execution of the Acquisition Agreement and prior to the consummation of the Transactions, the termination of the Acquisition Agreement in accordance with its terms, (iii) the consummation of the Transactions described in the Transaction Description without the funding of the Credit Facility and (iv) the first business day following the Termination Date (as defined in the Acquisition Agreement on the date hereof), upon which time this Commitment Letter and the commitments of the Commitment Parties hereunder and the agreement of the Commitment Parties to provide the services described herein to provide the services described herein shall terminate automatically and without further action or notice and without further obligation to you unless the Commitment Parties shall, in their sole discretion, agree to an extension in writing.

[THE REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

10

We are pleased to have been given the opportunity to assist you in connection with the financing for the Transactions.

| Very truly yours, | ||

| FORTRESS CREDIT CORP., | ||

| for itself and/or as Administrative Agent on behalf of one or more of its affiliates or assignees | ||

| By: | ||

| Name: | ||

| Title: | ||

Signature Page to Commitment Letter

| AGREED AND ACCEPTED | |||

| AS OF THE DATE FIRST WRITTEN ABOVE | |||

| RUCKUS ENERGY HOLDINGS, LLC | |||

| By | |||

| Name: | Ariella Fuchs | ||

| Title: | President and GC | ||

Signature Page to Commitment Letter

EXHIBIT A

Transaction Description

Capitalized terms used but not defined in this Exhibit A shall have the meanings set forth in the other Exhibits to the Commitment Letter to which this Exhibit A is attached or in the Commitment Letter. In the case of any such capitalized term that is subject to multiple and differing definitions, the appropriate meaning thereof in this Exhibit A shall be determined by reference to the context in which it is used.

Fury Resources, Inc. (“Parent”), directly controlled by Ruckus, intends to acquire the Company, all as set forth in the Acquisition Agreement (as defined below). In connection therewith:

(a) Parent, San Jacinto Merger Sub, Inc. (“Merger Sub”) and the Company will enter into that certain Agreement and Plan of Merger, dated as of the date hereof (together with the exhibits, annexes and disclosure schedules thereto, the “Acquisition Agreement”), by and among, inter alios, Parent, Merger Sub and the Company, pursuant to which, among other things, Merger Sub will merge with and into the Company, with the Company as the surviving entity (the “Acquisition”);

(b) following the date hereof and on or prior to the Closing Date, the investors, which may include members of management of Ruckus, the Company and certain other direct or indirect existing equity holders of the Company (collectively, the “Equity Investors”) will make or shall have made cash or rollover equity contributions (collectively, the “Equity Contribution”), directly or indirectly, to Parent, in the form of common equity, qualified preferred equity or other equity (such preferred and other equity, to be on terms reasonably satisfactory to the Commitment Parties) (collectively, the “Permitted Equity”);

(c) the Borrower will obtain a senior secured first lien term loan facility in the aggregate principal amount of $200 million (the “Credit Facility”);

(d) all existing third party debt for borrowed money of the Borrower under that certain Amended and Restated Credit Agreement, dated as of November 24, 2021 (as amended, restated, amended and restated, supplemented and/or otherwise modified from time to time), by and among the Borrower, as borrower, the Company, the lenders party thereto from time to time (the “Existing Lenders”) and Macquarie Bank Limited, as administrative agent for the Existing Lenders, will be repaid, redeemed, defeased, discharged, refinanced, replaced or terminated and all commitments to extend credit thereunder shall have been terminated, and all guarantees and security interests (if any), in each case, in respect thereof terminated and discharged substantially concurrently with the initial funding of the Credit Facility (or other arrangements for such termination and release reasonably satisfactory to Fortress shall have been made) (the “Refinancing”);

(e) the fees, premiums, expenses and other transaction costs incurred in connection with the Transactions, including to fund any original issue discount and/or upfront fees (the “Transaction Costs”), will be paid; and

(f) the proceeds of the Equity Contribution and the loans under the Credit Facility funded on the Closing Date will be used to pay the consideration for, and other amounts owing in connection with, the Acquisition under the Acquisition Agreement, to effect the Refinancing and to pay all or a portion of the Transaction Costs.

The transactions described above are collectively referred to herein as the “Transactions”.

A-1

EXHIBIT B

(See attached Exclusivity and Reimbursement Letter)

B-1

EXHIBIT C

Conditions Precedent to Initial Borrowing

Capitalized terms used but not defined in this Exhibit C shall have the meanings set forth in the other Exhibits to the Commitment Letter to which this Exhibit C is attached or in the Commitment Letter. In the case of any such capitalized term that is subject to multiple and differing definitions, the appropriate meaning thereof in this Exhibit C shall be determined by reference to the context in which it is used. The initial borrowing under the Credit Facility shall be subject only to the satisfaction (or waiver by the Commitment Parties in writing) of the following conditions in the reasonable discretion of the Commitment Parties:

| 1. | Since the date of the Acquisition Agreement, no Company Material Adverse Effect nor Parent Material Adverse Effect (as such terms are defined in the Acquisition Agreement) shall have occurred and be continuing. |

| 2. | The Acquisition shall have been consummated, or substantially simultaneously with the initial borrowing under the Credit Facility, shall be consummated, in accordance with the terms of the Acquisition Agreement, after giving effect to any modifications, amendments, consents or waivers thereto, other than those modifications, amendments, consents or waivers that are materially adverse to the interests of the Commitment Parties (in their capacities as such), unless consented to in advance in writing by the Commitment Parties (such consent not to be unreasonably withheld, delayed or conditioned) provided that the Commitment Parties shall be deemed to have consented to such modifications, amendments, consents or waivers unless it has objected thereto within four (4) business days after written notice to and receipt by the Commitment Parties of such modifications, amendments, consents or waivers). |

| 3. | Substantially simultaneously with the initial borrowing under the Credit Facility, the Preferred Stock Transactions shall have been consummated on the terms set forth in the Purchase Agreement and the Contribution Agreement. |

| 4. | Substantially simultaneously with the initial borrowing under the Credit Facility, the Refinancing shall have been consummated. |

| 5. | Fortress shall have received evidence satisfactory to it, in its reasonable discretion, that (a) the other participating Lenders (which, for the avoidance of doubt, may include any other Investor party to the Exclusivity and Reimbursement Letter) and/or (b) such other alternative financing sources identified by Ruckus and reasonably acceptable to Fortress and pursuant to documentation reasonably acceptable to Fortress, shall collectively be obligated to fund on the Closing Date an amount not less than the portion of the Credit Facility amount (after giving effect to any reductions contemplated by the Commitment Letter) that Fortress has not committed (or otherwise agreed in writing) to fund. |

| 6. | Fortress shall have received (a) the reviewed balance sheet of the Company as of December 31, 2022, and the related reviewed statement of income and retained earnings and statement of cash flow for the fiscal years then ended, together with the notes thereto and (b) the internally prepared balance sheet, of the Company as of the most recent reported month before close. |

| 7. | Fortress shall have received a pro forma consolidated balance sheet of the Company and the Borrower as of the twelve-month period ending on the last day of the most recently completed four fiscal quarter period for which financial statements are available pursuant to paragraph 5 above, prepared after giving effect to the Transactions as if the Transactions had occurred as of such date which need not be prepared in compliance with Regulation S-X of the Securities Act of 1933, as amended, or include adjustments for purchase accounting (including adjustments of the type contemplated by Financial Accounting Standards Board Accounting Standards Codification 805, Business Combinations (formerly SFAS 141R)). |

C-1

EXHIBIT C

| 8. | Subject in all respects to the Certain Funds Provisions, all documents and instruments (including schedules to security documentation) required to create and perfect the Administrative Agent’s security interests in the collateral described in the Term Sheet (with the requisite priority) shall have been executed and delivered by the Borrower and the Guarantors (or, where applicable, the Borrower and the Guarantors shall have authorized the filing of financing statements under the Uniform Commercial Code) and, if applicable, be in proper form for filing. |

| 9. | The Administrative Agent and the Lenders (as defined in the Term Sheet) shall have received at least three (3) business days prior to the Closing Date (a) all documentation and other information about the Loan Parties (as defined in the Term Sheet) and the principals thereof as has been reasonably requested in writing at least ten (10) days prior to the Closing Date by the Administrative Agent or any Lender that they reasonably determine is required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including without limitation the PATRIOT Act and (b) if the Borrower qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, a Beneficial Ownership Certification (as defined below) in relation to the Borrower. “Beneficial Ownership Certification” means a certificate regarding beneficial ownership required by the Beneficial Ownership Regulation. |

| 10. | (a) The execution and delivery of the Facility Documentation by the Loan Parties (including guarantees by the applicable Guarantors) which shall, in each case, be in accordance with the terms of the Commitment Letter and the Term Sheet and subject to the Certain Funds Provisions and (b) the delivery to the Administrative Agent of borrowing notices and/or issuance notices, as applicable, customary legal opinions, customary incumbency certificates and closing certificates, organizational documents, customary evidence of authorization and, as applicable, good standing certificates in jurisdictions of formation/organization, in each case with respect to the Borrower and the Guarantors and a solvency certificate of the Borrower, as of the Closing Date after and giving effect to the Transactions. The term “Facility Documentation” shall mean the documentation for the Credit Facility containing the terms and conditions in this Exhibit C and in the Term Sheet and, to the extent any terms are not so set forth, shall otherwise by usual and customary for transactions of this kind and shall contain such modifications as the Borrower, the Administrative Agent and the Lenders shall mutually agree, in each case, subject to the Certain Funds Provisions. |

| 11. | The Administrative Agent and each Lender shall have received evidence in form and substance satisfactory to them that all fees required to be paid on the Closing Date pursuant to the Term Sheet and the Facility Documentation, and reasonable out-of-pocket expenses required to be paid on the Closing Date pursuant to the Commitment Letter and the Facility Documentation, to the extent invoiced at least two (2) business days prior to the Closing Date (except for fees pursuant to the Term Sheet and as otherwise reasonably agreed by the Borrower), shall, upon the initial borrowing under the Credit Facility, have been, or will be substantially simultaneously, paid (which amounts may be offset against the proceeds of the Credit Facility). |

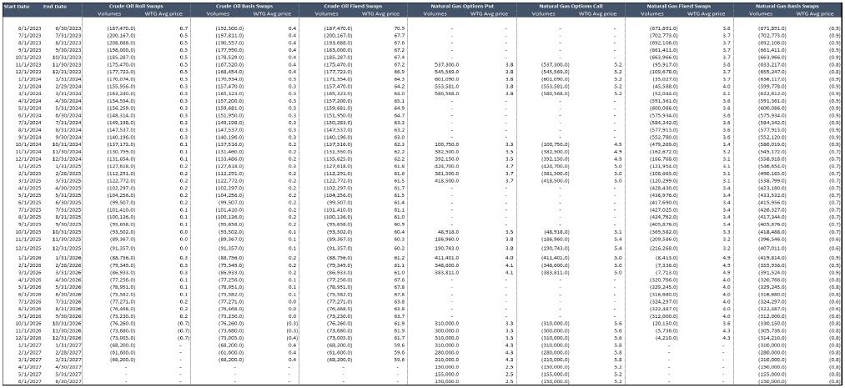

| 12. | The Administrative Agent shall have received evidence in form and substance reasonably satisfactory to it that (a) the commodity hedging transactions set forth on Schedule 1 attached hereto (collectively, the “Existing Hedges” and each, individually, an “Existing Hedge”) are in full force and effect on the Closing Date after giving effect to the closing of the Transactions on the Closing Date; provided, that (i) any novation of any Existing Hedge or replacement of an Existing Hedge, in each case with written notice to Administrative Agent, with a new hedge on substantially the same or better terms (e.g., price, tenor, type, volumes) than the Existing Hedge being novated or otherwise replaced, in each case shall not be treated as a termination of such Existing Hedge and such Existing Hedge shall be deemed to continue to be in full force and effect after giving effect to such novation or replacement, (ii) any modification of an Existing Hedge, with not less than three (3) Business Days’ prior written notice to, and the prior written consent of, Administrative Agent, shall be permitted and such modified hedge shall continue to be deemed to be the applicable Existing Hedge, and (iii) any Existing Hedge having an “End Date” listed on Schedule 1 that occurs on or prior to the Closing Date shall not be required to be in full force and effect on the Closing Date. |

C-2

EXHIBIT C

| 13. | Avi Mirman shall (a) have contributed up to $10 million of the $200 million of common equity and (b) hold (or have the right to appoint) no more than one (1) board seat on the board of directors (the “Board”) for the Company (which Board shall be composed of not less than five (5) seats), while Rich Little will lead management for the Holdings and the Borrower. For the avoidance of doubt, the Board shall contain not less than two (2) board seats appointed by independent investors in the Company. |

| 14. | On the Closing Date, the Administrative Agent shall have received evidence in form and substance satisfactory to it that the Borrower has, in an aggregate amount greater than or equal to $95 million, consisting of (a) funded capital expenditures to drill and complete two (2) oil and/or gas wells located in the Monument Draw area of the Delaware Basin and spudded during the period time beginning on the date of the Commitment Letter and ending on the Closing Date and (b) not less than $70 million of unrestricted cash is on its balance sheet. |

| 15. | The Closing Date shall not occur prior to the Closing Date (as defined in the Acquisition Agreement). |

C-3

EXHIBIT C

Schedule 1 to Exhibit C

Existing Hedges

C-4

EXHIBIT C

C-5