- BATL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

Battalion Oil (BATL) SC 13E3Going private transaction

Filed: 12 Jan 24, 4:23pm

Exhibit 99.(c)(iii)

Project San Jacinto SUPPLEMENTAL SCHEDULES FOR THE BOARD OF DIRECTORS OF BATTALION OIL CORPORATION DECEMBER 14, 2023 | CONFIDENTIAL

CONFIDENTIAL Table of Contents 2 Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

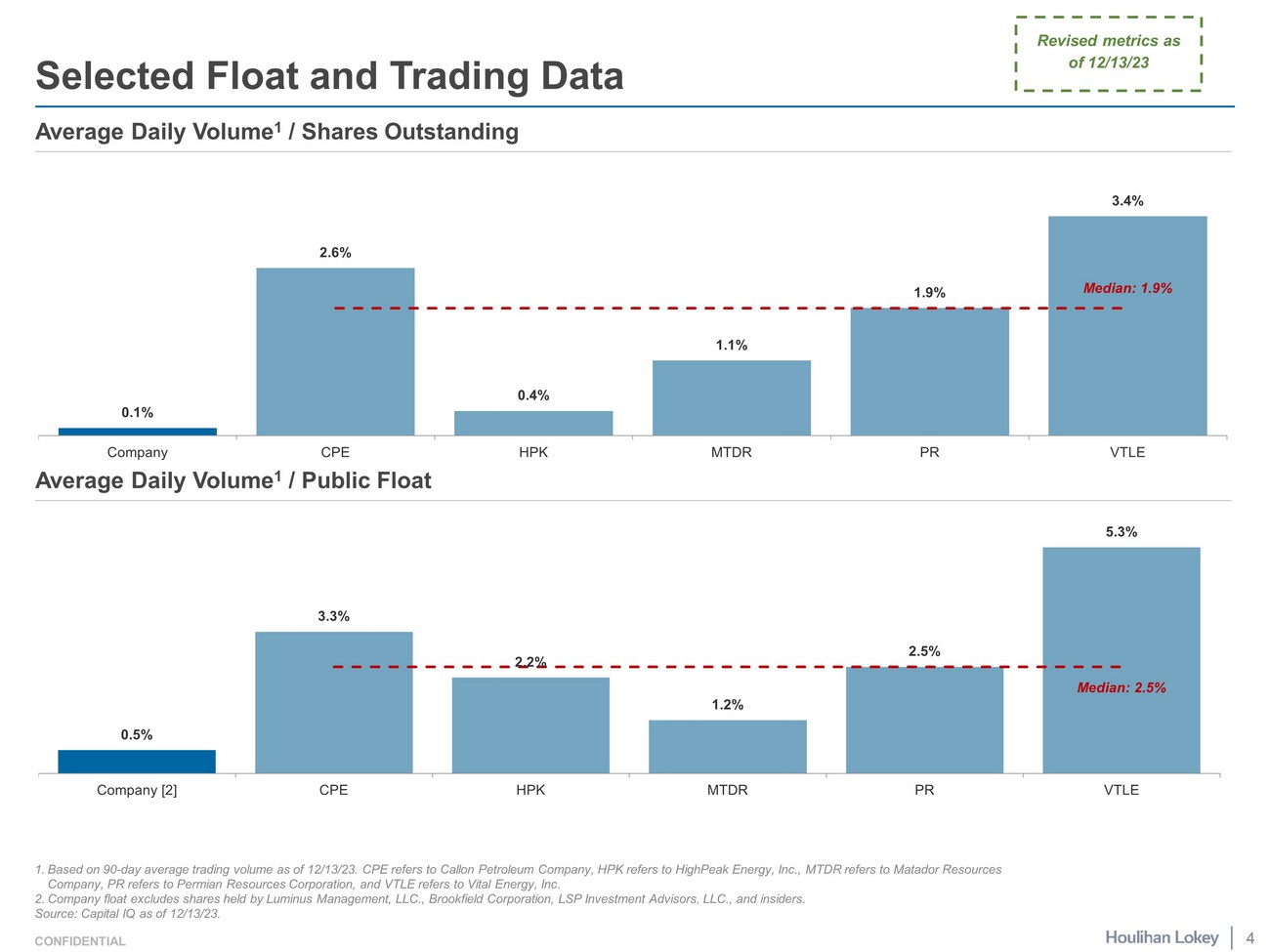

CONFIDENTIAL Selected Float and Trading Data Average Daily Volume 1 / Shares Outstanding Average Daily Volume 1 / Public Float 1. Based on 90 - day average trading volume as of 12/13/23. CPE refers to Callon Petroleum Company, HPK refers to HighPeak Energy, Inc., MTDR refers to Matador Resources Company, PR refers to Permian Resources Corporation, and VTLE refers to Vital Energy, Inc. 2. Company float excludes shares held by Luminus Management, LLC., Brookfield Corporation, LSP Investment Advisors, LLC., and insiders. Source: Capital IQ as of 12/13/23. 4 Revised metrics as of 12/13/23 0.1% 2.6% 0.4% 1.1% 1.9% 3.4% Median: 1.9% Company CPE HPK MTDR PR VTLE 0.5% 3.3% 2.2% 1.2% 2.5% 5.3% Median: 2.5% Company [2] CPE HPK MTDR PR VTLE

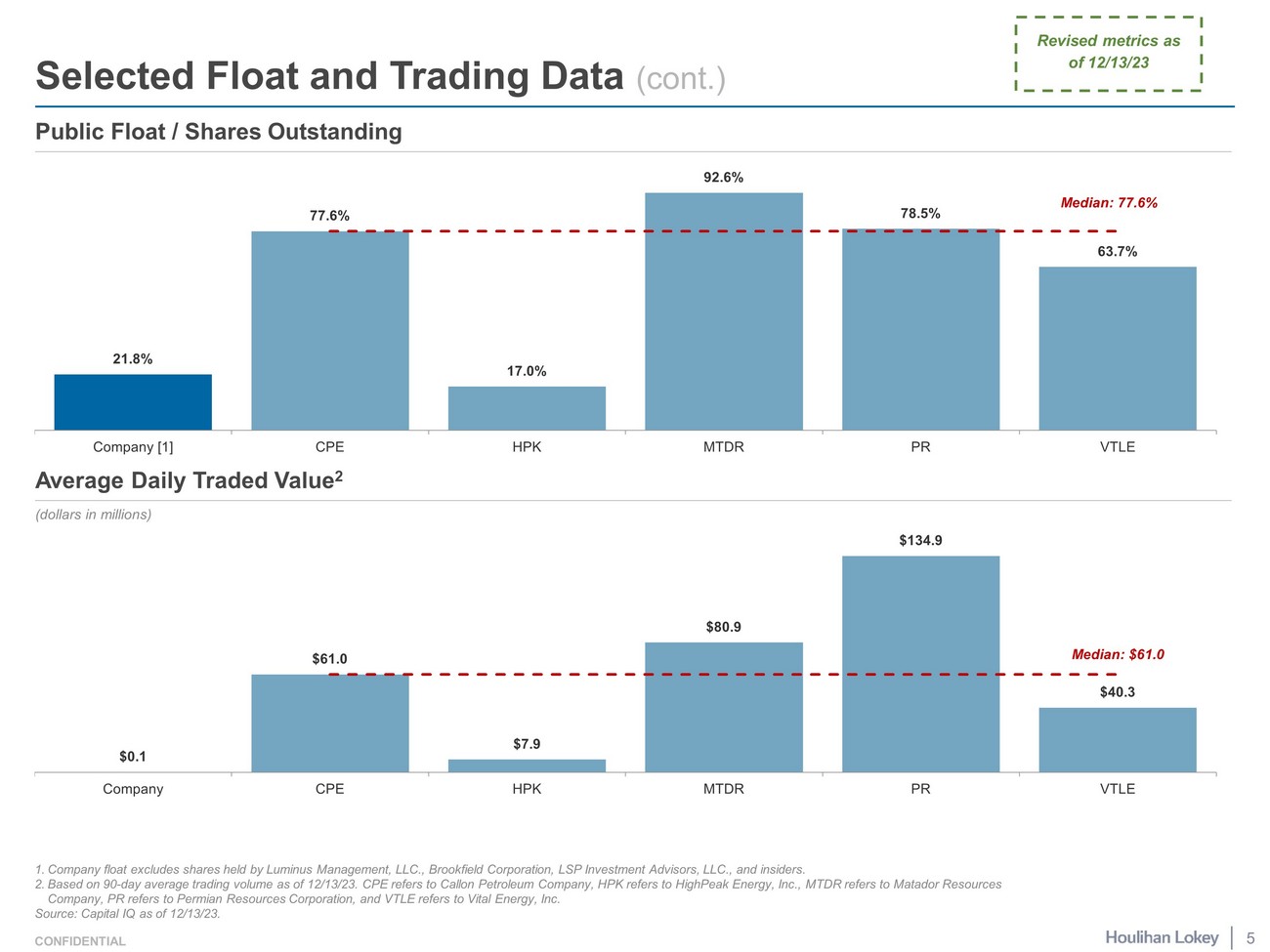

CONFIDENTIAL Selected Float and Trading Data (cont.) Public Float / Shares Outstanding Average Daily Traded Value 2 (dollars in millions) 1. Company float excludes shares held by Luminus Management, LLC., Brookfield Corporation, LSP Investment Advisors, LLC., and insiders. 2. Based on 90 - day average trading volume as of 12/13/23. CPE refers to Callon Petroleum Company, HPK refers to HighPeak Energy, Inc., MTDR refers to Matador Resources Company, PR refers to Permian Resources Corporation, and VTLE refers to Vital Energy, Inc. Source: Capital IQ as of 12/13/23. 5 Revised metrics as of 12/13/23 $0.1 $61.0 $7.9 $80.9 $134.9 $40.3 Median: $61.0 Company CPE HPK MTDR PR VTLE 21.8% 77.6% 17.0% 92.6% 78.5% 63.7% Median: 77.6% Company [1] CPE HPK MTDR PR VTLE

CONFIDENTIAL If Preferred does not convert: If Preferred [1] converts: Common Stock Common Stock Holder Shares % Outstanding Shares % Outstanding Luminus Management, LLC 6.2 37.4% 10.5 42.6% Brookfield Corporation 4.0 24.2% 76.0% 6.1 24.8% 83.9% LSP Investment Advisors, LLC 2.4 14.4% 4.0 16.4% Goldman Sachs Group 0.6 3.8% 0.6 2.5% Lion Point Capital, LP 0.4 2.3% 0.4 1.6% Jefferies Financial Group Inc. 0.4 2.2% 0.4 1.5% The Vanguard Group, Inc. 0.3 1.7% 0.3 1.2% Loomis Sayles & Company, L.P. 0.3 1.7% 0.3 1.1% Current / Former Directors and Executive Officers 0.4 2.2% 0.4 1.5% Other 1.7 10.1% 1.7 6.7% Total 16.5 100.0% 24.5 100.0% Ownership Summary 16.5 million shares Note: Ownership represents data as of 12/13/23. 1. Conversion of Preferred would result in an implied 8.1 million shares on an as converted basis. Illustrative analysis assumes co nversion date of 12/14/23, PIK interest rate of 16.0%, and conversion price of $9.03 per share for Series A convertible equity issued prior to 9/6/23 and $7.63 for Incremental Seri es A convertible equity issued on 9/6/23. Sources: Capital IQ and public filings. (shares in millions) 24.5 million shares 6 Revised metrics as of 12/13/23 1) Luminus Management, LLC: 37.4% 2) Brookfield Corporation: 24.2% 3) LSP Investment Advisors, LLC: 14.4% 4) Goldman Sachs Group: 3.8% 5) Lion Point Capital, LP: 2.3% 6) Jefferies Financial Group Inc.: 2.2% 7) The Vanguard Group, Inc.: 1.7% 8) Loomis Sayles & Company, L.P.: 1.7% Current / Former Directors and Executive Officers: 2.2% Other: 10.1% 1) Luminus Management, LLC: 42.6% 2) Brookfield Corporation: 24.8% 3) LSP Investment Advisors, LLC: 16.4% 4) Goldman Sachs Group: 2.5% 5) Lion Point Capital, LP: 1.6% 6) Jefferies Financial Group Inc.: 1.5% 7) The Vanguard Group, Inc.: 1.2% 8) Loomis Sayles & Company, L.P.: 1.1% Current / Former Directors and Executive Officers: 1.5% Other: 6.7%

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

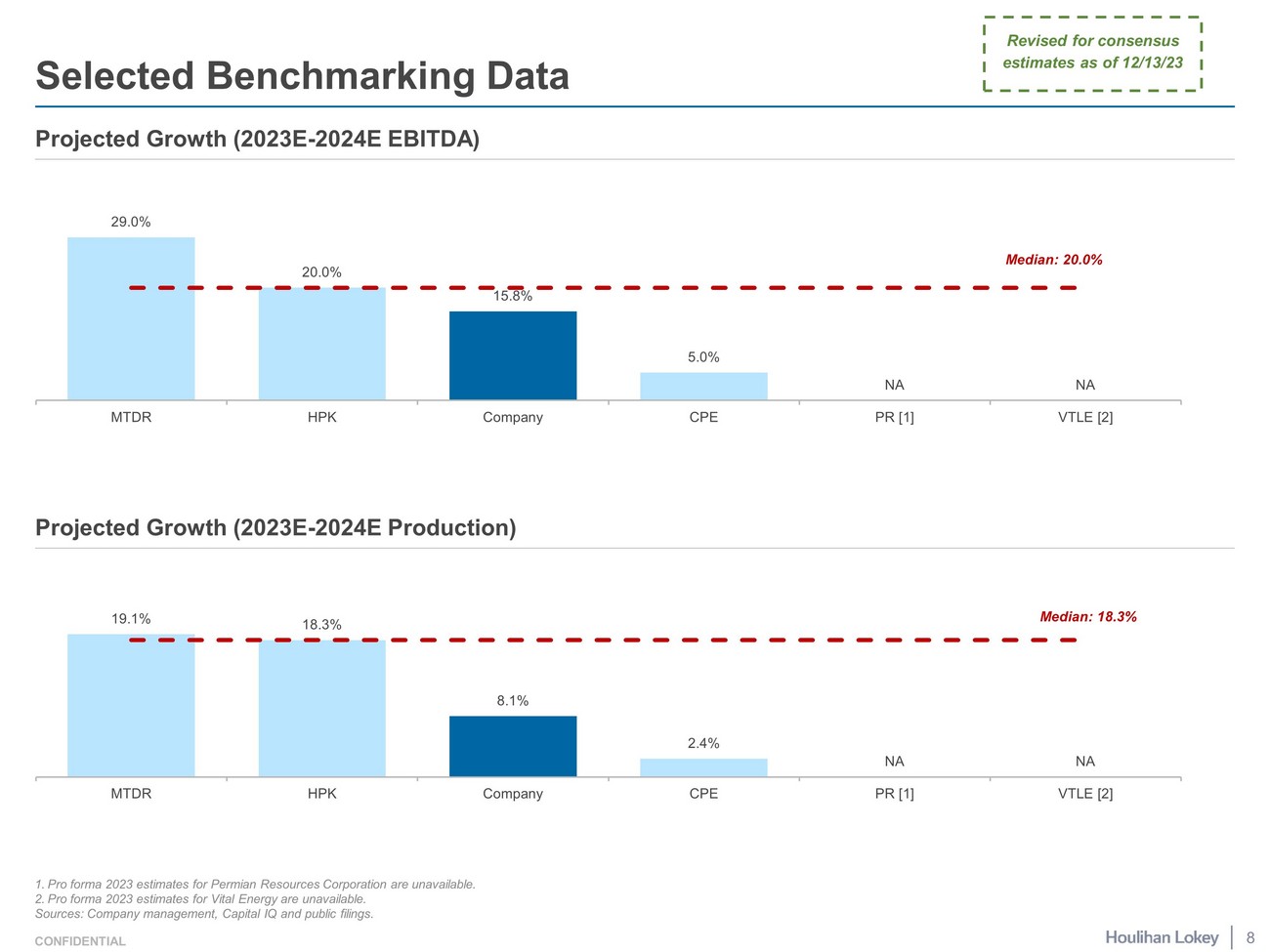

CONFIDENTIAL Selected Benchmarking Data Projected Growth (2023E - 2024E EBITDA) 1. Pro forma 2023 estimates for Permian Resources Corporation are unavailable. 2. Pro forma 2023 estimates for Vital Energy are unavailable. Sources: Company management, Capital IQ and public filings. Projected Growth (2023E - 2024E Production) 8 Revised for consensus estimates as of 12/13/23 29.0% 20.0% 15.8% 5.0% NA NA Median: 20.0% MTDR HPK Company CPE PR [1] VTLE [2] 19.1% 18.3% 8.1% 2.4% NA NA Median: 18.3% MTDR HPK Company CPE PR [1] VTLE [2]

CONFIDENTIAL Selected Benchmarking Data Projected Growth (2024E - 2025E EBITDA) 1. Shown pro forma for the Permian Earthstone Acquisition. 2. Shown pro forma for the Vital Acquisitions. Sources: Company management, Capital IQ and public filings. Projected Growth (2024E - 2025E Production) 9 Revised for consensus estimates as of 12/13/23 7.5% 7.3% 4.5% 4.3% 3.0% NA Median: 4.4% MTDR Company CPE VTLE [2] PR [1] HPK 7.4% 6.5% 4.2% 2.1% - 4.2% NA Median: 5.3% MTDR CPE PR [1] Company VTLE [2] HPK

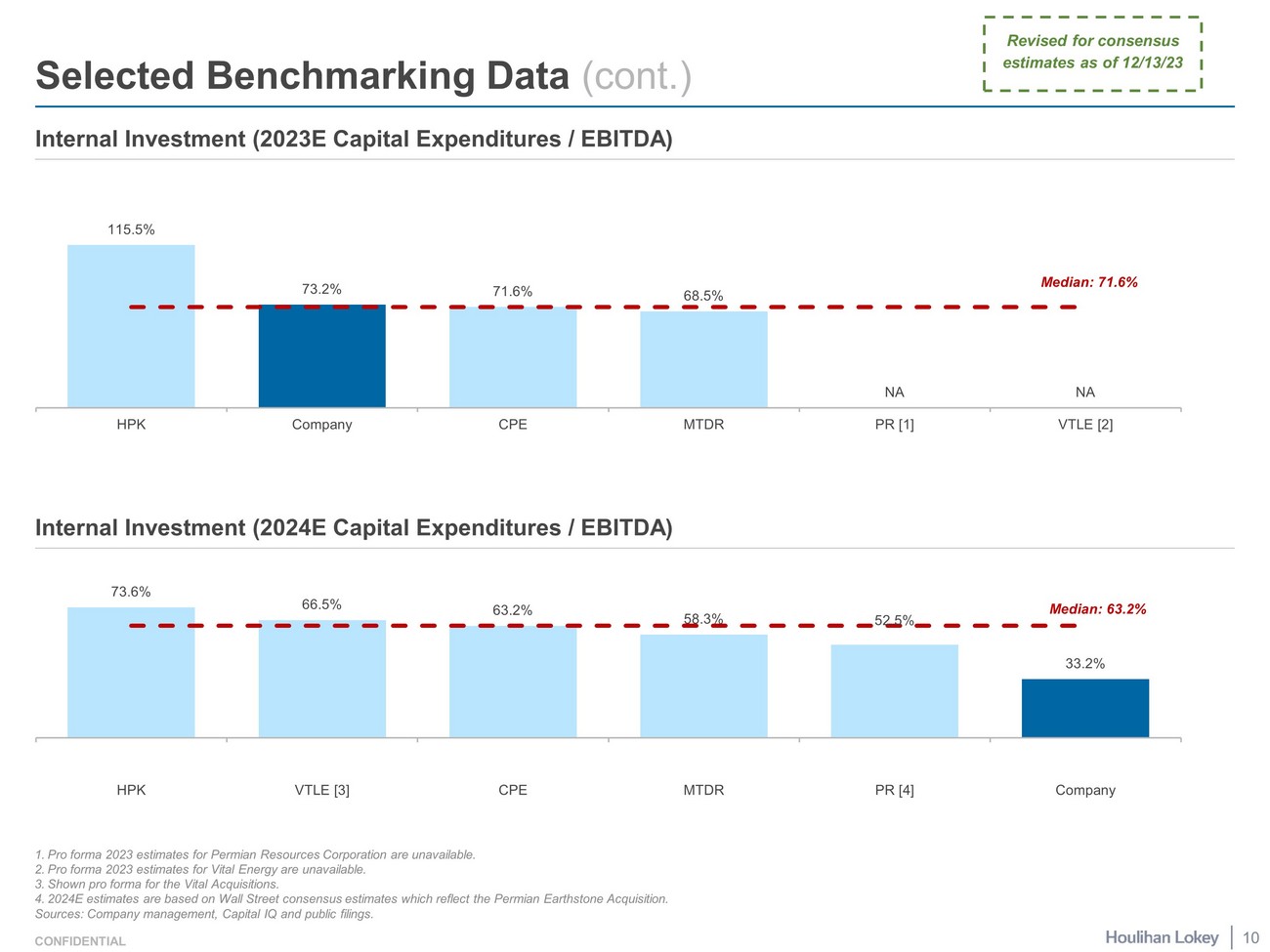

CONFIDENTIAL 73.6% 66.5% 63.2% 58.3% 52.5% 33.2% Median: 63.2% HPK VTLE [3] CPE MTDR PR [4] Company Selected Benchmarking Data (cont.) 81.6% 46.4% 22.2% 7.4% - 0.3% - 6.7% Median: 22.2% HPK PR MTDR VTLE CPE Company Internal Investment (2023E Capital Expenditures / EBITDA) Internal Investment (2024E Capital Expenditures / EBITDA) 1. Pro forma 2023 estimates for Permian Resources Corporation are unavailable. 2. Pro forma 2023 estimates for Vital Energy are unavailable. 3. Shown pro forma for the Vital Acquisitions. 4. 2024E estimates are based on Wall Street consensus estimates which reflect the Permian Earthstone Acquisition. Sources: Company management, Capital IQ and public filings. 10 Revised for consensus estimates as of 12/13/23 115.5% 73.2% 71.6% 68.5% NA NA Median: 71.6% HPK Company CPE MTDR PR [1] VTLE [2]

CONFIDENTIAL Selected Benchmarking Data (cont.) 1. Shown pro forma for the Permian Earthstone Acquisition. 2. Shown pro forma for the Vital Acquisitions. Source: public filings for period ending 12/31/22. 114.9% 72.3% 72.0% 70.2% 65.6% NA Median: 72.1% HPK MTDR CPE VTLE Company PR 2022 Proved Reserves 2022 PV - 10 11 1,035 627 480 359 123 92 Median: 480 PR [1] VTLE [2] CPE MTDR HPK Company $17,780 $10,404 $9,004 $6,983 $3,417 $1,462 Median: $9,004 PR [1] VTLE [2] CPE MTDR HPK Company

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

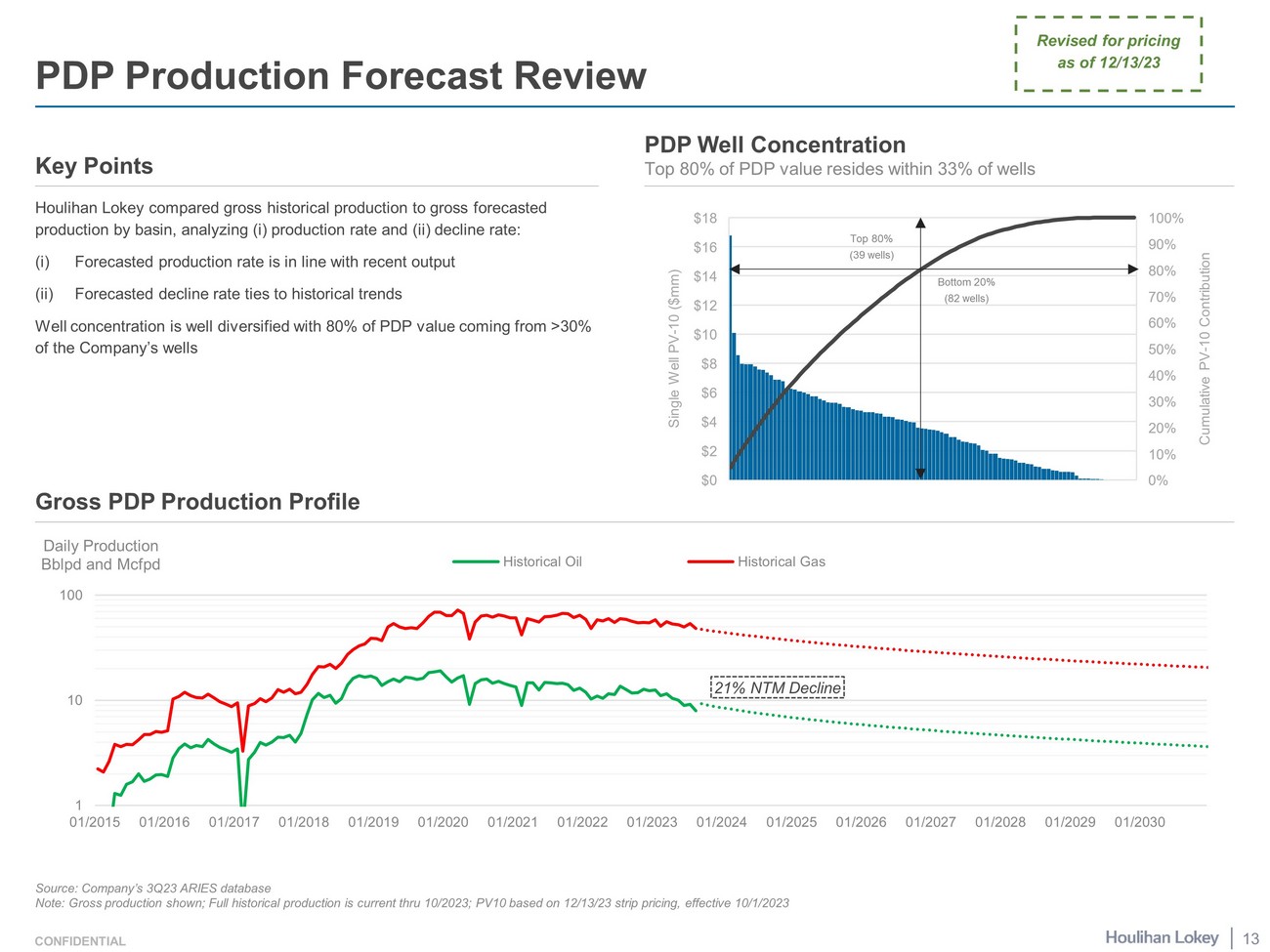

CONFIDENTIAL 1 10 100 01/2015 01/2016 01/2017 01/2018 01/2019 01/2020 01/2021 01/2022 01/2023 01/2024 01/2025 01/2026 01/2027 01/2028 01/2029 01/2030 Daily Production Bblpd and Mcfpd Historical Oil Historical Gas PDP Production Forecast Review Houlihan Lokey compared gross historical production to gross forecasted production by basin, analyzing ( i ) production rate and (ii) decline rate: (i) Forecasted production rate is in line with recent output (ii) Forecasted decline rate ties to historical trends Well concentration is well diversified with 80% of PDP value coming from >30% of the Company’s wells Source: Company’s 3Q23 ARIES database Note: Gross production shown; Full historical production is current thru 10/2023; PV10 based on 12/13/23 strip pricing, effec tiv e 10/1/2023 Top 80% (39 wells) Bottom 20% (82 wells) 21% NTM Decline Key Points Gross PDP Production Profile PDP Well Concentration Top 80% of PDP value resides within 33% of wells 13 Revised for pricing as of 12/13/23

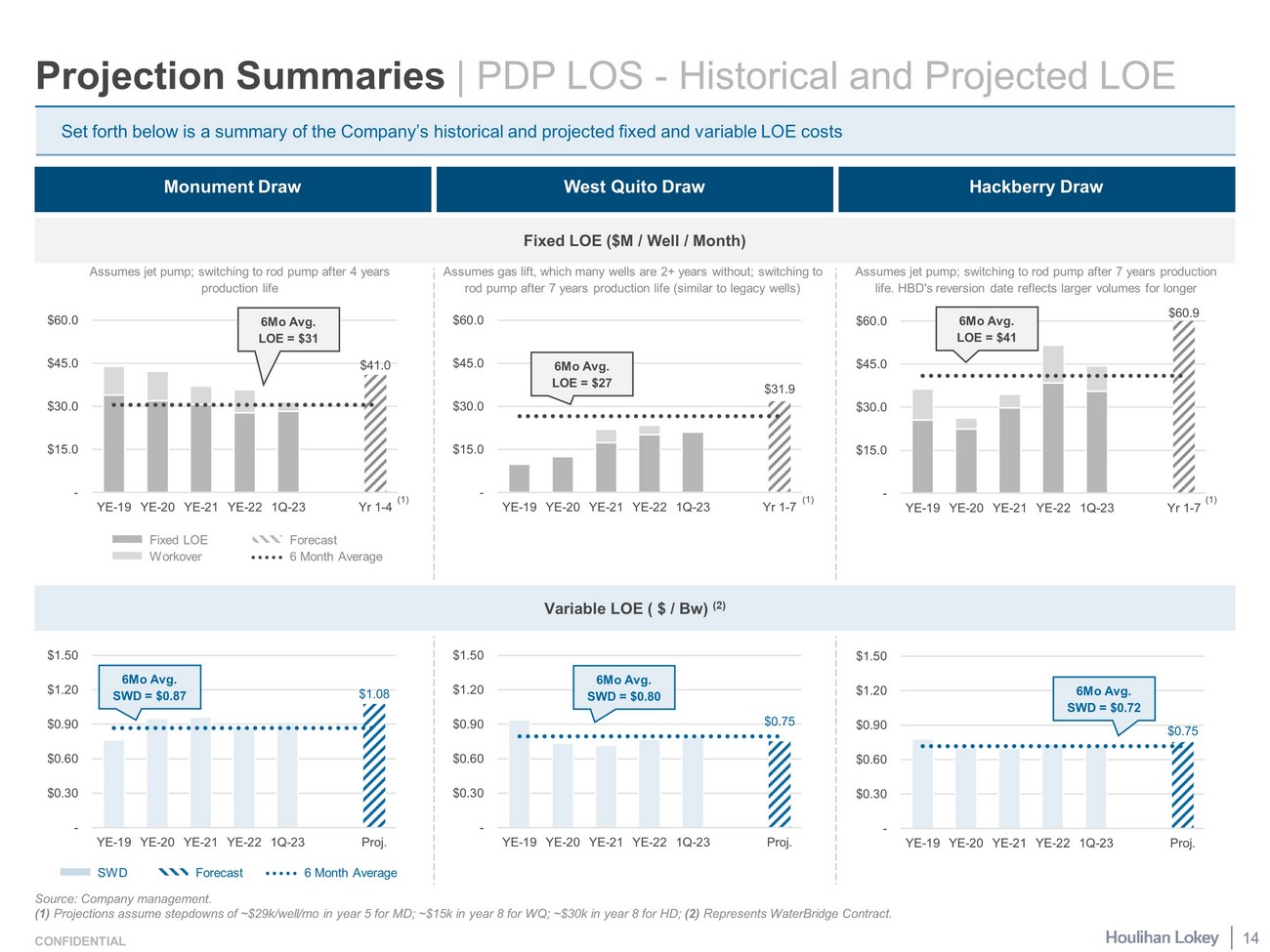

CONFIDENTIAL Monument Draw West Quito Draw Hackberry Draw Fixed LOE ($M / Well / Month) Variable LOE ( $ / Bw ) (2) $60.9 - $15.0 $30.0 $45.0 $60.0 YE-19 YE-20 YE-21 YE-22 1Q-23 Yr 1-7 $31.9 - $15.0 $30.0 $45.0 $60.0 YE-19 YE-20 YE-21 YE-22 1Q-23 Yr 1-7 $41.0 - $15.0 $30.0 $45.0 $60.0 YE-19 YE-20 YE-21 YE-22 1Q-23 Yr 1-4 $0.75 - $0.30 $0.60 $0.90 $1.20 $1.50 YE-19 YE-20 YE-21 YE-22 1Q-23 Proj. $0.75 - $0.30 $0.60 $0.90 $1.20 $1.50 YE-19 YE-20 YE-21 YE-22 1Q-23 Proj. $1.08 - $0.30 $0.60 $0.90 $1.20 $1.50 YE-19 YE-20 YE-21 YE-22 1Q-23 Proj. Projection Summaries | PDP LOS - Historical and Projected LOE Set forth below is a summary of the Company’s historical and projected fixed and variable LOE costs Assumes gas lift, which many wells are 2+ years without; switching to rod pump after 7 years production life (similar to legacy wells) Assumes jet pump; switching to rod pump after 4 years production life Assumes jet pump; switching to rod pump after 7 years production life. HBD's reversion date reflects larger volumes for longer SWD Forecast Fixed LOE Forecast Workover 6 Month Average 6Mo Avg. LOE = $27 6Mo Avg. LOE = $ 31 6Mo Avg. LOE = $41 6 Month Average 6Mo Avg. SWD = $0.87 6Mo Avg. SWD = $0.80 6Mo Avg. SWD = $0.72 Source: Company management. (1) Projections assume stepdowns of ~$29k/well/ mo in year 5 for MD; ~$15k in year 8 for WQ; ~$ 30 k in year 8 for HD; (2) Represents WaterBridge Contract. (1) (1) (1) 14

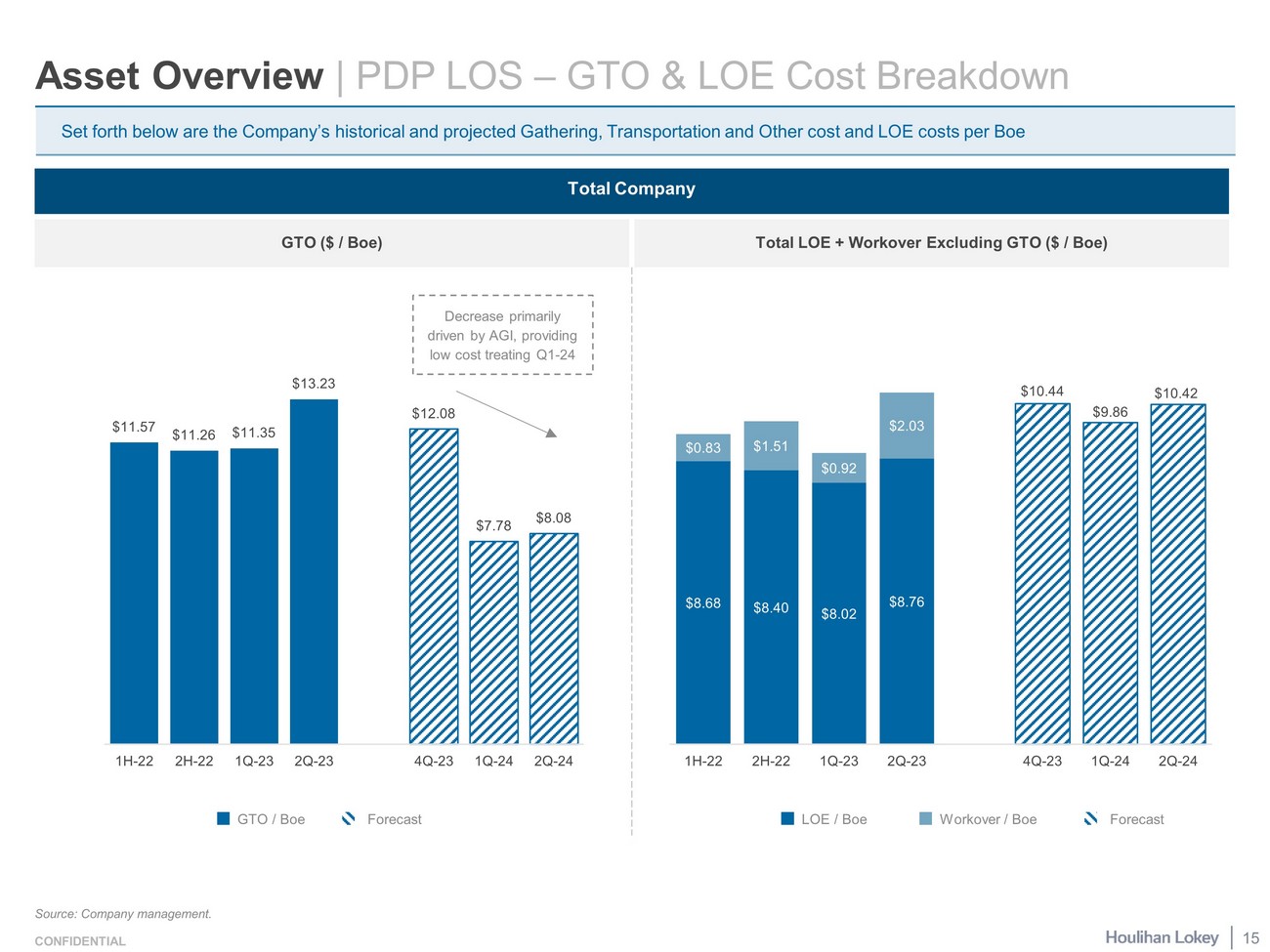

CONFIDENTIAL Total Company GTO ($ / Boe ) Total LOE + Workover Excluding GTO ($ / Boe ) $11.57 $11.26 $11.35 $13.23 $12.08 $7.78 $8.08 1H-22 2H-22 1Q-23 2Q-23 4Q-23 1Q-24 2Q-24 Asset Overview | PDP LOS – GTO & LOE Cost Breakdown Set forth below are the Company’s historical and projected Gathering, Transportation and Other cost and LOE costs per Boe Forecast GTO / Boe Source: Company management. LOE / Boe Forecast Workover / Boe Decrease primarily driven by AGI, providing low cost treating Q1 - 24 15 $8.68 $8.40 $8.02 $8.76 $0.83 $1.51 $0.92 $2.03 $10.44 $9.86 $10.42 1H-22 2H-22 1Q-23 2Q-23 4Q-23 1Q-24 2Q-24

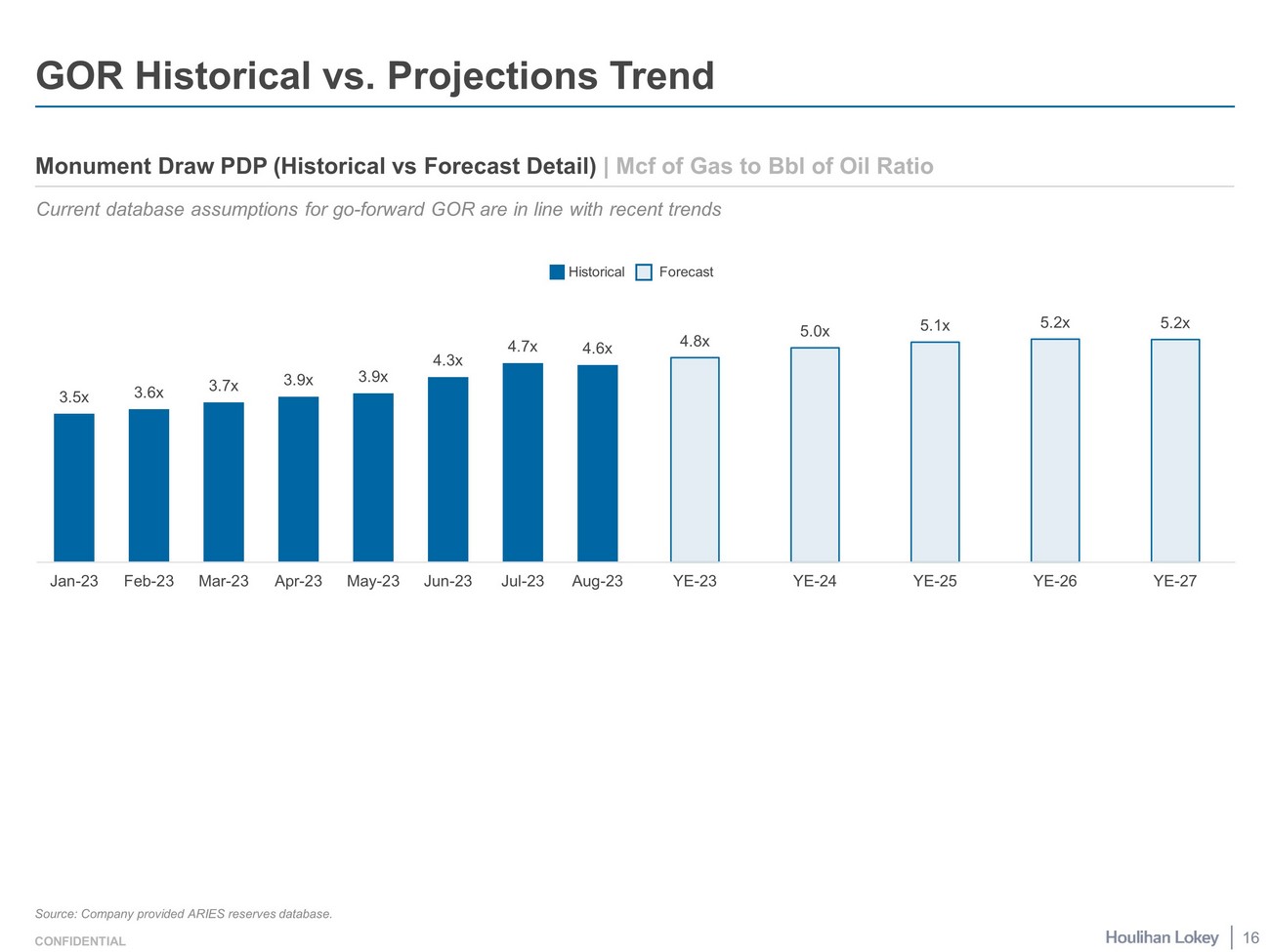

CONFIDENTIAL GOR Historical vs. Projections Trend Monument Draw PDP (Historical vs Forecast Detail) | Mcf of Gas to Bbl of Oil Ratio Source: Company provided ARIES reserves database. Current database assumptions for go - forward GOR are in line with recent trends 3.5x 3.6x 3.7x 3.9x 3.9x 4.3x 4.7x 4.6x Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 4.8x 5.0x 5.1x 5.2x 5.2x YE-23 YE-24 YE-25 YE-26 YE-27 Historical Forecast 16

CONFIDENTIAL LOE Historical vs. Projections Trend Source: Company provided ARIES reserves database. 1. Excludes July 2023 2. Excludes prior period workover adjustment Current database assumptions for go - forward LOE + Workover Expenses (Excluding GTO) are in line with the last 5 months LOE (Historical vs Forecast Detail) | $ / boe Historical LOE Forecast Historical Workover L5M Average (1) $8.62 $8.24 $7.22 $8.19 $9.03 $9.12 $8.32 $10.25 $0.61 $0.55 $1.55 $2.66 $1.14 $2.24 $1.59 $9.23 $8.79 $8.77 $10.85 $10.17 $11.36 $8.32 $11.83 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 (2) 17 $10.44 $10.64 $9.49 $8.52 $8.40 YE-23 YE-24 YE-25 YE-26 YE-27

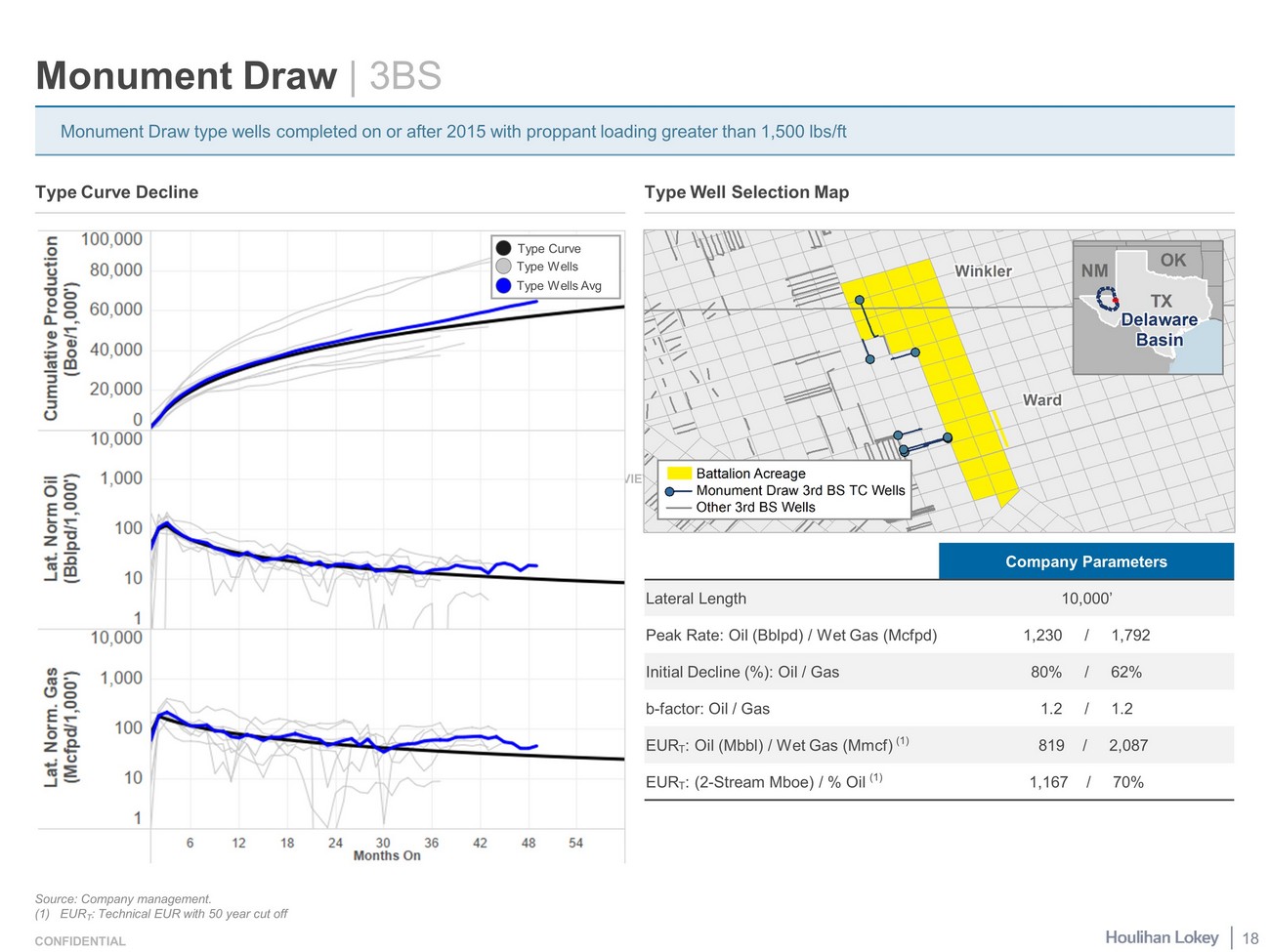

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Monument Draw | 3BS Type Well Selection Map Monument Draw type wells completed on or after 2015 with proppant loading greater than 1,500 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 1,230 / 1,792 Initial Decline (%): Oil / Gas 80% / 62% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 819 / 2,087 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,167 / 70% Type Curve BATL Type Wells Type Wells Avg Source: Company management. (1) EUR T : Technical EUR with 50 year cut off 18

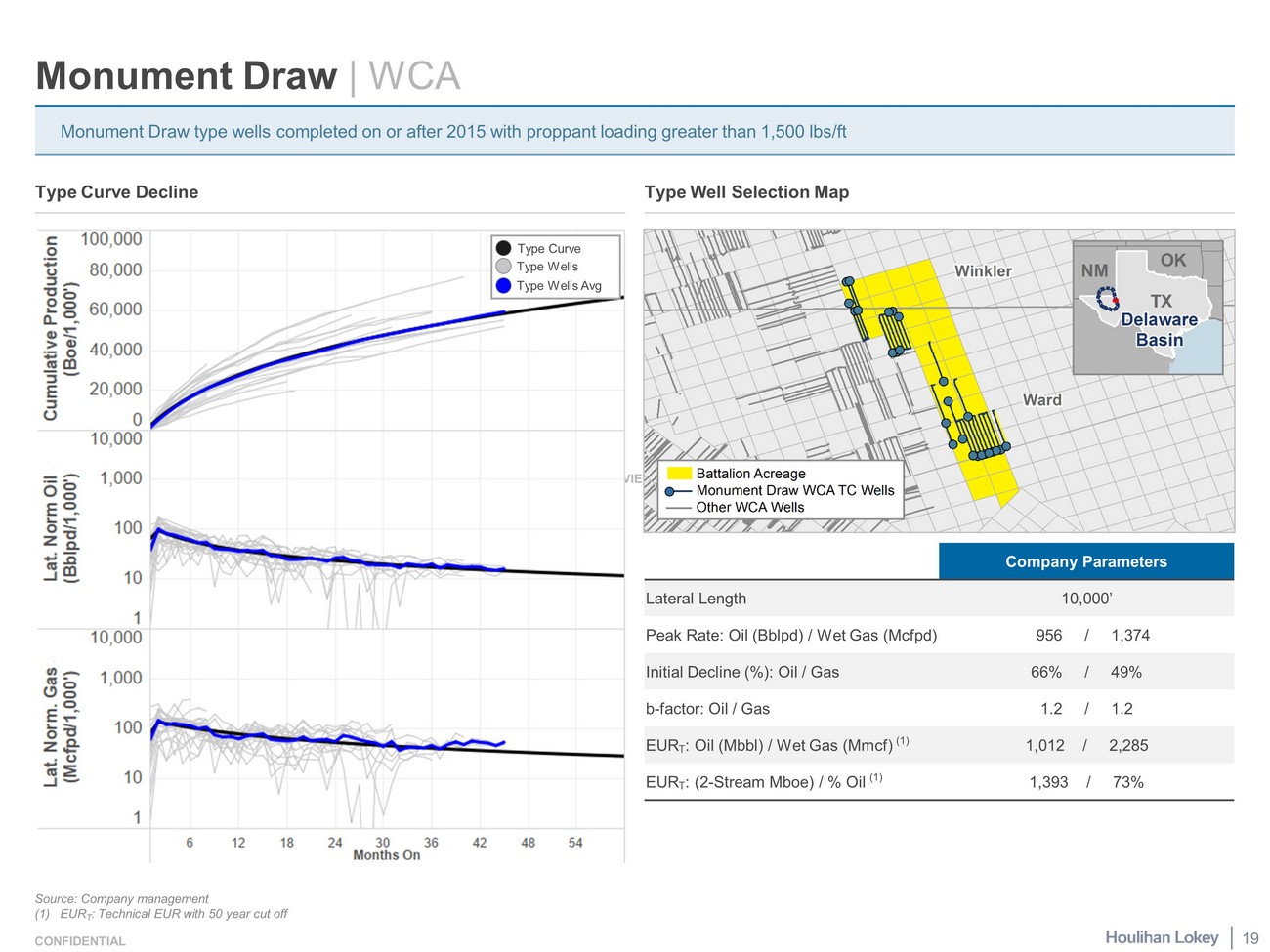

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Monument Draw | WCA Type Well Selection Map Monument Draw type wells completed on or after 2015 with proppant loading greater than 1,500 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 956 / 1,374 Initial Decline (%): Oil / Gas 66% / 49% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 1,012 / 2,285 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,393 / 73% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 19

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Monument Draw | WCB Type Well Selection Map Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 885 / 1,264 Initial Decline (%): Oil / Gas 67% / 39% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 914 / 2,693 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,363 / 67% Monument Draw type wells completed on or after 2015 with proppant loading greater than 1,500 lbs /ft Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 20

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline West Quito Draw | 3BS Type Well Selection Map West Quito Draw type wells completed on or after 2015 with proppant loading greater than 1,700 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 682 / 5,135 Initial Decline (%): Oil / Gas 74% / 73% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 552 / 4,307 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,269 / 43% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 21

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline West Quito Draw | WCA Type Well Selection Map West Quito Draw type wells completed on or after 2015 with proppant loading greater than 1,700 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 563 / 4,634 Initial Decline (%): Oil / Gas 64% / 62% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 631 / 5,521 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,552 / 41% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 22

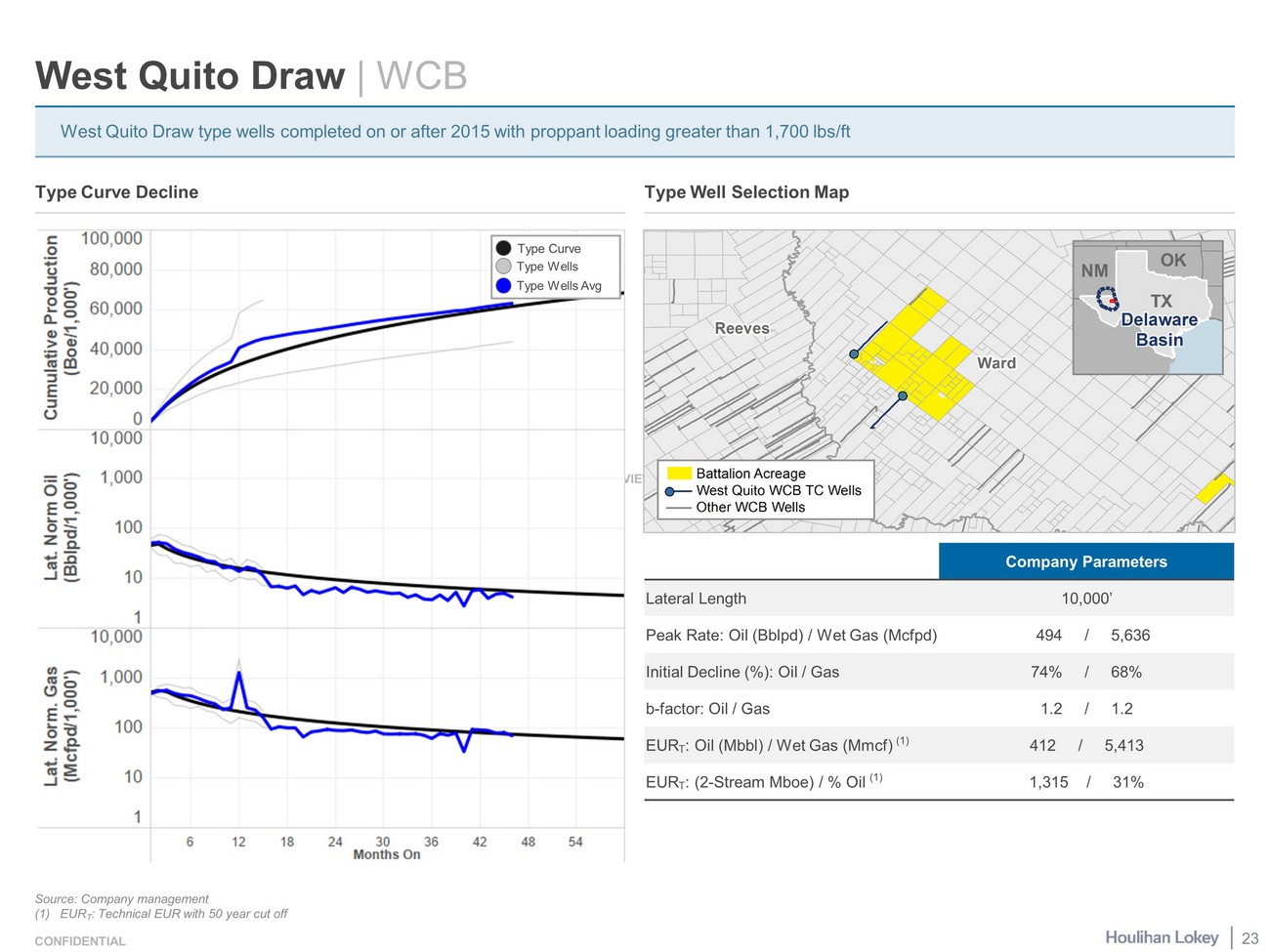

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline West Quito Draw | WCB Type Well Selection Map West Quito Draw type wells completed on or after 2015 with proppant loading greater than 1,700 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 494 / 5,636 Initial Decline (%): Oil / Gas 74% / 68% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 412 / 5,413 EUR T : (2 - Stream Mboe ) / % Oil (1) 1,315 / 31% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 23

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Hackberry Draw | 3BS Type Well Selection Map Hackberry Draw type wells completed on or after 2015 with proppant loading greater than 2,000 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 508 / 525 Initial Decline (%): Oil / Gas 62% / 34% b - factor: Oil / Gas 1.1 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 568 / 1,313 EUR T : (2 - Stream Mboe ) / % Oil (1) 787 / 72% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 24

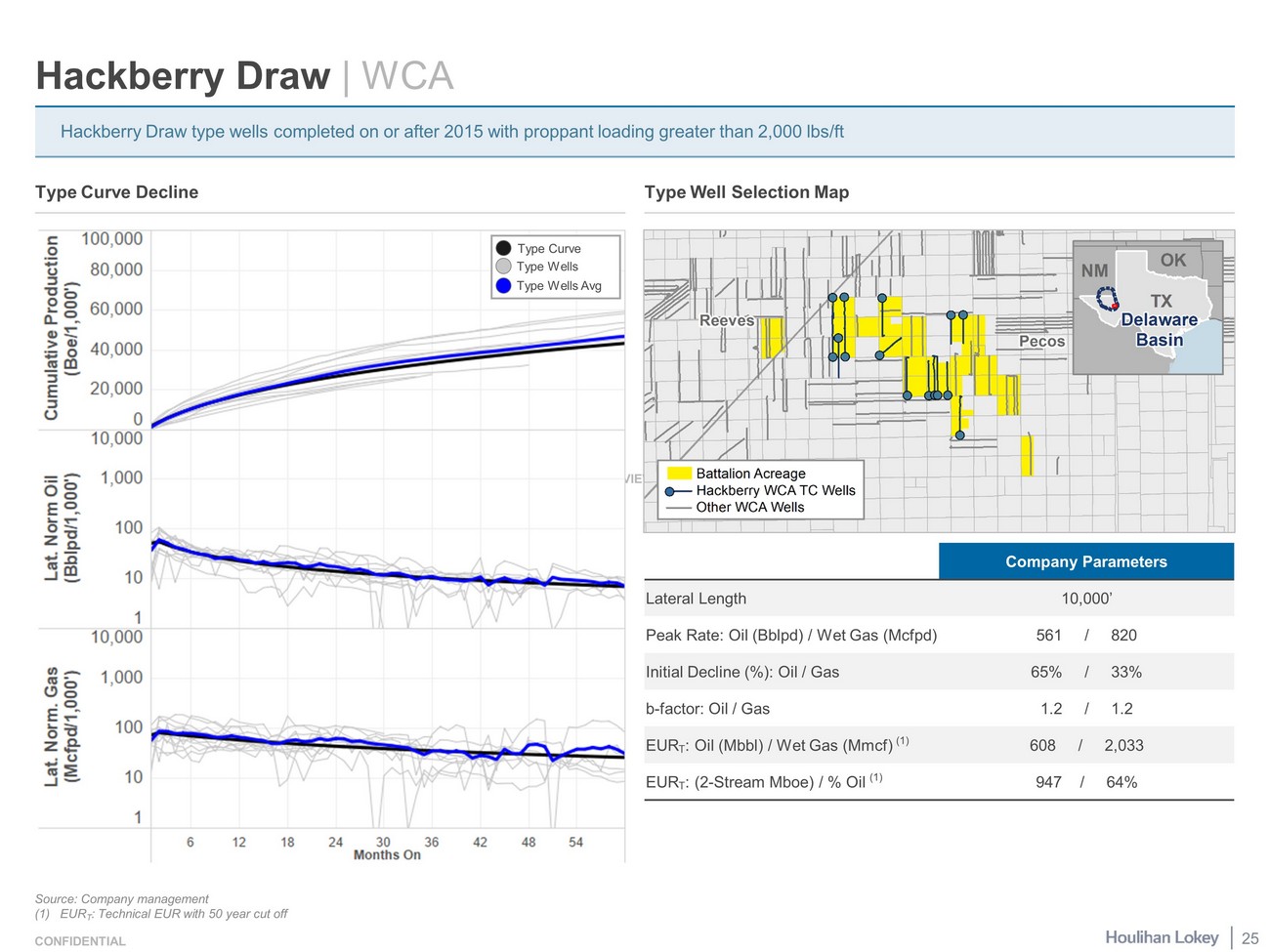

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Hackberry Draw | WCA Type Well Selection Map Hackberry Draw type wells completed on or after 2015 with proppant loading greater than 2,000 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 561 / 820 Initial Decline (%): Oil / Gas 65% / 33% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 608 / 2,033 EUR T : (2 - Stream Mboe ) / % Oil (1) 947 / 64% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 25

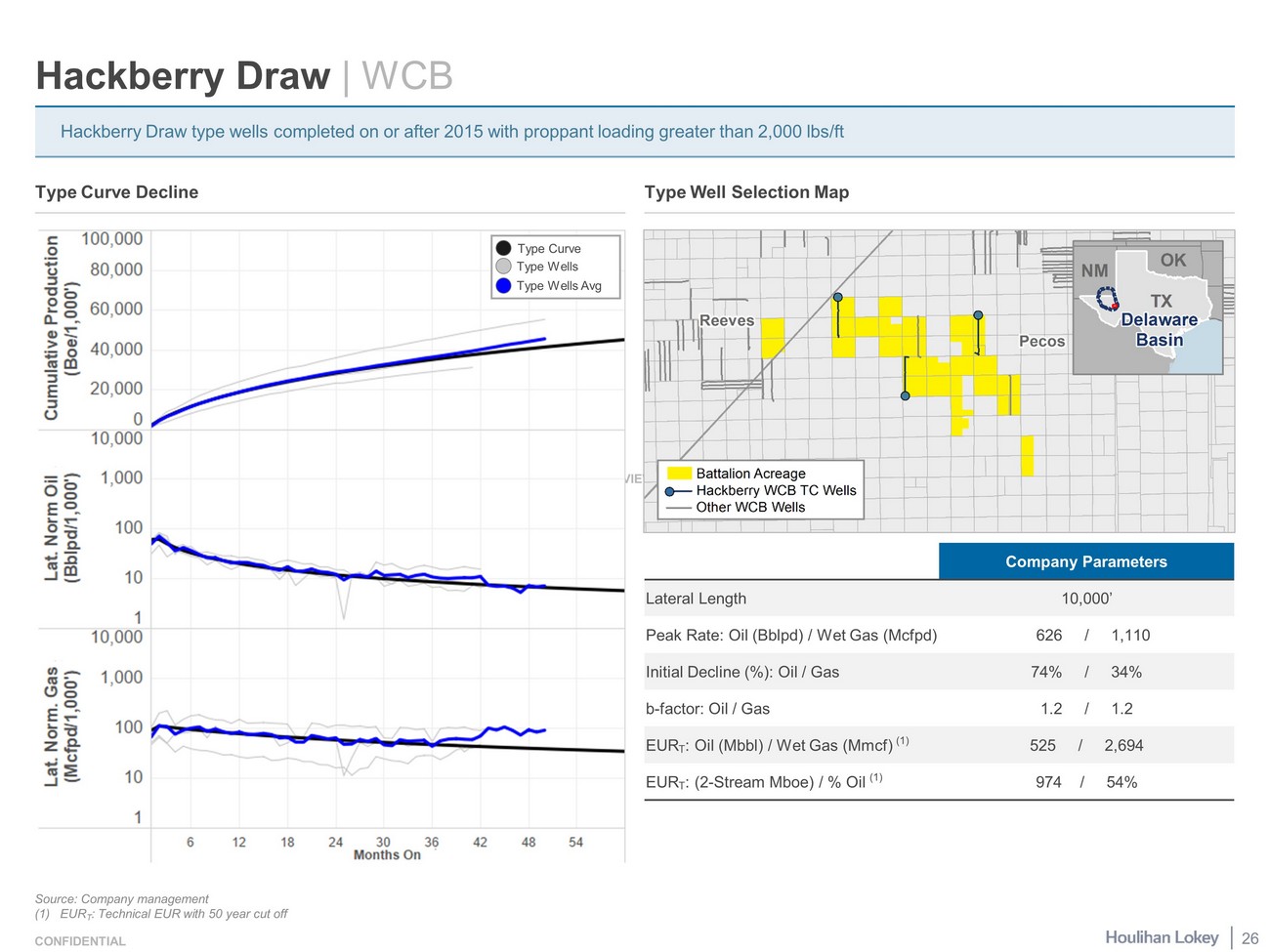

CONFIDENTIAL - PRELIMINARY DRAFT - SUBJECT TO FURTHER REVIEW CONFIDENTIAL Type Curve Decline Hackberry Draw | WCB Type Well Selection Map Hackberry Draw type wells completed on or after 2015 with proppant loading greater than 2,000 lbs /ft Company Parameters Lateral Length 10,000’ Peak Rate: Oil ( Bblpd ) / Wet Gas (Mcfpd) 626 / 1,110 Initial Decline (%): Oil / Gas 74% / 34% b - factor: Oil / Gas 1.2 / 1.2 EUR T : Oil ( Mbbl ) / Wet Gas ( Mmcf ) (1) 525 / 2,694 EUR T : (2 - Stream Mboe ) / % Oil (1) 974 / 54% Type Curve BATL Type Wells Type Wells Avg Source: Company management (1) EUR T : Technical EUR with 50 year cut off 26

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

CONFIDENTIAL Commodity Pricing Summary (dollars in actuals) WTI Comparison Natural Gas Comparison Source: Capital IQ as of 12/13/23. 28 Revised for pricing as of 12/13/23 Date NYMEX Strip Case NYMEX Strip +10% Pricing NYMEX Strip -10% Pricing Natural Gas Crude Oil - WTI Natural Gas Crude Oil - WTI Natural Gas Crude Oil - WTI 2023 $2.76 $78.93 $2.76 $78.93 $2.76 $78.93 2024 $2.56 $70.25 $2.56 $70.25 $2.56 $70.25 2025 $3.41 $68.42 $3.59 $71.81 $3.23 $65.04 2026 $3.69 $66.03 $4.06 $72.63 $3.32 $59.43 2027 $3.72 $64.43 $4.09 $70.88 $3.35 $57.99 After $3.72 $64.43 $4.09 $70.88 $3.35 $57.99 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 2023 2024 2025 2026 2027 After NYMEX Strip Case NYMEX Strip +10% Pricing NYMEX Strip -10% Pricing $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 2023 2024 2025 2026 2027 After NYMEX Strip Case NYMEX Strip +10% Pricing NYMEX Strip -10% Pricing

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

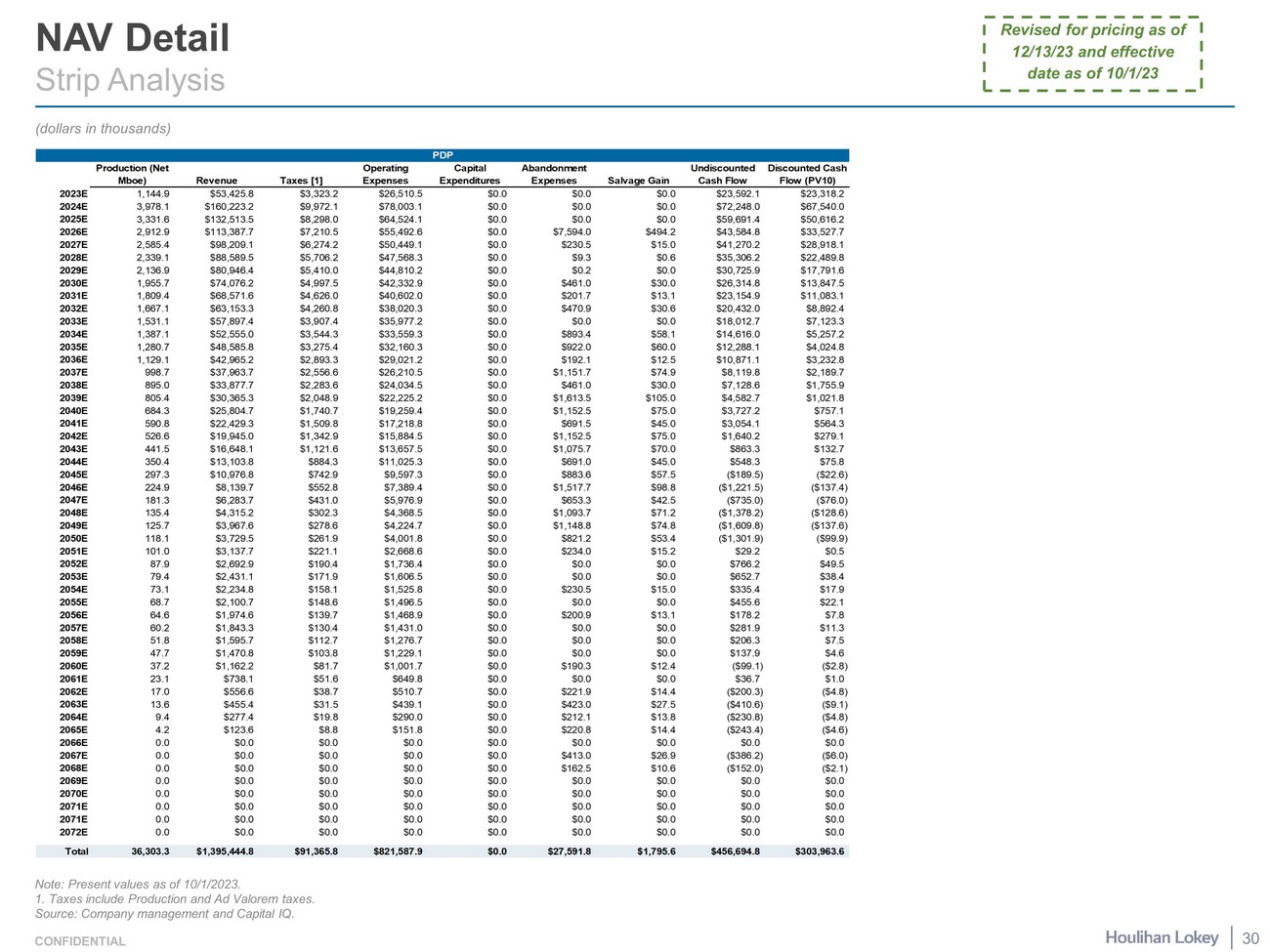

CONFIDENTIAL NAV Detail Strip Analysis (dollars in thousands) Note: Present values as of 10/1/2023. 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 30 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 PDP Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 1,144.9 $53,425.8 $3,323.2 $26,510.5 $0.0 $0.0 $0.0 $23,592.1 $23,318.2 2024E 3,978.1 $160,223.2 $9,972.1 $78,003.1 $0.0 $0.0 $0.0 $72,248.0 $67,540.0 2025E 3,331.6 $132,513.5 $8,298.0 $64,524.1 $0.0 $0.0 $0.0 $59,691.4 $50,616.2 2026E 2,912.9 $113,387.7 $7,210.5 $55,492.6 $0.0 $7,594.0 $494.2 $43,584.8 $33,527.7 2027E 2,585.4 $98,209.1 $6,274.2 $50,449.1 $0.0 $230.5 $15.0 $41,270.2 $28,918.1 2028E 2,339.1 $88,589.5 $5,706.2 $47,568.3 $0.0 $9.3 $0.6 $35,306.2 $22,489.8 2029E 2,136.9 $80,946.4 $5,410.0 $44,810.2 $0.0 $0.2 $0.0 $30,725.9 $17,791.6 2030E 1,955.7 $74,076.2 $4,997.5 $42,332.9 $0.0 $461.0 $30.0 $26,314.8 $13,847.5 2031E 1,809.4 $68,571.6 $4,626.0 $40,602.0 $0.0 $201.7 $13.1 $23,154.9 $11,083.1 2032E 1,667.1 $63,153.3 $4,260.8 $38,020.3 $0.0 $470.9 $30.6 $20,432.0 $8,892.4 2033E 1,531.1 $57,897.4 $3,907.4 $35,977.2 $0.0 $0.0 $0.0 $18,012.7 $7,123.3 2034E 1,387.1 $52,555.0 $3,544.3 $33,559.3 $0.0 $893.4 $58.1 $14,616.0 $5,257.2 2035E 1,280.7 $48,585.8 $3,275.4 $32,160.3 $0.0 $922.0 $60.0 $12,288.1 $4,024.8 2036E 1,129.1 $42,965.2 $2,893.3 $29,021.2 $0.0 $192.1 $12.5 $10,871.1 $3,232.8 2037E 998.7 $37,963.7 $2,556.6 $26,210.5 $0.0 $1,151.7 $74.9 $8,119.8 $2,189.7 2038E 895.0 $33,877.7 $2,283.6 $24,034.5 $0.0 $461.0 $30.0 $7,128.6 $1,755.9 2039E 805.4 $30,365.3 $2,048.9 $22,225.2 $0.0 $1,613.5 $105.0 $4,582.7 $1,021.8 2040E 684.3 $25,804.7 $1,740.7 $19,259.4 $0.0 $1,152.5 $75.0 $3,727.2 $757.1 2041E 590.8 $22,429.3 $1,509.8 $17,218.8 $0.0 $691.5 $45.0 $3,054.1 $564.3 2042E 526.6 $19,945.0 $1,342.9 $15,884.5 $0.0 $1,152.5 $75.0 $1,640.2 $279.1 2043E 441.5 $16,648.1 $1,121.6 $13,657.5 $0.0 $1,075.7 $70.0 $863.3 $132.7 2044E 350.4 $13,103.8 $884.3 $11,025.3 $0.0 $691.0 $45.0 $548.3 $75.8 2045E 297.3 $10,976.8 $742.9 $9,597.3 $0.0 $883.6 $57.5 ($189.5) ($22.6) 2046E 224.9 $8,139.7 $552.8 $7,389.4 $0.0 $1,517.7 $98.8 ($1,221.5) ($137.4) 2047E 181.3 $6,283.7 $431.0 $5,976.9 $0.0 $653.3 $42.5 ($735.0) ($76.0) 2048E 135.4 $4,315.2 $302.3 $4,368.5 $0.0 $1,093.7 $71.2 ($1,378.2) ($128.6) 2049E 125.7 $3,967.6 $278.6 $4,224.7 $0.0 $1,148.8 $74.8 ($1,609.8) ($137.6) 2050E 118.1 $3,729.5 $261.9 $4,001.8 $0.0 $821.2 $53.4 ($1,301.9) ($99.9) 2051E 101.0 $3,137.7 $221.1 $2,668.6 $0.0 $234.0 $15.2 $29.2 $0.5 2052E 87.9 $2,692.9 $190.4 $1,736.4 $0.0 $0.0 $0.0 $766.2 $49.5 2053E 79.4 $2,431.1 $171.9 $1,606.5 $0.0 $0.0 $0.0 $652.7 $38.4 2054E 73.1 $2,234.8 $158.1 $1,525.8 $0.0 $230.5 $15.0 $335.4 $17.9 2055E 68.7 $2,100.7 $148.6 $1,496.5 $0.0 $0.0 $0.0 $455.6 $22.1 2056E 64.6 $1,974.6 $139.7 $1,468.9 $0.0 $200.9 $13.1 $178.2 $7.8 2057E 60.2 $1,843.3 $130.4 $1,431.0 $0.0 $0.0 $0.0 $281.9 $11.3 2058E 51.8 $1,595.7 $112.7 $1,276.7 $0.0 $0.0 $0.0 $206.3 $7.5 2059E 47.7 $1,470.8 $103.8 $1,229.1 $0.0 $0.0 $0.0 $137.9 $4.6 2060E 37.2 $1,162.2 $81.7 $1,001.7 $0.0 $190.3 $12.4 ($99.1) ($2.8) 2061E 23.1 $738.1 $51.6 $649.8 $0.0 $0.0 $0.0 $36.7 $1.0 2062E 17.0 $556.6 $38.7 $510.7 $0.0 $221.9 $14.4 ($200.3) ($4.8) 2063E 13.6 $455.4 $31.5 $439.1 $0.0 $423.0 $27.5 ($410.6) ($9.1) 2064E 9.4 $277.4 $19.8 $290.0 $0.0 $212.1 $13.8 ($230.8) ($4.8) 2065E 4.2 $123.6 $8.8 $151.8 $0.0 $220.8 $14.4 ($243.4) ($4.6) 2066E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2067E 0.0 $0.0 $0.0 $0.0 $0.0 $413.0 $26.9 ($386.2) ($6.0) 2068E 0.0 $0.0 $0.0 $0.0 $0.0 $162.5 $10.6 ($152.0) ($2.1) 2069E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2070E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Total 36,303.3 $1,395,444.8 $91,365.8 $821,587.9 $0.0 $27,591.8 $1,795.6 $456,694.8 $303,963.6

CONFIDENTIAL NAV Detail Strip Analysis (cont.) (dollars in thousands) Note: Present values as of 10/1/2023. 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 31 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 63.4 $4,061.0 $252.9 $702.8 $28,044.0 $0.0 $0.0 ($24,938.8) ($24,768.4) 2024E 751.1 $40,996.7 $2,566.0 $11,198.0 $35,718.4 $0.0 $0.0 ($8,485.8) ($8,066.4) 2025E 1,789.4 $94,693.7 $5,965.3 $21,410.0 $126,853.2 $0.0 $0.0 ($59,534.8) ($51,331.7) 2026E 3,027.4 $153,140.7 $9,704.7 $35,288.2 $130,956.3 $0.0 $0.0 ($22,808.5) ($18,303.7) 2027E 3,899.0 $178,113.6 $11,476.2 $47,152.7 $124,906.2 $0.0 $0.0 ($5,421.5) ($4,049.0) 2028E 5,057.4 $227,040.0 $14,679.0 $57,461.8 $139,194.5 $0.0 $0.0 $15,704.7 $9,841.0 2029E 4,255.5 $190,573.1 $12,334.1 $53,713.7 $4,740.5 $0.0 $0.0 $119,784.8 $69,607.1 2030E 2,940.7 $127,330.9 $8,304.0 $44,621.4 $0.0 $0.0 $0.0 $74,405.5 $39,233.4 2031E 2,305.0 $99,400.3 $6,488.3 $38,400.7 $0.0 $0.0 $0.0 $54,511.4 $26,108.4 2032E 1,919.3 $82,646.9 $5,396.3 $33,616.1 $0.0 $0.0 $0.0 $43,634.5 $18,992.3 2033E 1,655.9 $71,235.5 $4,652.2 $30,586.9 $0.0 $0.0 $0.0 $35,996.4 $14,235.8 2034E 1,462.5 $62,864.9 $4,106.2 $27,909.7 $0.0 $0.0 $0.0 $30,849.1 $11,091.4 2035E 1,313.3 $56,419.3 $3,685.7 $26,527.2 $0.0 $0.0 $0.0 $26,206.4 $8,566.3 2036E 1,194.4 $51,280.8 $3,350.4 $25,778.6 $0.0 $0.0 $0.0 $22,151.9 $6,582.3 2037E 1,096.9 $47,075.3 $3,075.9 $25,165.4 $0.0 $0.0 $0.0 $18,834.1 $5,087.5 2038E 1,015.4 $43,557.3 $2,846.3 $24,652.2 $0.0 $0.0 $0.0 $16,058.8 $3,943.5 2039E 945.6 $40,547.7 $2,649.9 $24,213.1 $0.0 $0.0 $0.0 $13,684.7 $3,055.0 2040E 884.3 $37,904.8 $2,477.3 $23,827.0 $0.0 $0.0 $0.0 $11,600.5 $2,354.5 2041E 829.0 $35,529.1 $2,322.1 $23,478.9 $0.0 $0.0 $0.0 $9,728.0 $1,795.1 2042E 778.4 $33,359.5 $2,180.4 $23,160.3 $0.0 $0.0 $0.0 $8,018.9 $1,345.4 2043E 731.6 $31,351.2 $2,049.1 $22,864.9 $0.0 $0.0 $0.0 $6,437.2 $982.1 2044E 669.9 $28,661.9 $1,874.0 $21,814.1 $0.0 $0.0 $0.0 $4,973.9 $690.1 2045E 624.8 $26,720.6 $1,747.2 $21,349.3 $0.0 $0.0 $0.0 $3,624.1 $457.4 2046E 555.0 $23,648.0 $1,547.5 $19,703.2 $0.0 $0.0 $0.0 $2,397.3 $275.3 2047E 470.0 $19,877.2 $1,302.7 $17,237.0 $0.0 $461.0 $30.0 $906.5 $93.3 2048E 378.9 $15,827.0 $1,040.0 $14,327.5 $0.0 $461.0 $30.0 $28.5 $4.6 2049E 211.7 $8,287.6 $552.2 $7,867.7 $0.0 $1,152.5 $75.0 ($1,209.8) ($102.3) 2050E 116.1 $3,988.7 $274.0 $4,110.9 $0.0 $1,140.5 $74.2 ($1,462.5) ($113.4) 2051E 88.1 $2,790.9 $195.7 $3,149.1 $0.0 $2,057.2 $133.9 ($2,477.2) ($174.5) 2052E 68.5 $1,972.2 $141.9 $2,481.3 $0.0 $4,149.0 $270.0 ($4,529.9) ($293.3) 2053E 64.3 $1,853.9 $133.3 $2,452.9 $0.0 $230.5 $15.0 ($947.8) ($55.4) 2054E 60.5 $1,742.6 $125.3 $2,426.1 $0.0 $691.5 $45.0 ($1,455.3) ($77.6) 2055E 56.9 $1,638.1 $117.8 $1,233.2 $0.0 $0.0 $0.0 $287.1 $13.3 2056E 53.4 $1,539.8 $110.8 $820.3 $0.0 $0.0 $0.0 $608.8 $26.9 2057E 50.2 $1,447.4 $104.1 $798.1 $0.0 $0.0 $0.0 $545.2 $21.9 2058E 47.2 $1,360.6 $97.9 $777.2 $0.0 $0.0 $0.0 $485.5 $17.7 2059E 44.4 $1,278.9 $92.0 $757.6 $0.0 $0.0 $0.0 $429.3 $14.2 2060E 41.7 $1,202.2 $86.5 $739.2 $0.0 $0.0 $0.0 $376.6 $11.4 2061E 39.2 $1,130.1 $81.3 $721.8 $0.0 $0.0 $0.0 $326.9 $9.0 2062E 36.9 $1,062.3 $76.4 $705.5 $0.0 $0.0 $0.0 $280.3 $7.0 2063E 34.7 $998.5 $71.8 $690.2 $0.0 $0.0 $0.0 $236.5 $5.4 2064E 32.6 $938.6 $67.5 $675.8 $0.0 $0.0 $0.0 $195.3 $4.0 2065E 30.6 $882.3 $63.5 $662.3 $0.0 $0.0 $0.0 $156.5 $2.9 2066E 28.8 $829.4 $59.7 $649.6 $0.0 $0.0 $0.0 $120.1 $2.0 2067E 27.1 $779.6 $56.1 $637.6 $0.0 $0.0 $0.0 $85.9 $1.3 2068E 25.4 $732.8 $52.7 $626.4 $0.0 $0.0 $0.0 $53.7 $0.8 2069E 23.9 $688.8 $49.5 $615.8 $0.0 $0.0 $0.0 $23.5 $0.3 2070E 8.0 $231.0 $16.6 $211.7 $0.0 $0.0 $0.0 $2.6 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $220.0 $14.3 ($205.7) ($1.9) 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $619.4 $40.3 ($579.1) ($5.1) Total 41,804.3 $1,861,233.3 $120,700.2 $749,971.0 $590,413.2 $11,182.6 $727.7 $389,694.1 $117,137.1 PUD

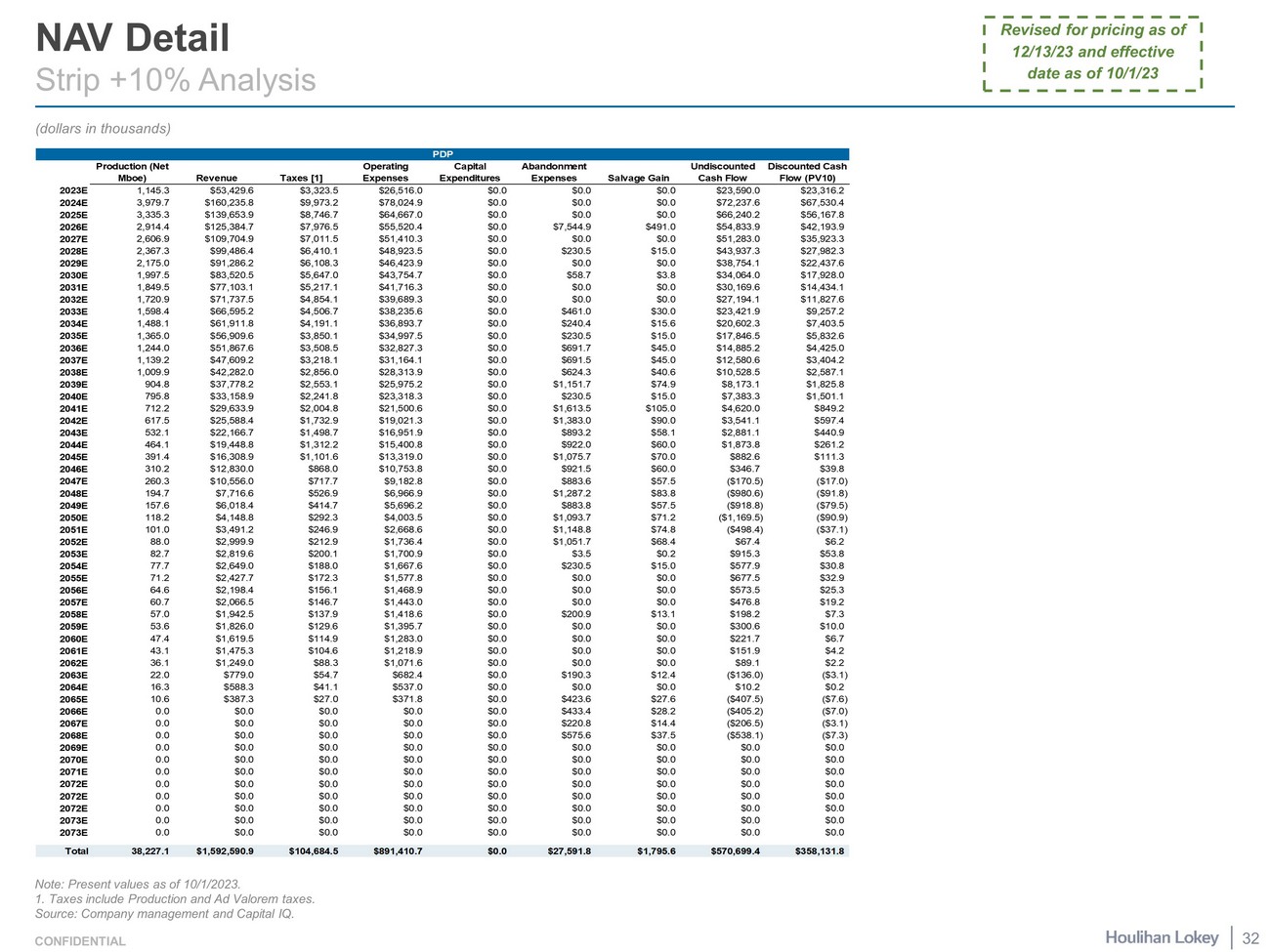

CONFIDENTIAL NAV Detail Strip +10% Analysis (dollars in thousands) Note: Present values as of 10/1/2023. 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 32 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 PDP Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 1,145.3 $53,429.6 $3,323.5 $26,516.0 $0.0 $0.0 $0.0 $23,590.0 $23,316.2 2024E 3,979.7 $160,235.8 $9,973.2 $78,024.9 $0.0 $0.0 $0.0 $72,237.6 $67,530.4 2025E 3,335.3 $139,653.9 $8,746.7 $64,667.0 $0.0 $0.0 $0.0 $66,240.2 $56,167.8 2026E 2,914.4 $125,384.7 $7,976.5 $55,520.4 $0.0 $7,544.9 $491.0 $54,833.9 $42,193.9 2027E 2,606.9 $109,704.9 $7,011.5 $51,410.3 $0.0 $0.0 $0.0 $51,283.0 $35,923.3 2028E 2,367.3 $99,486.4 $6,410.1 $48,923.5 $0.0 $230.5 $15.0 $43,937.3 $27,982.3 2029E 2,175.0 $91,286.2 $6,108.3 $46,423.9 $0.0 $0.0 $0.0 $38,754.1 $22,437.6 2030E 1,997.5 $83,520.5 $5,647.0 $43,754.7 $0.0 $58.7 $3.8 $34,064.0 $17,928.0 2031E 1,849.5 $77,103.1 $5,217.1 $41,716.3 $0.0 $0.0 $0.0 $30,169.6 $14,434.1 2032E 1,720.9 $71,737.5 $4,854.1 $39,689.3 $0.0 $0.0 $0.0 $27,194.1 $11,827.6 2033E 1,598.4 $66,595.2 $4,506.7 $38,235.6 $0.0 $461.0 $30.0 $23,421.9 $9,257.2 2034E 1,488.1 $61,911.8 $4,191.1 $36,893.7 $0.0 $240.4 $15.6 $20,602.3 $7,403.5 2035E 1,365.0 $56,909.6 $3,850.1 $34,997.5 $0.0 $230.5 $15.0 $17,846.5 $5,832.6 2036E 1,244.0 $51,867.6 $3,508.5 $32,827.3 $0.0 $691.7 $45.0 $14,885.2 $4,425.0 2037E 1,139.2 $47,609.2 $3,218.1 $31,164.1 $0.0 $691.5 $45.0 $12,580.6 $3,404.2 2038E 1,009.9 $42,282.0 $2,856.0 $28,313.9 $0.0 $624.3 $40.6 $10,528.5 $2,587.1 2039E 904.8 $37,778.2 $2,553.1 $25,975.2 $0.0 $1,151.7 $74.9 $8,173.1 $1,825.8 2040E 795.8 $33,158.9 $2,241.8 $23,318.3 $0.0 $230.5 $15.0 $7,383.3 $1,501.1 2041E 712.2 $29,633.9 $2,004.8 $21,500.6 $0.0 $1,613.5 $105.0 $4,620.0 $849.2 2042E 617.5 $25,588.4 $1,732.9 $19,021.3 $0.0 $1,383.0 $90.0 $3,541.1 $597.4 2043E 532.1 $22,166.7 $1,498.7 $16,951.9 $0.0 $893.2 $58.1 $2,881.1 $440.9 2044E 464.1 $19,448.8 $1,312.2 $15,400.8 $0.0 $922.0 $60.0 $1,873.8 $261.2 2045E 391.4 $16,308.9 $1,101.6 $13,319.0 $0.0 $1,075.7 $70.0 $882.6 $111.3 2046E 310.2 $12,830.0 $868.0 $10,753.8 $0.0 $921.5 $60.0 $346.7 $39.8 2047E 260.3 $10,556.0 $717.7 $9,182.8 $0.0 $883.6 $57.5 ($170.5) ($17.0) 2048E 194.7 $7,716.6 $526.9 $6,966.9 $0.0 $1,287.2 $83.8 ($980.6) ($91.8) 2049E 157.6 $6,018.4 $414.7 $5,696.2 $0.0 $883.8 $57.5 ($918.8) ($79.5) 2050E 118.2 $4,148.8 $292.3 $4,003.5 $0.0 $1,093.7 $71.2 ($1,169.5) ($90.9) 2051E 101.0 $3,491.2 $246.9 $2,668.6 $0.0 $1,148.8 $74.8 ($498.4) ($37.1) 2052E 88.0 $2,999.9 $212.9 $1,736.4 $0.0 $1,051.7 $68.4 $67.4 $6.2 2053E 82.7 $2,819.6 $200.1 $1,700.9 $0.0 $3.5 $0.2 $915.3 $53.8 2054E 77.7 $2,649.0 $188.0 $1,667.6 $0.0 $230.5 $15.0 $577.9 $30.8 2055E 71.2 $2,427.7 $172.3 $1,577.8 $0.0 $0.0 $0.0 $677.5 $32.9 2056E 64.6 $2,198.4 $156.1 $1,468.9 $0.0 $0.0 $0.0 $573.5 $25.3 2057E 60.7 $2,066.5 $146.7 $1,443.0 $0.0 $0.0 $0.0 $476.8 $19.2 2058E 57.0 $1,942.5 $137.9 $1,418.6 $0.0 $200.9 $13.1 $198.2 $7.3 2059E 53.6 $1,826.0 $129.6 $1,395.7 $0.0 $0.0 $0.0 $300.6 $10.0 2060E 47.4 $1,619.5 $114.9 $1,283.0 $0.0 $0.0 $0.0 $221.7 $6.7 2061E 43.1 $1,475.3 $104.6 $1,218.9 $0.0 $0.0 $0.0 $151.9 $4.2 2062E 36.1 $1,249.0 $88.3 $1,071.6 $0.0 $0.0 $0.0 $89.1 $2.2 2063E 22.0 $779.0 $54.7 $682.4 $0.0 $190.3 $12.4 ($136.0) ($3.1) 2064E 16.3 $588.3 $41.1 $537.0 $0.0 $0.0 $0.0 $10.2 $0.2 2065E 10.6 $387.3 $27.0 $371.8 $0.0 $423.6 $27.6 ($407.5) ($7.6) 2066E 0.0 $0.0 $0.0 $0.0 $0.0 $433.4 $28.2 ($405.2) ($7.0) 2067E 0.0 $0.0 $0.0 $0.0 $0.0 $220.8 $14.4 ($206.5) ($3.1) 2068E 0.0 $0.0 $0.0 $0.0 $0.0 $575.6 $37.5 ($538.1) ($7.3) 2069E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2070E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2073E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2073E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Total 38,227.1 $1,592,590.9 $104,684.5 $891,410.7 $0.0 $27,591.8 $1,795.6 $570,699.4 $358,131.8

CONFIDENTIAL NAV Detail Strip +10% Analysis (cont.) (dollars in thousands) Note: Present values as of 10/1/2023. 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 33 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 63.4 $4,061.0 $252.9 $702.8 $28,044.0 $0.0 $0.0 ($24,938.8) ($24,768.4) 2024E 751.1 $40,996.7 $2,566.0 $11,198.0 $35,718.4 $0.0 $0.0 ($8,485.8) ($8,066.4) 2025E 1,789.4 $99,489.7 $6,270.1 $21,410.0 $126,853.2 $0.0 $0.0 ($55,043.6) ($47,560.3) 2026E 3,027.4 $168,761.1 $10,702.4 $35,288.2 $130,956.3 $0.0 $0.0 ($8,185.8) ($7,075.7) 2027E 3,899.0 $196,532.0 $12,678.1 $47,152.7 $124,906.2 $0.0 $0.0 $11,795.0 $7,994.2 2028E 5,057.4 $250,603.2 $16,224.0 $57,461.8 $139,194.5 $0.0 $0.0 $37,723.0 $23,824.0 2029E 4,255.5 $210,318.8 $13,628.9 $53,713.7 $4,740.5 $0.0 $0.0 $138,235.7 $80,324.4 2030E 2,940.7 $140,574.4 $9,180.0 $44,621.4 $0.0 $0.0 $0.0 $86,773.1 $45,750.3 2031E 2,305.0 $109,745.7 $7,173.3 $38,400.7 $0.0 $0.0 $0.0 $64,171.7 $30,733.0 2032E 1,919.3 $91,251.2 $5,966.3 $33,616.1 $0.0 $0.0 $0.0 $51,668.8 $22,487.6 2033E 1,655.9 $78,653.2 $5,143.7 $30,586.9 $0.0 $0.0 $0.0 $42,922.7 $16,974.4 2034E 1,462.5 $69,412.0 $4,540.1 $27,909.7 $0.0 $0.0 $0.0 $36,962.3 $13,288.6 2035E 1,313.3 $62,295.9 $4,075.2 $26,527.2 $0.0 $0.0 $0.0 $31,693.4 $10,358.9 2036E 1,194.4 $56,622.7 $3,704.5 $25,778.6 $0.0 $0.0 $0.0 $27,139.6 $8,063.6 2037E 1,096.9 $51,979.6 $3,401.1 $25,165.4 $0.0 $0.0 $0.0 $23,413.2 $6,323.7 2038E 1,015.4 $48,095.5 $3,147.2 $24,652.2 $0.0 $0.0 $0.0 $20,296.1 $4,983.3 2039E 945.6 $44,772.6 $2,930.0 $24,213.1 $0.0 $0.0 $0.0 $17,629.5 $3,935.1 2040E 884.3 $41,854.7 $2,739.3 $23,827.0 $0.0 $0.0 $0.0 $15,288.4 $3,102.4 2041E 829.0 $39,231.5 $2,567.7 $23,478.9 $0.0 $0.0 $0.0 $13,184.9 $2,432.4 2042E 778.4 $36,835.9 $2,410.9 $23,160.3 $0.0 $0.0 $0.0 $11,264.7 $1,889.4 2043E 731.6 $34,618.3 $2,265.8 $22,864.9 $0.0 $0.0 $0.0 $9,487.6 $1,446.9 2044E 687.7 $32,541.1 $2,129.9 $22,588.1 $0.0 $0.0 $0.0 $7,823.1 $1,084.8 2045E 644.9 $30,514.4 $1,997.3 $22,258.5 $0.0 $0.0 $0.0 $6,258.7 $789.2 2046E 590.5 $27,892.0 $1,826.3 $21,252.8 $0.0 $0.0 $0.0 $4,812.9 $551.9 2047E 549.1 $25,923.9 $1,697.6 $20,751.6 $0.0 $0.0 $0.0 $3,474.7 $362.5 2048E 483.0 $22,704.7 $1,488.2 $18,947.2 $0.0 $461.0 $30.0 $1,838.4 $176.3 2049E 408.0 $19,033.7 $1,249.6 $16,548.1 $0.0 $0.0 $0.0 $1,235.9 $106.9 2050E 318.7 $14,641.2 $964.5 $13,288.7 $0.0 $691.5 $45.0 ($258.4) ($18.4) 2051E 163.7 $6,921.6 $464.8 $6,600.3 $0.0 $1,152.5 $75.0 ($1,220.9) ($85.1) 2052E 101.1 $3,837.3 $264.7 $3,951.1 $0.0 $910.0 $59.2 ($1,229.3) ($79.1) 2053E 73.4 $2,520.5 $178.6 $2,871.0 $0.0 $3,670.7 $238.9 ($3,960.9) ($229.4) 2054E 60.5 $1,943.4 $140.3 $2,426.1 $0.0 $2,535.5 $165.0 ($2,993.6) ($159.5) 2055E 56.9 $1,826.8 $131.9 $1,233.2 $0.0 $230.5 $15.0 $246.2 $11.3 2056E 53.4 $1,717.2 $124.0 $820.3 $0.0 $691.5 $45.0 $126.4 $5.2 2057E 50.2 $1,614.1 $116.5 $798.1 $0.0 $0.0 $0.0 $699.5 $28.1 2058E 47.2 $1,517.3 $109.6 $777.2 $0.0 $0.0 $0.0 $630.5 $23.0 2059E 44.4 $1,426.3 $103.0 $757.6 $0.0 $0.0 $0.0 $565.7 $18.8 2060E 41.7 $1,340.7 $96.8 $739.2 $0.0 $0.0 $0.0 $504.7 $15.2 2061E 39.2 $1,260.2 $91.0 $721.8 $0.0 $0.0 $0.0 $447.4 $12.3 2062E 36.9 $1,184.6 $85.5 $705.5 $0.0 $0.0 $0.0 $393.6 $9.8 2063E 34.7 $1,113.6 $80.4 $690.2 $0.0 $0.0 $0.0 $342.9 $7.8 2064E 32.6 $1,046.7 $75.6 $675.8 $0.0 $0.0 $0.0 $295.3 $6.1 2065E 30.6 $983.9 $71.0 $662.3 $0.0 $0.0 $0.0 $250.6 $4.7 2066E 28.8 $924.9 $66.8 $649.6 $0.0 $0.0 $0.0 $208.5 $3.6 2067E 27.1 $869.4 $62.8 $637.6 $0.0 $0.0 $0.0 $169.0 $2.6 2068E 25.4 $817.2 $59.0 $626.4 $0.0 $0.0 $0.0 $131.8 $1.9 2069E 23.9 $768.2 $55.5 $615.8 $0.0 $0.0 $0.0 $96.9 $1.2 2070E 22.5 $722.1 $52.1 $605.9 $0.0 $0.0 $0.0 $64.1 $0.7 2071E 21.1 $678.8 $49.0 $596.6 $0.0 $0.0 $0.0 $33.2 $0.4 2072E 13.3 $426.1 $30.8 $388.2 $0.0 $0.0 $0.0 $7.1 $0.1 2072E 0.4 $13.9 $1.0 $12.9 $0.0 $0.0 $0.0 $0.0 $0.0 2072E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2073E 0.0 $0.0 $0.0 $0.0 $0.0 $617.7 $40.2 ($577.5) ($4.2) 2073E 0.0 $0.0 $0.0 $0.0 $0.0 $221.7 $14.4 ($207.3) ($1.4) Total 42,626.4 $2,085,431.7 $135,431.5 $785,927.1 $590,413.2 $11,182.6 $727.7 $563,205.1 $199,088.3 PUD

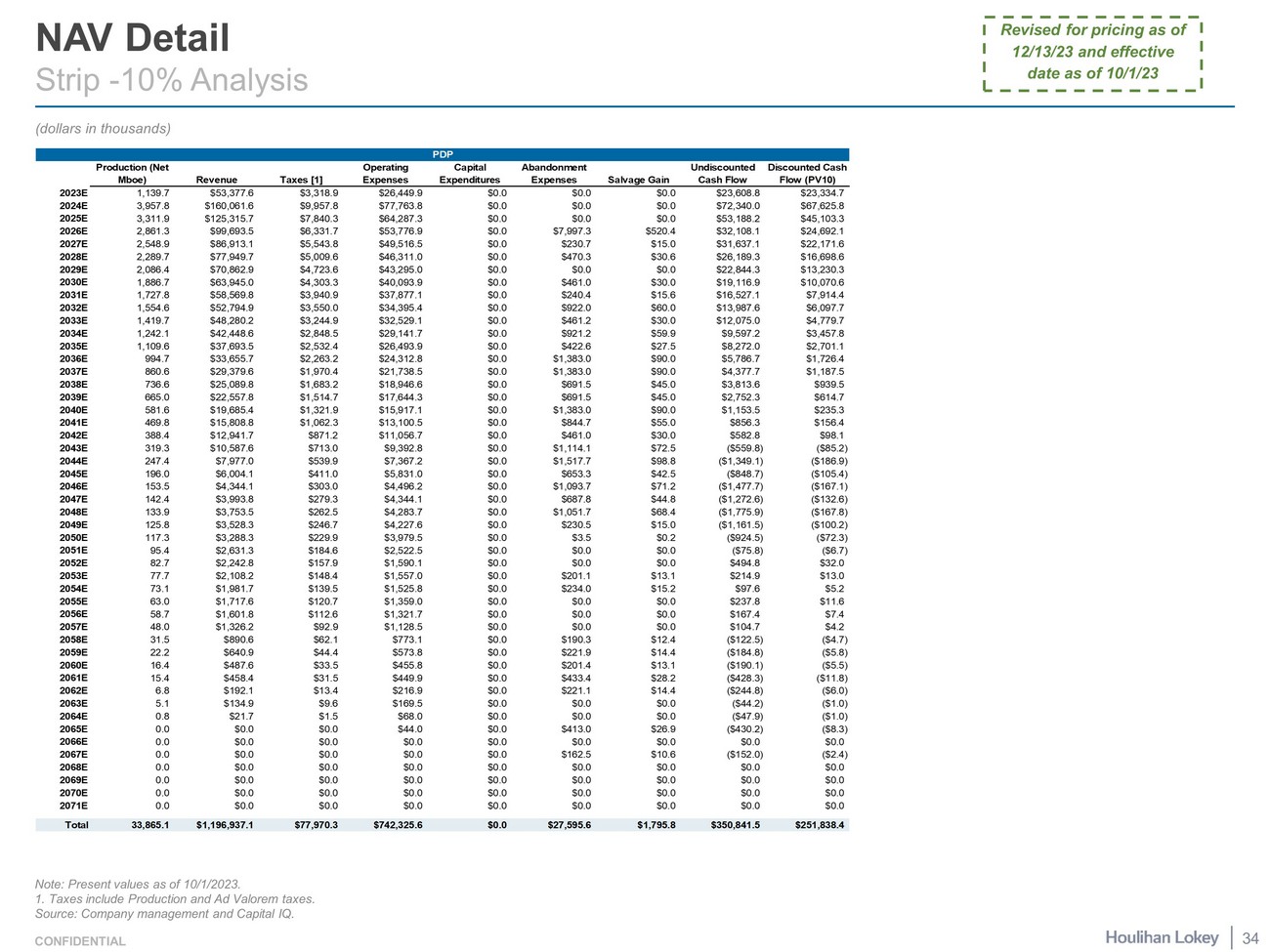

CONFIDENTIAL NAV Detail Strip - 10% Analysis (dollars in thousands) Note: Present values as of 10/1/2023. 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 34 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 PDP Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 1,139.7 $53,377.6 $3,318.9 $26,449.9 $0.0 $0.0 $0.0 $23,608.8 $23,334.7 2024E 3,957.8 $160,061.6 $9,957.8 $77,763.8 $0.0 $0.0 $0.0 $72,340.0 $67,625.8 2025E 3,311.9 $125,315.7 $7,840.3 $64,287.3 $0.0 $0.0 $0.0 $53,188.2 $45,103.3 2026E 2,861.3 $99,693.5 $6,331.7 $53,776.9 $0.0 $7,997.3 $520.4 $32,108.1 $24,692.1 2027E 2,548.9 $86,913.1 $5,543.8 $49,516.5 $0.0 $230.7 $15.0 $31,637.1 $22,171.6 2028E 2,289.7 $77,949.7 $5,009.6 $46,311.0 $0.0 $470.3 $30.6 $26,189.3 $16,698.6 2029E 2,086.4 $70,862.9 $4,723.6 $43,295.0 $0.0 $0.0 $0.0 $22,844.3 $13,230.3 2030E 1,886.7 $63,945.0 $4,303.3 $40,093.9 $0.0 $461.0 $30.0 $19,116.9 $10,070.6 2031E 1,727.8 $58,569.8 $3,940.9 $37,877.1 $0.0 $240.4 $15.6 $16,527.1 $7,914.4 2032E 1,554.6 $52,794.9 $3,550.0 $34,395.4 $0.0 $922.0 $60.0 $13,987.6 $6,097.7 2033E 1,419.7 $48,280.2 $3,244.9 $32,529.1 $0.0 $461.2 $30.0 $12,075.0 $4,779.7 2034E 1,242.1 $42,448.6 $2,848.5 $29,141.7 $0.0 $921.2 $59.9 $9,597.2 $3,457.8 2035E 1,109.6 $37,693.5 $2,532.4 $26,493.9 $0.0 $422.6 $27.5 $8,272.0 $2,701.1 2036E 994.7 $33,655.7 $2,263.2 $24,312.8 $0.0 $1,383.0 $90.0 $5,786.7 $1,726.4 2037E 860.6 $29,379.6 $1,970.4 $21,738.5 $0.0 $1,383.0 $90.0 $4,377.7 $1,187.5 2038E 736.6 $25,089.8 $1,683.2 $18,946.6 $0.0 $691.5 $45.0 $3,813.6 $939.5 2039E 665.0 $22,557.8 $1,514.7 $17,644.3 $0.0 $691.5 $45.0 $2,752.3 $614.7 2040E 581.6 $19,685.4 $1,321.9 $15,917.1 $0.0 $1,383.0 $90.0 $1,153.5 $235.3 2041E 469.8 $15,808.8 $1,062.3 $13,100.5 $0.0 $844.7 $55.0 $856.3 $156.4 2042E 388.4 $12,941.7 $871.2 $11,056.7 $0.0 $461.0 $30.0 $582.8 $98.1 2043E 319.3 $10,587.6 $713.0 $9,392.8 $0.0 $1,114.1 $72.5 ($559.8) ($85.2) 2044E 247.4 $7,977.0 $539.9 $7,367.2 $0.0 $1,517.7 $98.8 ($1,349.1) ($186.9) 2045E 196.0 $6,004.1 $411.0 $5,831.0 $0.0 $653.3 $42.5 ($848.7) ($105.4) 2046E 153.5 $4,344.1 $303.0 $4,496.2 $0.0 $1,093.7 $71.2 ($1,477.7) ($167.1) 2047E 142.4 $3,993.8 $279.3 $4,344.1 $0.0 $687.8 $44.8 ($1,272.6) ($132.6) 2048E 133.9 $3,753.5 $262.5 $4,283.7 $0.0 $1,051.7 $68.4 ($1,775.9) ($167.8) 2049E 125.8 $3,528.3 $246.7 $4,227.6 $0.0 $230.5 $15.0 ($1,161.5) ($100.2) 2050E 117.3 $3,288.3 $229.9 $3,979.5 $0.0 $3.5 $0.2 ($924.5) ($72.3) 2051E 95.4 $2,631.3 $184.6 $2,522.5 $0.0 $0.0 $0.0 ($75.8) ($6.7) 2052E 82.7 $2,242.8 $157.9 $1,590.1 $0.0 $0.0 $0.0 $494.8 $32.0 2053E 77.7 $2,108.2 $148.4 $1,557.0 $0.0 $201.1 $13.1 $214.9 $13.0 2054E 73.1 $1,981.7 $139.5 $1,525.8 $0.0 $234.0 $15.2 $97.6 $5.2 2055E 63.0 $1,717.6 $120.7 $1,359.0 $0.0 $0.0 $0.0 $237.8 $11.6 2056E 58.7 $1,601.8 $112.6 $1,321.7 $0.0 $0.0 $0.0 $167.4 $7.4 2057E 48.0 $1,326.2 $92.9 $1,128.5 $0.0 $0.0 $0.0 $104.7 $4.2 2058E 31.5 $890.6 $62.1 $773.1 $0.0 $190.3 $12.4 ($122.5) ($4.7) 2059E 22.2 $640.9 $44.4 $573.8 $0.0 $221.9 $14.4 ($184.8) ($5.8) 2060E 16.4 $487.6 $33.5 $455.8 $0.0 $201.4 $13.1 ($190.1) ($5.5) 2061E 15.4 $458.4 $31.5 $449.9 $0.0 $433.4 $28.2 ($428.3) ($11.8) 2062E 6.8 $192.1 $13.4 $216.9 $0.0 $221.1 $14.4 ($244.8) ($6.0) 2063E 5.1 $134.9 $9.6 $169.5 $0.0 $0.0 $0.0 ($44.2) ($1.0) 2064E 0.8 $21.7 $1.5 $68.0 $0.0 $0.0 $0.0 ($47.9) ($1.0) 2065E 0.0 $0.0 $0.0 $44.0 $0.0 $413.0 $26.9 ($430.2) ($8.3) 2066E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2067E 0.0 $0.0 $0.0 $0.0 $0.0 $162.5 $10.6 ($152.0) ($2.4) 2068E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2069E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2070E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Total 33,865.1 $1,196,937.1 $77,970.3 $742,325.6 $0.0 $27,595.6 $1,795.8 $350,841.5 $251,838.4

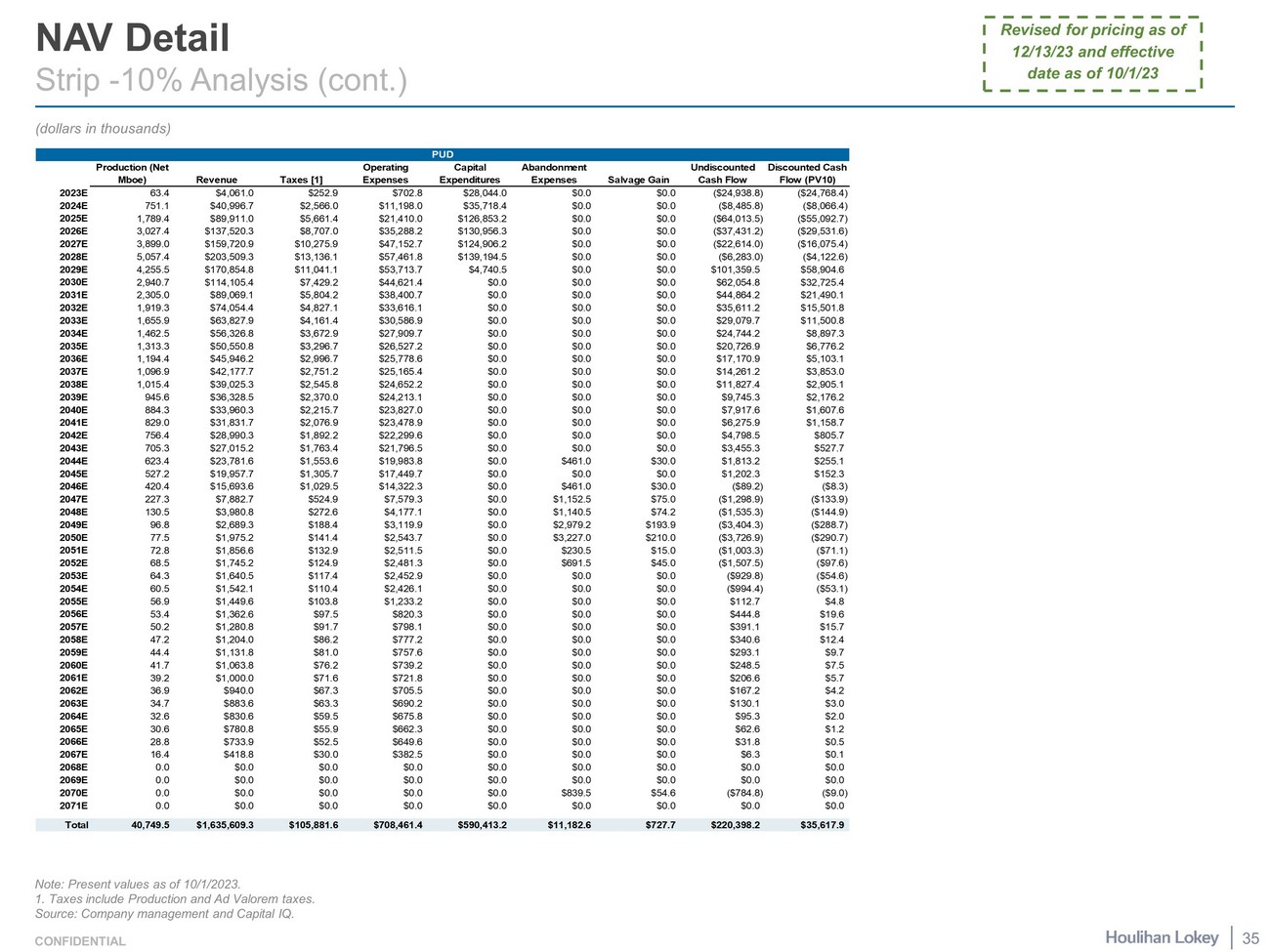

CONFIDENTIAL NAV Detail Strip - 10% Analysis (cont.) (dollars in thousands) Note: Present values as of 10/1/2023 . 1. Taxes include Production and Ad Valorem taxes. Source: Company management and Capital IQ. 35 Revised for pricing as of 12/13/23 and effective date as of 10/1/23 Production (Net Mboe) Revenue Taxes [1] Operating Expenses Capital Expenditures Abandonment Expenses Salvage Gain Undiscounted Cash Flow Discounted Cash Flow (PV10) 2023E 63.4 $4,061.0 $252.9 $702.8 $28,044.0 $0.0 $0.0 ($24,938.8) ($24,768.4) 2024E 751.1 $40,996.7 $2,566.0 $11,198.0 $35,718.4 $0.0 $0.0 ($8,485.8) ($8,066.4) 2025E 1,789.4 $89,911.0 $5,661.4 $21,410.0 $126,853.2 $0.0 $0.0 ($64,013.5) ($55,092.7) 2026E 3,027.4 $137,520.3 $8,707.0 $35,288.2 $130,956.3 $0.0 $0.0 ($37,431.2) ($29,531.6) 2027E 3,899.0 $159,720.9 $10,275.9 $47,152.7 $124,906.2 $0.0 $0.0 ($22,614.0) ($16,075.4) 2028E 5,057.4 $203,509.3 $13,136.1 $57,461.8 $139,194.5 $0.0 $0.0 ($6,283.0) ($4,122.6) 2029E 4,255.5 $170,854.8 $11,041.1 $53,713.7 $4,740.5 $0.0 $0.0 $101,359.5 $58,904.6 2030E 2,940.7 $114,105.4 $7,429.2 $44,621.4 $0.0 $0.0 $0.0 $62,054.8 $32,725.4 2031E 2,305.0 $89,069.1 $5,804.2 $38,400.7 $0.0 $0.0 $0.0 $44,864.2 $21,490.1 2032E 1,919.3 $74,054.4 $4,827.1 $33,616.1 $0.0 $0.0 $0.0 $35,611.2 $15,501.8 2033E 1,655.9 $63,827.9 $4,161.4 $30,586.9 $0.0 $0.0 $0.0 $29,079.7 $11,500.8 2034E 1,462.5 $56,326.8 $3,672.9 $27,909.7 $0.0 $0.0 $0.0 $24,744.2 $8,897.3 2035E 1,313.3 $50,550.8 $3,296.7 $26,527.2 $0.0 $0.0 $0.0 $20,726.9 $6,776.2 2036E 1,194.4 $45,946.2 $2,996.7 $25,778.6 $0.0 $0.0 $0.0 $17,170.9 $5,103.1 2037E 1,096.9 $42,177.7 $2,751.2 $25,165.4 $0.0 $0.0 $0.0 $14,261.2 $3,853.0 2038E 1,015.4 $39,025.3 $2,545.8 $24,652.2 $0.0 $0.0 $0.0 $11,827.4 $2,905.1 2039E 945.6 $36,328.5 $2,370.0 $24,213.1 $0.0 $0.0 $0.0 $9,745.3 $2,176.2 2040E 884.3 $33,960.3 $2,215.7 $23,827.0 $0.0 $0.0 $0.0 $7,917.6 $1,607.6 2041E 829.0 $31,831.7 $2,076.9 $23,478.9 $0.0 $0.0 $0.0 $6,275.9 $1,158.7 2042E 756.4 $28,990.3 $1,892.2 $22,299.6 $0.0 $0.0 $0.0 $4,798.5 $805.7 2043E 705.3 $27,015.2 $1,763.4 $21,796.5 $0.0 $0.0 $0.0 $3,455.3 $527.7 2044E 623.4 $23,781.6 $1,553.6 $19,983.8 $0.0 $461.0 $30.0 $1,813.2 $255.1 2045E 527.2 $19,957.7 $1,305.7 $17,449.7 $0.0 $0.0 $0.0 $1,202.3 $152.3 2046E 420.4 $15,693.6 $1,029.5 $14,322.3 $0.0 $461.0 $30.0 ($89.2) ($8.3) 2047E 227.3 $7,882.7 $524.9 $7,579.3 $0.0 $1,152.5 $75.0 ($1,298.9) ($133.9) 2048E 130.5 $3,980.8 $272.6 $4,177.1 $0.0 $1,140.5 $74.2 ($1,535.3) ($144.9) 2049E 96.8 $2,689.3 $188.4 $3,119.9 $0.0 $2,979.2 $193.9 ($3,404.3) ($288.7) 2050E 77.5 $1,975.2 $141.4 $2,543.7 $0.0 $3,227.0 $210.0 ($3,726.9) ($290.7) 2051E 72.8 $1,856.6 $132.9 $2,511.5 $0.0 $230.5 $15.0 ($1,003.3) ($71.1) 2052E 68.5 $1,745.2 $124.9 $2,481.3 $0.0 $691.5 $45.0 ($1,507.5) ($97.6) 2053E 64.3 $1,640.5 $117.4 $2,452.9 $0.0 $0.0 $0.0 ($929.8) ($54.6) 2054E 60.5 $1,542.1 $110.4 $2,426.1 $0.0 $0.0 $0.0 ($994.4) ($53.1) 2055E 56.9 $1,449.6 $103.8 $1,233.2 $0.0 $0.0 $0.0 $112.7 $4.8 2056E 53.4 $1,362.6 $97.5 $820.3 $0.0 $0.0 $0.0 $444.8 $19.6 2057E 50.2 $1,280.8 $91.7 $798.1 $0.0 $0.0 $0.0 $391.1 $15.7 2058E 47.2 $1,204.0 $86.2 $777.2 $0.0 $0.0 $0.0 $340.6 $12.4 2059E 44.4 $1,131.8 $81.0 $757.6 $0.0 $0.0 $0.0 $293.1 $9.7 2060E 41.7 $1,063.8 $76.2 $739.2 $0.0 $0.0 $0.0 $248.5 $7.5 2061E 39.2 $1,000.0 $71.6 $721.8 $0.0 $0.0 $0.0 $206.6 $5.7 2062E 36.9 $940.0 $67.3 $705.5 $0.0 $0.0 $0.0 $167.2 $4.2 2063E 34.7 $883.6 $63.3 $690.2 $0.0 $0.0 $0.0 $130.1 $3.0 2064E 32.6 $830.6 $59.5 $675.8 $0.0 $0.0 $0.0 $95.3 $2.0 2065E 30.6 $780.8 $55.9 $662.3 $0.0 $0.0 $0.0 $62.6 $1.2 2066E 28.8 $733.9 $52.5 $649.6 $0.0 $0.0 $0.0 $31.8 $0.5 2067E 16.4 $418.8 $30.0 $382.5 $0.0 $0.0 $0.0 $6.3 $0.1 2068E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2069E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 2070E 0.0 $0.0 $0.0 $0.0 $0.0 $839.5 $54.6 ($784.8) ($9.0) 2071E 0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Total 40,749.5 $1,635,609.3 $105,881.6 $708,461.4 $590,413.2 $11,182.6 $727.7 $220,398.2 $35,617.9 PUD

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

CONFIDENTIAL 12M refers to Twelve Month 1P refers to proven reserves A refers to Actual Adj. refers to Adjusted Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non - recurring items AGI refers to Acid Gas Injection Avg refers to Average Bblpd refers to Barrels per Day Boe refers to Barrels of Oil Equivalent Boepd refers to Barrels of Oil Equivalent per Day CAGR refers to Compound Annual Growth Rate CAPEX refers to Capital Expenditures CY refers to Calendar Year DCF refers to Discounted Cash Flow Disc. refers to discount E refers to Estimated EBIT refers to Earnings Before Interest and Taxes EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization EPS refers to E arnings Per Share EV refers to Enterprise Value FV refers to Fair Value FY refers to Fiscal Year G&A refers to General and Administrative GTO refers to Gathering, Transportation and Other K refers to T housand L5M refers to most recently completed 5 - month period Lbs /ft refers to Pounds per Foot LOE refers to lease operating expenses LOS refers to lease operating schedule LQA refers to Last Quarter Annualized LTM refers to Most recently completed 12 - month period for which financial information has been made public or available, other than for the Company, in which case LTM refers to Latest 12 Months Mbbl refers to One Thousand Barrels Mboe refers to One Thousand Barrel of Oil Equivalent Mcf refers to Thousand Cubic Feet Mcfpd refers to Million Cubic Feet per day MM refers to Million Mmboe refers to One Million Barrels of Oil Equivalent MMcf refers to Million Cubic Feet Mo refers to Month NA refers to Not Applicable NAV refers to Net Asset Value NDA refers to Non - Disclosure Agreement NFY refers to Refers to the next fiscal year for which financial information has not been made public, other than for the Company, in which case NFY refers to Next Fiscal Year Glossary of Selected Terms 37

CONFIDENTIAL NFY+1 refers to Next Fiscal Year following NFY NGL refers to Natural Gas Liquid NMF refers to Not Meaningful Figure NTM refers to Next Twelve Months NYMEX refers to New York Mercantile Exchange P&A refers to Plugging and Abandonment PDNP refers to Proved Developed Non - Producing PDP refers to Proved Developed Producing Prem. refers to premium PROB refers to Probable POSS refers to Possible PUD refers to Proved Undeveloped PV refers to Present Value PV - 10 refers to present value discounted at ten percent Q refers to Quarter R/P refers to Reserves/Production RADR refers to Risk - Adjusted Discount Rates RAF refers to Reserve Adjustment Factors RSU refers to Restricted Stock Unit SPEE refers to Society of Petroleum Evaluation Engineers SWD refers to Saltwater Disposal UCF refers to Unlevered Cash Flow VWAP refers to Volume - Weighted Average Price WACC refers to Weighted Average Cost of Capital WTI refers to West Texas Intermediate YoY refers to Year - over - Year YTD refers to Year to Date Glossary of Selected Terms (cont.) 38

Page 1. Selected Public Market Observations 3 2. Benchmarking Data 7 3. Selected Technical Observations 12 4. Pricing 27 5. NAV Analysis Detail 29 6. Glossary of Selected Terms 36 7. Disclaimer 39

CONFIDENTIAL This presentation, and any supplemental information (written or oral) or other documents provided in connection therewith (co lle ctively, the “materials”), are provided solely for the information of the Board of Directors (the “Board”) of Battalion Oil Corporation (the “Company”) by Houlihan Lokey in co nnection with the Board’s consideration of a potential transaction (the “Transaction”) involving the Company. This presentation is incomplete without reference to, and sh oul d be considered in conjunction with, any supplemental information provided by and discussions with Houlihan Lokey in connection therewith. Any defined terms used here in shall have the meanings set forth herein, even if such defined terms have been given different meanings elsewhere in the materials. The materials are for discussion purposes only. Houlihan Lokey expressly disclaims any and all liability, whether direct or i ndi rect, in contract or tort or otherwise, to any person in connection with the materials. The materials were prepared for specific persons familiar with the business and affa irs of the Company for use in a specific context and were not prepared with a view to public disclosure or to conform with any disclosure standards under any state, f ede ral or international securities laws or other laws, rules or regulations, and none of the Board, the Company or Houlihan Lokey takes any responsibility for the use of the mat erials by persons other than the Board. The materials are provided on a confidential basis solely for the information of the Board and may not be disclosed, summariz ed, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without Houlihan Lokey’s express prior written consent, except as expressly permi tte d by Houlihan Lokey’s engagement letter with the Company. Notwithstanding any other provision herein, the Company (and each employee, representative or other agent of the Company) may di sclose to any and all persons without limitation of any kind, the tax treatment and tax structure of any transaction and all materials of any kind (including opini ons or other tax analyses, if any) that are provided to the Company relating to such tax treatment and structure. However, any information relating to the tax treatment and tax s tru cture shall remain confidential (and the foregoing sentence shall not apply) to the extent necessary to enable any person to comply with securities laws. For this pur pos e, the tax treatment of a transaction is the purported or claimed U.S. income or franchise tax treatment of the transaction and the tax structure of a transaction is any fac t that may be relevant to understanding the purported or claimed U.S. income or franchise tax treatment of the transaction. If the Company plans to disclose information pur suant to the first sentence of this paragraph, the Company shall inform those to whom it discloses any such information that they may not rely upon such informat ion for any purpose without Houlihan Lokey’s prior written consent. Houlihan Lokey is not an expert on, and nothing contained in the materials should be construed as advice with regard to, legal, accounting, regulatory, insurance, tax or other specialist matters. Houlihan Lokey’s role in reviewing any information was limited solely to performing such a review as it deemed necessary to support its own advice and analysis and was not on behalf of the Board. The materials necessarily are based on financial, economic, market and other conditions as in effect on, and the information ava ilable to Houlihan Lokey as of, the date of the materials. Although subsequent developments may affect the contents of the materials, Houlihan Lokey has not undertaken, and is under no obligation, to update, revise or reaffirm the materials. The materials are not intended to provide the sole basis for evaluation of the Transaction and do not purport to contain all information that may be required. The materials do not address the underlying business decision of the Company or any other party to proceed w ith or effect the Transaction, or the relative merits of the Transaction as compared to any alternative business strategies or transactions that might be available fo r the Company or any other party. The materials do not constitute any opinion, nor do the materials constitute a recommendation to the Board, the Company, any secu rit y holder of the Company or any other party as to how to vote or act with respect to any matter relating to the Transaction or otherwise or whether to buy or sell any assets or securities of any company. Houlihan Lokey’s only opinion is the opinion, if any, that is actually delivered to the Board. In preparing the materials Hou lih an Lokey has acted as an independent contractor and nothing in the materials is intended to create or shall be construed as creating a fiduciary or other relation shi p between Houlihan Lokey and any party. The materials may not reflect information known to other professionals in other business areas of Houlihan Lokey and its affiliat es. Disclaimer 40

CONFIDENTIAL The preparation of the materials was a complex process involving quantitative and qualitative judgments and determinations wi th respect to the financial, comparative and other analytic methods employed and the adaption and application of these methods to the unique facts and circumstances prese nte d and, therefore, is not readily susceptible to partial analysis or summary description. Furthermore, Houlihan Lokey did not attribute any particular weight t o a ny analysis or factor considered by it, but rather made qualitative judgments as to the significance and relevance of each analysis and factor. Each analytical technique ha s inherent strengths and weaknesses, and the nature of the available information may further affect the value of particular techniques. Accordingly, the analyses cont ain ed in the materials must be considered as a whole. Selecting portions of the analyses, analytic methods and factors without considering all analyses and factors could c rea te a misleading or incomplete view. The materials reflect judgments and assumptions with regard to industry performance, general business, economic, regulatory, mark et and financial conditions and other matters, many of which are beyond the control of the participants in the Transaction. Any estimates of value contained in the ma terials are not necessarily indicative of actual value or predictive of future results or values, which may be significantly more or less favorable. Any analyses relat ing to the value of assets, businesses or securities do not purport to be appraisals or to reflect the prices at which any assets, businesses or securities may actuall y b e sold. The materials do not constitute a credit rating. In preparing the materials, Houlihan Lokey has not conducted any physical inspection or independent appraisal or eval uat ion of any of the assets, properties or liabilities (contingent or otherwise) of the Company or any other party and has no obligation to evaluate the solvency of the Co mpany or any other party under any law. All budgets, projections, estimates, financial analyses, reports and other information with respect to operations reflected i n t he materials have been prepared by management of the relevant party or are derived from such budgets, projections, estimates, financial analyses, reports and ot her information or from other sources, which involve numerous and significant subjective determinations made by management of the relevant party and/or which such managem ent has reviewed and found reasonable. The budgets, projections and estimates contained in the materials may or may not be achieved and differences bet wee n projected results and those actually achieved may be material. Houlihan Lokey has relied upon representations made by management of the Company that such budgets, pr ojections and estimates have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of such manag eme nt (or, with respect to information obtained from public sources, represent reasonable estimates), and Houlihan Lokey expresses no opinion with respect to such b udg ets, projections or estimates or the assumptions on which they are based. The scope of the financial analysis contained herein is based on discussions with the C omp any (including, without limitation, regarding the methodologies to be utilized), and Houlihan Lokey does not make any representation, express or implied, as to t he sufficiency or adequacy of such financial analysis or the scope thereof for any particular purpose. Houlihan Lokey has assumed and relied upon the accuracy and completeness of the financial and other information provided to, dis cussed with or reviewed by it without (and without assuming responsibility for) independent verification of such information, makes no representation or warranty ( exp ress or implied) in respect of the accuracy or completeness of such information and has further relied upon the assurances of the Company that it is not aware of any fac ts or circumstances that would make such information inaccurate or misleading. In addition, Houlihan Lokey has relied upon and assumed, without independent verificat ion , that there has been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company or any othe r p articipant in the Transaction since the respective dates of the most recent financial statements and other information, financial or otherwise, provided to, discusse d w ith or reviewed by Houlihan Lokey that would be material to its analyses, and that the final forms of any draft documents reviewed by Houlihan Lokey will not differ in any material respect from such draft documents. Disclaimer (cont.) 41

CONFIDENTIAL The materials are not an offer to sell or a solicitation of an indication of interest to purchase any security, option, commo dit y, future, loan or currency. The materials do not constitute a commitment by Houlihan Lokey or any of its affiliates to underwrite, subscribe for or place any securities, to e xte nd or arrange credit, or to provide any other services. In the ordinary course of business, certain of Houlihan Lokey’s affiliates and employees, as well as investment fun ds in which they may have financial interests or with which they may co - invest, may acquire, hold or sell, long or short positions, or trade or otherwise effect transactions, in debt, equity, and other securities and financial instruments (including loans and other obligations) of, or investments in, the Company, any Transaction counterparty, any oth er Transaction participant, any other financially interested party with respect to any transaction, other entities or parties that are mentioned in the materials, or any of the foregoing entities’ or parties’ respective affiliates, subsidiaries, investment funds, portfolio companies and representatives (collectively, the “Interested Parties”), or any currency or commodity that may be involved in the Transaction. Houlihan Lokey provides mergers and acquisitions, restructuring and other advisory and consultin g s ervices to clients, which may have in the past included, or may currently or in the future include, one or more Interested Parties, for which services Houlihan Lokey h as received, and may receive, compensation. Although Houlihan Lokey in the course of such activities and relationships or otherwise may have acquired, or may in the futu re acquire, information about one or more Interested Parties or the Transaction, or that otherwise may be of interest to the Board or the Company, Houlihan Lokey shall ha ve no obligation to, and may not be contractually permitted to, disclose such information, or the fact that Houlihan Lokey is in possession of such information, to the Board or the Company or to use such information on behalf of the Board or the Company. Houlihan Lokey’s personnel may make statements or provide advice that is c ont rary to information contained in the materials. Disclaimer (cont.) 42

CONFIDENTIAL 43 CORPORATE FINANCE FINANCIAL RESTRUCTURING FINANCIAL AND VALUATION ADVISORY HL .com