Semi-Annual Report –

Baird Funds

June 30, 2023

Taxable Bond Funds

Baird Ultra Short Bond Fund

Baird Short-Term Bond Fund

Baird Intermediate Bond Fund

Baird Aggregate Bond Fund

Baird Core Plus Bond Fund

Municipal Bond Funds

Baird Short-Term Municipal Bond Fund

Baird Strategic Municipal Bond Fund

Baird Quality Intermediate Municipal Bond Fund

Baird Core Intermediate Municipal Bond Fund

Baird Municipal Bond Fund

| Go Green. |  | Go Paperless. |

Sign up to receive your Baird Funds’ prospectuses and reports online.

Table of Contents

| Baird Ultra Short Bond Fund | | 1 |

| Baird Short-Term Bond Fund | | 11 |

| Baird Intermediate Bond Fund | | 24 |

| Baird Aggregate Bond Fund | | 41 |

| Baird Core Plus Bond Fund | | 73 |

| Baird Short-Term Municipal Bond Fund | | 102 |

| Baird Strategic Municipal Bond Fund | | 127 |

| Baird Quality Intermediate Municipal Bond Fund | | 143 |

| Baird Core Intermediate Municipal Bond Fund | | 159 |

| Baird Municipal Bond Fund | | 195 |

| Additional Information on Fund Expenses | | 206 |

| Statements of Assets and Liabilities | | 207 |

| Statements of Operations | | 209 |

| Statements of Changes in Net Assets | | 211 |

| Financial Highlights | | 216 |

| Notes to the Financial Statements | | 236 |

| Statement Regarding Liquidity Risk Management Program | | 247 |

| Additional Information | | 247 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Baird Ultra Short Bond Fund

June 30, 2023 (Unaudited)

Portfolio Characteristics

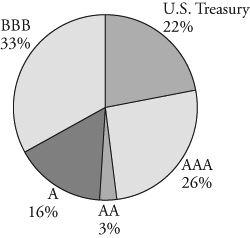

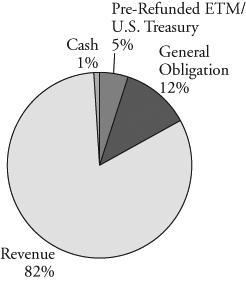

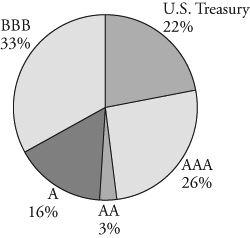

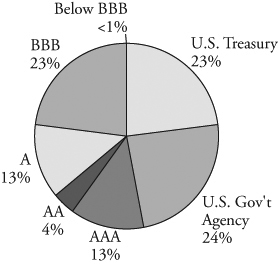

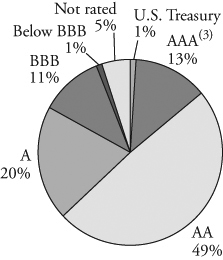

Quality Distribution(1)(2)

| | Net Assets | $6,200,539,163 | |

| | | | |

| | SEC 30-Day Yield(3) | | |

| | Institutional Class (Subsidized) | 5.27% | |

| | Institutional Class (Unsubsidized) | 5.12% | |

| | Investor Class (Subsidized) | 5.02% | |

| | Investor Class (Unsubsidized) | 4.87% | |

| | | | |

| | Average Effective Duration | 0.55 years | |

| | | | |

| | Average Effective Maturity | 0.62 years | |

| | | | |

| | Annualized Expense Ratio(4) | | |

| | Gross | | |

| | Institutional Class | 0.30% | |

| | | Investor Class | 0.55% | (5) |

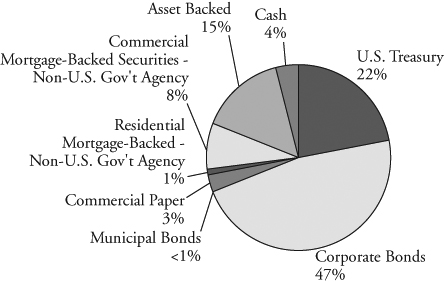

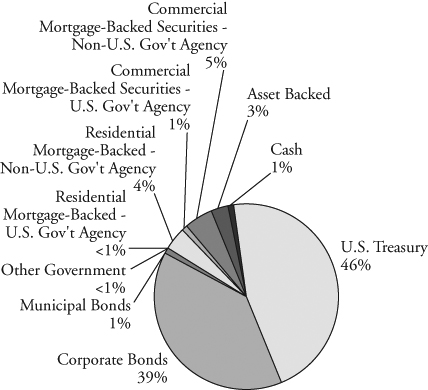

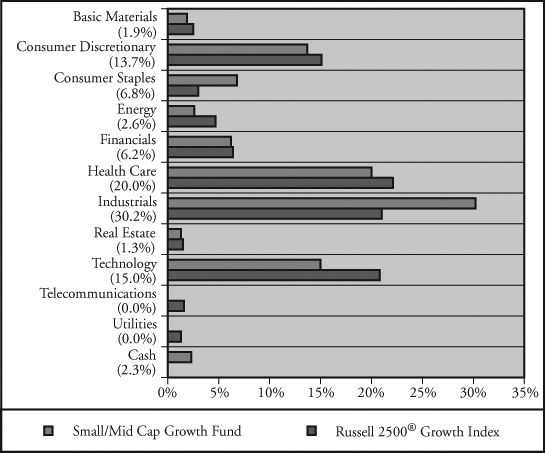

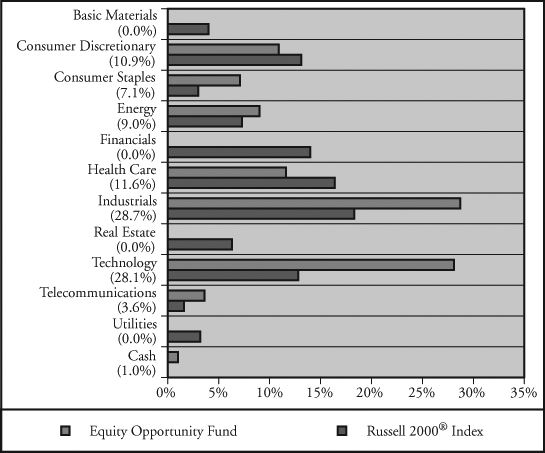

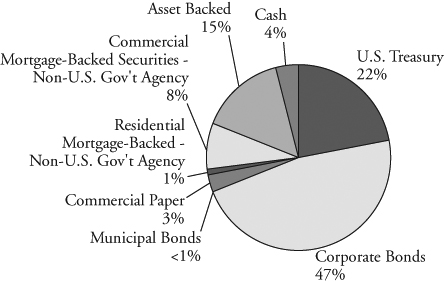

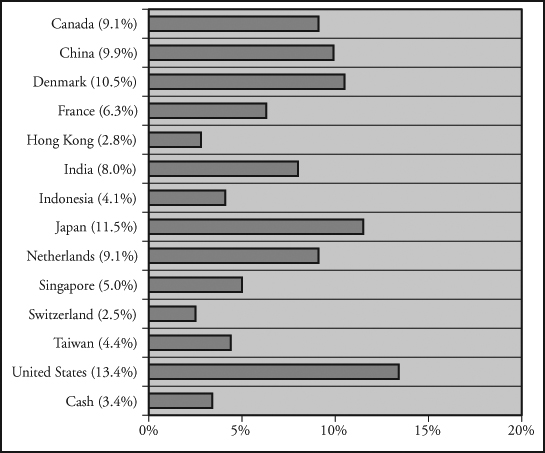

Sector Weightings(7) | | | | |

| | | Net | | |

| | Institutional Class | 0.15% | |

| | Investor Class | 0.40% | (5) |

| | | | |

| | Portfolio Turnover Rate | 58% | (6) |

| | | | |

| | Number of Holdings | 319 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

(1) | Percentages shown are based on the Fund’s total investments. |

(2) | The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

(3) | SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2023. |

(4) | Reflects expense ratios as stated in the Fund’s current prospectus dated May 1, 2023. The Advisor has contractually agreed to waive management fees in an amount equal to an annual rate of 0.15% of average daily net assets for the Fund, at least through April 30, 2024. The agreement may only be terminated prior to the end of this term by or with the consent of the Board of Directors of Baird Funds, Inc. |

(5) | Includes 0.25% 12b-1 fee. |

(6) | Not annualized. |

(7) | Percentages shown are based on the Fund’s total net assets. |

Baird Ultra Short Bond Fund

June 30, 2023 (Unaudited)

Total Returns

| | | | Average Annual |

| | Six | One | Three | Five | Since |

| For the Periods Ended June 30, 2023 | Months | Year | Years | Years | Inception(1) |

| Institutional Class Shares | 2.44% | 3.88% | 1.35% | 1.89% | 1.54% |

| Investor Class Shares | 2.30% | 3.50% | 1.06% | 1.68% | 1.31% |

Bloomberg Short-Term U.S. Government/Corporate Index(2) | 2.19% | 3.27% | 1.04% | 1.63% | 1.18% |

(1) | For the period from December 31, 2013 (inception date) through June 30, 2023. |

(2) | The Bloomberg Short-Term U.S. Government/Corporate Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities less than one year. This Index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible. |

The returns table shown above reflects reinvestment of dividends and/or capital gains distributions in additional shares. The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund’s gross and net expense ratio for each Class, as reflected in the Fund’s current prospectus, is set forth under “Portfolio Characteristics”.

The Fund may invest up to 10% of its net assets in non-investment grade debt securities (commonly referred to as “high yield” bonds). While these types of securities typically offer higher yields than investment grade securities, they also include greater risks including increased credit risk and the increased risk of default or bankruptcy. The Fund may also invest in U.S. dollar denominated foreign securities which involve additional risks such as political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund may also invest in mortgage- and asset-backed securities, which include interest rate and prepayment risks more pronounced than those of other fixed income securities. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors. Russia’s ongoing war with Ukraine has heightened global geopolitical tensions, resulting in an elevated risk environment and increased volatility in asset prices. The uncertain course of the war may have a significant negative impact on the global economy. U.S. relations with China have become increasingly strained, and tension between the U.S. and China may have a significant negative impact on the global economy and asset prices. Measures of inflation reached levels not experienced in several decades, leading the Federal Reserve to raise short term interest rates significantly over the last year, with the potential for further rate increases in 2023. Uncertainty regarding the ability of the Federal Reserve to successfully control inflation, the potential for incremental rate increases, and the full impact of prior rate increases on the economy may negatively impact asset prices and increase market volatility. The possibility of a U.S. or global recession may also contribute to market volatility. The coronavirus (COVID-19) pandemic caused significant economic disruption in recent years as countries worked to limit the negative health impacts of the virus. While the virus has entered an endemic stage, significant outbreaks or new variants present a continued risk to the global economy. These and other geopolitical events may cause market disruptions and could have an adverse effect on the value of the Fund’s investments.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

For information about the performance of the Fund as of the most recent month-end, please call 1-866-442-2473 or visit www.bairdfunds.com. Mutual fund performance changes over time and current performance may be lower or higher than that stated.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| U.S. Treasury Securities | | | | | | | | | |

| U.S. Treasury Bonds: | | | | | | | | | |

| 0.125%, 08/31/2023 | | $ | 70,000,000 | | | $ | 69,426,281 | | | | |

| 0.250%, 09/30/2023 | | | 30,000,000 | | | | 29,635,372 | | | | |

| 0.375%, 10/31/2023 | | | 100,000,000 | | | | 98,429,688 | | | | |

| 0.250%, 11/15/2023 | | | 95,000,000 | | | | 93,252,148 | | | | |

| 0.875%, 01/31/2024 | | | 245,000,000 | | | | 238,674,024 | | | | |

| 1.500%, 02/29/2024 | | | 125,000,000 | | | | 121,787,110 | | | | |

| Total U.S. Treasury Securities | | | | | | | | | | | |

| (Cost $652,651,029) | | | | | | | 651,204,623 | | | | 10.5 | % |

| Corporate Bonds | | | | | | | | | | | | |

| Industrials | | | | | | | | | | | | |

| 7-Eleven, Inc., | | | | | | | | | | | | |

| 0.800%, 02/10/2024 | | | | | | | | | | | | |

(Callable 07/31/2023)(1)(2) | | | 2,918,000 | | | | 2,828,141 | | | | | |

| Adventist Health System, | | | | | | | | | | | | |

| 2.433%, 09/01/2024 | | | | | | | | | | | | |

| (Callable 08/01/2024) | | | 5,120,000 | | | | 4,922,588 | | | | | |

| Anglo American Capital PLC, | | | | | | | | | | | | |

3.625%, 09/11/2024(1)(2) | | | 8,900,000 | | | | 8,649,622 | | | | | |

| Arrow Electronics, Inc., | | | | | | | | | | | | |

| 3.250%, 09/08/2024 | | | | | | | | | | | | |

| (Callable 07/08/2024) | | | 10,715,000 | | | | 10,338,963 | | | | | |

| Bayer US Finance II LLC, | | | | | | | | | | | | |

| 3.875%, 12/15/2023 | | | | | | | | | | | | |

(Callable 11/15/2023)(1)(2) | | | 20,078,000 | | | | 19,884,007 | | | | | |

| Bayer US Finance LLC, | | | | | | | | | | | | |

3.375%, 10/08/2024(1)(2) | | | 4,400,000 | | | | 4,260,056 | | | | | |

| Berry Global, Inc., | | | | | | | | | | | | |

| 0.950%, 02/15/2024 | | | | | | | | | | | | |

| (Callable 01/15/2024) | | | 45,677,000 | | | | 43,909,300 | | | | | |

| Boeing Co., | | | | | | | | | | | | |

| 1.433%, 02/04/2024 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 16,005,000 | | | | 15,579,387 | | | | | |

| British Telecommunications PLC, | | | | | | | | | | | | |

| 4.500%, 12/04/2023 | | | | | | | | | | | | |

(Callable 11/04/2023)(1) | | | 14,170,000 | | | | 14,089,205 | | | | | |

| CA Technologies, | | | | | | | | | | | | |

| 4.500%, 08/15/2023 | | | | | | | | | | | | |

| (Callable 07/31/2023) | | | 4,970,000 | | | | 4,961,905 | | | | | |

| Carlisle Companies, Inc., | | | | | | | | | | | | |

| 0.550%, 09/01/2023 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 10,000,000 | | | | 9,900,678 | | | | | |

| Celanese US Holdings LLC: | | | | | | | | | | | | |

| 3.500%, 05/08/2024 | | | | | | | | | | | | |

| (Callable 04/08/2024) | | | 7,243,000 | | | | 7,088,412 | | | | | |

| 5.900%, 07/05/2024 | | | 18,113,000 | | | | 18,074,496 | | | | | |

| Charter Communications Operating LLC, | | | | | | | | | | | | |

| 4.500%, 02/01/2024 | | | | | | | | | | | | |

| (Callable 01/01/2024) | | | 11,700,000 | | | | 11,596,726 | | | | | |

| CNH Industrial Capital LLC: | | | | | | | | | | | | |

1.950%, 07/02/2023(1) | | | 13,844,000 | | | | 13,844,000 | | | | | |

4.200%, 01/15/2024(1) | | | 6,700,000 | | | | 6,633,352 | | | | | |

| CNH Industrial NV, | | | | | | | | | | | | |

4.500%, 08/15/2023(1) | | | 5,595,000 | | | | 5,586,117 | | | | | |

| Conagra Brands, Inc., | | | | | | | | | | | | |

| 0.500%, 08/11/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 7,000,000 | | | | 6,960,459 | | | | | |

| Cox Communications, Inc., | | | | | | | | | | | | |

| 3.150%, 08/15/2024 | | | | | | | | | | | | |

(Callable 06/15/2024)(2) | | | 20,705,000 | | | | 20,004,572 | | | | | |

| Element Fleet Management Corp., | | | | | | | | | | | | |

| 1.600%, 04/06/2024 | | | | | | | | | | | | |

(Callable 03/06/2024)(1)(2) | | | 17,919,000 | | | | 17,278,819 | | | | | |

| Enbridge, Inc.: | | | | | | | | | | | | |

| 4.000%, 10/01/2023 | | | | | | | | | | | | |

(Callable 07/31/2023)(1) | | | 4,034,000 | | | | 4,017,926 | | | | | |

2.150%, 02/16/2024(1) | | | 19,482,000 | | | | 19,028,442 | | | | | |

| 3.500%, 06/10/2024 | | | | | | | | | | | | |

(Callable 03/10/2024)(1) | | | 2,300,000 | | | | 2,250,241 | | | | | |

| Energy Transfer LP: | | | | | | | | | | | | |

| 5.875%, 01/15/2024 | | | | | | | | | | | | |

| (Callable 10/15/2023) | | | 8,775,000 | | | | 8,776,480 | | | | | |

| 4.900%, 02/01/2024 | | | | | | | | | | | | |

| (Callable 11/01/2023) | | | 13,061,000 | | | | 12,971,387 | | | | | |

| 4.250%, 04/01/2024 | | | | | | | | | | | | |

| (Callable 01/01/2024) | | | 3,055,000 | | | | 3,008,083 | | | | | |

| 4.500%, 04/15/2024 | | | | | | | | | | | | |

| (Callable 03/15/2024) | | | 10,604,000 | | | | 10,482,111 | | | | | |

| 6.022%, 05/15/2024 | | | | | | | | | | | | |

| (Callable 02/15/2024) | | | 2,739,000 | | | | 2,692,637 | | | | | |

| Eni SpA, | | | | | | | | | | | | |

4.000%, 09/12/2023(1)(2) | | | 18,805,000 | | | | 18,725,431 | | | | | |

| EnLink Midstream Partners LP, | | | | | | | | | | | | |

| 4.400%, 04/01/2024 | | | | | | | | | | | | |

| (Callable 01/01/2024) | | | 2,000,000 | | | | 1,965,899 | | | | | |

| Enterprise Products Operating LLC, | | | | | | | | | | | | |

| 3.900%, 02/15/2024 | | | | | | | | | | | | |

| (Callable 11/15/2023) | | | 6,140,000 | | | | 6,072,505 | | | | | |

| ERAC USA Finance LLC, | | | | | | | | | | | | |

| 2.700%, 11/01/2023 | | | | | | | | | | | | |

(Callable 09/01/2023)(2) | | | 8,960,000 | | | | 8,867,524 | | | | | |

| Fortune Brands Home & Security, Inc., | | | | | | | | | | | | |

| 4.000%, 09/21/2023 | | | | | | | | | | | | |

| (Callable 08/21/2023) | | | 42,945,000 | | | | 42,758,372 | | | | | |

| Fresenius Medical Care US Finance II, Inc., | | | | | | | | | | | | |

| 4.750%, 10/15/2024 | | | | | | | | | | | | |

(Callable 07/17/2024)(1)(2) | | | 4,654,000 | | | | 4,555,837 | | | | | |

| General Motors Financial Co., Inc., | | | | | | | | | | | | |

| 1.050%, 03/08/2024 | | | 15,684,000 | | | | 15,166,597 | | | | | |

| Georgia-Pacific LLC, | | | | | | | | | | | | |

3.734%, 07/15/2023(2) | | | 14,935,000 | | | | 14,923,881 | | | | | |

| Graphic Packaging International LLC, | | | | | | | | | | | | |

| 0.821%, 04/15/2024 | | | | | | | | | | | | |

(Callable 03/15/2024)(2) | | | 37,512,000 | | | | 35,992,716 | | | | | |

| Gray Oak Pipeline LLC, | | | | | | | | | | | | |

2.000%, 09/15/2023(1)(2) | | | 28,995,000 | | | | 28,749,588 | | | | | |

| GSK Consumer Healthcare Capital US LLC, | | | | | | | | | | | | |

| 3.024%, 03/24/2024 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 22,825,000 | | | | 22,329,554 | | | | | |

| HCA, Inc., | | | | | | | | | | | | |

| 5.000%, 03/15/2024 | | | 14,010,000 | | | | 13,920,010 | | | | | |

| Hewlett Packard Enterprise Co.: | | | | | | | | | | | | |

| 4.450%, 10/02/2023 | | | | | | | | | | | | |

| (Callable 09/02/2023) | | | 7,900,000 | | | | 7,876,889 | | | | | |

| 5.900%, 10/01/2024 | | | 36,450,000 | | | | 36,460,470 | | | | | |

| HF Sinclair Corp., | | | | | | | | | | | | |

| 2.625%, 10/01/2023 | | | 24,141,000 | | | | 23,940,294 | | | | | |

| Huntington Ingalls Industries, Inc., | | | | | | | | | | | | |

| 0.670%, 08/16/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 32,144,000 | | | | 31,948,050 | | | | | |

| Hyatt Hotels Corp.: | | | | | | | | | | | | |

| 1.300%, 10/01/2023 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 17,070,000 | | | | 16,913,441 | | | | | |

| 1.800%, 10/01/2024 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 23,435,000 | | | | 22,305,159 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Hyundai Capital America: | | | | | | | | | |

1.250%, 09/18/2023(1)(2) | | $ | 2,500,000 | | | $ | 2,476,197 | | | |

| |

0.800%, 01/08/2024(1)(2) | | | 14,605,000 | | | | 14,221,949 | | | | | |

1.000%, 09/17/2024(1)(2) | | | 23,472,000 | | | | 22,073,335 | | | | | |

| Infor, Inc., | | | | | | | | | | | | |

1.450%, 07/15/2023(2) | | | 6,255,000 | | | | 6,244,295 | | | | | |

| Keysight Technologies, Inc., | | | | | | | | | | | | |

| 4.550%, 10/30/2024 | | | | | | | | | | | | |

| (Callable 07/30/2024) | | | 10,755,000 | | | | 10,572,801 | | | | | |

| Kinder Morgan Energy Partners LP: | | | | | | | | | | | | |

| 4.150%, 02/01/2024 | | | | | | | | | | | | |

| (Callable 11/01/2023) | | | 6,407,000 | | | | 6,344,205 | | | | | |

| 4.250%, 09/01/2024 | | | | | | | | | | | | |

| (Callable 06/01/2024) | | | 5,696,000 | | | | 5,580,978 | | | | | |

| Kinder Morgan, Inc., | | | | | | | | | | | | |

| 5.625%, 11/15/2023 | | | | | | | | | | | | |

(Callable 08/15/2023)(2) | | | 17,047,000 | | | | 17,036,695 | | | | | |

| Kinross Gold Corp., | | | | | | | | | | | | |

| 5.950%, 03/15/2024 | | | | | | | | | | | | |

(Callable 12/15/2023)(1) | | | 44,266,000 | | | | 44,192,023 | | | | | |

| Lennar Corp., | | | | | | | | | | | | |

| 4.500%, 04/30/2024 | | | | | | | | | | | | |

| (Callable 01/31/2024) | | | 8,743,000 | | | | 8,668,182 | | | | | |

| LYB International Finance BV, | | | | | | | | | | | | |

| 4.000%, 07/15/2023 | | | 23,642,000 | | | | 23,609,743 | | | | | |

| LyondellBasell Industries NV, | | | | | | | | | | | | |

| 5.750%, 04/15/2024 | | | | | | | | | | | | |

| (Callable 01/15/2024) | | | 554,000 | | | | 552,960 | | | | | |

| Marriott International, Inc., | | | | | | | | | | | | |

| 3.600%, 04/15/2024 | | | | | | | | | | | | |

| (Callable 03/15/2024) | | | 22,663,000 | | | | 22,281,971 | | | | | |

| Martin Marietta Materials, Inc., | | | | | | | | | | | | |

| 0.650%, 07/15/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 38,650,000 | | | | 38,569,602 | | | | | |

| Microchip Technology, Inc.: | | | | | | | | | | | | |

| 0.972%, 02/15/2024 | | | 1,375,000 | | | | 1,332,167 | | | | | |

| 0.983%, 09/01/2024 | | | 6,724,000 | | | | 6,351,297 | | | | | |

| Midwest Connector Capital Co. LLC, | | | | | | | | | | | | |

| 3.900%, 04/01/2024 | | | | | | | | | | | | |

(Callable 03/01/2024)(2) | | | 25,294,000 | | | | 24,763,772 | | | | | |

| Mylan, Inc., | | | | | | | | | | | | |

| 4.200%, 11/29/2023 | | | | | | | | | | | | |

| (Callable 08/29/2023) | | | 9,805,000 | | | | 9,735,720 | | | | | |

| Nissan Motor Acceptance Co. LLC: | | | | | | | | | | | | |

3.875%, 09/21/2023(1)(2) | | | 4,700,000 | | | | 4,673,665 | | | | | |

1.125%, 09/16/2024(1)(2) | | | 2,071,000 | | | | 1,929,113 | | | | | |

| Nissan Motor Co. Ltd., | | | | | | | | | | | | |

3.043%, 09/15/2023(1)(2) | | | 20,434,000 | | | | 20,289,428 | | | | | |

| NXP BV / NXP Funding LLC / | | | | | | | | | | | | |

| NXP USA, Inc., | | | | | | | | | | | | |

| 4.875%, 03/01/2024 | | | | | | | | | | | | |

(Callable 02/01/2024)(1) | | | 15,386,000 | | | | 15,275,854 | | | | | |

| Occidental Petroleum Corp., | | | | | | | | | | | | |

| 2.900%, 08/15/2024 | | | | | | | | | | | | |

| (Callable 07/15/2024) | | | 20,054,000 | | | | 19,305,458 | | | | | |

| Penske Truck Leasing Co.: | | | | | | | | | | | | |

| 4.125%, 08/01/2023 | | | | | | | | | | | | |

(Callable 07/31/2023)(2) | | | 1,225,000 | | | | 1,223,413 | | | | | |

| 3.900%, 02/01/2024 | | | | | | | | | | | | |

(Callable 01/01/2024)(2) | | | 4,663,000 | | | | 4,601,919 | | | | | |

| PerkinElmer, Inc., | | | | | | | | | | | | |

| 0.550%, 09/15/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 23,935,000 | | | | 23,714,894 | | | | | |

| Phillips 66 Co., | | | | | | | | | | | | |

| 0.900%, 02/15/2024 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 2,505,000 | | | | 2,430,567 | | | | | |

| Plains All American Pipeline LP / | | | | | | | | | | | | |

| PAA Finance Corp., | | | | | | | | | | | | |

| 3.850%, 10/15/2023 | | | | | | | | | | | | |

| (Callable 07/31/2023) | | | 42,718,000 | | | | 42,481,537 | | | | | |

| PVH Corp., | | | | | | | | | | | | |

| 7.750%, 11/15/2023 | | | 2,910,000 | | | | 2,917,428 | | | | | |

| Rogers Communications, Inc., | | | | | | | | | | | | |

| 4.100%, 10/01/2023 | | | | | | | | | | | | |

(Callable 07/31/2023)(1) | | | 29,075,000 | | | | 28,933,420 | | | | | |

| Royalty Pharma PLC, | | | | | | | | | | | | |

| 0.750%, 09/02/2023 | | | 47,319,000 | | | | 46,883,887 | | | | | |

| Ryder System, Inc., | | | | | | | | | | | | |

| 2.500%, 09/01/2024 | | | | | | | | | | | | |

| (Callable 08/01/2024) | | | 29,861,000 | | | | 28,672,122 | | | | | |

| Sabine Pass Liquefaction LLC, | | | | | | | | | | | | |

| 5.750%, 05/15/2024 | | | | | | | | | | | | |

| (Callable 02/15/2024) | | | 32,200,000 | | | | 32,144,593 | | | | | |

| Shire Acquisitions Investments Ireland DAC, | | | | | | | | | | | | |

| 2.875%, 09/23/2023 | | | | | | | | | | | | |

(Callable 07/31/2023)(1) | | | 5,029,000 | | | | 4,995,780 | | | | | |

| Sprint LLC: | | | | | | | | | | | | |

| 7.875%, 09/15/2023 | | | 40,195,000 | | | | 40,292,071 | | | | | |

| 7.125%, 06/15/2024 | | | 3,425,000 | | | | 3,455,630 | | | | | |

| Synnex Corporation, | | | | | | | | | | | | |

| 1.250%, 08/09/2024 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 3,490,000 | | | | 3,301,018 | | | | | |

| Teledyne Technologies, Inc., | | | | | | | | | | | | |

| 0.950%, 04/01/2024 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 15,746,000 | | | | 15,163,919 | | | | | |

| Thermo Fisher Scientific, Inc., | | | | | | | | | | | | |

| 0.797%, 10/18/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 25,000,000 | | | | 24,673,189 | | | | | |

| Toll Road Investors Partnership II LP, | | | | | | | | | | | | |

| 0.000%, 02/15/2024 | | | | | | | | | | | | |

(Insured by NATL)(1)(2) | | | 1,240,000 | | | | 1,188,927 | | | | | |

| TransCanada PipeLines Ltd., | | | | | | | | | | | | |

| 1.000%, 10/12/2024 | | | | | | | | | | | | |

(Callable 09/12/2024)(1) | | | 16,559,000 | | | | 15,557,133 | | | | | |

| Triton Container International Ltd.: | | | | | | | | | | | | |

0.800%, 08/01/2023(1)(2) | | | 44,377,000 | | | | 44,172,834 | | | | | |

| 1.150%, 06/07/2024 | | | | | | | | | | | | |

(Callable 05/07/2024)(1)(2) | | | 2,185,000 | | | | 2,072,069 | | | | | |

| Verizon Communications, Inc., | | | | | | | | | | | | |

| 6.421%, 05/15/2025 (3 Month LIBOR | | | | | | | | | | | | |

USD + 1.100%) (Callable 03/15/2025)(3) | | | 4,000,000 | | | | 4,032,734 | | | | | |

| VICI Properties LP, | | | | | | | | | | | | |

| 5.625%, 05/01/2024 | | | | | | | | | | | | |

(Callable 02/01/2024)(2) | | | 44,351,000 | | | | 44,077,603 | | | | | |

| Wabtec Corp., | | | | | | | | | | | | |

| 5.875%, 03/15/2024 | | | | | | | | | | | | |

| (Callable 02/15/2024) | | | 11,889,000 | | | | 11,729,445 | | | | | |

| Walgreens Boots Alliance, Inc., | | | | | | | | | | | | |

| 0.950%, 11/17/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 43,450,000 | | | | 42,792,519 | | | | | |

| Warnermedia Holdings, Inc.: | | | | | | | | | | | | |

| 3.428%, 03/15/2024 | | | 11,585,000 | | | | 11,374,345 | | | | | |

| 3.528%, 03/15/2024 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 24,199,000 | | | | 23,759,252 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Williams Companies, Inc., | | | | | | | | | |

| 4.550%, 06/24/2024 | | | | | | | | | |

| (Callable 03/24/2024) | | $ | 19,641,000 | | | $ | 19,375,060 | | | | |

| Total Industrials | | | | | | | | | | | |

| (Cost $1,519,503,021) | | | | | | | 1,515,189,047 | | | | 24.5 | % |

| Utilities | | | | | | | | | | | | |

| Black Hills Corp.: | | | | | | | | | | | | |

| 4.250%, 11/30/2023 | | | | | | | | | | | | |

| (Callable 08/30/2023) | | | 5,846,000 | | | | 5,805,190 | | | | | |

| 1.037%, 08/23/2024 | | | | | | | | | | | | |

| (Callable 07/17/2023) | | | 25,946,000 | | | | 24,509,041 | | | | | |

| CenterPoint Energy, Inc., | | | | | | | | | | | | |

| 2.500%, 09/01/2024 | | | | | | | | | | | | |

| (Callable 08/01/2024) | | | 9,603,000 | | | | 9,218,952 | | | | | |

| CMS Energy Corp., | | | | | | | | | | | | |

| 3.875%, 03/01/2024 | | | | | | | | | | | | |

| (Callable 12/01/2023) | | | 2,909,000 | | | | 2,867,545 | | | | | |

| EDP Finance BV, | | | | | | | | | | | | |

3.625%, 07/15/2024(1)(2) | | | 20,778,000 | | | | 20,240,837 | | | | | |

| Evergy, Inc., | | | | | | | | | | | | |

| 2.450%, 09/15/2024 | | | | | | | | | | | | |

| (Callable 08/15/2024) | | | 3,600,000 | | | | 3,448,540 | | | | | |

| IPALCO Enterprises, Inc., | | | | | | | | | | | | |

| 3.700%, 09/01/2024 | | | | | | | | | | | | |

| (Callable 07/01/2024) | | | 2,000,000 | | | | 1,933,631 | | | | | |

| ITC Holdings Corp., | | | | | | | | | | | | |

| 3.650%, 06/15/2024 | | | | | | | | | | | | |

(Callable 03/15/2024)(1) | | | 2,426,000 | | | | 2,375,262 | | | | | |

| Jersey Central Power & Light Co., | | | | | | | | | | | | |

| 4.700%, 04/01/2024 | | | | | | | | | | | | |

(Callable 01/01/2024)(2) | | | 9,438,000 | | | | 9,337,821 | | | | | |

| NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | | |

| 4.200%, 06/20/2024 | | | 5,395,000 | | | | 5,313,081 | | | | | |

| Public Service Enterprise Group, Inc.: | | | | | | | | | | | | |

| 0.841%, 11/08/2023 | | | | | | | | | | | | |

| (Callable 07/11/2023) | | | 9,910,000 | | | | 9,735,876 | | | | | |

| 2.875%, 06/15/2024 | | | | | | | | | | | | |

| (Callable 05/15/2024) | | | 19,993,000 | | | | 19,413,203 | | | | | |

| Southern Co.: | | | | | | | | | | | | |

| 2.950%, 07/01/2023 | | | 4,975,000 | | | | 4,975,000 | | | | | |

| 0.600%, 02/26/2024 | | | | | | | | | | | | |

| (Callable 01/26/2024) | | | 17,138,000 | | | | 16,565,444 | | | | | |

| Xcel Energy, Inc., | | | | | | | | | | | | |

| 0.500%, 10/15/2023 | | | | | | | | | | | | |

| (Callable 09/15/2023) | | | 6,080,000 | | | | 5,989,786 | | | | | |

| Total Utilities | | | | | | | | | | | | |

| (Cost $142,266,826) | | | | | | | 141,729,209 | | | | 2.3 | % |

| Financials | | | | | | | | | | | | |

| AerCap Holdings NV: | | | | | | | | | | | | |

| 4.500%, 09/15/2023 | | | | | | | | | | | | |

(Callable 08/15/2023)(1) | | | 4,055,000 | | | | 4,039,778 | | | | | |

1.150%, 10/29/2023(1) | | | 11,825,000 | | | | 11,635,534 | | | | | |

| 3.150%, 02/15/2024 | | | | | | | | | | | | |

(Callable 01/15/2024)(1) | | | 7,950,000 | | | | 7,798,782 | | | | | |

| AIB Group PLC: | | | | | | | | | | | | |

4.750%, 10/12/2023(1)(2) | | | 8,418,000 | | | | 8,379,453 | | | | | |

| 4.263%, 04/10/2025 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.874%) | | | | | | | | | | | | |

(Callable 04/10/2024)(1)(2)(3) | | | 36,420,000 | | | | 35,585,072 | | | | | |

| Air Lease Corp.: | | | | | | | | | | | | |

| 3.875%, 07/03/2023 | | | 31,274,000 | | | | 31,274,000 | | | | | |

| 0.700%, 02/15/2024 | | | | | | | | | | | | |

| (Callable 01/15/2024) | | | 11,550,000 | | | | 11,187,204 | | | | | |

| Ally Financial, Inc., | | | | | | | | | | | | |

| 1.450%, 10/02/2023 | | | | | | | | | | | | |

| (Callable 09/02/2023) | | | 32,785,000 | | | | 32,344,729 | | | | | |

| Australia & New Zealand | | | | | | | | | | | | |

| Banking Group Ltd., | | | | | | | | | | | | |

4.500%, 03/19/2024(1)(2) | | | 9,000,000 | | | | 8,886,573 | | | | | |

| Banco Bilbao Vizcaya Argentaria SA, | | | | | | | | | | | | |

0.875%, 09/18/2023(1) | | | 5,088,000 | | | | 5,035,094 | | | | | |

| Banco Santander SA, | | | | | | | | | | | | |

| 0.701%, 06/30/2024 | | | | | | | | | | | | |

(1 Year CMT Rate + 0.450%)(1)(3) | | | 8,865,000 | | | | 8,816,243 | | | | | |

| Bank of America Corp.: | | | | | | | | | | | | |

| 0.523%, 06/14/2024 (SOFR + 0.410%) | | | | | | | | | | | | |

(Callable 05/14/2024)(3) | | | 10,000,000 | | | | 9,985,033 | | | | | |

| 3.841%, 04/25/2025 (SOFR + 1.110%) | | | | | | | | | | | | |

(Callable 04/25/2024)(3) | | | 32,100,000 | | | | 31,464,167 | | | | | |

| Bank of Ireland Group PLC, | | | | | | | | | | | | |

4.500%, 11/25/2023(1)(2) | | | 15,140,000 | | | | 14,989,829 | | | | | |

| Bank of Nova Scotia, | | | | | | | | | | | | |

0.400%, 09/15/2023(1) | | | 28,133,000 | | | | 27,836,247 | | | | | |

| Barclays PLC, | | | | | | | | | | | | |

| 3.932%, 05/07/2025 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.610%) | | | | | | | | | | | | |

(Callable 05/07/2024)(1)(3) | | | 44,025,000 | | | | 43,024,136 | | | | | |

| BGC Partners, Inc., | | | | | | | | | | | | |

| 5.375%, 07/24/2023 | | | 24,196,000 | | | | 24,179,962 | | | | | |

| BNP Paribas SA: | | | | | | | | | | | | |

4.250%, 10/15/2024(1) | | | 7,505,000 | | | | 7,302,262 | | | | | |

| 4.705%, 01/10/2025 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 2.235%) | | | | | | | | | | | | |

(Callable 01/10/2024)(1)(2)(3) | | | 17,700,000 | | | | 17,542,218 | | | | | |

| Boston Properties LP: | | | | | | | | | | | | |

| 3.125%, 09/01/2023 | | | | | | | | | | | | |

| (Callable 07/31/2023) | | | 8,652,000 | | | | 8,599,548 | | | | | |

| 3.800%, 02/01/2024 | | | | | | | | | | | | |

| (Callable 11/01/2023) | | | 25,005,000 | | | | 24,467,520 | | | | | |

| BPCE SA, | | | | | | | | | | | | |

5.700%, 10/22/2023(1)(2) | | | 42,593,000 | | | | 42,406,948 | | | | | |

| Cantor Fitzgerald LP, | | | | | | | | | | | | |

| 4.875%, 05/01/2024 | | | | | | | | | | | | |

(Callable 04/01/2024)(2) | | | 7,336,000 | | | | 7,177,013 | | | | | |

| Capital One Financial Corp.: | | | | | | | | | | | | |

| 1.343%, 12/06/2024 (SOFR + 0.690%) | | | | | | | | | | | | |

(Callable 12/06/2023)(3) | | | 5,305,000 | | | | 5,166,461 | | | | | |

| 4.166%, 05/09/2025 (SOFR + 1.370%) | | | | | | | | | | | | |

(Callable 05/09/2024)(3) | | | 32,961,000 | | | | 32,107,987 | | | | | |

| Citigroup, Inc., | | | | | | | | | | | | |

| 0.776%, 10/30/2024 (SOFR + 0.686%) | | | | | | | | | | | | |

(Callable 10/30/2023)(3) | | | 52,580,000 | | | | 51,651,521 | | | | | |

| CNA Financial Corp., | | | | | | | | | | | | |

| 3.950%, 05/15/2024 | | | | | | | | | | | | |

| (Callable 02/15/2024) | | | 29,285,000 | | | | 28,787,580 | | | | | |

| Cooperatieve Rabobank UA, | | | | | | | | | | | | |

4.625%, 12/01/2023(1) | | | 6,048,000 | | | | 6,005,391 | | | | | |

| Credit Suisse AG, | | | | | | | | | | | | |

0.520%, 08/09/2023(1) | | | 1,125,000 | | | | 1,116,101 | | | | | |

| Credit Suisse Group AG, | | | | | | | | | | | | |

| 2.593%, 09/11/2025 (SOFR + 1.560%) | | | | | | | | | | | | |

(Callable 09/11/2024)(1)(2)(3) | | | 34,307,000 | | | | 32,700,435 | | | | | |

| Danske Bank A/S: | | | | | | | | | | | | |

3.875%, 09/12/2023(1)(2) | | | 1,995,000 | | | | 1,987,319 | | | | | |

| 3.773%, 03/28/2025 | | | | | | | | | | | | |

| (1 Year CMT Rate + 1.450%) | | | | | | | | | | | | |

(Callable 03/28/2024)(1)(2)(3) | | | 28,903,000 | | | | 28,249,832 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Deutsche Bank AG, | | | | | | | | | |

| 2.222%, 09/18/2024 (SOFR + 2.159%) | | | | | | | | | |

(Callable 09/18/2023)(1)(3) | | $ | 42,078,000 | | | $ | 41,545,246 | | | |

| |

| Discover Bank, | | | | | | | | | | | | |

| 4.682%, 08/09/2028 | | | | | | | | | | | | |

| (5 Year Swap Rate USD + 1.730%) | | | | | | | | | | | | |

(Callable 08/09/2023)(3) | | | 10,189,000 | | | | 9,315,878 | | | | | |

| Five Corners Funding Trust, | | | | | | | | | | | | |

4.419%, 11/15/2023(2) | | | 1,000,000 | | | | 989,013 | | | | | |

| GATX Corp., | | | | | | | | | | | | |

| 4.350%, 02/15/2024 | | | | | | | | | | | | |

| (Callable 01/15/2024) | | | 2,858,000 | | | | 2,822,647 | | | | | |

| Goldman Sachs Group, Inc.: | | | | | | | | | | | | |

| 1.217%, 12/06/2023 | | | | | | | | | | | | |

| (Callable 07/06/2023) | | | 5,000,000 | | | | 4,903,737 | | | | | |

| 0.925%, 10/21/2024 (SOFR + 0.486%) | | | | | | | | | | | | |

(Callable 10/21/2023)(3) | | | 16,930,000 | | | | 16,643,649 | | | | | |

| 3.272%, 09/29/2025 (SOFR + 1.463%) | | | | | | | | | | | | |

(Callable 09/29/2024)(3) | | | 10,242,000 | | | | 9,895,548 | | | | | |

| Host Hotels & Resorts LP, | | | | | | | | | | | | |

| 3.875%, 04/01/2024 | | | | | | | | | | | | |

| (Callable 02/01/2024) | | | 10,803,000 | | | | 10,628,841 | | | | | |

| HSBC Holdings PLC, | | | | | | | | | | | | |

| 3.803%, 03/11/2025 (SOFR + 1.473%) | | | | | | | | | | | | |

(Callable 03/11/2024)(1)(3) | | | 31,698,000 | | | | 31,079,485 | | | | | |

| ING Bank NV, | | | | | | | | | | | | |

5.800%, 09/25/2023(1)(2) | | | 38,289,000 | | | | 38,205,673 | | | | | |

| Invesco Finance PLC, | | | | | | | | | | | | |

| 4.000%, 01/30/2024 | | | 8,745,000 | | | | 8,631,393 | | | | | |

| Jackson National Life Global Funding, | | | | | | | | | | | | |

3.250%, 01/30/2024(2) | | | 2,136,000 | | | | 2,100,585 | | | | | |

| JPMorgan Chase & Co., | | | | | | | | | | | | |

| 3.797%, 07/23/2024 (SOFR + 1.152%) | | | | | | | | | | | | |

(Callable 07/23/2023)(3) | | | 25,174,000 | | | | 25,143,907 | | | | | |

| Lincoln National Corp., | | | | | | | | | | | | |

| 4.000%, 09/01/2023 | | | 1,148,000 | | | | 1,141,944 | | | | | |

| Lloyds Bank PLC, | | | | | | | | | | | | |

| 3.870%, 07/09/2025 | | | | | | | | | | | | |

| (1 Year CMT Rate + 3.500%) | | | | | | | | | | | | |

(Callable 07/09/2024)(1)(3) | | | 20,560,000 | | | | 20,025,208 | | | | | |

| Massachusetts Mutual Life Insurance Co., | | | | | | | | | | | | |

7.625%, 11/15/2023(2) | | | 5,280,000 | | | | 5,291,662 | | | | | |

| Metropolitan Tower Life Insurance Co., | | | | | | | | | | | | |

7.625%, 01/15/2024(2) | | | 2,760,000 | | | | 2,772,481 | | | | | |

| Mitsubishi UFJ Financial Group, Inc., | | | | | | | | | | | | |

| 0.848%, 09/15/2024 | | | | | | | | | | | | |

| (1 Year CMT Rate + 0.680%) | | | | | | | | | | | | |

(Callable 09/15/2023)(1)(3) | | | 15,700,000 | | | | 15,525,553 | | | | | |

| Mizuho Financial Group, Inc.: | | | | | | | | | | | | |

| 1.241%, 07/10/2024 (SOFR + 1.252%) | | | | | | | | | | | | |

(Callable 07/10/2023)(1)(3) | | | 22,209,000 | | | | 22,195,335 | | | | | |

| 3.922%, 09/11/2024 (SOFR + 1.262%) | | | | | | | | | | | | |

(Callable 09/11/2023)(1)(3) | | | 21,756,000 | | | | 21,652,437 | | | | | |

| Morgan Stanley, | | | | | | | | | | | | |

| 4.766%, 11/10/2023 (SOFR + 0.466%) | | | | | | | | | | | | |

(Callable 10/10/2023)(3) | | | 23,014,000 | | | | 22,999,271 | | | | | |

| Nationwide Building Society, | | | | | | | | | | | | |

| 4.363%, 08/01/2024 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.392%) | | | | | | | | | | | | |

(Callable 08/01/2023)(1)(2)(3) | | | 38,819,000 | | | | 38,740,579 | | | | | |

| NatWest Group PLC, | | | | | | | | | | | | |

| 4.269%, 03/22/2025 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.762%) | | | | | | | | | | | | |

(Callable 03/22/2024)(1)(3) | | | 1,772,000 | | | | 1,740,584 | | | | | |

| New England Mutual Life Insurance Co., | | | | | | | | | | | | |

7.875%, 02/15/2024(2) | | | 3,200,000 | | | | 3,208,122 | | | | | |

| Old Republic International Corp., | | | | | | | | | | | | |

| 4.875%, 10/01/2024 | | | | | | | | | | | | |

| (Callable 09/01/2024) | | | 15,833,000 | | | | 15,524,451 | | | | | |

| Pacific Life Insurance Co., | | | | | | | | | | | | |

7.900%, 12/30/2023(2) | | | 12,825,000 | | | | 12,904,725 | | | | | |

| Piedmont Operating Partnership LP, | | | | | | | | | | | | |

| 4.450%, 03/15/2024 | | | | | | | | | | | | |

| (Callable 12/15/2023) | | | 29,900,000 | | | | 29,220,798 | | | | | |

| PNC Bank NA, | | | | | | | | | | | | |

| 3.800%, 07/25/2023 | | | 14,315,000 | | | | 14,296,336 | | | | | |

| Reinsurance Group of America, Inc., | | | | | | | | | | | | |

| 4.700%, 09/15/2023 | | | 3,000,000 | | | | 2,992,582 | | | | | |

| Santander UK Group Holdings PLC, | | | | | | | | | | | | |

| 4.796%, 11/15/2024 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.570%) | | | | | | | | | | | | |

(Callable 11/15/2023)(1)(3) | | | 1,150,000 | | | | 1,141,235 | | | | | |

| SMBC Aviation Capital Finance DAC: | | | | | | | | | | | | |

4.125%, 07/15/2023(1)(2) | | | 7,695,000 | | | | 7,688,830 | | | | | |

| 3.550%, 04/15/2024 | | | | | | | | | | | | |

(Callable 03/15/2024)(1)(2) | | | 4,275,000 | | | | 4,185,004 | | | | | |

| Societe Generale SA: | | | | | | | | | | | | |

4.250%, 09/14/2023(1)(2) | | | 9,050,000 | | | | 9,006,777 | | | | | |

5.000%, 01/17/2024(1)(2) | | | 12,885,000 | | | | 12,728,985 | | | | | |

2.625%, 10/16/2024(1)(2) | | | 1,000,000 | | | | 946,351 | | | | | |

| Standard Chartered PLC: | | | | | | | | | | | | |

| 0.991%, 01/12/2025 | | | | | | | | | | | | |

| (1 Year CMT Rate + 0.780%) | | | | | | | | | | | | |

(Callable 01/12/2024)(1)(2)(3) | | | 24,490,000 | | | | 23,737,422 | | | | | |

| 3.785%, 05/21/2025 | | | | | | | | | | | | |

| (3 Month LIBOR USD + 1.560%) | | | | | | | | | | | | |

(Callable 05/21/2024)(1)(2)(3) | | | 13,427,000 | | | | 13,099,062 | | | | | |

| Sumitomo Mitsui Financial Group, Inc., | | | | | | | | | | | | |

4.436%, 04/02/2024(1)(2) | | | 33,150,000 | | | | 32,616,633 | | | | | |

| Sumitomo Mitsui Trust Bank Ltd., | | | | | | | | | | | | |

0.800%, 09/12/2023(1)(2) | | | 10,729,000 | | | | 10,630,939 | | | | | |

| Synchrony Financial: | | | | | | | | | | | | |

| 4.375%, 03/19/2024 | | | | | | | | | | | | |

| (Callable 02/19/2024) | | | 25,840,000 | | | | 25,335,149 | | | | | |

| 4.250%, 08/15/2024 | | | | | | | | | | | | |

| (Callable 05/15/2024) | | | 3,172,000 | | | | 3,058,225 | | | | | |

| Trinity Acquisition PLC, | | | | | | | | | | | | |

| 4.625%, 08/15/2023 | | | 8,948,000 | | | | 8,922,848 | | | | | |

| Ventas Realty LP, | | | | | | | | | | | | |

| 3.500%, 04/15/2024 | | | | | | | | | | | | |

| (Callable 03/15/2024) | | | 2,750,000 | | | | 2,688,302 | | | | | |

| Willis North America, Inc., | | | | | | | | | | | | |

| 3.600%, 05/15/2024 | | | | | | | | | | | | |

| (Callable 03/15/2024) | | | 34,700,000 | | | | 33,856,737 | | | | | |

| WP Carey, Inc., | | | | | | | | | | | | |

| 4.600%, 04/01/2024 | | | | | | | | | | | | |

| (Callable 01/01/2024) | | | 27,220,000 | | | | 26,845,224 | | | | | |

| Total Financials | | | | | | | | | | | | |

| (Cost $1,260,896,973) | | | | | | | 1,260,355,365 | | | | 20.3 | % |

| Total Corporate Bonds | | | | | | | | | | | | |

| (Cost $2,922,666,820) | | | | | | | 2,917,273,621 | | | | 47.1 | % |

| Municipal Bonds | | | | | | | | | | | | |

| City of Huron OH, | | | | | | | | | | | | |

| 6.875%, 09/07/2023 | | | 2,275,000 | | | | 2,272,561 | | | | | |

| City of West Carrollton OH, | | | | | | | | | | | | |

| 6.000%, 05/01/2024 (Insured by ST AID) | | | 6,150,000 | | | | 6,113,548 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Massachusetts Development Finance Agency, | | | | | | | | | |

0.250%, 07/01/2024(4) | | $ | 4,235,000 | | | $ | 4,235,000 | | | | |

| New York State Dormitory Authority: | | | | | | | | | | | |

| 2.550%, 07/01/2023 | | | 1,000,000 | | | | 1,000,000 | | | | |

| 3.187%, 07/01/2023 | | | 1,500,000 | | | | 1,500,000 | | | | |

| New York State Housing Finance Agency, | | | | | | | | | | | |

| 1.600%, 11/01/2024 | | | | | | | | | | | |

| (Callable 07/21/2023) | | | 7,875,000 | | | | 7,637,400 | | | | |

| North Dakota Housing Finance Agency, | | | | | | | | | | | |

| 5.500%, 01/01/2047 (Callable 07/03/2023) | | | | | | | | | | | |

(Optional Put Date 07/07/2023)(4) | | | 550,000 | | | | 550,000 | | | | |

| Total Municipal Bonds | | | | | | | | | | | |

| (Cost $23,472,979) | | | | | | | 23,308,509 | | | | 0.4 | % |

| Residential Mortgage-Backed Securities | | | | | | | | | | | | |

| Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| Arroyo Mortgage Trust: | | | | | | | | | | | | |

| Series 2019-3, Class A1, 2.962%, | | | | | | | | | | | | |

10/25/2048 (Callable 07/25/2023)(2)(4) | | | 14,081,078 | | | | 12,751,720 | | | | | |

| Series 2019-1, Class A1, 3.805%, | | | | | | | | | | | | |

01/25/2049 (Callable 07/25/2023)(2)(4) | | | 4,455,710 | | | | 4,144,547 | | | | | |

| Series 2019-2, Class A1, 3.347%, | | | | | | | | | | | | |

04/25/2049 (Callable 07/25/2023)(2)(4) | | | 7,713,481 | | | | 7,115,256 | | | | | |

| Starwood Mortgage Residential Trust, | | | | | | | | | | | | |

| Series 2021-1, Class A1, 1.219%, | | | | | | | | | | | | |

05/25/2065 (Callable 07/25/2023)(2)(4) | | | 8,448,394 | | | | 7,195,016 | | | | | |

| Towd Point Mortgage Trust: | | | | | | | | | | | | |

| Series 2017-1, Class A1, 2.750%, | | | | | | | | | | | | |

10/25/2056 (Callable 01/25/2030)(2)(4) | | | 1,339,572 | | | | 1,319,723 | | | | | |

| Series 2017-3, Class A1, 2.750%, | | | | | | | | | | | | |

06/25/2057 (Callable 10/25/2026)(2)(4) | | | 2,063,467 | | | | 2,003,934 | | | | | |

| Series 2017-4, Class A1, 2.750%, | | | | | | | | | | | | |

06/25/2057 (Callable 12/25/2029)(2)(4) | | | 2,016,438 | | | | 1,893,104 | | | | | |

| Series 2017-6, Class A1, 2.750%, | | | | | | | | | | | | |

10/25/2057 (Callable 02/25/2033)(2)(4) | | | 9,686,902 | | | | 9,154,244 | | | | | |

| Series 2018-6, Class A1A, 3.750%, | | | | | | | | | | | | |

03/25/2058 (Callable 11/25/2031)(2)(4) | | | 12,473,438 | | | | 12,042,643 | | | | | |

| Total Residential | | | | | | | | | | | | |

| Mortgage-Backed Securities | | | | | | | | | | | | |

| (Cost $62,816,603) | | | | | | | 57,620,187 | | | | 0.9 | % |

| Commercial Mortgage-Backed Securities | | | | | | | | | | | | |

| Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| Citigroup Commercial Mortgage Trust: | | | | | | | | | | | | |

| Series 2013-GC15, Class A4, 4.371%, | | | | | | | | | | | | |

09/10/2046 (Callable 09/10/2023)(4) | | | 841,079 | | | | 838,092 | | | | | |

| Series 2014-GC25, Class A4, 3.635%, | | | | | | | | | | | | |

| 10/10/2047 (Callable 10/10/2024) | | | 10,385,000 | | | | 9,985,129 | | | | | |

| COMM Mortgage Trust: | | | | | | | | | | | | |

| Series 2013-CR12, Class A4, 4.046%, | | | | | | | | | | | | |

| 10/10/2046 (Callable 11/10/2023) | | | 58,712,781 | | | | 58,421,578 | | | | | |

| Series 2013-CR13, Class A4, 4.194%, | | | | | | | | | | | | |

11/10/2046 (Callable 12/10/2023)(4) | | | 14,175,000 | | | | 14,020,502 | | | | | |

| Series 2014-LC15, Class A4, 4.006%, | | | | | | | | | | | | |

| 04/10/2047 (Callable 04/10/2024) | | | 7,525,000 | | | | 7,421,667 | | | | | |

| Series 2014-CR16, Class A4, 4.051%, | | | | | | | | | | | | |

| 04/10/2047 (Callable 04/10/2024) | | | 22,750,000 | | | | 22,295,821 | | | | | |

| Series 2014-UBS4, 3.694%, 08/10/2047 | | | 16,460,000 | | | | 15,934,761 | | | | | |

| GS Mortgage Securities Trust: | | | | | | | | | | | | |

| Series 2013-GC14, Class A5, 4.243%, | | | | | | | | | | | | |

| 08/10/2046 (Callable 06/10/2025) | | | 7,891,848 | | | | 7,878,201 | | | | | |

| Series 2014-GC20, Class A5, 3.998%, | | | | | | | | | | | | |

| 04/10/2047 (Callable 04/10/2024) | | | 9,700,000 | | | | 9,557,724 | | | | | |

| Series 2014-GC26, Class A5, 3.629%, | | | | | | | | | | | | |

| 11/10/2047 (Callable 12/10/2024) | | | 47,745,000 | | | | 45,637,464 | | | | | |

| J.P. Morgan Chase Commercial | | | | | | | | | | | | |

| Mortgage Securities Trust, | | | | | | | | | | | | |

| Series 2014-C20, Class A5, 3.805%, | | | | | | | | | | | | |

| 07/15/2047 (Callable 06/15/2024) | | | 18,626,000 | | | | 18,230,935 | | | | | |

| JPMBB Commercial | | | | | | | | | | | | |

| Mortgage Securities Trust: | | | | | | | | | | | | |

| Series 2013-C16, Class A4, 4.166%, | | | | | | | | | | | | |

| 12/15/2046 (Callable 11/15/2023) | | | 5,360,000 | | | | 5,331,022 | | | | | |

| Series 2013-C17, Class A4, 4.199%, | | | | | | | | | | | | |

| 01/15/2047 (Callable 01/15/2024) | | | 19,073,000 | | | | 18,860,565 | | | | | |

| Series 2014-C18, Class A5, 4.079%, | | | | | | | | | | | | |

| 02/15/2047 (Callable 01/15/2029) | | | 22,907,000 | | | | 22,515,666 | | | | | |

| Series 2014-C21, 3.775%, 08/15/2047 | | | 4,815,000 | | | | 4,680,397 | | | | | |

| Series 2014-C23, Class A5, 3.934%, | | | | | | | | | | | | |

| 09/15/2047 (Callable 02/15/2026) | | | 10,000,000 | | | | 9,669,113 | | | | | |

| Series 2014-C24, Class A5, 3.639%, | | | | | | | | | | | | |

| 11/15/2047 (Callable 10/15/2025) | | | 5,775,000 | | | | 5,542,856 | | | | | |

| Series 2014-C25, Class A5, 3.672%, | | | | | | | | | | | | |

| 11/15/2047 (Callable 11/15/2024) | | | 13,425,000 | | | | 12,858,932 | | | | | |

| Morgan Stanley Bank of | | | | | | | | | | | | |

| America Merrill Lynch Trust: | | | | | | | | | | | | |

| Series 2013-C11, Class A4, 4.126%, | | | | | | | | | | | | |

08/15/2046 (Callable 08/15/2023)(4) | | | 61,355,187 | | | | 61,135,486 | | | | | |

| Series 2013-C12, Class A4, 4.259%, | | | | | | | | | | | | |

10/15/2046 (Callable 10/15/2023)(4) | | | 3,633,724 | | | | 3,620,394 | | | | | |

| Series 2014-C16, Class A5, 3.892%, | | | | | | | | | | | | |

| 06/15/2047 (Callable 06/15/2026) | | | 15,705,000 | | | | 15,326,425 | | | | | |

| Series 2014-C17, Class A4, 3.443%, | | | | | | | | | | | | |

| 08/15/2047 (Callable 07/15/2024) | | | 2,518,302 | | | | 2,463,129 | | | | | |

| Series 2014-C19, Class A4, 3.526%, | | | | | | | | | | | | |

| 12/15/2047 (Callable 10/15/2026) | | | 10,700,000 | | | | 10,242,490 | | | | | |

| Wells Fargo Commercial Mortgage Trust: | | | | | | | | | | | | |

| Series 2013-LC12, Class A4, 4.195%, | | | | | | | | | | | | |

07/15/2046 (Callable 07/15/2023)(4) | | | 1,959,570 | | | | 1,954,268 | | | | | |

| Series 2014-LC16, Class A5, 3.817%, | | | | | | | | | | | | |

| 08/15/2050 (Callable 06/15/2024) | | | 7,443,000 | | | | 7,221,796 | | | | | |

| WFRBS Commercial Mortgage Trust: | | | | | | | | | | | | |

| Series 2013-C15, Class A4, 4.153%, | | | | | | | | | | | | |

08/15/2046 (Callable 08/15/2023)(4) | | | 6,232,254 | | | | 6,215,387 | | | | | |

| Series 2013-C16, Class A5, 4.415%, | | | | | | | | | | | | |

| 09/15/2046 (Callable 10/15/2023) | | | 11,235,678 | | | | 11,195,496 | | | | | |

| Series 2013-C18, Class A5, 4.162%, | | | | | | | | | | | | |

12/15/2046 (Callable 01/15/2024)(4) | | | 21,870,000 | | | | 21,546,687 | | | | | |

| Series 2014-LC14, Class A5, 4.045%, | | | | | | | | | | | | |

| 03/15/2047 (Callable 02/15/2024) | | | 11,543,000 | | | | 11,374,849 | | | | | |

| Series 2014-C20, Class A5, 3.995%, | | | | | | | | | | | | |

| 05/15/2047 (Callable 05/15/2024) | | | 30,191,119 | | | | 29,391,613 | | | | | |

| Series 2014-C24, Class A5, 3.607%, | | | | | | | | | | | | |

| 11/15/2047 (Callable 11/15/2024) | | | 5,500,736 | | | | 5,268,073 | | | | | |

| Series 2014-C25, Class A5, 3.631%, | | | | | | | | | | | | |

| 11/15/2047 (Callable 12/15/2024) | | | 6,186,421 | | | | 5,927,244 | | | | | |

| Series 2014-C22, Class A5, 3.752%, | | | | | | | | | | | | |

| 09/15/2057 (Callable 09/15/2024) | | | 11,336,000 | | | | 10,910,274 | | | | | |

| Series 2014-C23, Class A5, 3.917%, | | | | | | | | | | | | |

| 10/15/2057 (Callable 09/15/2025) | | | 3,373,000 | | | | 3,246,234 | | | | | |

| Total Commercial | | | | | | | | | | | | |

| Mortgage-Backed Securities | | | | | | | | | | | | |

| (Cost $495,483,585) | | | | | | | 496,720,270 | | | | 8.0 | % |

| Asset Backed Securities | | | | | | | | | | | | |

| Affirm Asset Securitization Trust: | | | | | | | | | | | | |

| Series 2020-Z2, Class A, 1.900%, | | | | | | | | | | | | |

01/15/2025 (Callable 07/15/2023)(2) | | | 7,836,455 | | | | 7,733,250 | | | | | |

| Series 2021-Z1, Class A, 1.070%, | | | | | | | | | | | | |

08/15/2025 (Callable 11/15/2023)(2) | | | 14,104,883 | | | | 13,708,112 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Ally Auto Receivables, | | | | | | | | | |

| Series 2022-3, Class A2, 5.290%, | | | | | | | | | |

| 06/16/2025 | | $ | 7,743,205 | | | $ | 7,731,772 | | | |

| |

| Capital One Multi-Asset Execution Trust, | | | | | | | | | | | | |

| Series 2021-A1, Class A1, 0.550%, | | | | | | | | | | | | |

| 07/15/2026 | | | 7,650,000 | | | | 7,253,216 | | | | | |

| Capital One Prime Auto Receivables Trust: | | | | | | | | | | | | |

| Series 2020-1, Class A3, 1.600%, | | | | | | | | | | | | |

| 11/15/2024 (Callable 10/15/2023) | | | 2,147,202 | | | | 2,141,851 | | | | | |

| Series 2022-2, Class A2A, 3.740%, | | | | | | | | | | | | |

| 09/15/2025 | | | 15,120,622 | | | | 14,973,674 | | | | | |

| CarMax Auto Owner Trust, | | | | | | | | | | | | |

| Series 2023-1, Class A2A, 5.230%, | | | | | | | | | | | | |

| 01/15/2026 | | | 6,250,000 | | | | 6,226,982 | | | | | |

| Chase Auto Credit Linked Notes: | | | | | | | | | | | | |

| Series 2021-1, Class B, 0.875%, | | | | | | | | | | | | |

09/25/2028 (Callable 04/25/2025)(2) | | | 11,477,694 | | | | 11,132,183 | | | | | |

| Series 2021-2, Class B, 0.889%, | | | | | | | | | | | | |

12/26/2028 (Callable 04/25/2025)(2) | | | 649,023 | | | | 627,519 | | | | | |

| Series 2021-3, Class B, 0.760%, | | | | | | | | | | | | |

02/26/2029 (Callable 04/25/2025)(2) | | | 6,866,878 | | | | 6,538,776 | | | | | |

| Chase Auto Owner Trust, | | | | | | | | | | | | |

| Series 2022-AA, Class A2, 3.860%, | | | | | | | | | | | | |

10/27/2025(2) | | | 5,742,210 | | | | 5,696,719 | | | | | |

| Citizens Auto Receivables Trust, | | | | | | | | | | | | |

| Series 2023-1, Class A2A, 6.130%, | | | | | | | | | | | | |

07/15/2026(2) | | | 58,350,000 | | | | 58,287,277 | | | | | |

| Dell Equipment Finance Trust: | | | | | | | | | | | | |

| Series 2022-2, Class A2, 4.030%, | | | | | | | | | | | | |

07/22/2027 (Callable 03/22/2025)(2) | | | 14,926,334 | | | | 14,749,257 | | | | | |

| Series 2023-1, Class A2, 5.650%, | | | | | | | | | | | | |

| 09/22/2028 | | | | | | | | | | | | |

(Callable 10/22/2025)(2) | | | 42,600,000 | | | | 42,359,740 | | | | | |

| Series 2023-2, Class A2, 5.840%, | | | | | | | | | | | | |

01/22/2029 (Callable 02/22/2026)(2) | | | 12,000,000 | | | | 11,971,955 | | | | | |

| Discover Card Execution Note Trust, | | | | | | | | | | | | |

| Series 2017-A4, Class A4, 2.530%, | | | | | | | | | | | | |

| 10/15/2026 | | | 2,400,000 | | | | 2,342,604 | | | | | |

| DLLAD LLC: | | | | | | | | | | | | |

| Series 2021-1A, Class A2, 0.350%, | | | | | | | | | | | | |

09/20/2024(2) | | | 947,580 | | | | 944,710 | | | | | |

| Series 2023-1A, Class A2, 5.190%, | | | | | | | | | | | | |

04/20/2026(2) | | | 7,500,000 | | | | 7,428,322 | | | | | |

| DLLMT LLC, | | | | | | | | | | | | |

| Series 2023-1A, Class A2, 5.830%, | | | | | | | | | | | | |

11/20/2025(2) | | | 35,150,000 | | | | 34,929,694 | | | | | |

| Donlen Fleet Lease Funding 2 LLC, | | | | | | | | | | | | |

| Series 2021-2, Class A2, 0.560%, | | | | | | | | | | | | |

12/11/2034(2) | | | 1,198,600 | | | | 1,168,294 | | | | | |

| Ford Credit Auto Lease Trust, | | | | | | | | | | | | |

| Series 2022-A, Class A2A, 2.780%, | | | | | | | | | | | | |

| 10/15/2024 | | | 10,450,801 | | | | 10,415,775 | | | | | |

| Ford Credit Auto Owner Trust: | | | | | | | | | | | | |

| Series 2018-2, Class A, 3.470%, | | | | | | | | | | | | |

01/15/2030 (Callable 07/15/2023)(2) | | | 21,334,000 | | | | 21,317,440 | | | | | |

| Series 2019-1, Class A, 3.520%, | | | | | | | | | | | | |

07/15/2030 (Callable 01/15/2024)(2) | | | 25,965,000 | | | | 25,631,342 | | | | | |

| Ford Credit Floorplan Master Owner Trust: | | | | | | | | | | | | |

| Series 2020-1, Class A1, 0.700%, | | | | | | | | | | | | |

| 09/15/2025 | | | 38,005,000 | | | | 37,593,174 | | | | | |

| Series 2019-2, Class A, 3.060%, | | | | | | | | | | | | |

| 04/15/2026 | | | 2,634,000 | | | | 2,577,642 | | | | | |

| Series 2019-4, Class A, 2.440%, | | | | | | | | | | | | |

| 09/15/2026 | | | 10,798,000 | | | | 10,370,958 | | | | | |

| GM Financial Automobile Leasing Trust: | | | | | | | | | | | | |

| Series 2023-1, Class A2A, 5.270%, | | | | | | | | | | | | |

| 06/20/2025 | | | 37,927,000 | | | | 37,772,701 | | | | | |

| Series 2023-2, Class A2A, 5.440%, | | | | | | | | | | | | |

| 10/20/2025 (Callable 08/20/2025) | | | 5,300,000 | | | | 5,277,632 | | | | | |

| Series 2023-1, Class A3, 5.160%, | | | | | | | | | | | | |

| 04/20/2026 (Callable 08/20/2025) | | | 2,055,000 | | | | 2,040,204 | | | | | |

| GM Financial Consumer | | | | | | | | | | | | |

| Automobile Receivables Trust: | | | | | | | | | | | | |

| Series 2023-1, Class A2A, 5.190%, | | | | | | | | | | | | |

| 03/16/2026 | | | 18,000,000 | | | | 17,932,693 | | | | | |

| Series 2023-2, Class A2A, 5.100%, | | | | | | | | | | | | |

| 05/18/2026 | | | 7,000,000 | | | | 6,962,082 | | | | | |

| GMF Floorplan Owner Revolving Trust: | | | | | | | | | | | | |

| Series 2020-1, Class A, 0.680%, | | | | | | | | | | | | |

08/15/2025(2) | | | 18,467,000 | | | | 18,361,819 | | | | | |

| Series 2020-2, Class A, 0.690%, | | | | | | | | | | | | |

10/15/2025(2) | | | 36,540,000 | | | | 36,039,497 | | | | | |

| Series 2019-2, Class A, 2.900%, | | | | | | | | | | | | |

04/15/2026(2) | | | 31,033,000 | | | | 30,338,479 | | | | | |

| Honda Auto Receivables Owner Trust: | | | | | | | | | | | | |

| Series 2022-1, Class A2, 1.440%, | | | | | | | | | | | | |

| 10/15/2024 | | | 45,187,221 | | | | 44,775,218 | | | | | |

| Series 2023-1, Class A2, 5.220%, | | | | | | | | | | | | |

| 10/21/2025 | | | 7,100,000 | | | | 7,073,446 | | | | | |

| HPEFS Equipment Trust, | | | | | | | | | | | | |

| Series 2022-1A, Class A2, 1.020%, | | | | | | | | | | | | |

05/21/2029 (Callable 03/20/2025)(2) | | | 791,110 | | | | 787,391 | | | | | |

| Hyundai Auto Lease Securitization Trust: | | | | | | | | | | | | |

| Series 2022-A, Class A2, 0.810%, | | | | | | | | | | | | |

04/15/2024(2) | | | 1,948,181 | | | | 1,943,552 | | | | | |

| Series 2023-A, Class A2A, 5.200%, | | | | | | | | | | | | |

04/15/2025(2) | | | 11,117,440 | | | | 11,072,690 | | | | | |

| Hyundai Auto Receivables Trust: | | | | | | | | | | | | |

| Series 2022-C, Class A2A, 5.350%, | | | | | | | | | | | | |

| 11/17/2025 | | | 3,745,053 | | | | 3,733,634 | | | | | |

| Series 2023-A, Class A2A, 5.190%, | | | | | | | | | | | | |

| 12/15/2025 | | | 12,850,000 | | | | 12,798,240 | | | | | |

| Series 2021-B, Class A3, 0.380%, | | | | | | | | | | | | |

| 01/15/2026 (Callable 11/15/2025) | | | 7,462,056 | | | | 7,219,342 | | | | | |

| Marlette Funding Trust, | | | | | | | | | | | | |

| Series 2021-3A, Class A, 0.650%, | | | | | | | | | | | | |

12/15/2031 (Callable 01/15/2026)(2) | | | 319,265 | | | | 318,743 | | | | | |

| Master Credit Card Trust, | | | | | | | | | | | | |

| Series 2021-1A, Class A, 0.530%, | | | | | | | | | | | | |

11/21/2025(1)(2) | | | 12,550,000 | | | | 11,957,673 | | | | | |

| Mercedes-Benz Auto Receivables Trust, | | | | | | | | | | | | |

| Series 2021-1, Class A3, 0.460%, | | | | | | | | | | | | |

| 06/15/2026 (Callable 08/15/2025) | | | 15,794,733 | | | | 15,187,272 | | | | | |

| MMAF Equipment Finance LLC, | | | | | | | | | | | | |

| Series 2020-A, Class A2, 0.740%, | | | | | | | | | | | | |

04/09/2024(2) | | | 313,154 | | | | 312,790 | | | | | |

| Nissan Auto Lease Trust, | | | | | | | | | | | | |

| Series 2023-A, Class A2A, 5.100%, | | | | | | | | | | | | |

| 03/17/2025 | | | 13,000,000 | | | | 12,945,222 | | | | | |

| Nissan Auto Receivables Owner Trust, | | | | | | | | | | | | |

| Series 2022-B, Class A2, 4.500%, | | | | | | | | | | | | |

| 08/15/2025 | | | 3,677,322 | | | | 3,656,555 | | | | | |

| PFS Financing Corp.: | | | | | | | | | | | | |

| Series 2020-E, Class A, 1.000%, | | | | | | | | | | | | |

10/15/2025(2) | | | 27,735,000 | | | | 27,368,765 | | | | | |

| Series 2020-G, Class A, 0.970%, | | | | | | | | | | | | |

02/15/2026(2) | | | 2,910,000 | | | | 2,815,457 | | | | | |

| Series 2021-A, Class A, 0.710%, | | | | | | | | | | | | |

04/15/2026(2) | | | 56,678,000 | | | | 54,287,390 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Santander Bank Auto Credit, | | | | | | | | | |

| Series 2022-A, Class B, 5.281%, | | | | | | | | | |

05/15/2032 (Callable 10/15/2025)(2) | | $ | 8,446,693 | | | $ | 8,306,551 | | | | |

| Santander Bank NA, | | | | | | | | | | | |

| Series 2021-1A, Class B, 1.833%, | | | | | | | | | | | |

12/15/2031 (Callable 06/15/2025)(2) | | | 13,002,374 | | | | 12,573,560 | | | | |

| Santander Retail Auto Lease Trust, | | | | | | | | | | | |

| Series 2022-A, Class A2, 0.970%, | | | | | | | | | | | |

03/20/2025 (Callable 11/20/2024)(2) | | | 3,966,714 | | | | 3,926,647 | | | | |

| SCF Equipment Leasing 2022-2 LLC, | | | | | | | | | | | |

| Series 2022-2A, Class A2, 6.240%, | | | | | | | | | | | |

07/20/2028(2) | | | 35,218,208 | | | | 35,206,822 | | | | |

| SFS Auto Receivables Securitization Trust, | | | | | | | | | | | |

| Series 2023-1A, Class A2A, 5.890%, | | | | | | | | | | | |

03/22/2027(2) | | | 16,150,000 | | | | 16,130,489 | | | | |

| SoFi Consumer Loan Program Trust, | | | | | | | | | | | |

| Series 2022-1S, Class A, 6.210%, | | | | | | | | | | | |

04/15/2031 (Callable 02/15/2025)(2) | | | 18,807,319 | | | | 18,818,381 | | | | |

| Towd Point Mortgage Trust: | | | | | | | | | | | |

| Series 2019-MH1, Class A1, 3.000%, | | | | | | | | | | | |

11/25/2058 (Callable 09/25/2024)(2)(4) | | | 512,976 | | | | 505,972 | | | | |

| Series 2020-MH1, Class A1, 2.250%, | | | | | | | | | | | |

02/25/2060 (Callable 07/25/2023)(2)(4) | | | 11,793,546 | | | | 10,958,234 | | | | |

| Toyota Auto Loan Extended Note Trust, | | | | | | | | | | | |

| Series 2019-1A, Class A, 2.560%, | | | | | | | | | | | |

11/25/2031 (Callable 05/25/2024)(2) | | | 37,035,000 | | | | 35,964,118 | | | | |

| Verizon Master Trust, | | | | | | | | | | | |

| Series 2022-7, Class A1A, 5.230%, | | | | | | | | | | | |

| 11/22/2027 (Callable 11/20/2024) | | | 45,310,000 | | | | 45,026,627 | | | | |

| Verizon Owner Trust, | | | | | | | | | | | |

| Series 2020-B, Class A, 0.470%, | | | | | | | | | | | |

| 02/20/2025 (Callable 10/20/2023) | | | 2,925,491 | | | | 2,905,084 | | | | |

| Wheels SPV 2 LLC, | | | | | | | | | | | |

| Series 2020-1A, Class A2, 0.510%, | | | | | | | | | | | |

08/20/2029 (Callable 02/20/2024)(2) | | | 95,276 | | | | 95,003 | | | | |

| World Omni Auto Receivables Trust: | | | | | | | | | | | |

| Series 2019-C, Class A3, 1.960%, | | | | | | | | | | | |

| 12/16/2024 (Callable 10/15/2023) | | | 298,373 | | | | 297,933 | | | | |

| Series 2022-D, Class A2A, 5.510%, | | | | | | | | | | | |

| 03/16/2026 (Callable 02/15/2026) | | | 11,142,868 | | | | 11,124,704 | | | | |

| Total Asset Backed Securities | | | | | | | | | | | |

| (Cost $943,548,108) | | | | | | | 940,670,850 | | | | 15.2 | % |

| Total Long-Term Investments | | | | | | | | | | | | |

| (Cost $5,100,639,124) | | | | | | | 5,086,798,060 | | | | 82.1 | % |

| Short-Term Investments | | | | | | | | | | | | |

| Commercial Paper | | | | | | | | | | | | |

| Baptist Memorial Health, 6.50%, | | | | | | | | | | | | |

| 08/14/2023 | | | 25,726,000 | | | | 25,725,401 | | | | | |

| Canadian Natural Resources Ltd., | | | | | | | | | | | | |

5.92%(6), 07/25/2023(1) | | | 25,000,000 | | | | 24,897,225 | | | | | |

| Catholic Health Initiatives, | | | | | | | | | | | | |

5.39%(6), 07/06/2023 | | | 44,600,000 | | | | 44,559,904 | | | | | |

| Friction Marketing Company, | | | | | | | | | | | | |

5.93%(6), 07/24/2023 | | | 11,300,000 | | | | 11,255,365 | | | | | |

AT&T, Inc., 5.73%(6), 12/19/2023 | | | 42,875,000 | | | | 41,701,021 | | | | | |

| Total Commercial Paper | | | | | | | | | | | | |

| (Cost $148,228,371) | | | | | | | 148,138,916 | | | | 2.4 | % |

| U.S. Treasury Securities | | | | | | | | | | | | |

| United States Treasury Bills: | | | | | | | | | | | | |

4.99%(6), 09/28/2023 | | | 100,000,000 | | | | 98,753,000 | | | | | |

5.10%(6), 11/30/2023 | | | 60,000,000 | | | | 58,700,334 | | | | | |

5.04%(6), 10/12/2023 | | | 220,000,000 | | | | 216,798,932 | | | | | |

5.11%(6), 05/16/2024 | | | 246,525,000 | | | | 235,290,567 | | | | | |

5.15%(6), 12/21/2023 | | | 120,000,000 | | | | 117,013,200 | | | | | |

| Total U.S. Treasury Securities | | | | | | | | | | | | |

| (Cost $727,298,418) | | | | | | | 726,556,033 | | | | 11.7 | % |

| | | | | | | | | | | | | |

| | | Shares | | | | | | | | | |

| Money Market Mutual Fund | | | | | | | | | | | | |

| First American Government Obligations | | | | | | | | | | | | |

Fund, Class U, 5.03%(5) | | | 88,273,701 | | | | 88,273,701 | | | | | |

| Total Money Market Mutual Fund | | | | | | | | | | | | |

| (Cost $88,273,701) | | | | | | | 88,273,701 | | | | 1.4 | % |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $963,800,490) | | | | | | | 962,968,650 | | | | 15.5 | % |

| Total Investments | | | | | | | | | | | | |

| (Cost $6,064,439,614) | | | | | | | 6,049,766,710 | | | | 97.6 | % |

| Other Assets in Excess of Liabilities | | | | | | | 150,772,453 | | | | 2.4 | % |

| TOTAL NET ASSETS | | | | | | $ | 6,200,539,163 | | | | 100.0 | % |

Notes to Schedule of Investments

NATL – National Public Finance Guarantee Corp.

ST AID – State Aid Intercept/Withholding

CMT – Constant Maturity Treasury

LIBOR – London Inter-bank Offered Rate

SOFR – Secured Overnight Financing Rate

(1) | Foreign security. |

(2) | Includes securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. At June 30, 2023, the value of these securities totaled $1,502,036,401, which represented 24.22% of total net assets. |

(3) | Variable rate security based on a reference index and spread. The rate reported is the rate as of the last reset date in effect as of June 30, 2023. |

(4) | Variable rate security. The coupon is based on an underlying pool of loans. The rate reported is the rate in effect as of June 30, 2023. |

(5) | Seven-day yield. |

(6) | Effective yield as of June 30, 2023. |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Summary of Fair Value Exposure at June 30, 2023 (Unaudited)

The Fund has adopted authoritative fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion on changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized into three broad levels and described below:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity can access at the measurement date.

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 – Unobservable inputs for the asset or liability.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2023:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments | | | | | | | | | | | | |

| U.S. Treasury Securities | | $ | — | | | $ | 651,204,623 | | | $ | — | | | $ | 651,204,623 | |

| Corporate Bonds | | | — | | | | 2,917,273,621 | | | | — | | | | 2,917,273,621 | |

| Municipal Bonds | | | — | | | | 23,308,509 | | | | — | | | | 23,308,509 | |

| Residential Mortgage-Backed Securities – Non-U.S. Government Agency Issues | | | — | | | | 57,620,187 | | | | — | | | | 57,620,187 | |

| Commercial Mortgage-Backed Securities – Non-U.S. Government Agency Issues | | | — | | | | 496,720,270 | | | | — | | | | 496,720,270 | |

| Asset Backed Securities | | | — | | | | 940,670,850 | | | | — | | | | 940,670,850 | |

| Total Long-Term Investments | | | — | | | | 5,086,798,060 | | | | — | | | | 5,086,798,060 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Commercial Paper | | | — | | | | 148,138,916 | | | | — | | | | 148,138,916 | |

| U.S. Treasury Securities | | | — | | | | 726,556,033 | | | | — | | | | 726,556,033 | |

| Money Market Mutual Fund | | | 88,273,701 | | | | — | | | | — | | | | 88,273,701 | |

| Total Short-Term Investments | | | 88,273,701 | | | | 874,694,949 | | | | — | | | | 962,968,650 | |

| Total Investments | | $ | 88,273,701 | | | $ | 5,961,493,009 | | | $ | — | | | $ | 6,049,766,710 | |

Changes in valuation techniques may result in transfers into or out of assigned levels within the fair value hierarchy. There were no transfers into or out of Level 3 during the reporting period, as compared to the security classifications from the prior year’s annual report. See the Fund’s Valuation Policy in Note 2a to the financial statements.

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

June 30, 2023 (Unaudited)

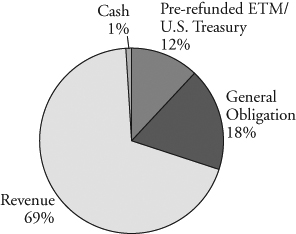

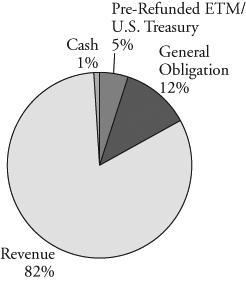

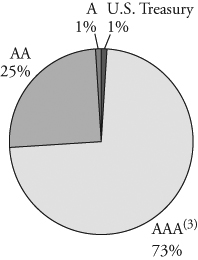

Portfolio Characteristics

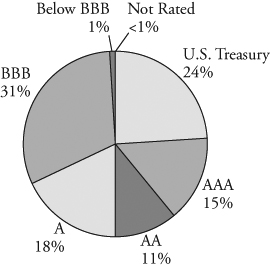

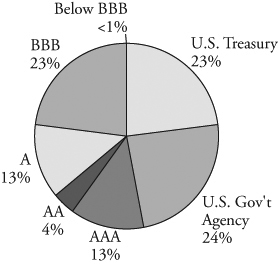

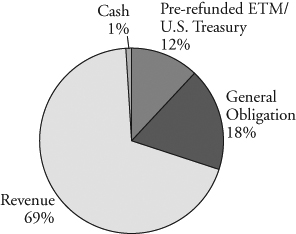

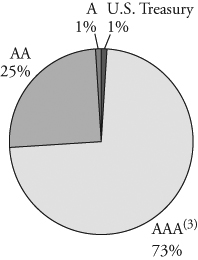

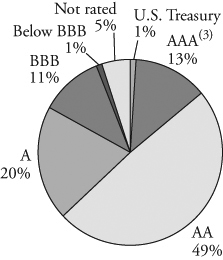

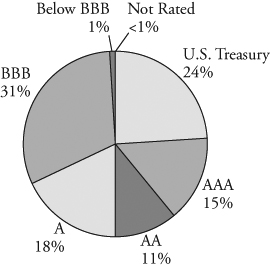

Quality Distribution(1)(2)

| | Net Assets | $9,148,929,551 | |

| | | | |

| | SEC 30-Day Yield(3) | | |

| | Institutional Class | 4.88% | |

| | Investor Class | 4.63% | |

| | | | |

| | Average Effective Duration | 1.86 years | |

| | | | |

| | Average Effective Maturity | 2.05 years | |

| | | | |

| | Annualized Expense Ratio(4) | | |

| | Institutional Class | 0.30% | |

| | Investor Class | 0.55% | (5) |

| | | | |

| | Portfolio Turnover Rate | 49% | (6) |

| | | | |

| | | Number of Holdings | 459 | |

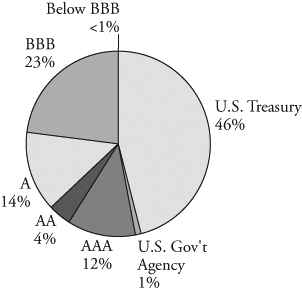

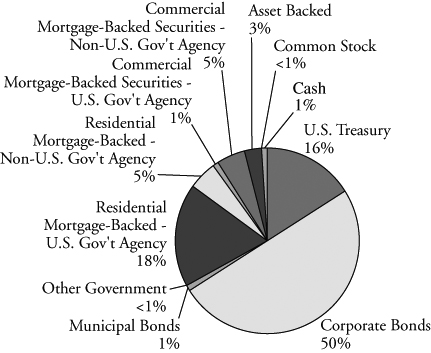

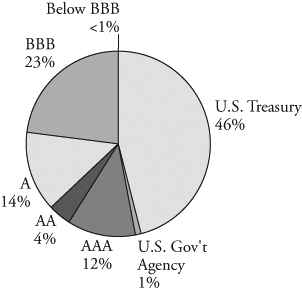

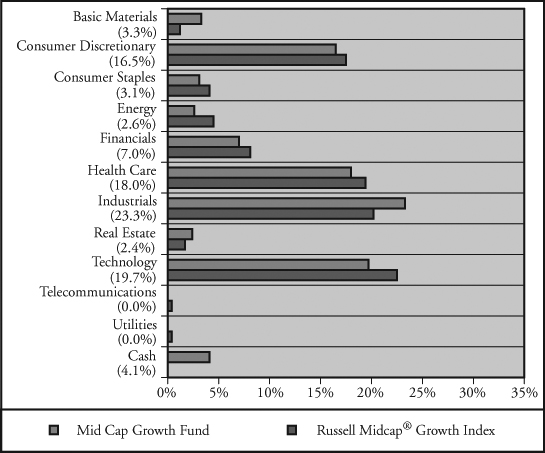

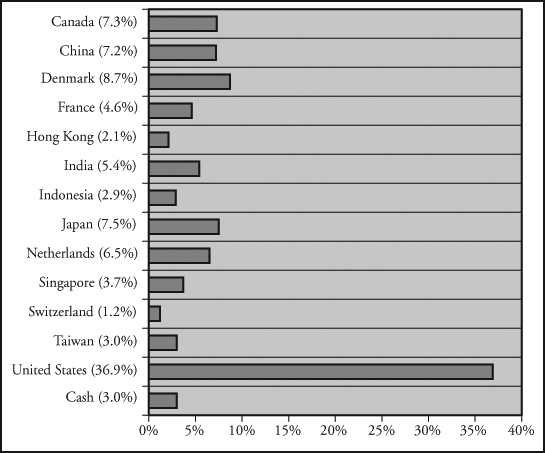

Sector Weightings(7) | | | | |

| | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

(1) | Percentages shown are based on the Fund’s total investments. |

(2) | The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

(3) | SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2023. |

(4) | Reflects expense ratios as stated in the Fund’s current prospectus dated May 1, 2023. |

(5) | Includes 0.25% 12b-1 fee. |

(6) | Not annualized. |

(7) | Percentages shown are based on the Fund’s total net assets. |

Baird Short-Term Bond Fund

June 30, 2023 (Unaudited)

Total Returns

| | | | Average Annual |

| | | | | | Since | Since |

| | Six | One | Five | Ten | Inception | Inception |

| For the Periods Ended June 30, 2023 | Months | Year | Years | Years | (8/31/04) | (9/19/12) |

| Institutional Class Shares | 1.55% | 1.46% | 1.51% | 1.50% | 2.36% | N/A |

| Investor Class Shares | 1.43% | 1.20% | 1.28% | 1.25% | N/A | 1.23% |

Bloomberg 1-3 Year U.S. Government/Credit Index(1) | 1.13% | 0.52% | 1.13% | 0.99% | 1.97% | 0.94% |

(1) | The Bloomberg 1-3 Year U.S. Government/Credit Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities between one and three years. This Index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible. |

The returns table shown above reflects reinvestment of dividends and/or capital gains distributions in additional shares. The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund’s expense ratio for each Class, as reflected in the Fund’s current prospectus, is set forth under “Portfolio Characteristics”.

The Fund may invest in U.S. dollar denominated foreign securities which involve additional risks such as political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund may also invest in mortgage- and asset-backed securities, which include interest rate and prepayment risks more pronounced than those of other fixed income securities. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors. Russia’s ongoing war with Ukraine has heightened global geopolitical tensions, resulting in an elevated risk environment and increased volatility in asset prices. The uncertain course of the war may have a significant negative impact on the global economy. U.S. relations with China have become increasingly strained, and tension between the U.S. and China may have a significant negative impact on the global economy and asset prices. Measures of inflation reached levels not experienced in several decades, leading the Federal Reserve to raise short term interest rates significantly over the last year, with the potential for further rate increases in 2023. Uncertainty regarding the ability of the Federal Reserve to successfully control inflation, the potential for incremental rate increases, and the full impact of prior rate increases on the economy may negatively impact asset prices and increase market volatility. The possibility of a U.S. or global recession may also contribute to market volatility. The coronavirus (COVID-19) pandemic caused significant economic disruption in recent years as countries worked to limit the negative health impacts of the virus. While the virus has entered an endemic stage, significant outbreaks or new variants present a continued risk to the global economy. These and other geopolitical events may cause market disruptions and could have an adverse effect on the value of the Fund’s investments.

Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

For information about the performance of the Fund as of the most recent month-end, please call 1-866-442-2473 or visit www.bairdfunds.com. Mutual fund performance changes over time and current performance may be lower or higher than that stated.

Baird Short-Term Bond Fund

Schedule of Investments, June 30, 2023 (Unaudited)

Long-Term Investments

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| U.S. Treasury Securities | | | | | | | | | |

| U.S. Treasury Bonds: | | | | | | | | | |

| 1.500%, 02/15/2025 | | $ | 316,450,000 | | | $ | 298,674,409 | | | | |

| 2.875%, 06/15/2025 | | | 685,150,000 | | | | 659,055,418 | | | | |

| 3.125%, 08/15/2025 | | | 794,600,000 | | | | 767,440,818 | | | | |

| 4.000%, 02/15/2026 | | | 476,300,000 | | | | 468,988,052 | | | | |

| Total U.S. Treasury Securities | | | | | | | | | | | |

| (Cost $2,213,833,895) | | | | | | | 2,194,158,697 | | | | 24.0 | % |

| Other Government Related Securities | | | | | | | | | | | | |

| Korea East-West Power Co. Ltd., | | | | | | | | | | | | |

3.600%, 05/06/2025(1)(2) | | | 5,875,000 | | | | 5,650,314 | | | | | |

| Korea Electric Power Corporation, | | | | | | | | | | | | |

5.375%, 04/06/2026(1)(2) | | | 15,000,000 | | | | 14,945,862 | | | | | |

| NBN Co. Ltd., | | | | | | | | | | | | |

| 0.875%, 10/08/2024 | | | | | | | | | | | | |

(Callable 09/08/2024)(1)(2) | | | 36,000,000 | | | | 33,763,931 | | | | | |

| Total Other Government Related Securities | | | | | | | | | | | | |

| (Cost $56,716,324) | | | | | | | 54,360,107 | | | | 0.6 | % |

| Corporate Bonds | | | | | | | | | | | | |

| Industrials | | | | | | | | | | | | |

| Advance Auto Parts, Inc., | | | | | | | | | | | | |

| 5.900%, 03/09/2026 | | | 10,000,000 | | | | 9,889,955 | | | | | |

| Allegion US Holding Co., Inc., | | | | | | | | | | | | |

| 3.200%, 10/01/2024 | | | | | | | | | | | | |

| (Callable 08/01/2024) | | | 20,250,000 | | | | 19,444,474 | | | | | |

| Anglo American Capital PLC: | | | | | | | | | | | | |

| 5.375%, 04/01/2025 | | | | | | | | | | | | |