UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09997

Baird Funds, Inc.

(Exact name of registrant as specified in charter)

777 East Wisconsin Avenue

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Andrew D. Ketter

Robert W. Baird & Co. Incorporated

777 East Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

1-866-442-2473

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) |

| Baird Ultra Short Bond Fund |  |

| Investor Class Shares | BUBSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $20 | 0.40% |

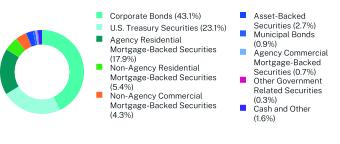

Net Assets | $6,645,668,615 |

Number of Holdings | 376 |

Portfolio Turnover | 44% |

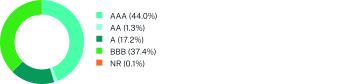

Average Credit Quality | A+ |

Effective Duration | 0.53 years |

Weighted Average Maturity | 0.56 years |

30-Day SEC Yield | 4.88% |

30-Day SEC Yield Unsubsidized | 4.73% |

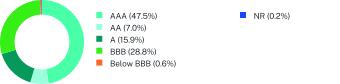

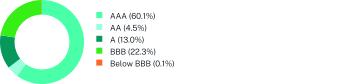

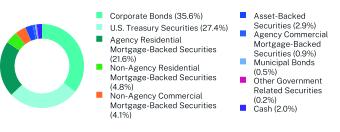

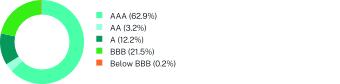

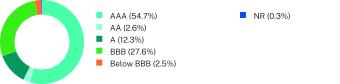

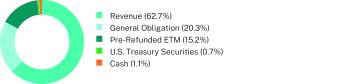

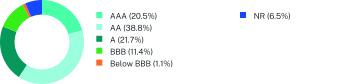

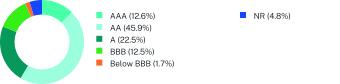

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Ultra Short Bond Fund | PAGE 1 | TSR_SAR_057071714 |

| Baird Ultra Short Bond Fund |  |

| Institutional Class Shares | BUBIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $8 | 0.15% |

Net Assets | $6,645,668,615 |

Number of Holdings | 376 |

Portfolio Turnover | 44% |

Average Credit Quality | A+ |

Effective Duration | 0.53 years |

Weighted Average Maturity | 0.56 years |

30-Day SEC Yield | 5.13% |

30-Day SEC Yield Unsubsidized | 4.98% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Ultra Short Bond Fund | PAGE 1 | TSR_SAR_057071722 |

| Baird Short-Term Bond Fund |  |

| Investor Class Shares | BSBSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

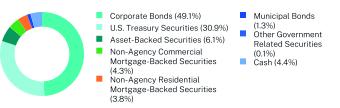

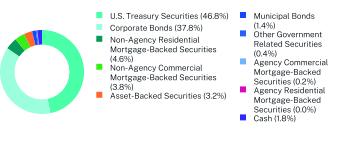

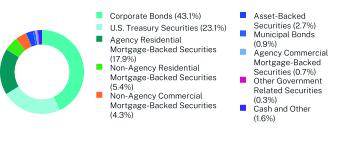

Net Assets | $10,353,722,233 |

Number of Holdings | 467 |

Portfolio Turnover | 47% |

Average Credit Quality | AA- |

Effective Duration | 1.85 years |

Weighted Average Maturity | 2.02 years |

30-Day SEC Yield | 4.53% |

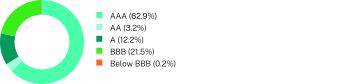

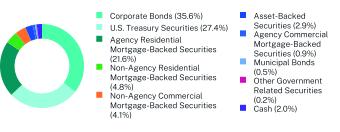

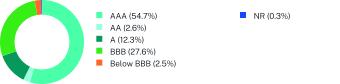

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Short-Term Bond Fund | PAGE 1 | TSR_SAR_057071730 |

| Baird Short-Term Bond Fund | PAGE 2 | TSR_SAR_057071730 |

| Baird Short-Term Bond Fund |  |

| Institutional Class Shares | BSBIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

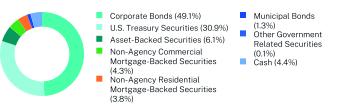

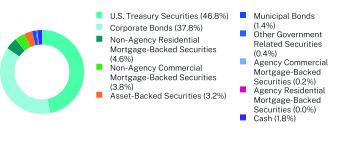

Net Assets | $10,353,722,233 |

Number of Holdings | 467 |

Portfolio Turnover | 47% |

Average Credit Quality | AA- |

Effective Duration | 1.85 years |

Weighted Average Maturity | 2.02 years |

30-Day SEC Yield | 4.78% |

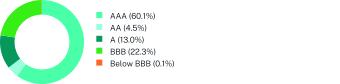

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Short-Term Bond Fund | PAGE 1 | TSR_SAR_057071409 |

| Baird Short-Term Bond Fund | PAGE 2 | TSR_SAR_057071409 |

| Baird Intermediate Bond Fund |  |

| Investor Class Shares | BIMSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $9,866,903,814 |

Number of Holdings | 745 |

Portfolio Turnover | 26% |

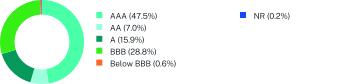

Average Credit Quality | AA- |

Effective Duration | 3.76 years |

Weighted Average Maturity | 4.36 years |

30-Day SEC Yield | 4.34% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Intermediate Bond Fund | PAGE 1 | TSR_SAR_057071706 |

| Baird Intermediate Bond Fund | PAGE 2 | TSR_SAR_057071706 |

| Baird Intermediate Bond Fund |  |

| Institutional Class Shares | BIMIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $9,866,903,814 |

Number of Holdings | 745 |

Portfolio Turnover | 26% |

Average Credit Quality | AA- |

Effective Duration | 3.76 years |

Weighted Average Maturity | 4.36 years |

30-Day SEC Yield | 4.59% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Intermediate Bond Fund | PAGE 1 | TSR_SAR_057071805 |

| Baird Intermediate Bond Fund | PAGE 2 | TSR_SAR_057071805 |

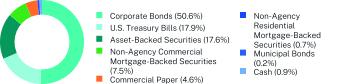

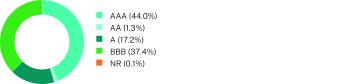

| Baird Aggregate Bond Fund |  |

| Investor Class Shares | BAGSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $46,399,392,040 |

Number of Holdings | 1,810 |

Portfolio Turnover | 17% |

Average Credit Quality | AA |

Effective Duration | 6.13 years |

Weighted Average Maturity | 8.23 years |

30-Day SEC Yield | 4.22% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Aggregate Bond Fund | PAGE 1 | TSR_SAR_057071862 |

| Baird Aggregate Bond Fund | PAGE 2 | TSR_SAR_057071862 |

| Baird Aggregate Bond Fund |  |

| Institutional Class Shares | BAGIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $46,399,392,040 |

Number of Holdings | 1,810 |

Portfolio Turnover | 17% |

Average Credit Quality | AA |

Effective Duration | 6.13 years |

Weighted Average Maturity | 8.23 years |

30-Day SEC Yield | 4.47% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Aggregate Bond Fund | PAGE 1 | TSR_SAR_057071854 |

| Baird Aggregate Bond Fund | PAGE 2 | TSR_SAR_057071854 |

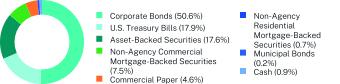

| Baird Core Plus Bond Fund |  |

| Investor Class Shares | BCOSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $30,371,634,739 |

Number of Holdings | 1,630 |

Portfolio Turnover | 19% |

Average Credit Quality | AA |

Effective Duration | 5.90 years |

Weighted Average Maturity | 7.97 years |

30-Day SEC Yield | 4.41% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Core Plus Bond Fund | PAGE 1 | TSR_SAR_057071888 |

| Baird Core Plus Bond Fund | PAGE 2 | TSR_SAR_057071888 |

| Baird Core Plus Bond Fund |  |

| Institutional Class Shares | BCOIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $30,371,634,739 |

Number of Holdings | 1,630 |

Portfolio Turnover | 19% |

Average Credit Quality | AA |

Effective Duration | 5.90 years |

Weighted Average Maturity | 7.97 years |

30-Day SEC Yield | 4.66% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Core Plus Bond Fund | PAGE 1 | TSR_SAR_057071870 |

| Baird Core Plus Bond Fund | PAGE 2 | TSR_SAR_057071870 |

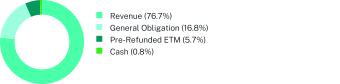

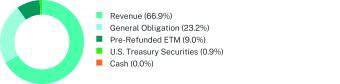

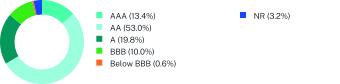

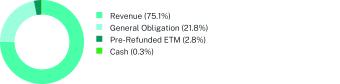

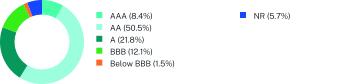

| Baird Short-Term Municipal Bond Fund |  |

| Investor Class Shares | BTMSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $1,537,883,393 |

Number of Holdings | 1,056 |

Portfolio Turnover | 16% |

Average Credit Quality | A+ |

Effective Duration | 2.13 years |

Weighted Average Maturity | 2.45 years |

30-Day SEC Yield | 3.30% |

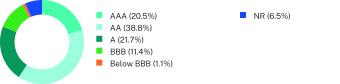

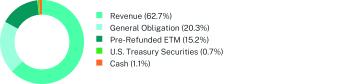

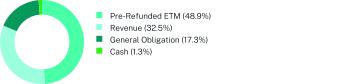

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Short-Term Municipal Bond Fund | PAGE 1 | TSR_SAR_057071623 |

| Baird Short-Term Municipal Bond Fund |  |

| Institutional Class Shares | BTMIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $1,537,883,393 |

Number of Holdings | 1,056 |

Portfolio Turnover | 16% |

Average Credit Quality | A+ |

Effective Duration | 2.13 years |

Weighted Average Maturity | 2.45 years |

30-Day SEC Yield | 3.55% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Short-Term Municipal Bond Fund | PAGE 1 | TSR_SAR_057071631 |

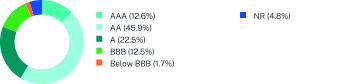

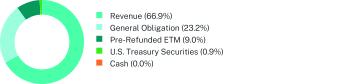

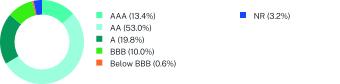

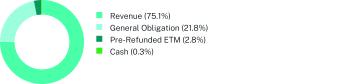

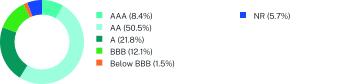

| Baird Strategic Municipal Bond Fund |  |

| Investor Class Shares | BSNSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $1,224,285,632 |

Number of Holdings | 1,151 |

Portfolio Turnover | 22% |

Average Credit Quality | A+ |

Effective Duration | 3.95 years |

Weighted Average Maturity | 4.25 years |

30-Day SEC Yield | 3.41% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Strategic Municipal Bond Fund | PAGE 1 | TSR_SAR_057071524 |

| Baird Strategic Municipal Bond Fund |  |

| Institutional Class Shares | BSNIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $1,224,285,632 |

Number of Holdings | 1,151 |

Portfolio Turnover | 22% |

Average Credit Quality | A+ |

Effective Duration | 3.95 years |

Weighted Average Maturity | 4.25 years |

30-Day SEC Yield | 3.66% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Strategic Municipal Bond Fund | PAGE 1 | TSR_SAR_057071516 |

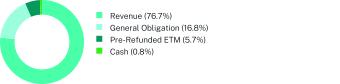

| Baird Quality Intermediate Municipal Bond Fund |  |

| Investor Class Shares | BMBSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $1,049,246,273 |

Number of Holdings | 602 |

Portfolio Turnover | 8% |

Average Credit Quality | AA+ |

Effective Duration | 4.12 years |

Weighted Average Maturity | 4.48 years |

30-Day SEC Yield | 3.07% |

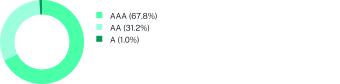

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Quality Intermediate Municipal Bond Fund | PAGE 1 | TSR_SAR_057071508 |

| Baird Quality Intermediate Municipal Bond Fund | PAGE 2 | TSR_SAR_057071508 |

| Baird Quality Intermediate Municipal Bond Fund |  |

| Institutional Class Shares | BMBIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $1,049,246,273 |

Number of Holdings | 602 |

Portfolio Turnover | 8% |

Average Credit Quality | AA+ |

Effective Duration | 4.12 years |

Weighted Average Maturity | 4.48 years |

30-Day SEC Yield | 3.32% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Quality Intermediate Municipal Bond Fund | PAGE 1 | TSR_SAR_057071607 |

| Baird Quality Intermediate Municipal Bond Fund | PAGE 2 | TSR_SAR_057071607 |

| Baird Core Intermediate Municipal Bond Fund |  |

| Investor Class Shares | BMNSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $3,459,174,556 |

Number of Holdings | 2,406 |

Portfolio Turnover | 13% |

Average Credit Quality | AA- |

Effective Duration | 4.55 years |

Weighted Average Maturity | 4.81 years |

30-Day SEC Yield | 3.43% |

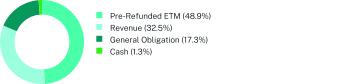

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Core Intermediate Municipal Bond Fund | PAGE 1 | TSR_SAR_057071649 |

| Baird Core Intermediate Municipal Bond Fund | PAGE 2 | TSR_SAR_057071649 |

| Baird Core Intermediate Municipal Bond Fund |  |

| Institutional Class Shares | BMNIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $3,459,174,556 |

Number of Holdings | 2,406 |

Portfolio Turnover | 13% |

Average Credit Quality | AA- |

Effective Duration | 4.55 years |

Weighted Average Maturity | 4.81 years |

30-Day SEC Yield | 3.68% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Core Intermediate Municipal Bond Fund | PAGE 1 | TSR_SAR_057071656 |

| Baird Core Intermediate Municipal Bond Fund | PAGE 2 | TSR_SAR_057071656 |

| Baird Municipal Bond Fund |  |

| Investor Class Shares | BMQSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $27 | 0.55% |

Net Assets | $238,702,581 |

Number of Holdings | 468 |

Portfolio Turnover | 25% |

Average Credit Quality | A |

Effective Duration | 6.10 years |

Weighted Average Maturity | 7.11 years |

30-Day SEC Yield | 3.56% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Municipal Bond Fund | PAGE 1 | TSR_SAR_057071490 |

| Baird Municipal Bond Fund |  |

| Institutional Class Shares | BMQIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $15 | 0.30% |

Net Assets | $238,702,581 |

Number of Holdings | 468 |

Portfolio Turnover | 25% |

Average Credit Quality | A |

Effective Duration | 6.10 years |

Weighted Average Maturity | 7.11 years |

30-Day SEC Yield | 3.81% |

| * | The credit rating quality profile is calculated on a market value-weighted basis as of the end of the period using the highest credit quality rating for each security held by the Fund given by a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| Baird Municipal Bond Fund | PAGE 1 | TSR_SAR_057071482 |

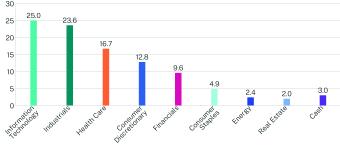

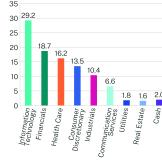

| Baird Mid Cap Growth Fund |  |

| Investor Class Shares | BMDSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $51 | 1.06% |

Net Assets | $2,229,654,959 |

Number of Holdings | 59 |

Portfolio Turnover | 19% |

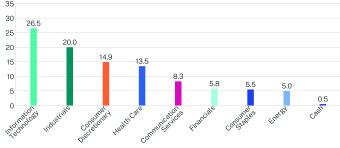

Top 10 Securities | (% of total investments) |

First American Government Obligations Fund | 3.0% |

Dexcom, Inc. | 2.9% |

Monolithic Power Systems, Inc. | 2.6% |

ICON PLC | 2.5% |

CDW Corp. | 2.5% |

IDEXX Laboratories, Inc. | 2.5% |

Tyler Technologies, Inc. | 2.4% |

Diamondback Energy, Inc. | 2.4% |

Copart, Inc. | 2.3% |

Burlington Stores, Inc. | 2.3% |

| Baird Mid Cap Growth Fund | PAGE 1 | TSR_SAR_057071821 |

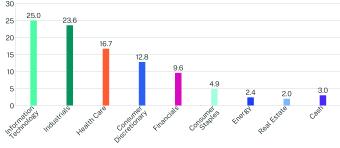

| Baird Mid Cap Growth Fund |  |

| Institutional Class Shares | BMDIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $39 | 0.81% |

Net Assets | $2,229,654,959 |

Number of Holdings | 59 |

Portfolio Turnover | 19% |

Top 10 Securities | (% of total investments) |

First American Government Obligations Fund | 3.0% |

Dexcom, Inc. | 2.9% |

Monolithic Power Systems, Inc. | 2.6% |

ICON PLC | 2.5% |

CDW Corp. | 2.5% |

IDEXX Laboratories, Inc. | 2.5% |

Tyler Technologies, Inc. | 2.4% |

Diamondback Energy, Inc. | 2.4% |

Copart, Inc. | 2.3% |

Burlington Stores, Inc. | 2.3% |

| Baird Mid Cap Growth Fund | PAGE 1 | TSR_SAR_057071813 |

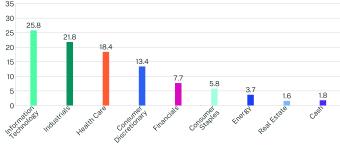

| Baird Small/Mid Cap Growth Fund |  |

| Investor Class Shares | BSGSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $54 | 1.10% |

Net Assets | $164,712,797 |

Number of Holdings | 63 |

Portfolio Turnover | 38% |

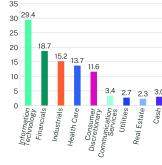

Top 10 Securities | (% of total investments) |

BWX Technologies, Inc. | 3.2% |

Descartes Systems Group, Inc. | 2.7% |

Kadant, Inc. | 2.6% |

Tyler Technologies, Inc. | 2.6% |

Shift4 Payments, Inc. | 2.5% |

Watsco, Inc. | 2.4% |

Insulet Corp. | 2.4% |

Kinsale Capital Group, Inc. | 2.3% |

Matador Resources Co. | 2.3% |

IDEX Corp. | 2.2% |

| Baird Small/Mid Cap Growth Fund | PAGE 1 | TSR_SAR_057071532 |

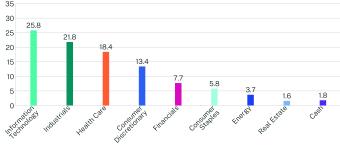

| Baird Small/Mid Cap Growth Fund |  |

| Institutional Class Shares | BSGIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $41 | 0.85% |

Net Assets | $164,712,797 |

Number of Holdings | 63 |

Portfolio Turnover | 38% |

Top 10 Securities | (% of total investments) |

BWX Technologies, Inc. | 3.2% |

Descartes Systems Group, Inc. | 2.7% |

Kadant, Inc. | 2.6% |

Tyler Technologies, Inc. | 2.6% |

Shift4 Payments, Inc. | 2.5% |

Watsco, Inc. | 2.4% |

Insulet Corp. | 2.4% |

Kinsale Capital Group, Inc. | 2.3% |

Matador Resources Co. | 2.3% |

IDEX Corp. | 2.2% |

| Baird Small/Mid Cap Growth Fund | PAGE 1 | TSR_SAR_057071540 |

| Baird Equity Opportunity Fund |  |

| Investor Class Shares | BSVSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $76 | 1.50% |

Net Assets | $64,158,134 |

Number of Holdings | 43 |

Portfolio Turnover | 38% |

Top 10 Securities | (% of total investments) |

Cadre Holdings, Inc. | 5.6% |

Chefs’ Warehouse, Inc. | 5.5% |

Universal Display Corp. | 5.5% |

Sportradar Group AG | 5.4% |

Fluor Corp. | 5.3% |

Envestnet, Inc. | 4.6% |

Merit Medical Systems, Inc. | 4.5% |

Madison Square Garden Sports Corp. | 4.3% |

Valmont Industries, Inc. | 4.0% |

AvidXchange Holdings, Inc. | 4.0% |

| Baird Equity Opportunity Fund | PAGE 1 | TSR_SAR_057071755 |

| Baird Equity Opportunity Fund |  |

| Institutional Class Shares | BSVIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $63 | 1.25% |

Net Assets | $64,158,134 |

Number of Holdings | 43 |

Portfolio Turnover | 38% |

Top 10 Securities | (% of total investments) |

Cadre Holdings, Inc. | 5.6% |

Chefs’ Warehouse, Inc. | 5.5% |

Universal Display Corp. | 5.5% |

Sportradar Group AG | 5.4% |

Fluor Corp. | 5.3% |

Envestnet, Inc. | 4.6% |

Merit Medical Systems, Inc. | 4.5% |

Madison Square Garden Sports Corp. | 4.3% |

Valmont Industries, Inc. | 4.0% |

AvidXchange Holdings, Inc. | 4.0% |

| Baird Equity Opportunity Fund | PAGE 1 | TSR_SAR_057071748 |

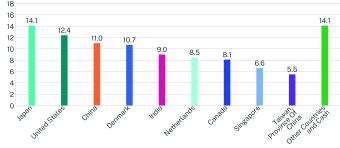

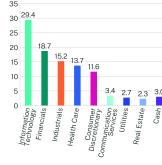

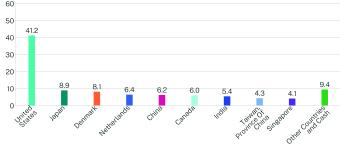

| Baird Chautauqua International Growth Fund |  |

| Investor Class Shares | CCWSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $54 | 1.05% |

Net Assets | $942,926,034 |

Number of Holdings | 32 |

Portfolio Turnover | 8% |

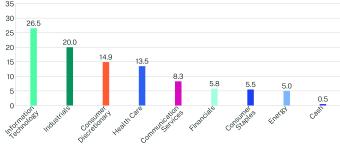

Top 10 Securities (% of total investments) | |

Taiwan Semiconductor Manufacturing Co. Ltd. | 5.5% |

Waste Connections, Inc. | 5.1% |

Constellation Software, Inc. | 5.0% |

ASML Holding NV | 5.0% |

Novo Nordisk AS | 4.9% |

Tata Consultancy Services Ltd. | 4.6% |

HDFC Bank Ltd. | 4.4% |

Recruit Holdings Co. Ltd. | 4.0% |

Prosus NV | 3.9% |

Keyence Corp. | 3.8% |

| Baird Chautauqua International Growth Fund | PAGE 1 | TSR-SAR-057071565 |

| Baird Chautauqua International Growth Fund | PAGE 2 | TSR-SAR-057071565 |

| Baird Chautauqua International Growth Fund |  |

| Institutional Class Shares | CCWIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $41 | 0.80% |

Net Assets | $942,926,034 |

Number of Holdings | 32 |

Portfolio Turnover | 8% |

Top 10 Securities (% of total investments) | |

Taiwan Semiconductor Manufacturing Co. Ltd. | 5.5% |

Waste Connections, Inc. | 5.1% |

Constellation Software, Inc. | 5.0% |

ASML Holding NV | 5.0% |

Novo Nordisk AS | 4.9% |

Tata Consultancy Services Ltd. | 4.6% |

HDFC Bank Ltd. | 4.4% |

Recruit Holdings Co. Ltd. | 4.0% |

Prosus NV | 3.9% |

Keyence Corp. | 3.8% |

| Baird Chautauqua International Growth Fund | PAGE 1 | TSR_SAR-057071557 |

| Baird Chautauqua International Growth Fund | PAGE 2 | TSR_SAR-057071557 |

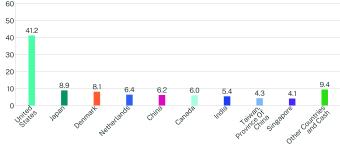

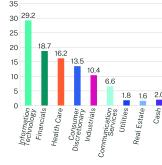

| Baird Chautauqua Global Growth Fund |  |

| Investor Class Shares | CCGSX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class Shares | $56 | 1.05% |

Net Assets | $365,661,820 |

Number of Holdings | 44 |

Portfolio Turnover | 7% |

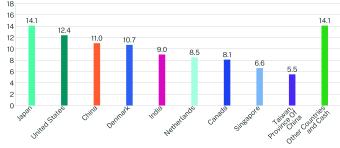

Top 10 Securities (% of total investments) | |

NVIDIA Corp. | 5.1% |

Alphabet, Inc. | 4.5% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 4.3% |

Novo Nordisk AS | 4.2% |

Mastercard, Inc. | 4.0% |

ASML Holding NV | 4.0% |

Constellation Software, Inc. | 3.8% |

Regeneron Pharmaceuticals, Inc. | 3.7% |

Waste Connections, Inc. | 3.5% |

Amazon.com, Inc. | 3.4% |

| Baird Chautauqua Global Growth Fund | PAGE 1 | TSR-SAR-057071573 |

| Baird Chautauqua Global Growth Fund | PAGE 2 | TSR-SAR-057071573 |

| Baird Chautauqua Global Growth Fund |  |

| Institutional Class Shares | CCGIX | ||

| Semi-Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class Shares | $43 | 0.80% |

Net Assets | $365,661,820 |

Number of Holdings | 44 |

Portfolio Turnover | 7% |

Top 10 Securities (% of total investments) | |

NVIDIA Corp. | 5.1% |

Alphabet, Inc. | 4.5% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 4.3% |

Novo Nordisk AS | 4.2% |

Mastercard, Inc. | 4.0% |

ASML Holding NV | 4.0% |

Constellation Software, Inc. | 3.8% |

Regeneron Pharmaceuticals, Inc. | 3.7% |

Waste Connections, Inc. | 3.5% |

Amazon.com, Inc. | 3.4% |

| Baird Chautauqua Global Growth Fund | PAGE 1 | TSR-SAR-057071581 |

| Baird Chautauqua Global Growth Fund | PAGE 2 | TSR-SAR-057071581 |

| (b) | Not applicable. |

Item 2. Code of Ethics.

Not applicable – only required for annual reports on Form N-CSR.

Item 3. Audit Committee Financial Expert.

Not applicable – only required for annual reports on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Not applicable – only required for annual reports on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable because the Registrant is not a “listed issuer” within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934.

Item 6. Investments.

| (a) | The complete Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period for the Baird Mid Cap Growth Fund, Baird Small/Mid Cap Growth Fund, Baird Equity Opportunity Fund, Baird Chautauqua International Growth Fund, Baird Chautauqua Global Growth Fund (collectively, the “Equity Funds”), Baird Ultra Short Bond Fund, Baird Short-Term Bond Fund, Baird Intermediate Bond Fund, Baird Aggregate Bond Fund, Baird Core Plus Bond Fund, Baird Short-Term Municipal Bond Fund, Baird Strategic Municipal Bond Fund, Baird Quality Intermediate Municipal Bond Fund, Baird Core Intermediate Municipal Bond Fund, and Baird Municipal Bond Fund (collectively, the “Bond Funds”) are included within the financial statements filed under Item 7 of this Form. |

| (b) | Not Applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies | |||

Par | Value | |||||

CORPORATE BONDS - 50.1% | ||||||

Financials - 22.3% | ||||||

ABN AMRO Bank NV, 4.75%, 07/28/2025(a) | $ 43,684,000 | $ 43,075,505 | ||||

AerCap Ireland Capital DAC/ AerCap Global Aviation Trust | ||||||

2.88%, 08/14/2024 (Callable 07/17/2024) | 2,300,000 | 2,290,783 | ||||

1.65%, 10/29/2024 (Callable 09/29/2024) | 18,762,000 | 18,507,805 | ||||

1.75%, 10/29/2024 (Callable 08/01/2024) | 17,885,000 | 17,645,790 | ||||

3.50%, 01/15/2025 (Callable 11/15/2024) | 1,125,000 | 1,110,895 | ||||

6.50%, 07/15/2025 (Callable 06/15/2025) | 1,000,000 | 1,007,647 | ||||

Air Lease Corp. | ||||||

4.25%, 09/15/2024 (Callable 08/01/2024) | 27,933,000 | 27,838,581 | ||||

2.30%, 02/01/2025 (Callable 01/01/2025) | 1,324,000 | 1,295,693 | ||||

3.25%, 03/01/2025 (Callable 01/01/2025) | 1,815,000 | 1,782,973 | ||||

3.38%, 07/01/2025 (Callable 06/01/2025) | 16,500,000 | 16,122,903 | ||||

Aircastle Ltd., 5.25%, 08/11/2025 (Callable 07/11/2025)(a) | 40,664,000 | 40,350,901 | ||||

Ally Financial, Inc., 4.63%, 03/30/2025 | 4,029,000 | 3,991,578 | ||||

Aviation Capital Group LLC | ||||||

5.50%, 12/15/2024 (Callable 11/15/2024)(a) | 22,176,000 | 22,117,773 | ||||

4.13%, 08/01/2025 (Callable 06/01/2025)(a) | 10,518,000 | 10,317,489 | ||||

Banco Bilbao Vizcaya Argentaria SA, 5.86% to 09/14/2025 then 1 yr. CMT Rate + 2.30%, 09/14/2026 (Callable 09/14/2025) | 4,600,000 | 4,600,244 | ||||

Banco Santander SA, 5.15%, 08/18/2025 | 12,700,000 | 12,601,198 | ||||

Bank of America Corp. | ||||||

3.37% to 01/23/2025 then 3 mo. Term SOFR + 1.07%, 01/23/2026 (Callable 01/23/2025) | 15,000,000 | 14,792,419 | ||||

1.32% to 06/19/2025 then SOFR + 1.15%, 06/19/2026 (Callable 06/19/2025) | 12,817,000 | 12,281,367 | ||||

4.83% to 07/22/2025 then SOFR + 1.75%, 07/22/2026 (Callable 07/22/2025) | 11,445,000 | 11,334,654 | ||||

Bank of Ireland Group PLC, 6.25% to 09/16/2025 then 1 yr. CMT Rate + 2.65%, 09/16/2026 (Callable 09/16/2025)(a) | 15,805,000 | 15,881,703 | ||||

Par | Value | |||||

Barclays PLC, 2.85% to 05/07/2025 then SOFR + 2.71%, 05/07/2026 (Callable 05/07/2025) | $ 35,484,000 | $ 34,596,340 | ||||

BGC Group, Inc., 3.75%, 10/01/2024 (Callable 09/01/2024) | 13,500,000 | 13,396,431 | ||||

BNP Paribas SA | ||||||

4.25%, 10/15/2024 | 17,087,000 | 16,996,083 | ||||

2.82% to 11/19/2024 then 3 mo. Term SOFR + 1.37%, 11/19/2025 (Callable 11/19/2024)(a) | 8,940,000 | 8,828,692 | ||||

2.22% to 06/09/2025 then SOFR + 2.07%, 06/09/2026 (Callable 06/09/2025)(a) | 21,400,000 | 20,686,870 | ||||

BPCE SA | ||||||

5.15%, 07/21/2024(a) | 3,735,000 | 3,731,544 | ||||

4.50%, 03/15/2025(a) | 47,548,000 | 46,911,588 | ||||

Brixmor Operating Partnership LP, 3.85%, 02/01/2025 (Callable 11/01/2024) | 31,355,000 | 31,013,971 | ||||

Citigroup, Inc., 6.05% (SOFR + 0.69%), 10/30/2024 (Callable 09/30/2024) | 52,580,000 | 52,628,373 | ||||

Citizens Bank NA/Providence RI, 5.28% to 01/26/2025 then SOFR + 1.02%, 01/26/2026 (Callable 01/26/2025) | 19,100,000 | 18,984,913 | ||||

CNO Global Funding, 1.65%, 01/06/2025(a) | 2,850,000 | 2,784,928 | ||||

Cooperatieve Rabobank UA | ||||||

4.38%, 08/04/2025 | 1,770,000 | 1,742,153 | ||||

1.34% to 06/24/2025 then 1 yr. CMT Rate + 1.00%, 06/24/2026 (Callable 06/24/2025)(a) | 13,931,000 | 13,344,080 | ||||

Credit Agricole SA, 4.38%, 03/17/2025(a) | 16,326,000 | 16,134,874 | ||||

Credit Agricole SA/London, 1.91% to 06/16/2025 then SOFR + 1.68%, 06/16/2026 (Callable 06/16/2025)(a) | 21,256,000 | 20,461,821 | ||||

Danske Bank AS | ||||||

3.24% to 12/20/2024 then 3 mo. LIBOR US + 1.59%, 12/20/2025 (Callable 12/20/2024)(a)(b) | 1,914,000 | 1,888,648 | ||||

6.47% (1 yr. CMT Rate + 2.10%), 01/09/2026 (Callable 01/09/2025)(a) | 8,351,000 | 8,373,486 | ||||

1.62% to 09/11/2025 then 1 yr. CMT Rate + 1.35%, 09/11/2026 (Callable 09/11/2025)(a) | 12,800,000 | 12,167,157 | ||||

1 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Financials - (Continued) | ||||||

Deutsche Bank AG/New York NY | ||||||

3.96% to 11/26/2024 then SOFR + 2.58%, 11/26/2025 (Callable 11/26/2024) | $ 41,239,000 | $ 40,886,743 | ||||

6.12% to 07/14/2025 then SOFR + 3.19%, 07/14/2026 (Callable 07/14/2025) | 11,400,000 | 11,410,029 | ||||

Discover Bank, 2.45%, 09/12/2024 (Callable 08/12/2024) | 31,674,000 | 31,452,921 | ||||

Discover Financial Services, 3.75%, 03/04/2025 (Callable 12/04/2024) | 2,200,000 | 2,170,923 | ||||

Fifth Third Bank NA, 5.85% to 10/27/2024 then SOFR + 1.23%, 10/27/2025 (Callable 10/27/2024) | 2,520,000 | 2,517,787 | ||||

Goldman Sachs Group, Inc. | ||||||

5.84% (SOFR + 0.49%), 10/21/2024 (Callable 09/21/2024) | 16,930,000 | 16,931,862 | ||||

3.27% to 09/29/2024 then 3 mo. Term SOFR + 1.46%, 09/29/2025 (Callable 09/29/2024) | 25,767,000 | 25,600,969 | ||||

Healthpeak OP LLC, 3.40%, 02/01/2025 (Callable 11/01/2024) | 428,000 | 421,643 | ||||

Host Hotels & Resorts LP, 4.00%, 06/15/2025 (Callable 03/15/2025) | 3,625,000 | 3,564,448 | ||||

HSBC Holdings PLC | ||||||

1.65% to 04/18/2025 then SOFR + 1.54%, 04/18/2026 (Callable 04/18/2025) | 24,500,000 | 23,711,810 | ||||

2.10% to 06/04/2025 then SOFR + 1.93%, 06/04/2026 (Callable 06/04/2025) | 8,625,000 | 8,338,653 | ||||

Huntington National Bank, 5.70% to 11/18/2024 then SOFR + 1.22%, 11/18/2025 (Callable 11/18/2024) | 8,770,000 | 8,756,620 | ||||

Jackson National Life Global Funding, 1.75%, 01/12/2025(a) | 3,500,000 | 3,422,147 | ||||

Jefferies Financial Group, Inc., 6.05%, 03/12/2025 (Callable 09/12/2024) | 37,775,000 | 37,749,993 | ||||

JPMorgan Chase & Co. | ||||||

2.30% to 10/15/2024 then SOFR + 1.16%, 10/15/2025 (Callable 10/15/2024) | 1,546,000 | 1,530,464 | ||||

2.08% to 04/22/2025 then SOFR + 1.85%, 04/22/2026 (Callable 04/22/2025) | 39,952,000 | 38,795,810 | ||||

Par | Value | |||||

Kilroy Realty LP, 3.45%, 12/15/2024 (Callable 09/15/2024) | $ 1,505,000 | $ 1,486,550 | ||||

Kimco Realty OP LLC | ||||||

3.30%, 02/01/2025 (Callable 12/01/2024) | 6,352,000 | 6,255,735 | ||||

3.85%, 06/01/2025 (Callable 03/01/2025) | 3,703,000 | 3,640,978 | ||||

Kite Realty Group Trust, 4.00%, 03/15/2025 (Callable 12/15/2024) | 4,696,000 | 4,625,252 | ||||

Liberty Mutual Insurance Co., 8.50%, 05/15/2025(a) | 1,063,000 | 1,083,798 | ||||

Lincoln National Corp., 3.35%, 03/09/2025 | 17,005,000 | 16,737,899 | ||||

Lloyds Banking Group PLC, 3.87% to 07/09/2024 then 1 yr. CMT Rate + 3.50%, 07/09/2025 (Callable 07/09/2024) | 48,385,000 | 48,362,996 | ||||

Macquarie Bank Ltd., 4.88%, 06/10/2025(a) | 15,355,000 | 15,198,673 | ||||

Macquarie Group Ltd., 6.21%, 11/22/2024(a) | 7,177,000 | 7,186,716 | ||||

Mitsubishi UFJ Financial Group, Inc. | ||||||

4.79% to 07/18/2024 then 1 yr. CMT Rate + 1.70%, 07/18/2025 (Callable 07/18/2024) | 11,011,000 | 11,004,532 | ||||

0.95% to 07/19/2024 then 1 yr. CMT Rate + 0.55%, 07/19/2025 (Callable 07/19/2024) | 4,025,000 | 4,014,851 | ||||

Morgan Stanley | ||||||

2.72% to 07/22/2024 then SOFR + 1.15%, 07/22/2025 (Callable 08/01/2024) | 24,219,000 | 24,173,508 | ||||

2.19% to 04/28/2025 then SOFR + 1.99%, 04/28/2026 (Callable 04/28/2025) | 41,615,000 | 40,414,167 | ||||

Nomura Holdings, Inc. | ||||||

2.65%, 01/16/2025 | 8,119,000 | 7,979,788 | ||||

1.85%, 07/16/2025 | 46,543,000 | 44,714,947 | ||||

Nuveen Finance LLC, 4.13%, 11/01/2024(a) | 950,000 | 944,061 | ||||

Old Republic International Corp., 4.88%, 10/01/2024 (Callable 09/01/2024) | 21,360,000 | 21,294,766 | ||||

Omega Healthcare Investors, Inc., 4.50%, 01/15/2025 (Callable 10/15/2024) | 17,767,000 | 17,624,353 | ||||

Peachtree Corners Funding Trust, 3.98%, 02/15/2025(a) | 23,992,000 | 23,644,150 | ||||

Reliance Standard Life Global Funding II | ||||||

2.50%, 10/30/2024(a) | 6,195,000 | 6,116,957 | ||||

2.75%, 05/07/2025(a) | 6,895,000 | 6,723,472 | ||||

2 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Financials - (Continued) | ||||||

Retail Opportunity Investments Partnership LP, 4.00%, 12/15/2024 (Callable 09/15/2024) | $ 4,939,000 | $ 4,887,397 | ||||

Santander UK Group Holdings PLC, 1.53% to 08/21/2025 then 1 yr. CMT Rate + 1.25%, 08/21/2026 (Callable 08/21/2025) | 14,300,000 | 13,609,248 | ||||

Societe Generale SA | ||||||

2.63%, 10/16/2024(a) | 1,000,000 | 990,662 | ||||

2.23% to 01/21/2025 then 1 yr. CMT Rate + 1.05%, 01/21/2026 (Callable 01/21/2025)(a) | 52,299,000 | 51,154,769 | ||||

Standard Chartered PLC | ||||||

1.82% to 11/23/2024 then 1 yr. CMT Rate + 0.95%, 11/23/2025 (Callable 11/23/2024)(a) | 10,747,000 | 10,573,098 | ||||

2.82% to 01/30/2025 then 3 mo. LIBOR US + 1.21%, 01/30/2026 (Callable 01/30/2025)(a)(b) | 4,710,000 | 4,626,369 | ||||

3.97% to 03/30/2025 then 1 yr. CMT Rate + 1.65%, 03/30/2026 (Callable 03/30/2025)(a) | 29,095,000 | 28,680,217 | ||||

Stifel Financial Corp., 4.25%, 07/18/2024 | 25,478,000 | 25,456,592 | ||||

Synchrony Financial | ||||||

4.25%, 08/15/2024 (Callable 08/01/2024) | 3,172,000 | 3,164,359 | ||||

4.88%, 06/13/2025 (Callable 05/13/2025) | 12,238,000 | 12,114,627 | ||||

4.50%, 07/23/2025 (Callable 04/23/2025) | 37,803,000 | 37,166,303 | ||||

UBS Group AG, 2.59% to 09/11/2024 then SOFR + 1.56%, 09/11/2025 (Callable 09/11/2024)(a) | 47,432,000 | 47,116,787 | ||||

WEA Finance LLC/Westfield UK & Europe Finance PLC, 3.75%, 09/17/2024 (Callable 07/17/2024)(a) | 10,245,000 | 10,168,622 | ||||

Wells Fargo & Co. | ||||||

2.41% to 10/30/2024 then 3 mo. Term SOFR + 1.09%, 10/30/2025 (Callable 10/30/2024) | 16,813,000 | 16,621,996 | ||||

3.91% to 04/25/2025 then SOFR + 1.32%, 04/25/2026 (Callable 04/25/2025) | 18,655,000 | 18,375,050 | ||||

Par | Value | |||||

2.19% to 04/30/2025 then SOFR + 2.00%, 04/30/2026 (Callable 04/30/2025) | $ 26,273,000 | $25,512,225 | ||||

1,484,329,145 | ||||||

Industrials - 24.4% | ||||||

Allegion US Holding Co., Inc., 3.20%, 10/01/2024 (Callable 08/01/2024) | 18,562,000 | 18,428,540 | ||||

Amcor Flexibles North America, Inc., 4.00%, 05/17/2025 (Callable 04/17/2025) | 19,920,000 | 19,630,958 | ||||

Anglo American Capital PLC | ||||||

3.63%, 09/11/2024(a) | 9,925,000 | 9,875,800 | ||||

4.88%, 05/14/2025(a) | 4,892,000 | 4,854,523 | ||||

Arrow Electronics, Inc., 3.25%, 09/08/2024 (Callable 07/17/2024) | 13,600,000 | 13,521,946 | ||||

AutoNation, Inc. | ||||||

3.50%, 11/15/2024 (Callable 09/15/2024) | 19,759,000 | 19,575,625 | ||||

4.50%, 10/01/2025 (Callable 07/01/2025) | 3,110,000 | 3,061,323 | ||||

Baxalta, Inc., 4.00%, 06/23/2025 (Callable 03/23/2025) | 12,083,000 | 11,906,543 | ||||

Baxter International, Inc., 1.32%, 11/29/2024 | 3,250,000 | 3,191,060 | ||||

Bayer US Finance II LLC, 2.85%, 04/15/2025 (Callable 01/15/2025)(a) | 2,677,000 | 2,600,938 | ||||

Bayer US Finance LLC, 3.38%, 10/08/2024(a) | 4,400,000 | 4,368,221 | ||||

Boardwalk Pipelines LP, 4.95%, 12/15/2024 (Callable 09/15/2024) | 42,805,000 | 42,640,427 | ||||

Broadcom Corp./Broadcom Cayman Finance Ltd., 3.13%, 01/15/2025 (Callable 11/15/2024) | 331,000 | 326,277 | ||||

Brunswick Corp./DE, 0.85%, 08/18/2024 (Callable 07/17/2024) | 46,577,000 | 46,242,455 | ||||

Canadian Natural Resources Ltd., 3.90%, 02/01/2025 (Callable 11/01/2024) | 3,096,000 | 3,060,433 | ||||

Carrier Global Corp., 2.24%, 02/15/2025 (Callable 01/15/2025) | 25,458,000 | 24,917,882 | ||||

CDW LLC/CDW Finance Corp. | ||||||

5.50%, 12/01/2024 (Callable 08/01/2024) | 6,632,000 | 6,615,476 | ||||

4.13%, 05/01/2025 (Callable 08/01/2024) | 5,158,000 | 5,072,509 | ||||

Celanese US Holdings LLC | ||||||

5.90%, 07/05/2024 | 1,405,000 | 1,404,927 | ||||

6.05%, 03/15/2025 | 5,320,000 | 5,326,761 | ||||

3 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Industrials - (Continued) | ||||||

Charter Communications Operating LLC / Charter Communications Operating Capital, 4.91%, 07/23/2025 (Callable 04/23/2025) | $ 52,607,000 | $ 52,095,985 | ||||

CNH Industrial Capital LLC, 3.95%, 05/23/2025 | 4,525,000 | 4,457,583 | ||||

Cox Communications, Inc., 3.15%, 08/15/2024 (Callable 08/01/2024)(a) | 22,255,000 | 22,170,377 | ||||

CRH America, Inc., 3.88%, 05/18/2025 (Callable 02/15/2025)(a) | 11,607,000 | 11,408,723 | ||||

Crown Castle, Inc., 3.20%, 09/01/2024 (Callable 08/01/2024) | 8,084,000 | 8,043,355 | ||||

DCP Midstream Operating LP, 5.38%, 07/15/2025 (Callable 04/15/2025) | 4,848,000 | 4,829,803 | ||||

Discovery Communications LLC | ||||||

3.45%, 03/15/2025 (Callable 12/15/2024) | 2,675,000 | 2,630,409 | ||||

3.95%, 06/15/2025 (Callable 03/15/2025) | 8,605,000 | 8,454,533 | ||||

Element Fleet Management Corp., 3.85%, 06/15/2025 (Callable 05/15/2025)(a) | 6,122,000 | 6,003,297 | ||||

Energy Transfer LP, 5.75%, 04/01/2025 (Callable 07/17/2024) | 28,237,000 | 28,153,379 | ||||

EnLink Midstream Partners LP, 4.15%, 06/01/2025 (Callable 03/01/2025) | 13,300,000 | 13,070,685 | ||||

Equifax, Inc., 2.60%, 12/01/2024 (Callable 11/01/2024) | 6,556,000 | 6,469,207 | ||||

Equinix, Inc., 2.63%, 11/18/2024 (Callable 10/18/2024) | 5,908,000 | 5,838,308 | ||||

Fiserv, Inc., 3.85%, 06/01/2025 (Callable 03/01/2025) | 21,326,000 | 20,961,736 | ||||

Flex Ltd., 4.75%, 06/15/2025 (Callable 03/15/2025) | 16,757,000 | 16,601,131 | ||||

Florida Gas Transmission Co. LLC, 4.35%, 07/15/2025 (Callable 04/15/2025)(a) | 22,751,000 | 22,398,286 | ||||

Ford Motor Credit Co. LLC | ||||||

2.30%, 02/10/2025 (Callable 01/10/2025) | 46,993,000 | 45,946,825 | ||||

4.13%, 08/04/2025 | 1,625,000 | 1,594,507 | ||||

Fortune Brands Innovations, Inc., 4.00%, 06/15/2025 (Callable 03/15/2025) | 19,078,000 | 18,757,921 | ||||

Freeport-McMoRan, Inc., 4.55%, 11/14/2024 (Callable 08/14/2024) | 37,172,000 | 36,979,449 | ||||

Par | Value | |||||

Fresenius Medical Care US Finance II, Inc., 4.75%, 10/15/2024 (Callable 08/01/2024)(a) | $ 17,636,000 | $ 17,537,283 | ||||

General Motors Financial Co., Inc. | ||||||

1.20%, 10/15/2024 | 9,165,000 | 9,045,671 | ||||

3.50%, 11/07/2024 (Callable 09/07/2024) | 7,945,000 | 7,878,222 | ||||

4.00%, 01/15/2025 (Callable 10/15/2024) | 13,176,000 | 13,046,990 | ||||

2.90%, 02/26/2025 (Callable 01/26/2025) | 1,367,000 | 1,341,287 | ||||

3.80%, 04/07/2025 | 2,000,000 | 1,969,755 | ||||

2.75%, 06/20/2025 (Callable 05/20/2025) | 10,000,000 | 9,719,899 | ||||

4.30%, 07/13/2025 (Callable 04/13/2025) | 2,875,000 | 2,836,597 | ||||

Genpact Luxembourg Sarl, 3.38%, 12/01/2024 (Callable 11/01/2024) | 41,306,000 | 40,784,880 | ||||

Genuine Parts Co., 1.75%, 02/01/2025 (Callable 07/12/2024) | 2,916,000 | 2,844,076 | ||||

Glencore Funding LLC | ||||||

4.00%, 04/16/2025(a) | 4,968,000 | 4,899,639 | ||||

1.63%, 09/01/2025 (Callable 08/01/2025)(a) | 11,435,000 | 10,906,866 | ||||

Global Payments, Inc. | ||||||

1.50%, 11/15/2024 (Callable 10/15/2024) | 8,217,000 | 8,091,931 | ||||

2.65%, 02/15/2025 (Callable 01/15/2025) | 5,732,000 | 5,620,412 | ||||

Harman International Industries, Inc., 4.15%, 05/15/2025 (Callable 02/15/2025) | 51,556,000 | 50,864,244 | ||||

HCA, Inc. | ||||||

5.38%, 02/01/2025 | 30,269,000 | 30,166,682 | ||||

5.25%, 04/15/2025 | 11,917,000 | 11,860,860 | ||||

Hewlett Packard Enterprise Co., 5.90%, 10/01/2024 | 36,450,000 | 36,445,405 | ||||

Hexcel Corp., 4.95%, 08/15/2025 (Callable 05/15/2025) | 1,732,000 | 1,713,449 | ||||

Howmet Aerospace, Inc. | ||||||

5.13%, 10/01/2024 (Callable 07/01/2024) | 1,030,000 | 1,030,000 | ||||

6.88%, 05/01/2025 (Callable 04/01/2025) | 6,262,000 | 6,308,307 | ||||

Hyatt Hotels Corp., 1.80%, 10/01/2024 (Callable 07/17/2024) | 27,711,000 | 27,418,248 | ||||

Hyundai Capital America | ||||||

1.00%, 09/17/2024(a) | 23,472,000 | 23,227,966 | ||||

2.65%, 02/10/2025 (Callable 01/10/2025)(a) | 18,880,000 | 18,523,964 | ||||

6.00%, 07/11/2025(a) | 1,370,000 | 1,374,464 | ||||

JDE Peet’s NV, 0.80%, 09/24/2024 (Callable 08/01/2024)(a) | 7,397,000 | 7,295,558 | ||||

4 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Industrials - (Continued) | ||||||

Keysight Technologies, Inc., 4.55%, 10/30/2024 (Callable 08/01/2024) | $ 12,755,000 | $ 12,718,934 | ||||

Kinder Morgan Energy Partners LP, 4.25%, 09/01/2024 (Callable 08/01/2024) | 8,684,000 | 8,658,076 | ||||

Kinder Morgan, Inc., 4.30%, 06/01/2025 (Callable 03/01/2025) | 31,567,000 | 31,155,952 | ||||

Laboratory Corp. of America Holdings, 3.25%, 09/01/2024 (Callable 08/01/2024) | 5,501,000 | 5,474,340 | ||||

Legrand France SA, 8.50%, 02/15/2025 | 6,284,000 | 6,389,964 | ||||

Microchip Technology, Inc., 0.98%, 09/01/2024 | 26,107,000 | 25,885,756 | ||||

MPLX LP | ||||||

4.88%, 12/01/2024 (Callable 09/01/2024) | 5,755,000 | 5,730,362 | ||||

4.00%, 02/15/2025 (Callable 11/15/2024) | 28,265,000 | 27,958,808 | ||||

4.88%, 06/01/2025 (Callable 03/01/2025) | 11,999,000 | 11,892,910 | ||||

Nissan Motor Acceptance Co. LLC, 1.13%, 09/16/2024(a) | 33,017,000 | 32,663,467 | ||||

Nissan Motor Co. Ltd., 3.52%, 09/17/2025 (Callable 08/17/2025)(a) | 8,309,000 | 8,062,199 | ||||

Nutrien Ltd., 5.90%, 11/07/2024 | 13,613,000 | 13,616,713 | ||||

NXP BV/NXP Funding LLC/NXP USA, Inc., 2.70%, 05/01/2025 (Callable 04/01/2025) | 6,250,000 | 6,101,833 | ||||

Occidental Petroleum Corp., 2.90%, 08/15/2024 (Callable 07/15/2024) | 20,054,000 | 19,956,425 | ||||

ONEOK, Inc., 2.75%, 09/01/2024 (Callable 08/01/2024) | 9,389,000 | 9,333,212 | ||||

Oracle Corp., 2.50%, 04/01/2025 (Callable 03/01/2025) | 9,119,000 | 8,907,746 | ||||

Owens Corning, 4.20%, 12/01/2024 (Callable 09/01/2024) | 7,620,000 | 7,568,194 | ||||

Penske Truck Leasing Co. Lp/PTL Finance Corp. | ||||||

2.70%, 11/01/2024 (Callable 10/01/2024)(a) | 4,510,000 | 4,459,298 | ||||

3.95%, 03/10/2025 (Callable 01/10/2025)(a) | 1,416,000 | 1,398,665 | ||||

4.00%, 07/15/2025 (Callable 06/15/2025)(a) | 2,358,000 | 2,317,261 | ||||

Plains All American Pipeline LP / PAA Finance Corp., 3.60%, 11/01/2024 (Callable 08/01/2024) | 4,515,000 | 4,481,165 | ||||

Qorvo, Inc., 1.75%, 12/15/2024 (Callable 07/12/2024) | 14,201,000 | 13,899,917 | ||||

Par | Value | |||||

Quanta Services, Inc., 0.95%, 10/01/2024 (Callable 07/12/2024) | $ 10,846,000 | $ 10,706,633 | ||||

Reliance Industries Ltd., 4.13%, 01/28/2025(a) | 16,328,000 | 16,185,810 | ||||

Reliance, Inc., 1.30%, 08/15/2025 (Callable 07/15/2025) | 6,000,000 | 5,714,279 | ||||

Revvity, Inc., 0.85%, 09/15/2024 (Callable 07/12/2024) | 23,033,000 | 22,773,076 | ||||

Royalty Pharma PLC, 1.20%, 09/02/2025 (Callable 08/02/2025) | 13,162,000 | 12,500,020 | ||||

Ryder System, Inc. | ||||||

2.50%, 09/01/2024 (Callable 08/01/2024) | 38,820,000 | 38,580,154 | ||||

4.63%, 06/01/2025 (Callable 05/01/2025) | 5,564,000 | 5,507,146 | ||||

Sabine Pass Liquefaction LLC, 5.63%, 03/01/2025 (Callable 12/01/2024) | 7,768,000 | 7,752,068 | ||||

Sonoco Products Co., 1.80%, 02/01/2025 (Callable 07/12/2024) | 18,438,000 | 17,996,606 | ||||

Suntory Holdings Ltd., 2.25%, 10/16/2024 (Callable 09/16/2024)(a) | 3,975,000 | 3,933,469 | ||||

TD SYNNEX Corp., 1.25%, 08/09/2024 (Callable 07/12/2024) | 47,494,000 | 47,241,058 | ||||

Thomas Jefferson University, 2.07%, 11/01/2024 | 625,000 | 614,934 | ||||

TransCanada PipeLines Ltd., 1.00%, 10/12/2024 (Callable 09/12/2024) | 46,371,000 | 45,737,638 | ||||

Trimble, Inc., 4.75%, 12/01/2024 (Callable 09/01/2024) | 5,350,000 | 5,325,862 | ||||

VICI Properties LP / VICI Note Co., Inc. | ||||||

3.50%, 02/15/2025 (Callable 07/12/2024)(a) | 2,975,000 | 2,934,671 | ||||

4.63%, 06/15/2025 (Callable 03/15/2025)(a) | 7,323,000 | 7,227,263 | ||||

Volkswagen Group of America Finance LLC | ||||||

2.85%, 09/26/2024(a) | 10,432,000 | 10,356,634 | ||||

3.35%, 05/13/2025(a) | 16,083,000 | 15,772,690 | ||||

3.95%, 06/06/2025(a) | 11,632,000 | 11,451,540 | ||||

West Fraser Timber Co. Ltd., 4.35%, 10/15/2024 (Callable 08/01/2024)(a) | 2,600,000 | 2,580,460 | ||||

Western Midstream Operating LP, 3.10%, 02/01/2025 (Callable 01/01/2025) | 32,578,000 | 32,016,346 | ||||

Westinghouse Air Brake Technologies Corp., 3.20%, 06/15/2025 (Callable 05/15/2025) | 45,851,000 | 44,742,746 | ||||

5 |

Par | Value | |||||

CORPORATE BONDS - (Continued) | ||||||

Industrials - (Continued) | ||||||

Williams Cos., Inc., 3.90%, 01/15/2025 (Callable 10/15/2024) | $ 16,940,000 | $16,778,960 | ||||

Woodside Finance Ltd., 3.65%, 03/05/2025 (Callable 12/05/2024)(a) | 30,400,000 | 29,969,022 | ||||

WPP Finance 2010, 3.75%, 09/19/2024 | 936,000 | 930,693 | ||||

WRKCo, Inc., 3.00%, 09/15/2024 (Callable 08/01/2024) | 6,691,000 | 6,649,716 | ||||

1,626,851,469 | ||||||

Utilities - 3.4% | ||||||

Ameren Corp., 2.50%, 09/15/2024 (Callable 08/15/2024) | 2,005,000 | 1,990,337 | ||||

Appalachian Power Co., 3.40%, 06/01/2025 (Callable 03/01/2025) | 3,748,000 | 3,669,141 | ||||

Aquarion Co., 4.00%, 08/15/2024 (Callable 08/01/2024)(a) | 962,000 | 958,736 | ||||

Avangrid, Inc. | ||||||

3.15%, 12/01/2024 (Callable 10/01/2024) | 8,605,000 | 8,510,171 | ||||

3.20%, 04/15/2025 (Callable 03/15/2025) | 11,588,000 | 11,345,933 | ||||

Black Hills Corp., 1.04%, 08/23/2024 (Callable 07/17/2024) | 39,065,000 | 38,781,597 | ||||

CenterPoint Energy, Inc., 2.50%, 09/01/2024 (Callable 08/01/2024) | 9,603,000 | 9,545,944 | ||||

Constellation Energy Generation LLC, 3.25%, 06/01/2025 (Callable 05/01/2025) | 3,488,000 | 3,410,434 | ||||

DTE Energy Co. | ||||||

2.53%, 10/01/2024(c) | 7,409,000 | 7,341,175 | ||||

4.22%, 11/01/2024(c) | 23,529,000 | 23,392,322 | ||||

EDP Finance BV, 3.63%, 07/15/2024(a) | 23,218,000 | 23,195,267 | ||||

Enel Finance International NV | ||||||

2.65%, 09/10/2024(a) | 1,800,000 | 1,787,938 | ||||

4.50%, 06/15/2025(a) | 1,700,000 | 1,677,617 | ||||

Evergy, Inc., 2.45%, 09/15/2024 (Callable 08/15/2024) | 13,600,000 | 13,504,180 | ||||

FirstEnergy Corp., 2.05%, 03/01/2025 (Callable 02/01/2025) | 1,100,000 | 1,069,910 | ||||

FirstEnergy Transmission LLC, 4.35%, 01/15/2025 (Callable 10/15/2024)(a) | 7,770,000 | 7,697,336 | ||||

Georgia Power Co., 2.20%, 09/15/2024 (Callable 08/15/2024) | 5,603,000 | 5,560,317 | ||||

NextEra Energy Capital Holdings, Inc., 5.75%, 09/01/2025 | 26,090,000 | 26,146,541 | ||||

Par | Value | |||||

Niagara Mohawk Power Corp., 3.51%, 10/01/2024 (Callable 08/01/2024)(a) | $ 4,450,000 | $4,419,347 | ||||

NiSource, Inc., 0.95%, 08/15/2025 (Callable 07/15/2025) | 12,733,000 | 12,093,670 | ||||

Puget Energy, Inc., 3.65%, 05/15/2025 (Callable 02/15/2025) | 22,450,000 | 22,008,262 | ||||

228,106,175 | ||||||

TOTAL CORPORATE BONDS (Cost $3,334,109,013) | 3,339,286,789 | |||||

ASSET-BACKED SECURITIES - 17.5% | ||||||

Affirm, Inc., Series 2021-Z1, Class A, 1.07%, 08/15/2025 (Callable 07/15/2024)(a) | 347,549 | 346,749 | ||||

Ally Bank Auto Credit-Linked Notes Series 2024-A, Series 2024-A, Class A2, 5.68%, 05/17/2032 (Callable 02/15/2028)(a) | 8,837,000 | 8,834,778 | ||||

American Express Travel Related Services Co., Inc., Series 2022-2, Class A, 3.39%, 05/15/2027 | 48,628,000 | 47,757,559 | ||||

ARI Fleet Lease Trust, Series 2023-A, Class A2, 5.41%, 02/17/2032 (Callable 07/15/2026)(a) | 20,672,591 | 20,626,808 | ||||

Bank of America Auto Trust | ||||||

Series 2023-1A, Class A2, 5.83%, 05/15/2026 (Callable 11/15/2026)(a) | 23,349,206 | 23,364,700 | ||||

Series 2024-1A, Class A2, 5.57%, 12/15/2026 (Callable 08/15/2027)(a) | 10,500,000 | 10,504,929 | ||||

Capital One Financial Corp. | ||||||

Series 2021-A1, Class A1, 0.55%, 07/15/2026 | 7,650,000 | 7,632,840 | ||||

Series 2021-A3, Class A3, 1.04%, 11/15/2026 | 72,033,000 | 70,800,911 | ||||

Series 2022-A1, Class A1, 2.80%, 03/15/2027 | 32,270,000 | 31,659,623 | ||||

Capital One Prime Auto Receivables Trust | ||||||

Series 2022-1, Class A3, 3.17%, 04/15/2027 (Callable 03/15/2026) | 14,659,353 | 14,394,057 | ||||

Series 2022-2, Class A2A, 3.74%, 09/15/2025 (Callable 06/15/2026) | 380,574 | 380,288 | ||||

CarMax Auto Owner Trust | ||||||

Series 2022-1, Class A3, 1.47%, 12/15/2026 (Callable 03/15/2026) | 27,828,263 | 27,099,343 | ||||

Series 2023-1, Class A2A, 5.23%, 01/15/2026 (Callable 12/15/2026) | 1,364,278 | 1,363,761 | ||||

6 |

Par | Value | |||||

ASSET-BACKED SECURITIES - (Continued) | ||||||

Series 2023-1, Class A3, 4.75%, 10/15/2027 (Callable 12/15/2026) | $ 35,881,000 | $ 35,589,887 | ||||

Series 2023-4, Class A2A, 6.08%, 12/15/2026 (Callable 03/15/2027) | 18,646,003 | 18,703,101 | ||||

Chase Auto Owner Trust, Series 2024-3A, Class A2, 5.53%, 09/27/2027 (Callable 05/25/2028)(a) | 21,750,000 | 21,753,284 | ||||

Citizens Auto Receivables Trust | ||||||

Series 2023-1, Class A2A, 6.13%, 07/15/2026 (Callable 02/15/2027)(a) | 31,000,330 | 31,040,969 | ||||

Series 2024-1, Class A2A, 5.43%, 10/15/2026 (Callable 07/15/2027)(a) | 13,200,000 | 13,183,991 | ||||

Series 2024-2, Class A2A, 5.54%, 11/16/2026 (Callable 08/15/2027)(a) | 12,264,000 | 12,258,763 | ||||

Dell Equipment Finance Trust | ||||||

Series 2023-1, Class A2, 5.65%, 09/22/2028 (Callable 10/22/2025)(a) | 16,064,698 | 16,065,765 | ||||

Series 2023-2, Class A2, 5.84%, 01/22/2029 (Callable 02/22/2026)(a) | 8,003,507 | 8,006,356 | ||||

Discover Card Execution Note Trust | ||||||

Series 2021-A1, Class A1, 0.58%, 09/15/2026 | 1,875,000 | 1,855,117 | ||||

Series 2022-A1, Class A1, 1.96%, 02/15/2027 | 31,077,000 | 30,374,977 | ||||

Series 2022-A2, Class A, 3.32%, 05/15/2027 | 63,975,000 | 62,792,313 | ||||

DLLAA LLC, Series 2023-1A, Class A2, 5.93%, 07/20/2026 (Callable 11/20/2027)(a) | 4,465,832 | 4,471,785 | ||||

DLLAD LLC | ||||||

Series 2023-1A, Class A2, 5.19%, 04/20/2026 (Callable 10/20/2027)(a) | 3,890,604 | 3,882,937 | ||||

Series 2024-1A, Class A2, 5.50%, 08/20/2027 (Callable 12/20/2028)(a) | 7,750,000 | 7,753,724 | ||||

DLLMT LLC, Series 2023-1A, Class A2, 5.78%, 11/20/2025 (Callable 01/20/2027)(a) | 22,643,310 | 22,651,778 | ||||

DLLST LLC, Series 2024-1A, Class A2, 5.33%, 01/20/2026 (Callable 08/20/2027)(a) | 5,225,000 | 5,211,811 | ||||

Fifth Third Auto Trust, Series 2023-1, Class A2A, 5.80%, 11/16/2026 (Callable 02/15/2027) | 12,784,037 | 12,794,662 | ||||

Par | Value | |||||

Ford Credit Auto Owner Trust, Series 2020-1, Class A, 2.04%, 08/15/2031 (Callable 02/15/2025)(a) | $ 51,383,000 | $ 50,238,475 | ||||

Ford Credit Floorplan LLC | ||||||

Series 2019-4, Class A, 2.44%, 09/15/2026 | 25,410,000 | 25,239,001 | ||||

Series 2020-2, Class A, 1.06%, 09/15/2027 | 16,692,000 | 15,827,388 | ||||

Ford Motor Co., Series 2018-1, Class A, 3.19%, 07/15/2031 (Callable 01/15/2025)(a) | 27,365,000 | 26,995,091 | ||||

GM Financial Consumer Automobile Receivables Trust | ||||||

Series 2023-1, Class A2A, 5.19%, 03/16/2026 (Callable 09/16/2026) | 5,834,589 | 5,829,337 | ||||

Series 2023-2, Class A2A, 5.10%, 05/18/2026 (Callable 11/16/2026) | 2,973,353 | 2,969,091 | ||||

GM Financial Leasing Trust | ||||||

Series 2023-1, Class A2A, 5.27%, 06/20/2025 (Callable 08/20/2025) | 1,998,484 | 1,998,174 | ||||

Series 2023-1, Class A3, 5.16%, 04/20/2026 (Callable 08/20/2025) | 2,055,000 | 2,050,493 | ||||

Series 2023-2, Class A2A, 5.44%, 10/20/2025 (Callable 11/20/2025) | 2,116,484 | 2,115,536 | ||||

Honda Auto Receivables Owner Trust | ||||||

Series 2023-1, Class A2, 5.22%, 10/21/2025 (Callable 06/21/2026) | 2,471,340 | 2,468,922 | ||||

Series 2023-3, Class A2, 5.71%, 03/18/2026 (Callable 11/18/2026) | 14,648,795 | 14,654,057 | ||||

HPEFS Equipment Trust, Series 2023-2A, Class A2, 6.04%, 01/21/2031 (Callable 11/20/2026)(a) | 11,600,000 | 11,629,689 | ||||

Huntington Bank Auto Credit-Linked Notes Series 2024-1, Series 2024-1, Class B1, 6.15%, 05/20/2032 (Callable 02/20/2028)(a) | 7,000,000 | 7,000,551 | ||||

Huntington Funding LLC, Series 2024-1A, Class A2, 5.50%, 03/15/2027 (Callable 07/15/2027)(a) | 21,025,000 | 21,004,017 | ||||

Hyundai Auto Lease Securitization Trust | ||||||

Series 2023-A, Class A2A, 5.20%, 04/15/2025 (Callable 06/15/2025)(a) | 370,573 | 370,525 | ||||

7 |

Par | Value | |||||

ASSET-BACKED SECURITIES - (Continued) | ||||||

Series 2023-B, Class A3, 5.15%, 06/15/2026 (Callable 11/15/2025)(a) | $ 14,310,000 | $ 14,266,847 | ||||

Series 2023-C, Class A3, 5.80%, 12/15/2026 (Callable 04/15/2026)(a) | 68,183,000 | 68,446,949 | ||||

Hyundai Auto Receivables Trust | ||||||

Series 2021-B, Class A3, 0.38%, 01/15/2026 (Callable 11/15/2025) | 1,702,588 | 1,687,077 | ||||

Series 2022-C, Class A2A, 5.35%, 11/17/2025 (Callable 01/15/2027) | 590,167 | 590,048 | ||||

Series 2023-A, Class A2A, 5.19%, 12/15/2025 (Callable 12/15/2026) | 4,585,032 | 4,581,021 | ||||

IPFS Corp. | ||||||

Series 2022-A, Class A, 2.47%, 02/15/2027(a) | 17,914,000 | 17,556,739 | ||||

Series 2022-C, Class A, 3.89%, 05/15/2027(a) | 14,701,000 | 14,476,251 | ||||

JPMorgan Chase Bank NA | ||||||

Series 2021-1, Class B, 0.88%, 09/25/2028 (Callable 04/25/2025)(a) | 814,453 | 811,013 | ||||

Series 2021-2, Class B, 0.89%, 12/26/2028 (Callable 09/25/2025)(a) | 435,172 | 430,327 | ||||

Series 2021-3, Class B, 0.76%, 02/26/2029 (Callable 04/25/2025)(a) | 2,577,334 | 2,517,710 | ||||

Kubota Credit Owner Trust, Series 2024-1A, Class A2, 5.39%, 01/15/2027 (Callable 01/15/2028)(a) | 31,225,000 | 31,155,987 | ||||

Marlette Funding Trust, Series 2023-3A, Class A, 6.49%, 09/15/2033 (Callable 09/15/2027)(a) | 5,105,485 | 5,109,419 | ||||

Mercedes-Benz Auto Receivables Trust, Series 2021-1, Class A3, 0.46%, 06/15/2026 (Callable 11/15/2025) | 5,681,921 | 5,576,988 | ||||

Nissan Auto Receivables Owner Trust, Series 2022-B, Class A2, 4.50%, 08/15/2025 (Callable 10/15/2026) | 394,911 | 394,646 | ||||

PHH Arval, Series 2023-2A, Class A1, 6.16%, 10/15/2035 (Callable 10/15/2026)(a) | 14,055,984 | 14,138,263 | ||||

Royal Bank of Canada, Series 2022-4A, Class A, 4.31%, 09/15/2027(a) | 30,320,000 | 29,889,987 | ||||

Santander Holdings USA, Inc. | ||||||

Series 2021-1A, Class B, 1.83%, 12/15/2031 (Callable 09/15/2025)(a) | 3,536,279 | 3,506,634 | ||||

Par | Value | |||||

Series 2022-A, Class B, 5.28%, 05/15/2032 (Callable 12/15/2025)(a) | $ 10,523,340 | $10,468,412 | ||||

SBNA Auto Lease Trust | ||||||

Series 2024-A, Class A2, 5.45%, 01/20/2026 (Callable 11/20/2026)(a) | 10,378,619 | 10,366,696 | ||||

Series 2024-B, Class A2, 5.67%, 11/20/2026 (Callable 04/20/2027)(a) | 8,000,000 | 8,006,542 | ||||

SCF Equipment Leasing LLC, Series 2022-2A, Class A2, 6.24%, 07/20/2028 (Callable 08/20/2029)(a) | 4,696,738 | 4,699,623 | ||||

SFS Auto Receivables Securitization Trust, Series 2023-1A, Class A2A, 5.89%, 03/22/2027 (Callable 08/20/2027)(a) | 8,703,536 | 8,711,490 | ||||

Synchrony Bank, Series 2022-A1, Class A, 3.37%, 04/15/2028 (Callable 04/15/2025) | 52,645,000 | 51,715,437 | ||||

Towd Point Mortgage Trust, Series 2020-MH1, Class A1, 2.25%, 02/25/2060 (Callable 07/25/2024)(a)(d) | 7,989,443 | 7,643,141 | ||||

US Bancorp, Series 2023-1, Class B, 6.79%, 08/25/2032 (Callable 09/25/2026)(a) | 5,714,593 | 5,738,098 | ||||

Verizon Master Trust | ||||||

Series 2022-6, Class A, 3.67%, 01/22/2029 (Callable 07/20/2025) | 24,273,000 | 23,817,563 | ||||

Series 2022-7, Class A1A, 5.23%, 11/22/2027 (Callable 11/20/2024) | 48,935,000 | 48,846,917 | ||||

World Omni Auto Receivables Trust, | ||||||

Series 2022-D, Class A2A, 5.51%, 03/16/2026 (Callable 08/15/2026) | 1,714,589 | 1,714,527 | ||||

TOTAL ASSET-BACKED SECURITIES (Cost $1,159,720,278) | 1,160,412,265 | |||||

NON-AGENCY COMMERCIAL MORTGAGE-BACKED SECURITIES - 7.4% | ||||||

Banc of America Merrill Lynch Commercial Mortgage, Inc., Series 2015-UBS7, Class A4, 3.71%, 09/15/2048 (Callable 09/15/2025) | 1,000,000 | 972,414 | ||||

BBCMS Trust, Series 2022-C14, Class A1, 1.73%, 02/15/2055 (Callable 02/15/2032) | 8,096,119 | 7,685,429 | ||||

8 |

Par | Value | |||||

NON-AGENCY COMMERCIAL MORTGAGE-BACKED SECURITIES - (Continued) | ||||||

Citigroup Commercial Mortgage Trust | ||||||

Series 2014-GC25, Class A4, 3.64%, 10/10/2047 (Callable 10/10/2024) | $ 13,292,000 | $ 13,233,890 | ||||

Series 2015-GC27, Class A5, 3.14%, 02/10/2048 (Callable 01/10/2025) | 2,260,848 | 2,234,205 | ||||

Series 2015-GC29, Class A4, 3.19%, 04/10/2048 (Callable 04/10/2025) | 12,665,000 | 12,392,274 | ||||

Series 2015-GC33, Class A4, 3.78%, 09/10/2058 (Callable 05/10/2026) | 9,000,588 | 8,718,029 | ||||

Series 2015-P1, Class A5, 3.72%, 09/15/2048 (Callable 05/15/2026) | 8,200,736 | 7,995,249 | ||||

Commercial Mortgage Pass Through Certificates | ||||||

Series 2014-CR17, Class A5, 3.98%, 05/10/2047 (Callable 07/10/2024) | 1,134,498 | 1,120,886 | ||||

Series 2014-UBS3, Class A4, 3.82%, 06/10/2047 (Callable 07/10/2024) | 5,144,449 | 5,131,069 | ||||

Series 2014-UBS4, Class A5, 3.69%, 08/10/2047 (Callable 07/10/2029) | 39,907,000 | 39,813,406 | ||||

Series 2015-CR23, Class A4, 3.50%, 05/10/2048 (Callable 05/10/2025) | 13,226,524 | 12,957,760 | ||||

Series 2015-CR27, Class A4, 3.61%, 10/10/2048 (Callable 10/10/2025) | 2,605,000 | 2,532,399 | ||||

Series 2015-LC23, Class A4, 3.77%, 10/10/2048 (Callable 11/10/2025) | 6,700,000 | 6,527,846 | ||||

Computershare Corporate Trust | ||||||

Series 2015-C27, Class A5, 3.45%, 02/15/2048 (Callable 03/15/2025) | 27,518,000 | 27,025,497 | ||||

Series 2015-C28, Class A4, 3.54%, 05/15/2048 (Callable 05/15/2025) | 12,035,000 | 11,789,555 | ||||

Series 2015-C31, Class A4, 3.70%, 11/15/2048 (Callable 11/15/2025) | 2,000,000 | 1,945,130 | ||||

Series 2015-LC20, Class A5, 3.18%, 04/15/2050 (Callable 05/15/2025) | 4,820,000 | 4,719,852 | ||||

Series 2015-LC22, Class A4, 3.84%, 09/15/2058 (Callable 09/15/2025) | 15,295,000 | 14,897,492 | ||||

Series 2015-SG1, Class A4, 3.79%, 09/15/2048 (Callable 08/15/2025) | 7,298,748 | 7,126,047 | ||||

Par | Value | |||||

CSAIL Commercial Mortgage Trust | ||||||

Series 2015-C2, Class A4, 3.50%, 06/15/2057 (Callable 05/15/2025) | $ 3,034,000 | $ 2,972,905 | ||||

Series 2015-C3, Class A4, 3.72%, 08/15/2048 (Callable 08/15/2025) | 14,090,820 | 13,715,948 | ||||

Series 2015-C4, Class A4, 3.81%, 11/15/2048 (Callable 11/15/2025) | 7,500,000 | 7,297,216 | ||||

GS Mortgage Securities Corp. II | ||||||

Series 2014-GC22, Class A5, 3.86%, 06/10/2047 (Callable 07/10/2024) | 2,984,726 | 2,977,565 | ||||

Series 2014-GC24, Class A5, 3.93%, 09/10/2047 (Callable 09/10/2024) | 6,825,343 | 6,797,686 | ||||

Series 2014-GC26, Class A5, 3.63%, 11/10/2047 (Callable 12/10/2024) | 52,905,000 | 52,427,108 | ||||

Series 2015-GC32, Class A4, 3.76%, 07/10/2048 (Callable 07/10/2025) | 3,658,000 | 3,576,130 | ||||

Series 2015-GC34, Class A4, 3.51%, 10/10/2048 (Callable 10/10/2025) | 8,490,000 | 8,126,387 | ||||

Series 2015-GS1, Class A3, 3.73%, 11/10/2048 (Callable 11/10/2025) | 500,000 | 482,344 | ||||

JP Morgan Chase Commercial Mortgage Securities, Series 2015-JP1, Class A5, 3.91%, 01/15/2049 (Callable 12/15/2025) | 4,803,000 | 4,657,372 | ||||

JPMBB Commercial Mortgage Securities Trust | ||||||

Series 2014-C23, Class A5, 3.93%, 09/15/2047 (Callable 08/15/2027) | 6,742,008 | 6,711,810 | ||||

Series 2014-C24, Class A5, 3.64%, 11/15/2047 (Callable 08/15/2027) | 25,565,000 | 25,347,117 | ||||

Series 2014-C25, Class A5, 3.67%, 11/15/2047 (Callable 11/15/2024) | 13,425,000 | 13,258,950 | ||||

Series 2014-C26, Class A4, 3.49%, 01/15/2048 (Callable 01/15/2025) | 5,488,000 | 5,429,261 | ||||

Series 2015-C27, Class A4, 3.18%, 02/15/2048 (Callable 09/15/2026) | 8,575,000 | 8,363,297 | ||||

Series 2015-C30, Class A5, 3.82%, 07/15/2048 (Callable 07/15/2025) | 12,178,000 | 11,789,827 | ||||

Series 2015-C32, Class A5, 3.60%, 11/15/2048 (Callable 10/15/2025) | 8,750,000 | 8,422,257 | ||||

9 |

Par | Value | |||||

NON-AGENCY COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | ||||||

Mcp Holding Co. LLC, Series 2015-GC30, Class A4, 3.38%, 05/10/2050 (Callable 05/10/2025) | $ 7,667,127 | $ 7,481,655 | ||||

Morgan Stanley Bank of America Merrill Lynch Trust | ||||||

Series 2014-C19, Class A4, 3.53%, 12/15/2047 (Callable 10/15/2026) | 10,700,000 | 10,604,186 | ||||

Series 2015-C22, Class A4, 3.31%, 04/15/2048 (Callable 04/15/2025) | 5,865,000 | 5,738,790 | ||||

Series 2015-C23, Class A4, 3.72%, 07/15/2050 (Callable 06/15/2025) | 31,541,000 | 30,838,664 | ||||

Series 2015-C27, Class A4, 3.75%, 12/15/2047 (Callable 11/15/2025) | 1,500,000 | 1,455,291 | ||||

WF-RBS Commercial Mortgage Trust | ||||||

Series 2014-C21, Class A5, 3.68%, 08/15/2047 (Callable 08/15/2024) | 1,880,133 | 1,871,335 | ||||

Series 2014-C22, Class A5, 3.75%, 09/15/2057 (Callable 08/15/2027) | 20,596,000 | 20,322,032 | ||||

Series 2014-C23, Class A5, 3.92%, 10/15/2057 (Callable 08/15/2027) | 13,563,000 | 13,407,822 | ||||

Series 2014-C24, Class A5, 3.61%, 11/15/2047 (Callable 11/15/2024) | 20,026,000 | 19,851,387 | ||||

Series 2014-C25, Class A5, 3.63%, 11/15/2047 (Callable 12/15/2024) | 10,208,211 | 10,107,126 | ||||

TOTAL NON-AGENCY COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $484,190,486) | 492,849,897 | |||||

NON-AGENCY RESIDENTIAL MORTGAGE-BACKED SECURITIES - 0.7% | ||||||

Arroyo Mortgage Trust | ||||||

Series 2019-1, Class A1, 3.81%, 01/25/2049 (Callable 07/25/2024)(a)(e) | 3,507,989 | 3,336,911 | ||||

Series 2019-2, Class A1, 3.35%, 04/25/2049 (Callable 07/25/2024)(a)(e) | 6,180,521 | 5,870,432 | ||||

Series 2019-3, Class A1, 2.96%, 10/25/2048 (Callable 07/25/2024)(a)(e) | 11,735,498 | 10,761,811 | ||||

Starwood Mortgage Residential Trust, Series 2021-1, Class A1, 1.22%, 05/25/2065 (Callable 07/25/2024)(a)(e) | 6,975,529 | 6,210,357 | ||||

Par | Value | |||||

Towd Point Mortgage Trust | ||||||

Series 2017-3, Class A1, 2.75%, 07/25/2057 (Callable 12/25/2026)(a)(e) | $ 843,763 | $ 831,564 | ||||

Series 2017-4, Class A1, 2.75%, 06/25/2057 (Callable 09/25/2031)(a)(e) | 1,535,866 | 1,467,391 | ||||

Series 2017-6, Class A1, 2.75%, 10/25/2057 (Callable 05/25/2029)(a)(e) | 7,265,724 | 7,004,422 | ||||

Series 2018-6, Class A1A, 3.75%, 03/25/2058 (Callable 02/25/2030)(a)(e) | 8,096,713 | 7,932,033 | ||||

TOTAL NON-AGENCY RESIDENTIAL MORTGAGE-BACKED SECURITIES (Cost $46,475,923) | 43,414,921 | |||||

MUNICIPAL BONDS - 0.2% | ||||||

City of Middletown OH, 6.05%, 04/29/2025 | 4,400,000 | 4,402,570 | ||||

City of West Carrollton OH, 6.90%, 05/01/2025 | 4,790,000 | 4,791,740 | ||||

County of Okeechobee FL, 3.80%, 07/01/2039(e) | 1,055,000 | 1,054,999 | ||||

Michigan Finance Authority, 2.99%, 09/01/2049 (Callable 08/01/2024)(e) | 2,560,000 | 2,547,779 | ||||

New York State Housing Finance Agency, 1.60%, 11/01/2024 (Callable 07/22/2024) | 2,205,000 | 2,185,887 | ||||

TOTAL MUNICIPAL BONDS (Cost $14,957,294) | 14,982,975 | |||||

SHORT-TERM INVESTMENTS - 23.4% | ||||||

Commercial Paper - 4.6% | ||||||

Bayer Corporation, 6.40%, 07/10/2024(f) | 25,000,000 | 24,953,568 | ||||

Beth Israel Deaconess Medical Center, 6.15%, 08/06/2024(f) | 41,925,000 | 41,652,805 | ||||

Catholic Health Initiatives, 6.16%, 07/02/2024(f) | 46,275,000 | 46,245,338 | ||||

Dentsply Sirona, Inc., 6.08%, 07/05/2024(f) | 26,075,000 | 26,044,630 | ||||

FMC Corporation, 6.08%, 07/12/2024(f) | 29,175,000 | 29,105,877 | ||||

FMC Corporation, 6.13%, 07/15/2024(f) | 18,850,000 | 18,795,713 | ||||

HSBC Bank USA, N.A., 6.57%, 09/09/2024(f) | 15,450,000 | 15,277,643 | ||||

L3HARRIS Technologies, Inc., 6.37%, 08/23/2024(f) | 44,100,000 | 43,719,453 | ||||

Targa Resources Corp., 6.20%, 07/26/2024(f) | 10,000,000 | 9,953,629 | ||||

Walgreens Boots Alliance, Inc., 6.43%, 07/01/2024(f) | 47,450,000 | 47,425,314 | ||||

303,173,970 | ||||||

10 |

Shares | Value | |||||

Money Market Funds - 1.0% | ||||||

First American Government Obligations Fund - Class U, 5.25%(g) | 64,459,271 | $64,459,271 | ||||

Par | ||||||

U.S. Treasury Bills - 17.8% | ||||||

5.33%, 08/20/2024(f) | 169,000,000 | 167,768,296 | ||||

5.23%, 09/19/2024(f) | 45,000,000 | 44,478,625 | ||||

5.16%, 10/03/2024(f) | 220,000,000 | 217,027,250 | ||||

5.31%, 10/17/2024(f) | 205,000,000 | 201,798,925 | ||||

4.71%, 12/26/2024(f) | 310,000,000 | 302,159,842 | ||||

5.10%, 02/20/2025(f) | 150,000,000 | 145,149,375 | ||||

5.00%, 03/20/2025(f) | 108,600,000 | 104,685,874 | ||||

1,183,068,187 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $1,552,123,000) | 1,550,701,428 | |||||

TOTAL INVESTMENTS - 99.3% (Cost $6,591,575,994) | $6,601,648,275 | |||||

Other Assets in Excess of Liabilities - 0.7% | 44,020,340 | |||||

TOTAL NET ASSETS - 100.0% | $6,645,668,615 | |||||

(a) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $1,489,734,676 or 22.4% of the Fund’s net assets. |

(b) | Securities referencing LIBOR are expected to transition to an alternative reference rate by the security’s next scheduled coupon reset date. |

(c) | Step coupon bond. The rate disclosed is as of June 30, 2024. |

(d) | Coupon rate is variable based on the weighted average coupon of the underlying collateral. To the extent the weighted average coupon of the underlying assets which comprise the collateral increases or decreases, the coupon rate of this security will increase or decrease correspondingly. The rate disclosed is as of June 30, 2024. |

(e) | Coupon rate is variable or floats based on components including but not limited to reference rate and spread. These securities may not indicate a reference rate and/or spread in their description. The rate disclosed is as of June 30, 2024. |

(f) | The rate shown is the effective yield as of June 30, 2024. |

(g) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

11 |

Level 1 | Level 2 | Level 3 | Total | |||||||||

Investments: | ||||||||||||

Corporate Bonds | $— | $3,339,286,789 | $ — | $3,339,286,789 | ||||||||

Asset-Backed Securities | — | 1,160,412,265 | — | 1,160,412,265 | ||||||||

Non-Agency Commercial Mortgage-Backed Securities | — | 492,849,897 | — | 492,849,897 | ||||||||

Non-Agency Residential Mortgage-Backed Securities | — | 43,414,921 | — | 43,414,921 | ||||||||

Municipal Bonds | — | 14,982,975 | — | 14,982,975 | ||||||||

Commercial Paper | — | 303,173,970 | — | 303,173,970 | ||||||||

Money Market Funds | 64,459,271 | — | — | 64,459,271 | ||||||||

U.S. Treasury Bills | — | 1,183,068,187 | — | 1,183,068,187 | ||||||||

Total Investments | $64,459,271 | $6,537,189,004 | $— | $6,601,648,275 | ||||||||

12 |

Par | Value | |||||

CORPORATE BONDS - 50.5% | ||||||

Financials - 25.8%(a) | ||||||

ABN AMRO Bank NV | ||||||

4.75%, 07/28/2025(b) | $ 34,188,000 | $ 33,711,779 | ||||

4.80%, 04/18/2026(b) | 12,400,000 | 12,166,536 | ||||

6.58% to 10/13/2025 then 1 yr. CMT Rate + 1.55%, 10/13/2026 (Callable 10/13/2025)(b) | 5,000,000 | 5,050,276 | ||||

AEGON Funding Co. LLC, 5.50%, 04/16/2027 (Callable 03/16/2027)(b) | 50,000,000 | 49,787,850 | ||||

AerCap Ireland Capital DAC/ AerCap Global Aviation Trust | ||||||

4.45%, 10/01/2025 (Callable 08/01/2025) | 18,937,000 | 18,672,404 | ||||

6.10%, 01/15/2027 (Callable 12/15/2026) | 5,000,000 | 5,073,340 | ||||

6.45%, 04/15/2027 (Callable 03/15/2027) | 15,773,000 | 16,132,974 | ||||

4.63%, 10/15/2027 (Callable 08/15/2027) | 7,300,000 | 7,112,681 | ||||

AIB Group PLC, 7.58% to 10/14/2025 then SOFR + 3.46%, 10/14/2026 (Callable 10/14/2025)(b) | 7,000,000 | 7,150,872 | ||||

Air Lease Corp. | ||||||

5.30%, 06/25/2026 | 15,000,000 | 14,947,387 | ||||

1.88%, 08/15/2026 (Callable 07/15/2026) | 1,679,000 | 1,556,952 | ||||

2.20%, 01/15/2027 (Callable 12/15/2026) | 2,817,000 | 2,600,583 | ||||

Aircastle Ltd., 6.50%, 07/18/2028 (Callable 06/18/2028)(b) | 22,700,000 | 23,125,486 | ||||

Aon North America, Inc., 5.13%, 03/01/2027 (Callable 02/01/2027) | 14,225,000 | 14,200,290 | ||||

ASB Bank Ltd., 5.35%, 06/15/2026(b) | 46,375,000 | 46,389,324 | ||||

Assurant, Inc., 6.10%, 02/27/2026 (Callable 01/27/2026) | 26,073,000 | 26,361,015 | ||||

Australia & New Zealand Banking Group Ltd., 4.40%, 05/19/2026(b) | 13,000,000 | 12,725,683 | ||||

Aviation Capital Group LLC | ||||||

1.95%, 09/20/2026 (Callable 08/20/2026)(b) | 11,983,000 | 11,043,660 | ||||

3.50%, 11/01/2027 (Callable 07/01/2027)(b) | 13,000,000 | 12,169,044 | ||||

6.25%, 04/15/2028 (Callable 03/15/2028)(b) | 5,000,000 | 5,100,495 | ||||