UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21539

First Trust Senior Floating Rate Income Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive

Wheaton, IL 60187

(Name and address of agent for service)

registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end:May 31

Date of reporting period:November 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust

Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

For the Six Months Ended

November 30, 2019

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2019

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and its representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Senior Floating Rate Income Fund II (the “Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and its representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visitwww.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on the Fund’s web page atwww.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep in mind that the opinions expressed by personnel of the Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Letter from the Chairman and CEO

November 30, 2019

Dear Shareholders,

First Trust is pleased to provide you with the semi-annual report for the First Trust Senior Floating Rate Income Fund II (the “Fund”), which contains detailed information about the Fund for the six months ended November 30, 2019, including a market overview and a performance analysis.

A significant event for the markets in the past six months was the decision by the Federal Reserve (the “Fed”) to reverse course with respect to monetary policy. For those who may not follow the Fed closely, after holding its federal funds target rate (upper bound) at an artificially low 0.25% for seven years (December 2008-December 2015) to help stimulate U.S. economic activity, the Fed spent the better part of the next four years (December 2015-July 2019) increasing its benchmark lending rate in an effort to normalize it. Over that period, the Fed increased the rate from 0.25% to 2.50%. To lend some perspective, the average federal funds target rate (upper bound) was 2.96% for the 30-year period ended November 30, 2019, so the Fed came close to achieving its goal of normalizing it, according to data from Bloomberg. From the end of July 2019 through the end of November, however, the Fed initiated three rate cuts that dropped it from 2.50% to 1.75%.

So why did the Fed reverse course on monetary policy? We believe, as well as others in the financial media, that the Fed’s reversal on monetary policy has to do with the trade tariffs. The Trump Administration first began implementing new trade tariffs on imported goods back in March 2018. While the original tariffs targeted just imported steel and aluminum, the use of tariffs quickly escalated to other goods and services. The lion’s share of the tariff conflict today is between the U.S. and China, the two largest economies in the world. In our opinion, it is widely believed that President Donald J. Trump is utilizing tariffs as leverage to try and negotiate more favorable trade agreements between the U.S. and its major trading partners. One of the byproducts of the escalation in the use of tariffs by all parties involved has been a slowdown in global economic growth, particularly in the U.S. The annualized U.S. real gross domestic product growth rate in the second quarter of 2018 (when new tariffs were introduced) was 3.5%. As of the second and third quarters of 2019, that annualized growth rate was down to 2.0% and 2.1%, respectively, according to data from the Bureau of Economic Analysis. For many months, President Trump has publicly challenged the Fed to lower rates aggressively to help offset the tempering of economic growth. President Trump has noted that the Fed has room to lower rates due to the extremely low-to-negative rate levels found in many countries abroad as well as the lack of any significant inflationary pressure in the current climate. While the Fed has delivered some rate cuts in recent months, we believe that President Trump will continue to bang the drum for even more cuts.

Investors continue to flock to income-oriented investment products, such as open-end bond mutual funds and exchange-traded bond funds (ETFs). Net inflows to taxable bond funds and ETFs totaled an estimated $319.0 billion for the 12-month period ended November 30, 2019, according to Morningstar. The current climate featuring low interest rates, low bond yields and low inflation, if sustained, could make closed-end funds an attractive alternative to other income-oriented products moving forward, in our opinion.

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

First Trust Senior Floating Rate Income Fund II (FCT)

“AT A GLANCE”

As of November 30, 2019 (Unaudited)

| Fund Statistics | |

| Symbol on New York Stock Exchange | FCT |

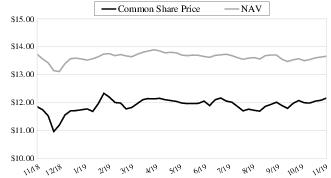

| Common Share Price | $12.16 |

| Common Share Net Asset Value (“NAV”) | $13.66 |

| Premium (Discount) to NAV | (10.98)% |

| Net Assets Applicable to Common Shares | $364,636,886 |

| Current Monthly Distribution per Common Share(1) | $0.0825 |

| Current Annualized Distribution per Common Share | $0.9900 |

| Current Distribution Rate on Common Share Price(2) | 8.14% |

| Current Distribution Rate on NAV(2) | 7.25% |

Common Share Price & NAV (weekly closing price)

| Performance | | | | | |

| | | | Average Annual Total Returns |

| | 6 Months Ended

11/30/19 | 1 Year Ended

11/30/19 | 5 Years Ended

11/30/19 | 10 Years Ended

11/30/19 | Inception

(5/25/04)

to 11/30/19 |

| Fund Performance(3) | | | | | |

| NAV | 3.44% | 6.42% | 4.97% | 6.49% | 4.40% |

| Market Value | 5.30% | 9.76% | 4.91% | 7.47% | 3.31% |

| Index Performance | | | | | |

| S&P/LSTA Leveraged Loan Index | 1.37% | 4.21% | 3.85% | 5.14% | 4.68% |

| (1) | Most recent distribution paid or declared through 11/30/2019. Subject to change in the future. |

| (2) | Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 11/30/2019. Subject to change in the future. |

| (3) | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. From inception to October 12, 2010, Four Corners Capital Management, LLC served as the Fund’s sub-advisor. Effective October 12, 2010, the Leveraged Finance Team of First Trust Advisors L.P. assumed the day-to-day responsibility for management of the Fund’s portfolio. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

First Trust Senior Floating Rate Income Fund II (FCT)

“AT A GLANCE” (Continued)

As of November 30, 2019 (Unaudited)

| Credit Quality (S&P Ratings)(4) | % of Senior

Loans and Other

Debt Securities(5) |

| BBB- | 6.0% |

| BB+ | 3.1 |

| BB | 8.5 |

| BB- | 19.6 |

| B+ | 24.6 |

| B | 26.5 |

| B- | 9.5 |

| CCC+ | 1.4 |

| CCC | 0.6 |

| Privately rated(6) | 0.2 |

| Total | 100.0% |

| Top 10 Issuers | % of Senior

Loans and other

Securities(5) |

| Bausch Health Companies, Inc. (Valeant) | 3.7% |

| Multiplan, Inc. (MPH) | 3.6 |

| HUB International Limited | 3.1 |

| Reynolds Group Holdings, Inc. | 2.6 |

| AlixPartners, LLP | 2.4 |

| Stars Group Holdings B.V. (Amaya) | 2.3 |

| Refinitiv US Holdings, Inc. | 2.3 |

| Amwins Group, Inc. | 2.3 |

| Asurion, LLC | 2.1 |

| CenturyLink, Inc. (Qwest) | 2.0 |

| Total | 26.4% |

| Industry Classification | % of Senior

Loans and Other

Securities(5) |

| Health Care Providers & Services | 15.9% |

| Software | 11.7 |

| Hotels, Restaurants & Leisure | 11.0 |

| Insurance | 8.5 |

| Media | 7.6 |

| Diversified Financial Services | 7.0 |

| Pharmaceuticals | 6.8 |

| Containers & Packaging | 3.7 |

| Life Sciences Tools & Services | 2.7 |

| Food & Staples Retailing | 2.7 |

| Diversified Telecommunication Services | 2.4 |

| Diversified Consumer Services | 2.1 |

| Building Products | 2.0 |

| Entertainment | 2.0 |

| Auto Components | 1.9 |

| Aerospace & Defense | 1.6 |

| Commercial Services & Supplies | 1.6 |

| Food Products | 1.5 |

| Health Care Technology | 1.0 |

| Capital Markets | 0.9 |

| Professional Services | 0.9 |

| Electric Utilities | 0.8 |

| Chemicals | 0.7 |

| Household Durables | 0.6 |

| Independent Power & Renewable Electricity Producers | 0.6 |

| Real Estate Management & Development | 0.5 |

| Oil, Gas & Consumable Fuels | 0.3 |

| Communications Equipment | 0.3 |

| Semiconductors & Semiconductor Equipment | 0.2 |

| Wireless Telecommunication Services | 0.2 |

| Machinery | 0.2 |

| Road & Rail | 0.1 |

| Specialty Retail | 0.0* |

| Construction & Engineering | 0.0* |

| Automobiles | 0.0* |

| Total | 100.0% |

| * | Amount is less than 0.1%. |

| (4) | The ratings are by Standard & Poor’s except where otherwise indicated. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (5) | Percentages are based on long-term positions. Money market funds are excluded. |

| (6) | Represents Senior Loans privately rated upon issuance. The rating agency does not provide ongoing surveillance on the rating. |

Portfolio Commentary

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2019 (Unaudited)

Advisor

The First Trust Advisors L.P. (“First Trust”) Leveraged Finance Team is comprised of 15 experienced investment professionals specializing in below investment grade securities. The team is comprised of portfolio management, research, trading and operations personnel. As of November 30, 2019, the First Trust Leveraged Finance Team managed or supervised approximately $4.30 billion in senior secured bank loans and high-yield bonds. These assets are managed across various strategies, including two closed-end funds, an open-end fund, three exchange-traded funds, and a series of unit investment trusts on behalf of retail and institutional clients.

Portfolio Management Team

William Housey, CFA – Managing Director of Fixed Income, Senior Portfolio Manager

Scott D. Fries, CFA – Senior Vice President, Portfolio Manager

Commentary

First Trust Senior Floating Rate Income Fund II

The primary investment objective of First Trust Senior Floating Rate Income Fund II (“FCT” or the “Fund”) is to seek a high level of current income. As a secondary objective, the Fund attempts to preserve capital. The Fund pursues its investment objectives by investing primarily in a portfolio of senior secured floating-rate corporate loans (“Senior Loans”). Under normal market conditions, at least 80% of the Fund’s Managed Assets are generally invested in lower grade debt instruments. “Managed Assets” means the total asset value of the Fund minus the sum of its liabilities, other than the principal amount of borrowings. There can be no assurance that the Fund will achieve its investment objectives. Investing in Senior Loans involves credit risk, and, during periods of generally declining credit quality, it may be particularly difficult for the Fund to achieve its secondary investment objective. The Fund may not be appropriate for all investors.

Market Recap

During the six-month period ended November 30, 2019 (the “Period”), President Trump and Chinese President Xi Jinping made progress with respect to the ongoing trade dispute by sketching broad brush strokes on “phase one” of a trade agreement, and the Federal Reserve (the “Fed”) cut its policy interest rate three times for a total of 75 basis points (bps), leading risk assets to rise sharply during the period, as evidenced by the equity market, which was up 15.26% during the Period, as measured by the S&P 500® Index. Interest rates, as measured by 10-Year U.S. Treasury yields, experienced volatility during the Period as the prevailing narrative surrounding the probability of a successful trade outcome fluctuated back and forth. Interest rates entered the Period at 2.12% before falling to 1.46% by early September, ultimately rising to 1.78% by the end of November. The senior loan market, as measured by the S&P/LSTA Leveraged Loan Index (the “Index”), returned 1.37% in the Period, and the high-yield bond market, as measured by the ICE BofAML US High Yield Constrained Index, returned 4.21%.1

Senior Loan Market

Although senior loans experienced a positive return during the Period, retail mutual fund and exchange-traded fund demand for senior loans remained muted. The senior loan market has now experienced fourteen consecutive months of outflows from mutual funds totaling $56 billion during that period, and $18 billion of outflows during the last six months.2 Consequently, spreads over 3-month London Interbank Offered Rate (“LIBOR”) increased 58 bps to L+504 bps.3 We believe that retail outflows are primarily due to investors anticipating the rate cuts from the Fed, and LIBOR, the benchmark rate for senior loan coupons, decreasing from 2.81% at the end of 2018 to 1.91% by the end of November 2019.1

Within the senior loan market, higher quality senior loans outperformed lower quality senior loans in the Period, a trend that has persisted since the end of 2018. BB rated issues returned 2.46%, outperforming the 1.31% return of B rated issues and -4.55% return of CCC rated issues in the Period. The average price of senior loans, as measured by the Index, declined in the Period from $96.99 to $95.58. The last twelve months (“LTM”) default rate within the Index ended the period at 1.48%, which compares favorably to the long-term average default rate of 2.90% of the Index, dating back to March 1999.3

| 1 | Source: Bloomberg. Performance of senior loans and high-yield bonds are based on the S&P/LSTA Leveraged Loan Index and ICE BofAML U.S. High Yield Constrained Index, respectively. |

| 2 | Source: JP Morgan High Yield Bond and Leveraged Loan Market Monitor |

| 3 | Source: Standard & Poor’s Leveraged Loan Commentary and Data. |

Portfolio Commentary (Continued)

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2019 (Unaudited)

Performance Analysis

The Fund generated a net asset value (“NAV”) return4 of 3.44% and a market price return4 of 5.30%, while the Index returned 1.37%. The Fund’s market price return benefited from the Fund’s discount to NAV narrowing over the Period ended November 30, 2019. At the start of the Period, the Fund’s market price was at a 12.55% discount to NAV and moved to a 10.98% discount to NAV by the end of the Period, a narrowing of 157 bps.

The largest contributing factor to the Fund’s performance relative to the Index during the Period was the Fund’s underweight position within the oil & gas industry as the industry was one of the worst performing industries within the Index during the Period. The Fund’s overweight position and asset selection within the insurance industry also positively impacted returns during the Period since the industry was one of the best performing industries within the Index. Specifically, several insurance brokers held by the Fund outperformed the broader insurance industry. Additionally, the Fund’s overweight position and asset selection within the electronics/electrical industry contributed positively to returns as a software company held by the Fund outperformed the broader electronics/electrical industry during the Period.

Partially offsetting these contributing factors was the Fund’s use of leverage as senior loan returns underperformed the cost of borrowing during the Period. Also detracting from the Fund’s return during the Period was its asset selection within the automotive and healthcare industries. Within the automotive industry, the Fund’s holdings in a specialty automotive lighting manufacturer underperformed the broader automotive industry. Finally, within the healthcare industry, the Fund’s holdings in two emergency medical services providers and an advanced wound care business underperformed the broader healthcare industry during the Period.

From an income perspective, the monthly distribution rate began the Period at $0.0625 per share and ended at $0.0825 per share. At the $0.0825 per share monthly distribution rate, the annualized distribution rate at the end of November 2019 was 7.25% at NAV and 8.14% at market price.

Market and Fund Outlook

The United States and China have come to a preliminary agreement on “phase one” of a trade deal, which will most likely be signed in early 2020. In our opinion, the signing of the “phase one” trade deal gives the Fed additional confirmation to keep its policy interest rate unchanged after cutting rates three times in the last six months. We believe that a predictable Fed will bode well for the U.S. economy as growth continues on the back of a healthy U.S. consumer.

We remain confident that the favorable backdrop for the macro economy will persist for the near to intermediate term and that we are in a healthy part of the economic cycle to own senior loans and high-yield bonds. We believe senior loans look relatively attractive given their current yields, the low corporate default rate and senior loans secured position in the capital structure. The current senior loan yield-to-maturity (“YTM”) is 6.47%, 8 bps higher than the high-yield bond YTM of 6.39%, a relationship that has existed for the past six months. The last time senior loans yielded more than high-yield bonds in consecutive months was in August and September of 2007.1,3 As we evaluate new investment opportunities, decisions will continue to be rooted in our rigorous bottom-up credit analysis and our focus will remain on identifying the opportunities that we believe offer the best risk and reward balance.

| 4 | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) – 136.3% |

| | | Aerospace & Defense – 2.3% | | | | | | |

| $7,382,023 | | Transdigm, Inc., Term Loan F, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 06/09/23 | | $7,382,023 |

| 880,539 | | Transdigm, Inc., Tranche E Term Loan, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 05/30/25 | | 879,377 |

| | | | | 8,261,400 |

| | | Alternative Carriers – 0.5% | | | | | | |

| 1,806,996 | | Level 3 Financing, Inc., Term Loan B, 1 Mo. LIBOR + 1.75%, 0.00% Floor

| | 3.45% | | 03/01/27 | | 1,805,876 |

| | | Application Software – 9.5% | | | | | | |

| 1,552,656 | | CCC Information Services, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.46% | | 04/26/24 | | 1,541,989 |

| 308,927 | | Hyland Software, Inc., 2nd Lien Term Loan, 1 Mo. LIBOR + 7.00%, 0.75% Floor

| | 8.70% | | 07/10/25 | | 312,532 |

| 4,586,224 | | Hyland Software, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.75% Floor

| | 5.20% | | 07/01/24 | | 4,596,268 |

| 4,724,400 | | Infor (US), Inc. (fka Lawson Software, Inc.), Term Loan B-6, 3 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.85% | | 02/02/22 | | 4,728,983 |

| 1,110,968 | | Informatica Corporation, Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 08/06/22 | | 1,111,368 |

| 1,043,815 | | Micro Focus International (MA Financeco, LLC), Miami Escrow TL B3, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 06/21/24 | | 1,036,967 |

| 7,049,139 | | Micro Focus International (MA Financeco, LLC), Seattle Spinco TLB, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 06/21/24 | | 7,002,896 |

| 3,789,735 | | Mitchell International, Inc., 1st Lien Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 11/30/24 | | 3,623,934 |

| 1,955,940 | | NCR Corporation, Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.21% | | 08/28/26 | | 1,956,761 |

| 752,400 | | Qlik Technologies (Project Alpha Intermediate Holding, Inc.), 2019 Incremental Term Loan B, 3 Mo. LIBOR + 4.25%, 0.00% Floor

| | 6.24% | | 04/26/24 | | 751,776 |

| 2,529,400 | | Qlik Technologies (Project Alpha Intermediate Holding, Inc.), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

| | 5.49% | | 04/26/24 | | 2,502,006 |

| 5,278,921 | | RP Crown Parent (JDA Software Group), Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.45% | | 10/12/23 | | 5,277,285 |

| 99,824 | | Ultimate Software Group, Inc., Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 5.45% | | 05/03/26 | | 100,268 |

| | | | | 34,543,033 |

| | | Asset Management & Custody Banks – 0.3% | | | | | | |

| 858,422 | | Harbourvest Partners L.P., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 4.02% | | 03/01/25 | | 858,422 |

| 380,847 | | Victory Capital Holdings, Inc., Term Loan B, 3 Mo. LIBOR + 3.25%, 0.00% Floor

| | 5.35% | | 07/01/26 | | 382,435 |

| | | | | 1,240,857 |

| | | Auto Parts & Equipment – 2.4% | | | | | | |

| 1,990,215 | | American Axle & Manufacturing, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

| | 3.96% | | 04/06/24 | | 1,952,540 |

| 494,817 | | American Axle & Manufacturing, Inc., Term Loan B, 3 Mo. LIBOR + 2.25%, 0.75% Floor

| | 4.19% | | 04/06/24 | | 485,450 |

| 4,916,079 | | Gates Global, LLC, Initial B-2 Dollar Term Loans, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.45% | | 03/31/24 | | 4,899,414 |

| 950,396 | | Lumileds (Bright Bidco B.V.), Term Loan B, 1 Mo. LIBOR + 3.50%, 1.00% Floor

| | 5.20% | | 06/30/24 | | 448,843 |

Page 6

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Auto Parts & Equipment (Continued) | | | | | | |

| $1,961,026 | | Lumileds (Bright Bidco B.V.), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

| | 5.60% | | 06/30/24 | | $926,134 |

| | | | | 8,712,381 |

| | | Automotive Retail – 0.0% | | | | | | |

| 188,461 | | KAR Auction Services, Inc. (Adesa), Term Loan B-6, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 4.00% | | 09/19/26 | | 189,403 |

| | | Broadcasting – 7.7% | | | | | | |

| 1,245,998 | | Cumulus Media Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 3.75%, 1.00% Floor

| | 5.45% | | 03/31/26 | | 1,252,004 |

| 2,577,013 | | E.W. Scripps Company, Incremental Term Loan B-1, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 05/01/26 | | 2,585,079 |

| 5,056,338 | | Gray Television, Inc., Term C Loan, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.28% | | 01/02/26 | | 5,071,103 |

| 9,192,349 | | iHeartCommunications, Inc., Exit Term Loan, 1 Mo. LIBOR + 4.00%, 0.00% Floor

| | 5.78% | | 05/01/26 | | 9,245,940 |

| 6,956,522 | | Nexstar Broadcasting, Inc., Incremental Term Loan B-4, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 09/19/26 | | 6,982,609 |

| 473,125 | | Nexstar Broadcasting, Inc., Mission Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 4.03% | | 01/17/24 | | 473,584 |

| 2,381,039 | | Nexstar Broadcasting, Inc., Nexstar Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 01/17/24 | | 2,383,348 |

| | | | | 27,993,667 |

| | | Building Products – 2.8% | | | | | | |

| 186,963 | | Beacon Roofing Supply, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 01/02/25 | | 185,385 |

| 85,550 | | JELD-WEN, Inc., Term Loan B-4, 3 Mo. LIBOR + 2.00%, 0.00% Floor

| | 4.10% | | 12/14/24 | | 85,528 |

| 10,065,750 | | Quikrete Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 11/15/23 | | 10,059,509 |

| | | | | 10,330,422 |

| | | Cable & Satellite – 2.6% | | | | | | |

| 2,613,978 | | Cablevision (aka CSC Holdings, Inc.), March 2017 Term Loan B-1, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 4.02% | | 07/17/25 | | 2,604,542 |

| 1,506,097 | | Cablevision (aka CSC Holdings, Inc.), Sept. 2019 Term Loan B-5, 2 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.33% | | 04/15/27 | | 1,506,473 |

| 5,329,500 | | Virgin Media Investment Holdings Limited, Term Loan N, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.27% | | 01/31/28 | | 5,330,246 |

| | | | | 9,441,261 |

| | | Casinos & Gaming – 11.2% | | | | | | |

| 7,914,643 | | Caesars Resort Collection, LLC, Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 12/22/24 | | 7,849,980 |

| 7,497,713 | | CityCenter Holdings, LLC, Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

| | 3.95% | | 04/18/24 | | 7,507,085 |

| 186,548 | | Golden Nugget, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.75% Floor

| | 4.45% | | 10/04/23 | | 186,412 |

| 3,642,122 | | Golden Nugget, Inc., Term Loan B, 3 Mo. LIBOR + 2.75%, 0.75% Floor

| | 4.68%-4.72% | | 10/04/23 | | 3,639,464 |

| 571,568 | | Penn National Gaming, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 10/15/25 | | 573,385 |

| 3,447,936 | | Scientific Games International, Inc., Term Loan B5, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 08/14/24 | | 3,430,697 |

See Notes to Financial Statements

Page 7

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Casinos & Gaming (Continued) | | | | | | |

| $11,593,427 | | Stars Group Holdings B.V. (Amaya), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

| | 5.60% | | 07/10/25 | | $11,637,946 |

| 5,355,614 | | Station Casinos, Inc. (Red Rocks), Term Loan B, 1 Mo. LIBOR + 2.50%, 0.75% Floor

| | 4.21% | | 06/08/23 | | 5,363,326 |

| 739,546 | | Twin River Worldwide Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 05/10/26 | | 736,906 |

| | | | | 40,925,201 |

| | | Coal & Consumable Fuels – 0.3% | | | | | | |

| 1,020,750 | | Arch Coal, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.45% | | 03/07/24 | | 973,111 |

| 305,209 | | Peabody Energy Corp., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 03/31/25 | | 255,994 |

| | | | | 1,229,105 |

| | | Communications Equipment – 0.4% | | | | | | |

| 1,483,058 | | Commscope, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 04/06/26 | | 1,471,624 |

| | | Construction & Engineering – 0.0% | | | | | | |

| 177,705 | | Pike Corp., 2019 New Term Loans, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.96% | | 07/24/26 | | 177,967 |

| | | Diversified Support Services – 0.4% | | | | | | |

| 1,369,908 | | Brightview Landscapes, LLC (FKA - Brickman), Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.25%-4.31% | | 08/15/25 | | 1,372,909 |

| | | Electric Utilities – 0.3% | | | | | | |

| 927,500 | | Vistra Operations Company, LLC (TEX/TXU), Term Loan B3, 1 Mo. LIBOR + 1.75%, 0.00% Floor

| | 3.45%-3.52% | | 12/31/25 | | 930,106 |

| | | Environmental & Facilities Services – 1.6% | | | | | | |

| 2,075,572 | | GFL Environmental, Inc., 2018 Incremental Term Loan B, 1 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.70% | | 05/31/25 | | 2,052,222 |

| 3,962,084 | | Packers Holdings, LLC, Term Loan B, 3 Mo. LIBOR + 3.25%, 1.00% Floor

| | 5.57% | | 12/04/24 | | 3,921,235 |

| | | | | 5,973,457 |

| | | Food Distributors – 0.4% | | | | | | |

| 1,468,359 | | US Foods, Inc., Incremental B-2019 Term Loan, 1 Mo. LIBOR + 2.00%, 0.00% Floor

| | 3.70% | | 08/31/26 | | 1,470,562 |

| | | Food Retail – 1.5% | | | | | | |

| 5,423,971 | | Albertson’s, LLC, Term Loan B-8, 1 Mo. LIBOR + 2.75%, 0.75% Floor

| | 4.45% | | 08/15/26 | | 5,455,918 |

| | | Health Care Facilities – 2.3% | | | | | | |

| 1,010,848 | | Acadia Healthcare Company, Inc., Term Loan B3, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 02/11/22 | | 1,011,950 |

| 1,157,570 | | Acadia Healthcare Company, Inc., Term Loan B4, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 02/16/23 | | 1,158,832 |

| 3,591,667 | | Concentra, Inc., Term Loan B, 6 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.54% | | 06/01/22 | | 3,590,158 |

| 1,562,064 | | Gentiva Health Services, Inc. (Kindred at Home), Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 5.50% | | 06/30/25 | | 1,566,953 |

| 745 | | Select Medical Corp., Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.21% | | 03/06/25 | | 741 |

Page 8

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Health Care Facilities (Continued) | | | | | | |

| $911,805 | | Select Medical Corp., Term Loan B, 6 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.58% | | 03/06/25 | | $907,246 |

| | | | | 8,235,880 |

| | | Health Care Services – 12.8% | | | | | | |

| 4,095,032 | | 21st Century Oncology Holdings, Inc., Tranche B Term Loan, 3 Mo. LIBOR + 6.13%, 1.00% Floor

| | 8.14% | | 01/16/23 | | 3,854,448 |

| 1,036,649 | | Air Medical Group Holdings, Inc. (Global Medical Response), 2018 New Term Loan, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.97% | | 04/28/22 | | 976,752 |

| 924,786 | | Air Medical Group Holdings, Inc. (Global Medical Response), Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.97% | | 03/14/25 | | 859,921 |

| 2,821,937 | | Air Methods Corp. (a/k/a ASP AMC Intermediate Holdings, Inc.), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

| | 5.60% | | 04/21/24 | | 2,326,179 |

| 1,074 | | athenahealth, Inc. (VVC Holding Corp.), Term Loan B, 1 Mo. LIBOR + 4.50%, 0.00% Floor

| | 6.26% | | 02/15/26 | | 1,072 |

| 426,499 | | athenahealth, Inc. (VVC Holding Corp.), Term Loan B, 3 Mo. LIBOR + 4.50%, 0.00% Floor

| | 6.40% | | 02/15/26 | | 425,539 |

| 9,727,122 | | CHG Healthcare Services, Inc., Term Loan, 1 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.70% | | 06/07/23 | | 9,737,238 |

| 5,716,775 | | DaVita, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 08/12/26 | | 5,743,816 |

| 3,621,534 | | DuPage Medical Group (Midwest Physician Admin. Services, LLC), Term Loan B, 1 Mo. LIBOR + 2.75%, 0.75% Floor

| | 4.45% | | 08/15/24 | | 3,552,725 |

| 5,579,756 | | Envision Healthcare Corporation, Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 5.45% | | 10/10/25 | | 4,373,134 |

| 802,472 | | Exam Works (Gold Merger Co, Inc.), Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.95% | | 07/27/23 | | 805,481 |

| 5,183,637 | | Surgery Centers Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.96% | | 08/31/24 | | 5,103,291 |

| 3,086,505 | | Team Health, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.45% | | 02/06/24 | | 2,167,313 |

| 1,683,589 | | U.S. Renal Care, Inc., Term Loan B, 1 Mo. LIBOR + 5.00%, 0.00% Floor

| | 6.75% | | 06/28/26 | | 1,599,409 |

| 4,804,791 | | Verscend Technologies, Inc., Term Loan B, 1 Mo. LIBOR + 4.50%, 0.00% Floor

| | 6.20% | | 08/27/25 | | 4,808,395 |

| 187,128 | | Vizient, Inc., Term Loan B-5, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 04/30/26 | | 187,186 |

| | | | | 46,521,899 |

| | | Health Care Technology – 1.4% | | | | | | |

| 4,313,745 | | Change Healthcare Holdings, Term Loan B, 1 Mo. LIBOR + 2.50%, 1.00% Floor

| | 4.20% | | 03/01/24 | | 4,310,510 |

| 728,240 | | Press Ganey (Azalea TopCo, Inc.), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 5.20% | | 07/25/26 | | 724,467 |

| | | | | 5,034,977 |

| | | Household Appliances – 0.9% | | | | | | |

| 3,489,465 | | Traeger Grills (TGP Holdings III, LLC), Term Loan B, 1 Mo. LIBOR + 4.25%, 1.00% Floor

| | 5.95% | | 09/25/24 | | 3,253,926 |

| | | Human Resource & Employment Services – 1.2% | | | | | | |

| 4,216,434 | | Alight, Inc. (fka Tempo Acq.), Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 05/01/24 | | 4,217,320 |

| | | Hypermarkets & Super Centers – 1.8% | | | | | | |

| 6,606,902 | | BJ’s Wholesale Club, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.51% | | 02/03/24 | | 6,617,539 |

See Notes to Financial Statements

Page 9

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Independent Power Producers & Energy Traders – 0.8% | | | | | | |

| $2,907,228 | | Calpine Corporation, New Term Loan B5, 3 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.61% | | 01/15/24 | | $2,913,944 |

| | | Industrial Machinery – 0.2% | | | | | | |

| 921,305 | | Douglas Dynamics, LLC, Term Loan B, 1 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.71% | | 12/31/21 | | 917,279 |

| | | Insurance Brokers – 11.8% | | | | | | |

| 545,556 | | Alliant Holdings I, LLC, 2019 New Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 5.02% | | 05/10/25 | | 542,419 |

| 6,654,345 | | Alliant Holdings I, LLC, Initial Term Loan, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.70% | | 05/09/25 | | 6,579,484 |

| 11,369,527 | | Amwins Group, Inc., Term Loan B (First Lien), 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.45%-4.52% | | 01/25/24 | | 11,390,902 |

| 40,409 | | HUB International Limited, Term Loan B, 2 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.65% | | 04/25/25 | | 39,825 |

| 15,921,035 | | HUB International Limited, Term Loan B, 3 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.69% | | 04/25/25 | | 15,690,816 |

| 2,101,643 | | National Financial Partners Corp. (NFP), Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.70% | | 01/06/24 | | 2,075,372 |

| 6,641,796 | | USI, Inc. (fka Compass Investors, Inc.), Term Loan B, 3 Mo. LIBOR + 3.00%, 0.00% Floor

| | 5.10% | | 05/15/24 | | 6,551,866 |

| | | | | 42,870,684 |

| | | Integrated Telecommunication Services – 2.8% | | | | | | |

| 10,234,539 | | CenturyLink, Inc. (Qwest), Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 01/31/25 | | 10,228,808 |

| | | Investment Banking & Brokerage – 0.9% | | | | | | |

| 3,372,846 | | Citadel Securities L.P., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 5.20% | | 02/28/26 | | 3,372,846 |

| | | Leisure Facilities – 1.4% | | | | | | |

| 5,669,962 | | ClubCorp Holdings, Inc., Term Loan B, 3 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.85% | | 09/18/24 | | 5,169,134 |

| | | Life Sciences Tools & Services – 3.8% | | | | | | |

| 2,281,206 | | Ortho-Clinical Diagnostics Holdings Luxembourg, Term Loan B, 3 Mo. LIBOR + 3.25%, 0.00% Floor

| | 5.31% | | 05/31/25 | | 2,248,881 |

| 4,033,948 | | Parexel International Corp., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 09/27/24 | | 3,889,896 |

| 3,239,753 | | Pharmaceutical Product Development, Inc. (PPDI), Term Loan B, 1 Mo. LIBOR + 2.50%, 1.00% Floor

| | 4.20% | | 08/18/22 | | 3,242,345 |

| 4,538,327 | | Sotera Health Holdings, LLC (Sterigenics), Term Loan B, 3 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.93% | | 05/15/22 | | 4,508,056 |

| | | | | 13,889,178 |

| | | Managed Health Care – 6.2% | | | | | | |

| 18,879,437 | | Multiplan, Inc. (MPH), Term Loan B, 3 Mo. LIBOR + 2.75%, 1.00% Floor

| | 4.85% | | 06/07/23 | | 18,034,582 |

| 4,683,005 | | Versant Health (Wink Holdco, Inc.), Initial Term Loan, 1 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.70% | | 12/02/24 | | 4,624,467 |

| | | | | 22,659,049 |

| | | Metal & Glass Containers – 1.5% | | | | | | |

| 5,517,006 | | Berry Global, Inc., Term Loan U, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.26% | | 07/01/26 | | 5,539,405 |

Page 10

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Movies & Entertainment – 2.8% | | | | | | |

| $2,715,853 | | AMC Entertainment, Inc., Term Loan B, 3 Mo. LIBOR + 3.00%, 0.00% Floor

| | 5.23% | | 04/22/26 | | $2,725,277 |

| 7,540,480 | | Cineworld Group PLC (Crown), Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 02/05/25 | | 7,510,318 |

| | | | | 10,235,595 |

| | | Other Diversified Financial Services – 9.7% | | | | | | |

| 12,235,876 | | AlixPartners, LLP, Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 04/04/24 | | 12,283,963 |

| 8,518,523 | | Duff & Phelps Corporation (Deerfield Dakota), Initial Term Loan, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.95% | | 02/13/25 | | 8,399,264 |

| 11,433,790 | | Refinitiv US Holdings, Inc., Initial Dollar Term Loan, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 5.45% | | 10/01/25 | | 11,500,448 |

| 3,096,440 | | Wex, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 05/17/26 | | 3,105,296 |

| | | | | 35,288,971 |

| | | Packaged Foods & Meats – 2.1% | | | | | | |

| 282,650 | | B&G Foods, Inc., Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

| | 4.20% | | 09/30/26 | | 284,298 |

| 415,882 | | BellRing Brands, LLC, Term Loan B, 1 Mo. LIBOR + 5.00%, 1.00% Floor

| | 6.70% | | 10/21/24 | | 415,362 |

| 2,010,582 | | Hostess Brands, LLC (HB Holdings), Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

| | 3.95% | | 08/03/25 | | 2,006,822 |

| 4,533,002 | | Hostess Brands, LLC (HB Holdings), Term Loan B, 3 Mo. LIBOR + 2.25%, 0.75% Floor

| | 4.18% | | 08/03/25 | | 4,524,525 |

| 366,937 | | Simply Good Foods (Atkins Nutritionals, Inc.), Term Loan B, 2 Mo. LIBOR + 3.75%, 1.00% Floor

| | 5.73% | | 07/07/24 | | 368,772 |

| | | | | 7,599,779 |

| | | Paper Packaging – 3.6% | | | | | | |

| 12,996,725 | | Reynolds Group Holdings, Inc., U.S. Term Loan, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 02/05/23 | | 13,014,141 |

| | | Pharmaceuticals – 9.5% | | | | | | |

| 1,692,270 | | Akorn, Inc., Loan, 1 Mo. LIBOR + 7.00%, 1.00% Floor

| | 8.70% | | 04/16/21 | | 1,599,804 |

| 18,787,806 | | Bausch Health Companies, Inc. (Valeant), Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.77% | | 06/01/25 | | 18,864,084 |

| 7,668,355 | | Endo, LLC, Term Loan B, 1 Mo. LIBOR + 4.25%, 0.75% Floor

| | 6.00% | | 04/29/24 | | 7,049,595 |

| 4,592,676 | | GoodRX, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.50% | | 10/15/25 | | 4,583,491 |

| 1,259,446 | | Grifols Worldwide Operations Limited, Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

| | 3.77% | | 11/15/27 | | 1,266,222 |

| 910,330 | | Mallinckrodt International Finance S.A., 2017 Term Loan B, 3 Mo. LIBOR + 2.75%, 0.75% Floor

| | 4.85% | | 09/24/24 | | 711,423 |

| 653,052 | | Mallinckrodt International Finance S.A., 2018 Incremental Term Loan, 3 Mo. LIBOR + 3.00%, 0.75% Floor

| | 4.91% | | 02/24/25 | | 506,116 |

| | | | | 34,580,735 |

| | | Railroads – 0.1% | | | | | | |

| 372,659 | | Genesee & Wyoming, Inc., Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

| | 3.70% | | 11/05/26 | | 375,122 |

| | | Real Estate Services – 0.5% | | | | | | |

| 232,008 | | Cushman & Wakefield (DTZ U.S. Borrower, LLC), Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 08/21/25 | | 232,299 |

See Notes to Financial Statements

Page 11

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Real Estate Services (Continued) | | | | | | |

| $1,658,228 | | Realogy Corporation, Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

| | 3.96% | | 02/08/25 | | $1,598,813 |

| | | | | 1,831,112 |

| | | Research & Consulting Services – 0.1% | | | | | | |

| 338,722 | | Clarivate Analytics PLC (Camelot), Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 10/31/26 | | 339,738 |

| | | Restaurants – 2.5% | | | | | | |

| 4,712,054 | | 1011778 B.C. Unlimited Liability Company (Restaurant Brands) (aka Burger King/Tim Horton’s), Term Loan B, 1 Mo. LIBOR + 1.75%, 0.00% Floor

| | 3.45% | | 11/14/26 | | 4,709,698 |

| 624,069 | | IRB Holding Corp. (Arby’s/Inspire Brands), Term Loan B, 3 Mo. LIBOR + 3.25%, 1.00% Floor

| | 5.19%-5.22% | | 01/18/25 | | 623,757 |

| 4,000,000 | | Portillo’s Holdings, LLC, Term Loan B, 3 Mo. LIBOR + 5.50%, 1.00% Floor

| | 7.20% | | 08/30/24 | | 3,973,320 |

| | | | | 9,306,775 |

| | | Security & Alarm Services – 0.2% | | | | | | |

| 799,642 | | Garda World Security Corp., Term Loan B, 1 Mo. LIBOR + 4.75%, 0.00% Floor

| | 6.55% | | 10/30/26 | | 796,443 |

| | | Semiconductors – 0.3% | | | | | | |

| 649,392 | | ON Semiconductor Corp., Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

| | 3.70% | | 09/19/26 | | 651,763 |

| 591,321 | | Western Digital Corporation, U.S. Term B-4 Loan, 1 Mo. LIBOR + 1.75%, 0.00% Floor

| | 3.53% | | 04/29/23 | | 589,423 |

| | | | | 1,241,186 |

| | | Specialized Consumer Services – 2.9% | | | | | | |

| 724,000 | | Asurion, LLC, Second Lien Replacement B-2 Term Loan, 1 Mo. LIBOR + 6.50%, 0.00% Floor

| | 8.20% | | 08/04/25 | | 729,205 |

| 4,949,875 | | Asurion, LLC, Term Loan B7, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.70% | | 11/03/24 | | 4,953,736 |

| 1,128,432 | | Asurion, LLC, Term Loan B4, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.70% | | 08/04/22 | | 1,130,317 |

| 3,622,530 | | Asurion, LLC, Term Loan B6, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 4.70% | | 11/03/23 | | 3,625,356 |

| | | | | 10,438,614 |

| | | Specialty Chemicals – 0.9% | | | | | | |

| 3,375,440 | | H.B. Fuller Company, Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

| | 3.72% | | 10/20/24 | | 3,375,811 |

| | | Systems Software – 6.8% | | | | | | |

| 4,973,714 | | Applied Systems, Inc., 1st Lien Term Loan, 3 Mo. LIBOR + 3.25%, 1.00% Floor

| | 5.35% | | 09/13/24 | | 4,951,631 |

| 1,511,161 | | Applied Systems, Inc., 2nd Lien Term Loan, 3 Mo. LIBOR + 7.00%, 1.00% Floor

| | 9.10% | | 09/13/25 | | 1,533,828 |

| 1,813,913 | | Dynatrace, LLC, Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 4.45% | | 08/22/25 | | 1,818,448 |

| 1,702,386 | | McAfee, LLC, Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 5.45% | | 09/30/24 | | 1,703,663 |

| 3,385,778 | | Misys Financial Software Ltd. (Almonde, Inc.) (Finastra), Term Loan B, 6 Mo. LIBOR + 3.50%, 1.00% Floor

| | 5.70% | | 06/13/24 | | 3,307,499 |

| 3,271,779 | | Riverbed Technology, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.96% | | 04/24/22 | | 2,591,871 |

Page 12

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Systems Software (Continued) | | | | | | |

| $1,462,088 | | SS&C European Holdings, S.a.r.l, Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 04/16/25 | | $1,468,945 |

| 951,755 | | SS&C European Holdings, S.a.r.l, Term Loan B-4, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 04/16/25 | | 956,218 |

| 1,744,206 | | SS&C European Holdings, S.a.r.l, Term Loan B-5, 1 Mo. LIBOR + 2.25%, 0.00% Floor

| | 3.95% | | 04/16/25 | | 1,752,491 |

| 1,322,436 | | SUSE (Marcel Lux IV SARL), Facility B1 USD, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 03/15/26 | | 1,299,294 |

| 3,374,529 | | Vertafore, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 4.95% | | 06/15/25 | | 3,271,605 |

| | | | | 24,655,493 |

| | | Wireless Telecommunication Services – 0.3% | | | | | | |

| 1,000,000 | | Frontier Communications Corp., Term Loan B-1, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 5.46% | | 06/15/24 | | 995,830 |

| | | Total Senior Floating-Rate Loan Interests

| | 497,042,362 |

| | | (Cost $504,392,950) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (c) – 1.5% |

| | | Auto Parts & Equipment – 0.3% | | | | | | |

| 1,093,000 | | American Axle & Manufacturing, Inc.

| | 6.63% | | 10/15/22 | | 1,109,736 |

| | | Cable & Satellite – 0.2% | | | | | | |

| 150,000 | | CCO Holdings, LLC / CCO Holdings Capital Corp.

| | 5.75% | | 01/15/24 | | 153,625 |

| 557,000 | | CSC Holdings, LLC (d)

| | 5.50% | | 05/15/26 | | 589,714 |

| | | | | 743,339 |

| | | Health Care Facilities – 0.7% | | | | | | |

| 2,136,000 | | Tenet Healthcare Corp.

| | 8.13% | | 04/01/22 | | 2,338,920 |

| | | Health Care Services – 0.1% | | | | | | |

| 438,000 | | DaVita, Inc.

| | 5.13% | | 07/15/24 | | 450,588 |

| | | Real Estate Services – 0.2% | | | | | | |

| 668,000 | | Realogy Group LLC / Realogy Co-Issuer Corp. (d)

| | 5.25% | | 12/01/21 | | 674,513 |

| | | Total Corporate Bonds and Notes

| | 5,317,096 |

| | | (Cost $5,087,131) | | | | | | |

| Shares | | Description | | Value |

| COMMON STOCKS (c) – 1.0% |

| | | Broadcasting – 0.1% | | |

| 25,815 | | Cumulus Media, Class A (e)

| | 447,632 |

| | | Electric Utilities – 0.8% | | |

| 106,607 | | Vistra Energy Corp.

| | 2,828,284 |

| | | Oil & Gas Exploration & Production – 0.1% | | |

| 119,734 | | Ascent Resources - Marcellus, LLC Class A Common Shares (e) (f)

| | 245,455 |

| 3,699 | | Fieldwood Energy Equity (e) (g)

| | 86,926 |

| | | | | 332,381 |

| | | Total Common Stocks

| | 3,608,297 |

| | | (Cost $3,357,339) | | |

See Notes to Financial Statements

Page 13

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

| Shares | | Description | | Value |

| RIGHTS (c) – 0.0% |

| | | Automobile Manufacturers – 0.0% | | |

| 782 | | General Motors Corporation (e)

| | $7,038 |

| | | Electric Utilities – 0.0% | | |

| 106,607 | | Vistra Energy Corp. (e)

| | 114,976 |

| | | Life Sciences Tools & Services – 0.0% | | |

| 1 | | New Millennium Holdco, Inc., Corporate Claim Trust (e) (h) (i) (j)

| | 0 |

| 1 | | New Millennium Holdco, Inc., Lender Claim Trust (e) (h) (i) (j)

| | 0 |

| | | | | 0 |

| | | Total Rights

| | 122,014 |

| | | (Cost $174,661) | | |

| WARRANTS (c) – 0.0% |

| | | Oil & Gas Exploration & Production – 0.0% | | |

| 31,000 | | Ascent Resources - Marcellus, LLC First Lien Warrants (e) (i)

| | 930 |

| | | (Cost $3,100) | | |

| MONEY MARKET FUNDS (c) – 1.2% |

| 4,533,125 | | Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 1.52% (k)

| | 4,533,125 |

| | | (Cost $4,533,125) | | |

| | | Total Investments – 140.0%

| | 510,623,824 |

| | | (Cost $517,548,306) (l) | | |

| | | Outstanding Loans – (40.3)%

| | (147,000,000) |

| | | Net Other Assets and Liabilities – 0.3%

| | 1,013,062 |

| | | Net Assets – 100.0%

| | $364,636,886 |

|

| (a) | Senior Floating-Rate Loan Interests (“Senior Loans”) in which the Fund invests pay interest at rates which are periodically predetermined by reference to a base lending rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as the LIBOR, (ii) the prime rate offered by one or more United States banks or (iii) the certificate of deposit rate. Certain Senior Loans are subject to a LIBOR floor that establishes a minimum LIBOR rate. When a range of rates is disclosed, the Fund holds more than one contract within the same tranche with identical LIBOR period, spread and floor, but different LIBOR reset dates. |

| (b) | Senior Loans generally are subject to mandatory and/or optional prepayment. As a result, the actual remaining maturity of Senior Loans may be substantially less than the stated maturities shown. |

| (c) | All of these securities are available to serve as collateral for the outstanding loans. |

| (d) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P. (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At November 30, 2019, securities noted as such amounted to $1,264,227 or 0.3% of net assets. |

| (e) | Non-income producing security. |

| (f) | Security received in a transaction exempt from registration under the 1933 Act. The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by the Advisor. Although market instability can result in periods of increased overall market illiquidity, liquidity for the security is determined based on security-specific factors and assumptions, which require subjective judgment. At November 30, 2019, securities noted as such amounted to $245,455 or 0.1% of net assets. |

| (g) | Security received in a transaction exempt from registration under the 1933 Act. The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by the Advisor. Although market instability can result in periods of increased overall market illiquidity, liquidity for the security is determined based on security-specific factors and assumptions, which require subjective judgment. At November 30, 2019, securities noted as such amounted to $86,296 or 0.0% of net assets. |

Page 14

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2019 (Unaudited)

| (h) | This security is fair valued by the Advisor’s Pricing Committee in accordance with procedures adopted by the Fund’s Board of Trustees, and in accordance with the provisions of the Investment Company Act of 1940, as amended. At November 30, 2019, securities noted as such are valued at $0 or 0.0% of net assets. |

| (i) | Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be illiquid by the Advisor. |

| (j) | This security’s value was determined using significant unobservable inputs (see Note 2A — Portfolio Valuation in the Notes to Financial Statements). |

| (k) | Rate shown reflects yield as of November 30, 2019. |

| (l) | Aggregate cost for financial reporting purposes approximates the aggregate cost for federal income tax purposes. As of November 30, 2019, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $3,163,728 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $10,088,210. The net unrealized depreciation was $6,924,482. |

| LIBOR | London Interbank Offered Rate |

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of November 30, 2019 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | Total

Value at

11/30/2019 | Level 1

Quoted

Prices | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

Senior Floating-Rate Loan Interests*

| $ 497,042,362 | $ — | $ 497,042,362 | $ — |

Corporate Bonds and Notes*

| 5,317,096 | — | 5,317,096 | — |

| Common Stocks: | | | | |

Oil & Gas Exploration & Production

| 332,381 | — | 332,381 | — |

Other industry categories*

| 3,275,916 | 3,275,916 | — | — |

| Rights: | | | | |

Automobile Manufacturers

| 7,038 | 7,038 | — | — |

Electric Utilities

| 114,976 | — | 114,976 | — |

Life Sciences Tools & Services

| —** | — | — | —** |

Warrants*

| 930 | — | 930 | — |

Money Market Funds

| 4,533,125 | 4,533,125 | — | — |

Total Investments

| $ 510,623,824 | $ 7,816,079 | $ 502,807,745 | $—** |

| * | See Portfolio of Investments for industry breakout. |

| ** | Investment is valued at $0. |

As of November 30, 2019, the Fund transferred common stocks and warrants valued at $246,385 from Level 3 to Level 2 of the fair value hierarchy. The common stocks and warrants that transferred from Level 3 to Level 2 did so as a result of being priced by an independent third-party pricing service.

Level 3 Rights that are fair valued by the Advisor’s Pricing Committee are footnoted in the Portfolio of Investments. All Level 3 values are based on unobservable inputs.

See Notes to Financial Statements

Page 15

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Assets and Liabilities

November 30, 2019 (Unaudited)

| ASSETS: | |

Investments, at value

(Cost $517,548,306)

| $ 510,623,824 |

Cash

| 211,548 |

| Receivables: | |

Investment securities sold

| 9,235,224 |

Interest

| 1,429,697 |

Prepaid expenses

| 7,896 |

Total Assets

| 521,508,189 |

| LIABILITIES: | |

Outstanding loans

| 147,000,000 |

| Payables: | |

Investment securities purchased

| 9,164,596 |

Investment advisory fees

| 315,620 |

Administrative fees

| 141,873 |

Interest and fees on loans

| 133,704 |

Audit and tax fees

| 34,163 |

Custodian fees

| 23,358 |

Shareholder reporting fees

| 22,386 |

Legal fees

| 15,458 |

Trustees’ fees and expenses

| 6,603 |

Transfer agent fees

| 4,294 |

Financial reporting fees

| 771 |

Other liabilities

| 8,477 |

Total Liabilities

| 156,871,303 |

NET ASSETS

| $364,636,886 |

| NET ASSETS consist of: | |

Paid-in capital

| $ 398,920,686 |

Par value

| 266,970 |

Accumulated distributable earnings (loss)

| (34,550,770) |

NET ASSETS

| $364,636,886 |

NET ASSET VALUE,per Common Share (par value $0.01 per Common Share)

| $13.66 |

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized)

| 26,696,982 |

Page 16

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Operations

For the Six Months Ended November 30, 2019 (Unaudited)

| INVESTMENT INCOME: | |

Interest

| $ 14,079,778 |

Dividends

| 26,652 |

Other

| 100,131 |

Total investment income

| 14,206,561 |

| EXPENSES: | |

Interest and fees on loans

| 2,357,426 |

Investment advisory fees

| 1,943,258 |

Administrative fees

| 180,873 |

Shareholder reporting fees

| 45,574 |

Custodian fees

| 36,745 |

Audit and tax fees

| 31,100 |

Legal fees

| 24,664 |

Listing expense

| 16,347 |

Transfer agent fees

| 12,626 |

Trustees’ fees and expenses

| 8,232 |

Financial reporting fees

| 4,625 |

Other

| 12,733 |

Total expenses

| 4,674,203 |

NET INVESTMENT INCOME (LOSS)

| 9,532,358 |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | |

Net realized gain (loss) on investments

| (1,132,352) |

Net change in unrealized appreciation (depreciation) on investments

| 2,199,127 |

NET REALIZED AND UNREALIZED GAIN (LOSS)

| 1,066,775 |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

| $ 10,599,133 |

See Notes to Financial Statements

Page 17

First Trust Senior Floating Rate Income Fund II (FCT)

Statements of Changes in Net Assets

| | Six Months

Ended

11/30/2019

(Unaudited) | | Year

Ended

5/31/2019 |

| OPERATIONS: | | | |

Net investment income (loss)

| $ 9,532,358 | | $ 19,688,863 |

Net realized gain (loss)

| (1,132,352) | | (5,925,300) |

Net change in unrealized appreciation (depreciation)

| 2,199,127 | | (3,619,109) |

Net increase (decrease) in net assets resulting from operations

| 10,599,133 | | 10,144,454 |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | |

Investment operations

| (11,766,695) | | (19,355,312) |

Total increase (decrease) in net assets

| (1,167,562) | | (9,210,858) |

| NET ASSETS: | | | |

Beginning of period

| 365,804,448 | | 375,015,306 |

End of period

| $ 364,636,886 | | $ 365,804,448 |

| COMMON SHARES: | | | |

Common Shares at end of period

| 26,696,982 | | 26,696,982 |

Page 18

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Cash Flows

For the Six Months Ended November 30, 2019 (Unaudited)

| Cash flows from operating activities: | | |

Net increase (decrease) in net assets resulting from operations

| $10,599,133 | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating activities: | | |

Purchases of investments

| (191,061,205) | |

Sales, maturities and paydown of investments

| 208,274,773 | |

Net amortization/accretion of premiums/discounts on investments

| (169,982) | |

Net realized gain/loss on investments

| 1,132,352 | |

Net change in unrealized appreciation/depreciation on investments

| (2,199,127) | |

| Changes in assets and liabilities: | | |

Decrease in interest receivable

| 314,709 | |

Decrease in prepaid expenses

| 11,222 | |

Decrease in interest and fees payable on loans

| (68,053) | |

Decrease in investment advisory fees payable

| (23,117) | |

Decrease in audit and tax fees payable

| (28,037) | |

Increase in legal fees payable

| 1,313 | |

Decrease in shareholder reporting fees payable

| (11,433) | |

Increase in administrative fees payable

| 15,085 | |

Increase in custodian fees payable

| 5,971 | |

Increase in transfer agent fees payable

| 367 | |

Increase in Trustees’ fees and expenses payable

| 4,057 | |

Increase in other liabilities payable

| 3,117 | |

Cash provided by operating activities

| | $26,801,145 |

| Cash flows from financing activities: | | |

Distributions to Common Shareholders from investment operations

| (11,766,695) | |

Repayment of borrowings

| (43,000,000) | |

Proceeds from borrowings

| 27,000,000 | |

Cash used in financing activities

| | (27,766,695) |

Decrease in cash

| | (965,550) |

Cash at beginning of period

| | 1,177,098 |

Cash at end of period

| | $211,548 |

| Supplemental disclosure of cash flow information: | | |

Cash paid during the period for interest and fees

| | $2,425,479 |

See Notes to Financial Statements

Page 19

First Trust Senior Floating Rate Income Fund II (FCT)

Financial Highlights

For a Common Share outstanding throughout each period

| | Six Months

Ended

11/30/2019

(Unaudited) | | Year Ended May 31, |

| 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

Net asset value, beginning of period

| $ 13.70 | | $ 14.05 | | $ 14.28 | | $ 14.03 | | $ 14.71 | | $ 14.95 |

| Income from investment operations: | | | | | | | | | | | |

Net investment income (loss)

| 0.36 | | 0.74 | | 0.70 | | 0.78 | | 0.83 | | 0.87 |

Net realized and unrealized gain (loss)

| 0.04 | | (0.36) | | (0.17) | | 0.30 | | (0.63) | | (0.27) |

Total from investment operations

| 0.40 | | 0.38 | | 0.53 | | 1.08 | | 0.20 | | 0.60 |

| Distributions paid to shareholders from: | | | | | | | | | | | |

Net investment income

| (0.44) | | (0.73) | | (0.70) | | (0.78) | | (0.88) | | (0.84) |

Return of capital

| — | | — | | (0.06) | | (0.05) | | — | | — |

Total distributions paid to Common Shareholders

| (0.44) | | (0.73) | | (0.76) | | (0.83) | | (0.88) | | (0.84) |

Net asset value, end of period

| $13.66 | | $13.70 | | $14.05 | | $14.28 | | $14.03 | | $14.71 |

Market value, end of period

| $12.16 | | $11.98 | | $12.99 | | $13.62 | | $13.05 | | $13.77 |

Total return based on net asset value (a)

| 3.44% | | 3.44% | | 4.24% | | 7.99% | | 2.36% | | 4.68% |

Total return based on market value (a)

| 5.30% | | (2.17)% | | 1.05% | | 10.89% | | 1.56% | | 4.64% |

| Ratios to average net assets/supplemental data: | | | | | | | | | | | |

Net assets, end of period (in 000’s)

| $ 364,637 | | $ 365,804 | | $ 375,015 | | $ 381,298 | | $ 374,685 | | $ 392,699 |

Ratio of total expenses to average net assets

| 2.57% (b) | | 2.53% | | 2.17% | | 2.06% | | 1.79% | | 1.69% |

Ratio of total expenses to average net assets excluding interest expense

| 1.27% (b) | | 1.24% | | 1.26% | | 1.33% | | 1.27% | | 1.28% |

Ratio of net investment income (loss) to average net assets

| 5.24% (b) | | 5.34% | | 4.94% | | 5.47% | | 5.98% | | 5.96% |

Portfolio turnover rate

| 19% | | 58% | | 101% | | 116% (c) | | 43% | | 63% |

| Indebtedness: | | | | | | | | | | | |

Total loans outstanding (in 000’s)

| $ 147,000 | | $ 163,000 | | $ 155,000 | | $ 146,000 | | $ 137,000 | | $ 159,000 |

Asset coverage per $1,000 of indebtedness (d)

| $ 3,481 | | $ 3,244 | | $ 3,419 | | $ 3,612 | | $ 3,735 | | $ 3,470 |

| (a) | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan, and changes in net asset value per share for net asset value returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

| (b) | Annualized. |

| (c) | The variation in portfolio turnover rate is due to a significant increase in the refinancing of the Senior Floating-Rate Loan Interests held by the Fund during the year ended May 31, 2017. |

| (d) | Calculated by subtracting the Fund’s total liabilities (not including the loans outstanding) from the Fund’s total assets, and dividing by the outstanding loans balance in 000’s. |

Page 20

See Notes to Financial Statements

Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

November 30, 2019 (Unaudited)

1. Organization

First Trust Senior Floating Rate Income Fund II (the “Fund”) is a diversified, closed-end management investment company organized as a Massachusetts business trust on March 25, 2004, and is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund trades under the ticker symbol “FCT” on the New York Stock Exchange (“NYSE”).

The primary investment objective of the Fund is to seek a high level of current income. As a secondary objective, the Fund attempts to preserve capital. The Fund pursues its investment objectives by investing primarily in a portfolio of senior secured floating-rate corporate loans (“Senior Loans”)(1). Under normal market conditions, at least 80% of the Fund’s Managed Assets are generally invested in lower grade debt instruments. “Managed Assets” means the total asset value of the Fund minus the sum of its liabilities, other than the principal amount of borrowings. There can be no assurance that the Fund will achieve its investment objectives. Investing in Senior Loans involves credit risk and, during periods of generally declining credit quality, it may be particularly difficult for the Fund to achieve its secondary investment objective. The Fund may not be appropriate for all investors.

2. Significant Accounting Policies

The Fund is considered an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

A. Portfolio Valuation

The net asset value (“NAV”) of the Common Shares of the Fund is determined daily as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. If the NYSE closes early on a valuation day, the NAV is determined as of that time. Domestic debt securities and foreign securities are priced using data reflecting the earlier closing of the principal markets for those securities. The Fund’s NAV per Common Share is calculated by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses, dividends declared but unpaid and any borrowings of the Fund), by the total number of Common Shares outstanding.

The Fund’s investments are valued daily at market value or, in the absence of market value with respect to any portfolio securities, at fair value. Market value prices represent last sale or official closing prices from a national or foreign exchange (i.e., a regulated market) and are primarily obtained from third-party pricing services. Fair value prices represent any prices not considered market value prices and are either obtained from a third-party pricing service or are determined by the Pricing Committee of the Fund’s investment advisor, First Trust Advisors L.P. (“First Trust” or the “Advisor”), in accordance with valuation procedures adopted by the Fund’s Board of Trustees, and in accordance with provisions of the 1940 Act. Investments valued by the Advisor’s Pricing Committee, if any, are footnoted as such in the footnotes to the Portfolio of Investments. The Fund’s investments are valued as follows:

Senior Loans are not listed on any securities exchange or board of trade. Senior Loans are typically bought and sold by institutional investors in individually negotiated private transactions that function in many respects like an over-the-counter secondary market, although typically no formal market-makers exist. This market, while having grown substantially since its inception, generally has fewer trades and less liquidity than the secondary market for other types of securities. Some Senior Loans have few or no trades, or trade infrequently, and information regarding a specific Senior Loan may not be widely available or may be incomplete. Accordingly, determinations of the market value of Senior Loans may be based on infrequent and dated information. Because there is less reliable, objective data available, elements of judgment may play a greater role in valuation of Senior Loans than for other types of securities. Typically, Senior Loans are fair valued using information provided by a third-party pricing service. The third-party pricing service primarily uses over-the-counter pricing from dealer runs and broker quotes from indicative sheets to value the Senior Loans. If the third-party pricing service cannot or does not provide a valuation for a particular Senior Loan or such valuation is deemed unreliable, the Advisor’s Pricing Committee may value such Senior Loan at a fair value according to procedures adopted by the Fund’s Board of Trustees, and in accordance with the provisions of the 1940 Act. Fair valuation of a Senior Loan is based on the consideration of all available information, including, but not limited to the following:

| 1) | the fundamental business data relating to the borrower; |

| 2) | an evaluation of the forces which influence the market in which these securities are purchased and sold; |

| (1) | The terms “security” and “securities” used throughout the Notes to Financial Statements include Senior Loans. |

Notes to Financial Statements (Continued)

First Trust Senior Floating Rate Income Fund II (FCT)

November 30, 2019 (Unaudited)

| 3) | the type, size and cost of the security; |

| 4) | the financial statements of the borrower; |

| 5) | the credit quality and cash flow of the borrower, based on the Advisor’s or external analysis; |

| 6) | the information as to any transactions in or offers for the security; |

| 7) | the price and extent of public trading in similar securities (or equity securities) of the borrower, or comparable companies; |

| 8) | the coupon payments; |

| 9) | the quality, value and salability of collateral, if any, securing the security; |

| 10) | the business prospects of the borrower, including any ability to obtain money or resources from a parent or affiliate and an assessment of the borrower’s management; |

| 11) | the prospects for the borrower’s industry, and multiples (of earnings and/or cash flows) being paid for similar businesses in that industry; |

| 12) | the borrower’s competitive position within the industry; |

| 13) | the borrower’s ability to access additional liquidity through public and/or private markets; and |