UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21539

First Trust Senior Floating Rate Income Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: May 31

Date of reporting period: November 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

First Trust

Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

For the Six Months Ended

November 30, 2021

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2021

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and its representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Senior Floating Rate Income Fund II (the “Fund”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and its representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Principal Risks” in the Additional Information section of this report for a discussion of certain other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep in mind that the opinions expressed by personnel of the Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Letter from the Chairman and CEO

November 30, 2021

Dear Shareholders,

First Trust is pleased to provide you with the semi-annual report for the First Trust Senior Floating Rate Income Fund II (the “Fund”), which contains detailed information about the Fund for the six months ended November 30, 2021.

Inflation is not going away anytime soon. Federal Reserve (the “Fed”) Chairman Jerome Powell has changed his expectations on inflation from characterizing it as transitory to it being more persistent in nature. In the hopes of keeping inflation from becoming entrenched, the Fed announced it will expedite the tapering of its monthly bond buying program as of December 2021. This program has been successful at pushing down intermediate and longer maturity bond yields and keeping them artificially low to help stimulate economic activity. The Fed will reduce its purchases of Treasuries and mortgage-backed securities by $30 billion per month, up from the original target of $15 billion per month set in November 2021. At that pace, it should be done buying bonds in the open market by the end of March 2022. The Fed also foresees hiking short-term interest rates three times in 2022. The Federal Funds target rate (upper bound) is currently at 0.25%. The trailing 12-month Consumer Price Index (“CPI”) rate stood at 6.8% in November 2021, according to the U.S. Bureau of Labor Statistics. That is up significantly from 1.4% in December 2020 and well above its 2.3% average rate over the past 30 years.

The U.S. has not experienced this type of inflationary pressure, as measured by the CPI, since the early 1980s. Industry pundits, including First Trust Portfolios L.P., have been talking about how artificially low bond yields have been for at least the past decade. Until 2021, bond investors could rationalize accepting less return on their bonds because inflation was also artificially low, but that is no longer the case. As of mid-December 2021, the yield on the benchmark 10-Year Treasury Note (“T-Note”) was fluctuating between 1.40% to 1.50%. That puts the current real rate of return (bond yield minus inflation rate) on the 10-Year T-Note at around -5.3%, according to data from Bloomberg. Suffice it to say, that is not an attractive investment. From November 30, 1971 through November 30, 2021, a period which captures the last 50 years, the average real rate of return on the 10-Year T-Note was 2.2%. Something has got to give, and if inflation remains elevated, then bond yields are likely going higher, in my opinion.

For the record, we have seen bond yields attempt to normalize on a couple of occasions over the past decade. In both 2013 and 2018, the yield on the 10-Year T-Note peaked at 3.03% and 3.24%, respectively, but was not able to hold the 3.00% mark for long. Over the past decade, the Fed has expanded its balance sheet of assets from $2.90 trillion to $8.76 trillion. The Fed’s quantitative easing (bond buying) has everything to do with why bond yields have been so depressed for so long, and it is time to let investors and the markets determine where yields and prices should trade. Let the fundamentals drive the process. The low interest rate climate has been a boon for equity investors. Corporate earnings have been strong even in the face of the coronavirus pandemic. If bond yields trend higher in the months ahead, investors should anticipate higher levels of volatility in both the stock and bond markets. Considering the guidance that we have been given by the Fed, I believe that investors should use this time to assess their holdings and adjust accordingly, if necessary, to the new higher-rate climate that is likely heading our way.

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

First Trust Senior Floating Rate Income Fund II (FCT)

“AT A GLANCE”

As of November 30, 2021 (Unaudited)

| Fund Statistics | |

| Symbol on New York Stock Exchange | FCT |

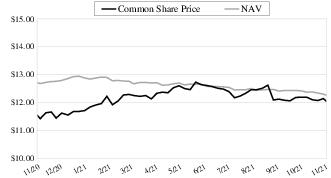

| Common Share Price | $12.04 |

| Common Share Net Asset Value (“NAV”) | $12.26 |

| Premium (Discount) to NAV | (1.79)% |

| Net Assets Applicable to Common Shares | $318,361,965 |

| Current Monthly Distribution per Common Share(1) | $0.0789 |

| Current Annualized Distribution per Common Share | $0.9468 |

| Current Distribution Rate on Common Share Price(2) | 7.86% |

| Current Distribution Rate on NAV(2) | 7.72% |

Common Share Price & NAV (weekly closing price)

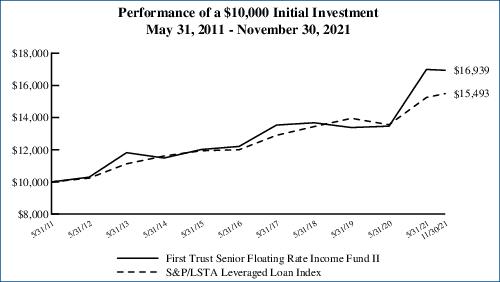

| Performance | | | | | |

| | | | Average Annual Total Returns |

| | 6 Months Ended

11/30/21 | 1 Year Ended

11/30/21 | 5 Years Ended

11/30/21 | 10 Years Ended

11/30/21 | Inception

(5/25/04)

to 11/30/21 |

| Fund Performance(3) | | | | | |

| NAV | 0.70% | 5.88% | 4.71% | 5.82% | 4.40% |

| Market Value | -0.32% | 14.42% | 4.96% | 6.34% | 4.02% |

| Index Performance | | | | | |

| S&P/LSTA Leveraged Loan Index | 1.59% | 5.94% | 4.38% | 4.67% | 4.68% |

| Credit Quality (S&P Ratings)(4) | % of Senior

Loans and other

Debt Securities(5) |

| BB | 1.9% |

| BB- | 4.4 |

| B+ | 18.0 |

| B | 47.3 |

| B- | 21.5 |

| CCC+ | 1.5 |

| CCC | 2.0 |

| D | 2.4 |

| Not Rated | 1.0 |

| Total | 100.0% |

| Top 10 Issuers | % of Total

Long-Term

Investments(5) |

| HUB International Limited | 3.2% |

| Alliant Holdings I, LLC | 3.2 |

| Internet Brands, Inc. (Web MD/MH Sub I, LLC) | 2.9 |

| Mallinckrodt International Finance S.A. | 2.3 |

| iHeartCommunications, Inc. | 2.3 |

| Asurion, LLC | 2.2 |

| Hyland Software, Inc. | 2.2 |

| Endo, LLC | 2.1 |

| Verscend Technologies, Inc. (Cotiviti) | 2.0 |

| Golden Nugget, Inc. | 2.0 |

| Total | 24.4% |

| (1) | Most recent distribution paid or declared through November 30, 2021. Subject to change in the future. |

| (2) | Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of November 30, 2021. Subject to change in the future. |

| (3) | Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per share for NAV returns and changes in Common Share Price for market value returns. From inception to October 12, 2010, Four Corners Capital Management, LLC served as the Fund’s sub-advisor. Effective October 12, 2010, the Leveraged Finance Team of First Trust Advisors L.P. assumed the day-to-day responsibility for management of the Fund’s portfolio. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of future results. |

| (4) | The ratings are by Standard & Poor’s except where otherwise indicated. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (5) | Percentages are based on long-term positions. Money market funds are excluded. |

First Trust Senior Floating Rate Income Fund II (FCT)

“AT A GLANCE” (Continued)

As of November 30, 2021 (Unaudited)

| Industry Classification | % of Total

Long-Term

Investments(5) |

| Software | 19.4% |

| Health Care Providers & Services | 15.1 |

| Pharmaceuticals | 9.6 |

| Insurance | 9.5 |

| Hotels, Restaurants & Leisure | 7.9 |

| Health Care Technology | 6.8 |

| Media | 4.4 |

| Diversified Telecommunication Services | 4.0 |

| Diversified Consumer Services | 2.7 |

| Commercial Services & Supplies | 2.3 |

| Specialty Retail | 2.3 |

| Entertainment | 2.2 |

| Containers & Packaging | 2.2 |

| Machinery | 1.9 |

| Electric Utilities | 1.8 |

| Health Care Equipment & Supplies | 1.2 |

| Professional Services | 1.2 |

| Aerospace & Defense | 0.9 |

| Road & Rail | 0.7 |

| Trading Companies & Distributors | 0.6 |

| Airlines | 0.5 |

| Building Products | 0.5 |

| Communications Equipment | 0.5 |

| Auto Components | 0.4 |

| Oil, Gas & Consumable Fuels | 0.2 |

| Construction & Engineering | 0.2 |

| Diversified Financial Services | 0.2 |

| Food Products | 0.2 |

| Electronic Equipment, Instruments & Components | 0.2 |

| Household Durables | 0.2 |

| Capital Markets | 0.1 |

| Textiles, Apparel & Luxury Goods | 0.1 |

| IT Services | 0.0* |

| Life Sciences Tools & Services | 0.0* |

| Total | 100.0% |

| * | Amount is less than 0.1%. |

Portfolio Commentary

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2021 (Unaudited)

Advisor

The First Trust Advisors L.P. (“First Trust”) Leveraged Finance Investment Team is comprised of 17 experienced investment professionals specializing in below investment grade securities. The team is comprised of portfolio management, research, trading and operations personnel. As of November 30, 2021, the First Trust Leveraged Finance Investment Team managed or supervised approximately $7.30 billion in senior secured bank loans and high-yield bonds. These assets are managed across various strategies, including three closed-end funds, an open-end fund, three exchange-traded funds, and a series of unit investment trusts on behalf of retail and institutional clients.

Portfolio Management Team

William Housey, CFA - Managing Director of Fixed Income, Senior Portfolio Manager

Jeffrey Scott, CFA - Senior Vice President, Portfolio Manager

Commentary

First Trust Senior Floating Rate Income Fund II

The primary investment objective of First Trust Senior Floating Rate Income Fund II (“FCT” or the “Fund”) is to seek a high level of current income. As a secondary objective, the Fund attempts to preserve capital. The Fund pursues its objectives by investing primarily in a portfolio of senior secured floating-rate corporate loans (“Senior Loans”). Under normal market conditions, at least 80% of the Fund’s Managed Assets are generally invested in lower grade debt instruments. “Managed Assets” means the total asset value of the Fund minus the sum of its liabilities, other than the principal amount of borrowings. There can be no assurance that the Fund will achieve its investment objectives. Investing in Senior Loans involves credit risk and, during periods of generally declining credit quality, it may be particularly difficult for the Fund to achieve its secondary investment objective. The Fund may not be appropriate for all investors.

Market Recap

During the six-month period ended November 30, 2021, markets continued an upward trend as the percentage of the population vaccinated against the coronavirus (“COVID-19”) continued to increase and economic tailwinds from the reopening of the economy persisted. Moreover, the Federal Reserve (the “Fed”), despite some hawkish overtures, reaffirmed their commitment to provide ongoing stimulus at both their June and September 2021 Federal Open Market Committee meetings. However, the U.S. Consumer Price Index (“CPI”) jumped to 6.2% year-over-year in October 2021, its highest reading in 31 years. In response to the mounting inflation data that exceeded the Fed’s 2.0% target and the continued progress on employment, the Fed announced in November 2021 that they would begin moderating the pace of asset purchases. Despite some volatility at the end of the period in response to news of the new COVID-19 variant, “Omicron”, and questions surrounding existing vaccine effectiveness in fighting the new variant, the S&P 500® Index finished the six-month period ended November 30, 2021 up 9.38%. The 10-Year U.S. Treasury yield (rates) decreased 15 basis points (“bps”) during the same period to 1.44%, after increasing 83 bps during the first quarter of 2021 to a peak of 1.74% on March 31, 2021.

Senior Loan Market

Senior loan spreads over 3-month London Interbank Offered Rate (“LIBOR”) increased 13 bps during the six-month period ended November 30, 2021, to L+432 bps. The current spread is 83 bps below the senior loan market’s long-term average spread of L+515 bps (December 1997 – November 2021). Retail senior loan funds experienced their 12th consecutive monthly inflow in November 2021, and inflows for loan funds totaled $19.4 billion during the six-month period ended November 30, 2021. We believe the strong demand for senior loans was driven by investor concern for the likelihood of interest rate hikes beginning next year and the threat of rising U.S. Treasury rates generally, going forward.

Lower rated senior loans outperformed higher quality senior loans during the six-month period ended November 30, 2021. BB rated issues returned 1.05%, underperforming the 1.77% return of B rated issues and the 2.13% return of CCC rated issues in the same period. The average price of senior loans in the market remained relatively flat entering the period at $98.08 and ended the period at $98.14.

During the same period, default rates decreased within the S&P/LSTA Leveraged Loan Index. The senior loan market default rate ended the period at 0.29% compared to the 1.73% rate at the beginning of the period. The default rate in the senior loan market is below the long-term average default rate of 2.85%.

Portfolio Commentary (Continued)

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2021 (Unaudited)

Performance Analysis

| | | | Average Annual Total Returns |

| | 6 Months Ended

11/30/21 | 1 Year Ended

11/30/21 | 5 Years Ended

11/30/21 | 10 Years Ended

11/30/21 | Inception

(5/25/04)

to 11/30/21 |

| Fund Performance1 | | | | | |

| NAV | 0.70% | 5.88% | 4.71% | 5.82% | 4.40% |

| Market Value | -0.32% | 14.42% | 4.96% | 6.34% | 4.02% |

| Index Performance | | | | | |

| S&P/LSTA Leveraged Loan Index | 1.59% | 5.94% | 4.38% | 4.67% | 4.68% |

Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, the index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance.

Over the six-month period ended November 30, 2021, the Fund generated a net asset value (“NAV”) return1 of 0.70% and a market price return1 of -0.32%. The S&P/LSTA Leveraged Loan Index (the “Index”) returned 1.59% over the same period. At the start of the period, the Fund’s market price was at a 0.79% discount to NAV and moved to a 1.79% discount to NAV by the end of the period, a widening of 100 bps.

The largest contributing factor to the Fund’s performance relative to the Index during the six-month period ended November 30, 2021 was the Fund’s use of leverage as risk asset prices generated positive returns during the period. The Fund’s leverage was 28.36% of adjusted net assets (net assets plus borrowings) at the end of the period. In addition, the Fund benefited from security selection in the Utilities industry. Within the Utilities industry, the primary driver of outperformance was the Fund’s overweight position in a utility company that significantly outperformed the broader Index during the period. Offsetting these contributing factors was the Fund’s security selection and overweight positions in the Pharmaceuticals and Healthcare industries, which underperformed the Index during the same period. The Fund had a 7.90% weight to the Pharmaceuticals sector and a 23.65% weight to the Healthcare sector, compared to the Index weights of 2.42% and 9.88%, respectively.

The Fund held 205 individual positions diversified across 32 industries at the end of the reporting period. Software (19.34%), Health Care Providers & Services (15.14%), and Pharmaceuticals (9.59%) were the Fund’s top three industry exposures at the end of the period. By comparison, the Fund held 169 individual positions across 28 industries on May 31, 2021. The Fund modestly reduced its allocation to high-yield bonds from 2.48% to 2.10% throughout the period, a decrease of 38 bps. The Fund’s duration remained low throughout the period and modestly decreased from 0.44 years at the beginning of the period to 0.42 years at the end of the period.

| 1 | Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per Common Share for NAV returns and changes in Common Share price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. |

Portfolio Commentary (Continued)

First Trust Senior Floating Rate Income Fund II (FCT)

Semi-Annual Report

November 30, 2021 (Unaudited)

The Fund has a practice of seeking to maintain a relatively stable monthly distribution, which may be changed at any time. The practice has no impact on the Fund’s investment strategy and may reduce the Fund’s NAV. However, the Advisor believes the practice helps maintain the Fund’s competitiveness and may benefit the Fund’s market price and premium/discount to the Fund’s NAV. The monthly distribution rate began the period at $0.0976 per share and ended at $0.0789 per share. Based on the $0.0789 per share monthly distribution, the annualized distribution rate as of November 30, 2021, was 7.72% at NAV and 7.86% at market price. The Fund’s distributions for the six-month period ended November 30, 2021, will consist of net investment income earned by the Fund, and return of capital and may also consist of net short-term realized capital gains. The final determination of the source and tax status of all 2021 distributions will be made after the end of 2021 and will be provided on Form 1099-DIV. The foregoing is not to be construed as tax advice. Please consult your tax advisor for further information regarding tax matters.

The Fund experienced zero defaults during the last twelve-month period (“LTM”). This compared to 5 defaults within the Index during the LTM period. Since the Leveraged Finance Investment Team began managing the Fund in October 2010, the Fund has experienced 12 defaults, which compares to 165 within the broad Index during the same period. The Index default rate ended the period at 0.29%.

Market and Fund Outlook

We believe that continued economic growth and persistently high inflation are likely to result in higher interest rates across the U.S. Treasury yield curve. As such, we expect long-duration fixed income asset class returns to be pressured as rates increase. We believe senior loans, given their senior secured position in the capital structure, floating rate coupon and strong fundamental tailwinds, as evidenced by the low corporate default rate, continue to offer an attractive solution to generate income and avoid interest rate risk in this environment. As we evaluate existing and new investment opportunities in this environment, our decisions will continue to be rooted in our rigorous bottom-up credit analysis process and our focus will remain on identifying the opportunities that we believe offer the best risk and reward balance.

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) – 136.0% |

| | | Aerospace & Defense – 1.2% | | | | | | |

| $740,834 | | Atlantic Aviation FBO, Inc. (KKR Apple Bidco, LLC), 1st Lien Term Loan, 1 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 07/31/28 | | $734,004 |

| 597,393 | | BBA Aviation (Signature Aviation US Holdings, Inc./Brown Group Holding, LLC), Term Loan B, 3 Mo. LIBOR + 2.75%, 0.50% Floor

| | 3.25% | | 04/30/28 | | 592,040 |

| 1,404,706 | | Peraton Corp., Term Loan B, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 02/28/28 | | 1,399,691 |

| 1,079,110 | | Spirit Aerosystems, Inc., New Term Loan B, 3 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 01/15/25 | | 1,077,092 |

| | | | | 3,802,827 |

| | | Airlines – 0.5% | | | | | | |

| 1,665,888 | | American Airlines, Inc. (AAdvantage Loyalty IP Ltd.), Initial Term Loan, 3 Mo. LIBOR + 4.75%, 0.75% Floor

| | 5.50% | | 03/24/28 | | 1,708,918 |

| | | Apparel, Accessories & Luxury Goods – 0.1% | | | | | | |

| 462,677 | | Careismatic Brands/New Trojan, Inc. (fka Strategic Partners), Term Loan B, 3 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 01/31/28 | | 457,935 |

| | | Application Software – 21.0% | | | | | | |

| 1,281,450 | | AppLovin Corp., Amendment No. 6 New Term Loan, 3 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 10/31/28 | | 1,271,839 |

| 476,270 | | CCC Intelligent Solutions, Inc., Term Loan B, 3 Mo. LIBOR + 2.50%, 0.50% Floor

| | 3.00% | | 09/21/28 | | 473,593 |

| 1,538,950 | | ConnectWise, LLC, Term Loan B, 3 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 09/30/28 | | 1,525,484 |

| 5,170,360 | | Epicor Software Corp., First Lien Term Loan C, 6 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 07/30/27 | | 5,144,508 |

| 129,935 | | Flexera Software, LLC, 2020 Term Loan B, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 01/26/28 | | 129,550 |

| 3,209,998 | | Gainwell Acquisition Corp. (fka Milano), Term Loan B, 3 Mo. LIBOR + 4.00%, 0.75% Floor

| | 4.75% | | 10/01/27 | | 3,203,995 |

| 4,699,181 | | Greeneden U.S. Holdings II, LLC (Genesys Telecommunications Laboratories, Inc.), Initial Dollar Term Loan, 1 Mo. LIBOR + 4.00%, 0.75% Floor

| | 4.75% | | 12/01/27 | | 4,685,460 |

| 330,422 | | Hyland Software, Inc., 2nd Lien Term Loan, 1 Mo. LIBOR + 6.25%, 0.75% Floor

| | 7.00% | | 07/10/25 | | 333,395 |

| 9,308,520 | | Hyland Software, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.75% Floor

| | 4.25% | | 07/01/24 | | 9,282,084 |

| 2,090,502 | | Imprivata, Inc., Term Loan B, 3 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 11/30/27 | | 2,085,715 |

| 5,915,391 | | Internet Brands, Inc. (Web MD/MH Sub I, LLC), 2020 June New Term Loan, 1 Mo. LIBOR + 3.75%, 1.00% Floor

| | 4.75% | | 09/15/24 | | 5,887,293 |

| 765,863 | | Internet Brands, Inc. (Web MD/MH Sub I, LLC), 2nd Lien Term Loan, 1 Mo. LIBOR + 6.25%, 0.00% Floor

| | 6.34% | | 02/15/29 | | 771,133 |

| 6,566,075 | | Internet Brands, Inc. (Web MD/MH Sub I, LLC), Initial Term Loan, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 09/13/24 | | 6,465,548 |

| 282,720 | | ION Trading Technologies, Term Loan B, 6 Mo. LIBOR + 4.75%, 0.00% Floor

| | 4.92% | | 04/01/28 | | 281,926 |

| 5,417,428 | | LogMeIn, Inc. (Logan), Term Loan B, 1 Mo. LIBOR + 4.75%, 0.00% Floor

| | 4.84% | | 08/31/27 | | 5,380,211 |

| 5,858,605 | | McAfee, LLC, Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.84% | | 09/30/24 | | 5,850,872 |

| 317,317 | | MeridianLink, Inc., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 11/09/28 | | 315,930 |

| 1,417,154 | | Micro Focus International (MA Financeco, LLC), Term Loan B4, 3 Mo. LIBOR + 4.25%, 1.00% Floor

| | 5.25% | | 06/05/25 | | 1,431,920 |

See Notes to Financial Statements

Page 7

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Application Software (Continued) | | | | | | |

| $733,330 | | N-Able, Inc., Term Loan B, 3 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 06/30/28 | | $730,125 |

| 620,901 | | RealPage, Inc., Second Lien Term Loan, 1 Mo. LIBOR + 6.50%, 0.75% Floor

| | 7.25% | | 04/22/29 | | 630,730 |

| 1,801,927 | | RealPage, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 04/24/28 | | 1,783,457 |

| 7,848,994 | | SolarWinds Holdings, Inc., Initial Term Loan, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.84% | | 02/05/24 | | 7,706,221 |

| 700,920 | | Solera Holdings, Inc. (Polaris Newco), Term Loan B, 6 Mo. LIBOR + 4.00%, 0.50% Floor

| | 4.50% | | 06/04/28 | | 697,794 |

| 311,890 | | Tenable, Inc., Term Loan B, 6 Mo. LIBOR + 2.75%, 0.50% Floor

| | 3.25% | | 06/30/28 | | 310,330 |

| 217,320 | | TIBCO Software, Inc., Term Loan B-3, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.84% | | 06/30/26 | | 214,603 |

| 234,309 | | Ultimate Kronos Group (UKG, Inc.), New Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 05/03/26 | | 232,917 |

| | | | | 66,826,633 |

| | | Asset Management & Custody Banks – 0.2% | | | | | | |

| 621,670 | | Edelman Financial Engines Center, LLC, Term Loan B, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 04/07/28 | | 618,177 |

| | | Auto Parts & Equipment – 0.6% | | | | | | |

| 547,253 | | Clarios Global, L.P. (Power Solutions), Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 04/30/26 | | 539,729 |

| 226,852 | | Dexko Global (Dornoch Debt Merger Sub, Inc.), Term Loan B, 3 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 09/30/28 | | 224,583 |

| 1,194,292 | | Truck Hero, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 01/31/28 | | 1,183,842 |

| | | | | 1,948,154 |

| | | Automotive Retail – 0.3% | | | | | | |

| 992,500 | | Les Schwab Tire Centers (LS Group OpCo Acq., LLC), Term Loan B, 3 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 10/31/27 | | 988,361 |

| | | Broadcasting – 3.6% | | | | | | |

| 390,375 | | E.W. Scripps Company, Incremental Term Loan, 1 Mo. LIBOR + 3.00%, 0.75% Floor

| | 3.75% | | 12/31/27 | | 389,462 |

| 4,304,924 | | iHeartCommunications, Inc., Second Amendment Incremental Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 05/01/26 | | 4,273,971 |

| 6,199,069 | | iHeartCommunications, Inc., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.09% | | 05/01/26 | | 6,117,738 |

| 132,000 | | Univision Communications, Inc., 2017 Replacement Repriced First Lien Term Loan C-5, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 3.75% | | 03/15/24 | | 131,529 |

| 524,804 | | Univision Communications, Inc., 2021 Replacement New First Lien Term Loan, 1 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 03/24/26 | | 523,166 |

| | | | | 11,435,866 |

| | | Building Products – 0.7% | | | | | | |

| 2,371,576 | | Chamberlain Group, Inc. (Chariot), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 10/31/28 | | 2,354,785 |

| | | Cable & Satellite – 1.4% | | | | | | |

| 1,030,471 | | DIRECTV Holdings, LLC, Term Loan B, 3 Mo. LIBOR + 5.00%, 0.75% Floor

| | 5.75% | | 07/31/27 | | 1,027,894 |

| 3,000,000 | | Radiate Holdco, LLC (RCN), Inc. Amendment No. 6 Term Loan, 1 Mo. LIBOR + 2.25%, 0.75% Floor

| | 3.00% | | 09/25/26 | | 2,972,820 |

Page 8

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Cable & Satellite (Continued) | | | | | | |

| $612,878 | | WideOpenWest Finance, LLC, Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.25% | | 08/19/23 | | $610,966 |

| | | | | 4,611,680 |

| | | Casinos & Gaming – 6.1% | | | | | | |

| 665,652 | | Caesars Resort Collection, LLC, New Term Loan B-1, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 07/20/25 | | 664,194 |

| 7,152,942 | | Caesars Resort Collection, LLC, Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.84% | | 12/22/24 | | 7,074,259 |

| 8,822,127 | | Golden Nugget, Inc., Term Loan B, 3 Mo. LIBOR + 2.50%, 0.75% Floor

| | 3.25% | | 10/04/23 | | 8,739,464 |

| 2,964,515 | | Scientific Games International, Inc., Term Loan B5, 1 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.84% | | 08/14/24 | | 2,939,406 |

| | | | | 19,417,323 |

| | | Coal & Consumable Fuels – 0.3% | | | | | | |

| 999,811 | | Arch Coal, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 3.75% | | 03/07/24 | | 953,570 |

| | | Communications Equipment – 0.7% | | | | | | |

| 2,357,394 | | Commscope, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 04/06/26 | | 2,294,050 |

| | | Construction & Engineering – 0.3% | | | | | | |

| 1,034,228 | | USIC, Inc., 1st Lien Term Loan, 1 Mo. LIBOR + 3.50%, 0.75% Floor

| | 4.25% | | 05/15/28 | | 1,028,736 |

| | | Data Processing & Outsourced Services – 0.1% | | | | | | |

| 202,232 | | Paysafe Holdings (US) Corp., New Term Loan B, 1 Mo. LIBOR + 2.75%, 0.50% Floor

| | 3.25% | | 06/24/28 | | 194,017 |

| | | Education Services – 0.5% | | | | | | |

| 1,479,315 | | Ascensus Holdings, Inc. (Mercury), Incremental Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 08/02/28 | | 1,466,371 |

| | | Electric Utilities – 1.8% | | | | | | |

| 5,829,133 | | PG&E Corp., Term Loan B, 3 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 06/23/25 | | 5,754,462 |

| | | Electronic Equipment & Instruments – 0.3% | | | | | | |

| 879,153 | | Verifone Systems, Inc., Term Loan B, 3 Mo. LIBOR + 4.00%, 0.00% Floor

| | 4.18% | | 08/20/25 | | 857,174 |

| | | Environmental & Facilities Services – 2.6% | | | | | | |

| 1,254,177 | | Allied Universal Holdco, LLC, Initial Term Loan, 3 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 05/14/28 | | 1,242,263 |

| 5,128,874 | | Packers Holdings, LLC (PSSI), Term Loan B, 6 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 03/15/28 | | 5,074,405 |

| 2,063,245 | | TruGreen, L.P., Second Refinancing Term Loan B, 1 Mo. LIBOR + 4.00%, 0.75% Floor

| | 4.75% | | 11/02/27 | | 2,062,110 |

| | | | | 8,378,778 |

| | | Health Care Distributors – 0.9% | | | | | | |

| 2,000,000 | | Huntsworth/UDG (Hunter Holdco 3 Limited), Term Loan B, 6 Mo. LIBOR + 4.25%, 0.50% Floor

| | 4.75% | | 08/06/28 | | 1,996,260 |

| 931,669 | | Radiology Partners, Inc., Term Loan B, 1 Mo. LIBOR + 4.25%, 0.00% Floor

| | 4.33%-4.34% | | 07/09/25 | | 917,890 |

| | | | | 2,914,150 |

See Notes to Financial Statements

Page 9

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Health Care Facilities – 0.3% | | | | | | |

| $500,276 | | Ardent Health Services, Inc. (AHP Health Partners, Inc.), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 08/04/28 | | $498,400 |

| 369,281 | | WP CityMD Bidco, LLC (Summit Health), Incremental Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 11/18/28 | | 367,279 |

| | | | | 865,679 |

| | | Health Care Services – 19.8% | | | | | | |

| 858,818 | | AccentCare (Pluto Acquisition I, Inc.), New Term Loan B, 3 Mo. LIBOR + 4.00%, 0.00% Floor

| | 4.18% | | 06/20/26 | | 852,016 |

| 2,533,136 | | ADMI Corp. (Aspen Dental), 2020 Incremental Term Loan B2, 1 Mo. LIBOR + 3.38%, 0.50% Floor

| | 3.88% | | 12/23/27 | | 2,492,505 |

| 3,023,432 | | ADMI Corp. (Aspen Dental), 2021 Incremental Term Loan B3, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 12/23/27 | | 3,004,535 |

| 2,412,375 | | Air Methods Corp., Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

| | 4.50% | | 04/21/24 | | 2,299,790 |

| 19,857 | | athenahealth, Inc. (VVC Holding Corp.), Term Loan B-1, 1 Mo. LIBOR + 4.25%, 0.00% Floor

| | 4.34% | | 02/11/26 | | 19,808 |

| 7,883,526 | | athenahealth, Inc. (VVC Holding Corp.), Term Loan B-1, 3 Mo. LIBOR + 4.25%, 0.00% Floor

| | 4.40% | | 02/11/26 | | 7,863,817 |

| 646,831 | | Aveanna Healthcare, LLC, Delayed Draw Term Loan, 1 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 06/30/28 | | 641,171 |

| 2,781,372 | | Aveanna Healthcare, LLC, New Term Loan B, 1 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 06/30/28 | | 2,757,035 |

| 1,076,838 | | Brightspring Health (Phoenix Guarantor, Inc.), Incremental Term Loan B-3, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 03/05/26 | | 1,065,671 |

| 3,539,039 | | CHG Healthcare Services, Inc., Term Loan B, 3 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 09/30/28 | | 3,518,901 |

| 1,850,585 | | Civitas Solutions (National Mentor Holdings, Inc.), Term Loan B, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 03/31/28 | | 1,826,138 |

| 60,213 | | Civitas Solutions (National Mentor Holdings, Inc.), Term Loan C, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 03/31/28 | | 59,417 |

| 563,506 | | Duly Health (fka DuPage Medical) (Midwest Physician Admin. Services, LLC), Incremental Term Loan B, 3 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 03/15/28 | | 559,516 |

| 5,467,317 | | Envision Healthcare Corporation, Initial Term Loan, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.84% | | 10/10/25 | | 4,108,853 |

| 5,200,411 | | ExamWorks Group, Inc. (Electron Bidco), Term Loan B, 3 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 10/29/28 | | 5,167,908 |

| 4,025,780 | | Global Medical Response, Inc. (fka Air Medical), 2021 Refinanicng Term Loan, 6 Mo. LIBOR + 4.25%, 1.00% Floor

| | 5.25% | | 10/02/25 | | 3,995,587 |

| 253,934 | | Help at Home (HAH Group Holding Company, LLC), Delayed Draw Term Loan, 3 Mo. LIBOR + 5.00%, 1.00% Floor

| | 6.00% | | 10/29/27 | | 254,144 |

| 2,001,876 | | Help at Home (HAH Group Holding Company, LLC), Initial Term Loan, 3 Mo. LIBOR + 5.00%, 1.00% Floor

| | 6.00% | | 10/29/27 | | 2,003,538 |

| 840,000 | | Medical Solutions, LLC (Reverb), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 10/31/28 | | 834,330 |

| 2,829,420 | | Packaging Coordinators, Inc. (PCI Pharma), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.75% Floor

| | 4.25% | | 11/30/27 | | 2,819,404 |

| 1,459,406 | | Radnet Management, Inc., Term Loan B, 3 Mo. LIBOR + 3.00%, 0.75% Floor

| | 3.75% | | 04/22/28 | | 1,449,380 |

| 3,667 | | Radnet Management, Inc., Term Loan B, Prime Rate + 2.00%, 0.75% Floor

| | 5.25% | | 04/22/28 | | 3,642 |

| 342,624 | | SCP Health (Onex TSG Intermediate Corp.), Term Loan B, 3 Mo. LIBOR + 4.75%, 0.75% Floor

| | 5.50% | | 02/28/28 | | 342,412 |

Page 10

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Health Care Services (Continued) | | | | | | |

| $1,995,000 | | Sound Inpatient Physicians, Inc., Incremental Term Loan B, 1 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 06/28/25 | | $1,987,519 |

| 891,954 | | Surgery Centers Holdings, Inc., 2021 Term Loan B, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 08/31/26 | | 887,869 |

| 3,776,317 | | Team Health, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

| | 3.75% | | 02/06/24 | | 3,572,736 |

| 2,694,468 | | U.S. Anesthesia Partners Intermediate Holdings, Inc., New Term Loan B, 6 Mo. LIBOR + 4.25%, 0.50% Floor

| | 4.75% | | 09/30/28 | | 2,674,745 |

| 5,858,890 | | U.S. Renal Care, Inc., Term Loan B, 1 Mo. LIBOR + 5.00%, 0.00% Floor

| | 5.09% | | 06/28/26 | | 5,685,057 |

| 248,612 | | US Radiology Specialists, Inc., Term Loan B, 3 Mo. LIBOR + 5.50%, 0.75% Floor

| | 6.25% | | 12/31/27 | | 248,212 |

| | | | | 62,995,656 |

| | | Health Care Supplies – 1.7% | | | | | | |

| 5,368,011 | | Medline Borrower, L.P. (Mozart), Initial Dollar Term Loan, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 10/15/28 | | 5,347,719 |

| | | Health Care Technology – 9.6% | | | | | | |

| 3,348,556 | | Change Healthcare Holdings, LLC, Closing Date Term Loan, 1 Mo. LIBOR + 2.50%, 1.00% Floor

| | 3.50% | | 03/01/24 | | 3,338,109 |

| 3,199,606 | | Ciox Health (Healthport/CT Technologies Intermediate Holdings, Inc.), New Term Loan B, 1 Mo. LIBOR + 4.25%, 0.75% Floor

| | 5.00% | | 12/16/25 | | 3,192,407 |

| 2,241,934 | | Ensemble RCM, LLC (Ensemble Health), Term Loan B, 3 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.88% | | 08/01/26 | | 2,233,123 |

| 166,429 | | eResearch Technology, Inc. (ERT), Incremental Term Loan B, 1 Mo. LIBOR + 4.50%, 1.00% Floor

| | 5.50% | | 02/04/27 | | 166,382 |

| 2,289,552 | | Mediware (Wellsky/Project Ruby Ultimate Parent Corp.), Term Loan B, 1 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 03/15/28 | | 2,271,144 |

| 387,452 | | Navicure, Inc. (Waystar Technologies, Inc.), Term Loan B, 1 Mo. LIBOR + 4.00%, 0.00% Floor

| | 4.09% | | 10/23/26 | | 386,646 |

| 1,000,000 | | nThrive (MedAssets Software Intermediate Holdings, Inc.), Term Loan B, 1 Mo. LIBOR + 4.00%, 0.50% Floor

| | 4.50% | | 11/30/28 | | 992,500 |

| 2,683,524 | | Press Ganey (Azalea TopCo, Inc.), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.63% | | 07/25/26 | | 2,653,335 |

| 9,066,861 | | Verscend Technologies, Inc. (Cotiviti), New Term Loan B-1, 1 Mo. LIBOR + 4.00%, 0.00% Floor

| | 4.09% | | 08/27/25 | | 9,044,194 |

| 1,716,565 | | Zelis Payments Buyer, Inc., New Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 09/30/26 | | 1,691,898 |

| 4,549,357 | | Zelis Payments Buyer, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 09/30/26 | | 4,491,352 |

| | | | | 30,461,090 |

| | | Homefurnishing Retail – 0.8% | | | | | | |

| 1,245,039 | | At Home Holding III, Inc. (Ambience), Term Loan B, 1 Mo. LIBOR + 4.25%, 0.50% Floor

| | 4.75% | | 07/30/28 | | 1,239,747 |

| 1,334,129 | | Rent-A-Center, Inc., New Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 02/15/28 | | 1,318,560 |

| | | | | 2,558,307 |

| | | Hotels, Resorts & Cruise Lines – 0.2% | | | | | | |

| 723,168 | | Alterra Mountain Company, Term Loan B-2, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 07/31/28 | | 714,584 |

See Notes to Financial Statements

Page 11

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Household Appliances – 0.2% | | | | | | |

| $677,143 | | Traeger Grills (TGP Holdings III, LLC), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.75% Floor

| | 4.25% | | 06/24/28 | | $671,502 |

| | | Industrial Machinery – 2.6% | | | | | | |

| 257,907 | | Filtration Group Corporation, 2021 Incremental Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 10/31/28 | | 256,359 |

| 3,488,303 | | Gates Global, LLC, Term Loan B-3, 1 Mo. LIBOR + 2.50%, 0.75% Floor

| | 3.25% | | 03/31/27 | | 3,455,618 |

| 498,750 | | Madison IAQ, LLC, Term Loan B, 6 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 06/30/28 | | 494,107 |

| 4,185,049 | | TK Elevator Newco GMBH (Vertical U.S. Newco, Inc.), New Term Loan B1 (USD), 6 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 07/31/27 | | 4,168,685 |

| | | | | 8,374,769 |

| | | Insurance Brokers – 13.2% | | | | | | |

| 4,556,563 | | Alliant Holdings I, LLC, 2019 New Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 05/10/25 | | 4,489,627 |

| 3,296,254 | | Alliant Holdings I, LLC, 2021 Term Loan B4, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 11/05/27 | | 3,276,246 |

| 6,519,574 | | Alliant Holdings I, LLC, Initial Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 05/09/25 | | 6,421,780 |

| 480,270 | | AssuredPartners, Inc., 2021 Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 02/13/27 | | 476,187 |

| 6,511,748 | | AssuredPartners, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 02/12/27 | | 6,414,072 |

| 2,815,214 | | BroadStreet Partners, Inc., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.09% | | 01/27/27 | | 2,766,539 |

| 1,180,022 | | Cross Financial Corp., Term Loan B, 1 Mo. LIBOR + 4.00%, 0.75% Floor

| | 4.75% | | 09/15/27 | | 1,180,518 |

| 35,875 | | HUB International Limited, Initial Term Loan B, 2 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.85% | | 04/25/25 | | 35,173 |

| 13,847,660 | | HUB International Limited, Initial Term Loan B, 3 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.87% | | 04/25/25 | | 13,576,938 |

| 772,586 | | HUB International Limited, New Term Loan B-3, 3 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 04/25/25 | | 768,661 |

| 458,381 | | Ryan Specialty Group, LLC, Term Loan B, 1 Mo. LIBOR + 3.00%, 0.75% Floor

| | 3.75% | | 09/01/27 | | 456,282 |

| 2,203,885 | | USI, Inc. (fka Compass Investors, Inc.), Term Loan B, 3 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.13% | | 05/15/24 | | 2,180,657 |

| | | | | 42,042,680 |

| | | Integrated Telecommunication Services – 5.1% | | | | | | |

| 6,187,772 | | Frontier Communications Corp., Term Loan B, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 05/01/28 | | 6,173,849 |

| 3,414,585 | | Numericable (Altice France S.A. or SFR), Term Loan B-11, 3 Mo. LIBOR + 2.75%, 0.00% Floor

| | 2.88% | | 07/31/25 | | 3,342,025 |

| 5,322,931 | | Numericable (Altice France S.A. or SFR), Term Loan B-13, 2 Mo. LIBOR + 4.00%, 0.00% Floor

| | 4.12% | | 08/14/26 | | 5,275,025 |

| 1,588,638 | | Zayo Group Holdings, Inc., Initial Dollar Term Loan, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.09% | | 03/09/27 | | 1,552,322 |

| | | | | 16,343,221 |

| | | Leisure Facilities – 0.3% | | | | | | |

| 1,075,433 | | SeaWorld Parks and Entertainment, Term Loan B, 1 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 08/13/28 | | 1,068,712 |

Page 12

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Managed Health Care – 1.0% | | | | | | |

| $3,286,991 | | Multiplan, Inc. (MPH), Term Loan B, 3 Mo. LIBOR + 4.25%, 0.50% Floor

| | 4.75% | | 08/31/28 | | $3,127,342 |

| | | Metal & Glass Containers – 0.5% | | | | | | |

| 486,642 | | Altium Packaging, LLC (FKA Consolidated Container), Term Loan B, 1 Mo. LIBOR + 2.75%, 0.50% Floor

| | 3.25% | | 02/15/28 | | 477,605 |

| 959,923 | | PODS, LLC, Term Loan B, 1 Mo. LIBOR + 3.00%, 0.75% Floor

| | 3.75% | | 03/31/28 | | 953,127 |

| | | | | 1,430,732 |

| | | Movies & Entertainment – 3.1% | | | | | | |

| 599,310 | | Cineworld Group PLC (Crown), New Priority Term Loan, 6 Mo. LIBOR + 8.25%, 1.00% Floor

| | 9.25% | | 05/23/24 | | 633,770 |

| 1,056,820 | | Cineworld Group PLC (Crown), Priority Term Loan B-1, Fixed Rate at 15.25% (d)

| | 15.25% | | 05/23/24 | | 1,253,653 |

| 7,407,939 | | Cineworld Group PLC (Crown), Term Loan B, 6 Mo. LIBOR + 2.50%, 1.00% Floor

| | 3.50% | | 02/28/25 | | 5,954,131 |

| 398,529 | | PUG, LLC (Stubhub/Viagogo), Incremental Term Loan B-2, 1 Mo. LIBOR + 4.25%, 0.50% Floor

| | 4.75% | | 02/13/27 | | 394,544 |

| 1,578,484 | | PUG, LLC (Stubhub/Viagogo), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.59% | | 02/12/27 | | 1,548,225 |

| | | | | 9,784,323 |

| | | Office Services & Supplies – 0.3% | | | | | | |

| 1,051,757 | | Dun & Bradstreet Corp., Refinancing Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 02/08/26 | | 1,040,366 |

| | | Packaged Foods & Meats – 0.3% | | | | | | |

| 362,381 | | BellRing Brands, LLC, New Term Loan B, 1 Mo. LIBOR + 4.00%, 0.75% Floor

| | 4.75% | | 10/21/24 | | 362,186 |

| 514,665 | | Simply Good Foods (Atkins Nutritionals, Inc.), Term Loan B, 1 Mo. LIBOR + 3.75%, 1.00% Floor

| | 4.75% | | 07/07/24 | | 514,824 |

| | | | | 877,010 |

| | | Paper Packaging – 2.6% | | | | | | |

| 4,527,675 | | Graham Packaging Company, L.P., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.75% Floor

| | 3.75% | | 08/04/27 | | 4,489,326 |

| 3,739,405 | | Pactiv, LLC / Evergreen Packaging, LLC (fka Reynolds Group Holdings), Tranche B-3 U.S. Term Loan, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 09/20/28 | | 3,716,034 |

| | | | | 8,205,360 |

| | | Pharmaceuticals – 12.0% | | | | | | |

| 1,766,509 | | Akorn, Inc., Exit Take Back Term Loan, 3 Mo. LIBOR + 7.50%, 1.00% Floor (e)

| | 8.50% | | 09/30/25 | | 1,735,595 |

| 1,000,000 | | Azurity Pharmaceuticals, Inc., Term Loan B, Prime Rate + 5.00%, 0.75% Floor

| | 8.25% | | 09/30/27 | | 973,330 |

| 433,767 | | Bausch Health Companies, Inc. (Valeant), Initial Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.09% | | 06/01/25 | | 429,499 |

| 9,552,000 | | Endo, LLC, 2021 Term Loan B, 3 Mo. LIBOR + 5.00%, 0.75% Floor

| | 5.75% | | 03/11/28 | | 9,273,846 |

| 3,223,394 | | Jazz Pharmaceuticals, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 05/05/28 | | 3,214,949 |

| 9,850,919 | | Mallinckrodt International Finance S.A., 2017 Term Loan B, 3 Mo. LIBOR + 5.25%, 0.75% Floor (f)

| | 6.00% | | 09/24/24 | | 9,176,427 |

| 1,364,348 | | Mallinckrodt International Finance S.A., 2018 Incremental Term Loan, 3 Mo. LIBOR + 5.50%, 0.75% Floor (f)

| | 6.25% | | 02/24/25 | | 1,272,254 |

See Notes to Financial Statements

Page 13

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Pharmaceuticals (Continued) | | | | | | |

| $5,457,725 | | Nestle Skin Health (Sunshine Lux VII SARL/Galderma), 2021 Term Loan B-3, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 10/02/26 | | $5,433,493 |

| 6,501,066 | | Parexel International Corp. (Phoenix Newco), First Lien Term Loan, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 08/31/28 | | 6,469,600 |

| 255,538 | | Perrigo Rx (Padagis, LLC), Term Loan B, 3 Mo. LIBOR + 4.75%, 0.50% Floor

| | 5.25% | | 06/29/28 | | 254,899 |

| | | | | 38,233,892 |

| | | Research & Consulting Services – 1.6% | | | | | | |

| 1,538,047 | | Clarivate Analytics PLC (Camelot), Amendment No. 2 Incremental Term Loan, 1 Mo. LIBOR + 3.00%, 1.00% Floor

| | 4.00% | | 10/31/26 | | 1,535,479 |

| 985,664 | | Corelogic, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 06/30/28 | | 973,343 |

| 390,752 | | J.D. Power (Project Boost Purchaser, LLC), 2021 Incremental Term Loan B, 1 Mo. LIBOR + 3.50%, 0.50% Floor

| | 4.00% | | 05/26/26 | | 388,556 |

| 1,971,815 | | Nielsen Consumer, Inc. (Indy US Holdco, LLC), Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.84% | | 03/05/28 | | 1,964,420 |

| 338,481 | | Veritext Corporation (VT TopCo, Inc.), Non-Fungible 1st Lien Term Loan, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 08/10/25 | | 338,271 |

| | | | | 5,200,069 |

| | | Restaurants – 3.7% | | | | | | |

| 1,985,000 | | IRB Holding Corp. (Arby’s/Inspire Brands), Fourth Amendment Incremental Term Loan B, 6 Mo. LIBOR + 3.25%, 1.00% Floor

| | 4.25% | | 12/31/27 | | 1,975,432 |

| 13,993 | | IRB Holding Corp. (Arby’s/Inspire Brands), Term Loan B, 3 Mo. LIBOR + 2.75%, 1.00% Floor

| | 3.75% | | 02/05/25 | | 13,886 |

| 5,387,482 | | IRB Holding Corp. (Arby’s/Inspire Brands), Term Loan B, 6 Mo. LIBOR + 2.75%, 1.00% Floor

| | 3.75% | | 02/05/25 | | 5,346,106 |

| 3,920,000 | | Portillo’s Holdings, LLC, Term Loan B-3, 1 Mo. LIBOR + 5.50%, 1.00% Floor

| | 6.50% | | 08/30/24 | | 3,915,100 |

| 398,282 | | Whatabrands, LLC, Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 07/31/28 | | 395,502 |

| | | | | 11,646,026 |

| | | Security & Alarm Services – 0.2% | | | | | | |

| 549,406 | | Garda World Security Corporation, Term Loan B, 1 Mo. LIBOR + 4.25%, 0.00% Floor

| | 4.35% | | 10/30/26 | | 547,934 |

| | | Specialized Consumer Services – 3.3% | | | | | | |

| 819,261 | | Asurion, LLC, 2nd Lien Term Loan B-4, 1 Mo. LIBOR + 5.25%, 0.00% Floor

| | 5.34% | | 01/20/29 | | 810,561 |

| 1,985,115 | | Asurion, LLC, New B-8 Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 12/23/26 | | 1,953,354 |

| 1,698,479 | | Asurion, LLC, Second Lien Term Loan B-3, 1 Mo. LIBOR + 5.25%, 0.00% Floor

| | 5.34% | | 01/31/28 | | 1,682,343 |

| 2,151,427 | | Asurion, LLC, Term Loan B7, 1 Mo. LIBOR + 3.00%, 0.00% Floor

| | 3.09% | | 11/03/24 | | 2,129,912 |

| 3,443,938 | | Asurion, LLC, Term Loan B6, 1 Mo. LIBOR + 3.13%, 0.00% Floor

| | 3.22% | | 11/03/23 | | 3,428,888 |

| 496,766 | | Driven Holdings, LLC, 2021 Term Loan B, 1 Mo. LIBOR + 3.00%, 0.50% Floor

| | 3.50% | | 11/30/28 | | 493,040 |

| | | | | 10,498,098 |

Page 14

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Rate (a) | | Stated

Maturity (b) | | Value |

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued) |

| | | Specialized Finance – 0.3% | | | | | | |

| $977,809 | | WCG Purchaser Corp. (WIRB- Copernicus Group), Term Loan B, 2 Mo. LIBOR + 4.00%, 1.00% Floor

| | 5.00% | | 01/08/27 | | $977,506 |

| | | Specialty Stores – 2.1% | | | | | | |

| 1,338,472 | | Bass Pro Group, LLC (Great Outdoors Group, LLC), Term Loan B, 1 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 03/05/28 | | 1,336,798 |

| 4,230,203 | | Petco Animal Supplies, Inc., Initial Term Loan B, 3 Mo. LIBOR + 3.25%, 0.75% Floor

| | 4.00% | | 03/03/28 | | 4,202,876 |

| 1,085,510 | | Petsmart, Inc., Initial Term Loan B, 3 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 02/15/28 | | 1,079,812 |

| | | | | 6,619,486 |

| | | Systems Software – 6.2% | | | | | | |

| 6,889,155 | | Applied Systems, Inc., 1st Lien Term Loan, 3 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 09/19/24 | | 6,864,423 |

| 1,483,019 | | Applied Systems, Inc., 2nd Lien Term Loan, 3 Mo. LIBOR + 5.50%, 0.75% Floor

| | 6.25% | | 09/19/25 | | 1,493,519 |

| 2,720,579 | | BMC Software Finance, Inc. (Boxer Parent), Term Loan B, 3 Mo. LIBOR + 3.75%, 0.00% Floor

| | 3.88% | | 10/02/25 | | 2,689,973 |

| 892,239 | | Idera, Inc., Initial Term Loan, 6 Mo. LIBOR + 3.75%, 0.75% Floor

| | 4.50% | | 02/15/28 | | 887,555 |

| 1,801,682 | | Misys Financial Software Ltd. (Almonde, Inc.) (Finastra), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

| | 4.50% | | 06/13/24 | | 1,783,665 |

| 1,592,969 | | Proofpoint, Inc., Term Loan B, 3 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 07/31/28 | | 1,576,593 |

| 3,116,966 | | Sophos Group PLC (Surf), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

| | 3.62% | | 03/05/27 | | 3,083,365 |

| 1,295,855 | | SUSE (Marcel Lux IV SARL), Facility B1 USD, 1 Mo. LIBOR + 3.25%, 0.00% Floor

| | 3.34% | | 03/15/26 | | 1,288,831 |

| | | | | 19,667,924 |

| | | Trading Companies & Distributors – 0.8% | | | | | | |

| 2,660,096 | | SRS Distribution, Inc., 2021 Refinancing Term Loan, 3 Mo. LIBOR + 3.75%, 0.50% Floor

| | 4.25% | | 06/04/28 | | 2,648,631 |

| | | Trucking – 1.0% | | | | | | |

| 2,658,400 | | Hertz (The) Corporation, Exit Term Loan B, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 06/30/28 | | 2,650,930 |

| 502,262 | | Hertz (The) Corporation, Exit Term Loan C, 1 Mo. LIBOR + 3.25%, 0.50% Floor

| | 3.75% | | 06/30/28 | | 500,851 |

| | | | | 3,151,781 |

| | | Total Senior Floating-Rate Loan Interests

| | 433,112,366 |

| | | (Cost $436,803,883) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (c) – 2.8% |

| | | Airlines – 0.2% | | | | | | |

| 605,000 | | Mileage Plus Holdings, LLC / Mileage Plus Intellectual Property Assets Ltd. (g)

| | 6.50% | | 06/20/27 | | 646,918 |

| | | Broadcasting – 1.1% | | | | | | |

| 1,119,000 | | Cumulus Media New Holdings, Inc. (g)

| | 6.75% | | 07/01/26 | | 1,163,094 |

| 2,500,000 | | Diamond Sports Group, LLC / Diamond Sports Finance Co. (g)

| | 5.38% | | 08/15/26 | | 1,112,338 |

See Notes to Financial Statements

Page 15

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| CORPORATE BONDS AND NOTES (c) (Continued) |

| | | Broadcasting (Continued) | | | | | | |

| $1,000,000 | | Univision Communications, Inc. (g)

| | 9.50% | | 05/01/25 | | $1,074,105 |

| | | | | 3,349,537 |

| | | Casinos & Gaming – 0.8% | | | | | | |

| 2,462,000 | | Caesars Entertainment, Inc. (g)

| | 6.25% | | 07/01/25 | | 2,562,671 |

| | | Health Care Services – 0.1% | | | | | | |

| 306,000 | | Global Medical Response, Inc. (g)

| | 6.50% | | 10/01/25 | | 306,659 |

| | | Insurance Brokers – 0.1% | | | | | | |

| 227,000 | | AmWINS Group, Inc. (g)

| | 4.88% | | 06/30/29 | | 223,738 |

| | | Integrated Telecommunication Services – 0.4% | | | | | | |

| 1,477,000 | | Zayo Group Holdings, Inc. (g)

| | 4.00% | | 03/01/27 | | 1,410,535 |

| | | Pharmaceuticals – 0.1% | | | | | | |

| 396,000 | | Organon & Co. / Organon Foreign Debt Co-Issuer BV (g)

| | 4.13% | | 04/30/28 | | 395,780 |

| | | Total Corporate Bonds and Notes

| | 8,895,838 |

| | | (Cost $9,546,007) | | | | | | |

| FOREIGN CORPORATE BONDS AND NOTES (c) – 0.2% |

| | | Environmental & Facilities Services – 0.2% | | | | | | |

| 305,000 | | Allied Universal Holdco, LLC / Allied Universal Finance Corp. / Atlas Luxco 4 Sarl (g)

| | 4.63% | | 06/01/28 | | 295,621 |

| 203,000 | | Allied Universal Holdco, LLC / Allied Universal Finance Corp. / Atlas Luxco 4 Sarl (g)

| | 4.63% | | 06/01/28 | | 196,772 |

| | | Total Foreign Corporate Bonds and Notes

| | 492,393 |

| | | (Cost $508,000) | | | | | | |

| Shares | | Description | | Value |

| COMMON STOCKS (c) – 1.3% |

| | | Broadcasting – 0.1% | | |

| 25,815 | | Cumulus Media, Inc., Class A (h)

| | 314,169 |

| | | Electric Utilities – 0.7% | | |

| 106,607 | | Vistra Energy Corp.

| | 2,119,347 |

| | | Oil & Gas Exploration & Production – 0.0% | | |

| 119,734 | | Ascent Resources - Marcellus, LLC Class A Common Shares (h) (i)

| | 149,667 |

| | | Pharmaceuticals – 0.5% | | |

| 150,392 | | Akorn, Inc. (h) (i)

| | 1,441,207 |

| | | Total Common Stocks

| | 4,024,390 |

| | | (Cost $4,081,425) | | |

| WARRANTS (c) – 0.1% |

| | | Movies & Entertainment – 0.1% | | |

| 315,514 | | Cineworld Group PLC, expiring 11/23/25 (h) (j)

| | 154,839 |

| | | Oil & Gas Exploration & Production – 0.0% | | |

| 31,000 | | Ascent Resources - Marcellus, LLC First Lien Warrants, expiring 3/30/23 (h) (j)

| | 775 |

| | | Total Warrants

| | 155,614 |

| | | (Cost $3,100) | | |

Page 16

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

| Shares | | Description | | Value |

| RIGHTS (c) – 0.0% |

| | | Electric Utilities – 0.0% | | |

| 106,607 | | Vistra Energy Corp., no expiration date (h) (j)

| | $146,318 |

| | | Life Sciences Tools & Services – 0.0% | | |

| 1 | | New Millennium Holdco, Inc., Corporate Claim Trust, no expiration date (h) (j) (k) (l)

| | 0 |

| 1 | | New Millennium Holdco, Inc., Lender Claim Trust, no expiration date (h) (j) (k) (l)

| | 0 |

| | | | | 0 |

| | | Total Rights

| | 146,318 |

| | | (Cost $174,207) | | |

| MONEY MARKET FUNDS (c) – 2.5% |

| 8,000,000 | | Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 0.01% (m)

| | 8,000,000 |

| | | (Cost $8,000,000) | | |

| | | Total Investments – 142.9%

| | 454,826,919 |

| | | (Cost $459,116,622) (n) | | |

| | | Outstanding Loans – (39.6)%

| | (126,000,000) |

| | | Net Other Assets and Liabilities – (3.3)%

| | (10,464,954) |

| | | Net Assets – 100.0%

| | $318,361,965 |

|

| (a) | Senior Floating-Rate Loan Interests (“Senior Loans”) in which the Fund invests pay interest at rates which are periodically predetermined by reference to a base lending rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as the LIBOR, (ii) the prime rate offered by one or more United States banks or (iii) the certificate of deposit rate. Certain Senior Loans are subject to a LIBOR floor that establishes a minimum LIBOR rate. When a range of rates is disclosed, the Fund holds more than one contract within the same tranche with identical LIBOR period, spread and floor, but different LIBOR reset dates. |

| (b) | Senior Loans generally are subject to mandatory and/or optional prepayment. As a result, the actual remaining maturity of Senior Loans may be substantially less than the stated maturities shown. |

| (c) | All of these securities are available to serve as collateral for the outstanding loans. |

| (d) | The issuer may pay interest on the loans in cash and in Payment-In-Kind (“PIK”) interest. Interest paid in cash will accrue at the rate of 7.00% per annum (“Cash Interest Rate”) and PIK interest will accrue on the loan at the rate of 8.25% per annum. For the six months ended November 30, 2021, the Fund received a portion of the interest in cash and PIK interest with a principal value of $42,964 for Cineworld Group PLC (Crown). |

| (e) | The issuer may pay interest on the loans (1) entirely in cash or (2) in the event that both the PIK Toggle Condition has been satisfied and the issuer elects to exercise the PIK interest, 2.50% payable in cash and 7.00% payable as PIK interest. For the six months ended November 30, 2021, this security paid all of its interest in cash. |

| (f) | This issuer has filed for protection in bankruptcy court. |

| (g) | This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P. (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At November 30, 2021, securities noted as such amounted to $9,388,231 or 3.0% of net assets. |

| (h) | Non-income producing security. |

| (i) | Security received in a transaction exempt from registration under the 1933 Act. The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by the Advisor. Although market instability can result in periods of increased overall market illiquidity, liquidity for the security is determined based on security-specific factors and assumptions, which require subjective judgment. At November 30, 2021, securities noted as such amounted to $1,590,874 or 0.5% of net assets. |

| (j) | Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be illiquid by the Advisor. |

| (k) | This security is fair valued by the Advisor’s Pricing Committee in accordance with procedures adopted by the Fund’s Board of Trustees, and in accordance with the provisions of the Investment Company Act of 1940, as amended. At November 30, 2021, securities noted as such are valued at $0 or 0.0% of net assets. |

| (l) | This security’s value was determined using significant unobservable inputs (see Note 2A – Portfolio Valuation in the Notes to Financial Statements). |

See Notes to Financial Statements

Page 17

First Trust Senior Floating Rate Income Fund II (FCT)

Portfolio of Investments (Continued)

November 30, 2021 (Unaudited)

| (m) | Rate shown reflects yield as of November 30, 2021. |

| (n) | Aggregate cost for financial reporting purposes approximates the aggregate cost for federal income tax purposes. As of November 30, 2021, the aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost was $2,463,610 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $6,753,313. The net unrealized depreciation was $4,289,703. |

| LIBOR | London Interbank Offered Rate |

Valuation Inputs

A summary of the inputs used to value the Fund’s investments as of November 30, 2021 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | Total

Value at

11/30/2021 | Level 1

Quoted

Prices | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

Senior Floating-Rate Loan Interests*

| $ 433,112,366 | $ — | $ 433,112,366 | $ — |

Corporate Bonds and Notes*

| 8,895,838 | — | 8,895,838 | — |

Foreign Corporate Bonds and Notes*

| 492,393 | — | 492,393 | — |

| Common Stocks: | | | | |

Oil & Gas Exploration & Production

| 149,667 | — | 149,667 | — |

Pharmaceuticals

| 1,441,207 | — | 1,441,207 | — |

Other industry categories*

| 2,433,516 | 2,433,516 | — | — |

Warrants*

| 155,614 | — | 155,614 | — |

| Rights: | | | | |

Electric Utilities

| 146,318 | — | 146,318 | — |

Life Sciences Tools & Services

| —** | — | — | —** |

Money Market Funds

| 8,000,000 | 8,000,000 | — | — |

Total Investments

| $ 454,826,919 | $ 10,433,516 | $ 444,393,403 | $—** |

| * | See Portfolio of Investments for industry breakout. |

| ** | Investment is valued at $0. |

Level 3 Rights that are fair valued by the Advisor’s Pricing Committee are footnoted in the Portfolio of Investments. All Level 3 values are based on unobservable inputs.

Page 18

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Assets and Liabilities

November 30, 2021 (Unaudited)

| ASSETS: | |

Investments, at value (Cost $459,116,622)

| $ 454,826,919 |

Cash

| 1,432,426 |

| Receivables: | |

Investment securities sold

| 7,001,873 |

Interest

| 1,385,106 |

Prepaid expenses

| 5,330 |

Total Assets

| 464,651,654 |

| LIABILITIES: | |

Outstanding loans

| 126,000,000 |

| Payables: | |

Investment securities purchased

| 19,825,940 |

Investment advisory fees

| 271,405 |

Interest and fees on loans

| 67,685 |

Audit and tax fees

| 48,693 |

Administrative fees

| 26,852 |

Legal fees

| 19,642 |

Shareholder reporting fees

| 4,478 |

Transfer agent fees

| 3,410 |

Trustees’ fees and expenses

| 2,814 |

Financial reporting fees

| 771 |

Unrealized depreciation on unfunded loan commitments

| 12,123 |

Other liabilities

| 5,876 |

Total Liabilities

| 146,289,689 |

NET ASSETS

| $318,361,965 |

| NET ASSETS consist of: | |

Paid-in capital

| $ 365,606,998 |

Par value

| 259,675 |

Accumulated distributable earnings (loss)

| (47,504,708) |

NET ASSETS

| $318,361,965 |

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)

| $12.26 |

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized)

| 25,967,477 |

See Notes to Financial Statements

Page 19

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Operations

For the Six Months Ended November 30, 2021 (Unaudited)

| INVESTMENT INCOME: | |

Interest

| $ 9,740,162 |

Dividends

| 31,982 |

Other

| 274,079 |

Total investment income

| 10,046,223 |

| EXPENSES: | |

Investment advisory fees

| 1,680,876 |

Interest and fees on loans

| 611,502 |

Administrative fees

| 154,847 |

Audit and tax fees

| 40,581 |

Shareholder reporting fees

| 37,362 |

Custodian fees

| 17,853 |

Listing expense

| 15,629 |

Transfer agent fees

| 14,228 |

Trustees’ fees and expenses

| 7,799 |

Financial reporting fees

| 4,625 |

Legal fees

| 3,203 |

Other

| 21,746 |

Total expenses

| 2,610,251 |

NET INVESTMENT INCOME (LOSS)

| 7,435,972 |

| NET REALIZED AND UNREALIZED GAIN (LOSS): | |

Net realized gain (loss) on investments

| (611,208) |

| Net change in unrealized appreciation (depreciation) on: | |

Investments

| (4,635,261) |

Unfunded loan commitments

| (13,838) |

Net change in unrealized appreciation (depreciation)

| (4,649,099) |

NET REALIZED AND UNREALIZED GAIN (LOSS)

| (5,260,307) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

| $ 2,175,665 |

Page 20

See Notes to Financial Statements

First Trust Senior Floating Rate Income Fund II (FCT)

Statements of Changes in Net Assets

| | Six Months

Ended

11/30/2021

(Unaudited) | | Year

Ended

5/31/2021 |

| OPERATIONS: | | | |

Net investment income (loss)

| $ 7,435,972 | | $ 14,436,970 |

Net realized gain (loss)

| (611,208) | | (2,412,935) |

Net change in unrealized appreciation (depreciation)

| (4,649,099) | | 25,732,266 |

Net increase (decrease) in net assets resulting from operations

| 2,175,665 | | 37,756,301 |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | |

Investment operations

| (13,608,245) | | (14,583,268) |

Return of capital

| — | | (17,948,187) |

Total distributions to shareholders

| (13,608,245) | | (32,531,455) |

| CAPITAL TRANSACTIONS: | | | |

Proceeds from Common Shares reinvested

| 175,903 | | — |

Repurchase of Common Shares (a)

| — | | (7,872,791) |

Net increase (decrease) in net assets resulting from capital transactions

| 175,903 | | (7,872,791) |

Total increase (decrease) in net assets

| (11,256,677) | | (2,647,945) |

| NET ASSETS: | | | |

Beginning of period

| 329,618,642 | | 332,266,587 |

End of period

| $ 318,361,965 | | $ 329,618,642 |

| CAPITAL TRANSACTIONS were as follows: | | | |

Common Shares at beginning of period

| 25,953,421 | | 26,666,989 |

Common Shares issued as reinvestment under the Dividend Reinvestment Plan

| 14,056 | | — |

Common Shares repurchased (a)

| — | | (713,568) |

Common Shares at end of period

| 25,967,477 | | 25,953,421 |

| (a) | On May 12, 2020, the Fund commenced a share repurchase program. For the fiscal year ended May 31, 2021, the Fund repurchased 713,568 Common Shares at a weighted-average discount of 12.09% from net asset value per share. The Fund’s Share repurchase program ended on March 15, 2021. |

See Notes to Financial Statements

Page 21

First Trust Senior Floating Rate Income Fund II (FCT)

Statement of Cash Flows

For the Six Months Ended November 30, 2021 (Unaudited)

| Cash flows from operating activities: | | |

Net increase (decrease) in net assets resulting from operations

| $2,175,665 | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating activities: | | |

Purchases of investments

| (198,565,513) | |

Sales, maturities and paydown of investments

| 215,821,560 | |

Net amortization/accretion of premiums/discounts on investments

| (553,009) | |

Net realized gain/loss on investments

| 611,208 | |

Net change in unrealized appreciation/depreciation on investments and unfunded loan commitments

| 4,649,099 | |

| Changes in assets and liabilities: | | |

Decrease in interest receivable

| 101,558 | |

Decrease in prepaid expenses

| 14,621 | |

Increase in interest and fees payable on loans

| 4,893 | |

Decrease in investment advisory fees payable

| (24,011) | |

Decrease in audit and tax fees payable

| (29,809) | |

Decrease in legal fees payable

| (18,177) | |

Decrease in shareholder reporting fees payable

| (14,913) | |

Increase in administrative fees payable

| 1,722 | |

Decrease in custodian fees payable

| (6,720) | |

Decrease in transfer agent fees payable

| (1,394) | |

Increase in trustees’ fees and expenses payable

| 230 | |

Increase in other liabilities payable

| 1,177 | |

Cash provided by operating activities

| | $24,168,187 |

| Cash flows from financing activities: | | |

Proceeds from Common Shares reinvested

| 175,903 | |

Distributions to Common Shareholders from investment operations

| (13,608,245) | |

Repayment of borrowings

| (43,000,000) | |

Proceeds from borrowings

| 33,000,000 | |

Cash used in financing activities

| | (23,432,342) |