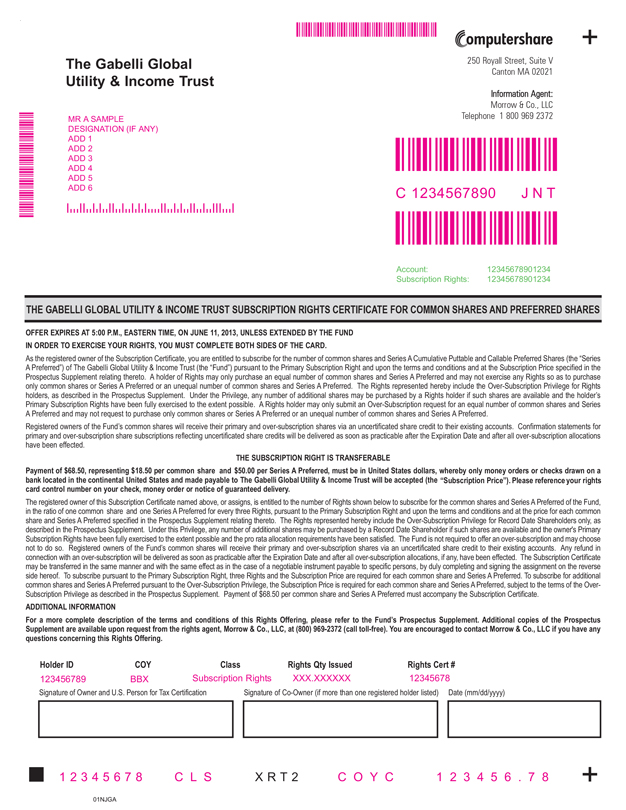

. + Signature of Owner and U.S. Person for Tax Certification Holder ID COY Class Rights Cert # Signature of Co-Owner (if more than one registered holder listed) Date (mm/dd/yyyy) 01NJGA X R T 2 + Rights Qty Issued OFFER EXPIRES AT 5:00 P.M., EASTERN TIME, ON JUNE 11, 2013, UNLESS EXTENDED BY THE FUND IN ORDER TO EXERCISE YOUR RIGHTS, YOU MUST COMPLETE BOTH SIDES OF THE CARD. As the registered owner of the Subscription Certificate, you are entitled to subscribe for the number of common shares and Series A Cumulative Puttable and Callable Preferred Shares (the “Series A Preferred”) of The Gabelli Global Utility & Income Trust (the “Fund”) pursuant to the Primary Subscription Right and upon the terms and conditions and at the Subscription Price specified in the Prospectus Supplement relating thereto. A holder of Rights may only purchase an equal number of common shares and Series A Preferred and may not exercise any Rights so as to purchase only common shares or Series A Preferred or an unequal number of common shares and Series A Preferred. The Rights represented hereby include the Over-Subscription Privilege for Rights holders, as described in the Prospectus Supplement. Under the Privilege, any number of additional shares may be purchased by a Rights holder if such shares are available and the holder’s Primary Subscription Rights have been fully exercised to the extent possible. A Rights holder may only submit an Over-Subscription request for an equal number of common shares and Series A Preferred and may not request to purchase only common shares or Series A Preferred or an unequal number of common shares and Series A Preferred. Registered owners of the Fund’s common shares will receive their primary and over-subscription shares via an uncertificated share credit to their existing accounts. Confirmation statements for primary and over-subscription share subscriptions reflecting uncertificated share credits will be delivered as soon as practicable after the Expiration Date and after all over-subscription allocations have been effected. THE SUBSCRIPTION RIGHT IS TRANSFERABLE Payment of $68.50, representing $18.50 per common shares and $50.00 per Series A Preferred, must be in United States dollars, whereby only money orders or checks drawn on a bank located in the continental United States (certain exceptions apply for Canadian residents) and made payable to The Gabelli Global Utility & Income Trust will be accepted (the “Subscription Price”). Please reference your rights card control number on your check, money order or notice of guaranteed delivery. The registered owner of this Subscription Certificate named above, or assigns, is entitled to the number of Rights shown below to subscribe for the common shares and Series A Preferred of the Fund, in the ratio of one common shares and one Series A Preferred for every three Rights, pursuant to the Primary Subscription Right and upon the terms and conditions and at the price for each common share and Series A Preferred specified in the Prospectus Supplement relating thereto. The Rights represented hereby include the Over-Subscription Privilege for Record Date Shareholders only, as described in the Prospectus Supplement. Under this Privilege, any number of additional shares may be purchased by a Record Date Shareholder if such shares are available and the owner’s Primary Subscription Rights have been fully exercised to the extent possible and the pro rata allocation requirements have been satisfied. The Fund is not required to offer an over-subscription and may choose not to do so. Registered owners of the Fund’s common shares will receive their primary and over-subscription shares via an uncertificated share credit to their existing accounts. Any refund in connection with an over-subscription will be delivered as soon as practicable after the Expiration Date and after all over-subscription allocations, if any, have been effected. The Subscription Certificate may be transferred in the same manner and with the same effect as in the case of a negotiable instrument payable to specific persons, by duly completing and signing the assignment on the reverse side hereof. To subscribe pursuant to the Primary Subscription Right, three Rights and the Subscription Price are required for each common share and Series A Preferred. To subscribe for additional common shares and Series A Preferred pursuant to the Over-Subscription Privilege, the Subscription Price is required for each common share and Series A Preferred, subject to the terms of the Over- Subscription Privilege as described in the Prospectus Supplement. Payment of $68.50 per common share and Series A Preferred must accompany the Subscription Certificate. ADDITIONAL INFORMATION For a more complete description of the terms and conditions of this Rights Offering, please refer to the Fund’s Prospectus Supplement. Additional copies of the Prospectus Supplement are available upon request from the rights agent, Morrow & Co., LLC, at (800) 969-2372 (call toll-free). You are encouraged to contact Morrow & Co., LLC if you have any questions concerning this Rights Offering. The Gabelli Global Utility & Income Trust 250 Royall Street, Suite V Canton MA 02021 Information Agent: Morrow & Co., LLC Telephone 1 800 969 2372 THE GABELLI UTILITY & INCOME TRUST SUBSCRIPTION RIGHTS CERTIFICATE FOR COMMON SHARES AND PREFERRED SHARES XXX.XXXXXX 1 2 3 4 5 6 7 8 123456789 BBX Subscription Rights 12345678 12345678901234 12345678901234 Account: Subscription Rights: NNNNNNNNN MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 C 1234567890 J N T NNNNNN NNNNNN NNNNNNNNNNNN C L S C O Y C 1 2 3 4 5 6 . 7 8 . To subscribe for your primary shares please complete line “A” on the card below. If you are not subscribing for your full Primary Subscription, check box “D” below and we will attempt to sell any remaining unexercised Rights. There can be no assurance that unexercised Rights will be sold, or the costs or proceeds that will result from any completed sales. To subscribe for any over-subscription shares please complete line “B” below. Please Note: Only Record Date Shareholders who have exercised their Primary Subscription in full may apply for shares pursuant to the Over-Subscription Privilege. A Rights holder may only submit an Over-Subscription request for an equal number of common shares and Series A Preferred and may not request to purchase only common shares or Series A Preferred or an unequal number of common shares and Series A Preferred. Payment of Shares: Full payment for both the primary and over-subscription shares or a notice of guaranteed delivery must accompany this subscription. Please reference your rights card control number on your check, money order or notice of guaranteed delivery. If the aggregate Subscription Price paid by a Record Date Shareholder is insufficient to purchase the number of common shares and Series A Preferred that the holder indicates are being subscribed for, or if a Record Date Shareholder does not specify the number of common shares and Series A Preferred to be purchased, then the Record Date Shareholder will be deemed to have exercised first, the Primary Subscription Right (if not already fully exercised) and second, the Over-Subscription Privilege to purchase common shares and Series A Preferred to the full extent of the payment rendered. If the aggregate Subscription Price paid by a Record Date Shareholder exceeds the amount necessary to purchase the number of common shares and Series A Preferred for which the Record Date Shareholder has indicted an intention to subscribe, then the Record Date Shareholder will be deemed to have exercised first, the Primary Subscription Right (if not already fully exercised) and second, the Over-Subscription Privilege to the full extent of the excess payment tendered. FOR A MORE COMPLETE DESCRIPTION OF THE TERMS AND CONDITIONS OF THIS RIGHTS OFFERING, PLEASE REFER TO THE FUND’S PROSPECTUS SUPPLEMENT, WHICH IS INCORPORATED HEREIN BY REFERENCE. COPIES OF THE PROSPECTUS SUPPLEMENT ARE AVAILABLE UPON REQUEST FROM THE RIGHTS AGENT, MORROW & CO., LLC, BY CALLING TOLL-FREE AT (800) 969-2372. Please complete all applicable information and return to the Subscription Agent: COMPUTERSHARE TRUST COMPANY, N.A. By First Class Mail: By Registered, Certified or Express Mail, or Overnight Courier: Computershare Computershare c/o Voluntary Corporate Actions c/o Voluntary Corporate Actions P.O. Box 43011 250 Royall Street Providence, RI 02940-3011 Suite V Canton, MA 02021 Delivery of this Subscription Rights Certificate to an address other than as set forth above does not constitute a valid delivery. SECTION 1. TO SUBSCRIBE: I acknowledge that I have received the Prospectus Supplement for the Rights Offering and I hereby irrevocably subscribe for the number of common shares and Series A Preferred indicated as the total of A and B hereon upon the terms and conditions specified in the Prospectus Supplement and incorporated by reference herein. I hereby agree that if I fail to pay in full for the common shares and Series A Preferred for which I have subscribed, the Fund may exercise any of the remedies provided for in the Prospectus Supplement. TO SELL: If I have checked the box on line D, I authorize the sale of Rights by the Subscription Agent according to the procedures described in the Prospectus Supplement. Print full name of Assignee and Social Security Number Address for delivery of certificate representing Unexercised Rights If permanent change of address, check here: Daytime telephone number: ( ) Evening telephone number: ( ) Email address: D. Sell any Unexercised Remaining Rights E. Deliver a certificate representing Unexercised Rights to the Assignee at t

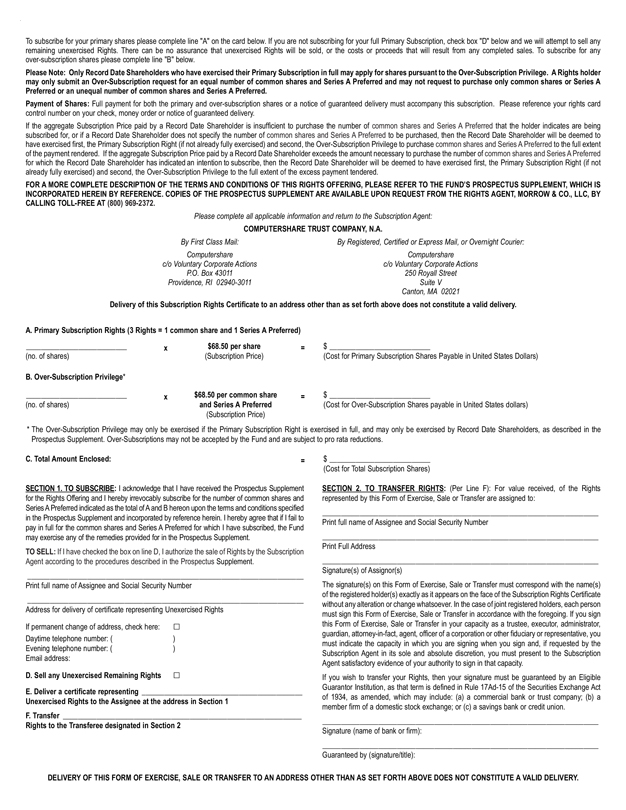

. To subscribe for your primary shares please complete line “A” on the card below. If you are not subscribing for your full Primary Subscription, check box “D” below and we will attempt to sell any remaining unexercised Rights. There can be no assurance that unexercised Rights will be sold, or the costs or proceeds that will result from any completed sales. To subscribe for any over-subscription shares please complete line “B” below. Please Note: Only Record Date Shareholders who have exercised their Primary Subscription in full may apply for shares pursuant to the Over-Subscription Privilege. A Rights holder may only submit an Over-Subscription request for an equal number of common shares and Series A Preferred and may not request to purchase only common shares or Series A Preferred or an unequal number of common shares and Series A Preferred. Payment of Shares: Full payment for both the primary and over-subscription shares or a notice of guaranteed delivery must accompany this subscription. Please reference your rights card control number on your check, money order or notice of guaranteed delivery. If the aggregate Subscription Price paid by a Record Date Shareholder is insufficient to purchase the number of common shares and Series A Preferred that the holder indicates are being subscribed for, or if a Record Date Shareholder does not specify the number of common shares and Series A Preferred to be purchased, then the Record Date Shareholder will be deemed to have exercised first, the Primary Subscription Right (if not already fully exercised) and second, the Over-Subscription Privilege to purchase common shares and Series A Preferred to the full extent of the payment rendered. If the aggregate Subscription Price paid by a Record Date Shareholder exceeds the amount necessary to purchase the number of common shares and Series A Preferred for which the Record Date Shareholder has indicted an intention to subscribe, then the Record Date Shareholder will be deemed to have exercised first, the Primary Subscription Right (if not already fully exercised) and second, the Over-Subscription Privilege to the full extent of the excess payment tendered. FOR A MORE COMPLETE DESCRIPTION OF THE TERMS AND CONDITIONS OF THIS RIGHTS OFFERING, PLEASE REFER TO THE FUND’S PROSPECTUS SUPPLEMENT, WHICH IS INCORPORATED HEREIN BY REFERENCE. COPIES OF THE PROSPECTUS SUPPLEMENT ARE AVAILABLE UPON REQUEST FROM THE RIGHTS AGENT, MORROW & CO., LLC, BY CALLING TOLL-FREE AT (800) 969-2372. Please complete all applicable information and return to the Subscription Agent: COMPUTERSHARE TRUST COMPANY, N.A. By First Class Mail: By Registered, Certified or Express Mail, or Overnight Courier: Computershare Computershare c/o Voluntary Corporate Actions c/o Voluntary Corporate Actions P.O. Box 43011 250 Royall Street Providence, RI 02940-3011 Suite V Canton, MA 02021 Delivery of this Subscription Rights Certificate to an address other than as set forth above does not constitute a valid delivery. SECTION 1. TO SUBSCRIBE: I acknowledge that I have received the Prospectus Supplement for the Rights Offering and I hereby irrevocably subscribe for the number of common shares and Series A Preferred indicated as the total of A and B hereon upon the terms and conditions specified in the Prospectus Supplement and incorporated by reference herein. I hereby agree that if I fail to pay in full for the common shares and Series A Preferred for which I have subscribed, the Fund may exercise any of the remedies provided for in the Prospectus Supplement. TO SELL: If I have checked the box on line D, I authorize the sale of Rights by the Subscription Agent according to the procedures described in the Prospectus Supplement. Print full name of Assignee and Social Security Number Address for delivery of certificate representing Unexercised Rights If permanent change of address, check here: Daytime telephone number: ( ) Evening telephone number: ( ) Email address: D. Sell any Unexercised Remaining Rights E. Deliver a certificate representing Unexercised Rights to the Assignee at the address in Section 1 F. Transfer Rights to the Transferee designated in Section 2 SECTION 2. TO TRANSFER RIGHTS: (Per Line F): For value received, of the Rights represented by this Form of Exercise, Sale or Transfer are assigned to: Print full name of Assignee and Social Security Number Print Full Address Signature(s) of Assignor(s) The signature(s) on this Form of Exercise, Sale or Transfer must correspond with the name(s) of the registered holder(s) exactly as it appears on the face of the Subscription Rights Certificate without any alteration or change whatsoever. In the case of joint registered holders, each person must sign this Form of Exercise, Sale or Transfer in accordance with the foregoing. If you sign this Form of Exercise, Sale or Transfer in your capacity as a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or other fiduciary or representative, you must indicate the capacity in which you are signing when you sign and, if requested by the Subscription Agent in its sole and absolute discretion, you must present to the Subscription Agent satisfactory evidence of your authority to sign in that capacity. If you wish to transfer your Rights, then your signature must be guaranteed by an Eligible Guarantor Institution, as that term is defined in Rule 17Ad-15 of the Securities Exchange Act of 1934, as amended, which may include: (a) a commercial bank or trust company; (b) a member firm of a domestic stock exchange; or (c) a savings bank or credit union. Signature (name of bank or firm): Guaranteed by (signature/title): DELIVERY OF THIS FORM OF EXERCISE, SALE OR TRANSFER TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE DOES NOT CONSTITUTE A VALID DELIVERY. $ (Cost for Primary Subscription Shares Payable in United States Dollars) (no. of shares) x $68.50 per share = (Subscription Price) A. Primary Subscription Rights (3 Rights = 1 common share and 1 Series A Preferred) $ (Cost for Over-Subscription Shares payable in United States dollars) x $68.50 per common share = and Series A Preferred (Subscription Price) B. Over-Subscription Privilege* $ (Cost for Total Subscription Shares) C. Total Amount Enclosed: = * The Over-Subscription Privilege may only be exercised if the Primary Subscription Right is exercised in full, and may only be exercised by Record Date Shareholders, as described in the Prospectus Supplement. Over-Subscriptions may not be accepted by the Fund and are subject to pro rata reductions. (no. of shares)