UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. _______)

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

WILSHIRE BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously by written preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: |

| 2) | Form Schedule or Registration Statement No.: |

Wilshire Bancorp, Inc.

3200 Wilshire Blvd.

Los Angeles, California 90010

(213) 387-3200

April 11, 2005

To the Shareholders of Wilshire Bancorp, Inc.:

It is with great pleasure that I extend a cordial invitation to attend the 2005 Annual Meeting of Shareholders of Wilshire Bancorp, Inc. to be held on May 25, 2005 at 10:00 a.m., local time, at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005.

Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting of Shareholders and the attached Proxy Statement.

Your vote is important. Whether or not you plan to attend the meeting, please complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope. Returning the proxy does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting.

We look forward to seeing you at the Annual Meeting.

Very truly yours,

/s/ Soo Bong Min

Soo Bong Min

President and Chief Executive Officer

Wilshire Bancorp, Inc.

Wilshire Bancorp, Inc.

3200 Wilshire Blvd.

Los Angeles, California 90010

(213) 387-3200

April 11, 2005

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 25, 2005

The 2005 Annual Meeting of Shareholders of Wilshire Bancorp, Inc. will be held on May 25, 2005 at 10:00 a.m., local time, at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005, for the following purposes:

| | 1. | The election of four directors assigned to Class I of the Board of Directors of Wilshire Bancorp for three year terms expiring at the 2008 Annual Meeting of Shareholders or until their successors are duly elected and qualified; and |

| | 2. | To transact such other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on March 31, 2005 as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting. Each share of Wilshire Bancorp common stock is entitled to one vote on all matters presented at the Annual Meeting.

Your vote is important. Whether or not you expect to attend the Annual Meeting in person,please vote by completing, signing and dating the enclosed proxy card and returning it promptly in the postage-paid reply envelope provided. The proxy is revocable by you at any time prior to its use at the Annual Meeting. If you are a holder of record, you may also cast your vote in person at the Annual Meeting. If you receive more than one proxy card because your shares are registered in different names or addresses, each proxy card should be signed and returned to ensure that all your shares will be voted at the Annual Meeting. If your shares are held at a brokerage firm or a bank, you must provide them with instructions on how to vote your shares.

By Order of the Board of Directors

/s/ Soo Bong Min

Soo Bong Min

President and Chief Executive Officer

Wilshire Bancorp, Inc.

Los Angeles, California

April 11, 2005

TABLE OF CONTENTS

| | Page |

| ABOUT THE ANNUAL MEETING | 1 |

| PROPOSAL NO. 1 ELECTION OF DIRECTORS | 5 |

| General | 5 |

| Business Experience of Nominees | 5 |

| Vote Required | 6 |

| Board Recommendation | 6 |

| Other Directors and Executive Officers | 6 |

| CORPORATE GOVERNANCE REFORMS | 7 |

| Corporate Governance Principles and Board Matters | 8 |

| Committees of Wilshire Bancorp | 10 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 13 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 14 |

| EXECUTIVE COMPENSATION | 15 |

| Summary of Cash and Certain Other Compensation | 15 |

| Stock Option Grants In 2004 | 16 |

| Year End 2004 Option Values | 16 |

| Stock Option Plan | 17 |

| Employment Contracts | 18 |

| Survivor Income Agreements; Bank-Owned Life Insurance Policies | 18 |

| REPORT OF THE HUMAN RESOURCES COMMITTEE OF THE BOARD OF DIRECTORS | 19 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 21 |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 22 |

| STOCK PERFORMANCE GRAPH | 22 |

| PRINCIPAL AUDITOR FEES AND SERVICES | 23 |

| OTHER MATTERS | 24 |

| SHAREHOLDER DIRECTOR NOMINATIONS AND OTHER PROPOSALS FOR THE NEXT ANNUAL MEETING OF SHAREHOLDERS | 24 |

| Consideration of Director Nominees | 24 |

| Consideration of Other Shareholder Proposals | 25 |

| NO INCORPORATION BY REFERENCE OF CERTAIN PORTIONS OF THIS PROXY STATEMENT | 25 |

| APPROVAL OF THE BOARD OF DIRECTORS | 26 |

| | |

| ANNEX AWilshire Bancorp, Inc. Audit Committee Charter | |

PROXY STATEMENT

FOR

ANNUAL MEETING OFSHAREHOLDERS

TO BE HELD ONMAY 25, 2005

_______________________________

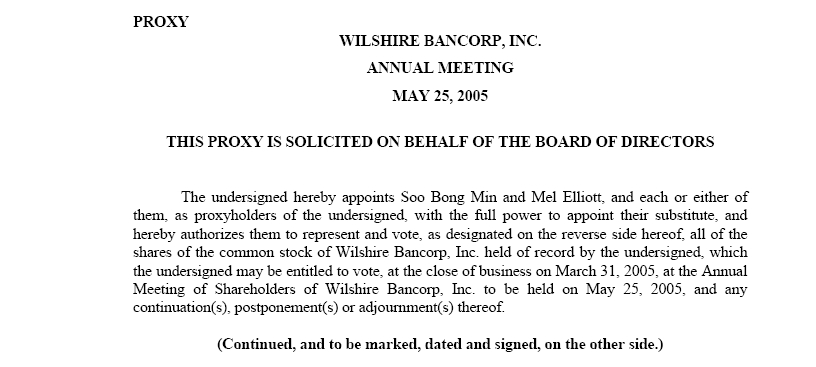

We are providing these proxy materials in connection with Wilshire Bancorp’s 2005 Annual Meeting of Shareholders. This proxy statement and the accompanying proxy card were first mailed to the shareholders on or about April 22, 2005. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

ABOUT THE ANNUAL MEETING

| Q: | Who is soliciting myvote? |

| A: | The Board of Directors of Wilshire Bancorp is soliciting your vote at the 2005 Annual Meeting of Shareholders. |

| Q: | What is the purpose of the Annual Meeting? |

| A: | You will be voting on the election of four directors assigned to Class I of the Board of Directors. |

We will also consider any other business that may properly come before the meeting.

Q: | What are the Board of Director’s recommendations? |

| A: | The Board of Directors recommends a vote: |

· FOR the election of the four nominees for directors assigned to Class I of the Board of Directors.

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | The Board of Directors set March 31, 2005 as the record date for the Annual Meeting (the “record date”). All shareholders who owned Wilshire Bancorp common stock at the close of business on March 31, 2005 may attend and vote at the Annual Meeting. |

| Q: | How many votes do I have? |

| A: | You will have one vote for each share of Wilshire Bancorp common stock you owned at the close of business on the record date, provided those shares are either held directly in your name as the shareholder of record or were held for you as the beneficial owner through a broker, bank or other nominee. |

| Q: | What is the difference between holding shares as a shareholder of record and beneficial owner? |

| A: | Most shareholders of Wilshire Bancorp hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Shareholder of Record. If your shares are registered directly in your name with Wilshire Bancorp’s transfer agent, U.S. Stock Transfer Corporation, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you by Wilshire Bancorp. As the shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you request, complete and deliver a proxy from your broker, bank or nominee. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares.

| A. | Your vote is important. You may vote by mail or by attending the Annual Meeting and voting by ballot. If you choose to vote by mail, simply mark your proxy, date and sign it, and return it to our transfer agent, U.S. Stock Transfer Corporation, in the postage-paid envelope provided. |

Submitting your completed proxy card will not limit your right to vote at the Annual Meeting if you attend the meeting and vote in person. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

The shares represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy card will be voted as recommended by the Board of Directors.

Q. How many votes can be cast by all shareholders?

| A. | Each share of Wilshire Bancorp common stock is entitled to one vote. There is no cumulative voting. We had 28,571,080 shares of common stock outstanding and entitled to vote on the record date. |

Q: How many votes must be present to hold the Annual Meeting?

| A: | A majority of Wilshire Bancorp’s outstanding shares as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or a proxy card has been properly submitted by you or on your behalf. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. |

| Q: | How many votes are required to elect directors? |

| A: | Directors are elected by apluralityof the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Nominees do not need to receive a majority to be elected. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those nominees indicated. Your shares will be counted for purposes of determining whether there is a quorum, but it will have no effect on the election of those nominees. |

Q: What if I do not vote for the items listed on my proxy card?

| A: | If you hold shares in your name and you return your signed proxy card in the enclosed envelope but do not mark selections, it will be voted in accordance with the recommendations of the Board of Directors. If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions.With respect to any other matter that properly comes before the meeting, the proxy holders will vote asrecommended by our Board of Directors, or if no recommendation is given, in their own discretion. |

If you are a beneficial owner and hold your shares in street name through a broker and do not return the voting instruction card, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the uncontested election of directors.

Q: Can I change or revoke my vote after I return my proxy card?

| A: | Yes. Even if you sign the proxy card in the form accompanying this proxy statement, you retain the power to revoke your proxy. You can revoke your proxy at any time before it is exercised by giving written notice to the Secretary of Wilshire Bancorp, specifying such revocation. |

Q: What does it mean if I receive more than one proxy?

| A: | It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy cards you receive. |

Q: Who can attend the Annual Meeting?

| A: | All shareholders as of the record date, or their duly appointed proxies, may attend. |

Q: What do I need to attend the Annual Meeting and when should I arrive?

| A: | In order to be admitted to the Annual Meeting, a shareholder must present proof of ownership of Wilshire Bancorp stock on the record date. If your shares are held in the name of a bank, broker or other holder of record, a brokerage statement or letter from a bank or broker is an example of proof of ownership. Any holder of a proxy from a shareholder must present the proxy card, properly executed, to be admitted. Shareholders and proxyholders must also present a form of photo identification such as a driver’s license. |

The Annual Meeting will be held at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005. Admission to the Annual Meeting will be limited.In order to ensure that you are seated by the commencement of the Annual Meeting at 9:45 a.m., we recommend you arrive early.

Q: Who pays for the proxy solicitation and how will Wilshire Bancorp solicit votes?

| A: | We will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request brokers and nominees who hold shares of our common stock in their names to furnish proxy material to beneficial owners of the shares. We may reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners. |

Q: How can I obtain a copy of Wilshire Bancorp’s 2004 Annual Report on Form 10-K?

| A: | A copy of our 2004 annual report is being mailed with this proxy statement to each shareholder of record. Shareholders not receiving a copy of the annual report may obtain one without charge. Our annual report on Form 10-K is also accessible through our website atwww.wilshirebank.com. Requests andinquiries should be addressed to: Wilshire Bancorp, Inc., 3200 Wilshire Blvd., Los Angeles, California 90010, Attn: Corporate Secretary. |

Q: | Is a list of shareholders available? |

| A: | The names of shareholders of record entitled to vote at the Annual Meeting will be available to shareholders entitled to vote at this meeting for ten days prior to the meeting for any purpose relevant to the meeting. This list can be viewed between the hours of 9:00 a.m. and 5:00 p.m. at our principal executive offices at 3200 Wilshire Blvd. Los Angeles, California 90010. Please contact Wilshire Bancorp’s Secretary to make arrangements. |

Q: How do I find out the voting results?

| A: | Preliminary voting results will be announced at the Annual Meeting, and the final voting results will be published in our Quarterly Report on Form 10-Q for the quarter ending June 30, 2005, which we will file with the SEC. |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

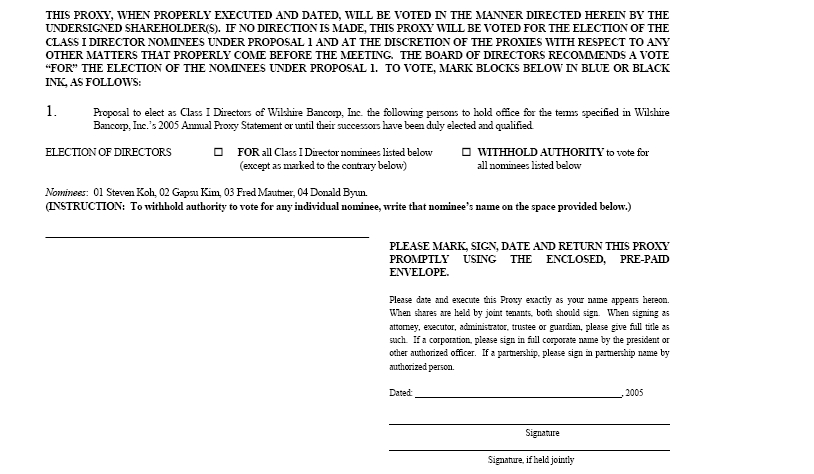

Our articles of incorporation provide that the terms of office of the members of our Board of Directors be divided into three classes, Class I, Class II and Class III, the members of which serve for a staggered three-year term. The terms of the current Class I, Class II and Class III directors are set to expire at the Annual Meeting of Shareholders in 2005, 2006 and 2007, respectively. Our amended and restated bylaws authorize our Board of Directors to fix the number of directors at not less than nine nor more than 15. Our Board of Directors presently consists of 11 members, with four directors serving in each class except for Class II, which has three directors. The number of directors has been fixed at 12 in connection with the Annual Meeting. At the Annual Meeting, four directors comprising the Class I directors are to be elected. The Board of Directors has proposed the nominees listed below for election as Class I directors to serve until the 2008 Annual Meeting or until their successors are duly elected and qualified. All of the nominees listed below currently serve as Class I directors on our Board of Directors and all of the nominees were recommended for re-election by the Nominating and Governance Committee of our Board of Directors.

Unless otherwise specified in the accompanying form of proxy, proxies solicited hereby will be voted for the election of the nominees listed below. Each of the nominees has agreed to serve for a three year term. If any of them should become unable to serve as a director, the Board of Directors may designate a substitute nominee. In that case, the proxies will be voted for the substitute nominee or nominees to be designated by the Board of Directors. If no substitute nominees are available, the size of the Board of Directors will be reduced.

There are no arrangements or understandings between Wilshire Bancorp and any person pursuant to which such person has been elected as a director.

Set forth below is certain information with respect to each nominee for election as a Class I director:

Name | Age | Position Held with Wilshire Bancorp |

| Steven Koh | 59 | Class I Director and Chairman of the Board |

| Gapsu Kim | 49 | Class I Director |

| Fred Mautner | 75 | Class I Director |

| Donald Byun | 53 | Class I Director |

| | | |

Business Experience of Nominees

Steven Koh. Mr. Koh has served as a director of Wilshire State Bank since 1986, and as Chairman of Wilshire State Bank’s Board since 1993. Mr. Koh was appointed as a Director and Chairman of the Wilshire Bancorp Board upon Wilshire Bancorp’s formation in December 2003. In addition to his activities at Wilshire State Bank and Wilshire Bancorp, Mr. Koh has served as Chairman of Pacific Steel Corporation in Los Angeles since 1997. Mr. Koh holds a B.S. degree in Business Administration from Yonsei University.

Gapsu Kim. Mr. Kim has been a member of the Wilshire State Bank Board of Directors since March 2004, and was appointed to the Wilshire Bancorp Board as a Class I Director in connection with the holding company reorganization in August 2004. Mr. Kim has served as the Chief Executive Officer of Investrade Industries Corporation, an export and general trading company, since 1999. Mr. Kim holds a B.A. degree from Yonsei University.

Fred Mautner. Mr. Mautner has served as a member of Wilshire State Bank’s Board of Directors since 1981, and was appointed to the Wilshire Bancorp Board as a Class I Director in connection with the holding company reorganization in August 2004. Formerly, Mr. Mautner practiced as a Certified Public Accountant. Mr. Mautner holds a B.S. degree in finance and a J.D. from UCLA.

Donald Byun. Mr. Byun was appointed to the Board of Directors of Wilshire State Bank and Wilshire Bancorp as a Class I Director in connection with the holding company reorganization in August 2004. Mr. Byun has served as the president of OTO Sportswear, Inc., a sportswear manufacturer, based in Gardena, California, since 1988. In addition, Mr. Byun served as an independent member of the board of directors of Pacific Union Bank from April 2000 until its sale in April 2004. Mr. Byun holds a B.S. in economics from the Yonsei University College of Commerce and Economics in Seoul, Korea, and attended an MBA program at the University of Hawaii.

Vote Required

Directors are elected by apluralityof the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Nominees do not need to receive a majority to be elected.

Board Recommendation

The Board of Directors recommends that shareholders voteFOR the election of the four nominees for directors assigned to Class I of the Board of Directors.

OtherDirectors and Executive Officers

The following table sets forth information concerning our Class II and Class III directors and our executive officers:

Name | Age | Position Held with Wilshire Bancorp |

| Soo Bong Min | 67 | Class III Director, President and Chief Executive Officer |

| Mel Elliot | 79 | Class II Director |

| Larry Greenfield, M.D. | 61 | Class III Director |

| Kyu-Hyun Kim | 70 | Class III Director |

| Richard Lim | 72 | Class II Director |

| Young Hi Pak | 56 | Class III Director |

| Harry Siafaris | 72 | Class II Director |

| Brian Cho | 45 | Chief Financial Officer and Executive Vice President |

| Joanne Kim | 50 | Chief Lending Officer and Executive Vice President |

| | | |

Soo Bong Min. Mr. Min has served as a director and President and Chief Executive Officer of Wilshire State Bank since 1999, and was appointed a Class III Director and President and Chief Executive Officer of Wilshire Bancorp upon its formation in December 2003. From 1994 to 1999, Mr. Min served as President of Hanmi Bank in Los Angeles, California. Mr. Min holds a B.A. degree from Seoul University.

Mel Elliot. Mr. Elliot has served as a member of the Wilshire State Bank Board of Directors since 1981, and was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. In 2004, Mr. Elliot founded Elliot Manhattan, LLC, a real estate development company of which he is the sole owner. Mr. Elliot is a graduate of the Bentley School of Accounting and Finance in Boston, Massachusetts.

Larry Greenfield, M.D. Dr. Greenfield has served as a member of the Wilshire State Bank Board of Directors since 2000, and was appointed a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Dr. Greenfield, a retired medical doctor, has been involved in real estate investing, development, and financing for over 30 years. He is the owner of the real estate corporation, 2240 Yucca, Inc. Dr. Greenfield holds a B.A. in Psychology from USC, and a M.D. from the Finch University of Health Sciences/The Chicago Medical School.

Kyu-Hyun Kim. Mr. Kim has served as a member of the Wilshire State Bank Board of Directors since 1994, and was appointed a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Kim formerly served as President and Chief Executive Officer of KEI Trading Co, Inc. Mr. Kim holds a B.A. degree from the Seoul National University College of Law.

Richard Lim. Mr. Lim has served as a member of the Wilshire State Bank Board of Directors since 1981, and was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Lim has been the owner and manager of High Society Tailor since 1968. Mr. Lim took business courses at Pacific State University for two years.

Young Hi Pak. Ms. Pak has served as a member of the Wilshire State Bank Board of Directors since 1994, and was appointed a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Ms. Pak has served as Vice President and Controller of Eden Marketing Corporation, an import/export company, since 1982, and Vice President of Eden Restaurant Supply since 2002. Ms. Pak holds a B.S. degree from Young-Nam University.

Harry Siafaris. Mr. Siafaris has served as a member of Wilshire State Bank Board of Directors since 1980, was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Siafaris has owned and operated Astro Restaurant since 1981 and Jan’s Restaurant since 1984. Mr. Siafaris is also a real estate investor.

Brian E. Cho. Mr. Cho has served as Senior Vice President and Chief Financial Officer of Wilshire State Bank since March 1995, and was appointed to the same positions with Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Cho was promoted to Executive Vice President of Wilshire Bancorp in March 2005. Mr. Cho, a certified public accountant, received the Elijah Watt Sells Award Gold Medal in 1988, and received his B.S. in Business Administration from Hong-Ik University in Seoul, Korea in 1983, and his M.S. in accountancy from California State University, Northridge in 1989.

Joanne Kim. Ms. Kim has been Senior Vice President and Chief Lending Officer of Wilshire State Bank since August 1999, and was appointed Senior Vice President with Wilshire Bancorp in connection with the holding company reorganization in August 2004. Ms. Kim was promoted to Executive Vice President of Wilshire Bancorp in March 2005. Previously, she served as Senior Vice President and Branch Manager of Hanmi Bank from 1995 until 1999. Ms. Kim holds a B.A. degree from Korea University.

CORPORATE GOVERNANCE REFORMS

Because our common stock is traded on the Nasdaq National Market, we are subject to a host of new corporate governance and related requirements under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), the SEC’s rules implementing Sarbanes-Oxley and the enhanced corporate governance listing standards of The Nasdaq Stock Market, Inc.

Sarbanes-Oxley, which was enacted on July 30, 2002 to address questionable corporate and accounting practices, imposes on public companies a variety of new requirements, prohibitions and disclosure obligations, including, but not limited to:

| · | certifications by the chief executive officer and chief financial officer as to the accuracy and adequacy of periodic reports filed with the SEC; |

| · | implementation and evaluation of our systems of disclosure controls and procedures and internal control over financial reporting; |

| · | auditing related restrictions, including prohibition on auditors providing certain non-audit services to public companies, mandatory audit partner rotation and restrictions on hiring employees of former auditors; |

| · | independence requirements and increased responsibilities for the audit committee, including responsibility for the engagement of our auditor, pre-approval of all services provided by the auditor, establishment of procedures for addressing accounting-related complaints and company disclosure of whether any member of the audit committee qualifies as an “audit committee financial expert”; |

| · | disclosure of whether we have a code of ethics applicable to the chief executive officer and senior financial officers; and |

| · | prohibition on the extension of personal loans to executive officers and directors (subject to certain exemptions). |

In addition, The Nasdaq Stock Market, Inc. implemented a number of additional listing requirements concerning director independence, board nominations, executive compensation and related corporate governance matters.

Corporate Governance Principles and Board Matters

We are committed to having sound corporate governance principles, both at the holding company level and at Wilshire State Bank. Such principles are essential to running our business efficiently and to maintaining our integrity in the marketplace. We have adopted a set of Corporate Governance Guidelines that embodies these principles. Wilshire Bancorp and Wilshire State Bank have also adopted a Personal and Business Code of Conduct that applies to all officers, directors, employees and consultants, in accordance with the applicable Nasdaq rules. In addition, our Chief Executive Officer and all senior financial officers, including the Chief Financial Officer, are bound by a separate Code of Professional Conduct for the Chief Executive Officer and Senior Financial Officers that complies with Item 406 of Regulation S-K of the Securities Exchange Act of 1934 (the “Exchange Act”) and with the applicable Nasdaq rules. Our Corporate Governance Guidelines, Personal and Business Code of Conduct, and Code of Professional Conduct for the Chief Executive Officer and Senior Financial Officers are posted on our Internet website (www.wilshirebank.com) under the Investor Relations page.

Director Compensation

Meetings of our Board of Directors are held each month, generally on the same day as meetings of the Wilshire State Bank Board. Each member of our Board of Directors also serves on Wilshire State Bank’s Board. Prior to August 2004, directors received $2,000 per month, and the Chairman of the Board received $9,000 per month, for their service on the Board of Directors of Wilshire State Bank. These payments were changed in August 2004 to $2,500 and $5,000 per month for directors and the Chairman, respectively. Non-employee directors also receive fees of $350 per meeting for attendance at Wilshire State Bank Board committee meetings, except for the Director Loan Committee, for which attendance compensation is not provided. The Chairman of the Audit Committee receives $1,000 per month in addition to the monthly director fee and Committee meeting fees. Directors are not paid additional fees for their service on the Wilshire Bancorp Board or its committees.

We entered into Deferred Compensation Agreements in 1983 and 1984 with certain of our directors, including Harry Siarfaris, a current director. Pursuant to the Deferred Compensation Agreements, the directors elected to defer certain directors' fees in exchange for specified benefits over a period of ten years beginning at age 65. The only payments under the Deferred Compensation Agreements made in 2004 to a current director were in the amount of $879 per month to Mr. Siafaris. It is anticipated that we will eventually be reimbursed for payments made under the Deferred Compensation Agreements through the proceeds of life insurance policies previously purchased by us on the participating directors, which policies name us as beneficiary.

Board Independence

Our Board of Directors has determined that each of our current directors, except Messrs. Min and Elliot, is independent under the applicable Nasdaq rules. Mr. Min currently serves as our President and Chief Executive Officer. Mr. Elliot formerly served as Corporate Secretary of Wilshire State Bank until he resigned in that capacity in June 2002. Nasdaq rules provide that a director of a company is not “independent” if he was an executive officer of that company within the past three years.

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business or banking. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties for us. Each director must represent the interests of all shareholders. When considering potential director candidates, the Board also considers the candidate’s character, judgment, diversity, age, skills, including financial literacy and experience in the context of our needs and the needs of the Board of Directors.

Independent Director Meetings

At least twice a year, the independent members of our Board of Directors meet separately from the full Board of Directors and outside the presence of our management in executive session.

Shareholder Communications with Our Board of Directors

Our Board of Directors has established a process for shareholders to communicate with the Board of Directors or with individual directors. Shareholders who wish to communicate with our Board of Directors or with individual directors should direct written correspondence to our Corporate Secretary at our principal executive offices located at 3200 Wilshire Blvd., Los Angeles, California 90010. Any such communication must contain:

| · | a representation that the shareholder is a holder of record of our capital stock; |

| · | the name and address, as they appear on our books, of the shareholder sending such communication; and |

| · | the class and number of shares of our capital stock that are beneficially owned by such shareholder. |

The Corporate Secretary will forward such communications to our Board of Directors or the specified individual director to whom the communication is directed unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or to take appropriate legal action regarding such communication.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board has 11 directors and the following committees: Audit; Nominations and Corporate Governance; and Human Resources. Each of our directors also serves on the Board of Wilshire State Bank. The Wilshire State Bank Board has the following committees: Director Loan, Asset/Liability Management and CRA.

The membership during 2004 and the function of each of the committees are described below. Since the holding company reorganization in August 2004, our Board of Directors has generally met in conjunction with the monthly meetings of the Board of Directors of Wilshire State Bank. During the fiscal year 2004, our Board held three meetings and the Wilshire State Bank Board held 13 meetings. Each director attended at least 75% of the total of all Board and applicable committee meetings. Directors are encouraged to attend annual meetings of our shareholders. Eleven directors attended the last annual meeting of our shareholders.

Committees ofWilshire Bancorp

Audit Committee

Our Board of Directors has established an Audit Committee to assist the Board in fulfilling its responsibilities for general oversight of the integrity of our consolidated financial statements, compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, the performance of independent auditors and our internal audit function, and risk assessment and risk management. The duties of the Audit Committee include:

| · | appointing, evaluating and determining the compensation of our independent auditors; |

| · | reviewing and approving the scope of the annual audit, the audit fee and the financial statements; |

| · | reviewing disclosure controls and procedures, internal control over financial reporting, the internal audit function and corporate policies with respect to financial information; |

| · | reviewing other risks that may have a significant impact on our financial statements; |

| · | preparing the Audit Committee report for inclusion in the annual proxy statement; |

| · | establishing procedures for the receipt, retention and treatment of complaints regarding accounting and auditing matters; and |

| · | evaluating annually the Audit Committee charter. |

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from us for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

Our Board of Directors has adopted a written charter for the Audit Committee meeting applicable standards of the SEC and Nasdaq. The members of the Audit Committee are Fred Matuner, Larry Greenfield, Kyu-Hyun Kim, and Donald Byun. Mr. Mautner serves as Chairman of the Audit Committee. The Audit Committee meets regularly and held six meetings during fiscal year 2004.

The Board of Directors has determined that the Audit Committee satisfies the independence and other composition requirements of the SEC and Nasdaq. Our Board has determined that Mr. Mautner qualifies as an “audit committee financial expert” under Item 401(h) of Regulation S-K under the Exchange Act, and has the requisite accounting or related financial expertise required by applicable Nasdaq rules. Mr. Mautner formerly practiced as a Certified Public Accountant.

A copy of our Audit Committee charter is attached asAnnex A and can also be found our Internet website (www.wilshirebank.com) under the Investor Relations page.

Human Resources Committee

Our Human Resources Committee discharges the Board’s responsibilities relating to compensation of our Chief Executive Officer, other executive officers and directors, produces an annual report on executive compensation for inclusion in our annual proxy statement, and provides general oversight of compensation structure. Other specific duties and responsibilities of the Human Resources Committee include:

| · | reviewing and approving objectives relevant to executive officer compensation; |

| · | evaluating performance and determining the compensation of our Chief Executive Officer and other executive officers in accordance with those objectives; |

| · | reviewing employment agreements for executive officers; |

| · | recommending to the Board the compensation for our directors; and |

| · | evaluating human resources and compensation strategies. |

Our Board of Directors has not adopted a written charter for our Human Resources Committee. The Human Resources Committee is composed of nine directors, Harry Siafaris, Young Hi Pak, Steven Koh, Kyu-Hyun Kim, Fred Mautner, Larry Greenfield, Richard Lim, Donald Byun, and Gapsu Kim, each of whom the Board has determined is independent under applicable rules and regulations of the SEC, Nasdaq and the Internal Revenue Service. Forrest Stichman was also a member of the Human Resource Committee during the 2004 fiscal year, but retired as a Director of the Company effective March 31, 2005. Mr. Siafaris serves as the Committee’s Chairman. The Human Resources Committee held two meetings during the fiscal year 2004.

Nominations andCorporate Governance Committee

Our Board has established a Nominations and Corporate Governance Committee for the purpose of reviewing all Board-recommended and shareholder-recommended nominees, determining each nominee’s qualifications and making a recommendation to the full Board as to which persons should be our Board’s nominees. Our Board has adopted a written charter for the Nominations and Corporate Governance Committee, a copy of which is posted on our website (www.wilshirebank.com) on the Investor Relations page. This Committee is composed of three directors, Kyu-Hyun Kim, Fred Mautner, and Larry Greenfield, each of whom the Board has determined is independent under the Nasdaq rules. Mr. Kim serves as the Committee’s Chairman. The Nominations and Corporate Governance Committee held one meeting during the fiscal year 2004. The duties and responsibilities of the Nominations and Corporate Governance Committee include:

| · | identifying and recommending to our Board individuals qualified to become members of our Board and to fill vacant Board positions; |

| · | recommending to our Board the director nominees for the next annual meeting of shareholders; |

| · | recommending to our Board director committee assignments; |

| · | reviewing and evaluating succession planning for our Chief Executive Officer and other executive officers; |

| · | monitoring the continuing education program for our directors; and |

| · | evaluating annually the Nominations and Corporate Governance Committee charter. |

Our Board of Directors believes that it is necessary that the majority of our Board of Directors be comprised of independent directors and that it is desirable to have at least one audit committee financial expert serving on the Audit Committee. The Nominations and Corporate Governance Committee considers these requirements when recommending Board nominees. Our Nominations and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. Our Nominations and Corporate Governance Committee will regularly assess the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or other circumstances. When considering potential director candidates, the Nominations and Corporate Governance Committee also considers the candidate’s character, judgment, age, skills, including financial literacy, and experience in the context of our needs, the needs of Wilshire Bancorp and the existing directors. While the Nominations and Corporate Governance Committee has the authority to do so, we have not, as of the date of this proxy statement, paid any third party to assist in identifying and evaluating Board nominees.

Our Board of Directors has established a procedure whereby our shareholders can nominate potential director candidates. The Nominations and Corporate Governance Committee will consider director candidates recommended by our shareholders in a similar manner as those recommended by members of management or other directors, provided the shareholder submitting such nomination has complied with procedures set forth in our amended and restated bylaws. See“Shareholder Director Nominations and Other Proposals for the Next Annual Meeting of Shareholders- Consideration of Director Nominees,” for additional information regarding shareholder nominations of director candidates.

No candidate for election to our Board has been recommended within the preceding year by a beneficial owner of 5% or more of our common stock who is not also a director of the Company.

Director Loan Committee

The Board of Directors of Wilshire State Bank has established a Director Loan Committee that monitors the activities of the Bank’s lending function utilizing information presented to it by management at regular meetings. This includes, but is not limited to, the review of trends in outstanding credit relationships, key quality measures, significant borrowing relationships, large problem loans, industry concentrations, all significant lending policies, and the adequacy of the allowance for loan losses. The Director Loan Committee also reviews lending-related reports from regulators, auditors, and internal personnel.

Each member of the Bank’s Board of Directors, except for Mr. Min, is also a member of the Director Loan Committee, and Kyu Hyun Kim serves as Chairman of the Committee. The Director Loan Committee held 46 meetings during fiscal 2004

Asset/Liability Management Committee

The Asset/Liability Management Committee of the Wilshire State Bank Board of Directors reviews, identifies and classifies the Bank’s assets based on credit risk, in accordance with regulatory guidelines. The Committee is also responsible for reviewing asset valuation and classification policies, as well as developing and monitoring asset disposition. In addition, the Committee reviews and monitors the Bank’s investment portfolio, liquidity position and the risk of our interest-earning assets in comparison to its interest-bearing liabilities.

Each member of the Bank’s Board of Directors also serves on the Asset/Liability Management Committee. Forrest Stichman served as Chairman of the Committee during the 2004 fiscal year, but retired as a Director of Wilshire Bancorp on March 31, 2005. Donald Byun is the current Chairman of the Committee. The Committee held 12 meetings during fiscal 2004.

Community Reinvestment Act Committee

The Community Reinvestment Act Committee, or CRA Committee, of the Wilshire State Bank Board of Directors is responsible for oversight of Wilshire State Bank’s performance under the requirements of the Federal Community Reinvestment Act of 1977 and similar state law requirements. The CRA Committee is composed of seven

directors, Mel Elliot, Richard Lim, Harry Siafaris, Fred Mautner, Young Hi Pak, Gapsu Kim and Soo Bong Min. Forrest Stichman was a member of the Committee during fiscal 2004, but retired as a Director on March 31, 2005. Mr. Elliot serves as Chairman of the Committee. The CRA Committee held four meetings during fiscal 2004.

REPORT OF THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

In accordance with its written charter, which was approved in its current form by the Board of Directors on August 25, 2004, the Audit Committee assists the Board in, among other things, oversight of our financial reporting process, including the effectiveness of our internal accounting and financial controls and procedures, and controls over the accounting, auditing, and financial reporting practices. A copy of the Audit Committee charter is attached to this proxy statement asAnnex A.

Our Board of Directors has determined that all four members of the Audit Committee meet the independence and experience requirements under the rules of the Nasdaq Stock Market.

Management is responsible for the financial reporting process, the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, the system of internal controls and procedures designed to insure compliance with accounting standards and applicable laws and regulations. Our independent auditors are responsible for auditing the financial statements. The Audit Committee’s responsibility is to monitor and review these processes and procedures. In accordance with the Audit Committee Charter, the Audit Committee acts only in an oversight capacity and relies, without independent verification, on the information provided to us and on the representations made by management that the financial statements have been prepared with integrity and objectivity and on the representations of management and the opinion of our independent registered public accounting firm that such financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America.

The Audit Committee recommended the engagement of Deloitte & Touche, LLP as our independent registered accounting firm for fiscal year 2004.

During fiscal 2004, the Audit Committee had six meetings. The Audit Committee’s regular meetings were conducted so as to encourage communication among the members of the Audit Committee, management, the internal auditors, and our independent registered public accounting firm, Deloitte & Touche LLP. Among other things, the Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee separately met with each of the internal and independent auditors, with and without management, to discuss the results of their examinations and their observations and recommendations regarding our internal controls. The Audit Committee also discussed with our independent auditors all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.”

The Audit Committee reviewed and discussed our audited consolidated financial statements as of and for the year ended December 31, 2004 with management, the internal auditors, and our independent registered public accounting firm. Management’s discussions with the Audit Committee included a review of critical accounting policies.

The Audit Committee obtained from the independent registered public accounting firm a formal written statement describing all relationships between us and our auditors that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee discussed with the independent registered public accounting firm any relationships that may have an impact on their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee has reviewed and approved the amount of fees paid to Deloitte & Touche for audit and non-audit services. The Audit Committee concluded that the provision of services by Deloitte & Touche is compatible with the maintenance of Deloitte & Touche’s independence.

At each of its six meetings during 2004, the Audit Committee met with members of senior management and the independent registered public accounting firm to review the certifications provided by the Chief Executive Officer and Chief Financial Officer under the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC and the overall certification process. At these meetings, company officers reviewed each of the Sarbanes-Oxley certification requirements concerning internal control over financial reporting and any fraud, whether or not material, involving management or other employees with a significant role in internal control over financial reporting.

Based on the above-mentioned review and discussions with management, the internal auditors and the independent registered public accounting firm, and subject to the limitations on our role and responsibilities described above and in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the SEC.

Audit Committee of the Board of Directors

Fred Matuner (Chairman)

Larry Greenfield

Kyu-Hyun Kim

Donald Byun

Dated: March 9, 2005

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock as of March 31, 2005 by (1) each of our directors, (2) each of our Named Executive Officers, and (3) all of our directors and Named Executive Officers as a group. Other than our Chairman, Steven Koh, we do not know of any shareholder who is the beneficial owner of more than 5% of the outstanding shares of our common stock.

Beneficial ownership is determined according to the rules of the SEC and generally includes any shares over which a person possesses sole or shared voting or dispositive power and options that are currently exercisable or exercisable within 60 days (listed below as “Vested Option Shares.” Each director, officer or 5% or more shareholder known to us, as the case may be, has furnished to us information with respect to beneficial ownership. Except as otherwise indicated in the footnotes to this table, we believe that the beneficial owners of common stock listed below, based on information each of them has provided to us, have sole voting and dispositive power with respect to their shares.

The table lists applicable percentage ownership based on 28,571,080 shares of common stock outstanding as of March 31, 2005. Shares of common stock subject to options currently exercisable or exercisable within 60 days of March 31, 2005 are deemed outstanding for the purpose of calculating the percentage ownership of the person holding these options, but are not treated as outstanding for the purpose of calculating the percentage ownership of any other person. Unless otherwise noted, the address for each shareholder listed below is: c/o Wilshire Bancorp, Inc., 3200 Wilshire Blvd., Los Angeles, California 90010.

| | | | | Common Stock Beneficially Owned(1) | |

Beneficial Owner | | Shares Beneficially Owned(a) | | Vested Option

Shares(b) | | Total (a) & (b) | | Percentage of Shares Beneficially Owned | |

| | | | | | | | | | |

Directors and Named Executive Officers: | | | | | | | | | |

| Steven Koh | | | 5,998,280 | | | | | | 5,998,280 | | | 20.99 | % |

| Mel Elliott | | | 729,820 | | | 120,000 | | | 849,820 | | | 2.96 | % |

| Larry Greenfield | | | 1,274,876 | | | | | | 1,274,876 | | | 4.46 | % |

| Kyu-Hyun Kim | | | 645,320 | | | | | | 645,320 | | | 2.26 | % |

| Richard Y. Lim | | | 736,748 | | | | | | 736,748 | | | 2.58 | % |

| Fred F. Mautner | | | 1,186,728 | | | 210,596 | | | 1,397,324 | | | 4.85 | % |

| Soo Bong Min | | | 495,134 | | | 96,566 | | | 591,700 | | | 2.06 | % |

| Young H. Pak | | | 726,846 | | | | | | 726,846 | | | 2.54 | % |

| Harry Siafaris | | | 394,126 | | | | | | 394,126 | | | 1.38 | % |

| Gapsu Kim | | | 241,000 | | | | | | 241,000 | | | 0.84 | % |

| Donald Byun | | | 179,050 | | | | | | 179,050 | | | 0.63 | % |

| Brian E. Cho | | | 60,660 | | | 5,920 | | | 66,580 | | | 0.23 | % |

| Joanne Kim | | | 93,760 | | | 7,200 | | | 100,960 | | | 0.35 | % |

| | | | | | | | | | | | | | |

| All officers and directors as a group (13) | | | 13,143,184 | | | 440,282 | | | 13,583,466 | | | 46.82 | % |

| (1) | Except as otherwise noted, may include shares held by such person’s spouse (except where legally separated) and minor children, and by any other relative of such person who has the same home; shares held in “street name” for the benefit of such person; shares held by a family or living trust as to which such person is a trustee and primary beneficiary with sole voting and investment power (or shared power with a spouse); or shares held in an Individual Retirement Account or pension plan as to which such person is the sole beneficiary. |

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table sets forth all compensation received during the three years ended December 31, 2004 by our Chief Executive Officer and each of the other most highly compensated executive officers whose total compensation exceeded $100,000 in such fiscal year. These three officers are referred to as the Named Executive Officers in this proxy statement.

| | | Annual Compensation | | Long-term Compensation | | All Other Compensation(6) | |

Name andPrincipal Position | | Year | | Salary(1)(2) | | Bonus(3) | | Other Annual

Compensation(4) | | Securities

Underlying Options(5) | | | |

Soo Bong Min. Chief Executive Officer and President | | | 2004 2003 2002 | | $ | 225,833 215,834 205,840 | | $ | 260,000 220,000 210,000 | | $ | 26,490 24,000 21,950 | | $ | ¾ 40,000 88,000 | | $ | 5,646 5,396 5,146 | |

Brian Cho Executive Vice President and Chief Financial Officer | | | 2004 2003 2002 | | $ | 109,692 104,848 102,608 | | $ | 77,532 51,149 35,172 | | | ¾ ¾ ¾ | | | ¾ ¾ 17,600 | | $ | 3,156 3,145 3,078 | |

Joanne Kim Executive Vice President and Chief Lending Officer | | | 2004 2003 2002 | | $ | 126,504 121,604 119,507 | | $ | 110,334 80,251 52,957 | | | ¾ ¾ ¾ | | | ¾ ¾ 22,000 | | $ | 3,660 3,319 3,335 | |

| (1) | Includes portions of these individual’s salaries which were deferred pursuant to our 401(k) Plan. The 401(k) Plan permits all participants to contribute up to 15% of their annual salary on a pre-tax basis (subject to a statutory maximum). |

| (2) | Amounts shown do not include amounts expended by Wilshire State Bank pursuant to plans (including group life and health) that do not discriminate in scope, terms or operation in favor of the executive officer and that are generally available to all salaried employees. |

| (3) | Amount includes bonus accrued, but paid in following year. |

| (4) | Does not include the value of perquisites or other personal benefits because the amount of such benefits does not exceed the lesser of $50,000 or 10% of total amount of annual salary and bonus of any named individual. |

| (5) | Figures in the table have been retroactively adjusted to reflect a two-for-one stock split in August 2002, the 10% stock dividend in May 2003, and 100% stock dividends in December 2003 and December 2004. |

| (6) | Consists entirely of Wilshire Bancorp’s matching contributions to the 401(k) Plan. Wilshire Bancorp’s contributions are discretionary (subject to specified limits), but in all three years amounted to 50% of employee contributions up to a maximum of 6% of the employee’s salary for the year. |

Stock Option Grants in 2004

No stock options were granted to the Named Executive Officers during 2004.

Year End 2004 Option Values

The following table provides information about stock options exercised in 2004 and options held as of December 31, 2004 by each of the Named Executive Officers. All share information is retroactively adjusted for stock dividends and stock splits. Actual gains on exercise, if any, will depend on the value of our common stock on the date on which the shares are sold.

| | | | Shares

Acquired | | | | | | Number of Securities

Underlying Unexercised

Options at December 31, 2004(2) | | Value of Unexercised In-The-Money Options at

December 31, 2004(2)(3) | |

| Name | | | on

Exercise | | | Value

Realized(1) | | | Exercisable | | | Unexercisable | | | Exercisable | | | Unexercisable | |

| Soo Bong Min | | | 170,134 | | $ | 1,792,396 | | | 93,866 | | | 40,000 | | $ | 1,352,879 | | $ | 480,300 | |

| Brian Cho | | | 38,720 | | | 516,417 | | | 14,080 | | | 7,040 | | | 213,284 | | | 98,361 | |

| Joanne Kim | | | 65,120 | | | 556,767 | | | 18,480 | | | 8,800 | | | 274,760 | | | 122,952 | |

___________________

| (1) | “Value Realized” is the difference between the exercise price and the market price on the exercise date, multiplied by the number of options exercised. “Value Realized” numbers do not necessarily reflect what the executive might receive if he or she sells the shares acquired by the option exercise, since the market price of the shares at the time of sale may be higher or lower than the price on the exercise date of the option. In addition, the “Value Realized” numbers do not reflect the tax impact of the exercise. |

| (2) | “Exercisable” refers to those options which were both exercisable and vested while “Unexercisable” refers to those options which were unvested as of December 31, 2004. |

| (3) | “Value of Unexercised In-the-Money Options” is the aggregate, calculated on a grant by grant basis, of the product of the number of unexercised options at the end of 2004 multiplied by the difference between the exercise price for the grant and the year-end market price, excluding grants for which the difference is equal to or less than zero. |

Stock Option Plan

Our 1997 Stock Option Plan, intended to advance the interests of the Wilshire Bancorp by encouraging stock ownership on the part of key employees, was approved by the shareholders on May 20, 1997 and amended by the shareholders on April 26, 2000 to increase the number of shares subject to the Plan to 4,326,894 shares (as adjusted for stock splits and dividends). Wilshire Bancorp assumed all obligations under the 1997 Stock Option Plan in connection with the holding company reorganization in August 2004, and all options granted under the 1997 Stock Option Plan became options to purchase shares of Wilshire Bancorp common stock. As of March 31, 2005, 845,662 shares of common stock were issuable in connection with the exercise of outstanding options and 882,720 shares remained available for option grants under the 1997 Stock Option Plan.

The 1997 Stock Option Plan is intended to provide our directors, executive officers and employees the opportunity to acquire a proprietary interest in the success of Wilshire Bancorp by granting stock options to such directors, executive officers and employees. Specifically, the plan is intended to advance the interests of Wilshire Bancorp by:

| · | enabling us to attract and retain the best available individuals for positions of substantial responsibility; |

| · | providing additional incentive to such persons by affording them an opportunity for equity participation in our business; and |

| · | rewarding directors, executive officers and employees for their contributions to our business. |

The 1997 Stock Option Plan is administered by our Board of Directors. The Board of Directors has authority with respect to the stock option plan to:

| · | adopt, amend and rescind administrative and interpretive rules relating to the plan; |

| · | accelerate the time of exercisability of any stock option that has been granted; |

| · | construe the terms of the plan and any related agreement (including those terms governing eligibility); and |

| · | make all other determinations and perform all other acts necessary or advisable for administering the plan, including the delegation of such ministerial acts and responsibilities as the Human Resources Committee deems appropriate. |

Both “Incentive Stock Options” and “Nonstatutory Options” may be granted under the 1997 Stock Option Plan from time to time. Incentive Stock Options are stock options intended to satisfy the requirements of Section 422 of the Internal Revenue Code. Nonstatutory Options are stock options that do not satisfy the requirements of Section 422 of the Internal Revenue Code.

All options are granted at an exercise price of not less than 100% of the fair market value of the stock on the date of grant. Each option expires not later than ten years from the date the option was granted. Options are exercisable in installments as provided in individual stock option agreements; provided, however, that if an optionee fails to exercise his or her rights under the options within the year such rights arise, the optionee may accumulate them and exercise the same at any time thereafter during the term of the option.

Employment Contracts

We entered into an employment agreement with Soo Bong Min effective June 1, 2003, for a term of four years, at an annual base salary of $220,000 for the first year, and $230,000 annually for the second, third and fourth years of the term. Mr. Min will also be entitled to an incentive bonus for each year of the agreement’s term equal to 8% of our pre-tax earnings exceeding 18% of our beginning primary capital for the year; provided, however, that in no event shall such bonus be more than the amount of Mr. Min’s annual base salary. Mr. Min is also entitled to medical and life insurance benefits, certain stock options, and reimbursement for business expenses, including expenses associated with his use of an automobile, which are reasonably and necessarily incurred in the performance of his duties. In the event of termination without cause by us, Mr. Min is entitled to receive the balance of the salary due under the agreement or six months’ severance pay, whichever is less.

Survivor Income Agreements; Bank-Owned Life Insurance Policies

In 2003, the Wilshire State Bank Board of Directors adopted a Survivor Income Plan for the benefit of our directors and officers to encourage their continued employment and service with Wilshire State Bank and to reward them for their past service and contribution. Wilshire State Bank has also entered into separate Survivor Income Agreements with its officers and directors relating to the Survivor Income Plan. Under the terms of the Survivor Income Plan, each participant is entitled to a base amount of death proceeds as set forth in the participant’s Election to Participate, which base amount increases three percent per calendar year, but only until normal retirement age, which is 65, and is grossed up for taxes using the Wilshire State Bank’s state and federal effective tax rate for the preceding calendar year. If the participant remains employed by Wilshire State Bank after age 65, the death benefit will be fixed at the amount determined at age 65. If a participant has attained age 65 prior to becoming a participant in the Survivor Income Plan, the death benefit shall be equal to the base amount set forth in their Election to Participate with no increases. Wilshire State Bank is obligated to pay any death benefit owing under the Survivor Income Plan in a lump sum within 90 days following the participant’s death.

The participant’s rights under the Survivor Income Plan terminate upon termination of employment with Wilshire State Bank. Upon termination of employment (except for termination for cause), the participant will have the option to convert the amount of death benefit calculated at such termination of employment date to a split dollar arrangement, provided such arrangement is available under bank regulation or tax law. If available, Wilshire State Bank and the participant will enter into a split dollar agreement and split dollar policy endorsement. Under such an arrangement, we would annually impute income to the officer or director based on tax law or rules in force upon conversion.

Forrest Stichman, Fred Mautner and Mel Elliot, who failed to qualify for Wilshire State Bank’s selected insurer’s standard or preferred-rate death benefit provided by the Survivor Income Plan, will receive payments from Wilshire State Bank in the amount of $5,000, payable annually, until their death in lieu of participating in the Survivor Income Plan.

In order to fund Wilshire State Bank’s obligations under the Survivor Income Plan, Wilshire State Bank purchased bank-owned life insurance policies covering the lives of our directors and certain officers with an aggregate face amount of $10.5 million. Wilshire State Bank is the sole owner of the policies, the primary beneficiary of the life insurance policies and recognizes the increase of the cash surrender value of the policies as tax-exempt other income.

The following table summarizes the amount of the supplemental death benefit each director and named executive officer is entitled to receive under the Survivor Income Plan:

Director or Executive Officer | | Initial Pre-Retirement

Death Benefit | | Post-Retirement

Death Benefit | |

| | | | | | |

| Larry D. Greenfield | | $ | 300,000 | | $ | 358,216 | |

| Kyu Hyum Kim | | | 300,000 | | | 300,000 | |

| Steven Koh | | | 1,000,000 | | | 1,229,874 | |

| Richard Y. Lim | | | 300,000 | | | 300,000 | |

| Young Hi Pak | | | 300,000 | | | 403,175 | |

| Harry Siafaris | | | 300,000 | | | 300,000 | |

| Brian Cho | | | 300,000 | | | 574,831 | |

| Soo Bong Min | | | 1,000,000 | | | 1,000,000 | |

| Joanne Kim | | | 300,000 | | | 481,412 | |

| | | | | | | | |

REPORT OF THEHUMAN RESOURCES COMMITTEE OF THE BOARD OF DIRECTORS

The Human Resources Committee of the Board determined the compensation of the Named Executive Officers in the Summary Compensation Table for the years in question. The Human Resources Committee has furnished the following report on executive compensation in connection with the Annual Meeting:

Compensation Philosophy

As members of the Human Resources Committee, it is our duty to administer the executive compensation program for Wilshire Bancorp. The Human Resources Committee is responsible for establishing appropriate compensation goals for the executive officers of Wilshire Bancorp, evaluating the performance of such executive officers in meeting such goals and making recommendations to the Board with regard to executive compensation. Wilshire Bancorp’s compensation philosophy is to ensure that executive compensation be directly linked to continuous improvements in corporate performance, achievement of specific operation, financial and strategic objectives, and increases in shareholder value. The Human Resources Committee regularly reviews the compensation packages of Wilshire Bancorp’s executive officers, taking into account factors which it considers relevant, such as business conditions within and outside the industry, Wilshire Bancorp’s financial performance, the market composition for executives of similar background and experience, and the performance of the executive officer under consideration. The particular elements of Wilshire Bancorp’s compensation programs for executive officers are described below.

Compensation Structure

The base compensation for the executive officers of Wilshire Bancorp named in the Summary Compensation Table is intended to be competitive with that paid in comparable situated industries, taking into account the scope of responsibilities. The goals of the Human Resource Committee in establishing Wilshire Bancorp’s executive compensation program are:

| · | to compensate the executive officers of Wilshire Bancorp fairly for their contributions to Wilshire Bancorp’s short, medium and long-term performance; and |

| · | to allow Wilshire Bancorp to attract, motivate and retain the management personnel necessary to Wilshire Bancorp’s success by providing an executive compensation program comparable to that offered by companies with which Wilshire Bancorp competes for management personnel. |

The base salary level for each officer is determined by taking into account individual experience, individual performance, individual potential, cost of living consideration and specific issues particular to Wilshire Bancorp. Base salary level for executive officers of selected banks and bank holding companies of similar size are taken into consideration in setting an appropriate base salary for the Named Executive Officers of Wilshire Bancorp. The base level established for each executive officer is considered by the Human Resources Committee to be competitive and reasonable.

The Human Resources Committee monitors the base salary levels and the various incentives of the executive officers of Wilshire Bancorp to ensure that overall compensation is consistent with Wilshire Bancorp’s objectives and remains competitive within the area of Wilshire Bancorp’s operations. In setting the goals and measuring an executive’s performance against those goals, Wilshire Bancorp considers the performance of its competitors and general economic and market conditions. None of the factors included in Wilshire Bancorp’s strategic and business goals are assigned a specific weight. Instead, the Human Resources Committee recognizes that the relative importance of these factors may change in order to adapt Wilshire Bancorp’s operations to specific business challenges and to reflect changing economic and marketplace conditions.

With the exception of the Chief Executive Officer, Wilshire Bancorp’s practice is not to provide employment contracts to any of its executive officers. If any additional employment contracts should ever be considered necessary and beneficial to Wilshire Bancorp, such a contract would require individual assessment by the Board of Directors.

Incentive Compensation

The annual compensation of the executive officers of Wilshire Bancorp consists of a base salary and discretionary bonus payments. Except for the Chief Executive Officer, who receives a bonus pursuant to his employment agreement based on the attainment of certain pre-tax earnings, the Board issues bonuses to our executive officers periodically throughout the year based on the financial performance of the company and the individual performance of the officer.

Stock Option Plan

Stock options are the primary source of long-term incentive compensation for the executive officers and directors of Wilshire Bancorp. Each of the executive officers and directors of Wilshire Bancorp are eligible to participate in the 1997 Stock Option Plan.

Stock option grants are made at the discretion of the Board. Each grant is designed to align the interests of the executive officer with those of the shareholders and provide each individual with a significant incentive to manage Wilshire Bancorp from the perspective of an owner with an equity stake in the business. Each grant allows the officer to acquire shares of Wilshire Bancorp’s common stock at a fixed price per share (typically, the market price on the grant date) over a specified period of time (up to ten years). Each option becomes exercisable in a series of installments over a four-year period, contingent upon the officer’s continued employment with Wilshire Bancorp. Accordingly, the option will provide a return to the executive officer only if he or she remains employed by Wilshire Bancorp during the vesting period, and then only if the market price of the shares appreciates over the option term.

The size of the option grant to each executive officer is set by the Board at a level that is intended to create a meaningful opportunity for stock ownership based upon the individual’s current position with Wilshire Bancorp, the individual’s personal performance in recent periods and his or her potential for future responsibility and promotion over the option term. The Board also takes into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. The relevant weight given to each of these factors varies from individual to individual. The Board, in conjunction with the

Human Resources Committee, has established certain guidelines with respect to the option grants made to the executive officers, but has the flexibility to make adjustments to those guidelines at its discretion.

Compensation of the Chief Executive Officer

The Company entered into an employment agreement with Soo Bong Min, the Chief Executive Officer of Wilshire Bancorp, effective June 1, 2003, for a term of four years, at an annual base salary of $220,000 for the first year, and $230,000 annually for the second, third and fourth years of the term. Mr. Min will also be entitled to an incentive bonus for each year of the agreement’s term equal to 8% of our pre-tax earnings exceeding 18% of our beginning primary capital for the year; provided, however, that in no event shall such bonus be more than the amount of Mr. Min’s annual base salary. Mr. Min is also entitled to medical and life insurance benefits, certain stock options, and reimbursement for business expenses, including expenses associated with his use of an automobile, which are reasonably and necessarily incurred in the performance of his duties. In the event of termination without cause by us, Mr. Min is entitled to receive the balance of the salary due under the agreement or six months’ severance pay, whichever is less. The Human Resources Committee believes that Mr. Min’s total compensation is reasonable and competitive based on comparative performance information and the overall performance of Wilshire Bancorp.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code (“Section 162(m)”) generally disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers, to the extent that compensation exceeds $1 million per covered officer in any fiscal year. The limitation applies only to compensation that is not considered to be performance-based. The Company generally intends to limit non-performance based compensation to its executive officers consistent with the terms of Section 162(m) so that compensation will not be subject to the $1 million deductibility limit. Cash and other non-performance-based compensation paid to Wilshire Bancorp’s executive officers for fiscal 2004 did not exceed the $1 million limit per officer.

Human Resources Committee Interlocks and Insider Participation

Wilshire State Bank has made loans to some of our Directors, including members of the Human Resources Committee. The loans to such persons were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and did not involve more than the normal risk of collectibility or present other unfavorable features.

Human Resources Committee of the Board of Directors

Harry Siafaris (Chairman)

Steven Koh

Young Hi Pak

Fred Mautner

Kyu-Hyun Kim

Larry Greenfield

Forrest Stichman

Richard Lim

Donald Byun

Gapsu Kim

Dated: March 16, 2005

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Under Section 402 of the Sarbanes-Oxley Act of 2002, it is now unlawful for any issuer to extend, renew or arrange for the extension of credit in the form of a personal loan to or for any director or executive officer of that

issuer. This prohibition does not apply to loans that were made on or prior to July 30, 2002, or certain types of loans described in Section 402 that are:

| · | made available by the issuer in the ordinary course of the issuer’s consumer credit business; |

| · | of a type generally made available by such issuer to the public; and |