UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. _______)

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

WILSHIRE BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

_______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously by written preliminary materials. |

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | | Date Filed: |

| | | |

Wilshire Bancorp, Inc.

3200 Wilshire Blvd.

Los Angeles, California 90010

(213) 387-3200

April 30, 2007

To the Shareholders of Wilshire Bancorp, Inc.:

It is with great pleasure that I extend a cordial invitation to attend the 2007 Annual Meeting of Shareholders of Wilshire Bancorp, Inc. to be held on May 30, 2007 at 10:00 a.m., local time, at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005.

Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting of Shareholders and the attached Proxy Statement.

Your vote is important. Whether or not you plan to attend the meeting, please complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope. Returning the proxy does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting.

We look forward to seeing you at the Annual Meeting.

Very truly yours,

/s/ Soo Bong Min

Soo Bong Min

President and Chief Executive Officer

Wilshire Bancorp, Inc.

Wilshire Bancorp, Inc.

3200 Wilshire Blvd.

Los Angeles, California 90010

(213) 387-3200

April 30, 2007

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 30, 2007

The 2007 Annual Meeting of Shareholders of Wilshire Bancorp, Inc. will be held on May 30, 2007 at 10:00 a.m., local time, at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005, for the following purposes:

| | 1. | The election of four directors assigned to Class III of the Board of Directors of Wilshire Bancorp for three year terms expiring at the 2010 Annual Meeting of Shareholders or until their successors are duly elected and qualified; and |

| | 2. | To transact such other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on April 16, 2007 as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting. Each share of Wilshire Bancorp common stock is entitled to one vote on all matters presented at the Annual Meeting.

Your vote is important. Whether or not you expect to attend the Annual Meeting in person, please vote by completing, signing and dating the enclosed proxy card and returning it promptly in the postage-paid reply envelope provided. The proxy is revocable by you at any time prior to its use at the Annual Meeting. If you are a holder of record, you may also cast your vote in person at the Annual Meeting. If you receive more than one proxy card because your shares are registered in different names or addresses, each proxy card should be signed and returned to ensure that all your shares will be voted at the Annual Meeting. If your shares are held at a brokerage firm or a bank, you must provide them with instructions on how to vote your shares.

By Order of the Board of Directors

/s/ Soo Bong Min

Soo Bong Min

President and Chief Executive Officer

Wilshire Bancorp, Inc.

Los Angeles, California

April 30, 2007

TABLE OF CONTENTS

| | Page |

| |

| ABOUT THE ANNUAL MEETING | 1 |

| PROPOSAL NO. 1 ELECTION OF DIRECTORS | 5 |

| General | 5 |

| Business Experience of Nominees | 5 |

| Vote Required | 6 |

| Board Recommendation | 6 |

| Other Directors and Executive Officers | 6 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | 8 |

| Board Independence | 8 |

| Director Qualifications | 8 |

| Independent Director Meetings | 8 |

| Shareholder Communications with Our Board of Directors | 8 |

| Board Structure and Committee Composition | 9 |

| Committees of Wilshire Bancorp | 9 |

| Audit Committee | 9 |

| Human Resources Committee | 10 |

| Nominations and Corporate Governance Committee | 10 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 11 |

| PRINCIPAL AUDITOR FEES AND SERVICES | 13 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 13 |

| COMPENSATION DISCUSSION & ANALYSIS | 14 |

| Executive Officer Compensation Program | 15 |

| Compensation Program Philosophy | 15 |

| Compensation Program Objectives and Rewards | 15 |

| Compensation Program Oversight and Implementation | 16 |

| Review of Named Executive Officers performance | 16 |

| Role of Named Executive Officers in Compensation Decisions | 16 |

| Peer Group and Compensation Targets | 16 |

| Compensation Program Elements | 17 |

| Base Salaries | 17 |

| Incentive Bonus Payments | 18 |

| Long-term incentive payments through stock option grants | 18 |

| Health and welfare benefits | 18 |

| Survivor Income Agreements; Bank-Owned Life Insurance Policies | 19 |

| Tax Implications of Executive Compensation | 20 |

| Severance Plan | 20 |

| Stock Ownership Guidelines | 21 |

| Hedging Policies | 21 |

| Compensation Recovery Policy | 21 |

EXECUTIVE COMPENSATION - SUMMARY TABLE | 22 |

| Grant of Plan-Based Awards | 22 |

| Outstanding Equity Awards at Fiscal Year End | 23 |

| Option Exercises and Stock Vested | 24 |

| Pension Benefits | 25 |

| Non-Qualified Deferred Compensation | 25 |

| DIRECTOR COMPENSATION | 25 |

| Cash Compensation Paid to Board Members | 25 |

| HUMAN RESOURCES COMMITTEE REPORT | 26 |

| HUMAN RESOURCES COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 27 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 27 |

| Policy and Procedures on Related Person Transaction | 27 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 27 |

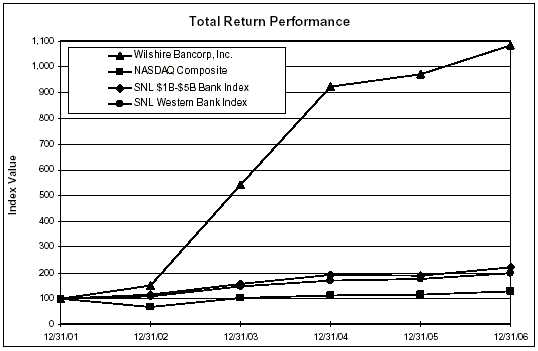

| STOCK PERFORMANCE GRAPH | 28 |

| OTHER MATTERS | 29 |

SHAREHOLDER DIRECTOR NOMINATIONS AND OTHER PROPOSALS FOR THE NEXT ANNUAL MEETING OF SHAREHOLDERS | 29 |

| Consideration of Director Nominees | 29 |

| Consideration of Other Shareholder Proposals | 30 |

| 30 |

| APPROVAL OF THE BOARD OF DIRECTORS | 31 |

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 30, 2007

We are providing these proxy materials in connection with Wilshire Bancorp’s 2007 Annual Meeting of Shareholders. This proxy statement and the accompanying proxy card were first mailed to the shareholders on or about April 30, 2007. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

ABOUT THE ANNUAL MEETING

| Q: | Who is soliciting my vote? |

| A: | The Board of Directors of Wilshire Bancorp is soliciting your vote at the 2007 Annual Meeting of Shareholders. |

| Q: | What is the purpose of the Annual Meeting? |

| A: | You will be voting on the election of four directors assigned to Class III of the Board of Directors. |

We will also consider any other business that may properly come before the meeting.

Q: | What are the Board of Director’s recommendations? |

| A: | The Board of Directors recommends a vote: |

For the election of the four nominees for directors assigned to Class III of the Board of Directors.

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | The Board of Directors set April 16, 2007 as the record date for the Annual Meeting (the “record date”). All shareholders who owned Wilshire Bancorp common stock at the close of business on the record date may attend and vote at the Annual Meeting. |

| Q: | How many votes do I have? |

| A: | You will have one vote for each share of Wilshire Bancorp common stock you owned at the close of business on the record date, provided those shares are either held directly in your name as the shareholder of record or were held for you as the beneficial owner through a broker, bank or other nominee. |

| Q: | What is the difference between holding shares as a shareholder of record and beneficial owner? |

| A: | Most shareholders of Wilshire Bancorp hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Shareholder of Record. If your shares are registered directly in your name with Wilshire Bancorp’s transfer agent, U.S. Stock Transfer Corporation, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you by Wilshire Bancorp. As the shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you request, complete and deliver a proxy from your broker, bank or nominee. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares.

| A. | Your vote is important. You may vote by mail or by attending the Annual Meeting and voting by ballot. If you choose to vote by mail, simply mark your proxy, date and sign it, and return it to our transfer agent, U.S. Stock Transfer Corporation, in the postage-paid envelope provided. |

Submitting your completed proxy card will not limit your right to vote at the Annual Meeting if you attend the meeting and vote in person. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

The shares represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy card will be voted as recommended by the Board of Directors.

| Q. | How many votes can be cast by all shareholders? |

| A. | Each share of Wilshire Bancorp common stock is entitled to one vote. There is no cumulative voting. We had 29,368,896 shares of common stock outstanding and entitled to vote on the record date. |

| Q: | How many votes must be present to hold the Annual Meeting? |

| A: | A majority of Wilshire Bancorp’s outstanding shares as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or a proxy card has been properly submitted by you or on your behalf. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. |

| Q: | How many votes are required to elect directors? |

| A: | Directors are elected by a plurality of the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Nominees do not need to receive a majority to be elected. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those nominees indicated. Your shares will be counted for purposes of determining whether there is a quorum, but it will have no effect on the election of those nominees. |

| Q: | What if I do not vote for the items listed on my proxy card? |

| A: | If you hold shares in your name and you return your signed proxy card in the enclosed envelope but do not mark selections, it will be voted in accordance with the recommendations of the Board of Directors. If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by our Board of Directors, or if no recommendation is given, in their own discretion. |

If you are a beneficial owner and hold your shares in street name through a broker and do not return the voting instruction card, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the uncontested election of directors.

| Q: | Can I change or revoke my vote after I return my proxy card? |

| A: | Yes. Even if you sign the proxy card in the form accompanying this proxy statement, you retain the power to revoke your proxy. You can revoke your proxy at any time before it is exercised by giving written notice to the Corporate Secretary of Wilshire Bancorp specifying such revocation. |

| Q: | What does it mean if I receive more than one proxy? |

| A: | It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy cards you receive. |

| Q: | Who can attend the Annual Meeting? |

| A: | All shareholders as of the record date, or their duly appointed proxies, may attend. |

| Q: | What do I need to bring to the Annual Meeting and when should I arrive? |

| A: | In order to be admitted to the Annual Meeting, a shareholder must present proof of ownership of Wilshire Bancorp stock on the record date. If your shares are held in the name of a bank, broker or other holder of record, a brokerage statement or letter from a bank or broker is an example of proof of ownership. Any holder of a proxy from a shareholder must present the proxy card, properly executed, to be admitted. Shareholders and proxy holders must also present a form of photo identification such as a driver’s license. |

The Annual Meeting will be held at the Oxford Palace Hotel, 745 South Oxford Avenue, Los Angeles, California 90005. Admission to the Annual Meeting will be limited. In order to ensure that you are seated by the commencement of the Annual Meeting at 10:00 a.m., we recommend you arrive early.

| Q: | Who pays for the proxy solicitation and how will Wilshire Bancorp solicit votes? |

| A: | We will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request brokers and nominees who hold shares of our common stock in their names to furnish proxy material to beneficial owners of the shares. We may reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners. |

| Q: | How can I obtain a copy of Wilshire Bancorp’s 2006 Annual Report on Form 10-K? |

| A: | A copy of our 2006 Annual Report is being mailed with this proxy statement to each shareholder of record. Upon written request to the Corporate Secretary of Wilshire Bancorp, Inc., 3200 Wilshire Blvd., Los Angeles, California 90010, any shareholder may obtain a copy of our annual report on Form 10-K, including the financial statements and the financial statement schedules attached thereto, at no charge. Our annual report on Form 10-K is also accessible through our website at www.wilshirebank.com. |

Q: | Is a list of shareholders available? |

| A: | The names of shareholders of record entitled to vote at the Annual Meeting will be available to shareholders entitled to vote at this meeting for ten days prior to the meeting for any purpose relevant to the meeting. This list can be viewed between the hours of 9:00 a.m. and 5:00 p.m. at our principal executive offices at 3200 Wilshire Blvd., Los Angeles, California 90010. Please contact Wilshire Bancorp’s Corporate Secretary to make arrangements. |

| Q: | How do I find out the voting results? |

| A: | Preliminary voting results will be announced at the Annual Meeting, and the final voting results will be published in our Quarterly Report on Form 10-Q for the quarter ending June 30, 2007, which we will file with the SEC. |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our articles of incorporation provide that the terms of office of the members of our Board of Directors be divided into three classes, Class I, Class II and Class III, the members of which serve for a staggered three-year term. The terms of the current Class I, Class II and Class III directors are set to expire at the Annual Meeting of Shareholders in 2008, 2009 and 2007, respectively. Four directors serve in each class except for Class II, which has three directors.

While the size of our Board of Directors is set at 12, there are currently only 11 members of the Board of Directors as a result of the retirement of Forrest Stichman in March 2005. Although there is currently a vacancy on the Board, you may not vote for a greater number of persons than the number of nominees named in this proxy statement. The Board of Directors, along with the assistance of the Nominating and Corporate Governance Committee, has considered, and continues to consider, whether to fill the current vacancy on the Board. At this time, the Board of Directors has determined not to fill such vacancy. In the event such appointment is made, however, the newly appointed director will be elected by the Board to serve on one of the three classes of our Board until that class is next up for re-election by our shareholders.

At the Annual Meeting, four directors comprising the Class III directors are to be elected. The Board of Directors has proposed the nominees listed below for election as Class III directors to serve until the 2010 Annual Meeting or until their successors are duly elected and qualified. All of the nominees listed below currently serve as Class III directors on our Board of Directors and all of the nominees were recommended for re-election by the Nominating and Governance Committee of our Board of Directors.

Unless otherwise specified in the accompanying form of proxy, proxies solicited hereby will be voted for the election of the nominees listed below. Each of the nominees has agreed to serve for a three-year term. If any of them should become unable to serve as a director, the Board of Directors may designate a substitute nominee. In that case, the proxies will be voted for the substitute nominee or nominees to be designated by the Board of Directors. If no substitute nominees are available, the size of the Board of Directors will be reduced.

There are no arrangements or understandings between Wilshire Bancorp and any person pursuant to which such person has been elected as a director.

Set forth below is certain information with respect to each nominee for election as a Class III director:

Name | | Age | | Position Held with Wilshire Bancorp |

| Soo Bong Min | | 69 | | Class III Director, President and Chief Executive Officer |

| Larry Greenfield, M.D. | | 63 | | Class III Director |

| Kyu-Hyun Kim | | 72 | | Class III Director |

| Young Hi Pak | | 58 | | Class III Director |

Business Experience of Nominees

Soo Bong Min. Mr. Min has served as a director and President and Chief Executive Officer of Wilshire State Bank since 1999, and was appointed a Class III Director and President and Chief Executive Officer of Wilshire Bancorp upon its formation in December 2003. From 1994 to 1999, Mr. Min served as President of Hanmi Bank in Los Angeles, California. Mr. Min holds a B.A. degree from Seoul National University.

Larry Greenfield, M.D. Dr. Greenfield has served as a member of the Wilshire State Bank Board of Directors since 2000, and was appointed a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Dr. Greenfield, a retired medical doctor, has been involved in real estate investing, development, and financing for over 30 years. He is the owner of the real estate corporation, 2240 Yucca, Inc. Dr. Greenfield holds a B.A. in Psychology from USC, and a M.D. from the Finch University of Health Sciences/The Chicago Medical School.

Kyu-Hyun Kim. Mr. Kim has served as a member of the Wilshire State Bank Board of Directors since 1994, and was appointed a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Kim formerly served as President and Chief Executive Officer of KEI Trading Co, Inc. Mr. Kim holds a B.A. degree from the Seoul National University College of Law.

Young Hi Pak. Ms. Pak has served as a member of the Wilshire State Bank Board of Directors since 1994, and was appointed as a Class III Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Ms. Pak has served as Vice President and Controller of Eden Marketing Corporation, an import/export company, since 1982, and Vice President of Eden Restaurant Supply since 2002. Ms. Pak holds a B.S. degree from Young-Nam University.

Vote Required

Directors are elected by a plurality of the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Nominees do not need to receive a majority to be elected.

Board Recommendation

The Board of Directors recommends that shareholders vote FOR the election of the four nominees for directors assigned to Class III of the Board of Directors.

Other Directors and Executive Officers

The following table sets forth information concerning our Class I and Class II directors, as well as our executive officers:

Name | | Age | | Position Held with Wilshire Bancorp |

| Steven Koh | | 61 | | Class I Director and Chairman of the Board |

| Donald Byun | | 54 | | Class I Director |

| Gapsu Kim | | 51 | | Class I Director |

| Fred Mautner | | 77 | | Class I Director |

| Mel Elliot | | 81 | | Class II Director |

| Richard Lim | | 74 | | Class II Director |

| Harry Siafaris | | 74 | | Class II Director |

| Soo Bong Min | | 69 | | President and Chief Executive Officer |

| Brian E. Cho | | 47 | | Chief Financial Officer and Executive Vice President |

| Sung Soo Han | | 49 | | SBA Manager and Executive Vice President |

| Joanne Kim | | 52 | | Chief Lending Officer and Executive Vice President |

Steven Koh. Mr. Koh has served as a director of Wilshire State Bank since 1986, and as Chairman of Wilshire State Bank’s Board since 1993. Mr. Koh was appointed as a Director and Chairman of the Wilshire Bancorp Board upon Wilshire Bancorp’s formation in December 2003. In addition to his activities at Wilshire State Bank and Wilshire Bancorp, Mr. Koh has served as Chairman of Pacific Steel Corporation in Los Angeles since 1997 and Chairman of the Koh Charitable Foundation since 2005. Mr. Koh holds a B.S. degree in Business Administration from and was awarded an honorary doctorial degree in Business Administration in 2006 by Yonsei University.

Donald Byun. Mr. Byun was appointed to the Board of Directors of Wilshire State Bank, and was appointed as a Class I Director of Wilshire Bancorp, in connection with the holding company reorganization in August 2004. Mr. Byun has served as the president of OTO Sportswear, Inc., a sportswear manufacturer, based in Gardena, California, since 1988. In addition, Mr. Byun served as an independent member of the Board of Directors of Pacific Union Bank from April 2000 until its sale in April 2004. Mr. Byun holds a B.S. in Economics from the Yonsei University College of Commerce and Economics in Seoul, Korea, and attended an MBA program at the University of Hawaii.

Gapsu Kim. Mr. Kim has been a member of the Wilshire State Bank Board of Directors since March 2004, and was appointed to the Wilshire Bancorp Board as a Class I Director in connection with the holding company reorganization in August 2004. Mr. Kim has served as the Chairman of Illisis Inc., an intelligent video surveillance design and manufacturer, since 2006. Previously, he served as the Chief Executive Officer of Investrade Industries Corporation, an export and general trading company, from 1999 to 2006. Mr. Kim holds a B.A. degree from Yonsei University.

Fred Mautner. Mr. Mautner has served as a member of Wilshire State Bank’s Board of Directors since 1981, and was appointed a Class I Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Formerly, Mr. Mautner practiced as a Certified Public Accountant. Mr. Mautner holds a B.S. degree in Finance and a J.D. from the University of California at Los Angeles.

Mel Elliot. Mr. Elliot has served as a member of the Wilshire State Bank Board of Directors since 1981, and was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. In 2004, Mr. Elliot founded Elliot Manhattan, LLC, a real estate development company of which he is the sole owner. Mr. Elliot is a graduate of the Bentley School of Accounting and Finance in Boston, Massachusetts.

Richard Lim. Mr. Lim has served as a member of the Wilshire State Bank Board of Directors since 1981, and was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Lim has been the owner and manager of High Society Tailor since 1968. Mr. Lim took business courses at Pacific State University for two years.

Harry Siafaris. Mr. Siafaris has served as a member of Wilshire State Bank Board of Directors since 1980, and was appointed a Class II Director of Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Siafaris has owned and operated Astro Restaurant since 1981 and Jan’s Restaurant since 1984. Mr. Siafaris is also a real estate investor.

Brian E. Cho. Mr. Cho has served as Senior Vice President and Chief Financial Officer of Wilshire State Bank since March 1995, and was appointed to the same positions with Wilshire Bancorp in connection with the holding company reorganization in August 2004. Mr. Cho was promoted to Executive Vice President of Wilshire Bancorp in March 2005. Mr. Cho, a Certified Public Accountant, received the Elijah Watt Sells Award Gold Medal in 1988, and received his B.S. in Business Administration from Hong-Ik University in Seoul, Korea in 1983, and his M.S. in accountancy from California State University, Northridge in 1989.

Sung Soo Han. Mr. Han has been Senior Vice President and Manager of Wilshire State Bank SBA Department since May 2000, and was promoted to Executive Vice President of Wilshire State Bank in March 2005. Mr. Han was appointed as Executive Vice President of Wilshire Bancorp in January 2006. Previously, he served as Senior Vice President and SBA Department Manager of Hanmi Bank from 1991 until 2000. Mr. Han holds a B.A. degree from Yonsei University.

Joanne Kim. Ms. Kim has been Senior Vice President and Chief Lending Officer of Wilshire State Bank since August 1999, and was appointed Senior Vice President with Wilshire Bancorp in connection with the holding company reorganization in August 2004. Ms. Kim was promoted to Executive Vice President of Wilshire Bancorp in March 2005. Previously, she served as Senior Vice President and Branch Manager of Hanmi Bank from 1995 until 1999. Ms. Kim holds a B.A. degree from Korea University.

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

We are committed to having sound corporate governance principles, both at the holding company level and at Wilshire State Bank. Such principles are essential to running our business efficiently and to maintaining our integrity in the marketplace. We have adopted a set of Corporate Governance Guidelines that embodies these principles. Wilshire Bancorp and Wilshire State Bank have also adopted a Personal and Business Code of Conduct that applies to all officers, directors, employees and consultants, in accordance with the applicable NASDAQ rules. In addition, our Chief Executive Officer and all senior financial officers, including the Chief Financial Officer, are bound by a separate Code of Professional Conduct for the Chief Executive Officer and Senior Financial Officers that complies with Item 406 of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and with the applicable NASDAQ rules. Our Corporate Governance Guidelines, Personal and Business Code of Conduct, and Code of Professional Conduct for the Chief Executive Officer and Senior Financial Officer are posted on our Internet website (www.wilshirebank.com) under the Investor Relations page.

Board Independence

Our Board of Directors has determined that each of our current directors, except Mr. Min, is independent under the applicable NASDAQ rules. Mr. Min currently serves as our President and Chief Executive Officer.

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business or banking. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties for us. Each director must represent the interests of all shareholders. When considering potential director candidates, the Board also considers the candidate’s character, judgment, diversity, age, skills, including financial literacy and experience in the context of our needs and the needs of the Board of Directors.

Independent Director Meetings

At least twice a year, the independent members of our Board of Directors meet separately from the full Board of Directors and outside the presence of our management in executive session. The Board of Directors held ten such executive sessions during the fiscal year 2006.

Shareholder Communications with Our Board of Directors

Our Board of Directors has established a process for shareholders to communicate with the Board of Directors or with individual directors. Shareholders who wish to communicate with our Board of Directors or with individual directors should direct written correspondence to our Corporate Secretary at our principal executive offices located at 3200 Wilshire Blvd., Los Angeles, California 90010. Any such communication must contain:

| · | a representation that the shareholder is a beneficial owner of our capital stock; |

| · | the name and address of the shareholder sending such communication; and |

| · | the class and number of shares of our capital stock that are beneficially owned by such shareholder. |

The Corporate Secretary will forward such communications to our Board of Directors or the specified individual director to whom the communication is directed unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or to take appropriate legal action regarding such communication.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board has 11 directors and the following committees: Audit, Nominations and Corporate Governance, and Human Resources. Each of our directors also serves on the Board of Wilshire State Bank.

The membership during 2006 and the function of each of the committees are described below. Our Board of Directors generally meets in conjunction with the monthly meetings of the Board of Directors of Wilshire State Bank. During the fiscal year 2006, our Board held 21 meetings and the Wilshire State Bank Board held 14 meetings. Each director attended at least 75% of the total of all Board and applicable committee meetings. Directors are encouraged to attend annual meetings of our shareholders, although we have no formal policy on director attendance at annual shareholders’ meetings. All directors attended the last annual meeting of our shareholders.

Committees of Wilshire Bancorp

Audit Committee

Our Board of Directors has established an Audit Committee to assist the Board in fulfilling its responsibilities for general oversight of the integrity of our consolidated financial statements, compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, the performance of independent auditors and our internal audit function, and risk assessment and risk management. The duties of the Audit Committee include:

| · | appointing, evaluating and determining the compensation of our independent auditors; |

| · | reviewing and approving the scope of the annual audit, the audit fee and the financial statements; |

| · | reviewing disclosure controls and procedures, internal control over financial reporting, the internal audit function and corporate policies with respect to financial information; |

| · | reviewing other risks that may have a significant impact on our financial statements; |

| · | preparing the Audit Committee report for inclusion in the annual proxy statement; |

| · | establishing procedures for the receipt, retention and treatment of complaints regarding accounting and auditing matters; and |

| · | evaluating annually the Audit Committee charter. |

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from us for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

Our Board of Directors has adopted a written charter for the Audit Committee meeting applicable standards of the SEC and NASDAQ. The members of the Audit Committee are Donald Byun, Larry Greenfield, Kyu-Hyun Kim and Fred Mautner. Mr. Mautner serves as Chairman of the Audit Committee. The Audit Committee meets regularly and held ten meetings during fiscal year 2006.

The Board of Directors has determined that each of the members of the Audit Committee satisfies the independence and other composition requirements of the SEC and NASDAQ. Our Board has determined that Mr. Mautner qualifies as an “audit committee financial expert” under Item 407(d)(5) of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”), and has the requisite accounting or related financial expertise required by applicable NASDAQ rules. Mr. Mautner formerly practiced as a Certified Public Accountant.

A copy of our Audit Committee charter can be found on our Internet website (www.wilshirebank.com) under the Investor Relations page.

Human Resources Committee

Our Human Resources Committee discharges the Board’s responsibilities relating to compensation of our Chief Executive Officer and other executive officers, approves an annual report on executive compensation for inclusion in this annual proxy statement, and provides general oversight of compensation structure. Other specific duties and responsibilities of the Human Resources Committee include:

| · | reviewing and approving objectives relevant to executive officer compensation; |

| · | evaluating performance and determining the compensation of our executive officers in accordance with those objectives; |

| · | reviewing employment agreements for executive officers and making recommendations to the Board of Directors concerning such employment agreements; and |

| · | evaluating human resources and compensation strategies. |

Our Board of Directors has not adopted a written charter for our Human Resources Committee. The Human Resources Committee is composed of ten directors, Donald Byun, Mel Eliot, Larry Greenfield, Gapsu Kim, Kyu-Hyun Kim, Steven Koh, Richard Lim, Fred Mautner, Young Hi Pak, and Harry Siafaris, each of whom the Board has determined is independent under applicable rules and regulations of the SEC, NASDAQ and the Internal Revenue Service. Mr. Siafaris serves as the Committee’s Chairman. The Human Resources Committee held five meetings during the fiscal year 2006.

Nominations and Corporate Governance Committee

Our Board has established a Nominations and Corporate Governance Committee for the purpose of reviewing all Board-recommended and shareholder-recommended nominees, determining each nominee’s qualifications and making a recommendation to the full Board as to which persons should be our Board’s nominees. Our Board has adopted a written charter for the Nominations and Corporate Governance Committee, a copy of which is posted on our website (www.wilshirebank.com) under the Investor Relations page. This Committee is composed of five directors, Kyu-Hyun Kim, Fred Mautner, Steven Koh, Harry Siafaris, and Larry Greenfield, each of whom the Board has determined is independent under the NASDAQ rules. Mr. Kim serves as the Committee’s Chairman. The Nominations and Corporate Governance Committee held two meetings during the fiscal year 2006. The duties and responsibilities of the Nominations and Corporate Governance Committee include:

| · | identifying and recommending to our Board individuals qualified to become members of our Board and to fill vacant Board positions; |

| · | recommending to our Board the director nominees for the next annual meeting of shareholders; |

| · | recommending to our Board director committee assignments; |

| · | recommending to the Board the compensation for our directors; and |

| · | reviewing and evaluating succession planning for our Chief Executive Officer and other executive officers; |

| · | monitoring the continuing education program for our directors; and |

| · | evaluating annually the Nominations and Corporate Governance Committee charter. |

Our Board of Directors believes that it is necessary that the majority of our Board of Directors be comprised of independent directors and that it is desirable to have at least one audit committee financial expert serving on the Audit Committee. The Nominations and Corporate Governance Committee considers these requirements when recommending Board nominees. Our Nominations and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. Our Nominations and Corporate Governance Committee will regularly assess the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or other circumstances. When considering potential director candidates, the Nominations and Corporate Governance Committee also considers the candidate’s character, judgment, age, skills, including financial literacy, and experience in the context of our needs, the needs of Wilshire Bancorp and the existing directors. While the Nominations and Corporate Governance Committee has the authority to do so, we have not, as of the date of this proxy statement, paid any third party to assist in identifying and evaluating Board nominees.

Our Board of Directors has established a procedure whereby our shareholders can nominate potential director candidates. The Nominations and Corporate Governance Committee will consider director candidates recommended by our shareholders in a similar manner as those recommended by members of management or other directors, provided the shareholder submitting such nomination has complied with procedures set forth in our amended and restated bylaws. See “Shareholder Director Nominations and Other Proposals for the Next Annual Meeting of Shareholders- Consideration of Director Nominees,” for additional information regarding shareholder nominations of director candidates.

No candidate for election to our Board has been recommended within the preceding year by a beneficial owner of 5% or more of our common stock who is not also a director of the Company.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

In accordance with its written charter, which was approved in its current form by the Board of Directors on August 25, 2004, the Audit Committee assists the Board in, among other things, oversight of our financial reporting process, including the effectiveness of our internal accounting and financial controls and procedures, and controls over the accounting, auditing, and financial reporting practices.

Our Board of Directors has determined that all four members of the Audit Committee meet the independence and experience requirements under the NASDAQ marketplace rules.

Management is responsible for the financial reporting process, the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, the system of internal controls and procedures designed to insure compliance with accounting standards and applicable laws and regulations. Our independent auditors are responsible for auditing the financial statements. The Audit Committee’s responsibility is to monitor and review these processes and procedures. In accordance with the Audit Committee Charter, the Audit Committee acts only in an oversight capacity and relies, without independent verification, on the information provided to the Committee and on the representations made by management that the financial statements have been prepared with integrity and objectivity and on the representations of management and the opinion of our independent registered public accounting firm that such financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America.

The Audit Committee recommended the engagement of Deloitte & Touche, LLP as our independent registered accounting firm for fiscal year 2006.

During fiscal 2006, the Audit Committee had ten meetings. The Audit Committee’s regular meetings were conducted so as to encourage communication among the members of the Audit Committee, management, the internal auditors, and our independent registered public accounting firm, Deloitte & Touche LLP. Among other things, the Audit Committee discussed with our internal auditors and independent registered public accounting firm the overall scope and plans for their respective audits. The Audit Committee separately met with each of our internal auditors and independent registered public accounting firm, with and without management, to discuss the results of their examinations and their observations and recommendations regarding our internal controls. The Audit Committee also discussed with our independent registered public accounting firm all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.”

The Audit Committee reviewed and discussed our audited consolidated financial statements as of and for the year ended December 31, 2006 with management, the internal auditors, and our independent registered public accounting firm. Management’s discussions with the Audit Committee included a review of critical accounting policies.

The Audit Committee obtained from the independent registered public accounting firm a formal written statement describing all relationships between us and our auditors that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee discussed with the independent registered public accounting firm any relationships that may have an impact on their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee has reviewed and approved the amount of fees paid to Deloitte & Touche for audit and non-audit services. The Audit Committee concluded that the provision of services by Deloitte & Touche is compatible with the maintenance of Deloitte & Touche’s independence.

At four of its ten meetings during 2006, the Audit Committee met with members of senior management and the independent registered public accounting firm to review the certifications provided by the Chief Executive Officer and Chief Financial Officer under the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC and the overall certification process. At these meetings, company officers reviewed each of the Sarbanes-Oxley certification requirements concerning internal control over financial reporting and any fraud, whether or not material, involving management or other employees with a significant role in internal control over financial reporting.

Based on the above-mentioned review and discussions with management, the internal auditors and the independent registered public accounting firm, and subject to the limitations on our role and responsibilities described above and in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2006, for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors

Fred Mautner (Chairman)

Donald Byun

Larry Greenfield

Kyu-Hyun Kim

Dated: March 9, 2007

PRINCIPAL AUDITOR FEES AND SERVICES

Our Audit Committee has appointed Deloitte & Touche LLP as our independent auditors for the fiscal years ended December 31, 2005 and 2006. Representatives of Deloitte & Touche are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

The following table shows the fees paid or accrued by us for the audit and other services provided by Deloitte & Touche for fiscal 2006 and 2005.

| | | 2006 | | 2005 | |

| | | | | | |

| Audit Fees | | $ | 580,000 | | $ | 475,000 | |

| Audit-Related Fees | | | 0 | | | 0 | |

| Tax Fees | | | 49,000 | | | 44,000 | |

| All Other Fees | | | 0 | | | 0 | |

| Total | | $ | 629,000 | | $ | 519,000 | |

As defined by the SEC, (i) “audit fees” are fees for professional services rendered by the independent registered public accounting firm for the audit of our annual financial statements and review of financial statements included in our Form 10-Q, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years; (ii) “audit-related fees” are fees for assurance and related services by our principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “audit fees;” (iii) “tax fees” are fees for professional services rendered by our principal accountant for tax compliance, tax advice, and tax planning; and (iv) “all other fees” are fees for products and services provided by our principal accountant, other than the services reported under “audit fees,” “audit-related fees,” and “tax fees.”

Under applicable SEC rules, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent registered public accounting firm in order to ensure that they do not impair the auditors’ independence. The SEC’s rules specify the types of non-audit services that an independent auditor may not provide to its audit client and establish the Audit Committee’s responsibility for administration of the engagement of the independent registered public accounting firm.

Consistent with the SEC’s rules, the Audit Committee Charter requires that the Audit Committee review and pre-approve all audit services and permitted non-audit services provided by the independent registered public accounting firm to us or any of our subsidiaries. The Audit Committee may delegate pre-approval authority to a member of the Audit Committee and if it does, the decisions of that member must be presented to the full Audit Committee at its next scheduled meeting.

The following table sets forth information regarding beneficial ownership of our common stock as of April 16, 2007 by (1) each shareholder known by us to be the beneficial owner of more than 5% of the outstanding shares of our common stock, (2) each of our directors, (3) each of our Named Executive Officers (as defined herein), and (4) all of our directors and Named Executive Officers as a group.

Beneficial ownership is determined according to the rules of the SEC and generally includes any shares over which a person possesses sole or shared voting or dispositive power and options that are currently exercisable or exercisable within 60 days (listed below as “Vested Option Shares”). Each director, officer or 5% or more shareholder known to us, as the case may be, has furnished to us information with respect to beneficial ownership. Except as otherwise indicated in the footnotes to this table, we believe that the beneficial owners of common stock listed below, based on information each of them has provided to us, have sole voting and dispositive power with respect to their shares.

The table lists applicable percentage ownership based on 29,368,896 shares of common stock outstanding as of April 16, 2007. Shares of common stock subject to options currently exercisable or exercisable within 60 days of April 16, 2007 are deemed outstanding for the purpose of calculating the percentage ownership of the person holding these options, but are not treated as outstanding for the purpose of calculating the percentage ownership of any other person. Unless otherwise noted, the address for each shareholder listed below is: c/o Wilshire Bancorp, Inc., 3200 Wilshire Blvd., Los Angeles, California 90010.

| | | Common Stock Beneficially Owned (1) | |

| | | | | | | | | | |

Beneficial Owner | | Shares Beneficially Owned(a) | | Vested Option Shares(b) | | Total (a) & (b) | | Percentage of Shares Beneficially Owned | |

| | | | | | | | | | |

Greater than 5% Shareholders | | | | | | | | | |

FMR Corp. (2) | | | 1,485,900 | | | | | | 1,485,900 | | | 5.06 | % |

| Steven Koh | | | 5,635,407 | | | | | | 5,635,407 | | | 19.19 | % |

Directors and Named Executive Officers: | | | | | | | | | | | | | |

| Donald Byun | | | 179,050 | | | | | | 179,050 | | | 0.61 | % |

| Brian E. Cho | | | 60,660 | | | 15,840 | | | 76,500 | | | 0.28 | % |

| Mel Elliott | | | 738,860 | | | | | | 738,860 | | | 2.59 | % |

| Larry Greenfield | | | 1,027,160 | | | | | | 1,027,160 | | | 3.50 | % |

| Sung Soo Han | | | 61,600 | | | 10,560 | | | 72,160 | | | 0.22 | % |

| Gapsu Kim | | | 256,100 | | | | | | 256,100 | | | 0.87 | % |

| Joanne Kim | | | 64,560 | | | 8,000 | | | 72,560 | | | 0.25 | % |

| Kyu-Hyun Kim | | | 550,320 | | | | | | 550,320 | | | 1.87 | % |

| Richard Y. Lim | | | 558,494 | | | | | | 558,494 | | | 1.90 | % |

| Fred F. Mautner | | | 1,197,324 | | | | | | 1,197,324 | | | 4.08 | % |

| Soo Bong Min | | | 370,922 | | | 167,366 | | | 538,288 | | | 1.82 | % |

| Young H. Pak | | | 647,572 | | | | | | 647,572 | | | 2.20 | % |

| Harry Siafaris | | | 394,126 | | | | | | 394,126 | | | 1.34 | % |

| | | | | | | | | | | | | | |

All executive officers and directors as a group (14) | | | 11,742,155 | | | 201,766 | | | 11,943,921 | | | 40.39 | % |

(1) | Except as otherwise noted, may include shares held by such person’s spouse (except where legally separated) and minor children, and by any other relative of such person who has the same home; shares held in “street name” for the benefit of such person; shares held by a charitable, family or living trust as to which such person is a trustee and primary beneficiary with sole voting and investment power (or shared power with a spouse); or shares held in an Individual Retirement Account or pension plan as to which such person is the sole beneficiary. |

| (2) | The information concerning the shares beneficially owned by FMR Corp. is based upon the Schedule 13G filed with the SEC on February 14, 2007 by FMR Corp. together with Edward C. Johnson 3d, Chairman of FMR Corp. Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp., is the beneficial owner of 1,485,900 shares as a result of acting as investment advisor to various investment companies registered under Section 8 of the Investment Company Act of 1940 (collectively, the “Funds”) which own in the aggregate 1,485,900 shares of the Company’s common stock. Edward C. Johnson 3d, FMR Corp., through its control of Fidelity, and the Funds each has sole power to dispose of the 1,485,900 shares owned by the Funds. Neither Edward C. Johnson 3d nor FMR Corp. has sole power to vote or direct the voting of the shares owned directly by Funds, which power resides with the Board of Trustees of the Funds. The principal business address of FMR Corp., Fidelity, Mr. Johnson and the Funds is 82 Devonshire Street, Boston, Massachusetts 02109. |

COMPENSATION DISCUSSION & ANALYSIS

This is a report of the Company and our senior management team, namely the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”), the Chief Lending Officer (“CLO”), and the SBA Department Manager (“SBA Manager”) (collectively referred to as the “Named Executive Officers” or “NEOs”). It is not the report of the Human Resources Committee. In this “Compensation Discussion and Analysis” section, the terms “we,” “our,” “us,” refer to the Company and, when the context requires, to the Named Executive Officers.

The Human Resources Committee of our Board of Directors (the “HR Committee”) oversees our compensation programs. Our compensation programs include programs designed specifically for our Named Executive Officers.

The Board of Directors established the HR Committee to, among other things, review and recommend the compensation levels of Named Executive Officers, evaluate the performance of Named Executive Officers and consider senior management succession issues and related matters of the Company.

In accordance with the Marketplace Rules of the Nasdaq Stock Market, Inc., the HR Committee is composed entirely of independent, non-management members of the Board of Directors. No HR Committee member participates in any of the Company’s employee compensation programs and none of the HR Committee members have any material business relationships with the Company.

Executive Officer Compensation Program

Compensation Program Philosophy

With the exception of the Chief Executive Officer, the Company’s practice is not to provide employment contracts to any of its executive officers. If any additional employment contracts should ever be considered necessary and beneficial to the Company, such a contract would require individual assessment by the Board of Directors based on a recommendation from the HR Committee.

The Company’s compensation philosophy is to attempt to directly link executive compensation to continuous improvements in corporate performance, achievement of specific operation, financial and strategic objectives, and increases in shareholder value. The HR Committee reviews the compensation packages of the Named Executive Officers, taking into account factors which it considers relevant, such as business conditions within and outside the industry, the Company’s financial performance, the market composition for executives of similar background and experience, and the performance of the executive officer under consideration.

Compensation Program Objectives and Rewards

The primary goal of the Company’s compensation program is to attract, motivate, and retain executives capable of leading the Company in achieving its business objectives. Our Board of Directors believes that compensation should:

| | · | relate to the value created for shareholders by being tied to the financial performance and condition of the Company and each executive officer’s contribution thereto; |

| | · | reward individuals who help the Company achieve its short-term and long-term objectives and thereby contribute significantly to the success of Company; |

| | · | help to attract and retain the most qualified individuals available by being competitive in terms of compensation paid to persons having similar responsibilities and duties in other companies in the same and closely-related industries; and |

| | · | reflect the qualifications, skills, experience and responsibilities of each executive officer. |

The Company uses a compensation framework with multiple payment components to balance various short-term and long-term objectives. This framework is designed to reward favorable total shareholder returns and to balance the Named Executive Officers’ need for current cash and security through compensation such as salary and annual incentives, with the need to align executives’ long-term interests with those of shareholders through compensation such as equity grants. Base salary and perquisites are designed to provide some degree of security to each executive at the base threshold level of compensation, to provide such executives with a reasonable standard of living and a base wage at a level comparable to our peers, and to encourage the executives’ day to day productivity. Annual cash incentives are designed to motivate executives to focus on our annual goals, while long-term incentives are designed to motivate the executives to focus on long-term strategic goals that will produce shareholder value and long-term rewards for the executives.

Compensation Program Oversight and Implementation

The HR Committee, which is composed of ten non-employee directors, is responsible for performing compensation committee functions, as provided under the rules of the SEC, including administration of the compensation of NEOs. The HR Committee exercises independent discretion in respect of executive compensation matters, subject to approval of their recommendations by the Board of Directors.

To carry out the compensation program process, the HR Committee meets once at the beginning of the fiscal year to determine the salary for each NEO. Salary is predominantly based upon the NEOs’ salaries in previous years. However, the HR Committee also considers several other factors when determining salary and other compensation for the NEO’s. Some of those factors are: (a) leadership; (b) performance compared to the financial and strategic goals for each NEO; (c) nature, scope and level of responsibilities; and (d) contribution to the Company’s financial results. Because there is no specific weighting applied to the factors considered, the HR Committee is expected to use its own judgment and expertise in determining appropriate compensation packages that meet the Company’s overall objectives. The HR Committee then compares its results with the Company’s Peer Group (discussed below) and makes any adjustments it believes are necessary to reflect changing market conditions that are witnessed in the Peer Group.

Review of Named Executive Officers performance

Our Board of Directors makes all final compensation decisions for Named Executive Officers, including incentive bonus payments and stock option grants. Annual reviews of the NEOs are presented to the HR Committee for its consideration. Upon review, the HR Committee has the discretion to make recommendations to the Board of Directors regarding each NEO’s compensation.

Role of Named Executive Officers in Compensation Decisions

The HR Committee works with each Named Executive Officer to review each element of his or her compensation. In each case, several factors, such as the scope of responsibilities and experience are taken into account and balance them against competitive salary levels. The HR Committee also reviews the CEO’s annual performance evaluation of each Named Executive Officer, including each executive’s contribution and performance over the past year, strengths, weaknesses, development plans and succession plans.

Peer Group and Compensation Targets

As described above, in order to ensure the Company’s overall Compensation Program is competitive to attract, retain, and motivate the Named Executive Officers, the HR Committee and management review the compensation programs of the three directly competing banks (the “Peer Group”) and those of the banking industry published by the California Department of Financial Institutions and California Bankers Association (the “Industry” data). The Peer Group is used to guide executive compensation levels against community banks that have executive positions with responsibilities similar in scope and have the business network that compete with the Company for executive talent.

Below is a table showing the comparable financial institutions in the Peer Group. The Peer Group includes three direct competitors which are publicly-traded community bank holding companies located in the same metropolitan areas as the Company: Hanmi Financial Corporation, Nara Bancorp., and Center Financial Corporation. In order to remain consistent from year to year, we plan to use this Peer Group as part of our annual marketplace study. On the other hand, because some of the specific financial institutions included in the Peer Group may change their size, relevance or other pertinent factors, the Peer Group could include new or different companies in the future. Industry data includes data published by the California Department of Financial Institutions, by California Bankers Association and by Carpenters and Company that is based on a large pool of financial institutions operating within the State of California. The Peer Group maintains branch network in areas with large number ethnic minority groups such as Los Angeles, New York, Chicago and Dallas metropolitan areas. The HR Committee reviews the data of the Peer Group and the Industry in general (collectively referred to as the “Survey Data”) in order to gauge whether it believes that the overall compensation of the Named Executive Officers is competitive. While the Industry data is relevant to the decision-making process, the Peer Group data is the most relevant factor. The following table outlines some key attributes of our Peer Group:

Peer Group Table1 (in thousands) | |

| | | Revenues($) | | Net Income($) | | Total Assets($) | | Market Cap($) | | 1 yr Shareholder Return | |

| Wilshire | | | 102,976 | | | | 33,942 | | | 2,008,484 | | | | 553,875 | | | | 25.51% | |

| Hanmi | | | 189,364 | | | | 65,649 | | | 3,725,243 | | | | 1,093,496 | | | | 14.33 % | |

| Nara | | | 113,914 | | | | 33,806 | | | 2,048,476 | | | | 546,172 | | | | 20.34 % | |

| Center | | | 93,636 | | | | 26,158 | | | 1,843,312 | | | | 398,683 | | | | 20.70 % | |

1 All financial information in the table above is as of December 31, 2006.

The HR Committee evaluates the NEOs total compensation relative to the total compensation provided by its competitors in the Survey Data. For 2006, the HR Committee determined that the Named Executive Officers’ total compensation was comparable to those of both the Peer Group and the Industry.

Compensation Program Elements

For 2006, the HR Committee determined that the Compensation Program, including the benefits program, for Named Executive Officers should consist of the following: (a) base salaries; (b) incentive bonus payments; (c) long-term incentive compensation through stock option grants; and (d) health, welfare, and survivor income benefits.

Base Salaries

The base salary level for each NEO is determined by taking into account individual experience, individual performance, individual potential, cost of living consideration and specific issues particular to the Company. Base salary levels for executive officers of the Peer Group are taken into consideration in setting an appropriate base salary for the NEOs. The base level established for each executive officer is considered by the HR Committee to be competitive and reasonable. Adjustments to base salaries, if any, are driven primarily by individual performance and comparative data from the Survey Data. In 2006, the HR Committee met twice to determine recommendations of two upward salary adjustments for our NEOs, excluding Mr. Min whose salary is set by his employment agreement, because they determined that our NEOs’ base salaries significantly lagged the salaries of executives with similar responsibilities employed by our competitors in the Survey Data. In order to retain our NEOs, the HR Committee recommended, and the Board of Directors approved, base salaries of $163,800, $174,800, and $157,500 for Mr. Cho, Ms. Kim and Mr. Han, respectively, as of December 31, 2006.

When considering the base salary of the Named Executive Officers, in addition to the Survey Data, the following factors, among others, were considered for 2006: (a) meet earnings per share and profit after tax goals; (b) increase in Loan and Deposit portfolios; (c) development of expansion strategy to the East Coast and successful implementation of the strategy; (d) successful management of personnel; and (e) successful completion of the financial audit and regulatory examinations.

Incentive Bonus Payments

Except for the Chief Executive Officer, who receives a bonus pursuant to his employment agreement based on the attainment of certain pre-tax earnings, the Company issues discretionary incentive bonus payments to the Named Executive Officers periodically throughout the year and in the early part of the following fiscal year, based on the financial performance of the Company and the individual performance of the individual Named Executive Officer. Payment and the amounts of the discretionary incentive bonus payments are based on (1) the Named Executive Officer’s performance against the annual goals set for the Named Executive Officer; (2) the corporate performance measured against the annual corporate goals; and (3) the Survey Data including the peer and the industry performance and compensations. In early 2007, the HR Committee recommended, and the Board of Directors approved, $63,000, $83,000 and $130,000 in incentive bonus payments for key officers based on the 2006 performances of Mr. Cho, Ms. Kim and Mr. Han, respectively. Additionally, Mr. Cho and Ms. Kim received $26,650 and $8,442, respectively, in bonus payments paid as part of the general summer and winter bonuses.

On January 31, 2007, we adopted the Wilshire Bonus Program (the “Bonus Program”) to assist the HR Committee in administering the executive compensation program. Under the Bonus Program, the HR Committee determines the annual bonus pool as a certain percentage of net income before tax and bonus. While there is some flexibility in this computation, the resulting bonus pool is split between a “programmed” portion that is paid as a percentage of monthly salary to all employees, and a “discretionary” portion for the NEOs and other key officers. Going forward, the discretionary bonus payment for NEOs will remain at the recommendation of the HR Committee, subject to approval by the Board of Directors, but the bonus pool from which the bonuses are paid will be determined by a more objective measure.

Long-term incentive payments through stock option grants

The grant of stock options to Named Executive Officers, employees, and directors has generally been made under the Company’s 1997 Stock Option Plan (the “1997 Plan”). From time to time, HR Committee makes recommendations to the full Board of Directors concerning Stock Option grants to Named Executive Officers and employees.

Each stock option permits the Named Executive Officer, generally for a period of five to ten years, to purchase one share of Company stock from the Company at the exercise price, which is the closing price of the Company stock on the date of grant. Stock options have value only to the extent the price of the Company stock on the date of exercise exceeds the exercise price. Stock options granted to executives in 2006 will generally become exercisable in five equal annual installments beginning the grant date. For outside directors, their stock options vested immediately on the date of grant. No stock options were granted to outside directors in 2006. The number of stock options granted to Named Executive Officers, and the value of these awards based on the Black-Scholes pricing model, are shown on the Grant of Plan-Based Awards Table below. Additional information on these grants, including the number of shares subject to each grant, is also shown in the Grants of Plan-Based Awards Table.

The Company’s stock option program is a vital element of our drive to identify, develop and motivate the high-potential leaders who will sustain the Company’s performance. The stock options are used to ensure that the Named Executive Officers’ stock ownerships are at levels high enough to assure the Named Executive Officer’s commitment to the Company and value creation for the stockholders.

Health and welfare benefits

The Company offers a variety of health and welfare programs to all eligible employees. The Named Executive Officers generally are eligible for the same benefit programs on the same basis as the rest of the broad-based employees. The health and welfare programs are intended to protect employees against catastrophic loss and encourage a healthy lifestyle. Our health and welfare programs include medical, pharmacy, dental, vision, life insurance and accidental death and disability.

The Company provides full time employees, regularly scheduled to work 30 or more hours per week, short-term disability, long-term disability and basic life insurance at no cost to the employee. We offer a qualified 401(k) savings and retirement plan. All Company employees, including Named Executive Officers, are generally eligible for the 401(k) plan.

Survivor Income Agreements; Bank-Owned Life Insurance Policies

In 2003, the Wilshire State Bank Board of Directors adopted a Survivor Income Plan for the benefit of our directors and officers to encourage their continued employment and service with Wilshire State Bank and to reward them for their past service and contribution. Wilshire State Bank has also entered into separate Survivor Income Agreements with its officers and directors relating to the Survivor Income Plan. Under the terms of the Survivor Income Plan, each participant is entitled to a base amount of death proceeds as set forth in the participant’s Election to Participate, which base amount increases three percent per calendar year, but only until normal retirement age, which is 65, and is grossed up for taxes using the Wilshire State Bank’s state and federal effective tax rate for the preceding calendar year. If the participant remains employed by Wilshire State Bank after age 65, the death benefit will be fixed at the amount determined at age 65. If a participant has attained age 65 prior to becoming a participant in the Survivor Income Plan, the death benefit shall be equal to the base amount set forth in their Election to Participate with no increases. Wilshire State Bank is obligated to pay any death benefit owing under the Survivor Income Plan in a lump sum within 90 days following the participant’s death.

The participant’s rights under the Survivor Income Plan terminate upon termination of employment with Wilshire State Bank. Upon termination of employment (except for termination for cause), the participant will have the option to convert the amount of death benefit calculated at such termination of employment date to a split dollar arrangement, provided such arrangement is available under bank regulation or tax law. If available, Wilshire State Bank and the participant will enter into a split dollar agreement and split dollar policy endorsement. Under such an arrangement, we would annually impute income to the officer or director based on tax law or rules in force upon conversion.

One of our former directors, Forrest Stichman, and two of our current directors, Fred Mautner and Mel Elliot, each of whom failed to qualify for Wilshire State Bank’s selected insurer’s standard or preferred-rate death benefit provided by the Survivor Income Plan, will receive payments from Wilshire State Bank in the amount of $5,000, payable annually, until their death in lieu of participating in the Survivor Income Plan.

In order to fund Wilshire State Bank’s obligations under the Survivor Income Plan, Wilshire State Bank purchased bank-owned life insurance policies covering the lives of our directors and certain officers with an aggregate face amount of $10.5 million in 2003 and $3 million in 2005. For these amounts, the Company paid a single premium in 2003 and 2005 and has not made any other payments since that time. Wilshire State Bank is the sole owner of the policies, the primary beneficiary of the life insurance policies and recognizes the increase of the cash surrender value of the policies as tax-exempt other income.

The following table summarizes the amount of the supplemental death benefit each director and named executive officer is entitled to receive under the Survivor Income Plan:

Director or Executive Officer | | Initial Pre-Retirement Death Benefit | | Post-Retirement Death Benefit | |

| | | | | | |

2003 Awards | | | | | |

| Brian Cho | | | $ 300,000 | | | $ 574,831 | |

| Larry D. Greenfield | | | 300,000 | | | 358,216 | |

| Sung Soo Han | | | 300,000 | | | 526,052 | |

| Joanne Kim | | | 300,000 | | | 481,412 | |

| Kyu-Hyun Kim | | | 300,000 | | | 300,000 | |

| Steven Koh | | | 1,000,000 | | | 1,229,874 | |

| Richard Y. Lim | | | 300,000 | | | 300,000 | |

| Soo Bong Min | | | 1,000,000 | | | 1,000,000 | |

| Young Hi Pak | | | 300,000 | | | 403,175 | |

| Harry Siafaris | | | 300,000 | | | 300,000 | |

| | | | | | | | |

2005 Awards | | | | | | | |

| | | | | | | | |

| Donald Byun | | | 150,000 | | | 207,635 | |

| Brian Cho | | | 200,000 | | | 361,222 | |

| Sung Soo Han | | | 200,000 | | | 330,570 | |

| Gapsu Kim | | | 150,000 | | | 240,706 | |

| Joanne Kim | | | 200,000 | | | 302,518 | |

Tax Implications of Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to the CEO or any other Named Executive Officers unless the compensation is performance-based compensation as described in Section 162(m) and the related regulations. The Company has qualified certain compensation paid to Named Executive Officers for deductibility under Section 162(m), including (i) certain amounts paid as base salary and incentive bonus, (ii) certain compensation expense related to options granted pursuant to the Company’s 1997 Stock Option Plan. The Company may from time to time pay compensation to our Named Executive Officers that may not be deductible, including discretionary bonuses or other types of compensation outside of our plans.

Although equity awards may be deductible for tax purposes by the Company, the accounting rules pursuant to APB 25 and FAS 123(R) require that the portion of the tax benefit in excess of the financial compensation cost be recorded to paid-in-capital.

Severance Plan

The Company does not have a severance plan in place for any of its Named Executive Officers except for Mr. Min, as described below.

Employment Agreements