The Mosaic Company August 2015 1

Click to edit Master title style 2 This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. Safe Harbor Statement

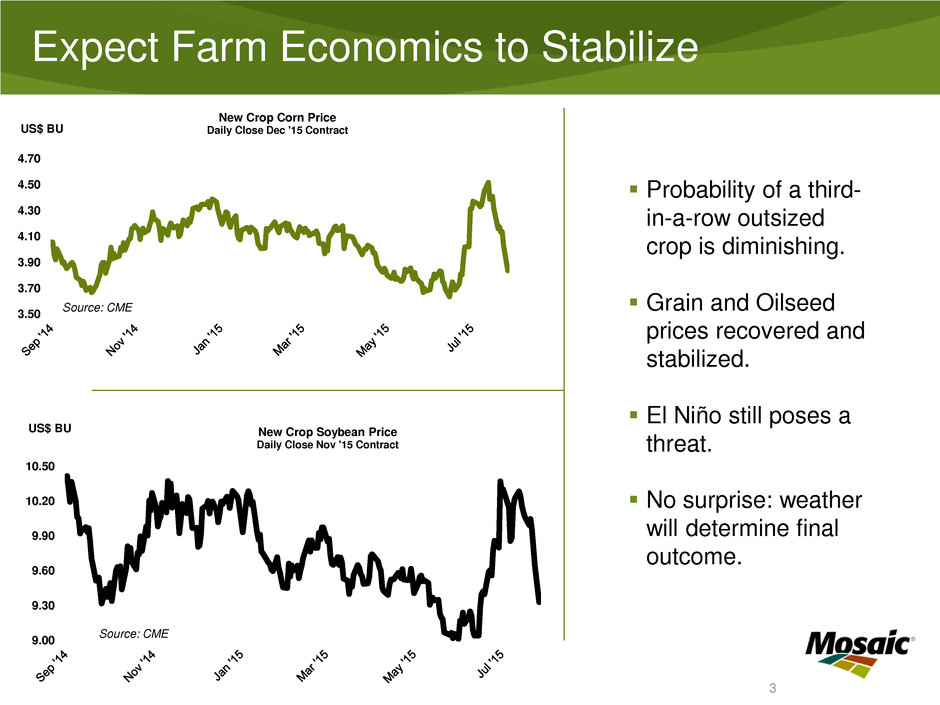

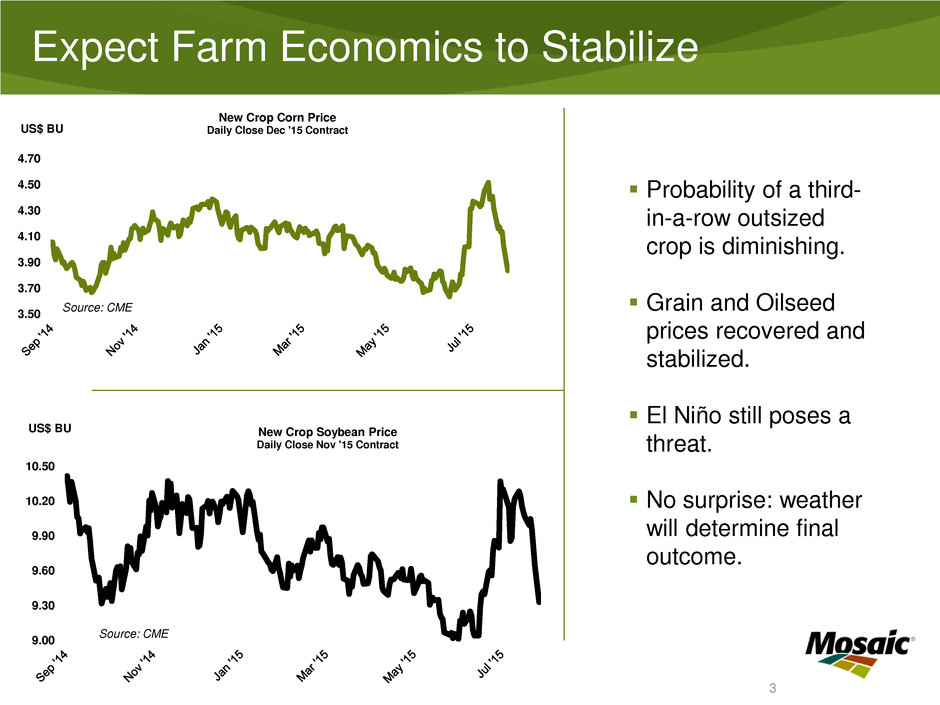

9.00 9.30 9.60 9.90 10.20 10.50 US$ BU New Crop Soybean Price Daily Close Nov '15 Contract Source: CME Expect Farm Economics to Stabilize 3 Probability of a third- in-a-row outsized crop is diminishing. Grain and Oilseed prices recovered and stabilized. El Niño still poses a threat. No surprise: weather will determine final outcome. 3.50 3.70 3.90 4.10 4.30 4.50 4.70 US$ BU New Crop Corn Price Daily Close Dec '15 Contract Source: CME

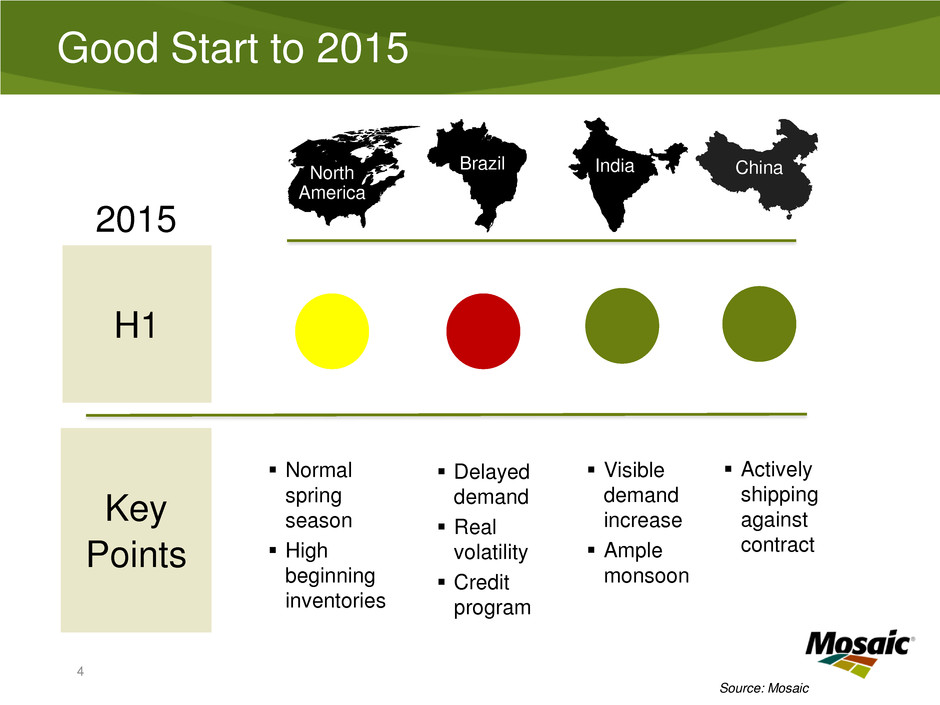

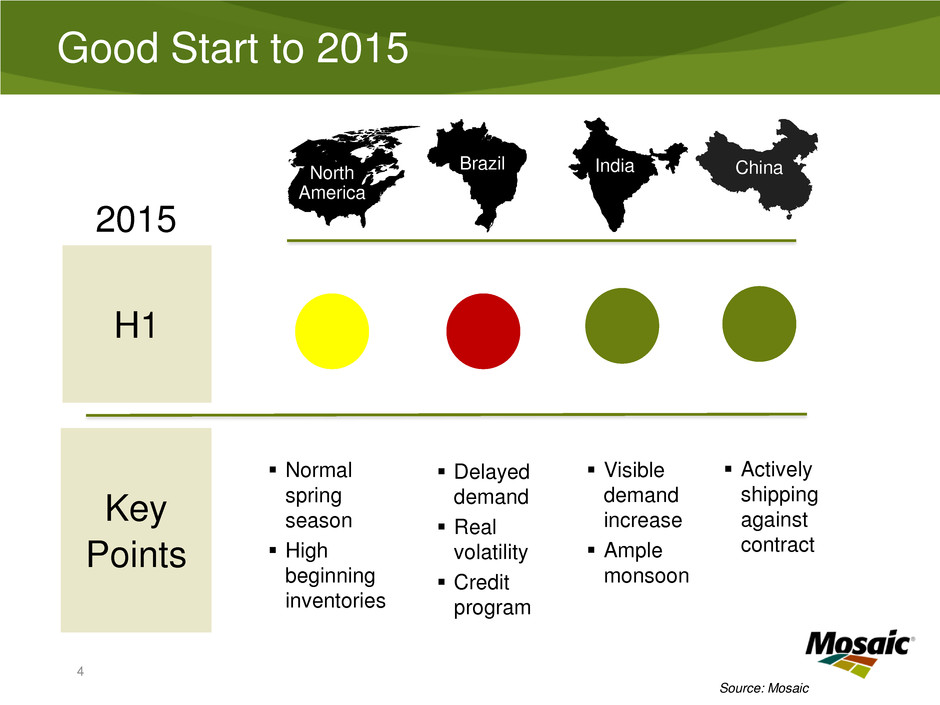

Good Start to 2015 Brazil India China North America H1 4 2015 Normal spring season High beginning inventories Key Points Delayed demand Real volatility Credit program Visible demand increase Ample monsoon Actively shipping against contract Source: Mosaic

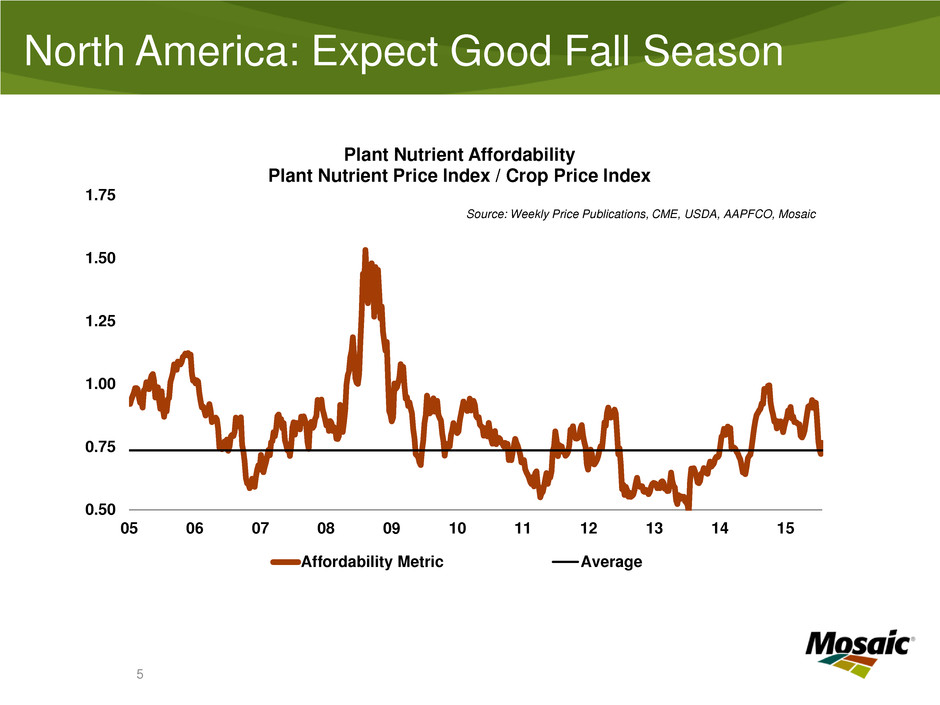

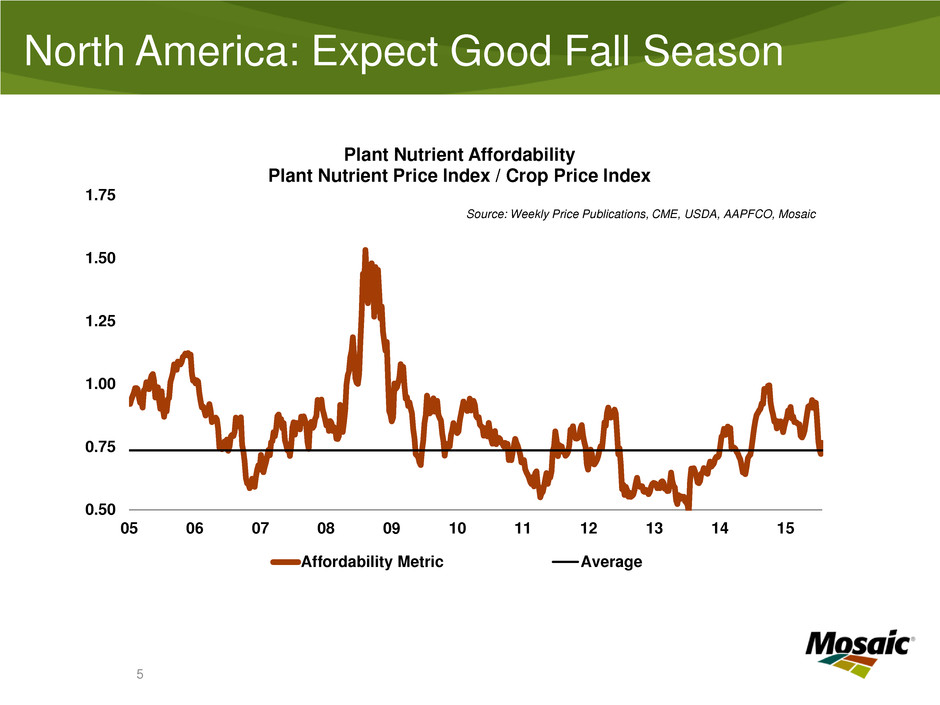

North America: Expect Good Fall Season 2 5 0.50 0.75 1.00 1.25 1.50 1.75 05 06 07 08 09 10 11 12 13 14 15 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic

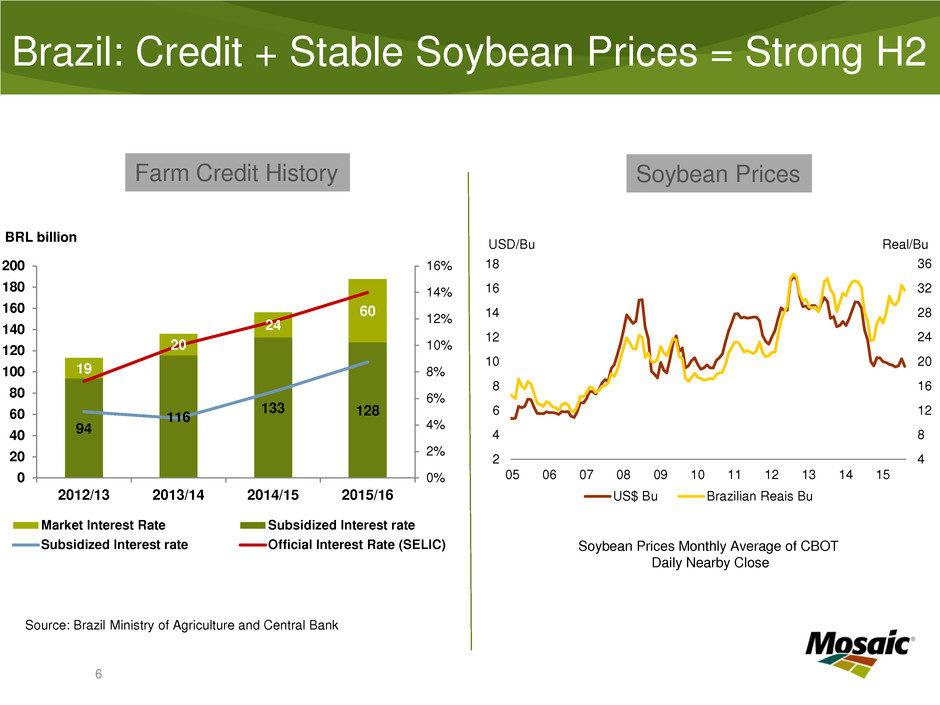

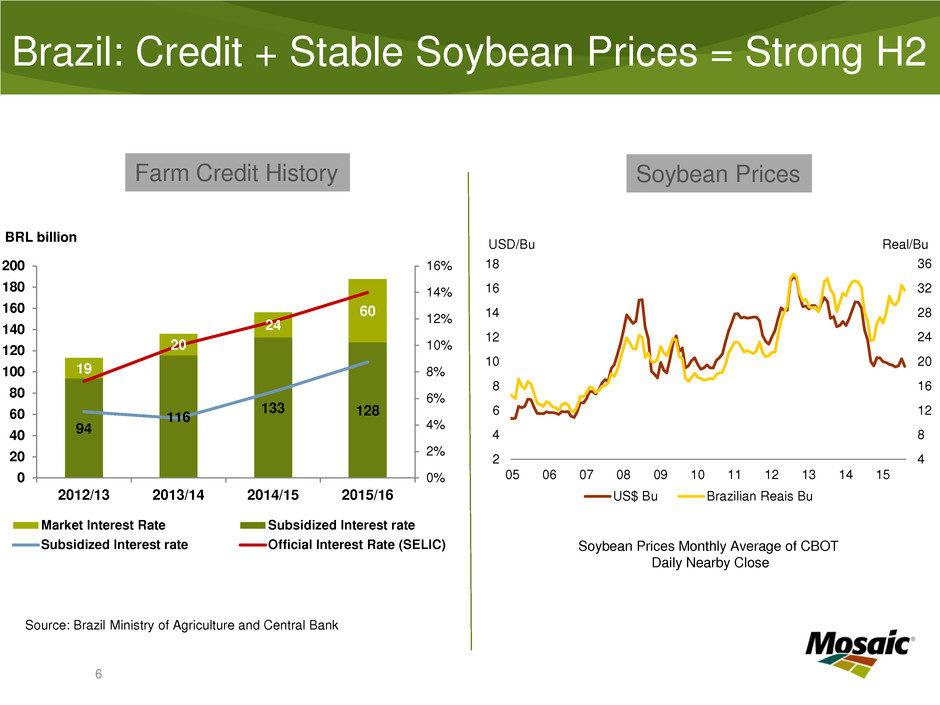

6 Brazil: Credit + Stable Soybean Prices = Strong H2 Soybean Prices Farm Credit History 94 116 133 128 19 20 24 60 0% 2% 4% 6% 8% 10% 12% 14% 16% 0 20 40 60 80 100 120 140 160 180 200 2012/13 2013/14 2014/15 2015/16 BRL billion Market Interest Rate Subsidized Interest rate Subsidized Interest rate Official Interest Rate (SELIC) Soybean Prices Monthly Average of CBOT Daily Nearby Close Source: Brazil Ministry of Agriculture and Central Bank 4 8 12 16 20 24 28 32 36 2 4 6 8 10 12 14 16 18 05 06 07 08 09 10 11 12 13 14 15 Real/Bu USD/Bu US$ Bu Brazilian Reais Bu

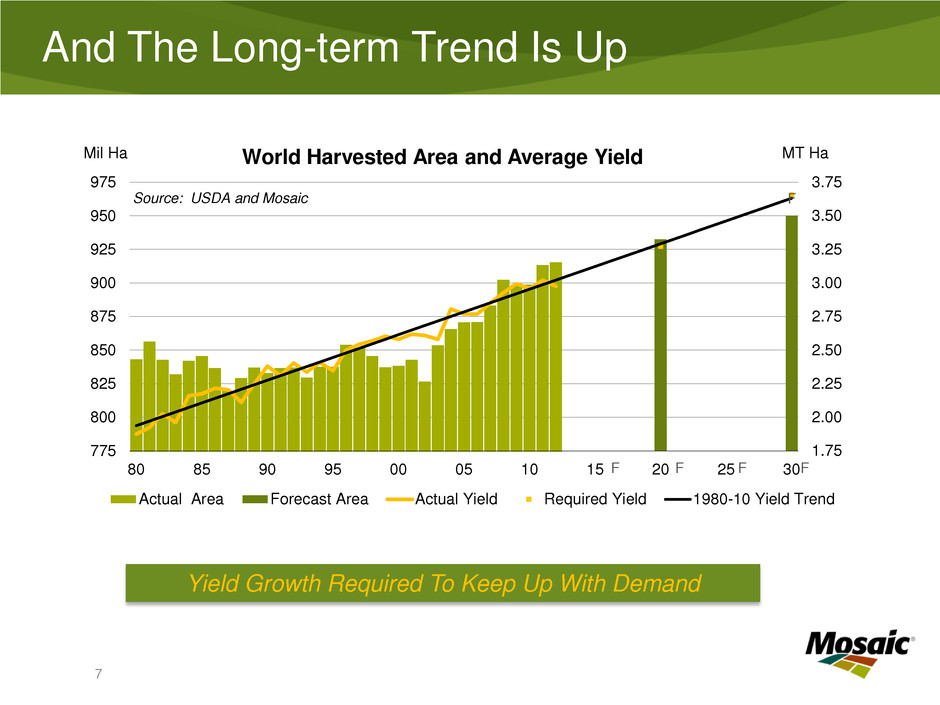

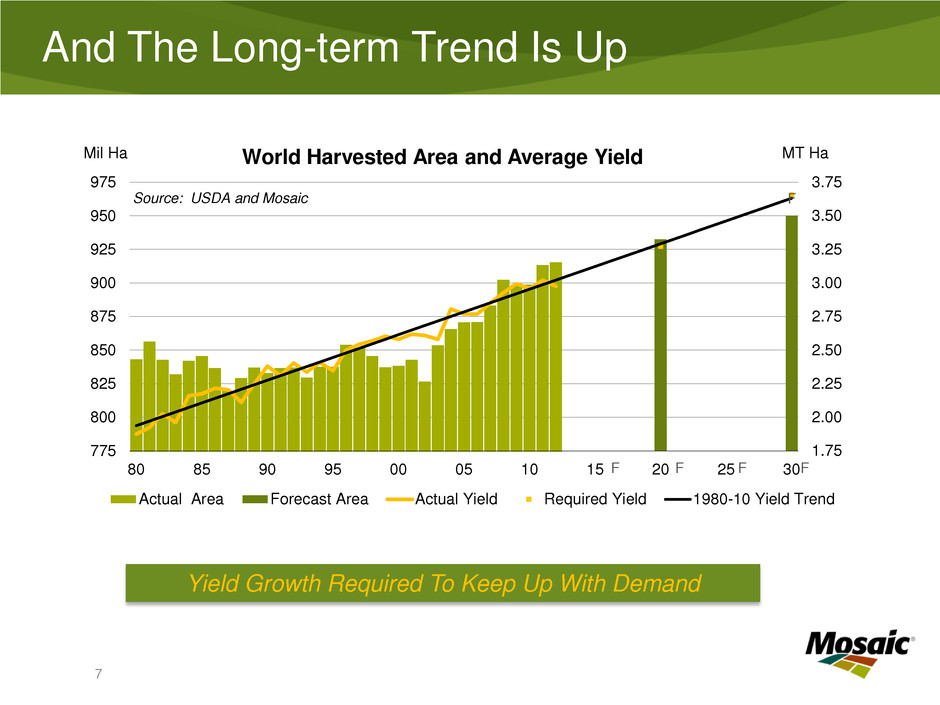

Yield Growth Required To Keep Up With Demand 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 775 800 825 850 875 900 925 950 975 80 85 90 95 00 05 10 15 20 25 30 MT Ha Mil Ha Source: USDA and Mosaic World Harvested Area and Average Yield Actual Area Forecast Area Actual Yield Required Yield 1980-10 Yield Trend F F F F 7 And The Long-term Trend Is Up

Why Mosaic?

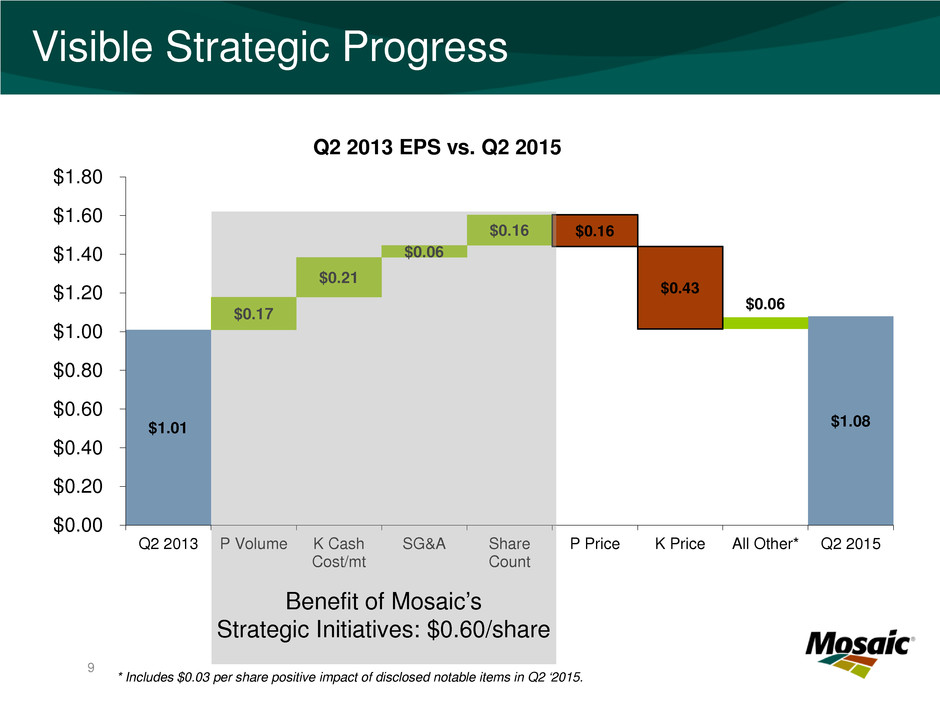

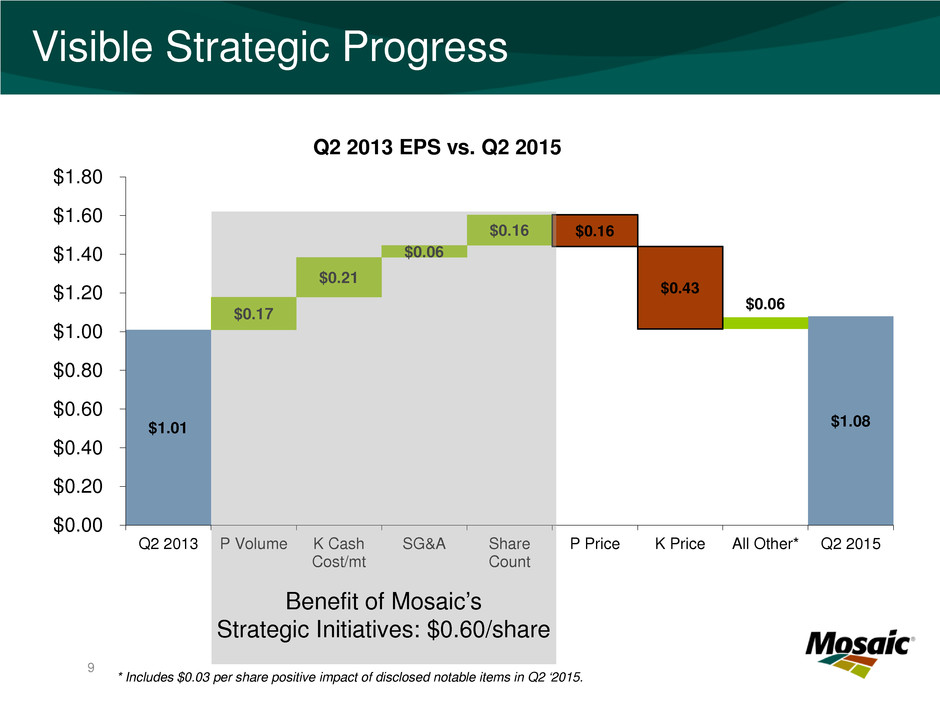

Visible Strategic Progress 2 9 $1.01 $1.08 $0.17 $0.21 $0.06 $0.16 $0.06 $0.16 $0.43 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 Q2 2013 P Volume K Cash Cost/mt SG&A Share Count P Price K Price All Other* Q2 2015 Q2 2013 EPS vs. Q2 2015 Benefit of Mosaic’s Strategic Initiatives: $0.60/share * Includes $0.03 per share positive impact of disclosed notable items in Q2 ‘2015.

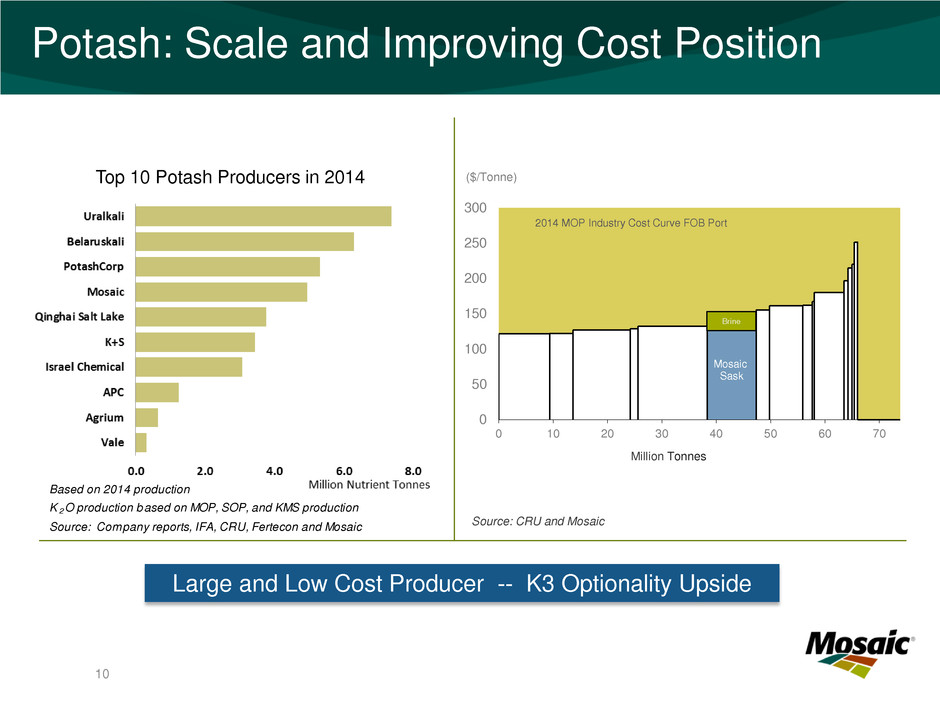

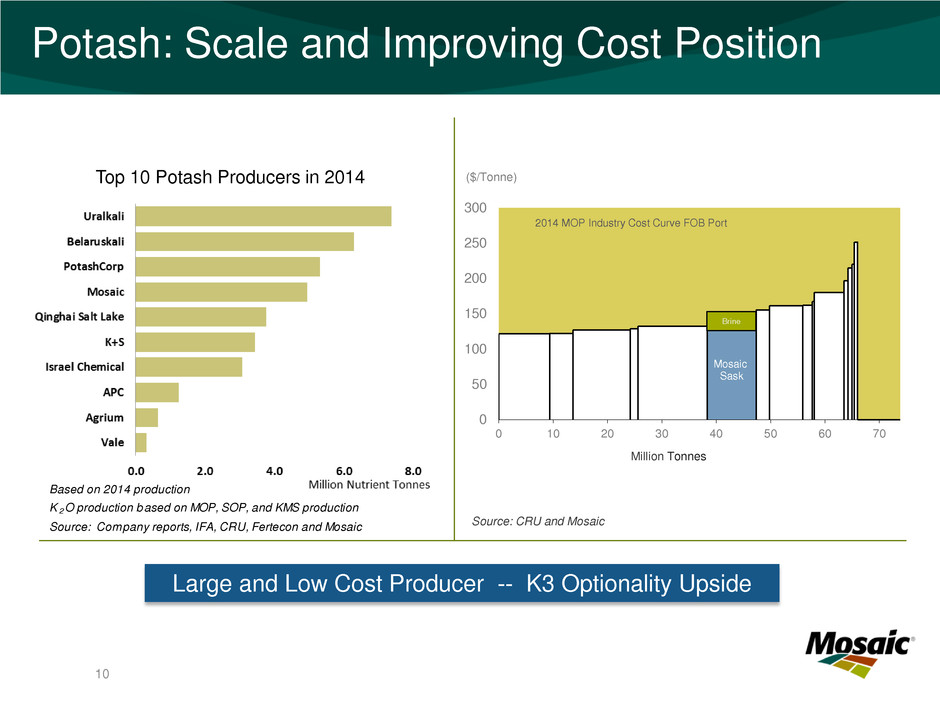

Large and Low Cost Producer -- K3 Optionality Upside 10 Potash: Scale and Improving Cost Position Top 10 Potash Producers in 2014 Source: CRU and Mosaic Mosaic Sask 0 50 100 150 200 250 300 0 10 20 30 40 50 60 70 ($/Tonne) Million Tonnes 2014 MOP Industry Cost Curve FOB Port Brine Based on 2014 production K 2 O production based on MOP, SOP, and KMS production Source: Company reports, IFA, CRU, Fertecon and Mosaic

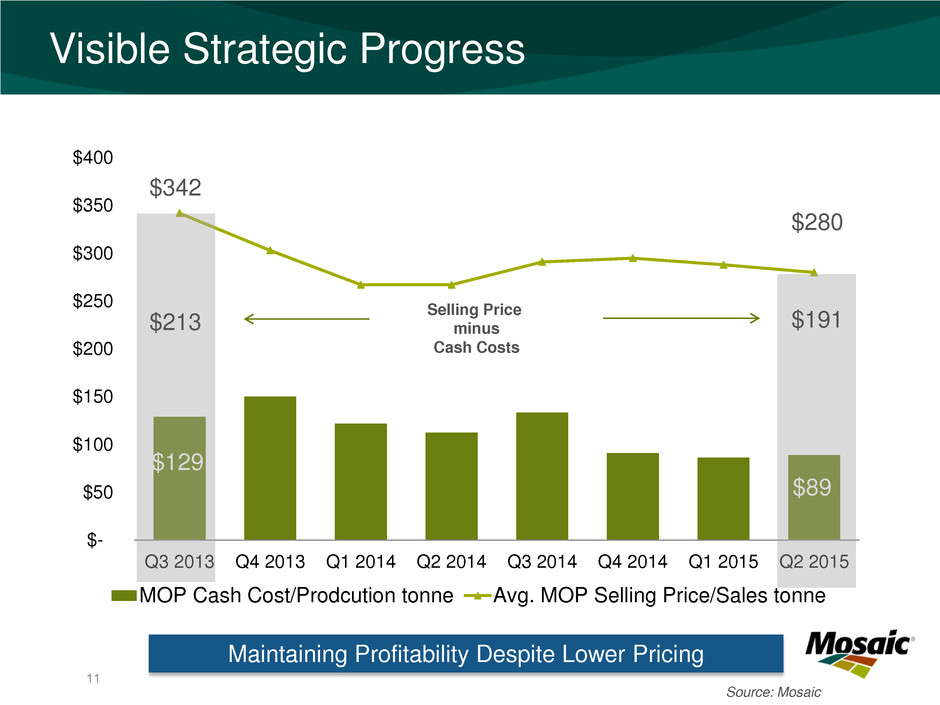

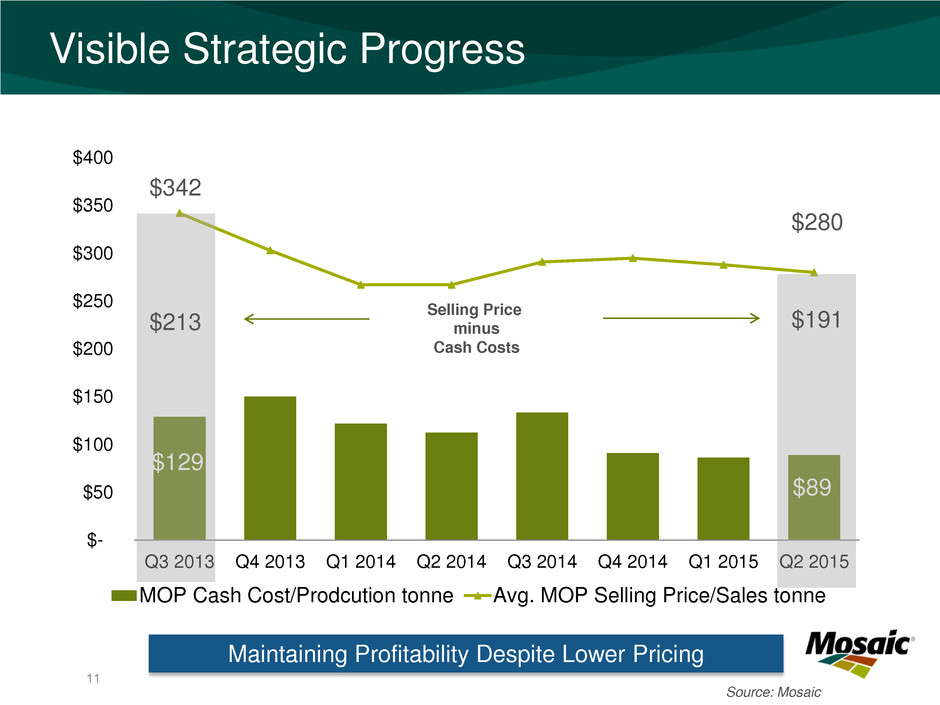

$129 $89 $- $50 $100 $150 $200 $250 $300 $350 $400 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 MOP Cash Cost/Prodcution tonne Avg. MOP Selling Price/Sales tonne Selling Price minus Cash Costs Visible Strategic Progress $213 $191 Maintaining Profitability Despite Lower Pricing 11 Source: Mosaic $342 $280

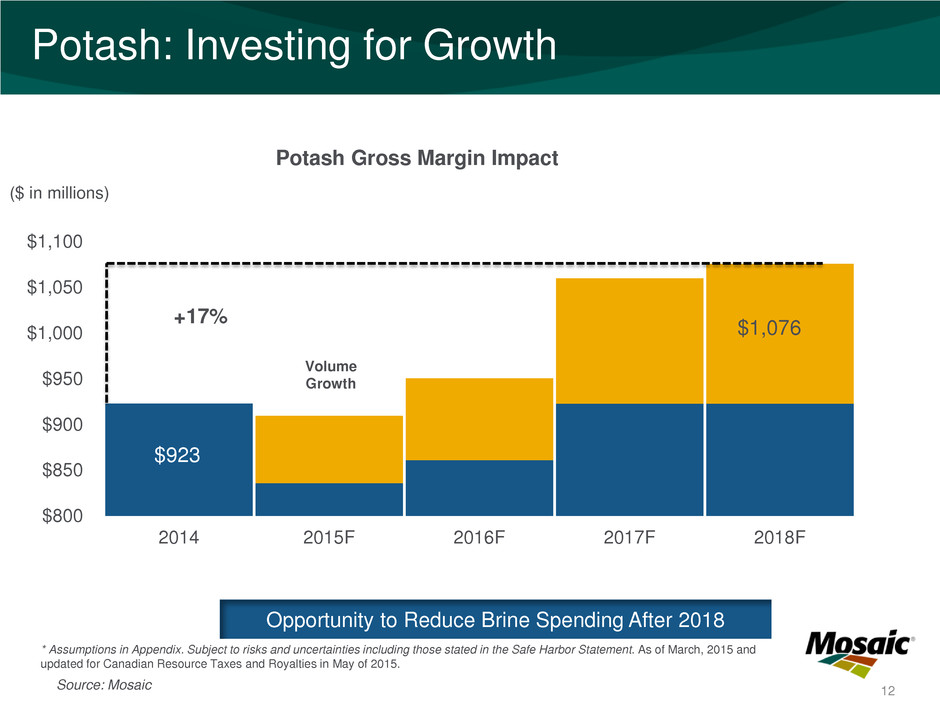

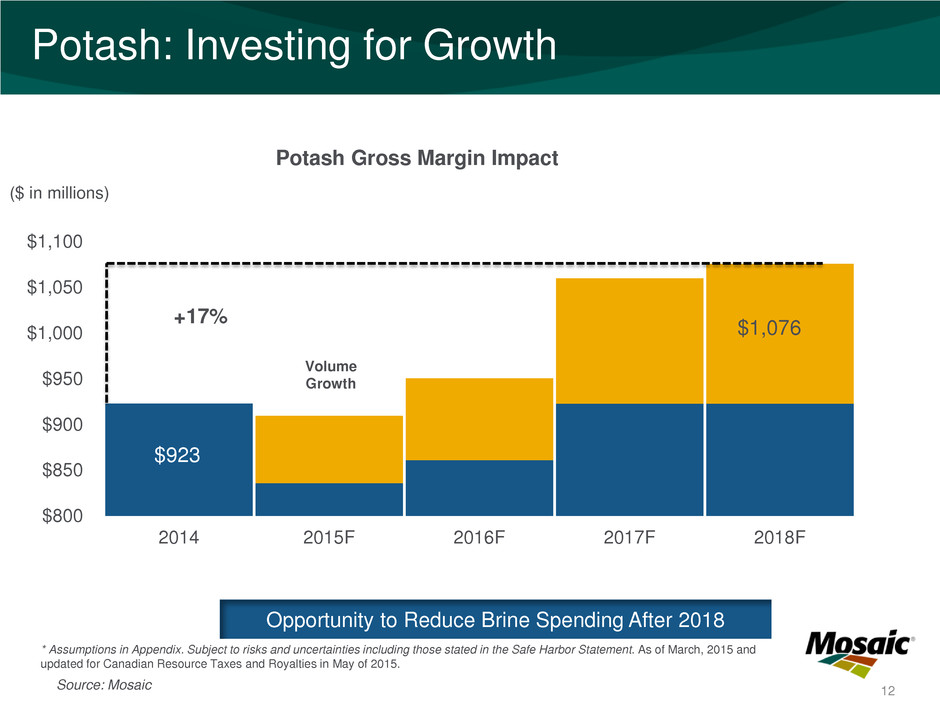

Potash: Investing for Growth * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. As of March, 2015 and updated for Canadian Resource Taxes and Royalties in May of 2015. Source: Mosaic 12 $923 $800 $850 $900 $950 $1,000 $1,050 $1,100 2014 2015F 2016F 2017F 2018F Potash Gross Margin Impact $1,076 ($ in millions) Volume Growth +17% Opportunity to Reduce Brine Spending After 2018

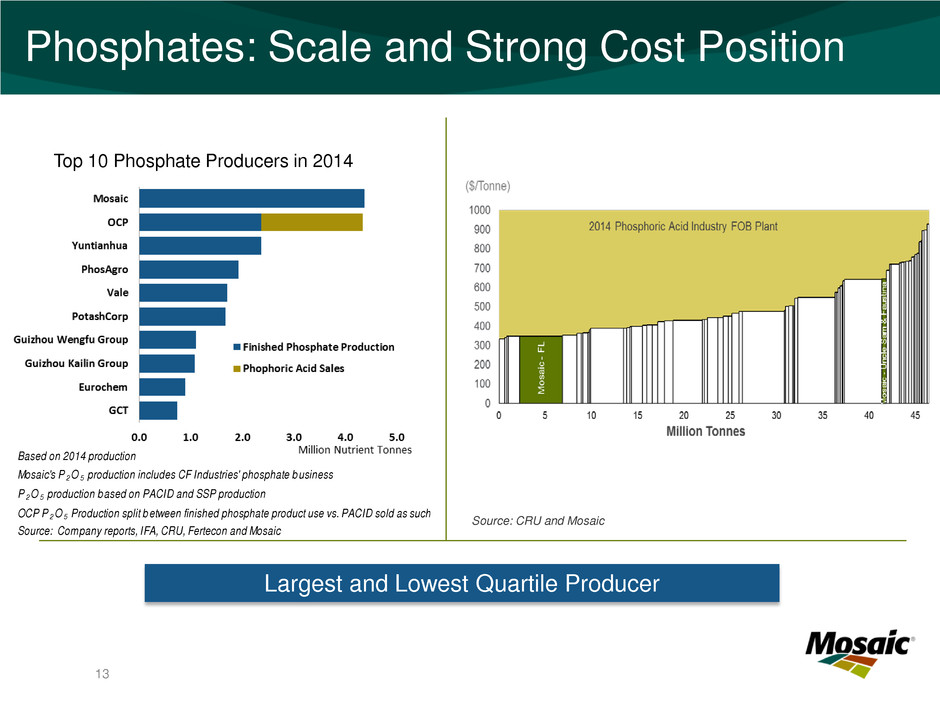

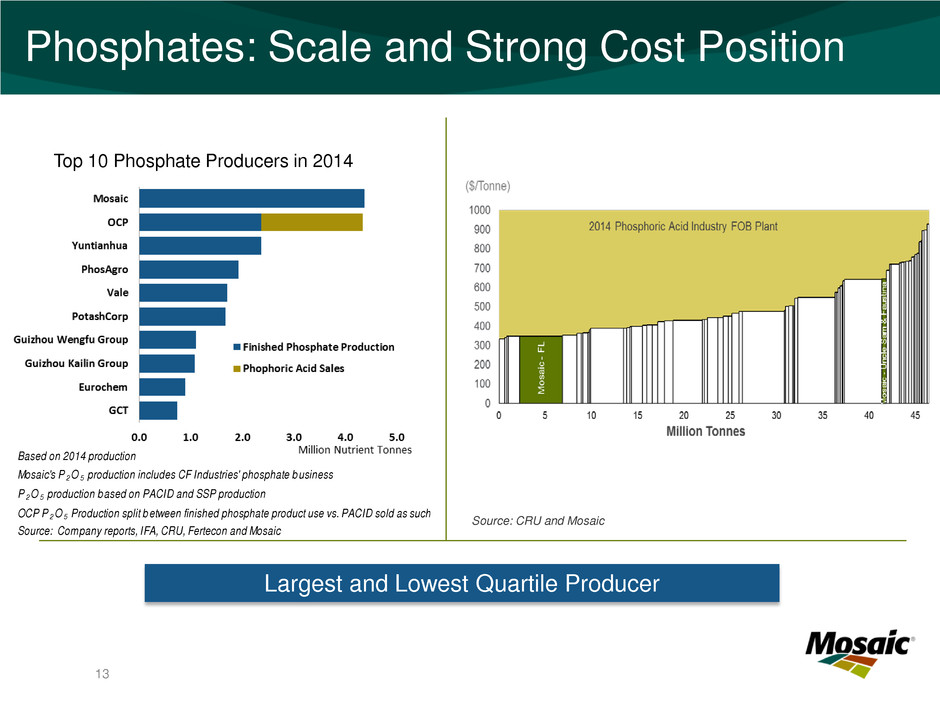

Phosphates: Scale and Strong Cost Position Largest and Lowest Quartile Producer 13 Top 10 Phosphate Producers in 2014 Source: CRU and Mosaic Based on 2014 production Mosaic's P 2 O 5 production includes CF Industries' phosphate business P 2 O 5 production based on PACID and SSP production OCP P 2 O 5 Production split between finished phosphate product use vs. PACID sold as such Source: Company reports, IFA, CRU, Fertecon and Mosaic

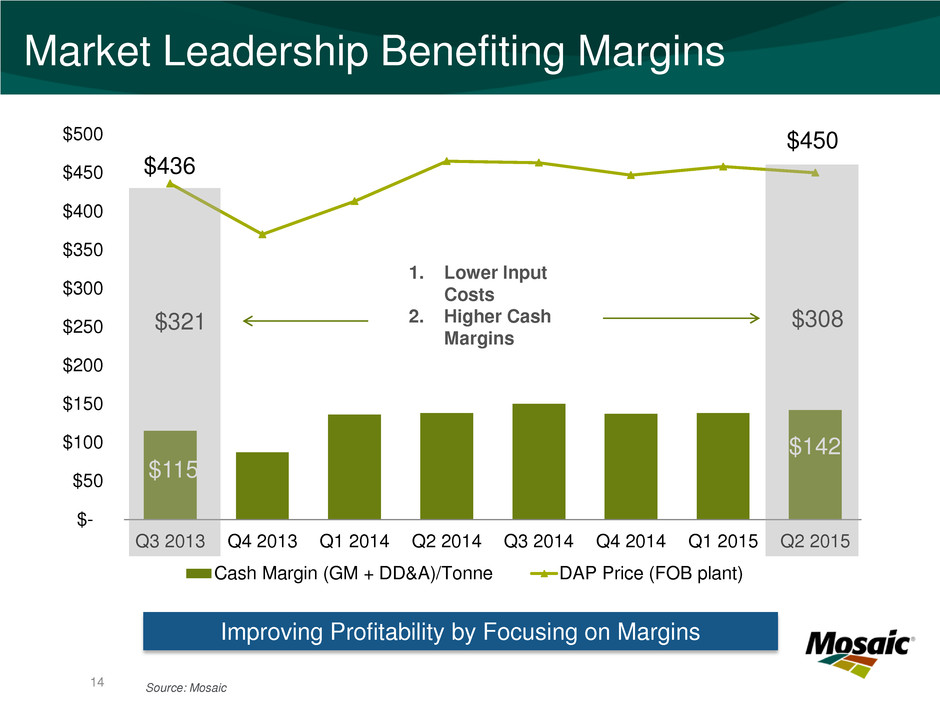

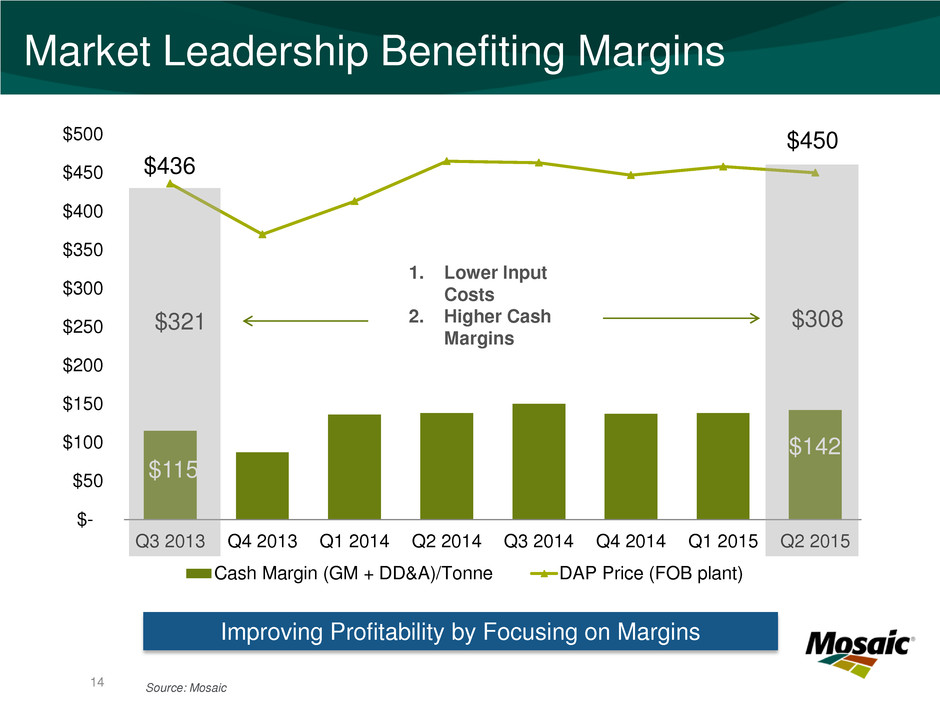

Market Leadership Benefiting Margins 14 $115 $142 $436 $450 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Cash Margin (GM + DD&A)/Tonne DAP Price (FOB plant) 1. Lower Input Costs 2. Higher Cash Margins $321 $308 Improving Profitability by Focusing on Margins Source: Mosaic

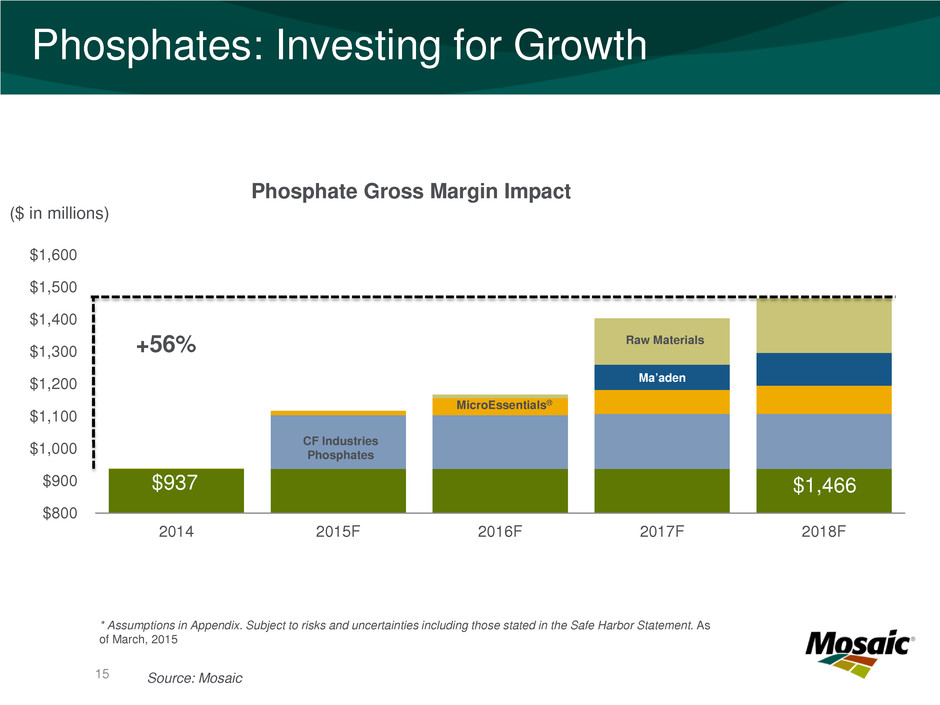

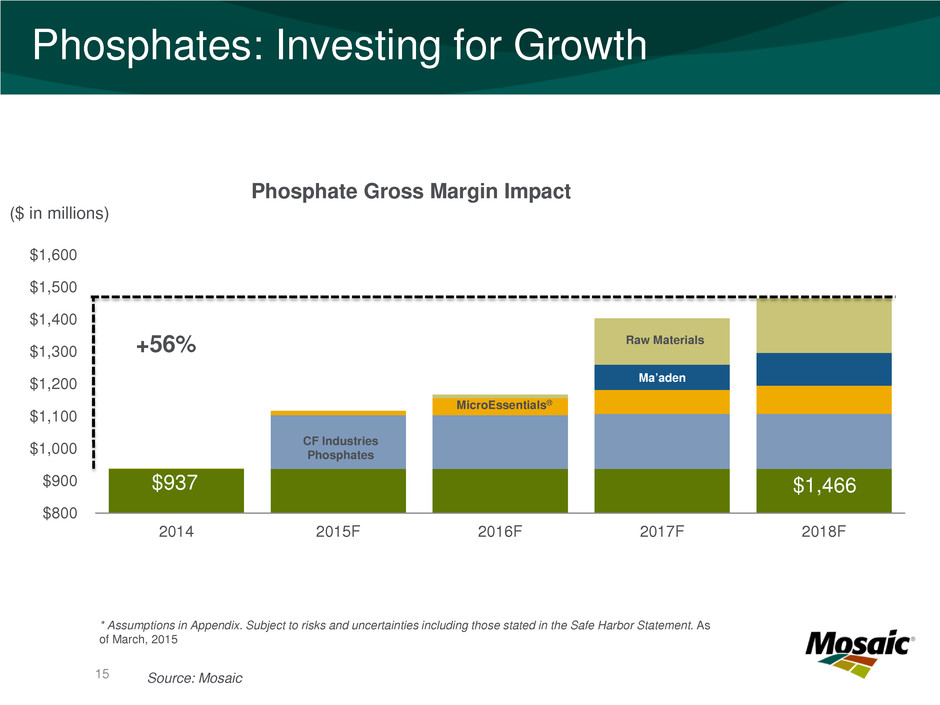

Phosphates: Investing for Growth 15 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 2014 2015F 2016F 2017F 2018F Phosphate Gross Margin Impact $1,466 $937 ($ in millions) CF Industries Phosphates MicroEssentials® Ma’aden Raw Materials +56% * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. As of March, 2015 Source: Mosaic

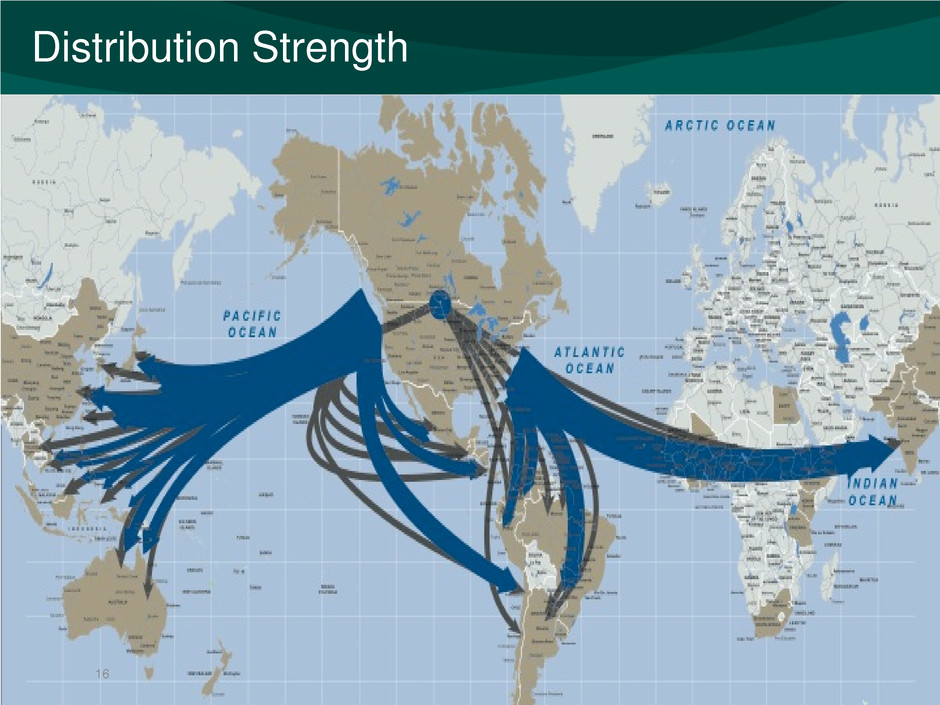

Distribution Strength 16

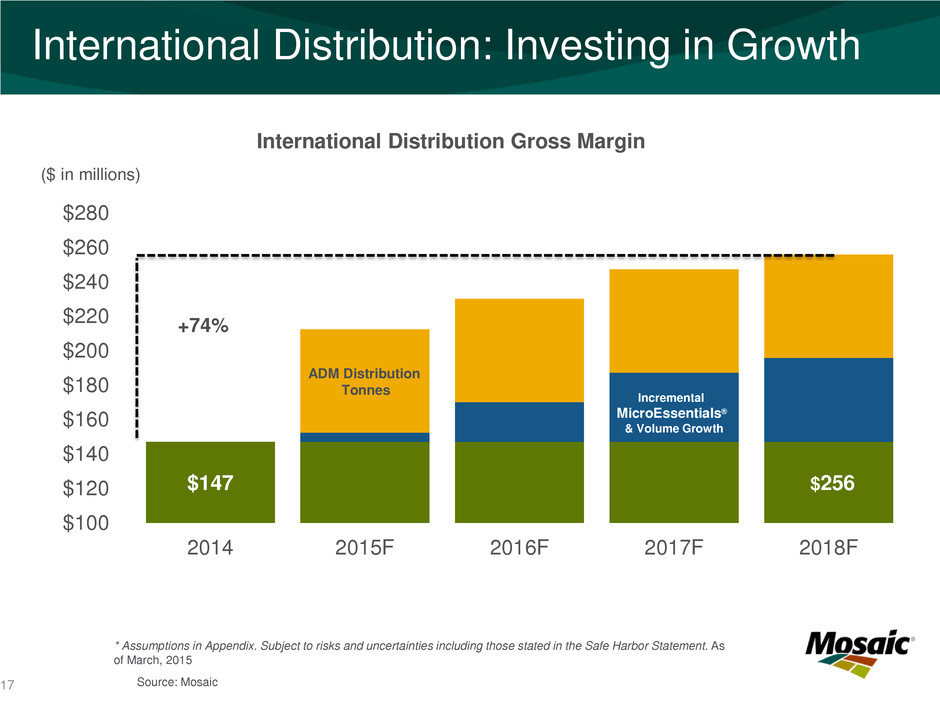

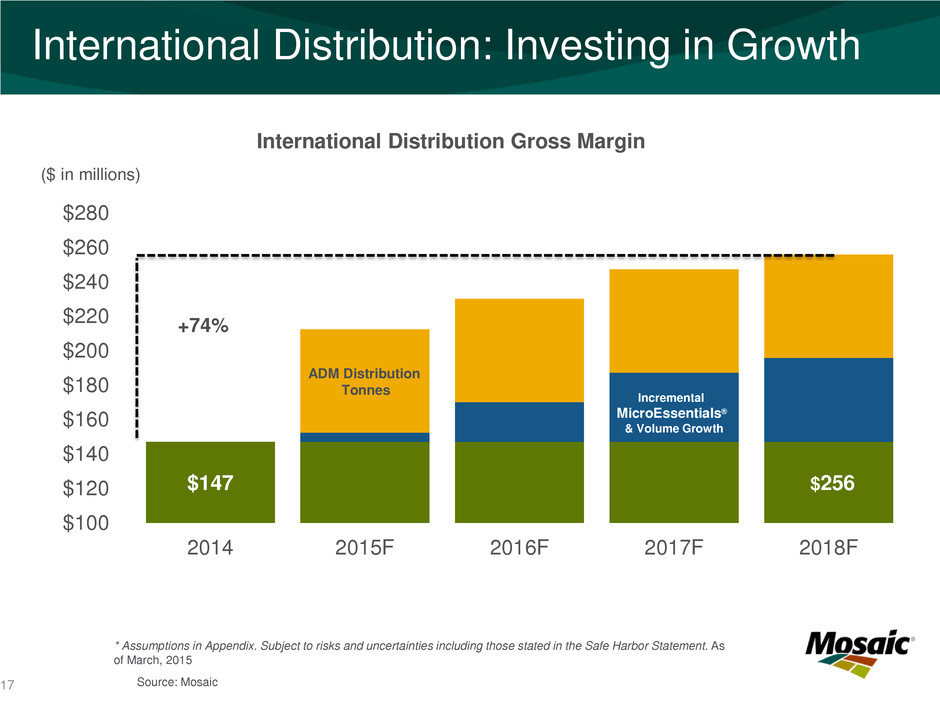

International Distribution: Investing in Growth $147 $256 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 2014 2015F 2016F 2017F 2018F International Distribution Gross Margin ($ in millions) Incremental MicroEssentials® & Volume Growth ADM Distribution Tonnes +74% * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. As of March, 2015 Source: Mosaic 17

Capital Deployment 18

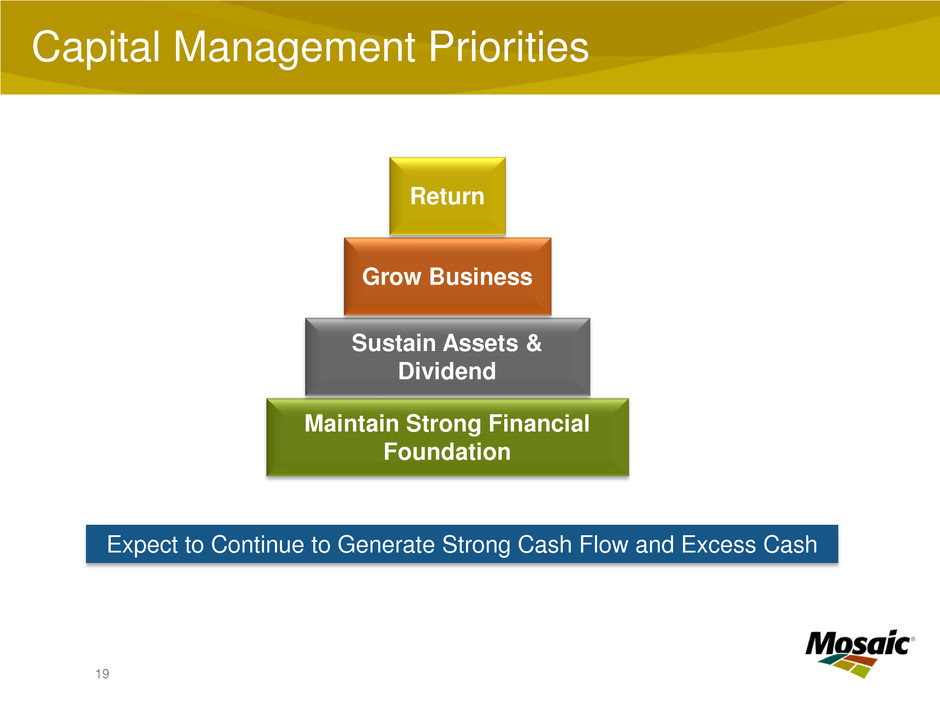

$47 per Share Capital Management Priorities 19 Expect to Continue to Generate Strong Cash Flow and Excess Cash Maintain Strong Financial Foundation Sustain Assets & Dividend Grow Business Return

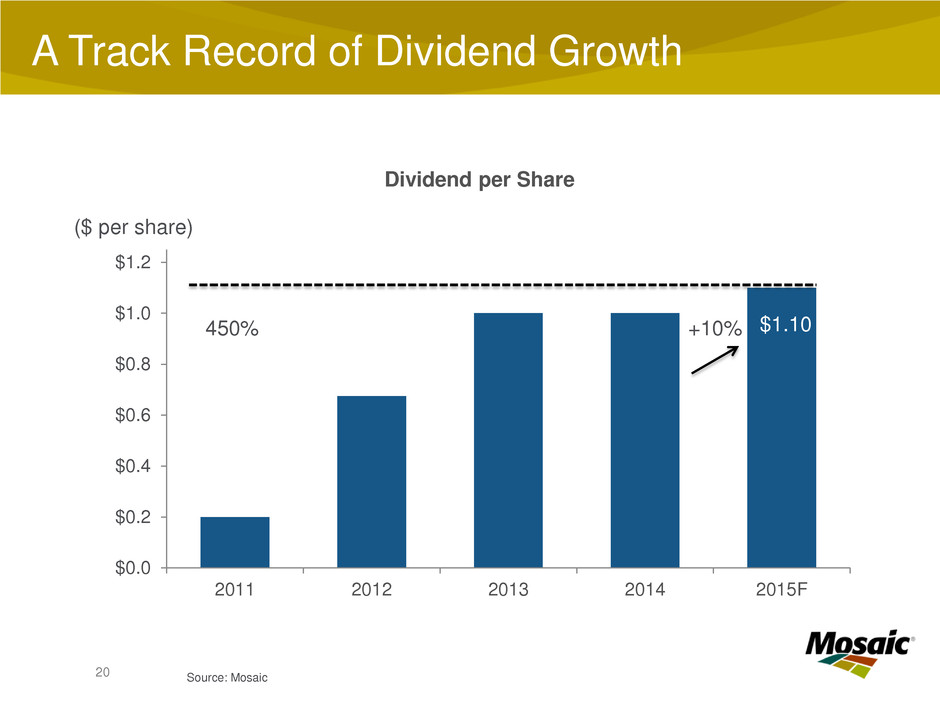

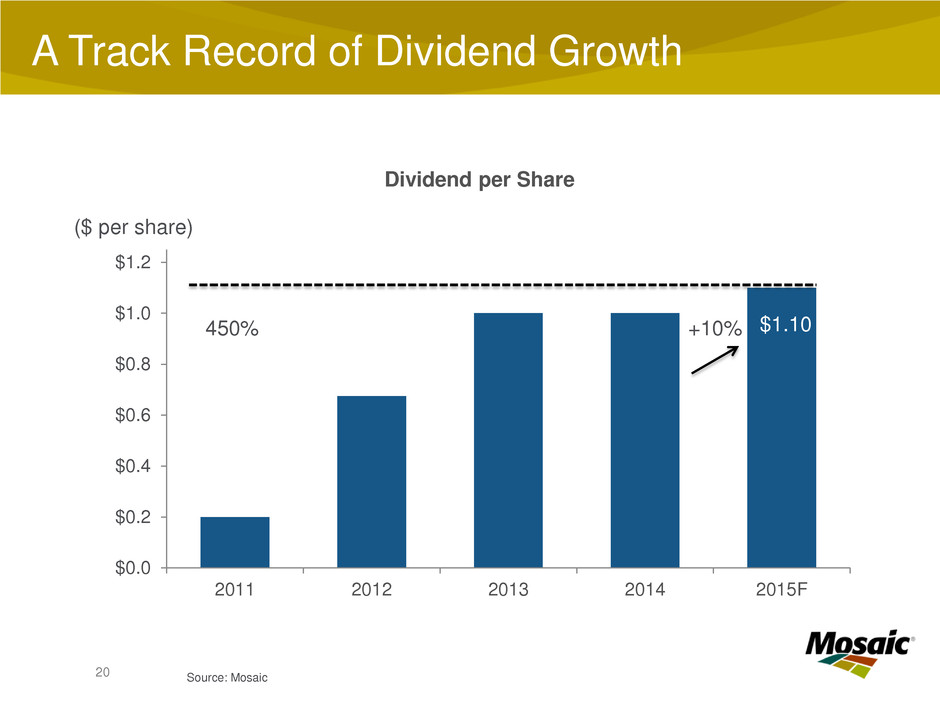

$1.10 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 2011 2012 2013 2014 2015F A Track Record of Dividend Growth ($ per share) Dividend per Share 450% +10% Source: Mosaic 20

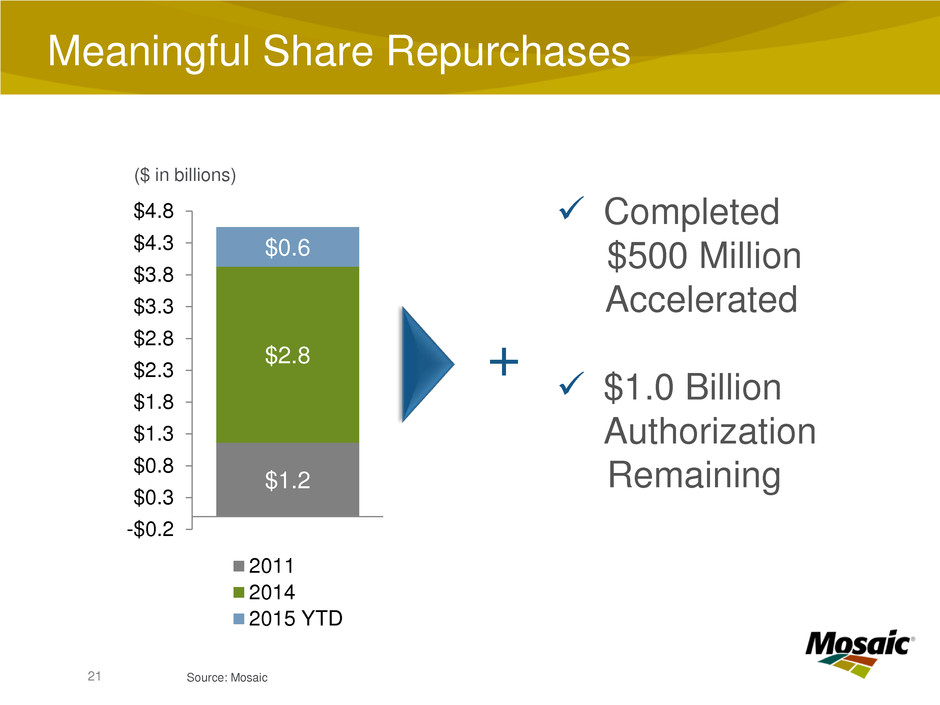

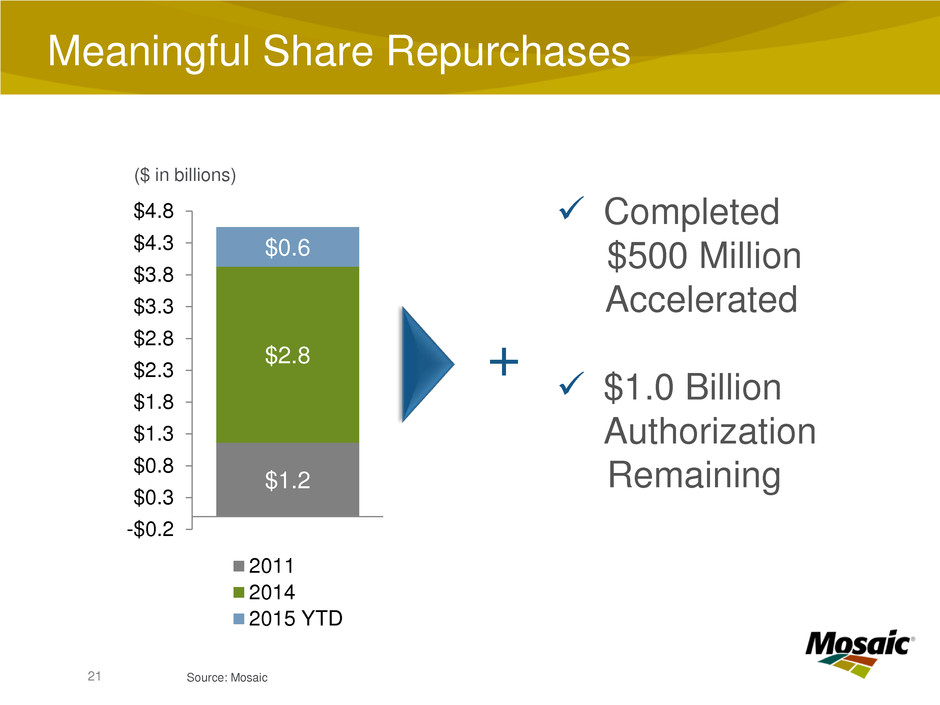

Meaningful Share Repurchases $1.2 $2.8 $0.6 -$0.2 $0.3 $0.8 $1.3 $1.8 $2.3 $2.8 $3.3 $3.8 $4.3 $4.8 2011 2014 2015 YTD Completed $500 Million Accelerated $1.0 Billion Authorization Remaining ($ in billions) + Source: Mosaic 21

22 Smart Capital Deployment Investment for Growth Shareholder Returns Capital Stewardship Source: Mosaic

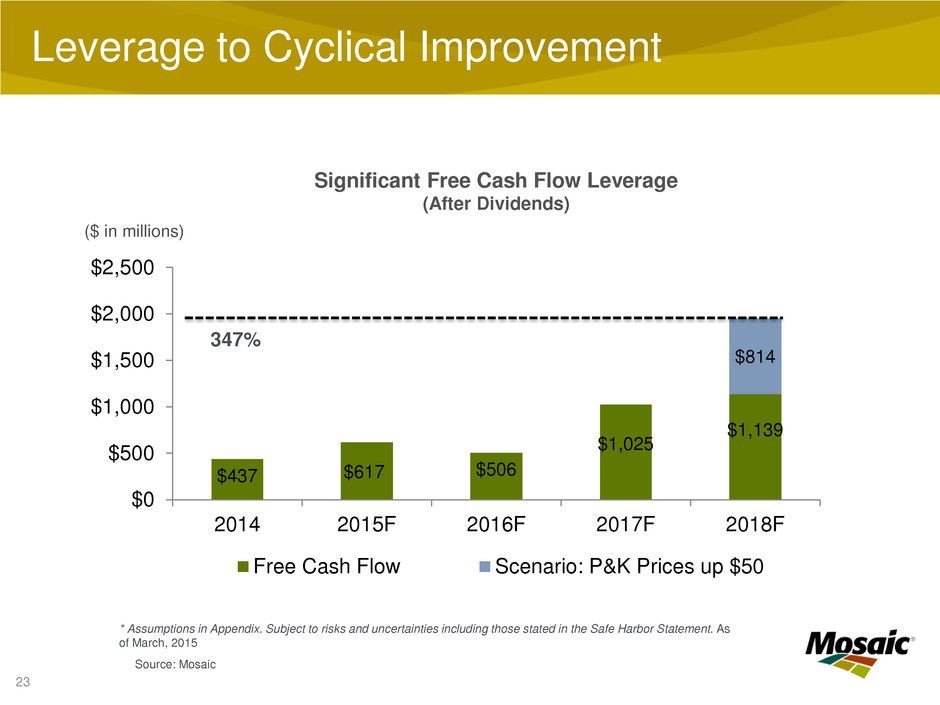

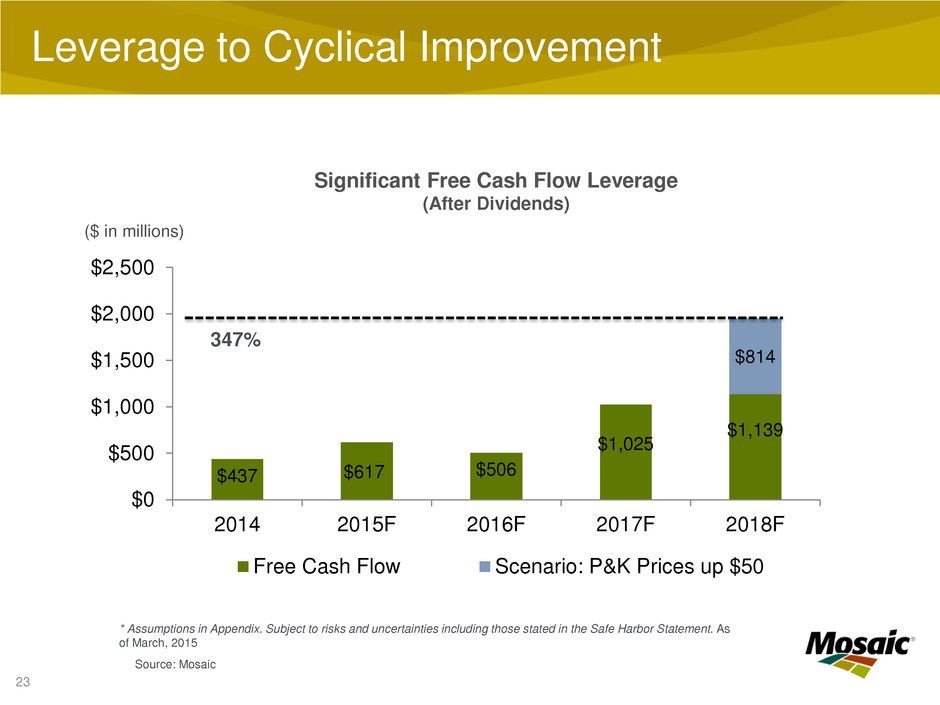

Leverage to Cyclical Improvement Significant Free Cash Flow Leverage (After Dividends) * Assumptions in Appendix. Subject to risks and uncertainties including those stated in the Safe Harbor Statement. As of March, 2015 Source: Mosaic 23 $437 $617 $506 $1,025 $1,139 $814 $0 $500 $1,000 $1,500 $2,000 $2,500 2014 2015F 2016F 2017F 2018F Free Cash Flow Scenario: P&K Prices up $50 ($ in millions) 347%

Click to edit Master title style 24 • In this cyclical industry, the positive secular trends continue. • Long-term value creation is predicated on effective capital deployment. • Capital deployment near the trough of the cycle maximizes value creation: – Depressed investment values – Increasing leverage to the upcycle • For Mosaic, and for our investors, now is the right time to invest. Investment Thesis

Thank you 25

26 Appendix

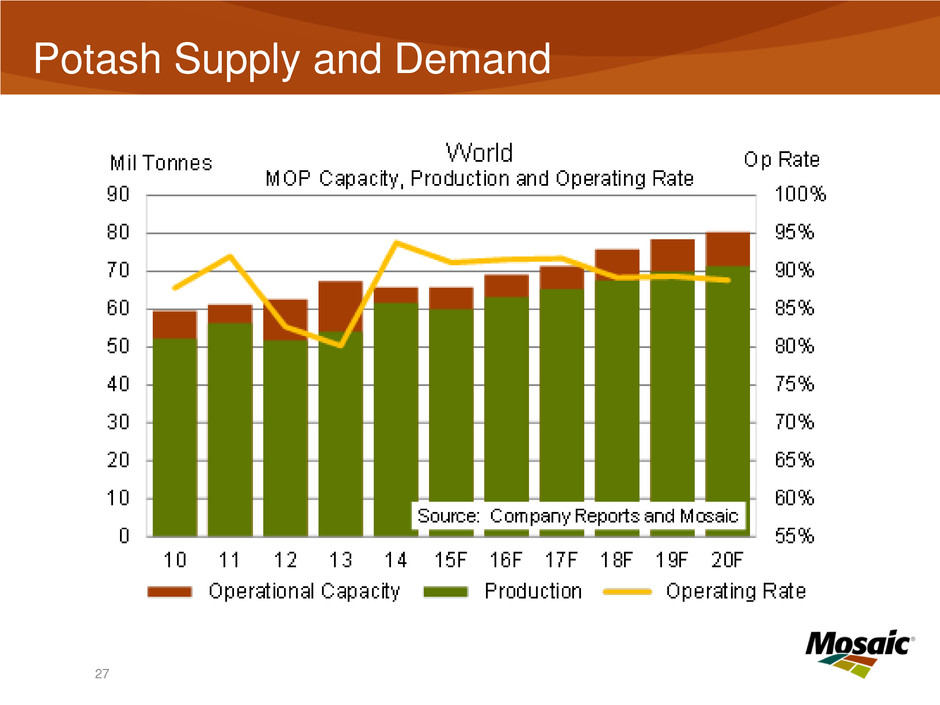

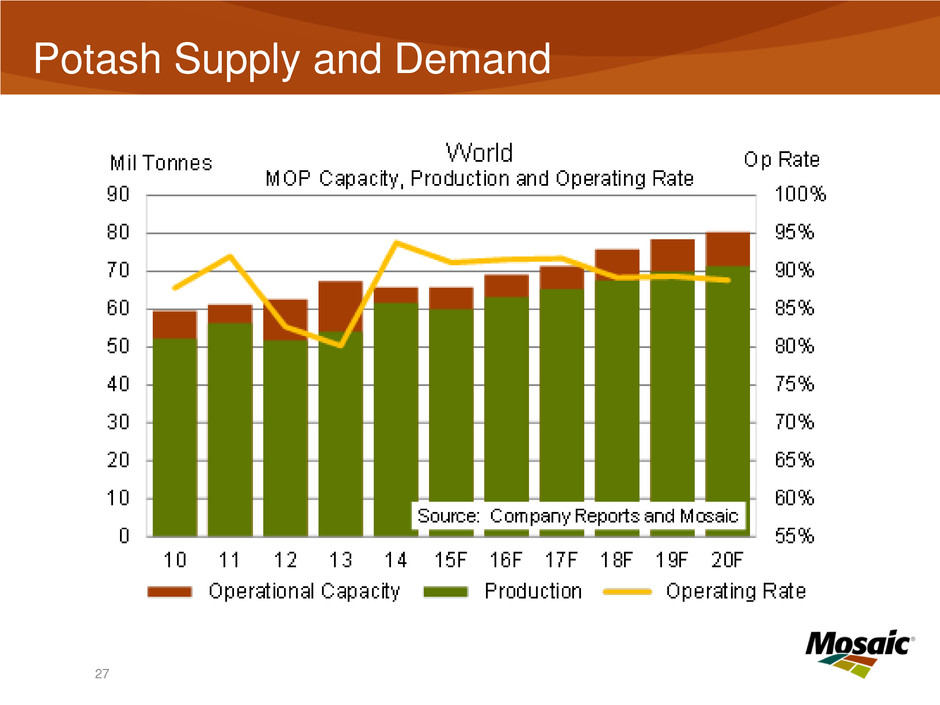

27 Potash Supply and Demand

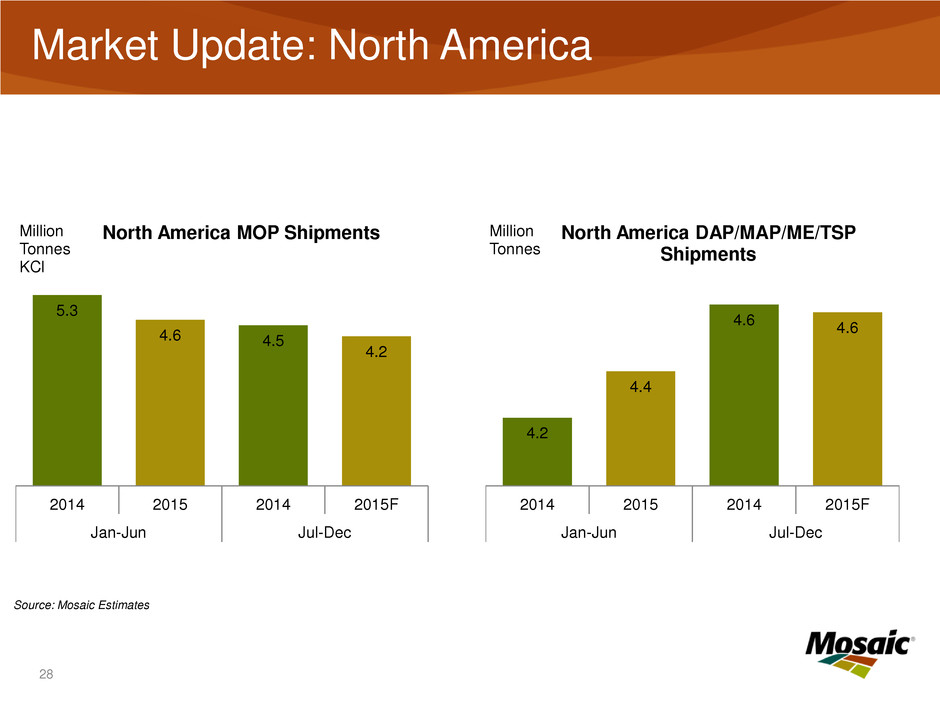

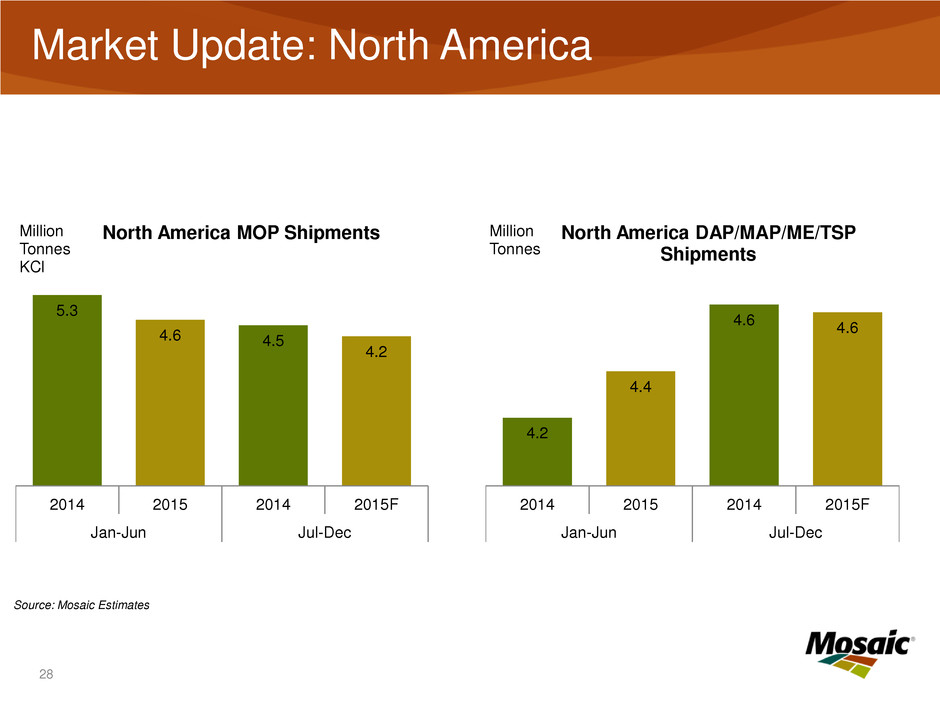

Market Update: North America 28 5.3 4.6 4.5 4.2 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes KCl North America MOP Shipments 4.2 4.4 4.6 4.6 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes North America DAP/MAP/ME/TSP Shipments Source: Mosaic Estimates

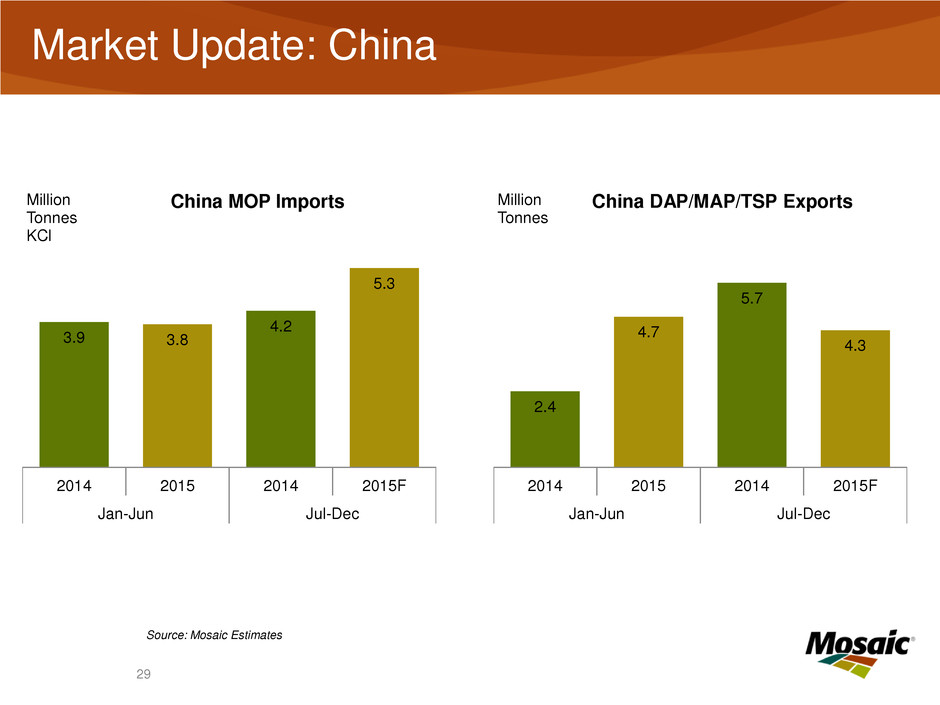

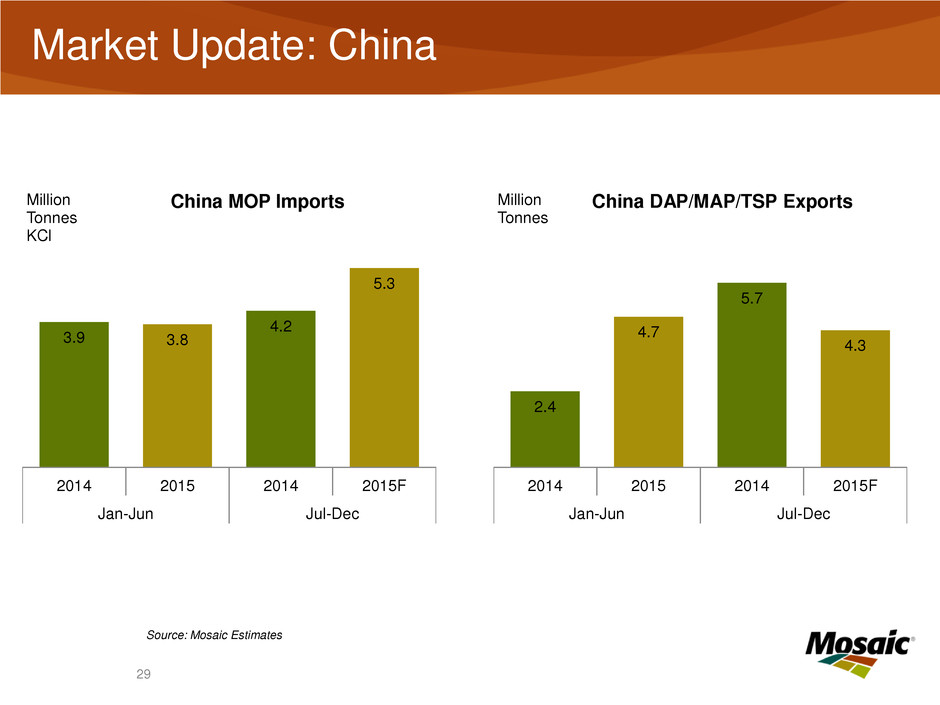

Market Update: China 2 29 3.9 3.8 4.2 5.3 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes KCl China MOP Imports 2.4 4.7 5.7 4.3 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes China DAP/MAP/TSP Exports Source: Mosaic Estimates

Market Update: India 2 30 1.6 1.8 2.7 3.2 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes KCl India MOP Imports 1.0 3.0 2.8 2.8 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes India DAP Imports Source: Mosaic Estimates

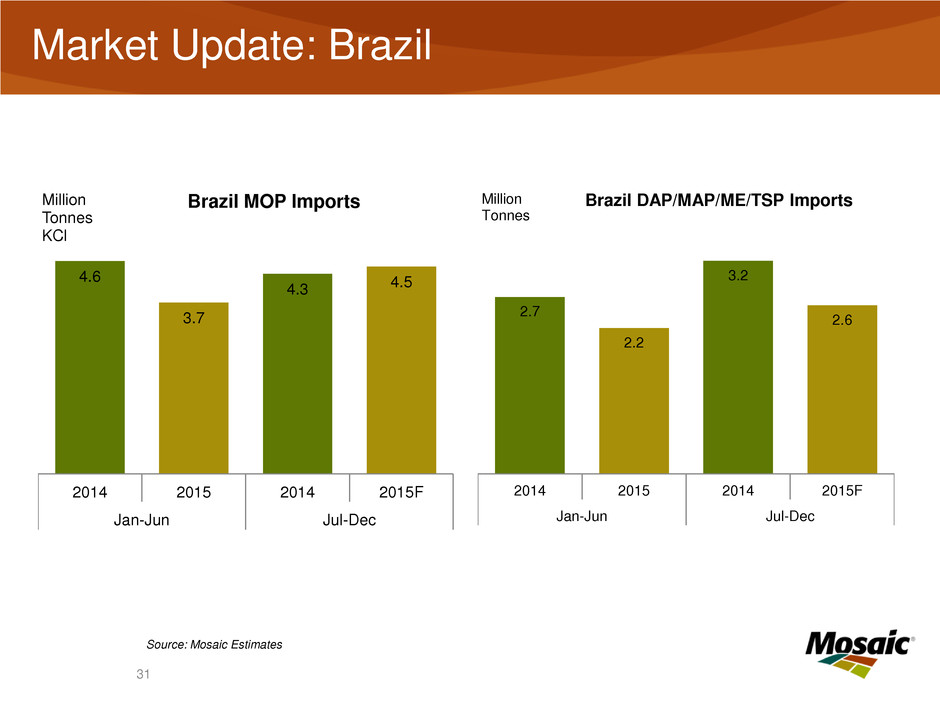

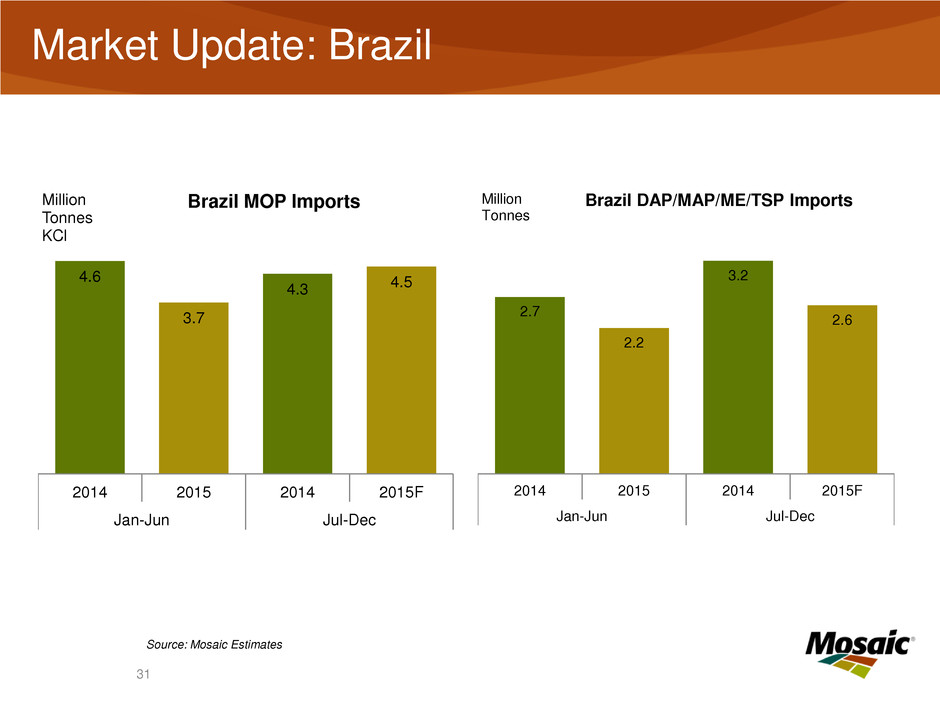

Market Update: Brazil 2 31 4.6 3.7 4.3 4.5 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes KCl Brazil MOP Imports 2.7 2.2 3.2 2.6 2014 2015 2014 2015F Jan-Jun Jul-Dec Million Tonnes Brazil DAP/MAP/ME/TSP Imports Source: Mosaic Estimates

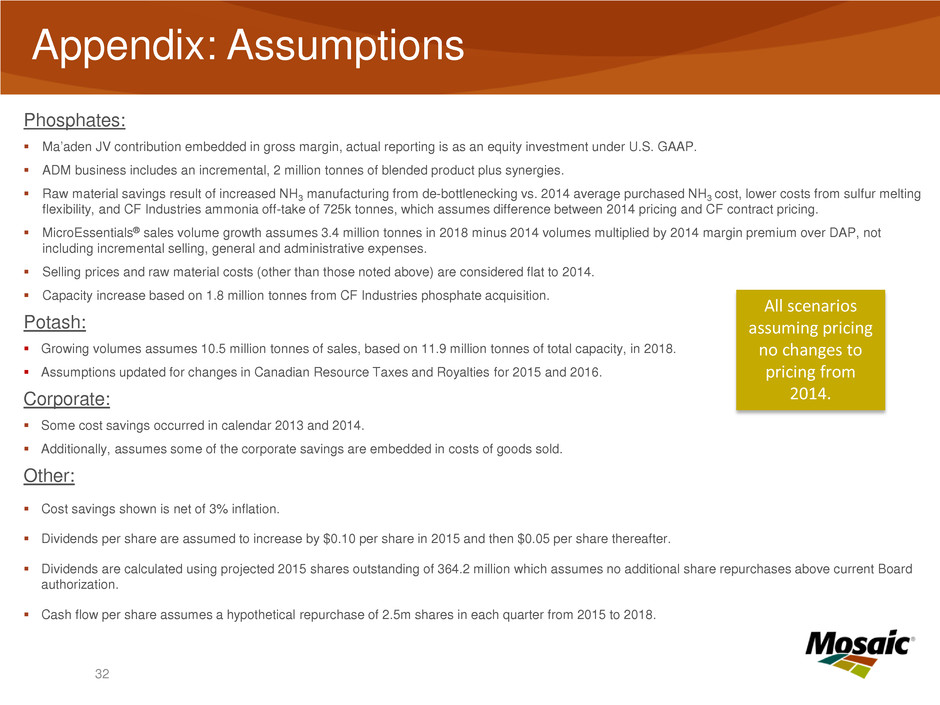

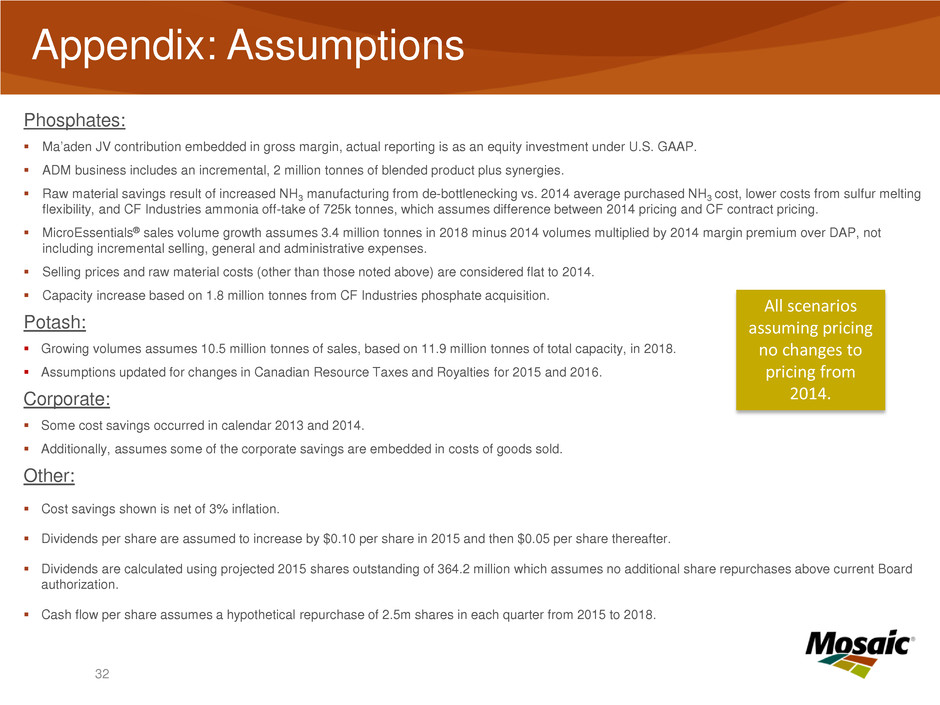

32 Phosphates: Ma’aden JV contribution embedded in gross margin, actual reporting is as an equity investment under U.S. GAAP. ADM business includes an incremental, 2 million tonnes of blended product plus synergies. Raw material savings result of increased NH3 manufacturing from de-bottlenecking vs. 2014 average purchased NH3 cost, lower costs from sulfur melting flexibility, and CF Industries ammonia off-take of 725k tonnes, which assumes difference between 2014 pricing and CF contract pricing. MicroEssentials® sales volume growth assumes 3.4 million tonnes in 2018 minus 2014 volumes multiplied by 2014 margin premium over DAP, not including incremental selling, general and administrative expenses. Selling prices and raw material costs (other than those noted above) are considered flat to 2014. Capacity increase based on 1.8 million tonnes from CF Industries phosphate acquisition. Potash: Growing volumes assumes 10.5 million tonnes of sales, based on 11.9 million tonnes of total capacity, in 2018. Assumptions updated for changes in Canadian Resource Taxes and Royalties for 2015 and 2016. Corporate: Some cost savings occurred in calendar 2013 and 2014. Additionally, assumes some of the corporate savings are embedded in costs of goods sold. Other: Cost savings shown is net of 3% inflation. Dividends per share are assumed to increase by $0.10 per share in 2015 and then $0.05 per share thereafter. Dividends are calculated using projected 2015 shares outstanding of 364.2 million which assumes no additional share repurchases above current Board authorization. Cash flow per share assumes a hypothetical repurchase of 2.5m shares in each quarter from 2015 to 2018. Appendix: Assumptions All scenarios assuming pricing no changes to pricing from 2014.

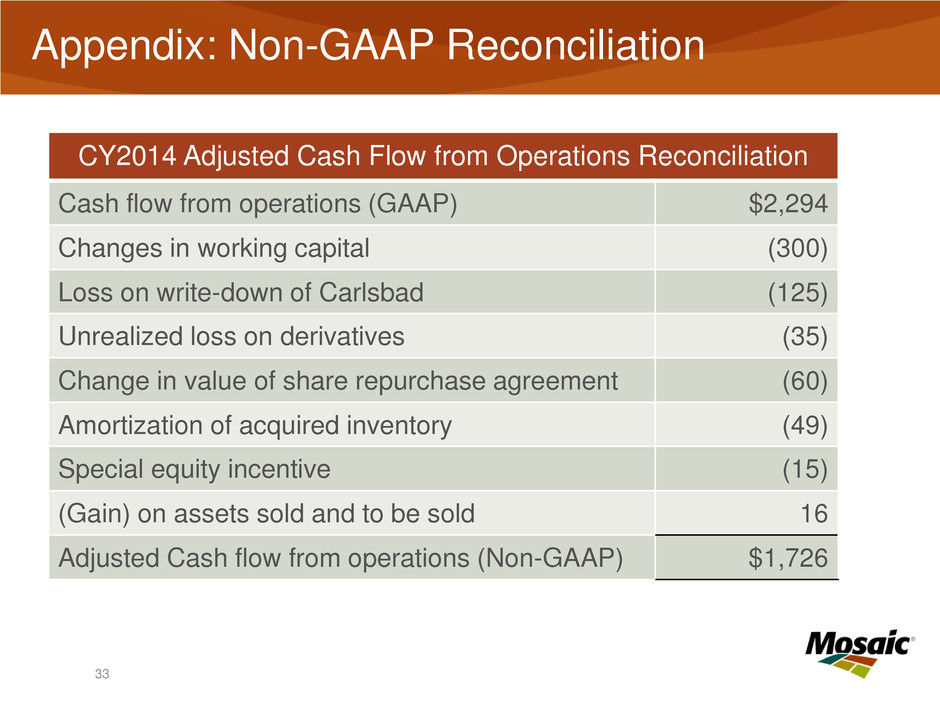

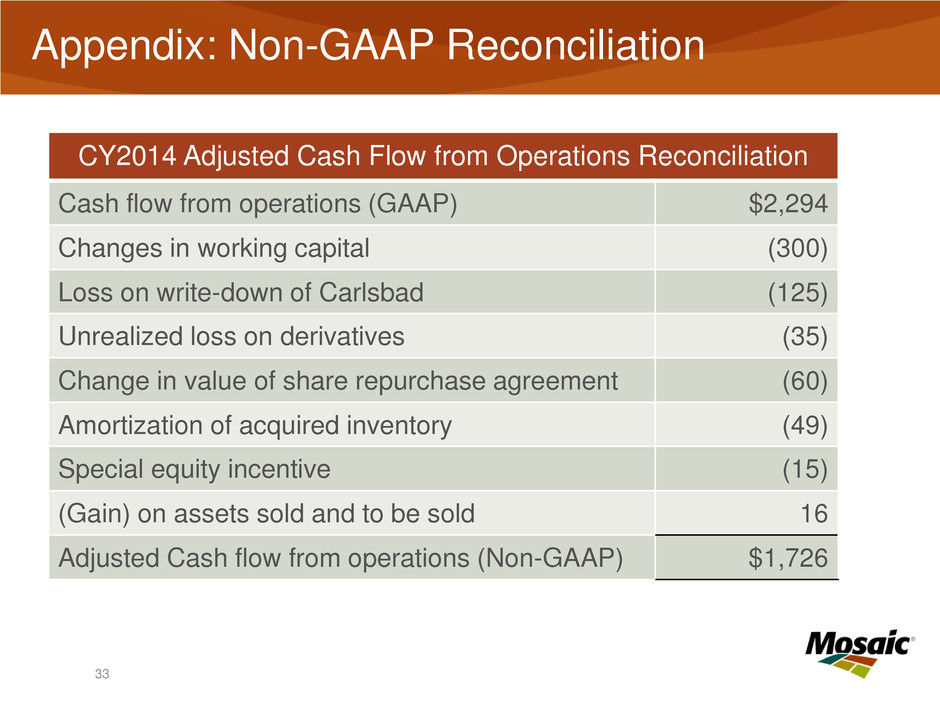

CY2014 Adjusted Cash Flow from Operations Reconciliation Cash flow from operations (GAAP) $2,294 Changes in working capital (300) Loss on write-down of Carlsbad (125) Unrealized loss on derivatives (35) Change in value of share repurchase agreement (60) Amortization of acquired inventory (49) Special equity incentive (15) (Gain) on assets sold and to be sold 16 Adjusted Cash flow from operations (Non-GAAP) $1,726 33 Appendix: Non-GAAP Reconciliation

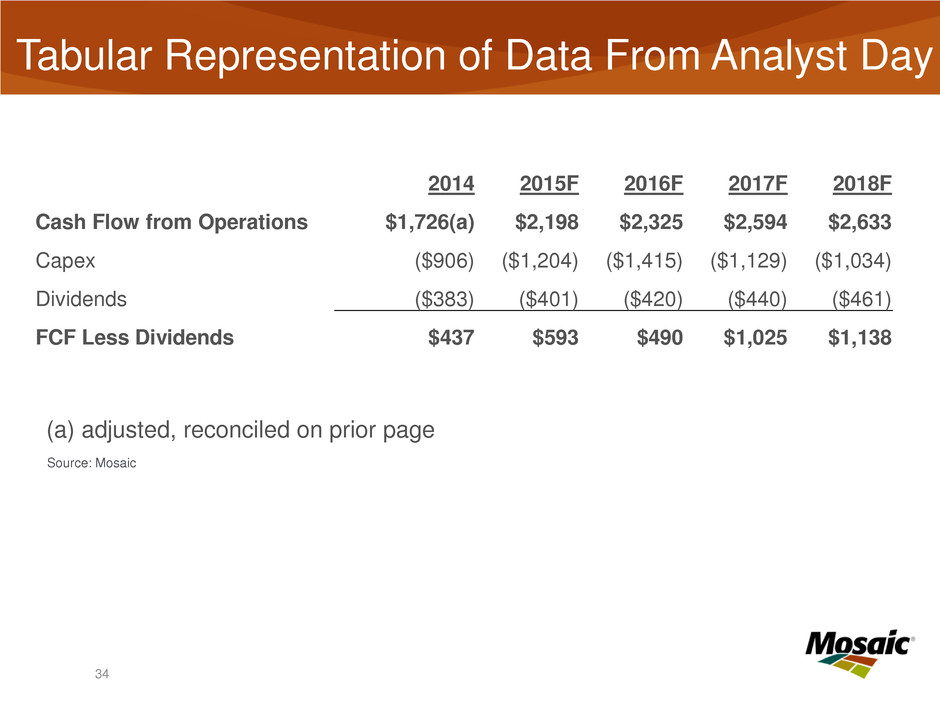

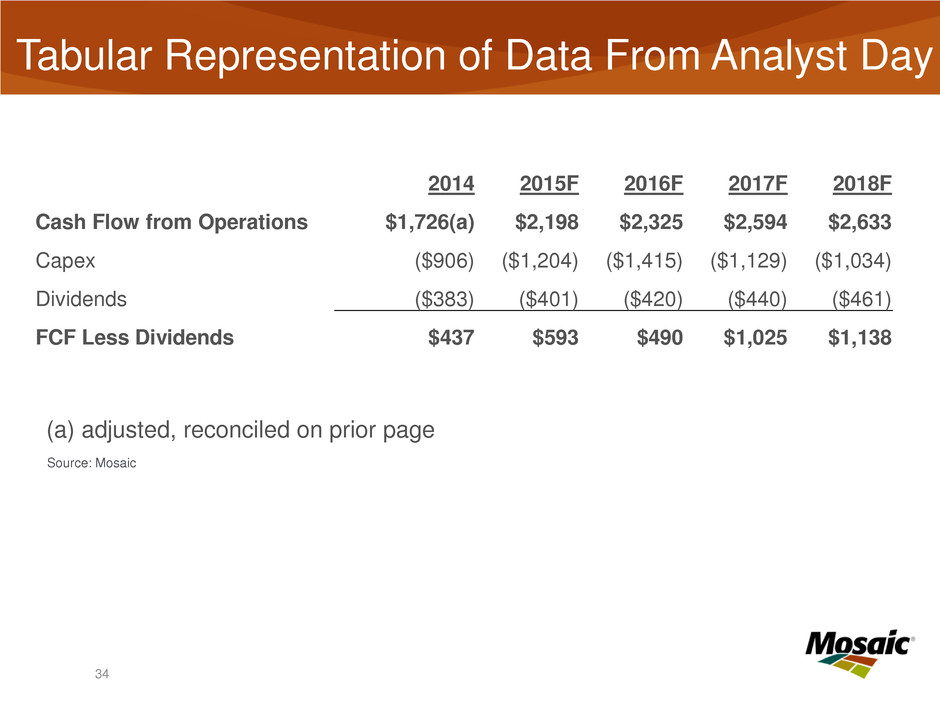

Source: Mosaic 2014 2015F 2016F 2017F 2018F Cash Flow from Operations $1,726(a) $2,198 $2,325 $2,594 $2,633 Capex ($906) ($1,204) ($1,415) ($1,129) ($1,034) Dividends ($383) ($401) ($420) ($440) ($461) FCF Less Dividends $437 $593 $490 $1,025 $1,138 (a) adjusted, reconciled on prior page Tabular Representation of Data From Analyst Day 34

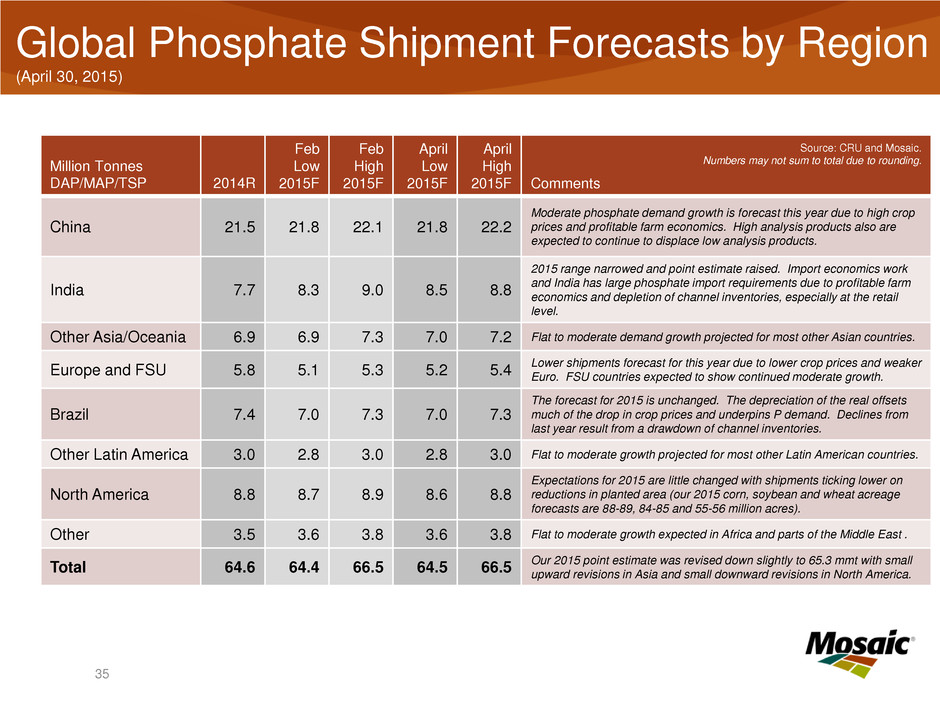

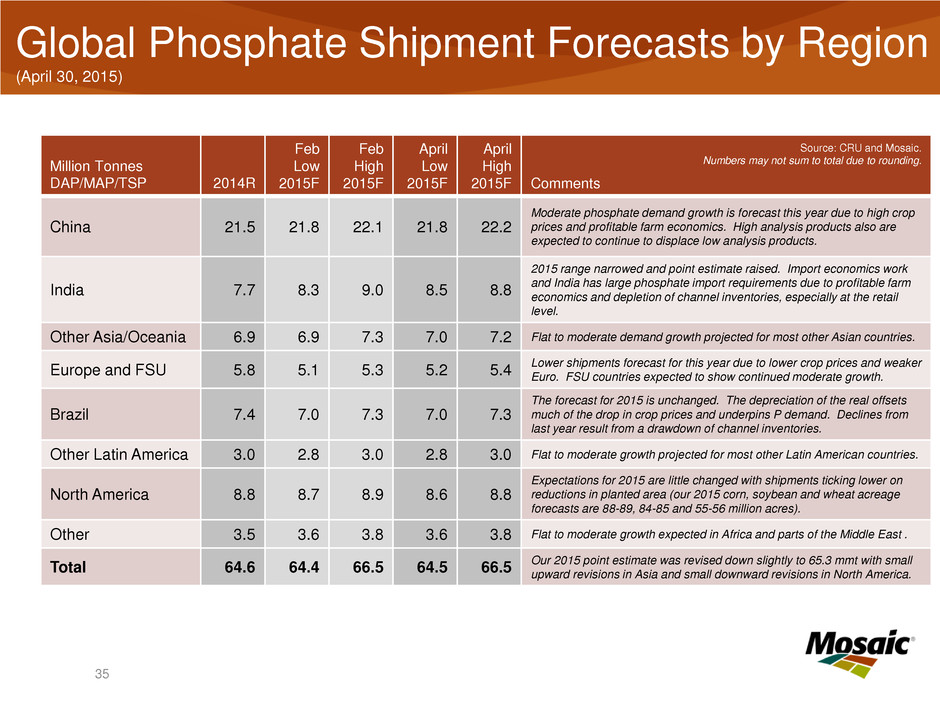

35 Global Phosphate Shipment Forecasts by Region (April 30, 2015) Million Tonnes DAP/MAP/TSP 2014R Feb Low 2015F Feb High 2015F April Low 2015F April High 2015F Comments China 21.5 21.8 22.1 21.8 22.2 Moderate phosphate demand growth is forecast this year due to high crop prices and profitable farm economics. High analysis products also are expected to continue to displace low analysis products. India 7.7 8.3 9.0 8.5 8.8 2015 range narrowed and point estimate raised. Import economics work and India has large phosphate import requirements due to profitable farm economics and depletion of channel inventories, especially at the retail level. Other Asia/Oceania 6.9 6.9 7.3 7.0 7.2 Flat to moderate demand growth projected for most other Asian countries. Europe and FSU 5.8 5.1 5.3 5.2 5.4 Lower shipments forecast for this year due to lower crop prices and weaker Euro. FSU countries expected to show continued moderate growth. Brazil 7.4 7.0 7.3 7.0 7.3 The forecast for 2015 is unchanged. The depreciation of the real offsets much of the drop in crop prices and underpins P demand. Declines from last year result from a drawdown of channel inventories. Other Latin America 3.0 2.8 3.0 2.8 3.0 Flat to moderate growth projected for most other Latin American countries. North America 8.8 8.7 8.9 8.6 8.8 Expectations for 2015 are little changed with shipments ticking lower on reductions in planted area (our 2015 corn, soybean and wheat acreage forecasts are 88-89, 84-85 and 55-56 million acres). Other 3.5 3.6 3.8 3.6 3.8 Flat to moderate growth expected in Africa and parts of the Middle East . Total 64.6 64.4 66.5 64.5 66.5 Our 2015 point estimate was revised down slightly to 65.3 mmt with small upward revisions in Asia and small downward revisions in North America. Source: CRU and Mosaic. Numbers may not sum to total due to rounding.

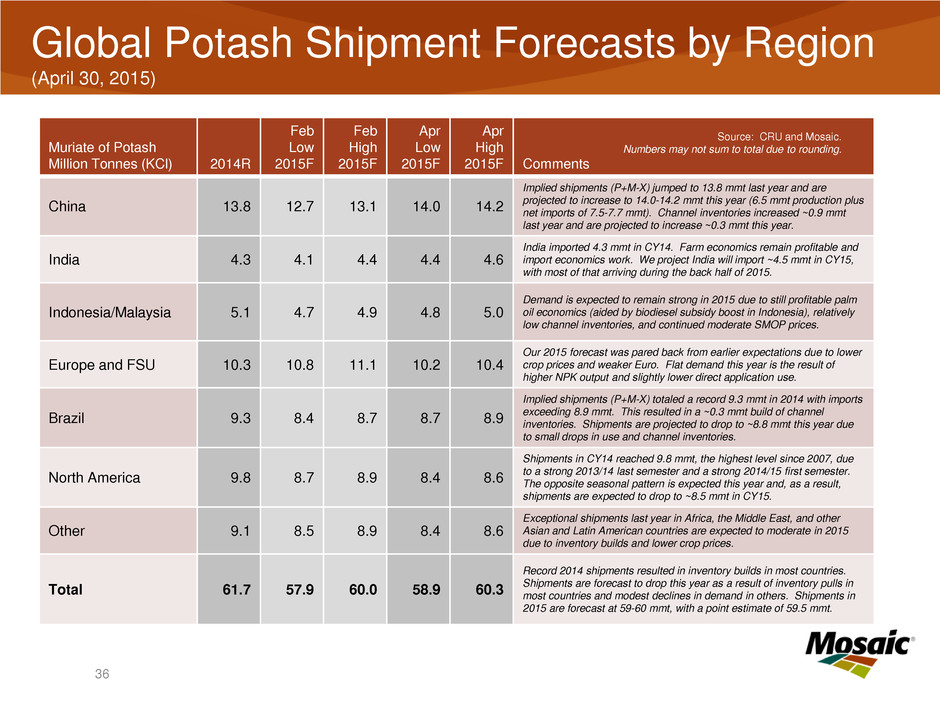

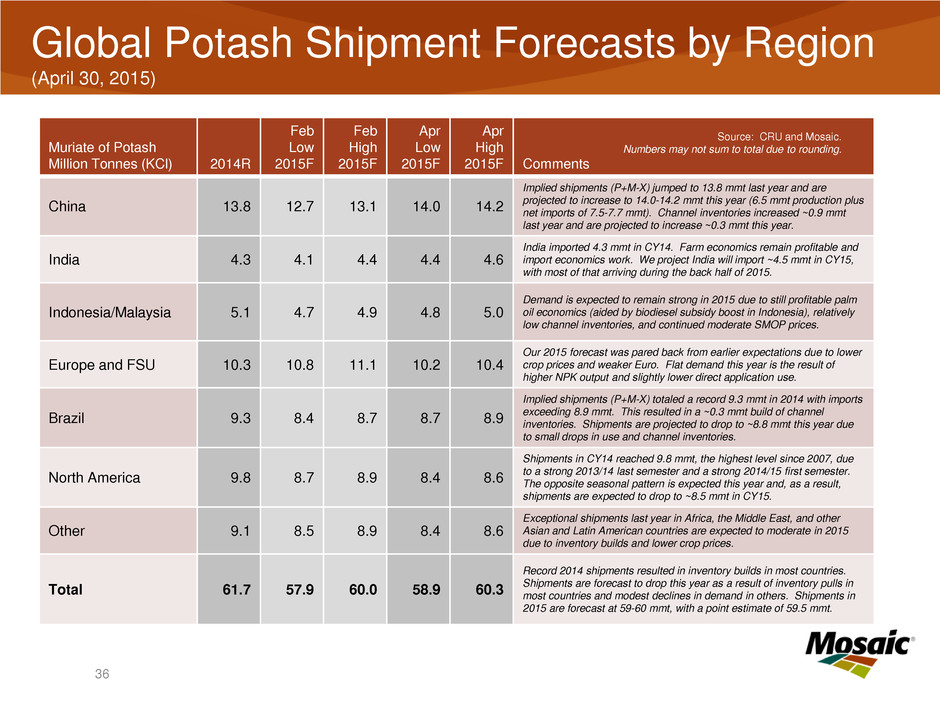

36 Global Potash Shipment Forecasts by Region (April 30, 2015) Muriate of Potash Million Tonnes (KCl) 2014R Feb Low 2015F Feb High 2015F Apr Low 2015F Apr High 2015F Comments China 13.8 12.7 13.1 14.0 14.2 Implied shipments (P+M-X) jumped to 13.8 mmt last year and are projected to increase to 14.0-14.2 mmt this year (6.5 mmt production plus net imports of 7.5-7.7 mmt). Channel inventories increased ~0.9 mmt last year and are projected to increase ~0.3 mmt this year. India 4.3 4.1 4.4 4.4 4.6 India imported 4.3 mmt in CY14. Farm economics remain profitable and import economics work. We project India will import ~4.5 mmt in CY15, with most of that arriving during the back half of 2015. Indonesia/Malaysia 5.1 4.7 4.9 4.8 5.0 Demand is expected to remain strong in 2015 due to still profitable palm oil economics (aided by biodiesel subsidy boost in Indonesia), relatively low channel inventories, and continued moderate SMOP prices. Europe and FSU 10.3 10.8 11.1 10.2 10.4 Our 2015 forecast was pared back from earlier expectations due to lower crop prices and weaker Euro. Flat demand this year is the result of higher NPK output and slightly lower direct application use. Brazil 9.3 8.4 8.7 8.7 8.9 Implied shipments (P+M-X) totaled a record 9.3 mmt in 2014 with imports exceeding 8.9 mmt. This resulted in a ~0.3 mmt build of channel inventories. Shipments are projected to drop to ~8.8 mmt this year due to small drops in use and channel inventories. North America 9.8 8.7 8.9 8.4 8.6 Shipments in CY14 reached 9.8 mmt, the highest level since 2007, due to a strong 2013/14 last semester and a strong 2014/15 first semester. The opposite seasonal pattern is expected this year and, as a result, shipments are expected to drop to ~8.5 mmt in CY15. Other 9.1 8.5 8.9 8.4 8.6 Exceptional shipments last year in Africa, the Middle East, and other Asian and Latin American countries are expected to moderate in 2015 due to inventory builds and lower crop prices. Total 61.7 57.9 60.0 58.9 60.3 Record 2014 shipments resulted in inventory builds in most countries. Shipments are forecast to drop this year as a result of inventory pulls in most countries and modest declines in demand in others. Shipments in 2015 are forecast at 59-60 mmt, with a point estimate of 59.5 mmt. Source: CRU and Mosaic. Numbers may not sum to total due to rounding.