1 The State of Agriculture and Plant Nutrient Industries Piper Jaffray Technology-Enabled Industrials Symposium Minneapolis, MN August 5, 2015 Dr. Michael R. Rahm Vice President Market and Strategic Analysis The Mosaic Company

2 Topics and Take-Aways Agricultural Observations and Outlook - Near term: Bipolar markets but likely no price collapse or spike - Long term: Food story not in vogue today but still solidly intact Plant Nutrient Observations and Outlook - The Mosaic Company - Near term • Cautious sentiment but positive demand prospects • Key countries insulated from vagaries of commodity markets • Several supply hiccups keep markets roughly balanced - Long term • Solid demand drivers and forecasts • A new supply ballgame • Better-than-expected supply/demand balances

3 Safe Harbor This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

4 Agricultural Observations and Outlook Near Term

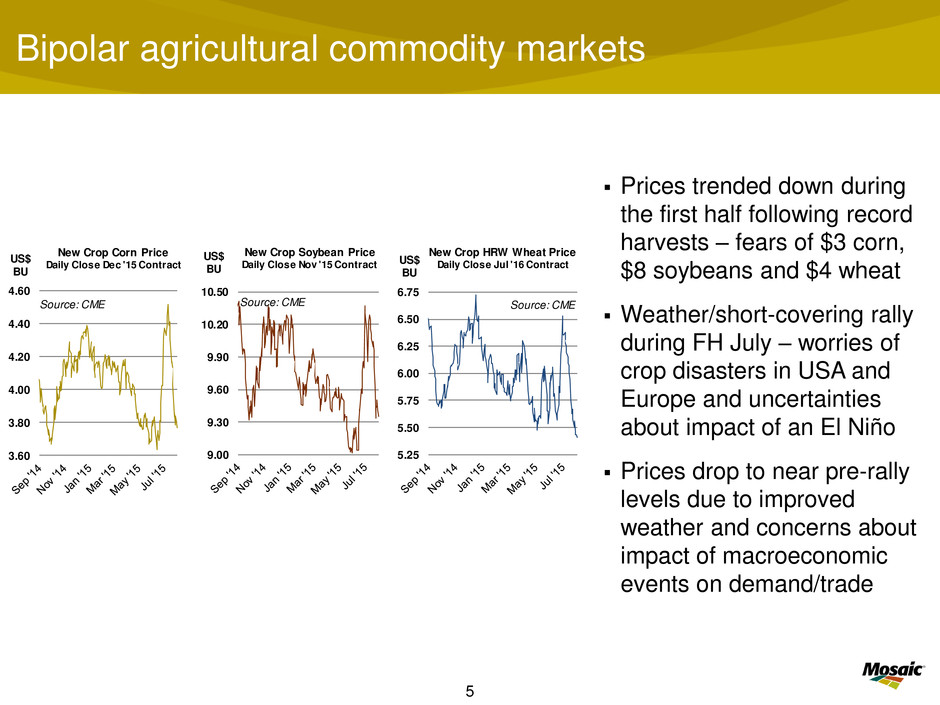

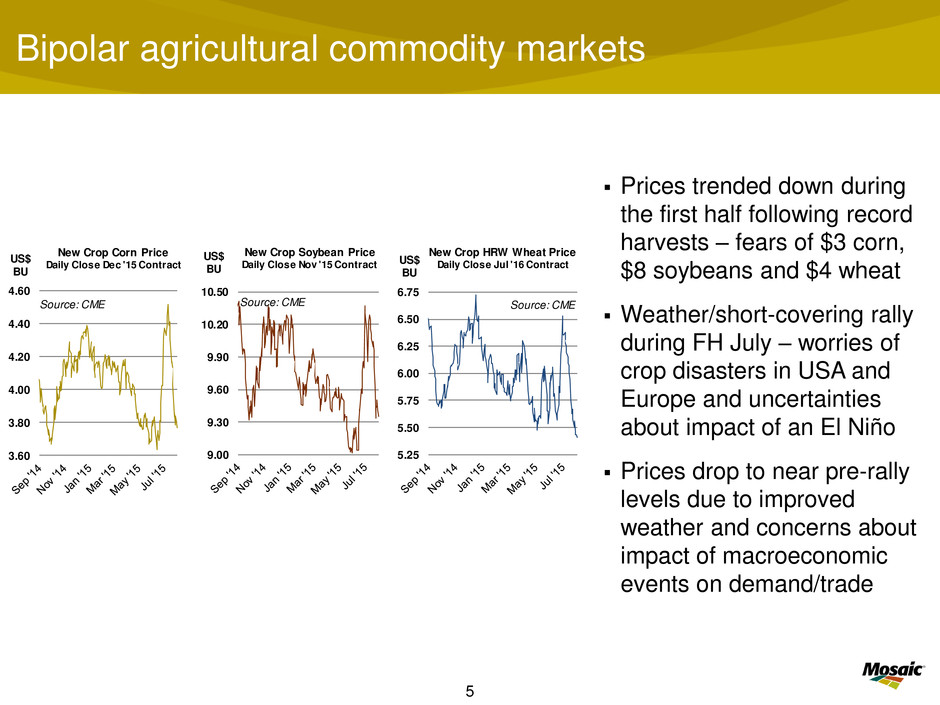

5 Bipolar agricultural commodity markets Prices trended down during the first half following record harvests – fears of $3 corn, $8 soybeans and $4 wheat Weather/short-covering rally during FH July – worries of crop disasters in USA and Europe and uncertainties about impact of an El Niño Prices drop to near pre-rally levels due to improved weather and concerns about impact of macroeconomic events on demand/trade 3.60 3.80 4.00 4.20 4.40 4.60 US$ BU New Crop Corn Price Daily Close Dec '15 Contract Source: CME 9.00 9.30 9.60 9.90 10.20 10.50 US$ BU New Crop Soybean Price Daily Close Nov '15 Contract Source: CME 5.25 5.50 5.75 6.00 6.25 6.50 6.75 US$ BU New C op HRW Wheat Price Daily Close Jul '16 Contract Source: CME

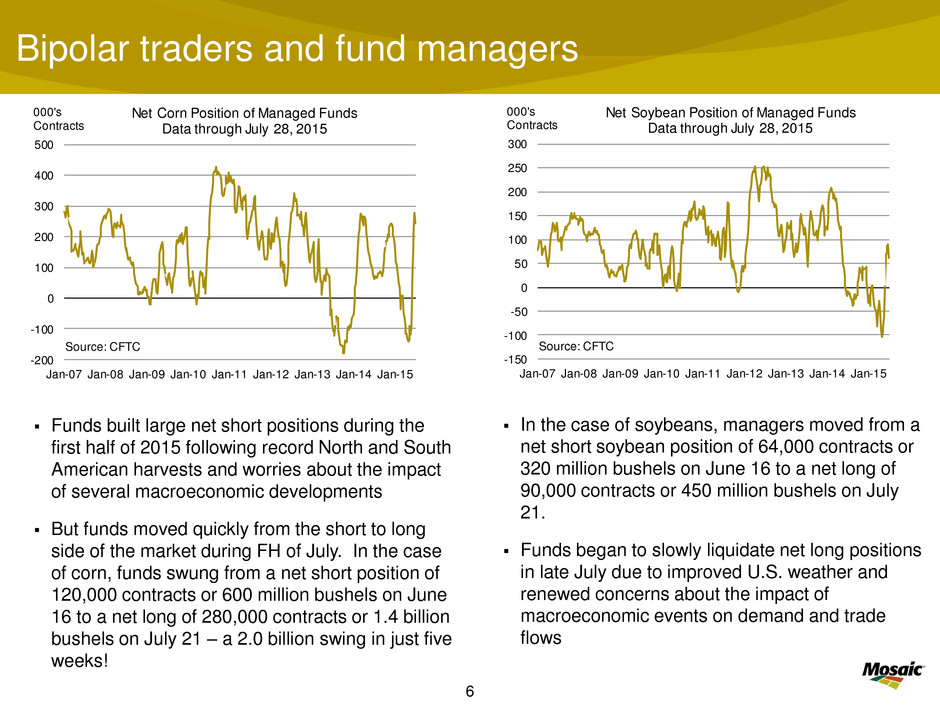

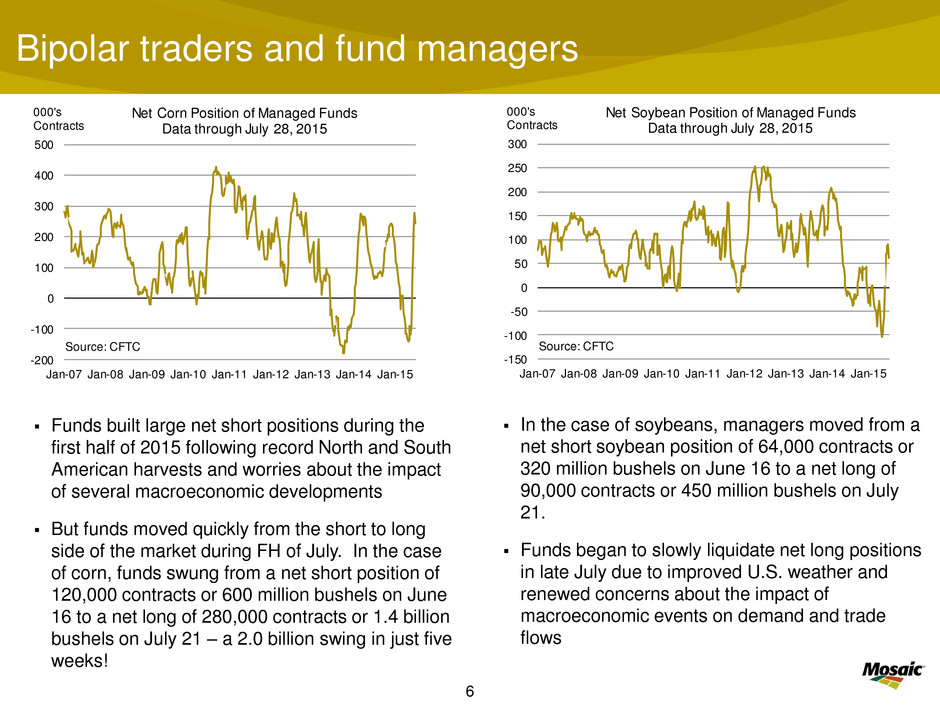

6 Bipolar traders and fund managers In the case of soybeans, managers moved from a net short soybean position of 64,000 contracts or 320 million bushels on June 16 to a net long of 90,000 contracts or 450 million bushels on July 21. Funds began to slowly liquidate net long positions in late July due to improved U.S. weather and renewed concerns about the impact of macroeconomic events on demand and trade flows Funds built large net short positions during the first half of 2015 following record North and South American harvests and worries about the impact of several macroeconomic developments But funds moved quickly from the short to long side of the market during FH of July. In the case of corn, funds swung from a net short position of 120,000 contracts or 600 million bushels on June 16 to a net long of 280,000 contracts or 1.4 billion bushels on July 21 – a 2.0 billion swing in just five weeks! -200 -100 0 100 200 300 400 500 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 000's Contracts Source: CFTC Net Corn Position of Managed Funds Data through July 28, 2015 -150 -100 -50 0 50 100 150 200 250 300 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 000's Contracts Source: CFTC Net Soybean Position of Managed Funds Data through July 28, 2015

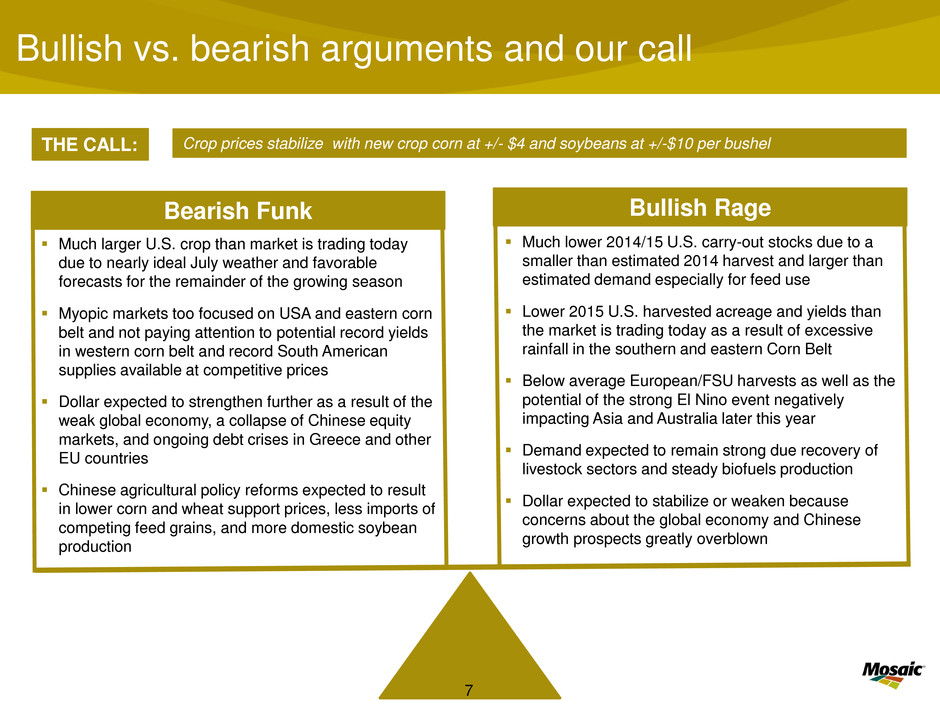

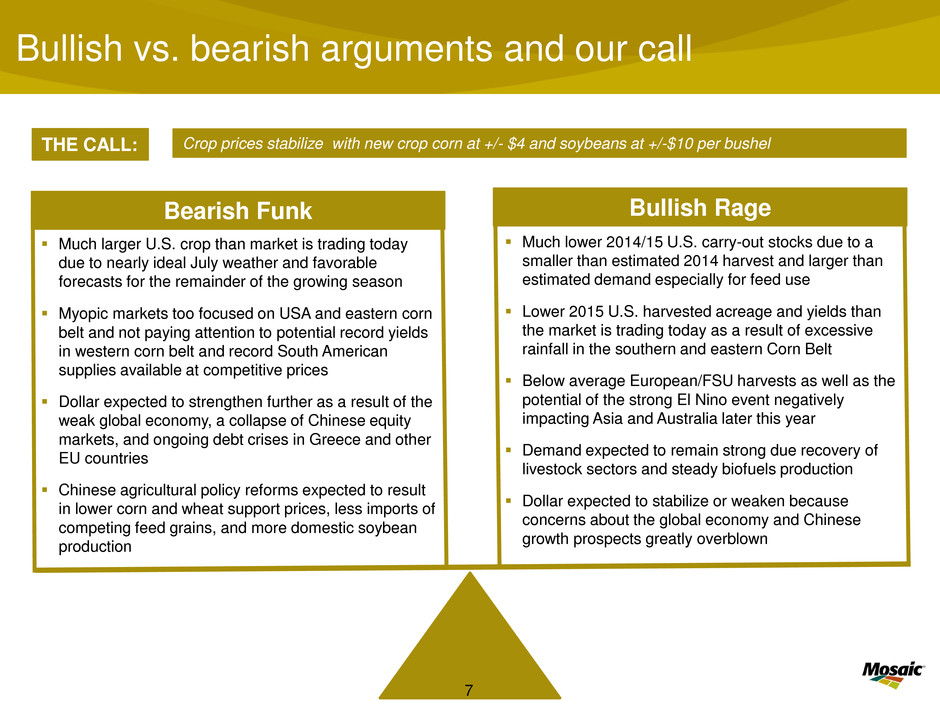

7 Bullish vs. bearish arguments and our call Bullish Rage Bearish Funk Much lower 2014/15 U.S. carry-out stocks due to a smaller than estimated 2014 harvest and larger than estimated demand especially for feed use Lower 2015 U.S. harvested acreage and yields than the market is trading today as a result of excessive rainfall in the southern and eastern Corn Belt Below average European/FSU harvests as well as the potential of the strong El Nino event negatively impacting Asia and Australia later this year Demand expected to remain strong due recovery of livestock sectors and steady biofuels production Dollar expected to stabilize or weaken because concerns about the global economy and Chinese growth prospects greatly overblown Much larger U.S. crop than market is trading today due to nearly ideal July weather and favorable forecasts for the remainder of the growing season Myopic markets too focused on USA and eastern corn belt and not paying attention to potential record yields in western corn belt and record South American supplies available at competitive prices Dollar expected to strengthen further as a result of the weak global economy, a collapse of Chinese equity markets, and ongoing debt crises in Greece and other EU countries Chinese agricultural policy reforms expected to result in lower corn and wheat support prices, less imports of competing feed grains, and more domestic soybean production Crop prices stabilize with new crop corn at +/- $4 and soybeans at +/-$10 per bushel THE CALL:

8 Agricultural Observations and Outlook Long Term

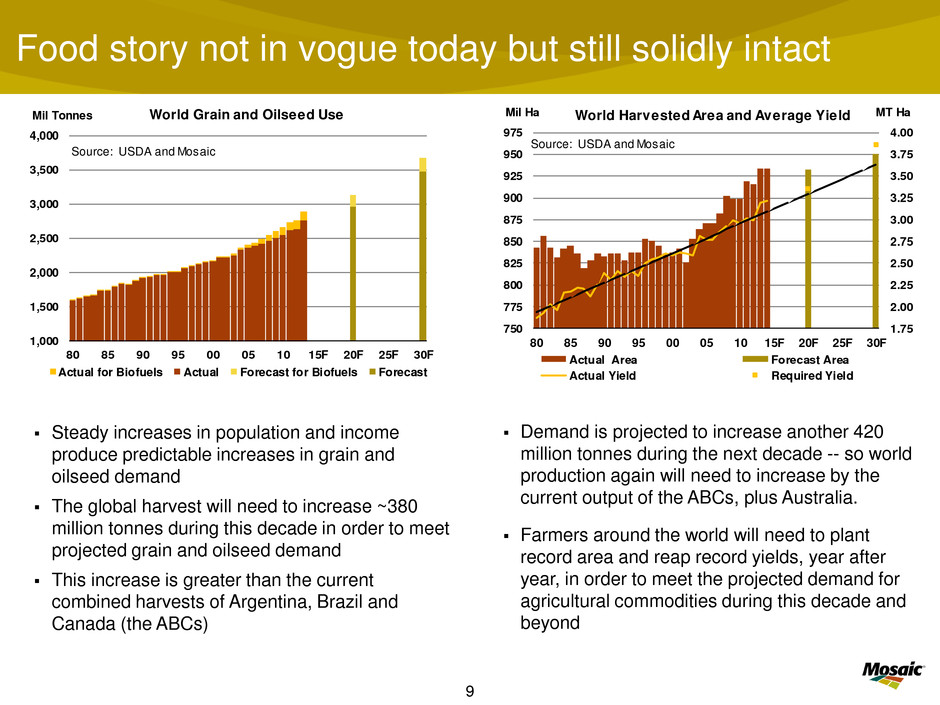

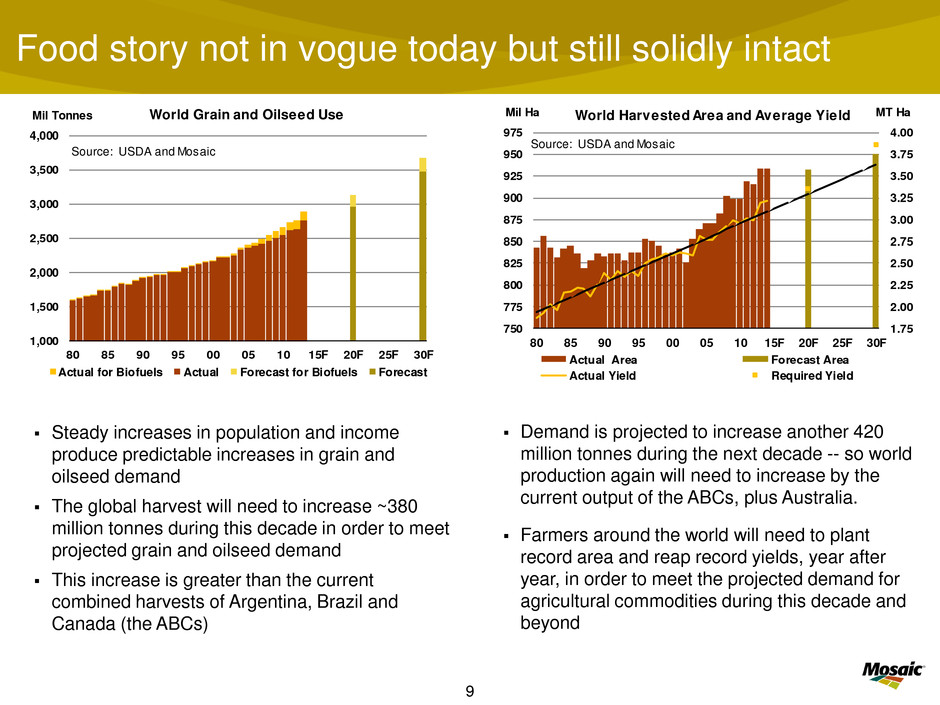

9 Food story not in vogue today but still solidly intact Demand is projected to increase another 420 million tonnes during the next decade -- so world production again will need to increase by the current output of the ABCs, plus Australia. Farmers around the world will need to plant record area and reap record yields, year after year, in order to meet the projected demand for agricultural commodities during this decade and beyond Steady increases in population and income produce predictable increases in grain and oilseed demand The global harvest will need to increase ~380 million tonnes during this decade in order to meet projected grain and oilseed demand This increase is greater than the current combined harvests of Argentina, Brazil and Canada (the ABCs) 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 750 775 800 825 850 875 900 925 950 975 80 85 90 95 00 05 10 15F 20F 25F 30F MT HaMil Ha World Harvested Area and Average Yield Actual Area Forecast Area Actual Yield Required Yield Source: USDA and Mosaic 1,000 1,500 2,000 2,500 3,000 3,500 4,000 80 85 90 95 00 05 10 15F 20F 25F 30F Mil Tonnes Source: USDA and Mosaic World Grain and Oilseed Use Actual for Biofuels Actual Forecast for Biofuels Forecast

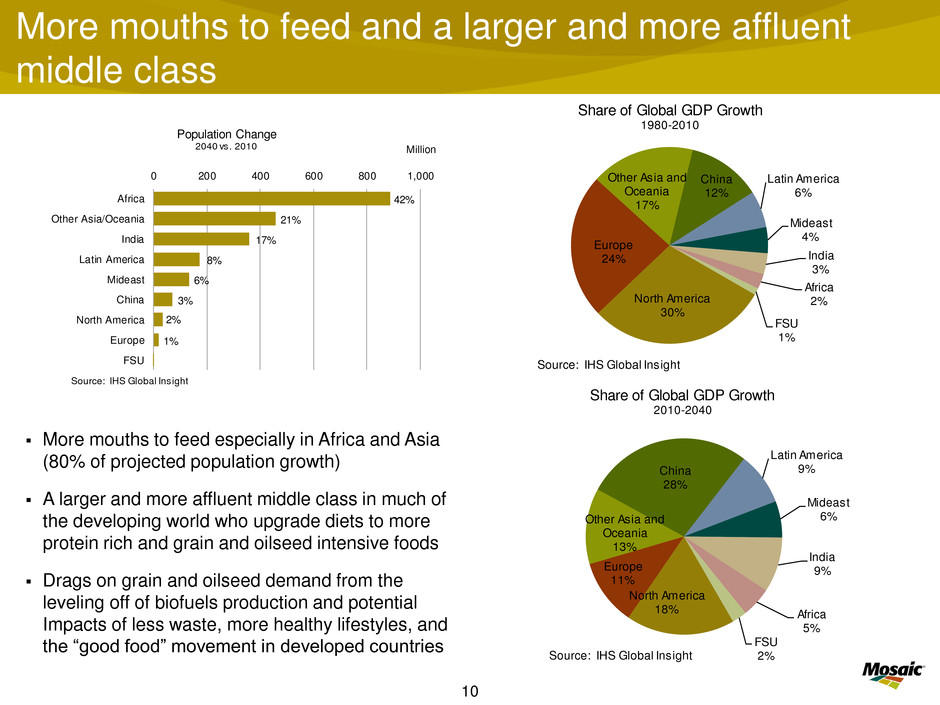

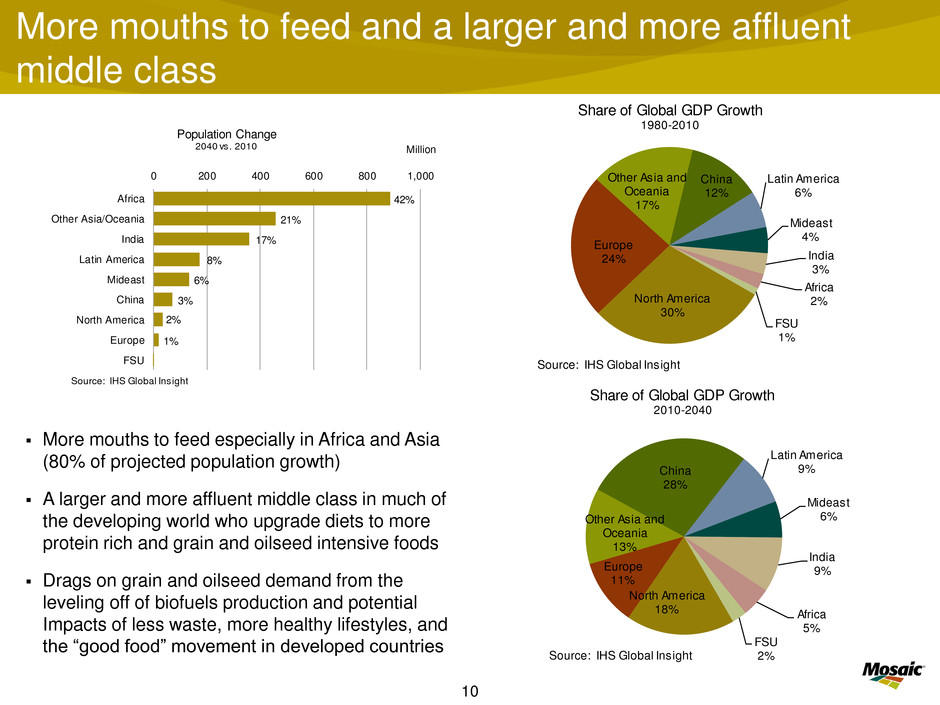

10 More mouths to feed and a larger and more affluent middle class More mouths to feed especially in Africa and Asia (80% of projected population growth) A larger and more affluent middle class in much of the developing world who upgrade diets to more protein rich and grain and oilseed intensive foods Drags on grain and oilseed demand from the leveling off of biofuels production and potential Impacts of less waste, more healthy lifestyles, and the “good food” movement in developed countries North America 30% Europe 24% Other Asia and Oceania 17% China 12% Latin America 6% Mideast 4% India 3% Africa 2% FSU 1% Share of Global GDP Growth 1980-2010 Source: IHS Global Insight North America 18% Europe 11% Other Asia and Oceania 13% China 28% Latin America 9% Mideast 6% India 9% Africa 5% FSU 2% Share of Global GDP Growth 2010-2040 Source: IHS Global Insight 1% 2% 3% 6% 8% 17% 21% 42% 0 200 400 600 800 1,000 FSU Europe North America China Mideast Latin America India Other Asia/Oceania Africa Million Population Change 2040 vs. 2010 Source: IHS Global Insight

11 Plant Nutrient Observations and Outlook The Mosaic Company

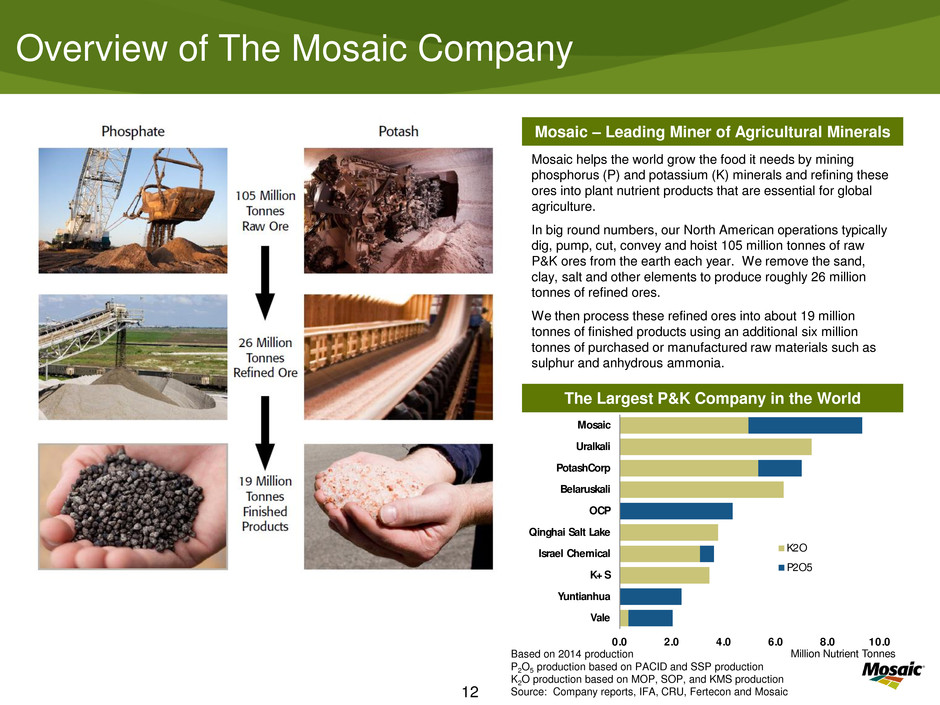

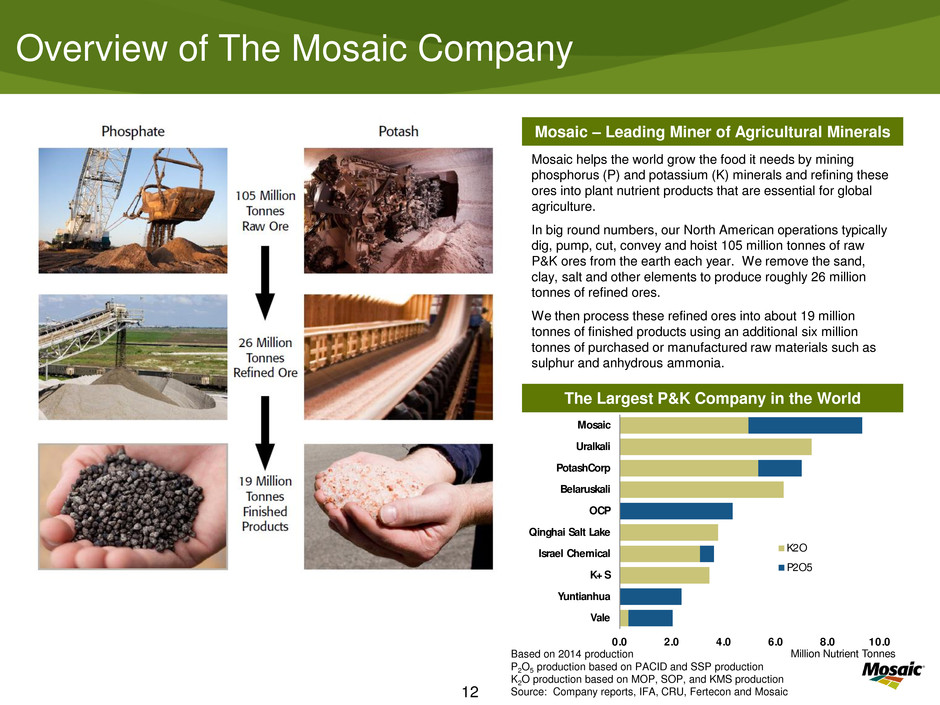

12 Overview of The Mosaic Company Mosaic helps the world grow the food it needs by mining phosphorus (P) and potassium (K) minerals and refining these ores into plant nutrient products that are essential for global agriculture. In big round numbers, our North American operations typically dig, pump, cut, convey and hoist 105 million tonnes of raw P&K ores from the earth each year. We remove the sand, clay, salt and other elements to produce roughly 26 million tonnes of refined ores. We then process these refined ores into about 19 million tonnes of finished products using an additional six million tonnes of purchased or manufactured raw materials such as sulphur and anhydrous ammonia. The Largest P&K Company in the World Mosaic – Leading Miner of Agricultural Minerals Based on 2014 production P2O5 production based on PACID and SSP production K2O production based on MOP, SOP, and KMS production Source: Company reports, IFA, CRU, Fertecon and Mosaic 0.0 2.0 4.0 6.0 8.0 10.0 Mosaic Uralkali PotashCorp Belaruskali OCP Qi ghai Salt Lake Israel Chemi al K+ S Yuntianhua Vale Million Nutrient Tonnes K2O P2O5

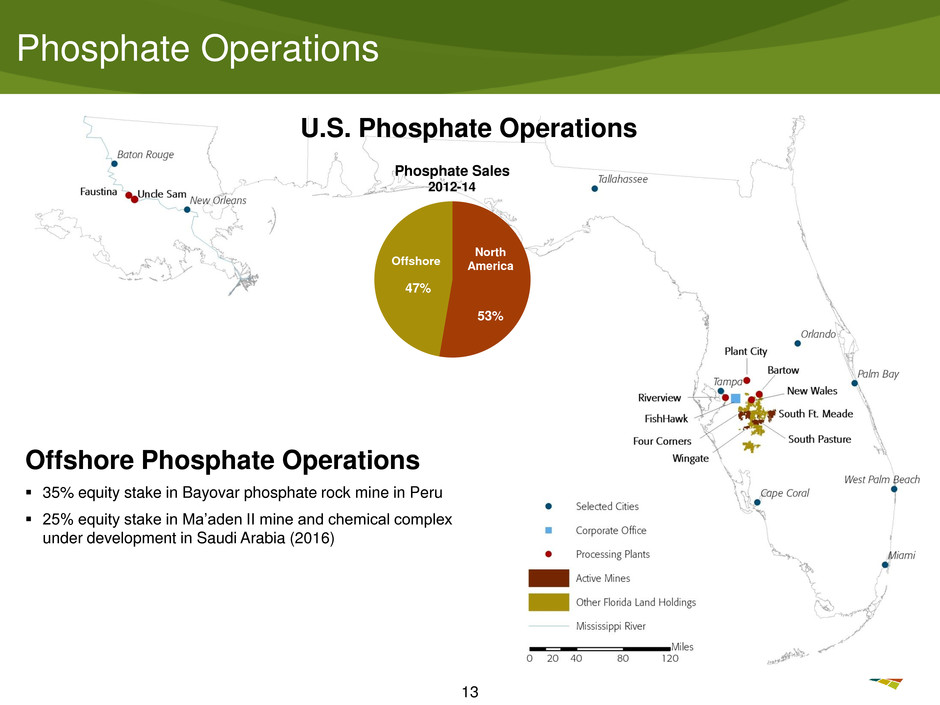

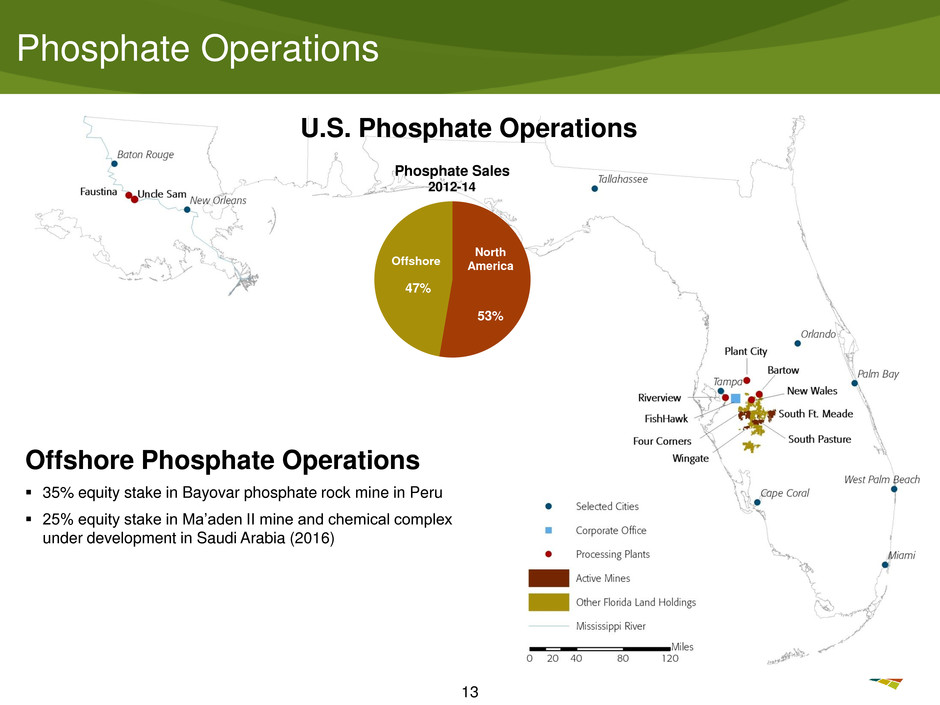

13 Phosphate Operations U.S. Phosphate Operations 53% 47% Phosphate Sales 2012-14 North America Offshore Offshore Phosphate Operations 35% equity stake in Bayovar phosphate rock mine in Peru 25% equity stake in Ma’aden II mine and chemical complex under development in Saudi Arabia (2016)

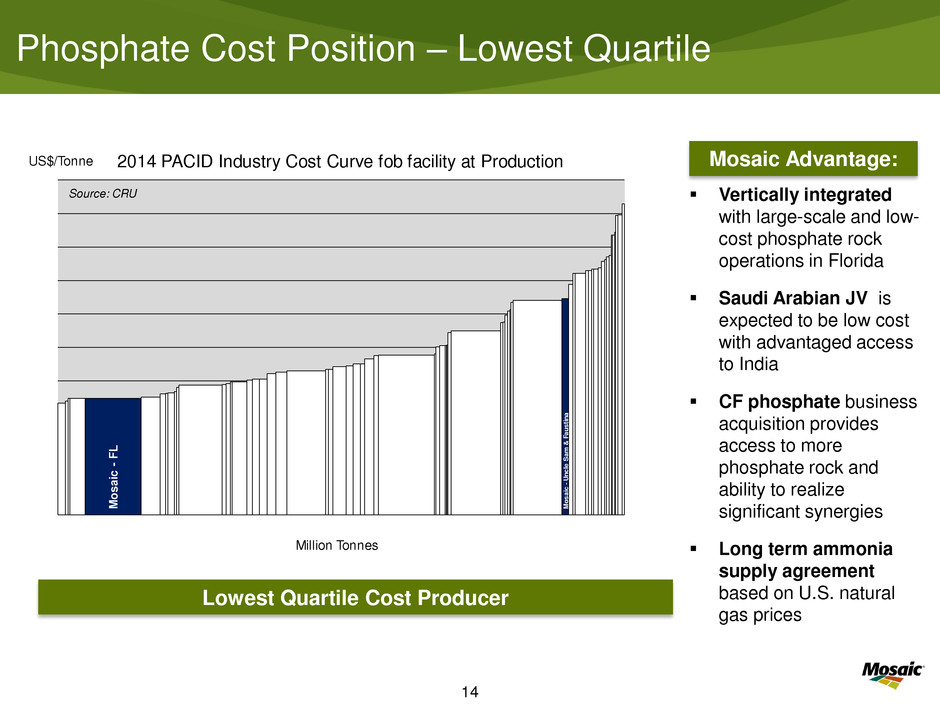

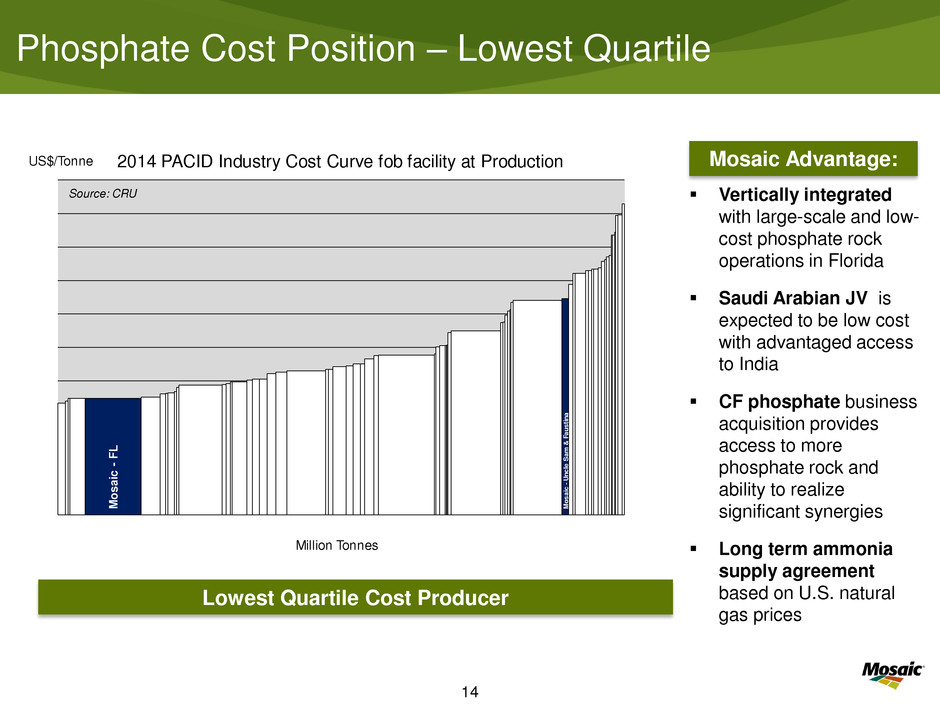

14 Phosphate Cost Position – Lowest Quartile Vertically integrated with large-scale and low- cost phosphate rock operations in Florida Saudi Arabian JV is expected to be low cost with advantaged access to India CF phosphate business acquisition provides access to more phosphate rock and ability to realize significant synergies Long term ammonia supply agreement based on U.S. natural gas prices Lowest Quartile Cost Producer Mosaic Advantage: M os ai c -F L M os ai c -U nc le S am & F au st in a US$/Tonne Million Tonnes 2014 PACID Industry Cost Curve fob facility at Production Source: CRU

15 Potash Operations NA Potash Operations 47% 53% Potash Sales 2012-14 North America Offshore

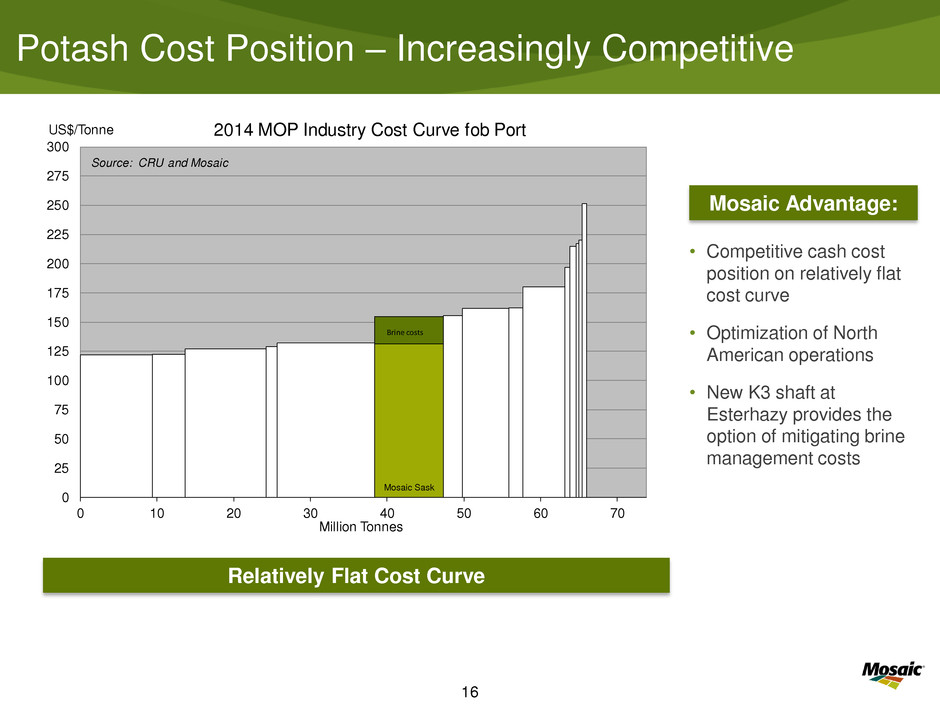

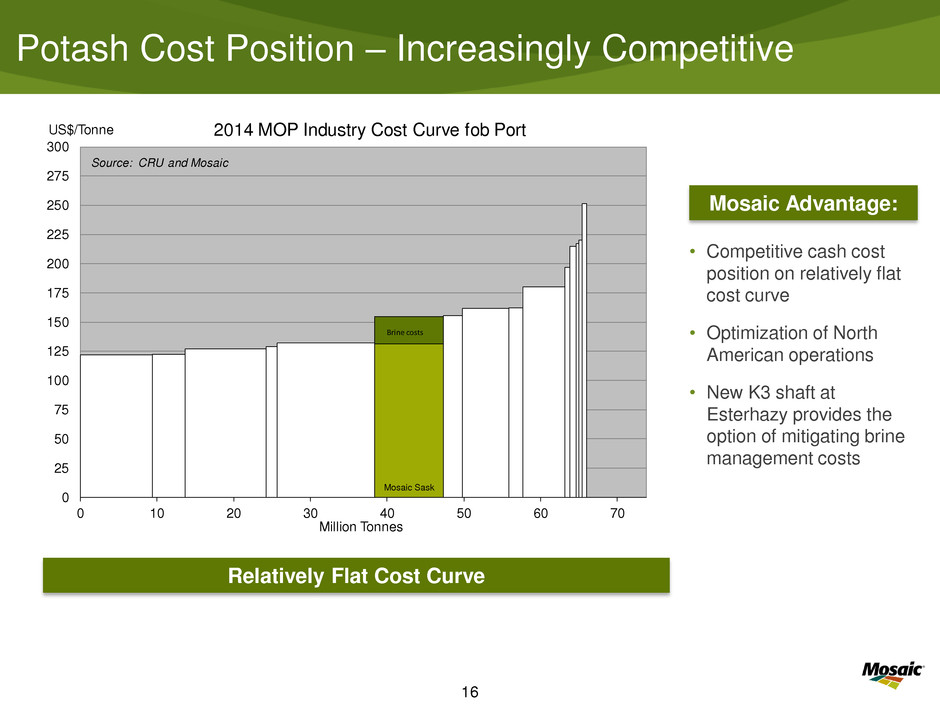

16 Potash Cost Position – Increasingly Competitive • Competitive cash cost position on relatively flat cost curve • Optimization of North American operations • New K3 shaft at Esterhazy provides the option of mitigating brine management costs Mosaic Advantage: Relatively Flat Cost Curve Brine costs Mosaic Sask 0 25 50 75 100 125 150 175 200 225 250 275 300 0 10 20 30 40 50 60 70 US$/Tonne Million Tonnes 2014 MOP Industry Cost Curve fob Port Source: CRU and Mosaic Brine costs

17 Innovation: Our MicroEssentials® Story Investing in expected future demand growth - Produced today in three granulation plants with annual capacity of 2.3 million tonnes - $225 million project approved and in progress will convert two more granulation plants at New Wales and increase capacity to 3.6 million tonnes MicroEssentials® deliver significant value - Sulphur in elemental and sulphate form as well as key micronutrients such as zinc ribboned throughout each granule - Yield increases of 3%-7% based on field trials conducted during the last 10 years - Largest yield boost in the most intensive cropping systems - Value share across supply chain from farmer to retail dealer to Mosaic Rapid adoption of MicroEssentials® - Production of 1.9 million tonnes in CY 2014 - Marketed to strategic customers in North America and offshore geographies

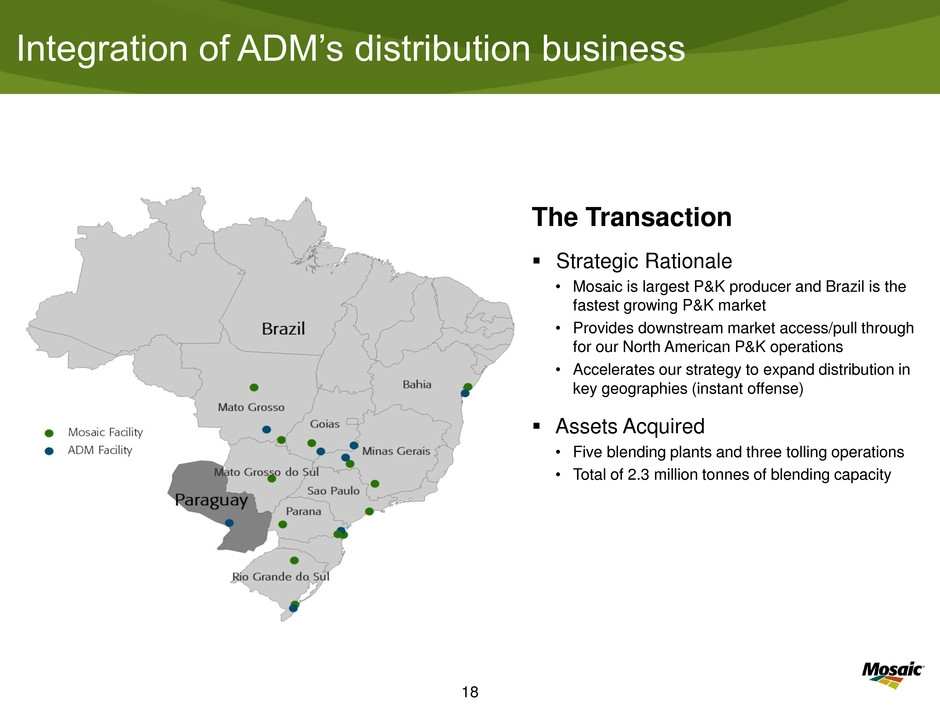

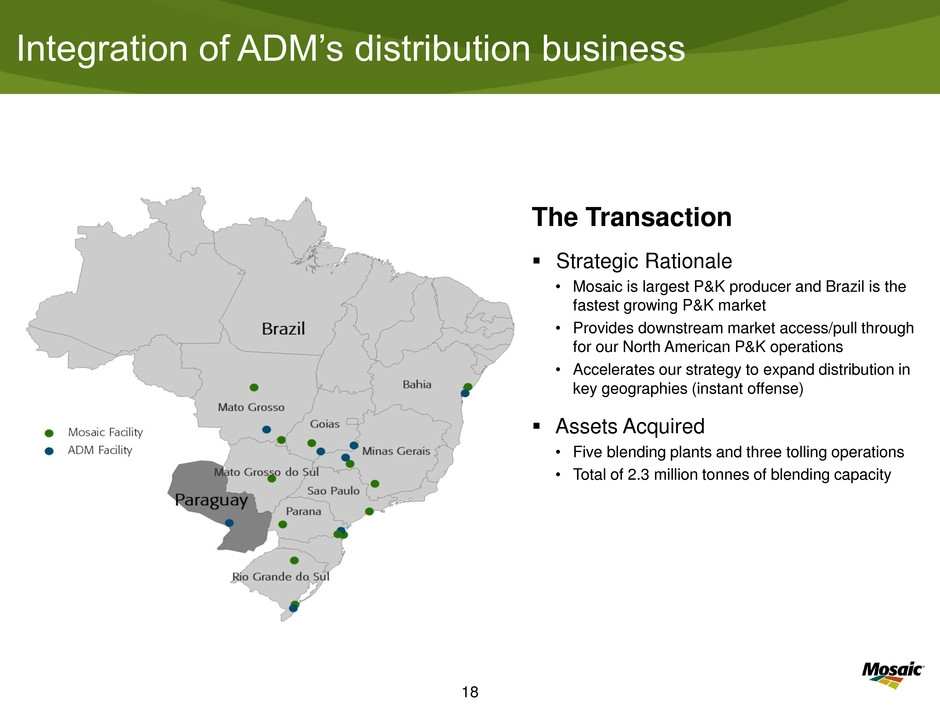

18 Integration of ADM’s distribution business The Transaction Strategic Rationale • Mosaic is largest P&K producer and Brazil is the fastest growing P&K market • Provides downstream market access/pull through for our North American P&K operations • Accelerates our strategy to expand distribution in key geographies (instant offense) Assets Acquired • Five blending plants and three tolling operations • Total of 2.3 million tonnes of blending capacity

19 Our Strategic Priorities + =

20 Plant Nutrient Observations and Outlook Near Term

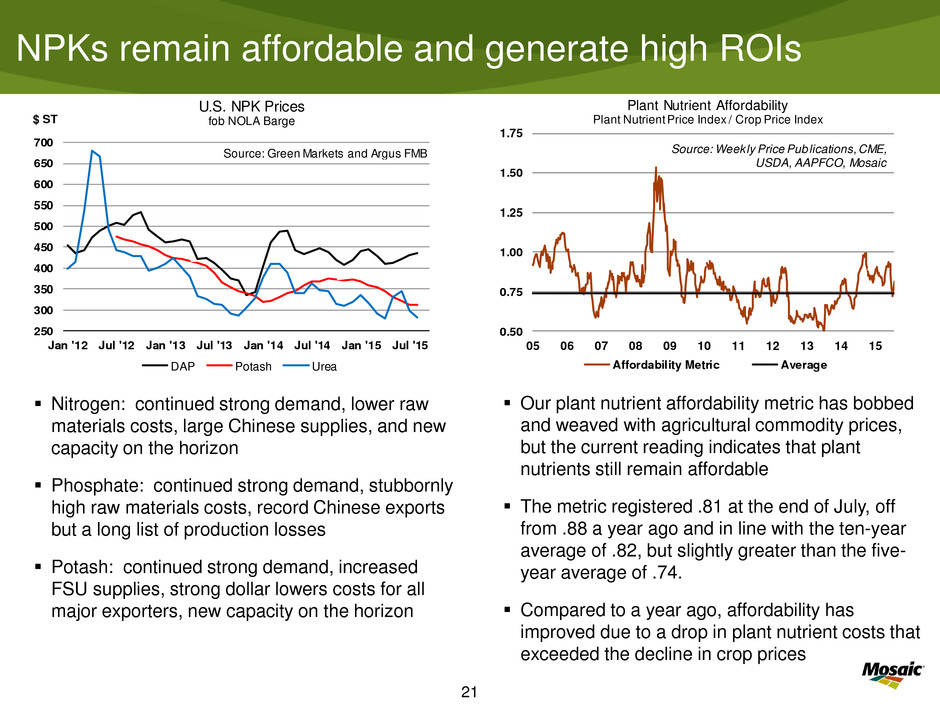

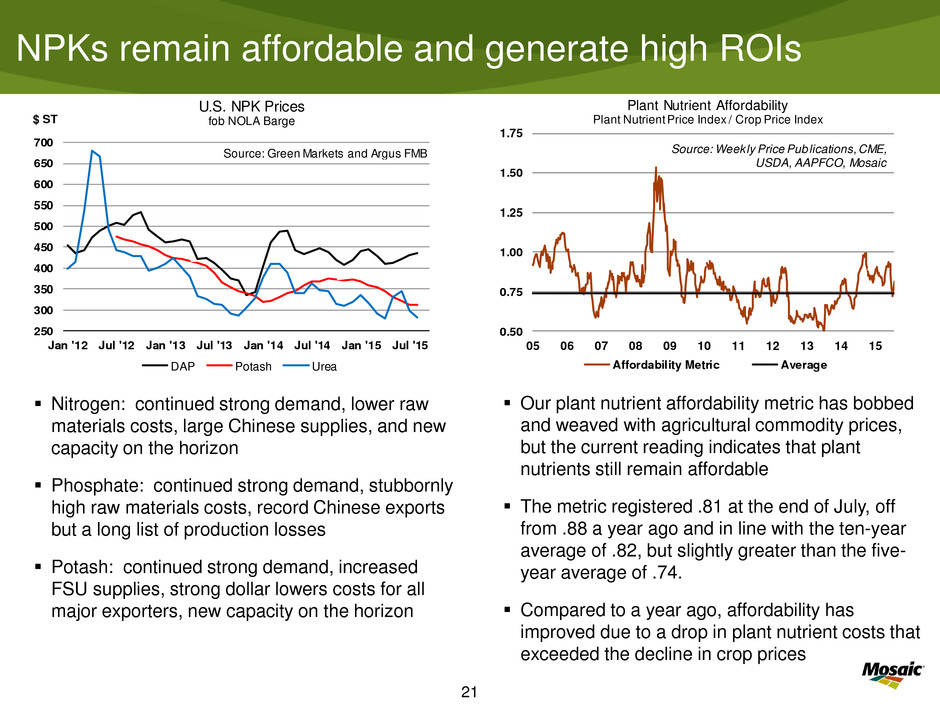

21 NPKs remain affordable and generate high ROIs Our plant nutrient affordability metric has bobbed and weaved with agricultural commodity prices, but the current reading indicates that plant nutrients still remain affordable The metric registered .81 at the end of July, off from .88 a year ago and in line with the ten-year average of .82, but slightly greater than the five- year average of .74. Compared to a year ago, affordability has improved due to a drop in plant nutrient costs that exceeded the decline in crop prices Nitrogen: continued strong demand, lower raw materials costs, large Chinese supplies, and new capacity on the horizon Phosphate: continued strong demand, stubbornly high raw materials costs, record Chinese exports but a long list of production losses Potash: continued strong demand, increased FSU supplies, strong dollar lowers costs for all major exporters, new capacity on the horizon 0.50 0.75 1.00 1.25 1.50 1.75 05 06 07 08 09 10 11 12 13 14 15 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic 250 300 350 400 450 500 550 600 650 700 Jan '12 Jul '12 Jan '13 Jul '13 Jan '14 Jul '14 Jan ' 5 Jul '15 $ ST U.S. NPK Prices fob NOLA Barge DAP Potash Urea Source: Green Markets and Argus FMB

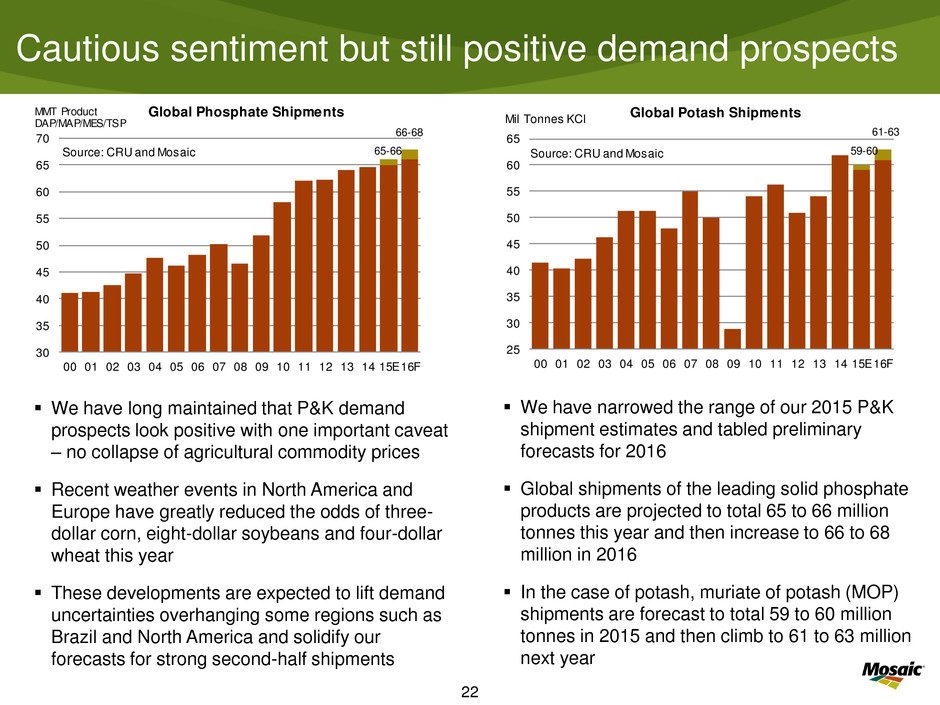

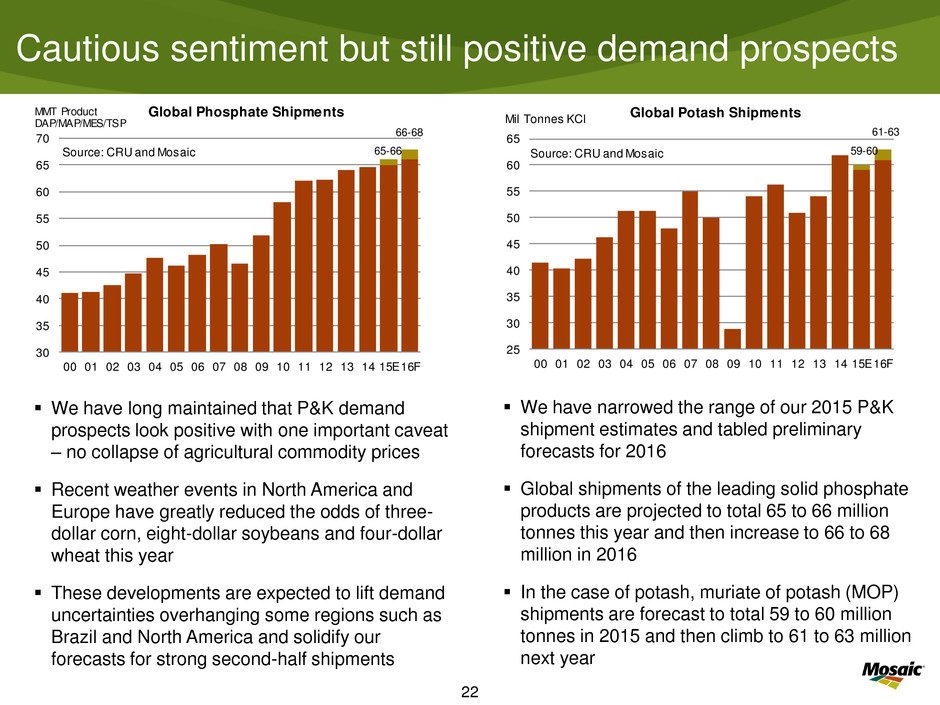

22 Cautious sentiment but still positive demand prospects We have narrowed the range of our 2015 P&K shipment estimates and tabled preliminary forecasts for 2016 Global shipments of the leading solid phosphate products are projected to total 65 to 66 million tonnes this year and then increase to 66 to 68 million in 2016 In the case of potash, muriate of potash (MOP) shipments are forecast to total 59 to 60 million tonnes in 2015 and then climb to 61 to 63 million next year We have long maintained that P&K demand prospects look positive with one important caveat – no collapse of agricultural commodity prices Recent weather events in North America and Europe have greatly reduced the odds of three- dollar corn, eight-dollar soybeans and four-dollar wheat this year These developments are expected to lift demand uncertainties overhanging some regions such as Brazil and North America and solidify our forecasts for strong second-half shipments 59-60 61-63 25 30 35 40 45 50 55 60 65 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E16F Global Potash ShipmentsMil Tonnes KCl Source: CRU and Mosaic 65-66 66-68 30 35 40 45 50 55 60 65 70 00 01 02 03 04 5 6 7 8 9 10 11 12 13 14 15E16F Global Phosphate ShipmentsMMT Product DAP/MAP/MES/TSP Source: CRU and Mosaic

23 Insulated from the vagaries of ag commodity prices China - Government supports crop prices at high levels through procurement programs that are designed to build strategic reserves and support rural economies. - Corn traded at an average price of $9.35 per bushel on the Dalian exchange and wheat traded at ~$12.00 per bushel on the Zhengzhou exchange during July. India - Government supports crop prices through procurement programs that pay farmers a Minimum Support Price for staple crops moving into government storage - Government also provides farmers with generous plant nutrient subsidies Brazil - The collapse of the real coupled with still relatively high soybean prices typically would have supercharged the export-oriented agricultural sector. - That has not happened yet, but the current price of soybeans in real per bushel is nearly equal to peaks of the last few years - Other factors including the volatility of the real, delays in releasing government- subsidized farm credit, and economic and political uncertainties have delayed shipments and imports this year

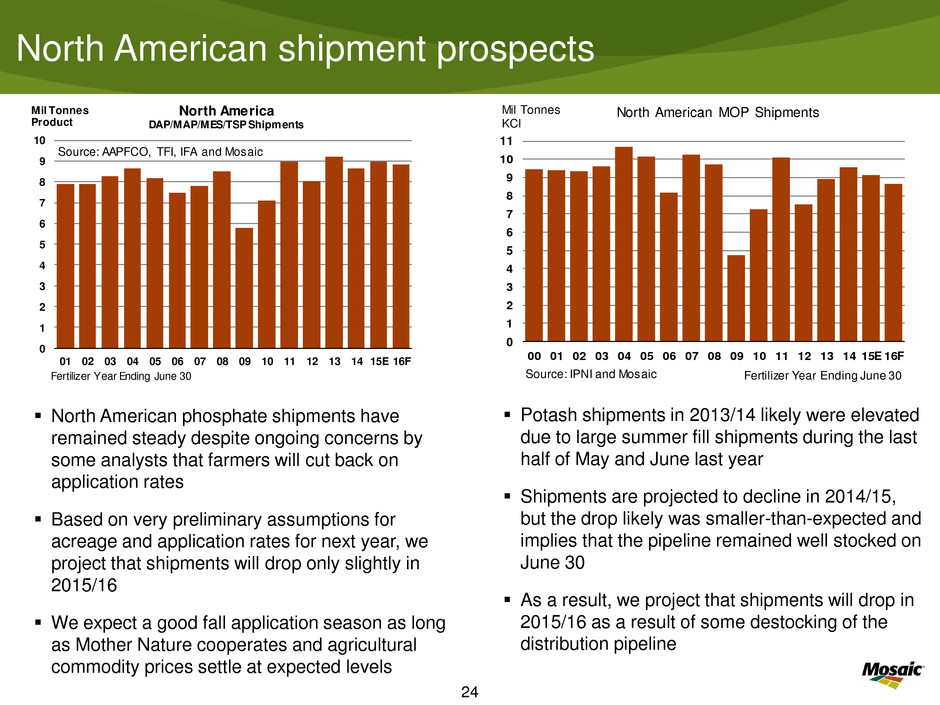

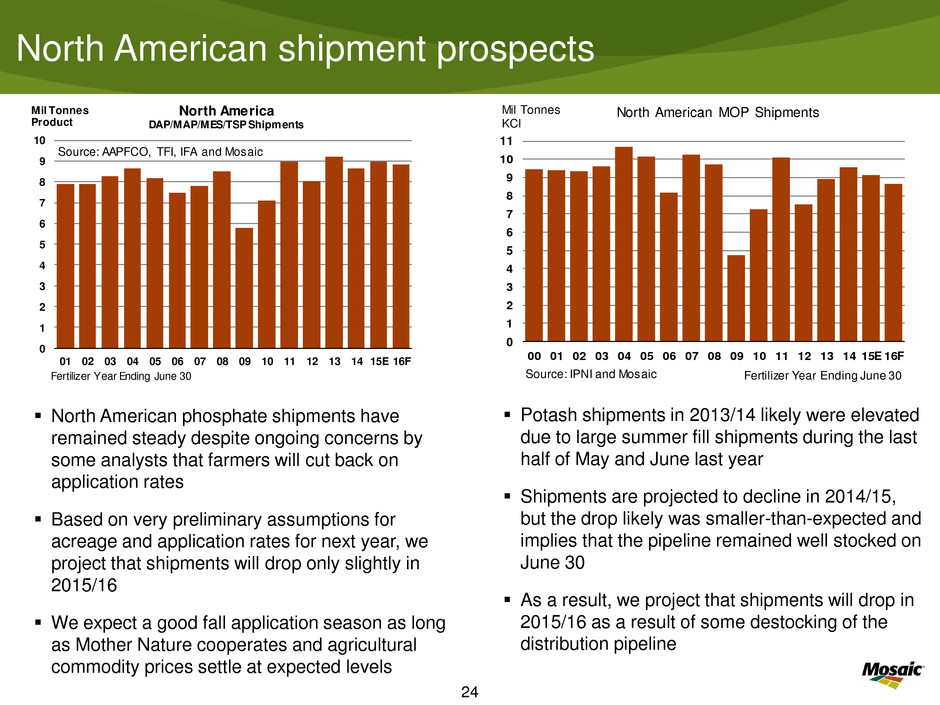

24 North American shipment prospects Potash shipments in 2013/14 likely were elevated due to large summer fill shipments during the last half of May and June last year Shipments are projected to decline in 2014/15, but the drop likely was smaller-than-expected and implies that the pipeline remained well stocked on June 30 As a result, we project that shipments will drop in 2015/16 as a result of some destocking of the distribution pipeline North American phosphate shipments have remained steady despite ongoing concerns by some analysts that farmers will cut back on application rates Based on very preliminary assumptions for acreage and application rates for next year, we project that shipments will drop only slightly in 2015/16 We expect a good fall application season as long as Mother Nature cooperates and agricultural commodity prices settle at expected levels 0 1 2 3 4 5 6 7 8 9 10 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Mil Tonnes Product North America DAP/MAP/MES/TSP Shipments Source: AAPFCO, TFI, IFA and Mosaic Fertilizer Year Ending June 30 0 1 2 3 4 5 6 7 8 9 10 11 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Mil Tonnes KCl North American MOP Shipments Source: IPNI and Mosaic Fertilizer Year Ending June 30

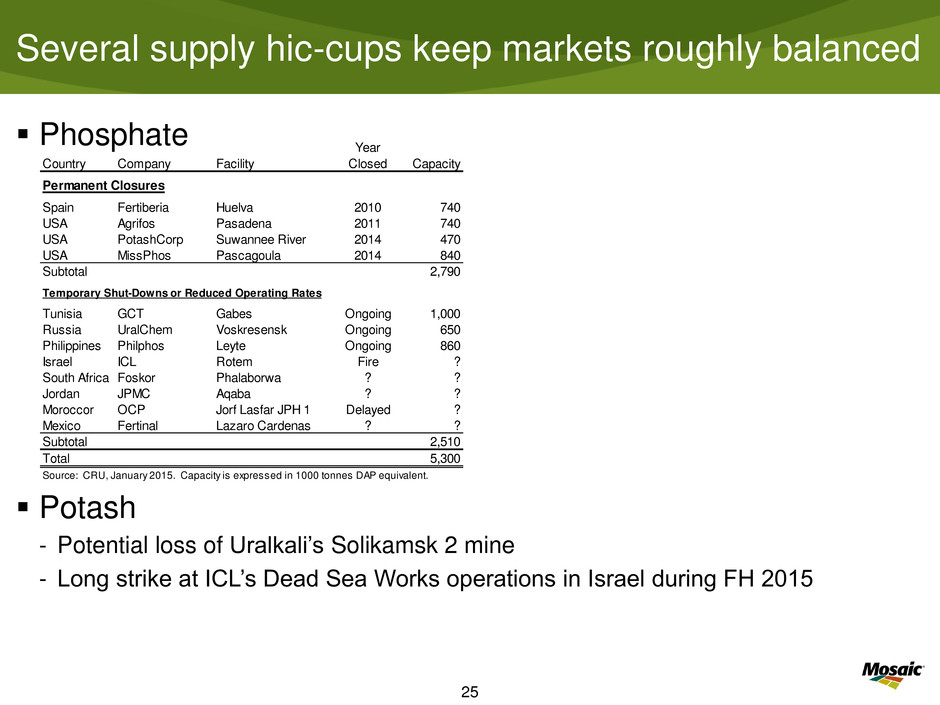

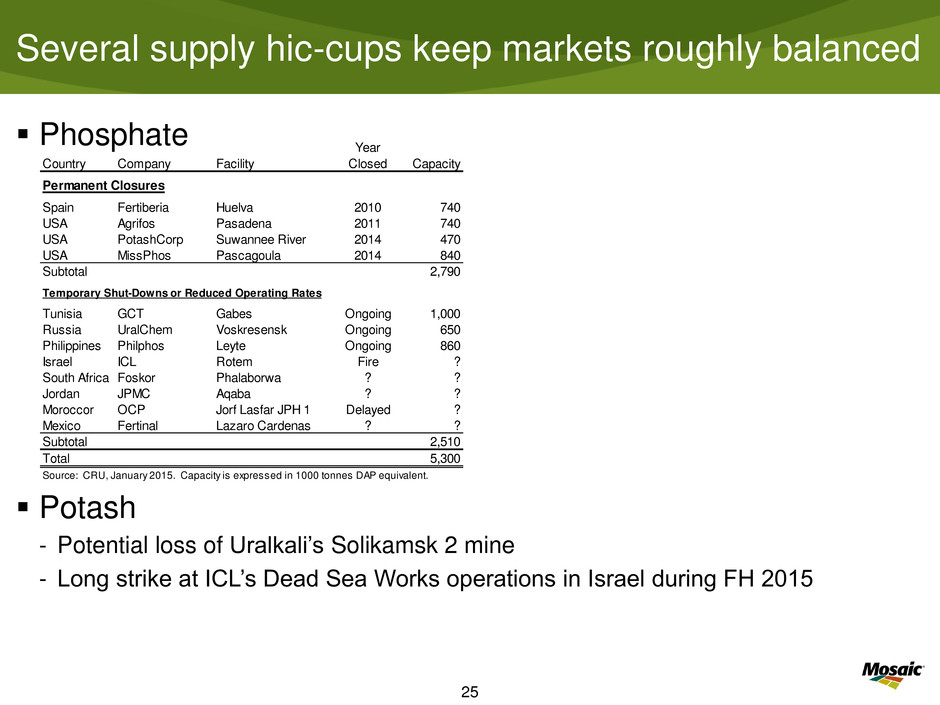

25 Several supply hic-cups keep markets roughly balanced Phosphate Potash - Potential loss of Uralkali’s Solikamsk 2 mine - Long strike at ICL’s Dead Sea Works operations in Israel during FH 2015 Year Country Company Facility Closed Capacity Permanent Closures Spain Fertiberia Huelva 2010 740 USA Agrifos Pasadena 2011 740 USA PotashCorp Suwannee River 2014 470 USA MissPhos Pascagoula 2014 840 Subtotal 2,790 Temporary Shut-Downs or Reduced Operating Rates Tunisia GCT Gabes Ongoing 1,000 Russia UralChem Voskresensk Ongoing 650 Philippines Philphos Leyte Ongoing 860 Israel ICL Rotem Fire ? South Africa Foskor Phalaborwa ? ? Jordan JPMC Aqaba ? ? Moroccor OCP Jorf Lasfar JPH 1 Delayed ? Mexico Fertinal Lazaro Cardenas ? ? Subtotal 2,510 Total 5,300 Source: CRU, January 2015. Capacity is expressed in 1000 tonnes DAP equivalent.

26 Plant Nutrient Observations and Outlook Long Term

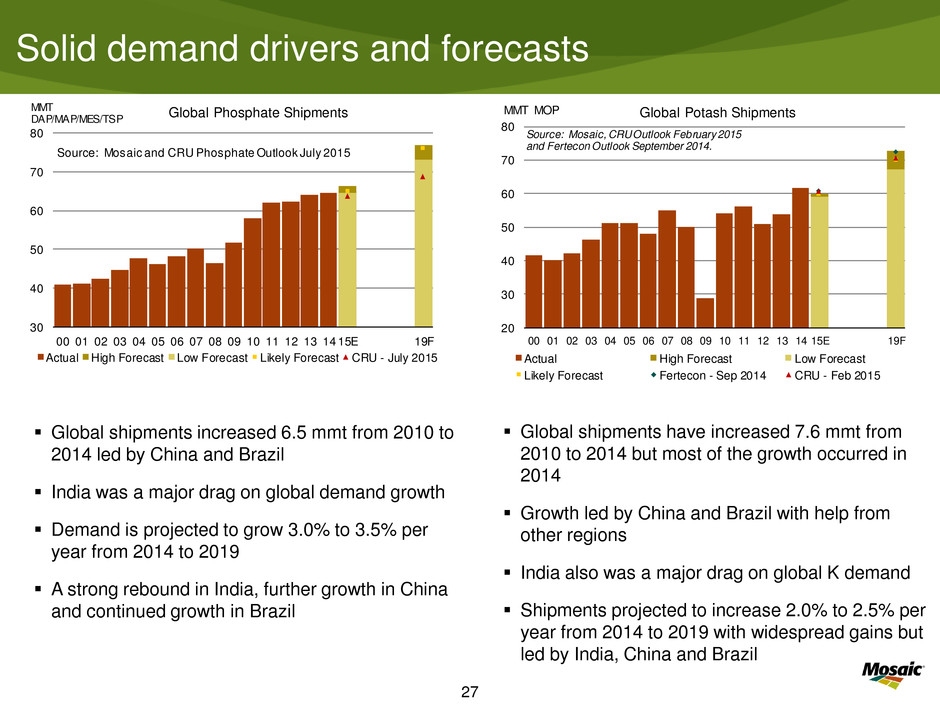

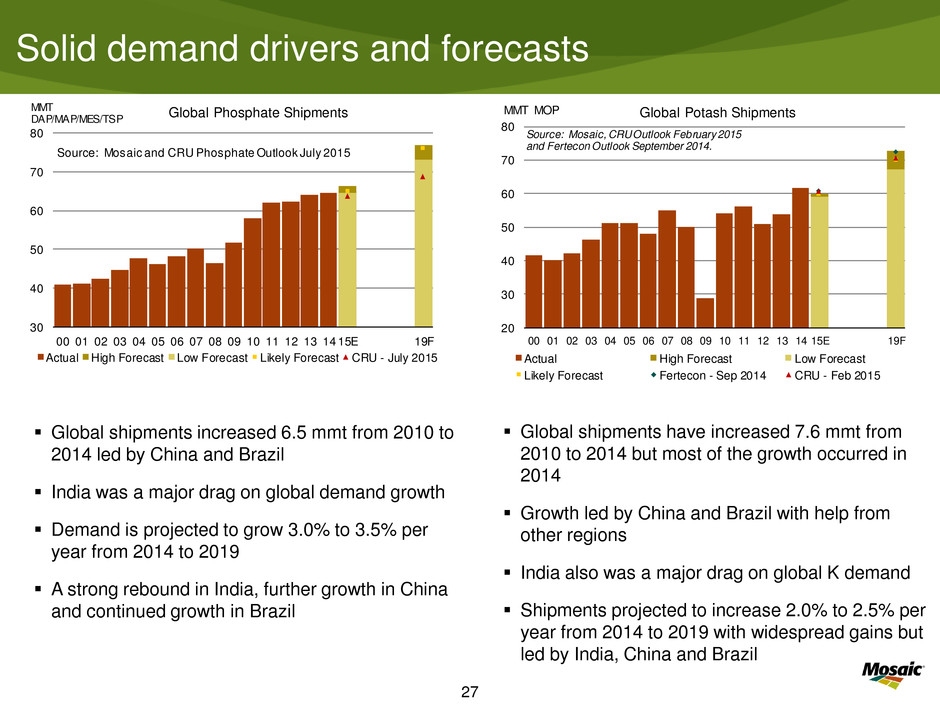

27 Solid demand drivers and forecasts Global shipments have increased 7.6 mmt from 2010 to 2014 but most of the growth occurred in 2014 Growth led by China and Brazil with help from other regions India also was a major drag on global K demand Shipments projected to increase 2.0% to 2.5% per year from 2014 to 2019 with widespread gains but led by India, China and Brazil Global shipments increased 6.5 mmt from 2010 to 2014 led by China and Brazil India was a major drag on global demand growth Demand is projected to grow 3.0% to 3.5% per year from 2014 to 2019 A strong rebound in India, further growth in China and continued growth in Brazil 30 40 50 60 70 80 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 19F Global Phosphate Shipments Actual High Forecast Low Forecast Likely Forecast CRU - July 2015 MMT DAP/MAP/MES/TSP Source: Mosaic and CRU Phosphate Outlook July 2015 20 30 40 50 60 70 80 0 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 19F MMT MOP Global Po ash Shipments Actual High Forecast Low Forecast Likely Forecast Fertecon - Sep 2014 CRU - Feb 2015 Source: Mosaic, CRU Outlook February 2015 and Fertecon Outlook September 2014.

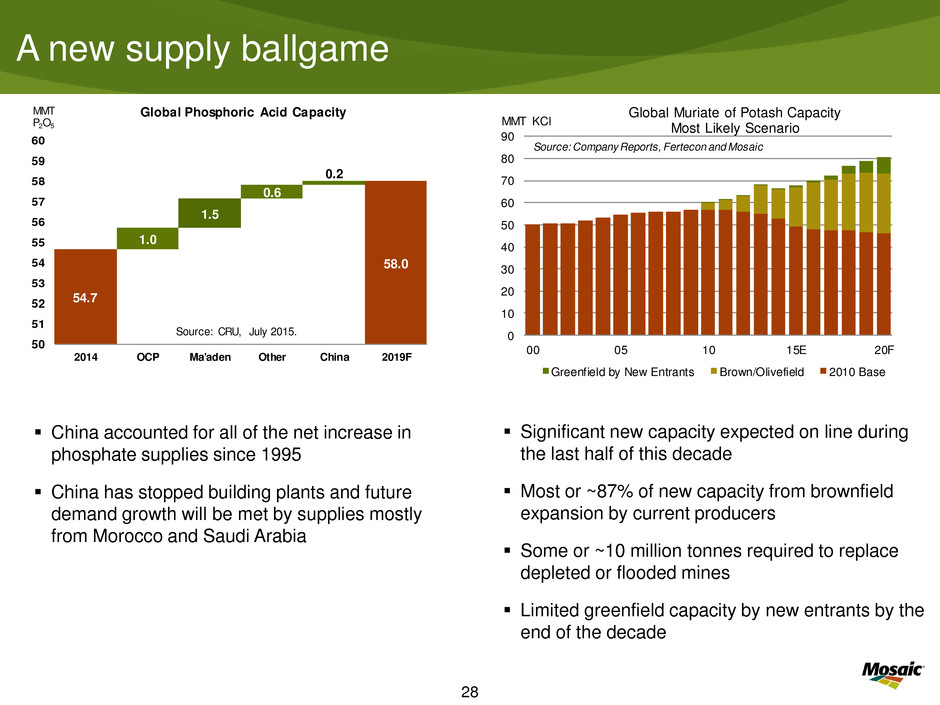

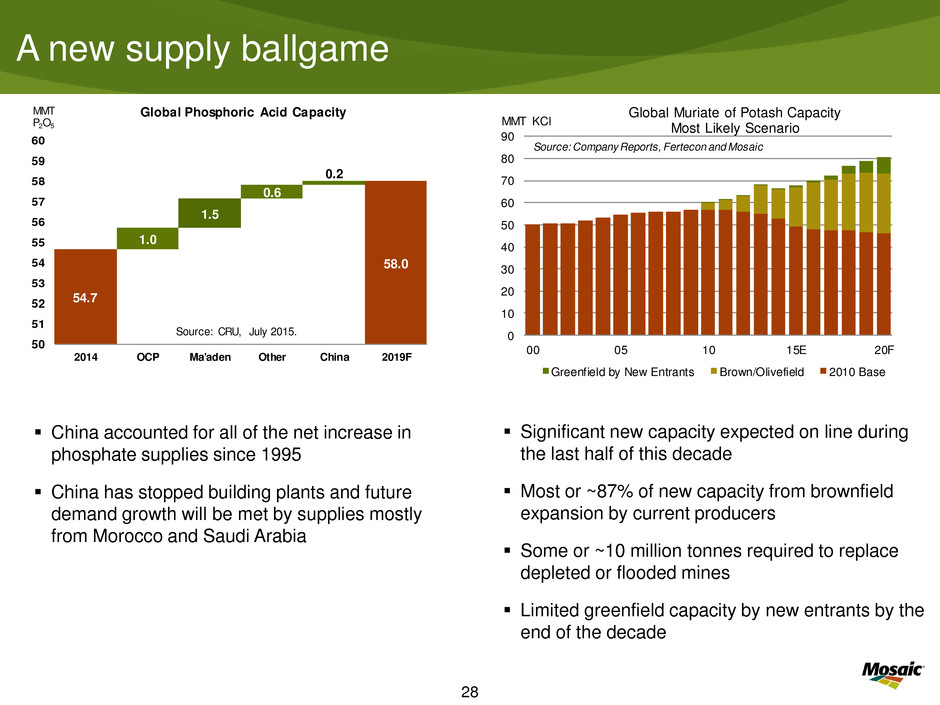

28 A new supply ballgame Significant new capacity expected on line during the last half of this decade Most or ~87% of new capacity from brownfield expansion by current producers Some or ~10 million tonnes required to replace depleted or flooded mines Limited greenfield capacity by new entrants by the end of the decade China accounted for all of the net increase in phosphate supplies since 1995 China has stopped building plants and future demand growth will be met by supplies mostly from Morocco and Saudi Arabia 54.7 58.0 1.0 1.5 0.6 0.2 50 51 52 53 54 55 56 57 58 59 60 2014 OCP Ma'aden Other China 2019F MMT P2O5 Source: CRU, July 2015. Global Phosphoric Acid Capacity 0 10 20 30 40 50 60 70 80 90 00 05 10 15E 20F MMT KCl Global Muriate of Potash Capacity Most Likely Scenario Greenfield by New Entrants Brown/Olivefield 2010 Base Source: Company Reports, Fertecon and Mosaic

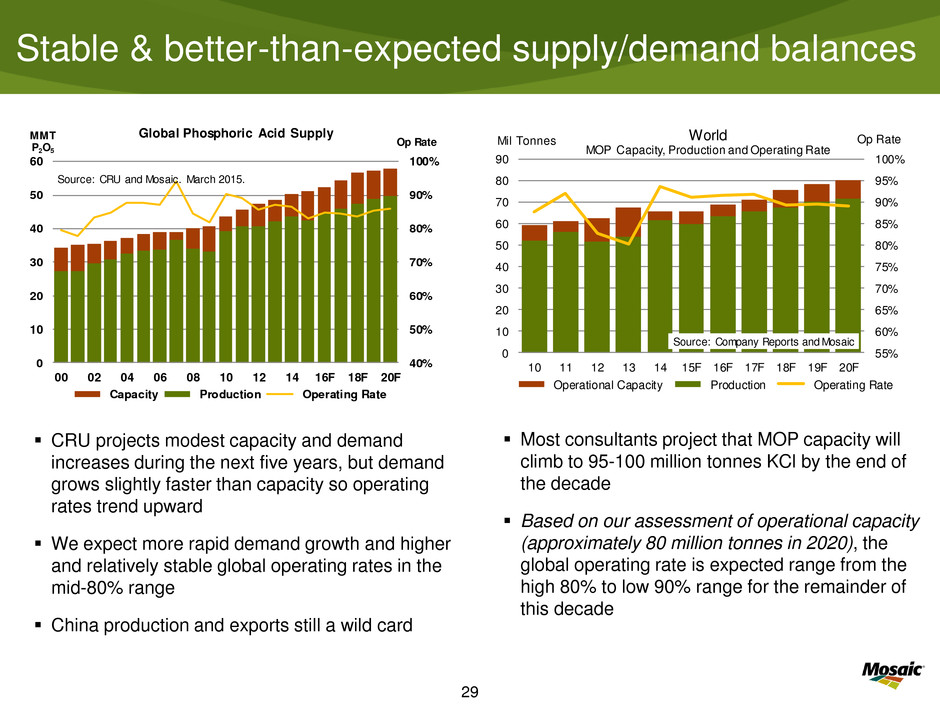

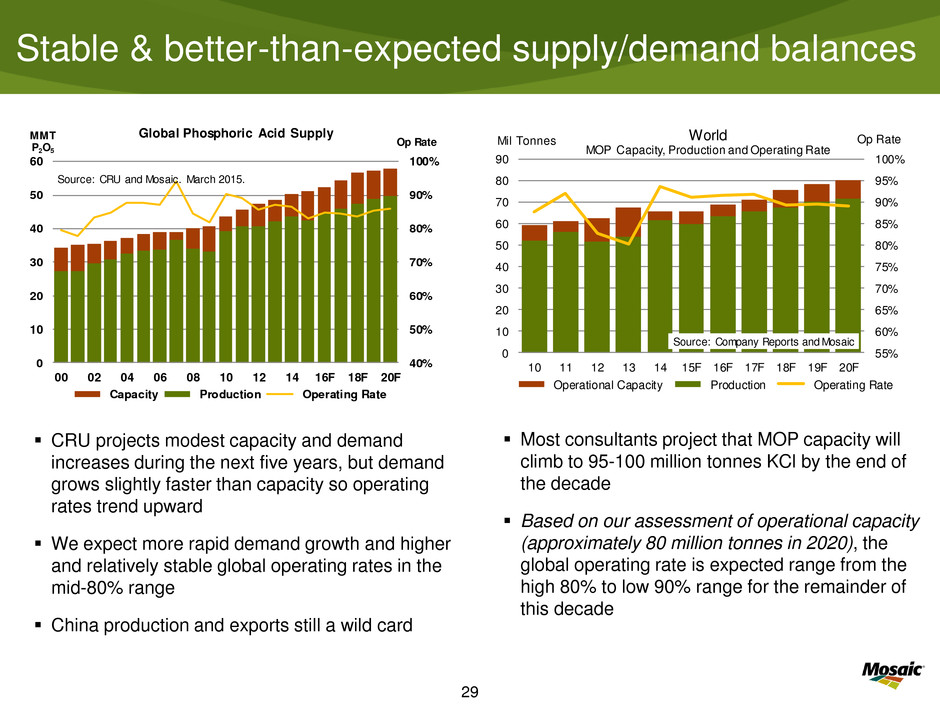

29 Stable & better-than-expected supply/demand balances Most consultants project that MOP capacity will climb to 95-100 million tonnes KCl by the end of the decade Based on our assessment of operational capacity (approximately 80 million tonnes in 2020), the global operating rate is expected range from the high 80% to low 90% range for the remainder of this decade CRU projects modest capacity and demand increases during the next five years, but demand grows slightly faster than capacity so operating rates trend upward We expect more rapid demand growth and higher and relatively stable global operating rates in the mid-80% range China production and exports still a wild card 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 0 10 20 30 40 50 60 70 80 90 10 11 12 13 14 15F 16F 17F 18F 19F 20F Op RateMil Tonnes Th ou sa nd s Source: Company Reports and Mosaic World MOP Capacity, Production and Operating Rate Operational Capacity Production Operating Rate 40% 50% 60% 70% 80% 90% 100% 0 10 20 30 40 50 60 00 02 04 06 08 10 12 14 16F 18F 20F Op Rate MMT P2O5 Source: CRU and Mosaic. March 2015. Global Phosphoric Acid Supply Capacity Production Operating Rate

30 The State of Agriculture and Plant Nutrient Industries Piper Jaffray Technology-Enabled Industrials Symposium Minneapolis, MN August 5, 2015 Dr. Michael R. Rahm Vice President Market and Strategic Analysis The Mosaic Company Thank You!