Annual Information Form

For the Nine Month Period Ended

December 31, 2011

Dated April 26, 2012

TABLE OF CONTENTS

3

FORWARD-LOOKING INFORMATION

This Annual Information Form (“AIF”) may contain statements of “forward-looking” information. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, operating costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic plans, completion of transactions, market prices for metals or other statements that are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent they involve estimates of the mineralization that will be encountered if the property is developed.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect:

- the Company’s ability to achieve production at any of its mineral properties;

- estimated capital costs, operating costs, production and economic returns;

- estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying the Company’s resource and reserve estimates;

- the Company’s expected ability to develop adequate infrastructure at a reasonable cost;

- assumptions that all necessary permits and governmental approvals will be obtained;

- assumptions made in the interpretation of drill results, the geology, grade and continuity of the Company’s mineral deposits;

- the Company’s expectations regarding demand for equipment, skilled labour and services needed for exploration and development of mineral properties; and

- the Company’s activities will not be adversely disrupted or impeded by development, operating or regulatory risks.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

- uncertainty of whether there will ever be production at the Company’s mineral exploration and development properties;

- uncertainty of estimates of capital costs, operating costs, production and economic returns;

- uncertainties relating to the assumptions underlying the Company’s resource and reserve estimates, such as metal pricing, metallurgy, mineability, marketability and operating and capital costs;

- risks related to the Company’s ability to commence production and generate material revenues or obtain adequate financing for its planned exploration and development activities;

4

- risks related to the Company’s ability to finance the development of its mineral properties through external financing, joint ventures or other strategic alliances, the sale of property interests or otherwise;

- risks related to the third parties on which the Company depends for its exploration and development activities;

- dependence on cooperation of joint venture partners in exploration and development of properties;

- credit, liquidity, interest rate and currency risks;

- risks related to market events and general economic conditions;

- uncertainty related to inferred mineral resources;

- risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of the Company’s mineral deposits;

- risks related to lack of adequate infrastructure;

- mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in development, construction or production;

- the risk that permits and governmental approvals necessary to develop and operate mines on the Company’s properties will not be available on a timely basis or at all;

- commodity price fluctuations;

- risks related to governmental regulation and permits, including environmental regulation;

- risks related to the need for reclamation activities on the Company’s properties and uncertainty of cost estimates related thereto;

- uncertainty related to title to the Company’s mineral properties;

- uncertainty as to the outcome of potential litigation;

- risks related to increases in demand for equipment, skilled labor and services needed for exploration and development of mineral properties, and related cost increases;

- increased competition in the mining industry;

- the Company’s need to attract and retain qualified management and technical personnel;

- risks related to hedging arrangements or the lack thereof;

- uncertainty as to the Company’s ability to acquire additional commercially mineable mineral rights;

- risks related to the integration of potential new acquisitions into the Company’s existing operations;

- risks related to unknown liabilities in connection with acquisitions;

- risks related to conflicts of interest of some of the directors of the Company;

- risks related to global climate change;

- risks related to adverse publicity from non-governmental organizations;

- uncertainty as to the Company’s ability to maintain the adequacy of internal control over financial reporting;

- uncertainty relating to the timing and ability to consummate the Company’s pending acquisition of Bullion Monarch Mining, Inc.; and

- risks related to regulatory and legal compliance.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this AIF under the heading “Risk Factors” and elsewhere.

The Company’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

5

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this AIF is as of December 31, 2011.

Currency and Exchange Rates

In this AIF, unless otherwise specified, all references to “dollars” and to “$” are to Canadian dollars, references to “U.S. dollars” and to “US$” are to United States dollars. The Bank of Canada noon buying rates for the purchase of one United States dollar using Canadian dollars were as follows for the indicated periods:

| Nine Month Period Ended December 31 |

| | 2011 | 2010 | 2009 |

| End of period | 1.0290 | 0.9846 | 0.7935 |

| High for the period | 1.0778 | 1.2643 | 1.3000 |

| Low for the period | 0.9686 | 1.0113 | 0.9844 |

| Average for the period | 1.0163 | 1.0904 | 1.1264 |

The Bank of Canada noon buying rate on April 25, 2012 for the purchase of one United States dollar using Canadian dollars was Cdn$0.9848 (one Canadian dollar on that date equalled U.S.$ 1.0154) .

Cautionary Note to U.S. Investors

Information Concerning Preparation of Resource and Reserve Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Unless otherwise indicated, all resource and reserve estimates included in this AIF have been prepared in accordance with National Instrument 43-101 (“NI 43-101”) of the Canadian Securities Administrators and the CIM Definition Standards on Mineral Resources and Mineral Reserves of the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits an historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) provides the key assumptions, parameters and methods used to prepare the historical estimate; (d) states whether the historical estimate uses mineral resource or reserve categories other than those prescribed by NI 43-101; (e) includes any more recent estimates or data available; (f) comments on what work needs to be done to upgrade or verify the historical estimate as mineral resources or reserves under NI 43-101; and (g) states with equal prominence that (i) a qualified person (as prescribed by NI 43-101) has not done sufficient work to classify the historical estimate as mineral resources or reserves under NI 43-101, and (ii) the issuer is not treating the historical estimate as mineral resources or reserves under NI 43-101.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and resource information contained in this AIF may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves.” Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources,” “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

6

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures.

The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with United States standards.

National Instrument 43-101

The technical information contained in this AIF has been verified, and the form of its disclosure approved, by the Company’s Manager of Technical Services, Michael P. Sheehan, CPG, a ‘qualified person’ for the purpose of NI 43-101.

EMX has implemented a QA/QC program to ensure that all exploration sampling and assay analysis is conducted in accordance with CIM Best Practice Guidelines, including the use of independent, certified analytic laboratories with an ISO 9001:2000 accreditation or higher. As standard procedure, the Company conducts routine QA/QC analysis on all assay and analytic results, including the systematic utilization of certified reference materials, blanks, and duplicate samples. Gold analysis is conducted by fire assay using atomic absorption or gravimetric finish. Multi-element analyses are performed with either aqua regia or four-acid "near total" digestion followed by analysis with ICP/AES or MS/AES techniques.

Glossary of Geological, Mining and other Terms

Certain terms used in this AIF are defined as follows:

Amphibolite:metamorphic rock composed chiefly of amphibole with minor plagioclase and little quartz.

Andalusite: an aluminium-silicate metamorphic mineral found in high-temperature, low-pressure metamorphic terranes.

Aplite:an intrusive igneous rock in which quartz and feldspar are the dominant minerals.

7

Assay: the chemical analysis of an ore, mineral or concentrate to determine the amount of valuable species.

BLEG:bulk leaching extractable gold.

Breccia:rock consisting of more or less angular fragments in a matrix of finer-grained material.

Bronco Creek or BCE:Bronco Creek Exploration, Inc., an Arizona corporation and wholly-owned subsidiary of Eurasian.

CIM:Canadian Institute of Mining, Metallurgy and Petroleum.

Carbonaceous:containing carbon or coal, especially shale or other rock containing small particles of carbon distributed throughout the whole mass.

Common Shares:common shares in the capital of Eurasian Minerals Inc.

Computershare:Computershare Investor Services Inc., the registrar and transfer agent for the Common Shares.

Dacite:an igneous, volcanic rock with high iron content.

Diabase:a fine-grained intrusive igneous rock.

Diorite:intermediate coarse grained igneous rock.

Dyke:a tabular igneous intrusion that cuts across the bedding or foliation of the country rock, generally vertical in nature.

EIA:environmental impact assessment.

Eurasian, EMX or the Company:Eurasian Minerals Inc., a British Columbia corporation.

Footwall:the underlying side of a fault, ore body, or mine working; particularly the wall rock beneath an inclined vein or fault.

Formation:a persistent body of igneous, sedimentary, or metamorphic rock, having easily recognizable boundaries that can be traced in the field without recourse to detailed paleontologic or petrologic analysis, and large enough to be represented on a geologic map as a practical or convenient unit for mapping and description.

Granitoid:pertaining to or composed of granite.

Gneiss:a type of rock formed by high-grade regional metamorphic processes from pre-existing formations of igneous or sedimentary rocks.

Hanging wall:the overlying side of an ore body, fault, or mine working, especially the wall rock above an inclined vein or fault.

Igneous rock:rock that is magmatic in origin.

Indicated mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and test information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

8

Inferred mineral resource:that part of a mineral resource for which the quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Intercalated:said of layered material that exists or is introduced between layers of a different character; especially said of relatively thin strata of one kind of material that alternates with thicker strata of some other kind, such as beds of shale intercalated in a body of sandstone.

IP:induced polarization.

IOCG:iron-oxide-copper-gold.

JV:joint venture.

Kriging: a weighted, moving-average interpolation method in which the set of weights assigned to samples minimizes the estimation variance, which is computed as a function of the variogram model and locations of the samples relative to each other, and to the point or block being estimated.

Lamprophyre:a group of dark-coloured, porphyritic, medium grained igneous rocks usually occurring as dykes or small intrusions.

Leach:to dissolve minerals or metals out of ore with chemicals.

LSE:London Stock Exchange.

LSE:low sulfidation epithermal.

Measured mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Meta:a prefix that, when used with the name of a sedimentary or igneous rock, indicates that the rock has been metamorphosed.

Mineral reserve: the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined.

9

Mineral resource (deposit):a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource (deposit) are known, estimated or interpreted from specific geological evidence and knowledge.

Net smelter return or NSR royalty: a type of royalty based on a percentage of the proceeds, net of smelting, refining and transportation and other non-minesite costs and penalties, from the sale of metals extracted from concentrate and doré by the smelter or refinery.

NI 43-101:National Instrument 43-101Standards of Disclosure for Mineral Projectsof the Canadian Securities Administrators.

NI 52-110:National Instrument 52-110Audit Committeesof the Canadian Securities Administrators.

Oxide:a compound of ore that has been subjected to weathering and alteration as a result of exposure to oxygen for a long period of time.

Pegmatite:a very coarse-grained igneous rock that has a grain size of 20 millimetres or more.

Phyllite:a regional metamorphic rock, intermediate in grade between slate and schist. Minute crystals of sericite and chlorite impart a silky sheen to the surfaces of cleavage.

Porphyry:igneous rock consisting of large-grained crystals dispersed in a fine-grained matrix or groundmass.

Probable reserve: the economically mineable part of an indicated and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

QA:quality assurance.

QC:quality control.

RC:reverse circulation.

Run-of-mine: ore in its natural state as it is removed from the mine that has not been subjected to additional size reduction.

Schist: a strongly foliated crystalline rock, which readily splits into sheets or slabs as a result of the planar alignment of the constituent crystals. The constituent minerals are commonly specified (e.g., “quartz-muscovite-chlorite schist”).

Shear zone: a tabular zone of rock that has been crushed and brecciated by parallel fractures due to “shearing” along a fault or zone of weakness. These can be mineralized with ore-forming solutions.

Strike:the direction, or course or bearing of a vein or rock formation measured on a level surface.

Strip (or stripping) ratio:the tonnage or volume of waste material that must be removed to allow the mining of one tonne of ore in an open pit.

Sulfides or sulphides:compounds of sulfur (or sulphur) with other metallic elements.

10

Tailings:material rejected from a mill after the recoverable valuable minerals have been extracted.

TSX-V:TSX Venture Exchange.

Vein:sheet-like body of minerals formed by fracture filling or replacement of host rock.

ZTEM:Z axis tipper electromagnetic system.

| Linear Measurements | | |

| 1inch | = | 2.54 centimetres |

| 1foot | = | 0.3048 metre |

| 1yard | = | 0.9144 metre |

| 1mile | = | 1.609 kilometres |

| Area Measurements | | |

| 1acre | = | 0.4047 hectare |

| 1hectare | = | 2.471 acres |

| 1square mile | = | 640 acres or 259 hectares or 2.590 square kilometres |

| Units of Weight | | |

| 1short ton | = | 2000 pounds or 0.9072 metric tonnes |

| 1long ton | = | 2240 pounds or 1.12 short tons |

| 1metric tonne | = | 2204.62 pounds or 1.10 short tons |

| 1pound (16 oz) | = | 0.454 kilograms or 14.583 troy ounces |

| 1troy oz | = | 31.1035 grams |

| 1troy oz per short ton | = | 34.2857 grams per metric tonne |

| Analytical | percent metric tonne | grams per tonne | troy oz per short ton |

| 1% | 1% | 10,000 | 291.67 |

| 1 gram/tonne | 0.0001% | 1 | 0.029167 |

| 1 troy oz/short ton | 0.003429% | 34.2857 | 1 |

| 100 ppm | | 100 | 2.9167 |

| Temperature Conversion Formulas |

| Degrees Fahrenheit | = | (°C X 1.8) + 32 |

| Degrees Celsius | = | (°F - 32) X 0.556 |

11

| Frequently Used Abbreviations |

| AA | atomic absorption spectrometry |

| Ag | silver |

| As | arsenic |

| Au | gold |

| °C | degrees Celsius (centigrade) |

| cm | centimetre |

| C.P.G. | Certified Professional Geologist |

| Cu | copper |

| F | fluorine |

| °F | degrees Fahrenheit |

| g | gram(s) |

| g/t | grams per tonne |

| Hg | mercury |

| kg | kilogram |

| km | kilometre |

| m | metre(s) |

| Ma | million years ago |

| Mn | manganese |

| n | number or count |

| NSR | net smelter return |

| oz | troy ounce |

| opt | ounce per short ton |

| oz/ton | ounce per short ton |

| Pb | lead |

| ppm | parts per million |

| sq | square |

| Sb | antimony |

| Tl | thallium |

| Zn | zinc |

12

CORPORATE STRUCTURE

Name, Address and Incorporation

Eurasian was incorporated under the laws of the Yukon Territory of Canada on August 21, 2001 as 33544 Yukon Inc. and, on October 10, 2001, changed its name to Southern European Exploration Ltd. On November 24, 2003, the Company completed the reverse take-over of Marchwell Capital Corp., a company incorporated in Alberta on August 12, 1996 and which changed its name on November 21, 2003 to Eurasian Minerals Inc. On September 24, 2004, EMX continued into British Columbia from Alberta under theBusiness Corporations Act(British Columbia).

EMX’s head office is located at Suite 501 – 543 Granville Street, Vancouver, British Columbia V6C 1X8, Canada, and its registered and records office is located at Northwest Law Group, Suite 950 – 650 West Georgia Street, Vancouver, British Columbia V6B 4N8, Canada.

Eurasian is a reporting issuer under the securities legislation of British Columbia and Alberta. The Common Shares are traded on the TSX-V (Tier 1) under the symbol EMX and on the NYSE Amex under the symbol EMXX.

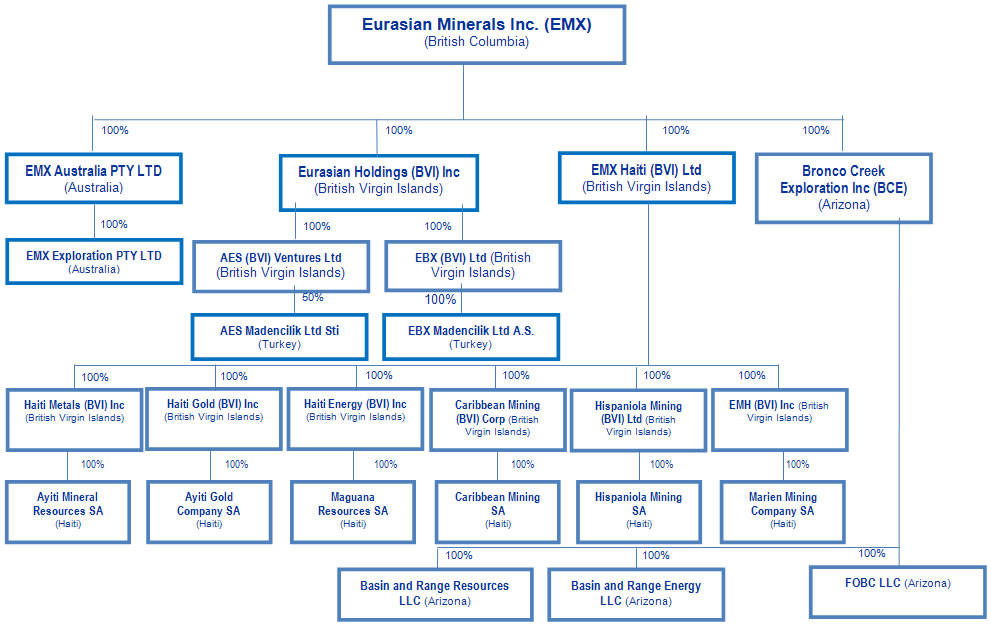

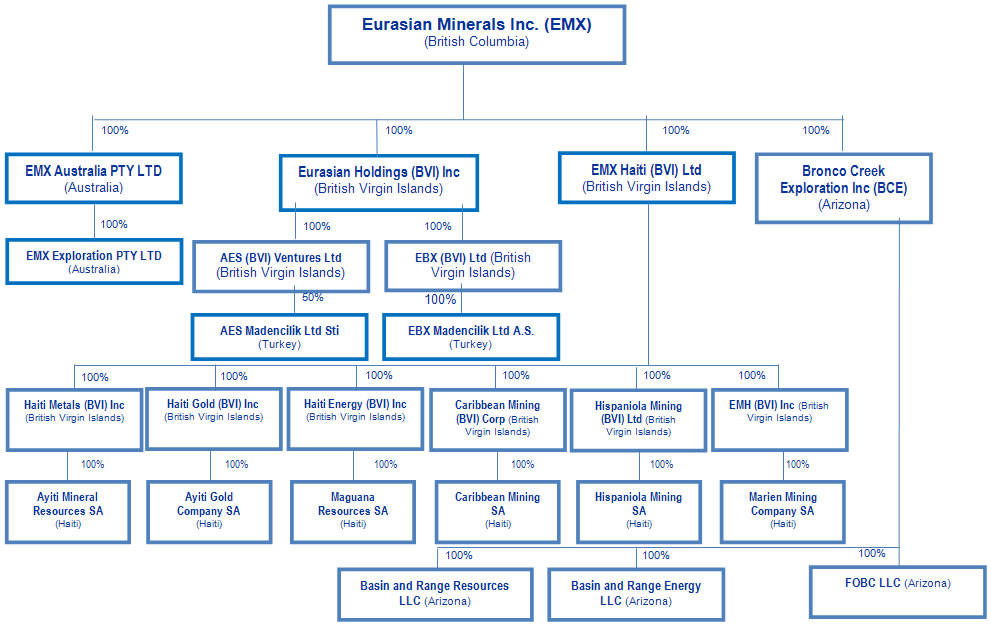

Inter-corporate Relationships

The corporate structure of Eurasian, its material (holding at least 10% of EMX’s assets, by value) subsidiaries, the percentage ownership that Eurasian holds or has contractual rights to acquire in such subsidiaries (if not wholly-owned) and the jurisdiction of incorporation of such corporations is set out in the following chart:

13

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

Eurasian is engaged in the acquisition and exploration of precious and base metals properties. The Company conducts exploration on properties located primarily in Turkey, Haiti, Kyrgyz Republic, Sweden, North America, Australia and the Asia-Pacific region. The Company’s royalty and merchant banking division, Eurasian Capital, is building a portfolio of revenue-generating royalties to complement EMX's prospect generation business model.

Three Year History

In December 2011, Eurasian changed its financial year-end from March 31st to December 31st. Accordingly, the references to Fiscal 2010 and 2011 below are for the financial years ended March 31st.

Fiscal 2010

In October 2009, the Company agreed to acquire Bronco Creek for its portfolio of gold and copper properties in Nevada, Wyoming and Arizona. When the acquisition was completed on January 29, 2010, the Company issued 2,127,790 Common Shares and 1,063,895 non-transferable warrants for 100% of BCE’s outstanding shares. Each warrant entitled a former BCE shareholder to purchase one additional EMX share for $2.00 until January 29, 2012. See “Mineral Properties – North America”.

On March 12, 2010, International Finance Corporation (“IFC”), a corporation headquartered in Washington, D.C. and established by the member countries of the World Bank Group, invested US$5 million by the purchase of 2,559,510 Common Shares and 1,919,633 share purchase warrants. Each warrant entitles IFC to purchase a further Common Share for $2.88 until the earlier of (a) three years from the date on which the drilling commences on the Company’s Treuil-La Mine property in Haiti, or (b) February 19, 2015.

Fiscal 2011

The Company appointed Dr. M. Stephen Enders to the position of Executive Chairman on May 7, 2010.

On June 4, 2010, Eurasian completed the first tranche of a $5.28 million private placement financing by issuing 2 million Common Shares at $2.20 per share to Newmont Mining Corporation, a publicly traded (NYSE: NEM) mining company based in Denver, Colorado, for proceeds of $4.4 million. On June 9, 2010, the Company closed the second and final tranche of the financing by issuing 400,000 Common Shares at $2.20 per share to IFC for proceeds of $880,000.

On August 3, 2010, Dr. Eric Jensen was promoted from Chief Geologist to Global Generative Exploration Team Leader.

The Company entered into an option and joint venture agreement on July 13, 2010 with Rodinia Resources Pty. Ltd. (“Rodinia”), a private Australian company, to acquire the Koonenberry gold property in Australia, subject to a 2% NSR royalty in favour of Rodinia. Under the agreement, EMX made a cash payment of A$50,000 and an advance minimum royalty payment of A$70,000 which was satisfied by the issuance of 28,283 Common Shares. To exercise its option, the Company must, over a period of five years, make a series of additional advance minimum royalty payments totalling A$2,020,000 (half in cash and half in Common Shares), and incur exploration expenditures of A$5,500,000. If a bankable feasibility study on the property is issued, EMX may acquire 1.5% of the NSR royalty for A$8,000,000 less all advance minimum royalty payments previously paid. See “Mineral Properties – Australia and Asia Pacific”.

14

Eurasian announced on September 3, 2010 that it intended to pay discretionary bonuses through the issuance of 480,000 Common Shares in aggregate to two officers and a director of the Company over the next two years. The purpose of the bonuses was to reward these individuals for the Company’s successes to date and to provide them with a long-term incentive to remain with the Company. Following shareholder approval, the first tranche of Common Shares was issued on September 27, 2010.

On August 11, 2010, the Company purchased a Swedish subsidiary of Freeport-McMoRan Copper & Gold Inc., a publicly traded (NYSE: FCX) mining company based in Phoenix, Arizona, the main assets of which were 1% NSR royalties over two advanced copper projects (the Viscaria and Adak Projects) in northern Sweden, two exploration permits in Sweden and a comprehensive exploration database on Sweden. The purchase was completed on August 12, 2010. The purchase price was US$150,000 and 160,000 Common Shares. See “Mineral Properties – Sweden”.

In September 2010, the Company appointed Mr. Paul H. Zink as President of Eurasian Capital, the Company’s royalty and merchant banking division.

In November, 2010, Eurasian completed a private placement financing raising $17.5 million from the sale of 7 million units at $2.50 each. Newmont purchased 1 million units of this placement for $2.5 million and IFC purchased 800,000 units for $2 million. Each unit consisted of one Common Share and one transferable share purchase warrant. Each warrant is exercisable over a five-year period expiring in November 2015 to purchase one Common Share at a purchase price of $3.50 during the first year (expired), $4.00 during the second year, $4.50 during the third year, $5.00 during the fourth year and $5.50 during fifth year. If the volume weighted average price of the Common Shares on the TSX-V is at least 30% above the current exercise price of the warrants for a period of 30 consecutive trading days, the Company may give notice that the warrants must be exercised within 15 trading days or they will be cancelled. In connection with some of the subscriptions, the Company paid finder’s fees in respect of subscriptions introduced by various finders of $1,321,747 (5%) and issued 255,900 units and 255,150 finder warrants (5%), with each finder warrant being exercisable until November 2012 to acquire one Common Share for $2.65.

In February 2011, Eurasian entered into a Strategic Alliance and Earn-in Agreement with Antofagasta Minerals S.A., a publicly traded (LSE: ANTO) copper mining company headquartered in Chile. This agreement focuses primarily on copper exploration in Sweden and includes a regional strategic exploration alliance that covers all of Sweden (subject to certain exclusions) an agreement to designate Eurasian’s Kiruna South copper property as a Designated Project and granting Antofagasta the right to earn up to a 70% interest therein and a $5,005,000 private placement in Eurasian. See “Mineral Properties – Sweden”. On March 1, 2011, Antofagasta purchased 1,540,000 units from the Company at a price of $3.25 per unit. Each unit consisted of one Common Share and one-half of one Common Share purchase warrant. Each full warrant entitles Antofagasta to purchase one additional Common Share for $4.00 until March 1, 2013.

In March 2011, Eurasian issued an additional 3.96 million units under the $3.25 unit private placement for gross proceeds of $12,870,000. In connection with some of the subscriptions, Eurasian paid finders’ fees of $464,978 (5%) and issued 286,140 finder warrants (5%), each finder warrant being exercisable to acquire one Common Share for $3.50 until March 2013.

On March 18, 2011, Mr. Brian K. Levet was appointed to the Board of Directors.

15

April 1 to December 31, 2011 Fiscal Period

On April 7, 2011, a Regional Acquisition Agreement between Bronco Creek and Vale S.A., a publicly traded (NYSE: VALE and São Paul, Hong Kong, Paris and Madrid stock exchanges) international mining company, which focuses on identifying and developing copper projects in the western United States, was reached. See “Mineral Properties – North America”.

In July 2011, the Company announced that it intended to pay discretionary bonuses through the issuance of an aggregate of 300,000 Common Shares to five officers and one director under its Incentive Stock Grant Program approved by disinterested shareholders at the Company’s annual general meeting held on August 24, 2010. The Common Shares will be issued in three tranches over a two-year period. The Company also announced that it intends to issue an aggregate of 157,500 Common Shares as a bonus to 15 employees and consultants. The Common Shares will be issued in three tranches over a two-year period. The first tranche of Common Shares were issued on October 14, 2011.

Subsequent Events

On January 24, 2012, Eurasian filed with the SEC a registration statement on Form 40-F relating to its Common Shares, and, on January 30, 2012, the Common Shares were listed on the NYSE Amex.

On February 7, 2012, Eurasian and Bullion Monarch Mining, Inc. (“Bullion”) announced they had entered into a definitive agreement with respect to a proposed merger of Bullion into a wholly owned subsidiary of Eurasian. Under the agreement, Eurasian agreed to acquire all of the outstanding common shares of Bullion for which Bullion shareholders will receive 0.45 Common Shares and US$0.11 for each Bullion share held. Following the completion of the acquisition, it is expected that Bullion’s President, James A. Morris, will join EMX’s Board of Directors and Bullion’s Chairman and Chief Executive Officer, R. Don Morris, will be appointed to EMX’s Advisory Board.

Consummation of the proposed merger with Bullion is subject to, among other things, approval of the merger agreement by Bullion’s common shareholders, and receipt of all necessary regulatory and stock exchange approvals and other customary closing conditions. If a superior proposal is made for Bullion by a third party, EMX has the right to match such proposal, and if Bullion’s board of directors changes its recommendation or terminates the merger agreement under certain circumstances, Bullion has agreed to pay EMX a termination fee of US$4 million. In other circumstances where the transaction is not completed, Eurasian could be obligated to pay Bullion a reverse termination fee of US$1 million or reimburse Bullion’s expenses up to US$500,000. A copy of the merger agreement may be found in Eurasian’s filings atwww.sedar.com or in Eurasian’s filings with the SEC.

On February 9, 2012, Eurasian announced it had extended the expiration date from January 9, 2012 to February 22, 2012 of 678,611 warrants held by employees or insiders of, or consultants to, BCE or Eurasian. These warrants were issued on January 29, 2010 as part of the consideration paid by Eurasian in connection with the acquisition of BCE. Due to a trading blackout imposed by Eurasian relating to the proposed acquisition of Bullion, the warrant holders were unable to exercise the warrants until the blackout was lifted subsequent to the public announcement of the Bullion acquisition on February 7, 2012. Each warrant entitled the holder to purchase one Common Share at a price of $2.00. All of the 678,611 warrants were subsequently exercised, for gross proceeds to Eurasian of $1,357,222.

On April 2, 2012, Eurasian signed an Option Agreement with Çolakoglu Ticari Yatirim A.S., a privately owned Turkish company, granting Çolakoglu the right to acquire EMX’s Sisorta gold property in north-central Turkey. The Sisorta property is held by EBX Madençilik A.S. (“EBX”), a Turkish corporation formed pursuant to a joint venture between ASX listed Chesser Resources Limited (51%) and EMX (49%). The Agreement requires Çolakoglu to make an up-front payment of 100 troy ounces of gold bullion, or its cash equivalent, and to undertake a US$500,000 work commitment over the first year. After completing those obligations, Çolakoglu can exercise an option to purchase EBX for an additional 7,900 troy ounces of gold, or its cash equivalent, which payments are binding on exercise of the option, but paid over a period of four years. In addition to the gold payments totalling 8,000 troy ounces, EMX and Chesser will also retain a 2.5% Net Smelter Return royalty on any production from the property. EMX’s share of the total consideration will comprise 3,920 troy ounces of gold bullion (or cash equivalent) and a 1.225% NSR Royalty.

16

On April 23, 2012, the Company announced that under the terms of a Memorandum of Understanding (“MOU”) the government of Haiti and the joint venture agreed to certain protocols to continue discussions around the pending Mining Convention. Furthermore the joint venture is allowed to drill on certain selected projects under the MOU, and drilling commenced at the La Miel Designated Project. In addition, Newmont relinquished its rights in the Grand Bois Research Permit that covers the historic gold resource area; as a result, EMX regained 100% control of the Grand Bois project.

Significant Acquisitions

The Company did not complete any significant acquisitions in the past financial year for which it was required to file a Business Acquisition Report.

DESCRIPTION OF THE BUSINESS

Overview

Eurasian is engaged in the acquisition and exploration of precious and base metals properties. All of its properties are in the exploration stage and it does not have any properties on which mining or preparation for mining is carried out.

Specialized Skill and Knowledge

All aspects of Eurasian business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, finance, accounting and law.

Competitive Conditions

Competition in the mineral exploration industry is intense. Eurasian competes with other companies, many of which have greater financial resources and technical facilities, for the acquisition and exploration of mineral interests, as well as for the recruitment and retention of qualified employees and consultants.

Raw Materials (Components)

Other than water and electrical or mechanical power –which are generally available on or near its properties – Eurasian does not require any raw materials with which to carry out its business.

Intangible Property

Eurasian does not have any need for nor does it use any brand names, circulation lists, patents, copyrights, trademarks, franchises, intellectual property licenses (other than commercially available) , software (other than commercially available software), subscription lists or other intellectual property in its business. The Company maintains certain geological databases and other proprietary data, and information derivative therefrom, in connection with its exploration properties.

17

Business Cycle & Seasonality

Eurasian’s business is not cyclical or seasonal.

Economic Dependence

Eurasian’s business is not substantially dependent on any contract such as a contract to sell the major part of its products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or licence or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Renegotiation or Termination of Contracts

It is not expected that Eurasian’s business will be materially affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Environmental Protection

All phases of Eurasian’s exploration are subject to environmental regulation in the various jurisdictions in which it operates.

Environmental legislation is evolving in a manner which requires stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. While manageable, Eurasian expects this evolution (which affects most mineral exploration companies) might result in increased costs.

Human Resources

At December 31, 2011, Eurasian had 86 employees and consultants working at various locations throughout the world. As at the date of this AIF, Eurasian had 88 employees and consultants.

Foreign Operations

The majority of Eurasian’s properties are located outside of North America and many are located in areas traditionally considered to be risky from a political or economic perspective including the Company’s projects in Haiti and the Kyrgyz Republic.

Bankruptcy Reorganizations

There has not been any voluntary or involuntary bankruptcy, receivership or similar proceedings against Eurasian within the three most recently completed financial years or the current financial year.

Material Reorganizations

There has not been any material reorganization of Eurasian within the three most recently completed financial years or the current financial year.

Social or Environmental Policies

The Company believes that good management at every project it manages requires proactive health and safety procedures, transparent interaction with local communities and implementation of prudent expenditures and business performance standards that constitute the foundation for successful exploration and subsequent development if the results warrant it. Accordingly, Eurasian has implemented various social and other policies that are fundamental to its operations, such as policies regarding its relationship with the communities where the Company operates.

18

Eurasian is committed to the implementation of comprehensive Environmental, Community Relations, Communication, Labor, Health, and Safety Policies and a proactive Stakeholder Engagement Strategy (the “Policies”). These Policies are reviewed and updated on an annual or “as needed” basis. EMX ensures these Policies are made known to all its managers, staff, contractors and partners, and that the requirements contained therein are adequately planned, resourced, implemented and monitored wherever EMX is actively managing the project and where EMX has obtained a formal commitment from its joint venture partners to adopt the same Policies. The Policies are described below.

1. Environmental Policy

Eurasian develops and implements appropriate standard operating procedures for different stages of its ground technical surveys, prospecting and evaluation and development work which procedures will be designed to meet all applicable environmental requirements and best environmental practices in the mineral exploration industry.

2. Community Relations, Communication and Notification Policy; Stakeholder Engagement

Proactive interaction with the stakeholders affected by the Company’s exploration and development programs is considered an important part of the long-term investment that the Company is planning in worldwide exploration programs, particularly in Haiti and Turkey.

Eurasian recognizes that from the inception of exploration activities or a new field work program, and as the exploration project progresses towards development, it will be important to:

communicate and proactively engage with all local communities and other stakeholders that may be affected by its exploration programs;

inform and obtain a consensus with the full range of stakeholders that may be impacted upon by exploration, evaluation and development; and

identify any vulnerable or marginalized groups within the affected communities (e.g. women, elders or handicapped) and ensure they are also reached by above information disclosure and consultation activities.

In these respects, Eurasian works actively and transparently with governmental authorities, other elected parties, non-governmental organizations, and the communities themselves, to ensure that they are aware of the activities of the Company, and that such activities are a benefit to the communities.

When detailed or advanced exploration activities, including drilling, evaluation and other such programs, are implemented, the Company endeavours to identify how the impacts of such work on communities can best be managed, and how benefits can best be provided to communities through its activities. This is undertaken in consultation with the affected communities.

3. Labor, Health and Safety Policy

The health and safety of its employees, contractors, affected communities and any other stakeholders that may participate and be affected by the activities of EMX are crucial to the long-term success of the Company.

19

The Company strives to establish and maintain a constructive work-management relationship, promote the fair treatment, non-discrimination, and equal opportunity of workers in accordance with IFC’s Performance Standards 2, Labor and Working Conditions.

Every effort will be made through training, regular reviews and briefings, and other procedures to ensure that best practice labor, health and safety and good international industry practices are implemented and maintained by Eurasian including prompt and in-depth accident and incident investigation and the implementation of the conclusions thereof. The Company takes measures to prevent any child labor or forced labor.

The Company’s aim is at all times to achieve zero lost-time injuries and fatalities.

4. Development Stage Environmental and Social Management Policy

Eurasian communicates and consults with local communities and stakeholders with a view to fostering mutual understanding and shared benefits through the promotion and maintenance of open and constructive dialogue and working relationships.

Risk Factors

Investment in the Common Shares involves a significant degree of risk and should be considered speculative due to the nature of Eurasian’s business and the present stage of its development. Prospective investors should carefully review the following factors together with other information contained in this AIF before making an investment decision.

Mineral Property Exploration Risks

Mineral exploration involves a high degree of risk. Few properties that are explored ultimately become producing mines. At present, none of the Company’s properties has a known commercial ore deposit. The main operating risks include ensuring ownership of and access to mineral properties by confirmation that option agreements, claims and leases are in good standing, retaining competent personnel to plan and carry out exploration and analyze the results from that exploration, and obtaining permits for drilling and other exploration activities.

Eurasian is currently earning an interest in some of its properties through option agreements and acquisition of title to the properties is only completed when the option conditions have been met. These conditions generally include making property payments, incurring exploration expenditures on the properties and can include the satisfactory completion of pre-feasibility studies. If the Company does not satisfactorily complete these option conditions in the timeframe laid out in the option agreements, the Company’s title to the related property will not vest and the Company will have to write-off the previously capitalized costs related to that property.

Foreign Country and Political Risks

The Company operates in countries with varied political and economic environments including countries such as Haiti and the Kyrgyz Republic that are traditionally considered to present higher levels of risk. As such, it is subject to certain risks, including currency fluctuations and possible political or economic instability which may result in the impairment or loss of mineral concessions or other mineral rights, opposition from environmental or other non-governmental organizations, and mineral exploration and mining activities may be affected in varying degrees by political stability and government regulations relating to the mineral exploration and mining industry. Any changes in regulations or shifts in political attitudes are beyond the control of the Company and may adversely affect its business. Exploration and development may be affected in varying degrees by government regulations with respect to restrictions on future exploitation and production, price controls, export controls, foreign exchange controls, income taxes, expropriation of property, environmental legislation and mine and site safety.

20

Notwithstanding any progress in restructuring political institutions or economic conditions, the present administrations, or successor governments, of some countries in which Eurasian operates may not be able to sustain any progress. If any negative changes occur in the political or economic environment of these countries, it may have an adverse effect on the Company’s operations in those countries. The Company does not carry political risk insurance.

Financing and Share Price Fluctuation Risks

Eurasian has limited financial resources, no source of operating cash flow (other than interest on its cash deposits) and no assurance that additional funding will be available to it for further exploration and development of its projects. Further exploration and development of one or more of the Company’s projects may be dependent upon the Company’s ability to obtain financing through equity or debt financing or other means. Failure to obtain this financing could result in delay or indefinite postponement of further exploration and development of its projects which could result in the loss of one or more of its properties.

The securities markets can experience a high degree of price and volume volatility, and the market price of securities of many companies, particularly those considered to be development stage companies such as Eurasian, may experience wide fluctuations in share prices which will not necessarily be related to their operating performance, underlying asset values or prospects. There can be no assurance that these kinds of share price fluctuations will not occur in the future, and if they do occur, of how severe the impact may be on Eurasian’s ability to raise additional funds through equity issues.

Competition

The Company competes with many companies and individuals that have substantially greater financial and technical resources than the Company for the acquisition and development of projects as well as for the recruitment and retention of qualified employees.

Return on Investment Risk

Investors cannot expect to receive a dividend on their investment in the foreseeable future, if at all. Accordingly, it is likely that investors will not receive any return on their investment in Eurasian’s securities other than possible capital gains.

Pending Acquisition of Bullion Monarch Mining, Inc.

The proposed acquisition of Bullion, whether or not consummated, may result in a diversion of management’s attention from day-to-day operations, a loss of key personnel and a disruption of EMX’s operations. The proposed transaction may also affect EMX’s relationships with third parties including its JV partners. The merger agreement imposes certain restrictions on the conduct of EMX’s business outside of the ordinary course prior to the closing of the transaction or the termination of the merger agreement, which may also adversely affect the Company’s ability to manage its operations effectively in light of changes in economic or market conditions or to execute its business strategy and meet its financial goals. Any delay in the consummation of the proposed transaction could exacerbate the impact of the risks associated with the proposed transaction, if they were to occur.

21

The proposed transaction is subject to customary closing conditions, including, among others, adoption of the merger agreement by the Bullion shareholders, regulatory and stock exchange approvals, absence of any law or order prohibiting the transaction, effectiveness of the registration statement for the EMX Common Shares to be issued in the merger and the listing of such shares on the TSX-V and NYSE Amex, accuracy of certain representations and warranties and material compliance with covenants, and absence of any material adverse change with respect to the business and affairs of EMX or Bullion. The merger agreement contains certain termination rights for both the Company and Bullion and provides that, upon termination of the merger agreement under specified circumstances, either the Company or Bullion may be required to pay the other party a termination fee of US$1 million or US$4 million, respectively, or pay certain of the other party’s transaction expenses.

EMX cannot predict whether or when the closing conditions for the proposed transaction set forth in the merger agreement will be satisfied or whether the proposed transaction will be completed. If the closing conditions are not satisfied or waived pursuant to the merger agreement or the contemplated schedule, or if consummation of the transaction is delayed, enjoined or not completed for any other reason, the market price of the Common Shares may decline. In addition, if the proposed transaction does not occur, EMX may nonetheless remain liable for significant transaction expenses.

No Assurance of Titles or Borders

The acquisition of the right to exploit mineral properties is a very detailed and time-consuming process. There can be no guarantee that the Company has acquired title to any such surface or mineral rights or that such rights will be obtained in the future. To the extent they are obtained, titles to the Company’s surface or mineral properties may be challenged or impugned and title insurance is generally not available. The Company’s surface or mineral properties may be subject to prior unregistered agreements, transfers or claims and title may be affected by, among other things, undetected defects. Such third party claims could have a material adverse impact on the Company’s operations.

Currency Risks

The Company’s equity financings are sourced in Canadian dollars but many of its expenditures are in local currencies or United States dollars. At this time, there are no currency hedges in place, therefore, a weakening of the Canadian dollar against the United States dollar could have an adverse impact on the amount of exploration conducted.

Joint Venture Funding Risk

Eurasian’s strategy is to seek partners through joint ventures to fund exploration and project development. The main risk of this strategy is that funding partners may not be able to raise sufficient capital in order to satisfy exploration and other expenditure terms in a particular joint venture agreement. As a result, exploration and development of one or more of the Company’s property interests may be delayed depending on whether Eurasian can find another partner or has enough capital resources to fund the exploration and development on its own.

Insured and Uninsured Risks

In the course of exploration, development and production of mineral properties, the Company is subject to a number of risks and hazards in general, including adverse environmental conditions, operational accidents, labor disputes, unusual or unexpected geological conditions, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, and earthquakes. Such occurrences could result in the damage to the Company’s property or facilities and equipment, personal injury or death, environmental damage to properties of the Company or others, delays, monetary losses and possible legal liability.

22

Although the Company may maintain insurance to protect against certain risks in such amounts as it considers reasonable, its insurance may not cover all the potential risks associated with its operations. The Company may also be unable to maintain insurance to cover these risks at economically feasible premiums or for other reasons. Should such liabilities arise, they could reduce or eliminate future profitability and result in increased costs, have a material adverse effect on the Company’s results and a decline in the value of the securities of the Company.

Some work is carried out through independent consultants and the Company requires all consultants to carry their own insurance to cover any potential liabilities as a result of their work on a project.

Environmental Risks and Hazards

The activities of the Company are subject to environmental regulations issued and enforced by government agencies. Environmental legislation is evolving in a manner that will require stricter standards and enforcement and involve increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There can be no assurance that future changes in environmental regulation, if any, will not adversely affect Eurasian’s operations. Environmental hazards may exist on properties in which the Company holds interests which are unknown to the Company at present.

Fluctuating Metal Prices

Factors beyond the control of the Company have a direct effect on global metal prices, which have fluctuated widely, particularly in recent years, and there is no assurance that a profitable market will exist for a production decision to be made or for the ultimate sale of the metals even if commercial quantities of precious and other metals are discovered on any of Eurasian’s properties. Consequently, the economic viability of any of the Company’s exploration projects and its ability to finance the development of its projects cannot be accurately predicted and may be adversely affected by fluctuations in metal prices.

Extensive Governmental Regulation and Permitting Requirements Risks

Exploration, development and mining of minerals are subject to extensive laws and regulations at various governmental levels governing the acquisition of the mining interests, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. In addition, the current and future operations of Eurasian, from exploration through development activities and production, require permits, licences and approvals from some of these governmental authorities. Eurasian has obtained all government licenses, permits and approvals necessary for the operation of its business to date. However, additional licenses, permits and approvals may be required. The failure to obtain any licenses, permits or approvals that may be required or the revocation of existing ones could have a material and adverse effect on Eurasian, its business and results of operations.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities requiring Eurasian’s operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Eurasian may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Any such events could have a material and adverse effect on Eurasian and its business and could result in Eurasian not meeting its business objectives.

23

Key Personnel Risk

Eurasian’s success is dependent upon the performance of key personnel working in management and administrative capacities or as consultants, The loss of the services of senior management or key personnel could have a material and adverse effect on the Company, its business and results of operations.

Conflicts of Interest

In accordance with the laws of British Columbia, the directors and officers of a corporation are required to act honestly, in good faith and in the best interests of the corporation. Eurasian’s directors and officers may serve as directors or officers of other companies or have significant shareholdings in other resource companies and, to the extent that such other companies may participate in ventures in which EMX may participate, such directors and officers may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. If such a conflict of interest arises at a meeting of the Company’s directors, a director with such a conflict will abstain from voting for or against the approval of such participation or such terms.

MINERAL PROPERTIES

Turkey

Eurasian’s property and royalty portfolio in Turkey is comprised of five exploration and five exploitation licenses that cover over 20,000 hectares in the Western Anatolia and the Eastern Pontides mineral belts. The properties include bulk tonnage gold, high-grade gold-silver vein, bedded copper-silver, and porphyry copper targets. Eurasian has two joint ventures in Turkey, including the Akarca property joint venture with Centerra Gold Inc. of Toronto, Ontario, and the Sisorta joint venture with Chesser Resources Limited of Norwood, Australia. Eurasian also holds royalty interests in the Balya lead-zinc-silver property. Significant drill programs were conducted in 2011 at the Akarca joint venture project and the Balya royalty property. Meanwhile, Eurasian continued to evaluate other projects in its property portfolio, including the Golcuk volcanic-hosted, stratabound copper-silver prospect, and assessed new exploration opportunities. There are no known reserves on any of Eurasian’s properties in Turkey, and all of the proposed programs on Eurasian’s properties in Turkey are exploratory in nature.

Akarca Property

Unless otherwise indicated, the information in this AIF regarding the Akarca property is based on information provided by the technical report dated November 1, 2011 entitled “Akarca Gold-Silver Project Technical Report” (the “Akarca Report”) prepared by John E. Dreier (Ph.D., AIPG CPG, of Exploration, Development, and Mining Inc.) and Mesut Soylu (Ph.D., AIPG CPG, the Country Manager, Turkey, of Eurasian). The Akarca Report may be found in Eurasian’s filings on SEDAR at www.sedar.com, or as Exhibit 99.109 to Eurasian’s registration statement on Form 40-F filed with the SEC on January 24, 2012.

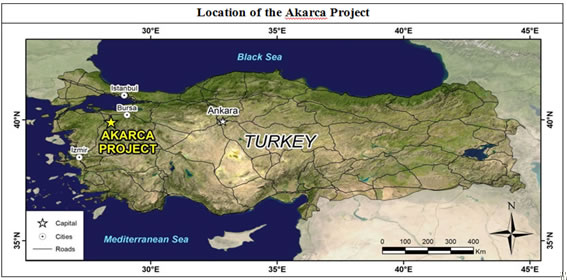

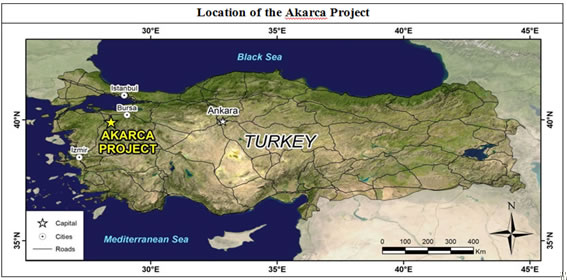

The Akarca property is located in the Anatolia region, Bursa province, western Turkey. The property is approximately 450 kilometers west of Ankara, the capital of Turkey, 70 kilometers southwest of the city of Bursa, a major industrial center, and 200 kilometers northeast of Izmir, the largest city in western Turkey.

24

Access to the Akarca property from the town of Bursa is southwest on 80 kilometers of paved road, and then south 15 kilometers from the town of Mustafakemalpasa on well-maintained dirt roads. Access from Ankara to Bursa via route E90 is 385 kilometers with a driving time of about five hours. Road conditions on the property are generally good throughout the year, and access is available under all climatic conditions from Bursa and Mustafakemalpasa.

Gold-silver mineralization on the Akarca property was discovered by Eurasian in 2006, and exploration licenses were granted on open ground that had undergone very limited, pre-modern, mining-related activity. The Akarca property is covered by one exploitation license and a second license that is currently in the process of being converted from exploration to exploitation status (Note: the second exploitation license was granted in March, 2012). These two licenses cover a combined area of 3901.31 hectares.

Since December 23, 2008, the Akarca property has been under option to a wholly owned subsidiary of Centerra. The licenses are held in AES Madencilik Ltd. Sti., a company incorporated under the laws of Turkey for the purposes of the option and subsequent joint venture and which is jointly owned by Centerra and Eurasian. Centerra has exclusive rights to maintain a 50% shareholding interest in AES and the Akarca property, by funding US$5 million in Phase One exploration expenditures by December 31, 2012, and paying Eurasian US$1 million within 30 days of earning its initial 50% shareholding interest in AES. Centerra can increase its interest to 70% by funding a further US$5 million of exploration within the next two years. Phase One exploration expenditures total approximately US$4.4 million. Eurasian is currently the manager of all exploration carried out on the Akarca property, but Centerra may assume these management duties on 60 days notice to Eurasian.

There have been no previous licenses granted on the Akarca property, and there are no other agreements, back-in rights or other encumbrances to which the property is subject. Initially Eurasian and, since 2008, AES have kept the Akarca licenses in good standing according to the requirements of Turkish mining law. Access, infrastructure and available workforce are adequate to support any development of a mineral deposit at the Akarca property.

The Akarca property occurs in the Western Pontides tectonic belt of western Anatolia, where deformation and magmatism occurred from the Cretaceous to the Neogene. Late Miocene extension created numerous fault-bounded basins, including the sedimentary basin that hosts the Akarca deposit. The geology at Akarca is dominated by Neogene-aged basin-fill sedimentary units, with local intercalations of tuffaceous rocks, that unconformably overlie Paleozoic schists and re-crystallized limestones. These rock sequences are cut by multiple zones of structurally controlled, LSE veining, silicification, and associated gold-silver mineralization.

25

The Akarca property covers six primary mineralized zones within a district-scale area of 6 by 1.5 kilometers. Eurasian and AES have conducted surface sampling, geologic mapping, geophysical surveys, and drill campaigns that have characterized the target areas with: a) 2,293 soil samples, b) 2,500 rocks samples of various types (i.e., channel, grab, float, etc.), c) four IP surveys, d) 61 core holes totaling over 7,600 meters, and e) 11 RC holes totaling approximately 1,400 meters. The property geology, for the most part, is concealed beneath a thin veneer of soil and vegetation, with exposures principally occurring as discontinuous outcrops of veins and silicified zones, or in drainages or road cuts. As a result, the soil geochemistry and IP-resistivity surveys have been instrumental in broadly outlining areas of gold-silver mineralization and buried vein targets. Within the target areas, outcrop mapping, rock sampling, and drilling have delineated the LSE vein systems and structurally controlled corridors of silicification along strike and down dip.

The known mineralized zones are oriented northeast-southwest and northwest-southeast, reflecting extension and horst and graben creation of the sedimentary basins hosting the mineralization. The vein systems range from approximately 100 to over 400 meters in length on the surface. The vein widths typically vary from 0.5 to 15 meters, and locally are in excess of 75 meters as constituted by brecciated and silicified zones in addition to the quartz veins. Gold and silver are hosted as both structurally focused vein-style, as well as lithologically controlled disseminated-style mineralization. The quartz veins tend to host the higher-grade mineralization, while the silicified halos in the wall-rocks host lower-grade disseminated mineralization. Gold and silver grades in the mineralized zones range from greater than 0.2 ppm Au and geochemically anomalous Ag to over 10 ppm Ag, with locally higher grades of greater than 10 ppm Au and/or greater than 100 ppm Ag. The vein targets have only been tested to shallow depths of 30 to 110 meters below the surface. The mineralized zones are to a large extent oxidized to a relatively consistent 80 to 100 meters below the surface. A summary of exploration results for the six principal target areas is given below:

The Kucukhugla Tepe zone, located in the south of the Central Target area, is defined as a northwest trending 100 meter wide corridor of oxide gold-silver mineralization occurring in two sub-parallel systems of veining and stockworking. Over 78% of 627 rock samples assayed greater than 0.2 ppm gold, and more than 32% exceeded 10 ppm silver. There are multiple high-grade surface samples greater than 10.0 ppm gold (n=34), and 100 ppm silver (n=43). Significant mineralization was intersected in 16 out of 20 holes along 600 meters of strike length, including an intercept of 63.7 meters (51-54m true width) averaging 1.54 ppm gold and 14.53 ppm silver.

The Hugla Tepe zone occurs in the middle of the Central Target area, and is outlined as a 650 by 350 meter gold-in-soil anomaly (i.e., > 0.1 ppm Au) with IP-resistivity targets. The northeast trending vein zone can be followed at the surface for about 400 meters and is up to 7 to 8 meters thick. Hugla Tepe is relatively low grade, with a median grade of 0.29 ppm gold from 267 rock samples. Significant mineralization was intersected in 20 out of 21 holes along 650 meters of strike length, delineating oxide gold-silver mineralization to depths of approximately 80-100 meters.

The Fula Tepe zone, located at the north end of the Central Target area, consists of a 900 by 200 meter northeast trending corridor of anomalous gold- and silver-in-soil geochemistry, veining, wall-rock silicification, and IP-resistivity anomalies. The median grades from 195 rock samples are relatively high at 1.14 ppm gold and 13 ppm silver, with high-grade maximums of 31 ppm gold and 322 ppm silver. Drilling has delineated 350 meters of the zone's strike length, including an intercept of 15.4 meters (10m true width) averaging 1.96 ppm gold and 15.95 ppm silver.

26

Sarikaya Tepe, located west of the Central Target area, is a 500 by 75 meter zone of surface exposed quartz veining and silicification coincident with a steep north-northwest trending topographic high. Three core holes delineated approximately 200 meters of strike length, and include a near surface intercept of 14.2 meters averaging 4.61 ppm gold, and a deeper zone with an intercept of 67.9 meters averaging 1.35 ppm gold and 16.08 ppm silver. In addition to the thicker intercepts of gold-silver mineralization, there are also higher-grade sub-intervals such as 11.4 meters averaging 4.90 g/t gold and 45.75 g/t silver and 5.8 meters averaging 10.00 g/t gold and 4.16 g/t silver. Note that true widths are interpreted to be approximately 70-90% of the reported interval length.

Arap Tepe is a three by two kilometer, northwest trending corridor of multiple, sub-parallel zones of oxide gold-silver mineralization, quartz veining, and IP-resistivity anomalies located approximately three kilometers east of the Central Target area. The veins range from 35 to 205 meters in strike length, and from 1 to 16 meters in width. The Arap Tepe vein zones host higher- grade surface samples, including Zone A with rock chip sample results of 19.55 ppm gold, and Zone B with channel sample results including 54.8 ppm gold and 24.7 ppm silver over 0.7 meters. Another noteworthy characteristic of the Arap Tepe target area is the presence of nine IP- resistivity anomalies representing over 3000 meters of untested vein zone targets beneath cover. Drill results include 11 out of 13 holes with significant intercepts, including 55.4 meters (36.0- 47.1m true width) averaging 3.10 ppm gold from Zone A, which has 250 meters of drilled strike length.

The Percem Tepe prospect, located north of Arap Tepe, is an 800-meter long northwest trend of oxide gold- silver mineralization, silicification and quartz veining, as well as concealed targets identified by IP- resistivity anomalies. Drill confirmation consisted of four holes that intersected two zones (i.e., Zones B and C) located approximately 650 meters from each other, including an intercept of 102.2 meters (66–86 meters true width) averaging 0.57 ppm gold and 5.50 ppm silver.

Eurasian and the AES JV have adhered to Best Practice guidelines of the CIM for the surface exploration and drilling programs. The surface and drill samples taken are representative of the altered and gold-silver mineralized material. Data verification by the independent author of the Akarca Report included sampling during the Akarca core review, field checks of drill collars, field checks of geologic mapping, and drill database assay verification in the office. Review of Eurasian’s assay QA for drill and surface samples confirmed that all QC tests were passed for standard, blank, and duplicate samples. The independent data verification work confirmed that the Eurasian and AES exploration results are representative and reproducible.

Exploration results from the Eurasian and AES programs have established Akarca as a property of merit, with zones of higher grade vein and lower grade bulk tonnage gold-silver mineralization that have district-scale exploration potential. Overall, Akarca has only been tested to relatively shallow depths, especially when considering the evidence for a shallow depth of erosion, and the vertical ranges typical for the low sulfidation styles of vein mineralization. Basement-hosted structures present excellent exploration targets at depth for follow-up. All of the vein zones drill-tested to date remain open down-dip as well as along strike. There are also a significant number of untested IP-resistivity targets that provide further upside exploration potential on the property.

The Akarca Report recommended a 12-month exploration program that totals approximately US $4.5 million, and includes a) 10,000 meters of core drilling, b) trenching and channel sampling programs to extend the gold-silver zones along strike and identify parallel zones at surface, c) extension and in-fill of the soil grids, d) additional geologic mapping to complete a 1:10,000 scale compilation for the entire property, e) additional IP surveys and a gravity survey, f) early-stage metallurgical testing, and g) initiation of an EIA study. The surface sampling, geologic mapping, and geophysical surveys will further define the mineralized zones at surface, and may result in the identification and discovery of new target zones. The recommended drilling will support a) definition of the mineralized zones along strike and down-dip, b) exploration for basement-hosted gold-silver mineralization, and c) testing concealed targets identified by IP-resistivity. As exploration of the Akarca property advances, it is important to establish the metallurgical properties of the mineralized material with a modest program that includes bottle roll and other tests. Finally, as a requirement to keep the licenses in good standing, it is critical to continue with ongoing environmental monitoring, and to initiate the required EIA study.

27

Subsequent to the Akarca Report, the second exploitation license was granted, and additional surface sampling and mapping was conducted by the joint venture. Eurasian and Centerra have reviewed the recommended work program from the Akarca Report, and are finalizing the 2012 exploration program.

Sisorta Project

Unless otherwise indicated, the information in this AIF regarding the Sisorta project is based on information provided by the technical report dated July 31, 2009 entitled “Technical Report on the Exploration Results and Resources Estimates for the Sisorta Property Sivas Province, Turkey” (the “Sisorta Report”) prepared by Andrew Vigar (BAppSc, FAusIMM, MSEG, of Mining Associates Pty. Ltd.), Simon Meldrum (B.Sc., MSEG, a Consulting Exploration Geologist), Gary Giroux (M. A.Sc., P.Eng., Mem APEG, of Giroux Consultants Ltd.), and Mesut Soylu (Ph.D., AIPG CPG, the Country Manager, Turkey, of Eurasian). The entire Sisorta Report may be found in Eurasian’s filings on SEDAR at www.sedar.com.

The Sisorta property is located in the Black Sea region of Sivas Province, north-eastern Turkey, on the southern flank of the east-west aligned Pontides mountain range. Sivas Province has a population of approximately 630,000, and a well-developed industrial and rural-based infrastructure. The Sisorta project is 60 kilometers south of the Black Sea coastal town of Ordu and 120 kilometers northeast of the provincial capital of Sivas.

The transportation network in the area surrounding the Sisorta property is well developed, with maintained roads allowing two wheel drive vehicles to access the project area from May until November. Access is limited at the higher elevations during the winter months due to snow cover. Locally, the property is 45 kilometers from the town of Koyulhisar (population 5,500). From Koyulhisar, access is on two-lane, all-weather paved highway D100 for 18 kilometers to the turnoff for the Sisorta village road, and then east 27 kilometers on paved road to Ortakent village. From Ortakent to the nearby Guzelyurt village (population 293), access is on a well-maintained dirt road for 18 kilometers, and from Guzelyurt to the property is another three kilometers along maintained forest and drill roads.

28