|

| MicroCrap Opportunities Fund Ultra MicroCap Fund Low Priced Stock Fund | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Semi-Annual Report April 30, 2018 (Unaudited) | | | | | | | |

The PERRITT MICROCAP OPPORTUNITIES FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $500 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have demonstrated above-average growth in revenues and/or earnings, possess relatively low levels of long-term debt, have a high percentage of their shares owned by company management, and possess modest price-to-sales ratios and price-to-earnings ratios that are below their long-term annual growth rate. At times, the Fund may also invest in “special situations” such as companies that possess valuable patents, companies undergoing restructuring, and companies involved in large share repurchase programs. Investors should expect the Fund to contain a mix of both value-priced and growth stocks.

The PERRITT ULTRA MICROCAP FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $300 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have a high percentage of their shares owned by company management, possess relatively low levels of long-term debt, have a potential for above average growth in revenues and/or earnings, and possess reasonable valuations based on the ratios of price-to-sales, price-to-earnings, and price-to-book values. The micro-cap companies in which the Fund may invest include “early stage” companies, which are companies that are in a relatively early stage of development with market capitalizations that are below $50 million. At times, the Fund may also invest in unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

The PERRITT LOW PRICED STOCK FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of low priced common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $3 billion. Low priced stocks are those that are trading at or below $15 per share at the time of initial purchase. Subsequent to the initial purchase, the Fund may purchase such securities at a price above $15 per share. The Fund’s strategy is based on the premise that low priced stocks offer growth potential because these stocks have limited broker research coverage, the companies’ prospects are misunderstood by most investors, and some investors mistakenly believe stocks trading below $15 per share are more “speculative” than those trading at higher levels and therefore avoid low priced stocks. The Fund will invest in “growth” stocks, “value” stocks, or a combination of both. Given the market capitalization restrictions, the Fund will normally invest in securities issued by small-cap companies, including some micro-cap companies. However, micro-cap companies will only make up a small portion of the Fund’s portfolio. Micro-cap companies represent the smallest sector of public companies based on market capitalization. At times, the Fund’s portfolio may contain the shares of unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

Semi-Annual Report

April 30, 2018

(Unaudited)

| |

| 2 |

| 6 |

| 8 |

| 9 |

| | |

| |

| 10 |

| 14 |

| 16 |

| 17 |

| | |

| |

| 18 |

| 20 |

| 22 |

| 23 |

| | |

| |

| 24 |

| 34 |

| 35 |

| 36 |

| 39 |

| 42 |

| 51 |

| 53 |

| 57 |

| 60 |

Perr

itt MicroCap Opportunities Fund

Portfo lio Managers’ Message |

| | |

Michael Corbett,

Portfolio Manager | | George Metrou,

Portfolio Manager |

The Perritt MicroCap Opportunities Fund posted a gain of +2.12% during the six-month period ended April 30, 2018, compared to a +3.95% gain for the Russell Microcap Index and +3.27% gain for the Russell 2000 Index. The Fund’s longer-term performance results, as well as the benchmark’s performance, can be found later in this report.

During the period, we continued the strategic reduction in the number of holdings in the fund. We have attempted to concentrate our efforts and our capital in our best ideas. We began the period with 83 positions and ended the period with 74 positions. While the net reduction represents only nine positions, a greater amount of rotation occurred within the portfolio. In gross terms, we eliminated fifteen positions, and initiated six new positions.

Within the six names added to the portfolio, we were able to find new opportunities in various sectors. We added two positions in consumer discretionary, two in technology, one bank, and one industrial company. Each of the companies added adhere to our disciplined focus on companies which can generate free cash flow, have a solid balance sheet, and earn an above average return on capital.

In consumer discretionary, we added BBX Capital Corp. (BBX) a holding company whose primary asset is a 90% ownership stake in a fast-growing public timeshare company, Bluegreen Vacations Corp. (BXG). BBX was trading at a significant discount to implied market value of its BXG holding and other assets. Our second addition in the consumer space was Lazydays Holdings, Inc. (LAZY), a company that owns RV dealerships. LAZY came public via a SPAC offering (Special Purpose Acquisition Company) and plans to use its new capital and public currency to roll-up the fragmented industry. We believe the non-traditional method of going public has created a steep discount in the shares.

In the technology sector, we added Digi International Inc. (DGII) and Limelight Networks, Inc. (LLNW). DGII sells networking hardware and solutions services in the Machine-to-Machine and Internet-of-Things arena. LLNW operates a traditional content delivery network. Both companies are engaged in turnarounds of their businesses and have potentially exciting new growth avenues being cultivated “under the hood.” Both companies were trading at steep discounts to peers, affording us the opportunity to acquire growing tech focused businesses at reasonable prices.

We added one new bank to the portfolio, Bridgewater Bancshares, Inc. (BWB). BWB went public via Initial Public Offering (IPO) in March 2018. We found their laser focus on the Minneapolis commercial market, pristine credit history, and attractive valuation compelling. Furthermore, we were highly impressed with the management team, including the founder and CEO, Jerry Baack and the entire team of highly engaged senior management.

Perritt MicroCap Opportunities Fund

Lastly, we have reintroduced Sparton Corp. (SPA) to our portfolio. Shareholders of the fund may recall that we had previously owned shares in SPA and sold our position after the company received a buyout offer last year. Subsequent to our sale, the announced acquisition of SPA was terminated and the shares were aggressively sold off. We repurchased a position in the company in the wake of the acquisition termination.

The average market capitalization of the positions added was $417 million. The average number of Wall Street analysts covering the companies was two. All the companies added to the portfolio generate cash flow from their operations. These data points on size, coverage, and cash flow speak to our dedication to remain true to our microcap space; investing in undiscovered and under-researched securities of high quality companies. Sticking to our process has yielded promising initial results from the new additions to the portfolio.

During the period, we liquidated fifteen positions. One position, Omega Protein (OME) was sold after receiving a valid buyout offer. Eight companies were sold after reaching our price targets: Aspen Aerogels, Inc. (ASPN), EMC Insurance Group, Inc. (EMCI), The Ensign Group, Inc. (ENSG), Kadant Inc. (KAI), Kforce Inc. (KFRC), OrthoPediatrics Corp. (KIDS), Systemax Inc. (SYX), and Weyco Group, Inc. (WEYS). The remaining six positions removed from the portfolio were sold after a downgrade in our view of the price appreciation potential of the security or to rotate capital to higher conviction ideas.

As of April 30, 2018, the Fund’s portfolio was comprised of 74 common stocks. The Fund’s 10 largest holdings and detailed descriptions can be found later in this report. Based on our earnings estimates, the Fund’s portfolio is trading at approximately 17.1 times 2018 earnings. Stocks in the portfolio are priced at a median 1.0x revenue and the median price to book value is 1.8x. Lastly, the median market capitalization is approximately $311 million.

We are encouraged by the current composition of the portfolio. The Fund’s companies have a median revenue growth rate of 9%, return on invested capital of 8%, free cash flow margin of 7%, and trade at 1.0x revenue. This compares to revenue growth of 7%, return on invested capital of 5%, free cash flow margins of 5%, and a valuation of 1.4x revenue for the Russell Microcap Index. The bottom line is we believe our portfolio has grown faster, is more profitable, has generated more cash, and is cheaper than the broader microcap market. This should serve the Fund’s shareholders well in the future.

I want to thank my fellow shareholders for their continued support and confidence in the Perritt Capital Management team. We remain dedicated to investing in high quality micro-cap companies at attractive valuations. If you have any questions or comments about this report or your investment in the Perritt MicroCap Opportunities Fund, please call us at (800) 331-8936 or visit our website at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies

George Metrou

Portfolio Manager

Perritt MicroCap Opportunities Fund

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Return on Equity is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders’ equity.

Return on Invested Capital is a fundamental method of determining a company’s financial performance. It is used to measure how well a company is investing its capital.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

Price to Book (P/B) is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Tangible Book Value is the total net asset value of a company (book value) minus intangible assets and goodwill.

(This Page Intentionally Left Blank.)

Perritt MicroCap Opportunities Fund

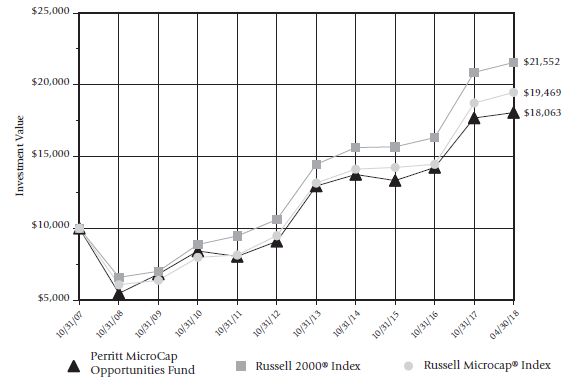

Perritt MicroCap Opportunities Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. The graph does not imply any future performance. |

Perritt MicroCap Opportunities Fund

| Performance (Unaudited) (Continued) | April 30, 2018 |

| Cumulative Total Returns* |

| Periods ended April 30, 2018 (Unaudited) |

| | Past

6 Months | Past

1 Year | Past

3 Years | Past

5 Years | Past

10 Years | Past

15 Years | Past

25 Years |

| Perritt Microcap Opportunities Fund | 2.12% | 9.78% | 29.05% | 70.14% | 120.42% | 382.51% | 1134.73% |

Russell 2000® Index | 3.27% | 11.54% | 31.79% | 74.22% | 147.49% | 371.63% | 870.53% |

| (reflects no deduction for fees and expenses) | | | | | | | |

| | | | | | | | |

Russell Microcap® Index | 3.95% | 13.76% | 30.75% | 76.65% | 138.89% | 318.29% | N/A |

| (reflects no deduction for fees and expenses) | | | | | | | |

| Average Annual Total Returns* |

| Periods ended April 30, 2018 (Unaudited) |

| | Past

1 Year | Past

3 Years | Past

5 Years | Past

10 Years | Past

15 Years | Past

25 Years |

| Perritt Microcap Opportunities Fund | 9.78% | 8.87% | 11.21% | 8.22% | 11.06% | 10.58% |

Russell 2000® Index | 11.54% | 9.64% | 11.74% | 9.49% | 10.89% | 9.52% |

| (reflects no deduction for fees and expenses) | | | | | | |

| | | | | | | |

Russell Microcap® Index | 13.76% | 9.35% | 12.05% | 9.10% | 10.01% | N/A |

| (reflects no deduction for fees and expenses) | | | | | | |

The Perritt MicroCap Opportunities Fund’s annualized expense ratio for the year ended October 31, 2017, as stated in the statutory prospectus, was 1.24%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt MicroCap Opportunities Fund

Ten Largest Co mmon Stock Holdings (Unaudited) |

Bluelinx Holdings, Inc. (BXC) distributes building and industrial products in the United States. The company also provides a range of value-added services and solutions to customers. It serves dealers, industrial manufacturers, manufactured housing producers and home improvement retailers through a network of distribution centers.

Northern Technologies Intl. Corp. (NTIC) develops and markets rust and corrosion inhibiting products and services to automotive, electronics, electrical, mechanical, military, retail consumer, and oil and gas markets. It sells its products and services through a direct sales force, a network of distributors and agents, manufacturer’s sales representatives, strategic partners, and joint venture arrangements primarily in North and South America, Europe, Asia and the Middle East.

First Internet Bancorp (INBK) operates as a bank holding company for First Internet Bank of Indiana that provides commercial and retail banking products and services through its website, firstib.com.

OMNOVA Solutions Inc. (OMN) provides emulsion polymers, specialty chemicals, and engineered surfaces for various commercial, industrial, and residential end uses in the United States, Europe, and Asia. Omnova operates in two segments, Performance Chemicals and Engineered Surfaces.

Silvercrest Asset Management Group Inc. (SAMG) is a wealth management firm that provides financial advisory and related family office services in the United States. The company serves ultra-high net worth individuals and families, as well as their trusts; endowments; foundations; and other institutional investors. It also manages funds of funds and other investment funds.

Addus HomeCare Corporation (ADUS) is a provider of home and community-based personal care services, which are provided primarily in the home, and is focused on the dual eligible (Medicare/Medicaid) population. Addus provides these services on a long-term, continuous basis, with an average duration of over 20 months per consumer.

Ooma, Inc. (OOMA) provides communications solutions and other connected services to small business, home, and mobile users in the United States and Canadian markets. The company offers its products through direct sales, retailers, and online, as well as through distributors and reseller partnership channels.

Miller Industries, Inc. (MLR) engages in the manufacture and sale of towing and recovery equipment. It offers wreckers, such as conventional tow trucks and recovery vehicles. The company also provides transport trailers for moving multiple vehicles, auto auctions, car dealerships, leasing companies, and other similar applications.

Bankwell Financial Group, Inc. (BWFG) operates as the bank holding company for Bankwell Bank, it provides a range of banking services to commercial and consumer customers in Connecticut.

Hill International, Inc. (HIL) provides project and construction management, and other consulting services primarily for the buildings, transportation, environmental, energy, and industrial markets.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt MicroCap Opportunities Fund

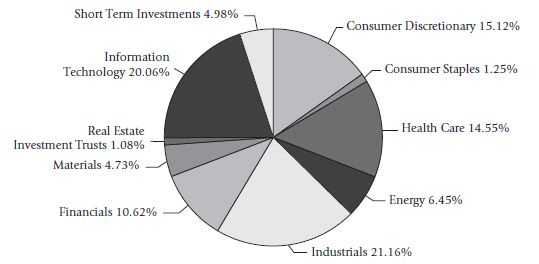

Allocation of Portfolio Investmen ts (Unaudited) | April 30, 2018 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Ul

tra MicroCap Fund

Portfolio Managers’ Messa ge |

|  |

Michael Corbett, Portfolio Manager | Matthew Brackmann, Portfolio Manager |

The Perritt Ultra MicroCap Fund had a negative return of -0.54% for the first half of fiscal 2018. This compares unfavorably to the positive 3.95% for the Russell Microcap Index. The complete performance for the fund and its benchmarks can be found later in this report.

During the first half of the fiscal year, the fund saw its strongest performance from its holdings in the Healthcare and Energy sectors. Our top performers were our investments in healthcare service providers including Addus HomeCare (ADUS), a provider of at home health services for patients that can’t take care of themselves, which increased 45.83% for the six month period. Another was Cynergistek, Inc. (CTEK) which provides managed print services and cyber security services to healthcare providers, which was up 68.58% in the past six months. Our positive contribution from the Energy space was driven entirely by our investment in a product and service company name, Profire Energy, Inc. (PFIE) which has increased 94% in the last six months. Profire manufactures burner management systems for use in the oil in gas rigs on both production wells and downstream pipeline & refining operations. This is a name that had been on our watch list for a number of years before we took a position in it, once we saw the energy markets start to improve after a couple of very tough years. This investment paid off as they have seen large improvement in their markets as energy prices have increased, including a year-over-year revenue increase of 55%! We still hold all three of these names and look forward to future results. Five additional names were added during the period including ASV, Inc. (ASV) which assembles and distributes compact construction equipment nationwide & Juniper Pharmaceuticals, Inc. (JNP) which is a commercial stage pharmaceutical company and lab technical service provider to the biopharma space.

Since the start of fiscal year 2018, the fund sold eight investments and made a “round trip” in one. The round trip was a unique situation where one of our holdings, US Global Investors (GROW), a money manager specializing in precious metals investing traded up rapidly on news they had invested in the crypto currency space. We chose to take advantage of this move in price and sold our position into the news and subsequently repurchased it when it traded back to its book value. Additionally, we had three buy-outs during the period of which we sold two. Hardinge, Inc (HDNG) and MGC Diagnostics Corp. (MGCD) were both purchased in cash deals and sold during the period. Layne Christensen Co. (LAYN) was purchased in an all stock deal by Granite Construction, Inc. (GVA) and while we did sell some of the position, we continue to hold the balance as we see upside in GVA. Three names were sold for reaching their valuation targets: Cutera, Inc. (CUTR), PAR Technologies Corp. (PAR), & Kingstone Companies, Inc. (KINS).

As of April 30, 2018, the Fund holds the common stock of 84 companies which is lower than the 87 names we held at the time of our annual report, October 31, 2017. Based on our earnings estimates, the Fund’s portfolio is trading at 16.1x forward earnings. The median price to sales ratio is 1.11x, the median price to book ratio is 1.69x, the trailing twelve-month P/E is 22.4x and the median market cap is unchanged at $90mm.

Perritt Ultra MicroCap Fund

In terms of allocations within each sector, the fund continues to maintain large underweights to both the Financial and Healthcare sectors. We continue to look for attractive names in the space that have a solid, niche business but will continue to avoid certain areas, such as regional banks and biotech stocks in each respective sector due to valuations, risk exposure and liquidity reasons. As we discuss in each letter, many of these names either have restricted growth prospects or do not generate any revenue which does not meet the investment criteria we have been relying on for almost three decades. We remain heavily overweight in Industrials and Information Technology with modest overweight positions in the Consumer Discretionary and Energy sectors.

The Ultra MicroCap fund tends to have investments that fly under the radar screen of most investors. The microcap universe, particularly the stocks in the Ultra MicroCap’s sweet spot is in the sub $100mm market capitalization companies, are often ignored by investors for an extended period. Therefore, we remind shareholders the potential rewards can take longer to achieve but can be swift. As fellow shareholders, we come to the midpoint of this year unhappy with our relative performance versus our index and are examining each position with fresh eyes to determine if they still meet our original investment thesis. If they do not, the positions will be exited. If they do, we will continue to focus on the long-term potential for each holding based on its sound fundamentals rather than the short-term fluctuations in the markets or lack of attention from the street as we believe this to be in the best interest of our shareholders. As always, we would like to remind investors that the rewards of microcap investing are typically never consistent in the short run but can have the potential to be rewarding in a full market cycle.

We want to thank our fellow shareholders for their continued support and confidence in the Perritt Capital Management team. Each member of our investment committee, as well as other employees have made investments in this Fund and remain shareholders alongside all of you. If you have any questions or comments about this report or your investment in the Perritt Ultra MicroCap Fund, please call us at (800) 331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Matthew Brackmann

Portfolio Manager

Perritt Ultra MicroCap Fund

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Earnings Growth is not a measure of the Fund’s future performance. Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Please refer to the Schedule of Investments in the report for more complete information regarding Fund holdings. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Price-to-Book (P/B) is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price-to-Sales (P/S) is a valuation ratio that compares a company’s stock price to its revenues. The price-to-sales ratio is an indicator of the value placed on each dollar of a company’s sales or revenues.

Trailing Price-to Earnings (P/E) is calculated by taking the current stock price and dividing it by the trailing earnings per share (EPS) for the past 12 months.

The semi-annual report must be preceded or accompanied by a prospectus. One cannot invest directly in an index.

The Perritt Funds are distributed by Quasar Distributors, LLC.

(This Page Intentionally Left Blank.)

Perritt Ultra MicroCap Fund

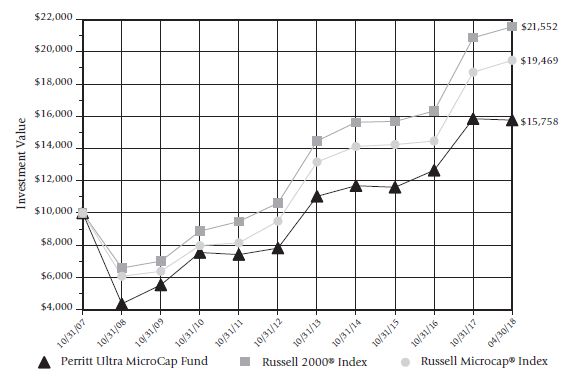

Perritt Ultra MicroCap Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

Perritt Ultra MicroCap Fund

| Performance (Unaudited) (Continued) | April 30, 2018 |

| Cumulative Total Returns** |

| Periods ended April 30, 2018 (Unaudited) |

| | Past | Past | Past | Past | Past | Since |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| Perritt Ultra Microcap Fund | (0.54)% | 11.72% | 32.26% | 78.35% | 106.09% | 179.46% |

Russell 2000® Index | 3.27% | 11.54% | 31.79% | 74.22% | 147.49% | 240.17% |

| (reflects no deduction for fees and expenses) | | | | | | |

Russell Microcap® Index | 3.95% | 13.76% | 30.75% | 76.65% | 138.89% | 184.75% |

| (reflects no deduction for fees and expenses) | | | | | | |

| Average Annual Total Returns** |

| Periods ended April 30, 2018 (Unaudited) |

| | Past | Past | Past | Past | Since |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| Perritt Ultra Microcap Fund | 11.72% | 9.77% | 12.27% | 7.50% | 7.81% |

Russell 2000® Index | 11.54% | 9.64% | 11.74% | 9.49% | 9.37% |

| (reflects no deduction for fees and expenses) | | | | | |

Russell Microcap® Index | 13.76% | 9.35% | 12.05% | 9.10% | 7.96% |

| (reflects no deduction for fees and expenses) | | | | | |

The Perritt Ultra MicroCap Fund’s annualized expense ratio for the year ended October 31, 2017, as stated in the statutory prospectus, was 1.71%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The since inception date is August 30, 2004. |

| ** | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Ultra MicroCap Fund

Ten Largest Common Stock Holdings (Unaudited) |

Cynergistek, Inc. (CTEK) provides outsource document solutions, IT consulting data security, and managed print services primarily to the healthcare industry in the United States. The company offers Incident Response, Vendor Security Management, and Patient Privacy Monitoring Service, as well as Compliance Assist Partner Program.

Galaxy Gaming, Inc. (GLXZ) is a gaming company that designs, develops, manufactures, markets, acquires, and licenses proprietary casino table games and associated technology, platforms, and systems for the gaming industry.

Profire Energy, Inc. (PFIE), an oilfield technology company, provides burner- and chemical-management products and services for the oil and gas industry in the United States and Canada. It assists energy production companies in the production and transportation of oil and natural gas.

DLH Holdings Corp. (DLHC) provides healthcare, logistics, and technical services and solutions to Federal Government agencies including the Department of Veteran Affairs, the Department of Defense, and other government clients.

Addus HomeCare Corporation (ADUS) is a provider of home and community-based personal care services, which are provided primarily in the home, and is focused on the dual eligible (Medicare/Medicaid) population. Addus provides these services on a long-term, continuous basis, with an average duration of over 20 months per consumer.

Luna Innovations (LUNA) develops, manufactures, and markets fiber optic sensing, and test and measurement products worldwide. It operates in two segments, Products and Licensing, and Technology Development.

Sensus Healthcare Inc. (SRTS) manufactures and markets superficial radiation therapy devices to healthcare providers worldwide. It also sells disposable lead shielding replacements: and disposable radiation safety items, such as aprons, eye shields, and disposable applicator tips.

Asure Software, Inc. (ASUR) provides cloud-based software-as-a-service (SaaS) time and labor management, and workspace management solutions worldwide. The company offers a suite of solutions to help clients optimize and manage their mobile workforces and their global workspaces.

First Internet Bancorp (INBK) operates as a bank holding company for First Internet Bank of Indiana that provides commercial and retail banking products and services through its website, firstib.com.

Information Services Group Inc. (III) operates as a technology research and advisory company in the Americas, Europe, and the Asia Pacific. The company offers digital transformation services, including automation, cloud, and data analytics; sourcing advisory; managed governance and risk; network carrier; technology strategy and operations design; change management; and market intelligence and technology research and analysis services.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt Ultra MicroCap Fund

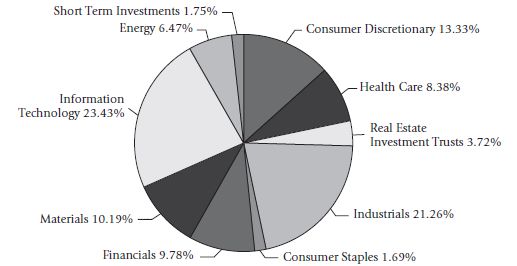

Allocation of Portfolio Investments (Unaudited) | April 30, 2018 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Low Priced Stock Fund

Portfolio Manager’s Message |

Michael Corbett,

Portfolio Manager

The Perritt Low Priced Stock Fund made some material changes to its portfolio in the past six months. We are excited about how the Fund is positioned for the next few years. Details of these changes will be discussed later in this letter. While the Fund performed well in fiscal 2017, these recent portfolio changes impacted the Fund’s short-term performance. For the six-month ended April 30, 2018, the Perritt Low Priced Stock Fund gained 0.19%, which compares to the 3.27% gain for the Russell 2000 Index. More detailed performance results for the Fund for the past year and three years, as well as the results for the Russell 2000 Index can be found later in this report.

During the past six months, we sold 14 companies from the portfolio. Four of these investments were sold due to reporting disappointing operating results. The remaining 10 companies were sold after reaching our price targets. Globus Medical (GMED) was one of the positions sold during the period. We believe GMED is a high-quality company, but the valuation became too rich. We first purchased GMED nearly three years ago when it traded at 20 times earnings and about 3 times revenue. While the company has grown revenue and earnings by 12% and 15% respectively per year during the past three years, the company’s stock rose by nearly three-fold. The net result is that GMED now trades at more than 40 times earnings and nearly 8 times revenue. The remaining 9 companies sold in the portfolio were sold for valuation reasons too, but not to the extreme we experienced with GMED. We reinvested the proceeds in companies we believe are of similar quality, but the valuations were much more attractive.

We added 19 new companies to the portfolio during the period. While we added new names in several different industries, the main changes made to the portfolio include our increased exposure to Energy and Materials while Technology and Consumer Discretionary were reduced. Following are a few examples of the attractive companies we added to the portfolio: Hudbay Minerals (HBM) is an integrated mining company of copper, gold and silver. The company’s stock trades at less than 1.7 times revenue and less than 9 times earnings, yet we expect earnings to grow vigorously this year and next year. Carrizo Oil & Gas (CRZO) engages in exploration, development, and production of oil and gas, mostly in the Eagle Ford region. Despite our expectation that earnings should grow robustly in 2018 and in 2019, the company’s stock trades at 2 times revenue and less than 10 times earnings. TPI Composites (TPIC) manufactures and sells composite wind blades and related precision systems for original equipment manufacturers. The company is investing heavily in its business this year due to huge orders for the next few years. Because of this increase in capital expenditures, earnings will decline this year, but we expect earnings to attractively rebound in 2019. Based on our estimates for 2019, the company’s stock is trading at 0.7 times revenue and less than 14 times earnings. These are just a few of the attractive companies we have added to the portfolio in the past six months and the net result of our changes is that valuations of the portfolio have significantly declined.

Perritt Low Priced Stock Fund

As of April 30, 2018, the Perritt Low Priced Stock Fund was comprised of 84 common stocks. The Fund’s 10 largest holdings and detailed description can be found later in this report. Based on our earnings estimate, the Fund’s portfolio trades at less than 14 times 2018 earnings. The median price to revenue is slightly less than 1.2 times and the median market capitalization is approximately $912 million. Lastly, we estimate that earnings growth should be very robust for our companies for the remainder of 2018, as well as 2019. On a median basis, our companies grew revenue by more than 15% and earnings by more than 28% for the first quarter of 2018. We also estimate that earnings could grow substantially in 2018 and in 2019. Given these robust earnings estimates and low valuations, we are very excited about how the portfolio is positioned for the future.

As we discussed in our annual report message, the markets in the past few years have been lacking a great deal of volatility. We said in the report, “While predicting the future is very difficult, it seems likely to us that volatility will increase in the future.”

The start of this calendar year was met with significant volatility. While the past few years hardly hit a 5% correction, we have already experienced a couple of 5% corrections, as well as a 10% correction in the smaller-cap market so far this year.

Thank you for entrusting your investment with us. The Perritt Capital Management team continues to show their commitment to the Fund’s success with their own personal investment. As a fellow shareholder and the largest shareholder, I am committed to the success of this fund. If you have any questions or comments about this report or your investment in the Perritt Low Priced Stock Fund, please call us at (800) 331-8936 or visit our website at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Michael Corbett

Portfolio Manager

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Perritt Low Priced Stock Fund

Perritt Low Priced Stock Fund** versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market. Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the Fund at inception (June 29, 2012) of the Fund’s predecessor account through April 30, 2018. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

| ** | June 29, 2012 is the inception date of the Fund’s predecessor account. The Fund commenced operations on February 28, 2014. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor account. |

Perritt Low Priced Stock Fund

| Performance (Unaudited) (Continued) | April 30, 2018 |

Cumulative Total Returns**

Periods ended April 30, 2018 (Unaudited) | | | | |

| | Past

6 Months | Past

1 Year | Past

3 Years | Since

Inception* |

| Perritt Low Priced Stock Fund | 0.19% | 7.97% | 26.40% | 113.21% |

Russell 2000® Index | 3.27% | 11.54% | 31.79% | 109.14% |

| (reflects no deduction for fees and expenses) | | | | |

Russell Microcap® Index | 3.95% | 13.76% | 30.75% | 110.63% |

| (reflects no deduction for fees and expenses) | | | | |

Average Annual Total Returns**

Periods ended April 30, 2018 (Unaudited) | | | |

| | Past

1 Year | Past

3 Years | Since

Inception* |

| Perritt Low Priced Stock Fund | 7.97% | 8.12% | 13.86% |

Russell 2000® Index | 11.54% | 9.64% | 13.48% |

| (reflects no deduction for fees and expenses) | | | |

Russell Microcap® Index | 13.76% | 9.35% | 13.62% |

| (reflects no deduction for fees and expenses) | | | |

The Perritt Low Priced Stock Fund’s annualized net expense ratio, as stated in the statutory prospectus, dated October 31, 2017, was 1.40%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The Fund is the successor to a separately managed account. Immediately prior to the Fund commencing operations on February 28, 2014, the predecessor account transferred its assets to the Fund in exchange for the Fund’s shares. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor. In addition, the predecessor’s portfolio managers are the current portfolio managers of the Fund. As a mutual fund registered under the Investment Company Act of 1940 (the “1940 Act”), the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code to which the predecessor was not subject. Had the predecessor been registered under the 1940 Act and been subject to the provisions of the 1940 Act and the Internal Revenue Code, its investment performance may have been adversely affected. The performance was achieved by the predecessor when Fund assets were relatively small; the same strategies may not be available, and similar performance may not be achieved, when the Fund’s assets are larger. The performance shown includes an annual management fee of 1.00% and does not include any expenses paid by the predecessor’s investment advisor. |

The since inception date is June 29, 2012, the date of inception of the Fund’s predecessor account. The past performance of the Fund and its predecessor account (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

| ** | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Low Priced Stock Fund

Ten Largest Common Stock Holdings (Unaudited) |

Kforce Inc. (KFRC) provides professional and technical specialty staffing services and solutions through three segments: Technology (Tech), Finance and Accounting (FA), and Government Solutions (GS). They serve clients in industries primarily in financial services, communications, insurance services, government sectors, and healthcare.

Mitel Networks Corp. (MITL) provides cloud and on-site business communications and collaboration software, services, and solutions through two segments, Enterprise and Cloud. The company sells its solutions through direct and indirect channels, as well as through strategic technology partnerships in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific regions.

New Media Invt. Group, Inc. (NEWM) – invests in, owns, and operates local media in the United States. The company’s principal products include 142 daily newspapers, 326 weekly newspapers, 140 shoppers, and 569 locally-focused Websites, including Internet and mobile devices.

U.S. Silica Hldgs. Inc. (SLCA) produces and sells commercial silica in the United States. The company operates through two segments, Oil & Gas Proppants and Industrial & Specialty Products.

Carrizo Oil & Gas, Inc. (CRZO) together with its subsidiaries, engages in the exploration, development, and production of crude oil, natural gas liquids, and gas from resource plays primarily in the United States.

Gencor Industries, Inc. (GENC) designs, manufactures, and sells machinery and related equipment used to produce asphalt and highway construction materials. The company’s products include asphalt plants, combustion systems, and fluid heat transfer systems, which are manufactured in two facilities in the United States.

Kemet Corp. (KEM) together with its subsidiaries, manufactures and sells passive electronic components under the KEMET brand worldwide and the TOKIN brand in Japan and Korea. It offers tantalum, aluminum polymer, and ceramic capacitors; film, paper, and electrolytic capacitors; and electro magnetically compatible materials and components, piezo materials and actuators, and various types of sensors.

Modine Manufacturing Company (MOD) develops, manufactures, and markets engineered heat transfer systems and heat transfer components for use in on- and off-highway original equipment manufacturer vehicular applications. The company operates through Americas, Europe, Asia, and Building HVAC segments.

SMART Global Holdings, Inc. (SGH) designs, manufactures, and supplies specialty memory solutions worldwide. It also provides flash memory, USB, and serial advanced technology attachment products, as well as supply chain services.

CNO Financial Group, Inc. (CNO) develops, markets and administers health insurance, annuity, individual life insurance and other insurance products. The Company’s segments include Bankers Life, Washington National and Colonial Penn.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt Low Priced Stock Fund

Allocation of Portfolio Investments (Unaudited) | April 30, 2018 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt MicroCap Opportunities Fund

| Schedule of Investments | April 30, 2018 (Unaudited) |

| Shares | | | COMMON STOCKS – 96.60% | | Value | |

| Aerospace & Defense – 2.07% | | | | |

| | 398,891 | | | CPI Aerostructures, | | | | |

| | | | | Inc.(a) | | $ | 3,809,409 | |

| | | | | | | | 3,809,409 | |

| Auto Parts & Equipment – 4.30% | | | | |

| | 162,271 | | | Miller Industries, Inc. | | | 4,016,207 | |

| | 135,500 | | | Motorcar Parts | | | | |

| | | | | of America, Inc. | | | | |

| | | | | (Acquired 9/10/12 | | | | |

| | | | | through 8/27/14, | | | | |

| | | | | Cost $1,127,230)(a)(b) | | | 2,380,000 | |

| | 10,500 | | | Motorcar Parts | | | | |

| | | | | of America, Inc.(a) | | | 199,920 | |

| | 50,000 | | | Stoneridge, Inc.(a) | | | 1,316,500 | |

| | | | | | | | 7,912,627 | |

| Automotive Retail – 0.34% | | | | |

| | 62,500 | | | Lazydays | | | | |

| | | | | Holdings, Inc.(a) | | | 621,250 | |

| | | | | | | | 621,250 | |

| Building Materials – 9.65% | | | | |

| | 225,000 | | | BlueLinx | | | | |

| | | | | Holdings, Inc.(a) | | | 9,049,500 | |

| | 94,452 | | | Global Brass & Copper | | | | |

| | | | | Holdings, Inc. | | | 2,833,560 | |

| | 471,677 | | | Huttig Building | | | | |

| | | | | Products, Inc.(a) | | | 2,929,114 | |

| | 47,454 | | | Insteel Industries, Inc. | | | 1,425,044 | |

| | 87,400 | | | PGT Innovations, Inc.(a) | | | 1,525,130 | |

| | | | | | | | 17,762,348 | |

| Business Services – 4.52% | | | | |

| | 115,000 | | | GP Strategies Corp.(a) | | | 2,397,750 | |

| | 171,383 | | | PCM, Inc.(a) | | | 2,219,410 | |

| | 397,969 | | | PFSweb, Inc.(a) | | | 3,697,132 | |

| | | | | | | | 8,314,292 | |

| Chemical & Related Products – 8.30% | | | | |

| | 20,000 | | | KMG Chemicals, Inc. | | | 1,229,800 | |

| | 204,165 | | | Northern Technologies | | | | |

| | | | | International Corp. | | | 6,094,325 | |

| | 387,738 | | | OMNOVA | | | | |

| | | | | Solutions, Inc.(a) | | | 4,226,344 | |

| | 287,266 | | | Trecora Resources(a) | | | 3,720,095 | |

| | | | | | | | 15,270,564 | |

| Commercial Banks – 7.33% | | | | |

| | 125,900 | | | Bankwell Financial | | | | |

| | | | | Group, Inc. | | | 3,975,922 | |

| | 87,691 | | | Berkshire Hills | | | | |

| | | | | Bancorp, Inc. | | $ | 3,327,874 | |

| | 25,000 | | | Bridgewater | | | | |

| | | | | Bancshares, Inc.(a) | | | 325,250 | |

| | 50,000 | | | Esquire Financial | | | | |

| | | | | Holdings, Inc.(a) | | | 1,204,500 | |

| | 69,185 | | | Triumph | | | | |

| | | | | Bancorp, Inc.(a) | | | 2,687,837 | |

| | 68,590 | | | Veritex Holdings, | | | | |

| | | | | Inc.(a) | | | 1,969,905 | |

| | | | | | | | 13,491,288 | |

| Commercial Services – 0.88% | | | | |

| | 65,000 | | | TriState Capital | | | | |

| | | | | Holdings, Inc.(a) | | | 1,625,000 | |

| | | | | | | | 1,625,000 | |

| Commercial Services & Supplies – 1.94% | | | | |

| | 352,573 | | | InnerWorkings, Inc.(a) | | | 3,560,987 | |

| | | | | | | | 3,560,987 | |

| Construction & Engineering – 5.82% | | | | |

| | 30,000 | | | Comfort Systems | | | | |

| | | | | USA, Inc. | | | 1,266,000 | |

| | 739,500 | | | Hill International, | | | | |

| | | | | Inc.(a) | | | 3,919,350 | |

| | 132,776 | | | IES Holdings, Inc.(a) | | | 2,243,915 | |

| | 260,700 | | | Limbach Holdings, | | | | |

| | | | | Inc.(a) | | | 3,274,392 | |

| | | | | | | | 10,703,657 | |

| Consumer Products – | | | | |

| Manufacturing – 1.69% | | | | |

| | 114,000 | | | Delta Apparel, Inc.(a) | | | 2,062,260 | |

| | 39,000 | | | Superior Uniform | | | | |

| | | | | Group, Inc. | | | 1,045,980 | |

| | | | | | | | 3,108,240 | |

| Consumer Services – 1.23% | | | | |

| | 173,583 | | | Primo Water Corp.(a) | | | 2,263,523 | |

| | | | | | | | 2,263,523 | |

| Data Processing, Hosting | | | | |

| and Related Services – 3.17% | | | | |

| | 330,000 | | | Limelight | | | | |

| | | | | Networks, Inc.(a) | | | 1,702,800 | |

| | 386,926 | | | Ooma, Inc.(a) | | | 4,120,762 | |

| | | | | | | | 5,823,562 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | April 30, 2018 (Unaudited) |

| Shares | | | | | Value | |

| Electronic Equipment & Instruments – 1.30% |

| | 123,728 | | | Bel Fuse, Inc. – Class B | | $ | 2,394,137 | |

| | | | | | | | 2,394,137 | |

| Energy & Related Services – 1.70% |

| | 202,564 | | | Matrix Service Co.(a) | | | 3,119,485 | |

| | | | | | | | 3,119,485 | |

| Financial Services – 7.28% |

| | 123,800 | | | First Internet Bancorp | | | 4,233,960 | |

| | 145,092 | | | Hennessy Advisors, Inc. | | | 2,872,822 | |

| | 53,124 | | | Northeast Bancorp | | | 1,035,918 | |

| | 40,950 | | | Oppenheimer Holdings, | | | | |

| | | | | Inc. – Class A | | | 1,099,508 | |

| | 270,006 | | | Silvercrest Asset | | | | |

| | | | | Management Group, | | | | |

| | | | | Inc. – Class A | | | 4,158,092 | |

| | | | | | | | 13,400,300 | |

| Food – 3.74% |

| | 101,533 | | | Crimson Wine | | | | |

| | | | | Group Ltd.(a) | | | 926,996 | |

| | 116,981 | | | Farmer Brothers Co.(a) | | | 3,316,411 | |

| | 198,500 | | | Landec Corp.(a) | | | 2,640,050 | |

| | | | | | | | 6,883,457 | |

| Industrial Goods – 1.89% |

| | 560,000 | | | Hudson Technologies, | | | | |

| | | | | Inc.(a) | | | 2,452,800 | |

| | 35,000 | | | Schnitzer Steel Industries, | | | | |

| | | | | Inc. – Class A | | | 1,030,750 | |

| | | | | | | | 3,483,550 | |

| Insurance – 2.22% |

| | 240,000 | | | Atlas Financial | | | | |

| | | | | Holdings, Inc.(a)(e) | | | 2,520,000 | |

| | 83,049 | | | United Insurance | | | | |

| | | | | Holdings Corp. | | | 1,566,304 | |

| | | | | | | | 4,086,304 | |

| Leisure – 0.83% |

| | 200,000 | | | Century Casinos, Inc.(a) | | | 1,536,000 | |

| | | | | | | | 1,536,000 | |

| Machinery Manufacturing – 1.16% |

| | 98,700 | | | Graham Corp. | | | 2,129,946 | |

| | | | | | | | 2,129,946 | |

| Medical Supplies & Services – 2.26% |

| | 79,150 | | | Addus HomeCare | | | | |

| | | | | Corp.(a) | | | 4,155,375 | |

| | | | | | | | 4,155,375 | |

| Private Equity & Venture Capital – 0.87% |

| | 160,000 | | | BBX Capital Corp. – | | | | |

| | | | | Class A | | $ | 1,596,800 | |

| | | | | | | | 1,596,800 | |

| Real Estate Investment Trust – 4.68% |

| | 191,553 | | | City Office Real Estate | | | | |

| | | | | Investment Trust, Inc. | | | 2,179,873 | |

| | 105,000 | | | Community Healthcare | | | | |

| | | | | Trust, Inc. | | | 2,677,500 | |

| | 232,515 | | | Global Medical | | | | |

| | | | | REIT, Inc. | | | 1,811,292 | |

| | 199,178 | | | Resource Capital Corp. | | | 1,943,977 | |

| | | | | | | | 8,612,642 | |

| Retail – 1.01% |

| | 175,000 | | | Kirkland’s, Inc.(a) | | | 1,853,250 | |

| | | | | | | | 1,853,250 | |

| Security Manufacturing – 0.91% |

| | 222,500 | | | Horizon Global Corp.(a) | | | 1,662,075 | |

| | | | | | | | 1,662,075 | |

| Semiconductor Related Products – 4.86% |

| | 286,367 | | | AXT, Inc.(a) | | | 1,675,247 | |

| | 128,327 | | | DSP Group, Inc.(a) | | | 1,533,508 | |

| | 71,111 | | | PDF Solutions, Inc.(a) | | | 792,888 | |

| | 415,000 | | | Photronics, Inc.(a) | | | 3,174,750 | |

| | 69,000 | | | Rudolph Technologies, | | | | |

| | | | | Inc.(a) | | | 1,749,150 | |

| | | | | | | | 8,925,543 | |

| Software – 2.47% |

| | 190,700 | | | American Software, | | | | |

| | | | | Inc. – Class A | | | 2,433,332 | |

| | 418,000 | | | Zix Corp.(a) | | | 2,110,900 | |

| | | | | | | | 4,544,232 | |

| Specialty Manufacturing – 4.15% |

| | 63,141 | | | Core Molding | | | | |

| | | | | Technologies, Inc. | | | 978,685 | |

| | 82,500 | | | Federal Signal Corp. | | | 1,786,950 | |

| | 327,696 | | | LSI Industries, Inc. | | | 2,008,776 | |

| | 188,733 | | | Manitex International, | | | | |

| | | | | Inc.(a) | | | 1,942,063 | |

| | 50,000 | | | Sparton Corp.(a) | | | 923,500 | |

| | | | | | | | 7,639,974 | |

| Telecommunications – 2.88% |

| | 700,000 | | | Ceragon Networks | | | | |

| | | | | Ltd.(a)(e) | | | 1,841,000 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | April 30, 2018 (Unaudited) |

| Shares | | | | | Value | |

| Telecommunications (Continued) |

| | 65,552 | | | Digi International, | | | | |

| | | | | Inc.(a) | | $ | 753,848 | |

| | 378,800 | | | PC-Tel, Inc. | | | 2,708,420 | |

| | | | | | | | 5,303,268 | |

| Transportation – 1.15% |

| | 600,000 | | | Radiant | | | | |

| | | | | Logistics, Inc.(a) | | | 2,118,000 | |

| | | | | | | | 2,118,000 | |

| | | | | TOTAL COMMON | | | | |

| | | | | STOCKS | | | | |

| | | | | (Cost $119,614,516) | | $ | 177,711,085 | |

| Contracts | | | WARRANTS – 0.00% | | Value | |

| Insurance – 0.00% | |

| | 38,106 | | | Emergent Capital, | | | | |

| | | | | Inc. Warrant; | | | | |

| | | | | Expiration: 10/06/2019, | | | | |

| | | | | Exercise Price | | | | |

| | | | | $10.75(a)(c) | | $ | — | |

| | | | | TOTAL WARRANTS | | | | |

| | | | | (Cost $0) | | $ | — | |

| Shares | | | SHORT-TERM | | Value | |

| | | | INVESTMENTS – 3.03% | | | |

| | 5,561,463 | | | Invesco Short Term | | | | |

| | | | | Investments Government | | | | |

| | | | | & Agency Portfolio – | | | | |

| | | | | Class I 1.61%(d) | | $ | 5,561,463 | |

| | | | | TOTAL SHORT-TERM | | | | |

| | | | | INVESTMENTS | | | | |

| | | | | (Cost $5,561,463) | | $ | 5,561,463 | |

| | | | | Total Investments | | | | |

| | | | | (Cost $125,175,979) – | | | | |

| | | | | 99.63% | | $ | 183,272,548 | |

| | | | | Other Assets in | | | | |

| | | | | Excess of | | | | |

| | | | | Liabilities – 0.37% | | | 689,117 | |

| | | | | TOTAL NET ASSETS – | | | | |

| | | | | 100.00% | | | | |

| | | | | | | $ | 183,961,665 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Security was purchased in a transaction exempt from registration in the U.S. under the Securities Act of 1933 (the “Act”) and, unless registered under the Act, may only be sold pursuant to exemption from registration and, in the case of a Rule 144A offering under the Act, may only be sold to “qualified institutional buyers.” The value of this security is $2,380,000 or 1.29% of the Fund’s net assets. This security is deemed to be liquid. |

| (c) | The price for this security was derived from an estimate of fair value using methods approved by the Fund’s Board of Directors. This security represents $0 or 0.00% of the Fund’s net assets. This security is classified as Level 2 and is deemed to be illiquid. |

| (d) | Variable rate security; the rate shown is the effective rate as of April 30, 2018. |

| (e) | Foreign issued security. |

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”).

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments | April 30, 2018 (Unaudited) |

| Shares | | | COMMON STOCKS – 94.75% | | Value | |

| Aerospace & Defense – 0.87% |

| | 60,000 | | | CPI Aerostructures, Inc.(a) | | $ | 573,000 | |

| | | | | | | | 573,000 | |

| Air Transport – 1.33% |

| | 54,886 | | | AeroCentury Corp.(a) | | | 875,432 | |

| | | | | | | | 875,432 | |

| Auto Parts & Equipment – 1.27% |

| | 90,000 | | | Unique | | | | |

| | | | | Fabricating, Inc. | | | 837,000 | |

| | | | | | | | 837,000 | |

| Business Services – 13.34% |

| | 50,000 | | | BG Staffing, Inc. | | | 953,500 | |

| | 350,000 | | | CynergisTek, Inc.(a) | | | 1,746,498 | |

| | 244,300 | | | DLH Holdings Corp.(a) | | | 1,424,269 | |

| | 275,000 | | | Information Services | | | | |

| | | | | Group, Inc.(a) | | | 1,193,500 | |

| | 109,336 | | | Innodata Isogen, Inc.(a) | | | 125,736 | |

| | 80,000 | | | PCM, Inc.(a) | | | 1,036,000 | |

| | 50,000 | | | Transcat, Inc.(a) | | | 825,000 | |

| | 125,000 | | | USA Technologies, | | | | |

| | | | | Inc.(a) | | | 1,093,750 | |

| | 701,005 | | | WidePoint Corp.(a) | | | 413,383 | |

| | | | | | | | 8,811,636 | |

| Chemical & Related Products – 2.31% |

| | 320,000 | | | Flexible Solutions | | | | |

| | | | | International, Inc.(a) | | | 453,504 | |

| | 36,000 | | | Northern Technologies | | | | |

| | | | | International Corp. | | | 1,074,600 | |

| | | | | | | | 1,528,104 | |

| Chemical Manufacturing – 1.37% |

| | 200,000 | | | Intrepid Potash, Inc.(a) | | | 906,000 | |

| | | | | | | | 906,000 | |

| Computer & Electronic |

| Product Manufacturing – 1.56% |

| | 200,000 | | | Dynatronics Corp.(a) | | | 600,000 | |

| | 1,000,000 | | | Singing Machine | | | | |

| | | | | Co., Inc.(a) | | | 430,000 | |

| | | | | | | | 1,030,000 | |

| Computer and Electronic |

| Product Manufacturing – 1.90% |

| | 381,799 | | | Luna Innovations, | | | | |

| | | | | Inc.(a) | | | 1,256,119 | |

| | | | | | | | 1,256,119 | |

| Computers & Electronics – 0.57% |

| | 35,000 | | | Napco Security | | | | |

| | | | | Technologies, Inc.(a) | | $ | 374,500 | |

| | | | | | | | 374,500 | |

| Construction & Engineering – 4.71% |

| | 65,353 | | | Gencor Industries, | | | | |

| | | | | Inc.(a) | | | 1,016,239 | |

| | 150,000 | | | Hill International, | | | | |

| | | | | Inc.(a) | | | 795,000 | |

| | 40,000 | | | Layne Christensen | | | | |

| | | | | Co.(a) | | | 564,400 | |

| | 12,500 | | | NV5 Global, Inc.(a) | | | 735,625 | |

| | | | | | | | 3,111,264 | |

| Consumer Goods – 1.27% |

| | 35,000 | | | MCBC Holdings, Inc.(a) | | | 840,000 | |

| | | | | | | | 840,000 | |

| Consumer Products – Distributing – 1.09% |

| | 400,000 | | | US Auto Parts | | | | |

| | | | | Network, Inc.(a) | | | 720,000 | |

| | | | | | | | 720,000 | |

| Consumer Services – 1.32% |

| | 100,000 | | | Xcel Brands, Inc.(a) | | | 310,000 | |

| | 50,000 | | | ZAGG, Inc.(a) | | | 560,000 | |

| | | | | | | | 870,000 | |

| Diversified Financials – 1.76% |

| | 90,000 | | | Safeguard | | | | |

| | | | | Scientifics, Inc.(a) | | | 1,165,500 | |

| | | | | | | | 1,165,500 | |

| Electronic Equipment & Instruments – 0.58% |

| | 75,000 | | | Iteris, Inc.(a) | | | 380,250 | |

| | | | | | | | 380,250 | |

| Energy & Related Services – 2.91% |

| | 145,000 | | | DHT Holdings, Inc.(d) | | | 526,350 | |

| | 65,000 | | | Matrix Service Co.(a) | | | 1,001,000 | |

| | 121,000 | | | Mitcham | | | | |

| | | | | Industries, Inc.(a) | | | 394,460 | |

| | | | | | | | 1,921,810 | |

| Environmental Services – 0.68% |

| | 236,801 | | | Quest Resource | | | | |

| | | | | Holding Corp.(a) | | | 447,554 | |

| | | | | | | | 447,554 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | April 30, 2018 (Unaudited) |

| Shares | | | | | Value | |

| Financial Holding Company – 0.62% |

| | 79,300 | | | CCUR Holdings, Inc. | | $ | 412,360 | |

| | | | | | | | 412,360 | |

| Financial Services – 6.60% |

| | 65,000 | | | AMREP Corp.(a) | | | 469,625 | |

| | 35,000 | | | First Internet Bancorp | | | 1,197,000 | |

| | 36,000 | | | Hennessy Advisors, Inc. | | | 712,800 | |

| | 50,000 | | | HopFed Bancorp, Inc. | | | 749,500 | |

| | 52,500 | | | Silvercrest Asset | | | | |

| | | | | Management Group, | | | | |

| | | | | Inc. – Class A | | | 808,500 | |

| | 150,851 | | | US Global Investors, | | | | |

| | | | | Inc. | | | 417,857 | |

| | | | | | | | 4,355,282 | |

| Food – 0.50% |

| | 40,000 | | | Willamette Valley | | | | |

| | | | | Vineyards, Inc.(a) | | | 332,000 | |

| | | | | | | | 332,000 | |

| Health Care – 0.98% |

| | 122,917 | | | Rockwell Medical | | | | |

| | | | | Technologies, Inc.(a) | | | 650,231 | |

| | | | | | | | 650,231 | |

| Industrial Goods – 0.93% |

| | 139,900 | | | Hudson Technologies, | | | | |

| | | | | Inc.(a) | | | 612,762 | |

| | | | | | | | 612,762 | |

| Insurance – 1.79% |

| | 50,000 | | | Atlas Financial | | | | |

| | | | | Holdings, Inc.(a)(d) | | | 525,000 | |

| | 35,000 | | | United Insurance | | | | |

| | | | | Holdings Corp. | | | 660,100 | |

| | | | | | | | 1,185,100 | |

| Leisure – 3.71% |

| | 97,322 | | | Century Casinos, Inc.(a) | | | 747,433 | |

| | 1,534,599 | | | Galaxy Gaming, Inc.(a) | | | 1,703,405 | |

| | | | | | | | 2,450,838 | |

| Machinery Manufacturing – 1.52% |

| | 125,000 | | | ASV Holdings, Inc.(a) | | | 1,001,250 | |

| | | | | | | | 1,001,250 | |

| Medical Supplies & Services – 7.05% |

| | 24,500 | | | Addus HomeCare | | | | |

| | | | | Corp.(a) | | | 1,286,250 | |

| | 75,049 | | | Birner Dental Management | | | | |

| | | | | Services, Inc.(a) | | | 525,343 | |

| | 649,000 | | | First Choice Healthcare | | | | |

| | | | | Solutions, Inc.(a) | | $ | 824,230 | |

| | 62,190 | | | Lakeland Industries, | | | | |

| | | | | Inc.(a) | | | 805,360 | |

| | 200,000 | | | Sensus Healthcare, | | | | |

| | | | | Inc.(a) | | | 1,214,000 | |

| | | | | | | | 4,655,183 | |

| Merchant Wholesalers, Nondurable Goods – 0.74% |

| | 515,000 | | | Innovative Food | | | | |

| | | | | Holdings, Inc.(a) | | | 489,250 | |

| | | | | | | | 489,250 | |

| Motion Pictures – 0.72% |

| | 100,000 | | | Ballantyne | | | | |

| | | | | Strong, Inc.(a) | | | 475,010 | |

| | | | | | | | 475,010 | |

| Oil & Gas Services – 2.16% |

| | 400,000 | | | Profire Energy, Inc.(a) | | | 1,428,000 | |

| | | | | | | | 1,428,000 | |

| Pharmaceuticals – 2.39% |

| | 154,300 | | | ImmuCell Corp.(a) | | | 1,129,476 | |

| | 55,000 | | | Juniper Pharmaceuticals, | | | | |

| | | | | Inc.(a) | | | 448,250 | |

| | | | | | | | 1,577,726 | |

| Professional, Scientific, and Technical Services – 2.60% |

| | 135,000 | | | AutoWeb, Inc.(a) | | | 492,750 | |

| | 350,000 | | | CUI Global, Inc.(a) | | | 962,500 | |

| | 240,000 | | | Sigma Labs, Inc.(a) | | | 261,600 | |

| | | | | | | | 1,716,850 | |

| Real Estate Investment Trusts – 2.22% |

| | 170,000 | | | Global Self | | | | |

| | | | | Storage, Inc. | | | 710,600 | |

| | 210,000 | | | Sachem Capital Corp. | | | 756,000 | |

| | | | | | | | 1,466,600 | |

| Retail – 2.67% |

| | 100,000 | | | Build-A-Bear | | | | |

| | | | | Workshop, Inc.(a) | | | 910,000 | |

| | 500,000 | | | Christopher & | | | | |

| | | | | Banks Corp.(a) | | | 530,000 | |

| | 325,000 | | | OurPet’s Co.(a) | | | 321,750 | |

| | | | | | | | 1,761,750 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | April 30, 2018 (Unaudited) |

| Shares | | | | | Value | |

| Semiconductor Related Products – 1.45% |

| | 82,181 | | | AXT, Inc.(a) | | $ | 480,759 | |

| | 40,000 | | | DSP Group, Inc.(a) | | | 478,000 | |

| | | | | | | | 958,759 | |

| Software – 4.87% |

| | 80,000 | | | Asure Software, Inc.(a) | | | 1,211,200 | |

| | 100,000 | | | BSQUARE Corp.(a) | | | 450,000 | |

| | 215,000 | | | Evolving Systems, Inc.(a) | | | 806,250 | |

| | 200,000 | | | GlobalSCAPE, Inc. | | | 746,000 | |

| | | | | | | | 3,213,450 | |

| Specialized Consumer Services – 0.59% |

| | 550,000 | | | XpresSpa Group, Inc.(a) | | | 390,500 | |

| | | | | | | | 390,500 | |

| Specialty Manufacturing – 10.98% |

| | 200,000 | | | Aspen Aerogels, Inc.(a) | | | 900,000 | |

| | 40,064 | | | Continental | | | | |

| | | | | Materials Corp.(a) | | | 759,530 | |

| | 93,500 | | | CTI Industries Corp.(a) | | | 374,000 | |

| | 120,000 | | | Data I/O Corp.(a) | | | 752,400 | |

| | 12,500 | | | Hurco Companies, Inc. | | | 552,500 | |

| | 33,691 | | | Kewaunee | | | | |

| | | | | Scientific Corp. | | | 1,164,024 | |

| | 88,467 | | | Pioneer Power | | | | |

| | | | | Solutions, Inc.(a) | | | 521,955 | |

| | 170,000 | | | Polar Power, Inc.(a) | | | 1,005,550 | |

| | 29,100 | | | Sparton Corp.(a) | | | 537,477 | |

| | 80,000 | | | Tecnoglass, Inc.(d) | | | 679,200 | |

| | | | | | | | 7,246,636 | |

| Telecommunications – 0.82% |

| | 550,000 | | | Mobivity | | | | |

| | | | | Holdings Corp.(a) | | | 544,500 | |

| | | | | | | | 544,500 | |

| | | | | TOTAL COMMON | | | | |

| | | | | STOCKS | | | | |

| | | | | (Cost $49,235,907) | | $ | 62,572,206 | |

| Contracts | | | WARRANTS – 0.00% | | Value | |

| Telecommunications – 0.00% | |

| | | | | Mobivity Holdings Corp. | | | | |

| | 165,000 | | | Expiration: 03/11/2019, | | | | |

| | | | | Exercise Price $1.20 | | | | |

| | | | | (Acquired 03/11/2014, | | | | |

| | | | | Cost $0)(a)(b) | | $ | — | |

| | | | | TOTAL WARRANTS | | | | |

| | | | | (Cost $0) | | $ | — | |

| Shares | | | SHORT-TERM | | Value | |

| | | | INVESTMENTS – 4.97% | | | |

| | 3,278,694 | | | Invesco Short Term | | | | |

| | | | | Investments Government | | | | |

| | | | | & Agency Portfolio – | | | | |

| | | | | Class I 1.61%(c) | | $ | 3,278,694 | |

| | | | | TOTAL SHORT-TERM | | | | |

| | | | | INVESTMENTS | | | | |

| | | | | (Cost $3,278,694) | | $ | 3,278,694 | |

| | | | | Total Investments | | | | |

| | | | | (Cost $52,514,601) – | | | | |

| | | | | 99.72% | | $ | 65,850,900 | |

| | | | | Other Assets in | | | | |

| | | | | Excess of | | | | |

| | | | | Liabilities – 0.28% | | | 183,808 | |

| | | | | TOTAL NET ASSETS – | | | | |

| | | | | 100.00% | | $ | 66,034,708 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The price for this security was derived from an estimate of fair market value using methods approved by the Fund’s Board of Directors. This security represents $0 or 0.00% of the Fund’s Net Assets. This security was classified as Level 2 and is considered to be illiquid. |

| (c) | Variable rate security; the rate shown is the effective rate as of April 30, 2018. |

| (d) | Foreign issued security. |

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”).

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Low Priced Stock Fund

| Schedule of Investments | April 30, 2018 (Unaudited) |

| Shares | | | COMMON STOCKS – 98.19% | | Value | |

| Administrative & Support Services – 2.29% | | | |

| | 7,100 | | | Kforce, Inc. | | $ | 188,505 | |

| | | | | | | | 188,505 | |

| Air Transportation – 1.51% | | | |

| | 3,000 | | | Hawaiian Holdings, | | | | |

| | | | | Inc. | | | 123,600 | |

| | | | | | | | 123,600 | |

| Auto Parts & Equipment – 5.27% | | | |

| | 4,000 | | | Miller Industries, Inc. | | | 99,000 | |

| | 8,000 | | | Modine | | | | |

| | | | | Manufacturing Co.(a) | | | 137,600 | |

| | 6,000 | | | Superior Industries | | | | |

| | | | | International, Inc. | | | 78,900 | |

| | 4,000 | | | Tower International, | | | | |

| | | | | Inc. | | | 118,000 | |

| | | | | | | | 433,500 | |

| Automobile Manufacturers – 0.92% | | | |

| | 2,000 | | | Winnebago | | | | |

| | | | | Industries, Inc. | | | 75,800 | |

| | | | | | | | 75,800 | |

| Biotechnology – 1.23% | | | |

| | 7,000 | | | Innoviva, Inc.(a) | | | 101,500 | |

| | | | | | | | 101,500 | |

| Building Material, Garden | | | |

| Equipment & Supplies Dealers – 0.42% | | | |

| | 2,000 | | | BMC Stock | | | | |

| | | | | Holdings, Inc.(a) | | | 34,500 | |

| | | | | | | | 34,500 | |

| Building Products – 2.29% | | | |

| | 7,000 | | | Builders | | | | |

| | | | | FirstSource, Inc.(a) | | | 127,610 | |

| | 1,500 | | | USG Corp.(a) | | | 60,345 | |

| | | | | | | | 187,955 | |

| Business Services – 3.99% | | | |

| | 2,000 | | | Darling Ingredients, | | | | |

| | | | | Inc.(a) | | | 34,280 | |

| | 29,515 | | | Information Services | | | | |

| | | | | Group, Inc.(a) | | | 128,095 | |

| | 10,000 | | | New Media Investment | | | | |

| | | | | Group, Inc. | | | 165,800 | |

| | | | | | | | 328,175 | |

| Chemical & Related Products – 1.46% | | | |

| | 11,000 | | | OMNOVA Solutions, | | | | |

| | | | | Inc.(a) | | $ | 119,900 | |

| | | | | | | | 119,900 | |

| Commercial Banks – 1.01% | | | |

| | 2,900 | | | Veritex Holdings, Inc.(a) | | | 83,288 | |

| | | | | | | | 83,288 | |

| Commercial Services & Supplies – 2.94% | | | |

| | 10,000 | | | ACCO Brands Corp. | | | 120,500 | |

| | 12,000 | | | InnerWorkings, Inc.(a) | | | 121,200 | |

| | | | | | | | 241,700 | |

| Communications Equipment – 3.21% | | | |

| | 9,000 | | | Extreme Networks, | | | | |

| | | | | Inc.(a) | | | 96,300 | |

| | 15,000 | | | Mitel Networks | | | | |

| | | | | Corp.(a)(c) | | | 167,400 | |

| | | | | | | | 263,700 | |

| Computer & Electronic | | | |

| Product Manufacturing – 1.09% | | | |