MicroCap Opportunities Fund

Ultra MicroCap Fund

Annual Report

October 31, 2023

The PERRITT MICROCAP OPPORTUNITIES FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $500 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have demonstrated above-average growth in revenues and/or earnings, possess relatively low levels of long-term debt, have a high percentage of their shares owned by company management, and possess modest price-to-sales ratios and price-to-earnings ratios that are below their long-term annual growth rate. At times, the Fund may also invest in “special situations” such as companies that possess valuable patents, companies undergoing restructuring, and companies involved in large share repurchase programs. Investors should expect the Fund to contain a mix of both value-priced and growth stocks.

The PERRITT ULTRA MICROCAP FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $300 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have a high percentage of their shares owned by company management, possess relatively low levels of long-term debt, have a potential for above average growth in revenues and/or earnings, and possess reasonable valuations based on the ratios of price-to-sales, price-to-earnings, and price-to-book values. The micro-cap companies in which the Fund may invest include “early stage” companies, which are companies that are in a relatively early stage of development with market capitalizations that are below $50 million. At times, the Fund may also invest in unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

Annual Report

October 31, 2023

| Perritt MicroCap Opportunities Fund | | |

| From the Portfolio Managers | | | 2 |

Performance | | | 6 |

Ten Largest Common Stock Holdings | | | 8 |

Allocation of Portfolio Investments | | | 9 |

| | | | |

| Perritt Ultra MicroCap Fund | | | |

| From the Portfolio Managers | | | 10 |

Performance | | | 14 |

Ten Largest Common Stock Holdings | | | 16 |

Allocation of Portfolio Investments | | | 17 |

| | | | |

| Perritt Funds | | | |

Schedules of Investments | | | 18 |

Statements of Assets and Liabilities | | | 24 |

Statements of Operations | | | 25 |

Statements of Changes in Net Assets | | | 26 |

Financial Highlights | | | 28 |

Notes to Financial Statements | | | 30 |

Report of the Independent Registered Public Accounting Firm | | | 41 |

Expense Example | | | 42 |

Directors and Officers | | | 44 |

Information | | | 47 |

Perritt MicroCap Opportunities Fund

| Portfolio Manager’s Message |

Michael Corbett,

Portfolio Manager

For the fiscal year ended October 31, 2023, the Perritt MicroCap Opportunities Fund (PRCGX) rose 2.76% which compares to the loss of 16.41% for the Russell Microcap Index and the 8.56% loss for the Russell 2000 Index. We are very proud of outperforming the Fund’s benchmark by more than 1900 basis points this past year, and we are equally proud of the Fund’s strong relative long-term outperformance record. While the performance of the microcap marketplace relative to the large cap market has been disappointing in the past decade, we believe things could change dramatically in the years ahead. We will discuss some of reasons for optimism later in this message. The Fund and benchmark performance details can be found in the next few pages of this report.

The Fund’s strong relative performance can be attributed to excellent stock selection and overweighting our investments within the industrial and information technology sectors. For stock selection, we had five stocks that more than doubled in the past year with the largest gain coming from Mama’s Creations (MAMA), which rose nearly 230%. These five companies provided more than 6% of the outperformance during the past year. We have approximately 30% of the Fund invested in the industrial sector which is more than double the Russell Microcap’s weight. Our industrial investments provided more than 8% of the outperformance for the past year. Finally, our information technology investments provided nearly 4% of the Fund’s outperformance, and we have a 14% weight versus a 10% weight for the Russell Microcap Index.

During the past year, we sold fourteen companies from the portfolio. We sold Opiant Pharmaceuticals after it received a 100% premium buyout offer from Indivior. There were six companies sold because they grew beyond our definition of a microcap stock: Addus Homecare (ADUS), CRA international (CRAI), Digi International (DGII), Green Brick Partners (GRBK), IES Holdings (IESC) and PGT Innovations (PGTI). We sold one company for valuation reasons and the remaining six companies were sold after reporting disappointing operating results. We purchased twenty-one new companies for the portfolio from seven different industries. While we added more companies to the industrial sector, our financial investment in the seven different industries was evenly distributed.

As of October 31, 2023, the Fund’s portfolio contained the common stocks of ninety-six companies. The Fund’s 10 largest holdings and detailed descriptions can be found on the following pages of this report. Based on our earnings estimates, the Fund’s portfolio is trading at approximately 12.1 times our 2024 earnings estimate. Stocks in the portfolio are priced at slightly more than 1.0 times average revenues, and the median market capitalization is approximately $193 million. Finally, the average stock in the Fund is trading at 1.3 times book value and approximately 6.7 times Enterprise Value to EBITDA (Earnings Before Interest Taxes Depreciation and Amortization). The valuation characteristics for the MicroCap Opportunities Fund are slightly more attractive than the Fund’s benchmark Russell Microcap Index. The Russell

Perritt MicroCap Opportunities Fund

Microcap Index is priced at more than 1.6 times revenue, 12 times future earnings and more than 1.3 times book value. However, it is important to note that more than 50% of the companies within the Russell Microcap Index are not profitable, which compares to only 9% for the Perritt MicroCap Opportunities Fund.

We believe there are several reasons small- and micro-cap stocks may have stronger relative performance to larger stocks in the years ahead. Here are a few of those reasons. We believe valuations among small- and micro-cap stocks are near the widest discounts to larger stocks in history. We recognize that valuations may not be a reason to spark a rally among smaller stocks, but we believe it can measure the potential degree of a rally once a catalyst arrives. Identifying a catalyst is difficult, but the list is vast today. First, sentiment toward smaller companies appears to be rather low today, so even a small improvement would help shares. Some of the other catalysts could be moderation of inflation, no increase in interest rates by the Federal Reserve, a stronger economy or smaller companies report stronger earnings growth. Each of these catalysts (or even all of them) are possible in the coming years. In our view, the long-term potential for smaller companies remains very promising.

Reviewing smaller company stock performance can also reveal great optimism for future performance. According to the Center for Research in Security Prices (CRSP), there have been 130 five-year periods in the past 78 years when small stocks (CRSP 6-10) produced less than 5% annualized return, which includes the most recent period. The subsequent five-year annualized return for the 129 periods was on average an impressive 20% annualized. While past performance is no indication of future results, we cannot help but be optimistic about the next five years for small-cap performance.

I want to thank my fellow shareholders for their continued support and confidence in the Perritt Capital Management team. I have been a shareholder of the Fund for more than 30 years and have nearly half of my liquid investments in the Perritt Funds. The Perritt team remains dedicated to investing in high quality micro-cap companies at attractive valuations. If you have any questions or comments about this report or your investment in the Perritt MicroCap Opportunities Fund, please call us toll-free at (800)331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Michael Corbett

President

Perritt MicroCap Opportunities Fund

Important Disclosures

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Earnings Growth is not a measure of the Fund’s future performance.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Please refer to the Schedule of Investments in the report for more complete information regarding Fund holdings. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

The CRSP (Center for Research in Security Prices) equally divides the companies listed on the NYSE into 10 deciles based on market capitalization. Deciles 1-5 represent the largest domestic equity companies and Deciles 6-10 represent the smallest. CRSP then sorts all listed domestic equity companies based on these market cap ranges. By way of comparison, the CRSP 1-5 would have similar capitalization parameters to the S&P 500, and the CRSP 6-10 would have a similar capitalization parameter to those of the Russell 2000.

One cannot invest directly in an index. The index is used herein for comparative purposes in accordance with SEC regulations.

Basis point is one hundredth of 1 percentage point.

Book Value is the net asset value of a company calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet.

Enterprise value to EBITDA Equals market capitalization + preferred shares + minority interest + debt - total cash divided by EBITDA.

Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) is an alternate measure of profitability to net income. By stripping out the non-cash depreciation and amortization expense as well as taxes and debt cost dependent on the capital structure, EBITDA attempts to represent cash profit generated by the company’s operations.

The annual report must be preceded or accompanied by a prospectus.

The Perritt Funds are distributed by Quasar Distributors, LLC.

(This Page Intentionally Left Blank.)

Perritt MicroCap Opportunities Fund

Performance (Unaudited)

| October 31, 2023

|

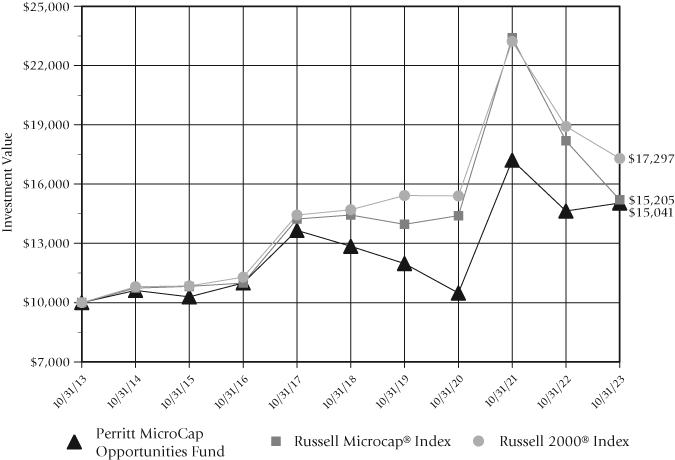

Perritt MicroCap Opportunities Fund versus

Russell Microcap® Index and Russell 2000® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. The graph does not imply any future performance. It is not possible to invest directly in an index. |

Perritt MicroCap Opportunities Fund

| Performance (Unaudited) (Continued) | October 31, 2023

|

| Average Annual Total Returns* |

| Year ended October 31, 2023 |

| | Past | Past | Past | Past | Past |

| | 1 Year | 5 Years | 10 Years | 15 Years | 25 Years |

| | | | | | |

Perritt MicroCap Opportunities Fund | 2.76% | 3.20% | 4.17% | 8.84% | 8.87% |

| | | | | | |

Russell Microcap® Index | -16.41% | 1.04% | 4.28% | 8.28% | n/a |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

Russell 2000® Index | -8.56% | 3.31% | 5.63% | 9.31% | 7.52% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the 2% redemption or exchange fee for shares held 90 days or less. If reflected, total return would be reduced. |

The Fund’s gross expense ratio is 1.56% as of the most recent prospectus dated February 28, 2023. Please see the Fund’s Financial Highlights in this report for the most recent expense ratio.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

Perritt MicroCap Opportunities Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Silvercrest Asset Management Group Inc. (SAMG) is a wealth management firm that provides financial advisory and related family office services in the United States. The company serves ultra-high net worth individuals and families, as well as their trusts; endowments; foundations; and other institutional investors. It also manages funds of funds and other investment funds.

Northern Technologies International, Corp. (NTIC) develops and markets rust and corrosion inhibiting products and services to automotive, electronics, electrical mechanical, military, retail consumer, and oil and gas markets.

DLH Holdings Corp. (DLHC) provides healthcare, logistics, and technical services and solutions to Federal Government agencies including the Department of Veteran Affairs, the Department of Defense, and other government clients.

Radiant Logistics, Inc. (RLGT) operates as a third-party logistics and multi-modal transportation services company primarily in the United States and Canada. The company offers domestic and international air and ocean freight forwarding services; and freight brokerage services, including truckload, less than truckload, and intermodal services.

Perma-Fix Environmental Services, Inc. (PESI) through its subsidiaries, operates as an environmental and technology know-how company in the United States and operates in two segments, Treatment and Services.

Legacy Housing Corp. (LEGH) builds, sells, and finances manufactured homes and tiny houses primarily in the southern United States. The company manufactures and provides for the transport of mobile homes; and offers wholesale financing to dealers and mobile home parks, as well as a range of homes.

Miller Industries, Inc. (MLR) engages in the manufacture and sale of towing and recovery equipment. It offers wreckers, such as conventional tow trucks and recovery vehicles. The company also provides transport trailers for moving multiple vehicles, auto auctions, car dealerships, leasing companies, and other similar applications.

Bel Fuse, Inc. (BELFB) designs, manufactures, markets, and sells products that are used in the networking, telecommunications, computing, general industrial, high-speed data transmission, military, commercial aerospace, transportation, and e-Mobility industries in the United States, the People's Republic of China, Macao, the United Kingdom, Slovakia, Germany, India, Switzerland, and internationally.

PC Tel, Inc. (PCTI) provides industrial Internet of Thing devices (IoT), antenna systems, and test and measurement solutions worldwide with its subsidiaries.

U.S. Global Investors, Inc. (GROW) is a publicly owned investment manager. The firm primarily provides its services to investment companies. It also provides its services to pooled investment vehicles. The firm manages equity and fixed income mutual funds, hedge funds and exchange traded funds. It also invests in the public equity and fixed income markets across the globe.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

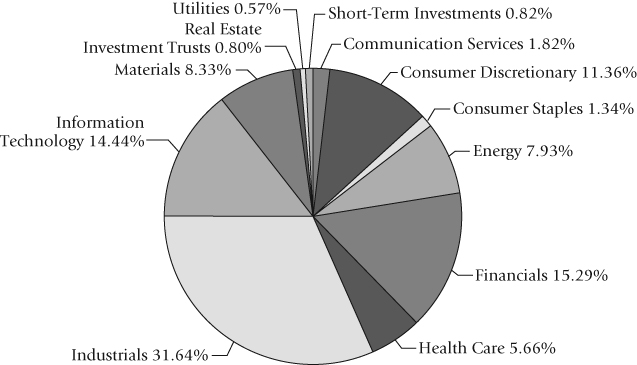

Perritt MicroCap Opportunities Fund

Allocation of Portfolio Investments (Unaudited)

| October 31, 2023

|

The sector classifications represented in the graph above and industry classifications represented in

the Schedule of Investments are in accordance with Global Industry Classification Standard

(GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Ultra MicroCap Fund

| Portfolio Manager’s Message |

Matthew Brackmann,

Portfolio Manager

The Perritt Ultra MicroCap Fund (PREOX) modestly outperformed the Russell Microcap Index for fiscal year 2023 on a net of fee basis, posting a loss of -12.03% versus a loss for the index of -16.41%. We are disappointed that we were not able to provide a positive return, however we are pleased to have beaten the index. Despite the continued inferior performance of the microcap space, we are confident that there is significant underlying value in our securities as well as the microcap space in general. The differentials in valuations between large cap stocks and microcap stocks remain at multi-decade highs and we believe that a thematic shift is on the horizon as investors become increasingly aware of the underlying value in our little segment of the market. By focusing on quality names are attractive valuations we believe that we are well positioned to benefit from this shift if and when it should happen.

Our relative outperformance for the fiscal year can primarily be attributed to our investments in the Industrial and Information Technology sectors. We maintained an overweight allocation in both sectors relative to the Index and outperformed in both by double digits, with our investments in the Industrial sector returning 21.30% versus a loss of -2.42% for the sector within the index. The top individual performing stock was P&F Industries (PFIN), which we added to the portfolio at the start of this fiscal year as one of the several new names mentioned as pending investments in last year’s letter. PFIN was originally purchased at $5.13 a share in the fund and was bought out just prior to the end of this year for $13.00 per share for a return of 158.10% over about 11 months. While we held the position through the fiscal year for tax purposes, we look forward to putting the proceeds to work in the next exciting opportunity.

We ended the fiscal year with seventy-four names in the portfolio, an increase from the previous year’s end where we held seventy-one positions. During the fiscal year we purchased sixteen new names, sold twelve and had one warrant position expire. The only name sold due to a buyout was Opiant Pharmaceuticals, which provided a 111.75% return for the year. One name, Transcats (TRNS) was sold due to a combination of valuations and having too large of a market cap. The other ten names that were sold were due to deteriorating fundamentals and adverse news announcements. A summary of the fund’s top ten holdings is included in this report.

As of the end of the fiscal year, the portfolio is trading at a forward price-to-earnings ratio of 11.4x based on our earnings estimates. Price-to-sales stands at 1.05x, price-to-book at 1.45x and a total enterprise value to EBITDA ratio of 8.84x. This is attractive by most metrics relative to the Russell Microcap Index, which is trading at 1.6x price-to-sales, a forward price-to-earnings ratio of 12x and a price-to-book ratio of 1.3x. 84% of the names in the Ultra are profitable or projected to be in 2024. This is an improvement for the portfolio, where that number stood closer to 70% a year ago. We believe this increased focus on investments with near term catalysts that are improving on existing profitability may provide us with better upside opportunities and cushion to the downside relative to the Index where only 50% of the names are profitable.

Perritt Ultra MicroCap Fund

We want to genuinely thank our fellow shareholders for their continued support and confidence in the Perritt Capital Management team. Each member of our investment committee as well as many other employees have made continued investment in this Fund over the years and remain shareholders alongside all of you. We also wish you and your loved ones well and wish you all continued good health as we emerge from the trials of the past year. If you have any questions or comments about this report or your investment in the Perritt Ultra MicroCap Fund, please call us toll- free at (800) 331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Matt Brackmann

Portfolio Manager

Perritt Ultra MicroCap Fund

Important Disclosures

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Earnings Growth is not a measure of the Fund’s future performance.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Please refer to the Schedule of Investments in the report for more complete information regarding Fund holdings. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

One cannot invest directly in an index. The index is used herein for comparative purposes in accordance with SEC regulations.

Book Value is the net asset value of a company calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

Trailing price-to-earnings (P/E) is a relative valuation multiple that is based on the last 12 months of actual earnings. It is calculated by taking the current stock price and dividing it by the trailing earnings per share (EPS) for the past 12 months.

Price-to-Book (P/B) is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price-to-Sales (P/S) is a valuation ratio that compares a company’s stock price to its revenues. The price-to-sales ratio is an indicator of the value placed on each dollar of a company’s sales or revenues.

Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. The forecasted earnings used in the formula typically uses either projected earnings for the following 12 months or for the next full-year fiscal (FY) period.

Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet.

Enterprise value to EBITDA Equals market capitalization + preferred shares + minority interest + debt -total cash divided by EBITDA.

The annual report must be preceded or accompanied by a prospectus.

The Perritt Funds are distributed by Quasar Distributors, LLC.

(This Page Intentionally Left Blank.)

Perritt Ultra MicroCap Fund

| Performance* (Unaudited) | October 31, 2023

|

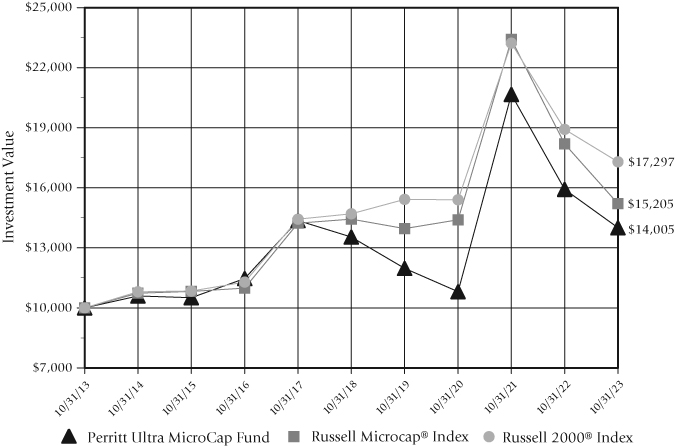

Perritt Ultra MicroCap Fund versus

Russell Microcap® Index and Russell 2000® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. It is not possible to invest directly in an index. |

Perritt Ultra MicroCap Fund

| Performance (Unaudited) (Continued) | October 31, 2023

|

| Average Annual Total Returns* |

| Year ended October 31, 2023 |

| | Past | Past | Past | Past |

| | 1 Year | 5 Years | 10 Years | 15 Years |

| | | | | |

Perritt Ultra MicroCap Fund | -12.03% | 0.68% | 3.43% | 8.79% |

| | | | | |

Russell Microcap® Index | -16.41% | 1.04% | 4.28% | 8.28% |

| (reflects no deduction | | | | |

| for fees and expenses) | | | | |

| | | | | |

Russell 2000® Index | -8.56% | 3.31% | 5.63% | 9.31% |

| (reflects no deduction | | | | |

| for fees and expenses) | | | | |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The performance data quoted does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the 2% redemption or exchange fee for shares held 90 days or less. If reflected, total return would be reduced. |

The Fund’s gross expense ratio is 2.66% as of the most recent prospectus dated February 28, 2023. Please see the Fund’s Financial Highlights in this report for the most recent expense ratio.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro-cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

Perritt Ultra MicroCap Fund

| Ten Largest Common Stock Holdings (Unaudited) |

DLH Holdings Corp. (DLHC) provides healthcare, logistics, and technical services and solutions to Federal Government agencies including the Department of Veteran Affairs, the Department of Defense, and other government clients.

PC Tel, Inc. (PCTI) provides industrial Internet of Thing devices (IoT), antenna systems, and test and measurement solutions worldwide with its subsidiaries.

P&F Industries, Inc. (PFIN) through its subsidiaries, designs, imports, manufactures, and sells pneumatic hand tools primarily to the retail, industrial, automotive, and aerospace markets primarily in the United States.

Quest Resource Holding Corp. (QRHC) through its subsidiaries, provides solutions for the reuse, recycling, and disposal of various waste streams and recyclables in the United States.

Northern Technologies International, Corp. (NTIC) develops and markets rust and corrosion inhibiting products and services to automotive, electronics, electrical mechanical, military, retail consumer, and oil and gas markets.

A-Mark Precious Metals, Inc. (AMRK) together with its subsidiaries, operates as a precious metals trading company. It operates in three segments: Wholesale Sales & Ancillary Services, Secured Lending, and Direct-to-Consumer.

Taylor Devices, Inc. (TAYD) engages in design, development, manufacture, and marketing of shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in North America, Asia, and internationally.

Gencor Industries, Inc. (GENC) together with its subsidiaries, designs, manufactures, and sells heavy machinery used in the production of highway construction materials and environmental control equipment.

DecisionPoint Systems, Inc. (DPSI) through its subsidiaries, engages in designs, consults, and implements mobility enterprise solutions and services. It provides managed and professional services that enable customers to implement and manage complex projects; and designs, deploys, and supports mobile computing systems that enable customers to access employers’ data networks.

Silvercrest Asset Management Group Inc. (SAMG) is a wealth management firm that provides financial advisory and related family office services in the United States. The company serves ultra-high net worth individuals and families, as well as their trusts; endowments; foundations; and other institutional investors. It also manages funds of funds and other investment funds.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt Ultra MicroCap Fund

| Allocation of Portfolio Investments (Unaudited) | October 31, 2023

|

The sector classifications represented in the graph above and industry classifications represented in

the Schedule of Investments are in accordance with Global Industry Classification Standard

(GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor Financial Services LLC. Percentages are based on total investments less investments purchased

with proceeds from securities lending collateral, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt MicroCap Opportunities Fund

| Schedule of Investments | October 31, 2023

|

| Shares | | COMMON STOCK – 98.35% | | Value | |

| Air Freight & Logistics – 3.68% | |

| | 320,000 | | Radiant Logistics, | | | |

| | | | Inc.(a) | | $ | 1,875,200 | |

| | | | | | | 1,875,200 | |

| | |

| Auto Components – 1.02% | |

| | 50,000 | | Motorcar Parts | | | | |

| | | | of America, Inc.(a) | | | 361,000 | |

| | 6,873 | | Strattec Security Corp.(a) | | | 156,361 | |

| | | | | | | 517,361 | |

| | |

| Banks – 0.49% | |

| | 5,000 | | Farmers & Merchants | | | | |

| | | | Bancorp, Inc. | | | 87,100 | |

| | 10,000 | | First Internet Bancorp | | | 163,700 | |

| | | | | | | 250,800 | |

| | |

| Capital Markets – 9.53% | |

| | 261,999 | | Heritage Global, Inc.(a) | | | 809,577 | |

| | 164,500 | | Silvercrest Asset | | | | |

| | | | Management Group, | | | | |

| | | | Inc. – Class A | | | 2,919,875 | |

| | 406,600 | | U.S. Global Investors, | | | | |

| | | | Inc. – Class A | | | 1,122,216 | |

| | | | | | | 4,851,668 | |

| | |

| Chemicals – 5.85% | |

| | 30,448 | | Advanced Emissions | | | | |

| | | | Solutions, Inc.(a) | | | 51,762 | |

| | 125,786 | | Flexible Solutions | | | | |

| | | | International, | | | | |

| | | | Inc. – ADR | | | 250,314 | |

| | 214,400 | | Northern Technologies | | | | |

| | | | International Corp. | | | 2,677,856 | |

| | | | | | | 2,979,932 | |

| | |

| Commercial Services | |

| & Supplies – 5.10% | |

| | 20,000 | | CECO Environmental | | | | |

| | | | Corp.(a) | | | 323,600 | |

| | 165,717 | | Perma-Fix Environmental | | | | |

| | | | Services, Inc.(a) | | | 1,541,168 | |

| | 101,000 | | Quest Resource | | | | |

| | | | Holding Corp.(a) | | | 732,250 | |

| | | | | | | 2,597,018 | |

| | |

| Communications Equipment – 3.96% | |

| | 16,000 | | Aviat Networks, Inc.(a) | | | 427,200 | |

| | 200,000 | | Ceragon Networks, | | | | |

| | | | Ltd. – ADR(a) | | | 340,000 | |

| | 182,612 | | PCTEL, Inc. | | | 1,250,892 | |

| | | | | | | 2,018,092 | |

| | |

| Construction & Engineering – 3.24% | |

| | 16,500 | | Bowman Consulting | | | | |

| | | | Group Ltd.(a) | |

| 438,405 | |

| | 45,000 | | Matrix Service Co.(a) | | | 524,250 | |

| | 25,223 | | Northwest Pipe Co.(a) | | | 687,579 | |

| | | | | | | 1,650,234 | |

| | | | | |

| Consumer Finance – 0.97% | | | | |

| | 60,000 | | EZCORP, Inc. – | | | | |

| | | | Class A(a) | | | 492,000 | |

| | | | | | | 492,000 | |

| | |

| Diversified Consumer Services – 2.11% | |

| | 200,000 | | Beachbody Co., Inc.(a) | | | 41,580 | |

| | 43,901 | | Lincoln Educational | | | | |

| | | | Services Corp.(a) | | | 375,354 | |

| | 75,000 | | Universal Technical | | | | |

| | | | Institute, Inc.(a) | | | 654,750 | |

| | | | | | | 1,071,684 | |

| | |

| Diversified Telecommunication | |

| Services – 0.54% | |

| | 25,000 | | Ooma, Inc.(a) | | | 272,750 | |

| | | | | | | 272,750 | |

| | | | | |

| Electrical Equipment – 1.74% | | | | |

| | 110,000 | | Broadwind, Inc.(a) | | | 288,200 | |

| | 40,000 | | LSI Industries, Inc. | | | 595,200 | |

| | | | | | | 883,400 | |

| | |

| Electronic Equipment, Instruments | |

| & Components – 4.97% | |

| | 26,000 | | Bel Fuse, Inc. – Class B | | | 1,408,680 | |

| | 66,545 | | Coda Octopus | | | | |

| | | | Group, Inc.(a) | | | 439,197 | |

| | 33,000 | | Identiv, Inc.(a) | | | 200,970 | |

| | 260,605 | | Powerfleet, Inc.(a) | | | 482,119 | |

| | | | | | | 2,530,966 | |

| | |

| Energy Equipment & Services – 4.08% | |

| | 325,000 | | CSI Compressco LP | | | 435,500 | |

| | 40,000 | | Geospace Technologies | | | | |

| | | | Corp.(a) | | | 479,600 | |

| | 120,000 | | Newpark Resources, | | | | |

| | | | Inc.(a) | | | 830,400 | |

| | 179,747 | | Profire Energy, Inc.(a) | | | 332,532 | |

| | | | | | | 2,078,032 | |

| | |

| Entertainment – 0.71% | |

| | 363,500 | | WildBrain Ltd. – ADR(a) | | | 360,228 | |

| | | | | | | 360,228 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2023

|

| Shares | | | | Value | |

| Financial Services – 3.06% | |

| | 31,000 | | A-Mark Precious | | | |

| | | | Metals, Inc. | | $ | 839,480 | |

| | 20,000 | | SWK Holdings Corp.(a) | | | 322,800 | |

| | 200,000 | | Usio, Inc.(a) | | | 398,000 | |

| | | | | | | 1,560,280 | |

| | |

| Food Products – 1.33% | |

| | 199,659 | | MamaMancini’s Holdings, | | | | |

| | | | Inc.(a) | | | 674,847 | |

| | | | | | | 674,847 | |

| | |

| Health Care Equipment | |

| & Services – 0.69% | |

| | 50,136 | | Accuray, Inc.(a) | | | 132,359 | |

| | 100,000 | | Sensus Healthcare, | | | | |

| | | | Inc.(a) | | | 219,000 | |

| | | | | | | 351,359 | |

| | |

| Health Care Providers | |

| & Services – 2.61% | |

| | 13,793 | | InfuSystem Holdings, | | | | |

| | | | Inc.(a) | | | 132,137 | |

| | 147,500 | | Quipt Home Medical | | | | |

| | | | Corp. ADR(a) | | | 697,675 | |

| | 79,000 | | Viemed Healthcare, | | | | |

| | | | Inc. ADR(a) | | | 498,490 | |

| | | | | | | 1,328,302 | |

| | |

| Health Care Technology – 0.29% | |

| | 110,000 | | iCAD, Inc.(a) | | | 147,400 | |

| | | | | | | 147,400 | |

| | |

| Hotels, Restaurants & Leisure – 1.28% | |

| | 87,100 | | Century Casinos, | | | | |

| | | | Inc.(a) | | | 381,498 | |

| | 103,000 | | Galaxy Gaming, Inc.(a) | | | 268,830 | |

| | | | | | | 650,328 | |

| | |

| Household Durables – 3.59% | |

| | 78,900 | | Legacy Housing | | | | |

| | | | Corp.(a) | | | 1,460,439 | |

| | 20,000 | | Lovesac Co.(a) | | | 329,200 | |

| | 44,701 | | Singing Machine | | | | |

| | | | Co., Inc.(a) | | | 38,443 | |

| | | | | | | 1,828,082 | |

| | |

| Interactive Media & Services – 0.56% | |

| | 103,800 | | DHI Group, Inc.(a) | | | 284,412 | |

| | | | | | | 284,412 | |

| | |

| IT Services – 2.82% | |

| | 79,950 | | DecisionPoint Systems, | | | | |

| | | | Inc.(a) | |

| 412,542 | |

| | 96,117 | | Information Services | | | | |

| | | | Group, Inc. | | | 390,235 | |

| | 270,000 | | Research Solutions, | | | | |

| | | | Inc.(a) | | | 631,800 | |

| | | | | | | 1,434,577 | |

| | |

| Machinery – 7.99% | |

| | 55,000 | | Commercial Vehicle | | | | |

| | | | Group, Inc.(a) | | | 383,350 | |

| | 30,367 | | Gencor Industries, | | | | |

| | | | Inc.(a) | | | 431,211 | |

| | 17,512 | | L B Foster Co. – | | | | |

| | | | Class A(a) | | | 343,585 | |

| | 15,000 | | Manitowoc Co., Inc.(a) | | | 192,000 | |

| | 35,000 | | Mayville Engineering | | | | |

| | | | Co., Inc.(a) | | | 423,150 | |

| | 40,000 | | Miller Industries, Inc. | | | 1,454,800 | |

| | 30,000 | | Shyft Group, Inc. | | | 329,400 | |

| | 3,302 | | Taylor Devices, Inc.(a) | | | 73,115 | |

| | 60,500 | | TechPrecision Corp.(a) | | | 437,415 | |

| | | | | | | 4,068,026 | |

| | |

| Marine Transportation – 1.15% | |

| | 23,000 | | Euroseas Ltd. – ADR | | | 584,200 | |

| | | | | | | 584,200 | |

| | |

| Metals & Mining – 2.40% | |

| | 200,000 | | Avino Silver & Gold | | | | |

| | | | Mines Ltd. ADR(a) | | | 89,920 | |

| | 125,000 | | Endeavour Silver | | | | |

| | | | Corp. ADR(a) | | | 267,500 | |

| | 41,429 | | Fortitude Gold Corp. | | | 244,431 | |

| | 200,000 | | Gold Resource Corp. | | | 80,400 | |

| | 78,000 | | McEwen Mining, Inc.(a) | | | 540,540 | |

| | | | | | | 1,222,791 | |

| | |

| Mortgage Real Estate | |

| Investment Trusts – 1.11% | |

| | 40,000 | | Chicago Atlantic Real | | | | |

| | | | Estate Finance, Inc. | | | 563,600 | |

| | | | | | | 563,600 | |

| | |

| Oil, Gas & Consumable Fuels – 3.78% | |

| | 141,783 | | Evolution | | | | |

| | | | Petroleum Corp. | | | 911,665 | |

| | 68,972 | | PHX Minerals, Inc. | | | 238,643 | |

| | 120,200 | | Vaalco Energy, Inc. | | | 537,294 | |

| | 10,000 | | Vitesse Energy, Inc. | | | 236,900 | |

| | | | | | | 1,924,502 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2023

|

| Shares | | | | Value | |

| Pharmaceuticals – 2.02% | |

| | 271,250 | | Assertio Holdings, | | | |

| | | | Inc.(a) | | $ | 583,188 | |

| | 5,000 | | Harrow Health, Inc.(a) | | | 71,675 | |

| | 135,100 | | Medexus | | | | |

| | | | Pharmaceuticals, | | | | |

| | | | Inc. – ADR(a) | | | 198,597 | |

| | 40,000 | | ProPhase Labs, Inc.(a) | | | 175,600 | |

| | | | | | | 1,029,060 | |

| | |

| Professional Services – 6.68% | |

| | 25,000 | | Asure Software, Inc.(a) | | | 211,500 | |

| | 37,523 | | BGSF, Inc. | | | 347,838 | |

| | 151,500 | | DLH Holdings Corp.(a) | | | 2,072,520 | |

| | 39,636 | | Hudson Global, Inc.(a) | | | 581,460 | |

| | 14,000 | | Where Food Comes | | | | |

| | | | From, Inc.(a) | | | 189,000 | |

| | | | | | | 3,402,318 | |

| | |

| Real Estate Management | |

| & Development – 0.80% | |

| | 100,000 | | LuxUrban Hotels, | | | | |

| | | | Inc.(a) | | | 405,500 | |

| | | | | | | 405,500 | |

| | |

| Semiconductors & | |

| Semiconductor Equipment – 1.08% | |

| | 30,000 | | Photronics, Inc.(a) | | | 550,800 | |

| | | | | | | 550,800 | |

| | |

| Software – 0.47% | |

| | 21,720 | | American Software, | | | | |

| | | | Inc. – Class A | | | 238,268 | |

| | | | | | | 238,268 | |

| | | | | | | |

| Specialty Retail – 1.35% | | | | |

| | 15,000 | | Build-A-Bear | | | | |

| | | | Workshop, Inc. | | | 372,000 | |

| | 316,842 | | Xcel Brands, Inc.(a) | | | 313,674 | |

| | | | | | | 685,674 | |

| | |

| Technology Hardware, | |

| Storage & Peripherals – 1.02% | |

| | 81,000 | | Immersion Corp. | | | 517,590 | |

| | | | | | | 517,590 | |

| | |

| Textile, Apparel & | |

| Luxury Goods – 1.93% | |

| | 14,000 | | Delta Apparel, Inc.(a) | | | 117,180 | |

| | 40,000 | | Lakeland | | | | |

| | | | Industries, Inc. | | | 584,400 | |

| | 35,000 | | Superior Group | | | | |

| | | | of Cos., Inc. | | | 280,000 | |

| | | | | | | 981,580 | |

| Trading Companies | |

| & Distributors – 1.79% | |

| | 7,000 | | BlueLinx Holdings, | | | | |

| | | | Inc.(a) | | | 497,770 | |

| | 20,000 | | Karat Packaging, Inc. | | | 412,600 | |

| | | | | | | 910,370 | |

| | |

| Water Utilities – 0.56% | |

| | 30,000 | | Pure Cycle Corp.(a) | | | 286,800 | |

| | | | | | | 286,800 | |

| | | | TOTAL COMMON | | | | |

| | | | STOCK | | | | |

| | | | (Cost $35,199,120) | | | 50,060,031 | |

| | | | Total Investments | | | | |

| | | | (Cost $35,199,120) – | | | | |

| | | | 98.35% | | $

| 50,060,031 | |

| | | | | | | | |

| | | | Other Assets in | | | | |

| | | | Excess of Liabilities – | | | | |

| | | | 1.65% | | | 838,689 | |

| | | | TOTAL NET ASSETS – | | | | |

| | | | 100.00% | | $ | 50,898,720 | |

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

(a) | Non-income producing security. |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments | October 31, 2023

|

| Shares | | COMMON STOCK – 90.16% | | Value | |

| Aerospace & Defense – 1.93% | |

| | 40,000 | | VirTra, Inc.(a) | | $ | 189,200 | |

| | | | | | | 189,200 | |

| | |

| Banks – 1.09% | |

| | 6,500 | | First Internet Bancorp | | | 106,405 | |

| | | | | | | 106,405 | |

| | |

| Biotechnology – 0.69% | |

| | 12,000 | | Actinium Pharmaceuticals, | | | | |

| | | | Inc.(a) | | | 66,960 | |

| | | | | | | 66,960 | |

| | | | | |

| Capital Markets – 1.99% | | | | |

| | 11,000 | | Silvercrest Asset | | | | |

| | | | Management Group, | | | | |

| | | | Inc. – Class A | | | 195,250 | |

| | | | | | | 195,250 | |

| | |

| Chemicals – 3.69% | |

| | 22,681 | | Advanced Emissions | | | | |

| | | | Solutions, Inc.(a) | | | 38,558 | |

| | 36,815 | | Flexible Solutions | | | | |

| | | | International, | | | | |

| | | | Inc. – ADR | | | 73,262 | |

| | 20,000 | | Northern Technologies | | | | |

| | | | International Corp. | | | 249,800 | |

| | | | | | | 361,620 | |

| | |

| Commercial Services & Supplies – 2.64% | |

| | 35,600 | | Quest Resource Holding | | | | |

| | | | Corp.(a) | | | 258,100 | |

| | | | | | | 258,100 | |

| | | | | |

| Communications Equipment – 5.29% | | | | |

| | 15,000 | | BK Technologies | | | | |

| | | | Corp.(a) | | | 189,000 | |

| | 48,075 | | PCTEL, Inc. | | | 329,314 | |

| | | | | | | 518,314 | |

| | |

| Construction & Engineering – 1.22% | |

| | 4,500 | | Bowman Consulting | | | | |

| | | | Group Ltd.(a)(c) | | | 119,565 | |

| | | | | | | 119,565 | |

| Consumer Staples | |

| Distribution & Retail – 1.03% | |

| | 25,000 | | HF Foods | | | | |

| | | | Group, Inc.(a) | | | 101,000 | |

| | | | | | | 101,000 | |

| | | | | | | | |

| | | | | |

| Distributors – 0.24% | | | | |

| | 25,090 | | Educational Development | | | | |

| | | | Corp.(a) | |

| 23,828 | |

| | | | | | | 23,828 | |

| Electrical Equipment – 0.64% | |

| | 15,000 | | Expion360, Inc.(a) | | | 62,550 | |

| | | | | | | 62,550 | |

| | |

| Electronic Equipment, Instruments | |

| & Components – 4.55% | |

| | 7,000 | | Airgain, Inc.(a) | | | 23,170 | |

| | 44,899 | | Data I/O Corp.(a) | | | 141,881 | |

| | 16,000 | | Identiv, Inc.(a) | | | 97,440 | |

| | 22,500 | | Luna Innovations, | | | | |

| | | | Inc. (a) | | | 127,800 | |

| | 3,000 | | Napco Security | | | | |

| | | | Technologies, Inc. | | | 55,110 | |

| | | | | | | 445,401 | |

| | |

| Energy Equipment | |

| & Services – 0.81% | |

| | 20,000 | | Gulf Island Fabrication, | | | | |

| | | | Inc.(a) | | | 78,800 | |

| | | | | | | 78,800 | |

| | |

| Equity Real Estate | |

| Investment Trusts – 3.11% | |

| | 30,000 | | Global Self | | | | |

| | | | Storage, Inc. | | | 135,600 | |

| | 11,000 | | Modiv, Inc. | | | 169,070 | |

| | | | | | | 304,670 | |

| | | | | |

| Financial Services – 4.92% | | | | |

| | 9,000 | | A-Mark Precious | | | | |

| | | | Metals, Inc. | | | 243,720 | |

| | 15,000 | | Cantaloupe, Inc.(a) | | | 98,700 | |

| | 70,000 | | Usio, Inc.(a) | | | 139,300 | |

| | | | | | | 481,720 | |

| | |

| Food Products – 0.63% | |

| | 25,000 | | Better Choice | | | | |

| | | | Co., Inc.(a)(c) | | | 5,347 | |

| | 34,708 | | BranchOut Food, | | | | |

| | | | Inc.(a) | | | 55,880 | |

| | | | | | | 61,227 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | October 31, 2023

|

| Shares | | | | Value | |

| Health Care Equipment | |

| & Supplies – 3.81% | |

| | 42,500 | | Biomerica, Inc.(a) | | $ | 41,650 | |

| | 60,000 | | Modular Medical, | | | | |

| | | | Inc.(a) | | | 76,200 | |

| | 5,586 | | Sensus Healthcare, | | | | |

| | | | Inc.(a) | | | 12,233 | |

| | 100,000 | | Strata Skin Sciences, | | | | |

| | | | Inc.(a) | | | 48,500 | |

| | 1,250 | | UFP Technologies, | | | | |

| | | | Inc.(a) | | | 194,900 | |

| | | | | | | 373,483 | |

| | |

| Health Care Providers | |

| & Services – 1.21% | |

| | 25,000 | | Quipt Home Medical | | | | |

| | | | Corp. – ADR(a) | | | 118,250 | |

| | | | | | | 118,250 | |

| | |

| Health Care Technology – 0.22% | |

| | 24,200 | | CareCloud, Inc.(a) | | | 21,780 | |

| | | | | | | 21,780 | |

| | |

| Hotels, Restaurants & Leisure – 4.44% | |

| | 40,000 | | Bragg Gaming Group, | | | | |

| | | | Inc. – ADR(a) | | | 173,200 | |

| | 20,000 | | Century | | | | |

| | | | Casinos, Inc.(a) | | | 87,600 | |

| | 66,621 | | Galaxy Gaming, Inc.(a) | | | 173,881 | |

| | | | | | | 434,681 | |

| | |

| Household Durables – 0.38% | |

| | 43,510 | | Singing Machine | | | | |

| | | | Co., Inc.(a) | | | 37,419 | |

| | | | | | | 37,419 | |

| | |

| Interactive Media & Services – 0.98% | |

| | 35,000 | | DHI Group, Inc.(a) | | | 95,900 | |

| | | | | | | 95,900 | |

| | |

| IT Services – 5.17% | |

| | 8,402 | | Data Storage Corp.(a) | | | 23,022 | |

| | 40,001 | | DecisionPoint Systems, | | | | |

| | | | Inc.(a) | | | 206,405 | |

| | 25,000 | | Information Services | | | | |

| | | | Group, Inc. | | | 101,500 | |

| | 75,000 | | Research Solutions, | | | | |

| | | | Inc.(a) | | | 175,500 | |

| | | | | | | 506,427 | |

| | |

| Leisure Products – 0.05% | |

| | 2,901 | | Vision Marine | | | | |

| | | | Technologies, | | | | |

| | | | Inc. – ADR(a) | |

| 5,251 | |

| | | | | | | 5,251 | |

| | |

| Machinery – 10.11% | |

| | 17,500 | | Commercial Vehicle | | | | |

| | | | Group, Inc.(a) | | | 121,975 | |

| | 15,000 | | Gencor Industries, | | | | |

| | | | Inc.(a) | | | 213,000 | |

| | 25,000 | | P&F Industries, | | | | |

| | | | Inc. – Class A | | | 318,500 | |

| | 10,315 | | Taylor Devices, Inc.(a) | | | 228,400 | |

| | 15,000 | | TechPrecision | | | | |

| | | | Corp.(a)(c) | | | 108,450 | |

| | | | | | | 990,325 | |

| | |

| Media – 2.53% | |

| | 25,000 | | Creative Realities, | | | | |

| | | | Inc.(a) | | | 47,250 | |

| | 53,183 | | Direct Digital Holdings, | | | | |

| | | | Inc. Class A(a) | | | 130,298 | |

| | 2,000 | | Perion Network | | | | |

| | | | Ltd. – ADR(a) | | | 50,800 | |

| | 1,000 | | Saga Communications, | | | | |

| | | | Inc. – Class A | | | 19,400 | |

| | | | | | | 247,748 | |

| | |

| Metals & Mining – 1.04% | |

| | 38,505 | | Ampco-Pittsburgh | | | | |

| | | | Corp.(a) | | | 102,038 | |

| | | | | | | 102,038 | |

| | |

| Mortgage Real Estate | |

| Investment Trusts – 2.65% | |

| | 10,950 | | Chicago Atlantic Real | | | | |

| | | | Estate Finance, Inc. | | | 154,285 | |

| | 32,500 | | Sachem Capital Corp. | | | 105,625 | |

| | | | | | | 259,910 | |

| | |

| Oil, Gas & Consumable Fuels – 2.40% | |

| | 4,000 | | Adams Resources & | | | | |

| | | | Energy, Inc. | | | 127,360 | |

| | 31,000 | | PHX Minerals, Inc. | | | 107,260 | |

| | | | | | | 234,620 | |

| | |

| Pharmaceuticals – 0.45% | |

| | 10,000 | | ProPhase Labs, Inc.(a) | | | 43,900 | |

| | | | | | | 43,900 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | October 31, 2023

|

| Shares | | | | Value | |

| Professional Services – 8.21% | |

| | 10,000 | | Asure Software, Inc.(a) | | $ | 84,600 | |

| | 10,000 | | BGSF, Inc. | | | 92,700 | |

| | 34,000 | | DLH Holdings Corp.(a) | | | 465,120 | |

| | 11,014 | | Hudson Global, Inc.(a) | | | 161,575 | |

| | | | | | | 803,995 | |

| | |

| Real Estate Management | |

| & Development – 1.04% | | | | |

| | 25,000 | | LuxUrban Hotels, | | | | |

| | | | Inc.(a)(c) | | | 101,375 | |

| | | | | | | 101,375 | |

| | |

| Semiconductors & | |

| Semiconductor Equipment – 0.99% | | | | |

| | 7,500 | | inTEST Corp.(a) | | | 96,975 | |

| | | | | | | 96,975 | |

| | |

| Software – 2.03% | |

| | 10,133 | | Issuer Direct Corp.(a) | | | 176,720 | |

| | 12,739 | | NetSol Technologies, | | | | |

| | | | Inc.(a) | | | 22,293 | |

| | | | | | | 199,013 | |

| | |

| Technology Hardware, | |

| Storage & Peripherals – 1.20% | |

| | 20,000 | | TransAct Technologies, | | | | |

| | | | Inc. (a) | | | 117,200 | |

| | | | | | | 117,200 | |

| | |

| Textile, Apparel & | |

| Luxury Goods – 2.93% | |

| | 30,000 | | Crown Crafts, Inc. | | | 126,300 | |

| | 11,000 | | Lakeland | | | | |

| | | | Industries, Inc. | | | 160,710 | |

| | | | | | | 287,010 | |

| | |

| Trading Companies | |

| & Distributors – 0.58% | |

| | 39,350 | | FGI Industries | | | | |

| | | | Ltd. – ADR(a) | | | 57,057 | |

| | | | | | | 57,057 | |

| | |

| Water Utilities – 1.94% | |

| | 18,000 | | Global Water Resources, | | | | |

| | | | Inc. | | | 189,540 | |

| | | | | | | 189,540 | |

| | | | | | | | |

| Wireless Telecommunications | | | | |

| Services – 1.33% | | | | |

| | 30,000 | | SurgePays, Inc.(a)(c) | |

| 130,200 | |

| | | | | | | 130,200 | |

| | | | TOTAL COMMON | | | | |

| | | | STOCK | | | | |

| | | | (Cost $7,224,161) | | $ | 8,828,707 | |

| | | | | | | | |

| Contracts | | WARRANTS – 0.04% | | | | |

| Metals & Mining – 0.04% | |

| | 15,000 | | Ampco-Pittsburgh Corp. | | | | |

| | | | Expiration: 08/01/2025, | | | | |

| | | | Exercise Price $5.75(a) | | $ | 3,750 | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $0) | | $ | 3,750 | |

| | | | | | | | |

| | | | INVESTMENTS PURCHASED | | | | |

| | | | WITH PROCEEDS FROM | | | | |

| | | | SECURITIES LENDING | | | | |

| Shares | | COLLATERAL – 3.87% | | | | |

| | 378,499 | | First American Government | | | | |

| | | | Obligations Fund, | | | | |

| | | | Class X, 5.21%(b) | | $ | 378,499 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | PURCHASED WITH | | | | |

| | | | PROCEEDS FROM | | | | |

| | | | SECURITIES LENDING | | | | |

| | | | COLLATERAL | | | | |

| | | | (Cost – $378,499) | | $ | 378,499 | |

| | | | Total Investments | | | | |

| | | | (Cost $7,602,660) – | | | | |

| | | | 94.07% | | $ | 9,210,956 | |

| | | | Other Assets in | | | | |

| | | | Excess of Liabilities – | | | | |

| | | | 5.93% | | | 580,326 | |

| | | | TOTAL NET ASSETS – | | | | |

| | | | 100.00% | | $ | 9,791,282 | |

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

(a) | Non-income producing security. |

(b) | Seven-day yield as of October 31, 2023. |

(c) | All or a portion of this security is on loan. At October 31, 2023 the total value of securities on loan was $346,915, which represents 3.54% of total net assets. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Funds, Inc.

| Statements of Assets and Liabilities |

October 31, 2023

| | | Perritt MicroCap | | | Perritt Ultra | |

| | | Opportunities Fund | | | MicroCap Fund | |

| Assets: | | | | | | |

Investments at value1 | | $ | 50,060,031 | | | $ | 9,210,956 | |

| Cash and cash equivalents | | | 414,456 | | | | 906,242 | |

| Receivable for investments sold | | | 225,547 | | | | 116,766 | |

| Receivable for fund shares issued | | | 298,446 | | | | 25 | |

| Dividends and interest receivable | | | 25,035 | | | | 10,687 | |

| Securities lending income receivable | | | — | | | | 1,088 | |

| Prepaid expenses | | | 378 | | | | 373 | |

| Total Assets | | | 51,023,893 | | | | 10,246,137 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for collateral on securities loaned | | | — | | | | 378,499 | |

| Payable for investments purchased | | | — | | | | 8,060 | |

| Payable for fund shares purchased | | | 4,967 | | | | — | |

| Payable to Advisor | | | 44,035 | | | | 10,536 | |

| Payable to Officer & Directors | | | 11,530 | | | | 12,050 | |

| Accrued accounting expense | | | 6,657 | | | | 1,899 | |

| Accrued administration expense | | | 8,952 | | | | 3,739 | |

| Accrued audit expense | | | 18,500 | | | | 18,500 | |

| Accrued legal expense | | | 2,034 | | | | 10,345 | |

| Accrued printing & mailing expense | | | 12,267 | | | | 3,749 | |

| Accrued transfer agent expense | | | 11,498 | | | | 3,893 | |

| Other accrued expenses & liabilities | | | 4,733 | | | | 3,585 | |

| Total Liabilities | | | 125,173 | | | | 454,855 | |

| Net Assets | | $ | 50,898,720 | | | $ | 9,791,282 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

| Capital Stock | | $ | 32,198,333 | | | $ | 8,116,628 | |

| Total Distributable Earnings | | | 18,700,387 | | | | 1,674,654 | |

| Total Net Assets | | $ | 50,898,720 | | | $ | 9,791,282 | |

| Capital Stock, $0.0001 par value | | | | | | | | |

| Authorized | | | 100,000,000 | | | | 100,000,000 | |

| Outstanding | | | 2,158,548 | | | | 706,310 | |

| Net Assets | | $ | 50,898,720 | | | $ | 9,791,282 | |

| Net asset value and offering price per share | | $ | 23.58 | | | $ | 13.86 | |

| Cost of Investments | | $ | 35,199,120 | | | $ | 7,602,660 | |

1 Includes loaned securities with a value of: | | $ | — | | | $ | 346,915 | |

The accompanying notes to financial statements are an integral part of these statements.

Perritt Funds, Inc.

For the Year Ended October 31, 2023

| | | Perritt MicroCap | | | Perritt Ultra | |

| | | Opportunities Fund | | | MicroCap Fund | |

| Investment Income: | | | | | | |

| Dividend Income (net of $1,916 and $362 | | | | | | |

| foreign withholding tax) | | $ | 1,075,338 | | | $ | 157,143 | |

| Interest income | | | 54,990 | | | | 33,768 | |

| Securities lending income | | | — | | | | 6,044 | |

| Total investment income | | | 1,130,328 | | | | 196,955 | |

| Expenses: | | | | | | | | |

| Investment advisory fee | | | 552,167 | | | | 142,077 | |

| Shareholder servicing | | | 115,337 | | | | 31,774 | |

| Administration fee | | | 56,467 | | | | 26,461 | |

| Officer & directors’ fees & expenses | | | 48,354 | | | | 48,580 | |

| Professional fees | | | 40,194 | | | | 42,903 | |

| Fund accounting expenses | | | 38,756 | | | | 11,391 | |

| Federal & state registration fees | | | 26,560 | | | | 28,216 | |

| Other expenses | | | 15,848 | | | | 7,276 | |

| Printing & mailing fees | | | 13,248 | | | | 3,980 | |

| Custodian fees | | | 6,758 | | | | 3,002 | |

| Total expenses | | | 913,689 | | | | 345,660 | |

| Net investment income (loss) | | | 216,639 | | | | (148,705 | ) |

| | | | | | | | | |

Realized and Unrealized Gain/(Loss) on Investments: | | | | | | | | |

| Net realized gain on investments | | | 4,245,869 | | | | 449,840 | |

| Change in unrealized depreciation on investments | | | (2,791,073 | ) | | | (1,641,496 | ) |

| Net realized and unrealized | | | | | | | | |

| gain (loss) on investments | | | 1,454,796 | | | | (1,191,656 | ) |

Net increase (decrease) in net assets | | | | | | | | |

resulting from operations | | $ | 1,671,435 | | | $ | (1,340,361 | ) |

The accompanying notes to financial statements are an integral part of these statements.

Perritt MicroCap Opportunities Fund

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2023 | | | October 31, 2022 | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 216,639 | | | $ | (263,559 | ) |

| Net realized gain on investments | | | 4,245,869 | | | | 2,311,640 | |

| Net change in unrealized depreciation on investments | | | (2,791,073 | ) | | | (11,944,738 | ) |

| Net increase (decrease) in net | | | | | | | | |

| assets resulting from operations | | | 1,671,435 | | | | (9,896,657 | ) |

| Dividends and Distributions to Shareholders: | | | | | | | | |

| Distributable Earnings | | | (1,722,564 | ) | | | (9,677,972 | ) |

| Total dividends and distributions | | | (1,722,564 | ) | | | (9,677,972 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 2,091,708 | | | | 2,026,338 | |

| Reinvestment of distributions | | | 1,656,524 | | | | 9,339,344 | |

| Cost of shares redeemed | | | (7,538,194 | ) | | | (9,548,812 | ) |

| Redemption fees | | | 369 | | | | 1,341 | |

| Net increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | (3,789,593 | ) | | | 1,818,211 | |

| Total Decrease in Net Assets | | | (3,840,722 | ) | | | (17,756,418 | ) |

| Net Assets | | | | | | | | |

| Beginning of the year | | | 54,739,442 | | | | 72,495,860 | |

| End of the year | | $ | 50,898,720 | | | $ | 54,739,442 | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | 87,888 | | | | 78,732 | |

| Shares issued on reinvestment of distributions | | | 70,073 | | | | 325,278 | |

| Shares redeemed | | | (311,342 | ) | | | (356,013 | ) |

| Net increase (decrease) from capital share transactions | | | (153,381 | ) | | | 47,997 | |

The accompanying notes to financial statements are an integral part of this statement.

Perritt Ultra MicroCap Fund

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2023 | | | October 31, 2022 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (148,705 | ) | | $ | (264,791 | ) |

| Net realized gain on investments | | | 449,840 | | | | 521,211 | |

| Net change in unrealized depreciation on investments | | | (1,641,496 | ) | | | (4,352,079 | ) |

| Net decrease in net assets resulting from operations | | | (1,340,361 | ) | | | (4,095,659 | ) |

| Dividends and Distributions to Shareholders: | | | | | | | | |

| Distributable Earnings | | | (137,724 | ) | | | (1,199,255 | ) |

| Total dividends and distributions | | | (137,724 | ) | | | (1,199,255 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 248,477 | | | | 843,647 | |

| Reinvestment of distributions | | | 129,312 | | | | 1,141,483 | |

| Cost of shares redeemed | | | (1,195,489 | ) | | | (6,655,111 | ) |

| Redemption fees | | | 259 | | | | 2,446 | |

| Net decrease in net assets | | | | | | | | |

| from capital share transactions | | | (817,441 | ) | | | (4,667,535 | ) |

| Total Decrease in Net Assets | | | (2,295,526 | ) | | | (9,962,449 | ) |

| Net Assets | | | | | | | | |

| Beginning of the year | | | 12,086,808 | | | | 22,049,257 | |

| End of the year | | $ | 9,791,282 | | | $ | 12,086,808 | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | 16,299 | | | | 41,993 | |

| Shares issued on reinvestment of distributions | | | 8,216 | | | | 55,278 | |

| Shares redeemed | | | (76,290 | ) | | | (338,658 | ) |

| Net decrease from capital share transactions | | | (51,775 | ) | | | (241,387 | ) |

The accompanying notes to financial statements are an integral part of this statement.

Perritt MicroCap Opportunities Fund

For a Fund share outstanding throughout the year

| | | For the Years Ended October 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value, beginning of year | | $ | 23.68 | | | $ | 32.02 | | | $ | 19.51 | | | $ | 23.12 | | | $ | 28.17 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | 0.10 | | | | (0.11 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.11 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.56 | | | | (3.95 | ) | | | 12.66 | | | | (2.66 | ) | | | (1.74 | ) |

| Total from investment operations | | | 0.66 | | | | (4.06 | ) | | | 12.51 | | | | (2.81 | ) | | | (1.85 | ) |

| Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains | | | (0.76 | ) | | | (4.28 | ) | | | — | | | | (0.80 | ) | | | (3.20 | ) |

| Total dividends and distributions | | | (0.76 | ) | | | (4.28 | ) | | | — | | | | (0.80 | ) | | | (3.20 | ) |

Redemption fees2,3 | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Net asset value, end of year | | $ | 23.58 | | | $ | 23.68 | | | $ | 32.02 | | | $ | 19.51 | | | $ | 23.12 | |

Total return1 | | | 2.76 | % | | | (14.95 | %) | | | 64.12 | % | | | (12.46 | %) | | | (6.80 | %) |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 50,899 | | | $ | 54,739 | | | $ | 72,496 | | | $ | 52,756 | | | $ | 107,875 | |

| Ratio of net expenses to average net assets | | | 1.65 | % | | | 1.56 | % | | | 1.56 | % | | | 1.64 | % | | | 1.38 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.39 | % | | | (0.43 | %) | | | (0.53 | %) | | | (0.73 | %) | | | (0.48 | %) |

| Portfolio turnover rate | | | 20.5 | % | | | 23.0 | % | | | 23.5 | % | | | 19.1 | % | | | 22.1 | % |

1 | Total return reflects reinvested dividends but does not reflect the impact of taxes. |

2 | Net investment income (loss) and redemption fees per share have been calculated based on average shares outstanding during the year. |

3 | Amount is less than $0.01 per share. |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

For a Fund share outstanding throughout the year

| | | For the Years Ended October 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value, beginning of year | | $ | 15.94 | | | $ | 22.06 | | | $ | 11.54 | | | $ | 12.81 | | | $ | 15.62 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss2 | | | (0.20 | ) | | | (0.32 | ) | | | (0.36 | ) | | | (0.11 | ) | | | (0.12 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (1.70 | ) | | | (4.43 | ) | | | 10.86 | | | | (1.14 | ) | | | (1.60 | ) |

| Total from investment operations | | | (1.90 | ) | | | (4.75 | ) | | | 10.50 | | | | (1.25 | ) | | | (1.72 | ) |

| Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains | | | (0.18 | ) | | | (1.37 | ) | | | — | | | | (0.01 | ) | | | (1.09 | ) |

| From return of capital | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Total dividends and distributions | | | (0.18 | ) | | | (1.37 | ) | | | — | | | | (0.02 | ) | | | (1.09 | ) |

Redemption fees2 | | | 0.00 | 3 | | | 0.00 | 3 | | | 0.02 | | | | 0.00 | 3 | | | 0.00 | 3 |

| Net asset value, end of year | | $ | 13.86 | | | $ | 15.94 | | | $ | 22.06 | | | $ | 11.54 | | | $ | 12.81 | |

Total return1 | | | (12.03 | %) | | | (22.95 | %) | | | 91.16 | % | | | (9.75 | %) | | | (11.54 | %) |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 9,791 | | | $ | 12,087 | | | $ | 22,049 | | | $ | 11,582 | | | $ | 34,154 | |

| Ratio of net expenses to average net assets | | | 3.04 | % | | | 2.66 | % | | | 2.42 | % | | | 2.68 | % | | | 1.83 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (1.26 | %) | | | (1.77 | %) | | | (1.85 | %) | | | (0.92 | %) | | | (0.85 | %) |

| Portfolio turnover rate | | | 27.2 | % | | | 15.4 | % | | | 25.7 | % | | | 14.3 | % | | | 13.3 | % |

1 | Total return reflects reinvested dividends but does not reflect the impact of taxes. |

2 | Net investment loss and redemption fees per share have been calculated based on average shares outstanding during the year. |

3 | Amount is less than $0.01 per share. |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Funds, Inc.

| Notes to Financial Statements |

October 31, 2023

| 1. | Organization |

| | |

| | Perritt Funds, Inc. (the “Corporation”) was organized on March 19, 2004 as a Maryland corporation and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment company, with each series below being a diversified fund. The Corporation currently consists of the following series: Perritt MicroCap Opportunities Fund (“MicroCap Fund”) and Perritt Ultra MicroCap Fund (“Ultra MicroCap Fund”) (each, a “Fund,” and collectively, the “Funds”). Perritt MicroCap Opportunities Fund, Inc., the predecessor to the MicroCap Fund, commenced operations on April 11, 1988. As part of a plan of reorganization, on February 28, 2013, Perritt MicroCap Opportunities Fund, Inc. merged into the MicroCap Fund, a series within the Corporation. The Ultra MicroCap Fund commenced operations on August 30, 2004. The MicroCap Fund’s investment objective is to invest in mainly common stocks of companies with market capitalizations that are below $500 million at the time of the initial purchase. The Ultra MicroCap Fund’s investment objective is to invest in mainly common stocks of companies with market capitalizations that are below $300 million at the time of the initial purchase. The Funds are each an investment company and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies.” |

| | |

| 2. | Summary of Significant Accounting Policies |

| | a. | Cash and cash equivalents include cash and overnight investments in interest-bearing demand deposits with a financial institution with maturities of three months or less. The Funds maintain deposits with a high quality financial institution in an amount that is in excess of federally insured limits. |

| | | |

| | b. | Exchange-listed securities are generally valued at the last sales price reported by the principal security exchange on which the security is traded, or if no sale is reported, the mean between the latest bid and ask price unless the Funds’ investment advisor believes that the mean does not represent a fair value, in which case the securities are fair valued as set forth below. Securities listed on NASDAQ are valued at the NASDAQ Official Closing Price. Demand notes, commercial paper, U.S. Treasury Bills and warrants are stated at fair value using market prices if available, or a pricing service when such prices are believed to reflect fair value. Money Market Funds are valued at amortized cost. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith by the Funds’ advisor. The Funds’ fair value procedures allow for the use of certain methods performed by the Funds’ advisor to value those securities for which market quotations are not readily available, at a price that a Fund might reasonably expect to receive upon a sale of such securities. For example, these methods may be based on a multiple of earnings, or a discount from market of a similar freely traded security, or a yield to maturity with respect to debt issues, or a combination of these and other methods. |

| | | |

| | c. | Net realized gains and losses on securities are computed using the first-in, first-out method. |

Perritt Funds, Inc.

| Notes to Financial Statements (Continued) |

| | d. | Dividend income is recognized on the ex-dividend date, and interest income is recognized on the accrual basis. Withholding taxes on foreign dividends and capital gains, which are included as a component of net investment income and realized gain (loss) on investments, respectively, have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. Discounts and premiums on securities purchased are amortized over the life of the respective securities using the interest method. Distributions received from real estate investment trusts (“REITs”) are classified as investment income or realized gains based on the U.S. income tax characteristics of the distribution. Return of capital distributions received from REIT securities and partnerships are recorded as an adjustment to the cost of the security and thus may impact unrealized or realized gains or losses on the security. Investment and shareholder transactions are recorded on the trade date. |

| | e. | Each Fund is charged for those expenses that are directly attributable to it. Expenses that are not readily identifiable to a specific Fund are generally allocated among the Funds in proportion to the relative net assets of the Funds. |

| | | |

| | f. | Provision has not been made for federal income tax since the Funds have each elected to be taxed as a “regulated investment company” and intend to distribute substantially all income to their shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| | | |

| | g. | The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| | | |

| | | In preparing these financial statements, the Funds have evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. |

| | | |