PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 25, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

| (Name of Registrant as Specified in Its Charter) |

| |

WESTERN INVESTMENT LLC WESTERN INVESTMENT HEDGED PARTNERS L.P. WESTERN INVESTMENT INSTITUTIONAL PARTNERS LLC WESTERN INVESTMENT TOTAL RETURN PARTNERS L.P. WESTERN INVESTMENT TOTAL RETURN FUND LTD. ARTHUR D. LIPSON BRUCE W. SHEWMAKER |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Western Investment LLC (“Western Investment”), together with the other participants named herein, is filing materials contained in this Schedule 14A with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies by Western Investment at the 2010 annual meeting of shareholders (the “Annual Meeting”) of MCG Capital Corporation (the “Company”). Western Investment has filed a definitive proxy statement with the SEC with regard to the Annual Meeting.

Item 1: On May 4, 2010, Western Investment issued the following press release:

MCG CAPITAL CORPORATION (NASDAQ:MCGC)

MANAGEMENT MISLEADS STOCKHOLDERS

Western Investment sets the record straight

New York - (May 4, 2010) Western Investment LLC today announced that it will send the following letter to MCG Capital Corporation (Nasdaq:MCGC) (“MCGC”) stockholders:

Dear Fellow Stockholder:

In a recent letter to stockholders MCGC management has tried to rewrite its abysmal performance record and distract stockholders from the real issues in this election. Attacks and misleading innuendo against Western Investment are no substitutes for full disclosure and honest communication. We urge stockholders of MCGC to not be fooled by management’s deceptive and misleading version of the facts:

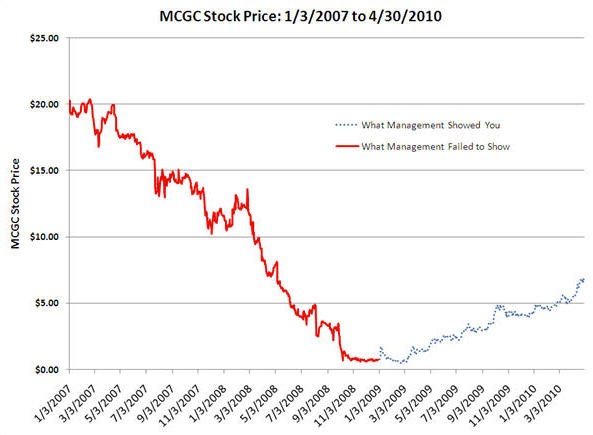

| | · | The chart below shows the real story – the COLLAPSE of MCGC’s share price since Steven Tunney became CEO – versus the short-term picture management would have you focus on. |

A $1,000 investment in MCGC when it became public in 2001 was only worth $697 on March 31, 2010, a loss of over 30%, including reinvestment of dividends. Do you want a repeat of these results?

We are disappointed that the management of a public company would, or even could, resort to such an obvious and clumsy manipulation of its reported performance in an effort to maintain its control and hide its role in stockholder value destruction at MCGC. Had management wanted to do otherwise, they would have shown stockholders the rest of the chart.�� MCGC stockholders deserve management that obtains real results; we urge you not to be fooled by management’s false claims of success despite MCGC’s sub-par performance.

It is clear that this management will do almost anything to stay in place. To us, that indicates that there is something seriously wrong with this company, something that is not being addressed. MCGC’s net asset value per share has declined EACH YEAR for the past three years from $12.83 in 2006 to $8.06 at the end of 2009, a drop of $4.77 per share or -37%. Western Investment is not “trying to take over your company” as management blithely accuses. We are investors like you, seeking to protect our investment and see it grow. We do not trust current management. We do not want them managing our money because we believe they are neither successful nor trustworthy. We believe they sh ould be replaced. The abysmal results they have produced simply do not deserve stockholder support.

Consider:

| | · | MCGC’s investment performance has racked up astounding losses. MCGC reported an incredible $191.9 million investment loss in 2009. |

| | · | During the period beginning December 31, 2006 (shortly after Steven Tunney assumed his position as CEO) through December 31, 2009, an investment in MCGC lost 73% of its value. |

| | · | In December of 2008, MCGC stock under Tunney’s leadership closed at $0.58, and the Company was rumored to be on the edge of bankruptcy. |

| | · | Western Investment’s only interest in MCGC is as a stockholder. Western Investment pledges not to accept any management fees from MCGC or assume any active management position. |

| | · | Western Investment is not trying to take over MCGC. If its two nominees are elected, any decisions about the direction of the Company will only be made and approved by a majority of the eight members of the Board. |

| | · | If elected, Western Investment’s only interest is working with the other board members to obtain the best management possible. We believe superior management is available to manage MCGC’s investments, and change is warranted NOW. |

Western Investment is only interested in maximizing short- and long-term value for all MCGC stockholders. The time to sit back and wait for management to improve is past. Stockholders deserve better management now. We urge you to vote the GOLD proxy today.

Sincerely,

Western Investment LLC