UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21558

Pioneer Short Term Income Fund

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: August 31, 2024

Date of reporting period: September 1, 2023 through February 29, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Pioneer Short Term Income Fund

Semiannual Report | February 29, 2024

| | | | | |

| A: STABX | C: PSHCX | C2: STIIX | K: STIKX | Y: PSHYX |

IMPORTANT NOTICE – UPCOMING CHANGES TO PIONEER FUNDS ANNUAL & SEMI-ANNUAL REPORTS

The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments that will result in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Beginning in July 2024, Reports will be streamlined to highlight key information (“Redesigned Reports”). Certain information currently included in the Reports, including financial statements, will no longer appear in the Reports but will be available online, delivered free of charge to shareholders upon request, and filed with the SEC.

If you previously elected to receive the Fund's Reports electronically, you will continue to receive the Redesigned Reports electronically. Otherwise, you will receive paper copies of the Fund's Redesigned Reports via USPS mail starting in July 2024. If you would like to receive the Fund's Redesigned Reports (and/or other communications) electronically instead of by mail, please contact your financial advisor or, if you are a direct investor, please log into your mutual fund account at amundi.com/usinvestors and select “E-Delivery” under the Profile page. You must be registered for online account access before you can enroll in E-Delivery.

visit us: www.amundi.com/us

Pioneer Short Term Income Fund | Semiannual Report | 2/29/241

Portfolio Summary | 2/29/24

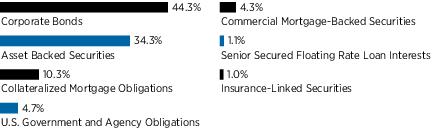

Portfolio Diversification

(As a percentage of total investments)*

10 Largest Holdings

| (As a percentage of total investments)* |

| 1. | U.S. Treasury Bonds, 6.375%, 8/15/27 | 1.29% |

| 2. | U.S. Treasury Bonds, 6.875%, 8/15/25 | 1.25 |

| 3. | Towd Point Mortgage Trust, Series 2024-CES1, Class A1A, 5.848%, 1/25/64 (144A) | 0.73 |

| 4. | Federal National Mortgage Association, 6.50%, 8/23/92 (TBA) | 0.71 |

| 5. | BHG Securitization Trust, Series 2022-C, Class B, 5.93%, 10/17/35 (144A) | 0.60 |

| 6. | US Bancorp, 6.787% (SOFR + 188 bps), 10/26/27 | 0.59 |

| 7. | ABPCI Direct Lending Fund CLO VI Ltd., Series 2019-6A, Class A2R, 7.57% (3 Month Term SOFR + 225 bps), 4/27/34 (144A) | 0.59 |

| 8. | U.S. Treasury Notes, 4.625%, 2/28/25 | 0.59 |

| 9. | Cooperatieve Rabobank UA, 6.056% (SOFR + 71 bps), 3/5/27 | 0.56 |

| 10. | American Express Co., 6.338% (SOFR + 133 bps), 10/30/26 | 0.56 |

* Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

2Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Prices and Distributions | 2/29/24

Net Asset Value per Share

| Class | 2/29/24 | 8/31/23 |

| A | $8.78 | $8.71 |

| C | $8.80 | $8.73 |

| C2 | $8.80 | $8.74 |

| K | $8.83 | $8.77 |

| Y | $8.79 | $8.73 |

| | | |

Distributions per Share: 9/1/23 - 2/29/24

| Class | Net

Investment

Income | Short-Term

Capital Gains | Long-Term

Capital Gains |

| A | $0.2482 | $— | $— |

| C | $0.2420 | $— | $— |

| C2 | $0.2425 | $— | $— |

| K | $0.2662 | $— | $— |

| Y | $0.2644 | $— | $— |

Index Definitions

The Bloomberg One- to Three-Year Government/Credit Index is an unmanaged measure of the performance of the short-term (1 to 3 years) government and investment-grade corporate bond markets. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 4 - 8.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/243

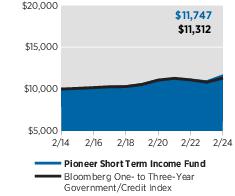

| Performance Update | 2/29/24 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg One- to Three-Year Government/Credit Index.

Average Annual Total Returns

(As of February 29, 2024) |

| Period | Net

Asset

Value

(NAV) | Bloomberg

One- to

Three-Year

Government/

Credit Index |

| 10 Years | 1.62% | 1.14% |

| 5 Years | 1.90 | 1.31 |

| 1 Year | 6.32 | 4.45 |

Expense Ratio

(Per prospectus dated December 28, 2023) |

| Gross | Net |

| 0.97% | 0.83% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share.

Class A shares of the Fund are not subject to sales charges. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results shown reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through January 1, 2025 for Class A shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

4Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

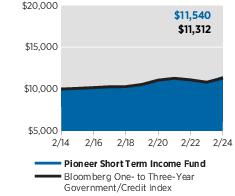

| Performance Update | 2/29/24 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg One- to Three-Year Government/Credit Index.

Average Annual Total Returns

(As of February 29, 2024) |

| Period | Net

Asset

Value

(NAV) | Bloomberg

One- to

Three-Year

Government/

Credit Index |

| 10 Years | 1.44% | 1.14% |

| 5 Years | 1.76 | 1.31 |

| 1 Year | 6.15 | 4.45 |

Expense Ratio

(Per prospectus dated December 28, 2023) |

| Gross |

| 1.06% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares are not subject to sales charges. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/245

| Performance Update | 2/29/24 | Class C2 Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C2 shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg One- to Three-Year Government/Credit Index.

Average Annual Total Returns

(As of February 29, 2024) |

| Period | If

Held | If

Redeemed | Bloomberg

One- to

Three-Year

Government/

Credit Index |

| 10 Years | 1.45% | 1.45% | 1.14% |

| 5 Years | 1.77 | 1.77 | 1.31 |

| 1 Year | 6.04 | 5.04 | 4.45 |

Expense Ratio

(Per prospectus dated December 28, 2023) |

| Gross |

| 1.03% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C2 shares held for less than one year are subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. “If Redeemed” returns reflect deduction of the CDSC for the one-year period, assuming a complete redemption of shares at the last price calculated on the last business day of the period, and no CDSC for the five- and 10-year periods. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

6Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

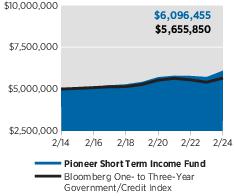

| Performance Update | 2/29/24 | Class K Shares |

Investment Returns

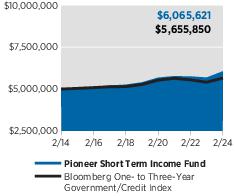

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg One- to Three-Year Government/Credit Index.

Average Annual Total Returns

(As of February 29, 2024) |

| Period | Net

Asset

Value

(NAV) | Bloomberg

One- to

Three-Year

Government/

Credit Index |

| 10 Years | 2.00% | 1.14% |

| 5 Years | 2.36 | 1.31 |

| 1 Year | 6.58 | 4.45 |

Expense Ratio

(Per prospectus dated December 28, 2023) |

| Gross | Net |

| 0.50% | 0.46% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for Class K shares for the period prior to the commencement of operations of Class K shares on December 31, 2014, is the net asset value performance of the Fund’s Class A shares, which has not been restated to reflect any differences in expenses, including Rule 12b-1 fees applicable to Class A shares. Since fees for Class A shares generally are higher than those of Class K shares, the performance of Class K shares prior to their inception would have been higher than the performance shown. For the period beginning December 31, 2014, the actual performance of Class K shares is reflected. Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results shown reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation in effect through January 1, 2025 for Class K shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/247

| Performance Update | 2/29/24 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg One- to Three-Year Government/Credit Index.

Average Annual Total Returns

(As of February 29, 2024) |

| Period | Net

Asset

Value

(NAV) | Bloomberg

One- to

Three-Year

Government/

Credit Index |

| 10 Years | 1.95% | 1.14% |

| 5 Years | 2.33 | 1.31 |

| 1 Year | 6.58 | 4.45 |

Expense Ratio

(Per prospectus dated December 28, 2023) |

| Gross | Net |

| 0.59% | 0.46% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation in effect through January 1, 2025 for Class Y shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

8Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Comparing Ongoing Fund Expenses

As a shareholder in the Fund, you incur two types of costs:

| (1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

| (2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| (1) | Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6 |

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Short Term Income Fund

Based on actual returns from September 1, 2023 through February 29, 2024.

| Share Class | A | C | C2 | K | Y |

Beginning Account

Value on 9/1/23 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 2/29/24 | $1,037.00 | $1,036.20 | $1,035.00 | $1,037.70 | $1,037.70 |

Expenses Paid

During Period* | $4.20 | $5.16 | $5.01 | $2.33 | $2.33 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.83%, 1.02%, 0.99%, 0.46%, and 0.46% for Class A, Class C, Class C2, Class K, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

Pioneer Short Term Income Fund | Semiannual Report | 2/29/249

Comparing Ongoing Fund Expenses (continued)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Short Term Income Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from September 1, 2023 through February 29, 2024.

| Share Class | A | C | C2 | K | Y |

Beginning Account

Value on 9/1/23 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 2/29/24 | $1,020.74 | $1,019.79 | $1,019.94 | $1,022.58 | $1,022.58 |

Expenses Paid

During Period* | $4.17 | $5.12 | $4.97 | $2.31 | $2.31 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.83%, 1.02%, 0.99%, 0.46%, and 0.46% for Class A, Class C, Class C2, Class K, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

10Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Schedule of Investments | 2/29/24

(unaudited)

Principal

Amount

USD ($) | | | | | | Value |

| | UNAFFILIATED ISSUERS — 102.0% | |

| | Senior Secured Floating Rate Loan

Interests — 1.0% of Net Assets*(a) | |

| | Advertising Sales — 0.1% | |

| 445,466 | Lamar Media Corp., Term B Loan, 6.926% (Term SOFR + 150 bps), 2/5/27 | $ 445,466 |

| 267,202 | Outfront Media Capital LLC (Outfront Media Capital Corp.), Extended Term Loan, 7.076% (Term SOFR + 175 bps), 11/18/26 | 266,575 |

| | Total Advertising Sales | $712,041 |

|

|

| | Airlines — 0.1% | |

| 246,250 | Air Canada, Term Loan, 8.935% (Term SOFR + 350 bps), 8/11/28 | $ 246,943 |

| | Total Airlines | $246,943 |

|

|

| | Applications Software — 0.0%† | |

| 244,375 | RealPage, Inc., First Lien Initial Term Loan, 8.441% (Term SOFR + 300 bps), 4/24/28 | $ 238,006 |

| | Total Applications Software | $238,006 |

|

|

| | Cable & Satellite Television — 0.0%† | |

| 235,662 | Virgin Media Bristol LLC, N Facility, 7.932% (Term SOFR + 250 bps), 1/31/28 | $ 233,850 |

| | Total Cable & Satellite Television | $233,850 |

|

|

| | Chemicals-Specialty — 0.1% | |

| 306,843 | Element Solutions Inc. (Macdermid, Inc.), Tranche B-2 Term Loan, 7.326% (Term SOFR + 200 bps), 12/18/30 | $ 306,131 |

| 234,233 | Tronox Finance LLC, First Lien Refinancing Term Loan, 8.11% (Term SOFR + 250 bps), 3/10/28 | 234,024 |

| | Total Chemicals-Specialty | $540,155 |

|

|

| | Computer Data Security — 0.0%† | |

| 244,375 | Magenta Buyer LLC, First Lien Initial Term Loan, 10.574% (Term SOFR + 500 bps), 7/27/28 | $ 148,152 |

| | Total Computer Data Security | $148,152 |

|

|

| | Containers-Paper & Plastic — 0.1% | |

| 394,339 | Berry Global, Inc., Term AA Loan, 7.182% (Term SOFR + 175 bps), 7/1/29 | $ 393,836 |

| 146,723 | Trident TPI Holdings, Inc., Tranche B-3 Initial Term Loan, 9.61% (Term SOFR + 400 bps), 9/15/28 | 146,758 |

| | Total Containers-Paper & Plastic | $540,594 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2411

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Diagnostic Equipment — 0.0%† | |

| 243,750 | Curia Global, Inc., First Lien 2021 Term Loan, 9.163% (Term SOFR + 375 bps), 8/30/26 | $ 230,300 |

| | Total Diagnostic Equipment | $230,300 |

|

|

| | Direct Marketing — 0.0%† | |

| 38,557 | Red Ventures LLC (New Imagitas, Inc.), First Lien Term B-4 Loan, 8.326% (Term SOFR + 300 bps), 3/3/30 | $ 38,404 |

| | Total Direct Marketing | $38,404 |

|

|

| | Disposable Medical Products — 0.1% | |

| 250,000 | Sotera Health Holdings LLC, First Lien Refinancing Loan, 8.191% (Term SOFR + 275 bps), 12/11/26 | $ 249,531 |

| | Total Disposable Medical Products | $249,531 |

|

|

| | Electric-Generation — 0.0%† | |

| 130,752 | Eastern Power LLC (Eastern Covert Midco LLC), Term Loan, 9.191% (Term SOFR + 375 bps), 10/2/25 | $ 130,558 |

| | Total Electric-Generation | $130,558 |

|

|

| | Finance-Leasing Company — 0.1% | |

| 244,347 | Avolon TLB Borrower 1 (US) LLC, Term B-6 Loan, 7.82% (Term SOFR + 200 bps), 6/22/28 | $ 244,640 |

| 169,412 | Delos Aircraft Designated Activity Co., 2023 Term Loan, 7.348% (Term SOFR + 200 bps), 10/31/27 | 170,047 |

| 270,000 | Setanta Aircraft Leasing DAC, Loan, 7.61% (Term SOFR + 200 bps), 11/5/28 | 270,579 |

| | Total Finance-Leasing Company | $685,266 |

|

|

| | Hotels & Motels — 0.1% | |

| 247,249 | Hilton Domestic Operating Co., Inc., Series B-4 Term Loan, 7.421% (Term SOFR + 200 bps), 11/8/30 | $ 247,686 |

| | Total Hotels & Motels | $247,686 |

|

|

| | Medical Labs & Testing Services — 0.0%† | |

| 238,800 | Phoenix Guarantor Inc., First Lien Tranche B-4 Term Loan, 8.576% (Term SOFR + 325 bps), 2/21/31 | $ 236,316 |

| | Total Medical Labs & Testing Services | $236,316 |

|

|

| | Medical-Drugs — 0.0%† | |

| 138,800(b) | Endo Luxembourg Finance Company I S.a r.l., 2021 Term Loan, 14.50% (LIBOR + 400 bps), 3/27/28 | $ 90,220 |

| | Total Medical-Drugs | $90,220 |

|

|

The accompanying notes are an integral part of these financial statements.

12Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Metal Processors & Fabrication — 0.0%† | |

| 131,083 | WireCo WorldGroup, Inc., 2023 Refinancing Term Loan, 9.068% (Term SOFR + 375 bps), 11/13/28 | $ 131,411 |

| | Total Metal Processors & Fabrication | $131,411 |

|

|

| | Physical Therapy & Rehabilitation Centers — 0.0%† | |

| 243,750 | Upstream Newco, Inc., First Lien August 2021 Incremental Term Loan, 9.824% (Term SOFR + 425 bps), 11/20/26 | $ 230,100 |

| | Total Physical Therapy & Rehabilitation Centers | $230,100 |

|

|

| | Retail — 0.1% | |

| 244,375 | Pilot Travel Centers LLC, Initial Tranche B Term Loan, 7.426% (Term SOFR + 200 bps), 8/4/28 | $ 244,597 |

| 243,908 | RVR Dealership Holdings LLC, Term Loan, 9.171% (Term SOFR + 375 bps), 2/8/28 | 228,664 |

| | Total Retail | $473,261 |

|

|

| | Telephone-Integrated — 0.0%† | |

| 117,636 | Level 3 Financing, Inc., Tranche B 2027 Term Loan, 7.191% (Term SOFR + 175 bps), 3/1/27 | $ 116,350 |

| | Total Telephone-Integrated | $116,350 |

|

|

| | Veterinary Diagnostics — 0.2% | |

| 897,785 | Elanco Animal Health Inc., Term Loan, 7.178% (Term SOFR + 175 bps), 8/2/27 | $ 887,573 |

| | Total Veterinary Diagnostics | $887,573 |

|

|

| | Total Senior Secured Floating Rate Loan Interests

(Cost $6,600,296) | $6,406,717 |

|

|

| | Asset Backed Securities — 31.5% of Net

Assets | |

| 75,806(a) | 321 Henderson Receivables I LLC, Series 2006-2A, Class A1, 5.632% (1 Month Term SOFR + 31 bps), 6/15/41 (144A) | $ 74,444 |

| 54,031(a) | 321 Henderson Receivables LLC, Series 2005-1A, Class A1, 5.662% (1 Month Term SOFR + 34 bps), 11/15/40 (144A) | 53,328 |

| 597,142 | A10 Bridge Asset Financing LLC, Series 2019-B, Class D, 4.523%, 8/15/40 (144A) | 572,439 |

| 3,440,000(a) | ABPCI Direct Lending Fund CLO VI Ltd., Series 2019-6A, Class A2R, 7.57% (3 Month Term SOFR + 225 bps), 4/27/34 (144A) | 3,388,827 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2413

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 870,000(a) | ABPCI Direct Lending Fund CLO X LP, Series 2020-10A, Class B1, 7.929% (3 Month Term SOFR + 261 bps), 1/20/32 (144A) | $ 869,930 |

| 500,000(a) | ABPCI Direct Lending Fund CLO X LP, Series 2020-10A, Class D, 11.079% (3 Month Term SOFR + 576 bps), 1/20/32 (144A) | 497,412 |

| 1,799,103(a) | ABPCI Direct Lending Fund IX LLC, Series 2020-9A, Class A1R, 6.981% (3 Month Term SOFR + 166 bps), 11/18/31 (144A) | 1,797,282 |

| 500,000 | ACC Auto Trust, Series 2022-A, Class D, 10.07%, 3/15/29 (144A) | 482,045 |

| 403,088 | Accelerated LLC, Series 2021-1H, Class C, 2.35%, 10/20/40 (144A) | 367,196 |

| 386,818 | ACHV ABS Trust, Series 2023-2PL, Class B, 6.88%, 5/20/30 (144A) | 387,471 |

| 1,000,000 | ACM Auto Trust, Series 2023-1A, Class C, 8.59%, 1/22/30 (144A) | 1,009,248 |

| 1,854,563 | ACM Auto Trust, Series 2024-1A, Class A, 7.71%, 1/21/31 (144A) | 1,863,599 |

| 1,000,000 | ACM Auto Trust, Series 2024-1A, Class B, 11.40%, 1/21/31 (144A) | 1,011,991 |

| 703,567(a) | ACREC, Ltd., Series 2021-FL1, Class A, 6.586% (1 Month Term SOFR + 126 bps), 10/16/36 (144A) | 699,093 |

| 625,000 | Affirm Asset Securitization Trust, Series 2022-A, Class 1A, 4.30%, 5/17/27 (144A) | 620,241 |

| 109,631 | Affirm Asset Securitization Trust, Series 2022-Z1, Class A, 4.55%, 6/15/27 (144A) | 108,713 |

| 2,000,000 | Affirm Asset Securitization Trust, Series 2023-A, Class 1A, 6.61%, 1/18/28 (144A) | 2,012,238 |

| 475,000 | Affirm Asset Securitization Trust, Series 2023-A, Class 1B, 7.18%, 1/18/28 (144A) | 478,599 |

| 497,680 | Affirm Asset Securitization Trust, Series 2023-X1, Class A, 7.11%, 11/15/28 (144A) | 499,906 |

| 2,420,000 | Affirm Asset Securitization Trust, Series 2024-A, Class A, 5.61%, 2/15/29 (144A) | 2,415,399 |

| 800,000 | American Credit Acceptance Receivables Trust, Series 2021-3, Class F, 3.64%, 5/15/28 (144A) | 766,696 |

| 1,250,000 | American Credit Acceptance Receivables Trust, Series 2022-3, Class D, 5.83%, 10/13/28 (144A) | 1,246,697 |

| 2,210,000 | American Credit Acceptance Receivables Trust, Series 2023-4, Class C, 6.99%, 9/12/30 (144A) | 2,254,522 |

| 600,000 | Americredit Automobile Receivables Trust, Series 2023-1, Class C, 5.80%, 12/18/28 | 604,171 |

The accompanying notes are an integral part of these financial statements.

14Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 1,000,000 | Amur Equipment Finance Receivables X LLC, Series 2022-1A, Class E, 5.02%, 12/20/28 (144A) | $ 967,315 |

| 800,000 | Amur Equipment Finance Receivables XI LLC, Series 2022-2A, Class D, 7.25%, 5/21/29 (144A) | 804,066 |

| 650,000 | Amur Equipment Finance Receivables XII LLC, Series 2023-1A, Class D, 7.48%, 7/22/30 (144A) | 659,494 |

| 1,085,188 | Aqua Finance Trust, Series 2019-A, Class C, 4.01%, 7/16/40 (144A) | 998,317 |

| 600,000 | Aqua Finance Trust, Series 2020-AA, Class C, 3.97%, 7/17/46 (144A) | 536,298 |

| 455,503 | Aqua Finance Trust, Series 2021-A, Class A, 1.54%, 7/17/46 (144A) | 405,931 |

| 484,684(a) | Arbor Realty Commercial Real Estate Notes, Ltd., Series 2021-FL1, Class A, 6.402% (1 Month Term SOFR + 108 bps), 12/15/35 (144A) | 482,990 |

| 500,000(a) | Arbor Realty Commercial Real Estate Notes, Ltd., Series 2021-FL4, Class E, 8.832% (1 Month Term SOFR + 351 bps), 11/15/36 (144A) | 464,593 |

| 2,600,000 | Arivo Acceptance Auto Loan Receivables Trust, Series 2021-1A, Class C, 3.77%, 3/15/27 (144A) | 2,509,205 |

| 600,000 | Arivo Acceptance Auto Loan Receivables Trust, Series 2021-1A, Class D, 5.83%, 1/18/28 (144A) | 578,627 |

| 800,000 | Arivo Acceptance Auto Loan Receivables Trust, Series 2022-2A, Class C, 9.84%, 3/15/29 (144A) | 745,984 |

| 600,000 | Atalaya Equipment Leasing Trust, Series 2021-1A, Class B, 2.08%, 2/15/27 (144A) | 585,767 |

| 1,050,000 | Avid Automobile Receivables Trust, Series 2021-1, Class F, 5.16%, 10/16/28 (144A) | 990,837 |

| 500,000 | Avid Automobile Receivables Trust, Series 2023-1, Class C, 7.35%, 12/15/27 (144A) | 502,285 |

| 1,000,000 | Avis Budget Rental Car Funding AESOP LLC, Series 2022-5A, Class C, 6.24%, 4/20/27 (144A) | 999,489 |

| 303,410 | Bayview Opportunity Master Fund VII Trust, Series 2024-CAR1F, Class A, 6.971%, 7/29/32 (144A) | 303,525 |

| 1,170,000 | BHG Securitization Trust, Series 2021-B, Class D, 3.17%, 10/17/34 (144A) | 995,268 |

| 3,490,000 | BHG Securitization Trust, Series 2022-C, Class B, 5.93%, 10/17/35 (144A) | 3,455,749 |

| 1,500,000 | BHG Securitization Trust, Series 2023-B, Class B, 7.45%, 12/17/36 (144A) | 1,535,560 |

| 303,442 | Blackbird Capital II Aircraft Lease Ltd., Series 2021-1A, Class B, 3.446%, 7/15/46 (144A) | 264,001 |

| 2,202,921 | Blue Bridge Funding LLC, Series 2023-1A, Class A, 7.37%, 11/15/30 (144A) | 2,205,648 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2415

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 548,714 | BRE Grand Islander Timeshare Issuer LLC, Series 2019-A, Class B, 3.78%, 9/26/33 (144A) | $ 521,404 |

| 500,000(a) | Brightwood Capital MM CLO, Ltd., Series 2020-1A, Class B1R, 9.064% (3 Month Term SOFR + 375 bps), 1/15/31 (144A) | 500,640 |

| 500,000(a) | Brightwood Capital MM CLO, Ltd., Series 2020-1A, Class C1R, 10.814% (3 Month Term SOFR + 550 bps), 1/15/31 (144A) | 497,732 |

| 1,000,000(a) | Brightwood Capital MM CLO, Ltd., Series 2020-1A, Class DR, 11.564% (3 Month Term SOFR + 625 bps), 1/15/31 (144A) | 986,022 |

| 290,000(a) | Brightwood Capital MM CLO, Ltd., Series 2023-1A, Class X, 7.611% (3 Month Term SOFR + 225 bps), 10/15/35 (144A) | 289,931 |

| 500,000(a) | BSPRT Issuer, Ltd., Series 2021-FL7, Class D, 8.182% (1 Month Term SOFR + 286 bps), 12/15/38 (144A) | 478,053 |

| 369,373 | BXG Receivables Note Trust, Series 2018-A, Class C, 4.44%, 2/2/34 (144A) | 354,413 |

| 200,499 | BXG Receivables Note Trust, Series 2020-A, Class B, 2.49%, 2/28/36 (144A) | 184,461 |

| 786,430(a) | CAL Receivables LLC, Series 2022-1, Class B, 9.675% (SOFR30A + 435 bps), 10/15/26 (144A) | 786,152 |

| 320,000(a) | Capital Four US CLO II, Ltd., Series 2022-1A, Class X, 6.654% (3 Month Term SOFR + 130 bps), 1/20/37 (144A) | 319,948 |

| 399,756 | CarNow Auto Receivables Trust, Series 2022-1A, Class B, 4.89%, 3/16/26 (144A) | 398,648 |

| 1,190,000 | CarNow Auto Receivables Trust, Series 2023-2A, Class B, 8.53%, 1/15/27 (144A) | 1,191,206 |

| 470,000 | Carvana Auto Receivables Trust, Series 2022-N1, Class D, 4.13%, 12/11/28 (144A) | 459,209 |

| 2,110,000 | Carvana Auto Receivables Trust, Series 2023-N4, Class C, 6.59%, 2/11/30 (144A) | 2,134,811 |

| 500,000(c) | Cascade Funding Mortgage Trust, Series 2021-HB6, Class M3, 3.735%, 6/25/36 (144A) | 494,369 |

| 900,000(c) | Cascade Funding Mortgage Trust, Series 2022-HB10, Class M2, 3.25%, 11/25/35 (144A) | 814,158 |

| 29,290(a) | CDC Mortgage Capital Trust, Series 2002-HE1, Class A, 6.055% (1 Month Term SOFR + 73 bps), 1/25/33 | 29,024 |

| 946,920(a) | Centerstone SBA Trust, Series 2023-1, Class A, 9.072% (SOFR30A + 375 bps), 12/27/50 (144A) | 947,972 |

| 589,218(a) | Cerberus Loan Funding XXIV LP, Series 2018-3A, Class A1, 6.976% (3 Month Term SOFR + 166 bps), 7/15/30 (144A) | 588,749 |

The accompanying notes are an integral part of these financial statements.

16Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 1,000,000(c) | CFMT LLC, Series 2021-HB7, Class M2, 2.679%, 10/27/31 (144A) | $ 942,536 |

| 600,000(c) | CFMT LLC, Series 2021-HB7, Class M3, 3.849%, 10/27/31 (144A) | 561,562 |

| 750,000(c) | CFMT LLC, Series 2023-HB12, Class M2, 4.25%, 4/25/33 (144A) | 674,392 |

| 200,000(c) | CFMT LLC, Series 2023-HB12, Class M3, 4.25%, 4/25/33 (144A) | 169,058 |

| 47,216(a) | Chase Funding Trust, Series 2003-3, Class 2A2, 5.975% (1 Month Term SOFR + 65 bps), 4/25/33 | 46,799 |

| 40,498(d) | Chase Funding Trust, Series 2003-6, Class 1A7, 4.868%, 11/25/34 | 39,125 |

| 500,000 | Commercial Equipment Finance LLC, Series 2021-A, Class C, 3.55%, 12/15/28 (144A) | 480,274 |

| 17,628 | Commonbond Student Loan Trust, Series 2017-BGS, Class C, 4.44%, 9/25/42 (144A) | 14,711 |

| 48,962 | Conn's Receivables Funding LLC, Series 2021-A, Class C, 4.59%, 5/15/26 (144A) | 48,829 |

| 107,045 | Conn's Receivables Funding LLC, Series 2023-A, Class A, 8.01%, 1/17/28 (144A) | 107,409 |

| 376,056 | Continental Credit Card ABS LLC, Series 2019-1A, Class B, 4.95%, 8/15/26 (144A) | 375,653 |

| 572,000 | Continental Credit Card ABS LLC, Series 2019-1A, Class C, 6.16%, 8/15/26 (144A) | 567,475 |

| 700,000 | Continental Finance Credit Card ABS Master Trust, Series 2022-A, Class A, 6.19%, 10/15/30 (144A) | 690,792 |

| 750,000 | Continental Finance Credit Card ABS Master Trust, Series 2022-A, Class C, 9.33%, 10/15/30 (144A) | 747,838 |

| 121,003(a) | Countrywide Asset-Backed Certificates, Series 2004-SD3, Class A2, 6.535% (1 Month Term SOFR + 121 bps), 9/25/34 (144A) | 114,202 |

| 1,012,392 | CP EF Asset Securitization II LLC, Series 2023-1A, Class A, 7.48%, 3/15/32 (144A) | 1,014,932 |

| 473,671 | Credito Real USA Auto Receivables Trust, Series 2021-1A, Class B, 2.87%, 2/16/27 (144A) | 467,997 |

| 519,000 | Crossroads Asset Trust, Series 2021-A, Class D, 2.52%, 1/20/26 (144A) | 513,947 |

| 420,000(a) | Deerpath Capital CLO, Ltd., Series 2021-1A, Class A1, 7.228% (3 Month Term SOFR + 191 bps), 4/17/33 (144A) | 419,918 |

| 1,000,000 | Dext ABS LLC, Series 2023-1, Class B, 6.55%, 3/15/32 (144A) | 986,202 |

| 1,033,909 | Dext ABS LLC, Series 2023-2, Class A2, 6.56%, 5/15/34 (144A) | 1,036,667 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2417

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 329,000 | DT Auto Owner Trust, Series 2022-1A, Class C, 2.96%, 11/15/27 (144A) | $ 324,078 |

| 1,000,000(a) | Ellington CLO III, Ltd., Series 2018-3A, Class C, 7.829% (3 Month Term SOFR + 251 bps), 7/20/30 (144A) | 992,076 |

| 1,250,000(a) | Ellington CLO IV, Ltd., Series 2019-4A, Class CR, 8.326% (3 Month Term SOFR + 301 bps), 4/15/29 (144A) | 1,248,016 |

| 560,000 | Exeter Automobile Receivables Trust, Series 2022-3A, Class C, 5.30%, 9/15/27 | 557,268 |

| 400,000 | Exeter Automobile Receivables Trust, Series 2022-3A, Class D, 6.76%, 9/15/28 | 403,604 |

| 2,000,000 | Exeter Automobile Receivables Trust, Series 2022-6A, Class D, 8.03%, 4/6/29 | 2,084,247 |

| 1,100,000 | Exeter Automobile Receivables Trust, Series 2023-5A, Class D, 7.13%, 2/15/30 | 1,133,184 |

| 1,662,000 | FHF Issuer Trust, Series 2023-2A, Class B, 7.49%, 11/15/29 (144A) | 1,707,590 |

| 388,000 | FHF Issuer Trust, Series 2023-2A, Class C, 7.97%, 12/17/29 (144A) | 399,558 |

| 1,500,000 | FHF Issuer Trust, Series 2024-1A, Class A2, 5.69%, 2/15/30 (144A) | 1,497,377 |

| 1,100,000 | FHF Issuer Trust, Series 2024-1A, Class B, 6.26%, 3/15/30 (144A) | 1,095,503 |

| 571,046 | FHF Trust, Series 2023-1A, Class A2, 6.57%, 6/15/28 (144A) | 573,743 |

| 500,000(c) | Finance of America HECM Buyout, Series 2022-HB1, Class M3, 5.084%, 2/25/32 (144A) | 453,727 |

| 925,000 | Ford Credit Auto Lease Trust, Series 2023-B, Class C, 6.43%, 4/15/27 | 941,988 |

| 1,000,000(a) | Fortress Credit Opportunities IX CLO, Ltd., Series 2017-9A, Class A1TR, 7.126% (3 Month Term SOFR + 181 bps), 10/15/33 (144A) | 986,585 |

| 238,832(a) | Fortress Credit Opportunities VI CLO, Ltd., Series 2015-6A, Class A1TR, 6.947% (3 Month Term SOFR + 162 bps), 7/10/30 (144A) | 238,356 |

| 223,104(a) | Fortress Credit Opportunities XVII CLO, Ltd., Series 2022-17A, Class A, 6.684% (3 Month Term SOFR + 137 bps), 1/15/30 (144A) | 222,820 |

| 170,310 | Foundation Finance Trust, Series 2021-1A, Class A, 1.27%, 5/15/41 (144A) | 154,580 |

| 1,000,000 | Foursight Capital Automobile Receivables Trust, Series 2022-2, Class D, 7.09%, 10/15/29 (144A) | 1,003,704 |

| 1,000,000 | Foursight Capital Automobile Receivables Trust, Series 2024-1, Class D, 6.83%, 3/15/30 (144A) | 998,259 |

The accompanying notes are an integral part of these financial statements.

18Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 74,036(a) | Freddie Mac Structured Pass-Through Certificates, Series T-20, Class A7, 5.736% (SOFR30A + 41 bps), 12/25/29 | $ 71,838 |

| 991,077 | Freed ABS Trust, Series 2021-3FP, Class D, 2.37%, 11/20/28 (144A) | 967,986 |

| 750,000 | Genesis Sales Finance Master Trust, Series 2021-AA, Class D, 2.09%, 12/21/26 (144A) | 686,405 |

| 2,890,000 | GLS Auto Receivables Issuer Trust, Series 2022-3A, Class D, 6.42%, 6/15/28 (144A) | 2,908,731 |

| 750,000 | GLS Auto Receivables Issuer Trust, Series 2023-1A, Class D, 7.01%, 1/16/29 (144A) | 765,643 |

| 2,000,000 | GLS Auto Receivables Issuer Trust, Series 2023-4A, Class C, 6.65%, 8/15/29 (144A) | 2,037,291 |

| 1,089,000 | GLS Auto Select Receivables Trust, Series 2023-1A, Class C, 6.41%, 8/15/29 (144A) | 1,107,495 |

| 1,000,000 | GLS Auto Select Receivables Trust, Series 2023-1A, Class D, 7.93%, 7/15/30 (144A) | 1,062,386 |

| 1,429,000 | GLS Auto Select Receivables Trust, Series 2023-2A, Class C, 7.31%, 1/15/30 (144A) | 1,494,693 |

| 230,000 | GLS Auto Select Receivables Trust, Series 2024-1A, Class C, 5.69%, 3/15/30 (144A) | 228,587 |

| 2,400,000(a) | Golub Capital Partners CLO 24M-R, Ltd., Series 2015-24A, Class BR, 7.534% (3 Month Term SOFR + 226 bps), 11/5/29 (144A) | 2,398,118 |

| 1,000,000(a) | Golub Capital Partners CLO 35B, Ltd., Series 2017-35A, Class BR, 7.629% (3 Month Term SOFR + 231 bps), 7/20/29 (144A) | 1,000,177 |

| 1,880,000(a) | Golub Capital Partners CLO 36m, Ltd., Series 2018-36A, Class B, 7.184% (3 Month Term SOFR + 191 bps), 2/5/31 (144A) | 1,867,131 |

| 779,962(a) | Gracie Point International Funding, Series 2023-1A, Class A, 7.308% (SOFR90A + 195 bps), 9/1/26 (144A) | 782,880 |

| 460,000(a) | Gracie Point International Funding, Series 2023-1A, Class C, 8.458% (SOFR90A + 310 bps), 9/1/26 (144A) | 461,651 |

| 500,000(a) | Gracie Point International Funding, Series 2023-1A, Class D, 9.858% (SOFR90A + 450 bps), 9/1/26 (144A) | 503,948 |

| 1,027,000(a) | Gracie Point International Funding LLC, Series 2024-1A, Class C, 8.858% (SOFR90A + 350 bps), 3/1/28 (144A) | 1,027,000 |

| 432,000(a) | Gracie Point International Funding LLC, Series 2024-1A, Class D, 12.508% (SOFR90A + 715 bps), 3/1/28 (144A) | 432,000 |

| 586,726(a) | Harvest SBA Loan Trust, Series 2023-1, Class A, 8.707% (SOFR30A + 325 bps), 10/25/50 (144A) | 587,718 |

| 79,175 | HIN Timeshare Trust, Series 2020-A, Class D, 5.50%, 10/9/39 (144A) | 74,665 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2419

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 900,000 | HOA Funding LLC - HOA, Series 2021-1A, Class B, 7.432%, 8/20/51 (144A) | $ 649,743 |

| 500,000(a) | ICG US CLO, Ltd., Series 2016-1A, Class DRR, 13.021% (3 Month Term SOFR + 770 bps), 4/29/34 (144A) | 399,573 |

| 826,584(a) | JP Morgan Mortgage Trust, Series 2023-HE1, Class A1, 7.074% (SOFR30A + 175 bps), 11/25/53 (144A) | 834,642 |

| 1,552,913(a) | JP Morgan Mortgage Trust, Series 2023-HE2, Class A1, 7.024% (SOFR30A + 170 bps), 3/25/54 (144A) | 1,563,653 |

| 1,064,447(a) | JP Morgan Mortgage Trust, Series 2023-HE3, Class A1, 6.924% (SOFR30A + 160 bps), 5/25/54 (144A) | 1,069,869 |

| 500,000 | Kubota Credit Owner Trust, Series 2023-1A, Class A3, 5.02%, 6/15/27 (144A) | 498,468 |

| 1,390,000 | LAD Auto Receivables Trust, Series 2024-1A, Class A2, 5.44%, 11/16/26 (144A) | 1,388,076 |

| 1,000,000 | LAD Auto Receivables Trust, Series 2024-1A, Class D, 6.15%, 6/16/31 (144A) | 994,678 |

| 950,000 | Lendbuzz Securitization Trust, Series 2023-3A, Class A2, 7.50%, 12/15/28 (144A) | 961,134 |

| 514,860 | LendingPoint Asset Securitization Trust, Series 2020-REV1, Class B, 4.494%, 10/15/28 (144A) | 512,427 |

| 217,989 | LFS LLC, Series 2021-A, Class A, 2.46%, 4/15/33 (144A) | 210,877 |

| 567,738 | LFS LLC, Series 2023-A, Class A, 7.173%, 7/15/35 (144A) | 567,713 |

| 177,597 | Libra Solutions LLC, Series 2022-2A, Class B, 8.85%, 10/15/34 (144A) | 177,242 |

| 325,496 | Libra Solutions LLC, Series 2023-1A, Class B, 10.25%, 2/15/35 (144A) | 327,123 |

| 1,000,000 | LL ABS Trust, Series 2022-1A, Class C, 5.88%, 11/15/29 (144A) | 981,040 |

| 452,174 | Lobel Automobile Receivables Trust, Series 2023-1, Class A, 6.97%, 7/15/26 (144A) | 453,038 |

| 399,711 | Lunar Structured Aircraft Portfolio Notes, Series 2021-1, Class A, 2.636%, 10/15/46 (144A) | 349,889 |

| 1,000,000 | Marlette Funding Trust, Series 2021-1A, Class D, 2.47%, 6/16/31 (144A) | 971,630 |

| 1,000,000 | Merchants Fleet Funding LLC, Series 2023-1A, Class E, 10.80%, 5/20/36 (144A) | 990,031 |

| 1,500,000 | Mercury Financial Credit Card Master Trust, Series 2023-1A, Class A, 8.04%, 9/20/27 (144A) | 1,515,107 |

| 710,000(a) | MidOcean Credit CLO XI, Ltd., Series 2022-11A, Class A1R, 7.096% (3 Month Term SOFR + 173 bps), 10/18/33 (144A) | 711,181 |

| 3,000,000 | Mission Lane Credit Card Master Trust, Series 2022-A, Class A, 6.92%, 9/15/27 (144A) | 3,000,195 |

The accompanying notes are an integral part of these financial statements.

20Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 1,000,000 | Mission Lane Credit Card Master Trust, Series 2023-A, Class C, 10.03%, 7/17/28 (144A) | $ 1,007,144 |

| 1,410,000 | Mission Lane Credit Card Master Trust, Series 2023-B, Class A, 7.69%, 11/15/28 (144A) | 1,428,224 |

| 1,000,000(a) | Monroe Capital MML CLO VII, Ltd., Series 2018-2A, Class C, 8.587% (3 Month Term SOFR + 326 bps), 11/22/30 (144A) | 998,924 |

| 4 | Mosaic Solar Loan Trust, Series 2019-2A, Class C, 4.35%, 9/20/40 (144A) | 4 |

| 153,103 | Mosaic Solar Loan Trust, Series 2019-2A, Class D, 6.18%, 9/20/40 (144A) | 147,799 |

| 63,837 | MVW LLC, Series 2020-1A, Class C, 4.21%, 10/20/37 (144A) | 61,321 |

| 2,041(c) | New Century Home Equity Loan Trust, Series 2004-A, Class AII9, 5.47%, 8/25/34 | 2,594 |

| 750,000 | NMEF Funding LLC, Series 2021-A, Class D, 5.78%, 12/15/27 (144A) | 740,353 |

| 690,000 | NMEF Funding LLC, Series 2023-A, Class C, 8.04%, 6/17/30 (144A) | 687,066 |

| 141,434(a) | NovaStar Mortgage Funding Trust, Series 2003-1, Class A2, 3.78% (1 Month Term SOFR + 89 bps), 5/25/33 | 135,906 |

| 93,290 | Oasis Securitization Funding LLC, Series 2021-2A, Class B, 5.147%, 10/15/33 (144A) | 93,040 |

| 1,500,000 | Octane Receivables Trust, Series 2022-1A, Class D, 5.54%, 2/20/29 (144A) | 1,453,571 |

| 1,610,000 | Octane Receivables Trust, Series 2022-2A, Class D, 7.70%, 2/20/30 (144A) | 1,630,633 |

| 1,000,000 | Octane Receivables Trust, Series 2023-1A, Class D, 7.76%, 3/20/30 (144A) | 1,018,579 |

| 965,000 | Octane Receivables Trust, Series 2023-3A, Class D, 7.58%, 9/20/29 (144A) | 975,874 |

| 1,000,000 | Octane Receivables Trust, Series 2024-1A, Class D, 6.43%, 10/21/30 (144A) | 988,660 |

| 170,077 | Oportun Funding XIV LLC, Series 2021-A, Class C, 3.44%, 3/8/28 (144A) | 163,331 |

| 1,000,000 | Oportun Issuance Trust, Series 2021-C, Class C, 3.61%, 10/8/31 (144A) | 916,804 |

| 960,000 | Oportun Issuance Trust, Series 2024-1A, Class A, 6.334%, 4/8/31 (144A) | 960,597 |

| 1,160,000 | Oportun Issuance Trust, Series 2024-1A, Class B, 6.546%, 4/8/31 (144A) | 1,156,886 |

| 282,648 | Orange Lake Timeshare Trust, Series 2019-A, Class A, 3.06%, 4/9/38 (144A) | 274,692 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2421

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 319,121 | Orange Lake Timeshare Trust, Series 2019-A, Class D, 4.93%, 4/9/38 (144A) | $ 305,056 |

| 1,000,000(a) | Owl Rock CLO II, Ltd., Series 2019-2A, Class ALR, 7.129% (3 Month Term SOFR + 181 bps), 4/20/33 (144A) | 989,180 |

| 750,000 | Oxford Finance Credit Fund III LP, Series 2024-A, Class A2, 6.675%, 1/14/32 (144A) | 745,129 |

| 1,459,877 | Oxford Finance Funding LLC, Series 2022-1A, Class B, 4.096%, 2/15/30 (144A) | 1,366,873 |

| 676,168 | Pagaya AI Debt Trust, Series 2022-5, Class A, 8.096%, 6/17/30 (144A) | 683,904 |

| 1,424,279 | Pagaya AI Debt Trust, Series 2023-3, Class A, 7.60%, 12/16/30 (144A) | 1,432,252 |

| 364,220 | Pagaya AI Debt Trust, Series 2023-5, Class A, 7.179%, 4/15/31 (144A) | 365,318 |

| 2,050,000 | Pagaya AI Debt Trust, Series 2023-7, Class B, 7.549%, 7/15/31 (144A) | 2,062,100 |

| 1,800,000 | Pagaya AI Debt Trust, Series 2024-1, Class B, 7.109%, 7/15/31 (144A) | 1,810,232 |

| 470,000 | Pagaya AI Debt Trust, Series 2024-2, Class A, 6.319%, 8/15/31 (144A) | 470,592 |

| 250,000(a) | Palmer Square Loan Funding, Ltd., Series 2022-1A, Class C, 7.917% (3 Month Term SOFR + 260 bps), 4/15/30 (144A) | 246,510 |

| 750,000 | Pawneee Equipment Receivables Series LLC, Series 2021-1, Class D, 2.75%, 7/15/27 (144A) | 700,124 |

| 750,000 | Pawneee Equipment Receivables Series LLC, Series 2021-1, Class E, 5.21%, 5/15/28 (144A) | 699,346 |

| 434,130 | PEAR LLC, Series 2023-1, Class A, 7.42%, 7/15/35 (144A) | 437,002 |

| 1,160,000 | PEAR LLC, Series 2024-1, Class A, 6.95%, 2/15/36 (144A) | 1,160,000 |

| 850,000 | Post Road Equipment Finance LLC, Series 2024-1A, Class B, 5.58%, 10/15/30 (144A) | 847,957 |

| 710,000 | Post Road Equipment Finance LLC, Series 2024-1A, Class C, 5.81%, 10/15/30 (144A) | 708,052 |

| 400,000 | Post Road Equipment Finance LLC, Series 2024-1A, Class E, 8.50%, 12/15/31 (144A) | 384,376 |

| 1,880,000 | Prestige Auto Receivables Trust, Series 2023-2A, Class C, 7.12%, 8/15/29 (144A) | 1,927,120 |

| 670,000 | Purchasing Power Funding LLC, Series 2024-A, Class D, 7.26%, 8/15/28 (144A) | 670,803 |

| 700,000 | Purchasing Power Funding LLC, Series 2024-A, Class E, 10.18%, 8/15/28 (144A) | 699,429 |

The accompanying notes are an integral part of these financial statements.

22Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 2,400,000 | Reach Abs Trust, Series 2024-1A, Class B, 6.29%, 2/18/31 (144A) | $ 2,403,844 |

| 309,902(a) | ReadyCap Lending Small Business Loan Trust, Series 2019-2, Class A, 8.00% (PRIME - 50 bps), 12/27/44 (144A) | 308,921 |

| 990,669(a) | ReadyCap Lending Small Business Loan Trust, Series 2023-3, Class A, 8.57% (PRIME + 7 bps), 4/25/48 (144A) | 1,000,012 |

| 940,000 | Research-Driven Pagaya Motor Asset Trust, Series 2023-4A, Class A, 7.54%, 3/25/32 (144A) | 947,115 |

| 1,000,000(c) | RMF Buyout Issuance Trust, Series 2021-HB1, Class M3, 3.69%, 11/25/31 (144A) | 866,279 |

| 500,000(c) + | RMF Buyout Issuance Trust, Series 2022-HB1, Class M5, 4.50%, 4/25/32 (144A) | 97,000 |

| 500,000 | SAFCO Auto Receivables Trust, Series 2024-1A, Class C, 6.96%, 1/18/30 (144A) | 498,821 |

| 1,121,508(c) | Saluda Grade Alternative Mortgage Trust, Series 2023-FIG4, Class A, 6.718%, 11/25/53 (144A) | 1,146,484 |

| 1,365,000 | Santander Bank Auto Credit-Linked Notes, Series 2022-A, Class D, 9.965%, 5/15/32 (144A) | 1,399,822 |

| 1,100,000 | Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class E, 8.408%, 12/15/33 (144A) | 1,098,794 |

| 43,725 | Santander Bank N.A. - SBCLN, Series 2021-1A, Class C, 3.268%, 12/15/31 (144A) | 42,990 |

| 575,000 | Santander Bank N.A. - SBCLN, Series 2021-1A, Class D, 5.004%, 12/15/31 (144A) | 556,822 |

| 700,000 | Santander Bank N.A. - SBCLN, Series 2021-1A, Class E, 6.171%, 12/15/31 (144A) | 658,931 |

| 1,000,000 | Santander Drive Auto Receivables Trust, Series 2023-1, Class C, 5.09%, 5/15/30 | 987,086 |

| 1,000,000 | Santander Drive Auto Receivables Trust, Series 2023-6, Class C, 6.40%, 3/17/31 | 1,026,368 |

| 2,000,000(a) | Sound Point CLO V-R, Ltd., Series 2014-1RA, Class B, 7.31% (3 Month Term SOFR + 201 bps), 7/18/31 (144A) | 1,998,576 |

| 500,000(a) | Sound Point CLO XVI, Ltd., Series 2017-2A, Class D, 9.186% (3 Month Term SOFR + 386 bps), 7/25/30 (144A) | 495,080 |

| 260,277 | Stonepeak ABS, Series 2021-1A, Class AA, 2.301%, 2/28/33 (144A) | 242,060 |

| 17,803 | Structured Receivables Finance LLC, Series 2010-B, Class A, 3.73%, 8/15/36 (144A) | 17,476 |

| 951,945 | Tidewater Auto Receivables Trust, Series 2020-AA, Class D, 2.31%, 3/15/27 (144A) | 937,436 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2423

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 1,250,000 | Tidewater Auto Receivables Trust, Series 2020-AA, Class E, 3.35%, 7/17/28 (144A) | $ 1,204,137 |

| 4,182,772(c) | Towd Point Mortgage Trust, Series 2024-CES1, Class A1A, 5.848%, 1/25/64 (144A) | 4,176,891 |

| 1,250,000 | Trafigura Securitisation Finance Plc, Series 2021-1A, Class B, 1.78%, 1/15/25 (144A) | 1,196,200 |

| 371,935 | Tricolor Auto Securitization Trust, Series 2021-1A, Class E, 3.23%, 9/15/26 (144A) | 368,760 |

| 750,000 | Tricolor Auto Securitization Trust, Series 2022-1A, Class F, 9.80%, 7/16/29 (144A) | 731,245 |

| 1,090,000 | Tricolor Auto Securitization Trust, Series 2023-1A, Class D, 8.56%, 7/15/27 (144A) | 1,099,432 |

| 1,000,000 | Tricolor Auto Securitization Trust, Series 2024-1A, Class B, 6.53%, 12/15/27 (144A) | 996,280 |

| 820,000 | Tricolor Auto Securitization Trust, Series 2024-1A, Class D, 8.61%, 4/17/28 (144A) | 817,226 |

| 96,603 | TVEST LLC, Series 2021-A, Class A, 2.35%, 9/15/33 (144A) | 95,957 |

| 107,432 | Upstart Pass-Through Trust, Series 2021-ST4, Class A, 2.00%, 7/20/27 (144A) | 103,408 |

| 248,608 | Upstart Securitization Trust, Series 2020-1, Class C, 4.899%, 4/22/30 (144A) | 247,502 |

| 222,692 | US Bank NA, Series 2023-1, Class B, 6.789%, 8/25/32 (144A) | 224,101 |

| 879,432 | Verdant Receivables LLC, Series 2023-1A, Class A2, 6.24%, 1/13/31 (144A) | 880,400 |

| 1,000,000 | Veros Auto Receivables Trust, Series 2021-1, Class C, 3.64%, 8/15/28 (144A) | 986,180 |

| 830,000 | Veros Auto Receivables Trust, Series 2022-1, Class C, 5.03%, 8/16/27 (144A) | 813,378 |

| 100,000 | Veros Auto Receivables Trust, Series 2022-1, Class D, 7.23%, 7/16/29 (144A) | 98,557 |

| 500,000 | Veros Auto Receivables Trust, Series 2023-1, Class C, 8.32%, 11/15/28 (144A) | 518,522 |

| 327,000 | VFI ABS LLC, Series 2023-1A, Class C, 9.26%, 12/24/29 (144A) | 331,293 |

| 455,902 | Welk Resorts LLC, Series 2019-AA, Class D, 4.03%, 6/15/38 (144A) | 431,872 |

| 101,450 | Westgate Resorts LLC, Series 2020-1A, Class C, 6.213%, 3/20/34 (144A) | 100,747 |

| 848,772 | Westgate Resorts LLC, Series 2023-1A, Class C, 7.49%, 12/20/37 (144A) | 842,707 |

| 424,386 | Westgate Resorts LLC, Series 2023-1A, Class D, 10.14%, 12/20/37 (144A) | 425,369 |

The accompanying notes are an integral part of these financial statements.

24Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Asset Backed Securities — (continued) | |

| 1,265,000 | Westlake Automobile Receivables Trust, Series 2023-1A, Class D, 6.79%, 11/15/28 (144A) | $ 1,284,562 |

| 350,000 | Westlake Automobile Receivables Trust, Series 2023-2A, Class D, 7.01%, 11/15/28 (144A) | 355,349 |

| 900,000(a) | Westlake Automobile Receivables Trust, Series 2023-3A, Class A2B, 5.995% (SOFR30A + 67 bps), 10/15/26 (144A) | 901,264 |

| 1,000,000 | Westlake Automobile Receivables Trust, Series 2023-4A, Class C, 6.64%, 11/15/28 (144A) | 1,017,449 |

| 677,296 | Willis Engine Structured Trust VI, Series 2021-A, Class B, 5.438%, 5/15/46 (144A) | 515,255 |

| 956,534(a) | Woodmont Trust, Series 2023-12A, Class A1A, 7.825% (3 Month Term SOFR + 250 bps), 7/25/31 (144A) | 959,839 |

| 1,000,000(a) | Z Capital Credit Partners CLO, Ltd., Series 2019-1A, Class BR, 7.576% (3 Month Term SOFR + 226 bps), 7/16/31 (144A) | 1,003,605 |

| 1,000,000(a) | Z Capital Credit Partners CLO, Ltd., Series 2019-1A, Class DR, 10.576% (3 Month Term SOFR + 526 bps), 7/16/31 (144A) | 970,315 |

| | Total Asset Backed Securities

(Cost $199,367,488) | $ 197,660,667 |

|

|

| | Collateralized Mortgage

Obligations—9.5% of Net Assets | |

| 5,860(c) | Bear Stearns Mortgage Securities, Inc., Series 1997-6, Class 3B1, 5.021%, 6/25/30 | $ 5,836 |

| 864,245(a) | Bellemeade Re, Ltd., Series 2019-1A, Class M2, 8.135% (1 Month Term SOFR + 281 bps), 3/25/29 (144A) | 869,464 |

| 2,000,000(a) | Bellemeade Re, Ltd., Series 2019-3A, Class B1, 7.935% (1 Month Term SOFR + 261 bps), 7/25/29 (144A) | 2,004,885 |

| 850,000(a) | Bellemeade Re, Ltd., Series 2021-3A, Class A2, 6.322% (SOFR30A + 100 bps), 9/25/31 (144A) | 844,896 |

| 500,000(a) | Bellemeade Re, Ltd., Series 2022-1, Class M1C, 9.022% (SOFR30A + 370 bps), 1/26/32 (144A) | 507,157 |

| 114,237(c) | BRAVO Residential Funding Trust, Series 2020-NQM1, Class A3, 2.406%, 5/25/60 (144A) | 108,843 |

| 2,767,755(c) | Cascade Funding Mortgage Trust, Series 2018-RM2, Class D, 4.00%, 10/25/68 (144A) | 2,379,488 |

| 1,000,000(c) | CFMT LLC, Series 2022-HB8, Class M3, 3.75%, 4/25/25 (144A) | 866,700 |

| 1,138,854(a) | Chase Mortgage Finance Corp., Series 2021-CL1, Class M3, 6.872% (SOFR30A + 155 bps), 2/25/50 (144A) | 1,077,664 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2425

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 676,213(c) | CHNGE Mortgage Trust, Series 2022-1, Class A1, 3.007%, 1/25/67 (144A) | $ 613,520 |

| 324 | Citigroup Mortgage Loan Trust, Inc., Series 2003-UP3, Class A1, 7.00%, 9/25/33 | 342 |

| 857,460(a) | Connecticut Avenue Securities Trust, Series 2019-HRP1, Class M2, 7.586% (SOFR30A + 226 bps), 11/25/39 (144A) | 864,307 |

| 684,781(a) | Connecticut Avenue Securities Trust, Series 2019-R06, Class 2B1, 9.186% (SOFR30A + 386 bps), 9/25/39 (144A) | 710,180 |

| 1,040,000(a) | Connecticut Avenue Securities Trust, Series 2020-SBT1, Class 1M2, 9.086% (SOFR30A + 376 bps), 2/25/40 (144A) | 1,094,451 |

| 2,130,000(a) | Connecticut Avenue Securities Trust, Series 2020-SBT1, Class 2M2, 9.086% (SOFR30A + 376 bps), 2/25/40 (144A) | 2,240,858 |

| 330,000(a) | Connecticut Avenue Securities Trust, Series 2022-R01, Class 1M2, 7.222% (SOFR30A + 190 bps), 12/25/41 (144A) | 332,278 |

| 810,000(a) | Connecticut Avenue Securities Trust, Series 2022-R02, Class 2M2, 8.322% (SOFR30A + 300 bps), 1/25/42 (144A) | 830,695 |

| 370,370(a) | Connecticut Avenue Securities Trust, Series 2022-R09, Class 2M1, 7.821% (SOFR30A + 250 bps), 9/25/42 (144A) | 376,371 |

| 771,713(a) | Connecticut Avenue Securities Trust, Series 2023-R01, Class 1M1, 7.721% (SOFR30A + 240 bps), 12/25/42 (144A) | 790,374 |

| 84,642(a) | Connecticut Avenue Securities Trust, Series 2023-R02, Class 1M1, 7.622% (SOFR30A + 230 bps), 1/25/43 (144A) | 86,498 |

| 613,159(a) | Connecticut Avenue Securities Trust, Series 2023-R03, Class 2M1, 7.822% (SOFR30A + 250 bps), 4/25/43 (144A) | 623,482 |

| 197,734(a) | Connecticut Avenue Securities Trust, Series 2023-R06, Class 1M1, 7.022% (SOFR30A + 170 bps), 7/25/43 (144A) | 199,209 |

| 461,990(a) | Connecticut Avenue Securities Trust, Series 2024-R01, Class 1M1, 6.372% (SOFR30A + 105 bps), 1/25/44 (144A) | 462,095 |

| 89,802 | Credit Suisse First Boston Mortgage Securities Corp., Series 2002-10, Class 2A1, 7.50%, 5/25/32 | 90,865 |

The accompanying notes are an integral part of these financial statements.

26Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 810,000(a) | Eagle Re, Ltd., Series 2021-2, Class M2, 9.572% (SOFR30A + 425 bps), 4/25/34 (144A) | $ 832,945 |

| 640,000(a) | Eagle Re, Ltd., Series 2023-1, Class M1A, 7.322% (SOFR30A + 200 bps), 9/26/33 (144A) | 642,054 |

| 630,000(a) | Eagle Re, Ltd., Series 2023-1, Class M1B, 9.272% (SOFR30A + 395 bps), 9/26/33 (144A) | 648,700 |

| 1,000,000(c) | Ellington Financial Mortgage Trust, Series 2020-1, Class A3, 3.999%, 5/25/65 (144A) | 926,698 |

| 137,533(c) | Fannie Mae Grantor Trust, Series 2004-T2, Class 2A, 4.582%, 7/25/43 | 136,474 |

| 145,040(a) | Fannie Mae Trust, Series 2005-W3, Class 2AF, 5.656% (SOFR30A + 33 bps), 3/25/45 | 143,636 |

| 43,918(c) | Fannie Mae Trust, Series 2005-W3, Class 3A, 4.264%, 4/25/45 | 41,893 |

| 31,663(c) | Fannie Mae Trust, Series 2005-W4, Class 3A, 4.216%, 6/25/45 | 30,634 |

| 92,862(a) | Fannie Mae Whole Loan, Series 2007-W1, Class 1AF1, 5.696% (SOFR30A + 37 bps), 11/25/46 | 91,947 |

| 25,695(a) | Federal Home Loan Mortgage Corp. REMICs, Series 2439, Class F, 6.439% (SOFR30A + 111 bps), 3/15/32 | 25,957 |

| 40,537(a) | Federal Home Loan Mortgage Corp. REMICs, Series 2470, Class AF, 6.439% (SOFR30A + 111 bps), 3/15/32 | 40,939 |

| 14,083(a) | Federal Home Loan Mortgage Corp. REMICs, Series 2916, Class NF, 5.689% (SOFR30A + 36 bps), 1/15/35 | 13,963 |

| 8,486(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3042, Class PF, 5.689% (SOFR30A + 36 bps), 8/15/35 | 8,427 |

| 4,629(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3102, Class FG, 5.739% (SOFR30A + 41 bps), 1/15/36 | 4,578 |

| 30,175(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3117, Class FE, 5.739% (SOFR30A + 41 bps), 2/15/36 | 29,738 |

| 14,061(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3173, Class FC, 5.859% (SOFR30A + 53 bps), 6/15/36 | 13,807 |

| 32,621(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3181, Class HF, 5.939% (SOFR30A + 61 bps), 7/15/36 | 32,254 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2427

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 29,278(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3239, Class EF, 5.789% (SOFR30A + 46 bps), 11/15/36 | $ 28,761 |

| 13,459(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3239, Class FB, 5.789% (SOFR30A + 46 bps), 11/15/36 | 13,229 |

| 53,007(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3373, Class FB, 6.019% (SOFR30A + 69 bps), 10/15/37 | 52,499 |

| 43,907(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3610, Class FA, 6.139% (SOFR30A + 81 bps), 12/15/39 | 43,787 |

| 11,509(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3868, Class FA, 5.839% (SOFR30A + 51 bps), 5/15/41 | 11,308 |

| 2,943(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3914, Class LF, 5.639% (SOFR30A + 31 bps), 8/15/26 | 2,939 |

| 134(a) | Federal Home Loan Mortgage Corp. REMICs, Series 3970, Class GF, 5.739% (SOFR30A + 41 bps), 9/15/26 | 134 |

| 76(a) | Federal National Mortgage Association REMICs, Series 1994-40, Class FC, 5.936% (SOFR30A + 61 bps), 3/25/24 | 76 |

| 10,724(a) | Federal National Mortgage Association REMICs, Series 2001-72, Class FB, 6.336% (SOFR30A + 101 bps), 12/25/31 | 10,778 |

| 7,713(a) | Federal National Mortgage Association REMICs, Series 2001-81, Class FL, 6.089% (SOFR30A + 76 bps), 1/18/32 | 7,705 |

| 11,599(a) | Federal National Mortgage Association REMICs, Series 2002-93, Class FH, 5.936% (SOFR30A + 61 bps), 1/25/33 | 11,569 |

| 14,743(a) | Federal National Mortgage Association REMICs, Series 2003-42, Class JF, 5.936% (SOFR30A + 61 bps), 5/25/33 | 14,644 |

| 16,944(a) | Federal National Mortgage Association REMICs, Series 2003-8, Class FJ, 5.786% (SOFR30A + 46 bps), 2/25/33 | 16,897 |

| 21,310(a) | Federal National Mortgage Association REMICs, Series 2004-52, Class FW, 5.836% (SOFR30A + 51 bps), 7/25/34 | 21,209 |

The accompanying notes are an integral part of these financial statements.

28Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 26,344(a) | Federal National Mortgage Association REMICs, Series 2005-83, Class KT, 5.736% (SOFR30A + 41 bps), 10/25/35 | $ 26,005 |

| 22,436(a) | Federal National Mortgage Association REMICs, Series 2005-83, Class LF, 5.746% (SOFR30A + 42 bps), 2/25/35 | 22,322 |

| 29,519(a) | Federal National Mortgage Association REMICs, Series 2006-42, Class CF, 5.886% (SOFR30A + 56 bps), 6/25/36 | 29,240 |

| 5,691(a) | Federal National Mortgage Association REMICs, Series 2006-82, Class F, 6.006% (SOFR30A + 68 bps), 9/25/36 | 5,641 |

| 7,841(a) | Federal National Mortgage Association REMICs, Series 2007-110, Class FA, 6.056% (SOFR30A + 73 bps), 12/25/37 | 7,766 |

| 11,112(a) | Federal National Mortgage Association REMICs, Series 2007-13, Class FA, 5.686% (SOFR30A + 36 bps), 3/25/37 | 10,786 |

| 13,864(a) | Federal National Mortgage Association REMICs, Series 2007-2, Class FT, 5.686% (SOFR30A + 36 bps), 2/25/37 | 13,493 |

| 6,715(a) | Federal National Mortgage Association REMICs, Series 2007-41, Class FA, 5.836% (SOFR30A + 51 bps), 5/25/37 | 6,602 |

| 37,251(a) | Federal National Mortgage Association REMICs, Series 2007-50, Class FN, 5.676% (SOFR30A + 35 bps), 6/25/37 | 36,585 |

| 30,799(a) | Federal National Mortgage Association REMICs, Series 2007-7, Class FJ, 5.636% (SOFR30A + 31 bps), 2/25/37 | 30,233 |

| 11,048(a) | Federal National Mortgage Association REMICs, Series 2007-92, Class OF, 6.006% (SOFR30A + 68 bps), 9/25/37 | 10,983 |

| 24,743(a) | Federal National Mortgage Association REMICs, Series 2008-88, Class FA, 6.656% (SOFR30A + 133 bps), 10/25/38 | 25,167 |

| 848,002(a) | Freddie Mac STACR REMIC Trust, Series 2021-DNA5, Class M2, 6.972% (SOFR30A + 165 bps), 1/25/34 (144A) | 857,906 |

| 248,708(a) | Freddie Mac STACR REMIC Trust, Series 2021-DNA7, Class M1, 6.172% (SOFR30A + 85 bps), 11/25/41 (144A) | 248,328 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2429

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 1,000,000(a) | Freddie Mac STACR REMIC Trust, Series 2021-HQA2, Class M2, 7.372% (SOFR30A + 205 bps), 12/25/33 (144A) | $ 1,011,685 |

| 1,300,000(a) | Freddie Mac STACR REMIC Trust, Series 2021-HQA3, Class M2, 7.422% (SOFR30A + 210 bps), 9/25/41 (144A) | 1,305,501 |

| 1,144,022(a) | Freddie Mac STACR REMIC Trust, Series 2021-HQA4, Class M1, 6.272% (SOFR30A + 95 bps), 12/25/41 (144A) | 1,138,167 |

| 310,000(a) | Freddie Mac STACR REMIC Trust, Series 2022-DNA1, Class M1B, 7.172% (SOFR30A + 185 bps), 1/25/42 (144A) | 310,962 |

| 1,835,000(a) | Freddie Mac STACR REMIC Trust, Series 2022-DNA1, Class M2, 7.822% (SOFR30A + 250 bps), 1/25/42 (144A) | 1,853,919 |

| 1,000,000(a) | Freddie Mac STACR REMIC Trust, Series 2022-DNA2, Class M2, 9.072% (SOFR30A + 375 bps), 2/25/42 (144A) | 1,043,440 |

| 1,500,000(a) | Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class M2, 9.672% (SOFR30A + 435 bps), 4/25/42 (144A) | 1,595,160 |

| 177,175(a) | Freddie Mac STACR REMIC Trust, Series 2022-DNA6, Class M1A, 7.472% (SOFR30A + 215 bps), 9/25/42 (144A) | 178,947 |

| 232,627(a) | Freddie Mac STACR REMIC Trust, Series 2022-HQA3, Class M1A, 7.622% (SOFR30A + 230 bps), 8/25/42 (144A) | 237,613 |

| 246,043(a) | Freddie Mac STACR REMIC Trust, Series 2023-HQA1, Class M1A, 7.322% (SOFR30A + 200 bps), 5/25/43 (144A) | 248,615 |

| 17,274(a) | Freddie Mac STRIPS, Series 237, Class F14, 5.839% (SOFR30A + 51 bps), 5/15/36 | 17,029 |

| 40,414(a) | Freddie Mac STRIPS, Series 239, Class F30, 5.739% (SOFR30A + 41 bps), 8/15/36 | 39,912 |

| 15,254(a) | Freddie Mac STRIPS, Series 244, Class F22, 5.789% (SOFR30A + 46 bps), 12/15/36 | 15,076 |

| 658,893(a) | Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2017-HRP1, Class M2D, 6.686% (SOFR30A + 136 bps), 12/25/42 | 660,789 |

| 257,537(a) | Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2021-DNA2, Class M2, 7.622% (SOFR30A + 230 bps), 8/25/33 (144A) | 262,817 |

The accompanying notes are an integral part of these financial statements.

30Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 775,983(a) | Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2023-DNA2, Class M1A, 7.422% (SOFR30A + 210 bps), 4/25/43 (144A) | $ 790,721 |

| 534,353(a) | Freddie Mac Structured Agency Credit Risk Debt Notes, Series 2023-HQA2, Class M1A, 7.322% (SOFR30A + 200 bps), 6/25/43 (144A) | 538,863 |

| 867,946(d) | GCAT Trust, Series 2022-NQM4, Class A3, 5.73%, 8/25/67 (144A) | 860,480 |

| 44,570(a) | Government National Mortgage Association, Series 2005-16, Class FA, 5.684% (1 Month Term SOFR + 36 bps), 2/20/35 | 44,123 |

| 44,879(a) | Government National Mortgage Association, Series 2005-3, Class FC, 5.686% (1 Month Term SOFR + 36 bps), 1/16/35 | 44,559 |

| 455,187(a) | Home Re, Ltd., Series 2019-1, Class M1, 7.086% (SOFR30A + 176 bps), 5/25/29 (144A) | 455,270 |

| 670,000(a) | Home Re, Ltd., Series 2021-1, Class M2, 8.286% (SOFR30A + 296 bps), 7/25/33 (144A) | 673,574 |

| 624,875(a) | Home Re, Ltd., Series 2022-1, Class M1A, 8.172% (SOFR30A + 285 bps), 10/25/34 (144A) | 629,515 |

| 250,000(a) | Home Re, Ltd., Series 2023-1, Class M1A, 7.472% (SOFR30A + 215 bps), 10/25/33 (144A) | 250,554 |

| 310,000(a) | Home Re, Ltd., Series 2023-1, Class M1B, 9.922% (SOFR30A + 460 bps), 10/25/33 (144A) | 320,697 |

| 400,000(c) | Imperial Fund Mortgage Trust, Series 2021-NQM2, Class M1, 2.489%, 9/25/56 (144A) | 262,096 |

| 400,000 | IMS Ecuadorian Mortgage Trust, Series 2021-1, Class GA, 3.40%, 8/18/43 (144A) | 368,000 |

| 16,873(c) | IndyMac INDX Mortgage Loan Trust, Series 2004-AR6, Class 6A1, 5.293%, 10/25/34 | 15,396 |

| 127,616(a) | JP Morgan Seasoned Mortgage Trust, Series 2014-1, Class AM, 5.935% (1 Month Term SOFR + 61 bps), 5/25/33 (144A) | 122,843 |

| 620,000(d) | LHOME Mortgage Trust, Series 2024-RTL1, Class A1, 7.017%, 1/25/29 (144A) | 619,809 |

| 771(c) | Merrill Lynch Mortgage Investors Trust, Series 2003-G, Class A3, 7.625%, 1/25/29 | 743 |

| 65,364(a) | Merrill Lynch Mortgage Investors Trust, Series 2003-H, Class A1, 6.075% (1 Month Term SOFR + 75 bps), 1/25/29 | 57,163 |

| 725,000(d) | MFA Trust, Series 2023-RTL2, Class A1, 8.498%, 11/25/28 (144A) | 734,598 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/29/2431

Schedule of Investments | 2/29/24

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 610,000(d) | MFA Trust, Series 2024-RTL1, Class A1, 7.093%, 2/25/29 (144A) | $ 612,691 |

| 162,016(c) | New Residential Mortgage Loan Trust, Series 2019-NQM4, Class A1, 2.492%, 9/25/59 (144A) | 149,071 |

| 1,350,000(a) | Oaktown Re III, Ltd., Series 2019-1A, Class B1A, 8.936% (SOFR30A + 361 bps), 7/25/29 (144A) | 1,359,882 |

| 163,465(a) | Oaktown Re III, Ltd., Series 2019-1A, Class M1B, 7.386% (SOFR30A + 206 bps), 7/25/29 (144A) | 163,699 |

| 223,892(a) | Oaktown Re V, Ltd., Series 2020-2A, Class M2, 10.686% (SOFR30A + 536 bps), 10/25/30 (144A) | 227,875 |

| 450,000(c) | Oceanview Mortgage Loan Trust, Series 2020-1, Class A3, 3.285%, 5/28/50 (144A) | 368,992 |

| 480,000 | Ocwen Loan Investment Trust, Series 2024-HB1, Class M2, 3.00%, 2/25/37 (144A) | 409,754 |

| 2,000,000 | Ocwen Loan Investment Trust, Series 2024-HB1, Class M3, 3.00%, 2/25/37 (144A) | 1,616,537 |

| 1,471,154(a) | PNMAC GMSR Issuer Trust, Series 2018-GT2, Class A, 8.836% (1 Month Term SOFR + 351 bps), 8/25/25 (144A) | 1,478,180 |

| 30,971(a) | Radnor Re, Ltd., Series 2021-1, Class M1B, 7.022% (SOFR30A + 170 bps), 12/27/33 (144A) | 30,981 |

| 630,000(a) | Radnor Re, Ltd., Series 2021-1, Class M2, 8.472% (SOFR30A + 315 bps), 12/27/33 (144A) | 635,501 |

| 1,900,000(a) | Radnor Re, Ltd., Series 2021-2, Class M1B, 9.022% (SOFR30A + 370 bps), 11/25/31 (144A) | 1,943,076 |

| 810,000(a) | Radnor Re, Ltd., Series 2023-1, Class M1A, 8.022% (SOFR30A + 270 bps), 7/25/33 (144A) | 817,065 |

| 460,000(a) | Radnor Re, Ltd., Series 2023-1, Class M1B, 9.672% (SOFR30A + 435 bps), 7/25/33 (144A) | 475,259 |

| 206,539(a) | RESI Finance LP, Series 2003-CB1, Class B3, 6.882% (1 Month Term SOFR + 156 bps), 6/10/35 (144A) | 172,761 |

| 635,191(c) | RMF Proprietary Issuance Trust, Series 2019-1, Class A, 2.75%, 10/25/63 (144A) | 530,865 |

| 380,000(d) | Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1, 7.50%, 2/25/30 (144A) | 380,646 |

| 280,000(c) | Seasoned Credit Risk Transfer Trust, Series 2019-3, Class M, 4.75%, 10/25/58 | 262,885 |

| 874(c) | Spruce Hill Mortgage Loan Trust, Series 2020-SH1, Class A1, 2.521%, 1/28/50 (144A) | 869 |

| 3,140,000(c) | Towd Point Mortgage Trust, Series 2024-CES2, Class A1A, 6.125%, 2/25/64 (144A) | 3,144,751 |

| 141,479(a) | Triangle Re, Ltd., Series 2021-1, Class M2, 9.335% (1 Month Term SOFR + 401 bps), 8/25/33 (144A) | 141,940 |

The accompanying notes are an integral part of these financial statements.

32Pioneer Short Term Income Fund | Semiannual Report | 2/29/24

Principal

Amount

USD ($) | | | | | | Value |

| | Collateralized Mortgage

Obligations—(continued) | |

| 169,733(a) | Triangle Re, Ltd., Series 2021-2, Class M1B, 8.035% (1 Month Term SOFR + 271 bps), 10/25/33 (144A) | $ 169,885 |

| 1,150,000(a) | Triangle Re, Ltd., Series 2021-3, Class M1B, 8.222% (SOFR30A + 290 bps), 2/25/34 (144A) | 1,156,012 |

| 1,360,000(a) | Triangle Re, Ltd., Series 2023-1, Class M1A, 8.722% (SOFR30A + 340 bps), 11/25/33 (144A) | 1,386,523 |

| 2,000,000(c) | Visio Trust, Series 2019-2, Class M1, 3.26%, 11/25/54 (144A) | 1,744,198 |

| 142,608(c) | Vista Point Securitization Trust, Series 2020-2, Class A3, 2.496%, 4/25/65 (144A) | 130,246 |

| | Total Collateralized Mortgage Obligations

(Cost $60,060,865) | $59,430,474 |

|

|

| | Commercial Mortgage-Backed

Securities—3.9% of Net Assets | |

| 1,160,000(a) | Arbor Realty Commercial Real Estate Notes, Ltd., Series 2022-FL2, Class A, 7.168% (1 Month Term SOFR + 185 bps), 5/15/37 (144A) | $ 1,148,762 |