visit us: www.amundi.com/us

| | |

| |

| 2 |

| 4 |

| 10 |

| 11 |

| 12 |

| 17 |

| 19 |

| 56 |

| 65 |

| 79 |

| 84 |

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 1

President’s LetterDear Shareholders,

The first quarter of 2021 has brought some better news on the COVID-19 global pandemic front, as the deployment of the first approved COVID-19 vaccines is well underway, with expectations for widespread vaccine distribution by the middle of the year. In general, COVID-19 cases and related hospitalizations have been on the decline in the US, despite a few problematic “hot spots” in some states, and that has had a positive effect on overall market sentiment.

While there may finally be a light visible at the end of the pandemic tunnel, the long-term impact on the global economy from COVID-19, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others, and the markets, which do not thrive on uncertainty, have been volatile. With that said, in the first few months of 2021, equity markets and other so-called “riskier” assets, such as high-yield bonds, have outperformed investments regarded as less risky, such as government debt. In addition, we’ve witnessed the long-awaited rebound in the performance of cyclical stocks, or stocks of companies with greater exposure to the ebbs and flows of the economic cycle, as investors have appeared to embrace the potential for a more widespread reopening of the economy in the coming months. Additional fiscal stimulus from the US government in recent months has also helped provide some market momentum.

However, despite the dramatic market rebound since its March 2020 low point, volatility has remained elevated, with momentum rising and falling on seemingly every bit of positive or negative news about the virus. In addition, the recent US Presidential and Congressional elections have resulted in a power shift in Washington, DC, and that most likely portends some changes in fiscal policy above and beyond just additional pandemic-related stimulus. That, too, could lead to increased market volatility as investors analyze the various tax and spending plans, and wait to see what proposed policy alterations actually become law.

With the advent of COVID-19 in early 2020, we implemented our business continuity plan according to the new COVID-19 guidelines, and most of our employees have been working remotely since March 2020. To date, our operating environment has faced no interruption. I am proud of the careful planning that has taken place and confident we can maintain this environment for as long as is prudent. History in the making for a company that first opened its doors way back in 1928.

2 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Since 1928, Amundi US’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the risks during periods of market volatility. As 2020 has reminded us, investment risk can arise from a number of factors in today’s global economy, including slower or stagnating growth, changing U.S. Federal Reserve policy, oil price shocks, political and geopolitical factors and, unfortunately, major public health concerns such as a viral pandemic.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress.

As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We remain confident that the current crisis, like others in human history, will pass, and we greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

April 2021

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 3

Portfolio Management Discussion |

2/28/21 In the following interview, portfolio managers Seth Roman, Noah Funderburk, and Nicolas Pauwels discuss the factors that influenced Pioneer Short Term Income Fund’s performance during the six-month period ended February 28, 2021. Mr. Roman, a vice president and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), Mr. Funderburk, a vice president and portfolio manager at Amundi US, and Mr. Pauwels, a vice president and portfolio manager at Amundi US, are responsible for the day-to-day management of the Fund.

Q How did the Fund perform during the six-month period ended February 28, 2021?

A Pioneer Short Term Income Fund’s Class A shares returned 3.44% at net asset value during the six-month period ended February 28, 2021, while the Fund’s benchmark, the Bloomberg Barclays One- to Three-Year Government/Credit Bond Index (the Bloomberg Barclays Index), returned 0.22%. During the same period, the average return of the 588 mutual funds in Morningstar’s Short-Term Bond Funds category was 1.15%.

Q Can you describe the market environment for fixed-income investors over the six-month period ended February 28, 2021?

A After simmering throughout the summer, macroeconomic uncertainty bubbled over during September of 2020, weighing on investor sentiment and the performance of so-called riskier assets. The focus on heightened macro risks revolved around three key areas: negotiations over another round of fiscal stimulus from the US government; COVID-19 cases and the pandemic situation at large; and the November US elections.

Regarding the status of new US fiscal legislation, a partisan dispute over when to appoint Supreme Court Justice Ginsburg’s replacement further hardened both parties’ negotiating positions and lowered the odds of broad fiscal support for the economy prior to the November election. Specific to COVID-19 risks, a notable uptick in European cases at that time had reignited concerns that the US remained at risk for another serious “wave” of cases with the arrival of cooler fall temperatures, which would come with the potential for a new round of state-mandated lockdowns and the associated negative effects on the economy. Lastly, the US election picture had been clouded with not only the typical uncertainty of any election season, but also concerns about the potential for a protracted dispute over the results of the presidential contest.

By the last month of the period, in February 2021, macroeconomic data and news headlines had turned largely positive, as investors keyed in on the development and deployment of the first COVID-19 vaccines, a rapid

4 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

decline in daily diagnosed cases of the virus, the corporate earnings season, and the steady progress made on another significant, albeit partisan, US fiscal stimulus bill in the wake of the Democratic Party’s taking control of the White House and both houses of Congress in January.

Market movements, however, told a “tale of two halves” during February. In the first two weeks of the month, investors seemed to appropriately price in an improved near-term economic growth outlook, leading both domestic equity prices and US Treasury yields to move higher. But, as the month progressed, market participants began to look beyond the better economic growth prospects and contemplated a more rapid path to a normalization of the extremely accommodative monetary policies enacted by the US Federal Reserve (Fed) in early 2020 to help combat the effects of the pandemic on the economy and the financial markets. The Fed had not indicated any plans to remove accommodation in the near term, but Treasury yields rose and equities generally declined anyway, in a market move somewhat reminiscent of 2013’s “taper tantrum,” which had followed the Fed’s announcement of its intention to gradually reduce the bond purchases that it had been making in the wake of the 2008-2009 financial crisis.

Q Can you review your principal investment strategies in managing the Fund during the six-month period ended February 28, 2021, and discuss how they affected benchmark-relative performance?

A The Fund’s significant underweight to Treasuries was a leading positive contributor to benchmark-relative returns during the six-month period, as credit-oriented assets outperformed interest-rate sensitive investments such as government debt. We continue to believe that short-term US Treasuries have offered little value to investors given the low yields available.

The Fund’s overweighting of a broad range of securitized assets also aided relative returns for the six-month period. These included allocations to asset-backed securities (ABS), residential-mortgage-backed securities (RMBS), and commercial mortgage-backed securities (CMBS). The Fund’s ABS exposures benefited relative performance as short-term issues within the ABS sector have continued to provide incremental income compared with short-term corporate bonds. Most notably, non-AAA-rated ABS have continued to trade at wider spreads versus their pre-pandemic levels, and have attracted strong investor demand. (Credit spreads are commonly defined as the differences in yield between Treasuries and other types of fixed-income securities with similar maturities.) US consumers have continued to demonstrate strength, with

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 5

a 40-year high savings rate and incomes (even without fiscal stimulus) in excess of pre-COVID-19 levels. In addition, banks have continued to release reserves due to better-than-expected loss experience on both their credit card and auto loan exposures.

The Fund’s allocation to non-agency RMBS also had a positive effect on benchmark-relative performance. Particularly helpful in that area was the portfolio’s exposure to credit-risk-transfer securities (CRT), which transfer a portion of the risk associated with credit losses within pools of conventional residential mortgage loans from government-sponsored entities to the private sector. RMBS have benefited from a strong housing market and a continued decline in the proportion of mortgages in forbearance. As period-end, the Case-Schiller Home Price Index had registered a 9.4% year-over-year improvement in housing prices, the best performance since 2014.

The Fund’s allocation to CMBS was another positive contributor to relative returns during the six-month period, as spreads for the sector have continued to narrow. We have emphasized relatively low loan-to-value ratios when investing the Fund in the CMBS sector, and we believe the portfolio’s well-diversified* exposure to CMBS could position the Fund to benefit from a broader reopening of the economy later in 2021. Within CMBS, the Fund’s exposures to hotels have fared well due to recovering industry revenues, particularly within the economy hotels segment, where revenues have returned to pre-pandemic levels. In a typical economic rebound, economy hotel revenues have recovered first, followed by travel/leisure hotel revenues and, finally, business hotel revenues.

The Fund’s overweights to floating-rate bank loans and collateralized loan obligations (CLOs) also aided relative returns during the period, as bank loans performed well due to increased CLO issuance. Loans had lagged the recovery in high-yield corporates following the dramatic market struggles during the first quarter of 2020, and investors had seen attractive relative value in the sector. In addition, the floating-rate feature of loans has been viewed favorably, given the potential for longer-term Treasury yields to rise in 2021.

The Fund’s overweights to financials and industrials within its allocation to investment-grade corporate credit had a positive impact on relative performance for the six-month period. The allocations benefited from the continued global demand for yield. We believe that strong demand and moderating supply may lead to a continued narrowing of short-term corporates spreads, thus potentially shrinking available yields.

* Diversification does not assure a profit nor protect against loss.

6 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Insurance-linked securities (ILS) were another portfolio allocation that made a notable positive contribution to the Fund’s relative performance over the six-month period. ILS returns are uncorrelated to the returns of other fixed-income assets, and we have viewed exposure to the incremental yield and diversification benefits of the ILS sector as a potential enhancer of the portfolio’s risk/reward profile.

Given the Fund’s strong relative outperformance, there were few detractors from returns versus the Bloomberg Barclays Index during the six-month period, but the portfolio’s overweight to agency mortgage-backed securities (MBS) did act as a slight drag on relative performance. The increase in 10-year Treasury yields from 0.92% in December 2020 to 1.29% in February 2021 raised fears of extension risk – or the risk that homeowners would be discouraged from refinancing their mortgages, thus reducing the flow of prepayments and possibly extending the duration of the loans in the MBS market – in light of the sector’s relatively low average spread and duration. In our view, however, the factors that would contribute to declining prepayments and significant extension risk in agency MBS have not been in place. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed-income investment to changes in interest rates, expressed as a number of years.)

Q Can you discuss the factors that affected the Fund’s income-generation (or yield), either positively or negatively, during the six-month period ended February 28, 2021?

A Credit spreads narrowed over the period, thus reducing the Fund’s income-generation. However, we believe the income-generation of the Fund relative to alternative investment options has remained attractive, given the continued low-interest-rate environment.

Q Did the Fund have any exposure to derivatives during the six-month period ended February 28, 2021? If so, did the derivatives have an effect on the Fund’s performance?

A We employed derivatives to help manage the overall duration of the portfolio. With the general decline in interest rates during the six-month period, the Fund’s below-benchmark duration stance detracted from relative performance.

Q What is your assessment of the current climate for fixed-income investing?

A By the end of February, the Eurodollar futures curve was pricing in a 0.25% increase in the federal funds rate target range by December of 2022, and 0.90% in cumulative rate hikes by December of 2023. When we

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 7

consider the Fed’s stated goal of attaining maximum US employment, inflation outlook, and its newly adopted tolerance of short-term inflation overshoots relative to the long-term target of 2%, we view the recent shift in investor expectations regarding interest-rate policy as premature. With respect to inflation, the Fed has been delivering two key messages. First, near-term increases in goods and services prices are likely to be transitory, and so the Fed will only adjust policy in response to sustained price increases. Second, the Fed will not raise the federal funds target range until inflation has exceeded 2% on a sustained basis (that is, for at least 12 months). Based on our current expectations, we feel it is unlikely that the Fed’s inflation and maximum employment targets will both be met by the end of 2022.

We do believe, however, that elevated interest-rate volatility will persist over the near term. As investors’ economic growth expectations build through the calendar year, the Fed’s commitment to its new inflation targeting framework may be tested. While the Fed has control over short-term risk-free rates, it has less control over long-term risk-free rates, and often relies on communications and asset purchases to implement policy. The Fed has not indicated concern over the recent rise in intermediate-and long-term Treasury yields, but may respond if higher intermediate rates ultimately tighten financial conditions and reduce the impact of the current and quite accommodative monetary policy stance.

As always, we will continue to monitor macroeconomic factors that have the potential to affect the markets, while remaining principally focused on adding value to the portfolio through individual security selection.

Please refer to the Schedule of Investments on pages 19–55 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

When interest rates rise, the prices of fixed-income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed-income securities held by the Fund will generally rise.

8 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Investments in the Fund are subject to possible loss due to the financial failure of the issuers of the underlying securities and their inability to meet their debt obligations.

Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.

Investments in high-yield or lower-rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.

The securities issued by U.S. government sponsored entities (i.e. Fannie Mae, Freddie Mac) are neither guaranteed nor issued by the U.S. government.

The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

At times, the Fund’s investments may represent industries or industry sectors that are interrelated or have common risks, making the Fund more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors.

These risks may increase share price volatility.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your financial professional or Amundi Asset Management US, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is not a guarantee of future results.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 9

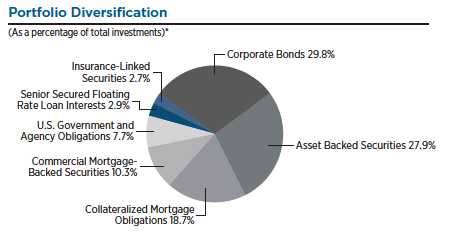

Portfolio Summary |

2/28/21

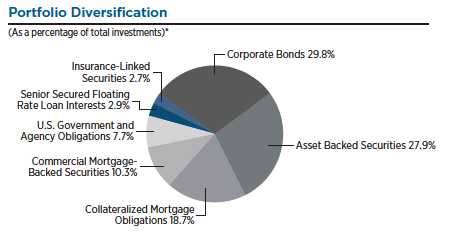

| | | |

| 10 Largest Holdings | |

(As a percentage of total investments)* | |

| 1. | U.S. Treasury Bills, 3/9/21 | 3.16% |

| 2. | Fannie Mae or Freddie Mac, 2.0%, 4/1/51 (TBA) | 2.25 |

| 3. | Wells Fargo & Co., 3.55%, 9/29/25 | 1.01 |

| 4. | UBS AG, 7.625%, 8/17/22 | 0.96 |

| 5. | Mitsubishi UFJ Financial Group, Inc., 3.407%, 3/7/24 | 0.89 |

| 6. | Nordea Bank Abp, 3.75%, 8/30/23 (144A) | 0.83 |

| 7. | U.S. Treasury Note, 2.0%, 11/30/22 | 0.73 |

| 8. | Fannie Mae or Freddie Mac, 1.5%, 3/15/36 (TBA) | 0.71 |

| 9. | NTT Finance Corp., 1.162%, 4/3/26 (144A) | 0.70 |

| 10. | Home Partners of America Trust, Series 2018-1, Class E, 1.956% | |

| (1 Month USD LIBOR + 185 bps), 7/17/37 (144A) | 0.70 |

* | Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

10 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Prices and Distributions |

2/28/21 Net Asset Value per Share

| Class | 2/28/21 | 8/31/20 |

A | $9.42 | $9.21 |

C | $9.43 | $9.23 |

C2 | $9.44 | $9.24 |

K | $9.47 | $9.27 |

Y | $9.43 | $9.23 |

| Distributions per Share: 9/1/20–2/28/21 | |

|

| Net Investment | Short-Term | Long-Term |

| Class | Income | Capital Gains | Capital Gains |

A | $0.1066 | $ — | $ — |

C | $0.0971 | $ — | $ — |

C2 | $0.0972 | $ — | $ — |

K | $0.1244 | $ — | $ — |

| Y | $0.1240 | $ — | $ — |

Index Definitions

The Bloomberg Barclays One- to Three-Year Government/Credit Index is an unmanaged measure of the performance of the short-term (1 to 3 years) government and investment-grade corporate bond markets. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 12–16.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 11

| | |

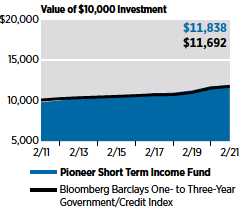

Performance Update | 2/28/21 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Short Term Income Fund at public offering price during the periods shown, compared to that of the Bloomberg Barclays One- to Three-Year Government/Credit Index.

| Average Annual Total Returns | |

(As of February 28, 2021) | |

| | | Bloomberg |

| | | Barclays |

| Net | Public | One- to |

| Asset | Offering | Three-Year |

| Value | Price | Government/ |

| Period | (NAV) | (POP)*

| Credit Index |

10 years | 1.96% | 1.70% | 1.58% |

5 years | 2.23 | 1.71 | 2.09 |

1 year | 0.95 | 0.95 | 1.94 |

| Expense Ratio | | |

(Per prospectus dated December 31, 2020) |

| Gross | | Net | |

0.85% | | 0.83% | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share.

* POP returns shown above reflect the deduction of the maximum 2.50% front-end sales charge on Class A shares purchased prior to February 5, 2018.

All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratios reflect the contractual expense limitations currently in effect through January 1, 2022 for Class A shares. There can be no assurance that Amundi US will extend the expense limitations beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

12 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| | |

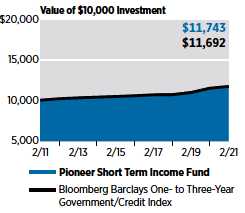

Performance Update | 2/28/21 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg Barclays One- to Three-Year Government/Credit Index.

| Average Annual Total Returns | |

(As of February 28, 2021) | |

| | | Bloomberg |

| | | Barclays |

| | | One- to |

| | | Three-Year |

| If | If | Government/ |

| Period | Held | Redeemed | Credit Index

|

10 years | 1.62% | 1.62% | 1.58% |

5 years | 2.06 | 2.06 | 2.09 |

1 year | 0.95 | 0.95 | 1.94 |

| Expense Ratio | | |

(Per prospectus dated December 31, 2020) |

| Gross | | | |

1.06% | | | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

“If Held” results represent the percent change in net asset value per share. “If Redeemed” returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 13

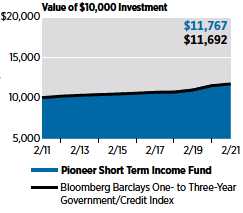

| | |

Performance Update | 2/28/21 | Class C2 Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C2 shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg Barclays One- to Three-Year Government/Credit Index.

| Average Annual Total Returns | |

(As of February 28, 2021) | |

| | | Bloomberg |

| | | Barclays |

| | | One- to |

| | | Three-Year |

| If | If | Government/ |

| Period | Held | Redeemed

| Credit Index |

10 years | 1.64% | 1.64% | 1.58% |

5 years | 2.09 | 2.09 | 2.09 |

1 year | 1.06 | 1.06 | 1.94 |

| Expense Ratio | | |

(Per prospectus dated December 31, 2020) |

| Gross | | | |

1.05% | | | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for periods prior to the inception of Class C2 shares on August 1, 2013 is the net asset value performance of the Fund’s Class C shares, which has not been restated to reflect any differences in expenses. For the period beginning August 1, 2013, the actual performance of Class C2 shares is reflected.

“If Held” results represent the percent change in net asset value per share. Class C2 shares held for less than one year are subject to a 1% contingent deferred sales charge (CDSC). “If Redeemed” returns would have been lower had sales charges been reflected. Returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

14 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Performance Update | 2/28/21 | Class K Shares |

Investment Returns

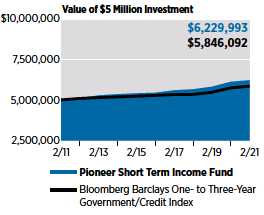

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg Barclays One- to Three-Year Government/Credit Index.

| Average Annual Total Returns |

(As of February 28, 2021) | |

| | Bloomberg |

| | Barclays |

| Net | One- to |

| Asset | Three-Year |

| Value | Government/ |

| Period | (NAV) | Credit Index |

10 years | 2.22% | 1.58% |

5 years | 2.68 | 2.09 |

1 year | 1.63 | 1.94 |

| Expense Ratio | | |

(Per prospectus dated December 31, 2020) |

| Gross | Net | |

0.47% | 0.46% | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for Class K shares for the period prior to the commencement of operations of Class K shares on December 1, 2014, is the net asset value performance of the Fund’s Class A shares, which has not been restated to reflect any differences in expenses, including Rule 12b-1 fees applicable to Class A shares. Since fees for Class A shares generally are higher than those of Class K shares, the performance of Class K shares prior to their inception would have been higher than the performance shown. For the period beginning December 1, 2014, the actual performance of Class K shares is reflected. Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratios reflect the contractual expense limitations currently in effect through January 1, 2022 for Class K shares. There can be no assurance that Amundi US will extend the expense limitations beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 15

| | |

Performance Update | 2/28/21 | Class Y Shares |

Investment Returns

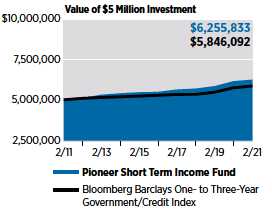

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Short Term Income Fund during the periods shown, compared to that of the Bloomberg Barclays One- to Three-Year Government/Credit Index.

| | | |

| Average Annual Total Returns |

(As of February 28, 2021) | |

| | Bloomberg |

| | Barclays |

| Net | One- to |

| Asset | Three-Year |

| Value | Government/ |

| Period | (NAV) | Credit Index |

10 years | 2.27% | 1.58% |

5 years | 2.60 | 2.09 |

1 year | 1.52 | 1.94 |

| Expense Ratio | | |

(Per prospectus dated December 31, 2020) |

| Gross | Net | |

0.59% | 0.46% | |

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through January 1, 2022 for Class Y shares. There can be no assurance that Amundi US will extend the expense limitations beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

16 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

(1) �� | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and

|

(2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

(1) | Divide your account value by $1,000 |

| Example: an $8,600 account value ÷ $1,000 = 8.6

|

(2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Short Term Income Fund

Based on actual returns from September 1, 2020 through February 28, 2021.

| Share Class | A | C | C2 | K | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 9/1/20 | | | | | |

Ending Account Value | $1,034.40 | $1,032.20 | $1,032.20 | $1,035.10 | $1,035.20 |

(after expenses) | | | | | |

on 2/28/21 | | | | | |

Expenses Paid | $4.14 | $5.14 | $5.19 | $2.32 | $2.32 |

During Period* | | | | | |

* | Expenses are equal to the Fund’s annualized expense ratio of 0.82%, 1.02%, 1.03%, 0.46%, and 0.46% for classes A, C, C2, K, and Y shares, respectively, multiplied by the average account value over the period, multiplied by 181/365, (to reflect the partial year period). |

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 17

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Short Term Income Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from September 1, 2020 through February 28, 2021.

| Share Class | A | C | C2 | K | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 9/1/20 | | | | | |

Ending Account Value | $1,020.73 | $1,019.74 | $1,019.69 | $1,022.51 | $1,022.51 |

(after expenses) | | | | | |

on 2/28/21 | | | | | |

Expenses Paid | $4.11 | $5.11 | $5.16 | $2.31 | $2.31 |

During Period* | | | | | |

* | Expenses are equal to the Fund’s annualized expense ratio of 0.82%, 1.02%, 1.03%, 0.46%, and 0.46% for classes A, C, C2, K, and Y shares, respectively, multiplied by the average account value over the period, multiplied by 181/365, (to reflect the partial year period). |

18 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

Schedule of Investments |

2/28/21 (unaudited)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | UNAFFILIATED ISSUERS — 100.4% | |

| | | ASSET BACKED SECURITIES — 28.0% of | |

| | Net Assets | |

| 170,724(a) | | 321 Henderson Receivables I LLC, Series 2006-2A, | |

| | Class A1, 0.307% (1 Month USD LIBOR + 20 bps), | |

| | 6/15/41 (144A) | $ 166,335 |

| 189,221(a) | | 321 Henderson Receivables I LLC, Series 2007-1A, | |

| | Class A1, 0.307% (1 Month USD LIBOR + 20 bps), | |

| | 3/15/42 (144A) | 181,577 |

| 123,613(a) | | 321 Henderson Receivables LLC, Series 2005-1A, | |

| | Class A1, 0.357% (1 Month USD LIBOR + 23 bps), | |

| | 11/15/40 (144A) | 121,577 |

| 1,500,000 | | A10 Bridge Asset Financing LLC, Series 2019-B, Class D, | |

| | 4.523%, 8/15/40 (144A) | 1,480,871 |

| 500,000(a) | | ABPCI Direct Lending Fund CLO X LP, Series 2020-10A, | |

| | Class D, 5.746% (3 Month USD LIBOR + 550 bps), | |

| | 1/20/32 (144A) | 506,867 |

| 1,500,000 | | ACC Trust, Series 2019-2, Class C, 5.24%, | |

| | 10/21/24 (144A) | 1,551,312 |

| 255,733 | | Access Point Funding I LLC, Series 2017-A, Class B, | |

| | 3.97%, 4/15/29 (144A) | 256,138 |

| 17,595(a) | | ACE Securities Corp. Home Equity Loan Trust, Series | |

| | 2005-WF1, Class M2, 0.778% (1 Month USD LIBOR + | |

| | 66 bps), 5/25/35 | 18,537 |

| 250,000 | | Amur Equipment Finance Receivables V LLC, Series | |

| | 2018-1A, Class D, 3.98%, 4/22/24 (144A) | 253,049 |

| 496,000 | | Amur Equipment Finance Receivables V LLC, Series | |

| | 2018-1A, Class E, 5.36%, 4/22/24 (144A) | 503,171 |

| 500,000 | | Amur Equipment Finance Receivables VI LLC, Series | |

| | 2018-2A, Class D, 4.45%, 6/20/23 (144A) | 508,598 |

| 400,000 | | Amur Equipment Finance Receivables VI LLC, Series | |

| | 2018-2A, Class E, 5.45%, 11/20/23 (144A) | 403,123 |

| 500,000 | | Amur Equipment Finance Receivables VII LLC, Series | |

| | 2019-1A, Class E, 4.47%, 3/20/25 (144A) | 502,317 |

| 1,500,000 | | Aqua Finance Trust, Series 2019-A, Class C, 4.01%, | |

| | 7/16/40 (144A) | 1,580,144 |

| 500,000 | | Aqua Finance Trust, Series 2020-AA, Class C, 3.97%, | |

| | 7/17/46 (144A) | 518,089 |

| 1,000,000 | | Arivo Acceptance Auto Loan Receivables Trust, | |

| | Series 2019-1, Class B, 3.37%, 6/15/25 (144A) | 1,029,490 |

| 1,000,000 | | Avid Automobile Receivables Trust, Series 2019-1, | |

| | Class C, 3.14%, 7/15/26 (144A) | 1,028,040 |

| 400,000 | | BCC Funding XVII LLC, Series 2020-1, Class C, 2.5%, | |

| | 9/22/25 (144A) | 401,681 |

| 1,274,337 | | BRE Grand Islander Timeshare Issuer LLC, Series 2019-A, | |

| | Class B, 3.78%, 9/26/33 (144A) | 1,323,794 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 19

Schedule of Investments | 2/28/21

(unaudited) (continued)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 1,000,000(a) | | Brightwood Capital MM CLO Ltd., Series 2020-1A, | |

| | | Class D, 5.63% (3 Month USD LIBOR + 540 bps), | |

| | 12/15/28 (144A) | $ 1,012,290 |

| 1,021,943 | | BXG Receivables Note Trust, Series 2018-A, Class C, | |

| | 4.44%, 2/2/34 (144A) | 1,057,504 |

| 460,582 | | BXG Receivables Note Trust, Series 2020-A, Class B, | |

| | 2.49%, 2/28/36 (144A) | 464,643 |

| 2,500,000 | | Carnow Auto Receivables Trust, Series 2019-1A, Class C, | |

| | 3.36%, 6/17/24 (144A) | 2,548,860 |

| 1,000,000 | | Carvana Auto Receivables Trust, Series 2019-4A, | |

| | Class E, 4.7%, 10/15/26 (144A) | 1,058,334 |

| 2,000,000 | | Carvana Auto Receivables Trust, Series 2020-N1A, | |

| | Class D, 3.43%, 1/15/26 (144A) | 2,089,418 |

| 248,554 | | Cazenovia Creek Funding II LLC, Series 2018-1A, Class B, | |

| | 3.984%, 7/15/30 (144A) | 247,455 |

| 122,983(a) | | CDC Mortgage Capital Trust, Series 2002-HE1, Class A, | |

| | 0.738% (1 Month USD LIBOR + 62 bps), 1/25/33 | 122,203 |

| 62,928(a) | | Chase Funding Trust, Series 2003-3, Class 2A2, 0.658% | |

| | (1 Month USD LIBOR + 54 bps), 4/25/33 | 61,365 |

| 70,151(b) | | Chase Funding Trust, Series 2003-6, Class 1A7, | |

| | 4.971%, 11/25/34 | 73,777 |

| 1,750,000 | | CIG Auto Receivables Trust, Series 2019-1A, Class C, | |

| | 3.82%, 8/15/24 (144A) | 1,795,631 |

| 400,000(b) | | Colony American Finance, Ltd., Series 2016-1, Class D, | |

| | 5.972%, 6/15/48 (144A) | 410,565 |

| 32,180 | | Commonbond Student Loan Trust, Series 2017-BGS, | |

| | Class C, 4.44%, 9/25/42 (144A) | 33,687 |

| 336,267 | | Conn’s Receivables Funding LLC, Series 2019-A, Class B, | |

| | 4.36%, 10/16/23 (144A) | 337,905 |

| 168,134 | | Conn’s Receivables Funding LLC, Series 2019-A, Class C, | |

| | 5.29%, 10/16/23 (144A) | 166,838 |

| 426,320 | | Conn’s Receivables Funding LLC, Series 2020-A, Class A, | |

| | 1.71%, 6/16/25 (144A) | 427,520 |

| 65,626(a) | | Conseco Finance Home Equity Loan Trust, Series | |

| | 2002-C, Class MV1, 1.607% (1 Month USD LIBOR + | |

| | 150 bps), 5/15/32 | 65,717 |

| 2,000,000 | | Continental Credit Card ABS LLC, Series 2019-1A, | |

| | Class A, 3.83%, 8/15/26 (144A) | 2,047,521 |

| 200,236(a) | | Countrywide Asset-Backed Certificates, Series | |

| | 2004-SD3, Class A2, 1.218% (1 Month USD LIBOR + | |

| | 110 bps), 9/25/34 (144A) | 198,055 |

| 519,000 | | Crossroads Asset Trust, Series 2021-A, Class D, 2.52%, | |

| | 1/20/26 (144A) | 517,633 |

| 853,289 | | Diamond Resorts Owner Trust, Series 2019-1A, Class B, | |

| | 3.53%, 2/20/32 (144A) | 876,860 |

| 284,430 | | Diamond Resorts Owner Trust, Series 2019-1A, Class D, | |

| | 5.25%, 2/20/32 (144A) | 278,482 |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 19,262(a) | | DRB Prime Student Loan Trust, Series 2016-B, | |

| | Class A1, 1.918% (1 Month USD LIBOR + 180 bps), | |

| | 6/25/40 (144A) | $ 19,418 |

| 73,139(a) | | Drug Royalty III LP 1, Series 2017-1A, Class A1, 2.741% | |

| | (3 Month USD LIBOR + 250 bps), 4/15/27 (144A) | 73,138 |

| 258,138 | | Drug Royalty III LP 1, Series 2017-1A, Class A2, 3.6%, | |

| | 4/15/27 (144A) | 258,871 |

| 455,228 | | Drug Royalty III LP 1, Series 2018-1A, Class A2, 4.27%, | |

| | 10/15/31 (144A) | 467,909 |

| 27,826(a) | | Earnest Student Loan Program LLC, Series 2017-A, | |

| | Class A1, 1.118% (1 Month USD LIBOR + 100 bps), | |

| | 1/25/41 (144A) | 27,854 |

| 1,500,000(a) | | Elevation CLO, Ltd., Series 2015-4A, Class CR, 2.423% | |

| | (3 Month USD LIBOR + 220 bps), 4/18/27 (144A) | 1,500,939 |

| 500,000 | | Elm Trust, Series 2020-3A, Class A2, 2.954%, | |

| | 8/20/29 (144A) | 502,156 |

| 1,100,000 | | Exeter Automobile Receivables Trust, Series 2020-1A, | |

| | Class C, 2.49%, 1/15/25 (144A) | 1,125,962 |

| 1,500,000 | | Fair Square Issuance Trust, Series 2020-AA, Class C, | |

| | 5.4%, 9/20/24 (144A) | 1,533,335 |

| 148,069 | | FCI Funding LLC, Series 2019-1A, Class B, 0.0%, | |

| | 2/18/31 (144A) | 149,642 |

| 200,000(c) | | Finance of America HECM Buyout, Series 2021-HB1, | |

| | Class M3, 3.64%, 2/25/31 (144A) | 199,999 |

| 500,000(a) | | Fortress Credit Opportunities VI CLO, Ltd., Series | |

| | 2015-6A, Class A1TR, 1.585% (3 Month USD LIBOR + | |

| | 136 bps), 7/10/30 (144A) | 496,310 |

| 1,100,000(a) | | Fortress Credit Opportunities IX CLO, Ltd., Series | |

| | 2017-9A, Class A1T, 1.744% (3 Month USD LIBOR + | |

| | 155 bps), 11/15/29 (144A) | 1,099,797 |

| 500,000 | | Four Seas LP, Series 2017-1A, Class A1, 4.95%, | |

| | 8/28/27 (144A) | 490,438 |

| 1,000,000 | | Foursight Capital Automobile Receivables Trust, Series | |

| | 2019-1, Class D, 3.27%, 6/16/25 (144A) | 1,038,768 |

| 113,225(a) | | Freddie Mac Structured Pass-Through Certificates, | |

| | Series T-20, Class A7, 0.268% (1 Month USD LIBOR + | |

| | 30 bps), 12/25/29 | 110,890 |

| 209,740 | | Freed ABS Trust, Series 2020-FP1, Class A, 2.52%, | |

| | 3/18/27 (144A) | 211,491 |

| 28,175(a) | | Fremont Home Loan Trust, Series 2005-E, Class 1A1, | |

| | 0.578% (1 Month USD LIBOR + 46 bps), 1/25/36 | 28,167 |

| 2,000,000 | | GLS Auto Receivables Issuer Trust, Series 2019-3A, | |

| | Class C, 2.96%, 5/15/25 (144A) | 2,056,584 |

| 134,849(c) | | Gold Key Resorts LLC, Series 2014-A, Class C, 5.87%, | |

| | 3/17/31 (144A) | 136,640 |

| 101,054(a) | | GSAA Home Equity Trust, Series 2005-8, Class A3, | |

| | 0.978% (1 Month USD LIBOR + 86 bps), 6/25/35 | 102,797 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 21

Schedule of Investments | 2/28/21

(unaudited) (continued)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 484,433 | | Hercules Capital Funding Trust, Series 2018-1A, Class A, | |

| | 4.605%, 11/22/27 (144A) | $ 488,915 |

| 4,741 | | Hero Residual Funding, Series 2016-1R, Class A1, 4.5%, | |

| | 9/21/42 (144A) | 4,744 |

| 400,000 | | Hertz Fleet Lease Funding LP, Series 2018-1, Class C, | |

| | 3.77%, 5/10/32 (144A) | 401,850 |

| 220,632 | | HIN Timeshare Trust, Series 2020-A, Class D, 5.5%, | |

| | 10/9/39 (144A) | 229,622 |

| 870,000 | | HOA Funding LLC, Series 2014-1A, Class A2, 4.846%, | |

| | 8/20/44 (144A) | 835,896 |

| 500,000 | | HOA Funding LLC, Series 2015-1A, Class B, 9.0%, | |

| | 8/20/44 (144A) | 468,560 |

| 2,950,000(a) | | Home Partners of America Trust, Series 2018-1, | |

| | Class E, 1.956% (1 Month USD LIBOR + 185 bps), | |

| | 7/17/37 (144A) | 2,954,520 |

| 1,750,000 | | Horizon Funding LLC, Series 2019-1A, Class A1, 4.21%, | |

| | 9/15/27 (144A) | 1,750,000 |

| 41,332(a) | | Interstar Millennium Trust, Series 2003-3G, Class A2, | |

| | 0.751% (3 Month USD LIBOR + 50 bps), 9/27/35 | 40,207 |

| 1,797,363(a) | | Invitation Homes Trust, Series 2017-SFR2, Class D, | |

| | 1.906% (1 Month USD LIBOR + 180 bps), | |

| | 12/17/36 (144A) | 1,798,190 |

| 1,072,810(a) | | Invitation Homes Trust, Series 2018-SFR3, Class E, | |

| | 2.106% (1 Month USD LIBOR + 200 bps), | |

| | 7/17/37 (144A) | 1,074,993 |

| 1,129,605(a) | | Invitation Homes Trust, Series 2018-SFR4, Class E, | |

| | 2.056% (1 Month USD LIBOR + 195 bps), | |

| | 1/17/38 (144A) | 1,129,604 |

| 1,500,000 | | Jamestown CLO V, Ltd., Series 2014-5A, Class B2R, | |

| | 3.84%, 1/17/27 (144A) | 1,505,034 |

| 126,376 | | Kabbage Funding LLC, Series 2019-1, Class C, 4.611%, | |

| | 3/15/24 (144A) | 126,402 |

| 536,949 | | Lendingpoint Asset Securitization Trust, Series 2019-1, | |

| | Class B, 3.613%, 8/15/25 (144A) | 537,917 |

| 1,500,000 | | LL ABS Trust, Series 2019-1A, Class B, 3.52%, | |

| | 3/15/27 (144A) | 1,508,072 |

| 300,000(a) | | Madison Park Funding XV, Ltd., Series 2014-15A, | |

| | Class A2R, 1.713% (3 Month USD LIBOR + 150 bps), | |

| | 1/27/26 (144A) | 300,244 |

| 1,000,000 | | Marlette Funding Trust, Series 2019-1A, Class C, 4.42%, | |

| | 4/16/29 (144A) | 1,036,086 |

| 1,150,000 | | Marlette Funding Trust, Series 2019-2A, Class C, 4.11%, | |

| | 7/16/29 (144A) | 1,178,999 |

| 1,103,954 | | Mosaic Solar Loan Trust, Series 2019-2A, Class C, 4.35%, | |

| | 9/20/40 (144A) | 1,098,845 |

| 422,991 | | Mosaic Solar Loan Trust, Series 2019-2A, Class D, 6.18%, | |

| | 9/20/40 (144A) | 407,211 |

The accompanying notes are an integral part of these financial statements.

22 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 214,993 | | MVW LLC, Series 2020-1A, Class C, 4.21%, | |

| | 10/20/37 (144A) | $ 225,945 |

| 652,000(c) | | Nationstar HECM Loan Trust, Series 2019-1A, Class M1, | |

| | 2.664%, 6/25/29 (144A) | 654,860 |

| 1,000,000(c) | | Nationstar HECM Loan Trust, Series 2019-1A, Class M3, | |

| | 3.276%, 6/25/29 (144A) | 1,002,716 |

| 11,089(c) | | New Century Home Equity Loan Trust, Series 2004-A, | |

| | Class AII9, 5.47%, 8/25/34 | 11,765 |

| 293,171(a) | | Newtek Small Business Loan Trust, Series 2017-1, | |

| | Class B, 3.118% (1 Month USD LIBOR + 300 bps), | |

| | 2/25/43 (144A) | 267,331 |

| 1,500,000 | | NMEF Funding LLC, Series 2019-A, Class B, 3.06%, | |

| | 8/17/26 (144A) | 1,523,693 |

| 1,000,000 | | NMEF Funding LLC, Series 2019-A, Class D, 4.39%, | |

| | 8/17/26 (144A) | 1,024,405 |

| 249,761(a) | | NovaStar Mortgage Funding Trust, Series 2003-1, | |

| | Class A2, 0.898% (1 Month USD LIBOR + | |

| | 78 bps), 5/25/33 | 248,288 |

| 560,000(a) | | NovaStar Mortgage Funding Trust, Series 2004-3, | |

| | Class M4, 1.693% (1 Month USD LIBOR + | |

| | 158 bps), 12/25/34 | 560,953 |

| 446,005 | | Oasis LLC, Series 2020-1A, Class A, 3.82%, | |

| | 1/15/32 (144A) | 448,788 |

| 636,363 | | Oasis LLC, Series 2020-2A, Class A, 4.262%, | |

| | 5/15/32 (144A) | 643,188 |

| 500,000 | | Oasis Securitization Funding LLC, Series 2021-1A, | |

| | Class A, 2.579%, 2/15/33 (144A) | 500,000 |

| 857,639 | | Orange Lake Timeshare Trust, Series 2019-A, Class A, | |

| | 3.06%, 4/9/38 (144A) | 893,503 |

| 1,000,586 | | Orange Lake Timeshare Trust, Series 2019-A, Class D, | |

| | 4.93%, 4/9/38 (144A) | 1,012,919 |

| 1,500,000(a) | | Owl Rock CLO II, Ltd., Series 2019-2A, Class A1L, 1.974% | |

| | (3 Month USD LIBOR + 175 bps), 1/20/31 (144A) | 1,500,000 |

| 1,700,000 | | Oxford Finance Funding LLC, Series 2019-1A, Class B, | |

| | 5.438%, 2/15/27 (144A) | 1,748,264 |

| 500,000(a) | | Palmer Square Loan Funding, Ltd., Series 2020-1A, | |

| | Class B, 2.082% (3 Month USD LIBOR + 190 bps), | |

| | 2/20/28 (144A) | 500,355 |

| 725,925 | | PEAR LLC, Series 2020-1, Class A, 3.75%, | |

| | 12/15/32 (144A) | 725,999 |

| 1,500,000 | | Perimeter Master Note Business Trust, Series 2019-2A, | |

| | Class B, 5.21%, 5/15/24 (144A) | 1,552,908 |

| 1,000,000 | | PG Receivables Finance, Series 2020-1, Class A1, | |

| | 3.968%, 7/20/25 (144A) | 1,003,398 |

| 1,000,000 | | PG Receivables Finance, Series 2020-1, Class B, 4.705%, | |

| | 7/20/25 (144A) | 1,003,398 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 23

Schedule of Investments | 2/28/21

(unaudited) (continued)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 2,250,000(a) | | PNMAC GMSR Issuer Trust, Series 2018-GT2, Class A, | |

| | | 2.768% (1 Month USD LIBOR + 265 bps), | |

| | 8/25/25 (144A) | $ 2,238,776 |

| 300,000 | | Progress Residential Trust, Series 2017-SFR1, Class B, | |

| | 3.017%, 8/17/34 (144A) | 303,361 |

| 333,000 | | Progress Residential Trust, Series 2017-SFR1, Class D, | |

| | 3.565%, 8/17/34 (144A) | 336,649 |

| 2,250,000 | | Progress Residential Trust, Series 2017-SFR1, Class E, | |

| | 4.261%, 8/17/34 (144A) | 2,280,395 |

| 2,175,000 | | Progress Residential Trust, Series 2018-SFR1, Class E, | |

| | 4.38%, 3/17/35 (144A) | 2,178,002 |

| 1,793,000 | | Progress Residential Trust, Series 2018-SFR2, Class E, | |

| | 4.656%, 8/17/35 (144A) | 1,813,181 |

| 2,600,000 | | Progress Residential Trust, Series 2018-SFR3, Class E, | |

| | 4.873%, 10/17/35 (144A) | 2,653,067 |

| 761,310(a) | | ReadyCap Lending Small Business Loan Trust, Series | |

| | | 2019-2, Class A, 2.75% (PRIME + -50 bps), | |

| | 12/27/44 (144A) | 726,108 |

| 1,500,000 | | Republic Finance Issuance Trust, Series 2019-A, Class B, | |

| | 3.93%, 11/22/27 (144A) | 1,516,557 |

| 152,825 | | SCF Equipment Leasing LLC, Series 2019-1A, Class A2, | |

| | 3.23%, 10/20/24 (144A) | 153,340 |

| 727,873 | | SCF Equipment Leasing LLC, Series 2019-1A, Class E, | |

| | 5.49%, 4/20/30 (144A) | 713,247 |

| 1,500,000 | | Small Business Lending Trust, Series 2019-A, Class B, | |

| | 3.42%, 7/15/26 (144A) | 1,489,186 |

| 400,000 | | Small Business Lending Trust, Series 2019-A, Class C, | |

| | 4.31%, 7/15/26 (144A) | 394,921 |

| 850,000 | | Small Business Lending Trust, Series 2020-A, Class C, | |

| | 5.01%, 12/15/26 (144A) | 787,801 |

| 23,346(a) | | Sofi Professional Loan Program LLC, Series 2016-C, | |

| | Class A1, 1.218% (1 Month USD LIBOR + 110 bps), | |

| | 10/27/36 (144A) | 23,476 |

| 2,000,000(a) | | Sound Point CLO V-R, Ltd., Series 2014-1RA, Class B, | |

| | | 1.973% (3 Month USD LIBOR + 175 bps), | |

| | 7/18/31 (144A) | 1,997,746 |

| 567(b) | | Structured Asset Securities Corp. Mortgage Loan Trust, | |

| | Series 2005-2XS, Class 1A5B, 5.15%, 2/25/35 | 573 |

| 57,594 | | Structured Receivables Finance LLC, Series 2010-B, | |

| | Class A, 3.73%, 8/15/36 (144A) | 60,297 |

| 52,479 | | Tax Ease Funding LLC, Series 2016-1A, Class A, 3.131%, | |

| | 6/15/28 (144A) | 52,607 |

| 400,000 | | Tidewater Auto Receivables Trust, Series 2018-AA, | |

| | Class D, 4.3%, 11/15/24 (144A) | 407,692 |

| 1,400,000 | | Tidewater Auto Receivables Trust, Series 2020-AA, | |

| | Class D, 2.31%, 3/15/27 (144A) | 1,425,446 |

| 1,250,000 | | Tidewater Auto Receivables Trust, Series 2020-AA, | |

| | Class E, 3.35%, 7/17/28 (144A) | 1,272,084 |

The accompanying notes are an integral part of these financial statements. | |

24 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | | ASSET BACKED SECURITIES — (continued) | |

| 139,111 | | TLF National Tax Lien Trust, Series 2017-1A, Class B, | |

| | 3.84%, 12/15/29 (144A) | $ 140,260 |

| 5,611(c) | | Towd Point Mortgage Trust, Series 2015-3, Class A1B, | |

| | 3.0%, 3/25/54 (144A) | 5,615 |

| 276,431(c) | | Towd Point Mortgage Trust, Series 2018-SJ1, Class A1, | |

| | 4.0%, 10/25/58 (144A) | 276,823 |

| 390,334(c) | | Towd Point Mortgage Trust, Series 2018-SJ1, Class XA, | |

| | 5.0%, 10/25/58 (144A) | 400,632 |

| 433,153 | | Towd Point Mortgage Trust, Series 2019-HY3, Class XA, | |

| | 4.5%, 10/25/59 (144A) | 429,705 |

| 998,635(c) | | Towd Point Mortgage Trust, Series 2019-SJ3, Class XA, | |

| | 4.5%, 11/25/59 (144A) | 1,001,132 |

| 1,250,000 | | Trafigura Securitisation Finance Plc, Series 2018-1A, | |

| | Class B, 4.29%, 3/15/22 (144A) | 1,251,725 |

| 1,600,000(a) | | TRTX Issuer, Ltd., Series 2019-FL3, Class C, 2.208% | |

| | (1 Month USD LIBOR + 210 bps), 10/15/34 (144A) | 1,592,996 |

| 637,858 | | TVEST LLC, Series 2020-A, Class A, 4.5%, 7/15/32 (144A) | 644,827 |

| 600,000 | | United Auto Credit Securitization Trust, Series 2018-2, | |

| | Class F, 6.82%, 6/10/25 (144A) | 603,830 |

| 500,000 | | United Auto Credit Securitization Trust, Series 2020-1, | |

| | Class D, 2.88%, 2/10/25 (144A) | 512,833 |

| 1,500,000 | | Upstart Securitization Trust, Series 2020-1, Class C, | |

| | 4.899%, 4/22/30 (144A) | 1,540,459 |

| 1,478,040 | | Veros Automobile Receivables Trust, Series 2018-1, | |

| | Class C, 4.65%, 2/15/24 (144A) | 1,493,703 |

| 2,000,000 | | Veros Automobile Receivables Trust, Series 2020-1, | |

| | Class B, 2.19%, 6/16/25 (144A) | 2,020,899 |

| 40,567 | | Welk Resorts LLC, Series 2013-AA, Class A, 3.1%, | |

| | 3/15/29 (144A) | 40,628 |

| 1,552,753 | | Welk Resorts LLC, Series 2019-AA, Class D, 4.03%, | |

| | 6/15/38 (144A) | 1,597,275 |

| 845,361 | | Westgate Resorts LLC, Series 2020-1A, Class C, 6.213%, | |

| | 3/20/34 (144A) | 893,284 |

| 2,500,000 | | Westlake Automobile Receivables Trust, Series 2018-3A, | |

| | Class D, 4.0%, 10/16/23 (144A) | 2,563,590 |

| 1,000,000 | | Westlake Automobile Receivables Trust, Series 2019-2A, | |

| | Class E, 4.02%, 4/15/25 (144A) | 1,047,908 |

| 1,500,000 | | Westlake Automobile Receivables Trust, Series 2019-3A, | |

| | Class E, 3.59%, 3/17/25 (144A) | 1,553,821 |

| 69,243 | | WRG Debt Funding II LLC, Series 2017-1, Class A, | |

| | 4.458%, 3/15/26 (144A) | 68,628 |

| | TOTAL ASSET BACKED SECURITIES | |

| | (Cost $116,594,637) | $118,291,750 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 25

Schedule of Investments | 2/28/21

(unaudited) (continued)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | COLLATERALIZED MORTGAGE OBLIGATIONS — | |

| | 18.8% of Net Assets | |

| 600,000(c) | | Angel Oak Mortgage Trust I LLC, Series 2019-1, Class M1, | |

| | | 4.5%, 11/25/48 (144A) | $ 625,253 |

| 21,153(c) | | Bear Stearns Mortgage Securities, Inc., Series 1997-6, | |

| | | Class 3B1, 2.818%, 6/25/30 | 21,730 |

| 1,233,769(a) | | Bellemeade Re, Ltd., Series 2017-1, Class M2, 3.468% | |

| | | (1 Month USD LIBOR + 335 bps), 10/25/27 (144A) | 1,256,245 |

| 750,462(a) | | Bellemeade Re, Ltd., Series 2018-1A, Class M1B, 1.718% | |

| | | (1 Month USD LIBOR + 160 bps), 4/25/28 (144A) | 750,687 |

| 1,255,159(a) | | Bellemeade Re, Ltd., Series 2018-3A, Class M1B, 1.968% | |

| | | (1 Month USD LIBOR + 185 bps), 10/25/28 (144A) | 1,262,016 |

| 800,000(a) | | Bellemeade Re, Ltd., Series 2019-1A, Class M1B, 1.868% | |

| | | (1 Month USD LIBOR + 175 bps), 3/25/29 (144A) | 802,273 |

| 1,000,000(a) | | Bellemeade Re, Ltd., Series 2019-1A, Class M2, 2.818% | |

| | | (1 Month USD LIBOR + 270 bps), 3/25/29 (144A) | 1,004,987 |

| 2,000,000(a) | | Bellemeade Re, Ltd., Series 2019-3A, Class B1, 2.618% | |

| | | (1 Month USD LIBOR + 250 bps), 7/25/29 (144A) | 2,027,861 |

| 750,000(a) | | Bellemeade Re, Ltd., Series 2020-2A, Class M1B, 3.318% | |

| | | (1 Month USD LIBOR + 320 bps), 8/26/30 (144A) | 759,011 |

| 1,500,000(a) | | Bellemeade Re, Ltd., Series 2020-2A, Class M1C, 4.118% | |

| | | (1 Month USD LIBOR + 400 bps), 8/26/30 (144A) | 1,541,399 |

| 450,000(a) | | Bellemeade Re, Ltd., Series 2020-3A, Class M1B, 2.968% | |

| | | (1 Month USD LIBOR + 285 bps), 10/25/30 (144A) | 453,951 |

| 610,000(a) | | Bellemeade Re, Ltd., Series 2020-3A, Class M1C, 3.818% | |

| | | (1 Month USD LIBOR + 370 bps), 10/25/30 (144A) | 620,570 |

| 630,000(a) | | Bellemeade Re, Ltd., Series 2020-3A, Class M2, 4.968% | |

| | | (1 Month USD LIBOR + 485 bps), 10/25/30 (144A) | 649,724 |

| 410,000(a) | | Bellemeade Re, Ltd., Series 2020-4A, Class M2B, 3.718% | |

| | | (1 Month USD LIBOR + 360 bps), 6/25/30 (144A) | 410,512 |

| 810,388(c) | | BRAVO Residential Funding Trust, Series 2020-NQM1, | |

| | | Class A3, 2.406%, 5/25/60 (144A) | 819,941 |

| 900,000(c) | | BRAVO Residential Funding Trust, Series 2020-NQM1, | |

| | | Class B1, 5.086%, 5/25/60 (144A) | 935,724 |

| 2,464,144(c) | | Cascade Funding Mortgage Trust, Series 2018-RM2, | |

| | | Class D, 4.0%, 10/25/68 (144A) | 2,471,068 |

| 124,855 | | Cendant Mortgage Corp., Series 2002-2, Class A6, 6.25%, | |

| | | 3/25/32 (144A) | 124,855 |

| 500,000(c) | | CFMT LLC, Series 2021-HB5, Class M3, 2.91%, | |

| | | 2/25/31 (144A) | 499,999 |

| 5,319 | | Citicorp Mortgage Securities REMIC Pass-Through | |

| | | Certificates Trust, Series 2005-4, Class 2A1, 5.0%, | |

| | | 7/25/20 | 5,436 |

| 6,296 | | Citigroup Mortgage Loan Trust, Inc., Series 2003-UP3, | |

| | | Class A1, 7.0%, 9/25/33 | 6,298 |

| 1,907,021(a) | | Connecticut Avenue Securities Trust, Series 2019-HRP1, | |

| | | Class M2, 2.28% (1 Month USD LIBOR + 215 bps), | |

| | | 11/25/39 (144A) | 1,893,882 |

The accompanying notes are an integral part of these financial statements.

26 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | COLLATERALIZED MORTGAGE | | |

| | OBLIGATIONS — (continued) | | |

| 1,530,000(a) | | Connecticut Avenue Securities Trust, Series 2020-SBT1, | | |

| | | Class 1M2, 3.768% (1 Month USD LIBOR + 365 bps), | | |

| | | 2/25/40 (144A) | $ 1,571,808 |

| 2,130,000(a) | | Connecticut Avenue Securities Trust, Series 2020-SBT1, | | |

| | | Class 2M2, 3.768% (1 Month USD LIBOR + 365 bps), | | |

| | | 2/25/40 (144A) | 2,196,926 |

| 124,966 | | Credit Suisse First Boston Mortgage Securities Corp., | | |

| | | Series 2002-10, Class 2A1, 7.5%, 5/25/32 | | 131,292 |

| 2,328 | | CSFB Mortgage-Backed Trust, Series 2004-7, Class 6A1, | | |

| | | 5.25%, 10/25/19 | | 2,443 |

| 1,000,000(c) | | Deephaven Residential Mortgage Trust, Series 2019-3A, | | |

| | | Class B1, 4.258%, 7/25/59 (144A) | | 999,408 |

| 750,889(a) | | Eagle Re, Ltd., Series 2018-1, Class M1, 1.818% (1 Month | | |

| | | USD LIBOR + 170 bps), 11/25/28 (144A) | | 754,453 |

| 1,064,770(a) | | Eagle Re, Ltd., Series 2019-1, Class M1B, 1.918% | | |

| | | (1 Month USD LIBOR + 180 bps), 4/25/29 (144A) | 1,066,090 |

| 270,000(a) | | Eagle Re, Ltd., Series 2020-2, Class M1C, 4.618% | | |

| | | (1 Month USD LIBOR + 450 bps), 10/25/30 (144A) | | 276,784 |

| 941,000(a) | | Eagle Re, Ltd., Series 2020-2, Class M2, 5.718% (1 Month | | |

| | | USD LIBOR + 560 bps), 10/25/30 (144A) | | 978,398 |

| 1,000,000(c) | | Ellington Financial Mortgage Trust, Series 2020-1, | | |

| | | Class A3, 3.999%, 5/25/65 (144A) | 1,042,127 |

| 272,698(c) | | Fannie Mae Grantor Trust, Series 2004-T2, Class 2A, | | |

| | | 3.706%, 7/25/43 | | 286,829 |

| 59,027(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2315, Class FW, 0.662% (1 Month USD LIBOR + | | |

| | | 55 bps), 4/15/27 | | 59,281 |

| 163,622(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2334, Class FA, 0.612% (1 Month USD LIBOR + | | |

| | | 50 bps), 7/15/31 | | 164,453 |

| 57,611(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2391, Class FJ, 0.612% (1 Month USD LIBOR + | | |

| | | 50 bps), 4/15/28 | | 57,830 |

| 47,518(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2439, Class F, 1.112% (1 Month USD LIBOR + | | |

| | | 100 bps), 3/15/32 | | 48,574 |

| 77,840(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2470, Class AF, 1.112% (1 Month USD LIBOR + | | |

| | 100 bps), 3/15/32 | | 79,556 |

| 68,223(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2489, Class FA, 1.112% (1 Month USD LIBOR + | | |

| | 100 bps), 2/15/32 | | 69,746 |

| 104,656(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2498, Class FL, 0.682% (1 Month USD LIBOR + | | |

| | 57 bps), 3/15/32 | | 105,488 |

| 42,943(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | | |

| | | 2916, Class NF, 0.362% (1 Month USD LIBOR + | | |

| | 25 bps), 1/15/35 | | 43,010 |

The accompanying notes are an integral part of these financial statements.

|

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 27

Schedule of Investments | 2/28/21

(unaudited) (continued)

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | COLLATERALIZED MORTGAGE | |

| | OBLIGATIONS — (continued) | |

| 20,479(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3042, Class PF, 0.362% (1 Month USD LIBOR + | |

| | | 25 bps), 8/15/35

| $ 20,515

|

| 13,109(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3102, Class FG, 0.412% (1 Month USD LIBOR + | |

| | 30 bps), 1/15/36 | 13,148 |

| 59,775(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3117, Class FE, 0.412% (1 Month USD LIBOR + | |

| | 30 bps), 2/15/36 | 59,951 |

| 33,779(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3173, Class FC, 0.532% (1 Month USD LIBOR + | |

| | 42 bps), 6/15/36 | 34,009 |

| 58,885(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3181, Class HF, 0.612% (1 Month USD LIBOR + | |

| | 50 bps), 7/15/36 | 59,590 |

| 20,712(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3235, Class FX, 0.432% (1 Month USD LIBOR + | |

| | 32 bps), 11/15/36 | 20,882 |

| 52,601(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3239, Class EF, 0.462% (1 Month USD LIBOR + | |

| | | 35 bps), 11/15/36 | 52,919 |

| 24,980(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3239, Class FB, 0.462% (1 Month USD LIBOR + | |

| | | 35 bps), 11/15/36 | 25,130 |

| 84,474(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3373, Class FB, 0.692% (1 Month USD LIBOR + | |

| | | 58 bps), 10/15/37 | 85,770 |

| 119,327(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3386, Class FB, 0.487% (1 Month USD LIBOR + | |

| | | 38 bps), 11/15/37 | 120,147 |

| 17,765 | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3416, Class BJ, 4.0%, 2/15/23 | 18,041 |

| 69,577(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3610, Class FA, 0.812% (1 Month USD LIBOR + | |

| | | 70 bps), 12/15/39 | 70,683 |

| 28,010(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3745, Class FB, 0.362% (1 Month USD LIBOR + | |

| | | 25 bps), 8/15/25 | 27,963 |

| 4,087(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3767, Class JF, 0.412% (1 Month USD LIBOR + | |

| | | 30 bps), 2/15/39 | 4,090 |

| 15,436(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3784, Class F, 0.512% (1 Month USD LIBOR + | |

| | | 40 bps), 7/15/23 | 15,401 |

| 72,703(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3807, Class FM, 0.612% (1 Month USD LIBOR + | |

| | | 50 bps), 2/15/41 | 71,336 |

The accompanying notes are an integral part of these financial statements.

28 Pioneer Short Term Income Fund | Semiannual Report | 2/28/21

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | COLLATERALIZED MORTGAGE | |

| | OBLIGATIONS — (continued) | |

| 100,258(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3850, Class FC, 0.532% (1 Month USD LIBOR + | |

| | | 42 bps), 4/15/41 | $ 101,000 |

| 22,165(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3868, Class FA, 0.512% (1 Month USD LIBOR + | |

| | | 40 bps), 5/15/41 | 22,352 |

| 18,739(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3914, Class LF, 0.312% (1 Month USD LIBOR + | |

| | | 20 bps), 8/15/26 | 18,665 |

| 39,815(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 3970, Class GF, 0.412% (1 Month USD LIBOR + | |

| | | 30 bps), 9/15/26 | 39,788 |

| 44,888(a) | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 4002, Class YF, 0.662% (1 Month USD LIBOR + | |

| | | 55 bps), 2/15/42 | 45,430 |

| 101,896 | | Federal Home Loan Mortgage Corp. REMICS, Series | |

| | | 4366, Class VA, 3.0%, 12/15/25 | 105,133 |

| 33,155(a) | | Federal Home Loan Mortgage Corp. Strips, Series 237, | |

| | | Class F14, 0.512% (1 Month USD LIBOR + | |

| | | 40 bps), 5/15/36 | 33,107 |

| 72,995(a) | | Federal Home Loan Mortgage Corp. Strips, Series 239, | |

| | | Class F30, 0.412% (1 Month USD LIBOR + | |

| | | 30 bps), 8/15/36 | 72,538 |

| 28,788(a) | | Federal Home Loan Mortgage Corp. Strips, Series 244, | |

| | | Class F22, 0.462% (1 Month USD LIBOR + | |

| | | 35 bps), 12/15/36 | 28,828 |

| 1,590,000(a) | | Federal National Mortgage Association, Connecticut | |

| | | Avenue Securities, Series 2017-C05, Class 1M2B, 2.318% | |

| | | (1 Month USD LIBOR + 220 bps), 1/25/30 | 1,606,548 |

| 142,971(a) | | Federal National Mortgage Association, Connecticut | |

| | | Avenue Securities, Series 2017-C07, Class 1M2A, | |

| | | 2.518% (1 Month USD LIBOR + 240 bps), 5/25/30 | 143,241 |

| 6,537(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 1992-162, Class FB, 0.9% (5 Year CMT Index + | |

| | | -5 bps), 9/25/22 | 6,516 |

| 25,328(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 1994-40, Class FC, 0.618% (1 Month USD LIBOR + | |

| | | 50 bps), 3/25/24 | 25,566 |

| 27,083 | | Federal National Mortgage Association REMICS, Series | |

| | | 1999-25, Class Z, 6.0%, 6/25/29 | 30,849 |

| 32,589(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2001-72, Class FB, 1.018% (1 Month USD LIBOR + | |

| | | 90 bps), 12/25/31 | 33,185 |

| 18,004(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2001-81, Class FL, 0.758% (1 Month USD LIBOR + | |

| | | 65 bps), 1/18/32 | 18,158 |

| 91,064(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2002-77, Class WF, 0.508% (1 Month USD LIBOR + | |

| | | 40 bps), 12/18/32 | 91,278 |

The accompanying notes are an integral part of these financial statements.

Pioneer Short Term Income Fund | Semiannual Report | 2/28/21 29

Schedule of Investments | 2/28/21

(unaudited) (continued)

| | | | |

| Principal | | | |

| Amount | | | |

| USD ($) | | | Value |

| | COLLATERALIZED MORTGAGE | |

| | OBLIGATIONS — (continued) | |

| 23,875(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2002-93, Class FH, 0.618% (1 Month USD LIBOR + | |

| | | 50 bps), 1/25/33 | $ 24,156 |

| 51,033(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2003-8, Class FJ, 0.468% (1 Month USD LIBOR + | |

| | | 35 bps), 2/25/33 | 51,055 |

| 30,768(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2003-42, Class JF, 0.618% (1 Month USD LIBOR + | |

| | | 50 bps), 5/25/33 | 30,954 |

| 72,832(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2003-63, Class F1, 0.418% (1 Month USD LIBOR + | |

| | | 30 bps), 11/25/27 | 72,786 |

| 44,361(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2004-28, Class PF, 0.518% (1 Month USD LIBOR + | |

| | | 40 bps), 3/25/34 | 44,530 |

| 38,568(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2004-52, Class FW, 0.518% (1 Month USD LIBOR + | |

| | | 40 bps), 7/25/34 | 38,835 |

| 51,186(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2005-83, Class KT, 0.418% (1 Month USD LIBOR + | |

| | | 30 bps), 10/25/35 | 51,374 |

| 54,823(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2005-83, Class LF, 0.428% (1 Month USD LIBOR + | |

| | | 31 bps), 2/25/35 | 54,968 |

| 31,579(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2006-33, Class FH, 0.468% (1 Month USD LIBOR + | |

| | | 35 bps), 5/25/36 | 31,718 |

| 56,469(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2006-42, Class CF, 0.568% (1 Month USD LIBOR + | |

| | | 45 bps), 6/25/36 | 57,003 |

| 42,217(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2006-81, Class FA, 0.468% (1 Month USD LIBOR + | |

| | | 35 bps), 9/25/36 | 42,595 |

| 15,060(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2006-82, Class F, 0.688% (1 Month USD LIBOR + | |

| | | 57 bps), 9/25/36 | 15,279 |

| 27,953(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2007-2, Class FT, 0.368% (1 Month USD LIBOR + | |

| | | 25 bps), 2/25/37 | 28,115 |

| 58,180(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2007-7, Class FJ, 0.318% (1 Month USD LIBOR + | |

| | | 20 bps), 2/25/37 | 58,157 |

| 57,466(a) | | Federal National Mortgage Association REMICS, Series | |

| | | 2007-9, Class FB, 0.468% (1 Month USD LIBOR + | |

| | | 35 bps), 3/25/37 | 58,039 |

| 17,808(a) | | Federal National Mortgage Association REMICS, Series | |