UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21552

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta, Esq.

J.P. Morgan Investment Management Inc.

270 Park Avenue, Floor 9

New York, NY 10017

(Name and address of agent for service)

Copy to:

Richard Horowitz, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: March 31

Date of reporting period: March 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Statements

For the year ended March 31, 2017

This report is open and authorized for distribution only to qualified and accredited investors or financial intermediaries who have received a copy of the Fund’s Private Placement Memorandum. This document, although required to be filed with the SEC, may not be copied, faxed or otherwise distributed to the general public.

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Statements

For the year ended March 31, 2017

Contents

Past performance is no guarantee of future results. Market volatility can significantly impact short-term performance. Results of an investment made today may differ substantially from the Fund’s historical performance. Investment return and principal value will fluctuate so that an investor’s interests, when redeemed, may be worth more or less than original cost.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Members of J.P. Morgan Access Multi-Strategy Fund, L.L.C:

In our opinion, the accompanying statement of assets, liabilities, and members’ capital, including the schedule of investments, and the related statements of operations, of changes in members’ capital and of cash flows and the financial highlights present fairly, in all material respects, the financial position of J.P. Morgan Access Multi-Strategy Fund, L.L.C. (the “Fund”) as of March 31, 2017, the results of its operations and its cash flows for the year then ended, the changes in its members’ capital for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments as of March 31, 2017 by correspondence with the underlying investment funds, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, NY

May 26, 2017

|

| PricewaterhouseCoopers LLP, PricewaterhouseCoopers Center, 300 Madison Avenue, New York, NY 10017 T: (646) 471 3000, |

F: (813) 286 6000, www.pwc.com/us |

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments

March 31, 2017

| | | | | | | | | | | | | | |

| Investment Funds (h) | | Cost ($) | | | Fair Value ($) | | | % of

Members’

Capital | | | Liquidity(e) |

Event Driven | | | | | | | | | | | | | | |

Corvex Partners LP (b),(i) | | | 33,409,465 | | | | 33,175,581 | | | | 4.27 | | | Quarterly |

Deephaven Event Fund LLC (i) | | | 81,842 | | | | 7,605 | | | | 0.00 (a) | | | In Liquidation** |

Pershing Square, L.P. (b),(i) | | | 35,915,122 | | | | 28,613,885 | | | | 3.70 | | | Quarterly |

Strategic Value Restructuring Fund, LP (j) | | | 1,031,585 | | | | 4,307 | | | | 0.00 (a) | | | In Liquidation** |

SVRF (Onshore) Holdings LLC (j) | | | 71,440 | | | | 31,105 | | | | 0.00 (a) | | | In Liquidation** |

Third Point Partners Qualified L.P. (b),(i) | | | 20,973,280 | | | | 24,377,498 | | | | 3.14 | | | Quarterly |

Tyrus Capital Event Fund, L.P. (i) | | | 1,745,693 | | | | 2,466,091 | | | | 0.32 | | | Quarterly |

ValueAct Capital Partners, L.P. (i) | | | 165,491 | | | | 289,059 | | | | 0.04 | | | Side Pocket* |

Varde Credit Partners Offshore, Ltd. (b),(j) | | | 46,500,000 | | | | 52,553,495 | | | | 6.77 | | | Quarterly |

York Credit Opportunities Fund, L.P. (b),(j) | | | 28,815,504 | | | | 26,939,110 | | | | 3.47 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | 168,709,422 | | | | 168,457,736 | | | | 21.71 | | | |

| | | | | | | | | | | | | | |

Long/Short Equities | | | | | | | | | | | | | | |

Alyeska Fund, L.P. (b) | | | 29,766,900 | | | | 28,338,026 | | | | 3.65 | | | Monthly |

Coatue Qualified Partners, L.P. (b) | | | 89,000,000 | | | | 98,209,349 | | | | 12.65 | | | Quarterly |

Copper River Partners, L.P. | | | 57,214 | | | | 14,784 | | | | 0.00 (a) | | | In Liquidation** |

Glenview Institutional Partners, L.P. (b) | | | 18,314,161 | | | | 17,278,347 | | | | 2.23 | | | Quarterly/Side Pocket* |

Highline Capital Partners QP, LP (b) | | | 25,500,000 | | | | 25,898,094 | | | | 3.34 | | | Quarterly |

Lakewood Capital Partners, L.P. (b) | | | 27,583,681 | | | | 31,495,503 | | | | 4.06 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | 190,221,956 | | | | 201,234,103 | | | | 25.93 | | | |

| | | | | | | | | | | | | | |

Opportunistic/Macro | | | | | | | | | | | | | | |

Black River Commodity Multi-Strategy Fund LLC | | | 399,123 | | | | 11,057 | | | | 0.00 (a) | | | Side Pocket* |

Brevan Howard L.P. (b) | | | 654,295 | | | | 1,476,373 | | | | 0.19 | | | Monthly |

Caxton Global Investments (USA) LLC (b) | | | 46,754,006 | | | | 46,880,177 | | | | 6.04 | | | Quarterly |

D.E. Shaw Oculus Fund, L.L.C. (b) | | | 29,597,953 | | | | 31,310,366 | | | | 4.03 | | | Quarterly |

Dymon Asia Macro (US) Fund (b) | | | 27,203,903 | | | | 28,710,724 | | | | 3.70 | | | Monthly |

NWI Emerging Market Fixed Income Fund LP (b) | | | 21,500,000 | | | | 22,547,777 | | | | 2.91 | | | Quarterly |

Winton Diversified Futures Fund (US) L.P. | | | 50,901,233 | | | | 51,075,603 | | | | 6.59 | | | Monthly |

| | | | | | | | | | | | | | |

Total | | | 177,010,513 | | | | 182,012,077 | | | | 23.46 | | | |

| | | | | | | | | | | | | | |

Relative Value | | | | | | | | | | | | | | |

Blue Mountain Credit Alternatives Fund L.P. (b) | | | 19,925,639 | | | | 22,082,860 | | | | 2.85 | | | Quarterly |

D.E. Shaw Composite Fund, L.L.C. (k) | | | 43,890,074 | | | | 45,679,844 | | | | 5.88 | | | Quarterly |

GoldenTree Partners, L.P. (b) | | | 4,137,879 | | | | 7,699,918 | | | | 0.99 | | | In Liquidation** |

Horizon Portfolio I Ltd. (b) | | | 40,000,000 | | | | 40,511,456 | | | | 5.22 | | | Quarterly |

King Street Capital, L.P. (b) | | | 39,657,887 | | | | 41,936,590 | | | | 5.41 | | | Quarterly/Side Pocket* |

Magnetar Capital Fund, LP | | | 10,603 | | | | 11,456 | | | | 0.00 (a) | | | In Liquidation** |

Magnetar Risk Linked Fund (US), Ltd. | | | 116,513 | | | | 121,957 | | | | 0.01 | | | Side Pocket* |

Magnetar SPV LLC | | | 325 | | | | 392 | | | | 0.00 (a) | | | In Liquidation** |

Tricadia Credit Strategies L.P. (b) | | | 25,417,618 | | | | 25,085,073 | | | | 3.23 | | | Quarterly |

Two Sigma Spectrum U.S. Fund, LP (b) | | | 33,804,926 | | | | 35,489,254 | | | | 4.58 | | | Quarterly |

Waterfall Victoria Fund, L.P. | | | 1,309 | | | | 8,528 | | | | 0.00 (a) | | | Side Pocket* |

| | | | | | | | | | | | | | |

Total | | | 206,962,773 | | | | 218,627,328 | | | | 28.17 | | | |

| | | | | | | | | | | | | | |

Total Investments in Investment Funds | | | 742,904,664 | | | | 770,331,244 | | | | 99.27 | | | |

| | | | | | | | | | | | | | |

| | | | |

Private Equity Investment (h) | | | | | | | | | | | | | | |

United States: | | | | | | | | | | | | | | |

Energy | | | | | | | | | | | | | | |

Brilliant Light Power, Inc. (g) | | | 179,400 | | | | 134,550 | | | | 0.02 | | | Illiquid |

| | | | | | | | | | | | | | |

Total Private Equity Investment | | | 179,400 | | | | 134,550 | | | | 0.02 | | | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

2

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments (continued)

March 31, 2017

| | | | | | | | | | | | | | | | |

| Short-Term Investments | | Cost ($) | | | Fair Value ($) | | | % of

Members’

Capital | | | Liquidity (e) | |

Investment Companies | | | | | | | | | | | | | | | | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 0.01% (b),(c),(f) | | | 1,499,309 | | | | 1,499,759 | | | | 0.19 | | | | Daily | |

JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 0.01% (b),(d),(f) | | | 68,827,989 | | | | 68,827,989 | | | | 8.87 | | | | Daily | |

| | | | | | | | | | | | | | | | |

Total Short-Term Investments | | | 70,327,298 | | | | 70,327,748 | | | | 9.06 | | | | | |

| | | | | | | | | | | | | | | | |

Total Investments | | | 813,411,362 | | | | 840,793,542 | | | | 108.35 | | | | | |

| | | | |

Liabilities, less other Assets | | | | | | | (64,773,526 | ) | | | (8.35) | | | | | |

| | | | | | | | | | | | | | | | |

Members’ Capital | | | | | | | 776,020,016 | | | | 100.00 | | | | | |

| | | | | | | | | | | | | | | | |

| | (a) | Amount rounds to less than 0.005%. |

| | (b) | Partially or wholly held in a pledged account by the Custodian as collateral for existing line of credit. The aggregate value of collateral pledged for the line of credit is $672,109,840. |

| | (c) | Investment in affiliate. The Fund holds 1,499,309 shares in the JPMorgan Prime Money Market Fund, which is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| | (d) | Investment in affiliate. The Fund holds 68,827,989 shares in the JPMorgan U.S. Government Money Market Fund, which is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| | (e) | Certain funds may be subject to an initial lock-up period, as described in Note 1 of the financial statements. |

| | (f) | The rate shown is the current yield as of March 31, 2017. |

| | (g) | Restricted investment. On November 30, 2014, the Fund received 15 shares via an in-kind distribution from Black Bear I, L.P. Fund, a previous investment of the Fund (See Note 2c). |

| | (h) | Non-income producing securities. |

| | (i) | Investment Fund was reclassified from “Event Driven – Core” strategy during the reporting year. |

| | (j) | Investment Fund was reclassified from “Event Driven – Distressed” strategy during the reporting year. |

| | (k) | Investment Fund was reclassified from “Diversified” strategy during the reporting year. |

| | * | A side pocket is an account within the Investment Fund that has additional restrictions on liquidity. |

| | ** | The Investment Fund is in the process of ceasing its operations or has created a special purpose vehicle to handle the orderly disposition of the underlying assets, which may result in J.P. Morgan Access Multi-Strategy Fund, L.L.C.’s delayed receipt of redemption proceeds. |

The accompanying notes are an integral part of these financial statements.

3

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Schedule of Investments (continued)

March 31, 2017

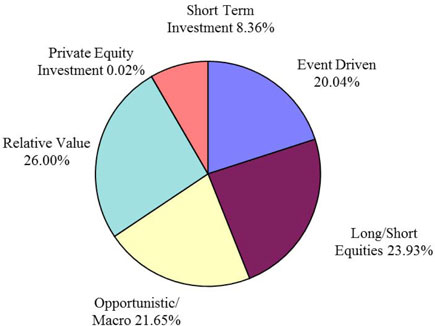

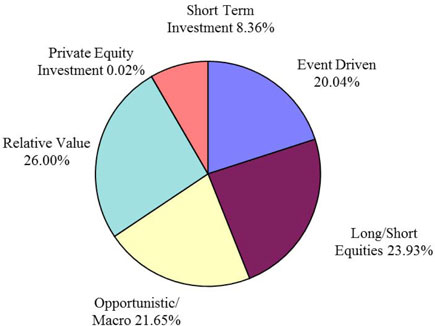

Investment Strategy as a Percentage of Total Investments

The management agreements of the general partners/managers provide for compensation to such general partners/managers in the form of management fees ranging from 1% to 3% annually of net assets and incentives of 20% to 30% of net profits earned.

The accompanying notes are an integral part of these financial statements.

4

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Assets, Liabilities and Members’ Capital

March 31, 2017

| | | | |

Assets | | | | |

| |

Investments in non-affiliates, at fair value (cost $743,084,064) | | $ | 770,465,794 | |

Investment in affiliate, at fair value (cost $68,827,365) | | | 68,827,365 | |

Investment in affiliate - restricted, at fair value (cost $1,499,933) (see Note 4) | | | 1,500,383 | |

| | | | |

Total Investments, at fair value (cost $813,411,362) | | | 840,793,542 | |

| |

Cash | | | 4,891 | |

Receivable for Investment Funds sold | | | 152,914,269 | |

Investments paid in advance (see Note 2d) | | | 6,750,000 | |

Prepaid expenses | | | 77,301 | |

Dividend receivable from affiliate | | | 32,798 | |

| | | | |

Total assets | | | 1,000,572,801 | |

| | | | |

| |

Liabilities | | | | |

Tender offer proceeds payable | | | 214,334,832 | |

Loan payable (see Note 4) | | | 5,500,000 | |

Contributions received in advance (see Note 6) | | | 2,130,118 | |

Management Fee payable | | | 1,497,883 | |

Professional fees payable | | | 575,835 | |

Administration Fee payable | | | 231,278 | |

Credit facility fees payable | | | 49,822 | |

Interest payable | | | 12,357 | |

Other accrued expenses | | | 220,660 | |

| | | | |

Total liabilities | | | 224,552,785 | |

| | | | |

| |

Members’ Capital | | $ | 776,020,016 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

5

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Operations

For the year ended March 31, 2017

| | | | |

Investment income | | | | |

Dividend income from affiliates | | $ | 731,700 | |

Interest income | | | 53,947 | |

| | | | |

Total investment income | | | 785,647 | |

| | | | |

| |

Expenses | | | | |

Management Fee (see Note 3) | | | 17,173,325 | |

Administration Fee (see Note 3) | | | 2,272,506 | |

Credit facility fees (see Note 4) | | | 1,486,398 | |

Fund accounting and custodian fees | | | 800,199 | |

Professional fees | | | 733,284 | |

Investor servicing fees | | | 429,225 | |

Interest (see Note 4) | | | 145,211 | |

Insurance | | | 99,495 | |

Directors’ and Chief Compliance Officer’s fees | | | 42,000 | |

Other | | | 332,742 | |

| | | | |

Total expenses | | | 23,514,385 | |

| | | | |

| |

Less: Waivers and/or expense reimbursements (see Note 3) | | | (351,719) | |

| | | | |

Net expenses | | | 23,162,666 | |

| | | | |

| |

Net investment income/(loss) | | | (22,377,019) | |

| | | | |

| |

Realized and unrealized gain/(loss) | | | | |

Net realized gain/(loss) from Investment Fund transactions | | | (23,622,112) | |

Net realized gain/(loss) from affiliated Investment Companies | | | 6,353 | |

Net change in unrealized appreciation/(depreciation) on Investment Funds | | | 135,377,014 | |

Net change in unrealized appreciation/(depreciation) on affiliated Investment Companies | | | 450 | |

| | | | |

| |

Net realized and unrealized gain/(loss) | | | 111,761,705 | |

| | | | |

| |

Net increase in Members’ Capital resulting from operations | | $ | 89,384,686 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

6

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statements of Changes in Members’ Capital

For the year ended March 31, 2017

| | | | | | | | | | | | | | | | |

| | | Managing

Member* | | | Special

Member | | | Other

Members | | | Total | |

From investment activities | | | | | | | | | | | | | | | | |

| | | | |

Net investment income/(loss) | | $ | – | | | $ | (26,407) | | | $ | (22,350,612) | | | $ | (22,377,019) | |

Net realized gain/(loss) from Investment Fund transactions | | | – | | | | (18,457) | | | | (23,603,655) | | | | (23,622,112) | |

Net realized gain/(loss) from affiliated Investment Companies | | | – | | | | 8 | | | | 6,345 | | | | 6,353 | |

Net change in unrealized appreciation/(depreciation) on Investment Funds | | | – | | | | 158,362 | | | | 135,218,652 | | | | 135,377,014 | |

Net change in unrealized appreciation/(depreciation) on affiliated Investment Companies | | | – | | | | 1 | | | | 449 | | | | 450 | |

Performance allocation | | | – | | | | 51,637 | | | | (51,637) | | | | – | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from operations | | | – | | | | 165,144 | | | | 89,219,542 | | | | 89,384,686 | |

| | | | |

From Members’ Capital transactions | | | | | | | | | | | | | | | | |

Capital contributions | | | – | | | | – | | | | 30,354,000 | | | | 30,354,000 | |

Repurchase fee | | | – | | | | 106 | | | | 70,539 | | | | 70,645 | |

Capital repurchases | | | – | | | | – | | | | (1,462,654,832) | | | | (1,462,654,832) | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from capital transactions | | | – | | | | 106 | | | | (1,432,230,293) | | | | (1,432,230,187) | |

| | | | |

Net change in Members’ Capital | | | – | | | | 165,250 | | | | (1,343,010,751) | | | | (1,342,845,501) | |

| | | | |

Members’ Capital at beginning of year | | | – | | | | 1,737,269 | | | | 2,117,128,248 | | | | 2,118,865,517 | |

| | | | |

| | | | |

Members’ Capital at end of year | | $ | – | | | $ | 1,902,519 | | | $ | 774,117,497 | | | $ | 776,020,016 | |

| | | | |

For the year ended March 31, 2016

| | | | | | | | | | | | | | | | |

| | | Managing

Member* | | | Special

Member | | | Other

Members | | | Total | |

From investment activities | | | | | | | | | | | | | | | | |

| | | | |

Net investment income/(loss) | | $ | (55) | | | $ | (27,813) | | | $ | (43,025,372) | | | $ | (43,053,240) | |

Net realized gain/(loss) from Investment Fund transactions | | | 221 | | | | 63,152 | | | | 52,628,545 | | | | 52,691,918 | |

Net change in unrealized appreciation/(depreciation) on Investment Funds | | | (179) | | | | (327,047) | | | | (420,959,800) | | | | (421,287,026) | |

Performance allocation | | | – | | | | (8,863,881) | | | | 8,863,881 | | | | – | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from operations | | | (13) | | | | (9,155,589) | | | | (402,492,746) | | | | (411,648,348) | |

| | | | |

From Members’ Capital transactions | | | | | | | | | | | | | | | | |

Capital contributions | | | – | | | | – | | | | 288,774,744 | | | | 288,774,744 | |

Repurchase fee | | | – | | | | 44 | | | | 72,280 | | | | 72,324 | |

Capital repurchases | | | (14,419) | | | | – | | | | (715,171,263) | | | | (715,185,682) | |

| | | | |

Net increase/(decrease) in Members’ Capital resulting from capital transactions | | | (14,419) | | | | 44 | | | | (426,324,239) | | | | (426,338,614) | |

| | | | |

Net change in Members’ Capital | | | (14,432) | | | | (9,155,545) | | | | (828,816,985) | | | | (837,986,962) | |

| | | | |

Members’ Capital at beginning of year | | | 14,432 | | | | 10,892,814 | | | | 2,945,945,233 | | | | 2,956,852,479 | |

| | | | |

| | | | |

Members’ Capital at end of year | | $ | – | | | $ | 1,737,269 | | | $ | 2,117,128,248 | | | $ | 2,118,865,517 | |

| | | | |

| * | As described in Note 1, the Fund’s Managing Member changed from JPMorgan Investment Management, Inc. (“JPMIM”) to MSFMM, Inc. (“MSFMM”). On July 1, 2015, MSFMM made a capital contribution of less than $1 and JPMIM redeemed its entire investment in the Fund. |

The accompanying notes are an integral part of these financial statements.

7

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Statement of Cash Flows

For the year ended March 31, 2017

| | | | |

Cash flows from operating activities | | | | |

| |

Net increase in Members’ Capital resulting from operations | | $ | 89,384,686 | |

Adjustments to reconcile net increase in Members’ Capital resulting from operations to net cash provided by operating activities: | | | | |

Purchases of Investment Funds | | | (394,450,878) | |

Sales of Investment Funds | | | 1,629,339,955 | |

Sales of short-term investments, net | | | 11,135,583 | |

Net realized (gain)/loss from Investment Fund transactions | | | 23,622,112 | |

Net realized (gain)/loss from affiliated Investment Companies | | | (6,353) | |

Net change in unrealized (appreciation)/depreciation on Investment Funds | | | (135,377,014) | |

Net change in unrealized (appreciation)/depreciation on affiliated Investment Companies | | | (450) | |

Decrease in dividend receivable from affiliate | | | 14,023 | |

Decrease in investments paid in advance | | | 76,550,000 | |

Decrease in prepaid expenses | | | 15,167 | |

Decrease in receivable for Investment Funds sold | | | 168,104,400 | |

Decrease in Administration Fee payable | | | (62,227) | |

Decrease in credit facility fees payable | | | (18,356) | |

Decrease in Management Fee payable | | | (923,454) | |

Increase in interest payable | | | 12,357 | |

Increase in professional fees payable | | | 89,011 | |

Decrease in other accrued expenses | | | (57,476) | |

| | | | |

| |

Net cash provided by operating activities | | | 1,467,371,086 | |

| | | | |

| |

Cash flows from financing activities | | | | |

| |

Capital contributions, including change in contributions received in advance | | | 26,270,643 | |

Capital redemptions, including change in tender offer proceeds payable and repurchase fees | | | (1,499,137,040) | |

Proceeds from loan payable | | | 106,500,000 | |

Repayment of loan payable | | | (101,000,000) | |

| | | | |

| |

Net cash used in financing activities | | | (1,467,366,397) | |

| | | | |

| |

Net increase in cash and cash equivalents | | | 4,689 | |

| |

Cash at beginning of year | | | 202 | |

| | | | |

Cash at end of year | | $ | 4,891 | |

| | | | |

| |

Supplemental disclosure of cash flow information | | | | |

Cash paid during the year for interest | | $ | 132,854 | |

| | | | |

For purposes of reporting the statement of cash flows, the Fund considers all cash accounts that are not subject to withdrawal restrictions or penalties to be cash equivalents.

The accompanying notes are an integral part of these financial statements.

8

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Financial Highlights

Ratios and other Financial Highlights

The following represents the ratios to the other Members’ Capital and other financial highlights information for Members’ Capital other than the Managing Member and Special Member.

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended March 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | |

Total return | | | 6.49% | | | | (14.42%) | | | | 3.56% | | | | 7.88% | | | | 9.05% | |

Performance allocation | | | 0.00% (a) | | | | 0.27% | | | | (0.34%) | | | | (0.81%) | | | | (0.84%) | |

| | | | |

Total return after performance allocation | | | 6.49% | | | | (14.15%) | | | | 3.22% | | | | 7.07% | | | | 8.21% | |

| | | | | |

Ratios to the other Members’ Capital: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, before waivers | | | 1.51% | | | | 1.59% | | | | 1.60% | | | | 1.60% | | | | 1.60% | |

Expenses, net of waivers | | | 1.49% | | | | 1.58% | | | | 1.59% | | | | 1.59% | | | | 1.59% | |

Performance allocation | | | 0.00% (a) | | | | (0.32%) | | | | 0.35% | | | | 0.79% | | | | 0.83% | |

| | | | |

Expenses, net of performance allocation and net of waivers | | | 1.49% | | | | 1.26% | | | | 1.94% | | | | 2.38% | | | | 2.42% | |

| | | | | |

Net investment income (loss), before waivers | | | (1.46%) | | | | (1.58%) | | | | (1.60%) | | | | (1.60%) | | | | (1.60%) | |

Net investment income (loss), net of waivers | | | (1.44%) | | | | (1.57%) | | | | (1.59%) | | | | (1.59%) | | | | (1.59%) | |

| | | | | |

Portfolio turnover rate | | | 26.94% | | | | 25.59% | | | | 32.38% | | | | 22.18% | | | | 23.95% | |

| | | | | |

Members’ Capital applicable to other Members | | $ | 774,117,497 | | | $ | 2,117,128,248 | | | $ | 2,945,945,233 | | | $ | 2,340,065,963 | | | $ | 1,170,171,993 | |

The above ratios and total returns are calculated for other Members taken as a whole. An individual investor’s return may vary from these returns based on the timing of capital contributions and performance allocation.

The above expense ratios do not include the expenses from the investment funds and affiliated money market funds. However, total returns take into account all expenses.

| (a) | Amount rounds to less than 0.005% |

The accompanying notes are an integral part of these financial statements.

9

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017

1. Organization

J.P. Morgan Access Multi-Strategy Fund, L.L.C. (the “Fund”) was organized as a limited liability company on April 6, 2004 under the laws of the State of Delaware and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified, management investment company. The Fund’s investment objective is to generate consistent capital appreciation over the long term, with relatively low volatility and a low correlation with traditional equity and fixed-income markets. The Fund will seek to accomplish this objective by allocating its assets primarily among professionally selected investment funds (collectively, “Investment Funds” and each individually, “Investment Fund”) that are managed by experienced third-party investment advisers (“Portfolio Managers”) who invest in a variety of markets and employ, as a group, a range of investment techniques and strategies. There can be no assurance that the Fund will achieve its investment objective.

The following is a description of strategies used by third party investment advisors:

Event Driven – Invests in securities of companies in financial difficulty, reorganization or bankruptcy, involved in mergers, acquisitions, restructurings, liquidations, spin-offs, or other special situations that alter a company’s financial structure or operating strategy, nonperforming and subperforming bank loans, and emerging market debt. Investment Funds within this strategy are generally subject to 45-90 day redemption notice periods and may have lock-up periods of up to two years as of March 31, 2017.

Long/Short Equities – Invests in long and short equity securities that are deemed to be under or overvalued. Investment Funds within this strategy are generally subject to 30-90 day redemption notice periods and may have lock-up periods of up to 18 months as of March 31, 2017.

Opportunistic/Macro – Invests in a wide variety of instruments using a broad range of strategies, often assuming an aggressive risk posture. This strategy uses a combination of macro-economic models and fundamental research to invest across countries, markets, sectors and companies, and have the flexibility to invest in numerous financial instruments. Investment Funds within this strategy are generally subject to 30-90 day redemption notice periods.

Relative Value – Makes simultaneous purchases and sales of similar securities to exploit pricing differentials or have long exposure in non-equity oriented beta opportunities (such as credit). Different relative value strategies include convertible bond arbitrage, statistical arbitrage, pairs trading, yield curve arbitrage and basis trading. Investment Funds within this strategy are generally subject to 30-90 day redemption notice periods and may have lock-up periods of up to one year as of March 31, 2017.

J.P. Morgan Investment Management Inc. (“JPMIM”), a corporation formed under the laws of the State of Delaware and an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan Chase”), acts as Investment Manager (the “Investment Manager”) and Administrator (the “Administrator”) and is responsible for the day-to-day management of the Fund, subject to policies adopted by the Board of Directors (the “Board”). The Investment Manager has in turn delegated substantially all investment authority and the allocation of the Fund’s assets among the Investment Funds and other instruments to J.P. Morgan Private Investments Inc. (the “Sub-Advisor” or “JPMPI”), a corporation formed under the laws of the State of Delaware and a wholly-owned subsidiary of JPMorgan Chase. The Sub-Advisor will allocate Fund assets among the Investment Funds and

10

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

1. Organization (continued)

other investments that, in its view, represent attractive investment opportunities. Effective July 1, 2015, the managing member of the Fund was changed from JPMIM to MSFMM, Inc. (“MSFMM” or the “Managing Member”), an entity established by Intertrust Group B.V. In conjunction with that change, MSFMM made a capital contribution of less than $1 and JPMIM redeemed its entire investment in the Fund.

Both the Investment Manager and the Sub-Advisor are registered as investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

2. Significant Accounting Policies

a. Use of Estimates

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 - Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in members’ capital (“Members’ Capital”) from operations during the reporting period. Actual results could differ from those estimates.

b. Valuation of Investments

The valuation of the investments is in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board, which established the following approach to valuation, as described more fully below. The Fund values its investments in Investment Funds at fair value. Fair value as of each month-end ordinarily is the net asset value (“NAV”) determined as of such month-end for each Investment Fund in accordance with the Investment Fund’s valuation policies and reported at the time of the Fund’s valuation.

The Administrator has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Funds’ investments. The Administrator implements the valuation policies of the Fund’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Fund as described in detail below. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

On a monthly basis, the NAV is used to determine the fair value of all underlying investments which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Investment Fund will represent the amount that the Fund could

11

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

2. Significant Accounting Policies (continued)

b. Valuation of Investments (continued)

reasonably expect to receive from an Investment Fund if the Fund’s interest were redeemed at the time of the valuation, based on information reasonably available at the time the valuation is made and that the Administrator believes to be reliable. In the unlikely event that an Investment Fund does not report a month-end NAV to the Fund on a timely basis, the Administrator would determine the fair value of such Investment Fund based on the most recent value reported by the Investment Fund, as well as any other relevant information available at such time. Considerable judgment is required to interpret the factors used to develop estimates at fair value. These factors include, but are not limited to, a review of the underlying securities of the Investment Fund when available, ongoing due diligence of the style, strategy and valuation methodology employed by each Investment Fund, and a review of market inputs that may be expected to impact the performance of a particular Investment Fund. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the financial statements.

Some of the Investment Funds may invest all or a portion of their assets in investments which may be illiquid. Some of these investments are held in “side pockets”, sub funds within the Investment Funds, which provide for their separate liquidation potentially over a much longer period than the liquidity an investment in the Investment Funds may provide. Should the Fund seek to liquidate its investment in an Investment Fund which maintains investments in a side pocket arrangement or which holds substantially all of its assets in illiquid investments, the Fund might not be able to fully liquidate its investment without considerable delay. In such cases, the value of its investment could fluctuate during the year until the Fund is permitted to fully liquidate its interest in the Investment Funds.

Investments in an affiliated money market fund are valued at such fund’s NAV per share as of the valuation date.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the fair value of the Fund’s investments are summarized into the three broad levels listed below.

Level 1 – Unadjusted inputs using quoted prices in active markets for identical investments.

Level 2 – Other significant observable inputs including, but not limited to, quoted prices for similar investments or other significant observable inputs.

Level 3 – Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments).

12

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

2. Significant Accounting Policies (continued)

b. Valuation of Investments (continued)

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The Fund’s investments in affiliated money market mutual funds and a private equity investment, as disclosed on the Schedule of Investments, are designated as Level 1 and Level 3, respectively. The private equity investment is valued using a 25% liquidity discount from the most recently available share price at the time of in-kind distribution to the Fund.

As of March 31, 2017, Investment Funds with a fair value of $762,631,326 have not been categorized in the fair value hierarchy as the Investment Funds were measured using the NAV per share as a practical expedient. Additionally, at March 31, 2017 the fair value of the GoldenTree Partners, L.P. Investment Fund reflects the amount at which the Investment Manager has committed to sell the Investment Fund back to its sponsor.

c. Restricted Securities

Certain securities held by the Fund may be subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under Securities Act of 1933 (the “Securities Act”). Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the net assets of the Fund.

As of March 31, 2017, the Fund had a restricted security as noted in the Schedule of Investments.

d. Investments Paid in Advance

Investments paid in advance represent cash which has been sent to Investment Funds prior to March 31, 2017 but the investment is not effective until April 1, 2017. At March 31, 2017, the Fund made the following commitments to purchase Investment Funds:

| | | | |

Investment Fund | | Amount | |

Two Sigma Spectrum U.S. Fund, LP | | $ | 6,750,000 | |

| | | | |

Total | | $ | 6,750,000 | |

| | | | |

e. Distributions from Investment Funds

Distributions received from Investment Funds, whether in the form of cash or securities, are applied as a reduction of the investment’s cost when identified by the Investment Fund as a return of capital. Once the investment’s cost is received, any further distributions are recognized as realized gains.

13

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

2. Significant Accounting Policies (continued)

f. Income Recognition and Security Transactions

Distributions of net investment income and realized capital gains from an affiliated money market fund, if any, are recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Realized gains and losses from Investment Fund transactions are calculated on the identified cost basis. Investments are recorded on the effective date of the subscription in the Investment Fund. All changes in the value of the Investment Funds are included in Net change in unrealized appreciation/(depreciation) on the Statement of Operations.

g. Fund Expenses

The Fund bears all expenses incurred in its business other than those that the Investment Manager assumes. The expenses of the Fund include, but are not limited to, the following: all costs and expenses related to investment transactions and positions for the Fund’s account; legal fees; accounting and auditing fees; custodial fees; costs of computing the Fund’s net asset value; costs of insurance; registration expenses; expenses of meetings of the Board; all costs with respect to communications to members (the “Members”); and other types of expenses as may be approved from time to time by the Board.

The Fund invests in Investment Funds and, as a result, bears a portion of the expenses incurred by these Investment Funds. These expenses are not reflected in the expenses shown on the Statement of Operations and are not included in the ratios to the other Members’ Capital shown in the Financial Highlights. Certain expenses incurred indirectly through investment in an affiliated money market fund are waived by the Fund as described in Note 3.

h. Income Taxes

The Fund intends to operate and has elected to be treated as a partnership for federal income tax purposes. Accordingly, no provision for the payment of federal, state or local income taxes has been provided. Each Member is individually responsible to report on its own tax return its distributive share of the Fund’s taxable income or loss.

The Investment Manager evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s financial statements to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions with respect to tax at the Fund level not deemed to meet the “more-likely-than-not” threshold would be recorded as a tax benefit or expense in the current year. The Investment Manager is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits or expense will significantly change in the next twelve months. The Investment Manager’s conclusions regarding tax positions will be subject to review and may be adjusted at a later date based on factors including, but not limited to, on-going analyses of tax laws, regulations and interpretations thereof.

The Investment Manager has reviewed the Fund’s tax positions for all open tax years and has determined that as of March 31, 2017, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, Investment Management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

14

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

3. Management Fee, Related Party Transactions and Other

The Fund has entered into an investment management agreement with the Investment Manager. In consideration of the advisory services provided by the Investment Manager to the Fund, the Fund pays the Investment Manager a management fee at an annual rate of 1.00% (the “Management Fee”), payable monthly at the rate of 1/12 of 1.00% of the month-end capital account balance of each Member, before giving effect to repurchases, Repurchase Fees (if any, as defined in Note 6) or the Performance Allocation (as defined in Note 6), but after giving effect to the Fund’s other expenses. Prior to September 1, 2016, the Management Fee was 1.25%. The Management Fee is an expense paid out of the Fund’s assets. The Management Fee is paid monthly in arrears within 30 days of the calculation of the Fund’s month-end Members’ Capital of each month. For the year ended March 31, 2017, the Management Fee earned by JPMIM totaled $17,173,325.

The Investment Manager, on behalf of the Fund, has entered into an investment sub-advisory agreement with JPMPI. For its services as sub-advisor, the Investment Manager pays JPMPI a monthly sub-advisory fee of 1/12 of 0.85% of the month-end capital balance of each Member of the Fund. Prior to September 1, 2016, the Investment Manager paid JPMPI a monthly sub-advisory fee of 1/12 of 1.10% of the month-end capital balance of each Member of the Fund.

The Sub-Advisor is the special member of the Fund (the “Special Member”). Prior to January 1, 2017, the Special Member was entitled to all incentive-based performance allocations, if any, from Members’ accounts (see Note 6).

Pursuant to an Administration Agreement, the Administrator provides certain administration services to the Fund. In consideration of these services, the Administrator receives a fee (the “Administration Fee”) paid monthly at the annual rate of 0.15% of the Fund’s month end Members’ Capital before repurchases, Repurchase Fees, or the performance allocation, but after giving effect to the Fund’s other expenses. For the year ended March 31, 2017, the Administration Fee earned by JPMIM totaled $2,272,506.

The Investment Manager, the Sub-Advisor and the Administrator, have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses, other than certain money market fund fees as described below, interest, brokerage commissions, other transaction-related expenses and any extraordinary expenses as well as any Performance Allocation) exceed 1.92% on an annualized basis of the Fund’s Members’ Capital as of the end of each month. This expense limitation agreement is in effect until August 26, 2017. There were no fees waived pursuant to this agreement during the year ended March 31, 2017.

The Fund may invest in one or more money market funds advised by the Investment Manager or its affiliates (affiliated money market funds). Effective August 26, 2016, the Investment Manager and/or Administrator have contractually agreed to waive fees and/or reimburse expenses in an amount sufficient to offset the respective net fees each collects from an affiliated money market fund on the Fund’s investment in such affiliated money market funds. Prior to August 26, 2016, a portion of the waiver was voluntary. The amount of waivers resulting from investments in the money market funds for the year ended March 31, 2017 was $351,719.

15

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

3. Management Fee, Related Party Transactions and Other (continued)

Entities may be retained by the Fund to assist in the placement of interests. These entities (“Placement Agents” or “Intermediaries”), which may include the Investment Manager and its affiliates, will generally be entitled to receive a placement fee of up to 2.0% of the invested amount from each investor purchasing an interest through a Placement Agent. The placement fee will be added to a prospective investor’s subscription amount; it will not constitute a capital contribution made by the investor to the Fund nor will it be included as part of the assets of the Fund. The placement fee may be adjusted or waived in the sole discretion of the Placement Agent.

Certain officers of the Fund are affiliated with the Investment Manager and the Administrator. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

The Board appointed a Chief Compliance Officer to the Fund in accordance with Federal securities regulations. The Fund, along with other affiliated funds, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Directors’ and Chief Compliance Officer’s fees on the Statement of Operations.

The Fund has adopted a Director Deferred Compensation Plan (the “Plan”) which allows the Independent Directors to defer the receipt of all or a portion of compensation related to performance of their duties as a Director. The deferred fees are invested in various J.P. Morgan Funds until distribution in accordance with the Plan.

4. Line of Credit

The Fund has a line of credit with Credit Suisse International in the amount of $200 million and from time to time may borrow cash under a credit agreement. Prior to February 23, 2017, the line of credit was $260 million. Interest charged on borrowings, which is calculated on any outstanding loan balance, and based on a LIBOR-based rate, is payable on a monthly basis. The Fund also pays a monthly fee on the unused amount of the line of credit. The Fund had an outstanding loan balance of $5.5 million on this line of credit as of March 31, 2017. This agreement terminates on May 31, 2017.

During the year ended March 31, 2017, the Fund had borrowings under the credit agreement as follows:

| | | | | | | | |

Average Daily

Loan Balance* | | Weighted

Average Interest

Rate | | Interest

Expense | | Number of Days

Borrowings Were

Outstanding | | Credit Facility

Fee** |

| $29,207,143 | | 2.56% | | $145,211 § | | 70 | | $1,486,398 § |

| | * | For the days borrowings were outstanding. |

| | ** | For the fiscal year ended March 31, 2017. |

| | § | Interest expense and credit facility fees incurred for the year ended March 31, 2017 are included in the Statement of Operations. |

16

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

4. Line of Credit (continued)

The Fund is required to pledge cash or securities as collateral to Credit Suisse International in an amount equal to a certain percentage of the available line of credit. Securities segregated as collateral are denoted on the Schedule of Investments. Cash collateral posted by the Fund is invested in an affiliated money market fund and reported on the Statement of Assets, Liabilities and Members’ Capital as Investment in affiliate-restricted, at fair value.

At a meeting held in May 2017, the Board approved the renewal of the line of credit until May 30, 2018 and reduction of the line of credit to $120 million, effective May 31, 2017.

5. Security Transactions

Aggregate purchases and sales of Investment Funds for the year ended March 31, 2017 amounted to $394,450,878 and $1,629,339,955, respectively.

At March 31, 2017, the estimated cost of investments for federal income tax purposes was $876,977,967. Accordingly, gross unrealized appreciation on investments was $43,418,247 and gross unrealized depreciation was $79,602,672, resulting in net unrealized depreciation of $36,184,425. The estimated cost of investments for federal income tax purposes is adjusted for items of taxable income or loss allocated to the Fund from the Investment Funds. The allocated taxable income or loss is reported to the Fund by the Investment Funds on their respective Schedule K-1. The Fund has not yet received all such Schedule K-1’s for the tax year ended December 31, 2016; therefore, the tax basis cost of investments as of March 31, 2017 is estimated based on information available, and will not be finalized by the Fund until after the fiscal year end.

6. Contributions, Redemptions, and Performance Allocation

Generally, initial and additional contributions for Interests (“Interests”) by eligible investors may be accepted at such times as the Fund may determine. The Fund reserves the right to reject any contributions for Interests in the Fund. The initial acceptance for contributions for Interests was April 1, 2004 (the “Initial Closing Date”). After the Initial Closing Date, the Fund generally accepts contributions for Interests as of the first day of each month. At March 31, 2017, the Fund received $2,130,118 in contribution proceeds in advance of the April 1, 2017 contribution date, which included Repurchase Fees, as defined below, related to repurchase of Members’ Interests at March 31, 2017. This amount is included in the Statement of Assets, Liabilities and Members’ Capital.

The Fund from time to time may offer to repurchase Interests pursuant to written tenders by Members. These repurchases will be made at such times, and in such amounts, and on such terms as may be determined by the Board, in its sole discretion. The Investment Manager expects to typically recommend to the Board that the Fund offer to repurchase Interests from Members of up to 25% of the Fund’s Member’s Capital quarterly, effective as of the last day of March, June, September, and December, although such recommendation may be less than or greater than 25%. A 1.5% repurchase fee (the “Repurchase Fee”) payable to the Fund will be charged for repurchases of Members’ Interests at any time prior to the day immediately preceding the one-year anniversary of a Member’s purchase of its Interests. For the year ended March 31, 2017, the Fund earned Repurchase Fees of $70,645, which is included on the Statements of Changes in Members’ Capital.

17

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

6. Contributions, Redemptions, and Performance Allocation (continued)

At the end of each Allocation Period of the Fund, any net capital appreciation or net capital depreciation of the Fund (both realized and unrealized), as the case may be, is allocated to the capital accounts of all of the Members (including the Special Member and the Managing Member) in proportion to their respective opening capital account balances for such Allocation Period. The initial “Allocation Period” began on the Initial Closing Date, with each subsequent Allocation Period beginning immediately after the close of the preceding Allocation Period. Each Allocation Period closes on the first to occur of (1) the last day of each month, (2) the date immediately prior to the effective date of (a) the admission of a new Member or (b) an increase in a Member’s capital contribution, (3) the effective date of any repurchase of Interests, or (4) the date when the Fund dissolves.

At the end of each calendar year, each Member’s return on investment for the year is determined and a portion of the net capital appreciation allocated to each Member’s capital account during the year (the “Performance Allocation”) if any, net of the Member’s allocable share of the Management Fee and the Administrative Fee, equal to 10% of the portion of such net capital appreciation that exceeds the Preferred Return (as defined below) will be reallocated to the capital account of the Special Member. The “Preferred Return” is equal to the 3-month U.S. Treasury Bill yield (as defined below) for each month during the relevant calendar year (or any shorter period of calculation). The “3-month U.S. Treasury Bill yield” for any month shall equal one-twelfth of the annual yield for the 3-month U.S. Treasury Bill for the first business day of the then current calendar quarter as set forth in the U.S. Federal Reserve Statistical Release H.15 (519) under the caption “Treasury constant maturities”, or if such measurement is not available, such other source as the Managing Member may determine appropriate in its discretion.

No Performance Allocation is made, however, with respect to a Member’s capital account until any cumulative net capital depreciation previously allocated to such Member’s capital account plus any Management Fees and Administrative Fees charged to such capital account (the “Loss Carry forward”) have been recovered. Any Loss Carry forward of a Member is reduced proportionately to reflect the repurchase of any portion of that Member’s Interest. Upon a repurchase of an Interest (other than at the end of a calendar year) from a Member, a Performance Allocation will be determined and allocated to the Special Member, and in the case of any repurchase of a partial Interest, on a “first in - first out” basis (i.e., the portion of the Interest being repurchased and the amount with respect to which the Performance Allocation is calculated) will be deemed to have been taken from the first capital contribution of such Member (as such contribution has been adjusted for net capital appreciation or depreciation, Management Fees, Manager Administrative Fees and other expenses) until it is decreased to zero and from each subsequent capital contribution until such contribution (as adjusted) is decreased to zero.

Effective September 1, 2016, the Performance Allocation for the 2016 calendar year was modified (“Modified Performance Allocation”). The Modified Performance Allocation is the lower of (i) the performance allocation that the Special Member would have been entitled to with respect to the capital account of any Member of the Fund as of the close of business on August 31, 2016 had such day been the close of the calendar year and (ii) the performance allocation that the Special Member would have been entitled to with respect to the capital account of any such Member of the Fund at the close of the calendar year 2016 (or if such Member withdraws or transfers all or a portion of its capital account before December 31, 2016, at the close of such Member’s withdrawal date or transfer date) had the previous performance fee arrangement described above been in effect.

18

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

6. Contributions, Redemptions, and Performance Allocation (continued)

Effective January 1, 2017, the Fund will no longer be subject to a Performance Allocation. In connection with this change, the Fund is no longer required to have a Special Member to receive the Performance Allocation.

Performance Allocation is earned on a calendar year basis, and is accrued and presented on the Statement of Changes in Members’ Capital on a fiscal year basis. The Performance Allocation for the period April 1, 2016 through December 31, 2016 and the fiscal year ended March 31, 2016 was $51,637 and $(8,863,881), respectively. These amounts are reported as Performance Allocation on the Statements of Changes in Members’ Capital.

The Performance Allocation for the fiscal year ended March 31, 2017 is comprised of the amounts noted below:

| | | | | | | | | | | | |

| | | Performance

Allocation Accrual | | | Performance Allocated

to Special Member | | | Total | |

12/31/2016 | | $ | - | | | $ | 51,637 | | | $ | 51,637 | |

| | | | | | | | | | | | |

The Performance Allocation for the fiscal year ended March 31, 2016 is comprised of the amounts noted below:

| | | | | | | | | | | | |

| | | Performance

Allocation Accrual | | | Performance Allocated

to Special Member | | | Total | |

12/31/2015 | | $ | (9,442,525) | * | | $ | 578,645 | | | $ | (8,863,881) | |

3/31/2016 | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (8,863,881) | |

| | * | Represents the reversal of the prior period fiscal year’s accrual, as no actual Performance Allocation occurred. |

7. Risk Exposure

In the normal course of business, the Investment Funds trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short-selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swaps contracts. The Fund’s risk of loss in these Investment Funds is limited to the value of the Fund’s investments in the Investment Funds.

In pursuing its investment objectives, the Fund invests in Investment Funds that are not registered under the 1940 Act. These Investment Funds may utilize diverse investment strategies, which are not generally managed against traditional investment indices. The Investment Funds selected by the Fund will invest in and actively traded securities and other financial instruments using a variety of strategies and investment techniques that may involve significant risks. Such risks arise from the volatility of the equity, fixed income, commodity and currency markets, leverage both on and off balance sheet associated with borrowings, short sales and derivative instruments, the potential illiquidity of certain instruments including emerging markets, private transactions, derivatives, and counterparty and broker defaults. Various risks are also associated with an investment in the Fund, including risks relating to the multi-

19

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

7. Risk Exposure (continued)

manager structure of the Fund, risks relating to compensation arrangements and risks related to limited liquidity of the Investment Funds. The Investment Funds provide for periodic redemptions generally ranging from monthly to semi-annually, and may be subject to various lock-up provisions and early withdrawal fees.

Because of the Fund’s investment in the Investment Funds, the Fund indirectly pays a portion of the expenses incurred by the Investment Funds. As a result, a cost of investing in the Fund may be higher than the cost of investing in a fund that invests directly in individual securities and financial instruments.

The investments of the Investment Funds are subject to normal market fluctuations and other risks inherent in investing in securities and there can be no assurance that any appreciation in value will occur. The value of investments can fall as well as rise and investors may not realize the amount that they invest.

Although the Investment Manager will seek to select Investment Funds that offer the opportunity to have their shares or units redeemed within a reasonable timeframe, there can be no assurance that the liquidity of the investments of such Investment Funds will always be sufficient to meet redemption requests as, and when, made.

The Investment Manager may invest the Fund’s assets in Investment Funds that invest in illiquid securities and do not permit frequent withdrawals. Illiquid securities owned by Investment Funds are generally riskier than liquid securities because the Investment Funds may not be able to dispose of the illiquid securities if their investment performance deteriorates, or may be able to dispose of the illiquid securities only at a greatly reduced price. Similarly, the illiquidity of the Investment Funds may cause Members to incur losses because of an inability to withdraw their investments from the Fund during or following periods of negative performance.

The Investment Funds may invest in the securities of foreign companies that involve special risks and considerations not typically associated with investing in U.S. companies. These risks include devaluation of currencies, less reliable information about issuers, different securities transaction clearance and settlement practices, and future adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those securities of comparable U.S. companies.

Since the Fund is non-diversified, it may invest a greater percentage of its assets in a particular issuer or group of issuers than a diversified fund would. This increased investment in fewer issuers may result in the Fund being more sensitive to economic results of those issuing the securities.

8. Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

20

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Notes to Financial Statements March 31, 2017 (continued)

9. Concentrations

As of March 31, 2017, an affiliate of the Investment Manager managed their client’s holdings in the Fund, which collectively represented all of the Members’ Capital. Significant Member transactions, if any, may impact the Fund’s performance.

10. Investment Company Reporting Modernization

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and forms, and amendments to certain current rules and forms, to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and will require standardized, enhanced disclosures about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. At this time, management is currently assessing the anticipated impact of the Regulation S-X amendments on the Funds’ financial statements and related disclosures.

21

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Directors and Officers Biographical Data (unaudited)

The business of the Fund is managed under the direction of the Board of Directors. Subject to the provisions of the operating agreement and Delaware law, the Directors have all powers necessary and convenient to carry out this responsibility. The Directors and officers of the Fund, their ages and descriptions of their principal occupations during the past five years are listed below.

| | | | | | | | | | |

Name (Year of Birth)

Positions With The Fund | | Principal Occupation(s) During

the Past 5 Years | | | | Number of

Portfolios in

Fund Complex

Overseen by

Director(1) (2) | | Other Directorships Held

by Director | | |

Independent Directors |

John F. Finn (1947); Chairman since 2013; Director since 2010. | | Chairman (1985—present), President and Chief Executive Officer, Gardner, Inc. (supply chain management company serving industrial and consumer markets) (1974—present). | | | | 153 | | Director, Greif, Inc. (GEF) (industrial package products and services) (2007—present); Trustee, Columbus Association for Performing Arts (1988— present); Director, Cardinal Health, Inc (CAH) (1994— 2014). | | |

Dr. Matthew Goldstein (1941); Chairman since 2013; Director since 2010. | | Chancellor Emeritus, City University of New York (2015—present); Professor, City University of New York (2013— present); Chancellor, City University of New York (1999—2013); President, Adelphi University (New York) (1998—1999). | | | | 153 | | Trustee, Museum of Jewish Heritage (2011—present); Trustee, National Museum of Mathematics (present); Chair, Association of College and University Administrators (present). | | |

Dennis P. Harrington (1950); Director since 2017. | | Retired; Partner, Deloitte LLP (1984— 2012). | | | | 153 | | None. | | |

Frankie D. Hughes (1952); Director since 2010. | | President, Ashland Hughes Properties (Property Management) (2014— present); President and Chief Investment Officer, Hughes Capital Management, Inc. (fixed income asset management) (1993—2014). | | | | 153 | | Trustee, The Victory Portfolios (2000—2008) (Investment Companies). | | |

Raymond Kannar (1953); Director since 2017. | | Retired; Managing Director & Chief Investment Officer, IBM Retirement Funds (2007—2016). | | | | 153 | | Director, Emerging Markets Growth Fund (1997—2016); Acting Executive Director, 2016—17, Committee on Investment of Employee Benefit Assets (CIEBA), 2016—17; Advisory Board Member, Betterment for Business (2016— present) (robo advisor); Advisory Board Member, Blue Star Indexes (2013—present) (index creator); Member, Russell Index Client Advisory Board (2001— 2015). | | |

Peter C. Marshall (1942); Director since 2010. | | Self-employed business consultant (2002—present). | | | | 153 | | None. | | |

22

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Directors and Officers Biographical Data (unaudited) (continued)

| | | | | | | | | | |

Name (Year of Birth)

Positions With The Fund | | Principal Occupation(s) During

the Past 5 Years | | | | Number of

Portfolios in

Fund Complex

Overseen by

Director(1) (2) | | Other Directorships Held

by Director | | |

Independent Directors |

Mary E. Martinez (1960); Director since 2013. | | Associate, Special Properties, a Christie’s International Real Estate Affiliate (2010—Present); Managing Director, Bank of America (Asset Management) (2007— 2008); Chief Operating Officer, U.S. Trust Asset Management; U.S. Trust Company (asset management) (2003— 2007); President, Excelsior Funds (registered investment companies) (2004—2005). | | | | 153 | | None. | | |

Marilyn McCoy* (1948); Director since 2010. | | Vice President of Administration and Planning, Northwestern University (1985—present). | | | | 153 | | None. | | |

Mitchell M. Merin (1953); Director since 2013. | | Retired; President and Chief Operating Officer, Morgan Stanley Investment Management, Member Morgan Stanley & Co. Management Committee (registered investment adviser) (1998— 2005). | | | | 153 | | Director, Sun Life Financial (SLF) (2007—2013) (financial services and insurance); Trustee, Trinity College, Hartford, CT (2002—2010). | | |

Dr. Robert A. Oden, Jr. (1946); Director since 2010. | | Retired; President, Carleton College (2002—2010); President, Kenyon College (1995—2002). | | | | 153 | | Chairman, Dartmouth-Hitchcock Medical Center (2011—present); Trustee, American Schools of Oriental Research (2011— present); Trustee, American University in Cairo (1999-2014); Trustee, American Museum of Fly Fishing (213—present) | | |

Marian U. Pardo** (1946); Director since 2013. | | Managing Director and Founder, Virtual Capital Management LLC (Investment Consulting) (2007—present); Managing Director, Credit Suisse Asset Management (portfolio manager) (2003—2006). | | | | 153 | | Member, Board of Governors, Columbus Citizens Foundation (not-for-profit supporting philanthropic and cultural programs) (2006—present). | | |

Frederick W. Ruebeck (1939); Director since 2010. | | Consultant (2000—present); Advisor, JP Greene & Associates, LLC (broker- dealer) (2000—2009); Chief Investment Officer, Wabash College (2004—2015); Director of Investments, Eli Lilly and Company (pharmaceuticals) (1988— 1999). | | | | 153 | | Trustee, Wabash College (1988—present); Chairman, Indianapolis Symphony Foundation (1994—present). | | |

James J. Schonbachler (1943); Director since 2010. | | Retired; Managing Director of Bankers Trust Company (financial services) (1968—1998). | | | | 153 | | None. | | |

| (1) | Each Director serves for an indefinite term, subject to the Fund’s current retirement policy, which is age 78 for all Directors. |

| (2) | A Fund Complex means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services or have a common investment adviser or have an investment adviser that is an affiliated person of the investment adviser of any of the other registered investment companies. The J.P. Morgan Funds Complex for which the Board of Trustees serves currently includes eleven registered investment companies (153 funds). |

23

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Directors and Officers Biographical Data (unaudited) (continued)

| * | Two members of the Board of Trustees of Northwestern University are executive officers of registered investment advisers (not affiliated with JPMorgan) that are under common control with sub-advisers to certain J.P. Morgan Funds. |

| ** | In connection with prior employment with JPMorgan Chase, Ms. Pardo is the recipient of non-qualified pension plan payments from JPMorgan Chase in the amount of approximately $2,055 per month, which she irrevocably waived effective January 1, 2013, and deferred compensation payments from JPMorgan Chase in the amount of approximately $7,294 per year, which ended in January 2013. In addition, Ms. Pardo receives payments from a fully funded qualified plan, which is not an obligation of JPMorgan Chase. |

The contact address for each of the Directors is 270 Park Avenue, New York, NY 10017.

24

J.P. Morgan Access Multi-Strategy Fund, L.L.C.

Directors and Officers Biographical Data (unaudited) (continued)

| | | | |

Name (Year of Birth),

Positions Held with the Fund (since) | | Principal Occupation(s) During the Past

5 Years | | |

| |

| Officers |

Brian S. Shlissel (1964), President and Principal Executive Officer (2016) | | Managing Director and Chief Administrative Officer for J.P. Morgan pooled vehicles, J.P. Morgan Investment Management Inc. (formerly JPMorgan Funds Management, Inc.) (2014 – present); Managing Director and Head of Mutual Fund Services, Allianz Global Investors; President and Chief Executive Officer, Allianz Global Investors Mutual Funds and PIMCO Closed-End Funds (1999 – 2014) | | |

Laura M. Del Prato (1964,) Treasurer and Principal Financial Officer (2015)** | | Managing Director, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc., since 2014; Partner, Cohen Fund Audit Services, Ltd (2012 – 2013); Partner (2004 – 2012) and various other titles (1990 – 2004) at KPMG, LLP. | | |

Frank J. Nasta (1964); Secretary (2011) | | Managing Director and Associate General Counsel, JPMorgan Chase since 2008. | | |

Stephen M. Ungerman (1953); Chief Compliance Officer (2011) | | Managing Director, JPMorgan Chase & Co.; Mr. Ungerman has been with JPMorgan Chase & Co. since 2000. | | |

Jessica K. Ditullio (1962); Assistant Secretary (2011) ** | | Executive Director and Assistant General Counsel, JPMorgan Chase; Ms. Ditullio has served as an attorney with various titles for JPMorgan Chase (formerly Bank One Corporation) since 1990. | | |

John T. Fitzgerald (1975); Assistant Secretary (2011) | | Executive Director and Assistant General Counsel, JPMorgan Chase; Mr. Fitzgerald has been with JPMorgan Chase since 2005. | | |

Carmine Lekstutis (1980), Assistant Secretary (2011) | | Executive Director and Assistant General Counsel, JPMorgan Chase since February 2015; formerly Vice President and Assistant General Counsel, JPMorgan Chase since from 2011 to February 2015. | | |

Michael M. D’Ambrosio (1969), Assistant Treasurer (2012) | | Managing Director, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc.) from July 2012; prior to joining JPMorgan Chase, Mr. D’Ambrosio was a Tax Director at PricewaterhouseCoopers LLP since 2006. | | |

Joseph Parascondola (1963); Assistant Treasurer (2011) * | | Vice President, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc.), Inc. since August 2006. | | |

Lauren A. Paino (1973), Assistant Treasurer (2015) * | | Treasurer and Principal Financial Officer of the Fund from 2013 to 2014; Executive Director, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc., since August 2013; Director of Operations & Investor Relations at Credit Suisse Alternative Investments (2005 – 2013). | | |

Matthew J. Plastina (1970); Assistant Treasurer (2011) * | | Executive Director, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc.) since February 2016; Vice President, JPMorgan Funds Management, Inc. from 2010 to August 2016. | | |

Julie A. Roach (1971), Assistant Treasurer (2012)** | | Executive Director, J.P. Morgan Investment Management Inc. (formerly JPMorgan Funds Management, Inc.) since February 2017;Vice President, JPMorgan Investment Management, Inc. (formerly JPMorgan Funds Management, Inc.) from August 2012 to January 2017; prior to joining JPMorgan Chase, Ms. Roach was a Senior Manager with Deloitte since 2001. | | |

| | The contact address for each of the officers, unless otherwise noted, is 270 Park Avenue, New York, NY 10017. |

| * | The contact address for the officer is 4 New York Plaza, New York, NY 10004. |

| ** | The contact address for the officer is 1111 Polaris Parkway, Westerville, OH 43082. |

25

Rev. January 2011

| | | | |

| | |

| FACTS | | WHAT DOES J.P. MORGAN FUNDS DO WITH YOUR PERSONAL INFORMATION? | | |

| | | | |

| | | |

| Why? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. | | |

| | | | |

| | | |

| What? | | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ◾ Social Security number and account balances ◾ transaction history and account transactions ◾ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. | | |

| | | | |

| | | |