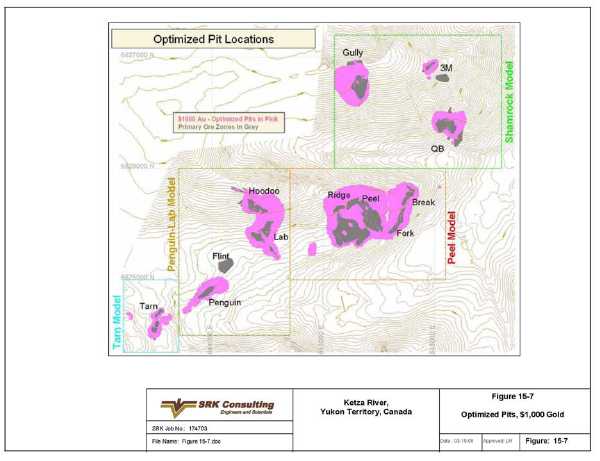

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from _______________________to ______________________

Commission file number000-52699

YUKON-NEVADA GOLD CORP.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

688 West Hastings Street, Suite 490, Vancouver, British Columbia V6B 1P1

(Address of principal executive offices)

Robert F. Baldock (604) 688-9427,rbaldock@yngc.ca 688 West Hastings Street, Suite 490, Vancouver, British Columbia V6B 1P1

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

2

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered |

| None | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common shares, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close

of the period covered by the annual report.

516,346,887 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [X] No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See

definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued | Other [X] |

| | By the International Accounting Standards Board [ ] | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant

has elected to follow.

3

[X] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act).

[ ] Yes [X] No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13

or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

[ ] Yes [ ] No

4

TABLE OF CONTENTS

5

6

PART I

Introduction

Yukon-Nevada Gold Corp. is a corporation incorporated under the laws of Canada and is referred to in this document, together with its subsidiaries, as “us”, “we” or “our”.

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in Canada ("Canadian GAAP") and are presented in US dollars unless otherwise indicated. All references in this Form 20-F to financial information concerning us refer to such information in accordance with Canadian GAAP and all dollar amounts in this Form 20-F are in US dollars unless otherwise indicated. A reconciliation to US GAAP is included in Note 22 to the consolidated financial statements.

In this document, cross-references relevant to the information being requested may be provided. These cross-references are provided for ease of reference only and are not meant to be exclusionary to other relevant information in this document that may relate to the disclosure in question.

Forward-Looking Information

This report contains “forward-looking statements”, including all statements that are not historical facts, and forward looking information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian Securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of deposits, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

With respect to forward-looking statements and the information included in this document, we have made numerous assumptions, including, among other things, assumptions about the price of gold, anticipated costs and expenditures and our ability to achieve our goals, even though our management believes that the assumptions made and the expectations represented by such statements or information will prove to be accurate. By their nature, forward-looking statements and information are based on assumptions and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from future results, performance or achievements expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include among other things the following: gold price volatility; discrepancies between actual and estimated production and mineral reserves and resources; the speculative nature of gold exploration; mining operational and development risk; and regulatory risks. See our Annual Information Form for additional information on risks, uncertainties and other factors related.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws.

Cautionary Note to U.S. Investors Concerning Resource Estimates

Resource estimates reported herein are made in accordance with definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum and incorporated into National Instrument 43-101 (“NI 43-101”). Estimates of mineral resources were prepared by or under the supervision of qualified persons who are identified in this document and other public filings. Yukon-Nevada reports its reserves and resources in accordance with NI 43-101, as required by Canadian securities regulatory

7

authorities. For U.S. reporting purposes, Industry Guide 7 under the Securities Exchange Act of 1934, as amended (as interpreted by Staff of the U.S. Securities and Exchange Commission (the “SEC”)), applies different standards in order to classify mineralization as a reserve. Accordingly, for U.S. reporting purposes all mineral resources must be considered as mineralized material. Mineral resources are not mineral reserves and do not have demonstrated economic viability, but do have reasonable prospects for economic extraction. Measured and indicated mineral resources are sufficiently well defined to allow geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the resources. Inferred resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred resources are too speculative geologically to have economic considerations applied to enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be upgraded to mineral reserves through continued exploration.

8

Item 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information.

A.Selected financial data.

The following table summarizes certain of our selected financial information (stated in thousands of U.S. dollars) prepared in accordance with Canadian GAAP. The information in the table was derived from the more detailed financial statements for the period ended December 31, 2005 through the fiscal year ended December 31, 2009, inclusive, and the related notes, and should be read in conjunction with the financial statements and with the information appearing under the headings "Item 5 – Operating and Financial Review and Prospects" and "Item 17 – Financial Statements". Historical results are not necessarily indicative of results to be expected for any future period. No dividends have been paid in any of the fiscal years ended December 31, 2005 throughout the fiscal year ended December 31, 2009.

(In thousands of U.S. dollars, except where noted) | | December

31, 2009 | | | December

31, 2008 | | | December

31, 2007 | | | December

31, 2006 | | | December

31, 2005 | |

| Gold sales | | 9,913 | | | 48,981 | | | 64,460 | | | - | | | n/a | |

| Cost of sales | | 26,049 | | | 58,742, | | | 48,218 | | | - | | | n/a | |

| Gross Margin | | (16,136 | ) | | (9,761 | ) | | 16,242, | | | - | | | n/a | |

| Temporary shutdown costs | | 10,550 | | | 13,115 | | | - | | | - | | | n/a | |

| Depletion, depreciation and amortization | | 6,271 | | | 9,279 | | | 5,731 | | | 16 | | | n/a | |

| Accretion | | 2,890 | | | 2,117 | | | 1,082 | | | 145 | | | n/a | |

| Earning (loss) from mining activities | | (35,847 | ) | | (34,272 | ) | | 9,429 | | | (161 | ) | | n/a | |

| Net loss | | (42,660 | ) | | (105,360 | ) | | (1,899 | ) | | (1,189 | ) | | n/a | |

| Basic and diluted net loss per share | | (0.13 | ) | | (0.57 | ) | | (0.02 | ) | | (0.02 | ) | | n/a | |

| Total assets | | 195,441 | | | 199,636 | | | 296,167 | | | 31,912 | | | n/a | |

| Share capital, warrants and contributed surplus | | 255,301 | | | 234,579 | | | 213,415 | | | 33,867 | | | 21,587 | |

| Accumulated deficit and accumulated other comprehensive loss | | (155,591 | ) | | (112,931 | ) | | (7,571 | ) | | (8,271 | ) | | (6,756 | ) |

| Net assets | | 99,710 | | | 121,648 | | | 205,844 | | | 25,596 | | | n/a | |

| Outstanding shares, in thousands | | 590,846 | | | 272,655 | | | 175,133 | | | 58,950 | | | 46,643 | |

Prior to July 1, 2007, the Company’s operations were measured in Canadian dollars and the consolidated financial statements were expressed in Canadian dollars. As a result of the significant operations (sales, assets) that are located in the United States arising from the acquisition of Queenstake Resources Ltd. (“Queenstake”) on June 20, 2007, it was determined that the Company’s functional currency had changed to the US dollar. Comparable numbers in U.S. dollars are not available for 2005 as the Company reported in Canadian currency for that year.

The following table summarizes certain of our selected financial information (stated in thousands of U.S. dollars) prepared in accordance with U.S GAAP:

(In thousands of U.S. dollars, except where noted)

| | December

31, 2009 | | | December

31, 2008 | | | December

31, 2007 | | | December

31, 2006 | | | December

31, 2005 | |

| Gold sales | | 9,913 | | | 48,981 | | | 64,460 | | | - | | | n/a | |

| Cost of sales | | 26,049 | | | 58,742, | | | 48,218 | | | - | | | n/a | |

| Gross Margin | | (16,136 | ) | | (9,761 | ) | | 16,242, | | | - | | | n/a | |

9

| (In thousands of U.S. dollars, except where noted) | | December | | | December | | | December | | | December | | | December | |

| | | 31, 2009 | | | 31, 2008 | | | 31, 2007 | | | 31, 2006 | | | 31, 2005 | |

| Temporary shutdown costs | | 10,550 | | | 13,115 | | | - | | | - | | | n/a | |

| Depletion, depreciation and amortization | | 6,617 | | | 9,665 | | | 5,731 | | | 16 | | | n/a | |

| Accretion | | 2,890 | | | 2,117 | | | 1,082 | | | 145 | | | n/a | |

| Earning (loss) from mining activities | | (36,193 | ) | | (34,658 | ) | | 9,429 | | | (161 | ) | | n/a | |

| Exploration expense | | 12,940 | | | 19,479 | | | 23,629 | | | 6,862 | | | | |

| Net loss | | (82,203 | ) | | (111,139 | ) | | (21,631 | ) | | (7,029 | ) | | n/a | |

| Basic and diluted net loss per share | | (0.24 | ) | | (0.60 | ) | | (0.18 | ) | | (0.13 | ) | | n/a | |

| Total assets | | 140,638 | | | 158,119 | | | 260,801 | | | 31,192 | | | n/a | |

| Share capital, warrants, accumulated paid in capital and contributed surplus | | 280,608 | | | 231,408 | | | 214,202 | | | 33,867 | | | n/a | |

| Accumulated deficit and accumulated other comprehensive loss | | (231,360 | ) | | (149,157 | ) | | (38,018 | ) | | (8,271 | ) | | n/a | |

| Net assets | | 49,248 | | | 82,251 | | | 176,184 | | | 25,596 | | | n/a | |

| Outstanding shares, in thousands | | 590,846 | | | 272,655 | | | 175,133 | | | 58,950 | | | 46,643 | |

Prior to July 1, 2007, the Company’s operations were measured in Canadian dollars and the consolidated financial statements were expressed in Canadian dollars. As a result of the significant operations (sales, assets) that are located in the United States arising from the acquisition of Queenstake Resources Ltd. (Queenstake) on June 20, 2007, it was determined that the Company’s functional currency had changed to the US dollar. Comparable numbers in U.S. dollars are not available for 2005 as the Company reported in Canadian currency for that year.

The Company acquired the Jerritt Canyon mine on June 20, 2007 with the acquisition of Queenstake. Jerritt Canyon consists of a milling facility as well as two underground mines, the Smith and the SSX. Jerritt Canyon operated continuously from the date of acquisition on June 20, 2007 until February 22, 2008 when it shut down to address infrastructure and safety concerns. In May 2008, Jerritt Canyon recommenced commercial production at reduced levels. On August 8, 2008 mining at Jerritt Canyon ceased again as a result of increasing costs and dilution resulting from the mine plan as well as the ongoing required development and infrastructure expenditures resulting from years of neglect. Subsequent to the closure of the mines, as a result of a dirty air fan that was damaged in the following week, the milling operation was also shut-down. Mining and milling operations did not resume for the remainder of 2008 while management pursued additional financing and continued work on addressing environmental concerns raised by the Nevada Division of Environmental Protection (the “NDEP”) in their stop order issued in March of 2008. Milling operations resumed March 25, 2009 when approvals were received from NDEP on the progress and plans developed by the Company.

On May 30, 2009, Jerritt Canyon shutdown roaster operations due to a delay in the fabrication of certain fiberglass ductwork required in the construction of the new mercury emission control system, resulting in the failure to meet the deadline for this equipment to be installed as set by the NDEP in their March restart order. The Company was able to complete the installation of a calomel emission system and the system instrumentation on July 20, 2009.

After coming to an agreement with the NDEP in the form of a Consent Decree, the Company resumed operations on October 20, 2009. The Consent Decree resolves all of the compliance concerns of the NDEP in relation to the mill and surrounding land holdings of the Company, as well as related environmental concerns and gives the Company the right to operate the milling facility from the effective date.

Currency and Exchange Rates

The following table sets out the exchange rates for currencies expressed in terms of one U.S. dollar in effect at the end of the following periods, and the average exchange rates (based on the average of the exchange rates on the last day of each month in such periods):

10

In Canadian $ | Year Ended December 31 |

| 2009 | 2008 | 2007 | 2006 | 2005 |

| End of period | 1.051 | 1.224 | 0.988 | 1.165 | 1.166 |

| Average for the period | 1.142 | 1.066 | 1.074 | 1.134 | 1.212 |

In Canadian $

| July

2009 | August

2009 | September

2009 | October

2009 | November

2009 | December

2009 |

| High for the month | 1.1625 | 1.1655 | 1.1079 | 1.0845 | 1.0743 | 1.0713 |

| Low for the month | 1.0827 | 1.079 | 1.0686 | 1.0292 | 1.046 | 1.0405 |

Exchange rates are based upon the noon buying rate from Bank of Canada. The noon rate of exchange on March 31, 2010 as reported by the Bank of Canada was C$1.0156 = US$1.00.

B.Capitalization and indebtedness.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

C.Reasons for the offer and use of proceeds.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

D.Risk factors.

We operate in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Shareholders should carefully consider the risks described below before purchasing our common shares. The occurrence of any of the following events could harm us. If these events occur, the trading price of our common shares could decline, and shareholders may lose part or even all of their investment.

Precious Metal Price Fluctuations

Our profitability from proposed operations will be dependent in part on:

• | the market price of precious metals; |

| | |

• | the price of metals or interests related thereto has fluctuated widely and is affected by numerous factors beyond our control including: |

| | |

| • | international economic and political conditions; |

| • | expectations of inflation |

| • | international currency exchange rates; |

| • | interest rates; |

| • | global or regional consumptive patterns; |

| • | speculative activities; |

| • | levels of supply and demand; |

| • | increased production due to new mine developments and improved mining and production methods; |

| • | availability and costs of metal substitutes; and |

| • | metal stock levels maintained by producers and others and inventory carrying costs. |

Although we cannot predict the exact effect of these factors, the combination of these factors may result in not receiving an adequate return on invested capital or an investment retaining its value.

11

Operating Hazards and Risks

Mining operations involve a high degree of risk, such as unusual or unexpected formations and other conditions, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which we have a direct or indirect interest are subject to all the hazards and risks normally incidental to exploration, development and production of precious metals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. We presently carry a limited amount of liability insurance, and may become subject to liability for pollution, cave-ins or other hazards, and the payment of such liabilities could have a material adverse effect on its financial position.

Exploration and Development

Mineral exploration and development involves a high degree of risk as few properties which are explored are developed into producing mines. We cannot provide assurance that our continuing mineral exploration and development activities will result in any discoveries of bodies of commercial ore. The long-term profitability of the operations will be in part directly related to the cost and success of its exploration and development programs, which may be adversely affected by a number of factors.

We will require funding for the substantial expenditures which are required to establish reserves through drilling, to evaluate metallurgical processes to extract metal from ore and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis.

Numerous factors will affect the marketability of any minerals acquired or discovered which are beyond our control and cannot be accurately predicted, including market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting minerals and environmental protection.

Calculation of Reserves, Resources and Metal Recoveries

There is a degree of uncertainty attributable to the calculation of reserves and resources and corresponding grades being mined or dedicated to future production. Until reserves or resources are actually mined and processed, the quantity of mineralization and grades must be considered as estimates only. In addition, the quantity of reserves and resources may vary depending on metal prices. Any material change in quantity of reserves, resources, grade, stripping ratio, or metallurgical recoveries may affect the economic viability of our properties. In addition, we cannot provide assurance that metallurgical recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Title to Mining Properties

Although we have taken steps to verify title to our mineral properties in a manner consistent with industry practice for the current stage of its evaluation of our properties, there is no guarantee that its title to the properties will not be challenged or impugned. We have not conducted surveys of some of the claims in which we hold a direct or indirect interest, therefore the precise area and location of the claims may be in doubt. There could be prior unregistered agreements or transfers or native land claims and our title may be affected by undetected defects.

Issuance of Debt

We may enter into transactions to acquire assets or the shares of other corporations which may be financed partially or wholly with debt, which may increase our debt levels above industry standards. Our articles do not limit the amount of indebtedness that we can incur. The level of our indebtedness could impair our ability to obtain additional financing in the future to take advantage of business opportunities that may arise.

12

Dilution

In order to finance its working capital requirements and to raise equity for the development of its projects we may enter into commitments which would require the issuance of additional shares, options, warrants and convertible debt. These commitments will comply with securities laws and could require the approval of the securities regulatory bodies, and in some cases, our shareholders.

Regulatory and environmental matters

The following discussion is necessarily brief and must not be taken to constitute a complete discussion of the various statutes, rules and governmental orders to which our operations may be subject. Our existing properties are located in Canada and the United States, and are subject to extensive federal, provincial and local governmental regulations in these countries. These regulations may be revised or expanded at any time. A broad number of matters are subject to regulation. Generally, compliance with these regulations requires us to obtain permits issued by federal, provincial and local regulatory agencies. Certain permits require periodic renewal or review of their conditions. It is impossible to predict whether it will be possible to obtain or renew such permits or whether material changes in permit conditions will be imposed. The inability to obtain or renew permits or the imposition of additional conditions could have a material adverse effect on our ability to develop and operate its properties.

Environmental laws and regulations to which we are subject as we progresses from the development stage to the production stage give rise to additional concerns and requirements. Failure to comply with applicable laws, regulations and permits can result in injunctive actions, suits for damages, and civil and criminal penalties. The laws and regulations applicable to our activities change frequently and it is not possible to predict the potential impact to us from any such future changes.

Passive Foreign Investment Company (“PFIC”)

We have not determined whether we meet the definition of PFIC, within the meaning of Sections 1291 through 1298 of the U.S. Internal Revenue Code of 1986, as amended, for the current tax year and any prior tax years. We may or may not qualify as a PFIC in subsequent years due to changes in its assets and business operations. A U.S. shareholder who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to numerous special U.S. federal income taxation rules and may elect to be taxed under two alternative tax regimes. A U.S. shareholder should consult their own U.S. tax advisor with respect to an investment in our shares and to ascertain which of the alternative tax regimes, if any, might be beneficial to the U.S. shareholder’s own facts and circumstances.

Enforcement of Civil Liabilities

We are incorporated under the laws of British Columbia, Canada. Some of our assets are located outside the United States and our directors and officers are residents of countries other than the United States. It could be difficult for our investors to effect service of process within the United States upon us and our directors and officers, or to realize in the United States upon judgments of courts of the United States predicated upon civil liability of us and our directors and officers under United States federal securities laws.

Item 4. Information on the Company.

A. History and Development of the Company.

The full corporate name of the company is Yukon-Nevada Gold Corp. We were incorporated under the laws of the Province of British Columbia, Canada under the name “YGC Resources Ltd.” on May 30, 1988. On January 25, 2002, we were struck from the Register of Companies for British Columbia and dissolved. We were restored to the Register on August 1, 2003. By Combination Agreement dated March 16, 2007 with Queenstake, we entered into an Arrangement with Queenstake, providing for, among other things, our acquisition of all of the issued and outstanding shares of Queenstake. The Arrangement closed on June 20, 2007, at which time we changed our name to our current name.

13

| Our head office address is: | #490, 688 West Hastings Street |

| | Vancouver, BC, V6B 1P1 |

| | Telephone: 6074-688-9427 |

| | |

| And our registered office address is: | #1040, 999 West Hastings Street |

| | Vancouver, B.C. V6C 2W2 |

| | Telephone: 604-683-1102 |

We do not have a registered agent in the United States.

We acquired the Jerritt Canyon gold mine upon completion of the plan of arrangement with Queenstake on June 20, 2007. On May 30, 2003, Queenstake entered into a definitive asset purchase and sale agreement with subsidiaries of AngloGold Limited and Meridian Gold Inc. (collectively, the “Sellers”) pursuant to which Queenstake agreed to acquire the Sellers’ respective 70% and 30% interests in the assets comprising the operating Jerritt Canyon gold mine. The acquisition closed on June 30, 2003. The Jerritt Canyon mine is a large-scale underground gold mining operation with significant exploration potential.

The table below shows our principal capital expenditures for the past three years: (in thousands of US dollars):

| Fiscal Year | Property, plant and equipment | Mineral properties |

| Fiscal 2007 | $6,266 | $26,588 |

| Fiscal 2008 | $25,703 | $29,104 |

| Fiscal 2009 | $2,629 | $12,835 |

For the past three fiscal years, we have financed our operations through the financings listed in the table shown below (in Canadian dollars).

| Date of Offering | Nature of Issuance | Number of Shares | Capital Raised |

| June 2007 | Private Placement(1) | 65,326,521 | $76,233,355 |

| October 5, 2007 | Private Placement(2) | 5,000,000 | $10,000,000 |

| May 12, 2008 | Private Placement(3) | 10,050,000 | $20,100,000 |

| July 17, 2008 | Promissory Note(4) | - | $4,500,000 |

| December 18, 2008 | Private Placement(5) | 79,800,000 | $3,990,000 |

| February 24, 2009 | Private Placement(6) | 10,000,000 | $500,000 |

| February 25, 2009 | Private Placement(7) | 17,333,333 | $1,040,000 |

| April 24, 2009 | Private Placement(8) | 12,000,000 | $720,000 |

| August 6 and 28, 2009 | Private Placement(9) | 41,050,000 | $4,105,000 |

| December 1, 2009 | Private Placement(10) | 10,000,000 | $1,000,000 |

| (1) | 42,351,864 Subscription Receipts (the “Subscription Receipts”) were sold at a price of C$1.80 per Subscription Receipt. Each Subscription Receipt is exercisable into one unit. Each Unit consists of one common share and ½ of one transferable common share purchase warrant (a “Warrant”). Each whole Warrant entitles the holder to purchase one additional share (a “Warrant Share”) at the price of C$3.00 per Warrant Share for a period of five years. A commission of 1,798,725 agents’ options (the “Agents’ Options”) were issued to the Agents. Each Agent’s Option entitled the Agents to purchase for a period of two years from the closing of the Plan of Arrangement, an agents’ share (an “Agent’s Option Share”) at a price of C$2.10 per Agents’ Option Share. |

| (2) | 5,000,000 Flow-Through Shares were issued at a price of C$2.00 per FT Share. No commission was paid. |

| (3) | 10,500,000 Flow-Through Shares were issued at a price of C$2.00 per FT Share. No commission was paid. |

| (4) | 250,000 Warrants were issued exercisable at a price of C$3.00 per share on or before June 20, 2012. |

| (5) | 79,800,000 Units were sold at a price of C$0.05 per unit, each unit comprising one common share (a “Share”), one series “A” share purchase warrant (the “”A” Warrant”), each “A” Warrant entitling the holder to purchase one additional share at a price of C$0.07 for a period of 12 months from the closing and one series “B” share purchase warrant (the ”B” Warrant”), each “B” Warrant entitling the holder to purchase one additional share at a price of C$0.09 for a period of 18 months from the closing. A commission of 7,400,000 Units were issued. |

| (6) | 10,000,000 Units were sold at a price of C$0.05 per unit, each unit comprising one common share (a “Share”), one series “A” share purchase warrant (the “”A” Warrant”), each “A” Warrant entitling the holder to purchase one additional share at a price of C$0.07 for a period of 12 months from the closing and one series “B” share purchase warrant (the ”B” Warrant”), each “B” Warrant entitling the |

14

| holder to purchase one additional share at a price of C$0.09 for a period of 18 months from the closing. A commission of 1,0000,00 Shares and 1,000,000 Series “A” Warrants were issued. |

| (7) | 17,333,333 Units were sold at a price of C$0.06 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of C$0.08 for a period of 24 months from the closing. A commission of 400,000 Units were issued. |

| (8) | 12,000,000 Units were sold at a price of C$0.06 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of C$0.08 for a period of 24 months from the closing. A commission of 400,000 Units were issued. |

| (9) | 41,050,000 Units were sold at a price of C$0.10 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of C$0.125 for a period of 30 months from the closing. No commission was paid. |

| (10) | 10,000,000 Units were sold at a price of C$0.10 per unit, each unit comprising one common share (a “Share”) and one share purchase warrant (the “Warrant”), each Warrant entitling the holder to purchase one additional share at a price of C$0.125 for a period of 18 months from the closing. No commission was paid. |

The information contained in this Annual Report is current as at December 31, 2009, other than where a different date is specified.

B. Business overview.

The principal businesses of the Company are the mining of the Jerritt Canyon gold mine in Nevada and toll milling with the existing facility, as well as the acquisition, exploration and development of economically viable natural resource properties with a particular focus on the Ketza River Property in the Yukon Territory.

Jerritt Canyon Property, Nevada, USA

We acquired the Jerritt Canyon gold mine upon completion of its plan of arrangement with Queenstake on June 20, 2007. On May 30, 2003, Queenstake entered into a definitive asset purchase and sale agreement with subsidiaries of AngloGold Limited and Meridian Gold Inc. (collectively, the “Sellers”) pursuant to which Queenstake agreed to acquire the Sellers’ respective 70% and 30% interests in the assets comprising the operating Jerritt Canyon gold mine. The acquisition closed on June 30, 2003.

Jerritt Canyon is a gold property with two underground mines, ore stockpiles and a 1.5 million ton per year capacity processing plant. In addition, the approximately 119 square miles that comprise the Jerritt Canyon property offer a significant number of advanced, early stage and district-scale exploration targets and potential to expand the currently defined mineral reserves and resources proximal to the producing mines.

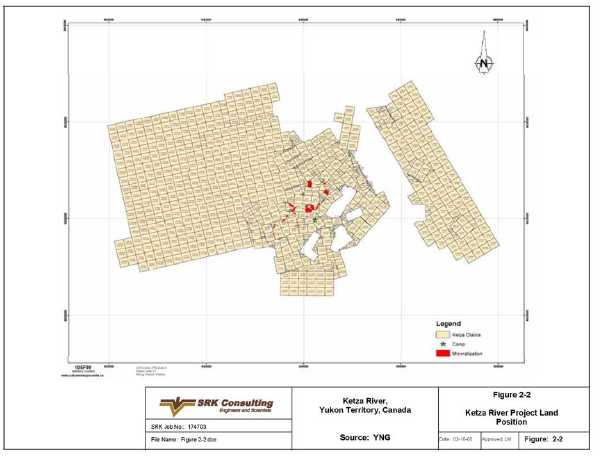

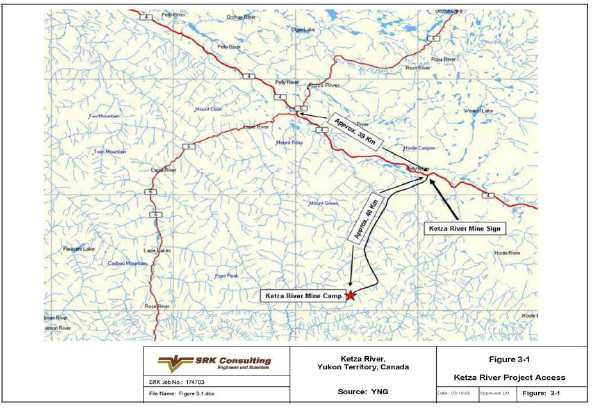

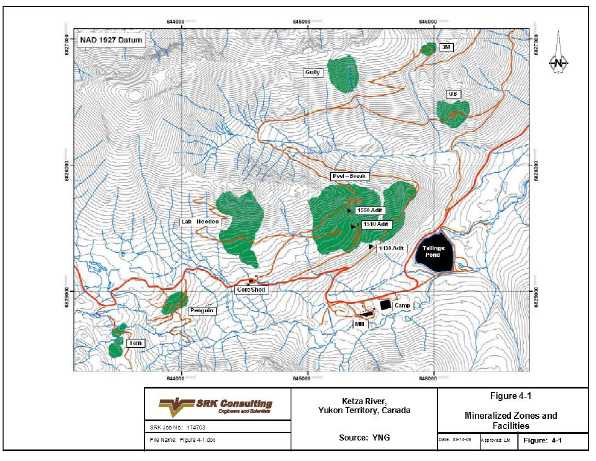

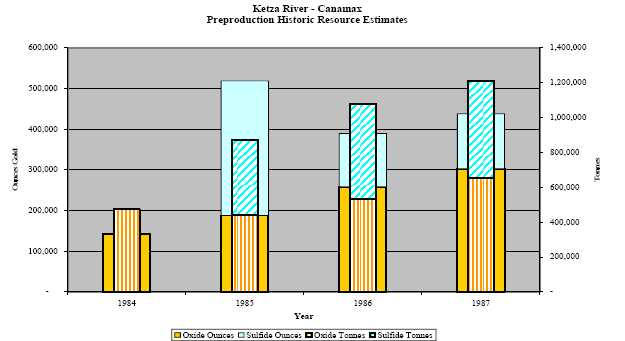

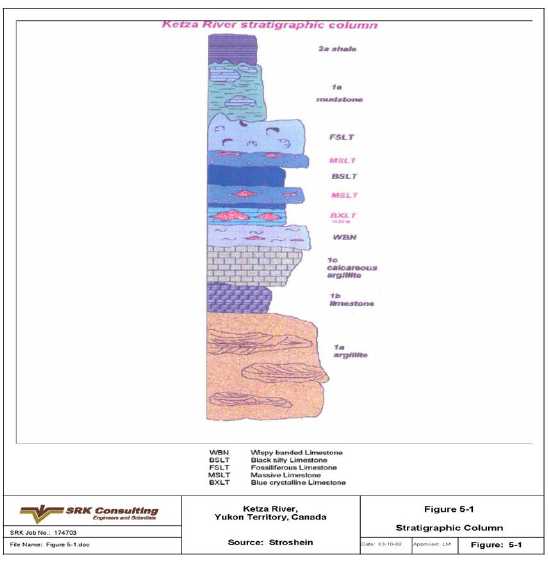

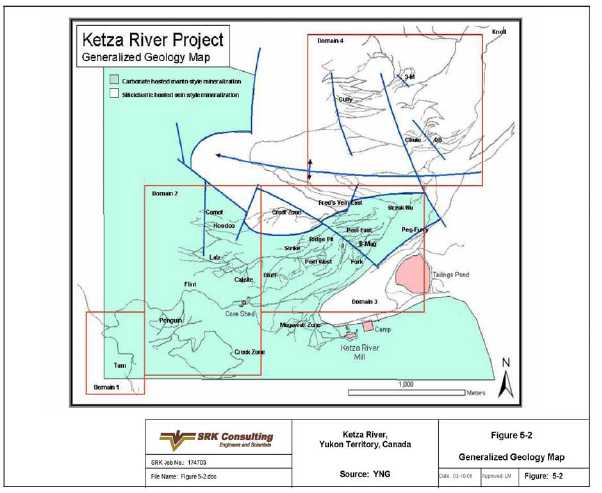

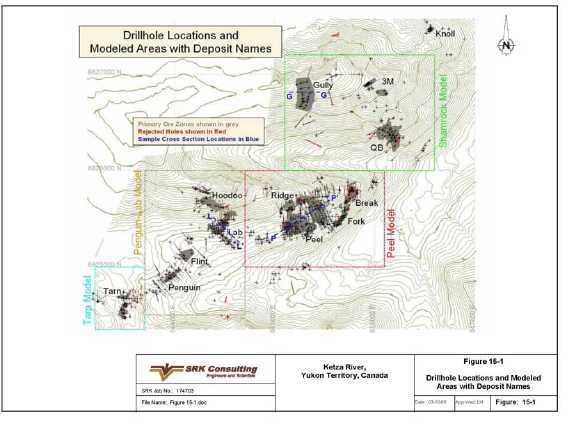

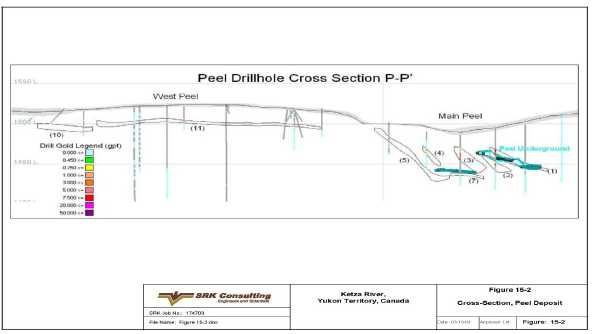

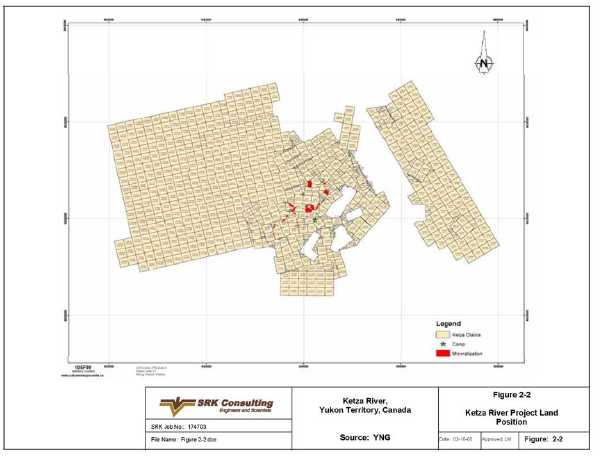

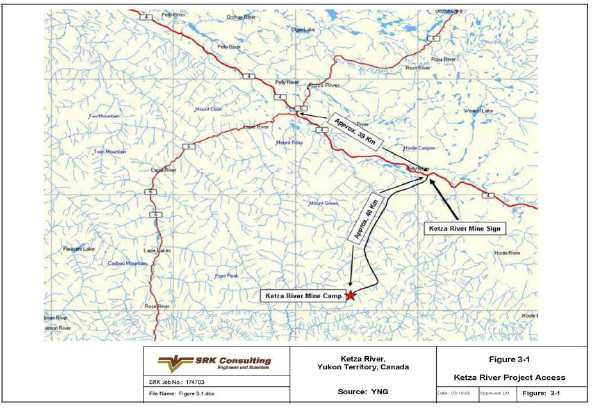

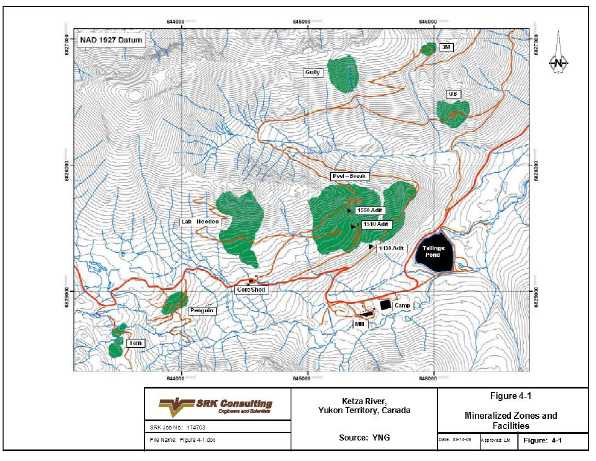

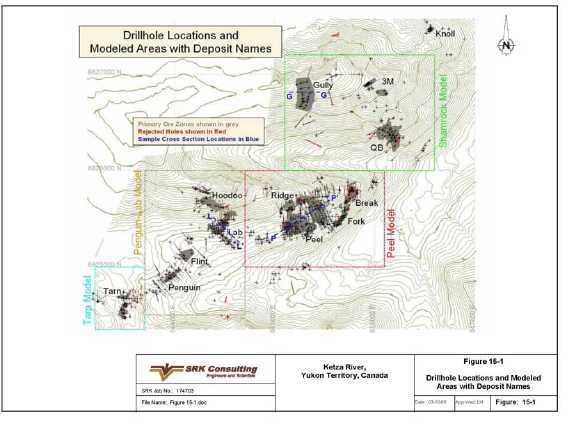

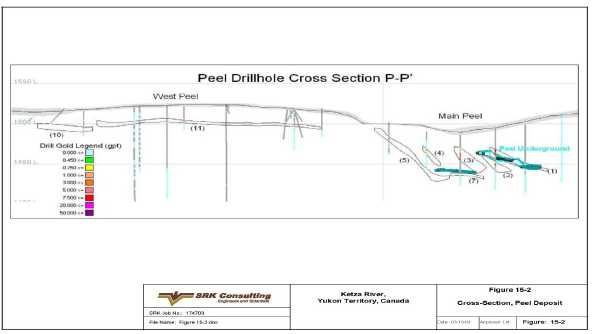

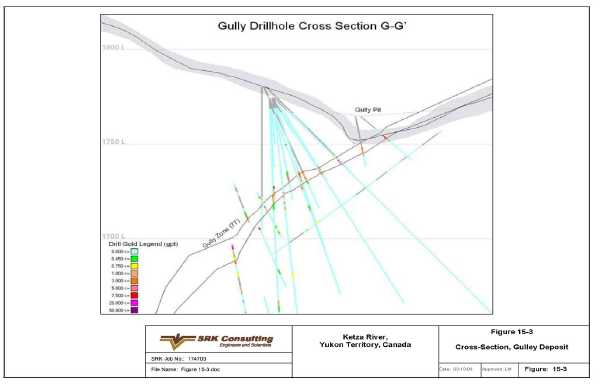

Ketza River Property, Yukon, Canada

We have owned the Ketza River Gold Property in the Yukon, since 1994. This former producing mine was shut down in November, 1990, due to the depletion of known oxide ore reserves identified at that time. The Ketza River Gold Property includes 565 mineral claims and leases, a gold mill and all associated chattels, tools, equipment and licences. Our Chief Operating Officer, Mr. Dickson, who is also a chemist and a professional mining consultant, identified areas which were under-explored and which could be mined and processed by different methods than those employed in the past. In particular, he identified the possibility of discovering significant quantities of sulphide ore. We have completed diamond drilling that resulted in the discovery of the Chimney and Fork zones and geologic mapping, prospecting, sampling and diamond drilling on the Shamrock zone. We are also carrying out an aggressive diamond drill program in an effort to increase mineral resources, to prepare a feasibility study and, if the results of the feasibility study are positive, to return the Property to commercial production as a mine.

Principal Markets

Product fabrication and bullion investment are the two principal uses of gold. Within the fabrication category there are a wide variety of end uses, the largest of which is the manufacture of jewelry. Other fabrication purposes include official coins, electronics, miscellaneous industrial and decorative uses, dentistry, medals and medallions.

15

Revenues

100% of our gold sales are to customers outside of the consolidated entity and are from our Jerritt Canyon property in Nevada, U.S.

C.Organizational Structure.

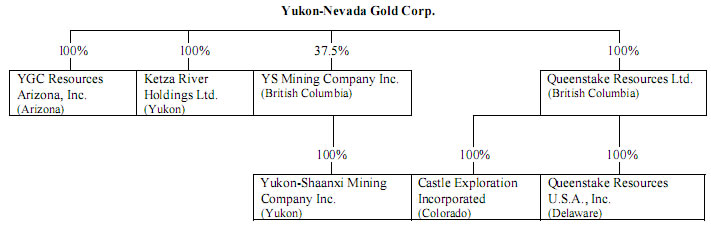

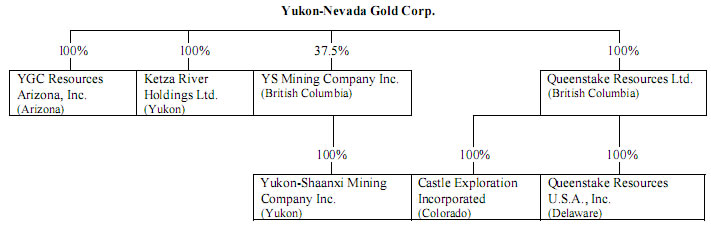

Set forth below are the names of our subsidiaries:

D.Property, plants and equipment.

(a) Jerritt Canyon Property, Nevada, USA

On June 30, 2003, one of our subsidiaries, Queenstake, acquired the Jerritt Canyon mine in Nevada. Jerritt Canyon mine is an operating gold property with one producing underground mine (Smith), one underground mine to be reactivated by early 2011 (SSX-Steer Mine Complex), ore stock piles, one potential new mine (Starvation Canyon) currently in the permitting stage, and a 1.5 million ton per year capacity processing plant.

16

Figure 1: General Location Map of the Jerritt Canyon Mine

17

Figure 2: General Land Map of the Jerritt Canyon District

18

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Jerritt Canyon Mine is located in Elko County, Nevada, approximately 50 miles north of Elko. Access to the property is by State Road 225 to the mine access road. The roads are paved and in excellent condition all the way through the main gate where the administrative offices, process plant, warehouse, and tailings impoundment are located. The mines are accessed by haul roads on Queenstake controlled land.

The climate is temperate with winter temperatures between 0ºF and 40ºF and summer temperatures between 35ºF and 90ºF. Average annual precipitation at the tailings impoundment is estimated at 14 inches per year with an estimated annual average evaporation of 43 inches. A significant amount of the total precipitation falls as snow and increases with elevation to the mining areas. Mine operations are only rarely halted by weather conditions, although ore haulage from the mines may be slowed. The mill, warehouse, shop, and administrative facilities are at a lower elevation and therefore are less exposed to weather extremes.

The vegetation is typical of the Basin and Range province with sagebrush vegetation dominant at the lower elevations. Small stands of aspen and isolated fir trees grow in canyons and drainages.

Jerritt Canyon mine is located in the Independence Mountain Range in the Basin and Range province of northern Nevada. The topography ranges from about 6,400 feet at the administrative facilities and mill site to about 8,000 feet at the highest point of the haul road to the mines.

Elko, Nevada with a population of about 36,000 is the closest city to the mine. The city is on Interstate 80 and is serviced by daily commercial flights to Salt Lake City, Utah. Elko is a center for the mining operations in northern Nevada and services necessary for the mine are readily available there.

History

The Jerritt Canyon mine is wholly owned by Queenstake after the purchase by that company from the joint venture of Anglo Gold and Meridian Gold in June 2003. The joint venture was formed in 1976 between Freeport Minerals Company, later Freeport McMoran Inc., and FMC, later Meridian Gold. In 1990, Freeport sold its interest in Jerritt Canyon to Minorco and their wholly owned subsidiary, Independence Mining Company, which became the new joint venture partner and operator of the mine. In 1998, Minorco’s North American gold assets, including a 70% interest in Jerritt Canyon were sold to Anglo Gold.

Prospectors explored for antimony in the 1910’s. Thirty to forty tons of stibnite as antimony ore were reportedly mined and shipped from the Burns Basin mine in the Jerritt Canyon district between 1918 and 1945. In the early 1970’s there was a renewed interest in antimony exploration when its price reached historic highs of $40 per pound. Around 1971, FMC began exploring for antimony in the Independence Mountains. In 1972, FMC, later known as Meridian, discovered a disseminated gold deposit in the Jerritt Canyon area. In 1976, a joint venture was formed with Freeport Minerals Company to explore and develop the area, and mining commenced at Jerritt in 1981.

Open pit mining was conducted at the site from startup in 1981 until 1999. The first underground operation at Jerritt Canyon started up in 1993 at West Generator. The mine during 2006 consisted of three underground mining operations feeding ore to a process plant consisting of a roaster followed by carbon-in-leach processing. The mines are mechanized operations using backfill for ground control and to increase ore recovery. In the early years, the ores mined at the operation were less refractory and were processed through a “wet” mill. This “wet” mill continued to operate until 1997 and is still located on site. With ores becoming more carbonaceous and refractory, as well as with the introduction of higher-grade ore from underground operations, a dry mill with an ore roasting circuit was added in 1989 and is currently in operation.

Since the first gold pour on July 4, 1981, the Jerritt Canyon Mine has produced approximately 8 million ounces of gold. Annual production has historically averaged between 125,000 and 350,000 ounces of gold. Queenstake reports the 2009 mill production at 9,770 ounces of gold, from a total of 197,503 tons of ore, significantly less than the past due to the shutdown which transpired for most of the year.

Surface exploration drilling and underground core drilling which is also used as an exploration tool, decreased from 2001 to 2002, when the former owner, Anglo Gold shifted focus from exploration to reserve development. In 2000, about 445,000 feet of exploration and development were completed, of which 165,000 feet consisted of surface Reverse Circulation (RC) drilling

19

and the remainder was underground (UG) core and RC drilling. In 2001, a total of about 500,450 feet were drilled, 65,450 of which were surface RC holes. In 2002, 435,000 feet were drilled, all of which were from underground. After the acquisition of Jerritt Canyon at mid-2003, Queenstake started more aggressive exploration and mine development programs and those programs have continued throughout 2006. These programs were continued into 2007 and 2008 after the merger of Queenstake Resources and YGC Resources in 2007 but ceased for 2009 due to the shutdown of the mill while plans for environmental compliance were reviewed by the NDEP.

The measured and indicated mineral resources, including reserves, at Jerritt Canyon during Queenstake’s ownership, as documented in NI 43-101 filings are given in Table 1.

Table 1: Historic Measured and Indicated Mineral Resources during Queenstake’s Ownership

| Year | Tons | Grade | Ounces |

| 2003 | 9,496,930 | 0.242 | 2,295,303 |

| 2004 | 9,987,840 | 0.241 | 2,409,624 |

| 2005 | 8,812,000 | 0.236 | 2,079,100 |

| 2006 | 8,203,000 | 0.232 | 1,907,200 |

| 2007 | 8,196,900 | 0.239 | 1,961,100 |

| 2008 | ND | ND | ND |

| 2009 | ND | ND | ND |

Notes: ND = not determined; all resources included in this table are calculated as of December 31 of the noted year.

The proven and probable reserves at Jerritt Canyon during Queenstake’s ownership, as documented in NI 43-101 filings are given in Table 2.

Table 2: Historic Proven and Probable Mineral Reserves during Queenstake’s Ownership

| Year | Tons | Grade | Ounces |

| 2003 | 3,065,000 | 0.268 | 820,000 |

| 2004 | 3,510,584 | 0.249 | 875,000 |

| 2005 | 3,723,000 | 0.236 | 878,000 |

| 2006 | 1,985,000 | 0.245 | 486,000 |

| 2007 | 3,155,000 | 0.227 | 717,000 |

| 2008 | ND | ND | ND |

| 2009 | ND | ND | ND |

Notes: ND = not determined; all resources included in this table are calculated as of December 31 of the noted year.

Geological Setting

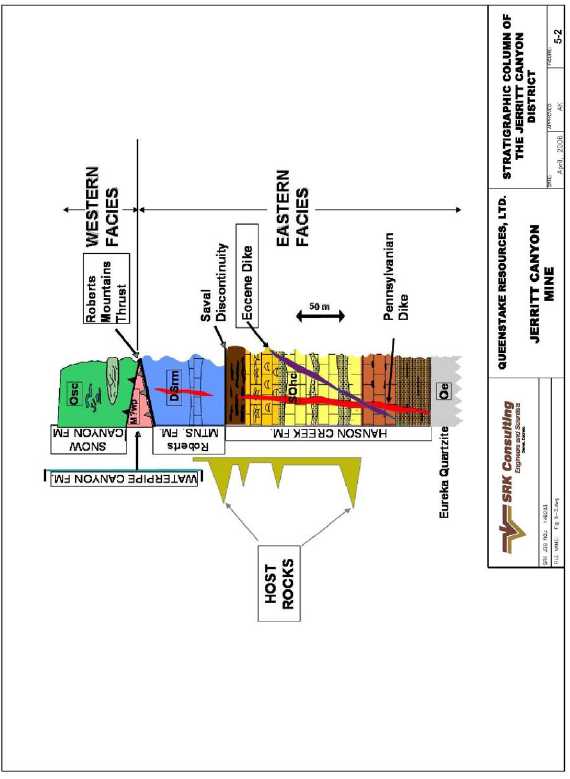

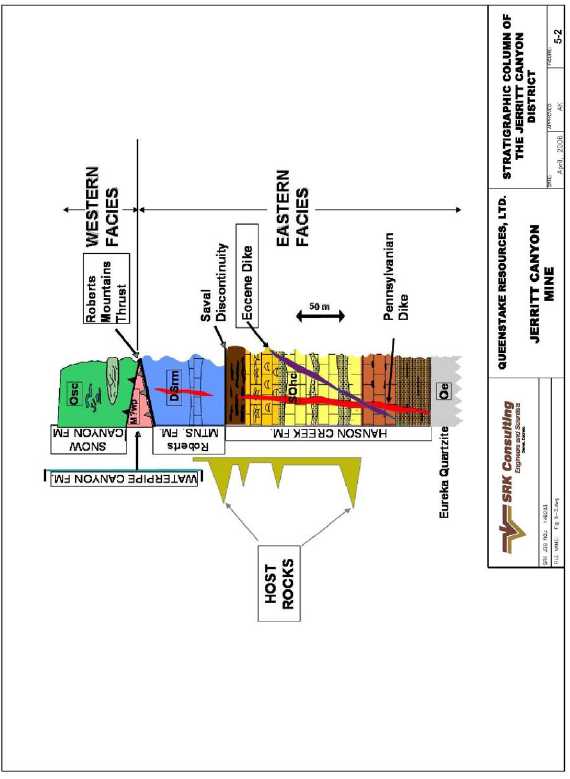

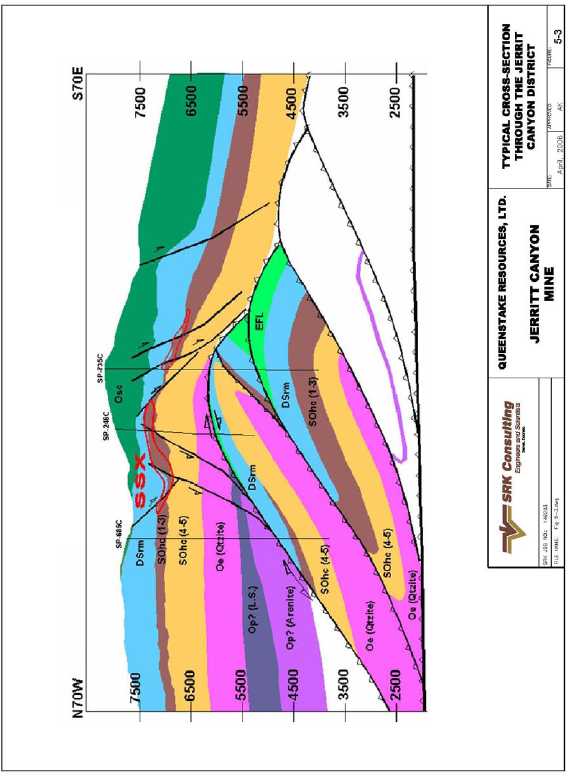

The Jerritt Canyon mining district is located in the Independence Mountain Range in northern Nevada. The range is part of the Basin and Range province of Nevada and is a horst block consisting primarily of Paleozoic sedimentary rocks with lesser Tertiary volcanics and intrusive dikes. A district geologic map is shown in Figure 3 and a stratigraphic column is shown in Figure 4.

There are four distinct assemblages in the district, characterized by their position relative to the Roberts Mountains thrust, a Devonian to Mississippian structure formed during the Antler orogeny:

The western facies, or upper plate of the thrust, consists of the Cambrian to Ordovician Valmy Group and forms about 70% of the exposed rock in the area. In the Jerritt Canyon district, the Valmy Group consists of the Snow Canyon formation, a chert, argillite, greenstone, and carbonaceous siltstone sequence, and the McAfee Quartzite, a sequence of massive quartzite and shale;

The eastern facies, or lower plate of the thrust, consists of a sequence of Ordovician to Devonian shallow water sedimentary rocks that are exposed in tectonic and erosional windows through the upper plate. The gold mineralization in the district is contained with the eastern facies rocks. The Pogonip Group rock is exposed in the west-central part of the district and is composed of fossiliferous limestone with calcareous shale and dolomite

20

interbeds. The Eureka Quartzite is a massive quartzite with minor interbeds of siltstone. The Hansen Creek Formation is one of two principal ore hosts in the district. It is divided into five units, with the contacts between the units being the favorable sites of gold mineralization. The Hansen Creek consists of interbedded silty limestone, calcareous siltstone, dolomite, chert, and carbonaceous limestone. The Roberts Mountains Formation is the second ore host and consists of calcareous, carbonaceous siltstone and thinly bedded, silty limestone. The Waterpipe Canyon formation is thought to have been deposited in a synkinematic foreland basin that formed during the Antler orogeny; it consists of greywacke with interbedded carbonaceous shale, chert pebble conglomerate, bedded chert, sandstone, and siltstone;

- The Schoonover sequence occurs north of the district and consists of basaltic and andesitic greenstone, chert, tuff, volcaniclastics, and siliciclastic and limestone turbidites of Devonian to Permian age; and

- The Antler overlap sequence is restricted to the north end of the range and consists of conglomerates, argillite, siltstone and limestone.

There are four sets of dikes: Pennsylvanian basalt dikes, Eocene basalt and quartz monzonite dikes and a Miocene basalt dike. The Pennsylvanian and Eocene basaltic dikes are altered and mineralized in most of the mines.

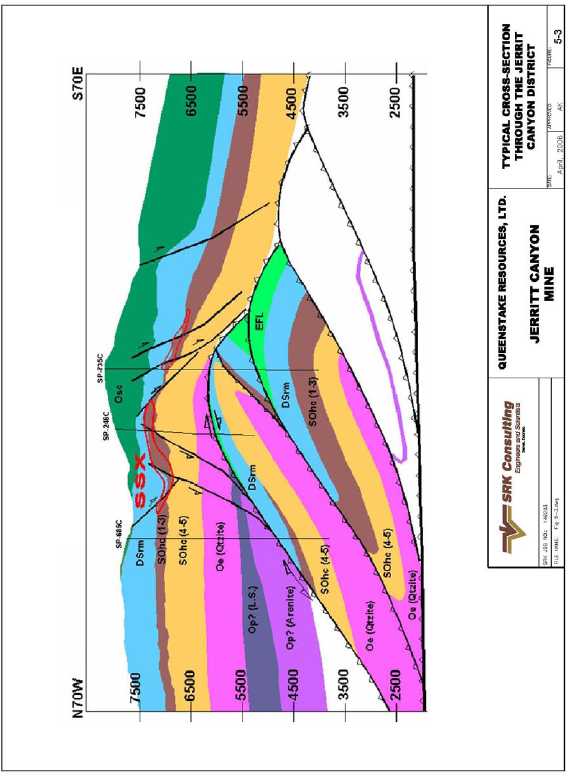

The regional structural setting of the Jerritt Canyon district is complex, with several regional deformation events being evident. The Devonian to Mississippian Antler orogeny, resulting from west to east compression, is represented in the upper plate Snow Canyon Formation with north-south folds in both the hanging wall and footwall of the thrust. The Permian to Triassic Sonoma orogeny emplaced the Golconda allochthon over parts of the Roberts Mountains allochthon to the north of the district. The northwest to southeast compression associated with this deformation is rarely seen in the district. The Jurassic to Cretaceous Nevadan orogeny resulted in east-west folds that are often associated with mineralization.

Within the Jerritt Canyon area, gold can locally occur within all sedimentary formations, but is preferentially hosted by the Roberts Mountains and Hansen Creek Formations of the eastern facies in the lower plate of the Roberts Mountains thrust . The Roberts Mountains Formation consists of calcareous to dolomitic siltstones and silty limestones. The Hansen Creek Formation is divided into five members, numbered I through V from the top of the formation to the bottom. Hansen Creek I is a thinly bedded sequence of gray, medium-grained limestones and continuous blocky chert beds; it is typically brecciated. Hansen Creek II is a dark to light gray, irregularly bedded to massive, vuggy, dolomitic limestone. Hansen Creek III consists of intercalated carbonaceous micrites and laminated argillaceous limestones. Hansen Creek IV is a thickly bedded, medium to coarse-grained, carbonaceous limestone with discontinuous black chert nodules. Hansen Creek V consists of laminated, carbonaceous siltstone with chert lenses.

The contact between the Roberts Mountains Formation and the overlying Snow Canyon Formation is a regional thrust fault which transported the Snow Canyon eastward over the Roberts Mountains Formation. The contact between the Roberts Mountain Formation and the underlying Hansen Creek Formation is a discontinuity locally known as the Saval discontinuity. The discontinuity may be an angular unconformity of local extent or a thrust fault. The base of the Hansen Creek is gradational into the Eureka Quartzite. Locally, the stratigraphic section has been repeated by thrust faulting as seen in the cross-section through the SSX mine in Figure 5.

Alteration in the Jerritt Canyon district includes silicification, dolomitization, remobilization, and reconstitution of organic carbon, decalcification, and argillization. The rocks also exhibit hypogene and supergene oxidation and bleaching. The most importation alteration types relative to gold deposition are silicification, remobilization and redeposition of organic carbon and decalcification.

21

Figure 3: General Geology Map of the Jerritt Canyon District

22

Figure 4: Stratigraphic Column of the Jerritt Canyon District

23

Figure 5: Typical Cross-Section through the Jerritt Canyon District

24

Exploration

The Jerritt Canyon district was explored by prospectors looking for antimony in the early 1900’s. FMC Corporation, exploring for antimony in the 1970’s, discovered gold occurrences similar to those in the nearby Carlin trend. In 1976, FMC, then known as Meridian Mining, formed a joint venture with Freeport Minerals to explore and develop the deposits. Mining commenced in 1981 with the North Generator open pit.

Since then, the operators of Jerritt Canyon have conducted exploration programs for the identification and development of new mineralized areas. Several open pit deposits were discovered, developed, and mined during the 1980’s and 1990’s, including North Generator, Alchem, Marlboro Canyon, Burns, Steer, Saval and Dash. Underground targets were also identified, and the first to be exploited was the West Generator underground deposit in 1993. The Murray deposit, originally discovered by condemnation drilling, has produced over 1 million ounces. The SSX deposit was discovered in the early 1990’s by geologists following the structural trends between Burns Basin and California Mountain open pits. The SSX mine has also produced over 1 million ounces. The MCE, Smith, and Steer extension of SSX are more recent discoveries.

The Jerritt Canyon operation has had a history of exploration and discovery since the 1970’s. In the last few years until Queenstake’s acquisition of the property, most of the exploration efforts have been concentrated at and around the existing underground mines. Exploration efforts in the southern part of the property were directed to areas such as Water Pipe, Pie Creek, and Starvation Canyon. Queenstake has increased the exploration effort near the mine areas and also in the south. As a result, the known mineralization at Starvation Canyon has increased in size and quality. Additional drilling at Starvation Canyon from 2006 to 2008 was targeted toward further definition and expansion of the resource.

Queenstake has carried out an aggressive program of exploration since its acquisition, with the following footages drilled in the past six years of its ownership of the property:

- 2003: 280,151 feet of underground and surface RC and Core Drilling;

- 2004: 710,896 feet of underground and surface RC and Core Drilling;

- 2005: 450,694 feet of underground and surface RC and Core Drilling;

- 2006: 396,063 feet of underground and surface RC and Core Drilling,

- 2007: 467,242 feet of underground and surface RC and Core Drilling; and

- 2008: 237,517 feet of underground and surface RC and Core Drilling.

No exploration activity was conducted in 2009 due to the temporary shutdown of the mill operations. Queenstake continues to evaluate its landholdings with the objective of focusing future exploration and drilling the most promising areas both near and away from the existing mines.

Mineralization

SSX-Steer Mine Complex

The SSX (South Saval Extension) deposit was discovered in late 1992 following the northeast structural trends between the Burns Basin and California Mountain deposits and the west-northwest mineralized dike trends from the Saval open-pit deposit. The main SSX portal was established in 1996 and mining started in 1997.

A portal was established in the Steer open pit in 2004 and drifting within this underground mine connected with the SSX underground mine in the latter half of 2005. The two mines have since been operated as a single underground mine referred to as the SSX-Steer mine complex. In 2007 a drift out to the Saval III portal was completed allowing access to the resource extending from the existing pit wall.

Mineralization at the SSX Steer Mine Complex occurs mostly in the micritic unit III of the Hansen Creek Formation. A smaller portion of the mineralization occurs in calcareous siltstone at the base of the Roberts Mountains Formation or in the upper two cherty and dolomitic members of the Hansen Creek Formation. Mineralized zones are localized in and near west-northwest trending steeply dipping dikes (e.g. South Boundary Dike); however, dike material is a minor component of the ore at the SSX Steer Mine Complex. Mineralization is also localized along cross-cutting northeast trending faults (the Purple Fault in Zones 4 and 6, and the Crestline Fault in Zone 1). Folding of the mineralized horizons is apparent along axes parallel to the west-northwest dike trend and, more prominently, parallel to the northeast fault set. Gold occurs in decarbonitized rock,

25

commonly in association with variable amounts of orpiment and realgar. Silicification with stibnite can also be associated with gold in portions of the upper cherty member of the Hansen Creek Formation. The intersection of the northeast and west-northwest structural trends remain a primary target for resource expansion. The westward extension of the South Boundary Dike and the West Mahala resource to the east represent exploration opportunities.

Gold mineralization in the Steer portion of the SSX mine complex has been identified in an area stretching approximately 3,000 feet east from the old Steer pit to halfway along the connection drift to SSX Zone 5. Most gold mineralization at Steer is associated with gently dipping structures cutting through the Hansen Creek III unit. These structures strike northeast and dip southeast, offsetting individual strata. Typical ore zones follow the structures and tend to be broad and relatively thin. The mineralized zones are usually at the contact between the Hansen Creek units III and IV and occasionally follow the structures up through the Hansen III. Both within the Steer portion and the western side of SSX several low-angle features have been observed. These features are at least partly responsible for the gold mineralization at the contact of the Hansen Creek Units III and IV.

In the eastern portion of the Steer area, high-grade mineralization is associated with the Husky fault, a major northeast trending normal fault with at least 300 feet of normal dip-slip displacement to the southeast. Major northwest trending dikes appear to have locally compartmentalized high-grade mineralization. The intersection of these dikes with the Hansen III unit and the Husky fault and its related structures offers excellent exploration potential. One of these dikes is interpreted to be the western extension of the South Boundary dike, which is an important ore-controlling structure at the SSX mine to the east.

At Steer and SSX the structural intersections are the primary targets for resource expansion, as well as the westward extension of the South Boundary dike. The West Mahala mineral resource located just east of the SSX Steer Complex remains an excellent near-mine exploration opportunity.

Smith Mine

The Smith underground mine, is accessed from the main portal, located in the bottom and in the northwestern part of the Dash open pit that was established in 1999 as the pit was being mined out. A second portal established in 2006 is also located in the DASH pit that accesses mineralization in the East DASH (Zone 9) area in the east highwall of the pit. Since the opening of this mine, near-mine exploration has been successful and focused on drilling and defining the following adjacent deposit areas: Mahala (including Mahala Dike Trend in Zone 4, and Mahala Extension in Zone 8), West Coulee and Coulee Dike Trend in Zone 2, West Dash and Dash Ridge in Zone 7, and B-pit in Zone 5.

Gold mineralization in the main Smith, Mahala, and West Dash deposits is associated with the northeast trending Coulee Fault and west-northwest trending faults and dikes. In Zone 1, high-grade gold mineralization is hosted in the upper and middle portions of the Hansen Creek Formation unit III within a northwest trending horst block between the South Graben fault and the 170 fault. Mineralization in Zones 2 and 3 is directly associated with west-northwest trending dikes. High-grade mineralization occurs within the Hansen Creek units II and III along the steeply dipping dikes. Lesser amounts of mineralization exist at higher levels where the dikes intersect favorable beds in the Roberts Mountains Formation. An exception to the tight elevation controls on mineralization is at the intersection of the west-northwest trending dikes and Coulee fault. Here, high-grade mineralization blows out into the Hansen Creek unit III along the west plunging intersection of the dikes and the fault for a down-dip depth of 600 ft.

Gold mineralization in the Mahala area is spatially associated with the west-northwest trending Mahala fault and associated dikes and favorable ore-host stratigraphy including units II and III of the Hansen Creek Formation and lower beds of the Roberts Mountains Formation. Mineralization at East Mahala occurs primarily in broad, SE-dipping lenses in Roberts Mountains Formation in the hanging wall of the Coulee Fault

The B-Pit deposit occurs as gently dipping, thin lenses of mineralized material north of the main Smith deposit. Three of the four lenses occur are stratigraphically bound within the Roberts Mountains Formation. The fourth lens occurs at the top of the Hansen unit III in the wall of a NW-trending horst block just to the south of the other three zones.

The West and East Dash deposits occur at the extreme ends of the west-northwest trending Dash Fault system which formed the mineralization mined in the Dash pit. The West Dash deposit occurs at the intersection of the Coulee fault and the west-northwest trending Dash fault. Most gold mineralization at West Dash occurs in fault-bounded slices of Hansen Creek unit III

26

with minor amounts in the overlying Hansen Creek unit II and Roberts Mountains Formation. West Dash is accessed through the Smith Portal. The East Dash deposit lies to the east of the Dash pit. A portion of this deposit has been accessed by a small portal in the pit. At East Dash, most gold occurs in two lenses parallel to the Dash Fault and dipping to the northeast. The largest lens is about 1,100 feet and is 15 feet to 25 feet thick. The north edge of the lens seems to be bounded by a steep east-west trending fault that is locally mineralized with high-grade material. The second lens is smaller at about 350 feet across, but much thicker, up to 120 feet.

In 2007, surface and underground drilling along the western extension of the Coulee and Mahala Dike Trends, revealed additional mineralization which was brought into the resource category. The 2008 drilling results are expected to extend the mineralization further to the northwest and add to the existing resource. This potential resource addition for this area will be addressed and updated in the next NI-43-101 resource update.

Murray Mine

The Murray Mine occurs within the Roberts Mountains Formation and the top three units of the Hansen Creek Formation. A minor amount of mineralization also occurs within the silicified unit IV of the Hansen Creek Formation. It was originally discovered in 1989 by condemnation drilling for a waste dump for one of the early open pits. Mineralization in the main Murray deposit occurs along the New Deep Fault which is a wrench fault striking west - -northwest and dipping 50º to 60º to the northeast. Mineralization in Zone 7 located about 750 feet north of the New Deep Fault occurred within calcareous siltstone beds of the Roberts Mountains Formation. Zone 7 and the main Murray have been largely mined out, with remnant pockets of mineralization remaining.

Zone 9 mineralization is located immediately west of the main Murray deposit and is associated with a westward projection of the New Deep Fault and several northeast trending faults. It was the focus of drilling campaigns in 2002-2005. Although there was no additional drilling in this resource it was removed from reserves in 2006 because of economics and possible water issues. It consists of two separate areas, a relatively flat-lying zone at the base of the Roberts Mountains Formation and a main zone which is associated with the New Deep fault. Mineralization is hosted by the Hansen Creek III which is locally overlain by the Snow Canyon Formation

Starvation Canyon

The original drill holes for the Starvation Canyon deposit were first completed by Freeport Exploration Company in the early 1980’s that targeted soil and surface rock-chip anomalies. Only low-grade gold was encountered in this early drilling. Additional drilling by Freeport in 1986 encountered higher grade mineralization. Since this deposit was not open-pitable at the time, not much additional work was conducted at Starvation until Queenstake re-examined the geological and deep underground potential in 2004. High-grade drill intersections were encountered in this deposit by Queenstake in January 2004. Mineralization at the Starvation Canyon project occurs at the Hansen II-III contact and is localized along a west-northwest fault zone at northeast structural intersections. The majority of the mineralization is within the interbedded micrite and argillaceous limestone of the Hansen Creek III, starting at or just beneath the contact. There are instances where mineralization has formed within the massive limestone of the basal Hansen Creek II, but these are rare. Drilling in 2007 and 2008 has further defined the resource at Starvation, along its outer edges as well as the internal grade distributions and higher angled structures.

Additional exploration potential exists to increase the resource of the presently known mineralized zones. The southern margin and the western extensions of the western zone have expansion potential along approximately 600 feet of strike length. The northwest structure that appears to be the primary control for the Starvation Canyon resource has potential for additional clusters of mineralization both to the northwest and southeast.

Saval

Gold mineralization in the Saval Basin area to the west of the SSX mine is primarily hosted in Hansen Creek Formation unit III where it has been structurally prepared by faulting and has locally been compartmentalized by northwest-trending dike systems. In this area, a series of west-northwest trending structures have been cut by northeast-trending faults. Notable structural features include the west-northwest trending Saval horst and the northeast-trending Husky fault, which cuts across the older Saval horst and down-drops it to the southeast. Ore zones were mostly formed in Hansen III host in the vicinity of structural intersections, often forming relatively steep, narrow, plunging orebodies. Dikes, such as the Saval 3 pit dike can be

27

traced for thousands of feet. High-grade gold mineralization has been concentrated along the Saval 3 pit dike in several locations, most prominently in the Saval 3 pit and in the north part of zone 5 at SSX. Except at the Saval 4 deposit, most economic zones in the Saval basin area have been mined out leaving relatively small mineralized zones in difficult-to-access pit walls and bottoms. During 2006 access to a small resource in the highwall of the Saval 2 pit was completed with a small amount of production. A small reserve is being carried in the highwall of the Saval 2 pit in 2009.

At Saval 4, a significant gold zone has been identified that can be mined from underground with hillside access. A small pit was excavated during 2006 to allow for a portal. This excavation occurred in mineralized Roberts Mountains formation with 2,050 ounces stockpiled. In this zone, relatively steep, confined, and vertically extensive high-grade ore-bodies have formed within the Saval horst beneath a splay fault of the large Sheep Tank fault. It is interpreted that the intersection of the west-northwest trending faults that bound the horst interact with northeast trending faults, forming structurally prepared ore hosts along their intersections. Additional mineralized zones form on the flanks of the horst where it intersects the NE-trending structures. Most notable is a high-grade zone directly in the Sheep Tank fault just to the north of the main pod. Thinner mineralization occurs near the top of the horst along its south bounding fault. Excellent opportunity exists for local resource expansion of the main pod and in the flanking fault-hosted zones with close-in underground drilling after mining has begun.

Other Reserve/Resource Areas

Wright Window Pit

The Wright Window is a small open pit reserve and resource area located on the west side of the Independence Mountains to the west of the Murray mine. The deposit is hosted by the lower Roberts Mountains and Upper Hansen Creek Formations along the Saval Discontinuity. Mineralization occurs on two zones; the west zone mineralization outcrops at the surface and is about 50 feet thick. The higher-grade east area is about 200 by 300 feet wide and 45 feet thick.

Pie Creek Resource

Potentially economic gold mineralization occurs in a series of near-surface zones in the head of the Pie Creek drainage on the east flank of Wheeler Mountain. Indicated and Inferred resources have been modeled and are shallow enough, at a depth of 200 feet, for consideration of open-pit mining. The main pod is about 800 feet long, dips moderately to the southeast at about 300, and is 20 feet to 45 feet in cross-sectional thickness. Mineralization is hosted in the top of unit III of the Hansen Creek Formation and is probably controlled by northeast trending faults. Three other smaller pods near the main pod are similarly in the top of the Hansen III, but strike northwest, dip moderately to the north, and are probably controlled by local faults of similar orientation. The main pod mineralization occurs between two of the mineralized northwesterly cross structures.

Drilling

Numerous drill campaigns have been executed at Jerritt Canyon since its discovery in the 1970’s. Exploration drilling programs typically consist of RC drilling at about 200 foot centers, the spacing is then reduced to about 140 feet and finally, to 100 foot centers or less. Surface core drilling typically makes up about 5% to 10% of the total drilling. At the underground mines, definition drilling consists of core drilling on 50 foot centers from underground stations, using NQ sized core which is 1.875 inches in diameter. Underground RC drilling (Cubex) is used for resource confirmation and is drilled on 20 to 40- foot centers. RC holes are generally less than 150 feet in length, but can be as long as 300 feet. Underground production sample drilling consists of Cubex and rotary percussion drilling (Solo and Secoma). Holes are generally short, less than 60 feet, and are drilled on center as close as 10 to 20 feet. The vast majority of drill holes, except the production holes, are measured for downhole deviation.

Tens of thousands of holes have been drilled on the property over the years. The Murray mine has over 22,000 holes with more than 2 million feet drilled; the Smith mine has over 5,500 holes with more than 1.40 million feet; the SSX mine has nearly 18,500 holes with 2.6 million feet of drilling.

Drilling at Jerritt Canyon for the last eight years is shown in Table 3. Drilling in 2000 through 2002 was conducted by the former owner, and drilling from 2003 to present was conducted by Queenstake.

28

Table 3: Jerritt Canyon Drilling (2001 through 2008)*

| Year | Surface RC | Surface Core | UG Core | UG RC | Production |

| | No. | Footage | No. | Footage | No. | Footage | No. | Footage | No. | Footage |

| 2001 | 59 | 65,450 | 0 | 0 | 268 | 86,134 | 914 | 112,129 | 5,086 | 349,157 |

| 2002 | 27 | 18,905 | 0 | 0 | 186 | 53,940 | 2,939 | 245,536 | 3,593 | 135,824 |

| 2003 | 108 | 47,277 | 0 | 0 | 119 | 41,458 | 2,057 | 191,416 | 3,643 | 141,218 |

| 2004 | 377 | 300,226 | 34 | 21,212 | 297 | 126,091 | 2,643 | 263,367 | 2,739 | 108,780 |

| 2005 | 126 | 101,413 | 4 | 1,403 | 179 | 80,251 | 2,618 | 267,627 | 2,414 | 94,793 |

| 2006 | 155 | 135,940 | 0 | 0 | 125 | 53,985 | 2,160 | 206,138 | 724 | 28,251 |

| 2007 | 220 | 216,592 | 15 | 12,495 | 44 | 20,580 | | 178,625 | 1,035 | 38,950 |

| 2008 | 101 | 104,182 | 7 | 8,939 | 94 | 41,915 | 240 | 45,661 | 578 | 36,820 |

* In 2009 no drilling activity was carried out due to the temporary shutdown of the milling operations.

Sampling and Analysis

Surface Drilling - Reverse Circulation Drilling

Surface exploration drilling programs at Jerritt Canyon consist predominantly of reverse circulation (RC) holes, with some surface core drilling. The drilling is conducted by a contract company and downhole surveys are taken by a contractor using a gyroscopic instrument. Collar locations are surveyed by a contracted survey company and/or in-house surveyors.

The surface RC holes are 5.5 inches in diameter and are sampled on 5 foot intervals, according to a protocol established by Queenstake.

Surface diamond drill core is HQ-sized (2.5 inches), unless it is necessary to reduce to NQ for completion of the hole. Surface core is logged for lithologic information and for geotechnical data according to the Jerritt Canyon logging manual at the logging facility. Surface core is split or cut with a diamond saw or hydraulic splitter and half of the sample is sent to the lab for analysis.

Underground Drilling

Drill hole spacing is targeted at 30 to 50 foot centers throughout the deposit. The attitude of the drill hole can be at any inclination to the mineralized unit although it is preferred to be as close to normal to the ore-controlling structures as possible. Collars of all drill holes are surveyed and the orientation of the holes is determined. All of the holes are surveyed by using a down-hole survey instrument (tropari or Flexit) or by a contract survey crew to measure the hole deviation. All of the collar and downhole surveys must pass quality assurance scrutiny by the site geologist prior to loading the data into the database. Only the actual data taken from the drill hole survey is used. Any projections of the survey beyond the length of the hole when surveyed are discarded. On rare occasions the collars are lost prior to collar or down hole surveys being completed; in this case the planned coordinates and hole orientation are used. However, when geological interpretation is done this factor is heavily considered in determining the validity of using the data from these holes.

Production Samples

Percussive drills (Solo, Airtrack, Secoma and others) are the dominant type used for collection of sludge samples over one rod length or six feet for final definition of the ore zones. It utilizes a rotary percussion drill with 3 inch diameter bits. Cuttings exit the hole via the annulus and are collected in a tray placed beneath the collar of the hole. These holes are drilled no longer than 60 feet in length due to hole deviation and downhole sample contamination issues. The hole and tray are cleaned prior to continuing the drill hole an additional six feet. Collar locations are surveyed but a downhole survey is not generally done. Some twinned data collected in 2001 suggests that there is a greater potential for these holes to have down-hole contamination beyond 36 feet depending largely on the orientation of the hole. For this reason the length of these holes has been decreased in the past few years. These drills are used for definition drilling at Murray and to a much lesser extent at SSX and Smith Mines;

Jumbo drill holes and jackleg holes are drilled for ore control only. This data, when collected, is used to help determine ore waste determinations but is not loaded into the database;

29

Selective rib and/or face samples are also used to help determine the ore boundaries and for grade control. They can be used to support the constrained ore boundary and in some cases at SSX are used to help estimate the block model grades; and

Cubex drills are sometime used for production drilling.

Truck Samples

At all the underground mines each haul truck is sampled for grade control purposes. The samples consist of grab samples taken over the entire load by the truck driver. Samples are placed in bags with pre-attached bar code numbered tags and transported to the Jerritt Canyon lab. Truck sample assays are cut by 8% which is a factor that has been determined through mine to mill reconciliation. The grades are used to state mine production.

Sample Preparation, Analyses and Security

Jerritt Canyon Laboratory Procedures

The mine utilizes the Jerritt Canyon laboratory for analytical work on the underground samples with check samples sent to ALS Chemex for comparisons. The samples for most of the surface drilling in the West Dash resource area in 2006 were also analyzed at the Jerritt Canyon facility. The assay lab is located in a separate building close to the ore processing plant. The laboratory has all the normal sample preparation equipment and facilities. The laboratory operates continually with a crew of 16 and performs about 500 fire assays per day with a 24-hour turn around from receipt of sample to reporting of assays.

Sample Preparation

All of the underground samples received at the Jerritt Canyon assay laboratory arrive with bar coded labels. The labels match drill logs maintained by samplers and drillers in the Jerritt Canyon Underground Department. Sample bar codes are scanned into the LIMS and assay lots are auto-created. The surface drill hole samples are labeled on the sample bag which are then logged into the LIMS system by the lab technicians. All logged samples dry for four to six hours at 325°F prior to prepping.

A rotary (automatic) 1:4 split (50 rotary cuts minimum) follows first stage crushing. Core samples first stage crush to 99% -1 inch prior to split; all other types are typically –1/2 inch prior to first stage split. Second stage crushing (99% - 3/8 inch) automatically passes through a rotary splitter (50 cut minimum). The assay split is then pulverized in a plate mill to 95%-150 mesh (Tyler) and blends for five minutes on a rotary blending wheel. The samples are placed in bar coded sample cups and transferred to fire assay.

Jerritt Canyon Lab Fire Assay Procedures:

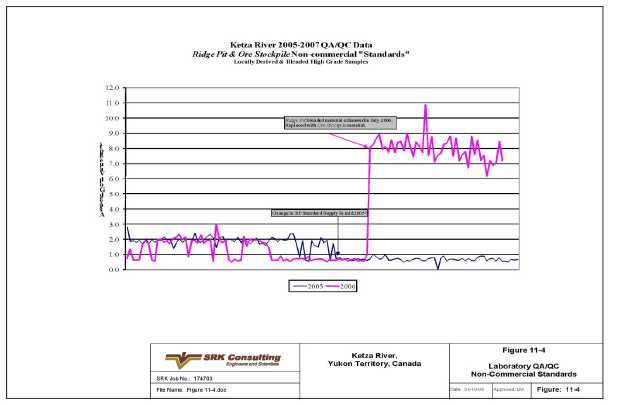

A tray of 24 thirty-gram charge crucibles is prepared with a standard litharge flux. Each sample is weighed at one assay ton. Of 24 samples on each tray, one is a repeat sample, one is a standard, one is a blank, and one is a blind standard inserted into the sample stream by the geology department. The samples are fired by the method of fusion/cupellation, with a gravimetric finish. The balance used for the final weighing is a Cahn C-30 microbalance that is serviced and calibrated on a semi-annual basis by Microlab Services.