[GRAPHIC]

Growth by Design

2004 Annual Investor Meeting

and Property Tour

[LOGO]

[GRAPHIC]

Bob Foley

Chief Financial Officer

Gramercy Capital Corporation

[GRAPHIC]

Company Overview

Core Business | | Real estate specialty finance company |

| | |

Structure | | Real Estate Investment Trust |

| | |

Manager | | Externally managed by an affiliate of SL Green (NYSE: SLG) |

| | |

Investment

Objective | | Current income and capital appreciation |

| | |

Key Products | | Whole loans, B-notes, mezzanine loans and preferred equity |

| | |

Market Focus | | Commercial and multi-family properties in select U.S. markets |

[GRAPHIC]

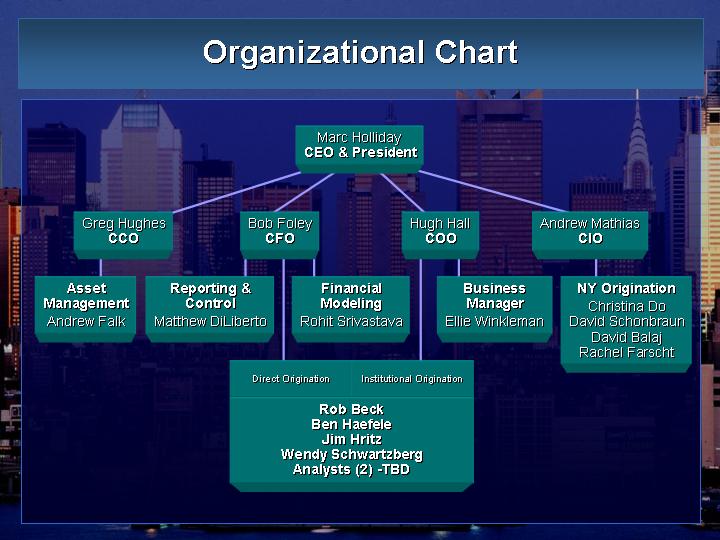

Organizational Chart

Marc Holliday |

CEO & President |

| | | | | | | | | |

Greg Hughes | | Bob Foley | | Hugh Hall | | Andrew Mathias | |

CCO | | CFO | | COO | | CIO | |

| | | | | | | | | |

Asset | | Reporting & | | Financial | | Business | | NY Origination | |

Management | | Control | | Modeling | | Manager | | Christina Do | |

Andrew Falk | | Matthew DiLiberto | | Rohit Srivastava | | Ellie Winkleman | | David Schonbraun | |

| | | | | | | | David Balaj | |

| | | | | | | | Rachel Farscht | |

| | | | | | | | | |

| | Direct Origination | Institutional Origination | | | |

| | Rob Beck | | | |

| | Ben Haefele | | | |

| | Jim Hritz | | | |

| | Wendy Schwartzberg | | | |

| | Analysts (2) -TBD | | | |

| | | | | | | | | | |

[GRAPHIC]

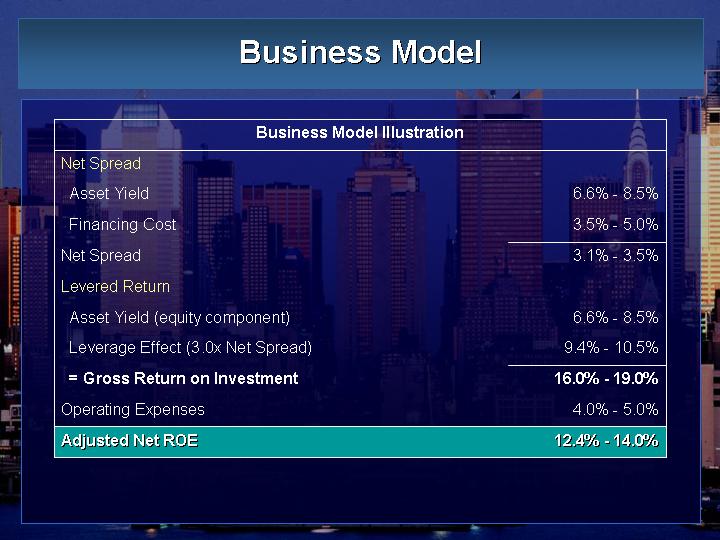

Business Model

Business Model Illustration

Net Spread | | | |

Asset Yield | | 6.6% - 8.5 | % |

Financing Cost | | 3.5% - 5.0 | % |

Net Spread | | 3.1% - 3.5 | % |

Levered Return | | | |

Asset Yield (equity component) | | 6.6% - 8.5 | % |

Leverage Effect (3.0x Net Spread) | | 9.4% - 10.5 | % |

= Gross Return on Investment | | 16.0% -19.0 | % |

Operating Expenses | | 4.0% - 5.0 | % |

Adjusted Net ROE | | 12.4% - 14.0 | % |

[GRAPHIC]

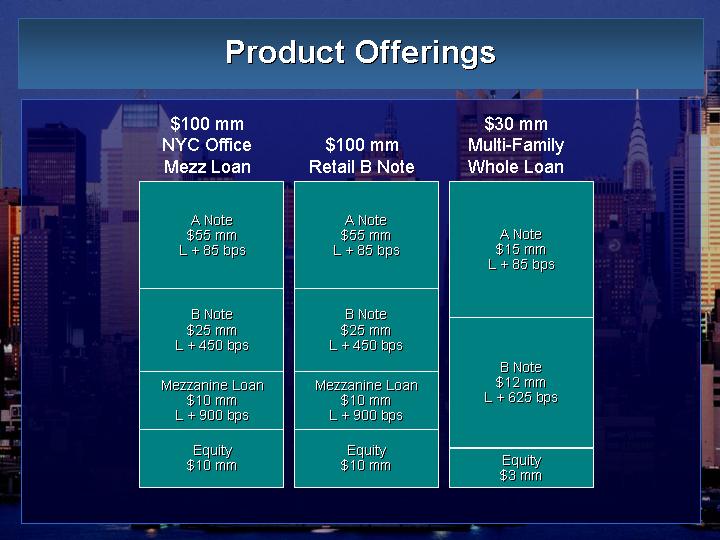

Product Offerings

$100 mm | | $30 mm |

NYC Office | $100 mm | Multi-Family |

MezzLoan | Retail B Note | Whole Loan |

| | |

A Note | A Note | |

$55 mm | $55 mm | A Note |

L + 85 bps | L + 85 bps | $15 mm |

| | L + 85 bps |

| | |

B Note | B Note | |

$25 mm | $25 mm | |

L + 450 bps | L + 450 bps | |

| | B Note |

Mezzanine Loan | Mezzanine Loan | $12 mm |

$10 mm | $10 mm | L + 625 bps |

L + 900 bps | L + 900 bps | |

| | |

Equity | Equity | |

$10 mm | $10 mm | Equity |

| | $3 mm |

[GRAPHIC]

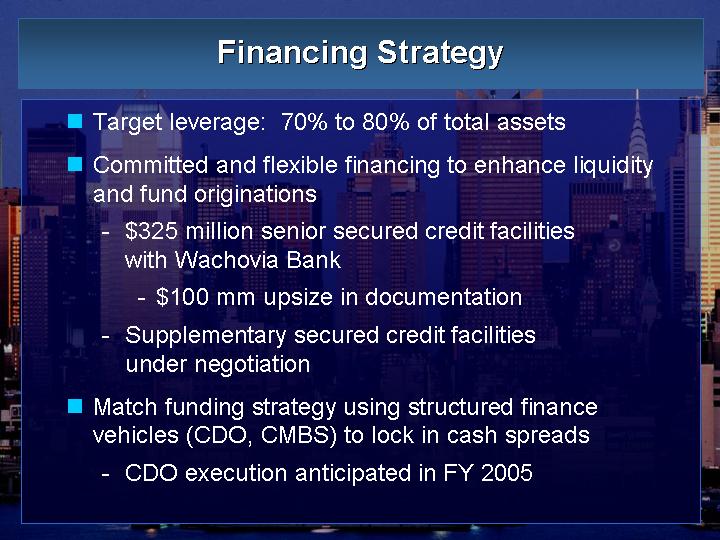

Financing Strategy

• Target leverage: 70% to 80% of total assets

• Committed and flexible financing to enhance liquidity and fund originations

• $325 million senior secured credit facilities with Wachovia Bank

• $100 mm upsize in documentation

• Supplementary secured credit facilities under negotiation

• Match funding strategy using structured finance vehicles (CDO, CMBS) to lock in cash spreads

• CDO execution anticipated in FY 2005

[GRAPHIC]

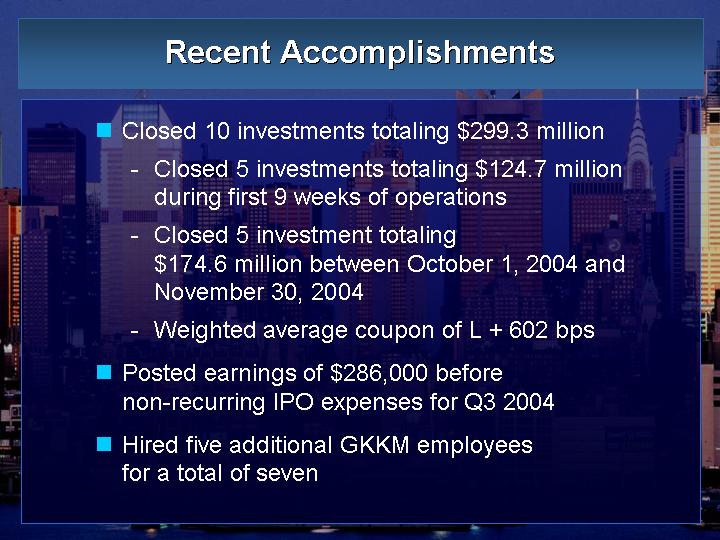

Recent Accomplishments

• Closed 10 investments totaling $299.3 million

• Closed 5 investments totaling $124.7 million during first 9 weeks of operations

•�� Closed 5 investment totaling $174.6 million between October 1, 2004 and November 30, 2004

• Weighted average coupon of L + 602 bps

• Posted earnings of $286,000 before non-recurring IPO expenses for Q3 2004

• Hired five additional GKKM employees for a total of seven

[GRAPHIC]

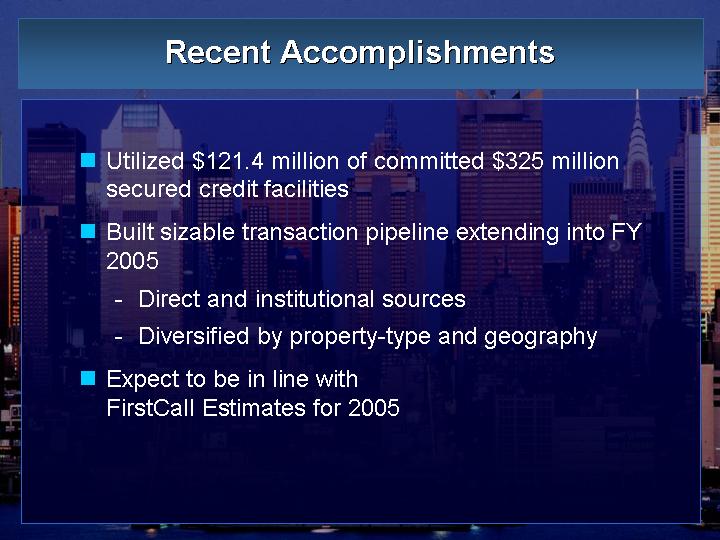

• Utilized $121.4 million of committed $325 million secured credit facilities

• Built sizable transaction pipeline extending into FY 2005

• Direct and institutional sources

• Diversified by property-type and geography

• Expect to be in line with FirstCall Estimates for 2005

[GRAPHIC]

Portfolio Stratification

Geographic Diversity ($MM)

[GRAPHIC]

Product Type ($MM)

[CHART]

[GRAPHIC]

Private Placement of Equity

Security: | | Common shares with par value of $0.01 per share |

| | |

Purchasers: | | Institutional investors and SL Green Realty Corp. |

| | |

Shares Issued: | | 5,500,000 |

| | |

Issue Price: | | $17.27 |

| | |

Net Proceeds: | | $94,985,000 |

| | |

Closing Date: | | December 3, 2004 |

| | |

Settlement Date: | | January 3, 2005 |

| | |

Use of Proceeds: | | To fund investment activity and general corporate purposes |

[GRAPHIC]

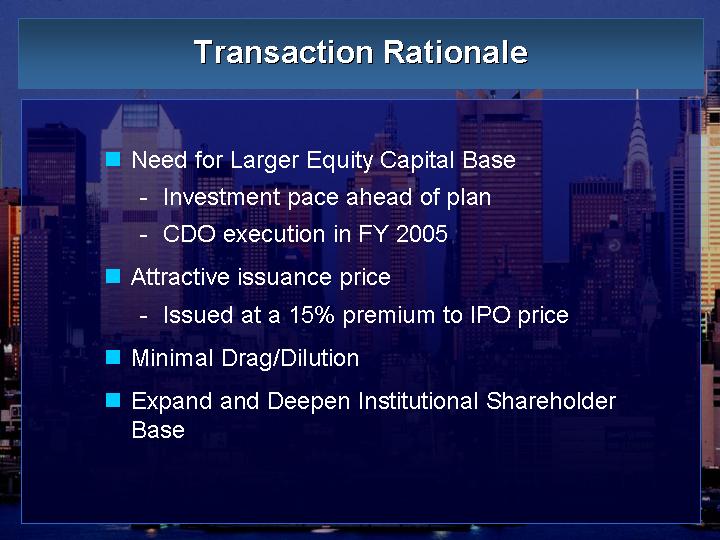

Transaction Rationale

• Need for Larger Equity Capital Base

• Investment pace ahead of plan

• CDO execution in FY 2005

• Attractive issuance price

• Issued at a 15% premium to IPO price

• Minimal Drag/Dilution

• Expand and Deepen Institutional Shareholder Base

[GRAPHIC]

Growth by Design

2004 Annual Investor Meeting

and Property Tour

[LOGO]