UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |  |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| |  |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

to

Commission File No. 1-32248

GRAMERCY CAPITAL CORP.

(Exact name of registrant as specified in its charter)

| |  |

| Maryland | | 06-1722127 |

(State or other jurisdiction

incorporation or organization) | | (I.R.S. Employer of

Identification No.) |

420 Lexington Avenue, New York, NY 10170

(Address of principal executive offices — zip code)

(212) 297-1000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| |  |

| Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.001 Par Value

Series A Cumulative Redeemable

Preferred Stock, $0.001 Par Value | | New York Stock Exchange

New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yeso Nox

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yeso Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| |  | |  | |  |

| Large accelerated filero | | Accelerated filerx | | Non-accelerated filero

(Do not check if a smaller reporting company) | | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso Nox

As of September 22, 2011, there were 50,517,365 shares of the Registrant’s common stock outstanding. The aggregate market value of common stock held by non-affiliates of the registrant (43,686,810 shares) at June 30, 2010, was $55,045,381. The aggregate market value was calculated by using the closing price of the common stock as of that date on the New York Stock Exchange, which was $1.26 per share.

TABLE OF CONTENTS

GRAMERCY CAPITAL CORP.

FORM 10-K

TABLE OF CONTENTS

10-K PART AND ITEM NO.

| |  |

| | Page |

PART I

| |

1. Business | | | 1 | |

1A. Risk Factors | | | 18 | |

1B. Unresolved Staff Comments | | | 53 | |

2. Properties | | | 54 | |

3. Legal Proceedings | | | 58 | |

4. Reserved | | | 59 | |

PART II

| |

5. Market for Registrant’s Common Equity, Related Stockholders Matters and Issuer Purchases of Equity Securities | | | 59 | |

6. Selected Financial Data | | | 62 | |

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 65 | |

7A. Quantitative and Qualitative Disclosures About Market Risk | | | 107 | |

8. Financial Statements and Supplementary Data | | | 109 | |

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 213 | |

9A. Controls and Procedures | | | 213 | |

9B. Other Information | | | 213 | |

PART III

| |

10. Directors, Executive Officers and Corporate Governance of the Registrant | | | 214 | |

11. Executive Compensation | | | 218 | |

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 235 | |

13. Certain Relationships and Related Transactions and Director Independence | | | 237 | |

14. Principal Accounting Fees and Services | | | 242 | |

PART IV

| |

15. Exhibits, Financial Statements and Schedules | | | 243 | |

| Signatures | | | 249 | |

i

TABLE OF CONTENTS

ITEM 1. BUSINESS

General

Gramercy Capital Corp. is a self-managed, integrated commercial real estate finance and property management and investment company. On April 1, 2008, we completed the acquisition of American Financial Realty Trust (NYSE: AFR), or American Financial, in a transaction with a total value of approximately $3.3 billion, including the assumption of approximately $1.3 billion of American Financial’s secured debt.

Our commercial real estate finance business, which operates under the name Gramercy Finance, focuses on the direct origination, acquisition and portfolio management of whole loans, bridge loans, subordinate interests in whole loans, mezzanine loans, preferred equity, commercial mortgage-backed securities, or CMBS, and other real estate related securities.

Our property management and investment business, which operates under the name Gramercy Realty, historically focused on the acquisition and management of commercial properties leased primarily to regulated financial institutions and affiliated users throughout the United States. These institutions are for the most part deposit taking commercial banks, thrifts and credit unions, which we generally refer to as “banks.” Our portfolio of wholly-owned and jointly-owned bank branches and office buildings is leased to large banks such as Bank of America, N.A., or Bank of America, Wells Fargo Bank National Association (formerly Wachovia Bank, National Association), or Wells Fargo Bank, Regions Financial Corporation, or Regions Financial, and Citizens Financial Group, Inc., or Citizens Financial, and to mid-sized and community banks.

In September 2011, we entered into a collateral transfer and settlement agreement, or Settlement Agreement, for an orderly transition of substantially all of Gramercy Realty’s assets to Gramercy Realty’s senior mezzanine lenders in full satisfaction of Gramercy Realty’s obligations with respect to Gramercy Realty’s $240.5 million mortgage loan, or the Goldman Mortgage Loan, and Gramercy Realty’s $549.7 million senior and junior mezzanine loans, or the Goldman Mezzanine Loans, in exchange for a mutual release of claims among us and the mortgage and mezzanine lenders and, subject to certain termination provisions, our continued management of Gramercy Realty’s assets on behalf of such mezzanine lenders for a fixed fee plus incentive fees. In July 2011, our Dana portfolio, which consists of 15 properties totaling approximately 3.8 million rentable square feet, was transferred to its mortgage lender through a deed in lieu of foreclosure. Subsequent to those agreements, the business of Gramercy Realty will change from being primarily an owner of commercial properties to being primarily a third-party manager of commercial properties. The scale of Gramercy Realty’s revenues will decline substantially as a substantial portion of net revenues from property operations will be replaced with fee revenues of a substantially smaller scale. Additionally, as assets are transferred, our total assets and liabilities are expected to decline. If the transfer had happened as of December 31, 2010, our assets would have declined from approximately $5.5 billion to approximately $2.8 billion and our liabilities would have declined from approximately $6.0 billion to approximately $2.9 billion. Our consolidated financial statements would have reflected significant liquidity including cash and cash equivalents of approximately $185.8 million and we would have no recourse debt obligations outstanding. We anticipate all transfers under the Settlement Agreement to be completed by December 15, 2011. After all transfers are complete, we expect to own a portfolio of commercial real estate with an aggregate book value of approximately $108.5 million, in addition to approximately $1.2 billion of loan investments, approximately $1.0 billion of CMBS, and approximately $463.1 million in other assets, based on our Consolidated Balance Sheet as of December 31, 2010.

During 2010, we recorded impairment charges totaling $912.1 million in continuing operations to reduce the carrying value of 692 properties to estimated fair value. All of the impaired properties are part of the Gramercy Realty portfolio and serve as collateral for the Goldman Mezzanine Loans. Substantially all of the impaired properties will be transferred to the mezzanine lenders pursuant to the Settlement Agreement. As a result of recording these impairments, our total stockholders’ equity, or book equity, is negative $493.9 million as of December 31, 2010 as compared to a positive book equity balance of $566.2 million as of December 31, 2009. The carrying value of liabilities associated with the impaired properties has not been adjusted and remained outstanding as of December 31, 2010. As of December 31, 2010, the liabilities of the impaired properties exceed the carrying value of the assets and accordingly, the subsequent transfer of assets and liabilities pursuant to the Settlement Agreement will generate gains as the carrying values of such liabilities

1

TABLE OF CONTENTS

are reduced to $0, which in turn will reduce our negative book equity balance. After all transfers under the Settlement Agreement are complete, which we anticipate will occur by December 15, 2011, we expect that stockholders’ equity will remain negative, however, such negative balance will be substantially lower than the negative $493.9 million balance presented on the December 31, 2010 balance sheet.

Neither Gramercy Finance nor Gramercy Realty is a separate legal entity but are divisions through which our commercial real estate finance and property management and investment businesses are conducted.

At December 31, 2010, we owned approximately 25.3 million net rentable square feet of commercial real estate in 36 states and the District of Columbia with an aggregate book value of approximately $2.6 billion, in addition to $1.1 billion of loan investments, $1.0 billion of CMBS, and $731.4 million in other assets. As of December 31, 2010, approximately 48.0% of our assets were comprised of commercial property, 20.4% of debt investments, 18.3% of commercial mortgage real estate securities and 13.3% of other assets.

Our corporate offices are located in midtown Manhattan at 420 Lexington Avenue, New York, New York 10170. As of December 31, 2010, we had 135 employees. We can be contacted at (212) 297-1000. We maintain a website atwww.gkk.com. On our website, you can obtain, free of charge, a copy of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as practicable after we file such material electronically with, or furnish it to, the Securities and Exchange Commission, or the SEC. We have also made available on our website our audit committee charter, compensation committee charter, nominating and corporate governance committee charter, code of business conduct and ethics and corporate governance principles. You can also read and copy materials we file with the SEC at its Public Reference Room at 100 F Street, NE, Washington, DC 20549 (1-800-SEC-0330). The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding the issuers that file electronically with the SEC.

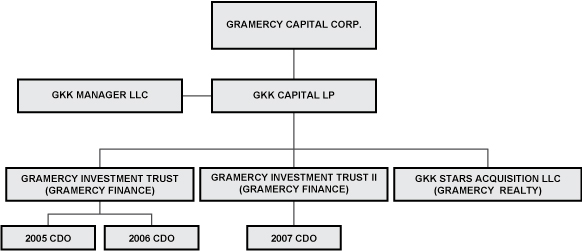

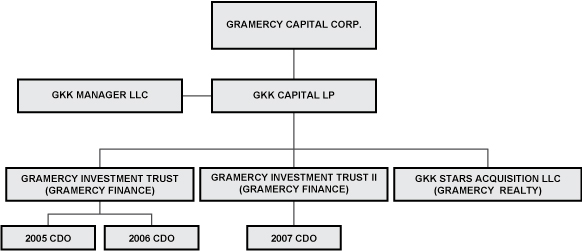

Corporate Structure

We were formed in April 2004 as a Maryland corporation and we completed our initial public offering in August 2004. We conduct substantially all of our operations through our operating partnership, GKK Capital LP, or our Operating Partnership. We are the sole general partner of our Operating Partnership. Our Operating Partnership conducts our finance business primarily through two private real estate investment trusts, or REITs, Gramercy Investment Trust and Gramercy Investment Trust II, and our commercial real estate investment and property management business through GKK Stars Acquisition LLC and various other wholly owned entities. The chart below summarizes the organizational structure of these entities as of December 31, 2010:

2

TABLE OF CONTENTS

Prior to the internalization of our management in April 2009, we were externally managed and advised by GKK Manager LLC, or the Manager, then a wholly-owned subsidiary of SL Green Realty Corp. (NYSE: SLG), or SL Green, which owned approximately 10.7% of the outstanding shares of our common stock as of December 31, 2010 and is our largest stockholder. On April 24, 2009, we completed the internalization of our management through the direct acquisition of the Manager from SL Green. As a result of the internalization, beginning in May 2009, management and incentive fees payable by us to the Manager ceased and we added 77 former employees of the Manager to our own staff.

We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, and generally will not be subject to U.S. federal income taxes to the extent we distribute our taxable income, if any, to our stockholders. We have in the past established, and may in the future establish, taxable REIT subsidiaries, or TRSs, to effect various taxable transactions. Those TRSs would incur U.S. federal, state and local taxes on the taxable income from their activities.

Unless the context requires otherwise, all references to “Gramercy,” “the Company,” “we,” “our,” and “us” in this annual report mean Gramercy Capital Corp., a Maryland corporation, and one or more of its subsidiaries, including our Operating Partnership.

Business and Strategy

During 2010, we remained focused on improving our consolidated balance sheet by reducing leverage, generating liquidity from existing assets, actively managing portfolio credit, accretively re-investing repayments from our loan and CMBS investments and renewing expiring leases.

In December 2010, we closed on the sale of certain investments to SL Green, including our 45% joint venture interests in the leased fee at 885 Third Avenue and 2 Herald Square, the entire leased fee interest in 292 Madison Avenue and a $38.7 million mezzanine loan secured by equity interests in 601 West 26th Street, New York, NY, also known as the Starrett-Lehigh Building, for an aggregate price of $390.8 million, including the assumption of $265.6 million of mortgage debt. Net of associated costs and including the release of approximately $6.0 million posted as cash collateral for related letters of credit, these transactions increased our unrestricted corporate liquidity by approximately $89.9 million and increased our restricted cash in one of our collaterized debt obligations, or CDOs, by approximately $38.9 million.

In November 2010, we completed a tender offer for approximately 23.4% of the outstanding shares of our Series A cumulative redeemable preferred stock, or Series A preferred stock, or 1,074,178 shares, at $15.00 per preferred share. Subsequent to the tender, 3,525,822 shares remain outstanding. Net of expenses, the tender offer used approximately $16.6 million of unrestricted cash and resulted in the extinguishment of accrued preferred stock dividends of approximately $4.4 million for no additional proceeds. The excess of the carrying amount of tendered Series A preferred stock over the consideration resulted in an increase in book value to the common stockholders of approximately $13.7 million.

In June 2010, we redeemed the remaining $52.5 million of junior subordinated notes liabilities by transferring to the holders of the junior subordinated notes an equivalent par value amount of various classes of bonds issued by our CDOs which were previously purchased by us in the open market and cash equivalents of $5.0 million. This redemption eliminated the liability for our junior subordinated notes from our consolidated financial statements, which had an original balance of $150.0 million. Additionally, during 2010, we repurchased $39.0 million of CDO bonds previously issued by two of our three CDOs, generating gains on early extinguishment of debt of approximately $19.4 million.

As a result of these and other transactions executed during the year, we increased our unrestricted cash on our balance sheet during the year by approximately $82.5 million to $220.8 million at December 31, 2010, increased restricted cash available for portfolio investments within two of our three CDOs by approximately $63.1 million to approximately $90.0 million at December 31, 2010 and reduced our secured and other debt by approximately $187.9 million to approximately $4.9 billion at December 31, 2010.

We also sought to extend or restructure the Goldman Mortgage Loan with Goldman Sachs Mortgage Company, or GSMC, Citicorp North America, Inc., or Citicorp, and SL Green and the Goldman Mezzanine Loans with KBS Real Estate Investment Trust, Inc., or KBS, GSMC, Citicorp and SL Green. The Goldman Mortgage Loan is collateralized by approximately 195 properties held by Gramercy Realty and the Goldman

3

TABLE OF CONTENTS

Mezzanine Loans are collateralized by the equity interest in substantially all of the entities comprising our Gramercy Realty division, including its cash and cash equivalents totaling $35.0 million of our unrestricted cash as of December 31, 2010. Subsequent to the final maturity of the Goldman Mortgage Loan and the Goldman Mezzanine Loans in March 2011, we entered into a series of short term extensions to provide additional time to exchange and consider proposals for an extension, modification, restructuring or refinancing of the Goldman Mortgage Loan and the Goldman Mezzanine Loans and to explore an orderly transition of the collateral to the lenders if such discussions failed. On May 9, 2011, we announced that the scheduled maturity of the Goldman Mortgage Loan and the Goldman Mezzanine Loans occurred without repayment and without an extension or restructuring of the loans by the lenders.

Notwithstanding the maturity and non-repayment of the loans, we maintained active communications with the lenders and in September 2011, we entered into the Settlement Agreement for an orderly transition of substantially all of Gramercy Realty’s assets to the mezzanine lenders, in exchange for a mutual release of claims among us and the mortgage and mezzanine lenders and, subject to certain termination provisions, an arrangement for our continued management of Gramercy Realty’s assets on behalf of such mezzanine lenders for a fixed fee plus incentive fees. In July 2011, our Dana portfolio, which consists of 15 properties totaling approximately 3.8 million rentable square feet, was transferred to its mortgage lender through a deed in lieu of foreclosure. Subsequent to the execution of the Settlement Agreement, the business of Gramercy Realty will change from being primarily an owner of commercial properties to being primarily a third party manager of commercial properties. The scale of Gramercy Realty’s revenues will substantially decline as a substantial portion of net revenues from property operations will be replaced with fee revenues of a substantially smaller scale. Additionally, as assets are transferred, our total assets and liabilities are expected to decline substantially.

Property Management and Investment

Our property management and investment business operates under the name Gramercy Realty. It historically focused on the acquisition and/or management of commercial properties primarily leased on a long-term basis to regulated financial institutions and affiliated users throughout the United States. The Gramercy Realty portfolio of bank branches and office buildings is leased to large banks such as Bank of America, Wells Fargo Bank, Regions Financial and Citizens Financial and to mid-sized and community banks. Summarized in the table below are our key property portfolio statistics as of December 31, 2010:

| |  | |  | |  | |  | |  | |  |

| | Number of Properties | | Rentable Square Feet | | Occupancy |

| Properties(1) | | December 31,

2010 | | December 31,

2009 | | December 31,

2010 | | December 31,

2009 | | December 31,

2010 | | December 31,

2009 |

| Branches | | | 571 | | | | 583 | | | | 3,689,190 | | | | 3,726,399 | | | | 84.4 | % | | | 85.5 | % |

| Office Buildings | | | 321 | | | | 324 | | | | 21,613,441 | | | | 21,847,249 | | | | 82.3 | % | | | 85.9 | % |

| Land | | | 2 | | | | 6 | | | | — | | | | — | | | | — | | | | — | |

| Total | | | 894 | | | | 913 | | | | 25,302,631 | | | | 25,573,648 | | | | 82.6 | % | | | 85.9 | % |

| (1) | Excludes investments in unconsolidated joint ventures. Approximately 872 properties, of which 54 properties are held by an unconsolidated joint venture, comprising approximately 20.9 million rentable square feet, or the Lender Portfolio, are expected to be subject to the Settlement Agreement and ownership will be transferred to Gramercy Realty’s mezzanine lenders, in exchange for a mutual release of claims among us and the mortgage and mezzanine lenders and, subject to certain termination provisions, our continued management of the properties on behalf of the mezzanine lenders for a fixed fee plus incentive fees. In addition, our Dana portfolio, which consists of 15 properties comprising approximately 3.8 million rentable square feet, was transferred to its mortgage lender through a deed in lieu of foreclosure. We will continue to manage the Lender Portfolio. |

Gramercy Realty’s investment strategy was to acquire, operate and selectively dispose of commercial properties leased to investment-grade financial services companies for the purpose of generating stable earnings, substantial depreciation expense to shield us from taxes and the distribution requirements of earnings, and the potential for long-term capital appreciation in the value of the underlying real estate. After the transition, Gramercy Realty will also provide property and asset management services for the lender portfolio.

4

TABLE OF CONTENTS

Gramercy Realty seeks to capitalize on its knowledge of the market for bank branches and office properties occupied by financial institutions by applying a proactive approach to leasing, which includes: (i) identifying the most attractive and efficient use of vacant or low occupancy properties; (ii) renegotiating short-term leases to achieve longer lease terms at market rates; (iii) using market research; and (iv) utilizing a broad network of third-party brokers. Gramercy Realty has in the past provided tenants who lease multiple properties with specialized lease structures such as substitution, relocation and early termination rights, rent step-downs and in some cases, shorter lease terms in selected properties within a portfolio.

Gramercy Realty seeks to apply a customer-focused, hands-on approach to asset and property management, which includes: (i) focusing on tenant satisfaction by providing quality tenant services at affordable rental rates; (ii) hiring and closely overseeing third party property managers; and (iii) imposing strict return-on-investment procedures when evaluating capital expenditures, acquisitions, and dispositions.

Gramercy Realty typically and historically entered into long-term leases with financial institution tenants. As of December 31, 2010, the weighted average remaining term of our leases was 8.5 years and approximately 70.6% of our base revenue was derived from triple-net and bond-net leases.

In September 2011, we entered into an asset management arrangement upon the terms and conditions set forth in the Settlement Agreement, or Interim Management Agreement, to provide for our continued management of the lender portfolio through December 31, 2013 for a fixed fee of $10.0 million annually, the reimbursement of certain costs and incentive fees equal to 10.0% of the excess of the equity value, if any, of the transferred collateral over $375.0 million plus all new capital invested into the transferred collateral by KBS, its affiliates and/or joint venture partners, or the Threshold Value Participation, and 12.5% of the excess equity value, if any, of the transferred collateral over $468.5 million plus all new capital invested into the transferred collateral by KBS, its affiliates and/or joint venture partners, or the Excess Value Participation. The minimum amount of the Threshold Value Participation equals $3.5 million. The Threshold Value Participation and the Excess Value Participation will be valued and paid following the earlier of December 13, 2013, subject to extension to no later than December 31, 2015, or the sale by KBS of at least 90% (by value) of the transferred collateral. Under the terms of the Interim Management Agreement, we do not forfeit our incentive fee rights unless we resign as manager or are terminated as manager for cause and, with respect to the Excess Value Participation, in the event of a Failure to Agree Termination (as defined below). The Interim Management Agreement may be terminated by either party without cause 90 days following written notice; however, any notice of termination given by us cannot be effective until December 31, 2011 at the earliest. Notwithstanding the foregoing, we have agreed with KBS to promptly commence and diligently seek to negotiate a full and complete management services agreement by no later than March 31, 2012. If the parties do not execute a mutually acceptable asset management services agreement prior to March 31, 2012, a Failure to Agree Termination shall be effectuated and the Interim Management Agreement shall automatically terminate on June 30, 2012, without liability or a penalty of any kind, except for our loss of the Excess Value Participation.

Commercial Real Estate Finance

Our commercial real estate finance business operates under the name Gramercy Finance. We invest in a diversified portfolio of real estate loans, including whole loans, bridge loans, subordinate interests in whole loans, mezzanine loans, CMBS and preferred equity involving commercial properties throughout the United States. As of December 31, 2010, Gramercy Finance also held interests in one credit tenant net lease investment, or CTL investment, and eight interests in real estate acquired through foreclosures. When evaluating transactions, we assess our risk-adjusted return and target transactions with yields that seek to provide excess returns for the risks being taken. In 2010, we engaged in a relatively small amount of new investment activity. In 2010, we had focused primarily on the asset management of our existing portfolio of real estate loans and CMBS.

We generate income principally from the spread between the yields on our assets and the cost of our borrowing and hedging activities. We have historically financed, or may finance in the future, assets through a

5

TABLE OF CONTENTS

variety of techniques, including repurchase agreements, secured and unsecured credit facilities, CDOs, unsecured junior subordinated corporate debt, issuances of CMBS, and other structured financings. In addition, we attempt to match fund interest rates with like-kind debt (i.e., fixed-rate assets are financed with fixed-rate debt, and floating rate assets are financed with floating rate debt), through the use of hedges such as interest rate swaps, caps, or through a combination of these strategies. This allows us to reduce the impact of changing interest rates on our cash flow and earnings. We actively manage our positions, using our credit, structuring and asset management resources to enhance returns.

We attempt to actively manage and maintain the credit quality of our portfolio by using our management team’s expertise in structuring and repositioning investments to improve the quality and yield on managed investments. When investing in higher leverage transactions, we use guidelines and standards developed and employed by senior management, including the underwriting of collateral performance and valuation, reviewing the creditworthiness of the equity investors, securing additional forms of collateral and developing strategies to increase the likelihood of repayment. If defaults occur, we employ our asset management resources to mitigate the severity of any losses and seek to optimize the recovery from assets in the event that we foreclose upon them.

We seek to control the negotiation and structure of the debt transactions in which we invest, which enhances our ability to mitigate our losses, to negotiate loan documents that afford us appropriate rights and control over our collateral, and to have the right to control the debt that is senior to our position. We generally avoid investments where we cannot secure adequate control rights, unless we believe the default risk is very low and the transaction involves high-quality sponsors. Our flexibility to invest in all or any part of a debt capital structure enables us to participate in many transactions and to retain only the investments that meet our investment parameters.

Our commercial real estate finance investments include the following:

Whole Loans — We originate or have originated fixed-rate, permanent whole loans with terms of up to 15 years. We may separate certain of these loans into tranches, which can be securitized and resold. When we do so, we occasionally retain that component of the whole loan that we believe has the most advantageous risk-adjusted returns. The retained interest can be the senior interest, a subordinate interest, a mezzanine loan or a preferred equity interest created in connection with such whole loan origination. At origination, our whole loans typically had last-dollar loan-to-value ratios between 65% and 75%. The initial stated maturity of our whole loan investments range from five years to 15 years. We may sell these investments prior to maturity.

Bridge Loans — We have offered floating rate bridge whole loans to borrowers who are seeking debt capital with a final term to maturity of not more than five years to be used in the acquisition, construction or redevelopment of a property. Typically, the borrower has identified a property in a favorable market that it believes to be poorly managed or undervalued. Bridge financing enables the borrower to employ short-term financing while improving the operating performance and physical aspects of the property and avoid burdening it with restrictive long-term debt. The bridge loans we originated are predominantly secured by first mortgage liens on the property. At origination, our bridge loans typically had last-dollar loan-to-value ratios between 70% and 80%. The initial stated maturity of our bridge loans range from two years to five years, and we frequently hold these investments to maturity.

Our bridge loans occasionally have led to additional financing opportunities since bridge facilities are often a first step toward permanent financing or a sale of the underlying real estate. We generally view securitization as a financing rather than a trading activity. We have pooled together smaller bridge loans with other loans and retained the resulting non-investment grade interests (and interest-only certificates, if any) resulting from these securitizations, which historically have taken the form of CDOs.

Subordinate Interests in Whole Loans — We purchase or have purchased from third parties, and may retain from whole loans we originate and co-originate and securitize or sell, subordinate interests in whole loans. Subordinate interests are participation interests in mortgage notes or loans secured by a lien subordinated to a senior interest in the same loan. The subordination is generally evidenced by a co-lender or participation agreement between the holders of the related senior interest and the subordinate interest. In some instances, the subordinate interest lender may additionally require a security interest in the stock or partnership

6

TABLE OF CONTENTS

interests of the borrower as part of the transaction. When we originate whole loans, we may divide them, and securitize or sell the senior interest and keep a subordinate interest for investment, or the opposite.

At origination, our subordinate interests in whole loans typically had last-dollar loan-to-value ratios between 65% and 85%. Subordinate interest lenders have the same obligations, collateral and borrower as the senior interest lender, but typically are subordinated in recovery upon a default. Subordinate interests in whole loans share certain credit characteristics with second mortgages, in that both are subject to greater credit risk with respect to the underlying mortgage collateral than the corresponding senior interest.

Subordinate interests created from bridge loans generally will have terms matching those of the whole loan of which they are a part, typically two to five years. Subordinate interests created from whole loans generally will have terms of five years to fifteen years. We expect to hold subordinate interests in whole loans to their maturity.

Upon co-origination or acquisition of subordinate interests in whole loans from third parties, we may earn income on the investment, in addition to the interest payable on the subordinate piece, in the form of fees charged to the borrower under that note or by receiving principal payments in excess of the discounted price (below par value) we paid to acquire the note. When we create subordinate interests out of whole loans and then sell the senior interest, we allocate our basis in the whole loan among the two (or more) components to reflect the fair market value of the new instruments. We may realize a profit on sale if our allocated value is below the sale price or we may realize a loss on sale if our allocated value is above the sale price. Our ownership of a subordinate interest with controlling class rights, which typically means we have the ability to determine when, and in what manner, to exercise the rights and remedies afforded the holder of the senior interest, may, in the event the financing fails to perform according to its terms, cause us to elect to pursue our remedies as owner of the subordinate interest, which may include foreclosure on, or modification of, the note. In some cases, usually restricted to situations where the appraised value of the collateral for the debt falls below agreed levels relative to the total outstanding debt, the owner of the senior interest may be able to foreclose or modify the note against our wishes as holder of the subordinate interest. As a result, our economic and business interests may diverge from the interests of the holders of the senior interest. These divergent interests among the holders of each investment may result in conflicts of interest.

Mezzanine Loans — We acquire and originate, or have acquired or originated mezzanine loans that are senior to the borrower’s equity in, and subordinate to a mortgage loan, on a property. These loans are secured by pledges of ownership interests, typically in whole but occasionally in part (but usually with effective sole control over all the ownership interests), in entities that directly or indirectly own the real property. In addition, we may require other collateral to secure mezzanine loans, including letters of credit, personal guarantees, or collateral unrelated to the property. We typically structure our mezzanine loans to receive a stated coupon (benchmarked usually against LIBOR, or occasionally against a Treasury index or a swap index). We may in certain select instances structure our mezzanine loans to receive a stated coupon plus a percentage of gross revenues and a percentage of the increase in the fair market value of the property securing the loan, payable upon maturity, refinancing or sale of the property.

At origination, these investments typically have initial terms from two to ten years. Some transactions entail the issuance of more than one tranche or class of mezzanine debt. At origination, our mezzanine loans usually had last-dollar loan-to-value ratios of between 65% and 90%, depending on their vintage. Mezzanine loans frequently have maturities that match the maturity of the related mortgage loan but may have shorter or longer terms. We expect to hold these investments to maturity.

Commercial Mortgage-Backed Securities (CMBS) — We acquire, or have acquired, CMBS that are created when commercial loans are pooled and securitized. CMBS are secured by or evidenced by ownership interests in a single commercial mortgage loan or a pool of mortgage loans secured by commercial properties. We expect a majority of our CMBS to be rated by at least one rating agency. CMBS are generally pass-through certificates that represent beneficial ownership interests in common law trusts whose assets consist of defined portfolios of one or more commercial mortgage loans. They are typically issued in multiple tranches whereby the more senior classes are entitled to priority distributions from the trust’s income to make specified interest and principal payments on such tranches. Losses and other shortfalls on the mortgage pool

7

TABLE OF CONTENTS

are borne by the most subordinate classes, which receive payments only after the more senior classes have received all principal and/or interest to which they are entitled.

The credit quality of CMBS depends on the credit quality of the underlying mortgage loans, which is a function of factors including but not limited to:

| • | the principal amount of loans relative to the value of the related properties; |

| • | the mortgage loan terms (e.g. amortization and remaining term); |

| • | market assessment and geographic location; |

| • | construction quality and economic utility of the property; and |

| • | the creditworthiness of the tenants. |

Expected maturities of our CMBS investments range from several months to up to 15 years. We designate our CMBS investments as held to maturity or available for sale, on the date of acquisition of the investment. CMBS securities that we do not hold for the purpose of selling in the near-term but may dispose of prior to maturity, are designated as available-for-sale.

Preferred Equity — We have originated preferred equity investments in entities that directly or indirectly own commercial real estate. Preferred equity is not secured, but holders have priority relative to common equity holders on cash flow distributions and proceeds from capital events. In addition, preferred holders can often enhance their position and protect their equity position with covenants that limit the entity’s activities and grant us the exclusive right to control the property after an event of default. Occasionally, the first mortgage on a property prohibits additional liens and a preferred equity structure provides an attractive financing alternative. With preferred equity investments, we may become a special limited partner or member in the ownership entity and may be entitled to take certain actions, or cause liquidation, upon a default. Preferred equity typically is more highly leveraged, with last-dollar loan-to-value ratios at origination of 85% to more than 90%. We expect our preferred equity to have mandatory redemption dates (that is, maturity dates) that range from three years to five years, and we expect to hold these investments to maturity.

The aggregate carrying values, allocated by product type and weighted average coupons of our loans, and other lending investments and CMBS investments as of December 31, 2010 and December 31, 2009, were as follows (dollars in thousands):

| |  | |  | |  | |  | |  | |  | |  | |  |

| |  | |  | |  | |  | |  | |  | |  | |  |

| | Carrying Value(1) | | Allocation by

Investment Type | | Fixed Rate

Average Yield | | Floating Rate Average

Spread over LIBOR(2) |

| | | 2010 | | 2009 | | 2010 | | 2009 | | 2010 | | 2009 | | 2010 | | 2009 |

| Whole loans, floating rate | | $ | 659,095 | | | $ | 830,617 | | | | 58.7 | % | | | 60.2 | % | | | — | | | | — | | | | 330 bps | | | | 454 bps | |

| Whole loans, fixed rate | | | 132,268 | | | | 122,846 | | | | 11.8 | % | | | 8.9 | % | | | 7.16 | % | | | 6.89 | % | | | — | | | | — | |

| Subordinate interests in whole loans, floating rate | | | 75,066 | | | | 76,331 | | | | 6.7 | % | | | 5.5 | % | | | — | | | | — | | | | 297 bps | | | | 246 bps | |

| Subordinate interests in whole loans, fixed rate | | | 46,468 | | | | 44,988 | | | | 4.1 | % | | | 3.2 | % | | | 6.01 | % | | | 7.46 | % | | | — | | | | — | |

| Mezzanine loans, floating rate | | | 152,349 | | | | 190,668 | | | | 13.5 | % | | | 13.7 | % | | | — | | | | — | | | | 754 bps | | | | 577 bps | |

| Mezzanine loans, fixed rate | | | 48,828 | | | | 85,898 | | | | 4.3 | % | | | 6.2 | % | | | 12.69 | % | | | 8.08 | % | | | — | | | | — | |

| Preferred equity, floating rate | | | 5,224 | | | | 28,228 | | | | 0.5 | % | | | 2.0 | % | | | — | | | | — | | | | 350 bps | | | | 1,064 bps | |

| Preferred equity, fixed rate | | | 4,230 | | | | 4,256 | | | | 0.4 | % | | | 0.3 | % | | | 7.25 | % | | | 7.23 | % | | | — | | | | — | |

| Subtotal/Weighted average | | | 1,123,528 | | | | 1,383,832 | | | | 100.0 | % | | | 100.0 | % | | | 8.09 | % | | | 7.39 | % | | | 400 bps | | | | 476 bps | |

| CMBS, floating rate | | | 50,798 | | | | 67,876 | | | | 5.1 | % | | | 6.9 | % | | | — | | | | — | | | | 394 bps | | | | 254 bps | |

| CMBS, fixed rate | | | 954,369 | | | | 916,833 | | | | 94.9 | % | | | 93.1 | % | | | 8.37 | % | | | 7.84 | % | | | — | | | | — | |

| Subtotal/Weighted average | | | 1,005,167 | | | | 984,709 | | | | 100.0 | % | | | 100.0 | % | | | 8.37 | % | | | 7.84 | % | | | 394 bps | | | | 254 bps | |

| Total | | $ | 2,128,695 | | | $ | 2,368,541 | | | | 100.0 | % | | | 100.0 | % | | | 8.32 | % | | | 7.74 | % | | | 400 bps | | | | 463 bps | |

| (1) | Loans and other lending investments and CMBS investments are presented net of unamortized fees, discounts, unfunded commitments, reserves for loan losses and other adjustments. |

| (2) | Spreads over an index other than 30 day-LIBOR have been adjusted to a LIBOR based equivalent. In some cases, LIBOR is floored, giving rise to higher current effective spreads. |

8

TABLE OF CONTENTS

The percentage of non-performing loans and sub-performing loans were as follows (dollars in thousands):

| |  | |  | |  | |  | |  | |  |

| | Number of

Investments | | Unpaid

Principal

Balance | | Carrying

Value | | Weighted

Average Last

Dollar Loan

to Value(1) | | Non-performing | | Sub-performing |

| Whole loans | | | 29 | | | $ | 917,065 | | | $ | 791,363 | | | | 69.4 | % | | | — | | | | 1.7 | % |

| Subordinate interests in whole loans | | | 9 | | | | 181,640 | | | | 121,534 | | | | 67.6 | % | | | — | | | | — | |

| Mezzanine loans | | | 12 | | | | 254,129 | | | | 201,177 | | | | 75.6 | % | | | — | | | | 4.9 | % |

| Preferred equity | | | 2 | | | | 60,668 | | | | 9,454 | | | | 78.6 | % | | | — | | | | — | |

| Total | | | 52 | | | $ | 1,413,502 | | | $ | 1,123,528 | | | | 70.7 | % | | | — | | | | 2.1 | % |

| (1) | Loan to Value is based upon appraised value at the date of origination. Interest only strips have no appraised value for the calculation. |

The period during which we are permitted to reinvest principal payments on the underlying assets into qualifying replacement collateral for our 2005 and 2006 CDOs expired in July 2010 and July 2011, respectively, and will expire for our 2007 CDO in August 2012. In the past, our ability to reinvest has been instrumental in maintaining compliance with the overcollateralization and interest coverage tests for our CDOs. Following the conclusion of the reinvestment period in one of our CDOs, our ability to maintain compliance with such tests for that CDO will be negatively impacted.

As of December 31, 2010, Gramercy Finance also held interests in one CTL investment and eight interests in real estate acquired through foreclosures.

Financing Strategy

Our financing strategy historically had focused on the use of match-funded financing structures. This means that we sought whenever possible to match the maturities of our financial obligations with the maturities of our debt and CMBS investments to minimize the risk that we have to refinance our liabilities prior to the maturities of our assets, and to reduce the impact of changing interest rates on our cash flow and earnings. In addition, subject to maintaining our qualification as a REIT, we seek whenever possible to match fund interest rates with like-kind debt (i.e., fixed-rate assets are financed with fixed-rate debt, and floating rate assets are financed with floating rate debt), through the use of hedges such as interest rate swaps, caps, or through a combination of these strategies. This allowed us to reduce the impact on our cash flow and earnings of changing interest rates. We used short-term financing in the form of our repurchase agreements, unsecured revolving credit facilities and bridge financings in conjunction with or prior to the implementation of longer-term match-funded financing.

Gramercy Realty properties subject to long-term remaining lease terms were typically financed with long-term, fixed rate mortgage loans issued by life insurance companies or other institutional lenders. However, we had entered into relatively short-term borrowing arrangements to acquire American Financial, such as the Goldman Mortgage Loan and Goldman Mezzanine Loans which are described more fully in Note 9 to the Consolidated Financial Statements. For funding in our Gramercy Finance business, we have historically utilized securitization structures, including CDOs, as well as other match-funded financing structures. Our CDOs are multiple class debt securities, or bonds, secured by pools of assets, such as CMBS, bridge loans, permanent loans, subordinate interests in whole loans and mezzanine loans. In our CDOs, the assets are owned via sale, assignment or participation by the issuer and co-issuer of the applicable CDO and subject to trustee oversight for the benefit of the holders of the bonds. The bonds were rated by one or more rating agencies. One or more classes of the bonds were marketed to a wide variety of fixed income investors, which enabled us to achieve a relatively low cost of long-term financing. CDOs were a suitable long-term financing vehicle for our investments because they enabled us to maintain our strategy of funding substantially all of our assets and related liabilities using the same, or similar, LIBOR benchmark, lock-in a long-term cost of funds tied to LIBOR, and reduced the risk that we have to refinance our liabilities prior to the maturities of our investments.

9

TABLE OF CONTENTS

Each CDO may be replenished, pursuant to limitations imposed by the indenture (including compliance with certain financial covenants) and rating agency guidelines, with substitute collateral for debt investments that are repaid or sold during the first five years of the CDO. Thereafter, the CDO securities will be retired in sequential order from senior-most to junior-most as debt investments are repaid or sold. The financial statements of the issuers are consolidated in our financial statements. The originally rated investment grade notes in our CDOs are treated as a secured financing, and are non-recourse to us. Proceeds from the sale of the originally rated investment grade notes issued in each CDO were used to repay outstanding debt under our repurchase agreements and to fund additional investments.

Our charter and bylaws do not limit the amount of indebtedness we can incur. Our board of directors has discretion to deviate from or change our indebtedness policy at any time. However, we seek to maintain an adequate capital base to protect against various business environments in which our financing and hedging costs might exceed the interest income from our investments. These conditions could occur, for example, due to credit losses or when, due to interest rate fluctuations, interest income on our investment lags behind interest rate increases on our borrowings, which are predominantly variable rate. We use leverage for the sole purpose of financing our portfolio and not for the purpose of speculating on changes in interest rates.

We have historically relied on the securitization markets as a source of efficient match-funded financing structures for our portfolio of commercial real estate loans and CMBS investment portfolio. It is unlikely that in the near term we will be able to issue liabilities similar to our existing CDOs. In 2010, the capital markets environment remained difficult for us with limited, if any, availability of new debt or equity capital. Our stock price remained low and we currently have limited, if any, availability to the public or private equity capital markets. In this environment, we have sought to raise capital or maintain liquidity through other means, such as modifying debt arrangements, selling assets and aggressively managing our loan portfolio to encourage repayments, as well as reducing capital and overhead expenses and as a result, have engaged in limited new investment activity, other than reinvestment of available restricted cash with our CDOs.

Origination, Acquisition and Asset Management

Our origination, acquisition and disposition of investments are based on careful review and preparation, and generally proceeds as follows:

| • | potential investments are analyzed for consistency with investment parameters adopted by our board of directors; |

| • | potential investment transactions considered are presented at a pipeline meeting attended by our senior executive officers; and |

| • | prior to consummation, potential investment opportunities must receive the required level of approvals from our senior management and, when applicable, board of directors approval as described more fully below. |

Investment transactions of $3.0 million or less must be approved by one of our senior executive officers. The affirmative vote of all members of a credit committee consisting, of our most senior officers, is necessary to approve all transactions over $3 million. The investment committee of our board of directors must unanimously approve all transactions involving investments of (i) $50 million or more with respect to CMBS investments, (ii) $35 million or more with respect to whole loans, (iii) $30 million or more with respect to subordinate interests in whole loans, and (iv) $20 million or over with respect to mezzanine loans, preferred equity, CTL and real estate investments. The full board of directors must approve investments (i) over $75 million with respect to whole loans and CMBS investments, (ii) over $65 million with respect to subordinate interests in whole loans, (iii) over $55 million with respect to mezzanine loans, and (iv) over $50 million with respect to preferred equity, CTL and other real estate investments.

Origination

We utilize an extensive national network of relationships with property owners, developers, mortgage loan brokers, commercial and investment banks and institutional investors. We may originate investments in direct transactions with borrowers, we co-originate with or acquire existing assets from third parties, primarily financial institutions and we may occasionally co-invest with other institutional partners.

10

TABLE OF CONTENTS

Acquisition

Once a potential investment has been identified, we perform comprehensive financial, structural, property, real estate market, operational and legal due diligence to assess the risks of the investment. We generally review the following criteria as part of the underwriting process, where applicable:

| • | the historic, in-place and projected property revenues and expenses; |

| • | the potential for near-term revenue growth and opportunity for expense reduction and increased operating efficiencies; |

| • | accountants may be engaged to audit operating expense recovery income; |

| • | the property’s location and its attributes; |

| • | the valuation of the property based upon financial projections prepared by us and confirmed by an independent “as is” and/or “as stabilized” appraisal; |

| • | market assessment, including, review of tenant lease files, surveys of property sales and leasing comparables based on conversations with local property owners, leasing brokers, investment sales brokers and other local market participants, and an analysis of area economic and demographic trends, and a review of an acceptable mortgagee’s title policy; |

| • | market rents, leasing projections for major vacant spaces and near-term vacancies, frequently prepared by commercial leasing brokers with local knowledge, or by members of our leasing and asset management group, and confirmed by discussion with other owners of competitive commercial properties in the same sub-market; |

| • | the terms and form of the leases at a property; |

| • | structural and environmental review of the property, including review of engineering and environmental reports and a site inspection, to determine future maintenance and capital expenditure requirements; |

| • | the requirements for any reserves, including those for immediate repairs or rehabilitation, replacement reserves, tenant improvement and leasing commission costs, real estate taxes and property, casualty and liability insurance; |

| • | the “Net Cash Flow” for a property, which is a set of calculations and adjustments prepared to assist in evaluating a property’s cash flows. The Net Cash Flow is generally the estimated stabilized annual revenue derived from the use and operation of the property (consisting primarily of rental income and reimbursement of expenses where applicable) after an allowance for vacancies, concessions and credit losses, less estimated stabilized annual expenses; |

| • | for financing transactions, credit quality of the borrower and sponsors through background checks and review of financial strength and real estate operating experience; and |

| • | for real estate investments, the credit quality and financial conditions of the financial institution that occupies all, or substantially all, of the property(ies) considered for acquisition. |

For debt investments at Gramercy Finance, additional key factors that are considered in credit decisions include, but are not limited to, debt service coverage, loan-to-value ratios and property and financial operating performance. Consideration is also given to other factors such as the experience, financial strength, reputation and investment track record of the borrower and individual sponsors, additional forms of collateral and identified likely strategies to effect repayment. Once diligence is completed, we determine the level in the capital structure at which an investment will be made, the pricing for such an investment, and the required legal and structural protections.

Asset Management

Our leasing and asset management group within Gramercy Realty is organized by geographic region and provides: tenant relationship management, leasing, operations, property management, lease administration, property accounting and construction management. Regional heads are primarily accountable for the

11

TABLE OF CONTENTS

profitability and investment performance of their portfolios, and have control over income statements and capital expenditures, subject to oversight and approval of senior management. To the extent that we provide asset management services for third-party property owners, we provide such services in consultation with and at the direction of such owners. Our approach is intended to provide greater control over operations, capital expenditures, and return on investment.

Our loan servicing and asset management group within Gramercy Finance monitors our debt investments to identify any potential underperformance of the asset and work to remedy the situation in an expeditious manner in order to mitigate any effects of underperformance. The asset manager is responsible for understanding our business plan with respect to each investment and the borrower’s business plan with respect to each property underlying our debt investment and monitoring performance measured against that plan. We believe that asset management is a vital component of our business because it enables us to be responsive, timely, anticipate changes to financing requirements and generally develop a strong relationship that can lead to repeat business.

Operating Policies

Investment and Borrowing Guidelines

We operate pursuant to the following general guidelines for our investments and borrowings:

| • | no investments are made that we believe would cause us to fail to qualify as a REIT; |

| • | no investments are made that we believe would cause us to be regulated as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act; |

| • | substantially all assets and investments are financed in whole or in part through mortgages, securitization, syndication and secured borrowings, and assets intended for inclusion in traditional securitization transactions will be hedged, where possible, against movements in the applicable swap yield through customary techniques; |

| • | we engage an outside advisory firm to assist in executing and monitoring hedges, advising management on the appropriateness of such hedges, and establishing the appropriate tax and accounting treatment of our hedges; and |

| • | we will not co-invest with SL Green or any of its affiliates unless the terms of such transaction are approved by a majority of our independent directors. |

These investment guidelines may be changed by our board of directors without the approval of our stockholders.

For debt investments, the affirmative vote of all members of a credit committee consisting of our most senior executive officers is necessary to approve all transactions over $3 million.

Hedging Activities

Subject to maintaining qualification as a REIT, we use a variety of commonly used derivative instruments that are considered conventional, or “plain vanilla” derivatives, including interest rate swaps, caps, collars and floors, in our risk management strategy to limit the effects of changes in interest rates on our operations. Each of our CDOs maintains a minimum amount of allowable unhedged interest rate risk. The CDO that closed in 2005 permits a minimum amount of unhedged interest rate risk of 20% of the net outstanding principal balance and both the CDO that closed in 2006 and the CDO that closed in 2007 permit a minimum amount of unhedged interest rate risk of 5% of the net outstanding principal balance. Our hedging strategy consists of entering into interest rate swap and interest rate cap contracts for Gramercy Finance and interest rate caps for Gramercy Realty. The value of our derivatives may fluctuate over time in response to changing market conditions, and will tend to change inversely with the value of the risk in our liabilities that we intend to hedge. Hedges are sometimes ineffective because the correlation between changes in value of the underlying investment and the derivative instrument is less than was expected when the hedging transaction was undertaken. We continuously monitor the effectiveness of our hedging strategies and we have retained the services of an outside financial services firm with expertise in the use of derivative instruments to advise us

12

TABLE OF CONTENTS

on our overall hedging strategy, to effect hedging trades, and to provide the appropriate designation and accounting of all hedging activities from a GAAP and tax accounting and reporting perspective.

These instruments are used to hedge as much of the interest rate risk as we determine is in the best interest of our stockholders, given the cost of such hedges and the need to maintain our qualifications as a REIT. To the extent that we enter into a hedging contract to reduce interest rate risk on indebtedness incurred to acquire or carry real estate assets, any income that we derive from the contract is not considered income for purposes of the REIT 95% gross income test and is either non-qualifying for the 75% gross income test (hedges entered into prior to August 1, 2008), or is not considered income for purposes of the 75% gross income test (hedges entered into after July 31, 2008). This change in character for the 75% gross income test was included in the Housing and Economic Recovery Act of 2008. We can elect to bear a level of interest rate risk that could otherwise be hedged when we believe, based on all relevant facts, that bearing such risk is advisable.

Disposition Policies

We evaluate our assets on a regular basis to determine if they continue to satisfy our investment criteria. Subject to market conditions certain restrictions applicable to REITs, we may sell our investments opportunistically and use the proceeds of any such sale for debt reduction, additional acquisitions or working capital purposes.

Equity Capital Policies

Subject to applicable law, our board of directors has the authority, without further stockholder approval, to issue additional authorized common stock and preferred stock or otherwise raise capital, including through the issuance of senior securities, in any manner and on the terms and for the consideration it deems appropriate.

We may, under certain circumstances, repurchase our common or preferred stock in private transactions with our stockholders if those purchases are approved by our board of directors. Our board of directors has no present intention of causing us to repurchase any shares, and any action would only be taken in conformity with applicable federal and state laws and the applicable requirements for qualifying as a REIT, for so long as our board of directors concludes that we should remain a qualified REIT.

Other Policies

We operate in a manner that we believe will not subject us to regulation under the Investment Company Act. We may invest in the securities of other issuers for the purpose of exercising control over such issuers. We do not underwrite the securities of other issuers.

Future Revisions in Policies and Strategies

Our board of directors has the power to modify or waive our investment guidelines, policies and strategies. Among other factors, developments in the market that either affects the policies and strategies mentioned herein or that change our assessment of the market may cause our board of directors to revise our investment guidelines, policies and strategies.

Competition

In our investment activities, we compete with other REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, hedge funds, institutional investors, investment banking firms, private equity firms, other lenders, governmental bodies and other entities, which may have greater financial resources and lower costs of capital available to them than we have. We also compete with numerous commercial properties for tenants. Some of the properties we compete with may be newer or have more desirable locations or the competing properties’ owners may be willing to accept lower rents than are acceptable to us. In addition, the competitive environment for leasing is affected considerably by a number of factors including, among other things, changes in economic factors and supply and demand of space. These factors may make it difficult for us to lease existing vacant space and space associated with future lease expirations at rental rates that are sufficient to meeting our capital needs.

13

TABLE OF CONTENTS

To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction or to employ more liberal standards when evaluating potential investments than we are, our origination volume and profit margins for our investment portfolio could be adversely affected. Our competitors may also be willing to accept lower returns on their investments and may succeed in originating or acquiring assets that we have targeted for acquisition. Although we believe that we are positioned to compete effectively in each facet of our business, there is considerable competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter further increased competition in the future that could limit our ability to conduct our business effectively.

Compliance With The Americans With Disabilities Act Of 1990

Properties that we acquire, and the properties underlying our investments, are required to meet federal requirements related to access and use by disabled persons as a result of the Americans with Disabilities Act of 1990. In addition, a number of additional federal, state and local laws may require modifications to any properties we purchase, or may restrict further renovations of our properties, with respect to access by disabled persons. Noncompliance with these laws or regulations could result in the imposition of fines or an award of damages to private litigants. Additional legislation could impose additional financial obligations or restrictions with respect to access by disabled persons. If required changes involve greater expenditures than we currently anticipate, or if the changes must be made on a more accelerated basis, our ability to make distributions could be adversely affected.

Industry Segments

We have determined that we operate two reportable operating segments: Finance and Real Estate. The reportable segments were determined based on the management approach, which looks to our internal organizational structure. These two lines of business require different support infrastructures.

The Real Estate segment includes substantially all of our activities related to the ownership, property management, investment and leasing of commercial real estate. We have an integrated asset management platform within Gramercy Realty to consolidate responsibility for, and control over, leasing, lease administration, property management, operations, construction management, tenant relationship management and property accounting. To the extent that we provide asset management services for third-party property owners, we provide such services in consultation with and at the direction of such owners.

The Finance segment includes all of our activities related to senior and mezzanine real estate debt and senior and mezzanine capital investment activities and the financing thereof, including our CMBS investments. These include a dedicated management team within Gramercy Finance for real estate lending, origination, acquisition, sales and syndications, asset management and primary and special servicing.

Segment revenue and profit information is presented in Note 21 to the Consolidated Financial Statements.

Employees

As of December 31, 2010, we had 135 employees. Our employees are not represented by a collective bargaining agreement.

Corporate Governance and Internet Address; Where Readers Can Find Additional Information

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our board of directors consists of a majority of independent directors; the Audit, Nominating and Corporate Governance, and Compensation Committees of our board of directors are composed exclusively of independent directors. We have adopted corporate governance guidelines and a code of business conduct and ethics.

We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the SEC. Readers may read and copy any document that we file at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public from the SEC’s internet site athttp://www.sec.gov. Copies of these reports, proxy statements and other information can also be inspected at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005.

14

TABLE OF CONTENTS

Our internet site ishttp://www.gkk.com. We make available free of charge through our internet site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website in the “Investor Relations — Corporate Governance” section are charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee as well as our Corporate Governance Guidelines and our Code of Business Conduct and Ethics governing our directors, officers and employees. Information on, or accessible through, our website is not a part of, and is not incorporated into, this report.

Investment Company Act Exemption

We have conducted our operations and intend to continue to conduct our operations so as not to become regulated as an investment company under the Investment Company Act. We believe that there are a number of exclusions or exemptions under the Investment Company Act that may be applicable to us. We will either be excluded from the definition of an investment company under Section 3(a)(1)(C) of the Investment Company Act, by owning or proposing to acquire “investment securities” having a value not exceeding 40% of the value of the our total assets (exclusive of U.S. Government securities and cash items) on an unconsolidated basis, or by qualifying for the exclusions from registration provided by Sections 3(a)(1)(A), 3(c)(5)(C) and/or 3(c)(6) of the Investment Company Act. We will monitor our portfolio periodically and prior to each acquisition to confirm that we continue to qualify for the relevant exclusion or exemption.

Qualifying for the Section 3(c)(5)(C) exemption requires that at least 55% of our portfolio be comprised of “qualifying assets,” and a total of at least 80% of our portfolio be comprised of “qualifying assets” and “real estate-related assets,” a category that includes qualifying assets. We generally expect whole mortgage loans, real property investments, and Tier 1 mezzanine loans to be qualifying assets, in each case meeting certain qualifications based on SEC staff no-action letters. Substantially all of the commercial properties owned in our Gramercy Realty segment are considered to be “real estate-related assets.” The treatment of distressed debt securities as qualifying assets is based on the characteristics of the particular type of loan, including its foreclosure rights. Although SEC staff no-action letters have not specifically addressed the categorization of these types of assets, we believe junior (first loss) interests in CMBS pools may constitute qualifying assets under Section 3(c)(5)(C), provided that we have the unilateral right to foreclose, directly or indirectly, on the mortgages in the pool and that we may act as the controlling class or directing holder of the pool.

Tier 1 mezzanine loans are loans granted to a mezzanine borrower that directly owns interests in the entity that owns the property being financed. Subordinate interests in whole loans may constitute qualifying assets under Section 3(c)(5)(C), provided that we have, among other things, approval rights in connection with any material decisions pertaining to the administration and servicing of the relevant mortgage loan and, in the event that the mortgage loan becomes non-performing, we have effective control over the remedies relating to the enforcement of the loan, including ultimate control of the foreclosure process. We generally do not treat preferred equity investments as qualifying assets. In relying on the exemption provided by Section 3(c)(5)(C), we also make investments so that at least 80% of our portfolio is comprised of qualifying assets and real estate-related assets, we expect that all of these classes of investments will be considered real estate-related assets under the Investment Company Act for purposes of the 80% investment threshold.

Qualification for the Section 3(a)(1)(C), Section 3(c)(5)(C) and/or Section 3(c)(6) exclusions or exemptions may limit our ability to make certain investments. No assurance can be given that the SEC staff will concur with our classification of our assets, or that the SEC staff will not, in the future, issue further guidance that may require us to reclassify those assets for purpose of qualifying for an exemption or exclusion from regulation under the Investment Company Act. To the extent that the staff of the SEC provides more specific guidance regarding any of the matters bearing upon the definition of investment company and the exceptions to that definition, we may be required to adjust our investment strategy accordingly. Any additional guidance from the staff of the SEC could provide additional flexibility to us, or it could further inhibit our ability to pursue the investment strategy we have chosen.

15

TABLE OF CONTENTS

The SEC recently solicited public comment on a wide range of issues relating to Section 3(c)(5)(C) of the 1940 Act, including the nature of the assets that qualify for purposes of the exemption and whether mortgage REITs should be regulated in a manner similar to investment companies. There can be no assurance that the laws and regulations governing the 1940 Act status of REITs, including the Division of Investment Management of the SEC providing more specific or different guidance regarding these exemptions, will not change in a manner that adversely affects our operations. If we or our subsidiaries fail to maintain an exception or exemption from the 1940 Act, we could, among other things, be required either to (a) change the manner in which we conduct our operations to avoid being required to register as an investment company, (b) effect sales of our assets in a manner that, or at a time when, we would not otherwise choose to do so, or (c) register as an investment company, any of which could negatively affect the value of our common stock, the sustainability of our business model, and our ability to make distributions which could have an adverse effect on our business and the market price for our shares of common stock.

Environmental Matters

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, under or in its property. Those laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of such hazardous or toxic substances. The costs of investigation, remediation or removal of those substances may be substantial. The owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners of real properties for personal injuries associated with asbestos-containing materials. Absent succeeding to ownership or control of real property, a secured lender is not likely to be subject to any of these forms of environmental liability. We are not currently aware of any environmental issues which could materially affect us or our operations.