The following table sets forth information relating to our outstanding equity compensation plans as of December 31, 2009:

A description of our 2005 Equity Incentive Compensation Plan is contained later in this Report under Part III, Item 11 – “Executive Compensation - Stock Option Plans”.

We have not sold any unregistered equity securities during the period covered by this Report, other than those previously reported in our quarterly reports on Form 10-Q or in our current reports on Form 8-K filed with the Securities and Exchange Commission.

As a smaller reporting company, we are not required to provide the information required under this item.

The following discussion and analysis of our consolidated financial conditions and results of operations for the year ended December 31, 2009 and 2008 should be read in conjunction with the consolidated financial statements and the related notes to our consolidated financial statements and other information presented elsewhere in this Report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this Report, particularly in the item entitled “Risk Factors” beginning on page 7 of this Report. Our consolidated audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

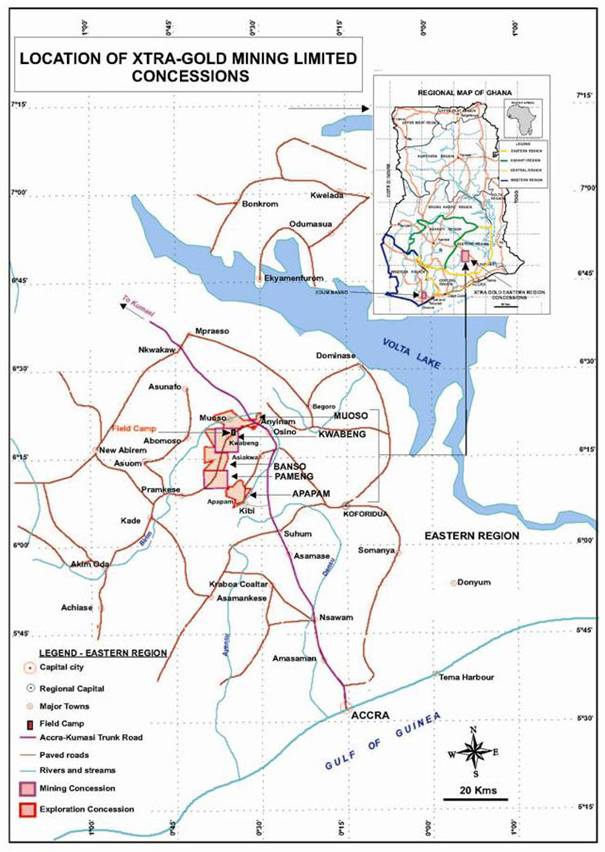

We are a gold exploration company engaged in the exploration of gold properties in the Republic of Ghana, West Africa. Our mining portfolio currently consists of 246.84 sq km comprised of 51.67 sq km for our Banso Project, 55.65 sq km for our Muoso Project, 33.65 sq km for our Apapam Project, 44.76 sq km for our Kwabeng Project, 40.51 sq km for our Pameng Project and 20.60 sq km for our Edum Banso Project, or 60,969 acres, pursuant to the leased and licensed areas set forth in our respective mining leases, prospecting licenses and/or option agreement.

Our strategic plan is, with respect to our gold projects: (i) to focus our efforts and dedicate our financial resources toward the potential to drill out a resource and, perhaps ultimately, a reserve of the Kibi Gold Trend located on our Apapam Project; (ii) to define a resource and, perhaps ultimately, a reserve on our other exploration projects; (iii) to enter into negotiations with independent Ghanaian contract miners and operators to assume our recovery of gold operations at our Kwabeng Project with a view to these contractors conducting recovery of gold operations for fixed payments to our company; and (iv) to acquire further interests in gold mineralized projects that fall within the criteria of providing a geological basis for development of drilling initiatives that can enhance shareholder value by demonstrating the potential to define reserves.

As part of our current business strategy, we plan to continue engaging technical personnel under contract where possible as Management believes that this strategy, at its current level of development, provides the best services available in the circumstances, leads to lower overall costs, and provides the best flexibility for our business operations.

We anticipate that our ongoing efforts, subject to adequate funding being available, will continue to be focused on the exploration and development of our Projects and completing acquisitions in strategic areas.

Our ability to continue to expand land acquisitions and drilling opportunities during the next 12 months is dependent on adequate capital resources being available. In October 2008, we temporarily suspended our operations at our Kwabeng Project while Management considered a more economic and efficient manner in which to extract and process the gold recovered from the mineralized material at this Project. As at the date of this Report, we have not planned to resume operations at our Kwabeng Project. During the next 12 months, we plan to (i) enter into negotiations to contract out the recovery of gold operations at this Project, as noted above; (ii) advance the development of our Kibi Gold Trend located on our Apapam Project by carrying out the Phase III Drill Program; and (iii) acquire further interests in mineral projects by way of acquisition or joint venture participation.

We anticipate that, over the next 12 months, we will spend an aggregate of approximately $2,000,000 comprised of $1,000,000 for exploration expenses in connection with our planned Phase III Drill Program of our Kibi Gold Trend located on our Apapam Project and approximately $1,000,000 for general and administrative expenses (which includes approximately $500,000 in non-cash expenses). However, we may not expend this amount unless we are able to raise additional capital. Upon completion of our planned exploration program at our Apapam Project, in particular, the Phase 3 Drill Program, we plan to spend an additional $5,000,000 in drilling expenditures in the Kibi Gold Trend to identify a potential resource. This $5,000,000 drilling program cannot be completed unless our company is successful in raising additional capital.

We require additional capital to implement our plan of operations. We anticipate that these funds primarily will be raised through equity and debt financing or from other available sources of financing. If we raise additional funds through the issuance of equity or convertible debt securities, it may result in the dilution in the equity ownership of investors in our common stock. There can be no assurance that additional financing will be available upon acceptable terms, if at all. If adequate funds are not available or are not available on acceptable terms, we may be unable to take advantage of prospective new opportunities or acquisitions, which could significantly and materially restrict our operations, or we may be forced to discontinue our current projects.

The cash proceeds derived from the sale of 12.40 fine ounces of gold recovered from the mineralized material at our Kwabeng Project during the year ended December 31, 2009, as discussed elsewhere in this Report, was categorized as Recovery of Gold. Since April 24, 2007 to December 31, 2009, we have recovered 8,814.82 fine ounces of gold from the mineralized material at our Kwabeng Project and derived cash proceeds of $6,843,965 from the related gold sales.

Results of Operations for the Year Ended December 31, 2009 Compared to the Year Ended December 31, 2008

Our loss for the year ended December 31, 2009 was $1,038,124 as compared to a loss of $3,231,403 for the year ended December 31, 2008, a decrease of $2,193,279. We incurred expenses of $2,105,612 in the year ended December 31, 2009 as compared to $6,239,722 in the year ended December 31, 2008, a decrease of $4,134,110. The decrease in expenses in the year ended December 31, 2009 can be primarily attributed to (a) a significant decrease in operational costs at our Kwabeng Project due to the suspension of operations at this Project since October 2008; and (b) limited or no exploration activities at our Banso and Muoso Project, our Edum Banso Project and our Pameng Project as compared to $5,140,679 expended on these Projects in the year ended December 31, 2008. Exploration expenses of $1,080,488 were incurred for the year ended December 31, 2009 as compared to $5,140,679 for the year ended December 31, 2008 and were primarily incurred in connection with drilling expenditures for our Phase II Drill Program at our Apapam Project, a trenching program at our Muoso Project, permitting costs and license renewal fees. General and administrative expenses (“G&A”) were $957,332 as compared to $1,035,369 for the year ended December 31, 2008. A down-sizing of management consultants, a significant reduction in legal costs and operational costs at our Kwabeng Project and a decrease in administrative costs in the year ended December 31, 2009 attributed to the decrease in our G&A.

Our loss for the year ended December 31, 2009 was less than our loss for the year ended December 31, 2008, partially due to (i) a significant net unrealized gain on trading securities of $789,934 (compared to a loss of $857,980 in 2008); and (ii) a foreign exchange gain of $303,243 (compared to a foreign exchange loss of $424,559 in 2008). Trading securities were comprised mostly of investments in common shares and income trust units of resource companies. The net unrealized gain can be attributed to an increase in the market value of those securities due to improved market conditions and less economic strain, in particular, the significant stability of the Canadian dollar in which our marketable securities are denominated.

- 47 -

Other items totaled a gain of $1,067,488 for the year ended December 31, 2009 compared to a gain of $3,008,319 for the year ended December 31, 2008. In particular, during the year ended December 31, 2009, due to the continued suspension of operations at our Kwabeng Project, we only recovered and sold 12.40 fine ounces of gold recovered from the mineralized material at this Project for cash proceeds of $10,958 which was booked as Recovery of Gold as compared to $4,140,765 for the year ended December 31, 2008. We had a foreign exchange gain of $303,243 for the year ended December 31, 2009 (2008 – loss of $424,559) which can be attributed to the sharp appreciation of the Canadian dollar. Additionally, the continuing weakness of the US dollar decreased our expenses that are denominated in other foreign currencies. Consequently, transactions denominated in US dollars would be less expensive.

Our portfolio of marketable securities had an unrealized gain of $789,934 (compared to an unrealized loss of $857,980 in 2008) due to improved market conditions and less economic strain than experienced in 2008. Our securities portfolio realized a loss of $172,638 on the sale of trading securities during the year ended December 31, 2009 compared to a gain in 2008 of $2,585. Other income of $138,558, derived from dividends, decreased on account of less investment activity during 2009 (2008 - $196,621). The decrease in our interest expense (2009 - $2,567; 2008 - $49,113) is largely attributable to our cessation of interest payable under convertible debentures due to the automatic conversion of the debentures in June 2008.

Our basic and diluted loss per share for the year ended December 31, 2009 was $0.03 compared to $0.11 per share for the year ended December 31, 2008. The weighted average number of shares outstanding was 32,101,330 at December 31, 2009 compared to 30,389,400 for the year ended December 31, 2008. The increase in the weighted average number of shares outstanding can be attributed to (i) the issuance of 2,100,875 shares in connection with private placement financings completed during fiscal 2009; and (ii) the repurchase and cancellation of 200,000 shares at $0.25 per share from a former shareholder of our company.

Liquidity and Capital Resources

Historically, our principal source of funds is our available resources of cash and cash equivalents and investments, as well as debt and equity financings. During the year ended December 31, 2009, we received cash proceeds of $10,958 derived from the sale of gold recovered from the mineralized material at our Kwabeng Project during this financial reporting period.

Unrealized Gain on Trading Securities

Unrealized gain on trading securities represents the change in value of securities as of the end of the financial reporting period. For the year ended December 31, 2009, we recognized an unrealized gain of $789,934 on trading securities, as compared to an unrealized loss of $857,980 for the year ended December 31, 2008. The change reflects a significant rebound in the value of our resource company investments following a significant decline during 2008. Trading securities were comprised mostly of investments in common shares and income trust units of resource companies.

Liquidity Discussion

Net cash provided by financing activities for the year ended December 31, 2009 was $1,612,710 (2008 - $2,489,460).

As of December 31, 2009, we had working capital equity of $2,119,159, comprised of current assets of $2,602,232 less current liabilities of $483,073. Our current assets were comprised mostly of $622,670 in cash and cash equivalents, $151,506 for a deposit on equipment and $1,781,594 in trading securities, which is based on our analysis of the ready saleable nature of the securities including an existing market for the securities, the lack of any restrictions for resale of the securities and sufficient active volume of trading in the securities. Our trading securities are held in our investment portfolio with an established brokerage in Canada in which we primarily invest in the common shares and income trust fund units of publicly traded resource companies.

We have historically relied on equity and debt financings to finance our ongoing operations. Existing working capital, possible debt instruments, anticipated warrant exercises, further private placements and anticipated cash flow are expected to be adequate to fund our operations over the next year. We have no lines of credit or other bank financing arrangements. Generally, we have financed operations to date through the proceeds of the private equity financings and a convertible debt financing. In connection with our business plan during the next 12 months, Management anticipates operating expenses as follows: (i) $1,000,000 for exploration activities, in particular, our planned Phase III Drill Program of our Kibi Gold Trend located on our Apapam Project; and (ii) $1,000,000 for general and administrative costs (which includes approximately $500,000 in non-cash expenses). Upon completion of our planned exploration program at our Apapam Project, in particular, the Phase 3 Drill Program, we plan to spend an additional $5,000,000 in drilling expenditures in the Kibi Gold Trend to identify a potential resource. This $5,000,000 drilling program cannot be completed unless our company is successful in raising additional capital.

- 48 -

Until we achieve profitability, we will need to raise additional capital for our exploration programs. We intend to finance these expenses with our cash proceeds and to the extent that our cash proceeds are not sufficient, then from further sales of our equity securities or debt securities, or from investment income. Thereafter, we may need to raise additional capital to meet long-term operating requirements. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavors or opportunities or existing agreements and projects which could significantly and materially restrict our business operations.

The independent auditors’ report accompanying our December 31, 2009 and December 31, 2008 consolidated financial statements contains an explanatory paragraph expressing doubt about our ability to continue as a going concern. The consolidated financial statements have been prepared “assuming that we will continue as a going concern”, which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Material Commitments

Mineral Property Commitments

Save and except for fees payable from time to time to (i) the Minerals Commission for an extension of an expiry date of a prospecting license (current consideration fee payable is $15,000) or mining lease or annual operating permits; (ii) the EPA for the issuance of permits prior to the commencement of any work at a particular concession or the posting of a bond in connection with any mining operations undertaken by our company; and (iii) a legal obligation associated with our mineral properties for clean up costs when work programs are completed, we are committed to expend an aggregate of less than $500 in connection with annual or ground rent and mining permits to enter upon and gain access to the following concessions and such other financial commitments arising out of any approved exploration programs in connection therewith:

| (i) | the Kwabeng concession (Kwabeng Project); |

| (ii) | the Pameng concession (Pameng Project); |

| (iii) | the Banso and Muoso concessions (Banso and Muoso Project); |

| (iv) | the Apapam concession (Apapam Project); and |

| (v) | the Edum Banso concession (Edum Banso Project). |

Upon and following the commencement of gold production at any of our Projects, a royalty of 5% of the net smelter returns is payable quarterly to the Government of Ghana.

With respect to the Edum Banso Project:

| (a) | $5,000 is payable to Adom Mining Limited (“Adom”) on the anniversary date of the Option Agreement in each year that we hold an interest in the agreement; |

| (b) | $200,000 is payable to Adom when the production of gold is commenced (or $100,000 in the event that less than 2 million ounces of proven and probable reserves are discovered on our project at this concession; and |

| (c) | an aggregate production royalty of 2% of the net smelter returns (“NSR”) from all ores, minerals and other products mined and removed from the project, except if less than 2 million ounces of proven and probable reserved are discovered in or at the Project, then the royalty shall be 1% of the NSR. |

Repayment of Convertible Debentures and Accrued Interest

We issued Convertible Debentures aggregating the face value of $900,000 in July 2005 under which interest was calculated at 7% per annum. Interest only payments were payable quarterly on the last days of September, December, March and June in each year of the term or until such time that the principal was repaid in the full. The Convertible Debenture holders were entitled, at their option, to convert, at any time and from time to time, until payment in full of their respective Convertible Debentures, all or any part of the outstanding principal amount of the Convertible Debenture, plus the Accrued Interest, into shares (the “Conversion Shares”) of our common stock at the conversion price of $1.00 per share (the “Conversion Price”). Each Convertible Debenture provided for the automatic conversion of the outstanding principal amount and all accrued but unpaid interest, into shares of our common stock, at the Conversion Price, in the event that our common stock traded for 20 consecutive trading days (a) with a closing bid price of at least $1.50 per share and (b) a cumulative trading volume during such twenty (20) trading day period of at least 1,000,000 shares.

- 49 -

In June 2008, we provided notice of the automatic conversion of the Convertible Debentures and in July 2008 we converted $650,000 of the aggregate principal of $900,000 of the Convertible Debentures by way of the issuance of 650,000 Conversion Shares. Subsequent to the year ended December 31, 2009, in February 2010 we converted the outstanding principal of $250,000 owing under one remaining Convertible Debenture by way of the issuance of 250,000 Conversion Shares.

Purchase of Significant Equipment

During the next 12 months, we do not expect to purchase significant equipment to conduct our exploration activities. During 2009, we purchased a new excavator to carry out trenching and drill pad activities. In addition, in connection with our exploration activities at our Projects, we own the equipment necessary to carry out such activities, except for a drill rig which we plan to rent.

Off Balance Sheet Arrangements

We have no off balance sheet arrangements.

Significant Accounting Applications

Application of Critical Accounting Policies

We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our financial statements.

Mineral Properties

The valuation of our mineral properties (the “Assets”) is based upon the fair value of cash or securities issued as consideration for the purchase of the Assets.

Asset Retirement Obligation

The fair value of our asset retirement obligation is recorded as liabilities when they are incurred. As such, the valuation could be affected by the following:

Costs - When work actually commences on asset retirement obligations, actual costs could materially differ from what has been projected. This would materially affect the value of the obligation.

Ghanaian laws and regulations - If the Government of Ghana approves or changes laws and regulations that affect mining operations in Ghana, the cost of meeting our asset retirement obligations could change materially.

Deferred Income Taxes

As we have no history of profitability and currently have derived limited cash proceeds, we have recognized a 100% valuation allowance on our future tax assets. If our company becomes profitable in the future, a material amount of these future tax assets could actually be realized.

Stock-based Compensation

Our company accounts for stock-based compensation under the provisions of ASC 718, “Compensation-Stock Compensation”. Under the fair value recognition provisions, stock-based compensation expense is measured at the grant date for all stock-based awards to employees and directors and is recognized as an expense over the requisite service period, which is generally the vesting period. The Black-Scholes option valuation model is used to calculate fair value.

Our company accounts for stock compensation arrangements with nonemployees in accordance with ASC 718 which require that such equity instruments are recorded at their fair value on the measurement date. The measurement of stock-based compensation is subject to periodic adjustment as the underlying equity instruments vest. Nonemployee stock-based compensation charges are amortized over the vesting period on a straight-line basis. For stock options granted to nonemployees, the fair value of the stock options is estimated using a Black-Scholes valuation model.

- 50 -

Recent Accounting Pronouncements

● | During the third quarter of 2009, our company adopted the FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles in accordance with FASB ASC Topic 105,”Generally Accepted Accounting Principles”(the Codification). The Codification has become the source of authoritative U.S. generally accepted accounting principles (GAAP) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (SEC) under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. Effective with our company’s adoption on July 1, 2009, the Codification has superseded all prior non-SEC accounting and reporting standards. All other non-grandfathered non-SEC accounting literature not included in the Codification has become non-authoritative. As the adoption of the Codification only affected how specific references to GAAP literature have been disclosed in the notes to our condensed consolidated financial statements, it did not result in any impact on our results of operations, financial condition, or cash flows. |

● | In December 2007, the FASB issued authoritative guidance related to non-controlling interests in consolidated financial statements, which was an amendment of ARB No. 51. This guidance is set forth in ASC 810, Consolidation. ASC 810 establishes accounting and reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. This accounting standard is effective for fiscal years beginning on or after December 15, 2008, which for the Company was the fiscal year beginning January 1, 2009. The Company adopted ASC 810 at January 1, 2009, which resulted in $76,629 allocated to the non-controlling interest. |

● | In September 2009, the FASB issued authoritative guidance regarding multiple-deliverable revenue arrangements. This guidance addresses how to separate deliverables and how to measure and allocate consideration to one or more units of accounting. Specifically, the guidance requires that consideration be allocated among multiple deliverables based on relative selling prices. The guidance establishes a selling price hierarchy of (1) vendor-specific objective evidence, (2) third-party evidence and (3) estimated selling price. This guidance is effective for annual periods beginning after June 15, 2010 but may be early adopted as of the beginning of an annual period. The Company is currently evaluating the effect that this guidance will have on consolidated financial position and results of operations. |

● | ASC 855-10-20, “Subsequent Events” establishes accounting and reporting standards for events that occur after the balance sheet date but before financial statements are issued or are available to be issued and requires the disclosure of the date through which a company has evaluated subsequent events. This statement is effective for our third quarter ended September 30, 2009 and the adoption did not have an impact on the condensed consolidated financial statements. See Note 17 for the required disclosures. |

● | In April 2009, the FASB issued ASC 820-10-65 formerly FASB Staff Position FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FSP 157-4”). This provides significant guidance for determining when a market has become inactive as well as guidance for determining whether transactions are not orderly. It also provides guidance on the use of valuation techniques and the use of broker quotes and pricing services. It reiterates that fair value is based on an exit price and also that fair value is market-driven and not entity-specific. The accounting standard of codification applies to all assets and liabilities within the scope of ASC 820 and is effective for all interim and annual periods ending after June 15, 2009. The adoption of ASC 820-10-65 did not have a material effect on our results of operations, financial position, and cash flows. |

● | In April 2009, the FASB issued ASC 320-10-65, formerly FASB Staff Position FAS 115-2, FAS 124-2 and EITF 99-20-2, “Recognition and Presentation of Other-Than-Temporary Impairments” (“FSP 115-2”). This accounting standard provides guidance related to determining the amount of an other-than-temporary impairment (OTTI) of debt securities and prescribes the method to be used to present information about an OTTI in the financial statements. It is effective for all interim and annual periods ending after June 15, 2009. The adoption of FSP 115-2 did not have a material effect on our results of operations, financial position, and cash flows. |

● | In April 2009, the FASB issued ASC 825-10-65, formerly FASB Staff Position FAS 107-1 and APB 28-1, “Interim Disclosures about Fair Value of Financial Instruments” (“FSP 107-1”), which increases the frequency of fair value disclosures to a quarterly basis instead of an annual basis. The guidance relates to fair value disclosures for any financial instruments that are not currently reflected on the balance sheet at fair value. This ASC is effective for interim and annual periods ending after June 15, 2009. The adoption did not have a material effect on our results of operations, financial position, and cash flows. |

We do not anticipate that the adoption of the foregoing pronouncements will have a material effect on our company’s consolidated financial position or results of operations.

- 51 -

Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

As a smaller reporting company, we are not required to provide the information required under this item.

Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Our financial statements are contained in pages F-1 through F-29, which appear at the end of this annual report.

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

There have been no changes in and disagreements with our accountants on accounting and financial disclosure from the inception of our company through to the date of this Report.

Item 9A(T). | CONTROLS AND PROCEDURES |

Disclosure Controls and Procedures

Our management, including our Chief Executive Officer who also serves as our Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this Report.

Based on that evaluation, our Chief Executive Officer concluded that as of the end of the period covered by this Report our disclosure controls and procedures were not effective such that the information required to be disclosed in our Securities and Exchange Commission reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms; and (ii) is accumulated and communicated to our management, including our Chief Executive Officer, to allow timely decisions regarding required disclosure. Our Chief Executive Officer is not a financial or accounting professional, and we lack any accounting staff who are sufficiently trained in the application of U.S. generally accepted accounting principles. Until such time as we hire a chief financial officer or similarly titled person with the requisite experience in the application of U.S. GAAP, there is a likelihood that we may experience material weaknesses in our disclosure controls that may result in errors in our financial statements in future periods.

Our management, including our Chief Executive Officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected.

Management’s Report on Internal Control over Financial Reporting

As we were not subject to the reporting requirements of the Securities Exchange Act of 1934 at December 31, 2009, our management was not then required to assess the effectiveness of our internal control over financial reporting as of December 31, 2009 pursuant to Section 404 of the Sarbanes-Oxley Act of 2002.

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting identified in connection with our evaluation that occurred during the last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. | OTHER INFORMATION |

None.

- 52 -

PART III

Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Directors and Executive Officers

The following individuals serve as our executive officers and members of our Board:

Name | Age | Position |

James Longshore | 43 | President, Chief Executive Officer, Chief Financial Officer and Director |

Richard W. Grayston | 65 | Chairman of the Board and Director |

Peter Minuk | 45 | Director and Secretary and Treasurer |

Robert H. Montgomery | 48 | Director |

Paul Zyla | 65 | Director |

Yves Pierre Clement | 45 | Vice-President, Exploration |

Victor Nkansa | 51 | Vice-President, Ghana Operations |

Alhaji Nantogma Abudulai | 67 | Vice-President, Community Relations |

James Werth Longshore, BA, Economics

President (Principal Executive Officer), Principal Financial Officer and Director

Mr. Longshore is one of the founders of our company and was appointed as President in March 2007 and a director in November 2006. Mr. Longshore has been a director of our Ghanaian subsidiaries, XGEL and XOG Ghana, since April 2006 and XG Mining, since June 2006 and an officer and director of Xtra Energy since March 2007. Mr. Longshore has approximately 18 years of business experience. Since 1995 to the present, Mr. Longshore has been President of Brokton International Ltd. (“Brokton”), a Turks & Caicos Islands, British West Indies based private investment company focused on investing in natural resource companies. Since February 2004 until February 2006, Mr. Longshore has provided financial advisory consulting services to our company through his corporation, Brokton. From 1990 to 1995, he was a salesman for UNUM Insurance Company selling in both the United States and Canada.

During the prior five years, Mr. Longshore has not been an officer and/or director of any other public companies.

In August 2002, Mr. Longshore, formerly known as James Pincock, entered into a settlement agreement and order with the Ontario Securities Commission (the “OSC”). Pursuant to a settlement agreement reached between the OSC and Mr. Longshore, he voluntarily agreed to abide by the order which included, among other things, that he cease trading in securities for five years from the date of the order (until August 27, 2007), with the exception that after three years he can trade in securities beneficially owned by him in his personal accounts in his name, and that he be prohibited from becoming or acting as an officer or director of any issuer in Ontario or an officer or director of any issuer which has an interest directly or indirectly in any registrant, for a period of five years. Mr. Longshore paid the OSC approximately $17,740 for cost incurred by the OSC and its Staff with respect to the proceeding. Mr. Longshore disclosed this matter to the company prior to his appointment as a director and advised that as he was a non-resident of Ontario at the relevant time, he had sought, relied and acted upon poor financial and legal advice of Ontario advisors and completed certain securities transactions which ultimately gave rise to the Order.

Mr. Longshore devotes approximately 90% of his time to our company. He currently provides 10% of his time to unrelated companies. During 2009, through Brokton, he entered into a management consulting agreement with our company to provide services as the general manager to XG Mining and XGEL. The renewal of this agreement for 2010 is currently being reviewed by the Compensation Committee.

Richard Walter Grayston

Chairman and Director

Mr. Grayston was appointed as Chairman and a director of our company in March 2007. Since 1985, Mr. Grayston has been a self-employed business consultant with more than 25 years of experience in financial and economic consulting and public company management including preparation of valuations, feasibility studies, capital budgeting, financial reorganizations, profit improvement studies and business plans and going public and business brokerage during which time he has provided his consulting services to oil and gas, mineral exploration, technology, manufacturing, retail and wholesale consumer businesses.

Mr. Grayston received a Ph.D. in Finance and Economics from the University of Chicago in 1971, a MBA from the University of Chicago in 1969, a BA of Commerce from the University of British Columbia in 1966 and has been a certified general accountant since 1977.

During the prior five years, Mr. Grayston has been an officer and/or director of the following public companies.

- 53 -

Name of Company | Position(s) Held | Term of Office |

| | |

Verbina Resources Inc. (1) | Director | November 2009 to present |

Ruby Red Resources Inc. (2) | President and Chief Executive Officer | October 2009 to present |

| Interim Chief Financial Officer and | October 2009 to |

| Vice President, Finance | December 2009 |

| Chief Financial Officer and | August 2008 to December 2009 |

| Vice President Finance | August 2008 to December 2009 |

Ranger Canyon Energy Inc. (3) | Director | May 2008 to present |

| Chief Executive Officer and | October 2008 to present |

| Chief Financial Officer | October 2008 to present |

New Cantech Ventures Inc. (4) | Director | January 1991 to May 2008 |

| (1) | Verbina Resources Inc. is a mineral exploration TSX Venture Exchange (the “TSXV”) listed issuer. |

| (2) | Ruby Red Resources Inc. is a mineral exploration TSXV listed issuer. |

| (3) | Ranger Canyon Energy Inc. is a private Alberta, Canada oil and gas company seeking listing on the TSXV. |

| (4) | New Cantech Ventures Inc. is an oil and gas and mineral exploration (diamonds and gold) TSXV listed issuer. |

Peter Minuk

Secretary and Treasurer and Director

Mr. Minuk was appointed as Vice-President, Finance (“VP, Finance”) and a director of our company in March 2007. He resigned as VP, Finance effective January 31, 2009 and was subsequently appointed Secretary and Treasurer on August 11, 2009 following the resignation of Kiomi Mori from this office. Mr. Minuk has more than 22 years of experience in finance and investment as well as experience in project management, training and developing staff and client relationships. From February 1, 2009 to May 31, 2009, he provided limited consulting services to our company. From June 1, 2009 to the present, Mr. Minuk has been a business analyst consultant for Industry Canada where he is responsible for reviewing proposals relating to regional development of public infrastructure projects and provides oversight over 40 projects assigned to him by the Federal Development Ontario Department which is responsible for administering a variety of government stimulus programs, resources and initiatives for the southern Ontario region. Prior to joining our company, from 1990 to 2006, Mr. Minuk was employed by BMO InvestorLine (“BMO”) in connection with implementing project management protocols. Mr. Minuk received a Masters Certificate in Project Management from the Schulich School of Business, York University in 2005. He obtained his FCSI (Fellow of the Canadian Securities Institute) in 1989 and completed the Business Administration program from Southern Alberta Institute of Technology in 1985.

During the prior five years, Mr. Minuk has not been an officer and/or director of any other public companies.

Mr. Minuk devotes approximately 10% of his time in consulting services to our company. He provides 90% of his time to unrelated companies. There is no management consulting agreement in force at this time nor has Mr. Minuk entered into a non-competition and non-disclosure agreement with our company.

Robert Hudson Montgomery, CA

Director

Mr. Montgomery was appointed as a director of our company in March 2007. Mr. Montgomery has more than 15 years of experience as a chartered accountant and auditor. Since September 2009 to the present, he has been a consultant to the Royal Bank of Canada, Capital Markets, Product Finance. Prior thereto, Mr. Montgomery was a consultant to CIBC Mellon, Internal Audit and Corporate Compliance Department (September to November 2008) and a consultant to Bank of Montreal, Corporate Audit Department (August 2007 to June 2008). Since February 2004 to June 2008, Mr. Montgomery has been a Sarbanes Oxley contractor to the Canadian Imperial Bank of Commerce (CIBC), from February 2004 to January 2005, the Bank of Montreal (BMO) from January to September 2005, Dundee Wealth Management, a major Canadian investment dealer from September 2005 to December 2006 where he was responsible for documentation and testing of key financial and non-financial controls for various lines of business and assisted in the preparation and transfer of Sarbanes Oxley audit files and supporting documentation from their project groups to internal and external auditors, and the Toronto Dominion Bank from May to August 2007. He was not employed during the periods November 2008 to January 2009, July to September 2008 and January to May 2007).

Mr. Montgomery assisted in the design of process narrative and control testing documents, planned and supervised the control testing program at a major Canadian investment dealer and assisted in the remediation of control gaps and weaknesses identified during the testing process and as identified by its external auditors. At CIBC, Mr. Montgomery assisted in the update and maintenance a database identifying key accounts, linking them to controls procedures, testing and lines of business and assisted in the remediation of control gaps and weaknesses identified during the testing process. He obtained his Chartered Accountant designation from the Institute of Chartered Accountants of Ontario in 1994 and a BA, Double Major Economics and Geography from the University of Victoria, Victoria, British Columbia in 1985.

- 54 -

During the prior five years, Mr. Montgomery has not been an officer and/or director of any other public companies.

Paul Norman Zyla

Director

Mr. Zyla was appointed as a director of our company in January 2010. Mr. Zyla has over 25 years of resource-based public company experience. Since September 1993 to the present, Mr. Zyla has been a self-employed consultant to the mining industry. Mr. Zyla was the former President, Secretary and Treasurer and a director of our company from November 2003 to August 2005.

During the prior five years, Mr. Zyla has been an officer and/or director of the following public companies:

Name of Company | Position(s) Held | Term of Office |

| | |

Verbina Resources Inc. (1) | President, Secretary-Treasurer | November 2009 to present |

| and Director | |

| (1) | Verbina Resources Inc. is mineral exploration TSXV listed issuer. |

Yves Pierre Clement, P. Geo.

Vice-President, Exploration

Mr. Clement was appointed Vice-President, Exploration of our company in May 2006. Mr. Clement has over 21 years experience in the generation, evaluation and development of a wide variety of mineral resources hosted by a broad spectrum of geological environments in Canada and South America. Prior to joining our company, Mr. Clement was senior project geologist for Lake Shore Gold Corp. in the Timmins lode gold camp from August 2005 to April 2006 and was formerly exploration manager for Aurora Platinum Corp.’s Sudbury operations from August 2000 to July 2005. Prior to joining Aurora, Mr. Clement was senior project geologist/exploration manager for Southwestern Resources Corp. where he was responsible for the generation of precious and base metal exploration opportunities in Peru and Chile. Mr. Clement’s experience will allow us to further maximize the value of our existing portfolio of projects, as well as allowing us to expand our strategy of growth through strategic acquisitions.

During the prior five years, Mr. Clement has been an officer and/or director of the following public companies:

Name of Company | Position(s) Held | Term of Office |

| | |

Ginguro Exploration Inc. (1) | Vice President, Exploration | March 2005 to July 2009 |

| (1) | Ginguro Exploration Inc. is a gold exploration TSXV listed issuer. |

Mr. Clement devotes approximately 90% of his time in consulting services to our company. He provides 10% of his time to unrelated companies. Our company and Mr. Clement entered into a management consulting agreement on May 1, 2006 for a three year term expiring on May 1, 2009. Prior to the expiration of this agreement, we mutually agreed to renew this agreement for a further one year term (see “Management Consulting Agreement with Vice-President, Exploration”). Mr. Clement has not entered into a non-competition and non-disclosure agreement with our company.

Victor Nkansa, CA, BA, Economics, MBA, Finance

Vice-President, Ghana Operations

Mr. Nkansa was appointed as Vice-President, Ghana Operations of our company in December 2009. Mr. Nkansa has assumed the responsibilities of this position previously held by Mr. Abudalai, which includes overseeing our operations in Ghana under the supervision of our President, James Longshore, who is also the President and General Manager of our Ghanaian subsidiaries. Mr. Nkansa is also the Secretary and a director of our Ghanaian subsidiaries. He is familiar and experienced with respect to obtaining mining permits, prospecting and reconnaissance licenses and the government regulations relating thereto and is knowledgeable in connection with environmental and forestry issues, immigration and customs affairs. His experience and background will assist us with respect to acquiring approvals, prospecting licenses, mining leases and related permits and renewals from the relevant government authorities in order to advance our operations in Ghana and acting as our primary government liaison in connection therewith. Mr. Nkansa has more than 26 years of business experience, the last 12 years of which have been in the mining industry. Since 2004, he has been the Controller of our Ghanaian subsidiaries where his responsibilities included the provision of accounting services and assisting with the facilitation of license renewals with respect to our property interests.

During the prior five years, Mr. Nkansa has not been an officer and/or director of any other public companies.

- 55 -

As at the date of this Report, Mr. Nkansa devotes a variable amount of his time in consulting services to our company, as he is currently engaged on an “as needed” basis. There is no management consulting agreement in force at this time. He has not entered into a non-competition and non-disclosure agreement with our company.

Alhaji Nantogma Abudulai, BA

Vice-President, Community Relations

Mr. Abudulai was appointed as Vice-President, Community Relations of our company in December 2008. He was formerly Vice-President, Ghana Operations of our company from April 2005 to December 2008. He is the former Secretary and President, Community Relations and a director of our Ghanaian subsidiaries which positions he resigned from in December 2008. Mr. Abudulai has more than 15 years of business experience in the mining industry. Since 1994 to the present, he has been the managing director of CME (Ghana) Ltd. and a director of CME (Nigeria) Ltd. where his responsibilities included protocol and coordination of government and local authority affairs in Ghana and overseeing logistical support. He is also the President of the Canadian Business Association in Ghana. Mr. Abudulai’s primary responsibilities with our company are the continued improvement of community relations on behalf of our Ghanaian subsidiaries.

During the prior five years, Mr. Abudulai has not been an officer and/or director of any other public companies:

As at the date of this Report, Mr. Abudulai devotes a variable amount of his time in consulting services to our company, as he is currently engaged on an “as needed” basis. He provides the majority of his time to unrelated companies. There is no management consulting agreement in force at this time. He previously entered into a non-disclosure agreement with our company which remains in force.

There are no family relationships between any of the executive officers and directors. Each director currently holds office until he resigns or his successor is elected at an annual stockholders’ meeting.

Consultants

One of our business strategies is to outsource other services as required by our company from time to time by engaging consultants on an “as needed” basis or entering into special purpose contracts with a view to maintaining our overhead at a reasonable, affordable cost.

Compliance with Section 16(a) of the Exchange Act

We are not currently subject to Section 16(a) of the Securities Exchange Act of 1934, and, therefore, our directors and executive officers, and persons who own more than 10% of our common stock are not required to file with the Securities and Exchange Commission reports disclosing their initial ownership and changes in their ownership of our common stock.

Corporate Governance Matters

Audit Committee

While we are not currently subject to any law, rule or regulation requiring that we establish or maintain an audit committee, our Board determined it advisable and in the best interests of our stockholders to establish an audit committee (the“Audit Committee”) in November 2009.

Our Audit Committee assists the Board in fulfilling its oversight responsibility relating to:

| ● | the integrity of our financial statements; |

| ● | our compliance with legal and regulatory requirements; and |

| ● | the qualifications and independence of our independent registered public accountants. |

Our Audit Committee has adopted a written charter pursuant to which the committee provides: (i) an independent review and oversight of our company's financial reporting processes, internal controls and independent auditors; (ii) a forum separate from Management in which auditors and other interested parties can candidly discuss concerns. By effectively carrying out its functions and responsibilities, our Audit Committee helps to ensure that: (i) Management properly develops and adheres to a sound system of internal controls; (ii) procedures are in place to objectively assess Management's practices and internal controls; and (iii) the outside auditors, through their own review, objectively assess our company's financial reporting practices. Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for our company.

- 56 -

Our Audit Committee is composed of two directors; namely Richard Grayston, who is also Chairman of our Audit Committee and Robert Montgomery, both of whom have been determined by the Board to be “independent,” as defined in the Marketplace Rules of the NASDAQ.

Board of Directors Independence

Our Board consists of five members. Although, we are not currently subject to any law, rule or regulation requiring that all or any portion of our Board include “independent” directors, three of our directors are considered to be “independent” directors, as defined in the Marketplace Rules of the NASDAQ.

Audit Committee Financial Expert

Each of Richard Grayston and Robert Montgomery is an “audit committee financial expert” within the meaning of Item 401(h)(1) of Regulation S-K. In general, an “audit committee financial expert” is an individual member of the audit committee who (a) understands generally accepted accounting principles and financial statements, (b) is able to assess the general application of such principles in connection with accounting for estimates and accruals, (c) has experience preparing, auditing, analyzing or evaluating financial statements comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the company’s financial statements, (d) understands internal controls over financial reporting (e) understands audit committee functions, and (f) is an independent director.

Code of Ethics

In December 2009, we adopted a new and expanded Code of Ethics applicable to our principal executive officer, principal financial and accounting officers and persons performing similar functions. A Code of Ethics is a written standard designed to deter wrongdoing and to promote (a) honest and ethical conduct, (b) full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements, (c) compliance with applicable laws, rules and regulations, (d) the prompt reporting violation of the code and (e) accountability for adherence to the Code. A copy of our Code of Ethics is filed as an exhibit to this Report. We will provide a copy of our Code of Ethics, without charge, to any person desiring a copy of the Code of Ethics, by written request to us at our principal offices.

Nominating and Corporate Governance Committee

We established a nominating and governance committee in November 2009. The Nominating and Corporate Governance Committee has adopted a written charter pursuant to which the committee: (i) recommends the slate of director nominees for election to our Board; (ii) identifies and recommends candidates to fill vacancies on our Board; (iii) reviews the composition of Board committees; and (iv) monitors compliance with, reviews and recommends changes to our various corporate governance policies and guidelines.

The committee also prepares and supervises the Board’s annual review of director independence and the Board’s annual self-evaluation. The Nominating and Corporate Governance Committee is composed of two directors, both of which have been determined by the Board to be “independent,” as defined in the Marketplace Rules of the NASDAQ.

A majority of the persons serving on our Board must be “independent”. Thus, the committee has considered transactions and relationships between each director or any member of his immediate family and us or our affiliates, including those reported under “Certain Relationships and Related Transactions” below. The committee also reviewed transactions and relationships between directors or their affiliates and members of our senior management or their affiliates. As a result of this review, the committee affirmatively determined that each of Messrs. Grayston, Montgomery and Zyla are independent.

Nomination of Directors

The committee considers all qualified candidates for our Board identified by members of the committee, by other members of the Board, by senior management and by our stockholders. The committee reviews each candidate including each candidate’s independence, skills and expertise based on a variety of factors, including the person’s experience or background in management, finance, regulatory matters and corporate governance. Further, when identifying nominees to serve as director, the Nominating and Corporate Governance Committee seeks to create a Board that is strong in its collective knowledge and has a diversity of skills and experience with respect to accounting and finance, management and leadership, vision and strategy, business operations, business judgment, industry knowledge and corporate governance. In addition, prior to nominating an existing director for re-election to the Board, the Nominating and Corporate Governance Committee will consider and review an existing director’s Board and committee attendance and performance, length of Board service, experience, skills and contributions that the existing director brings to the Board, equity ownership in our company and independence.

- 57 -

The committee follows the same process and uses the same criteria for evaluating candidates proposed by members of the Board, members of senior management and stockholders. Based on its assessment of each candidate, the committee recommends candidates to the Board. However, there is no assurance that there will be any vacancy on the Board at the time of any submission or that the committee will recommend any candidate for the Board.

Compensation Committee

We established a compensation committee (the “Compensation Committee”) in November 2009. The Compensation Committee has adopted a written charter pursuant to which the committee is responsible for overseeing our compensation programs and practices, including our executive compensation plans and incentive compensation plans. Our Chief Executive Officer provides input to the Compensation Committee with respect to the individual performance and compensation recommendations for the other executive officers. Although the committee’s charter authorizes the committee to retain an independent consultant, no third party compensation consultant was engaged for 2009. The Compensation Committee is composed of two directors, all of whom have been determined by the Board to be “independent,” as defined in the Marketplace Rules of the NASDAQ.

Item 11. | EXECUTIVE COMPENSATION |

Summary Compensation Table

The following table sets forth information relating to all compensation awarded to, earned by or paid by us during each of the two fiscal years ended December 31, 2009 and 2008 respectively, to: (a) our chief (principal) executive officer; (b) each of our executive officers who was awarded, earned or we paid more than $100,000; and (c) up to two additional individuals for whom disclosure would have been made in this table but for the fact that the individual was not serving as an executive officer of our company at December 31, 2009. The value attributable to any option awards is computed in accordance with ASC 718 (Accounting Standards Codification, Topic 718).

SUMMARY COMPENSATION TABLE

NAME AND

PRINCIPAL

POSITION

(A) | YEAR

(B) | SALARY

($)

(C) | BONUS

($)

(D) | STOCK AWARDS

($)

(E) | OPTION AWARDS

($)

(F) | NON-EQUITY

INCENTIVE PLAN COMPENSATION

($)

(G) | NONQUALIFIED DEFERRED COMPENSATION EARNINGS

($)

(H) | ALL OTHER COMPENSATION

($)

(I) | TOTAL

($)

(J) |

| | | | | | | | | |

James Longshore

CEO, CFO (1) | 2009 2008 | 0 0 | 0 0 | 0 0 | 79,637 13,948 | 0 0 | 0 0 | 60,000 0 | 139,637 13,948 |

| | | | | | | | | |

Yves Clement Vice-President, Exploration (2) | 2009 2008 | 0 N/A | 8,000 N/A | 0 N/A | 151,946 N/A | 0 N/A | 0 N/A | 83,000 N/A | 242,946 N/A |

(1) | Mr. Longshore was appointed as our CEO and CFO on March 3, 2007. Our company entered into a management consulting agreement with Brokton International Ltd. (“Brokton”), a corporation of which Mr. Longshore is the sole officer, director and shareholder from which Mr. Longshore received this compensation for the provision of consulting services as the general manager of XG Mining and XGEL during the year ended December 31, 2009. |

(2) | Mr. Clement was appointed as our Vice-President, Exploration, on May 1, 2006. Our company entered into a management consulting agreement with Mr. Clement (see “Management Consulting Agreement with Vice-President, Exploration” hereunder). |

As of the date of this Report, Mr. Longshore does not currently receive any monetary compensation in his capacity as our Chief Executive Officer or as our Chief Financial Officer, however, the Compensation Committee is currently reviewing a compensation package for Mr. Longshore for 2010. The terms of any future compensation to be paid to Mr. Longshore will be determined by our Compensation Committee. At such time, the Compensation Committee will consider a number of factors in determining Mr. Longshore’s compensation including the scope of his duties and responsibilities to our company and our subsidiaries and the time he devotes to our business. At the Compensation Committee’s discretion, it will be determined whether to consult with any experts or other third parties in fixing the amount of Mr. Longshore’s compensation. During fiscal 2009, Mr. Longshore received a compensation package, through Brokton, for providing his consulting services as general manager to XG Mining and XGEL. He was reimbursed for out-of-pocket expenses incurred on behalf of our company in connection with carrying out his duties and responsibilities.

- 58 -

Management Consulting Agreements

During the period covered by this Report, we had entered into the following management consulting agreements with two officers of our company.

Management Consulting Agreement with Chief Executive Officer

We entered into a management consulting agreement on January 3, 2009 with Brokton to provide the consulting services of our Chief Executive Officer, James Longshore, as general manager for XG Mining and XGEL for a one year term which expired on December 31, 2009. Brokton was paid $5,000 per month for providing Mr. Longshore’s services. As of the date of this Report, our Compensation Committee is reviewing the renewal of this agreement for the ensuing year.

Management Consulting Agreement with Vice-President, Exploration

We entered into a management consulting agreement with our Vice-President, Exploration (VPE”), Yves Clement, on May 1, 2006 for a term of 36 months which expired on May 1, 2009. Prior to the expiration of this agreement, we negotiated terms for renewal of this agreement for a further one year term with our VPE. Our VPE is paid approximately $8,804 (Cdn$10,000) per month and is reimbursed for expenses incurred by him on behalf of our company. Our VPE shall be paid compensation equivalent to 18 months’ fees, based on the rate of compensation being paid at the relevant time in the event of (i) termination without cause; or (ii) a Change of Control. Our VPE provides certain services to our company including, but not limited to, making project or property site attendances as may be required from time to time, preparing progress reports with respect to our mineral exploration projects, conducting due diligence as may be required from time to time in connection with potential mineral properties; reviewing geological data and liaising with principal owners of mineral properties in which our company may wish to acquire an interest, meeting with government authorities and retaining technical experts, making recommendations to the Board and its relevant committees with respect to the acquisition and/or abandonment of mineral exploration properties and preparing and implementing, subject to Board approval, plans for the operation of our company including plans for exploration programs, costs of operations and other expenditures in connection with our mineral projects.

Compensation of Management

The terms of the foregoing management consulting agreements were determined at the time by our then constituted Board. As at the date of this Report, our Compensation Committee has complete authority to determine the amount of compensation to be paid and the other terms of management compensation. At the time of entering into the foregoing agreements, our Board did not consult with any consultants or other third parties in determining the amount of compensation to be paid under the management consulting agreements.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information concerning our grant of options to purchase shares of our common stock during the fiscal year ended December 31, 2009 to each person named in the Summary Compensation table.

NAME

(A) | NUMBER OF SECURITIES UNDERLYING UNEXERCISED OPTIONS

(#)

EXERCISABLE

(B) | NUMBER OF SECURITIES UNDERLYING UNEXERCISED OPTIONS

(#)

UNEXERCISABLE

(C) | EQUITY INCENTIVE PLAN AWARDS NUMBER OF SECURITIES UNDERLYING UNEXERCISED UNEARNED OPTIONS

(#)

(D) | OPTION EXERCISE PRICE

($)

(E) | OPTION EXPIRATION DATE

(F) | NUMBER OF SHARES OR UNITS OF STOCK THAT

HAVE

NOT

VESTED

(#)

(G) | MARKET VALUE OF SHARES OR UNITS OF STOCK THAT

HAVE

NOT

VESTED

($)

(H) | EQUITY INCENTIVE PLANA AWARDS NUMBER OF UNEARNED SHARES, UNITS OR OTHER RIGHTS THAT

HAVE

NOT

VESTED

(#)

(I) | EQUITY INCENTIVE PLAN AWARDS MARKET OR PAYOUT VALUE OF UNEARNED SHARES, UNITS OR OTHER RIGHTS THAT

HAVE

NOT

VESTED

(#)

(J) |

| | | | | | | | | |

James Longshore | 0 | 0 | 0 | N/A | N/A | 0 | 0 | 0 | 0 |

| | | | | | | | | |

Yves Clement | 0 | 0 | 0 | N/A | N/A | 0 | 0 | 0 | 0 |

- 59 -

2005 Equity Incentive Compensation Plan

On June 21, 2005, our Board authorized, approved and adopted, our 2005 Equity Incentive Compensation Plan. As the Plan was not submitted to our shareholders for approval and was not approved by our shareholders, we are not permitted to issue any options qualifying as incentive stock options under Section 422 of the Internal Revenue Code of 1986, as amended. A total of 3,000,000 shares of our common stock have been reserved for issuance under the Plan. As at the date of this Report, we have granted options to purchase an aggregate of 972,000 shares of our common stock. During 2009, 108,000 options were cancelled pursuant to Board approval.

The purpose of the Plan is to encourage stock ownership by our officers, directors, key employees and consultants, and to give such persons a greater personal interest in the success of our business and an added incentive to continue to advance and contribute to us. Our Board, or a committee of the Board, will administer the Plan including, without limitation, the selection of the persons who will be awarded stock grants and granted options, the type of options to be granted, the number of shares subject to each option and the exercise price.

Plan options may only be non-qualified options. In addition, the Plan allows for the inclusion of a reload option provision, which permits an eligible person to pay the exercise price of the option with shares of common stock owned by the eligible person and receive a new option to purchase shares of common stock equal in number to the tendered shares. Furthermore, compensatory stock amounts may also be issued. The term of each plan option and the manner in which it may be exercised is determined by our Board or a committee of the Board. All awards granted under the Plan are made on a case by case basis, and the Board does not have any policy regarding timing of grants, amount of shares subject to any option to be granted or the exercise price, except that the Board does consider and/or approve option grants to incoming officers and directors at the time of their appointment.

Eligibility

Our officers, directors, key employees and consultants are eligible to receive stock grants and non-qualified options under the Plan.

Administration

The Plan will be administered by our Board or an underlying committee. The Board or an underlying committee determines from time to time those of our officers, directors, key employees and consultants to whom stock grants or plan options are to be granted, the terms and provisions of the respective option agreements, the time or times at which such options shall be granted, the dates such Plan options become exercisable, the number of shares subject to each option, the purchase price of such shares and the form of payment of such purchase price. All other questions relating to the administration of the Plan, and the interpretation of the provisions thereof and of the related option agreements, are resolved by our Board or an underlying committee. As of the date of this Report, the entire Board administers the Plan.

Shares Subject to Awards

We have currently reserved 3,000,000 of our authorized but unissued shares of common stock for issuance under the Plan, and a maximum of 3,000,000 shares may be issued, unless the Plan is subsequently amended, subject to adjustment in the event of certain changes in our capitalization, without further action by our Board and stockholders, as required. Subject to the limitation on the aggregate number of shares issuable under the Plan, there is no maximum or minimum number of shares as to which a stock grant or Plan option may be granted to any person. Shares used for stock grants and Plan options may be authorized and unissued shares or shares reacquired by us. Shares covered by Plan options which terminate unexercised or shares subject to stock awards which are forfeited or cancelled will again become available for grant as additional options or stock awards, without decreasing the maximum number of shares issuable under the Plan.

The Plan provides that, if our outstanding shares are increased, decreased, exchanged or otherwise adjusted due to a share dividend, forward or reverse share split, recapitalization, reorganization, merger, consolidation, combination or exchange of shares, an appropriate and proportionate adjustment shall be made in the number or kind of shares subject to unexercised options and in the purchase price per share under such options. Any adjustment, however, does not change the total purchase price payable for the shares subject to outstanding options. In the event of our proposed dissolution or liquidation, a proposed sale of all or substantially all of our assets, a merger or tender offer for our shares of common stock, the option may be assumed, converted or replaced by the successor corporation (if any) or may substitute equivalent awards or provide substantially similar consideration to awardees. In the event such successor corporation (if any) refuses or otherwise declines to assume or substitute awards, as provided above, (i) the vesting of any or all Awards granted pursuant to this Plan will accelerate immediately prior to the effective date of a transaction described above and (ii) any or all Options granted pursuant to the Plan will become exercisable in full prior to the consummation of such event at such time and on such conditions as our Board or an underlying committee determines. If such Options are not exercised prior to the consummation of the corporate transaction, they shall terminate at such time as determined by our Board or an underlying committee.

- 60 -

Terms of Exercise

The Plan provides that the options granted thereunder shall be exercisable from time to time in whole or in part, unless otherwise specified by our Board or an underlying committee.

Exercise Price

The purchase price for shares subject to options is determined by our Board or an underlying committee and may be below fair market value on the day of grant. If the purchase price is paid with consideration other than cash, our Board or an underlying committee shall determine the fair value of such consideration to us in monetary terms.

The per share purchase price of shares issuable upon exercise of a plan option may be adjusted in the event of certain changes in our capitalization, but no such adjustment shall change the total purchase price payable upon the exercise in full of options granted under the Plan.

Manner of Exercise

Plan options are exercisable by delivery of written notice to us stating the number of shares with respect to which the option is being exercised, together with full payment of the purchase price therefor. Payment shall be in cash, checks, certified or bank cashier’s checks, promissory notes secured by the shares issued through exercise of the related options, shares of common stock or in such other form or combination of forms which shall be acceptable to our Board or an underlying committee.

Option Period

The term of each non-qualified stock option is determined and fixed by our Board or an underlying committee.

Termination

Except as otherwise expressly provided in the option agreement, all Plan options are nonassignable and nontransferable, except by will or by the laws of descent and distribution, and during the lifetime of the optionee, may be exercised only by such optionee. If an optionee shall die while our employee or within three months after termination of employment by us because of disability, or retirement or otherwise, such options may be exercised, to the extent that the optionee shall have been entitled to do so on the date of death or termination of employment, by the person or persons to whom the optionee’s right under the option pass by will or applicable law, or if no such person has such right, by his executors or administrators.

In the event of termination of employment because of death while an employee or because of disability, an optionee’s options may be exercised not later than the expiration date specified in the option or one year after the optionee’s death, whichever date is earlier, or in the event of termination of employment because of retirement or otherwise, not later than the expiration date specified in the option or three months after the optionee’s retirement, whichever date is earlier.

If an optionee’s employment by us terminates because of disability and such optionee has not died within the following three months, the options may be exercised, to the extent that the optionee shall have been entitled to do so at the date of the termination of employment, at any time, or from time to time, but not later than the expiration date specified in the option or one year after termination of employment, whichever date is earlier.

If an optionee’s employment shall terminate for any reason other than death or disability, such optionee may exercise the options to the same extent that the options were exercisable on the date of termination, for up to three months following such termination, or on or before the expiration date of the options, whichever occurs first. In the event that the optionee was not entitled to exercise the options at the date of termination or if the optionee does not exercise such options (which were then exercisable) within the time specified herein, the options shall terminate.

If an optionee’s employment with us is terminated for any reason whatsoever, and within three months after the date thereof the optionee either (i) accepts employment with any competitor of, or otherwise engages in competition with us, or (ii) discloses to anyone outside our company or uses any confidential information or material of our company in violation of our policies or any agreement between the optionee and our company, the committee, in its sole discretion, may terminate any outstanding stock option and may require the optionee to return to us the economic value of any award that was realized or obtained by the optionee at any time during the period beginning on that date that is six months prior to the date the optionee’s employment with us is terminated.

- 61 -

Our Board or an underlying committee may, if an optionee’s employment with us is terminated for cause, annul any award granted under the Plan to such employee and, in such event, our Board or an underlying committee, in its sole discretion, may require the optionee to return to us the economic value of any award that was realized or obtained by an optionee at any time during the period beginning on that date that is six months prior to the date the optionee’s employment with us is terminated.

Modification and Termination of Plan

Our Board or an underlying committee may amend, suspend or terminate the Plan at any time. However, no such action may prejudice the rights of any holder of a stock grant or an optionee who has prior thereto been granted options under the Plan. Any such termination of the Plan shall not affect the validity of any stock grants or options previously granted thereunder. Unless terminated by our Board, the Plan shall continue to remain effective until such time as no further awards may be granted and all awards granted under the Plan are no longer outstanding.

Compensation of Directors

We established compensation arrangements for our directors for each individual’s service and expense on our Board in March 2007. Directors’ fees are paid on a quarterly basis. As of December 31, 2009, we did not pay fees to directors for their attendance at Board meetings. As an austerity measure, the Board agreed to reduce their respective directors’ fees by 50% in and from the fourth quarter ended December 31, 2008.

The following table sets forth information relating to the compensation paid to our directors for the fiscal year ended December 31, 2009:

DIRECTOR COMPENSATION

NAME

(A) | FEES

EARNED

OR PAID

IN CASH

($)

(B) | STOCK

AWARDS

($)

(C) | OPTION

AWARDS

($)

(D) | NON-EQUITY

INCENTIVE PLAN

COMPENSATION

($)

(E) | NON-QUALIFIED

DEFERRED

COMPENSATION

EARNNGS

($)

(F) | ALL OTHER

COMPENSATION

($)

(G) | TOTAL

($)

(H) |

| | | | | | | |

James Longshore | 5,282 | 0 | 0 | 0 | 0 | 0 | 5,282 |

| | | | | | | |

Richard Grayston | 5,282 | 0 | 0 | 0 | 0 | 0 | 5,282 |

| | | | | | | |

Peter Minuk | 3,962 | 0 | 0 | 0 | 0 | 0 | 3,962 |

| | | | | | | |

Robert Montgomery | 3,962 | 0 | 0 | 0 | 0 | 0 | 3,962 |

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

At March 29, 2010, we had 33,400,586 shares of common stock issued and outstanding. The following table sets forth information known to us as of March 29, 2010 relating to the beneficial ownership of shares of our common stock by:

| ● | each person who is known by us to be the beneficial owner of more than 5% of our outstanding common stock; |

| ● | each named executive officer; and |

| ● | all named executive officers and directors as a group. |

- 62 -

Unless otherwise indicated, the business address of each person listed is in care of our Field Camp located at 2 Masalakye Street, Kwabeng, Ghana. The percentages in the table have been calculated on the basis of treating as outstanding for a particular person, all shares of our common stock outstanding on that date and all shares of our common stock issuable to that holder in the event of exercise of outstanding options, warrants, rights or conversion privileges owned by that person at that date which are exercisable within 60 days of that date. Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of our common stock owned by them, except to the extent that power may be shared with a spouse.

NAME OF BENEFICIAL OWNER | AMOUNT AND NATURE

OF BENEFICIAL OWNERSHIP | PERCENTAGE

OF CLASS |

James Longshore | 2,662,000 shares (1) | 7.97% |

Richard W. Grayston | 187,000 shares (2) | 0.56% |

Robert H. Montgomery | 108,000 shares (3) | 0.32% |

Peter Minuk | 110,000 shares (4) | 0.33% |