UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21582

Madison/Claymore Covered Call Fund

(Exact name of registrant as specified in charter)

| | |

2455 Corporate West Drive Lisle, IL | | 60532 |

|

| (Address of principal executive offices) | | (Zip code) |

Nicholas Dalmaso, Chief Legal and Executive Officer

Madison/Claymore Covered Call Fund

2455 Corporate West Drive

Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: December 31,

Date of reporting period: December 31, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: [Provide full text of annual report.]

| | | | |

| | | www.madisonclaymore.com ... your road to the LATEST, most up-to-date INFORMATION about the Madison/Claymore Covered Call Fund | | |

The shareholder report you are reading right now is just the beginning of the story. Online at madisonclaymore.com, you will find:

| | • | | Daily, weekly and monthly data on share prices, distributions and more |

| | • | | Monthly portfolio overviews and performance analyses |

| | • | | Announcements, press releases and special notices |

| | • | | Fund and advisor contact information |

Madison Investment Advisors and Claymore Securities are constantly updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

| Annual Report | December 31, 2004

MCN | Madison/Claymore Covered Call Fund

Dear Shareholder

We are pleased to submit our first annual report to the shareholders of Madison/Claymore Covered Call Fund (the “Fund”). The Fund’s primary investment objective is to seek to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing in a portfolio consisting primarily of high-quality, large-capitalization stocks that are, in the view of the Fund’s Investment Manager, selling at a reasonable price in relation to their long-term earnings growth rates. The Fund will, on an ongoing and consistent basis, sell covered call options to seek to generate a reasonably steady production of option premiums. This report reflects the results of operations from commencement of the Fund on July 28, 2004 through December 31, 2004.

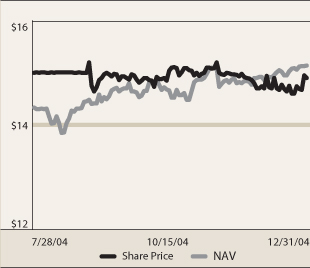

The Fund completed the initial public offering of its common shares on July 27, and commenced operations on July 28, 2004 with an initial Net Asset Value (NAV) of $14.33. On November 30, 2004, the Fund distributed its first quarterly dividend of $0.30 per share which represented an annualized distribution yield of 8.00% based upon the Fund’s initial $15 common share price. The Fund’s NAV at fiscal year-end December 31, 2004 was $15.14 resulting in a total return on NAV of 7.80%. The Fund’s NAV return represents the portfolio value of the Fund and assumes reinvestment of the $0.30 per share of dividends that were paid during the period. Additionally, we are pleased to announce that we have increased the Fund’s dividend rate to $0.33 per share effective with the next quarterly dividend which is payable on February 28, 2005.

The Fund began trading on the New York Stock Exchange on July 28, 2004 at price of $15 per share and ended the year at a price of $14.90, representing a slight market price discount from NAV of 1.59%. As a result of this discount, the total return at market price for the period ended December 31, 2004 was 1.35%, assuming the reinvestment of dividends.

Although the Fund has traded at a discount from NAV, this discount over time tends to provide higher compounded returns for shareholders who take advantage of the Dividend Reinvestment Plan (“DRIP”). When common shares trade at a discount to the net asset value, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an Internal Revenue Service limitation that the purchase price can not be more than 5% below the market price per share. The DRIP provides an effective means to accumulate additional shares and enjoy the benefits of compounded returns over time.

For more specific information on the positioning of the portfolio and the Investment Manager’s market outlook, please refer to the portfolio management question and answer portion of the report. We appreciate your investment with us and would like to thank you for giving us the opportunity to serve your investment needs. For further information on the Fund, please call 1-800-345-7999 or visit the Fund’s website at www.madisonclaymore.com.

Sincerely,

|

|

/s/ Nick Dalmaso |

| Nick Dalmaso |

Senior Managing Director – Claymore Advisors, LLC

February 11, 2005

Annual Report | December 31, 2004 | 1

MCN | Madison/Claymore Covered Call Fund

Questions & Answers

We at Madison Asset Management, LLC are very pleased with the progress of the Madison/Claymore Covered Call Fund. We believe that the strategy of combining ownership of high quality, what we feel are fundamentally sound companies with an active call option writing process provides investors with an attractive opportunity to participate in the equity markets while enjoying added capital protection provided by the option premiums the Fund receives that is not typically available with traditional equity vehicles. From its inception in July of 2004, the Fund has transitioned from its initial portfolio construction stage to its present fully operational structure in a very smooth manner. The early results have been very encouraging and the Fund is well positioned, in our view, as we move into the New Year.

As this report represents our first occasion to discuss the Fund’s structure and performance, we are pleased to address the following questions:

Please describe your investment process for selecting securities.

For the Madison/Claymore Covered Call Fund (MCN), Madison follows its time tested strategy for managing core equity portfolios. The core investment philosophy and process at Madison has been employed over three decades of market cycles and ever-changing investment environments. The construction of our portfolios begins with in-depth fundamental research on individual companies; a so called “bottom-up” approach. We subject our universe of large and mid-sized companies to rigorous fundamental analysis in order to reduce the list of potential investment candidates to those exhibiting the characteristics which we deem necessary for investment success. We seek to purchase high quality growth companies at reasonable valuations, sometimes referred to as “GARP” investing or “Growth At a Reasonable Price”. Companies must, in our view, have a sustainable competitive advantage in their business, predictable and dependable cash flow, a solid balance sheet and a high quality management team. Once we have identified the desirable companies, we determine the price we will pay for them which in many cases is evaluated by a company’s price to earnings multiple (“P/E”) to the growth rate at which we believe earnings can grow in the future. This relationship, called the PEG ratio or “P/E to Growth” ratio, must provide for meaningful stock appreciation potential with limited downside risk.

By maintaining a discipline of owning only high quality companies at reasonable valuations, we believe we can provide our shareholders attractive long-term returns without the added risk associated with higher valued stocks. Our investment process allows us to participate during strong markets but more importantly, attempts to protect capital in times of poor or distressed markets.

Once we have determined the most attractive companies to own, we embark on a covered call writing strategy which, through the collection of premium income, adds an additional layer of downside protection while providing the Fund with a high level of investment income. It is important to note that we primarily write (sell) call options on the individual companies that are owned by the Fund rather than on indices. The premiums that we receive on the sale of individual equity options are meaningfully higher than those on index options, thereby, enhancing the income generation of the Fund while providing additional protection. Typically, individual call options are written in accordance with our view on the underlying stock and, in most cases, are written “out of the money” so that the Fund may benefit from some upside growth in stock price. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

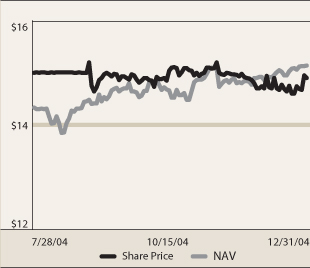

How has the Fund’s net asset value (“NAV”) and market share performed since inception through December 31, 2004?

The Fund completed the initial public offering (“IPO”) of its common shares on July 27th, 2004 and began trading on the New York Stock exchange on July 28th, 2004. The Fund was initially priced at $15 per share and ended the year priced at $14.90. The Fund’s NAV, which began at $14.33, closed the period at $15.14. This increase, coupled with the $.30 dividend paid in November represents a total return on NAV of 7.80%. During this period, the Fund outperformed the CBOE S&P 500 Buy/Write Index (BXM), which gained 5.64% for the period. The Fund traded at a premium to NAV on 79% of the trading days during the period. The Fund paid out its first quarterly dividend of $0.30 per share on November 30, 2004.

| | |

2 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund | Questions & Answers continued

Following the initial public offering, the Fund opportunistically invested the proceeds of the offering over a period of several weeks in a sluggish market environment. As the overall equity markets rallied following the November elections, the Fund was in position to participate in the positive market performance. Given the nature of a covered call writing strategy, during periods of sharp market advances, it is expected that the Fund would lag the overall market returns, but post meaningfully positive results. Please note that closed-end funds often trade at a discount to NAV.

How have the equity and options markets performed during the period and what do you foresee for the value of stocks going forward?

For much of the late summer and early fall of 2004, equity markets languished within a narrow trading range as concerns over potential pre-election terrorism, the election itself, rising interest rates and soaring oil prices kept many investors on the sidelines. As election day passed without a terror event, investor fears eased. This coincided with a peak and subsequent fall in crude oil prices, leading to a significant rally in US stocks which lasted through year end. In fact, in the fourth quarter alone, the S&P 500 Index rose 9.23%, accounting for the lion’s share of the full year return of 10.88%. For several quarters, corporate profits have been rising significantly as the economy expanded and productivity improvements caused profit margins to surge to multi-decade highs. The combination of record profits and modest P/E multiple expansion brought the S&P 500 back to levels not seen since the summer of 2001 but still 20% below the market peak in March of 2000.

The profit cycle, while still solid, will likely slow and the Federal Reserve will likely continue to raise short term interest rates as inflation risks build. In a rising interest rate environment, P/E multiples are unlikely to expand and, as such, the markets will be increasingly reliant on earnings growth to fuel further gains. With wages cost beginning to creep higher and energy costs remaining high, profit margins should come down from their recent highs and without margin expansion, earnings growth will be driven by revenue growth. In such an environment, the continuing strength of the economy will be of utmost importance and the quality and competitiveness of individual companies will be a prime determinant of returns. This expected environment conforms nicely to our focus on high-quality, market leaders with excellent management teams.

Overall volatility in the equity markets was at multi-year lows at the time of the Fund’s IPO and remained low though year end. In such a low volatility environment, premiums which are received when call option are sold, are lower than they would be in times of higher volatility. Despite this, we are relatively pleased with the opportunities that have been available in writing (selling) call options on our individual equity holdings and believe that when volatility moves higher, the premium income generated by the Fund will become even more significant than it already is. In the event that volatility remains low, we are very comfortable with the Fund’s ability to meet or exceed its income distribution targets.

Are there any specific sectors that you have avoided or over-weighted?

As of December 31, 2004, Consumer Discretionary, Financials, Health Care and Technology represented the largest sector exposure of the Fund and comprised the majority of the equity exposure of the Fund. Sectors which exhibit a very high degree of cyclicality and/or reliance on commodity prices are under-exposed in the Fund due to the highly variable nature of corporate cash flows. These areas include the Energy and Materials sectors.

How do the Fund’s equity characteristics compare to the S&P 500?

Due to the inclusion of some mid-sized companies in the Fund’s portfolio, the average market capitalization of the Fund’s current holdings is smaller than the S&P 500 ( $36 billion vs. $90 billion). As is the nature of our “Growth at a Reasonable Price” investment philosophy, the Fund has a significantly higher earnings growth rate than the overall market (16% vs. 6% over the next 5 years) and a P/E valuation that is very similar to the market (17.3x 2005 earnings vs. 16.7x). The average return on equity of the Fund’s holdings as of the date of this report is higher than the market and the quality of balance sheets as measured by the amount of debt to capital is significantly better than the market (13% vs. 28%).

| | |

| | | Annual Report | December 31, 2004 | 3 |

MCN | Madison/Claymore Covered Call Fund

Fund Summary | As of December 31, 2004 (unaudited)

| | | | |

Fund Statistics

| | | |

Share Price | | $ | 14.90 | |

Net Asset Value | | $ | 15.14 | |

Premium/(Discount) to NAV | | | (1.59 | %) |

Net Assets ($ 000) | | $ | 280,290 | |

| | | | | | |

Total Returns (non-annualized) | | | | | | |

| | |

(Inception 7/28/04)

| | Market

| | | NAV

| |

Since Inception | | 1.35 | % | | 7.80 | % |

| | | |

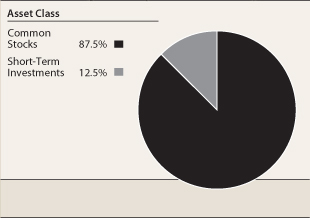

Sector Breakdown

| | % of Long-Term

Investments

| |

Consumer Discretionary | | 25.3 | % |

Financials | | 19.1 | % |

Health Care | | 17.6 | % |

Technology | | 17.5 | % |

Insurance | | 4.9 | % |

Business Services | | 4.5 | % |

Exchange-Traded Funds | | 4.4 | % |

Software | | 3.4 | % |

Consumer Services | | 3.3 | % |

Securities are classified by sectors that represent broad groupings of related industries.

| | | |

Top Ten Holdings

| | % of Long-Term

Investments

| |

Nasdaq-100 Index Tracking Stock | | 4.4 | % |

Best Buy Co., Inc. | | 4.0 | % |

Capital One Financial Corp. | | 3.8 | % |

Bed Bath & Beyond, Inc. | | 3.6 | % |

Morgan Stanley | | 3.5 | % |

Intel Corp. | | 3.4 | % |

Intuit, Inc. | | 3.3 | % |

Lowe’s Cos., Inc. | | 3.2 | % |

MBNA Corp. | | 2.9 | % |

CARMAX, Inc. | | 2.8 | % |

Past performance does not guarantee future results. Portfolio composition, holdings and sectors are subject to change daily.

Share Price & NAV Performance

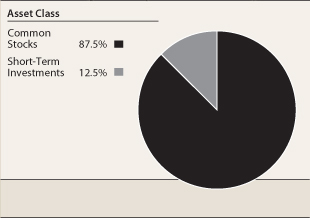

Portfolio Composition (% of Total Investment)

| | |

4 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Portfolio of Investments | December 31, 2004

| | | | | | | |

Number of Shares

| | | | Value

| |

| | | | Common Stocks – 94.3% | | | | |

| | | | Business Services – 4.3% | | | | |

| | 61,000 | | Cintas Corp. | | $ | 2,675,460 | |

| | 115,000 | | First Data Corp. | | | 4,892,100 | |

| | 109,900 | | Fiserv, Inc. (a) | | | 4,416,881 | |

| | | | | |

|

|

|

| | | | | | | 11,984,441 | |

| | | | | |

|

|

|

| | |

| | | | Consumer Discretionary – 23.8% | | | | |

| | 105,000 | | American Eagle Outfitters, Inc. | | | 4,945,500 | |

| | 240,000 | | Bed Bath & Beyond, Inc. (a) | | | 9,559,200 | |

| | 180,000 | | Best Buy Co., Inc. | | | 10,695,600 | |

| | 239,200 | | CARMAX, Inc. (a) | | | 7,427,160 | |

| | 85,000 | | Coach, Inc.(a) | | | 4,794,000 | |

| | 190,575 | | Family Dollar Stores, Inc. | | | 5,951,657 | |

| | 140,000 | | Kohl’s Corp. (a) | | | 6,883,800 | |

| | 148,000 | | Lowe’s Cos., Inc. | | | 8,523,320 | |

| | 100,000 | | Ross Stores, Inc. | | | 2,887,000 | |

| | 160,000 | | Tiffany & Co. | | | 5,115,200 | |

| | | | | |

|

|

|

| | | | | | | 66,782,437 | |

| | | | | |

|

|

|

| | |

| | | | Consumer Services – 3.1% | | | | |

| | 200,000 | | Intuit, Inc. (a) | | | 8,802,000 | |

| | | | | |

|

|

|

| | | | Exchange-Traded Funds – 4.1% | | | | |

| | 290,000 | | Nasdaq-100 Index Tracking Stock | | | 11,573,900 | |

| | | | | |

|

|

|

| | |

| | | | Financials – 18.0% | | | | |

| | 105,000 | | Affiliated Managers Group, Inc. | | | 7,112,700 | |

| | 120,000 | | Capital One Financial Corp. | | | 10,105,200 | |

| | 113,000 | | Citigroup, Inc. | | | 5,444,340 | |

| | 130,000 | | Countrywide Financial Corp | | | 4,811,300 | |

| | 270,000 | | MBNA Corp. | | | 7,611,300 | |

| | 104,000 | | Merrill Lynch & Co., Inc. | | | 6,216,080 | |

| | 165,000 | | Morgan Stanley | | | 9,160,800 | |

| | | | | |

|

|

|

| | | | | | | 50,461,720 | |

| | | | | |

|

|

|

| | |

| | | | Health Care – 16.6% | | | | |

| | 115,000 | | Amgen, Inc. (a) | | | 7,377,250 | |

| | 180,000 | | Boston Scientific Corp. (a) | | | 6,399,000 | |

| | 100,000 | | Community Health Systems, Inc.(a) | | | 2,788,000 | |

| | 59,000 | | Eli Lilly & Co. | | | 3,348,250 | |

| | 263,000 | | Health Management Associates, Inc. | | | 5,975,360 | |

| | 126,000 | | Laboratory Corp. of America Holdings (a) | | | 6,277,320 | |

| | 217,500 | | Mylan Laboratories, Inc. | | | 3,845,400 | |

| | 200,000 | | Pfizer, Inc. | | | 5,378,000 | |

| | 170,000 | | TEVA Pharmaceutical Industries Ltd. | | | 5,076,200 | |

| | | | | |

|

|

|

| | | | | | | 46,464,780 | |

| | | | | |

|

|

|

| | | | Insurance – 4.7% | | | | |

| | 104,000 | | American International Group, Inc. | | $ | 6,829,680 | |

| | 90,000 | | MGIC Investment Corp. | | | 6,201,900 | |

| | | | | |

|

|

|

| | | | | | | 13,031,580 | |

| | | | | |

|

|

|

| | |

| | | | Software – 3.2% | | | | |

| | 143,000 | | Check Point Software Technologies Ltd.(a) | | | 3,522,090 | |

| | 195,000 | | Veritas Software Corp. (a) | | | 5,567,250 | |

| | | | | |

|

|

|

| | | | | | | 9,089,340 | |

| | | | | |

|

|

|

| | |

| | | | Technology – 16.5% | | | | |

| | 117,000 | | Altera Corp. (a) | | | 2,421,900 | |

| | 310,000 | | Applied Materials, Inc. (a) | | | 5,301,000 | |

| | 187,000 | | Cisco Systems, Inc. (a) | | | 3,609,100 | |

| | 400,000 | | Flextronics International Ltd. (a) | | | 5,528,000 | |

| | 327,000 | | Hewlett-Packard Co. | | | 6,857,190 | |

| | 382,000 | | Intel Corp. | | | 8,934,980 | |

| | 70,000 | | KLA-Tencor Corp. (a) | | | 3,260,600 | |

| | 56,000 | | Maxim Integrated Products, Inc. | | | 2,373,840 | |

| | 58,000 | | Symantec Corp. | | | 1,494,080 | |

| | 132,900 | | Texas Instruments, Inc. | | | 3,271,999 | |

| | 105,000 | | Xilinx, Inc. | | | 3,113,250 | |

| | | | | |

|

|

|

| | | | | | | 46,165,939 | |

| | | | | |

|

|

|

| | |

| | | | Total Long-Term Investments (Cost $238,889,241) | | | 264,356,137 | |

| | | | | |

|

|

|

| | |

| | | | Short-Term Investments – 13.5% | | | | |

| | | | Money Market Funds – 0.00% | | | | |

| | 6,029 | | AIM Liquid Assets Money Market Fund (Cost $ 6,029) | | | 6,029 | |

| | | | | |

|

|

|

| | |

| | | | Repurchase Agreement – 13.5% | | | | |

| $ | 37,671,000 | | Morgan Stanley (issued 12/31/04 at 1.00% due

1/3/05 collateralized by $27,380,000 par of U.S.Treasury Notes

due 4/15/32). Proceeds at maturity are $37,674,139 (Cost $37,671,000) | | | 37,671,000 | |

| | | | | |

|

|

|

| | |

| | | | Total Short-Term Investments (Cost $37,677,029) | | | 37,677,029 | |

| | | | | |

|

|

|

| | |

| | | | Total Investments – 107.8% (Cost $276,566,270) | | | 302,033,166 | |

| | | | Other assets less liabilities - 1.7% | | | 4,758,219 | |

| | | | Total Options Written - (9.5%) | | | (26,501,615 | ) |

| | | | | |

|

|

|

| | |

| | | | Net Assets – 100.0% | | $ | 280,289,770 | |

| | | | | |

|

|

|

See notes to financial statements.

| | |

| | | Annual Report | December 31, 2004 | 5 |

MCN | Madison/Claymore Covered Call Fund | Portfolio of Investments continued

| | | | | | | | | | | |

Contracts

(100 shares

per contract)

| | | Call Options Written(a)

| | Expiration Date

| | Exercise

Price

| | Market Value

|

| 700 | * | | Affiliated Managers Group, Inc. | | January 2005 | | $ | 53.375 | | $ | 1,512,000 |

| 1,170 | | | Altera Corp. | | January 2005 | | | 20.00 | | | 122,850 |

| 950 | | | American International Group, Inc. | | February 2005 | | | 60.00 | | | 603,250 |

| 90 | | | American International Group, Inc. | | February 2005 | | | 65.00 | | | 22,725 |

| 500 | | | Amgen, Inc. | | January 2005 | | | 60.00 | | | 217,500 |

| 650 | | | Amgen, Inc. | | April 2005 | | | 60.00 | | | 383,500 |

| 50 | | | American Eagle Outfitters, Inc. | | February 2005 | | | 35.00 | | | 61,000 |

| 1,000 | | | American Eagle Outfitters, Inc. | | May 2005 | | | 35.00 | | | 1,285,000 |

| 470 | | | Applied Materials, Inc. | | April 2005 | | | 17.00 | | | 58,750 |

| 1,930 | | | Applied Materials, Inc. | | January 2005 | | | 17.50 | | | 53,075 |

| 700 | | | Applied Materials, Inc. | | April 2005 | | | 18.00 | | | 57,750 |

| 800 | | | Bed Bath & Beyond, Inc. | | February 2005 | | | 42.50 | | | 28,000 |

| 1,400 | | | Bed Bath & Beyond, Inc. | | May 2005 | | | 40.00 | | | 339,500 |

| 200 | | | Bed Bath & Beyond, Inc. | | January 2005 | | | 40.00 | | | 14,000 |

| 1,000 | | | Best Buy Co., Inc. | | January 2005 | | | 55.00 | | | 470,000 |

| 800 | | | Best Buy Co., Inc. | | March 2005 | | | 60.00 | | | 226,000 |

| 400 | | | Boston Scientific Corp. | | February 2005 | | | 35.00 | | | 75,000 |

| 300 | | | Boston Scientific Corp. | | February 2005 | | | 40.00 | | | 9,000 |

| 500 | | | Boston Scientific Corp. | | May 2005 | | | 37.50 | | | 90,000 |

| 150 | | | Capital One Financial Corp. | | January 2005 | | | 70.00 | | | 214,500 |

| 1,050 | | | Capital One Financial Corp. | | March 2005 | | | 75.00 | | | 1,107,750 |

| 2,392 | | | CARMAX, Inc. | | January 2005 | | | 20.00 | | | 2,643,160 |

| 930 | | | Check Point Software Technologies Ltd. | | January 2005 | | | 17.50 | | | 664,950 |

| 500 | | | Check Point Software Technologies Ltd. | | January 2005 | | | 20.00 | | | 235,000 |

| 610 | | | Cintas Corp. | | February 2005 | | | 45.00 | | | 62,525 |

| 1,270 | | | Cisco Systems, Inc. | | January 2005 | | | 20.00 | | | 28,575 |

| 515 | | | Coach, Inc. | | May 2005 | | | 40.00 | | | 888,375 |

| 335 | | | Coach, Inc. | | May 2005 | | | 45.00 | | | 430,475 |

| 200 | | | Community Health Systems, Inc. | | March 2005 | | | 25.00 | | | 68,000 |

| 250 | | | Community Health Systems, Inc. | | March 2005 | | | 30.00 | | | 15,000 |

| 550 | | | Community Health Systems, Inc. | | June 2005 | | | 30.00 | | | 64,625 |

| 600 | | | Countrywide Financial Corp. | | April 2005 | | | 35.00 | | | 219,000 |

| 422 | | | Countrywide Financial Corp. | | April 2005 | | | 37.50 | | | 93,895 |

| 590 | | | Eli Lilly & Co. | | January 2005 | | | 55.00 | | | 168,150 |

| 200 | | | First Data Corp. | | May 2005 | | | 45.00 | | | 23,000 |

| 172 | | | Fiserv, Inc. | | March 2005 | | | 35.00 | | | 98,040 |

| 927 | | | Fiserv, Inc. | | March 2005 | | | 40.00 | | | 176,130 |

| 4,000 | | | Flextronics International Ltd. | | January 2005 | | | 12.50 | | | 570,000 |

| 1,570 | | | Hewlett-Packard Co. | | February 2005 | | | 20.00 | | | 235,500 |

| 740 | | | Hewlett-Packard Co. | | May 2005 | | | 22.50 | | | 59,200 |

| 182 | | | Health Management Associates, Inc. | | January 2005 | | | 20.00 | | | 50,050 |

| 1,718 | | | Health Management Associates, Inc. | | May 2005 | | | 22.50 | | | 240,520 |

| 2,860 | | | Intel Corp. | | January 2005 | | | 22.50 | | | 364,650 |

| 960 | | | Intel Corp. | | April 2005 | | | 25.00 | | | 84,000 |

| 1,000 | | | Intuit, Inc. | | January 2005 | | | 37.50 | | | 655,000 |

| 685 | | | Intuit, Inc. | | April 2005 | | | 45.00 | | | 145,563 |

| 315 | | | Intuit, Inc. | | January 2005 | | | 45.00 | | | 17,325 |

| 700 | | | KLA-Tencor Corp. | | January 2005 | | $ | 37.50 | | $ | 637,000 |

| 820 | | | Kohl’s Corp. | | January 2005 | | | 45.00 | | | 369,000 |

| 200 | | | Kohl’s Corp. | | January 2005 | | | 50.00 | | | 24,000 |

| 380 | | | Kohl’s Corp. | | April 2005 | | | 50.00 | | | 110,200 |

| 1,260 | | | Laboratory Corp. of America Holdings | | February 2005 | | | 42.50 | | | 938,700 |

| 780 | | | Lowe’s Cos, Inc. | | January 2005 | | | 55.00 | | | 235,950 |

| 700 | | | Lowe’s Cos, Inc. | | April 2005 | | | 55.00 | | | 311,500 |

| 560 | | | Maxim Integrated Products, Inc. | | January 2005 | | | 45.00 | | | 15,400 |

| 1,100 | | | MBNA Corp. | | June 2005 | | | 27.50 | | | 233,750 |

| 920 | | | Merrill Lynch & Co., Inc. | | January 2005 | | | 50.00 | | | 910,800 |

| 120 | | | Merrill Lynch & Co., Inc. | | April 2005 | | | 55.00 | | | 72,000 |

| 700 | | | MGIC Investment Corp. | | March 2005 | | | 65.00 | | | 392,000 |

| 200 | | | MGIC Investment Corp. | | January 2005 | | | 70.00 | | | 23,500 |

| 800 | | | Morgan Stanley | | April 2005 | | | 55.00 | | | 242,000 |

| 1,995 | | | Mylan Laboratories, Inc. | | January 2005 | | | 17.50 | | | 114,712 |

| 180 | | | Mylan Laboratories, Inc. | | April 2005 | | | 17.50 | | | 25,650 |

| 50 | | | Pfizer, Inc. | | January 2005 | | | 30.00 | | | 375 |

| 1,000 | | | Pfizer, Inc. | | March 2005 | | | 25.00 | | | 252,500 |

| 300 | | | Pfizer, Inc. | | March 2005 | | | 27.50 | | | 32,250 |

| 280 | | | Nasdaq-100 Index Tracking Stock | | January 2005 | | | 34.625 | | | 147,000 |

| 2,620 | | | Nasdaq-100 Index Tracking Stock | | January 2005 | | | 35.625 | | | 1,113,500 |

| 1,000 | | | Ross Stores, Inc. | | February 2005 | | | 25.00 | | | 415,000 |

| 286 | | | Symantec Corp. | | April 2005 | | | 25.00 | | | 81,510 |

| 1,540 | | | TEVA Pharmaceutical Industries Ltd. | | March 2005 | | | 25.00 | | | 823,900 |

| 160 | | | TEVA Pharmaceutical Industries Ltd. | | March 2005 | | | 27.50 | | | 51,200 |

| 1,329 | | | Texas Instruments, Inc. | | January 2005 | | | 20.00 | | | 617,985 |

| 1,600 | | | Tiffany & Co. | | May 2005 | | | 30.00 | | | 576,000 |

| 1,950 | | | Veritas Software Corp. | | January 2005 | | | 17.50 | | | 2,135,250 |

| 450 | | | Xilinx, Inc. | | January 2005 | | | 27.50 | | | 113,625 |

| 600 | | | Xilinx, Inc. | | January 2005 | | | 30.00 | | | 55,500 |

| | | | | | | | | | |

|

|

| | | | Total Call Options Written (Premiums received $15,040,275) | | | | | | | $ | 26,323,615 |

| | | | |

Contracts

(100 shares

per contract)

| | | Put Options Written(a)

| | Expiration Date

| | Exercise

Price

| | Market Value

|

| 4,000 | | | Flextronics International Ltd. | | January 2005 | | $ | 12.50 | | $ | 40,000 |

| 800 | | | Tiffany & Co. | | May 2005 | | | 25.00 | | | 26,000 |

| 800 | | | Tiffany & Co. | | May 2005 | | | 30.00 | | | 112,000 |

| | | | | | | | | | |

|

|

| | | | |

| | | | Total Put Options Written (Premium received $1,003,976) | | | | | | | | 178,000 |

| | | | | | | | | | |

|

|

| | | | |

| | | | Total Options Written (Premiums received $16,044,251) | | | | | | | | $26,501,615 |

| | | | | | | | | | |

|

|

| (a) | Non-income producing security. |

| * | 150 shares per contract as a result of a 3 for 2 stock split |

See notes to financial statements.

| | |

6 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Statement of Assets and Liabilities | December 31, 2004

| | | | | | |

Assets | | | | | | |

| | |

Investments, at value (cost $238,895,270) | | $ | 264,362,166 | | | |

Repurchase Agreement (cost $37,671,000) | | | 37,671,000 | | | |

| | |

|

| | | |

Total Investments (cost $276,566,270) | | | | | $ | 302,033,166 |

Cash | | | | | | 5,010,649 |

Dividends and interest receivable | | | | | | 89,179 |

Other assets | | | | | | 8,839 |

| | | | | |

|

|

Total assets | | | | | | 307,141,833 |

| | | | | |

|

|

| | |

Liabilities | | | | | | |

| | |

Options written, at value (premiums received of $16,044,251) | | | | | | 26,501,615 |

Payables: | | | | | | |

Investment Advisory Fee | | | | | | 117,781 |

Investment Management Fee | | | | | | 117,781 |

Other Affiliates | | | | | | 22,539 |

Trustees’ Fees | | | | | | 8,121 |

Accrued expenses and other liabilities | | | | | | 84,226 |

| | | | | |

|

|

Total liabilities | | | | | | 26,852,063 |

| | | | | |

|

|

| | |

Net Assets | | | | | $ | 280,289,770 |

| | | | | |

|

|

| | |

Composition of Net Assets | | | | | | |

| | |

Common stock, $.01 par value per share; unlimited number of shares authorized, 18,513,442 shares issued and outstanding | | | | | $ | 185,134 |

Additional paid-in capital | | | | | | 264,513,258 |

Accumulated net realized gain on investments and options transactions | | | | | | 581,846 |

Net unrealized appreciation on investments and options transactions | | | | | | 15,009,532 |

| | | | | |

|

|

| | |

Net Assets | | | | | $ | 280,289,770 |

| | | | | |

|

|

| | |

Net Asset Value

(based on 18,513,442 common shares outstanding) | | | | | $ | 15.14 |

| | | | | |

|

|

See notes to financial statements.

| | |

| | | Annual Report | December 31, 2004 | 7 |

MCN | Madison/Claymore Covered Call Fund

Statement of Operations | For the Period July 28, 2004* through December 31, 2004

| | | | | | | |

Investment Income | | | | | | | |

Dividends (net of foreign withholding taxes of $1,597) | | $ | 673,353 | | | | |

Interest | | | 332,321 | | | | |

| | |

|

| |

|

|

|

Total income | | | | | $ | 1,005,674 | |

| | | | | |

|

|

|

| | |

Expenses | | | | | | | |

Investment Advisory fee | | | 568,073 | | | | |

Investment Management fee | | | 568,073 | | | | |

Trustees’ fees and expenses | | | 47,041 | | | | |

Audit fees | | | 45,000 | | | | |

Legal fees | | | 41,726 | | | | |

Administrative fee | | | 33,287 | | | | |

Printing expenses | | | 26,220 | | | | |

Fund accounting | | | 26,195 | | | | |

Insurance | | | 23,355 | | | | |

Custodian fee | | | 21,289 | | | | |

Transfer agent fee | | | 16,325 | | | | |

NYSE listing fee | | | 14,999 | | | | |

Other | | | 3,492 | | | | |

Total expenses | | | | | | 1,435,075 | |

| | | | | |

|

|

|

| | |

Net Investment Loss | | | | | | (429,401 | ) |

| | | | | |

|

|

|

| | |

Realized and Unrealized Gain (Loss) on Investments Transactions | | | | | | | |

Net realized gain (loss) on: | | | | | | | |

Investments | | | | | | 2,410,287 | |

Options | | | | | | 4,124,338 | |

Net unrealized appreciation (depreciation) on: | | | | | | | |

Investments | | | | | | 25,466,896 | |

Options | | | | | | (10,457,364 | ) |

| | | | | |

|

|

|

Net realized and unrealized gain on investments and options transactions | | | | | | 21,544,157 | |

| | | | | |

|

|

|

| | |

Net Increase in Net Assets Resulting from Operations | | | | | $ | 21,114,756 | |

| | | | | |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

| | |

8 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Statement of Changes in Net Assets

For the Period July 28, 2004* through December 31, 2004

| | | | |

Increase in Net Assets Resulting from Operations | | | | |

Net investment loss | | $ | (429,401 | ) |

Net realized gain on investments and options transactions | | | 6,534,625 | |

Net unrealized appreciation on investments and options transactions | | | 15,009,532 | |

| | |

|

|

|

Net increase in net assets resulting from operations | | | 21,114,756 | |

| | |

|

|

|

| |

Distributions to Shareholders | | | | |

In excess of net investment income | | | (5,523,378 | ) |

| | |

|

|

|

| |

Capital Share Transactions | | | | |

Proceeds from the issuance of common shares | | | 263,641,039 | |

Reinvestment of dividends | | | 1,509,206 | |

Common share offering costs charged to paid-in-capital | | | (552,128 | ) |

| | |

|

|

|

Net increase from capital share transactions | | | 264,598,117 | |

| | |

|

|

|

| |

Total increase in net assets | | | 280,189,495 | |

| |

Net Assets | | | | |

Beginning of period | | | 100,275 | |

| | |

|

|

|

End of period (including undistributed net investment income of $0) | | $ | 280,289,770 | |

| | |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

| | |

| | | Annual Report | December 31, 2004 | 9 |

MCN | Madison/Claymore Covered Call Fund

Financial Highlights | For the Period July 28, 2004* through December 31, 2004

| | | | |

Per Share Operating Performance for One Share Outstanding Throughout the Period | | | | |

Net Asset Value, Beginning of Period | | $ | 14.33 | (a) |

Investment Operations | | | | |

Net investment loss(b) | | | (0.02 | ) |

Net realized and unrealized gain on investments and options transactions | | | 1.16 | |

| | |

|

|

|

Total from investment operations | | | 1.14 | |

| | |

|

|

|

| |

Distributions in Excess of Net Investment Income | | | (0.30 | ) |

| | |

|

|

|

| |

Offering Costs Charged to Paid-in-Capital | | | (0.03 | ) |

| | |

|

|

|

| |

Net Asset Value, End of Period | | $ | 15.14 | |

| | |

|

|

|

| |

Market Value, End of Period | | $ | 14.90 | |

| | |

|

|

|

| |

Total Investment Return(C) | | | | |

Net asset value | | | 7.80 | % |

Market value | | | 1.35 | % |

| |

Ratios and Supplemental Data | | | | |

Net assets, end of period (thousands) | | $ | 280,290 | |

| |

Ratio of expenses to average net assets(d) | | | 1.24 | % |

Ratio of net investment income (loss) to average net assets(d) | | | (0.36 | %) |

Portfolio turnover | | | 33 | % |

| * | Commencement of operations. |

| (a) | Before deduction of offering costs charged to capital. |

| (b) | Based on average shares outstanding. |

| (c) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for returns at NAV or in accordance with the Fund’s dividend reinvestment plan for returns at market value. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

See notes to financial statements.

| | |

10 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Notes to Financial Statements | December 31, 2004

Note 1 – Organization:

Madison/Claymore Covered Call Fund (the “Fund”) was organized as a Delaware statutory trust on May 6, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended.

The Fund’s primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing in a portfolio consisting primarily of high quality, large capitalization common stocks that are, in the view of the Fund’s Investment Manager, selling at a reasonable price in relation to their long-term earnings growth rates. The Fund will, on an ongoing and consistent basis, sell covered call options to seek to generate a reasonably steady production of option premiums. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

Note 2 – Significant Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Fund.

(a) Valuation of Investments

Readily marketable portfolio securities listed on an exchange or traded in the over-the-counter market are generally valued at their last reported sale price. If no sales are reported, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day, then the security is valued by such method as the Fund’s Board of Trustees shall determine in good faith to reflect its fair value. Portfolio securities traded on more than one securities exchange are valued at the last sale price at the close of the exchange representing the principal market for such securities. Debt securities are valued at the last available bid price for such securities or, if such prices are not available, at the mean between the last bid and asked price. Exchange-traded options are valued at the mean of the best bid and best asked prices across all option exchanges.

Short-term debt securities having a remaining maturity of sixty days or less are valued at amortized cost, which approximates market value.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis.

The Fund may invest in repurchase agreements, which are short-term investments in which the Fund acquires ownership of a debt security and the seller agrees to repurchase the security at a future time and specified price. Repurchase agreements are fully collateralized by the underlying debt security. The Fund will make payment for such securities only upon physical delivery or evidence of book entry transfer to the account of the custodian bank. The seller is required to maintain the value of the underlying security at not less than the repurchase proceeds due the Fund.

Note 3 – Investment Advisory Agreement, Investment Management Agreement and Other Transactions with Affiliates:

Pursuant to an Investment Advisory Agreement (the “Agreement”) between the Fund and Claymore Advisors, LLC (“the Advisor”), the Advisor will furnish offices, necessary facilities and equipment, provide administrative services, oversee the activities of the Fund’s Investment Manager, provide personnel, including certain officers required for the Fund’s administrative management and compensate all officers and trustees of the Fund who are its affiliates. As compensation for these services, the Fund will pay the Investment Advisor a fee, payable monthly, in an amount equal to 0.50% of the Fund’s average daily net assets.

Pursuant to an Investment Management Agreement between the Fund and Madison Asset Management LLC (the “Investment Manager”), the Investment Manager, under the supervision of the Fund’s Board of Trustees and the Advisor, will provide a continuous investment program for the Fund’s portfolio; provide investment research and make and execute recommendations for the purchase and sale of securities; and provide certain facilities and personnel, including officers required for the Fund’s administrative management and compensation of all officers and trustees of the Fund who are its affiliate. For these services, the Fund will pay the Investment Manager a fee, payable monthly, in an amount equal to 0.50% of the Funds average daily net assets.

Under separate Fund Administration and Fund Accounting agreements, effective November 15, 2004, the Advisor provides fund administration services and the Investment Manager provides fund accounting services to the Fund. Prior to November 15, 2004, these services were provided, for a fee, by the Bank of New York. The Fund recognized expenses of approximately $8,800 and $9,000 representing Claymore’s and Madison’s cost of providing fund administration and fund accounting services to the Fund, respectively.

Certain officers and trustees of the Fund are also officers and directors of Claymore Securities Inc. or Madison Asset Management LLC. The Fund does not compensate its officers or trustees who are officers of the two aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

| | |

| | | Annual Report | December 31, 2004 | 11 |

MCN | Madison/Claymore Covered Call Fund | Notes to Financial Statements continued

Information on the tax components of capital, excluding option contracts, as of December 31, 2004 is as follows:

| | | | | | | | | | | | | | |

Cost of Investments for Tax Purposes

| | Gross Tax Unrealized Appreciation

| | Gross Tax Unrealized Depreciation

| | | Net tax Unrealized Appreciation on

Investments

| | Undistributed Ordinary Income

|

| $ | 276,729,533 | | $ | 28,783,523 | | $ | (3,479,890 | ) | | $ | 25,303,633 | | $ | 745,109 |

Due to inherent differences in the recognition of income, expenses, and realized gains/losses under U.S. generally accepted accounting principles and federal income tax purposes, permanent differences between book and tax basis reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities. A permanent book and tax difference relating to short-term capital gains in the amount of $5,952,779 was reclassified from accumulated net realized gain to accumulated undistributed net investment income. Net realized gains or losses differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions.

For the period ended December 31, 2004, the tax character of distributions paid to shareholders of $5,523,378, as reflected on the Statement of Changes in Net Assets, was ordinary income.

Note 5 – Investment Transactions:

During the period, the cost of purchases and proceeds from sales of investments, including premiums received from options written but excluding short-term investments were $291,841,486 and $77,138,041 respectively.

Note 6 – Covered Call Options:

The Fund will pursue its primary objective by employing an option strategy of writing (selling) covered call options on common stocks. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or to pay the exercise price upon delivery of the underlying security (in the case of a put).

There are several risks associated with transactions in options on securities. As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call but has retained the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

Transactions in option contracts during the period ended December 31, 2004 were as follows:

| | | | | | | |

| | | Number of Contracts

| | | Premiums Received

| |

Options written during the period | | 99,702 | | | $ | 22,205,570 | |

Options expired during the period | | (10,730 | ) | | | (1,738,537 | ) |

Options closed during the period | | (13,559 | ) | | | (3,629,760 | ) |

Options assigned during the period | | (5,930 | ) | | | (793,022 | ) |

| | |

|

| |

|

|

|

Options outstanding, end of period | | 69,483 | | | $ | 16,044,251 | |

| | |

|

| |

|

|

|

Note 7 – Capital:

Common Shares

In connection with its organizational process, the Fund sold 7,000 common shares of beneficial interest to Claymore Securities Inc., an affiliate of the Advisor, for consideration of $100,275. The Fund has an unlimited amount of common shares, $0.01 par value, authorized and issued 17,350,000 shares of common stock in its initial public offering. These shares were all issued at $14.325 per share after deducting the sales load but before a reimbursement of expenses to the underwriters of $0.005 per share. In connection with the initial public offering of the Fund’s common shares, the underwriters were granted an option to purchase additional common shares. On August 26, 2004 and September 14, 2004, the underwriters purchased, at a price of $14.325 per common share (after deducting the sales load but before underwriter’s expense reimbursement) 1,000,000 and 54,261 common shares, respectively, of the Fund pursuant to the over-allotment option.

Offering costs, estimated at $552,128 or $0.03 per share, in connection with the issuance of the common shares have been borne by the Fund and were charged to paid-in-capital. The Advisor has agreed to pay the Fund’s organizational expenses, which are estimated at $25,000.

In connection with the Fund’s dividend reinvestment plan, the Fund issued 102,181 shares during the period.

Note 8 – Indemnifications

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and, therefore cannot be estimated; however, the risk of material loss from such claims is considered remote.

Note 9 – Subsequent Event:

The Board of Trustees declared an increase in the quarterly dividend effective with the February 2005 dividend. As such, a quarterly dividend of $0.330 per share will be payable on February 28, 2005, to shareholders of record on February 15, 2005.

| | |

12 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of Madison/Claymore Covered Call Fund

We have audited the accompanying statement of assets and liabilities of Madison/Claymore Covered Call Fund (the “Fund”), including the portfolio of investments, as of December 31, 2004, and the related statement of operations, statement of changes in net assets, and financial highlights for the period from July 28, 2004 (commencement of operations) through December 31, 2004. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2004, by correspondence with the custodian. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Madison/Claymore Covered Call Fund at December 31, 2004, and the results of its operations, changes in its net assets, and the financial highlights for the period from July 28, 2004 through December 31, 2004, in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

February 11, 2005

| | |

| | | Annual Report | December 31, 2004 | 13 |

MCN | Madison/Claymore Covered Call Fund

Supplemental Information | (unaudited)

Federal Income Tax Information

Qualified dividend income of as much as $635,680 was received by the Fund through December 31, 2004. The Fund intends to designate the maximum amount of dividends that qualify the reduced tax rate pursuant to the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For corporate shareholders, $635,680 of investment income qualifies for the dividends received deduction.

In January 2005, you will be advised on IRS Form 1099 DIV or substitute 1099 DIV as to the federal tax status of the distributions received by you in the calendar year 2004.

Trustees

The trustees of the Madison/Claymore Covered Call Fund and their principal occupations during the past five years:

| | | | | | |

Name, Address*, Age

and Position(s) held

with Registrant

| | Term of Office

and Length of

Time Served

| | Principal Occupation During

the Past Five Years and

Other Affiliations

| | Other Directorships

Held by

Trustee

|

Independent Trustees: | | | | | | |

| | | |

Randall C. Barnes Age: 52 Trustee | | Since 2004 | | Formerly, Senior Vice President, Treasurer (1993-1997), President, Pizza Hut International (1991-1993) and Senior Vice President, Strategic Planning and New Business Development (1987-1990) of PepsiCo, Inc. (1987-1997). | | Trustee, Fiduciary/Claymore MLP Opportunity Fund. Director, Lykes Bros., Inc. |

| | | |

Philip E. Blake Age: 60 1 South Pinckney Street Suite 501 Madison, WI 53703 Trustee | | Since 2004 | | Managing Partner of Forecastle Inc. (2000-present). Formerly, President and CEO of Madison Newspapers Inc. (1993-2000) and Vice President, Publishing, Lee Enterprises (1998-2001). | | Director, Madison Newspapers, Inc., Forecastle, Inc, Nerites Corporation and US Bank-Madison. Trustee, the Mosaic family of mutual funds. |

| | | |

James R. Imhoff, Jr. Age: 60 429 Gammon Place Madison, WI 53719 Trustee | | Since 2004 | | Chairman and CEO of First Weber Group. | | Director, Park Bank. Trustee, the Mosaic family of mutual funds. |

| | | |

Ronald A. Nyberg Age: 51 Trustee | | Since 2004 | | Principal of Ronald A. Nyberg, Ltd., a law firm specializing in corporate law, estate planning and business transactions from 2000-present. Formerly, Executive Vice President, General Counsel and Corporate Secretary of Van Kampen Investments (1982-1999). | | Trustee, Advent Claymore Convertible Securities and Income Fund, MBIA Capital/ Claymore Managed Duration Investment Grade Municipal Fund, Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund, Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2, TS&W/ Claymore Tax-Advantaged Balanced Fund, Dreman/Claymore Dividend & Income Fund and Fiduciary/Claymore MLP Opportunity Fund. |

| | | |

Ronald E. Toupin, Jr. Age: 46 Trustee | | Since 2004 | | Formerly, Vice President, Manager and Portfolio Manager of Nuveen Asset Management (1998- 1999), Vice President of Nuveen Investment Advisory Corporation (1992-1999), Vice President and Manager of Nuveen Unit Investment Trusts (1991-1999), and Assistant Vice President and Portfolio Manager of Nuveen Unit Investment Trusts (1988-1999), each of John Nuveen & Company, Inc. (1982-1999). | | Trustee, Advent Claymore Convertible Securities and Income Fund, MBIA Capital/ Claymore Managed Duration Investment Grade Municipal Fund, Western Asset/ Claymore U.S. Treasury Inflation Protected Securities Fund, Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2, TS&W/Claymore Tax-Advantaged Balanced Fund, Dreman/Claymore Dividend & Income Fund and Fiduciary/Claymore MLP Opportunity Fund. |

| | | |

Lorence Wheeler Age: 66 135 Grand County Road 8300 Tabernash, CO 80478 Trustee | | Since 2004 | | Formerly, President of Credit Union Benefits Services, Inc. and Pension Specialist for CUNA Mutual Group. | | Trustee, the Mosaic family of mutual funds. Director, Grand Mountain Bank, FSB. |

| | |

14 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund | Supplemental Information (unaudited) continued

| | | | | | |

Name, Address*, Age

and Position(s) held

with Registrant

| | Term of Office

and Length of

Time Served

| | Principal Occupation During

the Past Five Years and

Other Affiliations

| | Other Directorships

Held by

Trustee

|

Interested Trustees: | | | | | | |

| | | |

Nicholas Dalmaso† Age: 39 Trustee and Chief Legal and Executive Officer | | Since 2004 | | Senior Managing Director and General Counsel of Claymore Advisors, LLC and Claymore Securities, Inc. (2001-present). Formerly, Assistant General Counsel, John Nuveen and Company, Inc. (1999-2000). Former Vice President and Associate General Counsel of Van Kampen Investments, Inc. (1992-1999). | | Trustee, Advent Claymore Convertible Securities and Income Fund, MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund, Western Asset/Claymore U.S.Treasury Inflation Protected Securities Fund, Flaherty & Crumrine/Claymore Preferred Securities & Income Fund, Flaherty & Crumrine/ Claymore Total Return Fund, Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2, TS&W/Claymore Tax-Advantaged Balanced Fund, Dreman/Claymore Dividend & Income Fund and Fiduciary/Claymore MLP Opportunity Fund. |

| | | |

Frank E. Burgess†† Age: 61 550 Science Drive Madison, WI 53711 Trustee and Senior Vice President | | Since 2004 | | Founder, President and CEO of Madison Investment Advisors, Inc. (1974-present) and Madison Asset Management, LLC. | | Director, Capital Bankshares, Inc. and Outrider Foundation, Inc. Trustee, the Mosaic family of mutual funds. |

| * | Address, unless otherwise noted: 2455 Corporate West Drive, Lisle, IL 60532 |

| † | Mr. Dalmaso may be deemed an “interested person” because of his position as an officer of Claymore Advisors, LLC, the Fund’s Advisor. |

| †† | Mr. Burgess may be deemed an “interested person” because of his position as an officer of Madison Asset Management, LLC, the Fund’s Investment Manager. |

| | |

| | | Annual Report | December 31, 2004 | 15 |

MCN | Madison/Claymore Covered Call Fund

Dividend Reinvestment Plan

Unless the registered owner of common shares elects to receive cash by contacting the Plan Administrator, all dividends declared on common shares of the Fund will be automatically reinvested by the Bank of New York (the “Plan Administrator”), Administrator for shareholders in the Fund’s Dividend Reinvestment Plan (the “Plan”), in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all dividends declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder’s common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a “Dividend”) payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding common shares on the open market (“Open-Market Purchases”) on the New York Stock Exchange or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Dividend by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Dividend, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Dividend amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Dividends.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, The Bank of New York, 2 Hanson Place, Brooklyn, NY, 11217, Phone Number: (718) 315-4818.

| | |

16 | Annual Report | December 31, 2004 | | |

MCN | Madison/Claymore Covered Call Fund

Fund Information

Board of Trustees

Randall C. Barnes

Philip E. Blake

Frank Burgess

Nicholas Dalmaso

James Imhoff, Jr.

Ronald A. Nyberg

Ronald E.Toupin, Jr.

Lorence Wheeler

Officers

Nicholas Dalmaso

Chief Executive and Legal Officer

Steven M. Hill

Chief Financial Officer and Treasurer

Heidemarie Gregoriev

Secretary

Frank Burgess

Senior Vice President

Jay Sekelsky

Vice President

Kay Frank

Vice President

Rita Bauer

Vice President

Ray DiBernardo

Vice President

Deborah Pines

Vice President

Richard C. Sarhaddi

Assiastant Secretary

Investment Manager

Madison Asset Management, LLC.

550 Science Drive

Madison, WI 53711

Investment Advisor

Claymore Advisors, LLC.

2455 Corporate West Drive

Lisle, IL 60532

Administrator

Claymore Advisors, LLC.

2455 Corporate West Drive

Lisle, IL 60532

Custodian and Transfer Agent

The Bank of New York

New York, New York

Legal Counsel

Skadden, Arps, Slate, Meagher &

Flom LLP

Chicago, Illinois

Independent Registered Public Accounting Firm

Ernst & Young LLP

Chicago, Illinois

Privacy Principles of Madison/Claymore Covered Call Fund for Shareholders

The Fund is committed to maintaining the privacy of shareholders and to safeguarding its non-public information. The following information is provided to help you understand what personal information the Fund collects, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, the Fund does not receive any nonpublic personal information relating to its shareholders, although certain nonpublic personal information of its shareholders may become available to the Fund. The Fund does not disclose any nonpublic personal information about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator).

The Fund restricts access to nonpublic personal information about the shareholders to Claymore Advisors, LLC employees with a legitimate business need for the information. The Fund maintains physical, electronic and procedural safeguards designed to protect the nonpublic personal information of its shareholders.

Question concerning your shares of Madison/Claymore Covered Call Fund?

| | • | | If your shares are held in a Brokerage Account, contact your Broker |

| | • | | If you have physical possession of your shares in certificate form, contact the Fund’s Custodian and Transfer Agent: |

The Bank of New York, 101 Barclay Street, New York, New York 10286 1-800-701-8178

This report is sent to shareholders of Madison/Claymore Covered Call Fund for their information. It is not a Prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report

A description of the Fund’s proxy voting policies and procedures related to portfolio securities is available without charge, upon request, by calling the Fund at 1-800-345-7999 or on the U.S. Securities and Exchange Commission’s website at http://www.sec.gov

Information regarding how the Fund voted proxies for portfolio securities, if applicable, during the most recent 12-month period ended June 30, will be available beginning in August 2005 without charge and upon request by calling the Fund at (800) 345-7999 or by accessing the Fund’s Form N-PX on the Commission’s website at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC website at http://www. sec. gov. The Fund’s Form N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

| | |

| | | Annual Report | December 31, 2004 | 17 |

Item 2. Code of Ethics.

(a) The registrant has adopted a code of ethics (the “Code of Ethics”) that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

(b) No information need be disclosed pursuant to this paragraph.

(c) A provision regarding the procedures for reporting violations under the Code of Ethics was amended during the period covered by the shareholder report presented in Item 1.

(d) The registrant has not granted a waiver or an implicit waiver from a provision of its Code of Ethics during the period covered by the report.

(e) Not applicable.

(f) (1) The registrant’s Code of Ethics is attached hereto as an exhibit.

(2) Not applicable.

(3) Not applicable.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that it has at least one audit committee financial expert serving on its audit committee, Ronald E. Toupin, Jr. Mr. Toupin is an “independent” Trustee. Mr. Toupin qualifies as an audit committee financial expert by virtue of his experience obtained as a portfolio manager and research analyst, which included review and analysis of offering documents and audited and un-audited financial statements using GAAP to show accounting estimates, accruals and reserves.

(Under applicable securities laws, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.)

Item 4. Principal Accountant Fees and Services.

a). Audit Fees: the aggregate fees billed for the fiscal year 2004, for professional services rendered by the principal accountant for the audit were $37,500. The aggregate fees billed for fiscal year 2003 for professional services rendered by the principal accountant were $0 as this fund was not in existence in 2003.

(b). Audit-Related Fees: the aggregate fees billed for the fiscal year 2004, for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item is $0.

The Audit-Related Fees for 2003 were $0 as this fund was not in existence in 2003.

(c). Tax Fees, the aggregate fees billed for the fiscal year 2004, for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $2,000. The Tax Fees for 2003 were $0 as this fund was not in existence in 2003.

(d). All Other Fees, the aggregate fees billed for the fiscal year 2004, for products and services provided by the principal accountant, other than the services reported in paragraphs (a) and (c) of this Item were $0. The Other Audit Fees for 2003 were $0 as this fund was not in existence in 2003.

(e) Audit Committee Pre-Approval Policies and Procedures.

(i) The registrant’s audit committee reviews, and in its sole discretion, pre-approves, pursuant to written pre-approval procedures (A) all engagements for audit and non-audit services to be provided by the principal accountant to the registrant and (B) all engagements for non-audit services to be provided by the principal accountant (1) to the registrant’s investment adviser (not including a sub-adviser whose role is primarily portfolio management and is sub-contracted or overseen by another investment adviser) and (2) to any entity controlling, controlled by or under common control with the registrant’s investment adviser that provides ongoing services to the registrant; but in the case of the services described in subsection (B)(1) or (2), only if the engagement relates directly to the operations and financial reporting of the registrant; provided that such pre-approval need not be obtained in circumstances in which the pre-approval requirement is waived under rules promulgated by the Securities and Exchange Commission or New York Stock Exchange listing standards. The pre-approval policies are attached as an exhibit hereto. The policies provide for both “general pre-approval” and “specific pre-approval” as defined therein. During the fiscal period ended December 31, 2004, the registrant utilized only the specific pre-approval method.

(ii) 100% of services described in each of Items 4(b) through (d) were approved by the audit committee pursuant to paragraph (c)(7)(A) of Rule 2-01 of Regulation S-X.

(f) The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year attributable to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant (not including a sub-adviser whose role is primarily portfolio management and is sub-contracted or overseen by another investment adviser) that directly related to the operations and financial reporting of the registrant for the period from July 28, 2004 to December 31, 2004 were $2,000.

(h) Not Applicable

Item 5. Audit Committee of Listed Registrants.

The registrant has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The audit committee of the registrant is comprised of: Randall C. Barnes, Philip E. Blake, James R. Imhoff, Jr., Ronald A. Nyberg, Ronald E. Toupin, Jr. and Lorence D. Wheeler.

(b) Not Applicable.

Item 6. Schedule of Investments.

The Schedule of Investments is included as part of Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The registrant has delegated the voting of proxies relating to its voting securities to its Investment Manager, Madison Asset Management, LLC (the “Investment Manager”). The Investment Manager’s Proxy Voting Policies and Procedures are included as an exhibit hereto.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not Applicable at this reporting period

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

None.

Item 10. Submission of Matters to a Vote of Security Holders.

During the period covered by this report, the registrant adopted written procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported in a timely manner.