UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-21582

(Investment Company Act File Number)

XAI Madison Equity Premium Income Fund

(Exact Name of Registrant as Specified in Charter)

321 North Clark Street, Suite 2430

Chicago, IL 60654

(Address of Principal Executive Offices)

Benjamin D. McCulloch, Esq.

XA Investments LLC

321 North Clark Street, Suite 2430

Chicago, IL 60654

(Name and Address of Agent for Service)

(312) 374-6930

(Registrant’s Telephone Number)

Date of Fiscal Year End: December 31

Date of Reporting Period: December 31, 2024

| Item 1. | Reports to Stockholders. |

(a)

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Shareholder Letter

Dear Shareholder:

We thank you for your investment in the XAI Madison Equity Premium Income Fund (formerly the Madison Covered Call & Equity Strategy Fund) (the “Fund”). This report covers the fiscal year ended December 31, 2024 (the “Period”).

On December 2, 2024, the Fund appointed XA Investments LLC as its investment adviser, and it also retained Madison Asset Management, LLC as its sub-adviser. This transition has not impacted the Fund’s portfolio management team, ensuring consistency in the Fund’s investment approach. Additionally, the Fund changed its corporate name from Madison Covered Call & Equity Strategy to the XAI Madison Equity Premium Income Fund.

During the Period, the Fund declared quarterly distributions totaling an aggregated $0.72 per common share. The quarterly distribution of $0.18 per common share declared on December 2, 2024, represented an annualized distribution rate of 10.73% based on the Fund’s closing market price of $6.71 per common share on December 31, 2024.

As we navigate the dynamic market environment, we remain committed to our 20-year track record of delivering lower volatility and strong cash flows for our shareholders. The partnership with XA Investments and the continued expertise of Madison Asset Management position the Fund well to pursue attractive investment opportunities in the coming year.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.xainvestments.com/MCN.

Sincerely,

Kimberly Flynn

President

XA Investments LLC

February 15, 2025

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Management‘s Discussion of Fund Performance

Covered Call strategies, by their nature, are defensive. They are structured to knowingly sacrifice a portion of upside growth potential to provide additional downside protection. The XAI Madison Equity Premium Income Fund (the “Fund”) pursues these strategies by owning a very high-quality portfolio of individual equities and selling equity call options on the portfolio holdings. The Fund provides a total return platform which seeks capital appreciation and a high distribution rate which is primarily sourced from selling call options and realizing capital gains on the underlying portfolio. It is a relatively concentrated, actively managed portfolio providing a defensive way to participate in U.S. equity markets.

Does This Party Ever End?

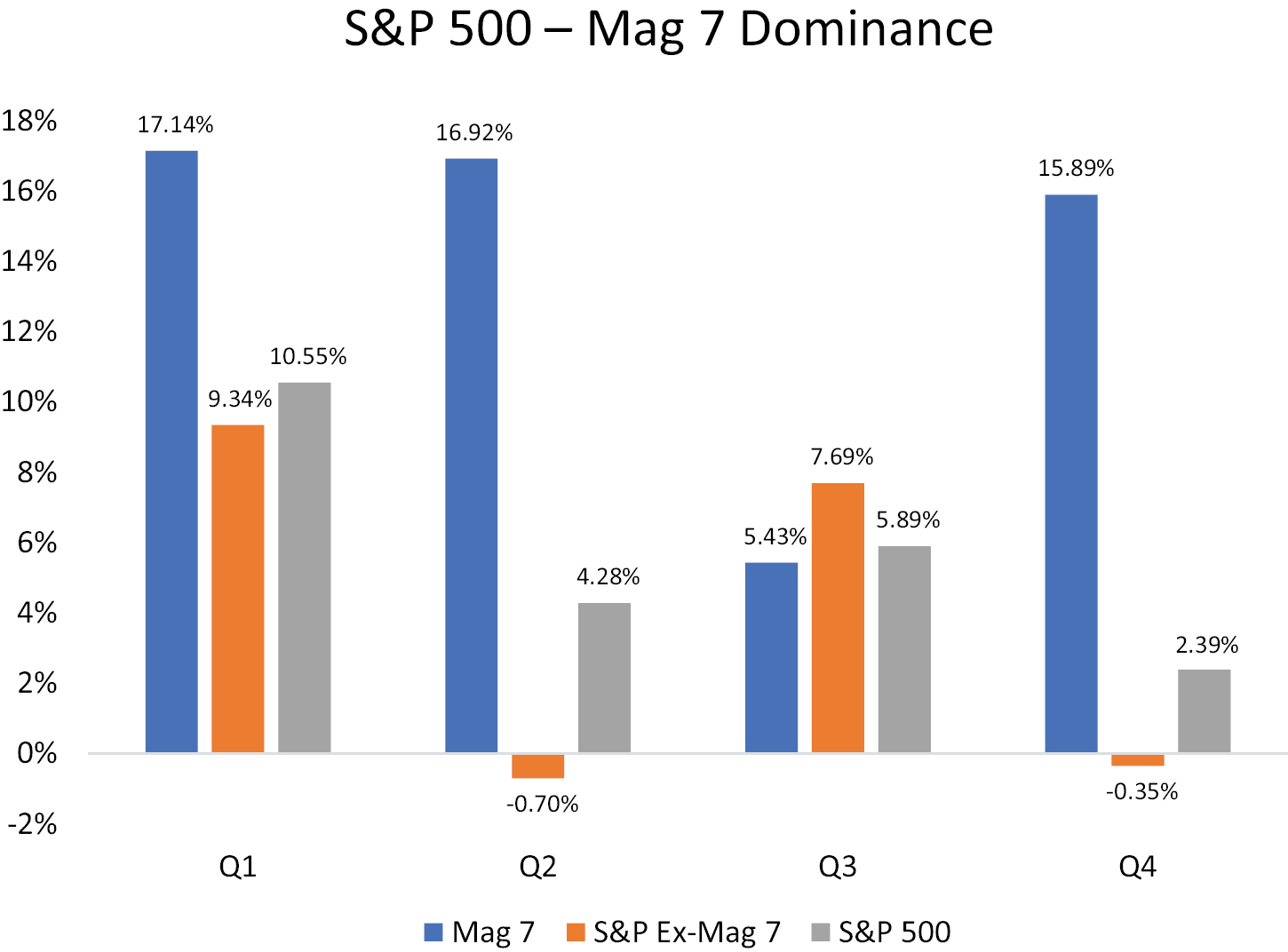

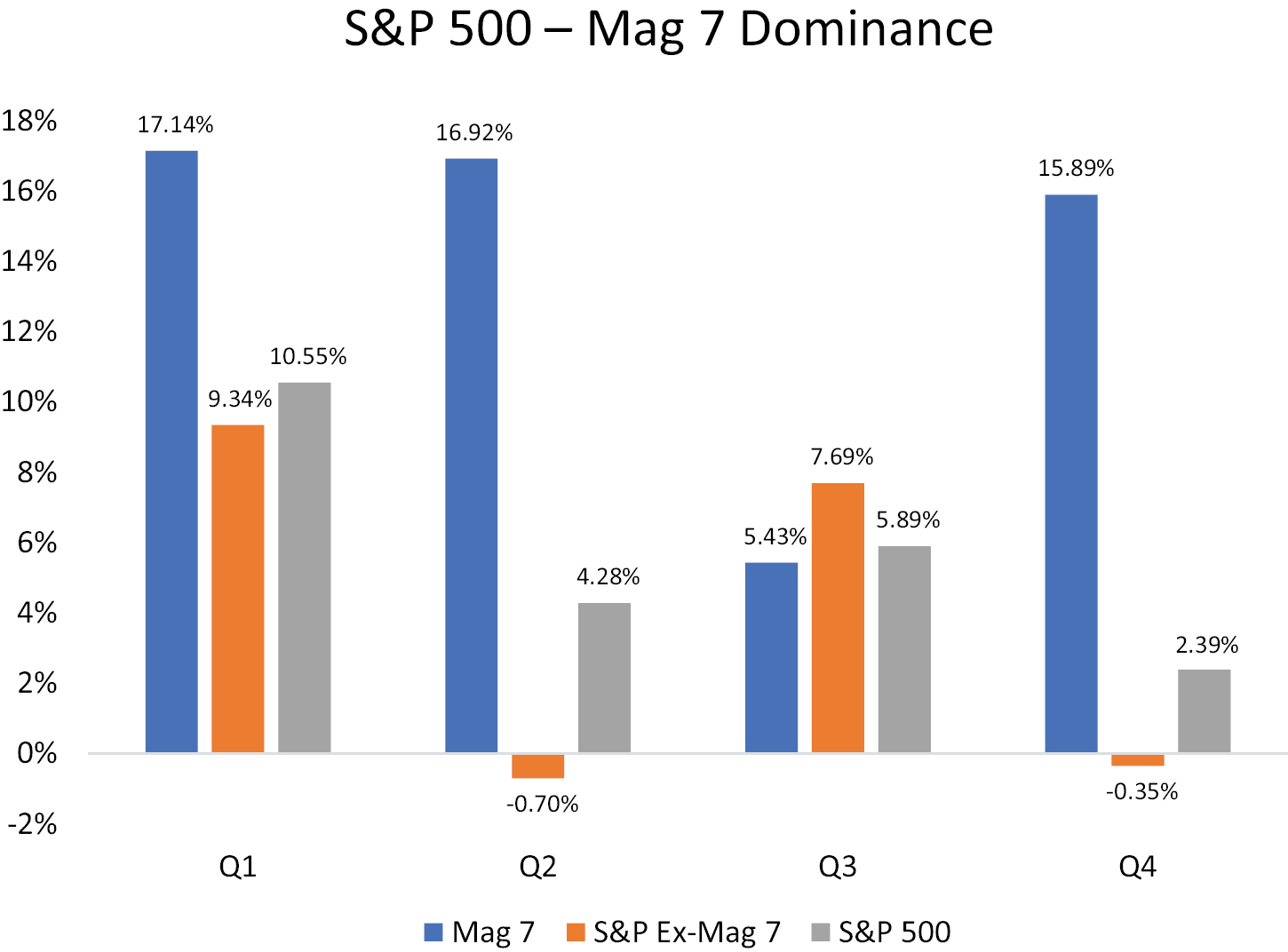

In the post-Covid era, ultra-loose monetary and fiscal policies have contributed to one helluva party in equity markets. Even when interest rates began rising on inflation fears in 2022, the party paused for a short time only to find resurgence in the name of “Artificial Intelligence”. AI has been the driver of the party since late 2022 but only a handful of participants are getting the most out of the celebration. The so called “Magnificent 7”, the 7 seven largest stocks by market capitalization in the S&P 500, dominated performance throughout 2024 at an unprecedented scale. At year end, these 7 behemoths alone represented 33.4% of the total S&P 500. Led by “AI” chip manufacturer Nvidia, this small group of companies were the primary drivers of the overall market’s return. During some periods, specifically in the 2nd and 4th quarters of the year, the remaining stocks within the index had negative returns while the “Mag 7” skyrocketed as noted in the chart below.

Source: Madison Investments

MCN | XAI Madison Equity Premium Income Fund | Management’s Discussion of Fund Performance - continued | December 31, 2024

The Mag 7 stocks rose more than 67% in 2024, allowing the S&P 500 to post a 25% return, its 2nd consecutive year of 20%+ gains, a feat not accomplished since the Dotcom Bubble in 1997/98. Back then, the market was growing progressively more concentrated in large technology and telecom stocks and was getting increasingly expensive from a price to earnings ratio perspective. The market’s exuberance continued through 1999 before collapsing in early 2000, leading to a significant bear market which ended in early 2003 after the market lost almost 50% of its value. The chart below shows the market’s forward P/E ratio going back to 1990. The market’s current valuation has only been exceeded in 2 periods, the dotcom bubble and briefly during Covid when earnings shrank dramatically as the global economy shut down. The market is currently more expensive than at the end of 2021, a year that ended in a similarly concentrated Mag 7 rally. That was followed in 2022 by a meaningful contraction in P/E multiples and a 20%+ market decline even though company and economic fundamentals remained fairly strong.

Source: Madison Investments

So, does the party continue for a while longer as it did in the late 1990’s or does a multiple contraction occur sooner as in 2022? In either case, it is clear that markets do not remain this expensive for a long period of time and the subsequent valuation contractions can be very significant. While our strategy is defensive in its nature, we have been very concerned about the market’s high valuation levels for some time now and, as such, we have missed much of the upside that came from the Mag 7 moonshot. While frustrating that we did not participate as much as hoped, we remain true to our objective of providing a solid income stream and downside protection in times of market stress.

How did the Fund perform given the marketplace conditions during 2024?

While “Big Tech” and “AI” were throwing the party, much of the rest of the market proved to be wallflowers. So, in terms of keeping up, one had to be aggressively focused on a narrow and increasingly concentrated group of companies. Given the defensive nature of the Fund’s strategy and concerns about high valuations within the Technology sector, the Fund was not positioned to fully participate in the “AI” boom of 2024. While it is normal for a covered call strategy to lag in a strongly upward trending market, the highly concentrated nature of the market’s rise

MCN | XAI Madison Equity Premium Income Fund | Management’s Discussion of Fund Performance - continued | December 31, 2024

resulted in a more pronounced gap between the overall market and Fund returns. Other than a relatively small decline in April due to a lack of Federal Reserve action and a further minor correction in July due to Yen carry trade concerns, there was little opportunity for the Fund to gain ground versus the market index. While the Fund’s defensive posture did result in protection during those few market hiccups, the upward surges during the rest of the period proved difficult to overcome. Over the full year, the S&P 500 rose 25% while the CBOE S&P 500 Buy-Write Index (BXM) rose 20.1%. In comparison, the Fund NAV gained 3.7% and on a stock price basis, the Fund declined 1.5%.

The Fund has consistently maintained a very defensive position for much of the year, primarily due to market valuation concerns and our expectations that interest rates would remain higher for longer. Although we believe that both assessments were ultimately correct, the short-term animal spirits of the market continued to drive prices higher. The most significant divergence between the Fund and market returns occurred during the 1st quarter of the year during which the market surged almost 11% on rate-cut expectations that did not ultimately occur until much later in the year and on a much smaller scale than expected. The Fund also lagged during the 2nd and 4th quarters as those periods were completely dominated by the performance of the “Mag 7” mega-caps. Ultimately, not having significant exposure to the “Mag 7” and the sectors in which they dominate, was the major contributing factor in the Fund’s inability to more fully participate.

Over the full year, the Fund’s cash allocation and call option coverage detracted from relative returns as would be expected in a strong upward trending market. Option coverage remained consistently elevated throughout the year as we anticipated greater volatility and negative market sentiment than what ultimately occurred. Cash levels remained higher than normal as rising markets led to significant option assignment activity. While the Fund reinvested cash opportunistically, it became more challenging to find companies that met our valuation criteria. We anticipate more aggressively reinvesting as opportunities arise, particularly as we expect the impact of past monetary and fiscal tightening to negatively impact the economy moving forward. We also believe that at current extreme market valuation, there is greater downside risk versus further upward momentum.

The Fund came into the year with a tilt toward defensive sectors and less exposure to the higher flying and expensive Technology and Communication Services sectors. This gave the Fund a decidedly value oriented tilt which was not favorable given the robust move in growth stocks. We expect that as the economy weakens, the Fund’s value posture will help defend in a potentially weaker market environment. We are, however, prepared to move to a more balanced approach once the market environment allows. As noted, the Fund focused on defending during the year and, as such, stock selection was negatively impacted by this positioning. With “Mag7” stocks rising over 67% during the year, overall stock selection within the Fund was as much driven by what was not owned rather than what was owned. “Mag 7” stocks also dominate the market’s sector exposure with Apple, Microsoft and Nvidia making up 60% of the Technology sector, Amazon and Tesla representing 57% of the Consumer Discretionary sector and Google and Meta representing 70% of the Communication Services sector. Many individual companies that lagged market performance were housed within traditionally defensive areas such as Consumer Staples, Health Care and Utilities.

Describe the Fund’s portfolio equity and option structure:

As of December 31, 2024, the Fund held 45 equity securities and unexpired covered call options had been written against 87.7% of the Fund’s stock holdings. It is the strategy of the Fund to write “out-of-the-money” call options, and, as of December 31, 93% of the Fund’s call options (43 of 46 different options) remained “out-of-the-money”. (Out-of-the-money means the stock price is below the strike price at which the shares could be called away by the option holder.) On average, the call options in the Fund were 9.7% out-the-money at year end with an average time to expiration of 50.4 days.

MCN | XAI Madison Equity Premium Income Fund | Management’s Discussion of Fund Performance - continued | December 31, 2024

Which sectors are prevalent in the Fund?

From a sector perspective, the Fund’s largest exposure as of December 31, 2024 was to the Information Technology sector, followed by Health Care, Consumer Staples, Consumer Discretionary, Energy, Financials and Industrials. The most significant divergences from the sector weightings of the S&P 500 were over-weightings in the Energy, Consumer Staples and Health Care sectors and under-weightings in the Information Technology, Financials and Communication Services sectors.

Discuss the Fund’s security and option selection process:

The Fund is managed by primarily focusing on active stock selection before adding the call option overlay utilizing individual equity call options rather than index options. We use fundamental analysis to select solid companies with good growth prospects and attractive valuations. We then seek attractive call options to write on those stocks. It is our belief that this partnership of active management of the equity and option strategies provides investors with an innovative, risk-moderated approach to equity investing. The Fund’s portfolio managers seek to invest in a portfolio of common stocks that have favorable “PEG” ratios (Price-Earnings ratio to Growth rate) as well as financial strength and industry leadership. As bottom-up investors, we focus on the fundamental businesses of our companies. Our stock selection philosophy strays away from the “beat the street” mentality, as we seek companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management teams. By concentrating on long-term prospects and circumventing the “instant gratification” school of thought, we believe we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for the Fund, we employ our call writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price, so that the Fund can participate in some stock appreciation. By receiving option premiums, the Fund receives a high level of investment income and adds an element of downside protection. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

Discuss how risk is managed through the Fund’s investment process:

Risk management is a critical component of the investment manager’s overall philosophy and investment process. The primary means for managing risk are as follows:

1. Focus on the underlying security. The manager’s bottom-up stock selection process is geared toward investing in companies with very strong fundamentals including market leadership, balance sheet strength, attractive growth prospects, sustainable competitive advantages, predictable cash flows, and high-quality management teams. Purchasing such companies at attractive valuations is vital to providing an added margin of safety and the manager’s “growth-at-a-reasonable-price (GARP) philosophy is specifically tuned to such valuation discipline.

2. Active covered call writing. The manager actively sells (writes) individual equity call options on equities that are owned by the Fund. The specific characteristics of the call options (strike price, expiration, degree of coverage) are dependent on the manager’s outlook on the underlying equity and/or general market conditions. If equity prices appear over-valued due to individual company strength or surging markets, the manager may choose to become more defensive with the Fund’s option strategy by selling call options that are closer to the current equity market price, generating larger option premiums which would help defend against a market reversal. The manager may also sell call options on a greater percentage of the portfolio to provide for more downside protection. Following a

MCN | XAI Madison Equity Premium Income Fund | Management’s Discussion of Fund Performance - continued | December 31, 2024

market downturn, the manager may sell options further out of the money to allow the Fund to benefit from a market recovery. In such an environment, the manager may also determine that a lesser percentage of the portfolio be covered by call options to more fully participate in market upside.

3. Cash management and timing. Generally, the manager believes that the Fund should be fully invested under normal market conditions. A covered call strategy is rather unique relative to most equity portfolios as the short-term nature of call options can lead to the assignment or sale of underlying stock positions on a regular basis. As a result, the Fund’s cash levels are likely to frequently fluctuate based on the characteristics of the call options and the market conditions. The thoughtful reinvestment of cash levels adds a layer of risk management to the investment process. This is most evident following a strong surge in equity prices above the strike prices of call options written against individual stocks in the Fund (call options move in-the-money). This could lead to a larger than normal wave of stock sales via call option assignment which would increase the Fund’s cash position following a period of very strong stock performance. Given the manager’s disciplined focus on purchasing underlying securities at appropriate valuation levels, the immediate reinvestment of cash may be delayed until market conditions and valuations become more attractive. If market conditions continue to surge for a period of time, the Fund may underperform due to higher-than-normal cash levels, however, it is the manager’s belief that maintaining a strong valuation discipline will provide greater downside protection over a full market cycle.

What is management’s outlook for the market and the Fund in 2025?

Clearly, the market is extremely concentrated, near peak historic valuations and monetary/fiscal stimuli are very unlikely to be as ultra-loose as they have been in recent years. The best-case scenario is that the “AI” fever keeps the largest stocks in the market moving higher despite their lofty valuations. This would look a lot like the 1999 extension of the dotcom bubble. As investor complacency builds even beyond current levels, the market’s upward trend will ultimately become unsustainable. “AI” is an amazing technological advancement that could significantly enhance economic and human achievement. However, at present, the benefits are rather benign. The true potential of “AI” will take many years or decades to potentially bear real fruit. In the meantime, Nvidia sells many chips which are purchased by Google, Meta, Microsoft, Amazon, etc. who are committing hundreds of billions of dollars in capital expenditures for data centers and computing power. Ultimately, these companies will have to achieve a return on these huge investments. Whether that happens is uncertain today. It is distinctly possible that the hot early investment stage of this new technology will cool off until real economic gains can be discerned. In other words, the “AI” boom could pause just like the internet boom paused in 2000. Without “AI” as the over-riding driver of market gains and with less monetary/fiscal stimulus, the perfection that is currently priced into market levels could be rather dangerous.

Although we are certainly frustrated and disappointed that the Fund positioning has not been conducive to capturing more of the market’s upside, we are also steadfast in our focus on being defensively postured in what we believe to be an unsustainable market environment. Covered call writing, after all, is a defensive equity strategy and we will remain consistent to that mandate.

MCN | XAI Madison Equity Premium Income Fund | Management’s Discussion of Fund Performance - concluded | December 31, 2024

ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 12/31/24 |

Communication Services | 4.3% |

Consumer Discretionary | 11.0% |

Consumer Staples | 11.5% |

Energy | 10.6% |

Financials | 7.8% |

Health Care | 15.7% |

Industrials | 6.1% |

Information Technology | 17.7% |

Materials | 2.7% |

Real Estate Investment Trusts (REITs) | 2.5% |

Short Term Investments | 7.4% |

Utilities | 2.7% |

TOP TEN EQUITY HOLDINGS AS OF 12/31/24 |

% of Total Investments |

Las Vegas Sands Corp. | 4.5% |

PayPal Holdings, Inc. | 3.1% |

Medtronic PLC | 3.0% |

Transocean Ltd. | 3.0% |

ConocoPhillips | 2.8% |

AES Corp. | 2.7% |

Barrick Gold Corp. | 2.7% |

Hershey Co. | 2.7% |

Nordstrom, Inc. | 2.7% |

Accenture PLC | 2.6% |

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

| | Shares | | Value (Note 2) |

COMMON STOCKS - 94.0% | | | | | |

Communication Services - 4.4% | | | | | |

Alphabet, Inc., Class C(A) | | 18,500 | | $ | 3,523,140 |

Comcast Corp., Class A(A) | | 51,500 | | | 1,932,795 |

Lumen Technologies, Inc.* | | 124,000 | | | 658,440 |

| | | | | | 6,114,375 |

Consumer Discretionary - 11.2% | | | | | |

Las Vegas Sands Corp.(A) | | 123,900 | | | 6,363,504 |

Lowe’s Cos., Inc.(A) | | 8,700 | | | 2,147,160 |

Nordstrom, Inc.(A) | | 156,000 | | | 3,767,400 |

Ross Stores, Inc.(A) | | 21,500 | | | 3,252,305 |

| | | | | | 15,530,369 |

Consumer Staples - 11.6% | | | | | |

Archer-Daniels-Midland Co. | | 55,500 | | | 2,803,860 |

Constellation Brands, Inc., Class A(A) | | 13,000 | | | 2,873,000 |

Dollar Tree, Inc.* (A) | | 42,500 | | | 3,184,950 |

Hershey Co.(A) | | 22,000 | | | 3,725,700 |

PepsiCo, Inc.(A) | | 23,400 | | | 3,558,204 |

| | | | | | 16,145,714 |

Energy - 10.8% | | | | | |

APA Corp.(A) | | 133,700 | | | 3,087,133 |

ConocoPhillips(A) | | 40,000 | | | 3,966,800 |

Matador Resources Co.(A) | | 65,000 | | | 3,656,900 |

Transocean Ltd.* (B) | | 1,140,000 | | | 4,275,000 |

| | | | | | 14,985,833 |

Financials - 7.9% | | | | | |

Charles Schwab Corp.(A) | | 29,000 | | | 2,146,290 |

CME Group, Inc.(A) | | 10,000 | | | 2,322,300 |

PayPal Holdings, Inc. * (A) | | 51,300 | | | 4,378,455 |

Visa, Inc., Class A(A) | | 7,000 | | | 2,212,280 |

| | | | | | 11,059,325 |

Health Care - 16.0% | | | | | |

Abbott Laboratories(A) | | 27,000 | | | 3,053,970 |

Agilent Technologies, Inc.(A) | | 25,000 | | | 3,358,500 |

CVS Health Corp.(A) | | 48,500 | | | 2,177,165 |

Danaher Corp.(A) | | 13,000 | | | 2,984,150 |

Johnson & Johnson(A) | | 14,000 | | | 2,024,680 |

Labcorp Holdings, Inc.(A) | | 9,500 | | | 2,178,540 |

Medtronic PLC(A) | | 53,300 | | | 4,257,604 |

Pfizer, Inc.(A) | | 74,000 | | | 1,963,220 |

Solventum Corp.* | | 3,125 | | | 206,438 |

| | | | | | 22,204,267 |

Industrials - 6.2% | | | | | |

Automatic Data Processing, Inc.(A) | | 8,000 | | | 2,341,840 |

Honeywell International, Inc.(A) | | 9,500 | | | 2,145,955 |

Rockwell Automation, Inc.(A) | | 7,500 | | | 2,143,425 |

United Parcel Service, Inc., Class B | | 15,800 | | | 1,992,380 |

| | | | | | 8,623,600 |

| | Shares | | Value (Note 2) |

Information Technology - 17.9% | | | | | | |

Accenture PLC, Class A(A) | | 10,500 | | $ | 3,693,795 | |

Adobe, Inc.* (A) | | 8,300 | | | 3,690,844 | |

Advanced Micro Devices, Inc.* (A) | | 18,000 | | | 2,174,220 | |

ASML Holding NV(A) | | 4,100 | | | 2,841,628 | |

Hewlett Packard Enterprise Co. | | 100,000 | | | 2,135,000 | |

Microchip Technology, Inc.(A) | | 49,500 | | | 2,838,825 | |

Microsoft Corp.(A) | | 6,000 | | | 2,529,000 | |

MKS Instruments, Inc.(A) | | 21,000 | | | 2,192,190 | |

Texas Instruments, Inc.(A) | | 15,100 | | | 2,831,401 | |

| | | | | | 24,926,903 | |

Materials - 2.7% | | | | | | |

Barrick Gold Corp.(A) | | 244,500 | | | 3,789,750 | |

Real Estate Investment Trusts (REITs) - 2.5% | | | | | | |

American Tower Corp., REIT(A) | | 19,000 | | | 3,484,790 | |

Utilities – 2.8% | | | | | | |

AES Corp. | | 299,000 | | | 3,848,130 | |

Total Common Stocks (Cost $156,644,130) | | | | | 130,713,056 | |

SHORT-TERM INVESTMENTS - 7.5% | | | | |

State Street Institutional U.S. Government Money Market Fund, Premier Class(C), 4.43% | | 10,483,487 | | | 10,483,487 | |

Total Short-Term Investments (Cost $10,483,487) | | | 10,483,487 | |

TOTAL INVESTMENTS - 101.5% (Cost $167,127,617) | | | | | 141,196,543 | |

TOTAL CALL OPTIONS WRITTEN - (1.5%) | | | (2,044,024 | ) |

NET OTHER ASSETS AND LIABILITIES - (0.0%) | | | (34,743 | ) |

TOTAL NET ASSETS - 100.0% | | | | $ | 139,117,776 | |

* | | Non-income producing. |

(A) | | All or a portion of these securities’ positions, with a value of $114,793,808, represent covers (directly or through conversion rights) for outstanding options written. |

(B) | | All or a portion of these securities, with an aggregate fair value of $2,701,128, are on loan as part of a securities lending program. See Note 4 for details on the securities lending program. |

| | |

| | |

REIT | | Real Estate Investment Trust. |

See accompanying Notes to Financial Statements.

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Schedule of Written Options

Description | | Exercise

Price | | Expiration

Date | | Number

of

Contracts | | Notional

Amount | | Market

Value | | Premiums

Paid

(Received) | | Unrealized

Appreciation

(Depreciation) |

Call Options Written | | | | | | | | | | | | | | | | | | | | | | | | |

Abbott Laboratories | | $ | 115.00 | | 2/21/25 | | (270 | ) | | $ | (3,105,000 | ) | | $ | (73,845 | ) | | $ | (92,872 | ) | | $ | 19,027 | |

Accenture PLC, Class A | | | 370.00 | | 2/21/25 | | (105 | ) | | | (3,885,000 | ) | | | (41,475 | ) | | | (91,376 | ) | | | 49,901 | |

Adobe, Inc. | | | 525.00 | | 1/17/25 | | (58 | ) | | | (3,045,000 | ) | | | (2,117 | ) | | | (127,328 | ) | | | 125,211 | |

Adobe, Inc. | | | 470.00 | | 2/21/25 | | (25 | ) | | | (1,175,000 | ) | | | (20,250 | ) | | | (22,474 | ) | | | 2,224 | |

Advanced Micro Devices, Inc. | | | 140.00 | | 2/21/25 | | (180 | ) | | | (2,520,000 | ) | | | (54,450 | ) | | | (91,438 | ) | | | 36,988 | |

Agilent Technologies, Inc. | | | 145.00 | | 1/17/25 | | (70 | ) | | | (1,015,000 | ) | | | — | | | | (20,947 | ) | | | 20,947 | |

Agilent Technologies, Inc. | | | 145.00 | | 3/21/25 | | (180 | ) | | | (2,610,000 | ) | | | (54,900 | ) | | | (62,847 | ) | | | 7,947 | |

Alphabet, Inc., Class C | | | 185.00 | | 1/17/25 | | (185 | ) | | | (3,422,500 | ) | | | (156,325 | ) | | | (59,008 | ) | | | (97,317 | ) |

American Tower Corp., REIT | | | 240.00 | | 1/17/25 | | (130 | ) | | | (3,120,000 | ) | | | — | | | | (62,265 | ) | | | 62,265 | |

American Tower Corp., REIT | | | 190.00 | | 2/21/25 | | (60 | ) | | | (1,140,000 | ) | | | (23,400 | ) | | | (20,560 | ) | | | (2,840 | ) |

APA Corp. | | | 25.00 | | 2/21/25 | | (660 | ) | | | (1,650,000 | ) | | | (45,540 | ) | | | (34,966 | ) | | | (10,574 | ) |

ASML Holding NV | | | 730.00 | | 1/17/25 | | (41 | ) | | | (2,993,000 | ) | | | (26,035 | ) | | | (78,706 | ) | | | 52,671 | |

Automatic Data Processing, Inc. | | | 290.00 | | 1/17/25 | | (80 | ) | | | (2,320,000 | ) | | | (45,600 | ) | | | (49,214 | ) | | | 3,614 | |

Barrick Gold Corp. | | | 23.00 | | 1/17/25 | | (1,225 | ) | | | (2,817,500 | ) | | | — | | | | (93,516 | ) | | | 93,516 | |

Charles Schwab Corp. | | | 80.00 | | 3/21/25 | | (290 | ) | | | (2,320,000 | ) | | | (44,225 | ) | | | (50,903 | ) | | | 6,678 | |

CME Group, Inc. | | | 240.00 | | 3/21/25 | | (100 | ) | | | (2,400,000 | ) | | | (53,500 | ) | | | (54,397 | ) | | | 897 | |

Comcast Corp., Class A | | | 45.00 | | 1/17/25 | | (515 | ) | | | (2,317,500 | ) | | | (1,030 | ) | | | (41,348 | ) | | | 40,318 | |

ConocoPhillips | | | 120.00 | | 1/17/25 | | (400 | ) | | | (4,800,000 | ) | | | (4,400 | ) | | | (85,463 | ) | | | 81,063 | |

Constellation Brands, Inc., Class A | | | 250.00 | | 1/17/25 | | (130 | ) | | | (3,250,000 | ) | | | (1,625 | ) | | | (72,964 | ) | | | 71,339 | |

CVS Health Corp. | | | 50.00 | | 2/21/25 | | (485 | ) | | | (2,425,000 | ) | | | (62,080 | ) | | | (73,059 | ) | | | 10,979 | |

Danaher Corp. | | | 240.00 | | 3/21/25 | | (130 | ) | | | (3,120,000 | ) | | | (87,750 | ) | | | (91,665 | ) | | | 3,915 | |

Dollar Tree, Inc. | | | 85.00 | | 3/21/25 | | (425 | ) | | | (3,612,500 | ) | | | (153,000 | ) | | | (139,851 | ) | | | (13,149 | ) |

Hershey Co. | | | 180.00 | | 2/21/25 | | (133 | ) | | | (2,394,000 | ) | | | (37,905 | ) | | | (42,423 | ) | | | 4,518 | |

Hewlett Packard Enterprise Co. | | | 23.00 | | 2/21/25 | | (1,000 | ) | | | (2,300,000 | ) | | | (45,000 | ) | | | (43,980 | ) | | | (1,020 | ) |

Honeywell International, Inc. | | | 240.00 | | 3/21/25 | | (95 | ) | | | (2,280,000 | ) | | | (52,725 | ) | | | (67,355 | ) | | | 14,630 | |

Johnson & Johnson | | | 170.00 | | 1/17/25 | | (140 | ) | | | (2,380,000 | ) | | | — | | | | (36,955 | ) | | | 36,955 | |

Labcorp Holdings, Inc. | | | 240.00 | | 2/21/25 | | (95 | ) | | | (2,280,000 | ) | | | (39,900 | ) | | | (39,341 | ) | | | (559 | ) |

Las Vegas Sands Corp. | | | 55.00 | | 2/21/25 | | (620 | ) | | | (3,410,000 | ) | | | (85,250 | ) | | | (99,440 | ) | | | 14,190 | |

Las Vegas Sands Corp. | | | 55.00 | | 3/21/25 | | (619 | ) | | | (3,404,500 | ) | | | (117,301 | ) | | | (100,263 | ) | | | (17,038 | ) |

Lowe’s Cos., Inc. | | | 260.00 | | 3/21/25 | | (87 | ) | | | (2,262,000 | ) | | | (47,850 | ) | | | (61,488 | ) | | | 13,638 | |

Matador Resources Co. | | | 60.00 | | 3/21/25 | | (650 | ) | | | (3,900,000 | ) | | | (121,875 | ) | | | (103,312 | ) | | | (18,563 | ) |

Medtronic PLC | | | 85.00 | | 3/21/25 | | (533 | ) | | | (4,530,500 | ) | | | (63,960 | ) | | | (82,070 | ) | | | 18,110 | |

Microchip Technology, Inc. | | | 65.00 | | 2/21/25 | | (495 | ) | | | (3,217,500 | ) | | | (61,875 | ) | | | (97,023 | ) | | | 35,148 | |

Microsoft Corp. | | | 435.00 | | 2/21/25 | | (60 | ) | | | (2,610,000 | ) | | | (62,100 | ) | | | (75,057 | ) | | | 12,957 | |

MKS Instruments, Inc. | | | 115.00 | | 2/21/25 | | (210 | ) | | | (2,415,000 | ) | | | (68,775 | ) | | | (70,951 | ) | | | 2,176 | |

Nordstrom, Inc. | | | 25.00 | | 1/17/25 | | (1,560 | ) | | | (3,900,000 | ) | | | (3,900 | ) | | | (150,605 | ) | | | 146,705 | |

PayPal Holdings, Inc. | | | 92.50 | | 1/17/25 | | (513 | ) | | | (4,745,250 | ) | | | (15,133 | ) | | | (126,124 | ) | | | 110,991 | |

PepsiCo, Inc. | | | 180.00 | | 1/17/25 | | (66 | ) | | | (1,188,000 | ) | | | — | | | | (24,021 | ) | | | 24,021 | |

PepsiCo, Inc. | | | 160.00 | | 3/21/25 | | (168 | ) | | | (2,688,000 | ) | | | (42,840 | ) | | | (48,925 | ) | | | 6,085 | |

Pfizer, Inc. | | | 29.00 | | 3/21/25 | | (740 | ) | | | (2,146,000 | ) | | | (25,530 | ) | | | (28,105 | ) | | | 2,575 | |

Rockwell Automation, Inc. | | | 310.00 | | 3/21/25 | | (75 | ) | | | (2,325,000 | ) | | | (48,750 | ) | | | (63,175 | ) | | | 14,425 | |

Ross Stores, Inc. | | | 150.00 | | 1/17/25 | | (150 | ) | | | (2,250,000 | ) | | | (54,750 | ) | | | (54,789 | ) | | | 39 | |

Ross Stores, Inc. | | | 160.00 | | 2/21/25 | | (65 | ) | | | (1,040,000 | ) | | | (11,700 | ) | | | (17,032 | ) | | | 5,332 | |

Texas Instruments, Inc. | | | 210.00 | | 1/17/25 | | (80 | ) | | | (1,680,000 | ) | | | (1,160 | ) | | | (49,516 | ) | | | 48,356 | |

Texas Instruments, Inc. | | | 200.00 | | 3/21/25 | | (71 | ) | | | (1,420,000 | ) | | | (38,873 | ) | | | (47,520 | ) | | | 8,647 | |

Visa, Inc. | | | 325.00 | | 2/21/25 | | (70 | ) | | | (2,275,000 | ) | | | (45,325 | ) | | | (43,327 | ) | | | (1,998 | ) |

Total Call Options Written | | | | | | | | | | | $ | (2,044,024 | ) | | $ | (3,089,964 | ) | | $ | 1,045,940 | |

Total Options Written, at Value | | | | | | | | | | | $ | (2,044,024 | ) | | $ | (3,089,964 | ) | | $ | 1,045,940 | |

See accompanying Notes to Financial Statements.

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Statement of Assets and Liabilities as of December 31, 2024

Assets: | | |

Investments in unaffiliated securities, at fair value† | | $ | 141,196,543 | |

Receivables: | | | | |

Dividends and Interest | | | 96,385 | |

Total assets | | | 141,292,928 | |

Liabilities: | | | | |

Payables: | | | | |

Advisory agreement fees (Note 3) | | | 96,593 | |

Administrative services agreement fees (Note 3) | | | 31,393 | |

Trustee fees | | | 3,142 | |

Options written, at value (premium received $3,089,964) | | | 2,044,024 | |

Total liabilities | | | 2,175,152 | |

Net assets | | $ | 139,117,776 | |

| | | | | |

Net assets consist of: | | | | |

Common Stock/Shares: | | | | |

Paid-in capital | | $ | 164,884,828 | |

Accumulated distributable earnings (loss) | | | (25,767,052 | ) |

Net Assets | | $ | 139,117,776 | |

| | | | | |

Capital Shares Issued and Outstanding (Note 9) | | | 21,116,722 | |

Net Asset Value per share | | $ | 6.59 | |

| | | | | |

† Cost of Investments in unaffiliated securities | | $ | 167,127,617 | |

§ Fair Value of securities on loan | | $ | 2,701,128 | |

See accompanying Notes to Financial Statements. |

11 |

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Statement of Operations for the year ended December 31, 2024

Investment Income: | | | | |

Dividends | | | | |

Unaffiliated issuers | | | 4,328,323 | |

Less: Foreign taxes withheld/reclaimed | | | (14,670 | ) |

Income from securities lending | | | 985 | |

Total investment income | | | 4,314,638 | |

Expenses (Note 3): | | | | |

Advisory agreement fees | | | 1,170,897 | |

Administrative services agreement fees | | | 380,541 | |

Trustee fees | | | 37,203 | |

Other expenses | | | 318 | |

Total expenses | | | 1,588,959 | |

Net Investment Income | | | 2,725,679 | |

Net Realized and Unrealized Gain (loss) on Investments | | | | |

Net realized gain (loss) on investments | | | | |

Options purchased | | | (1,512,200 | ) |

Options written | | | 4,542,386 | |

Unaffiliated issuers | | | 5,038,818 | |

Net change in unrealized appreciation (depreciation) on investments | | | | |

Options written | | | 1,930,840 | |

Unaffiliated issuers | | | (7,436,207 | ) |

Net Realized and Unrealized Gain on Investments | | | 2,563,637 | |

Net Increase in Net Assets from Operations | | $ | 5,289,316 | |

See accompanying Notes to Financial Statements. |

12 |

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Statement of Changes in Net Assets

Year Ended December 31, | | 2024 | | 2023 |

Net Assets at beginning of period | | $ | 148,630,589 | | | $ | 148,156,022 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment income | | | 2,725,679 | | | | 2,504,393 | |

Net realized gain | | | 8,069,004 | | | | 7,266,373 | |

Net change in unrealized appreciation (depreciation) | | | (5,505,367 | ) | | | 5,518,091 | |

Net increase in net assets from operations | | | 5,289,316 | | | | 15,288,857 | |

Distributions to shareholders from: | | | | | | | | |

Accumulated earnings (combined net investment income and net realized gains) | | | (10,862,312 | ) | | | (10,100,837 | ) |

Return of capital | | | (4,316,385 | ) | | | (5,042,064 | ) |

Total distributions | | | (15,178,697 | ) | | | (15,142,901 | ) |

Capital Share transactions: | | | | | | | | |

Newly issued to shareholders in reinvestment of distributions | | | 376,568 | | | | 328,611 | |

Increase from capital stock transactions | | | 376,568 | | | | 328,611 | |

Total increase (decrease) in net assets | | | (9,512,813 | ) | | | 474,567 | |

Net Assets at end of period | | $ | 139,117,776 | | | $ | 148,630,589 | |

| | | | | | | | | |

Capital Share transactions: | | | | | | | | |

Newly issued shares reinvested | | | 54,354 | | | | 45,862 | |

Increase from capital share transactions | | | 54,354 | | | | 45,862 | |

See accompanying Notes to Financial Statements. |

13 |

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Financial Highlights for a Common Share Outstanding

| | Year Ended December 31, |

| | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

Net Asset Value at beginning of period | | $ | 7.06 | | | $ | 7.05 | | | $ | 7.45 | | | $ | 7.09 | | | $ | 7.35 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1 | | | 0.13 | | | | 0.12 | | | | 0.06 | | | | 0.01 | | | | 0.04 | |

Net realized and unrealized gain on investments | | | 0.12 | | | | 0.61 | | | | 0.26 | | | | 1.07 | | | | 0.42 | |

Total from investment operations | | | 0.25 | | | | 0.73 | | | | 0.32 | | | | 1.08 | | | | 0.46 | |

Less Distributions From: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.52 | ) | | | (0.48 | ) | | | (0.65 | ) | | | (0.60 | ) | | | (0.50 | ) |

Capital gains | | | — | | | | — | | | | (0.07 | ) | | | — | | | | — | |

Return of Capital | | | (0.20 | ) | | | (0.24 | ) | | | — | | | | (0.12 | ) | | | (0.22 | ) |

Total distributions | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) | | | (0.72 | ) |

Net increase (decrease) in net asset value | | | (0.47 | ) | | | 0.01 | | | | (0.40 | ) | | | 0.36 | | | | (0.26 | ) |

Net Asset Value at end of period | | $ | 6.59 | | | $ | 7.06 | | | $ | 7.05 | | | $ | 7.45 | | | $ | 7.09 | |

Market Value at end of period | | $ | 6.71 | | | $ | 7.53 | | | $ | 7.75 | | | $ | 8.02 | | | $ | 6.75 | |

Total Return | | | | | | | | | | | | | | | | | | | | |

Net asset value (%)2 | | | 3.58 | | | | 10.68 | | | | 4.90 | | | | 15.36 | | | | 7.72 | |

Market value (%)3 | | | (1.12 | ) | | | 7.38 | | | | 7.12 | | | | 30.44 | | | | 15.22 | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets at end of period (in 000‘s) | | $ | 139,118 | | | $ | 148,631 | | | $ | 148,156 | | | $ | 156,220 | | | $ | 148,475 | |

Ratios of expenses to average net assets (%) | | | 1.09 | | | | 1.08 | | | | 1.08 | | | | 1.08 | | | | 1.07 | |

Ratio of net investment income to average net assets (%) | | | 1.87 | | | | 1.66 | | | | 0.77 | | | | 0.16 | | | | 0.61 | |

Portfolio turnover (%) | | | 124 | | | | 106 | | | | 104 | | | | 178 | | | | 128 | |

See accompanying Notes to Financial Statements. |

14 |

MCN | XAI Madison Equity Premium Income Fund | December 31, 2024

Notes to Financial Statements

1. ORGANIZATION

XAI Madison Equity Premium Income Fund (the “Fund”) is a diversified, closed-end management investment company under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund was organized as a Delaware statutory trust on May 6, 2004, and commenced operations on July 28, 2004. Prior to December 2, 2024, XAI Madison Equity Premium Income Fund was known as Madison Covered Call & Equity Strategy Fund. The Fund’s common shares are listed on the NYSE under the symbol “MCN”.

At a special meeting of shareholders held on October 15, 2024 (the “Special Meeting”), shareholders approved a newly constituted slate of trustees to serve on the Fund’s board of trustees, consisting of one Class I trustee, two Class II trustees and two Class III trustees (the “Trustees” or “Board of Trustees”). The New Agreements were executed on December 2, 2024.

The Fund’s primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund seeks to achieve its investment objectives by investing primarily in large and mid-capitalization common stocks that are, in the view of Madison Asset Management, LLC (“Madison” or the “Sub-Adviser”) selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Use of Estimates – The financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which requires management to make estimates and assumptions that affect the reported amounts and disclosures, including contingent assets and liabilities, in the financial statements during the period reported. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on December 31, 2024.

Expense Recognition – Expenses are recorded on the accrual basis of accounting.

Calculation of Net Asset Value – The calculation of net asset value (“NAV”) per common share of the Fund is determined daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern Time). The Fund’s NAV per common share is calculated by dividing the value of the Fund’s total assets, less its liabilities, by the number of shares outstanding.

Cash – The Fund considers its investment in an FDIC insured interest bearing account to be cash. Cash is valued at cost. The Fund maintains cash balances, which at times may exceed federally insured limits. The Fund maintains these balances with a high quality financial institution.

The Fund monitors this credit risk and has not experienced any losses related to this risk.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Securities Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes.

Portfolio Valuation – Investments are presented at fair value using the following techniques. Securities traded on a national securities exchange are valued at their closing sale price, except for securities traded on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), which are valued at the NASDAQ official closing price (“NOCP”). If no sale occurs, equities traded on a U.S. exchange or on NASDAQ are valued at the bid price. Options are valued at the mean between the best bid and best ask price across all option exchanges. Debt securities are valued on the basis of the last available bid prices or current market quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their NAV. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

The Board of Trustees has designated the Adviser, as the “valuation designee” for the Fund pursuant to Rule 2a-5 under the Investment Company Act. The valuation designee is responsible for making fair value determinations pursuant to Valuation Policies and Procedures adopted by XA Investments LLC (“XAI” or the “Adviser”) and the Fund (the “Valuation Policy”). A committee of voting members comprised of senior personnel of XAI considers various pricing issues and establishes fair valuations of portfolio securities and other instruments held by the Fund in accordance with the Valuation Policy (the “Pricing Committee”). XAI as valuation designee is subject to monitoring and oversight by the Board of Trustees. As a general principle, the fair value of a portfolio instrument is the amount that an owner might reasonably expect to receive upon the instrument’s current sale. A range of factors and analysis may be considered when determining fair value, including relevant market data, interest rates, credit considerations and/or issuer specific news. The Pricing Committee may consult with and receive input from third parties, such as the Sub-Adviser, and will utilize a variety of market data including yields or prices of investments of comparable quality, type of issue, indications of value from security dealers, evaluations of anticipated cash flows or collateral, spread over U.S. Treasury obligations, and other information and analysis. In addition, the Pricing Committee may consider valuations provided by valuation firms retained to assist in the valuation of certain of the Fund’s investments. Fair valuation involves subjective judgments. While the Fund’s use of fair valuation is intended to result in calculation of NAV that fairly reflects values of the Fund’s portfolio securities as of the time of pricing, the Fund cannot guarantee that any fair valuation will, in fact, approximate the amount the Fund would actually realize upon the sale of the securities in question. It is possible that the fair value determined for a portfolio instrument may be materially different from the value that could be realized upon the sale of that instrument.

Covered Call and Put Options: An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has an obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or pay the exercise price upon delivery of the underlying security (in the case of a put).

The number of call options the Fund can write (sell) is limited by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered call options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Options on securities indices are designed to reflect price fluctuations in a group of securities or segment of the securities market rather than price fluctuations in a single security and are similar to options on single securities, except that the exercise of securities index options requires cash settlement payments and does not involve the actual purchase or sale of securities.

When an option is written, a liability is recorded equal to the premium received. This liability for options written is marked-to-market on a daily basis to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options that expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss.

Distributions to Shareholders: The Fund declares and pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These distributions consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains, including premiums received on written options. Distributions may also include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders. The character of the distributions are determined annually in accordance with federal income tax regulations.

Adopted Accounting Standards: In this reporting period, the Fund adopted FASB Accounting Standards Update 2023-07, Segment Reporting (“Topic 280”) – Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which requires a public entity to make enhanced disclosures about significant segment expenses that are regularly provided to the chief operating decision maker (the “CODM”). The Fund’s Adviser acts as the CODM. Adoption of the new standard impacted financial statement disclosures only and did not affect the Fund’s financial position or the results of its operations.

The Fund represents a single operating segment, as the CODM monitors the operating results of the Fund as a whole and the Fund’s long-term strategic asset allocation is pre-determined in accordance with the terms of its prospectus, based on a defined investment strategy which is executed by the Fund’s portfolio managers as a team. The financial information in the form of the Fund’s portfolio composition, total returns, expense ratios and changes in net assets resulting from operations, which are used by the CODM to assess the segment’s performance versus the Fund’s comparative benchmarks and to make resource allocation decisions for the Fund’s single segment, is consistent with that presented within the Fund’s financial statements. Segment assets are reflected on the accompanying Statement of Assets and Liabilities and significant segment expenses are listed on the accompanying Statement of Operations.

Valuation: The Fund has adopted FASB applicable guidance on fair value measurements. Fair value is defined as the price that the fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

• Level 1 - unadjusted quoted prices in active markets for identical investments

• Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

• Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The valuation techniques used by the Fund to measure fair value seek to maximize the use of observable inputs and minimize the use of unobservable inputs.

There were no transfers between classifications levels during the year ended December 31, 2024. As of and during the year ended December 31, 2024, the Fund did not hold securities deemed as a Level 3.

The following is a summary of the inputs used as of December 31, 2024, in valuing the Fund’s investments carried at fair value:

Description | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets:1 | | | | | | | | | | | | | | |

Common Stocks | | $ | 130,713,056 | | | $ | — | | $ | — | | $ | 130,713,056 | |

Short-Term Investments | | | 10,483,487 | | | | — | | | — | | | 10,483,487 | |

| | | $ | 141,196,543 | | | $ | — | | $ | — | | $ | 141,196,543 | |

Liabilities:1 | | | | | | | | | | | | | | |

Options Written | | $ | (2,044,024 | ) | | $ | — | | $ | — | | $ | (2,044,024 | ) |

3. ADVISORY, SUB-ADVISORY, ADMINISTRATIVE SERVICES AND OTHER EXPENSES

XAI serves as the investment adviser to the Fund and is responsible for overseeing the Fund’s overall management and implementation of the investment strategy. The Sub-Adviser serves as the investment sub-adviser of the Fund and is responsible for investing the Fund’s assets. The Fund pays an advisory fee to the Adviser. The Adviser pays to the Sub-Adviser a sub-advisory fee out of the advisory fee received by the Adviser.

At the Fund’s Special Meeting, shareholders approved a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and XAI, pursuant to which XAI serves as the investment adviser to the Fund, and a new investment sub-advisory agreement (the “New Sub-Advisory Agreement” and together with the New Advisory Agreement, the “New Agreements”) among the Fund, XAI and Madison, pursuant to which Madison serves as the sub-adviser to the Fund. The New Agreements were executed on December 2, 2024.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Pursuant to the New Advisory Agreement, the Fund pays the Adviser a fee, payable monthly in arrears, in an annual amount equal to 0.80% of the Fund’s average daily Managed Assets. “Managed Assets” means the total assets of the Fund, including assets attributable to the Fund’s use of leverage and preferred shares, minus the sum of its accrued liabilities (other than liabilities incurred for the purpose of creating leverage). For the year ended December 31, 2024, the Fund paid XAI $96,593 in advisory fees.

Pursuant to the New Sub-Advisory Agreement, the sub-advisory fee, payable monthly in arrears to the Sub-Adviser, is calculated as a specified percentage of the advisory fee payable by the Fund to the Adviser (before giving effect to any fees waived or expenses reimbursed by the Adviser). The specified percentage is equal to either an absolute or blended percentage, as the case may be, computed by applying the following percentages to the aggregate average daily Managed Assets of the advisory fee payable to the Adviser from the Fund:

Fund Average Daily Managed Assets | | Percentage of

Advisory Fee | | Type of Specified

Percentage |

First $175 million | | 55% | | Absolute |

Greater than $175 million and up to $250 million | | 50% | | Blended |

Over $250 million | | 50% | | Absolute |

Prior to December 2, 2024, pursuant to an investment advisory agreement with the Fund, Madison served as the Fund’s investment adviser and received an advisory fee payable monthly, in an amount equal to an annualized rate of 0.80% of the Fund’s average daily Managed Assets. “Managed Assets” means the total assets of the Fund, including assets attributable to the Fund’s use of leverage and preferred shares, minus the sum of its accrued liabilities (other than liabilities incurred for the purpose of creating leverage). For the year ended December 31, 2024, Madison received $1,074,303 and $53,126 in advisory and sub-advisory fees, respectively, for its services to the Fund.

Prior to December 2, 2024, Madison contractually agreed to enter into an operating expense limitation agreement with the Fund (the “Prior OELA”), as approved by the Fund’s Board of Trustees, under which the Adviser agreed to waive its management fees and/or reimburse expenses of the Fund to the extent necessary to limit the Fund’s total operating expenses (excluding taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions, acquired fund fees and expenses, extraordinary expenses such as litigation and other “Excluded Expenses”) to the annual rate, as referenced in the Fund’s 2023 Annual Report to Shareholders. The Prior OELA became effective on December 1, 2023 and remained in place until it was superseded by the New OELA (as defined below).

In connection with the approval by the Board of Trustees of the New Advisory Agreement, the Adviser contractually agreed to enter into an Operating Expense Limitation Agreement with the Fund (the “New OELA”), under which XAI agreed to waive its management fees and/or reimburse expenses of the Fund to the extent necessary to limit the Fund’s total operating expenses (excluding taxes, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage commissions, acquired fund fees and expenses, extraordinary and non-routine expenses such as litigation and other “Excluded Expenses” (as defined in the Administrative Services Agreement, described below)) to 1.08%. The New OELA superseded the Prior OELA; it became effective on December 2, 2024 and will remain in place until at least December 2, 2026. For the year ended December 31, 2024, the Fund did not receive a reimbursement for any expenses or waiver of any advisory fees.

Under a new services agreement between the Fund and XAI dated December 2, 2024 (the “New Administrative Services Agreement”), XAI provides or arranges to have a third party provide the Fund with such services as it may require in the ordinary course of its business. Services to the Fund include: transfer agent services, custodial

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

services, Fund administration services, Fund accounting services, and such other services necessary to conduct the Fund’s business. In addition, XAI shall arrange and pay for independent public accounting services for audit and tax purposes, legal services, a fidelity bond, and directors and officers/errors and omissions insurance. In exchange for these services, the Fund pays the Adviser a service fee, payable monthly, equal to an annualized rate of 0.26% of the Fund’s managed assets. Not included in this fee and, therefore, the responsibility of the Fund are the following fees and expenses: (i) any fees and expenses relating to portfolio holdings (e.g., brokerage commissions, interest on loans, etc.); (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating to any borrowing costs, overdrafts or taxes the Fund may owe, etc.); (iii) the costs associated with investment by the Fund in other investment companies (i.e., acquired fund fees and expenses); and (iv) Independent Trustees compensation, including Lead Independent Trustee compensation (collectively referred to as “Excluded Expenses”).

Certain officers and Trustees of the Fund may also be officers, directors and/or employees of XAI or its affiliates. The Fund does not compensate its officers or Trustees who are officers, directors and/or employees of XAI or its affiliates.

4. SECURITIES LENDING

The Board of Trustees has authorized the Fund to engage in securities lending with State Street Bank and Trust Company as securities lending agent pursuant to a Securities Lending Authorization Agreement (the “Agreement”) and subject to the Fund’s securities lending policies and procedures. Under the terms of the Agreement, and subject to the policies and procedures, the Fund may lend portfolio securities to qualified borrowers in order to generate additional income, while managing risk associated with the securities lending program. The Agreement requires that loans are collateralized at all times by cash or U.S.government securities, initially equal to at least 102% of the value of the domestic securities and 105% of non-domestic securities, based upon the prior days market value for securities loaned. The loaned securities and collateral are marked to market daily to maintain collateral at 102% of the total loaned portfolio. Amounts earned as interest on investments of cash collateral, net of rebates and fees, if any, are included in the Statement of Operations. The primary risk associated with securities lending is loss associated with investment of cash and non-cash collateral. A secondary risk is if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons. The Fund could experience delays and costs in recovering securities loaned or in gaining access to the collateral. Under the Agreement, the securities lending agent has provided a limited indemnification in the event of a borrower default. The Fund does not have a master netting agreement.

Cash collateral received for securities on loan are reinvested into the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral is invested in U.S.treasuries or government securities. See below for fair value on loan and collateral breakout for the Fund and the Fund’s schedule of investments for Individual securities identified on loan as of December 31, 2024

| | Fair Value on Loan | | Cash Collateral* | | Non-Cash Collateral* | | |

| | | $ | 2,701,128 | | $ | — | | $ | 2,757,240 | | |

The cash collateral pledged for securities lending transactions is accounted for as secured borrowing. The non-cash collateral is not accounted in financial statements as the Fund cannot repledge or resell the non-cash collateral.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

5. DERIVATIVES

The FASB issued guidance intended to enhance financial statement disclosure for derivative instruments and enable investors to understand: a) how and why a fund uses derivative investments, b) how derivative instruments are accounted for, and c) how derivative instruments affect a fund’s financial position, and results of operations.

In addition, in November 2020, the SEC adopted Rule 18f-4 under the 1940 Act to govern the use of derivatives and certain related instruments by registered investment companies. Rule 18f-4, which had a compliance date of August 19, 2022, replaced existing SEC and staff guidance with a new framework for the use of derivatives by registered investment companies. Unless a fund qualifies as a “limited derivatives user,” as defined in Rule 18f-4, Rule 18f-4 requires registered investment companies that trade derivatives and other instruments that create future payment or delivery obligations to adopt a value at-risk leverage limit and implement a derivatives risk management program. Because the Fund’s strategy involves investing in derivatives, and the Fund’s use of such derivatives does not meet the conditions applicable to the “limited user exception” in Rule 18f-4, the Fund has adopted a derivatives program that complies with the requirements of the rule. As part of this, certain officers of the Investment Adviser and the Fund serve as the “derivatives risk manager” for the Fund.

The following table presents the types of derivatives in the Fund by location and as presented in the Statement of Assets and Liabilities as of December 31, 2024.

Statements of Asset & Liability Presentation of Fair Values of Derivative Instruments |

| | | Asset Derivatives | | Liability Derivatives |

Underlying Risk | | Statements of Assets and

Liabilities Location | | Fair Value | | Statements of Assets and

Liabilities Location | | Fair Value |

Equity | | Options purchased | | $ | — | | Options written | | $ | (2,044,024 | ) |

The following table presents the effect of derivative instruments on the Statement of Operations for the year ended December 31, 2024.

Statement of Operations | | Underlying Risk | | Net Realized Gain (Loss)

on Investments | | Net Change in

Unrealized

Appreciation

(Depreciation) on

Investments |

Options Purchased | | Equity | | $ | (1,512,200 | ) | | $ | — |

Options Written | | Equity | | | 4,542,386 | | | | 1,930,840 |

| | | | | $ | 3,030,186 | | | $ | 1,930,840 |

The average volume (based on the open positions at each month-end) of derivative activity during the year ended December 31, 2024.

| | Options Purchased Contracts(1) | | Options Written Contracts(1) |

| | | 42 | | 13,794 |

6. FEDERAL INCOME TAX INFORMATION

No provision is made for federal income taxes since it is the intention of the Fund to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986 as amended, applicable to regulated investment companies and to make the requisite distribution to shareholders of taxable income, which will be sufficient to relieve it from all or substantially all federal income taxes.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Classification of Distributions – Because U.S. federal income tax regulations differ from U.S. GAAP, net investment income and net realized gains may differ for financial statement and tax purposes. Due to inherent differences in the recognition of income, expenses, and realized gains/losses under U.S. GAAP and federal income tax purposes, permanent differences between book and tax basis may be required to be reclassified on the Statement of Assets and Liabilities. During the fiscal year, there were no permanent differences that resulted in adjustments to accumulated loss or paid-in capital.

At December 31, 2024, the cost of securities, gross unrealized appreciation (depreciation) (including written options), as computed on a federal income tax basis for the fund were as follows:

Cost | | $ | 164,919,564 | |

Gross appreciation | | | 2,452,424 | |

Gross depreciation | | | (28,219,469 | ) |

Net depreciation | | $ | (25,767,045 | ) |

Net unrealized appreciation (depreciation) may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions.

For the years ended December 31, 2024, and 2023, the tax character of distributions paid to shareholders was as follows:

Fund | | 2024 | | 2023 |

Ordinary Income | | $ | 10,862,312 | | $ | 10,100,837 |

Return of Capital | | | 4,316,385 | | | 5,042,064 |

As of December 31, 2024, the components of distributable earnings (loss) on a tax basis were as follows:

Unrealized Appreciation (Depreciation) | | $ | (25,767,045 | ) |

Distributions Payable | | | (8 | ) |

Total Distributable Earnings (Loss): | | $ | (25,767,053 | ) |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. It is the Fund’s policy to recognize accrued interest and penalties related to uncertain tax benefits in income taxes, as appropriate.

7. PORTFOLIO INFORMATION

Purchase and Sale of Securities – For the year ended December 31, 2024, the cost of purchases and proceeds from sales of securities, excluding short-term investments were as follows:

Cost of Investments Purchased | | $ | 161,399,894 |

Proceeds from Investments Sold | | $ | 142,650,178 |

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

8. CAPITAL

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 21,116,722 shares issued and outstanding as of December 31, 2024. During the years ended December 31, 2024 and December 31, 2023, 54,354 and 45,862 shares were issued and reinvested, respectively, per the Dividend Reinvestment Plan, since the Fund was trading at a premium.

9. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and therefore cannot be estimated; however, the Fund considers the risk of material loss from such claims as remote.

10. DISCUSSION OF RISKS

Equity Risk: The value of the securities held by the Fund may decline due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Option Risk: Trading in options involves a number of risks. There are several risks associated with transactions in options on securities. For example, there are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events.

As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

When the Fund writes covered put options, it bears the risk of loss if the value of the underlying stock declines below the exercise price. If the option is exercised, the Fund could incur a loss if it is required to purchase the stock underlying the put option at a price greater than the market price of the stock at the time of exercise. While the Fund’s potential gain in writing a covered put option is limited to the interest earned on the liquid assets securing the put option plus the premium received from the purchaser of the put option, the Fund risks a loss equal to the entire value of the stock.

Derivatives Risk: Derivatives are financial contracts in which the value depends on, or is derived from, the value of an underlying asset, reference rate or index. The Fund’s use of derivative instruments involves risks different from, and possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks, such as interest rate risk, market risk and credit risk. They also involve the risk of mispricing or improper valuation and the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. If the Fund invests in a derivative instrument it could lose more than the principal amount invested. Derivative instruments may be illiquid, difficult to price and leveraged so that small

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

changes in the value of the underlying instruments may produce disproportionate losses to the fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations.

Industry Concentration Risk: To the extent that the Fund makes substantial investments in a single industry, the Fund will be more susceptible to adverse economic or regulatory occurrences affecting those sectors.

Fund Distribution Risk: In order to make regular quarterly distributions on its common shares, the Fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the SEC, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a common shareholder, which is in effect a partial return of the amount a shareholder invested in the Fund, up to the amount of the shareholder’s tax basis in their shares, which would reduce such tax basis. Although a return of capital may not be taxable, it will generally increase the shareholder’s potential gain, or reduce the shareholder’s potential loss, on any subsequent sale or other disposition of shares. Shareholders who periodically receive the payment of a distribution consisting of a return of capital may be under the impression that they are receiving net income or profits when they are not. Shareholders should not assume that the source of a distribution from the Fund is net income or profit. In addition, sch return of capital distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

Cybersecurity Risk: The Fund is also subject to cybersecurity risk, which includes the risks associated with computer systems, networks and devices to carry out routine business operations. These systems, networks and devices employ a variety of protections that are designed to prevent cyberattacks. Despite the various cyber protections utilized by the Fund, the Adviser, and other service providers, their systems, networks, or devices could potentially be breached. The Fund, its shareholders, and the Adviser could be negatively impacted as a result of a cybersecurity breach. The Fund cannot control the cybersecurity plans and systems put in place by service providers or any other third parties whose operations may affect the Fund.

Foreign Investment Risk: Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risks, as well as lower market liquidity, generally greater market volatility and less complete financial information than for U.S. issuers.

Mid-Cap Company Risk: Investments in securities of mid-cap companies may be subject to more abrupt or erratic market movements than larger, more established companies, because these securities typically are traded in lower volume and issuers are typically more subject to changes in earnings and future earnings prospects. Mid-cap companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies. Furthermore, these companies often have limited product lines, services, markets or financial resources, or are dependent on a small management group. Since these securities are not well-known to the investing public, do not have significant institutional ownership and are followed by relatively few security analysts, there will normally be less publicly available information concerning these securities compared to what is available for the securities of larger companies. Adverse publicity and investor perceptions, whether or not based on fundamental analysis, can decrease the value and liquidity of securities held by the Fund. As a result, mid-cap companies’ performance can be more volatile and the companies face greater risk of business failure, which could increase the volatility of the Fund’s portfolio.

MCN | XAI Madison Equity Premium Income Fund | Notes to the Financial Statements - continued | December 31, 2024

Financial Leverage Risk: The Fund is authorized to utilize leverage through the issuance of preferred shares and/or the Fund may borrow or issue debt securities for financial leveraging purposes and for temporary purposes such as settlement of transactions. There can be no assurance that the Adviser’s and the Sub-Adviser’s expectations will be realized or that a leveraging strategy will be successful in any particular time period. Use of leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. Leverage is a speculative technique that exposes the Fund to greater risk and increased costs than if it were not implemented. There can be no assurance that a leveraging strategy will be utilized or will be successful.