OMB APPROVAL

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response...20.6

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21582

Madison Covered Call & Equity Strategy Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Steven J. Fredricks

Chief Legal Officer & Chief Compliance Officer

Madison Asset Management, LLC

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Form N-CSRS is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSRS in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSRS, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSRS unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Certified Financial Statement

Semi-annual Report

June 30, 2021

Madison Funds®

MADISON COVERED CALL &

EQUITY STRATEGY FUND (MCN)

Active Equity Management combined

with a Covered Call Option Strategy

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Table of Contents

| | | | | |

| Review of Period | 2 |

| Portfolio of Investments | 6 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights for a Share of Beneficial Interest Outstanding | 11 |

| Notes to Financial Statements | 12 |

| Other Information | 20 |

| Dividend Reinvestment Plan | 21 |

1

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Review of Period

What happened in the market during the first half of 2021?

The post-Covid market recovery continued unabated during the first half of 2021. The only problem with this scenario is that Covid has not yet been eradicated and along with its variants, remains a threat to a true global “reopening”. We are, however, in a better place than we were a year ago and this optimism is largely based on much improved vaccine availability and a sense that the worst of the global epidemic is behind us. The market rally has been based on the belief that the global economy would relatively quickly return to a normalized state. This, in turn, spurred investment in commodity related industries where demand had been lacking and capacity investment had been largely put on hold. In early 2020, many commodities were simultaneously hit by both a demand and supply shock. Historically, one or the other would be enough to cause significant price declines so both concurrently resulted in a very troubling environment. Optimism on the demand side in early 2021 has led to a very strong rebound in these sectors while supply remains relatively constrained. Commodity cyclicals lead the market higher during the first half until mid-second quarter when inflation concerns emerged and the Covid delta variant challenged the global reopening scenario. While stock markets generally maintained their lofty levels, market leadership switched back to large technology growth oriented companies (read FAANG) that had dominated performance in the pre-Covid market environment.

It’s pretty clear that price inflation in most things has surged this year. Demand has risen while in many cases supply is still trying to catch up. Bottlenecks in the global supply chain continue to present a major hurdle and cost in returning the economy back to normal. Labor shortages remain a key issue for employers and as a result, wage inflation has become part of the inflation story for the first time in decades. While most companies attempt to pass higher input costs through to the end buyer, some margin pressure has to be expected. Another less talked about inflationary source is the tidal wave of money that has been created by the Federal Reserve’s monetary stimulus and the Federal Government’s massive fiscal spending and debt binge. The Federal Reserve seems to be in a tough spot. They are talking up the transitory nature of inflation so as not to spook the market with the possibility of higher interest rates. But, if things are so great, then why have they not pulled back on their asset buying program which has been the rocket fuel behind the growth of risk assets. Well, pulling back on monetary stimulus would likely not be looked upon kindly by the stock and bond markets. So, it appears that the message from the Fed is that things will be totally fine and the economy will grow without meaningful inflation but things are not so great as to enable the

removal of monetary support. Can we truly expect such a goldilocks scenario? Equity markets appear to be fully pricing in such a euphoric environment. We’re having a tough time buying it.

A Word on Volatility

Following a volatility spike associated with the Covid induced market correction in early 2020, overall volatility has steadily declined. While the CBOE Volatility Index (VIX) remained above the 20 level for most of the first quarter of this year, it has, more recently, declined below that mark and is back to levels generally seen in the 2018/19 period. This shouldn’t be surprising as it has been a pretty calm and uneventful period for the market with a steadily rising trend. While short term measures of volatility such as the VIX Index reflect a relatively benign environment, expectations for higher volatility further out in time remain elevated.

How did the Fund perform given the marketplace conditions during the first six months of 2021?

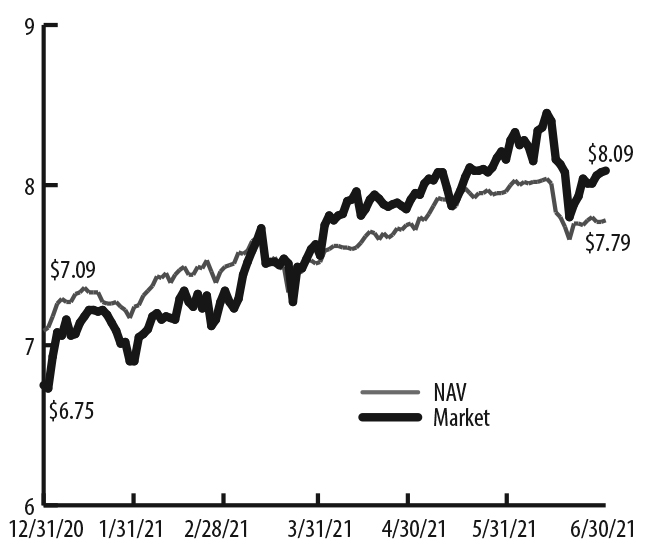

Over the full six months ending June 30, 2021, the Fund’s market price rose 25.4%, well ahead of the CBOE S&P BuyWrite Index (BXM) return of 11.1% and the S&P 500’s gain of 15.2%. The Fund’s Net Asset Value (NAV) rose 15.0%. The Fund ended the period trading at a premium to NAV of 4%. The Fund began the year trading at a discount to NAV of -4.8%.

The Fund’s strong performance in a steadily rising market has been accomplished despite being positioned in a relatively defensive posture. Option coverage has routinely been in the upper 70% to lower 80% range over

2

MCN | Madison Covered Call & Equity Strategy Fund | Review of Period (unaudited) - continued | June 30, 2021

the period and cash levels have been higher than in a normalized environment. The positive relative performance has been driven primarily by the Fund’s underlying equity holdings and its exposure to more cyclically oriented sectors. Late in the period, some of the relative outperformance, particularly against the S&P 500, was reversed as large cap growth companies returned to favor. However, over the entirety of the period, the underlying portfolio performed extremely well.

As noted, call option coverage remained fairly consistent during the period, starting at 84.8% and ending at 83.1%. With concerns heightened that the market may have recovered too quickly without confirmation from economic data, we have remained defensively postured. Cash levels have also remained elevated as the market’s steady advance has led to a very high level of holdings sold into option assignments. While we attempt to recycle cash in a timely fashion, markets have become more challenged from a valuation perspective and we have taken a more cautious and opportunistic approach in efforts to reinvest cash. As expected, both cash and option coverage were drags to performance in a rising market environment. In essence, we did not increase risk to achieve good returns but rather remained quite defensively postured.

Over the full period, individual stock performance was very additive to overall performance. While traditional commodity cyclicals were among the best performers, other holdings were also very additive. Within the energy complex, natural gas producer Range Resources was a top performer along with EOG Resources and Transocean. Baker Hughes, the diversified energy service company lagged as short term concerns over General Electric’s equity stake sale resurfaced. In the industrial commodity area, Alcoa was a very strong performer as aluminum prices surged. Media service company Discovery was also a top performer on new streaming opportunities and General Motors also performed well as its electric vehicle capabilities received increased attention. Gold holdings Barrick Gold and the Van Eck Gold Miners Fund lagged as the price of gold trended lower during the period. Other small drags on performance came from large cap companies such as Berkshire Hathaway, Microsoft and Baxter international.

The top performing sectors for the market during the period were Energy, Financials, Real Estate and Communication Services. The laggards were Utilities, Consumer Staples, Consumer Discretionary and Health Care. The Fund’s sector allocation added value during the period with its overweighting in the Energy sector as the primary driver. Later in the period, the Information Technology sector rallied strongly and the Fund’s underweighting there reduced its relative gains. As the period moved forward, cash generated from option assignments was broadly

reallocated to more defensive sectors which had underperformed year-to-date such as Consumer Staples, Utilities and Health Care. Also, the Fund entered the period with a meaningful overweighting in the Materials sector, benefitting from the continued strength in industrial commodities. In the second quarter of the year, this positioning was significantly reduced as we realized gains and grew increasingly concerned that China was removing financial liquidity and potentially reducing its stockpiles in various commodities such as copper, aluminum and iron ore in an effort to keep price increases in check. We continue to believe that commodities represent a good longer term investment but shorter term factors have caused us to become somewhat more cautious.

| | |

SHARE PRICE AND NAV PERFORMANCE FOR

MADISON COVERED CALL & EQUITY STRATEGY FUND |

3

MCN | Madison Covered Call & Equity Strategy Fund | Review of Period (unaudited) - continued | June 30, 2021

Describe the Fund’s portfolio equity and option structure.

As of June 30, 2021, the Fund held 34 equity securities and unexpired call options had been written against 83.1% of the Fund’s stock holdings. It is the strategy of the Fund to write “out-of-the-money” call options and as of June 30, 84% of the Fund’s call options (37 of 44 different options) remained “out-of-the-money.” (Out-of-the-money means the stock price is below the strike price at which the shares could be called away by the option holder). On average, the Fund’s call options had 53.3 days to expiration.

| | | | | | | | | | | |

ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS

AS OF 6/30/21 |

| Communication Services | 6.8% | Health Care | 12.4% |

| Consumer Discretionary | 9.5% | Industrials | 2.8% |

| Consumer Staples | 7.1% | Information Technology | 6.1% |

| Energy | 8.7% | Materials | 4.1% |

| Exchange Traded Funds | 2.1% | Short-Term Investments | 31.4% |

| Financials | 3.7% | Utilities | 5.3% |

Discuss the Fund’s security and option selection process:

The Fund is managed by primarily focusing on active stock selection before adding the call option overlay utilizing individual equity call options rather than index options. We use Fundamental analysis to select solid companies with good growth prospects and attractive valuations. We then seek attractive call options to write on those stocks. It is our belief that this partnership of active management of the equity and option strategies provides investors with an innovative, risk-moderated approach to equity investing. The Fund’s portfolio managers seek to invest in a portfolio of common stocks that have favorable “PEG” ratios (Price-Earnings ratio to Growth rate) as well as financial strength and industry leadership. As bottom-up investors, we focus on the Fundamental businesses of our companies. Our stock selection philosophy strays away from the “beat the street” mentality, as we seek companies that have sustainable competitive advantages, predictable cash flows, solid balance sheets and high-quality management teams. By concentrating on long-term prospects and circumventing the “instant gratification” school of thought, we believe we bring elements of consistency, stability and predictability to our shareholders.

Once we have selected attractive and solid names for the Fund, we employ our call writing strategy. This procedure entails selling calls that are primarily out-of the-money, meaning that the strike price is higher than the common stock price, so that the Fund can participate in some stock appreciation. By receiving option premiums, the Fund receives a high level of investment income and adds an

element of downside protection. Call options may be written over a number of time periods and at differing strike prices in an effort to maximize the protective value to the strategy and spread income evenly throughout the year.

What is the management’s outlook for the market and Fund for the remainder of 2021?

The Fund’s overall strategy has always been geared toward being defensive and will remain so. The Fund’s underlying positioning has allowed us to perform very well in a rising market despite our high option coverage and high cash levels. In other words, we have not compromised the Fund’s goals and objective in order to “reach” for returns. While we can become moderately more aggressive within our defensive construct, we do not believe that this is an appropriate time to do so. As noted above, we believe that equity markets, in particular, are priced for absolute perfection and any hint of monetary tapering, margin pressure, non-transitory inflation or other “market unfriendly” issues may result in a correction of sorts. Global economies are beginning to normalize and that’s a very positive thing, however, risks remain. We continue to believe it to be prudent to be conservatively positioned while being prepared to take advantage of opportunities as they arise.

So, to say that we remain concerned about the future would be an understatement. We have become increasingly defensive within the Fund, the further the market has rebounded. Stimulus may be enough to continue the uptrend for a while, the V-shaped recovery may ultimately become reality or a vaccine comes sooner rather than later. We truly hope that these things occur but our strategy tells us to be level-headed and always look to protect capital. We believe it is prudent to follow our beliefs and remain conservatively positioned.

4

MCN | Madison Covered Call & Equity Strategy Fund | Review of Period (unaudited) - concluded | June 30, 2021

With significant market uncertainty and yields that will likely remain subdued for some time, equity income investing provides a less volatile approach to asset allocation structuring while also providing an attractive alternative income source for investors. We see covered call writing as an attractive solution given the current investment environment.

| | | | | |

| TOP TEN HOLDINGS AS OF 6/30/21 |

| % of Total Investments |

| Comcast Corp. | 3.5% |

| CVS Health Corp. | 3.3% |

| Baxter International Inc. | 3.0% |

| Fiserv Inc. | 3.0% |

| Honeywell International Inc. | 2.8% |

| Lowe’s Cos. Inc. | 2.7% |

| Barrick Gold Corp. | 2.7% |

| Gilead Sciences Inc. | 2.7% |

| Las Vegas Sands Corp. | 2.6% |

| TJX Cos. Inc./The | 2.6% |

INDEX DEFINITIONS

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The S&P 500® Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Chicago Board Options Exchange (CBOE) Market Volatility Index, often referred to as the VIX (its ticker symbol), the fear index or the fear gauge, is a measure of the implied volatility of S&P 500® Index options. It represents a measure of the market’s expectation of stock market volatility over the next 30-day period. Quoted in percentage points, the VIX represents the expected daily movement in the S&P 500® Index over the next 30-day period, which is then annualized.

The CBOE S&P 500 Buy/Write Index (BXM) is a benchmark index designed to show the hypothetical performance of a portfolio that purchases all the constituents of the S&P 500® Index and then sells at-the-money (meaning same as purchase price) call options of one-month duration against those positions.

Past performance is no guarantee of future results.

5

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Portfolio of Investments (unaudited)

| | | | | | | | |

| Shares | Value (Note 2,3) |

| COMMON STOCKS - 73.0% | | |

| Communication Services - 7.5% | | |

| Comcast Corp., Class A (A) | 111,500 | $ 6,357,730 |

| Lumen Technologies Inc. (A) | 214,000 | 2,908,260 |

| T-Mobile U.S. Inc. * (A) | 20,000 | 2,896,600 |

| | 12,162,590 |

| Consumer Discretionary - 10.4% | | |

| Las Vegas Sands Corp. * (A) | 89,000 | 4,689,410 |

| Lowe’s Cos. Inc. (A) | 25,400 | 4,926,838 |

| Nordstrom Inc. * (A) | 75,000 | 2,742,750 |

| TJX Cos. Inc./The (A) | 69,500 | 4,685,690 |

| | 17,044,688 |

| Consumer Staples - 7.7% | | |

| Archer-Daniels-Midland Co. (A) | 55,000 | 3,333,000 |

| Constellation Brands Inc., Class A (A) | 8,000 | 1,871,120 |

| JM Smucker Co./The (A) | 31,700 | 4,107,369 |

| PepsiCo Inc. (A) | 22,500 | 3,333,825 |

| | 12,645,314 |

| Energy - 9.6% | | |

| APA Corp. | 95,300 | 2,061,339 |

| Baker Hughes Co. | 171,000 | 3,910,770 |

| EOG Resources Inc. (A) | 48,000 | 4,005,120 |

| Range Resources Corp. * (A) | 242,000 | 4,055,920 |

| Transocean Ltd. * | 345,000 | 1,559,400 |

| | 15,592,549 |

| Financials - 4.1% | | |

| Aflac Inc. (A) | 62,500 | 3,353,750 |

| JPMorgan Chase & Co. (A) | 21,000 | 3,266,340 |

| | 6,620,090 |

| Health Care - 13.6% | | |

| Abbott Laboratories (A) | 30,000 | 3,477,900 |

| Baxter International Inc. (A) | 67,000 | 5,393,500 |

| CVS Health Corp. (A) | 70,800 | 5,907,552 |

| Gilead Sciences Inc. (A) | 70,100 | 4,827,086 |

| Stryker Corp. (A) | 10,000 | 2,597,300 |

| | 22,203,338 |

| Industrials - 3.1% | | |

| Honeywell International Inc. (A) | 23,000 | 5,045,050 |

| | |

| | | | | | | | |

| Shares | Value (Note 2,3) |

| Information Technology - 6.7% | | |

| Fiserv Inc. * (A) | 50,000 | $ 5,344,500 |

| Microsoft Corp. (A) | 7,000 | 1,896,300 |

| Texas Instruments Inc. (A) | 11,000 | 2,115,300 |

| Visa Inc., Class A (A) | 7,000 | 1,636,740 |

| | 10,992,840 |

| Materials - 4.5% | | |

| Alcoa Corp. * (A) | 66,500 | 2,449,860 |

| Barrick Gold Corp. | 236,000 | 4,880,480 |

| | 7,330,340 |

| Utilities - 5.8% | | |

| AES Corp./The (A) | 131,000 | 3,415,170 |

| Entergy Corp. (A) | 25,000 | 2,492,500 |

| NextEra Energy Inc. (A) | 48,000 | 3,517,440 |

| | 9,425,110 |

Total Common Stocks

(Cost $132,623,895) | | 119,061,909 |

| EXCHANGE TRADED FUNDS - 2.3% | | |

| VanEck Vectors Gold Miners ETF (A) | 110,000 | 3,737,800 |

Total Exchange Traded Funds

(Cost $4,301,041) | | 3,737,800 |

| SHORT-TERM INVESTMENTS - 34.3% | | |

| State Street Institutional U.S. Government Money Market Fund, 0.03%, Premier Class (B) | 56,073,641 | 56,073,641 |

Total Short-Term Investments

(Cost $56,073,641) | | 56,073,641 |

TOTAL INVESTMENTS - 109.6% (Cost $192,998,577**) | 178,873,350 |

| TOTAL CALL OPTIONS WRITTEN - (1.4%) | (2,254,488) |

| NET OTHER ASSETS AND LIABILITIES - (8.2%) | (13,460,462) |

| TOTAL NET ASSETS - 100.0% | $163,158,400 |

| | | | | |

| * | Non-income producing. |

| ** | Aggregate cost for Federal tax purposes was $193,593,142. |

| (A) | All or a portion of these securities’ positions, with a value of $110,387,720, represent covers (directly or through conversion rights) for outstanding options written. |

| (B) | 7-day yield. |

| ETF | Exchange Traded Fund. |

See accompanying Notes to Financial Statements.

6

MCN | Madison Covered Call & Equity Strategy Fund | Portfolio of Investments (unaudited) - concluded | June 30, 2021

| | | | | | | | | | | | | | | | | | | | | | | |

| Written Option Contracts Outstanding at June 30, 2021 |

| Description | Exercise

Price | Expiration Date | Number of Contracts | Notional

Amount | Fair

Value | Premiums (Received) | Unrealized Appreciation (Depreciation) |

| Call Options Written | | | | | | | |

| Abbott Laboratories | $115.00 | 8/20/21 | (230) | $(2,645,000) | $ (94,875) | $ (43,678) | $ (51,197) |

| Abbott Laboratories | 120.00 | 8/20/21 | (70) | (840,000) | (13,860) | (13,718) | (142) |

| AES Corp./The | 27.00 | 8/20/21 | (1,310) | (3,537,000) | (78,600) | (109,477) | 30,877 |

| Aflac Inc. | 55.00 | 8/20/21 | (625) | (3,437,500) | (57,812) | (64,478) | 6,666 |

| Alcoa Corp. | 40.00 | 8/20/21 | (665) | (2,660,000) | (121,695) | (137,546) | 15,851 |

| Archer-Daniels-Midland Co. | 70.00 | 9/17/21 | (380) | (2,660,000) | (11,400) | (60,407) | 49,007 |

| Baxter International Inc. | 87.50 | 8/20/21 | (280) | (2,450,000) | (25,900) | (49,229) | 23,329 |

| Comcast Corp. | 60.00 | 8/20/21 | (315) | (1,890,000) | (23,783) | (21,985) | (1,798) |

| Comcast Corp. | 60.00 | 9/17/21 | (800) | (4,800,000) | (94,800) | (98,852) | 4,052 |

| Constellation Brands Inc. | 230.00 | 7/16/21 | (80) | (1,840,000) | (44,000) | (33,517) | (10,483) |

| CVS Health Corp. | 92.50 | 8/20/21 | (250) | (2,312,500) | (10,000) | (32,741) | 22,741 |

| CVS Health Corp. | 95.00 | 8/20/21 | (253) | (2,403,500) | (6,072) | (50,705) | 44,633 |

| CVS Health Corp. | 90.00 | 11/19/21 | (205) | (1,845,000) | (43,050) | (47,378) | 4,328 |

| Entergy Corp. | 105.00 | 8/20/21 | (250) | (2,625,000) | (21,250) | (29,741) | 8,491 |

| EOG Resources Inc. | 90.00 | 7/16/21 | (175) | (1,575,000) | (13,125) | (33,337) | 20,212 |

| EOG Resources Inc. | 90.00 | 8/20/21 | (305) | (2,745,000) | (82,655) | (88,939) | 6,284 |

| Fiserv Inc. | 115.00 | 8/20/21 | (350) | (4,025,000) | (40,950) | (62,018) | 21,068 |

| Fiserv Inc. | 125.00 | 9/17/21 | (150) | (1,875,000) | (7,575) | (36,221) | 28,646 |

| Gilead Sciences Inc. | 72.50 | 9/17/21 | (323) | (2,341,750) | (45,381) | (35,583) | (9,798) |

| Gilead Sciences Inc. | 75.00 | 1/21/22 | (378) | (2,835,000) | (79,947) | (76,222) | (3,725) |

| Honeywell International Inc. | 220.00 | 7/16/21 | (230) | (5,060,000) | (66,930) | (56,434) | (10,496) |

| | | | | | | | | | | | | | | | | | | | | | | |

| JM Smucker Co./The | 135.00 | 7/16/21 | (128) | (1,728,000) | (4,160) | (39,547) | 35,387 |

| JM Smucker Co./The | 135.00 | 8/20/21 | (189) | (2,551,500) | (25,515) | (43,602) | 18,087 |

| JPMorgan Chase & Co. | 155.00 | 8/20/21 | (115) | (1,782,500) | (59,513) | (35,658) | (23,855) |

| JPMorgan Chase & Co. | 160.00 | 8/20/21 | (95) | (1,520,000) | (29,925) | (28,591) | (1,334) |

| Las Vegas Sands Corp. | 57.50 | 8/20/21 | (180) | (1,035,000) | (26,910) | (26,094) | (816) |

| Las Vegas Sands Corp. | 60.00 | 8/20/21 | (470) | (2,820,000) | (47,470) | (86,938) | 39,468 |

| Lowe’s Cos. Inc. | 200.00 | 7/16/21 | (85) | (1,700,000) | (7,947) | (40,712) | 32,765 |

| Lowe’s Cos. Inc. | 200.00 | 8/20/21 | (169) | (3,380,000) | (75,628) | (73,050) | (2,578) |

| Lumen Technologies Inc. | 15.00 | 11/19/21 | (3) | (4,500) | (195) | (216) | 21 |

| Microsoft Corp. | 270.00 | 7/16/21 | (70) | (1,890,000) | (28,175) | (20,294) | (7,881) |

| NextEra Energy Inc. | 77.50 | 7/16/21 | (250) | (1,937,500) | (4,375) | (29,741) | 25,366 |

| NextEra Energy Inc. | 77.50 | 8/20/21 | (230) | (1,782,500) | (18,975) | (28,514) | 9,539 |

| Nordstrom Inc. | 37.50 | 7/16/21 | (750) | (2,812,500) | (75,000) | (93,896) | 18,896 |

| PepsiCo Inc. | 150.00 | 8/20/21 | (225) | (3,375,000) | (58,500) | (44,933) | (13,567) |

| Range Resources Corp. | 15.00 | 9/17/21 | (1,210) | (1,815,000) | (347,875) | (126,342) | (221,533) |

| Range Resources Corp. | 20.00 | 12/17/21 | (1,210) | (2,420,000) | (208,120) | (211,199) | 3,079 |

| Stryker Corp. | 270.00 | 8/20/21 | (100) | (2,700,000) | (38,500) | (37,030) | (1,470) |

| T-Mobile U.S. Inc. | 155.00 | 8/20/21 | (200) | (3,100,000) | (27,200) | (34,448) | 7,248 |

| Texas Instruments Inc. | 190.00 | 7/16/21 | (110) | (2,090,000) | (50,325) | (22,277) | (28,048) |

| TJX Cos. Inc./The | 70.00 | 7/16/21 | (250) | (1,750,000) | (7,250) | (32,626) | 25,376 |

| TJX Cos. Inc./The | 70.00 | 8/20/21 | (445) | (3,115,000) | (64,970) | (56,973) | (7,997) |

| VanEck Vectors Gold Miners ETF | 40.00 | 9/17/21 | (1,100) | (4,400,000) | (44,000) | (141,861) | 97,861 |

| Visa Inc. | 245.00 | 8/20/21 | (70) | (1,715,000) | (20,300) | (23,377) | 3,077 |

| Total Options Written, at Value | | | | $(2,254,488) | $(2,460,125) | $205,637 |

See accompanying Notes to Financial Statements.

7

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Statement of Assets and Liabilities as of June 30, 2021 (unaudited)

| | | | | |

| Assets: | |

Investments in unaffiliated securities, at fair value† | $178,873,350 |

| Receivables: | |

| Investments sold | 497,635 |

| Dividends and interest | 23,155 |

| Total assets | 179,394,140 |

| Liabilities: | |

| Payables: | |

| Investments purchased | 13,771,909 |

| Advisory agreement fees | 108,707 |

| Administrative services agreement fees | 35,177 |

| Due to Custodian | 65,459 |

| Options written, at value (premium received $2,460,125) | 2,254,488 |

| Total liabilities | 16,235,740 |

| Net assets applicable to outstanding capital stock | $163,158,400 |

| Net assets consist of: | |

| Common Stock/Shares: | |

| Paid-in capital in excess of par | $175,645,120 |

| Accumulated distributable earnings (loss) | (12,486,720) |

| Net Assets | $163,158,400 |

| |

| Capital Shares Issued and Outstanding (Note 9) | 20,957,893 |

Net Asset Value per share | $ 7.79 |

†Cost of Investments in unaffiliated securities | $192,998,577 |

See accompanying Notes to Financial Statements.

8

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Statement of Operations For the Period Ended June 30, 2021 (unaudited)

| | | | | |

| Investment Income: | |

| Interest | $ 8,252 |

| Dividends | |

| Unaffiliated issuers | 857,971 |

| Less: Foreign taxes withheld/reclaimed | (13,681) |

| Income from securities lending | 272 |

| Total investment income | 852,814 |

| Expenses (Note 4): | |

| Advisory agreement fees | 631,882 |

| Administrative services agreement fees | 205,362 |

| Trustee fees | 18,348 |

| Other expenses | 164 |

| Total expenses | 855,756 |

| Net Investment Income | (2,942) |

| Net Realized and Unrealized Gain (Loss) on Investments | |

| Net realized gain (loss) on investments (including net realized gain (loss) on foreign currency related transactions) | |

| Options written | 294,380 |

| Unaffiliated issuers | 9,511,381 |

| Net change in unrealized appreciation (depreciation) on investments (including net unrealized appreciation (depreciation) on foreign currency related transactions) | |

| Options written | 1,103,629 |

| Unaffiliated issuers | 11,237,269 |

| Net Realized and Unrealized Gain on Investments | 22,146,659 |

| Net Increase in Net Assets from Operations | $ 22,143,717 |

See accompanying Notes to Financial Statements.

9

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Statements of Changes in Net Assets

| | | | | | | | |

| (unaudited)

Six-Months

Ended 6/30/21 | Year

Ended 12/31/20 |

| Net Assets at beginning of period | $148,475,062 | $153,962,823 |

| Increase (decrease) in net assets from operations: | | |

| Net investment income (loss) | (2,942) | 851,650 |

| Net realized gain | 9,805,761 | 8,828,114 |

| Net change in unrealized appreciation (depreciation) | 12,340,898 | (85,740) |

| Net increase in net assets from operations | 22,143,717 | 9,594,024 |

| Distributions to shareholders from: | | |

| Accumulated earnings (combined net investment income and net realized gains) | (7,542,867) | (10,395,696) |

| Return of capital | – | (4,686,089) |

| Total distributions | (7,542,867) | (15,081,785) |

| Capital Stock transactions: | | |

| Newly issued shares issued and reinvested | 82,488 | – |

| Total increase from capital stock transactions | 82,488 | – |

| Total increase (decrease) in net assets | 14,683,338 | (5,487,761) |

| Net Assets at end of period | $163,158,400 | $148,475,062 |

| Capital Share transactions: | | |

| Newly issued shares issued and reinvested | 10,969 | – |

| Net increase from capital stock transactions | 10,969 | – |

See accompanying Notes to Financial Statements.

10

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Financial Highlights for a Share of

Beneficial Interest Outstanding

| | | | | | | | | | | | | | | | | | | | |

| (unaudited)

Six-Months Ended

6/30/21 |

Year Ended December 31, |

| 2020 | 2019 | 2018 | 2017 | 2016 |

| Net Asset Value at beginning of period | $7.09 | $7.35 | $6.91 | $8.27 | $8.41 | $8.48 |

| Income from Investment Operations: | | | | | | |

| Net investment income | (0.00)1 | 0.04 | 0.08 | 0.10 | 0.09 | 0.032 |

| Net realized and unrealized gain (loss) on investments | 1.06 | 0.42 | 1.08 | (0.74) | 0.49 | 0.62 |

| Total from investment operations | 1.06 | 0.46 | 1.16 | (0.64) | 0.58 | 0.65 |

| Less Distributions From: | | | | | | |

| Net investment income | (0.36) | (0.50) | (0.47) | (0.51) | (0.55) | (0.46) |

| Return of capital | – | (0.22) | (0.25) | (0.21) | (0.17) | (0.26) |

| Total distributions | (0.36) | (0.72) | (0.72) | (0.72) | (0.72) | (0.72) |

| Net increase (decrease) in net asset value | 0.70 | (0.26) | 0.44 | (1.36) | (0.14) | (0.07) |

| Net Asset Value at end of period | $7.79 | $7.09 | $7.35 | $6.91 | $8.27 | $8.41 |

| Market Value at end of period | $8.09 | $6.75 | $6.63 | $6.16 | $7.72 | $7.70 |

| Total Return | | | | | | |

Net asset value (%)3 | 14.964 | 7.72 | 17.39 | (8.37) | 7.14 | 7.92 |

Market value (%)5 | 25.444 | 15.22 | 19.83 | (11.79) | 9.77 | 14.51 |

| Ratios/Supplemental Data: | | | | | | |

| Net Assets at end of period (in 000’s) | $163,158 | $148,475 | $153,963 | $144,686 | $159,377 | $162,087 |

| Ratios of expenses to average net assets(%) | 1.087 | 1.07 | 1.076 | 1.176 | 1.136 | 1.06 |

| Ratio of net investment income (loss) to average net assets (%) | (0.00)7,8 | 0.61 | 1.15 | 0.75 | 1.13 | 0.38 |

| Portfolio turnover (%) | 1044 | 128 | 114 | 114 | 152 | 134 |

| | | | | |

| 1 | Amounts represent less than $(0.005) per share. |

| 2 | Based on average shares outstanding during the year. |

| 3 | Total net asset value return is calculated based on changes in the net asset value per share for the period reported on. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at the net asset value amount on the date of the distribution. |

| 4 | Not annualized. |

| 5 | Total market value return is calculated assuming a purchase of a share of common stock at the market price on the first day and a sale of a share of common stock at the market price on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the dividend reinvestment plan. Total market value return does not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund stock. |

| 6 | Includes Board approved expenses related to special and annual meetings that took place during the year. |

| 7 | Annualized. |

| 8 | Amounts represent less than (0.01)%. |

See accompanying Notes to Financial Statements.

11

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Notes to Financial Statements (unaudited)

1. ORGANIZATION

Madison Covered Call & Equity Strategy Fund (the “Fund”) was organized as a Delaware statutory trust on May 6, 2004. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940 (“1940 Act”), as amended, and the Securities Act of 1933, as amended.

The Fund’s primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund will pursue its investment objectives by investing primarily in large and mid-capitalization common stocks that are, in the view of Madison Asset Management, LLC, the Fund’s investment adviser (the “Adviser”), selling at a reasonable price in relation to their long-term earnings growth rates. Under normal market conditions, the Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investment objectives are considered fundamental and may not be changed without shareholder approval.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Securities traded on a national securities exchange are valued at their closing sale price, except for securities traded on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), which are valued at the NASDAQ official closing price (“NOCP”). If no sale occurs, equities traded on a U.S. exchange or on NASDAQ are valued at the bid price. Options are valued at the mean between the best bid and best ask price across all option exchanges. Debt securities having maturities of 60 days or less are valued at amortized cost,

which approximates market value. Debt securities having longer maturities are valued on the basis of the last available bid prices or current market quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their net asset value (“NAV”). Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

At times, the Fund maintains cash balances at financial institutions in excess of federally insured limits. The Fund monitors this credit risk and has not experienced any losses related to this risk.

Investment Transactions and Investment Income: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

Distributions to Shareholders: The Fund declares and pays quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from Generally Accepted Accounting Principles (“GAAP”). These distributions consist of investment company taxable income, which generally includes qualified dividend income, ordinary

12

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

income and short-term capital gains, including premiums received on written options. Distributions may also include a return of capital. Any net realized long-term capital gains are distributed annually to shareholders. The character of the distributions are determined annually in accordance with federal income tax regulations.

Recently Issued Accounting Pronouncements: In March 2020, the FASB issued Accounting Standards Update (“ASU”) 2020-04, which provides optional expedients and exceptions for contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. The adoption of the ASU is elective. At this time, management is evaluating the implications of these changes on the financial statements.

In October 2020, the U.S. Securities and Exchange Commission (“SEC”) adopted new regulations governing the use of derivatives by registered investment companies. Rule 18f-4 will impose limits on the amount of derivatives a fund could enter into, eliminate the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, and require funds whose use of derivatives is more than a limited specified exposure to establish and maintain a derivatives risk management program and appoint a derivatives risk manager. While the new rule became effective February 19, 2021, funds will not be required to fully comply with the new rule until August 19, 2022. It is not currently clear what impact, if any, the new rule will have on the availability, liquidity or performance of derivatives. When fully implemented, the new rule may require changes in how a Fund will use derivatives, may adversely affect a Fund’s performance and may increase costs related to a Fund’s use of derivatives.

Covered Call and Put Options: An option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from (in the case of a call) or sell to (in the case of a put) the writer of the option the security underlying the option at a specified exercise or “strike” price. The writer of an option on a security has an obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price (in the case of a call) or pay the exercise price upon delivery of the underlying security (in the case of a put).

The number of call options the Fund can write (sell) is limited by the amount of equity securities the Fund holds in its portfolio. The Fund will not write (sell) “naked” or uncovered call options. The Fund seeks to produce a high level of current income and gains generated from option writing premiums and, to a lesser extent, from dividends.

When an option is written, a liability is recorded equal to the premium received. This liability for options written is marked-to-market on a daily basis to reflect the current market value of the option written. These liabilities are reflected as options written in the Statement of Assets and Liabilities. Premiums received from writing options that expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transactions, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss.

3. FAIR VALUE MEASUREMENTS

The Fund has adopted FASB applicable guidance on fair value measurements. Fair value is defined as the price that each fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

13

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The valuation techniques used by the Fund to measure fair value for the period ended June 30, 2021, maximized the use of observable inputs and minimized the use of unobservable inputs.

There were no transfers between classifications levels during the period ended June 30, 2021. As of and during the period ended June 30, 2021, the Fund did not hold securities deemed as a Level 3.

| | | | | | | | | | | | | | |

| Description | Quoted Prices in

Active Markets for Identical Investments (Level 1) | Significant Other

Observable

Inputs

(Level 2) | Significant

Unobservable

Inputs

(Level 3) | Value at

6/30/21 |

Assets:1 | | | | |

| Common Stocks | $119,061,909 | $ – | $ – | $119,061,909 |

| Exchange Traded Funds | 3,737,800 | – | – | 3,737,800 |

| Short-Term Investments | 56,073,641 | – | – | 56,073,641 |

| $178,873,350 | $ – | $ – | $178,873,350 |

Liabilities:1 | | | | |

| Options Written | $(2,254,488) | $ – | $ – | $ (2,254,488) |

1Please see the Portfolio of Investments for a listing of all securities within each category. |

4. ADVISORY, ADMINISTRATIVE SERVICES AND OTHER EXPENSES

Pursuant to an Investment Advisory Agreement with the Fund, the Adviser, under the supervision of the Fund’s Board of Trustees, provides a continuous investment program for the Fund’s portfolio; provides investment research and makes and executes recommendations for the purchase and sale of securities; and provides certain facilities and personnel, including officers required for the Fund’s administrative management and compensation of all officers and interested trustees of the Fund. For these services, the Fund pays the Adviser an advisory fee, payable monthly, in an amount equal to an annualized rate of 0.80% of the Fund’s average daily net assets.

Under a separate Administrative Services Agreement, the Adviser also provides or arranges to have a third party provide the Fund with such services as it may require in the ordinary course of its business. Services to the Fund include: compliance services, custodial services, Fund administration services, Fund accounting services, and such other services necessary to conduct the Fund’s business. In addition, the Adviser shall arrange and pay for independent public accounting services for audit and tax purposes, legal services, a fidelity bond, and directors and officers/errors and omissions insurance. In exchange

14

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

for these services, the Fund pays the Adviser a service fee, payable monthly, equal to an annualized rate of 0.26% of the Fund’s average daily net assets. Not included in this fee and, therefore, the responsibility of the Fund are “excluded expenses” and “transitional expenses.” Excluded expenses consist of (i) any fees and expenses relating to portfolio holdings (e.g., brokerage commissions, interest on loans, etc.); (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating to any borrowing costs, overdrafts or taxes the Fund may owe, etc.); and (iii) the costs associated with investment by the Fund in other investment companies (i.e., acquired fund fees and expenses). For period-end June 30, 2021, the Fund did not incur any extraordinary expenses.

Certain officers and Trustees of the Fund may also be officers, directors and/or employees of the Adviser or its affiliates. The Fund does not compensate its officers or Trustees who are officers, directors and/or employees of the Adviser or its affiliates. The Independent Trustees fees are a direct expense of the Fund which is included in the “Trustee fees” line item on the Statement of Operations for the period ended June 30, 2021.

5. SECURITIES LENDING

The Board of Trustees has authorized the Fund to engage in securities lending with State Street Bank and Trust Company as securities lending agent pursuant to a Securities Lending Authorization Agreement (the “Agreement”) and subject to the Fund’s securities lending policies and procedures. Under the terms of the Agreement, and subject to the policies and procedures, the Fund may lend portfolio securities to qualified borrowers in order to generate additional income, while managing risk associated with the securities lending program. The Agreement requires that loans are collateralized at all times by cash or U.S.government securities, initially equal to at least 102% of the value of the domestic securities and 105% of non-domestic securities, based upon the prior days market value for securities loaned. The loaned securities and collateral are marked to market daily to maintain collateral at 102% of the total loaned portfolio. Amounts earned as interest on investments of cash collateral, net of rebates and fees, if any, are included in the Statement of Operations. The primary risk associated with securities lending is loss associated with investment of cash and non-cash collateral. A secondary risk is if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons. The Fund could experience delays and costs in recovering securities loaned or in gaining access to the collateral. Under the Agreement, the securities lending agent has provided a limited indemnification in the event of a borrower default. The Fund does not have a master netting agreement.

Cash collateral received for securities on loan are reinvested into the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral is invested in U.S. treasuries or government securities. As of June 30, 2021, the Fund did not have any securities on loan to brokers/dealers.

6. DERIVATIVES

The FASB issued guidance intended to enhance financial statement disclosure for derivative instruments and enable investors to understand: a) how and why a fund uses derivative investments, b) how derivative instruments are accounted for, and c) how derivative instruments affect a fund’s financial position, and results of operations.

The following table presents the types of derivatives in the fund by location and as presented on the Statement of Assets and Liabilities as of June 30, 2021.

| | | | | | | | | | | | | | |

| Statements of Asset & Liability Presentation of Fair Values of Derivative Instruments |

| Asset Derivatives | Liability Derivatives |

| Underlying Risk | Statement of Assets

and Liabilities Location | Fair Value | Statement of Assets

and Liabilities Location | Fair Value |

| Equity | Options purchased | – | Options written | $(2,254,488) |

15

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

The following table presents the effect of derivative instruments on the Statement of Operations for the period ended June 30, 2021.

| | | | | | | | | | | |

| Statement of Operations | Underlying Risk | Realized Gain

(Loss) on Derivatives: | Change in Unrealized Appreciation

(Depreciation) on Derivatives |

| Options Written | Equity | 294,380 | 1,103,629 |

The average volume (based on the open positions at each month-end) of derivative activity during the period ended June 30, 2021.

| | | | | |

| Options Written Contracts |

Madison Covered Call &

Equity Strategy Fund | 5,267 |

7. FEDERAL INCOME TAX INFORMATION

No provision is made for federal income taxes since it is the intention of the Fund to comply with the provisions of Subchapter M of the Internal Revenue Code of 1986 as amended, applicable to regulated investment companies and to make the requisite distribution to shareholders of taxable income, which will be sufficient to relieve it from all or substantially all federal income taxes.

At June 30, 2021, the aggregate gross unrealized appreciation (depreciation) and net unrealized depreciation for all securities, as computed on a federal income tax basis for the Fund were as follows:

| | | | | |

| Cost | $193,593,142 |

| Gross appreciation | 1,800,564 |

| Gross depreciation | (16,520,356) |

| Net depreciation | $ (14,719,792) |

Net realized gains or losses may differ for financial reporting and tax purposes primarily as a result of the deferral of losses relating to wash sale transactions and certain market-to-market investments.

8. INVESTMENT TRANSACTIONS

During the period ended June 30, 2021, the cost of purchases and proceeds from sales of investments, excluding short-term investments, were $112,526,886 and $134,124,096 respectively. No long-term U.S. government securities were purchased or sold during the period.

9. CAPITAL

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 20,957,893 shares issued and outstanding as of June 30, 2021. During the six months ended June 30, 2021, 10,969 shares were issued and reinvested, per the Dividend Reinvestment Plan, since the Fund was trading at a premium. There were no shares issued and reinvested for the year ended December 2020.

10. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent upon claims that may be made against the Fund in the future and therefore cannot be estimated; however, the Fund considers the risk of material loss from such claims as remote.

16

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

11. DISCUSSION OF RISKS

Equity Risk: The value of the securities held by the Fund may decline due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests.

Option Risk: There are several risks associated with transactions in options on securities. For example, there are significant differences between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events.

As the writer of a covered call option, the Fund forgoes, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but retains the risk of loss should the price of the underlying security decline. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

When the Fund writes covered put options, it bears the risk of loss if the value of the underlying stock declines below the exercise price. If the option is exercised, the Fund could incur a loss if it is required to purchase the stock underlying the put option at a price greater than the market price of the stock at the time of exercise. While the Fund’s potential gain in writing a covered put option is limited to the interest earned on the liquid assets securing the put option plus the premium received from the purchaser of the put option, the Fund risks a loss equal to the entire value of the stock.

Derivatives Risk: The risk that loss may result from investments in options, forwards, futures, swaps and other derivatives instruments. These instruments may be illiquid, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations.

Industry Concentration Risk: To the extent that the Fund makes substantial investments in a single industry, the Fund will be more susceptible to adverse economic or regulatory occurrences affecting those sectors.

Fund Distribution Risk: In order to make regular quarterly distributions on its common shares, the Fund may have to sell a portion of its investment portfolio at a time when independent investment judgment may not dictate such action. In addition, the Fund’s ability to make distributions more frequently than annually from any net realized capital gains by the Fund is subject to the Fund obtaining exemptive relief from the SEC, which cannot be assured. To the extent the total quarterly distributions for a year exceed the Fund’s net investment company income and net realized capital gain for that year, the excess will generally constitute a return of the Fund’s capital to its common shareholders. Such return of capital distributions generally are tax-free up to the amount of a common shareholder’s tax basis in the common shares (generally, the amount paid for the common shares). In addition, such excess distributions will decrease the Fund’s total assets and may increase the Fund’s expense ratio.

Cybersecurity Risk: The Fund is also subject to cybersecurity risk, which includes the risks associated with computer systems, networks and devices to carry out routine business operations. These systems, networks and devices employ a variety of protections that are designed to prevent cyberattacks. Despite the various cyber protections utilized by the Fund, the Adviser, and other service providers, their systems, networks, or devices could potentially be breached. The Fund, its shareholders, and the Adviser could be negatively impacted as a result of a cybersecurity breach. The Fund cannot control the

17

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - continued | June 30, 2021

cybersecurity plans and systems put in place by service providers or any other third parties whose operations may affect the Fund.

Recent Market Events: U.S. and international markets have experienced volatility in recent months and years due to a number of economic, political and global macro factors, including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a public health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors and reduced consumer spending. The effects of COVID-19 may lead to a substantial economic downturn or recession in the U.S. and global economies, the recovery from which is uncertain and may last for an extended period of time. Uncertainties regarding interest rates, political events, rising government debt in the U.S. and trade tensions have also contributed to market volatility. Global economies and financial markets are increasingly interconnected, which increases the possibility that conditions in one country or region might adversely impact issuers in a different country or region. In particular, a rise in protectionist trade policies, slowing global economic growth, risks associated with epidemic and pandemic diseases, risks associated with the United Kingdom’s departure from the European Union, the risk of trade disputes, and the possibility of changes to some international trade agreements, could affect the economies of many nations, including the United States, in ways that cannot necessarily be foreseen at the present time. Continuing market volatility as a result of recent market conditions or other events may have adverse effects on the funds and their shareholders.

Foreign Investment Risk: Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risks, as well as lower market liquidity, generally greater market volatility and less complete financial information than for U.S. issuers.

Mid-Cap Company Risk: Mid-Cap companies often are newer or less established companies than larger companies. Investments in mid-cap companies carry additional risks because earnings of these companies tend to be less predictable; they often have limited product lines, markets, distribution channels or financial resources; and the management of such companies may be dependent upon one or a few key people. The market movements of equity securities of mid-cap companies may be more abrupt or erratic than the market movements of equity securities of larger, more established companies or the stock market in general.

Financial Leverage Risk: The Fund is authorized to utilize leverage through the issuance of preferred shares and/ or the Fund may borrow or issue debt securities for financial leveraging purposes and for temporary purposes such as settlement of

transactions. Although the use of any financial leverage by the Fund may create an opportunity for increased net income, gains and capital appreciation for common shares, it also results in additional risks and can magnify the effect of any losses. If the income and gains earned on securities purchased with financial leverage proceeds are greater than the cost of financial leverage, the Fund’s return will be greater than if financial leverage had not been used. Conversely, if the income or gain from the securities purchased with such proceeds does not cover the cost of financial leverage, the return to the Fund will be less than if financial leverage had not been used. Financial leverage also increases the likelihood of greater volatility of the NAV and market price of, and dividends on, the common shares than a comparable portfolio without leverage.

Additional Risks: While investments in securities have been keystones in wealth building and management, at times these investments have produced surprises. Those who enjoyed growth and income of their investments generally were rewarded for the risks they took by investing in the markets. Although the Adviser seeks to appropriately address and manage the risks identified and disclosed to you in connection with the management of the securities in the Fund, you should understand that the very nature of the securities markets includes the possibility that there may be additional risks of which we are not aware. We certainly seek to identify all applicable risks and then appropriately address them, take appropriate action to reasonably manage them and to make you aware of them so you can determine if they exceed your risk tolerance. Nevertheless, the often volatile nature of the securities markets and the global economy in which we work suggests that the

18

MCN | Madison Covered Call & Equity Strategy Fund | Notes to Financial Statements - concluded | June 30, 2021

risk of the unknown is something to consider in connection with an investment in securities. Unforeseen events could under certain circumstances produce a material loss of the value of some or all of the securities we manage for you in the Fund.

12. IMPACTS OF COVID-19

The global outbreak of COVID-19 has disrupted financial markets and the prolonged economic impact is uncertain. The performance of the Funds’ investments depends on future developments, including the duration and spread of the outbreak and the creation, distribution and efficacy of a vaccine. Events related to COVID-19 may result in further global economic disruption and market volatility which in turn may impact the value of the fund’s investments.

13. SUBSEQUENT EVENTS

Management has evaluated all subsequent events through the date the financial statements were available for issue. No events have taken place that meet the definition of a subsequent event that requires adjustment to, or disclosure in, the financial statements.

19

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Other Information (unaudited)

ADDITIONAL INFORMATION

Notice is hereby given in accordance with Section 23(c) of the 1940 Act that from time to time, the Fund may purchase shares of its common stock in the open market at prevailing market prices.

This report is sent to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or any securities mentioned in this report.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULES

The fund file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-EX. Form NPORT-EX is available upon request to shareholders at no cost by calling 1-800-877-6089 or on the SEC’s website at www.sec.gov. Form NPORT-EX may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. More information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PROXY VOTING POLICIES, PROCEDURES AND RECORDS

A description of the policies and procedures used by the funds to vote proxies related to portfolio securities is available to shareholders at no cost on the funds’ website at www.madisonfunds.com or by calling 1-800-877-6089 or on the SEC’s website at www.sec.gov. The proxy voting records for the funds for the most recent twelvemonth period ended June 30 are available to shareholders at no cost 1-800-SEC-0330 on the SEC’s website at www.sec.gov.

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as investment company managers is to communicate with shareholders in an open and direct manner. Some of our comments in the “Management’s Discussion of Fund Performance” are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as estimate, may, will, expect, believe, plan and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

20

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Dividend Reinvestment Plan (unaudited)

Unless the registered owner of common shares elects to receive cash by contacting Computershare Trust Company, Inc. (the “Plan Administrator”), all distributions declared on common shares of the Fund will be automatically reinvested by the Plan Administrator in the Fund’s Dividend Reinvestment Plan (the “Plan”) in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the distribution record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all distributions declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder’s common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a “Distribution”) payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding common shares on the open market (“Open-Market Purchases”) on the New York Stock Exchange or elsewhere. If, on the payment date for any Distribution, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Distribution amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Distribution by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Distribution will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Distribution, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Distribution amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Distribution had been paid in Newly Issued Common Shares on the Distribution payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Distribution amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Distribution amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Distribution will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

21

MCN | Madison Covered Call & Equity Strategy Fund | Dividend Reinvestment Plan - concluded | June 30, 2021

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Distributions will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Distributions.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, Computershare Trust Company, N.A., P.O. Box 505000, Louisville, KY 40233, Phone Number: 1-781-575-4523.

22

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

Board of Trustees

Richard E. Struthers

James R. Imhoff, Jr.

Steven P. Riege

Paul A. Lefurgey (Interested)

Officers

Patrick F. Ryan

President

Paul A. Lefurgey

Vice President

Greg D. Hoppe

Vice President & Chief Financial Officer

Holly S. Baggot

Secretary & Assistant Treasurer

Steven J. Fredricks

Chief Compliance Officer & Assistant Secretary and Anti-Money Laundering Officer

Trey D. Edgerle

Assistant Secretary

Investment Adviser and Administrator

Madison Asset Management, LLC

550 Science Drive

Madison, WI 53711

Custodian

State Street Bank

Kansas City, Missouri

Transfer Agent

Computershare Investor Services, LLC

Canton, Massachusetts

Independent Registered

Public Accounting Firm

Deloitte & Touche LLP

Chicago, Illinois

Question concerning your shares of Madison Covered Call & Equity Strategy Fund?

•If your shares are held in a Brokerage Account, contact your Broker

•If you have physical possession of your shares in certificate form, contact the Fund’s Transfer Agent:

Computershare Trust Company, N.A., P.O. Box 505000, Louisville, KY 40233

This report is sent to shareholders of Madison Covered Call & Equity Strategy Fund for their information. It is not a Prospectus, circular or representation intended for

use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

A description of the Fund’s proxy voting policies and procedures related to portfolio securities is available without charge, upon request, by calling the Fund at (800) 368-3195 and is available on the SEC’s website at www.sec.gov.

Information regarding how the Fund voted proxies for portfolio securities, if applicable, during the most recent 12-month period ended June 30, is also available, without charge and upon request by calling the Fund at (800) 368-3195 or by accessing the Fund’s Form N-PX on the SEC’s website at www.sec.gov.

In September 2020, the Fund submitted a CEO annual certification to the NYSE in which the Fund’s principal executive officer certified that they were not aware, as of the date of the certification, of any violation by the Fund of the NYSE’s Corporate Governance listing standards. In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules, the Fund’s principal executive and principal financial officers have made quarterly certifications, including in filings with the SEC on forms N-CSR and N-PORT, relating to, among other things, the Fund’s disclosure controls and procedures and internal control over financial reporting.

23

MCN | Madison Covered Call & Equity Strategy Fund | June 30, 2021

This page was intentionally left blank.

24

madisonfunds.com

Madison Funds®

550 Science Drive

Madison, WI 53711

800.368.3195

Item 2. Code of Ethics.

Not applicable in semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable in semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable in semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable in semi-annual report.

Item 6. Schedule of Investments

Included in report to shareholders (Item 1) above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable in semi-annual report.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable in semi-annual report.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

(a) None*

(b) None*

*Note to Item 9: As announced and disclosed in the registrant’s prospectus, the registrant maintains a Dividend Reinvestment Plan. The plan has no expiration date and no limits on the dollar amount of securities that may be purchased by the registrant to satisfy the plan’s dividend reinvestment requirements.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the registrant’s disclosure controls and procedures are effective, based on their evaluation of these controls and procedures within 90 days of the date of this report. There were no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There have been no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable in semi-annual report.

Item 13. Exhibits.

(a) (1) Code of Ethics – See Item 2

(3) Not applicable

(4) There was no change in the registrant’s independent accountant for the period covered by this report

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Madison Covered Call & Equity Strategy Fund

/s/ Steven J. Fredricks

Steven J. Fredricks, Chief Legal Officer & Chief Compliance Officer

Date: August 26, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

/s/ Patrick F. Ryan

Patrick F. Ryan, Principal Executive Officer

Date: August 26, 2021

/s/ Greg Hoppe