INVESTOR DAY November 3, 2015 Vince Kelly CEO

2 SAFE HARBOR STATEMENT This presentation includes forward‐looking statements that are subject to risks and uncertainties relating to Spok’s future financial and business performance. Such statements may include estimates of revenue, expenses, and income, as well as other predictive statements or plans which are dependent upon future events or conditions. These statements represent the Company’s estimates only on the date of this presentation and are not intended to give any assurance as to actual future results. Spok’s actual results could differ materially from those anticipated in these forward‐ looking statements. Although these statements are based upon assumptions that the Company believes to be reasonable, based upon available information, they are subject to risks and uncertainties. Please review the risk factors section relating to our operations and the business environment in which we compete, contained in our 2014 Form 10‐K and related Company documents filed with the Securities and Exchange Commission, for a description of these risks and uncertainties. Please note that Spok assumes no obligation to update any forward‐looking statements contained in this presentation or from past or future filings and conference calls.

3 PRESENTING TODAY Vince Kelly Chief Executive Officer Hemant Goel President Tom Saine Chief Information Officer Kyle Gunderson Vice President of Development and Chief Technology Officer Shawn Endsley Chief Financial Officer Brian Edds Vice President of Product Strategy Gary Ash Global Executive Vice President of Sales

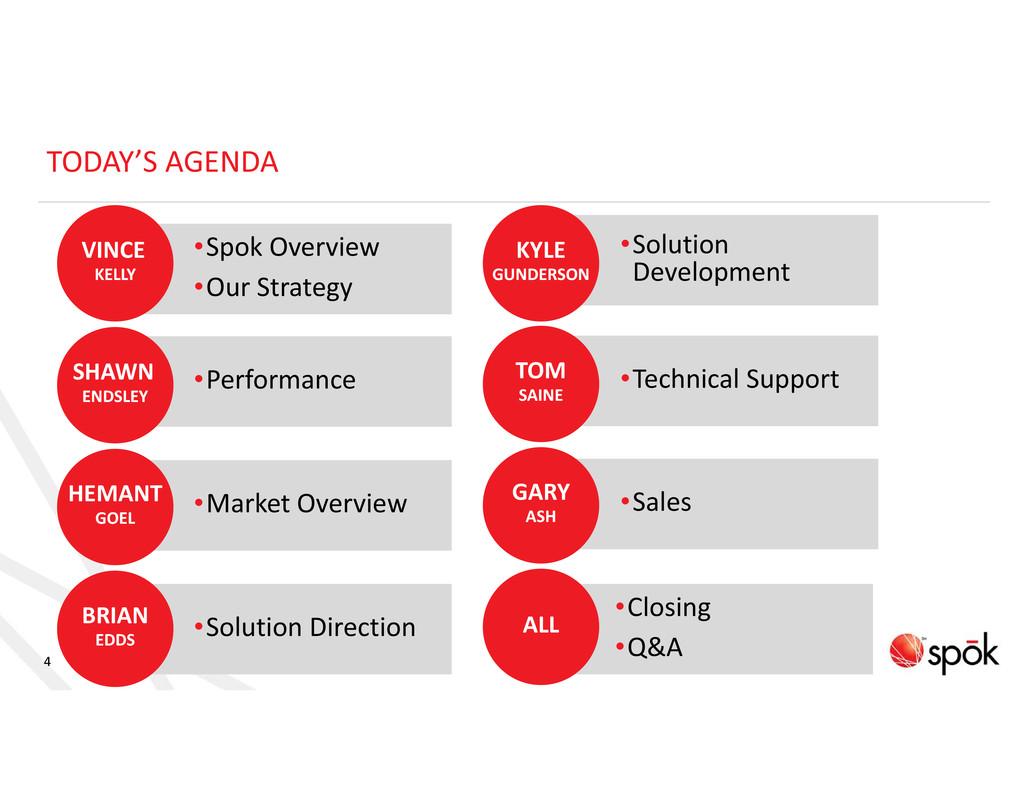

4 •Closing •Q&A •Solution Development •Technical Support •Sales•Market Overview •Spok Overview •Our Strategy •Performance •Solution Direction TODAY’S AGENDA VINCE KELLY SHAWN ENDSLEY HEMANT GOEL BRIAN EDDS KYLE GUNDERSON GARY ASH TOM SAINE ALL

5 SPOK OVERVIEW Public Company Since 2004 Profitable & Debt Free Return Capital to Shareholders Focus on Growth Invest in the Future Deliver smart, reliable communication solutions to help protect the health, well‐ being, and safety of people around the globe.

6 COMPANY VALUES VALUES We put the customer first in everything we do What we do matters: our solutions improve communications in critical situations We are committed to innovation and offering new solutions for future growth We are accountable to each other, to shareholders, and to our customers

7 THE BEST ADULT AND CHILDREN’S HOSPITALS CHOOSE SPOK Source: U.S. News & World Report’s “Best Hospitals” list 2015‐16 5,000 ADULT HOSPITALS SURVEYED 15 QUALIFIED for “HONOR ROLL” ALL USE SPOK SOLUTIONS 184 CHILDREN’S HOSPITALS SURVEYED 12 QUALIFIED for “HONOR ROLL” ALL USE SPOK SOLUTIONS Source: U.S. News & World Report’s “Best Children’s Hospitals” list 2015‐16

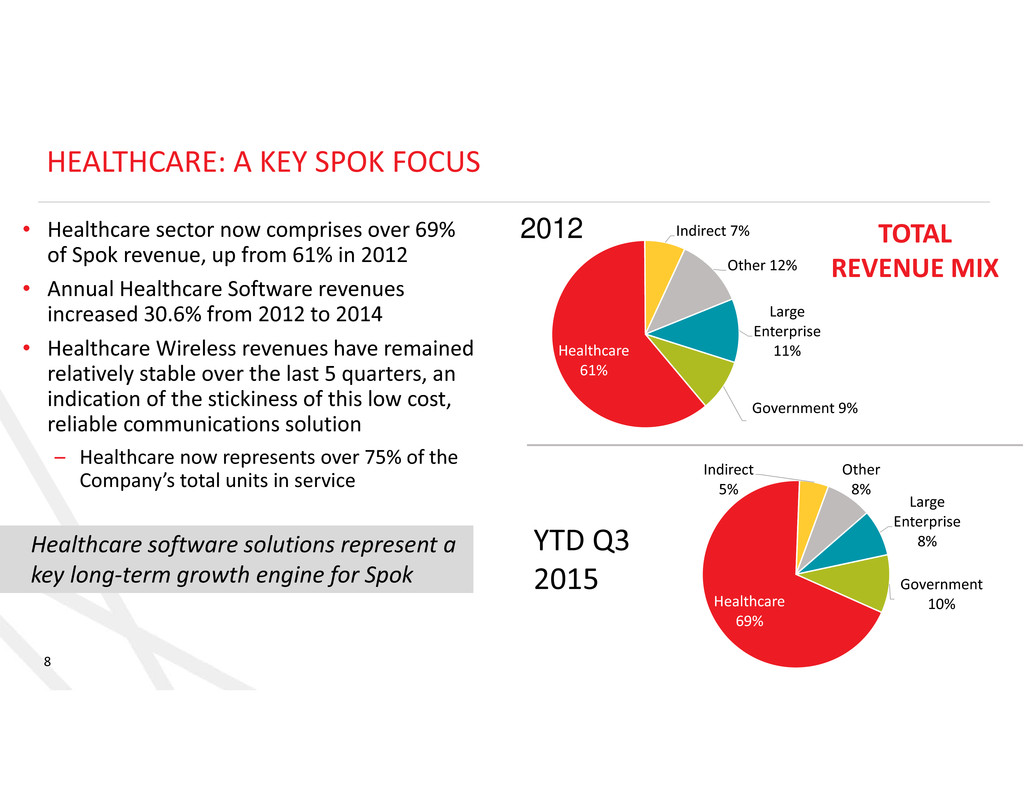

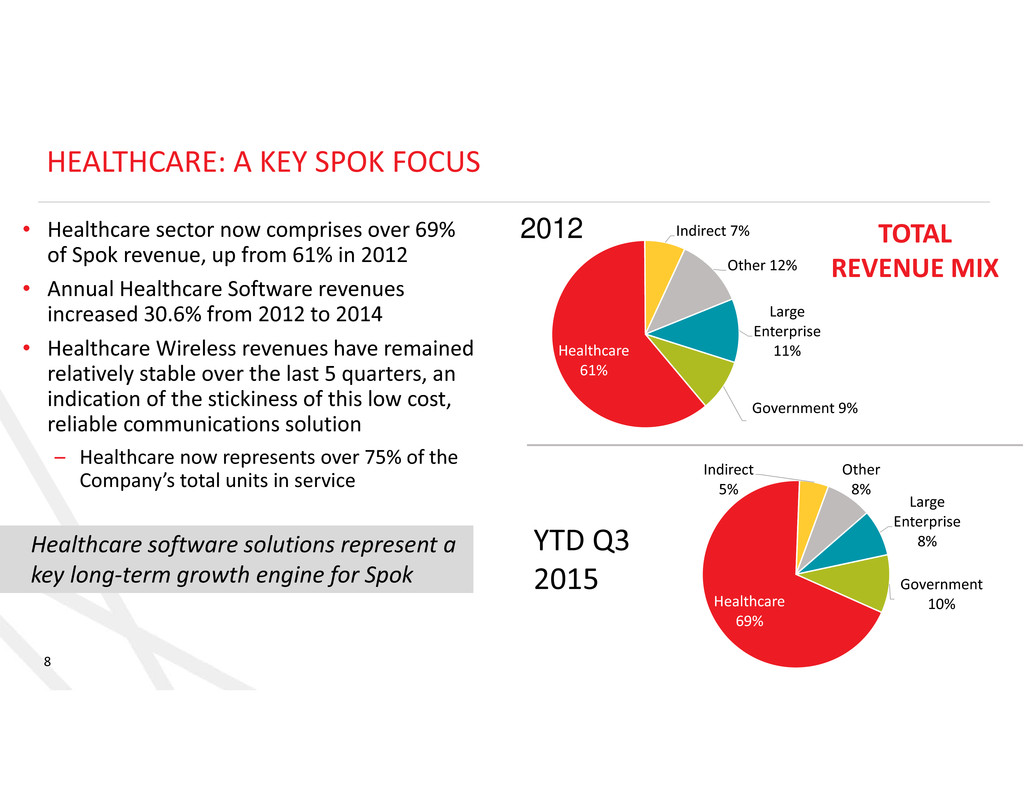

8 HEALTHCARE: A KEY SPOK FOCUS • Healthcare sector now comprises over 69% of Spok revenue, up from 61% in 2012 • Annual Healthcare Software revenues increased 30.6% from 2012 to 2014 • Healthcare Wireless revenues have remained relatively stable over the last 5 quarters, an indication of the stickiness of this low cost, reliable communications solution – Healthcare now represents over 75% of the Company’s total units in service Healthcare software solutions represent a key long‐term growth engine for Spok TOTAL REVENUE MIX Healthcare 69% Indirect 5% Other 8% Large Enterprise 8% Government 10% YTD Q3 2015 2012 Healthcare 61% Indirect 7% Other 12% Large Enterprise 11% Government 9%

9 WHY CUSTOMERS HAVE CHOSEN SPOK Banner Health and Spok created a video to highlight ways Spok technology improves staff communication and patient care

10 2015 REFLECTS SUCCESSFUL EXECUTION OF OUR STRATEGY Capitalized on Our New Global Spok Brand Completed Comprehensive Market Evaluation Reorganized Our Management Team Continued to Make Significant Investments in Key Spok Teams Met/Exceeded Majority of Key Performance Goals Committed a Minimum of $26 Million to Our Stockholders Strengthened Our Balance Sheet

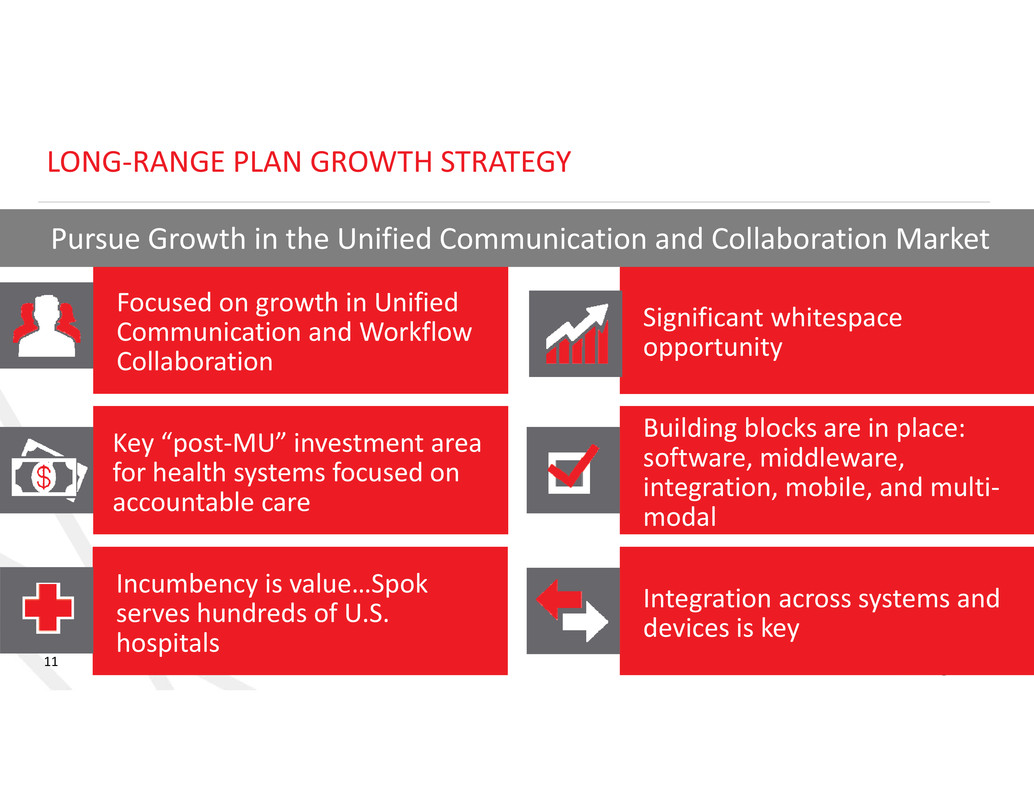

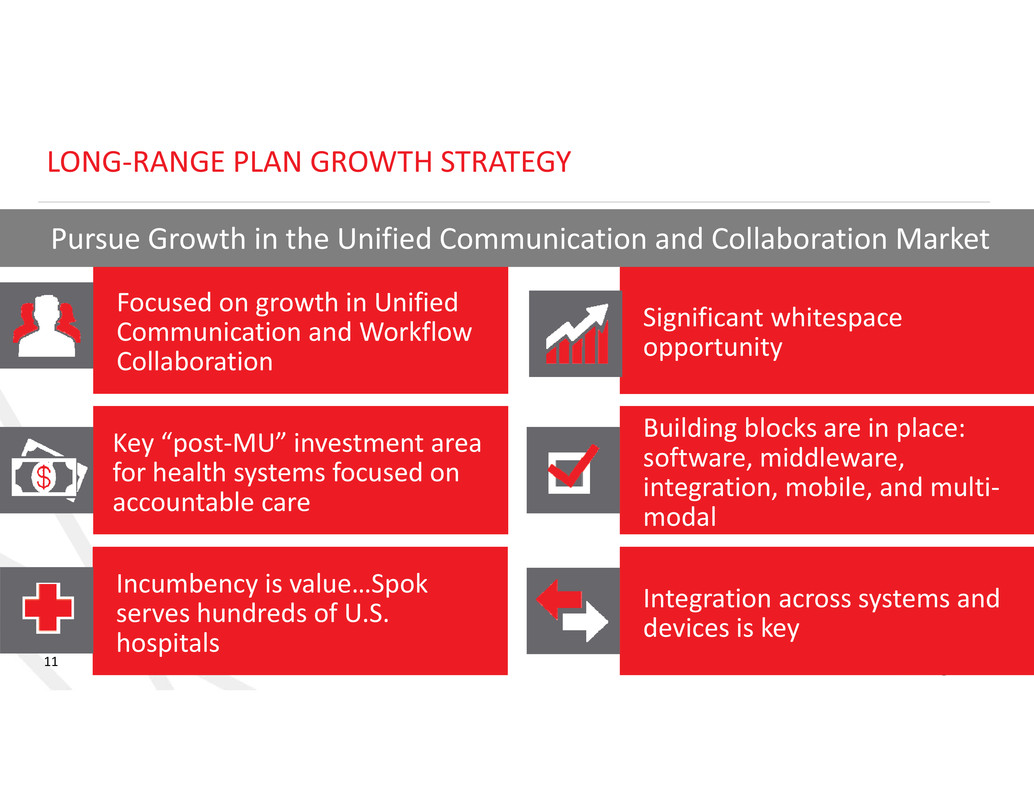

11 LONG‐RANGE PLAN GROWTH STRATEGY Focused on growth in Unified Communication and Workflow Collaboration Key “post‐MU” investment area for health systems focused on accountable care Incumbency is value…Spok serves hundreds of U.S. hospitals Significant whitespace opportunity Building blocks are in place: software, middleware, integration, mobile, and multi‐ modal Integration across systems and devices is key Pursue Growth in the Unified Communication and Collaboration Market

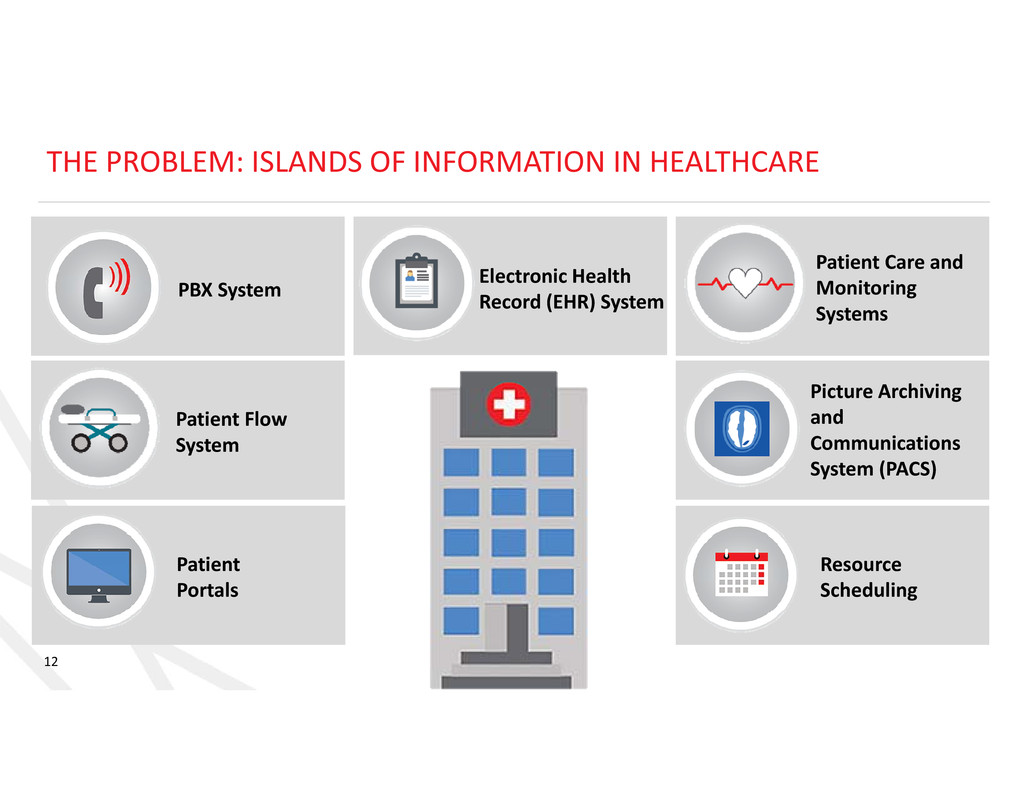

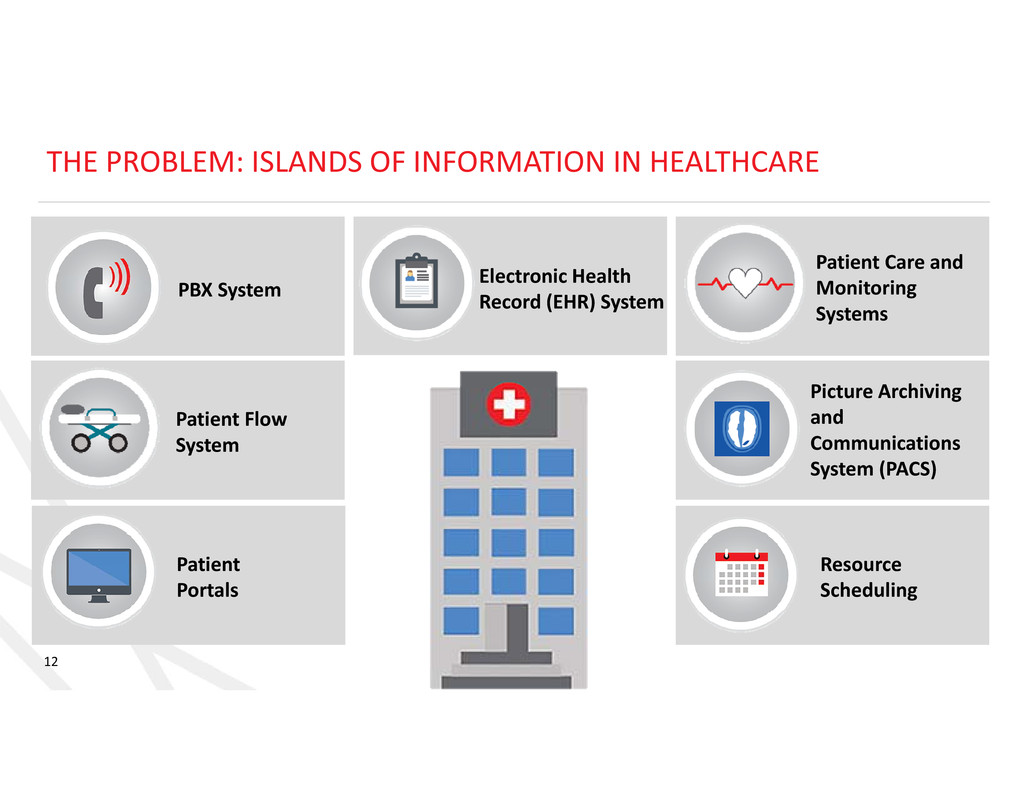

12 THE PROBLEM: ISLANDS OF INFORMATION IN HEALTHCARE Electronic Health Record (EHR) System PBX System Patient Care and Monitoring Systems Picture Archiving and Communications System (PACS) Patient Flow System Resource Scheduling Patient Portals

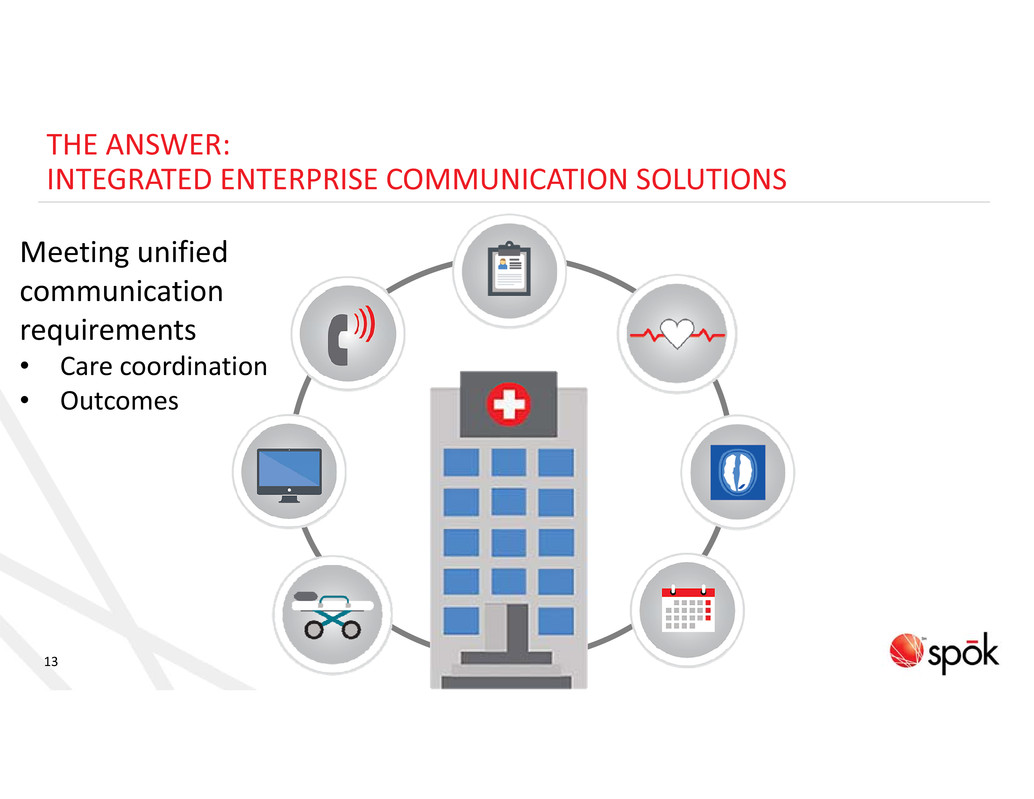

13 THE ANSWER: INTEGRATED ENTERPRISE COMMUNICATION SOLUTIONS Meeting unified communication requirements • Care coordination • Outcomes

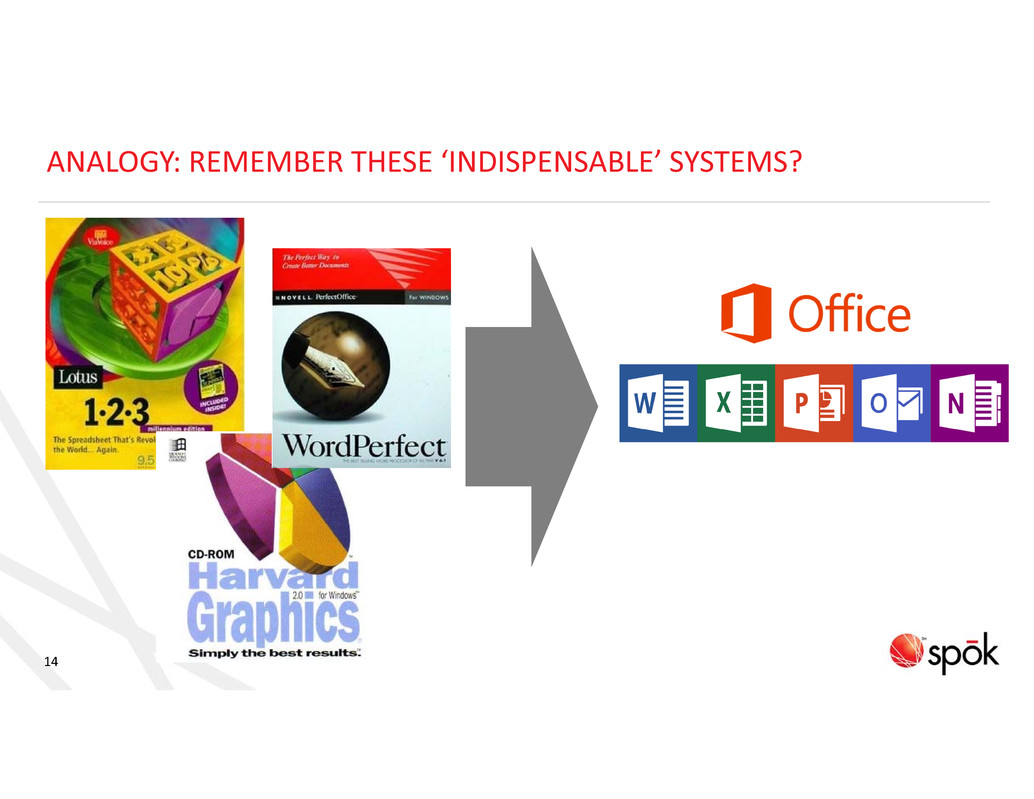

14 ANALOGY: REMEMBER THESE ‘INDISPENSABLE’ SYSTEMS?

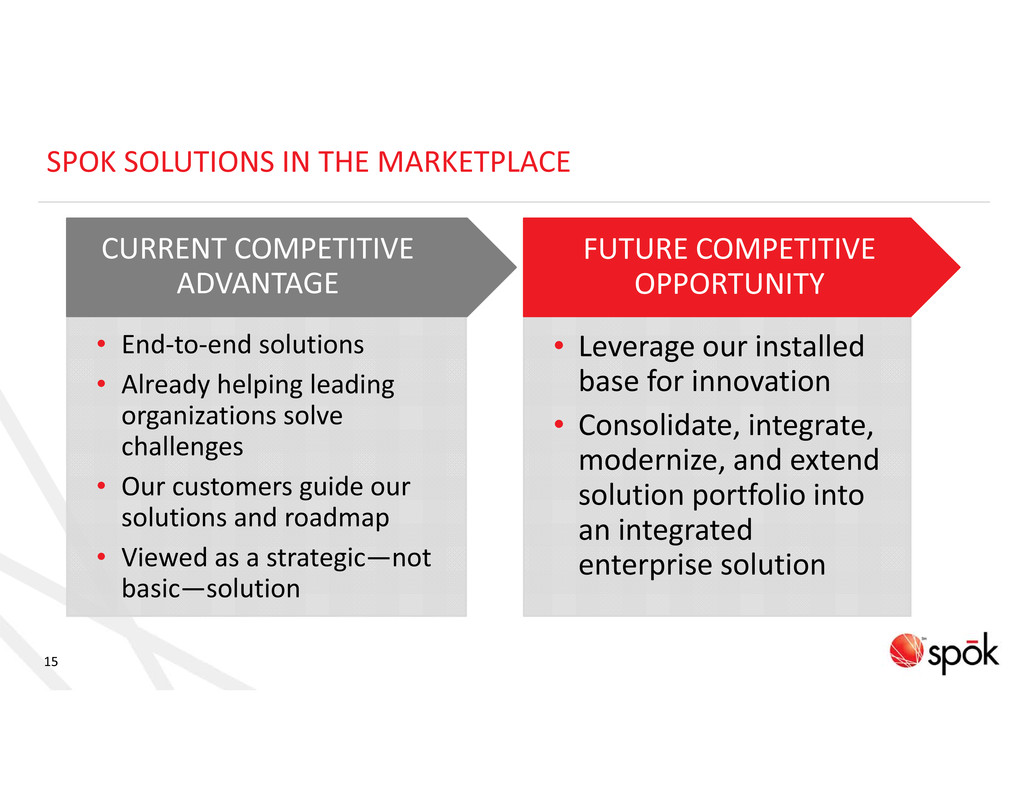

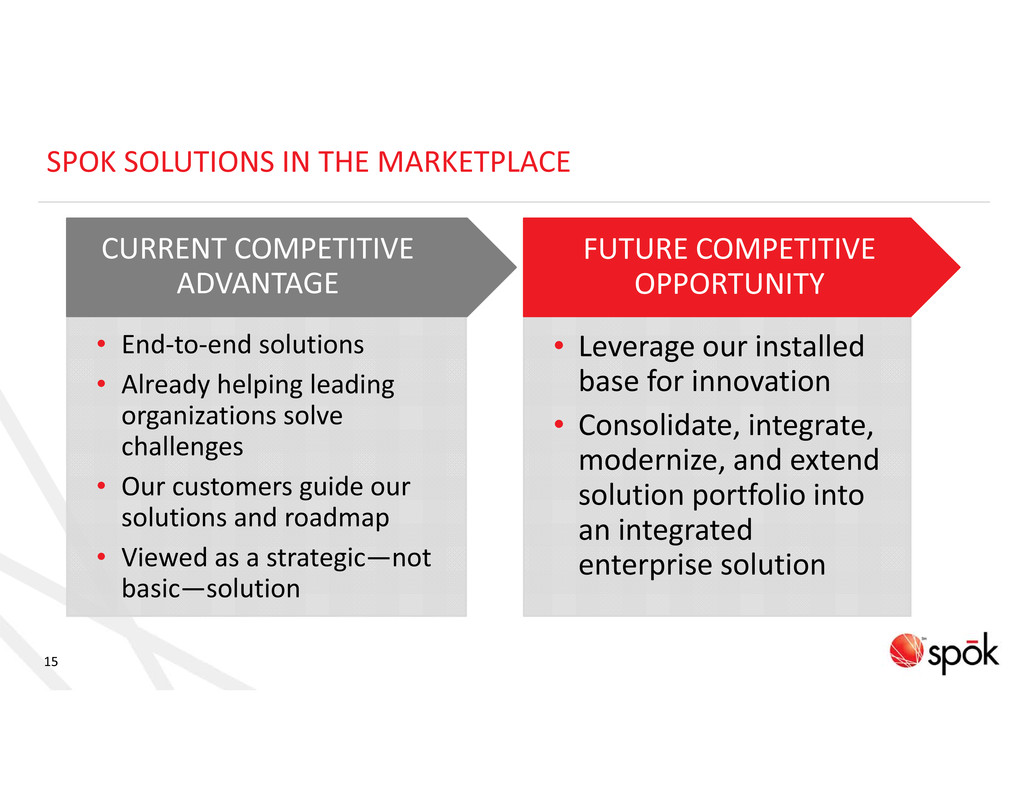

15 • Leverage our installed base for innovation • Consolidate, integrate, modernize, and extend solution portfolio into an integrated enterprise solution • End‐to‐end solutions • Already helping leading organizations solve challenges • Our customers guide our solutions and roadmap • Viewed as a strategic—not basic—solution SPOK SOLUTIONS IN THE MARKETPLACE FUTURE COMPETITIVE OPPORTUNITY CURRENT COMPETITIVE ADVANTAGE

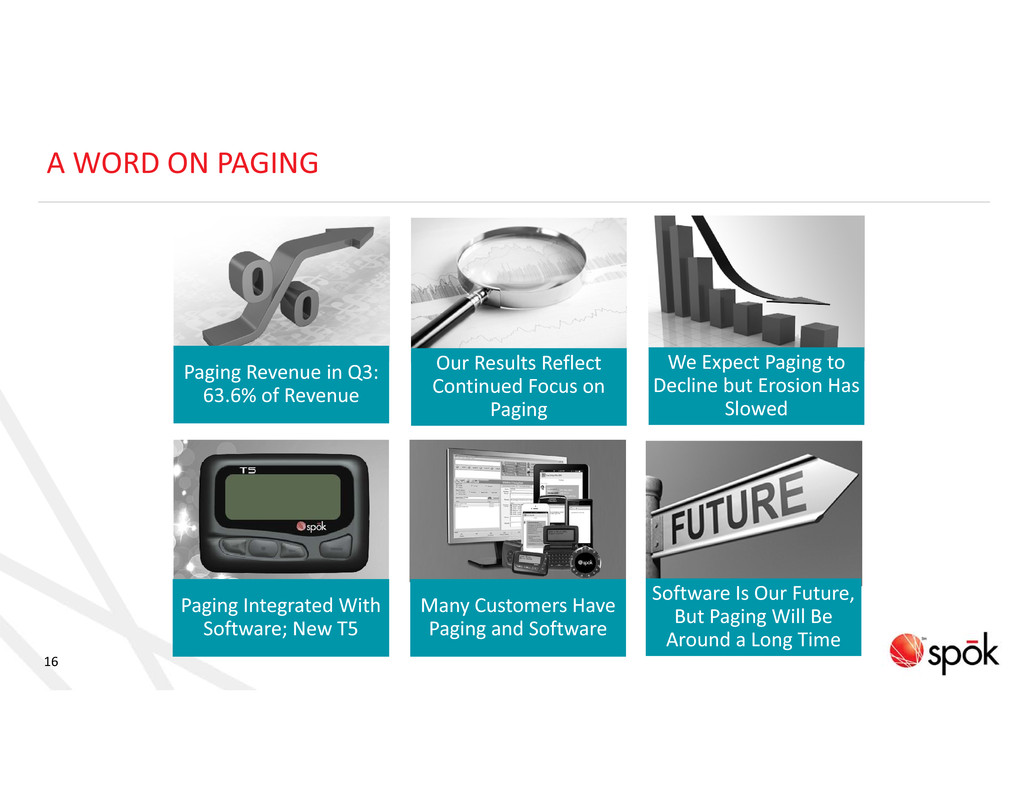

16 A WORD ON PAGING Paging Revenue in Q3: 63.6% of Revenue Our Results Reflect Continued Focus on Paging We Expect Paging to Decline but Erosion Has Slowed Paging Integrated With Software; New T5 Many Customers Have Paging and Software Software Is Our Future, But Paging Will Be Around a Long Time

17 KEY POINTS IN SUPPORT OF OUR STRATEGY We are financially strong, with an extensive customer base Product strategy and development have a clear vision and plan Our network and underlying infrastructure are best‐in‐class Spok is well positioned to provide THE integrated healthcare communications and collaboration enterprise solution

PERFORMANCE Shawn Endsley Chief Financial Officer

19 2015 RESULTS TO DATE Grow software bookings and revenue Retain wireless subscribers and revenues Deploy capital to stockholders

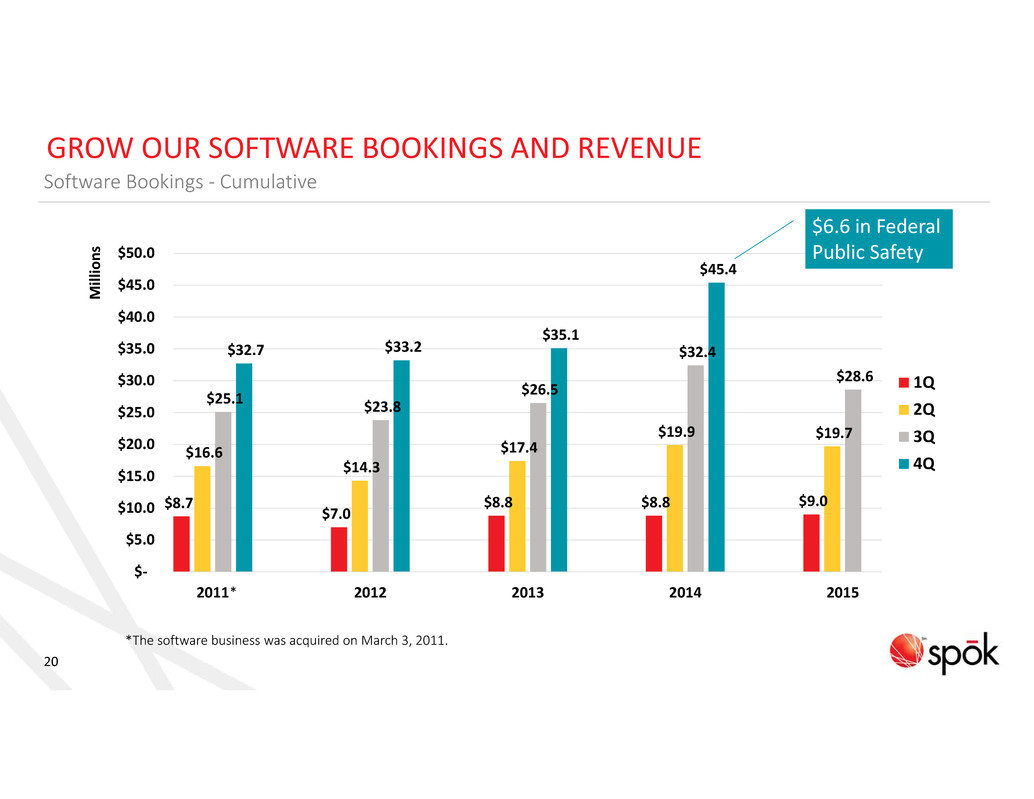

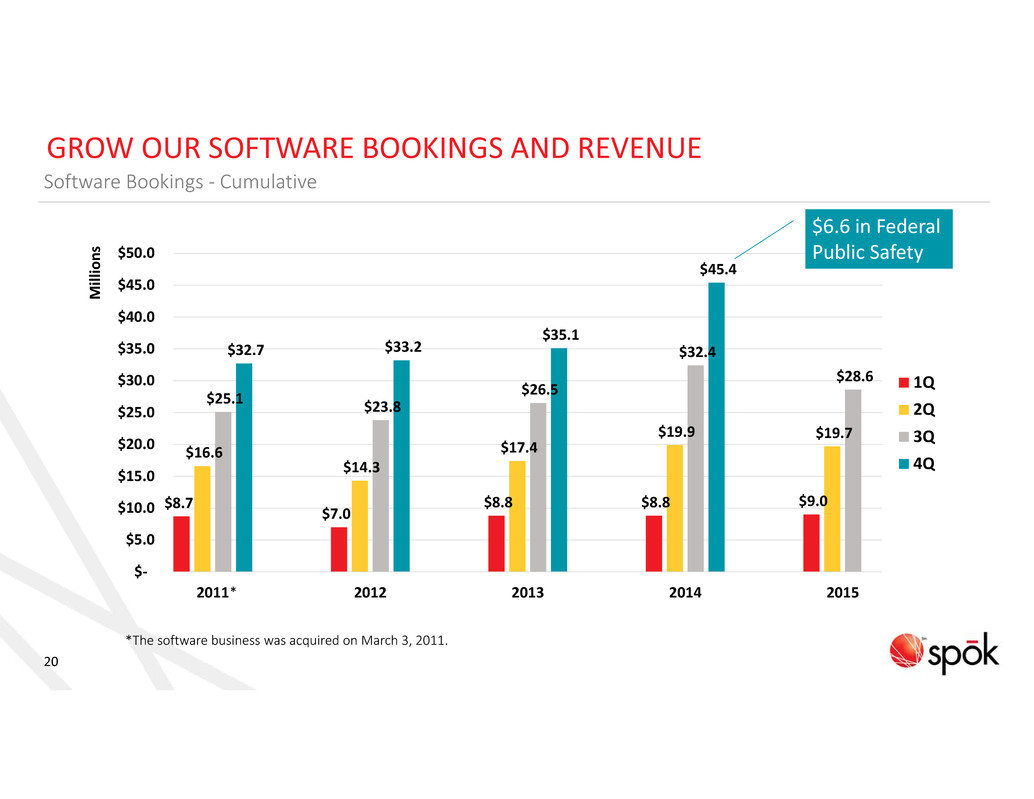

20 GROW OUR SOFTWARE BOOKINGS AND REVENUE Software Bookings ‐ Cumulative M i l l i o n s *The software business was acquired on March 3, 2011. $8.7 $7.0 $8.8 $8.8 $9.0 $16.6 $14.3 $17.4 $19.9 $19.7 $25.1 $23.8 $26.5 $32.4 $28.6 $32.7 $33.2 $35.1 $45.4 $‐ $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 2011 2012 2013 2014 2015 1Q 2Q 3Q 4Q * $6.6 in Federal Public Safety

21 GROW OUR SOFTWARE BOOKINGS AND REVENUE Software Revenue $20.2 $25.4 $32.4 $37.1 $25.5 $26.6 $13.8 $25.9 $27.9 $30.8 $22.8 $25.4 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 2011 2012 2013 2014 2014 2015 M i l l i o n s Through 3Q TOTAL: $34.0 TOTAL: $51.3 TOTAL: $60.3 TOTAL: $67.9 TOTAL: $48.3 Growth: 12.6% Growth: 7.7% *The software business was acquired on March 3, 2011. * Operations Maintenance TOTAL: $52.0

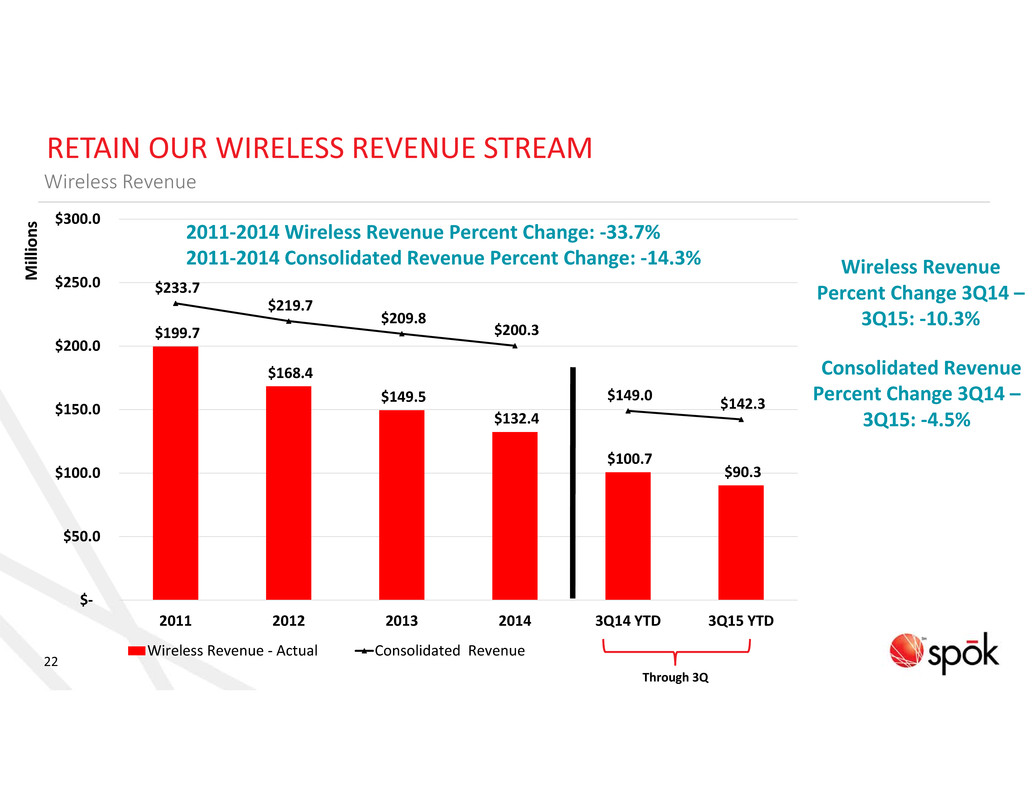

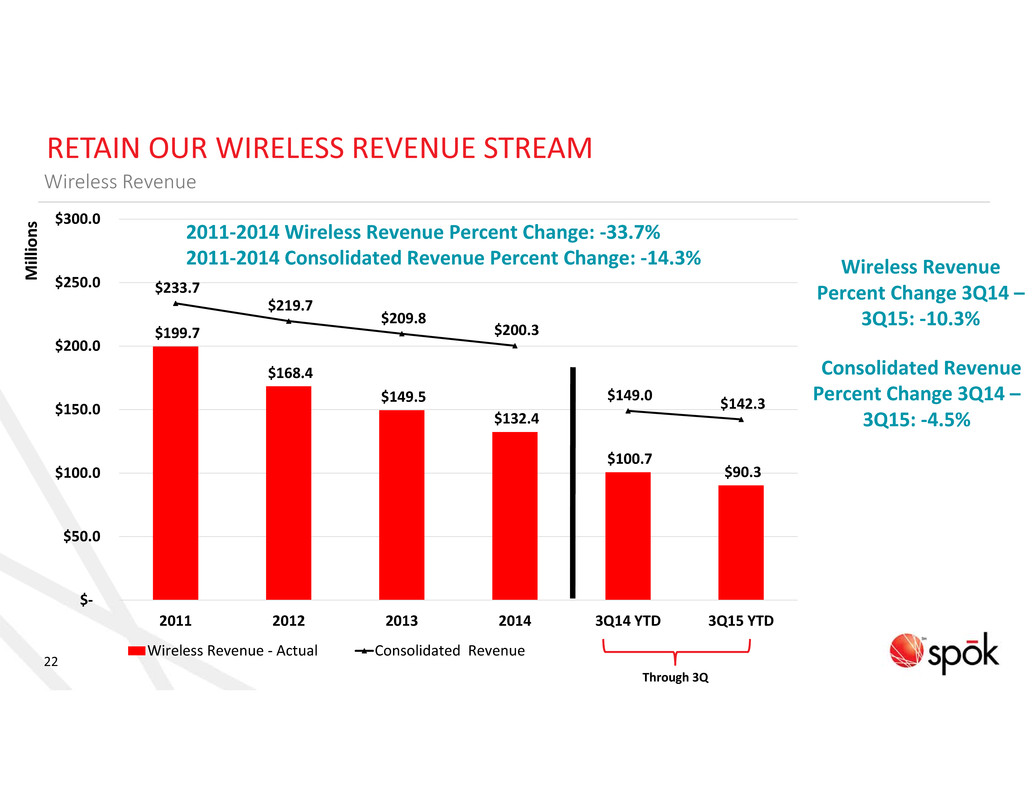

22 $199.7 $168.4 $149.5 $132.4 $100.7 $90.3 $233.7 $219.7 $209.8 $200.3 $149.0 $142.3 $‐ $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 2011 2012 2013 2014 3Q14 YTD 3Q15 YTD Wireless Revenue ‐ Actual Consolidated Revenue RETAIN OUR WIRELESS REVENUE STREAM Wireless Revenue M i l l i o n s Consolidated Revenue Percent Change 3Q14 – 3Q15: ‐4.5% Wireless Revenue Percent Change 3Q14 – 3Q15: ‐10.3% 2011‐2014 Wireless Revenue Percent Change: ‐33.7% 2011‐2014 Consolidated Revenue Percent Change: ‐14.3% Through 3Q

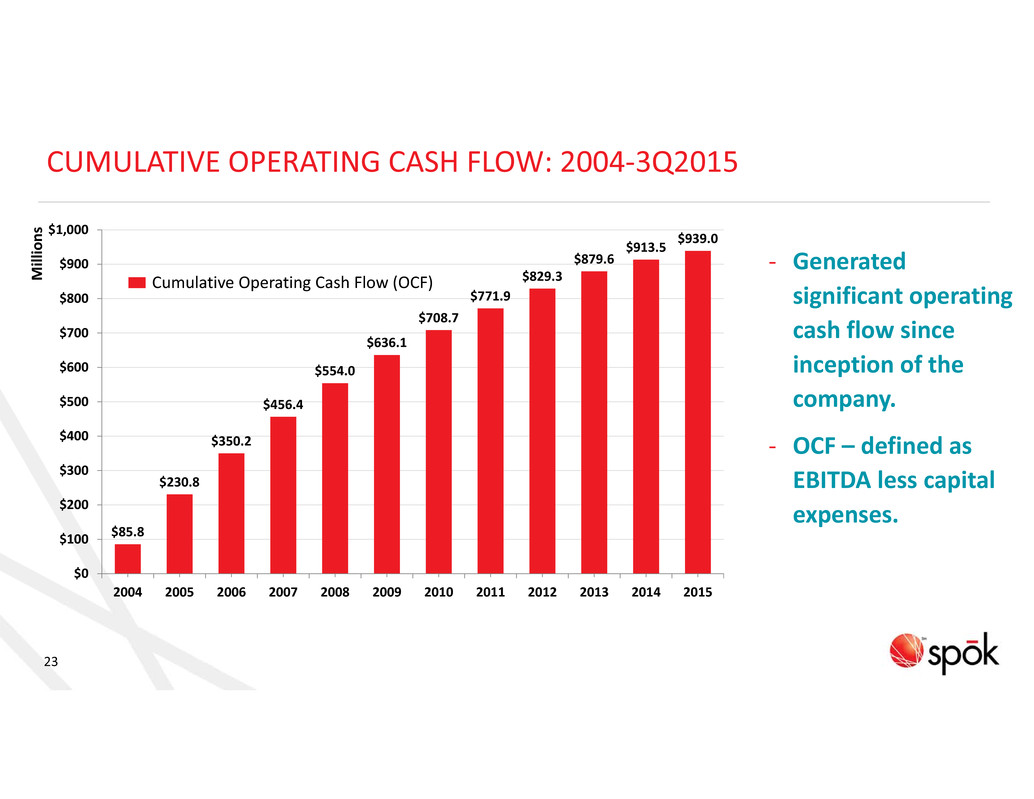

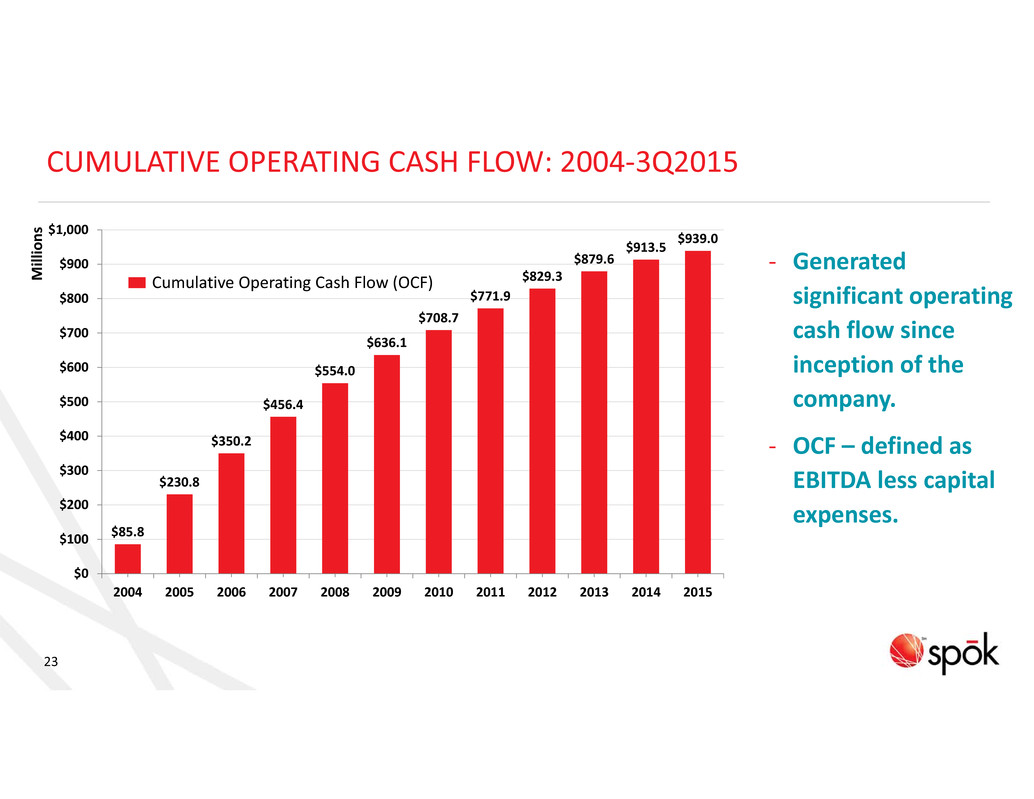

23 CUMULATIVE OPERATING CASH FLOW: 2004‐3Q2015 ‐ Generated significant operating cash flow since inception of the company. ‐ OCF – defined as EBITDA less capital expenses. $85.8 $230.8 $350.2 $456.4 $554.0 $636.1 $708.7 $771.9 $829.3 $879.6 $913.5 $939.0 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Cumulative Operating Cash Flow (OCF)M i l l i o n s

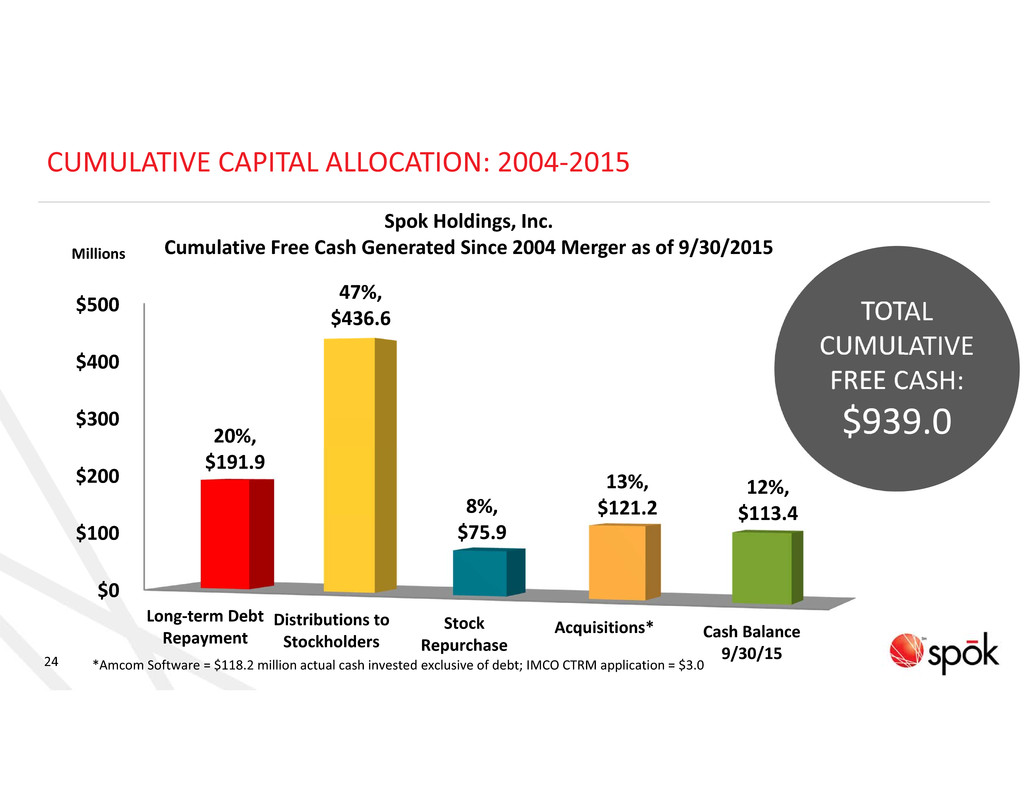

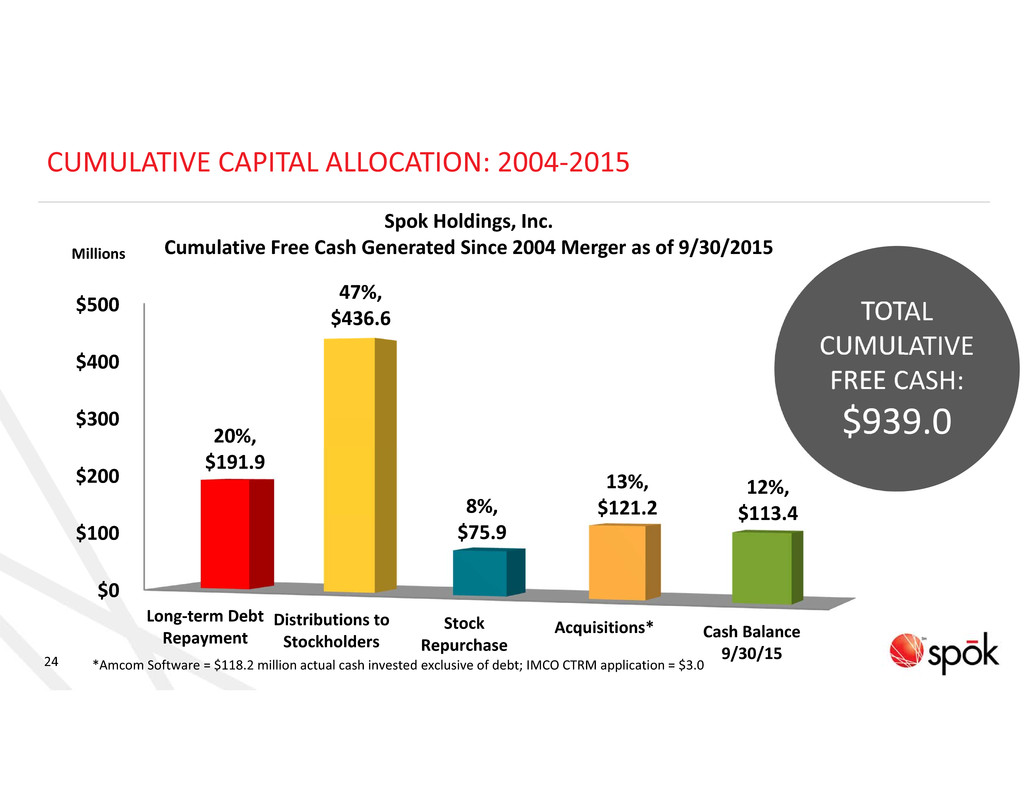

24 CUMULATIVE CAPITAL ALLOCATION: 2004‐2015 TOTAL CUMULATIVE FREE CASH: $939.0 $0 $100 $200 $300 $400 $500 Long‐term Debt Repayment Distributions to Stockholders Stock Repurchase Acquisitions* Cash Balance 9/30/15 20%, $191.9 47%, $436.6 8%, $75.9 13%, $121.2 12%, $113.4 Spok Holdings, Inc. Cumulative Free Cash Generated Since 2004 Merger as of 9/30/2015 *Amcom Software = $118.2 million actual cash invested exclusive of debt; IMCO CTRM application = $3.0 Millions

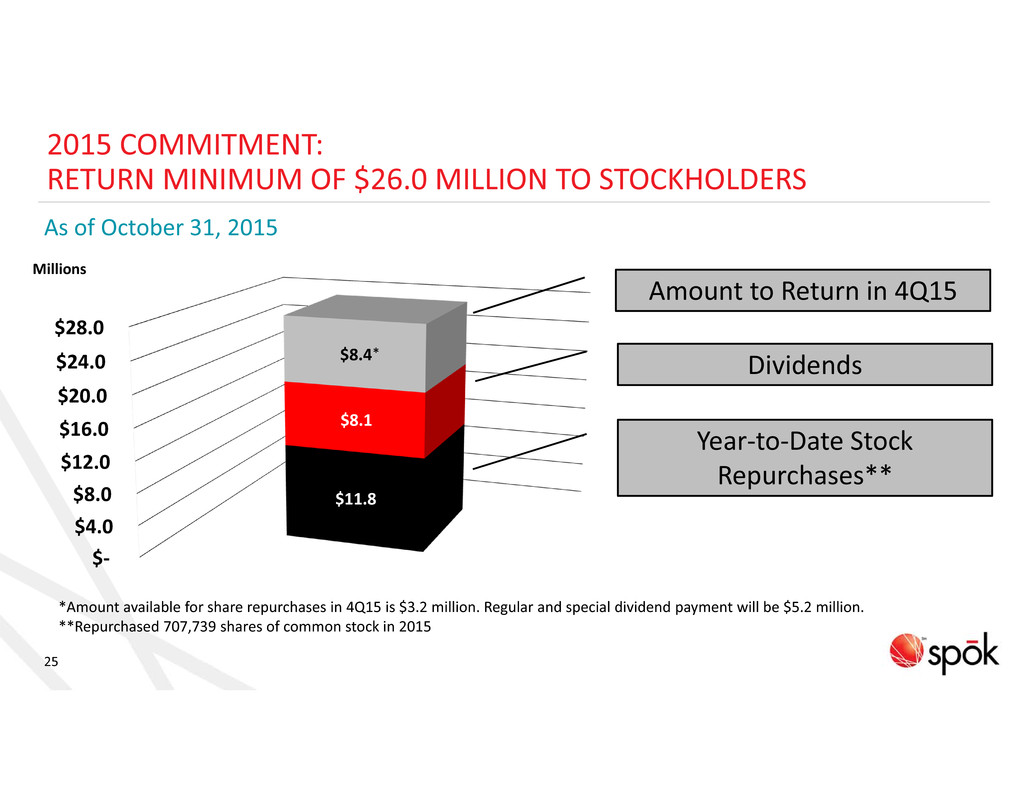

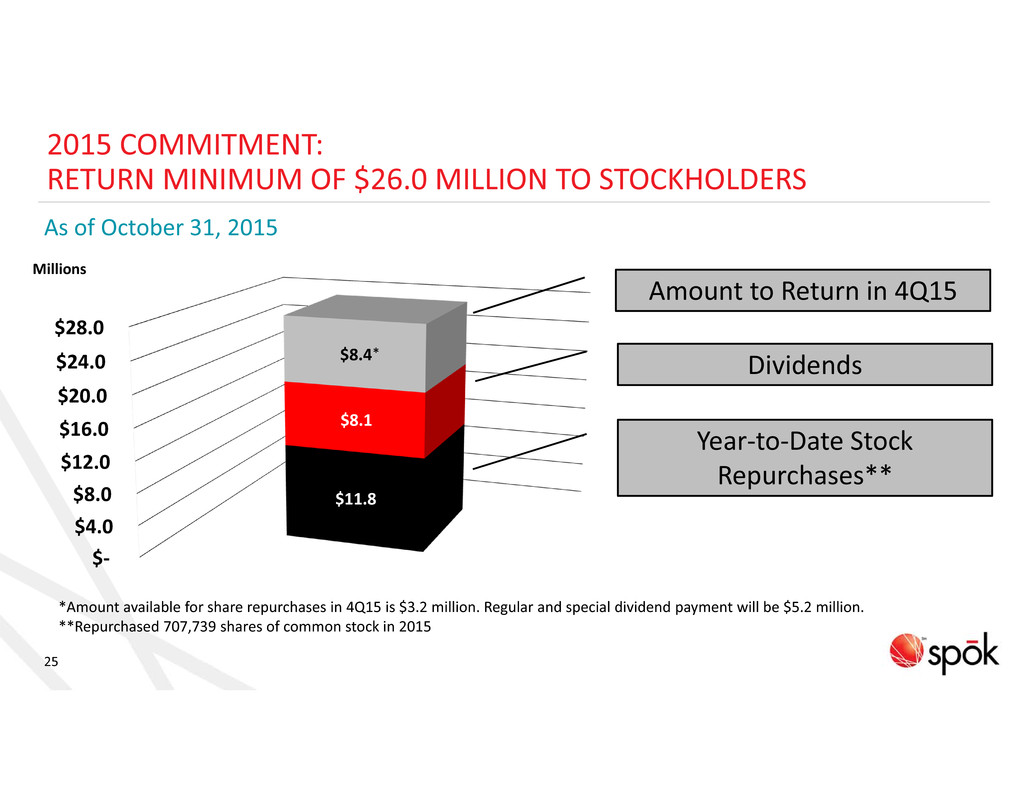

25 $‐ $4.0 $8.0 $12.0 $16.0 $20.0 $24.0 $28.0 $11.8 $8.1 $8.4 2015 COMMITMENT: RETURN MINIMUM OF $26.0 MILLION TO STOCKHOLDERS Amount to Return in 4Q15 Millions Dividends Year‐to‐Date Stock Repurchases** As of October 31, 2015 *Amount available for share repurchases in 4Q15 is $3.2 million. Regular and special dividend payment will be $5.2 million. **Repurchased 707,739 shares of common stock in 2015 *

MARKET OVERVIEW Hemant Goel President

THE FUTURE OF SOLUTIONS

28 THE HEADLINES

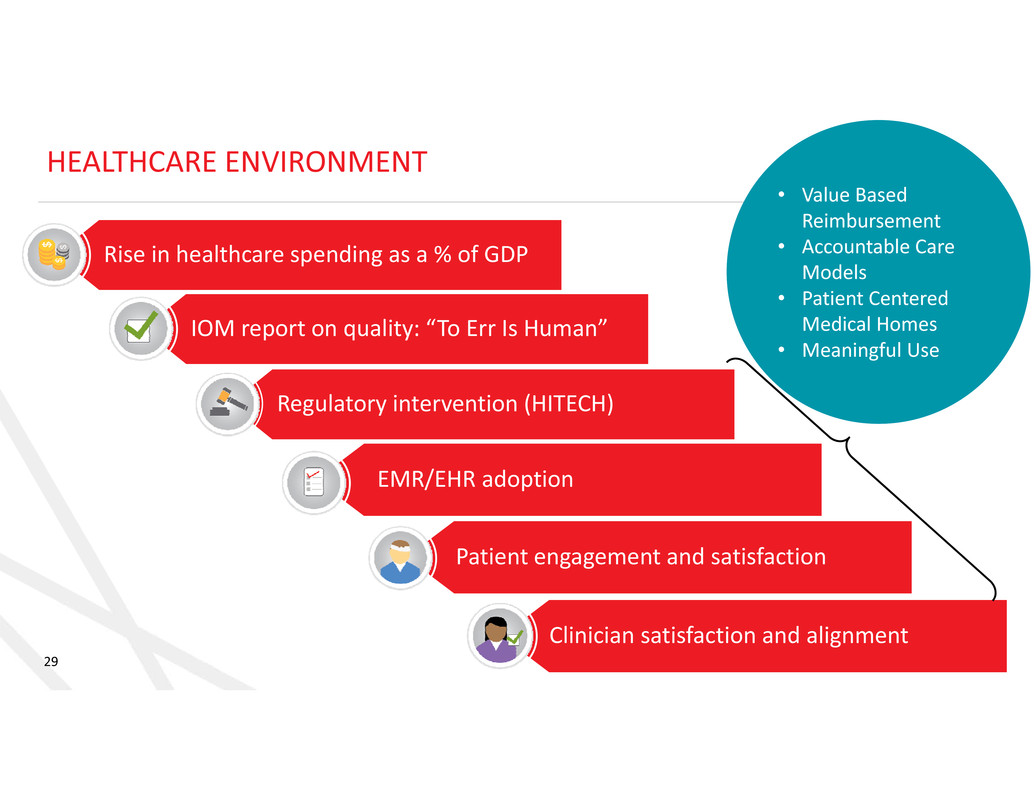

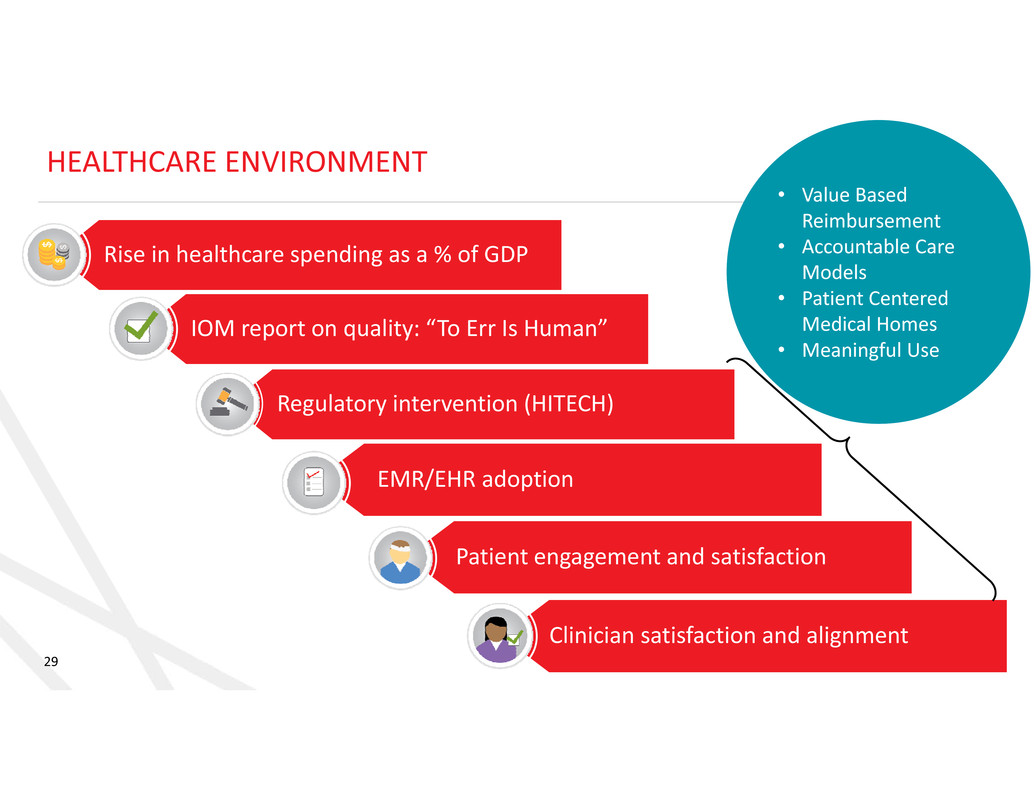

29 HEALTHCARE ENVIRONMENT Rise in healthcare spending as a % of GDP IOM report on quality: “To Err Is Human” Regulatory intervention (HITECH) EMR/EHR adoption Patient engagement and satisfaction Clinician satisfaction and alignment • Value Based Reimbursement • Accountable Care Models • Patient Centered Medical Homes • Meaningful Use

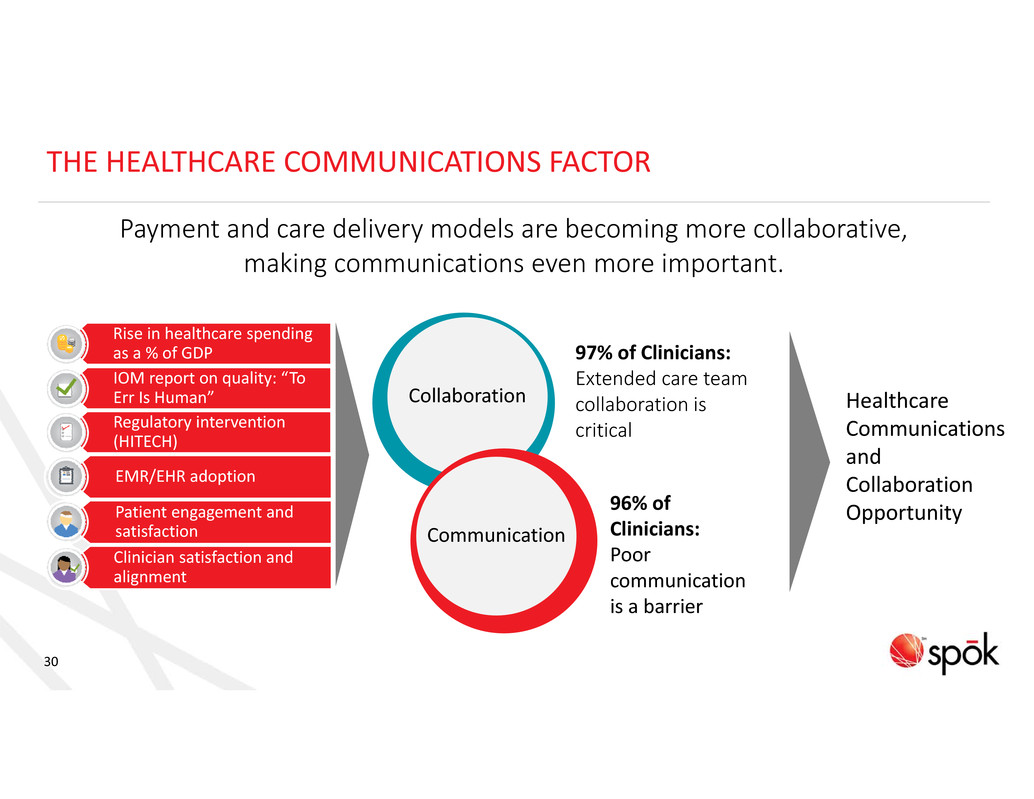

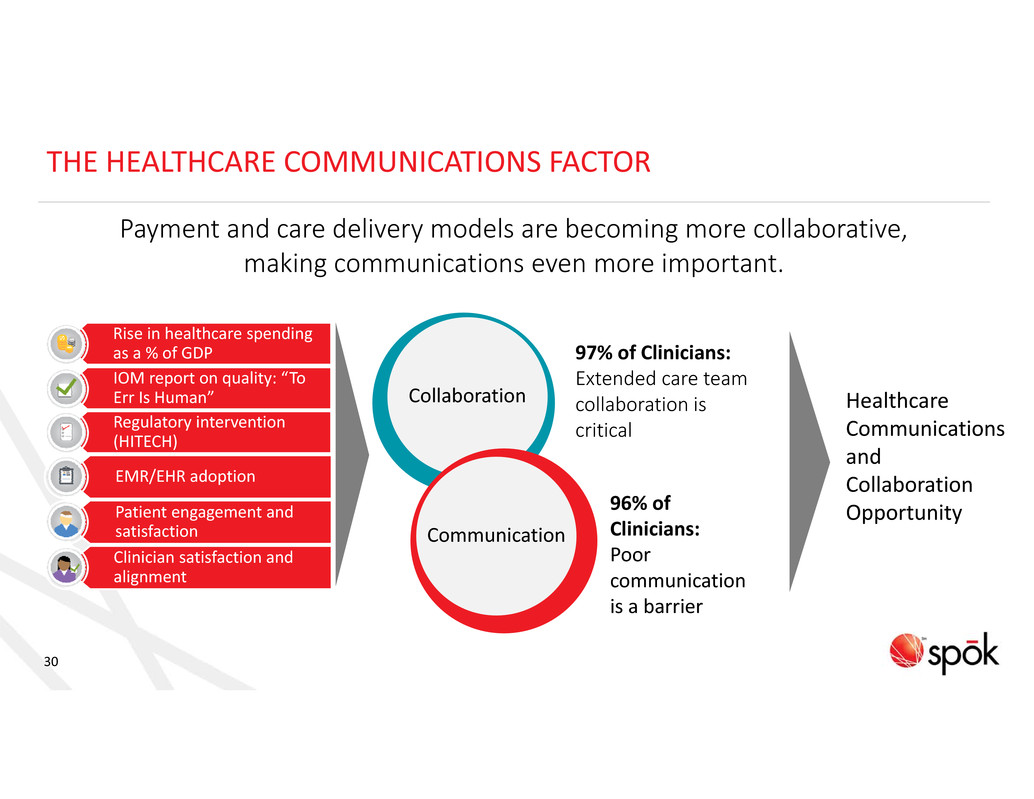

30 THE HEALTHCARE COMMUNICATIONS FACTOR 96% of Clinicians: Poor communication is a barrier Rise in healthcare spending as a % of GDP IOM report on quality: “To Err Is Human” Regulatory intervention (HITECH) EMR/EHR adoption Patient engagement and satisfaction Clinician satisfaction and alignment Collaboration Communication Payment and care delivery models are becoming more collaborative, making communications even more important. 97% of Clinicians: Extended care team collaboration is critical Healthcare Communications and Collaboration Opportunity

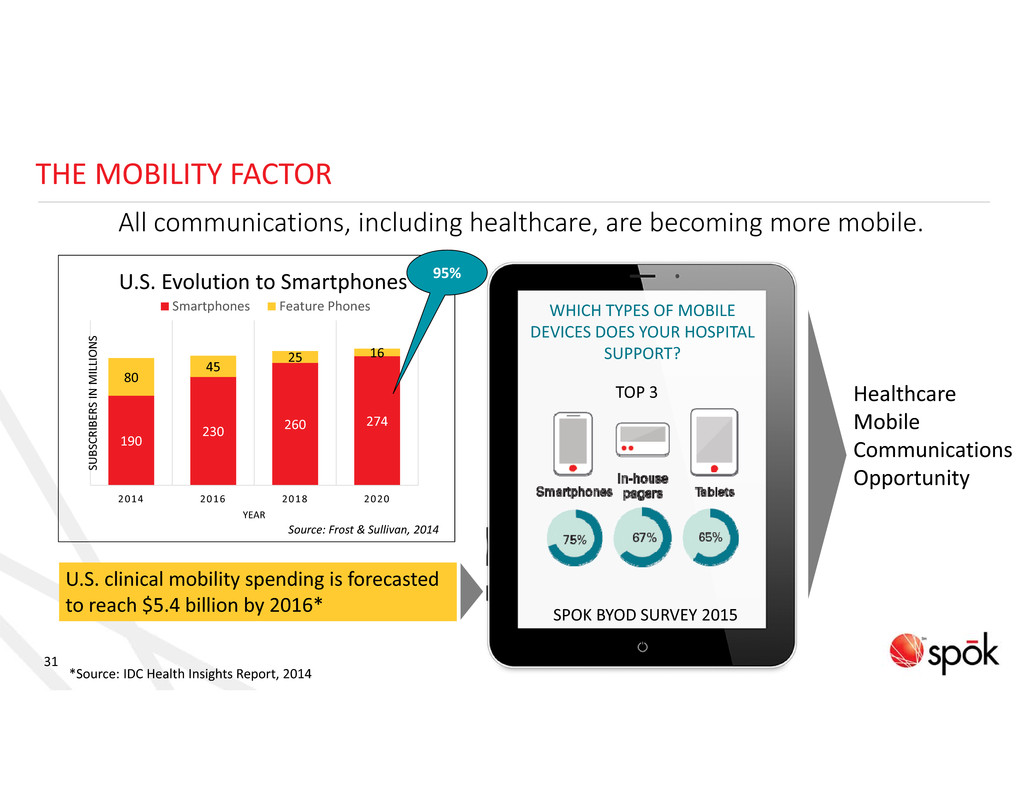

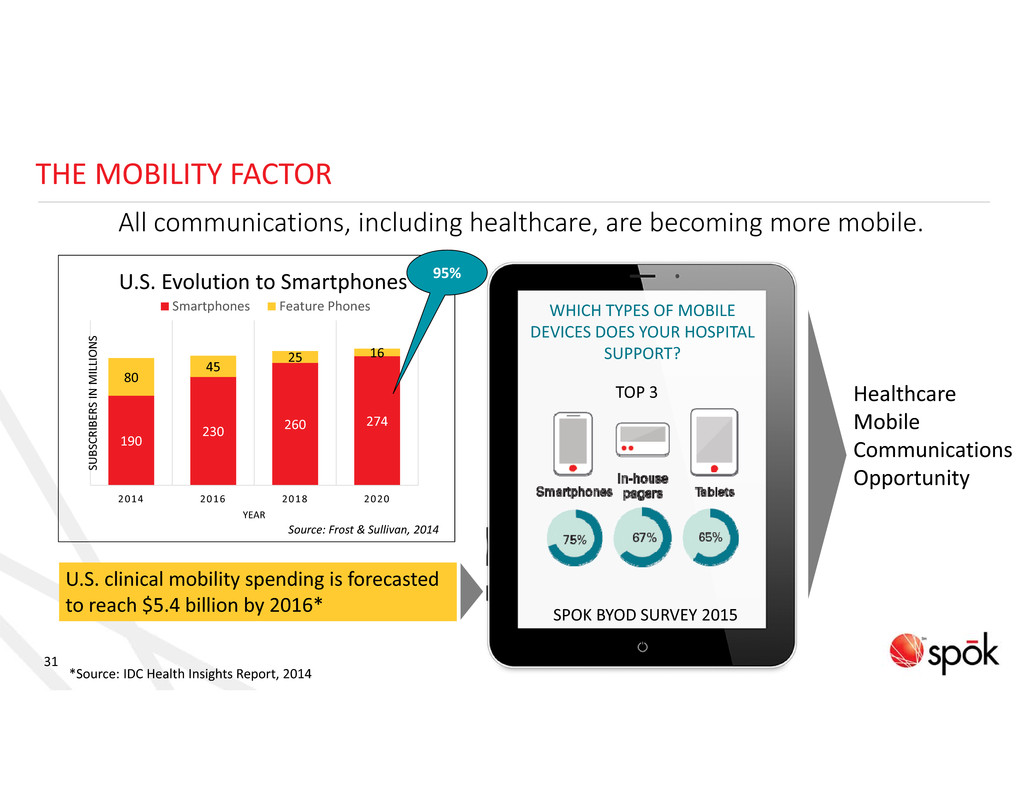

31 THE MOBILITY FACTOR All communications, including healthcare, are becoming more mobile. Healthcare Mobile Communications Opportunity U.S. Evolution to Smartphones SPOK BYOD SURVEY 2015 WHICH TYPES OF MOBILE DEVICES DOES YOUR HOSPITAL SUPPORT? TOP 3 190 230 260 274 80 45 25 16 2014 2016 2018 2020 S U B S C R I B E R S I N M I L L I O N S YEAR Smartphones Feature Phones Source: Frost & Sullivan, 2014 U.S. clinical mobility spending is forecasted to reach $5.4 billion by 2016* *Source: IDC Health Insights Report, 2014 95%

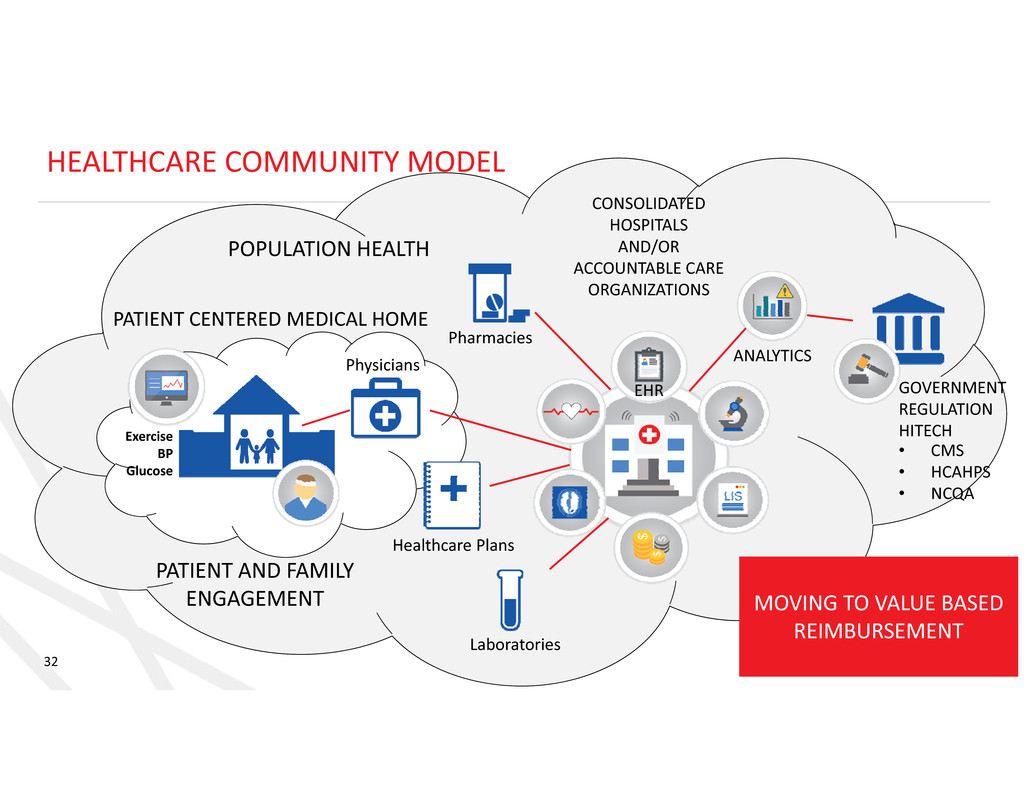

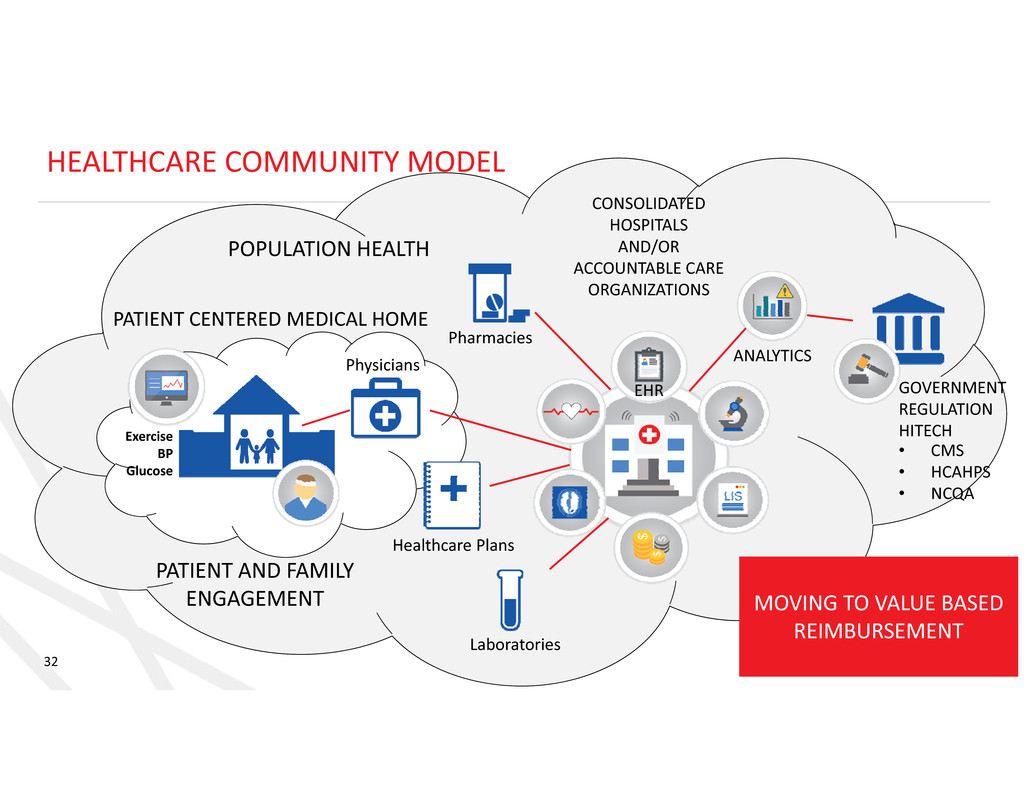

32 HEALTHCARE COMMUNITY MODEL GOVERNMENT REGULATION HITECH ANALYTICS • CMS • HCAHPS • NCQA MOVING TO VALUE BASED REIMBURSEMENT EHR CONSOLIDATED HOSPITALS AND/OR ACCOUNTABLE CARE ORGANIZATIONS PATIENT CENTERED MEDICAL HOME Exercise BP Glucose POPULATION HEALTH PATIENT AND FAMILY ENGAGEMENT Laboratories Healthcare Plans Physicians Pharmacies

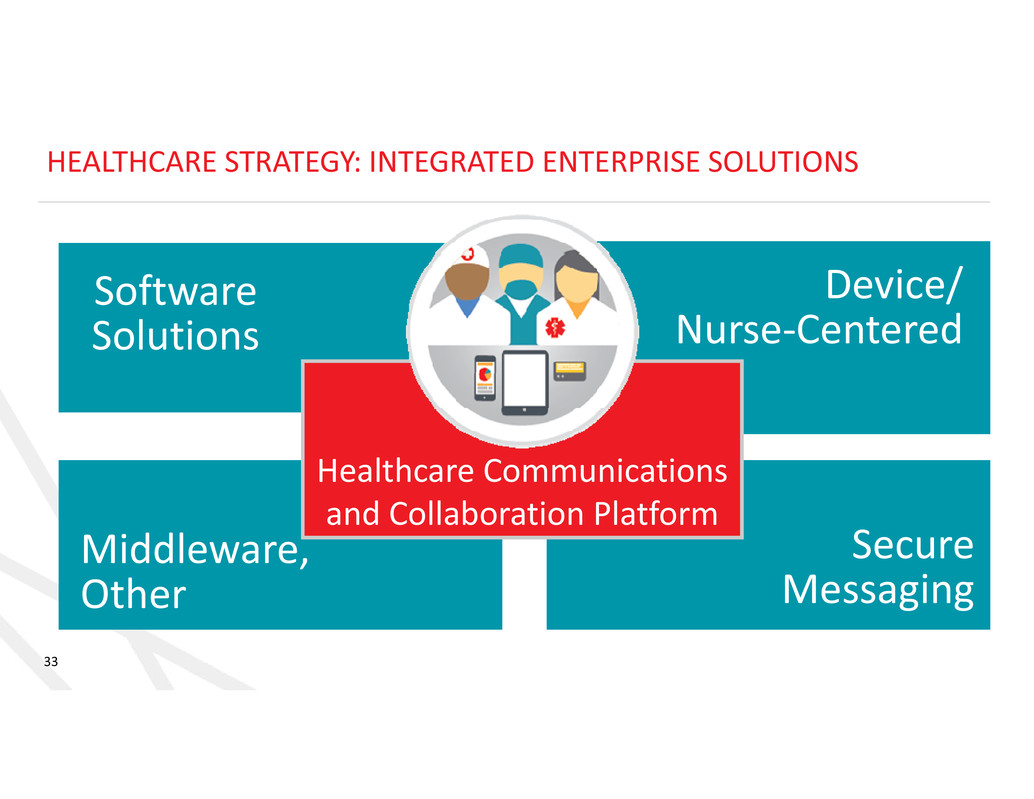

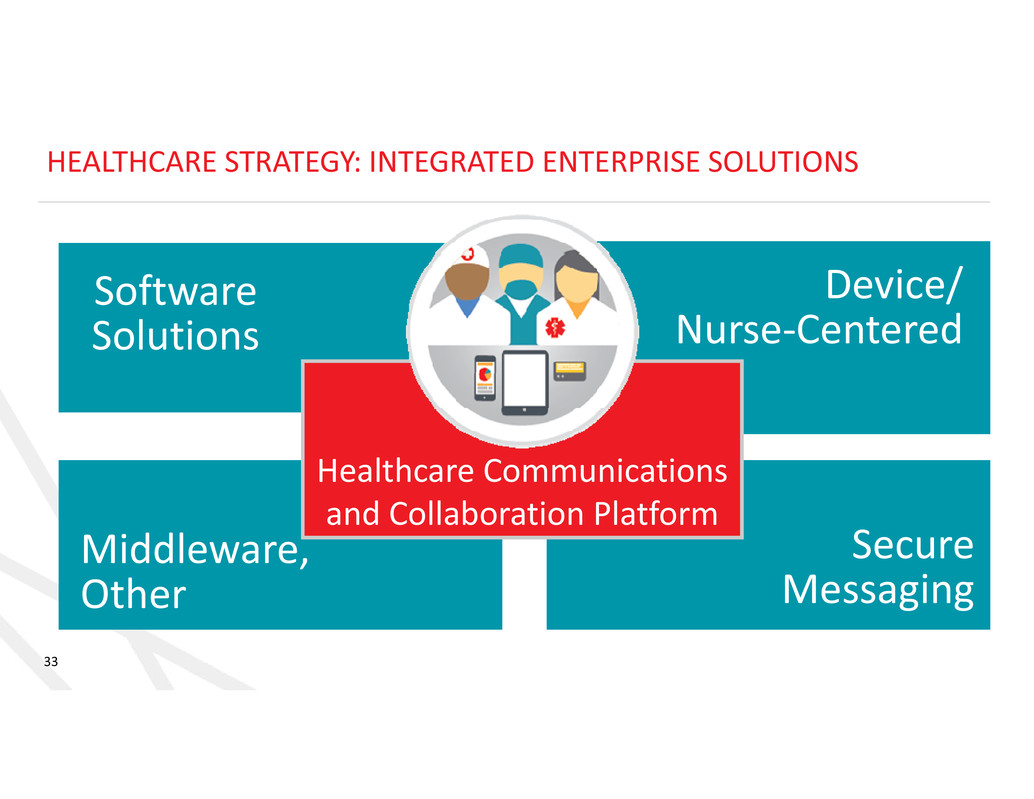

33 Healthcare Communications and Collaboration Platform Software Solutions Device/ Nurse‐Centered Middleware, Other Secure Messaging HEALTHCARE STRATEGY: INTEGRATED ENTERPRISE SOLUTIONS

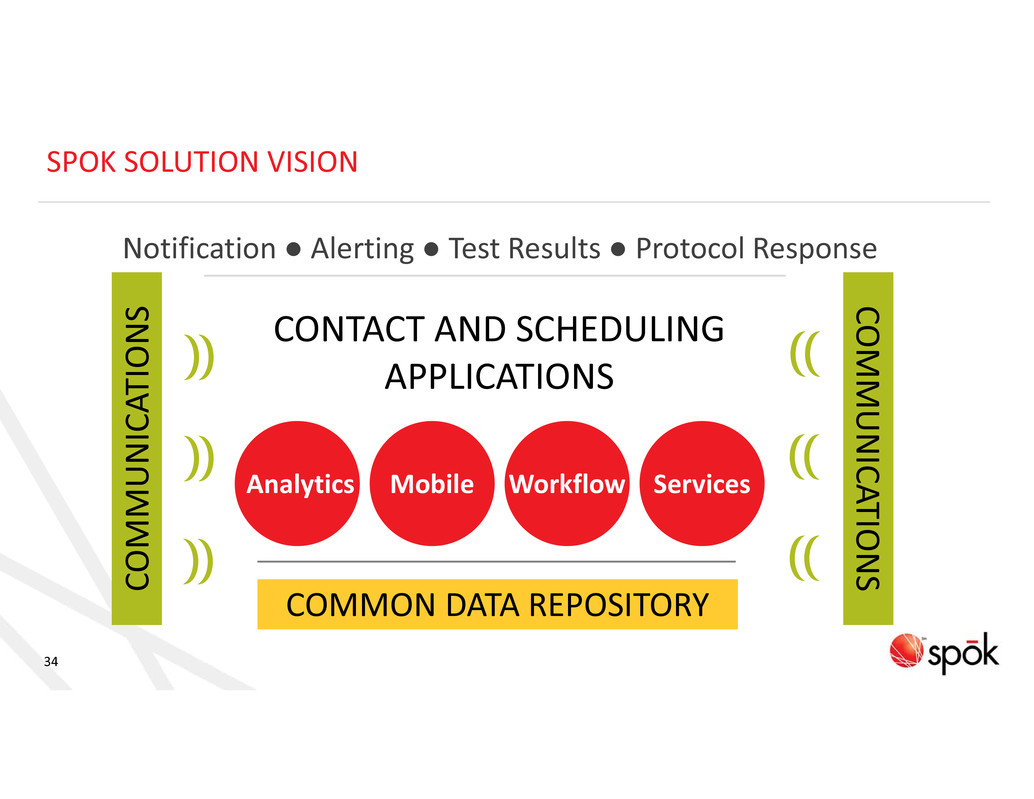

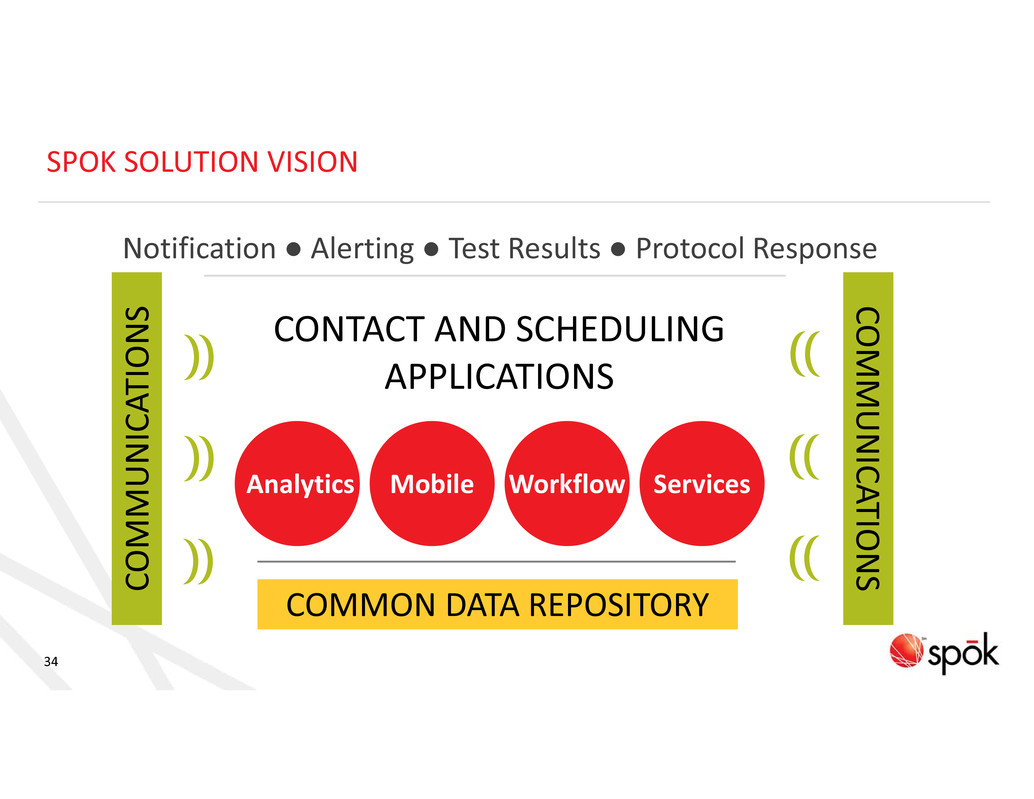

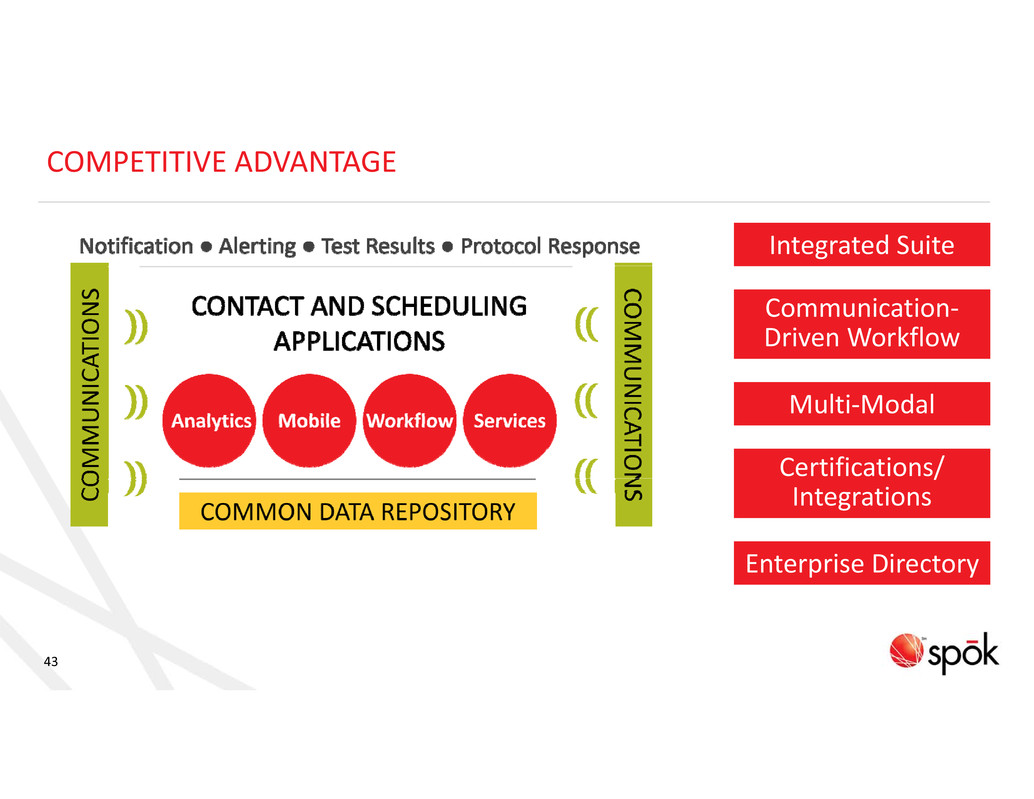

34 Notification ● Alerting ● Test Results ● Protocol Response CONTACT AND SCHEDULING APPLICATIONS Analytics Mobile Workflow Services COMMON DATA REPOSITORY C O M M U N I C A T I O N S CO M M U N ICATIO N S SPOK SOLUTION VISION

35 Clinical ‐ Nursing Middleware/ Device Centered Innovation New Solutions Consolidation/ Integration Unified Platform Mobile Secure Messaging FOCUS AREAS

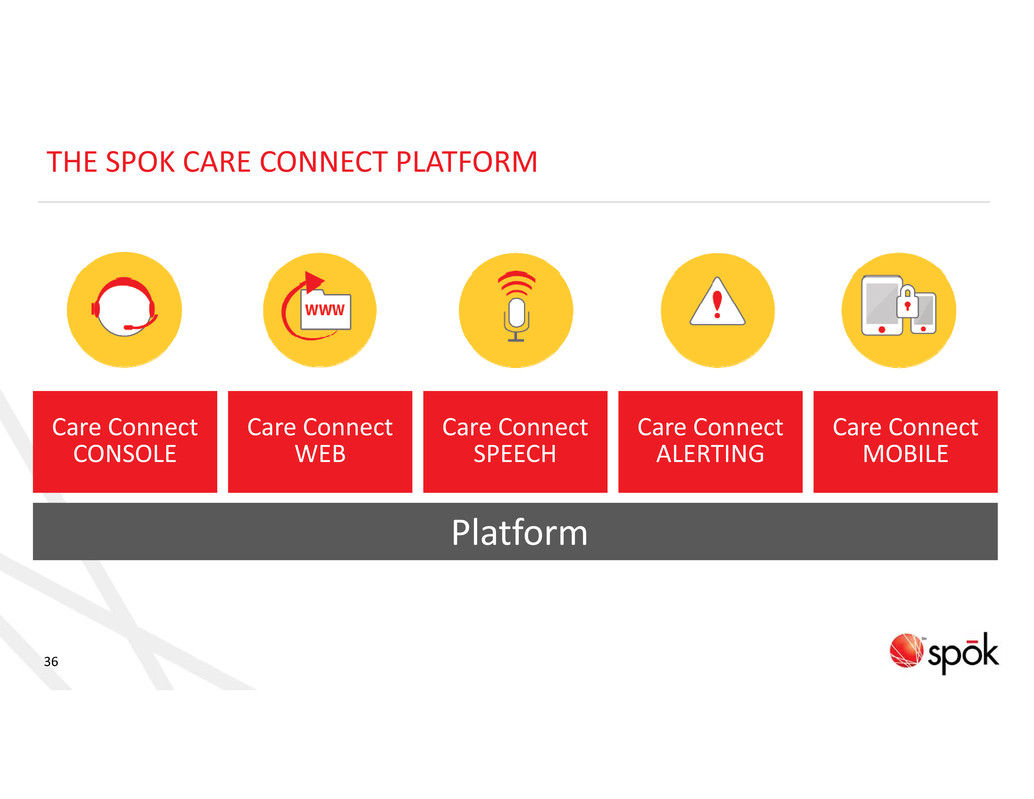

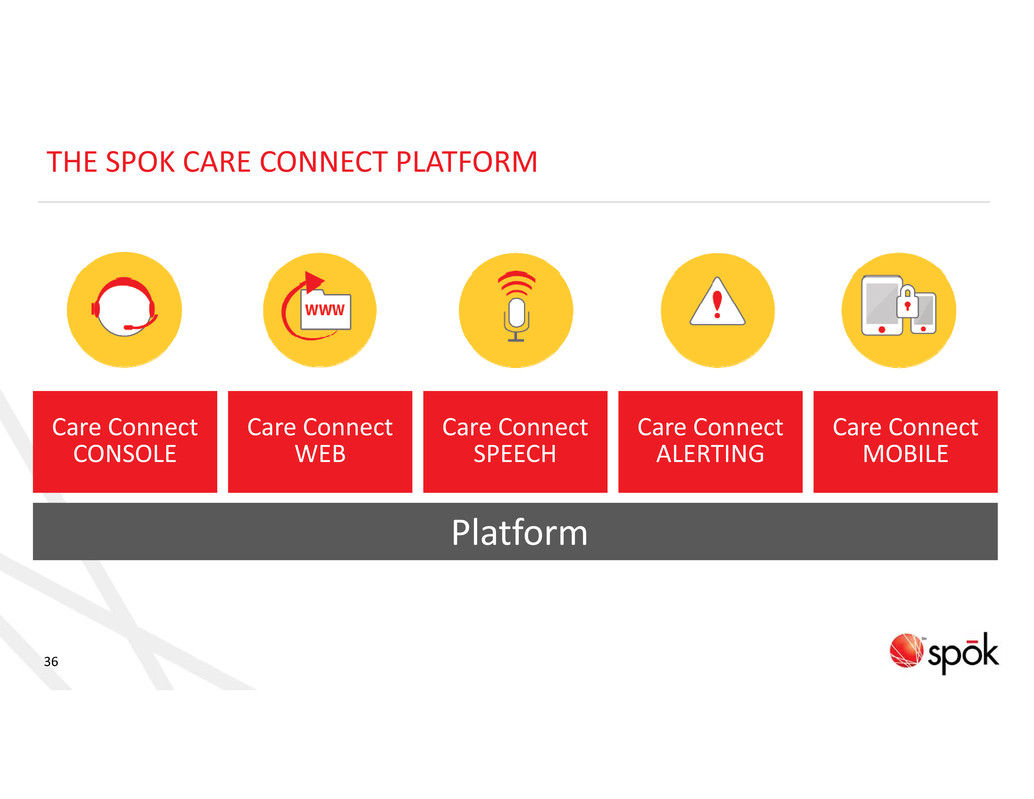

36 Platform Care Connect CONSOLE Care Connect WEB Care Connect SPEECH Care Connect ALERTING Care Connect MOBILE THE SPOK CARE CONNECT PLATFORM

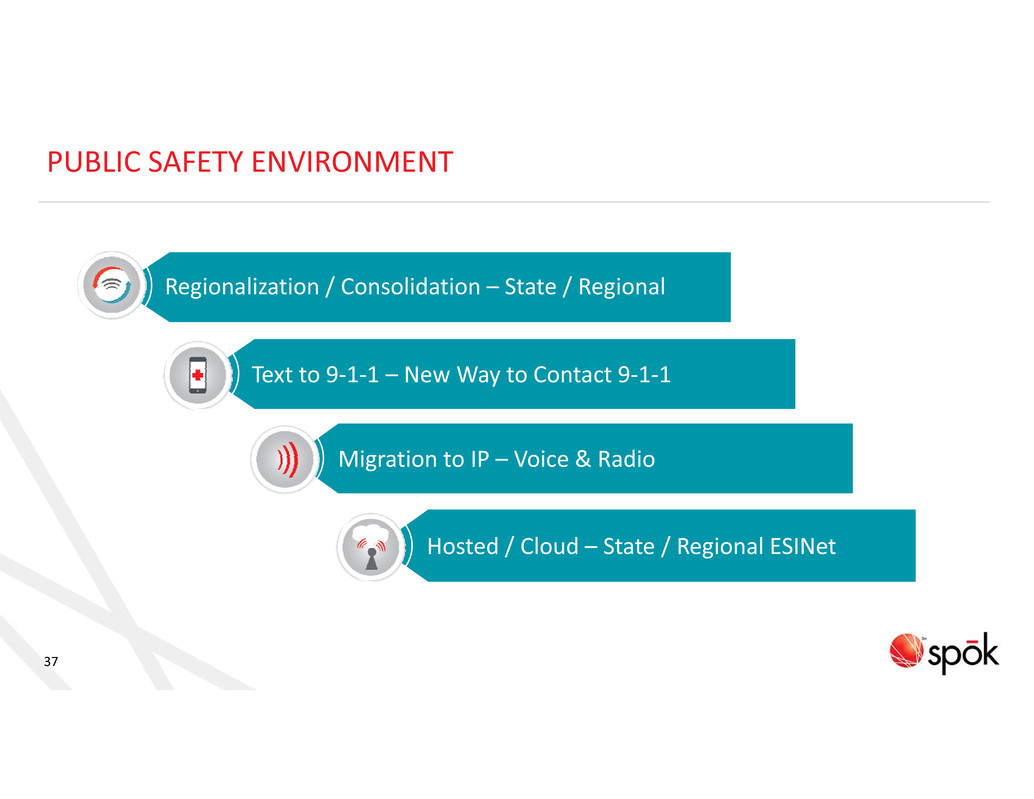

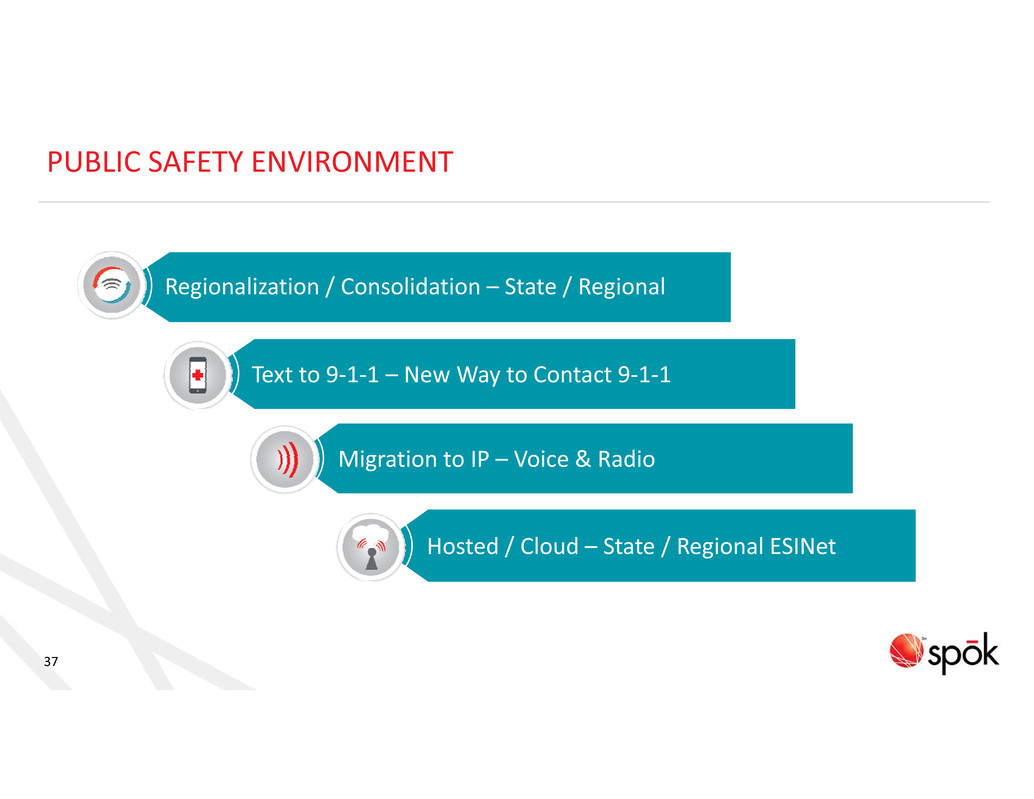

37 PUBLIC SAFETY ENVIRONMENT Regionalization / Consolidation – State / Regional Text to 9‐1‐1 – New Way to Contact 9‐1‐1 Migration to IP – Voice & Radio Hosted / Cloud – State / Regional ESINet

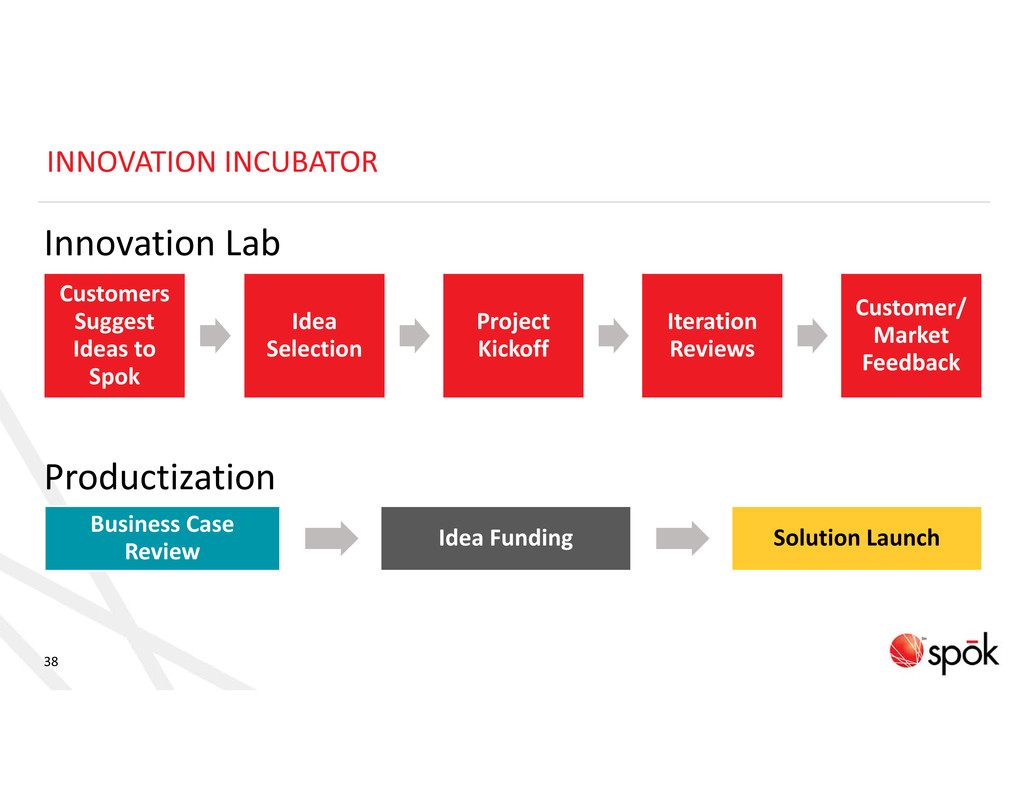

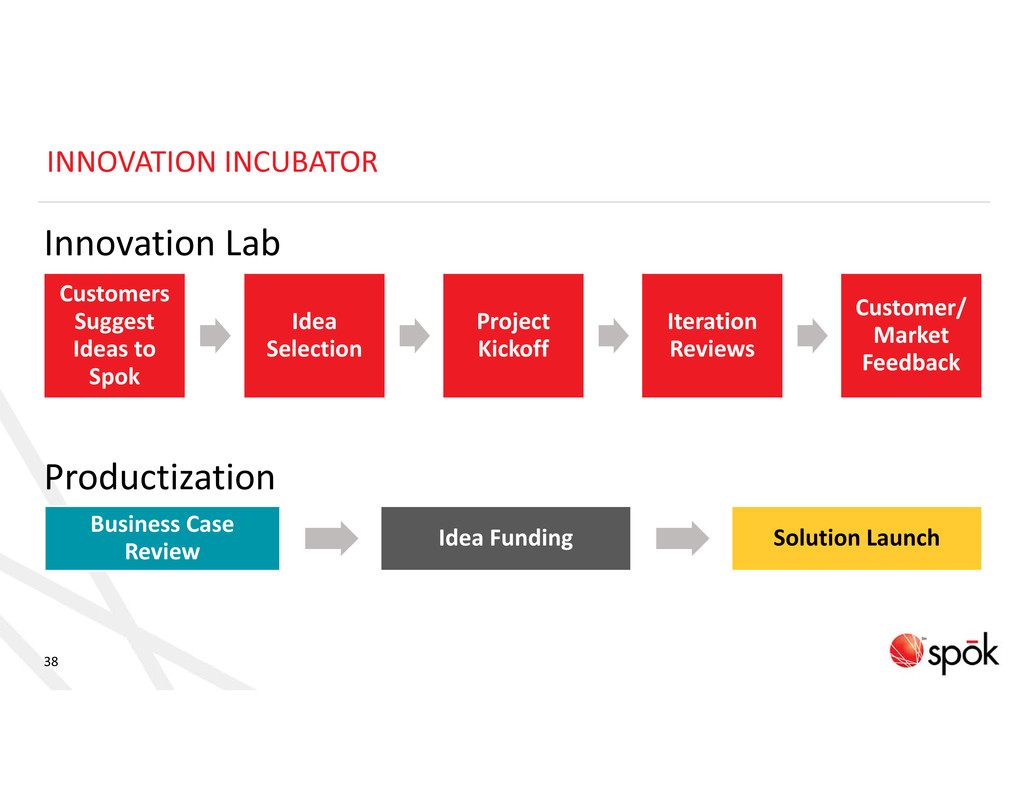

38 INNOVATION INCUBATOR Customers Suggest Ideas to Spok Idea Selection Project Kickoff Iteration Reviews Customer/ Market Feedback Innovation Lab Productization Business Case Review Idea Funding Solution Launch

SOLUTION DIRECTION Brian Edds Vice President of Product Strategy

40 KEY TRENDS IN CRITICAL COMMUNICATIONS ENTERPRISE COLLABORATION NEW RULES & REGULATIONS EVENTS & ALARMS APP INTEROPERABILITY FAST DATA

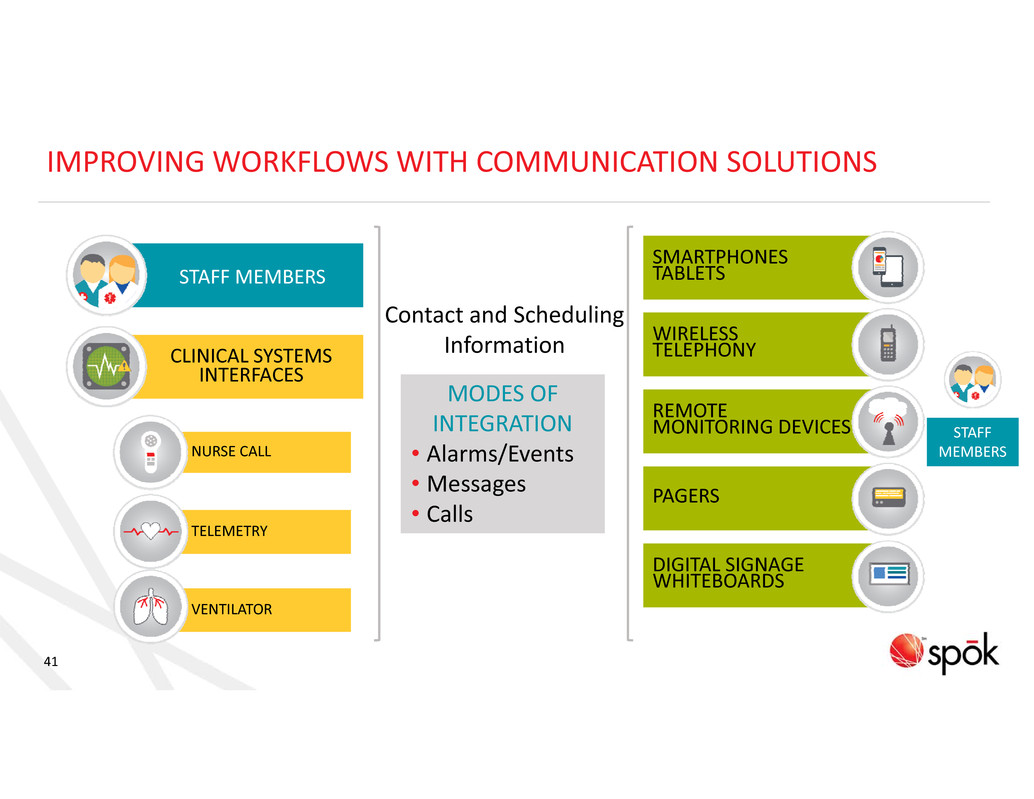

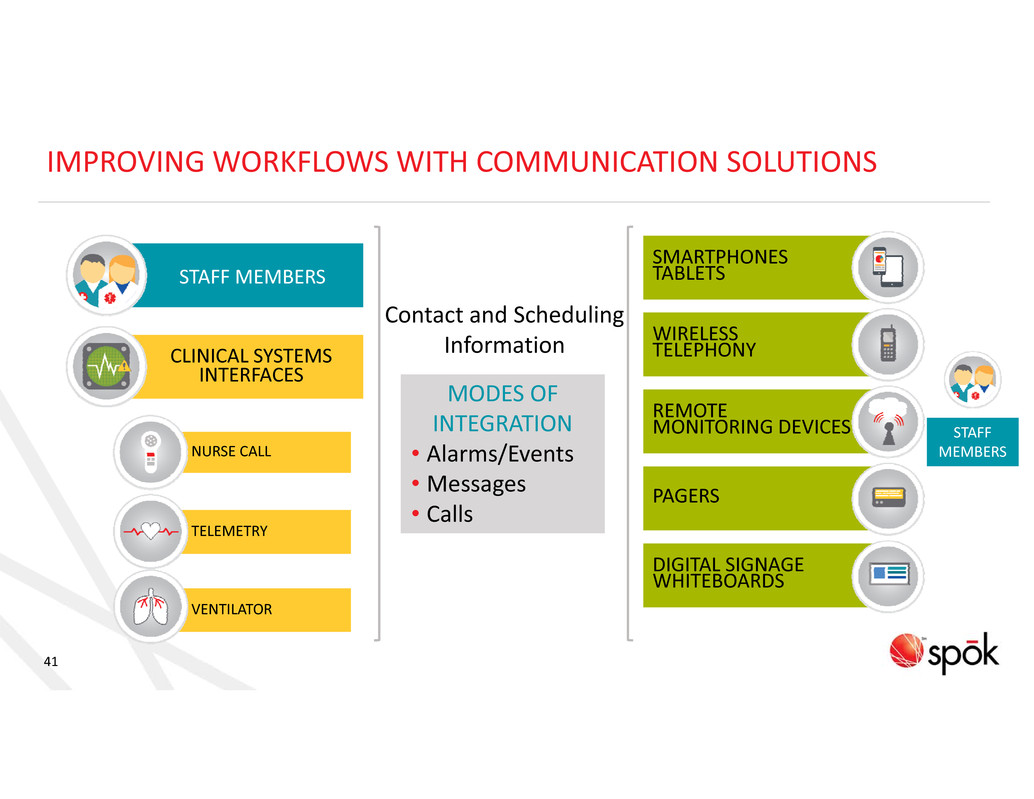

41 IMPROVING WORKFLOWS WITH COMMUNICATION SOLUTIONS Contact and Scheduling Information STAFF MEMBERS CLINICAL SYSTEMS INTERFACES STAFF MEMBERS SMARTPHONES TABLETS WIRELESS TELEPHONY REMOTE MONITORING DEVICES PAGERS DIGITAL SIGNAGE WHITEBOARDS MODES OF INTEGRATION • Alarms/Events • Messages • Calls NURSE CALL TELEMETRY VENTILATOR

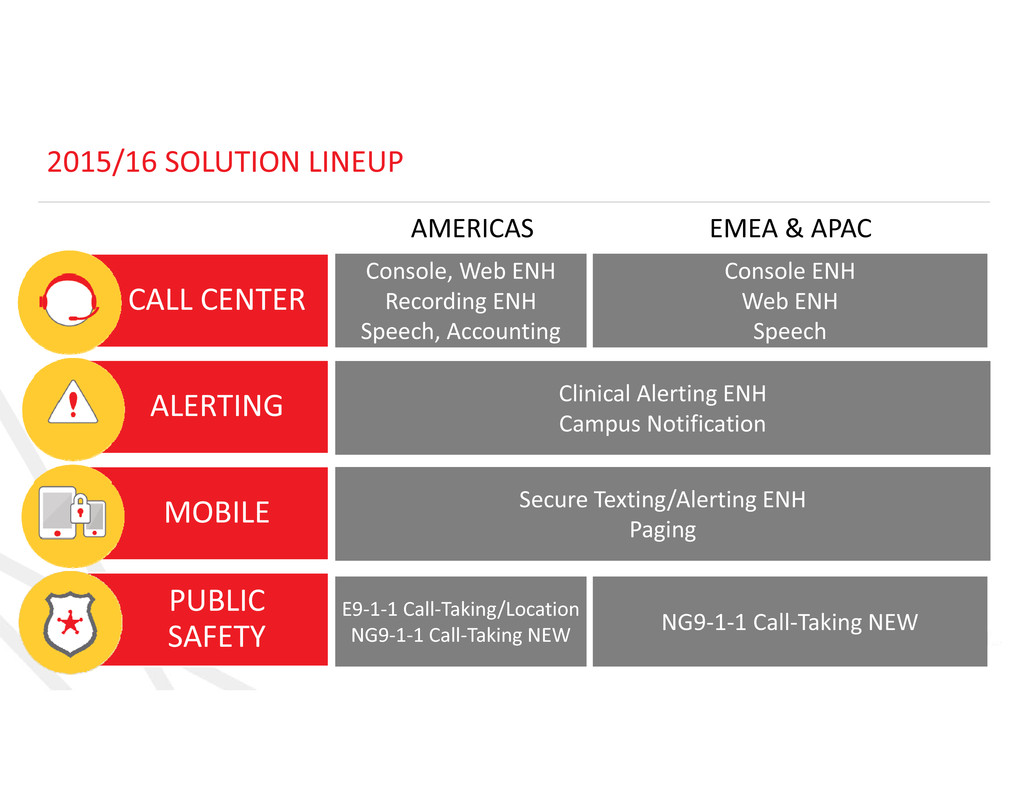

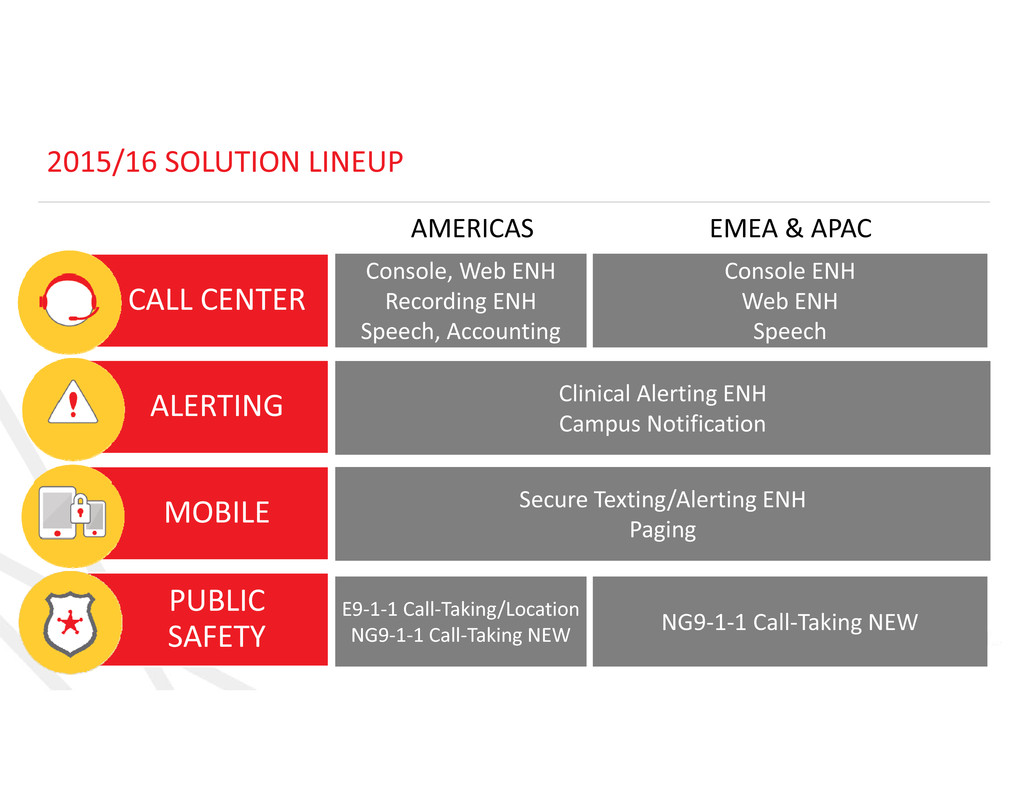

42 2015/16 SOLUTION LINEUP CALL CENTER ALERTING MOBILE PUBLIC SAFETY AMERICAS EMEA & APAC Console, Web ENH Recording ENH Speech, Accounting Console ENH Web ENH Speech Clinical Alerting ENH Campus Notification Secure Texting/Alerting ENH Paging E9‐1‐1 Call‐Taking/Location NG9‐1‐1 Call‐Taking NEW NG9‐1‐1 Call‐Taking NEW

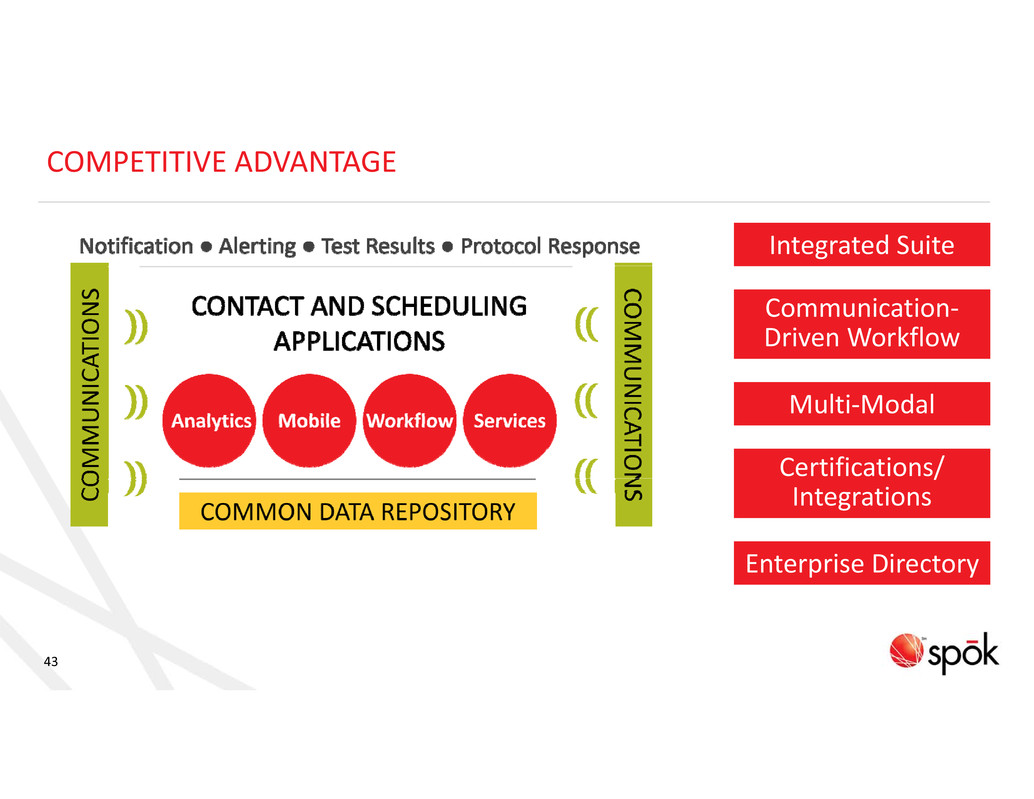

43 COMPETITIVE ADVANTAGE Integrated Suite Communication‐ Driven Workflow Multi‐Modal Certifications/ Integrations Enterprise Directory

SOLUTION DEVELOPMENT Kyle Gunderson Vice President of Development and Chief Technology Officer

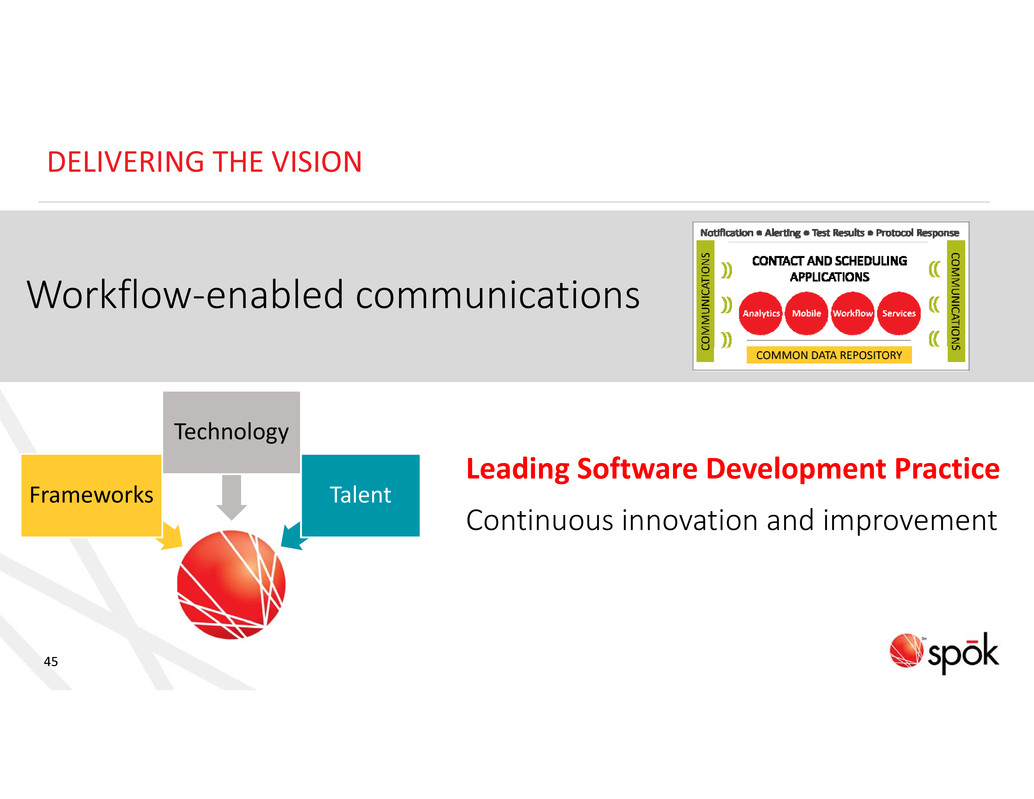

45 DELIVERING THE VISION Leading Software Development Practice Continuous innovation and improvement Frameworks Technology Talent Workflow‐enabled communications

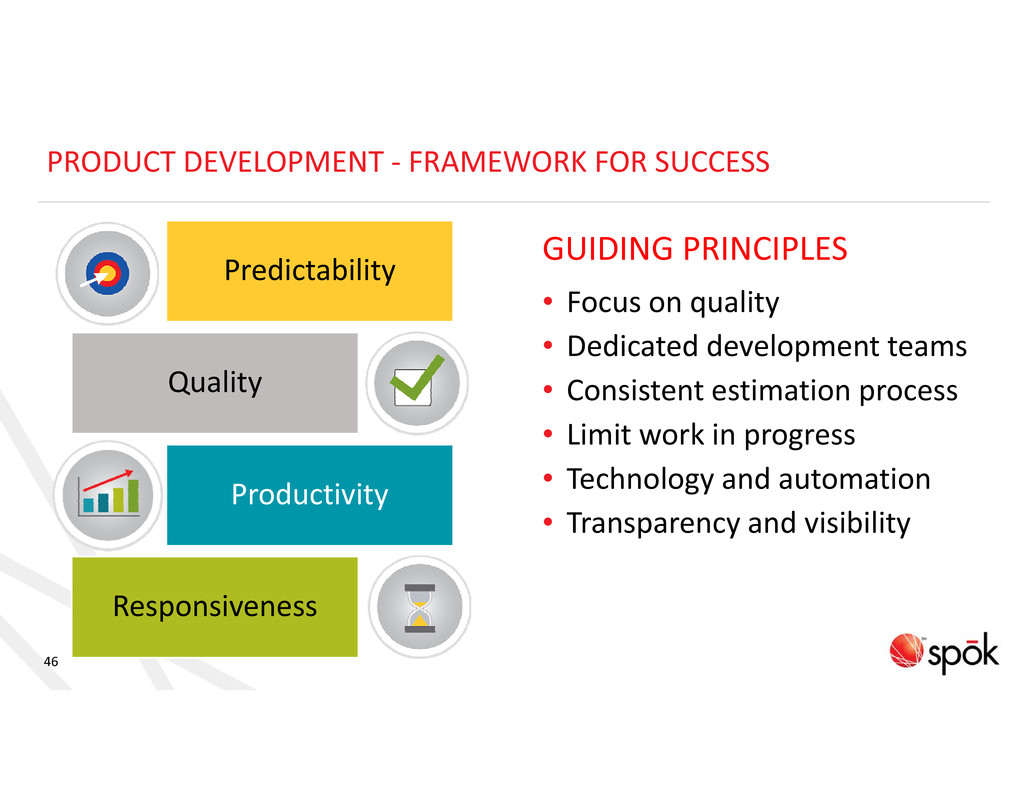

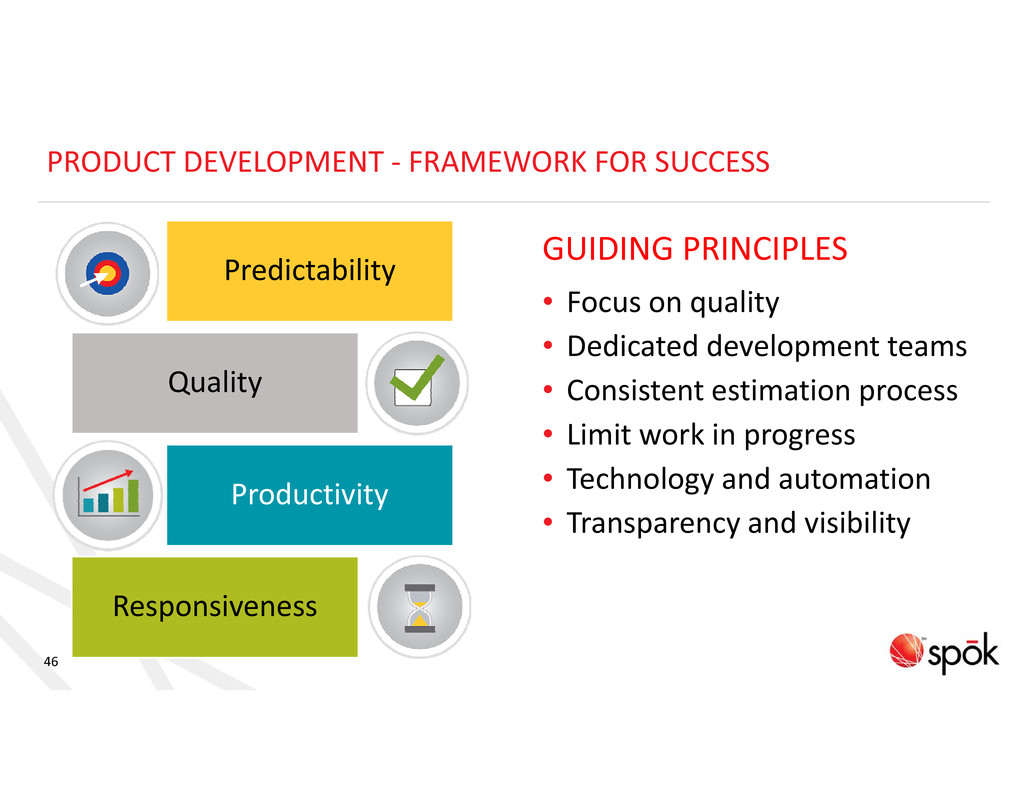

46 PRODUCT DEVELOPMENT ‐ FRAMEWORK FOR SUCCESS GUIDING PRINCIPLES • Focus on quality • Dedicated development teams • Consistent estimation process • Limit work in progress • Technology and automation • Transparency and visibility Predictability Quality Productivity Responsiveness

47 INNOVATION IN SOFTWARE SOLUTION DEVELOPMENT TOOLS TECHNOLOGY ARCHITECTURE

48 SOFTWARE TECHNOLOGY TALENT Develop and Grow Attract and Retain Partner and Extend Train and Prepare Mobile 1 Web Mobile 3 Clinical 3 Console 1 Mobile 2 Clinical 1 Console 2 Platform 1 Telephony Clinical 2 Platform 2 Development Teams

49 SOFTWARE SOLUTION DEVELOPMENT ?Development Team Effectiveness ?Software Product Release ?Software Solution Quality ?Spok Agile Framework

TECHNICAL SUPPORT Thomas Saine, CISSP Chief Information Officer

51 SYSTEMS ENHANCEMENTS Development, QA, and Performance Testing Systems Well positioned to support existing operations and growth into the future Cloud: CRM, incident management Tools: KM, Idea Management, and CPQ Billing, Operations, and Financial Support System

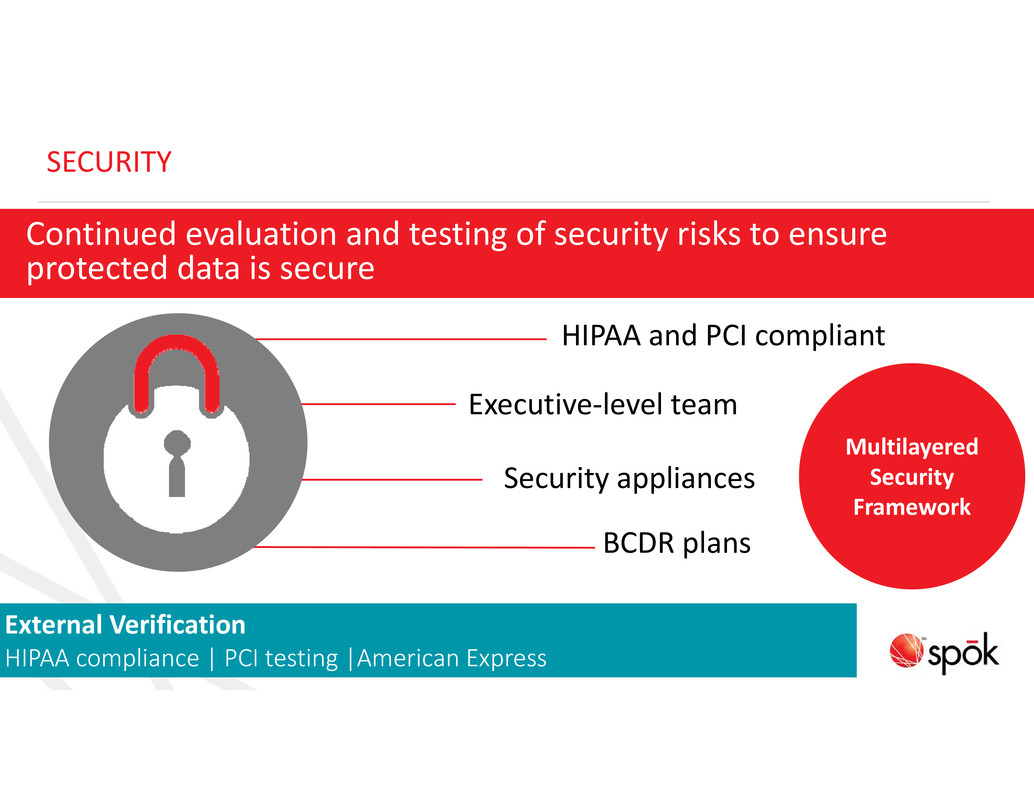

52 SECURITY HIPAA and PCI compliant Executive‐level team Security appliances Continued evaluation and testing of security risks to ensure protected data is secure BCDR plans External Verification HIPAA compliance | PCI testing |American Express Multilayered Security Framework

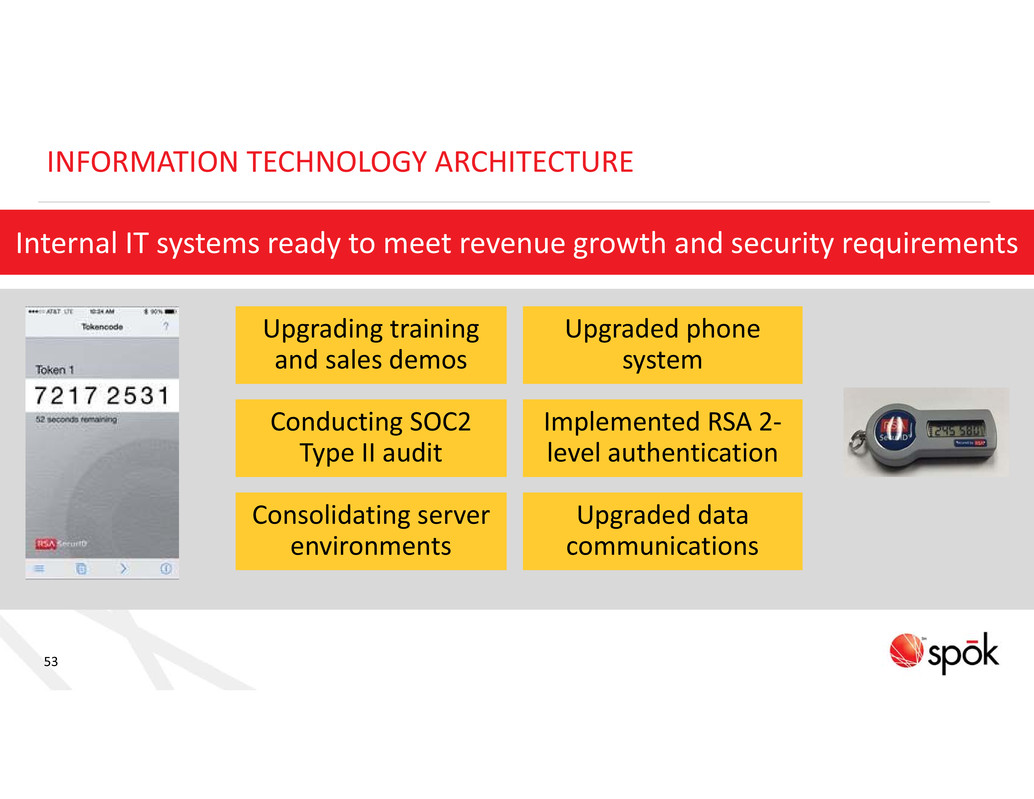

53 INFORMATION TECHNOLOGY ARCHITECTURE Internal IT systems ready to meet revenue growth and security requirements Upgraded phone system Implemented RSA 2‐ level authentication Upgraded data communications Upgrading training and sales demos Conducting SOC2 Type II audit Consolidating server environments

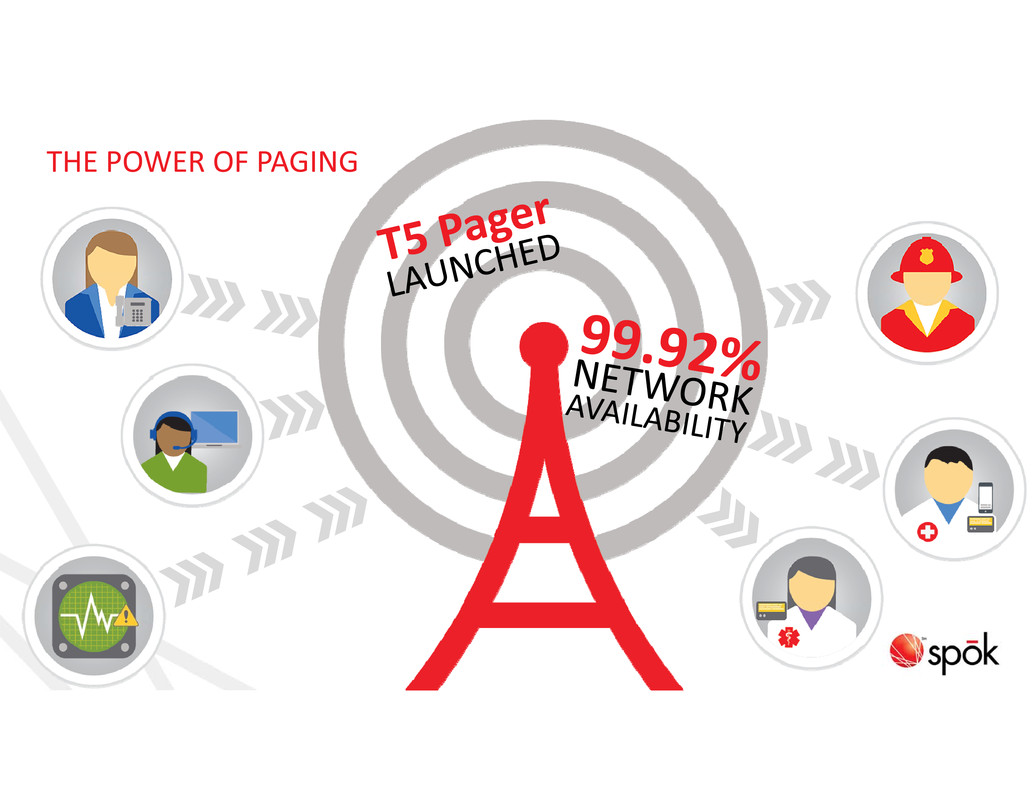

54 THE POWER OF PAGING

55 PAGING ARCHITECTURE: TECHNOLOGY REFRESH Core paging systems operating in efficient and supportable environments DID PHONE NUMBERS CORE WIRELESS MESSAGING ENGINE PAGING TERMINALS & ENCODERS

SALES Gary Ash Global Executive Vice President of Sales

57 WHEN COMMUNICATIONS MATTER, SPOK DELIVERS OUR GOAL

58 CUSTOMER PERCEPTION OF SPOK LEADER/ EXPERT TRUSTED SERVICE ORIENTED INNOVATIVE

59 IN THEIR WORDS Spok is the best fit for us. It fulfills all of our requirements and quickly delivers messages wherever they need to go—in all the formats and to all the devices we use. We could survive without our EHR for a few hours if we had to, but we don't feel like we could survive even for minutes without Spok. –Ann Tesmer Regional Director of Operations Froedtert & The Medical College of Wisconsin–Anne McNulty Applications Specialist Douglas County Sheriff’s Office (CO)

60 CUSTOMER EXPECTATIONS: CLINICAL WORKFLOW • Clinician communications • Integration • Notifications • Patient‐centric alerting • Contextual/alarming info • Alarm fatigue reduction

61 CUSTOMER EXPECTATIONS: MOBILE ENABLEMENT • Mobile is the new desktop • Experience of a social platform • Information and alarms • Integrated directory • Data security

62 CUSTOMER EXPECTATIONS: PUBLIC SAFETY • Experience delivering mission‐critical communications • Next‐generation technology • JITC‐certified solutions • Integration

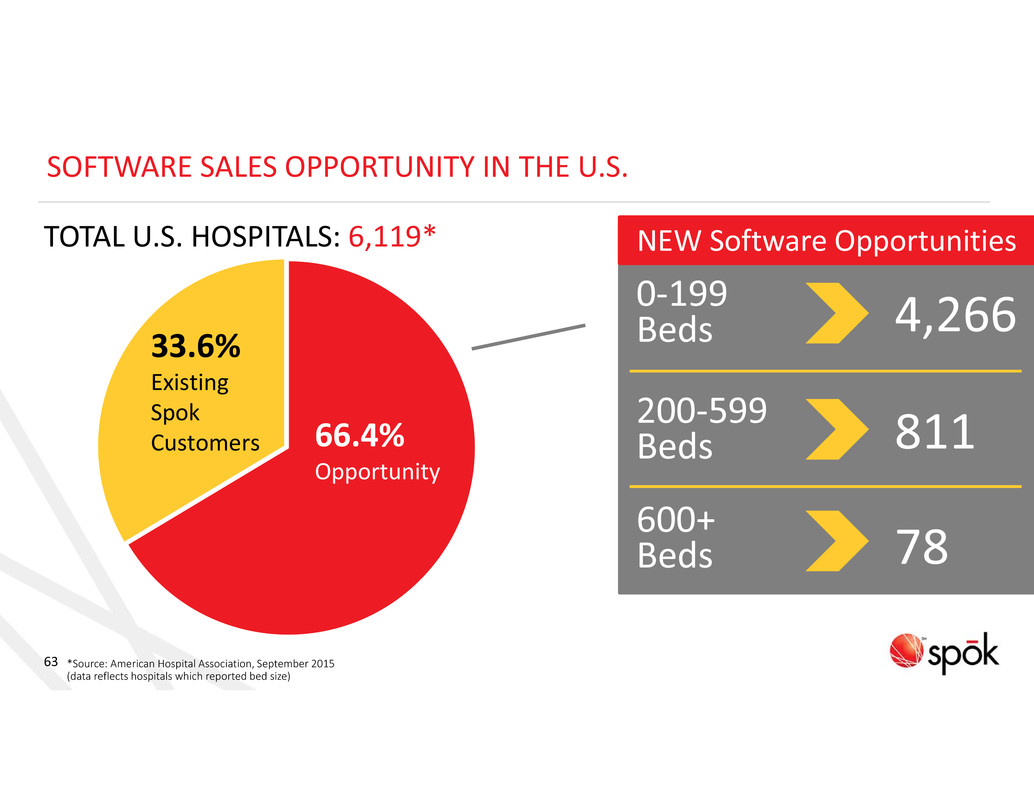

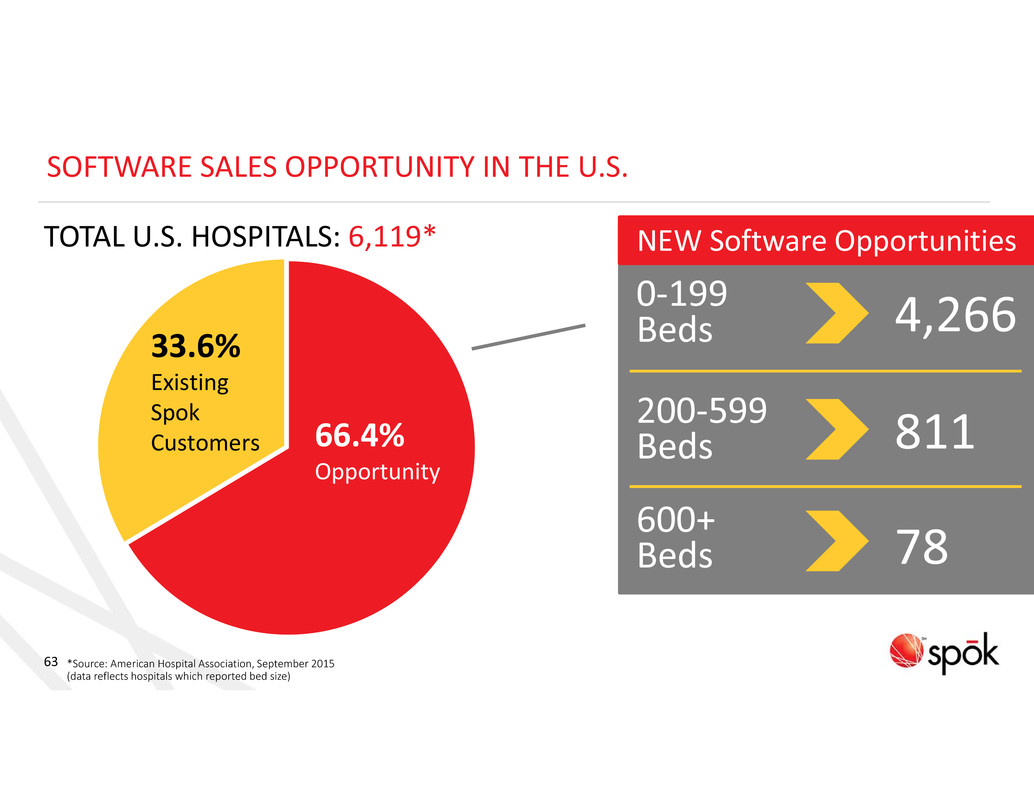

63 SOFTWARE SALES OPPORTUNITY IN THE U.S. 33.6% Existing Spok Customers 66.4% Opportunity *Source: American Hospital Association, September 2015 (data reflects hospitals which reported bed size) TOTAL U.S. HOSPITALS: 6,119* NEW Software Opportunities 0‐199 Beds 200‐599 Beds 600+ Beds 4,266 811 78

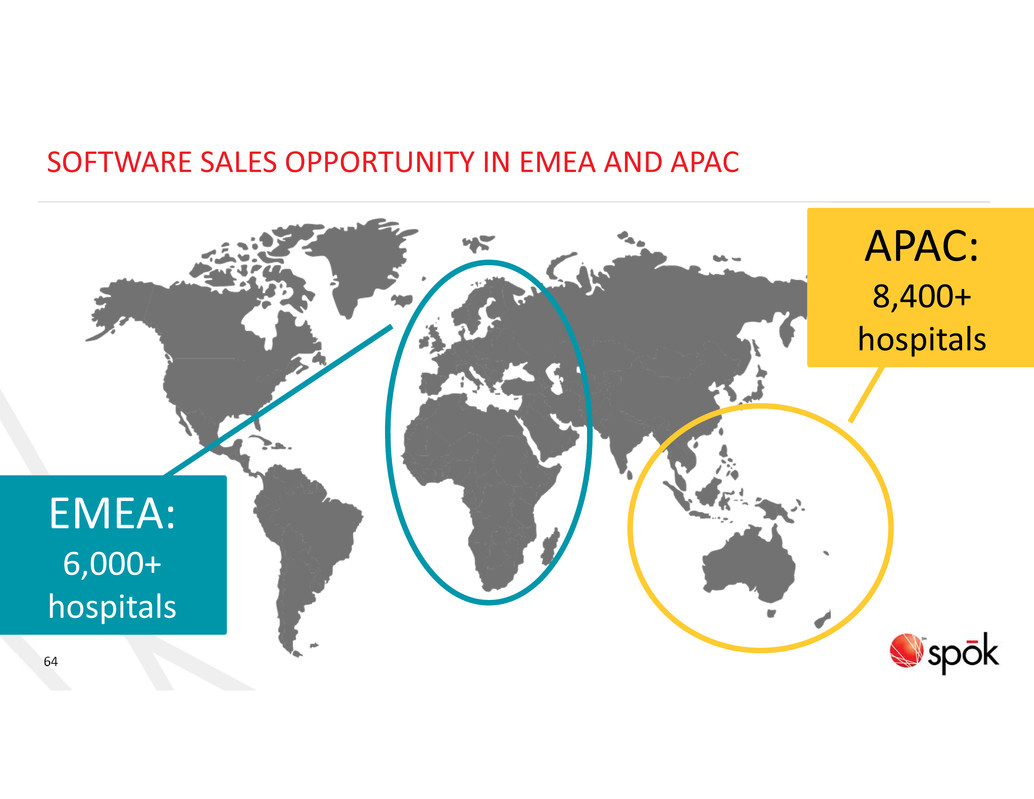

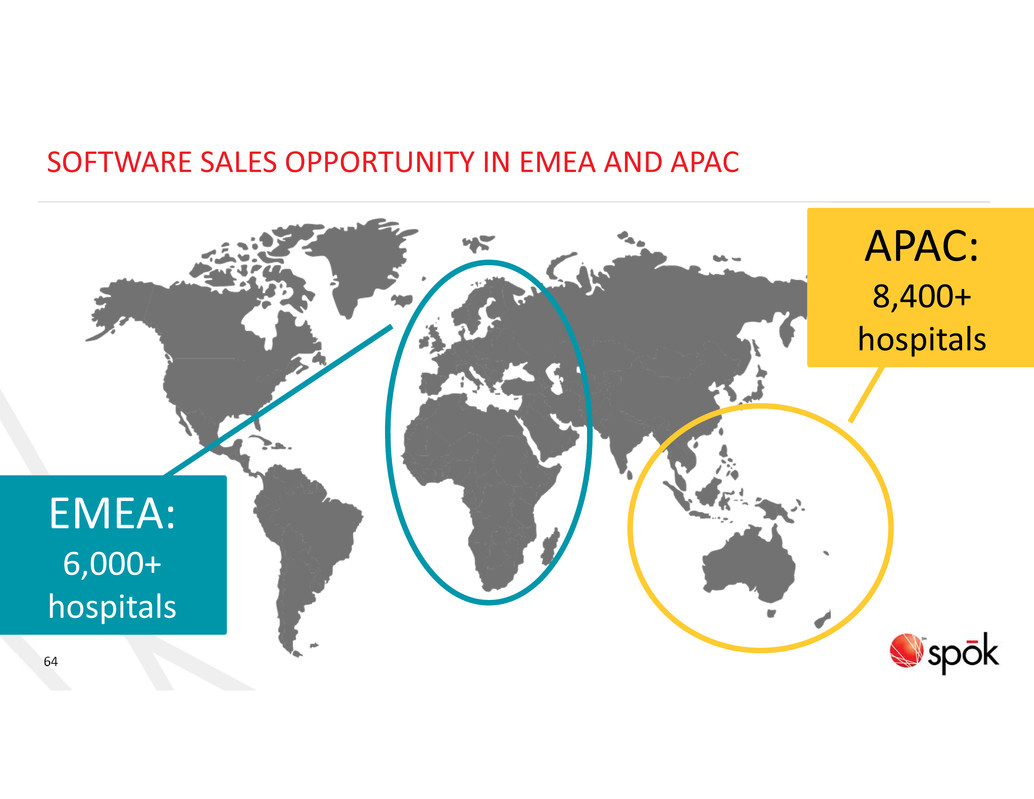

64 SOFTWARE SALES OPPORTUNITY IN EMEA AND APAC EMEA: 6,000+ hospitals APAC: 8,400+ hospitals

65 ANATOMY OF A SUCCESSFUL WIN Trusted Advisor Status Need, Value, Budget Defined Collaborative Discovery at All Levels Clearly Defined Delivery and Support C‐Level Endorsement Reference‐ability

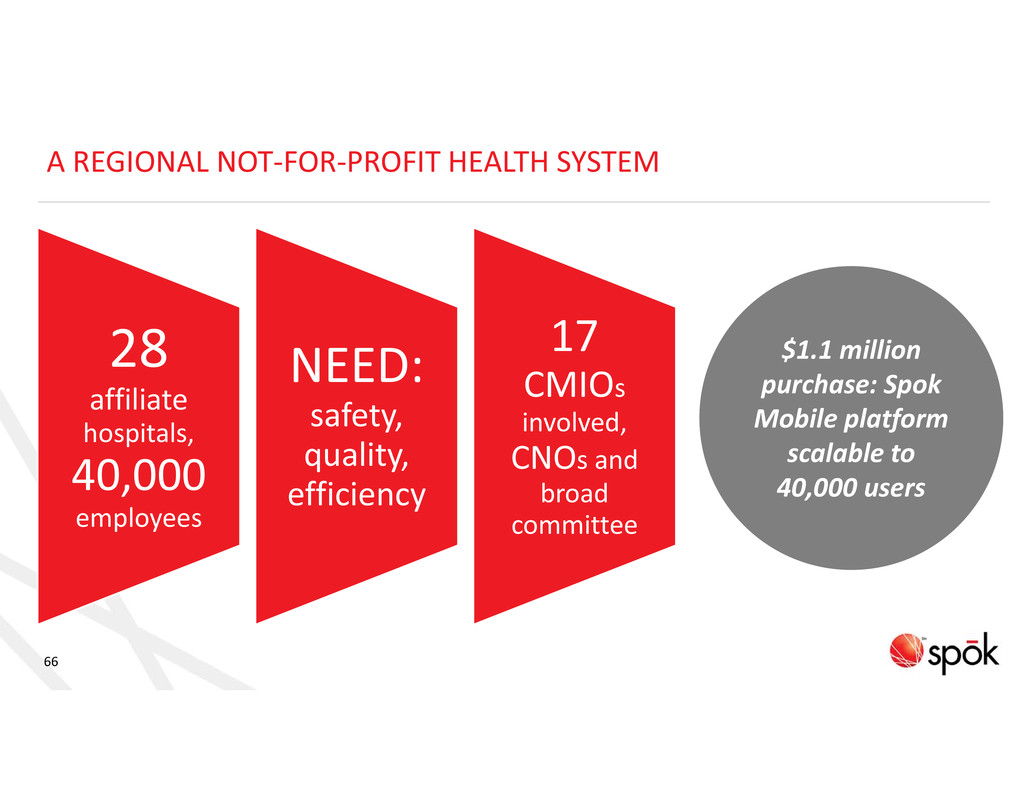

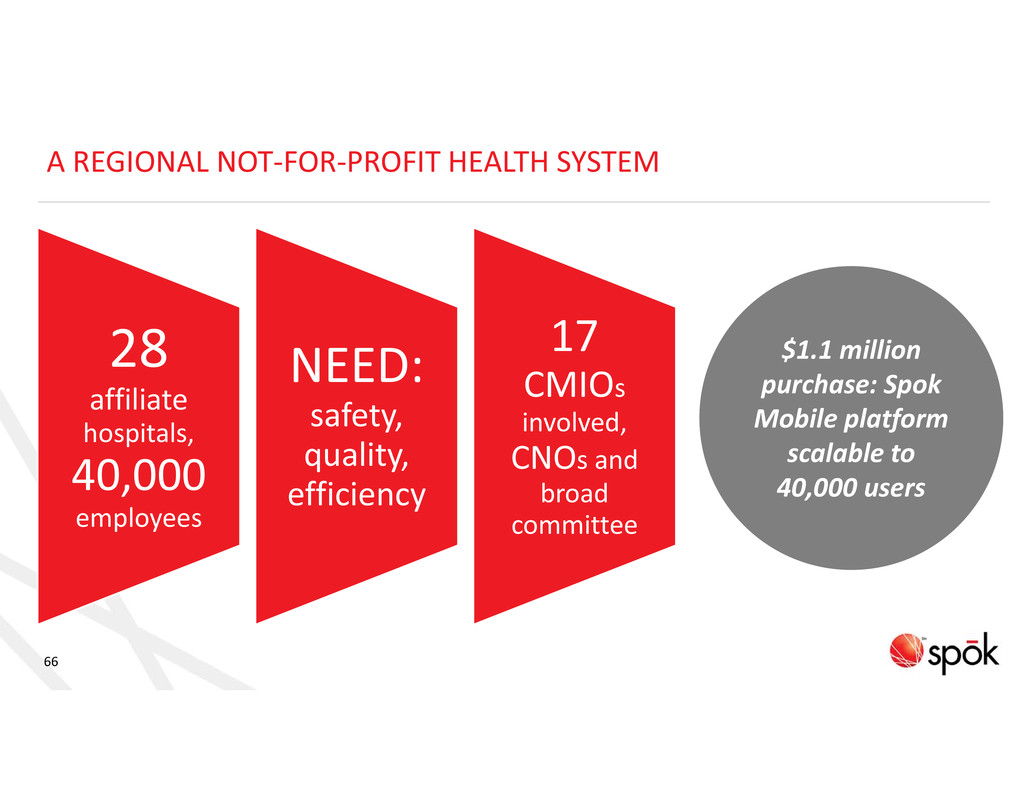

66 A REGIONAL NOT‐FOR‐PROFIT HEALTH SYSTEM 28 affiliate hospitals, 40,000 employees NEED: safety, quality, efficiency 17 CMIOs involved, CNOs and broad committee $1.1 million purchase: Spok Mobile platform scalable to 40,000 users

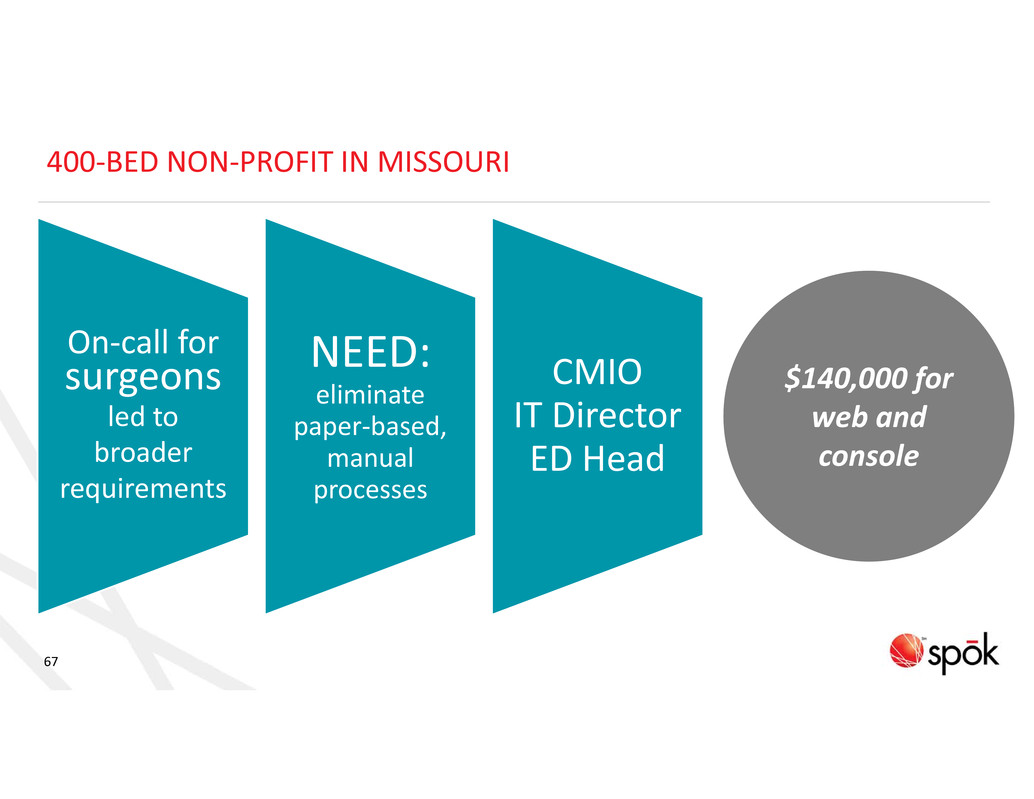

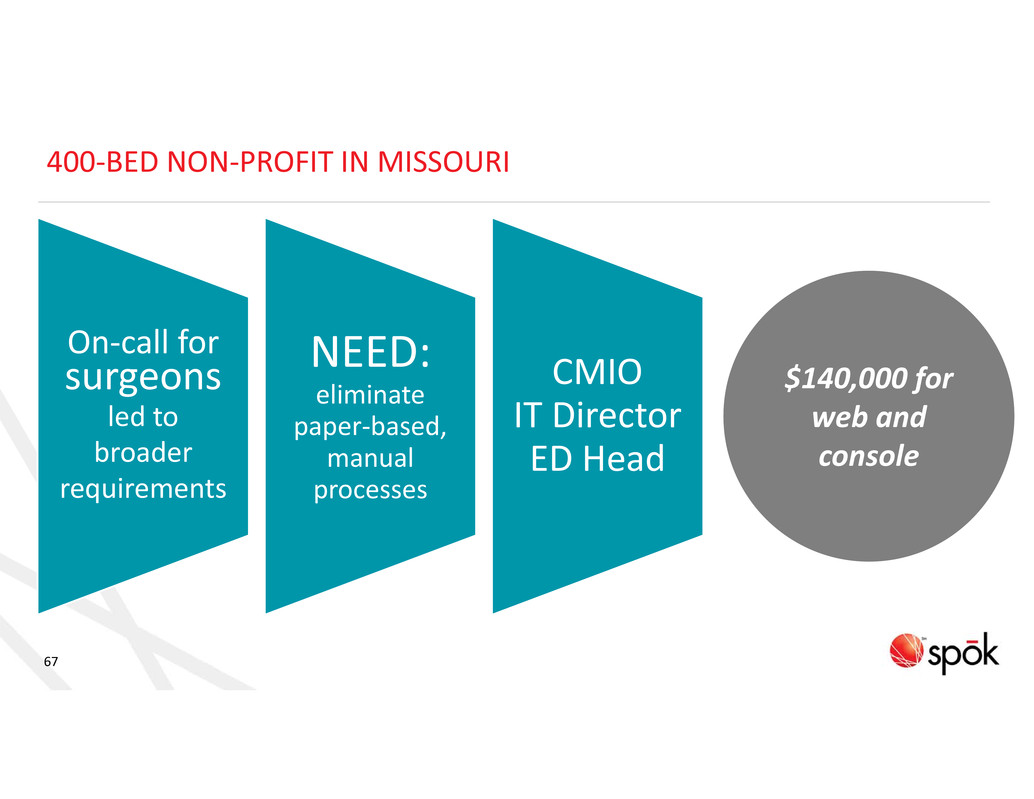

67 400‐BED NON‐PROFIT IN MISSOURI On‐call for surgeons led to broader requirements NEED: eliminate paper‐based, manual processes CMIO IT Director ED Head $140,000 for web and console

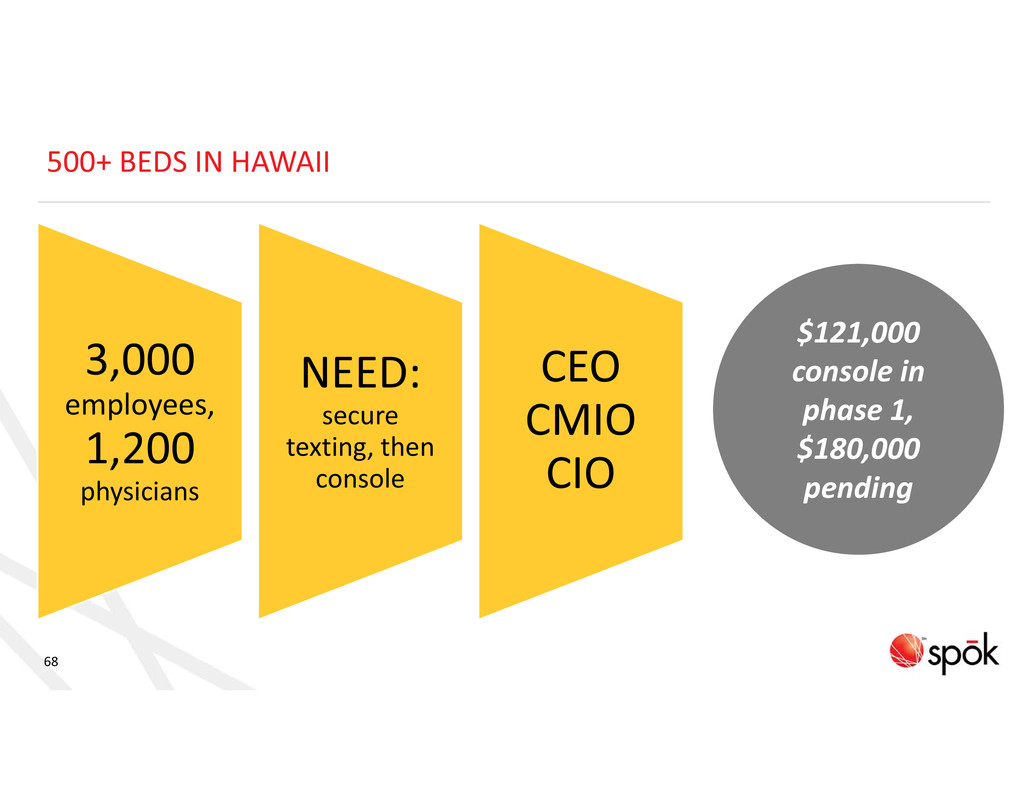

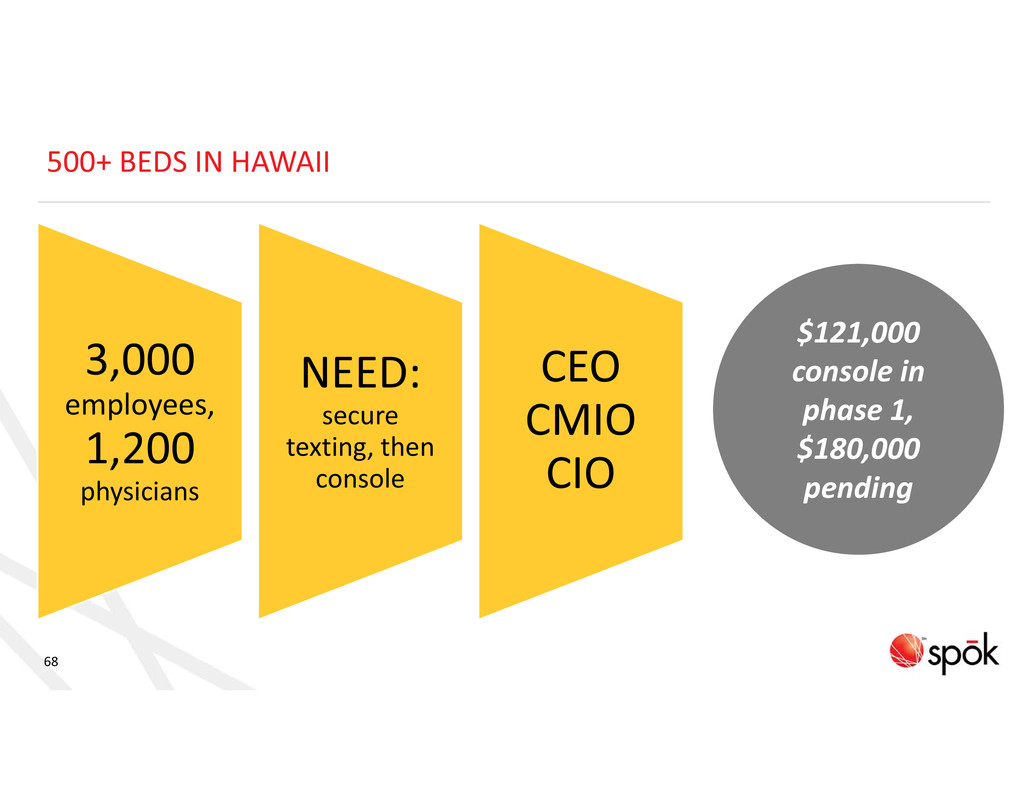

68 500+ BEDS IN HAWAII 3,000 employees, 1,200 physicians NEED: secure texting, then console CEO CMIO CIO $121,000 console in phase 1, $180,000 pending

69 WE WIN TODAY AND WILL CONTINUE TO WIN WE SOLVE CRITICAL PROBLEMS: • Collaboration of care • Faster emergency response • Alarm fatigue • Patient and citizen safety WE WILL CONTINUE TO WIN AS WE INNOVATE: • Enhanced clinical workflow solutions • Enhanced mobile platform • Next‐generation 9‐1‐1 offering COMPETITIVE ADVANTAGE: Single Platform for Critical Communications • Data security • Interoperability • Staff productivity • Improving patient satisfaction

WRAP‐UP Vince Kelly

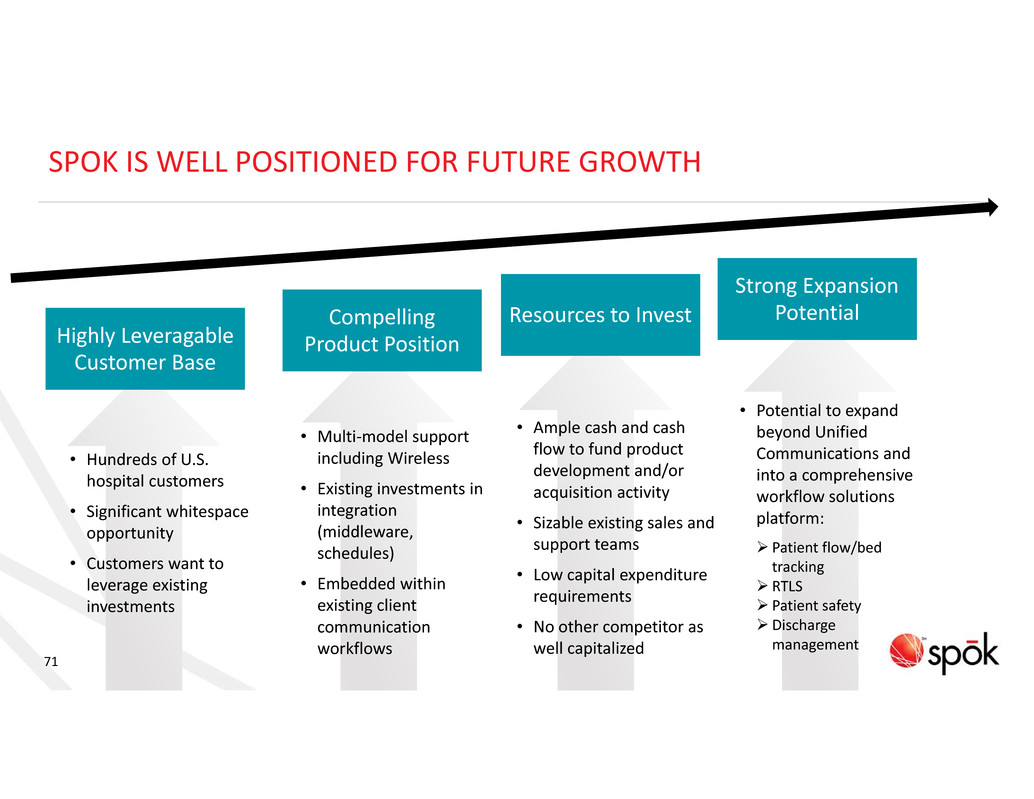

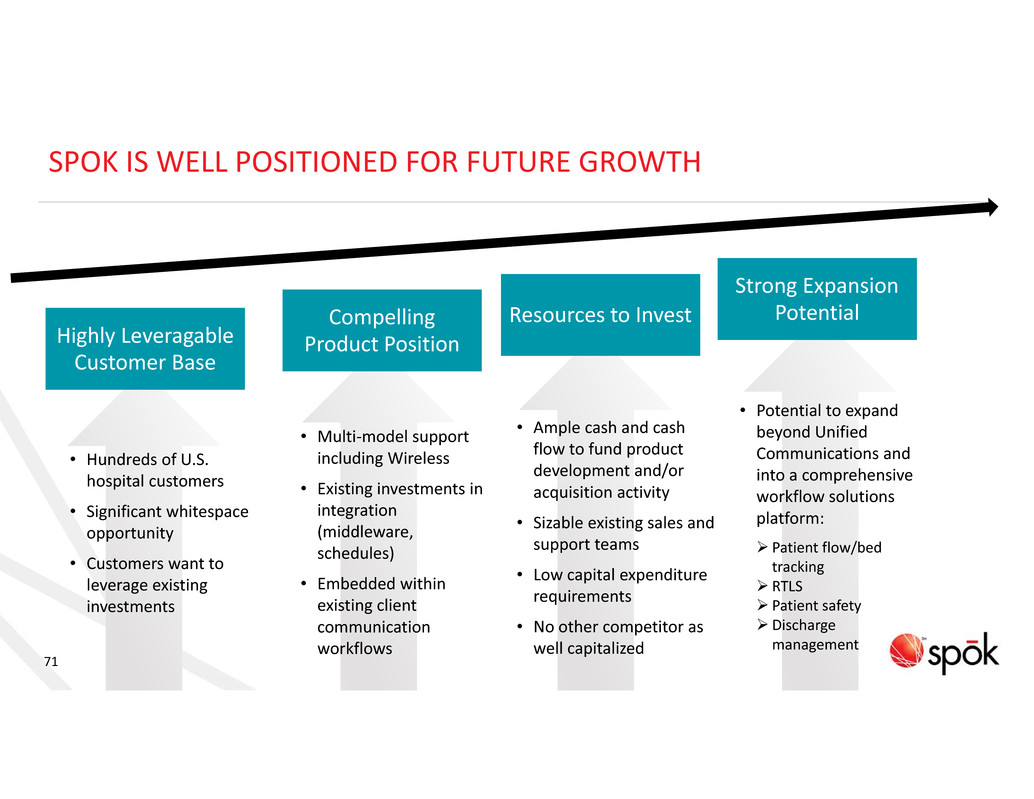

71 SPOK IS WELL POSITIONED FOR FUTURE GROWTH Highly Leveragable Customer Base Compelling Product Position Resources to Invest Strong Expansion Potential • Potential to expand beyond Unified Communications and into a comprehensive workflow solutions platform: ? Patient flow/bed tracking ? RTLS ? Patient safety ?Discharge management • Hundreds of U.S. hospital customers • Significant whitespace opportunity • Customers want to leverage existing investments • Multi‐model support including Wireless • Existing investments in integration (middleware, schedules) • Embedded within existing client communication workflows • Ample cash and cash flow to fund product development and/or acquisition activity • Sizable existing sales and support teams • Low capital expenditure requirements • No other competitor as well capitalized

QUESTIONS & DISCUSSION