UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File No. 811-21589

- ---------------------------------------------------------------------

CREDIT SUISSE COMMODITY RETURN STRATEGY FUND

- ------------------------------------------------------------------------

(Exact Name of Registrant as Specified in Charter)

Eleven Madison Avenue, New York, New York 10010

- -------------------------------------------------------------------------

(Address of Principal Executive Offices) (Zip Code)

J. Kevin Gao, Esq.

Credit Suisse Commodity Return Strategy Fund

Eleven Madison Avenue

New York, New York 10010

Registrant’s telephone number, including area code: (212) 325-2000

Date of fiscal year end: October 31st

Date of reporting period: November 1, 2005 to October 31, 2006

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

October 31, 2006

n CREDIT SUISSE

COMMODITY RETURN STRATEGY FUND

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-927-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Ave., New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.50% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Fund's management are as of the date of the letter and the Fund holdings described in this document are as of October 31, 2006; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report

October 31, 2006 (unaudited)

December 11, 2006

Dear Shareholder:

Performance Summary

11/01/05 – 10/31/06

| Fund & Benchmark | | Performance | |

| Common Class Shares1 | | | 4.72 | % | |

| Class A Shares1,2 | | | 4.51 | % | |

| Class C Shares1,2 | | | 3.78 | % | |

| Dow Jones-AIG Commodity Index3 | | | 4.94 | % | |

Performance for the Fund's Class A and Class C shares is without the maximum sales charge of 3.00% and 1.00%, respectively.2

Market Review: A Year of Uncertainty in Many Sectors

Commodities posted positive gains for the year ended October 31, 2006, marking the fifth consecutive year of gains. The Dow Jones-AIG Commodity (DJ-AIG) Index, the Fund's benchmark, returned 4.9% for the year, trailing the 16.3% total return of the S&P 500 Index4 and the 5.2% total return of the Lehman Brothers U.S. Aggregate Bond Index.4 The Fund underperformed the benchmark negligibly due to transaction costs incurred in replicating the Dow Jones-AIG Commodity Index components.

The Fund's fiscal year was characterized by several reversals due to market uncertainty. For the period, the commodities within the industrial metals, precious metals and agricultural sectors contributed positively to performance, while energy-related commodities were negative. During four separate periods, the DJ-AIG Index increased or decreased by more than 10%, and it ranged from down 3.3% to up 15.3% on the year. A cold start to December resulted in energy prices spiking initially before a turn to an abnormally warm winter caused reduced demand for heating. May presented geopolitical tensions and predicted global economic strength drove the DJ-AIG Index to record levels, while much of the remainder of the year was marked by excess inventories in energy and tight production supply in industrial metals.

Industrial metals were the top performers for the year, up 106.1% on a total return basis. Zinc and nickel returned in excess of 180%, while copper increased by more than 100%. Demand for metals, particularly out of Asia, continued to push prices higher. At the same time, miners worldwide attempted to gain higher compensation. This labor unrest resulted in frequent supply disruptions and caused additional pressures in an already tight inventory environment. Precious metals also performed well due to concerns over a weakening dollar, rising

1

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

inflationary expectations and the potential for a sharp deceleration in U.S. growth. Wheat and corn led agriculture higher — with both rising more than 28% — primarily due to an autumn surge after a severe drought in the southern hemisphere combined with wet conditions to hinder harvesting efforts in the United States.

Natural gas was by far the worst performer in the DJ-AIG Index for the fiscal year, down 67.1% on a total return basis. The lack of winter demand for heating or summer demand for cooling, combined with the lack of supply disruptions during the hurricane season, resulted in a very poor year for this commodity. The front futures contract of crude oil hit an all-time intraday high of $78.40 in July during the Israeli-Lebanese conflict. As geopolitical tensions cooled, however, projected demand dropped, and inventories continued to build. Subsequently, prices fell and crude oil returned -12.8% for the year. The energy sector as a whole lost 40.2% on a total return basis for the year.

Strategic Review and Outlook: Diversification and Potential Upside

Historically, commodity index returns have tended to exhibit long-term positive returns with low correlations to other asset classes, creating potential risk/return benefits within a diversified portfolio. In fact, the DJ-AIG Index itself represents various different commodities and sectors, and accordingly has the potential for positive returns even when individual component or sector returns are negative — as was the case in the most recent fiscal year when metals returns greatly outperformed energy returns. These characteristics highlight the strategic benefits that we believe commodities offer.

Tactically, we believe that continued global economic growth — especially driven by the emerging Asian economies of China and India — may continue to drive commodity prices higher in the near future. The need for raw materials as the countries become more industrialized can fuel the demand for energy and industrial metals. Additionally, an emerging middle class could increase the demand for precious metals, while a more Western diet could continue to open markets for agriculture products in our view. Domestically, potential continued U.S. demand for energy, combined with the recent willingness of OPEC to cut production to prevent a further fall in oil, could provide a support for energy prices in the future.

Within the fixed income holdings of the Fund, we remain positioned in short-term instruments with a bias toward liquid and high credit quality assets. The short-term nature of these instruments proved to be beneficial to our strategy in an environment where the Federal Reserve increased the Fed Funds interest rate from 3.75% to 5.25%.

2

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

The DJ-AIG Index is a broadly diversified futures index composed of futures contracts on 19 physical commodities. The Index is weighted among commodity sectors using dollar-adjusted liquidity and production data. Currently, four energy products, six metals and nine agricultural products are represented in the Index. The Index is rebalanced at the beginning of each calendar year so that no single commodity constitutes less than 2% or more than 15% of the Index, and each sector represented in the Index is limited to 33%. However, following this rebalancing and for the remainder of the calendar year, these percentages may change so that a single commodity may constitute a greater or lesser percentage of the DJ-AIG Index and different sectors may represent different proportions of the DJ-AIG Index.

The Fund may seek to track the performance of the DJ-AIG Index by investing in commodity-linked structured notes and swaps. The Fund has obtained a private letter ruling from the Internal Revenue Service (IRS) confirming that the income produced by certain types of structured notes constitutes "qualifying income" under the Internal Revenue Code of 1986, as amended.

The Credit Suisse Commodities Management Team

Nelson Louie

Kam T. Poon

Andrew S. Lenskold

Christopher Burton

This Fund is non-diversified, which means it may invest a greater proportion of its assets in the securities of a smaller number of issuers than a diversified fund and may therefore be subject to greater volatility. Exposure to commodity markets should form only a small part of a diversified portfolio. Investment in commodity markets may not be suitable for all investors. The Fund's investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities, particularly in investments involving leverage.

The use of derivatives such as swaps, commodity–linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation risk, liquidity risk, interest-rate risk, market risk, credit risk, valuation risk and tax risk. Gains and losses from speculative positions in derivatives may be much greater than the derivatives' cost. At any time, the risk of loss of any individual security held by the Fund could be significantly higher than 50% of the security's value. For a detailed discussion of these

3

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

and other risks, please refer to the Fund's Prospectus, which should be read carefully before you invest.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign markets, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

4

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

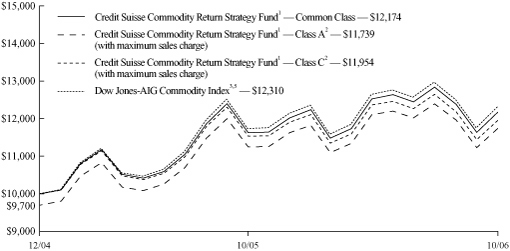

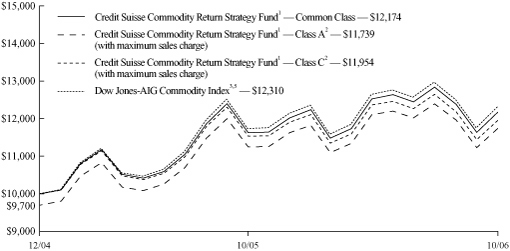

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Commodity Return Strategy Fund1 Common Class shares, Class A shares2, Class C shares2 and the

Dow Jones-AIG Commodity Index3,5 from Inception (12/30/04).

Average Annual Returns as of September 30, 20061

| | | 1 Year | | Since

Inception | |

| Common Class | | | (6.17 | )% | | | 9.00 | % | |

| Class A Without Sales Charge | | | (6.45 | )% | | | 8.69 | % | |

| Class A With Maximum Sales Charge | | | (9.27 | )% | | | 6.81 | % | |

| Class C Without CDSC | | | (7.03 | )% | | | 7.98 | % | |

| Class C With CDSC | | | (7.89 | )% | | | 7.98 | % | |

5

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

Average Annual Returns as of October 31, 20061

| | | 1 Year | | Since

Inception | |

| Common Class | | | 4.72 | % | | | 11.30 | % | |

| Class A Without Sales Charge | | | 4.51 | % | | | 10.94 | % | |

| Class A With Maximum Sales Charge | | | 1.41 | % | | | 9.11 | % | |

| Class C Without CDSC | | | 3.78 | % | | | 10.19 | % | |

| Class C With CDSC | | | 2.82 | % | | | 10.19 | % | |

Returns represent past performance and include changes in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 3.00%), was 1.41%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1.00%) was 2.82%.

3 The Dow Jones-AIG Commodity Index is composed of futures contracts on 19 physical commodities. Investors cannot invest directly in an index.

4 The Lehman Brothers U.S Aggregate Bond Index is composed of the Lehman Brothers Government/Corporate Bond Index and the Lehman Brothers Mortgage-Backed Securities Index. It includes U.S Treasury and agency issues, corporate bond issues and mortgage-backed securities rated investment-grade or higher by Moody's Investors Service; the Standard and Poor's division of The McGraw-Hill Companies, Inc.; or Fitch IBCA Inc. The Standard & Poor's 500 Index is an unmanaged index (with no defined investment objective) of common stocks. It includes reinvestment of dividends, and is a registered trademark of The McGraw-Hill Companies, Inc. Investors cannot invest directly in an index.

5 Performance for the benchmark is not available for the period beginning December 30, 2004. For that reason, performance is shown for the period beginning January 1, 2005.

6

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2006.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

7

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended October 31, 2006

| Actual Fund Return | | Common

Class | | Class A | | Class C | |

| Beginning Account Value 5/01/06 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/06 | | $ | 971.90 | | | $ | 969.70 | | | $ | 966.80 | | |

| Expenses Paid per $1,000* | | $ | 3.48 | | | $ | 4.72 | | | $ | 8.43 | | |

| Hypothetical 5% Fund Return | |

| Beginning Account Value 5/01/06 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

| Ending Account Value 10/31/06 | | $ | 1,021.68 | | | $ | 1,020.42 | | | $ | 1,016.64 | | |

| Expenses Paid per $1,000* | | $ | 3.57 | | | $ | 4.84 | | | $ | 8.64 | | |

| | | Common

Class | | Class A | | Class C | |

| Annualized Expense Ratios* | | | 0.70 | % | | | 0.95 | % | | | 1.70 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the fiscal period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

8

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2006 (unaudited)

| Sector Breakdown* | |

| Commercial Paper | | | 41.9 | % | |

| Structured Notes | | | 35.9 | % | |

| Variable Rate Corporate Obligations | | | 12.5 | % | |

| Mortgage Backed Securities | | | 4.2 | % | |

| Asset Backed Securities | | | 2.9 | % | |

| Corporate Obligations | | | 2.5 | % | |

| Short-Term Investment | | | 0.1 | % | |

| Total | | | 100.0 | % | |

* Expressed as a percentage of total investments and may vary over time.

9

Credit Suisse Commodity Return Strategy Fund

Schedule of Investments

October 31, 2006

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| COMMERCIAL PAPER (44.5%) | | | |

| ASSET BACKED (44.5%) | | | |

| $ | 7,900 | | | Ajax Bambino Funding, Inc. | | (A-1+, P-1) | | 12/06/06 | | | 5.324 | | | $ | 7,859,523 | | |

| | 2,100 | | | Altius Capital Funding Corp. | | (A-1+, P-1) | | 12/07/06 | | | 5.333 | | | | 2,088,870 | | |

| | 8,450 | | | ASAP Funding Ltd. | | (A-1, P-1) | | 11/02/06 | | | 5.325 | | | | 8,448,758 | | |

| | 12,000 | | | Atlas I Funding Corp. | | (AAA, Aaa) | | 12/13/06 | | | 5.330 | | | | 11,926,220 | | |

| | 6,700 | | | Beethoven Funding Corp. | | (A-1, P-1) | | 11/21/06 | | | 5.289 | | | | 6,680,384 | | |

| | 5,600 | | | Brahms Funding Corp. | | (A-1, P-1) | | 11/01/06 | | | 5.318 | | | | 5,600,000 | | |

| | 5,456 | | | Buckingham CDO LLC | | (A-1+, P-1) | | 12/15/06 | | | 5.359 | | | | 5,420,724 | | |

| | 6,000 | | | CC USA, Inc. | | (A-1+, P-1) | | 03/08/07 | | | 5.362 | | | | 5,889,510 | | |

| | 10,400 | | | Cheyne Finance LLC | | (AAA, Aaa) | | 01/18/07 | | | 5.334 | | | | 10,281,700 | | |

| | 1,600 | | | Cobbler Funding LLC | | (A-1, P-1) | | 01/29/07 | | | 5.351 | | | | 1,579,115 | | |

| | 8,400 | | | Davis Square Funding VI Corp. | | (A-1+, P-1) | | 11/02/06 | | | 5.383 | | | | 8,398,759 | | |

| | 2,700 | | | Georgetown Funding Co. | | (A-1+, P-1) | | 12/06/06 | | | 5.332 | | | | 2,686,088 | | |

| | 2,800 | | | Golden Fish LLC | | (A-1, P-1) | | 11/13/06 | | | 5.336 | | | | 2,795,063 | | |

| | 9,200 | | | Golden Fish LLC | | (A-1, P-1) | | 11/17/06 | | | 5.336 | | | | 9,178,370 | | |

| | 500 | | | Golden Fish LLC | | (A-1, P-1) | | 12/07/06 | | | 5.325 | | | | 497,355 | | |

| | 5,700 | | | Main Street Warehouse LLC | | (A-1+, P-1) | | 11/16/06 | | | 5.300 | | | | 5,687,413 | | |

| | 2,300 | | | Mica Funding LLC | | (A-1, P-1) | | 01/12/07 | | | 5.329 | | | | 2,275,804 | | |

| | 1,200 | | | Rathgar Capital Corp. | | (AAA, Aaa) | | 01/11/07 | | | 5.320 | | | | 1,187,575 | | |

| | 6,600 | | | Rhineland Funding Capital Corp. | | (A-1+, P-1) | | 11/17/06 | | | 5.382 | | | | 6,584,395 | | |

| | 1,800 | | | Rhineland Funding Capital Corp. | | (A-1+, P-1) | | 01/08/07 | | | 5.370 | | | | 1,781,980 | | |

| | 5,000 | | | Rhineland Funding Capital Corp. | | (A-1+, P-1) | | 01/08/07 | | | 5.371 | | | | 4,949,945 | | |

| | 400 | | | Rhineland Funding Capital Corp. | | (A-1+, P-1) | | 01/30/07 | | | 5.382 | | | | 394,690 | | |

| | 5,500 | | | Romulus Funding Corp. | | (A-1, P-1) | | 12/05/06 | | | 5.340 | | | | 5,472,625 | | |

| | 16,800 | | | Thornburg Mortgage Capital Resources LLC | | (A-1+, P-1) | | 12/18/06 | | | 5.313 | | | | 16,684,192 | | |

| | 10,000 | | | Transamerica Securities | | (A-1+, P-1) | | 11/09/06 | | | 5.313 | | | | 9,988,244 | | |

| | 1,950 | | | Whistlejacket Capital, Ltd. | | (A-1+, P-1) | | 11/06/06 | | | 5.318 | | | | 1,948,573 | | |

| | 3,400 | | | White Pine Finance LLC | | (A-1+, P-1) | | 11/30/06 | | | 5.329 | | | | 3,385,566 | | |

| | 1,772 | | | Witherspoon CDO Funding LLC | | (A-1+, P-1) | | 11/15/06 | | | 5.340 | | | | 1,768,344 | | |

| | 10,200 | | | Witherspoon CDO Funding LLC# | | (A-1+, P-1) | | 03/15/07 | | | 5.340 | | | | 10,200,000 | | |

| TOTAL COMMERCIAL PAPER (Cost $161,639,785) | | | | | | | | | | | | | 161,639,785 | | |

| ASSET BACKED SECURITIES (2.9%) | | | |

| | 77 | | | Ace Securities Corp., Series 2003-0P1,

Class A2# | | (AAA, Aaa) | | 12/25/33 | | | 5.680 | | | | 77,435 | | |

| | 88 | | | Ameriquest Mortgage Securities, Inc.,

Series 2003-12, Class AV2# | | (AAA, Aaa) | | 01/25/34 | | | 5.690 | | | | 88,193 | | |

| | 305 | | | Ameriquest Mortgage Securities, Inc.,

Series 2003-9, Class AV2# | | (AAA, Aaa) | | 09/25/33 | | | 5.660 | | | | 306,184 | | |

| | 138 | | | Bear Stearns Asset Backed Securities, Inc.,

Series 2004-HE8, Class A# | | (AAA, Aaa) | | 09/25/34 | | | 5.700 | | | | 138,563 | | |

| | 40 | | | CDC Mortgage Capital Trust, Series

2003-HE4, Class A3# | | (AAA, Aaa) | | 03/25/34 | | | 5.870 | | | | 39,851 | | |

| | 102 | | | Countrywide Home Equity Loan Trust,

Series 2004-R, Class 2A# | | (AAA, Aaa) | | 03/15/30 | | | 5.570 | | | | 102,737 | | |

| | 77 | | | Countrywide Home Equity Loan Trust,

Series 2005-B, Class 2A# | | (AAA, Aaa) | | 05/15/35 | | | 5.500 | | | | 77,486 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse Commodity Return Strategy Fund

Schedule of Investments (continued)

October 31, 2006

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| ASSET BACKED SECURITIES | | | |

| $ | 254 | | | First Franklin Mortgage Loan Asset Backed

Certificates, Series 2004-FF4, Class A2# | | (AAA, Aaa) | | 06/25/34 | | | 5.610 | | | $ | 254,520 | | |

| | 272 | | | First Franklin Mortgage Loan Asset Backed

Certificates, Series 2004-FF6, Class A2B# | | (AAA, Aaa) | | 07/25/34 | | | 5.730 | | | | 272,071 | | |

| | 147 | | | Fremont Home Loan Trust, Series 2004-D,

Class 1A2# | | (AAA, Aaa) | | 11/25/34 | | | 5.700 | | | | 146,991 | | |

| | 230 | | | GE Capital Credit Card Master Note Trust,

Series 2004-2, Class A# | | (AAA, Aaa) | | 09/15/10 | | | 5.360 | | | | 230,243 | | |

| | 164 | | | MSDWCC Heloc Trust, Series 2005-1, Class A# | | (AAA, Aaa) | | 07/25/17 | | | 5.510 | | | | 164,466 | | |

| | 8,250 | | | Newcastle CDO, Ltd., Series 2005-6A, Class lM1# | | (AAA, Aaa) | | 04/24/07 | | | 5.320 | | | | 8,248,693 | | |

| | 136 | | | Novastar Home Equity Loan Trust, Series 2004-3,

Class A3D# | | (AAA, Aaa) | | 12/25/34 | | | 5.680 | | | | 192,327 | | |

| | 133 | | | Option One Mortgage Loan Trust, Series 2003-3,

Class A2# | | (AAA, Aaa) | | 06/25/33 | | | 5.620 | | | | 133,737 | | |

| | 144 | | | Specialty Underwriting & Residential Finance,

Series 2004-BC2, Class A2# | | (AAA, Aaa) | | 05/25/35 | | | 5.590 | | | | 143,638 | | |

| TOTAL ASSET BACKED SECURITIES (Cost $10,615,800) | | | | | | | | | | | | | 10,617,135 | | |

| MORTGAGE BACKED SECURITIES (4.1%) | | | |

| | 15,000 | | | Paragon Mortgages PLC, Series 12A, Class A1#‡‡ | | (AAA, Aaa) | | 11/15/38 | | | 5.300 | | | | 15,000,000 | | |

| | 77 | | | Washington Mutual, Series 2005-AR4, Class A1 | | (AAA, Aaa) | | 04/25/35 | | | 3.624 | | | | 76,886 | | |

| TOTAL MORTGAGE BACKED SECURITIES (Cost $15,077,089) | | | | | | | | | | | | | 15,076,886 | | |

| CORPORATE OBLIGATION (2.5%) | | | |

| FINANCE (2.5%) | | | |

| | 9,000 | | | CC USA, Inc., Series MTN, Notes‡‡

(Cost $9,000,000) | | (AAA, Aaa) | | 06/18/07 | | | 5.520 | | | | 8,998,263 | | |

| STRUCTURED NOTES (35.7%) | | | |

| | 15,700 | | | ABN AMRO BANK NV: Commodity Index

Linked Notes# | | (A-1+, P-1) | | 10/22/07 | | | 5.279 | | | | 18,502,073 | | |

| | 13,000 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.173 | | | | 14,670,500 | | |

| | 700 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 11/01/07 | | | 5.165 | | | | 784,273 | | |

| | 800 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 11/01/07 | | | 5.165 | | | | 910,176 | | |

| | 500 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 11/01/07 | | | 5.500 | | | | 500,000 | | |

| | 500 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.159 | | | | 490,570 | | |

| | 300 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.161 | | | | 330,264 | | |

| | 700 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.165 | | | | 749,049 | | |

| | 500 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.168 | | | | 603,310 | | |

| | 300 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.226 | | | | 287,511 | | |

| | 300 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.229 | | | | 297,705 | | |

| | 500 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.232 | | | | 496,020 | | |

| | 700 | | | AIG: Commodity Index Linked Notes# | | (A-1+, P-1) | | 12/31/07 | | | 5.500 | | | | 663,208 | | |

| | 15,600 | | | Barclays Bank PLC: Commodity Index

Linked Notes# | | (A-1+, P-1) | | 10/28/07 | | | 5.264 | | | | 18,343,931 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse Commodity Return Strategy Fund

Schedule of Investments (continued)

October 31, 2006

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| STRUCTURED NOTES | | | |

| $ | 15,500 | | | Bear Stearns Co., Inc.: Commodity Index

Linked Notes# | | (A-1+, P-1) | | 11/06/07 | | | 5.150 | | | $ | 17,491,905 | | |

| | 15,500 | | | IXIS: Commodity Index Linked Notes# | | (A-1+, P-1) | | 11/05/07 | | | 5.120 | | | | 18,061,530 | | |

| | 16,100 | | | Morgan Stanley: Commodity Index

Linked Notes# | | (A-1, P-1) | | 10/15/07 | | | 5.290 | | | | 15,410,437 | | |

| | 18,750 | | | Swedish Exportkredit AB: Commodity Index

Linked Notes# | | (A-1+, P-1) | | 11/09/07 | | | 5.500 | | | | 21,159,375 | | |

| TOTAL STRUCTURED NOTES (Cost $115,950,000) | | | | | | | | | | | | | 129,751,837 | | |

| VARIABLE RATE CORPORATE OBLIGATIONS (9.6%) | | | |

| DIVERSIFIED FINANCIALS (9.6%) | | | |

| | 10,000 | | | Atlas Capital Funding Corp., Series MTN, Notes# | | (AAA, Aaa) | | 07/16/07 | | | 5.310 | | | | 10,001,590 | | |

| | 6,000 | | | Dorada Finance, Inc., Series MTN# | | (AAA, Aaa) | | 04/25/08 | | | 5.362 | | | | 6,003,960 | | |

| | 5,500 | | | Five Finance, Inc., Series MTN, Global Senior

Unsecured Notes# | | (AAA, Aaa) | | 09/13/07 | | | 5.360 | | | | 5,502,783 | | |

| | 6,000 | | | Sigma Finance, Inc., Series MTN1, Company

Guaranteed Notes# | | (AAA, Aaa) | | 03/23/07 | | | 5.347 | | | | 6,001,584 | | |

| | 7,500 | | | White Pine Finance LLC# | | (AAA, Aaa) | | 04/20/07 | | | 5.364 | | | | 7,503,795 | | |

TOTAL VARIABLE RATE CORPORATE OBLIGATIONS

(Cost $34,998,221) | | | | | | | | | | | | | 35,013,712 | | |

| UNITED STATES AGENCY OBLIGATION (0.0%) | | | |

| | 145 | | | Fannie Mae Discount Notes

(Cost $144,568) | | (AAA, Aaa) | | 11/22/06 | | | 5.079 | | | | 144,568 | | |

| SHORT-TERM INVESTMENT (0.1%) | | | |

| | 259 | | | State Street Bank and Trust Co. Euro

Time Deposit (Cost $259,000) | | | | 11/01/06 | | | 4.100 | | | | 259,000 | | |

| TOTAL INVESTMENTS AT VALUE (99.4%) (Cost $347,684,463) | | | | | | | | | | | | | 361,501,186 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (0.6%) | | | | | | | | 2,065,799 | |

| NET ASSETS (100.0%) | | | | | | | | | | | | $ | 363,566,985 | | |

INVESTMENT ABBREVIATIONS

MTN = Medium Term Note

MTN1 = Medium Term Note, Series 1

† Credit ratings given by the Standard & Poor's Division of the McGraw-Hill Companies, Inc. ("S&P") and Moody's Investors Service, Inc. ("Moody's") are unaudited.

# Variable rate obligations — The interest rate shown is the rate as of October 31, 2006.

‡‡ Collateral segregated for futures contracts.

See Accompanying Notes to Financial Statements.

12

Credit Suisse Commodity Return Strategy Fund

Statement of Assets and Liabilities

October 31, 2006

| Assets | |

| Investments at value (Cost $347,684,463) (Note 2) | | $ | 361,501,186 | | |

| Cash | | | 411 | | |

| Receivable for fund shares sold | | | 3,072,831 | | |

| Interest receivable | | | 888,413 | | |

| Prepaid expenses and other assets | | | 29,670 | | |

| Total Assets | | | 365,492,511 | | |

| Liabilities | |

| Advisory fee payable (Note 3) | | | 55,168 | | |

| Distribution fee payable (Note 3) | | | 56,415 | | |

| Administrative services fee payable (Note 3) | | | 52,765 | | |

| Payable for investments purchased | | | 1,200,000 | | |

| Payable for fund shares redeemed | | | 359,011 | | |

| Variation margin payable (Note 2) | | | 44,531 | | |

| Trustees' fee payable | | | 7,587 | | |

| Other accrued expenses payable | | | 150,049 | | |

| Total Liabilities | | | 1,925,526 | | |

| Net Assets | |

| Capital stock, $0.001 par value (Note 6) | | | 33,142 | | |

| Paid-in capital (Note 6) | | | 365,604,991 | | |

| Undistributed net investment income | | | 2,147,523 | | |

| Accumulated net realized loss on investments, futures contracts and swap contracts | | | (17,950,748 | ) | |

| Net unrealized appreciation from investments and futures contracts | | | 13,732,077 | | |

| Net Assets | | $ | 363,566,985 | | |

| Common Shares | |

| | | $ | 125,612,565 | | |

| Shares outstanding | | | 11,441,366 | | |

| Net asset value, offering price, and redemption price per share | | $ | 10.98 | | |

| A Shares | |

| Net assets | | $ | 223,377,445 | | |

| Shares outstanding | | | 20,371,116 | | |

| Net asset value, offering price, and redemption price per share | | $ | 10.97 | | |

| Maximum offering price per share (net asset value/(1-3.00%)) | | $ | 11.31 | | |

| C Shares | | | | | |

| Net assets | | $ | 14,576,975 | | |

| Shares outstanding | | | 1,329,350 | | |

| Net asset value and redemption price per share | | $ | 10.97 | | |

See Accompanying Notes to Financial Statements.

13

Credit Suisse Commodity Return Strategy Fund

Statement of Operations

For the Year Ended October 31, 2006

| Investment Income (Note 2) | |

| Interest | | $ | 12,469,433 | | |

| Securities lending | | | 1,348 | | |

| Total investment income | | | 12,470,781 | | |

| Expenses | |

| Investment advisory fees (Note 3) | | | 1,248,425 | | |

| Administrative services fees (Note 3) | | | 381,939 | | |

| Distribution fees (Note 3) | |

| Class A | | | 420,446 | | |

| Class C | | | 106,803 | | |

| Transfer agent fees (Note 3) | | | 280,016 | | |

| Legal fees | | | 135,662 | | |

| Registration fees | | | 106,963 | | |

| Printing fees (Note 3) | | | 60,136 | | |

| Offering costs (Note 3) | | | 47,014 | | |

| Audit and tax fees | | | 29,368 | | |

| Custodian fees | | | 25,933 | | |

| Trustees' fees | | | 24,816 | | |

| Insurance expense | | | 12,421 | | |

| Commitment fees (Note 4) | | | 7,346 | | |

| Miscellaneous expense | | | 4,284 | | |

| Total expenses | | | 2,891,572 | | |

| Less: fees waived (Note 3) | | | (616,527 | ) | |

| Net expenses | | | 2,275,045 | | |

| Net investment income | | | 10,195,736 | | |

| Net Realized and Unrealized Gain (Loss) from Investments, Futures Contracts, and Swap Contracts | |

| Net realized loss from investments | | | (3,119,427 | ) | |

| Net realized gain from futures contracts | | | 63,340 | | |

| Net realized loss from swap contracts | | | (14,870,444 | ) | |

| Net change in unrealized appreciation (depreciation) from investments | | | 13,936,336 | | |

| Net change in unrealized appreciation (depreciation) from futures contracts | | | (94,372 | ) | |

| Net realized and unrealized loss from investments, futures contracts and swap contracts | | | (4,084,567 | ) | |

| Net increase in net assets resulting from operations | | $ | 6,111,169 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse Commodity Return Strategy Fund

Statements of Changes in Net Assets

| | | For the Year

Ended

October 31, 2006 | | For the Period

Ended

October 31, 20051 | |

| From Operations | |

| Net investment income | | $ | 10,195,736 | | | $ | 1,744,732 | | |

| Net realized gain (loss) from investments, futures contracts and swap contracts | | | (17,926,531 | ) | | | 8,604,041 | | |

Net change in unrealized appreciation (depreciation) from investments,

futures contracts and swap contracts | | | 13,841,964 | | | | (109,887 | ) | |

| Net increase in net assets resulting from operations | | | 6,111,169 | | | | 10,238,886 | | |

| From Dividends and Distributions | |

Dividends from net investment income

Common Class shares | | | (280,022 | ) | | | (495,741 | ) | |

| Class A shares | | | (5,744,986 | ) | | | (831,811 | ) | |

| Class C shares | | | (2,734,504 | ) | | | (19,814 | ) | |

Distributions from net realized gains

Common Class shares | | | (2,883,677 | ) | | | — | | |

| Class A shares | | | (5,418,265 | ) | | | — | | |

| Class C shares | | | (304,976 | ) | | | — | | |

| Net decrease in net assets resulting from dividends and distributions | | | (17,366,430 | ) | | | (1,347,366 | ) | |

| From Capital Share Transactions (Note 6) | |

| Proceeds from sale of shares | | | 333,893,604 | | | | 186,333,387 | | |

| Reinvestment of dividends and distributions | | | 11,220,860 | | | | 804,195 | | |

| Net asset value of shares redeemed | | | (132,023,847 | )2 | | | (34,397,473 | ) | |

| Net increase in net assets from capital share transactions | | | 213,090,617 | | | | 152,740,109 | | |

| Net increase in net assets | | | 201,835,356 | | | | 161,631,629 | | |

| Net Assets | |

| Beginning of year | | | 161,731,629 | | | | 100,0003 | | |

| End of year | | $ | 363,566,985 | | | $ | 161,731,629 | | |

| Undistributed net investment income | | $ | 2,147,523 | | | $ | 649,851 | | |

1 For the period December 30, 2004 (inception date) through October 31, 2005.

2 Net of $20,115 of redemption fees retained by the Fund.

3 The Fund was seeded on December 1, 2004 and commenced operations on December 30, 2004.

See Accompanying Notes to Financial Statements.

15

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Common Class Share of the Fund Outstanding Throughout Each Period)

| | | For the Year

Ended

October 31, 2006 | | For the Period

Ended

October 31, 20051 | |

| Per share data | |

| Net asset value, beginning of period | | $ | 11.47 | | | $ | 10.00 | | |

| INVESTMENT OPERATIONS | |

| Net investment income2 | | | 0.48 | | | | 0.23 | | |

Net gain on investments, futures contracts, swap contracts

(both realized and unrealized) | | | 0.05 | | | | 1.39 | | |

| Total from investment operations | | | 0.53 | | | | 1.62 | | |

| REDEMPTION FEES | | | 0.003 | | | | — | | |

| LESS DIVIDENDS AND DISTRIBUTIONS | |

| Dividends from net investment income | | | (0.40 | ) | | | (0.15 | ) | |

| Distributions from net realized gains | | | (0.62 | ) | | | — | | |

| Total dividends and distributions | | | (1.02 | ) | | | (0.15 | ) | |

| Net asset value, end of period | | $ | 10.98 | | | $ | 11.47 | | |

| Total return4 | | | 4.72 | % | | | 16.25 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (000s omitted) | | $ | 125,613 | | | $ | 48,207 | | |

| Ratio of expenses to average net assets | | | 0.70 | % | | | 0.70 | %5 | |

| Ratio of net investment income to average net assets | | | 4.29 | % | | | 2.53 | %5 | |

Decrease reflected in above operating expense ratios due to

waivers/reimbursements | | | 0.25 | % | | | 0.80 | %5 | |

| Portfolio turnover rate | | | 60 | % | | | 0 | % | |

1 For the period December 30, 2004 (inception date) through October 31, 2005.

2 Per share information is calculated using the average shares outstanding method.

3 This amount represents less than $0.01 per share.

4 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

5 Annualized.

See Accompanying Notes to Financial Statements.

16

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Class A Share of the Fund Outstanding Throughout Each Period)

| | | For the Year

Ended

October 31, 2006 | | For the Period

Ended

October 31, 20051 | |

| Per share data | |

| Net asset value, beginning of period | | $ | 11.45 | | | $ | 10.00 | | |

| INVESTMENT OPERATIONS | |

| Net investment income2 | | | 0.45 | | | | 0.23 | | |

Net gain on investments, futures contracts, and swap contracts

(both realized and unrealized) | | | 0.06 | | | | 1.36 | | |

| Total from investment operations | | | 0.51 | | | | 1.59 | | |

| REDEMPTION FEES | | | 0.003 | | | | — | | |

| LESS DIVIDENDS AND DISTRIBUTIONS | |

| Dividends from net investment income | | | (0.37 | ) | | | (0.14 | ) | |

| Distributions from net realized gains | | | (0.62 | ) | | | — | | |

| Total dividends and distributions | | | (0.99 | ) | | | (0.14 | ) | |

| Net asset value, end of period | | $ | 10.97 | | | $ | 11.45 | | |

| Total return4 | | | 4.51 | % | | | 15.91 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (000s omitted) | | $ | 223,377 | | | $ | 108,4315 | | |

| Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | |

| Ratio of net investment income to average net assets | | | 4.04 | % | | | 2.28 | %5 | |

Decrease reflected in above operating expense ratios due to

waivers/reimbursements | | | 0.25 | % | | | 0.80 | %5 | |

| Portfolio turnover rate | | | 60 | % | | | 0 | % | |

1 For the period December 30, 2004 (inception date) through October 31, 2005.

2 Per share information is calculated using the average shares outstanding method.

3 This amount represents less than $0.01 per share.

4 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

5 Annualized.

See Accompanying Notes to Financial Statements.

17

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Class C Share of the Fund Outstanding Throughout Each Period)

| | | For the Year

Ended

October 31, 2006 | | For the Period

Ended

October 31, 20051 | |

| Per share data | |

| Net asset value, beginning of period | | $ | 11.43 | | | $ | 10.00 | | |

| INVESTMENT OPERATIONS | |

| Net investment income2 | | | 0.37 | | | | 0.17 | | |

Net gain on investments, futures contracts, and swap contracts

(both realized and unrealized) | | | 0.06 | | | | 1.36 | | |

| Total from investment operations | | | 0.43 | | | | 1.53 | | |

| REDEMPTION FEES | | | 0.003 | | | | — | | |

| LESS DIVIDENDS AND DISTRIBUTIONS | |

| Dividends from net investment income | | | (0.27 | ) | | | (0.10 | ) | |

| Distributions from net realized gains | | | (0.62 | ) | | | — | | |

| Total dividends and distributions | | | (0.89 | ) | | | (0.10 | ) | |

| Net asset value, end of period | | $ | 10.97 | | | $ | 11.43 | | |

| Total return4 | | | 3.78 | % | | | 15.29 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (000s omitted) | | $ | 14,577 | | | $ | 5,094 | | |

| Ratio of expenses to average net assets | | | 1.70 | % | | | 1.70 | %5 | |

| Ratio of net investment income to average net assets | | | 3.29 | % | | | 1.53 | %5 | |

Decrease reflected in above operating expense ratios due to

waivers/reimbursements | | | 0.25 | % | | | 0.80 | %5 | |

| Portfolio turnover rate | | | 60 | % | | | 0 | % | |

1 For the period December 30, 2004 (inception date) through October 31, 2005.

2 Per share information is calculated using the average shares outstanding method.

3 This amount represents less than $0.01 per share.

4 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

5 Annualized.

See Accompanying Notes to Financial Statements.

18

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements

October 31, 2006

Note 1. Organization

Credit Suisse Commodity Return Strategy Fund (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a non-diversified open-end management investment company that seeks total return. The Fund was organized as a statutory trust under the laws of the State of Delaware on May 19, 2004.

The Fund is authorized to offer three classes of shares: Common Class, Class A shares and Class C shares. Each class of shares represents an equal pro rata interest in the Fund, except that they bear different expenses which reflect the differences in the range of services provided to them. The Fund's Common Class shares are closed to new investors, with certain exceptions as set forth in the prospectus. Class A shares are sold subject to a front end sales charge of up to 3.00%. Class C Shares are sold subject to a contingent deferred sales charge of 1.00% if redeemed within the first year of purchase.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equ ity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation. Swap contracts are generally valued at a price at which the counterparty to such contract would repurchase the instrument or terminate the contract. Securities, options, futures contracts and other assets (including swap and structured note agreements), for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees under procedures established by the Board of Trustees. The Fund may utilize a service provided by an independent third party which has been approved by the Board o f Trustees to fair value certain securities. When fair-value pricing is employed, the prices of

19

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 2. Significant Accounting Policies

securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities.

B) SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Certain expenses are class-specific expenses and vary by class. Income, expenses (excluding class-specific expenses) and realized/unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of the outstanding shares of that class. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes.

C) DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income are declared and paid quarterly. Distributions of net realized capital gains, if any, are declared and paid at least annually. However, to the extent that a net realized capital gain can be reduced by a capital loss carryforward, such gain will not be distributed. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America ("GAAP").

D) FEDERAL INCOME TAXES — No provision is made for federal taxes as it is the Fund's intention to have the Fund continue to qualify for and elect the tax treatment applicable to regulated investment companies ("RICs") under the Internal Revenue Code of 1986, as amended (the "Code"), and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

In order to qualify as a RIC under the Code, the Fund must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its income. One of these requirements is that the Fund derive at least 90% of its gross income for each taxable year from dividends, interest, payments with respect to certain securities loans, gains from the sale or other disposition of stock, securities or foreign currencies, other income derived with respect to its business of investing in such stock, securities or currencies or net income derived from interests in certain publicly traded partnerships ("Qualifying Income"). The Fund has gained exposure to the commodities market by entering into commodity-linked swaps on the Dow Jones AIG Commodity Index ("DJ-AIG Index"). The IRS has issued rulings that would cause certain income from commodity-linked swaps not to be considered Qualifying Income if earned by the F und after September 30, 2006. The application of these rulings do not permit the Fund to invest in commodity-linked swaps after September 30, 2006 in the manner that it had since inception. As a result, the income the Fund derives from such commodity-linked swaps or certain other commodity-linked derivatives after

20

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 2. Significant Accounting Policies

September 30, 2006 must be limited to a maximum of 10 percent of its annual gross income. The Fund may seek to track the performance of the DJ-AIG Index through investing in structured notes designed to track the performance of the DJ-AIG Index. On June 1, 2006, the Fund received a private letter ruling from the IRS which confirms that the Fund's use of certain structured notes designed to track the performance of the DJ-AIG Index will produce Qualifying Income. If the Fund is unable to ensure continued qualification, the Fund may be required to change its investment objective, policies or techniques, or may be liquidated. A liquidation would subject investors to tax on the difference between the liquidating distribution and their basis in their shares, if those shares are held in a taxable account. If the Fund fails to qualify as a RIC, the Fund will be subject to federal income tax on its net income and capital gains at regular corporate r ates (without reduction for distributions to shareholders). When distributed, that income would also be taxable to shareholders as an ordinary dividend to the extent attributable to the Fund's earnings and profits. If the Fund were to fail to qualify as a RIC and become subject to federal income tax, shareholders of the Fund would be subject to the risk of diminished returns.

E) USE OF ESTIMATES — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

F) SHORT-TERM INVESTMENTS — The Fund, together with other funds/portfolios advised by Credit Suisse Asset Management, LLC ("Credit Suisse"), an indirect, wholly-owned subsidiary of Credit Suisse Group, pools available cash into either a short-term variable rate time deposit issued by State Street Bank and Trust Company ("SSB"), the Fund's custodian, or a money market fund advised by Credit Suisse. The short-term time deposit issued by SSB is a variable rate account classified as a short-term investment.

G) FUTURES — The Fund may enter into futures contracts to the extent permitted by its investment policies and objectives. Upon entering into a futures contract, the Fund is required to deposit cash and/or pledge U.S. Government securities as initial margin. Subsequent payments, which are dependent on the daily fluctuations in the value of the underlying instrument, are made or received by the Fund each day (daily variation margin) and are recorded as unrealized gains or losses until the contracts are closed. When the contracts are closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund's basis in the contract. Risks of entering into futures contracts for hedging purposes include the possibility that a change in the value of the

21

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 2. Significant Accounting Policies

contract may not correlate with the changes in the value of the underlying instruments. In addition, the purchase of a futures contract involves the risk that the Fund could lose more than the original margin deposit and subsequent payments required for a futures transaction. At October 31, 2006, the Fund had the following open futures contracts:

| Futures Contracts | | Number of

Contracts | | Expiration

Date | | Contract

Amount | | Contract

Value | | Unrealized

Appreciation/

(Depreciation) | |

U.S. Treasury

2 Year Notes Futures | | | (32 | ) | | 12/29/06 | | $ | (6,550,404 | ) | | $ | (6,541,000 | ) | | $ | 9,404 | | |

U.S. Treasury

10 Year Notes Futures | | | (79 | ) | | 12/19/06 | | | (8,455,232 | ) | | | (8,549,282 | ) | | | (94,050 | ) | |

| | | | | $ | (15,005,636 | ) | | $ | (15,090,282 | ) | | $ | (84,646 | ) | |

H) SWAPS — The Fund may enter into index swaps for hedging purposes or to seek to increase total return. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset or notional principal amount. The Fund will enter into index swaps only on a net basis, which means that the two payment streams are netted out, with the Fund receiving or paying, as the case may be, only the net amount of the two payments. Risks may arise as a result of the failure of the counterparty to the swap contract to comply with the terms of the swap contract. The loss incurred by the failure of a counterparty is generally limited to the net interest payment to be received by the Fund, and/or the termination value at the end of the contract. Therefore, the Fund considers the creditworthiness of ea ch counterparty to a swap contract in evaluating potential credit risk. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying reference asset or index.

The Fund may enter into total return swap contracts, involving commitments to pay interest in exchange for a market-linked return, both based on notional amounts. To the extent the total return of the security or index underlying the transactions exceeds or falls short of the offsetting interest rate obligation, the Fund will receive a payment from or make a payment to the counterparty.

The Fund records unrealized gains or losses on a daily basis representing the value and the current net receivable or payable relating to open swap contracts. Net amounts received or paid on the swap contract are recorded as realized gains or losses. Fluctuations in the value of swaps contracts are recorded for financial statement purposes as unrealized appreciation or depreciation of swap contracts. Realized gains and losses from terminated swaps are included in net realized gains/losses on swap contracts transactions.

22

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 2. Significant Accounting Policies

I) COMMODITY INDEX-LINKED NOTES — The Fund may invest in structured notes whose value is based on the price movements of a commodity index. The structured notes are often leveraged, increasing the volatility of each note's value relative to the change in the underlying linked financial element. The value of these notes will rise and fall in response to changes in the underlying commodity index. Structured notes may entail a greater degree of market risk than other types of debt securities because the investor bears the risk of the underlying commodity index. Structured notes may also be more volatile, less liquid, and more difficult to accurately price than less complex securities or more traditional debt securities. Fluctuations in the value of the structured notes are recorded as unrealized gains and losses in the accompanying financial statements. Net payments are recorded as net realized gains/(losses). These notes are subject to pr epayment, credit and interest risks. The Fund has the option to request prepayment from the issuer. At maturity, or when a note is sold, the Fund records a realized gain or loss. At October 31, 2006, the value of these securities comprised 35.7% of the Fund's net assets and resulted in unrealized appreciation of $13, 801,837.

J) SECURITIES LENDING — Loans of securities are required at all times to be secured by collateral at least equal to 102% of the market value of domestic securities on loan (including any accrued interest thereon) and 105% of the market value of foreign securities on loan (including any accrued interest thereon). Cash collateral received by the Fund in connection with securities lending activity may be pooled together with cash collateral for other funds/portfolios advised by Credit Suisse and may be invested in a variety of investments, including certain Credit Suisse-advised funds, funds advised by SSB, the Fund's securities lending agent, or money market instruments. However, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

SSB has been engaged by the Fund to act as the Fund's securities lending agent. The Fund's securities lending arrangement provides that the Fund and SSB will share the net income earned from securities lending activities. During the year ended October 31, 2006, total earnings from the Fund's investment in cash collateral received in connection with security lending arrangements was $38,454, of which $36,729 was rebated to borrowers (brokers). The Fund retained $1,348 in income from the cash collateral investment and SSB, as a lending agent, was paid $377. The Fund may also be entitled to certain minimum amounts of income from their securities lending activities. Securities lending income is accrued as earned.

K) OTHER — The Fund may invest in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency

23

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 2. Significant Accounting Policies

risks (fluctuations in currency exchange rates), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks of investing in foreign securities include liquidity and valuation risks.

The Fund may be subject to taxes imposed by countries in which it invests with respect to its investments in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Fund accrues such taxes when the related income is earned or gains are realized.

Note 3. Transactions with Affiliates and Related Parties

Credit Suisse serves as investment adviser for the Fund. For its investment advisory services, Credit Suisse is entitled to receive a fee from the Fund at an annual rate of 0.50% of the Fund's average daily net assets. For the year ended October 31, 2006, investment advisory fees earned and voluntarily waived were $1,248,425, and $616,527, respectively. Credit Suisse will not recapture from the Fund any fees it waived during the fiscal year ended October 31, 2006. Fee waivers and reimbursements are voluntary and may be discontinued by Credit Suisse at any time.

Credit Suisse Asset Management Securities, Inc. ("CSAMSI"), an affiliate of Credit Suisse, and SSB serve as co-administrators to the Fund. For its co-administrative services, CSAMSI currently receives a fee calculated at an annual rate of 0.10% of the Fund's average daily net assets. For the year ended October 31, 2006, co-administrative services fees earned by CSAMSI were $249,685. Effective December 1, 2006, the co-administration fee was reduced to an annual rate of 0.09%.

For its co-administrative services, SSB receives a fee, exclusive of out-of-pocket expenses, calculated in total for all the Credit Suisse funds/portfolios co-administered by SSB and allocated based upon relative average net assets of each fund/portfolio, subject to an annual minimum fee. For the year ended October 31, 2006, co-administrative services fees earned by SSB (including out-of-pocket expenses) were $132,254.

In addition to serving as the Fund's co-administrator, CSAMSI currently serves as distributor of the Fund's shares. Pursuant to distribution plans adopted by the Fund pursuant to Rule 12b-1 under the 1940 Act, CSAMSI receives fees for its distribution services. These fees are calculated at an annual rate of 0.25% of the average daily net assets of the Class A shares and 1.00% of the average daily net assets of the Class C shares. Common Class shares are not subject to distribution fees.

24

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 3. Transactions with Affiliates and Related Parties

Certain brokers, dealers and financial representatives provide transfer agent related services to the Fund, and receive compensation for these services from Credit Suisse. Credit Suisse is then reimbursed by the Fund. For the year ended October 31, 2006, the Fund reimbursed Credit Suisse $27,180, which is included in the Fund's transfer agent expense.

For the year ended October 31, 2006, CSAMSI and its affiliates advised the Fund that they retained $144,010 from commissions earned on the sale of the Fund's Class A shares.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Fund to provide certain financial printing and fulfillment services. For the year ended October 31, 2006, Merrill was paid $371 for its services to the Fund.

The Fund reimbursed Credit Suisse for offering costs in the amount of $291,619 that have been paid for by Credit Suisse. Offering costs, including initial registration costs, were deferred and were charged to expenses during the Fund's first year of operation, which ended December 30, 2005. For the period November 1, 2005 through December 30, 2005, $47,014 has been expensed to the Fund.

Note 4. Line of Credit

The Fund, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $75 million committed, unsecured line of credit facility ("Credit Facility") for temporary or emergency purposes with Deutsche Bank, A.G. as administrative agent and syndication agent and SSB as operations agent. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal Funds rate plus 0.50%. At October 31, 2006 and during the year ended October 31, 2006, the Fund had no borrowings under the Credit Facility.

Note 5. Purchases and Sales of Securities

For the year ended October 31, 2006, purchases and sales of investment securities (excluding short-term investments) were $240,231,782 and $47,641,631, respectively.

25

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 6. Capital Share Transactions

The Fund is authorized to issue an unlimited number of shares of beneficial interest, $.001 par value per share. The Fund currently offers Common Class, Class A and Class C shares. Transactions in capital shares for each class of the Fund were as follows:

| | | Common Class | |

| | | For the Year Ended

October 31, 2006 | | For the Period Ended

October 31, 20051,2 | |

| | | Shares | | Value | | Shares | | Value | |

| Shares sold | | | 11,424,189 | | | $ | 127,730,179 | | | | 6,256,152 | | | $ | 66,913,391 | | |

Shares issued in reinvestment of

dividends and distributions | | | 107,152 | | | | 1,151,007 | | | | 1,263 | | | | 14,869 | | |

| Shares redeemed | | | (4,293,659 | ) | | | (48,444,519 | ) | | | (2,053,731 | ) | | | (22,211,127 | ) | |

| Net increase | | | 7,237,682 | | | $ | 80,436,667 | | | | 4,203,684 | | | $ | 44,717,433 | | |

| | | Class A | |

| | | For the Year Ended

October 31, 2006 | | For the Period Ended

October 31, 20051,3 | |

| | | Shares | | Value | | Shares | | Value | |

| Shares sold | | | 17,309,927 | | | $ | 194,057,517 | | | | 10,437,176 | | | $ | 114,232,081 | | |

Shares issued in reinvestment of

dividends and distributions | | | 865,886 | | | | 9,606,302 | | | | 67,348 | | | | 773,758 | | |

| Shares redeemed | | | (7,273,976 | ) | | | (80,937,976 | ) | | | (1,035,245 | ) | | | (11,981,062 | ) | |

| Net increase | | | 10,901,837 | | | $ | 122,725,843 | | | | 9,469,279 | | | $ | 103,024,777 | | |

| | | Class C | |

| | | For the Year Ended

October 31, 2006 | | For the Period Ended

October 31, 20051,2 | |

| | | Shares | | Value | | Shares | | Value | |

| Shares sold | | | 1,076,973 | | | $ | 12,105,908 | | | | 461,504 | | | $ | 5,187,915 | | |

Shares issued in reinvestment of

dividends and distributions | | | 41,893 | | | | 463,551 | | | | 1,337 | | | | 15,568 | | |

| Shares redeemed | | | (235,096 | ) | | | (2,641,352 | ) | | | (17,261 | ) | | | (205,284 | ) | |

| Net increase | | | 883,770 | | | $ | 9,928,107 | | | | 445,580 | | | $ | 4,998,199 | | |

1 For the period December 30, 2004 (inception date) through October 31, 2005.

2 The Classes were seeded on December 1, 2004 with initial capital of $10 and 1 share.

3 The Class was seeded on December 1, 2004 with initial capital of $99,980 and 9,998 shares.

A redemption fee of 2% of the value of Common Class shares, Class A shares and Class C shares redeemed or exchanged within 30 days from the date of purchase is charged to shareholders. Reinvested dividends and distributions are not subject to the fee. The fee is charged based on the value of shares at redemption, is paid directly to the Fund and becomes part of the Fund's daily net asset value calculation. When shares are redeemed that are subject to the fee, reinvested dividends and distributions are redeemed first, followed by the shares held longest.

26

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 6. Capital Share Transactions

On October 31, 2006, the number of shareholders that held 5% or more of the outstanding shares of each class of the Fund was as follows:

| | | Number of

Shareholders | | Approximate Percentage

of Outstanding Shares | |

| Common Class | | | 3 | | | | 81 | % | |

| Class A | | | 3 | | | | 61 | % | |

Some of the shareholders are omnibus accounts, which hold shares on behalf of individual shareholders.

Note 7. Federal Income Taxes

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The tax characteristics of dividends and distributions paid during the years ended October 31, 2006 and 2005, respectively by the Fund were as follows:

| Ordinary Income | | Long-Term Capital Gain | |

| 2006 | | 2005 | | 2006 | | 2005 | |

| $ | 17,360,478 | | | $ | 1,347,366 | | | $ | 5,952 | | | $ | — | | |

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to a mark to market of futures contracts. At October 31, 2006, the components of distributable earnings on a tax basis by the Fund were as follows:

| Undistributed net investment income | | $ | 2,147,523 | | |

| Accumulated long term capital loss | | | (18,035,394 | ) | |

| Unrealized appreciation | | | 13,816,723 | | |

| | | $ | (2,071,148 | ) | |

At October 31, 2006, the Fund had capital loss carryforwards available to offset possible future capital gains as follows:

| Expires October 31, | |

| 2014 | |

| $ | 18,035,394 | | |

At October 31, 2006, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $347,684,463, $14,574,420, $(757,697) and $13,816,723, respectively.

At October 31, 2006, the Fund reclassified $14,434 from accumulated net realized loss from investments and $47,014 from paid-in capital to undistributed net investment income, to adjust for current period permanent

27

Credit Suisse Commodity Return Strategy Fund

Notes to Financial Statements (continued)

October 31, 2006

Note 7. Federal Income Taxes

book/tax differences. These permanent differences are due to differing book/tax treatments on paydowns and organization costs. Net assets were not affected by these reclassifications.

Note 8. Contingencies

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 9. Recent Accounting Pronouncements

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48" or the "Interpretation"), Accounting for Uncertainty in Income Taxes — an interpretation of FASB statement 109. FIN 48 supplements FASB Statement 109, Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the t ax effects of a position be recognized only if it is "more likely than not" to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently support the position's sustainability with a likelihood of more than 50 percent. FIN 48 is effective for fiscal periods beginning after December 15, 2006. At adoption, the financial statements must be adjusted to reflect only those tax positions that are more likely than not to be sustained as of the adoption date.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 "Fair Value Measurements" ("FAS 157"). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years, beginning after November 15, 2007 and interim periods within those fiscal years.

At this time, management is evaluating the implications of FIN 48 and FAS 157 and their impact on the financial statements has not yet been determined.

28

Credit Commodity Return Strategy Income Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Credit Suisse Commodity Return Strategy Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Credit Suisse Commodity Return Strategy Fund (the "Fund") at October 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the periods then ended and the financial highlights for the years (or periods) presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with t he standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

December 18, 2006

29

Credit Suisse Commodity Return Strategy Fund

Information Concerning Trustees and Officers (unaudited)

Name, Address and

Date of Birth | | Position(s)

Held with

Fund | | Term

of Office1

and

Length

of Time

Served | | Principal

Occupation(s) During

Past Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Other

Directorships

Held by

Trustee | |

| Independent Trustees | | | | | | | | | | | | | |

|

Enrique Arzac

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

Date of Birth: 10/02/41 | | Trustee, Nominating Committee Member and Audit Committee Chairman | | Since

2005 | | Professor of Finance and Economics, Graduate School of Business, Columbia University since 1971. | | | 42 | | | Director of The Adams Express Company (a closed-end investment company); Director of Petroleum and Resources Corporation (a closed-end investment company). | |

|

Richard H. Francis

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

Date of Birth: 04/23/32 | | Trustee, Nominating and Audit Committee Member | | Since Fund Inception | | Currently retired | | | 36 | | | None | |

|

Jeffrey E. Garten

Box 208200

New Haven, Connecticut

06520-8200

Date of Birth: 10/29/46 | | Trustee, Nominating and Audit Committee Member | | Since Fund Inception | | The Juan Trippe Professor in the Practice of International Trade, Finance and Business from July 2005 to present; Partner and Chairman of Garten Rothkopf (consulting firm) from October 2005 to present; Dean of Yale School of Management from November 1995 to June 2005. | | | 35 | | | Director of Aetna, Inc. (insurance company); Director of CarMax Group (used car dealers). | |

|

Peter F. Krogh

301 ICC

Georgetown University

Washington, DC 20057

Date of Birth: 02/11/37 | | Trustee, Nominating and Audit Committee Member | | Since Fund Inception | | Dean Emeritus and Distinguished Professor of International Affairs at the Edmund A. Walsh School of Foreign Service, Georgetown University from June 1995 to present. | | | 35 | | | Director of Carlisle Companies Incorporated (diversified manufacturing company). | |