UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21589 |

|

CREDIT SUISSE COMMODITY STRATEGY FUNDS |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

John G. Popp Credit Suisse Commodity Strategy Funds One Madison Avenue New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | October 31st | |

|

Date of reporting period: | November 1, 2011 to October 31, 2012 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

October 31, 2012

n CREDIT SUISSE

COMMODITY RETURN STRATEGY FUND

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 877-870-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Securities (USA) LLC, Distributor, is located at One Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Class I shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Fund's management are as of the date of the letter and the Fund holdings described in this document are as of October 31, 2012; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report

October 31, 2012 (unaudited)

December 6, 2012

Dear Shareholder:

We are pleased to present this Annual Report covering the activities of the Credit Suisse Commodity Return Strategy Fund for the 12-month period ended October 31, 2012.

Performance Summary

11/1/11 – 10/31/12

Fund & Benchmark | | Performance | |

| Class I1 | | | -5.26 | % | |

| Class A1, 2 | | | -5.42 | % | |

| Class C1, 2 | | | -6.25 | % | |

| Dow Jones-UBS Commodity Index Total Return3 | | | -4.44 | % | |

| Standard & Poor's 500 Index4 | | | 15.21 | % | |

Performance shown for the Fund's Class A and Class C Shares does not reflect sales charges, which are a maximum of 3.00% and 1.00%, respectively.2

Market Review: A Mixed Period for Commodities

The 12-month period ended October 31, 2012 was a difficult one for commodities with commodities down for the year. The Dow Jones-UBS Commodity Index Total Return (the "DJ-UBS Index"), the Fund's benchmark, lost 4.44% for the period, with 14 out of 20 Index constituents trading lower than their levels at the beginning of the period.

Despite the recent additional quantitative easing measures undertaken by the Federal Reserve, commodity markets were not able to sustain gains and subsequently declined toward the end of the period as continued macroeconomic uncertainty generally weighed on the markets. However, recent positive employment data and higher than expected GDP and consumer confidence readings in the United States provided some indications that the U.S. economy may be improving. The latest PMI readings in China suggest economic recovery there may also be accelerating.

At the end of the period, politics remained very much in focus in two of the world's most important economies: the United States and China. Uncertainty remains on what policies will be followed and how they will impact the economy and markets. Both governments will oversee economies in transition, trying to deal with structural challenges while maintaining burgeoning economic recoveries. Increased certainty may be supportive of these economies, but neither political event will automatically solve any long-term structural issues.

1

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

Hurricane Sandy, despite the extreme damage and tragic loss of life, has passed with relatively little impact on commodity markets. Ongoing macroeconomic uncertainty continues to be the biggest factor weighing on the commodity markets.

Strategy Review and Outlook: Diversification and Inflation Protection

The DJ-UBS Index, the Fund's benchmark, is a broadly diversified futures index composed of futures contracts on 20 physical commodities. The DJ-UBS Index is weighted among commodity sectors using dollar-adjusted liquidity and production data and is rebalanced as of the beginning of each calendar year. The Fund seeks total return and is designed to achieve positive total return relative to the performance of the DJ-UBS Index. To do so, the Fund invests in commodity linked derivative instruments and fixed-income securities. The Fund gains exposure to commodity markets by investing through its wholly-owned subsidiary (the "Subsidiary") in structured notes linked to the DJ-UBS Index, other commodity indexes, or the value of a particular commodity or commodity futures contract or subset of commodities or commodity futures contracts. The Subsidiary primarily invests in commodity-linked swap agreements and other commodity-linked derivative investments, including futures contracts on individual commodities. For the 12-month period ended October 31, 2012, the Fund slightly underperformed the benchmark. Management of the fixed income portion contributed 0.18% to the Fund's performance, while commodity strategies detracted 0.24%. Within the Fund's commodity exposure, forward curve positioning in agricultural and livestock detracted from performance, while positioning in energy had a positive impact on performance.

For the period, agriculture was the best performing sector, up 9.30%. Soybeans experienced the largest increase, up 33.80%, buoyed by strength in U.S. export demand, downward revisions to South American production, and an already tight supply/demand balance in the United States and around the globe. Corn increased 27.24%, supported initially by lower-than-expected ending supplies and, later on, the drought in the U.S. Midwest, which led to deteriorating crop prospects and lowered yield expectations. Wheat, supported by the drought as well as lower expectations for Russian output due to similarly dry weather, was also higher, up 23.90%. Additionally, despite benefiting from summer drought conditions in the U.S. Midwest, weaker-than-expected demand in the spring led livestock 6.93% lower for the year.

Precious metals decreased 2.44% despite stimulus measures from major central banks that continued to increase the appeal for gold and silver as an inflation hedge. Although financial demand remained strong, silver led the sector lower as industrial demand continued to decline amid continued mine supply growth

2

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

toward the end of the period. Industrial metals declined 11.98% as risk appetite weakened amid worsening macroeconomic sentiment. The lack of concrete resolution in Europe and the World Bank's downgrade of its economic growth forecast for China were also contributing factors, although recent Chinese manufacturing data did offer some encouraging signs that activity may be beginning to accelerate.

Coffee dropped 35.95% to its lowest level since the summer of 2010, due to expectations of a record Brazilian crop for the 2012-2013 harvest season. Cotton also declined 26.02% as a result of oversupply concerns following the USDA's increased expectations for global inventories, due primarily to increases in China, Australia and India. Ending inventory for the 2012-2013 crop year is expected to be around 50% higher than the previous year, while usage is projected to be lower.

Energy was the worst performing sector for the period, falling 12.21%. Natural gas declined 41.65% following record warm winter temperatures across the United States and continued strong production. Department of Energy storage reports showed larger-than-expected inventory builds toward the end of 2011, as the injection season completed. Subsequently, the storage level at the start of the 2012 injection season was at its highest level on record, fueling concerns that the storage system may run out of space by the end of 2012. Storage concerns eased and prices increased after low prices brought about an increase in coal to gas switching. WTI crude oil also declined for the period as the worsening economic environment in Europe and a perceived slowdown in China raised concerns of a possible softening in underlying consumption.

In our opinion, continued quantitative easing in the United States and accommodative monetary policy seen across most key markets, should continue to support the appeal of hard assets as an inflation hedge. Signs of improved economic growth in the United States and elsewhere have not yet dampened central bank enthusiasm for trying to stimulate economic growth, nor caused inflation expectations to increase. Inflation expectations remain anchored near historic levels with markets continuing to focus on weak economic conditions and safety of capital, rather than the eventual impact of prolonged, exceptionally loose monetary policies. This may lead to inflation overshooting expectations if economic activity begins to pick up more robustly than expected. Commodities have historically tended to outperform during periods of higher-than-expected inflation, while traditional asset classes, including equities and fixed income, may be affected differently by these risks. We believe investors will continue to benefit from the long-term diversification benefits that commodities provide.

3

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

The Credit Suisse Commodities Management Team

Nelson Louie

Christopher Burton

This Fund is non-diversified, which means it may invest a greater proportion of its assets in the securities of a smaller number of issuers than a diversified mutual fund and may therefore be subject to greater volatility. Exposure to commodity markets should only form a small part of a diversified portfolio. Investment in commodity markets may not be suitable for all investors. The Fund's investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities, particularly in investments involving leverage.

The use of derivatives such as commodity-linked structured notes, swaps and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation risk, liquidity risk, interest rate risk, market risk, credit risk, and tax risk. Gains and losses from speculative positions in derivatives may be much greater than the derivative's cost. At any time, the risk of loss of any individual security held by the Fund could be significantly higher than 50% of the security's value. For a detailed discussion of these and other risks, please refer to the Fund's Prospectus, which should be read carefully before investing.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

The views of the Fund's management are as of the date of the letter and the Fund holdings described in this document are as of October 31, 2012; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

4

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

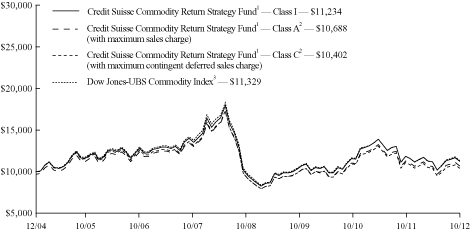

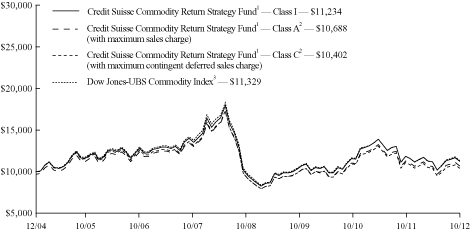

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Commodity Return Strategy Fund1 Class I shares,

Class A shares2, Class C shares2 and the Dow Jones-UBS

Commodity Index3 from Inception (12/30/04).

Average Annual Returns as of September 30, 20121

| | | 1 Year | | 5 Years | | Since

Inception | |

Class I | | | 4.93 | % | | | (2.93 | )% | | | 2.04 | % | |

Class A Without Sales Charge | | | 4.73 | % | | | (3.16 | )% | | | 1.78 | % | |

Class A With Maximum

Sales Charge | | | 1.59 | % | | | (3.74 | )% | | | 1.38 | % | |

Class C Without CDSC | | | 3.82 | % | | | (3.88 | )% | | | 1.04 | % | |

Class C With CDSC | | | 2.82 | % | | | (3.88 | )% | | | 1.04 | % | |

5

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

Average Annual Returns as of October 31, 20121

| | | 1 Year | | 5 Years | | Since

Inception | |

Class I | | | (5.26 | )% | | | (4.32 | )% | | | 1.50 | % | |

Class A Without Sales Charge | | | (5.42 | )% | | | (4.55 | )% | | | 1.25 | % | |

Class A With Maximum

Sales Charge | | | (8.29 | )% | | | (5.13 | )% | | | 0.85 | % | |

Class C Without CDSC | | | (6.25 | )% | | | (5.27 | )% | | | 0.50 | % | |

Class C With CDSC | | | (7.19 | )% | | | (5.27 | )% | | | 0.50 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us/funds.

The annualized gross expense ratios are 0.81% for Class I shares, 1.06% for Class A shares and 1.81% for Class C shares. The annualized net expense ratios after fee waivers and/or expense reimbursements are 0.80% for Class I shares, 1.05% for Class A shares and 1.80% for Class C shares.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Voluntary waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 3.00%), was (8.29)%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1.00%), was (7.19)%.

3 The Dow Jones-UBS Commodity Index Total Return is composed of futures contracts on 20 physical commodities. An index does not have transaction costs; investors may not invest directly in an index.

4 The Standard & Poor's 500 Index is an unmanaged index (with no defined investment objective) of common stocks, includes reinvestment of dividends, and is a registered trademark of The McGraw-Hill Companies, Inc. An index does not have transaction costs; investors may not invest directly in an index.

6

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2012.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

7

Credit Suisse Commodity Return Strategy Fund

Annual Investment Adviser's Report (continued)

October 31, 2012 (unaudited)

Expenses and Value for a $1,000 Investment

for the six month period ended October 31, 2012

Actual Fund Return | | Class I | | Class A | | Class C | |

Beginning Account Value 5/1/12 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value 10/31/12 | | $ | 1,004.90 | | | $ | 1,004.90 | | | $ | 1,000.00 | | |

Expenses Paid per $1,000* | | $ | 4.03 | | | $ | 5.29 | | | $ | 9.05 | | |

Hypothetical 5% Fund Return | |

Beginning Account Value 5/1/12 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value 10/31/12 | | $ | 1,021.11 | | | $ | 1,019.86 | | | $ | 1,016.09 | | |

Expenses Paid per $1,000* | | $ | 4.06 | | | $ | 5.33 | | | $ | 9.12 | | |

| | | Class I | | Class A | | Class C | |

Annualized Expense Ratios* | | | 0.80 | % | | | 1.05 | % | | | 1.80 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 366.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

Sector Breakdown*

United States Agency Obligations | | | 80.88 | % | |

United States Treasury Obligations | | | 13.81 | % | |

Commodity Indexed Structured Notes | | | 3.83 | % | |

Short-term Investments | | | 1.48 | % | |

Total | | | 100.00 | % | |

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

8

Credit Suisse Commodity Return Strategy Fund

Consolidated Schedule of Investments

October 31, 2012

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| COMMODITY INDEXED STRUCTURED NOTES (3.6%) | | | |

$ | 27,400 | | | BNP Paribas, Commodity Index Linked

Senior Unsecured Notes# | | (A+, A2) | | 03/15/13 | | | 0.436 | | | $ | 26,120,420 | | |

| | 67,300 | | | BNP Paribas, Commodity Index Linked

Senior Unsecured Notes# | | (A+, A2) | | 03/27/13 | | | 0.433 | | | | 59,607,610 | | |

| | 30,200 | | | Deutsche Bank AG London, Commodity

Index Linked Senior Unsecured Notes# | | (A+, A2) | | 12/17/12 | | | 0.061 | | | | 29,662,440 | | |

| | 32,400 | | | Deutsche Bank AG London, Commodity

Index Linked Senior Unsecured Notes# | | (A+, A2) | | 01/11/13 | | | 0.064 | | | | 33,832,080 | | |

| | 50,000 | | | Svensk AB Exportkredit, Commodity Index

Linked Senior Unsecured Notes# | | (AA+, Aa1) | | 11/21/12 | | | 0.000 | | | | 47,810,253 | | |

| TOTAL COMMODITY INDEXED STRUCTURED NOTES (Cost $207,300,000) | | | 197,032,803 | | |

| UNITED STATES AGENCY OBLIGATIONS (76.5%) | |

| | 15,000 | | | Fannie Mae Discount Notes | | (AA+, Aaa) | | 11/21/12 | | | 0.130 | | | | 14,998,917 | | |

| | 25,000 | | | Fannie Mae Discount Notes | | (AA+, Aaa) | | 02/19/13 | | | 0.130 | | | | 24,991,600 | | |

| | 100,000 | | | Fannie Mae Discount Notes | | (AA+, Aaa) | | 02/19/13 | | | 0.130 | | | | 99,966,400 | | |

| | 30,035 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 04/21/14 | | | 0.297 | | | | 30,072,664 | | |

| | 138,765 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 05/19/14 | | | 0.410 | | | | 139,168,529 | | |

| | 89,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 05/21/14 | | | 0.250 | | | | 89,013,350 | | |

| | 100,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 05/29/14 | | | 0.440 | | | | 100,337,800 | | |

| | 14,770 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 09/29/14 | | | 0.241 | | | | 14,783,780 | | |

| | 97,500 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 10/14/14 | | | 0.280 | | | | 97,499,610 | | |

| | 111,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 01/20/15 | | | 0.330 | | | | 111,102,009 | | |

| | 119,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 01/28/15 | | | 0.201 | | | | 118,983,697 | | |

| | 150,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 02/13/15 | | | 0.244 | | | | 150,105,600 | | |

| | 130,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 03/20/15 | | | 0.236 | | | | 130,065,910 | | |

| | 100,000 | | | Federal Farm Credit Bank# | | (AA+, Aaa) | | 06/22/15 | | | 0.231 | | | | 100,009,300 | | |

| | 60,000 | | | Federal Farm Credit Banks# | | (AA+, Aaa) | | 04/06/15 | | | 0.249 | | | | 60,034,140 | | |

| | 125,000 | | | Federal Farm Credit Banks# | | (AA+, Aaa) | | 07/20/15 | | | 0.241 | | | | 125,033,000 | | |

| | 76,000 | | | Federal Farm Credit Banks# | | (AA+, Aaa) | | 08/03/15 | | | 0.360 | | | | 76,082,536 | | |

| | 21,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 03/08/13 | | | 0.280 | | | | 21,010,731 | | |

| | 126,000 | | | Federal Home Loan Banks# | | (AA+, Aaa) | | 03/15/13 | | | 0.390 | | | | 126,111,636 | | |

| | 10,000 | | | Federal Home Loan Banks# | | (AA+, Aaa) | | 04/05/13 | | | 0.350 | | | | 10,000,450 | | |

| | 100,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 04/16/13 | | | 0.240 | | | | 100,043,600 | | |

| | 50,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 04/18/13 | | | 0.230 | | | | 50,019,450 | | |

| | 110,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 04/30/13 | | | 0.200 | | | | 110,025,190 | | |

| | 50,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 05/03/13 | | | 0.220 | | | | 50,016,100 | | |

| | 87,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 05/17/13 | | | 0.320 | | | | 87,070,905 | | |

| | 50,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 05/23/13 | | | 0.300 | | | | 50,003,750 | | |

| | 100,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 11/08/13 | | | 0.290 | | | | 100,093,200 | | |

| | 130,000 | | | Federal Home Loan Banks# | | (AA+, Aaa) | | 11/25/13 | | | 0.250 | | | | 130,071,630 | | |

| | 41,300 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 01/03/14 | | | 0.330 | | | | 41,351,749 | | |

| | 118,000 | | | Federal Home Loan Banks# | | (AA+, Aaa) | | 06/11/14 | | | 0.300 | | | | 118,135,346 | | |

| | 29,000 | | | Federal Home Loan Banks | | (AA+, Aaa) | | 06/13/14 | | | 2.500 | | | | 30,035,677 | | |

| | 170,000 | | | Federal Home Loan Discount Notes | | (AA+, Aaa) | | 04/15/13 | | | 0.155 | | | | 169,906,500 | | |

| | 27,000 | | | Federal Home Loan Mortgage Corp. | | (AA+, Aaa) | | 12/28/12 | | | 0.625 | | | | 27,015,156 | | |

| | 158,000 | | | Federal Home Loan Mortgage Corp.# | | (AA+, Aaa) | | 03/21/13 | | | 0.171 | | | | 158,036,024 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse Commodity Return Strategy Fund

Consolidated Schedule of Investments (continued)

October 31, 2012

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

UNITED STATES AGENCY OBLIGATIONS | | | |

$ | 141,755 | | | Federal Home Loan Mortgage Corp. | | (AA+, Aaa) | | 12/23/13 | | | 0.625 | | | $ | 142,365,113 | | |

| | 93,875 | | | Federal Home Loan Mortgage Corp. | | (AA+, Aaa) | | 01/15/14 | | | 4.500 | | | | 98,669,478 | | |

| | 100,000 | | | Federal Home Loan Mortgage Corp. | | (AA+, Aaa) | | 04/28/14 | | | 0.375 | | | | 100,151,300 | | |

| | 80,000 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 11/23/12 | | | 0.231 | | | | 79,998,545 | | |

| | 125,000 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 12/03/12 | | | 0.360 | | | | 124,996,907 | | |

| | 105,000 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 12/28/12 | | | 0.241 | | | | 104,997,317 | | |

| | 75,000 | | | Federal National Mortgage Association | | (AA+, Aaa) | | 12/28/12 | | | 0.375 | | | | 75,020,084 | | |

| | 83,228 | | | Federal National Mortgage Association | | (AA+, Aaa) | | 02/26/13 | | | 0.750 | | | | 83,391,376 | | |

| | 64,800 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 08/09/13 | | | 0.380 | | | | 64,902,838 | | |

| | 155,000 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 11/08/13 | | | 0.189 | | | | 155,023,250 | | |

| | 94,500 | | | Federal National Mortgage Association# | | (AA+, Aaa) | | 09/11/14 | | | 0.196 | | | | 94,518,522 | | |

| | 24,000 | | | Federal National Mortgage Association | | (AA+, Aaa) | | 11/07/14 | | | 1.000 | | | | 24,002,568 | | |

| | 32,257 | | | Freddie Mac Discount Notes | | (AA+, Aaa) | | 11/01/12 | | | 0.140 | | | | 32,257,000 | | |

| | 100,000 | | | Freddie Mac Discount Notes | | (AA+, Aaa) | | 11/26/12 | | | 0.130 | | | | 99,990,972 | | |

| | 25,000 | | | Freddie Mac Discount Notes | | (AA+, Aaa) | | 12/26/12 | | | 0.140 | | | | 24,994,653 | | |

| TOTAL UNITED STATES AGENCY OBLIGATIONS (Cost $4,164,042,207) | | | 4,166,475,859 | | |

| UNITED STATES TREASURY OBLIGATIONS (13.1%) | |

| | 25,000 | | | United States Treasury Bills | | (AA+, Aaa) | | 11/01/12 | | | 0.130 | | | | 25,000,000 | | |

| | 110,000 | | | United States Treasury Bills§ | | (AA+, Aaa) | | 01/31/13 | | | 0.135 | | | | 109,970,080 | | |

| | 23,000 | | | United States Treasury Bills | | (AA+, Aaa) | | 04/11/13 | | | 0.143 | | | | 22,986,131 | | |

| | 20,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 01/31/13 | | | 0.625 | | | | 20,026,560 | | |

| | 125,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 02/28/13 | | | 0.625 | | | | 125,210,000 | | |

| | 130,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 05/15/13 | | | 1.375 | | | | 130,853,190 | | |

| | 50,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 05/31/13 | | | 0.500 | | | | 50,101,550 | | |

| | 100,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 07/15/13 | | | 1.000 | | | | 100,578,100 | | |

| | 125,000 | | | United States Treasury Notes | | (AA+, Aaa) | | 02/15/14 | | | 1.250 | | | | 126,635,750 | | |

| TOTAL UNITED STATES TREASURY OBLIGATIONS (Cost $711,220,450) | | | 711,361,361 | | |

Number of

Shares | |

| |

| |

| |

| |

| |

| SHORT-TERM INVESTMENTS (3.3%) | |

| | 102,000,000 | | | State Street Navigator Prime Portfolio, 0.31%§§ | | | | | | | | | | | | | | | 102,000,000 | | |

Par

(000) | |

| |

| |

| |

| |

| |

$ | 76,281 | | | State Street Bank and Trust Co. Euro Time Deposit | | | | 11/01/12 | | | 0.010 | | | | 76,281,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $178,281,000) | | | 178,281,000 | | |

| TOTAL INVESTMENTS AT VALUE (96.5%) (Cost $5,260,843,657) | | | 5,253,151,023 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (3.5%) | | | 189,103,302 | | |

| NET ASSETS (100.0%) | | $ | 5,442,254,325 | | |

† Credit ratings given by the Standard & Poor's Division of The McGraw-Hill Companies, Inc. ("S&P") and Moody's Investors Service, Inc. ("Moody's") are unaudited.

# Variable rate obligations — The interest rate is the rate as of October 31, 2012.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan. The rate shown is the annualized one-day yield at October 31, 2012.

See Accompanying Notes to Financial Statements.

10

Credit Suisse Commodity Return Strategy Fund

Consolidated Statement of Assets and Liabilities

October 31, 2012

Assets | |

Investments at value, including collateral for securities on loan of $102,000,000

(Cost $5,260,843,657) (Note 2) | | $ | 5,253,151,0231 | | |

Cash segregated at brokers for futures contracts and swap contracts | | | 303,087,622 | | |

Cash | | | 12,795,233 | | |

Receivable for fund shares sold | | | 25,306,139 | | |

Interest receivable | | | 5,464,688 | | |

Prepaid expenses and other assets | | | 409,737 | | |

Total Assets | | | 5,600,214,442 | | |

Liabilities | |

Advisory fee payable (Note 3) | | | 2,464,265 | | |

Administrative services fee payable (Note 3) | | | 648,182 | | |

Shareholder servicing/Distribution fee payable (Note 3) | | | 159,028 | | |

Payable upon return of securities loaned (Note 2) | | | 102,000,000 | | |

Unrealized depreciation on open swap contracts | | | 40,245,941 | | |

Payable for fund shares redeemed | | | 9,066,477 | | |

Variation Margin Payable | | | 50,720 | | |

Trustees' fee payable | | | 18,863 | | |

Other accrued expenses payable | | | 3,306,641 | | |

Total Liabilities | | | 157,960,117 | | |

Net Assets | |

Capital stock, $.001 par value (Note 6) | | | 662,644 | | |

Paid-in capital (Note 6) | | | 5,521,724,535 | | |

Accumulated net investment loss | | | (29,217,296 | ) | |

Accumulated net realized loss on investments, futures contracts and swap contracts | | | (3,136,829 | ) | |

Net unrealized depreciation from investments, futures contracts and swap contracts | | | (47,778,729 | ) | |

Net Assets | | $ | 5,442,254,325 | | |

I Shares | |

Net assets | | $ | 4,818,146,498 | | |

Shares outstanding | | | 585,823,393 | | |

Net asset value, offering price and redemption price per share | | $ | 8.22 | | |

A Shares | |

Net assets | | $ | 591,660,764 | | |

Shares outstanding | | | 72,715,486 | | |

Net asset value and redemption price per share | | $ | 8.14 | | |

Maximum offering price per share (net asset value/(1-3.00%)) | | $ | 8.39 | | |

C Shares | |

Net assets | | $ | 32,447,063 | | |

Shares outstanding | | | 4,105,378 | | |

Net asset value and offering price per share | | $ | 7.90 | | |

1 Including $99,970,950 of securities on loan.

See Accompanying Notes to Financial Statements.

11

Credit Suisse Commodity Return Strategy Fund

Consolidated Statement of Operations

For the Year Ended October 31, 2012

| Investment Income (Note 2) | |

Interest | | $ | 12,858,727 | | |

Securities lending | | | 159,737 | | |

Total investment income | | | 13,018,464 | | |

Expenses | |

Investment advisory fees (Note 3) | | | 27,694,276 | | |

Administrative services fees (Note 3) | | | 5,780,861 | | |

Shareholder servicing/Distribution fees (Note 3) | |

Class A | | | 2,172,645 | | |

Class C | | | 388,319 | | |

Transfer agent fees (Note 3) | | | 9,371,949 | | |

Printing fees (Note 3) | | | 691,468 | | |

Registration fees | | | 542,280 | | |

Custodian fees | | | 275,079 | | |

Insurance expense | | | 189,182 | | |

Legal fees | | | 139,282 | | |

Trustees' fees | | | 83,684 | | |

Audit and tax fees | | | 74,267 | | |

Commitment fees (Note 4) | | | 22,818 | | |

Miscellaneous expense | | | 62,511 | | |

Total expenses | | | 47,488,621 | | |

Less: fees waived (Note 3) | | | (616,815 | ) | |

Net expenses | | | 46,871,806 | | |

Net investment loss | | | (33,853,342 | ) | |

Net Realized and Unrealized Gain (Loss) from Investments, Futures Contracts and Swap Contracts | |

Net realized loss from investments | | | (3,046,228 | ) | |

Net realized gain from futures contracts | | | 15,515,483 | | |

Net realized loss from swap contracts | | | (219,039,496 | ) | |

Net change in unrealized appreciation (depreciation) from investments | | | (27,341,119 | ) | |

Net change in unrealized appreciation (depreciation) from futures contracts | | | 1,357,316 | | |

Net change in unrealized appreciation (depreciation) from swap contracts | | | (68,956,419 | ) | |

Net realized and unrealized loss from investments, futures contracts and swap contracts | | | (301,510,463 | ) | |

Net decrease in net assets resulting from operations | | $ | (335,363,805 | ) | |

See Accompanying Notes to Financial Statements.

12

Credit Suisse Commodity Return Strategy Fund

Consolidated Statements of Changes in Net Assets

| | | For the Year

Ended

October 31, 2012 | | For the Year

Ended

October 31, 2011 | |

From Operations | |

Net investment loss | | $ | (33,853,342 | ) | | $ | (32,423,803 | ) | |

Net realized gain (loss) from investments, futures contracts

and swap contracts | | | (206,570,241 | ) | | | 99,966 | | |

Net change in unrealized appreciation (depreciation) from

investments, futures contracts and swap contracts | | | (94,940,222 | ) | | | (19,913,515 | ) | |

Net decrease in net assets resulting from operations | | | (335,363,805 | ) | | | (52,237,352 | ) | |

From Dividends and Distributions | |

Dividends from net investment income | |

Class I shares | | | — | | | | (240,462,846 | ) | |

Class A shares | | | — | | | | (55,838,829 | ) | |

Class C shares | | | — | | | | (2,580,771 | ) | |

Distributions from net realized gains | |

Class I shares | | | (6,882,755 | ) | | | — | | |

Class A shares | | | (1,499,022 | ) | | | — | | |

Class C shares | | | (66,401 | ) | | | — | | |

Net decrease in net assets resulting from dividends and distributions | | | (8,448,178 | ) | | | (298,882,446 | ) | |

| From Capital Share Transactions (Note 6) | |

Proceeds from sale of shares | | | 3,275,434,008 | | | | 4,176,094,956 | | |

Reinvestment of dividends and distributions | | | 6,171,593 | | | | 238,860,637 | | |

Net asset value of shares redeemed | | | (3,430,273,269 | )1 | | | (1,966,297,618 | )2 | |

Net increase (decrease) in net assets from capital share transactions | | | (148,667,668 | ) | | | 2,448,657,975 | | |

Net increase (decrease) in net assets | | | (492,479,651 | ) | | | 2,097,538,177 | | |

Net Assets | |

Beginning of year | | | 5,934,733,976 | | | | 3,837,195,799 | | |

End of year | | $ | 5,442,254,325 | | | $ | 5,934,733,976 | | |

Undistributed (accumulated) net investment income (loss) | | $ | (29,217,296 | ) | | $ | 5,454,794 | | |

1 Net of $433,448 of redemption fees retained by the Fund.

2 Net of $222,526 of redemption fees retained by the Fund.

See Accompanying Notes to Financial Statements.

13

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Class I Share of the Fund Outstanding Throughout Each Year)

| | | For the Year Ended October 31, | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Per share data | |

Net asset value, beginning of year | | $ | 8.69 | | | $ | 9.12 | | | $ | 8.64 | | | $ | 8.61 | | | $ | 12.16 | | |

INVESTMENT OPERATIONS | |

Net investment income (loss)1 | | | (0.05 | ) | | | (0.05 | )4 | | | (0.04 | )4 | | | (0.01 | )4 | | | 0.254 | | |

Net gain (loss) on investments,

futures contracts and swap contracts

(both realized and unrealized) | | | (0.41 | ) | | | 0.294 | | | | 1.064 | | | | 0.094 | | | | (3.44 | )4 | |

Total from investment operations | | | (0.46 | ) | | | 0.24 | | | | 1.02 | | | | 0.08 | | | | (3.19 | ) | |

REDEMPTION FEES | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | |

LESS DIVIDENDS AND DISTRIBUTIONS | |

Dividends from net investment income | | | — | | | | (0.67 | ) | | | (0.54 | ) | | | (0.05 | ) | | | (0.30 | ) | |

Distributions from net realized gains | | | (0.01 | ) | | | — | | | | — | | | | — | | | | (0.06 | ) | |

Total dividends and distributions | | | (0.01 | ) | | | (0.67 | ) | | | (0.54 | ) | | | (0.05 | ) | | | (0.36 | ) | |

Net asset value, end of year | | $ | 8.22 | | | $ | 8.69 | | | $ | 9.12 | | | $ | 8.64 | | | $ | 8.61 | | |

Total return3 | | | (5.26 | )% | | | 2.47 | % | | | 12.14 | % | | | 1.02 | % | | | (27.08 | )% | |

RATIOS AND SUPPLEMENTAL DATA | |

Net assets, end of year (000s omitted) | | $ | 4,818,146 | | | $ | 4,779,638 | | | $ | 3,099,449 | | | $ | 1,911,091 | | | $ | 515,476 | | |

Ratio of expenses to average net assets | | | 0.80 | % | | | 0.79 | %4 | | | 0.70 | %4 | | | 0.70 | %4 | | | 0.70 | %4 | |

Ratio of net investment income (loss)

to average net assets | | | (0.56 | )% | | | (0.59 | )%4 | | | (0.47 | )%4 | | | (0.15 | )%4 | | | 1.92 | %4 | |

Decrease reflected in above operating expense

ratios due to waivers/reimbursements | | | 0.01 | % | | | 0.03 | %4 | | | 0.13 | %4 | | | 0.15 | %4 | | | 0.07 | %4 | |

Portfolio turnover rate | | | 84 | % | | | 165 | % | | | 104 | % | | | 43 | % | | | 109 | % | |

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $0.01 per share.

3 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the years shown, total returns would have been lower.

4 Effective October 31, 2012, the Fund began reporting operations of its wholly-owned subsidiary on a consolidated basis. Had the Fund reported on a consolidated basis in prior periods, ratio of expenses to average net assets without fee waivers and/or expense reimbursements would have increased by 0.00%, 0.01%, 0.01% and 0.01% for the years ended October 31, 2008, 2009, 2010, and 2011, respectively. The ratio of expenses to average net assets with fee waivers and/or expense reimbursements would have increased 0.00%, 0.00%, 0.00% and 0.00%, respectively for the same time period. The ratio of net investment income (loss) to average net assets would have increased 0.17%, 0.07%, 0.04% and 0.03% for the years ended October 31, 2008, 2009, 2010 and 2011, respectively. This change did not have material impact to net investment income (loss) per share or net realized and unrealized gain (loss) per share.

See Accompanying Notes to Financial Statements.

14

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Class A Share of the Fund Outstanding Throughout Each Year)

| | | For the Year Ended October 31, | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Per share data | |

Net asset value, beginning of year | | $ | 8.62 | | | $ | 9.07 | | | $ | 8.62 | | | $ | 8.61 | | | $ | 12.15 | | |

| INVESTMENT OPERATIONS4 | |

Net investment income (loss)1 | | | (0.07 | ) | | | (0.08 | )4 | | | (0.06 | )4 | | | (0.02 | ) | | | 0.234 | | |

Net gain (loss) on investments,

futures contracts and swap contracts

(both realized and unrealized) | | | (0.40 | ) | | | 0.304 | | | | 1.054 | | | | 0.074 | | | | (3.44 | )4 | |

Total from investment operations | | | (0.47 | ) | | | 0.22 | | | | 0.99 | | | | 0.05 | | | | (3.21 | ) | |

REDEMPTION FEES | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | |

LESS DIVIDENDS AND DISTRIBUTIONS | |

Dividends from net investment income | | | — | | | | (0.67 | ) | | | (0.54 | ) | | | (0.04 | ) | | | (0.27 | ) | |

Distributions from net realized gains | | | (0.01 | ) | | | — | | | | — | | | | — | | | | (0.06 | ) | |

Total dividends and distributions | | | (0.01 | ) | | | (0.67 | ) | | | (0.54 | ) | | | (0.04 | ) | | | (0.33 | ) | |

Net asset value, end of year | | $ | 8.14 | | | $ | 8.62 | | | $ | 9.07 | | | $ | 8.62 | | | $ | 8.61 | | |

Total return3 | | | (5.42 | )% | | | 2.24 | % | | | 11.80 | % | | | 0.68 | % | | | (27.20 | )% | |

RATIOS AND SUPPLEMENTAL DATA | |

Net assets, end of year (000s omitted) | | $ | 591,661 | | | $ | 1,108,846 | | | $ | 705,895 | | | $ | 350,204 | | | $ | 171,619 | | |

Ratio of expenses to average net assets | | | 1.05 | % | | | 1.04 | %4 | | | 0.95 | %4 | | | 0.95 | %4 | | | 0.95 | %4 | |

Ratio of net investment income (loss)

to average net assets | | | (0.82 | )% | | | (0.84 | )%4 | | | (0.72 | )%4 | | | (0.29 | )%4 | | | 1.76 | %4 | |

Decrease reflected in above operating expense

ratios due to waivers/reimbursements | | | 0.01 | % | | | 0.03 | %4 | | | 0.13 | %4 | | | 0.15 | %4 | | | 0.08 | %4 | |

Portfolio turnover rate | | | 84 | % | | | 165 | % | | | 104 | % | | | 43 | % | | | 109 | % | |

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $0.01 per share.

3 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the years shown, total returns would have been lower.

4 Effective October 31, 2012, the Fund began reporting operations of its wholly-owned subsidiary on a consolidated basis. Had the Fund reported on a consolidated basis in prior periods, ratio of expenses to average net assets without fee waivers and/or expense reimbursements would have increased by 0.00%, 0.01%, 0.02% and 0.01% for the years ended October 31, 2008, 2009, 2010, and 2011, respectively. The ratio of expenses to average net assets with fee waivers and/or expense reimbursements would have increased 0.00%, 0.00%, 0.00% and 0.00%, respectively for the same time period. The ratio of net investment income (loss) to average net assets would have increased 0.17%, 0.08%, 0.04% and 0.04% for the years ended October 31, 2008, 2009, 2010 and 2011, respectively. This change did not have material impact to net investment income (loss) per share or net realized and unrealized gain (loss) per share.

See Accompanying Notes to Financial Statements.

15

Credit Suisse Commodity Return Strategy Fund

Financial Highlights

(For a Class C Share of the Fund Outstanding Throughout Each Year)

| | | For the Year Ended October 31, | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Per share data | |

Net asset value, beginning of year | | $ | 8.44 | | | $ | 8.96 | | | $ | 8.57 | | | $ | 8.61 | | | $ | 12.15 | | |

INVESTMENT OPERATIONS | |

Net investment income (loss)1 | | | (0.12 | ) | | | (0.14 | )4 | | | (0.12 | )4 | | | (0.08 | )4 | | | 0.124 | | |

Net gain (loss) on investments,

futures contracts and swap contracts

(both realized and unrealized) | | | (0.41 | ) | | | 0.294 | | | | 1.054 | | | | 0.074 | | | | (3.43 | )4 | |

Total from investment operations | | | (0.53 | ) | | | 0.15 | | | | 0.93 | | | | (0.01 | ) | | | (3.31 | ) | |

REDEMPTION FEES | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | |

LESS DIVIDENDS AND DISTRIBUTIONS | |

Dividends from net investment income | | | — | | | | (0.67 | ) | | | (0.54 | ) | | | (0.03 | ) | | | (0.17 | ) | |

Distributions from net realized gains | | | (0.01 | ) | | | — | | | | — | | | | — | | | | (0.06 | ) | |

Total dividends and distributions | | | (0.01 | ) | | | (0.67 | ) | | | (0.54 | ) | | | (0.03 | ) | | | (0.23 | ) | |

Net asset value, end of year | | $ | 7.90 | | | $ | 8.44 | | | $ | 8.96 | | | $ | 8.57 | | | $ | 8.61 | | |

Total return3 | | | (6.25 | )% | | | 1.44 | % | | | 11.14 | % | | | (0.07 | )% | | | (27.76 | )% | |

RATIOS AND SUPPLEMENTAL DATA | |

Net assets, end of year (000s omitted) | | $ | 32,447 | | | $ | 46,250 | | | $ | 31,852 | | | $ | 22,035 | | | $ | 13,113 | | |

Ratio of expenses to average net assets | | | 1.80 | % | | | 1.79 | %4 | | | 1.70 | %4 | | | 1.70 | %4 | | | 1.70 | %4 | |

Ratio of net investment income (loss)

to average net assets | | | (1.57 | )% | | | (1.59 | )%4 | | | (1.47 | )%4 | | | (0.97 | )%4 | | | 0.97 | %4 | |

Decrease reflected in above operating expense

ratios due to waivers/reimbursements | | | 0.01 | % | | | 0.03 | %4 | | | 0.13 | %4 | | | 0.15 | %4 | | | 0.07 | %4 | |

Portfolio turnover rate | | | 84 | % | | | 165 | % | | | 104 | % | | | 43 | % | | | 109 | % | |

1 Per share information is calculated using the average shares outstanding method.

2 This amount represents less than $0.01 per share.

3 Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and sales charge. Had certain expenses not been reduced during the years shown, total returns would have been lower.

4 Effective October 31, 2012, the Fund began reporting operations of its wholly-owned subsidiary on a consolidated basis. Had the Fund reported on a consolidated basis in prior periods, ratio of expenses to average net assets without fee waivers and/or expense reimbursements would have increased by 0.00%, 0.01%, 0.01% and 0.01% for the years ended October 31, 2008, 2009, 2010, and 2011, respectively. The ratio of expenses to average net assets with fee waivers and/or expense reimbursements would have increased 0.00%, 0.00%, 0.00% and 0.00%, respectively for the same time period. The ratio of net investment income (loss) to average net assets would have increased 0.17%, 0.07%, 0.04% and 0.03% for the years ended October 31, 2008, 2009, 2010 and 2011, respectively. This change did not have material impact to net investment income (loss) per share or net realized and unrealized gain (loss) per share.

See Accompanying Notes to Financial Statements.

16

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements

October 31, 2012

Credit Suisse Commodity Return Strategy Fund (the "Fund"), a series of Credit Suisse Commodity Strategy Funds (the "Trust"), a Delaware statutory trust, is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a non-diversified open-end management investment company that seeks total return. The Trust was organized under the laws of the State of Delaware as a statutory trust on May 19, 2004. Effective September 20, 2012, the name of the Trust was changed from Credit Suisse Commodity Return Strategy Fund. The Fund intends to gain exposure to commodities derivatives through investing in a wholly-owned subsidiary, Credit Suisse Cayman Commodity Fund I, Ltd., organized under the laws of the Cayman Islands (the "Subsidiary"). The Subsidiary invests in commodity-linked derivative instruments, such as swaps and futures. The Subsidiary may also invest in debt securities, some of which are intended to serve as margin or collateral for the Subsidiary's derivatives positions. The Subsidiary is managed by the same portfolio managers that manage the Fund. As of October 31, 2012, the fund held $924,012,438 in the Subsidiary, representing 16.9% of the Fund's assets.

The Fund offers three classes of shares: Class I shares, Class A shares and Class C shares. Each class of shares represents an equal pro rata interest in the Fund, except that they bear different expenses, which reflect the differences in the range of services provided to them. Class A shares are sold subject to a front-end sales charge of 3.00%. Class C shares are sold subject to a contingent deferred sales charge of 1.00% if the shares are redeemed within the first year of purchase.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Equity investments are generally categorized as Level 1. Investments in open-end investment companies are valued at their net asset value each business day and are generally categorized as Level 1. Debt securities with a remaining maturity greater than 60 days are valued in

17

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Debt securities are generally categorized as Level 2. Structured note agreements are valued in accordance with a dealer-supplied valuation based on changes in the value of the underlying index and are generally categorized as Level 2. Time Deposits are valued at cost and are generally categorized as Level 2. Securities, structured note agreements and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees under procedures established by the Board of Trustees and are generally categorized as Level 3. The Fund may utilize a service provided by an independent third party which has been approved by the Board of Trustees to fair value certain securities. When fair value pricing is employed, the prices of securities used by the Fund to calculate its net asset value may differ from quoted or published prices for the same securities.

In accordance with the authoritative guidance on fair value measurements and disclosures under accounting principles generally accepted in the United States of America ("GAAP"), the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. In accordance with GAAP, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own

18

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security, the size of the holding, the initial cost of the security, the existence of any contractual restrictions on the security's disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies, quotations or evaluated prices from broker-dealers and/or pricing services, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company's or issuer's financial statements, an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which the security is normally traded. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1 – quoted prices in active markets for identical investments

• Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2012 in valuing the Fund's investments carried at value:

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

Investments in Securities | |

Commodity Indexed Structured Notes | | $ | — | | | $ | 197,032,803 | | | $ | — | | | $ | 197,032,803 | | |

United States Agency Obligations | | | — | | | | 4,166,475,859 | | | | — | | | | 4,166,475,859 | | |

United States Treasury Obligations | | | — | | | | 711,361,361 | | | | — | | | | 711,361,361 | | |

Short-Term Investments | | | 102,000,000 | | | | 76,281,000 | | | | — | | | | 178,281,000 | | |

Other Financial Instruments* | |

Futures | | | 159,846 | | | | — | | | | — | | | | 159,846 | | |

Swap Contracts | | | — | | | | (40,245,941 | ) | | | — | | | | (40,245,941 | ) | |

| | | $ | 102,159,846 | | | $ | 5,110,905,082 | | | $ | — | | | $ | 5,213,064,928 | | |

*Other financial instruments include futures and swap contracts.

19

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

The Fund adopted FASB amendments to authoritative guidance which require the Fund to disclose details of transfers in and out of Level 1 and Level 2 measurements and Level 2 and Level 3 measurements and the reasons for the transfers. For the year ended October 31, 2012, there were no transfers in and out of Level 1, Level 2 and Level 3.

B) DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES — The Fund adopted amendments to authoritative guidance on disclosures about derivative instruments and hedging activities which require that the Fund disclose (a) how and why an entity uses derivative instruments, (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect a fund's financial position, financial performance, and cash flows. The Fund has not entered into any derivative or hedging activities during the period covered by this report. However, the Fund does invest indirectly in derivative instruments through the Subsidiary.

Fair Values of Derivative Instruments as of October 31, 2012

| | | Asset Derivatives | | Liability Derivatives | |

| | | Balance Sheet

Location | | Fair Value | | Balance Sheet

Location | | Fair Value | |

Commodity Index

Return Contracts | | Unrealized appreciation/

depreciation on futures

contracts | | $ | 1,573,214 | * | | Unrealized appreciation/

depreciation on futures

contracts | | $ | 1,413,368 | * | |

| | | Unrealized appreciation/

depreciation on swap

contracts | | | 573,940 | | | Unrealized appreciation/

depreciation on swap

contracts | | | 40,819,881 | | |

| | | Variation margin

receivable | | | — | * | | Variation margin

payable | | | 50,720 | * | |

| | | | | | $ | 2,147,154 | | | | | | | $ | 42,283,969 | | |

*Includes cumulative appreciation/depreciation of futures contracts and swap contracts as reported in the Statement of Assets and Liabilities and Notes to Financial Statements. Only the current day's variation margin is reported within the Statement of Assets and Liabilities.

Effect of Derivative Instruments on the Statement of Operations

| | Location | | Realized

Gain/Loss | | Location | | Unrealized

Appreciation/

Depreciation | |

Commodity Index

Return Contracts | | Net realized loss from

swap contracts | | $ | (219,039,496 | ) | | Net change in unrealized

appreciation

(depreciation) from

swap contracts | | $ | (68,956,419 | ) | |

| | | Net realized gain from

futures contracts | | | 15,515,483 | | | Net change in unrealized

appreciation

(depreciation) from

futures contracts | | | 1,357,316 | | |

Total | | | | | | $ | (203,524,013 | ) | | | | | | $ | (67,599,103 | ) | |

20

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

The notional amount of futures contracts and swap contracts at year end are reflected in the Notes to Financial Statements. The notional amounts of long and short open positions of futures contracts and swap contracts at each month end throughout the reporting period averaged approximately 9.3% and 88.3%, respectively of net assets of the Fund.

C) SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis. The Fund amortizes premiums and accretes discounts using the effective interest method. Dividends are recorded on the ex-dividend date. Certain expenses are class-specific expenses and vary by class. Income, expenses (excluding class-specific expenses) and realized/unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of the outstanding shares of that class. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes.

D) DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income, if any, are declared and paid quarterly. Distributions of net realized capital gains, if any, are declared and paid at least annually. However, to the extent that a net realized capital gain can be reduced by a capital loss carryforward, such gain will not be distributed. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

E) FEDERAL INCOME TAXES — No provision is made for federal taxes as it is the Fund's intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies ("RIC") under the Internal Revenue Code of 1986, as amended (the "Code"), and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

In order to qualify as a RIC under the Code, the Fund must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its income. One of these requirements is that the Fund derive at least 90% of its gross income for each taxable year from dividends, interest, payments with respect to certain securities loans, gains from the sale or other disposition of stock, securities or foreign currencies, other income derived with respect to its business of investing in such stock, securities or currencies or net income derived from interests in certain publicly traded partnerships ("Qualifying Income"). The Fund may seek to track the

21

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

performance of the Dow Jones-UBS Commodity Index Total Return ("DJ-UBS Index") through investing in structured notes designed to track the performance of the DJ-UBS Index. The Fund has received a private letter ruling from the IRS which confirms that the Fund's use of certain types of structured notes designed to track the performance of the DJ-UBS Index produce Qualifying Income. In addition, the Fund may, through its investment in the Subsidiary, seek to track the performance of the DJ-UBS Index by the Subsidiary's investments in commodity-linked swaps and/or futures contracts. The Fund has obtained a private letter ruling from the IRS that its investment in the Subsidiary will produce Qualifying Income. If the Fund is unable to ensure continued qualification as a RIC, the Fund may be required to change its investment objective, policies or techniques, or may be liquidated. If the Fund fails to qualify as a RIC, the Fund will be subject to federal income tax on its net income and capital gains at regular corporate rates (without reduction for distributions to shareholders). If the Fund were to fail to qualify as a RIC and become subject to federal income tax, shareholders of the Fund would be subject to the risk of diminished returns.

The Fund adopted the authoritative guidance for uncertainty in income taxes and recognizes a tax benefit or liability from an uncertain position only if it is more likely than not that the position is sustainable based solely on its technical merits and consideration of the relevant taxing authority's widely understood administrative practices and procedures. The Fund has reviewed its current tax positions and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

F) USE OF ESTIMATES — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates. The consolidated financial statements include the accounts of the Fund and the Subsidiary. All inter-company transactions and balances have been eliminated.

G) SHORT-TERM INVESTMENTS — The Fund, together with other funds/portfolios advised by Credit Suisse, an indirect, wholly-owned subsidiary of Credit Suisse Group AG, pools available cash into a short-term variable rate time deposit issued by State Street Bank and Trust Company

22

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

("SSB"), the Fund's custodian. The short-term time deposit issued by SSB is a variable rate account classified as a short-term investment.

H) FUTURES — The Fund may enter into futures contracts to the extent permitted by its investment policies and objectives. The Fund may use futures contracts to gain exposure to, or hedge against changes in commodities. Upon entering into a futures contract, the Fund is required to deposit cash and/or pledge U.S. Government securities as initial margin. Subsequent payments, which are dependent on the daily fluctuations in the value of the underlying instrument, are made or received by the Fund each day (daily variation margin) and are recorded as unrealized gains or losses until the contracts are closed. When the contracts are closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund's basis in the contract. Risks of entering into futures contracts for hedging purposes include the possibility that a change in the value of the contract may not correlate with the changes in the value of the underlying instruments. With futures, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange's clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default. In addition, the purchase of a futures contract involves the risk that the Fund could lose more than the original margin deposit and subsequent payments may be required for a futures transaction. At October 31, 2012, the Fund had the following open futures contracts:

| Contract Description | | Currency | | Expiration

Date | | Notional

Value | | Unrealized

Appreciation

(Depreciation) | |

Contracts to Purchase | |

Energy | | | | | | | | | | | | | | | | | |

| | USD | | | | Mar 2013 | | | 49,887,440 | | | $ | 187,674 | | |

| | USD | | | | Apr 2013 | | | 70,894,800 | | | | (1,413,368 | ) | |

| | | | | | | | | (1,225,694 | ) | |

Contracts to Sell | |

Energy | | | | | | | | | | | | | | | | | |

| | USD | | | | Jan 2013 | | | (121,078,640 | ) | | $ | 1,385,540 | | |

Net unrealized appreciation (depreciation) | | | | | | | | $ | 159,846 | | |

I) SWAPS — The Fund may enter into swap contacts either for hedging purposes or to seek to increase total return. A swap contract is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices

23

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

or rates for a specified amount of an underlying asset or notional principal amount. The Fund will enter into swap contracts only on a net basis, which means that the two payment streams are netted out, with the Fund receiving or paying, as the case may be, only the net amount of the two payments. Risks may arise as a result of the failure of the counterparty to the swap contract to comply with the terms of the swap contract. The extent of the Fund's exposure to credit and counterparty risks is the discounted net value of the cash flows to be received from/paid to the counterparty over the contract's remaining life, to the extent that the amount is positive. These risks are mitigated by having a master netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund's exposure to the counterparty. Therefore, the Fund considers the creditworthiness of each counterparty to a swap contract in evaluating potential credit risk. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying reference asset or index.

The Fund may enter into total return swap contracts, involving commitments to pay interest in exchange for a market-linked return, both based on notional amounts. To the extent the total return of the security or index underlying the transactions exceeds or falls short of the offsetting interest rate obligation, the Fund will receive a payment from or make a payment to the counterparty.

The Fund records unrealized gains or losses on a daily basis representing the value and the current net receivable or payable relating to open swap contracts. Net amounts received or paid on the swap contract are recorded as realized gains or losses. Fluctuations in the value of swap contracts are recorded for financial statement purposes as unrealized appreciation or depreciation on swap contracts. Realized gains and losses from terminated swaps are included in net realized gains/losses on swap contracts transactions. At October 31, 2012, the Fund had the following outstanding swap contracts:

Currency | | Notional

Amount | | Expiration

Date | | Counterparty | | Receive | | Pay | | Unrealized

Appreciation/

(Depreciation) | |

USD | | | | $ | 584,099,404 | | | 12/23/2013 | | Morgan Stanley

Capital Group | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | $ | (5,802,306 | ) | |

USD | | | | $ | 123,580,876 | | |

12/23/2013 | | Morgan Stanley

Capital Group | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (1,075,752 | ) | |

24

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

Currency | | Notional

Amount | | Expiration

Date | | Counterparty | | Receive | | Pay | | Unrealized

Appreciation/

(Depreciation) | |

USD | | | | $ | 49,580,872 | | | 11/26/2012 | | Morgan Stanley

Capital Group | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | $ | (246,220 | ) | |

USD | | | | $ | 105,398,230 | | |

11/26/2012 | | Morgan Stanley

Capital Group | | Fee Plus

Treasury Bill Rate | | Commodity

Index Return1 | | | 573,940 | | |

USD | | | | $ | 269,284,526 | | |

10/23/2013 | |

UBS | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (2,347,030 | ) | |

USD | | | | $ | 350,678,385 | | |

10/23/2013 | |

UBS | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (3,483,556 | ) | |

USD | | | | $ | 656,614,054 | | |

11/26/2012 | |

CITI | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (3,259,681 | ) | |

USD | | | | $ | 85,048,040 | | |

11/26/2012 | |

CIBC | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (422,351 | ) | |

USD | | | | $ | 39,235,959 | | |

11/26/2012 | |

CIBC | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (213,657 | ) | |

USD | | | | $ | 49,063,039 | | |

09/23/2013 | |

Goldman Sachs | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (427,193 | ) | |

USD | | | | $ | 547,418,254 | | |

11/26/2012 | | JPMorgan

Chase | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (2,716,692 | ) | |

USD | | | | $ | 99,298,969 | | |

11/26/2012 | | JPMorgan

Chase | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (540,563 | ) | |

USD | | | | $ | 260,797,034 | | |

11/26/2012 | | Societe

Generale | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (1,297,267 | ) | |

USD | | | | $ | 309,167,840 | | |

11/26/2012 | | Societe

Generale | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (1,683,047 | ) | |

USD | | | | $ | 542,144,941 | | |

11/26/2012 | |

Barclays | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (2,696,760 | ) | |

USD | | | | $ | 47,647,021 | | |

11/26/2012 | |

Barclays | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (259,459 | ) | |

USD | | | | $ | 61,830,146 | | |

11/26/2012 | |

BNP Paribas | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (337,642 | ) | |

USD | | | | $ | 195,747,603 | | |

11/26/2012 | | Bank of

America | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (3,223,770 | ) | |

USD | | | | $ | 100,209,294 | | |

11/26/2012 | | Bank of

America | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (1,649,607 | ) | |

USD | | | | $ | 599,216,445 | | |

11/26/2012 | | Bank of

America | | Commodity

Index Return1 | | Fee Plus

Treasury Bill Rate | | | (9,137,328 | ) | |

| | | $ | (40,245,941 | ) | |

1 The Commodity Index Return is comprised of futures contracts on physical commodities.

25

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies

J) COMMODITY INDEXED STRUCTURED NOTES — The Fund may invest in structured notes whose value is based on the price movements of the DJ-UBS Index. The structured notes are often leveraged, increasing the volatility of each note's value relative to the change in the underlying linked financial element. The value of these notes will rise and fall in response to changes in the underlying commodity index. Structured notes may entail a greater degree of market risk than other types of debt securities because the investor bears the risk of the underlying commodity index. Structured notes may also be more volatile, less liquid, and more difficult to accurately price than less complex securities or more traditional debt securities. Fluctuations in the value of the structured notes are recorded as unrealized gains and losses in the accompanying financial statements. Net payments are recorded as interest income. These notes are subject to prepayment, credit and interest risks. The Fund has the option to request prepayment from the issuer. At maturity, or when a note is sold, the Fund records a realized gain or loss. At October 31, 2012, the value of these securities comprised 3.6% of the Fund's net assets and resulted in unrealized depreciation of ($10,267,197).

K) CHANGE IN ACCOUNTING POLICY — INVESTMENT IN CREDIT SUISSE CAYMAN COMMODITY FUND I, LTD. — The accompanying financial statements reflect the financial position of the Fund and its Subsidiary and the results of operations on a consolidated basis. Prior to October 31, 2012, the financial statements for the Fund reflected its wholly owned Subsidiary as a single investment. As a result of the change in accounting policy the fund consolidates the assets and liabilities as well as its operations of the wholly owned Subsidiary within its financial statements. The change in policy was implemented to provide shareholders of the Fund with a more accurate and transparent portrayal of the Fund's investment strategy, financial position and the results of its operations and more fully reflects the fact that the sole purpose of the Subsidiary is to serve as a vehicle through which the Fund gains additional exposure to commodities. The result of the policy change did not have an impact on total net assets of the Fund, but resulted in the following changes to the financial statements. As of the beginning of the Fund's fiscal period, the financial statement line items on the Statement of Assets and Liabilities were affected by the change as follows: Investments, at value increased $1,053,115,996; wholly-owned subsidiary, at value decreased by $1,028,627,544; other assets and liabilities decreased by $24,488,452. Undistributed net investment income increased $5,454,794; undistributed net realized gain (loss) increased $174,638,331 and unrealized depreciation decreased $180,093,125. For the period ended October 31, 2012, the financial

26

Credit Suisse Commodity Return Strategy Fund

Notes to Consolidated Financial Statements (continued)

October 31, 2012

Note 2. Significant Accounting Policies